As filed with the Securities and Exchange Commission on August 29, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Stacey E. Hong, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: June 30

Date of reporting period: July 1, 2013 – June 30, 2014

ITEM 1. REPORT TO STOCKHOLDERS.

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

AUXIER FOCUS FUND

PERFORMANCE UPDATE

June 30, 2014

| | ANNUALIZED | |

| | | Inception * | Ten Year | Five Year | Three Year | One Year | |

| | Auxier Focus Fund Investor Class Shares | 7.60% | 7.40% | 13.93% | 10.95% | 15.43% | |

| | S&P 500 Index | 4.20% | 7.78% | 18.83% | 16.58% | 24.61% | |

| | CUMULATIVE | |

| | | Inception * | Ten Year | Five Year | Three Year | One Year | |

| | Auxier Focus Fund Investor Class Shares | 199.54% | 104.15% | 91.92% | 36.60% | 15.43% | |

| | S&P 500 Index | 85.07% | 111.59% | 136.98% | 58.46% | 24.61% | |

| | * Fund inception: July 9, 1999 | | | | | |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s Investor Class Share’s annual operating expense ratio (gross) is 1.28%. The Fund’s adviser has contractually agreed to waive a portion of its fee and/or reimburse Fund expenses to limit total annual operating expenses (excluding all taxes, interest, portfolio transaction expenses, dividend expenses on short sales and extraordinary expenses) to 1.25%, through October 31, 2015. Other share classes may vary. The Fund charges a 2.0% redemption fee on shares redeemed within six months of purchase. For the most recent month-end performance, please call (877)328-9437 or visit the Adviser’s website at www.auxierasset.com. The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future.

Summer 2014 Market Commentary

Auxier Focus Fund returned 3.96% for the second quarter. The Fund’s stockholdings gained 5.46%, outpacing the corresponding returns of 5.23% for Standard and Poor’s 500 Stock Index and 2.83% for the Dow Jones Industrial Average. Foreign stocks comprised about 18% of the Fund portfolio. Note that since inception in 1999, Auxier Focus’ stock exposure has averaged 72%, a much lower risk stance than the S&P 500 and Dow Jones Industrial Average (both 100% invested in stocks). Yet we nonetheless outperformed both indices for the period. A hypothetical $10,000 investment in the Fund on July 9, 1999 through June 30, 2014 would have grown to $29,954. That’s 61% more than the S&P 500’s $18,507 and 39% better than the Dow’s $21,484 for a similar investment.

July 2014 marks the Fund’s 15th anniversary. That period included two 40% market corrections; and the worst recorded ten-year U.S. market returns (1999-2009); and numerous mega-cap financial institutions being wiped out. Since 1999 we have sought to match good markets and outperform in flat and declining markets. The power of compounding is so underappreciated. We strive to keep it going and keep shareholders in the game longer term by identifying, quantifying and minimizing risk. We have over thirty years of experience navigating numerous market downturns, a healthy respect for the extremes in market behavior and a systematic approach based on price and value.

The benefits of such bargain hunting, compounded over decades, are illustrated by a recent James Cullen study. He found that a $1 million investment in the S&P 500 in 1968 grew to $79 million by the end of 2013. Sounds mighty impressive until you learn that $1 million invested in the 20% of the S&P 500 with the lowest price-to-earnings ratio correspondingly multiplied to $578 million, a sixfold return advantage. Yes, it’s difficult to buy the unloved, especially in roaring up markets. History, however, shows that investors consistently overpay to get rich quick. Then they tend to suffer as their portfolio is “torpedoed” by high priced, high expectation momentum stocks that fall short and crash, interrupting the compounding process.

1

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

Reduced Purchasing Power’s Insidious Risk

Those enormous returns reported in Cullen’s study include of course lots of inflation. Over the past 50 years, investors would have needed a sevenfold return just to maintain the purchasing power of their original investment. For example, it would take over 30 years after tax to double your money with a ten-year U.S. Treasury Bond yielding a recent 2.5%.

The Fed’s pro-inflation policies are starting to work. The seeds of inflation are showing up in skilled labor shortages. According to the Department of Labor, more than half of the country’s tradesmen are over 45. Shortages of carpenters, welders, plumbers and cement masons are driving wages and benefits higher. Baby boomers are big travelers and look at the prices of rental cars, airfares, lodging etc. People are demanding better quality food, pushing up costs and prices. Meat prices are soaring. California, one of the biggest producers of agricultural products, is suffering drought in 82% of the state. To stay ahead of inflation, we seek businesses that have stable demand, nominal mandatory capital spending needs, sustainable pricing, high rates of return on capital and excess cash flow. We firmly believe that investors need to seek investments with potential to be double to triple plays over a number of years—not months—to maintain purchasing power while deferring tax burdens. In 1949, the U.S. Treasury ten-year note yield dropped to under 2.8%. The decade following was one of the best in history for stocks, while bonds endured a principal-depleting bear market that continued through 1981.

The Portfolio

So far in 2014 merger activity has accelerated as deals totaling $771 billion have been announced. U.S. corporations are sitting on close to $2 trillion in cash with access to very cheap credit. In past cycles we have benefited as our portfolio typically has companies with attributes attractive to both corporate and private equity buyers. High return businesses sporting high free cash flow yields often become targets. DIRECTV is a recent example. In addition, tax inversions are the current craze. In this maneuver, U.S. companies are buying competitors domiciled in lower tax countries and then moving headquarters to take advantage of the lower tax rates. Fund stockholdings that are impacted include AbbVie, Medtronic and Hospira. Activist investors are also adding positive catalysts to our positions like Pepsico, Bank of New York and Dow Chemical. On the downside, retailers in general continue to suffer from excess supply in retail space and the transition to online shopping.

Fetching Bargains Among Unfashionable Stocks

Looking across the investment spectrum, the plethora of U.S. initial public offerings (IPOs) look overpriced (e.g., biotechs and internet stocks) with many trading over fourteen times sales (versus less than 1.6 times sales for the S&P 500). The proliferation of “covenant lite” bonds adds to the risk in junk bonds. Liquidity in corporate bonds has shrunk so much (by some estimates 70% since 2007) that the Federal Reserve has floated the idea of backend surrender charges levied when you sell bond funds. High quality bonds suffer from the potential for principal loss if rates rise together with the long-term loss of purchasing power. Some bond rates in Europe are at low levels not seen in 300 years. Investors scrambling for yield have bid up shares of electric utilities that suffer from negative cash flows in the face of major capital spending programs. In the 1980s, we enjoyed tremendous bargain opportunities in utility stocks. Many had crashed from cost overruns as the industry embarked on record nuclear power plant construction in an environment of high oil prices. The ratepayers refused to cover the costs and shareholders were hammered, which created outstanding buys.

We continue to believe that the best approach today is to be very selective, flexible and focused on quality businesses that have temporarily fallen out of favor with the investment community. Managements’ capital allocation needs to be monitored closely in higher markets. A recent example of value-added managerial behavior took place with America Movil, run by Carlos Slim and family. The headlines were extremely negative in the midst of a Mexican telecom deregulation. At the same time AT&T was liquidating a multibillion dollar position in America Movil. The Slim family proceeded to step up and buy over $5 billion worth of their stock with family money. They then aggressively started breaking up the Mexican operations.

2

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

This is a family with generations of experience and an outstanding record of deploying capital in times of distress. The bad news had driven the price of the stock to an attractive 11 times earnings. This was a bargain for a proven capital allocator that has consistently reinvested in the business. Molson Coors is another example of a business with heavy family ownership that has endured for centuries and has been quietly executing and innovating in an unexciting industry. We like companies whose leadership has heavy ownership, steadfast focus on building the business and a history of executing for the long term—not in building to sell or in cashing out stock options.

Lessons Learned Over the Fund’s First 15 Years

- Better to focus on the direction of a company’s underlying cash flows than on stated earnings.

- Talk is cheap. Understand the accounting and start with numbers. Promoters come out of the woodwork when rates are low and investors blindly stretch for yield.

- Overpaying and over-borrowing. Both are recurring investment sins that consistently destroy shareholder value.

- Look for skin in the game. Barron’s recently reported that half of U.S. mutual fund managers had zero invested in their funds. The average tenure is less than five years.

- Bigger is not safer. The balance sheet needs to be monitored closely as big firms often employ excessive leverage in good times. In 2008, many of the so called “blue chip” financials were leveraging up over 70 to 1. Banks had some of the best dividends but were built on a foundation of borrowed money.

- There are no shortcuts in risk management. Our daily research commitment strives to increase odds, reduce risk and maintain the compounding process. Price discovery is paramount.

- Humility, a rational temperament and a long-term orientation are crucial to surviving and thriving in the changing auction markets.

We appreciate your trust.

Sincerely,

Jeff Auxier

Fund returns (i) assume the reinvestment of all dividends and capital gain distributions and (ii) would have been lower during the period if certain fees and expenses had not been waived. Performance shown is for the Fund’s Investor Class shares; returns for other share classes will vary. Performance for Investor Class shares for periods prior to December 10, 2004 reflects performance of the applicable share class of Auxier Focus Fund, a series of Unified Series Trust (the “Predecessor Fund”). Prior to January 3, 2003, the Predecessor Fund was a series of Ameriprime Funds. The performance of the Fund’s Investor Class shares for the period prior to December 10, 2004 reflects the expenses of the Predecessor Fund.

The Fund may invest in value and/or growth stocks. Investments in value stocks are subject to risk that their intrinsic value may never be realized and investments in growth stocks may be susceptible to rapid price swings, especially during periods of economic uncertainty. In addition, the Fund may invest in mid-sized companies which generally carry greater risk than is customarily associated with larger companies. Moreover, if the Fund's portfolio is overweighted in a sector, any negative development affecting that sector will have a greater impact on the Fund than a fund that is not overweighted in that sector. An increase in interest rates typically causes a fall in the value of a debt security (Fixed-Income Securities Risk) with corresponding changes to the Fund’s value. Foreign securities are subject to additional risks including international trade, currency, political, regulatory and diplomatic risks

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on 500 widely held common stocks. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. One cannot invest directly in an index or average

Price-to-earnings ratio is a valuation ratio of a company's current share price compared to its per-share earnings.

3

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

The views in this shareholder letter were those of the Fund Manager as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice

4

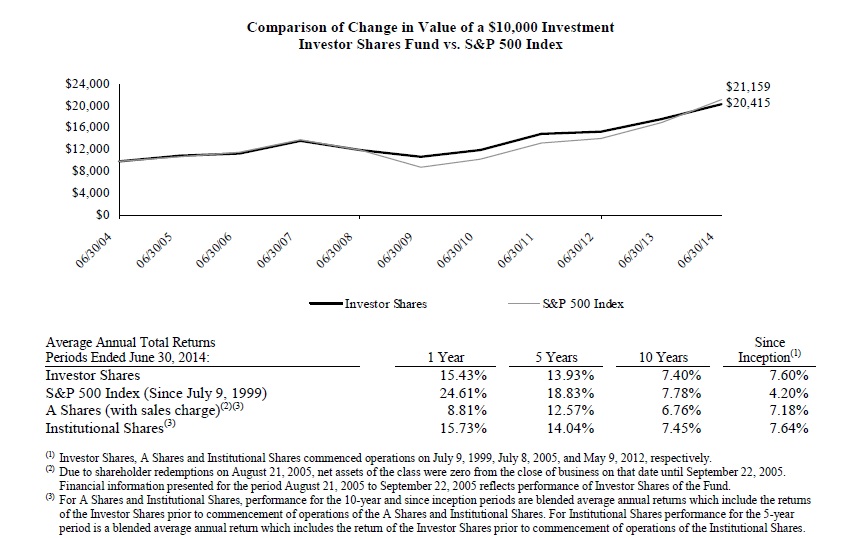

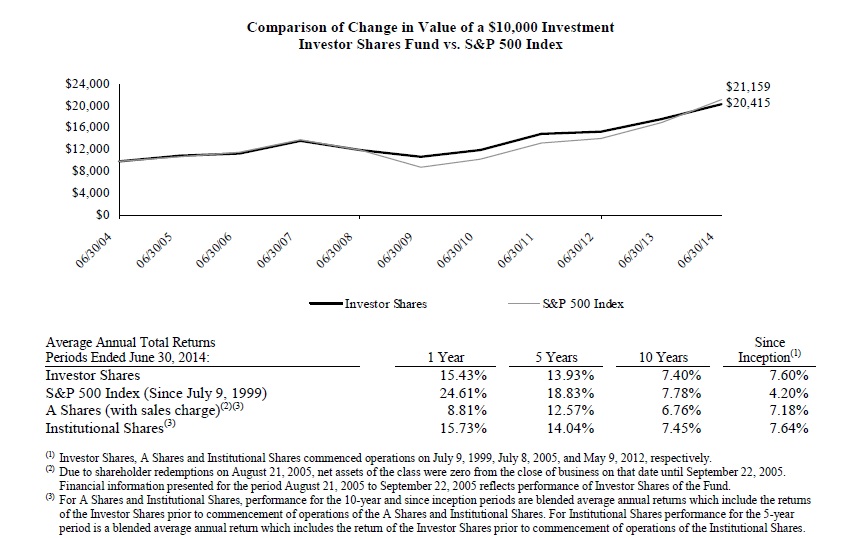

PERFORMANCE CHART AND ANALYSIS (Unaudited)

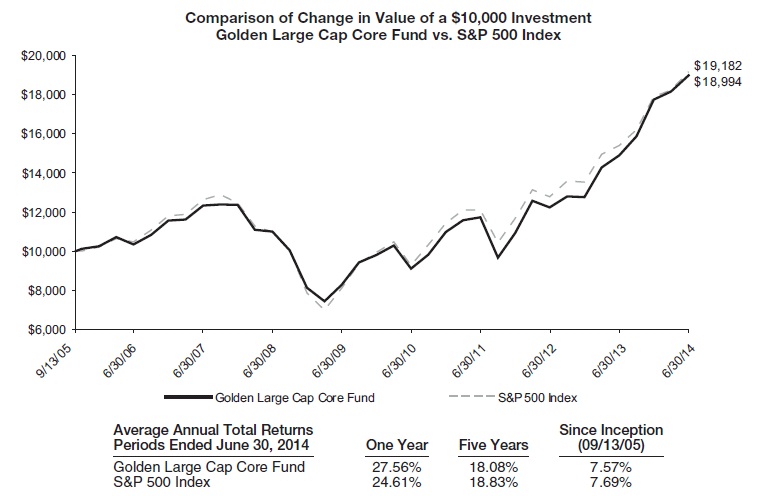

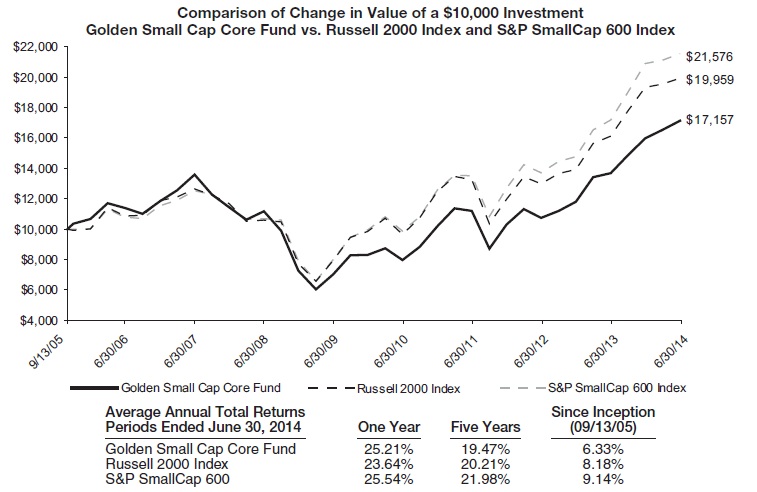

The following chart reflects the change in the value of a hypothetical $10,000 investment in Investor Shares, including reinvested dividends and distributions, in the Fund compared with the performance of the benchmark, the S&P 500 Index ("S&P 500"), over the past ten fiscal years. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The total return of the Fund's classes includes the maximum sales charge of 5.75% (A Shares only) and operating expenses that reduce returns, while the total return of the S&P 500 does not include the effect of sales charges and expenses. A Shares are subject to a 1.00% contingent deferred sales charge on shares purchased without an initial sales charge and redeemed less than one year after purchase. The total return of the S&P 500 includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the S&P 500 does not include expenses. The Fund is professionally managed while the S&P 500 is unmanaged and is not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please visit the website of the Fund's investment adviser at www.auxierasset.com or call (877) 328-9437. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Institutional Shares, Investor Shares and A Shares are 1.55%, 1.28% and 1.62%, respectively. However, the Fund's adviser has contractually agreed to waive a portion of its fees and/or to reimburse expenses to limit total annual fund operating expenses (excluding all taxes, interest, portfolio transaction expenses, dividend expenses on short sales, and extraordinary expenses) to 1.00%, 1.25% and 1.25% for Institutional Shares, Investor Shares and A Shares,respectively through October 31, 2015. Shares redeemed or exchanged within 180 days of purchase will be charged a 2.00% redemption fee. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

Performance for Investor Shares for periods prior to December 10, 2004, reflects performance and expenses of Auxier Focus Fund, a series of Unified Series Trust (the “Predecessor Fund”). Prior to January 3, 2003, the Predecessor Fund was a series of Ameriprime Funds.

5

| Shares | | Security Description | | | | Value | |

| | | | | | | | |

| Common Stock - 90.8% | | | | | | | |

| Communications - 7.2% | | | | | | | |

| | 290,875 | | America Movil SAB de CV, ADR | | | | $ | 6,035,656 | |

| | 23,834 | | Cisco Systems, Inc. | | | | | 592,275 | |

| | 276,750 | | Corning, Inc. | | | | | 6,074,663 | |

| | 15,499 | | DIRECTV (a) | | | | | 1,317,570 | |

| | 1,100 | | eBay, Inc. (a) | | | | | 55,066 | |

| | 388,000 | | Telefonica SA, ADR | | | | | 6,658,080 | |

| | 10,000 | | Twenty-First Century Fox, Inc., Class A | | | | | 351,500 | |

| | 3,000 | | Viacom, Inc., Class B | | | | | 260,190 | |

| | | | | | | | | 21,345,000 | |

| Consumer Discretionary - 11.1% | | | | | | |

| | 132,579 | | Apollo Education Group, Inc. (a) | | | | | 4,143,094 | |

| | 95,150 | | Arcos Dorados Holdings, Inc. | | | | | 1,065,680 | |

| | 39,380 | | Coach, Inc. | | | | | 1,346,402 | |

| | 37,860 | | Comcast Corp., Class A | | | | | 2,032,325 | |

| | 47,694 | | CST Brands, Inc. | | | | | 1,645,443 | |

| | 51,490 | | CVS Caremark Corp. | | | | | 3,880,801 | |

| | 1,547 | | Discovery Communications, Inc., Class A (a) | | | | | 114,911 | |

| | 1,547 | | Discovery Communications, Inc., Class C (a) | | | | | 112,297 | |

| | 13,875 | | General Motors Co. | | | | | 503,663 | |

| | 164,150 | | H&R Block, Inc. | | | | | 5,502,308 | |

| | 249,878 | | Lincoln Educational Services Corp. | | | | | 1,121,952 | |

| | 23,850 | | Lowe's Cos., Inc. | | | | | 1,144,561 | |

| | 10,750 | | McDonald's Corp. | | | | | 1,082,955 | |

| | 3,250 | | Sally Beauty Holdings, Inc. (a) | | | | | 81,510 | |

| | 1,176 | | The Andersons, Inc. | | | | | 60,658 | |

| | 5,725 | | The Home Depot, Inc. | | | | | 463,496 | |

| | 290 | | Time Warner Cable, Inc. | | | | | 42,717 | |

| | 12,650 | | Time Warner, Inc. | | | | | 888,663 | |

| | 6,185 | | Vitamin Shoppe, Inc. (a) | | | | | 266,079 | |

| | 61,000 | | Wal-Mart Stores, Inc. | | | | | 4,579,270 | |

| | 116,102 | | Weight Watchers International, Inc. | | | | | 2,341,777 | |

| | 8,600 | | Yum! Brands, Inc. | | | | | 698,320 | |

| | | | | | | | | 33,118,882 | |

| Consumer Staples - 28.7% | | | | | | | | |

| | 36,600 | | AbbVie, Inc. | | | | | 2,065,704 | |

| | 3,400 | | Alkermes PLC (a) | | | | | 171,122 | |

| | 441,378 | | Alliance One International, Inc. (a) | | | | | 1,103,445 | |

| | 62,500 | | Altria Group, Inc. | | | | | 2,621,250 | |

| | 143,647 | | Avon Products, Inc. | | | | | 2,098,683 | |

| | 19,200 | | Baxter International, Inc. | | | | | 1,388,160 | |

| | 15,100 | | British American Tobacco PLC, ADR | | | | | 1,798,108 | |

| | 13,200 | | Coca-Cola HBC AG, ADR (a) | | | | | 300,300 | |

| | 21,580 | | Community Health Systems, Inc. (a) | | | | | 979,084 | |

| | 54,435 | | ConAgra Foods, Inc. | | | | | 1,615,631 | |

| | 8,785 | | Diageo PLC, ADR | | | | | 1,118,067 | |

| | 35,050 | | Dr. Pepper Snapple Group, Inc. | | | | | 2,053,229 | |

| | 49,228 | | Express Scripts Holding Co. (a) | | | | | 3,412,977 | |

| | 108,258 | | Hospira, Inc. (a) | | | | | 5,561,213 | |

| | 20,100 | | Kelly Services, Inc., Class A | | | | | 345,117 | |

| | 181,832 | | Molson Coors Brewing Co., Class B | | | | | 13,484,661 | |

| | 13,100 | | Monster Beverage Corp. (a) | | | | | 930,493 | |

| | 108,710 | | PepsiCo, Inc. | | | | | 9,712,151 | |

| | 76,400 | | Philip Morris International, Inc. | | | | | 6,441,284 | |

| | 548,921 | | Tesco PLC, ADR | | | | | 8,041,693 | |

| | 66,500 | | The Coca-Cola Co. | | | | | 2,816,940 | |

| | 1,100 | | The JM Smucker Co. | | | | | 117,227 | |

| | 119,084 | | The Kroger Co. | | | | | 5,886,322 | |

| | 45,925 | | The Procter & Gamble Co. | | | | | 3,609,246 | |

| | 215,090 | | The Western Union Co. | | | | | 3,729,661 | |

| | | | | | | | | | |

| Shares | | Security Description | | | | Value | |

| | | | | | | | | | |

| | 96,000 | | Unilever NV, ADR | | | | $ | 4,200,960 | |

| | | | | | | | | 85,602,728 | |

| Energy - 5.4% | | | | | | | | |

| | 10,235 | | Apache Corp. | | | | | 1,029,846 | |

| | 143,710 | | BP PLC, ADR | | | | | 7,580,702 | |

| | 16,750 | | Chevron Corp. | | | | | 2,186,712 | |

| | 15,600 | | ConocoPhillips | | | | | 1,337,388 | |

| | 9,200 | | Exxon Mobil Corp. | | | | | 926,256 | |

| | 800 | | Lukoil OAO, ADR | | | | | 47,856 | |

| | 11,700 | | Petroleo Brasileiro SA, ADR | | | | | 171,171 | |

| | 7,800 | | Phillips 66 | | | | | 627,354 | |

| | 1,100 | | Royal Dutch Shell PLC, ADR | | | | | 90,607 | |

| | 22,550 | | Transocean, Ltd. | | | | | 1,015,427 | |

| | 19,100 | | Valero Energy Corp. | | | | | 956,910 | |

| | | | | | | | | 15,970,229 | |

| Financials - 15.3% | | | | | | | | |

| | 42,250 | | Aflac, Inc. | | | | | 2,630,063 | |

| | 39,000 | | American International Group, Inc. | | | | | 2,128,620 | |

| | 1,280 | | Ameriprise Financial, Inc. | | | | | 153,600 | |

| | 186,683 | | Bank of America Corp. | | | | | 2,869,318 | |

| | 16,000 | | Berkshire Hathaway, Inc., Class B (a) | | | | | 2,024,960 | |

| | 570 | | Capital One Financial Corp. | | | | | 47,082 | |

| | 76,724 | | Central Pacific Financial Corp. | | | | | 1,522,971 | |

| | 23,050 | | Citigroup, Inc. | | | | | 1,085,655 | |

| | 123,593 | | Credit Suisse Group AG, ADR | | | | | 3,506,333 | |

| | 80,175 | | Franklin Resources, Inc. | | | | | 4,637,322 | |

| | 24,900 | | Legg Mason, Inc. | | | | | 1,277,619 | |

| | 51,390 | | Marsh & McLennan Cos., Inc. | | | | | 2,663,030 | |

| | 61,950 | | MasterCard, Inc., Class A | | | | | 4,551,467 | |

| | 12,745 | | Mercury General Corp. | | | | | 599,525 | |

| | 500 | | The Allstate Corp. | | | | | 29,360 | |

| | 227,600 | | The Bank of New York Mellon Corp. | | | | | 8,530,448 | |

| | 38,418 | | The Travelers Cos., Inc. | | | | | 3,613,981 | |

| | 7,350 | | U.S. Bancorp | | | | | 318,402 | |

| | 3,974 | | Unum Group | | | | | 138,136 | |

| | 7,900 | | Visa, Inc., Class A | | | | | 1,664,609 | |

| | 23,000 | | Waddell & Reed Financial, Inc., Class A | | | | | 1,439,570 | |

| | 500 | | Wells Fargo & Co. | | | | | 26,280 | |

| | | | | | | | | 45,458,351 | |

| Health Care - 14.7% | | | | | | | | |

| | 42,600 | | Abbott Laboratories | | | | | 1,742,340 | |

| | 25,700 | | Becton Dickinson and Co. | | | | | 3,040,310 | |

| | 52,725 | | GlaxoSmithKline PLC, ADR | | | | | 2,819,733 | |

| | 50,950 | | Johnson & Johnson | | | | | 5,330,389 | |

| | 1,100 | | Laboratory Corp. of America Holdings (a) | | | | | 112,640 | |

| | 98,153 | | Medtronic, Inc. | | | | | 6,258,235 | |

| | 106,610 | | Merck & Co., Inc. | | | | | 6,167,388 | |

| | 63,782 | | Pfizer, Inc. | | | | | 1,893,050 | |

| | 54,267 | | Quest Diagnostics, Inc. | | | | | 3,184,930 | |

| | 63,674 | | UnitedHealth Group, Inc. | | | | | 5,205,350 | |

| | 27,221 | | WellPoint, Inc. | | | | | 2,929,252 | |

| | 49,400 | | Zimmer Holdings, Inc. | | | | | 5,130,684 | |

| | | | | | | | | 43,814,301 | |

| Industrials - 1.6% | | | | | | | | |

| | 21,550 | | AGCO Corp. | | | | | 1,211,541 | |

| | 22,030 | | Brady Corp., Class A | | | | | 658,036 | |

| | 19,000 | | General Electric Co. | | | | | 499,320 | |

| | 12,500 | | Raytheon Co. | | | | | 1,153,125 | |

| | 3,500 | | Textainer Group Holdings, Ltd. | | | | | 135,170 | |

| | 2,550 | | The Boeing Co. | | | | | 324,436 | |

| | | | | | | | | | |

See Notes to Financial Statements. 6

| Shares | | Security Description | | | | Value | |

| | | | | | | | | | |

| | 8,515 | | United Parcel Service, Inc., Class B | | | | $ | 874,150 | |

| | | | | | | | | 4,855,778 | |

| Information Technology - 3.9% | | | | | | |

| | 52,325 | | Intel Corp. | | | | | 1,616,842 | |

| | 159,114 | | Microsoft Corp. | | | | | 6,635,054 | |

| | 82,320 | | Oracle Corp. | | | | | 3,336,430 | |

| | | | | | | | | 11,588,326 | |

| Materials - 2.4% | | | | | | | | |

| | 28,050 | | E.I. du Pont de Nemours & Co. | | | | | 1,835,592 | |

| | 7,000 | | LyondellBasell Industries NV, Class A | | | | | 683,550 | |

| | 19,175 | | Newmont Mining Corp. | | | | | 487,812 | |

| | 6,400 | | Precision Castparts Corp. | | | | | 1,615,360 | |

| | 47,350 | | The Dow Chemical Co. | | | | | 2,436,631 | |

| | 14,000 | | Vale SA, ADR | | | | | 185,220 | |

| | | | | | | | | 7,244,165 | |

| Telecommunications - 0.4% | | | | | | |

| | 27,300 | | AT&T, Inc. | | | | | 965,328 | |

| | 7,335 | | Verizon Communications, Inc. | | | | | 358,902 | |

| | | | | | | | | 1,324,230 | |

| Utilities - 0.1% | | | | | | | | |

| | 5,616 | | FirstService Corp. | | | | | 284,113 | |

Total Common Stock (Cost $183,017,581) | | | | | | | 270,606,103 | |

| Rights - 0.0% | | | | | | | | |

| | 310,867 | | Community Health Systems, Inc. (a) (Cost $0) | | | | | 20,797 | |

Total Equity Securities (Cost $183,017,581) | | | | | | | 270,626,900 | |

| | | | | | | | | | |

| Principal | | | Rate | Maturity | | | |

| | | | | | | | | | |

| Corporate Non-Convertible Bonds - 0.1% | | | | | | |

| Materials - 0.1% | | | | | | | | |

| $ | 200,000 | | Newmont Mining Corp. (Cost $187,777) | 3.50% | 03/15/22 | | $ | 193,150 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Municipal Bonds - 0.1% | | | | | | | | |

| Ohio - 0.1% | | | | | | | | |

| | 550,000 | | Buckeye Tobacco Settlement Financing Authority (Cost $376,998) | 5.88 | 06/01/47 | | | 437,481 | |

| | | | | | | | | | |

Total Fixed Income Securities (Cost $564,775) | | | | | 630,631 | |

Total Investments - 91.0% (Cost $183,582,356)* | | | | $ | 271,257,531 | |

| Other Assets & Liabilities, Net – 9.0% | | | | | 26,945,962 | |

| Net Assets – 100.0% | | | | | | $ | 298,203,493 | |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| (a) | Non-income producing security. |

| | * Cost for federal income tax purposes is $183,585,566 and net unrealized appreciation consists of: |

| Gross Unrealized Appreciation | | $ | 95,664,659 | |

| Gross Unrealized Depreciation | | | (7,992,694 | ) |

| Net Unrealized Appreciation | | $ | 87,671,965 | |

The following is a summary of the inputs used to value the Fund’s investments as of June 30, 2014.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Investments At Value |

| Common Stock | | | | | | | | | | | | | | | | |

| Communications | | $ | 21,345,000 | | | $ | - | | | $ | - | | | $ | 21,345,000 | |

| Consumer Discretionary | | | 33,118,882 | | | | - | | | | - | | | | 33,118,882 | |

| Consumer Staples | | | 85,602,728 | | | | - | | | | - | | | | 85,602,728 | |

| Energy | | | 15,970,229 | | | | - | | | | - | | | | 15,970,229 | |

| Financials | | | 45,458,351 | | | | - | | | | - | | | | 45,458,351 | |

| Health Care | | | 43,814,301 | | | | - | | | | - | | | | 43,814,301 | |

| Industrials | | | 4,855,778 | | | | - | | | | - | | | | 4,855,778 | |

| Information Technology | | | 11,588,326 | | | | - | | | | - | | | | 11,588,326 | |

| Materials | | | 7,244,165 | | | | - | | | | - | | | | 7,244,165 | |

| Telecommunications | | | 1,324,230 | | | | - | | | | - | | | | 1,324,230 | |

| Utilities | | | 284,113 | | | | - | | | | - | | | | 284,113 | |

| Corporate Non-Convertible Bonds | | | - | | | | 193,150 | | | | - | | | | 193,150 | |

| Municipal Bonds | | | - | | | | 437,481 | | | | - | | | | 437,481 | |

| Rights | | | 20,797 | | | | - | | | | - | | | | 20,797 | |

| Total Assets | | $ | 270,626,900 | | | $ | 630,631 | | | | - | | | $ | 271,257,531 | |

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the year ended June 30, 2014.

AFA

| PORTFOLIO HOLDINGS | | | |

| % of Net Assets | | | |

| Common Stock | | | 90.8 | % |

| Corporate Non-Convertible Bonds | | | 0.1 | % |

| Municipal Bonds | | | 0.1 | % |

| Rights | | | 0.0 | % |

| Cash and Other Net Assets | | | 9.0 | % |

| | | | 100.0 | % |

AFA

See Notes to Financial Statements. 7

STATEMENT OF ASSETS AND LIABILITIES

| | | | | | |

| ASSETS | | | | |

| | Total investments, at value (Cost $183,582,356) | | $ | 271,257,531 | |

| | Cash | | | 25,982,938 | |

| | Receivables: | | | | |

| | Fund shares sold | | | 450,589 | |

| | Investment securities sold | | | 495,636 | |

| | Dividends and interest | | | 641,458 | |

| | Prepaid expenses | | | 24,288 | |

| Total Assets | | | 298,852,440 | |

| | | | | | |

| LIABILITIES | | | | |

| | Payables: | | | | |

| | Investment securities purchased | | | 51,928 | |

| | Fund shares redeemed | | | 282,414 | |

| | Accrued Liabilities: | | | | |

| | Investment adviser fees | | | 244,907 | |

| | Trustees’ fees and expenses | | | 185 | |

| | Fund services fees | | | 31,579 | |

| | Other expenses | | | 37,934 | |

| Total Liabilities | | | 648,947 | |

| | | | | | |

| NET ASSETS | | $ | 298,203,493 | |

| | | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| | Paid-in capital | | $ | 202,925,910 | |

| | Undistributed net investment income | | | 1,537,864 | |

| | Accumulated net realized gain | | | 6,064,544 | |

| | Net unrealized appreciation | | | 87,675,175 | |

| NET ASSETS | | $ | 298,203,493 | |

| | | | | | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | | |

| | Investor Shares | | | 13,736,373 | |

| | A Shares | | | 245,027 | |

| | Institutional Shares | | | 382,655 | |

| | | | | | |

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE* | | | | |

| | Investor Shares (based on net assets of $285,094,375) | | $ | 20.75 | |

| | A Shares (based on net assets of $5,107,641) | | $ | 20.85 | |

| | A Shares Maximum Public Offering Price Per Share (net asset value per share/(100%-5.75%)) | | $ | 22.12 | |

| | Institutional Shares (based on net assets of $8,001,477) | | $ | 20.91 | |

| * | Shares redeemed or exchanged within 180 days of purchase are charged a 2.00% redemption fee. |

See Notes to Financial Statements. 8

| | | | | |

| INVESTMENT INCOME | | | | |

| Dividend income (Net of foreign withholding taxes of $81,491) | | $ | 6,218,343 | |

| Interest income | | | 498,306 | |

| Total Investment Income | | | 6,716,649 | |

| Adviser | | | | |

| EXPENSES | | | | |

| Investment adviser fees | | | 3,008,313 | |

| Fund services fees | | | 365,417 | |

| Transfer agent fees: | | | | |

| Investor Shares | | | 78,799 | |

| A Shares | | | 1,350 | |

| Institutional Shares | | | 126 | |

| Distribution fees: | | | | |

| A Shares | | | 8,863 | |

| Custodian fees | | | 30,241 | |

| Registration fees: | | | | |

| Investor Shares | | | 19,233 | |

| A Shares | | | 4,772 | |

| Institutional Shares | | | 13,604 | |

| Professional fees | | | 48,787 | |

| Trustees' fees and expenses | | | 11,541 | |

| Miscellaneous expenses | | | 220,293 | |

| Total Expenses | | | 3,811,339 | |

| Fees waived and expenses reimbursed | | | (108,940 | ) |

| Net Expenses | | | 3,702,399 | |

| | | | | |

| NET INVESTMENT INCOME | | | 3,014,250 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

| Net realized gain on: | | | | |

| Investments | | | 9,279,954 | |

| Foreign currency transactions | | | 48,101 | |

| Net realized gain | | | 9,328,055 | |

| Net change in unrealized appreciation (depreciation) on Investments | | | 30,624,138 | |

| NET REALIZED AND UNREALIZED GAIN | | | 39,952,193 | |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 42,966,443 | |

| | | | | |

See Notes to Financial Statements. 9

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | For the Year Ended June 30, 2014 | | For the Year Ended June 30, 2013 | |

| OPERATIONS | | | | | | Shares | | | | | | | Shares | | |

| | Net investment income | | $ | 3,014,250 | | | | | | $ | 3,245,945 | | | | | |

| | Net realized gain | | | 9,328,055 | | | | | | | 3,805,431 | | | | | |

| | Net change in unrealized appreciation (depreciation) | | | 30,624,138 | | | | | | | 30,379,936 | | | | | |

| Increase in Net Assets Resulting from Operations | | | 42,966,443 | | | | | | | 37,431,312 | | | | | |

| | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | |

| | Net investment income: | | | | | | | | | | | | | | | |

| | | Investor Shares | | | (3,247,269 | ) | | | | | | (3,345,187 | ) | | | | |

| | | A Shares | | | (30,251 | ) | | | | | | (20,863 | ) | | | | |

| | | Institutional Shares | | | (66,782 | ) | | | | | | (25,206 | ) | | | | |

| | Net realized gain: | | | | | | | | | | | | | | | |

| | | Investor Shares | | | (6,549,711 | ) | | | | | | (1,800,956 | ) | | | | |

| | | A Shares | | | (73,681 | ) | | | | | | (13,195 | ) | | | | |

| | | Institutional Shares | | | (149,889 | ) | | | | | | (9,775 | ) | | | | |

| Total Distributions to Shareholders | | | (10,117,583 | ) | | | | | | (5,215,182 | ) | | | | |

| | | | | | | | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | | | | |

| | Sale of shares: | | | | | | | | | | | | | | | |

| | | Investor Shares | | | 39,233,303 | | | 1,999,149 | | | | 46,679,365 | | | 2,687,515 | | |

| | | A Shares | | | 2,512,274 | | | 127,528 | | | | 327,028 | | | 19,179 | | |

| | | Institutional Shares | | | 2,223,679 | | | 110,806 | | | | 4,058,596 | | | 226,829 | | |

| | Reinvestment of distributions: | | | | | | | | | | | | | | | |

| | | Investor Shares | | | 9,563,734 | | | 488,464 | | | | 5,041,540 | | | 301,707 | | |

| | | A Shares | | | 95,499 | | | 4,869 | | | | 30,079 | | | 1,797 | | |

| | | Institutional Shares | | | 216,672 | | | 11,017 | | | | 34,981 | | | 2,092 | | |

| | Redemption of shares: | | | | | | | | | | | | | | | |

| | 1 | Investor Shares | | | (72,978,455 | ) | | (3,681,662 | ) | | | (49,230,617 | ) | | (2,816,017 | ) | |

| | 2 | A Shares | | | (62,884 | ) | | (3,204 | ) | | | (132,450 | ) | | (7,863 | ) | |

| | 3 | Institutional Shares | | | (470,453 | ) | | (23,897 | ) | | | (340,053 | ) | | (18,753 | ) | |

| | Redemption fees | | | 14,278 | | | - | | | | 32,290 | | | - | | |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | (19,652,353 | ) | | (966,930 | ) | | | 6,500,759 | | | 396,486 | | |

| Increase in Net Assets | | | 13,196,507 | | | | | | | 38,716,889 | | | | | |

| | | | | | | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | | | | | | |

| | Beginning of Year | | | 285,006,986 | | | | | | | 246,290,097 | | | | | |

| | End of Year (Including line (a)) | | $ | 298,203,493 | | | | | | $ | 285,006,986 | | | | | |

| (a) | Undistributed net investment income | | $ | 1,537,864 | | | | | | $ | 1,595,099 | | | | | |

| See Notes to Financial Statements. | 10 | |

| These financial highlights reflect selected data for a share outstanding throughout each year. | | | | | | |

| | | For the Years Ended June 30, | |

| | | 2014 | | | | 2013 | | | | 2012 | | | | 2011 | | | | 2010 | | |

| INVESTOR SHARES | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Year | $ | 18.59 | | | $ | 16.49 | | | $ | 16.45 | | | $ | 13.49 | | | $ | 12.16 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | 0.20 | | | | 0.21 | | | | 0.22 | | | | 0.26 | | | | 0.32 | | |

| Net realized and unrealized gain | | 2.63 | | | | 2.23 | | | | 0.20 | (b) | | 3.00 | | | | 1.27 | | |

| Total from Investment Operations | | 2.83 | | | | 2.44 | | | | 0.42 | | | | 3.26 | | | | 1.59 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.22 | ) | | | (0.22 | ) | | | (0.16 | ) | | | (0.29 | ) | | | (0.26 | ) | |

| Net realized gain | | (0.45 | ) | | | (0.12 | ) | | | (0.23 | ) | | | (0.01 | ) | | | — | | |

| Total Distributions to Shareholders | | (0.67 | ) | | | (0.34 | ) | | | (0.39 | ) | | | (0.30 | ) | | | (0.26 | ) | |

| REDEMPTION FEES (a) | | — | (c) | | — | (c) | | 0.01 | | | | — | (c) | | — | (c) |

| NET ASSET VALUE, End of Year | $ | 20.75 | | | $ | 18.59 | | | $ | 16.49 | | | $ | 16.45 | | | $ | 13.49 | | |

| TOTAL RETURN | | 15.43 | % | | 15.06 | % | | 2.84 | % | | 24.35 | % | | 12.99 | % |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000's omitted) | $285,094 | | | $277,536 | | | $243,366 | | | $163,699 | | | $100,712 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | 1.00 | % | | 1.22 | % | | 1.36 | % | | 1.68 | % | | 2.29 | % |

| Net expense | | 1.24 | % | | 1.25 | % | | 1.25 | % | | 1.25 | % | | 1.30 | % |

| Gross expense (d) | | 1.26 | % | | 1.28 | % | | 1.27 | % | | 1.25 | % | | 1.30 | % |

| PORTFOLIO TURNOVER RATE | | 9 | % | | 11 | % | | 8 | % | | 20 | % | | 15 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | The net realized and unrealized gain (loss) per share does not correlate to the aggregate of the net realized and unrealized loss in the Statement of Operations for the year ended June 30, 2012, primarily due to the timing of the sales and repurchases of the Fund's shares in relation to fluctuating market values for the Fund's portfolio. |

| (c) | Less than $0.01 per share. |

| (d) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements. 11

| These financial highlights reflect selected data for a share outstanding throughout each year. | | | | | | |

| | | For the Years Ended June 30, | |

| | | 2014 | | | | 2013 | | | | 2012 | | | | 2011 | | | | 2010 | | |

| A SHARES | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Year | $ | 18.63 | | | $ | 16.49 | | | $ | 16.45 | | | $ | 13.49 | | | $ | 12.17 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | 0.20 | | | | 0.21 | | | | 0.22 | | | | 0.25 | | | | 0.32 | | |

| Net realized and unrealized gain | | 2.64 | | | | 2.24 | | | | 0.21 | (b) | | 3.01 | | | | 1.26 | | |

| Total from Investment Operations | | 2.84 | | | | 2.45 | | | | 0.43 | | | | 3.26 | | | | 1.58 | | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.17 | ) | | | (0.19 | ) | | | (0.16 | ) | | | (0.29 | ) | | | (0.26 | ) | |

| Net realized gain | | (0.45 | ) | | | (0.12 | ) | | | (0.23 | ) | | | (0.01 | ) | | | — | | |

| Total Distributions to Shareholders | | (0.62 | ) | | | (0.31 | ) | | | (0.39 | ) | | | (0.30 | ) | | | (0.26 | ) | |

| REDEMPTION FEES (a) | | — | (c) | | — | (c) | | — | (c) | | — | (c) | | — | (c) |

| NET ASSET VALUE, End of Year | $ | 20.85 | | | $ | 18.63 | | | $ | 16.49 | | | $ | 16.45 | | | $ | 13.49 | | |

| TOTAL RETURN (d) | | 15.45 | % | | 15.06 | % | | 2.84 | % | | 24.35 | % | | 12.90 | % |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000's omitted) | $5,108 | | | $2,158 | | | $1,694 | | | $660 | | | $157 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | 1.02 | % | | 1.22 | % | | 1.39 | % | | 1.61 | % | | 2.29 | % |

| Net expense | | 1.25 | % | | 1.25 | % | | 1.25 | % | | 1.25 | % | | 1.30 | % |

| Gross expense (e) | | 1.62 | % | | 1.62 | % | | 1.52 | % | | 1.50 | % | | 1.55 | % |

| PORTFOLIO TURNOVER RATE | | 9 | % | | 11 | % | | 8 | % | | 20 | % | | 15 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | The net realized and unrealized gain (loss) per share does not correlate to the aggregate of the net realized and unrealized loss in the Statement of Operations for the year ended June 30, 2012, primarily due to the timing of the sales and repurchases of the Fund's shares in relation to fluctuating market values for the Fund's portfolio. |

| (c) | Less than $0.01 per share. |

| (d) | Total Return does not include the effect of front end sales charge or contingent deferred sales charge. |

| (e) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements. 12

| These financial highlights reflect selected data for a share outstanding throughout each period. |

| | | For the Years Ended June 30, | | May 9, 2012 (a) through | |

| | | 2014 | | | | 2013 | | | June 30, 2012 | |

| INSTITUTIONAL SHARES | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Period | $ | 18.66 | | | $ | 16.50 | | | $ | 16.27 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | |

| Net investment income (b) | | 0.25 | | | | 0.26 | | | | 0.04 | | |

| Net realized and unrealized gain | | 2.64 | | | | 2.22 | | | | 0.19 | | |

| Total from Investment Operations | | 2.89 | | | | 2.48 | | | | 0.23 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | |

| Net investment income | | (0.19 | ) | | | (0.20 | ) | | | — | | |

| Net realized gain | | (0.45 | ) | | | (0.12 | ) | | | — | | |

| Total Distributions to Shareholders | | (0.64 | ) | | | (0.32 | ) | | | — | | |

| REDEMPTION FEES (b) | | — | (c) | | — | (c) | | — | (c) |

| NET ASSET VALUE, End of Period | $ | 20.91 | | | $ | 18.66 | | | $ | 16.50 | | |

| TOTAL RETURN | | 15.73 | % | | 15.28 | % | | 1.41 | %(d) |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | |

| Net Assets at End of Period (000's omitted) | $8,001 | | | $5,313 | | | $1,230 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | |

| Net investment income | | 1.25 | % | | 1.48 | % | | 1.62 | %(e) |

| Net expense | | 1.00 | % | | 1.00 | % | | 1.10 | %(e) |

| Gross expense (f) | | 1.47 | % | | 1.55 | % | | 1.50 | %(e) |

| PORTFOLIO TURNOVER RATE | | 9 | % | | 11 | % | | 8 | %(d) |

| | | | | | | | | | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during each period. |

| (c) | Less than $0.01 per share. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements. 13

NOTES TO FINANCIAL STATEMENTS

The Auxier Focus Fund (the “Fund”) is a diversified portfolio of Forum Funds (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940 (the “Act”), as amended. Under its Trust Instrument, the Trust is authorized to issue an unlimited number of the Fund’s shares of beneficial interest without par value.

Note 2. Summary of Significant Accounting Policies

These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the fiscal year. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation – Exchange-traded securities and over-the-counter securities are valued using the last quoted trade or official closing price, provided by independent pricing services as of the close of trading on the market or exchange for which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and ask price provided by independent pricing services. Non-exchange traded securities for which quotations are available are valued using the last quoted sales price, or in the absence of a sale, at the mean of the last bid and ask prices provided by independent pricing services. Debt securities may be valued at prices supplied by a fund’s pricing agent based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics such as rating, interest rate and maturity. Shares of open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in 60 days or less may be valued at amortized cost.

The Fund values its investments at fair value pursuant to procedures adopted by the Trust's Board of Trustees (the "Board") if (1) market quotations are insufficient or not readily available or (2) the adviser believes that the values available are unreliable. The Trust’s Valuation Committee, as defined in the Fund’s registration statement, performs certain functions as they relate to the administration and oversight of the Fund’s valuation procedures. Under these procedures, the Valuation Committee convenes on a regular and ad-hoc basis to review such securities and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

The Valuation Committee may work with the adviser to provide valuation inputs. In determining fair valuations, inputs may include market-based analytics which may consider related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant investment information. Adviser inputs may include an income-based approach in which the anticipated future cash flows of the investment are discounted in determining fair value. Discounts may also be applied based on the nature or duration of any restrictions on the disposition of the investments. The Valuation Committee performs regular reviews of valuation methodologies, key inputs and assumptions, disposition analysis and market activity.

Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different Net Asset Value ("NAV") than a NAV determined by using market quotes.

The Fund has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets and liabilities

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

14

NOTES TO FINANCIAL STATEMENTS

The aggregate value by input level, as of June 30, 2014, for the Fund’s investments is included at the end of the Fund’s Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted using the effective interest method. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Foreign Currency Translations – Foreign currency amounts are translated into U.S. dollars as follows: (1) assets and liabilities at the rate of exchange at the end of the respective period; and (2) purchases and sales of securities and income and expenses at the rate of exchange prevailing on the dates of such transactions. The portion of the results of operations arising from changes in the exchange rates and the portion due to fluctuations arising from changes in the market prices of securities are not isolated. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Distributions to Shareholders – Distributions to shareholders of net investment income and net capital gains, if any, are declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund.

Federal Taxes – The Fund intends to continue to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code and to distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all of its net investment income and capital gains, if any, the Fund will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required. The Fund files a U.S. federal income and excise tax return as required. A fund’s federal income tax returns are subject to examination by the Internal Revenue Service for a period of three fiscal years after they are filed. As of June 30, 2014, there are no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

The Fund’s class-specific expenses are charged to the operations of that class of shares. Income and expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on the class’ respective net assets to the total net assets of the Fund.

Redemption Fees – A shareholder who redeems shares within 180 days of purchase will incur a redemption fee of 2.00% of the current net asset value of shares redeemed, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

Commitments and Contingencies – In the normal course of business, the Fund enters into contracts that provide general indemnifications by the Fund to the counterparty to the contract. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 3. Fees and Expenses

Investment Adviser – Auxier Asset Management LLC (the “Adviser”), is the investment adviser to the Fund. Pursuant to an

15

NOTES TO FINANCIAL STATEMENTS

investment advisory agreement, the Adviser receives an advisory fee from the Fund at an annual rate of 1.00% of the Fund’s average daily assets.

Distribution – Foreside Fund Services, LLC serves as the Fund’s distributor (the “Distributor”). The Distributor is not affiliated with the Adviser or Atlantic Fund Administration, LLC (d/b/a Atlantic Fund Services) (“Atlantic”) or their affiliates. The Fund has adopted a Distribution Plan (the “Plan”) for A Shares of the Fund in accordance with Rule 12b-1 of the Act. Under the Plan, the Fund pays the Distributor and/or any other entity as authorized by the Board a fee of up to 0.25% of the average daily net assets of A Shares. The Distributor has no role in determining the investment policies or which securities are to be purchased or sold by the Trust or its Funds.

For the year ended June 30, 2014, there were $109,867 in front-end sales charges assessed on the sale of A Shares and no contingent deferred sales charges were assessed on the sale of A Shares. The Distributor received $19,396 of the total front-end sales charges. Such amounts are set aside by the Distributor and used solely for distribution-related expenses.

Other Service Providers – Atlantic provides fund accounting, fund administration, compliance and transfer agency services to the Fund. Atlantic also provides certain shareholder report production, and EDGAR conversion and filing services. Atlantic provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer, and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each independent Trustee an annual retainer fee of $45,000 for service to the Trust ($66,000 for the Chairman). The Trustees and Chairman may receive additional fees for special Board meetings. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with his duties as a Trustee, including travel and related expenses incurred in attending Board meetings. The amount of Trustees’ fees attributable to the Fund is disclosed in the Statement of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from the Fund.

Note 4. Expense Reimbursements and Fees Waived

The Adviser has contractually agreed to waive a portion of its fees and reimburse expenses through October 31, 2015, to the extent necessary to maintain the total operating expenses (excluding all taxes, interest, portfolio transaction expenses, dividend expenses on short sales, and extraordinary expenses) at 1.25% of average daily net assets of the Investor Shares and A Shares and 1.00% of average daily net assets of Institutional Shares. These contractual waivers may only be raised or eliminated with consent of the Board. Other fund service providers have voluntarily agreed to waive a portion of their fees. These voluntary reductions may be reduced or eliminated at any time. For the year ended June 30, 2014, fees waived and expenses reimbursed were as follows:

| Investment Adviser Expenses Reimbursed | | | Other Waivers | | | Total Fees Waived and Expenses Reimbursed | |

| $ | 41,258 | | | $ | 67,682 | | | $ | 108,940 | |

| | | | | | | | | | | |

Note 5. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments during the year ended June 30, 2014, were $23,005,588 and $41,123,143, respectively.

16

NOTES TO FINANCIAL STATEMENTS

Distributions paid during the fiscal years ended as noted were characterized for tax purposes as follows:

| Ordinary Income | | $ | 3,868,873 | | $ | 4,175,748 |

| Long-Term Capital Gain | | | 6,248,710 | | | 1,039,434 |

| | | $ | 10,117,583 | | $ | 5,215,182 |

As of June 30, 2014, distributable earnings (accumulated loss) on a tax basis were as follows:

| Undistributed Ordinary Income | | $ | 1,561,515 | |

| Undistributed Long-Term Gain | | | 6,044,103 | |

| Unrealized Appreciation | | | 87,671,965 | |

| Total | | $ | 95,277,583 | |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales.

On the Statement of Assets and Liabilities, as a result of permanent book to tax differences, certain amounts have been reclassified for the year ended June 30, 2014. The following reclassification was the result of currency gain/loss reclassifications and has no impact on the net assets of the Fund.

| Undistributed Net Investment Income | | $ | 272,817 | |

| Accumulated Net Realized Gain | | | (272,817 | ) |

Note 7. Subsequent Events

Subsequent events occurring after the date of this report through the date these financial statements were issued have been evaluated for potential impact and the Fund has had no such events.

17

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Forum Funds

and the Shareholders of Auxier Focus Fund

We have audited the accompanying statement of assets and liabilities of the Auxier Focus Fund, a series of shares of beneficial interest in the Forum Funds, including the schedule of investments, as of June 30, 2014, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2014 by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Auxier Focus Fund as of June 30, 2014, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

August 21, 2014

18

ADDITIONAL INFORMATION (Unaudited)

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (877) 328-9437, on the Fund's website at www.auxierasset.com and on the U.S. Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov. The Fund’s proxy voting record for the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling (877) 328-9437 and on the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. These filings are available, without charge and upon request on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments on certain classes, redemption fees, exchange fees, and CDSC fees, and (2) ongoing costs, including management fees, 12b-1 fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2014, through June 30, 2014.

Actual Expenses – The first line under each share class of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes – The second line under each share class of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments on certain classes, redemption fees, exchange fees, and CDSC fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | | Ending | | Expenses | | Annualized |

| | Account Value | | Account Value | | Paid During | | Expense |

| | January 1, 2014 | | June 30, 2014 | | Period* | | Ratio* |

| Investor Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,042.19 | | $ | 6.18 | | 1.22 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,018.74 | | $ | 6.11 | | 1.22 | % |

| A Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,042.50 | | $ | 6.33 | | 1.25 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,018.60 | | $ | 6.26 | | 1.25 | % |

19

ADDITIONAL INFORMATION (Unaudited)

| | | | | | | | |

| | Beginning | | Ending | | Expenses | | Annualized |

| | Account Value | | Account Value | | Paid During | | Expense |

| | January 1, 2014 | | June 30, 2014 | | Period* | | Ratio* |

| Institutional Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,043.93 | | $ | 5.07 | | 1.00 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,019.84 | | $ | 5.01 | | 1.00 | % |

| | | | | | | | | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 to reflect the half-year period. |

Federal Tax Status of Dividends Declared during the Fiscal Year

For federal income tax purposes, dividends from short-term capital gains are classified as ordinary income. The Fund designates 100.00% of its income dividend distributed as qualifying for the corporate dividends-received deduction (DRD) and 100.00% for the qualified dividend rate (QDI) as defined in Section 1(h)(11) of the Internal Revenue Code. The Fund also designates 8.67% of its income dividends as qualified interest income exempt from U.S. tax for foreign shareholders (QII) and 13.56% of its income dividends as qualified short-term gain exempt from U.S. tax for foreign shareholders (QSD).

Trustees and Officers of the Trust

The Board is responsible for oversight of the management of the Trust’s business affairs and of the exercise of all the Trust’s powers except those reserved for the shareholders. The following table provides information about each Trustee and certain officers of the Trust. Each Trustee and officer holds office until the person resigns, is removed, or is replaced. Unless otherwise noted, the persons have held their principal occupations for more than five years. The address for all Trustees and officers is Three Canal Plaza, Suite 600, Portland, Maine 04101. Mr. Keffer is considered an Interested Trustee due to his affiliation with Atlantic. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge and upon request, by calling (877) 328-9437.

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Series of Fund Complex¹ Overseen by Trustee | Other Directorships Held by Trustee |

| Independent Trustees | | | | | |

J. Michael Parish Born: 1943 | Chairman of the Board; Trustee; Chairman, Nominating Committee and Qualified Legal Compliance Committee | Since 1989 (Chairman since 2004) | Retired since 2003. | 24 | 0 |

Costas Azariadis Born: 1943 | Trustee | Since 1989 | Professor of Economics, Washington University since 2006. | 24 | 0 |

James C. Cheng Born: 1942 | Trustee; Chairman, Audit Committee | Since 1989 | President, Technology Marketing Associates (marketing company for small- and medium-sized businesses in New England) since 1991. | 24 | 0 |

David Tucker Born: 1958 | Trustee | Since 2011 | Director, Blue Sky Experience since 2008; Senior Vice President & General Counsel, American Century Companies 1998-2008. | 28 | Trustee, Forum Funds II and Forum ETF Trust |

1The Fund Complex includes the Trust, Forum Funds II and Forum ETF Trust and is overseen by different Boards of Trustees. |

20

ADDITIONAL INFORMATION (Unaudited)

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Series of Fund Complex¹ Overseen by Trustee | Other Directorships Held by Trustee |

| Interested Trustee | | | | | |

John Y. Keffer2 Born: 1942 | Trustee; Vice Chairman | Since 1989 | Chairman, Atlantic since 2008; President, Forum Investment Advisors, LLC since 2011; President, Forum Foundation (a charitable organization) since 2005; President, Forum Trust, LLC (a non-depository trust company chartered in the State of Maine) since 1997. | 28 | Director, Wintergreen Fund, Inc.; Trustee, Forum Funds II, Forum ETF Trust and ALTX Trust |

| Officers | | | | | |

Stacey E. Hong Born: 1966 | President; Principal Executive Officer | Since 2008 | President, Atlantic since 2008. | N/A | N/A |

Karen Shaw Born: 1972 | Treasurer; Principal Financial Officer | Since 2008 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Zachary Tackett Born: 1988 | Vice President; Secretary; Anti-Money Laundering Compliance Officer | Since 2014 | Associate Counsel, Atlantic since 2014; Intern Associate, Coakley & Hyde, PLLC, 2010-2013. | N/A | N/A |

Michael J. McKeen Born: 1971 | Vice President | Since 2009 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Timothy Bowden Born: 1969 | Vice President | Since 2009 | Manager, Atlantic since 2008. | N/A | N/A |

Geoffrey Ney Born: 1975 | Vice President | Since 2013 | Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013. | N/A | N/A |

Todd Proulx Born: 1978 | Vice President | Since 2013 | Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013. | N/A | N/A |

1The Fund Complex includes the Trust, Forum Funds II and Forum ETF Trust and is overseen by different Boards of Trustees. 2Atlantic is a subsidiary of Forum Holdings Corp. I, a Delaware corporation that is wholly owned by Mr. Keffer. |

DF Dent Premier Growth Fund

A Message to Our Shareholders (Unaudited) .............................................................................................. 1

Management Discussion of Fund Performance (Unaudited) ..................................................................... 8

Performance Chart and Analysis (Unaudited) ............................................................................................ 14

Schedule of Investments ................................................................................................................................ 15

Statement of Assets and Liabilities .............................................................................................................. 17

Statement of Operations.................................................................................................................................. 18

Statements of Changes in Net Assets .......................................................................................................... 19

Financial Highlights ........................................................................................................................................ 20

DF Dent Midcap Growth Fund

A Message to Our Shareholders (Unaudited) ............................................................................................ 21

Performance Chart and Analysis (Unaudited) ............................................................................................ 26

Schedule of Investments ................................................................................................................................ 27

Statement of Assets and Liabilities .............................................................................................................. 29

Statement of Operations.................................................................................................................................. 30

Statements of Changes in Net Assets .......................................................................................................... 31

Financial Highlights ........................................................................................................................................ 32

DF Dent Small Cap Growth Fund

A Message to Our Shareholders (Unaudited) ............................................................................................ 33

Performance Chart and Analysis (Unaudited) ............................................................................................ 38

Schedule of Investments ................................................................................................................................ 39

Statement of Assets and Liabilities .............................................................................................................. 41

Statement of Operations.................................................................................................................................. 42

Statement of Changes in Net Assets ............................................................................................................ 43

Financial Highlights ......................................................................................................................................... 44

DF Dent Growth Funds

Notes to Financial Statements ....................................................................................................................... 45

Report of Independent Registered Public Accounting Firm...................................................................... 50

Additional Information (Unaudited).............................................................................................................. 51

DF DENT PREMIER GROWTH FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

Dear Fellow Shareholder,

Performance

Please find below recent performance results for each of the DF Dent Growth Funds compared against their respective benchmarks for periods ending June 30, 2014:

| | | DF Dent Premier Growth | | DF Dent Midcap Growth | | DF Dent Small Cap Growth |

| 6 Months | | | | | | | | | | | | |

| Fund | | - | 0.23 | % | | - | 1.40 | % | | - | 0.55 | % |

| Benchmark | | S&P 500 | | Russell Midcap Growth | | Russell 2000 Growth |

| Benchmark Performance | | + | 7.14 | % | | + | 6.51 | % | | + | 2.22 | % |

| Fund vs Benchmark | | - | 7.37 | % | | - | 7.91 | % | | - | 2.77 | % |

| | | | | | | | | | | | | |

| 12 Months | | | | | | | | | | | | |

| Fund | | + | 21.49 | % | | + | 22.95 | % | | | N/A | |

| Benchmark | | + | 24.61 | % | | + | 26.04 | % | | | N/A | |

| Fund vs Benchmark | | - | 3.12 | % | | - | 3.09 | % | | | N/A | |

| | | | | | | | | | | | | |

| 5 Years | | | | | | | | | | | | |

| Fund | | + | 19.06 | % | | | N/A | | | | N/A | |

| Benchmark | | + | 18.83 | % | | | N/A | | | | N/A | |

| Fund vs Benchmark | | + | 0.23 | % | | | N/A | | | | N/A | |

| | | | | | | | | | | | | |

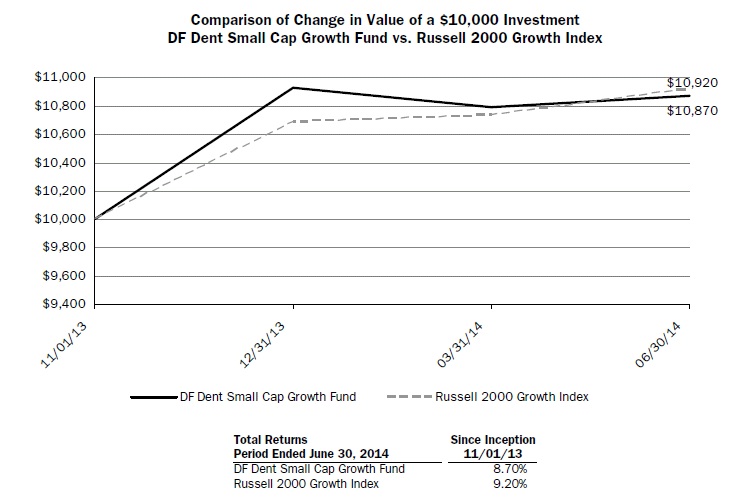

| Since Inception | | | | | | | | | | | | |

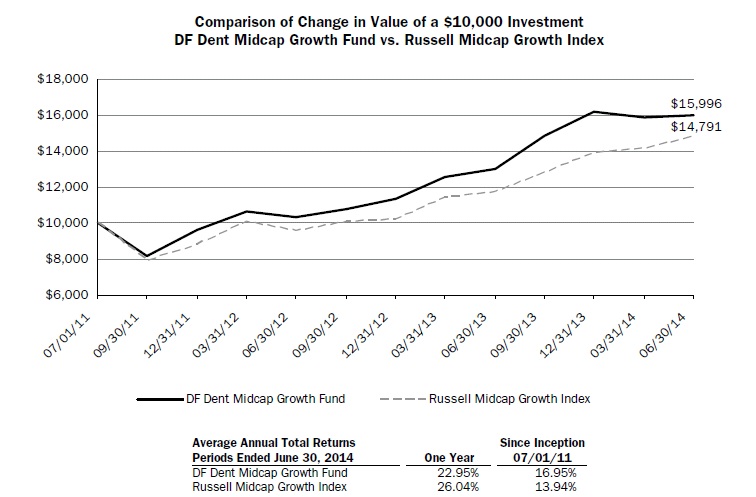

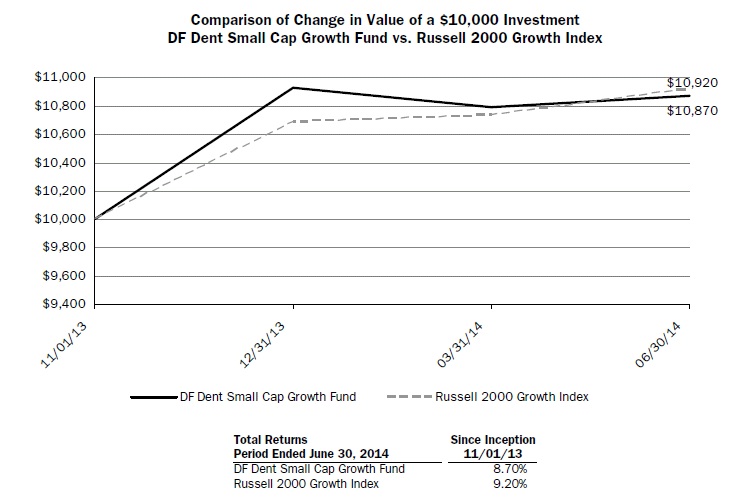

| Fund | | + | 8.19 | %* | | + | 16.95 | %* | | + | 8.70 | % |

| Benchmark | | + | 5.93 | %* | | + | 13.94 | %* | | + | 9.20 | % |

| Fund vs Benchmark | | + | 2.26 | %* | | + | 3.01 | %* | | - | 0.50 | % |

| * annualized | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Cumulative Since Inception | | | | | | | | | | | | |

| Fund | | + | 177.13 | % | | + | 59.96 | % | | + | 8.70 | % |

| Benchmark | | + | 110.84 | % | | + | 47.91 | % | | + | 9.20 | % |

| Fund vs Benchmark | | + | 66.29 | % | | + | 12.05 | % | | - | 0.50 | % |

| Inception Date | | 07/16/2001 | | 07/01/2011 | | 11/01/2013 |

N/A- Periods which exceed the life of the particular fund.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (866) 233-3368. As stated in the current prospectus, the DF Dent Premier Growth Fund’s and DF Dent Midcap Growth Fund’s annual operating expense ratios (gross) are

1 DF DENT GROWTH FUNDS

DF DENT PREMIER GROWTH FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited)

1.26% and 1.86%, respectively. However, the Funds’ Adviser has contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expenses to 1.10% on the first $150 million in Fund net assets and to 0.90% on net assets exceeding $150 million. This agreement is in effect through October 31, 2016. The DF Dent Small Cap Growth Fund’s estimated annual operating expense ratio (gross) is 5.80%. However, D.F. Dent and Company (the Fund’s “Adviser”) has contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expense to 1.25% through October 31, 2016. These expense caps may be changed or eliminated prior to their expiration date only with the consent of the Board of Trustees. Both the DF Dent Midcap Growth Fund and DF Dent Small Cap Growth Fund charge a 2.00% redemption fee on shares redeemed within 60 days of purchase. Fund performance returns shown do not reflect fees; if reflected, the returns would have been lower. Returns greater than one year are annualized.

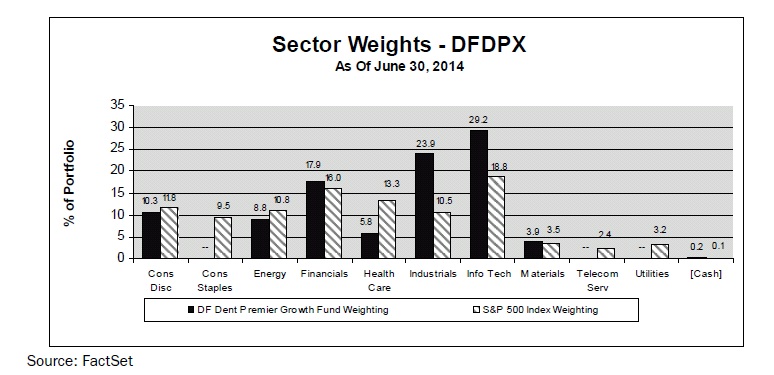

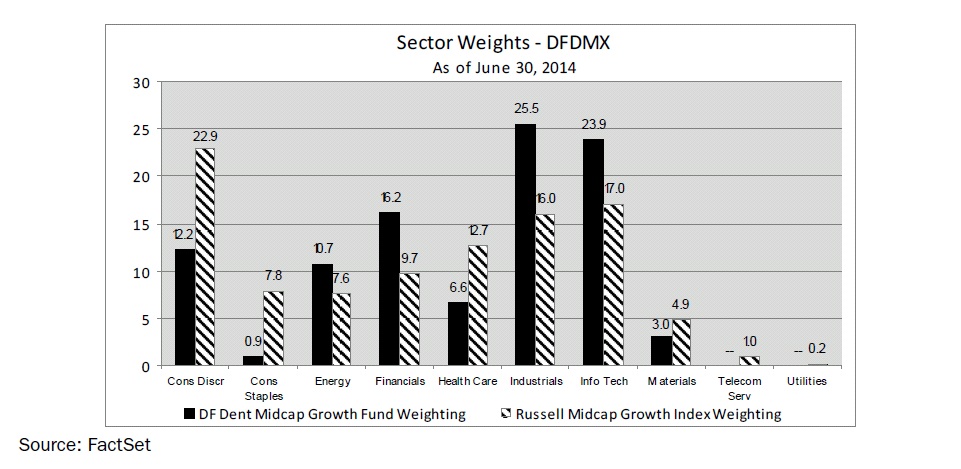

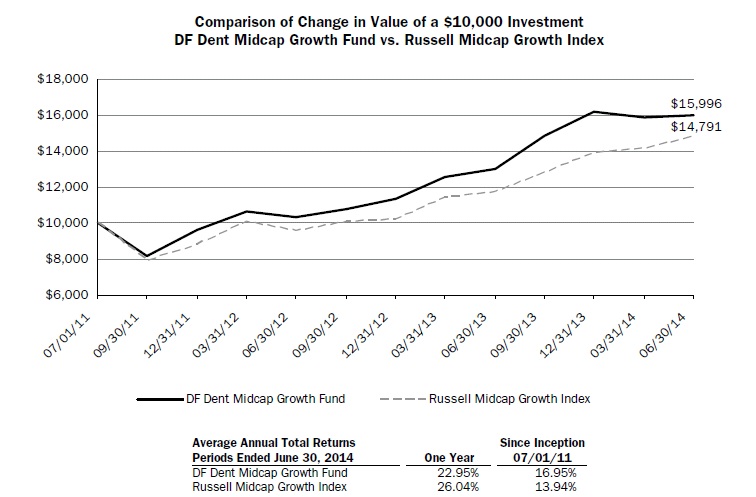

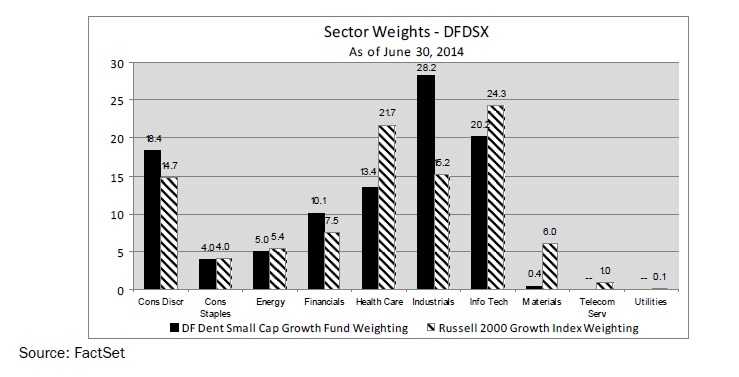

DF Dent Premier Growth Fund