UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-00173

DODGE & COX FUNDS

(Exact name of registrant as specified in charter)

555 California Street, 40th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Roberta R.W. Kameda, Esq.

555 California Street, 40th Floor

San Francisco, CA 94104

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-981-1710

Date of fiscal year end: DECEMBER 31, 2018

Date of reporting period: JUNE 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following are the June 30, 2018 semi-annual reports for the Dodge & Cox Funds, a Delaware statutory trust, consisting of six series: Dodge & Cox Stock Fund, Dodge & Cox Global Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund, Dodge & Cox Income Fund, and Dodge & Cox Global Bond Fund. The reports of each series were transmitted to their respective shareholders on August 16, 2018.

DODGE & COX FUNDS®

Semi-Annual Report

June 30, 2018

Stock Fund

ESTABLISHED 1965

TICKER: DODGX

6/18 SF SAR  Printed on recycled paper

Printed on recycled paper

TO OUR SHAREHOLDERS

The Dodge & Cox Stock Fund had a total return of 1.0% for the six months ended June 30, 2018, compared to a return of 2.6% for the S&P 500 Index.

MARKET COMMENTARY

During the first half of 2018, U.S. growth stocks (the higher valuation portion of the equity market) outperformed value stocks (the lower valuation portion) by nine percentage points,(a) continuing a long-term trend. Since the end of 2014, growth has bested value by 32 percentage points;(b) growth-oriented companies in sectors and industries associated with technology—most notably the “FAANG” stocks (Facebook, Amazon, Apple, Netflix, Google)—have led markets.

Dodge & Cox’s approach is value oriented, and the Fund has performed well compared to the U.S. value investment universe—outperforming the Russell 1000 Value Index by 12 percentage points over the past three and a half years. However, the broad-based S&P 500, which was boosted by growth stocks, outperformed the Fund by four percentage points over this same period.(c)

INVESTMENT STRATEGY

We understand that there are periods when value is trumped by growth. However, we believe the current divergence may narrow. In the United States, the valuation differential between growth and value stocks is wider than usual, with growth stocks trading at historically large premiums. Returns of value-focused strategies have been influenced by valuation spreads, and we believe current conditions are favorable for value stocks to rebound. While investors may not immediately recognize the intrinsic value of companies in relation to sales, cash flows, earnings, or book value, market prices over time tend to be driven by long-term fundamentals.

In the first six months of 2018, we made gradual portfolio adjustments in response to diverging valuations. For example, we sold selected technology and retail holdings that had performed strongly, such as Walmart.(d) In recent years, Walmart—the largest retailer in the world—has faced additional competition from large online retailers, such as Amazon. In 2015, Walmart announced a transformation plan that focused on increasing investment in labor, technology, and sales growth; the company successfully executed on these initiatives and improved its same store sales. In addition, Walmart restructured and expanded its ecommerce division by entering into a partnership with JD.com (China’s largest retailer), purchasing Jet.com, and naming Jet founder Marc Lore as head of Walmart’s ecommerce. Under Lore’s leadership, U.S. online sales growth year over year increased from 29% at the end of fiscal 2016 to at least 50% in each of the first three quarters of fiscal 2017.

On the heels of these positive developments, Walmart’s share price performed strongly, and we sold the position in early 2018. We continue to find selected opportunities in industries such as Media and Banks.

Media

Within Consumer Discretionary, Media is an important overweight position: 11%(e) of the Fund compared to 2% of the S&P 500 on June 30. The media landscape is evolving due to new direct-to-consumer entrants, changes in consumer viewing and listening habits, shifting revenue streams, and industry consolidation. Uncertainty surrounding pending merger and acquisition (M&A) transactions and potential regulatory incursions (e.g., unbundling, forced wholesale access, price regulation on broadband) pose risks to the Fund’s media investments. Nevertheless, we recently added to Comcast, Time Warner (before it was acquired by AT&T), and Charter Communications after weighing each company’s long-term fundamentals against its attractive valuation.

Comcast

Comcast—the largest U.S. cable provider—has been held in the Fund since 2002; over the years, we have actively added to and trimmed from the position based on relative valuation. In the first half of 2018, Comcast’s share price declined 17% amid concerns about its $31 billion cash offer to acquire UK-based pay-television company Sky PLC and its $65 billion all-cash bid for a majority of Twenty-First Century Fox’s assets.

Given these developments, our equity and fixed income teams worked together to evaluate Comcast’s risk/return profiles for a range of potential M&A outcomes. We spoke with company management about their overall M&A strategy and reconfirmed our longstanding view that they are skilled at allocating capital to create shareholder value. We believe the Sky acquisition is strategically sound because it would expand Comcast’s international presence and provide greater scale to amortize content costs. In July, Comcast dropped its bid for Fox and continued its pursuit of Sky.

In our opinion, the market has overly penalized Comcast’s share price as a result of concerns about bidding wars and subscriber growth. Trading at a multi-decade low valuation versus the S&P 500, Comcast was our largest addition in the Media industry during the first six months of 2018. The company has a de-facto local monopoly on broadband internet services in many parts of the United States and, despite talk of “cord cutting,” has the potential to grow through increased broadband penetration and pricing power in residential and business services. We believe NBC Universal (owned by Comcast) can increase its operating profit through affiliate fee increases at NBC and continued investment in its theme parks. In addition, owner-operator Brian Roberts has created significant shareholder value and leads a strong management team. Comcast, the Fund’s second-largest holding, was a 3.8% position on June 30.

Wells Fargo

During the first half of 2018, we opportunistically added to Wells Fargo (down 7%), which was weak among bank stocks and detracted from performance. In February, Wells Fargo entered into a consent agreement with the Federal Reserve (Fed) that, among

PAGE 2 § DODGE & COX STOCK FUND

other things, placed restrictions on the bank’s asset growth (capped at $1.952 trillion). This regulatory agreement stemmed from Wells Fargo’s previously disclosed improper sales practices.

Since 2016, Wells Fargo has made substantial progress improving its governance, compliance controls, and operational risk management. Notably, the leadership and composition of the company’s board has improved, including the election of six new independent directors in 2017. Management has affirmed its commitment to have third parties conduct an initial risk management review by the end of 2018. The company has settled with regulators regarding its auto insurance and mortgage sales practices and has also resolved class-action lawsuits with shareholders and consumers. Furthermore, Wells Fargo passed the Fed’s annual industry stress test in June and received approval to use $32.9 billion for dividends and share buybacks over the next 12 months, representing a significant return of capital to shareholders.

After a comprehensive review, we believe Wells Fargo’s superior franchise, deep management team, track record of generating higher returns than other banks, and attractive valuation at 1.5 times book value make it a compelling long-term investment opportunity. On June 30, Wells Fargo was the Fund’s largest holding (a 3.9% position).

IN CLOSING

Despite concerns about tariffs and trade wars, we remain optimistic about the long-term outlook for the U.S. economy and the portfolio, which trades at a discount to the overall market (13.9 times forward earnings compared to 17.1 times for the S&P 500).

As a result of individual security selection, the Fund remains tilted toward more economically sensitive companies: as of June 30, Financials comprised 26% of the portfolio, Information Technology accounted for 16%, Consumer Discretionary was 15%, and Energy represented 9%. We believe the Fund is well positioned based on our view that longer-term global economic growth will be better than many investors expect, interest rates will continue to rise, and the outlook for corporate earnings remains attractive.

Patience, persistence, and a long-term investment horizon are essential to our investment approach. We encourage our shareholders to take a similar view. Thank you for your continued confidence in our firm. As always, we welcome your comments and questions.

For the Board of Trustees,

| | |

| |  |

Charles F. Pohl, Chairman | | Dana M. Emery, President |

August 1, 2018

| (a) | | The Russell 1000 Growth Index had a total return of 7.3% compared to –1.7% for the Russell 1000 Value Index during the first six months of 2018. |

| (b) | | The Russell 1000 Growth Index had a total return of 58.0% compared to 26.1% for the Russell 1000 Value Index from December 31, 2014 through June 30, 2018. |

| (c) | | The Dodge & Cox Stock Fund had a total return of 38.4% compared to 26.1% for the Russell 1000 Value Index and 42.0% for the S&P 500 from December 31, 2014 through June 30, 2018. |

| (d) | | The use of specific examples does not imply that they are more or less attractive investments than the portfolio’s other holdings. |

| (e) | | Unless otherwise specified, all weightings and characteristics are as of June 30, 2018. |

DODGE & COX STOCK FUND §PAGE 3

YEAR-TO-DATE PERFORMANCE REVIEW

The Fund underperformed the S&P 500 by 1.7 percentage points year to date.

Key Detractors from Relative Results

| | § | | Similar to full-year 2017, the strong performance of several large internet and technology stocks not held by the Fund (including Amazon, Apple, Facebook, and Netflix) negatively impacted relative results. This was significant in both the Information Technology and Consumer Discretionary sectors. | |

| | § | | Within Information Technology (holdings up 6% compared to up 11% for the S&P 500 sector), Micro Focus International (down 48%) was particularly weak. | |

| | § | | Within Consumer Discretionary (holdings up 2% compared to up 12% for the S&P 500 sector), media holdings DISH Network (down 30%), Comcast (down 17%), and Charter Communications (down 13%) performed poorly. | |

| | § | | The Fund’s average overweight position (28% versus 15% for the S&P 500 sector) in the Financials sector detracted. Goldman Sachs (down 13%) and MetLife (down 12%) were weak. | |

| | § | | Cigna (down 16%) and Johnson Controls International (down 11%) also lagged. | |

Key Contributors to Relative Results

| | § | | In the Consumer Staples sector, the Fund’s underweight position (average less than 1% versus 7% for the S&P 500 sector) helped results. The Fund’s lack of holdings in the Tobacco and Household Products industries, down 20% and 12% in the Index, respectively, was a meaningful positive. | |

| | § | | A higher average weighting (8% versus 6%) and strong returns from holdings in the Energy sector (up 16% compared to up 7% for the S&P 500 sector) aided performance. Anadarko Petroleum (up 38%), National Oilwell Varco (up 21%), and Apache (up 12%) were key contributors. | |

| | § | | Twenty-First Century Fox (up 45%) and GlaxoSmithKline (up 17%) also contributed. | |

KEY CHARACTERISTICS OF DODGE & COX

Independent Organization

Dodge & Cox is one of the largest privately owned investment managers in the world. We remain committed to independence, with a goal of providing the highest quality investment management service to our existing clients.

Over 85 Years of Investment Experience

Dodge & Cox was founded in 1930. We have a stable and well-qualified team of investment professionals, most of whom have spent their entire careers at Dodge & Cox.

Experienced Investment Team

The U.S. Equity Investment Committee, which is the decision-making body for the Stock Fund, is a nine-member committee with an average tenure at Dodge & Cox of 24 years.

One Business with a Single Research Office

Dodge & Cox manages equity (domestic, international, and global), fixed income (domestic and global), and balanced investments, operating from one office in San Francisco.

Consistent Investment Approach

Our team decision-making process involves thorough, bottom-up fundamental analysis of each investment.

Long-Term Focus and Low Expenses

We invest with a three- to five-year investment horizon, which has historically resulted in low turnover relative to our peers. We manage Funds that maintain low expense ratios.

Risks: The Fund is subject to market risk, meaning holdings in the Fund may decline in value for extended periods due to the financial prospects of individual companies, or due to general market and economic conditions. Please read the prospectus and summary prospectus for specific details regarding the Fund’s risk profile.

PAGE 4 § DODGE & COX STOCK FUND

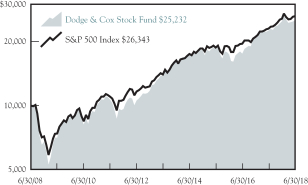

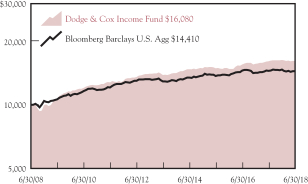

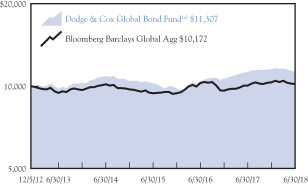

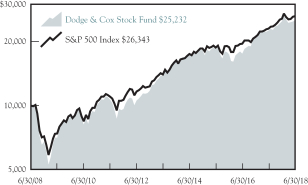

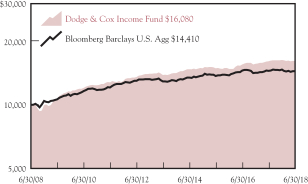

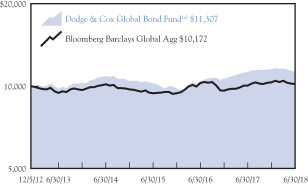

GROWTH OF $10,000 OVER 10 YEARS

FOR AN INVESTMENT MADE ON JUNE 30, 2008

AVERAGE ANNUAL TOTAL RETURN

FOR PERIODS ENDED JUNE 30, 2018

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | 20 Years | |

Dodge & Cox Stock Fund | | | 11.87 | % | | | 12.81 | % | | | 9.69 | % | | | 9.16 | % |

S&P 500 Index | | | 14.37 | | | | 13.42 | | | | 10.17 | | | | 6.46 | |

Returns represent past performance and do not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Fund performance changes over time and currently may be significantly lower than stated. Performance is updated and published monthly. Visit the Fund’s website at dodgeandcox.com or call 800-621-3979 for current performance figures.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions or on Fund share redemptions. Index returns include dividends but, unlike Fund returns, do not reflect fees or expenses. The S&P 500 Index is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market.

S&P 500® is a trademark of S&P Global Inc.

FUND EXPENSE EXAMPLE

As a Fund shareholder, you incur ongoing Fund costs, including management fees and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The following example shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The example assumes a $1,000 investment held for the six months indicated.

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and expenses based on the Fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON WITH OTHER MUTUAL FUNDS

Information on the second line of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the Fund and an assumed 5% annual rate of return before expenses (not the Fund’s actual return). The amount under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other mutual funds.

| | | | | | | | | | | | |

Six Months Ended

June 30, 2018 | | Beginning Account Value

1/1/2018 | | | Ending Account Value

6/30/2018 | | | Expenses Paid

During Period* | |

Based on Actual Fund Return | | $ | 1,000.00 | | | $ | 1,009.50 | | | $ | 2.61 | |

Based on Hypothetical 5% Yearly Return | | | 1,000.00 | | | | 1,022.20 | | | | 2.63 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.52%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional fees or account maintenance fees. Though other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

DODGE & COX STOCK FUND §PAGE 5

| | | | |

| FUND INFORMATION (unaudited) | | | June 30, 2018 | |

| | | | |

| GENERAL INFORMATION | | | |

Net Asset Value Per Share | | | $201.86 | |

Total Net Assets (billions) | | | $70.5 | |

Expense Ratio | | | 0.52% | |

Portfolio Turnover Rate (1/1/18 to 6/30/18, unannualized) | | | 8% | |

30-Day SEC Yield(a) | | | 1.29% | |

Active Share(b) | | | 80% | |

Number of Companies | | | 65 | |

Fund Inception | | | 1965 | |

No sales charges or distribution fees | | | | |

Investment Manager: Dodge & Cox, San Francisco. Managed by the U.S. Equity Investment Committee, whose nine members’ average tenure at Dodge & Cox is 24 years.

| | | | | | | | |

| PORTFOLIO CHARACTERISTICS | | Fund | | | S&P 500 | |

Median Market Capitalization (billions) | | | $45 | | | | $21 | |

Weighted Average Market Capitalization (billions) | | | $144 | | | | $217 | |

Price-to-Earnings Ratio(c) | | | 13.9x | | | | 17.1x | |

Foreign Securities not in the S&P 500(d) | | | 11.0% | | | | 0.0% | |

| | | | |

| TEN LARGEST HOLDINGS (%)(e) | | Fund | |

Wells Fargo & Co. | | | 3.9 | |

Comcast Corp. | | | 3.8 | |

Twenty-First Century Fox, Inc. | | | 3.6 | |

Capital One Financial Corp. | | | 3.5 | |

Charles Schwab Corp. | | | 3.4 | |

Microsoft Corp. | | | 3.3 | |

Bank of America Corp. | | | 3.2 | |

Alphabet, Inc. | | | 3.1 | |

Charter Communications, Inc. | | | 3.0 | |

Anadarko Petroleum Corp. | | | 2.9 | |

| | | | | | | | |

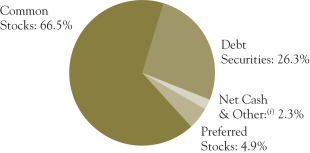

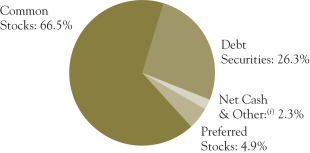

| SECTOR DIVERSIFICATION (%) | | Fund | | | S&P 500 | |

Financials | | | 26.3 | | | | 13.8 | |

Health Care | | | 22.6 | | | | 14.1 | |

Information Technology | | | 16.4 | | | | 26.0 | |

Consumer Discretionary | | | 14.6 | | | | 12.9 | |

Energy | | | 9.2 | | | | 6.3 | |

Industrials | | | 4.9 | | | | 9.5 | |

Telecommunication Services | | | 2.8 | | | | 2.0 | |

Materials | | | 1.0 | | | | 2.6 | |

Consumer Staples | | | 0.2 | | | | 7.0 | |

Utilities | | | 0.0 | | | | 2.9 | |

Real Estate | | | 0.0 | | | | 2.9 | |

| (a) | SEC Yield is an annualization of the Fund’s net investment income for the trailing 30-day period. Dividends paid by the Fund may be higher or lower than implied by the SEC Yield. |

| (b) | Active share is a measure of how much an investment portfolio differs from its benchmark index, based on a scale of 0% (complete overlap with the index) to 100% (no overlap). Overlap for each security in the Fund is the lower of either its percentage weight in the Fund or its percentage weight in the relevant index. The Stock Fund’s total overlap with the S&P 500 is the sum of each security’s calculated overlap. |

| (c) | Price-to-earnings (P/E) ratios are calculated using 12-month forward earnings estimates from third-party sources. |

| (d) | Foreign securities are U.S. dollar denominated. |

| (e) | The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation to buy, sell, or hold any particular security and is not indicative of Dodge & Cox’s current or future trading activity. |

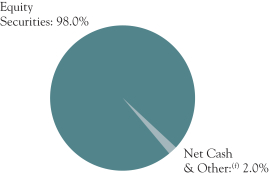

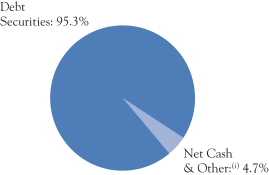

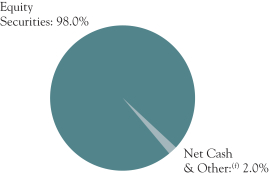

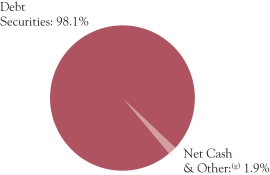

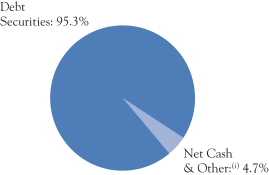

| (f) | Net Cash & Other includes cash, short-term investments, derivatives, receivables, and payables. |

PAGE 6 § DODGE & COX STOCK FUND

| | | | |

| PORTFOLIO OF INVESTMENTS (unaudited) | | | June 30, 2018 | |

| | | | | | | | |

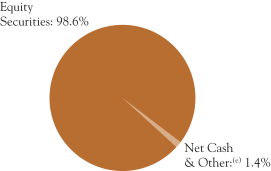

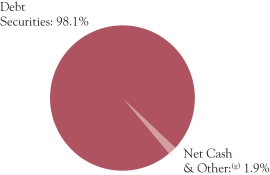

| COMMON STOCKS: 98.0% | | | | | | |

| | |

| | | SHARES | | | VALUE | |

| CONSUMER DISCRETIONARY: 14.6% | |

AUTOMOBILES & COMPONENTS: 0.3% | |

Harley-Davidson, Inc. | | | 5,581,047 | | | $ | 234,850,458 | |

|

CONSUMER DURABLES & APPAREL: 0.5% | |

Mattel, Inc.(a)(b) | | | 20,504,501 | | | | 336,683,906 | |

| | |

MEDIA: 11.1% | | | | | | | | |

Charter Communications, Inc., Class A(a) | | | 7,233,786 | | | | 2,121,018,393 | |

Comcast Corp., Class A | | | 81,005,794 | | | | 2,657,800,101 | |

DISH Network Corp., Class A(a) | | | 9,976,176 | | | | 335,299,276 | |

News Corp., Class A | | | 7,528,790 | | | | 116,696,245 | |

Twenty-First Century Fox, Inc., Class A | | | 42,510,126 | | | | 2,112,328,161 | |

Twenty-First Century Fox, Inc., Class B | | | 9,300,600 | | | | 458,240,562 | |

| | | | | | | | |

| | | | | | | 7,801,382,738 | |

RETAILING: 2.7% | | | | | | | | |

Booking Holdings, Inc.(a) | | | 406,600 | | | | 824,214,794 | |

Qurate Retail, Inc., Series A(a) | | | 22,509,076 | | | | 477,642,593 | |

Target Corp. | | | 7,728,254 | | | | 588,274,694 | |

| | | | | | | | |

| | | | | | | 1,890,132,081 | |

| | | | | | | | |

| | | | | | | 10,263,049,183 | |

| CONSUMER STAPLES: 0.2% | |

FOOD, BEVERAGE & TOBACCO: 0.2% | |

Molson Coors Brewing Company, Class B | | | 1,843,925 | | | | 125,460,657 | |

| | |

| ENERGY: 9.2% | | | | | | | | |

Anadarko Petroleum Corp.(b) | | | 27,357,621 | | | | 2,003,945,738 | |

Apache Corp.(b) | | | 24,184,032 | | | | 1,130,603,496 | |

Baker Hughes, a GE Company | | | 25,498,040 | | | | 842,200,261 | |

Concho Resources, Inc.(a) | | | 2,550,500 | | | | 352,861,675 | |

National Oilwell Varco, Inc.(b) | | | 19,498,800 | | | | 846,247,920 | |

Occidental Petroleum Corp. | | | 3,044,726 | | | | 254,782,672 | |

Schlumberger, Ltd. (Curacao/United States) | | | 13,905,645 | | | | 932,095,385 | |

Weatherford International PLC(a) (Ireland) | | | 29,359,600 | | | | 96,593,084 | |

| | | | | | | | |

| | | | | | | 6,459,330,231 | |

| FINANCIALS: 26.3% | | | | | | | | |

BANKS: 10.3% | | | | | | | | |

Bank of America Corp. | | | 80,235,100 | | | | 2,261,827,469 | |

BB&T Corp. | | | 11,315,944 | | | | 570,776,215 | |

JPMorgan Chase & Co. | | | 16,329,700 | | | | 1,701,554,740 | |

Wells Fargo & Co. | | | 49,727,141 | | | | 2,756,872,697 | |

| | | | | | | | |

| | | | | | | 7,291,031,121 | |

DIVERSIFIED FINANCIALS: 13.4% | |

American Express Co. | | | 16,413,200 | | | | 1,608,493,600 | |

Bank of New York Mellon Corp. | | | 27,262,624 | | | | 1,470,273,312 | |

Capital One Financial Corp.(b) | | | 26,775,511 | | | | 2,460,669,461 | |

Charles Schwab Corp. | | | 47,605,000 | | | | 2,432,615,500 | |

Goldman Sachs Group, Inc. | | | 6,699,500 | | | | 1,477,708,715 | |

| | | | | | | | |

| | | | | | | 9,449,760,588 | |

INSURANCE: 2.6% | |

AEGON NV (Netherlands) | | | 71,237,724 | | | | 421,727,326 | |

Brighthouse Financial, Inc.(a) | | | 2,099,363 | | | | 84,121,476 | |

MetLife, Inc. | | | 30,428,900 | | | | 1,326,700,040 | |

| | | | | | | | |

| | | | | | | 1,832,548,842 | |

| | | | | | | | |

| | | | | | | 18,573,340,551 | |

| HEALTH CARE: 22.6% | | | | | | | | |

HEALTH CARE EQUIPMENT & SERVICES: 7.6% | |

Cigna Corp. | | | 6,191,117 | | | | 1,052,180,334 | |

Danaher Corp. | | | 3,229,500 | | | | 318,687,060 | |

Express Scripts Holding Co.(a) | | | 25,487,758 | | | | 1,967,909,795 | |

Medtronic PLC (Ireland) | | | 11,373,400 | | | | 973,676,774 | |

UnitedHealth Group, Inc. | | | 4,249,260 | | | | 1,042,513,449 | |

| | | | | | | | |

| | | | | | | 5,354,967,412 | |

| | | | | | | | |

| | |

| | | SHARES | | | VALUE | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES: 15.0% | |

Alnylam Pharmaceuticals, Inc.(a) | | | 2,813,861 | | | $ | 277,137,170 | |

AstraZeneca PLC ADR (United Kingdom) | | | 34,646,973 | | | | 1,216,455,222 | |

Bristol-Myers Squibb Co. | | | 19,848,739 | | | | 1,098,429,216 | |

Eli Lilly and Co. | | | 16,568,419 | | | | 1,413,783,193 | |

Gilead Sciences, Inc. | | | 10,745,612 | | | | 761,219,154 | |

GlaxoSmithKline PLC ADR (United Kingdom) | | | 32,000,000 | | | | 1,289,920,000 | |

Merck & Co., Inc. | | | 1,131,632 | | | | 68,690,063 | |

Novartis AG ADR (Switzerland) | | | 21,730,200 | | | | 1,641,499,308 | |

Roche Holding AG ADR (Switzerland) | | | 42,192,699 | | | | 1,165,784,273 | |

Sanofi ADR (France) | | | 40,619,428 | | | | 1,625,183,314 | |

| | | | | | | | |

| | | | | | | 10,558,100,913 | |

| | | | | | | | |

| | | | | | | 15,913,068,325 | |

| INDUSTRIALS: 4.9% | | | | | | | | |

CAPITAL GOODS: 1.7% | | | | | | | | |

Johnson Controls International PLC (Ireland) | | | 36,754,251 | | | | 1,229,429,696 | |

| | |

TRANSPORTATION: 3.2% | | | | | | | | |

FedEx Corp. | | | 6,288,999 | | | | 1,427,980,113 | |

Union Pacific Corp. | | | 5,837,300 | | | | 827,028,664 | |

| | | | | | | | |

| | | | | | | 2,255,008,777 | |

| | | | | | | | |

| | | | | | | 3,484,438,473 | |

| INFORMATION TECHNOLOGY: 16.4% | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT: 0.5% | |

Maxim Integrated Products, Inc. | | | 5,795,475 | | | | 339,962,564 | |

|

SOFTWARE & SERVICES: 8.8% | |

Alphabet, Inc., Class A(a) | | | 82,500 | | | | 93,158,175 | |

Alphabet, Inc., Class C(a) | | | 1,886,153 | | | | 2,104,286,594 | |

Dell Technologies, Inc., Class V(a) | | | 9,452,510 | | | | 799,493,296 | |

Micro Focus International PLC ADR (United Kingdom) | | | 20,522,377 | | | | 354,421,451 | |

Microsoft Corp. | | | 23,231,000 | | | | 2,290,808,910 | |

Synopsys, Inc.(a) | | | 3,454,669 | | | | 295,616,026 | |

VMware, Inc.(a) | | | 2,120,000 | | | | 311,576,400 | |

| | | | | | | | |

| | | | | | | 6,249,360,852 | |

TECHNOLOGY, HARDWARE & EQUIPMENT: 7.1% | |

Cisco Systems, Inc. | | | 25,225,111 | | | | 1,085,436,526 | |

Hewlett Packard Enterprise Co.(b) | | | 84,295,793 | | | | 1,231,561,536 | |

HP Inc. | | | 51,646,578 | | | | 1,171,860,855 | |

Juniper Networks, Inc.(b) | | | 24,633,165 | | | | 675,441,384 | |

TE Connectivity, Ltd. (Switzerland) | | | 9,198,175 | | | | 828,387,641 | |

| | | | | | | | |

| | | | | | | 4,992,687,942 | |

| | | | | | | | |

| | | | | | | 11,582,011,358 | |

| MATERIALS: 1.0% | | | | | | | | |

Celanese Corp., Series A | | | 6,266,298 | | | | 695,935,056 | |

|

| TELECOMMUNICATION SERVICES: 2.8% | |

AT&T, Inc. | | | 27,637,787 | | | | 887,449,340 | |

Sprint Corp.(a) | | | 100,731,527 | | | | 547,979,507 | |

Zayo Group Holdings, Inc.(a)(b) | | | 14,627,500 | | | | 533,611,200 | |

| | | | | | | | |

| | | | | | | 1,969,040,047 | |

TOTAL COMMON STOCKS

(Cost $45,720,734,469) | | | | | | $ | 69,065,673,881 | |

| | |

| See accompanying Notes to Financial Statements | | DODGE & COX STOCK FUND §PAGE 7 |

| | | | |

| PORTFOLIO OF INVESTMENTS (unaudited) | | | June 30, 2018 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS: 2.1% | |

| | |

| | | PAR VALUE/ SHARES | | | VALUE | |

REPURCHASE AGREEMENT: 1.7% | |

Fixed Income Clearing Corporation(c)

1.20%, dated 6/29/18, due 7/2/18, maturity value $1,209,687,957 | | $ | 1,209,567,000 | | | $ | 1,209,567,000 | |

|

MONEY MARKET FUND: 0.4% | |

State Street Institutional U.S. Government Money Market Fund | | | 282,279,936 | | | | 282,279,936 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $1,491,846,936) | | | $ | 1,491,846,936 | |

| | | | | | | | |

TOTAL INVESTMENTS IN SECURITIES

(Cost $47,212,581,405) | | | 100.1 | % | | $ | 70,557,520,817 | |

OTHER ASSETS LESS LIABILITIES | | | (0.1 | %) | | | (69,476,993 | ) |

| | | | | | | | |

| NET ASSETS | | | 100.0 | % | | $ | 70,488,043,824 | |

| | | | | | | | |

| (b) | See Note 8 regarding holdings of 5% voting securities |

| (c) | Repurchase agreement is collateralized by U.S. Treasury Notes 2.375%-3.125%, 3/15/21-5/15/21. Total collateral value is $1,233,769,748. |

In determining a company’s country designation, the Fund generally references the country of incorporation. In cases where the Fund considers the country of incorporation to be a “jurisdiction of convenience” chosen primarily for tax purposes or in other limited circumstances, the Fund uses the country designation of an appropriate broad-based market index. In those cases, two countries are listed — the country of incorporation and the country designated by an appropriate index, respectively.

ADR: American Depositary Receipt

| | | | | | | | | | | | | | | | |

| FUTURES CONTRACTS | |

| Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Value /

Unrealized

Appreciation

(Depreciation) | |

E-mini S&P 500 Index—Long Position | | | 9,058 | | | | 9/21/18 | | | $ | 1,232,612,640 | | | $ | (27,127,390 | ) |

| | |

| PAGE 8 § DODGE & COX STOCK FUND | | See accompanying Notes to Financial Statements |

| | | | |

STATEMENT OF ASSETS AND LIABILITIES (unaudited) | |

| |

| | | June 30, 2018 | |

ASSETS: | | | | |

Investments in securities, at value | | | | |

Unaffiliated issuers (cost $40,064,419,760) | | $ | 61,338,756,176 | |

Affiliated issuers (cost $7,148,161,645) | | | 9,218,764,641 | |

| | | | |

| | | 70,557,520,817 | |

Deposits with broker for futures contracts | | | 50,724,818 | |

Receivable for variation margin for futures contracts | | | 6,819,678 | |

Receivable for investments sold | | | 116,132,320 | |

Receivable for Fund shares sold | | | 120,341,535 | |

Dividends and interest receivable | | | 77,771,551 | |

Prepaid expenses and other assets | | | 111,409 | |

| | | | |

| | | 70,929,422,128 | |

| | | | |

LIABILITIES: | | | | |

Payable for investments purchased | | | 71,897,404 | |

Payable for Fund shares redeemed | | | 339,901,315 | |

Management fees payable | | | 29,409,708 | |

Accrued expenses | | | 169,877 | |

| | | | |

| | | 441,378,304 | |

| | | | |

NET ASSETS | | $ | 70,488,043,824 | |

| | | | |

NET ASSETS CONSIST OF: | | | | |

Paid in capital | | $ | 43,906,895,374 | |

Undistributed net investment income | | | 7,094,335 | |

Undistributed net realized gain | | | 3,256,242,093 | |

Net unrealized appreciation | | | 23,317,812,022 | |

| | | | |

| | $ | 70,488,043,824 | |

| | | | |

Fund shares outstanding (par value $0.01 each, unlimited shares authorized) | | | 349,185,202 | |

Net asset value per share | | $ | 201.86 | |

| |

STATEMENT OF OPERATIONS (unaudited) | | | | |

| |

| | | Six Months Ended

June 30, 2018 | |

INVESTMENT INCOME: | | | | |

Dividends (net of foreign taxes of $25,830,560) | | | | |

Unaffiliated issuers | | $ | 653,099,857 | |

Affiliated issuers | | | 73,594,263 | |

Interest | | | 4,427,970 | |

| | | | |

| | | 731,122,090 | |

| | | | |

EXPENSES: | | | | |

Management fees | | | 177,423,841 | |

Custody and fund accounting fees | | | 432,085 | |

Transfer agent fees | | | 1,722,513 | |

Professional services | | | 107,761 | |

Shareholder reports | | | 732,863 | |

Registration fees | | | 262,993 | |

Trustees’ fees | | | 162,083 | |

ADR depositary service fees | | | 4,653,615 | |

Miscellaneous | | | 424,858 | |

| | | | |

| | | 185,922,612 | |

| | | | |

NET INVESTMENT INCOME | | | 545,199,478 | |

| | | | |

REALIZED AND UNREALIZED GAIN (LOSS): | |

Net realized gain | | | | |

Investments in securities of unaffiliated issuers | | | 3,175,910,706 | |

Investments in securities of affiliated issuers | | | 100,554,131 | |

Futures contracts | | | 32,562,748 | |

Net change in unrealized appreciation/depreciation | | | | |

Investments in securities of unaffiliated issuers | | | (3,729,426,024 | ) |

Investments in securities of affiliated issuers | | | 599,888,797 | |

Futures contracts | | | (38,450,343 | ) |

| | | | |

Net realized and unrealized gain | | | 141,040,015 | |

| | | | |

NET CHANGE IN NET ASSETS

FROM OPERATIONS | | $ | 686,239,493 | |

| | | | |

| | | | | | | | |

STATEMENT OF CHANGES IN NET ASSETS (unaudited) | |

| | |

| | | Six Months Ended

June 30, 2018 | | | Year Ended

December 31, 2017 | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 545,199,478 | | | $ | 1,049,903,472 | |

Net realized gain (loss) | | | 3,309,027,585 | | | | 3,567,659,704 | |

Net change in unrealized appreciation/depreciation | | | (3,167,987,570 | ) | | | 6,614,504,649 | |

| | | | | | | | |

| | | 686,239,493 | | | | 11,232,067,825 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | |

Net investment income | | | (545,894,033 | ) | | | (1,054,882,152 | ) |

Net realized gain | | | (720,505,797 | ) | | | (3,605,758,265 | ) |

| | | | | | | | |

Total distributions | | | (1,266,399,830 | ) | | | (4,660,640,417 | ) |

| | | | | | | | |

| | |

FUND SHARE

TRANSACTIONS: | | | | | | | | |

Proceeds from sale of shares | | | 4,103,049,775 | | | | 8,669,060,752 | |

Reinvestment of distributions | | | 1,199,876,016 | | | | 4,418,678,881 | |

Cost of shares redeemed | | | (5,135,648,283 | ) | | | (10,358,716,247 | ) |

| | | | | | | | |

Net change from Fund share transactions | | | 167,277,508 | | | | 2,729,023,386 | |

| | | | | | | | |

Total change in net assets | | | (412,882,829 | ) | | | 9,300,450,794 | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 70,900,926,653 | | | | 61,600,475,859 | |

| | | | | | | | |

End of period (including undistributed net investment income of $7,094,335 and $7,788,890, respectively) | | $ | 70,488,043,824 | | | $ | 70,900,926,653 | |

| | | | | | | | |

| | |

SHARE INFORMATION: | | | | | | | | |

Shares sold | | | 19,943,961 | | | | 44,674,938 | |

Distributions reinvested | | | 6,026,848 | | | | 22,297,192 | |

Shares redeemed | | | (25,001,976 | ) | | | (53,003,282 | ) |

| | | | | | | | |

Net change in shares outstanding | | | 968,833 | | | | 13,968,848 | |

| | | | | | | | |

| | |

| See accompanying Notes to Financial Statements | | DODGE & COX STOCK FUND §PAGE 9 |

NOTES TO FINANCIAL STATEMENTS (unaudited)

NOTE 1—ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Dodge & Cox Stock Fund (the “Fund”) is one of the series constituting the Dodge & Cox Funds (the “Trust” or the “Funds”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Fund commenced operations on January 4, 1965, and seeks long-term growth of principal and income. Risk considerations and investment strategies of the Fund are discussed in the Fund’s Prospectus.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require the use of estimates and assumptions by management. Actual results may differ from those estimates. Significant accounting policies are as follows:

Security valuation The Fund’s net assets are normally valued as of the scheduled close of trading on the New York Stock Exchange (NYSE), generally 4 p.m. Eastern Time, each day that the NYSE is open for business.

Portfolio holdings for which market quotes are readily available are valued at market value. Listed securities, for example, are generally valued using the official quoted close price or the last sale on the exchange that is determined to be the primary market for the security. Exchange-traded derivatives are generally valued at the settlement price determined by the relevant exchange. Short-term securities less than 60 days to maturity may be valued at amortized cost if amortized cost approximates current value. Mutual funds are valued at their respective net asset values. Security values are not discounted based on the size of the Fund’s position and may differ from the value a Fund receives upon sale of the securities. All securities held by the Fund are denominated in U.S. dollars.

If market quotations are not readily available or if normal valuation procedures produce valuations that are deemed unreliable or inappropriate under the circumstances existing at the time, the investment will be valued at fair value as determined in good faith by or under the direction of the Fund’s Board of Trustees. The Board of Trustees has appointed Dodge & Cox, the Fund’s investment manager, to make fair value determinations in accordance with the Dodge & Cox Funds Valuation Policies (“Valuation Policies”), subject to Board oversight. Dodge & Cox has established a Pricing Committee that is comprised of representatives from Treasury, Legal, Compliance, and Operations. The Pricing Committee is responsible for implementing the Valuation Policies, including determining the fair value of securities and other investments when necessary. The Pricing Committee considers relevant indications of value that are reasonably available to it in determining the fair value assigned to a particular security, such as the value of similar financial instruments, trading volumes, contractual restrictions on disposition, related corporate actions, and changes in economic conditions. In doing so, the Pricing Committee employs various

methods for calibrating fair valuation approaches, including a regular review of key inputs and assumptions, back-testing, and review of any related market activity.

Valuing securities through a fair value determination involves greater reliance on judgment than valuation of securities based on readily available market quotations. In some instances, lack of information and uncertainty as to the significance of information may lead to a conclusion that a prior valuation is the best indication of a security’s value. When fair value pricing is employed, the prices of securities used by the Fund to calculate its net asset value may differ from quoted or published prices for the same securities.

Security transactions, investment income, expenses, and distributions Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Dividend income and corporate action transactions are recorded on the ex-dividend date, or when the Fund first learns of the dividend/corporate action if the ex-dividend date has passed. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Dividends characterized as return of capital for U.S. tax purposes are recorded as a reduction of cost of investments and/or realized gain. Interest income is recorded on the accrual basis.

Expenses are recorded on the accrual basis. Some expenses of the Trust can be directly attributed to a specific series. Expenses which cannot be directly attributed are allocated among the Funds in the Trust using methodologies determined by the nature of the expense.

Distributions to shareholders are recorded on the ex-dividend date.

Repurchase agreements Repurchase agreements are transactions under which a Fund purchases a security from a dealer counterparty and agrees to resell the security to that counterparty on a specified future date at the same price, plus a specified interest rate. The Fund’s repurchase agreements are secured by U.S. government or agency securities. It is the Fund’s policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. In the event of default by the counterparty, the Fund has the contractual right to liquidate the collateral securities and to apply the proceeds in satisfaction of the obligation.

Foreign taxes The Fund may be subject to foreign taxes which may be imposed by certain countries in which the Fund invests. The Fund endeavors to record foreign taxes based on applicable foreign tax law. Withholding taxes are incurred on certain foreign dividends and are accrued at the time the associated dividend is recorded. The Fund files withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. The Fund records a reclaim receivable based on, among other things, a jurisdiction’s legal obligation to pay reclaims as well as payment history and market convention. In consideration of recent decisions rendered by

PAGE 10 § DODGE & COX STOCK FUND

NOTES TO FINANCIAL STATEMENTS (unaudited)

European courts, the Fund has filed for additional reclaims related to prior years. A corresponding receivable is established when both the amount is known and significant contingencies or uncertainties regarding collectability are removed. These amounts, if any, are reported in “dividends and interest receivable” in the Statement of Assets and Liabilities.

Futures contracts Futures contracts involve an obligation to purchase or sell (depending on whether the Fund has entered a long or short futures contract, respectively) an asset at a future date, at a price set at the time of the contract. Upon entering into a futures contract, the Fund is required to deposit an amount of cash or liquid assets (referred to as initial margin) in a segregated account with the clearing broker. Subsequent payments (referred to as variation margin) to and from the clearing broker are made on a daily basis based on changes in the market value of futures contracts. Futures contracts are traded publicly and their market value changes daily. Changes in the market value of open futures contracts are recorded as unrealized appreciation or depreciation in the Statement of Operations. Realized gains and losses on futures contracts are recorded in the Statement of Operations at the closing or expiration of the contracts. Cash deposited with a broker as initial margin is recorded in the Statement of Assets and Liabilities. A receivable and/or payable to brokers for daily variation margin is also recorded in the Statement of Assets and Liabilities.

Investments in futures contracts may include certain risks, which may be different from, and potentially greater than, those of the underlying securities. To the extent the Fund uses futures, it is exposed to additional volatility and potential losses resulting from leverage.

The Fund has maintained long S&P 500 futures contracts to provide equity exposure that approximates the Fund’s “net cash and other” position, which includes cash, short-term investments, receivables, and payables. During the six months ended June 30, 2018, these S&P 500 futures contracts had notional values up to 2% of net assets.

Indemnification Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business the Trust enters into contracts that provide general indemnities to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 2—VALUATION MEASUREMENTS

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| § | | Level 1: Quoted prices in active markets for identical securities |

| § | | Level 2: Other significant observable inputs (including quoted prices for similar securities, market indices, interest rates, credit risk, forward exchange rates, etc.) |

| § | | Level 3: Significant unobservable inputs (including Fund management’s assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s holdings at June 30, 2018:

| | | | | | | | |

| Classification(a) | | LEVEL 1

(Quoted Prices) | | | LEVEL 2

(Other Significant

Observable Inputs) | |

Securities | | | | | | | | |

Common Stocks(b) | | $ | 69,065,673,881 | | | $ | — | |

Short-term Investments | | | | | | | | |

Repurchase Agreement | | | — | | | | 1,209,567,000 | |

Money Market Fund | | | 282,279,936 | | | | — | |

| | | | | | | | |

Total | | $ | 69,347,953,817 | | | $ | 1,209,567,000 | |

| | | | | | | | |

Other Investments | | | | | | | | |

Futures Contracts | | | | | | | | |

Depreciation | | $ | (27,127,390 | ) | | $ | — | |

| | | | | | | | | |

| (a) | There were no transfers between Level 1 and Level 2 during the six months ended June 30, 2018. There were no Level 3 securities at June 30, 2018 and December 31, 2017, and there were no transfers to Level 3 during the period. |

| (b) | All common stocks held in the Fund are Level 1 securities. For a detailed break-out of common stocks by major industry classification, please refer to the Portfolio of Investments. |

NOTE 3—RELATED PARTY TRANSACTIONS

Management fees Under a written agreement approved by a unanimous vote of the Board of Trustees, the Fund pays a management fee monthly at an annual rate of 0.50% of the Fund’s average daily net assets to Dodge & Cox, investment manager of the Fund. The agreement further provides that Dodge & Cox shall waive its fee to the extent that such fee plus all other ordinary operating expenses of the Fund exceed 0.75% of the average daily net assets for the year.

Fund officers and trustees All officers and two of the trustees of the Trust are officers or employees of Dodge & Cox. The Trust pays a fee only to those trustees who are not affiliated with Dodge & Cox.

NOTE 4—INCOME TAX INFORMATION AND DISTRIBUTIONS TO SHAREHOLDERS

A provision for federal income taxes is not required since the Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income to shareholders. Distributions are determined in accordance with income tax regulations, and such amounts may differ from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book to tax differences at year end to reflect tax character. Book to tax differences are primarily due to differing treatments of wash sales, net short-term realized gain (loss), certain dividends, and derivatives.

DODGE & COX STOCK FUND §PAGE 11

NOTES TO FINANCIAL STATEMENTS (unaudited)

Distributions during the periods noted below were characterized as follows for federal income tax purposes:

| | | | | | | | |

| | | Six Months Ended

June 30, 2018 | | | Year Ended

December 31, 2017 | |

Ordinary income | | $ | 562,174,692 | | | $ | 1,232,159,263 | |

| | | ($1.617 per share | ) | | | ($3.636 per share | ) |

Long-term capital gain | | $ | 704,225,138 | | | $ | 3,428,481,154 | |

| | | ($2.033 per share | ) | | | ($10.173 per share | ) |

The components of distributable earnings on a tax basis are reported as of the Fund’s most recent year end. At December 31, 2017, the tax basis components of distributable earnings were as follows:

| | | | |

Undistributed ordinary income | | $ | 23,926,831 | |

Undistributed long-term capital gain | | | 703,938,909 | |

At June 30, 2018, unrealized appreciation and depreciation for investments and derivatives based on cost for federal income tax purposes was as follows:

| | | | |

Tax cost | | $ | 47,226,487,609 | |

| | | | |

Unrealized appreciation | | | 24,873,177,532 | |

Unrealized depreciation | | | (1,569,271,714 | ) |

| | | | |

Net unrealized appreciation | | | 23,303,905,818 | |

| | | | | |

Fund management has reviewed the tax positions for open periods (three years and four years, respectively, from filing the Fund’s Federal and State tax returns) as applicable to the Fund, and has determined that no provision for income tax is required in the Fund’s financial statements.

NOTE 5—LOAN FACILITIES

Pursuant to an exemptive order issued by the Securities and Exchange Commission (SEC), the Fund may participate in an interfund lending facility (Facility). The Facility allows the Fund to borrow money from or loan money to the Funds. Loans under the Facility are made for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest on borrowings is the average of the current repurchase agreement rate and the bank loan rate. There was no activity in the Facility during the period.

All Funds in the Trust participate in a $500 million committed credit facility (Line of Credit) with State Street Bank and Trust Company, to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The maximum amount available to the Fund is $250 million. Each Fund pays an annual commitment fee on its pro-rata portion of the Line of Credit. For the six months ended June 30, 2018, the Fund’s commitment fee amounted to $201,233 and is reflected as a Miscellaneous Expense in the Statement of Operations. Interest on borrowings is charged at the prevailing rate. There were no borrowings on the Line of Credit during the period.

NOTE 6—PURCHASES AND SALES OF INVESTMENTS

For the six months ended June 30, 2018, purchases and sales of securities, other than short-term securities, aggregated $5,829,833,197 and $6,825,864,822, respectively.

NOTE 7—SUBSEQUENT EVENTS

Fund management has determined that no material events or transactions occurred subsequent to June 30, 2018, and through the date of the Fund’s financial statements issuance, which require additional disclosure in the Fund’s financial statements.

PAGE 12 § DODGE & COX STOCK FUND

NOTES TO FINANCIAL STATEMENTS (unaudited)

NOTE 8—HOLDINGS OF 5% VOTING SECURITIES

Each of the companies listed below was considered to be an affiliate of the Fund because the Fund owned 5% or more of the company’s voting securities during all or part of the six months ended June 30, 2018. Transactions during the period in these securities were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares at

Beginning of Period | | | Additions | | | Reductions | | | Shares at

End of Period | | | Dividend Income(a) | | | Realized Gain (Loss) | | | Net Change

in Unrealized Appreciation/

Depreciation | | | Value at

End of Period | |

| COMMON STOCKS: 13.1% | | | | | | | | | |

| CONSUMER DISCRETIONARY: 0.5% | | | | | | | | | |

Mattel, Inc.(b) | | | 16,700,000 | | | | 3,804,501 | | | | — | | | | 20,504,501 | | | $ | — | | | $ | — | | | $ | 30,529,122 | | | $ | 336,683,906 | |

| | |

| ENERGY: 5.6% | | | | | | | | | |

Anadarko Petroleum Corp. | | | 27,357,621 | | | | — | | | | — | | | | 27,357,621 | | | | 13,678,811 | | | | — | | | | 536,482,948 | | | | 2,003,945,738 | |

Apache Corp. | | | 18,700,694 | | | | 5,483,338 | | | | — | | | | 24,184,032 | | | | 10,721,182 | | | | — | | | | 143,441,646 | | | | 1,130,603,496 | |

National Oilwell Varco, Inc. | | | 18,698,800 | | | | 1,300,000 | | | | (500,000 | ) | | | 19,498,800 | | | | 1,965,509 | | | | 4,985,023 | | | | 139,834,828 | | | | 846,247,920 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,980,797,154 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FINANCIALS: 3.5% | | | | | | | | | |

Capital One Financial Corp. | | | 26,795,511 | | | | 150,000 | | | | (170,000 | ) | | | 26,775,511 | | | | 21,368,409 | | | | 3,576,505 | | | | (209,575,696 | ) | | | 2,460,669,461 | |

| | |

| INFORMATION TECHNOLOGY: 2.7% | | | | | | | | | |

Hewlett Packard Enterprise Co. | | | 102,041,816 | | | | — | | | | (17,746,023 | ) | | | 84,295,793 | | | | 17,136,413 | | | | 91,992,603 | | | | (13,695,115 | ) | | | 1,231,561,536 | |

Juniper Networks, Inc. | | | 22,833,165 | | | | 1,800,000 | | | | — | | | | 24,633,165 | | | | 8,723,939 | | | | — | | | | (23,218,716 | ) | | | 675,441,384 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1,907,002,920 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TELECOMMUNICATION SERVICES: 0.8% | | | | | | | | | |

Zayo Group Holdings, Inc.(b) | | | 14,027,500 | | | | 600,000 | | | | — | | | | 14,627,500 | | | | — | | | | — | | | | (3,910,220 | ) | | | 533,611,200 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 73,594,263 | | | $ | 100,554,131 | | | $ | 599,888,797 | | | $ | 9,218,764,641 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Net of foreign taxes, if any |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

SELECTED DATA AND RATIOS (for a share outstanding throughout each period) | | Six Months

Ended June 30, | | | Year Ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | | | | | | |

Net asset value, beginning of period | | | $203.61 | | | | $184.30 | | | | $162.77 | | | | $180.94 | | | | $168.87 | | | | $121.90 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 1.57 | | | | 3.09 | | | | 3.05 | | | | 2.42 | | | | 2.83 | | | | 2.11 | |

Net realized and unrealized gain (loss) | | | 0.33 | | | | 30.03 | | | | 30.56 | | | | (10.55 | ) | | | 14.60 | | | | 46.97 | |

| | | | | | | | |

Total from investment operations | | | 1.90 | | | | 33.12 | | | | 33.61 | | | | (8.13 | ) | | | 17.43 | | | | 49.08 | |

| | | | | | | | |

Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (1.57 | ) | | | (3.11 | ) | | | (3.03 | ) | | | (2.46 | ) | | | (2.80 | ) | | | (2.11 | ) |

Net realized gain | | | (2.08 | ) | | | (10.70 | ) | | | (9.05 | ) | | | (7.58 | ) | | | (2.56 | ) | | | — | |

| | | | | | | | |

Total distributions | | | (3.65 | ) | | | (13.81 | ) | | | (12.08 | ) | | | (10.04 | ) | | | (5.36 | ) | | | (2.11 | ) |

| | | | | | | | |

Net asset value, end of period | | | $201.86 | | | | $203.61 | | | | $184.30 | | | | $162.77 | | | | $180.94 | | | | $168.87 | |

| | | | | | | | |

Total return | | | 0.95 | % | | | 18.32 | % | | | 21.27 | % | | | (4.47 | )% | | | 10.43 | % | | | 40.55 | % |

Ratios/supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (millions) | | | $70,488 | | | | $70,901 | | | | $61,600 | | | | $54,845 | | | | $60,260 | | | | $54,848 | |

Ratio of expenses to average net assets | | | 0.52 | %(a) | | | 0.52 | % | | | 0.52 | % | | | 0.52 | % | | | 0.52 | % | | | 0.52 | % |

Ratio of net investment income to average net assets | | | 1.54 | %(a) | | | 1.58 | % | | | 1.83 | % | | | 1.36 | % | | | 1.62 | % | | | 1.45 | % |

Portfolio turnover rate | | | 8 | % | | | 13 | % | | | 16 | % | | | 15 | % | | | 17 | % | | | 15 | % |

See accompanying Notes to Financial Statements

DODGE & COX STOCK FUND §PAGE 13

FUND HOLDINGS

The Fund provides a complete list of its holdings four times each fiscal year, as of the end of each quarter. The Fund files the lists with the Securities and Exchange Commission (SEC) on Form N-CSR (second and fourth quarters) and Form N-Q (first and third quarters). Shareholders may view the Fund’s Forms N-CSR and N-Q on the SEC’s website at sec.gov. Forms N-CSR and N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling 800-SEC-0330. A list of the Fund’s quarter-end holdings is also available at dodgeandcox.com on or about 15 days following each quarter end and remains available on the website until the list is updated in the subsequent quarter.

PROXY VOTING

For a free copy of the Fund’s proxy voting policies and procedures, please call 800-621-3979, visit the Fund’s website at dodgeandcox.com, or visit the SEC’s website at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ending June 30 is also available at dodgeandcox.com or at sec.gov.

HOUSEHOLD MAILINGS

The Fund routinely mails shareholder reports and summary prospectuses to shareholders and, on occasion, proxy statements. In order to reduce the volume of mail, when possible, only one copy of these documents will be sent to shareholders who are part of the same family and share the same residential address.

If you have a direct account with the Funds and you do not want the mailing of shareholder reports and summary prospectuses combined with other members in your household, contact the Funds at 800-621-3979. Your request will be implemented within 30 days.

PAGE 14 § DODGE & COX STOCK FUND

TRUSTEES AND EXECUTIVE OFFICERS

Charles F. Pohl, Chairman and Trustee

Chairman, Dodge & Cox

Dana M. Emery, President and Trustee

Chief Executive Officer and President, Dodge & Cox

Caroline M. Hoxby, Independent Trustee

Professor of Economics, Stanford University; Senior Fellow, Hoover Institution

Thomas A. Larsen, Independent Trustee

Former Senior Counsel, Arnold & Porter Kaye Scholer LLP

Ann Mather, Independent Trustee

Former Executive Vice President, Chief Financial Officer, and Company Secretary, Pixar Animation Studios

Robert B. Morris III, Independent Trustee

Former Partner and Managing director - Global Investment Research, Goldman Sachs; former Advisory Director, The Presidio Group

Gary Roughead, Independent Trustee

Robert and Marion Oster Distinguished Military Fellow, Hoover Institution; former U.S. Navy Chief of Naval Operations

Mark E. Smith, Independent Trustee

Former Executive Vice President and Managing Director-Fixed Income, Loomis Sayles & Company, L.P.

John B. Taylor, Independent Trustee

Professor of Economics, Stanford University; Senior Fellow, Hoover Institution; and former Under Secretary for International Affairs, United States Treasury

Diana S. Strandberg, Senior Vice President

Senior Vice President and Director of International Equity, Dodge & Cox

David H. Longhurst, Treasurer

Vice President and Assistant Treasurer, Dodge & Cox

Katherine M. Primas, Chief Compliance Officer

Vice President and Chief Compliance Officer, Dodge & Cox

Roberta R.W. Kameda, Secretary

Vice President, General Counsel, and Secretary, Dodge & Cox

William W. Strickland, Vice President, Assistant Secretary, and Assistant Treasurer

Vice President and Chief Operating Officer, Dodge & Cox

Additional information about the Trust’s Trustees and Officers is available in the Trust’s Statement of Additional Information (SAI). You can get a free copy of the SAI by visiting the Funds’ website at dodgeandcox.com or calling 800-621-3979.

DODGE & COX STOCK FUND §PAGE 15

dodgeandcox.com

For Fund literature, transactions, and account

information, please visit the Funds’ website.

or write or call:

DODGE & COX FUNDS

c/o DST Asset Manager Solutions, Inc.

P.O. Box 8422

Boston, Massachusetts 02266-8422

(800) 621-3979

INVESTMENT MANAGER

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions, and portfolio holdings as of June 30, 2018, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

DODGE & COX FUNDS®

Semi-Annual Report

June 30, 2018

Global Stock Fund

ESTABLISHED 2008

TICKER: DODWX

6/18 GSF SAR  Printed on recycled paper

Printed on recycled paper

TO OUR SHAREHOLDERS

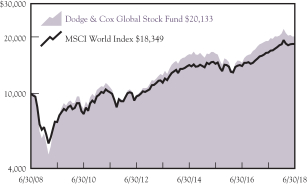

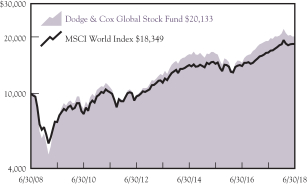

The Dodge & Cox Global Stock Fund had a total return of –3.4% for the six months ended June 30, 2018, compared to a return of 0.4% for the MSCI World Index. As fellow shareholders, we are disappointed by the Fund’s recent performance.

WHY HAS THE FUND UNDERPERFORMED?

The Fund’s underperformance in the first half of 2018 is explained by a combination of industry positioning and poor stock selection. The Fund’s overweight positions and holdings in the Financials sector, Europe, and emerging markets detracted significantly from relative performance. These areas of the market were particularly weak as macroeconomic concerns dominated headlines. Heightened rhetoric about tariffs and trade wars, the rise of populism, higher oil prices, and a strengthening U.S. dollar weighed on the outlook for continued global economic growth.

Stock selection, particularly in companies that are in the midst of some form of business restructuring, further hindered performance. In the Media industry, weak performers included Liberty Global(a) (European cable) and U.S.-based Comcast, Charter Communications, and DISH Network. Magnit (Russian food retailer) and Micro Focus International (UK software) also did poorly and were affected by company-specific issues that disrupted improvement plans. However, we believe the challenges these companies face are fixable over our three- to five-year investment horizon and that their management teams are tackling the issues with a sense of urgency.

HOW ARE WE RESPONDING?

Since the Fund’s inception in 2008, there have been periods of short-term underperformance. During these intervals, we ask ourselves: Have the fundamentals changed? If so, how has our investment thesis changed? Are we being adequately compensated for the thesis to work over our investment time horizon, such that we should hold or even add to our position? Or should we sell our position because the risk/reward profile is no longer attractive?

We answer these questions by using a “clean sheet of paper” approach to determine whether the long-term fundamentals have changed in relation to valuation. We rigorously employ our bottom-up analysis to assess concerns facing a company and its industry. We evaluate growth prospects and competitive dynamics by meeting with the management of our holdings and their competitors. And we vigorously debate the relative opportunities and risks as part of our team decision-making process.

In some cases, we conclude the thesis has changed and decide to sell. For example, we sold Saipem, an engineering and construction company focused on oil and gas, during the second quarter. The company is heavily tied to offshore oilfield activity, and we think a rebound in that market has been pushed back and Saipem’s competitive position has weakened.

In other cases, we reaffirmed the merit of an investment and added to our position. For example, we added to Grupo Televisa, the dominant television content producer and pay-television operator in Mexico, earlier in the year. The shares had been weak due to concerns about lower ratings, changes to the company’s

advertising pricing model, and slowing cable subscriber growth. We think those are short-term challenges that should not overshadow the substantive changes a new and improved management team is making to improve content programming and capital allocation. Grupo Televisa was subsequently a strong contributor to performance during the second quarter.

WHY ARE WE OPTIMISTIC?

The process of re-evaluating each of the Fund’s holdings has reinforced our positive outlook for the portfolio. We have many different potential drivers of long-term performance, including those in:

| | § | | Financials—valuations have fallen yet fundamentals have improved; | |

| | § | | Health Care—fundamentals are stable, while attractive dividend yields and share buybacks enable us to be patient; | |

| | § | | Media—an attractively valued way to benefit from growing demand for communications and entertainment around the world; | |

| | § | | Emerging markets—valuations are reasonable for companies with strong franchises and above average growth; | |

| | § | | Energy—we are in the early innings of a recovery; and | |

| | § | | The previously mentioned companies involved in restructuring —we see potential for significant earnings and cash flow improvement. | |

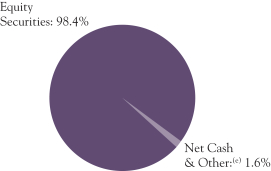

We are particularly enthusiastic about the Fund’s holdings in the Financials and Health Care sectors and Media industry, which collectively represent 59% of the portfolio and the three largest overweight positions in the Fund.(b)

Financials

The Fund is overweight Financials (27% versus 17% for the MSCI World), with 21% domiciled in developed markets and 6% in emerging markets. Despite current macroeconomic concerns, we find the Fund’s financial services holdings to be increasingly attractive investment opportunities. This sector exemplifies the recent trend of lower valuations despite improving fundamentals. Over the past year, the forward price-to-earnings ratio for the MSCI World Financials sector contracted from 12.8 to 11.3 times, while trailing earnings per share grew by 14%. The decline in valuation suggests a worsening outlook for earnings and capital generation. However, we reach a different conclusion when we evaluate the Fund’s 21 financial services investments using our bottom-up approach. Management teams are actively cutting costs, exiting low-return businesses, strengthening balance sheets, and improving returns on equity. UniCredit, the largest bank in Italy, is a good example of this divergence between fundamentals and valuation.

UniCredit declined 19% in the second quarter. Recent fears that a new anti-establishment Italian government would leave the Eurozone or repudiate debt have overshadowed the progress UniCredit has made in improving its balance sheet and profitability. From 2014 to 2017, UniCredit’s non-performing loan ratio declined from 16.5% to 10.3%, and its adjusted return on

PAGE 2 § DODGE & COX GLOBAL STOCK FUND

tangible equity increased from 4.6% to 7.6% on a much bigger capital cushion. In spite of these improvements, the company’s valuation declined from 0.7 times price to tangible book value to 0.6 times. Current valuation does not give credit for UniCredit’s deep restructuring of its balance sheet and cost structure, and reflects market skepticism of management reaching its target of 9% return on tangible equity. However, we believe their target is achievable through internal self-help measures, and we added to the Fund’s UniCredit position during the first half of 2018.

Health Care

Health Care continues to be an attractive area of the market, where underlying fundamentals have remained stable while valuations have declined. The Fund is overweight Health Care (20% compared to 12% of the MSCI World). Six of the Fund’s Health Care sector holdings are European pharmaceutical companies with global footprints. Despite pricing pressures in the U.S. market, profit margins have been resilient and free cash flow has been robust. Most of the Fund’s current pharmaceutical holdings have returned one-third of their market capitalization in dividends and share buybacks over the past five years, while at the same time investing meaningfully in research and development (R&D).

We believe growth can accelerate due to improved R&D productivity in a variety of groundbreaking areas of innovation, including immuno-oncology and rare diseases. Nevertheless, valuations for the Fund’s European pharmaceutical holdings have declined from an average of 17 times forward earnings in 2015 to 14 times on June 30, 2018, with an average dividend yield of 4%. At this lower valuation, we believe we are being compensated for our patience.

Media

Within Consumer Discretionary, Media is an important overweight position: 12% of the Fund compared to 2% of the MSCI World on June 30. The media landscape is evolving due to new direct-to-consumer entrants, changes in consumer viewing and listening habits, shifting revenue streams, and industry consolidation. Uncertainty surrounding pending mergers and potential regulatory incursions (e.g., unbundling, forced wholesale access, price regulation on broadband) pose risks to the Fund’s media investments.

Nevertheless, we recently added to Comcast and Charter Communications—the largest and second-largest cable providers in the United States—because we believe the market has overly penalized their share prices as a result of concerns about subscriber growth and potential bidding wars. Both companies have attractive valuations, difficult-to-replicate assets, and the potential to benefit from growth in data consumption. Comcast and Charter Communications also have de-facto local monopolies on broadband internet services in many parts of the United States and, despite talk of “cord cutting,” have potential to grow through increased broadband penetration and pricing power in residential and business services. Furthermore, their shareholder-friendly management teams are skilled capital allocators who seek to

maximize value. Among the ten largest holdings in the Fund, Comcast and Charter Communications were 2.5% and 2.2% positions, respectively, on June 30.

IN CLOSING

In many respects, the recent underperformance echoes what happened in 2015 when macroeconomic concerns also weighed heavily on the market. Back then, international equity markets were volatile due to fears of slowing growth in China, a stronger U.S. dollar, and growing populist sentiment in Europe that culminated in the Brexit decision the following June. The Fund trailed the MSCI World by seven percentage points in 2015, then outperformed the benchmark by 13 percentage points over the next seven quarters.

Although we do not know how the future will unfold, our investment team has successfully navigated a number of difficult periods in the market. The 2015-17 period illustrates the importance of employing a consistent process and staying the course with our convictions in the face of underperformance.

Starting points, as measured by valuation, matter for investment returns. With many of the Fund’s holdings trading at lower valuations than they did six or nine months ago, we are increasingly optimistic about the potential for the current portfolio to generate strong returns over the long term. Our time-tested approach requires persistence, and we thank our fellow shareholders for your continued confidence in Dodge & Cox.

For the Board of Trustees,

| | |

| |  |

Charles F. Pohl, Chairman | | Dana M. Emery, President |

August 1, 2018

| (a) | | The use of specific examples does not imply that they are more or less attractive investments than the portfolio’s other holdings. |

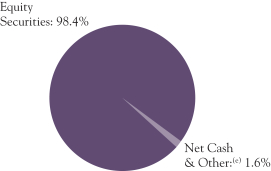

| (b) | | Unless otherwise specified, all weightings and characteristics are as of June 30, 2018. |

DODGE & COX GLOBAL STOCK FUND §PAGE 3

YEAR-TO-DATE PERFORMANCE REVIEW

The Fund underperformed the MSCI World by 3.8 percentage points year to date.

Key Detractors from Relative Results

| | § | | Weak returns from holdings in the Financials sector (down 9% versus down 6% for the MSCI World sector), combined with an average overweight position (28% versus 18%), hindered performance. ICICI Bank (down 18%) was a notable detractor. | |

| | § | | The Fund’s relative returns in the Information Technology sector (up 1% compared to up 9% for the MSCI World sector) and average underweight position (13% versus 18%) hurt results. Micro Focus International (down 48%) and Samsung Electronics (down 12%) detracted from results. | |

| | § | | Additional detractors included Magnit (down 33%), MTN Group (down 26%), and Liberty Global (down 21%). | |

Key Contributors to Relative Results

| | § | | Relative returns in the Energy sector (up 15% compared to up 7% for the MSCI World sector) had a positive impact. Anadarko Petroleum (up 38%) and Suncor Energy (up 13%) were strong performers. | |

| | § | | The Fund’s average underweight position in the Industrials sector (5% versus 12% for the MSCI World sector) contributed to returns. | |

| | § | | Additional contributors included Twenty-First Century Fox (up 45%), Target (up 19%), and GlaxoSmithKline (up 16%). | |

KEY CHARACTERISTICS OF DODGE & COX

Independent Organization

Dodge & Cox is one of the largest privately owned investment managers in the world. We remain committed to independence, with a goal of providing the highest quality investment management service to our existing clients.

Over 85 Years of Investment Experience

Dodge & Cox was founded in 1930. We have a stable and well-qualified team of investment professionals, most of whom have spent their entire careers at Dodge & Cox.

Experienced Investment Team

The Global Equity Investment Committee, which is the decision-making body for the Global Stock Fund, is a seven-member committee with an average tenure at Dodge & Cox of 24 years.

One Business with a Single Research Office

Dodge & Cox manages equity (domestic, international, and global), fixed income (domestic and global), and balanced investments, operating from one office in San Francisco.

Consistent Investment Approach

Our team decision-making process involves thorough, bottom-up fundamental analysis of each investment.

Long-Term Focus and Low Expenses

We invest with a three- to five-year investment horizon, which has historically resulted in low turnover relative to our peers. We manage Funds that maintain low expense ratios.