UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03015

Ohio National Fund, Inc.

(Exact name of registrant as specified in charter)

| | |

| One Financial Way, Cincinnati, Ohio | | 45242 |

| | |

| (Address of principal executive offices) | | (Zip code) |

CT Corporation 300 E. Lombard St. Suite 1400 Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-794-6971

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Item 1. Reports To Stockholders.

(a)

Ohio National Fund, Inc.

SEMIANNUAL REPORT June 30, 2022

Jeffery A. Bley Jr., CRCP

President, Ohio National Fund, Inc.

Dear Investor:

Multiple factors combined in the first half of 2022 to create substantial headwinds that resulted in poor market performance, and virtually every asset class declining by double digits. Commodities were the only major exception, led by strong energy markets. This was a marked turnaround from 2021, which seems like a distant memory now. Geopolitical risk, a spike in inflation, and the response from central banks across the globe were the major story lines during the first half of 2022. Lower corporate profits and a potential recession may be the story lines during the second half of the year.

Russia’s invasion of Ukraine highlighted how significant geopolitical risk can be. In response to the invasion, the western world has ostracized Russia economically, financially, and politically. The downstream impacts are being felt worldwide, in the energy, agricultural, and broader financial markets. At this point, there has clearly been a paradigm shift that will last decades.

The combination of supply chain bottlenecks, a spike in energy prices and a tight labor market has unleashed a global spike in inflation that is proving not to be transitory. The U.S. inflation rate hit 9.1% in June, which is the highest rate in over 40 years. Clearly, this rate of inflation is unacceptable, and the Federal Reserve is taking action in an effort to curb it.

The Federal Reserve is raising interest rates aggressively to combat inflation. Central banks worldwide are doing the same, to various degrees. Importantly, the Federal Reserve is prioritizing the fight against inflation above economic growth at this point in time, and is willing to cause a recession, if that is required to curb the rate of inflation. Given that raising interest rates will not solve the supply chain or energy issues, it appears that demand destruction will be required to reduce the inflation rate.

Equity Markets

Equity markets declined substantially during the first half of 2022. Domestic indices generally underperformed international and emerging market indices during the period. Within the domestic equity market, the S&P 500®, S&P MidCap 400® and Russell 2000® indices all posted negative returns, ranging from -19.5% to -23.4%. Value stocks outperformed growth stocks by a wide margin during the period, which is a reversal from the last several years. The S&P 500® Value Index provided a return of -11.4%, while the S&P 500® Growth Index provided a return of -27.6%. Within foreign equity markets for the six month period, international indices of developed countries outperformed emerging market indices slightly.

A summary of returns for key equity benchmarks is presented below:

| Index | | 06/30/22 YTD U.S. Dollar Total Return

(price and dividend) |

| S&P 500® | | -20.0% |

| S&P 500® Growth | | -27.6% |

| S&P 500® Value | | -11.4% |

| S&P MidCap 400® | | -19.5% |

| Russell 2000® | | -23.4% |

| Index | | 06/30/22 YTD U.S. Dollar Total Return

(price and dividend) |

| MSCI All Country World Ex-USA (Net - USD) | | -18.4% |

| MSCI Emerging Markets | | -19.2% |

Fixed Income Markets

Fixed income markets registered large negative returns during the first half of 2022. The Federal Reserve has raised the Fed Funds rate aggressively in 2022 in an attempt to curb inflation, and has indicated that it will continue to raise the Fed Funds rate until inflation is under control. Interest rates increased across the curve during the period, in response to the Federal Reserve’s policy to aggressively combat inflation. Short-term interest rates increased more than long term interest rates, which caused the Treasury curve to invert from two years to ten years. Historically, an inverted yield curve has preceded a recession. Corporate credit spreads also widened during the period, as credit markets are pricing in additional stress in the future. As bond prices react negatively to rising interest rates, these factors combined to create substantial negative returns for fixed income investors in the first half of 2022.

The Bloomberg U.S. Aggregate Bond Index posted a total return of -10.4% in the first half of 2022. Lower quality indices, like the Bloomberg Corporate Index and the Bloomberg U.S. Corporate High Yield Index provided total returns of -14.4% and -14.2%, respectively. Other higher quality, shorter duration indices, such as the Bloomberg U.S. Securitized Index, provided a return of -8.7% for the period. The table below illustrates the returns of the various indices.

| Index | | 06/30/22 YTD U.S. Dollar Total Return

(price and interest) |

| Bloomberg U.S. Aggregate Bond | | -10.4% |

| Bloomberg U.S. Treasury | | -14.8% |

| Bloomberg U.S. Securitized | | -8.7% |

| Bloomberg U.S. Corporate Bond | | -14.4% |

| Bloomberg U.S. Corporate High Yield Bond | | -14.2% |

The Ohio National Fund, Inc.

The Ohio National Fund continues to offer a wide array of investment options that can be used to build a diversified portfolio. During the first half of 2022, six of the 20 actively managed Portfolios beat their respective peer groups. In addition, the returns of the three index portfolios, before expenses, performed in line with their respective indices during the period.

Looking Ahead

The second half of 2022 will likely be a volatile period. The Federal Reserve has moved from being accommodative to being restrictive, and short-term interest rates are expected to increase further. Economic growth is slowing domestically and internationally, and a recession appears more likely than not. Inflation is not under control at this point in time, and geopolitical risks continue to pressure the market. In addition, corporate profit margins and earnings will likely decline. Having said that, financial markets are forward looking, discounting mechanisms. Much of the above has been discounted during the first half of 2022, as evidenced by the negative returns for the period. Performance in the second half of the year will likely be driven by changing expectations around interest rates, inflation, earnings, and the depth/length of a potential recession.

In this environment, we believe that staying the course in a well-diversified portfolio will serve one well over the long term.

Thank you for entrusting your assets to the Ohio National Fund, Inc. We look forward to continuing to serve your financial needs.

| Ohio National Fund, Inc. | ON Bond Portfolio (Unaudited) |

The ON Bond Portfolio seeks a high level of income and opportunity for capital appreciation consistent with preservation of capital by investing, under normal circumstances, at least 80% of its net assets in corporate debt securities.

Performance as of June 30, 2022

| Average Annual returns | |

| One year | -14.26% |

| Five years | 1.10% |

| Ten years | 2.20% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price and reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information up to the most recent month end, call toll-free 1-877-781-6392.

The Portfolio is not open to direct retail investment. Beneficial interest in the Portfolio’s shares is obtained either through an allocation to the Portfolio as an investment vehicle within variable life insurance policies or annuity contracts, or as an underlying investment by the ON Model Portfolios. Actual performance results for variable annuity and variable universal life contracts will be lower due to contract charges. Consult your contract for applicable charges.

Total expense ratio is 0.59% per the Fund’s prospectus dated April 29, 2022. Additional information pertaining to the Portfolio’s expense ratio as of June 30, 2022 can be found in the Portfolio’s Financial Highlights.

Q. How did the Portfolio perform in comparison to its benchmark during the reporting period?

A. For the six-month period ended June 30, 2022, the Portfolio returned -14.03% versus -13.93% for its benchmark, the ICE BofA U.S. Corporate Master Index.

Q. Were there specific market conditions, investment strategies, or techniques that materially affected the Portfolio’s benchmark-relative performance during the reporting period?

A. Fixed income markets registered negative returns during the first half of 2022. The Federal Reserve has raised the Fed Funds rate aggressively in 2022 in an attempt to curb inflation, and has indicated that it will continue to raise the Fed Funds rate until inflation is under control. Interest rates increased across the entire yield curve, but short-term interest rates increased at a faster rate. Even so, shorter duration bonds outperformed longer duration bonds during the period. The yield curve has become inverted between the 2 year and 10 year Treasury rate, which can be a harbinger of a recession. Credit spreads widened during the period, and lower quality bonds generally underperformed higher quality bonds.

From an investment strategy perspective, the Portfolio was positioned with a slightly shorter duration than the benchmark during the period, which enhanced performance. In terms of bond quality, the Portfolio was slightly overweight lower rated bonds, which detracted from performance. (1)

Q. How did sector allocation and security selection each impact the Portfolio’s performance relative to its benchmark?

A. Sector allocation was a slight positive for the Portfolio’s relative performance for the six-month period. The overweights to U.S. Treasuries and Consumer Discretionary sectors enhanced performance. The overweight to the Materials sector, and underweight to the Financials sector, detracted from performance. Security selection, in aggregate, slightly detracted.(1)

Q. Which securities contributed the most to, and detracted the most from, the Portfolio’s benchmark-relative performance?

A. The top three contributors to the Portfolio’s performance relative to the benchmark were Southwest Gas Corp. 3.875% due 04/01/2022, American Airlines 2015-1 Class B Pass Through Trust 3.700% due 05/01/2023, and General Motors Financial Co., Inc. QL + 89 due 01/05/2023. Each of these bonds are shorter duration bonds. The top three detractors from the Portfolio’s performance relative to the benchmark were Charter Communications Operating LLC / Charter Communications Operating 3.700% due 04/01/2051, Lowe’s Cos., Inc. 3.000% due 10/15/2050, and FirstEnergy Transmission 4.550% due 04/01/2049. Each of these bonds are longer duration bonds, which performed poorly due to rising interest rates. (1)

| (1) | The Portfolio’s composition is subject to change. Holdings and weightings are as of June 30, 2022. |

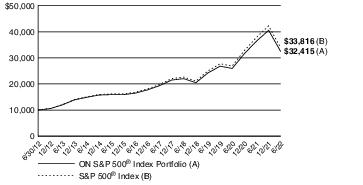

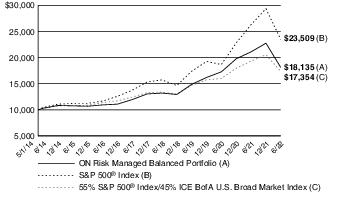

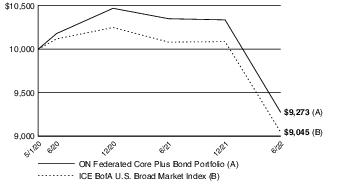

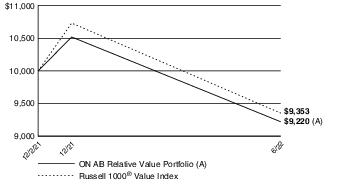

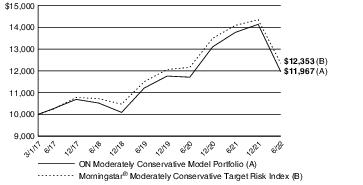

Change in Value of $10,000 Investment

Hypothetical illustration based on past performance. Future performance will vary. The Portfolio’s returns reflect reinvested dividends. The Portfolio’s holdings may differ significantly from the securities in the index. The index is unmanaged and therefore does not reflect the cost of portfolio management and accounting.

The ICE BofA U.S. Corporate Master Index tracks the performance of all U.S. dollar-denominated, investment grade corporate public debt issued in the U.S. domestic bond market. Qualifying bonds must have an investment grade rating (based on an average of Moody’s, S&P, and Fitch). In addition, qualifying securities must have at least one year remaining term to maturity, a fixed coupon schedule, and a minimum amount outstanding of $250 million.

Past performance is no guarantee of future results. Redemption of fund shares could have tax implications unique to each shareholder.

| Ohio National Fund, Inc. | ON Bond Portfolio (Unaudited) (Continued) |

| Portfolio Composition as of June 30, 2022 (1) |

| | % of Net Assets |

| Corporate Bonds (4) | 96.4 |

| Asset-Backed Securities (4) | 2.9 |

Money Market Funds

Less Net Liabilities | 0.7 |

| | 100.0 |

| Top 10 Portfolio Holdings as of June 30, 2022 (1) (2) (3) |

| | | % of Net Assets |

| 1. | Campbell Soup Co. 4.150%, 03/15/2028 | 1.8 |

| 2. | Lear Corp. 4.250%, 05/15/2029 | 1.7 |

| 3. | Mosaic Co. / The 4.050%, 11/15/2027 | 1.4 |

| 4. | Kinross Gold Corp. 4.500%, 07/15/2027 | 1.4 |

| 5. | Hasbro, Inc. 3.900%, 11/19/2029 | 1.3 |

| 6. | AbbVie, Inc. 4.250%, 11/21/2049 | 1.2 |

| 7. | Boeing Co. / The 3.200%, 03/01/2029 | 1.2 |

| 8. | Bank of Montreal 3.803%, 12/15/2032 | 1.2 |

| 9. | Ares Capital Corp. 3.200%, 11/15/2031 | 1.2 |

| 10. | RPM International, Inc. 4.250%, 01/15/2048 | 1.2 |

| | |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Portfolio Holdings is presented at an individual security level. Total investment exposure by issuer may be higher. |

| (4) | Sectors (Corporate Bonds, Asset-Backed Securities): |

| | % of Net Assets |

| Financials | 27.5 |

| Industrials | 13.3 |

| Consumer Staples | 10.4 |

| Consumer Discretionary | 8.8 |

| Energy | 8.1 |

| Materials | 7.9 |

| Utilities | 7.8 |

| Communication Services | 5.9 |

| Health Care | 4.1 |

| Real Estate | 3.8 |

| Information Technology | 1.7 |

| | 99.3 |

| Ohio National Fund, Inc. | ON Bond Portfolio |

| Schedule of Investments | June 30, 2022 (Unaudited) |

| Corporate Bonds–96.4% | Rate | Maturity | Face Amount | Value |

Communication Services–5.9%

| | | | | |

AT&T, Inc. (Diversified Telecom. Svs.)

| | 4.900% | 08/15/2037 | $1,000,000 | $ 996,001 |

Charter Communications Operating LLC / Charter Communications Operating Capital (Media)

| | 3.700% | 04/01/2051 | 2,800,000 | 1,894,747 |

Comcast Corp. (Media)

| | 3.250% | 11/01/2039 | 3,000,000 | 2,465,681 |

Lamar Media Corp. (Media)

| | 4.875% | 01/15/2029 | 1,200,000 | 1,080,139 |

Rogers Communications, Inc. (Wireless Telecom. Svs.)

| | 3.700% | 11/15/2049 | 2,100,000 | 1,600,337 |

Time Warner Cable LLC (Media)

| | 6.550% | 05/01/2037 | 850,000 | 851,084 |

T-Mobile U.S.A., Inc. (Wireless Telecom. Svs.)

| | 3.875% | 04/15/2030 | 1,800,000 | 1,679,861 |

Verizon Communications, Inc. (Diversified Telecom. Svs.)

| | 4.400% | 11/01/2034 | 1,500,000 | 1,437,311 |

Verizon Communications, Inc. (Diversified Telecom. Svs.)

| | 2.875% | 11/20/2050 | 1,000,000 | 709,610 |

| | | | | | 12,714,771 |

Consumer Discretionary–8.8%

| | | | | |

Amazon.com, Inc. (Internet & Direct Marketing Retail)

| | 3.875% | 08/22/2037 | 1,000,000 | 947,915 |

Aptiv PLC (Auto Components)

| | 4.350% | 03/15/2029 | 1,000,000 | 945,917 |

Aptiv PLC / Aptiv Corp. (Auto Components)

| | 3.250% | 03/01/2032 | 2,000,000 | 1,699,181 |

Best Buy Co., Inc. (Specialty Retail)

| | 1.950% | 10/01/2030 | 3,000,000 | 2,382,799 |

Expedia Group, Inc. (Hotels, Restaurants & Leisure)

| | 4.625% | 08/01/2027 | 1,000,000 | 960,753 |

Hasbro, Inc. (Leisure Products)

| | 3.900% | 11/19/2029 | 3,000,000 | 2,754,798 |

Home Depot, Inc. / The (Specialty Retail)

| | 2.375% | 03/15/2051 | 2,000,000 | 1,352,502 |

Lear Corp. (Auto Components)

| | 4.250% | 05/15/2029 | 4,000,000 | 3,673,866 |

Lowe's Cos., Inc. (Specialty Retail)

| | 3.000% | 10/15/2050 | 2,000,000 | 1,393,556 |

M.D.C. Holdings, Inc. (Household Durables)

| | 3.850% | 01/15/2030 | 2,000,000 | 1,657,265 |

Magna International, Inc. (Auto Components)

| | 3.625% | 06/15/2024 | 1,000,000 | 999,618 |

| | | | | | 18,768,170 |

Consumer Staples–10.4%

| | | | | |

Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc. (Beverages)

| | 4.700% | 02/01/2036 | 2,000,000 | 1,916,054 |

Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc. (Beverages)

| | 4.900% | 02/01/2046 | 1,000,000 | 939,890 |

Anheuser-Busch InBev Worldwide, Inc. (Beverages)

| | 4.600% | 04/15/2048 | 2,000,000 | 1,795,585 |

B.A.T. Capital Corp. (Tobacco)

| | 3.215% | 09/06/2026 | 1,000,000 | 933,996 |

B.A.T. Capital Corp. (Tobacco)

| | 4.700% | 04/02/2027 | 2,000,000 | 1,953,622 |

Campbell Soup Co. (Food Products)

| | 4.150% | 03/15/2028 | 4,000,000 | 3,928,034 |

Coca-Cola Co. / The (Beverages)

| | 3.000% | 03/05/2051 | 1,000,000 | 807,464 |

Coca-Cola Co. / The (Beverages)

| | 2.500% | 03/15/2051 | 1,000,000 | 724,220 |

Hershey Co. / The (Food Products)

| | 1.700% | 06/01/2030 | 1,800,000 | 1,518,099 |

JBS U.S.A. LUX SA / JBS U.S.A. Food Co. / JBS U.S.A. Finance, Inc. (Food Products)

| (a) | 5.750% | 04/01/2033 | 1,200,000 | 1,142,748 |

Kimberly-Clark Corp. (Household Products)

| | 1.050% | 09/15/2027 | 2,000,000 | 1,746,032 |

Kraft Heinz Foods Co. (Food Products)

| | 4.625% | 10/01/2039 | 1,200,000 | 1,053,106 |

Philip Morris International, Inc. (Tobacco)

| | 3.375% | 08/15/2029 | 2,500,000 | 2,255,300 |

Smithfield Foods, Inc. (Food Products)

| (a) | 3.000% | 10/15/2030 | 2,000,000 | 1,657,994 |

| | | | | | 22,372,144 |

Energy–8.1%

| | | | | |

Baker Hughes Holdings LLC / Baker Hughes Co-Obligor, Inc. (Energy Equip. & Svs.)

| | 4.080% | 12/15/2047 | 2,000,000 | 1,690,789 |

BP Capital Markets America, Inc. (Oil, Gas & Consumable Fuels)

| | 3.017% | 01/16/2027 | 1,000,000 | 952,731 |

BP Capital Markets America, Inc. (Oil, Gas & Consumable Fuels)

| | 1.749% | 08/10/2030 | 1,000,000 | 818,467 |

Chevron Corp. (Oil, Gas & Consumable Fuels)

| | 2.236% | 05/11/2030 | 1,800,000 | 1,579,697 |

Energy Transfer LP (Oil, Gas & Consumable Fuels)

| | 4.950% | 06/15/2028 | 2,000,000 | 1,970,771 |

Exxon Mobil Corp. (Oil, Gas & Consumable Fuels)

| | 4.114% | 03/01/2046 | 900,000 | 820,659 |

Halliburton Co. (Energy Equip. & Svs.)

| | 4.850% | 11/15/2035 | 1,000,000 | 961,550 |

Kinder Morgan, Inc. (Oil, Gas & Consumable Fuels)

| | 5.300% | 12/01/2034 | 1,000,000 | 976,838 |

Marathon Petroleum Corp. (Oil, Gas & Consumable Fuels)

| | 4.750% | 09/15/2044 | 1,000,000 | 880,980 |

ONEOK, Inc. (Oil, Gas & Consumable Fuels)

| | 5.850% | 01/15/2026 | 1,200,000 | 1,243,861 |

ONEOK, Inc. (Oil, Gas & Consumable Fuels)

| | 6.000% | 06/15/2035 | 1,000,000 | 976,056 |

Shell International Finance B.V. (Oil, Gas & Consumable Fuels)

| | 4.000% | 05/10/2046 | 1,000,000 | 890,471 |

Tennessee Gas Pipeline Co. LLC (Oil, Gas & Consumable Fuels)

| (a) | 2.900% | 03/01/2030 | 1,000,000 | 863,800 |

Texas Eastern Transmission LP (Oil, Gas & Consumable Fuels)

| (a) | 4.150% | 01/15/2048 | 1,000,000 | 827,730 |

Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels)

| | 3.750% | 06/15/2027 | 1,000,000 | 954,900 |

Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels)

| | 5.400% | 03/04/2044 | 1,000,000 | 952,527 |

| | | | | | 17,361,827 |

Financials–27.5%

| | | | | |

AerCap Ireland Capital DAC / AerCap Global Aviation Trust (Diversified Financial Svs.)

| | 3.300% | 01/23/2023 | 2,000,000 | 1,992,040 |

AerCap Ireland Capital DAC / AerCap Global Aviation Trust (Diversified Financial Svs.)

| | 3.300% | 01/30/2032 | 1,500,000 | 1,200,737 |

Ares Capital Corp. (Capital Markets)

| | 3.200% | 11/15/2031 | 3,500,000 | 2,543,123 |

Bank of America Corp. (Banks)

| | 3.875% | 08/01/2025 | 1,000,000 | 995,656 |

Bank of America Corp. (Rate is fixed until 03/08/2032, at which point, the rate becomes H15T5Y + 200) (Banks)

| (b) | 3.846% | 03/08/2037 | 1,000,000 | 864,349 |

| Ohio National Fund, Inc. | ON Bond Portfolio (Continued) |

| Schedule of Investments | June 30, 2022 (Unaudited) |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value |

| Financials (continued) | | | | | |

Bank of America Corp. (Rate is fixed until 04/24/2037, at which point, the rate becomes QL + 181) (Banks)

| (b) | 4.244% | 04/24/2038 | $1,000,000 | $ 916,116 |

Bank of Montreal (Rate is fixed until 12/15/2027, at which point, the rate becomes USSW5 + 143) (Banks)

| (b) | 3.803% | 12/15/2032 | 2,800,000 | 2,595,278 |

BlackRock, Inc. (Capital Markets)

| | 2.400% | 04/30/2030 | 1,000,000 | 875,613 |

BlackRock, Inc. (Capital Markets)

| | 2.100% | 02/25/2032 | 2,000,000 | 1,651,801 |

Capital One Bank U.S.A. N.A. (Rate is fixed until 01/28/2025, at which point, the rate becomes SOFR + 91) (Consumer Finance)

| (b) | 2.280% | 01/28/2026 | 1,500,000 | 1,424,362 |

Charles Schwab Corp. / The (Capital Markets)

| | 3.300% | 04/01/2027 | 2,000,000 | 1,941,460 |

Citigroup, Inc. (Banks)

| | 4.400% | 06/10/2025 | 2,000,000 | 1,997,013 |

Citigroup, Inc. (Banks)

| | 3.700% | 01/12/2026 | 1,000,000 | 979,894 |

Citigroup, Inc. (Banks)

| | 4.450% | 09/29/2027 | 2,000,000 | 1,958,663 |

Discover Bank (Rate is fixed until 08/09/2023, at which point, the rate becomes USSW5 + 173) (Banks)

| (b) | 4.682% | 08/09/2028 | 2,000,000 | 1,944,300 |

General Motors Financial Co., Inc. (Consumer Finance)

| | QL + 99 | 01/05/2023 | 2,000,000 | 1,998,345 |

Goldman Sachs Group, Inc. / The (Capital Markets)

| | 3.750% | 05/22/2025 | 2,000,000 | 1,976,021 |

Intercontinental Exchange, Inc. (Capital Markets)

| | 3.750% | 12/01/2025 | 1,000,000 | 991,966 |

Jefferies Group LLC / Jefferies Group Capital Finance, Inc. (Diversified Financial Svs.)

| | 4.850% | 01/15/2027 | 1,800,000 | 1,800,617 |

JPMorgan Chase & Co. (Banks)

| | 3.625% | 12/01/2027 | 2,000,000 | 1,920,015 |

JPMorgan Chase & Co. (Rate is fixed until 05/13/2030, at which point, the rate becomes SOFR + 252) (Banks)

| (b) | 2.956% | 05/13/2031 | 2,000,000 | 1,726,767 |

KeyCorp (Rate is fixed until 06/01/2032, at which point, the rate becomes SOFRINDX + 206) (Banks)

| (b) | 4.789% | 06/01/2033 | 2,500,000 | 2,466,518 |

Marsh & McLennan Cos., Inc. (Insurance)

| | 3.500% | 06/03/2024 | 1,400,000 | 1,395,377 |

Morgan Stanley (Capital Markets)

| | 3.950% | 04/23/2027 | 1,000,000 | 968,336 |

Morgan Stanley (Rate is fixed until 01/23/2029, at which point, the rate becomes QL + 163) (Capital Markets)

| (b) | 4.431% | 01/23/2030 | 2,000,000 | 1,943,248 |

Morgan Stanley Domestic Holdings, Inc. (Capital Markets)

| | 2.950% | 08/24/2022 | 1,000,000 | 1,000,276 |

PNC Bank N.A. (Banks)

| | 2.700% | 10/22/2029 | 2,500,000 | 2,178,503 |

State Street Corp. (Capital Markets)

| | 2.200% | 03/03/2031 | 2,000,000 | 1,635,528 |

Synchrony Financial (Consumer Finance)

| | 4.250% | 08/15/2024 | 1,000,000 | 993,791 |

Synchrony Financial (Consumer Finance)

| | 5.150% | 03/19/2029 | 2,000,000 | 1,871,125 |

Truist Bank (Banks)

| | 3.625% | 09/16/2025 | 1,000,000 | 979,028 |

U.S. Bancorp (Banks)

| | 1.375% | 07/22/2030 | 2,000,000 | 1,593,721 |

Wells Fargo & Co. (Banks)

| | 3.000% | 04/22/2026 | 1,000,000 | 951,566 |

Wells Fargo & Co. (Rate is fixed until 10/30/2029, at which point, the rate becomes SOFR + 143) (Banks)

| (b) | 2.879% | 10/30/2030 | 2,000,000 | 1,758,751 |

Wells Fargo & Co. (Rate is fixed until 04/30/2040, at which point, the rate becomes SOFR + 253) (Banks)

| (b) | 3.068% | 04/30/2041 | 1,200,000 | 929,298 |

Wells Fargo & Co. (Banks)

| | 4.650% | 11/04/2044 | 1,000,000 | 899,375 |

Westpac Banking Corp. (Rate is fixed until 02/04/2025, at which point, the rate becomes H15T5Y + 135) (Banks)

| (b) | 2.894% | 02/04/2030 | 1,500,000 | 1,421,186 |

Westpac Banking Corp. (Rate is fixed until 11/23/2026, at which point, the rate becomes USISDA05 + 224) (Banks)

| (b) | 4.322% | 11/23/2031 | 1,800,000 | 1,730,832 |

| | | | | | 59,010,595 |

Health Care–4.1%

| | | | | |

AbbVie, Inc. (Biotechnology)

| | 3.200% | 11/21/2029 | 1,000,000 | 919,941 |

AbbVie, Inc. (Biotechnology)

| | 4.250% | 11/21/2049 | 3,000,000 | 2,663,195 |

HCA, Inc. (Health Care Providers & Svs.)

| | 5.250% | 06/15/2026 | 1,000,000 | 994,921 |

Quest Diagnostics, Inc. (Health Care Providers & Svs.)

| | 2.950% | 06/30/2030 | 2,000,000 | 1,759,914 |

Quest Diagnostics, Inc. (Health Care Providers & Svs.)

| | 2.800% | 06/30/2031 | 1,200,000 | 1,027,973 |

Regeneron Pharmaceuticals, Inc. (Biotechnology)

| | 1.750% | 09/15/2030 | 1,800,000 | 1,443,138 |

| | | | | | 8,809,082 |

Industrials–10.4%

| | | | | |

Air Lease Corp. (Trading Companies & Distributors)

| | 2.250% | 01/15/2023 | 2,000,000 | 1,979,683 |

Air Lease Corp. (Trading Companies & Distributors)

| | 2.300% | 02/01/2025 | 2,000,000 | 1,871,798 |

BAE Systems PLC (Aerospace & Defense)

| (a) | 1.900% | 02/15/2031 | 2,000,000 | 1,608,793 |

Boeing Co. / The (Aerospace & Defense)

| | 3.200% | 03/01/2029 | 3,000,000 | 2,595,851 |

Burlington Northern Santa Fe LLC (Road & Rail)

| | 4.550% | 09/01/2044 | 900,000 | 865,036 |

Canadian Pacific Railway Co. (Road & Rail)

| | 2.050% | 03/05/2030 | 1,300,000 | 1,100,099 |

FedEx Corp. (Air Freight & Logistics)

| | 4.900% | 01/15/2034 | 2,000,000 | 1,998,710 |

Lockheed Martin Corp. (Aerospace & Defense)

| | 1.850% | 06/15/2030 | 1,200,000 | 1,024,097 |

Lockheed Martin Corp. (Aerospace & Defense)

| | 3.600% | 03/01/2035 | 1,000,000 | 925,090 |

Northrop Grumman Corp. (Aerospace & Defense)

| | 2.930% | 01/15/2025 | 2,500,000 | 2,444,877 |

Parker-Hannifin Corp. (Machinery)

| | 4.200% | 11/21/2034 | 1,400,000 | 1,300,366 |

Union Pacific Corp. (Road & Rail)

| | 3.250% | 08/15/2025 | 1,000,000 | 987,797 |

United Rentals North America, Inc. (Trading Companies & Distributors)

| | 5.250% | 01/15/2030 | 2,000,000 | 1,855,000 |

Waste Connections, Inc. (Commercial Svs. & Supplies)

| | 4.250% | 12/01/2028 | 1,800,000 | 1,775,479 |

| | | | | | 22,332,676 |

| Ohio National Fund, Inc. | ON Bond Portfolio (Continued) |

| Schedule of Investments | June 30, 2022 (Unaudited) |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value |

Information Technology–1.7%

| | | | | |

Broadcom, Inc. (Semiconductors & Equip.)

| (a) | 2.600% | 02/15/2033 | $2,000,000 | $ 1,537,816 |

VMware, Inc. (Software)

| | 2.200% | 08/15/2031 | 2,800,000 | 2,204,795 |

| | | | | | 3,742,611 |

Materials–7.9%

| | | | | |

Anglo American Capital PLC (Metals & Mining)

| (a) | 4.750% | 04/10/2027 | 1,000,000 | 987,919 |

Anglo American Capital PLC (Metals & Mining)

| (a) | 4.000% | 09/11/2027 | 800,000 | 760,546 |

Dow Chemical Co. / The (Chemicals)

| | 4.250% | 10/01/2034 | 1,402,000 | 1,329,834 |

Glencore Funding LLC (Metals & Mining)

| (a) | 2.850% | 04/27/2031 | 2,000,000 | 1,651,239 |

Kinross Gold Corp. (Metals & Mining)

| | 4.500% | 07/15/2027 | 3,000,000 | 2,922,360 |

Mosaic Co. / The (Chemicals)

| | 4.050% | 11/15/2027 | 3,000,000 | 2,934,297 |

Nutrien Ltd. (Chemicals)

| | 4.200% | 04/01/2029 | 1,900,000 | 1,845,695 |

RPM International, Inc. (Chemicals)

| | 4.250% | 01/15/2048 | 3,000,000 | 2,521,133 |

Steel Dynamics, Inc. (Metals & Mining)

| | 3.250% | 01/15/2031 | 1,200,000 | 1,041,313 |

Syngenta Finance N.V. (Chemicals)

| (a) | 5.182% | 04/24/2028 | 1,000,000 | 1,012,266 |

| | | | | | 17,006,602 |

Real Estate–3.8%

| | | | | |

Alexandria Real Estate Equities, Inc. (Equity REIT)

| | 3.950% | 01/15/2028 | 1,000,000 | 968,041 |

Federal Realty Investment Trust (Equity REIT)

| | 3.250% | 07/15/2027 | 2,000,000 | 1,880,183 |

Healthcare Realty Trust, Inc. (Equity REIT)

| | 3.875% | 05/01/2025 | 1,400,000 | 1,372,476 |

Healthcare Realty Trust, Inc. (Equity REIT)

| | 3.625% | 01/15/2028 | 1,000,000 | 932,915 |

VICI Properties LP / VICI Note Co., Inc. (Equity REIT)

| (a) | 4.625% | 12/01/2029 | 1,300,000 | 1,162,141 |

Welltower, Inc. (Equity REIT)

| | 4.250% | 04/01/2026 | 1,000,000 | 989,158 |

Welltower, Inc. (Equity REIT)

| | 2.700% | 02/15/2027 | 1,000,000 | 923,512 |

| | | | | | 8,228,426 |

Utilities–7.8%

| | | | | |

AEP Transmission Co. LLC (Electric Utilities)

| | 4.000% | 12/01/2046 | 1,000,000 | 883,310 |

AEP Transmission Co. LLC (Electric Utilities)

| | 3.750% | 12/01/2047 | 1,351,000 | 1,147,774 |

Ameren Corp. (Multi-Utilities)

| | 3.500% | 01/15/2031 | 2,000,000 | 1,832,020 |

American Water Capital Corp. (Water Utilities)

| | 4.300% | 12/01/2042 | 1,400,000 | 1,290,933 |

Berkshire Hathaway Energy Co. (Multi-Utilities)

| | 3.250% | 04/15/2028 | 1,900,000 | 1,806,144 |

Commonwealth Edison Co. (Electric Utilities)

| | 4.350% | 11/15/2045 | 2,000,000 | 1,846,055 |

Connecticut Light & Power Co. / The (Electric Utilities)

| | 4.000% | 04/01/2048 | 1,000,000 | 905,248 |

Duke Energy Corp. (Electric Utilities)

| | 3.750% | 09/01/2046 | 1,000,000 | 787,496 |

Eversource Energy (Electric Utilities)

| | 3.300% | 01/15/2028 | 1,000,000 | 939,927 |

FirstEnergy Transmission LLC (Electric Utilities)

| (a) | 4.550% | 04/01/2049 | 1,800,000 | 1,448,323 |

Florida Power & Light Co. (Electric Utilities)

| | 3.150% | 10/01/2049 | 2,000,000 | 1,588,492 |

Jersey Central Power & Light Co. (Electric Utilities)

| (a) | 4.300% | 01/15/2026 | 900,000 | 888,914 |

Public Service Electric & Gas Co. (Multi-Utilities)

| | 3.600% | 12/01/2047 | 1,500,000 | 1,268,713 |

| | | �� | | | 16,633,349 |

Total Corporate Bonds (Cost $230,839,212)

| | | | | $206,980,253 |

| Asset-Backed Securities–2.9% | Rate | Maturity | Face Amount | Value |

Industrials–2.9%

| | | | | |

Air Canada 2017-1 Class B Pass Through Trust

| (a) | 3.700% | 01/15/2026 | $1,643,518 | $ 1,537,474 |

American Airlines 2015-1 Class B Pass Through Trust

| | 3.700% | 05/01/2023 | 390,549 | 377,607 |

FedEx Corp. 2020-1 Class AA Pass Through Trust

| | 1.875% | 02/20/2034 | 2,759,373 | 2,393,780 |

United Airlines 2016-1 Class B Pass Through Trust

| | 3.650% | 01/07/2026 | 1,183,333 | 1,076,722 |

United Airlines 2019-2 Class AA Pass Through Trust

| | 2.700% | 05/01/2032 | 910,051 | 775,935 |

Total Asset-Backed Securities (Cost $6,886,897)

| | | | | $ 6,161,518 |

| Money Market Funds–2.3% | Shares | Value |

State Street Institutional Liquid Reserves Fund Institutional Class, 1.494%

| (c) | 4,896,314 | $ 4,895,824 |

Total Money Market Funds (Cost $4,896,214)

| | | $ 4,895,824 |

Total Investments – 101.6% (Cost $242,622,323)

| (d) | | $218,037,595 |

Liabilities in Excess of Other Assets – (1.6)%

| | | (3,445,478) |

| Net Assets – 100.0% | | | $214,592,117 |

Percentages are stated as a percent of net assets. |

| Abbreviations: | |

| H15T5Y: | U.S. Treasury Yield Curve Rate T-Note Constant Maturity 5 Year, 3.010% at 06/30/2022 |

| QL: | Quarterly U.S. LIBOR Rate, 2.285% at 06/30/2022 |

| SOFR: | Secured Overnight Financing Rate, 1.500% at 06/30/2022 |

| USISDA05: | USD ICE Swap Rate 11:00am NY 5 Year, 3.091% at 06/30/2022 |

| USSW5: | USD Swap Semi 30/360 5 Year, 3.075% at 06/30/2022 |

| Ohio National Fund, Inc. | ON Bond Portfolio (Continued) |

| Schedule of Investments | June 30, 2022 (Unaudited) |

| Footnotes: | |

| (a) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At June 30, 2022, the value of these securities totaled $17,087,703, or 8.0% of the Portfolio’s net assets. |

| (b) | Security is a fixed-then-variable rate instrument in which the coupon or dividend rate is fixed until a later specified date, then is adjusted periodically. Rates stated, including interest rate caps and floors, if any, are those in effect at June 30, 2022. |

| (c) | Rate represents the seven-day yield at June 30, 2022. |

| (d) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Unaudited) |

The ON BlackRock Balanced Allocation Portfolio seeks a high level of long-term total return consistent with preservation of capital by investing in stocks, bonds, and money market instruments.

Performance as of June 30, 2022

| Average Annual returns | |

| One year | -12.45% |

| Five years | 6.43% |

| Ten years | 10.31% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price and reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information up to the most recent month end, call toll-free 1-877-781-6392.

The Portfolio is not open to direct retail investment. Beneficial interest in the Portfolio’s shares is obtained either through an allocation to the Portfolio as an investment vehicle within variable life insurance policies or annuity contracts, or as an underlying investment by the ON Model Portfolios. Actual performance results for variable annuity and variable universal life contracts will be lower due to contract charges. Consult your contract for applicable charges.

Total expense ratio is 0.54% per the Fund’s prospectus dated April 29, 2022. Additional information pertaining to the Portfolio’s expense ratio as of June 30, 2022 can be found in the Portfolio’s Financial Highlights.

Comments from Sub-Adviser/Adviser

Q. How did the Portfolio perform in comparison to its benchmark during the reporting period?

A. For the six-month period ended June 30, 2022, the Portfolio returned -18.90% versus -19.96%% for its benchmark, the S&P 500® Index. The Portfolio’s secondary benchmark, which is comprised of 70% S&P 500® Index and 30% ICE BofA U.S. Corporate Master Index, returned -18.11% for the six-month period ended June 30, 2022.

Q. Were there specific market conditions, investment strategies, or techniques that materially affected the Portfolio’s benchmark-relative performance during the reporting period?

A. The Portfolio’s equity sleeve underperformed the primary benchmark for the six-month period, while the Portfolio’s fixed income sleeve significantly outperformed the primary benchmark but underperformed the fixed income portion of the secondary benchmark. While both fixed income and equity returns were negative for the period, fixed income performed significantly better than equities. As such, the Portfolio’s allocation to fixed income securities aided performance during the period as compared to the primary, equity-only benchmark.

Despite positive relative performance in the second quarter, relative weakness at the start of the year led to the Portfolio’s equity underperformance for the period. Early performance from positioning capturing policy normalization quickly eroded amid the conflict in the Ukraine. Equity underperformance was driven by non-traditional fundamental quality measures, particularly environmental, social, and governance (“ESG”) insights, while fundamental value measures aided performance.

Fundamental quality insights with a growth flavor led the detraction. Insights evaluating managerial quality, corporate culture, and favoring founder-led ownership structures all detracted. Nontraditional fundamental quality measures, specifically ESG insights, struggled as markets continued to focus on macro dynamics over company results. Insights designed to track company controversies detracted, as it was

incorrectly positioned around select consumer names that had sales exposure to Russia. Also, measures that evaluate carbon emissions intensity and track companies across green patent filings detracted, as those measures helped to motivate an overweight across Industrials.

Additionally, given the market rotations, sentiment-based stock selection that captures trends across participants struggled to gain direction. Specifically, text analyses designed to capture both short-term results and long-term fundamentals struggled, and helped motivate an unsuccessful overweight stance across Health Care. Elsewhere, positioning based on informed investor views detracted as the shared exposures ran against rising style volatility. Conversely, capturing sentiment from bond markets benefitted gains, given rate volatility.

Finally, fundamental value insights provided ballast for the period, as they benefitted from the market style preference. Traditional valuation measuring company ownership structures and sources of financing, cash usage efficiency, and other financial statement metrics motivated a successful overweight to Energy names, benefitting performance. (1)

As it relates to the fixed income sleeve of the Portfolio, interest rates rose during the first half of 2022, as the Federal Reserve raised the Fed Funds rate aggressively in 2022 in an attempt to curb inflation, and has indicated that it will continue to raise the Fed Funds rate until inflation is under control. Interest rates increased across the entire yield curve, but short-term interest rates increased at a faster rate. Even so, shorter duration bonds outperformed longer duration bonds during the period. The yield curve has become inverted between the 2 year and 10 year Treasury rate, which can be a harbinger of a recession. Credit spreads widened during the period, and lower quality bonds generally underperformed higher quality bonds. From an investment strategy perspective, the portfolio was positioned with a slightly shorter duration than the benchmark throughout the year, which enhanced performance slightly. (1)

Q. How did sector allocation and security selection each impact the Portfolio’s performance relative to its benchmark?

A. The portfolio management team targets a relatively sector-neutral approach and seeks to derive the majority of any excess return from security selection. During the six-month period, however, sector allocation decisions contributed to relative returns. A slight underweight position within Consumer Discretionary names contributed to relative performance, as the market was more focused on durables. Security selection, however, had a more meaningful impact on the Portfolio’s overall relative underperformance. Security selection was weakest in Industrials and Consumer Staples, but was somewhat offset by stronger security selection in Communication Services. (1)

For the fixed income sleeve of the Portfolio, security selection was a slight contributor to the Portfolio’s fixed income performance against the fixed income sleeve of the secondary benchmark. Sector allocation was a slight detractor from performance. Taken together, security selection and sector allocation did not meaningfully impact performance of the fixed income portion of the Portfolio. (1)

Q. Which securities contributed the most to, and detracted the most from, the Portfolio’s benchmark-relative performance?

A. From an equity security standpoint, the Portfolio’s overweight position in EOG Resources, Inc., a Texas-based Energy company, was a top contributor to relative performance for the six-month period. The stock benefitted from the broader Energy rally and run up in commodities prices. An underweight to Netflix, Inc. was also a top contributor, as the stock struggled amid a stagnant user base.

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Unaudited) (Continued) |

In contrast, an underweight to Chevron Corp. was a key equity detractor from relative performance for the period, as the stock benefitted from the broader Energy rally and runup in commodities prices. Further hindering results was an overweight stance in IDEXX Laboratories, Inc., as the company missed on its first quarter earnings estimates. (1)

For the fixed income sleeve of the Portfolio, the top three contributors to the Portfolio’s performance relative to the fixed income portion of the secondary benchmark were AerCap Ireland Capital DAC / AerCap Global Aviation Trust 3.300% due 1/23/2023, Ford Motor Credit Co. LLC 3.087% due 01/09/2023, and Air Lease Corp 2.250% due 01/15/2023. Each of these bonds are shorter duration bonds. The top three detractors to the Portfolio’s relative performance were Charter Communications Operating LLC / Charter Communications Operating 3.700% due 04/01/2051, Lowe’s Cos., Inc. 3.000% due 10/15/2050, and FirstEnergy Transmission 4.550% due 04/01/2049. Each of these bonds are longer duration bonds. (1)

Q. How did the Portfolio’s use of derivative instruments and initial public offerings (IPOs), if any, impact performance?

A. Pursuant to the Portfolio’s investment strategy, futures contracts were used to prevent a cash drag on performance. The futures contracts detracted 20 basis points from the absolute return of the Portfolio for the six-month period. The Portfolio did not participate in any IPOs during the period. (1)

| (1) | The Portfolio’s composition is subject to change. Holdings and weightings are as of June 30, 2022. |

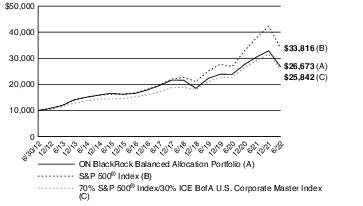

Change in Value of $10,000 Investment

Hypothetical illustration based on past performance. Future performance will vary. The Portfolio’s returns reflect reinvested dividends. The Portfolio’s holdings may differ significantly from the securities in the index. The index is unmanaged and therefore does not reflect the cost of portfolio management and accounting.

The S&P 500® Index is a capitalization-weighted index designed to measure performance of the broad domestic market through changes in the aggregate market value of 500 stocks representing all major industries. The index presented includes the effects of reinvested dividends.

The ICE BofA U.S. Corporate Master Index tracks the performance of all U.S. dollar-denominated, investment grade corporate public debt issued in the U.S. domestic bond market. Qualifying bonds must have an investment grade rating (based on an average of Moody’s, S&P, and Fitch). In addition, qualifying securities must have at least one year remaining term to maturity, a fixed coupon schedule, and a minimum amount outstanding of $250 million.

Past performance is no guarantee of future results. Redemption of fund shares could have tax implications unique to each shareholder.

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Unaudited) (Continued) |

| Portfolio Composition as of June 30, 2022 (1) |

| | % of Net Assets |

| Common Stocks (4) | 69.8 |

| Corporate Bonds (4) | 27.0 |

| Asset-Backed Securities (4) | 0.6 |

| U.S. Treasury Obligations | 0.2 |

Money Market Funds and

Other Net Assets | 2.4 |

| | 100.0 |

| Top 10 Portfolio Holdings as of June 30, 2022 (1) (2) (3) |

| | | % of Net Assets |

| 1. | Microsoft Corp. | 4.8 |

| 2. | Apple, Inc. | 4.5 |

| 3. | Amazon.com, Inc. | 1.9 |

| 4. | Alphabet, Inc. Class A | 1.8 |

| 5. | Alphabet, Inc. Class C | 1.3 |

| 6. | Exxon Mobil Corp. | 1.3 |

| 7. | UnitedHealth Group, Inc. | 1.3 |

| 8. | Tesla, Inc. | 1.3 |

| 9. | Visa, Inc. | 1.2 |

| 10. | Johnson & Johnson | 1.1 |

| | |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Portfolio Holdings is presented at an individual security level. Total investment exposure by issuer may be higher. |

| (4) | Sectors (Common Stocks, Corporate Bonds, Asset-Backed Securities): |

| | % of Net Assets |

| Information Technology | 20.5 |

| Financials | 15.1 |

| Health Care | 12.7 |

| Consumer Discretionary | 9.0 |

| Industrials | 8.4 |

| Consumer Staples | 8.0 |

| Communication Services | 7.7 |

| Energy | 5.5 |

| Utilities | 4.7 |

| Materials | 3.2 |

| Real Estate | 2.6 |

| | 97.4 |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio |

| Schedule of Investments | June 30, 2022 (Unaudited) |

| Common Stocks–69.8% | Shares | Value |

Communication Services–5.8%

| | | |

Alphabet, Inc. Class A (Interactive Media & Svs.)

| (a) | 3,615 | $ 7,878,025 |

Alphabet, Inc. Class C (Interactive Media & Svs.)

| (a) | 2,628 | 5,748,619 |

Charter Communications, Inc. Class A (Media)

| (a) | 1,888 | 884,585 |

Comcast Corp. Class A (Media)

| | 84,138 | 3,301,575 |

Electronic Arts, Inc. (Entertainment)

| | 3,042 | 370,059 |

Fox Corp. Class A (Media)

| | 73,956 | 2,378,425 |

Fox Corp. Class B (Media)

| | 1,543 | 45,827 |

Meta Platforms, Inc. Class A (Interactive Media & Svs.)

| (a) | 22,016 | 3,550,080 |

Verizon Communications, Inc. (Diversified Telecom. Svs.)

| | 11,854 | 601,590 |

Walt Disney Co. / The (Entertainment)

| (a) | 4,844 | 457,274 |

Warner Bros Discovery, Inc. (Entertainment)

| (a) | 13,519 | 181,425 |

| | | | 25,397,484 |

Consumer Discretionary–7.0%

| | | |

Amazon.com, Inc. (Internet & Direct Marketing Retail)

| (a) | 77,648 | 8,246,994 |

AutoNation, Inc. (Specialty Retail)

| (a) | 3,079 | 344,109 |

Best Buy Co., Inc. (Specialty Retail)

| | 1,949 | 127,055 |

Choice Hotels International, Inc. (Hotels, Restaurants & Leisure)

| | 2,418 | 269,921 |

Dollar General Corp. (Multiline Retail)

| | 2,094 | 513,951 |

Expedia Group, Inc. (Hotels, Restaurants & Leisure)

| (a) | 471 | 44,665 |

Ford Motor Co. (Automobiles)

| | 12,906 | 143,644 |

General Motors Co. (Automobiles)

| (a) | 24,556 | 779,898 |

Home Depot, Inc. / The (Specialty Retail)

| | 14,551 | 3,990,903 |

Lowe's Cos., Inc. (Specialty Retail)

| | 8,456 | 1,477,009 |

McDonald's Corp. (Hotels, Restaurants & Leisure)

| | 6,584 | 1,625,458 |

NIKE, Inc. Class B (Textiles, Apparel & Luxury Goods)

| | 7,938 | 811,264 |

Ralph Lauren Corp. (Textiles, Apparel & Luxury Goods)

| | 2,758 | 247,255 |

Target Corp. (Multiline Retail)

| | 15,694 | 2,216,464 |

Tesla, Inc. (Automobiles)

| (a) | 8,211 | 5,529,452 |

TJX Cos., Inc. / The (Specialty Retail)

| | 8,418 | 470,145 |

Travel + Leisure Co. (Hotels, Restaurants & Leisure)

| | 44,055 | 1,710,215 |

Whirlpool Corp. (Household Durables)

| | 5,131 | 794,638 |

Yum! Brands, Inc. (Hotels, Restaurants & Leisure)

| | 8,780 | 996,618 |

| | | | 30,339,658 |

Consumer Staples–5.1%

| | | |

Altria Group, Inc. (Tobacco)

| | 28,032 | 1,170,897 |

Brown-Forman Corp. Class B (Beverages)

| | 38,081 | 2,671,763 |

Bunge Ltd. (Food Products)

| | 5,645 | 511,945 |

Coca-Cola Co. / The (Beverages)

| | 1,691 | 106,381 |

Colgate-Palmolive Co. (Household Products)

| | 44,053 | 3,530,408 |

Costco Wholesale Corp. (Food & Staples Retailing)

| | 4,543 | 2,177,369 |

Hershey Co. / The (Food Products)

| | 416 | 89,507 |

Kellogg Co. (Food Products)

| | 12,057 | 860,146 |

Keurig Dr Pepper, Inc. (Beverages)

| | 37,208 | 1,316,791 |

McCormick & Co., Inc. (Food Products)

| | 6,567 | 546,703 |

PepsiCo, Inc. (Beverages)

| | 18,946 | 3,157,540 |

Philip Morris International, Inc. (Tobacco)

| | 5,083 | 501,895 |

Procter & Gamble Co. / The (Household Products)

| | 33,168 | 4,769,227 |

Tyson Foods, Inc. Class A (Food Products)

| | 6,290 | 541,317 |

| | | | 21,951,889 |

Energy–3.2%

| | | |

Chevron Corp. (Oil, Gas & Consumable Fuels)

| | 11,485 | 1,662,798 |

EOG Resources, Inc. (Oil, Gas & Consumable Fuels)

| | 21,705 | 2,397,100 |

Exxon Mobil Corp. (Oil, Gas & Consumable Fuels)

| | 66,197 | 5,669,111 |

Halliburton Co. (Energy Equip. & Svs.)

| | 27,494 | 862,212 |

Marathon Oil Corp. (Oil, Gas & Consumable Fuels)

| | 57,905 | 1,301,705 |

Occidental Petroleum Corp. (Oil, Gas & Consumable Fuels)

| | 7,338 | 432,062 |

Schlumberger N.V. (Energy Equip. & Svs.)

| | 34,092 | 1,219,130 |

Valero Energy Corp. (Oil, Gas & Consumable Fuels)

| | 3,901 | 414,598 |

| | | | 13,958,716 |

Financials–7.6%

| | | |

American Express Co. (Consumer Finance)

| | 12,597 | 1,746,196 |

Bank of America Corp. (Banks)

| | 152,269 | 4,740,134 |

Bank of New York Mellon Corp. / The (Capital Markets)

| | 22,374 | 933,220 |

Berkshire Hathaway, Inc. Class B (Diversified Financial Svs.)

| (a) | 13,670 | 3,732,183 |

Capital One Financial Corp. (Consumer Finance)

| | 3,559 | 370,812 |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Continued) |

| Schedule of Investments | June 30, 2022 (Unaudited) |

| Common Stocks (Continued) | Shares | Value |

| Financials (continued) | | | |

Charles Schwab Corp. / The (Capital Markets)

| | 13,899 | $ 878,139 |

Citigroup, Inc. (Banks)

| | 29,210 | 1,343,368 |

JPMorgan Chase & Co. (Banks)

| | 40,276 | 4,535,480 |

Marsh & McLennan Cos., Inc. (Insurance)

| | 9,692 | 1,504,683 |

MetLife, Inc. (Insurance)

| | 59,622 | 3,743,665 |

Moody's Corp. (Capital Markets)

| | 2,789 | 758,524 |

Pinnacle Financial Partners, Inc. (Banks)

| | 5,254 | 379,917 |

PNC Financial Services Group, Inc. / The (Banks)

| | 4,172 | 658,217 |

Regions Financial Corp. (Banks)

| | 75,027 | 1,406,756 |

Stifel Financial Corp. (Capital Markets)

| | 603 | 33,780 |

Travelers Cos., Inc. / The (Insurance)

| | 14,056 | 2,377,291 |

Voya Financial, Inc. (Diversified Financial Svs.)

| | 53,305 | 3,173,247 |

Wells Fargo & Co. (Banks)

| | 20,446 | 800,870 |

| | | | 33,116,482 |

Health Care–10.8%

| | | |

Abbott Laboratories (Health Care Equip. & Supplies)

| | 18,088 | 1,965,261 |

AbbVie, Inc. (Biotechnology)

| | 8,363 | 1,280,877 |

Agilent Technologies, Inc. (Life Sciences Tools & Svs.)

| | 22,560 | 2,679,451 |

AmerisourceBergen Corp. (Health Care Providers & Svs.)

| | 7,591 | 1,073,975 |

Amgen, Inc. (Biotechnology)

| | 9,485 | 2,307,700 |

Boston Scientific Corp. (Health Care Equip. & Supplies)

| (a) | 45,966 | 1,713,153 |

Cigna Corp. (Health Care Providers & Svs.)

| | 4,878 | 1,285,451 |

CVS Health Corp. (Health Care Providers & Svs.)

| | 11,095 | 1,028,063 |

Danaher Corp. (Life Sciences Tools & Svs.)

| | 7,868 | 1,994,695 |

Elevance Health, Inc. (Health Care Providers & Svs.)

| | 6,343 | 3,061,005 |

Eli Lilly & Co. (Pharmaceuticals)

| | 6,521 | 2,114,304 |

Johnson & Johnson (Pharmaceuticals)

| | 26,957 | 4,785,137 |

McKesson Corp. (Health Care Providers & Svs.)

| | 2,659 | 867,392 |

Medtronic PLC (Health Care Equip. & Supplies)

| | 13,542 | 1,215,394 |

Merck & Co., Inc. (Pharmaceuticals)

| | 41,371 | 3,771,794 |

Mettler-Toledo International, Inc. (Life Sciences Tools & Svs.)

| (a) | 671 | 770,825 |

Pfizer, Inc. (Pharmaceuticals)

| | 52,656 | 2,760,754 |

Syneos Health, Inc. (Life Sciences Tools & Svs.)

| (a) | 27,103 | 1,942,743 |

Thermo Fisher Scientific, Inc. (Life Sciences Tools & Svs.)

| | 3,635 | 1,974,823 |

UnitedHealth Group, Inc. (Health Care Providers & Svs.)

| | 10,776 | 5,534,877 |

Zoetis, Inc. (Pharmaceuticals)

| | 16,065 | 2,761,413 |

| | | | 46,889,087 |

Industrials–5.8%

| | | |

AMETEK, Inc. (Electrical Equip.)

| | 2,840 | 312,088 |

Caterpillar, Inc. (Machinery)

| | 2,919 | 521,800 |

CSX Corp. (Road & Rail)

| | 21,911 | 636,734 |

Cummins, Inc. (Machinery)

| | 1,679 | 324,937 |

Curtiss-Wright Corp. (Aerospace & Defense)

| | 7,669 | 1,012,768 |

Deere & Co. (Machinery)

| | 1,169 | 350,080 |

Delta Air Lines, Inc. (Airlines)

| (a) | 18,176 | 526,559 |

Eaton Corp. PLC (Electrical Equip.)

| | 16,338 | 2,058,425 |

Expeditors International of Washington, Inc. (Air Freight & Logistics)

| | 2,276 | 221,819 |

General Dynamics Corp. (Aerospace & Defense)

| | 17,411 | 3,852,184 |

HEICO Corp. (Aerospace & Defense)

| | 4,184 | 548,606 |

HEICO Corp. Class A (Aerospace & Defense)

| | 13,730 | 1,446,867 |

Honeywell International, Inc. (Industrial Conglomerates)

| | 3,776 | 656,306 |

Illinois Tool Works, Inc. (Machinery)

| | 16,350 | 2,979,787 |

Landstar System, Inc. (Road & Rail)

| | 7,271 | 1,057,349 |

Lennox International, Inc. (Building Products)

| | 227 | 46,896 |

Lockheed Martin Corp. (Aerospace & Defense)

| | 5,627 | 2,419,385 |

Masco Corp. (Building Products)

| | 8,923 | 451,504 |

Norfolk Southern Corp. (Road & Rail)

| | 740 | 168,195 |

Old Dominion Freight Line, Inc. (Road & Rail)

| | 501 | 128,396 |

Owens Corning (Building Products)

| | 1,902 | 141,338 |

PACCAR, Inc. (Machinery)

| | 5,974 | 491,899 |

SiteOne Landscape Supply, Inc. (Trading Companies & Distributors)

| (a) | 10,592 | 1,259,071 |

Tetra Tech, Inc. (Commercial Svs. & Supplies)

| | 863 | 117,843 |

Union Pacific Corp. (Road & Rail)

| | 2,816 | 600,596 |

United Parcel Service, Inc. Class B (Air Freight & Logistics)

| | 15,000 | 2,738,100 |

| | | | 25,069,532 |

Information Technology–19.1%

| | | |

Accenture PLC Class A (IT Svs.)

| | 692 | 192,134 |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Continued) |

| Schedule of Investments | June 30, 2022 (Unaudited) |

| Common Stocks (Continued) | Shares | Value |

Information Technology (continued)

| | | |

Adobe, Inc. (Software)

| (a) | 5,168 | $ 1,891,798 |

Advanced Micro Devices, Inc. (Semiconductors & Equip.)

| (a) | 19,048 | 1,456,601 |

Analog Devices, Inc. (Semiconductors & Equip.)

| | 9,388 | 1,371,493 |

Apple, Inc. (Tech. Hardware, Storage & Periph.)

| | 143,900 | 19,674,008 |

Applied Materials, Inc. (Semiconductors & Equip.)

| | 13,342 | 1,213,855 |

Automatic Data Processing, Inc. (IT Svs.)

| | 4,391 | 922,286 |

Broadcom, Inc. (Semiconductors & Equip.)

| | 1,837 | 892,433 |

Ciena Corp. (Communications Equip.)

| (a) | 3,284 | 150,079 |

Cognizant Technology Solutions Corp. Class A (IT Svs.)

| | 7,802 | 526,557 |

Dell Technologies, Inc. Class C (Tech. Hardware, Storage & Periph.)

| | 31,874 | 1,472,898 |

Fidelity National Information Services, Inc. (IT Svs.)

| | 8,438 | 773,511 |

Global Payments, Inc. (IT Svs.)

| | 4,903 | 542,468 |

Hewlett Packard Enterprise Co. (Tech. Hardware, Storage & Periph.)

| | 84,999 | 1,127,087 |

HP, Inc. (Tech. Hardware, Storage & Periph.)

| | 46,487 | 1,523,844 |

Intel Corp. (Semiconductors & Equip.)

| | 103,053 | 3,855,213 |

Intuit, Inc. (Software)

| | 1,336 | 514,948 |

Juniper Networks, Inc. (Communications Equip.)

| | 27,381 | 780,358 |

KLA Corp. (Semiconductors & Equip.)

| | 2,391 | 762,920 |

Lam Research Corp. (Semiconductors & Equip.)

| | 2,692 | 1,147,196 |

Mastercard, Inc. Class A (IT Svs.)

| | 3,410 | 1,075,787 |

Micron Technology, Inc. (Semiconductors & Equip.)

| | 10,154 | 561,313 |

Microsoft Corp. (Software)

| | 81,838 | 21,018,454 |

NetApp, Inc. (Tech. Hardware, Storage & Periph.)

| | 6,654 | 434,107 |

NVIDIA Corp. (Semiconductors & Equip.)

| | 22,779 | 3,453,069 |

PayPal Holdings, Inc. (IT Svs.)

| (a) | 14,067 | 982,439 |

QUALCOMM, Inc. (Semiconductors & Equip.)

| | 15,998 | 2,043,584 |

Salesforce, Inc. (Software)

| (a) | 9,088 | 1,499,883 |

ServiceNow, Inc. (Software)

| (a) | 5,608 | 2,666,716 |

Silicon Laboratories, Inc. (Semiconductors & Equip.)

| (a) | 6,970 | 977,333 |

TE Connectivity Ltd. (Electronic Equip., Instr. & Comp.)

| | 2,766 | 312,973 |

Teradyne, Inc. (Semiconductors & Equip.)

| | 287 | 25,701 |

Texas Instruments, Inc. (Semiconductors & Equip.)

| | 6,670 | 1,024,845 |

Visa, Inc. (IT Svs.)

| | 25,289 | 4,979,151 |

Workday, Inc. Class A (Software)

| (a) | 5,909 | 824,778 |

| | | | 82,671,820 |

Materials–1.7%

| | | |

Corteva, Inc. (Chemicals)

| | 12,306 | 666,247 |

Ecolab, Inc. (Chemicals)

| | 17,862 | 2,746,461 |

Freeport-McMoRan, Inc. (Metals & Mining)

| | 12,571 | 367,828 |

Linde PLC (Chemicals)

| | 10,923 | 3,140,690 |

LyondellBasell Industries N.V. Class A (Chemicals)

| | 5,122 | 447,970 |

| | | | 7,369,196 |

Real Estate–1.6%

| | | |

CBRE Group, Inc. Class A (Real Estate Mgmt. & Development)

| (a) | 8,098 | 596,094 |

Crown Castle International Corp. (Equity REIT)

| | 8,999 | 1,515,252 |

CubeSmart (Equity REIT)

| | 17,656 | 754,264 |

Extra Space Storage, Inc. (Equity REIT)

| | 7,344 | 1,249,361 |

Mid-America Apartment Communities, Inc. (Equity REIT)

| | 2,632 | 459,731 |

Prologis, Inc. (Equity REIT)

| | 21,529 | 2,532,887 |

| | | | 7,107,589 |

Utilities–2.1%

| | | |

CMS Energy Corp. (Multi-Utilities)

| | 33,942 | 2,291,085 |

DTE Energy Co. (Multi-Utilities)

| | 16,196 | 2,052,843 |

Entergy Corp. (Electric Utilities)

| | 22,339 | 2,516,265 |

NextEra Energy, Inc. (Electric Utilities)

| | 12,596 | 975,686 |

NRG Energy, Inc. (Ind. Power & Renewable Elec.)

| | 13,699 | 522,891 |

OGE Energy Corp. (Electric Utilities)

| | 19,558 | 754,156 |

| | | | 9,112,926 |

Total Common Stocks (Cost $322,057,730)

| | | $302,984,379 |

| Corporate Bonds–27.0% | Rate | Maturity | Face Amount | Value |

Communication Services–1.9%

| | | | | |

AT&T, Inc. (Diversified Telecom. Svs.)

| | 4.900% | 08/15/2037 | $1,000,000 | $ 996,001 |

Charter Communications Operating LLC / Charter Communications Operating Capital (Media)

| | 3.700% | 04/01/2051 | 1,200,000 | 812,034 |

Comcast Corp. (Media)

| | 3.250% | 11/01/2039 | 2,000,000 | 1,643,788 |

Lamar Media Corp. (Media)

| | 4.875% | 01/15/2029 | 800,000 | 720,093 |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Continued) |

| Schedule of Investments | June 30, 2022 (Unaudited) |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value |

Communication Services (continued)

| | | | | |

Rogers Communications, Inc. (Wireless Telecom. Svs.)

| | 3.700% | 11/15/2049 | $1,400,000 | $ 1,066,892 |

Time Warner Cable LLC (Media)

| | 6.550% | 05/01/2037 | 150,000 | 150,191 |

T-Mobile U.S.A., Inc. (Wireless Telecom. Svs.)

| | 3.875% | 04/15/2030 | 1,200,000 | 1,119,907 |

Verizon Communications, Inc. (Diversified Telecom. Svs.)

| | 4.400% | 11/01/2034 | 1,000,000 | 958,207 |

Verizon Communications, Inc. (Diversified Telecom. Svs.)

| | 2.875% | 11/20/2050 | 1,000,000 | 709,610 |

| | | | | | 8,176,723 |

Consumer Discretionary–2.0%

| | | | | |

Amazon.com, Inc. (Internet & Direct Marketing Retail)

| | 3.875% | 08/22/2037 | 1,000,000 | 947,915 |

Best Buy Co., Inc. (Specialty Retail)

| | 1.950% | 10/01/2030 | 2,000,000 | 1,588,533 |

Expedia Group, Inc. (Hotels, Restaurants & Leisure)

| | 4.625% | 08/01/2027 | 1,000,000 | 960,754 |

Hasbro, Inc. (Leisure Products)

| | 3.900% | 11/19/2029 | 2,000,000 | 1,836,532 |

Lear Corp. (Auto Components)

| | 3.500% | 05/30/2030 | 1,000,000 | 872,364 |

Lowe's Cos., Inc. (Specialty Retail)

| | 3.000% | 10/15/2050 | 1,000,000 | 696,778 |

Target Corp. (Multiline Retail)

| | 2.350% | 02/15/2030 | 2,000,000 | 1,766,271 |

| | | | | | 8,669,147 |

Consumer Staples–2.9%

| | | | | |

Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc. (Beverages)

| | 4.700% | 02/01/2036 | 2,000,000 | 1,916,054 |

B.A.T. Capital Corp. (Tobacco)

| | 3.215% | 09/06/2026 | 1,000,000 | 933,996 |

B.A.T. Capital Corp. (Tobacco)

| | 4.700% | 04/02/2027 | 1,000,000 | 976,811 |

Campbell Soup Co. (Food Products)

| | 4.150% | 03/15/2028 | 2,000,000 | 1,964,017 |

Coca-Cola Co. / The (Beverages)

| | 3.000% | 03/05/2051 | 2,000,000 | 1,614,929 |

Diageo Capital PLC (Beverages)

| | 2.375% | 10/24/2029 | 2,000,000 | 1,775,549 |

Hershey Co. / The (Food Products)

| | 1.700% | 06/01/2030 | 1,200,000 | 1,012,066 |

JBS U.S.A. LUX SA / JBS U.S.A. Food Co. / JBS U.S.A. Finance, Inc. (Food Products)

| (b) | 5.750% | 04/01/2033 | 800,000 | 761,832 |

Kraft Heinz Foods Co. (Food Products)

| | 4.625% | 10/01/2039 | 800,000 | 702,071 |

Philip Morris International, Inc. (Tobacco)

| | 3.375% | 08/15/2029 | 1,000,000 | 902,120 |

| | | | | | 12,559,445 |

Energy–2.3%

| | | | | |

Baker Hughes Holdings LLC / Baker Hughes Co-Obligor, Inc. (Energy Equip. & Svs.)

| | 3.337% | 12/15/2027 | 1,000,000 | 944,171 |

BP Capital Markets America, Inc. (Oil, Gas & Consumable Fuels)

| | 3.017% | 01/16/2027 | 1,000,000 | 952,731 |

Chevron Corp. (Oil, Gas & Consumable Fuels)

| | 2.236% | 05/11/2030 | 1,200,000 | 1,053,132 |

Energy Transfer LP (Oil, Gas & Consumable Fuels)

| | 4.950% | 06/15/2028 | 1,000,000 | 985,386 |

Halliburton Co. (Energy Equip. & Svs.)

| | 4.850% | 11/15/2035 | 1,000,000 | 961,550 |

Kinder Morgan, Inc. (Oil, Gas & Consumable Fuels)

| | 5.300% | 12/01/2034 | 1,000,000 | 976,838 |

ONEOK, Inc. (Oil, Gas & Consumable Fuels)

| | 5.850% | 01/15/2026 | 800,000 | 829,241 |

Shell International Finance B.V. (Oil, Gas & Consumable Fuels)

| | 4.000% | 05/10/2046 | 1,500,000 | 1,335,707 |

Tennessee Gas Pipeline Co. LLC (Oil, Gas & Consumable Fuels)

| (b) | 2.900% | 03/01/2030 | 1,000,000 | 863,800 |

Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels)

| | 3.750% | 06/15/2027 | 1,000,000 | 954,900 |

Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels)

| | 5.400% | 03/04/2044 | 100,000 | 95,253 |

| | | | | | 9,952,709 |

Financials–7.5%

| | | | | |

AerCap Ireland Capital DAC / AerCap Global Aviation Trust (Diversified Financial Svs.)

| | 3.300% | 01/23/2023 | 1,000,000 | 996,020 |

AerCap Ireland Capital DAC / AerCap Global Aviation Trust (Diversified Financial Svs.)

| | 4.875% | 01/16/2024 | 1,000,000 | 994,773 |

AerCap Ireland Capital DAC / AerCap Global Aviation Trust (Diversified Financial Svs.)

| | 3.300% | 01/30/2032 | 1,000,000 | 800,491 |

Ares Capital Corp. (Capital Markets)

| | 3.200% | 11/15/2031 | 1,500,000 | 1,089,910 |

Bank of Montreal (Rate is fixed until 12/15/2027, at which point, the rate becomes USSW5 + 143) (Banks)

| (c) | 3.803% | 12/15/2032 | 200,000 | 185,377 |

BlackRock, Inc. (Capital Markets)

| | 2.100% | 02/25/2032 | 1,000,000 | 825,900 |

Capital One Bank U.S.A. N.A. (Rate is fixed until 01/28/2025, at which point, the rate becomes SOFR + 91) (Consumer Finance)

| (c) | 2.280% | 01/28/2026 | 1,000,000 | 949,575 |

Charles Schwab Corp. / The (Capital Markets)

| | 3.300% | 04/01/2027 | 1,000,000 | 970,730 |

Citigroup, Inc. (Banks)

| | 4.125% | 07/25/2028 | 1,000,000 | 959,213 |

Citigroup, Inc. (Rate is fixed until 11/05/2029, at which point, the rate becomes SOFR + 142) (Banks)

| (c) | 2.976% | 11/05/2030 | 1,000,000 | 872,810 |

Citigroup, Inc. (Rate is fixed until 05/01/2031, at which point, the rate becomes SOFR + 117) (Banks)

| (c) | 2.561% | 05/01/2032 | 2,000,000 | 1,646,724 |

Discover Bank (Banks)

| | 2.450% | 09/12/2024 | 1,000,000 | 961,715 |

Discover Bank (Rate is fixed until 08/09/2023, at which point, the rate becomes USSW5 + 173) (Banks)

| (c) | 4.682% | 08/09/2028 | 250,000 | 243,038 |

Ford Motor Credit Co. LLC (Consumer Finance)

| | 3.087% | 01/09/2023 | 2,000,000 | 1,980,145 |

General Motors Financial Co., Inc. (Consumer Finance)

| | 2.700% | 06/10/2031 | 3,000,000 | 2,363,730 |

Goldman Sachs Group, Inc. / The (Capital Markets)

| | 3.750% | 05/22/2025 | 1,000,000 | 988,010 |

JPMorgan Chase & Co. (Banks)

| | 3.625% | 12/01/2027 | 1,000,000 | 960,008 |

JPMorgan Chase & Co. (Rate is fixed until 05/13/2030, at which point, the rate becomes SOFR + 252) (Banks)

| (c) | 2.956% | 05/13/2031 | 1,000,000 | 863,384 |

Morgan Stanley (Capital Markets)

| | 3.950% | 04/23/2027 | 1,000,000 | 968,336 |

Morgan Stanley (Rate is fixed until 01/22/2030, at which point, the rate becomes SOFR + 114) (Capital Markets)

| (c) | 2.699% | 01/22/2031 | 1,500,000 | 1,299,180 |

Nasdaq, Inc. (Capital Markets)

| | 3.850% | 06/30/2026 | 1,000,000 | 993,052 |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Continued) |

| Schedule of Investments | June 30, 2022 (Unaudited) |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value |

| Financials (continued) | | | | | |

PNC Bank N.A. (Banks)

| | 4.050% | 07/26/2028 | $1,950,000 | $ 1,887,132 |

State Street Corp. (Capital Markets)

| | 2.200% | 03/03/2031 | 1,000,000 | 817,764 |

Synchrony Financial (Consumer Finance)

| | 4.250% | 08/15/2024 | 1,000,000 | 993,791 |

Truist Bank (Rate is fixed until 09/17/2024, at which point, the rate becomes H15T5Y + 115) (Banks)

| (c) | 2.636% | 09/17/2029 | 2,500,000 | 2,377,368 |

U.S. Bancorp (Banks)

| | 1.375% | 07/22/2030 | 1,000,000 | 796,861 |

Wells Fargo & Co. (Banks)

| | 3.000% | 04/22/2026 | 1,500,000 | 1,427,349 |

Wells Fargo & Co. (Rate is fixed until 04/30/2040, at which point, the rate becomes SOFR + 253) (Banks)

| (c) | 3.068% | 04/30/2041 | 800,000 | 619,532 |

Westpac Banking Corp. (Rate is fixed until 02/04/2025, at which point, the rate becomes H15T5Y + 135) (Banks)

| (c) | 2.894% | 02/04/2030 | 1,500,000 | 1,421,186 |

Westpac Banking Corp. (Rate is fixed until 11/23/2026, at which point, the rate becomes USISDA05 + 224) (Banks)

| (c) | 4.322% | 11/23/2031 | 200,000 | 192,315 |

| | | | | | 32,445,419 |

Health Care–1.9%

| | | | | |

AbbVie, Inc. (Biotechnology)

| | 3.200% | 11/21/2029 | 1,000,000 | 919,941 |

AbbVie, Inc. (Biotechnology)

| | 4.250% | 11/21/2049 | 2,000,000 | 1,775,463 |

HCA, Inc. (Health Care Providers & Svs.)

| | 5.250% | 06/15/2026 | 2,000,000 | 1,989,843 |

Quest Diagnostics, Inc. (Health Care Providers & Svs.)

| | 2.800% | 06/30/2031 | 800,000 | 685,315 |

Regeneron Pharmaceuticals, Inc. (Biotechnology)

| | 1.750% | 09/15/2030 | 1,200,000 | 962,092 |

UnitedHealth Group, Inc. (Health Care Providers & Svs.)

| | 3.875% | 12/15/2028 | 2,000,000 | 1,989,224 |

| | | | | | 8,321,878 |

Industrials–2.0%

| | | | | |

Air Lease Corp. (Trading Companies & Distributors)

| | 2.250% | 01/15/2023 | 1,000,000 | 989,842 |

Air Lease Corp. (Trading Companies & Distributors)

| | 2.300% | 02/01/2025 | 2,000,000 | 1,871,798 |

Boeing Co. / The (Aerospace & Defense)

| | 3.200% | 03/01/2029 | 1,500,000 | 1,297,926 |

Burlington Northern Santa Fe LLC (Road & Rail)

| | 4.550% | 09/01/2044 | 100,000 | 96,115 |

FedEx Corp. (Air Freight & Logistics)

| | 4.900% | 01/15/2034 | 1,000,000 | 999,355 |

Lockheed Martin Corp. (Aerospace & Defense)

| | 1.850% | 06/15/2030 | 800,000 | 682,731 |

United Rentals North America, Inc. (Trading Companies & Distributors)

| | 4.875% | 01/15/2028 | 1,000,000 | 945,480 |

Waste Connections, Inc. (Commercial Svs. & Supplies)

| | 2.600% | 02/01/2030 | 2,000,000 | 1,749,835 |

| | | | | | 8,633,082 |

Information Technology–1.4%

| | | | | |

Broadcom, Inc. (Semiconductors & Equip.)

| (b) | 2.600% | 02/15/2033 | 1,000,000 | 768,908 |

HP, Inc. (Tech. Hardware, Storage & Periph.)

| | 2.650% | 06/17/2031 | 3,000,000 | 2,409,896 |

Oracle Corp. (Software)

| | 4.300% | 07/08/2034 | 2,100,000 | 1,832,069 |

VMware, Inc. (Software)

| | 2.200% | 08/15/2031 | 1,200,000 | 944,912 |

| | | | | | 5,955,785 |

Materials–1.5%

| | | | | |

Dow Chemical Co. / The (Chemicals)

| | 4.250% | 10/01/2034 | 1,402,000 | 1,329,834 |

Glencore Funding LLC (Metals & Mining)

| (b) | 2.850% | 04/27/2031 | 3,000,000 | 2,476,859 |

Kinross Gold Corp. (Metals & Mining)

| | 4.500% | 07/15/2027 | 1,000,000 | 974,120 |

Mosaic Co. / The (Chemicals)

| | 4.050% | 11/15/2027 | 1,000,000 | 978,099 |

Steel Dynamics, Inc. (Metals & Mining)

| | 3.250% | 01/15/2031 | 800,000 | 694,208 |

| | | | | | 6,453,120 |

Real Estate–1.0%

| | | | | |

Alexandria Real Estate Equities, Inc. (Equity REIT)

| | 3.950% | 01/15/2028 | 1,000,000 | 968,041 |

American Tower Corp. (Equity REIT)

| | 2.750% | 01/15/2027 | 2,000,000 | 1,829,023 |

VICI Properties LP / VICI Note Co., Inc. (Equity REIT)

| (b) | 4.625% | 12/01/2029 | 700,000 | 625,769 |

Welltower, Inc. (Equity REIT)

| | 2.700% | 02/15/2027 | 1,000,000 | 923,512 |

| | | | | | 4,346,345 |

Utilities–2.6%

| | | | | |

AEP Transmission Co. LLC (Electric Utilities)

| | 4.000% | 12/01/2046 | 1,000,000 | 883,310 |

AEP Transmission Co. LLC (Electric Utilities)

| | 3.750% | 12/01/2047 | 1,000,000 | 849,574 |

Ameren Corp. (Multi-Utilities)

| | 2.500% | 09/15/2024 | 1,000,000 | 969,195 |

Ameren Corp. (Multi-Utilities)

| | 3.500% | 01/15/2031 | 1,000,000 | 916,010 |

American Water Capital Corp. (Water Utilities)

| | 4.300% | 12/01/2042 | 100,000 | 92,209 |

Black Hills Corp. (Multi-Utilities)

| | 3.050% | 10/15/2029 | 2,500,000 | 2,237,311 |

Commonwealth Edison Co. (Electric Utilities)

| | 4.350% | 11/15/2045 | 1,000,000 | 923,027 |

Connecticut Light & Power Co. / The (Electric Utilities)

| | 4.000% | 04/01/2048 | 1,000,000 | 905,248 |

Duke Energy Corp. (Electric Utilities)

| | 3.750% | 09/01/2046 | 1,500,000 | 1,181,244 |

Duke Energy Indiana LLC (Electric Utilities)

| | 3.250% | 10/01/2049 | 1,000,000 | 773,031 |

FirstEnergy Transmission LLC (Electric Utilities)

| (b) | 4.550% | 04/01/2049 | 200,000 | 160,925 |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Continued) |

| Schedule of Investments | June 30, 2022 (Unaudited) |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value |

| Utilities (continued) | | | | | |

Florida Power & Light Co. (Electric Utilities)

| | 3.150% | 10/01/2049 | $1,000,000 | $ 794,246 |

Public Service Electric & Gas Co. (Multi-Utilities)

| | 3.600% | 12/01/2047 | 1,000,000 | 845,809 |

| | | | | | 11,531,139 |

Total Corporate Bonds (Cost $134,424,954)

| | | | | $117,044,792 |

| Asset-Backed Securities–0.6% | Rate | Maturity | Face Amount | Value |

Industrials–0.6%

| | | | | |

FedEx Corp. 2020-1 Class AA Pass Through Trust

| | 1.875% | 02/20/2034 | $1,839,582 | $ 1,595,853 |

United Airlines 2016-1 Class B Pass Through Trust

| | 3.650% | 01/07/2026 | 131,481 | 119,636 |

United Airlines 2019-2 Class AA Pass Through Trust

| | 2.700% | 05/01/2032 | 910,051 | 775,935 |

Total Asset-Backed Securities (Cost $2,881,115)

| | | | | $ 2,491,424 |

| U.S. Treasury Obligations–0.2% | Rate | Maturity | Face Amount | Value |

U.S. Treasury Note

| | 1.875% | 02/15/2032 | $1,000,000 | $ 905,937 |

Total U.S. Treasury Obligations (Cost $952,779)

| | | | | $ 905,937 |

| Money Market Funds–1.8% | Shares | Value |

State Street Institutional Liquid Reserves Fund Institutional Class, 1.494%

| (d) | 7,925,656 | $ 7,924,863 |

Total Money Market Funds (Cost $7,925,464)

| | | $ 7,924,863 |

Total Investments – 99.4% (Cost $468,242,042)

| (e) | | $431,351,395 |

Other Assets in Excess of Liabilities – 0.6%

| (f) | | 2,484,241 |

| Net Assets – 100.0% | | | $433,835,636 |

Percentages are stated as a percent of net assets. |

| Abbreviations: | |

| H15T5Y: | U.S. Treasury Yield Curve Rate T-Note Constant Maturity 5 Year, 3.010% at 06/30/2022 |

| SOFR: | Secured Overnight Financing Rate, 1.500% at 06/30/2022 |

| USISDA05: | USD ICE Swap Rate 11:00am NY 5 Year, 3.091% at 06/30/2022 |

| USSW5: | USD Swap Semi 30/360 5 Year, 3.075% at 06/30/2022 |

| Footnotes: | |

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At June 30, 2022, the value of these securities totaled $5,658,093, or 1.3% of the Portfolio’s net assets. |

| (c) | Security is a fixed-then-variable rate instrument in which the coupon or dividend rate is fixed until a later specified date, then is adjusted periodically. Rates stated, including interest rate caps and floors, if any, are those in effect at June 30, 2022. |

| (d) | Rate represents the seven-day yield at June 30, 2022. |

| (e) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

| (f) | Includes $273,000 of cash pledged as collateral for the futures contracts outstanding at June 30, 2022. See also the following Schedule of Open Futures Contracts. |

The accompanying notes are an integral part of these financial statements.

| Schedule of Open Futures Contracts | June 30, 2022 (Unaudited) |

| Description | | Number of

contracts | | Expiration Date | | Notional

Amount | | Value | | Unrealized

Appreciation

(Depreciation) | | Variation Margin

Receivable

(Payable) |

| CME E-mini S&P 500 Index - Long | | 26 | | September 16, 2022 | | $5,017,907 | | $4,926,350 | | $(91,557) | | $(41,275) |

The accompanying notes are an integral part of these financial statements.

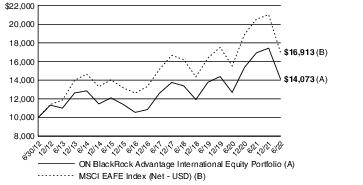

| Ohio National Fund, Inc. | ON BlackRock Advantage International Equity Portfolio (Unaudited) |

The ON Blackrock Advantage International Equity Portfolio seeks long-term growth of capital by investing, under normal circumstances, at least 80% of its net assets in non-U.S. equity securities and equity-like instruments of companies that are components of, or have characteristics similar to, the companies included in the MSCI EAFE Index (Net - USD).

Performance as of June 30, 2022

| Average Annual returns | |

| One year | -16.94% |

| Five years | 2.24% |

| Ten years | 3.48% |