UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811- 02753

Guggenheim Variable Funds Trust

(Exact name of registrant as specified in charter)

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Guggenheim Variable Funds Trust

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: December 31

Date of reporting period: January 1, 2022 – June 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

6.30.2022

Guggenheim Variable Funds Trust Semi-Annual Report

Series |

Series A | (StylePlus—Large Core Series) |

Series B | (Large Cap Value Series) |

Series D | (World Equity Income Series) |

Series E | (Total Return Bond Series) |

Series F | (Floating Rate Strategies Series) |

Series J | (StylePlus—Mid Growth Series) |

Series N | (Managed Asset Allocation Series) |

Series O | (All Cap Value Series) |

Series P | (High Yield Series) |

Series Q | (Small Cap Value Series) |

Series V | (SMid Cap Value Series) |

Series X | (StylePlus—Small Growth Series) |

Series Y | (StylePlus—Large Growth Series) |

Series Z | (Alpha Opportunity Series) |

GuggenheimInvestments.com | GVFT-SEMI-0622x1222 |

| | |

DEAR SHAREHOLDER | 2 |

ECONOMIC AND MARKET OVERVIEW | 5 |

ABOUT SHAREHOLDERS’ FUND EXPENSES | 7 |

SERIES A (STYLEPLUS—LARGE CORE SERIES) | 9 |

SERIES B (LARGE CAP VALUE SERIES) | 16 |

SERIES D (WORLD EQUITY INCOME SERIES) | 22 |

SERIES E (TOTAL RETURN BOND SERIES) | 29 |

SERIES F (FLOATING RATE STRATEGIES SERIES) | 50 |

SERIES J (STYLEPLUS—MID GROWTH SERIES) | 63 |

SERIES N (MANAGED ASSET ALLOCATION SERIES) | 71 |

SERIES O (ALL CAP VALUE SERIES) | 78 |

SERIES P (HIGH YIELD SERIES) | 85 |

SERIES Q (SMALL CAP VALUE SERIES) | 100 |

SERIES V (SMID CAP VALUE SERIES) | 106 |

SERIES X (STYLEPLUS—SMALL GROWTH SERIES) | 113 |

SERIES Y (STYLEPLUS—LARGE GROWTH SERIES) | 121 |

SERIES Z (ALPHA OPPORTUNITY SERIES) | 128 |

NOTES TO FINANCIAL STATEMENTS | 143 |

OTHER INFORMATION | 167 |

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | 175 |

GUGGENHEIM INVESTMENTS PRIVACY NOTICE | 181 |

LIQUIDITY RISK MANAGEMENT PROGRAM | 184 |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC and Guggenheim Partners Investment Management, LLC (the “Investment Advisers”) are pleased to present the semi-annual shareholder report for funds that are part of the Guggenheim Variable Funds Trust (the “Funds”). This report covers performance of the Funds for the semi-annual period ended June 30, 2022.

The Investment Advisers are part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC (“Guggenheim”), a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim and the Investment Advisers.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Security Investors, LLC

Guggenheim Partners Investment Management, LLC

July 31, 2022

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

COVID-19 and Other Market Risks. The COVID-19 pandemic and the recovery response has caused and continues to cause at times reduced consumer demand and economic output, supply chain disruptions, market closures, travel restrictions, quarantines, and disparate global vaccine distributions. As with other serious economic disruptions, governmental authorities and regulators have responded in recent years to this situation with significant fiscal and monetary policy changes. These included providing direct capital infusions into companies, introducing new monetary programs, and lowering interest rates. In some cases, these responses resulted in high inflation, low interest rates, and negative interest rates (which have since risen). Recently, the United States and other governments have also made investments and engaged in infrastructure modernization projects that have also increased public debt and spending. These actions, including their reversal or potential ineffectiveness, could further increase volatility in securities and other financial markets, reduce market liquidity, continue to cause higher inflation, heighten investor uncertainty, and adversely affect the value of the Funds’ investments and the performance of the Funds. These actions also contribute to a risk that asset prices have a high degree of correlation across markets and asset classes. The duration and extent of COVID-19 over the long term cannot be reasonably estimated at this time. The ultimate impact of COVID-19 and the extent to which COVID-19 impacts the Funds will depend on future developments, which are highly uncertain and difficult to predict.

The value of, or income generated by, the investments held by the Funds are subject to the possibility of rapid and unpredictable fluctuation, and loss. These movements may result from factors affecting individual companies, or from broader influences, including real or perceived changes in prevailinginterest rates (which have since risen and may continue to rise), changes in inflation rates or expectations about inflation rates (which are currently elevated relative to normal conditions), adverse investor confidence or sentiment, changing economic, political (including geopolitical), social or financial market conditions, increased instability or general uncertainty, environmental disasters, governmental actions, public health emergencies (such as the spread of infectious diseases, pandemics and epidemics), debt crises, actual or threatened wars or other armed conflicts (such as the current Russia-Ukraine conflict and its risk of expansion or collateral economic and other effects) or ratings downgrades, and other similar events, each of which may be temporary or last for extended periods. Moreover, changing economic, political, geopolitical, social, financial market or other conditions in one country or geographic region could adversely affect the value, yield and return of the investments held by the Funds in a different country or geographic region and economies, markets and issuers generally because of the increasingly interconnected global economies and financial markets.

2 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

The Series StylePlus Funds may not be suitable for all investors. Investments in large capitalization stocks may underperform other segments of the equity market or the equity market as a whole. ● Investments in small-sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies. ● Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing companies. ● The Funds may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● The Funds’ use of leverage, through borrowings or instruments such as derivatives, may cause the Funds to be more volatile than if they had not been leveraged. ● The Funds’ investments in other investment vehicles subject the Funds to those risks and expenses affecting the investment vehicle. ● The Funds may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). ● The Funds may invest in fixed income securities whose market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Funds’ exposure to high yield securities may subject the Funds to greater volatility. ● The Funds may invest in bank loans and asset-backed securities, including mortgage-backed, which involve special types of risks. ● The Funds may invest in restricted securities which may involve financial and liquidity risk. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Funds are not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series Value Funds may not be suitable for all investors. ● An investment in the Funds will fluctuate and is subject to investment risks, which means investors could lose money. The intrinsic value of the underlying stocks may never be realized or the stocks may decline in value. Investments in small- and/or mid-sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series D (World Equity Income Series) may not be suitable for all investors. ● Investments in securities in general are subject to market risks that may cause their prices to fluctuate over time. ●The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets are generally subject to an even greater level of risks). Additionally, the Fund’s exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. Dollar. ● The Fund’s investments in derivatives may pose risks in addition to those associated with investing directly in securities or other investments, including illiquidity of the derivatives, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, lack of availability and counterparty risk. ●The Fund’s use of leverage, through instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. ●The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ●The Fund may have significant exposure to securities in a particular capitalization range e.g., large-, mid- or small-cap securities. As a result, the Fund may be subject to the risk that the pre-denominate capitalization range may underperform other segments of the equity market or the equity market as a whole. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series E (Total Return Bond Series) may not be suitable for all investors. ● The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Fund’s exposure to high yield securities may subject the Fund to greater volatility. ● When market conditions are deemed appropriate, the Fund will leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● Instruments and strategies (such as borrowing transactions and reverse repurchase agreements) may provide leveraged exposure to a particular investment, which will magnify any gains or losses on those investments. ● Investments in reverse repurchase agreements expose the Fund to many of the same risks as investments in derivatives. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political, or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● Investments in syndicated bank loans generally offer a floating interest rate and involve special types of risks. ● The Fund’s investments in municipal securities can be affected by events that affect the municipal bond market. ● The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. ● The Fund’s investments in restricted securities may involve financial and liquidity risk. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series F (Floating Rate Strategies Series) may not be suitable for all investors. ● Investments in floating rate senior secured syndicated bank loans and other floating rate securities involve special types of risks, including credit rate risk, interest rate risk, liquidity risk and prepayment risk. ● The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Fund’s exposure to high yield securities may subject the Fund to greater volatility. ● When market conditions are deemed appropriate, the Fund may use leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● Instruments and strategies (such as borrowing transactions and reverse repurchase agreements) may provide leveraged exposure to a particular investment, which will magnify any gains or losses on those investments. ● Investments in reverse repurchase agreements and synthetic instruments (such as synthetic collateralized debt obligations) expose the Fund to many of the same risks as investments in derivatives. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. ● The Fund’s investments in restricted securities may involve financial and liquidity risk. ● The Fund is subject to active trading risks that may increase volatility and impact its ability to achieve its investment objective. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series N (Managed Asset Allocation Series) may not be suitable for all investors. ● The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The Fund could lose money if the issuer of a bond or a counterparty to a derivatives transaction or other transaction is unable to repay interest and principal on time or defaults. The issuer of a bond could also suffer a decrease in quality rating, which would affect the volatility and liquidity

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 3 |

of the bond. Derivatives may pose risks in addition to those associated with investing directly in securities or other investments, including the risk that the Fund will be unable to sell, unwind or value the derivative because of an illiquid market, the risk that the derivative is not well correlated with underlying investments or the Fund’s other portfolio holdings, and the risk that the counterparty is unwilling or unable to meet its obligation. The use of derivatives by the Fund to hedge risk may reduce the opportunity for gain by offsetting the positive effect of favorable price movements. Furthermore, if the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could result in a loss, which in some cases may be unlimited. Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs. The Investment Manager may not be able to cause certain of the underlying funds’ performance to match or correlate to that of the underlying funds’ respective underlying index or benchmark, either on a daily or aggregate basis. Factors such as underlying fund expenses, imperfect correlation between an underlying fund’s investments and those of its underlying index or underlying benchmark, rounding of share prices, changes to the composition of the underlying index or underlying benchmark, regulatory policies, high portfolio turnover rate, and the use of leverage all contribute to tracking error. Tracking error may cause an underlying fund’s and, thus the Fund’s, performance to be less than you expect. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series P (High Yield Series) may not be suitable for all investors. ● The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Fund’s exposure to high yield securities may subject the Fund to greater volatility. ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ●The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. ● Instruments and strategies (such as borrowing transactions and reverse repurchase agreements) may provide leveraged exposure to a particular investment, which will magnify any gains or losses on those investments. ● The Fund may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). ● Investments in syndicated bank loans generally offer a floating interest rate and involve special types of risks. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund’s investments in restricted securities may involve financial and liquidity risk. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series Z (Alpha Opportunity Series) may not be suitable for all investors. ● Investments in securities and derivatives, in general, are subject to market risks that may cause their prices to fluctuate over time. An investment in the Fund may lose money. There can be no guarantee the Fund will achieve it investment objective. ●The Fund’s use of derivatives such as futures, options and swap agreements may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. ● Certain of the derivative instruments, such as swaps and structured notes, are also subject to the risks of counterparty default and adverse tax treatment. ●The more the Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● The Fund’s use of short selling involves increased risk and costs, including paying more for a security than it received from its sale and the risk of unlimited losses. ●In certain circumstances the Fund may be subject to liquidity risk and it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price. ●The Fund’s fixed income investments will change in value in response to interest rate changes and other factors. ● Please read the prospectus for more detailed information regarding these and other risks.

4 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ECONOMIC AND MARKET OVERVIEW (Unaudited) | June 30, 2022 |

Equity and fixed income markets declined during the first six months of 2022 amid market volatility, Federal Reserve policy, and global economic headwinds.

With the labor market overheated and inflation considerably above the U.S. Federal Reserve’s (the “Fed”) target, we have entered an uncomfortable regime where “good news is bad news,” and the “Fed put” is deeply out of the money. For the first time in many years, the Fed is aggressively tightening financial conditions in an effort to slow the economy, keep inflation expectations in check, and bring inflation down to the 2% target.

The Fed’s crusade to crush inflation is reverberating around the world, as the strengthening dollar is boosting inflation and inflation expectations in other countries, forcing central banks to tighten policy abruptly to avoid an erosion of their own credibility. The tightening of global financial conditions will likely restrain growth, which is also being hampered by supply-side constraints: the U.S. unemployment rate has fallen to just 3.6%, commodity markets have been roiled by Russia’s war in Ukraine, and the Chinese economy has been hobbled by renewed COVID-19 lockdowns and property sector woes.

Recession risks have clearly risen. The U.S. monthly real gross domestic product (“GDP”) has declined at an annual rate of 1.8% from October 2021 through May 2022. Available employment data remains strong, contradicting the recession narrative, but the pace of improvement in the labor market has slowed markedly since last fall. This indicates that the labor market has already started to cool even before the full impact of tighter financial conditions has been felt. High-frequency indicators and news reports point to a further slowdown in the job market in coming months.

Inflation is a lagging indicator and continues to run far above the Fed’s target. While commodity prices and other leading indicators of inflation have cooled in recent months, the all-important headline consumer price index (“CPI”) number sits at a cycle high of 9.1% year over year as of June. Our analysis indicates that a Fed-induced downturn will be required to bring inflation down to target. We expect the Fed will raise rates to a range of 3.50–3.75% by December, which may tip the economy into recession in 2023.

For the six-month period ended June 30, 2022, the S&P 500® Index* returned -19.96%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* returned -19.57%. The return of the MSCI Emerging Markets Index* was -17.63%.

In the bond market, the Bloomberg U.S. Aggregate Bond Index* posted a -10.35% return for the six-month period, while the Bloomberg U.S. Corporate High Yield Index* returned -14.19%. The return of the ICE Bank of America (“BofA”) 3-Month U.S. Treasury Bill Index* was 0.14% for the six-month period.

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

Bloomberg U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market.

ICE BofA 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 5 |

ECONOMIC AND MARKET OVERVIEW (Unaudited)(concluded) | |

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

MSCI World Index is calculated with net dividends reinvested. It is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

Morningstar Long/Short Equity Category Average represents long-short portfolios which hold sizable stakes in both long and short positions in equities and related derivatives. Some funds that fall into this category will shift their exposure to long and short positions depending on their macro outlook or the opportunities they uncover through bottom-up research. Some funds may simply hedge long stock positions through exchange traded funds or derivatives. At least 75% of the assets are in equity securities or derivatives.

Russell 3000® Index measures the performance of the largest 3,000 U.S. companies, representing approximately 98% of the investable U.S. equity market.

Russell 3000® Value Index measures the performance of the broad value segment of the U.S. equity value universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2500® Value Index measures the performance of the small- to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth value.

Russell 1000® Value Index: A measure of the performance for the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

Russell Midcap® Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values.

S&P 500® Index is a broad-based index, the performance of which is based on the performance of 500 widely held common stocks chosen for market size, liquidity, and industry group representation.

6 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) | |

All mutual funds have operating expenses, and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, other distributions, and exchange fees, and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning December 31, 2021 and ending June 30, 2022.

The following tables illustrate the Funds’ costs in two ways:

Table 1. Based on actual Fund return: This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fifth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return: This section is intended to help investors compare a fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about the Funds’ expenses, including annual expense ratios for periods up to five years (subject to the Fund’s inception date), can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 7 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) | |

| | Expense

Ratio1 | | | Fund

Return | | | Beginning

Account Value

December 31, 2021 | | | Ending

Account Value

June 30, 2022 | | | Expenses

Paid During

Period2 | |

Table 1. Based on actual Fund return3 | | | | | | | | | | | | | | | | | |

Series A (StylePlus—Large Core Series) | | | 0.87 | % | | | (21.94 | %) | | $ | 1,000.00 | | | $ | 780.60 | | | $ | 3.84 | |

Series B (Large Cap Value Series) | | | 0.79 | % | | | (7.88 | %) | | | 1,000.00 | | | | 921.20 | | | | 3.76 | |

Series D (World Equity Income Series) | | | 0.89 | % | | | (12.57 | %) | | | 1,000.00 | | | | 874.30 | | | | 4.14 | |

Series E (Total Return Bond Series) | | | 0.79 | % | | | (13.58 | %) | | | 1,000.00 | | | | 864.20 | | | | 3.65 | |

Series F (Floating Rate Strategies Series) | | | 1.17 | % | | | (5.00 | %) | | | 1,000.00 | | | | 950.00 | | | | 5.66 | |

Series J (StylePlus—Mid Growth Series) | | | 0.92 | % | | | (31.70 | %) | | | 1,000.00 | | | | 683.00 | | | | 3.84 | |

Series N (Managed Asset Allocation Series) | | | 0.93 | % | | | (17.43 | %) | | | 1,000.00 | | | | 825.70 | | | | 4.21 | |

Series O (All Cap Value Series) | | | 0.87 | % | | | (7.99 | %) | | | 1,000.00 | | | | 920.10 | | | | 4.14 | |

Series P (High Yield Series) | | | 1.07 | % | | | (12.67 | %) | | | 1,000.00 | | | | 873.30 | | | | 4.97 | |

Series Q (Small Cap Value Series) | | | 1.13 | % | | | (11.48 | %) | | | 1,000.00 | | | | 885.20 | | | | 5.28 | |

Series V (SMid Cap Value Series) | | | 0.90 | % | | | (9.83 | %) | | | 1,000.00 | | | | 901.70 | | | | 4.24 | |

Series X (StylePlus—Small Growth Series) | | | 1.06 | % | | | (29.38 | %) | | | 1,000.00 | | | | 706.20 | | | | 4.48 | |

Series Y (StylePlus—Large Growth Series) | | | 0.90 | % | | | (29.45 | %) | | | 1,000.00 | | | | 705.50 | | | | 3.81 | |

Series Z (Alpha Opportunity Series) | | | 2.01 | % | | | (7.40 | %) | | | 1,000.00 | | | | 926.00 | | | | 9.60 | |

|

Table 2. Based on hypothetical 5% return (before expenses) | | | | | | | | | | | | | | | | |

Series A (StylePlus—Large Core Series) | | | 0.87 | % | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,020.48 | | | $ | 4.36 | |

Series B (Large Cap Value Series) | | | 0.79 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.88 | | | | 3.96 | |

Series D (World Equity Income Series) | | | 0.89 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.38 | | | | 4.46 | |

Series E (Total Return Bond Series) | | | 0.79 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.88 | | | | 3.96 | |

Series F (Floating Rate Strategies Series) | | | 1.17 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,018.99 | | | | 5.86 | |

Series J (StylePlus—Mid Growth Series) | | | 0.92 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.23 | | | | 4.61 | |

Series N (Managed Asset Allocation Series) | | | 0.93 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.18 | | | | 4.66 | |

Series O (All Cap Value Series) | | | 0.87 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.48 | | | | 4.36 | |

Series P (High Yield Series) | | | 1.07 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.49 | | | | 5.36 | |

Series Q (Small Cap Value Series) | | | 1.13 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.19 | | | | 5.66 | |

Series V (SMid Cap Value Series) | | | 0.90 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.33 | | | | 4.51 | |

Series X (StylePlus—Small Growth Series) | | | 1.06 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.54 | | | | 5.31 | |

Series Y (StylePlus—Large Growth Series) | | | 0.90 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.33 | | | | 4.51 | |

Series Z (Alpha Opportunity Series) | | | 2.01 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,014.83 | | | | 10.04 | |

1 | Annualized and excludes expenses of the underlying funds in which the Funds invest, if any. This ratio represents net expenses, which may include expenses that are excluded from the expense limitation agreement and affiliated waivers. Excluding these expenses, the net expense ratios for the period would be: |

| | Fund | 06/30/22 |

| | Series A (StylePlus—Large Core Series) | 0.86% |

| | Series B (Large Cap Value Series) | 0.79% |

| | Series D (World Equity Income Series) | 0.89% |

| | Series E (Total Return Bond Series) | 0.76% |

| | Series F (Floating Rate Strategies Series) | 1.14% |

| | Series J (StylePlus—Mid Growth Series) | 0.92% |

| | Series O (All Cap Value Series) | 0.87% |

| | Series P (High Yield Series) | 1.06% |

| | Series Q (Small Cap Value Series) | 1.13% |

| | Series V (SMid Cap Value Series) | 0.90% |

| | Series X (StylePlus—Small Growth Series) | 1.05% |

| | Series Y (StylePlus—Large Growth Series) | 0.89% |

| | Series Z (Alpha Opportunity Series) | 2.01% |

2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses shown do not include fees charged by insurance companies. |

3 | Actual cumulative return at net asset value for the period December 31, 2021 to June 30, 2022. |

8 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | June 30, 2022 |

SERIES A (STYLEPLUS—LARGE CORE SERIES)

OBJECTIVE: Seeks long-term growth of capital.

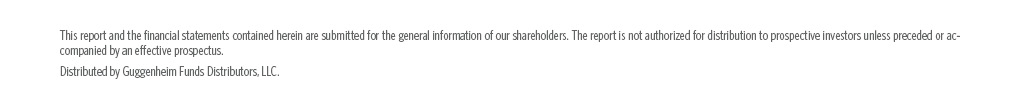

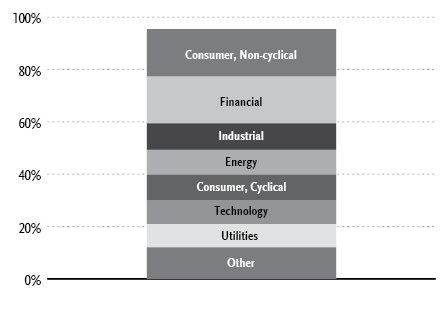

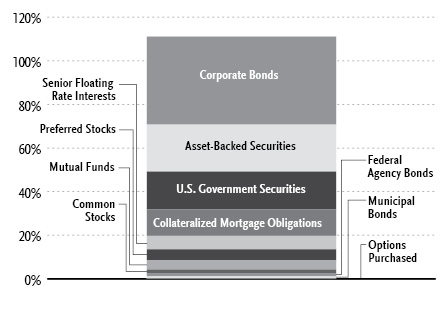

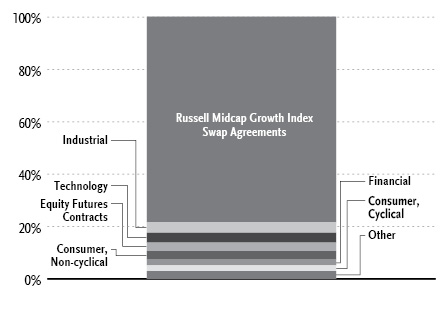

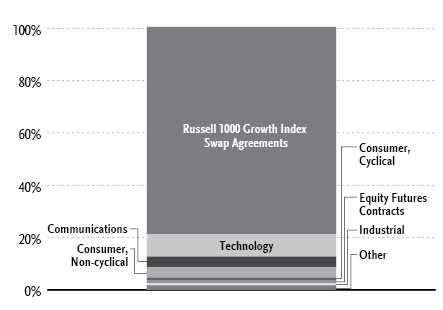

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund.

Inception Date: May 1, 1979 |

Ten Largest Holdings (% of Total Net Assets) |

Guggenheim Strategy Fund III | 30.9% |

Guggenheim Variable Insurance Strategy Fund III | 26.9% |

Guggenheim Ultra Short Duration Fund — Institutional Class | 15.0% |

Guggenheim Strategy Fund II | 4.7% |

Apple, Inc. | 1.3% |

Microsoft Corp. | 1.2% |

Alphabet, Inc. — Class C | 0.7% |

Procter & Gamble Co. | 0.4% |

Amazon.com, Inc. | 0.4% |

Exxon Mobil Corp. | 0.4% |

Top Ten Total | 81.9% |

| | |

“Ten Largest Holdings” excludes any temporary cash or derivative investments. |

Average Annual Returns*,†

Periods Ended June 30, 2022

| 6 Month‡ | 1 Year | 5 Year | 10 Year |

Series A (StylePlus—Large Core Series) | (21.94%) | (13.11%) | 10.09% | 12.25% |

S&P 500 Index | (19.96%) | (10.62%) | 11.31% | 12.96% |

* | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The S&P 500 Index is an unmanaged index and, unlike the Fund, has no management fees or operating expenses to reduce its reported return. |

† | Performance figures do not reflect fees and expenses associated with an investment in variable insurance products. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a series of Guggenheim Variable Funds Trust are available only through the purchase of such products. |

‡ | 6 month returns are not annualized. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 9 |

SCHEDULE OF INVESTMENTS (Unaudited) | June 30, 2022 |

SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

| | Shares | | | Value | |

COMMON STOCKS† - 18.8% |

| | | | | | | | | |

Technology - 5.3% |

Apple, Inc. | | | 19,345 | | | $ | 2,644,848 | |

Microsoft Corp. | | | 9,578 | | | | 2,459,918 | |

International Business Machines Corp. | | | 3,467 | | | | 489,506 | |

Oracle Corp. | | | 5,936 | | | | 414,748 | |

QUALCOMM, Inc. | | | 3,215 | | | | 410,684 | |

NetApp, Inc. | | | 6,108 | | | | 398,486 | |

Intel Corp. | | | 10,298 | | | | 385,248 | |

Micron Technology, Inc. | | | 5,459 | | | | 301,774 | |

Qorvo, Inc.* | | | 3,072 | | | | 289,751 | |

HP, Inc. | | | 8,506 | | | | 278,827 | |

NXP Semiconductor N.V. | | | 1,861 | | | | 275,484 | |

Skyworks Solutions, Inc. | | | 2,917 | | | | 270,231 | |

Broadcom, Inc. | | | 487 | | | | 236,590 | |

Hewlett Packard Enterprise Co. | | | 17,292 | | | | 229,292 | |

Seagate Technology Holdings plc | | | 3,036 | | | | 216,892 | |

Cognizant Technology Solutions Corp. — Class A | | | 3,153 | | | | 212,796 | |

Akamai Technologies, Inc.* | | | 2,198 | | | | 200,743 | |

NVIDIA Corp. | | | 1,227 | | | | 186,001 | |

KLA Corp. | | | 479 | | | | 152,839 | |

Applied Materials, Inc. | | | 1,503 | | | | 136,743 | |

Lam Research Corp. | | | 316 | | | | 134,663 | |

Advanced Micro Devices, Inc.* | | | 1,586 | | | | 121,281 | |

Texas Instruments, Inc. | | | 737 | | | | 113,240 | |

Salesforce, Inc.* | | | 669 | | | | 110,412 | |

Total Technology | | | | | | | 10,670,997 | |

| | | | | | | | | |

Consumer, Non-cyclical - 5.1% |

Procter & Gamble Co. | | | 5,700 | | | | 819,603 | |

AbbVie, Inc. | | | 4,335 | | | | 663,948 | |

Bristol-Myers Squibb Co. | | | 8,021 | | | | 617,617 | |

Merck & Company, Inc. | | | 6,211 | | | | 566,257 | |

Gilead Sciences, Inc. | | | 8,086 | | | | 499,796 | |

Pfizer, Inc. | | | 9,132 | | | | 478,791 | |

Kimberly-Clark Corp. | | | 3,246 | | | | 438,697 | |

Vertex Pharmaceuticals, Inc.* | | | 1,509 | | | | 425,221 | |

Quest Diagnostics, Inc. | | | 3,171 | | | | 421,679 | |

CVS Health Corp. | | | 4,542 | | | | 420,862 | |

Tyson Foods, Inc. — Class A | | | 4,865 | | | | 418,682 | |

Kellogg Co. | | | 5,745 | | | | 409,848 | |

Amgen, Inc. | | | 1,663 | | | | 404,608 | |

Philip Morris International, Inc. | | | 4,081 | | | | 402,958 | |

Hologic, Inc.* | | | 5,743 | | | | 397,990 | |

Avery Dennison Corp. | | | 2,395 | | | | 387,678 | |

Regeneron Pharmaceuticals, Inc.* | | | 638 | | | | 377,141 | |

Church & Dwight Company, Inc. | | | 3,198 | | | | 296,327 | |

FleetCor Technologies, Inc.* | | | 1,402 | | | | 294,574 | |

UnitedHealth Group, Inc. | | | 433 | | | | 222,402 | |

Altria Group, Inc. | | | 5,043 | | | | 210,646 | |

DaVita, Inc.* | | | 2,256 | | | | 180,390 | |

Johnson & Johnson | | | 788 | | | | 139,878 | |

Conagra Brands, Inc. | | | 3,841 | | | | 131,516 | |

PepsiCo, Inc. | | | 751 | | | | 125,162 | |

Molson Coors Beverage Co. — Class B | | | 2,291 | | | | 124,882 | |

Laboratory Corporation of America Holdings | | | 510 | | | | 119,524 | |

S&P Global, Inc. | | | 354 | | | | 119,319 | |

PayPal Holdings, Inc.* | | | 1,413 | | | | 98,684 | |

Total Consumer, Non-cyclical | | | | | | | 10,214,680 | |

| | | | | | | | | |

Communications - 2.2% |

Alphabet, Inc. — Class C* | | | 634 | | | | 1,386,843 | |

Amazon.com, Inc.* | | | 7,666 | | | | 814,206 | |

Motorola Solutions, Inc. | | | 2,087 | | | | 437,435 | |

Meta Platforms, Inc. — Class A* | | | 2,578 | | | | 415,703 | |

Juniper Networks, Inc. | | | 13,903 | | | | 396,236 | |

Cisco Systems, Inc. | | | 7,470 | | | | 318,521 | |

Corning, Inc. | | | 8,993 | | | | 283,369 | |

AT&T, Inc. | | | 8,142 | | | | 170,656 | |

Netflix, Inc.* | | | 630 | | | | 110,168 | |

Verizon Communications, Inc. | | | 1,616 | | | | 82,012 | |

Total Communications | | | | | | | 4,415,149 | |

| | | | | | | | | |

Industrial - 1.7% |

3M Co. | | | 3,524 | | | | 456,041 | |

Keysight Technologies, Inc.* | | | 3,029 | | | | 417,548 | |

Sealed Air Corp. | | | 6,703 | | | | 386,897 | |

Snap-on, Inc. | | | 1,920 | | | | 378,298 | |

Packaging Corporation of America | | | 2,684 | | | | 369,050 | |

Amcor plc | | | 27,045 | | | | 336,170 | |

Nordson Corp. | | | 1,570 | | | | 317,831 | |

General Dynamics Corp. | | | 1,374 | | | | 303,997 | |

Garmin Ltd. | | | 2,266 | | | | 222,634 | |

Amphenol Corp. — Class A | | | 2,834 | | | | 182,453 | |

CSX Corp. | | | 4,455 | | | | 129,462 | |

Total Industrial | | | | | | | 3,500,381 | |

| | | | | | | | | |

Financial - 1.7% |

U.S. Bancorp | | | 9,546 | | | | 439,307 | |

MetLife, Inc. | | | 6,992 | | | | 439,028 | |

Everest Re Group Ltd. | | | 1,494 | | | | 418,738 | |

Prudential Financial, Inc. | | | 4,375 | | | | 418,600 | |

Visa, Inc. — Class A | | | 1,887 | | | | 371,531 | |

Citigroup, Inc. | | | 7,668 | | | | 352,651 | |

Charles Schwab Corp. | | | 5,522 | | | | 348,880 | |

Berkshire Hathaway, Inc. — Class B* | | | 1,116 | | | | 304,690 | |

Mastercard, Inc. — Class A | | | 503 | | | | 158,687 | |

Travelers Companies, Inc. | | | 701 | | | | 118,560 | |

JPMorgan Chase & Co. | | | 962 | | | | 108,331 | |

Total Financial | | | | | | | 3,479,003 | |

| | | | | | | | | |

Energy - 1.4% |

Exxon Mobil Corp. | | | 8,915 | | | | 763,481 | |

Chevron Corp. | | | 4,599 | | | | 665,843 | |

Williams Companies, Inc. | | | 12,486 | | | | 389,688 | |

Kinder Morgan, Inc. | | | 23,047 | | | | 386,268 | |

ONEOK, Inc. | | | 6,559 | | | | 364,024 | |

Occidental Petroleum Corp. | | | 3,855 | | | | 226,982 | |

Total Energy | | | | | | | 2,796,286 | |

| | | | | | | | | |

10 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2022 |

SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

| | Shares | | | Value | |

Consumer, Cyclical - 0.7% |

Lowe’s Companies, Inc. | | | 2,515 | | | $ | 439,295 | |

Home Depot, Inc. | | | 1,146 | | | | 314,313 | |

Tesla, Inc.* | | | 445 | | | | 299,672 | |

Whirlpool Corp. | | | 1,759 | | | | 272,416 | |

Bath & Body Works, Inc. | | | 4,664 | | | | 125,555 | |

Total Consumer, Cyclical | | | | | | | 1,451,251 | |

| | | | | | | | | |

Basic Materials - 0.7% |

International Paper Co. | | | 9,166 | | | | 383,414 | |

Dow, Inc. | | | 7,076 | | | | 365,192 | |

LyondellBasell Industries N.V. — Class A | | | 4,019 | | | | 351,502 | |

Nucor Corp. | | | 1,927 | | | | 201,198 | |

Total Basic Materials | | | | | | | 1,301,306 | |

| | | | | | | | | |

Total Common Stocks | | | | |

(Cost $39,522,507) | | | | | | | 37,829,053 | |

| | | | | | | | | |

MUTUAL FUNDS† - 77.5% |

Guggenheim Strategy Fund III1 | | | 2,578,470 | | | | 62,424,748 | |

Guggenheim Variable Insurance Strategy Fund III1 | | | 2,251,429 | | | | 54,462,061 | |

Guggenheim Ultra Short Duration Fund — Institutional Class1 | | | 3,133,920 | | | | 30,242,325 | |

Guggenheim Strategy Fund II1 | | | 393,038 | | | | 9,487,933 | |

Total Mutual Funds | | | | |

(Cost $161,633,002) | | | | | | | 156,617,067 | |

| | | | | | | | | |

MONEY MARKET FUND† - 4.6% |

Dreyfus Treasury Securities Cash Management Fund — Institutional Shares, 0.97%2 | | | 9,391,441 | | | $ | 9,391,441 | |

Total Money Market Fund | | | | |

(Cost $9,391,441) | | | | | | | 9,391,441 | |

| | | | | | | | | |

Total Investments - 100.9% | | | | |

(Cost $210,546,950) | | $ | 203,837,561 | |

Other Assets & Liabilities, net - (0.9)% | | | (1,789,536 | ) |

Total Net Assets - 100.0% | | $ | 202,048,025 | |

Total Return Swap Agreements |

Counterparty | Index | Type | Financing

Rate | | Payment

Frequency | | | Maturity

Date | | | Units | | | Notional

Amount | | | Value and

Unrealized

Depreciation | |

OTC Equity Index Swap Agreements†† |

Wells Fargo Bank, N.A. | S&P 500 Total Return Index | Pay | 1.83% (Federal Funds Rate + 0.25%) | | | At Maturity | | | | 09/30/22 | | | | 20,770 | | | $ | 165,988,855 | | | $ | (31,698,717 | ) |

* | Non-income producing security. |

† | Value determined based on Level 1 inputs — See Note 4. |

†† | Value determined based on Level 2 inputs — See Note 4. |

1 | Affiliated issuer. |

2 | Rate indicated is the 7-day yield as of June 30, 2022. |

| | plc — Public Limited Company |

| | |

| | See Sector Classification in Other Information section. |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 11 |

SCHEDULE OF INVESTMENTS (Unaudited)(concluded) | June 30, 2022 |

SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

The following table summarizes the inputs used to value the Fund’s investments at June 30, 2022 (See Note 4 in the Notes to Financial Statements):

Investments in Securities (Assets) | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

Common Stocks | | $ | 37,829,053 | | | $ | — | | | $ | — | | | $ | 37,829,053 | |

Mutual Funds | | | 156,617,067 | | | | — | | | | — | | | | 156,617,067 | |

Money Market Fund | | | 9,391,441 | | | | — | | | | — | | | | 9,391,441 | |

Total Assets | | $ | 203,837,561 | | | $ | — | | | $ | — | | | $ | 203,837,561 | |

Investments in Securities (Liabilities) | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

Equity Index Swap Agreements** | | $ | — | | | $ | 31,698,717 | | | $ | — | | | $ | 31,698,717 | |

** | This derivative is reported as unrealized appreciation/depreciation at period end. |

Affiliated Transactions

Investments representing 5% or more of the outstanding voting shares of a company, or control of or by, or common control under Guggenheim Investments (“GI”), result in that company being considered an affiliated issuer, as defined in the 1940 Act.

The Fund may invest in certain of the underlying series of Guggenheim Strategy Funds Trust, including Guggenheim Strategy Fund II, Guggenheim Strategy Fund III, and Guggenheim Variable Insurance Strategy Fund III, (collectively, the “Short Term Investment Vehicles”), each of which are open-end management investment companies managed by GI. The Short Term Investment Vehicles, which launched on March 11, 2014, are offered as short term investment options only to mutual funds, trusts, and other accounts managed by GI and/or its affiliates, and are not available to the public. The Short Term Investment Vehicles pay no investment management fees. The Short Term Investment Vehicles’ annual report on Form N-CSR dated September 30, 2021, is available publicly or upon request. This information is available from the EDGAR database on the SEC’s website at https://www.sec.gov/Archives/edgar/data/1601445/000182126821000490/gugg83048-ncsr.htm. The Fund may invest in certain of the underlying series of Guggenheim Fund Trust, which are open-end management investment companies managed by GI, are available to the public and whose most recent annual report on Form N-CSR is available publicly or upon request.

Transactions during the period ended June 30, 2022, in which the company is an affiliated issuer, were as follows:

Security Name | | Value

12/31/21 | | | Additions | | | Reductions | | | Realized

Gain (Loss) | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Value

06/30/22 | | | Shares

06/30/22 | | | Investment

Income | |

Mutual Funds | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Guggenheim Strategy Fund II | | $ | 16,780,495 | | | $ | 12,128,265 | | | $ | (19,000,000 | ) | | $ | (250,107 | ) | | $ | (170,720 | ) | | $ | 9,487,933 | | | | 393,038 | | | $ | 129,387 | |

Guggenheim Strategy Fund III | | | 81,097,553 | | | | 626,267 | | | | (16,865,987 | ) | | | (228,637 | ) | | | (2,204,448 | ) | | | 62,424,748 | | | | 2,578,470 | | | | 631,917 | |

Guggenheim Ultra Short Duration Fund — Institutional Class | | | 54,253,430 | | | | 190,699 | | | | (23,334,988 | ) | | | 152,490 | | | | (1,019,306 | ) | | | 30,242,325 | | | | 3,133,920 | | | | 193,390 | |

Guggenheim Variable Insurance Strategy Fund III | | | 67,541,303 | | | | 530,390 | | | | (11,605,006 | ) | | | (289,994 | ) | | | (1,714,632 | ) | | | 54,462,061 | | | | 2,251,429 | | | | 534,871 | |

| | | $ | 219,672,781 | | | $ | 13,475,621 | | | $ | (70,805,981 | ) | | $ | (616,248 | ) | | $ | (5,109,106 | ) | | $ | 156,617,067 | | | | | | | $ | 1,489,565 | |

12 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) |

June 30, 2022 |

Assets: |

Investments in unaffiliated issuers, at value (cost $48,913,948) | | $ | 47,220,494 | |

Investments in affiliated issuers, at value (cost $161,633,002) | | | 156,617,067 | |

Cash | | | 1,483 | |

Segregated cash with broker | | | 30,550,000 | |

Prepaid expenses | | | 5,018 | |

Receivables: |

Dividends | | | 330,941 | |

Interest | | | 4,398 | |

Fund shares sold | | �� | 2,786 | |

Total assets | | | 234,732,187 | |

| | | | | |

Liabilities: |

Unrealized depreciation on OTC swap agreements | | | 31,698,717 | |

Payable for: |

Swap settlement | | | 443,359 | |

Securities purchased | | | 287,807 | |

Management fees | | | 83,143 | |

Distribution and service fees | | | 43,046 | |

Fund shares redeemed | | | 29,649 | |

Fund accounting/administration fees | | | 11,881 | |

Trustees’ fees* | | | 8,269 | |

Transfer agent/maintenance fees | | | 2,081 | |

Miscellaneous | | | 76,210 | |

Total liabilities | | | 32,684,162 | |

Commitments and contingent liabilities (Note 12) | | | — | |

Net assets | | $ | 202,048,025 | |

| | | | | |

Net assets consist of: |

Paid in capital | | $ | 173,609,536 | |

Total distributable earnings (loss) | | | 28,438,489 | |

Net assets | | $ | 202,048,025 | |

Capital shares outstanding | | | 4,558,041 | |

Net asset value per share | | $ | 44.33 | |

STATEMENT OF OPERATIONS (Unaudited) |

Six Months Ended June 30, 2022 |

Investment Income: |

Dividends from securities of unaffiliated issuers (net of foreign withholding tax of $236) | | $ | 438,747 | |

Dividends from securities of affiliated issuers | | | 1,489,565 | |

Interest | | | 9,138 | |

Total investment income | | | 1,937,450 | |

| | | | | |

Expenses: |

Management fees | | | 878,513 | |

Distribution and service fees | | | 292,838 | |

Transfer agent/maintenance fees | | | 12,636 | |

Fund accounting/administration fees | | | 81,201 | |

Professional fees | | | 17,123 | |

Custodian fees | | | 6,784 | |

Interest expense | | | 5,679 | |

Line of credit fees | | | 3,490 | |

Trustees’ fees* | | | 3,475 | |

Miscellaneous | | | 17,311 | |

Total expenses | | | 1,319,050 | |

Less: |

Expenses reimbursed by Adviser: | | | (7 | ) |

Expenses waived by Adviser | | | (298,764 | ) |

Total waived/reimbursed expenses | | | (298,771 | ) |

Net expenses | | | 1,020,279 | |

Net investment income | | | 917,171 | |

| | | | | |

Net Realized and Unrealized Gain (Loss): |

Net realized gain (loss) on: |

Investments in unaffiliated issuers | | | (22,155 | ) |

Investments in affiliated issuers | | | (616,248 | ) |

Swap agreements | | | 8,204,202 | |

Futures contracts | | | (153,607 | ) |

Net realized gain | | | 7,412,192 | |

Net change in unrealized appreciation (depreciation) on: |

Investments in unaffiliated issuers | | | (9,317,245 | ) |

Investments in affiliated issuers | | | (5,109,106 | ) |

Swap agreements | | | (51,677,872 | ) |

Futures contracts | | | (100,275 | ) |

Net change in unrealized appreciation (depreciation) | | | (66,204,498 | ) |

Net realized and unrealized loss | | | (58,792,306 | ) |

Net decrease in net assets resulting from operations | | $ | (57,875,135 | ) |

* | Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act. |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 13 |

SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

STATEMENTS OF CHANGES IN NET ASSETS |

| | Six Months Ended

June 30, 2022

(Unaudited) | | | Year Ended

December 31,

2021 | |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 917,171 | | | $ | 1,220,679 | |

Net realized gain on investments | | | 7,412,192 | | | | 62,342,705 | |

Net change in unrealized appreciation (depreciation) on investments | | | (66,204,498 | ) | | | (926,499 | ) |

Net increase (decrease) in net assets resulting from operations | | | (57,875,135 | ) | | | 62,636,885 | |

| | | | | | | | | |

Distributions to shareholders | | | — | | | | (26,897,830 | ) |

| | | | | | | | | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | 3,099,778 | | | | 2,897,714 | |

Distributions reinvested | | | — | | | | 26,897,830 | |

Cost of shares redeemed | | | (13,147,173 | ) | | | (25,651,784 | ) |

Net increase (decrease) from capital share transactions | | | (10,047,395 | ) | | | 4,143,760 | |

Net increase (decrease) in net assets | | | (67,922,530 | ) | | | 39,882,815 | |

| | | | | | | | | |

Net assets: | | | | | | | | |

Beginning of period | | | 269,970,555 | | | | 230,087,740 | |

End of period | | $ | 202,048,025 | | | $ | 269,970,555 | |

| | | | | | | | | |

Capital share activity: | | | | | | | | |

Shares sold | | | 57,744 | | | | 54,152 | |

Shares issued from reinvestment of distributions | | | — | | | | 518,662 | |

Shares redeemed | | | (253,421 | ) | | | (478,128 | ) |

Net increase (decrease) in shares | | | (195,677 | ) | | | 94,686 | |

14 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | Six Months Ended

June 30, 2022a | | | Year Ended

December 31,

2021 | | | Year Ended

December 31,

2020 | | | Year Ended

December 31,

2019 | | | Year Ended

December 31,

2018 | | | Year Ended

December 31,

2017 | |

Per Share Data |

Net asset value, beginning of period | | $ | 56.79 | | | $ | 49.39 | | | $ | 44.24 | | | $ | 36.80 | | | $ | 45.50 | | | $ | 38.20 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | .20 | | | | .26 | | | | .38 | | | | .68 | | | | .83 | | | | .62 | |

Net gain (loss) on investments (realized and unrealized) | | | (12.66 | ) | | | 13.22 | | | | 7.46 | | | | 10.06 | | | | (3.10 | ) | | | 7.76 | |

Total from investment operations | | | (12.46 | ) | | | 13.48 | | | | 7.84 | | | | 10.74 | | | | (2.27 | ) | | | 8.38 | |

Less distributions from: |

Net investment income | | | — | | | | (.41 | ) | | | (.74 | ) | | | (.91 | ) | | | (.75 | ) | | | (.50 | ) |

Net realized gains | | | — | | | | (5.67 | ) | | | (1.95 | ) | | | (2.39 | ) | | | (5.68 | ) | | | (.58 | ) |

Total distributions | | | — | | | | (6.08 | ) | | | (2.69 | ) | | | (3.30 | ) | | | (6.43 | ) | | | (1.08 | ) |

Net asset value, end of period | | $ | 44.33 | | | $ | 56.79 | | | $ | 49.39 | | | $ | 44.24 | | | $ | 36.80 | | | $ | 45.50 | |

|

Total Returnc | | | (21.94 | %) | | | 28.48 | % | | | 18.78 | % | | | 29.97 | % | | | (6.56 | %) | | | 22.22 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 202,048 | | | $ | 269,971 | | | $ | 230,088 | | | $ | 218,082 | | | $ | 190,644 | | | $ | 251,795 | |

Ratios to average net assets: |

Net investment income (loss) | | | 0.78 | % | | | 0.49 | % | | | 0.88 | % | | | 1.65 | % | | | 1.89 | % | | | 1.48 | % |

Total expensesd | | | 1.13 | % | | | 1.14 | % | | | 1.22 | % | | | 1.27 | % | | | 1.26 | % | | | 1.12 | % |

Net expensese,f,g | | | 0.87 | % | | | 0.85 | % | | | 0.89 | % | | | 0.95 | % | | | 0.97 | % | | | 0.91 | % |

Portfolio turnover rate | | | 29 | % | | | 34 | % | | | 63 | % | | | 41 | % | | | 45 | % | | | 44 | % |

a | Unaudited figures for the period ended June 30, 2022. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

b | Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

c | Total return does not take into account any of the expenses associated with an investment in variable insurance products. If total return had taken into account these expenses, performance would have been lower. Shares of a series of Guggenheim Variable Funds Trust are available only through the purchase of such products. |

d | Does not include expenses of the underlying funds in which the Fund invests. |

e | Net expense information reflects the expense ratios after expense waivers and reimbursements, as applicable. |

f | The portion of the ratios of net expenses to average net assets attributable to recoupments of prior fee reductions or expense reimbursements for the periods presented was as follows: |

| | 06/30/22a | 12/31/21 | 12/31/20 | 12/31/19 | 12/31/18 | 12/31/17 |

| | — | — | — | — | 0.02% | — |

g | Net expenses may include expenses that are excluded from the expense limitation agreement. Excluding these expenses, the net expense ratios for the periods presented would be: |

| | 06/30/22a | 12/31/21 | 12/31/20 | 12/31/19 | 12/31/18 | 12/31/17 |

| | 0.86% | 0.84% | 0.87% | 0.89% | 0.91% | 0.90% |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 15 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | June 30, 2022 |

SERIES B (LARGE CAP VALUE SERIES)

OBJECTIVE: Seeks long-term growth of capital.

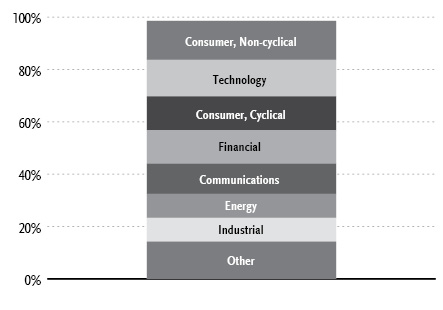

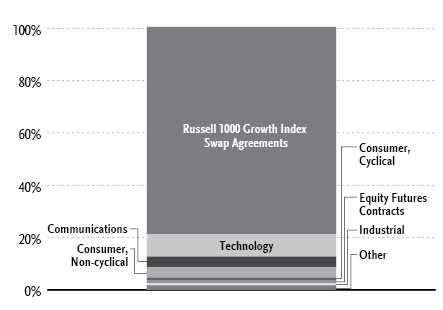

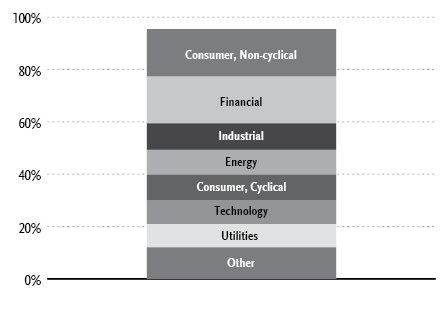

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

Inception Date: May 1, 1979 |

Ten Largest Holdings (% of Total Net Assets) |

Johnson & Johnson | 2.6% |

Berkshire Hathaway, Inc. — Class B | 2.4% |

Tyson Foods, Inc. — Class A | 2.3% |

Verizon Communications, Inc. | 2.3% |

Chevron Corp. | 2.2% |

Alphabet, Inc. — Class A | 2.2% |

Humana, Inc. | 2.1% |

JPMorgan Chase & Co. | 2.0% |

Exelon Corp. | 1.7% |

Bank of America Corp. | 1.6% |

Top Ten Total | 21.4% |

| | |

“Ten Largest Holdings” excludes any temporary cash investments. |

Average Annual Returns*,†

Periods Ended June 30, 2022

| 6 Month‡ | 1 Year | 5 Year | 10 Year |

Series B (Large Cap Value Series) | (7.88%) | (1.08%) | 7.92% | 10.73% |

Russell 1000 Value Index | (12.86%) | (6.82%) | 7.17% | 10.50% |

* | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The Russell 1000 Value Index is an unmanaged index and, unlike the Fund, has no management fees or operating expenses to reduce its reported return. |

† | Performance figures do not reflect fees and expenses associated with an investment in variable insurance products. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a series of Guggenheim Variable Funds Trust are available only through the purchase of such products. |

‡ | 6 month returns are not annualized. |

16 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

SCHEDULE OF INVESTMENTS (Unaudited) | June 30, 2022 |

SERIES B (LARGE CAP VALUE SERIES) | |

| | Shares | | | Value | |

COMMON STOCKS† - 94.0% |

| | | | | | | | | |

Consumer, Non-cyclical - 21.1% |

Johnson & Johnson | | | 30,481 | | | $ | 5,410,682 | |

Tyson Foods, Inc. — Class A | | | 57,068 | | | | 4,911,272 | |

Humana, Inc. | | | 9,178 | | | | 4,295,946 | |

Quest Diagnostics, Inc. | | | 23,274 | | | | 3,094,977 | |

Medtronic plc | | | 33,173 | | | | 2,977,277 | |

Ingredion, Inc. | | | 31,921 | | | | 2,814,155 | |

Merck & Company, Inc. | | | 29,200 | | | | 2,662,164 | |

Henry Schein, Inc.* | | | 29,932 | | | | 2,296,982 | |

J M Smucker Co. | | | 17,762 | | | | 2,273,714 | |

Bunge Ltd. | | | 24,190 | | | | 2,193,791 | |

McKesson Corp. | | | 6,681 | | | | 2,179,409 | |

Archer-Daniels-Midland Co. | | | 25,255 | | | | 1,959,788 | |

Amgen, Inc. | | | 6,861 | | | | 1,669,281 | |

Pfizer, Inc. | | | 29,771 | | | | 1,560,894 | |

Encompass Health Corp. | | | 25,501 | | | | 1,429,331 | |

Bristol-Myers Squibb Co. | | | 16,678 | | | | 1,284,206 | |

HCA Healthcare, Inc. | | | 6,743 | | | | 1,133,229 | |

Total Consumer, Non-cyclical | | | | | | | 44,147,098 | |

| | | | | | | | | |

Financial - 14.2% |

Berkshire Hathaway, Inc. — Class B* | | | 18,228 | | | | 4,976,609 | |

JPMorgan Chase & Co. | | | 38,094 | | | | 4,289,765 | |

Bank of America Corp. | | | 105,080 | | | | 3,271,140 | |

Wells Fargo & Co. | | | 62,015 | | | | 2,429,128 | |

Charles Schwab Corp. | | | 27,103 | | | | 1,712,368 | |

Voya Financial, Inc. | | | 27,419 | | | | 1,632,253 | |

Mastercard, Inc. — Class A | | | 5,096 | | | | 1,607,686 | |

Medical Properties Trust, Inc. REIT | | | 87,952 | | | | 1,343,027 | |

American Tower Corp. — Class A REIT | | | 4,618 | | | | 1,180,315 | |

KeyCorp | | | 64,668 | | | | 1,114,230 | |

Goldman Sachs Group, Inc. | | | 3,673 | | | | 1,090,954 | |

STAG Industrial, Inc. REIT | | | 34,679 | | | | 1,070,888 | |

Zions Bancorp North America | | | 20,791 | | | | 1,058,262 | |

BOK Financial Corp. | | | 13,286 | | | | 1,004,156 | |

Park Hotels & Resorts, Inc. REIT | | | 64,125 | | | | 870,176 | |

Gaming and Leisure Properties, Inc. REIT | | | 12,532 | | | | 574,717 | |

T. Rowe Price Group, Inc. | | | 4,535 | | | | 515,221 | |

Total Financial | | | | | | | 29,740,895 | |

| | | | | | | | | |

Technology - 10.4% |

Micron Technology, Inc. | | | 51,683 | | | | 2,857,036 | |

Activision Blizzard, Inc. | | | 35,893 | | | | 2,794,629 | |

Leidos Holdings, Inc. | | | 23,089 | | | | 2,325,293 | |

Microsoft Corp. | | | 8,150 | | | | 2,093,164 | |

KLA Corp. | | | 6,419 | | | | 2,048,175 | |

DXC Technology Co.* | | | 67,488 | | | | 2,045,561 | |

Teradyne, Inc. | | | 22,246 | | | | 1,992,129 | |

Fiserv, Inc.* | | | 17,379 | | | | 1,546,210 | |

Amdocs Ltd. | | | 15,609 | | | | 1,300,386 | |

Qorvo, Inc.* | | | 12,467 | | | | 1,175,888 | |

Intel Corp. | | | 21,442 | | | | 802,145 | |

Skyworks Solutions, Inc. | | | 8,084 | | | | 748,902 | |

Total Technology | | | | | | | 21,729,518 | |

| | | | | | | | | |

Utilities - 10.1% |

Exelon Corp. | | | 76,577 | | | | 3,470,470 | |

Edison International | | | 51,562 | | | | 3,260,781 | |

Duke Energy Corp. | | | 26,854 | | | | 2,879,017 | |

OGE Energy Corp. | | | 72,349 | | | | 2,789,777 | |

Pinnacle West Capital Corp. | | | 34,050 | | | | 2,489,736 | |

Black Hills Corp. | | | 26,749 | | | | 1,946,525 | |

NiSource, Inc. | | | 65,351 | | | | 1,927,201 | |

Constellation Energy Corp. | | | 25,525 | | | | 1,461,562 | |

PPL Corp. | | | 33,862 | | | | 918,676 | |

Total Utilities | | | | | | | 21,143,745 | |

| | | | | | | | | |

Energy - 8.8% |

Chevron Corp. | | | 32,110 | | | | 4,648,886 | |

ConocoPhillips | | | 35,652 | | | | 3,201,906 | |

Coterra Energy, Inc. — Class A | | | 91,049 | | | | 2,348,154 | |

Equities Corp. | | | 52,053 | | | | 1,790,623 | |

Kinder Morgan, Inc. | | | 95,042 | | | | 1,592,904 | |

Pioneer Natural Resources Co. | | | 7,109 | | | | 1,585,876 | |

Marathon Oil Corp. | | | 69,368 | | | | 1,559,392 | |

Diamondback Energy, Inc. | | | 9,973 | | | | 1,208,229 | |

Patterson-UTI Energy, Inc. | | | 32,374 | | | | 510,214 | |

Total Energy | | | | | | | 18,446,184 | |

| | | | | | | | | |

Consumer, Cyclical - 8.7% |

Walmart, Inc. | | | 23,914 | | | | 2,907,464 | |

DR Horton, Inc. | | | 32,298 | | | | 2,137,805 | |

LKQ Corp. | | | 40,623 | | | | 1,994,183 | |

Whirlpool Corp. | | | 11,825 | | | | 1,831,338 | |

Southwest Airlines Co.* | | | 47,188 | | | | 1,704,431 | |

PACCAR, Inc. | | | 20,253 | | | | 1,667,632 | |

Delta Air Lines, Inc.* | | | 57,154 | | | | 1,655,751 | |

Lear Corp. | | | 12,115 | | | | 1,525,157 | |

Ralph Lauren Corp. — Class A | | | 11,569 | | | | 1,037,161 | |

PVH Corp. | | | 14,248 | | | | 810,711 | |

Home Depot, Inc. | | | 2,909 | | | | 797,851 | |

Total Consumer, Cyclical | | | | | | | 18,069,484 | |

| | | | | | | | | |

Communications - 8.3% |

Verizon Communications, Inc. | | | 94,596 | | | | 4,800,747 | |

Alphabet, Inc. — Class A* | | | 2,078 | | | | 4,528,502 | |

T-Mobile US, Inc.* | | | 15,182 | | | | 2,042,586 | |

Cisco Systems, Inc. | | | 46,985 | | | | 2,003,441 | |

Comcast Corp. — Class A | | | 47,311 | | | | 1,856,484 | |

Juniper Networks, Inc. | | | 43,590 | | | | 1,242,315 | |

Walt Disney Co.* | | | 8,284 | | | | 782,009 | |

Total Communications | | | | | | | 17,256,084 | |

| | | | | | | | | |

Industrial - 7.1% |

Curtiss-Wright Corp. | | | 20,865 | | | | 2,755,432 | |

L3Harris Technologies, Inc. | | | 10,969 | | | | 2,651,207 | |

FedEx Corp. | | | 10,893 | | | | 2,469,552 | |

Johnson Controls International plc | | | 46,562 | | | | 2,229,388 | |

Knight-Swift Transportation Holdings, Inc. | | | 46,371 | | | | 2,146,514 | |

Valmont Industries, Inc. | | | 7,628 | | | | 1,713,478 | |

Advanced Energy Industries, Inc. | | | 12,693 | | | | 926,335 | |

Total Industrial | | | | | | | 14,891,906 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 17 |

SCHEDULE OF INVESTMENTS (Unaudited)(concluded) | June 30, 2022 |

SERIES B (LARGE CAP VALUE SERIES) | |

| | Shares | | | Value | |

Basic Materials - 5.3% |

Westlake Corp. | | | 30,967 | | | $ | 3,035,385 | |

Huntsman Corp. | | | 105,501 | | | | 2,990,954 | |

Reliance Steel & Aluminum Co. | | | 10,519 | | | | 1,786,758 | |

International Flavors & Fragrances, Inc. | | | 6,793 | | | | 809,182 | |

Freeport-McMoRan, Inc. | | | 26,902 | | | | 787,152 | |

Nucor Corp. | | | 6,881 | | | | 718,445 | |

Dow, Inc. | | | 9,877 | | | | 509,752 | |

DuPont de Nemours, Inc. | | | 8,550 | | | | 475,209 | |

Total Basic Materials | | | | | | | 11,112,837 | |

| | | | | | | | | |

Total Common Stocks | | | | |

(Cost $162,209,534) | | | | | | | 196,537,751 | |

| | | | | | | | | |

EXCHANGE-TRADED FUNDS† - 1.0% |

iShares Russell 1000 Value ETF | | | 14,571 | | | | 2,112,358 | |

Total Exchange-Traded Funds | | | | |

(Cost $2,304,195) | | | | | | | 2,112,358 | |

| | | | | | | | | |

MONEY MARKET FUND† - 3.7% |

Dreyfus Treasury Securities Cash Management Fund — Institutional Shares, 0.97%1 | | | 7,704,777 | | | | 7,704,777 | |

Total Money Market Fund | | | | |

(Cost $7,704,777) | | | | | | | 7,704,777 | |

| | | | | | | | | |

Total Investments - 98.7% | | | | |

(Cost $172,218,506) | | $ | 206,354,886 | |

Other Assets & Liabilities, net - 1.3% | | | 2,719,659 | |

Total Net Assets - 100.0% | | $ | 209,074,545 | |

* | Non-income producing security. |

† | Value determined based on Level 1 inputs — See Note 4. |

1 | Rate indicated is the 7-day yield as of June 30, 2022. |

| | plc — Public Limited Company |

| | REIT — Real Estate Investment Trust |

| | |

| | See Sector Classification in Other Information section. |

The following table summarizes the inputs used to value the Fund’s investments at June 30, 2022 (See Note 4 in the Notes to Financial Statements):

Investments in Securities (Assets) | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

Common Stocks | | $ | 196,537,751 | | | $ | — | | | $ | — | | | $ | 196,537,751 | |

Exchange-Traded Funds | | | 2,112,358 | | | | — | | | | — | | | | 2,112,358 | |

Money Market Fund | | | 7,704,777 | | | | — | | | | — | | | | 7,704,777 | |

Total Assets | | $ | 206,354,886 | | | $ | — | | | $ | — | | | $ | 206,354,886 | |

18 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SERIES B (LARGE CAP VALUE SERIES) | |

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) |

June 30, 2022 |

Assets: |

Investments, at value (cost $172,218,506) | | $ | 206,354,886 | |

Prepaid expenses | | | 1,235 | |

Receivables: |

Securities sold | | | 2,678,020 | |

Dividends | | | 231,502 | |

Interest | | | 4,035 | |

Total assets | | | 209,269,678 | |

| | | | | |

Liabilities: |

Payable for: |

Management fees | | | 71,036 | |

Distribution and service fees | | | 44,870 | |

Fund shares redeemed | | | 31,447 | |

Professional fees | | | 21,433 | |

Fund accounting/administration fees | | | 12,586 | |

Trustees’ fees* | | | 3,036 | |

Transfer agent/maintenance fees | | | 2,100 | |

Miscellaneous | | | 8,625 | |