UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02884

Barrett Opportunity Fund, Inc.

(Exact name of registrant as specified in charter)

90 Park Avenue

New York, NY 10016

(Address of principal executive offices) (Zip code)

Peter Shriver

90 Park Avenue

New York, NY 10016

(Name and address of agent for service)

(212) 983-5080

Registrant's telephone number, including area code

Date of fiscal year end: August 31

Date of reporting period: February 29, 2012

Item 1. Reports to Stockholders.

February 29, 2012

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

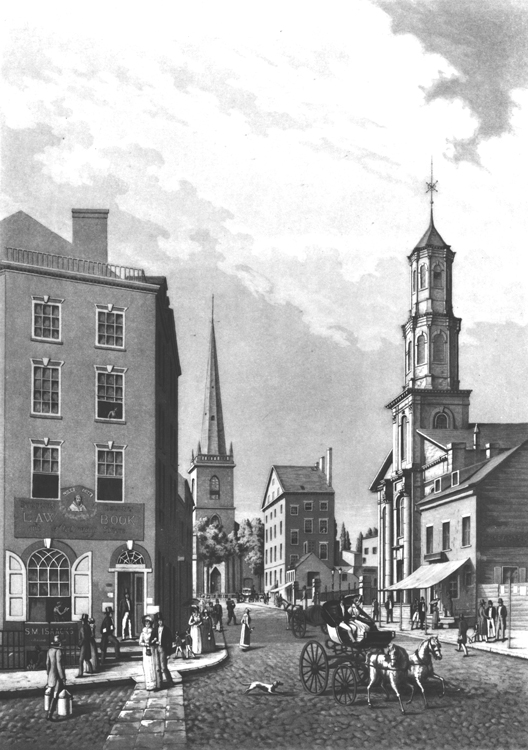

OPPORTUNITY FUND, INC.

| Semi-Annual Report • | February 29, 2012 |

| | |

| | |

| | |

| | |

| Fund Objectives | The Fund seeks to achieve above average long-term capital appreciation. Current income is a secondary objective. The Fund invests primarily in |

| | common stocks and securities convertible into or exchangeable for common stock such as convertible preferred stock or convertible debt securities. |

| | | |

| What’s Inside | Letter from the Chairperson | 1 |

| | | |

| | Manager Overview | 1 |

| | | |

| | Fund at a Glance | 4 |

| | | |

| | Fund Expenses | 5 |

| | | |

| | Schedule of Investments | 6 |

| | | |

| | Statement of Assets and Liabilities | 8 |

| | | |

| | Statement of Operations | 9 |

| | | |

| | Statements of Changes in Net Assets | 10 |

| | | |

| | Financial Highlights | 11 |

| | | |

| | Notes to Financial Statements | 12 |

| | | |

| | Additional Information | 20 |

| | | |

| | Important Tax Information | 22 |

| | | |

OPPORTUNITY FUND, INC.

Letter from the | Dear Shareholder, |

| Chairperson | |

| | We are pleased to provide the semi-annual report of the Barrett Opportunity Fund, Inc.1 (the “Fund”) for the six-month period ended February 29th, 2012. The management team at Barrett Asset Management, LLC (“Barrett”) has prepared the enclosed Manager’s Overview, which includes a brief market overview, as well as a performance review. I urge you to read it as well as the accompanying financial statements. I am sure you will find this report informative and useful. On behalf of the Directors and the officers of the Fund, I thank you for your ongoing confidence in the Fund and its investment policies. Sincerely, |

| |  |

| | Rosalind A. Kochman |

| | Chairperson |

| | March 20, 2012 |

| | 1 | The Fund was formerly known as the Salomon Brothers Opportunity Fund Inc. The Fund name, investment manager and certain investment policies were changed effective December 1, 2006. |

| Manager | Market Overview |

| Overview | |

| | The stock market sell-off that lasted for most of last summer bottomed at the end of September. After a volatile November and December, the market has climbed steadily in 2012. Certainly one part of the market recovery has been an improvement in investor sentiment regarding the European debt crisis. During the summer, concerns about Greece had spread to worries about Italy and Spain. Italian and Spanish bond yields were rising all summer until November when they began a rapid decline as bond investors became convinced that the worst was over. More aggressive actions by Mario Draghi, who succeeded Jean-Claude Trichet, as President of the European Central Bank last November, were instrumental in improving investor outlooks, particularly on the European banking system. In December, Mr. Draghi implemented a three year loan program from the ECB to European banks, which further seemed to relieve much of the anxiety that gripped Europe in 2011. U.S. investors were focused on events in Europe and became more optimistic on both bonds and stocks once foreign markets settled down. |

OPPORTUNITY FUND, INC.

| | Not to be outdone by Mr. Draghi, Mr. Bernanke, the head of the U.S. Federal Reserve, said in January of this year that he expected short term rates to remain near zero into 2014. The backdrop of an accommodative monetary policy both in Europe and at home warmed the hearts of equity investors who remained in a buying mode through February. There were also improvements in some U.S. economic reports, such as employment gains and regional pockets of housing recovery, which have been depressed for so long. The corporate earnings reports that came out in mid January were basically in line. Management comments were predictably cautious at the start of the year about the financial crisis in Europe and the economic slowdown in China but they were more optimistic about the U.S. through 2012. We would expect investors to become more circumspect as the year develops. The European situation has quieted down for the time being, but there is likely to be flare ups throughout 2012. The U.S. election may also become more of an issue as the year progresses and the uncertainty of it typically unnerves investors. There is increasing concern about the austerity programs that are due to be implemented next year as well as higher taxes that are set to occur. Unless energy prices reverse, there may be mounting concerns about the U.S. economy in 2013. Nonetheless, for the time being, stock investors seem eager to remain buyers with a critical factor being little competition from low interest rates that offer such meager returns. Performance Review In the last six months ended February 29, 2012, the Fund gained 8.89% compared to a gain of 13.31% for the S&P 500 and 11.75% for the Lipper Large-Cap Value Fund Index. The best performing segments of the market during this period were technology and consumer discretionary stocks. The worst performing sectors were health care and consumer staples. During the six month period, the best performers in the Fund relative to the broader market included Murphy Oil and General Dynamics. Large positions in Royal Dutch and Chubb boasted absolute performance although they trailed the market slightly. Several stocks performed in line with the market including Monsanto and Alexander & Baldwin. The two holdings that actually declined marginally in the period were Leucadia National and Philips Electronics. Clearly, European concerns affected Philips, and Leucadia was affected by general weakness in the financial sector. During the six month period the Fund established positions in several new holdings, including Abbott Laboratories, PepsiCo, and Johnson & Johnson. All three of these holdings have brought more international exposure to the Fund, possess strong brand value, and produce more stable earnings than some of the Fund’s more cyclical holdings. They are all companies under some shareholder pressure to restructure, and Abbott is already in the midst of rationalizing its corporate makeup. Finally, the valuation of each company is low relative to what we think the company is worth. |

| | |

| | |

OPPORTUNITY FUND, INC.

| | Thank you for your continued interest in the Fund. Sincerely, |

| |  |  |

| | Robert Milnamow | E. Wells Beck, CFA |

| | Portfolio Manager | Portfolio Manager |

| | | |

| | Past performance is not a guarantee of future results. The outlook, views, and opinions presented are those of the Adviser as of 02/29/2012. These are not intended to be a forecast of future events, a guarantee of future results, or investment advice. Must be preceded or accompanied by a prospectus. The Fund is non-diversified, which means that it can invest a higher percentage of its assets in any one issuer. Investing in a non-diversified fund may entail greater risks than is normally associated with more widely diversified funds. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on fund performance. Investing in foreign securities is subject to certain risks not associated with domestic investing, such as currency fluctuations, and changes in political and economic conditions. These risks are magnified in emerging or developing markets. The Fund may use leverage, which may adversely impact performance. Investments in debt securities typically decrease when interest rates rise. These risks are greater for longer-term debt securities. Lipper Large-Cap Value Funds Index includes funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s U.S. Diversified Equity large-cap floor. The S&P 500® Index is a market-value weighted index comprised of 500 widely held common stocks. It is not possible to invest directly in the Index. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of portfolio holdings, please refer the Schedule of Investments provided in this report. The Barrett Opportunity Fund is distributed by Quasar Distributors, LLC. |

| | |

OPPORTUNITY FUND, INC.

Fund at a Glance (Unaudited)

| Top Ten Holdings - as of 2/29/12 |

| (As a percentage of Total Investments) |

| | | | |

| Chubb Corp. | | | 19.2 | % |

| Royal Dutch Shell PLC - Class A - ADR | | | 16.2 | % |

| General Dynamics Corp. | | | 10.7 | % |

| Bank of New York Mellon Corp. | | | 9.9 | % |

| Murphy Oil Corp. | | | 8.5 | % |

| Koninklijke Philips Elections N.V. | | | 7.7 | % |

| Rayonier, Inc. | | | 6.0 | % |

| Leucadia National Corp. | | | 5.5 | % |

| Forest City Enterprises, Inc. - Class B | | | 2.5 | % |

| Monsanto Co. | | | 2.4 | % |

Sector Weightings - as of 2/29/12

(As a percentage of Total Investments)

OPPORTUNITY FUND, INC.

Fund Expenses (Unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on September 1, 2011 and held for the six months ended February 29, 2012.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning | Ending | During the Period* |

| | Account | Account | September 1, 2011 to |

| | Value | Value | February 29, 2012 |

| Actual Barrett Opportunity Fund, Inc. Expenses | $1,000.00 | $1,088.90 | $6.23 |

| | | | |

| Hypothetical Expenses | | | |

| (5% return per year before expenses) | $1,000.00 | $1,018.90 | $6.02 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.20% (which reflects fee waivers in place during the period), multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

OPPORTUNITY FUND, INC.

Schedule of Investments

February 29, 2012 (Unaudited)

| Shares | | | | Value | |

| | | | | | |

| | | COMMON STOCKS - 93.20% | | | |

| | | | | | |

| | | Beverage and | | | |

| | | Tobacco Product | | | |

| | | Manufacturing - 0.96% | | | |

| | 10,000 | | PepsiCo, Inc. | | $ | 629,400 | |

| | | | | | | | |

| | | | Chemical | | | | |

| | | | Manufacturing - 3.43% | | | | |

| | 12,000 | | Abbott Laboratories | | | 679,320 | |

| | 20,242 | | Monsanto Co. | | | 1,566,326 | |

| | | | | | | 2,245,646 | |

| | | | | | | | |

| | | | Computer and | | | | |

| | | | Electronic Product | | | | |

| | | | Manufacturing - 9.03% | | | | |

| | 10,000 | | 3M Co. | | | 876,000 | |

| | 240,210 | | Koninklijke Philips Electronics | | | | |

| | | | NV - NY Registered | | | | |

| | | | Shares - ADR | | | 5,039,606 | |

| | | | | | | 5,915,606 | |

| | | | | | | | |

| | | | Credit Intermediation and | | | | |

| | | | Related Activities - 9.89% | | | | |

| | 292,971 | | The Bank of New York | | | | |

| | | | Mellon Corp. | | | 6,477,589 | |

| | | | | | | | |

| | | | Data Processing, Hosting | | | | |

| | | | and Related Services - 1.24% | | | | |

| | 15,000 | | Automatic Data Processing, Inc. | | | 814,800 | |

| | | | | | | | |

| | | | Food and Beverage | | | | |

| | | | Stores - 0.00% | | | | |

| | 96,000 | | FHC Delaware, Inc. (a)(b)(c) | | | — | |

| | | | | | | | |

| | | | Food Manufacturing - 0.93% | | | | |

| | 10,000 | | The Hershey Co. | | | 607,000 | |

| | | | | | | | |

| | | | Insurance Carriers and | | | | |

| | | | Related Activities - 19.25% | | | | |

| | 185,500 | | The Chubb Corp. | | | 12,606,580 | |

| | | | | | | | |

| | | | Petroleum and Coal Products | | | | |

| | | | Manufacturing - 24.72% | | | | |

| | 87,300 | | Murphy Oil Corp. | | | 5,581,962 | |

| | 145,100 | | Royal Dutch Shell PLC - | | | | |

| | | | Class A - ADR | | | 10,605,359 | |

| | | | | | | 16,187,321 | |

| | | | | | | | |

| | | | Pharmaceuticals, | | | | |

| | | | Biotechnology & Life | | | | |

| | | | Sciences - 0.50% | | | | |

| | 5,000 | | Johnson & Johnson | | | 325,400 | |

| | | | | | | | |

| | | | Real Estate - 4.76% | | | | |

| | 100,400 | | Forest City Enterprises, | | | | |

| | | | Inc. - Class A (a) | | | 1,467,848 | |

| | 112,500 | | Forest City Enterprises, | | | | |

| | | | Inc. - Class B (a)(d) | | | 1,647,562 | |

| | | | | | | 3,115,410 | |

| | | | | | | | |

| | | | Transportation Equipment | | | | |

| | | | Manufacturing - 10.66% | | | | |

| | 95,300 | | General Dynamics Corp. | | | 6,978,819 | |

| | | | | | | | |

| | | | Waste Management and | | | | |

| | | | Remediation Services - 0.70% | | | | |

| | 88,850 | | TRC Cos., Inc. (a) | | | 459,355 | |

| | | | | | | | |

| | | | Water Transportation - 1.61% | | | | |

| | 22,800 | | Alexander & Baldwin, Inc. | | | 1,058,148 | |

| | | | | | | | |

| | | | Wood Product | | | | |

| | | | Manufacturing - 5.52% | | | | |

| | 126,800 | | Leucadia National Corp. | | | 3,612,532 | |

| | | | | | | | |

| | | | Total Common Stocks | | | | |

| | | | (Cost $8,298,750) | | | | |

| | | | | | | 61,033,606 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

OPPORTUNITY FUND, INC.

Schedule of Investments

February 29, 2012 (Unaudited)

| Shares | | | | Value | |

| | | | | | |

| | | REAL ESTATE INVESTMENT | | | |

| | | TRUSTS (REITS) - 6.02% | | | |

| | | | | | |

| | | Real Estate - 6.02% | | | |

| | 88,485 | | Rayonier, Inc. | | $ | 3,939,352 | |

| | | | Total Real Estate Investment | | | | |

| | | | Trusts (Cost $853,173) | | | 3,939,352 | |

| | | | | | | | |

| | | | SHORT-TERM | | | | |

| | | | INVESTMENTS - 0.76% | | | | |

| | | | Money Market Fund - 0.76% | | | | |

| | 501,134 | | Fidelity Institutional Money | | | | |

| | | | Market Fund - Government | | | | |

| | | | Portfolio, 0.01% (e) | | | 501,134 | |

| | | | Total Short-Term Investments | | | | |

| | | | (Cost $501,134) | | | 501,134 | |

| | | | | | | | |

| | | | Total Investments | | | | |

| | | | (Cost $9,653,057) - 99.98% | | | 65,474,092 | |

| | | | Other Assets in Excess | | | | |

| | | | of Liabilities - 0.02% | | | 15,788 | |

| | | | Total Net Assets - 100.00% | | $ | 65,489,880 | |

Percentages are stated as a percent of net assets.

ADR - American Depository Receipt

| (a) | Non-income producing security. |

| (c) | Security is valued by management in good faith at fair value in accordance with procedures approved by the Board of Directors. |

| (d) | Convertible into Forest City Enterprises, Inc. - Class A shares. |

| (e) | Variable rate security. The rate listed is as of February 29, 2012. |

The accompanying notes are an integral part of these financial statements.

OPPORTUNITY FUND, INC.

Statement of Assets & Liabilities

February 29, 2012 (Unaudited)

ASSETS: | | | |

| Investments, at value (cost $9,653,057) | | $ | 65,474,092 | |

| Dividend and interest receivable | | | 152,495 | |

| Other assets | | | 14,865 | |

| Total Assets | | | 65,641,452 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable to adviser | | | 33,638 | |

| Payable for fund shares redeemed | | | 39,403 | |

| Other accrued expenses | | | 78,531 | |

| Total Liabilities | | | 151,572 | |

| | | | | |

| NET ASSETS | | $ | 65,489,880 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital stock | | $ | 7,719,758 | |

| Accumulated undistributed net investment income | | | 141,838 | |

| Accumulated undistributed net realized gain | | | 1,807,249 | |

| Net unrealized appreciation on investments | | | 55,821,035 | |

| Total Net Assets | | $ | 65,489,880 | |

| | | | | |

| Shares outstanding | | | 2,079,092 | |

| Net asset value, offering price and redemption price | | | | |

| per share (15,000,000 shares authorized, $0.01 par value) | | $ | 31.50 | |

The accompanying notes are an integral part of these financial statements.

OPPORTUNITY FUND, INC.

Statement of Operations

Period Ended February 29, 2012 (Unaudited)

| INVESTMENT INCOME: | | | |

| Dividend income* | | $ | 764,041 | |

| Interest income | | | 105 | |

| | | | 764,146 | |

| EXPENSES: | | | | |

| Investment advisory fees (see Note 2) | | | 219,145 | |

| Legal fees | | | 48,851 | |

| Directors’ fees and expenses | | | 27,182 | |

| Administration fees | | | 19,607 | |

| Federal and state registration fees | | | 14,306 | |

| Transfer agent fees and expenses | | | 13,828 | |

| Fund accounting fees | | | 13,259 | |

| Audit fees | | | 9,157 | |

| Reports to shareholders | | | 7,265 | |

| Custody fees | | | 2,641 | |

| Other | | | 16,474 | |

| Total expenses | | | 391,715 | |

| Less: Fees waived by adviser (Note 2) | | | (15,653 | ) |

| Net expenses | | | 376,062 | |

| Net investment income | | | 388,084 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | | |

| Net realized gain on investments | | | 4,897,722 | |

| Change in net unrealized appreciation on investments | | | 158,078 | |

| Net realized and unrealized gain on investments | | | 5,055,800 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 5,443,884 | |

* Net of $36,565 of foreign taxes withheld.

The accompanying notes are an integral part of these financial statements.

OPPORTUNITY FUND, INC.

Statements of Changes in Net Assets

| | | Period Ended | | | Year Ended | |

| | | February 29, 2012 | | | August 31, 2011 | |

| | | (Unaudited) | | | | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 388,084 | | | $ | 944,184 | |

| Net realized gain on investments | | | 4,897,722 | | | | 2,523,311 | |

| Change in net unrealized appreciation on investments | | | 158,078 | | | | 3,962,451 | |

| Net increase in net assets resulting from operations | | | 5,443,884 | | | | 7,429,946 | |

| | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Net investment income | | | (597,335 | ) | | | (900,000 | ) |

| Net realized gains on investment | | | (5,425,499 | ) | | | (3,569,540 | ) |

| Total dividends and distributions | | | (6,022,834 | ) | | | (4,469,540 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Shares sold | | | 36,491 | | | | 81,838 | |

| Shares issued in reinvestment of dividends | | | 3,279,278 | | | | 2,660,712 | |

| Shares redeemed | | | (1,484,808 | ) | | | (4,502,965 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| from capital share transactions | | | 1,830,961 | | | | (1,760,415 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 1,252,011 | | | | 1,199,991 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 64,237,869 | | | | 63,037,878 | |

| End of period (including accumulated undistributed net | | | | | | | | |

| investment income of $141,838 and $351,089, respectively) | | $ | 65,489,880 | | | $ | 64,237,869 | |

The accompanying notes are an integral part of these financial statements.

Financial Highlights

| | | Period Ended | | | | | | | | | | | | | | | | |

| | | February 29, | | | Year Ended August 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | | | | |

| beginning of period | | $ | 31.87 | | | $ | 30.53 | | | $ | 32.72 | | | $ | 50.14 | | | $ | 60.62 | | | $ | 56.71 | |

| Income (loss) from | | | | | | | | | | | | | | | | | | | | | | | | |

| investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.19 | | | | 0.47 | | | | 0.39 | | | | 0.49 | | | | 0.48 | | | | 0.45 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 2.47 | | | | 3.09 | | | | (0.74 | ) | | | (13.02 | ) | | | (7.55 | ) | | | 5.67 | |

| Total from investment operations | | | 2.66 | | | | 3.56 | | | | (0.35 | ) | | | (12.53 | ) | | | (7.07 | ) | | | 6.12 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.30 | ) | | | (0.44 | ) | | | (0.48 | ) | | | (0.59 | ) | | | (0.37 | ) | | | (0.35 | ) |

| Net realized gain on investments | | | (2.73 | ) | | | (1.78 | ) | | | (1.36 | ) | | | (4.30 | ) | | | (3.04 | ) | | | (1.86 | ) |

| Total distributions | | | (3.03 | ) | | | (2.22 | ) | | | (1.84 | ) | | | (4.89 | ) | | | (3.41 | ) | | | (2.21 | ) |

| Net asset value, end of period | | $ | 31.50 | | | $ | 31.87 | | | $ | 30.53 | | | $ | 32.72 | | | $ | 50.14 | | | $ | 60.62 | |

Total return1 | | | 8.89 | % | | | 11.07 | % | | | (1.38 | )% | | | (23.37 | )% | | | (12.55 | )% | | | 10.92 | % |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000,000’s) | | $ | 65 | | | $ | 64 | | | $ | 63 | | | $ | 70 | | | $ | 114 | | | $ | 148 | |

| Ratio of net expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 1.20 | %2 | | | 1.10 | %2 | | | 1.20 | % | | | 1.31 | % | | | 1.03 | % | | | 1.01 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 1.24 | %2 | | | 1.32 | %2 | | | 1.15 | % | | | 1.50 | % | | | 0.83 | % | | | 0.70 | % |

| Portfolio turnover rate | | | 3 | % | | | 0 | % | | | 3 | % | | | 0 | %3,4 | | | 3 | %3 | | | 6 | % |

| 1 | Performance figures may reflect compensating balance arrangements fee waivers and/or expense reimbursements. In the absence of these arrangements, total returns would have been lower. |

| 2 | Such percentages are after advisory fee waiver. Effective April 29, 2011, the adviser voluntarily agreed to waive a portion of its advisory fee, equal to 0.05% and 0.02% of average net assets for the periods ended February 29, 2012 and August 31, 2011, respectively. |

| 3 | Excludes the value of portfolio securities delivered as a result of in-kind redemptions of Fund’s capital shares. |

| 4 | Amount represents less than 1%. |

The accompanying notes are an integral part of these financial statements.

OPPORTUNITY FUND, INC.

Notes to Financial Statements (Unaudited)

| 1. ORGANIZATION | Barrett Opportunity Fund, Inc. (the “Fund”), a Maryland corporation organized in 1978, is registered as a non-diversified, open-end management |

| AND | investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is to achieve |

| SIGNIFICANT | above average long-term capital appreciation. |

| ACCOUNTING | |

| POLICIES | The following are significant accounting policies consistently followed by the Fund and are in conformity with generally accepted accounting |

| | principles (“GAAP”) in the United States of America. |

| | |

| | (a) Investment Valuation Equity securities, including common stocks and REITs, for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. Debt securities are valued at the mean between the last quoted bid and asked prices provided by an independent pricing service, which are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various other relationships between securities. Short-term obligations with maturities of 60 days or less are valued at amortized cost, which approximates fair value. Redeemable securities issued by open-end, registered investment companies, including money market funds, are valued at the net asset value (“NAV”) of such companies for purchase and/or redemption orders placed on that day. When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities at fair value as determined in accordance with procedures approved by the Fund’s Board of Directors. The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of the security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value. Financial Accounting Standards Board (“FASB”) Accounting Standards Codification, “Fair Value Measurements and Disclosures” Topic 820 (“ASC Topic 820”), establishes a single definition of fair value, creates a three-tier hierarchy as a framework for measuring fair value based on inputs used to value the Fund’s investments, and requires additional disclosure about fair value. The hierarchy of inputs is summarized below. |

| | • Level 1 – quoted prices in active markets for identical investments • Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) • Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) Inputs refer broadly to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Fund. The Fund considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument. Investments whose values are based on quoted market prices in active markets include active listed equities, REITs and certain money market securities, and are classified within Level 1. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs, are classified within Level 2. Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all. The Fund held one Level 3 security as of February 29, 2012. As a result of the portfolio company’s declaration of bankruptcy, this security no longer trades; however, it is maintained in the Fund’s records because of possible receipt of money by the Fund as a result of the bankruptcy litigation. The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value as of February 29, 2012. The inputs and methodologies used to value securities may not be an indication of the risk associated with investing in these securities. |

| | |

| | | | | | | Other | | | | | | | |

| | | | | | | Significant | | | | | | | |

| | | | Quoted | | | | | | | | | | |

| | | | Prices | | | | | | | | | | |

| | Description | | (Level 1) | | | (Level 2) | | | (Level 3) | | | | |

| | | | | | | | | | | | | | |

| | Common Stocks† | | $ | 61,033,606 | | | $ | — | | | $ | 0 | * | | $ | 61,033,606 | |

| | REITs | | | 3,939,352 | | | | — | | | | — | | | | 3,939,352 | |

| | Money Market Funds | | | 501,134 | | | | — | | | | — | | | | 501,134 | |

| | Total Investments | | $ | 65,474,092 | | | $ | — | | | $ | 0 | * | | $ | 65,474,092 | |

| | † See Schedule of Investments for additional industry classifications. * Value is less than $1. The Fund did not hold any Level 3 securities during the period other than the holding discussed above, which was fair valued at $0 for the entire period. The Fund did not purchase or sell any Level 3 investments during the period. There were no transfers of securities between levels during the reporting period. It is the Fund’s policy to record transfers between levels as of the end of the reporting period. The Fund did not hold any derivative instruments during the reporting period. (b) Repurchase Agreements The Fund may enter into repurchase agreements with institutions that its investment adviser has determined are creditworthy. Each repurchase agreement is recorded at cost. Under the terms of a typical repurchase agreement, the Fund acquires a debt security subject to an obligation of the seller to repurchase, and of the Fund to resell, the security at an agreed-upon price and time, thereby determining the yield during the Fund’s holding period. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian, acting on the Fund’s behalf, take possession of the underlying collateral securities, the market value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction maturity exceeds one business day, the value of the collateral is marked to market and measured against the value of the agreement in an effort to ensure the adequacy of the collateral. If the counterparty defaults, the Fund generally has the right to use the collateral to satisfy the terms of the repurchase transaction. However, if the market value of the collateral declines during the period in which the Fund seeks to assert its rights or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited. The Fund did not hold repurchase agreements at February 29, 2012. (c) Security Transactions and Investment Income Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on |

| | |

| | the accrual basis. Dividend income is recorded on the ex-dividend date. Under applicable tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates. The cost of investments sold is determined by use of the specific identification method for computing the gain/loss on the transaction. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event. (d) Distributions to Shareholders The Fund will distribute any net investment income and any net realized long or short-term capital gains at least annually. Distributions from net realized gains for book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. Distributions to shareholders are recorded on the ex-dividend date. The Fund may also pay a special distribution at the end of the calendar year to comply with federal tax requirements. (e) REIT Distributions The character of distributions received from REITs held by the Fund is generally comprised of net investment income, capital gains, and return of capital. It is the policy of the Fund to estimate the character of distributions received from underlying REITs based on historical data provided by the REITs. After each calendar year end, REITs report the actual tax character of these distributions. Differences between the estimated and actual amounts reported by the REITs are reflected in the Fund’s records in the year in which they are reported by the REITs by adjusting related investment cost basis, capital gains and income, as necessary. (f) Federal Income Taxes It is the Fund’s policy to comply with the federal income and excise tax requirements of subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), necessary to qualify as a regulated investment company. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal income tax provision is provided in the Fund’s financial statements. As of and during the year ended August 31, 2011, the Fund did not have a liability of any unrecognized tax benefits. The Fund recognizes interest and penalties, in any, related to uncertain tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. taxing authorities for tax periods prior to 2007. |

| | |

OPPORTUNITY FUND, INC.

| | (g) Use of Estimates The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. |

| | | |

| 2. INVESTMENT | Effective April 29, 2011, Barrett Asset Management, LLC (“Barrett”) became the Fund’s investment adviser. Under the Investment Advisory |

| ADVISER | Agreement, the Fund pays an advisory fee, calculated daily and paid monthly, in accordance with the following breakpoint schedule: |

| AGREEMENT | | |

| AND OTHER | Average Daily Net Assets | Annual Rate |

| TRANSACTIONS | First $1 billion | 0.700% |

| WITH AFFILIATES | Next $1 billion | 0.675% |

| | | |

| | | |

| | | |

| | | |

| | In addition, Barrett has voluntarily agreed to reduce its investment advisory fee by an additional 0.05% through April 29, 2012, which is not subject to recoupment by Barrett. For the six-months ended February 29, 2012, this advisory fee totaled $219,145. During the six-months ended February 29, 2012, Barrett voluntarily waived $15,653 of its advisory fee. Such waivers are not subject to recoupment. Prior to April 29, 2011, Barrett Associates, Inc. (“Barrett Associates”) was the Fund’s investment adviser. Barrett Associates was a wholly-owned subsidiary of Legg Mason, Inc. (“Legg Mason”), a financial services holding company. Under the Management Agreement between the Fund and Barrett Associates, the Fund paid an investment advisory fee, calculated daily and paid monthly, in accordance with the following breakpoint schedule: |

| | Average Daily Net Assets | Annual Rate |

| | First $1 billion | 0.750% |

| | Next $1 billion | 0.725% |

| | Next $3 billion | 0.700% |

| | Next $5 billion | 0.675% |

| | Over $10 billion | 0.650% |

| | | |

| | Prior to April 29, 2011, Legg Mason Partners Fund Advisor, LLC (“LMPFA”) served as the sub-administrator of the Fund, providing certain administrative services to the Fund pursuant to a sub-administration agreement between Barrett Associates and LMPFA. LMPFA is an affiliate of Legg Mason and Barrett Associates. Barrett Associates, and not the Fund, paid LMPFA for its services as |

OPPORTUNITY FUND, INC.

| | sub-administrator. Also, prior to April 29, 2011, Legg Mason Investor Services, LLC, a wholly-owned broker-dealer subsidiary of Legg Mason, served as the Fund’s sole and exclusive distributor. The officers of the Fund are also officers and employees of Barrett and do not receive compensation from the Fund. |

| | |

| 3. INVESTMENTS | During the period ended February 29, 2012, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows: |

| | Purchases | Sales |

| | $1,856,297 | $5,875,905 |

| | | |

| 4. CAPITAL SHARES | At February 29, 2012, the Fund had 15,000,000 shares of capital stock authorized with a par value of $0.01 per share. Transactions in shares of the Fund were as follows: |

| | | | Period Ended | | | Year Ended | |

| | | | February 29, 2012 | | | August 31, 2011 | |

| | Shares sold | | | 1,172 | | | | 2,333 | |

| | Shares issued on reinvestment | | | 109,932 | | | | 76,567 | |

| | Shares redeemed | | | (47,647 | ) | | | (127,953 | ) |

| | Net increase (decrease) | | | 63,457 | | | | (49,053 | ) |

| 5. | INCOME TAX | The tax character of distributions paid during the fiscal years ended August 31, were as follows: |

| | INFORMATION | | | |

| | AND | | | |

| | DISTRIBUTIONS | | | |

| | TO | Distributions Paid From: | | 2011 | | | 2010 | |

| | SHAREHOLDERS | Ordinary income | | $ | 900,000 | | | $ | 1,000,003 | |

| | | Net long-term capital gains | | | 3,569,540 | | | | 2,850,011 | |

| | | Total distributions paid | | $ | 4,469,540 | | | $ | 3,850,014 | |

| | The Fund designated as long-term capital gain dividend, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits of the Fund related to net capital gain to zero for the tax year ended August 31, 2011. The Fund utilized earnings and profits distributed to shareholders on redemption of shares as part of the dividend paid deduction. The amount designated as long-term capital gain for the fiscal year ended August 31, 2011 was $173,810. |

OPPORTUNITY FUND, INC.

| | At August 31, 2011, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows |

| | Tax cost of investments | | $ | 8,496,305 | |

| | Gross unrealized appreciation | | | 55,899,350 | |

| | Gross unrealized depreciation | | | (236,393 | ) |

| | Net unrealized appreciation | | $ | 55,662,957 | |

| | As of August 31, 2011, the components of accumulated earnings on a tax basis were as follows: |

| | Undistributed operating income | | $ | 375,281 | |

| | Undistributed long-term gains | | | 2,335,026 | |

| | Distributable earnings | | | 2,710,307 | |

| | Unrealized appreciation | | | 55,662,957 | |

| | Other accumulated losses* | | | (24,192 | ) |

| | Total accumulated gain | | $ | 58,349,072 | |

| | * Other temporary differences are primarily attributable to timing of certain expenses. |

| | |

| | GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. During the current year, accumulated net realized gain was decreased by $237,794 and paid-in-capital was increased by $237,794 for permanent book to tax differences. |

| | |

| 6. LEGAL MATTERS | Beginning in May 2004, class action lawsuits alleging violations of the federal securities laws were filed against Citigroup Global Markets Inc. (“CGM”), a former distributor of the Fund, and other affiliated funds (collectively, the “Funds”) and a number of its then affiliates, including Smith Barney Fund Management LLC (“SBFM”) and Salomon Brothers Asset Management Inc. (“SBAM”), which were then investment adviser or manager to certain of the Funds (collectively the “Managers”), substantially all of the mutual funds then managed by the Managers (the “Defendant Funds”), and Board members of the Defendant Funds (collectively, the “Defendants”). The complaints alleged, among other things, that CGM created various undisclosed incentives for its brokers to sell Smith Barney and Salomon Brothers funds. In addition, according to the complaints, the Managers caused the Defendant Funds to pay excessive brokerage commissions to CGM for steering clients towards proprietary funds. The complaints also alleged that the Defendants breached their fiduciary duty to the Defendant Funds by improperly charging Rule 12b-1 fees and by drawing on fund assets to make undisclosed payments of soft dollars and excessive brokerage commissions. The complaints also alleged that the Defendant Funds failed to adequately disclose certain of the allegedly |

| | |

OPPORTUNITY FUND, INC.

| | wrongful conduct. The complaints sought injunctive relief and compensatory and punitive damages, rescission of the Defendant Funds’ contracts with the Managers, recovery of all fees paid to the Managers pursuant to such contracts and an award of attorneys’ fees and litigation expenses. On December 15, 2004, a consolidated amended complaint (the “Complaint”) was filed alleging substantially similar causes of action. On May 27, 2005, all of the Defendants filed motions to dismiss the Complaint. On July 26, 2006, the court issued a decision and order (1) finding that plaintiffs lacked standing to sue on behalf of the shareholders of the Funds in which none of the plaintiffs had invested and dismissing those Funds from the case (although stating that they could be brought back into the case if standing as to them could be established), and (2) other than one stayed claim, dismissing all of the causes of action against the remaining Defendants, with prejudice, except for the cause of action under Section 36(b) of the 1940 Act, which the court granted plaintiffs leave to replead as a derivative claim. On October 16, 2006, plaintiffs filed their Second Consolidated Amended Complaint (“Second Amended Complaint”) which alleges derivative claims on behalf of nine funds identified in the Second Amended Complaint, under Section 36(b) of the 1940 Act, against Citigroup Asset Management, SBAM and SBFM as investment advisers to the identified funds, as well as CGM as a distributor for the identified funds (collectively, the “Second Amended Complaint Defendants”). The Fund was not identified in the Second Amended Complaint. The Second Amended Complaint alleges no claims against any of the funds or any of their Board Members. Under Section 36(b), the Second Amended Complaint alleges similar facts and seeks similar relief against the Second Amended Complaint Defendants as the Complaint. On December 3, 2007, the court granted the Defendants’ motion to dismiss, with prejudice. On January 2, 2008, the plaintiffs filed a notice of appeal to the Second Circuit Court of Appeals. The appeal was fully briefed and oral argument before the U.S. Court of Appeals for the Second Circuit took place on March 5, 2009. On June 9, 2011, the Second Circuit ruled, affirming the dismissal of all claims with one exception; the Section 36(b) excessive fee claim, but only as it relates to transfer agent fees. The Defendants are working to provide their counsel with the factual and statistical data they need to move for a dismissal of this one remaining claim. On September 30, 2011, Plaintiff’s counsel notified Defendant’s Counsel that Plaintiffs were willing to voluntarily dismiss the case provided that the Defendants made no claim for attorneys fees. Formal paperwork will be drafted to cause the case to be dismissed. This matter has been indemnified by Citigroup. |

Additional Information

(Unaudited)

1. INFORMATION ABOUT DIRECTORS AND OFFICERS

The business and affairs of the Fund are conducted by management under the supervision and subject to the direction of its Board of Directors. The business address of each Director is c/o Barrett Asset Management, LLC, the Fund’s investment manager (“Barrett Asset Management”), 90 Park Avenue, 34th Floor, New York, New York 10016. Information pertaining to the Directors and officers of the Fund is set forth below.

The Statement of Additional Information includes additional information about Directors and is available, without charge, upon request by calling the Fund at 1-877-363-6333.

| | | | | Number of | |

| | | | | Portfolios | |

| | | | | in Fund | Other Board |

| | Position(s) | Term of Office* | | Complex | Memberships |

| Name, Address | Held with | and Length of | Principal Occupation(s) | Overseen | Held by |

| and Birth Year | Fund | Time Served** | During Past 5 Years | by Director | Director |

| | | | | | |

INDEPENDENT DIRECTORS†: | | | | | |

| Barry Handel, CPA | Director | Since 2005 | Partner, Shalik, Morris & | 1 | None |

| Birth Year: 1951 | | | Company, LLP (accounting | | |

| | | | firm) (since 2010); formerly, | | |

| | | | Partner, Falk & Handel LLP | | |

| | | | (accounting firm) | | |

| | | | | | |

David H. Kochman(1) | Director | Since 2011 | Member, Harris Beach PLLC | 1 | None |

| Birth Year: 1959 | | | (law firm) | | |

| | | | | | |

Rosalind A. Kochman(2) | Director | Since 1990 | Retired (since 2002); formerly, | 1 | None |

| Birth Year: 1937 | | | Chief Executive Officer, | | |

| | Chairperson | Since 2005 | Brooklyn Eye Surgery Center, | | |

| | | | and Administrator, Kochman, | | |

| | | | Lebowitz & Mogil, MDs | | |

| | | | | | |

| William Morris, Jr., CPA | Director | Since 2005 | President, William Morris & | 1 | None |

| Birth Year: 1948 | | | Associates P.C. (accounting | | |

| | | | firm) | | |

| | | | | | |

| Irving Sonnenschein | Director | Since 1994 | Partner in the law firm of | 1 | None |

| Birth Year: 1920 | | | Sonnenschein, Sherman & | | |

| | | | Deutsch | | |

| | | | | | |

| OFFICERS: | | | | | |

| Peter H. Shriver, CFA | President | Since 2006 | President and Chief | N/A | N/A |

| Barrett Asset Management | and Chief | | Executive Officer of Barrett | | |

| 90 Park Avenue | Executive | | Asset Management (since | | |

| New York, NY 10016 | Officer | | 2011); President of Barrett | | |

| Birth Year: 1952 | | | Associates, Inc. (2004-2011) | | |

| (1) | Mr. Kochman is Ms. Kochman’s son. |

| (2) | Ms. Kochman is Mr. Kochman’s mother. |

OPPORTUNITY FUND, INC.

| | | | | Number of | |

| | | | | Portfolios | |

| | | | | in Fund | Other Board |

| | Position(s) | Term of Office* | | Complex | Memberships |

| Name, Address | Held with | and Length of | Principal Occupation(s) | Overseen | Held by |

| and Birth Year | Fund | Time Served** | During Past 5 Years | by Director | Director |

| | | | | | |

| OFFICERS (Continued): | | | | | |

| E. Wells Beck, CFA | Vice | Since 2010 | Managing Director, Barrett | N/A | N/A |

| Barrett Asset Management | President | | Asset Management (since | | |

| 90 Park Avenue | and | | 2011); Managing Director, | | |

| New York, NY 10016 | Investment | | Barrett Associates (2006-2011); | | |

| Birth Year: 1968 | Officer | | Analyst and Portfolio | | |

| | | | Manager at Haven Capital | | |

| | | | Management (2001-2006) | | |

| | | | | | |

| Robert J. Milnamow | Vice | Since 2006 | Managing Director, Barrett | N/A | N/A |

| Barrett Asset Management | President | | Asset Management (since | | |

| 90 Park Avenue | and | | 2011); Managing Director, | | |

| New York, NY 10016 | Investment | | Barrett Associates (2003-2011) | | |

| Birth Year: 1950 | Officer | | | | |

| | | | | | |

| Madeleine Morreale | Secretary, | Since 2011 | Chief Compliance Officer, | N/A | N/A |

| Barrett Asset Management | Chief | | Barrett Asset Management | | |

| 90 Park Avenue | Compliance | | (2011-Present); Compliance | | |

| New York, NY 10016 | Officer | | Officer, Barrett Associates | | |

| Birth Year: 1956 | and | | (2010-2011); Head Trader, | | |

| | Anti-Money | | Barrett Associates | | |

| | Laundering | | (2003-2010) | | |

| | Officer | | | | |

| | | | | | |

| John G. Youngman | Chief | Since 2011 | Managing Director, | N/A | N/A |

| Barrett Asset Management | Financial | | Barrett Asset Management | | |

| 90 Park Avenue | Officer | | (2011-Present); Managing | | |

| New York, NY 10016 | and | | Director, Barrett Associates | | |

| Birth Year: 1968 | Treasurer | | (2010-2011); Managing | | |

| | | | Director, Griffin Asset | | |

| | | | Management (1994-2010) | | |

| † | Directors who are not “interested persons” of the Fund within the meaning of Section 2(a)(19) of the 1940 Act. |

| * | Each Director and officer serves until his respective successor has been duly elected and qualified or until his earlier death, resignation, retirement or removal. |

| ** | Indicates the earliest year in which the Director became a board member or the officer took such office. |

OPPORTUNITY FUND, INC.

2. IMPORTANT TAX INFORMATION (UNAUDITED)

The following information is provided with respect to the distributions paid during the taxable year ended August 31, 2011:

| Record Date: | | 12/21/2010 |

| Payable Date: | | 12/22/2011 |

| Ordinary Income: | | | |

| Qualified Dividend Income for Individuals | | | 100.00 | % |

| Dividends Qualifying for the Dividends | | | | |

| Received Deduction for Corporations | | | 100.00 | % |

| Long-Term Capital Gain Dividend | | | $1.77700 |

Please retain this information for your records.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. To obtain information on Form N-Q from the Fund, shareholders can call the Fund at 1-877-363-6333.

Information on how the Fund voted proxies relating to portfolio securities during the prior 12-month period ended June 30th of each year and a description of the policies and procedures that the Fund uses to determine how to vote proxies related to portfolio transactions are available (1) without charge, upon request, by calling the Fund at 1-877-363-6333 and (2) on the SEC’s website at www.sec.gov.

OPPORTUNITY FUND, INC.

NOTICE OF PRIVACY POLICY & PRACTICES

We collect non-public personal information about you from the following sources:

•information we receive about you on applications or other forms;

•information you give us orally; and

•information about your transactions with us or others.

We do not disclose any non-public personal information about our shareholders or former shareholders without the shareholder’s authorization, except as permitted by law or in response to inquiries from governmental authorities. We may share information with affiliated parties and unaffiliated third parties with whom we have contracts for servicing the Fund. We will provide unaffiliated third parties with only the information necessary to carry out their assigned responsibility. All shareholder records will be disposed of in accordance with applicable law. We maintain physical, electronic and procedural safeguards to protect your non-public personal information and require third parties to treat your nonpublic personal information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank or trust company, the privacy policy of your financial intermediary would govern how your non-public personal information would be shared with unaffiliated third parties.

(This Page Intentionally Left Blank.)

BARRETT OPPORTUNITY FUND, INC.

c/o U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

DIRECTORS

Barry Handel, CPA

David H. Kochman

Rosalind A. Kochman, Chairperson

William Morris, Jr., CPA

Irving Sonnenschein

INVESTMENT MANAGER

Barrett Asset Management, LLC

90 Park Avenue

New York, NY 10016

ADMINISTRATOR, FUND ACCOUNTANT & TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

DISTRIBUTOR

Quasar Distributors, LLC

615 E. Michigan Street

Milwaukee, WI 53202

CUSTODIAN

U.S. Bank, N.A.

Custody Operations

1555 River Center Drive, Suite 302

Milwaukee, WI 53212

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

800 Westpoint Parkway, Suite 1100

Westlake, OH 44145

This report is transmitted to the shareholders of Barrett Opportunity Fund, Inc. for their information. This is not a prospectus, circular or representation intended for use in the purchase of shares of the Fund or any securities mentioned in this report.

This report must be preceded or accompanied by a free prospectus. Investors should consider the Fund’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other important information about the Fund. Please read the prospectus carefully before investing.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Barrett Opportunity Fund, Inc.

By (Signature and Title)* /s/ Peter Shriver

Peter Shriver, President

Date 4/25/2012

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Peter Shriver

Peter Shriver, President

Date 4/25/2012

By (Signature and Title)* /s/ John Youngman

John Youngman, Treasurer

Date 4/25/2012

* Print the name and title of each signing officer under his or her signature.