UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02688

Name of Fund: BlackRock Municipal Bond Fund, Inc.

BlackRock High Yield Municipal Fund

BlackRock National Municipal Fund

BlackRock Short-Term Municipal Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Municipal Bond Fund, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 06/30/2013

Date of reporting period: 12/31/2012

Item 1 – Report to Stockholders

| SEMI-ANNUAL REPORT (UNAUDITED) |  |

> | BlackRock High Yield Municipal Fund |

> | BlackRock National Municipal Fund |

> | BlackRock Short-Term Municipal Fund |

> | BlackRock New York Municipal Bond Fund |

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Table of Contents

| Page | ||||||

Dear Shareholder | 3 | |||||

Semi-Annual Report: | ||||||

Fund Summaries | 4 | |||||

About Fund Performance | 12 | |||||

Disclosure of Expenses | 13 | |||||

The Benefits and Risks of Leveraging | 14 | |||||

Derivative Financial Instruments | 14 | |||||

Financial Statements: | ||||||

Schedules of Investments | 15 | |||||

Statements of Assets and Liabilities | 41 | |||||

Statements of Operations | 43 | |||||

Statements of Changes in Net Assets | 44 | |||||

Financial Highlights | 48 | |||||

Notes to Financial Statements | 71 | |||||

Officers and Directors | 83 | |||||

Additional Information | 84 | |||||

A World-Class Mutual Fund Family | 86 |

| 2 | SEMI-ANNUAL REPORT | DECEMBER 31, 2012 |

| Dear Shareholder |

President, BlackRock Advisors, LLC

|

| “Although 2012 brought its share of headwinds, the strongest returns came from higher-risk asset classes as investors reached for yield in an environment of extremely low interest rates.” |

President, BlackRock Advisors, LLC

Total Returns as of December 31, 2012

| 6-month | 12-month | |||||||||

US large cap equities (S&P 500® Index) | 5.95 | % | 16.00 | % | ||||||

US small cap equities (Russell 2000® Index) | 7.20 | 16.35 | ||||||||

International equities (MSCI Europe, Australasia, Far East Index) | 13.95 | 17.32 | ||||||||

Emerging market equities (MSCI Emerging Markets Index) | 13.75 | 18.22 | ||||||||

3-month Treasury bill (BofA Merrill Lynch 3-Month US Treasury Bill Index) | 0.07 | 0.11 | ||||||||

US Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index) | 0.71 | 4.18 | ||||||||

US investment grade bonds (Barclays US Aggregate Bond Index) | 1.80 | 4.21 | ||||||||

Tax-exempt municipal bonds (S&P Municipal Bond Index) | 3.15 | 7.42 | ||||||||

US high yield bonds (Barclays US Corporate High Yield 2% Issuer Capped Index) | 7.97 | 15.78 | ||||||||

| THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

| Fund Summary as of December 31, 2012 | BlackRock High Yield Municipal Fund |

Investment Objective

Portfolio Management Commentary

| • | For the six-month period ended December 31, 2012, the Fund outperformed its primary benchmark, the S&P® Municipal Bond Index, and underperformed its secondary benchmark, the S&P® Customized High Yield Municipal Bond Index. The following discussion of relative performance pertains to the S&P® Customized High Yield Municipal Bond Index. |

| • | Relative to the benchmark index, security selection within the corporate and transportation sectors detracted from Fund performance, as did an underweight in tobacco bonds as the sector generated superior returns for the period. |

| • | The Fund benefited from its more seasoned short-dated holdings as the slope of the yield curve remained positive during the period. (A bond’s yield decreases as it approaches maturity. As yields fall, prices rise.) Sector allocation also contributed positively to relative results. The Fund’s concentrations in corporate, transportation and health bonds proved advantageous as these sectors outperformed the overall municipal market. The Fund’s yield curve positioning was another positive factor. An emphasis on longer-dated bonds was beneficial as the yield curve flattened over the period (i.e., prices on bonds with longer maturities rose more than those with intermediate maturities). A modestly long duration (higher sensitivity to interest rate movements) helped performance as interest rates declined over the period. |

| • | During the six-month period, portfolio activity remained focused on maintaining a fully invested stance in an effort to capitalize on robust market conditions. Major themes included increased exposure to the tobacco sector and continued participation in the new issue market, where better value can often be found in contrast to more seasoned issues. These new purchases were typically within the transportation, health and corporate sectors, although additional purchases involved student housing and tax-increment bonds. |

| • | As of period end, the Fund continued to maintain its large allocations to the transportation, health and corporate sectors. The Fund held a long duration stance relative to the S&P® Customized High Yield Municipal Bond Index and a yield curve-flattening bias. As such, the Fund was positioned to benefit from further flattening of the municipal yield curve and a more modest compression in credit spreads. |

Sector Allocation |

Health | 29 | % | ||||

Transportation | 16 | |||||

Corporate | 13 | |||||

Utilities | 12 | |||||

County/City/Special District/School District | 11 | |||||

Education | 7 | |||||

Tobacco | 5 | |||||

State | 5 | |||||

Housing | 2 |

Credit Quality Allocation1 |

AAA/Aaa | 2 | % | ||||

AA/Aa | 17 | |||||

A | 11 | |||||

BBB/Baa | 39 | |||||

BB/Ba | 6 | |||||

B | 8 | |||||

Not Rated2 | 17 |

| 1 | Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investors Service (“Moody’s”) ratings. |

| 2 | The investment advisor has deemed certain of these non-rated securities to be of investment grade quality. As of December 31, 2012, the market value of these securities was $11,838,299, representing 3% of the Fund’s long-term investments. |

Call/Maturity Structure3 |

Calendar Year Ended December 31, | ||||||

2013 | 6 | % | ||||

2014 | 6 | |||||

2015 | 3 | |||||

2016 | 5 | |||||

2017 | 6 |

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| 4 | SEMI-ANNUAL REPORT | DECEMBER 31, 2012 |

| BlackRock High Yield Municipal Fund |

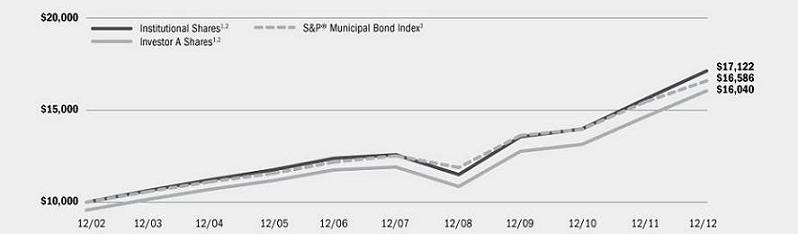

Total Return Based on a $10,000 Investment

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | The Fund may invest in municipal bonds rated in any rating category or in unrated municipal bonds. The Fund will usually invest in municipal bonds that have a maturity of five years or longer. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than 1 month. |

| 4 | The S&P® Customized High Yield Municipal Bond Index is a blended subset of the S&P® Municipal Bond Index that includes non-insured bonds rated below BBB— or non-rated (85%) and bonds rated BBB (15%), excluding those that are in default, are pre-refunded, or are escrowed to maturity. |

| 5 | Commencement of Operations. |

Performance Summary for the Period Ended December 31, 2012

| Average Annual Total Returns6 | ||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | Since Inception7 | ||||||||||||||||||||||||||||||||

| | Standardized 30-Day Yields | | 6-Month Total Returns | | w/o sales charge | | w/sales charge | | w/o sales charge | | w/sales charge | | w/o sales charge | | w/sales charge | |||||||||||||||||||

| Institutional | 3.86 | % | 5.56 | % | 15.24 | % | N/A | 6.58 | % | N/A | 4.68 | % | N/A | |||||||||||||||||||||

| Investor A | 3.44 | 5.43 | 14.96 | 10.08 | % | 6.28 | 5.36 | % | 4.37 | 3.67 | % | |||||||||||||||||||||||

| Investor C | 2.83 | 4.91 | 14.08 | 13.08 | 5.49 | 5.49 | 3.62 | 3.62 | ||||||||||||||||||||||||||

S&P® Municipal Bond Index | — | 3.15 | 7.42 | N/A | 5.78 | N/A | 5.48 | N/A | ||||||||||||||||||||||||||

S&P® Customized High Yield Municipal Bond Index | — | 7.05 | 17.27 | N/A | 6.36 | N/A | 5.14 | N/A | ||||||||||||||||||||||||||

| 6 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 7 | The Fund commenced operations on 8/01/06. |

Expense Example

| Actual | Hypothetical10 | |||||||||||||||||||||||||||||||||||||

| Expenses Paid During the Period | Including Interest Expense and Fees | Excluding Interest Expense and Fees | ||||||||||||||||||||||||||||||||||||

| Beginning Account Value July 1, 2012 | Ending Account Value December 31, 2012 | Including Interest Expense and Fees8 | Excluding Interest Expense and Fees9 | Beginning Account Value July 1, 2012 | Ending Account Value December 31, 2012 | Expenses Paid During the Period8 | Ending Account Value December 31, 2012 | Expenses Paid During the Period9 | ||||||||||||||||||||||||||||||

| Institutional | $ | 1,000.00 | $ | 1,055.60 | $ | 3.78 | $ | 3.26 | $ | 1,000.00 | $ | 1,021.51 | $ | 3.72 | $ | 1,022.01 | $ | 3.21 | ||||||||||||||||||||

| Investor A | $ | 1,000.00 | $ | 1,054.30 | $ | 5.07 | $ | 4.56 | $ | 1,000.00 | $ | 1,020.21 | $ | 4.99 | $ | 1,020.81 | $ | 4.48 | ||||||||||||||||||||

| Investor C | $ | 1,000.00 | $ | 1,049.10 | $ | 9.04 | $ | 8.47 | $ | 1,000.00 | $ | 1,016.41 | $ | 8.89 | $ | 1,016.91 | $ | 8.34 | ||||||||||||||||||||

| 8 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.73% for Institutional, 0.98% for Investor A, and 1.75% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 9 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.63% for Institutional, 0.88% for Investor A, and 1.64% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 10 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| SEMI-ANNUAL REPORT | DECEMBER 31, 2012 | 5 |

| Fund Summary as of December 31, 2012 | BlackRock National Municipal Fund |

Investment Objective |

Portfolio Management Commentary

| • | For the six-month period ended December 31, 2012, the Fund’s BlackRock, Institutional, Service and Investor A Shares outperformed the benchmark, the S&P® Municipal Bond Index, while Investor B and Investor B1 Shares performed in line with the benchmark, and Investor C and Investor C1 Shares underperformed the benchmark index. |

| • | The Fund’s slightly longer duration (higher sensitivity to interest rate movements) as compared to the benchmark index had a positive impact on performance as rates generally declined during the period. The Fund’s holdings were more concentrated on the long end of the yield curve, which benefited performance as the yield curve flattened (i.e., longer-term rates declined more than rates on shorter-dated bonds). Overweights to health, education and transportation enhanced results as those sectors outperformed the broader market during the period. The Fund’s lower-quality holdings boosted returns as credit spreads narrowed. The Fund maintained an above-industry-average coupon structure in order to maximize its income accrual, which contributed positively to total return. These higher-coupon holdings also benefited from strong demand during the period as investors sought yield in the low interest rate environment. Exposure to tender option bonds was another contributor to the Fund’s yield advantage. |

| • | Detracting from performance was the Fund’s lack of exposure to the tobacco sector, which rallied significantly during the period. Given a lack of attractive yield opportunities in the market, the Fund continued to hold cash and cash equivalents that had been reserved for defensive purposes after a period of significant market volatility and mutual fund outflows in 2011. As interest rates on cash investments remained near zero, the Fund’s cash holdings hindered relative performance while longer assets performed better in the declining rate environment. |

| • | As municipal bond valuations generally improved during the six-month period, the Fund increased its credit quality profile by taking advantage of tighter credit quality spreads to sell some of the Fund’s lower-rated holdings. As the Fund took profits on certain positions where performance targets had been reached, the Fund’s duration moved lower. New purchases during the period were concentrated in the primary market where more generous (higher) coupon rates could be structured. The Fund’s largest exposures to single names were concentrated in the highest quality structures that were suitable for the Fund. These holdings provided better relative price appreciation and increased the Fund’s liquidity. Overall, the Fund maintained its focus on maximizing income accrual using a high-quality asset mix, while managing portfolio volatility. |

| • | As of period end, the Fund continued to maintain a position in tender option bonds to boost current yield while the yield curve remained steep and short-term borrowing rates remained low. The Fund also continued to maintain a bias toward higher quality securities as well as a high average coupon rate, which stood at 5.80% at period end. Cash reserves remained elevated due to the limited availability of attractive yield opportunities. The Fund ended the period with a neutral duration posture relative to the S&P® Municipal Bond Index. |

Sector Allocation

Health | 22 | % | ||||

Utilities | 21 | |||||

County/City/Special District/School District | 17 | |||||

Transportation | 15 | |||||

State | 11 | |||||

Education | 8 | |||||

Corporate | 5 | |||||

Housing | 1 |

Credit Quality Allocation1

AAA/Aaa | 18 | % | ||||

AA/Aa | 44 | |||||

A | 29 | |||||

BBB/Baa | 6 | |||||

BB/Ba | 1 | |||||

Not Rated2 | 2 |

| 1 | Using the higher of S&P’s or Moody’s ratings. |

| 2 | The investment advisor has deemed certain of these non-rated securities to be of investment grade quality. As of December 31, 2012, the market value of these securities was $70,389,111, representing 1% of the Fund’s long-term investments. |

Call/Maturity Structure3

Calendar Year Ended December 31, | ||||||

2013 | 3 | % | ||||

2014 | 5 | |||||

2015 | 4 | |||||

2016 | 7 | |||||

2017 | 6 |

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| 6 | SEMI-ANNUAL REPORT | DECEMBER 31, 2012 |

| BlackRock National Municipal Fund |

Total Return Based on a $10,000 Investment

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | The Fund may invest in municipal bonds rated in any rating category or in unrated municipal bonds. The Fund will usually invest in municipal bonds that have a maturity of five years or longer. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than 1 month. |

Performance Summary for the Period Ended December 31, 2012

| Average Annual Total Returns4 | ||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||

| | Standardized 30-Day Yields | | 6-Month Total Returns | | w/o sales charge | | w/sales charge | | w/o sales charge | | w/sales charge | | w/o sales charge | | w/sales charge | |||||||||||||||||||

| BlackRock | 2.29 | % | 3.52 | % | 9.92 | % | N/A | 6.48 | % | N/A | 5.65 | % | N/A | |||||||||||||||||||||

| Institutional | 2.21 | 3.47 | 9.81 | N/A | 6.36 | N/A | 5.53 | N/A | ||||||||||||||||||||||||||

| Service | 1.70 | 3.21 | 9.13 | N/A | 6.04 | N/A | 5.24 | N/A | ||||||||||||||||||||||||||

| Investor A | 1.94 | 3.38 | 9.63 | 4.97 | % | 6.13 | 5.21 | % | 5.29 | 4.84 | % | |||||||||||||||||||||||

| Investor B | 1.51 | 3.12 | 9.10 | 5.10 | 5.60 | 5.28 | 4.77 | 4.77 | ||||||||||||||||||||||||||

| Investor B1 | 1.65 | 3.20 | 9.17 | 4.67 | 5.45 | 5.12 | 4.55 | 4.55 | ||||||||||||||||||||||||||

| Investor C | 1.27 | 2.99 | 8.82 | 7.82 | 5.34 | 5.34 | 4.49 | 4.49 | ||||||||||||||||||||||||||

| Investor C1 | 1.47 | 3.09 | 9.03 | 8.03 | 5.55 | 5.55 | 4.70 | 4.70 | ||||||||||||||||||||||||||

S&P® Municipal Bond Index | — | 3.15 | 7.42 | N/A | 5.78 | N/A | 5.19 | N/A | ||||||||||||||||||||||||||

| 4 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

Expense Example

| Actual | Hypothetical7 | |||||||||||||||||||||||||||||||||||||

| Expenses Paid During the Period | | Including Interest Expense and Fees | Excluding Interest Expense and Fees | |||||||||||||||||||||||||||||||||||

| | Beginning Account Value July 1, 2012 | | Ending Account Value December 31, 2012 | | Including Interest Expense and Fees5 | | Excluding Interest Expense and Fees6 | | Beginning Account Value July 1, 2012 | | Ending Account Value December 31, 2012 | | Expenses Paid During the Period5 | | Ending Account Value December 31, 2012 | | Expenses Paid During the Period6 | |||||||||||||||||||||

| BlackRock | $ | 1,000.00 | $ | 1,035.20 | $ | 2.72 | $ | 2.36 | $ | 1,000.00 | $ | 1,022.53 | $ | 2.70 | $ | 1,022.89 | $ | 2.35 | ||||||||||||||||||||

| Institutional | $ | 1,000.00 | $ | 1,034.70 | $ | 3.13 | $ | 2.77 | $ | 1,000.00 | $ | 1,022.13 | $ | 3.11 | $ | 1,022.48 | $ | 2.75 | ||||||||||||||||||||

| Service | $ | 1,000.00 | $ | 1,032.10 | $ | 5.69 | $ | 5.33 | $ | 1,000.00 | $ | 1,019.61 | $ | 5.65 | $ | 1,019.96 | $ | 5.30 | ||||||||||||||||||||

| Investor A | $ | 1,000.00 | $ | 1,033.80 | $ | 4.05 | $ | 3.69 | $ | 1,000.00 | $ | 1,021.22 | $ | 4.02 | $ | 1,021.58 | $ | 3.67 | ||||||||||||||||||||

| Investor B | $ | 1,000.00 | $ | 1,031.20 | $ | 6.66 | $ | 6.30 | $ | 1,000.00 | $ | 1,018.65 | $ | 6.61 | $ | 1,019.00 | $ | 6.26 | ||||||||||||||||||||

| Investor B1 | $ | 1,000.00 | $ | 1,032.00 | $ | 5.79 | $ | 5.43 | $ | 1,000.00 | $ | 1,019.51 | $ | 5.75 | $ | 1,019.86 | $ | 5.40 | ||||||||||||||||||||

| Investor C | $ | 1,000.00 | $ | 1,029.90 | $ | 7.88 | $ | 7.52 | $ | 1,000.00 | $ | 1,017.44 | $ | 7.83 | $ | 1,017.80 | $ | 7.48 | ||||||||||||||||||||

| Investor C1 | $ | 1,000.00 | $ | 1,030.90 | $ | 6.86 | $ | 6.55 | $ | 1,000.00 | $ | 1,018.45 | $ | 6.82 | $ | 1,018.75 | $ | 6.51 | ||||||||||||||||||||

| 5 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.53% for BlackRock, 0.61% for Institutional, 1.11% for Service, 0.79% for Investor A, 1.30% for Investor B, 1.13% for Investor B1, 1.54% for Investor C and 1.34% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Expenses are net of waiver. |

| 6 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.46% for BlackRock, 0.54% for Institutional, 1.04% for Service, 0.72% for Investor A, 1.23% for Investor B, 1.06% for Investor B1, 1.47% for Investor C and 1.28% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Expenses are net of waiver. |

| 7 | Hypothetical 5% before expenses is calculated by pro rating the number of days in the most fiscal half year divided by 365. |

| SEMI-ANNUAL REPORT | DECEMBER 31, 2012 | 7 |

| Fund Summary as of December 31, 2012 | BlackRock Short-Term Municipal Fund |

Investment Objective

Portfolio Management Commentary

| • | For the six-month period ended December 31, 2012, the Fund underperformed its primary benchmark, the S&P® Municipal Bond Index, and its secondary benchmark, the S&P® Limited Maturity Municipal Bond Index. The following discussion of relative performance pertains to the Fund’s secondary benchmark, the S&P® Limited Maturity Municipal Bond Index. |

| • | The Fund’s shorter average portfolio duration (lower sensitivity to interest rate movements) relative to the benchmark index detracted from performance as interest rates generally declined during the period. Also hindering returns was the Fund’s positioning within local bonds due to allocation decisions and security selection driven by the Fund’s high quality bias. Higher quality bonds underperformed lower quality tiers in the fourth quarter of 2012. |

| • | Conversely, yield curve positioning and sector allocation contributed positively to the Fund’s relative performance. Overweights to housing and tobacco were particularly beneficial as these sectors performed well during the period. Security selection within utilities also had a positive impact. |

| • | Demand for short-duration municipal bonds was significant during the six-month period as near-zero rates on cash instruments compelled short-term investors to move further out on the yield curve. Among securities with maturities inside of four years, yields declined most dramatically in the four-year area of that range. Because the Fund is limited by its prospectus to a maximum dollar weighted maturity of no more than two years and, therefore, is limited in its ability to benefit from yield curve flattening in a declining interest rate environment, portfolio activity was focused on credit selection. The Fund sought investments in relatively higher-yielding credit sectors such as health, housing and tax-exempt corporate bonds as well as tax-backed municipal securities. |

| • | The Fund was fully invested at period end and maintained a portfolio duration that was modestly short relative to the S&P® Limited Maturity Municipal Bond Index. |

Sector Allocation

State | 38 | % | ||||

County/City/Special District/School District | 20 | |||||

Transportation | 12 | |||||

Utilities | 12 | |||||

Corporate | 8 | |||||

Health | 5 | |||||

Education | 3 | |||||

Tobacco | 2 |

Credit Quality Allocation1

AAA/Aaa | 23 | % | ||||

AA/Aa | 43 | |||||

A | 29 | |||||

BBB/Baa | 4 | |||||

Not Rated2 | 1 |

| 1 | Using the higher of S&P’s or Moody’s ratings. |

| 2 | The investment advisor has deemed certain of these non-rated securities to be of investment grade quality. As of December 31, 2012, the market value of these securities was $9,214,796, representing 1% of the Fund’s long-term investments. |

Call/Maturity Structure3

Calendar Year Ended December 31, | ||||||

2013 | 30 | % | ||||

2014 | 29 | |||||

2015 | 22 | |||||

2016 | 18 | |||||

2017 | — |

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| 8 | SEMI-ANNUAL REPORT | DECEMBER 31, 2012 |

| BlackRock Short-Term Municipal Fund |

Total Return Based on a $10,000 Investment

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | The Fund invests primarily in investment grade municipal bonds or municipal notes, including variable rate demand obligations. The Fund will maintain a dollar-weighted maturity of no more than 2 years. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than 1 month. |

| 4 | The S&P® Limited Maturity Municipal Bond Index includes all bonds in the S&P® Municipal Bond Index with a remaining maturity of less than 4 years. |

Performance Summary for the Period Ended December 31, 2012

| Average Annual Total Returns5 | ||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||

| | Standardized 30-Day Yields | | 6-Month Total Returns | | w/o sales charge | | w/sales charge | | w/o sales charge | | w/sales charge | | w/o sales charge | | w/sales charge | |||||||||||||||||||

BlackRock | 0.16 | % | 0.17 | % | 0.69 | % | N/A | 2.07 | % | N/A | 2.09 | % | N/A | |||||||||||||||||||||

Institutional | 0.16 | 0.17 | 0.58 | N/A | 2.09 | N/A | 2.09 | N/A | ||||||||||||||||||||||||||

Investor A | 0.00 | 0.03 | 0.42 | (2.60 | )% | 1.82 | 1.20 | % | 1.84 | 1.53 | % | |||||||||||||||||||||||

Investor A1 | 0.04 | 0.11 | 0.56 | (0.44 | ) | 1.97 | 1.77 | 1.98 | 1.88 | |||||||||||||||||||||||||

Investor B | 0.00 | 0.06 | 0.28 | (0.72 | ) | 1.71 | 1.71 | 1.72 | 1.72 | |||||||||||||||||||||||||

Investor C | 0.00 | (0.39 | ) | (0.39 | ) | (1.39 | ) | 1.06 | 1.06 | 1.06 | 1.06 | |||||||||||||||||||||||

S&P® Municipal Bond Index | — | 3.15 | 7.42 | N/A | 5.78 | N/A | 5.19 | N/A | ||||||||||||||||||||||||||

S&P® Limited Maturity Municipal Bond Index | — | 0.41 | 1.26 | N/A | 2.88 | N/A | 2.83 | N/A | ||||||||||||||||||||||||||

| 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

Expense Example

| Actual | Hypothetical7 | | ||||||||||||||||||||||||||||

| | Beginning Account Value July 1, 2012 | | Ending Account Value December 31, 2012 | | Expenses Paid During the Period6 | | Beginning Account Value July 1, 2012 | | Ending Account Value December 31, 2012 | | Expenses Paid During the Period6 | | Annualized Expense Ratio | |||||||||||||||||

| BlackRock | $ | 1,000.00 | $ | 1,001.70 | $ | 1.97 | $ | 1,000.00 | $ | 1,023.24 | $ | 1.99 | 0.39 | % | ||||||||||||||||

| Institutional | $ | 1,000.00 | $ | 1,001.70 | $ | 2.02 | $ | 1,000.00 | $ | 1,023.19 | $ | 2.04 | 0.40 | % | ||||||||||||||||

| Investor A | $ | 1,000.00 | $ | 1,000.30 | $ | 3.38 | $ | 1,000.00 | $ | 1,021.83 | $ | 3.41 | 0.67 | % | ||||||||||||||||

| Investor A1 | $ | 1,000.00 | $ | 1,001.10 | $ | 2.62 | $ | 1,000.00 | $ | 1,022.58 | $ | 2.65 | 0.52 | % | ||||||||||||||||

| Investor B | $ | 1,000.00 | $ | 1,000.60 | $ | 4.08 | $ | 1,000.00 | $ | 1,021.12 | $ | 4.13 | 0.81 | % | ||||||||||||||||

| Investor C | $ | 1,000.00 | $ | 996.10 | $ | 7.35 | $ | 1,000.00 | $ | 1,017.85 | $ | 7.43 | 1.46 | % | ||||||||||||||||

| 6 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 7 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| SEMI-ANNUAL REPORT | DECEMBER 31, 2012 | 9 |

| Fund Summary as of December 31, 2012 | BlackRock New York Municipal Bond Fund |

Investment Objective

Portfolio Management Commentary

| • | For the six-month period ended December 31, 2012, the Fund outperformed its primary benchmark, the S&P® Municipal Bond Index, and its secondary benchmark, the S&P® New York Municipal Bond Index. The following discussion of relative performance pertains to the Fund’s secondary benchmark, the S&P® New York Municipal Bond Index. |

| • | The Fund’s longer duration (higher sensitivity to interest rate movements) as compared to the benchmark index had a positive impact on performance as rates generally declined during the period. The Fund’s holdings were more concentrated on the long end of the yield curve, which benefited performance as the yield curve flattened (i.e., longer-term rates declined more than rates on shorter-dated bonds). Overweights to health and education enhanced results as those sectors outperformed the broader market during the period. The Fund’s lower-quality holdings also boosted returns as credit spreads narrowed. |

| • | Detracting from performance was the Fund’s exposure, although small, to Puerto Rico-related credits, which underperformed the municipal market during the period. Other exposures having a negative impact were tax-backed credits (the Fund’s largest credit exposure) and a small allocation to pre-refunded bonds as these sectors were among the weaker performers for the period. |

| • | The Fund maintained a long duration stance during the six-month period. There were no significant structural changes to the portfolio. Sales during the period were mostly relative value trades of liquid and lower-yielding bonds. The Fund continued to participate in the new issue market, seeking opportunities to add income or to maintain or broaden diversification as New York’s market tends to be dominated by a few large issuers. Because new issuance was relatively limited while demand for these bonds was usually high, the amounts allocated to the Fund tended to be modest and thus the Fund regularly supplemented these purchases with additions to existing credits that are more accessible. |

| • | The Fund ended the period with a long duration bias as compared to the S&P® New York Municipal Bond Index. |

Sector Allocation

County/City/Special District/School District | 22 | % | ||||

Health | 17 | |||||

Transportation | 14 | |||||

Education | 14 | |||||

Utilities | 11 | |||||

State | 9 | |||||

Corporate | 7 | |||||

Housing | 5 | |||||

Tobacco | 1 |

Credit Quality Allocation1

AAA/Aaa | 9 | % | ||||

AA/Aa | 40 | |||||

A | 33 | |||||

BBB/Baa | 8 | |||||

BB/Ba | 3 | |||||

B | 1 | |||||

Not Rated2 | 6 |

| 1 | Using the higher of S&P’s or Moody’s ratings. |

| 2 | The investment advisor has deemed certain of these securities to be of investment grade quality. As of December 31, 2012 the market value of these securities was $639,854, representing less than 1% of the Fund’s long-term investments. |

Call/Maturity Structure3

Calendar Year Ended December 31, | ||||||

2013 | 5 | % | ||||

2014 | 5 | |||||

2015 | 4 | |||||

2016 | 4 | |||||

2017 | 10 |

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| 10 | SEMI-ANNUAL REPORT | DECEMBER 31, 2012 |

| BlackRock New York Municipal Bond Fund |

Total Return Based on a $10,000 Investment

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | The Fund invests primarily in a portfolio of investment grade New York municipal bonds. The Fund expects to maintain an average weighted maturity of greater than ten years. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard& Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than 1 month. |

| 4 | The S&P® New York Municipal Bond Index includes all New York bonds in the S&P® Municipal Bond Index. |

Performance Summary for the Period Ended December 31, 2012

| Average Annual Total Returns5 | ||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||

| | Standardized 30-Day Yields | | 6-Month Total Returns | | w/o sales charge | | w/sales charge | | w/o sales charge | | w/sales charge | | w/o sales charge | | w/sales charge | |||||||||||||||||||

Institutional | 2.49 | % | 4.12 | % | 10.34 | % | N/A | 5.66 | % | N/A | 4.76 | % | N/A | |||||||||||||||||||||

Investor A | 2.13 | 3.89 | 9.97 | 5.29 | % | 5.38 | 4.46 | % | 4.48 | 4.03 | % | |||||||||||||||||||||||

Investor A1 | 2.29 | 3.97 | 10.25 | 5.84 | 5.55 | 4.69 | 4.65 | 4.23 | ||||||||||||||||||||||||||

Investor B | 1.88 | 3.82 | 9.75 | 5.75 | 5.10 | 4.78 | 4.22 | 4.22 | ||||||||||||||||||||||||||

Investor C | 1.49 | 3.60 | 9.27 | 8.27 | 4.61 | 4.61 | 3.71 | 3.71 | ||||||||||||||||||||||||||

Investor C1 | 1.89 | 3.71 | 9.71 | 8.71 | 5.03 | 5.03 | 4.13 | 4.13 | ||||||||||||||||||||||||||

S&P® Municipal Bond Index | — | 3.15 | 7.42 | N/A | 5.78 | N/A | 5.19 | N/A | ||||||||||||||||||||||||||

S&P® New York Municipal Bond Index | — | 2.89 | 6.66 | N/A | 5.67 | N/A | 5.13 | N/A | ||||||||||||||||||||||||||

| 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

Expense Example

| Actual | Hypothetical8 | |||||||||||||||||||||||||||||||||||||

| Expenses Paid During the Period | Including Interest Expense and Fees | Excluding Interest Expense and Fees | ||||||||||||||||||||||||||||||||||||

| | Beginning Account Value July 1, 2012 | | Ending Account Value December 31, 2012 | | Including Interest Expense and Fees6 | | Excluding Interest Expense and Fees7 | | Beginning Account Value July 1, 2012 | | Ending Account Value December 31, 2012 | | Expenses Paid During the Period6 | | Ending Account Value December 31, 2012 | | Expenses Paid During the Period7 | |||||||||||||||||||||

| Institutional | $ | 1,000.00 | $ | 1,041.20 | $ | 3.96 | $ | 3.60 | $ | 1,000.00 | $ | 1,021.31 | $ | 3.92 | $ | 1,021.71 | $ | 3.57 | ||||||||||||||||||||

| Investor A | $ | 1,000.00 | $ | 1,038.90 | $ | 5.29 | $ | 4.98 | $ | 1,000.00 | $ | 1,020.01 | $ | 5.24 | $ | 1,020.31 | $ | 4.94 | ||||||||||||||||||||

| Investor A1 | $ | 1,000.00 | $ | 1,039.70 | $ | 4.47 | $ | 4.11 | $ | 1,000.00 | $ | 1,020.81 | $ | 4.43 | $ | 1,021.11 | $ | 4.08 | ||||||||||||||||||||

| Investor B | $ | 1,000.00 | $ | 1,038.20 | $ | 6.83 | $ | 6.47 | $ | 1,000.00 | $ | 1,018.51 | $ | 6.77 | $ | 1,018.81 | $ | 6.41 | ||||||||||||||||||||

| Investor C | $ | 1,000.00 | $ | 1,036.00 | $ | 9.03 | $ | 8.67 | $ | 1,000.00 | $ | 1,016.31 | $ | 8.94 | $ | 1,016.71 | $ | 8.59 | ||||||||||||||||||||

| Investor C1 | $ | 1,000.00 | $ | 1,037.10 | $ | 7.03 | $ | 6.67 | $ | 1,000.00 | $ | 1,018.31 | $ | 6.97 | $ | 1,018.61 | $ | 6.61 | ||||||||||||||||||||

| 6 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.77% for Institutional, 1.03% for Investor A, 0.87% for Investor A1, 1.33% for Investor B, 1.76% for Investor C and 1.37% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 7 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.70% for Institutional, 0.97% for Investor A, 0.80% for Investor A1, 1.26% for Investor B, 1.69% for Investor C and 1.30% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 8 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| SEMI-ANNUAL REPORT | DECEMBER 31, 2012 | 11 |

| About Fund Performance | |

| • | BlackRock and Institutional Shares (BlackRock Shares are available only in BlackRock Short-Term Municipal Fund and BlackRock National Municipal Fund) are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to eligible investors. Prior to October 2, 2006, for BlackRock Short-Term Municipal Fund and prior to July 18, 2011 for BlackRock National Municipal Fund, BlackRock Share performance results are those of the Institutional Shares restated to reflect BlackRock Share fees. |

| • | Service Shares (available only in BlackRock National Municipal Fund) are not subject to any sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are available only to eligible investors. Prior to July 18, 2011, Service Share performance results are those of the Institutional Shares restated to reflect Service Share fees. |

| • | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 4.25% for all Funds except BlackRock Short-Term Municipal Fund, which incurs a 3.00% maximum initial sales charge, and all Funds incur a service fee of 0.25% per year (but no distribution fee). Prior to October 2, 2006 for BlackRock Short-Term Municipal Fund and BlackRock New York Municipal Fund, Investor A Share performance results are those of the Institutional Shares (which have no distribution or service fees) restated to reflect Investor A Share fees. |

| • | Investor A1 Shares (available only in BlackRock Short-Term Municipal Fund and BlackRock New York Municipal Bond Fund) incur a maximum initial sales charge (front-end load) of 1.00% for BlackRock Short-Term Municipal Fund and 4.00% for BlackRock New York Municipal Fund; and a service fee of 0.10% per year (but no distribution fee). |

| • | Investor B Shares (available to all Funds except BlackRock High Yield Municipal Fund) are subject to the following maximum contingent deferred sales charges (“CDSC”): |

| | Maximum CDSC | |||

BlackRock National Municipal Fund | 4.00%, declining to 0% after 6 years | |||

BlackRock New York Municipal Bond Fund | 4.00%, declining to 0% after 6 years | |||

BlackRock Short-Term Municipal Fund | 1.00%, declining to 0% after 3 years | |||

In addition, these shares are subject to distribution and service fees per year as follows:

| | Distribution Fee | | Service Fee | |||||||

BlackRock National Municipal Fund | 0.50 | % | 0.25 | % | ||||||

BlackRock New York Municipal Bond Fund | 0.25 | % | 0.25 | % | ||||||

BlackRock Short-Term Municipal Fund | 0.20 | % | 0.15 | % | ||||||

For BlackRock Short-Term Municipal Fund and BlackRock New York Municipal Bond Fund, the shares automatically convert to Investor A1 Shares after approximately 10 years. For BlackRock National Municipal Fund, the shares automatically convert to Investor A Shares after approximately 10 years. (There is no initial sales charge for automatic sales conversions.)

| • | Investor B1 Shares (available only in BlackRock National Municipal Fund) are subject to a maximum CDSC of 4.50%, declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately seven years. Prior to July 18, 2011, Investor B1 Share performance results are those of the Institutional Shares restated to reflect Investor B1 Share fees. |

| • | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. Prior to October 2, 2006 (for all Funds except BlackRock High Yield Municipal Fund), Investor C Share performance results are those of Institutional Shares (which have no distribution or service fees) restated to reflect Investor C Share fees. |

| • | Investor C1 Shares (available only in BlackRock National Municipal Fund and BlackRock New York Municipal Fund) are subject to a 1.00% CDSC if redeemed within one year of purchase. |

| • | In addition, these shares are subject to distribution and service fees per year as follows: |

| | Distribution Fee | | Service Fee | |||||||

BlackRock National Municipal Fund | 0.55 | % | 0.25 | % | ||||||

BlackRock New York Municipal Bond Fund | 0.35 | % | 0.25 | % | ||||||

| 12 | SEMI-ANNUAL REPORT | DECEMBER 31, 2012 |

| Disclosure of Expenses |

| SEMI-ANNUAL REPORT | DECEMBER 31, 2012 | 13 |

| The Benefits and Risks of Leveraging |

Derivative Financial Instruments

| 14 | SEMI-ANNUAL REPORT | DECEMBER 31, 2012 |

| Schedule of Investments December 31, 2012 (Unaudited) | BlackRock High Yield Municipal Fund (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) | Value | ||||||||

Alabama — 2.4% | ||||||||||

Alabama State Docks Department, Refunding RB, 6.00%, 10/01/40 | $ | 710 | $ | 832,156 | ||||||

County of Jefferson Alabama, RB, Series A: | ||||||||||

5.25%, 1/01/17 | 1,000 | 1,000,100 | ||||||||

5.25%, 1/01/19 | 1,000 | 998,980 | ||||||||

5.25%, 1/01/20 | 500 | 498,845 | ||||||||

5.50%, 1/01/21 | 1,200 | 1,202,424 | ||||||||

5.00%, 1/01/24 | 2,000 | 1,952,100 | ||||||||

4.75%, 1/01/25 | 325 | 309,556 | ||||||||

Phoenix City Industrial Development Board, Refunding RB, Meadwestvaco Coated Board Project, Series A, AMT, 4.13%, 5/15/35 | 1,840 | 1,829,806 | ||||||||

| 8,623,967 | ||||||||||

Alaska — 1.1% | ||||||||||

Northern Tobacco Securitization Corp., Refunding RB, Asset-Backed, Series A: | ||||||||||

4.63%, 6/01/23 | 1,235 | 1,235,284 | ||||||||

5.00%, 6/01/32 | 1,500 | 1,345,095 | ||||||||

5.00%, 6/01/46 | 1,620 | 1,397,720 | ||||||||

| 3,978,099 | ||||||||||

Arizona — 3.5% | ||||||||||

Arizona Health Facilities Authority, Refunding RB, Phoenix Children’s Hospital, Series A, 5.00%, 2/01/42 | 2,500 | 2,706,575 | ||||||||

Maricopa County IDA Arizona, RB, Arizona Charter Schools Project, Series A: | ||||||||||

6.63%, 7/01/20 | 25 | 20,495 | ||||||||

6.75%, 7/01/29 | 300 | 211,575 | ||||||||

Phoenix IDA Arizona, ERB, Great Hearts Academies—Veritas Project, 6.40%, 7/01/47 | 415 | 447,918 | ||||||||

Phoenix IDA Arizona, Refunding RB, America West Airlines, Inc. Project, AMT, 6.30%, 4/01/23 | 1,000 | 890,460 | ||||||||

Pima County IDA, RB, Tucson Electric Power Co. Project, Series A: | ||||||||||

6.38%, 9/01/29 | 780 | 784,766 | ||||||||

5.25%, 10/01/40 | 1,390 | 1,514,377 | ||||||||

Pima County IDA, Refunding RB, Tucson Electric Power Co. Project, Series A, 4.50%, 6/01/30 | 2,000 | 2,085,740 | ||||||||

Salt Verde Financial Corp., RB, Senior: | ||||||||||

5.00%, 12/01/32 | 750 | 853,493 | ||||||||

5.00%, 12/01/37 | 2,180 | 2,433,490 | ||||||||

Tempe IDA, Refunding RB, Friendship Village of Tempe, Series A, 6.25%, 12/01/42 | 280 | 303,346 | ||||||||

University Medical Center Corp. Arizona, RB, 6.25%, 7/01/29 | 180 | 208,555 | ||||||||

| 12,460,790 | ||||||||||

| Municipal Bonds | Par (000) | Value | ||||||||

Arkansas — 0.2% | ||||||||||

Benton County Public Facilities Board, RB, BCCSO Project, Series A, 6.00%, 6/01/40 | $ | 750 | $ | 855,225 | ||||||

California — 7.7% | ||||||||||

California Health Facilities Financing Authority, RB: | ||||||||||

St. Joseph Health System, Series A, 5.75%, 7/01/39 | 1,000 | 1,147,950 | ||||||||

Sutter Health, Series B, 6.00%, 8/15/42 | 1,000 | 1,193,990 | ||||||||

California Health Facilities Financing Authority, Refunding RB, Catholic Healthcare West, Series A, 6.00%, 7/01/39 | 265 | 312,491 | ||||||||

California HFA, RB, Home Mortgage, Series I, AMT: | ||||||||||

4.60%, 8/01/21 | 855 | 857,403 | ||||||||

4.70%, 8/01/26 | 2,500 | 2,476,150 | ||||||||

4.80%, 8/01/36 | 1,500 | 1,472,925 | ||||||||

California Pollution Control Financing Authority, RB: | ||||||||||

Poseidon Resources (Channel Side) LP Desalination, AMT, 5.00%, 7/01/37 (a) | 775 | 791,461 | ||||||||

Poseidon Resources (Channel Side) LP Desalination, AMT, 5.00%, 11/21/45 (a) | 1,925 | 1,936,572 | ||||||||

San Diego County Water Authority Desalination Project, 5.00%, 11/21/45 | 920 | 938,924 | ||||||||

Waste Management Inc. Project, Series C, AMT, 5.13%, 11/01/23 (b) | 750 | 814,372 | ||||||||

California Pollution Control Financing Authority, Refunding RB, Waste Management Inc. Project, Series B, AMT, 5.00%, 7/01/27 | 1,000 | 1,069,370 | ||||||||

California Statewide Communities Development Authority, RB: | ||||||||||

John Muir Health, 5.13%, 7/01/39 | 425 | 464,585 | ||||||||

Kaiser Permanente, Series A, 5.00%, 4/01/42 | 1,145 | 1,279,663 | ||||||||

Sutter Health, Series A, 6.00%, 8/15/42 | 400 | 477,596 | ||||||||

California Statewide Communities Development Authority, Refunding RB: | ||||||||||

American Baptist Homes of the West, 6.25%, 10/01/39 | 2,575 | 2,804,896 | ||||||||

Eskaton Properties, Inc., 5.25%, 11/15/34 | 905 | 963,029 | ||||||||

City of Chula Vista California, Refunding RB, San Diego Gas & Electric, Series A, 5.88%, 2/15/34 | 500 | 588,750 | ||||||||

City of Roseville California, Special Tax Bonds, Fiddyment Ranch Community Facilities District No. 1, 5.25%, 9/01/36 | 465 | 465,116 | ||||||||

City of San Jose California, RB, Convention Center Expansion & Renovation Project: | ||||||||||

6.50%, 5/01/36 | 310 | 372,970 | ||||||||

6.50%, 5/01/42 | 760 | 911,362 | ||||||||

Foothill Eastern Transportation Corridor Agency California, Refunding RB, CAB, 6.06%, 1/15/33 (c) | 6,525 | 1,971,333 | ||||||||

Portfolio Abbreviations

| To simplify the listings of portfolio holdings in the Schedules of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list: | COP | Certificates of Participation | LOC | Letter of Credit | |

| EDA | Economic Development Authority | LRB | Lease Revenue Bonds | ||

| EDC | Economic Development Corp. | M/F | Multi-Family | ||

| ERB | Education Revenue Bonds | MRB | Mortgage Revenue Bonds | ||

| ERS | Extendible Reset Securities | NPFGC | National Public Finance Guarantee Corp. | ||

| ACA | American Capital Access Corp. | FHA | Federal Housing Administration | PSF-GTD | Permanent School Fund Guaranteed |

| AGC | Assured Guaranty Corp. | GARB | General Airport Revenue Bonds | PILOT | Payment in Lieu of Taxes |

| AGM | Assured Guaranty Municipal Corp. | GO | General Obligation Bonds | Radian | Radian Financial Guaranty |

| AMBAC | American Municipal Bond Assurance Corp. | HDA | Housing Development Authority | RB | Revenue Bonds |

| AMT | Alternative Minimum Tax (subject to) | HFA | Housing Finance Agency | RAN | Revenue Anticipation Notes |

| ARB | Airport Revenue Bonds | HRB | Housing Revenue Bonds | S/F | Single-Family |

| BARB | Building Aid Revenue Bonds | IDA | Industrial Development Authority | SONYMA | State of New York Mortgage Agency |

| BHAC | Berkshire Hathaway Assurance Corp. | IDB | Industrial Development Board | Syncora | Syncora Guarantee |

| CAB | Capital Appreciation Bonds | IDRB | Industrial Development Revenue Bonds | TRAN | Tax Revenue Anticipation Notes |

| CIFG | CDC IXIS Financial Guaranty | ISD | Independent School District | VRDN | Variable Rate Demand Notes |

| SEMI-ANNUAL REPORT | DECEMBER 31, 2012 | 15 |

| Schedule of Investments (continued) | BlackRock High Yield Municipal Fund (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) | Value | ||||||||

California (concluded) | ||||||||||

Lammersville School District Community Facilities District, Special Tax Bonds, District No. 2002, Mountain House, 5.13%, 9/01/35 | $ | 325 | $ | 326,648 | ||||||

Roseville Finance Authority, Special Tax Bonds, Refunding, Senior Lien, Series A (AMBAC), 4.50%, 9/01/33 | 725 | 685,132 | ||||||||

San Jose Redevelopment Agency, Tax Allocation Bonds, Merged Arearedev Project (NPFGC), 4.90%, 8/01/33 | 405 | 405,089 | ||||||||

San Marcos County Unified School District, GO, CAB, Election of 2010, Series B (c): | ||||||||||

4.84%, 8/01/37 | 1,000 | 308,610 | ||||||||

5.21%, 8/01/51 | 4,450 | 612,765 | ||||||||

Temecula Public Financing Authority, Special Tax Bonds, Refunding, Harveston, Sub-Series B, 5.10%, 9/01/36 | 170 | 166,780 | ||||||||

Tobacco Securitization Authority of Southern California, Refunding RB, Senior Series A-1, 5.00%, 6/01/37 | 2,140 | 1,905,028 | ||||||||

| 27,720,960 | ||||||||||

Colorado — 0.8% | ||||||||||

Denver Convention Center Hotel Authority, Refunding RB, Senior (Syncora), 5.00%, 12/01/30 | 1,500 | 1,562,490 | ||||||||

Regional Transportation District, RB, Denver Transport Partners, 6.00%, 1/15/41 | 1,000 | 1,165,080 | ||||||||

| 2,727,570 | ||||||||||

Connecticut — 0.2% | ||||||||||

Mohegan Tribe of Indians of Connecticut, Refunding RB, Public Improvement, Priority Distribution, 6.25%, 1/01/31 | 605 | 605,484 | ||||||||

Delaware — 0.4% | ||||||||||

Delaware State EDA, RB, Exempt Facilities, Indian River Power, 5.38%, 10/01/45 | 1,480 | 1,597,986 | ||||||||

District of Columbia — 1.8% | ||||||||||

District of Columbia, RB, Methodist Home District of Columbia, Series A: | ||||||||||

7.38%, 1/01/30 | 310 | 322,251 | ||||||||

7.50%, 1/01/39 | 500 | 519,390 | ||||||||

District of Columbia Tobacco Settlement Financing Corp., Refunding RB, Asset-Backed: | ||||||||||

6.50%, 5/15/33 | 1,510 | 1,765,220 | ||||||||

6.75%, 5/15/40 | 385 | 388,854 | ||||||||

Metropolitan Washington Airports Authority, Refunding RB: | ||||||||||

CAB, Second Senior Lien, Series B (AGC), 4.65%, 10/01/30 (c) | 3,005 | 1,328,901 | ||||||||

First Senior Lien, Series A, 5.00%, 10/01/39 | 185 | 203,530 | ||||||||

First Senior Lien, Series A, 5.25%, 10/01/44 | 1,610 | 1,785,136 | ||||||||

| 6,313,282 | ||||||||||

Florida — 5.3% | ||||||||||

Greater Orlando Aviation Authority Florida, RB, Special Purpose, JetBlue Airways Corp., AMT, 6.38%, 11/15/26 | 1,740 | 1,754,755 | ||||||||

Highland Meadows Community Development District, Special Assessment Bonds, Series A, 5.50%, 5/01/36 (d)(e) | 490 | 197,641 | ||||||||

Hillsborough County IDA, RB: | ||||||||||

National Gypsum Co., Series B, AMT, 7.13%, 4/01/30 | 1,500 | 1,500,615 | ||||||||

Tampa General Hospital Project, 5.25%, 10/01/41 | 1,000 | 1,043,770 | ||||||||

Jacksonville Economic Development Commission, RB, Gerdau Ameristeel US, Inc., AMT, 5.30%, 5/01/37 | 3,300 | 3,302,706 | ||||||||

Lakewood Ranch Stewardship District, Refunding, Special Assessment Bonds, Lakewood Center & NW Sector Projects, 8.00%, 5/01/40 | 515 | 580,271 | ||||||||

Mid-Bay Bridge Authority, RB, Series A, 7.25%, 10/01/40 | 1,450 | 1,852,897 | ||||||||

| Municipal Bonds | Par (000) | Value | ||||||||

Florida (concluded) | ||||||||||

Palm Beach County Health Facilities Authority, RB, ACTS Retirement-Life Community, 5.50%, 11/15/33 | $ | 1,500 | $ | 1,641,060 | ||||||

Santa Rosa Bay Bridge Authority, RB, 6.25%, 7/01/28 (d)(e) | 500 | 193,680 | ||||||||

Sarasota County Health Facilities Authority, Refunding RB, Village On The Isle Project, 5.50%, 1/01/27 | 210 | 225,032 | ||||||||

Sumter Landing Community Development District Florida, RB, Sub-Series B, 5.70%, 10/01/38 | 780 | 722,537 | ||||||||

Tolomato Community Development District, Special Assessment Bonds (d)(e): | ||||||||||

Series 1, 6.65%, 5/01/40 | 10 | 5,345 | ||||||||

Series 2, 6.65%, 5/01/40 | 330 | 149,589 | ||||||||

Series 3, 6.65%, 5/01/40 | 105 | 1 | ||||||||

Tolomato Community Development District, Special Assessment Bonds, Refunding: | ||||||||||

Convertible CAB, 0.00%, 5/01/17 (f) | 40 | 28,706 | ||||||||

Convertible CAB, 0.00%, 5/01/19 (f) | 90 | 51,854 | ||||||||

Convertible CAB, 0.00%, 5/01/22 (f) | 50 | 21,193 | ||||||||

Series A-1, 6.65%, 5/01/40 | 140 | 137,136 | ||||||||

Viera East Community Development District, Refunding, Special Assessment Bonds, 5.00%, 5/01/26 | 640 | 647,098 | ||||||||

Village Community Development District No. 9, Special Assessment Bonds: | ||||||||||

7.00%, 5/01/41 | 1,680 | 1,948,783 | ||||||||

5.50%, 5/01/42 | 615 | 652,023 | ||||||||

Village Community Development District No. 10, Special Assessment Bonds, 5.13%, 5/01/43 | 1,855 | 1,812,984 | ||||||||

Watergrass Community Development District, Special Assessment Bonds, Series A, 5.38%, 5/01/39 | 650 | 338,162 | ||||||||

| 18,807,838 | ||||||||||

Georgia — 1.1% | ||||||||||

Clayton County Development Authority, Refunding RB, Delta Air Lines, Inc. Project, Series A, 8.75%, 6/01/29 | 635 | 798,246 | ||||||||

County of Clayton Georgia, Tax Allocation Bonds, Ellenwood Project, 7.50%, 7/01/33 | 345 | 358,486 | ||||||||

DeKalb County Hospital Authority Georgia, Refunding RB, DeKalb Medical Center, Inc. Project, 6.13%, 9/01/40 | 1,240 | 1,452,598 | ||||||||

Gainesville & Hall County Development Authority, Refunding RB, ACTS Retirement-Life Community, Series A-2, 6.63%, 11/15/39 | 220 | 253,106 | ||||||||

Private Colleges & Universities Authority, Refunding RB, Mercer University Project, Series A, 5.00%, 10/01/32 | 395 | 433,682 | ||||||||

Richmond County Development Authority, RB, International Paper Co. Projects, Series A, AMT, 5.00%, 8/01/30 | 500 | 501,260 | ||||||||

| 3,797,378 | ||||||||||

Guam — 0.8% | ||||||||||

Guam Government Waterworks Authority, Refunding RB, Water and Wastewater System, 6.00%, 7/01/25 | 735 | 764,496 | ||||||||

Territory of Guam, GO, Series A: | ||||||||||

6.00%, 11/15/19 | 100 | 109,861 | ||||||||

6.75%, 11/15/29 | 1,650 | 1,847,290 | ||||||||

7.00%, 11/15/39 | 160 | 180,138 | ||||||||

| 2,901,785 | ||||||||||

Idaho — 0.1% | ||||||||||

Power County Industrial Development Corp., RB, FMC Corp. Project, AMT, 6.45%, 8/01/32 | 265 | 265,437 | ||||||||

Illinois — 3.5% | ||||||||||

City of Chicago Illinois, Refunding RB, American Airlines, Inc. Project, 5.50%, 12/01/30 (d)(e) | 1,000 | 870,090 | ||||||||

Illinois Finance Authority, RB, Lake Forest College, Series A: | ||||||||||

5.75%, 10/01/32 | 600 | 630,558 | ||||||||

6.00%, 10/01/48 | 1,700 | 1,773,746 | ||||||||

| 16 | SEMI-ANNUAL REPORT | DECEMBER 31, 2012 |

| Schedule of Investments (continued) | BlackRock High Yield Municipal Fund (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) | Value | ||||||||

Illinois (concluded) | ||||||||||

Illinois Finance Authority, Refunding RB: | ||||||||||

Central DuPage Health, Series B, 5.50%, 11/01/39 | $ | 1,400 | $ | 1,575,126 | ||||||

Friendship Village of Schaumburg, 7.13%, 2/15/39 | 1,000 | 1,102,810 | ||||||||

Lutheran Home & Services Obligated Group, 5.63%, 5/15/42 | 1,605 | 1,632,943 | ||||||||

Roosevelt University Project, 6.50%, 4/01/44 | 830 | 942,166 | ||||||||

Swedish Covenant, Series A, 6.00%, 8/15/38 | 1,000 | 1,132,770 | ||||||||

Metropolitan Pier & Exposition Authority, Refunding RB, CAB, McCormick Place Expansion Project, Series B (AGM), 4.93%, 6/15/44 (c) | 3,455 | 746,660 | ||||||||

Quad Cities Regional EDA, Refunding RB, Augustana College, 4.75%, 10/01/32 | 1,000 | 1,060,830 | ||||||||

Railsplitter Tobacco Settlement Authority, RB: | ||||||||||

5.50%, 6/01/23 | 355 | 423,856 | ||||||||

6.00%, 6/01/28 | 390 | 469,685 | ||||||||

| 12,361,240 | ||||||||||

Indiana — 1.2% | ||||||||||

City of Carmel, RB, Barrington Carmel Project, Series A: | ||||||||||

7.13%, 11/15/42 | 1,500 | 1,614,930 | ||||||||

7.13%, 11/15/47 | 1,500 | 1,609,170 | ||||||||

Indiana Finance Authority, Refunding RB, Marquette Project, 5.00%, 3/01/39 | 725 | 741,544 | ||||||||

Indiana Health Facility Financing Authority, Refunding RB, Methodist Hospital, Inc., 5.38%, 9/15/22 | 185 | 185,211 | ||||||||

| 4,150,855 | ||||||||||

Iowa — 1.5% | ||||||||||

Iowa Finance Authority, RB, Alcoa, Inc. Project, 4.75%, 8/01/42 | 2,500 | 2,522,925 | ||||||||

Iowa Finance Authority, Refunding RB: | ||||||||||

Development, Care Initiatives Project, Series A, 5.00%, 7/01/19 | 500 | 531,915 | ||||||||

Sunrise Retirement Community Project, 5.50%, 9/01/37 | 890 | 875,760 | ||||||||

Sunrise Retirement Community Project, 5.75%, 9/01/43 | 1,385 | 1,386,911 | ||||||||

| 5,317,511 | ||||||||||

Kentucky — 0.8% | ||||||||||

Kentucky Economic Development Finance Authority, RB, Owensboro Medical Health System, Series A: | ||||||||||

6.38%, 6/01/40 | 1,050 | 1,242,643 | ||||||||

6.50%, 3/01/45 | 1,000 | 1,188,690 | ||||||||

Kentucky Economic Development Finance Authority, Refunding RB: | ||||||||||

Norton Healthcare, Inc., Series B (NPFGC), 4.39%, 10/01/24 (c) | 250 | 150,043 | ||||||||

Owensboro Medical Health System, Series B, 6.38%, 3/01/40 | 395 | 466,625 | ||||||||

| 3,048,001 | ||||||||||

Louisiana — 0.5% | ||||||||||

Louisiana Local Government Environmental Facilities & Community Development Authority, RB, Westlake Chemical Corp. Projects, 6.75%, 11/01/32 | 1,000 | 1,122,500 | ||||||||

Louisiana Public Facilities Authority, RB, Belle Chasse Educational Foundation Project, 6.75%, 5/01/41 | 645 | 759,101 | ||||||||

| 1,881,601 | ||||||||||

Maine — 0.4% | ||||||||||

Maine Health & Higher Educational Facilities Authority, RB, Maine General Medical Center, 6.75%, 7/01/41 | 1,075 | 1,286,248 | ||||||||

Maryland — 1.8% | ||||||||||

County of Howard Maryland, Refunding RB, Vantage House Facility, Series A, 5.25%, 4/01/33 | 500 | 500,240 | ||||||||

Gaithersburg Maryland, Refunding RB, Asbury Maryland Obligation, Series B, 6.00%, 1/01/23 | 750 | 842,258 | ||||||||

| Municipal Bonds | Par (000) | Value | ||||||||

Maryland (concluded) | ||||||||||

Maryland EDC, RB: | ||||||||||

Term Project, Series B, 5.75%, 6/01/35 | $ | 1,500 | $ | 1,706,145 | ||||||

Transportation Facilities Project, Series A, 5.75%, 6/01/35 | 265 | 301,419 | ||||||||

Maryland EDC, Refunding RB, CNX Marine Terminals, Inc., 5.75%, 9/01/25 | 2,000 | 2,224,820 | ||||||||

Maryland Health & Higher Educational Facilities Authority, RB, Washington Christian Academy, 5.25%, 7/01/18 (d)(e) | 250 | 99,985 | ||||||||

Maryland Health & Higher Educational Facilities Authority, Refunding RB, Doctors Community Hospital, 5.75%, 7/01/38 | 890 | 960,746 | ||||||||

| 6,635,613 | ||||||||||

Massachusetts — 1.3% | ||||||||||

Massachusetts Development Finance Agency, RB: | ||||||||||

Foxborough Regional Charter School, Series A, 7.00%, 7/01/42 | 350 | 413,234 | ||||||||

Linden Ponds, Inc. Facility, Series A-1, 6.25%, 11/15/39 | 353 | 263,894 | ||||||||

Linden Ponds, Inc. Facility, Series A-2, 5.50%, 11/15/46 | 19 | 11,764 | ||||||||

Linden Ponds, Inc. Facility, Series B, 0.00%, 11/15/56 (c) | 94 | 500 | ||||||||

Massachusetts Development Finance Agency, Refunding RB: | ||||||||||

Boston Medical Center, Series C, 5.00%, 7/01/29 | 2,500 | 2,735,250 | ||||||||

Eastern Nazarene College, 5.63%, 4/01/29 | 500 | 499,980 | ||||||||

Tufts Medical Center, Series I, 6.75%, 1/01/36 | 510 | 620,017 | ||||||||

| 4,544,639 | ||||||||||

Michigan — 2.2% | ||||||||||

City of Detroit Michigan, GO: | ||||||||||

Taxable Capital Improvement, Limited Tax, Series A-1, 5.00%, 4/01/16 | 350 | 311,616 | ||||||||

Taxable Capital Improvement, Limited Tax, Series A-2, 8.00%, 4/01/14 | 1,715 | 1,483,406 | ||||||||

Kentwood EDC, Refunding RB, Limited Obligation Holland Home, 5.63%, 11/15/41 | 1,250 | 1,299,750 | ||||||||

Michigan State Hospital Finance Authority, Refunding RB, Hospital, Henry Ford Health, 5.75%, 11/15/39 | 1,710 | 1,949,862 | ||||||||

Monroe County Hospital Finance Authority, Refunding RB, Mercy Memorial Hospital Corp. Obligation, 5.50%, 6/01/35 | 1,565 | 1,680,575 | ||||||||

Royal Oak Hospital Finance Authority Michigan, Refunding RB, William Beaumont Hospital, 8.25%, 9/01/39 | 915 | 1,169,599 | ||||||||

| 7,894,808 | ||||||||||

Minnesota — 0.8% | ||||||||||

City of Woodbury, Refunding RB, MSA Building Co., Series A, 5.00%, 12/01/43 | 885 | 893,930 | ||||||||

Minnesota State Higher Education Facilities Authority, RB, College of St. Benedict, Series 7-M, 5.13%, 3/01/36 | 275 | 291,808 | ||||||||

St. Paul Housing & Redevelopment Authority, RB, Nova Classical Academy, Series A, 6.63%, 9/01/42 | 500 | 559,615 | ||||||||

St. Paul Port Authority, RB, Energy Park Utility Co. Project, AMT, 5.70%, 8/01/36 | 1,265 | 1,287,352 | ||||||||

| 3,032,705 | ||||||||||

Mississippi — 0.6% | ||||||||||

Warren County Mississippi, RB, Gulf Opportunity Zone Bonds, International Paper Co. Project, Series A, AMT, 5.38%, 12/01/35 | 2,000 | 2,199,760 | ||||||||

| SEMI-ANNUAL REPORT | DECEMBER 31, 2012 | 17 |

| Schedule of Investments (continued) | BlackRock High Yield Municipal Fund (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) | Value | ||||||||

Missouri — 0.9% | ||||||||||

City of Kansas City Missouri, Tax Allocation Bonds, Kansas City MainCor Project, Series A, 5.25%, 3/01/18 | $ | 600 | $ | 631,230 | ||||||

Kirkwood IDA Missouri, RB, Aberdeen Heights, Series A, 8.25%, 5/15/39 | 435 | 520,652 | ||||||||

Poplar Bluff Regional Transportation Development District, RB, 4.75%, 12/01/42 | 2,200 | 2,192,938 | ||||||||

| 3,344,820 | ||||||||||

Nebraska — 0.4% | ||||||||||

Central Plains Energy Project Nebraska, RB, Gas Project No. 3: | ||||||||||

5.25%, 9/01/37 | 445 | 482,238 | ||||||||

5.00%, 9/01/42 | 780 | 826,675 | ||||||||

| 1,308,913 | ||||||||||

Nevada — 0.4% | ||||||||||

County of Clark Nevada, RB, Southwest Gas Corp. Project, Series A, AMT (NPFGC), 4.75%, 9/01/36 | 20 | 20,213 | ||||||||

County of Clark Nevada, Special Assessment Bonds, Refunding, Special Improvement District No. 142, Mountain’s Edge: | ||||||||||

4.00%, 8/01/22 | 885 | 883,646 | ||||||||

4.00%, 8/01/23 | 555 | 550,777 | ||||||||

| 1,454,636 | ||||||||||

New Hampshire — 1.0% | ||||||||||

New Hampshire Health & Education Facilities Authority, Refunding RB: | ||||||||||

Dartmouth-Hitchcock, 6.00%, 8/01/38 | 435 | 509,307 | ||||||||

Havenwood-Heritage Heights, Series A, 5.40%, 1/01/30 | 500 | 505,645 | ||||||||

Southern New Hampshire University, 5.00%, 1/01/34 | 2,500 | 2,705,075 | ||||||||

| 3,720,027 | ||||||||||

New Jersey — 5.3% | ||||||||||

Burlington County Bridge Commission, Refunding RB, The Evergreens Project, 5.63%, 1/01/38 | 750 | 779,242 | ||||||||

New Jersey EDA, RB: | ||||||||||

Cigarette Tax, 5.75%, 6/15/14 (g) | 1,100 | 1,186,680 | ||||||||

Cigarette Tax, 5.75%, 6/15/14 (g) | 535 | 577,158 | ||||||||

Continental Airlines, Inc. Project, AMT, 5.13%, 9/15/23 | 1,965 | 1,964,214 | ||||||||

Continental Airlines, Inc. Project, AMT, 5.25%, 9/15/29 | 840 | 840,672 | ||||||||

Kapkowski Road Landfill Project, Series 1998B-MB, AMT, 6.50%, 4/01/31 | 3,000 | 3,542,220 | ||||||||

Patterson Charter School for Science and Technology, Inc. Project, Series A, 6.10%, 7/01/44 | 660 | 718,014 | ||||||||

New Jersey Educational Facilities Authority, Refunding RB, University of Medicine & Dentistry, Series B, 7.13%, 12/01/23 | 580 | 743,386 | ||||||||

New Jersey Health Care Facilities Financing Authority, RB: | ||||||||||

Pascack Valley Hospital Association, 6.63%, 7/01/36 (d)(e) | 650 | 6 | ||||||||

RWJ Healthcare Corp., Series B (Radian), 5.00%, 7/01/35 | 1,570 | 1,583,942 | ||||||||

New Jersey Health Care Facilities Financing Authority, Refunding RB: | ||||||||||

Barnabas Health, Series A, 5.63%, 7/01/37 | 1,000 | 1,124,550 | ||||||||

St. Joseph’s Healthcare System, 6.63%, 7/01/38 | 725 | 837,462 | ||||||||

Tobacco Settlement Financing Corp. New Jersey, Refunding RB, Series 1A, 4.50%, 6/01/23 | 4,955 | 4,930,374 | ||||||||

| 18,827,920 | ||||||||||

New Mexico — 0.7% | ||||||||||

City of Farmington New Mexico, Refunding RB, Arizona Public Service, Series A, 4.70%, 5/01/24 | 500 | 558,315 | ||||||||

New Mexico Hospital Equipment Loan Council, Refunding RB, Gerald Champion, 5.50%, 7/01/42 | 2,030 | 2,078,253 | ||||||||

| 2,636,568 | ||||||||||

| Municipal Bonds | Par (000) | Value | ||||||||

New York — 3.0% | ||||||||||

Chautauqua County Industrial Development Agency, RB, NRG Dunkirk Power Project, 5.88%, 4/01/42 | $ | 1,615 | $ | 1,816,972 | ||||||

Genesee County Industrial Development Agency New York, Refunding RB, United Memorial Medical Center Project, 5.00%, 12/01/32 | 500 | 490,095 | ||||||||

New York City Industrial Development Agency, RB, AMT: | ||||||||||

American Airlines, Inc., JFK International Airport, 8.00%, 8/01/28 (b)(d)(e) | 235 | 270,722 | ||||||||

British Airways Plc Project, 7.63%, 12/01/32 | 1,500 | 1,537,635 | ||||||||

JetBlue Airways Corp. Project, 5.13%, 5/15/30 | 1,750 | 1,719,287 | ||||||||

New York Liberty Development Corp., Refunding RB, Second Priority, Bank of America Tower at One Bryant Park Project, 6.38%, 7/15/49 | 375 | 441,229 | ||||||||

Niagara Area Development Corp., Refunding RB, Solid Waste Disposal Facility, Covanta Energy Project, Series A, AMT, 5.25%, 11/01/42 | 1,265 | 1,291,401 | ||||||||

Onondaga Civic Development Corp., RB, St. Joseph’s Hospital Health Center, 5.00%, 7/01/42 | 1,220 | 1,244,034 | ||||||||

Westchester County Industrial Development Agency New York, RB, Kendal on Hudson Project, Series A, 6.38%, 1/01/24 | 1,500 | 1,501,290 | ||||||||

Yonkers Industrial Development Agency New York, RB, Sarah Lawrence College Project, Series A, 6.00%, 6/01/41 | 410 | 463,661 | ||||||||

| 10,776,326 | ||||||||||

North Carolina — 1.9% | ||||||||||

City of Charlotte North Carolina, Refunding RB, Charlotte-Douglas International Airport, Special Facilities Revenue, US Airway, Inc. Project, AMT, 5.60%, 7/01/27 | 1,180 | 1,157,073 | ||||||||

North Carolina Capital Facilities Finance Agency, Refunding RB, High Point University, 4.38%, 5/01/34 | 2,100 | 2,167,263 | ||||||||

North Carolina Medical Care Commission, RB, First Mortgage, Galloway Ridge Project, Series A, 6.00%, 1/01/39 | 1,520 | 1,613,449 | ||||||||

North Carolina Medical Care Commission, Refunding RB: | ||||||||||

Carolina Village Project, 6.00%, 4/01/38 | 1,000 | 1,052,650 | ||||||||

First Mortgage, Whitestone, Series A, 7.75%, 3/01/41 | 830 | 947,337 | ||||||||

| 6,937,772 | ||||||||||

Ohio — 1.9% | ||||||||||

Buckeye Tobacco Settlement Financing Authority, RB, Asset-Backed Bonds, Series A-2, 5.75%, 6/01/34 | 4,460 | 3,958,384 | ||||||||

County of Hamilton Ohio, RB, Christ Hospital Project, 5.00%, 6/01/42 | 1,120 | 1,199,856 | ||||||||

State of Ohio, RB, Ford Motor Co. Project, AMT, 5.75%, 4/01/35 | 1,720 | 1,783,657 | ||||||||

| 6,941,897 | ||||||||||

Oklahoma — 0.5% | ||||||||||

Oklahoma County Finance Authority, Refunding RB, Epworth Villa Project, Series A, 5.13%, 4/01/42 | 1,025 | 989,176 | ||||||||

Oklahoma Development Finance Authority, Refunding RB, Inverness Village Community, 6.00%, 1/01/32 | 695 | 755,375 | ||||||||

| 1,744,551 | ||||||||||

Pennsylvania — 6.0% | ||||||||||

Allegheny County Hospital Development Authority, Refunding RB, Health System, West Pennsylvania, Series A, 5.38%, 11/15/40 | 2,140 | 1,461,406 | ||||||||

Allegheny County IDA, RB, US Steel Corp. Project, AMT, 5.75%, 8/01/42 | 1,500 | 1,461,030 | ||||||||

Allentown Neighborhood Improvement Zone Development Authority, Refunding RB, Series A: | ||||||||||

5.00%, 5/01/35 | 1,185 | 1,273,614 | ||||||||

5.00%, 5/01/42 | 2,730 | 2,907,914 | ||||||||

City of Philadelphia Pennsylvania Gas Works, RB, Ninth Series, 5.25%, 8/01/40 | 1,000 | 1,074,270 | ||||||||

| 18 | SEMI-ANNUAL REPORT | DECEMBER 31, 2012 |

| Schedule of Investments (continued) | BlackRock High Yield Municipal Fund (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) | Value | ||||||||

Pennsylvania (concluded) | ||||||||||

Cumberland County Municipal Authority, Refunding RB, Diakon Lutheran, 6.38%, 1/01/39 | $ | 2,680 | $ | 2,998,384 | ||||||

Lancaster County Hospital Authority, Refunding RB, Brethren Village Project, Series A, 6.50%, 7/01/40 | 835 | 896,373 | ||||||||

Lehigh County General Purpose Authority, Refunding RB, Bible Fellowship Church Homes, 5.13%, 7/01/32 (a) | 2,095 | 2,050,146 | ||||||||

Pennsylvania Economic Development Financing Authority, RB, US Airways Group, Series A, 7.50%, 5/01/20 | 1,200 | 1,353,132 | ||||||||

Pennsylvania Higher Educational Facilities Authority, RB, 5.00%, 10/01/44 | 2,025 | 2,187,040 | ||||||||

Pennsylvania Higher Educational Facilities Authority, Refunding RB, LaSalle University, 5.00%, 5/01/37 | 1,500 | 1,646,475 | ||||||||

Philadelphia Hospitals & Higher Education Facilities Authority, RB, Temple University Health System, Series A, 5.63%, 7/01/42 | 1,865 | 2,012,279 | ||||||||

| 21,322,063 | ||||||||||

Puerto Rico — 2.4% | ||||||||||

Puerto Rico Electric Power Authority, RB: | ||||||||||

Series A, 5.00%, 7/01/42 | 965 | 915,167 | ||||||||

Series WW, 5.50%, 7/01/38 | 1,000 | 1,009,430 | ||||||||

Puerto Rico Public Buildings Authority, Refunding RB, Government Facilities, Series U, 5.25%, 7/01/42 | 2,210 | 2,098,947 | ||||||||

Puerto Rico Public Finance Corp., Refunding RB, Series B, 5.50%, 8/01/31 | 2,500 | 2,527,125 | ||||||||

Puerto Rico Sales Tax Financing Corp., RB, First Sub-Series A, 6.50%, 8/01/44 | 750 | 833,258 | ||||||||

Puerto Rico Sales Tax Financing Corp., Refunding RB, CAB, First Sub-Series C, 5.96%, 8/01/38 (c) | 5,000 | 1,112,900 | ||||||||

| 8,496,827 | ||||||||||

Tennessee — 0.7% | ||||||||||

Johnson City Health & Educational Facilities Board, RB, Mountain States Health, 5.00%, 8/15/42 | 1,000 | 1,093,380 | ||||||||

Tennessee Energy Acquisition Corp., RB, Series A, 5.25%, 9/01/26 | 1,250 | 1,420,375 | ||||||||

| 2,513,755 | ||||||||||

Texas — 11.8% | ||||||||||

Bexar County Health Facilities Development Corp., RB, Army Retirement Residence Project, 6.20%, 7/01/45 | 1,320 | 1,475,747 | ||||||||

Brazos River Authority, RB, TXU Electric, Series A, AMT, 8.25%, 10/01/30 | 750 | 102,187 | ||||||||

Central Texas Regional Mobility Authority, Refunding RB: | ||||||||||

CAB, 4.86%, 1/01/28 (c) | 3,000 | 1,459,830 | ||||||||

CAB, 4.91%, 1/01/29 (c) | 500 | 230,140 | ||||||||

CAB, 5.04%, 1/01/30 (c) | 1,330 | 570,916 | ||||||||

CAB, 5.15%, 1/01/31 (c) | 4,000 | 1,600,840 | ||||||||

Senior Lien, 5.75%, 1/01/25 | 250 | 292,257 | ||||||||

Senior Lien, 6.25%, 1/01/46 | 765 | 904,834 | ||||||||

City of Houston Texas, RB, Special Facilities: | ||||||||||

Continental Airlines, Inc. Terminal Improvement Projects, AMT, 6.63%, 7/15/38 | 1,110 | 1,235,719 | ||||||||

Continental Airlines, Series E, AMT, 7.38%, 7/01/22 | 500 | 502,125 | ||||||||

Continental Airlines, Series E, AMT, 6.75%, 7/01/21 | 630 | 632,350 | ||||||||

City of Houston Texas, Refunding RB, Senior Lien, Series A, 5.50%, 7/01/39 | 120 | 137,794 | ||||||||

Clifton Higher Education Finance Corp., ERB, Idea Public Schools: | ||||||||||

5.50%, 8/01/31 | 370 | 405,875 | ||||||||

5.75%, 8/01/41 | 280 | 308,764 | ||||||||

5.00%, 8/15/42 | 1,360 | 1,455,336 | ||||||||

Danbury Higher Education Authority, Inc., RB, A.W. Brown Fellowship Charter, Series A (ACA), 5.00%, 8/15/16 (g) | 355 | 409,091 | ||||||||

Fort Bend County Industrial Development Corp., RB, NRG Energy, Inc. Project, Series B, 4.75%, 11/01/42 | 1,705 | 1,782,612 | ||||||||

| Municipal Bonds | Par (000) | Value | ||||||||

Texas (concluded) | ||||||||||

Gulf Coast IDA, RB, Citgo Petroleum Project, AMT, 4.88%, 5/01/25 | $ | 1,580 | $ | 1,598,849 | ||||||

Harris County-Houston Sports Authority, Refunding RB, CAB, Senior Lien, Series G, 5.91%, 11/15/41 (c) | 350 | 65,170 | ||||||||

Houston Higher Education Finance Corp., RB, Cosmos Foundation, Inc., Series A: | ||||||||||

6.50%, 5/15/31 | 1,000 | 1,247,310 | ||||||||

6.88%, 5/15/41 | 205 | 259,801 | ||||||||

Love Field Airport Modernization Corp., RB, Southwest Airlines Co. Project: | ||||||||||

5.25%, 11/01/40 | 500 | 547,275 | ||||||||

AMT, 5.00%, 11/01/28 | 530 | 579,931 | ||||||||

Matagorda County Navigation District No. 1 Texas, Refunding RB, Central Power & Light Co. Project, Series A, 6.30%, 11/01/29 | 290 | 341,101 | ||||||||

North Texas Education Finance Corporation, ERB, Uplift Education, Series A, 5.13%, 12/01/42 | 1,255 | 1,345,987 | ||||||||

North Texas Tollway Authority, RB, CAB, Special Projects System, Series B, 5.27%, 9/01/37 (c) | 725 | 200,876 | ||||||||

North Texas Tollway Authority, Refunding RB, Toll, Second Tier, Series F, 6.13%, 1/01/31 | 1,150 | 1,262,769 | ||||||||

Red River Health Facilities Development Corp., First MRB: | ||||||||||

Eden Home, Inc. Project, 7.25%, 12/15/42 | 1,330 | 1,432,476 | ||||||||

Wichita Falls Retirement Foundation Project, 5.13%, 1/01/41 | 600 | 604,842 | ||||||||

Sam Rayburn Municipal Power Agency, Refunding RB, 5.00%, 10/01/21 | 500 | 596,700 | ||||||||

Tarrant County Cultural Education Facilities Finance Corp., RB, Series A: | ||||||||||

CC Young Memorial Home, 8.00%, 2/15/38 | 330 | 378,045 | ||||||||

Senior Living Center Project, 8.25%, 11/15/44 | 800 | 890,552 | ||||||||

Tarrant County Cultural Education Facilities Finance Corp., Refunding RB, Northwest Senior Housing, Edgemere Project, Series A, 6.00%, 11/15/36 | 1,500 | 1,594,935 | ||||||||

Texas Municipal Gas Acquisition & Supply Corp. III, Gas Supply, RB, 5.00%, 12/15/29 | 1,360 | 1,476,865 | ||||||||

Texas Private Activity Bond Surface Transportation Corp., RB, Senior Lien: | ||||||||||

LBJ Infrastructure Group LLC, LBJ Freeway Managed Lanes Project, 7.00%, 6/30/40 | 2,320 | 2,823,533 | ||||||||

NTE Mobility Partners LLC, North Tarrant Express Managed Lanes Project, 6.88%, 12/31/39 | 1,740 | 2,080,327 | ||||||||

Texas State Public Finance Authority, Refunding ERB, KIPP, Inc., Series A (ACA): | ||||||||||

5.00%, 2/15/28 | 680 | 695,871 | ||||||||

5.00%, 2/15/36 | 2,000 | 2,041,740 | ||||||||

Texas State Turnpike Authority, RB, CAB (AMBAC) (c): | ||||||||||

5.93%, 8/15/30 | 5,200 | 1,855,620 | ||||||||

6.01%, 8/15/35 | 10,000 | 2,617,800 | ||||||||

Texas Transportation Commission, Refunding RB, First Tier, Series A, 5.00%, 8/15/41 | 1,890 | 2,052,219 | ||||||||

| 42,097,011 | ||||||||||

US Virgin Islands — 0.6% | ||||||||||

Virgin Islands Public Finance Authority, RB, Matching Fund Loan Note, Series A, 5.00%, 10/01/32 | 2,025 | 2,195,546 | ||||||||

Utah — 0.3% | ||||||||||

Utah State Charter School Finance Authority, RB, Navigator Pointe Academy, Series A, 5.63%, 7/15/40 | 1,000 | 1,064,660 | ||||||||

Vermont — 0.3% | ||||||||||

Vermont EDA, Refunding MRB, Wake Robin Corp. Project, 5.40%, 5/01/33 | 930 | 979,671 | ||||||||

Virginia — 5.9% | ||||||||||

Albemarle County IDA, Refunding RB, Westminster-Canterbury, 5.00%, 1/01/31 | 500 | 510,710 | ||||||||

City of Norfolk Virginia, Refunding RB, Series B (AMBAC), 5.50%, 2/01/31 | 220 | 220,268 | ||||||||

| SEMI-ANNUAL REPORT | DECEMBER 31, 2012 | 19 |

| Schedule of Investments (continued) | BlackRock High Yield Municipal Fund (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) | Value | ||||||||

Virginia (concluded) | ||||||||||

Fairfax County EDA, Refunding RB, Goodwin House, Inc.: | ||||||||||

5.13%, 10/01/37 | $ | 2,040 | $ | 2,114,134 | ||||||

5.13%, 10/01/42 | 1,185 | 1,224,460 | ||||||||

Hanover County Economic Development Authority, Refunding RB, Residential Care Facility, Covenant Woods, Series A: | ||||||||||

5.00%, 7/01/42 | 770 | 767,644 | ||||||||

5.00%, 7/01/47 | 1,015 | 1,003,480 | ||||||||

Lexington IDA, Refunding MRB, Kendal at Lexington, Series A, 5.38%, 1/01/28 | 210 | 214,654 | ||||||||

Mosaic District Community Development Authority, RB, Special Assessment Bonds, Series A: | ||||||||||

6.63%, 3/01/26 | 515 | 589,819 | ||||||||

6.88%, 3/01/36 | 450 | 511,133 | ||||||||

Route 460 Funding Corp. of Virginia Toll Road, RB, Senior Lien: | ||||||||||

CAB, Series B, 5.45%, 7/01/42 (c) | 2,515 | 515,097 | ||||||||

CAB, Series B, 5.47%, 7/01/43 (c) | 2,600 | 501,410 | ||||||||