Item 1. Reports to Stockholders

Annual report

Fixed income mutual funds

Delaware Corporate Bond Fund

Delaware Extended Duration Bond Fund

July 31, 2019

|

Beginning on or about June 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your Fund’s shareholder reports will no longer be sent to you by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker/dealer, bank, or insurance company. Instead, you will be notified by mail each time a report is posted on the website and provided with a link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by signing up at delawarefunds.com/edelivery. If you own these shares through a financial intermediary, you may contact your financial intermediary. You may elect to receive paper copies of all future shareholder reports free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at 800 523-1918. If you own these shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the Delaware Funds® by Macquarie or your financial intermediary. |

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus and their summary prospectuses, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail. Visit delawarefunds.com/edelivery.

Experience Delaware Funds®by Macquarie

Macquarie Investment Management (MIM) is a global asset manager with offices throughout the United States, Europe, Asia, and Australia. As active managers we prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 80 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Corporate Bond Fund and Delaware Extended Duration Bond Fund at delawarefunds.com/literature.

Manage your account online

| · | | Check your account balance and transactions |

| · | | View statements and tax forms |

| · | | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. MIM is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following registered investment advisers: Macquarie Investment Management Business Trust (MIMBT), Delaware Capital Management Advisers, Inc., Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Capital Investment Management LLC, and Macquarie Investment Management Europe S.A.

The Funds are distributed byDelaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Funds are governed by US laws and regulations.

Table of contents

Unless otherwise noted, views expressed herein are current as of July 31, 2019, and subject to change for events occurring after such date.

The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2019 Macquarie Management Holdings, Inc.

| | | | |

| Portfolio management review | | | | |

| Delaware Corporate Bond Fund and Delaware Extended Duration Bond Fund | | | August 13, 2019 | |

| | | | | | |

| Performance preview (for the year ended July 31, 2019) | | | | | |

Delaware Corporate Bond Fund (Institutional Class shares) | | 1-year return | | | +10.93% | |

Delaware Corporate Bond Fund (Class A shares) | | 1-year return | | | +10.65% | |

Bloomberg Barclays US Corporate Investment Grade Index (benchmark) | | 1-year return | | | +10.42% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Corporate Bond Fund, please see the table on page 6.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Please see page 9 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| | | | | | |

Delaware Extended Duration Bond Fund (Institutional Class shares) | | 1-year return | | | +13.46%* | |

Delaware Extended Duration Bond Fund (Class A shares) | | 1-year return | | | +13.17% | |

Bloomberg Barclays Long US Corporate Index (benchmark) | | 1-year return | | | +14.65% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Extended Duration Bond Fund, please see the table on page 11.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Please see page 14 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

*Total return for the report period presented in the table differs from the return in “Financial highlights.” The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in “Financial highlights” is calculated in the same manner but also takes into account certain adjustments that are necessary under US generally accepted accounting principles (US GAAP) required in the annual report.

Market review

Investors’ continued quest for yield, the global economic slowdown, trade tensions, and the US Federal Reserve’s capitulation on interest rates in January 2019 drove financial markets during the Funds’ fiscal year ended July 31, 2019. As the fiscal year unfolded, markets also benefited from the December 2017 tax reforms.

It seemed clear that financial markets were fairly deep into the economic and credit cycle that had propelled both equities and bonds for the past several years from the Funds’ fiscal year’s outset. And as 2019 approached, it seemed likely that earnings growth would be challenged.

|

· In late 2018, concerns about tariffs and an interest rate hike sparked a massive selloff that significantly pared calendar 2018 returns. · Investor sentiment changed dramatically in January 2019, when the Fed turned dovish. · Given the slowdown in international growth, along with trade tensions, earnings generally were better for companies with a domestic US focus. · With interest rates at or near zero in most developed markets, the US market was generally attractive to many foreign investors. |

1

Portfolio management review

Delaware Corporate Bond Fund and Delaware Extended Duration Bond Fund

In November and December 2018, growing concern about tariffs, the waning boost from tax reform, and an interest rate hike combined to spark a massive risk-off environment that significantly pared calendar 2018 returns.

Investor sentiment changed dramatically in January 2019, however, when the Fed turned dovish, indicating not only that further rate hikes were off the table through 2019, but a reduction would be considered later in the year. By March, the resulting V-shaped recovery more than restored financial markets to previous levels.

Although US economic growth slowed, it continued to outpace other developed countries. Growth of corporate earnings and revenue remained positive, if anemic. At this writing, with more than half of the companies in the S&P 500® Index having reported second-quarter earnings, overall year-over-year earnings rose 4.1% while revenue fell 1.0%. Given the slowdown in international growth, along with persistent trade tensions, earnings were generally better for companies with a domestic focus than for those with high exposure to international demand.

With interest rates at or near zero in most developed markets, the US market has been generally attractive to many foreign investors. For most of 2018, interest rates and hedging costs were favorable. Late in the year, however, hedging costs increased and foreign investment flows reversed out of the investment grade bond market, a major reason for the year-end downdraft. As noted above, early in 2019, the Fed took further rate hikes off the table, which helped spark a return of foreign investors to the US market. Investors generally felt it was safer to look to the long end of the market for incrementally higher yield. The increased demand caused spreads in the US investment grade credit market to compress below historical averages in the first half of 2019. As a result, at fiscal year end, the market was pricing in further rate cuts, totaling 0.75 percentage points by the end of 2019.

Although the US-China trade dispute dominated conversations on corporate earnings calls, we believe the effect was manageable. While the tariffs cut into profits somewhat, the impact was largely offset by the benefits of 2018’s tax cuts. The most significantly affected sectors were chemicals, retailers, and technology. Companies generally mitigated the effect on their businesses by passing costs on to consumers and shifting manufacturing to regions unaffected by the dispute. The trade restrictions placed on Huawei, a Chinese multinational technology company, had a more profound effect on technology and communication companies.

The 2018 tax cuts had a positive impact on corporate credit. Lower corporate tax rates boosted earnings while the easing of tax penalties on foreign cash repatriated to the United States reduced the need for companies to issue new investment grade credit.

A reduction in shareholder-friendly activity also curtailed supply. Additionally, there were fewer megadeals in the first half of 2019 than in the first half of 2018.

At the same time, demand for corporate credit remained strong. Inflows in the second half of 2018 totaled $14.5 billion, climbing sharply in the first half of 2019 to $53.5 billion. Investors’ quest for yield and the Fed’s dovish turn helped drive the investment grade market, providing more than enough to overcome tariff concerns and mildly deteriorating fundamentals.

Source: Bloomberg.

Within the Funds

For the fiscal year ended July 31, 2019, Delaware Corporate Bond Fund outperformed its benchmark, the Bloomberg Barclays US Corporate Investment Grade Index. The Fund’s Institutional Class shares gained 10.93%. The Fund’s Class A shares advanced 10.65% at net asset value and 5.75% at maximum offer price.

2

These figures reflect all distributions reinvested. During the same period, the benchmark gained 10.42%. For complete, annualized performance of Delaware Corporate Bond Fund, please see the table on page 6.

During the same period, Delaware Extended Duration Bond Fund underperformed its benchmark, the Bloomberg Barclays Long US Corporate Index. The Fund’s Institutional Class shares gained 13.46%. The Fund’s Class A shares advanced 13.17% at net asset value and 8.01% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the benchmark gained 14.65%. For complete, annualized performance of Delaware Extended Duration Bond Fund, please see the table on page 11.

As gross domestic product (GDP) growth slowed abroad and to a lesser extent in the US, and as the trade disputes posed challenges to companies operating internationally, we began to focus more on domestic-facing US companies that were less likely to confront tariff-related business disruptions. This was one of the themes that informed our decisions on positioning the portfolios of both Funds.

The Funds also benefited from an overweight to BBB-rated bonds, as this exposure enabled the Funds to pick up extra spread with what we believed was an acceptable level of additional risk over A-rated debt. While some investors and the press have speculated about the potential for downgrades in the BBB market, through our bottom-up (bond by bond) fundamental research we sought to reduce the risk that the Funds’ BBB-rated holdings would be downgraded to high yield, focusing on companies that we believed had a cushion that appeared ample to weather a slowdown in the economy or profitability.

Delaware Corporate Bond Fund

Throughout 2018, Delaware Corporate Bond Fund benefited from its exposure to high yield issues,

which amounted to roughly 17% of the Fund’s portfolio at the end of 2018. During the credit rout of November and December, however, high yield securities were beaten up relative to investment grade. Valuations had become expensive and we felt the Fund’s high yield exposure no longer provided enough spread or enough yield relative to the investment grade market, so we reduced the position. We took profits in the first half of 2019 and redeployed the proceeds in the long end of the investment grade market, which appeared cheaper and safer to us following the Fed’s capitulation on interest rates. These moves contributed to Fund performance during the fiscal year, and, at fiscal year end, we had lowered the Fund’s high yield exposure to just 8% of the portfolio.

In making these changes, we trimmed the Fund’s exposure to the subordinated part of banking issuers and basic industry, including chemicals and metals and mining. In turn, we increased the Fund’s exposure to more defensive sectors, such as communications and utilities. The Fund’s overweight to the communications sector added to performance; the Fund also benefited from solid security selection in the sector as wider-trading, longer-dated sectors outperformed.

The energy sector also contributed significantly to performance. Security selection, including exposure to some higher-beta (higher-risk) midstream names and a small amount of high yield, was favorable. Banking likewise contributed to performance as the Fund benefited from its investments in higher-beta portions of the market, including subordinated and hybrid debt. Several high yield issues contributed to performance. The Fund’s repositioning to longer-duration securities added to performance in the sector.

Natural gas, a utility subsector, detracted from performance due to the Fund’s underweight relative to the benchmark. We exited the Fund’s position inSempra Energy Co.in January, concerned that a resolution to the California

3

Portfolio management review

Delaware Corporate Bond Fund and Delaware Extended Duration Bond Fund

wildfire legislation might be detrimental. Instead, the market rallied following passage of the bill. The transportation sector also detracted somewhat as the Fund was underweight both the sector and some of the long spread duration railroads.

Time Warner Cable Inc., one of the Fund’s higher-beta names, contributed significantly to performance. Time Warner was the second-largest US cable company when Charter Communications acquired it in 2016. Following the merger, the company initially maintained its brand name but has since rebranded as Spectrum Cable in most major markets.

Verizon Communications Inc.was another leading contributor during the 12-month period. The performance of its credits had suffered as the company made little progress with its plans to deleverage and take out maturities. During the fiscal year, however, Verizon took material steps toward those goals, sparking a rally in its bonds.

Telefonica Emisiones S.A.U., also a strong contributor, is a multinational communications company based in Madrid that provides mobile, broadband, and television services throughout Europe and the Americas. As we sought to increase the Fund’s exposure to the communications sector, we took advantage of a new credit the company issued.

VOYA Financial Inc., an insurance company focused on the retirement and investment markets, was a leading detractor from Fund performance. VOYA has significant exposure to equity markets via its variable annuity products. Its securities suffered late in 2018 when equity markets turned sharply downward.

Bayer US Finance II LLCdetracted from performance. The US subsidiary of German pharmaceutical giant Bayer AG has been saddled with more than 18,000 lawsuits following its acquisition of Monsanto and its herbicide Roundup. The potential liability weighed heavily on

the company’s securities. We sold the position during the fiscal year.

Campbell Soup Co.also detracted meaningfully. The producer of canned soups and related products brought a new bond early in 2019 that we felt had a decent valuation. Just a few weeks later, however, the company materially reduced its full-year guidance and announced restructuring efforts, including the replacement of its chief executive officer. As a result, the bonds sold off sharply. We exited the Fund’s position during the fiscal year.

The Fund made minimal use of US Treasury futures during the fiscal year, to hedge out unwanted exposures to the Treasury yield curve. This exposure had no material impact on Fund performance.

Delaware Extended Duration Bond Fund

Delaware Extended Duration Bond Fund is designed to provide investors with access to the long end of the US investment grade corporate market. Our management of the Fund is strategically similar to that of Delaware Corporate Bond Fund. Since many companies do not issue longer-duration bonds, we identify additional opportunities as needed to complete the portfolio. The Fund has a lower risk profile than Delaware Corporate Bond Fund, due both to its longer duration and to its lower exposure to high yield securities.

While both Funds operated against the same economic backdrop – characterized by the global slowdown, trade disputes, and a newly dovish Fed – Delaware Extended Duration Bond Fund lagged the performance of its benchmark. This mainly resulted from the Fund’s relative underweight to the communications sector, which is dominated byAT&T Inc. andVerizon Communications Inc. Combined, the two companies comprise more than 5.5% of the benchmark, which are larger positions than the Fund normally takes, to avoid concentration risk – the risk of amplified losses

4

that may occur from having a large portion of holdings in a particular market segment relative to the Fund’s overall portfolio.

Banks also detracted from performance, as the Fund held shorter-dated out-of-index securities that underperformed as rates declined. Additionally, the Fund was underweight several higher-beta (higher-risk) names, includingGoldman Sachs Group Inc.andWells Fargo Capital,both of which confronted charges related to unethical treatment of customers. Nonetheless, the market rally in the first half of 2019 cost the Fund material performance as both companies gained sharply.

The utility sector contributed to performance owing to the Fund’s overweight to long spread duration and down-in-capital-structure securities relative to the benchmark. We achieved this by focusing on holding companies, which carry higher spreads, rather than the individual operating companies. The capital goods sector also contributed to performance, primarily due to an underweight toGE Capital Corp.andBoeing Co.We avoided GE due to its well-publicized and long-running financial problems. As for Boeing, even before the grounding of the 737 MAX, we had determined that the company’s credit was tightly traded and would not sufficiently compensate the Fund’s shareholders. Those issues were magnified when problems with the new aircraft developed.

An underweight to the energy sector also contributed to performance. Over the course of the fiscal year, the price of West Texas

Intermediate (WTI) crude oil declined 17%, creating a significant drag on the benchmark and providing the Fund with a relative boost.

Aircraft manufacturerUnited Technologies Corp.aided Fund performance when, following a strategic review, the company merged with Raytheon. The Fund benefited from its overweight position. Insurance conglomerateCigna Corp.also contributed to performance, as new bonds issued to finance its merger with Express Scripts performed well. And despite problems in the communications sector overall, several media companies performed well, includingFox Corp.andViacom Inc., which issued debt to finance merger and acquisition activity. These executed well and credit spreads compressed, providing a boost to Fund performance.

Detracting from Fund performance was tobacco producer and marketerAltria Group Inc., which faced regulatory and secular pressures resulting from a potential ban on menthol cigarettes and regulation of vaping. Pharmaceutical companyMylan Inc.detracted from performance as pressure on its generic drug business and an ongoing strategic review weighed on the bonds. We sold these positions during the fiscal year. Bayer and Campbell Soup, both discussed earlier, were also significant detractors.

During the fiscal year, the Fund made minimal use of US Treasury futures to hedge out unwanted exposures to the Treasury yield curve. This exposure had no material impact on Fund performance.

5

Performance summaries

| | |

| Delaware Corporate Bond Fund | | July 31, 2019 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| | | | | | | | |

| Fund and benchmark performance1,2 | | Average annual total returns through July 31, 2019 |

| | | | | | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | | | Lifetime | |

Class A (Est. Sept. 15, 1998) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +10.65% | | | | +3.56% | | | | +6.55% | | | | +6.40% | |

Including sales charge | | | +5.75% | | | | +2.60% | | | | +6.06% | | | | +6.16% | |

Class C (Est. Sept. 15, 1998) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +9.83% | | | | +2.79% | | | | +5.74% | | | | +5.61% | |

Including sales charge | | | +8.83% | | | | +2.79% | | | | +5.74% | | | | +5.61% | |

Class R (Est. June 2, 2003) | | | | | �� | | | | | | | | | | | |

Excluding sales charge | | | +10.36% | | | | +3.30% | | | | +6.28% | | | | +5.60% | |

Including sales charge | | | +10.36% | | | | +3.30% | | | | +6.28% | | | | +5.60% | |

Institutional Class (Est. Sept. 15, 1998) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +10.93% | | | | +3.82% | | | | +6.82% | | | | +6.67% | |

Including sales charge | | | +10.93% | | | | +3.82% | | | | +6.82% | | | | +6.67% | |

Class R6 (Est. Jan 31, 2019) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | n/a | | | | n/a | | | | n/a | | | | +8.98% | |

Including sales charge | | | n/a | | | | n/a | | | | n/a | | | | +8.98% | |

Bloomberg Barclays US Corporate Investment Grade Index | | | +10.42% | | | | +4.21% | | | | +5.68% | | | | +5.56% | * |

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 8. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual 12b-1 fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first

6

12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds.

If and when the Fund invests in forward foreign currency contracts or uses other investments to

hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

Gross domestic product, mentioned on page 3, is a measure of all goods and services produced by a nation in a year.

7

Performance summaries

Delaware Corporate Bond Fund

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) from exceeding 0.57% of the Fund’s average daily net assets for all shares classes other than Class R6 from Aug. 1, 2018 through July 31, 2019,* and 0.48% of the Fund’s Class R6 shares’ average daily net assets from Aug. 1, 2018 through July 31, 2019.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | | | |

| Fund expense ratios | | Class A | | Class C | | Class R | | Institutional Class | | Class R6 |

Total annual operating expenses (without fee waivers) | | 0.92% | | 1.67% | | 1.17% | | 0.67% | | 0.58% |

Net expenses (including fee waivers, if any) | | 0.82% | | 1.57% | | 1.07% | | 0.57% | | 0.48% |

Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

*The aggregate contractual waiver period covering this report is from April 1, 2018 through Jan. 31, 2020.

8

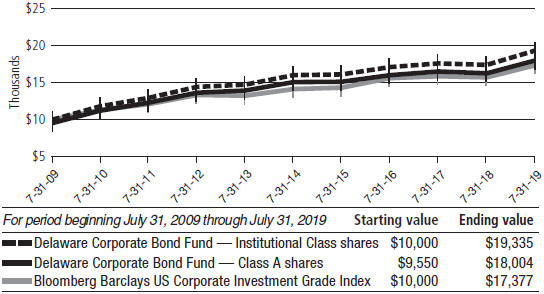

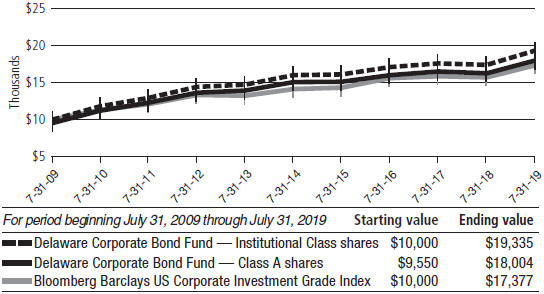

Performance of a $10,000 investment1

Average annual total returns from July 31, 2009 through July 31, 2019

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on July 31, 2009, and includes the effect of a 4.50% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 8. Please note additional details on pages 6 through 10.

The graph also assumes $10,000 invested in the Bloomberg Barclays US Corporate Investment Grade Index as of July 31, 2009. The Bloomberg Barclays US Corporate Investment Grade Index is composed of US dollar-denominated, investment

grade, SEC-registered corporate bonds issued by industrial, utility, and financial companies. All bonds have at least one year to maturity.

The S&P 500 Index, mentioned on page 2, measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the US stock market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

9

Performance summaries

Delaware Corporate Bond Fund

| | | | | | | | |

| | | Nasdaq symbols | | CUSIPs | | | |

Class A | | DGCAX | | | 245908785 | | | |

Class C | | DGCCX | | | 245908769 | | | |

Class R | | DGCRX | | | 245908744 | | | |

Institutional Class | | DGCIX | | | 245908751 | | | |

Class R6 | | DGCZX | | | 24610J100 | | | |

10

| | | | |

| Performance summaries | | | | |

| Delaware Extended Duration Bond Fund | | | July 31, 2019 | |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| | | | | | | | | | | | |

Fund and benchmark performance1,2 | | Average annual total returns through July 31, 2019 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 year | | | | | | 5 years | | | | | | 10 years | | | Lifetime | |

Class A (Est. Sept. 15, 1998) | | | | | | | | | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +13.17% | | | | | | | | +4.84% | | | | | | | | +8.68% | | | | +7.86% | |

Including sales charge | | | +8.01% | | | | | | | | +3.89% | | | | | | | | +8.19% | | | | +7.62% | |

Class C (Est. Sept. 15, 1998) | | | | | | | | | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +12.34% | | | | | | | | +4.03% | | | | | | | | +7.85% | | | | +7.06% | |

Including sales charge | | | +11.34% | | | | | | | | +4.03% | | | | | | | | +7.85% | | | | +7.06% | |

Class R (Est. Oct. 3, 2005) | | | | | | | | | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +12.87% | | | | | | | | +4.58% | | | | | | | | +8.40% | | | | +7.42% | |

Including sales charge | | | +12.87% | | | | | | | | +4.58% | | | | | | | | +8.40% | | | | +7.42% | |

Institutional Class (Est. Sept. 15, 1998) | | | | | | | | | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +13.46% | * | | | | | | | +5.11% | | | | | | | | +8.96% | | | | +8.12% | |

Including sales charge | | | +13.46% | | | | | | | | +5.11% | | | | | | | | +8.96% | | | | +8.12% | |

Class R6 (Est. May 2, 2016) | | | | | | | | | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +13.56% | | | | | | | | n/a | | | | | | | | n/a | | | | +6.23% | |

Including sales charge | | | +13.56% | | | | | | | | n/a | | | | | | | | n/a | | | | +6.23% | |

Bloomberg Barclays Long US Corporate Index | | | +14.65% | | | | | | | | +6.02% | | | | | | | | +7.89% | | | | +6.82% | ** |

*Total return for the report period presented in the table differs from the return in “Financial highlights.” The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in “Financial highlights” is calculated in the same manner but also takes into account certain adjustments that are necessary under US generally accepted accounting principles (US GAAP) required in the annual report.

**The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund

expense ratios” table on page 13. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual

11

Performance summaries

Delaware Extended Duration Bond Fund

12b-1 fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

Gross domestic product, mentioned on page 3, is a measure of all goods and services produced by a nation in a year.

12

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) from exceeding 0.57% of the Fund’s average daily net assets for all shares classes other than Class R6 from Aug. 1, 2018 through July 31, 2019,* and 0.49% of the Fund’s Class R6 shares’ average daily net assets from Aug. 1, 2018 through July 31, 2019.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | | | |

| Fund expense ratios | | Class A | | Class C | | Class R | | Institutional Class | | Class R6 |

| | | | | |

| Total annual operating expenses (without fee waivers) | | 0.98% | | 1.73% | | 1.23% | | 0.73% | | 0.65% |

| Net expenses (including fee waivers, if any) | | 0.82% | | 1.57% | | 1.07% | | 0.57% | | 0.49% |

Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

*The aggregate contractual waiver period covering this report is from Nov. 28, 2017 through Jan. 31, 2020.

13

Performance summaries

Delaware Extended Duration Bond Fund

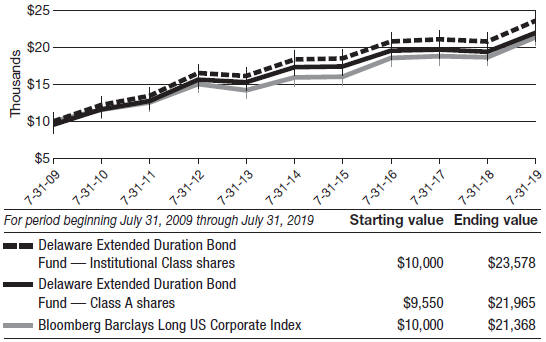

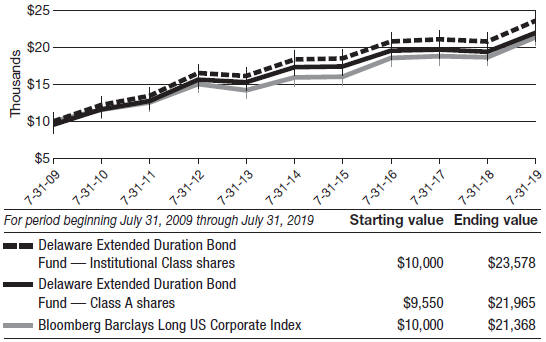

Performance of a $10,000 investment1

Average annual total returns from July 31, 2009 through July 31, 2019

1The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on July 31, 2009, and includes the effect of a 4.50% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 13. Please note additional details on pages 11 through 15.

The graph also assumes $10,000 invested in the Bloomberg Barclays Long US Corporate Index as of July 31, 2009. The Bloomberg Barclays Long US Corporate Index is composed of US dollar-denominated, investment grade, SEC-registered

corporate bonds issued by industrial, utility, and financial companies. All bonds in the index have at least 10 years to maturity.

The S&P 500 Index, mentioned on page 2, measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the US stock market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

14

| | | | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | DEEAX | | 245908835 | | |

Class C | | DEECX | | 245908819 | | |

Class R | | DEERX | | 245908728 | | |

Institutional Class | | DEEIX | | 245908793 | | |

Class R6 | | DEZRX | | 245908629 | | |

15

Disclosure of Fund expenses

For the six-month period from February 1, 2019 to July 31, 2019 (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. These following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from Feb. 1, 2019 to July 31, 2019.

Actual expenses

The first section of the tables shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

16

Delaware Corporate Bond Fund

Expense analysis of an investment of $1,000

| | | | | | | | | | | | | | | | |

| | | Beginning | | | Ending | | | | | | Expenses | |

| | | Account Value | | | Account Value | | | Annualized | | | Paid During Period | |

| | | 2/1/19 | | | 7/31/19 | | | Expense Ratio | | | 2/1/19 to 7/31/19* | |

Actual Fund return† | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,088.00 | | | | 0.82% | | | | $4.25 | |

Class C | | | 1,000.00 | | | | 1,084.00 | | | | 1.57% | | | | 8.11 | |

Class R | | | 1,000.00 | | | | 1,086.50 | | | | 1.07% | | | | 5.54 | |

Institutional Class | | | 1,000.00 | | | | 1,089.30 | | | | 0.57% | | | | 2.95 | |

Class R6 | | | 1,000.00 | | | | 1,089.80 | | | | 0.48% | | | | 2.49 | |

Hypothetical 5% return(5% return before expenses) | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,020.73 | | | | 0.82% | | | | $4.11 | |

Class C | | | 1,000.00 | | | | 1,017.01 | | | | 1.57% | | | | 7.85 | |

Class R | | | 1,000.00 | | | | 1,019.49 | | | | 1.07% | | | | 5.36 | |

Institutional Class | | | 1,000.00 | | | | 1,021.97 | | | | 0.57% | | | | 2.86 | |

Class R6 | | | 1,000.00 | | | | 1,022.41 | | | | 0.48% | | | | 2.41 | |

| | | | |

Delaware Extended Duration Bond Fund Expense analysis of an investment of $1,000 | | | | | | | | | | | | | | | | |

| | | Beginning | | | Ending | | | | | | Expenses | |

| | | Account Value | | | Account Value | | | Annualized | | | Paid During Period | |

| | | 2/1/19 | | | 7/31/19 | | | Expense Ratio | | | 2/1/19 to 7/31/19* | |

Actual Fund return† | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,128.80 | | | | 0.82% | | | | $4.33 | |

Class C | | | 1,000.00 | | | | 1,124.90 | | | | 1.57% | | | | 8.27 | |

Class R | | | 1,000.00 | | | | 1,127.20 | | | | 1.07% | | | | 5.64 | |

Institutional Class | | | 1,000.00 | | | | 1,128.70 | | | | 0.57% | | | | 3.01 | |

Class R6 | | | 1,000.00 | | | | 1,130.80 | | | | 0.49% | | | | 2.59 | |

Hypothetical 5% return(5% return before expenses) | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,020.73 | | | | 0.82% | | | | $4.11 | |

Class C | | | 1,000.00 | | | | 1,017.01 | | | | 1.57% | | | | 7.85 | |

Class R | | | 1,000.00 | | | | 1,019.49 | | | | 1.07% | | | | 5.36 | |

Institutional Class | | | 1,000.00 | | | | 1,021.97 | | | | 0.57% | | | | 2.86 | |

Class R6 | | | 1,000.00 | | | | 1,022.36 | | | | 0.49% | | | | 2.46 | |

| *“ | Expenses Paid During Period” are equal to the relevant Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). | |

† Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns.

In addition to the Delaware Corporate Bond Fund expenses reflected above, the Fund also indirectly bears its portion of the fees and expenses of the investment companies (Underlying Funds) in which it invests. The table above does not reflect the expenses of the Underlying Funds.

17

Security type / sector allocations

| | |

| Delaware Corporate Bond Fund | | As of July 31, 2019 (Unaudited) |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| | |

| Security type / sector | | Percentage of net assets |

Convertible Bond | | 0.28% |

Corporate Bonds | | 89.39% |

Banking | | 19.43% |

Basic Industry | | 4.51% |

Brokerage | | 1.92% |

Capital Goods | | 3.66% |

Communications | | 11.48% |

Consumer Cyclical | | 3.70% |

Consumer Non-Cyclical | | 5.78% |

Electric | | 10.33% |

Energy | | 10.30% |

Finance Companies | | 2.79% |

Insurance | | 3.77% |

Real Estate Investment Trusts | | 2.97% |

Technology | | 5.72% |

Transportation | | 1.11% |

Utilities | | 1.92% |

Municipal Bonds | | 1.04% |

Loan Agreements | | 1.23% |

Convertible Preferred Stock | | 0.41% |

Preferred Stock | | 0.36% |

Short-Term Investments | | 4.65% |

Total Value of Securities | | 97.36% |

Receivables and Other Assets Net of Liabilities | | 2.64% |

Total Net Assets | | 100.00% |

18

| | |

| Security type / sector allocations | | |

| Delaware Extended Duration Bond Fund | | As of July 31, 2019 (Unaudited) |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| | |

| Security type / sector | | Percentage of net assets |

Convertible Bond | | 0.34% |

Corporate Bonds | | 93.06% |

Banking | | 7.81% |

Basic Industry | | 4.53% |

Brokerage | | 2.23% |

Capital Goods | | 7.65% |

Communications | | 10.97% |

Consumer Cyclical | | 3.00% |

Consumer Non-Cyclical | | 10.14% |

Electric | | 18.02% |

Energy | | 7.79% |

Finance Companies | | 1.42% |

Insurance | | 8.06% |

Natural Gas | | 3.86% |

Technology | | 2.46% |

Transportation | | 3.47% |

Utilities | | 1.65% |

Municipal Bonds | | 3.10% |

Convertible Preferred Stock | | 0.68% |

Preferred Stock | | 0.67% |

Total Value of Securities | | 97.85% |

Receivables and Other Assets Net of Liabilities | | 2.15% |

Total Net Assets | | 100.00% |

19

| | |

| Schedules of investments | | |

Delaware Corporate Bond Fund | | July 31, 2019 |

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Convertible Bond – 0.28% | | | | | | | | |

| |

Cemex 3.72% exercise price $10.88, maturity date 3/15/20 | | | 2,760,000 | | | $ | 2,763,616 | |

| | | | | | | | |

Total Convertible Bond(cost $2,708,835) | | | | | | | 2,763,616 | |

| | | | | | | | |

| | | | | | | | |

| |

Corporate Bonds – 89.39% | | | | | | | | |

| |

Banking – 19.43% | | | | | | | | |

Ally Financial 8.00% 11/1/31 | | | 1,840,000 | | | | 2,468,360 | |

Banco Santander | | | | | | | | |

2.706% 6/27/24 | | | 6,000,000 | | | | 5,985,118 | |

3.306% 6/27/29 | | | 4,400,000 | | | | 4,453,434 | |

Bank of America | | | | | | | | |

3.194% 7/23/30 µ | | | 3,325,000 | | | | 3,356,473 | |

3.458% 3/15/25 µ | | | 3,380,000 | | | | 3,499,166 | |

5.125%µy | | | 4,845,000 | | | | 4,911,619 | |

5.625% 7/1/20 | | | 1,965,000 | | | | 2,023,849 | |

Bank of Montreal 3.30% 2/5/24 | | | 6,630,000 | | | | 6,856,755 | |

BB&T | | | | | | | | |

2.50% 8/1/24 | | | 4,725,000 | | | | 4,718,120 | |

3.875% 3/19/29 | | | 4,435,000 | | | | 4,742,155 | |

BBVA USA | | | | | | | | |

2.875% 6/29/22 | | | 3,360,000 | | | | 3,385,353 | |

3.875% 4/10/25 | | | 3,955,000 | | | | 4,083,346 | |

Citibank | | | | | | | | |

2.844% 5/20/22 µ | | | 2,900,000 | | | | 2,919,797 | |

3.165% 2/19/22 µ | | | 4,460,000 | | | | 4,509,762 | |

Citizens Financial Group 2.85% 7/27/26 | | | 3,100,000 | | | | 3,091,538 | |

Credit Suisse Group | | | | | | | | |

144A 3.869% 1/12/29 #µ | | | 5,200,000 | | | | 5,389,615 | |

144A 7.50%#µy | | | 2,662,000 | | | | 2,830,278 | |

Fifth Third Bancorp 3.95% 3/14/28 | | | 1,860,000 | | | | 2,014,818 | |

Fifth Third Bank 3.85% 3/15/26 | | | 7,115,000 | | | | 7,516,921 | |

Goldman Sachs Group 6.00% 6/15/20 | | | 3,045,000 | | | | 3,140,568 | |

JPMorgan Chase & Co. | | | | | | | | |

4.023% 12/5/24 µ | | | 4,005,000 | | | | 4,242,313 | |

5.00%µy | | | 5,630,000 | | | | 5,701,783 | |

KeyBank 3.40% 5/20/26 | | | 10,360,000 | | | | 10,692,262 | |

Morgan Stanley | | | | | | | | |

3.78% (LIBOR03M + 1.22%) 5/8/24● | | | 3,455,000 | | | | 3,505,171 | |

5.00% 11/24/25 | | | 5,080,000 | | | | 5,622,005 | |

5.50% 1/26/20 | | | 3,105,000 | | | | 3,149,785 | |

PNC Bank 4.05% 7/26/28 | | | 3,035,000 | | | | 3,303,951 | |

PNC Financial Services Group 2.60% 7/23/26 | | | 9,160,000 | | | | 9,146,977 | |

Popular 6.125% 9/14/23 | | | 5,020,000 | | | | 5,409,050 | |

20

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds(continued) | | | | | | | | |

| |

Banking(continued) | | | | | | | | |

Regions Financial 3.80% 8/14/23 | | | 3,335,000 | | | $ | 3,497,102 | |

Royal Bank of Scotland Group | | | | | | | | |

4.519% 6/25/24 µ | | | 3,585,000 | | | | 3,721,974 | |

8.625%µy | | | 3,555,000 | | | | 3,790,519 | |

Santander UK 144A 5.00% 11/7/23 # | | | 3,765,000 | | | | 3,972,067 | |

SunTrust Bank 2.80% 5/17/22 | | | 9,715,000 | | | | 9,823,821 | |

SunTrust Banks 4.00% 5/1/25 | | | 2,575,000 | | | | 2,749,013 | |

SVB Financial Group 3.50% 1/29/25 | | | 655,000 | | | | 667,710 | |

UBS 7.625% 8/17/22 | | | 3,430,000 | | | | 3,842,303 | |

UBS Group Funding Switzerland | | | | | | | | |

6.875%µy | | | 2,745,000 | | | | 2,844,781 | |

7.125%µy | | | 860,000 | | | | 899,403 | |

US Bancorp | | | | | | | | |

3.00% 7/30/29 | | | 2,285,000 | | | | 2,300,626 | |

3.375% 2/5/24 | | | 10,425,000 | | | | 10,879,700 | |

USB Capital IX 3.50% (LIBOR03M + 1.02%)y● | | | 3,207,000 | | | | 2,710,941 | |

Wells Fargo Capital X 5.95% 12/15/36 | | | 5,645,000 | | | | 6,756,164 | |

Zions Bancorp 3.35% 3/4/22 | | | 250,000 | | | | 253,756 | |

| | | | | | | | |

| | | | | | | 191,380,222 | |

| | | | | | | | |

Basic Industry – 4.51% | | | | | | | | |

ArcelorMittal | | | | | | | | |

3.60% 7/16/24 | | | 2,220,000 | | | | 2,240,184 | |

4.25% 7/16/29 | | | 2,610,000 | | | | 2,620,635 | |

BHP Billiton Finance USA 144A 6.25% 10/19/75 #µ | | | 9,455,000 | | | | 9,852,299 | |

Equate Petrochemical 144A 3.00% 3/3/22 # | | | 2,840,000 | | | | 2,852,982 | |

Georgia-Pacific 8.00% 1/15/24 | | | 4,345,000 | | | | 5,335,868 | |

Olin 5.625% 8/1/29 | | | 2,075,000 | | | | 2,134,656 | |

RPM International 4.55% 3/1/29 | | | 2,965,000 | | | | 3,151,300 | |

SASOL Financing USA | | | | | | | | |

5.875% 3/27/24 | | | 1,150,000 | | | | 1,233,673 | |

6.50% 9/27/28 | | | 1,165,000 | | | | 1,312,818 | |

Syngenta Finance | | | | | | | | |

144A 3.933% 4/23/21 # | | | 2,560,000 | | | | 2,601,798 | |

144A 4.441% 4/24/23 # | | | 1,100,000 | | | | 1,151,087 | |

144A 5.182% 4/24/28 # | | | 2,260,000 | | | | 2,374,501 | |

Teck Resources 6.25% 7/15/41 | | | 4,925,000 | | | | 5,573,170 | |

Westlake Chemical 4.375% 11/15/47 | | | 2,080,000 | | | | 2,002,558 | |

| | | | | | | | |

| | | | | | | 44,437,529 | |

| | | | | | | | |

Brokerage – 1.92% | | | | | | | | |

E*TRADE Financial 3.80% 8/24/27 | | | 2,395,000 | | | | 2,454,592 | |

Jefferies Group | | | | | | | | |

4.15% 1/23/30 | | | 1,725,000 | | | | 1,711,191 | |

21

Schedules of investments

Delaware Corporate Bond Fund

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds(continued) | | | | | | | | |

| |

Brokerage(continued) | | | | | | | | |

Jefferies Group | | | | | | | | |

6.45% 6/8/27 | | | 5,627,000 | | | $ | 6,464,038 | |

6.50% 1/20/43 | | | 1,575,000 | | | | 1,771,808 | |

Lazard Group | | | | | | | | |

3.625% 3/1/27 | | | 2,260,000 | | | | 2,328,410 | |

3.75% 2/13/25 | | | 1,075,000 | | | | 1,118,964 | |

4.375% 3/11/29 | | | 2,890,000 | | | | 3,086,789 | |

| | | | | | | | |

| | | | | | | 18,935,792 | |

| | | | | | | | |

Capital Goods – 3.66% | | | | | | | | |

Anixter 6.00% 12/1/25 | | | 1,570,000 | | | | 1,715,225 | |

Boeing 3.75% 2/1/50 | | | 2,135,000 | | | | 2,153,387 | |

Crown Americas 4.75% 2/1/26 | | | 1,115,000 | | | | 1,149,008 | |

General Electric 5.55% 5/4/20 | | | 395,000 | | | | 403,456 | |

Ingersoll-Rand Luxembourg Finance 3.80% 3/21/29 | | | 4,135,000 | | | | 4,389,023 | |

L3Harris Technologies 144A 4.40% 6/15/28 # | | | 8,105,000 | | | | 8,920,704 | |

nVent Finance 4.55% 4/15/28 | | | 664,000 | | | | 681,157 | |

Parker-Hannifin | | | | | | | | |

3.25% 6/14/29 | | | 4,455,000 | | | | 4,572,174 | |

4.00% 6/14/49 | | | 1,455,000 | | | | 1,522,643 | |

United Technologies 3.65% 8/16/23 | | | 4,300,000 | | | | 4,504,974 | |

Waste Management | | | | | | | | |

2.95% 6/15/24 | | | 2,790,000 | | | | 2,860,993 | |

4.00% 7/15/39 | | | 1,000,000 | | | | 1,092,262 | |

4.15% 7/15/49 | | | 1,835,000 | | | | 2,029,650 | |

| | | | | | | | |

| | | | | | | 35,994,656 | |

| | | | | | | | |

Communications – 11.48% | | | | | | | | |

Altice France 144A 6.25% 5/15/24 # | | | 1,016,000 | | | | 1,052,830 | |

AMC Networks 4.75% 8/1/25 | | | 2,450,000 | | | | 2,502,063 | |

American Tower 3.80% 8/15/29 | | | 4,305,000 | | | | 4,475,352 | |

AT&T | | | | | | | | |

4.35% 3/1/29 | | | 5,940,000 | | | | 6,422,245 | |

4.85% 7/15/45 | | | 6,010,000 | | | | 6,463,662 | |

Bell Canada 4.30% 7/29/49 | | | 7,160,000 | | | | 7,767,218 | |

Charter Communications Operating | | | | | | | | |

4.908% 7/23/25 | | | 3,830,000 | | | | 4,134,146 | |

5.125% 7/1/49 | | | 2,625,000 | | | | 2,684,075 | |

Crown Castle International 5.25% 1/15/23 | | | 2,580,000 | | | | 2,799,136 | |

CSC Holdings 144A 5.375% 2/1/28 # | | | 2,720,000 | | | | 2,842,400 | |

Discovery Communications | | | | | | | | |

4.125% 5/15/29 | | | 5,630,000 | | | | 5,886,129 | |

5.20% 9/20/47 | | | 2,710,000 | | | | 2,879,445 | |

22

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds(continued) | | | | | | | | |

| |

Communications(continued) | | | | | | | | |

Fox | | | | | | | | |

144A 4.709% 1/25/29 # | | | 2,960,000 | | | $ | 3,315,453 | |

144A 5.576% 1/25/49 # | | | 4,365,000 | | | | 5,335,046 | |

GTP Acquisition Partners I 144A 2.35% 6/15/20 # | | | 2,130,000 | | | | 2,123,782 | |

Sprint Spectrum | | | | | | | | |

144A 3.36% 9/20/21 # | | | 2,179,688 | | | | 2,194,945 | |

144A 4.738% 3/20/25 # | | | 4,195,000 | | | | 4,420,481 | |

Telefonica Emisiones 5.52% 3/1/49 | | | 5,285,000 | | | | 6,260,333 | |

Time Warner Cable 7.30% 7/1/38 | | | 5,490,000 | | | | 6,811,559 | |

Time Warner Entertainment 8.375% 3/15/23 | | | 4,965,000 | | | | 5,858,653 | |

Verizon Communications | | | | | | | | |

4.50% 8/10/33 | | | 12,025,000 | | | | 13,605,800 | |

4.522% 9/15/48 | | | 3,405,000 | | | | 3,763,690 | |

Viacom 4.375% 3/15/43 | | | 7,515,000 | | | | 7,440,456 | |

Virgin Media Secured Finance 144A 5.50% 5/15/29 # | | | 2,000,000 | | | | 2,054,000 | |

| | | | | | | | |

| | | | | | | 113,092,899 | |

| | | | | | | | |

Consumer Cyclical – 3.70% | | | | | | | | |

Dollar Tree 3.70% 5/15/23 | | | 7,455,000 | | | | 7,700,501 | |

General Motors Financial | | | | | | | | |

4.35% 4/9/25 | | | 7,425,000 | | | | 7,695,271 | |

5.25% 3/1/26 | | | 2,150,000 | | | | 2,318,363 | |

Lowe’s | | | | | | | | |

4.05% 5/3/47 | | | 2,000,000 | | | | 2,010,043 | |

4.55% 4/5/49 | | | 6,835,000 | | | | 7,430,002 | |

Royal Caribbean Cruises 3.70% 3/15/28 | | | 6,170,000 | | | | 6,241,096 | |

SBA Tower Trust 144A 2.898% 10/15/19 #f | | | 3,005,000 | | | | 3,005,377 | |

| | | | | | | | |

| | | | | | | 36,400,653 | |

| | | | | | | | |

Consumer Non-Cyclical – 5.78% | | | | | | | | |

Anheuser-Busch InBev Worldwide | | | | | | | | |

3.65% 2/1/26 | | | 5,630,000 | | | | 5,944,014 | |

4.75% 1/23/29 | | | 3,055,000 | | | | 3,481,286 | |

Bristol-Myers Squibb | | | | | | | | |

144A 2.90% 7/26/24 # | | | 4,940,000 | | | | 5,058,968 | |

144A 4.125% 6/15/39 # | | | 415,000 | | | | 453,391 | |

144A 4.25% 10/26/49 # | | | 4,880,000 | | | | 5,348,399 | |

Cigna 144A 4.125% 11/15/25 # | | | 9,451,000 | | | | 10,045,688 | |

Constellation Brands 3.15% 8/1/29 | | | 5,865,000 | | | | 5,888,370 | |

CVS Health 5.05% 3/25/48 | | | 3,745,000 | | | | 4,076,607 | |

Eli Lilly & Co. 3.375% 3/15/29 | | | 2,320,000 | | | | 2,471,471 | |

Imperial Brands Finance 144A 3.50% 7/26/26 # | | | 4,400,000 | | | | 4,386,469 | |

Mars | | | | | | | | |

144A 3.875% 4/1/39 # | | | 615,000 | | | | 673,771 | |

23

Schedules of investments

Delaware Corporate Bond Fund

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds(continued) | | | | | | | | |

| |

Consumer Non-Cyclical(continued) | | | | | | | | |

Mars | | | | | | | | |

144A 3.95% 4/1/49 # | | | 6,310,000 | | | $ | 6,870,306 | |

Universal Health Services 144A 4.75% 8/1/22 # | | | 2,170,000 | | | | 2,202,550 | |

| | | | | | | | |

| | | | | | | 56,901,290 | |

| | | | | | | | |

Electric – 10.33% | | | | | | | | |

AES 4.50% 3/15/23 | | | 2,094,000 | | | | 2,151,585 | |

Ausgrid Finance 144A 3.85% 5/1/23 # | | | 2,000,000 | | | | 2,074,611 | |

Avangrid 3.15% 12/1/24 | | | 3,485,000 | | | | 3,572,802 | |

Cleveland Electric Illuminating 5.50% 8/15/24 | | | 4,605,000 | | | | 5,212,100 | |

ComEd Financing III 6.35% 3/15/33 | | | 4,635,000 | | | | 4,808,405 | |

DPL 144A 4.35% 4/15/29 # | | | 1,215,000 | | | | 1,188,405 | |

Emera 6.75% 6/15/76 µ | | | 4,665,000 | | | | 5,080,278 | |

Entergy Arkansas 4.20% 4/1/49 | | | 5,940,000 | | | | 6,666,657 | |

Entergy Mississippi 3.85% 6/1/49 | | | 860,000 | | | | 917,431 | |

FirstEnergy Transmission 144A 4.55% 4/1/49 # | | | 4,430,000 | | | | 4,964,913 | |

Interstate Power & Light 4.10% 9/26/28 | | | 3,500,000 | | | | 3,800,392 | |

IPALCO Enterprises 3.70% 9/1/24 | | | 2,075,000 | | | | 2,136,158 | |

Louisville Gas & Electric 4.25% 4/1/49 | | | 6,020,000 | | | | 6,856,313 | |

National Rural Utilities Cooperative Finance 5.25% 4/20/46 µ | | | 3,045,000 | | | | 3,196,256 | |

NextEra Energy Capital Holdings | | | | | | | | |

3.15% 4/1/24 | | | 4,935,000 | | | | 5,080,101 | |

5.65% 5/1/79 µ | | | 665,000 | | | | 700,580 | |

NRG Energy | | | | | | | | |

144A 3.75% 6/15/24 # | | | 1,985,000 | | | | 2,034,007 | |

144A 4.45% 6/15/29 # | | | 3,180,000 | | | | 3,285,217 | |

NV Energy 6.25% 11/15/20 | | | 2,975,000 | | | | 3,115,076 | |

PacifiCorp 3.50% 6/15/29 | | | 8,170,000 | | | | 8,799,649 | |

Southern California Edison | | | | | | | | |

4.20% 3/1/29 | | | 3,720,000 | | | | 4,062,520 | |

4.875% 3/1/49 | | | 3,555,000 | | | | 4,119,655 | |

Southwestern Electric Power 4.10% 9/15/28 | | | 8,270,000 | | | | 9,049,469 | |

Tampa Electric 3.625% 6/15/50 | | | 3,455,000 | | | | 3,474,394 | |

Vistra Operations | | | | | | | | |

144A 3.55% 7/15/24 # | | | 3,310,000 | | | | 3,338,428 | |

144A 4.30% 7/15/29 # | | | 2,045,000 | | | | 2,059,641 | |

| | | | | | | | |

| | | | | | | 101,745,043 | |

| | | | | | | | |

Energy – 10.30% | | | | | | | | |

Continental Resources 3.80% 6/1/24 | | | 9,485,000 | | | | 9,726,053 | |

Enbridge Energy Partners | | | | | | | | |

4.375% 10/15/20 | | | 770,000 | | | | 785,975 | |

5.50% 9/15/40 | | | 1,320,000 | | | | 1,526,074 | |

24

��

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds(continued) | | | | | | | | |

| |

Energy(continued) | | | | | | | | |

Energy Transfer Operating | | | | | | | | |

5.25% 4/15/29 | | | 185,000 | | | $ | 206,685 | |

6.00% 6/15/48 | | | 1,365,000 | | | | 1,571,099 | |

6.25% 4/15/49 | | | 1,445,000 | | | | 1,719,568 | |

6.625%µy | | | 5,105,000 | | | | 4,857,510 | |

Eni 144A 4.25% 5/9/29 # | | | 5,475,000 | | | | 5,815,692 | |

Enterprise Products Operating | | | | | | | | |

3.125% 7/31/29 | | | 1,975,000 | | | | 1,991,082 | |

4.20% 1/31/50 | | | 5,100,000 | | | | 5,206,867 | |

Husky Energy 4.40% 4/15/29 | | | 5,030,000 | | | | 5,292,028 | |

Marathon Oil 4.40% 7/15/27 | | | 10,600,000 | | | | 11,174,816 | |

MPLX | | | | | | | | |

4.875% 12/1/24 | | | 7,875,000 | | | | 8,583,070 | |

5.50% 2/15/49 | | | 1,865,000 | | | | 2,083,435 | |

Newfield Exploration 5.625% 7/1/24 | | | 1,345,000 | | | | 1,486,000 | |

Noble Energy | | | | | | | | |

3.90% 11/15/24 | | | 2,315,000 | | | | 2,413,996 | |

4.95% 8/15/47 | | | 2,170,000 | | | | 2,307,712 | |

NuStar Logistics 5.625% 4/28/27 | | | 2,585,000 | | | | 2,677,827 | |

ONEOK 7.50% 9/1/23 | | | 4,985,000 | | | | 5,825,159 | |

Petrobras Global Finance 7.25% 3/17/44 | | | 2,560,000 | | | | 3,005,440 | |

Sabine Pass Liquefaction | | | | | | | | |

5.625% 3/1/25 | | | 3,825,000 | | | | 4,256,312 | |

5.75% 5/15/24 | | | 5,964,000 | | | | 6,623,577 | |

Saudi Arabian Oil 144A 4.375% 4/16/49 # | | | 1,495,000 | | | | 1,555,048 | |

Schlumberger Holdings 144A 4.30% 5/1/29 # | | | 5,445,000 | | | | 5,886,628 | |

Targa Resources Partners 5.875% 4/15/26 | | | 2,370,000 | | | | 2,511,489 | |

Transcanada Trust 5.875% 8/15/76 µ | | | 2,245,000 | | | | 2,357,924 | |

| | | | | | | | |

| | | | | | | 101,447,066 | |

| | | | | | | | |

Finance Companies – 2.79% | | | | | | | | |

AerCap Ireland Capital 3.65% 7/21/27 | | | 7,027,000 | | | | 7,049,682 | |

Aviation Capital Group 144A 4.375% 1/30/24 # | | | 2,670,000 | | | | 2,808,215 | |

Avolon Holdings Funding | | | | | | | | |

144A 3.95% 7/1/24 # | | | 3,265,000 | | | | 3,344,862 | |

144A 4.375% 5/1/26 # | | | 2,075,000 | | | | 2,148,600 | |

144A 5.25% 5/15/24 # | | | 2,970,000 | | | | 3,195,482 | |

Depository Trust & Clearing 144A 4.875%#µy | | | 6,000,000 | | | | 6,046,290 | |

International Lease Finance 8.625% 1/15/22 | | | 2,500,000 | | | | 2,842,233 | |

| | | | | | | | |

| | | | | | | 27,435,364 | |

| | | | | | | | |

Insurance – 3.77% | | | | | | | | |

AXA Equitable Holdings 5.00% 4/20/48 | | | 2,370,000 | | | | 2,509,375 | |

Brighthouse Financial 4.70% 6/22/47 | | | 2,525,000 | | | | 2,182,525 | |

25

Schedules of investments

Delaware Corporate Bond Fund

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | | | | | | | | |

| |

Insurance (continued) | | | | | | | | |

MetLife 144A 9.25% 4/8/38 # | | | 2,160,000 | | | $ | 3,059,845 | |

PartnerRe Finance 3.70% 7/2/29 | | | 2,985,000 | | | | 3,061,335 | |

Pine Street Trust I 144A 4.572% 2/15/29 # | | | 375,000 | | | | 394,496 | |

Prudential Financial 4.35% 2/25/50 | | | 5,985,000 | | | | 6,815,750 | |

Reinsurance Group of America 3.90% 5/15/29 | | | 6,535,000 | | | | 6,811,315 | |

UnitedHealth Group 3.50% 8/15/39 | | | 7,070,000 | | | | 7,122,705 | |

Voya Financial 4.70% 1/23/48 µ | | | 3,390,000 | | | | 3,129,057 | |

XLIT 4.761% (LIBOR03M + 2.46%)y● | | | 2,042,000 | | | | 2,046,125 | |

| | | | | | | | |

| | | | | | | 37,132,528 | |

| | | | | | | | |

Real Estate Investment Trusts – 2.97% | | | | | | | | |

American Tower Trust #1 144A 3.07% 3/15/23 # | | | 2,726,000 | | | | 2,753,225 | |

Corporate Office Properties 5.25% 2/15/24 | | | 5,730,000 | | | | 6,130,803 | |

Digital Realty Trust 3.60% 7/1/29 | | | 4,920,000 | | | | 5,036,260 | |

Host Hotels & Resorts 3.75% 10/15/23 | | | 2,750,000 | | | | 2,832,502 | |

Life Storage 4.00% 6/15/29 | | | 945,000 | | | | 980,329 | |

LifeStorage 3.50% 7/1/26 | | | 2,745,000 | | | | 2,772,144 | |

WEA Finance 144A 3.50% 6/15/29 # | | | 6,350,000 | | | | 6,473,848 | |

WP Carey 4.60% 4/1/24 | | | 2,120,000 | | | | 2,260,461 | |

| | | | | | | | |

| | | | | | | 29,239,572 | |

| | | | | | | | |

Technology – 5.72% | | | | | | | | |

Broadcom | | | | | | | | |

3.50% 1/15/28 | | | 2,755,000 | | | | 2,595,604 | |

144A 4.25% 4/15/26 # | | | 750,000 | | | | 756,393 | |

Fiserv 3.50% 7/1/29 | | | 7,445,000 | | | | 7,651,373 | |

International Business Machines | | | | | | | | |

3.00% 5/15/24 | | | 2,935,000 | | | | 3,005,871 | |

3.30% 5/15/26 | | | 3,260,000 | | | | 3,389,433 | |

3.50% 5/15/29 | | | 1,935,000 | | | | 2,027,821 | |

Marvell Technology Group 4.875% 6/22/28 | | | 6,280,000 | | | | 6,803,113 | |

Microchip Technology | | | | | | | | |

3.922% 6/1/21 | | | 1,335,000 | | | | 1,358,848 | |

4.333% 6/1/23 | | | 9,520,000 | | | | 9,902,916 | |

Micron Technology | | | | | | | | |

4.185% 2/15/27 | | | 3,090,000 | | | | 3,127,128 | |

4.663% 2/15/30 | | | 3,390,000 | | | | 3,426,524 | |

NXP | | | | | | | | |

144A 4.125% 6/1/21 # | | | 1,935,000 | | | | 1,980,207 | |

144A 4.875% 3/1/24 # | | | 7,660,000 | | | | 8,222,851 | |

SS&C Technologies 144A 5.50% 9/30/27 # | | | 2,035,000 | | | | 2,120,216 | |

| | | | | | | | |

| | | | | | | 56,368,298 | |

| | | | | | | | |

Transportation – 1.11% | | | | | | | | |

FedEx 4.05% 2/15/48 | | | 8,845,000 | | | | 8,572,282 | |

26

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | | | | | | | | |

| |

Transportation (continued) | | | | | | | | |

United Airlines 2019-1 Class AA Pass Through Trust 4.15% 8/25/31¨ | | | 2,220,000 | | | $ | 2,385,436 | |

| | | | | | | | |

| | | | | | | 10,957,718 | |

| | | | | | | | |

Utilities – 1.92% | | | | | | | | |

American Water Capital | | | | | | | | |

3.45% 6/1/29 | | | 3,635,000 | | | | 3,819,859 | |

4.15% 6/1/49 | | | 4,010,000 | | | | 4,398,305 | |

Aqua America 4.276% 5/1/49 | | | 3,270,000 | | | | 3,588,243 | |

Boston Gas 144A 3.001% 8/1/29 # | | | 7,030,000 | | | | 7,104,474 | |

| | | | | | | | |

| | | | | | | 18,910,881 | |

| | | | | | | | |

Total Corporate Bonds(cost $847,193,606) | | | | | | | 880,379,511 | |

| | | | | | | | |

| | | | | | | | |

| |

Municipal Bonds – 1.04% | | | | | | | | |

| |

Buckeye, Ohio Tobacco Settlement Financing Authority (Asset-Backed Senior Turbo) Series A-2 5.875% 6/1/47 | | | 2,195,000 | | | | 2,159,331 | |

Los Angeles, California Department of Water & Power Revenue

(Federally Taxable - Direct Payment - Build America Bonds) Series D 6.574% 7/1/45 | | | 5,365,000 | | | | 8,121,054 | |

| | | | | | | | |

Total Municipal Bonds(cost $7,479,351) | | | | | | | 10,280,385 | |

| | | | | | | | |

| | | | | | | | |

| |

Loan Agreements – 1.23% | | | | | | | | |

| |

Altice France Tranche B13 1st Lien 6.325% (LIBOR01M + 4.00%) 8/14/26● | | | 2,481,250 | | | | 2,460,298 | |

Mauser Packaging Solutions Holding Tranche B 1st Lien 5.59% (LIBOR03M + 3.25%) 4/3/24● | | | 2,474,747 | | | | 2,439,688 | |

Stars Group Holdings Tranche B 1st Lien 5.83% (LIBOR03M + 3.50%) 7/10/25● | | | 2,230,245 | | | | 2,244,184 | |

Unitymedia Finance Tranche E 1st Lien 4.354% (LIBOR03M + 2.00%) 6/1/23● | | | 2,500,000 | | | | 2,499,575 | |

USI Tranche B 1st Lien 5.33% (LIBOR03M + 3.00%) 5/16/24● | | | 2,474,811 | | | | 2,444,136 | |

| | | | | | | | |

Total Loan Agreements(cost $12,078,560) | | | | | | | 12,087,881 | |

| | | | | | | | |

| | |

| | | Number of shares | | | | |

| |

Convertible Preferred Stock – 0.41% | | | | | | | | |

| |

A Schulman 6.00% exercise price $52.33y | | | 2,808 | | | | 2,871,180 | |

El Paso Energy Capital Trust I 4.75% exercise price $34.49, maturity date 3/31/28 | | | 22,731 | | | | 1,204,743 | |

| | | | | | | | |

Total Convertible Preferred Stock(cost $4,053,106) | | | | | | | 4,075,923 | |

| | | | | | | | |

27

Schedules of investments

Delaware Corporate Bond Fund

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

| |

Preferred Stock – 0.36% | | | | | | | | |

| |

GMAC Capital Trust I 8.303% (LIBOR03M + 5.785%)● | | | 50,000 | | | $ | 1,318,000 | |

Morgan Stanley 5.55% µ | | | 1,850,000 | | | | 1,873,736 | |

USB Realty 144A 3.45% (LIBOR03M + 1.147%)#● | | | 400,000 | | | | 344,608 | |

| | | | | | | | |

Total Preferred Stock(cost $3,134,700) | | | | | | | 3,536,344 | |

| | | | | | | | |

| | | | | | | | |

| |

Short-Term Investments – 4.65% | | | | | | | | |

| |

Money Market Mutual Funds – 4.65% | | | | | | | | |

BlackRock FedFund - Institutional Shares (seven-day effective yield 2.23%) | | | 9,160,963 | | | | 9,159,701 | |

Fidelity Investments Money Market Government Portfolio - Class I (seven-day effective yield 2.19%) | | | 9,160,963 | | | | 9,159,668 | |

GS Financial Square Government Fund - Institutional Shares (seven-day effective yield 2.23%) | | | 9,160,963 | | | | 9,159,697 | |

Morgan Stanley Government Portfolio - Institutional Class (seven-day effective yield 2.21%) | | | 9,160,963 | | | | 9,159,684 | |

State Street Institutional US Government Money Market Fund - Investor Class (seven-day effective yield 2.18%) | | | 9,160,963 | | | | 9,159,655 | |

| | | | | | | | |

Total Short-Term Investments(cost $45,798,405) | | | | | | | 45,798,405 | |

| | | | | | | | |

Total Value of Securities – 97.36%

(cost $922,446,563) | | | | | | $ | 958,922,065 | |

| | | | | | | | |