UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-02071 |

| | |

| Exact name of registrant as specified in charter: | Delaware Group® Income Funds |

| | |

| Address of principal executive offices: | 610 Market Street Philadelphia, PA 19106 |

| | |

| Name and address of agent for service: | David F. Connor, Esq. 610 Market Street Philadelphia, PA 19106 |

| | |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| | |

| Date of fiscal year end: | July 31 |

| | |

| Date of reporting period: | July 31, 2023 |

Item 1. Reports to Stockholders

Annual report

Fixed income mutual funds

Delaware Corporate Bond Fund

Delaware Extended Duration Bond Fund

July 31, 2023

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus and their summary prospectuses, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Experience Delaware Funds by Macquarie®

Macquarie Asset Management (MAM) is a global asset manager that aims to deliver positive impact for everyone. MAM Public Investments traces its roots to 1929 and partners with institutional and individual clients to deliver specialist active investment capabilities across global equities, fixed income, and multi-asset solutions using a conviction-based, long-term approach to investing. In the US, retail investors recognize our Delaware Funds by Macquarie family of funds as one of the oldest mutual fund families.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Corporate Bond Fund and Delaware Extended Duration Bond Fund at delawarefunds.com/literature.

Manage your account online

| ● | Check your account balance and transactions |

| ● | View statements and tax forms |

| ● | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) is the asset management division of Macquarie Group. MAM is a full-service asset manager offering a diverse range of products across public and private markets including fixed income, equities, multi-asset solutions, private credit, infrastructure, renewables, natural assets, real estate, and asset finance. The Public Investments business is a part of MAM and includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

The Funds are distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited ABN 46 008 583 542 (“Macquarie Bank”), any Macquarie Group entity noted in this document is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

The Funds are governed by US laws and regulations.

Table of contents

This annual report is for the information of Delaware Corporate Bond Fund and Delaware Extended Duration Bond Fund shareholders, but it may be used with prospective investors when preceded or accompanied by the Delaware Fund fact sheet for the most recently completed calendar quarter. These documents are available at delawarefunds.com/literature.

Unless otherwise noted, views expressed herein are current as of July 31, 2023, and subject to change for events occurring after such date.

The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor. All third-party marks cited are the property of their respective owners.

© 2023 Macquarie Management Holdings, Inc.

Portfolio management reviews

| Delaware Corporate Bond Fund and | |

| Delaware Extended Duration Bond Fund | July 31, 2023 (Unaudited) |

Performance preview (for the year ended July 31, 2023)

| Delaware Corporate Bond Fund (Institutional Class shares) | 1-year return | -1.91% |

| Delaware Corporate Bond Fund (Class A shares) | 1-year return | -2.15% |

| Bloomberg US Corporate Bond Index (benchmark) | 1-year return | -1.30% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Corporate Bond Fund, please see the table on page 6. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 9 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| Delaware Extended Duration Bond Fund (Institutional Class shares) | 1-year return | -4.90% |

| Delaware Extended Duration Bond Fund (Class A shares) | 1-year return | -5.12% |

| Bloomberg Long US Corporate Index (benchmark) | 1-year return | -3.78% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Extended Duration Bond Fund, please see the table on page 11.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 14 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Funds seek to provide investors with total return.

Market review

The Funds’ fiscal year ended July 31, 2023, began much as the previous period ended, with investment grade debt weakening further as the US Federal Reserve continued its assault on inflation by raising interest rates. In the final quarter of 2022, however, the investment grade market showed marked signs of improvement with indications that the Fed’s aggressive series of rate hikes was achieving its desired effect. That fueled investor demand as yields reached historically attractive levels. While the full calendar year 2022 was one of the weakest ever for fixed income markets, investors had cause for optimism when 2023 began.

Investor sentiment reversed abruptly in March 2023 with the collapse of Silicon Valley Bank (SVB). We held SVB in both Funds during the fiscal year; however, Delaware Extended Duration Bond Fund held no exposure to the name when the bank released the news. While the bank’s sudden failure was an isolated event involving a large percentage of uninsured deposits, mismatched liabilities, and inadequate risk management, it set off a near panic that threatened to engulf the entire regional banking sector. The Fed’s quick action, however, enabled banks to meet

Portfolio management reviews

Delaware Corporate Bond Fund and

Delaware Extended Duration Bond Fund

obligations without having to sell bonds at a loss, as SVB did (along with Signature Bank and First Republic). While that was sufficient to stabilize the US banking system, it did not prevent Credit Suisse Group from succumbing to investor pressure. Only the intervention of the Swiss authorities, which engineered a takeover by UBS Group, eased the looming banking crisis.

Throughout the fiscal period, we anticipated several potential pitfalls that, surprisingly in our view, did not materialize. The war in Ukraine is a case in point. Starting just months before the Funds’ fiscal year began, the conflict continued throughout the 12-month period. As did most of Europe, we anticipated supply disruptions, particularly for food, energy, and several vital commodities. We thought that the war, taking place in the breadbasket of Europe, would have an adverse impact throughout the region and beyond. Early in the war, Russia shut down a large natural gas supply that threatened the winter heating season in Europe. This pressured energy prices, and food prices increased as well – though perhaps due largely to overall inflation already being high due to factors unrelated to the war – but all in all, we were surprised by how well financial markets navigated the situation.

Our concern about Europe was much broader than the war in Ukraine. When Credit Suisse showed signs of distress, we thought that higher energy costs, food shortages, and supply disruptions combined with banking turmoil would lead the region into a recession. Here again, our concern did not manifest itself. Demand, and the ability to navigate the supply-side disruptions, has been noteworthy, in our view.

We think that central banks – the Fed and the European Central Bank (ECB) in particular – deserve credit for their handling of the inflationary pressures that took hold in the wake of the pandemic and the lifting of economic lockdowns. In all candor, we thought the Fed should have gone more slowly and waited to see if negative effects resulted from its aggressive rate-tightening regime. The Fed raised rates seven times during the 12-month period, taking the federal funds rate from 2.25% in August 2022 to 5.25% in July 2023. Much to our surprise, the housing market barely reacted, labor markets were incredibly resilient, and bank lending conditions didn’t cause massive deterioration on Main Street. While you could argue that SVB, Signature Bank, First Republic, and Credit Suisse were casualties, we think that was the direct result of management teams that took their eye off the ball from a risk-management perspective. After four to five years of near-zero interest rates, the Fed has taken notable steps towards achieving its goal without severe damage to the economy.

The ECB has been just as aggressive, with similar results. For the past few years, interest rates in Europe had been near zero, even negative. In just 18 months, though, the ECB brought rates nearly in line with the Fed. That has created a bit of a headwind for US credit markets. With higher interest rates, investing in Europe became more attractive than it had been for the past five years. While the investment grade market in the US had benefited from offshore investors’ demand, we were not surprised that as European rates increased, the US market grew less attractive to offshore investors.

What did surprise us is that demand for investment grade corporate bonds increased from US entities during the same period. Now that yields are in the 5.5% to 6.0% range, we’re seeing increased demand domestically from pension funds, companies, and individual

investors. As the fiscal period came to a close, inflation was still stubbornly elevated. But at these yields, even if inflation recedes, the real yield could exceed anything that investors have seen in years. In the near term, we believe investors’ return on fixed income may even exceed the return on stocks in a mediocre equity market.

High yield bonds outperformed investment grade credits during the Fund’s fiscal year. High yield benefited from less rate sensitivity when rates steadily advanced early in the fiscal year. More recently, macroeconomic conditions were favorable, and investor sentiment was positive. With investors holding the Fed in a favorable light, a risk-on mood generated strong performance in high yield.

Source: Bloomberg, unless otherwise noted.

Within the Funds

For the fiscal year ended July 31, 2023, Delaware Corporate Bond Fund posted a negative return and underperformed its benchmark, the Bloomberg US Corporate Bond Index. The Fund’s Institutional Class shares fell 1.91%. The Fund’s Class A shares declined 2.15% at net asset value and fell 6.53% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the benchmark declined 1.30%. For complete, annualized performance of Delaware Corporate Bond Fund, please see the table on page 6.

During the same period, Delaware Extended Duration Bond Fund posted a negative return and underperformed its benchmark, the Bloomberg Long US Corporate Index. The Fund’s Institutional Class shares fell 4.90%. The Fund’s Class A shares declined 5.12% at net asset value and fell 9.42% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the benchmark declined 3.78%. For complete, annualized performance of Delaware Extended Duration Bond Fund, please see the table on page 11.

Duration, a measure of a portfolio’s sensitivity to higher interest rates, was the chief culprit in the underperformance of both Funds. With the longer duration of the Funds’ holdings on average, higher interest rates drove the prices of credits held in the portfolios lower. Given the difficulties in navigating a fraught investment environment, we think it is notable that we had only a few investments that particularly underperformed, the first and most significant of which was SVB in Delaware Corporate Bond Fund. On the plus side, both Funds benefited from out-of-benchmark investments in high yield securities, which generally outperformed their investment grade counterparts through the fiscal year by virtue of their inherent lower duration.

Both Funds performed well in the last five months of 2022. When the Fed began raising rates in March 2022, we tried to insulate the Funds from further rate increases by reducing duration. Whereas in the previous fiscal period we thought that rates would not rise as rapidly as they did, in this past period we took a more cautious approach. We expected that rates would continue to rise and that credit spreads, the difference in yield between corporate bonds and Treasurys, would widen. Higher interest rates and tighter lending conditions have historically led to wider credit spreads. We think spreads were highly optimistic, reflecting investors’ belief that the Fed would engineer a soft landing. Consequently, we were more prepared for volatility in the spread market.

Portfolio management reviews

Delaware Corporate Bond Fund and

Delaware Extended Duration Bond Fund

Delaware Corporate Bond Fund

Early in the Fund’s fiscal year, we were concerned that a consumer slowdown, higher inflation that adversely affected profit margins, and the ongoing war in Ukraine were all risks confronting the Fund. We wanted to adopt a more defensive position and we achieved that by increasing the credit quality of the Fund’s portfolio.

We began by reducing the Fund’s overweight to BBB-rated bonds and investing in higher-quality credits. We purchased higher-quality bonds, such as Alphabet Inc. (Google), at very low dollar prices. That enabled us to create a convex profile in the Fund, meaning that if rates continued to go up, there would be less pressure on the price of those bonds.

As 2023 began, we also reduced the Fund’s exposure to high yield securities. When investing in high yield, we want to feel compelled that the valuations of high yield warrant going out of index into that part of the asset class. When both valuations and risks increased, however, we reduced the Fund’s exposure to high yield from 12.0% at the beginning of the fiscal year to 10.5% at the end of the fiscal year.

During the fiscal year, the Fund benefited by underweighting longer-dated issues in the healthcare, pharmaceutical, and food and beverage industries. Usually considered defensive businesses, valuations in these industries had become high, and long-duration credits were volatile. The Fund also benefited from security selection in capital goods, particularly its investments in aerospace-defense and building materials. Finance was another contributor, stemming from the Fund’s exposure to shorter-dated aircraft lessors that reported solid operating metrics during the 12-month period.

Banking was the weakest-performing sector during the fiscal period, due to the Fund’s exposure to regional banking, especially SVB. We generally consider regional banks to be more defensive than the large money-center banks, given that the smaller banks engage in less trading and merger and acquisition activity, which can be problematic when capital markets enter a downturn. As a result, the Fund’s overweight to regional banks, driven by our defensive mindset, underperformed in the SVB debacle.

The Fund’s overweight to utilities, traditionally a longer-duration sector, also detracted from performance during a period of rising interest rates, while the Fund’s exposure to basic industry suffered from poor security selection within the paper and metals and mining sectors. The Fund also had exposure to Treasurys that detracted from performance. As part of our defensive posture, we had built up some cash in the portfolio, which has no duration. We hedged that with Treasurys, to add some duration. But in a period of rising interest rates, that detracted from performance.

Looking at individual credits, defense contractor Lockheed Martin Corp. contributed to the Fund’s performance as its credit rating improved. Oracle Corp. also contributed to performance, owing to an attractively priced issue. Morgan Stanley performed well with an attractively priced new issue. Additionally, a new attractively priced issue from Southern California Gas, a subsidiary of Sempra Energy, also contributed to performance during the 12-month period.

SVB, PacifiCorp, and UBS Group AG were the leading detractors from the Fund’s performance during the fiscal year. Bonds issued by PacifiCorp declined after the

company was found liable for damages related to 2020 wildfires in Oregon. UBS detracted from performance due to its acquisition of Credit Suisse Group. Despite the takeover, the financial collapse of Credit Suisse resulted in its bonds underperforming.

During the fiscal year, we made minimal use of US Treasury futures to adjust the overall duration of the Fund. This exposure had no material impact on Fund performance.

Delaware Extended Duration Bond Fund

Delaware Extended Duration Bond Fund is designed to provide investors with access to the long end of the US investment grade corporate market. The management of the Fund is strategically similar to that of Delaware Corporate Bond Fund. Since many companies do not issue longer-duration bonds, however, we seek out additional opportunities as needed to complete the Fund’s portfolio.

During periods of rising rates, including this fiscal year, Delaware Extended Duration Bond Fund is at a distinct disadvantage. With its emphasis on longer-duration issues, the Fund is more sensitive to higher rates than Delaware Corporate Bond Fund. However, offsetting that built-in headwind, the Fund benefited by virtue of having less exposure to the banking sector than Delaware Corporate Bond Fund. We tend not to find much value in the long bonds of banks, so the Fund’s exposure to the sector was much more in line with the Index and thus did not detract significantly from performance.

The Fund benefited from underweight positions in the transportation and communication sectors. The Fund’s less-then-benchmark exposure contributed to performance in these sectors that typically feature longer-duration issues.

Conversely, the Fund’s overweight exposure to both insurance and utilities, also traditionally long-duration sectors, detracted from performance in a period of rising interest rates. In the energy sector, adverse security selection within the independent and refining subsectors detracted from performance.

Like Delaware Corporate Bond Fund, Lockheed Martin and Oracle Corp. also added to performance in Delaware Extended Duration Bond Fund, for the reasons mentioned earlier.

Again, similar to Delaware Corporate Bond Fund, PacifiCorp was a leading detractor from performance during the fiscal period. JPMorgan Chase & Co. detracted from performance as its significant overweight to the long end of the credit curve underperformed the benchmark. AT&T Inc. also underperformed due to concerns that lead cables buried decades ago were a potential environmental liability.

During the fiscal year, the Fund made minimal use of Treasury futures to hedge out unwanted exposures to the Treasury yield curve. That exposure had no material impact on Fund performance.

Performance summaries

| Delaware Corporate Bond Fund | July 31, 2023 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through July 31, 2023 |

| | 1 year | 5 year | 10 year | Lifetime |

| Class A (Est. September 15, 1998) | | | | |

| Excluding sales charge | -2.15% | +1.52% | +2.32% | — |

| Including sales charge | -6.53% | +0.60% | +1.85% | — |

| Class C (Est. September 15, 1998) | | | | |

| Excluding sales charge | -2.87% | +0.76% | +1.54% | — |

| Including sales charge | -3.82% | +0.76% | +1.54% | — |

| Class R (Est. June 2, 2003) | | | | |

| Excluding sales charge | -2.33% | +1.24% | +2.05% | — |

| Including sales charge | -2.33% | +1.24% | +2.05% | — |

| Institutional Class (Est. September 15, 1998) | | | | |

| Excluding sales charge | -1.91% | +1.77% | +2.57% | — |

| Including sales charge | -1.91% | +1.77% | +2.57% | — |

| Class R6 (Est. January 31, 2019) | | | | |

| Excluding sales charge | -1.71% | — | — | +1.64% |

| Including sales charge | -1.71% | — | — | +1.64% |

| Bloomberg US Corporate Bond Index | -1.30% | +1.67% | +2.58% | — |

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed in the “Fund expense ratios” table on page 8. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service (12b-1) fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no 12b-1 fee.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

Fixed income securities and bond funds can lose value, and investors can lose principal as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. This includes prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult to obtain precise valuations of the high yield securities.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

Performance summaries

Delaware Corporate Bond Fund

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. The expense ratios below may differ from the expense ratios in the “Financial highlights” since they are based on different time periods and the expense ratios in the prospectus include acquired fund fees and expenses, if any. See Note 2 in “Notes to financial statements” for additional details. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| Fund expense ratios | Class A | Class C | Class R | Institutional

Class | Class R6 |

| Total annual operating expenses (without fee waivers) | 0.91% | 1.66% | 1.16% | 0.66% | 0.57% |

| Net expenses (including fee waivers, if any) | 0.82% | 1.57% | 1.07% | 0.57% | 0.48% |

| Type of waiver | Contractual | Contractual | Contractual | Contractual | Contractual |

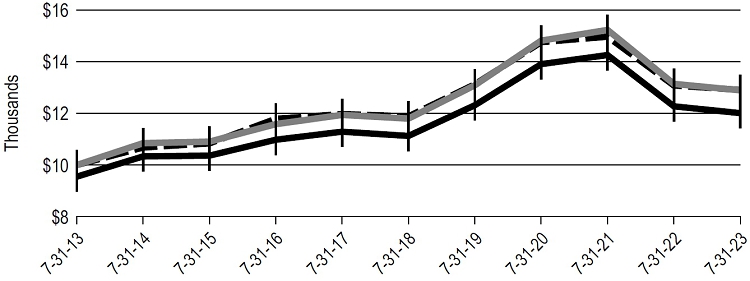

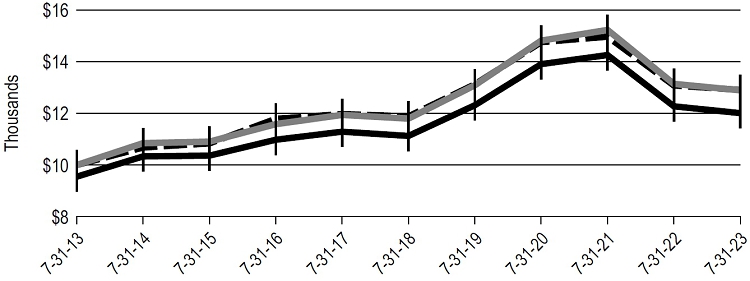

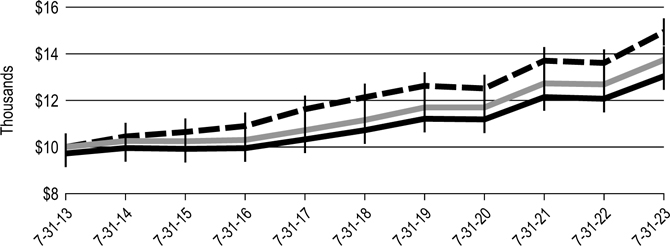

Performance of a $10,000 investment1

For the period July 31, 2013 through July 31, 2023

| | | | | | |

| | | | Starting value | | Ending value |

| Bloomberg US Corporate Bond Index | | $ | 10,000 | | | $ | 12,907 | |

| Delaware Corporate Bond Fund − Institutional Class shares | | $ | 10,000 | | | $ | 12,890 | |

| Delaware Corporate Bond Fund − Class A shares | | $ | 9,550 | | | $ | 12,008 | |

1The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on July 31, 2013, and includes the effect of a 4.50% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 8. Please note additional details on pages 6 through 10.

The graph also assumes $10,000 invested in the Bloomberg US Corporate Bond Index as of July 31, 2013. The Bloomberg US Corporate Bond Index, formerly also known as the Bloomberg US Corporate Investment Grade Index, is composed of US dollar-denominated, investment grade corporate bonds that are SEC-registered or 144A with registration rights, and issued by industrial, utility, and financial companies. All bonds in the index have at least one year to maturity.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary due to different charges and expenses.

Performance summaries

Delaware Corporate Bond Fund

| | Nasdaq symbols | | CUSIPs | |

| Class A | DGCAX | | 245908785 | |

| Class C | DGCCX | | 245908769 | |

| Class R | DGCRX | | 245908744 | |

| Institutional Class | DGCIX | | 245908751 | |

| Class R6 | DGCZX | | 24610J100 | |

Performance summaries

| Delaware Extended Duration Bond Fund | July 31, 2023 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through July 31, 2023 |

| | 1 year | 5 year | 10 year | Lifetime |

| Class A (Est. September 15, 1998) | | | | |

| Excluding sales charge | -5.12% | +0.70% | +2.78% | — |

| Including sales charge | -9.42% | -0.23% | +2.30% | — |

| Class C (Est. September 15, 1998) | | | | |

| Excluding sales charge | -5.95% | -0.04% | +2.00% | — |

| Including sales charge | -6.86% | -0.04% | +2.00% | — |

| Class R (Est. October 3, 2005) | | | | |

| Excluding sales charge | -5.40% | +0.44% | +2.51% | — |

| Including sales charge | -5.40% | +0.44% | +2.51% | — |

| Institutional Class (Est. September 15, 1998) | | | | |

| Excluding sales charge | -4.90% | +0.95% | +3.03% | — |

| Including sales charge | -4.90% | +0.95% | +3.03% | — |

| Class R6 (Est. May 2, 2016) | | | | |

| Excluding sales charge | -4.74% | +1.05% | — | +1.69% |

| Including sales charge | -4.74% | +1.05% | — | +1.69% |

| Bloomberg Long US Corporate Index | -3.78% | +1.25% | +3.39% | — |

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed in the “Fund expense ratios” table on page 13. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service (12b-1) fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold

Performance summaries

Delaware Extended Duration Bond Fund

without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no 12b-1 fee.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

Fixed income securities and bond funds can lose value, and investors can lose principal as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. This includes prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult to obtain precise valuations of the high yield securities.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. The expense ratios below may differ from the expense ratios in the “Financial highlights” since they are based on different time periods and the expense ratios in the prospectus include acquired fund fees and expenses, if any. See Note 2 in “Notes to financial statements” for additional details. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| Fund expense ratios | Class A | Class C | Class R | Institutional

Class | Class R6 |

| Total annual operating expenses (without fee waivers) | 1.01% | 1.76% | 1.26% | 0.76% | 0.66% |

| Net expenses (including fee waivers, if any) | 0.82% | 1.57% | 1.07% | 0.57% | 0.47% |

| Type of waiver | Contractual | Contractual | Contractual | Contractual | Contractual |

Performance summaries

Delaware Extended Duration Bond Fund

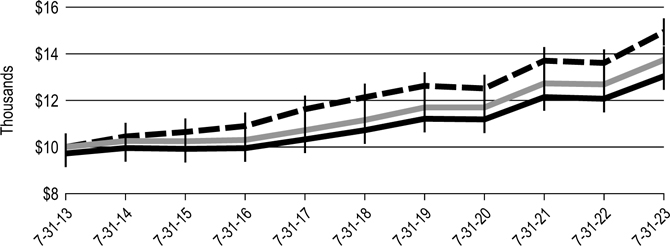

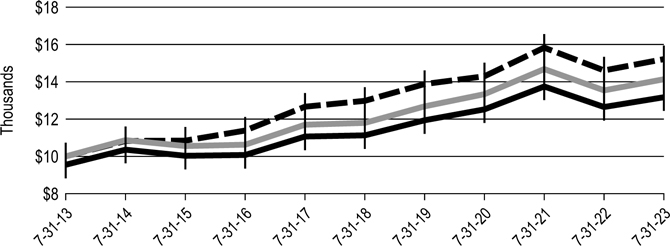

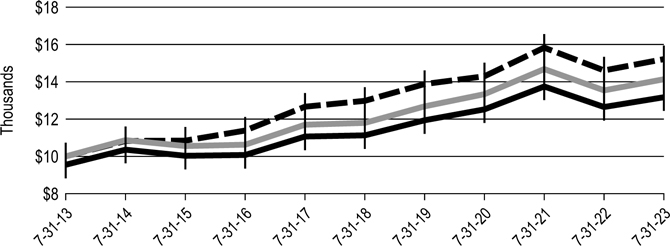

Performance of a $10,000 investment1

For the period July 31, 2013 through July 31, 2023

| | | | | | |

| | | | Starting value | | Ending value |

| Bloomberg Long US Corporate Index | | $ | 10,000 | | | $ | 13,963 | |

| Delaware Extended Duration Bond Fund − Institutional Class shares | | $ | 10,000 | | | $ | 13,480 | |

| Delaware Extended Duration Bond Fund − Class A shares | | $ | 9,550 | | | $ | 12,550 | |

1The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on July 31, 2013, and includes the effect of a 4.50% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 13. Please note additional details on pages 11 through 15.

The graph also assumes $10,000 invested in the Bloomberg Long US Corporate Index as of July 31, 2013. The Bloomberg Long US Corporate Index is composed of US dollar-denominated, investment grade corporate bonds that are SEC-registered or 144A with registration rights, and issued by industrial, utility, and financial companies. All bonds in the index have at least 10 years to maturity.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | Nasdaq symbols | | CUSIPs | |

| Class A | DEEAX | | 245908835 | |

| Class C | DEECX | | 245908819 | |

| Class R | DEERX | | 245908728 | |

| Institutional Class | DEEIX | | 245908793 | |

| Class R6 | DEZRX | | 245908629 | |

Disclosure of Fund expenses

For the six-month period from February 1, 2023 to July 31, 2023 (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from February 1, 2023 to July 31, 2023.

Actual expenses

The first section of the tables shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

Delaware Corporate Bond Fund

Expense analysis of an investment of $1,000

| | | Beginning

Account Value

2/1/23 | | Ending

Account Value

7/31/23 | | Annualized

Expense Ratio | | Expenses

Paid During Period

2/1/23 to 7/31/23* |

| Actual Fund return† | | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 987.30 | | | 0.82% | | $ | 4.04 | |

| Class C | | | 1,000.00 | | | | 983.00 | | | 1.57% | | | 7.72 | |

| Class R | | | 1,000.00 | | | | 985.50 | | | 1.07% | | | 5.27 | |

| Institutional Class | | | 1,000.00 | | | | 988.50 | | | 0.57% | | | 2.81 | |

| Class R6 | | | 1,000.00 | | | | 988.90 | | | 0.48% | | | 2.37 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 1,020.73 | | | 0.82% | | $ | 4.11 | |

| Class C | | | 1,000.00 | | | | 1,017.01 | | | 1.57% | | | 7.85 | |

| Class R | | | 1,000.00 | | | | 1,019.49 | | | 1.07% | | | 5.36 | |

| Institutional Class | | | 1,000.00 | | | | 1,021.97 | | | 0.57% | | | 2.86 | |

| Class R6 | | | 1,000.00 | | | | 1,022.41 | | | 0.48% | | | 2.41 | |

Delaware Extended Duration Bond Fund

Expense analysis of an investment of $1,000

| | | Beginning

Account Value

2/1/23 | | Ending

Account Value

7/31/23 | | Annualized

Expense Ratio | | Expenses

Paid During Period

2/1/23 to 7/31/23* |

| Actual Fund return† | | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 976.80 | | | 0.82% | | $ | 4.02 | |

| Class C | | | 1,000.00 | | | | 972.50 | | | 1.57% | | | 7.68 | |

| Class R | | | 1,000.00 | | | | 975.00 | | | 1.07% | | | 5.24 | |

| Institutional Class | | | 1,000.00 | | | | 977.90 | | | 0.57% | | | 2.80 | |

| Class R6 | | | 1,000.00 | | | | 978.50 | | | 0.47% | | | 2.31 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 1,020.73 | | | 0.82% | | $ | 4.11 | |

| Class C | | | 1,000.00 | | | | 1,017.01 | | | 1.57% | | | 7.85 | |

| Class R | | | 1,000.00 | | | | 1,019.49 | | | 1.07% | | | 5.36 | |

| Institutional Class | | | 1,000.00 | | | | 1,021.97 | | | 0.57% | | | 2.86 | |

| Class R6 | | | 1,000.00 | | | | 1,022.46 | | | 0.47% | | | 2.36 | |

*“Expenses Paid During Period” are equal to the relevant Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Disclosure of Fund expenses

For the six-month period from February 1, 2023 to July 31, 2023 (Unaudited)

†Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns.

In addition to the Funds’ expenses reflected on the previous page, each Fund also indirectly bears its portion of the fees and expenses of any investment companies (Underlying Funds), in which it invests. The tables on the previous page do not reflect the expenses of any Underlying Funds.

Security type / sector allocations

| Delaware Corporate Bond Fund | As of July 31, 2023 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type / sector | | Percentage of net assets |

| Convertible Bonds | | | 0.42 | % |

| Corporate Bonds | | | 88.70 | % |

| Banking | | | 20.56 | % |

| Basic Industry | | | 1.26 | % |

| Brokerage | | | 1.00 | % |

| Capital Goods | | | 3.75 | % |

| Communications | | | 9.43 | % |

| Consumer Cyclical | | | 4.79 | % |

| Consumer Non-Cyclical | | | 8.17 | % |

| Electric | | | 10.77 | % |

| Energy | | | 8.04 | % |

| Finance Companies | | | 3.32 | % |

| Insurance | | | 5.97 | % |

| Natural Gas | | | 1.61 | % |

| Real Estate Investment Trusts | | | 1.23 | % |

| Technology | | | 5.81 | % |

| Transportation | | | 2.99 | % |

| Municipal Bonds | | | 0.25 | % |

| Loan Agreements | | | 1.03 | % |

| US Treasury Obligations | | | 6.87 | % |

| Convertible Preferred Stock | | | 0.29 | % |

| Short-Term Investments | | | 1.84 | % |

| Total Value of Securities | | | 99.40 | % |

| Receivables and Other Assets Net of Liabilities | | | 0.60 | % |

| Total Net Assets | | | 100.00 | % |

Security type / sector allocations

| Delaware Extended Duration Bond Fund | As of July 31, 2023 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type / sector | | Percentage of net assets |

| Convertible Bond | | | 0.14 | % |

| Corporate Bonds | | | 90.57 | % |

| Banking | | | 10.83 | % |

| Basic Industry | | | 1.53 | % |

| Brokerage | | | 0.63 | % |

| Capital Goods | | | 4.76 | % |

| Communications | | | 9.78 | % |

| Consumer Cyclical | | | 4.23 | % |

| Consumer Non-Cyclical | | | 12.05 | % |

| Electric | | | 13.24 | % |

| Energy | | | 12.35 | % |

| Finance Companies | | | 1.08 | % |

| Insurance | | | 8.48 | % |

| Natural Gas | | | 3.83 | % |

| Technology | | | 4.44 | % |

| Transportation | | | 2.78 | % |

| Utilities | | | 0.56 | % |

| Municipal Bonds | | | 1.99 | % |

| US Treasury Obligations | | | 3.65 | % |

| Convertible Preferred Stock | | | 0.90 | % |

| Short-Term Investments | | | 1.16 | % |

| Total Value of Securities | | | 98.41 | % |

| Receivables and Other Assets Net of Liabilities | | | 1.59 | % |

| Total Net Assets | | | 100.00 | % |

Schedules of investments

| Delaware Corporate Bond Fund | July 31, 2023 |

| | | Principal

amount° | | | Value (US $) | |

| Convertible Bonds — 0.42% | | | | | | | | |

| Kaman 3.25% exercise price $65.26, maturity date 5/1/24 | | | 3,500,000 | | | $ | 3,381,000 | |

| Spirit Airlines 1.00% exercise price $42.10, maturity date 5/15/26 | | | 1,790,000 | | | | 1,584,485 | |

| Total Convertible Bonds (cost $5,106,654) | | | | | | | 4,965,485 | |

| | | | | | | | | |

| Corporate Bonds — 88.70% | | | | | | | | |

| Banking — 20.56% | | | | | | | | |

| Banco Santander | | | | | | | | |

| 5.588% 8/8/28 | | | 5,400,000 | | | | 5,400,000 | |

| 6.921% 8/8/33 | | | 2,600,000 | | | | 2,600,000 | |

| Bank of America | | | | | | | | |

| 2.482% 9/21/36 µ | | | 5,855,000 | | | | 4,490,787 | |

| 2.972% 2/4/33 µ | | | 5,795,000 | | | | 4,843,977 | |

| 6.204% 11/10/28 µ | | | 9,785,000 | | | | 10,062,057 | |

| Bank of New York Mellon | | | | | | | | |

| 4.70% 9/20/25 µ, ψ | | | 8,770,000 | | | | 8,583,882 | |

| 5.802% 10/25/28 µ | | | 699,000 | | | | 714,048 | |

| 5.834% 10/25/33 µ | | | 8,386,000 | | | | 8,689,934 | |

| Barclays | | | | | | | | |

| 6.224% 5/9/34 µ | | | 3,210,000 | | | | 3,241,151 | |

| 7.385% 11/2/28 µ | | | 2,450,000 | | | | 2,579,186 | |

| Citigroup | | | | | | | | |

| 5.61% 9/29/26 µ | | | 5,900,000 | | | | 5,889,995 | |

| 6.174% 5/25/34 µ | | | 5,080,000 | | | | 5,162,894 | |

| Citizens Bank 6.064% 10/24/25 µ | | | 3,040,000 | | | | 2,944,423 | |

| Credit Agricole 144A 5.514% 7/5/33 # | | | 8,330,000 | | | | 8,405,185 | |

| Credit Suisse 7.95% 1/9/25 | | | 10,335,000 | | | | 10,572,552 | |

| Deutsche Bank | | | | | | | | |

| 6.72% 1/18/29 µ | | | 4,839,000 | | | | 4,931,300 | |

| 7.146% 7/13/27 µ | | | 3,240,000 | | | | 3,306,116 | |

| Fifth Third Bancorp 6.339% 7/27/29 µ | | | 2,910,000 | | | | 2,964,675 | |

| Fifth Third Bank 5.852% 10/27/25 µ | | | 5,745,000 | | | | 5,656,723 | |

| Goldman Sachs Group 1.542% 9/10/27 µ | | | 13,429,000 | | | | 11,858,260 | |

| Huntington National Bank | | | | | | | | |

| 4.552% 5/17/28 µ | | | 9,151,000 | | | | 8,697,576 | |

| 5.65% 1/10/30 | | | 2,590,000 | | | | 2,543,890 | |

| JPMorgan Chase & Co. | | | | | | | | |

| 1.764% 11/19/31 µ | | | 9,750,000 | | | | 7,701,546 | |

| 5.35% 6/1/34 µ | | | 14,890,000 | | | | 15,002,802 | |

Schedules of investments

Delaware Corporate Bond Fund

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Banking (continued) | | | | | | | | |

| KeyBank | | | | | | | | |

| 4.15% 8/8/25 | | | 1,189,000 | | | $ | 1,138,327 | |

| 5.00% 1/26/33 | | | 8,105,000 | | | | 7,327,602 | |

| 5.85% 11/15/27 | | | 3,703,000 | | | | 3,632,978 | |

| KeyCorp | | | | | | | | |

| 3.878% 5/23/25 µ | | | 3,180,000 | | | | 2,994,633 | |

| 4.789% 6/1/33 µ | | | 1,285,000 | | | | 1,140,993 | |

| Morgan Stanley | | | | | | | | |

| 1.928% 4/28/32 µ | | | 3,765,000 | | | | 2,946,931 | |

| 2.484% 9/16/36 µ | | | 5,529,000 | | | | 4,240,485 | |

| 5.25% 4/21/34 µ | | | 1,879,000 | | | | 1,855,567 | |

| 5.424% 7/21/34 µ | | | 5,620,000 | | | | 5,617,721 | |

| 6.138% 10/16/26 µ | | | 1,105,000 | | | | 1,119,055 | |

| 6.342% 10/18/33 µ | | | 3,510,000 | | | | 3,733,718 | |

| PNC Bank 4.05% 7/26/28 | | | 8,420,000 | | | | 7,798,275 | |

| PNC Financial Services Group | | | | | | | | |

| 5.068% 1/24/34 µ | | | 3,080,000 | | | | 2,972,714 | |

| 5.671% 10/28/25 µ | | | 3,820,000 | | | | 3,802,353 | |

| Popular | | | | | | | | |

| 6.125% 9/14/23 | | | 5,020,000 | | | | 5,014,730 | |

| 7.25% 3/13/28 | | | 6,010,000 | | | | 6,076,170 | |

| SVB Financial Group | | | | | | | | |

| 1.80% 2/2/31 ‡ | | | 2,597,000 | | | | 1,620,995 | |

| 2.10% 5/15/28 ‡ | | | 995,000 | | | | 677,540 | |

| 4.00% 5/15/26 ‡, ψ | | | 2,647,000 | | | | 179,373 | |

| 4.57% 4/29/33 ‡ | | | 2,833,000 | | | | 1,902,889 | |

| Truist Bank 2.636% 9/17/29 µ | | | 10,460,000 | | | | 9,700,643 | |

| Truist Financial | | | | | | | | |

| 4.95% 9/1/25 µ, ψ | | | 8,635,000 | | | | 8,166,074 | |

| 6.123% 10/28/33 µ | | | 2,311,000 | | | | 2,371,339 | |

| US Bancorp | | | | | | | | |

| 2.491% 11/3/36 µ | | | 3,030,000 | | | | 2,282,203 | |

| 4.653% 2/1/29 µ | | | 4,687,000 | | | | 4,500,492 | |

| 5.727% 10/21/26 µ | | | 1,787,000 | | | | 1,793,397 | |

| Wells Fargo & Co. 5.557% 7/25/34 µ | | | 3,750,000 | | | | 3,766,220 | |

| | | | | | | | 245,216,376 | |

| Basic Industry — 1.26% | | | | | | | | |

| Celanese US Holdings 6.05% 3/15/25 | | | 5,915,000 | | | | 5,911,815 | |

| Graphic Packaging International 144A 3.50% 3/1/29 # | | | 3,155,000 | | | | 2,751,264 | |

| Newmont 2.80% 10/1/29 | | | 1,945,000 | | | | 1,684,516 | |

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Basic Industry (continued) | | | | | | | | |

| Sherwin-Williams 2.90% 3/15/52 | | | 7,185,000 | | | $ | 4,660,119 | |

| | | | | | | | 15,007,714 | |

| Brokerage — 1.00% | | | | | | | | |

| Jefferies Financial Group | | | | | | | | |

| 2.625% 10/15/31 | | | 10,260,000 | | | | 8,031,529 | |

| 5.875% 7/21/28 | | | 1,835,000 | | | | 1,831,596 | |

| 6.50% 1/20/43 | | | 2,090,000 | | | | 2,081,953 | |

| | | | | | | | 11,945,078 | |

| Capital Goods — 3.75% | | | | | | | | |

| Amphenol 2.20% 9/15/31 | | | 3,205,000 | | | | 2,610,744 | |

| Ardagh Metal Packaging Finance USA 144A 4.00% 9/1/29 # | | | 3,515,000 | | | | 2,878,505 | |

| Ashtead Capital | | | | | | | | |

| 144A 1.50% 8/12/26 # | | | 6,880,000 | | | | 6,055,307 | |

| 144A 5.95% 10/15/33 # | | | 2,465,000 | | | | 2,460,924 | |

| Boeing 3.75% 2/1/50 | | | 8,110,000 | | | | 6,165,064 | |

| Lockheed Martin 4.75% 2/15/34 | | | 4,545,000 | | | | 4,519,592 | |

| Pactiv Evergreen Group Issuer 144A 4.00% 10/15/27 # | | | 3,385,000 | | | | 3,051,730 | |

| Raytheon Technologies 5.15% 2/27/33 | | | 12,520,000 | | | | 12,535,029 | |

| RTX 3.03% 3/15/52 | | | 1,775,000 | | | | 1,209,940 | |

| Waste Connections 2.95% 1/15/52 | | | 4,760,000 | | | | 3,212,607 | |

| | | | | | | | 44,699,442 | |

| Communications — 9.43% | | | | | | | | |

| Altice France 144A 5.125% 1/15/29 # | | | 3,720,000 | | | | 2,596,243 | |

| AMC Networks 4.75% 8/1/25 | | | 3,325,000 | | | | 2,948,794 | |

| AT&T 3.50% 9/15/53 | | | 16,060,000 | | | | 10,900,825 | |

| CCO Holdings | | | | | | | | |

| 144A 4.50% 6/1/33 # | | | 945,000 | | | | 748,629 | |

| 144A 4.75% 2/1/32 # | | | 3,870,000 | | | | 3,198,592 | |

| 144A 6.375% 9/1/29 # | | | 2,005,000 | | | | 1,918,947 | |

| Cellnex Finance 144A 3.875% 7/7/41 # | | | 6,857,000 | | | | 4,964,673 | |

| Charter Communications Operating 3.85% 4/1/61 | | | 9,995,000 | | | | 6,078,044 | |

| Comcast | | | | | | | | |

| 2.80% 1/15/51 | | | 14,135,000 | | | | 9,241,513 | |

| 4.80% 5/15/33 | | | 5,425,000 | | | | 5,370,787 | |

| Crown Castle | | | | | | | | |

| 1.05% 7/15/26 | | | 3,925,000 | | | | 3,459,103 | |

| 2.10% 4/1/31 | | | 5,665,000 | | | | 4,518,991 | |

| CSC Holdings 144A 4.50% 11/15/31 # | | | 5,855,000 | | | | 4,206,306 | |

| Directv Financing 144A 5.875% 8/15/27 # | | | 3,965,000 | | | | 3,582,869 | |

Schedules of investments

Delaware Corporate Bond Fund

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Communications (continued) | | | | | | | | |

| Discovery Communications 4.00% 9/15/55 | | | 9,185,000 | | | $ | 6,094,237 | |

| Sprint Capital 6.875% 11/15/28 | | | 5,025,000 | | | | 5,331,270 | |

| Sprint Spectrum 144A 4.738% 9/20/29 # | | | 1,835,312 | | | | 1,815,428 | |

| Time Warner Cable 7.30% 7/1/38 | | | 2,930,000 | | | | 2,989,522 | |

| T-Mobile USA | | | | | | | | |

| 3.375% 4/15/29 | | | 13,605,000 | | | | 12,256,579 | |

| 5.05% 7/15/33 | | | 4,870,000 | | | | 4,767,863 | |

| Verizon Communications 2.875% 11/20/50 | | | 7,895,000 | | | | 5,022,223 | |

| Virgin Media Secured Finance 144A 5.50% 5/15/29 # | | | 3,458,000 | | | | 3,195,490 | |

| VZ Secured Financing 144A 5.00% 1/15/32 # | | | 2,540,000 | | | | 2,066,410 | |

| Warnermedia Holdings 6.412% 3/15/26 | | | 5,220,000 | | | | 5,229,617 | |

| | | | | | | | 112,502,955 | |

| Consumer Cyclical — 4.79% | | | | | | | | |

| ADT Security 144A 4.875% 7/15/32 # | | | 3,663,000 | | | | 3,148,898 | |

| Amazon.com 2.50% 6/3/50 | | | 15,385,000 | | | | 10,036,095 | |

| Aptiv 3.10% 12/1/51 | | | 10,601,000 | | | | 6,664,701 | |

| Ford Motor Credit | | | | | | | | |

| 6.95% 3/6/26 | | | 2,435,000 | | | | 2,461,201 | |

| 6.95% 6/10/26 | | | 3,410,000 | | | | 3,440,349 | |

| General Motors Financial | | | | | | | | |

| 5.85% 4/6/30 | | | 9,085,000 | | | | 9,079,781 | |

| 6.40% 1/9/33 | | | 3,795,000 | | | | 3,906,795 | |

| Mercedes-Benz Finance North America | | | | | | | | |

| 144A 5.05% 8/3/33 # | | | 2,100,000 | | | | 2,090,718 | |

| 144A 5.10% 8/3/28 # | | | 5,055,000 | | | | 5,049,035 | |

| Toyota Motor 5.123% 7/13/33 | | | 3,315,000 | | | | 3,394,913 | |

| VICI Properties 4.95% 2/15/30 | | | 8,305,000 | | | | 7,865,243 | |

| | | | | | | | 57,137,729 | |

| Consumer Non-Cyclical — 8.17% | | | | | | | | |

| Amgen | | | | | | | | |

| 5.15% 3/2/28 | | | 2,220,000 | | | | 2,221,911 | |

| 5.25% 3/2/30 | | | 2,310,000 | | | | 2,325,912 | |

| 5.25% 3/2/33 | | | 7,515,000 | | | | 7,502,985 | |

| Astrazeneca Finance 4.875% 3/3/28 | | | 4,580,000 | | | | 4,589,742 | |

| Baxter International 3.132% 12/1/51 | | | 6,660,000 | | | | 4,435,731 | |

| Bimbo Bakeries USA 144A 4.00% 5/17/51 # | | | 3,540,000 | | | | 2,818,760 | |

| Bunge Limited Finance 2.75% 5/14/31 | | | 7,475,000 | | | | 6,325,680 | |

| Cigna Group 5.685% 3/15/26 | | | 7,970,000 | | | | 7,975,177 | |

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Consumer Non-Cyclical (continued) | | | | | | | | |

| CVS Health | | | | | | | | |

| 2.70% 8/21/40 | | | 12,941,000 | | | $ | 8,989,789 | |

| 4.78% 3/25/38 | | | 1,816,000 | | | | 1,676,974 | |

| 5.25% 1/30/31 | | | 2,015,000 | | | | 2,016,109 | |

| Eli Lilly & Co. 5.00% 2/27/26 | | | 3,320,000 | | | | 3,323,593 | |

| HCA | | | | | | | | |

| 3.50% 7/15/51 | | | 6,074,000 | | | | 4,179,015 | |

| 5.20% 6/1/28 | | | 2,425,000 | | | | 2,405,665 | |

| JBS USA LUX 144A 3.00% 2/2/29 # | | | 3,287,000 | | | | 2,820,961 | |

| Merck & Co. 2.75% 12/10/51 | | | 4,532,000 | | | | 3,060,953 | |

| Perrigo Finance Unlimited 4.375% 3/15/26 | | | 7,415,000 | | | | 7,040,685 | |

| Pfizer Investment Enterprises | | | | | | | | |

| 4.75% 5/19/33 | | | 4,935,000 | | | | 4,904,272 | |

| 5.11% 5/19/43 | | | 3,430,000 | | | | 3,406,338 | |

| 5.30% 5/19/53 | | | 2,860,000 | | | | 2,940,957 | |

| Royalty Pharma 3.35% 9/2/51 | | | 14,781,000 | | | | 9,446,570 | |

| US Foods 144A 4.75% 2/15/29 # | | | 3,265,000 | | | | 3,005,946 | |

| | | | | | | | 97,413,725 | |

| Electric — 10.77% | | | | | | | | |

| AEP Texas 5.40% 6/1/33 | | | 1,655,000 | | | | 1,659,492 | |

| American Electric Power 5.699% 8/15/25 | | | 3,235,000 | | | | 3,240,362 | |

| Appalachian Power 4.50% 8/1/32 | | | 7,500,000 | | | | 7,051,693 | |

| Berkshire Hathaway Energy 2.85% 5/15/51 | | | 5,078,000 | | | | 3,278,751 | |

| CenterPoint Energy Houston Electric 4.95% 4/1/33 | | | 6,175,000 | | | | 6,162,756 | |

| Commonwealth Edison 2.75% 9/1/51 | | | 5,025,000 | | | | 3,213,795 | |

| Constellation Energy Generation 5.60% 3/1/28 | | | 3,460,000 | | | | 3,501,300 | |

| Consumers Energy 4.625% 5/15/33 | | | 3,800,000 | | | | 3,711,852 | |

| Duke Energy Carolinas 4.95% 1/15/33 | | | 2,892,000 | | | | 2,880,565 | |

| Duke Energy Indiana 5.40% 4/1/53 | | | 3,355,000 | | | | 3,376,251 | |

| Duke Energy Ohio 5.25% 4/1/33 | | | 2,405,000 | | | | 2,434,608 | |

| Edison International 8.125% 6/15/53 µ | | | 4,766,000 | | | | 4,891,536 | |

| Eversource Energy 5.45% 3/1/28 | | | 3,605,000 | | | | 3,657,731 | |

| Exelon 5.30% 3/15/33 | | | 2,065,000 | | | | 2,065,377 | |

| Fells Point Funding Trust 144A 3.046% 1/31/27 # | | | 4,685,000 | | | | 4,319,972 | |

| IPALCO Enterprises 4.25% 5/1/30 | | | 2,525,000 | | | | 2,303,855 | |

| Liberty Utilities Finance GP 1 144A 2.05% 9/15/30 # | | | 3,000,000 | | | | 2,343,983 | |

| Louisville Gas and Electric 5.45% 4/15/33 | | | 2,935,000 | | | | 3,004,872 | |

| NextEra Energy Capital Holdings | | | | | | | | |

| 3.00% 1/15/52 | | | 6,630,000 | | | | 4,355,755 | |

| 6.051% 3/1/25 | | | 5,160,000 | | | | 5,199,634 | |

Schedules of investments

Delaware Corporate Bond Fund

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Electric (continued) | | | | | | | | |

| NRG Energy 144A 2.45% 12/2/27 # | | | 2,470,000 | | | $ | 2,098,110 | |

| Oglethorpe Power | | | | | | | | |

| 3.75% 8/1/50 | | | 5,235,000 | | | | 3,868,040 | |

| 4.50% 4/1/47 | | | 5,500,000 | | | | 4,520,266 | |

| 5.25% 9/1/50 | | | 6,830,000 | | | | 6,329,077 | |

| Pacific Gas and Electric | | | | | | | | |

| 3.30% 8/1/40 | | | 1,125,000 | | | | 774,821 | |

| 3.50% 8/1/50 | | | 1,690,000 | | | | 1,096,459 | |

| 4.60% 6/15/43 | | | 4,405,000 | | | | 3,334,103 | |

| PacifiCorp 2.90% 6/15/52 | | | 13,799,000 | | | | 8,444,552 | |

| Public Service Co. of Oklahoma 3.15% 8/15/51 | | | 4,285,000 | | | | 2,853,225 | |

| San Diego Gas & Electric 3.32% 4/15/50 | | | 2,270,000 | | | | 1,610,501 | |

| Southern California Edison 3.45% 2/1/52 | | | 1,680,000 | | | | 1,189,753 | |

| Vistra Operations | | | | | | | | |

| 144A 3.55% 7/15/24 # | | | 6,327,000 | | | | 6,149,952 | |

| 144A 5.125% 5/13/25 # | | | 5,920,000 | | | | 5,785,173 | |

| WEC Energy Group 5.15% 10/1/27 | | | 7,770,000 | | | | 7,771,967 | |

| | | | | | | | 128,480,139 | |

| Energy — 8.04% | | | | | | | | |

| BP Capital Markets 4.875% 3/22/30 µ, ψ | | | 8,805,000 | | | | 8,214,184 | |

| BP Capital Markets America | | | | | | | | |

| 2.939% 6/4/51 | | | 2,260,000 | | | | 1,535,585 | |

| 4.812% 2/13/33 | | | 4,968,000 | | | | 4,889,499 | |

| Cheniere Energy Partners 144A 5.95% 6/30/33 # | | | 3,620,000 | | | | 3,667,567 | |

| ConocoPhillips 5.30% 5/15/53 | | | 3,415,000 | | | | 3,454,415 | |

| Diamondback Energy | | | | | | | | |

| 3.125% 3/24/31 | | | 6,845,000 | | | | 5,943,406 | |

| 4.25% 3/15/52 | | | 3,735,000 | | | | 2,904,929 | |

| Enbridge 5.75% 7/15/80 µ | | | 4,710,000 | | | | 4,311,113 | |

| Energy Transfer | | | | | | | | |

| 6.25% 4/15/49 | | | 3,410,000 | | | | 3,354,382 | |

| 6.50% 11/15/26 µ, ψ | | | 9,654,000 | | | | 8,768,796 | |

| Enterprise Products Operating | | | | | | | | |

| 3.30% 2/15/53 | | | 10,375,000 | | | | 7,341,268 | |

| 5.35% 1/31/33 | | | 905,000 | | | | 923,575 | |

| Galaxy Pipeline Assets Bidco 144A 2.94% 9/30/40 # | | | 4,041,612 | | | | 3,271,888 | |

| Kinder Morgan | | | | | | | | |

| 4.80% 2/1/33 | | | 2,410,000 | | | | 2,286,527 | |

| 5.20% 6/1/33 | | | 9,915,000 | | | | 9,686,560 | |

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Energy (continued) | | | | | | | | |

| Marathon Oil 5.20% 6/1/45 | | | 3,040,000 | | | $ | 2,639,349 | |

| Occidental Petroleum 6.125% 1/1/31 | | | 7,140,000 | | | | 7,299,722 | |

| Targa Resources Partners | | | | | | | | |

| 4.00% 1/15/32 | | | 2,880,000 | | | | 2,527,661 | |

| 5.00% 1/15/28 | | | 10,334,000 | | | | 9,931,627 | |

| 6.875% 1/15/29 | | | 2,882,000 | | | | 2,934,912 | |

| | | | | | | | 95,886,965 | |

| Finance Companies — 3.32% | | | | | | | | |

| AerCap Ireland Capital DAC | | | | | | | | |

| 1.65% 10/29/24 | | | 1,845,000 | | | | 1,743,949 | |

| 3.00% 10/29/28 | | | 8,720,000 | | | | 7,612,568 | |

| 3.40% 10/29/33 | | | 7,268,000 | | | | 5,817,596 | |

| Air Lease | | | | | | | | |

| 2.20% 1/15/27 | | | 1,050,000 | | | | 941,665 | |

| 2.875% 1/15/32 | | | 3,880,000 | | | | 3,127,679 | |

| 4.125% 12/15/26 µ, ψ | | | 4,080,000 | | | | 2,968,363 | |

| 5.85% 12/15/27 | | | 2,290,000 | | | | 2,310,746 | |

| Aviation Capital Group | | | | | | | | |

| 144A 1.95% 1/30/26 # | | | 7,443,000 | | | | 6,691,051 | |

| 144A 1.95% 9/20/26 # | | | 2,180,000 | | | | 1,910,536 | |

| 144A 5.50% 12/15/24 # | | | 1,540,000 | | | | 1,513,640 | |

| 144A 6.25% 4/15/28 # | | | 1,107,000 | | | | 1,108,145 | |

| 144A 6.375% 7/15/30 # | | | 3,820,000 | | | | 3,807,818 | |

| | | | | | | | 39,553,756 | |

| Insurance — 5.97% | | | | | | | | |

| American International Group 5.125% 3/27/33 | | | 5,430,000 | | | | 5,342,526 | |

| Aon 5.00% 9/12/32 | | | 2,925,000 | | | | 2,891,744 | |

| Athene Global Funding | | | | | | | | |

| 144A 1.985% 8/19/28 # | | | 15,617,000 | | | | 12,844,979 | |

| 144A 2.50% 3/24/28 # | | | 3,455,000 | | | | 2,953,678 | |

| 144A 2.717% 1/7/29 # | | | 3,515,000 | | | | 2,933,485 | |

| Athene Holding 3.45% 5/15/52 | | | 3,215,000 | | | | 2,060,016 | |

| Berkshire Hathaway Finance 3.85% 3/15/52 | | | 6,515,000 | | | | 5,342,142 | |

| Brighthouse Financial 4.70% 6/22/47 | | | 2,152,000 | | | | 1,659,768 | |

| Global Atlantic 144A 4.70% 10/15/51 #, µ | | | 5,070,000 | | | | 3,658,550 | |

| Hartford Financial Services Group 2.90% 9/15/51 | | | 3,625,000 | | | | 2,386,166 | |

| Humana 5.75% 3/1/28 | | | 984,000 | | | | 1,005,028 | |

| New York Life Global Funding | | | | | | | | |

| 144A 1.20% 8/7/30 # | | | 4,355,000 | | | | 3,364,244 | |

| 144A 4.85% 1/9/28 # | | | 4,650,000 | | | | 4,616,294 | |

Schedules of investments

Delaware Corporate Bond Fund

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Insurance (continued) | | | | | | | | |

| Prudential Financial 3.70% 10/1/50 µ | | | 7,005,000 | | | $ | 5,989,267 | |

| UnitedHealth Group | | | | | | | | |

| 4.20% 5/15/32 | | | 2,875,000 | | | | 2,742,155 | |

| 4.50% 4/15/33 | | | 9,297,000 | | | | 9,060,939 | |

| 5.05% 4/15/53 | | | 2,364,000 | | | | 2,326,962 | |

| | | | | | | | 71,177,943 | |

| Natural Gas — 1.61% | | | | | | | | |

| Sempra | | | | | | | | |

| 4.125% 4/1/52 µ | | | 2,775,000 | | | | 2,283,011 | |

| 4.875% 10/15/25 µ, ψ | | | 6,363,000 | | | | 6,028,942 | |

| Southern California Gas | | | | | | | | |

| 5.20% 6/1/33 | | | 4,295,000 | | | | 4,257,746 | |

| 6.35% 11/15/52 | | | 2,780,000 | | | | 3,069,430 | |

| Spire Missouri 4.80% 2/15/33 | | | 3,695,000 | | | | 3,630,822 | |

| | | | | | | | 19,269,951 | |

| Real Estate Investment Trusts — 1.23% | | | | | | | | |

| Alexandria Real Estate Equities 4.75% 4/15/35 | | | 3,590,000 | | | | 3,352,354 | |

| American Homes 4 Rent 3.625% 4/15/32 | | | 4,840,000 | | | | 4,206,558 | |

| Extra Space Storage 2.35% 3/15/32 | | | 9,040,000 | | | | 7,127,694 | |

| | | | | | | | 14,686,606 | |

| Technology — 5.81% | | | | | | | | |

| Alphabet 2.05% 8/15/50 | | | 10,280,000 | | | | 6,343,654 | |

| Apple | | | | | | | | |

| 4.30% 5/10/33 | | | 705,000 | | | | 701,496 | |

| 4.85% 5/10/53 | | | 3,215,000 | | | | 3,277,379 | |

| Autodesk 2.40% 12/15/31 | | | 7,435,000 | | | | 6,099,886 | |

| Broadcom 144A 3.469% 4/15/34 # | | | 9,922,000 | | | | 8,144,397 | |

| CDW 3.276% 12/1/28 | | | 11,570,000 | | | | 10,124,618 | |

| CoStar Group 144A 2.80% 7/15/30 # | | | 4,235,000 | | | | 3,544,889 | |

| Entegris Escrow | | | | | | | | |

| 144A 4.75% 4/15/29 # | | | 3,650,000 | | | | 3,408,384 | |

| 144A 5.95% 6/15/30 # | | | 3,680,000 | | | | 3,532,720 | |

| Leidos 2.30% 2/15/31 | | | 2,201,000 | | | | 1,763,011 | |

| Marvell Technology | | | | | | | | |

| 1.65% 4/15/26 | | | 4,460,000 | | | | 4,038,696 | |

| 2.45% 4/15/28 | | | 2,820,000 | | | | 2,470,401 | |

| Micron Technology 5.875% 9/15/33 | | | 5,885,000 | | | | 5,858,483 | |

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Technology (continued) | | | | | | | | |

| Oracle | | | | | | | | |

| 3.60% 4/1/50 | | | 3,410,000 | | | $ | 2,426,154 | |

| 4.65% 5/6/30 | | | 1,445,000 | | | | 1,399,509 | |

| 5.55% 2/6/53 | | | 2,235,000 | | | | 2,145,090 | |

| Sensata Technologies 144A 3.75% 2/15/31 # | | | 4,715,000 | | | | 3,986,673 | |

| | | | | | | | 69,265,440 | |

| Transportation — 2.99% | | | | | | | | |

| Air Canada 144A 3.875% 8/15/26 # | | | 6,285,000 | | | | 5,838,138 | |

| American Airlines 144A 5.50% 4/20/26 # | | | 5,545,833 | | | | 5,468,120 | |

| Burlington Northern Santa Fe 2.875% 6/15/52 | | | 8,087,000 | | | | 5,477,078 | |

| DAE Funding | | | | | | | | |

| 144A 1.55% 8/1/24 # | | | 2,260,000 | | | | 2,155,170 | |

| 144A 3.375% 3/20/28 # | | | 1,105,000 | | | | 995,229 | |

| Delta Air Lines 144A 7.00% 5/1/25 # | | | 6,212,000 | | | | 6,358,824 | |

| ERAC USA Finance | | | | | | | | |

| 144A 4.90% 5/1/33 # | | | 2,305,000 | | | | 2,272,113 | |

| 144A 5.40% 5/1/53 # | | | 1,445,000 | | | | 1,449,441 | |

| Mileage Plus Holdings 144A 6.50% 6/20/27 # | | | 4,092,000 | | | | 4,095,455 | |

| United Airlines 2019-1 Class AA Pass Through Trust Series 2019-1 AA 4.15% 2/25/33 ♦ | | | 1,665,184 | | | | 1,525,471 | |

| | | | | | | | 35,635,039 | |

| Total Corporate Bonds (cost $1,151,624,630) | | | | | | | 1,057,878,858 | |

| | | | | | | | | |

| Municipal Bonds — 0.25% | | | | | | | | |

| Commonwealth of Puerto Rico (Restructured) | | | | | | | | |

| Series A-1 2.993% 7/1/24^ | | | 29,562 | | | | 28,394 | |

| Series A-1 4.00% 7/1/35 | | | 132,326 | | | | 122,572 | |

| Series A-1 4.00% 7/1/37 | | | 140,560 | | | | 126,321 | |

| GDB Debt Recovery Authority of Puerto Rico (Taxable) 7.50% 8/20/40 | | | 3,335,429 | | | | 2,743,391 | |

| Total Municipal Bonds (cost $3,472,794) | | | | | | | 3,020,678 | |

Schedules of investments

Delaware Corporate Bond Fund

| | | Principal

amount° | | | Value (US $) | |

| Loan Agreements — 1.03% | | | | | | | | |

| Horizon Therapeutics USA Tranche B-2 7.156% (SOFR01M + 1.86%) 3/15/28 ● | | | 2,824,975 | | | $ | 2,823,797 | |

| Standard Industries 7.906% (SOFR01M + 2.50%) 9/22/28 ● | | | 9,427,701 | | | | 9,456,088 | |

| Total Loan Agreements (cost $12,125,745) | | | | | | | 12,279,885 | |

| | | | | | | | | |

| US Treasury Obligations — 6.87% | | | | | | | | |

| US Treasury Bonds | | | | | | | | |

| 3.625% 2/15/53 | | | 23,035,000 | | | | 21,490,936 | |

| 3.625% 5/15/53 | | | 12,410,000 | | | | 11,595,594 | |

| 3.875% 2/15/43 | | | 4,160,000 | | | | 3,975,400 | |

| US Treasury Notes | | | | | | | | |

| 3.375% 5/15/33 | | | 1,035,000 | | | | 987,374 | |

| 3.50% 1/31/30 | | | 20,090,000 | | | | 19,395,874 | |

| 3.75% 6/30/30 | | | 3,300,000 | | | | 3,235,547 | |

| 4.00% 6/30/28 | | | 16,765,000 | | | | 16,631,405 | |

| 4.50% 7/15/26 | | | 4,670,000 | | | | 4,669,088 | |

| Total US Treasury Obligations (cost $82,533,852) | | | | | | | 81,981,218 | |

| | | | | | | | | |

| | | | Number of

shares | | | | | |

| Convertible Preferred Stock — 0.29% | | | | | | | | |

| El Paso Energy Capital Trust I 4.75% exercise price $34.49, maturity date 3/31/28 | | | 22,731 | | | | 1,049,490 | |

| Lyondellbasell Advanced Polymers 6.00% exercise price $52.33 ω | | | 2,808 | | | | 2,386,800 | |

| Total Convertible Preferred Stock (cost $4,053,107) | | | | | | | 3,436,290 | |

| | | | | | | | | |

| Short-Term Investments — 1.84% | | | | | | | | |

| Money Market Mutual Funds — 1.84% | | | | | | | | |

| BlackRock Liquidity FedFund – Institutional Shares (seven-day effective yield 5.15%) | | | 5,469,764 | | | | 5,469,764 | |

| Fidelity Investments Money Market Government Portfolio – Class I (seven-day effective yield 5.16%) | | | 5,469,764 | | | | 5,469,764 | |

| Goldman Sachs Financial Square Government Fund – Institutional Shares (seven-day effective yield 5.29%) | | | 5,469,764 | | | | 5,469,764 | |

| | | | | | | | | |

| | | Number of

shares | | | Value (US $) | |

| Short-Term Investments (continued) | | | | | | | | |

| Money Market Mutual Funds (continued) | | | | | | | | |

| Morgan Stanley Institutional Liquidity Funds Government Portfolio – Institutional Class (seven-day effective yield 5.19%) | | | 5,469,763 | | | $ | 5,469,763 | |

| Total Short-Term Investments (cost $21,879,055) | | | | | | | 21,879,055 | |

Total Value of Securities—99.40%

(cost $1,280,795,837) | | | | | | $ | 1,185,441,469 | |

| | |

| ° | Principal amount shown is stated in USD unless noted that the security is denominated in another currency. |

| µ | Fixed to variable rate investment. The rate shown reflects the fixed rate in effect at July 31, 2023. Rate will reset at a future date. |

| ψ | Perpetual security. Maturity date represents next call date. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At July 31, 2023, the aggregate value of Rule 144A securities was $197,119,438, which represents 16.53% of the Fund’s net assets. See Note 10 in “Notes to financial statements.” |

| ‡ | Non-income producing security. Security is currently in default. |

| ♦ | Pass Through Agreement. Security represents the contractual right to receive a proportionate amount of underlying payments due to the counterparty pursuant to various agreements related to the rescheduling of obligations and the exchange of certain notes. |