The table below shows the expected benefit payments from defined benefit plans. The benefits paid from funded plans include amounts funded by employee contributions. The benefits paid in respect of unfunded plans are made from the Group’s cash resources.

Under IFRS, deferred tax on share-based compensation is provided based on the actual tax credit expected to be received using the fair market value of the share price at the year end (the intrinsic value). The deferred tax is credited to the income statement to the extent of the tax recognised on the share-based compensation charge with the excess recognised directly in equity. Under US GAAP, upon adoption of FAS 123(R), ‘Share Based Payments’, deferred tax is recognised to the extent of the cumulative amount of compensation cost recognised through the income statement. Upon exercise, the deferred tax adjustment required is recognised in the income statement or equity, dependent on whether a windfall pool exists or not.

Back to Contents

| | |

| | Financial Statements (continued) |

| | |

| Notes to the consolidated accountsUnilever Group |

|

34 Divergences from United States GAAP(continued)

Profit or loss on disposal of group companies

Under both IFRS and US GAAP, Unilever calculates profit or loss on sale of group companies net of goodwill included on the balance sheet and after the write-back of cumulative currency retranslation differences. Under previous GAAP, goodwill and intangible assets purchased prior to 1 January 1998 were written off in the year of acquisition as a movement in profits retained. Under US GAAP, such goodwill and intangible assets were capitalised and, prior to 1 January 2002, were amortised over their useful lives. These different accounting treatments give rise to differences between net profit or loss calculated under IFRS and that calculated under US GAAP. In 2006, the additional goodwill and intangibles recorded under US GAAP for disposals during the year means that the disposal profit was €167 million (2005: €217 million; 2004: €11 million) lower than that reported under IFRS.

Under IFRS, cumulative currency retranslation differences arising from the transition date to IFRS of 1 January 2004 are included in the calculation whereas under US GAAP the profit or loss on disposal includes cumulative currency retranslation differences which have arisen since the date that the businesses were originally acquired.

Currency retranslation

Under IFRS, the gain from cumulative translation differences arising from the partial repayment of capital of a subsidiary is recognised within the income statement. Under US GAAP, currency translation gains and losses are only recycled to the income statement on the sale or upon the complete or substantially complete liquidation of the investment.

Financial instruments

From 1 January 2005, Unilever recognises all derivative financial instruments on the balance sheet at fair value and applies hedge accounting to a portion of its portfolio of derivative financial instruments, meaning that changes in the fair value of derivative financial instruments that are designated and effective as hedges of future cash flows are recognised directly in equity and any ineffective portion is recognised immediately in the income statement. This is similar to requirements under FAS 133, ‘Accounting for Derivatives and Hedging Activities’.

Prior to the adoption of IAS 32 and IAS 39 on 1 January 2005, Unilever applied hedge accounting to its portfolio of derivative financial instruments, meaning that changes in the value of forward exchange contracts were recognised in the results in the same period as changes in the values of the assets and liabilities they were intended to hedge. Interest payments and receipts arising from interest rate derivatives such as swaps and forward rate agreements were matched to those arising from underlying debt and investment positions. Payments made or received in respect of the early termination of derivative instruments were spread over the original life of the instrument so long as the underlying exposure continues to exist.

Prior to 1 January 2005, Unilever had not designated any of its derivative financial instruments as qualifying hedge instruments under FAS 133 and accordingly, under US GAAP, all derivative financial instruments were valued at fair value with changes in fair value reflected in the income statement.

Sale and leaseback

The test for determining if an asset qualifies for treatment as a sale in a sale and leaseback transaction is stricter under US GAAP than that under IFRS, in particular where the lessee has continuing involvement. As a result, certain sale and leaseback transactions entered into by Unilever are reversed for the purposes of US GAAP reporting.

Other

Other equity differences relate to joint ventures and associates, biological assets, preference shares, borrowing costs, outsourcing contracts, sale and leaseback and financial instruments. Other net profit differences relate to biological assets, dividends on preference shares, joint ventures and associates, borrowing costs and outsourcing contracts.

Share-based payments

Unilever has adopted FAS 123(R) as of 1 January 2006 on a prospective basis. Since the Group had already voluntarily adopted the fair value measurements from FAS 123 in prior years, the adoption of this Standard has had no material impact on the consolidated results from operations and financial position of Unilever.

Recent accounting developments

In June 2006, the FASB issued FASB Interpretation No. 48 (FIN 48), ‘Accounting for Uncertainty in Income Taxes’. The provisions of FIN 48 will be effective for all outstanding tax positions on adoption, which for Unilever is 1 January 2007. FIN 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The impact of FIN 48 on the consolidated results of the operations and financial position of Unilever is currently being assessed by the Group.

In October 2006, FASB issued FAS 157, ‘Fair Value Measurement’. The standard addresses how companies should measure fair value when they are required to use a fair value measure for recognition or disclosure purposes, and move toward a market-based measure instead of an entity-based measure, and expands disclosure requirements about fair value measurements. The standard is effective for fiscal years beginning after 15 November 2007 and will be adopted by Unilever as at 1 January 2008. The impact of FAS 157 on the consolidated results of operations and financial position of Unilever is currently being assessed by the Group.

In February 2006, the FASB issued FAS 155, ‘Accounting for Certain Hybrid Financial Instruments, an amendment of FAS 133 and FAS 140’. This statement simplifies accounting for certain hybrid financial instruments by permitting fair value remeasurement for any hybrid financial instrument that contains an embedded derivative that otherwise would require bifurcation. FAS 155 is effective for Unilever for all financial instruments acquired, issued, or subject to a remeasurement (new basis) event occurring after 1 January 2007. The adoption is not expected to have a material effect on the consolidated results of operations or financial position of Unilever.

In February 2007, the FASB issued FAS 159 ‘The Fair Value Option for Financial Assets and Financial Liabilities’. The standard provides companies with an option to report selected financial assets and liabilities at fair value. FAS 159 is effective for fiscal years beginning after 15 November 2007, and will be adopted by Unilever as at 1 January 2008. The impact on the consolidated results of operations and financial position of Unilever is currently being assessed by the Group.

Documents on display in the United States

Unilever files and furnishes reports and information with the United States Securities and Exchange Commission (SEC). Such reports and information can be inspected and copied at the SEC’s public reference facilities in Washington DC, Chicago and New York. Certain of our reports and other information that we file or furnish to the SEC are also available to the public over the internet on the SEC’s website at www.sec.gov.

| Unilever Annual Report on Form 20-F 2006 | 131 |

Back to Contents

| | |

| Financial Statements (continued) | |

| | |

| Notes to the consolidated accounts Unilever Group |

|

35 Additional information for US investors

Presented below is additional information required for reporting in the United States, prepared on an IFRS basis:

(i) Segment information; (ii) Summarised presentation of the NV and PLC parts of the Group; and (iii) Guarantor statements.

(i) Segment information (prepared on an IFRS basis)

Unilever has reviewed the extent of its business with major customers, and has concluded that it has no customers that would require separate disclosure during the reporting periods covered by this filing.

For management reporting purposes, Unilever uses a number of measures of segment performance at constant average rates of exchange (that is, the same rates as in the preceding year). The internal management measure of profit that is most consistent with operating profit reported in the accounts is ‘Trading Result’. This differs from operating profit, mainly because Trading Result includes a number of statistical and other adjustments including the application of an inflation charge on working capital which is added back to arrive at operating profit.

| | € million | | € million | | € million | | € million | |

| | | | The | | Asia | | | |

| Analysis by geographical segment | Europe | | Americas | | Africa | | Total | |

|

|

|

|

|

|

|

| |

| 2006 | | | | | | | | |

| Turnover | | | | | | | | |

| At constant 2005 exchange rates | 14 967 | | 13 591 | | 10 983 | | 39 541 | |

| Exchange rate adjustments | 33 | | 188 | | (120 | ) | 101 | |

| |

|

|

|

|

|

|

| |

| At current 2006 exchange rates | 15 000 | | 13 779 | | 10 863 | | 39 642 | |

| | | | | | | | | |

| Trading result | | | | | | | | |

| At constant 2005 exchange rates | 1 966 | | 2 096 | | 1 320 | | 5 382 | |

| Exchange rate adjustments | 5 | | 20 | | (9 | ) | 16 | |

| |

|

|

|

|

|

|

| |

| At current 2006 exchange rates | 1 971 | | 2 116 | | 1 311 | | 5 398 | |

| Other adjustments | | | | | | | 10 | |

| | | | | | | |

| |

| Operating profit | | | | | | | 5 408 | |

|

|

|

|

|

|

|

| |

| 2005 | | | | | | | | |

| Turnover | | | | | | | | |

| At constant 2004 exchange rates | 14 879 | | 12 715 | | 10 281 | | 37 875 | |

| Exchange rate adjustments | 61 | | 464 | | 1 | | 526 | |

| |

|

|

|

|

|

|

| |

| At current 2005 exchange rates | 14 940 | | 13 179 | | 10 282 | | 38 401 | |

| | | | | | | | | |

| Trading result | | | | | | | | |

| At constant 2004 exchange rates | 2 101 | | 1 942 | | 1 234 | | 5 277 | |

| Exchange rate adjustments | 6 | | 58 | | (3 | ) | 61 | |

| |

|

|

|

|

|

|

| |

| At current 2005 exchange rates | 2 107 | | 2 000 | | 1 231 | | 5 338 | |

| Other adjustments | | | | | | | (264 | ) |

| | | | | | | |

| |

| Operating profit | | | | | | | 5 074 | |

|

|

|

|

|

|

|

| |

| 2004 | | | | | | | | |

| Turnover | | | | | | | | |

| At constant 2003 exchange rates | 15 246 | | 13 380 | | 10 122 | | 38 748 | |

| Exchange rate adjustments | 6 | | (1 084 | ) | (502 | ) | (1 580 | ) |

| |

|

|

|

|

|

|

| |

| At current 2004 exchange rates | 15 252 | | 12 296 | | 9 620 | | 37 168 | |

| | | | | | | | | |

| Trading result | | | | | | | | |

| At constant 2003 exchange rates | 2 236 | | 2 153 | | 1 090 | | 5 479 | |

| Exchange rate adjustments | 5 | | (186 | ) | (57 | ) | (238 | ) |

| |

|

|

|

|

|

|

| |

| At current 2004 exchange rates | 2 241 | | 1 967 | | 1 033 | | 5 241 | |

| Other adjustments | | | | | | | (1 260 | ) |

| | | | | | | |

| |

| Operating profit | | | | | | | 3 981 | |

|

|

|

|

|

|

|

| |

| Depreciation, amortisation and impairment | | | | | | | | |

| 2006 | | | | | | | | |

| At constant 2005 exchange rates | (442 | ) | (313 | ) | (200 | ) | (955 | ) |

| Exchange rate adjustments | (1 | ) | (4 | ) | 2 | | (3 | ) |

| |

|

|

|

|

|

|

| |

| At current 2006 exchange rates | (443 | ) | (317 | ) | (198 | ) | (958 | ) |

| | | | | | | | | |

| 2005 | | | | | | | | |

| At constant 2004 exchange rates | (442 | ) | (630 | ) | (184 | ) | (1 256 | ) |

| Exchange rate adjustments | – | | (8 | ) | (2 | ) | (10 | ) |

| |

|

|

|

|

|

|

| |

| At current 2005 exchange rates | (442 | ) | (638 | ) | (186 | ) | (1 266 | ) |

| | | | | | | | | |

| 2004 | | | | | | | | |

| At constant 2003 exchange rates | (613 | ) | (1 236 | ) | (297 | ) | (2 146 | ) |

| Exchange rate adjustments | – | | 116 | | 14 | | 130 | |

| |

|

|

|

|

|

|

| |

| At current 2004 exchange rates | (613 | ) | (1 120 | ) | (283 | ) | (2 016 | ) |

|

|

|

|

|

|

|

| |

| 132 | Unilever Annual Report on Form 20-F 2006 |

Back to Contents

| | |

| | Financial Statements (continued) |

| | |

| Notes to the consolidated accountsUnilever Group |

|

35 Additional information for US investors(continued)

(i) Segment information(continued)

| | € million | | € million | | € million | | € million | |

| | | | The | | Asia | | | |

| Capital expenditure | Europe | | Americas | | Africa | | Total | |

|

|

|

|

|

|

|

| |

| 2006 | | | | | | | | |

| At constant 2005 exchange rates | 507 | | 389 | | 296 | | 1 192 | |

| Exchange rate adjustments | 4 | | 7 | | (2 | ) | 9 | |

| |

|

|

|

|

|

|

| |

| At current 2006 exchange rates | 511 | | 396 | | 294 | | 1 201 | |

| | | | | | | | | |

| 2005 | | | | | | | | |

| At constant 2004 exchange rates | 446 | | 291 | | 298 | | 1 035 | |

| Exchange rate adjustments | 1 | | 14 | | – | | 15 | |

| |

|

|

|

|

|

|

| |

| At current 2005 exchange rates | 447 | | 305 | | 298 | | 1 050 | |

|

|

|

|

|

|

|

| |

| | | | | | | | | |

| | € million | | € million | | € million | | € million | |

| | United | | | | | | | |

| | Kingdom & | | United | | | | | |

| Analysis by geographical area(a) | Netherlands | | States | | Other | | Total | |

|

|

|

|

|

|

|

| |

| Turnover | | | | | | | | |

| 2006 | | | | | | | | |

| At constant 2005 exchange rates | 3 703 | | 7 688 | | 28 150 | | 39 541 | |

| Exchange rate adjustments | 7 | | (61 | ) | 155 | | 101 | |

| |

|

|

|

|

|

|

| |

| At current 2006 exchange rates | 3 710 | | 7 627 | | 28 305 | | 39 642 | |

| |

|

|

|

|

|

|

| |

| 2005 | | | | | | | | |

| At constant 2004 exchange rates | 3 700 | | 7 587 | | 26 588 | | 37 875 | |

| Exchange rate adjustments | (21 | ) | (37 | ) | 584 | | 526 | |

| |

|

|

|

|

|

|

| |

| At current 2005 exchange rates | 3 679 | | 7 550 | | 27 172 | | 38 401 | |

| |

|

|

|

|

|

|

| |

| 2004 | | | | | | | | |

| At constant 2003 exchange rates | 3 779 | | 8 093 | | 26 876 | | 38 748 | |

| Exchange rate adjustments | 52 | | (732 | ) | (900 | ) | (1 580 | ) |

| |

|

|

|

|

|

|

| |

| At current 2004 exchange rates | 3 831 | | 7 361 | | 25 976 | | 37 168 | |

|

|

|

|

|

|

|

| |

| Property, plant and equipment | | | | | | | | |

| 2006 | 967 | | 1 060 | | 4 249 | | 6 276 | |

| 2005 | 1 018 | | 1 140 | | 4 334 | | 6 492 | |

|

|

|

|

|

|

|

| |

| (a) | For the United Kingdom and the Netherlands, which are the home countries of the parent companies, the combined operating profit in 2006 was €555 million (2005: €648 million; 2004: €667 million). |

| Unilever Annual Report on Form 20-F 2006 | 133 |

Back to Contents

| | |

| Financial Statements (continued) | |

| | |

| Notes to the consolidated accounts Unilever Group |

|

35 Additional information for US investors(continued)

(ii) Summarised presentation of the NV and PLC parts of the Group (prepared on an IFRS basis)

NV and PLC and their group companies constitute a single reporting entity for the purposes of presenting consolidated accounts. The following supplemental information shows the consolidated income statement and balance sheet of the Group analysed according to the relative legal ownership of individual entities by NV or PLC.

| | € million | | € million | | € million | | € million | | € million | | € million | |

| | NV | | NV | | NV | | PLC | | PLC | | PLC | |

| Income statementfor the year ended 31 December | 2006 | | 2005 | | 2004 | | 2006 | | 2005 | | 2004 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Continuing operations: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Turnover | 27 376 | | 26 479 | | 25 328 | | 12 266 | | 11 922 | | 11 840 | |

| | | | | | | | | | | | | |

| Operating profit | 3 608 | | 3 552 | | 2 666 | | 1 800 | | 1 522 | | 1 315 | |

| Net finance costs | (686 | ) | (470 | ) | (375 | ) | (35 | ) | (143 | ) | (248 | ) |

| Share in net profit of joint ventures | 59 | | 35 | | 30 | | 19 | | 12 | | 9 | |

| Share in net profit of associates | – | | (12 | ) | 8 | | 36 | | (13 | ) | (6 | ) |

| Other income from non-current investments | 13 | | 20 | | 35 | | 17 | | 13 | | 19 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Profit before taxation | 2 994 | | 3 125 | | 2 364 | | 1 837 | | 1 391 | | 1 089 | |

| Taxation | (727 | ) | (774 | ) | (471 | ) | (419 | ) | (407 | ) | (254 | ) |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Net profit from continuing operations | 2 267 | | 2 351 | | 1 893 | | 1 418 | | 984 | | 835 | |

| Net profit from discontinued operations | 836 | | 455 | | 131 | | 494 | | 185 | | 82 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Net profit | 3 103 | | 2 806 | | 2 024 | | 1 912 | | 1 169 | | 917 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| Attributable to: | | | | | | | | | | | | |

| Minority interest | 66 | | 57 | | 56 | | 204 | | 152 | | 130 | |

| Shareholders’ equity | 3 037 | | 2 749 | | 1 968 | | 1 708 | | 1 017 | | 787 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | € million | | € million | | | | € million | | € million | |

| | NV | | NV | | | | PLC | | PLC | |

| Balance sheetas at 31 December | 2006 | | 2005 | | | | 2006 | | 2005 | |

|

|

|

|

|

|

|

|

|

| |

| Goodwill and intangible assets | 12 569 | | 14 152 | | | | 4 637 | | 3 903 | |

| Property, plant and equipment | 3 642 | | 4 321 | | | | 2 634 | | 2 171 | |

| Pension asset for funded schemes in surplus | 1 484 | | 966 | | | | 213 | | 70 | |

| Deferred tax assets | 755 | | 961 | | | | 511 | | 742 | |

| Other non-current assets | 723 | | 695 | | | | 403 | | 377 | |

| |

|

|

| | | |

|

|

| |

| Total non-current assets | 19 173 | | 21 095 | | | | 8 398 | | 7 263 | |

| | | | | | | | | | | |

| Inventories | 2 141 | | 2 661 | | | | 1 655 | | 1 446 | |

| Trade and other current receivables | 2 744 | | 3 628 | | | | 1 546 | | 1 202 | |

| Cash and cash equivalents | 565 | | 941 | | | | 474 | | 588 | |

| Other financial assets | 143 | | 317 | | | | 219 | | 142 | |

| Assets held for sale | 7 | | 166 | | | | 7 | | 51 | |

| |

|

|

| | | |

|

|

| |

| Total current assets | 5 600 | | 7 713 | | | | 3 901 | | 3 429 | |

| | | | | | | | | | | |

| Borrowings due within one year | (3 925 | ) | (5 506 | ) | | | (437 | ) | (436 | ) |

| Trade payables and other current liabilities | (5 469 | ) | (6 114 | ) | | | (3 044 | ) | (2 668 | ) |

| Provisions | (806 | ) | (460 | ) | | | (203 | ) | (184 | ) |

| Liabilities associated with assets held for sale | – | | (16 | ) | | | – | | (10 | ) |

| |

|

|

| | | |

|

|

| |

| Total current liabilities | (10 200 | ) | (12 096 | ) | | | (3 684 | ) | (3 298 | ) |

| |

|

|

| | | |

|

|

| |

| Net current assets/(liabilities) | (4 600 | ) | (4 383 | ) | | | 217 | | 131 | |

| |

|

|

| | | |

|

|

| |

| Total assets less current liabilities | 14 573 | | 16 712 | | | | 8 615 | | 7 394 | |

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | |

| Borrowings due after more than one year | 3 172 | | 5 484 | | | | 1 067 | | 973 | |

| Pension and post-retirement healthcare liabilities: | | | | | | | | | | |

| Funded schemes in deficit | 465 | | 757 | | | | 914 | | 1 658 | |

| Unfunded schemes | 2 097 | | 3 040 | | | | 1 301 | | 1 162 | |

| Provisions | 674 | | 635 | | | | 152 | | 97 | |

| Deferred tax liabilities | 888 | | 770 | | | | 115 | | 163 | |

| Other non-current liabilities | 247 | | 338 | | | | 424 | | 264 | |

| |

|

|

| | | |

|

|

| |

| Total non-current liabilities | 7 543 | | 11 024 | | | | 3 973 | | 4 317 | |

| Intra-group – NV/PLC | (368 | ) | (1 932 | ) | | | 368 | | 1 932 | |

| | | | | | | | | | | |

| Shareholders’ equity | 7 360 | | 7 571 | | | | 3 870 | | 790 | |

| Minority interests | 38 | | 49 | | | | 404 | | 355 | |

| |

|

|

| | | |

|

|

| |

| Total equity | 7 398 | | 7 620 | | | | 4 274 | | 1 145 | |

| |

|

|

| | | |

|

|

| |

| Total capital employed | 14 573 | | 16 712 | | | | 8 615 | | 7 394 | |

|

|

|

|

|

|

|

|

|

| |

| 134 | Unilever Annual Report on Form 20-F 2006 |

Back to Contents

| | |

| | Financial Statements (continued) |

| | |

| Notes to the consolidated accounts Unilever Group |

|

35 Additional information for US investors(continued)

(iii) Guarantor statements (prepared on an IFRS basis)

On 2 October 2000, NV and Unilever Capital Corporation (UCC) filed a US $15 billion Shelf registration, which is unconditionally and fully guaranteed, jointly and severally, by NV, PLC and Unilever United States, Inc. (UNUS). Of the US $15 billion Shelf registration, US $2.75 billion of Notes were outstanding at 31 December 2006 (2005: US $2.75 billion; 2004: US $4.25 billion) with coupons ranging from 5.90% to 7.125%. These Notes are repayable between 1 November 2010 and 15 November 2032.

Provided below are the income statements, cash flow statements and balance sheets of each of the companies discussed above, together with the income statement, cash flow statement and balance sheet of non-guarantor subsidiaries. These have been prepared under the historical cost convention, and, aside from the basis of accounting for investments at net asset value (equity accounting), comply in all material respects with International Financial Reporting Standards. We have not provided reconciliations from the accounting principles used by Unilever to US GAAP for the columns relating to the guarantor entities, as such reconciliations would not materially affect an investor’s understanding of the nature of this guarantee. The financial information in respect of NV, PLC and UNUS has been prepared with all subsidiaries accounted for on an equity basis. The financial information in respect of the non-guarantor subsidiaries has been prepared on a consolidated basis.

| | €million | | €million | | €million | | €million | | €million | | €million | | €million | |

| | Unilever | | Unilever | | | | Unilever | | | | | | | |

| | Capital | | N.V. | | | | United | | | | | | | |

| | Corporation | | parent | | Unilever PLC | | States Inc. | | Non- | | | | | |

| Income statement | subsidiary | | issuer/ | | parent | | subsidiary | | guarantor | | | | Unilever | |

| for the year ended 31 December 2006 | issuer | | guarantor | | guarantor | | guarantor | | subsidiaries | | Eliminations | | Group | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Continuing operations: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Turnover | – | | – | | – | | – | | 39 642 | | – | | 39 642 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating profit | (1 | ) | (126 | ) | (108 | ) | (16 | ) | 5 659 | | – | | 5 408 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Finance income | – | | 38 | | 5 | | 1 | | 84 | | – | | 128 | |

| Finance costs | (169 | ) | (662 | ) | – | | – | | (59 | ) | – | | (890 | ) |

| Pensions and similar obligations | – | | (5 | ) | – | | (61 | ) | 107 | | – | | 41 | |

| Intercompany finance costs | 187 | | 805 | | (20 | ) | (29 | ) | (943 | ) | – | | – | |

| Dividends | – | | 1 916 | | 1 337 | | – | | (3 253) | | – | | – | |

| Share of net profit/(loss) of joint ventures | – | | – | | – | | – | | 78 | | – | | 78 | |

| Share of net profit/(loss) of associates | – | | – | | – | | – | | 36 | | – | | 36 | |

| Other income from non-current investments | – | | – | | – | | – | | 30 | | – | | 30 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Profit before taxation | 17 | | 1 966 | | 1 214 | | (105 | ) | 1 739 | | – | | 4 831 | |

| Taxation | (6 | ) | (119 | ) | 16 | | 76 | | (1 113 | ) | – | | (1 146 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net profit from continuing operations | 11 | | 1 847 | | 1 230 | | (29 | ) | 626 | | – | | 3 685 | |

| Net profit from discontinued operations | – | | – | | 180 | | – | | 1 150 | | – | | 1 330 | |

| Equity earnings of subsidiaries | – | | 2 898 | | 3 335 | | 567 | | – | | (6 800 | ) | – | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net profit | 11 | | 4 745 | | 4 745 | | 538 | | 1 776 | | (6 800 | ) | 5 015 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Attributable to: | | | | | | | | | | | | | | |

| Minority interest | – | | – | | – | | – | | 270 | | – | | 270 | |

| Shareholders’ equity | 11 | | 4 745 | | 4 745 | | 538 | | 1 506 | | (6 800 | ) | 4 745 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | |

| Income statement | | | | | | | | | | | | | | |

| for the year ended 31 December 2005 | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Continuing operations: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Turnover | – | | – | | – | | – | | 38 401 | | – | | 38 401 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating profit | – | | 87 | | (61 | ) | (3 | ) | 5 051 | | – | | 5 074 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Finance income | – | | 61 | | 11 | | – | | 57 | | – | | 129 | |

| Finance costs | (241 | ) | (274 | ) | (2 | ) | (3 | ) | (169 | ) | – | | (689 | ) |

| Pensions and similar obligations | – | | (5 | ) | – | | (61 | ) | 13 | | – | | (53 | ) |

| Intercompany finance costs | 256 | | 509 | | (11 | ) | (40 | ) | (714 | ) | – | | – | |

| Dividends | – | | 1 043 | | 856 | | – | | (1 899 | ) | – | | – | |

| Share of net profit/(loss) of joint ventures | – | | – | | – | | – | | 47 | | – | | 47 | |

| Share of net profit/(loss) of associates | – | | – | | – | | – | | (25 | ) | – | | (25 | ) |

| Other income from non-current investments | – | | – | | – | | – | | 33 | | – | | 33 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Profit before taxation | 15 | | 1 421 | | 793 | | (107 | ) | 2 394 | | – | | 4 516 | |

| Taxation | (5 | ) | (118 | ) | 36 | | 45 | | (1 139 | ) | – | | (1 181 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net profit from continuing operations | 10 | | 1 303 | | 829 | | (62 | ) | 1 255 | | – | | 3 335 | |

| | | | | | | | | | | | | | | |

| Net profit from discontinued operations | – | | – | | – | | – | | 640 | | – | | 640 | |

| Equity earnings of subsidiaries | – | | 2 463 | | 2 937 | | 732 | | – | | (6 132 | ) | – | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net profit | 10 | | 3 766 | | 3 766 | | 670 | | 1 895 | | (6 132 | ) | 3 975 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Attributable to: | | | | | | | | | | | | | | |

| Minority interest | – | | – | | – | | – | | 209 | | – | | 209 | |

| Shareholders’ equity | 10 | | 3 766 | | 3 766 | | 670 | | 1 686 | | (6 132 | ) | 3 766 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Unilever Annual Report on Form 20-F 2006 | 135 |

Back to Contents

| | |

| Financial Statements (continued) | |

| | |

| Notes to the consolidated accounts Unilever Group |

|

35 Additional information for US investors(continued)

(iii) Guarantor statements(continued)

| | € million | | € million | | € million | | € million | | € million | | € million | | € million | |

| | Unilever | | Unilever | | | | Unilever | | | | | | | |

| | Capital | | N.V. | | | | United | | | | | | | |

| | Corporation | | parent | | Unilever PLC | | States Inc. | | Non- | | | | | |

| Income statement | subsidiary | | issuer/ | | parent | | subsidiary | | guarantor | | | | Unilever | |

| for the year ended 31 December 2004 | issuer | | guarantor | | guarantor | | guarantor | | subsidiaries | | Eliminations | | Group | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Continuing operations: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Turnover | – | | – | | – | | – | | 37 168 | | – | | 37 168 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating profit | – | | 59 | | 33 | | 6 | | 3 883 | | – | | 3 981 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Finance income | – | | 26 | | 6 | | – | | 113 | | – | | 145 | |

| Finance costs | (282 | ) | (160 | ) | (2 | ) | (3 | ) | (267 | ) | – | | (714 | ) |

| Pensions and similar obligations | – | | (6 | ) | – | | (10 | ) | (38 | ) | – | | (54 | ) |

| Intercompany finance costs | 296 | | 211 | | (3 | ) | (22 | ) | (482 | ) | – | | | |

| Dividends | – | | 1 960 | | 770 | | – | | (2 730 | ) | – | | – | |

| Share of net profit/(loss) of joint ventures | – | | – | | – | | – | | 39 | | – | | 39 | |

| Share of net profit/(loss) of associates | – | | – | | – | | – | | 2 | | – | | 2 | |

| Other income from non-current investments | – | | – | | – | | – | | 54 | | – | | 54 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Profit before taxation | 14 | | 2 090 | | 804 | | (29 | ) | 574 | | – | | 3 453 | |

| Taxation | (5 | ) | 35 | | 16 | | 11 | | (782 | ) | – | | (725 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net profit from continuing operations | 9 | | 2 125 | | 820 | | (18 | ) | (208 | ) | – | | 2 728 | |

| | | | | | | | | | | | | | | |

| Net profit from discontinued operations | – | | – | | – | | – | | 213 | | – | | 213 | |

| Equity earnings of subsidiaries | – | | 630 | | 1 935 | | (76 | ) | – | | (2 489 | ) | – | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net profit | 9 | | 2 755 | | 2 755 | | (94 | ) | 5 | | (2 489 | ) | 2 941 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Attributable to: | | | | | | | | | | | | | | |

| Minority interest | – | | – | | – | | – | | 186 | | – | | 186 | |

| Shareholders’ equity | 9 | | 2 755 | | 2 755 | | (94 | ) | (181 | ) | (2 489 | ) | 2 755 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| 136 | Unilever Annual Report on Form 20-F 2006 |

Back to Contents

| | |

| | Financial Statements (continued) |

| | |

| Notes to the consolidated accounts Unilever Group |

|

35 Additional information for US investors(continued)

(iii) Guarantor statements(continued)

| | € million | | € million | | € million | | € million | | € million | | € million | | € million | |

| | Unilever | | Unilever | | | | Unilever | | | | | | | |

| | Capital | | N.V. | | | | United | | | | | | | |

| | Corporation | | parent | | Unilever PLC | | States Inc. | | Non- | | | | | |

| | subsidiary | | issuer/ | | parent | | subsidiary | | guarantor | | | | Unilever | |

| Balance sheetas at 31 December 2006 | issuer | | guarantor | | guarantor | | guarantor | | subsidiaries | | Eliminations | | Group | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Goodwill and intangible assets | – | | 53 | | 46 | | – | | 17 107 | | – | | 17 206 | |

| Property, plant and equipment | – | | – | | – | | 8 | | 6 268 | | – | | 6 276 | |

| Pension asset for funded schemes in surplus | – | | – | | – | | 83 | | 1 614 | | – | | 1 697 | |

| Deferred tax assets | – | | – | | – | | 941 | | 325 | | – | | 1 266 | |

| Other non-current assets | – | | – | | – | | 9 | | 1 117 | | – | | 1 126 | |

| Amounts due from group companies after one year | 2 567 | | 2 269 | | 67 | | – | | (4 903 | ) | – | | – | |

| Net assets of subsidiaries (equity accounted) | – | | 28 775 | | 12 453 | | 5 946 | | (29 790 | ) | (17 384 | ) | – | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total non-current assets | 2 567 | | 31 097 | | 12 566 | | 6 987 | | (8 262 | ) | (17 384 | ) | 27 571 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Inventories | – | | – | | – | | – | | 3 796 | | – | | 3 796 | |

| Amounts due from group companies within one year | – | | 3 289 | | 163 | | – | | (3 452 | ) | – | | – | |

| Trade and other current receivables | – | | 445 | | 34 | | 7 | | 3 804 | | – | | 4 290 | |

| Current tax assets | – | | – | | – | | 40 | | 85 | | – | | 125 | |

| Other financial assets | – | | – | | – | | – | | 237 | | – | | 237 | |

| Cash and cash equivalents | – | | 7 | | – | | (5 | ) | 1 037 | | – | | 1 039 | |

| Assets held for sale | – | | – | | – | | – | | 14 | | – | | 14 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total current assets | – | | 3 741 | | 197 | | 42 | | 5 521 | | – | | 9 501 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Borrowings due within one year | (258 | ) | (1 503 | ) | – | | – | | (2 601 | ) | – | | (4 362 | ) |

| Amounts due to group companies within one year | – | | (18 490 | ) | (1 363 | ) | – | | 19 853 | | – | | – | |

| Provisions | – | | – | | – | | (1 | ) | (1 008 | ) | – | | (1 009 | ) |

| Trade payables and other current liabilities | (22 | ) | (612 | ) | (39 | ) | (7 | ) | (7 254 | ) | – | | (7 934 | ) |

| Current tax liabilities | (6 | ) | (38 | ) | (121 | ) | – | | (414 | ) | – | | (579 | ) |

| Liabilities held for sale | – | | – | | – | | – | | – | | – | | – | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total current liabilities | (286 | ) | (20 643 | ) | (1 523 | ) | (8 | ) | 8 576 | | – | | (13 884 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net current assets/(liabilities) | (286 | ) | (16 902 | ) | (1 326 | ) | 34 | | 14 097 | | – | | (4 383 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total assets less current liabilities | 2 281 | | 14 195 | | 11 240 | | 7 021 | | 5 835 | | (17 384 | ) | 23 188 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Borrowings due after one year | 2 066 | | 866 | | – | | – | | 1 307 | | – | | 4 239 | |

| Amounts due to group companies after one year | – | | 1 522 | | – | | 279 | | (1 801 | ) | – | | – | |

| Pension liability for funded schemes in deficit | – | | – | | – | | 133 | | 1 246 | | – | | 1 379 | |

| Pension liability for unfunded schemes | – | | 149 | | – | | 879 | | 2 370 | | – | | 3 398 | |

| Provisions | – | | 340 | | – | | 2 | | 484 | | – | | 826 | |

| Deferred tax liabilities | – | | 27 | | 10 | | 62 | | 904 | | – | | 1 003 | |

| Other non-current liabilities | – | | 61 | | – | | 193 | | 417 | | – | | 671 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total non-current liabilities | 2 066 | | 2 965 | | 10 | | 1 548 | | 4 927 | | – | | 11 516 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Shareholders’ equity attributable to: | | | | | | | | | | | | | | |

| PLC | – | | 3 807 | | – | | – | | – | | (3 807 | ) | – | |

| NV | – | | – | | 7 423 | | – | | – | | (7 423 | ) | – | |

| Called up share capital | – | | 274 | | 210 | | – | | – | | – | | 484 | |

| Share premium account | – | | 25 | | 140 | | – | | – | | – | | 165 | |

| Other reserves | (4 | ) | (1 280 | ) | (863 | ) | (467 | ) | (418 | ) | 889 | | (2 143 | ) |

| Retained profit | 219 | | 8 404 | | 4 320 | | 5 940 | | 884 | | (7 043 | ) | 12 724 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total shareholders’ equity | 215 | | 11 230 | | 11 230 | | 5 473 | | 466 | | (17 384 | ) | 11 230 | |

| Minority interests | – | | – | | – | | – | | 442 | | – | | 442 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total equity | 215 | | 11 230 | | 11 230 | | 5 473 | | 908 | | (17 384 | ) | 11 672 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total capital employed | 2 281 | | 14 195 | | 11 240 | | 7 021 | | 5 835 | | (17 384 | ) | 23 188 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Unilever Annual Report on Form 20-F 2006 | 137 |

Back to Contents

| | |

| Financial Statements (continued) | |

| | |

| Notes to the consolidated accounts Unilever Group |

|

35 Additional information for US investors(continued)

(iii) Guarantor statements(continued)

| | € million | | € million | | € million | | € million | | € million | | € million | | € million | |

| | Unilever | | Unilever | | | | Unilever | | | | | | | |

| | Capital | | N.V. | | | | United | | | | | | | |

| | Corporation | | parent | | Unilever PLC | | States Inc. | | Non- | | | | | |

| | subsidiary | | issuer/ | | parent | | subsidiary | | guarantor | | | | Unilever | |

| Balance sheetas at 31 December 2005 | issuer | | guarantor | | guarantor | | guarantor | | subsidiaries | | Eliminations | | Group | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Goodwill and intangible assets | – | | 32 | | 54 | | – | | 17 969 | | – | | 18 055 | |

| Property, plant and equipment | – | | – | | – | | 6 | | 6 486 | | – | | 6 492 | |

| Pension asset for funded schemes in surplus | – | | – | | – | | 67 | | 969 | | – | | 1 036 | |

| Deferred tax assets | – | | – | | – | | 1 012 | | 691 | | – | | 1 703 | |

| Other non-current assets | – | | 16 | | – | | 11 | | 1 045 | | – | | 1 072 | |

| Amounts due from group companies after one year | 2 512 | | 6 628 | | 102 | | 1 281 | | (10 523 | ) | – | | – | |

| Net assets of subsidiaries (equity accounted) | – | | 11 176 | | 9 823 | | 6 234 | | (14 593 | ) | (12 640 | ) | – | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total non-current assets | 2 512 | | 17 852 | | 9 979 | | 8 611 | | 2 044 | | (12 640 | ) | 28 358 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Inventories | – | | – | | – | | – | | 4 107 | | – | | 4 107 | |

| Amounts due from group companies within one year | – | | 19 619 | | 294 | | – | | (19 913 | ) | – | | – | |

| Trade and other current receivables | – | | 635 | | 1 | | 34 | | 4 160 | | – | | 4 830 | |

| Current tax assets | – | | – | | – | | 43 | | 81 | | – | | 124 | |

| Other financial assets | – | | – | | – | | – | | 335 | | – | | 335 | |

| Cash and cash equivalents | 35 | | 163 | | – | | (3 | ) | 1 334 | | – | | 1 529 | |

| Assets held for sale | – | | – | | – | | – | | 217 | | – | | 217 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total current assets | 35 | | 20 417 | | 295 | | 74 | | (9 679 | ) | – | | 11 142 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Borrowings due within one year | – | | (4 548 | ) | – | | – | | (1 394 | ) | – | | (5 942 | ) |

| Amounts due to group companies within one year | – | | (22 027 | ) | (1 871 | ) | – | | 23 898 | | – | | – | |

| Provisions | – | | (16 | ) | – | | (5 | ) | (623 | ) | – | | (644 | ) |

| Trade payables and other current liabilities | (31 | ) | (514 | ) | (4 | ) | (100 | ) | (7 579 | ) | – | | (8 228 | ) |

| Current tax liabilities | – | | (20 | ) | (26 | ) | – | | (508 | ) | – | | (554 | ) |

| Liabilities held for sale | – | | – | | – | | – | | (26 | ) | – | | (26 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total current liabilities | (31 | ) | (27 125 | ) | (1 901 | ) | (105 | ) | 13 768 | | – | | (15 394 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net current assets/(liabilities) | 4 | | (6 708 | ) | (1 606 | ) | (31 | ) | 4 089 | | – | | (4 252 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total assets less current liabilities | 2 516 | | 11 144 | | 8 373 | | 8 580 | | 6 133 | | (12 640 | ) | 24 106 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Borrowings due after one year | 2 296 | | 2 442 | | – | | – | | 1 719 | | – | | 6 457 | |

| Amounts due to group companies after one year | – | | – | | – | | – | | – | | – | | – | |

| Pension liability for funded schemes in deficit | – | | – | | – | | 372 | | 2 043 | | – | | 2 415 | |

| Pension liability for unfunded schemes | – | | 159 | | – | | 1 260 | | 2 783 | | – | | 4 202 | |

| Provisions | – | | 32 | | – | | 3 | | 697 | | – | | 732 | |

| Deferred tax liabilities | – | | 94 | | 12 | | – | | 827 | | – | | 933 | |

| Other non-current liabilities | – | | 56 | | – | | 202 | | 344 | | – | | 602 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total non-current liabilities | 2 296 | | 2 783 | | 12 | | 1 837 | | 8 413 | | – | | 15 341 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Shareholders’ equity attributable to: | | | | | | | | | | | | | | |

| PLC | – | | 790 | | – | | – | | – | | (790 | ) | – | |

| NV | – | | – | | 7 571 | | – | | – | | (7 571 | ) | – | |

| Called up share capital | – | | 290 | | 222 | | – | | – | | – | | 512 | |

| Share premium account | – | | 25 | | 137 | | – | | – | | – | | 162 | |

| Other reserves | (5 | ) | (1 465 | ) | (863 | ) | (291 | ) | (393 | ) | 689 | | (2 328 | ) |

| Retained profit | 225 | | 8 721 | | 1 294 | | 7 034 | | (2 291 | ) | (4 968 | ) | 10 015 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total shareholders’ equity | 220 | | 8 361 | | 8 361 | | 6 743 | | (2 684 | ) | (12 640 | ) | 8 361 | |

| Minority interests | – | | – | | – | | – | | 404 | | – | | 404 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total equity | 220 | | 8 361 | | 8 361 | | 6 743 | | (2 280 | ) | (12 640 | ) | 8 765 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total capital employed | 2 516 | | 11 144 | | 8 373 | | 8 580 | | 6 133 | | (12 640 | ) | 24 106 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| 138 | Unilever Annual Report on Form 20-F 2006 |

Back to Contents

| | |

| | Financial Statements(continued) |

| | |

| Notes to the consolidated accountsUnilever Group |

|

35 Additional information for US investors(continued)

(iii) Guarantor statements(continued)

| | € million | | € million | | € million | | € million | | € million | | € million | | € million | |

| | Unilever | | Unilever | | | | Unilever | | | | | | | |

| | Capital | | N.V. | | | | United | | | | | | | |

| | Corporation | | parent | | Unilever PLC | | States Inc. | | Non- | | | | | |

| Cash flow statement | subsidiary | | issuer/ | | parent | | subsidiary | | guarantor | | | | Unilever | |

| for the year ended 31 December 2006 | issuer | | guarantor | | guarantor | | guarantor | | subsidiaries | | Eliminations | | Group | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash flow from operating activities | 1 | | (336 | ) | (17 | ) | (408 | ) | 6 334 | | – | | 5 574 | |

| Income tax paid | – | | (163 | ) | 42 | | (33 | ) | (909 | ) | – | | (1 063 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from operating activities | 1 | | (499 | ) | 25 | | (441 | ) | 5 425 | | – | | 4 511 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Interest received | 187 | | 995 | | 5 | | – | | 33 | | (1 095 | ) | 125 | |

| Net capital expenditure | – | | (28 | ) | – | | (3 | ) | (903 | ) | – | | (934 | ) |

| Acquisitions and disposals | – | | – | | 212 | | – | | 1 565 | | – | | 1 777 | |

| Other investing activities | (324 | ) | 3 799 | | – | | 480 | | (7 302 | ) | 3 534 | | 187 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from/(used in) investing activities | (137 | ) | 4 766 | | 217 | | 477 | | (6 607 | ) | 2 439 | | 1 155 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Dividends paid on ordinary share capital | – | | 460 | | 154 | | – | | (3 216 | ) | – | | (2 602 | ) |

| Interest and preference dividends paid | (170 | ) | (349 | ) | (20 | ) | (28 | ) | (1 133 | ) | 1 095 | | (605 | ) |

| Change in borrowings and finance leases | 274 | | (4 621 | ) | (420 | ) | – | | 5 020 | | (3 534 | ) | (3 281 | ) |

| Movement on treasury stock | – | | 88 | | 48 | | 15 | | 23 | | – | | 98 | |

| Other finance activities | – | | – | | – | | – | | (182 | ) | – | | (182 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from/(used in) financing activities | 104 | | (4 422 | ) | (238 | ) | (43 | ) | 466 | | (2 439 | ) | (6 572 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net increase/(decrease) in cash and | | | | | | | | | | | | | | |

| cash equivalents | (32 | ) | (155 | ) | 4 | | (7 | ) | (716 | ) | – | | (906 | ) |

| Cash and cash equivalents at the beginning | | | | | | | | | | | | | | |

| of the year | 35 | | 162 | | – | | (3 | ) | 1 071 | | – | | 1 265 | |

| | | | | | | | | | | | | | | |

| Effect of foreign exchange rate changes | (3 | ) | – | | – | | 5 | | 349 | | – | | 351 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash and cash equivalents at the end of the year | – | | 7 | | 4 | | (5 | ) | 704 | | – | | 710 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | |

| Cash flow statement | | | | | | | | | | | | | | |

| for the year ended 31 December 2005 | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash flow from operating activities | – | | (5 | ) | (156 | ) | 33 | | 6 052 | | – | | 5 924 | |

| Income tax paid | – | | (86 | ) | (19 | ) | (177 | ) | (1 289 | ) | – | | (1 571 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from operating activities | – | | (91 | ) | (175 | ) | (144 | ) | 4 763 | | – | | 4 353 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Interest received | 253 | | 285 | | 10 | | – | | (106 | ) | (312 | ) | 130 | |

| Net capital expenditure | – | | (24 | ) | (3 | ) | (2 | ) | (784 | ) | – | | (813 | ) |

| Acquisitions and disposals | – | | – | | – | | – | | 784 | | – | | 784 | |

| Other investing activities | 1 796 | | (689 | ) | – | | 189 | | 443 | | (1 325 | ) | 414 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from/(used in) investing activities | 2 049 | | (428 | ) | 7 | | 187 | | 337 | | (1 637 | ) | 515 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Dividends paid on ordinary share capital | – | | 28 | | 37 | | – | | (1 869 | ) | – | | (1 804 | ) |

| Interest and preference dividends paid | (253 | ) | (181 | ) | (7 | ) | (43 | ) | (471 | ) | 312 | | (643 | ) |

| Change in borrowings and finance leases | (1 774 | ) | 1 623 | | 309 | | – | | (2 363 | ) | 1 325 | | (880 | ) |

| Movement on treasury stock | – | | (1 068 | ) | (171 | ) | – | | (37 | ) | – | | (1 276 | ) |

| Other finance activities | – | | – | | – | | – | | (218 | ) | – | | (218 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from/(used in) financing activities | (2 027 | ) | 402 | | 168 | | (43 | ) | (4 958 | ) | 1 637 | | (4 821 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net increase/(decrease) in cash and | | | | | | | | | | | | | | |

| cash equivalents | 22 | | (117 | ) | – | | – | | 142 | | – | | 47 | |

| | | | | | | | | | | | | | | |

| Cash and cash equivalents at the beginning | | | | | | | | | | | | | | |

| of the year | 10 | | 279 | | – | | (3 | ) | 1 120 | | – | | 1 406 | |

| | | | | | | | | | | | | | | |

| Effect of foreign exchange rate changes | 3 | | – | | – | | – | | (191 | ) | – | | (188 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash and cash equivalents at the end of the year | 35 | | 162 | | – | | (3 | ) | 1 071 | | – | | 1 265 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Unilever Annual Report on Form 20-F 2006 | 139 |

Back to Contents

| | |

| Financial Statements (continued) | |

| | |

| Notes to the consolidated accountsUnilever Group |

|

35 Additional information for US investors(continued)

(iii) Guarantor statements(continued)

| | € million | | € million | | € million | | € million | | € million | | € million | | € million | |

| | Unilever | | Unilever | | | | Unilever | | | | | | | |

| | Capital | | N.V. | | | | United | | | | | | | |

| | Corporation | | parent | | Unilever PLC | | States Inc. | | Non- | | | | | |

| Cash flow statement | subsidiary | | issuer/ | | parent | | subsidiary | | guarantor | | | | Unilever | |

| for the year ended 31 December 2004 | issuer | | guarantor | | guarantor | | guarantor | | subsidiaries | | Eliminations | | Group | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash flow from operating activities | 6 | | 58 | | 45 | | (200 | ) | 7 016 | | – | | 6 925 | |

| Income tax paid | – | | (96 | ) | (126 | ) | (145 | ) | (1 011 | ) | – | | (1 378 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from operating activities | 6 | | (38 | ) | (81 | ) | (345 | ) | 6 005 | | – | | 5 547 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Interest received | 295 | | 356 | | 6 | | – | | 106 | | (595 | ) | 168 | |

| Net capital expenditure | – | | (9 | ) | (17 | ) | (1 | ) | (842 | ) | – | | (869 | ) |

| Acquisitions and disposals | – | | – | | – | | – | | 316 | | – | | 316 | |

| Other investing activities | (311 | ) | 2 375 | | – | | 372 | | 288 | | (2 459 | ) | 265 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from/(used in) investing activities | (16 | ) | 2 722 | | (11 | ) | 371 | | (132 | ) | (3 054 | ) | (120 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Dividends paid on ordinary share capital | – | | 971 | | – | | – | | (2 691 | ) | – | | (1 720 | ) |

| Interest and preference dividends paid | (282 | ) | (249 | ) | (3 | ) | (24 | ) | (824 | ) | 595 | | (787 | ) |

| Change in borrowings and finance leases | 302 | | (3 402 | ) | 116 | | – | | (2 365 | ) | 2 459 | | (2 890 | ) |

| Movement on treasury stock | – | | (148 | ) | (21 | ) | (2 | ) | (161 | ) | – | | (332 | ) |

| Other finance activities | – | | – | | – | | – | | (209 | ) | – | | (209 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cash flow from/(used in) financing activities | 20 | | (2 828 | ) | 92 | | (26 | ) | (6 250 | ) | 3 054 | | (5 938 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net increase/(decrease) in cash and | | | | | | | | | | | | | | |

| cash equivalents | 10 | | (144 | ) | – | | – | | (377 | ) | – | | (511 | ) |

| | | | | | | | | | | | | | | |

| Cash and cash equivalents at the beginning | | | | | | | | | | | | | | |

| of the year | 1 | | 423 | | – | | (3 | ) | 1 007 | | – | | 1 428 | |

| | | | | | | | | | | | | | | |

| Effect of foreign exchange rate changes | (1 | ) | – | | – | | – | | 490 | | – | | 489 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash and cash equivalents at the end of the year | 10 | | 279 | | – | | (3 | ) | 1 120 | | – | | 1 406 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| 140 | Unilever Annual Report on Form 20-F 2006 |

Back to Contents

| | |

| | Financial Statements(continued) |

| | |

| Selected financial dataUnilever Group |

|

Selected financial data under IFRS

In the schedules below, figures within the income statement and for earnings per share reflect the classification between continuing and discontinued operations which is applicable for our 2006 reporting. This classification differs from that which would have applied under our reporting basis for 2005.

| | € million | | € million | | € million | |

| Consolidated income statement | 2006 | | 2005 | | 2004 | |

|

|

|

|

|

| |

| Continuing operations: | | | | | | |

| Turnover | 39 642 | | 38 401 | | 37 168 | |

| | | | | | | |

| Operating profit | 5 408 | | 5 074 | | 3 981 | |

| | | | | | | |

| Net finance costs | (721 | ) | (613 | ) | (623 | ) |

| Income from non-current investments | 144 | | 55 | | 95 | |

| |

|

|

|

|

| |

| Profit before taxation | 4 831 | | 4 516 | | 3 453 | |

| Taxation | (1 146 | ) | (1 181 | ) | (725 | ) |

| |

|

|

|

|

| |

| Net profit from continuing operations | 3 685 | | 3 335 | | 2 728 | |

| Net profit from discontinued operations | 1 330 | | 640 | | 213 | |

| |

|

|

|

|

| |

| Net profit | 5 015 | | 3 975 | | 2 941 | |

| Attributable to: | | | | | | |

| Minority interests | 270 | | 209 | | 186 | |

| Shareholders’ equity | 4 745 | | 3 766 | | 2 755 | |

|

|

|

|

|

| |

| | | | | | | |

| | € | | € | | € | |

| Combined earnings per share(a) | 2006 | | 2005 | | 2004 | |

|

|

|

|

|

| |

| Continuing operations | | | | | | |

| Basic earnings per share | 1.19 | | 1.07 | | 0.87 | |

| Diluted earnings per share | 1.15 | | 1.04 | | 0.84 | |

| Total operations | | | | | | |

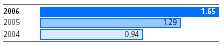

| Basic earnings per share | 1.65 | | 1.29 | | 0.94 | |

| Diluted earnings per share | 1.60 | | 1.25 | | 0.91 | |

|

|

|

|

|

| |

| | | | | | | |

| | € million | | € million | | € million | |

| Consolidated balance sheet | 2006 | | 2005 | | 2004 | |

|

|

|

|

|

| |

| Non-current assets | 27 571 | | 28 358 | | 26 368 | |

| Current assets | 9 501 | | 11 142 | | 10 490 | |

| Current liabilities | (13 884 | ) | (15 394 | ) | (14 186 | ) |

| |

|

|

|

|

| |

| Total assets less current liabilities | 23 188 | | 24 106 | | 22 672 | |

| |

|

|

|

|

| |

| Non-current liabilities | 11 516 | | 15 341 | | 15 043 | |

| | | | | | | |

| Shareholders’ equity | 11 230 | | 8 361 | | 7 264 | |

| Minority interests | 442 | | 404 | | 365 | |

| |

|

|

|

|

| |

| Total equity | 11 672 | | 8 765 | | 7 629 | |

| |

|

|

|

|

| |

| Total capital employed | 23 188 | | 24 106 | | 22 672 | |

|

|

|

|

|

| |

| | | | | | | |

| | € million | | € million | | € million | |

| Consolidated cash flow statement | 2006 | | 2005 | | 2004 | |

|

|

|

|

|

| |

| Net cash flow from operating activities | 4 511 | | 4 353 | | 5 547 | |

| Net cash flow from/(used in) investing activities | 1 155 | | 515 | | (120 | ) |

| Net cash flow from/(used in) financing activities | (6 572 | ) | (4 821 | ) | (5 938 | ) |

| |

|

|

|

|

| |

| Net increase/(decrease) in cash and cash equivalents | (906 | ) | 47 | | (511 | ) |

| Cash and cash equivalents at the beginning of the year | 1 265 | | 1 406 | | 1 428 | |

| Effect of foreign exchange rates | 351 | | (188 | ) | 489 | |

| |

|

|

|

|

| |

| Cash and cash equivalents at the end of the year | 710 | | 1 265 | | 1 406 | |

|

|

|

|

|

| |

| | | | | | | |

| Ratios and other metrics | 2006 | | 2005 | | 2004 | |

|

|

|

|

|

| |

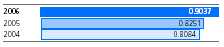

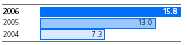

| Operating margin (%) | 13.6 | | 13.2 | | 10.7 | |

| Net profit margin (%)(b) | 12.0 | | 9.8 | | 7.4 | |

| Ungeared free cash flow (€ million)(c) | 4 222 | | 4 011 | | 5 346 | |

| Return on invested capital (%)(c) | 14.6 | | 12.5 | | 10.7 | |

| Ratio of earnings to fixed charges (times)(d) | 7.5 | | 6.5 | | 5.1 | |

|

|

|

|

|

| |

| (a) | For the basis of the calculations of combined earnings per share see note 7 on page 87. |

| (b) | Net profit margin is expressed as net profit attributable to shareholders’ equity as a percentage of turnover from continuing operations. |

| (c) | As defined on page 25. |

| (d) | In the ratio of earnings to fixed charges, earnings consist of net profit from continuing operations excluding net profit or loss of joint ventures and associates increased by fixed charges, income taxes and dividends received from joint ventures and associates. Fixed charges consist of interest payable on debt and a portion of lease costs determined to be representative of interest. This ratio takes no account of interest receivable although Unilever’s treasury operations involve both borrowing and depositing funds. |

| Unilever Annual Report on Form 20-F 2006 | 141 |

Back to Contents

| | |

| Financial Statements (continued) | |

| | |

| Selected financial data (continued)Unilever Group |

|

Selected financial data under IFRS(continued)

| | € million | | € million | | € million | |

| By geographical area | 2006 | | 2005 | | 2004 | |

|

|

|

|

|

| |

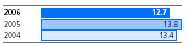

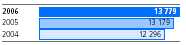

| Turnover | | | | | | |

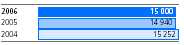

| Europe | 15 000 | | 14 940 | | 15 252 | |

| The Americas | 13 779 | | 13 179 | | 12 296 | |

| Asia Africa | 10 863 | | 10 282 | | 9 620 | |

| |

|

|

|

|

| |

| | 39 642 | | 38 401 | | 37 168 | |

|

|

|

|

|

| |

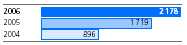

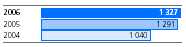

| Operating profit | | | | | | |

| Europe | 1 903 | | 2 064 | | 2 045 | |

| The Americas | 2 178 | | 1 719 | | 896 | |

| Asia Africa | 1 327 | | 1 291 | | 1 040 | |

| |

|

|

|

|

| |

| | 5 408 | | 5 074 | | 3 981 | |

|

|

|

|

|

| |

| Total assets | | | | | | |

| Europe | 14 523 | | 15 164 | | 15 586 | |

| The Americas | 11 566 | | 12 569 | | 11 486 | |

| Asia Africa | 5 884 | | 6 320 | | 4 369 | |

| Corporate | 5 099 | | 5 447 | | 5 417 | |

| |

|

|

|

|

| |

| | 37 072 | | 39 500 | | 36 858 | |

|

|

|

|

|

| |

| Capital expenditure | | | | | | |

| Europe | 511 | | 447 | | 497 | |

| The Americas | 396 | | 305 | | 297 | |

| Asia Africa | 294 | | 298 | | 305 | |

| |

|

|

|

|

| |

| | 1 201 | | 1 050 | | 1 099 | |

|

|

|

|

|

| |

| | | | | | | |

| | € million | | € million | | € million | |

| By operation | 2006 | | 2005 | | 2004 | |

|

|

|

|

|

| |

| Turnover | | | | | | |

| Foods | 21 345 | | 20 889 | | 20 566 | |

| Home and Personal Care | 18 297 | | 17 512 | | 16 602 | |

| |

|

|

|

|

| |

| | 39 642 | | 38 401 | | 37 168 | |

|

|

|

|

|

| |

| Operating profit | | | | | | |

| Foods | 2 893 | | 2 635 | | 1 850 | |

| Home and Personal Care | 2 515 | | 2 439 | | 2 131 | |

| |

|

|

|

|

| |

| | 5 408 | | 5 074 | | 3 981 | |

|

|

|

|

|

| |

| Total assets | | | | | | |

| Foods | 24 972 | | 26 798 | | 25 382 | |

| Home and Personal Care | 7 001 | | 7 255 | | 6 059 | |

| Corporate | 5 099 | | 5 447 | | 5 417 | |

| |

|

|

|

|

| |

| | 37 072 | | 39 500 | | 36 858 | |

|

|

|

|

|

| |

| Capital expenditure | | | | | | |

| Foods | 714 | | 572 | | 588 | |

| Home and Personal Care | 487 | | 478 | | 511 | |

| |

|

|

|

|

| |

| | 1 201 | | 1 050 | | 1 099 | |

|

|

|

|

|

| |

| 142 | Unilever Annual Report on Form 20-F 2006 |

Back to Contents

| | |

| | Financial Statements(continued) |

| | |

| Selected financial data (continued)Unilever Group |

|

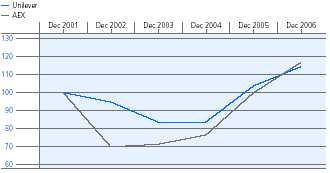

Selected financial data under previous GAAP

Unilever adopted International Financial Reporting Standards as adopted by the EU with effect from 1 January 2005, with a transition date of 1 January 2004. Information for the period from 2002 to 2004 as reported under our previous accounting policies (which is not directly comparable with IFRS) is set out below and on pages 144 and 145.

This information is derived from the audited consolidated accounts of the Unilever Group for the years 2002 to 2004, and should be read in the context of those accounts and notes. Those accounts were prepared under the accounting policies which the Group applied prior to its adoption of IFRS. These were based on United Kingdom accounting standards and applicable Dutch and UK law. Further information can be found in the ‘Accounting information and policies’ sections of the Report and Accounts for the years in question.

The adoption, in 2003, of UK Financial Reporting Standard 17 on pensions accounting was reflected by restating the consolidated profit and loss accounts for the years ended and the balance sheets as at 31 December 2002 and 31 December 2001.

| | € million | | € million | | € million | |

| Consolidated profit and loss account | 2004 | | 2003 | | 2002 | |

|

|

|

|

|

| |

| Group turnover | 40 169 | | 42 693 | | 48 270 | |

| |

|

|

|

|

| |

| Group operating profit | 3 411 | | 5 483 | | 5 007 | |

| After charging: | | | | | | |

| Exceptional items | (1 595 | ) | (97 | ) | (707 | ) |

| Amortisation of goodwill and intangible assets | (1 086 | ) | (1 139 | ) | (1 245 | ) |

| Income from fixed investments | 117 | | 68 | | 111 | |

| Interest | (689 | ) | (1 013 | ) | (1 065 | ) |

| |

|

|

|

|

| |

| Profit on ordinary activities before taxation | 2 839 | | 4 538 | | 4 053 | |

| |

|

|

|

|

| |

| Profit on ordinary activities after taxation | 2 057 | | 3 011 | | 2 448 | |

| |

|

|

|

|

| |

| Net profit | 1 876 | | 2 762 | | 2 136 | |

| |

|

|

|

|

| |

| Preference dividends | (28 | ) | (27 | ) | (42 | ) |

| Dividends on ordinary capital | (1 815 | ) | (1 682 | ) | (1 659 | ) |

| |

|

|

|

|

| |

| Result for the year retained | 33 | | 1 053 | | 435 | |

|

|

|

|

|

| |

| Combined earnings per share | €0.64 | | €0.94 | | €0.71 | |

|

|

|

|

|

| |

| Ordinary dividends | | | | | | |

| NV – euros per €0.16 of ordinary capital | 0.6300 | | 0.5800 | | 0.5666 | |

| PLC – pounds per 31/9p of ordinary capital | 0.4256 | | 0.4018 | | 0.3565 | |

|

|

|

|

|

| |

| | | | | | | |

| | € million | | € million | | € million | |

| Consolidated balance sheet | 2004 | | 2003 | | 2002 | |

|

|

|

|

|

| |

| Goodwill and intangible assets | 15 338 | | 17 713 | | 20 274 | |

| Other fixed assets and investments | 6 473 | | 6 854 | | 8 115 | |

| Stocks | 3 758 | | 4 175 | | 4 500 | |

| Debtors | 5 703 | | 5 881 | | 6 571 | |

| Total cash and current investments | 2 603 | | 3 345 | | 2 904 | |

| |

|

|

|

|

| |

| Total assets | 33 875 | | 37 968 | | 42 364 | |

| | | | | | | |

| Creditors due within one year | (14 570 | ) | (17 074 | ) | (19 955 | ) |

| |

|

|

|

|

| |

| Total assets less current liabilities | 19 305 | | 20 894 | | 22 409 | |

|

|

|

|

|

| |

| Creditors due after one year | 7 610 | | 9 130 | | 11 574 | |

| Provisions for liabilities and charges | 5 799 | | 5 404 | | 5 514 | |

| |

|

|

|

|

| |

| Total long-term liabilities | 13 409 | | 14 534 | | 17 088 | |

| | | | | | | |

| Minority interests | 362 | | 440 | | 619 | |

| Capital and reserves | 5 534 | | 5 920 | | 4 702 | |

| |

|

|

|

|

| |

| Total capital employed | 19 305 | | 20 894 | | 22 409 | |

|

|

|

|

|

| |

| Unilever Annual Report on Form 20-F 2006 | 143 |

Back to Contents

| | |

| Financial Statements (continued) | |

| | |

| Selected financial data (continued) Unilever Group |

|

Selected financial data under previous GAAP(continued)

| | € million | | € million | | € million | |

| By geographical area | 2004 | | 2003 | | 2002 | |

|

|

|

|

|

| |

| Group turnover | | | | | | |

| Europe | 17 314 | | 18 208 | | 19 573 | |

| The Americas | 13 120 | | 14 146 | | 17 879 | |

| Asia Africa | 9 735 | | 10 339 | | 10 818 | |

| |

|

|

|

|

| |

| | 40 169 | | 42 693 | | 48 270 | |

|

|

|

|

|

| |

| Group operating profit | | | | | | |

| Europe | 1 827 | | 2 563 | | 1 598 | |

| The Americas | 617 | | 1 429 | | 2 046 | |

| Asia Africa | 967 | | 1 491 | | 1 363 | |

| |

|

|

|

|

| |

| | 3 411 | | 5 483 | | 5 007 | |

|

|

|

|

|

| |

| Net operating assets | | | | | | |

| Europe | 9 748 | | 11 306 | | 12 301 | |

| The Americas | 8 869 | | 11 033 | | 13 441 | |

| Asia Africa | 2 294 | | 2 582 | | 2 445 | |

| |

|

|

|

|

| |

| | 20 911 | | 24 921 | | 28 187 | |

|

|

|

|

|

| |

| Capital expenditure | | | | | | |

| Europe | 461 | | 471 | | 552 | |

| The Americas | 262 | | 316 | | 468 | |

| Asia Africa | 282 | | 251 | | 278 | |

| |

|

|

|

|

| |

| | 1 005 | | 1 038 | | 1 298 | |

|

|

|

|

|

| |

| | | | | | | |

| | € million | | € million | | € million | |

| By operation | 2004 | | 2003 | | 2002 | |

|

|

|

|

|

| |

| Group turnover | | | | | | |

| Foods | 22 530 | | 23 971 | | 26 937 | |

| Home and Personal Care | 17 639 | | 18 722 | | 21 333 | |

| |

|

|

|

|

| |

| | 40 169 | | 42 693 | | 48 270 | |

|

|

|

|

|

| |

| Group operating profit | | | | | | |

| Foods | 1 267 | | 2 648 | | 2 083 | |

| Home and Personal Care | 2 144 | | 2 835 | | 2 924 | |

| |

|

|

|

|

| |

| | 3 411 | | 5 483 | | 5 007 | |

|

|

|

|

|

| |

| Net operating assets | | | | | | |

| Foods | 19 014 | | 22 469 | | 25 156 | |

| Home and Personal Care | 1 897 | | 2 452 | | 3 031 | |

| |

|

|

|

|

| |

| | 20 911 | | 24 921 | | 28 187 | |

|

|

|

|

|

| |

| Capital expenditure | | | | | | |

| Foods | 532 | | 602 | | 805 | |

| Home and Personal Care | 473 | | 436 | | 493 | |

| |

|

|

|

|

| |

| | 1 005 | | 1 038 | | 1 298 | |

|

|

|

|

|

| |

| 144 | Unilever Annual Report on Form 20-F 2006 |

Back to Contents

| | |

| | Financial Statements (continued) |

| | |

| Selected financial data (continued) Unilever Group |

|

Selected financial data under previous GAAP(continued)

| | € million | | € million | | € million | |

| Consolidated cash flow statement | 2004 | | 2003 | | 2002 | |

|

|

|

|

|

| |

| Cash flow from operating activities | 6 853 | | 6 780 | | 7 883 | |

| Dividends from joint ventures | 60 | | 52 | | 83 | |

| Returns on investments and servicing of finance | (807 | ) | (1 180 | ) | (1 386 | ) |

| Taxation | (1 378 | ) | (1 423 | ) | (1 817 | ) |

| Capital expenditure and financial investment | (1 044 | ) | (1 024 | ) | (1 706 | ) |

| Acquisitions and disposals | 316 | | 622 | | 1 755 | |

| Dividends paid on ordinary share capital | (1 720 | ) | (1 715 | ) | (1 580 | ) |

| |

|

|

|

|

| |

| Cash flow before management of liquid resources and financing | 2 280 | | 2 112 | | 3 232 | |

| Management of liquid resources | (31 | ) | (41 | ) | (592 | ) |

| Financing | (2 921 | ) | (2 917 | ) | (3 078 | ) |

| |