UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03010

Fidelity Advisor Series VII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | July 31 |

|

|

Date of reporting period: | January 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity Advisor Focus Funds®

Fidelity Advisor® Biotechnology Fund

Fidelity Advisor® Consumer Discretionary Fund

Fidelity Advisor® Energy Fund

Fidelity Advisor® Financial Services Fund

Fidelity Advisor® Health Care Fund

Fidelity Advisor® Industrials Fund

Fidelity Advisor® Semiconductors Fund

Fidelity Advisor® Technology Fund

Fidelity Advisor® Utilities Fund

(Fidelity Advisor® Financial Services Fund to be renamed Fidelity Advisor® Financials Fund effective April 28, 2023)

Semi-Annual Report

January 31, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Top Holdings (% of Fund's net assets) |

| |

| AbbVie, Inc. | 18.0 | |

| Regeneron Pharmaceuticals, Inc. | 9.3 | |

| Vertex Pharmaceuticals, Inc. | 6.5 | |

| Alnylam Pharmaceuticals, Inc. | 4.5 | |

| Argenx SE ADR | 4.3 | |

| Ascendis Pharma A/S sponsored ADR | 3.5 | |

| Blueprint Medicines Corp. | 3.2 | |

| Cytokinetics, Inc. | 3.0 | |

| Xenon Pharmaceuticals, Inc. | 2.3 | |

| Gilead Sciences, Inc. | 2.3 | |

| | 56.9 | |

| |

| Industries (% of Fund's net assets) |

| |

| Biotechnology | 91.2 | |

| Pharmaceuticals | 8.3 | |

| Health Care Providers & Services | 0.2 | |

| Health Care Technology | 0.1 | |

| |

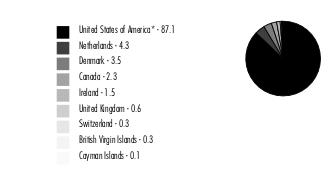

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable. |

| |

Fidelity Advisor® Biotechnology Fund

Showing Percentage of Net Assets

| Common Stocks - 97.6% |

| | | Shares | Value ($) |

| Biotechnology - 89.5% | | | |

| Biotechnology - 89.5% | | | |

| AbbVie, Inc. | | 2,159,880 | 319,122,266 |

| Aerovate Therapeutics, Inc. (a)(b) | | 322,400 | 7,366,840 |

| Alkermes PLC (a) | | 484,200 | 13,867,488 |

| Alnylam Pharmaceuticals, Inc. (a) | | 350,686 | 79,395,310 |

| ALX Oncology Holdings, Inc. (a)(b) | | 1,191,906 | 11,084,726 |

| Amgen, Inc. | | 56,700 | 14,311,080 |

| Arcellx, Inc. | | 177,700 | 5,936,957 |

| Arcutis Biotherapeutics, Inc. (a)(b) | | 906,594 | 15,022,263 |

| Argenx SE ADR (a) | | 199,400 | 76,220,650 |

| Ascendis Pharma A/S sponsored ADR (a)(b) | | 506,125 | 62,799,990 |

| Astria Therapeutics, Inc. (a)(c) | | 1,411,190 | 19,403,863 |

| BioCryst Pharmaceuticals, Inc. (a) | | 884,000 | 9,326,200 |

| Biogen, Inc. (a) | | 30,400 | 8,843,360 |

| Biohaven Ltd. (a) | | 282,300 | 5,389,107 |

| Blueprint Medicines Corp. (a) | | 1,232,730 | 57,617,800 |

| Celldex Therapeutics, Inc. (a) | | 901,207 | 39,707,180 |

| Cerevel Therapeutics Holdings (a)(b) | | 613,338 | 20,945,493 |

| Cyteir Therapeutics, Inc. (a)(b) | | 1,419,670 | 2,172,095 |

| Cytokinetics, Inc. (a)(b) | | 1,273,471 | 54,097,048 |

| Day One Biopharmaceuticals, Inc. (a) | | 863,569 | 18,799,897 |

| Exact Sciences Corp. (a) | | 270,800 | 18,284,416 |

| Exelixis, Inc. (a) | | 1,824,200 | 32,142,404 |

| Fusion Pharmaceuticals, Inc. (a) | | 1,546,014 | 4,684,422 |

| Gilead Sciences, Inc. | | 484,900 | 40,702,506 |

| Icosavax, Inc. (a)(b) | | 1,907,714 | 20,126,383 |

| Instil Bio, Inc. (a)(b) | | 1,028,660 | 837,226 |

| Janux Therapeutics, Inc. (a)(b) | | 456,700 | 10,143,307 |

| Karuna Therapeutics, Inc. (a) | | 198,167 | 39,512,518 |

| Keros Therapeutics, Inc. (a) | | 599,500 | 35,112,715 |

| Madrigal Pharmaceuticals, Inc. (a) | | 18,100 | 5,217,325 |

| Monte Rosa Therapeutics, Inc. (a)(b) | | 698,958 | 5,172,289 |

| Moonlake Immunotherapeutics (a)(b) | | 185,500 | 2,216,725 |

| Morphic Holding, Inc. (a) | | 211,700 | 6,928,941 |

| Nuvalent, Inc. Class A (a)(b) | | 735,406 | 22,246,032 |

| ORIC Pharmaceuticals, Inc. (a)(b) | | 1,206,016 | 6,826,051 |

| PepGen, Inc. | | 697,100 | 10,888,702 |

| Poseida Therapeutics, Inc. (a) | | 482,846 | 3,360,608 |

| Prelude Therapeutics, Inc. (a)(b) | | 1,500,952 | 9,576,074 |

| Prothena Corp. PLC (a) | | 171,900 | 9,720,945 |

| PTC Therapeutics, Inc. (a) | | 486,440 | 22,322,732 |

| Regeneron Pharmaceuticals, Inc. (a) | | 216,992 | 164,581,922 |

| Relay Therapeutics, Inc. (a)(b) | | 360,400 | 7,734,184 |

| Sage Therapeutics, Inc. (a) | | 215,400 | 9,550,836 |

| Sarepta Therapeutics, Inc. (a) | | 71,500 | 8,935,355 |

| Scholar Rock Holding Corp. (a) | | 487,376 | 5,897,250 |

| Scholar Rock Holding Corp. warrants 12/31/25 (a)(d) | | 6,000 | 39,162 |

| Shattuck Labs, Inc. (a)(b) | | 706,434 | 2,945,830 |

| Stoke Therapeutics, Inc. (a)(b) | | 446,619 | 4,448,325 |

| Tango Therapeutics, Inc. (a) | | 1,530,891 | 10,103,881 |

| Tyra Biosciences, Inc. (a)(b) | | 730,700 | 7,760,034 |

| Vaxcyte, Inc. (a) | | 558,329 | 25,320,220 |

| Vera Therapeutics, Inc. (a)(b) | | 980,468 | 8,314,369 |

| Vertex Pharmaceuticals, Inc. (a) | | 356,227 | 115,096,944 |

| Verve Therapeutics, Inc. (a)(b) | | 630,594 | 14,346,014 |

| Viking Therapeutics, Inc. (a)(b) | | 547,600 | 4,796,976 |

| Xenon Pharmaceuticals, Inc. (a) | | 1,061,058 | 41,476,757 |

| Zentalis Pharmaceuticals, Inc. (a) | | 490,692 | 11,580,331 |

| | | | 1,590,380,324 |

| Pharmaceuticals - 8.1% | | | |

| Pharmaceuticals - 8.1% | | | |

| Acelyrin, Inc. (e) | | 1,343,629 | 8,357,507 |

| Acelyrin, Inc. rights (a)(e) | | 163,271 | 967,627 |

| Afferent Pharmaceuticals, Inc. rights 12/31/24 (a)(e) | | 1,915,787 | 2,145,681 |

| Arvinas Holding Co. LLC (a) | | 244,500 | 8,012,265 |

| Axsome Therapeutics, Inc. (a)(b) | | 237,500 | 17,812,500 |

| DICE Therapeutics, Inc. (a) | | 328,700 | 10,442,799 |

| Edgewise Therapeutics, Inc. (a) | | 1,459,200 | 14,927,616 |

| Enliven Therapeutics, Inc. (a)(c) | | 739,725 | 3,417,530 |

| Enliven Therapeutics, Inc. (c)(f) | | 2,110,376 | 8,774,943 |

| GH Research PLC (a)(b) | | 385,500 | 3,427,095 |

| Ikena Oncology, Inc. (a)(b)(c) | | 2,144,926 | 9,137,385 |

| Intra-Cellular Therapies, Inc. (a) | | 250,700 | 12,013,544 |

| Longboard Pharmaceuticals, Inc. (a)(b)(c) | | 968,917 | 4,127,586 |

| Pharvaris BV (a)(b) | | 372,633 | 3,353,697 |

| Terns Pharmaceuticals, Inc. (a)(b) | | 952,048 | 8,635,075 |

| Ventyx Biosciences, Inc. (a) | | 408,730 | 17,166,660 |

| Verona Pharma PLC ADR (a) | | 484,367 | 10,675,449 |

| | | | 143,394,959 |

| TOTAL COMMON STOCKS (Cost $1,261,692,455) | | | 1,733,775,283 |

| | | | |

| Convertible Preferred Stocks - 2.2% |

| | | Shares | Value ($) |

| Biotechnology - 1.7% | | | |

| Biotechnology - 1.7% | | | |

| Apogee Therapeutics Series B (d)(e) | | 1,039,132 | 3,433,874 |

| Bright Peak Therapeutics AG Series B (a)(d)(e) | | 1,920,122 | 5,645,159 |

| Dianthus Therapeutics, Inc. Series A (d)(e) | | 906,629 | 3,925,704 |

| Fog Pharmaceuticals, Inc. Series D (d)(e) | | 239,281 | 2,575,405 |

| LifeMine Therapeutics, Inc. Series C (d)(e) | | 1,950,028 | 3,588,052 |

| Sonoma Biotherapeutics, Inc.: | | | |

| Series B (a)(d)(e) | | 1,967,762 | 3,286,163 |

| Series B1 (a)(d)(e) | | 1,049,456 | 2,130,396 |

| T-Knife Therapeutics, Inc. Series B (a)(d)(e) | | 1,300,097 | 4,979,372 |

| Treeline Biosciences Series A (a)(d)(e) | | 47,600 | 400,316 |

| | | | 29,964,441 |

| Health Care Providers & Services - 0.2% | | | |

| Health Care Facilities - 0.2% | | | |

| Boundless Bio, Inc. Series B (a)(d)(e) | | 3,703,704 | 3,370,371 |

| Health Care Technology - 0.1% | | | |

| Health Care Technology - 0.1% | | | |

| Wugen, Inc. Series B (a)(d)(e) | | 580,277 | 3,029,046 |

| Pharmaceuticals - 0.2% | | | |

| Pharmaceuticals - 0.2% | | | |

| Afferent Pharmaceuticals, Inc. Series C (a)(d)(e) | | 1,915,787 | 19 |

| Aristea Therapeutics, Inc. Series B (a)(d)(e) | | 677,328 | 3,732,077 |

| | | | 3,732,096 |

| TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $49,528,509) | | | 40,095,954 |

| | | | |

| Money Market Funds - 9.6% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 4.38% (g) | | 12,408,387 | 12,410,869 |

| Fidelity Securities Lending Cash Central Fund 4.38% (g)(h) | | 157,427,085 | 157,442,828 |

| TOTAL MONEY MARKET FUNDS (Cost $169,849,574) | | | 169,853,697 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 109.4% (Cost $1,481,070,538) | 1,943,724,934 |

NET OTHER ASSETS (LIABILITIES) - (9.4)% | (166,898,912) |

| NET ASSETS - 100.0% | 1,776,826,022 |

| | |

Legend

| (b) | Security or a portion of the security is on loan at period end. |

| (d) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $40,135,116 or 2.3% of net assets. |

| (f) | Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

| (g) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (h) | Investment made with cash collateral received from securities on loan. |

| Additional information on each restricted holding is as follows: |

| Security | Acquisition Date | Acquisition Cost ($) |

| Afferent Pharmaceuticals, Inc. Series C | 7/01/15 | 0 |

| | | |

| Apogee Therapeutics Series B | 11/15/22 | 3,433,874 |

| | | |

| Aristea Therapeutics, Inc. Series B | 10/06/20 - 7/27/21 | 3,734,584 |

| | | |

| Boundless Bio, Inc. Series B | 4/23/21 | 5,000,000 |

| | | |

| Bright Peak Therapeutics AG Series B | 5/14/21 | 7,499,997 |

| | | |

| Dianthus Therapeutics, Inc. Series A | 4/06/22 | 3,940,663 |

| | | |

| Fog Pharmaceuticals, Inc. Series D | 11/17/22 | 2,575,405 |

| | | |

| LifeMine Therapeutics, Inc. Series C | 2/15/22 | 3,971,408 |

| | | |

| Scholar Rock Holding Corp. warrants 12/31/25 | 6/17/22 | 0 |

| | | |

| Sonoma Biotherapeutics, Inc. Series B | 7/26/21 | 3,888,888 |

| | | |

| Sonoma Biotherapeutics, Inc. Series B1 | 7/26/21 | 3,111,112 |

| | | |

| T-Knife Therapeutics, Inc. Series B | 6/30/21 | 7,500,000 |

| | | |

| Treeline Biosciences Series A | 7/30/21 | 372,589 |

| | | |

| Wugen, Inc. Series B | 7/09/21 | 4,499,990 |

| | | |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.38% | 7,889,645 | 287,557,884 | 283,036,660 | 214,879 | - | - | 12,410,869 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 4.38% | 195,515,949 | 392,411,762 | 430,484,883 | 947,916 | - | - | 157,442,828 | 0.5% |

| Total | 203,405,594 | 679,969,646 | 713,521,543 | 1,162,795 | - | - | 169,853,697 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are presented in the table below. Certain corporate actions, such as mergers, are excluded from the amounts in this table if applicable. A dash in the Value end of period ($) column means either the issuer is no longer held at period end, or the issuer is held at period end but is no longer an affiliate.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Astria Therapeutics, Inc. | 1,547,525 | 13,000,003 | 1,436,842 | - | 504,461 | 5,788,716 | 19,403,863 |

| Enliven Therapeutics, Inc. | - | 2,958,666 | - | - | - | 458,864 | 3,417,530 |

| Enliven Therapeutics, Inc. | - | 8,105,912 | - | - | - | 669,031 | 8,774,943 |

| Ikena Oncology, Inc. | 5,294,759 | 2,643,313 | - | - | - | 1,199,313 | 9,137,385 |

| Longboard Pharmaceuticals, Inc. | 1,743,340 | 2,284,259 | - | - | - | 99,987 | 4,127,586 |

| Total | 8,585,624 | 28,992,153 | 1,436,842 | - | 504,461 | 8,215,911 | 44,861,307 |

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Common Stocks | 1,733,775,283 | 1,713,490,363 | 8,814,105 | 11,470,815 |

|

| Convertible Preferred Stocks | 40,095,954 | - | - | 40,095,954 |

|

| Money Market Funds | 169,853,697 | 169,853,697 | - | - |

| Total Investments in Securities: | 1,943,724,934 | 1,883,344,060 | 8,814,105 | 51,566,769 |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

| |

| Investments in Securities: | |

| Convertible Preferred Stocks | | | |

| Beginning Balance | $ | 36,066,970 | |

| Net Realized Gain (Loss) on Investment Securities | | - | |

| Net Unrealized Gain (Loss) on Investment Securities | | 2,703,402 | |

| Cost of Purchases | | 6,009,279 | |

| Proceeds of Sales | | - | |

| Amortization/Accretion | | - | |

| Transfers into Level 3 | | - | |

| Transfers out of Level 3 | | (4,683,697) | |

| Ending Balance | $ | 40,095,954 | |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2023 | $ | 2,703,402 | |

| Other Investments in Securities | | | |

| Beginning Balance | $ | 1,800,841 | |

| Net Realized Gain (Loss) on Investment Securities | | (3) | |

| Net Unrealized Gain (Loss) on Investment Securities | | 4,986,280 | |

| Cost of Purchases | | - | |

| Proceeds of Sales | | - | |

| Amortization/Accretion | | - | |

| Transfers into Level 3 | | 4,683,697 | |

| Transfers out of Level 3 | | - | |

| Ending Balance | $ | 11,470,815 | |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2023 | $ | 4,986,278 | |

| The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Cost of purchases and proceeds of sales may include securities received and/or delivered through in-kind transactions. Transfers into Level 3 were attributable to a lack of observable market data resulting from decreases in market activity, decreases in liquidity, security restructurings or corporate actions. Transfers out of Level 3 were attributable to observable market data becoming available for those securities. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations. | |

Fidelity Advisor® Biotechnology Fund

| Statement of Assets and Liabilities |

| | | | January 31, 2023 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $158,019,783) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $1,255,729,661) | $ | 1,729,009,930 | | |

Fidelity Central Funds (cost $169,849,574) | | 169,853,697 | | |

Other affiliated issuers (cost $55,491,303) | | 44,861,307 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $1,481,070,538) | | | $ | 1,943,724,934 |

| Receivable for investments sold | | | | 208,912 |

| Receivable for fund shares sold | | | | 302,448 |

| Dividends receivable | | | | 3,196,623 |

| Distributions receivable from Fidelity Central Funds | | | | 151,503 |

| Prepaid expenses | | | | 8,677 |

Total assets | | | | 1,947,593,097 |

| Liabilities | | | | |

| Payable to custodian bank | $ | 23,428 | | |

| Payable for investments purchased | | | | |

Regular delivery | | 1,271,616 | | |

Delayed delivery | | 8,105,912 | | |

| Payable for fund shares redeemed | | 2,514,379 | | |

| Accrued management fee | | 772,816 | | |

| Distribution and service plan fees payable | | 321,753 | | |

| Other affiliated payables | | 301,889 | | |

| Other payables and accrued expenses | | 45,557 | | |

| Collateral on securities loaned | | 157,409,725 | | |

| Total Liabilities | | | | 170,767,075 |

| Net Assets | | | $ | 1,776,826,022 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 1,451,276,946 |

| Total accumulated earnings (loss) | | | | 325,549,076 |

| Net Assets | | | $ | 1,776,826,022 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($663,033,067 ÷ 26,221,216 shares) (a) | | | $ | 25.29 |

| Maximum offering price per share (100/94.25 of $25.29) | | | $ | 26.83 |

| Class M : | | | | |

Net Asset Value and redemption price per share ($122,360,148 ÷ 5,285,032 shares) (a) | | | $ | 23.15 |

| Maximum offering price per share (100/96.50 of $23.15) | | | $ | 23.99 |

| Class C : | | | | |

Net Asset Value and offering price per share ($159,808,401 ÷ 8,080,705 shares) (a) | | | $ | 19.78 |

| Class I : | | | | |

Net Asset Value , offering price and redemption price per share ($774,855,454 ÷ 28,059,468 shares) | | | $ | 27.61 |

| Class Z : | | | | |

Net Asset Value , offering price and redemption price per share ($56,768,952 ÷ 2,050,200 shares) | | | $ | 27.69 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| | | | Six months ended January 31, 2023 (Unaudited) |

| Investment Income | | | | |

| Dividends | | | $ | 7,538,716 |

| Income from Fidelity Central Funds (including $947,916 from security lending) | | | | 1,162,795 |

| Total Income | | | | 8,701,511 |

| Expenses | | | | |

| Management fee | $ | 4,654,194 | | |

| Transfer agent fees | | 1,584,951 | | |

| Distribution and service plan fees | | 1,975,043 | | |

| Accounting fees | | 240,324 | | |

| Custodian fees and expenses | | 26,080 | | |

| Independent trustees' fees and expenses | | 3,066 | | |

| Registration fees | | 79,621 | | |

| Audit | | 36,801 | | |

| Legal | | 2,236 | | |

| Miscellaneous | | 7,350 | | |

| Total expenses before reductions | | 8,609,666 | | |

| Expense reductions | | (35,125) | | |

| Total expenses after reductions | | | | 8,574,541 |

| Net Investment income (loss) | | | | 126,970 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (19,930,173) | | |

| Affiliated issuers | | 504,461 | | |

| Total net realized gain (loss) | | | | (19,425,712) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 251,366,843 | | |

| Affiliated issuers | | 8,215,911 | | |

| Total change in net unrealized appreciation (depreciation) | | | | 259,582,754 |

| Net gain (loss) | | | | 240,157,042 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 240,284,012 |

| Statement of Changes in Net Assets |

| |

| | Six months ended January 31, 2023 (Unaudited) | | Year ended July 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 126,970 | $ | (4,304,003) |

| Net realized gain (loss) | | (19,425,712) | | (9,400,446) |

| Change in net unrealized appreciation (depreciation) | | 259,582,754 | | (408,605,977) |

| Net increase (decrease) in net assets resulting from operations | | 240,284,012 | | (422,310,426) |

| Distributions to shareholders | | - | | (389,242,813) |

| Share transactions - net increase (decrease) | | (96,789,209) | | (72,894,135) |

| Total increase (decrease) in net assets | | 143,494,803 | | (884,447,374) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 1,633,331,219 | | 2,517,778,593 |

| End of period | $ | 1,776,826,022 | $ | 1,633,331,219 |

| | | | | |

| | | | | |

Financial Highlights

| Fidelity Advisor® Biotechnology Fund Class A |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 22.00 | $ | 32.58 | $ | 31.03 | $ | 25.48 | $ | 27.80 | $ | 24.45 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | - C | | (.06) | | .07 | | .03 | | .03 | | (.14) |

| Net realized and unrealized gain (loss) | | 3.29 | | (5.16) | | 4.42 | | 7.40 | | (1.76) | | 3.49 |

| Total from investment operations | | 3.29 | | (5.22) | | 4.49 | | 7.43 | | (1.73) | | 3.35 |

| Distributions from net investment income | | - | | (.11) | | (.13) | | - | | - | | - |

| Distributions from net realized gain | | - | | (5.25) | | (2.81) | | (1.88) | | (.59) | | - |

| Total distributions | | - | | (5.36) | | (2.94) | | (1.88) | | (.59) | | - |

| Net asset value, end of period | $ | 25.29 | $ | 22.00 | $ | 32.58 | $ | 31.03 | $ | 25.48 | $ | 27.80 |

Total Return D,E,F | | 14.95% | | (18.95)% | | 14.03% | | 30.00% | | (6.17)% | | 13.70% |

Ratios to Average Net Assets B,G,H | | | | | | | | | | | | |

| Expenses before reductions | | 1.01% I | | 1.00% | | 1.01% | | 1.02% | | 1.04% | | 1.06% |

| Expenses net of fee waivers, if any | | 1.01% I | | 1.00% | | 1.00% | | 1.02% | | 1.03% | | 1.06% |

| Expenses net of all reductions | | 1.01% I | | 1.00% | | 1.00% | | 1.02% | | 1.03% | | 1.06% |

| Net investment income (loss) | | (.02)% I | | (.23)% | | .20% | | .11% | | .13% | | (.53)% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 663,033 | $ | 594,911 | $ | 808,610 | $ | 722,896 | $ | 616,894 | $ | 766,303 |

Portfolio turnover rate J | | 70% I | | 43% | | 72% | | 66% | | 62% | | 45% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized.

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Biotechnology Fund Class M |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 20.17 | $ | 30.35 | $ | 29.08 | $ | 24.02 | $ | 26.32 | $ | 23.22 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | (.03) | | (.13) | | (.02) | | (.05) | | (.04) | | (.21) |

| Net realized and unrealized gain (loss) | | 3.01 | | (4.73) | | 4.14 | | 6.96 | | (1.67) | | 3.31 |

| Total from investment operations | | 2.98 | | (4.86) | | 4.12 | | 6.91 | | (1.71) | | 3.10 |

| Distributions from net investment income | | - | | (.07) | | (.07) | | - | | - | | - |

| Distributions from net realized gain | | - | | (5.25) | | (2.78) | | (1.85) | | (.59) | | - |

| Total distributions | | - | | (5.32) | | (2.85) | | (1.85) | | (.59) | | - |

| Net asset value, end of period | $ | 23.15 | $ | 20.17 | $ | 30.35 | $ | 29.08 | $ | 24.02 | $ | 26.32 |

Total Return C,D,E | | 14.77% | | (19.18)% | | 13.69% | | 29.64% | | (6.44)% | | 13.35% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | 1.29% H | | 1.28% | | 1.28% | | 1.32% | | 1.34% | | 1.38% |

| Expenses net of fee waivers, if any | | 1.29% H | | 1.28% | | 1.28% | | 1.32% | | 1.34% | | 1.38% |

| Expenses net of all reductions | | 1.28% H | | 1.28% | | 1.28% | | 1.31% | | 1.34% | | 1.38% |

| Net investment income (loss) | | (.30)% H | | (.51)% | | (.07)% | | (.18)% | | (.18)% | | (.84)% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 122,360 | $ | 109,815 | $ | 161,619 | $ | 144,568 | $ | 119,312 | $ | 135,879 |

Portfolio turnover rate I | | 70% H | | 43% | | 72% | | 66% | | 62% | | 45% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Biotechnology Fund Class C |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 17.27 | $ | 26.79 | $ | 25.97 | $ | 21.71 | $ | 23.96 | $ | 21.23 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | (.07) | | (.21) | | (.15) | | (.15) | | (.14) | | (.29) |

| Net realized and unrealized gain (loss) | | 2.58 | | (4.07) | �� | 3.71 | | 6.26 | | (1.52) | | 3.02 |

| Total from investment operations | | 2.51 | | (4.28) | | 3.56 | | 6.11 | | (1.66) | | 2.73 |

| Distributions from net investment income | | - | | - | | (.01) | | - | | - | | - |

| Distributions from net realized gain | | - | | (5.24) | | (2.73) | | (1.85) | | (.59) | | - |

| Total distributions | | - | | (5.24) | | (2.74) | | (1.85) | | (.59) | | - |

| Net asset value, end of period | $ | 19.78 | $ | 17.27 | $ | 26.79 | $ | 25.97 | $ | 21.71 | $ | 23.96 |

Total Return C,D,E | | 14.53% | | (19.54)% | | 13.15% | | 29.07% | | (6.87)% | | 12.86% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | 1.77% H | | 1.75% | | 1.75% | | 1.77% | | 1.78% | | 1.80% |

| Expenses net of fee waivers, if any | | 1.76% H | | 1.74% | | 1.75% | | 1.77% | | 1.77% | | 1.80% |

| Expenses net of all reductions | | 1.76% H | | 1.74% | | 1.75% | | 1.76% | | 1.77% | | 1.80% |

| Net investment income (loss) | | (.78)% H | | (.97)% | | (.55)% | | (.63)% | | (.61)% | | (1.27)% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 159,808 | $ | 168,797 | $ | 328,417 | $ | 384,420 | $ | 398,749 | $ | 558,420 |

Portfolio turnover rate I | | 70% H | | 43% | | 72% | | 66% | | 62% | | 45% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Biotechnology Fund Class I |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 23.99 | $ | 35.00 | $ | 33.16 | $ | 27.08 | $ | 29.42 | $ | 25.80 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .03 | | .01 | | .17 | | .11 | | .11 | | (.07) |

| Net realized and unrealized gain (loss) | | 3.59 | | (5.61) | | 4.72 | | 7.88 | | (1.86) | | 3.69 |

| Total from investment operations | | 3.62 | | (5.60) | | 4.89 | | 7.99 | | (1.75) | | 3.62 |

| Distributions from net investment income | | - | | (.16) | | (.21) | | - | | - | | - |

| Distributions from net realized gain | | - | | (5.25) | | (2.85) | | (1.91) | | (.59) | | - |

| Total distributions | | - | | (5.41) | | (3.05) C | | (1.91) | | (.59) | | - |

| Net asset value, end of period | $ | 27.61 | $ | 23.99 | $ | 35.00 | $ | 33.16 | $ | 27.08 | $ | 29.42 |

Total Return D,E | | 15.09% | | (18.74)% | | 14.34% | | 30.32% | | (5.89)% | | 14.03% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | .74% H | | .73% | | .74% | | .75% | | .76% | | .79% |

| Expenses net of fee waivers, if any | | .74% H | | .73% | | .74% | | .75% | | .76% | | .79% |

| Expenses net of all reductions | | .74% H | | .73% | | .74% | | .75% | | .76% | | .79% |

| Net investment income (loss) | | .25% H | | .04% | | .47% | | .38% | | .40% | | (.26)% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 774,855 | $ | 697,079 | $ | 1,129,492 | $ | 1,092,145 | $ | 1,006,084 | $ | 1,307,833 |

Portfolio turnover rate I | | 70% H | | 43% | | 72% | | 66% | | 62% | | 45% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor® Biotechnology Fund Class Z |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 A |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 24.04 | $ | 35.05 | $ | 33.22 | $ | 27.10 | $ | 30.06 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) B,C | | .05 | | .05 | | .21 | | .15 | | .16 |

| Net realized and unrealized gain (loss) | | 3.60 | | (5.62) | | 4.74 | | 7.90 | | (2.53) |

| Total from investment operations | | 3.65 | | (5.57) | | 4.95 | | 8.05 | | (2.37) |

| Distributions from net investment income | | - | | (.19) | | (.26) | | (.02) | | - |

| Distributions from net realized gain | | - | | (5.25) | | (2.87) | | (1.91) | | (.59) |

| Total distributions | | - | | (5.44) | | (3.12) D | | (1.93) | | (.59) |

| Net asset value, end of period | $ | 27.69 | $ | 24.04 | $ | 35.05 | $ | 33.22 | $ | 27.10 |

Total Return E,F | | 15.18% | | (18.63)% | | 14.49% | | 30.53% | | (7.83)% |

Ratios to Average Net Assets C,G,H | | | | | | | | | | |

| Expenses before reductions | | .61% I | | .61% | | .61% | | .62% | | .63% I |

| Expenses net of fee waivers, if any | | .61% I | | .60% | | .61% | | .62% | | .63% I |

| Expenses net of all reductions | | .61% I | | .60% | | .61% | | .62% | | .62% I |

| Net investment income (loss) | | .38% I | | .16% | | .60% | | .51% | | .73% I |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 56,769 | $ | 62,729 | $ | 89,641 | $ | 62,743 | $ | 30,116 |

Portfolio turnover rate J | | 70% I | | 43% | | 72% | | 66% | | 62% |

A For the period October 2, 2018 (commencement of sale of shares) through July 31, 2019.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

D Total distributions per share do not sum due to rounding.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized.

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

Top Holdings (% of Fund's net assets) |

| |

| Amazon.com, Inc. | 22.4 | |

| Tesla, Inc. | 10.2 | |

| The Home Depot, Inc. | 5.2 | |

| Lowe's Companies, Inc. | 4.7 | |

| NIKE, Inc. Class B | 4.2 | |

| TJX Companies, Inc. | 3.9 | |

| Hilton Worldwide Holdings, Inc. | 2.8 | |

| Booking Holdings, Inc. | 2.5 | |

| Target Corp. | 2.2 | |

| Dick's Sporting Goods, Inc. | 2.1 | |

| | 60.2 | |

| |

| Industries (% of Fund's net assets) |

| |

| Internet & Direct Marketing Retail | 23.2 | |

| Specialty Retail | 21.8 | |

| Hotels, Restaurants & Leisure | 17.8 | |

| Textiles, Apparel & Luxury Goods | 13.8 | |

| Automobiles | 10.6 | |

| Multiline Retail | 6.7 | |

| Household Durables | 2.9 | |

| Auto Components | 1.6 | |

| Food & Staples Retailing | 0.8 | |

| Building Products | 0.4 | |

| |

Fidelity Advisor® Consumer Discretionary Fund

Showing Percentage of Net Assets

| Common Stocks - 99.6% |

| | | Shares | Value ($) |

| Auto Components - 1.6% | | | |

| Auto Parts & Equipment - 1.6% | | | |

| Adient PLC (a) | | 72,331 | 3,256,342 |

| Magna International, Inc. Class A (b) | | 50,700 | 3,292,458 |

| | | | 6,548,800 |

| Automobiles - 10.6% | | | |

| Automobile Manufacturers - 10.6% | | | |

| Ferrari NV | | 6,803 | 1,709,662 |

| Tesla, Inc. (a) | | 242,515 | 42,008,448 |

| | | | 43,718,110 |

| Building Products - 0.4% | | | |

| Building Products - 0.4% | | | |

| The AZEK Co., Inc. (a)(b) | | 64,011 | 1,544,585 |

| Food & Staples Retailing - 0.8% | | | |

| Food Distributors - 0.8% | | | |

| Performance Food Group Co. (a) | | 56,542 | 3,467,155 |

| Hotels, Restaurants & Leisure - 17.8% | | | |

| Casinos & Gaming - 3.2% | | | |

| Caesars Entertainment, Inc. (a) | | 57,651 | 3,001,311 |

| Churchill Downs, Inc. | | 24,967 | 6,194,313 |

| Penn Entertainment, Inc. (a) | | 111,635 | 3,957,461 |

| | | | 13,153,085 |

| Hotels, Resorts & Cruise Lines - 7.7% | | | |

| Booking Holdings, Inc. (a) | | 4,255 | 10,357,096 |

| Hilton Worldwide Holdings, Inc. | | 80,255 | 11,644,198 |

| Marriott International, Inc. Class A | | 48,744 | 8,490,230 |

| Royal Caribbean Cruises Ltd. (a) | | 17,200 | 1,116,968 |

| | | | 31,608,492 |

| Leisure Facilities - 0.6% | | | |

| Planet Fitness, Inc. (a) | | 28,027 | 2,372,486 |

| Restaurants - 6.3% | | | |

| ARAMARK Holdings Corp. | | 110,519 | 4,921,411 |

| Brinker International, Inc. (a) | | 25,120 | 991,235 |

| Chipotle Mexican Grill, Inc. (a) | | 3,764 | 6,196,974 |

| Domino's Pizza, Inc. | | 14,699 | 5,188,747 |

| Dutch Bros, Inc. (a)(b) | | 18,809 | 716,811 |

| McDonald's Corp. | | 29,991 | 8,019,593 |

| | | | 26,034,771 |

TOTAL HOTELS, RESTAURANTS & LEISURE | | | 73,168,834 |

| Household Durables - 2.9% | | | |

| Home Furnishings - 1.3% | | | |

| Tempur Sealy International, Inc. | | 129,285 | 5,268,364 |

| Homebuilding - 1.6% | | | |

| KB Home | | 62,400 | 2,399,280 |

| PulteGroup, Inc. | | 76,800 | 4,369,152 |

| | | | 6,768,432 |

TOTAL HOUSEHOLD DURABLES | | | 12,036,796 |

| Internet & Direct Marketing Retail - 23.2% | | | |

| Internet & Direct Marketing Retail - 23.2% | | | |

| Amazon.com, Inc. (a) | | 896,829 | 92,489,975 |

| eBay, Inc. | | 66,724 | 3,302,838 |

| | | | 95,792,813 |

| Multiline Retail - 6.7% | | | |

| General Merchandise Stores - 6.7% | | | |

| Dollar General Corp. | | 29,673 | 6,931,613 |

| Dollar Tree, Inc. (a) | | 55,824 | 8,383,648 |

| Ollie's Bargain Outlet Holdings, Inc. (a) | | 63,043 | 3,452,235 |

| Target Corp. | | 52,124 | 8,972,625 |

| | | | 27,740,121 |

| Specialty Retail - 21.8% | | | |

| Apparel Retail - 5.7% | | | |

| Burlington Stores, Inc. (a) | | 22,263 | 5,116,705 |

| TJX Companies, Inc. | | 196,089 | 16,051,846 |

| Victoria's Secret & Co. (a) | | 57,809 | 2,436,649 |

| | | | 23,605,200 |

| Automotive Retail - 0.4% | | | |

| O'Reilly Automotive, Inc. (a) | | 1,800 | 1,426,230 |

| Home Improvement Retail - 11.7% | | | |

| Floor & Decor Holdings, Inc. Class A (a)(b) | | 82,878 | 7,522,836 |

| Lowe's Companies, Inc. | | 91,977 | 19,154,210 |

| The Home Depot, Inc. | | 66,163 | 21,448,060 |

| | | | 48,125,106 |

| Homefurnishing Retail - 0.5% | | | |

| Williams-Sonoma, Inc. | | 14,400 | 1,943,136 |

| Specialty Stores - 3.5% | | | |

| Bath & Body Works, Inc. | | 34,218 | 1,574,370 |

| Dick's Sporting Goods, Inc. (b) | | 66,324 | 8,672,526 |

| Five Below, Inc. (a) | | 17,861 | 3,520,939 |

| Sally Beauty Holdings, Inc. (a) | | 50,990 | 794,424 |

| | | | 14,562,259 |

TOTAL SPECIALTY RETAIL | | | 89,661,931 |

| Textiles, Apparel & Luxury Goods - 13.8% | | | |

| Apparel, Accessories & Luxury Goods - 7.0% | | | |

| Capri Holdings Ltd. (a) | | 129,630 | 8,619,099 |

| lululemon athletica, Inc. (a) | | 20,770 | 6,373,898 |

| LVMH Moet Hennessy Louis Vuitton SE | | 2,692 | 2,350,050 |

| PVH Corp. | | 34,219 | 3,076,288 |

| Tapestry, Inc. | | 184,504 | 8,407,847 |

| | | | 28,827,182 |

| Footwear - 6.8% | | | |

| Crocs, Inc. (a) | | 8,420 | 1,025,303 |

| Deckers Outdoor Corp. (a) | | 18,527 | 7,919,922 |

| NIKE, Inc. Class B | | 135,882 | 17,301,855 |

| On Holding AG (a) | | 39,844 | 924,381 |

| Skechers U.S.A., Inc. Class A (sub. vtg.) (a) | | 18,800 | 905,220 |

| | | | 28,076,681 |

TOTAL TEXTILES, APPAREL & LUXURY GOODS | | | 56,903,863 |

| TOTAL COMMON STOCKS (Cost $249,657,680) | | | 410,583,008 |

| | | | |

| Money Market Funds - 4.3% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 4.38% (c) | | 954,750 | 954,941 |

| Fidelity Securities Lending Cash Central Fund 4.38% (c)(d) | | 16,797,445 | 16,799,125 |

| TOTAL MONEY MARKET FUNDS (Cost $17,754,066) | | | 17,754,066 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 103.9% (Cost $267,411,746) | 428,337,074 |

NET OTHER ASSETS (LIABILITIES) - (3.9)% | (16,259,864) |

| NET ASSETS - 100.0% | 412,077,210 |

| | |

Legend

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.38% | - | 67,017,065 | 66,062,124 | 18,290 | - | - | 954,941 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 4.38% | 3,926,447 | 54,667,429 | 41,794,751 | 64,715 | - | - | 16,799,125 | 0.1% |

| Total | 3,926,447 | 121,684,494 | 107,856,875 | 83,005 | - | - | 17,754,066 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Common Stocks | 410,583,008 | 408,232,958 | 2,350,050 | - |

|

| Money Market Funds | 17,754,066 | 17,754,066 | - | - |

| Total Investments in Securities: | 428,337,074 | 425,987,024 | 2,350,050 | - |

Fidelity Advisor® Consumer Discretionary Fund

| Statement of Assets and Liabilities |

| | | | January 31, 2023 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $17,149,541) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $249,657,680) | $ | 410,583,008 | | |

Fidelity Central Funds (cost $17,754,066) | | 17,754,066 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $267,411,746) | | | $ | 428,337,074 |

| Foreign currency held at value (cost $21,151) | | | | 19,178 |

| Receivable for investments sold | | | | 1,735,297 |

| Receivable for fund shares sold | | | | 160,447 |

| Dividends receivable | | | | 119,148 |

| Distributions receivable from Fidelity Central Funds | | | | 6,675 |

| Prepaid expenses | | | | 1,273 |

| Other receivables | | | | 2,352 |

Total assets | | | | 430,381,444 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 819,477 | | |

| Payable for fund shares redeemed | | 345,413 | | |

| Accrued management fee | | 168,711 | | |

| Distribution and service plan fees payable | | 79,665 | | |

| Other affiliated payables | | 63,434 | | |

| Other payables and accrued expenses | | 28,584 | | |

| Collateral on securities loaned | | 16,798,950 | | |

| Total Liabilities | | | | 18,304,234 |

| Net Assets | | | $ | 412,077,210 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 269,665,524 |

| Total accumulated earnings (loss) | | | | 142,411,686 |

| Net Assets | | | $ | 412,077,210 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($169,781,662 ÷ 5,180,526 shares) (a) | | | $ | 32.77 |

| Maximum offering price per share (100/94.25 of $32.77) | | | $ | 34.77 |

| Class M : | | | | |

Net Asset Value and redemption price per share ($31,177,656 ÷ 1,040,727 shares) (a) | | | $ | 29.96 |

| Maximum offering price per share (100/96.50 of $29.96) | | | $ | 31.05 |

| Class C : | | | | |

Net Asset Value and offering price per share ($44,156,236 ÷ 1,783,903 shares) (a) | | | $ | 24.75 |

| Class I : | | | | |

Net Asset Value , offering price and redemption price per share ($96,839,601 ÷ 2,679,518 shares) | | | $ | 36.14 |

| Class Z : | | | | |

Net Asset Value , offering price and redemption price per share ($70,122,055 ÷ 1,931,714 shares) | | | $ | 36.30 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| | | | Six months ended January 31, 2023 (Unaudited) |

| Investment Income | | | | |

| Dividends | | | $ | 1,451,922 |

| Income from Fidelity Central Funds (including $64,715 from security lending) | | | | 83,005 |

| Total Income | | | | 1,534,927 |

| Expenses | | | | |

| Management fee | $ | 1,070,355 | | |

| Transfer agent fees | | 336,092 | | |

| Distribution and service plan fees | | 520,973 | | |

| Accounting fees | | 71,855 | | |

| Custodian fees and expenses | | 9,316 | | |

| Independent trustees' fees and expenses | | 717 | | |

| Registration fees | | 63,596 | | |

| Audit | | 32,756 | | |

| Legal | | 2,315 | | |

| Miscellaneous | | 1,705 | | |

| Total expenses before reductions | | 2,109,680 | | |

| Expense reductions | | (7,585) | | |

| Total expenses after reductions | | | | 2,102,095 |

| Net Investment income (loss) | | | | (567,168) |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 4,724,880 | | |

| Foreign currency transactions | | (1,345) | | |

| Total net realized gain (loss) | | | | 4,723,535 |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (15,322,548) | | |

| Assets and liabilities in foreign currencies | | 778 | | |

| Total change in net unrealized appreciation (depreciation) | | | | (15,321,770) |

| Net gain (loss) | | | | (10,598,235) |

| Net increase (decrease) in net assets resulting from operations | | | $ | (11,165,403) |

| Statement of Changes in Net Assets |

| |

| | Six months ended January 31, 2023 (Unaudited) | | Year ended July 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | (567,168) | $ | (2,177,425) |

| Net realized gain (loss) | | 4,723,535 | | 22,343,203 |

| Change in net unrealized appreciation (depreciation) | | (15,321,770) | | (130,859,779) |

| Net increase (decrease) in net assets resulting from operations | | (11,165,403) | | (110,694,001) |

| Distributions to shareholders | | (17,163,454) | | (44,840,619) |

| Share transactions - net increase (decrease) | | (585,230) | | (144,288,903) |

| Total increase (decrease) in net assets | | (28,914,087) | | (299,823,523) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 440,991,297 | | 740,814,820 |

| End of period | $ | 412,077,210 | $ | 440,991,297 |

| | | | | |

| | | | | |

Financial Highlights

| Fidelity Advisor® Consumer Discretionary Fund Class A |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 35.05 | $ | 45.74 | $ | 33.70 | $ | 29.83 | $ | 28.22 | $ | 22.92 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | (.05) | | (.16) | | (.20) | | (.04) | | (.02) | | (.02) |

| Net realized and unrealized gain (loss) | | (.88) | | (7.62) | | 12.82 | | 4.73 | | 1.90 | | 5.32 |

| Total from investment operations | | (.93) | | (7.78) | | 12.62 | | 4.69 | | 1.88 | | 5.30 |

| Distributions from net realized gain | | (1.35) | | (2.91) | | (.58) | | (.82) | | (.27) | | - |

| Total distributions | | (1.35) | | (2.91) | | (.58) | | (.82) | | (.27) | | - |

| Net asset value, end of period | $ | 32.77 | $ | 35.05 | $ | 45.74 | $ | 33.70 | $ | 29.83 | $ | 28.22 |

Total Return C,D,E | | (2.47)% | | (18.26)% | | 37.68% | | 16.03% | | 6.81% | | 23.12% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | 1.06% H | | 1.01% | | 1.03% | | 1.07% | | 1.08% | | 1.12% |

| Expenses net of fee waivers, if any | | 1.05% H | | 1.01% | | 1.03% | | 1.07% | | 1.08% | | 1.12% |

| Expenses net of all reductions | | 1.05% H | | 1.01% | | 1.03% | | 1.06% | | 1.07% | | 1.11% |

| Net investment income (loss) | | (.30)% H | | (.38)% | | (.48)% | | (.14)% | | (.09)% | | (.08)% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 169,782 | $ | 188,092 | $ | 259,488 | $ | 159,603 | $ | 159,298 | $ | 146,605 |

Portfolio turnover rate I | | 47% H | | 34% | | 35% | | 41% J | | 60% | | 60% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

J Portfolio turnover rate excludes securities received or delivered in-kind.

| Fidelity Advisor® Consumer Discretionary Fund Class M |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 32.20 | $ | 42.23 | $ | 31.23 | $ | 27.78 | $ | 26.36 | $ | 21.47 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | (.08) | | (.24) | | (.29) | | (.11) | | (.09) | | (.08) |

| Net realized and unrealized gain (loss) | | (.81) | | (7.02) | | 11.87 | | 4.38 | | 1.78 | | 4.97 |

| Total from investment operations | | (.89) | | (7.26) | | 11.58 | | 4.27 | | 1.69 | | 4.89 |

| Distributions from net realized gain | | (1.35) | | (2.77) | | (.58) | | (.82) | | (.27) | | - |

| Total distributions | | (1.35) | | (2.77) | | (.58) | | (.82) | | (.27) | | - |

| Net asset value, end of period | $ | 29.96 | $ | 32.20 | $ | 42.23 | $ | 31.23 | $ | 27.78 | $ | 26.36 |

Total Return C,D,E | | (2.57)% | | (18.49)% | | 37.32% | | 15.70% | | 6.56% | | 22.78% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | 1.32% H | | 1.28% | | 1.30% | | 1.34% | | 1.34% | | 1.38% |

| Expenses net of fee waivers, if any | | 1.32% H | | 1.27% | | 1.30% | | 1.34% | | 1.34% | | 1.38% |

| Expenses net of all reductions | | 1.32% H | | 1.27% | | 1.29% | | 1.33% | | 1.34% | | 1.38% |

| Net investment income (loss) | | (.56)% H | | (.64)% | | (.75)% | | (.41)% | | (.35)% | | (.35)% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 31,178 | $ | 35,219 | $ | 48,288 | $ | 33,896 | $ | 32,792 | $ | 34,622 |

Portfolio turnover rate I | | 47% H | | 34% | | 35% | | 41% J | | 60% | | 60% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

J Portfolio turnover rate excludes securities received or delivered in-kind.

| Fidelity Advisor® Consumer Discretionary Fund Class C |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 26.92 | $ | 35.82 | $ | 26.69 | $ | 23.97 | $ | 22.90 | $ | 18.74 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | (.13) | | (.36) | | (.40) | | (.21) | | (.19) | | (.17) |

| Net realized and unrealized gain (loss) | | (.69) | | (5.87) | | 10.11 | | 3.75 | | 1.53 | | 4.33 |

| Total from investment operations | | (.82) | | (6.23) | | 9.71 | | 3.54 | | 1.34 | | 4.16 |

| Distributions from net realized gain | | (1.35) | | (2.67) | | (.58) | | (.82) | | (.27) | | - |

| Total distributions | | (1.35) | | (2.67) | | (.58) | | (.82) | | (.27) | | - |

| Net asset value, end of period | $ | 24.75 | $ | 26.92 | $ | 35.82 | $ | 26.69 | $ | 23.97 | $ | 22.90 |

Total Return C,D,E | | (2.82)% | | (18.88)% | | 36.66% | | 15.14% | | 6.02% | | 22.20% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | 1.81% H | | 1.77% | | 1.79% | | 1.82% | | 1.83% | | 1.87% |

| Expenses net of fee waivers, if any | | 1.81% H | | 1.76% | | 1.79% | | 1.82% | | 1.83% | | 1.87% |

| Expenses net of all reductions | | 1.81% H | | 1.76% | | 1.79% | | 1.82% | | 1.82% | | 1.86% |

| Net investment income (loss) | | (1.05)% H | | (1.13)% | | (1.24)% | | (.90)% | | (.83)% | | (.83)% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 44,156 | $ | 54,035 | $ | 85,549 | $ | 65,223 | $ | 70,890 | $ | 71,116 |

Portfolio turnover rate I | | 47% H | | 34% | | 35% | | 41% J | | 60% | | 60% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

J Portfolio turnover rate excludes securities received or delivered in-kind.

| Fidelity Advisor® Consumer Discretionary Fund Class I |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 38.45 | $ | 49.91 | $ | 36.63 | $ | 32.27 | $ | 30.42 | $ | 24.64 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | - C | | (.05) | | (.10) | | .04 | | .06 | | .06 |

| Net realized and unrealized gain (loss) | | (.96) | | (8.36) | | 13.96 | | 5.14 | | 2.06 | | 5.72 |

| Total from investment operations | | (.96) | | (8.41) | | 13.86 | | 5.18 | | 2.12 | | 5.78 |

| Distributions from net realized gain | | (1.35) | | (3.05) | | (.58) | | (.82) | | (.27) | | - |

| Total distributions | | (1.35) | | (3.05) | | (.58) | | (.82) | | (.27) | | - |

| Net asset value, end of period | $ | 36.14 | $ | 38.45 | $ | 49.91 | $ | 36.63 | $ | 32.27 | $ | 30.42 |

Total Return D,E | | (2.33)% | | (18.04)% | | 38.05% | | 16.34% | | 7.10% | | 23.46% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | .78% H | | .75% | | .77% | | .79% | | .80% | | .84% |

| Expenses net of fee waivers, if any | | .78% H | | .74% | | .76% | | .79% | | .80% | | .83% |

| Expenses net of all reductions | | .78% H | | .74% | | .76% | | .79% | | .80% | | .83% |

| Net investment income (loss) | | (.02)% H | | (.11)% | | (.22)% | | .13% | | .19% | | .20% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 96,840 | $ | 118,859 | $ | 259,846 | $ | 134,907 | $ | 159,613 | $ | 152,711 |

Portfolio turnover rate I | | 47% H | | 34% | | 35% | | 41% J | | 60% | | 60% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

J Portfolio turnover rate excludes securities received or delivered in-kind.

| Fidelity Advisor® Consumer Discretionary Fund Class Z |

| |

| | Six months ended (Unaudited) January 31, 2023 | | Years ended July 31, 2022 | | 2021 | | 2020 | | 2019 A |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 38.59 | $ | 50.10 | $ | 36.72 | $ | 32.31 | $ | 31.56 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) B,C | | .02 | | - D | | (.04) | | .09 | | .10 |

| Net realized and unrealized gain (loss) | | (.96) | | (8.38) | | 14.00 | | 5.14 | | .92 |

| Total from investment operations | | (.94) | | (8.38) | | 13.96 | | 5.23 | | 1.02 |

| Distributions from net realized gain | | (1.35) | | (3.13) | | (.58) | | (.82) | | (.27) |

| Total distributions | | (1.35) | | (3.13) | | (.58) | | (.82) | | (.27) |

| Net asset value, end of period | $ | 36.30 | $ | 38.59 | $ | 50.10 | $ | 36.72 | $ | 32.31 |

Total Return E,F | | (2.27)% | | (17.93)% | | 38.23% | | 16.48% | | 3.36% |

Ratios to Average Net Assets C,G,H | | | | | | | | | | |

| Expenses before reductions | | .66% I | | .62% | | .64% | | .66% | | .67% I |

| Expenses net of fee waivers, if any | | .65% I | | .62% | | .64% | | .66% | | .66% I |

| Expenses net of all reductions | | .65% I | | .62% | | .64% | | .66% | | .66% I |

| Net investment income (loss) | | .10% I | | .01% | | (.09)% | | .26% | | .39% I |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 70,122 | $ | 44,785 | $ | 87,644 | $ | 48,668 | $ | 6,786 |

Portfolio turnover rate J | | 47% I | | 34% | | 35% | | 41% K | | 60% |

A For the period October 2, 2018 (commencement of sale of shares) through July 31, 2019.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

D Amount represents less than $.005 per share.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized.

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

K Portfolio turnover rate excludes securities received or delivered in-kind.

Top Holdings (% of Fund's net assets) |

| |

| Exxon Mobil Corp. | 23.8 | |

| Chevron Corp. | 6.6 | |

| ConocoPhillips Co. | 5.1 | |

| Valero Energy Corp. | 5.0 | |

| Halliburton Co. | 4.6 | |

| Schlumberger Ltd. | 4.2 | |

| Marathon Petroleum Corp. | 4.1 | |

| Hess Corp. | 3.7 | |

| Canadian Natural Resources Ltd. | 3.4 | |

| Occidental Petroleum Corp. | 3.4 | |

| | 63.9 | |

| |

| Industries (% of Fund's net assets) |

| |

| Oil, Gas & Consumable Fuels | 84.4 | |

| Energy Equipment & Services | 15.1 | |

| Independent Power and Renewable Electricity Producers | 0.4 | |

| |

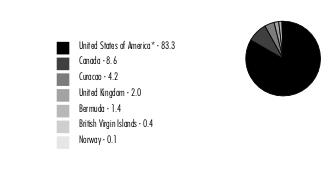

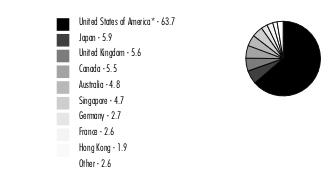

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable. |

| |

Fidelity Advisor® Energy Fund

Showing Percentage of Net Assets

| Common Stocks - 99.9% |

| | | Shares | Value ($) |

| Energy Equipment & Services - 15.1% | | | |

| Oil & Gas Drilling - 1.5% | | | |

| Nabors Industries Ltd. (a) | | 7,112 | 1,262,664 |

| Nabors Industries Ltd. warrants 6/11/26 (a) | | 6,604 | 188,214 |

| Noble Corp. PLC (a) | | 106,400 | 4,329,416 |

| Odfjell Drilling Ltd. (a) | | 722,656 | 1,918,569 |

| Odfjell Technology Ltd. (a) | | 104,337 | 376,306 |

| Shelf Drilling Ltd. (a)(b) | | 579,628 | 1,713,055 |

| Valaris Ltd. (a) | | 210,900 | 15,319,776 |

| | | | 25,108,000 |

| Oil & Gas Equipment & Services - 13.6% | | | |

| Baker Hughes Co. Class A | | 8,700 | 276,138 |

| Cactus, Inc. | | 30,700 | 1,661,177 |

| Halliburton Co. | | 1,879,900 | 77,489,478 |

| Nextier Oilfield Solutions, Inc. (a) | | 2,218,200 | 20,895,444 |

| NOV, Inc. | | 417,000 | 10,191,480 |

| Oceaneering International, Inc. (a) | | 512,600 | 10,944,010 |

| ProPetro Holding Corp. (a) | | 727,100 | 7,234,645 |

| Schlumberger Ltd. | | 1,242,818 | 70,815,770 |

| TechnipFMC PLC (a) | | 2,102,400 | 29,202,336 |

| | | | 228,710,478 |

TOTAL ENERGY EQUIPMENT & SERVICES | | | 253,818,478 |

| Independent Power and Renewable Electricity Producers - 0.4% | | | |

| Independent Power Producers & Energy Traders - 0.4% | | | |

| The AES Corp. | | 13,200 | 361,812 |

| Vistra Corp. | | 304,100 | 7,012,546 |

| | | | 7,374,358 |

| Oil, Gas & Consumable Fuels - 84.4% | | | |

| Coal & Consumable Fuels - 0.8% | | | |

| Arch Resources, Inc. (c) | | 35,000 | 5,180,700 |

| CONSOL Energy, Inc. | | 21,400 | 1,237,562 |

| Enviva, Inc. | | 4,200 | 191,016 |

| Peabody Energy Corp. (a) | | 216,700 | 6,043,763 |

| | | | 12,653,041 |

| Integrated Oil & Gas - 39.1% | | | |

| Cenovus Energy, Inc. (Canada) (c) | | 2,564,600 | 51,232,248 |

| Chevron Corp. | | 637,870 | 111,002,137 |

| Exxon Mobil Corp. | | 3,448,261 | 400,032,756 |

| Imperial Oil Ltd. | | 265,800 | 14,527,057 |