UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

Delaware Group® Income Funds

(Exact name of registrant as specified in charter)

610 Market Street

Philadelphia, PA 19106

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Delaware Corporate Bond Fund

Class A: DGCAX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Corporate Bond Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $85 | 0.82% |

Management’s discussion of Fund performance

Performance highlights

Delaware Corporate Bond Fund (Class A) returned 6.38% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Bloomberg US Corporate Bond Index, the Fund's narrowly based securities market index and secondary benchmark, returned 6.76%.

Top contributors to performance relative to the primary benchmark:

Overweight to lower-quality corporate debt, such as BBB-rated (investment grade) and BB-rated (high yield) bonds, which outperformed higher-quality investments over the Fund's fiscal year ended July 31, 2024 due to the risk rally and overall positive market tone that began late in 2023

Investments in banking and energy companies

Top detractors from performance relative to the primary benchmark:

Long-duration investments, which lagged as long-end Treasury rates climbed over the fiscal year

Investments in the corporate debt of basic industry and real estate investment trusts (REITs)

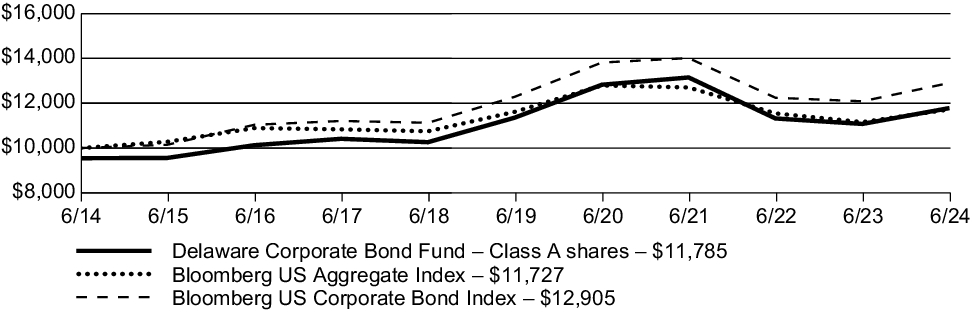

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period and the deduction of the maximum applicable sales charge for Class A shares.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Corporate Bond Fund (Class A) – including sales charge | 1.60 | % | -0.20 | % | 1.66 | % |

| Delaware Corporate Bond Fund (Class A) – excluding sales charge | 6.38 | % | 0.72 | % | 2.13 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Bloomberg US Corporate Bond Index | 6.76 | % | 0.98 | % | 2.58 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg US Corporate Bond Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $1,269,022,895% |

| Total number of portfolio holdings | $244% |

| Total advisory fees paid | $4,791,798% |

| Portfolio turnover rate | $123% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Banking | 24.29% |

| Energy | 11.81% |

| Electric | 10.04% |

| Consumer Non-Cyclical | 8.38% |

| Communications | 7.72% |

| Capital Goods | 7.50% |

| Consumer Cyclical | 6.80% |

| Technology | 4.96% |

| Insurance | 4.84% |

| Finance Companies | 3.97% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Corporate Bond Fund

Class C: DGCCX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Corporate Bond Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $161 | 1.57% |

Management’s discussion of Fund performance

Performance highlights

Delaware Corporate Bond Fund (Class C) returned 5.66% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Bloomberg US Corporate Bond Index, the Fund's narrowly based securities market index and secondary benchmark, returned 6.76%.

Top contributors to performance relative to the primary benchmark:

Overweight to lower-quality corporate debt, such as BBB-rated (investment grade) and BB-rated (high yield) bonds, which outperformed higher-quality investments over the Fund's fiscal year ended July 31, 2024 due to the risk rally and overall positive market tone that began late in 2023

Investments in banking and energy companies

Top detractors from performance relative to the primary benchmark:

Long-duration investments, which lagged as long-end Treasury rates climbed over the fiscal year

Investments in the corporate debt of basic industry and real estate investment trusts (REITs)

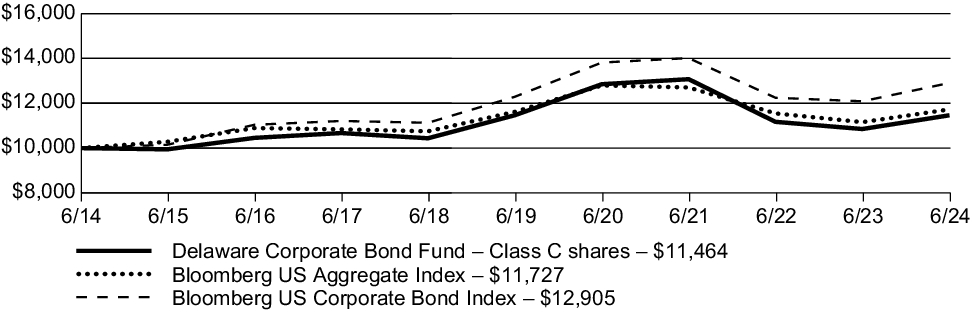

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Corporate Bond Fund (Class C) – including sales charge | 4.66 | % | -0.01 | % | 1.38 | % |

| Delaware Corporate Bond Fund (Class C) – excluding sales charge | 5.66 | % | -0.01 | % | 1.38 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Bloomberg US Corporate Bond Index | 6.76 | % | 0.98 | % | 2.58 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg US Corporate Bond Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $1,269,022,895% |

| Total number of portfolio holdings | $244% |

| Total advisory fees paid | $4,791,798% |

| Portfolio turnover rate | $123% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Banking | 24.29% |

| Energy | 11.81% |

| Electric | 10.04% |

| Consumer Non-Cyclical | 8.38% |

| Communications | 7.72% |

| Capital Goods | 7.50% |

| Consumer Cyclical | 6.80% |

| Technology | 4.96% |

| Insurance | 4.84% |

| Finance Companies | 3.97% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Corporate Bond Fund

Class R: DGCRX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Corporate Bond Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R | $110 | 1.07% |

Management’s discussion of Fund performance

Performance highlights

Delaware Corporate Bond Fund (Class R) returned 6.18% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Bloomberg US Corporate Bond Index, the Fund's narrowly based securities market index and secondary benchmark, returned 6.76%.

Top contributors to performance relative to the primary benchmark:

Overweight to lower-quality corporate debt, such as BBB-rated (investment grade) and BB-rated (high yield) bonds, which outperformed higher-quality investments over the Fund's fiscal year ended July 31, 2024 due to the risk rally and overall positive market tone that began late in 2023

Investments in banking and energy companies

Top detractors from performance relative to the primary benchmark:

Long-duration investments, which lagged as long-end Treasury rates climbed over the fiscal year

Investments in the corporate debt of basic industry and real estate investment trusts (REITs)

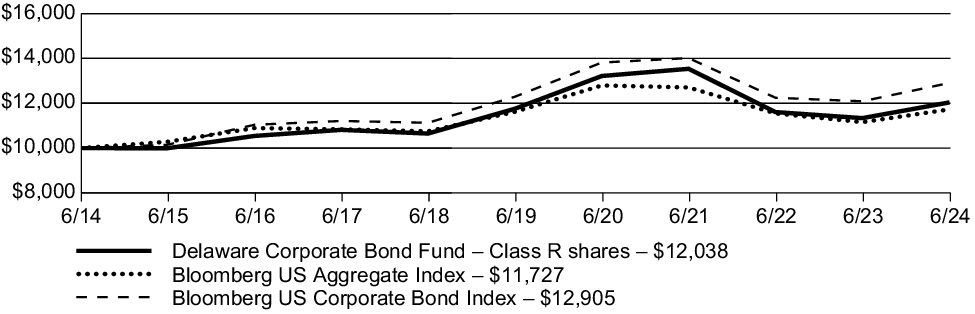

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Corporate Bond Fund (Class R) – including sales charge | 6.18 | % | 0.47 | % | 1.87 | % |

| Delaware Corporate Bond Fund (Class R) – excluding sales charge | 6.18 | % | 0.47 | % | 1.87 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Bloomberg US Corporate Bond Index | 6.76 | % | 0.98 | % | 2.58 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg US Corporate Bond Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $1,269,022,895% |

| Total number of portfolio holdings | $244% |

| Total advisory fees paid | $4,791,798% |

| Portfolio turnover rate | $123% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Banking | 24.29% |

| Energy | 11.81% |

| Electric | 10.04% |

| Consumer Non-Cyclical | 8.38% |

| Communications | 7.72% |

| Capital Goods | 7.50% |

| Consumer Cyclical | 6.80% |

| Technology | 4.96% |

| Insurance | 4.84% |

| Finance Companies | 3.97% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Corporate Bond Fund

Institutional Class: DGCIX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Corporate Bond Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $59 | 0.57% |

Management’s discussion of Fund performance

Performance highlights

Delaware Corporate Bond Fund (Institutional Class) returned 6.65% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Bloomberg US Corporate Bond Index, the Fund's narrowly based securities market index and secondary benchmark, returned 6.76%.

Top contributors to performance relative to the primary benchmark:

Overweight to lower-quality corporate debt, such as BBB-rated (investment grade) and BB-rated (high yield) bonds, which outperformed higher-quality investments over the Fund's fiscal year ended July 31, 2024 due to the risk rally and overall positive market tone that began late in 2023

Investments in banking and energy companies

Top detractors from performance relative to the primary benchmark:

Long-duration investments, which lagged as long-end Treasury rates climbed over the fiscal year

Investments in the corporate debt of basic industry and real estate investment trusts (REITs)

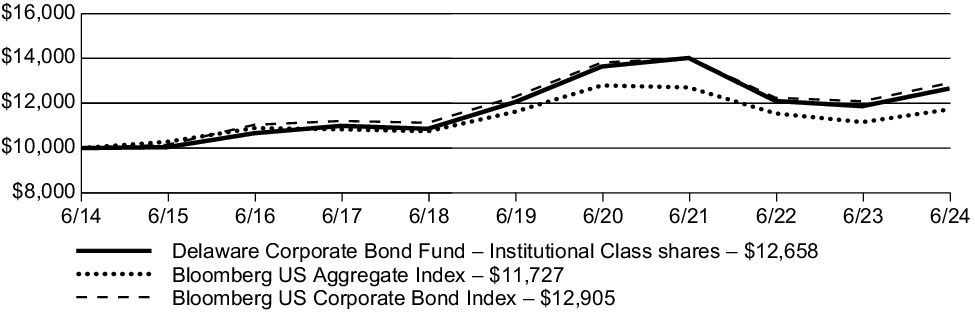

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Corporate Bond Fund (Institutional Class) – including sales charge | 6.65 | % | 0.97 | % | 2.38 | % |

| Delaware Corporate Bond Fund (Institutional Class) – excluding sales charge | 6.65 | % | 0.97 | % | 2.38 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Bloomberg US Corporate Bond Index | 6.76 | % | 0.98 | % | 2.58 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg US Corporate Bond Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $1,269,022,895% |

| Total number of portfolio holdings | $244% |

| Total advisory fees paid | $4,791,798% |

| Portfolio turnover rate | $123% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Banking | 24.29% |

| Energy | 11.81% |

| Electric | 10.04% |

| Consumer Non-Cyclical | 8.38% |

| Communications | 7.72% |

| Capital Goods | 7.50% |

| Consumer Cyclical | 6.80% |

| Technology | 4.96% |

| Insurance | 4.84% |

| Finance Companies | 3.97% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Corporate Bond Fund

Class R6: DGCZX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Corporate Bond Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R6 | $48 | 0.46% |

Management’s discussion of Fund performance

Performance highlights

Delaware Corporate Bond Fund (Class R6) returned 6.76% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Bloomberg US Corporate Bond Index, the Fund's narrowly based securities market index and secondary benchmark, returned 6.76%.

Top contributors to performance relative to the primary benchmark:

Overweight to lower-quality corporate debt, such as BBB-rated (investment grade) and BB-rated (high yield) bonds, which outperformed higher-quality investments over the Fund's fiscal year ended July 31, 2024 due to the risk rally and overall positive market tone that began late in 2023

Investments in banking and energy companies

Top detractors from performance relative to the primary benchmark:

Long-duration investments, which lagged as long-end Treasury rates climbed over the fiscal year

Investments in the corporate debt of basic industry and real estate investment trusts (REITs)

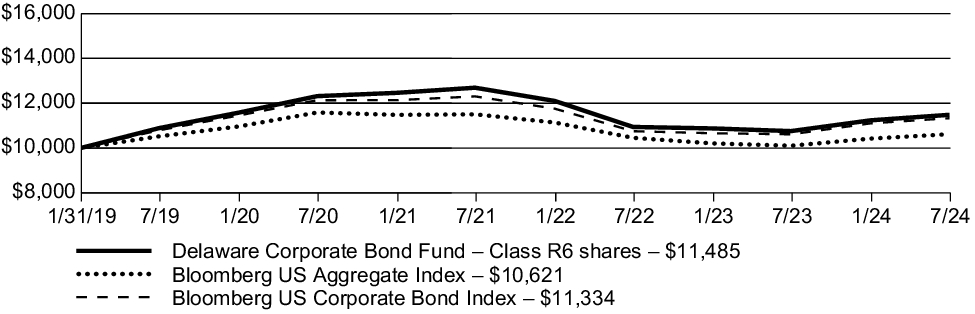

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years (or period) of the Class for the life of the Class. It also assumes a $10,000 initial investment at the Class's inception date in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment

For the period January 31, 2019 (Class R6's inception), through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | Since Inception

(1/31/19) | |

| Delaware Corporate Bond Fund (Class R6) – including sales charge | 6.76 | % | 1.06 | % | 2.55 | % |

| Delaware Corporate Bond Fund (Class R6) – excluding sales charge | 6.76 | % | 1.06 | % | 2.55 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.10 | % |

| Bloomberg US Corporate Bond Index | 6.76 | % | 0.98 | % | 2.30 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg US Corporate Bond Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $1,269,022,895% |

| Total number of portfolio holdings | $244% |

| Total advisory fees paid | $4,791,798% |

| Portfolio turnover rate | $123% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Banking | 24.29% |

| Energy | 11.81% |

| Electric | 10.04% |

| Consumer Non-Cyclical | 8.38% |

| Communications | 7.72% |

| Capital Goods | 7.50% |

| Consumer Cyclical | 6.80% |

| Technology | 4.96% |

| Insurance | 4.84% |

| Finance Companies | 3.97% |

| |

| |

| |

During the fiscal year ended July 31, 2024, the Fund introduced a new fee waiver for Class R6 shares of 0.45% (excluding certain items).

This is a summary of certain changes to the Fund since the beginning of the reporting period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 30, 2024, at delawarefunds.com/literature or upon request at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Extended Duration Bond Fund

Class A: DEEAX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Extended Duration Bond Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $84 | 0.82% |

Management’s discussion of Fund performance

Performance highlights

Delaware Extended Duration Bond Fund (Class A) returned 4.70% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Bloomberg Long US Corporate Index, the Fund's narrowly based securities market index and secondary benchmark, returned 5.56%.

Top contributors to performance relative to the primary benchmark:

Overweight to lower-quality corporate debt, such as BBB-rated (investment grade) and BB-rated (high yield) bonds, which outperformed higher-quality investments over the Fund's fiscal year ended July 31, 2024 due to the risk rally and overall positive market tone that began late in 2023

Investments in communications and energy companies

Top detractors from performance relative to the primary benchmark:

Long-duration investments, which lagged as long-end Treasury rates climbed over the fiscal year

Investments in consumer non-cyclicals and insurance

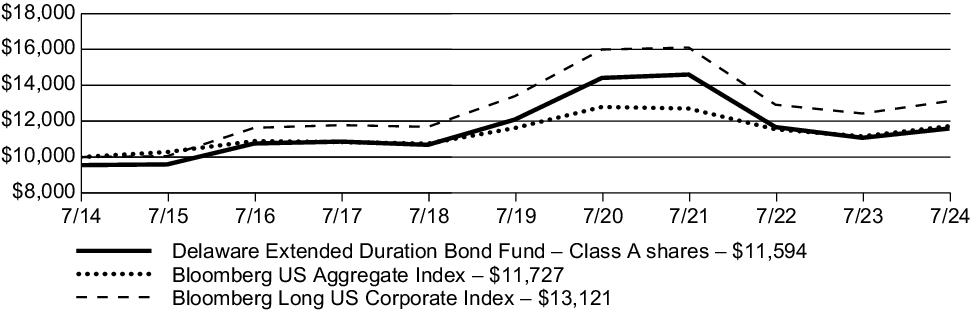

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period and the deduction of the maximum applicable sales charge for Class A shares.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Extended Duration Bond Fund (Class A) – including sales charge | -0.02 | % | -1.75 | % | 1.49 | % |

| Delaware Extended Duration Bond Fund (Class A) – excluding sales charge | 4.70 | % | -0.85 | % | 1.96 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Bloomberg Long US Corporate Index | 5.56 | % | -0.41 | % | 2.75 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg Long US Corporate Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $475,509,003% |

| Total number of portfolio holdings | $151% |

| Total advisory fees paid | $1,741,311% |

| Portfolio turnover rate | $86% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Energy | 17.24% |

| Electric | 14.99% |

| Insurance | 10.62% |

| Communications | 9.57% |

| Banking | 9.34% |

| Capital Goods | 8.58% |

| Consumer Non-Cyclical | 7.92% |

| Consumer Cyclical | 5.34% |

| Basic Industry | 4.67% |

| Natural Gas | 3.41% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Extended Duration Bond Fund

Class C: DEECX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Extended Duration Bond Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $160 | 1.57% |

Management’s discussion of Fund performance

Performance highlights

Delaware Extended Duration Bond Fund (Class C) returned 3.99% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Bloomberg Long US Corporate Index, the Fund's narrowly based securities market index and secondary benchmark, returned 5.56%.

Top contributors to performance relative to the primary benchmark:

Overweight to lower-quality corporate debt, such as BBB-rated (investment grade) and BB-rated (high yield) bonds, which outperformed higher-quality investments over the Fund's fiscal year ended July 31, 2024 due to the risk rally and overall positive market tone that began late in 2023

Investments in communications and energy companies

Top detractors from performance relative to the primary benchmark:

Long-duration investments, which lagged as long-end Treasury rates climbed over the fiscal year

Investments in consumer non-cyclicals and insurance

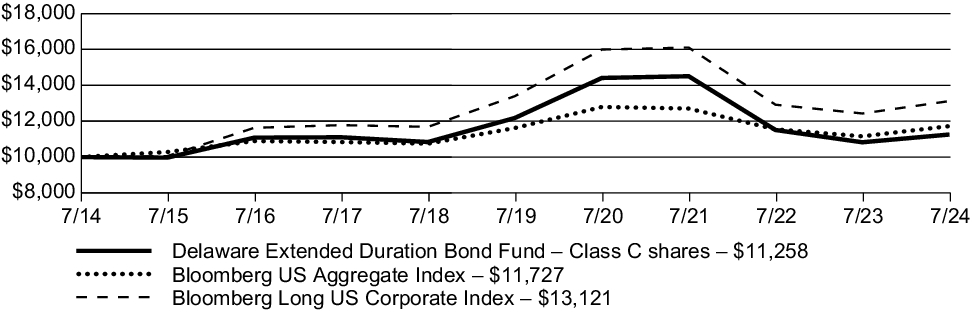

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Extended Duration Bond Fund (Class C) – including sales charge | 2.99 | % | -1.57 | % | 1.19 | % |

| Delaware Extended Duration Bond Fund (Class C) – excluding sales charge | 3.99 | % | -1.57 | % | 1.19 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Bloomberg Long US Corporate Index | 5.56 | % | -0.41 | % | 2.75 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg Long US Corporate Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $475,509,003% |

| Total number of portfolio holdings | $151% |

| Total advisory fees paid | $1,741,311% |

| Portfolio turnover rate | $86% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Energy | 17.24% |

| Electric | 14.99% |

| Insurance | 10.62% |

| Communications | 9.57% |

| Banking | 9.34% |

| Capital Goods | 8.58% |

| Consumer Non-Cyclical | 7.92% |

| Consumer Cyclical | 5.34% |

| Basic Industry | 4.67% |

| Natural Gas | 3.41% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Extended Duration Bond Fund

Class R: DEERX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Extended Duration Bond Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R | $109 | 1.07% |

Management’s discussion of Fund performance

Performance highlights

Delaware Extended Duration Bond Fund (Class R) returned 4.51% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Bloomberg Long US Corporate Index, the Fund's narrowly based securities market index and secondary benchmark, returned 5.56%.

Top contributors to performance relative to the primary benchmark:

Overweight to lower-quality corporate debt, such as BBB-rated (investment grade) and BB-rated (high yield) bonds, which outperformed higher-quality investments over the Fund's fiscal year ended July 31, 2024 due to the risk rally and overall positive market tone that began late in 2023

Investments in communications and energy companies

Top detractors from performance relative to the primary benchmark:

Long-duration investments, which lagged as long-end Treasury rates climbed over the fiscal year

Investments in consumer non-cyclicals and insurance

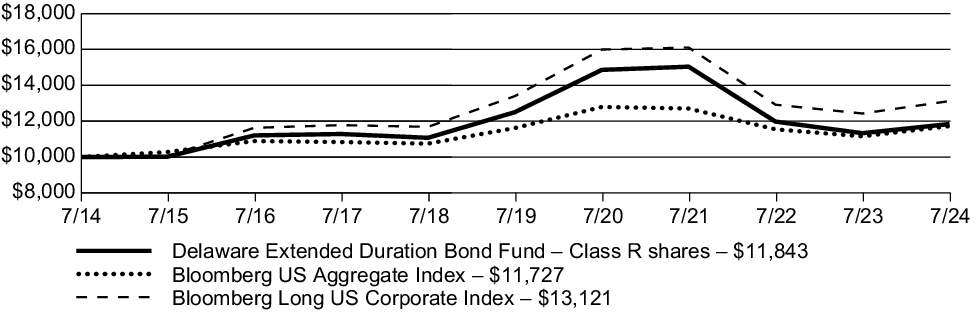

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Extended Duration Bond Fund (Class R) – including sales charge | 4.51 | % | -1.09 | % | 1.71 | % |

| Delaware Extended Duration Bond Fund (Class R) – excluding sales charge | 4.51 | % | -1.09 | % | 1.71 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Bloomberg Long US Corporate Index | 5.56 | % | -0.41 | % | 2.75 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg Long US Corporate Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $475,509,003% |

| Total number of portfolio holdings | $151% |

| Total advisory fees paid | $1,741,311% |

| Portfolio turnover rate | $86% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Energy | 17.24% |

| Electric | 14.99% |

| Insurance | 10.62% |

| Communications | 9.57% |

| Banking | 9.34% |

| Capital Goods | 8.58% |

| Consumer Non-Cyclical | 7.92% |

| Consumer Cyclical | 5.34% |

| Basic Industry | 4.67% |

| Natural Gas | 3.41% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Extended Duration Bond Fund

Institutional Class: DEEIX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Extended Duration Bond Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $58 | 0.57% |

Management’s discussion of Fund performance

Performance highlights

Delaware Extended Duration Bond Fund (Institutional Class) returned 4.96% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Bloomberg Long US Corporate Index, the Fund's narrowly based securities market index and secondary benchmark, returned 5.56%.

Top contributors to performance relative to the primary benchmark:

Overweight to lower-quality corporate debt, such as BBB-rated (investment grade) and BB-rated (high yield) bonds, which outperformed higher-quality investments over the Fund's fiscal year ended July 31, 2024 due to the risk rally and overall positive market tone that began late in 2023

Investments in communications and energy companies

Top detractors from performance relative to the primary benchmark:

Long-duration investments, which lagged as long-end Treasury rates climbed over the fiscal year

Investments in consumer non-cyclicals and insurance

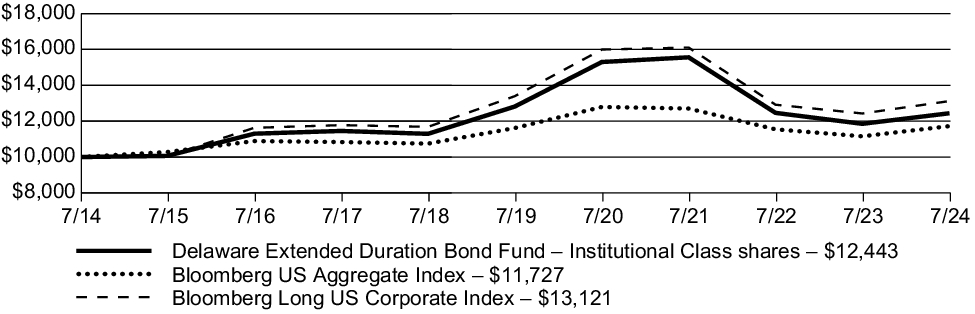

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Extended Duration Bond Fund (Institutional Class) – including sales charge | 4.96 | % | -0.61 | % | 2.21 | % |

| Delaware Extended Duration Bond Fund (Institutional Class) – excluding sales charge | 4.96 | % | -0.61 | % | 2.21 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Bloomberg Long US Corporate Index | 5.56 | % | -0.41 | % | 2.75 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg Long US Corporate Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $475,509,003% |

| Total number of portfolio holdings | $151% |

| Total advisory fees paid | $1,741,311% |

| Portfolio turnover rate | $86% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Energy | 17.24% |

| Electric | 14.99% |

| Insurance | 10.62% |

| Communications | 9.57% |

| Banking | 9.34% |

| Capital Goods | 8.58% |

| Consumer Non-Cyclical | 7.92% |

| Consumer Cyclical | 5.34% |

| Basic Industry | 4.67% |

| Natural Gas | 3.41% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Extended Duration Bond Fund

Class R6: DEZRX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Extended Duration Bond Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R6 | $47 | 0.46% |

Management’s discussion of Fund performance

Performance highlights

Delaware Extended Duration Bond Fund (Class R6) returned 5.07% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Bloomberg Long US Corporate Index, the Fund's narrowly based securities market index and secondary benchmark, returned 5.56%.

Top contributors to performance relative to the primary benchmark:

Overweight to lower-quality corporate debt, such as BBB-rated (investment grade) and BB-rated (high yield) bonds, which outperformed higher-quality investments over the Fund's fiscal year ended July 31, 2024 due to the risk rally and overall positive market tone that began late in 2023

Investments in communications and energy companies

Top detractors from performance relative to the primary benchmark:

Long-duration investments, which lagged as long-end Treasury rates climbed over the fiscal year

Investments in consumer non-cyclicals and insurance

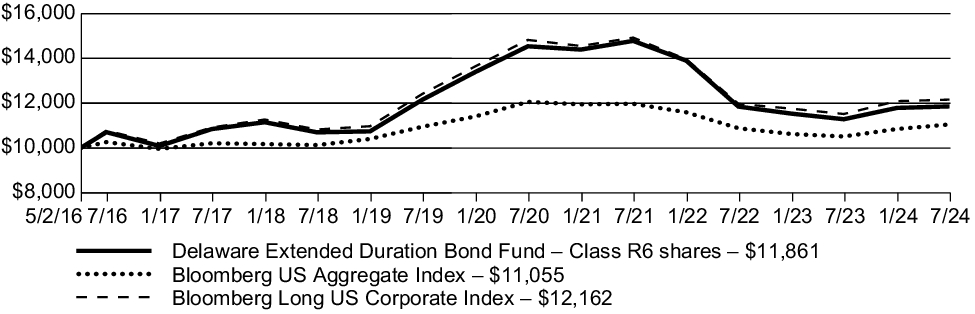

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years (or period) of the Class for the life of the Class. It also assumes a $10,000 initial investment at the Class's inception date in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment

For the period May 2, 2016 (Class R6's inception), through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | Since Inception

(5/2/16) | |

| Delaware Extended Duration Bond Fund (Class R6) – including sales charge | 5.07 | % | -0.51 | % | 2.09 | % |

| Delaware Extended Duration Bond Fund (Class R6) – excluding sales charge | 5.07 | % | -0.51 | % | 2.09 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.22 | % |

| Bloomberg Long US Corporate Index | 5.56 | % | -0.41 | % | 2.40 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg Long US Corporate Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $475,509,003% |

| Total number of portfolio holdings | $151% |

| Total advisory fees paid | $1,741,311% |

| Portfolio turnover rate | $86% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Energy | 17.24% |

| Electric | 14.99% |

| Insurance | 10.62% |

| Communications | 9.57% |

| Banking | 9.34% |

| Capital Goods | 8.58% |

| Consumer Non-Cyclical | 7.92% |

| Consumer Cyclical | 5.34% |

| Basic Industry | 4.67% |

| Natural Gas | 3.41% |

| |

| |

| |

During the fiscal year ended July 31, 2024, the Fund introduced a new fee waiver for Class R6 shares of 0.46% (excluding certain items).

This is a summary of certain changes to the Fund since the beginning of the reporting period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 30, 2024, at delawarefunds.com/literature or upon request at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Floating Rate Fund

Class A: DDFAX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Floating Rate Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $98 | 0.93% |

Management’s discussion of Fund performance

Performance highlights

Delaware Floating Rate Fund (Class A) returned 10.18% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Morningstar LSTA US Leveraged Loan Index, the Fund's narrowly based securities market index and secondary benchmark, returned 10.45%.

Top contributors to performance relative to the secondary benchmark:

A high average coupon of approximately 9.5%, plus reduced capital markets volatility, helped drive the historically strong total returns.

Positioning skewed more to single-B rated loans, which outperformed BB-rated loans.

An overweight and security selection in the materials, telecommunications, and utilities sectors

An overweight and security selection in the consumer discretionary and retail sectors

Top detractors from performance relative to the secondary benchmark:

An underweight in the financial services, consumer services, and the commercial and professional services sectors

An overweight and security selection in the media sector

Security selection in the healthcare sector

Overweight to BB-rated loans

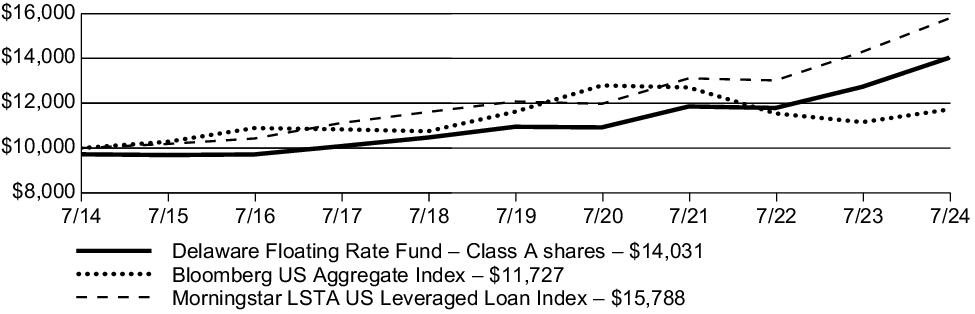

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period and the deduction of the maximum applicable sales charge for Class A shares.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Floating Rate Fund (Class A) – including sales charge | 7.20 | % | 4.48 | % | 3.44 | % |

| Delaware Floating Rate Fund (Class A) – excluding sales charge | 10.18 | % | 5.05 | % | 3.73 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Morningstar LSTA US Leveraged Loan Index | 10.45 | % | 5.50 | % | 4.67 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Morningstar LSTA US Leveraged Loan Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $624,069,415% |

| Total number of portfolio holdings | $197% |

| Total advisory fees paid | $2,897,103% |

| Portfolio turnover rate | $104% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Industrials | 15.82% |

| Information Technology | 14.76% |

| Consumer Discretionary | 11.92% |

| Communication Services | 11.72% |

| Financials | 11.44% |

| Materials | 10.66% |

| Utilities | 8.81% |

| Healthcare | 8.44% |

| Consumer Staples | 2.09% |

| Energy | 0.78% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Floating Rate Fund

Class C: DDFCX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Floating Rate Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $176 | 1.68% |

Management’s discussion of Fund performance

Performance highlights

Delaware Floating Rate Fund (Class C) returned 9.37% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Morningstar LSTA US Leveraged Loan Index, the Fund's narrowly based securities market index and secondary benchmark, returned 10.45%.

Top contributors to performance relative to the secondary benchmark:

A high average coupon of approximately 9.5%, plus reduced capital markets volatility, helped drive the historically strong total returns.

Positioning skewed more to single-B rated loans, which outperformed BB-rated loans.

An overweight and security selection in the materials, telecommunications, and utilities sectors

An overweight and security selection in the consumer discretionary and retail sectors

Top detractors from performance relative to the secondary benchmark:

An underweight in the financial services, consumer services, and the commercial and professional services sectors

An overweight and security selection in the media sector

Security selection in the healthcare sector

Overweight to BB-rated loans

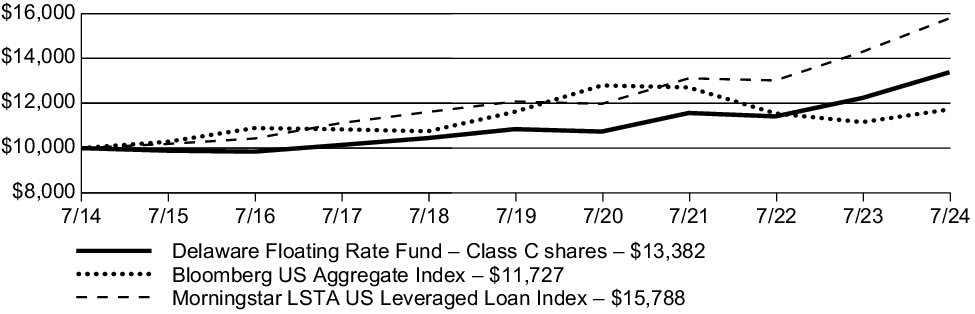

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Floating Rate Fund (Class C) – including sales charge | 8.37 | % | 4.27 | % | 2.96 | % |

| Delaware Floating Rate Fund (Class C) – excluding sales charge | 9.37 | % | 4.27 | % | 2.96 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Morningstar LSTA US Leveraged Loan Index | 10.45 | % | 5.50 | % | 4.67 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Morningstar LSTA US Leveraged Loan Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $624,069,415% |

| Total number of portfolio holdings | $197% |

| Total advisory fees paid | $2,897,103% |

| Portfolio turnover rate | $104% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Industrials | 15.82% |

| Information Technology | 14.76% |

| Consumer Discretionary | 11.92% |

| Communication Services | 11.72% |

| Financials | 11.44% |

| Materials | 10.66% |

| Utilities | 8.81% |

| Healthcare | 8.44% |

| Consumer Staples | 2.09% |

| Energy | 0.78% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Floating Rate Fund

Class R: DDFFX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Floating Rate Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R | $124 | 1.18% |

Management’s discussion of Fund performance

Performance highlights

Delaware Floating Rate Fund (Class R) returned 9.91% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Morningstar LSTA US Leveraged Loan Index, the Fund's narrowly based securities market index and secondary benchmark, returned 10.45%.

Top contributors to performance relative to the secondary benchmark:

A high average coupon of approximately 9.5%, plus reduced capital markets volatility, helped drive the historically strong total returns.

Positioning skewed more to single-B rated loans, which outperformed BB-rated loans.

An overweight and security selection in the materials, telecommunications, and utilities sectors

An overweight and security selection in the consumer discretionary and retail sectors

Top detractors from performance relative to the secondary benchmark:

An underweight in the financial services, consumer services, and the commercial and professional services sectors

An overweight and security selection in the media sector

Security selection in the healthcare sector

Overweight to BB-rated loans

Fund performance

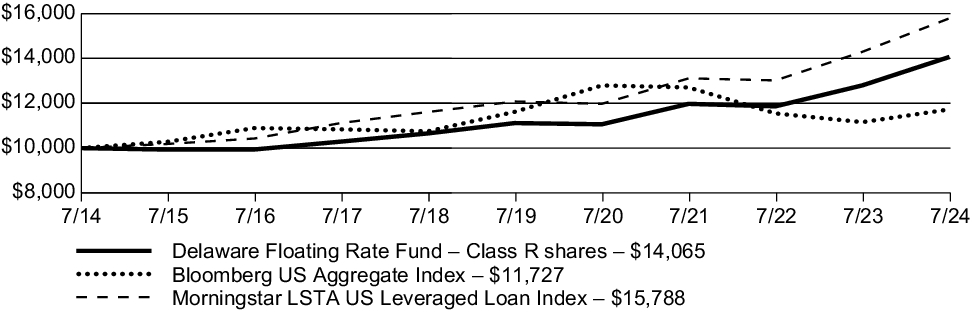

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment

For the period July 31, 2014, through July 31, 2024

| Average annual total returns (as of July 31, 2024) | 1 year | | 5 year | | 10 year | |

| Delaware Floating Rate Fund (Class R) – including sales charge | 9.91 | % | 4.79 | % | 3.47 | % |

| Delaware Floating Rate Fund (Class R) – excluding sales charge | 9.91 | % | 4.79 | % | 3.47 | % |

| Bloomberg US Aggregate Index | 5.10 | % | 0.19 | % | 1.61 | % |

| Morningstar LSTA US Leveraged Loan Index | 10.45 | % | 5.50 | % | 4.67 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the Bloomberg US Aggregate Index. Although the Bloomberg US Aggregate Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Morningstar LSTA US Leveraged Loan Index for comparative purposes because the Delaware Management Company, the Fund's manager, believes it is more representative of the Fund’s investment universe.

Fund statistics (as of July 31, 2024)

| Fund net assets | $624,069,415% |

| Total number of portfolio holdings | $197% |

| Total advisory fees paid | $2,897,103% |

| Portfolio turnover rate | $104% |

Fund holdings (as of July 31, 2024)

The table below shows the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Industrials | 15.82% |

| Information Technology | 14.76% |

| Consumer Discretionary | 11.92% |

| Communication Services | 11.72% |

| Financials | 11.44% |

| Materials | 10.66% |

| Utilities | 8.81% |

| Healthcare | 8.44% |

| Consumer Staples | 2.09% |

| Energy | 0.78% |

| |

| |

| |

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Floating Rate Fund

Institutional Class: DDFLX

Annual shareholder report | July 31, 2024

This annual shareholder report contains important information about Delaware Floating Rate Fund (Fund) for the period of August 1, 2023, to July 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $72 | 0.68% |

Management’s discussion of Fund performance

Performance highlights

Delaware Floating Rate Fund (Institutional Class) returned 10.46% (excluding sales charge) for the 12 months ended July 31, 2024. During the same period, the Bloomberg US Aggregate Index, the Fund's broad-based securities market index and primary benchmark, returned 5.10%, while the Morningstar LSTA US Leveraged Loan Index, the Fund's narrowly based securities market index and secondary benchmark, returned 10.45%.

Top contributors to performance relative to the secondary benchmark:

A high average coupon of approximately 9.5%, plus reduced capital markets volatility, helped drive the historically strong total returns.

Positioning skewed more to single-B rated loans, which outperformed BB-rated loans.

An overweight and security selection in the materials, telecommunications, and utilities sectors

An overweight and security selection in the consumer discretionary and retail sectors

Top detractors from performance relative to the secondary benchmark:

An underweight in the financial services, consumer services, and the commercial and professional services sectors

An overweight and security selection in the media sector

Security selection in the healthcare sector

Overweight to BB-rated loans

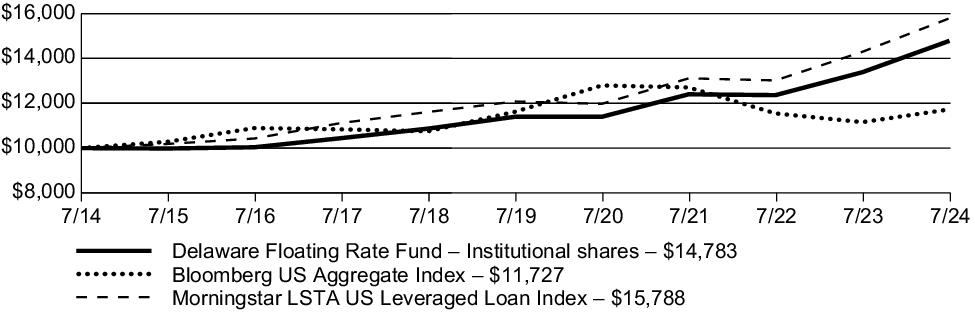

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index and an additional narrowly based securities market index for the same period.

Growth of $10,000 investment