As filed with the Securities and Exchange Commission on June 5, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Stacey E. Hong, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: March 31

Date of reporting period: April 1, 2013 – March 31, 2014

ITEM 1. REPORT TO STOCKHOLDERS.

The views in this report were those of Absolute Strategies Fund and Absolute Opportunities Fund’s (each a “Fund” and collectively the “Funds”) adviser as of March 31, 2014, and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and do not constitute investment advice. None of the information presented should be construed as an offer to sell or recommendation of any security mentioned herein.

Since the Funds utilize multi-manager strategies with multiple sub-advisers, they may be exposed to varying forms of risk. These risks include, but are not limited to, general market risk, multi-manager risk, non-diversification risk, small company risk, foreign risk, interest rate risk, credit risk, prepayment risk, IPO risk, liquidity risk, high turnover risk, leverage risk, pooled investment vehicle risk and derivatives risk. For a complete description of the Funds’ principal investment risks, please refer to each Fund’s prospectus.

Beta is a measure of an asset’s sensitivity to broad market moves, as measured for instance by the S&P 500® Index. A fund with a realized beta of 0.5 with respect to the S&P 500®Index infers that about 50% of the fund’s returns were explained by the performance of the index (the rest of the performance was independent of the index). Standard deviation indicates the volatility of a fund’s total returns and is useful because it identifies the spread of a fund’s short-term fluctuations. The HFR Indices are equally weighted performance indexes, utilized by numerous hedge fund managers as a benchmark for their own hedge funds. One cannot invest directly in an index.

Absolute Opportunities Fund, Absolute Strategies Fund, Absolute Funds, and Absolute Investment Advisers are registered service marks of Absolute Investment Advisers LLC (“AIA” and “Absolute”) and the respective logos are service marks of AIA; and other marks referred to herein are the trademarks, service marks or registered trademarks of their respective owners.

| |

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS MARCH 31, 2014 |

| |

Dear Shareholder,

We are pleased to present the annual report for the Absolute Strategies Fund (the “Fund”) for the 12 month period ended March 31, 2014 (the “Period”). The Fund (Institutional Shares) returned -2.05% for the Period, versus 21.86% for the S&P 500 Index (“S&P 500”) and 4.63% for the HFRX Global Hedge Fund Index.

Fund performance over the last year was a result of having defensive overall positioning. Fund assets were allocated to target very low net exposures. Fund beta to equity indices, bond indices, and hedge fund indices was purposely low and, at times, negative.

The Fund has been positioned defensively based on the belief that low economic growth globally and low cash flow/earnings growth for companies should result in an environment best suited for fundamental stock/bond pickers and those focused on avoiding risk. Instead, low economic growth, low earnings growth, valuation, and fundamentals as a whole seemed to have been mostly ignored during the year. Macro investing, speculation, and, ultimately, momentum seem to have dominated asset prices. The Fund was geared towards fundamentals in a year when fundamentals didn’t seem to matter very much. We firmly believe that long-term equity market valuations are double historical averages and at levels that have only been met 3 other times in history: 1929, 2000, and 2007. Periods of highly correlated, short-term equity rallies in over-valued markets have not been kind to investors. As such, positioning the Fund to participate in such rallies would put it at risk of failing to achieve its objectives of avoiding large drawdowns and permanent loss of capital. These points are further analyzed in the philosophy and outlook section of this letter.

The Fund is designed with a high degree of flexibility to take a patient and conservative stance if we see the potential for significant losses in financial markets. The willingness and discipline to hedge and/or vary capital at risk to a substantial degree is just one thing that we believe separates the Fund from most mutual funds and many hedge funds. We believe investors, like the Fund, who are concerned about long-term diversification will ultimately be greatly rewarded for their patience.

We currently allocate the Fund’s assets to eleven subadvisers (managers) that utilize twelve strategies. As of March 31, 2014, we allocated approximately 98% of the Fund’s assets; the remaining 2% was held in cash for future allocations and rebalancing. Allocations to manager strategies were highly focused as of the Period end. The top five manager allocations made up almost 75% of Fund assets. The largest allocation to a single manager strategy was approximately 18% and the smallest was approximately 1%.

While conservative overall, the Fund has had significant long and short exposures. These exposures are achieved through a mix of equity, credit (or fixed income), and arbitrage strategies. It is important to note that we do not allocate to fill a strategy bucket. We view each manager strategy as unique and vary the Fund’s allocations to achieve its objective of providing risk-adjusted performance. Equity, credit, and arbitrage strategies are currently the predominant Fund exposures; however, it is likely that the Fund will have different exposures over time as manager positions evolve.

Convertible arbitrage strategies made up approximately 20% of Fund assets as of March 31st. This included a mix of hedged income, credit, and volatility trading designed to generate moderate but consistent returns in the current environment. During the Period, these strategies generated single low digit returns on a net basis.

Credit strategies made up approximately 12% of Fund assets as of March 31st. This area is largely focused on asset-backed and non-agency residential mortgage backed securities. The Fund had very little corporate credit exposure given a lack of distressed securities and the fact that bond yields are near all-time lows. During the Period, these strategies generated returns in the high single digits.

Allocations to equity related strategies made up approximately 63% of Fund assets as of March 31st. This included long/short strategies, opportunistic equity strategies, special situations strategies, and a portfolio hedge. During the Period, these strategies produced a small aggregate loss in the low single digits. Over the past year, this group had a balance of both long and short positions. At times, the mix was even net short. The long equity

| |

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS MARCH 31, 2014 |

| |

portfolio is largely made up of large-cap companies within consumer staples, health care, and (legacy) technology companies. These are companies with strong brand names and competitive advantages. The short equity portfolio is largely made up of small-cap, cyclical, and financial companies (specifically those in Europe & Asia). These are companies that are trading at high valuations and/or are dependent on a high level of economic growth.

The biggest challenge to Fund performance has been on the short side. During the period, the Fund’s long investments have performed consistent with our expectations, but below market levels due to the factors that have dominated asset prices noted above. The Fund has maintained a significant amount of short equity exposure, including short equity market futures, in large part because that is where we believe the largest mis-pricings to exist. This is similar to the approach we took leading up to 2008. However, back then roughly 30% of the Fund’s assets were allocated to equity market neutral strategies with an additional 15% allocated to opportunistic long strategies that were hedged using an overlay strategy. Currently, we have removed all of our market neutral strategies and instead have increased our allocations to concentrated opportunistic long strategies (stock pickers) that we manage using an equity market futures overlay strategy. We believe the Fund’s current positioning creates a similar overall net exposure to the concentrated opportunistic long strategies group as it had in 2008. The reason for this approach is that market neutral strategies are highly static and performance has not met our expectations due to crowded, quantitative positioning and low interest rates. Instead, we believe exposures that are more dynamic and fundamentally driven provide the Fund with a more asymmetric risk profile focused around valuation arbitrage and added liquidity.

With respect to the overlay strategy, during periods of excessive over-valuation or under-valuation in markets, we may utilize futures positions or other securities to provide added long exposure (under-valued markets) or short exposure (over-valued markets). This may result in the Fund having slightly more or less net exposure than usual, including the potential for certain areas of the Fund to have a slight net short bias which could have a negative or positive impact on performance when segments of the market are extremely overvalued or undervalued. Overall the Fund has a positive net exposure although it had a slight net short bias in equity sensitive investments as of March 31, 2014.

Additionally, the Fund has added allocations to several new managers that also have more flexibility to vary their net exposures between defensive (more short), or aggressive (more long). Those managers are also currently positioned defensively. The difference in the Fund’s performance during the Period vs. prior periods of defensive positioning is the lack of divergence in prices of companies with positive vs. negative fundamentals. The recent share price appreciation of many of the companies in the Fund’s short portfolio makes little sense to us given the multitude of data points that historically would have sent prices lower, e.g. missed revenue/earnings targets, negative guidance, and low or flat or negative earnings growth. However, we believe these divergences are likely to correct over the completion of the current market cycle and the Fund’s performance will likely benefit.

Going forward, we could throw in the towel and cut the Fund’s short exposure in hopes of generating slightly better short term results. Many hedge funds appear to have done just that. Yet doing so would run counter to our investment philosophy and everything that has allowed the Fund to achieve its objectives since its inception. Thus, we remain steadfast in our disciplined approach which we believe will produce solid risk-adjusted performance over a full market cycle.

The Fund’s overall positioning is not meant to express a one-way directional bet on the markets. We believe it is designed to benefit from a convergence in price and valuation and between the long and short exposures. We believe this convergence will be driven by a renewed focus on asset-specific or company-specific fundamentals versus the focus on market momentum which seems to have driven market performance more recently.

It has been disappointing to watch the price and valuation gap between long and short positions widen over the last year. This is especially true considering many of the underlying fundamentals (low economic growth, low earnings growth and valuation) played out the way we thought they would. Given the foregoing, however, we are more excited about the portfolio. We believe that the potential for both absolute and relative performance is greater now than a year ago. We also expect the current lineup of managers to provide the Fund with added

| |

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS MARCH 31, 2014 |

| |

flexibility and a larger range of net exposures. This would include a much more aggressive profile and higher net exposure should equity and credit market volatility pick up and valuations move closer to historical averages.

Philosophy and Outlook

One of our Subadviser’s portfolio managers, Robert Mark, recently wrote a quarterly letter highlighting how “groupthink” has caused many a seasoned professional to follow each other off a cliff toward bad decisions. Many studies have been done over the years illustrating how group pressure can alter opinion or even obvious facts. Robert highlights one study in particular by Solomon Asch, a social psychologist, who was well known for conformity experiments. In 1951, Asch brought together a group of students in a study and asked them to solve a set of problems. These were simple problems with obvious answers, such as whether or not two lines were the same length. However, several of the students were actors hired by Asch and their job was to purposely give the wrong answers in front of their peers to see if it would sway the students’ opinions. Asch repeated the study with varying numbers of actor-students calling out the wrong answers. As a result, just one in four of the students consistently gave the right answer when their acting peers disagreed with them.

When everyone around gives an obviously wrong answer, many people tend to second-guess themselves for fear of embarrassment. Our natural desire to conform can undermine our rationality.

We believe a similar phenomenon is affecting the investment community, and it’s as though the actor-peers that Solomon Asch used for this studies are influencing the community’s view of the status quo. In support of our belief we have assembled a modest list of simple yet meaningful facts that are rarely discussed in public by the investing community. The following items may not be as obvious as whether or not two lines are the same length, but they should give pause to a reasonable person, who possesses a moderate understanding of finance and investing, as to whether the current market environment is divorced from fundamentals.

Corporate Earnings and Valuation:

Global equity operating earnings peaked in 2011, yet the MSCI World Equity Index rose almost 50% from 2011-2013 on no earnings growth.

S&P 500 operating earnings grew a cumulative total of 10% from 2011-2013 (expectations were for 36% growth), yet the index gained almost 55% over that time.

Russell 2000 operating earnings fell nearly 20% from 2011-2013 (expectations were for 100% growth), yet the index gained 60% over that time. The Russell 2000 operating P/E ratio is near 50 and the GAAP P/E is over 80. (Note: most published results of the Russell 2000 P/E ratio, such as iShares IWM ETF, now exclude companies with negative earnings and cap all other P/E ratios at 60 in an effort to make the index appear more reasonably valued).

The Shiller cyclically-adjusted P/E ratio of the S&P 500 recently reached 26, a level that has only been met 3 other times in over 130 years of data, 1929, 2000, and 2007; each peak preceded at least a 50% decline in the S&P 500.

Except for the 2000 peak, each of the Price/Sales ratio and Price/EBITDA ratio of the S&P 500 is the highest in history and double the historical average despite historically low growth for revenue and earnings.

Corporate profit margins have always been cyclical and have averaged 6% since 1950. If the S&P 500 profit margin reverted to 6% and maintained a Price to Earnings ratio of 15, the price of the S&P 500 based on current revenue would be around 1000; at a 7% margin it would be around 1150. The price of the S&P 500 as of March 31 was 1872.

| |

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS MARCH 31, 2014 |

| |

Economic and Macro Data:

China’s banking assets total $25 trillion and represent 33% of all Global GDP, higher than both Japan and the US at their respective bubble peaks. China credit growth has accounted for more than $15 trillion of the $30 trillion in worldwide credit growth since 2008. To put this in perspective, US subprime totaled $1.2 trillion.

China and Emerging Markets have been the main drivers of economic growth since 2009. Growth has slowed dramatically since 2010 while debt levels have surged. The latest Markit PMI Index for Emerging Markets signaled near-stagnation conditions bordering on contraction.

45% of global imports flow through China and Emerging Markets compared to only 14% for U.S.

Real U.S. GDP growth was only 1.9% in 2013, which was actually lower than 2012’s growth rate. The U.S. has been operating with $1 trillion budget deficits augmented by $1 trillion in Fed monetary liquidity to create about $300 billion in annual economic growth.

Despite claims that the U.S. economy is going to reach sustained GDP growth of 3-4%, U.S. real GDP growth has only been 3% or higher in just 2 out of the past 13 years; both of which occurred during the housing bubble. The average growth rate of the U.S. economy since 1999 has been 1.9%, or right where we are now, even with tremendous stimulus. Q1 2014 GDP growth was near 0%.

Speculative and Miscellaneous concerns

NYSE margin debt is at historic highs and well beyond 2000 and 2007 peaks. U.S. Covenant Lite and PIK lending have surged well beyond 2006-2007 levels.

Many internet, biotech and technology stocks are trading at 1999 dot.com levels. Over the past 6 months, 74% of companies doing IPOs have no earnings, the highest level since March 2000.

The Federal Reserve (“Fed”) has said Quantitative Easing helps to keep interest rates low, yet the yield on the U.S. 10-yr note doubled from July 2012 to December 2013. The Bankrate.com 30-yr mortgage rate rose from 3.4% to 4.5% in 2013.

According to Dallas Fed President Fisher, by the end of QE3 the Fed will hold more than 40% of the mortgage-backed securities (“MBS”) market and almost 25% of outstanding Treasuries. With the decline in mortgage supply, the Fed’s QE is absorbing 85% of fixed-rate MBS issuance; the fall in net MBS supply is outpacing the taper.

Greece, an economy on the verge of bankruptcy with debt to GDP of 175% and a 27% unemployment rate, recently issued 5-yr bonds with a coupon of 4.75%, and a yield of 4.95%. Spain’s 5-yr yield has fallen to parity with both US and UK equivalents (Spanish GDP has not recovered and growth has been negative, unemployment is over 25%, house prices are down 30% and loan delinquencies are over 13%).

The correlation of the HFRI Equity Hedge Index to the Russell 2000 is 90%. The correlation of the HFRI Fund of Funds Index to the S&P 500 is over 80%. Both indices have become more sensitive to equity market beta as the market has become more expensive.

We believe the above facts are very important. There’s no need to defend or object to them because they are basic facts (although we are sure readers will be surprised by many of them). Yet, despite these facts, investor sentiment appears to be uniformly bullish. Overall, however, we believe financial markets have spent the past couple of years discounting a future economic and earnings environment that remains unfulfilled and may now be well out of reach. As suggested above, in our view it’s not a stretch to place fair value on the S&P 500 around 1000. That doesn’t mean the market needs to drop there immediately, but we believe it does mean that the market has already priced in an incredible future scenario.

| |

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS MARCH 31, 2014 |

| |

We continue to be amazed by the counterintuitive desire to go long risk in overvalued markets, yet shun risk when markets are undervalued; for so-called “hedge” funds to be doing this is extraordinary. Not only do we see investor preference for risky assets, investors are choosing investments, including higher-beta hedge funds, which have been highly correlated with a market advance devoid of fundamental reasoning. In effect, investors are choosing the highest point in the market cycle to take on aggressive allocations after avoiding aggressive tactics near the low point of the market cycle. From our point of view, this can only be explained by the fear of non-conformity. We view this environment, in which markets are heavily influenced by central bank determinations and QE inspirations, as very fragile and ultimately unsustainable.

Along with other well respected investment managers, we believe in order to achieve investment success over time you must be able to take on non-consensus and sometimes uncomfortable ideas. Most money managers and asset allocators never need to worry about “looking” wrong because they are either passive or they hug a benchmark. Unfortunately for their investors, not looking wrong has absolutely nothing to do with investment risk or avoiding large losses. This ultimately defines our willingness to be uncomfortable and not take the same actions as everyone else. Understanding that the financial industry is currently built on conformity vs. rationality gives us tremendous optimism. The short term periods when are Fund zigs and the overall market zags is exactly what is required for diversification to work over a full market cycle. When the reverse is true, as it has been in the past, our Fund’s performance will likely provide returns that are equally impressive. Given the very high correlations of both traditional and alternative investments to equity markets, we believe the Fund may be one of a very few things in a portfolio that provide real and meaningful diversification.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

Sources:

St. James Investment Company LLC, Bloomberg, Zero Hedge, Dallas Federal Reserve, yale.edu/shiller, Federal Reserve Bank of St. Louis, iShares.com, Longhorn Capital, U.S. Treasury, Wall Street Journal

| |

ABSOLUTE OPPORTUNITIES FUND A MESSAGE TO OUR SHAREHOLDERS MARCH 31, 2014 |

| |

Dear Shareholder,

We are pleased to present the annual report for the Absolute Opportunities Fund (the “Fund”) for the year ended March 31, 2014 (the “Period”). As a reminder, the Fund was created to access a concentrated number of market inefficiencies and securities mis-pricings and is designed to complement the Absolute Strategies Fund. Many of the Fund’s positions are catalyst or event driven and, at times, may include highly contrarian investments. As such, the Fund is not intended to perform in line with other asset classes. The Fund returned -5.16% over the Period versus 21.86% for the S&P 500 Index and 4.63% for the HFRX Global Hedge Fund Index.

Fund performance over the last year was a result of having significant short exposure during a time when equity and credit (or fixed income) markets went up despite a multitude of data points that historically would have sent prices lower, e.g. missed revenue/earnings targets, negative guidance, low or flat or negative earnings growth. The Fund’s short credit instruments experienced a negative carry, which was largely responsible for the Fund’s loss. We believe the Fund’s long investments performed quite well, however, due to the low beta nature of the Fund’s long portfolio, returns were less than market indices.

To best understand Fund performance and Fund exposures, we believe it is helpful to think of the Fund as having experienced two distinct periods over its history.

2008 (Inception) - 2011

We designed the Fund in early 2008 based on the premise that financial markets were likely to experience some kind of distressed credit environment. The Fund’s original investment manager (“Subadviser”) line-up was geared toward managers with particular expertise in distressed debt, special situations (re-capitalizations, re-organizations), and investing in highly leveraged companies based on in-depth analyses of their capital structures.

The Fund also included Subadvisers whose strategies could take advantage of expected equity market volatility.

That distressed environment did materialize for a period of time and the Fund took advantage of a number of opportunities in both the equity and credit markets while many other managers of “alternative” strategies appeared to be sitting on the sidelines. Most of these opportunities occurred on the long side, resulting in strong performance from inception in October of 2008 through December of 2011 with the Fund returning 29.81% versus 11.47% and 1.21% for the S&P 500 Index and the HFRX Global Hedge Fund Index, respectively. The Fund’s beta to the S&P 500 during that period was just 0.15 highlighting the unique nature of the Fund’s returns.

2012 - Present

This period represents a much different market environment. By 2011, we believe it was clear that a combination of government stimulus (monetary & fiscal) and accounting rule changes effectively ended the distressed cycle much earlier than would have otherwise occurred. Many debts were refinanced, amended, and/or extended rather than being allowed to default. As a result, we were forced us to re-think the Fund’s roster of Subadvisers and shift Fund allocations to achieve what we believe to be a more balanced long and short positioning.

During 2012 – 2013, the Fund did not have a significant long bias and we found it difficult to generate meaningful performance for the Fund. In those years, high beta was rewarded and short exposures were punished. In fact, short exposures suffered despite deteriorating fundamentals for many companies.

Recently we have chosen to maintain that balance of long and short investments rather than throw in the towel on the short side. Indeed, we believe that the largest mis-pricings in the Fund at this point, and therefore the most attractive opportunities, are in the Fund’s short investments. Thus, we think the Fund’s collection of longs and shorts represents a highly unique portfolio that has the ability to generate solid risk-adjusted performance over the next few years without relying on market beta.

| |

ABSOLUTE OPPORTUNITIES FUND A MESSAGE TO OUR SHAREHOLDERS MARCH 31, 2014 |

| |

The Fund’s long investments are largely made up of a concentrated group of special situations equities (selected by Pine Cobble Capital & Sabal Capital). Special situations in which companies may find themselves include those that are a result of a capital structure change (e.g. spin-off), a company operational change (e.g. MLP conversion). A misunderstood company with a unique business prospect (e.g. new product launch) may also be considered a special situations company. Such special situation companies tend to be lower beta investments that don’t necessarily track the equity markets in up or down periods.

The Fund’s short investment strategies are largely dominated by a short-biased investment grade credit strategy (implemented by LakeWater Capital). The Fund also achieves short exposure through an equity market futures overlay strategy. The short-biased investment grade credit strategy has been discussed at length in previous commentaries. As a reminder, it is focused on a highly concentrated group of positions where LakeWater Capital believes there is a mismatch between the credit spread and balance sheet risk of an issuer company. The Fund’s allocation to this strategy has increased significantly over the past few years as credit spreads have narrowed despite balance sheet risk actually going up in some cases. Simply put, we’ve increased the allocation as these mismatches have grown. With respect to the overlay strategy, during periods of excessive over-valuation or under-valuation in markets, we may utilize futures positions or other securities to provide added long exposure (under-valued markets) or short exposure (over-valued markets). This may result in the Fund having slightly more or less net exposure than usual, including the potential for certain areas of the Fund to have a slight net short bias which could have a negative or positive impact on performance when segments of the market are extremely overvalued or undervalued. The Fund currently has a slight net short bias in equity sensitive investments. The Fund also utilizes a long/short strategy (managed by Harvest Capital) focused on agricultural related companies. We think this strategy is attractive because of longer-term secular tailwinds that we believe will propel the agriculture industry and because near-term supply chain dynamics create shorter-term dislocations. Again, this is a lower beta strategy that we believe will do well over time but not necessarily keep up with rising equity markets.

We continue to look for ways to improve Fund exposures and performance. As always, our analysis will be based on an investment approach of sourcing mis-priced securities, long and short. It won’t be based on momentum or guessing on market direction or simply on what worked over the last 6 or 12 months.

As a result, our approach will likely lead the Fund to have performance that looks very different from many other investment funds. At times that may appear great. At times that may feel disappointing. Over a long period of time, however, we believe the Fund will generate solid risk-adjusted returns and help diversify investor portfolios.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

| |

ABSOLUTE STRATEGIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2014 |

| |

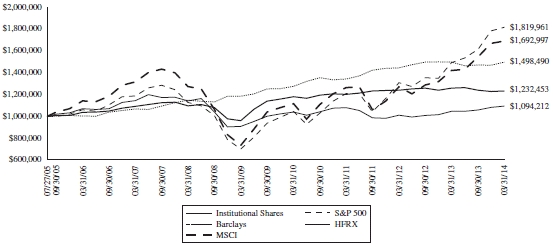

The following charts reflect the change in the value of a hypothetical $1,000,000 investment in Institutional Shares and a $250,000 investment in R Shares, including reinvested dividends and distributions, in Absolute Strategies Fund (the “Fund”) compared with the performance of the benchmarks, the S&P 500 Index ("S&P 500"), Barclays Capital U.S. Aggregate Bond Index ("Barclays Index"), the HFRX Global Hedge Fund Index ("HFRX") and the MSCI World Index ("MSCI World"), since inception. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Barclays Index covers the U.S. dollar-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The MSCI World measures the performance of a diverse range of 24 developed countries' stock markets including the United States, Canada, Europe, the Middle East and the Pacific. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $1,000,000 Investment

Institutional Shares vs. S&P 500 Index, Barclays Capital U.S. Aggregate Bond Index,

HFRX Global Hedge Fund Index and MSCI World Index

| Average Annual Total Return as of 03/31/14 | | One Year | | Five Years | | Commencement of Investment Operations 07/27/05 |

| Absolute Strategies Fund - Institutional Shares | | -2.05% | | 5.12% | | 2.44% |

| S&P 500 Index | | 21.86% | | 21.16% | | 7.15% |

| Barclays Capital U.S. Aggregate Bond Index | | -0.10% | | 4.80% | | 4.77% |

| HFRX Global Hedge Fund Index | | 4.63% | | 3.82% | | 1.04% |

| MSCI World Index | | 19.07% | | 18.28% | | 6.26% |

| |

ABSOLUTE STRATEGIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2014 |

| |

Comparison of Change in Value of a $250,000 Investment

R Shares vs. S&P 500 Index, Barclays Capital U.S. Aggregate Bond Index,

HFRX Global Hedge Fund Index and MSCI World Index

| Average Annual Total Return as of 03/31/14 | | One Year | | Five Years | | Commencement of Investment Operations 07/27/05 |

| Absolute Strategies Fund - R Shares | | -2.05% | | 4.66% | | 2.02% |

| S&P 500 Index | | 21.86% | | 21.16% | | 7.15% |

| Barclays Capital U.S. Aggregate Bond Index | | -0.10% | | 4.80% | | 4.77% |

| HFRX Global Hedge Fund Index | | 4.63% | | 3.82% | | 1.04% |

| MSCI World Index | | 19.07% | | 18.28% | | 6.26% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (888) 992-2765. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Institutional Shares and R Shares are 2.47% and 2.87%, respectively. Excluding the effect of expenses attributable to dividends and interest on short sales, the Fund’s total annual operating expense ratios would be 1.74% and 2.14% for Institutional Shares and R Shares, respectively. However, the Fund's adviser has agreed to contractually reduce its advisory fee to 1.55% on average net assets exceeding $4.5 billion but less than $5 billion and to 1.50% on the average net assets exeeeding $5 billion through July 31, 2015. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

| |

ABSOLUTE OPPORTUNITIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2014 |

| |

The following charts reflect the change in the value of a hypothetical $1,000,000 investment in Institutional Shares, including reinvested dividends and distributions, in the Absolute Opportunities Fund (the “Fund”) compared with the performance of the benchmarks, the S&P 500 Index ("S&P 500"), HFRX Global Hedge Fund Index ("HFRX"), and the MSCI World Index ("MSCI World"), since inception. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The MSCI World measures the performance of a diverse range of 24 developed countries' stock markets including thet United States, Canada, Europe, the Middle East and the Pacific. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $1,000,000 Investment

Absolute Opportunities Fund vs. S&P 500 Index,

HFRX Global Hedge Fund Index and MSCI World Index

| Average Annual Total Return as of 03/31/14 | | One Year | | Five Years | | Commencement of Investment Operations 10/21/08 |

| Absolute Opportunites Fund - Institutional Shares | | -5.16% | | 3.14% | | 3.98% |

| S&P 500 Index | | 21.86% | | 21.16% | | 15.71% |

| HFRX Global Hedge Fund Index | | 4.63% | | 3.82% | | 2.28% |

| MSCI World Index | | 19.07% | | 18.28% | | 12.94% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (888) 992-2765. As stated in the Fund's prospectus, the annual operating expense ratio (gross) is 4.00%. Excluding the effect of expenses attributable to dividends and interest on short sales, the Fund’s total annual operating expense ratio would be 3.01%. However, the Fund's adviser has agreed to contractually waive a portion of its fees and to reimburse expenses to limit total annual operating expenses to 1.95% (excluding all interest, taxes, portfolio transaction expenses, dividends and interest on short sales, acquired fund fees and expenses, proxy expenses, and extraordinary expenses), for the period January 1, 2014 to August 1, 2015. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

| |

ABSOLUTE STRATEGIES FUND PORTFOLIO HOLDINGS SUMMARY (Unaudited) MARCH 31, 2014 |

| |

| Portfolio Breakdown (% of Net Assets) |

| Long Positions |

| Equity Securities | 37.6% | |

| Asset Backed Obligations | 6.5% | |

| Corporate Convertible Bonds | 17.7% | |

| Corporate Non-Convertible Bonds | 2.6% | |

| Exchange Traded Notes | 0.0% | |

| Foreign Government Bonds | 0.0% | |

| Interest Only Bonds | 0.1% | |

| Municipal Bonds | 0.5% | |

| Municipal Demand Notes | 0.1% | |

| Syndicated Loans | 0.1% | |

| U.S. Government & Agency Obligations | 1.0% | |

| Rights | 0.0% | |

| Investment Companies | 9.1% | |

| Short-Term Investments | 0.3% | |

| Purchased Options | 1.6% | |

| Short Positions |

| Equity Securities | -27.6% | |

| Investment Companies | -1.5% | |

| Written Options | -1.1% | |

| Other Assets less Liabilities* | 53.0% | |

| | 100.0% | |

| * | Consists of deposits with the custodian and/or brokers for securities sold short, cash, foreign currency, prepaid expenses, receivables, payables and accrued liabilities. Deposits with the custodian and/or brokers for securities sold short represents 40.1% of net assets. See Note 2. |

| | (% of Equity Holdings) |

| Sector Breakdown | Long | Short |

| Consumer Discretionary | 17.1% | 20.8% | |

| Consumer Staples | 22.1% | 5.1% | |

| Energy | 9.1% | 2.2% | |

| Financial | 16.7% | 30.3% | |

| Healthcare | 7.7% | 2.9% | |

| Industrial | 5.4% | 20.6% | |

| Information Technology | 11.1% | 9.8% | |

| Materials | 3.7% | 4.3% | |

| Telecommunication Services | 6.9% | 4.0% | |

| Utilities | 0.2% | 0.0% | |

| | 100.0% | 100.0% | |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2014 |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Security | | | | | | | | | | | Security | | | | | | | |

| | Shares | | Description | | | | | | Value | | | Shares | | Description | | | | | | Value | |

| Long Positions - 77.2% | | | | | | | | Energy - 3.1% | | | | | | | |

| Equity Securities - 37.6% | | | | | | | | | 225,000 | | Apache Corp. | | | | | $ | 18,663,750 | |

| Common Stock - 36.6% | | | | | | | | | 60,000 | | ConocoPhillips | | | | | | 4,221,000 | |

| Consumer Discretionary - 6.4% | | | | | | | | | 8,692 | | Continental Resources, Inc. (a) | | | | | | 1,080,155 | |

| | 40,000 | | Apollo Education Group, Inc. (a) | | | | | $ | 1,369,600 | | | 406,200 | | Enbridge, Inc. | | | | | | 18,486,162 | |

| | 186,700 | | Bed Bath & Beyond, Inc. (a)(b)(c)(d) | | | | | | 12,844,960 | | | 168,000 | | Ensco PLC, Class A | | | | | | 8,867,040 | |

| | 158,300 | | CarMax, Inc. (a)(b)(c)(d) | | | | | | 7,408,440 | | | 120,000 | | Exxon Mobil Corp. | | | | | | 11,721,600 | |

| | 147,500 | | Coach, Inc. (b)(c)(d) | | | | | | 7,324,850 | | | 106,000 | | National Oilwell Varco, Inc. | | | | | | 8,254,220 | |

| | 309,500 | | CVS Caremark Corp. (b)(c)(d) | | | | | | 23,169,170 | | | 61,519 | | Ocean Rig UDW, Inc. (a)(b) | | | | | | 1,094,423 | |

| | 152,600 | | DIRECTV (a)(b)(c)(d) | | | | | | 11,661,692 | | | 400,000 | | Spectra Energy Corp. | | | | | | 14,776,000 | |

| | 4,346 | | Dunkin' Brands Group, Inc. | | | | | | 218,082 | | | | | | | | | | | 87,164,350 | |

| | 100,000 | | eBay, Inc. (a) | | | | | | 5,524,000 | | | | | | | | | | | | |

| | 78,212 | | General Motors Co. (c)(d) | | | | | | 2,692,057 | | Financial - 5.9% | | | | | | | |

| | 7,704 | | Google, Inc., Class A (a)(b)(c)(d) | | | | | | 8,586,185 | | | 1,135 | | Affiliated Managers Group, Inc. (a)(b) | | | | | | 227,057 | |

| | 16,974 | | Hanesbrands, Inc. (b) | | | | | | 1,298,172 | | | 80,000 | | American Express Co. (b)(c)(d) | | | | | | 7,202,400 | |

| | 581,400 | | Hertz Global Holdings, Inc. (a)(b)(c)(d) | | | | | | 15,488,496 | | | 266,900 | | American International Group, Inc. (b)(c)(d) | | | | | | 13,347,669 | |

| | 242,800 | | Kohl's Corp. (b)(c)(d) | | | | | | 13,791,040 | | | 52,100 | | Aon PLC (b) | | | | | | 4,390,988 | |

| | 4,346 | | Las Vegas Sands Corp. | | | | | | 351,070 | | | 83,400 | | Bancorp, Inc. (a) | | | | | | 1,568,754 | |

| | 38,000 | | McDonald's Corp. (b) | | | | | | 3,725,140 | | | 601,300 | | Bank of America Corp. (b)(c)(d) | | | | | | 10,342,360 | |

| | 8,692 | | MGM Resorts International (a) | | | | | | 224,775 | | | 50 | | Berkshire Hathaway, Inc., Class A (a)(b) | | | | | | 9,367,505 | |

| | 633,588 | | Office Depot, Inc. (a)(b) | | | | | | 2,616,718 | | | 171,700 | | Berkshire Hathaway, Inc., Class B (a)(b)(c)(d) | | | | | | 21,457,349 | |

| | 184,200 | | Target Corp. (b)(c)(d) | | | | | | 11,145,942 | | | 13,037 | | Blackstone Group LP | | | | | | 433,480 | |

| | 5,215 | | Tesla Motors, Inc. (a) | | | | | | 1,087,067 | | | 276,352 | | DFC Global Corp. (a)(b) | | | | | | 2,440,188 | |

| | 21,730 | | The Goodyear Tire & Rubber Co. | | | | | | 567,805 | | | 470 | | Fairfax Financial Holdings, Ltd. | | | | | | 203,557 | |

| | 72,300 | | The Walt Disney Co. (b)(c)(d) | | | | | | 5,789,061 | | | 214,600 | | JPMorgan Chase & Co. (b)(c)(d) | | | | | | 13,028,366 | |

| | 100,000 | | Viacom, Inc., Class B | | | | | | 8,499,000 | | | 354,700 | | Leucadia National Corp. (b) | | | | | | 9,931,600 | |

| | 239,800 | | Walgreen Co. (b)(c)(d) | | | | | | 15,833,994 | | | 189,700 | | Ocwen Financial Corp. (a) | | | | | | 7,432,446 | |

| | 202,200 | | Wal-Mart Stores, Inc. (b)(c)(d) | | | | | | 15,454,146 | | | 34,856 | | Rayonier, Inc. REIT (b) | | | | | | 1,600,239 | |

| | 60,500 | | Weight Watchers International, Inc. (b)(c)(d) | | | | | | 1,242,670 | | | 150,000 | | Resource America, Inc., Class A | | | | | | 1,285,500 | |

| | 1,738 | | Wynn Resorts, Ltd. | | | | | | 386,097 | | | 30,421 | | Square 1 Financial, Inc. (a) | | | | | | 611,462 | |

| | | | | | | | | | 178,300,229 | | | 588,100 | | The Bank of New York Mellon Corp. (b)(c)(d) | | | | | | 20,754,049 | |

| | | | | | | | | | | | | 72,500 | | The Travelers Cos., Inc. (b) | | | | | | 6,169,750 | |

| Consumer Staples - 8.2% | | | | | | | | | 266,750 | | Wells Fargo & Co. (b)(c)(d) | | | | | | 13,268,145 | |

| | 102,000 | | Aggreko PLC | | | | | | 2,578,560 | | | 420,000 | | WR Berkley Corp. | | | | | | 17,480,400 | |

| | 317,500 | | Avon Products, Inc. | | | | | | 4,648,200 | | | | | | | | | | | 162,543,264 | |

| | 70,000 | | Campbell Soup Co. (b) | | | | | | 3,141,600 | | | | | | | | | | | | |

| | 200,000 | | Express Scripts Holding Co. (a) | | | | | | 15,018,000 | | Healthcare - 2.8% | | | | | | | |

| | 399,780 | | Great Lakes Dredge & Dock Corp. (a)(b) | | | | | | 3,649,992 | | | 82,600 | | Abbott Laboratories (b)(c)(d) | | | | | | 3,180,926 | |

| | 88,000 | | Hengan International Group Co., Ltd. | | | | | | 915,200 | | | 32,655 | | Alere, Inc. (a) | | | | | | 1,121,699 | |

| | 265,000 | | Molson Coors Brewing Co., Class B | | | | | | 15,597,900 | | | 63,000 | | Becton Dickinson and Co. | | | | | | 7,376,040 | |

| | 180,000 | | Nestle SA, ADR | | | | | | 13,539,600 | | | 77,300 | | CR Bard, Inc. | | | | | | 11,438,854 | |

| | 510,000 | | PepsiCo, Inc. (b) | | | | | | 42,585,000 | | | 120,000 | | Johnson & Johnson (c)(d) | | | | | | 11,787,600 | |

| | 211,010 | | Philip Morris International, Inc. | | | | | | 17,275,389 | | | 175,000 | | Medtronic, Inc. | | | | | | 10,769,500 | |

| | 960,000 | | Sysco Corp. | | | | | | 34,684,800 | | | 180,000 | | Novartis AG, ADR | | | | | | 15,303,600 | |

| | 76,400 | | The Clorox Co. | | | | | | 6,723,964 | | | 150,000 | | Stryker Corp. | | | | | | 12,220,500 | |

| | 811,400 | | The Coca-Cola Co. (c)(d) | | | | | | 31,368,724 | | | 40,000 | | WellPoint, Inc. | | | | | | 3,982,000 | |

| | 370,000 | | The Procter & Gamble Co. | | | | | | 29,822,000 | | | | | | | | | | | 77,180,719 | |

| | 638,385 | | TherapeuticsMD, Inc. (a)(b) | | | | | | 4,028,209 | | | | | | | | | | | | |

| | | | | | | | | | 225,577,138 | | Industrial - 2.0% | | | | | | | |

| | | | | | | | | | | | | 95,000 | | CH Robinson Worldwide, Inc. | | | | | | 4,977,050 | |

| | | | | | | | | | | | | 10,215 | | EnPro Industries, Inc. (a)(b) | | | | | | 742,324 | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 12 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2014 |

| |

| | | Security | | | | | | | | | | | | | | | | | | |

| | Shares | | Description | | | | | | Value | | | | | Security | | | | | | | |

| | 460,400 | | Expeditors International of Washington, Inc. (b)(c)(d) | | | | | $ | 18,245,652 | | | Shares | | Description | | | | | | Value | |

| | 151,704 | | Global Brass & Copper Holdings, Inc. (b) | | | | | | 2,392,372 | | | 42,246 | | FTD Cos., Inc. (a) | | | | | $ | 1,343,845 | |

| | 44,943 | | ITT Corp. (b) | | | | | | 1,921,763 | | | 120,089 | | Lee Enterprises, Inc. (a)(b) | | | | | | 536,798 | |

| | 62,252 | | KBR, Inc. | | | | | | 1,660,883 | | | 159,014 | | News Corp., Class A (a)(b) | | | | | | 2,738,221 | |

| | 173,747 | | Quality Distribution, Inc. (a)(b) | | | | | | 2,256,973 | | | 300,000 | | Orange SA, ADR | | | | | | 4,407,000 | |

| | 35,768 | | Rock-Tenn Co., Class A (b) | | | | | | 3,776,028 | | | 8,692 | | Palo Alto Networks, Inc. (a) | | | | | | 596,271 | |

| | 87,500 | | The Boeing Co. (b)(c)(d) | | | | | | 10,980,375 | | | 15,210 | | Pandora Media, Inc. (a) | | | | | | 461,167 | |

| | 152,365 | | Tutor Perini Corp. (a)(b) | | | | | | 4,368,305 | | | 477,984 | | Parkervision, Inc. (a)(b) | | | | | | 2,294,323 | |

| | 41,100 | | United Parcel Service, Inc., Class B (b)(c)(d) | | | | | | 4,002,318 | | | 2,173 | | Qihoo 360 Technology Co., Ltd., ADR (a) | | | | | | 216,388 | |

| | | | | | | | | | 55,324,043 | | | 364,000 | | Spark Networks, Inc. (a) | | | | | | 1,903,720 | |

| | | | | | | | | | | | | 6,519 | | Splunk, Inc. (a) | | | | | | 466,043 | |

| Information Technology - 4.2% | | | | | | | | | 89,538 | | Telephone & Data Systems, Inc. (b) | | | | | | 2,346,791 | |

| | 130,800 | | Accenture PLC, Class A (b)(c)(d) | | | | | | 10,427,376 | | | 700,000 | | Twenty-First Century Fox, Inc., Class B | | | | | | 21,784,000 | |

| | 29,750 | | Apple, Inc. (b)(d) | | | | | | 15,968,015 | | | 52,363 | | Verizon Communications, Inc. (b) | | | | | | 2,490,908 | |

| | 109,486 | | CareView Communications, Inc. (a) | | | | | | 72,261 | | | 113,578 | | Vitacost.com, Inc. (a)(b) | | | | | | 805,268 | |

| | 107,500 | | Check Point Software Technologies, Ltd. (a) | | | | | | 7,270,225 | | | 108,600 | | Vodafone Group PLC, ADR (b) | | | | | | 3,997,566 | |

| | 502,500 | | Corning, Inc. (b)(c)(d) | | | | | | 10,462,050 | | | | | | | | | | | 70,593,614 | |

| | 102,400 | | Electronic Arts, Inc. (a)(b) | | | | | | 2,970,624 | | | | | | | | | | | | |

| | 244,584 | | FormFactor, Inc. (a)(b) | | | | | | 1,562,892 | | Utilities - 0.0% | | | | | | | |

| | 20,100 | | Hewlett-Packard Co. | | | | | | 650,436 | | | 49,903 | | Dynegy, Inc. (a)(b) | | | | | | 1,244,581 | |

| | 75 | | International Business Machines Corp. | | | | | | 14,437 | | | | | | | | | | | | |

| | 29,000 | | Intuit, Inc. (b) | | | | | | 2,254,170 | | Total Common Stock | | | | | | | |

| | 21,730 | | Micron Technology, Inc. (a) | | | | | | 514,132 | | (Cost $756,844,277) | | | | | | 1,011,644,514 | |

| | 860,000 | | Microsoft Corp. (d) | | | | | | 35,251,400 | | | | | Security | | | | | | | |

| | 64,597 | | NCR Corp. (a)(b) | | | | | | 2,361,020 | | | Shares | | Description | | Rate | | | | Value | |

| | 440,000 | | Oracle Corp. | | | | | | 18,000,400 | | Preferred Stock - 1.0% | | | | | | | |

| | 32,000 | | QUALCOMM, Inc. (b)(d) | | | | | | 2,523,520 | | Consumer Staples - 0.2% | | | | | | | |

| | 10,864 | | Salesforce.com, Inc. (a) | | | | | | 620,226 | | | 18,089 | | Bunge, Ltd. (b) | | 4.88 | % | | | 1,912,912 | |

| | 40,241 | | Silicon Graphics International Corp. (a) | | | | | | 494,159 | | | 6,472 | | Post Holdings, Inc. (b)(e) | | 3.75 | | | | 824,274 | |

| | 63,369 | | Skyworks Solutions, Inc. (a)(b) | | | | | | 2,377,605 | | | 1,252 | | Universal Corp. (b) | | 6.75 | | | | 1,591,135 | |

| | 4,346 | | Tableau Software, Inc., Class A (a) | | | | | | 330,643 | | | | | | | | | | | 4,328,321 | |

| | 27,549 | | Verint Systems, Inc. (a)(b) | | | | | | 1,291,910 | | | | | | | | | | | | |

| | 19,387 | | Vocera Communications, Inc. (a) | | | | | | 316,590 | | Energy - 0.3% | | | | | | | |

| | | | | | | | | | 115,734,091 | | | 1,299 | | Chesapeake Energy Corp. (b)(e) | | 5.75 | | | | 1,458,940 | |

| | | | | | | | | | | | | 4,349 | | Energy XXI Bermuda, Ltd. (b) | | 5.63 | | | | 1,181,025 | |

| Materials - 1.4% | | | | | | | | | 12,844 | | Goodrich Petroleum Corp., Series B (b) | | 5.38 | | | | 543,301 | |

| | 19,210 | | Century Aluminum Co. (a) | | | | | | 253,764 | | | 4,710 | | Penn Virginia Corp., Series A (b) | | 6.00 | | | | 1,418,087 | |

| | 111,002 | | Constellium NV, Class A (a)(b) | | | | | | 3,257,909 | | | 20,954 | | Sanchez Energy Corp. (b) | | 4.88 | | | | 1,568,931 | |

| | 230,000 | | Franco-Nevada Corp. | | | | | | 10,547,800 | | | 6,620 | | Sanchez Energy Corp., Series B (e) | | 6.50 | | | | 505,503 | |

| | 149,242 | | Noranda Aluminum Holding Corp. | | | | | | 613,384 | | | 6,236 | | SandRidge Energy, Inc. (b) | | 7.00 | | | | 629,446 | |

| | 68,000 | | Praxair, Inc. | | | | | | 8,905,960 | | | | | | | | | | | 7,305,233 | |

| | 165,000 | | Royal Gold, Inc. | | | | | | 10,332,300 | | | | | | | | | | | | |

| | 43,600 | | Sigma-Aldrich Corp. | | | | | | 4,071,368 | | Financial - 0.4% | | | | | | | |

| | | | | | | | | | 37,982,485 | | | 56,652 | | Alexandria Real Estate Equities, Inc. REIT, Series D (b) | | 7.00 | | | | 1,522,239 | |

| | | | | | | | | | | | | 20,316 | | AMG Capital Trust II (b) | | 5.15 | | | | 1,306,573 | |

| Telecommunication Services - 2.6% | | | | | | | | | 368 | | Bank of America Corp., Series L (b) | | 7.25 | | | | 422,142 | |

| | 800,000 | | Cisco Systems, Inc. | | | | | | 17,928,000 | | | 20,298 | | Health Care REIT, Inc., Series I (b) | | 6.50 | | | | 1,127,148 | |

| | 127,628 | | CommScope Holding Co., Inc. (a)(b) | | | | | | 3,149,859 | | | 16,503 | | iStar Financial, Inc. REIT, Series J (b) | | 4.50 | | | | 1,064,443 | |

| | 45,017 | | Comverse, Inc. (a)(b) | | | | | | 1,556,688 | | | 5,148 | | KeyCorp, Series A (b) | | 7.75 | | | | 669,137 | |

| | 26,075 | | Facebook, Inc., Class A (a) | | | | | | 1,570,758 | | | | | | | | | | | | |

| See Notes to Financial Statements. | 13 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2014 |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Shares | | Description | | Rate | | | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| | 15,413 | | Lexington Realty Trust REIT, Series C | | 6.50 | % | | $ | 722,870 | | $ | 124,382 | | Adjustable Rate Mortgage Trust, Series 2005-3 8A32 (b)(h) | | 0.47 | % | 07/25/35 | $ | 120,248 | |

| | 528 | | OFG Bancorp, Series C (b) | | 8.75 | | | | 844,932 | | | 1,227,225 | | Adjustable Rate Mortgage Trust, Series 2006-1 2A1 (h) | | 2.99 | | 03/25/36 | | 944,585 | |

| | 1,375 | | Wells Fargo & Co., Series L | | 7.50 | | | | 1,612,875 | | | 65,657 | | Adjustable Rate Mortgage Trust, Series 2006-1 3A3 (h) | | 2.75 | | 03/25/36 | | 50,047 | |

| | 1,141 | | Wintrust Financial Corp., Series C (b) | | 5.00 | | | | 1,475,741 | | | 400,000 | | Alm Loan Funding, Series 2012-7A A1 (e)(h) | | 1.66 | | 10/19/24 | | 399,380 | |

| | | | | | | | | | 10,768,100 | | | 850,885 | | Alta Wind Holdings, LLC (e) | | 7.00 | | 06/30/35 | | 936,675 | |

Healthcare - 0.1% | | | | | | | | | | 1,940,801 | | American Airlines Pass Through Trust, Series 2013-2 Class A (b)(e) | | 4.95 | | 01/15/23 | | 2,091,213 | |

| | 3,639 | | Alere, Inc., Series B (b) | | 3.00 | | | | 1,049,542 | | | 195,316 | | American Home Mortgage Assets Trust, Series 2007-4 A2 (h) | | 0.34 | | 08/25/37 | | 181,631 | |

| | 70 | | HealthSouth Corp. (b)(e) | | 6.50 | | | | 91,280 | | | 903,629 | | ARES XII CLO, Ltd., Series 2007-12A A (e)(h) | | 0.86 | | 11/25/20 | | 899,487 | |

| | 591 | | HealthSouth Corp., Series A (b) | | 6.50 | | | | 770,664 | | | 1,125,148 | | Asset Backed Funding Certificates, Series 2007-NC1 M2 (e)(h) | | 1.40 | | 05/25/37 | | 7,216 | |

| | 10,378 | | Omnicare Capital Trust II, Series B (b) | | 4.00 | | | | 763,432 | | | 1,285,000 | | Astoria Depositor Corp. (e) | | 8.14 | | 05/01/21 | | 1,349,250 | |

| | | | | | | | | | 2,674,918 | | | 751,160 | | AWAS Aviation Capital, Ltd. (e) | | 7.00 | | 10/17/16 | | 781,206 | |

Industrial - 0.0% | | | | | | | | | | 500,000 | | Axis Equipment Finance Receivables, LLC, Series 2012-1I D (b)(f) | | 5.50 | | 11/20/15 | | 502,150 | |

| | 18,041 | | Continental Airlines Finance Trust II (b) | | 6.00 | | | | 911,071 | | | 500,000 | | Axis Equipment Finance Receivables, LLC, Series 2012-1I E1 (b)(f) | | 6.25 | | 04/20/16 | | 503,160 | |

| | | | | | | | | | | | | 550,000 | | Axis Equipment Finance Receivables, LLC, Series 2012-1I E2 (b)(f) | | 7.00 | | 03/20/17 | | 529,594 | |

| Materials - 0.0% | | | | | | | | | | | | | | | | | | | |

| | 32,397 | | ArcelorMittal, Series MTUS (b) | | 6.00 | | | | 776,880 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Telecommunication Services - 0.0% | | | | | | | | | | | | | | | | | | | |

| | 6,790 | | Iridium Communications, Inc. (b)(e) | | 7.00 | | | | 700,219 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Utilities - 0.0% | | | | | | | | | | | | | | | | | | | |

| | 20,534 | | CenterPoint Energy, Inc. (b)(g) | | 3.72 | | | | 1,085,735 | | | | | | | | | | | | |

| Total Preferred Stock | | | | | | | | | | | | | | | | | | | |

| (Cost $20,764,526) | | | | | | | 28,550,477 | | | | | | | | | | | | |

| Total Equity Securities | | | | | | | | | | | | | | | | | | | |

| (Cost $777,608,803) | | | | | | 1,040,194,991 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Security | | | | | | | | | | | | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | | | | | | | | | | |

| Fixed Income Securities - 28.6% | | | | | | | | | | | | | | | | | | |

| Asset Backed Obligations - 6.5% | | | | | | | | | | | | | | | | | | |

| $ | 480,884 | | ACE Securities Corp. Home Equity Loan Trust, Series 2007-HE1 A2A (h) | | 0.24 | | 01/25/37 | | 283,399 | | | | | | | | | | | | |

| | 873,283 | | ACS Pass Through Trust, Series 2007-1A G1 (b)(e)(h) | | 0.46 | | 06/14/37 | | 830,754 | | | | | | | | | | | | |

| | 1,387,668 | | Adjustable Rate Mortgage Trust, Series 2005-11 2A41 (h) | | 2.63 | | 02/25/36 | | 1,340,734 | | | | | | | | | | | | |

| | 98,426 | | Adjustable Rate Mortgage Trust, Series 2005-12 2A1 (h) | | 2.79 | | 03/25/36 | | 76,784 | | | | | | | | | | | | |

| See Notes to Financial Statements. | 14 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2014 |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 1,067,031 | | Banc of America Alternative Loan Trust, Series 2005-2 4A1 | | 5.50 | % | 03/25/20 | $ | 1,117,435 | | $ | 193,705 | | Bear Stearns Adjustable Rate Mortgage Trust, Series 2007-5 1A1 (h) | | 2.68 | % | 08/25/47 | $ | 144,517 | |

| | 215,732 | | Banc of America Alternative Loan Trust, Series 2005-8 2CB1 | | 6.00 | | 09/25/35 | | 198,867 | | | 205,739 | | Bear Stearns ALT-A Trust, Series 2005-4 1A1 (h) | | 0.59 | | 04/25/35 | | 191,428 | |

| | 52,319 | | Banc of America Funding Corp., Series 2006-E 2A1 (h) | | 2.81 | | 06/20/36 | | 43,891 | | | 191,479 | | Bear Stearns ALT-A Trust, Series 2005-8 11A1 (h) | | 0.69 | | 10/25/35 | | 169,164 | |

| | 221,420 | | Banc of America Funding Corp., Series 2006-F 1A1 (h) | | 2.61 | | 07/20/36 | | 219,570 | | | 409,123 | | Bear Stearns ALT-A Trust, Series 2006-1 22A1 (h) | | 2.41 | | 02/25/36 | | 305,833 | |

| | 44,443 | | Banc of America Funding Corp., Series 2006-G 2A3 (b)(h) | 0.33 | | 07/20/36 | | 44,408 | | | 1,881,887 | | Bear Stearns ALT-A Trust, Series 2006-2 21A1 (h) | | 2.58 | | 03/25/36 | | 1,282,026 | |

| | 181,792 | | Banc of America Funding Corp., Series 2006-H 6A1 (h) | | 0.35 | | 10/20/36 | | 130,664 | | | 181,825 | | Bear Stearns ALT-A Trust, Series 2006-2 23A1 (h) | | 2.61 | | 03/25/36 | | 129,143 | |

| | 114,634 | | Banc of America Funding Corp., Series 2007-E 4A1 (h) | | 2.67 | | 07/20/47 | | 91,461 | | | 1,172,687 | | Bear Stearns ALT-A Trust, Series 2006-3 1A1 (h) | | 0.53 | | 05/25/36 | | 778,278 | |

| | 1,488,207 | | Bayview Commercial Asset Trust, Series 2004-3 A1 (e)(h) | 0.52 | | 01/25/35 | | 1,386,365 | | | 1,288,974 | | Bear Stearns ALT-A Trust, Series 2006-4 11A1 (h) | | 0.47 | | 08/25/36 | | 884,235 | |

| | 1,225,000 | | Bayview Commercial Mortgage Pass-Through Trust, Series 2006-SP1 M1 (b)(e)(h) | | 0.60 | | 04/25/36 | | 1,049,462 | | | 75,972 | | Bear Stearns Asset Backed Securities Trust, Series 2005-TC2 A3 (b)(h) | | 0.52 | | 08/25/35 | | 75,273 | |

| | 54,920 | | Bayview Financial Mortgage Pass-Through Trust, Series 2005-D AF3 (b)(h) | | 5.50 | | 12/28/35 | | 56,069 | | | 191,729 | | Bear Stearns Commercial Mortgage Securities Trust, Series 2005-T20 AAB (b)(h) | | 5.12 | | 10/12/42 | | 193,706 | |

| | 2,314,104 | | BCAP, LLC, Series 2013-RR2 6A1 (e)(h) | | 3.00 | | 06/26/37 | | 2,319,271 | | | 1,200,000 | | BlueMountain CLO, Ltd., Series 2013-1A A1 (e)(h) | | 1.44 | | 05/15/25 | | 1,187,171 | |

| | 85,261 | | Beacon Container Finance, LLC, Series 2012-1A A (b)(e) | 3.72 | | 09/20/27 | | 85,563 | | | 55,867 | | BNC Mortgage Loan Trust, Series 2007-1 A2 (b)(h) | | 0.21 | | 03/25/37 | | 55,013 | |

| | | | | | | | | | | | | 1,500,000 | | BNC Mortgage Loan Trust, Series 2007-3 A3 (h) | | 0.28 | | 07/25/37 | | 1,362,594 | |

| | | | | | | | | | | | | 63,125 | | BNC Mortgage Loan Trust, Series 2007-4 A3A (h) | | 0.40 | | 11/25/37 | | 62,931 | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 15 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2014 |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 200,106 | | Centex Home Equity Loan Trust, Series 2005-C AF6 (g) | | 4.64 | % | 06/25/35 | $ | 197,948 | | $ | 832,136 | | Conseco Finance Home Equity Loan Trust, Series 2002-C BF1 (h) | | 8.00 | % | 06/15/32 | $ | 912,905 | |

| | 853,276 | | Chase Mortgage Finance Trust, Series 2007-A1 8A1 (h) | | 2.65 | | 02/25/37 | | 870,506 | | | 787,107 | | Conseco Finance Securitizations Corp., Series 2001-4 A4 (b) | | 7.36 | | 08/01/32 | | 861,546 | |

| | 313,088 | | ChaseFlex Trust, Series 2007-1 2A9 | | 6.00 | | 02/25/37 | | 277,177 | | | 461,778 | | Continental Airlines Pass Through Trust, Series 2007-1 B (b) | 6.90 | | 04/19/22 | | 500,151 | |

| | 100,000 | | CIFC Funding Ltd., Series 2012-2A A1L (b)(e)(h) | | 1.64 | | 12/05/24 | | 99,816 | | | 658,730 | | Continental Airlines Pass Through Trust, Series 2009-1 (b) | 9.00 | | 07/08/16 | | 754,246 | |

| | 630,000 | | CIFC Funding, Ltd., Series 2012-2A A3L (e)(h) | | 3.24 | | 12/05/24 | | 624,240 | | | 697,738 | | Coso Geothermal Power Holdings, LLC (e) | | 7.00 | | 07/15/26 | | 404,688 | |

| | 675,000 | | CIFC Funding, Ltd., Series 2013-3A B (e)(h) | | 2.91 | | 10/24/25 | | 663,325 | | | 59,366 | | Countrywide Alternative Loan Trust, Series 2004-J10 4CB1 | 6.50 | | 10/25/34 | | 63,922 | |

| | 1,514,879 | | CIT Education Loan Trust, Series 2007-1 A (e)(h) | | 0.32 | | 03/25/42 | | 1,417,672 | | | 64,688 | | Countrywide Alternative Loan Trust, Series 2005-50CB 1A1 | 5.50 | | 11/25/35 | | 58,969 | |

| | 1,200,000 | | Citicorp Residential Mortgage Trust, Series 2006-2 A5 (g) | | 6.04 | | 09/25/36 | | 1,155,853 | | | 225,124 | | Countrywide Alternative Loan Trust, Series 2005-73CB 1A8 | | 5.50 | | 01/25/36 | | 210,863 | |

| | 1,200,000 | | Citicorp Residential Mortgage Trust, Series 2007-1 A5 (g) | | 6.05 | | 03/25/37 | | 1,107,184 | | | 669,057 | | Countrywide Alternative Loan Trust, Series 2005-J10 1A16 | | 5.50 | | 10/25/35 | | 615,733 | |

| | 317,712 | | Citigroup Mortgage Loan Trust, Inc., Series 2006-WF1 A2D (g) | | 5.62 | | 03/25/36 | | 215,835 | | | 483,333 | | Countrywide Alternative Loan Trust, Series 2005-J12 2A1 (h) | | 0.42 | | 08/25/35 | | 292,039 | |

| | 499,787 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-AR8 2A1A (h) | | 2.76 | | 07/25/37 | | 423,229 | | | 262,920 | | Countrywide Alternative Loan Trust, Series 2006-36T2 1A1 (h) | | 0.47 | | 12/25/36 | | 167,914 | |

| | 285,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-WFH4 A2C (h) | | 1.45 | | 07/25/37 | | 227,289 | | | 29,205 | | Countrywide Alternative Loan Trust, Series 2006-7CB 3A1 | | 5.25 | | 05/25/21 | | 25,405 | |

| | 130,514 | | CitiMortgage Alternative Loan Trust, Series 2006-A7 1A12 | | 6.00 | | 12/25/36 | | 114,223 | | | 290,874 | | Countrywide Alternative Loan Trust, Series 2007-16CB 4A7 | | 6.00 | | 08/25/37 | | 263,250 | |

| | 50,716 | | CitiMortgage Alternative Loan Trust, Series 2007-A4 1A6 | | 5.75 | | 04/25/37 | | 44,145 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 16 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2014 |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 223,657 | | Countrywide Alternative Loan Trust, Series 2007-19 1A34 | | 6.00 | % | 08/25/37 | $ | 186,697 | | $ | 1,359,067 | | Credit-Based Asset Servicing and Securitization, LLC, Series 2006-CB8 A2B (h) | | 0.26 | % | 10/25/36 | $ | 1,280,411 | |

| | 123,581 | | Countrywide Asset-Backed Certificates, Series 2004-7 MV3 (b)(h) | | 1.20 | | 12/25/34 | | 123,026 | | | 2,643,525 | | Credit-Based Asset Servicing and Securitization, LLC, Series 2007-CB2 A2E (b)(g) | | 4.82 | | 02/25/37 | | 1,944,958 | |

| | 1,414,415 | | Countrywide Asset-Backed Certificates, Series 2007-13 2A1 (h) | | 1.05 | | 10/25/47 | | 1,233,276 | | | 1,351,859 | | Credit-Based Asset Servicing and Securitization, LLC, Series 2007-CB5 A3 (h) | | 0.40 | | 04/25/37 | | 909,909 | |

| | 1,279,942 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2004-HYB5 3A1 (h) | | 2.62 | | 04/20/35 | | 1,138,707 | | | 490,000 | | Cronos Containers Program, Ltd., Series 2012-1A A (e) | | 4.21 | | 05/18/27 | | 491,384 | |

| | 237,048 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2007-HY3 4A1 (h) | | 5.24 | | 06/25/47 | | 221,484 | | | 425,000 | | Cronos Containers Program, Ltd., Series 2012-2A A (e) | | 3.81 | | 09/18/27 | | 428,680 | |

| | 81,304 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2007-HY5 1A1 (h) | | 2.86 | | 09/25/47 | | 71,395 | | | 881,008 | | CSAB Mortgage Backed Trust, Series 2007-1 1A1A (h) | | 5.90 | | 05/25/37 | | 492,386 | |

| | 17,543 | | Credit Suisse First Boston Mortgage Securities Corp., Series 2003-AR24 2A4 (h) | | 2.58 | | 10/25/33 | | 17,087 | | | 1,513,483 | | CSMC Trust, Series 2013-3R 5A1 (e)(h) | | 2.50 | | 10/27/36 | | 1,519,603 | |

| | 389,563 | | Credit Suisse First Boston Mortgage Securities Corp., Series 2005-11 8A9 | | 5.25 | | 12/25/35 | | 395,439 | | | 75,000 | | DBRR Trust, Series 2011-LC2 A4A (b)(e)(h) | | 4.54 | | 07/12/44 | | 81,420 | |

| | 77,996 | | Credit Suisse First Boston Mortgage Securities Corp., Series 2005-6 8A1 (b) | | 4.50 | | 07/25/20 | | 79,366 | | | 158,431 | | Delta Air Lines Pass Through Trust, Series 2002-1 G-1 (b) | | 6.72 | | 01/02/23 | | 186,354 | |

| | 84,419 | | Credit Suisse Mortgage Capital Mortgage-Backed Trust, Series 2006-8 3A1 | | 6.00 | | 10/25/21 | | 80,919 | | | 656,294 | | Deutsche Alt-A Securities, Inc. Mortgage Loan Trust, Series 2007-AR1 A4 (h) | | 0.31 | | 01/25/47 | | 472,138 | |

| | 1,372,601 | | Credit-Based Asset Servicing and Securitization, LLC, Series 2006-CB7 A5 (h) | | 0.39 | | 10/25/36 | | 900,425 | | | 241,303 | | Deutsche Alt-B Securities, Inc. Mortgage Loan Trust, Series 2006-AB2 A5B (g) | | 6.09 | | 06/25/36 | | 195,700 | |

| | | | | | | | | | | | | 600,000 | | Dryden XXII Senior Loan Fund, Series 2013-30A C (e)(h) | | 3.09 | | 11/15/25 | | 599,863 | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 17 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2014 |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 1,000,000 | | Dryden XXVI Senior Loan Fund, Series 2013-26A C (e)(h) | | 2.74 | % | 07/15/25 | $ | 967,470 | | $ | 577,593 | | GE Business Loan Trust, Series 2004-1 A (b)(e)(h) | | 0.45 | % | 05/15/32 | $ | 552,335 | |

| | 2,015,000 | | Education Loan Asset-Backed Trust I, Series 2013-1 A2 (e)(h) | | 0.95 | | 04/26/32 | | 1,989,621 | | | 887,513 | | GE Business Loan Trust, Series 2005-1A A3 (b)(e)(h) | | 0.41 | | 06/15/33 | | 833,956 | |

| | 2,920,000 | | Equifirst Loan Securitization Trust, Series 2007-1 A2B (h) | | 0.34 | | 04/25/37 | | 2,158,966 | | | 127,856 | | GE Business Loan Trust, Series 2005-2A A (b)(e)(h) | | 0.40 | | 11/15/33 | | 118,818 | |

| | 61,248 | | Equity One Mortgage Pass-Through Trust, Series 2002-4 M1 (h) | | 5.22 | | 02/25/33 | | 58,598 | | | 49,175 | | GE Business Loan Trust, Series 2005-2A B (b)(e)(h) | | 0.66 | | 11/15/33 | | 45,139 | |

| | 2,851,797 | | First Franklin Mortgage Loan Trust, Series 2006-FF18 A2B (h) | | 0.26 | | 12/25/37 | | 1,696,748 | | | 103,895 | | Goal Capital Funding Trust, Series 2006-1 A3 (b)(h) | | 0.35 | | 11/25/26 | | 102,958 | |

| | 1,190,529 | | First Horizon Alternative Mortgage Securities Trust, Series 2005-AA3 2A1 (h) | | 2.25 | | 05/25/35 | | 964,433 | | | 1,300,000 | | GoldenTree Loan Opportunities VII, Ltd., Series 2013-7A A (e)(h) | | 1.39 | | 04/25/25 | | 1,283,275 | |

| | 402,476 | | First Horizon Alternative Mortgage Securities Trust, Series 2006-FA8 1A1 | | 6.25 | | 02/25/37 | | 349,549 | | | 274,399 | | Green Tree Financial Corp., Series 1997-1 A6 (b) | | 7.29 | | 03/15/28 | | 279,215 | |

| | 474,261 | | First Horizon Alternative Mortgage Securities Trust, Series 2006-FA8 1A8 (h) | | 0.52 | | 02/25/37 | | 309,702 | | | 769,577 | | Green Tree, Series 2008-MH1 A2 (b)(e)(h) | | 8.97 | | 04/25/38 | | 832,310 | |

| | 216,457 | | FNMA, Series 2012-M15, Class A (b)(h) | | 2.66 | | 10/25/22 | | 211,431 | | | 747,286 | | Green Tree, Series 2008-MH1 A3 (b)(e)(h) | | 8.97 | | 04/25/38 | | 808,202 | |

| | 148,447 | | FPL Energy National Wind Portfolio, LLC (e) | | 6.13 | | 03/25/19 | | 146,247 | | | 250,000 | | GS Mortgage Securities Trust, Series 2011-GC5 A4 | | 3.71 | | 08/10/44 | | 261,270 | |

| | 1,860,005 | | GCO Education Loan Funding Master Trust-II, Series 2006-2AR A1RN (b)(e)(h) | | 0.80 | | 08/27/46 | | 1,794,832 | | | 270,080 | | GSAA Home Equity Trust, Series 2005-12 AF3 (h) | | 5.07 | | 09/25/35 | | 255,026 | |

| | 968,871 | | GE Business Loan Trust, Series 2003-2A A (e)(h) | | 0.53 | | 11/15/31 | | 929,142 | | | 1,372,438 | | GSAA Home Equity Trust, Series 2006-20 1A1 (h) | | 0.22 | | 12/25/46 | | 773,024 | |

| | | | | | | | | | | | | 1,222,499 | | GSAA Home Equity Trust, Series 2007-5 2A3A (h) | | 0.47 | | 04/25/47 | | 710,623 | |

| | | | | | | | | | | | | 2,503,163 | | GSAA Trust, Series 2007-3 1A1B (h) | | 0.25 | | 03/25/47 | | 371,655 | |

| | | | | | | | | | | | | 354,800 | | GSR Mortgage Loan Trust, Series 2004-14 3A2 (h) | | 2.76 | | 12/25/34 | | 319,943 | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 18 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2014 |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 1,525,000 | | GSR Mortgage Loan Trust, Series 2004-9 5A7 (h) | | 2.62 | % | 08/25/34 | $ | 1,476,604 | | $ | 304,965 | | Indymac Index Mortgage Loan Trust, Series 2005-AR5 1A1 (h) | | 2.52 | % | 05/25/35 | $ | 222,777 | |

| | 199,454 | | GSR Mortgage Loan Trust, Series 2005-AR5 1A1 (h) | | 2.72 | | 10/25/35 | | 177,280 | | | 1,613,313 | | Indymac Index Mortgage Loan Trust, Series 2006-AR19 1A2 (b)(h) | | 2.77 | | 08/25/36 | | 1,142,587 | |

| | 860,000 | | Halcyon Loan Advisors Funding, Ltd., Series 2012-2A C (e)(h) | | 3.08 | | 12/20/24 | | 855,028 | | | 79,174 | | Indymac Index Mortgage Loan Trust, Series 2006-AR25 3A1 (h) | | 2.71 | | 09/25/36 | | 58,016 | |

| | 15,476 | | HarborView Mortgage Loan Trust, Series 2004-8 2A4A (b)(h) | | 0.56 | | 11/19/34 | | 12,916 | | | 151,096 | | Indymac Index Mortgage Loan Trust, Series 2006-AR29 A1 (h) | | 0.32 | | 11/25/36 | | 112,079 | |

| | 68,000 | | Hewett's Island Clo V, Ltd., Series 2006-5A D (e)(h) | | 1.69 | | 12/05/18 | | 65,934 | | | 201,599 | | Indymac Index Mortgage Loan Trust, Series 2006-AR33 3A1 (h) | | 2.95 | | 01/25/37 | | 175,314 | |

| | 243,019 | | HomeBanc Mortgage Trust, Series 2004-1 2A (h) | | 1.01 | | 08/25/29 | | 229,974 | | | 2,516,643 | | Indymac Index Mortgage Loan Trust, Series 2006-AR41 A3 (h) | | 0.33 | | 02/25/37 | | 1,825,215 | |

| | 900,000 | | HSBC Home Equity Loan Trust, Series 2006-3 A4 (h) | | 0.40 | | 03/20/36 | | 878,917 | | | 749,978 | | Indymac Index Mortgage Loan Trust, Series 2006-AR7 1A1 (h) | | 2.88 | | 05/25/36 | | 556,934 | |

| | 83,283 | | HSBC Home Equity Loan Trust, Series 2006-4 A3V (h) | | 0.31 | | 03/20/36 | | 83,033 | | | 1,520,341 | | Indymac Index Mortgage Loan Trust, Series 2006-AR7 3A1 (h) | | 2.70 | | 05/25/36 | | 1,185,632 | |

| | 153,996 | | HSBC Home Equity Loan Trust, Series 2007-3 APT (b)(h) | | 1.36 | | 11/20/36 | | 153,257 | | | 391,476 | | Indymac Index Mortgage Loan Trust, Series 2006-AR7 4A1 (h) | | 2.89 | | 05/25/36 | | 268,779 | |

| | 209,923 | | HSI Asset Loan Obligation Trust, Series 2007-AR2 2A1 (h) | | 2.78 | | 09/25/37 | | 163,149 | | | 450,000 | | Indymac Index Mortgage Loan Trust, Series 2006-R1 A3 (h) | | 4.69 | | 12/25/35 | | 364,109 | |

| | 1,065,930 | | Indiantown Cogeneration LP, Series A-10 (b) | | 9.77 | | 12/15/20 | | 1,202,485 | | | 367,119 | | Indymac Index Mortgage Loan Trust, Series 2007-FLX2 A1C (h) | | 0.34 | | 04/25/37 | | 263,753 | |

| | 208,965 | | Indymac INDA Mortgage Loan Trust, Series 2007-AR7 1A1 (h) | | 2.82 | | 11/25/37 | | 199,574 | | | 699,669 | | Indymac Manufactured Housing Contract Pass Through Certificates, Series 1998-2 A4 (b)(h) | | 6.64 | | 08/25/29 | | 697,723 | |

| | 1,087,233 | | Indymac Index Mortgage Loan Trust, Series 2004-AR12 A1 (h) | | 0.93 | | 12/25/34 | | 920,607 | | | | | | | | | | | | |

| | 554,573 | | Indymac Index Mortgage Loan Trust, Series 2004-AR7 A2 (h) | | 1.01 | | 09/25/34 | | 483,245 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 19 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2014 |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 250,000 | | ING Investment Management Co., Series 2012-4A A1 (e)(h) | | �� 1.63 | % | 10/15/23 | $ | 249,536 | | $ | 2,373,353 | | JP Morgan Mortgage Trust, Series 2006-S2 2A2 | | 5.88 | % | 06/25/21 | $ | 2,376,212 | |

| | 1,000,000 | | ING Investment Management Co., Series 2013-3A B (e)(h) | | 2.94 | | 01/18/26 | | 993,742 | | | 955,098 | | JP Morgan Mortgage Trust, Series 2007-A1 5A2 (b)(h) | | 2.66 | | 07/25/35 | | 959,728 | |

| | 677,330 | | JetBlue Airways Pass Through Trust, Series 2004-2 G1 (h) | | 0.61 | | 08/15/16 | | 668,863 | | | 45,112 | | JP Morgan Mortgage Trust, Series 2007-A2 4A1M (h) | | 4.86 | | 04/25/37 | | 41,394 | |

| | 2,000,000 | | JetBlue Airways Pass Through Trust, Series 2004-2 G-2 (h) | | 0.69 | | 11/15/16 | | 1,965,000 | | | 1,500,000 | | KKR Financial CLO, Ltd., Series 2005-1A B (e)(h) | | 0.69 | | 04/26/17 | | 1,491,428 | |

| | 2,705,946 | | JP Morgan Alternative Loan Trust, Series 2006-A2 3A1 (h) | | 2.94 | | 05/25/36 | | 2,131,260 | | | 909,063 | | Lehman ABS Manufactured Housing Contract Trust, Series 2001-B A6 (b)(h) | | 6.47 | | 04/15/40 | | 979,281 | |

| | 2,930,588 | | JP Morgan Mortgage Acquisition Trust, Series 2006-WMC3 A4 (h) | | 0.30 | | 08/25/36 | | 1,548,054 | | | 8,959 | | Lehman Mortgage Trust, Series 2006-1 3A3 | | 5.50 | | 02/25/36 | | 8,959 | |

| | 400,000 | | JP Morgan Mortgage Acquisition Trust, Series 2007-CH3 A4 (h) | | 0.36 | | 03/25/37 | | 341,928 | | | 196,924 | | Lehman XS Trust, Series 2005-6 1A1 (h) | | 0.41 | | 11/25/35 | | 133,176 | |

| | 1,110,000 | | JP Morgan Mortgage Acquisition Trust, Series 2007-CH4 A5 (h) | | 0.39 | | 05/25/37 | | 640,412 | | | 1,605,962 | | Lehman XS Trust, Series 2006-13 1A2 (h) | | 0.32 | | 09/25/36 | | 1,326,630 | |

| | 2,590,000 | | JP Morgan Mortgage Acquisition Trust, Series 2007-HE1 AF2 (g) | | 4.55 | | 03/25/47 | | 1,979,760 | | | 833,982 | | Lehman XS Trust, Series 2006-14N 3A2 (h) | | 0.27 | | 08/25/36 | | 613,636 | |

| | 2,938,000 | | JP Morgan Mortgage Acquisition Trust, Series 2007-HE1 AV4 (h) | | 0.43 | | 03/25/47 | | 1,639,137 | | | 1,535,840 | | Lehman XS Trust, Series 2006-19 A2 (h) | | 0.32 | | 12/25/36 | | 1,244,379 | |

| | 163,897 | | JP Morgan Mortgage Trust, Series 2005-A5 TA1 (h) | | 5.25 | | 08/25/35 | | 163,932 | | | 1,733,952 | | Lehman XS Trust, Series 2006-9 A1B (h) | | 0.31 | | 05/25/46 | | 1,406,265 | |

| | 1,600,293 | | JP Morgan Mortgage Trust, Series 2006-A3 2A1 (h) | | 2.75 | | 05/25/36 | | 1,334,571 | | | 1,270,000 | | Limerock CLO, Series 2014-2A A (e)(h) | | 1.73 | | 04/18/26 | | 1,271,267 | |

| | | | | | | | | | | | | 289,197 | | MASTR Adjustable Rate Mortgages Trust, Series 2007-R5 A1 (e)(h) | | 2.52 | | 11/25/35 | | 214,135 | |

| | | | | | | | | | | | | 885,000 | | MASTR Asset Backed Securities Trust, Series 2007-HE1 A3 (h) | | 0.36 | | 05/25/37 | | 600,646 | |

| | | | | | | | | | | | | 13,442 | | MASTR Seasoned Securitization Trust, Series 2004-1 4A1 (b)(h) | | 2.58 | | 10/25/32 | | 13,462 | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 20 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2014 |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 1,068,693 | | Merrill Lynch First Franklin Mortgage Loan Trust, Series 2007-1 A2C (h) | | 0.40 | % | 04/25/37 | $ | 590,237 | | $ | 1,655,152 | | Morgan Stanley Mortgage Loan Trust, Series 2006-11 1A3 (g) | | 6.42 | % | 08/25/36 | $ | 850,007 | |

| | 61,655 | | Merrill Lynch First Franklin Mortgage Loan Trust, Series 2007-1 A2D (h) | | 0.49 | | 04/25/37 | | 34,487 | | | 2,381,410 | | Morgan Stanley Mortgage Loan Trust, Series 2006-7 5A2 (h) | | 5.96 | | 06/25/36 | | 1,423,781 | |

| | 1,347,163 | | Merrill Lynch First Franklin Mortgage Loan Trust, Series 2007-3 A2B (h) | | 0.28 | | 06/25/37 | | 873,863 | | | 215,040 | | Morgan Stanley Mortgage Loan Trust, Series 2007-13 6A1 | | 6.00 | | 10/25/37 | | 176,052 | |

| | 2,241,000 | | Merrill Lynch First Franklin Mortgage Loan Trust, Series 2007-3 A2C (h) | | 0.33 | | 06/25/37 | | 1,463,900 | | | 2,509,364 | | Morgan Stanley Reremic Trust, Series 2013-R3 12A (e)(h) | | 2.71 | | 01/26/47 | | 2,522,632 | |

| | 2,869,681 | | Merrill Lynch First Franklin Mortgage Loan Trust, Series 2007-4 2A4 (h) | | 0.40 | | 07/25/37 | | 1,751,472 | | | 985,113 | | Nelnet Student Loan Trust, Series 2012-5A A (e)(h) | | 0.75 | | 10/27/36 | | 989,222 | |