0000217087 gvft:SeriesJStylePlus8212MidGrowthSeriesVariableAnnuitySampP500IndexMember 2016-12-31 0000217087 gvft:SeriesXStylePlus8212SmallGrowthSeriesVariableAnnuitySampP500IndexMember 2018-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811- 02753

Guggenheim Variable Funds Trust

(Exact name of registrant as specified in charter)

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Guggenheim Variable Funds Trust

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: (301) 296-5100

Date of fiscal year end: December 31

Date of reporting period: January 1, 2024 – June 30, 2024

| Item 1. | Reports to Stockholders. |

| (a) | The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: |

Semi-Annual Shareholder Report | June 30, 2024

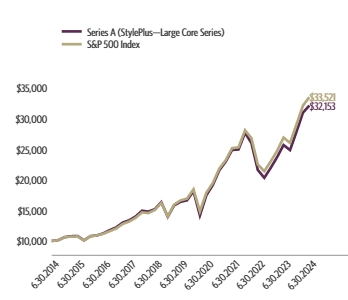

This semi-annual shareholder report contains important information about the Series A (StylePlus—Large Core Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 15.31%, outperforming the fund's benchmark, the S&P 500 Index, which returned 15.29% for the same period.

What factors materially affected the fund's performance over the last six months?

The equity sleeve was allocated 15%-25% to actively managed equity and 75%-85% to passive equity. Relative to the fund's benchmark, the active equity sleeve contributed to performance. The passive equity component, which accounted for most of the fund's exposure to the broad equity market, consisted of equity index swaps and equity index futures, and generated performance roughly in line with fund's benchmark (before costs associated with derivatives); the active fixed income sleeve generated excess returns over the costs of equity index derivatives.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 |

| 09/30/2014 | 10130 | 10113 |

| 12/31/2014 | 10629 | 10612 |

| 03/31/2015 | 10773 | 10712 |

| 06/30/2015 | 10816 | 10742 |

| 09/30/2015 | 10094 | 10051 |

| 12/31/2015 | 10788 | 10758 |

| 03/31/2016 | 10911 | 10903 |

| 06/30/2016 | 11238 | 11171 |

| 09/30/2016 | 11767 | 11602 |

| 12/31/2016 | 12228 | 12045 |

| 03/31/2017 | 12996 | 12776 |

| 06/30/2017 | 13371 | 13170 |

| 09/30/2017 | 13986 | 13760 |

| 12/31/2017 | 14945 | 14675 |

| 03/31/2018 | 14804 | 14563 |

| 06/30/2018 | 15188 | 15064 |

| 09/30/2018 | 16344 | 16225 |

| 12/31/2018 | 13964 | 14031 |

| 03/31/2019 | 15813 | 15946 |

| 06/30/2019 | 16401 | 16633 |

| 09/30/2019 | 16643 | 16915 |

| 12/31/2019 | 18149 | 18449 |

| 03/31/2020 | 14178 | 14834 |

| 06/30/2020 | 17464 | 17881 |

| 09/30/2020 | 19156 | 19478 |

| 12/31/2020 | 21557 | 21844 |

| 03/31/2021 | 22967 | 23193 |

| 06/30/2021 | 24884 | 25175 |

| 09/30/2021 | 24966 | 25322 |

| 12/31/2021 | 27697 | 28114 |

| 03/31/2022 | 26034 | 26821 |

| 06/30/2022 | 21620 | 22503 |

| 09/30/2022 | 20328 | 21404 |

| 12/31/2022 | 21972 | 23023 |

| 03/31/2023 | 23717 | 24749 |

| 06/30/2023 | 25691 | 26912 |

| 09/30/2023 | 24866 | 26031 |

| 12/31/2023 | 27883 | 29075 |

| 03/31/2024 | 30976 | 32144 |

| 06/30/2024 | 32153 | 33521 |

| Series A (StylePlus—Large Core Series) | 15.31% | 25.15% | 14.41% | 12.39% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $249,083,822 |

| Number of Portfolio Holdings | 85 |

| Portfolio Turnover Rate | 26% |

| S&P 500 Index Swap Agreements | 76.2% |

| Technology | 8.1% |

| Consumer, Non-cyclical | 3.6% |

| Communications | 2.8% |

| Industrial | 2.7% |

| Financial | 2.5% |

| Consumer, Cyclical | 2.0% |

| Other | 2.4% |

| Guggenheim Strategy Fund III | 24.5% |

| Guggenheim Variable Insurance Strategy Fund III | 23.8% |

| Guggenheim Strategy Fund II | 14.2% |

| Guggenheim Ultra Short Duration Fund — Institutional Class | 11.6% |

| Microsoft Corp. | 1.9% |

| Apple, Inc. | 1.7% |

| NVIDIA Corp. | 1.3% |

| Alphabet, Inc. — Class C | 0.7% |

| Amazon.com, Inc. | 0.7% |

| Broadcom, Inc. | 0.5% |

| Top 10 Total | 80.9% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027852-063024

Semi-Annual Shareholder Report | June 30, 2024

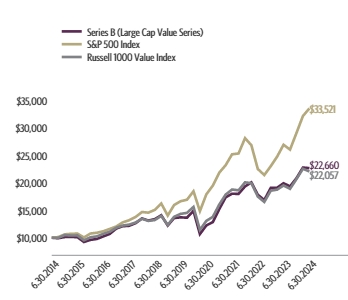

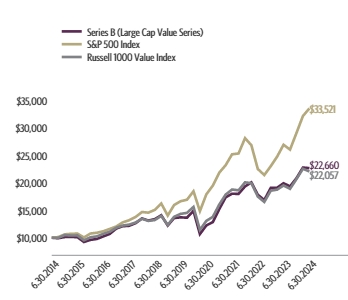

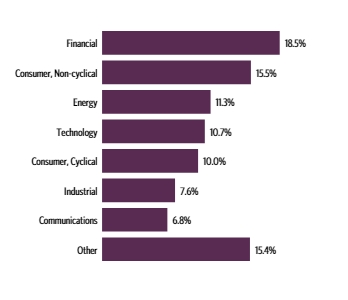

This semi-annual shareholder report contains important information about the Series B (Large Cap Value Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 8.72%, underperforming the fund's benchmark, the S&P 500 Index, which returned 15.29% for the same period and outperforming the fund's secondary index, the Russell 1000 Value Index, which returned 6.62% for the same period.

The fund's broad-based securities market index was changed from the Russell 1000 Value Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last six months?

The fund's stock selection was the most significant contributor to outperformance relative to the Russell 1000 Value Index for the reporting period, due to the AI-driven Technology holdings in Alphabet, Inc.- Class A, Qualcomm Inc, KLA Corp, Teradyne Inc., and Applied Materials. Positions in Diamondback Energy and Leidos Holdings in the Energy and Professional Services sectors also contributed meaningfully.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 09/30/2014 | 9907 | 10113 | 9981 |

| 12/31/2014 | 10122 | 10612 | 10478 |

| 03/31/2015 | 10154 | 10712 | 10402 |

| 06/30/2015 | 10093 | 10742 | 10413 |

| 09/30/2015 | 9223 | 10051 | 9539 |

| 12/31/2015 | 9608 | 10758 | 10077 |

| 03/31/2016 | 9778 | 10903 | 10242 |

| 06/30/2016 | 10239 | 11171 | 10711 |

| 09/30/2016 | 10694 | 11602 | 11084 |

| 12/31/2016 | 11664 | 12045 | 11824 |

| 03/31/2017 | 12088 | 12776 | 12211 |

| 06/30/2017 | 12166 | 13170 | 12375 |

| 09/30/2017 | 12639 | 13760 | 12760 |

| 12/31/2017 | 13508 | 14675 | 13440 |

| 03/31/2018 | 13125 | 14563 | 13059 |

| 06/30/2018 | 13374 | 15064 | 13212 |

| 09/30/2018 | 14088 | 16225 | 13966 |

| 12/31/2018 | 12221 | 14031 | 12329 |

| 03/31/2019 | 13578 | 15946 | 13800 |

| 06/30/2019 | 13703 | 16633 | 14331 |

| 09/30/2019 | 13647 | 16915 | 14525 |

| 12/31/2019 | 14888 | 18449 | 15601 |

| 03/31/2020 | 10658 | 14834 | 11431 |

| 06/30/2020 | 12237 | 17881 | 13064 |

| 09/30/2020 | 12833 | 19478 | 13795 |

| 12/31/2020 | 15216 | 21844 | 16037 |

| 03/31/2021 | 17349 | 23193 | 17842 |

| 06/30/2021 | 18004 | 25175 | 18771 |

| 09/30/2021 | 17979 | 25322 | 18625 |

| 12/31/2021 | 19330 | 28114 | 20072 |

| 03/31/2022 | 20065 | 26821 | 19924 |

| 06/30/2022 | 17810 | 22503 | 17491 |

| 09/30/2022 | 16854 | 21404 | 16508 |

| 12/31/2022 | 19074 | 23023 | 18559 |

| 03/31/2023 | 19098 | 24749 | 18746 |

| 06/30/2023 | 19912 | 26912 | 19509 |

| 09/30/2023 | 19337 | 26031 | 18892 |

| 12/31/2023 | 20842 | 29075 | 20686 |

| 03/31/2024 | 22764 | 32144 | 22545 |

| 06/30/2024 | 22660 | 33521 | 22057 |

| Series B (Large Cap Value Series) | 8.72% | 13.80% | 10.58% | 8.52% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

| Russell 1000 Value Index | 6.62% | 13.06% | 9.01% | 8.23% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $203,542,452 |

| Number of Portfolio Holdings | 83 |

| Portfolio Turnover Rate | 8% |

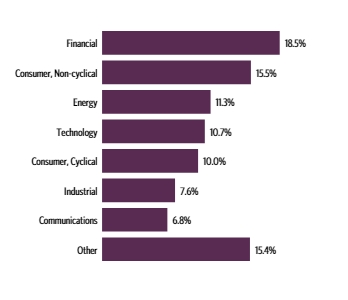

| Financial | 18.5% |

| Consumer, Non-cyclical | 15.5% |

| Energy | 11.3% |

| Technology | 10.7% |

| Consumer, Cyclical | 10.0% |

| Industrial | 7.6% |

| Communications | 6.8% |

| Other | 15.4% |

| iShares Russell 1000 Value ETF | 3.6% |

| Bank of America Corp. | 2.7% |

| Berkshire Hathaway, Inc. — Class B | 2.6% |

| Chevron Corp. | 2.6% |

| Verizon Communications, Inc. | 2.5% |

| Walmart, Inc. | 2.3% |

| Alphabet, Inc. — Class A | 2.1% |

| ConocoPhillips | 2.1% |

| Diamondback Energy, Inc. | 1.9% |

| JPMorgan Chase & Co. | 1.8% |

| Top 10 Total | 24.2% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027862-063024

Semi-Annual Shareholder Report | June 30, 2024

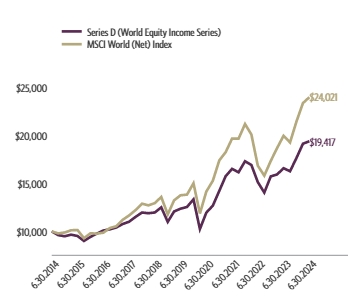

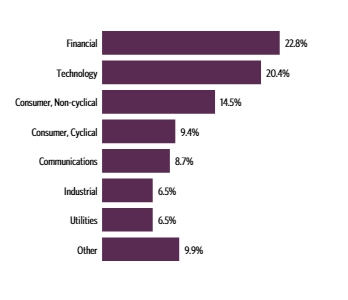

This semi-annual shareholder report contains important information about the Series D (World Equity Income Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 9.83%, underperforming the fund's benchmark, the MSCI World (Net) Index, which returned 11.75% for the same period.

What factors materially affected the fund's performance over the last six months?

An underweight in the Health Care sector and good selection in Financials were the largest positive contributors to the fund's return. The leading overall detractor from return was allocation, with the Information Technology and Communication Services sectors responsible for most of the relative underperformance. The fund was also most underweight relative to the Benchmark in the Information Technology sector, which exacerbated the underperformance. From a country perspective, Security selection in Australia was a large positive contributor to return. Europe as a whole contributed to return, with the largest relative contributions from Italy, France, and Sweden. The U.S. was the single largest relative detractor from return. The UK and Germany were the other leading detractors from return on a relative basis. The top relative individual contributor to the fund was Dell Technologies, Inc. The biggest detractor was an underweight in Nvidia Corp.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 |

| 09/30/2014 | 9608 | 9784 |

| 12/31/2014 | 9488 | 9883 |

| 03/31/2015 | 9654 | 10112 |

| 06/30/2015 | 9518 | 10143 |

| 09/30/2015 | 8997 | 9286 |

| 12/31/2015 | 9425 | 9797 |

| 03/31/2016 | 9767 | 9763 |

| 06/30/2016 | 10086 | 9861 |

| 09/30/2016 | 10211 | 10341 |

| 12/31/2016 | 10403 | 10533 |

| 03/31/2017 | 10764 | 11204 |

| 06/30/2017 | 11004 | 11655 |

| 09/30/2017 | 11508 | 12219 |

| 12/31/2017 | 11969 | 12892 |

| 03/31/2018 | 11895 | 12719 |

| 06/30/2018 | 11969 | 12948 |

| 09/30/2018 | 12510 | 13592 |

| 12/31/2018 | 10992 | 11769 |

| 03/31/2019 | 12077 | 13238 |

| 06/30/2019 | 12366 | 13767 |

| 09/30/2019 | 12550 | 13841 |

| 12/31/2019 | 13344 | 15025 |

| 03/31/2020 | 10241 | 11862 |

| 06/30/2020 | 11959 | 14159 |

| 09/30/2020 | 12682 | 15281 |

| 12/31/2020 | 14231 | 17415 |

| 03/31/2021 | 15761 | 18272 |

| 06/30/2021 | 16531 | 19687 |

| 09/30/2021 | 16173 | 19685 |

| 12/31/2021 | 17325 | 21214 |

| 03/31/2022 | 16934 | 20121 |

| 06/30/2022 | 15147 | 16864 |

| 09/30/2022 | 14052 | 15821 |

| 12/31/2022 | 15745 | 17366 |

| 03/31/2023 | 15949 | 18708 |

| 06/30/2023 | 16598 | 19986 |

| 09/30/2023 | 16281 | 19294 |

| 12/31/2023 | 17679 | 21496 |

| 03/31/2024 | 19155 | 23399 |

| 06/30/2024 | 19417 | 24021 |

| Series D (World Equity Income Series) | 9.83% | 16.98% | 9.44% | 6.86% |

| MSCI World (Net) Index | 11.75% | 20.19% | 11.78% | 9.16% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $115,943,933 |

| Number of Portfolio Holdings | 146 |

| Portfolio Turnover Rate | 56% |

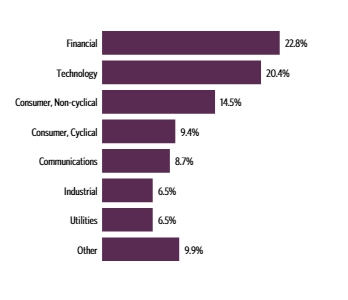

| Financial | 22.8% |

| Technology | 20.4% |

| Consumer, Non-cyclical | 14.5% |

| Consumer, Cyclical | 9.4% |

| Communications | 8.7% |

| Industrial | 6.5% |

| Utilities | 6.5% |

| Other | 9.9% |

| United States | 69.5% |

| Japan | 3.6% |

| Netherlands | 3.6% |

| Denmark | 2.7% |

| Australia | 2.2% |

| France | 2.2% |

| Canada | 2.1% |

| Other | 14.1% |

| Total Investments | 100.0% |

| NVIDIA Corp. | 3.4% |

| Apple, Inc. | 3.4% |

| Microsoft Corp. | 3.3% |

| Alphabet, Inc. — Class C | 2.4% |

| Amazon.com, Inc. | 2.0% |

| Novo Nordisk A/S — Class B | 1.5% |

| Walmart, Inc. | 1.3% |

| Johnson & Johnson | 1.2% |

| Berkshire Hathaway, Inc. — Class B | 1.2% |

| UnitedHealth Group, Inc. | 1.1% |

| Top 10 Total | 20.8% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027864-063024

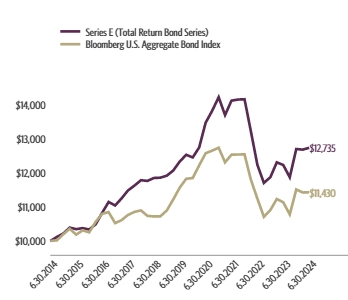

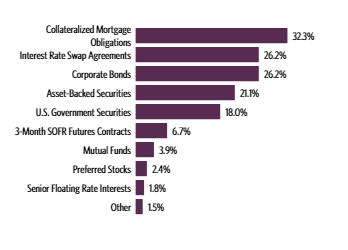

Semi-Annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Series E (Total Return Bond Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 0.21%, outperforming the fund's benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned (0.71%) for the same period.

What factors materially affected the fund's performance over the last six months?

The fund's relative outperformance to the Benchmark was primarily driven by security selection, sector allocation and the fund's carry advantage over the benchmark. Carry is the difference between the cost of financing an asset and the interest received on that asset. Duration was a detractor from absolute returns as interest rates rose roughly 50 basis points over the performance period but only a modest detractor in relative terms. The fund benefited from an overweight allocation to asset-backed securities, as securitized credit spreads broadly outperformed corporate credit spreads. Security selection within agency residential mortgage-backed securities, investment grade corporates, and high yield corporates were key contributors to relative performance.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 |

| 09/30/2014 | 10116 | 10017 |

| 12/31/2014 | 10219 | 10196 |

| 03/31/2015 | 10392 | 10360 |

| 06/30/2015 | 10347 | 10186 |

| 09/30/2015 | 10376 | 10311 |

| 12/31/2015 | 10336 | 10252 |

| 03/31/2016 | 10488 | 10563 |

| 06/30/2016 | 10824 | 10797 |

| 09/30/2016 | 11145 | 10847 |

| 12/31/2016 | 11042 | 10524 |

| 03/31/2017 | 11248 | 10610 |

| 06/30/2017 | 11482 | 10763 |

| 09/30/2017 | 11626 | 10854 |

| 12/31/2017 | 11784 | 10897 |

| 03/31/2018 | 11763 | 10737 |

| 06/30/2018 | 11849 | 10720 |

| 09/30/2018 | 11858 | 10722 |

| 12/31/2018 | 11918 | 10898 |

| 03/31/2019 | 12068 | 11219 |

| 06/30/2019 | 12331 | 11564 |

| 09/30/2019 | 12530 | 11826 |

| 12/31/2019 | 12453 | 11848 |

| 03/31/2020 | 12746 | 12221 |

| 06/30/2020 | 13472 | 12575 |

| 09/30/2020 | 13821 | 12652 |

| 12/31/2020 | 14222 | 12737 |

| 03/31/2021 | 13696 | 12308 |

| 06/30/2021 | 14120 | 12533 |

| 09/30/2021 | 14152 | 12539 |

| 12/31/2021 | 14161 | 12541 |

| 03/31/2022 | 13215 | 11797 |

| 06/30/2022 | 12237 | 11243 |

| 09/30/2022 | 11704 | 10709 |

| 12/31/2022 | 11874 | 10909 |

| 03/31/2023 | 12308 | 11232 |

| 06/30/2023 | 12231 | 11137 |

| 09/30/2023 | 11870 | 10778 |

| 12/31/2023 | 12700 | 11512 |

| 03/31/2024 | 12682 | 11423 |

| 06/30/2024 | 12735 | 11430 |

| Series E (Total Return Bond Series) | 0.21% | 4.12% | 0.65% | 2.45% |

| Bloomberg U.S. Aggregate Bond Index | -0.71% | 2.63% | -0.23% | 1.35% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $160,389,829 |

| Number of Portfolio Holdings | 538 |

| Portfolio Turnover Rate | 41% |

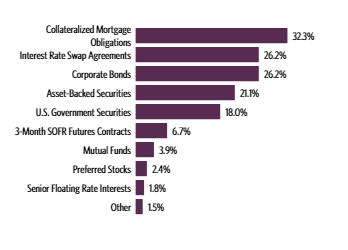

| Collateralized Mortgage Obligations | 32.3% |

| Interest Rate Swap Agreements | 26.2% |

| Corporate Bonds | 26.2% |

| Asset-Backed Securities | 21.1% |

| U.S. Government Securities | 18.0% |

| 3-Month SOFR Futures Contracts | 6.7% |

| Mutual Funds | 3.9% |

| Preferred Stocks | 2.4% |

| Senior Floating Rate Interests | 1.8% |

| Other | 1.5% |

| AAA | 46.1% |

| AA | 6.2% |

| A | 13.6% |

| BBB | 14.6% |

| BB | 5.4% |

| B | 1.3% |

| CCC | 0.3% |

| CC | 1.4% |

| C | 0.1% |

| NR3 | 3.2% |

| Other Instruments | 7.8% |

| Guggenheim Total Return Bond Fund — R6-Class | 3.9% |

| U.S. Treasury Notes, 4.13% due 03/31/31 | 2.7% |

| Uniform MBS 30 Year due 09/01/24 | 2.7% |

| Uniform MBS 30 Year due 09/01/24 | 2.6% |

| U.S. Treasury Bonds due 05/15/53 | 2.2% |

| U.S. Treasury Notes, 4.00% due 02/15/34 | 2.1% |

| U.S. Treasury Notes, 4.50% due 05/31/29 | 2.0% |

| U.S. Treasury Notes, 4.63% due 04/30/31 | 1.6% |

| Uniform MBS 15 Year due 08/01/24 | 1.3% |

| Freddie Mac, 5.00% due 06/01/53 | 1.1% |

| Top 10 Total | 22.2% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | Source: BlackRock Solutions. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All securities except for those labeled "NR" have been rated by Moody's, Standard & Poor's ("S&P"), or Fitch, each of which is a Nationally Recognized Statistical Rating Organization ("NRSRO"). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted ratings to the equivalent S&P rating. Security ratings are determined at the time of purchase and may change thereafter. |

3 | NR (not rated) securities do not necessarily indicate low credit quality. |

| |

4 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027865-063024

Semi-Annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Series F (Floating Rate Strategies Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 3.12%, outperforming the fund's benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned (0.71%) for the same period and underperforming the fund's secondary index, the Credit Suisse Leveraged Loan Index, which returned 4.44% for the same period.

The fund's broad-based securities market index was changed from the Credit Suisse Leveraged Loan Index to the Bloomberg U.S. Aggregate Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last six months?

Above-average returns for both the fund and the Credit Suisse Leveraged Loan Index (the "Index") continued to be driven by high all-in coupon. Interest return accounted for over 100% of overall return for both the fund and the benchmark during the first half of the year (more than offsetting a negative return from price movement). From a supply/demand perspective, record collateralized loan obligation issuance pushed the supply deficit to all-time highs as robust primary activity remained primarily opportunistic (refinancings/repricings). Comparing the fund to the Index, credit issues in the consumer and communications sectors were the primary detractors to performance during the reporting period. Relative performance benefited from an overweight to the consumer non-cyclicals sector and from the fund's small high yield bond allocation.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 07/31/2014 | 10000 | 9975 | 9996 |

| 08/31/2014 | 10027 | 10085 | 10019 |

| 09/30/2014 | 10015 | 10017 | 9967 |

| 10/31/2014 | 10038 | 10115 | 9996 |

| 11/30/2014 | 10080 | 10187 | 10041 |

| 12/31/2014 | 10004 | 10196 | 9930 |

| 01/31/2015 | 10023 | 10410 | 9956 |

| 02/28/2015 | 10133 | 10312 | 10096 |

| 03/31/2015 | 10179 | 10360 | 10136 |

| 04/30/2015 | 10252 | 10323 | 10227 |

| 05/31/2015 | 10294 | 10298 | 10247 |

| 06/30/2015 | 10282 | 10186 | 10215 |

| 07/31/2015 | 10324 | 10257 | 10224 |

| 08/31/2015 | 10277 | 10242 | 10158 |

| 09/30/2015 | 10241 | 10311 | 10090 |

| 10/31/2015 | 10226 | 10313 | 10076 |

| 11/30/2015 | 10163 | 10286 | 9987 |

| 12/31/2015 | 10077 | 10252 | 9892 |

| 01/31/2016 | 10049 | 10393 | 9820 |

| 02/29/2016 | 9936 | 10467 | 9766 |

| 03/31/2016 | 10190 | 10563 | 10023 |

| 04/30/2016 | 10363 | 10604 | 10214 |

| 05/31/2016 | 10445 | 10607 | 10307 |

| 06/30/2016 | 10425 | 10797 | 10310 |

| 07/31/2016 | 10577 | 10865 | 10455 |

| 08/31/2016 | 10647 | 10853 | 10538 |

| 09/30/2016 | 10739 | 10847 | 10630 |

| 10/31/2016 | 10814 | 10764 | 10711 |

| 11/30/2016 | 10852 | 10509 | 10746 |

| 12/31/2016 | 10940 | 10524 | 10869 |

| 01/31/2017 | 10969 | 10544 | 10927 |

| 02/28/2017 | 11019 | 10615 | 10991 |

| 03/31/2017 | 11040 | 10610 | 11000 |

| 04/30/2017 | 11061 | 10692 | 11048 |

| 05/31/2017 | 11094 | 10774 | 11090 |

| 06/30/2017 | 11098 | 10763 | 11083 |

| 07/31/2017 | 11167 | 10809 | 11169 |

| 08/31/2017 | 11163 | 10906 | 11154 |

| 09/30/2017 | 11206 | 10854 | 11200 |

| 10/31/2017 | 11279 | 10861 | 11274 |

| 11/30/2017 | 11297 | 10847 | 11287 |

| 12/31/2017 | 11318 | 10897 | 11331 |

| 01/31/2018 | 11404 | 10771 | 11453 |

| 02/28/2018 | 11404 | 10669 | 11473 |

| 03/31/2018 | 11443 | 10737 | 11510 |

| 04/30/2018 | 11456 | 10658 | 11566 |

| 05/31/2018 | 11461 | 10734 | 11588 |

| 06/30/2018 | 11435 | 10720 | 11600 |

| 07/31/2018 | 11516 | 10723 | 11696 |

| 08/31/2018 | 11551 | 10792 | 11744 |

| 09/30/2018 | 11626 | 10722 | 11824 |

| 10/31/2018 | 11618 | 10638 | 11825 |

| 11/30/2018 | 11524 | 10701 | 11729 |

| 12/31/2018 | 11227 | 10898 | 11460 |

| 01/31/2019 | 11471 | 11014 | 11724 |

| 02/28/2019 | 11658 | 11007 | 11908 |

| 03/31/2019 | 11591 | 11219 | 11893 |

| 04/30/2019 | 11791 | 11221 | 12082 |

| 05/31/2019 | 11724 | 11421 | 12055 |

| 06/30/2019 | 11755 | 11564 | 12081 |

| 07/31/2019 | 11853 | 11589 | 12176 |

| 08/31/2019 | 11825 | 11890 | 12141 |

| 09/30/2019 | 11876 | 11826 | 12193 |

| 10/31/2019 | 11811 | 11862 | 12133 |

| 11/30/2019 | 11904 | 11856 | 12200 |

| 12/31/2019 | 12081 | 11848 | 12397 |

| 01/31/2020 | 12123 | 12076 | 12463 |

| 02/29/2020 | 11918 | 12293 | 12294 |

| 03/31/2020 | 10643 | 12221 | 10762 |

| 04/30/2020 | 11001 | 12438 | 11224 |

| 05/31/2020 | 11388 | 12496 | 11650 |

| 06/30/2020 | 11415 | 12575 | 11807 |

| 07/31/2020 | 11607 | 12762 | 12029 |

| 08/31/2020 | 11730 | 12659 | 12210 |

| 09/30/2020 | 11760 | 12652 | 12294 |

| 10/31/2020 | 11780 | 12596 | 12316 |

| 11/30/2020 | 11938 | 12720 | 12578 |

| 12/31/2020 | 12082 | 12737 | 12741 |

| 01/31/2021 | 12141 | 12646 | 12903 |

| 02/28/2021 | 12176 | 12463 | 12990 |

| 03/31/2021 | 12156 | 12308 | 12997 |

| 04/30/2021 | 12191 | 12405 | 13063 |

| 05/31/2021 | 12235 | 12445 | 13131 |

| 06/30/2021 | 12255 | 12533 | 13185 |

| 07/31/2021 | 12227 | 12673 | 13184 |

| 08/31/2021 | 12267 | 12649 | 13249 |

| 09/30/2021 | 12348 | 12539 | 13334 |

| 10/31/2021 | 12343 | 12536 | 13366 |

| 11/30/2021 | 12308 | 12573 | 13345 |

| 12/31/2021 | 12384 | 12541 | 13429 |

| 01/31/2022 | 12409 | 12271 | 13477 |

| 02/28/2022 | 12328 | 12134 | 13411 |

| 03/31/2022 | 12328 | 11797 | 13416 |

| 04/30/2022 | 12328 | 11349 | 13439 |

| 05/31/2022 | 12034 | 11422 | 13102 |

| 06/30/2022 | 11765 | 11243 | 12832 |

| 07/31/2022 | 12050 | 11518 | 13072 |

| 08/31/2022 | 12211 | 11192 | 13272 |

| 09/30/2022 | 11925 | 10709 | 12985 |

| 10/31/2022 | 12065 | 10570 | 13095 |

| 11/30/2022 | 12216 | 10959 | 13240 |

| 12/31/2022 | 12278 | 10909 | 13287 |

| 01/31/2023 | 12590 | 11245 | 13628 |

| 02/28/2023 | 12637 | 10954 | 13714 |

| 03/31/2023 | 12637 | 11232 | 13701 |

| 04/30/2023 | 12705 | 11300 | 13831 |

| 05/31/2023 | 12658 | 11177 | 13819 |

| 06/30/2023 | 12970 | 11137 | 14128 |

| 07/31/2023 | 13116 | 11130 | 14312 |

| 08/31/2023 | 13267 | 11059 | 14477 |

| 09/30/2023 | 13348 | 10778 | 14604 |

| 10/31/2023 | 13326 | 10607 | 14609 |

| 11/30/2023 | 13477 | 11088 | 14783 |

| 12/31/2023 | 13644 | 11512 | 15021 |

| 01/31/2024 | 13693 | 11481 | 15138 |

| 02/29/2024 | 13800 | 11318 | 15273 |

| 03/31/2024 | 13908 | 11423 | 15400 |

| 04/30/2024 | 13962 | 11134 | 15504 |

| 05/31/2024 | 14070 | 11323 | 15645 |

| 06/30/2024 | 14070 | 11430 | 15688 |

| Series F (Floating Rate Strategies Series) | 3.12% | 8.48% | 3.66% | 3.47% |

| Bloomberg U.S. Aggregate Bond Index | -0.71% | 2.63% | -0.23% | 1.35% |

| Credit Suisse Leveraged Loan Index | 4.44% | 11.04% | 5.36% | 4.61% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $56,876,119 |

| Number of Portfolio Holdings | 235 |

| Portfolio Turnover Rate | 31% |

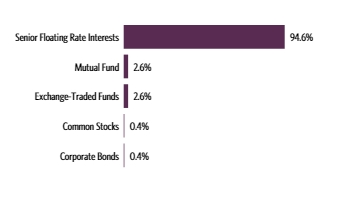

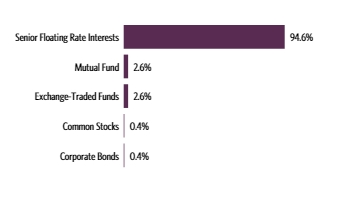

| Senior Floating Rate Interests | 94.6% |

| Mutual Fund | 2.6% |

| Exchange-Traded Funds | 2.6% |

| Common Stocks | 0.4% |

| Corporate Bonds | 0.4% |

| BBB | 6.7% |

| BB | 35.3% |

| B | 46.5% |

| CCC | 3.0% |

| CC | 0.1% |

| NR3 | 0.2% |

| Other Instruments | 8.2% |

| Guggenheim Floating Rate Strategies Fund — Class R6 | 2.6% |

| SPDR Blackstone Senior Loan ETF | 2.6% |

| Arsenal AIC Parent LLC, 9.10% | 0.9% |

| Planview Parent, Inc., 9.08% | 0.9% |

| Restaurant Brands, 7.09% | 0.9% |

| WMG Acquisition Corp. | 0.9% |

| McGraw Hill LLC, 10.20% | 0.9% |

| American Builders & Contractors Supply Co., Inc., 7.34% | |

| Summit Behavioral Healthcare LLC, 9.60% | 0.9% |

| Beacon Roofing Supply, Inc., 7.34% | 0.9% |

| Top 10 Total | 12.4% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | Source: BlackRock Solutions. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All securities except for those labeled "NR" have been rated by Moody's, Standard & Poor's ("S&P"), or Fitch, each of which is a Nationally Recognized Statistical Rating Organization ("NRSRO"). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted ratings to the equivalent S&P rating. Security ratings are determined at the time of purchase and may change thereafter. |

3 | NR (not rated) securities do not necessarily indicate low credit quality. |

| |

4 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000125779-063024

Semi-Annual Shareholder Report | June 30, 2024

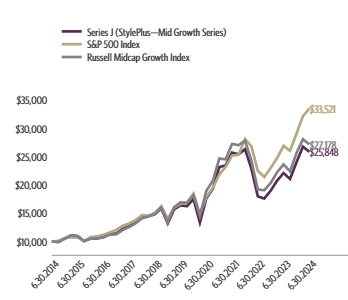

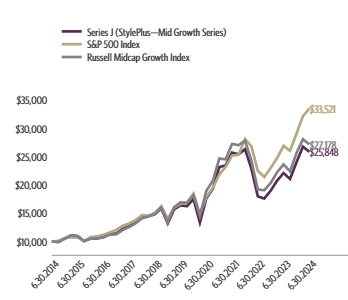

This semi-annual shareholder report contains important information about the Series J (StylePlus—Mid Growth Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 7.60%, underperforming the fund's benchmark, the S&P 500 Index, which returned 15.29% for the same period and outperforming the fund's secondary index, the Russell Midcap Growth Index, which returned 5.98% for the same period.

The fund's broad-based securities market index was changed from the Russell Midcap Growth Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last six months?

The fund outperformed the Russell Midcap Growth Index (the "Index") for the reporting period. The equity sleeve was allocated 15%-25% to actively managed equity and 75%-85% to passive equity. Relative to the Index, the active equity sleeve contributed to performance. The passive equity component, which accounted for most of the fund's exposure to the broad equity market, consisted of equity index swaps and equity index futures, and generated performance roughly in line with the Index (before costs associated with derivatives); the active fixed income sleeve generated excess returns over the costs of equity index derivatives.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 09/30/2014 | 9912 | 10113 | 9927 |

| 12/31/2014 | 10502 | 10612 | 10507 |

| 03/31/2015 | 11080 | 10712 | 11072 |

| 06/30/2015 | 10958 | 10742 | 10945 |

| 09/30/2015 | 10080 | 10051 | 10071 |

| 12/31/2015 | 10494 | 10758 | 10486 |

| 03/31/2016 | 10538 | 10903 | 10546 |

| 06/30/2016 | 10759 | 11171 | 10711 |

| 09/30/2016 | 11322 | 11602 | 11203 |

| 12/31/2016 | 11402 | 12045 | 11254 |

| 03/31/2017 | 12217 | 12776 | 12030 |

| 06/30/2017 | 12695 | 13170 | 12537 |

| 09/30/2017 | 13340 | 13760 | 13199 |

| 12/31/2017 | 14215 | 14675 | 14098 |

| 03/31/2018 | 14457 | 14563 | 14404 |

| 06/30/2018 | 14811 | 15064 | 14859 |

| 09/30/2018 | 15849 | 16225 | 15985 |

| 12/31/2018 | 13205 | 14031 | 13428 |

| 03/31/2019 | 15657 | 15946 | 16063 |

| 06/30/2019 | 16385 | 16633 | 16930 |

| 09/30/2019 | 16247 | 16915 | 16816 |

| 12/31/2019 | 17524 | 18449 | 18191 |

| 03/31/2020 | 13335 | 14834 | 14545 |

| 06/30/2020 | 17617 | 17881 | 18947 |

| 09/30/2020 | 19319 | 19478 | 20723 |

| 12/31/2020 | 23150 | 21844 | 24664 |

| 03/31/2021 | 23444 | 23193 | 24525 |

| 06/30/2021 | 25709 | 25175 | 27240 |

| 09/30/2021 | 25419 | 25322 | 27033 |

| 12/31/2021 | 26318 | 28114 | 27804 |

| 03/31/2022 | 22867 | 26821 | 24306 |

| 06/30/2022 | 17978 | 22503 | 19184 |

| 09/30/2022 | 17593 | 21404 | 19059 |

| 12/31/2022 | 19008 | 23023 | 20374 |

| 03/31/2023 | 20758 | 24749 | 22236 |

| 06/30/2023 | 22105 | 26912 | 23622 |

| 09/30/2023 | 21050 | 26031 | 22388 |

| 12/31/2023 | 24027 | 29075 | 25644 |

| 03/31/2024 | 26769 | 32144 | 28080 |

| 06/30/2024 | 25848 | 33521 | 27178 |

| Series J (StylePlus—Mid Growth Series) | 7.60% | 16.93% | 9.55% | 9.96% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

| Russell Midcap Growth Index | 5.98% | 15.05% | 9.93% | 10.51% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $173,487,396 |

| Number of Portfolio Holdings | 150 |

| Portfolio Turnover Rate | 34% |

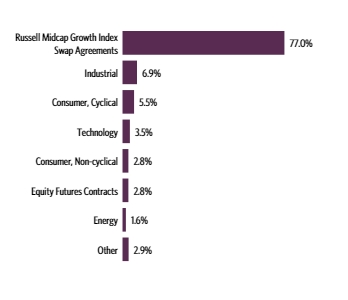

| Russell Midcap Growth Index Swap Agreements | 77.0% |

| Industrial | 6.9% |

| Consumer, Cyclical | 5.5% |

| Technology | 3.5% |

| Consumer, Non-cyclical | 2.8% |

| Equity Futures Contracts | 2.8% |

| Energy | 1.6% |

| Other | 2.9% |

| Guggenheim Variable Insurance Strategy Fund III | 26.8% |

| Guggenheim Strategy Fund III | 26.5% |

| Guggenheim Strategy Fund II | 20.2% |

| Guggenheim Ultra Short Duration Fund — Institutional Class | 1.7% |

| Owens Corning | 0.5% |

| Neurocrine Biosciences, Inc. | 0.5% |

| Pure Storage, Inc. — Class A | 0.4% |

| Lennox International, Inc. | 0.4% |

| Toll Brothers, Inc. | 0.4% |

| United Therapeutics Corp. | 0.4% |

| Top 10 Total | 77.8% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027868-063024

Semi-Annual Shareholder Report | June 30, 2024

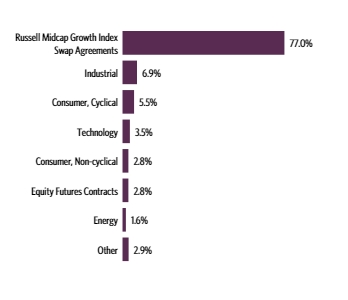

This semi-annual shareholder report contains important information about the Series N (Managed Asset Allocation Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 5.88%, outperforming the fund's benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned (0.71%) for the same period and underperforming the fund's secondary index, the S&P 500 Index, which returned 15.29% for the same period.

What factors materially affected the fund's performance over the last six months?

Strong earnings growth in large cap technology stocks propelled the equity market, more particularly the U.S. large cap equity market, to historical records multiple times during the reporting period. Smaller U.S. stocks and international equity markets performed less strongly. Bond markets have struggled with the oscillating outlook on whether or how frequently the Federal Reserve might cut interest rates this year. Treasury and high quality bonds, in general, declined. S&P 500 futures and ETFs, the S&P Mid Cap ETF, and MSCI EAFE Index futures and ETFs were the biggest contributors to the fund's return, while the biggest detractors were the Bloomberg U.S. Aggregate Bond ETF, iShares iBoxx Investment Grade Bond ETF, and the 10-year U.S. Treasury ETF and related futures.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 09/30/2014 | 9864 | 10017 | 10113 |

| 12/31/2014 | 10136 | 10196 | 10612 |

| 03/31/2015 | 10410 | 10360 | 10712 |

| 06/30/2015 | 10326 | 10186 | 10742 |

| 09/30/2015 | 9876 | 10311 | 10051 |

| 12/31/2015 | 10146 | 10252 | 10758 |

| 03/31/2016 | 10320 | 10563 | 10903 |

| 06/30/2016 | 10572 | 10797 | 11171 |

| 09/30/2016 | 10921 | 10847 | 11602 |

| 12/31/2016 | 10960 | 10524 | 12045 |

| 03/31/2017 | 11410 | 10610 | 12776 |

| 06/30/2017 | 11737 | 10763 | 13170 |

| 09/30/2017 | 12101 | 10854 | 13760 |

| 12/31/2017 | 12536 | 10897 | 14675 |

| 03/31/2018 | 12370 | 10737 | 14563 |

| 06/30/2018 | 12536 | 10720 | 15064 |

| 09/30/2018 | 12959 | 10722 | 16225 |

| 12/31/2018 | 11818 | 10898 | 14031 |

| 03/31/2019 | 12882 | 11219 | 15946 |

| 06/30/2019 | 13357 | 11564 | 16633 |

| 09/30/2019 | 13522 | 11826 | 16915 |

| 12/31/2019 | 14195 | 11848 | 18449 |

| 03/31/2020 | 12233 | 12221 | 14834 |

| 06/30/2020 | 13885 | 12575 | 17881 |

| 09/30/2020 | 14561 | 12652 | 19478 |

| 12/31/2020 | 15981 | 12737 | 21844 |

| 03/31/2021 | 16388 | 12308 | 23193 |

| 06/30/2021 | 17196 | 12533 | 25175 |

| 09/30/2021 | 17112 | 12539 | 25322 |

| 12/31/2021 | 17974 | 12541 | 28114 |

| 03/31/2022 | 16895 | 11797 | 26821 |

| 06/30/2022 | 14846 | 11243 | 22503 |

| 09/30/2022 | 14054 | 10709 | 21404 |

| 12/31/2022 | 14995 | 10909 | 23023 |

| 03/31/2023 | 15734 | 11232 | 24749 |

| 06/30/2023 | 16236 | 11137 | 26912 |

| 09/30/2023 | 15640 | 10778 | 26031 |

| 12/31/2023 | 17112 | 11512 | 29075 |

| 03/31/2024 | 17930 | 11423 | 32144 |

| 06/30/2024 | 18119 | 11430 | 33521 |

| Series N (Managed Asset Allocation Series) | 5.88% | 11.59% | 6.29% | 6.12% |

| Bloomberg U.S. Aggregate Bond Index | -0.71% | 2.63% | -0.23% | 1.35% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $35,573,951 |

| Number of Portfolio Holdings | 23 |

| Portfolio Turnover Rate | 1% |

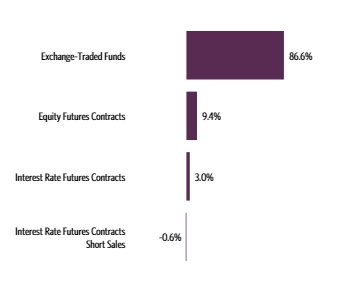

| Exchange-Traded Funds | 86.6% |

| Equity Futures Contracts | 9.4% |

| Interest Rate Futures Contracts | 3.0% |

| Interest Rate Futures Contracts Short Sales | -0.6% |

| Vanguard S&P 500 ETF | 23.3% |

| Schwab U.S. Aggregate Bond ETF | 14.5% |

| SPDR S&P 500 ETF Trust | 12.5% |

| iShares MSCI EAFE ETF | 8.6% |

| iShares 7-10 Year Treasury Bond ETF | 7.8% |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | 7.1% |

| iShares 1-3 Year Treasury Bond ETF | 6.6% |

| iShares Core S&P Mid-Cap ETF | 6.2% |

| Guggenheim Variable Insurance Strategy Fund III | 3.1% |

| Guggenheim Strategy Fund II | 3.0% |

| Top 10 Total | 92.7% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027869-063024

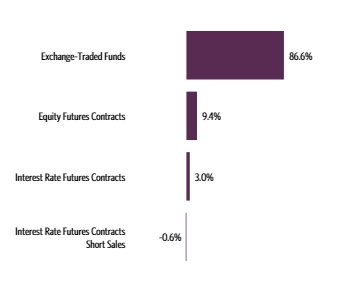

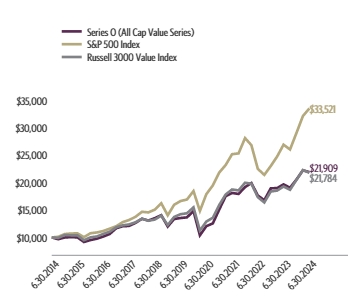

Semi-Annual Shareholder Report | June 30, 2024

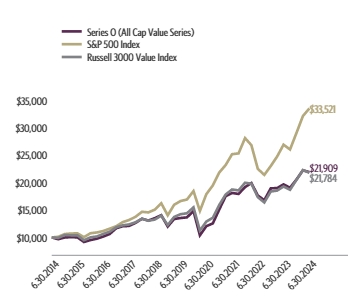

This semi-annual shareholder report contains important information about the Series O (All Cap Value Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 6.52%, underperforming the fund's benchmark, the S&P 500 Index, which returned 15.29% for the same period and outperforming the fund's secondary index, the Russell 3000 Value Index, which returned 6.18% for the same period.

The fund's broad-based securities market index was changed from the Russell 3000 Value Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last six months?

The fund slightly outperformed the Russell 3000 Value Index for the reporting period. It benefited from its underweight to the Health Care and REITs sectors. Its overweight to smaller-market-cap companies detracted from performance as the larger, mega-cap companies in the market performed best. The fund's stock selection was the most significant contributor to outperformance due to the AI-driven technology holdings in Alphabet, KLA Corp, Teradyne, and Qualcomm as well as holdings in Diamondback Energy, Jefferies Financial, Leidos, and Encompass Health.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 09/30/2014 | 9675 | 10113 | 9913 |

| 12/31/2014 | 9989 | 10612 | 10439 |

| 03/31/2015 | 10054 | 10712 | 10386 |

| 06/30/2015 | 10003 | 10742 | 10386 |

| 09/30/2015 | 9168 | 10051 | 9494 |

| 12/31/2015 | 9519 | 10758 | 10008 |

| 03/31/2016 | 9769 | 10903 | 10173 |

| 06/30/2016 | 10159 | 11171 | 10637 |

| 09/30/2016 | 10635 | 11602 | 11049 |

| 12/31/2016 | 11681 | 12045 | 11850 |

| 03/31/2017 | 12028 | 12776 | 12204 |

| 06/30/2017 | 12100 | 13170 | 12361 |

| 09/30/2017 | 12647 | 13760 | 12765 |

| 12/31/2017 | 13407 | 14675 | 13413 |

| 03/31/2018 | 13072 | 14563 | 13035 |

| 06/30/2018 | 13512 | 15064 | 13258 |

| 09/30/2018 | 14056 | 16225 | 13972 |

| 12/31/2018 | 11983 | 14031 | 12263 |

| 03/31/2019 | 13352 | 15946 | 13726 |

| 06/30/2019 | 13541 | 16633 | 14231 |

| 09/30/2019 | 13660 | 16915 | 14405 |

| 12/31/2019 | 14827 | 18449 | 15482 |

| 03/31/2020 | 10387 | 14834 | 11252 |

| 06/30/2020 | 12050 | 17881 | 12890 |

| 09/30/2020 | 12557 | 19478 | 13588 |

| 12/31/2020 | 15106 | 21844 | 15927 |

| 03/31/2021 | 17508 | 23193 | 17821 |

| 06/30/2021 | 18111 | 25175 | 18742 |

| 09/30/2021 | 17928 | 25322 | 18568 |

| 12/31/2021 | 19177 | 28114 | 19968 |

| 03/31/2022 | 19914 | 26821 | 19799 |

| 06/30/2022 | 17644 | 22503 | 17343 |

| 09/30/2022 | 16789 | 21404 | 16379 |

| 12/31/2022 | 18952 | 23023 | 18375 |

| 03/31/2023 | 18992 | 24749 | 18543 |

| 06/30/2023 | 19677 | 26912 | 19289 |

| 09/30/2023 | 19057 | 26031 | 18681 |

| 12/31/2023 | 20568 | 29075 | 20516 |

| 03/31/2024 | 22241 | 32144 | 22285 |

| 06/30/2024 | 21909 | 33521 | 21784 |

| Series O (All Cap Value Series) | 6.52% | 11.34% | 10.10% | 8.16% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

| Russell 3000 Value Index | 6.18% | 12.93% | 8.89% | 8.10% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $93,533,140 |

| Number of Portfolio Holdings | 141 |

| Portfolio Turnover Rate | 12% |

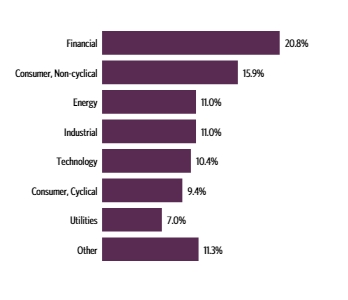

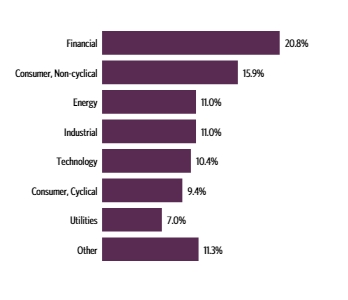

| Financial | 20.8% |

| Consumer, Non-cyclical | 15.9% |

| Energy | 11.0% |

| Industrial | 11.0% |

| Technology | 10.4% |

| Consumer, Cyclical | 9.4% |

| Utilities | 7.0% |

| Other | 11.3% |

| Jefferies Financial Group, Inc. | 2.4% |

| Chevron Corp. | 2.3% |

| Diamondback Energy, Inc. | 2.1% |

| Berkshire Hathaway, Inc. — Class B | 2.0% |

| JPMorgan Chase & Co. | 2.0% |

| Bank of America Corp. | 1.9% |

| OGE Energy Corp. | 1.9% |

| Walmart, Inc. | 1.8% |

| Verizon Communications, Inc. | 1.7% |

| Pinnacle West Capital Corp. | 1.7% |

| Top 10 Total | 19.8% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027853-063024

Semi-Annual Shareholder Report | June 30, 2024

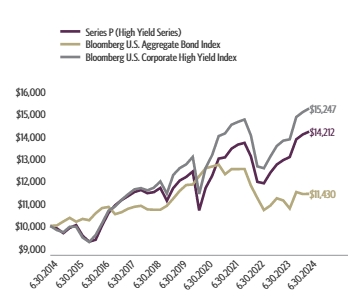

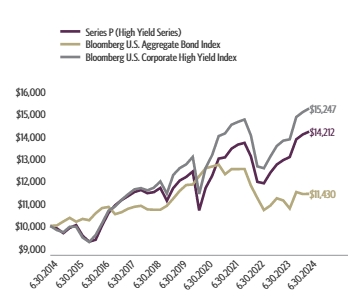

This semi-annual shareholder report contains important information about the Series P (High Yield Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 2.49%, outperforming the fund's benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned (0.71%) for the same period and underperforming the fund's secondary index, the Bloomberg U.S. Corporate High Yield Index, which returned 2.58% for the same period.

The fund's broad-based securities market index was changed from the Bloomberg U.S. Corporate High Yield Index to the Bloomberg U.S. Aggregate Bond Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last six months?

Overall, lower financing costs and borrower sentiment spurred heavy new issuance volume while strong market conditions kept spreads tight. The primary contributors to the fund's performance were exposure to higher quality credit and a restructured equity position, and the primary detractor was weaker performance from consumer cyclical holdings.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 09/30/2014 | 9889 | 10017 | 9813 |

| 12/31/2014 | 9677 | 10196 | 9715 |

| 03/31/2015 | 9909 | 10360 | 9960 |

| 06/30/2015 | 10037 | 10186 | 9960 |

| 09/30/2015 | 9557 | 10311 | 9476 |

| 12/31/2015 | 9295 | 10252 | 9281 |

| 03/31/2016 | 9382 | 10563 | 9592 |

| 06/30/2016 | 10018 | 10797 | 10121 |

| 09/30/2016 | 10579 | 10847 | 10683 |

| 12/31/2016 | 10923 | 10524 | 10871 |

| 03/31/2017 | 11149 | 10610 | 11164 |

| 06/30/2017 | 11327 | 10763 | 11407 |

| 09/30/2017 | 11514 | 10854 | 11632 |

| 12/31/2017 | 11604 | 10897 | 11686 |

| 03/31/2018 | 11462 | 10737 | 11586 |

| 06/30/2018 | 11507 | 10720 | 11705 |

| 09/30/2018 | 11695 | 10722 | 11986 |

| 12/31/2018 | 11125 | 10898 | 11443 |

| 03/31/2019 | 11687 | 11219 | 12274 |

| 06/30/2019 | 12023 | 11564 | 12580 |

| 09/30/2019 | 12188 | 11826 | 12748 |

| 12/31/2019 | 12428 | 11848 | 13082 |

| 03/31/2020 | 10692 | 12221 | 11422 |

| 06/30/2020 | 11698 | 12575 | 12585 |

| 09/30/2020 | 12239 | 12652 | 13163 |

| 12/31/2020 | 13005 | 12737 | 14012 |

| 03/31/2021 | 13062 | 12308 | 14131 |

| 06/30/2021 | 13449 | 12533 | 14519 |

| 09/30/2021 | 13633 | 12539 | 14647 |

| 12/31/2021 | 13708 | 12541 | 14752 |

| 03/31/2022 | 13106 | 11797 | 14038 |

| 06/30/2022 | 11967 | 11243 | 12658 |

| 09/30/2022 | 11904 | 10709 | 12576 |

| 12/31/2022 | 12379 | 10909 | 13101 |

| 03/31/2023 | 12741 | 11232 | 13569 |

| 06/30/2023 | 12938 | 11137 | 13806 |

| 09/30/2023 | 13076 | 10778 | 13869 |

| 12/31/2023 | 13867 | 11512 | 14863 |

| 03/31/2024 | 14082 | 11423 | 15082 |

| 06/30/2024 | 14212 | 11430 | 15247 |

| Series P (High Yield Series) | 2.49% | 9.84% | 3.40% | 3.58% |

| Bloomberg U.S. Aggregate Bond Index | -0.71% | 2.63% | -0.23% | 1.35% |

| Bloomberg U.S. Corporate High Yield Index | 2.58% | 10.44% | 3.92% | 4.31% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $32,004,941 |

| Number of Portfolio Holdings | 273 |

| Portfolio Turnover Rate | 24% |

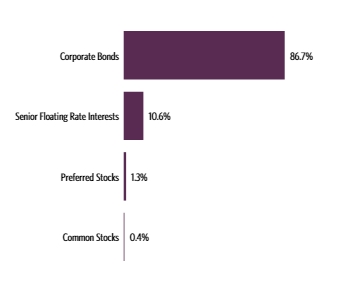

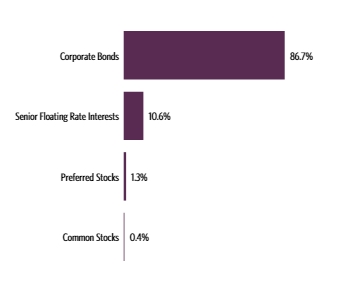

| Corporate Bonds | 86.7% |

| Senior Floating Rate Interests | 10.6% |

| Preferred Stocks | 1.3% |

| Common Stocks | 0.4% |

| BBB | 3.1% |

| BB | 46.7% |

| B | 39.3% |

| CCC | 6.5% |

| CC | 0.1% |

| NR3 | 0.1% |

| Other Instruments | 4.2% |

| Terraform Global Operating, LP, 6.13% | 1.3% |

| CPI CG, Inc., 8.63% | 1.1% |

| Cheplapharm Arzneimittel GmbH, 5.50% | 1.1% |

| Enviri Corp., 5.75% | 1.0% |

| CVR Energy, Inc., 5.75% | 1.0% |

| ITT Holdings LLC, 6.50% | 0.9% |

| VZ Secured Financing BV, 5.00% | 0.9% |

| CPI CG, Inc., 10.00% | 0.9% |

| Trinity Industries, Inc., 7.75% | 0.9% |

| GrafTech Finance, Inc., 4.63% | 0.8% |

| Top 10 Total | 9.9% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | Source: BlackRock Solutions. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All securities except for those labeled "NR" have been rated by Moody's, Standard & Poor's ("S&P"), or Fitch, each of which is a Nationally Recognized Statistical Rating Organization ("NRSRO"). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted ratings to the equivalent S&P rating. Security ratings are determined at the time of purchase and may change thereafter. |

3 | NR (not rated) securities do not necessarily indicate low credit quality. |

| |

4 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027854-063024

Semi-Annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Series Q (Small Cap Value Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 0.32%, underperforming the fund's benchmark, the S&P 500 Index, which returned 15.29% for the same period and outperforming the fund's secondary index, the Russell 2000 Value Index, which returned (0.85%) for the same period.

The fund's broad-based securities market index was changed from the Russell 2000 Value Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last six months?

The fund outperformed the Russell 2000 Value Index for the reporting period. However, the return was subdued relative to many other equity benchmarks, as the AI-driven large cap technology growth stocks drove many indices much higher. The fund benefited from its underweight to banks, REITs, and consumer discretionary sectors. There was meaningful contribution from holdings in Kirby Corp, Pioneer Natural Resources, Encompass Health, Stifel Financial, Crocs, and Radnet.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 09/30/2014 | 8969 | 10113 | 9142 |

| 12/31/2014 | 9505 | 10612 | 10001 |

| 03/31/2015 | 9670 | 10712 | 10200 |

| 06/30/2015 | 9536 | 10742 | 10078 |

| 09/30/2015 | 8534 | 10051 | 8996 |

| 12/31/2015 | 8876 | 10758 | 9254 |

| 03/31/2016 | 9231 | 10903 | 9412 |

| 06/30/2016 | 9397 | 11171 | 9817 |

| 09/30/2016 | 9872 | 11602 | 10688 |

| 12/31/2016 | 11237 | 12045 | 12192 |

| 03/31/2017 | 11235 | 12776 | 12176 |

| 06/30/2017 | 11213 | 13170 | 12258 |

| 09/30/2017 | 11559 | 13760 | 12884 |

| 12/31/2017 | 11653 | 14675 | 13148 |

| 03/31/2018 | 11496 | 14563 | 12800 |

| 06/30/2018 | 12069 | 15064 | 13863 |

| 09/30/2018 | 12295 | 16225 | 14086 |

| 12/31/2018 | 10177 | 14031 | 11456 |

| 03/31/2019 | 11198 | 15946 | 12823 |

| 06/30/2019 | 11395 | 16633 | 12999 |

| 09/30/2019 | 11562 | 16915 | 12924 |

| 12/31/2019 | 12475 | 18449 | 14022 |

| 03/31/2020 | 8237 | 14834 | 9022 |

| 06/30/2020 | 9786 | 17881 | 10727 |

| 09/30/2020 | 9747 | 19478 | 11001 |

| 12/31/2020 | 12354 | 21844 | 14672 |

| 03/31/2021 | 14842 | 23193 | 17777 |

| 06/30/2021 | 15236 | 25175 | 18588 |

| 09/30/2021 | 14910 | 25322 | 18034 |

| 12/31/2021 | 15588 | 28114 | 18819 |

| 03/31/2022 | 15825 | 26821 | 18368 |

| 06/30/2022 | 13802 | 22503 | 15562 |

| 09/30/2022 | 13235 | 21404 | 14844 |

| 12/31/2022 | 15006 | 23023 | 16094 |

| 03/31/2023 | 14857 | 24749 | 15988 |

| 06/30/2023 | 15226 | 26912 | 16497 |

| 09/30/2023 | 14755 | 26031 | 16008 |

| 12/31/2023 | 16549 | 29075 | 18451 |

| 03/31/2024 | 17300 | 32144 | 18986 |

| 06/30/2024 | 16603 | 33521 | 18294 |

| Series Q (Small Cap Value Series) | 0.32% | 9.04% | 7.82% | 5.20% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

| Russell 2000 Value Index | -0.85% | 10.90% | 7.07% | 6.23% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $57,391,967 |

| Number of Portfolio Holdings | 103 |

| Portfolio Turnover Rate | 13% |

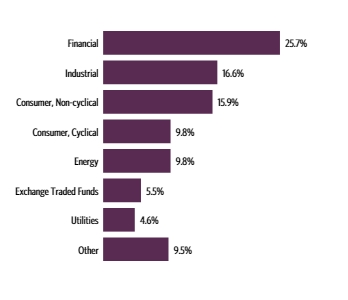

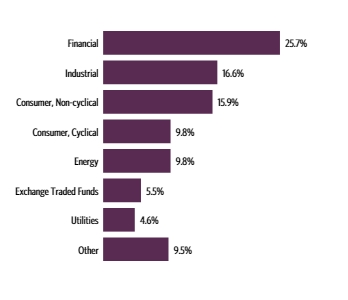

| Financial | 25.7% |

| Industrial | 16.6% |

| Consumer, Non-cyclical | 15.9% |

| Consumer, Cyclical | 9.8% |

| Energy | 9.8% |

| Exchange Traded Funds | 5.5% |

| Utilities | 4.6% |

| Other | 9.5% |

| SPDR S&P Biotech ETF | 3.1% |

| iShares Russell 2000 Value ETF | 2.5% |

| Encompass Health Corp. | 2.4% |

| Stifel Financial Corp. | 2.2% |

| Liberty Energy, Inc. — Class A | 2.0% |

| MGP Ingredients, Inc. | 2.0% |

| Murphy Oil Corp. | 2.0% |

| Rush Enterprises, Inc. — Class A | 2.0% |

| Kirby Corp. | 2.0% |

| OGE Energy Corp. | 1.9% |

| Top 10 Total | 22.1% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027855-063024

Semi-Annual Shareholder Report | June 30, 2024

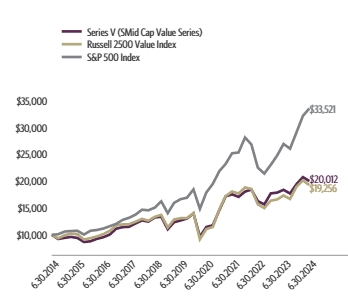

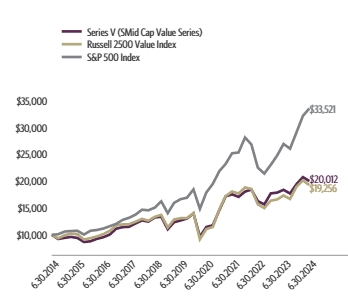

This semi-annual shareholder report contains important information about the Series V (SMid Cap Value Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 2.98%, underperforming the fund's benchmark, the S&P 500 Index, which returned 15.29% for the same period and outperforming the fund's secondary index, the Russell 2500 Value Index, which returned 1.50% for the same period.

The fund's broad-based securities market index was changed from the Russell 2500 Value Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last six months?

The fund outperformed the Russell 2500 Value Index for the reporting period. However, the return was subdued relative to many other equity benchmarks, as the AI-driven large cap technology growth stocks drove many indices much higher. The fund benefited from its industry allocations (overweight in Utilities and Technology while underweight in Consumer Discretionary and REITs) as well as strong individual stock performance from Jefferies Financial, Stifel Financial, Leidos and Crocs.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 09/30/2014 | 9230 | 9360 | 10113 |

| 12/31/2014 | 9439 | 9930 | 10612 |

| 03/31/2015 | 9611 | 10229 | 10712 |

| 06/30/2015 | 9418 | 10099 | 10742 |

| 09/30/2015 | 8669 | 9131 | 10051 |

| 12/31/2015 | 8798 | 9385 | 10758 |

| 03/31/2016 | 9257 | 9698 | 10903 |

| 06/30/2016 | 9554 | 10121 | 11171 |

| 09/30/2016 | 10052 | 10746 | 11602 |

| 12/31/2016 | 11151 | 11750 | 12045 |

| 03/31/2017 | 11430 | 11941 | 12776 |

| 06/30/2017 | 11501 | 11979 | 13170 |

| 09/30/2017 | 12119 | 12438 | 13760 |

| 12/31/2017 | 12680 | 12967 | 14675 |

| 03/31/2018 | 12455 | 12623 | 14563 |

| 06/30/2018 | 13228 | 13356 | 15064 |

| 09/30/2018 | 13378 | 13713 | 16225 |

| 12/31/2018 | 11035 | 11365 | 14031 |

| 03/31/2019 | 12347 | 12855 | 15946 |

| 06/30/2019 | 12671 | 13099 | 16633 |

| 09/30/2019 | 13027 | 13116 | 16915 |

| 12/31/2019 | 13981 | 14043 | 18449 |

| 03/31/2020 | 9648 | 9178 | 14834 |

| 06/30/2020 | 11459 | 11069 | 17881 |

| 09/30/2020 | 11773 | 11461 | 19478 |

| 12/31/2020 | 14582 | 14728 | 21844 |

| 03/31/2021 | 17140 | 17206 | 23193 |

| 06/30/2021 | 17537 | 18067 | 25175 |

| 09/30/2021 | 17062 | 17694 | 25322 |

| 12/31/2021 | 18045 | 18819 | 28114 |

| 03/31/2022 | 18425 | 18537 | 26821 |

| 06/30/2022 | 16271 | 15684 | 22503 |

| 09/30/2022 | 15651 | 14977 | 21404 |

| 12/31/2022 | 17710 | 16357 | 23023 |

| 03/31/2023 | 17855 | 16585 | 24749 |

| 06/30/2023 | 18374 | 17310 | 26912 |

| 09/30/2023 | 17693 | 16676 | 26031 |

| 12/31/2023 | 19433 | 18971 | 29075 |

| 03/31/2024 | 20739 | 20122 | 32144 |

| 06/30/2024 | 20012 | 19256 | 33521 |

| Series V (SMid Cap Value Series) | 2.98% | 8.91% | 9.57% | 7.18% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

| Russell 2500 Value Index | 1.50% | 11.24% | 8.01% | 6.77% |

The fund's past performance is not a good predictor of the fund's future performance.

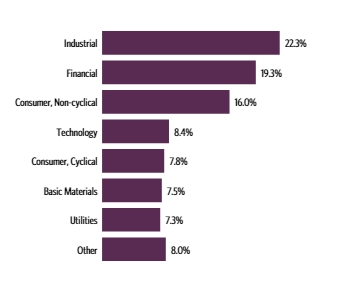

| Net Assets | $155,845,824 |

| Number of Portfolio Holdings | 91 |

| Portfolio Turnover Rate | 17% |

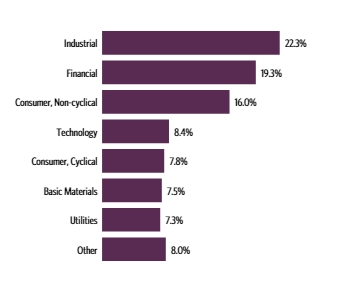

| Industrial | 22.3% |

| Financial | 19.3% |

| Consumer, Non-cyclical | 16.0% |

| Technology | 8.4% |

| Consumer, Cyclical | 7.8% |

| Basic Materials | 7.5% |

| Utilities | 7.3% |

| Other | 8.0% |

| Unum Group | 2.8% |

| Jefferies Financial Group, Inc. | 2.5% |

| Teradyne, Inc. | 2.4% |

| Stifel Financial Corp. | 2.4% |

| Pinnacle West Capital Corp. | 2.4% |

| OGE Energy Corp. | 2.3% |

| Teledyne Technologies, Inc. | 2.3% |

| Old Republic International Corp. | 2.2% |

| Evergy, Inc. | 2.2% |

| Diamondback Energy, Inc. | 2.2% |

| Top 10 Total | 23.7% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027857-063024

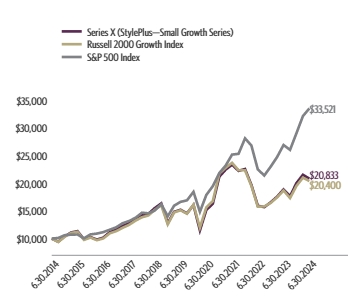

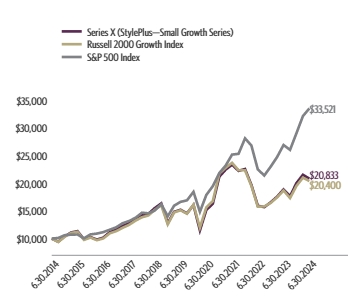

Semi-Annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Series X (StylePlus—Small Growth Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 3.93%, underperforming the fund's benchmark, the S&P 500 Index, which returned 15.29% for the same period and underperforming the fund's secondary index, the Russell 2000 Growth Index, which returned 4.44% for the same period.

The fund's broad-based securities market index was changed from the Russell 2000 Growth Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last six months?

The fund underperformed the Russell 2000 Growth Index (the "Index") for the reporting period. The equity sleeve was allocated 20%-30% to actively managed equity and 70%-80% to passive equity. Relative to the Index, the active equity sleeve detracted from performance. The passive equity component, which accounted for most of the fund's exposure to the broad equity market, consisted of equity index swaps and equity index futures, and generated performance roughly in line with the Index (before costs associated with derivatives); the active fixed income sleeve generated excess returns over the costs of equity index derivatives.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 09/30/2014 | 9437 | 9387 | 10113 |

| 12/31/2014 | 10403 | 10331 | 10612 |

| 03/31/2015 | 11100 | 11016 | 10712 |

| 06/30/2015 | 11346 | 11234 | 10742 |

| 09/30/2015 | 9881 | 9767 | 10051 |

| 12/31/2015 | 10268 | 10189 | 10758 |

| 03/31/2016 | 9821 | 9711 | 10903 |

| 06/30/2016 | 10172 | 10026 | 11171 |

| 09/30/2016 | 11150 | 10951 | 11602 |

| 12/31/2016 | 11650 | 11342 | 12045 |

| 03/31/2017 | 12287 | 11948 | 12776 |

| 06/30/2017 | 12791 | 12473 | 13170 |

| 09/30/2017 | 13604 | 13248 | 13760 |

| 12/31/2017 | 14257 | 13856 | 14675 |

| 03/31/2018 | 14470 | 14174 | 14563 |

| 06/30/2018 | 15509 | 15200 | 15064 |

| 09/30/2018 | 16359 | 16039 | 16225 |

| 12/31/2018 | 12788 | 12566 | 14031 |

| 03/31/2019 | 14830 | 14721 | 15946 |

| 06/30/2019 | 15207 | 15125 | 16633 |

| 09/30/2019 | 14563 | 14494 | 16915 |

| 12/31/2019 | 16072 | 16145 | 18449 |

| 03/31/2020 | 11477 | 11986 | 14834 |

| 06/30/2020 | 15173 | 15651 | 17881 |

| 09/30/2020 | 16304 | 16771 | 19478 |

| 12/31/2020 | 21186 | 21737 | 21844 |

| 03/31/2021 | 22460 | 22797 | 23193 |

| 06/30/2021 | 23361 | 23690 | 25175 |

| 09/30/2021 | 22243 | 22351 | 25322 |

| 12/31/2021 | 22572 | 22353 | 28114 |

| 03/31/2022 | 19712 | 19530 | 26821 |

| 06/30/2022 | 15939 | 15770 | 22503 |

| 09/30/2022 | 15684 | 15808 | 21404 |

| 12/31/2022 | 16565 | 16461 | 23023 |

| 03/31/2023 | 17579 | 17461 | 24749 |

| 06/30/2023 | 18882 | 18692 | 26912 |

| 09/30/2023 | 17669 | 17324 | 26031 |

| 12/31/2023 | 20046 | 19533 | 29075 |

| 03/31/2024 | 21531 | 21014 | 32144 |

| 06/30/2024 | 20833 | 20400 | 33521 |

| Series X (StylePlus—Small Growth Series) | 3.93% | 10.34% | 6.50% | 7.62% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

| Russell 2000 Growth Index | 4.44% | 9.14% | 6.17% | 7.39% |

The fund's past performance is not a good predictor of the fund's future performance.

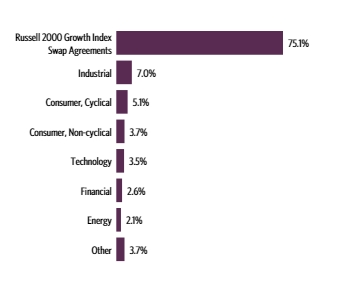

| Net Assets | $26,201,956 |

| Number of Portfolio Holdings | 137 |

| Portfolio Turnover Rate | 40% |

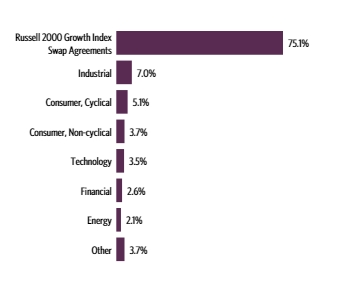

| Russell 2000 Growth Index Swap Agreements | 75.1% |

| Industrial | 7.0% |

| Consumer, Cyclical | 5.1% |

| Consumer, Non-cyclical | 3.7% |

| Technology | 3.5% |

| Financial | 2.6% |

| Energy | 2.1% |

| Other | 3.7% |

| Guggenheim Variable Insurance Strategy Fund III | 27.3% |

| Guggenheim Strategy Fund III | 26.2% |

| Guggenheim Strategy Fund II | 16.5% |

| Guggenheim Ultra Short Duration Fund — Institutional Class | 1.2% |

| Mueller Industries, Inc. | 0.6% |

| Boise Cascade Co. | 0.4% |

| Meritage Homes Corp. | 0.4% |

| Abercrombie & Fitch Co. — Class A | 0.4% |

| Fabrinet | 0.4% |

| InterDigital, Inc. | 0.4% |

| Top 10 Total | 73.8% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027859-063024

Semi-Annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Series Y (StylePlus—Large Growth Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

For the period of January 1, 2024 to June 30, 2024, the fund returned 20.67%, outperforming the fund's benchmark, the S&P 500 Index, which returned 15.29% for the same period and underperforming the fund's secondary index, the Russell 1000 Growth Index, which returned 20.70% for the same period.

The fund's broad-based securities market index was changed from the Russell 1000 Growth Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last six months?

The fund slightly underperformed the Russell 1000 Growth Index (the "Index") for the reporting period. The equity sleeve was allocated 15%-25% to actively managed equity and 75%-85% to passive equity. Relative to the Index, the active equity sleeve returns were roughly in line. The passive equity component, which accounted for most of the fund's exposure to the broad equity market, consisted of equity index swaps and equity index futures, and generated performance roughly in line with the Index (before costs associated with derivatives); the active fixed income sleeve generated excess returns over the costs of equity index derivatives.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 09/30/2014 | 10164 | 10113 | 10149 |

| 12/31/2014 | 10679 | 10612 | 10634 |

| 03/31/2015 | 11097 | 10712 | 11042 |

| 06/30/2015 | 11117 | 10742 | 11056 |

| 09/30/2015 | 10519 | 10051 | 10471 |

| 12/31/2015 | 11265 | 10758 | 11237 |

| 03/31/2016 | 11324 | 10903 | 11320 |

| 06/30/2016 | 11466 | 11171 | 11390 |

| 09/30/2016 | 12084 | 11602 | 11912 |

| 12/31/2016 | 12247 | 12045 | 12032 |

| 03/31/2017 | 13351 | 12776 | 13104 |

| 06/30/2017 | 13935 | 13170 | 13716 |

| 09/30/2017 | 14788 | 13760 | 14525 |

| 12/31/2017 | 15934 | 14675 | 15667 |

| 03/31/2018 | 16099 | 14563 | 15889 |

| 06/30/2018 | 16916 | 15064 | 16804 |

| 09/30/2018 | 18460 | 16225 | 18345 |

| 12/31/2018 | 15355 | 14031 | 15430 |

| 03/31/2019 | 17723 | 15946 | 17915 |

| 06/30/2019 | 18469 | 16633 | 18746 |

| 09/30/2019 | 18675 | 16915 | 19025 |

| 12/31/2019 | 20564 | 18449 | 21045 |

| 03/31/2020 | 17119 | 14834 | 18078 |

| 06/30/2020 | 22265 | 17881 | 23110 |

| 09/30/2020 | 25296 | 19478 | 26165 |

| 12/31/2020 | 28352 | 21844 | 29146 |

| 03/31/2021 | 28791 | 23193 | 29421 |

| 06/30/2021 | 32144 | 25175 | 32932 |

| 09/30/2021 | 32395 | 25322 | 33313 |

| 12/31/2021 | 36226 | 28114 | 37189 |

| 03/31/2022 | 32642 | 26821 | 33827 |

| 06/30/2022 | 25556 | 22503 | 26749 |

| 09/30/2022 | 24451 | 21404 | 25787 |

| 12/31/2022 | 25108 | 23023 | 26353 |

| 03/31/2023 | 28520 | 24749 | 30139 |

| 06/30/2023 | 31878 | 26912 | 34000 |

| 09/30/2023 | 30842 | 26031 | 32936 |

| 12/31/2023 | 35130 | 29075 | 37601 |

| 03/31/2024 | 39361 | 32144 | 41893 |

| 06/30/2024 | 42392 | 33521 | 45384 |

| Series Y (StylePlus—Large Growth Series) | 20.67% | 32.98% | 18.08% | 15.54% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

| Russell 1000 Growth Index | 20.70% | 33.48% | 19.34% | 16.33% |

The fund's past performance is not a good predictor of the fund's future performance.

| Net Assets | $55,059,332 |

| Number of Portfolio Holdings | 63 |

| Portfolio Turnover Rate | 21% |

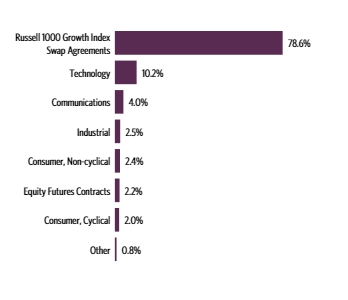

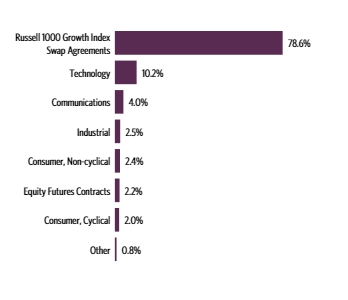

| Russell 1000 Growth Index Swap Agreements | 78.6% |

| Technology | 10.2% |

| Communications | 4.0% |

| Industrial | 2.5% |

| Consumer, Non-cyclical | 2.4% |

| Equity Futures Contracts | 2.2% |

| Consumer, Cyclical | 2.0% |

| Other | 0.8% |

| Guggenheim Strategy Fund III | 25.9% |

| Guggenheim Variable Insurance Strategy Fund III | 23.0% |

| Guggenheim Strategy Fund II | 19.4% |

| Guggenheim Ultra Short Duration Fund — Institutional Class | 7.6% |

| Microsoft Corp. | 2.6% |

| Apple, Inc. | 2.4% |

| NVIDIA Corp. | 2.2% |

| Alphabet, Inc. — Class C | 1.5% |

| Amazon.com, Inc. | 1.3% |

| Meta Platforms, Inc. — Class A | 0.7% |

| Top 10 Total | 86.6% |

| |

1 | "Holdings Diversification (Market Exposure as % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings" excludes any temporary cash or derivative investments. |

There were no changes in or disagreements with fund accountants for the period.

| |  | For additional information, including the fund's prospectus, financial information, holdings and proxy voting information, go to GuggenheimInvestments.com/variable-insurance-funds or, call 800 820 0888. |

SAR-C000027860-063024

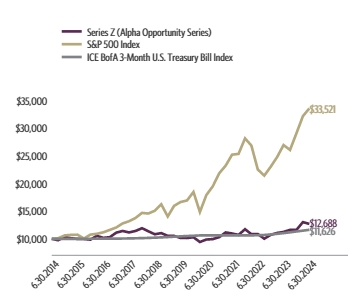

Semi-Annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Series Z (Alpha Opportunity Series) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the fund at GuggenheimInvestments.com/variable-insurance-funds. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

| Variable Annuity | $102 | 1.97% |

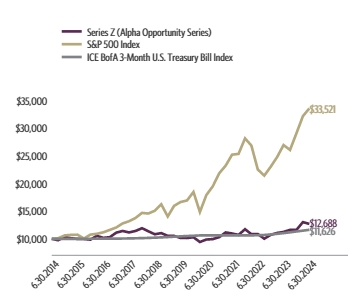

For the period of January 1, 2024 to June 30, 2024, the fund returned 9.07%, underperforming the fund's benchmark, the S&P 500 Index, which returned 15.29% for the same period and outperforming the fund's secondary index, the ICE BofA 3-Month U.S. Treasury Bill Index, which returned 2.65% for the same period.

The fund's broad-based securities market index was changed from the ICE BofA 3-Month U.S. Treasury Bill Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last six months?

The global growth outlook remained modestly bullish and steady during the reporting period, while inflation seemed to be finally tamed, which could foreshadow interest rate cuts in the second half of 2024. This optimism helped the S&P 500 Index to gain more than 15% during the reporting period. The fund significantly outperformed the ICE BofA 3-Month U.S. Treasury Bill Index. Among the fundamental factors, the fund's exposure in higher profitability, lower volatility, and higher momentum names paid off well. The overall contribution of the industry tilts (overweights/underweights) was moderate whereas security selection was quite strong during the reporting period.

Cumulative performance* for the fund's most recently completed 10 years, assuming a $10,000 initial investment.

| 06/30/2014 | 10000 | 10000 | 10000 |

| 09/30/2014 | 9747 | 10113 | 10001 |

| 12/31/2014 | 10337 | 10612 | 10001 |

| 03/31/2015 | 10102 | 10712 | 10002 |

| 06/30/2015 | 9981 | 10742 | 10002 |

| 09/30/2015 | 9965 | 10051 | 10003 |

| 12/31/2015 | 9852 | 10758 | 10007 |

| 03/31/2016 | 10535 | 10903 | 10014 |

| 06/30/2016 | 10178 | 11171 | 10021 |

| 09/30/2016 | 10291 | 11602 | 10031 |

| 12/31/2016 | 11111 | 12045 | 10039 |

| 03/31/2017 | 11414 | 12776 | 10050 |

| 06/30/2017 | 11153 | 13170 | 10070 |

| 09/30/2017 | 11414 | 13760 | 10097 |

| 12/31/2017 | 11913 | 14675 | 10125 |

| 03/31/2018 | 11361 | 14563 | 10161 |

| 06/30/2018 | 10820 | 15064 | 10207 |

| 09/30/2018 | 11025 | 16225 | 10257 |

| 12/31/2018 | 10535 | 14031 | 10315 |

| 03/31/2019 | 10528 | 15946 | 10377 |

| 06/30/2019 | 10149 | 16633 | 10443 |

| 09/30/2019 | 10138 | 16915 | 10502 |

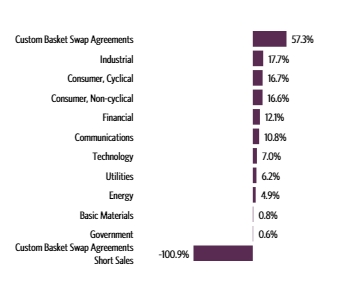

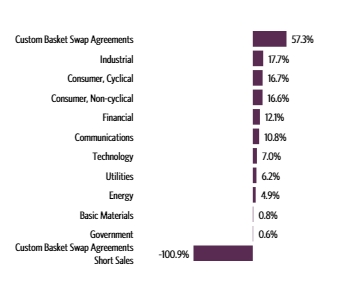

| 12/31/2019 | 10277 | 18449 | 10550 |