As filed with the Securities and Exchange Commission on June 6, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Stacey E. Hong, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: March 31

Date of reporting period: April 1, 2011 – March 31, 2012

ITEM 1. REPORT TO STOCKHOLDERS.

The views in this report were those of the Absolute Strategies Fund and Absolute Opportunities Fund’s (each a “Fund” and collectively the “Funds”) adviser as of March 31, 2012, and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and do not constitute investment advice. None of the information presented should be construed as an offer to sell or recommendation of any security mentioned herein.

Since the Funds utilize multi-manager strategies with multiple sub-advisers, they may be exposed to varying forms of risk. These risks include, but are not limited to, general market risk, multi-manager risk, non-diversification risk, small company risk, foreign risk, interest rate risk, credit risk, prepayment risk, IPO risk, liquidity risk, high turnover risk, leverage risk, pooled investment vehicle risk and derivatives risk. For a complete description of the Funds’ principal investment risks, please refer to each Fund’s prospectus.

Beta is a measure of an asset’s sensitivity to broad market moves, as measured for instance by the S&P 500® Index. A fund with a realized beta of 0.5 with respect to the S&P 500®Index infers that about 50% of the fund’s returns were explained by the performance of the index (the rest of the performance was independent of the index). Standard deviation indicates the volatility of a fund’s total returns and is useful because it identifies the spread of a fund’s short-term fluctuations. The HFR Indices are equally weighted performance indexes, utilized by numerous hedge fund managers as a benchmark for their own hedge funds. One cannot invest directly in an index or average.

Absolute Opportunities Fund, Absolute Strategies Fund, Absolute Funds, and Absolute Investment Advisers are registered service marks of Absolute Investment Advisers LLC (“AIA” and “Absolute”) and the respective logos are service marks of AIA; and other marks referred to herein are the trademarks, service marks or registered trademarks of the respective owners thereof.

A MESSAGE TO OUR SHAREHOLDERS

Dear Shareholder,

We are pleased to present the annual report for the Absolute Strategies Fund (the “Fund”) for the 12 months ended March 31, 2012. The Fund (Institutional Shares) returned 3.36% for the twelve months ended March 31, 2012, versus 8.54% for the S&P 500 Index (“S&P 500”) and -6.38% for the HFRX Global Hedge Fund Index. More importantly, the Fund’s performance was achieved without taking meaningful risks and the Fund’s overall net exposure was held to modest levels throughout the past year. From inception through March 31, the Fund’s beta was 0.21, (beta measures the Fund’s sensitivity to the S&P 500) demonstrating that Fund returns were largely independent of this market index.

As of March 31, 2012, 1-year, 5-year and since inception (July 27, 2005) annualized performance for the Fund (Institutional Shares) was 3.36%, 2.60% and 3.29%, respectively. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance current to the most recent month-end, call the Fund at (888) 992-2765. As stated in the current prospectus, the Fund’s total annual operating expense ratio (gross) is 2.28% for Institutional Shares. Excluding the effect of expenses attributable to dividends and interest on short sales and acquired fund fees and expenses, the Fund’s total annual operating expense ratio (net) would be 1.73% for Institutional Shares. Returns include the reinvestments of dividends and capital gains.

The Fund’s allocations and performance can be viewed across multiple dimensions. Overall holdings of the Fund, aggregated across sub-adviser strategies, are diversified across a wide range of industries and asset classes. As such, it is difficult to attribute performance to any small group of securities. The Fund held over 1,200 securities, including both long and short equity, fixed income, ETFs, options, cash and financial futures hedges. Detailed positioning can be found in the schedule of investments section of the annual report.

We currently allocate assets to ten sub-advisers (managers) that utilize eleven strategies. As of March 31, 2012, we allocated approximately 93% of the Fund’s assets; the remaining 7% was held in cash for future allocations and rebalancing. Of the sub-advisers who received assets, the largest allocation to a single manager strategy was approximately 15%; the smallest was roughly 1%. We view each manager strategy as an independent risk/return profile as opposed to designating categories, benchmarks or buckets. The following list provides insight into the more concentrated nature of our allocations where we currently have our largest single strategy allocations. The strategies below (listed alphabetically by manager) each had an allocation between 8%-15% as of March 31:

Aronson Johnson Ortiz – Equity Market Neutral

Kovitz Investment Group – Long/Short Equity

Longhorn Capital Partners – Global Long/Short Equity

Metropolitan West Asset Management – Distressed Debt

Mohican Financial Management – Convertible Arbitrage

St. James Investment Management – Concentrated Equity

Yacktman Asset Management – Concentrated Equity

The Fund’s beta (sensitivity) to the S&P 500 has been trending lower during the run-up in asset prices and has been averaging near zero over the past two years. Our performance can be explained by the Fund’s manager changes and overall positioning, which has become much more strategic and conservative as markets have appeared more speculative and momentum driven. As such, our beta and volatility have been lower than normal. This is to be expected given the Fund’s desire to preserve capital and our managers’ willingness to change their exposures from “aggressive” to “conservative” as the price of risk changes.

We remain pleased with the Fund’s performance in what continues to be a very volatile and emotional environment for many investors. While the performance for any one month or even a few quarters may appear “disappointing,” investors with reasonable and rational time horizons will understand the Fund’s ability to provide a unique risk/return profile that does not rely on beta-driven, correlated asset allocation strategies. In order to provide diversification to an overall portfolio in today’s momentum-fueled markets, one cannot be investing in the same

1 ABSOLUTE FUNDS

A MESSAGE TO OUR SHAREHOLDERS

things as everyone else. You have to be doing something different. As a result, overall returns and performance are likely to come at different times and intervals than other parts of a portfolio. This is the definition of diversification. It may come as a surprise to many investors that even with the significant gains in global equities over the past 6 months, our Fund has actually outperformed the MSCI World Equity Index over the past 12 months, as well as the past 5 years through March 31. Additionally, the Fund produced a positive return during last year’s volatile global equity sell-off. This is why we stress patience and discipline. The Fund’s overall positioning is relatively unchanged and remains well hedged and defensive. A recap of our positioning is discussed in more detail toward the end of this letter.

It is no secret the structural problems and crises throughout the global economy stem from excess debt. This letter attempts to explain why we think the global economy is in this situation, why the process for creating the problems continues to this day, why financial markets are not out of the woods, and how we plan to manage your money within this environment. We are extremely optimistic about the future investing climate, but only after we get through the final stage of the credit bubble. In our view, the root of the problem stems from the willingness of a broad swath of investors and money managers to bid up asset prices to extreme levels. The price increases are based on short term fundamentals, powerful momentum, and easy money from central banks. This creates a speculative environment that along with easy money, allows borrowers to take on excessive levels of debt based on short term, unsustainable asset prices. Money managers and investors are also providing the supply of credit in addition to the high asset prices that serve as collateral. This again is based on short term, unsustainable fundamentals. Asset prices eventually drop once long-term fundamentals trump the short-term; however the debt remains fixed. This creates an immediate collateral problem for both the borrower AND lender. Again, we blame the allocators of capital (largely using other peoples’ money) for this misallocation of capital. The allocators will make large sums of money until investors finally lose faith in the process.

The reason the above process continues today is many investors have learned very little from the credit crisis and multiple investing bubbles over the past decade-plus. They are reverting back to bad investing habits and are chasing short-term performance because markets are going up. You do not need a global survey to realize that investors are now expecting returns monthly and they possess an obsession for relative returns. This is forcing money managers, who fear losing clients to someone else who promises performance, to once again buy what is “working” and sell what is “not working” regardless of valuation or fundamentals. As a result, critical thinking and independent judgments are displaced for fear of being different from the herd or benchmark. The herd grows larger and larger until momentum carries every asset class to a level where investors are “locked-in” to an incredibly low expected return across their entire portfolio. This further stresses the need for short-term performance and puts more pressure on the herd to chase performance. Eventually, momentum dies off and there are no more buyers. A large supply/demand imbalance results and markets fall off of a cliff.

Money managers who brought us the tech bubble, the housing bubble, the bond bubble, and various swings in herding investor psychology have not altered their incentive structures. The incentive structure is not based on whether managers make money or lose money for their clients; that appears to be irrelevant. The focus is on keeping the asset base and waiting for the Federal Reserve to bail them out. If you are skeptical, explain how an entire industry missed the multitude of risks and overvalued markets over the past decade that resulted in multiple bouts of large investor losses? The signs were there and were glaringly obvious in hindsight. And, if the past decade wasn’t an appropriate time to think about systemic risks, when would be? Our guess…probably never. The markets, benchmarks and peer groups continue to serve as cover for reason and judgment regardless of potential investor losses. There is no critical thinking. Most of the money management industry simply desires to keep investors invested. Period.

The discussion of the money management industry’s inability to manage risk is not about throwing stones. We certainly do not have all of the answers and we will inevitably make plenty of mistakes. However, understanding the financial industry’s repetitive conditioning is essential for understanding the ongoing problems affecting banks, the financial system, and the economy as a whole. Blindly allocating capital to both winners and losers not only stresses misallocation of capital, but creates discrepancies between assets and liabilities. “Catch us if we fall” attitudes further erode true price discovery. The warning signals that market prices and interest rates normally provide are being suppressed. As the process builds, it becomes insurmountable. Hugh Hendry, a European

2 ABSOLUTE FUNDS

A MESSAGE TO OUR SHAREHOLDERS

money manager, recently commented at the Milken Conference about the current credit crisis in Europe, “You can’t make up how bad it is.” Commenting further he stated, “We have reached a profound point in economic history where the truth is unpalatable to the political class, and that truth is that the scale and magnitude of the problem is larger than their ability to respond, and it terrifies them.” We agree. In our view, the financial and political elite are being intellectually dishonest with understanding, managing, and communicating systemic risks and they are attempting to control markets, prices and interest rates. The risks are not complicated and do not require a brilliant mind or a Ph.D. in economics to understand. It is simple exponential math and the ability and willingness to think for yourself.

Why do we believe we are not out of the woods? The seriousness of this process is creating the current, global structural problems because it impacts the most vital element: collateral. Collateral is what serves as the foundation for the current leveraged financial economy globally as it provides the means (the asset-side of a balance sheet) for lending and borrowing. When asset prices rise, additional debt can be created. When asset prices rise artificially, thanks to the effort of central banks over the past decade-plus through artificially low interest rates, it provides an unsustainable foundation for new debt. A simple example of this is the artificial increase in house prices (collateral) that allowed homeowners to take on additional debt and use their home values as an ATM. When prices of homes dropped back to supply/demand equilibrium, the higher levels of debt that were based on artificially high home prices caused a massive collateral problem. The asset/home dropped in value while the liability remained the same, thus wiping out all of the homeowner’s equity. This process continues to this day. The Federal Reserve and other central banks try to inflate asset prices through money creation to entice the creation of new credit. This creates more debt on asset prices that are artificially elevated in hopes of kick-starting the economy. Unfortunately, newly created debt today has diminishing marginal productivity and is contributing very little to GDP growth. GDP is simply a measure of spending, not a measure of prosperity or wealth. One-time measures that create spending levels that again are artificial through deficit spending or credit are simply unsustainable (borrow and spend has limits).

Additionally, with interest rates at historic lows, investment models have low hurdle rates for success, which leads to low return-on-investment projects or crowded speculative bets on financial products. Banks have controlled much of the new liquidity and are using additional leverage on low returning bets on real estate, financial instruments and derivatives. These financial bets tend to be short lived and traders withdraw when momentum wanes or they experience losses. Asset prices then drop (think housing) and you have new collateral problems, which now include both borrower and lender, all over again. These experiments to jump start the economy create further credit and solvency problems once supply and demand revert back to natural equilibrium. Credit problems create a further drop in asset prices as banks must sell assets, and collateral problems worsen to the point where there is no fix and it spirals out of control. Collateral is about money and when money is lost, banks run into severe funding problems due to highly leveraged positions on little equity. Enter the financial elite to provide taxpayer funded bailouts. This ongoing financial repression, where failure and speculation are rewarded and savers are punished, is controlled by a small, non-elected group of economists with no market experience and a poor history of understanding anything that isn’t constant and linear. These economists fail to understand that the reason capital markets aren’t working is because the mechanism for pricing risk (interest rates) is broken. Amazingly, there has never been more blind faith in this group by the “catch us if we fall” investment industry.

Regardless of how much faith investors currently have in central banks, there are limits to creating money out of thin air and faith can disappear quickly. Nothing stresses the gaping income and wealth disparity more than central bank money printing and inflation. It doesn’t take long for young, educationally-indebted and highly unemployed generations to resort to severe social unrest and political pressures. The 99% represents a majority last we checked, but even large voter turnouts by small factions can dramatically upend the status quo. Smaller factions have indeed defined democracy and upheaval since the beginning of time. The only thing holding up the current system is propaganda and the ability of the financial and political elite to stay in power. Many things can change the status quo, but the most powerful multiples are the bond markets (rising sovereign yields) and the political process (elections or scandal). This is where the Euro-zone is right now. National elections are pushing back against the bail-out and financial regimes and against German political will to control Euro-zone economic policy. If the status quo is upended and nationalism and self-protection re-roots itself in Europe, there will likely

3 ABSOLUTE FUNDS

A MESSAGE TO OUR SHAREHOLDERS

be a reassessment of basic math showing that debts cannot be supported or paid back. Political instability is the last thing Europe can afford right now and it could potentially upset the entire global financial system.

According to the World Bank, almost half of all global trade involves Europe, which also serves as China’s largest customer. As Euro-zone economic and credit conditions worsen, we expect global trade dislocations to reverberate; this will likely impact China and the rest of Asia on a large scale. Problems in the Euro-zone could take place simultaneously with China’s need to address their own credit bubble and economic imbalances. As we’ve been discussing for almost a year, China has been the main driver of global growth through a massive stimulus phase that fostered unsustainably high fixed investment levels. This has created a severe imbalance between fixed investment and consumption in China that will likely require much slower GDP growth to rebalance. According to analysis by Michael Pettis, even if consumption growth averages 7-8%, a rebalancing of investment vs. consumption implies overall real GDP growth for China averaging not much more than 3% annually over the rest of the decade. A slowing of the investment boom in China, while difficult to time, is mathematically inevitable. Many emerging market countries and even US based companies have enjoyed huge profit growth that was directly tied to the China story. This means that the countries and companies who benefited greatly from China’s investment and infrastructure boom, notably those that are capital intensive or tied to industrial commodities, are at risk of a severe downturn. This assumes that China is able to handle its own credit and housing bubble, which could also be called into question once the slowdown begins. We view a hard landing in China as defined not by negative growth, but by subpar real growth. We believe this scenario is very likely, especially given credit strains and elevated inflation levels throughout Asia.

When considering the problems facing the Euro-zone, China, and the potential impact on emerging markets, we have become increasingly optimistic about the future for the United States within the global economy. Europe is a collection of insolvent nations that must come together to avert disaster. However, the opposite is occurring. China has severe imbalances that are the responsibility of a small political committee censoring a nation of very low per capita wealth. Emerging markets live largely off of the successes of Europe and China. While the U.S. has the tools to fix our own problems, Americans must be willing to accept some pain. We are optimistic the U.S. will eventually come out of this better than we went into it and the U.S. economy will greatly outperform on a relative basis in the long run. However, this is not necessarily a positive for broad U.S. markets due to global market correlation and the initial pain needed to tackle our own debt problems. U.S. equity markets have also become heavily dependent on current record profit margins, a declining U.S. dollar, and foreign sources of earnings growth. The positive impact of direct government subsidies on economic growth, corporate margins, and cost of capital will prove to be transitory, unsustainable, and likely costly for many investors. U.S. companies that were leveraged to the China miracle could be exposed to significant downturns. Broadly speaking, U.S. equities are not cheap based on normalized fundamentals and most U.S. bonds are completely unattractive long-term. Most alarming is the massive capital flows into bond funds and bond ETFs. This is coming at a time when Wall Street dealer balance sheets have been shrinking significantly, which should be a red flag for significant liquidity concerns when selling becomes necessary. When viewing the overall environment for asset allocation and highly correlated price movements, the task of a financial advisor could not be more challenging.

We firmly believe managing money in this environment needs to take into account the idea that the risk of loss has been conditioned out of most investors’ thought and risk management processes. The overall positioning of both of our Funds is driven largely by the bottoms-up analysis and security selection of our managers, but it also contemplates the environment outlined above. There is an obsession with short-term relative returns and it is resulting in passive asset allocation strategies that are fully invested and very crowded; investors are all competing for the same ideas. This can create significant opportunities for managers like ours, who focus on individual security selection and the mis-pricing of assets. But time and patience are required. Short-term, emotion-driven markets can create a gap between price and value that can remain wide for frustratingly long periods of time; however, price and value eventually converge. We remain committed to our longer-term theses, despite short-term volatility and we are enthusiastic about the potential for a vast re-pricing of risk.

Currently, the Strategies Fund’s positioning continues to seek opportunity and discrepancy in the pricing of high quality vs. high risk companies (measured by price/cash generation and balance sheet strength). The long equity portfolio is skewed largely toward select domestic companies that have stable economic profiles, attractive

4 ABSOLUTE FUNDS

A MESSAGE TO OUR SHAREHOLDERS

valuations, and low sensitivity to cyclical margin pressure. The short equity portfolio leans toward companies where earnings power and valuations are stretched or face significant economic headwinds. These short positions include European financials, China-related growth stories, and select low quality industrial, consumer, and financial stocks in the U.S. Fundamental data and recent earnings reports point out underlying weaknesses and fragile foundations for growth in these businesses. Overlay futures hedges include certain equity indices, Euro currency, and to a lesser extent long-term U.S. Government debt. The Fund also continues to have a large allocation to convertible arbitrage which we believe provides an attractive balance of risk and reward that can also benefit from equity volatility. In other credit, certain tranches of sub-prime mortgage and asset backed debt remain reasonably priced with attractive yields.

As a reminder, the Fund is designed for patient, disciplined investors who are looking for something to preserve capital and provide a diversifying element to a mix of directional asset classes. Given the high sensitivities and correlations across most global asset classes, diversification can be incredibly difficult; we cannot think of a better time to be using our Fund.

Thank you for your investment in our Fund.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

5 ABSOLUTE FUNDS

ABSOLUTE OPPORTUNITIES FUNDA MESSAGE TO OUR SHAREHOLDERS

Dear Shareholder,

We are pleased to present the annual report for the Absolute Opportunities Fund (the “Fund”) for the period ended March 31, 2012. For new readers, the Fund was created as a compliment to the Absolute Strategies Fund to capture a variety of investment opportunities and market inefficiencies. The Fund currently utilizes five managers with highly flexible investment strategies and thus, is intended to have a more concentrated, idiosyncratic risk profile compared to the Strategies Fund. Many of the investment positions are catalyst or event driven and the Fund’s performance has the potential to be a bit lumpier than the Strategies Fund. However, much of the discussion and analysis of the macro-economic and investing climate found in the Strategies Fund letter applies to both Funds. To reiterate our view, we firmly believe managing money in this environment needs to take into account the idea that the risk of loss has been conditioned out of most investors’ thought and risk management processes.

The Fund returned -3.68% for the twelve months ended March 31, 2012, versus 8.54% for the S&P 500 Index and -6.38% for the HFRX Global Hedge Fund Index. Since inception through March 31, the Fund returned 29.92% versus 59.28% for the S&P 500 and 4.39% for the HFRX Index. Additionally the Fund has achieved this performance without taking on significant market risks while having low net exposure to broader equity and credit markets. The Fund’s volatility has been roughly one-fourth that of the S&P 500 and the Fund’s beta has been 0.14, (beta measures the Fund’s sensitivity to the S&P 500). We do anticipate Fund volatility to pick up a bit once new opportunities arise from a re-pricing of risk. Outside of a handful of event-driven and special situation securities, the equity and credit markets currently are not offering a plethora of dramatically cheap, high conviction long prospects. In fact, while much of the Fund’s gains in 2009-2010 resulted from being long distressed, idiosyncratic credit positions, many of the Fund’s more asymmetric opportunities are now actually on the short side in corporate credit.

As of March 31, 2012, 1-year and since inception annualized performance for the Fund was -3.68% and 7.90%, respectively. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance current to the most recent month-end, call the Fund at (888) 992-2765. As stated in the current prospectus, the Fund’s total annual operating expense ratio (gross) is 3.43%. Excluding the effect of expenses attributable to dividends and interest on short sales and acquired fund fees and expenses, the Fund’s total annual operating expense ratio (net) would be 3.00%. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and to reimburse expenses such that total operating expenses do not exceed 2.95% (excluding all interest, taxes, portfolio transaction expenses, dividends and interest on short sales, acquired fund fees and expenses, proxy expenses, and extraordinary expenses), which is in effect until July 31, 2012. Returns include the reinvestments of dividends and capital gains.

The past 12 months was a challenging period for the Absolute Opportunities Fund to deliver a meaningful return. The Fund focuses on security selection, real mis-pricings, and the key attribute that has served the test of time, patience. As such, the Fund may develop high conviction contrarian views from the bottom up. This style of investing has become something of a dinosaur and has been completely out of favor by the crowded, short-term mentality of today’s investors and asset allocators. Risk-on/risk-off investing seems to be driving the thought processes of most money managers over the past couple of years. As discussed in the Absolute Strategies Fund letter, many asset allocators are desperate to create short term performance to appease relative-return focused investors. Neither of our Funds follows such a philosophy and the Opportunities Fund should be viewed as a polar opposite to industry herding. While inactivity during momentum-fueled markets can seem frustrating, these environments are usually short-lived. We are very comfortable with our Fund managers’ exposures and are optimistic about the Fund’s longer-term positioning in an incredibly complex environment.

The Fund’s performance has largely been agnostic to recent market movements and may seem to ignore investor preference for short-term, risk-on rallies. This is exactly what the Fund was designed for. Much of the Fund’s larger long equity positions are in companies that were previously aggressively levered, but have shown meaningful balance sheet improvements and have broken free from restrictive bond or bank covenants. By and large, these

6 ABSOLUTE FUNDS

ABSOLUTE OPPORTUNITIES FUNDA MESSAGE TO OUR SHAREHOLDERS

companies are very cheap and continue to both generate substantial free cash and de-lever as fundamentals improve. However, this bias worked against many of the Fund’s positions during the latest market rally as cash generation, balance sheet quality, and valuation all seemed to take a back seat to momentum. During periods of market momentum, outperforming stocks continued higher and underperformers grinded lower. One of the more enduring features of the markets of late has been that lower-valuation stocks have lagged while high-valuation stocks continue to outperform. As our managers’ preference is to generally seek out “unloved” companies to buy (buying low) and “over-loved” companies to sell or short (selling high), short-term pricing and investor attitudes were simply not in our favor. These periods do not last forever, tend to end unexpectedly, and usually serve as a precursor for eventual mis-pricings. In the meantime, we will heed the words of Oaktree’s Howard Marks: “you simply cannot create investment opportunities when they’re not there…when prices are high, it’s inescapable that prospective returns are low.”

The Fund has a large allocation to specific short positions in investment grade corporate debt, many of which have very low yields and extremely expensive valuations. The manager of this strategy has identified appealing short opportunities in several issuers with cyclical sensitivity to their cash flows, largely in retailing, transportation, leisure and lodging industries. Several of the issuers face meaningful margin pressures with the cost of food, fuel and other commodities becoming increasingly difficult to pass along to cash strapped consumers. Many of these forces are also compounded in certain high yield credits where companies have re-levered their balance sheets at a time when margins have peaked, cash generation has slowed, and costs are rising. Companies whose earnings growth had already benefited from significant cost cutting programs are particularly at risk as fundamentals start to decline. These companies may face substantial headwinds at a time when their low-cost debt needs to be refinanced. The Fund maintains several short credit and short equity positions in these more leveraged companies as well. Shorting credit is highly contrarian and can cause a bit of a performance drag in the short term; however, we believe the longer term risk/reward opportunity is one of the best available in any asset class today.

We believe that bottom-up analysis and focused, idiosyncratic positioning has the potential for superior long-term performance versus crowded, directional asset class investing that appears priced for perfection. As a reminder, the Fund may expose investors to different risks, including highly contrarian views, and should be utilized by patient, long-term investors seeking diversification away from traditional investments.

We have a tremendous amount of conviction in the Absolute Opportunities Fund; however we only market the Fund selectively to patient, disciplined financial advisors and investors. We very much appreciate the advisors who continue to understand how the Fund is different and the contrarian role it can play within an overall portfolio.

Thank you for your investment in our Fund.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

7 ABSOLUTE FUNDS

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2012 (Unaudited)

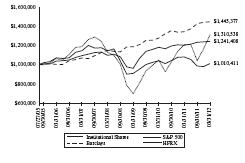

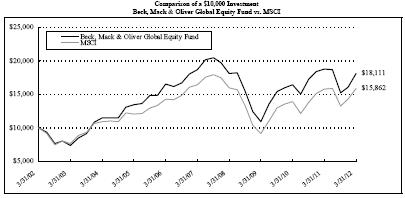

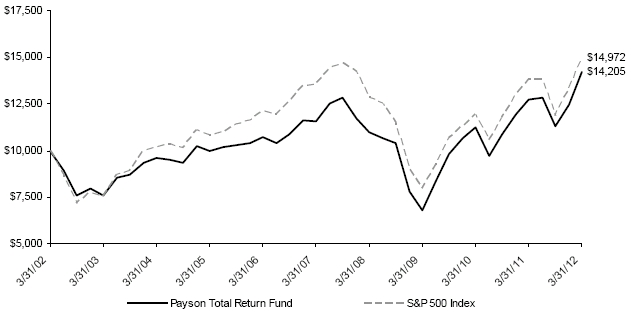

The following charts reflect the change in the value of a hypothetical $1,000,000 investment in Institutional Shares and a $250,000 investment in R Shares, including reinvested dividends and distributions, in the Absolute Strategies Fund (the “Fund”) compared with the performance of the benchmark, S&P 500 Index ("S&P 500"), Barclays Capital U.S. Aggregate Bond Index ("Barclays Index") and the HFRX Global Hedge Fund Index ("HFRX"), since inception. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Barclays Index covers the U.S. dollar-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed while the indices are unmanaged and are not available for investment.

Comparison of Changes in Value of a $1,000,000 Investment

Institutinal Shares vs. S&P 500 Index, Barclays Capital U.S. Aggregate Bond Index

and HFRX Global Hedge Fund Index

| Average Annual Total Return as of 03/31/12 | | One Year | | | Five Years | | | Commencement of Investment Operations 07/27/05 | |

| Absolute Strategies Fund - Institutional Shares | | | 3.36 | % | | | 2.60 | % | | | 3.29 | % |

| S&P 500 Index | | | 8.54 | % | | | 2.01 | % | | | 4.13 | % |

| Barclays Capital U.S. Aggregate Bond Index | | | 7.71 | % | | | 6.25 | % | | | 5.67 | % |

| HFRX Global Hedge Fund Index | | | -6.38 | % | | | -2.46 | % | | | 0.16 | % |

8 ABSOLUTE FUNDS

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2012 (Unaudited)

Comparison of Changes in Value of a $250,000 Investment

R Shares vs. S&P 500 Index, Barclays Capital U.S. Aggregate Bond Index

and HFRX Global Hedge Fund Index

| Average Annual Total Return as of 03/31/12 | | One Year | | | Five Years | | | Commencement of Investment Operations 07/27/05 | |

| Absolute Strategies Fund - R Shares | | | 2.87 | % | | | 2.19 | % | | | 2.89 | % |

| S&P 500 Index | | | 8.54 | % | | | 2.01 | % | | | 4.13 | % |

| Barclays Capital U.S. Aggregate Bond Index | | | 7.71 | % | | | 6.25 | % | | | 5.67 | % |

| HFRX Global Hedge Fund Index | | | -6.38 | % | | | -2.46 | % | | | 0.16 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (888) 992-2765. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Institutional Shares and R Shares are 2.28% and 2.66%, respectively. Excluding the effect of expenses attributable to dividends and interest on short sales and acquired fund fees and expenses, the Fund’s total annual operating expense ratios would be 1.73% and 2.11% for Institutional Shares and R Shares, respectively. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

9 ABSOLUTE FUNDS

ABSOLUTE OPPORTUNITIES FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2012 (Unaudited)

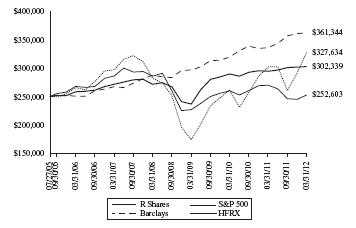

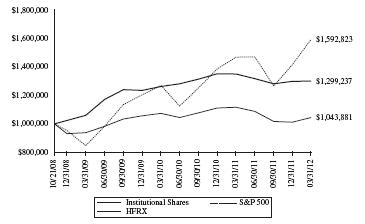

The following chart reflects the change in the value of a hypothetical $1,000,000 investment in Institutional Shares, including reinvested dividends and distributions, in the Absolute Opportunities Fund (the “Fund”) compared with the performance of the benchmark, the S&P 500 Index ("S&P 500") and the HFRX Global Hedge Fund Index ("HFRX"), since inception. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed while the indices are unmanaged and are not available for investment.

Comparison of Changes in Value of a $1,000,000 Investment

Absolute Opportunities Fund vs. S&P 500 Index and HFRX Global Hedge Fund Index

| Average Annual Total Return as of 03/31/12 | | One Year | | | Commencement of Investment Operations 10/21/08 | |

| Absolute Opportunities Fund - Institutional Shares | | | -3.68 | % | | | 7.90 | % |

| S&P 500 Index | | | 8.54 | % | | | 14.49 | % |

| HFRX Global Hedge Fund Index | | | -6.38 | % | | | 1.26 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (888) 992-2765. As stated in the Fund's prospectus, the annual operating expense ratio (gross) is 3.43%. Excluding the effect of expenses attributable to dividends and interest on short sales and acquired fund fees and expenses, the Fund’s total annual operating expense ratio would be 3.00%. However, the Fund's adviser has agreed to contractually waive a portion of its fees and to reimburse expenses such that total operating expenses do not exceed 2.95% (excluding all interest, taxes, portfolio transaction expenses, dividends and interest on short sales, acquired fund fees and expenses, proxy expenses, and extraordinary expenses), which is in effect until July 31, 2012. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

10 ABSOLUTE FUNDS

ABSOLUTE STRATEGIES FUND

PORTFOLIO HOLDINGS SUMMARY (Unaudited)

MARCH 31, 2012

| Portfolio Breakdown (% of Net Assets) |

| Long Positions |

| Equity Securities | | | 41.7 | % |

| Asset Backed Obligations | | | 7.0 | % |

| Corporate Convertible Bonds | | | 18.1 | % |

| Corporate Non-Convertible Bonds | | | 2.2 | % |

| Exchange Traded Notes | | | 0.0 | % |

| Foreign Government Bonds | | | 0.0 | % |

| Interest Only Bonds | | | 0.1 | % |

| Municipal Bonds | | | 0.1 | % |

| Syndicated Loans | | | 0.1 | % |

| U.S. Government & Agency Obligations | | | 2.1 | % |

| Rights | | | 0.0 | % |

| Investment Companies | | | 8.9 | % |

| Short-Term Investments | | | 0.1 | % |

| Purchased Options | | | 1.2 | % |

| Short Positions |

| Equity Securities | | | -37.2 | % |

| Investment Companies | | | -0.8 | % |

| Written Options | | | -0.5 | % |

| Other Assets and Liabilities, Net* | | | 56.9 | % |

| | | | 100.0 | % |

* Consists of deposits with the custodian and/or brokers for securities sold short, cash, foreign currency, prepaid expenses, receivables, payables, and accrued liabilities. Deposits with the custodian and/or brokers for securities sold short represents 38.6% of net assets. See Note 2.

| | (% of Equity Holdings) |

| Sector Breakdown | Long | Short |

| Consumer Discretionary | 24.4% | 20.1% | |

| Consumer Staples | 13.6% | 5.1% | |

| Energy | 6.3% | 4.6% | |

| Financial | 18.1% | 21.7% | |

| Healthcare | 11.6% | 8.3% | |

| Industrial | 5.1% | 18.8% | |

| Information Technology | 11.6% | 11.2% | |

| Materials | 1.6% | 5.1% | |

| Telecommunication Services | 5.8% | 4.3% | |

| Utilities | 1.9% | 0.8% | |

| | 100.0% | 100.0% | |

A

11 ABSOLUTE FUNDS

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2012

| | | Security | | | | | | | | |

| | Shares | | Description | | | | | | | | Value |

| Long Positions - 81.6% | | | | | | | | | | | |

| Equity Securities - 41.7% | | | | | | | | | | | |

| Common Stock - 39.6% | | | | | | | | | | | |

| Consumer Discretionary - 9.9% | | | | | | | | | | | |

| | 69,600 | | Aaron's, Inc. (a) | | | | | | | $ | 1,802,640 |

| | 103,700 | | Aeropostale, Inc. (a)(b) | | | | | | | | 2,241,994 |

| | 22,600 | | Airgas, Inc. (a) | | | | | | | | 2,010,722 |

| | 106,950 | | ANN, Inc. (a)(b) | | | | | | | | 3,063,048 |

| | 203,750 | | Apollo Group, Inc., Class A (a)(b) | | | | | | | | 7,872,900 |

| | 45,900 | | Arctic Cat, Inc. (a)(b) | | | | | | | | 1,965,897 |

| | 6,200 | | AutoZone, Inc. (a)(b) | | | | | | | | 2,305,160 |

| | 32,100 | | Bally Technologies, Inc. (a)(b) | | | | | | | | 1,500,675 |

| | 155,100 | | Bebe Stores, Inc. (a) | | | | | | | | 1,431,573 |

| | 278,400 | | Bed Bath & Beyond, Inc. (a)(b)(c) | | | | | | | | 18,310,368 |

| | 44,092 | | Biglari Holdings, Inc. (a)(b) | | | | | | | | 17,762,462 |

| | 52,000 | | Brinker International, Inc. (a) | | | | | | | | 1,432,600 |

| | 75,600 | | Capella Education Co. (a)(b) | | | | | | | | 2,717,820 |

| | 543,700 | | CarMax, Inc. (a)(b)(c) | | | | | | | | 18,839,205 |

| | 33,900 | | Casey's General Stores, Inc. (a) | | | | | | | | 1,880,094 |

| | 93,700 | | Cash America International, Inc. (a) | | | | | | | | 4,491,041 |

| | 3,500 | | Chipotle Mexican Grill, Inc., Class A (a)(b) | | | | | | | | 1,463,000 |

| | 59,600 | | Coach, Inc. (a) | | | | | | | | 4,605,888 |

| | 24,400 | | Coinstar, Inc. (a)(b) | | | | | | | | 1,550,620 |

| | 300,000 | | Comcast Corp., Special Class A | | | | | | | | 8,853,000 |

| | 141,400 | | Copart, Inc. (a)(b) | | | | | | | | 3,686,298 |

| | 54,300 | | Costco Wholesale Corp. (a)(c) | | | | | | | | 4,930,440 |

| | 638,936 | | CVS Caremark Corp. (a) | | | | | | | | 28,624,333 |

| | 85,100 | | DIRECTV, Class A (a)(b) | | | | | | | | 4,198,834 |

| | 32,000 | | Dollar Tree, Inc. (a)(b) | | | | | | | | 3,023,680 |

| | 37,300 | | Equifax, Inc. (a) | | | | | | | | 1,650,898 |

| | 13,500 | | Fossil, Inc. (a)(b) | | | | | | | | 1,781,730 |

| | 41,800 | | FTI Consulting, Inc. (a)(b) | | | | | | | | 1,568,336 |

| | 39,250 | | Gartner, Inc. (a)(b) | | | | | | | | 1,673,620 |

| | 24,000 | | Google, Inc., Class A (a)(b) | | | | | | | | 15,389,760 |

| | 101,900 | | Grand Canyon Education, Inc. (a)(b) | | | | | | | | 1,809,744 |

| | 350,000 | | H&R Block, Inc. | | | | | | | | 5,764,500 |

| | 68,450 | | IAC/InterActiveCorp. (a) | | | | | | | | 3,360,211 |

| | 175,500 | | Interval Leisure Group, Inc. (a) | | | | | | | | 3,053,700 |

| | 19,000 | | ITT Educational Services, Inc. (a)(b) | | | | | | | | 1,256,660 |

| | 139,700 | | Kirkland's, Inc. (a)(b) | | | | | | | | 2,260,346 |

| | 222,000 | | Kohl's Corp. (a)(c) | | | | | | | | 11,106,660 |

| | 300,000 | | Liberty Media Corp. - Interactive, Class A (b) | | | | | | | | 5,727,000 |

| | 36,000 | | LKQ Corp. (a)(b) | | | | | | | | 1,122,120 |

| | 728,900 | | Lowe's Cos., Inc. (a)(c) | | | | | | | | 22,872,882 |

| | 33,550 | | Ltd. Brands, Inc. (a) | | | | | | | | 1,610,400 |

| | 42,400 | | Mattel, Inc. (a) | | | | | | | | 1,427,184 |

| | 162,000 | | Meritor, Inc. (a)(b) | | | | | | | | 1,307,340 |

| | 118,400 | | Newell Rubbermaid, Inc. (a) | | | | | | | | 2,108,704 |

| | 83,300 | | Papa John's International, Inc. (a)(b) | | | | | | | | 3,137,078 |

| | 362,700 | | PetMed Express, Inc. (a) | | | | | | | | 4,490,226 |

| | 25,000 | | PetSmart, Inc. (a) | | | | | | | | 1,430,500 |

| | | Security | | | | | | | | |

| | Shares | | Description | | | | | | | | Value |

| | 21,100 | | Polaris Industries, Inc. (a) | | | | | | | $ | 1,522,365 |

| | 14,400 | | Ralph Lauren Corp. (a) | | | | | | | | 2,510,352 |

| | 364,400 | | Robert Half International, Inc. (a) | | | | | | | | 11,041,320 |

| | 72,150 | | Rollins, Inc. (a) | | | | | | | | 1,535,352 |

| | 44,700 | | Royal Caribbean Cruises, Ltd. | | | | | | | | 1,315,521 |

| | 42,600 | | Scholastic Corp. (a) | | | | | | | | 1,502,928 |

| | 30,000 | | Starbucks Corp. (a) | | | | | | | | 1,676,700 |

| | 31,100 | | Strayer Education, Inc. (a) | | | | | | | | 2,932,108 |

| | 342,650 | | Target Corp. (a)(c) | | | | | | | | 19,966,215 |

| | 45,000 | | The Cheesecake Factory, Inc. (a)(b) | | | | | | | | 1,322,550 |

| | 106,600 | | The Corporate Executive Board Co. (a) | | | | | | | | 4,584,866 |

| | 227,000 | | The Geo Group, Inc. (a)(b) | | | | | | | | 4,315,270 |

| | 138,400 | | The Goodyear Tire & Rubber Co. (a)(b) | | | | | | | | 1,552,848 |

| | 60,800 | | The Toro Co. (a) | | | | | | | | 4,323,488 |

| | 179,100 | | The Walt Disney Co. (a)(c) | | | | | | | | 7,840,998 |

| | 136,500 | | Total System Services, Inc. (a) | | | | | | | | 3,149,055 |

| | 160,000 | | Toyota Industries Corp., ADR | | | | | | | | 4,852,784 |

| | 413,000 | | Viacom, Inc., Class B | | | | | | | | 19,600,980 |

| | 373,200 | | Walgreen Co. (a)(c) | | | | | | | | 12,498,468 |

| | 501,000 | | Wal-Mart Stores, Inc. (a)(c) | | | | | | | | 30,661,200 |

| | 203,200 | | Websense, Inc. (a)(b) | | | | | | | | 4,285,488 |

| | 7,500 | | WW Grainger, Inc. (a) | | | | | | | | 1,611,075 |

| | 98,500 | | Wyndham Worldwide Corp. (a) | | | | | | | | 4,581,235 |

| | | | | | | | | | | | 395,657,057 |

| | | | | | | | | | | | |

| Consumer Staples - 5.6% | | | | | | | | | | | |

| | 1,337,300 | | Allos Therapeutics, Inc. (a)(b) | | | | | | | | 1,979,204 |

| | 110,800 | | Amedisys, Inc. (a)(b) | | | | | | | | 1,602,168 |

| | 41,300 | | Arbitron, Inc. (a) | | | | | | | | 1,527,274 |

| | 400,000 | | Avon Products, Inc. | | | | | | | | 7,744,000 |

| | 33,200 | | Cal-Maine Foods, Inc. (a) | | | | | | | | 1,270,232 |

| | 454,000 | | Campbell Soup Co. (a) | | | | | | | | 15,367,900 |

| | 108,500 | | Clorox Co. (a) | | | | | | | | 7,459,375 |

| | 31,900 | | Cyberonics, Inc. (a)(b) | | | | | | | | 1,216,347 |

| | 56,200 | | Deluxe Corp. (a) | | | | | | | | 1,316,204 |

| | 37,600 | | DENTSPLY International, Inc. (a) | | | | | | | | 1,508,888 |

| | 39,050 | | Dr. Pepper Snapple Group, Inc. (a) | | | | | | | | 1,570,201 |

| | 26,650 | | Herbalife, Ltd. (a) | | | | | | | | 1,834,053 |

| | 36,450 | | Hormel Foods Corp. (a) | | | | | | | | 1,076,004 |

| | 41,800 | | Iron Mountain, Inc. (a) | | | | | | | | 1,203,840 |

| | 12,400 | | Kimberly-Clark Corp. (a) | | | | | | | | 916,236 |

| | 125,000 | | Kraft Foods, Inc., Class A | | | | | | | | 4,751,250 |

| | 25,050 | | Lorillard, Inc. (a) | | | | | | | | 3,243,474 |

| | 275,000 | | Molson Coors Brewing Co., Class B | | | | | | | | 12,443,750 |

| | 596,000 | | PepsiCo, Inc. (a) | | | | | | | | 39,544,600 |

| | 177,000 | | QLT, Inc. (a)(b) | | | | | | | | 1,239,000 |

| | 81,150 | | Sara Lee Corp. (a) | | | | | | | | 1,747,159 |

| | 835,000 | | Sysco Corp. | | | | | | | | 24,933,100 |

| | 200,000 | | The Coca-Cola Co. (c) | | | | | | | | 14,802,000 |

| | 15,600 | | The Hershey Co. (a) | | | | | | | | 956,748 |

| | 885,000 | | The Procter & Gamble Co. (a) | | | | | | | | 59,480,850 |

| | 600,000 | | The Western Union Co. | | | | | | | | 10,560,000 |

| | 18,150 | | Tupperware Brands Corp. (a) | | | | | | | | 1,152,525 |

| | | | | | | | | | | | 222,446,382 |

See Notes to Financial Statements. 12 ABSOLUTE FUNDS

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2012

| | Shares | | Security Description | | | | | | | | Value |

Energy - 2.3% | | | | | | | | | | | |

| | 28,600 | | Cabot Oil & Gas Corp. (a) | | | | | | | $ | 891,462 |

| | 216,200 | | ConocoPhillips (a) | | | | | | | | 16,433,362 |

| | 19,550 | | EQT Corp. (a) | | | | | | | | 942,506 |

| | 152,800 | | Exxon Mobil Corp. (a) | | | | | | | | 13,252,344 |

| | 229,500 | | Gran Tierra Energy, Inc. (a)(b) | | | | | | | | 1,443,555 |

| | 67,800 | | Gulf Island Fabrication, Inc. (a) | | | | | | | | 1,984,506 |

| | 30,800 | | Hess Corp. (a) | | | | | | | | 1,815,660 |

| | 39,550 | | HollyFrontier Corp. (a) | | | | | | | | 1,271,533 |

| | 73,600 | | Marathon Oil Corp. (a) | | | | | | | | 2,333,120 |

| | 36,800 | | Marathon Petroleum Corp. (a) | | | | | | | | 1,595,648 |

| | 142,100 | | Matrix Service Co. (a)(b) | | | | | | | | 1,990,821 |

| | 72,500 | | Murphy Oil Corp. (a) | | | | | | | | 4,079,575 |

| | 51,100 | | Oceaneering International, Inc. (a) | | | | | | | | 2,753,779 |

| | 225,700 | | Patterson-UTI Energy, Inc. (a) | | | | | | | | 3,902,353 |

| | 11,300 | | Pioneer Natural Resources Co. (a) | | | | | | | | 1,260,967 |

| | 18,250 | | SM Energy Co. (a) | | | | | | | | 1,291,552 |

| | 275,000 | | Spectra Energy Corp. | | | | | | | | 8,676,250 |

| | 113,500 | | Sunoco, Inc. (a) | | | | | | | | 4,330,025 |

| | 55,800 | | Tesoro Corp. (a)(b) | | | | | | | | 1,497,672 |

| | 154,900 | | Tetra Technologies, Inc. (a)(b) | | | | | | | | 1,459,158 |

| | 175,000 | | Total SA, ADR | | | | | | | | 8,946,000 |

| | 53,100 | | Unit Corp. (a)(b) | | | | | | | | 2,270,556 |

| | 294,300 | | Vaalco Energy, Inc. (a)(b) | | | | | | | | 2,781,135 |

| | 159,500 | | Valero Energy Corp. (a) | | | | | | | | 4,110,315 |

| | | | | | | | | | | | 91,313,854 |

| Financial - 6.6% | | | | | | | | | | | |

| | 284,500 | | American Express Co. (a) | | | | | | | | 16,461,170 |

| | 26,200 | | American Tower Corp. REIT (a) | | | | | | | | 1,651,124 |

| | 63,100 | | Aon PLC (a) | | | | | | | | 3,095,686 |

| | 57,250 | | Apartment Investment & Management Co., Class A REIT (a) | | | | | | | | 1,511,972 |

| | 180,500 | | Artio Global Investors, Inc. (a) | | | | | | | | 860,985 |

| | 165,900 | | Banco Latinoamericano de Comerico Exterior SA, Class E (a) | | | | | | | | 3,502,149 |

| | 447,000 | | Bancorp, Inc. (b) | | | | | | | | 4,487,880 |

| | 144 | | Berkshire Hathaway, Inc., Class A (a)(b) | | | | | | | | 17,553,600 |

| | 262,600 | | Berkshire Hathaway, Inc., Class B (a)(b)(c) | | | | | | | | 21,309,990 |

| | 134,600 | | Boston Private Financial Holdings, Inc. (a) | | | | | | | | 1,333,886 |

| | 166,400 | | Capitol Federal Financial, Inc. (a) | | | | | | | | 1,973,504 |

| | 36,700 | | Cardinal Health, Inc. (a) | | | | | | | | 1,582,137 |

| | 79,300 | | Chemical Financial Corp. (a) | | | | | | | | 1,858,792 |

| | 39,300 | | City Holding Co. (a) | | | | | | | | 1,364,496 |

| | 11,000 | | CME Group, Inc. (a) | | | | | | | | 3,182,630 |

| | 93,800 | | Columbia Banking System, Inc. (a) | | | | | | | | 2,136,764 |

| | 31,200 | | Coventry Health Care, Inc. (a) | | | | | | | | 1,109,784 |

| | 34,800 | | Erie Indemnity Co., Class A (a) | | | | | | | | 2,712,312 |

| | 470 | | Fairfax Financial Holdings, Ltd. | | | | | | | | 189,217 |

| | 113,400 | | Fifth Third Bancorp (a) | | | | | | | | 1,593,270 |

| | 7,500 | | First Citizens BancShares, Inc., Class A (a) | | | | | | | | 1,370,175 |

| | | | | | | | | | | |

| | | | Security | | | | | | | | |

| | Shares | | Description | | | | | | | | Value |

| | 108,330 | | Franklin Resources, Inc. (a) | | | | | | | $ | 13,436,170 |

| | 22,300 | | Global Payments, Inc. (a)(d) | | | | | | | | 1,058,581 |

| | 31,100 | | Greenhill & Co., Inc. (a) | | | | | | | | 1,357,204 |

| | 152,700 | | Health Net, Inc. (a)(b) | | | | | | | | 6,065,244 |

| | 398,600 | | Huntington Bancshares, Inc. (a) | | | | | | | | 2,570,970 |

| | 106,200 | | Interactive Brokers Group, Inc., Class A (a) | | | | | | | | 1,805,400 |

| | 190,650 | | International Bancshares Corp. (a) | | | | | | | | 4,032,247 |

| | 179,300 | | Janus Capital Group, Inc. (a) | | | | | | | | 1,597,563 |

| | 335,300 | | KeyCorp (a) | | | | | | | | 2,850,050 |

| | 66,300 | | Lincoln National Corp. (a) | | | | | | | | 1,747,668 |

| | 21,400 | | Markel Corp. (b) | | | | | | | | 9,607,316 |

| | 75,300 | | Moody's Corp. (a) | | | | | | | | 3,170,130 |

| | 101,600 | | National Financial Partners Corp. (a)(b) | | | | | | | | 1,538,224 |

| | 52,600 | | National Health Investors, Inc. REIT (a) | | | | | | | | 2,565,828 |

| | 262,100 | | Net 1 UEPS Technologies, Inc. (a)(b) | | | | | | | | 2,369,384 |

| | 162,100 | | Oritani Financial Corp. (a) | | | | | | | | 2,379,628 |

| | 325,000 | | Paychex, Inc. | | | | | | | | 10,071,750 |

| | 414,170 | | PrivateBancorp, Inc. (a) | | | | | | | | 6,282,959 |

| | 20,400 | | PS Business Parks, Inc. REIT (a) | | | | | | | | 1,337,016 |

| | 11,800 | | Public Storage REIT (a) | | | | | | | | 1,630,406 |

| | 200,000 | | Resource America, Inc., Class A | | | | | | | | 1,262,000 |

| | 39,000 | | SunTrust Banks, Inc. (a) | | | | | | | | 942,630 |

| | 42,000 | | T. Rowe Price Group, Inc. (a) | | | | | | | | 2,742,600 |

| | 587,600 | | The Bank of New York Mellon Corp. (a)(c) | | | | | | | | 14,178,788 |

| | 111,800 | | The Goldman Sachs Group, Inc. (a) | | | | | | | | 13,904,566 |

| | 38,200 | | The Hanover Insurance Group, Inc. (a) | | | | | | | | 1,570,784 |

| | 30,350 | | The Macerich Co. REIT (a) | | | | | | | | 1,752,712 |

| | 71,250 | | The Progressive Corp. (a) | | | | | | | | 1,651,575 |

| | 72,500 | | The Travelers Cos., Inc. (a) | | | | | | | | 4,292,000 |

| | 51,450 | | UDR, Inc. REIT (a) | | | | | | | | 1,374,230 |

| | 28,350 | | Ventas, Inc. REIT (a) | | | | | | | | 1,618,785 |

| | 13,000 | | Visa, Inc., Class A (a) | | | | | | | | 1,534,000 |

| | 196,700 | | Washington Federal, Inc. (a) | | | | | | | | 3,308,494 |

| | 865,650 | | Wells Fargo & Co. (a) | | | | | | | | 29,553,291 |

| | 200,000 | | Weyerhaeuser Co. REIT | | | | | | | | 4,384,000 |

| | 275,000 | | WR Berkley Corp. | | | | | | | | 9,933,000 |

| | | | | | | | | | | | 262,318,716 |

| Healthcare - 4.6% | | | | | | | | | | | |

| | 42,000 | | Abbott Laboratories (a) | | | | | | | | 2,574,180 |

| | 123,950 | | Aetna, Inc. (a) | | | | | | | | 6,217,332 |

| | 17,200 | | Alexion Pharmaceuticals, Inc. (a)(b) | | | | | | | | 1,597,192 |

| | 119,900 | | AMAG Pharmaceuticals, Inc. (a)(b) | | | | | | | | 1,910,007 |

| | 95,350 | | AmerisourceBergen Corp. (a) | | | | | | | | 3,783,488 |

| | 363,150 | | Becton Dickinson and Co. (a) | | | | | | | | 28,198,597 |

| | 23,400 | | Cerner Corp. (a)(b) | | | | | | | | 1,782,144 |

| | 97,100 | | Charles River Laboratories International, Inc. (a)(b) | | | | | | | | 3,504,339 |

| | 141,300 | | Community Health Systems, Inc. (a)(b) | | | | | | | | 3,142,512 |

| | 26,750 | | Covidien PLC (a) | | | | | | | | 1,462,690 |

| | 110,000 | | CR Bard, Inc. | | | | | | | | 10,859,200 |

See Notes to Financial Statements. 13 ABSOLUTE FUNDS

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2012

| | | | | | | | | | | |

| | | | Security | | | | | | | | |

| | Shares | | Description | | | | | | | | Value |

| | 16,000 | | Henry Schein, Inc. (a)(b) | | | | | | | $ | 1,210,880 |

| | 78,400 | | Hill-Rom Holdings, Inc. (a) | | | | | | | | 2,619,344 |

| | 2,900 | | Intuitive Surgical, Inc. (a)(b) | | | | | | | | 1,571,075 |

| | 438,600 | | Johnson & Johnson (a) | | | | | | | | 28,930,056 |

| | 19,700 | | Kensey Nash Corp. (a) | | | | | | | | 576,422 |

| | 75,600 | | Magellan Health Services, Inc. (a)(b) | | | | | | | | 3,690,036 |

| | 300,000 | | Medtronic, Inc. | | | | | | | | 11,757,000 |

| | 117,400 | | Myriad Genetics, Inc. (a)(b) | | | | | | | | 2,777,684 |

| | 205,800 | | Nordion, Inc. (a) | | | | | | | | 2,000,376 |

| | 230,000 | | Novartis AG, ADR | | | | | | | | 12,744,300 |

| | 500,000 | | Pfizer, Inc. | | | | | | | | 11,330,000 |

| | 76,000 | | Quest Diagnostics, Inc. (a) | | | | | | | | 4,647,400 |

| | 159,300 | | St. Jude Medical, Inc. (a)(c) | | | | | | | | 7,058,583 |

| | 145,000 | | Stryker Corp. | | | | | | | | 8,044,600 |

| | 242,400 | | Tenet Healthcare Corp. (a)(b) | | | | | | | | 1,287,144 |

| | 117,350 | | Thoratec Corp. (a)(b) | | | | | | | | 3,955,869 |

| | 73,500 | | Triple-S Management Corp., Class B (a)(b) | | | | | | | | 1,697,850 |

| | 87,500 | | UnitedHealth Group, Inc. | | | | | | | | 5,157,250 |

| | 116,700 | | Warner Chilcott PLC, Class A (a)(b) | | | | | | | | 1,961,727 |

| | 58,050 | | WellPoint, Inc. (a) | | | | | | | | 4,284,090 |

| | 181,000 | | XenoPort, Inc. (a)(b) | | | | | | | | 814,500 |

| | | | | | | | | | | | 183,147,867 |

| Industrial - 2.1% | | | | | | | | | | | |

| | 24,200 | | Acuity Brands, Inc. (a) | | | | | | | | 1,520,486 |

| | 28,500 | | Agilent Technologies, Inc. (a) | | | | | | | | 1,268,535 |

| | 37,900 | | Alliant Techsystems, Inc. (a) | | | | | | | | 1,899,548 |

| | 11,600 | | Amerco, Inc. (a) | | | | | | | | 1,223,916 |

| | 32,700 | | Analogic Corp. (a) | | | | | | | | 2,208,558 |

| | 217,300 | | Apogee Enterprises, Inc. (a) | | | | | | | | 2,814,035 |

| | 30,300 | | Applied Industrial Technologies, Inc. (a) | | | | | | | | 1,246,239 |

| | 18,000 | | BE Aerospace, Inc. (a)(b) | | | | | | | | 836,460 |

| | 307,852 | | Cemex SAB de CV, ADR (a)(b) | | | | | | | | 2,388,935 |

| | 35,500 | | Chicago Bridge & Iron Co. NV (a) | | | | | | | | 1,533,245 |

| | 25,500 | | Crane Co. (a) | | | | | | | | 1,236,750 |

| | 11,500 | | Cummins, Inc. (a) | | | | | | | | 1,380,460 |

| | 149,800 | | Delta Air Lines, Inc. (a)(b) | | | | | | | | 1,484,518 |

| | 20,000 | | Dover Corp. (a) | | | | | | | | 1,258,800 |

| | 28,600 | | Fluor Corp. (a) | | | | | | | | 1,717,144 |

| | 82,800 | | Foster Wheeler AG (a)(b) | | | | | | | | 1,884,528 |

| | 27,450 | | Graco, Inc. (a) | | | | | | | | 1,456,497 |

| | 19,750 | | Hubbell, Inc., Class B (a) | | | | | | | | 1,551,955 |

| | 61,000 | | Jabil Circuit, Inc. (a) | | | | | | | | 1,532,320 |

| | 48,700 | | JB Hunt Transport Services, Inc. (a) | | | | | | | | 2,647,819 |

| | 347 | | Kansas City Southern (a)(b) | | | | | | | | 24,876 |

| | 15,000 | | Lockheed Martin Corp. (a) | | | | | | | | 1,347,900 |

| | 5,800 | | Mettler-Toledo International, Inc. (a)(b) | | | | | | | | 1,071,550 |

| | 38,700 | | Mine Safety Appliances Co. (a) | | | | | | | | 1,589,796 |

| | 178,200 | | Myers Industries, Inc. (a) | | | | | | | | 2,628,450 |

| | 48,800 | | Northrop Grumman Corp. (a) | | | | | | | | 2,980,704 |

| | 56,300 | | Packaging Corp. of America (a) | | | | | | | | 1,665,917 |

| | 59,350 | | Raytheon Co. (a) | | | | | | | | 3,132,493 |

| | 35,768 | | Rock-Tenn Co., Class A (a) | | | | | | | | 2,416,486 |

| | | | | | | | | | | |

| | | | Security | | | | | | | | |

| | Shares | | Description | | | | | | | | Value |

| | 232,400 | | SAIC, Inc. (a) | | | | | | | $ | 3,067,680 |

| | 34,200 | | Sturm Ruger & Co., Inc. (a) | | | | | | | | 1,679,220 |

| | 164,800 | | The Boeing Co. (a)(c) | | | | | | | | 12,256,176 |

| | 98,050 | | United Parcel Service, Inc., Class B (a) | | | | | | | | 7,914,596 |

| | 44,600 | | URS Corp. (a) | | | | | | | | 1,896,392 |

| | 540 | | USG Corp. (a)(b)(c) | | | | | | | | 9,288 |

| | 37,250 | | Waste Connections, Inc. (a) | | | | | | | | 1,211,743 |

| | 47,000 | | Werner Enterprises, Inc. (a) | | | | | | | | 1,168,420 |

| | 125,000 | | Xylem, Inc. | | | | | | | | 3,468,750 |

| | | | | | | | | | | | 82,621,185 |

| Information Technology - 4.8% | | | | | | | | | | | |

| | 210,600 | | Accenture PLC, Class A (a)(c) | | | | | | | | 13,583,700 |

| | 327,200 | | Activision Blizzard, Inc. (a) | | | | | | | | 4,194,704 |

| | 244,100 | | Actuate Corp. (a)(b) | | | | | | | | 1,532,948 |

| | 63,700 | | Adobe Systems, Inc. (a)(b) | | | | | | | | 2,185,547 |

| | 164,800 | | Amtech Systems, Inc. (a)(b) | | | | | | | | 1,372,784 |

| | 43,400 | | Apple, Inc. (a)(b)(e) | | | | | | | | 26,016,998 |

| | 233,400 | | Automatic Data Processing, Inc. (a) | | | | | | | | 12,881,346 |

| | 34,100 | | Avago Technologies, Ltd. (a) | | | | | | | | 1,328,877 |

| | 101,300 | | BMC Software, Inc. (a)(b) | | | | | | | | 4,068,208 |

| | 163,700 | | CA, Inc. (a) | | | | | | | | 4,511,572 |

| | 70,700 | | CACI International, Inc., Class A (a)(b) | | | | | | | | 4,403,903 |

| | 45,500 | | Computer Sciences Corp. (a) | | | | | | | | 1,362,270 |

| | 340,000 | | Corning, Inc. | | | | | | | | 4,787,200 |

| | 29,150 | | DST Systems, Inc. (a) | | | | | | | | 1,580,805 |

| | 154,050 | | Electronic Arts, Inc. (a)(b) | | | | | | | | 2,538,744 |

| | 134,300 | | EPIQ Systems, Inc. (a) | | | | | | | | 1,625,030 |

| | 40,100 | | Fair Isaac Corp. (a) | | | | | | | | 1,760,390 |

| | 310,000 | | Hewlett-Packard Co. | | | | | | | | 7,387,300 |

| | 29,000 | | Intuit, Inc. (a) | | | | | | | | 1,743,770 |

| | 25,700 | | KLA-Tencor Corp. (a) | | | | | | | | 1,398,594 |

| | 526,700 | | LSI Corp. (a)(b) | | | | | | | | 4,571,756 |

| | 31,850 | | MICROS Systems, Inc. (a)(b) | | | | | | | | 1,760,986 |

| | 1,475,000 | | Microsoft Corp. | | | | | | | | 47,568,750 |

| | 123,300 | | Monolithic Power Systems, Inc. (a)(b) | | | | | | | | 2,425,311 |

| | 41,600 | | Nuance Communications, Inc. (a)(b) | | | | | | | | 1,064,128 |

| | 47,000 | | Parametric Technology Corp. (a)(b) | | | | | | | | 1,313,180 |

| | 40,000 | | QUALCOMM, Inc. (a) | | | | | | | | 2,720,800 |

| | 185,300 | | Quest Software, Inc. (a)(b) | | | | | | | | 4,311,931 |

| | 30,700 | | Red Hat, Inc. (a)(b) | | | | | | | | 1,838,623 |

| | 280,000 | | Research In Motion, Ltd. (b) | | | | | | | | 4,118,800 |

| | 46,000 | | Silicon Laboratories, Inc. (a)(b) | | | | | | | | 1,978,000 |

| | 254,500 | | Symantec Corp. (a)(b) | | | | | | | | 4,759,150 |

| | 32,600 | | Tyler Technologies, Inc. (a)(b) | | | | | | | | 1,252,166 |

| | 128,400 | | Unisys Corp. (a)(b) | | | | | | | | 2,532,048 |

| | 798,000 | | United Online, Inc. (a) | | | | | | | | 3,902,220 |

| | 53,500 | | VeriSign, Inc. (a) | | | | | | | | 2,051,190 |

| | 80,650 | | Xerox Corp. (a) | | | | | | | | 651,652 |

| | 207,600 | | Xyratex, Ltd. (a) | | | | | | | | 3,302,916 |

| | | | | | | | | | | | 192,388,297 |

| | | | | | | | | | | |

See Notes to Financial Statements. 14 ABSOLUTE FUNDS

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2012

| | | | Security | | | | | | | | |

| | Shares | | Description | | | | | | | | Value |

| Materials - 0.6% | | | | | | | | | | | |

| | 74,400 | | A Schulman, Inc. (a) | | | | | | | $ | 2,010,288 |

| | 34,900 | | Cytec Industries, Inc. (a) | | | | | | | | 2,121,571 |

| | 33,400 | | Eastman Chemical Co. (a) | | | | | | | | 1,726,446 |

| | 56,800 | | Freeport-McMoRan Copper & Gold, Inc. (a) | | | | | | | | 2,160,672 |

| | 53,000 | | H.B. Fuller Co. (a) | | | | | | | | 1,739,990 |

| | 25,600 | | International Flavors & Fragrances, Inc. (a) | | | | | | | | 1,500,160 |

| | 33,100 | | Minerals Technologies, Inc. (a) | | | | | | | | 2,165,071 |

| | 17,700 | | PPG Industries, Inc. (a) | | | | | | | | 1,695,660 |

| | 52,300 | | RPM International, Inc. (a) | | | | | | | | 1,369,737 |

| | 39,600 | | Schweitzer-Mauduit International, Inc. (a) | | | | | | | | 2,734,776 |

| | 21,300 | | Sigma-Aldrich Corp. (a) | | | | | | | | 1,556,178 |

| | 34,450 | | United States Steel Corp. (a) | | | | | | | | 1,011,797 |

| | 65,100 | | Valspar Corp. (a) | | | | | | | | 3,143,679 |

| | | | | | | | | | | | 24,936,025 |

| Telecommunication Services - 2.4% | | | | | | | | | | | |

| | 27,000 | | AMC Networks, Inc., Class A (a)(b) | | | | | | | | 1,205,010 |

| | 136,300 | | Amdocs, Ltd. (a)(b) | | | | | | | | 4,304,354 |

| | 159,200 | | Cbeyond, Inc. (a)(b) | | | | | | | | 1,273,600 |

| | 15,700 | | Charter Communications, Inc., Class A (a)(b) | | | | | | | | 996,165 |

| | 1,000,000 | | Cisco Systems, Inc. | | | | | | | | 21,150,000 |

| | 48,600 | | Comtech Telecommunications Corp. (a) | | | | | | | | 1,583,388 |

| | 22,300 | | Crown Castle International Corp. (a)(b) | | | | | | | | 1,189,482 |

| | 30,300 | | Discovery Communications, Inc., Class A (a)(b) | | | | | | | | 1,533,180 |

| | 14,900 | | F5 Networks, Inc. (a)(b) | | | | | | | | 2,010,904 |

| | 29,400 | | Motorola Solutions, Inc. (a) | | | | | | | | 1,494,402 |

| | 97,100 | | NeuStar, Inc., Class A (a)(b) | | | | | | | | 3,616,975 |

| | 141,700 | | Neutral Tandem, Inc. (a)(b) | | | | | | | | 1,727,323 |

| | 2,400,000 | | News Corp., Class A | | | | | | | | 47,256,000 |

| | 75,600 | | Plantronics, Inc. (a) | | | | | | | | 3,043,656 |

| | 64,200 | | Sycamore Networks, Inc. (a)(b) | | | | | | | | 1,138,908 |

| | 37,600 | | Verizon Communications, Inc. (a) | | | | | | | | 1,437,448 |

| | 161,300 | | XO Group, Inc. (a)(b) | | | | | | | | 1,514,607 |

| | | | | | | | | | | | 96,475,402 |

| Utilities - 0.7% | | | | | | | | | | | |

| | 28,500 | | Alliant Energy Corp. (a) | | | | | | | | 1,234,620 |

| | 63,000 | | Edison International (a) | | | | | | | | 2,678,130 |

| | 68,250 | | Entergy Corp. (a) | | | | | | | | 4,586,400 |

| | 400,000 | | Exelon Corp. | | | | | | | | 15,684,000 |

| | 16,650 | | ITC Holdings Corp. (a) | | | | | | | | 1,281,051 |

| | 78,050 | | Questar Corp. (a) | | | | | | | | 1,503,243 |

| | | | | | | | | | | | 26,967,444 |

| | | | | | | | | | | | |

| Total Common Stock | | | | | | | | | | | |

| (Cost $1,282,122,949) | | | | | | | | | | | 1,578,272,229 |

| | | | | | | | | | | | |

| | | | Security | | | | | | | | |

| | Shares | | Description | | Rate | | | | | | Value |

| Preferred Stock - 2.1% | | | | | | | | | | | |

| | | | | | | | | | | | |

| Consumer Discretionary - 0.2% | | | | | | | | | | | |

| | 20,641 | | Callaway Golf Co., Series B (a) | | 7.50 | % | | | | $ | 2,126,023 |

| | 29,029 | | Newell Financial Trust I (a) | | 5.25 | | | | | | 1,378,878 |

| | 43,669 | | The Goodyear Tire & Rubber Co. (a) | | 5.88 | | | | | | 1,809,207 |

| | 3,622 | | The Interpublic Group of Cos., Inc., Series B (a) | | 5.25 | | | | | | 3,758,730 |

| | | | | | | | | | | | 9,072,838 |

| Consumer Staples - 0.1% | | | | | | | | | | | |

| | 35,751 | | Bunge, Ltd. (a) | | 4.88 | | | | | | 3,592,975 |

| Energy - 0.3% | | | | | | | | | | | |

| | 2,483 | | Chesapeake Energy Corp. (a)(f) | | 5.75 | | | | | | 2,532,660 |

| | 9,496 | | Energy XXI Bermuda, Ltd. (a) | | 5.63 | | | | | | 3,590,675 |

| | 62,936 | | Goodrich Petroleum Corp., Series B (a) | | 5.38 | | | | | | 2,366,394 |

| | 26,079 | | Petroquest Energy, Inc., Series B (a) | | 6.88 | | | | | | 904,615 |

| | 32,696 | | SandRidge Energy, Inc. (a) | | 8.50 | | | | | | 4,016,703 |

| | | | | | | | | | | | 13,411,047 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Financial - 1.0% | | | | | | | | | | | |

| | 205,298 | | 2009 Dole Food Automatic Common Exchange Security Trust (a)(f) | | 7.00 | | | | | | 2,062,608 |

| | 62,932 | | 2010 Swift Mandatory Common Exchange Security Trust (a)(f) | | 6.00 | | | | | | 700,194 |

| | 173,460 | | Alexandria Real Estate Equities, Inc. REIT, Series D (a) | | 7.00 | | | | | | 4,610,567 |

| | 89,153 | | AMG Capital Trust II (a) | | 5.15 | | | | | | 3,828,007 |

| | 51,762 | | Aspen Insurance Holdings, Ltd. (a) | | 5.63 | | | | | | 2,782,725 |

| | 1,507 | | Bank of America Corp., Series L (a) | | 7.25 | | | | | | 1,475,353 |

| | 35,212 | | Forest City Enterprises, Inc., Series A (a) | | 7.00 | | | | | | 1,910,357 |

| | 65,734 | | Health Care REIT, Inc., Series I (a) | | 6.50 | | | | | | 3,436,574 |

| | 35,643 | | KeyCorp, Series A (a) | | 7.75 | | | | | | 4,015,362 |

| | 15,413 | | Lexington Realty Trust, Series C | | 6.50 | | | | | | 673,355 |

| | 51,413 | | MetLife, Inc. (a) | | 5.00 | | | | | | 3,635,927 |

| | 101,296 | | Synovus Financial Corp. (a) | | 8.25 | | | | | | 1,939,818 |

| | 138,235 | | UBS AG (a) | | 9.38 | | | | | | 2,291,936 |

| | 1,375 | | Wells Fargo & Co., Series L | | 7.50 | | | | | | 1,535,463 |

| | 69,709 | | Wintrust Financial Corp. (a) | | 7.50 | | | | | | 3,842,709 |

| | 474 | | Wintrust Financial Corp., Series C (d) | | 5.00 | | | | | | 488,813 |

| | | | | | | | | | | | 39,229,768 |

| Healthcare - 0.2% | | | | | | | | | | | |

| | 7,166 | | Alere, Inc., Series B (a) | | 3.00 | | | | | | 1,727,006 |

| | 70 | | HealthSouth Corp. (a)(f) | | 6.50 | | | | | | 68,968 |

| | 4,324 | | HealthSouth Corp., Series A (a) | | 6.50 | | | | | | 4,260,221 |

| | | | | | | | | | | | |

See Notes to Financial Statements. 15 ABSOLUTE FUNDS

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2012

| | | | Security | | | | | | | | |

| | Shares | | Description | | Rate | | | | | | Value |

| | 59,028 | | Omnicare Capital Trust II, Series B (a) | | 4.00 | % | | | | $ | 2,837,033 |

| | | | | | | | | | | | 8,893,228 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Industrial - 0.1% | | | | | | | | | | | |

| | 67,813 | | Continental Airlines Finance Trust II (a) | | 6.00 | | | | | | 2,335,310 |

| Materials - 0.1% | | | | | | | | | | | |

| | 58,847 | | AngloGold Ashanti Holdings Finance PLC (a) | | 6.00 | | | | | | 2,533,952 |

| Utilities - 0.1% | | | | | | | | | | | |

| | 62,828 | | CenterPoint Energy, Inc. (a)(g) | | 0.47 | | | | | | 2,359,977 |

| | 38,200 | | PPL Corp. (a) | | 9.50 | | | | | | 2,075,788 |

| | | | | | | | | | | | 4,435,765 |

| Total Preferred Stock | | | | | | | | | | | |

| (Cost $78,690,080) | | | | | | | | | | | 83,504,883 |

| | | | | | | | | | | | |

| Total Equity Securities | | | | | | | | | | | |

| (Cost $1,360,813,029) | | | | | | | | | | | 1,661,777,112 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | Security | | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | | | Value |

| | | | | | | | | | | | |

| Fixed Income Securities - 29.7% | | | | | | | | | | | |

| Asset Backed Obligations - 7.0% | | | | | | | | | | | |

| $ | 3,337,000 | | ACE Securities Corp., Series 2006-ASP3 A2C (g) | | 0.39 | % | 06/25/36 | | | $ | 1,447,858 |

| | 1,775,000 | | ACE Securities Corp., Series 2006-HE1 A2D (g) | | 0.54 | | 02/25/36 | | | | 593,327 |

| | 561,852 | | ACE Securities Corp., Series 2007-HE1 A2A (g) | | 0.33 | | 01/25/37 | | | | 160,001 |

| | 125,127 | | Adjustable Rate Mortgage Trust, Series 2005-12 2A1 (a)(g) | | 2.95 | | 03/25/36 | | | | 76,206 |

| | 193,848 | | Adjustable Rate Mortgage Trust, Series 2005-3 8A32 (a)(g) | | 0.56 | | 07/25/35 | | | | 167,292 |

| | 2,154,211 | | Adjustable Rate Mortgage Trust, Series 2006-1 2A1 (g) | | 3.23 | | 03/25/36 | | | | 1,267,918 |

| | 96,695 | | Adjustable Rate Mortgage Trust, Series 2006-1 3A3 (a)(g) | | 5.50 | | 03/25/36 | | | | 62,660 |

| | 3,135,490 | | Adjustable Rate Mortgage Trust, Series 2007-1 5A1 (g) | | 0.39 | | 03/25/37 | | | | 1,503,502 |

| | 1,349,999 | | Aircastle Aircraft Lease Backed Trust, Series 2007-1A G1 (a)(f)(g) | | 0.50 | | 06/14/37 | | | | 1,169,859 |

| | 944,532 | | Alta Wind Holdings, LLC (f) | | 7.00 | | 06/30/35 | | | | 1,020,257 |

| | | | | | | | | | | | |

| | | | Security | | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | | | Value |

| $ | 590,727 | | American Home Mortgage Assets, LLC, Series 2007-4 A2 (g) | | 0.43 | % | 08/25/37 | | | $ | 445,620 |

| | 1,144,000 | | Argent Securities, Inc., Series 2005-W5 A2D (g) | | 0.56 | | 01/25/36 | | | | 425,909 |

| | 1,000,000 | | Asset Backed Funding Certificates, Series 2006-HE1 A2C (g) | | 0.40 | | 01/25/37 | | | | 314,958 |

| | 1,875,000 | | Asset Backed Funding Certificates, Series 2007-NC1 M2 (f)(g) | | 1.49 | | 05/25/37 | | | | 73,952 |

| | 1,500,000 | | Asset Backed Funding Certificates, Series 2007-WMC1 A2B (g) | | 1.24 | | 06/25/37 | | | | 603,817 |

| | 1,315,000 | | Astoria Depositor Corp. (f) | | 8.14 | | 05/01/21 | | | | 1,117,750 |

| | 1,140,000 | | Avalon IV Capital, Ltd., Series 2012-1A C (a)(d)(f)(g) | | 4.39 | | 04/17/23 | | | | 1,093,260 |

| | 953,720 | | AWAS Aviation Capital, Ltd. (f) | | 7.00 | | 10/17/16 | | | | 994,253 |

| | 500,000 | | Axis Equipment Finance Receivables, LLC, Series 2012-1I D (a)(d) | | 5.50 | | 11/20/15 | | | | 427,843 |

| | 500,000 | | Axis Equipment Finance Receivables, LLC, Series 2012-1I E1 (a)(d) | | 6.25 | | 04/20/16 | | | | 411,253 |

| | 550,000 | | Axis Equipment Finance Receivables, LLC, Series 2012-1I E2 (a)(d) | | 7.00 | | 03/20/17 | | | | 414,714 |

| | 1,154,479 | | Babcock & Brown Air Funding I, Ltd., Series 2007-1A G1 (a)(f)(g) | | 0.54 | | 11/14/33 | | | | 969,762 |

| | 333,107 | | Banc of America Alternative Loan Trust, Series 2005-8 2CB1 (a) | | 6.00 | | 09/25/35 | | | | 272,333 |

| | 205,825 | | Banc of America Funding Corp., Series 2005-B 3A1B (a)(g) | | 0.55 | | 04/20/35 | | | | 156,279 |

| | 7,580,000 | | Banc of America Funding Corp., Series 2006-D 1A2 (g) | | 0.52 | | 05/20/36 | | | | 1,731,806 |

| | | | | | | | | | | | |

See Notes to Financial Statements. 16 ABSOLUTE FUNDS

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2012

| | | | Security | | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | | | Value |

| $ | 80,117 | | Banc of America Funding Corp., Series 2006-E 2A1 (a)(g) | | 2.83 | % | 06/20/36 | | | $ | 53,373 |

| | 339,770 | | Banc of America Funding Corp., Series 2006-F 1A1 (a)(g) | | 2.67 | | 07/20/36 | | | | 273,824 |

| | 150,446 | | Banc of America Funding Corp., Series 2006-G 2A3 (a)(g) | | 0.41 | | 07/20/36 | | | | 146,761 |

| | 225,059 | | Banc of America Funding Corp., Series 2006-H 6A1 (g) | | 0.43 | | 10/20/36 | | | | 119,119 |

| | 655,284 | | Banc of America Funding Corp., Series 2007-8 2A1 | | 7.00 | | 10/25/37 | | | | 471,675 |

| | 159,415 | | Banc of America Funding Corp., Series 2007-E 4A1 (g) | | 5.40 | | 07/20/47 | | | | 110,168 |

| | 1,485,000 | | Banc of America Merrill Lynch Commercial Mortgage, Inc., Series 2004-4 A6 (g) | | 4.88 | | 07/10/42 | | | | 1,588,977 |

| | 175,000 | | Banc of America Merrill Lynch Commercial Mortgage, Inc., Series 2005-2 A5 (a)(g) | | 4.86 | | 07/10/43 | | | | 191,589 |

| | 2,320,521 | | Bayview Commercial Asset Trust, Series 2004-3 A1 (a)(f)(g) | | 0.61 | | 01/25/35 | | | | 1,886,427 |

| | 1,225,000 | | Bayview Commercial Asset Trust, Series 2006-SP1 M1 (a)(f)(g) | | 0.69 | | 04/25/36 | | | | 836,287 |

| | 94,138 | | Bayview Financial Acquisition Trust, Series 2005-D AF3 (a)(g) | | 5.50 | | 12/28/35 | | | | 88,710 |

| | 266,764 | | Bear Stearns Adjustable Rate Mortgage Trust, Series 2007-5 1A1 (a)(g) | | 5.20 | | 08/25/47 | | | | 155,417 |

| | 1,254,849 | | Bear Stearns Alt-A Trust, Series 2005-4 21A1 (g) | | 2.85 | | 05/25/35 | | | | 814,600 |