Provisions related to excess lease costs for onerous contracts are reduced by assumed sub-lease income for the periods impacted.

The lease for this transaction is payable from 30 March 2007 until the lease expiry date of 29 September 2027.

Back to Contents

Additional information for US investors(continued)

Unilever Group

Financial Instruments

Under the rules governing the transition to IFRSs, Unilever has adopted IAS 32/39 on financial instruments from 1 January 2005. Unilever’s accounting policies in respect of derivative financial instruments under IFRSs are described in note 1 on page 83. There are minor differences between these and the application of US GAAP from 1 January 2005.

In particular, from 1 January 2005, Unilever recognises all derivative financial instruments on balance sheet at fair value and applies hedge accounting to a portion of its portfolio of derivative financial instruments, meaning that changes in the fair value of derivative financial instruments that are designated and effective as hedges of future cash flows are recognised directly in equity and any ineffective portion is recognised immediately in the income statement.

Prior to the adoption of IAS 32/39 on 1 January 2005, Unilever applied hedge accounting to its portfolio of derivative financial instruments, meaning that changes in the value of forward exchange contracts were recognised in the results in the same period as changes in the values of the assets and liabilities they were intended to hedge. Interest payments and receipts arising from interest rate derivatives such as swaps and forward rate agreements were matched to those arising from underlying debt and investment positions. Payments made or received in respect of the early termination of derivative instruments were spread over the original life of the instrument so long as the underlying exposure continues to exist.

Prior to 1 January 2005, Unilever had not designated any of its derivative financial instruments as qualifying hedge instruments under US FAS 133 and accordingly, under US GAAP, all derivative financial instruments were valued at fair value with changes in fair value reflected in the income statement.

Investments

The adoption of IAS 32/39 eliminates any previous divergence between Unilever’s accounting for non-derivative financial instruments and US GAAP. A divergence therefore only exists in the 2004 comparative figures.

Prior to 1 January 2005 Unilever accounted for changes in the market value of current investments as interest receivable in the income statement for the year. Non-current investments, other than interests in joint ventures and associates, are stated at cost less any amounts written off to reflect a permanent impairment. Under US GAAP, such current asset investments are generally classified as ‘available for sale securities’ and changes in market values, which represent unrealised gains or losses, are excluded from earnings and taken to stockholders’ equity unless such losses are deemed to be other than temporary at which time they are recognised through the income statement. Unrealised gains and losses arising from changes in the market values of securities available for sale are not material at 31 December 2004.

Preference shares

Under IAS 32, Unilever recognises preference shares that provide a fixed preference dividend as borrowings with preference dividends recognised in the income statement. Under US GAAP such preference shares are classified in shareholders’ equity with dividends treated as a deduction to shareholder’s equity.

Pensions

Under IAS 19, the expected costs of providing retirement benefits are charged to the income statement over the periods benefiting from the employees’ services. Variations from the expected cost are recognised as they occur in the statement of recognised income and expense . The assets and liabilities of pension plans are included in the Group balance sheet at fair value. Under US GAAP, pensions costs and liabilities are accounted for in accordance with the prescribed actuarial method and measurement principles of FAS 87. The most significant difference is that variations from the expected costs are recognised in the income statement over the expected service lives of the employees.

Under US GAAP, an additional minimum liability is recognised and a charge made to other comprehensive income when the accumulated benefit obligation exceeds the fair value of plan assets to the extent that this amount is not covered by the net liability recognised in the balance sheet.

Deferred tax

Under IFRSs, a provision is made on unremitted earnings of controlled group companies to the extent that the distributions are considered probable. US GAAP requires full provision to be made assuming all earnings will be distributed, unless those earnings can be recovered tax-free or will be permanently reinvested in the controlled group company.

Under IFRSs, deferred tax on share-based compensation is provided based on the actual tax credit expected to be received using the fair market value of the share price at the year end (the intrinsic value). The deferred tax is credited to the income statement to the extent of the tax recognised on the share-based compensation charge with the excess recognised directly in equity. Under US GAAP, deferred tax on the share-based awards that ordinarily result in future tax deductions is recognised to the extent of the cumulative amount of compensation cost recognised through the income statement. Tax deductions inherent in the current fair value of the entity’s stock are not taken into account.

Profit or loss on disposal of businesses

Under both IFRSs and US GAAP, Unilever calculates profit or loss on sale of businesses net of goodwill included on the balance sheet and after the write-back of cumulative currency retranslation differences. Under previous GAAP, goodwill and intangible assets purchased prior to 1 January 1998 were written off in the year of acquisition as a movement in profits retained. Under US GAAP, such goodwill and intangible assets were capitalised and, prior to 1 January 2002, were amortised over their useful lives. These different accounting treatments give rise to differences between net profit or loss calculated under IFRSs and that calculated under US GAAP. The additional goodwill and intangibles recorded under US GAAP for our UCI business means that the US GAAP profit on disposal of this business is €217 million lower than that reported under IFRSs. Under IFRSs, cumulative currency retranslation differences arising from the transition date to IFRSs of 1 January 2004 are included in the calculation whereas under US GAAP the profit or loss on disposal includes cumulative currency retranslation differences which have arisen since the date that the businesses were originally acquired.

Currency Recycling

Under IFRSs, the gain from cumulative translation differences arising from the partial repayment of capital of a subsidiary is recognised within the income statement. Under US GAAP, currency translation gains and losses are only recycled to the income statement on the sale or upon the complete or substantially complete liquidation of the investment.

| 160 | Unilever Annual Report and Accounts 2005 |

Back to Contents

Financial Statements |

Additional information for US investors (continued)

Unilever Group

Classification differences between IFRSs and US GAAP

Cash flow statement

Under US GAAP, various items would be reclassified within the consolidated cash flow statement. In particular, interest received and interest paid would be part of net cash flow from operating activities. In addition, under US GAAP, cash and cash equivalents comprise cash balances and cash equivalents with an original maturity at the date of investment of less than three months. Under Unilever’s presentation, cash and cash equivalents are net of bank overdrafts. Cash flows from movements in bank overdrafts would be classified as part of cash flows from financingactivities under US GAAP. Cash flows from movements in bank overdrafts were €61 million for the year ended 31 December 2005 (2004: €(134) million).

Recent accounting developments

In November 2004, the Financial Accounting Standards Board (FASB) issued FASB Statement No. 151 ‘Inventory Costs – an amendment ofARB 43’ (FAS 151). The standard clarifies that abnormal amounts of idle facility expense, freight, handling costs, and wasted materials (spoilage)should be recognised as current-period charges. In addition, FAS 151 requires that the allocation of fixed production overheads to inventory values be based on the normal capacity of the production facilities. The provisions of FAS 151 will be effective for inventory costs incurredduring reporting periods beginning after 15 June 2005. FAS 151 does not have an impact on the results of operations or financial position ofUnilever since the key elements are already applied in Unilever’s financial statements.

In December 2004, the FASB issued a revision of FASB Statement No. 123 – ‘Share-Based Payments’ (FAS 123(R)) which also supersedes APB Opinion No. 25 – ‘Accounting for Stock Issued to Employees’. Generally the valuation methods contained in FAS 123(R) are similar to those in FAS 123, but FAS 123(R) requires all share-based payments to employees, including grants of employee share options, to be charged to thestatement of income. Pro forma disclosure is no longer an alternative. With limited exceptions, the amount charged to the statement of incomefor share options will be measured based on the grant date fair value of the option amortised over the period to the date of vesting of theaward. FAS 123(R) is effective for annual reporting periods beginning after 15 June 2005. The company is currently evaluating the provisions of this Statement. The adoption of FAS 123(R) is not expected to have a significant impact on the consolidated results of operations or financialposition of Unilever as Unilever adopted the fair value measurement provisions of FAS 123 in 2003.

In March 2005 the FASB issued Financial Interpretation No. 47 ‘Accounting for Conditional Asset Retirement Obligations’ (FIN 47), whichclarifies the term conditional asset retirement obligation used in FAS 143. Unilever will apply the standard to the financial year beginning on1 January 2006; this is not expected to have a material impact on the consolidated results of operations or financial position of Unilever.

In May 2005 the FASB issued FASB Statement No. 154 ‘Accounting changes and error corrections’ (FAS 154) as a replacement of APB OpinionNo. 20 ‘Accounting changes’ and FASB Statement No. 3 ‘Reporting Accounting Changes in Interim Financial Statements’, which has to beapplied for financial years beginning on or after 15 December 2005. It requires retrospective application, and Unilever will apply the standard tothe financial year beginning on 1 January 2006. The adoption is not expected to have a material effect on the consolidated results of operations or financial position of Unilever.

Documents on display in the United States

Unilever files and furnishes reports and information with the United States Securities and Exchange Commission (SEC). Such reports andinformation can be inspected and copied at the SEC’s public reference facilities in Washington DC, Chicago and New York. Certain of ourreports and other information that we file or furnish to the SEC are also available to the public over the internet on the SEC’s website atwww.sec.gov.

| Unilever Annual Report and Accounts 2005 | 161 |

Back to Contents

Additional information for US investors(continued)

Unilever Group

Summarised presentation of the NV and PLC parts of the Group

NV and PLC and their group companies constitute a single reporting entity for the purposes of presenting consolidated accounts. The following supplemental information shows the consolidated income statement and balance sheet of the Group analysed according to the relative legal ownership of individual entities by NV or PLC.

| | € million | | € million | | € million | | € million | | € million | | € million | |

| | NV | | NV | | PLC | | PLC | | Total | | Total | |

| Income statementfor the year ended 31 December | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Continuing operations: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

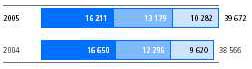

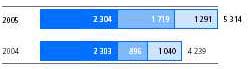

| Turnover | 27 159 | | 26 078 | | 12 513 | | 12 488 | | 39 672 | | 38 566 | |

| | | | | | | | | | | | | |

| Operating profit | 3 682 | | 2 814 | | 1 632 | | 1 425 | | 5 314 | | 4 239 | |

| Net finance costs | (472 | ) | (379 | ) | (146 | ) | (251 | ) | (618 | ) | (630 | ) |

| Share in net profit of joint ventures | 35 | | 30 | | 12 | | 9 | | 47 | | 39 | |

| Share in net profit of associates | (12 | ) | 8 | | (13 | ) | (6 | ) | (25 | ) | 2 | |

| Other income from non-current investments | 20 | | 35 | | 13 | | 19 | | 33 | | 54 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Profit before taxation | 3 253 | | 2 508 | | 1 498 | | 1 196 | | 4 751 | | 3 704 | |

| Taxation | (814 | ) | (520 | ) | (435 | ) | (290 | ) | (1 249 | ) | (810 | ) |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Net profit from continuing operations | 2 439 | | 1 988 | | 1 063 | | 906 | | 3 502 | | 2 894 | |

| Net profit from discontinued operations | 367 | | 36 | | 106 | | 11 | | 473 | | 47 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Net profit | 2 806 | | 2 024 | | 1 169 | | 917 | | 3 975 | | 2 941 | |

| | | | | | | | | | | | | |

| Attributable to: | | | | | | | | | | | | |

| Minority interest | 57 | | 56 | | 152 | | 130 | | 209 | | 186 | |

| Shareholders’ equity | 2 749 | | 1 968 | | 1 017 | | 787 | | 3 766 | | 2 755 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | |

| | € million | | € million | | € million | | € million | | € million | | € million | |

| | NV | | NV | | PLC | | PLC | | Total | | Total | |

| Balance sheetas at 31 December | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Goodwill and intangible assets | 14 152 | | 13 268 | | 3 903 | | 3 739 | | 18 055 | | 17 007 | |

| Property, plant and equipment | 4 321 | | 4 115 | | 2 171 | | 2 066 | | 6 492 | | 6 181 | |

| Pension asset for funded schemes in surplus | 966 | | 558 | | 70 | | 67 | | 1 036 | | 625 | |

| Deferred tax assets | 961 | | 948 | | 742 | | 543 | | 1 703 | | 1 491 | |

| Other non-current assets | 695 | | 721 | | 377 | | 343 | | 1 072 | | 1 064 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Total non-current assets | 21 095 | | 19 610 | | 7 263 | | 6 758 | | 28 358 | | 26 368 | |

| | | | | | | | | | | | | |

| Assets held for sale | 166 | | n/a | | 51 | | n/a | | 217 | | n/a | |

| | | | | | | | | | | | | |

| Inventories | 2 661 | | 2 436 | | 1 446 | | 1 320 | | 4 107 | | 3 756 | |

| Trade and other current receivables | 3 628 | | 3 026 | | 1 202 | | 1 105 | | 4 830 | | 4 131 | |

| Other financial assets | 235 | | 707 | | 100 | | 306 | | 335 | | 1 013 | |

| Cash and cash equivalents | 941 | | 1 109 | | 588 | | 481 | | 1 529 | | 1 590 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Total current assets | 7 465 | | 7 278 | | 3 336 | | 3 212 | | 10 801 | | 10 490 | |

| | | | | | | | | | | | | |

| Borrowings due within one year | (5 506 | ) | (4 101 | ) | (436 | ) | (1 054 | ) | (5 942 | ) | (5 155 | ) |

| Trade payables and other current liabilities | (6 032 | ) | (5 720 | ) | (2 626 | ) | (2 512 | ) | (8 658 | ) | (8 232 | ) |

| Restructuring and other provisions | (460 | ) | (555 | ) | (184 | ) | (244 | ) | (644 | ) | (799 | ) |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Total current liabilities | (11 998 | ) | (10 376 | ) | (3 246 | ) | (3 810 | ) | (15 244 | ) | (14 186 | ) |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Net current assets/(liabilities) | (4 533 | ) | (3 098 | ) | 90 | | (598 | ) | (4 443 | ) | (3 696 | ) |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Total assets less current liabilities | 16 728 | | 16 512 | | 7 404 | | 6 160 | | 24 132 | | 22 672 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Borrowings due after one year | 5 484 | | 5 969 | | 973 | | 924 | | 6 457 | | 6 893 | |

| Pension liability for funded schemes in deficit | 757 | | 698 | | 1 658 | | 1 641 | | 2 415 | | 2 339 | |

| Pension liability for unfunded schemes | 3 040 | | 2 726 | | 1 162 | | 1 014 | | 4 202 | | 3 740 | |

| Restructuring and other provisions | 635 | | 480 | | 97 | | 85 | | 732 | | 565 | |

| Deferred tax liabilities | 770 | | 693 | | 163 | | 96 | | 933 | | 789 | |

| Other non-current liabilities | 338 | | 428 | | 264 | | 289 | | 602 | | 717 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Total non-current liabilities | 11 024 | | 10 994 | | 4 317 | | 4 049 | | 15 341 | | 15 043 | |

| | | | | | | | | | | | | |

| Liabilities held for sale | 16 | | n/a | | 10 | | n/a | | 26 | | n/a | |

| | | | | | | | | | | | | |

| Intra-group – NV/PLC | (1 932 | ) | (2 779 | ) | 1 932 | | 2 779 | | – | | – | |

| | | | | | | | | | | | | |

| Shareholders’ equity | 7 571 | | 8 243 | | 790 | | (979 | ) | 8 361 | | 7 264 | |

| Minority interests | 49 | | 54 | | 355 | | 311 | | 404 | | 365 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Total equity | 7 620 | | 8 297 | | 1 145 | | (668 | ) | 8 765 | | 7 629 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Total capital employed | 16 728 | | 16 512 | | 7 404 | | 6 160 | | 24 132 | | 22 672 | |

|

|

|

|

|

|

|

|

|

|

|

| |

The negative reserves shown for the PLC part of this analysis for 2004 arise largely because of an accounting policy of writing off goodwill in previous years. These write-offs do not have an impact on distributable reserves. See also note 26 on page 126 in connection with the impact of the implementation of IAS 32 and IAS 39 in 2005.

| 162 | Unilever Annual Report and Accounts 2005 |

Back to Contents

Financial Statements |

Additional information for US investors(continued)

Unilever Group

Guarantor statements

On 2 October 2000, NV and Unilever Capital Corporation (UCC) filed a US $15 billion Shelf registration, which is unconditionally and fully guaranteed, jointly and severally, by NV, PLC and Unilever United States, Inc. (UNUS). Of the US $15 billion Shelf registration, US $2.75 billion of Notes were outstanding at 31 December 2005 (2004: US $4.25 billion) with coupons ranging from 5.90% to 7.125%. These Notes are repayable between 1 November 2010 and 15 November 2032.

Provided below are the income statements, cash flow statements and balance sheets of each of the companies discussed above, together with the income statement, cash flow statement and balance sheet of non-guarantor subsidiaries. These have been prepared under the historical cost convention, and, aside from the basis of accounting for investments at net asset value (equity accounting), comply in all material respects with International Financial Reporting Standards. Divergences from US GAAP are disclosed on pages 157 to 161. We have not provided reconciliations from the accounting principles used by Unilever to US GAAP for the columns relating to the guarantor entities, as such reconciliations would not materially affect an investor’s understanding of the nature of this guarantee. The financial information in respect of NV, PLC and UNUS has been prepared with all subsidiaries accounted for on an equity basis. The financial information in respect of the non-guarantor subsidiaries has been prepared on a consolidated basis.

| | € million | | € million | | € million | | € million | | € million | | € million | | € million | |

| | Unilever | | Unilever | | | | Unilever | | | | | | | |

| | Capital | | N.V. | | | | United | | | | | | | |

| | Corporation | | parent | | Unilever PLC | | States Inc. | | Non- | | | | | |

| Income statement | subsidiary | | issuer/ | | parent | | subsidiary | | guarantor | | | | Unilever | |

| for the year ended 31 December 2005 | issuer | | guarantor | | guarantor | | guarantor | | subsidiaries | | Eliminations | | Group | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Continuing operations: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Turnover | – | | – | | – | | – | | 39 672 | | – | | 39 672 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating profit | – | | 87 | | (61 | ) | (3 | ) | 5 291 | | – | | 5 314 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Finance income | – | | 61 | | 11 | | – | | 58 | | – | | 130 | |

| Finance costs | (241 | ) | (274 | ) | (2 | ) | (3 | ) | (173 | ) | – | | (693 | ) |

| Pensions and similar obligations | – | | (5 | ) | – | | (61 | ) | 11 | | – | | (55 | ) |

| Intercompany finance costs | 256 | | 509 | | (11 | ) | (40 | ) | (714 | ) | – | | – | |

| Dividends | – | | 1 043 | | 856 | | – | | (1 899 | ) | – | | – | |

| Share of net profit/(loss) of joint ventures | – | | – | | – | | – | | 47 | | – | | 47 | |

| Share of net profit/(loss) of associates | – | | – | | – | | – | | (25 | ) | – | | (25 | ) |

| Other income from non-current investments | – | | – | | – | | – | | 33 | | – | | 33 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Profit before taxation | 15 | | 1 421 | | 793 | | (107 | ) | 2 629 | | – | | 4 751 | |

| Taxation | (5 | ) | (118 | ) | 36 | | 45 | | (1 207 | ) | – | | (1 249 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net profit from continuing operations | 10 | | 1 303 | | 829 | | (62 | ) | 1 422 | | – | | 3 502 | |

| | | | | | | | | | | | | | | |

| Net profit from discontinued operations | – | | – | | – | | – | | 473 | | – | | 473 | |

| Equity earnings of subsidiaries | – | | 2 463 | | 2 937 | | 732 | | – | | (6 132 | ) | – | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net profit | 10 | | 3 766 | | 3 766 | | 670 | | 1 895 | | (6 132 | ) | 3 975 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Attributable to: | | | | | | | | | | | | | | |

| Minority interest | – | | – | | – | | – | | 209 | | – | | 209 | |

| Shareholders’ equity | 10 | | 3 766 | | 3 766 | | 670 | | 1 686 | | (6 132 | ) | 3 766 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | |

| Income statement | | | | | | | | | | | | | | |

| for the year ended 31 December 2004 | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Continuing operations: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Turnover | – | | – | | – | | – | | 38 566 | | – | | 38 566 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating profit | – | | 59 | | 33 | | 6 | | 4 141 | | – | | 4 239 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Finance income | – | | 26 | | 6 | | – | | 113 | | – | | 145 | |

| Finance costs | (282 | ) | (160 | ) | (2 | ) | (3 | ) | (270 | ) | – | | (717 | ) |

| Pensions and similar obligations | – | | (6 | ) | – | | (10 | ) | (42 | ) | – | | (58 | ) |

| Intercompany finance costs | 296 | | 211 | | (3 | ) | (22 | ) | (482 | ) | – | | – | |

| Dividends | – | | 1 960 | | 770 | | – | | (2 730 | ) | – | | – | |

| Share of net profit/(loss) of joint ventures | – | | – | | – | | – | | 39 | | – | | 39 | |

| Share of net profit/(loss) of associates | – | | – | | – | | – | | 2 | | – | | 2 | |

| Other income from non-current investments | – | | – | | – | | – | | 54 | | – | | 54 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Profit before taxation | 14 | | 2 090 | | 804 | | (29 | ) | 825 | | – | | 3 704 | |

| Taxation | (5 | ) | 35 | | 16 | | 11 | | (867 | ) | – | | (810 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net profit from continuing operations | 9 | | 2 125 | | 820 | | (18 | ) | (42 | ) | – | | 2 894 | |

| | | | | | | | | | | | | | | |

| Net profit from discontinued operations | – | | – | | – | | – | | 47 | | – | | 47 | |

| Equity earnings of subsidiaries | – | | 630 | | 1 935 | | (76 | ) | – | | (2 489 | ) | – | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net profit | 9 | | 2 755 | | 2 755 | | (94 | ) | 5 | | (2 489 | ) | 2 941 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Attributable to: | | | | | | | | | | | | | | |

| Minority interest | – | | – | | – | | – | | 186 | | – | | 186 | |

| Shareholders’ equity | 9 | | 2 755 | | 2 755 | | (94 | ) | (181 | ) | (2 489 | ) | 2 755 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Unilever Annual Report and Accounts 2005 | 163 |

Back to Contents

Additional information for US investors(continued)

Unilever Group

| Guarantor statements(continued) | | | | | | | | | | | | | | |

| | € million | | € million | | € million | | € million | | € million | | € million | | € million | |

| | Unilever | | Unilever | | | | Unilever | | | | | | | |

| | Capital | | N.V. | | | | United | | | | | | | |

| | Corporation | | parent | | Unilever PLC | | States Inc. | | Non- | | | | | |

| | subsidiary | | issuer/ | | parent | | subsidiary | | guarantor | | | | Unilever | |

| Balance sheetas at 31 December 2005 | issuer | | guarantor | | guarantor | | guarantor | | subsidiaries | | Eliminations | | Group | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | |

| Goodwill and intangible assets | – | | 32 | | 54 | | – | | 17 969 | | – | | 18 055 | |

| Property, plant and equipment | – | | – | | – | | 6 | | 6 486 | | – | | 6 492 | |

| Pension asset for funded schemes in surplus | – | | – | | – | | 67 | | 969 | | – | | 1 036 | |

| Deferred tax assets | – | | – | | – | | 1 012 | | 691 | | – | | 1 703 | |

| Other non-current assets | – | | 16 | | – | | 11 | | 1 045 | | – | | 1 072 | |

| Amounts due from group companies after one year | 2 512 | | 6 628 | | 102 | | 1 281 | | (10 523 | ) | – | | – | |

| Net assets of subsidiaries (equity accounted) | – | | 11 176 | | 9 823 | | 6 234 | | (14 593 | ) | (12 640 | ) | – | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total non-current assets | 2 512 | | 17 852 | | 9 979 | | 8 611 | | 2 044 | | (12 640 | ) | 28 358 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Assets held for sale | – | | – | | – | | – | | 217 | | – | | 217 | |

| | | | | | | | | | | | | | | |

| Inventories | – | | – | | – | | – | | 4 107 | | – | | 4 107 | |

| Amounts due from group companies within one year | – | | 19 619 | | 294 | | – | | (19 913 | ) | – | | – | |

| Trade and other current receivables | – | | 635 | | 35 | | 34 | | 4 126 | | – | | 4 830 | |

| Other financial assets | – | | – | | – | | – | | 335 | | – | | 335 | |

| Cash and cash equivalents | 35 | | 163 | | – | | (3 | ) | 1 334 | | – | | 1 529 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total current assets | 35 | | 20 417 | | 329 | | 31 | | (10 011 | ) | – | | 10 801 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Borrowings due within one year | – | | (4 548 | ) | – | | – | | (1 394 | ) | – | | (5 942 | ) |

| Amounts due to group companies within one year | – | | (22 027 | ) | (1 871 | ) | – | | 23 898 | | – | | – | |

| Restructuring and other provisions | – | | (16 | ) | – | | (5 | ) | (623 | ) | – | | (644 | ) |

| Trade payables and other current liabilities | (31 | ) | (534 | ) | (64 | ) | (57 | ) | (7 972 | ) | – | | (8 658 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total current liabilities | (31 | ) | (27 125 | ) | (1 935 | ) | (62 | ) | 13 909 | | – | | (15 244 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net current assets/(liabilities) | 4 | | (6 708 | ) | (1 606 | ) | (31 | ) | 3 898 | | – | | (4 443 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total assets less current liabilities | 2 516 | | 11 144 | | 8 373 | | 8 580 | | 6 159 | | (12 640 | ) | 24 132 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | |

| Borrowings due after one year | 2 296 | | 2 442 | | – | | – | | 1 719 | | – | | 6 457 | |

| Amounts due to group companies after one year | – | | – | | – | | – | | – | | – | | – | |

| Pension liability for funded schemes in deficit | – | | – | | – | | 372 | | 2 043 | | – | | 2 415 | |

| Pension liability for unfunded schemes | – | | 159 | | – | | 1 260 | | 2 783 | | – | | 4 202 | |

| Restructuring and other provisions | – | | 32 | | – | | 3 | | 697 | | – | | 732 | |

| Deferred tax liabilities | – | | 94 | | 12 | | – | | 827 | | – | | 933 | |

| Other non-current liabilities | – | | 56 | | – | | 202 | | 344 | | – | | 602 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total non-current liabilities | 2 296 | | 2 783 | | 12 | | 1 837 | | 8 413 | | – | | 15 341 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Liabilities held for sale | – | | – | | – | | – | | 26 | | – | | 26 | |

| | | | | | | | | | | | | | | |

| Shareholders equity attributable to: | | | | | | | | | | | | | | |

| PLC | – | | 790 | | – | | – | | – | | (790 | ) | – | |

| NV | – | | – | | 7 571 | | – | | – | | (7 571 | ) | – | |

| Called up share capital | – | | 290 | | 222 | | – | | – | | – | | 512 | |

| Share premium account | – | | 25 | | 137 | | – | | – | | – | | 162 | |

| Other reserves | (5 | ) | (1 465 | ) | (863 | ) | (291 | ) | (393 | ) | 689 | | (2 328 | ) |

| Retained profit | 225 | | 8 721 | | 1 294 | | 7 034 | | (2 291 | ) | (4 968 | ) | 10 015 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total shareholders’ equity | 220 | | 8 361 | | 8 361 | | 6 743 | | (2 684 | ) | (12 640 | ) | 8 361 | |

| Minority interests | – | | – | | – | | – | | 404 | | – | | 404 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total equity | 220 | | 8 361 | | 8 361 | | 6 743 | | (2 280 | ) | (12 640 | ) | 8 765 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total capital employed | 2 516 | | 11 144 | | 8 373 | | 8 580 | | 6 159 | | (12 640 | ) | 24 132 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| 164 | Unilever Annual Report and Accounts 2005 |

Back to Contents

Financial Statements |

Additional information for US investors(continued)

Unilever Group

| Guarantor statements(continued) | | | | | | | | | | | | | | |

| | € million | | € million | | € million | | € million | | € million | | € million | | € million | |

| | Unilever | | Unilever | | | | Unilever | | | | | | | |

| | Capital | | N.V. | | | | United | | | | | | | |

| | Corporation | | parent | | Unilever PLC | | States Inc. | | Non- | | | | | |

| | subsidiary | | issuer/ | | parent | | subsidiary | | guarantor | | | | Unilever | |

| Balance sheetas at 31 December 2004 | issuer | | guarantor | | guarantor | | guarantor | | subsidiaries | | Eliminations | | Group | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Goodwill and intangible assets | – | | 10 | | 49 | | – | | 16 948 | | – | | 17 007 | |

| Property, plant and equipment | – | | – | | – | | 4 | | 6 177 | | – | | 6 181 | |

| Pension asset for funded schemes in surplus | – | | – | | – | | 70 | | 555 | | – | | 625 | |

| Deferred tax assets | – | | – | | – | | 585 | | 906 | | – | | 1 491 | |

| Other non-current assets(a) | 17 | | 445 | | 27 | | 11 | | 564 | | – | | 1 064 | |

| Amounts due from group companies after one year | 3 811 | | 710 | | 65 | | 678 | | (5 264 | ) | – | | – | |

| Net assets of subsidiaries (equity accounted)(a) | – | | 8 578 | | 8 528 | | 7 898 | | (14 004 | ) | (11 000 | ) | – | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total non-current assets | 3 828 | | 9 743 | | 8 669 | | 9 246 | | 5 882 | | (11 000 | ) | 26 368 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Assets held for sale | n/a | | n/a | | n/a | | n/a | | n/a | | n/a | | n/a | |

| Inventories | – | | – | | – | | – | | 3 756 | | – | | 3 756 | |

| Amounts due from group companies within one year | – | | 17 053 | | 273 | | – | | (17 326 | ) | – | | – | |

| Trade and other current receivables | – | | 135 | | 48 | | 116 | | 3 832 | | – | | 4 131 | |

| Other financial assets | – | | – | | – | | – | | 1 013 | | – | | 1 013 | |

| Cash and cash equivalents | 10 | | 280 | | – | | (3 | ) | 1 303 | | – | | 1 590 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total current assets | 10 | | 17 468 | | 321 | | 113 | | (7 422 | ) | – | | 10 490 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Borrowings due within one year | (1 618 | ) | (2 149 | ) | (71 | ) | – | | (1 317 | ) | – | | (5 155 | ) |

| Amounts due to group companies within one year | – | | (14 443 | ) | (1 549 | ) | – | | 15 992 | | – | | – | |

| Restructuring and other provisions | – | | (49 | ) | – | | (4 | ) | (746 | ) | – | | (799 | ) |

| Trade payables and other current liabilities | (40 | ) | (203 | ) | (93 | ) | (58 | ) | (7 838 | ) | – | | (8 232 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total current liabilities | (1 658 | ) | (16 844 | ) | (1 713 | ) | (62 | ) | 6 091 | | – | | (14 186 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net current assets/(liabilities) | (1 648 | ) | 624 | | (1 392 | ) | 51 | | (1 331 | ) | – | | (3 696 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total assets less current liabilities | 2 180 | | 10 367 | | 7 277 | | 9 297 | | 4 551 | | (11 000 | ) | 22 672 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Borrowings due after one year | 1 999 | | 2 844 | | – | | – | | 2 050 | | – | | 6 893 | |

| Amounts due to group companies after one year | – | | – | | – | | – | | – | | – | | – | |

| Pension liability for funded schemes in deficit | – | | – | | – | | 245 | | 2 094 | | – | | 2 339 | |

| Pension liability for unfunded schemes | – | | 156 | | – | | 356 | | 3 228 | | – | | 3 740 | |

| Restructuring and other provisions | – | | – | | – | | – | | 565 | | – | | 565 | |

| Deferred tax liabilities | – | | 59 | | 14 | | – | | 716 | | – | | 789 | |

| Other non-current liabilities | – | | 44 | | – | | 184 | | 489 | | – | | 717 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total non-current liabilities | 1 999 | | 3 103 | | 14 | | 785 | | 9 142 | | – | | 15 043 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Liabilities held for sale | n/a | | n/a | | n/a | | n/a | | n/a | | n/a | | n/a | |

| | | | | | | | | | | | | | | |

| Shareholders equity attributable to: | | | | | | | | | | | | | | |

| PLC | – | | (982 | ) | – | | – | | – | | 982 | | – | |

| NV | – | | – | | 8 242 | | – | | – | | (8 242 | ) | – | |

| Called up share capital | – | | 421 | | 222 | | – | | (1 | ) | – | | 642 | |

| Share premium account | – | | 1 399 | | 133 | | – | | (2 | ) | – | | 1 530 | |

| Other reserves | – | | (1 905 | ) | (650 | ) | (448 | ) | (643 | ) | 1 091 | | (2 555 | ) |

| Retained profit | 181 | | 8 331 | | (684 | ) | 8 960 | | (4 310 | ) | (4 831 | ) | 7 647 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total shareholders’ equity | 181 | | 7 264 | | 7 263 | | 8 512 | | (4 956 | ) | (11 000 | ) | 7 264 | |

| Minority interests | – | | – | | – | | – | | 365 | | – | | 365 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total equity | 181 | | 7 264 | | 7 263 | | 8 512 | | (4 591 | ) | (11 000 | ) | 7 629 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total capital employed | 2 180 | | 10 367 | | 7 277 | | 9 297 | | 4 551 | | (11 000 | ) | 22 672 | |

|

|

|

|

|

|

|

|

| |

| (a) | Certain prior year balances have been reclassified to conform with current year presentation. |

| Unilever Annual Report and Accounts 2005 | 165 |

Back to Contents

Additional information for US investors(continued)

Unilever Group

Guarantor statements(continued)

| | € million | | € million | | € million | | € million | | € million | | € million | | € million | |

| | Unilever | | Unilever | | | | Unilever | | | | | | | |

| | Capital | | N.V. | | | | United | | | | | | | |

| | Corporation | | parent | | Unilever PLC | | States Inc. | | Non- | | | | | |

| Cash flow statement | subsidiary | | issuer/ | | parent | | subsidiary | | guarantor | | | | Unilever | |

| for the year ended 31 December 2005 | issuer | | guarantor | | guarantor | | guarantor | | subsidiaries | | Eliminations | | Group | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash flow from operating activities | – | | (5 | ) | (156 | ) | 33 | | 6 052 | | – | | 5 924 | |

| Income tax paid | – | | (86 | ) | (19 | ) | (177 | ) | (1 289 | ) | – | | (1 571 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from operating activities | – | | (91 | ) | (175 | ) | (144 | ) | 4 763 | | – | | 4 353 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Interest received | 253 | | 285 | | 10 | | – | | (106 | ) | (312 | ) | 130 | |

| Net capital expenditure | – | | (24 | ) | (3 | ) | (2 | ) | (784 | ) | – | | (813 | ) |

| Acquisitions and disposals | – | | – | | – | | – | | 784 | | – | | 784 | |

| Other investing activities | 1 796 | | (689 | ) | – | | 189 | | 443 | | (1 325 | ) | 414 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from/(used in) investing activities | 2 049 | | (428 | ) | 7 | | 187 | | 337 | | (1 637 | ) | 515 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Dividends paid on ordinary share capital | – | | 28 | | 37 | | – | | (1 869 | ) | – | | (1 804 | ) |

| Interest and preference dividends paid | (253 | ) | (181 | ) | (7 | ) | (43 | ) | (471 | ) | 312 | | (643 | ) |

| Change in borrowings and finance leases | (1 774 | ) | 1 623 | | 309 | | – | | (2 363 | ) | 1 325 | | (880 | ) |

| Purchase of treasury stock | – | | (1 068 | ) | (171 | ) | – | | (37 | ) | – | | (1 276 | ) |

| Other finance activities | – | | – | | – | | – | | (218 | ) | – | | (218 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from/(used in) financing activities | (2 027 | ) | 402 | | 168 | | (43 | ) | (4 958 | ) | 1 637 | | (4 821 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net increase/(decrease) in cash and cash equivalents | 22 | | (117 | ) | – | | – | | 142 | | – | | 47 | |

| | | | | | | | | | | | | | | |

| Cash and cash equivalents at the beginning of the year | 10 | | 279 | | – | | (3 | ) | 1 120 | | – | | 1 406 | |

| | | | | | | | | | | | | | | |

| Effect of foreign exchange rate changes | 3 | | – | | – | | – | | (191 | ) | – | | (188 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash and cash equivalents at the end of the year | 35 | | 162 | | – | | (3 | ) | 1 071 | | – | | 1 265 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash flow statement | | | | | | | | | | | | | | |

| for the year ended 31 December 2004 | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash flow from operating activities | 6 | | 58 | | 45 | | (200 | ) | 7 016 | | – | | 6 925 | |

| Income tax paid | – | | (96 | ) | (126 | ) | (145 | ) | (1 011 | ) | – | | (1 378 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from operating activities | 6 | | (38 | ) | (81 | ) | (345 | ) | 6 005 | | – | | 5 547 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Interest received | 295 | | 356 | | 6 | | – | | 106 | | (595 | ) | 168 | |

| Net capital expenditure | – | | (9 | ) | (17 | ) | (1 | ) | (842 | ) | – | | (869 | ) |

| Acquisitions and disposals | – | | – | | – | | – | | 316 | | – | | 316 | |

| Other investing activities | (311 | ) | 2 375 | | – | | 372 | | 288 | | (2 459 | ) | 265 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from/(used in) investing activities | (16 | ) | 2 722 | | (11 | ) | 371 | | (132 | ) | (3 054 | ) | (120 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Dividends paid on ordinary share capital | – | | 971 | | – | | – | | (2 691 | ) | – | | (1 720 | ) |

| Interest and preference dividends paid | (282 | ) | (249 | ) | (3 | ) | (24 | ) | (824 | ) | 595 | | (787 | ) |

| Change in borrowings and finance leases | 302 | | (3 402 | ) | 116 | | – | | (2 365 | ) | 2 459 | | (2 890 | ) |

| Purchase of treasury stock | – | | (148 | ) | (21 | ) | (2 | ) | (161 | ) | – | | (332 | ) |

| Other finance activities | – | | – | | – | | – | | (209 | ) | – | | (209 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from/(used in) financing activities | 20 | | (2 828 | ) | 92 | | (26 | ) | (6 250 | ) | 3 054 | | (5 938 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net increase/(decrease) in cash and cash equivalents | 10 | | (144 | ) | – | | – | | (377 | ) | – | | (511 | ) |

| | | | | | | | | | | | | | | |

| Cash and cash equivalents at the beginning of the year | 1 | | 423 | | – | | (3 | ) | 1 007 | | – | | 1 428 | |

| | | | | | | | | | | | | | | |

| Effect of foreign exchange rate changes | (1 | ) | – | | – | | – | | 490 | | – | | 489 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash and cash equivalents at the end of the year | 10 | | 279 | | – | | (3 | ) | 1 120 | | – | | 1 406 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| 166 | Unilever Annual Report and Accounts 2005 |

Back to Contents

Financial Statements |

Principal group companies and non-current investments

Unilever Groupas at 31 December 2005

|

| The companies listed below and on page 168 are those which, in the opinion of the Directors, principally affect the amount of profit and assets shown in the Unilever Group accounts. The Directors consider that those companies not listed are not significant in relation toUnilever as a whole. |

| |

| Full information as required by Articles 379 and 414 of Book 2 of the Civil Code in the Netherlands has been filed by Unilever N.V. with theCommercial Registry in Rotterdam. |

| |

| Particulars of PLC group companies and other significant holdings as required by the United Kingdom Companies Act 1985 will beannexed to the next Annual Return of Unilever PLC. |

| |

| Unless otherwise indicated, the companies are incorporated and principally operate in the countries under which they are shown. |

| |

| The aggregate percentage of equity capital directly or indirectly held by NV or PLC is shown in the margin, except where it is 100%. All thesepercentages are rounded down to the nearest whole number. |

| |

| The percentage of Unilever’s shareholdings held either directly orindirectly by NV and PLC are identified in the tables according to the following code: |

|

|

| NV 100% | a |

| PLC 100% | b |

| NV 73%; PLC 27% | c |

| NV 90%; PLC 10% | d |

| NV 19%; PLC 81% | e |

| NV 57%; PLC 43% | f |

|

|

Due to the inclusion of certain partnerships in the consolidated group accounts of Unilever, para 264(b) of the German trade law grants an exemption from the duty to prepare individual statutory financial statements and management reports in accordance with the requirements for limited liability companies and to have these audited.

|

|

| Principal group companies | |

|

|

| % | Europe | Ownership |

|

|

| | Austria | |

| | Unilever Austria GmbH | d |

|

|

| | Belgium | |

| | Unilever Belgium BVBA/SPRL (Unibel) | d |

|

|

| | France | |

| | Amora Maille Société Industrielle S.A.S | d |

| | Cogesal-Miko S.A.S | d |

| 99 | Lever Fabergé France S.A.S | d |

| | Unilever France S.A.S | d |

|

|

| | Germany | |

| | Maizena Grundstücksverwaltungs | |

| | GmbH & Co. OHG | d |

| | Pfanni GmbH & Co. OHG Stavenhagen | d |

| | Pfanni Werke Grundstücksverwaltungs | |

| | GmbH & Co. OHG | d |

| | PW Vermietungs GmbH & Co. KG | d |

| | UBG Vermietungs GmbH & Co. OHG | d |

| | Unilever Deutschland GmbH | d |

| | Unilever Deutschland Holding GmbH | d |

| | Unilever Deutschland Immobilien Leasing | |

| | GmbH & Co. OHG | d |

| | Wizona IPR GmbH & Co. OHG | d |

| | Wizona Vermögensverwaltugs GmbH & Co. | |

| | OHG | d |

|

|

| | Greece | |

| 67 | Elais-Unilever S.A. | a |

| | Unilever Hellas A.E.B.E. | a |

|

|

| | Italy | |

| | Unilever Italia SrL | d |

|

|

| | The Netherlands | |

| | Mixhold B.V. | d |

| | Unilever N.V.(a) | |

| | Unilever Nederland B.V. | d |

|

|

| | Poland | |

| 99 | Unilever Polska S.A. | d |

|

|

| | Spain | |

| | Unilever España S.A. | a |

| | Unilever Foods España S.A. | a |

|

|

| | Sweden | |

| | Unilever Sverige | a |

|

|

| | Switzerland | |

| | Unilever Raw Materials AG | a |

| | Unilever Schweiz GmbH | d |

|

|

| | United Kingdom | |

| | Lever Fabergé Ltd. | e |

| | Unilever Bestfoods UK Ltd. | e |

| | Unilever Ice Cream & Frozen Food Ltd. | e |

| | Unilever PLC(a) | |

| | Unilever UK Holdings Ltd. | b |

| | Unilever UK & CN Holdings Ltd. | e |

|

|

| (a) See ‘Basis of consolidation’ in note 1 on page 82 | |

In addition, we have operations in the following countries: Bulgaria,

Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, Hungary,

Ireland, Latvia, Lithuania, Norway, Portugal, Romania, Russia, Serbia,

Slovakia, Slovenia and Ukraine.

| Unilever Annual Report and Accounts 2005 | 167 |

Back to Contents

Principal group companies and fixed investments

Unilever Groupas at 31 December 2005

|

|

| Principal group companies(continued) | |

|

|

|

| % | The Americas | Ownership |

|

|

|

| | Argentina | |

| | Unilever de Argentina S.A. | d |

|

|

|

| | Brazil | |

| | Unilever Brasil Ltda. | d |

|

|

|

| | Canada | |

| | Unilever Canada Inc. | e |

|

|

|

| | Chile | |

| | Unilever Chile Home and Personal Care Ltda. | d |

|

|

|

| | Mexico | |

| | Unilever de México S. de R.L. de C.V. | d |

| | Unilever Holding México, S. de R.L. de C.V. | d |

|

|

|

| | United States of America | |

| | Conopco, Inc. | c |

| | Unilever Capital Corporation | c |

| | Unilever United States, Inc. | c |

|

|

In addition, we have operations in the following countries: Bolivia, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Netherlands Antilles, Nicaragua, Panama, Paraguay, Peru, Trinidad & Tobago, Uruguay and Venezuela.

|

|

|

| % | Asia Africa | Ownership |

|

|

|

| | Australia | |

| | Unilever Australia Ltd. | b |

|

|

|

| | China | |

| | Unilever (China) Investing Company Ltd. | a |

| | Unilever Services (Hefei) Limited | a |

|

|

|

| | India | |

| 51 | Hindustan Lever Ltd. | b |

|

|

|

| | Indonesia | |

| 85 | P.T. Unilever Indonesia Tbk | a |

|

|

|

| | Japan | |

| | Unilever Japan KK | a |

|

|

|

| | Thailand | |

| | Unilever Thai Trading Ltd. | d |

|

|

|

| | South Africa | |

| 59 | Unilever South Africa Foods (Pty) Limited | f |

| | Unilever South Africa Home and | |

| | Personal Care (Pty) Ltd. | b |

|

|

|

| | Turkey | |

| | Unilever Sanayi ve Ticaret Türk A.S. | a |

|

|

|

In addition, we have operations in the following countries: Abu Dhabi, Algeria, Bahrain, Bangladesh, Cambodia, Cameroon, Côte d’Ivoire, Democratic Republic of Congo, Dubai, Egypt, Ghana, Israel, Jordan, Kenya, Lebanon, Malawi, Malaysia, Morocco, Mozambique, Namibia, New Zealand, Niger, Nigeria, Oman, Pakistan, Palestine, Philippines, Saudi Arabia, Senegal, Singapore, South Korea, Sri Lanka, Syria, Taiwan, Tanzania, Tunisia, Uganda, United Arab Emirates, Vietnam, Zambia and Zimbabwe.

|

|

| Principal non-current investments | |

|

|

| Joint ventures | |

|

|

|

| % | Europe | Ownership |

|

|

|

| | Portugal | |

| 49 | FIMA/VG-Distribuição de Produtos | |

| | Alimentares, Lda. | a |

|

|

|

| % | The Americas | |

|

|

|

| | United States of America | |

| 50 | Pepsi/Lipton Partnership | c |

|

|

|

| Associates | |

|

|

|

| % | Europe | Ownership |

|

|

|

| | United Kingdom | |

| 40 | Langholm Capital Partners L.P. | b |

|

|

|

| % | The Americas | |

|

|

|

| | United States of America | |

| 33 | JohnsonDiversey Holdings, Inc. | a |

|

|

|

| % | Asia Africa | |

|

|

|

| | Côte d’Ivoire | |

| 40 | Palmci | b |

|

|

|

| 168 | Unilever Annual Report and Accounts 2005 |

Back to Contents

[THIS PAGE HAS BEEN DELIBERATELY LEFT BLANK]

| Unilever Annual Report and Accounts 2005 | 169 |

Back to Contents

Company accounts

Unilever N.V.

Balance sheetas at 31 December

| | € million | | € million | |

| | 2005 | | 2004 | |

| | | | Restated | |

|

|

|

| |

| Fixed assets | | | | |

| Fixed investments | 11 276 | | 11 233 | |

| | | | | |

| Current assets | | | | |

| Debtors | 26 898 | | 16 623 | |

| Cash at bank and in hand | 163 | | 280 | |

| |

|

|

| |

| Total current assets | 27 061 | | 16 903 | |

| Creditors due within one year | (27 109 | ) | (16 863 | ) |

| | | | | |

| Net current assets/(liabilities) | (48 | ) | 40 | |

| |

|

|

| |

| Total assets less current liabilities | 11 228 | | 11 273 | |

|

|

|

| |

| Creditors due after more than one year | 2 503 | | 2 885 | |

| | | | | |

| Provisions for liabilities and charges (excluding pensions and similar obligations) | 115 | | 102 | |

| | | | | |

| Net pension liability for unfunded schemes | 157 | | 152 | |

| | | | | |

| Capital and reserves | 8 453 | | 8 134 | |

| Called up share capital: | | | | |

| Preferential share capital | – | | 130 | |

| Ordinary share capital | 291 | | 291 | |

| |

|

|

| |

| | 291 | | 421 | |

| Share premium account | 20 | | 1 399 | |

| Other reserves | (1 321 | ) | (1 379 | ) |

| Profit retained | 9 463 | | 7 693 | |

| | | | | |

| Total capital employed | 11 228 | | 11 273 | |

|

|

|

| |

Profit and loss account for the year ended 31 December

| | € million | | € million | |

| | 2005 | | 2004 | |

| | | | Restated | |

|

|

|

| |

| Income from fixed investments after taxation | 2 347 | | 618 | |

| Other income and expenses | 289 | | 158 | |

| |

|

|

| |

| Profit for the year | 2 636 | | 776 | |

|

|

|

| |

For the information required by Article 392 of Book 2 of the Civil Code in the Netherlands, refer to pages 169 and 173. Pages 167 and 168 are part of the notes to the Unilever N.V. company accounts.

The company accounts of Unilever N.V. are included in the consolidated accounts of the Unilever Group. Therefore, and in accordance with Article 402 of Book 2 of the Civil Code in the Netherlands, the profit and loss account only reflects the income from fixed investments after taxation and other income and expenses after taxes. The company accounts of Unilever N.V. do not contain a cash flow statement as this is not required by book 2 of the Civil Code in the Netherlands.

The company accounts of Unilever N.V. comply in all material respects with legislation in the Netherlands. As allowed by Article 362.1 of Book 2 of the Civil Code in the Netherlands, the company accounts are prepared in accordance with United Kingdom accounting standards, unless such standards conflict with the Civil Code in the Netherlands which would in such case prevail.

The Board of Directors

28 February 2006

| 170 | Unilever Annual Report and Accounts 2005 |

Back to Contents

Financial Statements |

Notes to the company accounts

Unilever N.V.

Accounting information and policies

Basis of preparation

The accounts have been prepared in accordance with applicable United Kingdom accounting standards as allowed by Article 362.1 of Book 2 of the Civil Code in the Netherlands.

The accounts are prepared under the historical cost convention as modified by the revaluation of financial assets classified as 'available-for-sale investments', 'financial assets at fair value through profit or loss', and 'derivative financial instruments' in accordance with the accounting policies set out below which have been consistently applied except as highlighted in the ‘Prior year adjustment’ note below.

Accounting policies

The principal accounting policies are as follows:

Fixed investments

Shares in group companies are stated at cost less any amounts written off to reflect a permanent impairment. Any impairment is charged to the profit and loss account as it arises. In accordance with Article 385.5 of Book 2 of the Civil Code in the Netherlands, Unilever N.V. shares held by Unilever N.V. subsidiaries are deducted from the carrying value of those subsidiaries. This differs from the accounting treatment under UK GAAP (UITF 37) which would require these amounts to be included within fixed investments.

Financial instruments and derivative financial instruments

The company’s accounting policies under United Kingdom generally accepted accounting principles (UK GAAP) namely FRS 25 ‘Financial Instruments: Disclosure and Presentation’ and FRS 26 ‘Financial Instruments: Measurement’ are the same as the Unilever Group’s accounting policies under International Financial Reporting Standards (IFRSs) namely IAS 32 ‘Financial Instruments: Disclosure and Presentation’ and IAS 39 ‘Financial Instruments: Recognition and Measurement’. These standards are effective from 1 January 2005 and the policies are set out under the heading ‘Financial instruments’ in note 1 to the consolidated accounts on page 83. Unilever NV is taking the exemption for not providing all the financial instruments disclosures, because IAS 32 disclosures are given in note 19 to the consolidated accounts on pages 110 to 113. The changes to preference share capital, share premium account and profit retained in this regard are set out in the following notes and further described in the notes to the consolidated accounts.

Deferred taxation

Full provision is made for deferred taxation on all significant timing differences arising from the recognition of items for taxation purposes in different periods from those in which they are included in the company's accounts. Full provision is made at the rates of tax prevailing at the year end unless future rates have been enacted or substantively enacted. Deferred tax assets and liabilities have not been discounted.

Own shares held

Own shares held by the company are accounted for in accordance with Netherlands law and United Kingdom UITF 37. All differences between the purchase price of the shares held to satisfy options granted and the proceeds received for the shares, whether on exercise or lapse, are charged to reserves.

Retirement benefits

Unilever N.V. has accounted for pensions and similar benefits under the United Kingdom Financial Reporting Standard 17 'Retirement benefits' (FRS 17). The operating and financing costs of defined benefit plans are recognised separately in the profit and loss account; service costs are systematically spread over the service lives of employees, and financing costs are recognised in the periods in which

they arise. Variations from expected costs, arising from the experience of the plans or changes in actuarial assumptions, are recognised immediately in the statement of total recognised gains and losses. The costs of individual events such as past service benefit enhancements, settlements and curtailments are recognised immediately in the profit and loss account. The liabilities and, where applicable, the assets of defined benefit plans are recognised at fair value in the balance sheet. The charges to the profit and loss account for defined contribution plans are the company contributions payable and the assets of such plans are not included in the company balance sheet.

Prior year adjustment

Financial Reporting Standard 21 (FRS 21) 'Events after the Balance Sheet Date' has been adopted for the first time in the year ended 31 December 2005. Under FRS 21, proposed dividends do not meet the definition of a liability until such time as they have been approved by shareholders at the Annual General Meeting. Therefore, Unilever N.V. no longer recognises a liability in any period for dividends that have been proposed but will not be approved until after the balance sheet date. This holds for external dividends as well as intra-group dividends paid to the parent company.

The effect for the company of implementing FRS 21 has been to increase retained profits by €729 million in the current period (2004: decrease of €646 million), decrease dividend creditors due within one year by €729 million (2004: decrease by €696 million), decrease intergroup debtors due within one year by € nil (2004: €1 274 million) and increase inter-group creditors due within one year by € nil (2004: €67 million). The impact of the FRS 21 implementation on profits for the years 2004 and 2005 is explained in the notes under the heading ‘Profit retained’.

The comparative amounts for the year ended 31 December 2004 have been restated accordingly.

| Fixed investments | € million | | € million | |

| | 2005 | | 2004 | |

|

|

|

| |

| Shares in group companies | 11 082 | | 11 024 | |

| Book value of PLC shares held in | | | | |

| connection with share options | 432 | | 445 | |

| Less NV shares held by group companies | (238 | ) | (236 | ) |

| |

|

|

| |

| | 11 276 | | 11 233 | |

| |

|

|

| |

| Movements during the year: | | | | |

| 1 January | 11 233 | | 11 161 | |

| Movement in PLC shares held in connection | | | | |

| with share options | (13 | ) | 64 | |

| Movement in NV shares held by group companies | (2 | ) | (8 | ) |

| Additions | 89 | | 16 | |

| Decreases | (31 | ) | – | |

| |

|

|

| |

| 31 December | 11 276 | | 11 233 | |

|

|

|

| |

| Debtors | € million | | € million | |

| | 2005 | | 2004 | |

| | | | Restated | |

|

|

|

| |

| Loans to group companies | 22 460 | | 14 056 | |

| Other amounts owed by group companies | 3 771 | | 2 433 | |

| Amounts owed by undertakings in which | | | | |

| the company has a participating interest | 15 | | 15 | |

| Prepayments and accrued income | 587 | | 98 | |

| Other | 65 | | 21 | |

| |

|

|

| |

| | 26 898 | | 16 623 | |

| |

|

|

| |

| Of which due after more than one year | 6 645 | | 710 | |

|

|

|

| |

| Unilever Annual Report and Accounts 2005 | 171 |

Back to Contents

Notes to the company accounts(continued)

Unilever N.V.

| Cash at bank and in hand | € million | | € million | |

| | 2005 | | 2004 | |

|

|

|

| |

| This includes amounts for which repayment notice is required of: | 38 | | 80 | |

|

|

|

| |

| | | | | |

| Creditors | € million | | € million | |

| | 2005 | | 2004 | |

| | | | Restated | |

|

|

|

| |

| Due within one year: | | | | |

| Bank loans and overdrafts | – | | 1 | |

| Bonds and other loans | 4 548 | | 2 148 | |

| Loans from group companies | 3 328 | | 310 | |

| Other amounts owed to group companies | 18 699 | | 14 200 | |

| Taxation and social security | 20 | | 22 | |

| Accruals and deferred income | 405 | | 173 | |

| Other | 109 | | 9 | |

| |

|

|

| |

| | 27 109 | | 16 863 | |

| |

|

|

| |

| Due after more than one year: | | | | |

| Accruals and deferred income | 56 | | 41 | |

| Preference shares | 124 | | – | |

| Bonds and other loans | 2 323 | | 2 844 | |

| |

|

|

| |

| | 2 503 | | 2 885 | |

|

|

|

| |

From 1 January 2005, Unilever N.V. has adopted FRS 25 ‘Financial Instruments: Disclosure and Presentation’ which requires preference shares that provide for a fixed preference dividend to be classified as borrowings. In accordance with the transitional rules for FRS 25, 2004 comparatives have not been restated.

Creditors due after 5 years amount to €870 million (Article 375.2 of Book 2 of the Civil Code in the Netherlands).

| Provisions for liabilities and charges (excluding pensions | | | |

| and similar obligations) | | | | |

| | € million | | € million | |

| | 2005 | | 2004 | |

|

|

|

| |

| Deferred taxation and other provisions | 115 | | 102 | |

| |

|

|

| |

| Of which due within one year | 34 | | 55 | |

|

|

|

| |

| | | | | |

| Preference share capital | | | € million | |

|

|

|

| |

| At 31 December 2004 | | | 130 | |

| FRS 25/26 adjustments | | | (130 | ) |

| | | |

| |

| At 1 January 2005 and 31 December 2005 | | | – | |

|

|

|

| |

Ordinary share capital

Shares numbered 1 to 2 400 are held by a subsidiary of NV and a subsidiary of PLC, each holding 50%. Additionally, 24 603 661 (2004: 24 898 145) €0.51 ordinary shares are held by NV and other group companies. Full details are given in note 24 to the consolidated accounts on page 124, and note 31 on page 141.

| Share premium account | € million | |

|

| |

| At 31 December 2004 | 1 399 | |

| FRS 25/26 adjustments | (1 379 | ) |

| |

| |

| At 1 January 2005 and 31 December 2005 | 20 | |

|

| |

The share premium shown in the balance sheet is not available for the issue of bonus shares or for repayment without incurring withholding tax payable by the company. This is despite the change in the Netherlands tax law, as a result of which dividends received from 2001 onwards by individual shareholders who are Netherlands residents are no longer taxed.

| Other reserves | € million | | € million | |

| | 2005 | | 2004 | |

|

|

|

| |

| 1 January | (1 379 | ) | (1 243 | ) |

| Change in own shares held | 58 | | (136 | ) |

| |

|

|

| |

| 31 December | (1 321 | ) | (1 379 | ) |

|

|

|

| |

| Profit retained | € million | | € million | |

| | 2005 | | 2004 | |

| | | | Restated | |

|

|

|

| |

| Balance brought forward | 8 339 | | 7 304 | |

| FRS 21 adjustments | (646 | ) | 638 | |

| |

|

|

| |

| Balance brought forward – restated | 7 693 | | 7 942 | |

| FRS 25/26 adjustments | 412 | | n/a | |

| |

|

|

| |

| 1 January – restated | 8 105 | | 7 942 | |

| Profit for the year(a) | 2 636 | | 776 | |

| Preference dividends | – | | (28 | ) |

| Ordinary dividends – final 2003 | – | | (638 | ) |

| Ordinary dividends – interim 2004 | – | | (346 | ) |

| Ordinary dividends – final 2004 | (716 | ) | – | |

| Ordinary dividends – interim 2005 | (367 | ) | – | |

| Conversion of preference shares | (199 | ) | – | |

| Fair value adjustments for cash flow hedges | 4 | | – | |

| Realised profit/(loss) on shares/certificates held | | | | |

| to meet employee share options | (1 | ) | (9 | ) |

| Changes in present value of net pension liability | 1 | | (4 | ) |

| |

|

|

| |

| 31 December | 9 463 | | 7 693 | |

|

|

|

| |

| (a) | Profit for the year as reported in 2004 was €2 118 million. This includes intra-group dividends of €1 342 million which under FRS 21 are not recognised until they have been approved by shareholders at the Annual General Meeting. This €1 342 million has now been added to the 2005 profit for the year. |

Profit retained shown in the company accounts and the notes thereto differs from the amount shown in note 26 to the consolidated accounts on page 126 mainly because of certain inter-company transactions which are eliminated in the consolidated accounts.

| | € million | |

|

| |

| Difference as at 31 December 2004 as previously reported | 1 061 | |

| Accounting policy change | 214 | |

| |

| |

| Difference as at 31 December 2004 as restated | 1 275 | |

| Changes in equity value of the consolidated participations | (3 580 | ) |

| Change in the accumulated intercompany results | 3 047 | |

| |

| |

| Difference as at 31 December 2005 | 742 | |

|

| |

| | | | | |

| Contingent liabilities | € million | | € million | |

| | 2005 | | 2004 | |

|

|

|

| |

These are not expected to give rise to any material loss and include guarantees given for group companies, under which amounts outstanding at 31 December were: | 5 416 | | 6 822 | |

| |

|

|

| |

| Of the above, guaranteed also by PLC | 3 705 | | 5 010 | |

|

|

|

| |

The guarantees given to other companies were immaterial.

NV has issued joint and several liability undertakings, as defined in Article 403 of Book 2 of the Civil Code in the Netherlands, for almost all Dutch group companies. These written undertakings have been filed with the office of the Company Registry in whose area of jurisdiction the group company concerned has its registered office.

| 172 | Unilever Annual Report and Accounts 2005 |

Back to Contents

Financial Statements |

Further statutory and other information

Unilever N.V.

The rules for profit appropriation in the Articles of Association

(summary of Article 38)

The profit for the year is applied firstly to the reserves required by law or by the Equalisation Agreement, secondly to cover losses of previous years, if any, and thirdly to the reserves deemed necessary by the Board of Directors. Dividends due to the holders of the Cumulative Preference Shares, including any arrears in such dividends, are then paid; if the profit is insufficient for this purpose, the amount available is distributed to them in proportion to the dividend percentages of their shares. Any profit remaining thereafter shall be distributed to them in proportion to the dividend percentages of their shares. The General Meeting can only decide to make distributions from reserves on the basis of a proposal by the Board and in compliance with the law and the Equalisation Agreement.

| | € million | |

| | 2005 | |

|

| |

| Proposed profit appropriation | | |

| Profit for the year | 2 636 | |

| Of which already appropriated in 2004 | (1 342 | ) |

| |

| |

| Available for distribution | 1 294 | |

| Interim dividend 2005 already paid | (367 | ) |

| |

| |

| To profit retained | 927 | |

|

| |

Post balance sheet event

The directors propose a final dividend of €1.32 per share (totalling

€729 million) out of the profits retained for the year ended

31 December 2005. The dividend will be submitted for formal

approval at the Annual General Meeting to be held on 8 May 2006.

In accordance with FRS 21, these financial statements do not reflect

this dividend payable, which will be accounted for in shareholders’

equity as an appropriation of retained earnings in the year ended

31 December 2006. During 2005, a final dividend of €1.26 per share

(totalling €716 million) was paid in respect of the dividend declared

for the year ended 31 December 2004.

Special controlling rights under the Articles of Association

See note 24 to the consolidated accounts on page 124.

Auditors

A resolution will be proposed at the Annual General Meeting on

8 May 2006 for the re-appointment of PricewaterhouseCoopers

Accountants N.V. as auditors of NV. The present appointment will

end at the conclusion of the Annual General Meeting.

Corporate Centre

Unilever N.V.

Weena 455

PO Box 760

3000 DK Rotterdam

J A A van der Bijl

S G Williams

Joint Secretaries of Unilever N.V.

28 February 2006

| Unilever Annual Report and Accounts 2005 | 173 |

Back to Contents

[THIS PAGE HAS BEEN DELIBERATELY LEFT BLANK]

| 174 | Unilever Annual Report and Accounts 2005 |

Back to Contents

Financial Statements |

Company accounts

Unilever PLC

Balance sheetas at 31 December

| | | | | |

| | £ million | | £ million | |

| | 2005 | | 2004 | |

| | | | Restated | |

|

|

|

| |

| Fixed assets | | | | |

| Intangible assets | 28 | | 31 | |

| Fixed investments | 2 237 | | 2 237 | |

| | | | | |

| Current assets | | | | |

| Debtors | | | | |

| Debtors due within one year | 226 | | 227 | |

| Debtors due after more than one year | 70 | | 65 | |

| |

|

|

| |

| Total current assets | 296 | | 292 | |

| Creditors due within one year | (1 328 | ) | (1 681 | ) |

| |

|

|

| |

| Net current liabilities | (1 032 | ) | (1 389 | ) |

| |

|

|

| |

| Total assets less current liabilities | 1 233 | | 879 | |

|

|

|

| |

| Provision for liabilities and charges (excluding pensions and similar obligations) | 6 | | 10 | |

| | | | | |

| Capital and reserves | 1 227 | | 869 | |

| Called up share capital 24 | 41 | | 41 | |

| Share premium account | 94 | | 94 | |

| Capital redemption reserve | 11 | | 11 | |

| Other reserves | (385 | ) | (268 | ) |

| Profit retained | 1 466 | | 991 | |

| Total capital employed | 1 233 | | 879 | |

|

|

|

| |

As permitted by Section 230 of the United Kingdom Companies Act 1985, an entity profit and loss account is not included as part of the published company accounts for PLC.

On behalf of the Board of Directors

A BurgmansChairman

P CescauGroup Chief Executive

28 February 2006

| Unilever Annual Report and Accounts 2005 | 175 |

Back to Contents

Notes to the company accounts

Unilever PLC

Accounting information and policies

Basis of preparation

The accounts have been prepared in accordance with applicable United Kingdom accounting standards and the United Kingdom Companies Act 1985.