UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-173

DODGE & COX FUNDS

(Exact name of registrant as specified in charter)

555 California Street, 40th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Roberta R.W. Kameda, Esq.

555 California Street, 40th Floor

San Francisco, CA 94104

(Name and address of agent for service)

Registrant’s telephone number, including area code:415-981-1710

Date of fiscal year end: DECEMBER 31, 2018

Date of reporting period: DECEMBER 31, 2018

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following are the December 31, 2018 annual reports for the Dodge & Cox Funds, a Delaware statutory trust, consisting of six series: Dodge & Cox Stock Fund, Dodge & Cox Global Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund, Dodge & Cox Income Fund, and Dodge & Cox Global Bond Fund. The reports of each series were transmitted to their respective shareholders on February 19, 2019.

DODGE & COX FUNDS®

Annual Report

December 31, 2018

Stock Fund

ESTABLISHED 1965

TICKER: DODGX

Important Notice:

Beginning on January 1, 2021, we intend to discontinue mailing paper copies of the Fund’s shareholder reports as permitted by new regulations adopted by the Securities and Exchange Commission, unless you specifically request paper copies from Dodge & Cox Funds or from your financial intermediary, such as a broker-dealer or bank. The reports will remain available to you on the Dodge & Cox Funds website (dodgeandcox.com), and you will be notified by mail each time a report is posted and provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. If you have not done so already, you may elect to receive shareholder reports and other communications electronically by enrolling ine-delivery on the Funds website, or, if you are invested through a financial intermediary, by updating your mailing preferences through the intermediary.

If you wish to continue receiving paper copies of all future shareholder reports, please contact us at (800)621-3979. Reports will be provided to you free of charge. If you are invested through a financial intermediary, you may contact your financial intermediary to request to receive paper copies. Your election to receive reports in paper form will apply to all funds held with Dodge & Cox Funds or through your financial intermediary, as applicable.

12/18 SF AR  Printed on recycled paper

Printed on recycled paper

TO OUR SHAREHOLDERS

The Dodge & Cox Stock Fund had a total return of –7.1% for the year ended December 31, 2018, compared to a return of –4.4% for the S&P 500 Index.

MARKET COMMENTARY

In 2018, global equity markets were volatile and posted significant losses. Although returns were negative, the United States outperformed most other equity markets—the S&P 500 was down 4% compared to a decline of nearly 14% for the MSCI EAFE Index.(a) Over the course of the year, the S&P 500 experienced two divergent periods of performance.

During the first nine months of 2018, U.S. equities posted strong returns: the S&P 500 was up 11% and reached anall-time high in late September. U.S. growth stocks (the higher valuation portion of the equity market) outperformed value stocks (the lower valuation portion) by 13 percentage points, continuing a longer-term trend.(b) From 2014 through September 30, 2018, growth outperformed value by 39 percentage points,(c) fueled by growth-oriented companies in sectors and industries associated with technology—most notably the “FAANG” stocks (Facebook, Amazon, Apple, Netflix, Google). Over this period, the Fund performed strongly compared to the U.S. value investment universe; however, the Fund’s value-oriented approach hindered its relative returns versus the broad-based S&P 500.

Starting in October, volatility spiked as investors became worried about the pace of U.S. interest rate increases, a weakening global economy, and rising geopolitical concerns, including the escalating trade conflict between the United States and China. Brexit-related uncertainty and Italy’s political turmoil also weighed on multinational companies. There was a significant correction in the fourth quarter, especially among technology stocks. Companies in more value-oriented sectors, including Health Care and Utilities, outperformed. Overall, the S&P 500 declined 14% during the quarter.

INVESTMENT STRATEGY

Market volatility can create buying opportunities for patient, long-term, value-oriented investors like Dodge & Cox. Asbottom-up investors, we pay close attention to macro factors, but our research process places more emphasis on individual company fundamentals relative to valuation. We view this approach as a more reliable factor in determining long-term investment merit.

In 2018, we made gradual portfolio adjustments based on relative valuation changes. For example, as valuations increased, we trimmed selected Information Technology and Health Care holdings that had performed strongly. The Fund’s largest sale was Merck, a leading pharmaceutical company held in the Fund since 2009. While the company has a strong management team, we decided to sell Merck given its higher valuation and our concerns about Merck’s dependence on its blockbuster cancer drug Keytruda for future sales growth. In addition, we believe the company is entering a period of heavy, sustained investment as it manages through a product cycle, which could pressure profit margins.

Nevertheless, the Fund remained overweight the Health Care sector (22.8% compared to 15.5% for the S&P 500).(d) We are enthusiastic about the Fund’s Pharmaceuticals holdings because valuations are attractive and new drug approvals demonstrate improving research productivity. Moreover, the substantial cash flows at these companies are not sensitive to economic swings and their healthy dividends provide a solid, stable source of return. We believe Health Care is a more attractive, defensive alternative to Consumer Staples, where valuations are higher but growth prospects are lower.

Additionally, as a result of individual security selection, we increased the Fund’s Energy exposure from 7.8% to 8.5% during 2018—a significant add given the S&P 500 Energy sector was down 18%. We also increased the portfolio’s exposure to select Industrials companies as valuations declined. For example, we initiated a position in United Technologies(e) (highlighted below) and added to the Fund’s existing holdings in FedEx and Johnson Controls International.

Energy

During the fourth quarter, Brent crude oil prices dropped 35%, weighing heavily on the outlook for energy-related companies, and Energy was the worst-performing sector (down 24%) within the S&P 500. While the short-term direction of oil prices is difficult to forecast, we believe slower supply growth and increasing demand point to higher prices over our investment horizon. Weighing valuation against individual company fundamentals, we recently added to the Fund’s positions in Occidental Petroleum and Halliburton, among others.

Occidental Petroleum

A multinational oil and gas company, Occidental Petroleum’s stock price declined 24% in the fourth quarter along with the broader Energy sector, due to concerns about the macro environment and oil supply. While the company faces political risks in Oman and the United Arab Emirates, we believe investors overreacted in the short term, given Occidental’s solid long-term underlying business fundamentals. Occidental is considered a partner of choice for many companies and countries due to its technological capabilities, experience managing reservoirs, and global reach. The company has an attractive growth profile andlow-cost assets in the Permian Basin and the Middle East. Given low operating costs and modest maintenance capital expenditures, these businesses are profitable across a broad range of oil prices. Occidental’s proven management team has created a strong corporate culture with a focus on returns, steady growth, and consistent dividends. In addition, the company has a strong balance sheet, an attractive valuation at 14 times forward earnings, and a 5% dividend yield. On December 31, Occidental comprised 1.6% of the Fund.

Halliburton

Halliburton is the second-largest diversified oil services company after Schlumberger. Of the “big four” diversified oil services

PAGE 2§ DODGE & COX STOCK FUND

companies, Halliburton has the largest and strongest position in the North American market, primarily due to its leading pressure pumping (hydraulic fracturing) business. In 2018, investors became concerned that insufficient pipeline capacity to transport oil out of the Permian Basin may negatively impact North American pressure pumping activity. Infrastructure in the Permian has failed to keep pace with production growth, causing Permian-produced barrels to trade at a steep discount and exploration and production companies to scale back activity until new capacity comes online. As a result, oil services companies with large exposure to North America, like Halliburton, sold off in the first half of 2018. These concerns depressed Halliburton’s valuation and presented an attractive long-term buying opportunity, given the company’s strong franchise.

Although North American services activity has rebounded meaningfully since early 2016, our analysis suggests further investment will be needed for North America to maintain and grow oil production. With competitive advantages due to its scale and superior execution, we expect Halliburton to grow operating profits in North America over the next three to five years. Halliburton’s international business is much better positioned than in previous cycles. Over the past several years, the company invested in key product lines, expanded its international presence, and built deeper relationships with national oil companies. These investments are paying off—Halliburton has outpaced Schlumberger, the leading international service company, on international growth in most quarters since 2015. We believe Halliburton can continue gaining share as international markets recover. In addition, management has renewed its focus on returning capital to shareholders. Thus, we initiated a position in Halliburton during the third quarter and added further in December as oil prices fell. At year end, Halliburton accounted for 0.7% of the Fund’s net assets.

United Technologies

United Technologies is a multi-industry conglomerate comprised of world-class franchises in elevators/escalators (Otis), jet engines and aerospace supply (Pratt and Whitney), HVAC(f) (Carrier), fire/security, and refrigeration. United Technologies’ aerospace margins have been under pressure as Boeing and Airbus moved into the aftermarket, squeezing their supply base. Despite this risk, we believe the company is an attractive long-term investment opportunity at 14 times forward earnings. United Technologies has premier global franchises with attractive long-term growth potential and a high degree of visibility based on its substantial backlog (over seven years) of aerospace contracts. United Technologies recently acquired Rockwell Collins, making the combined company the largest global aerospace supplier. The launch of its new jet engine platform should drive earnings growth in the years ahead. Meanwhile, United Technologies has announced plans to split into three companies, which could create substantial shareholder value; we estimate each of its world-class franchises trades 15 to 20% below “pure-play” peers. United Technologies was a 1.4% position on December 31.

IN CLOSING

Despite the market turmoil, we remain optimistic about the long-term prospects for the Fund’s investments. The portfolio’s valuation is attractive and trades at a meaningful discount to the overall market: 12.1 times forward earnings compared to 15.4 times for the S&P 500. We also believe longer-term global economic growth will be better than many investors expect, and the Fund is well positioned to capitalize on this.

Our fundamental, active, value-oriented investment approach requires conviction and patience. Accordingly, maintaining a long-term investment horizon and staying the course are essential. We thank you for your continued confidence in Dodge & Cox. As always, we welcome your comments and questions.

For the Board of Trustees,

| | |

| |  |

Charles F. Pohl, Chairman | | Dana M. Emery, President |

January 31, 2019

| (a) | | The MSCI EAFE (Europe, Australasia, Far East) Index is a broad-based, unmanaged equity market index aggregated from 21 developed market country indices, excluding the United States and Canada. |

| (b) | | The Russell 1000 Growth Index had a total return of 17.1% compared to 3.9% for the Russell 1000 Value Index from December 31, 2017 through September 30, 2018. |

| (c) | | The Russell 1000 Growth Index had a total return of 72.5% compared to 33.2% for the Russell 1000 Value Index from December 31, 2014 through September 30, 2018. |

| (d) | | Unless otherwise specified, all weightings and characteristics are as of December 31, 2018. |

| (e) | | The use of specific examples does not imply that they are more or less attractive investments than the portfolio’s other holdings. |

| (f) | | HVAC = heating, ventilation, and air conditioning. |

DODGE & COX STOCK FUND§PAGE 3

2018 PERFORMANCE REVIEW

The Fund underperformed the S&P 500 by 2.7 percentage points in 2018.

Key Detractors from Relative Results

| | § | | The Fund’s average overweight position (27% versus 14%) and weak returns from holdings in the Financials sector (down 17% compared to down 13% for the S&P 500 sector) hampered results. Goldman Sachs (down 34%), Capital One Financial (down 23%), and Wells Fargo (down 22%) were key detractors. | |

| | § | | The Energy sector was the worst-performing segment of the Fund (holdings down 27%) and the S&P 500 (down 18%). The Fund’s higher average weighting in the sector (8% versus 6%) also hurt results. Schlumberger (down 45%), Apache (down 36%), and Baker Hughes, a GE Company (down 30%) were notable. | |

| | § | | Within the reconstituted Consumer Discretionary sector (down 7% compared to up 2% for the S&P 500 sector), not owning Amazon (up 28%) was the main drag on relative performance. In contrast, small holdings Mattel (down 35%) and Harley-Davidson (down 31%) lagged. | |

| | § | | Other detractors included DISH Network (down 48%), Micro Focus International (down 46%), FedEx (down 35%), and Charter Communications (down 15%). | |

Key Contributors to Relative Results

| | § | | In Health Care, the Fund’s average overweight position (23% versus 15% for the S&P 500) and holdings (up 9% compared to up 6% for the S&P 500 sector) had a significant, positive impact. Eli Lilly (up 40%), Express Scripts (up 24% to date of acquisition by Cigna), AstraZeneca (up 14%), and GlaxoSmithKline (up 14%) performed well. | |

| | § | | The Fund’s significant underweight position (average less than 1% versus 7%) in the Consumer Staples sector, which lagged the overall Index (down 9% for the S&P 500 sector), helped results. | |

| | § | | Standout performers included Twenty-First Century Fox (up 41% owing to a bidding war for most of the company) and Dell Technologies (up 39%). | |

| | § | | Not owning certain large companies in the S&P 500, including General Electric (down 55%) and Facebook (down 26%), also contributed notably. | |

KEY CHARACTERISTICS OF DODGE & COX

Independent Organization

Dodge & Cox is one of the largest privately owned investment managers in the world. We remain committed to independence, with a goal of providing the highest quality investment management service to our existing clients.

Over 85 Years of Investment Experience

Dodge & Cox was founded in 1930. We have a stable and well-qualified team of investment professionals, most of whom have spent their entire careers at Dodge & Cox.

Experienced Investment Team

The U.S. Equity Investment Committee, which is the decision-making body for the Stock Fund, is a nine-member committee with an average tenure at Dodge & Cox of 24 years.

One Business with a Single Research Office

Dodge & Cox manages equity (domestic, international, and global), fixed income (domestic and global), and balanced investments, operating from one office in San Francisco.

Consistent Investment Approach

Our team decision-making process involves thorough, bottom-up fundamental analysis of each investment.

Long-Term Focus and Low Expenses

We invest with a three- to five-year investment horizon, which has historically resulted in low turnover relative to our peers. We manage Funds that maintain low expense ratios.

Risks: The Fund is subject to market risk, meaning holdings in the Fund may decline in value for extended periods due to the financial prospects of individual companies, or due to general market and economic conditions. Please read the prospectus and summary prospectus for specific details regarding the Fund’s risk profile.

PAGE 4§ DODGE & COX STOCK FUND

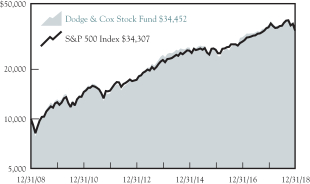

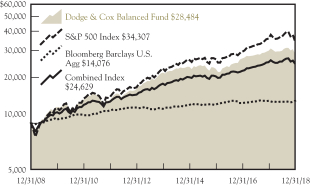

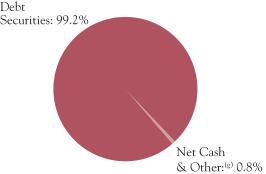

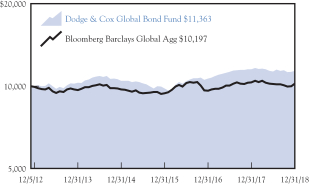

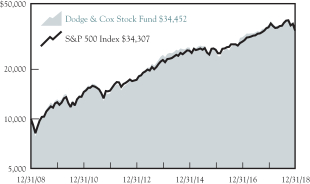

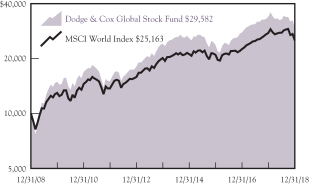

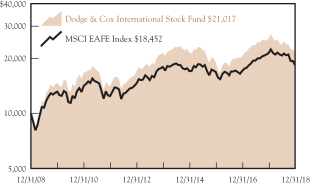

GROWTH OF $10,000 OVER 10 YEARS

FOR AN INVESTMENT MADE ON DECEMBER 31, 2008

AVERAGE ANNUAL TOTAL RETURN

FOR PERIODS ENDED DECEMBER 31, 2018

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | 20 Years | |

Dodge & Cox Stock Fund | | | –7.08 | % | | | 7.05 | % | | | 13.17 | % | | | 8.87 | % |

S&P 500 Index | | | –4.38 | | | | 8.49 | | | | 13.12 | | | | 5.62 | |

Returns represent past performance and do not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Fund performance changes over time and currently may be significantly lower than stated. Performance is updated and published monthly. Visit the Fund’s website at dodgeandcox.com or call800-621-3979 for current performance figures.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions or on Fund share redemptions. Index returns include dividends but, unlike Fund returns, do not reflect fees or expenses. The S&P 500 Index is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market.

S&P 500® is a trademark of S&P Global Inc.

FUND EXPENSE EXAMPLE

As a Fund shareholder, you incur ongoing Fund costs, including management fees and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The following example shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The example assumes a $1,000 investment held for the six months indicated.

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and expenses based on the Fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON WITH OTHER MUTUAL FUNDS

Information on the second line of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the Fund and an assumed 5% annual rate of return before expenses (not the Fund’s actual return). The amount under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other mutual funds.

| | | | | | | | | | | | |

Six Months Ended

December 31, 2018 | | Beginning Account Value

7/1/2018 | | | Ending Account Value

12/31/2018 | | | Expenses Paid

During Period* | |

Based on Actual Fund Return | | $ | 1,000.00 | | | $ | 920.60 | | | $ | 2.50 | |

Based on Hypothetical 5% Yearly Return | | | 1,000.00 | | | | 1,022.60 | | | | 2.64 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.52%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional fees or account maintenance fees. Though other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

DODGE & COX STOCK FUND§PAGE 5

| | | | |

| FUND INFORMATION (unaudited) | | | December 31, 2018 | |

| | | | |

| GENERAL INFORMATION | | | |

Net Asset Value Per Share | | | $172.81 | |

Total Net Assets (billions) | | | $63.0 | |

Expense Ratio | | | 0.52% | |

Portfolio Turnover Rate | | | 20% | |

30-Day SEC Yield(a) | | | 1.76% | |

Active Share(b) | | | 79% | |

Number of Companies | | | 69 | |

Fund Inception | | | 1965 | |

No sales charges or distribution fees | | | | |

Investment Manager: Dodge & Cox, San Francisco. Managed by the U.S. Equity Investment Committee, whose nine members’ average tenure at Dodge & Cox is 24 years.

| | | | | | | | |

| PORTFOLIO CHARACTERISTICS | | Fund | | | S&P 500 | |

Median Market Capitalization (billions) | | | $36 | | | | $19 | |

Weighted Average Market Capitalization (billions) | | | $136 | | | | $201 | |

Price-to-Earnings Ratio(c) | | | 12.1x | | | | 15.4x | |

Foreign Securities not in the S&P 500(d) | | | 12.7% | | | | 0.0% | |

| | | | |

| TEN LARGEST HOLDINGS (%)(e) | | Fund | |

Comcast Corp. | | | 4.1 | |

Wells Fargo & Co. | | | 3.6 | |

Charter Communications, Inc. | | | 3.2 | |

Charles Schwab Corp. | | | 3.1 | |

Microsoft Corp. | | | 3.1 | |

Alphabet, Inc. | | | 3.1 | |

Sanofi(France) | | | 2.8 | |

Bank of America Corp. | | | 2.7 | |

Capital One Financial Corp. | | | 2.7 | |

Novartis AG(Switzerland) | | | 2.6 | |

| | | | | | | | |

SECTOR DIVERSIFICATION (%) | | Fund | | | S&P 500 | |

Financials | | | 24.9 | | | | 13.3 | |

Health Care | | | 22.8 | | | | 15.5 | |

Communication Services | | | 15.3 | | | | 10.1 | |

Information Technology | | | 13.1 | | | | 20.1 | |

Energy | | | 8.5 | | | | 5.3 | |

Industrials | | | 6.4 | | | | 9.2 | |

Consumer Discretionary | | | 3.6 | | | | 10.0 | |

Materials | | | 1.0 | | | | 2.7 | |

Consumer Staples | | | 0.5 | | | | 7.4 | |

Utilities | | | 0.0 | | | | 3.4 | |

Real Estate | | | 0.0 | | | | 3.0 | |

| (a) | SEC Yield is an annualization of the Fund’s net investment income for the trailing30-day period. Dividends paid by the Fund may be higher or lower than implied by the SEC Yield. |

| (b) | Active share is a measure of how much an investment portfolio differs from its benchmark index, based on a scale of 0% (complete overlap with the index) to 100% (no overlap). Overlap for each security in the Fund is the lower of either its percentage weight in the Fund or its percentage weight in the relevant index. The Fund’s total overlap with the S&P 500 is the sum of each security’s calculated overlap. |

| (c) | Price-to-earnings (P/E) ratios are calculated using12-month forward earnings estimates from third-party sources. |

| (d) | Foreign securities are U.S. dollar denominated. |

| (e) | The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation to buy, sell, or hold any particular security and is not indicative of Dodge & Cox’s current or future trading activity. |

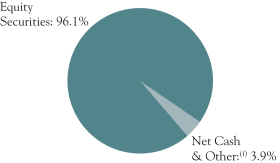

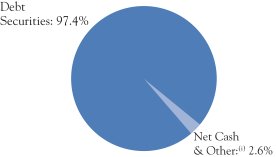

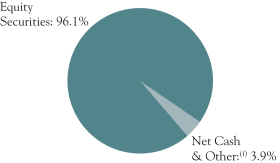

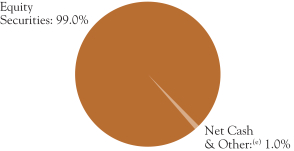

| (f) | Net Cash & Other includes cash, short-term investments, derivatives, receivables, and payables. |

PAGE 6§ DODGE & COX STOCK FUND

| | | | |

| PORTFOLIO OF INVESTMENTS | | | December 31, 2018 | |

| | | | | | | | |

| COMMON STOCKS: 96.1% | |

| | |

| | | SHARES | | | VALUE | |

| COMMUNICATION SERVICES: 15.3% | |

MEDIA & ENTERTAINMENT: 13.6% | |

Alphabet, Inc., Class A(a) | | | 82,500 | | | $ | 86,209,200 | |

Alphabet, Inc., Class C(a) | | | 1,793,153 | | | | 1,857,007,178 | |

Charter Communications, Inc., Class A(a) | | | 7,023,786 | | | | 2,001,568,296 | |

Comcast Corp., Class A | | | 76,555,794 | | | | 2,606,724,786 | |

DISH Network Corp., Class A(a) | | | 11,776,176 | | | | 294,051,115 | |

News Corp., Class A | | | 7,528,790 | | | | 85,451,767 | |

Twenty-First Century Fox, Inc., Class A | | | 25,409,326 | | | | 1,222,696,767 | |

Twenty-First Century Fox, Inc., Class B | | | 8,300,600 | | | | 396,602,668 | |

| | | | | | | | |

| | | | 8,550,311,777 | |

TELECOMMUNICATION SERVICES: 1.7% | |

AT&T, Inc. | | | 12,615,287 | | | | 360,040,291 | |

Sprint Corp.(a) | | | 58,634,327 | | | | 341,251,783 | |

Zayo Group Holdings, Inc.(a)(b) | | | 16,027,500 | | | | 366,068,100 | |

| | | | | | | | |

| | | | 1,067,360,174 | |

| | | | | | | | |

| | | | 9,617,671,951 | |

| CONSUMER DISCRETIONARY: 3.6% | |

AUTOMOBILES & COMPONENTS: 0.3% | |

Harley-Davidson, Inc. | | | 6,581,047 | | | | 224,545,324 | |

|

CONSUMER DURABLES & APPAREL: 0.3% | |

Mattel, Inc.(a)(b) | | | 20,504,501 | | | | 204,839,965 | |

|

RETAILING: 3.0% | |

Booking Holdings, Inc.(a) | | | 532,600 | | | | 917,360,892 | |

Qurate Retail, Inc., Series A(a) | | | 32,289,076 | | | | 630,282,764 | |

Target Corp. | | | 1,337,915 | | | | 88,422,802 | |

The Gap, Inc. | | | 8,991,303 | | | | 231,615,965 | |

| | | | | | | | |

| | | | 1,867,682,423 | |

| | | | | | | | |

| | | | 2,297,067,712 | |

| CONSUMER STAPLES: 0.5% | |

FOOD, BEVERAGE & TOBACCO: 0.5% | |

Molson Coors Brewing Company, Class B | | | 5,801,525 | | | | 325,813,644 | |

|

| ENERGY: 8.5% | |

Anadarko Petroleum Corp.(b) | | | 26,957,621 | | | | 1,181,822,105 | |

Apache Corp.(b) | | | 31,484,032 | | | | 826,455,840 | |

Baker Hughes, a GE Company | | | 36,084,952 | | | | 775,826,468 | |

Concho Resources, Inc.(a) | | | 2,450,500 | | | | 251,886,895 | |

Halliburton Co. | | | 17,500,000 | | | | 465,150,000 | |

National Oilwell Varco, Inc.(b) | | | 10,645,009 | | | | 273,576,731 | |

Occidental Petroleum Corp. | | | 16,914,726 | | | | 1,038,225,882 | |

Schlumberger, Ltd.

(Curacao/United States) | | | 14,955,645 | | | | 539,599,672 | |

Weatherford International PLC(a) (Ireland/United States) | | | 29,359,600 | | | | 16,412,016 | |

| | | | | | | | |

| | | | 5,368,955,609 | |

| FINANCIALS: 24.9% | |

BANKS: 9.6% | |

Bank of America Corp. | | | 69,596,700 | | | | 1,714,862,688 | |

BB&T Corp. | | | 11,015,944 | | | | 477,210,694 | |

JPMorgan Chase & Co. | | | 16,329,700 | | | | 1,594,105,314 | |

Wells Fargo & Co. | | | 49,727,141 | | | | 2,291,426,657 | |

| | | | | | | | |

| | | | 6,077,605,353 | |

DIVERSIFIED FINANCIALS: 12.4% | |

American Express Co. | | | 16,313,200 | | | | 1,554,974,224 | |

Bank of New York Mellon Corp. | | | 31,562,624 | | | | 1,485,652,712 | |

Capital One Financial Corp.(b) | | | 22,661,213 | | | | 1,712,961,090 | |

Charles Schwab Corp. | | | 47,605,000 | | | | 1,977,035,650 | |

Goldman Sachs Group, Inc. | | | 6,476,000 | | | | 1,081,815,800 | |

| | | | | | | | |

| | | | 7,812,439,476 | |

INSURANCE: 2.9% | |

AEGON NV (Netherlands) | | | 73,163,067 | | | | 340,208,262 | |

Brighthouse Financial, Inc.(a)(b) | | | 6,699,363 | | | | 204,196,584 | |

| | | | | | | | |

| | |

| | | SHARES | | | VALUE | |

MetLife, Inc. | | | 30,428,900 | | | $ | 1,249,410,634 | |

| | | | | | | | |

| | | | 1,793,815,480 | |

| | | | | | | | |

| | | | 15,683,860,309 | |

| HEALTH CARE: 22.8% | |

HEALTH CARE EQUIPMENT & SERVICES: 6.0% | |

Cigna Corp. | | | 8,097,805 | | | | 1,537,935,072 | |

CVS Health Corp. | | | 9,300,000 | | | | 609,336,000 | |

Danaher Corp. | | | 3,129,500 | | | | 322,714,040 | |

Medtronic PLC (Ireland/United States) | | | 3,517,100 | | | | 319,915,416 | |

UnitedHealth Group, Inc. | | | 3,860,160 | | | | 961,643,059 | |

| | | | | | | | |

| | | | 3,751,543,587 | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES: 16.8% | |

Alnylam Pharmaceuticals, Inc.(a) | | | 2,813,861 | | | | 205,158,605 | |

AstraZeneca PLC ADR (United Kingdom) | | | 32,696,973 | | | | 1,241,831,035 | |

Bristol-Myers Squibb Co. | | | 25,848,739 | | | | 1,343,617,453 | |

Eli Lilly and Co. | | | 9,160,219 | | | | 1,060,020,543 | |

Gilead Sciences, Inc. | | | 10,945,612 | | | | 684,648,031 | |

GlaxoSmithKline PLC ADR (United Kingdom) | | | 32,000,000 | | | | 1,222,720,000 | |

Incyte Corp.(a) | | | 2,000,000 | | | | 127,180,000 | |

Novartis AG ADR (Switzerland) | | | 19,251,900 | | | | 1,652,005,539 | |

Roche Holding AG ADR (Switzerland) | | | 42,192,699 | | | | 1,311,349,085 | |

Sanofi ADR (France) | | | 40,419,428 | | | | 1,754,607,369 | |

| | | | | | | | |

| | | | 10,603,137,660 | |

| | | | | | | | |

| | | | 14,354,681,247 | |

| INDUSTRIALS: 6.4% | |

CAPITAL GOODS: 3.4% | |

Johnson Controls International PLC (Ireland/United States) | | | 42,454,251 | | | | 1,258,768,542 | |

United Technologies Corp. | | | 8,350,000 | | | | 889,108,000 | |

| | | | | | | | |

| | | | 2,147,876,542 | |

TRANSPORTATION: 3.0% | |

FedEx Corp. | | | 9,663,999 | | | | 1,559,092,959 | |

Union Pacific Corp. | | | 2,344,600 | | | | 324,094,058 | |

| | | | | | | | |

| | | | 1,883,187,017 | |

| | | | | | | | |

| | | | 4,031,063,559 | |

| INFORMATION TECHNOLOGY: 13.1% | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT: 1.7% | |

Maxim Integrated Products, Inc. | | | 5,445,475 | | | | 276,902,404 | |

Microchip Technology, Inc. | | | 11,350,233 | | | | 816,308,757 | |

| | | | | | | | |

| | | | 1,093,211,161 | |

SOFTWARE & SERVICES: 4.3% | |

Dell Technologies, Inc., Class C(a) | | | 5,625,133 | | | | 274,900,250 | |

Micro Focus International PLC ADR(b)(United Kingdom) | | | 24,000,377 | | | | 413,046,488 | |

Microsoft Corp. | | | 19,280,600 | | | | 1,958,330,542 | |

Synopsys, Inc.(a) | | | 533,863 | | | | 44,972,619 | |

| | | | | | | | |

| | | | 2,691,249,899 | |

TECHNOLOGY, HARDWARE & EQUIPMENT: 7.1% | |

Cisco Systems, Inc. | | | 20,308,411 | | | | 879,963,449 | |

Hewlett Packard Enterprise Co.(b) | | | 84,295,793 | | | | 1,113,547,426 | |

HP Inc. | | | 50,846,578 | | | | 1,040,320,986 | |

Juniper Networks, Inc.(b) | | | 25,633,165 | | | | 689,788,470 | |

TE Connectivity, Ltd. (Switzerland) | | | 9,527,564 | | | | 720,569,665 | |

| | | | | | | | |

| | | | 4,444,189,996 | |

| | | | | | | | |

| | | | 8,228,651,056 | |

| MATERIALS: 1.0% | |

Ball Corporation | | | 1,468,578 | | | | 67,525,216 | |

Celanese Corp. | | | 6,266,298 | | | | 563,778,831 | |

| | | | | | | | |

| | | | 631,304,047 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $46,623,019,047) | | | $ | 60,539,069,134 | |

| | |

| See accompanying Notes to Financial Statements | | DODGE & COX STOCK FUND§PAGE 7 |

| | | | |

| PORTFOLIO OF INVESTMENTS | | | December 31, 2018 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS: 3.7% | |

| | |

| | | PAR VALUE/ SHARES | | | VALUE | |

REPURCHASE AGREEMENT: 3.3% | |

Fixed Income Clearing Corporation(c)

1.60%, dated 12/31/18, due 1/2/19, maturity value $2,093,395,063 | | $ | 2,093,209,000 | | | $ | 2,093,209,000 | |

|

MONEY MARKET FUND: 0.4% | |

State Street Institutional U.S. Government Money Market Fund | | | 250,412,031 | | | | 250,412,031 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $2,343,621,031) | | | $ | 2,343,621,031 | |

| | | | | | | | |

TOTAL INVESTMENTS IN SECURITIES

(Cost $48,966,640,078) | | | 99.8 | % | | $ | 62,882,690,165 | |

OTHER ASSETS LESS LIABILITIES | | | 0.2 | % | | | 122,001,982 | |

| | | | | | | | |

| NET ASSETS | | | 100.0 | % | | $ | 63,004,692,147 | |

| | | | | | | | |

| (b) | See Note 9 regarding holdings of 5% voting securities |

| (c) | Repurchase agreement is collateralized by U.S. Treasury Inflation Indexed Note 0.125%, 4/15/20 and U.S. Treasury Notes1.375%-2.625%,4/30/20-8/15/20. Total collateral value is $2,135,088,878. |

In determining a company’s country designation, the Fund generally references the country of incorporation. In cases where the Fund considers the country of incorporation to be a “jurisdiction of convenience” chosen primarily for tax purposes or in other limited circumstances, the Fund uses the country designation of an appropriate broad-based market index. In those cases, two countries are listed - the country of incorporation and the country designated by an appropriate index, respectively.

ADR: American Depositary Receipt

FUTURES CONTRACTS

| | | | | | | | | | | | | | | | |

| Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Value /

Unrealized

Appreciation

(Depreciation) | |

E-mini S&P 500 Index—Long Position | | | 18,732 | | | | 3/15/19 | | | $ | 2,346,370,320 | | | $ | 1,506,941 | |

| | |

| PAGE 8§ DODGE & COX STOCK FUND | | See accompanying Notes to Financial Statements |

| | | | |

STATEMENT OF ASSETS AND LIABILITIES | |

| |

| | | December 31, 2018 | |

ASSETS: | | | | |

Investments in securities, at value | | | | |

Unaffiliated issuers (cost $42,930,003,077) | | $ | 57,882,925,187 | |

Affiliated issuers (cost $6,036,637,001) | | | 4,999,764,978 | |

| | | | |

| | | 62,882,690,165 | |

Cash | | | 74,206 | |

Deposits with broker for futures contracts | | | 112,392,000 | |

Receivable for variation margin for futures contracts | | | 17,982,720 | |

Receivable for investments sold | | | 8,400,861 | |

Receivable for Fund shares sold | | | 97,603,948 | |

Dividends and interest receivable | | | 84,026,675 | |

Prepaid expenses and other assets | | | 696,135 | |

| | | | |

| | | 63,203,866,710 | |

| | | | |

LIABILITIES: | | | | |

Payable for investments purchased | | | 1,412,076 | |

Payable for Fund shares redeemed | | | 168,366,092 | |

Management fees payable | | | 27,919,273 | |

Accrued expenses | | | 1,477,122 | |

| | | | |

| | | 199,174,563 | |

| | | | |

NET ASSETS | | $ | 63,004,692,147 | |

| | | | |

NET ASSETS CONSIST OF: | | | | |

Paid in capital | | $ | 46,748,088,472 | |

Total distributable earnings | | | 16,256,603,675 | |

| | | | |

| | $ | 63,004,692,147 | |

| | | | |

Fund shares outstanding (par value $0.01 each, unlimited shares authorized) | | | 364,587,708 | |

Net asset value per share | | $ | 172.81 | |

| |

STATEMENT OF OPERATIONS | | | | |

| |

| | | Year Ended

December 31, 2018 | |

INVESTMENT INCOME: | | | | |

Dividends (net of foreign taxes of $25,995,122) | | | | |

Unaffiliated issuers | | $ | 1,197,694,770 | |

Affiliated issuers | | | 167,687,233 | |

Interest | | | 13,295,726 | |

| | | | |

| | | 1,378,677,729 | |

| | | | |

EXPENSES: | | | | |

Management fees | | | 357,797,197 | |

Custody and fund accounting fees | | | 872,436 | |

Transfer agent fees | | | 3,666,090 | |

Professional services | | | 225,658 | |

Shareholder reports | | | 1,478,710 | |

Registration fees | | | 382,627 | |

Trustees’ fees | | | 324,167 | |

ADR depositary service fees | | | 6,722,477 | |

Miscellaneous | | | 985,758 | |

| | | | |

| | | 372,455,120 | |

| | | | |

NET INVESTMENT INCOME | | | 1,006,222,609 | |

| | | | |

REALIZED AND UNREALIZED GAIN (LOSS): | | | | |

Net realized gain (loss) | | | | |

Investments in securities of unaffiliated issuers | | | 6,817,569,932 | |

Investments in securities of affiliated issuers | | | 4,300,134 | |

Futures contracts | | | (72,552,552 | ) |

Net change in unrealized appreciation/depreciation | | | | |

Investments in securities of unaffiliated issuers | | | (10,566,446,809 | ) |

Investments in securities of affiliated issuers | | | (1,991,979,743 | ) |

Futures contracts | | | (9,816,012 | ) |

| | | | |

Net realized and unrealized loss | | | (5,818,925,050 | ) |

| | | | |

NET CHANGE IN NET ASSETS FROM OPERATIONS | | $ | (4,812,702,441 | ) |

| | | | |

| | | | | | | | |

STATEMENT OF CHANGES IN NET ASSETS | |

| | |

| | | Year Ended

December 31, 2018 | | | Year Ended

December 31, 2017 | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 1,006,222,609 | | | $ | 1,049,903,472 | |

Net realized gain (loss) | | | 6,749,317,514 | | | | 3,567,659,704 | |

Net change in unrealized appreciation/depreciation | | | (12,568,242,564 | ) | | | 6,614,504,649 | |

| | | | | | | | |

| | | (4,812,702,441 | ) | | | 11,232,067,825 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Total distributions | | | (5,765,113,809 | ) | | | (4,660,640,417 | )(a) |

| | |

FUND SHARE

TRANSACTIONS: | | | | | | | | |

Proceeds from sale of shares | | | 8,154,979,913 | | | | 8,669,060,752 | |

Reinvestment of distributions | | | 5,469,183,979 | | | | 4,418,678,881 | |

Cost of shares redeemed | | | (10,942,582,148 | ) | | | (10,358,716,247 | ) |

| | | | | | | | |

Net change from Fund share transactions | | | 2,681,581,744 | | | | 2,729,023,386 | |

| | | | | | | | |

Total change in net assets | | | (7,896,234,506 | ) | | | 9,300,450,794 | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 70,900,926,653 | | | | 61,600,475,859 | |

| | | | | | | | |

End of year | | $ | 63,004,692,147 | | | $ | 70,900,926,653 | (b) |

| | | | | | | | |

| | |

SHARE INFORMATION: | | | | | | | | |

Shares sold | | | 40,043,780 | | | | 44,674,938 | |

Distributions reinvested | | | 30,452,377 | | | | 22,297,192 | |

Shares redeemed | | | (54,124,818 | ) | | | (53,003,282 | ) |

| | | | | | | | |

Net change in shares outstanding | | | 16,371,339 | | | | 13,968,848 | |

| | | | | | | | |

| (a) | Prior year comparative amounts have been adjusted to reflect current presentation under new accounting standards. Prior year distributions consisted of $1,054,882,152 from net investment income and $3,605,758,265 from net realized gain. |

| (b) | Includes undistributed net investment income of $7,788,890. |

| | |

| See accompanying Notes to Financial Statements | | DODGE & COX STOCK FUND§PAGE 9 |

NOTES TO FINANCIAL STATEMENTS

NOTE 1—ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Dodge & Cox Stock Fund (the “Fund”) is one of the series constituting the Dodge & Cox Funds (the “Trust” or the “Funds”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as anopen-end management investment company. The Fund commenced operations on January 4, 1965, and seeks long-term growth of principal and income. Risk considerations and investment strategies of the Fund are discussed in the Fund’s Prospectus.

The Fund is an investment company and follows the accounting and reporting guidance issued in Topic 946 by the Financial Accounting Standards Board. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require the use of estimates and assumptions by management. Actual results may differ from those estimates. Significant accounting policies are as follows:

Security valuation The Fund’s net assets are normally valued as of the scheduled close of trading on the New York Stock Exchange (NYSE), generally 4 p.m. Eastern Time, each day that the NYSE is open for business.

Portfolio holdings for which market quotes are readily available are valued at market value. Listed securities, for example, are generally valued using the official quoted close price or the last sale on the exchange that is determined to be the primary market for the security. Exchange-traded derivatives are generally valued at the settlement price determined by the relevant exchange. Short-term securities less than 60 days to maturity may be valued at amortized cost if amortized cost approximates current value. Mutual funds are valued at their respective net asset values. Security values are not discounted based on the size of the Fund’s position and may differ from the value a Fund receives upon sale of the securities. All securities held by the Fund are denominated in U.S. dollars.

If market quotations are not readily available or if normal valuation procedures produce valuations that are deemed unreliable or inappropriate under the circumstances existing at the time, the investment will be valued at fair value as determined in good faith by or under the direction of the Fund’s Board of Trustees. The Board of Trustees has appointed Dodge & Cox, the Fund’s investment manager, to make fair value determinations in accordance with the Dodge & Cox Funds Valuation Policies (“Valuation Policies”), subject to Board oversight. Dodge & Cox has established a Pricing Committee that is comprised of representatives from Treasury, Legal, Compliance, and Operations. The Pricing Committee is responsible for implementing the Valuation Policies, including determining the fair value of securities and other investments when necessary. The Pricing Committee considers relevant indications of value that are reasonably available to it in determining the fair value assigned to a particular security, such as the value of similar financial instruments, trading volumes, contractual restrictions on disposition, related corporate actions, and changes in economic conditions. In doing so, the Pricing Committee employs various

methods for calibrating fair valuation approaches, including a regular review of key inputs and assumptions, back-testing, and review of any related market activity.

Valuing securities through a fair value determination involves greater reliance on judgment than valuation of securities based on readily available market quotations. In some instances, lack of information and uncertainty as to the significance of information may lead to a conclusion that a prior valuation is the best indication of a security’s value. When fair value pricing is employed, the prices of securities used by the Fund to calculate its net asset value may differ from quoted or published prices for the same securities.

Security transactions, investment income, expenses, and distributions Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Dividend income and corporate action transactions are recorded on theex-dividend date, or when the Fund first learns of the dividend/corporate action if the ex-dividend date has passed.Non-cash dividends, if any, are recorded at the fair market value of the securities received. Dividends characterized as return of capital for U.S. tax purposes are recorded as a reduction of cost of investments and/or realized gain. Interest income is recorded on the accrual basis.

Expenses are recorded on the accrual basis. Some expenses of the Trust can be directly attributed to a specific series. Expenses which cannot be directly attributed are allocated among the Funds in the Trust using methodologies determined by the nature of the expense.

Distributions to shareholders are recorded on theex-dividend date.

Repurchase agreements Repurchase agreements are transactions under which a Fund purchases a security from a dealer counterparty and agrees to resell the security to that counterparty on a specified future date at the same price, plus a specified interest rate. The Fund’s repurchase agreements are secured by U.S. government or agency securities. It is the Fund’s policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. In the event of default by the counterparty, the Fund has the contractual right to liquidate the collateral securities and to apply the proceeds in satisfaction of the obligation.

Foreign taxes The Fund may be subject to foreign taxes which may be imposed by certain countries in which the Fund invests. The Fund endeavors to record foreign taxes based on applicable foreign tax law. Withholding taxes are incurred on certain foreign dividends and are accrued at the time the associated dividend is recorded. The Fund files withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. The Fund records a reclaim receivable based on, among other things, a jurisdiction’s legal obligation to pay reclaims as well as payment history and market convention. In consideration of recent decisions rendered by

PAGE 10§ DODGE & COX STOCK FUND

NOTES TO FINANCIAL STATEMENTS

European courts, the Fund has filed for additional reclaims related to prior years. A corresponding receivable is established when both the amount is known and significant contingencies or uncertainties regarding collectability are removed. These amounts, if any, are reported in “dividends and interest receivable” in the Statement of Assets and Liabilities.

Futures contracts Futures contracts involve an obligation to purchase or sell (depending on whether the Fund has entered a long or short futures contract, respectively) an asset at a future date, at a price set at the time of the contract. Upon entering into a futures contract, the Fund is required to deposit an amount of cash or liquid assets (referred to as initial margin) in a segregated account with the clearing broker. Subsequent payments (referred to as variation margin) to and from the clearing broker are made on a daily basis based on changes in the market value of futures contracts. Futures contracts are traded publicly and their market value changes daily. Changes in the market value of open futures contracts are recorded as unrealized appreciation or depreciation in the Statement of Operations. Realized gains and losses on futures contracts are recorded in the Statement of Operations at the closing or expiration of the contracts. Cash deposited with a broker as initial margin is recorded in the Statement of Assets and Liabilities. A receivable and/or payable to brokers for daily variation margin is also recorded in the Statement of Assets and Liabilities.

Investments in futures contracts may include certain risks, which may be different from, and potentially greater than, those of the underlying securities. To the extent the Fund uses futures, it is exposed to additional volatility and potential losses resulting from leverage.

The Fund has maintained long S&P 500 futures contracts to provide equity exposure that approximates the Fund’s “net cash and other” position, which includes cash, short-term investments, receivables, and payables. During the year ended December 31, 2018, these S&P 500 futures contracts had notional values up to 4% of net assets.

Indemnification Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business the Trust enters into contracts that provide general indemnities to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 2—VALUATION MEASUREMENTS

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| § | | Level 1: Quoted prices in active markets for identical securities |

| § | | Level 2: Other significant observable inputs (including quoted prices for similar securities, market indices, interest rates, credit risk, forward exchange rates, etc.) |

| § | | Level 3: Significant unobservable inputs (including Fund management’s assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s holdings at December 31, 2018:

| | | | | | | | |

| Classification | | LEVEL 1

(Quoted Prices) | | | LEVEL 2

(Other Significant

Observable Inputs) | |

Securities | | | | | | | | |

Common Stocks(a) | | $ | 60,539,069,134 | | | $ | — | |

Short-term Investments | | | | | | | | |

Repurchase Agreement | | | — | | | | 2,093,209,000 | |

Money Market Fund | | | 250,412,031 | | | | — | |

| | | | | | | | |

Total | | $ | 60,789,481,165 | | | $ | 2,093,209,000 | |

| | | | | | | | |

| | |

Other Investments | | | | | | | | |

Futures Contracts | | | | | | | | |

Appreciation | | $ | 1,506,941 | | | $ | — | |

| | | | | | | | | |

| (a) | All common stocks held in the Fund are Level 1 securities. For a detailed break-out of common stocks by major industry classification, please refer to the Portfolio of Investments. |

NOTE 3—RELATED PARTY TRANSACTIONS

Management fees Under a written agreement approved by a unanimous vote of the Board of Trustees, the Fund pays a management fee monthly at an annual rate of 0.50% of the Fund’s average daily net assets to Dodge & Cox, investment manager of the Fund. The agreement further provides that Dodge & Cox shall waive its fee to the extent that such fee plus all other ordinary operating expenses of the Fund exceed 0.75% of the average daily net assets for the year.

Fund officers and trustees All officers and two of the trustees of the Trust are officers or employees of Dodge & Cox. The Trust pays a fee only to those trustees who are not affiliated with Dodge & Cox.

NOTE 4—INCOME TAX INFORMATION AND DISTRIBUTIONS TO SHAREHOLDERS

A provision for federal income taxes is not required since the Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income to shareholders. Distributions are determined in accordance with income tax regulations, and such amounts may differ from net investment income and realized gains for financial reporting purposes. The Fund may also designate a portion of the amount paid to redeeming shareholders as a distribution for tax purposes. Financial reporting records are adjusted for permanent book to tax differences at year end to reflect tax character. Book to tax differences are primarily due to differing treatments of wash sales, net short-term realized gain (loss), certain corporate action transactions, derivatives, and distributions.

DODGE & COX STOCK FUND§PAGE 11

NOTES TO FINANCIAL STATEMENTS

Distributions during the years noted below were characterized as follows for federal income tax purposes:

| | | | | | | | |

| | | Year Ended

December 31, 2018 | | | Year Ended

December 31, 2017 | |

Ordinary income | | $ | 1,021,848,439 | | | $ | 1,232,159,263 | |

| |

| ($2.947 per share

| )

| | | ($3.636 per share | ) |

Long-term capital gain | | $

| 4,743,265,370

|

| | $ | 3,428,481,154 | |

| |

| ($13.793 per share

| )

| | | ($10.173 per share | ) |

At December 31, 2018, the tax basis components of distributable earnings were as follows:

| | | | |

Undistributed ordinary income | | $ | 91,321,645 | |

Undistributed long-term capital gain | | | 2,175,559,439 | |

At December 31, 2018, unrealized appreciation and depreciation for investments and derivatives based on cost for federal income tax purposes were as follows:

| | | | |

Tax cost | | $ | 48,894,474,515 | |

| | | | |

Unrealized appreciation | | | 18,171,642,663 | |

Unrealized depreciation | | | (4,181,920,072 | ) |

| | | | |

Net unrealized appreciation | | | 13,989,722,591 | |

| | | | | |

Fund management has reviewed the tax positions for open periods (three years and four years, respectively, from filing the Fund’s Federal and State tax returns) as applicable to the Fund, and has determined that no provision for income tax is required in the Fund’s financial statements.

NOTE 5—LOAN FACILITIES

Pursuant to an exemptive order issued by the Securities and Exchange Commission (SEC), the Fund may participate in an interfund lending facility (Facility). The Facility allows the Fund to borrow money from or loan money to the Funds. Loans under the Facility are made for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest on borrowings is the average of the current repurchase agreement rate and the bank loan rate. There was no activity in the Facility during the year.

All Funds in the Trust participate in a $500 million committed credit facility (Line of Credit) with State Street Bank and Trust Company, to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The maximum amount available to the Fund is $250 million. Each Fund pays an annual commitment fee on itspro-rata portion of the Line of Credit. For the year ended December 31, 2018, the Fund’s commitment fee amounted to $426,145 and is reflected as a Miscellaneous Expense in the Statement of Operations. Interest on borrowings is charged at the prevailing rate. There were no borrowings on the Line of Credit during the year.

NOTE 6—PURCHASES AND SALES OF INVESTMENTS

For the year ended December 31, 2018, purchases and sales of securities, other than short-term securities, aggregated $13,763,687,829 and $17,402,330,258, respectively.

NOTE 7—NEW ACCOUNTING GUIDANCE

In August 2018, the Financial Accounting Standards Board issued Accounting Standards Update “Fair Value Measurement (Topic 820)” (ASU 2018-13) which modifies the disclosure requirements for fair value measurement by removing, modifying, or adding certain disclosures. The amendments are effective for annual periods beginning after December 15, 2019, and interim periods within those annual periods. The Fund is permitted to early adopt any removed or modified disclosures upon issuance of this update and delay adoption of the additional disclosures until their effective date. The Fund has early adopted the updated accounting standards on the Fund’s financial statements.

NOTE 8—SUBSEQUENT EVENTS

Fund management has determined that no material events or transactions occurred subsequent to December 31, 2018, and through the date of the Fund’s financial statements issuance, which require additional disclosure in the Fund’s financial statements.

PAGE 12§ DODGE & COX STOCK FUND

NOTES TO FINANCIAL STATEMENTS

NOTE 9—HOLDINGS OF 5% VOTING SECURITIES

Each of the companies listed below was considered to be an affiliate of the Fund because the Fund owned 5% or more of the company’s voting securities during all or part of the year ended December 31, 2018. Transactions during the year in these securities were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares at

Beginning of Year | | | Additions | | | Reductions | | | Shares at

End of Year | | | Dividend Income(a) | | | Realized Gain (Loss) | | | Net Change in Unrealized Appreciation/

Depreciation | | | Value at

End of Year | |

COMMON STOCKS: 7.9% | | | | | | | | | |

COMMUNICATION SERVICES: 0.6% | | | | | | | | | |

Zayo Group Holdings, Inc.(b) | | | 14,027,500 | | | | 2,000,000 | | | | — | | | | 16,027,500 | | | $ | — | | | $ | — | | | $ | (216,664,513 | ) | | $ | 366,068,100 | |

| | |

CONSUMER DISCRETIONARY: 0.3% | | | | | | | | | |

Mattel, Inc.(b) | | | 16,700,000 | | | | 3,804,501 | | | | — | | | | 20,504,501 | | | | — | | | | — | | | | (101,314,820 | ) | | | 204,839,965 | |

| | |

ENERGY: 3.2% | | | | | | | | | |

Anadarko Petroleum Corp. | | | 27,357,621 | | | | — | | | | (400,000 | ) | | | 26,957,621 | | | | 28,505,502 | | | | 3,924,232 | | | | (263,811,523 | ) | | | 1,181,822,105 | |

Apache Corp. | | | 18,700,694 | | | | 12,783,338 | | | | — | | | | 31,484,032 | | | | 22,813,198 | | | | — | | | | (373,508,584 | ) | | | 826,455,840 | |

National Oilwell Varco, Inc. | | | 18,698,800 | | | | 1,300,000 | | | | (9,353,791 | ) | | | 10,645,009 | | | | 3,398,645 | | | | (190,658,754 | ) | | | 156,065,615 | | | | — | (c) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2,008,277,945 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

FINANCIALS: 0.3% | | | | | | | | | |

Brighthouse Financial, Inc.(b) | | | 2,099,363 | | | | 4,600,000 | | | | — | | | | 6,699,363 | | | | — | | | | — | | | | (114,097,793 | ) | | | 204,196,584 | |

Capital One Financial Corp. | | | 26,795,511 | | | | 150,000 | | | | (4,284,298 | ) | | | 22,661,213 | | | | 41,143,098 | | | | 99,042,053 | | | | (654,296,219 | ) | | | — | (c) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 204,196,584 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

INFORMATION TECHNOLOGY: 3.5% | | | | | | | | | |

Hewlett Packard Enterprise Co. | | | 102,041,816 | | | | — | | | | (17,746,023 | ) | | | 84,295,793 | | | | 36,102,966 | | | | 91,992,603 | | | | (131,709,225 | ) | | | 1,113,547,426 | |

Juniper Networks, Inc. | | | 22,833,165 | | | | 2,800,000 | | | | — | | | | 25,633,165 | | | | 17,951,879 | | | | — | | | | (35,026,797 | ) | | | 689,788,470 | |

Micro Focus International PLC ADR | | | 14,012,968 | | | | 9,987,409 | | | | — | | | | 24,000,377 | | | | 17,771,945 | | | | — | | | | (257,615,884 | ) | | | 413,046,488 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2,216,382,384 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 167,687,233 | | | $ | 4,300,134 | | | $ | (1,991,979,743 | ) | | $ | 4,999,764,978 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Net of foreign taxes, if any |

| (c) | Company was not an affiliate at year end |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

SELECTED DATA AND RATIOS (for a share outstanding throughout each year) | | Year Ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | | |

Net asset value, beginning of year | | | $203.61 | | | | $184.30 | | | | $162.77 | | | | $180.94 | | | | $168.87 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 2.90 | | | | 3.09 | | | | 3.05 | | | | 2.42 | | | | 2.83 | |

Net realized and unrealized gain (loss) | | | (16.96 | ) | | | 30.03 | | | | 30.56 | | | | (10.55 | ) | | | 14.60 | |

| | | | |

Total from investment operations | | | (14.06 | ) | | | 33.12 | | | | 33.61 | | | | (8.13 | ) | | | 17.43 | |

| | | | |

Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (2.90 | ) | | | (3.11 | ) | | | (3.03 | ) | | | (2.46 | ) | | | (2.80 | ) |

Net realized gain | | | (13.84 | ) | | | (10.70 | ) | | | (9.05 | ) | | | (7.58 | ) | | | (2.56 | ) |

| | | | |

Total distributions | | | (16.74 | ) | | | (13.81 | ) | | | (12.08 | ) | | | (10.04 | ) | | | (5.36 | ) |

| | | | |

Net asset value, end of year | | | $172.81 | | | | $203.61 | | | | $184.30 | | | | $162.77 | | | | $180.94 | |

| | | | |

Total return | | | (7.08 | )% | | | 18.32 | % | | | 21.27 | % | | | (4.47 | )% | | | 10.43 | % |

Ratios/supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (millions) | | | $63,005 | | | | $70,901 | | | | $61,600 | | | | $54,845 | | | | $60,260 | |

Ratio of expenses to average net assets | | | 0.52 | % | | | 0.52 | % | | | 0.52 | % | | | 0.52 | % | | | 0.52 | % |

Ratio of net investment income to average net assets | | | 1.41 | % | | | 1.58 | % | | | 1.83 | % | | | 1.36 | % | | | 1.62 | % |

Portfolio turnover rate | | | 20 | % | | | 13 | % | | | 16 | % | | | 15 | % | | | 17 | % |

See accompanying Notes to Financial Statements

DODGE & COX STOCK FUND§PAGE 13

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of the Dodge & Cox Funds and Shareholders of Dodge & Cox Stock Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of Dodge & Cox Stock Fund (one of the funds constituting Dodge & Cox Funds, referred to hereafter as the “Fund”) as of December 31, 2018, the related statement of operations for the year ended December 31, 2018, the statement of changes in net assets for each of the two years in the period ended December 31, 2018, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2018 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2018 and the financial highlights for each of the five years in the period ended December 31, 2018 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2018 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

February 15, 2019

We have served as the auditor of one or more investment companies in the Dodge & Cox Funds since 1931.

PAGE 14§ DODGE & COX STOCK FUND

SPECIAL 2018 TAX INFORMATION

(unaudited)

The following information is provided pursuant to provisions of the Internal Revenue Code:

The Fund designates $4,949,127,203 as long-term capital gain distributions in 2018.

The Fund designates up to a maximum amount of $1,390,396,699 of its distributions paid to shareholders in 2018 as qualified dividends (treated for federal income tax purposes in the hands of shareholders as taxable at a maximum rate of 20%).

For shareholders that are corporations, the Fund designates 79% of its ordinary dividends paid to shareholders in 2018 as dividends from domestic corporations eligible for the corporate dividends received deduction, provided that the shareholder otherwise satisfies applicable requirements to claim that deduction.

BOARD APPROVAL OF FUNDS’ INVESTMENT

MANAGEMENT AGREEMENTS AND MANAGEMENT FEES

(unaudited)

The Board of Trustees is responsible for overseeing the performance of the Dodge & Cox Funds’ investment manager and determining whether to continue the Investment Management Agreements between the Funds and Dodge & Cox each year (the “Agreements”). At a meeting of the Board of Trustees of the Trust held on December 13, 2018, the Trustees, by a unanimous vote (including a separate vote of those Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940) (the “Independent Trustees”)), approved the renewal of the Agreements for an additional one-year term through December 31, 2019 with respect to each Fund. During the course of the year, the Board received extensive information and materials relating to the investment management and administrative services provided by Dodge & Cox and the performance of each of the Funds.

INFORMATION RECEIVED

Over the past several years, the Board has requested, received, and discussed a number of special presentations on topics relevant to their annual consideration of the proposed renewal of the Funds’ Agreements. In addition to the foregoing and in advance of the meetings referred to below, the Board, including the Independent Trustees, requested, received, and reviewed materials relating to the Agreements and the services provided by Dodge & Cox. The Independent Trustees retained Broadridge to prepare an independent expense and performance summary for each Fund and comparable funds managed by other advisers identified by Broadridge. The Broadridge materials included information regarding advisory fee rates, expense ratios, and transfer agency, custodial, and distribution expenses, as well as performance comparisons to each Fund’s peer group and to a broad-based securities index or combination of indices. The Broadridge materials also included a comparison of expenses of various share classes offered by comparable funds. The materials reviewed by the Board contained information concerning, among other things, Dodge & Cox’s profitability, financial results and condition, advisory fee revenue, and separate account fee schedules. The Board additionally considered the Funds’ brokerage commissions,

turnover rates, sales and redemption data, and the significant investment that Dodge & Cox makes in research used in managing the Funds. The Board received and reviewed memoranda and related materials addressing, among other things, Dodge & Cox’s services to the Funds; how Dodge & Cox Funds’ fees compare to fees of peer group funds; the different fees, services, costs, and risks associated with other accounts managed by Dodge & Cox as compared to the Dodge & Cox Funds; and the ways in which the Funds realize economies of scale. Throughout the process of reviewing the services provided by Dodge & Cox and preparing for the meeting, the Independent Trustees found Dodge & Cox to be open, forthright, detailed, and very helpful in answering questions about all issues. The Board received copies of the Agreements and a memorandum from the independent legal counsel to the Independent Trustees discussing the factors generally regarded as appropriate to consider in evaluating advisory arrangements. The Trust’s Contract Review Committee, consisting solely of Independent Trustees, met with the independent legal counsel on November 8, 2018 and again on December 13, 2018 to discuss whether to renew the Agreements. The Board, including the Independent Trustees, subsequently concluded that the existing Agreements are fair and reasonable and voted to approve the Agreements. In considering the Agreements, the Board, including the Independent Trustees, did not identify any single factor or particular information as all-important or controlling. In reaching the decision to approve the Agreements, the Board considered several factors, discussed below, to be key factors and reached the conclusions described below.

NATURE, QUALITY, AND EXTENT OF THE SERVICES

The Board considered that Dodge & Cox provides a wide range of services to the Funds in addition to portfolio management, including regulatory compliance, trading desks, proxy voting, transfer agent and custodian oversight, administration, regulatory filings, tax compliance and filings, web site, and anti-money laundering. The extensive nature of services provided by Dodge & Cox has been documented in materials provided to the Board and in presentations made to the Board throughout the year. In particular, the Board considered the nature, quality, and extent of portfolio management, administrative, and shareholder services performed by Dodge & Cox. With regard to portfolio management services, the Board considered Dodge & Cox’s established long-term history of care and conscientiousness in the management of the Funds; its demonstrated consistency in investment approach and depth; the background and experience of the Dodge & Cox U.S. Equity Investment Committee, International Equity Investment Committee, Global Equity Investment Committee, U.S. Fixed Income Investment Committee, and Global Fixed Income Investment Committee, and research analysts responsible for managing the Funds; Dodge & Cox’s methods for assessing the regulatory and investment climate in various jurisdictions; its overall high level of attention to its core investment management function; and its commitment to the Funds and their shareholders. The Board noted Dodge & Cox’s long record of favorable press and industry coverage, as well as its positive compliance record, and its reputation as a trusted, shareholder-friendly mutual fund family.

DODGE & COX STOCK FUND§PAGE 15

In addition, the Board considered that Dodge & Cox manages approximately $215 billion in Fund assets with fewer professionals than most comparable funds, and that on average these professionals have more experience and longer tenure than investment professionals at comparable funds. The Board also noted that Dodge & Cox is an investment research-oriented firm with no other business endeavors to distract management’s attention from its research efforts or to present material conflicts of interest with the operations of the Funds, that its investment professionals adhere to a consistent investment approach across the Funds, and that due to its careful and deliberate strategy with respect to new products, Dodge & Cox has had remarkable stability in its mutual fund product offerings over the course of the past 88 years and has the fewest funds of any of the 25 largest mutual fund families by assets. The Board further considered the “Gold” analyst rating awarded by Morningstar to all of the Funds (other than the Global Bond Fund, which has a “Bronze” rating). The Board concluded that it was satisfied with the nature, extent, and quality of investment management and other services provided to the Funds by Dodge & Cox.

INVESTMENT PERFORMANCE

The Board completed an intensive review and assessment of each Fund’s recent and long-term investment performance (including periods of outperformance and underperformance), as compared to relevant indices and the performance of such Fund’s peer group and broader Morningstar category. In assessing the performance of the Funds, the Board considered the Funds’ investment returns over various periods and the volatility thereof and concluded that the levels experienced were consistent with Dodge & Cox’s long-term approach and active investment style. The Board also compared the short- and long-term investment performance of the equity funds to value-oriented indices, in recognition of the significant performance divergence between value and growth stocks over the past several years. It was noted that equity performance has been consistent with the value oriented investment strategy employed by Dodge & Cox. The Board further noted that the equity funds have outperformed over their medium to long-term investment horizons as compared to their corresponding value equity indices.

The Board determined after extensive review and inquiry that Dodge & Cox’s historic, long-term, team-oriented, bottom-up investment approach remains consistent and that Dodge & Cox continues to be distinguished by its integrity, transparency, and independence. The Board considered that the performance of the Funds is the result of a value-oriented investment management process that emphasizes a long-term investment horizon, comprehensive independent research, a team approach, price discipline, low cost, and low portfolio turnover. The Board also considered that the investment performance delivered by Dodge & Cox to the Funds appeared to be consistent with the relevant performance delivered for other clients of Dodge & Cox. The Board concluded that Dodge & Cox has delivered favorable long-term performance for Fund investors consistent with the long-term investment strategies being pursued by the Funds.

COSTS AND ANCILLARY BENEFITS

Costs of Services to Funds: Fees and Expenses The Board considered each Fund’s management fee rate and net expense ratio relative to (1) a broad category of other mutual funds with similar portfolio characteristics and share class and expense structures and (2) a much smaller group of peers selected by Broadridge based on investment style, share class characteristics, and asset levels. The Board also considered the management fees charged by Dodge & Cox to other clients. In particular, the Board considered that the Funds continue to be below their peer group median in net expense ratios and that many media and industry reports specifically comment on the low cost of the Funds, which have been a defining characteristic of the Funds for many years. The Board also evaluated the operating structures of the Funds and Dodge & Cox, noting that the Funds do not charge front-end sales commissions or distribution fees, and Dodge & Cox bears, among other things, the significant cost of third party research, reimbursement for shareholder recordkeeping and administrative costs to third-party retirement plan administrators, and administrative and office overhead.