Table of Contents

Annual report

Fixed income mutual funds

(As revised November 23, 2022 to reflect a reverse stock split for each Fund)

Delaware Corporate Bond Fund

Delaware Extended Duration Bond Fund

July 31, 2022

Carefully consider the Funds' investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds' prospectus and their summary prospectuses, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Table of Contents

Experience Delaware Funds by Macquarie®

Macquarie Asset Management (MAM) is a global asset manager that aims to deliver positive impact for everyone. MAM Public Investments traces its roots to 1929 and partners with institutional and individual clients to deliver specialist active investment capabilities across global equities, fixed income, and multi-asset solutions using a conviction-based, long-term approach to investing. In the US, retail investors recognize our Delaware Funds by Macquarie family of funds as one of the oldest mutual fund families.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Corporate Bond Fund and Delaware Extended Duration Bond Fund at delawarefunds.com/literature.

Manage your account online

| ● | Check your account balance and transactions |

| ● | View statements and tax forms |

| ● | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) is the asset management division of Macquarie Group. MAM is a full-service asset manager offering a diverse range of products across public and private markets including fixed income, equities, multi-asset solutions, private credit, infrastructure, renewables, natural assets, real estate, and asset finance. The Public Investments business is a part of MAM and includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

The Funds are distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited ABN 46 008 583 542 ("Macquarie Bank"), any Macquarie Group entity noted in this document is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

The Funds are governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of July 31, 2022, and subject to change for events occurring after such date.

The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2022 Macquarie Management Holdings, Inc.

Table of Contents

Portfolio management review | Delaware Corporate Bond Fund and | |

| Delaware Extended Duration Bond Fund | July 31, 2022 (Unaudited) |

| Performance preview (for the year ended July 31, 2022) | | | | | |

| Delaware Corporate Bond Fund (Institutional Class shares) | | 1-year return | | -13.69 | % |

| Delaware Corporate Bond Fund (Class A shares) | | 1-year return | | -13.91 | % |

| Bloomberg US Corporate Investment Grade Index (benchmark) | | 1-year return | | -12.61 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Corporate Bond Fund, please see the table on page 7. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 10 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| Delaware Extended Duration Bond Fund (Institutional Class shares) | 1-year return | | -19.90 | % |

| Delaware Extended Duration Bond Fund (Class A shares) | 1-year return | | -20.07 | % |

| Bloomberg Long US Corporate Index (benchmark) | 1-year return | | -19.79 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Extended Duration Bond Fund, please see the table on page 12. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 15 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objectives

The Funds seek to provide investors with total return.

Market review

The first five months of the Funds’ fiscal year ended July 31, 2022 – August through December 2021 – can best be described as calm, with little movement in rates. Although the overall economic environment was slowing after the superheated recovery that characterized the latter half of the previous fiscal period, economic fundamentals were still sound. The one concern that many investors shared was inflation.

When the fiscal year began, the US Federal Reserve noted various pressures on prices and concluded that inflation was real but transitory. As 2022 began, however, it became apparent to all that inflation was severe and sticky, owing to a combination of labor shortages, low unemployment, high consumer demand, and supply chain shortages.

As did many investors, we foresaw that the Fed would react by raising rates. What we did not anticipate was just how fast, steep, and tenacious those increases would be. Many investors expected that rates would rise gradually and were surprised by the Fed’s pace of hikes that began with a

1

Table of Contents

Portfolio management review

Delaware Corporate Bond Fund and

Delaware Extended Duration Bond Fund

0.25-percentage-point increase in mid-March followed by a 0.50-percentage-point hike in early May and increases of 0.75 percentage points in both mid-June and late July. That said, we believe the Fed appears to have made the right call. Though the Fed was initially constrained by the need to reduce its balance sheet, by the time it acted, a more aggressive approach seemed necessary.

The Russia-Ukraine war and China’s economic lockdowns to prevent the spread of COVID-19 also surprised investors. Both caused severe disruptions of the global supply chain, putting significant pressure on inflation. The world learned an expensive lesson on just how important Ukraine is to the global supply of agricultural and energy products. While less surprising, the disruption in the supply of Russian energy was also painful. The problems in China were unexpected as the spread of the virus began to increase despite the onset of warmer weather. Rather than take a more moderate approach to managing the virus as many observers had predicted, China reacted with a broad swath of shutdowns that sharply curtailed industrial output.

All three events – the Fed’s aggressive response to inflation, the Russia-Ukraine war, and China’s zero-COVID policy – had a dramatic effect on bond markets in the latter half of the Funds' fiscal year. Driven primarily by rates and inflation, the first half of 2022 was the corporate bond market’s worst opening six months of any calendar year on record. This was attributable mainly to duration, a measure of a portfolio’s sensitivity to higher interest rates. The longer the duration of a portfolio, the more sensitive it is to higher rates.

As 2022 progressed, we saw significant rate volatility. When the Fed began raising rates aggressively, and investors began talking of an imminent recession, spreads reacted negatively and began to widen. The 10-year Treasury yield rose from 1.51% at December 31, 2021 to 2.65% at end of July 2022, an increase of 114 basis points (or 1.14 percentage points), which sharply stung long-duration credits. While spreads in the investment grade market increased only about 45 to 50 basis points, the combination of rising rates and widening spreads was both unusual and painful to investors.

Looking at the relative performance of investment grade versus high yield securities, duration was the key differentiator, with the activity from January through July 2022 driving results for the entire fiscal year. High yield performed much better than investment grade, with most of the damage in the investment grade market resulting more from duration than from widening spreads. Because high yield tends to be a shorter-duration asset class, it held up better. Given the perception that the corporate finance world is in good shape, with solid credit metrics and profit margins, investment grade credits tend to be longer duration. The result was a 12.6% decline for investment grade bonds, as measured by the Bloomberg US Corporate Investment Grade Index, for the fiscal year. High yield bonds, as measured by the Bloomberg US Corporate High-Yield Index, declined 8.0%, about two-thirds of investment grade’s loss.

Issuance in 2021 was the second-highest annual total ever, behind only the record pace set in 2020. While tapering off somewhat in 2022, it remained stronger than we would have expected. At July 31, 2022, year-to-date issuance was running about 15% below the previous year’s torrid pace. With rate hikes looming, however, many companies rushed to obtain financing before rates could rise even higher. So even though issuance was down, it was generally higher than anticipated. Some

2

Table of Contents

sectors, notably banking, unexpectedly flooded the market with new issuance.

As difficult as the first half of 2022 was, there was some good news for bond investors. Throughout the first half of the Funds’ fiscal year and well into the second half, corporate profitability was never higher, with record-setting margins and healthy cash flows. From a fundamental standpoint, the corporate bond market was extremely healthy. We entered 2022 with the expectation that credit upgrades would outnumber downgrades, and this proved to be true. Even at fiscal year-end, despite the worries of recession, credit upgrades were still outpacing downgrades. We think that may continue into 2023.

Source: Bloomberg.

Within the Funds

For the fiscal year ended July 31, 2022, Delaware Corporate Bond Fund underperformed its benchmark, the Bloomberg US Corporate Investment Grade Index. The Fund’s Institutional Class shares returned -13.69%. The Fund’s Class A shares returned -13.91% at net asset value and -17.83% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the benchmark returned -12.61%. For complete, annualized performance of Delaware Corporate Bond Fund, please see the table on page 7.

During the same period, Delaware Extended Duration Bond Fund underperformed its benchmark, the Bloomberg Long US Corporate Index. The Fund’s Institutional Class shares returned -19.90%. The Fund’s Class A shares returned -20.07% at net asset value and -23.71% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the benchmark returned -19.79%. For complete, annualized performance of Delaware Extended Duration Bond Fund, please see the table on page 12.

Duration was the chief factor in the underperformance of both Funds. Given the overweight to BBB-rated spread duration of the Funds’ holdings, higher interest rates drove the price of credits held in the portfolios sharply lower. Somewhat offsetting that, both Funds benefited from out-of-benchmark investments in high yield (non-investment-grade) securities, which generally outperformed their investment grade counterparts for the fiscal year by virtue of their lower-duration nature. The Funds are each allowed to invest up to 20% of their assets in high yield securities; each maintained a portfolio allocation that varied throughout the fiscal year, as described later.

The fiscal year was an unusual period for the Funds, in our view. Although we believe that most of the underperformance was attributable to rising rates and higher duration, we acknowledge that credit spreads widened meaningfully as well. It is rare to see rates rise and spreads widen at the same time. Usually spreads increase in the face of a potential recession and consequently weigh on issuers’ earnings. But this year, rates and spreads moved in the same direction, resulting in the corporate bond market’s worst start to a calendar year in its history.

Delaware Corporate Bond Fund

Although the Fund performed fairly well in the latter part of 2021, we knew that valuations were rich coming into 2022. At the same time, credit fundamentals and credit metrics were still extremely strong, and we wanted the Fund to own bonds that exhibited higher yields or had higher spreads than the overall benchmark. We still believed there was a long

3

Table of Contents

Portfolio management review

Delaware Corporate Bond Fund and

Delaware Extended Duration Bond Fund

runway before the Fed would become aggressive in raising rates. And of course, we did not anticipate the Russia-Ukraine war. So, we began 2022 with the assumption that the best way to add performance in this environment was through higher yield, given that we did not expect further price appreciation or spread compression, either of which would also have contributed to performance, if available. We purchased credits that had higher spreads and higher yields, believing that the strong economic backdrop would afford us some time for the Fund to benefit from this strategy.

When sentiment turned, however, the Fund’s positions were affected more than those in the benchmark, which contained higher-quality credits with less income, less spread, and less yield, the types of credits that we would not have gravitated toward unless the economy were signaling problems ahead. We got no such signals in January and February. Our attempt to achieve a higher yield and carry higher spreads than the benchmark was the source of a large part of the Fund’s underperformance.

On a more granular level, the banking sector detracted the most from the Fund’s performance. Ironically, the credit quality in the banking industry has generally been pristine, much stronger today than it was during the recession of 2008-2009. The Fund underperformed entirely due to security selection. In an effort to add yield, we invested in longer-duration and subordinated instruments, under the assumption that fundamentals were strong and valuations were attractive, in our view, relative to other sectors. As the year progressed, however, the combination of higher rates and longer duration proved detrimental for such a strategy. Banking credits that the Fund owned included Credit Suisse Group AG and Deutsche Bank AG.

Aside from banking, the remainder of the financial sector also detracted significantly from performance, again mainly during the latter half of the fiscal year. Although the Fund’s holdings were primarily BBB-rated credits (investment grade), life insurers were more volatile than the overall market because of capital market volatility. Aircraft lessors underperformed as some bonds had exposure to Russian aircraft that could not be seized after the outbreak of war in Ukraine. Real estate investment trusts (REITs) also lagged mainly due to rate volatility. Fund holdings in the sector included life insurer Brighthouse Financial Inc. and retirement services provider Athene Holding Ltd., which merged into Apollo Global Management during the fiscal year.

Among contributors to performance during the period, the Fund’s overweight in energy, particularly midstream and production, was beneficial. While we didn’t expect oil prices to reach, much less exceed, $100 a barrel, the Fund did benefit from the increase. Cheniere Energy Inc., a producer of liquefied natural gas; Devon Energy Corp., an exploration company; and ONEOK Inc., a midstream service provider, were among the Fund’s holdings in the sector.

The Fund likewise benefited from its transportation holdings, particularly airlines, including Delta Air Lines Inc. and United Airlines Holdings Inc. We recognize that airlines could struggle in a recession, but the Fund’s holdings have shorter duration and what we view as an attractive structure that includes collateral packages.

In addition, the Fund’s out-of-benchmark allocation to risk-free assets, including Treasurys and short-duration sectors, such as

4

Table of Contents

bank loans and convertibles, contributed to performance during the fiscal year.

Most of the changes that we made to the Fund’s portfolio occurred in the second half of the fiscal year. Once higher rates and wider spreads had done material damage to the asset class, we sought to increase the credit quality of the Fund. With prices at historic lows, we began buying lower-priced bonds. The asset class experienced some of the lowest dollar prices on securities in the past 30 to 40 years. Consequently, the decision to buy bonds of high-quality issuers at historically low prices appeared to us to be an attractive opportunity.

At fiscal year end, the Fund was positioned with 90% of its assets in investment grade securities and the balance in high yield. Earlier in the fiscal year, the Fund had as much as 15% in high yield. We also reduced the Fund’s BBB-rated allocation within investment grade, having moved up in quality within the asset class.

During the fiscal year, the Fund held a small position in credit default swaps on the investment grade index as a temporary hedge given valuations and technicals we observed in the market. The Fund also held a small position in credit default swaps on the investment grade index via options as a way to add incremental income with upside potential for performance gains. Neither position had a material impact on the Fund’s performance.

Delaware Extended Duration Bond Fund

Delaware Extended Duration Bond Fund is designed to provide investors with access to the long end of the US investment grade corporate market. The management of the Fund is strategically like that of Delaware Corporate Bond Fund. As many companies do not issue longer-duration bonds, however, we identify additional opportunities as needed to complete the Fund’s portfolio.

On a sector basis, financials were a leading detractor from performance as higher interest rates roiled capital markets and, in turn, life insurance companies, including Brighthouse Financial Inc. and Athene Holding Ltd., mentioned earlier. The Fund also had exposure to several aircraft lessors, who were blindsided by the outbreak of war in Ukraine. Economic sanctions imposed on Russia made it impossible for lessors to collect payments or reclaim aircraft, and those credits suffered.

The Fund also held bonds issued by chemical companies in the industrials sector. These were typically long duration and given the overweight positions, it detracted from performance during the fiscal year. Fund holdings included petrochemical producer Westlake Corp. and coatings manufacturer The Sherwin-Williams Co.

The Fund’s exposure to long Treasury futures used to control duration also detracted from performance. The Fund was invested in securities issued by banks and aircraft lessors, and in bank loans and high yield bonds. While these are often strong-performing securities, they are typically issued in the intermediate part of the yield curve that is not consistent with an extended duration portfolio. We use Treasury futures to add duration to the Fund’s portfolio, offsetting the shorter-duration credits. In this case, the long-duration futures show as detractors from performance, even as the underlying securities, in many cases, outperformed by virtue of being in the right spot on the curve.

As was the case with Delaware Corporate Bond Fund, the Fund benefited from investments in airlines Delta Air Lines Inc. and United Airlines Holdings Inc. The Fund also benefited from several high yield credits

5

Table of Contents

Portfolio management review

Delaware Corporate Bond Fund and

Delaware Extended Duration Bond Fund

including US Foods Inc., a food service distributor, and NCR Corp., a developer and supplier of point-of-sale systems and services for retailers.

At the end of the fiscal year, approximately 9% of the Fund’s portfolio was invested in high yield credits and bank loans, down from a peak exposure of about 13% in high yield earlier in the period. The remainder of the portfolio was invested in investment grade securities, where we have reduced the Fund’s position in BBB-rated bonds somewhat to go higher in quality, given the dramatic dollar-price drops that have taken place. The average dollar price in the Fund’s portfolio at the close of the period was $80, compared with the benchmark’s average price of $93.

During the period, the Fund made minimal use of Treasury futures to hedge out unwanted exposures to the Treasury yield curve. The Fund also held a small position in credit default swaps on the investment grade index as a temporary hedge given valuations and technicals we observed in the market. Lastly, the Fund held a small position in credit default swaps on the investment grade index via options as a way to add incremental income with upside potential for performance gains. None of these positions had a material impact on the Fund’s performance.

6

Table of Contents

| Performance summaries |

| Delaware Corporate Bond Fund | July 31, 2022 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | | Average annual total returns through July 31, 2022 |

| | 1 year | | 5 year | | 10 year | | Lifetime |

| Class A (Est. September 15, 1998) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | -13.91 | % | | | | +1.67 | % | | | | +2.74 | % | | | | +5.55 | % | |

| Including sales charge | | | -17.83 | % | | | | +0.73 | % | | | | +2.28 | % | | | | +5.35 | % | |

| Class C (Est. September 15, 1998) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | -14.55 | % | | | | +0.91 | % | | | | +1.98 | % | | | | +4.77 | % | |

| Including sales charge | | | -15.38 | % | | | | +0.91 | % | | | | +1.98 | % | | | | +4.77 | % | |

| Class R (Est. June 2, 2003) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | -14.26 | % | | | | +1.41 | % | | | | +2.47 | % | | | | +4.63 | % | |

| Including sales charge | | | -14.26 | % | | | | +1.41 | % | | | | +2.47 | % | | | | +4.63 | % | |

| Institutional Class (Est. September 15, 1998) | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | -13.69 | % | | | | +1.92 | % | | | | +3.00 | % | | | | +5.82 | % | |

| Including sales charge | | | -13.69 | % | | | | +1.92 | % | | | | +3.00 | % | | | | +5.82 | % | |

| Class R6 (Est. January 31, 2019) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | -13.78 | % | | | | — | | | | | — | | | | | +2.62 | % | |

| Including sales charge | | | -13.78 | % | | | | — | | | | | — | | | | | +2.62 | % | |

| Bloomberg US Corporate Investment | | | | | | | | | | | | | | | | | | | | |

| Grade Index | | | -12.61 | % | | | | +1.78 | % | | | | +2.65 | % | | | | +4.83 | %* | |

| * | The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date. |

1 | Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. |

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed in the “Fund expense ratios” table on page 9. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual 12b-1 fee of 0.25% of average daily net assets.

7

Table of Contents

Performance summaries

Delaware Corporate Bond Fund

Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

Fixed income securities and bond funds can lose value, and investors can lose principal as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. This includes prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult to obtain precise valuations of the high yield securities.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

8

Table of Contents

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

| 2 | The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. The expense ratios below may differ from the expense ratios in the “Financial highlights” since they are based on different time periods and the expense ratios in the prospectus include acquired fund fees and expenses, if any. See Note 2 in “Notes to financial statements” for additional details. Please see the “Financial highlights” section in this report for the most recent expense ratios. |

| | | | | | | | | | | | | | | | | Institutional | | | | | |

| Fund expense ratios | | Class A | | Class C | | Class R | | Class | | Class R6 |

Total annual operating expenses

(without fee waivers) | | | 0.91 | % | | | | 1.66 | % | | | | 1.16 | % | | | | 0.66 | % | | | | 0.57 | % | |

Net expenses (including fee

waivers, if any) | | | 0.82 | % | | | | 1.57 | % | | | | 1.07 | % | | | | 0.57 | % | | | | 0.48 | % | |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

9

Table of Contents

Performance summaries

Delaware Corporate Bond Fund

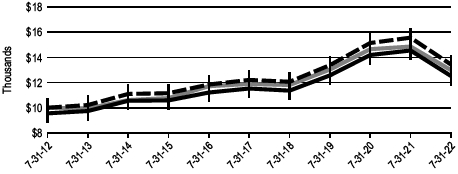

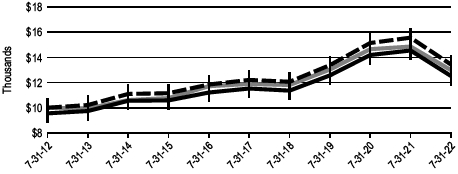

Performance of a $10,000 investment1

For the period July 31, 2012 through July 31, 2022

| | | Starting value | | Ending value |

| Delaware Corporate Bond Fund — Institutional Class shares | | | $10,000 | | | $13,441 |

| Bloomberg US Corporate Investment Grade Index | | | $10,000 | | | $12,991 |

| Delaware Corporate Bond Fund — Class A shares | | | $9,550 | | | $12,529 |

| 1 | The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on July 31, 2012, and includes the effect of a 4.50% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 9. Please note additional details on pages 7 through 11. |

The graph also assumes $10,000 invested in the Bloomberg US Corporate Investment Grade Index as of July 31, 2012. The Bloomberg US Corporate Investment Grade Index is composed of US dollar-denominated, investment grade corporate bonds that are SEC-registered or 144A with registration rights, and issued by industrial, utility, and financial companies. All bonds in the index have at least one year to maturity.

The Bloomberg US Corporate High-Yield Index, mentioned on page 2, is composed of US dollar-denominated, non-investment-grade corporate bonds for which the middle rating among Moody’s Investors Service, Inc., Fitch, Inc., and Standard & Poor’s is Ba1/BB+/BB+ or below.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary due to different charges and expenses.

10

Table of Contents

| | Nasdaq symbols | | CUSIPs |

| Class A | | | DGCAX | | | 245908785 |

| Class C | | | DGCCX | | | 245908769 |

| Class R | | | DGCRX | | | 245908744 |

| Institutional Class | | | DGCIX | | | 245908751 |

| Class R6 | | | DGCZX | | | 24610J100 |

11

Table of Contents

| Performance summaries | |

| Delaware Extended Duration Bond Fund | July 31, 2022 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | | Average annual total returns through July 31, 2022 |

| | 1 year | | 5 year | | 10 year | | Lifetime |

| Class A (Est. September 15, 1998) | | | | | | | | |

| Excluding sales charge | | -20.07% | | +1.43% | | +3.06% | | +6.67% |

| Including sales charge | | -23.71% | | +0.51% | | +2.58% | | +6.47% |

| Class C (Est. September 15, 1998) | | | | | | | | |

| Excluding sales charge | | -20.66% | | +0.71% | | +2.30% | | +5.89% |

| Including sales charge | | -21.40% | | +0.71% | | +2.30% | | +5.89% |

| Class R (Est. October 3, 2005) | | | | | | | | |

| Excluding sales charge | | -20.35% | | +1.18% | | +2.81% | | +5.78% |

| Including sales charge | | -20.35% | | +1.18% | | +2.81% | | +5.78% |

| Institutional Class (Est. September 15, 1998) | | | | | | |

| Excluding sales charge | | -19.90% | | +1.68% | | +3.32% | | +6.94% |

| Including sales charge | | -19.90% | | +1.68% | | +3.32% | | +6.94% |

| Class R6 (Est. May 2, 2016) | | | | | | | | |

| Excluding sales charge | | -19.83% | | +1.76% | | — | | +2.76% |

| Including sales charge | | -19.83% | | +1.76% | | — | | +2.76% |

| Bloomberg Long US Corporate Index | | -19.79% | | +1.86% | | +3.20% | | +5.77%* |

| * | The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date. |

| 1 | Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. |

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed in the “Fund expense ratios” table on page 14. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual 12b-1 fee of 0.25% of average daily net assets. Performance for Class A shares,

12

Table of Contents

excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

Fixed income securities and bond funds can lose value, and investors can lose principal as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. This includes prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult to obtain precise valuations of the high yield securities.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

13

Table of Contents

Performance summaries

Delaware Extended Duration Bond Fund

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

| 2 | The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. The expense ratios below may differ from the expense ratios in the “Financial highlights” since they are based on different time periods and the expense ratios in the prospectus include acquired fund fees and expenses, if any. See Note 2 in “Notes to financial statements” for additional details. Please see the “Financial highlights” section in this report for the most recent expense ratios. |

| | | | | | | | Institutional | | |

| Fund expense ratios | | Class A | | Class C | | Class R | | Class | | Class R6 |

| Total annual operating expenses | | | | | | | | |

| (without fee waivers) | | 0.99% | | 1.74% | | 1.24% | | 0.74% | | 0.65% |

| Net expenses (including fee | | | | | | | | | | |

| waivers, if any) | | 0.82% | | 1.57% | | 1.07% | | 0.57% | | 0.48% |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

14

Table of Contents

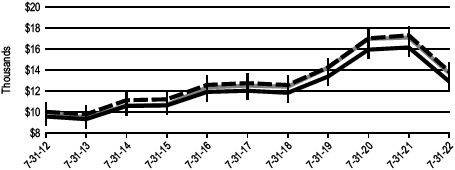

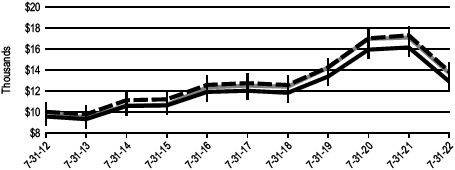

Performance of a $10,000 investment1

For the period July 31, 2012 through July 31, 2022

| | | Starting value | | Ending value |

| Delaware Extended Duration Bond Fund — Institutional Class shares | | $10,000 | | $13,862 |

| Bloomberg Long US Corporate Index | | $10,000 | | $13,708 |

| Delaware Extended Duration Bond Fund — Class A shares | | $9,550 | | $12,907 |

| 1 | The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on July 31, 2012, and includes the effect of a 4.50% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 14. Please note additional details on pages 12 through 16. |

The graph also assumes $10,000 invested in the Bloomberg Long US Corporate Index as of July 31, 2012. The Bloomberg Long US Corporate Index is composed of US dollar-denominated, investment grade corporate bonds that are SEC-registered or 144A with registration rights, and issued by industrial, utility, and financial companies. All bonds in the index have at least 10 years to maturity.

The Bloomberg US Corporate Investment Grade Index, mentioned on page 2, is composed of US dollar-denominated, investment grade corporate bonds that are US Securities and Exchange Commission (SEC)-registered or 144A with registration rights, and issued by industrial, utility, and financial companies. All bonds in the index have at least one year to maturity.

The Bloomberg US Corporate High-Yield Index, mentioned on page 2, is composed of US dollar-denominated, non-investment-grade corporate bonds for which the middle rating

15

Table of Contents

Performance summaries

Delaware Extended Duration Bond Fund

among Moody’s Investors Service, Inc., Fitch, Inc., and Standard & Poor’s is Ba1/BB+/BB+ or below.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary due to different charges and expenses.

| Nasdaq symbols | | CUSIPs |

| Class A | | DEEAX | | | 245908835 |

| Class C | | DEECX | | | 245908819 |

| Class R | | DEERX | | | 245908728 |

| Institutional Class | | DEEIX | | | 245908793 |

| Class R6 | | DEZRX | | | 245908629 |

16

Table of Contents

Disclosure of Fund expenses

For the six-month period from February 1, 2022 to July 31, 2022 (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from February 1, 2022 to July 31, 2022.

Actual expenses

The first section of the tables shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds' expenses shown in the tables reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

17

Table of Contents

Disclosure of Fund expenses

For the six-month period from February 1, 2022 to July 31, 2022 (Unaudited)

Delaware Corporate Bond Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 2/1/22 | | 7/31/22 | | Expense Ratio | | 2/1/22 to 7/31/22* |

| Actual Fund return† | | | | | | | | | | | | | | | | | |

| Class A | | | $1,000.00 | | | | $904.40 | | | | 0.82 | % | | | | $3.87 | |

| Class C | | | 1,000.00 | | | | 901.00 | | | | 1.57 | % | | | | 7.40 | |

| Class R | | | 1,000.00 | | | | 901.80 | | | | 1.07 | % | | | | 5.05 | |

| Institutional Class | | | 1,000.00 | | | | 905.50 | | | | 0.57 | % | | | | 2.69 | |

| Class R6 | | | 1,000.00 | | | | 904.20 | | | | 0.47 | % | | | | 2.22 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | | |

| Class A | | | $1,000.00 | | | | $1,020.73 | | | | 0.82 | % | | | | $4.11 | |

| Class C | | | 1,000.00 | | | | 1,017.01 | | | | 1.57 | % | | | | 7.85 | |

| Class R | | | 1,000.00 | | | | 1,019.49 | | | | 1.07 | % | | | | 5.36 | |

| Institutional Class | | | 1,000.00 | | | | 1,021.97 | | | | 0.57 | % | | | | 2.86 | |

| Class R6 | | | 1,000.00 | | | | 1,022.46 | | | | 0.47 | % | | | | 2.36 | |

Delaware Extended Duration Bond Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 2/1/22 | | 7/31/22 | | Expense Ratio | | 2/1/22 to 7/31/22* |

| Actual Fund return† | | | | | | | | | | | | | | | | | |

| Class A | | | $1,000.00 | | | | $851.40 | | | | 0.82 | % | | | | $3.76 | |

| Class C | | | 1,000.00 | | | | 849.60 | | | | 1.57 | % | | | | 7.20 | |

| Class R | | | 1,000.00 | | | | 850.60 | | | | 1.07 | % | | | | 4.91 | |

| Institutional Class | | | 1,000.00 | | | | 853.50 | | | | 0.57 | % | | | | 2.62 | |

| Class R6 | | | 1,000.00 | | | | 852.50 | | | | 0.48 | % | | | | 2.20 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | | |

| Class A | | | $1,000.00 | | | | $1,020.73 | | | | 0.82 | % | | | | $4.11 | |

| Class C | | | 1,000.00 | | | | 1,017.01 | | | | 1.57 | % | | | | 7.85 | |

| Class R | | | 1,000.00 | | | | 1,019.49 | | | | 1.07 | % | | | | 5.36 | |

| Institutional Class | | | 1,000.00 | | | | 1,021.97 | | | | 0.57 | % | | | | 2.86 | |

| Class R6 | | | 1,000.00 | | | | 1,022.41 | | | | 0.48 | % | | | | 2.41 | |

| * | “Expenses Paid During Period” are equal to the relevant Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

18

Table of Contents

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

In addition to the Funds' expenses reflected on the previous page, each Fund also indirectly bears its portion of the fees and expenses of any investment companies (Underlying Funds) in which it invests. The tables on the previous page do not reflect the expenses of any Underlying Funds.

19

Table of Contents

| Security type / sector allocations |

| Delaware Corporate Bond Fund | As of July 31, 2022 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type / sector | | Percentage of net assets |

| Convertible Bonds | | | 0.39 | % | |

| Corporate Bonds | | | 88.94 | % | |

| Banking | | | 18.64 | % | |

| Basic Industry | | | 3.97 | % | |

| Brokerage | | | 1.34 | % | |

| Capital Goods | | | 5.83 | % | |

| Communications | | | 9.94 | % | |

| Consumer Cyclical | | | 3.77 | % | |

| Consumer Non-Cyclical | | | 5.88 | % | |

| Electric | | | 8.81 | % | |

| Energy | | | 7.82 | % | |

| Finance Companies | | | 3.33 | % | |

| Insurance | | | 5.28 | % | |

| Natural Gas | | | 0.77 | % | |

| Real Estate Investment Trusts | | | 2.54 | % | |

| Technology | | | 8.33 | % | |

| Transportation | | | 2.28 | % | |

| Utilities | | | 0.41 | % | |

| Municipal Bonds | | | 0.33 | % | |

| Non-Agency Asset-Backed Securities | | | 1.79 | % | |

| Loan Agreements | | | 2.52 | % | |

| US Treasury Obligation | | | 1.14 | % | |

| Convertible Preferred Stock | | | 0.25 | % | |

| Short-Term Investments | | | 4.80 | % | |

| Total Value of Securities Before Options Written | | | 100.16 | % | |

| Options Written | | | 0.00 | % | |

| Liabilities Net of Receivables and Other Assets | | | (0.16 | %) | |

| Total Net Assets | | | 100.00 | % | |

20

Table of Contents

| Security type / sector allocations |

| Delaware Extended Duration Bond Fund | As of July 31, 2022 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type / sector | | Percentage of net assets |

| Convertible Bond | | | 0.15 | % | |

| Corporate Bonds | | | 93.16 | % | |

| Banking | | | 9.45 | % | |

| Basic Industry | | | 3.93 | % | |

| Brokerage | | | 0.93 | % | |

| Capital Goods | | | 4.85 | % | |

| Communications | | | 11.28 | % | |

| Consumer Cyclical | | | 4.25 | % | |

| Consumer Non-Cyclical | | | 7.64 | % | |

| Electric | | | 14.11 | % | |

| Energy | | | 11.95 | % | |

| Finance Companies | | | 1.84 | % | |

| Insurance | | | 10.87 | % | |

| Natural Gas | | | 4.21 | % | |

| Real Estate Investment Trusts | | | 0.92 | % | |

| Technology | | | 4.79 | % | |

| Transportation | | | 1.84 | % | |

| Utilities | | | 0.30 | % | |

| Municipal Bonds | | | 2.27 | % | |

| Loan Agreements | | | 0.64 | % | |

| Convertible Preferred Stock | | | 0.86 | % | |

| Short-Term Investments | | | 2.70 | % | |

| Total Value of Securities Before Options Written | | | 99.78 | % | |

| Options Written | | | 0.00 | % | |

| Receivables and Other Assets Net of Liabilities | | | 0.22 | % | |

| Total Net Assets | | | 100.00 | % | |

21

Table of Contents

| Schedules of investments |

| Delaware Corporate Bond Fund | July 31, 2022 |

| | | | | Principal | | | |

| | | | amount° | | Value (US $) |

| Convertible Bonds – 0.39% | | | | | |

| Kaman 3.25% exercise price $65.26, maturity date | | | | | |

| | 5/1/24 | | 3,500,000 | | $ | 3,335,938 |

| Spirit Airlines 1.00% exercise price $49.07, maturity | | | | | |

| | date 5/15/26 | | 1,790,000 | | | 1,619,055 |

| Total Convertible Bonds (cost $5,106,654) | | | | | 4,954,993 |

| | | | | | | | |

| Corporate Bonds – 88.94% | | | | | |

| Banking – 18.64% | | | | | |

| Ally Financial | | | | | |

| | 4.70% 5/15/26 µ, Ψ | | 3,525,000 | | | 2,981,533 |

| | 5.75% 11/20/25 | | 4,525,000 | | | 4,588,158 |

| | 8.00% 11/1/31 | | 1,840,000 | | | 2,083,682 |

| Bank of America | | | | | |

| | 2.482% 9/21/36 µ | | 11,720,000 | | | 9,483,941 |

| | 2.676% 6/19/41 µ | | 1,795,000 | | | 1,359,151 |

| | 4.948% 7/22/28 µ | | 3,090,000 | | | 3,181,005 |

| | 5.015% 7/22/33 µ | | 1,865,000 | | | 1,946,565 |

| | 6.125% 4/27/27 µ, Ψ | | 3,505,000 | | | 3,531,288 |

| Bank of New York Mellon | | | | | |

| | 4.596% 7/26/30 µ | | 7,560,000 | | | 7,807,700 |

| | 4.70% 9/20/25 µ, Ψ | | 8,770,000 | | | 8,756,845 |

| BPCE 144A 3.582% 10/19/42 #, µ | | 2,695,000 | | | 2,017,330 |

| Fifth Third Bancorp 4.337% 4/25/33 µ | | 4,180,000 | | | 4,115,948 |

| Goldman Sachs Group | | | | | |

| | 1.542% 9/10/27 µ | | 10,839,000 | | | 9,705,456 |

| | 2.383% 7/21/32 µ | | 10,220,000 | | | 8,628,784 |

| Huntington National Bank 4.552% 5/17/28 µ | | 9,310,000 | | | 9,486,417 |

| JPMorgan Chase & Co. | | | | | |

| | 1.764% 11/19/31 µ | | 15,640,000 | | | 12,801,385 |

| | 4.851% 7/25/28 µ | | 9,705,000 | | | 9,965,178 |

| | 4.912% 7/25/33 µ | | 1,865,000 | | | 1,946,376 |

| KeyBank 4.39% 12/14/27 | | 1,445,000 | | | 1,469,244 |

| KeyCorp 4.789% 6/1/33 µ | | 2,350,000 | | | 2,391,162 |

| Morgan Stanley | | | | | |

| | 1.928% 4/28/32 µ | | 11,065,000 | | | 9,123,221 |

| | 2.484% 9/16/36 µ | | 14,899,000 | | | 12,064,577 |

| NatWest Group 4.60% 6/28/31 µ, Ψ | | 4,175,000 | | | 3,303,728 |

| PNC Bank 4.05% 7/26/28 | | 3,665,000 | | | 3,625,441 |

| PNC Financial Services Group 6.00% 5/15/27 µ, Ψ | | 3,675,000 | | | 3,707,156 |

| Popular 6.125% 9/14/23 | | 5,020,000 | | | 5,070,150 |

22

Table of Contents

| | | Principal | | | |

| | | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Banking (continued) | | | | | |

| State Street | | | | | |

| 1.684% 11/18/27 µ | | 4,165,000 | | $ | 3,810,544 |

| 2.203% 2/7/28 µ | | 3,630,000 | | | 3,381,664 |

| 4.421% 5/13/33 µ | | 2,125,000 | | | 2,178,860 |

| SVB Financial Group | | | | | |

| 2.10% 5/15/28 | | 5,155,000 | | | 4,490,279 |

| 4.00% 5/15/26 µ, ψ | | 4,072,000 | | | 3,306,060 |

| 4.57% 4/29/33 µ | | 3,810,000 | | | 3,695,839 |

| Toronto-Dominion Bank 4.108% 6/8/27 | | 9,770,000 | | | 9,890,965 |

| Truist Bank 2.636% 9/17/29 µ | | 10,460,000 | | | 9,982,100 |

| Truist Financial | | | | | |

| 4.916% 7/28/33 µ | | 5,721,000 | | | 5,776,410 |

| 4.95% 9/1/25 µ, ψ | | 8,635,000 | | | 8,747,255 |

| UBS 7.625% 8/17/22 | | 4,145,000 | | | 4,149,965 |

| UBS Group 144A 4.375% 2/10/31 #, µ, ψ | | 4,390,000 | | | 3,539,438 |

| US Bancorp | | | | | |

| 2.491% 11/3/36 µ | | 3,030,000 | | | 2,557,020 |

| 2.677% 1/27/33 µ | | 2,230,000 | | | 1,998,368 |

| 4.548% 7/22/28 µ | | 14,185,000 | | | 14,563,288 |

| Wells Fargo & Co. | | | | | |

| 4.611% 4/25/53 µ | | 3,260,000 | | | 3,197,445 |

| 4.808% 7/25/28 µ | | 8,190,000 | | | 8,385,511 |

| | | | | | 238,792,432 |

| Basic Industry – 3.97% | | | | | |

| Celanese US Holdings | | | | | |

| 6.05% 3/15/25 | | 5,245,000 | | | 5,291,412 |

| 6.165% 7/15/27 | | 1,215,000 | | | 1,234,618 |

| Georgia-Pacific 8.00% 1/15/24 | | 4,345,000 | | | 4,630,098 |

| Graphic Packaging International 144A 3.50% 3/1/29 # | | 3,155,000 | | | 2,847,928 |

| Newmont | | | | | |

| 2.25% 10/1/30 | | 3,210,000 | | | 2,742,335 |

| 2.60% 7/15/32 | | 2,570,000 | | | 2,195,643 |

| 2.80% 10/1/29 | | 9,845,000 | | | 8,909,545 |

| Sherwin-Williams 2.90% 3/15/52 | | 11,730,000 | | | 8,220,997 |

| Steel Dynamics 1.65% 10/15/27 | | 2,520,000 | | | 2,208,507 |

| Suzano Austria 3.125% 1/15/32 | | 7,100,000 | | | 5,779,507 |

| Westlake 3.125% 8/15/51 | | 9,465,000 | | | 6,809,349 |

| | | | | | 50,869,939 |

23

Table of Contents

Schedules of investments

Delaware Corporate Bond Fund

| | | Principal | | | |

| | | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Brokerage – 1.34% | | | | | |

| Blackstone Holdings Finance 144A 1.625% 8/5/28 # | | 2,865,000 | | $ | 2,491,597 |

| Charles Schwab 5.375% 6/1/25 µ, ψ | | 4,195,000 | | | 4,280,578 |

| Jefferies Group | | | | | |

| 2.625% 10/15/31 | | 10,260,000 | | | 8,287,362 |

| 6.50% 1/20/43 | | 2,090,000 | | | 2,119,056 |

| | | | | | 17,178,593 |

| Capital Goods – 5.83% | | | | | |

| Amphenol 2.20% 9/15/31 | | 3,585,000 | | | 3,050,424 |

| Ardagh Metal Packaging Finance USA 144A 4.00% | | | | | |

| 9/1/29 # | | 3,515,000 | | | 3,030,598 |

| Ashtead Capital | | | | | |

| 144A 1.50% 8/12/26 # | | 6,880,000 | | | 6,056,824 |

| 144A 2.45% 8/12/31 # | | 4,995,000 | | | 4,014,861 |

| Boeing 3.75% 2/1/50 | | 9,770,000 | | | 7,417,531 |

| Lockheed Martin | | | | | |

| 3.90% 6/15/32 | | 3,205,000 | | | 3,307,256 |

| 4.15% 6/15/53 | | 2,390,000 | | | 2,347,072 |

| Madison IAQ 144A 4.125% 6/30/28 # | | 1,880,000 | | | 1,666,253 |

| Pactiv Evergreen Group Issuer 144A 4.00% 10/15/27 # | | 3,385,000 | | | 2,986,958 |

| Parker-Hannifin 4.25% 9/15/27 | | 10,885,000 | | | 11,131,838 |

| Republic Services 2.375% 3/15/33 | | 12,537,000 | | | 10,753,231 |

| Teledyne Technologies 2.25% 4/1/28 | | 13,780,000 | | | 12,218,740 |

| Waste Connections 2.95% 1/15/52 | | 2,315,000 | | | 1,767,310 |

| Weir Group 144A 2.20% 5/13/26 # | | 5,605,000 | | | 4,966,885 |

| | | | | | 74,715,781 |

| Communications – 9.94% | | | | | |

| Altice France | | | | | |

| 144A 5.125% 1/15/29 # | | 3,720,000 | | | 3,156,067 |

| 144A 5.50% 10/15/29 # | | 3,395,000 | | | 2,923,944 |

| AMC Networks | | | | | |

| 4.25% 2/15/29 | | 600,000 | | | 529,193 |

| 4.75% 8/1/25 | | 3,325,000 | | | 3,195,807 |

| AT&T | | | | | |

| 3.50% 9/15/53 | | 16,340,000 | | | 12,937,437 |

| 4.50% 5/15/35 | | 3,270,000 | | | 3,249,574 |

| CCO Holdings | | | | | |

| 144A 4.50% 6/1/33 # | | 945,000 | | | 800,845 |

| 144A 4.75% 2/1/32 # | | 3,870,000 | | | 3,426,982 |

| Cellnex Finance 144A 3.875% 7/7/41 # | | 3,267,000 | | | 2,332,780 |

| Charter Communications Operating 3.85% 4/1/61 | | 9,585,000 | | | 6,566,019 |

24

Table of Contents

| | | Principal | | | |

| | | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Communications (continued) | | | | | |

| Comcast 3.20% 7/15/36 | | 12,674,000 | | $ | 11,330,254 |

| CSC Holdings 144A 4.50% 11/15/31 # | | 5,855,000 | | | 4,991,124 |

| Directv Financing 144A 5.875% 8/15/27 # | | 3,965,000 | | | 3,700,753 |

| Discovery Communications 4.00% 9/15/55 | | 7,970,000 | | | 5,803,039 |

| Magallanes 144A 5.141% 3/15/52 # | | 7,660,000 | | | 6,755,505 |

| Netflix 4.875% 4/15/28 | | 2,970,000 | | | 2,954,467 |

| Rogers Communications 144A 4.55% 3/15/52 # | | 1,235,000 | | | 1,159,242 |

| Sprint Spectrum 144A 4.738% 9/20/29 # | | 2,884,069 | | | 2,899,651 |

| Time Warner Cable 7.30% 7/1/38 | | 2,930,000 | | | 3,175,568 |

| Time Warner Entertainment 8.375% 3/15/23 | | 6,100,000 | | | 6,269,154 |

| T-Mobile USA | | | | | |

| 3.00% 2/15/41 | | 5,100,000 | | | 3,971,462 |

| 3.375% 4/15/29 | | 13,605,000 | | | 12,723,804 |

| Verizon Communications | | | | | |

| 2.875% 11/20/50 | | 4,285,000 | | | 3,174,383 |

| 4.50% 8/10/33 | | 10,110,000 | | | 10,301,228 |

| Virgin Media Secured Finance 144A 5.50% 5/15/29 # | | 7,158,000 | | | 6,813,306 |

| VZ Secured Financing 144A 5.00% 1/15/32 # | | 2,540,000 | | | 2,268,995 |

| | | | | | 127,410,583 |

| Consumer Cyclical – 3.77% | | | | | |

| ADT Security 144A 4.875% 7/15/32 # | | 3,663,000 | | | 3,249,795 |

| Amazon.com 2.50% 6/3/50 | | 15,385,000 | | | 11,578,942 |

| Aptiv 3.10% 12/1/51 | | 15,996,000 | | | 10,665,035 |

| General Motors 5.60% 10/15/32 | | 1,585,000 | | | 1,584,458 |

| General Motors Financial 5.70% 9/30/30 µ, ψ | | 2,922,000 | | | 2,779,553 |

| Levi Strauss & Co. 144A 3.50% 3/1/31 # | | 2,866,000 | | | 2,594,475 |

| Lowe's 2.80% 9/15/41 | | 3,855,000 | | | 2,953,571 |

| Prime Security Services Borrower 144A 3.375% | | | | | |

| 8/31/27 # | | 952,000 | | | 870,528 |

| VICI Properties 4.95% 2/15/30 | | 8,305,000 | | | 8,144,929 |

| Volkswagen Group of America Finance 144A 4.35% | | | | | |

| 6/8/27 # | | 3,845,000 | | | 3,826,897 |

| | | | | | 48,248,183 |

| Consumer Non-Cyclical – 5.88% | | | | | |

| Amgen 3.00% 1/15/52 | | 2,970,000 | | | 2,246,660 |

| Baxter International | | | | | |

| 2.539% 2/1/32 | | 3,645,000 | | | 3,167,294 |

| 3.132% 12/1/51 | | 6,660,000 | | | 5,074,834 |

| Bimbo Bakeries USA 144A 4.00% 5/17/51 # | | 3,540,000 | | | 2,946,295 |

| Bunge Finance 2.75% 5/14/31 | | 7,475,000 | | | 6,453,340 |

25

Table of Contents

Schedules of investments

Delaware Corporate Bond Fund

| | | Principal | | | |

| | | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Consumer Non-Cyclical (continued) | | | | | |

| CVS Health 2.70% 8/21/40 | | 12,941,000 | | $ | 9,873,914 |

| JBS USA LUX 144A 3.00% 2/2/29 # | | 3,287,000 | | | 2,833,614 |

| Keurig Dr Pepper 3.95% 4/15/29 | | 3,425,000 | | | 3,403,391 |

| Merck & Co. 2.75% 12/10/51 | | 4,532,000 | | | 3,528,361 |

| PepsiCo 3.90% 7/18/32 | | 3,385,000 | | | 3,502,577 |

| Perrigo Finance Unlimited 4.375% 3/15/26 | | 7,415,000 | | | 7,306,037 |

| Royalty Pharma 3.35% 9/2/51 | | 12,513,000 | | | 8,910,606 |

| Sodexo | | | | | |

| 144A 1.634% 4/16/26 # | | 5,520,000 | | | 5,082,041 |

| 144A 2.718% 4/16/31 # | | 2,290,000 | | | 2,005,674 |

| Tenet Healthcare 144A 4.25% 6/1/29 # | | 3,575,000 | | | 3,332,258 |

| US Foods 144A 4.75% 2/15/29 # | | 3,265,000 | | | 3,054,653 |

| Viatris 4.00% 6/22/50 | | 3,778,000 | | | 2,623,404 |

| | | | | | 75,344,953 |

| Electric – 8.81% | | | | | |

| Appalachian Power 4.50% 8/1/32 | | 2,415,000 | | | 2,433,362 |

| Berkshire Hathaway Energy 2.85% 5/15/51 | | 5,078,000 | | | 3,851,582 |

| Commonwealth Edison 2.75% 9/1/51 | | 5,025,000 | | | 3,783,905 |

| Duke Energy Carolinas 3.95% 11/15/28 | | 6,187,000 | | | 6,296,496 |

| Enel Finance International 144A 4.25% 6/15/25 # | | 7,357,000 | | | 7,307,687 |

| Entergy Texas 3.55% 9/30/49 | | 2,695,000 | | | 2,251,605 |

| Fells Point Funding Trust 144A 3.046% 1/31/27 # | | 4,685,000 | | | 4,415,477 |

| IPALCO Enterprises 4.25% 5/1/30 | | 3,220,000 | | | 3,070,777 |

| Liberty Utilities Finance GP 1 144A 2.05% 9/15/30 # | | 3,000,000 | | | 2,556,679 |

| NextEra Energy Capital Holdings | | | | | |

| 3.00% 1/15/52 | | 5,850,000 | | | 4,419,641 |

| 5.00% 7/15/32 | | 5,470,000 | | | 5,850,499 |

| NRG Energy | | | | | |

| 144A 2.45% 12/2/27 # | | 2,470,000 | | | 2,179,669 |

| 144A 3.375% 2/15/29 # | | 1,051,000 | | | 907,859 |

| Oglethorpe Power | | | | | |

| 3.75% 8/1/50 | | 5,235,000 | | | 4,266,923 |

| 144A 4.50% 4/1/47 # | | 5,500,000 | | | 4,931,633 |

| Pacific Gas and Electric | | | | | |

| 3.30% 8/1/40 | | 1,125,000 | | | 823,091 |

| 3.50% 8/1/50 | | 1,690,000 | | | 1,197,552 |

| 4.60% 6/15/43 | | 4,405,000 | | | 3,492,249 |

| 4.95% 7/1/50 | | 3,615,000 | | | 3,000,776 |

| PacifiCorp 2.90% 6/15/52 | | 13,799,000 | | | 10,615,231 |

| Public Service Co. of Colorado 4.10% 6/1/32 | | 6,405,000 | | | 6,609,651 |

26

Table of Contents

| | | Principal | | | |

| | | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Electric (continued) | | | | | |

| Public Service Co. of Oklahoma 3.15% 8/15/51 | | 4,285,000 | | $ | 3,278,146 |

| San Diego Gas & Electric 3.32% 4/15/50 | | 2,270,000 | | | 1,853,532 |

| Southern California Edison | | | | | |

| 3.45% 2/1/52 | | 1,680,000 | | | 1,326,416 |

| 4.125% 3/1/48 | | 3,090,000 | | | 2,680,104 |

| 4.875% 3/1/49 | | 1,865,000 | | | 1,767,037 |

| 6.00% 1/15/34 | | 1,415,000 | | | 1,566,727 |

| Southwestern Electric Power 3.25% 11/1/51 | | 4,281,000 | | | 3,296,731 |

| Vistra Operations | | | | | |

| 144A 3.55% 7/15/24 # | | 4,381,000 | | | 4,248,242 |

| 144A 5.125% 5/13/25 # | | 2,360,000 | | | 2,362,537 |

| Xcel Energy 4.60% 6/1/32 | | 6,075,000 | | | 6,303,277 |

| | | | | | 112,945,093 |

| Energy – 7.82% | | | | | |

| BP Capital Markets 4.875% 3/22/30 µ, ψ | | 8,805,000 | | | 8,032,292 |

| BP Capital Markets America 2.939% 6/4/51 | | 2,260,000 | | | 1,708,733 |

| Cheniere Corpus Christi Holdings 7.00% 6/30/24 | | 6,760,000 | | | 7,014,181 |

| ConocoPhillips 3.80% 3/15/52 | | 5,860,000 | | | 5,266,036 |

| Continental Resources | | | | | |

| 144A 2.875% 4/1/32 # | | 3,721,000 | | | 3,042,029 |

| 4.375% 1/15/28 | | 2,809,000 | | | 2,710,750 |

| Diamondback Energy | | | | | |

| 3.125% 3/24/31 | | 4,840,000 | | | 4,384,175 |

| 4.25% 3/15/52 | | 2,125,000 | | | 1,828,501 |

| Enbridge | | | | | |

| 1.60% 10/4/26 | | 3,180,000 | | | 2,905,780 |

| 5.75% 7/15/80 µ | | 4,710,000 | | | 4,448,124 |

| Energy Transfer | | | | | |

| 6.25% 4/15/49 | | 3,410,000 | | | 3,416,842 |

| 6.50% 11/15/26 µ, ψ | | 9,654,000 | | | 8,785,140 |

| Enterprise Products Operating 3.30% 2/15/53 | | 8,920,000 | | | 6,973,734 |

| EQM Midstream Partners 144A 4.75% 1/15/31 # | | 3,775,000 | | | 3,419,489 |

| Galaxy Pipeline Assets Bidco 144A 2.94% 9/30/40 # | | 4,181,006 | | | 3,523,921 |

| Kinder Morgan 5.45% 8/1/52 | | 6,365,000 | | | 6,390,043 |

| NuStar Logistics 5.625% 4/28/27 | | 4,294,000 | | | 4,114,446 |

| ONEOK 7.50% 9/1/23 | | 6,625,000 | | | 6,823,266 |

| Targa Resources Partners | | | | | |

| 4.00% 1/15/32 | | 2,880,000 | | | 2,573,971 |

| 4.875% 2/1/31 | | 3,225,000 | | | 3,035,800 |

| 5.00% 1/15/28 | | 2,810,000 | | | 2,763,888 |

27

Table of Contents

Schedules of investments

Delaware Corporate Bond Fund

| | | Principal | | | |

| | | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Energy (continued) | | | | | |

| Valero Energy 3.65% 12/1/51 | | 8,850,000 | | $ | 7,045,950 |

| | | | | | 100,207,091 |

| Finance Companies – 3.33% | | | | | |

| AerCap Ireland Capital DAC | | | | | |

| 3.00% 10/29/28 | | 5,966,000 | | | 5,238,597 |

| 3.40% 10/29/33 | | 6,712,000 | | | 5,545,806 |

| Air Lease | | | | | |

| 2.875% 1/15/32 | | 3,880,000 | | | 3,200,738 |

| 4.125% 12/15/26 µ, ψ | | 4,080,000 | | | 3,050,451 |

| Aviation Capital Group | | | | | |

| 144A 1.95% 1/30/26 # | | 7,894,000 | | | 6,908,770 |

| 144A 5.50% 12/15/24 # | | 8,565,000 | | | 8,505,609 |

| Avolon Holdings Funding 144A 2.75% 2/21/28 # | | 9,935,000 | | | 8,226,085 |

| DAE Sukuk DIFC 144A 3.75% 2/15/26 # | | 2,140,000 | | | 2,033,663 |

| | | | | | 42,709,719 |

| Insurance – 5.28% | | | | | |

| Aon 2.90% 8/23/51 | | 7,710,000 | | | 5,638,611 |

| Athene Global Funding 144A 1.985% 8/19/28 # | | 4,980,000 | | | 4,222,768 |

| Athene Holding | | | | | |

| 3.45% 5/15/52 | | 3,215,000 | | | 2,261,576 |

| 3.95% 5/25/51 | | 5,365,000 | | | 4,043,517 |

| Berkshire Hathaway Finance 3.85% 3/15/52 | | 9,335,000 | | | 8,479,633 |

| Brighthouse Financial | | | | | |

| 3.85% 12/22/51 | | 2,395,000 | | | 1,668,992 |

| 4.70% 6/22/47 | | 9,863,000 | | | 8,052,181 |

| Global Atlantic 144A 4.70% 10/15/51 #, µ | | 5,070,000 | | | 4,206,781 |

| Hartford Financial Services Group 2.90% 9/15/51 | | 3,625,000 | | | 2,618,624 |

| Humana 1.35% 2/3/27 | | 4,087,000 | | | 3,672,337 |

| Jackson Financial | | | | | |

| 144A 3.125% 11/23/31 # | | 3,140,000 | | | 2,554,414 |

| 144A 4.00% 11/23/51 # | | 135,000 | | | 95,554 |

| Prudential Financial 3.70% 10/1/50 µ | | 7,005,000 | | | 6,141,660 |

| UnitedHealth Group 4.00% 5/15/29 | | 13,655,000 | | | 14,021,388 |

| | | | | | 67,678,036 |

| Natural Gas – 0.77% | | | | | |

| Atmos Energy 2.85% 2/15/52 | | 473,000 | | | 359,718 |

28

Table of Contents

| | | | | Principal | | | |

| | | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Natural Gas (continued) | | | | | |

| Sempra Energy | | | | | |

| | 4.125% 4/1/52 µ | | 2,775,000 | | $ | 2,349,082 |

| | 4.875% 10/15/25 µ, Ψ | | 7,360,000 | | | 7,153,326 |

| | | | | | | 9,862,126 |

| Real Estate Investment Trusts – 2.54% | | | | | |

| American Homes 4 Rent 3.625% 4/15/32 | | 4,840,000 | | | 4,395,828 |

| Corporate Office Properties 2.75% 4/15/31 | | 5,520,000 | | | 4,516,183 |

| Crown Castle | | | | | |

| | 1.05% 7/15/26 | | 5,500,000 | | | 4,897,105 |

| | 2.10% 4/1/31 | | 4,563,000 | | | 3,806,745 |

| Extra Space Storage 2.35% 3/15/32 | | 9,040,000 | | | 7,341,766 |

| Global Net Lease 144A 3.75% 12/15/27 # | | 3,160,000 | | | 2,773,376 |

| MPT Operating Partnership 3.50% 3/15/31 | | 3,180,000 | | | 2,744,658 |

| Public Storage 1.85% 5/1/28 | | 2,240,000 | | | 2,012,031 |

| | | | | | | 32,487,692 |

| Technology – 8.33% | | | | | |

| Alphabet 2.05% 8/15/50 | | 10,280,000 | | | 7,352,205 |

| Autodesk 2.40% 12/15/31 | | 7,435,000 | | | 6,371,859 |

| Broadcom 144A 3.469% 4/15/34 # | | 9,922,000 | | | 8,503,074 |

| Broadridge Financial Solutions 2.60% 5/1/31 | | 8,112,000 | | | 7,066,119 |

| CDW 3.276% 12/1/28 | | 11,570,000 | | | 10,191,911 |

| Clarivate Science Holdings 144A 3.875% 7/1/28 # | | 3,763,000 | | | 3,432,872 |

| CoStar Group 144A 2.80% 7/15/30 # | | 4,235,000 | | | 3,587,392 |

| Entegris Escrow | | | | | |

| | 144A 4.75% 4/15/29 # | | 3,650,000 | | | 3,522,250 |

| | 144A 5.95% 6/15/30 # | | 3,680,000 | | | 3,657,221 |

| Fidelity National Information Services 4.70% 7/15/27 | | 1,505,000 | | | 1,540,281 |

| Global Payments | | | | | |

| | 2.15% 1/15/27 | | 2,335,000 | | | 2,118,312 |

| | 2.90% 11/15/31 | | 6,595,000 | | | 5,555,191 |

| KLA 4.95% 7/15/52 | | 4,345,000 | | | 4,683,326 |

| Marvell Technology | | | | | |

| | 1.65% 4/15/26 | | 4,460,000 | | | 4,094,861 |

| | 2.45% 4/15/28 | | 2,820,000 | | | 2,517,671 |

| NCR 144A 5.125% 4/15/29 # | | 3,525,000 | | | 3,392,002 |

| NXP | | | | | |

| | 3.125% 2/15/42 | | 2,940,000 | | | 2,221,094 |

| | 4.40% 6/1/27 | | 2,010,000 | | | 2,017,167 |

| | 5.55% 12/1/28 | | 3,750,000 | | | 3,899,902 |

29

Table of Contents

Schedules of investments

Delaware Corporate Bond Fund

| | | | | Principal | | | |

| | | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Technology (continued) | | | | | |

| PayPal Holdings | | | | | |

| | 3.90% 6/1/27 | | 9,490,000 | | $ | 9,679,638 |

| | 4.40% 6/1/32 | | 2,475,000 | | | 2,569,539 |

| Sensata Technologies 144A 3.75% 2/15/31 # | | 4,715,000 | | | 4,103,276 |

| Workday | | | | | |

| | 3.50% 4/1/27 | | 590,000 | | | 579,663 |

| | 3.70% 4/1/29 | | 915,000 | | | 883,529 |

| | 3.80% 4/1/32 | | 3,285,000 | | | 3,137,656 |

| | | | | | | 106,678,011 |

| Transportation – 2.28% | | | | | |

| Burlington Northern Santa Fe 2.875% 6/15/52 | | 5,602,000 | | | 4,438,291 |

| DAE Funding | | | | | |

| | 144A 1.55% 8/1/24 # | | 2,260,000 | | | 2,117,278 |

| | 144A 3.375% 3/20/28 # | | 1,105,000 | | | 976,197 |

| Delta Air Lines 144A 7.00% 5/1/25 # | | 4,097,000 | | | 4,283,800 |

| Mileage Plus Holdings 144A 6.50% 6/20/27 # | | 5,115,000 | | | 5,174,053 |

| Penske Truck Leasing 144A 4.40% 7/1/27 # | | 8,115,000 | | | 8,124,524 |

| Seaspan 144A 5.50% 8/1/29 # | | 3,050,000 | | | 2,394,616 |

| United Airlines 2019-1 Class AA Pass Through Trust | | | | | |

| | Series 2019-1 AA 4.15% 2/25/33 ◆ | | 1,767,857 | | | 1,675,812 |

| | | | | | | 29,184,571 |

| Utilities – 0.41% | | | | | |

| American Water Capital 4.45% 6/1/32 | | 5,080,000 | | | 5,256,236 |

| | | | | | | 5,256,236 |

| Total Corporate Bonds (cost $1,253,533,411) | | | | | 1,139,569,039 |

| | | | | | | |

| Municipal Bonds – 0.33% | | | | | |

| Commonwealth of Puerto Rico | | | | | |

| | (Restructured) | | | | | |

| | Series A-1 2.993% 7/1/24^ | | 60,624 | | | 56,412 |

| | Series A-1 4.00% 7/1/33 | | 182,199 | | | 174,860 |

| | Series A-1 4.00% 7/1/35 | | 132,326 | | | 125,273 |

| | Series A-1 4.00% 7/1/37 | | 140,560 | | | 131,670 |

| | Series A-1 4.364% 7/1/33^ | | 234,472 | | | 139,736 |

| | Series A-1 5.625% 7/1/29 | | 153,227 | | | 169,593 |

| GDB Debt Recovery Authority of Puerto Rico (Taxable) | | | | | |