As filed with the Securities and Exchange Commission on June 4, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: March 31

Date of reporting period: April 1, 2018 – March 31, 2019

ITEM 1. REPORT TO STOCKHOLDERS.

ANNUAL REPORT

MARCH 31, 2019

Beginning on January 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by contacting the Fund at (888) 992-2765, or by contacting your financial intermediary directly.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (888) 992-2765, or by contacting your financial intermediary directly. Your election to receive reports in paper will apply to all funds held with Absolute Funds.

The views in this report were those of Absolute Investment Advisers LLC (“AIA” and “Absolute”), the investment adviser to the Absolute Strategies Fund, Absolute Capital Opportunities Fund and Absolute Convertible Arbitrage Fund (each a “Fund” and collectively the “Funds”) as of March 31, 2019, and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and do not constitute investment advice. None of the information presented should be construed as an offer to sell or recommendation of any security mentioned herein.

The Absolute Strategies Fund utilizes a multi-manager strategy. For a complete description of each Fund’s principal investment risks please refer to its respective prospectus.

Although each Fund’s strategy is different, each Fund is subject to the following risks: Small- and medium-sized company risk; foreign or emerging markets securities risk which involves special risks, including the volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets; interest rate risk; and high yield, lower-rated (junk) bonds risk.

Other principal risks include investing in initial public offerings; selling securities short with the risk of magnified capital losses; investing in derivatives which can be volatile and involve various types and degrees of risks; and investing in options and futures which are subject to special risks and may not fully protect a Fund against declines in the value of its stocks. In addition, an option writing strategy limits the upside profit potential normally associated with stocks. Futures trading is very speculative, largely due to the traditional volatility of futures prices.

Beta is a measure of an asset’s sensitivity to broad market moves, as measured for instance by the S&P 500® Index. A fund with a realized beta of 0.5 with respect to the S&P 500®Index infers that about 50% of the fund’s returns were explained by the performance of the index (the rest of the performance was independent of the index). The HFR Indices are equally weighted performance indexes, utilized by numerous hedge fund managers as a benchmark for their own hedge funds. One cannot invest directly in an index.

Absolute Strategies Fund, Absolute Funds, and Absolute Investment Advisers are registered service marks. Other marks referred to herein are the trademarks, service marks or registered trademarks of their respective owners.

ABSOLUTE STRATEGIES FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2019

Dear Shareholder,

We are pleased to present the Annual Report for the Absolute Strategies Fund (the “Fund”) for the year ended March 31, 2019.

The Fund’s main goals reflect the potential for capital preservation/downside protection through risk and return positioning that helps diversify traditional portfolios. Achieving these goals over the course of an investment cycle often means constructing a portfolio of investments that looks very different from other investment funds, including alternative funds. It requires being defensive at times when others are overly aggressive. It requires looking for value in areas of the market that are over-looked or unloved by other investors. Achieving these goals also means that the Fund’s performance is likely to go through periods of under-performance as well as out-performance versus other strategies. Over time this has created significant non-correlation and diversification characteristics.

Financial markets in 2018 had a very difficult 4th quarter that was favorable for the Fund. The Fund was positioned for a downturn in the markets heading into that period and was able to capitalize on volatility and provide a meaningful portfolio hedge for investors. For the 4th quarter, the Fund returned 4.75% vs. -5.56% and -13.52% for the HRFX Global Hedge Fund Index and the S&P 500 Index respectively. For the calendar year 2018, the Fund returned 1.33% vs. -6.72% and -4.39% for the HRFX Global Hedge Fund Index and the S&P 500 Index respectively. During much of the Fund’s fiscal year, however, markets were routinely bailed out by intervention from global central banks, most notably China. These sudden rallies compress volatility and result in large short-term recoveries that are not favorable to a value-biased long portfolio. The Fund returned -3.23% over the 12 months ended March 31. By comparison, the HRFX Global Hedge Fund Index returned -3.32% and the S&P 500 Index returned 9.50%.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most month-end, call the Fund at 888-99-ABSOLUTE.

Since the introduction of asset purchases by central banks (also known as quantitative easing), financial assets have become increasingly expensive and highly correlated; price-discovery and volatility have been artificially suppressed. Constructing a portfolio of various industry-favored hedge fund strategies does not achieve the risk-adjusted results we desire. Traditional assets classes and most hedge fund strategies have become a correlated beta trade that acts in unison with the overall equity markets. This is clear when looking at the performance of hedge fund strategies during volatile markets; the hedge fund strategies and the S&P 500 are regularly correlated and go down together. A repricing of financial markets caused by artificially suppressed interest rates would very likely result in large losses across equities, fixed income and many alternative investments. To produce alpha within such an environment would require an investment strategy to do something very different including, at times, to take the other side. While this approach has been frustrating over the past few years, we believe the eventual unwinding of correlated asset risks creates an opportunity to set up a portfolio that can generate significant outperformance during periods of high volatility.

Long periods of low volatility and high valuations have historically given way to periods of high volatility, leading to market valuations reverting to the mean. This, we believe, is how markets cycle over time. Occasionally cycles reach extremes, which has actually been a common occurrence over the past 20 years. We believe we have entered a period of higher volatility and a compression in market valuations. This may result in a large drawdown in markets or simply a large trading range with significant swings in prices, similar to the period of the 1970s. The latter could be likely if the future period coincides with an inflationary era that causes a rise in interest rates and a contraction in profit margins.

Overall Positioning and Performance Review:

We continue to allocate capital based on opportunities to be long and short. The challenge has come from a market cycle that has been skewed by central bank intrusions. In this regard, as prudent investors who view markets through a lens of capital at risk, we must take into account what we believe are extreme levels of high valuations,

ABSOLUTE STRATEGIES FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2019

the proliferation of momentum/trend investing, and artificially suppressed volatility when constructing the Fund’s portfolio. All of these have been coiled against us in both time and price. From a long/short perspective, we tend to favor underpriced or out of favor long ideas vs a short portfolio of overpriced or crowded areas. Many of these positions are simply relative-value relationships that revert to the mean. Volatility is used to help monetize these relationships over time. Our performance has been directly impacted by a lack of volatility, and an extreme turn of the market cycle that has punished out-of-favor longs while rewarding crowded, over-valued indexing.

Value vs Growth. The Fund continues to carry a large value-bias overall with the majority of the long equity portfolio in value-style securities vs a short portfolio that has been heavily growth-weighted, and in our view, significantly over-priced. This positioning served well during the downturn in equity markets in the 4th quarter and contributed to the Fund’s performance during that period. However, this value-bias in long vs short securities has struggled for several years as markets have been in a period where index investing has favored momentum and growth. We believe this momentum cycle is similar to that of the late 1990s and will likely revert to a period where value out performs growth for several years.

Short Equity. Market indices are trading at valuation levels only seen near the 1929 and 2000 peaks. The median price/sales for the S&P 500 is over 2.5x, or nearly 50% higher than the prior peak in 2007. While having a net short equity allocation has had a negative impact on Fund performance, we believe many securities in various global markets and sectors are at risk of significant repricing, some upwards of 50% or more. The Fund’s overall portfolio is currently positioned with a net short equity bias. This positioning was highly beneficial during periods of market volatility, but negatively impacted performance for the fiscal period.

Convertible Arbitrage. Convertible arbitrage is one of few areas of financial markets that is not flooded with excess capital and has provided modest returns. Hedged convertible securities have offered attractive return and risk characteristics relative to most other areas of the bond market. This strategy also has offered a relatively steady return profile to diversify away from other areas of our portfolio and performed well during the period.

In summary, the Fund’s convertible arbitrage strategy was the best performer during the period. This is notable because the strategy typically exhibits low sensitivity to equity markets. Manager strategies based on long equity exposure performed well, but lagged market indices. Long/short strategies were detractors. The Fund’s short exposure remains flexible and has varied over the past year as large spikes in volatility have offered opportunities to monetize short term gains using both index futures and options. During periods of low volatility the Fund has maintained a large amount of short exposure due to historically high valuations and weak fundamentals. The timing is uncertain but we believe the payoff in short opportunities could be significant.

The Fund held its highest defensive positioning from October to the December low. Once markets reached extremely oversold levels, we monetized some of our short exposure near the lows and bought some upside optionality (hedging) in the form of index call spreads. We expect to continue to trade around market volatility while maintaining a highly defensive posture. We plan to become aggressively defensive again as rallies wear thin and investor optimism returns; this is likely to coincide with a more dovish Federal Reserve. It’s also likely any slowdown in US growth will be blamed on the 2018/2019 government shutdown, which may recover short term. Therefore we believe some period of volatile consolidation with several rallies and selloffs, followed by the next major leg lower in equity markets will most likely occur during the second half of 2019.

We hope investors and advisors can recognize the need for diversification away from a 100% passive, beta portfolio and re-introduce strategies that may provide some defense by taking advantage of difficult, volatile environments. We believe the last few years were not indicative of a free market system, nor a fair market test for strategies like ours given the flood of liquidity and interference by global central banks. This intervention caused a massive, artificial suppression of interest rates and volatility, which are key drivers in adequately pricing risk and delivering alpha. Instead, many strategies were given a free pass to take on “risk-free” beta and everything correlated into one large liquidity bet. Many of our competitors benefited from our headwinds by posting what appeared to be solid performance. However the 4th quarter of 2018, (much like hedge funds in 2007-2009) proved that some of them are nothing more than a complex idea inside a beta-chasing wrapper. Further, many do not provide diversification and are

ABSOLUTE STRATEGIES FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2019

actually leveraged to the same beta investments that exist across a traditional investor portfolio. We do not believe this is an appropriate profile for an alternative strategy fund.

Our philosophy and process, on the other hand, have never varied. We do not chase risk. We do not chase beta. We recognize that certain market environments will be challenging. We do not pretend to try to avoid them; providing a diversifying strategy that varies capital at risk is not supposed to be easy. Outside of the past five years, our strategy performed well in a variety of market environments. We generally kept pace with market indices and easily outperformed most benchmarks from inception in 2005 through 2012, a period containing only one down year. We believe the last five years will be looked at as an historic outlier brought on by an extraordinary effort by global central banks to artificially extend an already 40-year decline in interest rates. This experiment is being unwound and in the end we believe it will likely be viewed as destructive; at least until the next major crisis wipes out asset prices.

Conversely, we also believe it is necessary to learn from our own investment experiences. Our fault in the recent past was not recognizing zero percent rates and that central bank liquidity could drive speculation to reach such extreme levels. We recognize that fundamental and valuation analysis are not the sole driver of market pricing and certain mechanisms have been altered due to the high concentration of capital allocated to passive, quantitative/algo and momentum strategies. These strategies are generally insensitive to valuation and fundamental concerns which can cause large deviations from historical market averages. We have added technical research and analysis to our efforts in order to better assess the overall market cycle as it relates to our positioning. This is simply an added tool to our process and we hope these efforts will help minimize periods of underperformance. We also have provided access to two single-manager strategies in separate funds to fit alongside more traditional equity or fixed income allocations. We anticipate that our overall collection of funds will provide a better choice of strategies for investors and advisors looking for more flexibility and diversification across a market cycle

Outlook and comments on recent market volatility:

Our commentary of October 18, 2018, was aptly titled, “Global markets have begun to show their hand.” We stressed that markets were providing a back drop, similar to the year 2000 peak, which could be the start of a long drawn-out bear market lasting several years. The similarities to the 2000 period were striking: extreme valuations; global markets and sectors diverging following an extended market and economic cycle; big swings in volatility along with several advances back toward markets highs. The spark was simply due to a sharp rise in interest rates and threats of inflation that is being accompanied by central banks unwinding their balance sheets and tightening liquidity.

Since that time, markets appeared to have entered a bear market period with every major market index falling 20% or more from early October to late December. Similar to early 2001 or early 2008, we believe this is just the first leg of what may be a lengthy and volatile bear market period. We do expect (much like prior downturns) violent rallies lasting weeks or even months, and may provide a feeling of relief that everything is back to normal. This is how bear markets work. In fact, the recent late December low may hold for some time, possibly into the second half of 2019, with the potential for some indices to rally back near prior highs, (similar to 2001).

Markets are still adjusting to what is likely a secular trend of higher interest rates which could result in a complete repricing of risk across a variety of asset classes. In effect, the past 5-6 years have seen investors pile into risky assets believing that low rates would be permanent. Given the extended rise in LIBOR and other market rates, we now know this idea was misplaced and is likely to result in a complete reversion to the mean. This may imply equity markets revisiting 2013-2015 market levels, which would require an overall drop of 40-50%. The forces of higher interest rates and resulting profit margin contraction are now set in motion and will not be easily reversed. Why? Because markets were addicted to many years of zero percent interest rates. As a result, the scale of leveraged loans and lower graded investments has exploded. The US leveraged loan market now exceeds $1 trillion with most of these being highly illiquid. BBB rated US corporate debt has grown to over $3 trillion; BBB rated debt now represents half of all investment grade corporate debt and we aren’t even in a recession…yet.

Globally, a slowdown in China may be the largest economic risk for equity markets. China has seen a major decline in a variety of business sectors while vehicle sales had its first annual decline since 1990. One major global supplier of

ABSOLUTE STRATEGIES FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2019

electronic components, Japan’s Nidec Corp., is seeing a sharp slowdown in Chinese demand for auto and appliance makers by more than 30%. Nidec’s CEO stated, “…this is the first time I’ve seen such a large single-month drop in orders…what we witnessed in November and December was just extraordinary.” (WSJ, Jan 17, 2019). China appears to be doing all it can to attempt a soft landing, including a new round of liquidity injections.

While trade wars and other headlines appear to be drawing political focus, we believe that there is one very serious threat that is not receiving much financial media attention: the accusation that China is hacking and stealing US intellectual property. This could be a macro, secular driver of both supply and demand for the US technology sector. Not only is China a major source of cheap labor for US companies’ products, it is also an enormous end market. Thinking through this logically, the risk of US technology companies completely pulling out of China, or worse, having their intellectual property used against them, is a very real risk. Imagine the outcome if top technology companies were forced to relocate to more expensive manufacturing sites, and ended up in a price war with similar/copied Chinese technologies. Several stories have surfaced on the subject but it is almost as if they are being hidden by media outlets. Bloomberg wrote an expansive article outlining the hacking and infiltration of US technology on October 4, 2018. In December, the CFO of a major Chinese tech company, Huawei, was detained in Canada at the request of US authorities. In January, Congress introduced a bill to ban the sale of US semiconductor chips to Chinese telecommunications companies. Other than the arrest of Huawei’s CFO, these stories have not received much attention compared to Fed tightening and trade war threats. Yet the Bloomberg article appeared to be the immediate catalyst for the initial downturn in the markets; in fact it was the same day. These issues do not appear to be among strategic trading partners, but between major economic adversaries. Other than handshakes and smiles, we do not see much if any real trade deal between the US and China. Quite the contrary, we believe these issues could have a major economic impact on long-term US technology company profitability.

We do not expect credit concerns or a global economic slowdown to drive markets straight down as happened in 2008. We anticipate markets will go through various periods of ups and downs, but are likely to correct meaningfully over a 2-3 year period.

We very much appreciate your investment in the Absolute Strategies Fund.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

ABSOLUTE STRATEGIES FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

MARCH 31, 2019

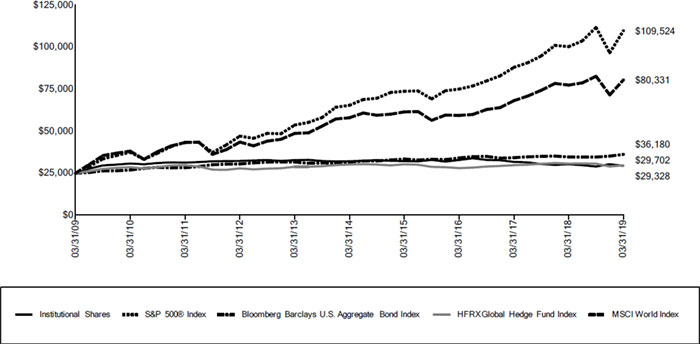

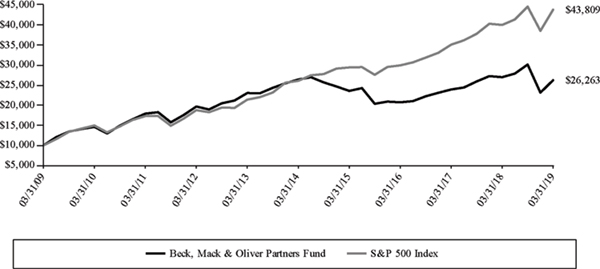

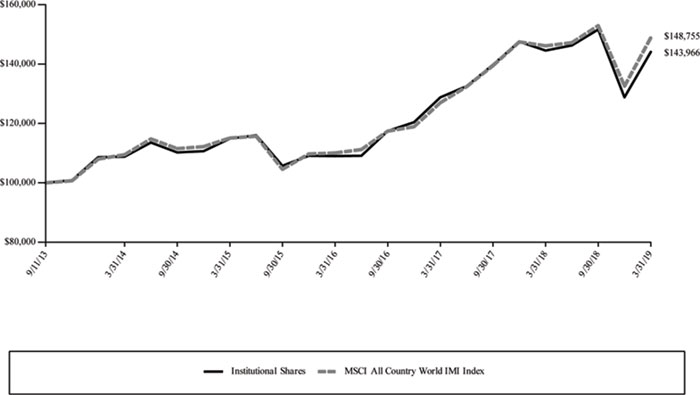

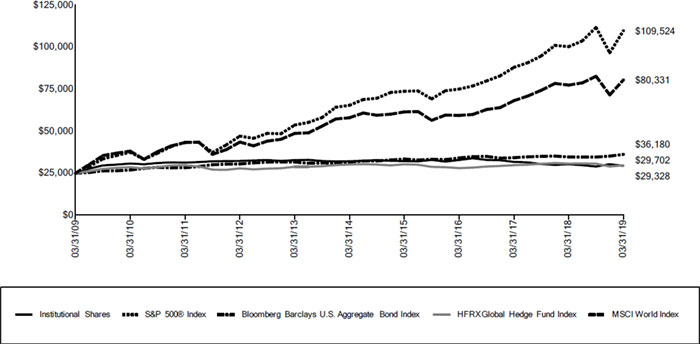

The following chart reflects the change in the value of a hypothetical $25,000 investment in Institutional Shares, including reinvested dividends and distributions, in Absolute Strategies Fund (the “Fund”) compared with the performance of the benchmarks, S&P 500 Index (“S&P 500”), Bloomberg Barclays U.S. Aggregate Bond Index (“Barclays Index”), the HFRX Global Hedge Fund Index (“HFRX”) and the MSCI World Index (“MSCI World”), over the past ten fiscal years. The S&P 500 is a broad-based measurement of the U.S. stock market based on the performance of 500 widely held large capitalization common stocks. The Barclays Index is a broad based measurement of the U.S. dollar-denominated, investment-grade, fixed-rate, SEC registered taxable bond market. The HFRX is a broad-based measurement of the performance of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The MSCI World measures the performance of a diverse range of 24 developed countries’ stock markets including the United States and Canada, and countries in Europe, the Middle East; Asia and the Pacific. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $25,000 Investment

Absolute Strategies Fund - Institutional Shares vs. S&P 500 Index, Bloomberg Barclays U.S. Aggregate Bond Index,

HFRX Global Hedge Fund Index and MSCI World Index

| | Average Annual Total Returns

Periods Ended March 31, 2019 | One Year | Five Year | Ten Year | |

| | Absolute Strategies Fund Institutional Shares | -3.23% | -1.78% | 1.61% | |

| | S&P 500® Index | 9.50% | 10.91% | 15.92% | |

| | Bloomberg Barclays U.S. Aggregate Bond Index | 4.48% | 2.74% | 3.77% | |

| | HFRX Global Hedge Fund Index | -3.32% | -0.30% | 1.74% | |

| | MSCI World Index | 4.01% | 6.78% | 12.38% | |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratio (gross) is 3.23%. Excluding the effect of expenses attributable to dividends and interest on short sales and acquired fund fees and expenses, the Fund's total annual operating expense ratio would be 2.41%. However, the Fund’s adviser has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, dividend and interest expenses on short sales, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.99% for Institutional Shares, through August 1, 2019 (the “Expense Cap”). The Expense Cap may be raised or eliminated only with the consent of the Board of Trustees. The adviser may be reimbursed by the Fund for fees waived and expenses reimbursed by the adviser pursuant to the Expense Cap if such payment is made within three years of the fee waiver or expense reimbursement and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap and (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. Total

ABSOLUTE STRATEGIES FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

MARCH 31, 2019

Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement will increase if exclusions from the Expense Cap apply. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. To the extent that the Fund invests in another fund sponsored by the Fund's adviser or its affiliates, the adviser may waive certain fees and expenses. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (888) 992-2765.

ABSOLUTE CAPITAL OPPORTUNITIES FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2019

Dear Shareholder,

We are pleased to present the Annual Report for the Absolute Capital Opportunities Fund (“the Fund”) for the year ended March 31, 2019 (“the Period”).

The Fund declined 1.78% during the Period but is up 2.04% year-to-date through March of 2019.Despite the Period decline we are satisfied with this performance given that Fund’s positioning, calendar year performance and the fact that the Fund has been positive by 7.9%, 5.37% and 5.99% for the calendar years 2016, 2017 and 2018, respectively. The Fund’s beta to the S&P 500 has been very low (0.13) since inception which highlights that returns have not been driven solely by a rise in broader markets.

Performance data quoted represents past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, call the Fund at 888-99-ABSOLUTE.

Options positions designed to capture large moves (“tail hedges”) in the S&P 500 were positive contributors. Starbucks and Jacobs Engineering were also among larger gainers. CBS, Mohawk Industries, and American Airlines were single name detractors.

The Fund continues to maintain a bias towards value-based long positions. Despite the market appearing to favor “growth” stocks over “value” stocks over the past several years, many “value” stocks have been growing their earnings at roughly the same rate as the overall market throughout this period. Market participants have rewarded what we believe are already richly priced companies (primarily in the Technology sector) with even higher valuations. We believe these levels require a high degree of certainty that the future path of earnings will closely resemble the recent past just to be called fair and they provide very little room for error in that assessment. Meanwhile, many of the companies owned by the Fund have been cast aside under the guise of a different kind of certainty: that earnings for these companies will not grow or grow only modestly for the foreseeable future despite these same companies disproving that theory many times over the past several years.

This divergence continues to appear untenable to us over any meaningfully long period of time. We believe that over a long period of time, the cash flow produced by a company may force that company’s stock price to revert back to a level better approximating fair value. Alternatively, the company may be acquired by a strategic competitor looking to capitalize on the mispricing. This is why we focus on math. Over time, we believe math is what ultimately drives returns.

Looking forward, the Fund continues to be positioned much as it had been in the past. We continue to carry substantial hedges, but believe our stock holdings have become the most attractively priced in relative terms to the overall market since 2010. As a result, we have structured the Fund with the potential to benefit from either stock selection, or absolute movement in either direction.

We are pleased with our overall results and very much appreciate the faith you, our investors, have placed with us. Please know we are invested significantly alongside you.

ABSOLUTE CAPITAL OPPORTUNITIES FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

MARCH 31, 2019

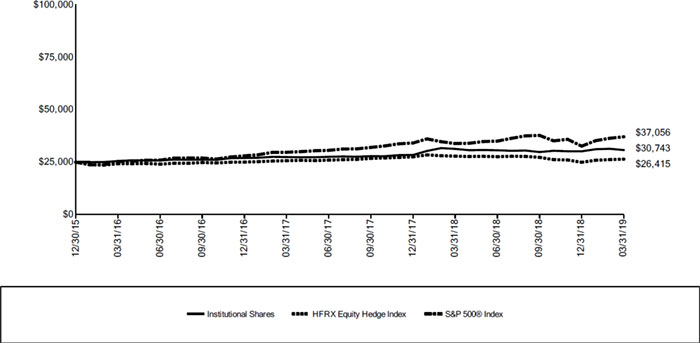

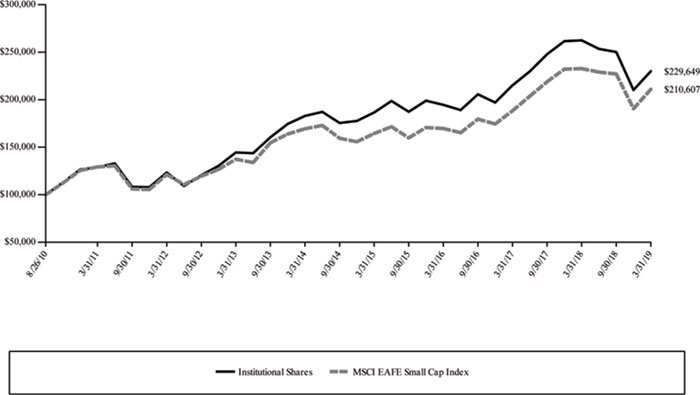

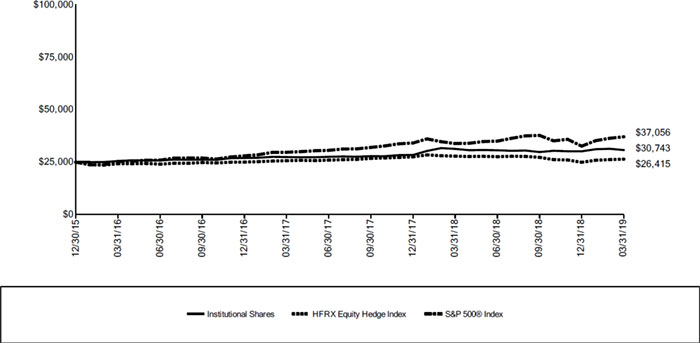

The following chart reflects the change in the value of a hypothetical $25,000 investment, including reinvested dividends and distributions, in the Absolute Capital Opportunities Fund (the “Fund”) compared with the performance of the benchmarks, the HFRX Equity Hedge Index (“HFRX Equity”) and the S&P 500 Index (“S&P 500”), since inception. HFRX Equity measures the performance of strategies that maintain positions both long and short in primarily equity and equity derivative securities. The S&P 500 is a broad-based measurement of the U.S. stock market based on the performance of 500 widely held large capitalization common stocks. The total return of the indices includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $25,000 Investment

Absolute Capital Opportunities Fund vs. HFRX Equity Hedge Index

and S&P 500 Index

| | Average Annual Total Returns

Periods Ended March 31, 2019 | One Year | Since Inception 12/30/15 | |

| | Absolute Capital Opportunities Fund | -1.78% | 6.57% | |

| | HFRX Equity Hedge Index | -5.14% | 1.65% | |

| | S&P 500® Index | 9.50% | 12.54% | |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratio (gross) is 3.37%. Excluding the effect of expenses attributable to dividends and interest on short sales, the Fund's total annual operating expense ratio would be 2.51%. However, the Fund’s adviser has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, dividend and interest expenses on short sales, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.75%, through August 1, 2019 (the “Expense Cap”). The Expense Cap may be raised or eliminated only with the consent of the Board of Trustees. The adviser may be reimbursed by the Fund for fees waived and expenses reimbursed by the adviser pursuant to the Expense Cap if such payment is made within three years of the fee waiver or expense reimbursement and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap and (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement will increase if exclusions from the Expense Cap apply. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (888) 992-2765.

ABSOLUTE CONVERTIBLE ARBITRAGE FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

MARCH 31, 2019

Dear Shareholder,

The twelve month period ended March 31, 2019 (the “Period”) has provided a robust test for the Absolute Convertible Arbitrage Fund (“ARBIX”) and other credit oriented strategies. Interest rates rose and fell. Credit spreads widened and tightened. We are pleased with the Fund’s return of +3.95% for the Period. Additionally, the annualized return over the last three years is +7.7%. The Fund has been positive 36 out of the last 38 months. Fund volatility has been extremely low and beta to traditional stocks and bonds has also been close to zero.

Encore Capital Group, Harmonic Inc., Avis Technology Inc. and MongoDB, Inc. were positive contributors and Global Eagle Entertainment Inc., Infinera Corporation and Accelerate Diagnostic Inc. underperformed our expectations.

One of the reasons for the Fund’s consistent performance is that it utilizes a total return approach across credit, yield, and volatility. Over time there has been a natural offset between these three areas that does not exist in more traditional bond markets because in traditional bond markets, volatility isn’t a specific factor. For example, as convertible prices increased during the first quarter of 2019 and our equity hedges got heavier, the Fund’s portfolio inherently became more sensitive to future moves in equity volatility and less sensitive to both credit moves and interest rates. Additionally, through security selection, we can actively bias the portfolio toward the area that may be cheap when another is more expensive. The portfolio sensitivity weights naturally move toward buying low and selling high and vice versa when these moves reverse.

The convertible marketplace is a niche market best suited for focused, experienced, convertible specialists who grind away daily to extract nickels and dimes in a tightly risk controlled manner. Preservation of capital is always a key focus. The downside risk in any position, and the portfolio as a whole, is very tightly controlled. The potential upside reward in any trade takes a back seat to what we could lose if we are wrong.

The investment process requires extreme focus and discipline. The vast majority of companies targeted do not have straight bonds outstanding and are typically small and mid-cap companies. Therefore, analysis requires dedicated, bottom-up, internally generated credit work which establishes its own unique opinion of the credit quality of the company. Company filings, news events and research reports are continuously monitored and analyzed for any changes in business developments and credit quality. This process also requires name by name modeling of securities where inputs such as equity volatility, credit spreads, interest rates, delta hedges, stock loan rates, takeover provisions and secondary market prices continuously change by the minute. Newly issued convertibles often involve new companies coming to market in a 24 hour period which requires access to deals and mandates that we perform fast and focused research and analysis.

As a reminder to our investors, the Fund’s subadviser has been managing this strategy since 2002. During those 17 years they’ve witnessed many different types of markets with varying degrees of opportunity. While always keeping an eye on risk, the subadviser constantly adapts its approach to best match a given opportunity. The potential benefits to the strategy and Fund are well established – moderate returns with low volatility and low beta to traditional stocks and bonds. As always, this remains the Fund’s focus.

ABSOLUTE CONVERTIBLE ARBITRAGE FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

MARCH 31, 2019

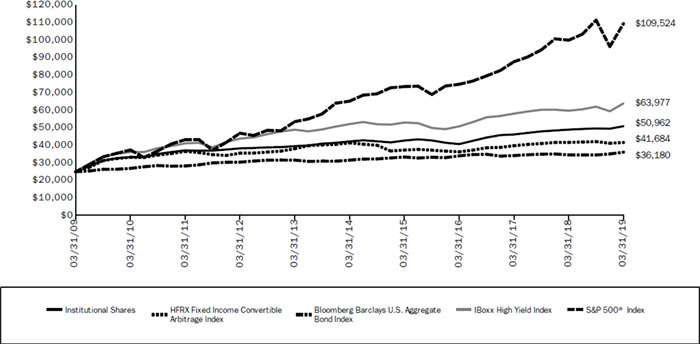

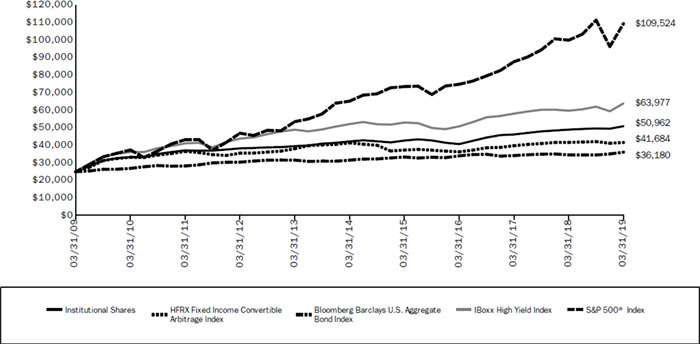

The following chart reflects the change in the value of a hypothetical $25,000 investment, including reinvested dividends and distributions, in Absolute Convertible Arbitrage Fund (the “Fund”) compared with the performance of the benchmarks, HFRX Fixed Income Convertible Arbitrage Index ("HFRX Fixed Income"), Bloomberg Barclays U.S. Aggregate Bond Index ('Barclays Index'), IBoxx High Yield Index ("iBoxx Index") and the S&P 500 Index ("S&P 500"), over the past ten fiscal years. The HFRX Fixed Income measures the performance of hedge fund strategies that are predicated on realizing of a spread between related instruments at least one of which is a convertible fixed income instrument. The iBoxx Index consists of liquid USD high yield bonds, selected to provide a balanced representation of the broad USD high yield corporate bond universe. The S&P 500 is a broad-based measurement of the U.S. stock market based on the performance of 500 widely held large capitalization common stocks. The Barclays Index is a broad based measurement of the U.S. dollar-denominated, investment-grade, fixed-rate, SEC registered taxable bond market. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $25,000 Investment

Absolute Convertible Arbitrage Fund vs. HFRX Fixed Income Convertible Arbitrage Index, Bloomberg Barclays U.S. Aggregate Bond Index, iBoxx High Yield Index and S&P 500 Index

| | Average Annual Total Returns

Periods Ended March 31, 2019 | One Year | Five Year | Ten Year | |

| | Absolute Convertible Arbitrage Fund Institutional Shares | 3.95% | 3.79% | 7.38% | |

| | HFRX Fixed Income Convertible Arbitrage Index | -0.14% | 0.09% | 5.25% | |

| | Bloomberg Barclays U.S. Aggregate Bond Index | 4.48% | 2.74% | 3.77% | |

| | IBoxx High Yield Index | 7.01% | 4.17% | 9.85% | |

| | S&P 500® Index | 9.50% | 10.91% | 15.92% | |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratio (gross) is 1.75%. However, the Fund’s adviser has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, dividend and interest on short sales, acquired fund fees and expenses, broker charges, proxy expenses and extraordinary expenses) to 1.60%, through August 1, 2019 (the “Expense Cap”). The Expense Cap may be raised or eliminated only with the consent of the Board of Trustees. The adviser may be reimbursed by the Fund for fees waived and expenses reimbursed by the adviser pursuant to the Expense Cap if such payment is made within three years of the fee waiver or expense reimbursement and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap and (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement will increase if exclusions from the Expense Cap apply. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on

ABSOLUTE CONVERTIBLE ARBITRAGE FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

MARCH 31, 2019

Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (888) 992-2765.

In August 2017, a hedge fund managed by Mohican Financial Management LLC reorganized into the Fund. The Fund’s performance for periods prior to the commencement of operations is that of the hedge fund and is based on calculations that are different from the standardized method of calculations adopted by the SEC. The performance of the hedge fund was calculated net of the hedge fund’s fees and expenses. The performance of the hedge fund is not the performance of the Fund, has not been restated to reflect the fees, estimated expenses and fee waivers and/or expense limitations of the Fund, and is not necessarily indicative of the Fund’s future performance. If the performance of the hedge fund had been restated to reflect the applicable fees and expenses of the Fund, the performance may have been lower. The hedge fund was not registered under the Investment Company Act of 1940 (“1940 Act”) and was not subject to certain investment limitations, diversification requirements and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, which, if applicable, may have adversely affected its performance.

ABSOLUTE STRATEGIES FUND

PORTFOLIO HOLDINGS SUMMARY (Unaudited)

MARCH 31, 2019

| Portfolio Breakdown (% of Net Assets) | |

| Common Stock | 21.0% |

| Asset Backed Obligations | 0.3% |

| Investment Companies | 49.9% |

| Money Market Fund | 15.9% |

| Purchased Options | 1.0% |

| Written Options | (0.1)% |

| Other Assets & Liabilities, Net * | 12.0% |

| | 100.0% |

| * | Consists of deposits with the custodian and/or brokers for put options written, cash, prepaid expenses, receivables, payables and accrued liabilities. Deposits with the custodian and/or brokers for put options written represent 11.8% of net assets. See Note 2 of the accompanying Notes to Financial Statements. |

| See Notes to Financial Statements. | 12 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2019

| Shares | | | Security Description | | Value | |

| Common Stock - 21.0% | |

| Communication Services - 1.2% |

| | 45,000 | | | Liberty Global PLC, Class C (a) | | $ | 1,089,450 | |

| Consumer Discretionary - 3.6% |

| | 10,000 | | | Anheuser-Busch InBev SA/NV, ADR | | | 839,700 | |

| | 15,000 | | | CVS Health Corp. | | | 808,950 | |

| | 14,000 | | | The TJX Cos., Inc. | | | 744,940 | |

| | 6,500 | | | The Walt Disney Co. | | | 721,695 | |

| | | | | | | | 3,115,285 | |

| Consumer Staples - 0.7% |

| | 6,000 | | | Nestle SA, ADR | | | 571,920 | |

| Energy - 2.6% |

| | 40,000 | | | Enbridge, Inc. | | | 1,450,400 | |

| | 19,000 | | | Schlumberger, Ltd. | | | 827,830 | |

| | | | | | | | 2,278,230 | |

| Financials - 7.0% |

| | 6,000 | | | Berkshire Hathaway, Inc., Class B (a) | | | 1,205,340 | |

| | 28,000 | | | Brookfield Asset Management, Inc., Class A | | | 1,306,200 | |

| | 18,000 | | | Franklin Resources, Inc. | | | 596,520 | |

| | 25,000 | | | Loews Corp. | | | 1,198,250 | |

| | 14,000 | | | The Bank of New York Mellon Corp. | | | 706,020 | |

| | 5,500 | | | The Howard Hughes Corp. (a) | | | 605,000 | |

| | 6,500 | | | WR Berkley Corp. | | | 550,680 | |

| | | | | | | | 6,168,010 | |

| Health Care - 1.5% |

| | 30,000 | | | Sanofi, ADR | | | 1,328,400 | |

| Industrials - 0.3% |

| | 3,500 | | | Expeditors International of Washington, Inc. | | | 265,650 | |

| Information Technology - 0.8% |

| | 12,000 | | | Cerner Corp. (a) | | | 686,520 | |

| Materials - 1.8% |

| | 9,500 | | | DowDuPont, Inc. | | | 506,445 | |

| | 12,000 | | | Royal Gold, Inc. | | | 1,091,160 | |

| | | | | | | | 1,597,605 | |

| Real Estate - 0.3% |

| | 8,500 | | | Equity Commonwealth REIT (a) | | | 277,865 | |

| Utilities - 1.2% |

| | 14,000 | | | Dominion Energy, Inc. | | | 1,073,240 | |

| | | | | |

| Total Common Stock (Cost $15,763,733) | | | 18,452,175 | |

| Principal | | | Security Description | | Rate | | | Maturity | | | Value | |

| Asset Backed Obligations - 0.3% |

| $ | 42,343 | | | Adjustable Rate Mortgage Trust, Series 2005-12 2A1 (b) | | | 4.41 | % | | 03/25/36 | | | | 38,645 | |

| | 27,262 | | | Adjustable Rate Mortgage Trust, Series 2006-1 3A3 (b) | | | 4.27 | | | 03/25/36 | | | | 24,130 | |

| | 18,987 | | | Banc of America Funding Corp., Series 2006-E 2A1 (b) | | | 4.25 | | | 06/20/36 | | | | 18,582 | |

| | 26,569 | | | Banc of America Funding Corp., Series 2007-E 4A1 (b) | | | 3.85 | | | 07/20/47 | | | | 21,353 | |

| | 57,139 | | | CitiMortgage Alternative Loan Trust, Series 2006-A7 1A12 | | | 6.00 | | | 12/25/36 | | | | 53,596 | |

| | 21,708 | | | CitiMortgage Alternative Loan Trust, Series 2007-A4 1A6 | | | 5.75 | | | 04/25/37 | | | | 20,827 | |

| | 23,040 | | | Countrywide Alternative Loan Trust, Series 2005-50CB 1A1 | | | 5.50 | | | 11/25/35 | | | | 21,549 | |

| | 27,232 | | | Countrywide Home Loan Mortgage Pass-Through Trust, Series 2007-HY5 1A1 (b) | | | 4.51 | | | 09/25/47 | | | | 26,548 | |

| | 43,808 | | | IndyMac Index Mortgage Loan Trust, Series 2006-AR25 3A1 (b) | | | 4.06 | | | 09/25/36 | | | | 37,775 | |

| | 17,544 | | | JP Morgan Mortgage Trust, Series 2007-A2 4A1M (b) | | | 4.26 | | | 04/25/37 | | | | 16,347 | |

| | 25,544 | | | Structured Adjustable Rate Mortgage Loan Trust, Series 2007-3 3A1 (b) | | | 4.17 | | | 04/25/47 | | | | 19,348 | |

| Total Asset Backed Obligations (Cost $200,756) | | | | | | | | | | 298,700 | |

| Shares | | | Security Description | | Value | |

| Investment Companies - 49.9% |

| | 1,713,508 | | | Absolute Capital Opportunities Fund (c) | | | 19,705,339 | |

| | 2,314,548 | | | Absolute Convertible Arbitrage Fund (a)(c) | | | 24,279,613 | |

| Total Investment Companies (Cost $41,721,835) | | | 43,984,952 | |

| See Notes to Financial Statements. | 13 | ABSOLUTE FUNDS |

| ABSOLUTE STRATEGIES FUND |

| SCHEDULE OF INVESTMENTS | |

| MARCH 31, 2019 |

| Shares | | | Security Description | | Value | |

| Money Market Fund - 15.9% | |

| | 13,987,734 | | | BlackRock Liquidity Funds T-Fund Portfolio, Institutional Shares, 2.32% (d)

(Cost $13,987,734) | | $ | 13,987,734 | |

| Contracts | | Security Description | | Strike Price | | | Exp. Date | | | Notional Contract Value | | | Value | |

| Purchased Options - 1.0% |

| Call Options Purchased - 0.6% |

| | 20 | | CME E-Mini Russell | | $ | 2810.00 | | | 04/19 | | | $ | 2,810,000 | | | | 43,500 | |

| | 3,000 | | Financial Select Sector SPDR Fund ETF | | | 26.00 | | | 04/19 | | | | 7,800,000 | | | | 93,000 | |

| | 1,250 | | SPDR S&P 500 ETF Trust | | | 288.00 | | | 05/19 | | | | 36,000,000 | | | | 361,875 | |

| Total Call Options Purchased (Premiums Paid $426,978) | | | | | | | | | | 498,375 | |

| Put Options Purchased - 0.4% |

| | 500 | | Invesco QQQ Trust ETF | | | 180.00 | | | 05/19 | | | | 9,102,000 | | | | 169,750 | |

| | 500 | | Invesco QQQ Trust ETF | | | 175.00 | | | 05/19 | | | | 9,102,000 | | | | 93,500 | |

| | 500 | | Invesco QQQ Trust ETF | | | 155.00 | | | 05/19 | | | | 9,102,000 | | | | 8,500 | |

| | 2,000 | | iShares Russell 2000 ETF | | | 144.00 | | | 04/19 | | | | 30,952,000 | | | | 74,000 | |

| | 1,000 | | iShares Russell 2000 ETF | | | 140.00 | | | 04/19 | | | | 15,476,000 | | | | 17,000 | |

| Total Put Options Purchased (Premiums Paid $727,500) | | | | | | | | | 362,750 | |

| Total Purchased Options (Premiums Paid $1,154,478) | | | | | | | | 861,125 | |

| Investments, at value - 88.1% (Cost $72,828,536) | | | | | | | | $ | 77,584,686 | |

| Total Written Options - (0.1)% (Premiums Received $(209,997)) | | | | | | | | (130,250 | ) |

| Other Assets & Liabilities, Net - 12.0% | | | | | | | | | 10,593,252 | |

| Net Assets - 100.0% | | | | | | | | | | $ | 88,047,688 | |

| See Notes to Financial Statements. | 14 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF PUT OPTIONS WRITTEN

MARCH 31, 2019

| Contracts | | Security Description | | Strike Price | | | Exp. Date | | | Notional Contract

Value | | | Value | |

| Written Options - (0.1)% | | | | | | | | | | |

| Put Options Written - (0.1)% | | | | | | | | | | | | |

| | (500) | | Invesco QQQ Trust ETF | | $ | 170.00 | | | 05/19 | | | $ | 8,500,000 | | | $ | (50,250 | ) |

| | (1,000) | | Invesco QQQ Trust ETF | | | 165.00 | | | 05/19 | | | | 16,500,000 | | | | (53,000 | ) |

| | (2,000) | | iShares Russell 2000 ETF | | | 139.00 | | | 04/19 | | | | 27,800,000 | | | | (27,000 | ) |

| Total Put Options Written (Premiums Received $(209,997)) | | | | | | | | | | | (130,250 | ) |

| Total Written Options - (0.1)% (Premiums Received $(209,997)) | | | | | | | | | $ | (130,250 | ) |

| See Notes to Financial Statements. | 15 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

NOTES TO SCHEDULES OF INVESTMENTS AND PUT OPTIONS WRITTEN

MARCH 31, 2019

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Variable rate security, the interest rate of which adjusts periodically based on changes in current interest rates. Rate represented is as of March 31, 2019. |

| (d) | Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of March 31, 2019. |

At March 31, 2019, the Fund held the following exchange traded futures contracts:

| Contracts | | | Type | | Expiration

Date | | Notional Contract Value | | | Value | | | Net Unrealized

Depreciation | |

| | (130 | ) | | CME E-Mini Russell Future | | 06/21/19 | | $ | (9,991,244 | ) | | $ | (10,034,700 | ) | | $ | (43,456 | ) |

| | (160 | ) | | Nasdaq 100 E-Mini Future | | 06/21/19 | | | (23,124,721 | ) | | | (23,681,600 | ) | | | (556,879 | ) |

| | (70 | ) | | S&P 500 E-mini Future | | 06/21/19 | | | (9,781,131 | ) | | | (9,932,300 | ) | | | (151,169 | ) |

| | | | | | | | | $ | (42,897,096 | ) | | $ | (43,648,600 | ) | | $ | (751,504 | ) |

Affiliated investments are investments that are managed by the adviser, and are noted in the Absolute Strategies Fund’s Schedule of Investments. Transactions during the year with affiliates were as follows:

| Investment Companies | | | | | | | | | | | | | | | | | | | | | |

| Absolute Capital Opportunities Fund | | Balance 3/31/2018 | | | Gross Additions | | | Gross Reductions | | | Change in Unrealized Appreciation | | | Balance 3/31/2019 | | | Realized Gain | | | Investment Income | |

| Shares | | | 1,529,930 | | | | 696,538 | | | | (512,960 | ) | | | – | | | | 1,713,508 | | | | | | | | | |

| Cost | | $ | 16,010,000 | | | $ | 8,481,606 | | | $ | (6,000,000 | ) | | $ | – | | | $ | 18,084,900 | | | $ | 212,857 | | | $ | 862,043 | |

| Value | | | 19,154,722 | | | | – | | | | – | | | | (1,524,283 | ) | | | 19,705,339 | | | | | | | | | |

Absolute Convertible Arbitrage Fund | | Balance 3/31/2018 | | | Gross Additions | | | Gross Reductions | | | Change in Unrealized Depreciation | | | Balance 3/31/2019 | | | Realized Gain | | | Investment Income | |

| Shares | | | 2,840,976 | | | | 53,111 | | | | (579,539 | ) | | | – | | | | 2,314,548 | | | | | | | | | |

| Cost | | $ | 29,047,189 | | | $ | 542,972 | | | $ | (6,000,000 | ) | | $ | – | | | $ | 23,636,935 | | | $ | 206,223 | | | $ | 383,523 | |

| Value | | | 29,233,640 | | | | – | | | | – | | | | 456,227 | | | | 24,279,613 | | | | | | | | | |

At March 31, 2019, the value of investments in affiliated companies was $43,984,952 representing 49.96% of net assets, and the total cost was $41,721,835. Net realized gain was $419,080 and investment income was $1,245,566.

The following is a summary of the inputs used to value the Fund's investments and other financial instruments and liabilities as of March 31, 2019.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Investments at Value | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | | | | | | | |

| Communication Services | | $ | 1,089,450 | | | $ | – | | | $ | – | | | $ | 1,089,450 | |

| Consumer Discretionary | | | 3,115,285 | | | | – | | | | – | | | | 3,115,285 | |

| Consumer Staples | | | 571,920 | | | | – | | | | – | | | | 571,920 | |

| Energy | | | 2,278,230 | | | | – | | | | – | | | | 2,278,230 | |

| Financials | | | 6,168,010 | | | | – | | | | – | | | | 6,168,010 | |

| Health Care | | | 1,328,400 | | | | – | | | | – | | | | 1,328,400 | |

| Industrials | | | 265,650 | | | | – | | | | – | | | | 265,650 | |

| Information Technology | | | 686,520 | | | | – | | | | – | | | | 686,520 | |

| Materials | | | 1,597,605 | | | | – | | | | – | | | | 1,597,605 | |

| Real Estate | | | 277,865 | | | | – | | | | – | | | | 277,865 | |

| Utilities | | | 1,073,240 | | | | – | | | | – | | | | 1,073,240 | |

| Asset Backed Obligations | | | – | | | | 298,700 | | | | – | | | | 298,700 | |

| Investment Companies | | | 43,984,952 | | | | – | | | | – | | | | 43,984,952 | |

| See Notes to Financial Statements. | 16 | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

NOTES TO SCHEDULES OF INVESTMENTS AND PUT OPTIONS WRITTEN

MARCH 31, 2019

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Money Market Fund | | $ | – | | | $ | 13,987,734 | | | $ | – | | | $ | 13,987,734 | |

| Purchased Options | | | 192,500 | | | | 668,625 | | | | – | | | | 861,125 | |

| Investments at Value | | $ | 62,629,627 | | | $ | 14,955,059 | | | $ | – | | | $ | 77,584,686 | |

| Total Assets | | $ | 62,629,627 | | | $ | 14,955,059 | | | $ | – | | | $ | 77,584,686 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Other Financial Instruments* | | | | | | | | | | | | | | | | |

| Written Options | | | – | | | | (130,250 | ) | | | – | | | | (130,250 | ) |

| Futures | | | (751,504 | ) | | | – | | | | – | | | | (751,504 | ) |

| Total Other Financial Instruments* | | $ | (751,504 | ) | | $ | (130,250 | ) | | $ | – | | | $ | (881,754 | ) |

| Total Liabilities | | $ | (751,504 | ) | | $ | (130,250 | ) | | $ | – | | | $ | (881,754 | ) |

| * | Other Financial Instruments are derivatives not reflected in the Schedule of Investments, such as futures, which are valued at the unrealized appreciation/(depreciation) and written options, which are reported at their market value at year end. |

| See Notes to Financial Statements. | 17 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUND

PORTFOLIO HOLDINGS SUMMARY (Unaudited)

MARCH 31, 2019

| Portfolio Breakdown (% of Net Assets) | |

| Long Positions | |

| Common Stock | 71.1% |

| Money Market Fund | 19.8% |

| Purchased Options | 5.3% |

| Short Positions | |

| Common Stock | (0.2)% |

| Investment Company | (114.4)% |

| Written Options | (1.3)% |

| Other Assets & Liabilities, Net * | 119.7% |

| | 100.0% |

| * | Consists of deposits with the custodian and/or brokers for securities sold short, cash, prepaid expenses, receivables, payables and accrued liabilities. Deposits with the custodian and/or brokers for securities sold short represent 119.5% of net assets. See Note 2 of the accompanying Notes to Financial Statements. |

| See Notes to Financial Statements. | 18 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2019

| Shares | | | Security Description | | Value | |

| Long Positions - 96.2% | | | | |

| Common Stock - 71.1% | | | | |

| Communication Services - 14.1% | | | | |

| | 644 | | | Alphabet, Inc., Class A (a) | | $ | 757,917 | |

| | 644 | | | Alphabet, Inc., Class C (a)(b) | | | 755,612 | |

| | 350 | | | Booking Holdings, Inc. (a) | | | 610,718 | |

| | 29,779 | | | CBS Corp., Class B | | | 1,415,396 | |

| | 3,013 | | | Comcast Corp., Class A | | | 120,460 | |

| | 7,967 | | | Expedia, Inc. (b) | | | 948,073 | |

| | 7,609 | | | Facebook, Inc., Class A(a)(b) | | | 1,268,344 | |

| | 4,791 | | | MultiChoice Group, Ltd., ADR (a) | | | 39,909 | |

| | 23,955 | | | Naspers, Ltd., ADR, Class N | | | 1,112,231 | |

| | 1,607 | | | Omnicom Group, Inc. | | | 117,295 | |

| | 3,211 | | | Spark Networks SE, ADR (a) | | | 51,055 | |

| | | | | | | | 7,197,010 | |

| Consumer Discretionary - 14.3% | | | | |

| | 29,034 | | | American Airlines Group, Inc. (b) | | | 922,120 | |

| | 2,409 | | | CarMax, Inc. (a)(b) | | | 168,148 | |

| | 7,710 | | | Delta Air Lines, Inc. | | | 398,221 | |

| | 26,720 | | | General Motors Co. (b) | | | 991,312 | |

| | 12,230 | | | Mohawk Industries, Inc. (a)(b)(c) | | | 1,542,815 | |

| | 9,957 | | | Robert Half International, Inc. | | | 648,798 | |

| | 19,878 | | | Starbucks Corp. | | | 1,477,731 | |

| | 3,315 | | | The Walt Disney Co. | | | 368,064 | |

| | 9,400 | | | United Continental Holdings, Inc. (a) | | | 749,932 | |

| | | | | | | | 7,267,141 | |

| Consumer Staples - 4.4% | | | | |

| | 4,193 | | | AMERCO (a) | | | 1,557,741 | |

| | 2,800 | | | The Kraft Heinz Co. (d) | | | 91,420 | |

| | 16,595 | | | US Foods Holding Corp. (a)(b) | | | 579,332 | |

| | | | | | | | 2,228,493 | |

| Energy - 0.7% | | | | |

| | 11,750 | | | Halliburton Co. | | | 344,275 | |

| Financials - 19.0% | | | | |

| | 5,534 | | | American Express Co. | | | 604,866 | |

| | 4,699 | | | Aon PLC | | | 802,119 | |

| | 38,044 | | | Bank of America Corp. (b) | | | 1,049,634 | |

| | 7,546 | | | Berkshire Hathaway, Inc., Class B (a)(b)(c) | | | 1,515,916 | |

| | 25,276 | | | CBRE Group, Inc., Class A (a)(b) | | | 1,249,898 | |

| | 8,904 | | | Citigroup, Inc. | | | 554,007 | |

| | 10,800 | | | JPMorgan Chase & Co. | | | 1,093,284 | |

| | 43,706 | | | The Blackstone Group LP (b) | | | 1,528,399 | |

| | 18,155 | | | The Charles Schwab Corp. | | | 776,308 | |

| | 2,765 | | | The Goldman Sachs Group, Inc. | | | 530,852 | |

| | | | | | | | 9,705,283 | |

| Health Care - 1.1% | | | | |

| | 9,095 | | | Bayer AG | | | 587,653 | |

| Industrials - 9.4% | | | | |

| | 19,548 | | | Jacobs Engineering Group, Inc. | | | 1,469,814 | |

| | 41,406 | | | Quanta Services, Inc. (b)(c) | | | 1,562,662 | |

| | 2,077 | | | The Boeing Co. | | | 792,209 | |

| | 3,651 | | | United Parcel Service, Inc., Class B | | | 407,963 | |

| | 4,275 | | | Valmont Industries, Inc. | | | 556,178 | |

| | | | | | | | 4,788,826 | |

| Information Technology - 6.1% | | | | |

| | 9,864 | | | Analog Devices, Inc. (b) | | | 1,038,383 | |

| | 9,420 | | | Apple, Inc. | | | 1,789,329 | |

| | 613 | | | IBM | | | 86,495 | |

| | 4,600 | | | Micron Technology, Inc. (a)(b)(d) | | | 190,118 | |

| | | | | | | | 3,104,325 | |

| Materials - 2.0% | | | | |

| | 8,921 | | | PPG Industries, Inc. (b) | | | 1,006,913 | |

| Total Common Stock (Cost $34,288,606) | | | 36,229,919 | |

| See Notes to Financial Statements. | 19 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2019

| Shares | | | Security Description | | Value | |

| Money Market Fund - 19.8% | | | |

| | 10,066,356 | | | BlackRock Liquidity Funds T-Fund Portfolio, Institutional Shares, 2.32% (e) | | | | |

| | | | | (Cost $10,066,356) | | $ | 10,066,356 | |

| Contracts | | | Security Description | | Strike Price | | | Exp. Date | | | Notional Contract

Value | | | Value | |

| Purchased Options - 5.3% | | | | | | | | | | | | | | | |

| Call Options Purchased - 4.3% | | | | | | | | | | | | | | | |

| | 103 | | | Discovery, Inc. | | $ | 27.50 | | | 06/19 | | | $ | 283,250 | | | | 9,012 | |

| | 58 | | | Discovery, Inc. | | | 25.00 | | | 06/19 | | | | 145,000 | | | | 10,875 | |

| | 1,665 | | | SPDR S&P 500 ETF Trust | | | 280.00 | | | 04/19 | | | | 46,620,000 | | | | 865,800 | |

| | 715 | | | SPDR S&P 500 ETF Trust | | | 265.00 | | | 04/19 | | | | 18,947,500 | | | | 1,322,750 | |

| Total Call Options Purchased (Premiums Paid $714,315) | | | | | | | | | | | | | | 2,208,437 | |

| Put Options Purchased - 1.0% | | | | | | | | | | | | | | | |

| | 29 | | | Comcast Corp. | | | 40.00 | | | 01/20 | | | | 115,942 | | | | 9,425 | |

| | 28 | | | Intel Corp. | | | 42.00 | | | 01/20 | | | | 152,628 | | | | 3,416 | |

| | 19 | | | Micron Technology, Inc. | | | 42.00 | | | 01/20 | | | | 78,527 | | | | 11,875 | |

| | 27 | | | Micron Technology, Inc. | | | 40.00 | | | 01/20 | | | | 111,591 | | | | 13,986 | |

| | 16 | | | Omnicom Group, Inc. | | | 72.50 | | | 01/20 | | | | 116,784 | | | | 9,040 | |

| | 1,428 | | | SPDR S&P 500 ETF Trust | | | 235.00 | | | 04/19 | | | | 40,338,144 | | | | 5,712 | |

| | 655 | | | SPDR S&P 500 ETF Trust | | | 255.00 | | | 01/20 | | | | 18,502,440 | | | | 443,763 | |

| Total Put Options Purchased (Premiums Paid $1,152,777) | | | | | | | | | | | | | | 497,217 | |

| Total Purchased Options (Premiums Paid $1,867,092) | | | | | | | | | | | | | | 2,705,654 | |

| Total Long Positions - 96.2% (Cost $46,222,054) | | | | | | | | | | | | | | 49,001,929 | |

| Total Short Positions - (114.6)% (Proceeds $(56,195,004)) | | | | | | | | | | | | | | (58,381,192 | ) |

| Total Written Options - (1.3)% (Premiums Received $(1,073,056)) | | | | | | | | | | | | | | (682,531 | ) |

| Other Assets & Liabilities, Net - 119.7% | | | | | | | | | | | | | | 61,020,252 | |

| Net Assets - 100.0% | | | | | | | | | | | | | $ | 50,958,458 | |

| See Notes to Financial Statements. | 20 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUND

SCHEDULE OF SECURITIES SOLD SHORT

MARCH 31, 2019

| Shares | | | Security Description | | Value | |

| Short Positions - (114.6)% | | | | |

| Common Stock - (0.2)% | | | | |

| Industrials - (0.2)% | | | | |

| | (677) | | | Caterpillar, Inc. (b)

(Proceeds $(112,724)) | | $ | (91,727 | ) |

| Shares | | | Security Description | | Value | |

| Investment Company - (114.4)% | | | | |

| | (206,349) | | | SPDR S&P 500 ETF Trust (b)

(Proceeds $(56,082,280)) | | | (58,289,465 | ) |

| Total Short Positions - (114.6)% (Proceeds $(56,195,004)) | | $ | (58,381,192 | ) |

| See Notes to Financial Statements. | 21 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUND

SCHEDULE OF CALL AND PUT OPTIONS WRITTEN

MARCH 31, 2019

| Contracts | | | Security Description | | Strike Price | | | Exp. Date | | Notional Contract

Value | | | Value | |

| Written Options - (1.3)% | | | | | | | | | | | | | | | |

| Call Options Written - 0.0% | | | | | | | | | | | | | | | |

| | (19 | ) | | Micron Technology, Inc. | | $ | 70.00 | | | | 01/20 | | $ | 78,527 | | | $ | (1,140 | ) |

| | (27 | ) | | Micron Technology, Inc. | | | 60.00 | | | | 01/20 | | | 111,591 | | | | (4,050 | ) |

| | (28 | ) | | The Kraft Heinz Co. | | | 40.00 | | | | 01/21 | | | 91,420 | | | | (6,440 | ) |

| Total Call Options Written (Premiums Received $(35,556)) | | | | | | | | | | | | | | (11,630 | ) |

| Put Options Written - (1.3)% | | | | | | | | | | | | | | | |

| | (21 | ) | | Acuity Brands, Inc. | | | 80.00 | | | | 12/19 | | | 168,000 | | | | (3,727 | ) |

| | (4 | ) | | Alphabet, Inc. | | | 900.00 | | | | 01/20 | | | 360,000 | | | | (6,160 | ) |

| | (73 | ) | | American Airlines Group, Inc. | | | 25.00 | | | | 01/20 | | | 182,500 | | | | (9,125 | ) |

| | (28 | ) | | Analog Devices, Inc. | | | 75.00 | | | | 01/20 | | | 210,000 | | | | (4,270 | ) |

| | (87 | ) | | Bank of America Corp. | | | 20.00 | | | | 01/20 | | | 174,000 | | | | (3,219 | ) |

| | (24 | ) | | Berkshire Hathaway, Inc. | | | 165.00 | | | | 01/20 | | | 396,000 | | | | (7,656 | ) |

| | (37 | ) | | Bristol-Myers Squibb Co. | | | 47.00 | | | | 01/20 | | | 173,900 | | | | (15,910 | ) |

| | (31 | ) | | Capital One Financial Corp. | | | 75.00 | | | | 01/20 | | | 232,500 | | | | (13,640 | ) |

| | (32 | ) | | CarMax, Inc. | | | 55.00 | | | | 01/20 | | | 176,000 | | | | (6,160 | ) |

| | (6 | ) | | Caterpillar, Inc. | | | 125.00 | | | | 05/19 | | | 75,000 | | | | (1,320 | ) |

| | (60 | ) | | CBRE Group, Inc. | | | 35.00 | | | | 06/19 | | | 210,000 | | | | (960 | ) |

| | (13 | ) | | CVS Health Corp. | | | 55.00 | | | | 08/19 | | | 71,500 | | | | (6,110 | ) |

| | (20 | ) | | Expedia Group, Inc. | | | 85.00 | | | | 01/20 | | | 170,000 | | | | (4,600 | ) |

| | (32 | ) | | Facebook, Inc. | | | 120.00 | | | | 01/20 | | | 384,000 | | | | (8,288 | ) |

| | (17 | ) | | FedEx Corp. | | | 160.00 | | | | 01/20 | | | 272,000 | | | | (12,920 | ) |

| | (10 | ) | | FedEx Corp. | | | 150.00 | | | | 01/20 | | | 150,000 | | | | (5,150 | ) |

| | (44 | ) | | General Motors Co. | | | 45.00 | | | | 01/20 | | | 198,000 | | | | (39,050 | ) |

| | (71 | ) | | General Motors Co. | | | 30.00 | | | | 01/20 | | | 213,000 | | | | (7,952 | ) |

| | (74 | ) | | General Motors Co. | | | 25.00 | | | | 01/20 | | | 185,000 | | | | (3,108 | ) |

| | (28 | ) | | Intel Corp. | | | 47.00 | | | | 01/20 | | | 131,600 | | | | (6,412 | ) |

| | (28 | ) | | Intel Corp. | | | 45.00 | | | | 01/20 | | | 126,000 | | | | (5,012 | ) |

| | (33 | ) | | Lam Research Corp. | | | 110.00 | | | | 01/20 | | | 363,000 | | | | (7,062 | ) |

| | (9 | ) | | Micron Technology, Inc. | | | 35.00 | | | | 01/20 | | | 31,500 | | | | (2,781 | ) |

| | (6 | ) | | Mohawk Industries, Inc. | | | 130.00 | | | | 12/19 | | | 78,000 | | | | (8,280 | ) |

| | (42 | ) | | Morgan Stanley | | | 38.00 | | | | 01/20 | | | 159,600 | | | | (9,366 | ) |

| | (27 | ) | | Northern Trust Corp. | | | 75.00 | | | | 04/19 | | | 202,500 | | | | (27 | ) |

| | (22 | ) | | PPG Industries, Inc. | | | 90.00 | | | | 01/20 | | | 198,000 | | | | (4,620 | ) |

| | (27 | ) | | QUALCOMM, Inc. | | | 55.00 | | | | 01/20 | | | 148,500 | | | | (12,825 | ) |

| | (74 | ) | | Quanta Services, Inc. | | | 28.00 | | | | 05/19 | | | 207,200 | | | | (74 | ) |

| | (489 | ) | | SPDR S&P 500 ETF Trust | | | 265.00 | | | | 01/20 | | | 12,958,500 | | | | (432,276 | ) |

| | (70 | ) | | The Blackstone Group LP | | | 28.00 | | | | 01/20 | | | 196,000 | | | | (5,600 | ) |

| | (33 | ) | | Twitter, Inc. | | | 25.00 | | | | 01/20 | | | 82,500 | | | | (6,204 | ) |

| | (18 | ) | | United Technologies Corp. | | | 115.00 | | | | 01/20 | | | 207,000 | | | | (8,190 | ) |

| | (79 | ) | | US Foods Holding Corp. | | | 25.00 | | | | 04/19 | | | 197,500 | | | | (79 | ) |

| | (9 | ) | | Vail Resorts, Inc. | | | 160.00 | | | | 12/19 | | | 144,000 | | | | (2,768 | ) |

| Total Put Options Written (Premiums Received $(1,037,500)) | | | | | | | | | | | | | | (670,901 | ) |

| Total Written Options - (1.3)% (Premiums Received $(1,073,056)) | | | | | | | | | | $ | (682,531 | ) |

| See Notes to Financial Statements. | 22 | ABSOLUTE FUNDS |

ABSOLUTE CAPITAL OPPORTUNITIES FUND

NOTES TO SCHEDULES OF INVESTMENTS, SECURITIES SOLD SHORT AND CALL AND PUT OPTIONS WRITTEN

MARCH 31, 2019

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| (a) | Non-income producing security. |

| (b) | Subject to put option written by the Fund. |

| (c) | All or a portion of this security is held as collateral for securities sold short. |

| (d) | Subject to call option written by the Fund. |

| (e) | Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of March 31, 2019. |

The following is a summary of the inputs used to value the Fund's investments and other financial instruments and liabilities as of March 31, 2019.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Investments at Value | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | | | | | | | |

| Communication Services | | $ | 7,197,010 | | | $ | – | | | $ | – | | | $ | 7,197,010 | |

| Consumer Discretionary | | | 7,267,141 | | | | – | | | | – | | | | 7,267,141 | |

| Consumer Staples | | | 2,228,493 | | | | – | | | | – | | | | 2,228,493 | |

| Energy | | | 344,275 | | | | – | | | | – | | | | 344,275 | |

| Financials | | | 9,705,283 | | | | – | | | | – | | | | 9,705,283 | |

| Health Care | | | 587,653 | | | | – | | | | – | | | | 587,653 | |

| Industrials | | | 4,788,826 | | | | – | | | | – | | | | 4,788,826 | |

| Information Technology | | | 3,104,325 | | | | – | | | | – | | | | 3,104,325 | |

| Materials | | | 1,006,913 | | | | – | | | | – | | | | 1,006,913 | |

| Money Market Fund | | | – | | | | 10,066,356 | | | | – | | | | 10,066,356 | |

| Purchased Options | | | 2,232,964 | | | | 472,690 | | | | – | | | | 2,705,654 | |

| Investments at Value | | $ | 38,462,883 | | | $ | 10,539,046 | | | $ | – | | | $ | 49,001,929 | |

| Total Assets | | $ | 38,462,883 | | | $ | 10,539,046 | | | $ | – | | | $ | 49,001,929 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Securities Sold Short | | | | | | | | | | | | | | | | |

| Common Stock | | $ | (91,727 | ) | | $ | – | | | $ | – | | | $ | (91,727 | ) |

| Investment Company | | | (58,289,465 | ) | | | – | | | | – | | | | (58,289,465 | ) |

| Securities Sold Short | | $ | (58,381,192 | ) | | $ | – | | | $ | – | | | $ | (58,381,192 | ) |

| Other Financial Instruments* | | | | | | | | | | | | | | | | |

| Written Options | | | (139,108 | ) | | | (543,423 | ) | | | – | | | | (682,531 | ) |

| Total Liabilities | | $ | (58,520,300 | ) | | $ | (543,423 | ) | | $ | – | | | $ | (59,063,723 | ) |

| * | Other Financial Instruments are derivatives not reflected in the Schedule of Investments and Schedule of Securities Sold Short, such as written options, which are reported at their market value at year end. |

| See Notes to Financial Statements. | 23 | ABSOLUTE FUNDS |

ABSOLUTE CONVERTIBLE ARBITRAGE FUND

PORTFOLIO HOLDINGS SUMMARY (Unaudited)

MARCH 31, 2019

| Portfolio Breakdown (% of Net Assets) |

| Long Positions |

| Corporate Convertible Bonds | 90.2% |

| Money Market Fund | 7.3% |

| Short Positions | |

| Common Stock | (46.4)% |

| Other Assets & Liabilities, Net * | 48.9% |

| | 100.0% |

| * | Consists of deposits with the custodian and/or brokers for securities sold short, cash, prepaid expenses, receivables, payables and accrued liabilities. Deposits with the custodian and/or brokers for securities sold short represent 48.4% of net assets. See Note 2 of the accompanying Notes to Financial Statements. |

| See Notes to Financial Statements. | 24 | ABSOLUTE FUNDS |

ABSOLUTE CONVERTIBLE ARBITRAGE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2019

| Principal | | | Security Description | | Rate | | | Maturity | | | Value | |

| Long Positions - 97.5% | |

| Corporate Convertible Bonds - 90.2% | |

| Communication Services - 23.3% |

| $ | 500,000 | | | 8x8, Inc. (a) | | | 0.50 | % | | | 02/01/24 | | | $ | 513,050 | |

| | 1,500,000 | | | CalAmp Corp. (a) | | | 2.00 | | | | 08/01/25 | | | | 1,177,622 | |

| | 2,000,000 | | | Chegg, Inc. (a)(b) | | | 0.25 | | | | 05/15/23 | | | | 3,020,789 | |

| | 500,000 | | | FireEye, Inc. (b) | | | 1.63 | | | | 06/01/35 | | | | 468,991 | |

| | 750,000 | | | FireEye, Inc. (a)(b) | | | 0.88 | | | | 06/01/24 | | | | 768,437 | |

| | 1,000,000 | | | Gannett Co., Inc. (a) | | | 4.75 | | | | 04/15/24 | | | | 1,089,279 | |

| | 500,000 | | | Global Eagle Entertainment, Inc. (b) | | | 2.75 | | | | 02/15/35 | | | | 325,463 | |

| | 1,250,000 | | | Harmonic, Inc. (b) | | | 4.00 | | | | 12/01/20 | | | | 1,427,433 | |

| | 1,500,000 | | | Infinera Corp. | | | 2.13 | | | | 09/01/24 | | | | 1,188,360 | |

| | 1,000,000 | | | iQIYI, Inc. (a) | | | 2.00 | | | | 04/01/25 | | | | 1,045,000 | |

| | 2,000,000 | | | MercadoLibre, Inc. (a) | | | 2.00 | | | | 08/15/28 | | | | 2,693,750 | |

| | 1,500,000 | | | Perficient, Inc. (a) | | | 2.38 | | | | 09/15/23 | | | | 1,465,221 | |

| | 1,500,000 | | | Q2 Holdings, Inc. | | | 0.75 | | | | 02/15/23 | | | | 1,968,405 | |

| | 1,000,000 | | | Quotient Technology, Inc. | | | 1.75 | | | | 12/01/22 | | | | 941,692 | |

| | 750,000 | | | RingCentral, Inc. (c) | | | 0.00 | | | | 03/15/23 | | | | 1,072,717 | |

| | 1,000,000 | | | Twitter, Inc. (a) | | | 0.25 | | | | 06/15/24 | | | | 927,881 | |

| | 651,000 | | | Twitter, Inc., Series 2014 | | | 1.00 | | | | 09/15/21 | | | | 614,193 | |

| | | | | | | | | | | | | | | | 20,708,283 | |

| Consumer Discretionary - 2.3% |

| | 1,000,000 | | | EZCORP, Inc. | | | 2.88 | | | | 07/01/24 | | | | 1,125,856 | |

| | 380,000 | | | EZCORP, Inc. (a)(b) | | | 2.38 | | | | 05/01/25 | | | | 331,169 | |

| | 500,000 | | | Live Nation Entertainment, Inc. | | | 2.50 | | | | 03/15/23 | | | | 577,801 | |

| | | | | | | | | | | | | | | | 2,034,826 | |

| Consumer Staples - 2.4% |

| | 625,000 | | | Flexion Therapeutics, Inc. (b) | | | 3.38 | | | | 05/01/24 | | | | 548,437 | |

| | 1,500,000 | | | FTI Consulting, Inc. (a) | | | 2.00 | | | | 08/15/23 | | | | 1,535,625 | |

| | | | | | | | | | | | | | | | 2,084,062 | |

| Energy - 4.6% |

| | 2,000,000 | | | Helix Energy Solutions Group, Inc. (b) | | | 4.13 | | | | 09/15/23 | | | | 2,247,585 | |

| | 1,500,000 | | | Newpark Resources, Inc. (b) | | | 4.00 | | | | 12/01/21 | | | | 1,850,700 | |

| | | | | | | | | | | | | | | | 4,098,285 | |

| Financials - 1.6% |

| | 500,000 | | | Encore Capital Europe Finance, Ltd. (b) | | | 4.50 | | | | 09/01/23 | | | | 449,348 | |

| | 61,000 | | | Encore Capital Group, Inc. (b) | | | 3.00 | | | | 07/01/20 | | | | 58,382 | |

| | 400,000 | | | Encore Capital Group, Inc. | | | 2.88 | | | | 03/15/21 | | | | 369,527 | |

| | 500,000 | | | New Mountain Finance Corp. | | | 5.75 | | | | 08/15/23 | | | | 502,725 | |

| | | | | | | | | | | | | | | | 1,379,982 | |

| Health Care - 16.5% |

| | 1,000,000 | | | Accuray, Inc. (a) | | | 3.75 | | | | 07/15/22 | | | | 1,090,052 | |

| | 1,250,000 | | | Alder Biopharmaceuticals, Inc. | | | 2.50 | | | | 02/01/25 | | | | 1,199,467 | |

| | 500,000 | | | CONMED Corp. (a) | | | 2.63 | | | | 02/01/24 | | | | 556,009 | |

| | 525,000 | | | DexCom, Inc. (b) | | | 0.75 | | | | 05/15/22 | | | | 706,077 | |

| | 1,000,000 | | | Exact Sciences Corp. (b) | | | 1.00 | | | | 01/15/25 | | | | 1,367,502 | |

| | 1,500,000 | | | Inovio Pharmaceuticals, Inc. (a) | | | 6.50 | | | | 03/01/24 | | | | 1,507,318 | |

| | 1,500,000 | | | Insmed, Inc. | | | 1.75 | | | | 01/15/25 | | | | 1,520,408 | |

| | 1,500,000 | | | Insulet Corp. (a) | | | 1.38 | | | | 11/15/24 | | | | 1,810,313 | |

| | 500,000 | | | Karyopharm Therapeutics, Inc. (a) | | | 3.00 | | | | 10/15/25 | | | | 311,161 | |