0000034273 vet:C000060276Member oef:WithoutSalesLoadMember 2022-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9668

Jennifer Fromm, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-2608

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Virtus KAR Capital Growth Fund

Class A / PSTAX

Annual SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Virtus KAR Capital Growth Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus KAR Capital Growth Fund

Class A / PSTAX | $144 | 1.21% |

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

For the fiscal year ended September 30, 2024, the Fund’s Class A shares at NAV returned 38.53%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 35.17% and the Russell 1000® Growth Index, which serves as the style-specific index, returned 42.19%.

The FT Wilshire 5000 Index is a broad-based free-float market capitalization-weighted index that aims to capture 100% of the U.S. investable market capitalization. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The Russell 1000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

What factors impacted Fund performance over the reporting period?

The Fund utilizes an actively managed, bottom-up fundamental research approach to identify a select group of companies believed by the Fund’s portfolio managers to possess sustainable competitive advantages. As such, the performance of the Fund is expected to be primarily determined by market reactions, both positive and negative, to activity related to these companies. Stock selection and an underweight in information technology, as well as stock selection in consumer staples, detracted from performance relative to the Fund’s style-specific benchmark for the fiscal year. Stock selection in industrials and communication services contributed to performance. The biggest contributors to performance for the 12-month period were NVIDIA, Fair Isaac, Meta Platforms, Amazon.com, and Amphenol. The biggest detractors from performance during the period were Paycom Software, BILL, Estee Lauder, MongoDB, and Monster Beverage. The following table outlines key factors that materially affected the Fund’s performance during the reporting period.

| FACTOR | IMPACT | SUMMARY |

NVIDIA

| Positive

| Demand continued to grow for NVIDIA’s graphics processing units. The company’s large number of units in use by customers, innovation at the data center level, and robust software offerings remained powerful competitive advantages.

|

Fair Isaac

| Positive

| Fair Issac outperformed due to continued strength in its high-profit-margin credit scores business, along with growth in its software business driven by increased adoption of the FICO platform. The stock also benefited from anticipated tailwinds from lower interest rates.

|

Paycom Software

| Negative

| Paycom significantly reduced its topline, or total revenue, guidance for fiscal year 2024 due to a revenue headwind from its automated payroll software. In addition, the weak macroeconomic environment weighed on revenues.

|

| BILL | Negative | BILL, which provides automated, cloud-based software for financial operations, faced headwinds in commissions, a slowdown in small- and medium-sized business customer spending, and pressure from a competitor. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

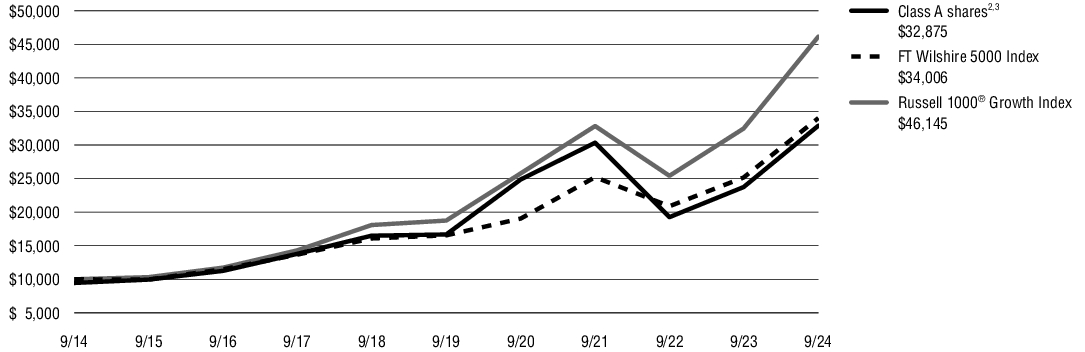

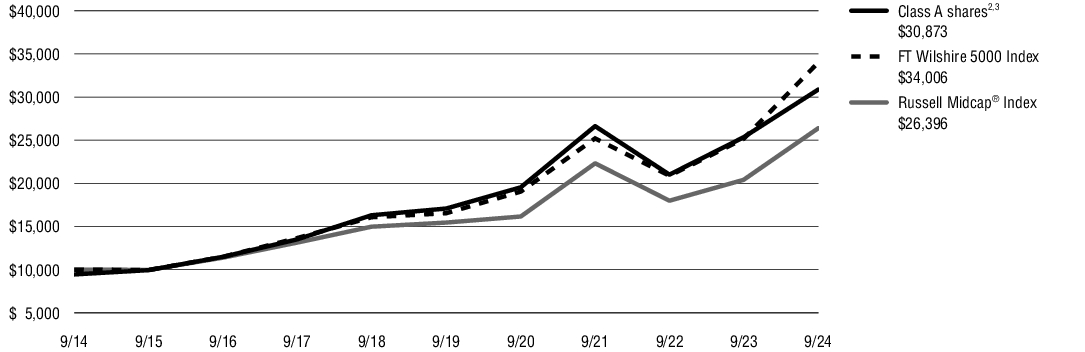

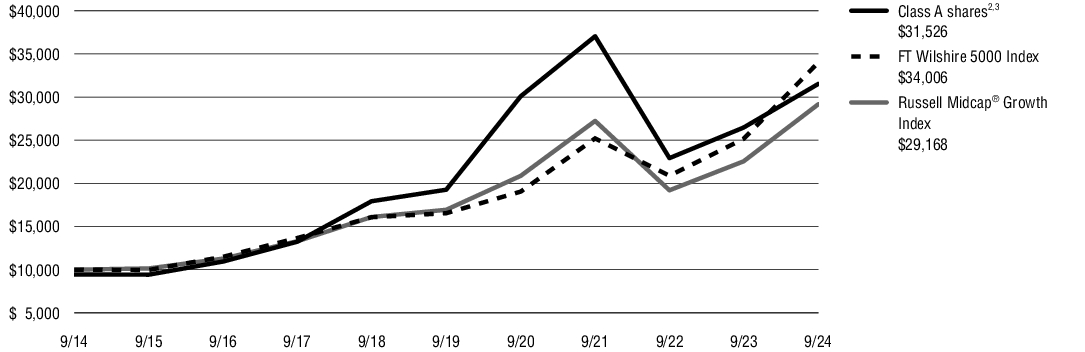

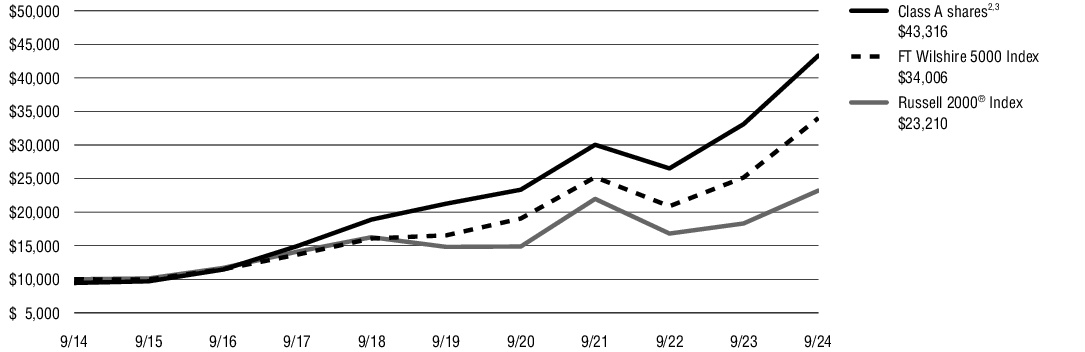

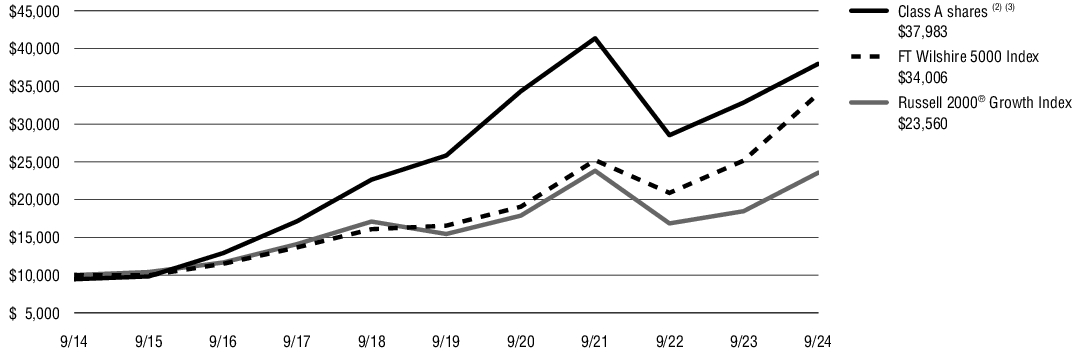

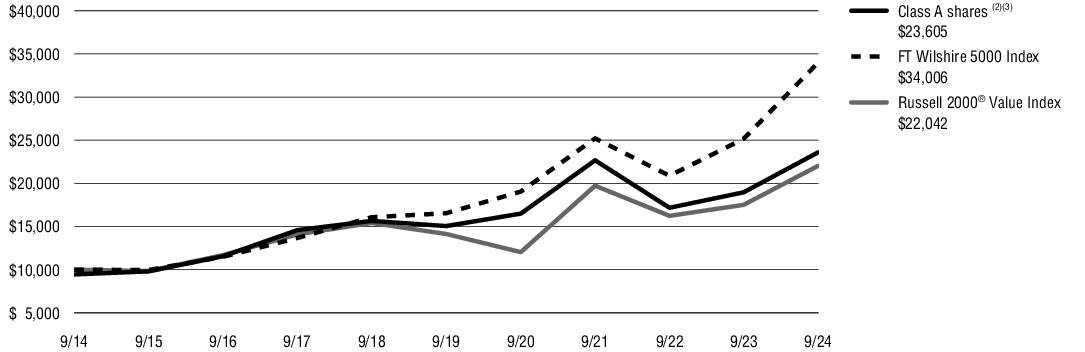

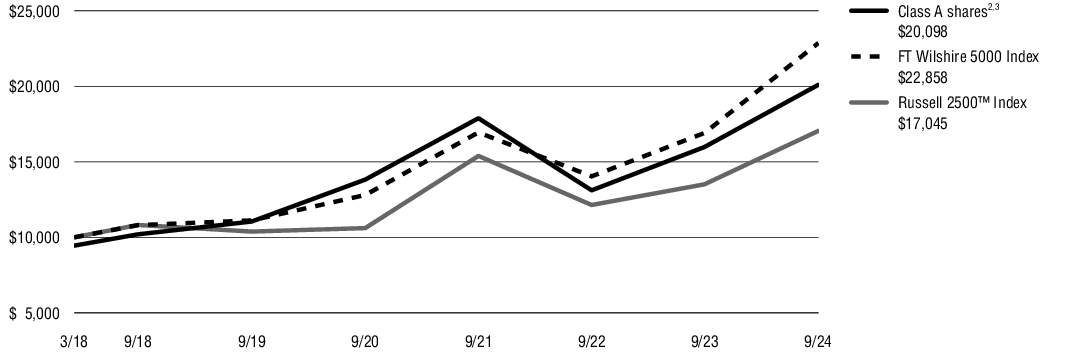

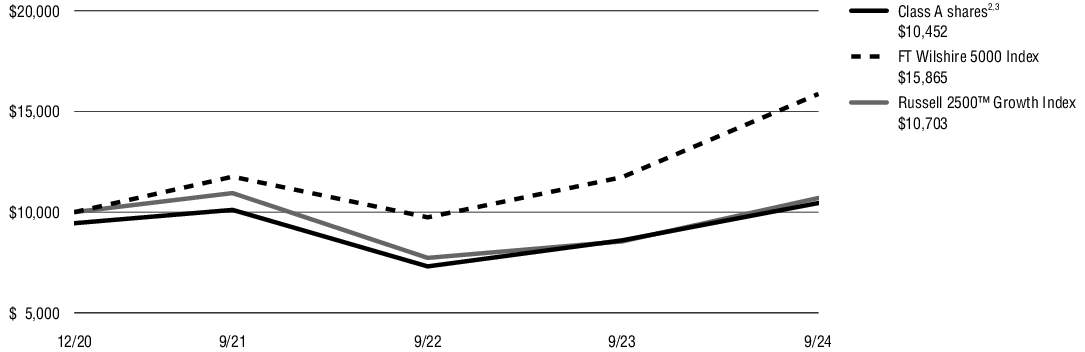

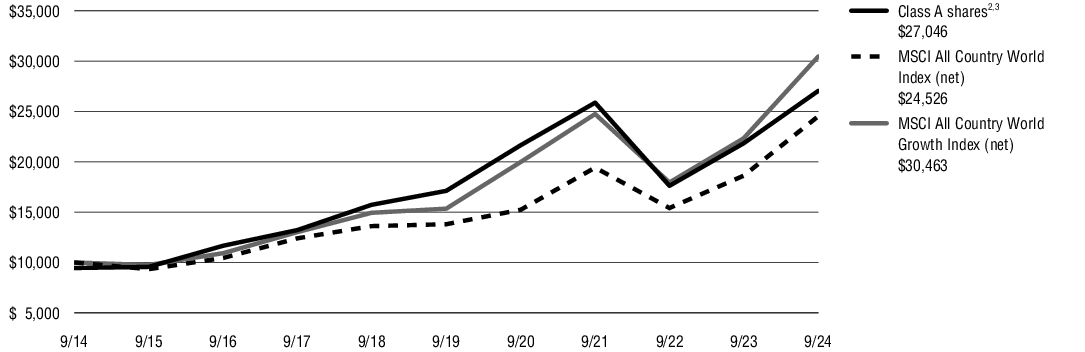

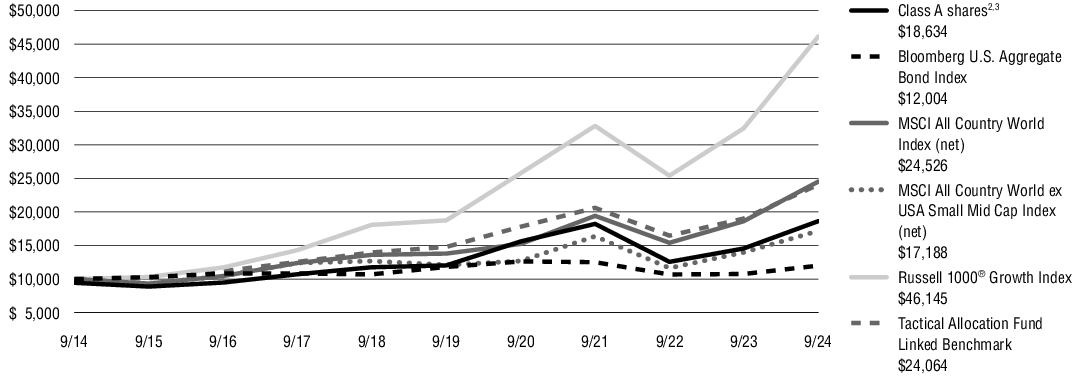

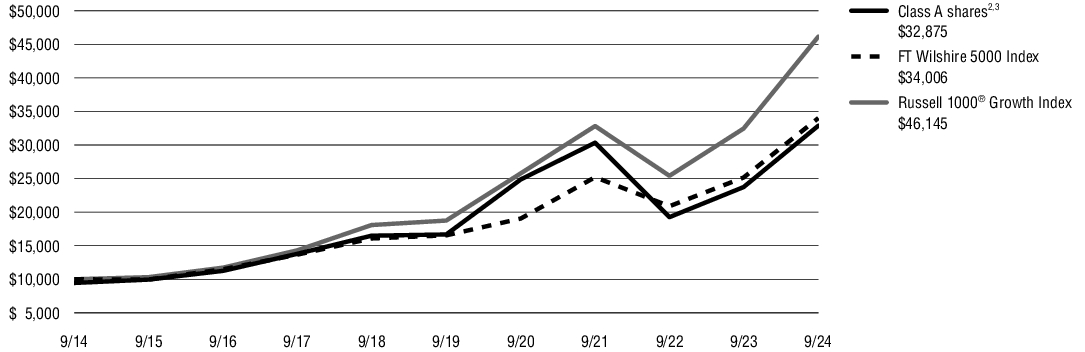

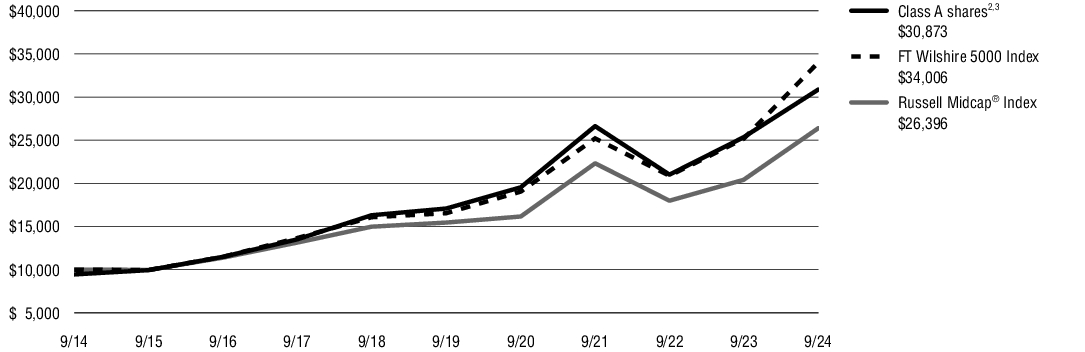

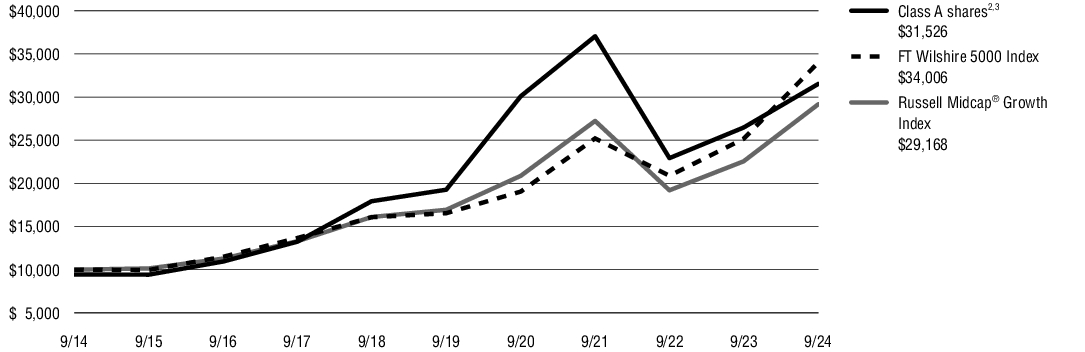

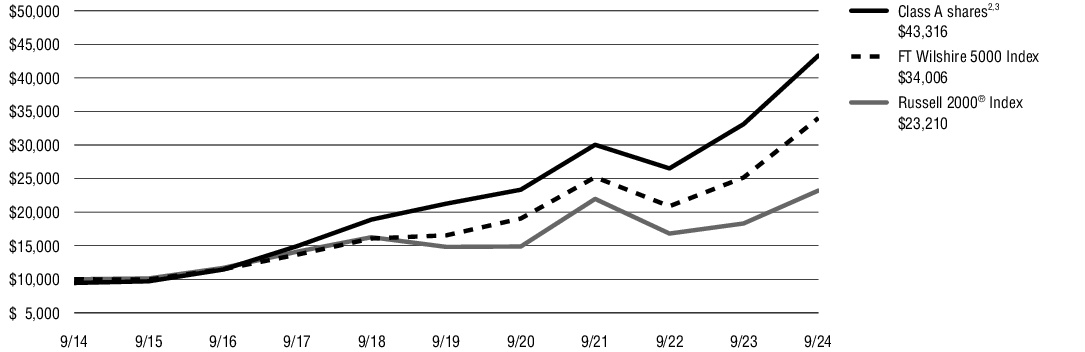

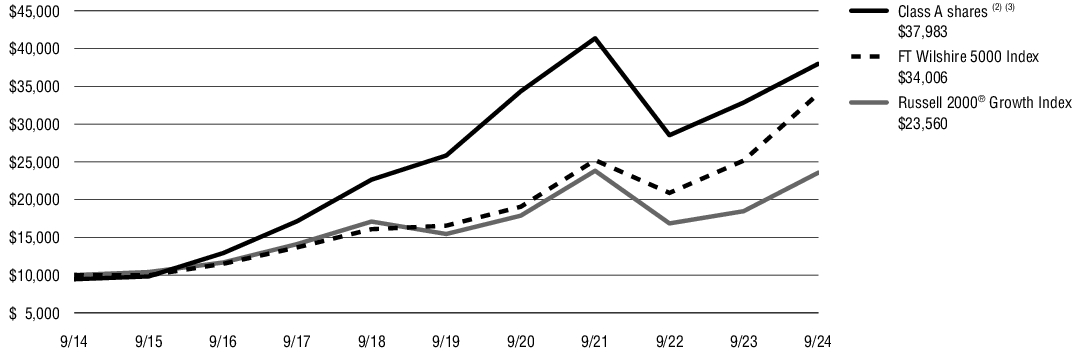

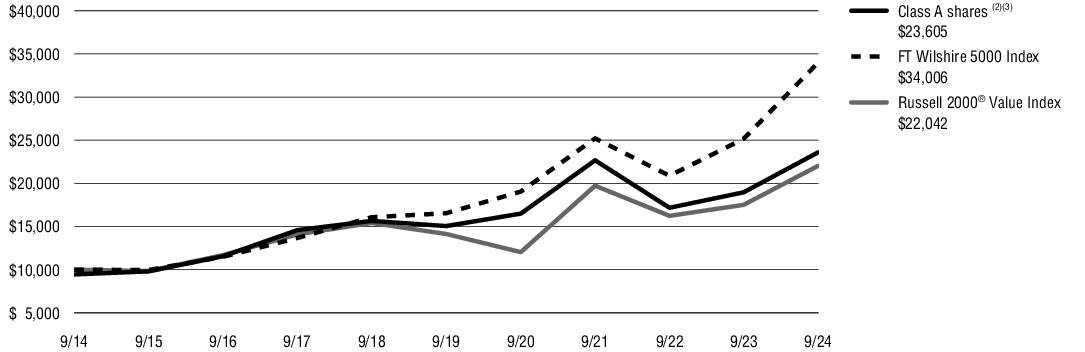

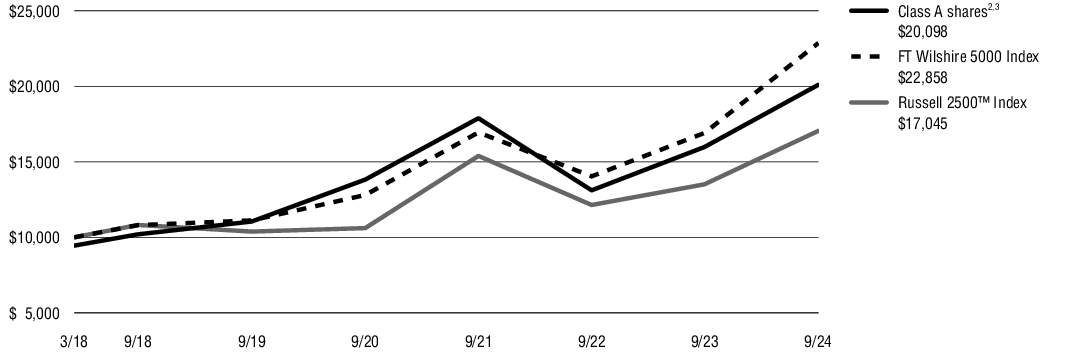

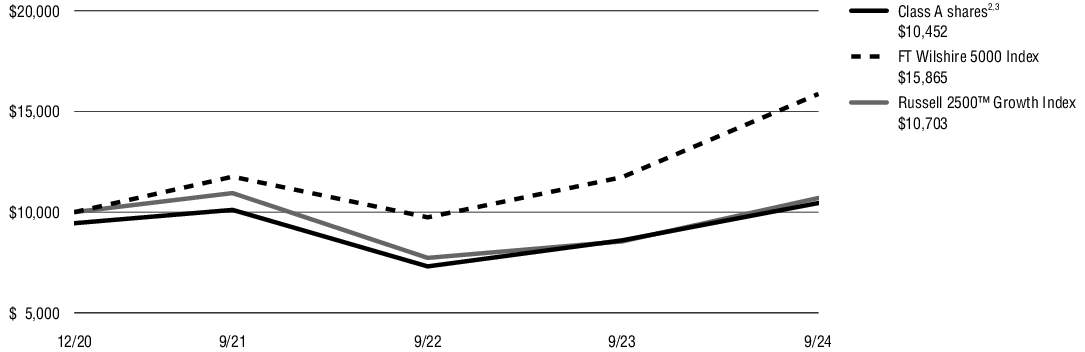

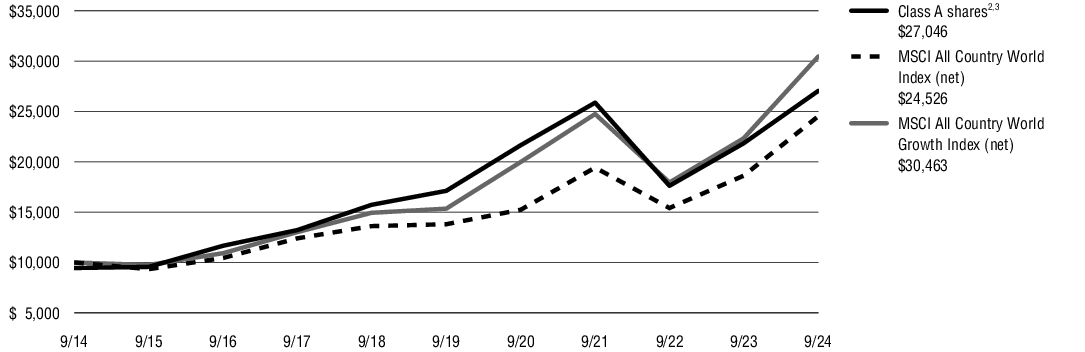

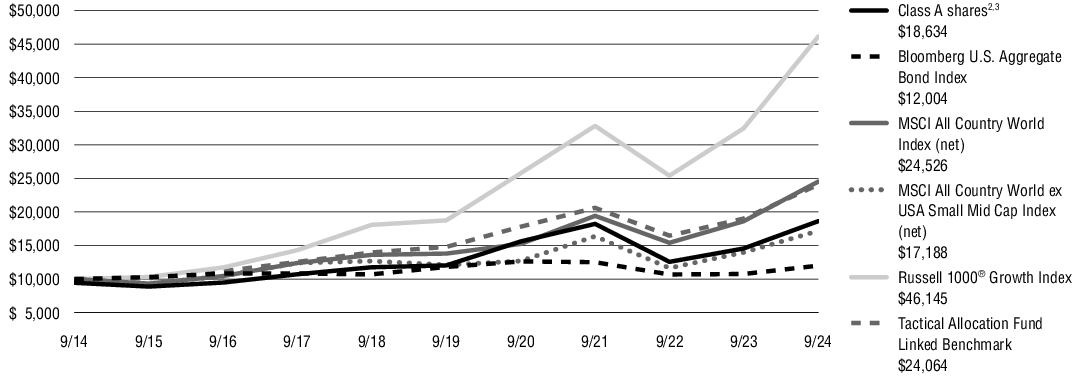

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class A shares including any applicable sales charges or fees. It assumes a $10,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 9/30/24 | 1 Year | 5 Years | 10 Years |

| Virtus KAR Capital Growth Fund (Class A/PSTAX) at NAV(1) | 38.53% | 14.55% | 13.28% |

| Virtus KAR Capital Growth Fund (Class A/PSTAX) at POP(2),(3) | 30.91% | 13.26% | 12.64% |

| FT Wilshire 5000 Index | 35.17% | 15.50% | 13.02% |

| Russell 1000® Growth Index | 42.19% | 19.74% | 16.52% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| (3) | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. A CDSC may be imposed on certain redemptions of Class A shares made within 18 months of a finder’s fee being paid. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of September 30, 2024)

| Fund net assets (‘000s) | $645,532 |

| Total number of portfolio holdings | 40 |

| Total advisory fee paid (‘000s) | $4,194 |

| Portfolio turnover rate as of the end of the reporting period | 14% |

| Information Technology | 29% |

| Consumer Discretionary | 20% |

| Communication Services | 12% |

| Health Care | 12% |

| Financials | 11% |

| Industrials | 11% |

| Real Estate | 3% |

| Other | 2% |

| Total | 100% |

(1) | Percentage of total investments as of September 30, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Virtus KAR Capital Growth Fund

Class C / SSTFX

Annual SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Virtus KAR Capital Growth Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus KAR Capital Growth Fund

Class C / SSTFX | $240 | 2.02% |

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

For the fiscal year ended September 30, 2024, the Fund’s Class C shares at NAV returned 37.37%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 35.17% and the Russell 1000® Growth Index, which serves as the style-specific index, returned 42.19%.

The FT Wilshire 5000 Index is a broad-based free-float market capitalization-weighted index that aims to capture 100% of the U.S. investable market capitalization. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The Russell 1000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

What factors impacted Fund performance over the reporting period?

The Fund utilizes an actively managed, bottom-up fundamental research approach to identify a select group of companies believed by the Fund’s portfolio managers to possess sustainable competitive advantages. As such, the performance of the Fund is expected to be primarily determined by market reactions, both positive and negative, to activity related to these companies. Stock selection and an underweight in information technology, as well as stock selection in consumer staples, detracted from performance relative to the Fund’s style-specific benchmark for the fiscal year. Stock selection in industrials and communication services contributed to performance. The biggest contributors to performance for the 12-month period were NVIDIA, Fair Isaac, Meta Platforms, Amazon.com, and Amphenol. The biggest detractors from performance during the period were Paycom Software, BILL, Estee Lauder, MongoDB, and Monster Beverage. The following table outlines key factors that materially affected the Fund’s performance during the reporting period.

| FACTOR | IMPACT | SUMMARY |

NVIDIA

| Positive

| Demand continued to grow for NVIDIA’s graphics processing units. The company’s large number of units in use by customers, innovation at the data center level, and robust software offerings remained powerful competitive advantages.

|

Fair Isaac

| Positive

| Fair Issac outperformed due to continued strength in its high-profit-margin credit scores business, along with growth in its software business driven by increased adoption of the FICO platform. The stock also benefited from anticipated tailwinds from lower interest rates.

|

Paycom Software

| Negative

| Paycom significantly reduced its topline, or total revenue, guidance for fiscal year 2024 due to a revenue headwind from its automated payroll software. In addition, the weak macroeconomic environment weighed on revenues.

|

| BILL | Negative | BILL, which provides automated, cloud-based software for financial operations, faced headwinds in commissions, a slowdown in small- and medium-sized business customer spending, and pressure from a competitor. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

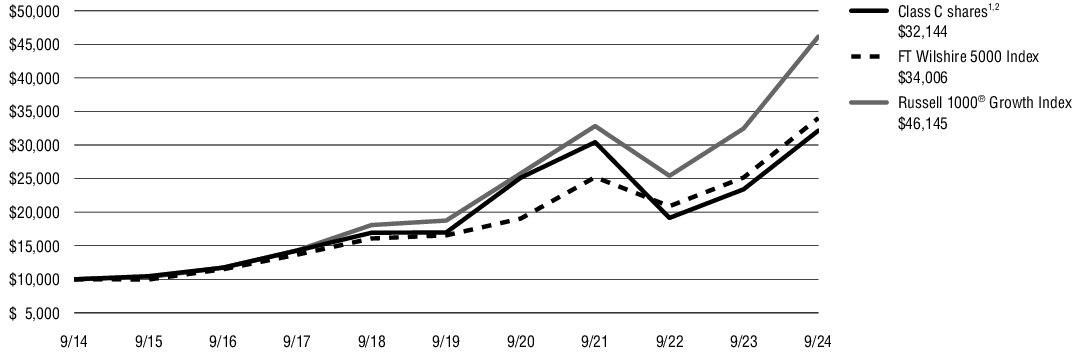

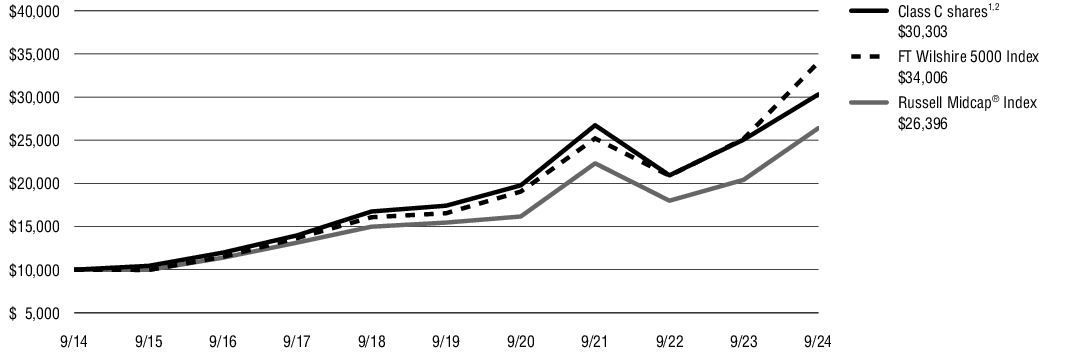

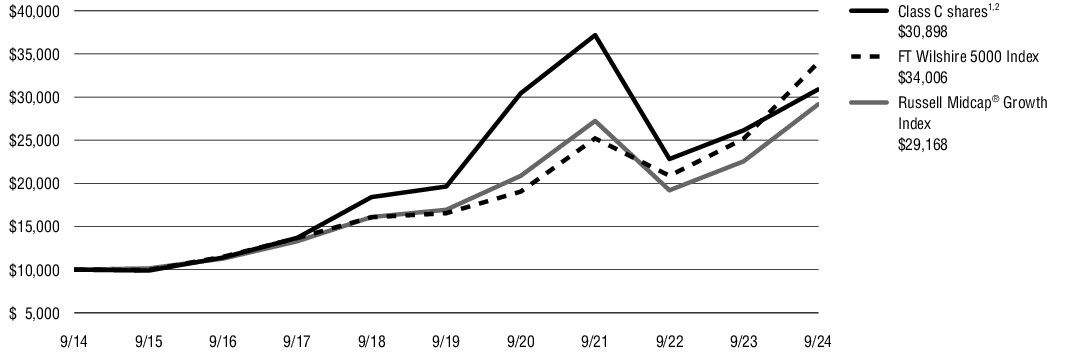

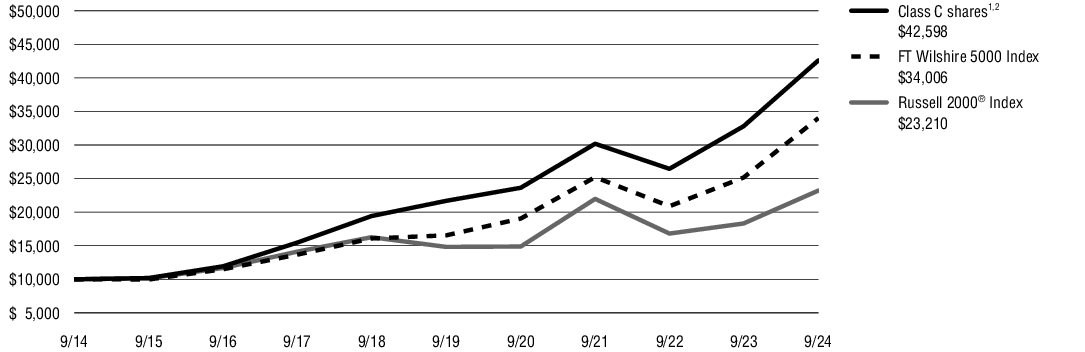

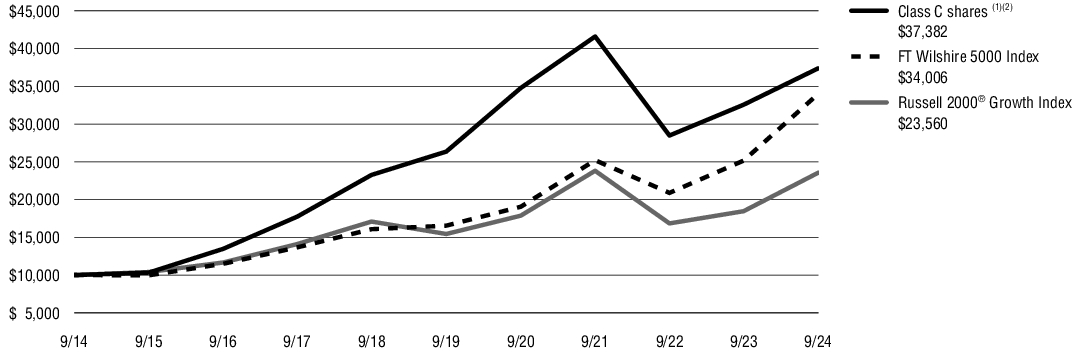

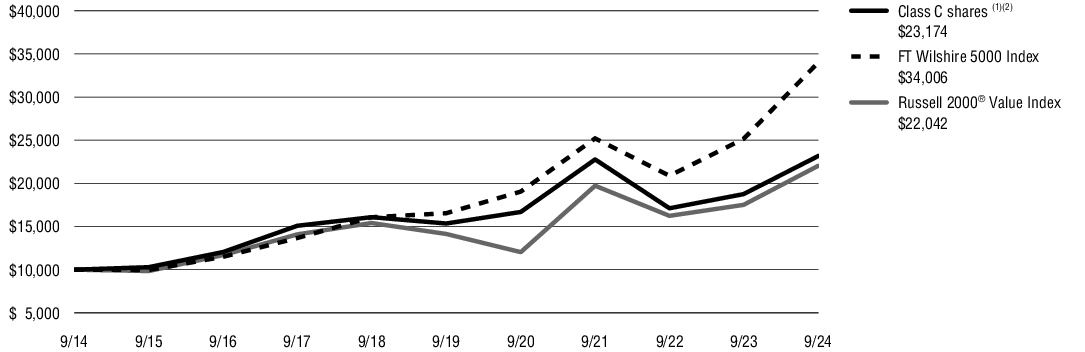

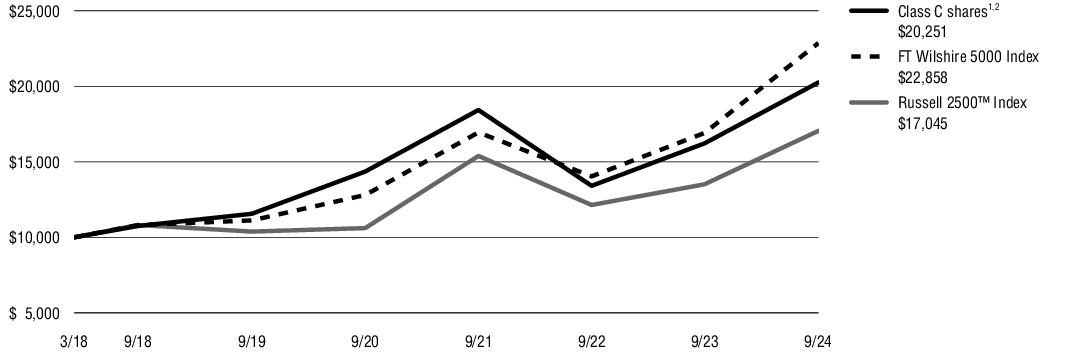

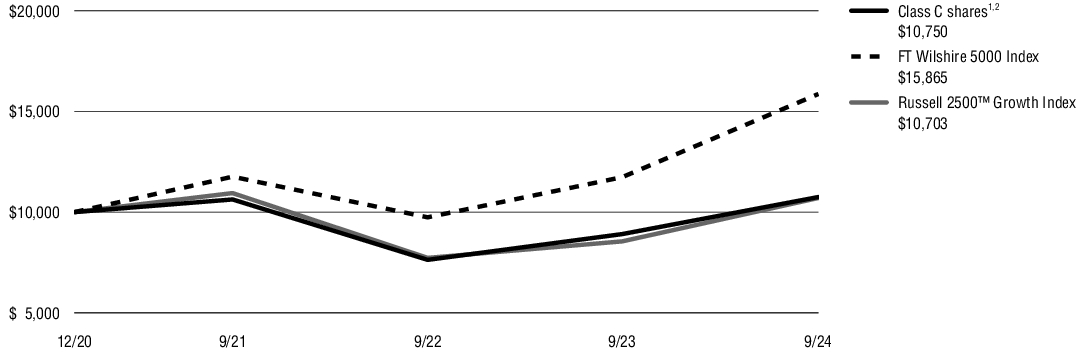

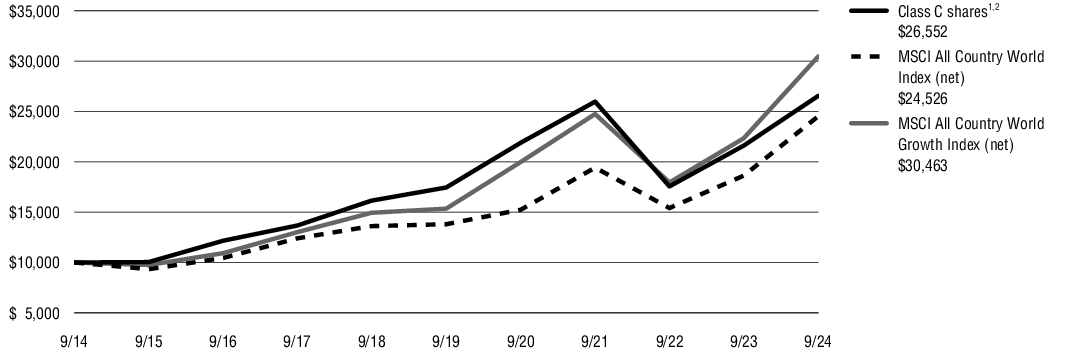

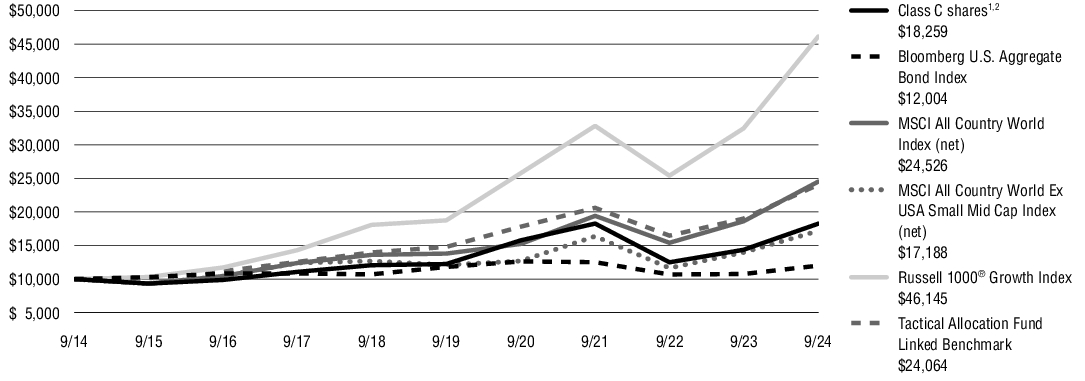

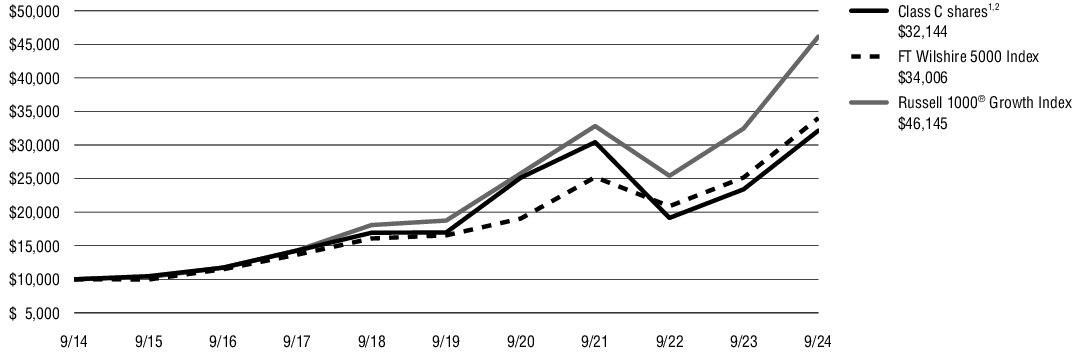

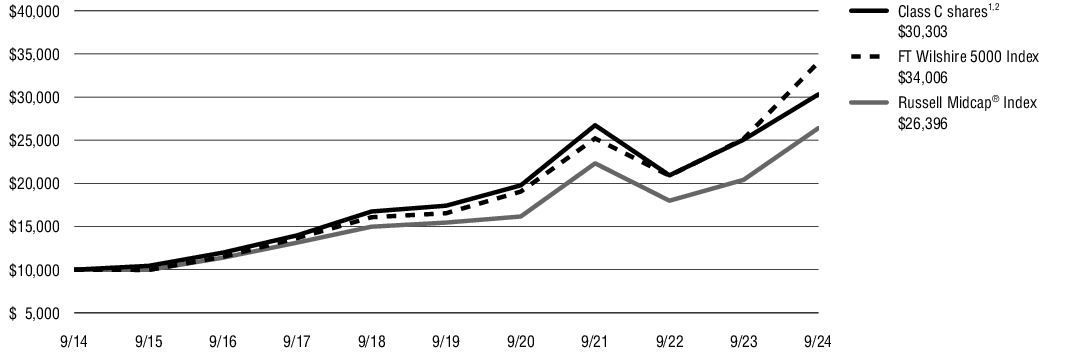

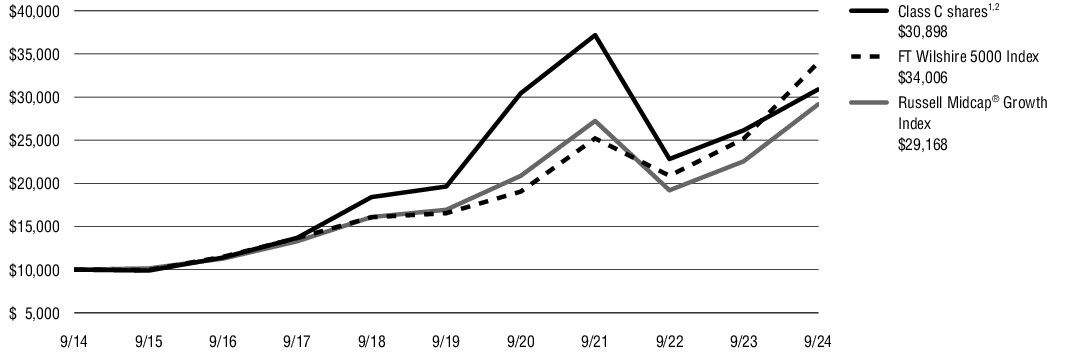

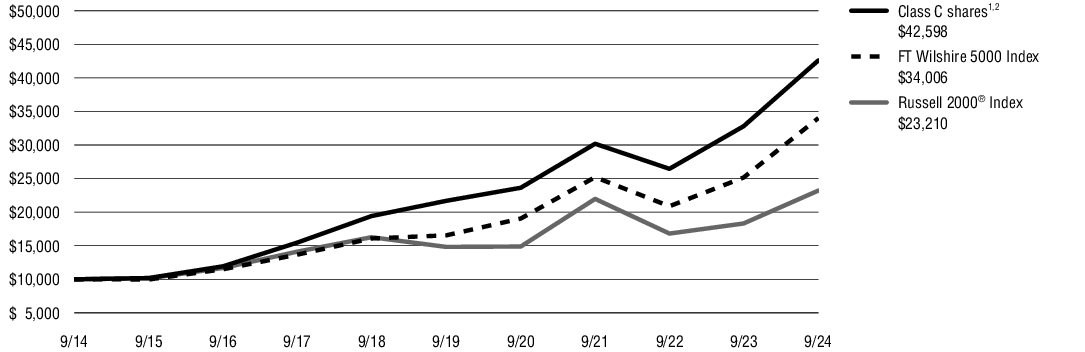

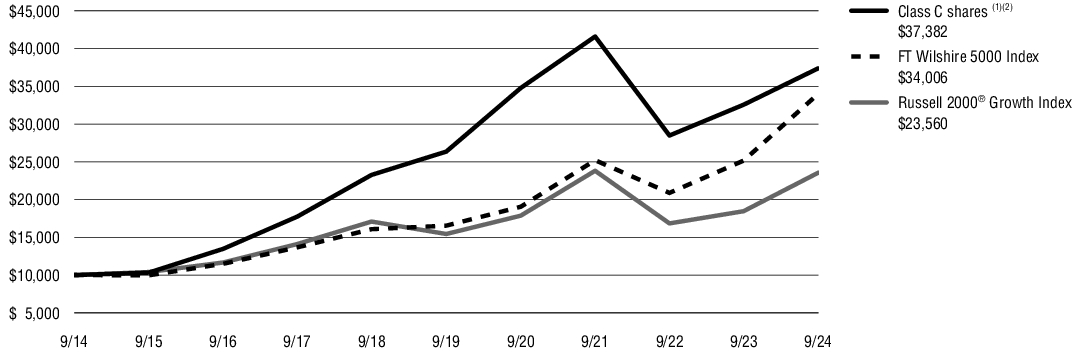

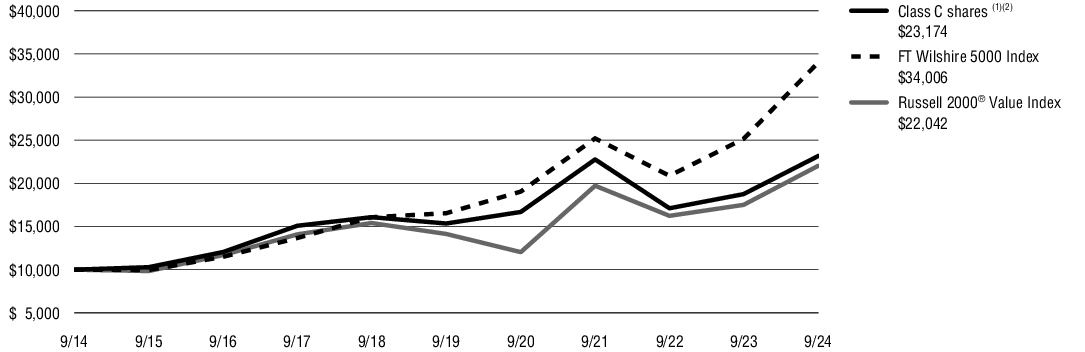

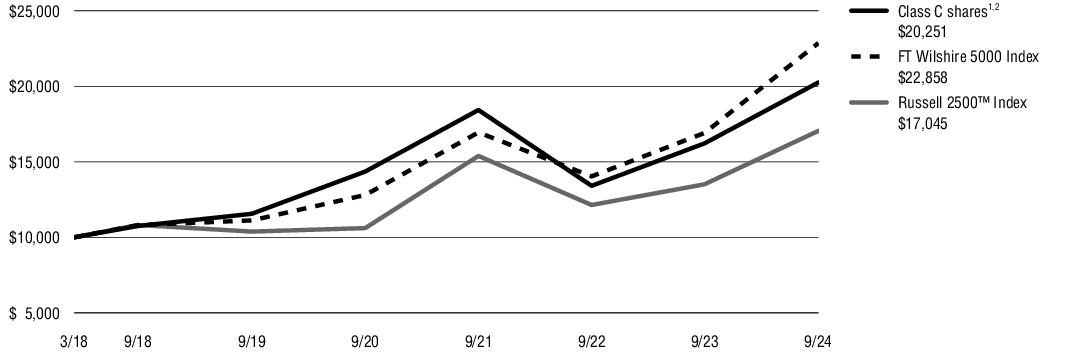

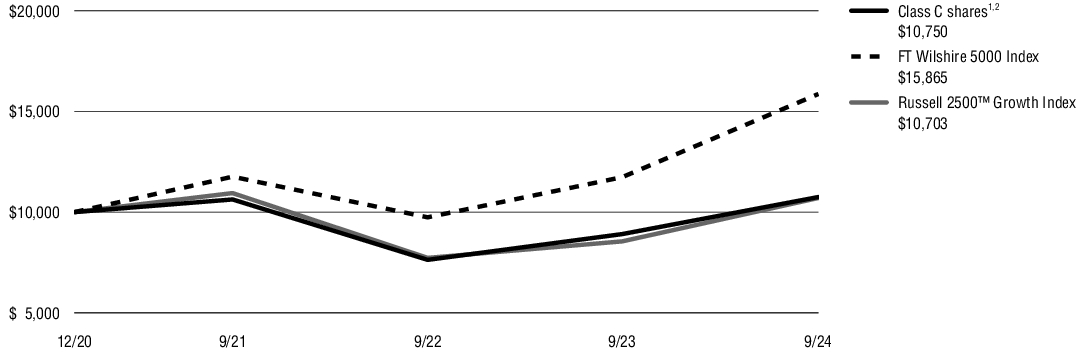

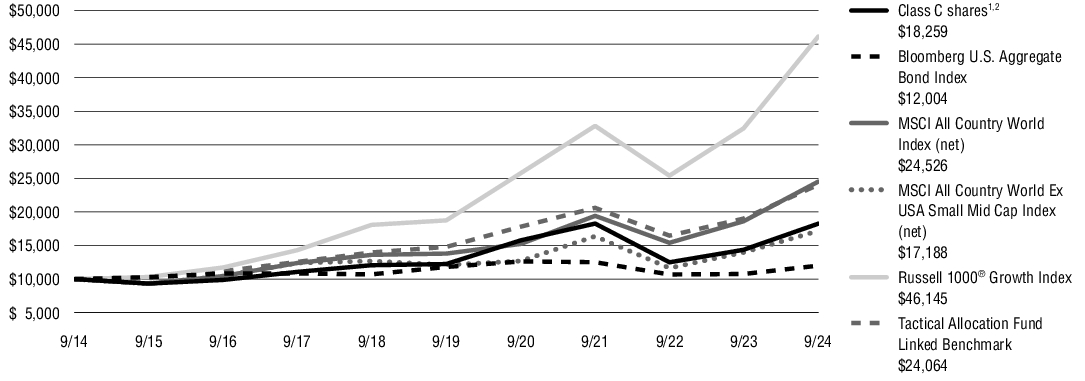

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class C shares. It assumes a $10,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 9/30/24 | 1 Year | 5 Years | 10 Years |

| Virtus KAR Capital Growth Fund (Class C/SSTFX) at NAV(1) and with CDSC(2) | 37.37% | 13.62% | 12.39% |

| FT Wilshire 5000 Index | 35.17% | 15.50% | 13.02% |

| Russell 1000® Growth Index | 42.19% | 19.74% | 16.52% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of time of purchase. CDSC for all Class C shares are 1% within the first year and 0% thereafter. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of September 30, 2024)

| Fund net assets (‘000s) | $645,532 |

| Total number of portfolio holdings | 40 |

| Total advisory fee paid (‘000s) | $4,194 |

| Portfolio turnover rate as of the end of the reporting period | 14% |

| Information Technology | 29% |

| Consumer Discretionary | 20% |

| Communication Services | 12% |

| Health Care | 12% |

| Financials | 11% |

| Industrials | 11% |

| Real Estate | 3% |

| Other | 2% |

| Total | 100% |

(1) | Percentage of total investments as of September 30, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Virtus KAR Capital Growth Fund

Class I / PLXGX

Annual SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Virtus KAR Capital Growth Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus KAR Capital Growth Fund

Class I / PLXGX | $118 | 0.99% |

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

For the fiscal year ended September 30, 2024, the Fund’s Class I shares at NAV returned 38.76%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 35.17% and the Russell 1000® Growth Index, which serves as the style-specific index, returned 42.19%.

The FT Wilshire 5000 Index is a broad-based free-float market capitalization-weighted index that aims to capture 100% of the U.S. investable market capitalization. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The Russell 1000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

What factors impacted Fund performance over the reporting period?

The Fund utilizes an actively managed, bottom-up fundamental research approach to identify a select group of companies believed by the Fund’s portfolio managers to possess sustainable competitive advantages. As such, the performance of the Fund is expected to be primarily determined by market reactions, both positive and negative, to activity related to these companies. Stock selection and an underweight in information technology, as well as stock selection in consumer staples, detracted from performance relative to the Fund’s style-specific benchmark for the fiscal year. Stock selection in industrials and communication services contributed to performance. The biggest contributors to performance for the 12-month period were NVIDIA, Fair Isaac, Meta Platforms, Amazon.com, and Amphenol. The biggest detractors from performance during the period were Paycom Software, BILL, Estee Lauder, MongoDB, and Monster Beverage. The following table outlines key factors that materially affected the Fund’s performance during the reporting period.

| FACTOR | IMPACT | SUMMARY |

NVIDIA

| Positive

| Demand continued to grow for NVIDIA’s graphics processing units. The company’s large number of units in use by customers, innovation at the data center level, and robust software offerings remained powerful competitive advantages.

|

Fair Isaac

| Positive

| Fair Issac outperformed due to continued strength in its high-profit-margin credit scores business, along with growth in its software business driven by increased adoption of the FICO platform. The stock also benefited from anticipated tailwinds from lower interest rates.

|

Paycom Software

| Negative

| Paycom significantly reduced its topline, or total revenue, guidance for fiscal year 2024 due to a revenue headwind from its automated payroll software. In addition, the weak macroeconomic environment weighed on revenues.

|

| BILL | Negative | BILL, which provides automated, cloud-based software for financial operations, faced headwinds in commissions, a slowdown in small- and medium-sized business customer spending, and pressure from a competitor. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

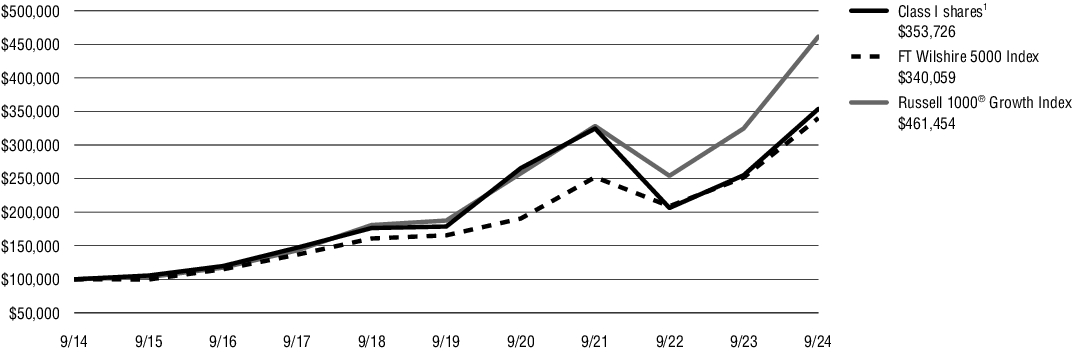

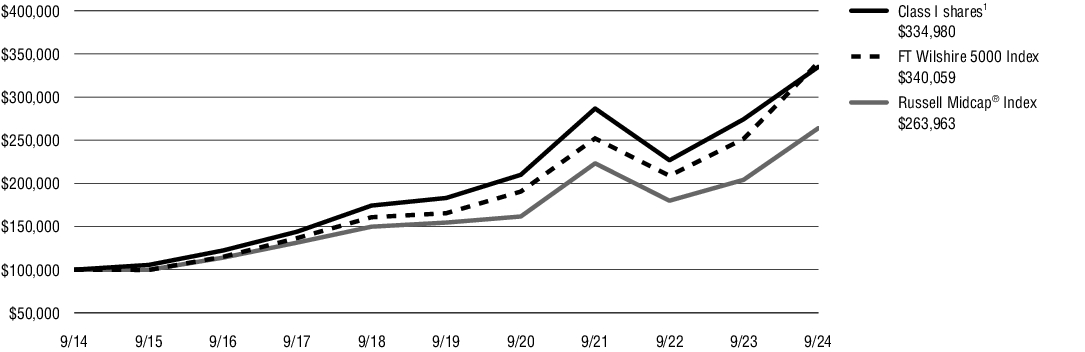

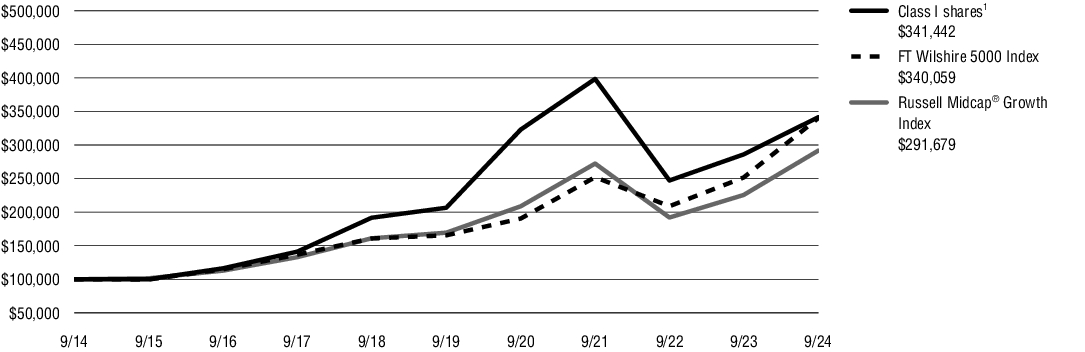

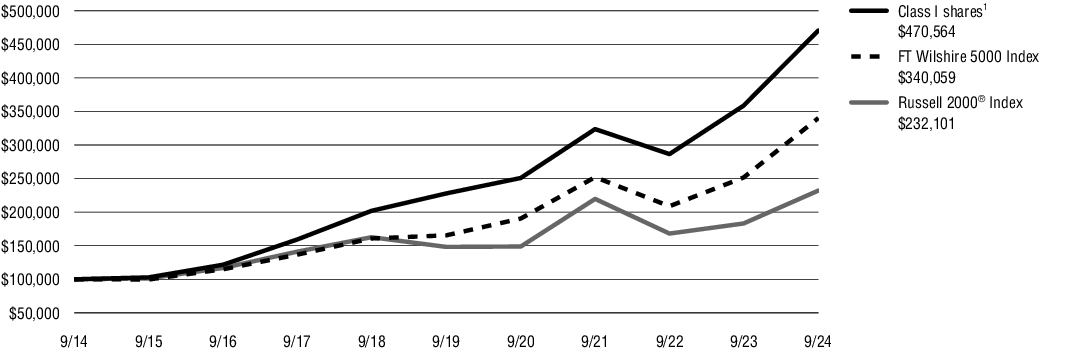

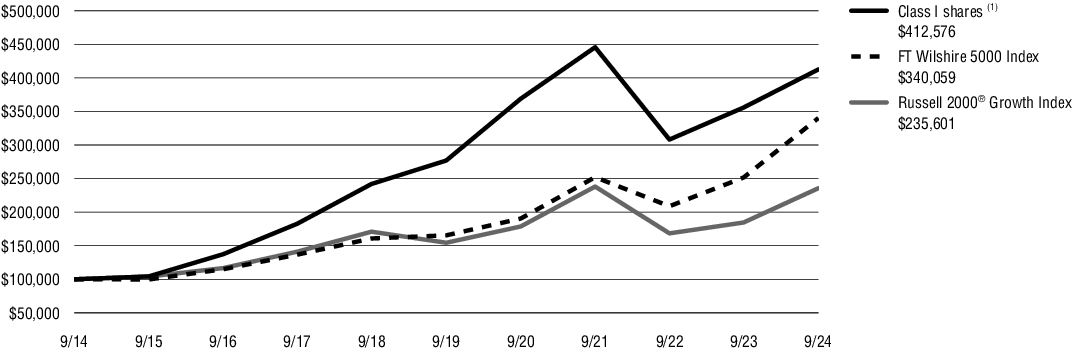

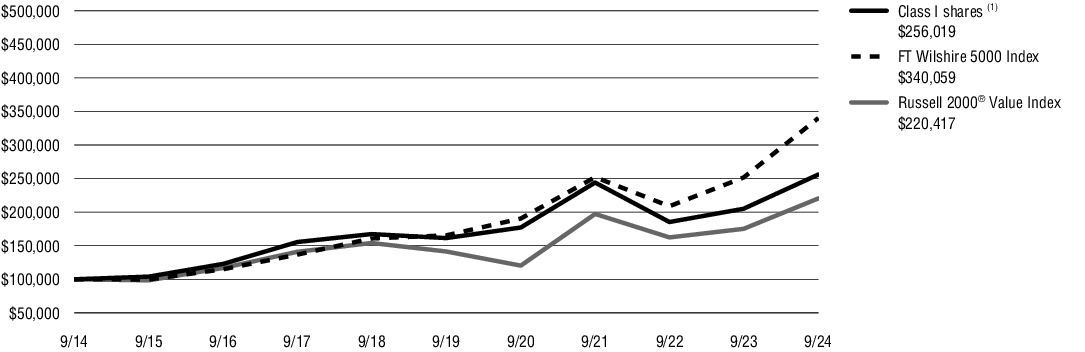

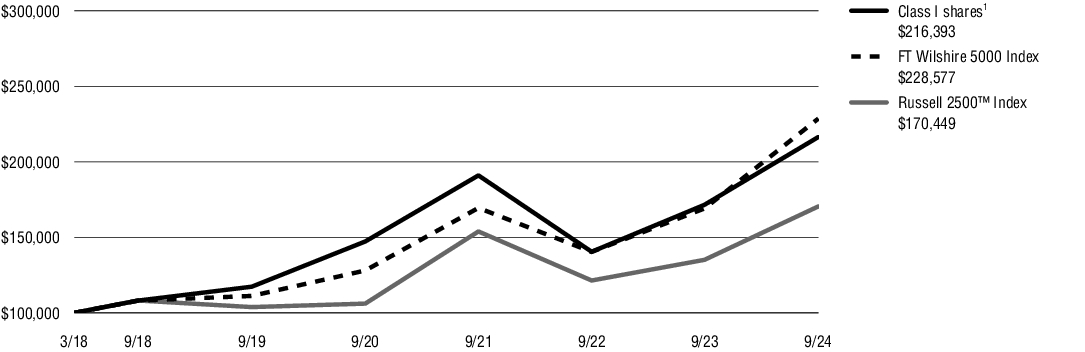

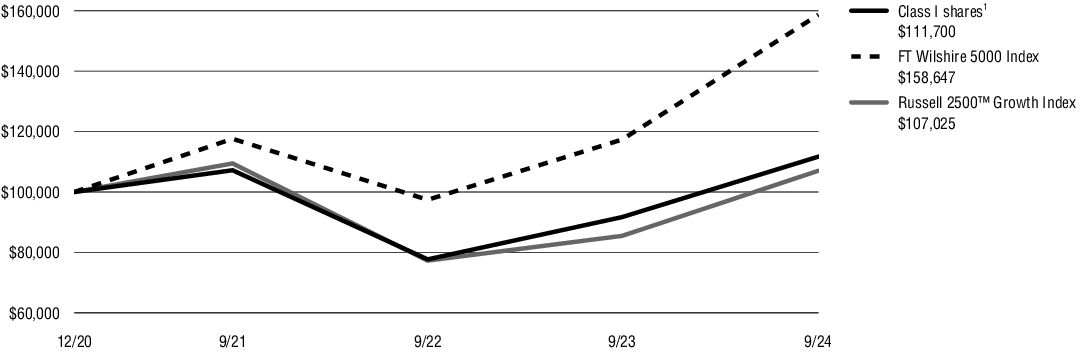

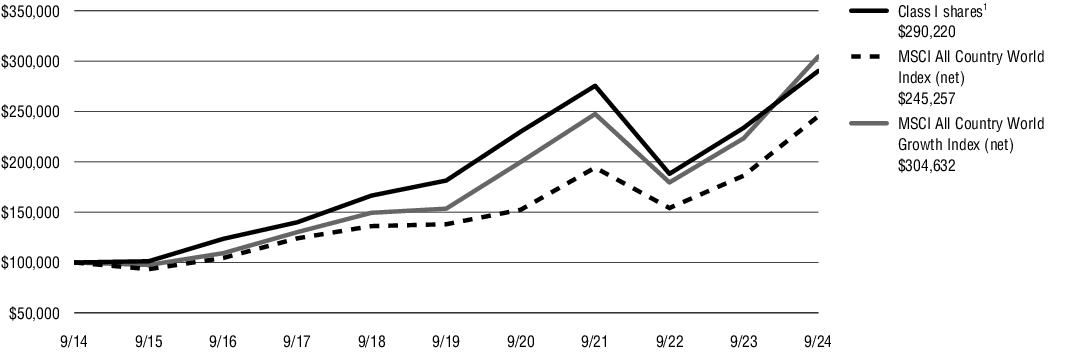

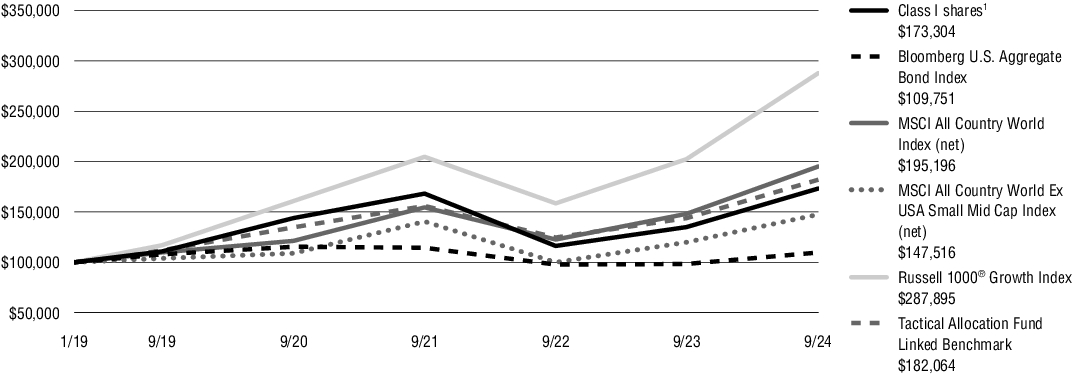

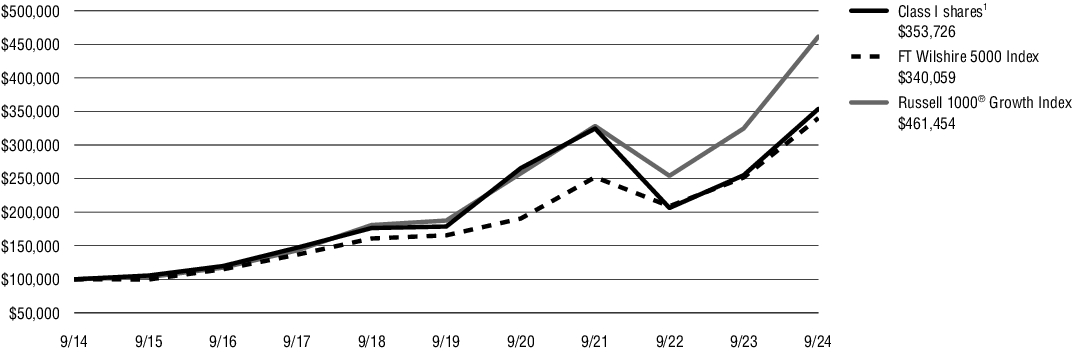

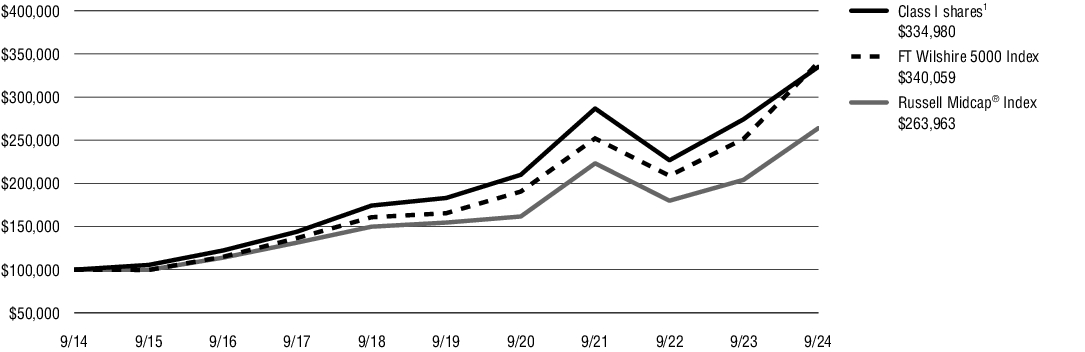

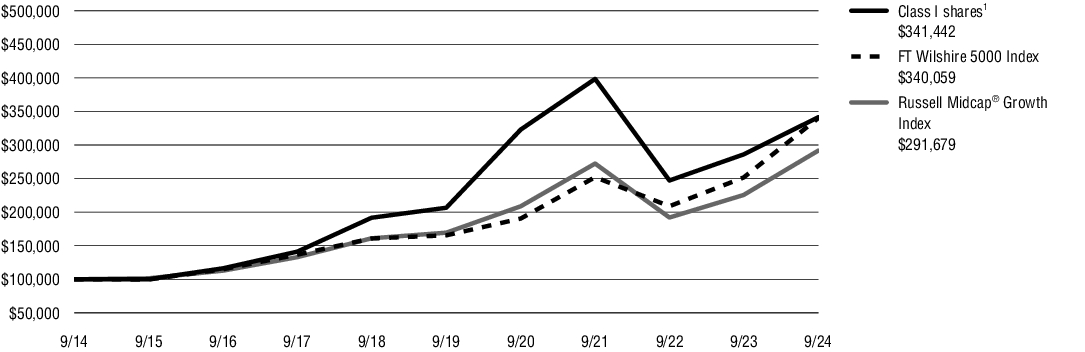

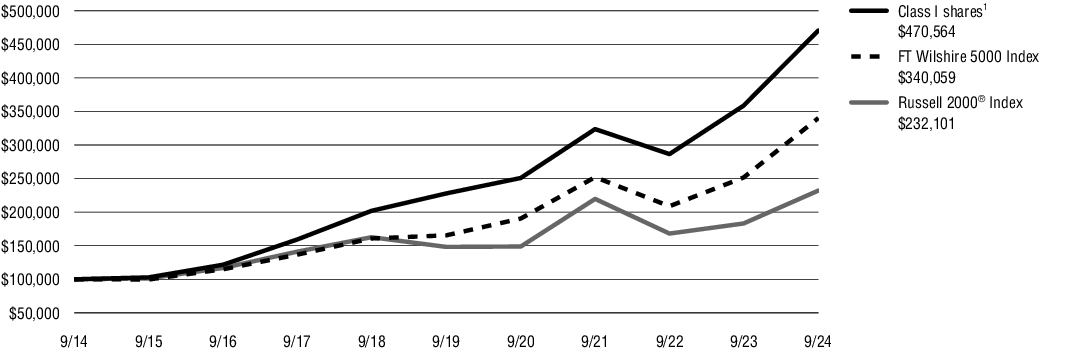

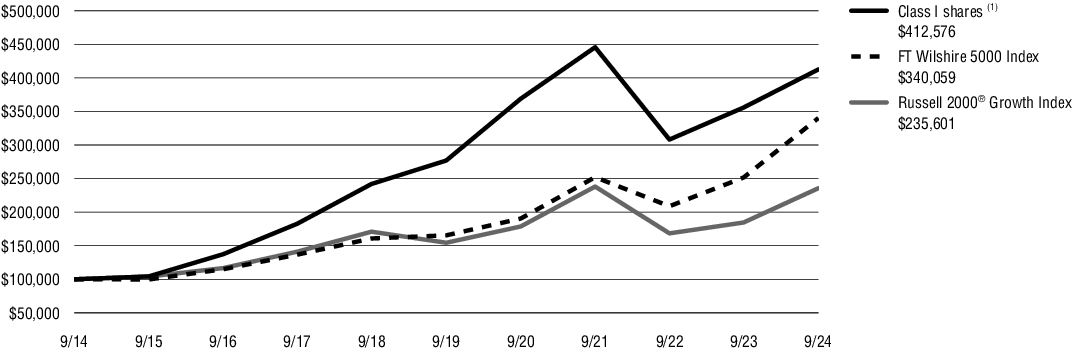

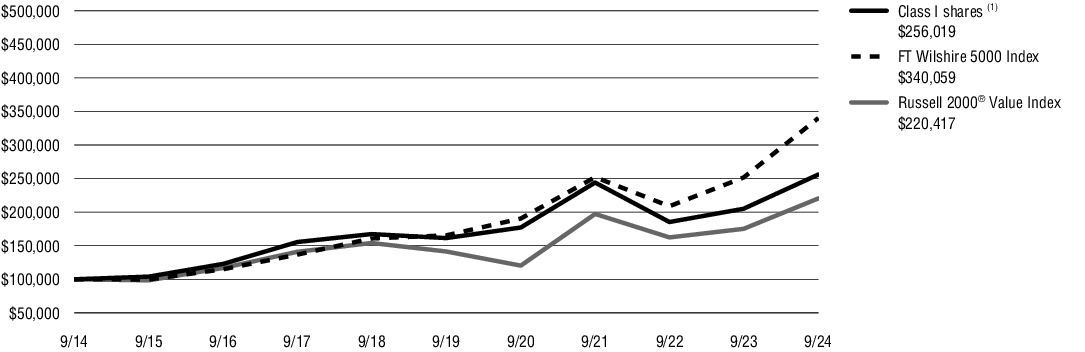

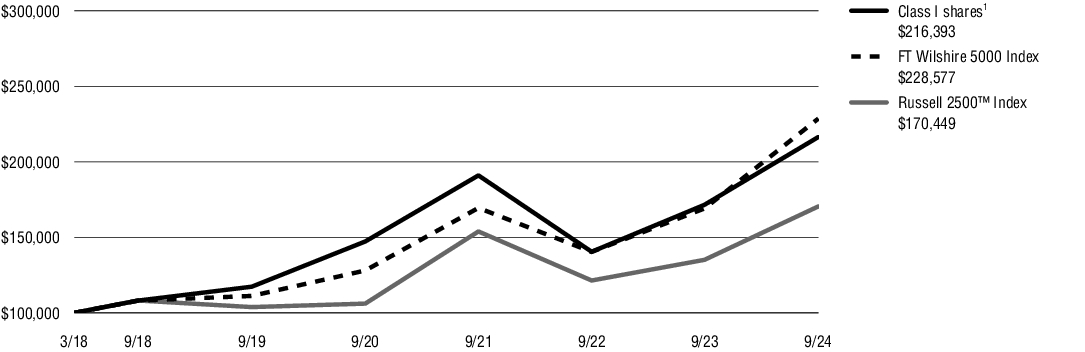

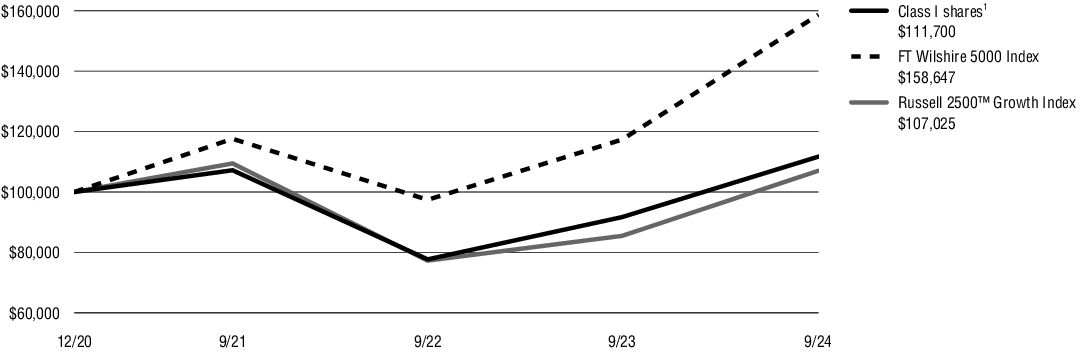

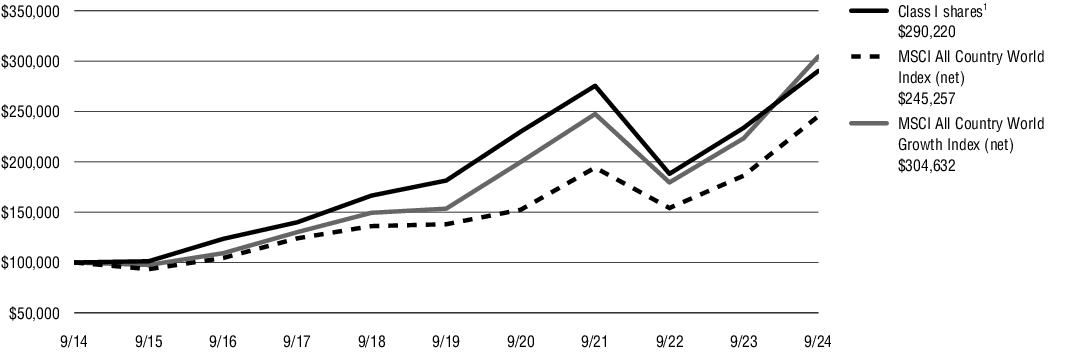

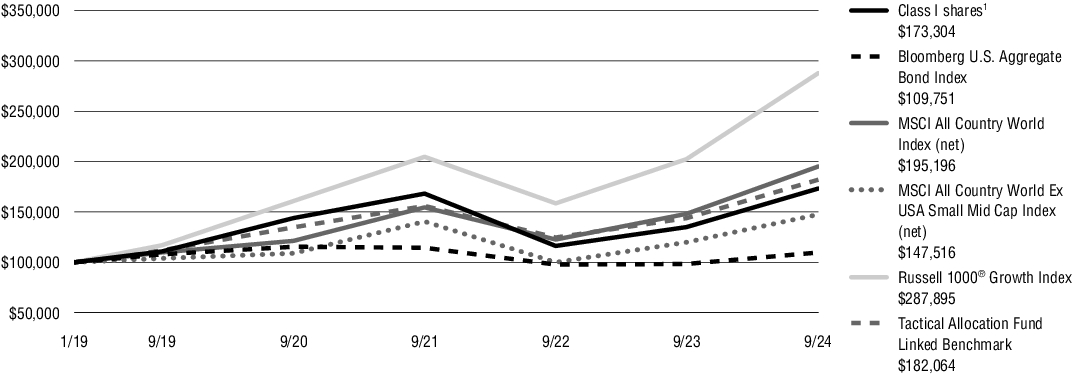

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class I shares. It assumes a $100,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $100,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 9/30/24 | 1 Year | 5 Years | 10 Years |

| Virtus KAR Capital Growth Fund (Class I/PLXGX) at NAV(1) | 38.76% | 14.65% | 13.47% |

| FT Wilshire 5000 Index | 35.17% | 15.50% | 13.02% |

| Russell 1000® Growth Index | 42.19% | 19.74% | 16.52% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of September 30, 2024)

| Fund net assets (‘000s) | $645,532 |

| Total number of portfolio holdings | 40 |

| Total advisory fee paid (‘000s) | $4,194 |

| Portfolio turnover rate as of the end of the reporting period | 14% |

| Information Technology | 29% |

| Consumer Discretionary | 20% |

| Communication Services | 12% |

| Health Care | 12% |

| Financials | 11% |

| Industrials | 11% |

| Real Estate | 3% |

| Other | 2% |

| Total | 100% |

(1) | Percentage of total investments as of September 30, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Virtus KAR Capital Growth Fund

Class R6 / VCGRX

Annual SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Virtus KAR Capital Growth Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus KAR Capital Growth Fund

Class R6 / VCGRX | $87 | 0.73% |

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

For the fiscal year ended September 30, 2024, the Fund’s Class R6 shares at NAV returned 39.15%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 35.17% and the Russell 1000® Growth Index, which serves as the style-specific index, returned 42.19%.

The FT Wilshire 5000 Index is a broad-based free-float market capitalization-weighted index that aims to capture 100% of the U.S. investable market capitalization. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The Russell 1000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

What factors impacted Fund performance over the reporting period?

The Fund utilizes an actively managed, bottom-up fundamental research approach to identify a select group of companies believed by the Fund’s portfolio managers to possess sustainable competitive advantages. As such, the performance of the Fund is expected to be primarily determined by market reactions, both positive and negative, to activity related to these companies. Stock selection and an underweight in information technology, as well as stock selection in consumer staples, detracted from performance relative to the Fund’s style-specific benchmark for the fiscal year. Stock selection in industrials and communication services contributed to performance. The biggest contributors to performance for the 12-month period were NVIDIA, Fair Isaac, Meta Platforms, Amazon.com, and Amphenol. The biggest detractors from performance during the period were Paycom Software, BILL, Estee Lauder, MongoDB, and Monster Beverage. The following table outlines key factors that materially affected the Fund’s performance during the reporting period.

| FACTOR | IMPACT | SUMMARY |

NVIDIA

| Positive

| Demand continued to grow for NVIDIA’s graphics processing units. The company’s large number of units in use by customers, innovation at the data center level, and robust software offerings remained powerful competitive advantages.

|

Fair Isaac

| Positive

| Fair Issac outperformed due to continued strength in its high-profit-margin credit scores business, along with growth in its software business driven by increased adoption of the FICO platform. The stock also benefited from anticipated tailwinds from lower interest rates.

|

Paycom Software

| Negative

| Paycom significantly reduced its topline, or total revenue, guidance for fiscal year 2024 due to a revenue headwind from its automated payroll software. In addition, the weak macroeconomic environment weighed on revenues.

|

| BILL | Negative | BILL, which provides automated, cloud-based software for financial operations, faced headwinds in commissions, a slowdown in small- and medium-sized business customer spending, and pressure from a competitor. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

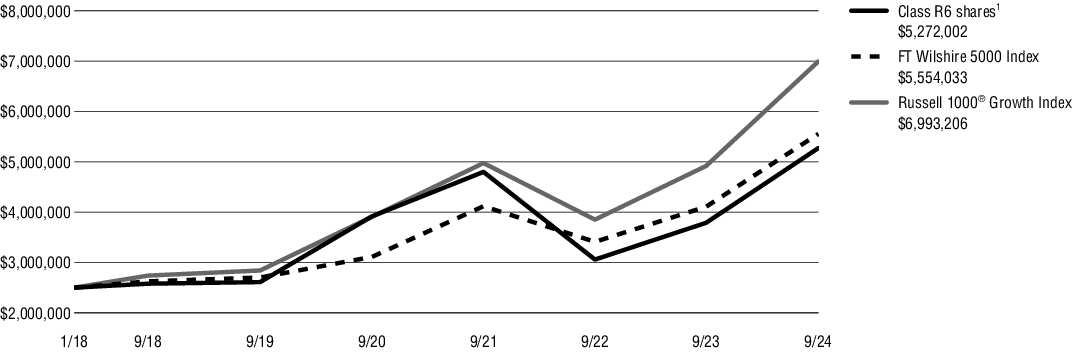

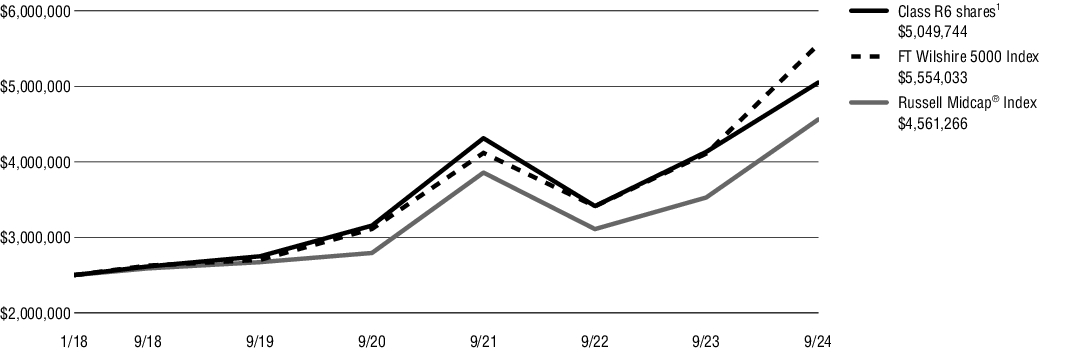

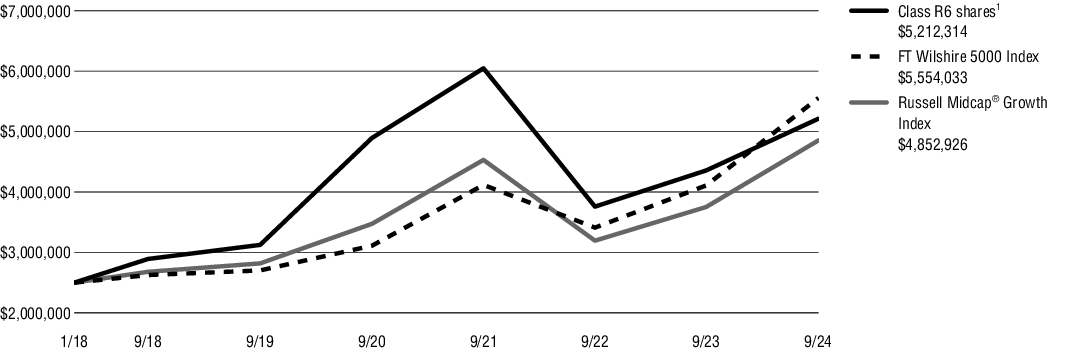

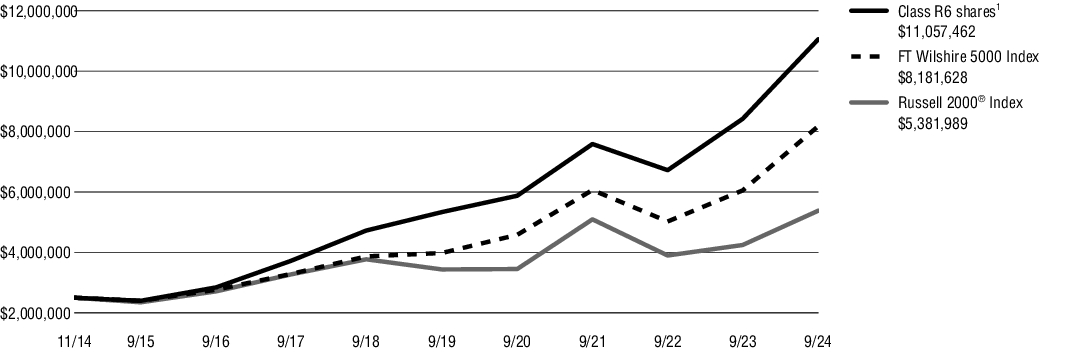

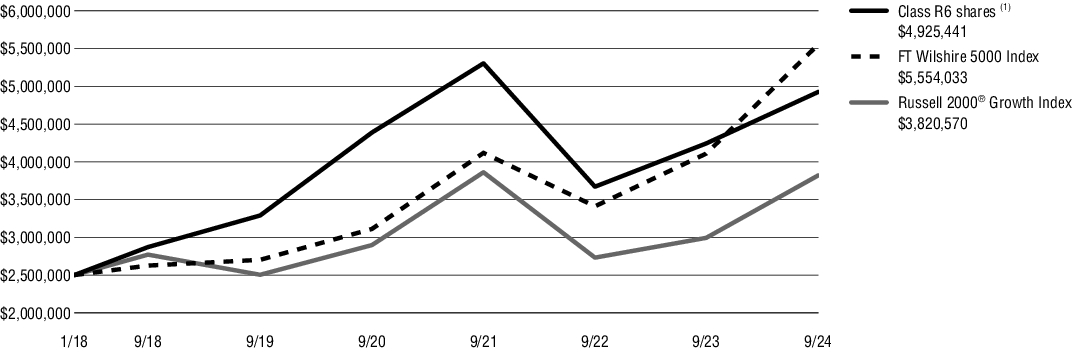

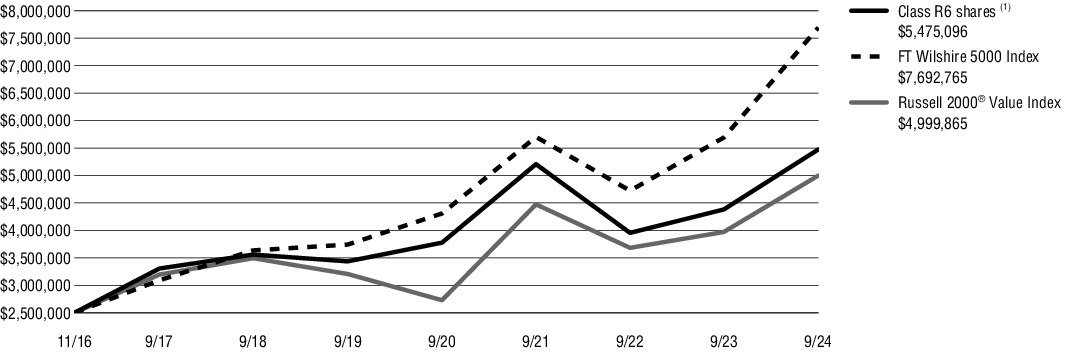

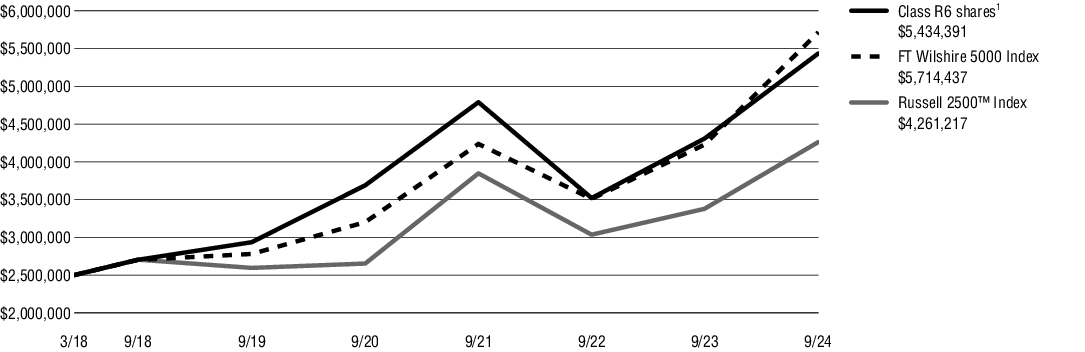

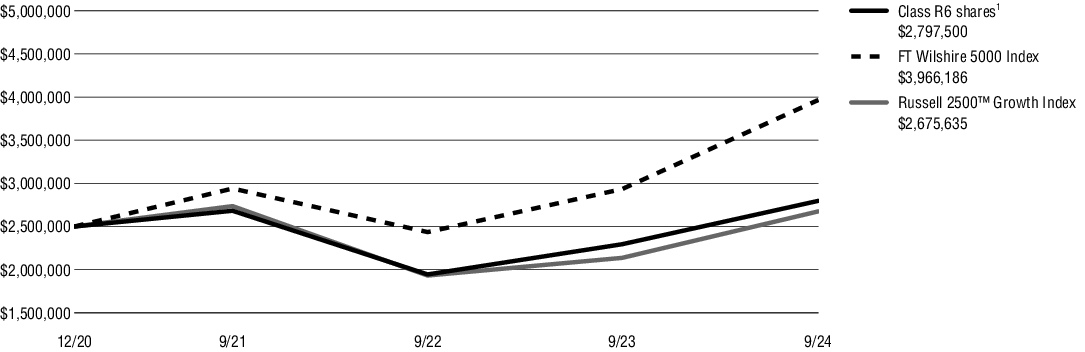

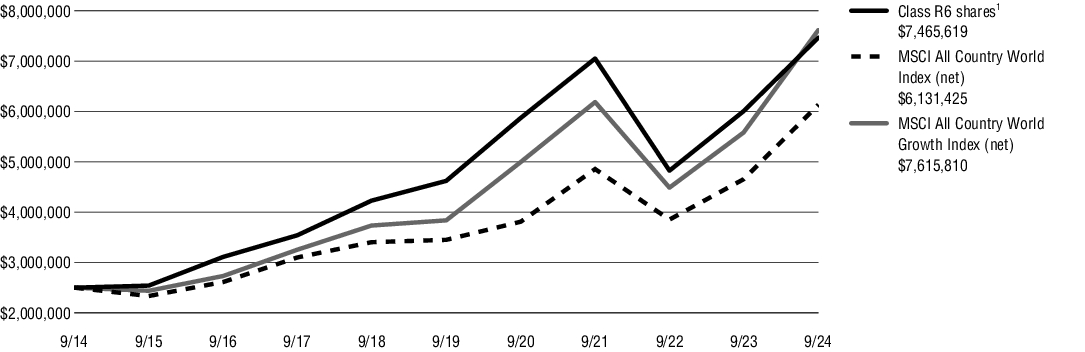

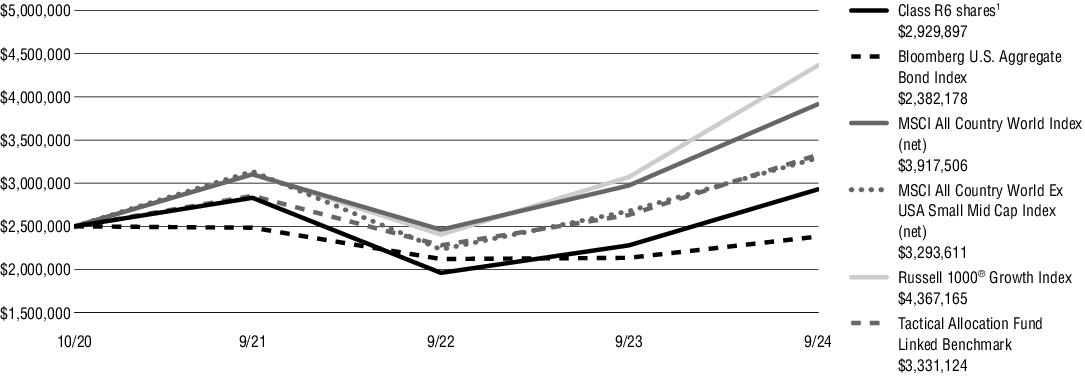

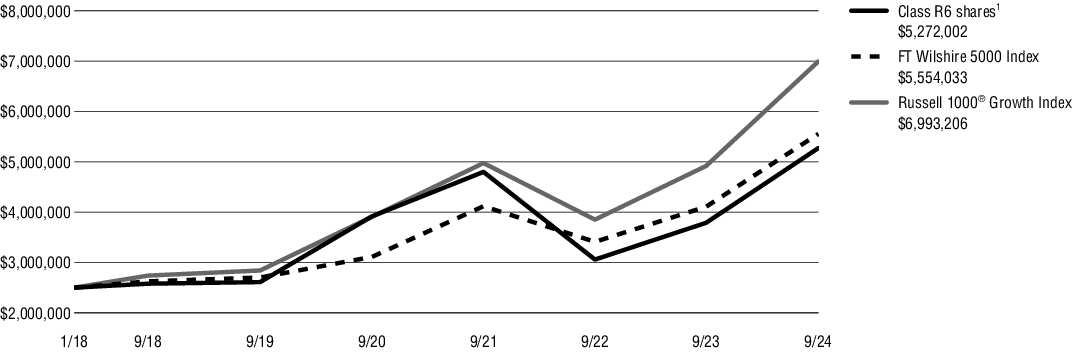

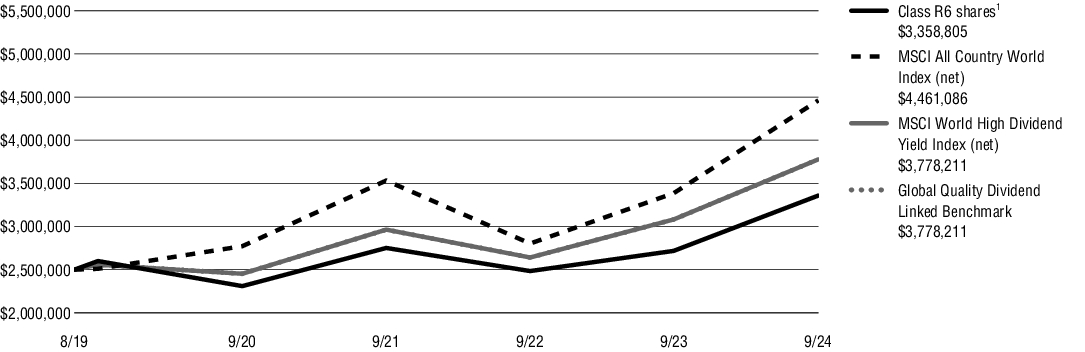

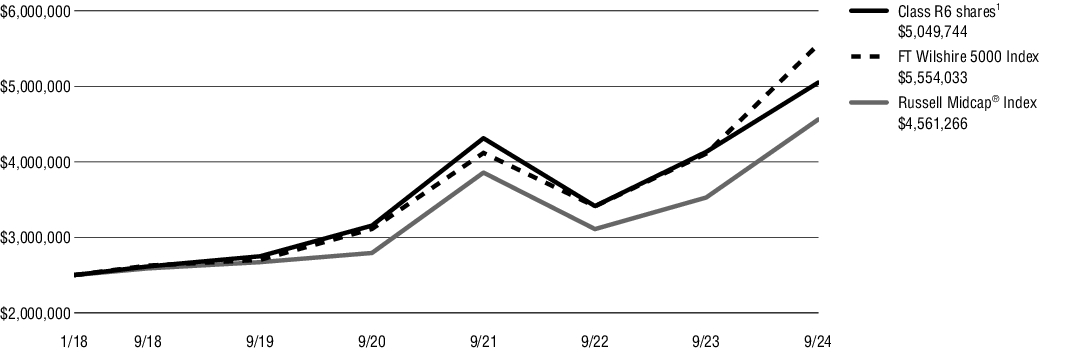

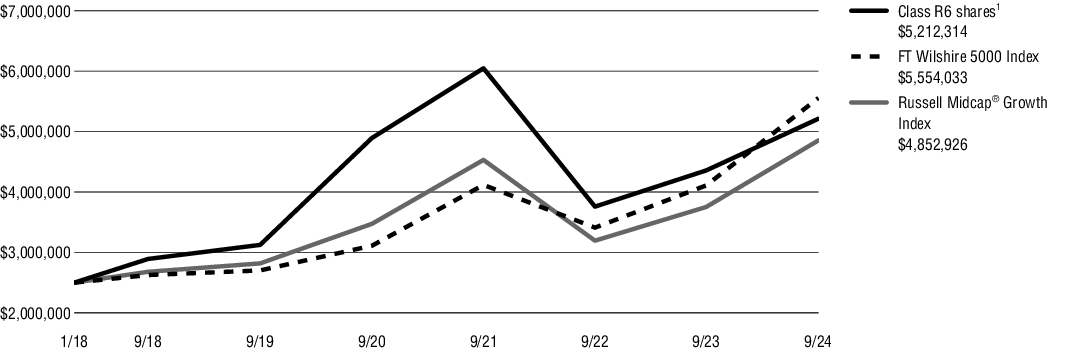

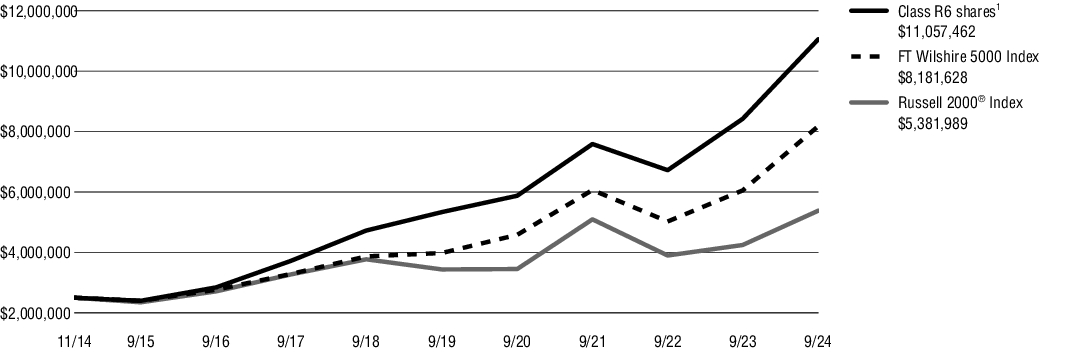

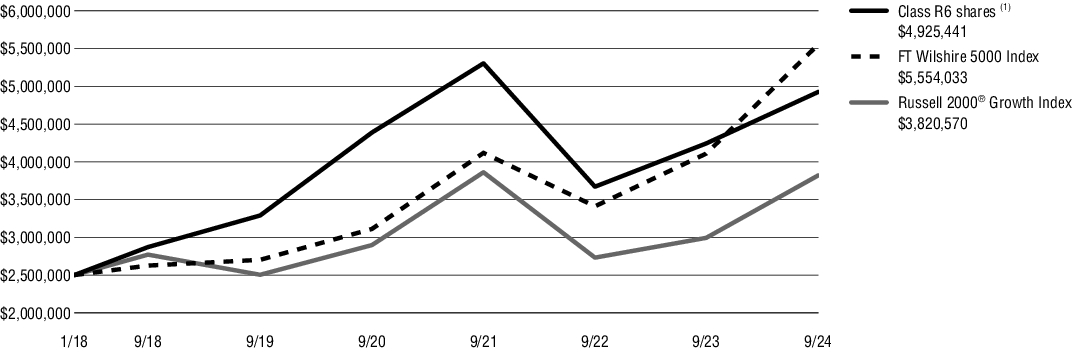

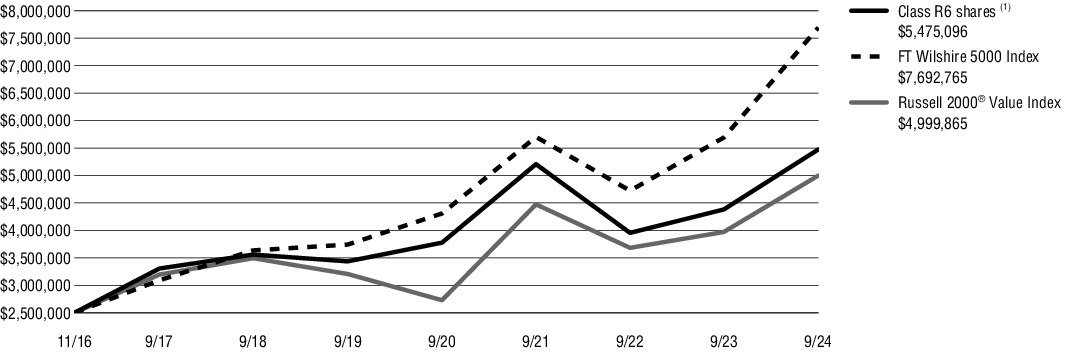

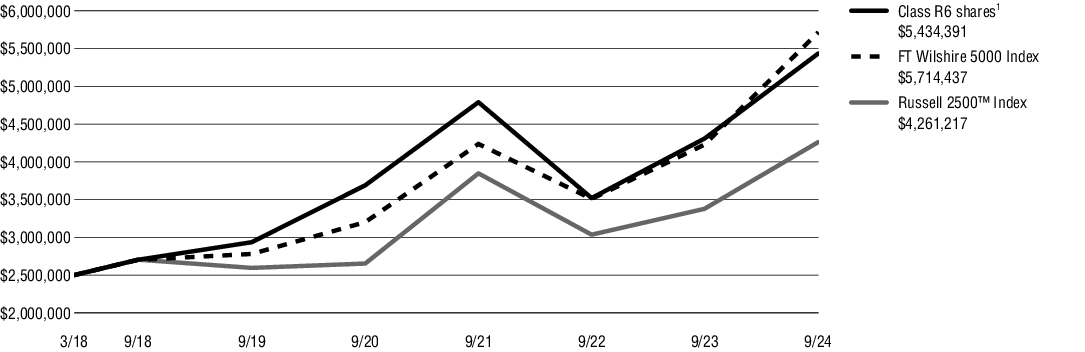

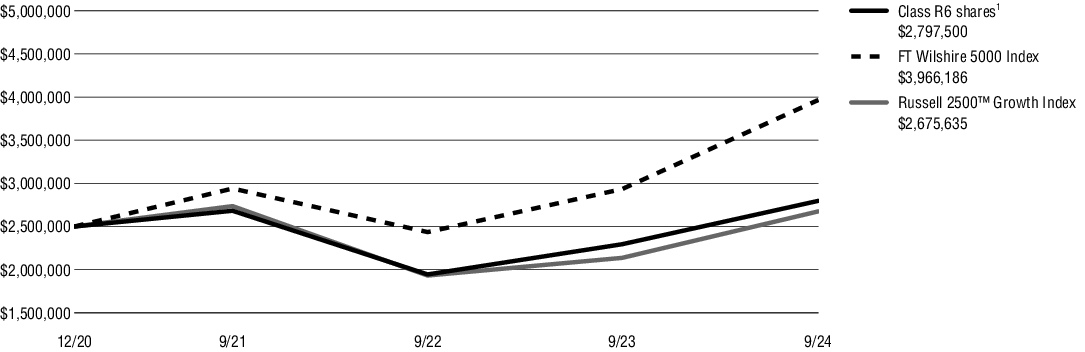

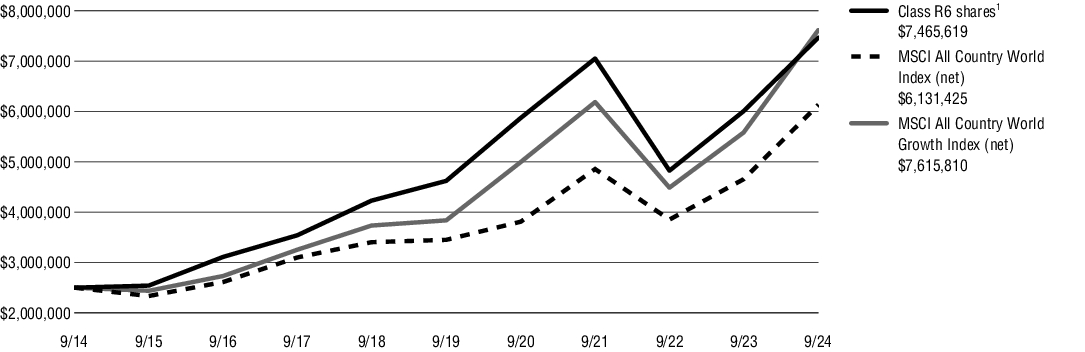

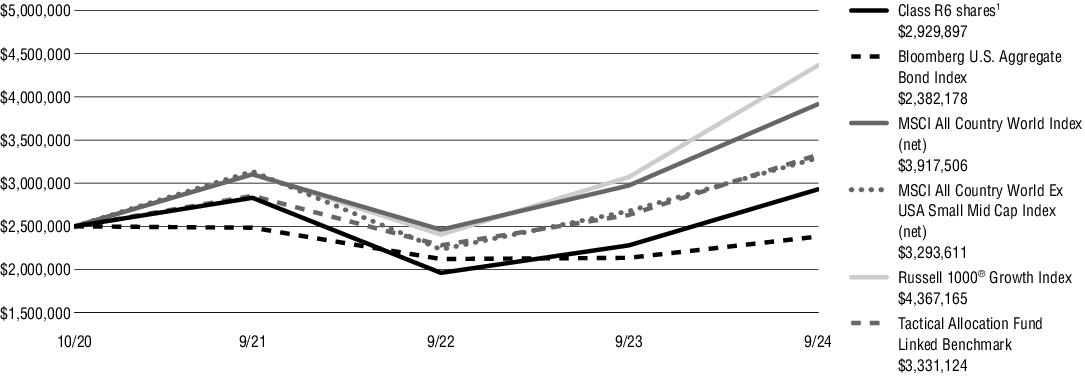

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years of Class R6 shares from inception (January 30, 2018). It assumes a $2,500,000 initial investment from inception, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $2,500,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 9/30/24 | 1 Year | 5 Years | Since Inception |

| Virtus KAR Capital Growth Fund (Class R6/VCGRX) at NAV(1) | 39.15% | 15.09% | 11.83% |

| FT Wilshire 5000 Index | 35.17% | 15.50% | 12.71% |

| Russell 1000® Growth Index | 42.19% | 19.74% | 16.67% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of September 30, 2024)

| Fund net assets (‘000s) | $645,532 |

| Total number of portfolio holdings | 40 |

| Total advisory fee paid (‘000s) | $4,194 |

| Portfolio turnover rate as of the end of the reporting period | 14% |

| Information Technology | 29% |

| Consumer Discretionary | 20% |

| Communication Services | 12% |

| Health Care | 12% |

| Financials | 11% |

| Industrials | 11% |

| Real Estate | 3% |

| Other | 2% |

| Total | 100% |

(1) | Percentage of total investments as of September 30, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Virtus KAR Equity Income Fund

Class A / PDIAX

Annual SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Virtus KAR Equity Income Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus KAR Equity Income Fund

Class A / PDIAX | $134 | 1.20% |

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

For the fiscal year ended September 30, 2024, the Fund’s Class A shares at NAV returned 22.81%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 35.17% and the MSCI USA High Dividend Yield Index (net), which serves as the style-specific index, returned 25.09%.

The FT Wilshire 5000 Index is a broad-based free-float market capitalization-weighted index that aims to capture 100% of the U.S. investable market capitalization. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The MSCI USA High Dividend Yield Index is based on the MSCI USA Index, its parent index, and includes large and mid cap stocks. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The index also applies quality screens and reviews 12-month past performance to omit stocks with potentially deteriorating fundamentals that could force them to cut or reduce dividends. The index is calculated on a total return basis with net dividends reinvested; it is unmanaged; its returns do not reflect any fees, expenses or sales charges; and it is not available for direct investment.

What factors impacted Fund performance over the reporting period?

The Fund utilizes an actively managed, bottom-up fundamental research approach to identify a select group of companies believed by the Fund’s portfolio managers to possess sustainable competitive advantages. As such, the performance of the Fund is expected to be primarily determined by market reactions, both positive and negative, to activity related to these companies. Stock selection in industrials, as well as stock selection and an underweight in information technology, detracted from performance relative to the Fund’s style-specific benchmark for the fiscal year. An underweight in energy and stock selection in communication services contributed to performance. The biggest contributors to performance for the 12-month period were IBM, PNC Financial Services, Verizon Communications, Zurich Insurance, and AbbVie. The biggest detractors from performance during the period were MSC Industrial Direct, Pfizer, PepsiCo, Patterson Companies, and UPS. The following table outlines key factors that materially affected the Fund’s performance during the reporting period.

| FACTOR | IMPACT | SUMMARY |

IBM

| Positive

| After several years of investment, IBM has seen its hybrid cloud offering resonate with clients. This has benefited both the company’s software and consulting businesses.

|

PNC Financial Services

| Positive

| Despite weak loan growth, PNC’s business performed well and its shares traded higher on the basis of good credit and the news of lower interest rates.

|

MSC Industrial Direct

| Negative

| A sluggish macroeconomy negatively impacted customer sentiment. In addition, the company had some execution issues regarding a web pricing initiative designed to help stimulate business among its core customers.

|

| Pfizer | Negative | Pfizer remained in a period of uncertainty as it dealt with some loss of exclusivity in advance of new product launches. In addition, the long-term opportunity related to Covid products, including the vaccine and Paxlovid treatment, proved to be weaker than expected. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

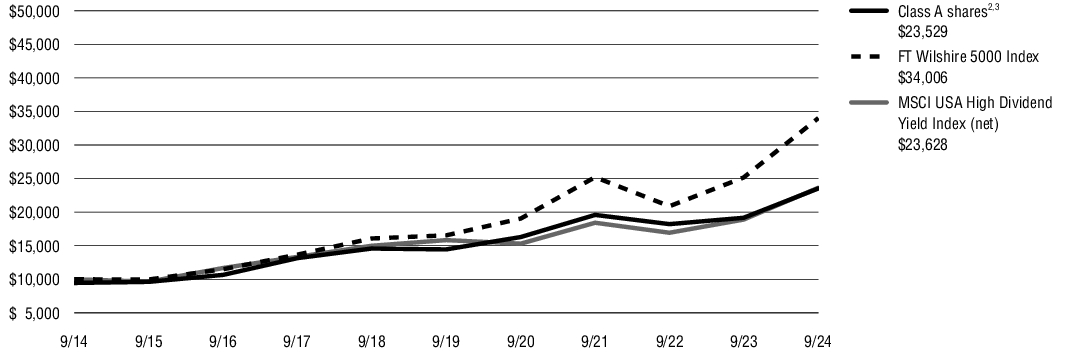

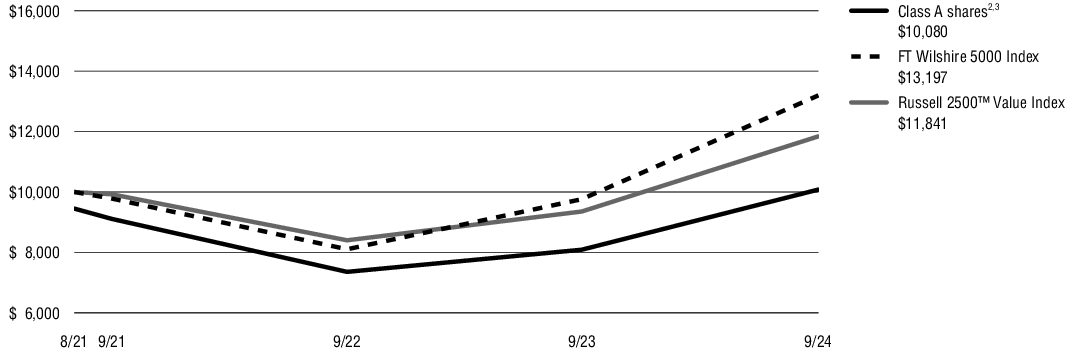

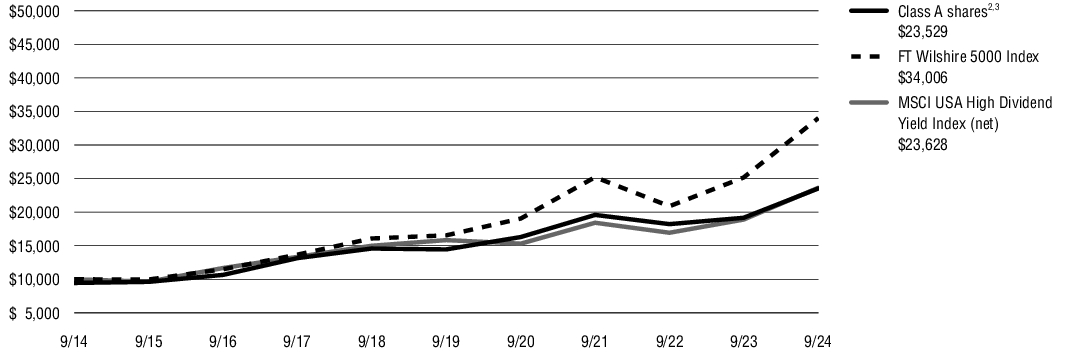

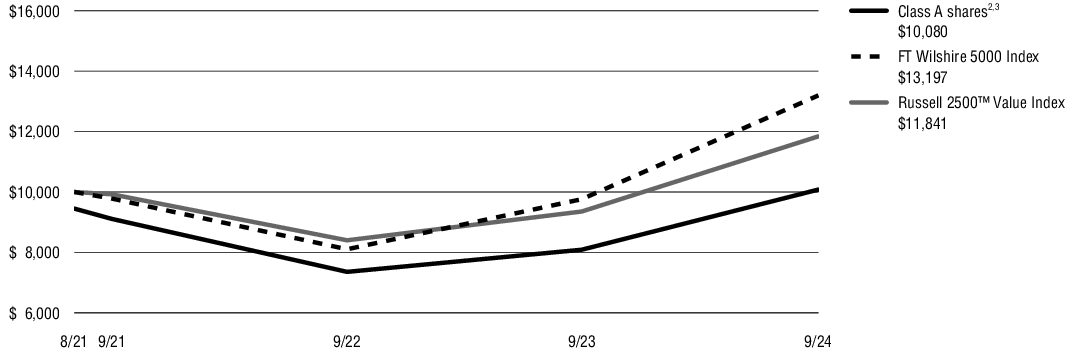

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class A shares including any applicable sales charges or fees. It assumes a $10,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 9/30/24 | 1 Year | 5 Years | 10 Years |

| Virtus KAR Equity Income Fund (Class A/PDIAX) at NAV(1) | 22.81% | 10.24% | 9.55% |

| Virtus KAR Equity Income Fund (Class A/PDIAX) at POP(2),(3) | 16.06% | 9.00% | 8.93% |

| FT Wilshire 5000 Index | 35.17% | 15.50% | 13.02% |

| MSCI USA High Dividend Yield Index (net) | 25.09% | 8.34% | 8.98% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| (3) | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. A CDSC may be imposed on certain redemptions of Class A shares made within 18 months of a finder’s fee being paid. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of September 30, 2024)

| Fund net assets (‘000s) | $127,973 |

| Total number of portfolio holdings | 36 |

| Total advisory fee paid (‘000s) | $735 |

| Portfolio turnover rate as of the end of the reporting period | 17% |

| Financials | 19% |

| Industrials | 16% |

| Information Technology | 15% |

| Consumer Staples | 10% |

| Health Care | 9% |

| Utilities | 9% |

| Materials | 7% |

| Other (includes securities lending collateral) | 15% |

| Total | 100% |

(1) | Percentage of total investments as of September 30, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Virtus KAR Equity Income Fund

Class C / PGICX

Annual SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Virtus KAR Equity Income Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus KAR Equity Income Fund

Class C / PGICX | $216 | 1.95% |

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

For the fiscal year ended September 30, 2024, the Fund’s Class C shares at NAV returned 21.82%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 35.17% and the MSCI USA High Dividend Yield Index (net), which serves as the style-specific index, returned 25.09%.

The FT Wilshire 5000 Index is a broad-based free-float market capitalization-weighted index that aims to capture 100% of the U.S. investable market capitalization. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The MSCI USA High Dividend Yield Index is based on the MSCI USA Index, its parent index, and includes large and mid cap stocks. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The index also applies quality screens and reviews 12-month past performance to omit stocks with potentially deteriorating fundamentals that could force them to cut or reduce dividends. The index is calculated on a total return basis with net dividends reinvested; it is unmanaged; its returns do not reflect any fees, expenses or sales charges; and it is not available for direct investment.

What factors impacted Fund performance over the reporting period?

The Fund utilizes an actively managed, bottom-up fundamental research approach to identify a select group of companies believed by the Fund’s portfolio managers to possess sustainable competitive advantages. As such, the performance of the Fund is expected to be primarily determined by market reactions, both positive and negative, to activity related to these companies. Stock selection in industrials, as well as stock selection and an underweight in information technology, detracted from performance relative to the Fund’s style-specific benchmark for the fiscal year. An underweight in energy and stock selection in communication services contributed to performance. The biggest contributors to performance for the 12-month period were IBM, PNC Financial Services, Verizon Communications, Zurich Insurance, and AbbVie. The biggest detractors from performance during the period were MSC Industrial Direct, Pfizer, PepsiCo, Patterson Companies, and UPS. The following table outlines key factors that materially affected the Fund’s performance during the reporting period.

| FACTOR | IMPACT | SUMMARY |

IBM

| Positive

| After several years of investment, IBM has seen its hybrid cloud offering resonate with clients. This has benefited both the company’s software and consulting businesses.

|

PNC Financial Services

| Positive

| Despite weak loan growth, PNC’s business performed well and its shares traded higher on the basis of good credit and the news of lower interest rates.

|

MSC Industrial Direct

| Negative

| A sluggish macroeconomy negatively impacted customer sentiment. In addition, the company had some execution issues regarding a web pricing initiative designed to help stimulate business among its core customers.

|

| Pfizer | Negative | Pfizer remained in a period of uncertainty as it dealt with some loss of exclusivity in advance of new product launches. In addition, the long-term opportunity related to Covid products, including the vaccine and Paxlovid treatment, proved to be weaker than expected. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

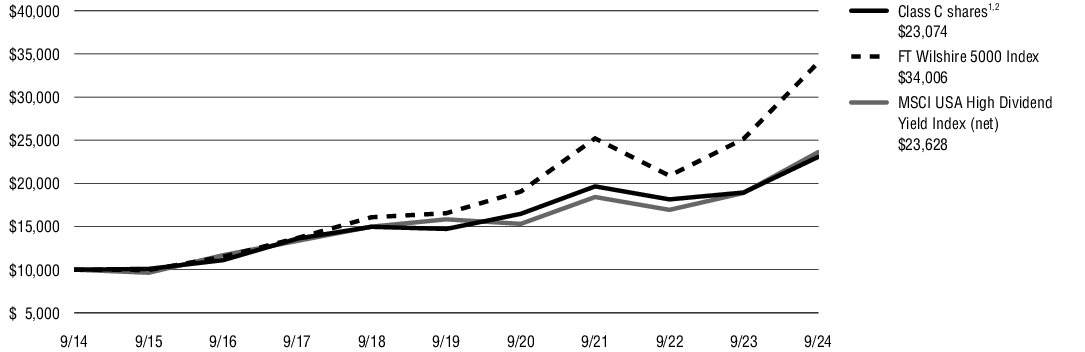

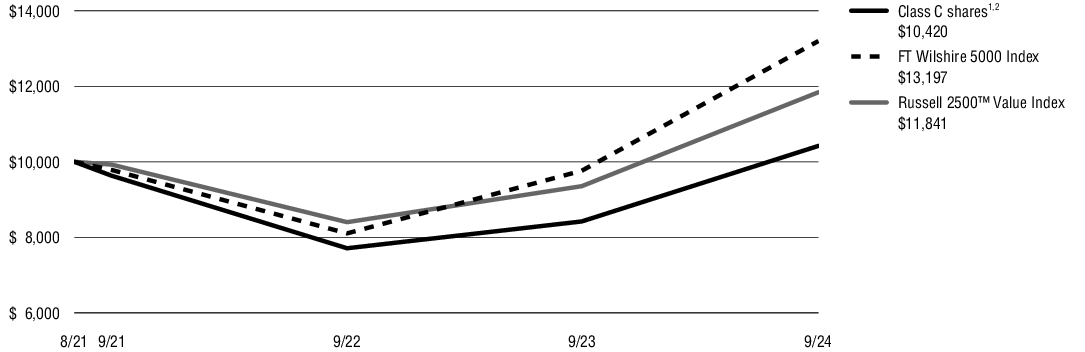

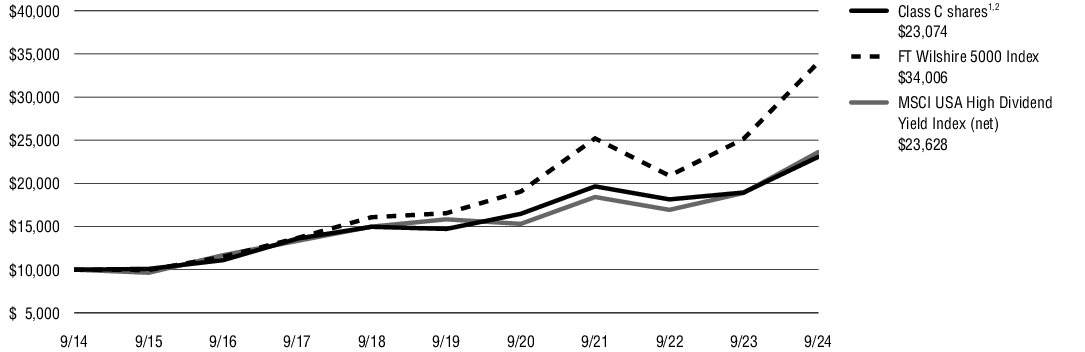

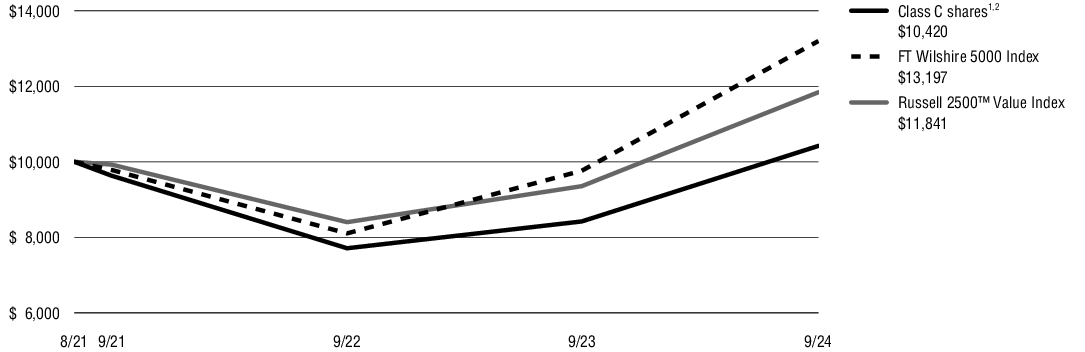

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class C shares. It assumes a $10,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 9/30/24 | 1 Year | 5 Years | 10 Years |

| Virtus KAR Equity Income Fund (Class C/PGICX) at NAV(1) and with CDSC(2) | 21.82% | 9.41% | 8.72% |

| FT Wilshire 5000 Index | 35.17% | 15.50% | 13.02% |

| MSCI USA High Dividend Yield Index (net) | 25.09% | 8.34% | 8.98% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of time of purchase. CDSC for all Class C shares are 1% within the first year and 0% thereafter. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of September 30, 2024)

| Fund net assets (‘000s) | $127,973 |

| Total number of portfolio holdings | 36 |

| Total advisory fee paid (‘000s) | $735 |

| Portfolio turnover rate as of the end of the reporting period | 17% |

| Financials | 19% |

| Industrials | 16% |

| Information Technology | 15% |

| Consumer Staples | 10% |

| Health Care | 9% |

| Utilities | 9% |

| Materials | 7% |

| Other (includes securities lending collateral) | 15% |

| Total | 100% |

(1) | Percentage of total investments as of September 30, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Virtus KAR Equity Income Fund

Class I / PXIIX

Annual SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Virtus KAR Equity Income Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus KAR Equity Income Fund

Class I / PXIIX | $106 | 0.95% |

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

For the fiscal year ended September 30, 2024, the Fund’s Class I shares at NAV returned 23.06%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 35.17% and the MSCI USA High Dividend Yield Index (net), which serves as the style-specific index, returned 25.09%.

The FT Wilshire 5000 Index is a broad-based free-float market capitalization-weighted index that aims to capture 100% of the U.S. investable market capitalization. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The MSCI USA High Dividend Yield Index is based on the MSCI USA Index, its parent index, and includes large and mid cap stocks. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The index also applies quality screens and reviews 12-month past performance to omit stocks with potentially deteriorating fundamentals that could force them to cut or reduce dividends. The index is calculated on a total return basis with net dividends reinvested; it is unmanaged; its returns do not reflect any fees, expenses or sales charges; and it is not available for direct investment.

What factors impacted Fund performance over the reporting period?

The Fund utilizes an actively managed, bottom-up fundamental research approach to identify a select group of companies believed by the Fund’s portfolio managers to possess sustainable competitive advantages. As such, the performance of the Fund is expected to be primarily determined by market reactions, both positive and negative, to activity related to these companies. Stock selection in industrials, as well as stock selection and an underweight in information technology, detracted from performance relative to the Fund’s style-specific benchmark for the fiscal year. An underweight in energy and stock selection in communication services contributed to performance. The biggest contributors to performance for the 12-month period were IBM, PNC Financial Services, Verizon Communications, Zurich Insurance, and AbbVie. The biggest detractors from performance during the period were MSC Industrial Direct, Pfizer, PepsiCo, Patterson Companies, and UPS. The following table outlines key factors that materially affected the Fund’s performance during the reporting period.

| FACTOR | IMPACT | SUMMARY |

IBM

| Positive

| After several years of investment, IBM has seen its hybrid cloud offering resonate with clients. This has benefited both the company’s software and consulting businesses.

|

PNC Financial Services

| Positive

| Despite weak loan growth, PNC’s business performed well and its shares traded higher on the basis of good credit and the news of lower interest rates.

|

MSC Industrial Direct

| Negative

| A sluggish macroeconomy negatively impacted customer sentiment. In addition, the company had some execution issues regarding a web pricing initiative designed to help stimulate business among its core customers.

|

| Pfizer | Negative | Pfizer remained in a period of uncertainty as it dealt with some loss of exclusivity in advance of new product launches. In addition, the long-term opportunity related to Covid products, including the vaccine and Paxlovid treatment, proved to be weaker than expected. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

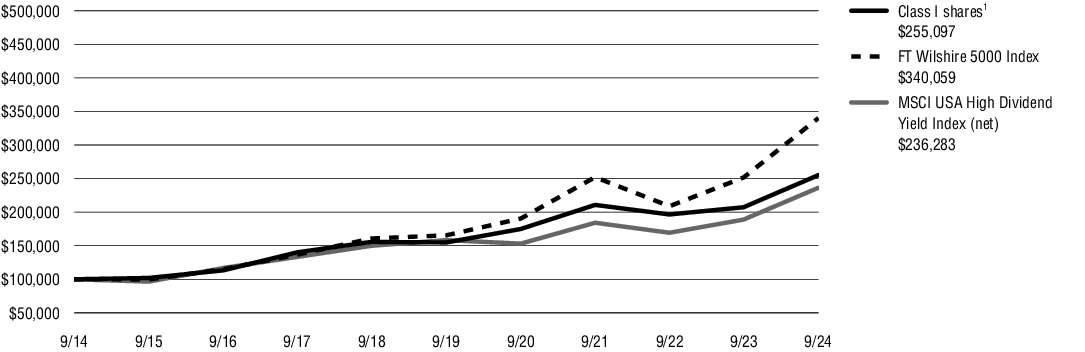

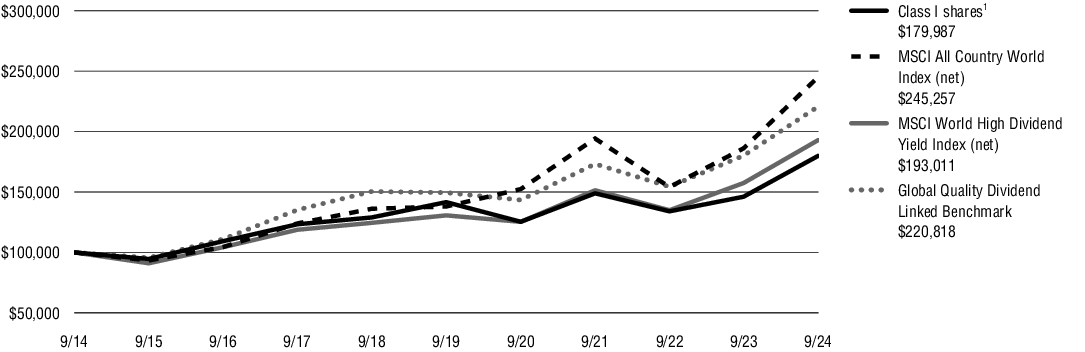

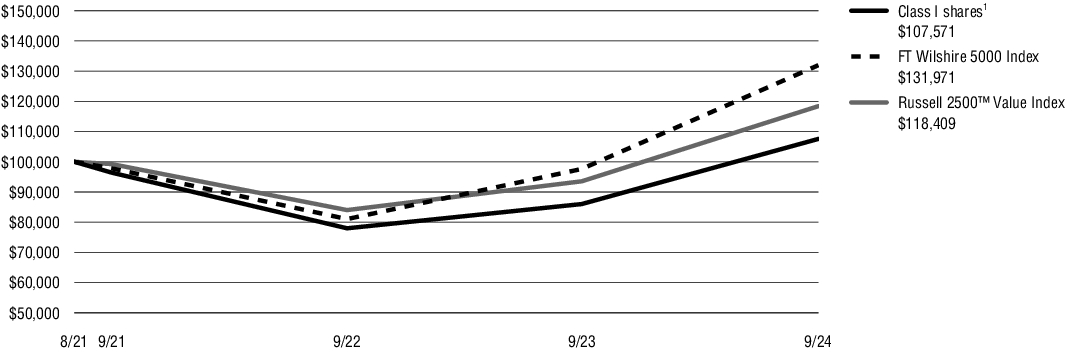

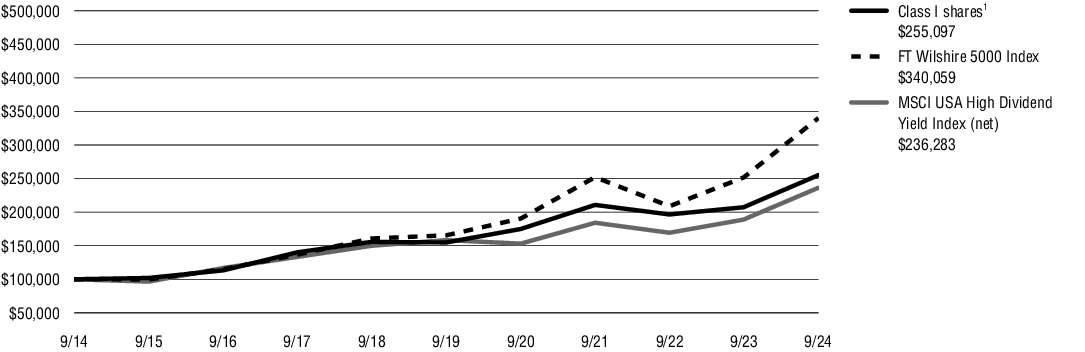

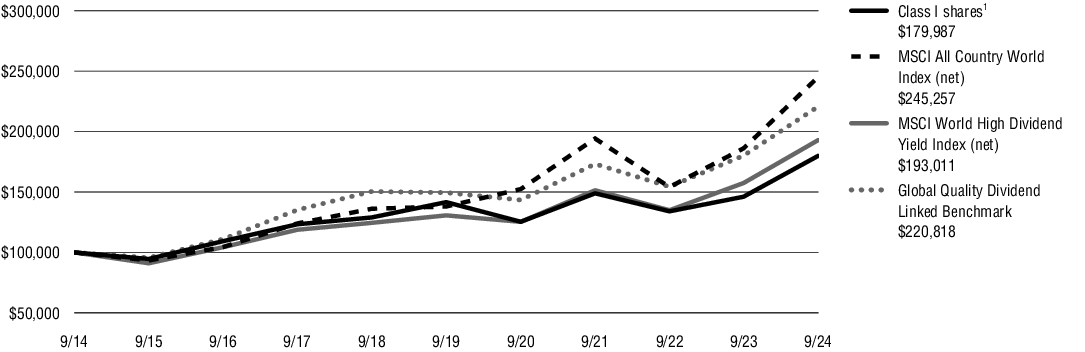

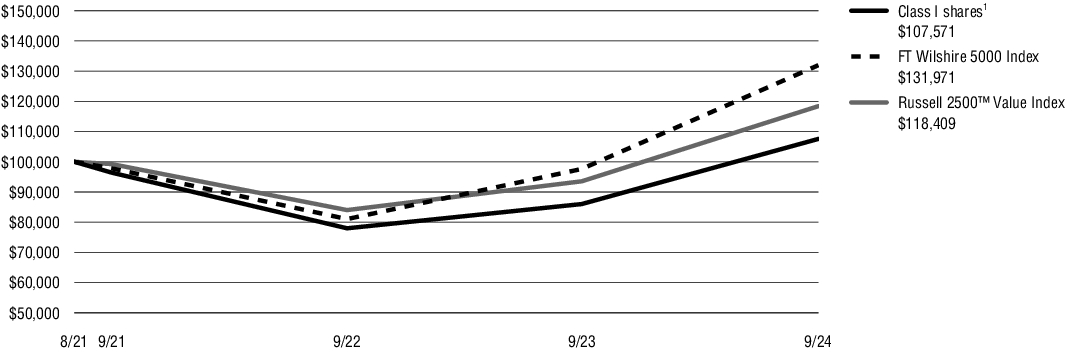

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class I shares. It assumes a $100,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $100,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 9/30/24 | 1 Year | 5 Years | 10 Years |

| Virtus KAR Equity Income Fund (Class I/PXIIX) at NAV(1) | 23.06% | 10.50% | 9.82% |

| FT Wilshire 5000 Index | 35.17% | 15.50% | 13.02% |

| MSCI USA High Dividend Yield Index (net) | 25.09% | 8.34% | 8.98% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of September 30, 2024)

| Fund net assets (‘000s) | $127,973 |

| Total number of portfolio holdings | 36 |

| Total advisory fee paid (‘000s) | $735 |

| Portfolio turnover rate as of the end of the reporting period | 17% |

| Financials | 19% |

| Industrials | 16% |

| Information Technology | 15% |

| Consumer Staples | 10% |

| Health Care | 9% |

| Utilities | 9% |

| Materials | 7% |

| Other (includes securities lending collateral) | 15% |

| Total | 100% |

(1) | Percentage of total investments as of September 30, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Virtus KAR Equity Income Fund

Class R6 / VECRX

Annual SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Virtus KAR Equity Income Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus KAR Equity Income Fund

Class R6 / VECRX | $102 | 0.91% |

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

For the fiscal year ended September 30, 2024, the Fund’s Class R6 shares at NAV returned 23.17%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 35.17% and the MSCI USA High Dividend Yield Index (net), which serves as the style-specific index, returned 25.09%.

The FT Wilshire 5000 Index is a broad-based free-float market capitalization-weighted index that aims to capture 100% of the U.S. investable market capitalization. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The MSCI USA High Dividend Yield Index is based on the MSCI USA Index, its parent index, and includes large and mid cap stocks. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The index also applies quality screens and reviews 12-month past performance to omit stocks with potentially deteriorating fundamentals that could force them to cut or reduce dividends. The index is calculated on a total return basis with net dividends reinvested; it is unmanaged; its returns do not reflect any fees, expenses or sales charges; and it is not available for direct investment.

What factors impacted Fund performance over the reporting period?

The Fund utilizes an actively managed, bottom-up fundamental research approach to identify a select group of companies believed by the Fund’s portfolio managers to possess sustainable competitive advantages. As such, the performance of the Fund is expected to be primarily determined by market reactions, both positive and negative, to activity related to these companies. Stock selection in industrials, as well as stock selection and an underweight in information technology, detracted from performance relative to the Fund’s style-specific benchmark for the fiscal year. An underweight in energy and stock selection in communication services contributed to performance. The biggest contributors to performance for the 12-month period were IBM, PNC Financial Services, Verizon Communications, Zurich Insurance, and AbbVie. The biggest detractors from performance during the period were MSC Industrial Direct, Pfizer, PepsiCo, Patterson Companies, and UPS. The following table outlines key factors that materially affected the Fund’s performance during the reporting period.

| FACTOR | IMPACT | SUMMARY |

IBM

| Positive

| After several years of investment, IBM has seen its hybrid cloud offering resonate with clients. This has benefited both the company’s software and consulting businesses.

|

PNC Financial Services

| Positive

| Despite weak loan growth, PNC’s business performed well and its shares traded higher on the basis of good credit and the news of lower interest rates.

|

MSC Industrial Direct

| Negative

| A sluggish macroeconomy negatively impacted customer sentiment. In addition, the company had some execution issues regarding a web pricing initiative designed to help stimulate business among its core customers.

|

| Pfizer | Negative | Pfizer remained in a period of uncertainty as it dealt with some loss of exclusivity in advance of new product launches. In addition, the long-term opportunity related to Covid products, including the vaccine and Paxlovid treatment, proved to be weaker than expected. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

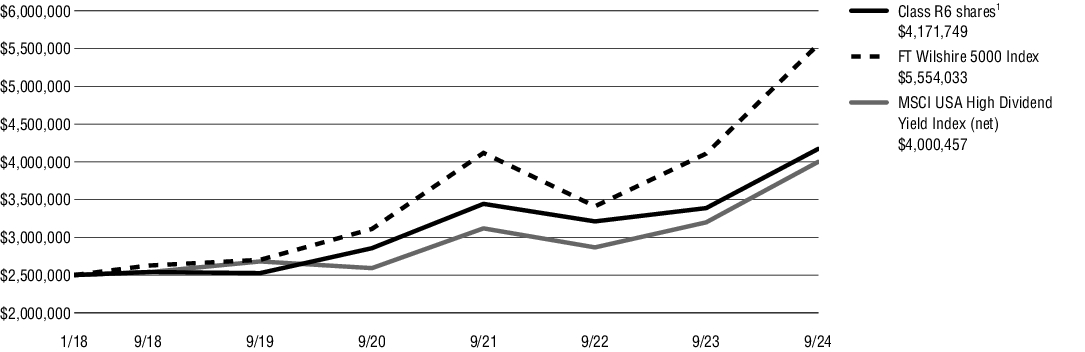

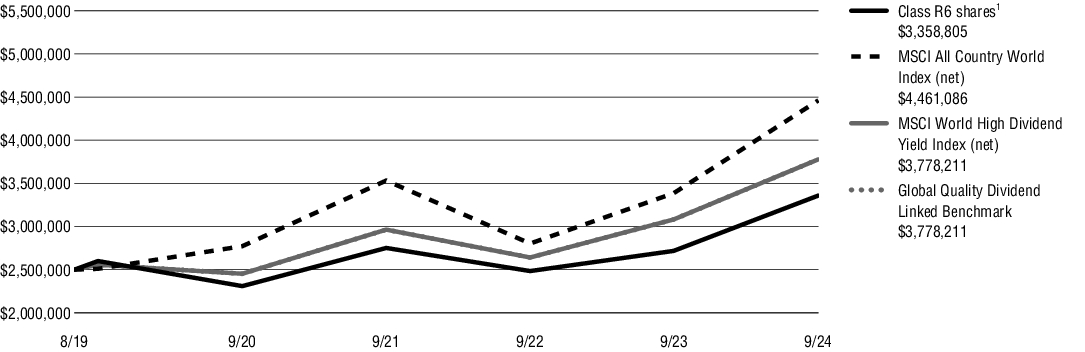

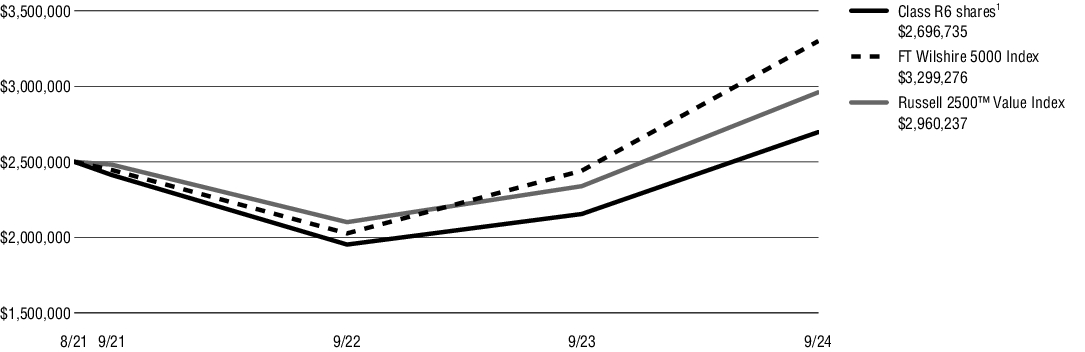

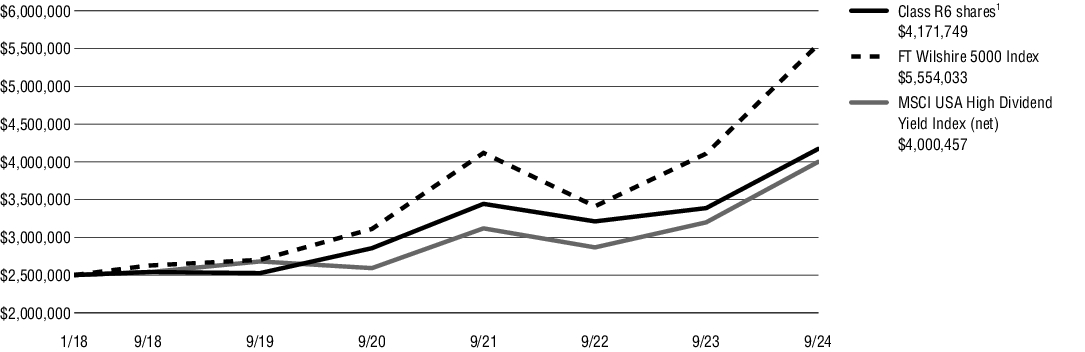

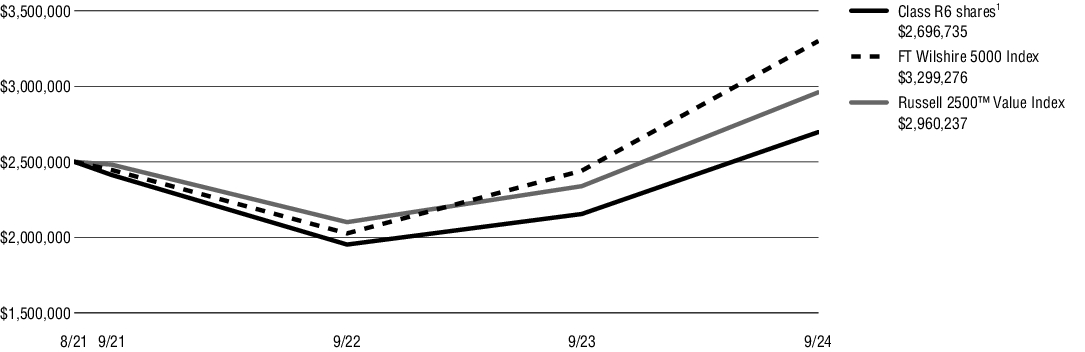

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years of Class R6 shares from inception (January 30, 2018). It assumes a $2,500,000 initial investment from inception, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $2,500,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 9/30/24 | 1 Year | 5 Years | Since Inception |

| Virtus KAR Equity Income Fund (Class R6/VECRX) at NAV(1) | 23.17% | 10.56% | 7.98% |

| FT Wilshire 5000 Index | 35.17% | 15.50% | 12.71% |

| MSCI USA High Dividend Yield Index (net) | 25.09% | 8.34% | 7.30% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of September 30, 2024)

| Fund net assets (‘000s) | $127,973 |

| Total number of portfolio holdings | 36 |

| Total advisory fee paid (‘000s) | $735 |

| Portfolio turnover rate as of the end of the reporting period | 17% |

| Financials | 19% |

| Industrials | 16% |

| Information Technology | 15% |

| Consumer Staples | 10% |

| Health Care | 9% |

| Utilities | 9% |

| Materials | 7% |

| Other (includes securities lending collateral) | 15% |

| Total | 100% |

(1) | Percentage of total investments as of September 30, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Virtus KAR Global Quality Dividend Fund

Class A / PPTAX

Annual SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Virtus KAR Global Quality Dividend Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus KAR Global Quality Dividend Fund

Class A / PPTAX | $150 | 1.35% |

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

For the fiscal year ended September 30, 2024, the Fund’s Class A shares at NAV returned 22.88%. For the same period, the MSCI All Country World Index (net) serve as broad-based securities market index, returned 31.76%. The MSCI World High Dividend Yield Index (net) and the Global Quality Dividend Linked Benchmark, which serve as the style specific indexes, returned 22.60% and 22.60% respectively.

The MSCI All Country World Index (net) is a free float-adjusted market capitalization-weighted index that measures equity performance of developed and emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The MSCI World High Dividend Yield Index (net) is based on the MSCI World Index, its parent index, and includes large and mid cap stocks across 23 Developed Markets (DM) countries. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The index also applies quality screens and reviews 12-month past performance to omit stocks with potentially deteriorating fundamentals that could force them to cut or reduce dividends. The index is calculated on a total return basis with net dividends reinvested; it is unmanaged; its returns do not reflect any fees, expenses or sales charges; and it is not available for direct investment.

The Global Quality Dividend Linked Benchmark consists of the MSCI World High Dividend Yield Index (net). Performance of the Global Quality Dividend Linked Benchmark between February 1, 2017 and December 31, 2018 is that of the Russell 1000® Value Index. The indexes are unmanaged and not available for direct investment.

What factors impacted Fund performance over the reporting period?

The Fund utilizes an actively managed, bottom-up fundamental research approach to identify a select group of companies believed by the Fund’s portfolio managers to possess sustainable competitive advantages. As such, the performance of the Fund is expected to be primarily determined by market reactions, both positive and negative, to activity related to these companies. Stock selection in industrials, as well as stock selection and an overweight in communication services, detracted from performance relative to the Fund’s style-specific benchmark for the fiscal year. Stock selection and an underweight in energy, as well as stock selection and an overweight in materials, contributed to performance. The biggest contributors to performance for the 12-month period were IBM, Southern Company, Verizon Communications, AbbVie, and Tokio Marine. The biggest detractors from performance during the period were Spark New Zealand, MSC Industrial Direct, Adecco Group, Pfizer, and BCE. The following table outlines key factors that materially affected the Fund’s performance during the reporting period.

| FACTOR | IMPACT | SUMMARY |

IBM

| Positive

| After several years of investment, IBM has seen its hybrid cloud offering resonate with clients. This has benefited both the company’s software and consulting businesses.

|

Southern Company

| Positive

| Southern Company recently placed its second and final nuclear plant into service. In addition, the stock benefited from market sentiment that artificial intelligence (AI)-related demand and a desire from AI customers for green energy may provide good momentum for the business going forward.

|

Spark New Zealand

| Negative

| During the reporting period, the New Zealand economy and the company’s revenue slowed faster than expected. Given the uncertainty that developed about the sustainability of the company’s dividend, the Fund sold its shares.

|

| MSC Industrial Direct | Negative | A sluggish macroeconomy negatively impacted customer sentiment. In addition, the company had some execution issues regarding a web pricing initiative designed to help stimulate business among its core customers. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

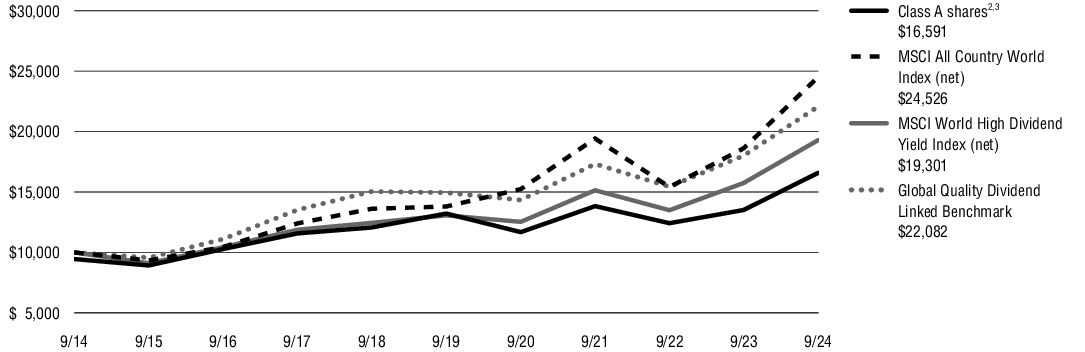

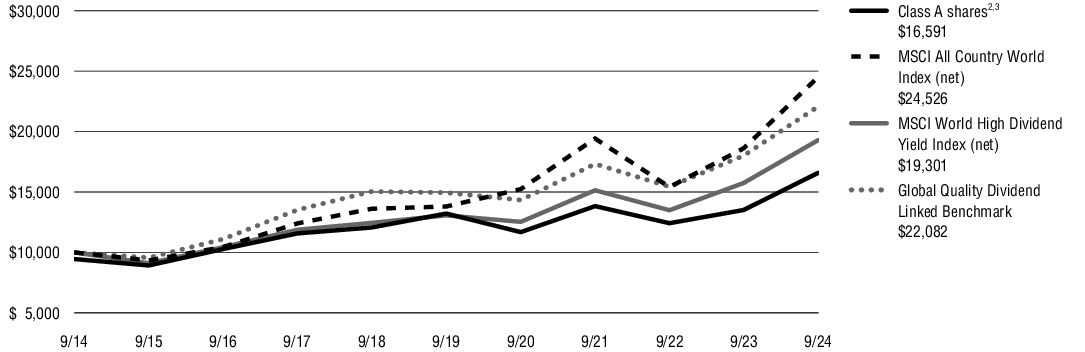

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class A shares including any applicable sales charges or fees. It assumes a $10,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific indexes for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 9/30/24 | 1 Year | 5 Years | 10 Years |

| Virtus KAR Global Quality Dividend Fund (Class A/PPTAX) at NAV(1) | 22.88% | 4.65% | 5.79% |

| Virtus KAR Global Quality Dividend Fund (Class A/PPTAX) at POP(2),(3) | 16.12% | 3.48% | 5.19% |

| MSCI All Country World Index (net) | 31.76% | 12.19% | 9.39% |

| MSCI World High Dividend Yield Index (net) | 22.60% | 8.12% | 6.80% |

| Global Quality Dividend Linked Benchmark | 22.60% | 8.12% | 8.24% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| (3) | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. A CDSC may be imposed on certain redemptions of Class A shares made within 18 months of a finder’s fee being paid. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of September 30, 2024)

| Fund net assets (‘000s) | $32,140 |

| Total number of portfolio holdings | 38 |

| Total advisory fee paid (‘000s) | $150 |

| Portfolio turnover rate as of the end of the reporting period | 16% |

| Financials | 22% |

| Industrials | 15% |

| Utilities | 12% |

| Information Technology | 10% |

| Communication Services | 10% |

| Consumer Staples | 9% |

| Materials | 7% |

| Other (includes securities lending collateral) | 15% |

| Total | 100% |

(1) | Percentage of total investments as of September 30, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Virtus KAR Global Quality Dividend Fund

Class C / PPTCX

Annual SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Virtus KAR Global Quality Dividend Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus KAR Global Quality Dividend Fund

Class C / PPTCX | $233 | 2.10% |

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

For the fiscal year ended September 30, 2024, the Fund’s Class C shares at NAV returned 21.93%. For the same period, the MSCI All Country World Index (net) serve as broad-based securities market index, returned 31.76%. The MSCI World High Dividend Yield Index (net) and the Global Quality Dividend Linked Benchmark, which serve as the style specific indexes, returned 22.60% and 22.60% respectively.

The MSCI All Country World Index (net) is a free float-adjusted market capitalization-weighted index that measures equity performance of developed and emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The MSCI World High Dividend Yield Index (net) is based on the MSCI World Index, its parent index, and includes large and mid cap stocks across 23 Developed Markets (DM) countries. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The index also applies quality screens and reviews 12-month past performance to omit stocks with potentially deteriorating fundamentals that could force them to cut or reduce dividends. The index is calculated on a total return basis with net dividends reinvested; it is unmanaged; its returns do not reflect any fees, expenses or sales charges; and it is not available for direct investment.

The Global Quality Dividend Linked Benchmark consists of the MSCI World High Dividend Yield Index (net). Performance of the Global Quality Dividend Linked Benchmark between February 1, 2017 and December 31, 2018 is that of the Russell 1000® Value Index. The indexes are unmanaged and not available for direct investment.

What factors impacted Fund performance over the reporting period?

The Fund utilizes an actively managed, bottom-up fundamental research approach to identify a select group of companies believed by the Fund’s portfolio managers to possess sustainable competitive advantages. As such, the performance of the Fund is expected to be primarily determined by market reactions, both positive and negative, to activity related to these companies. Stock selection in industrials, as well as stock selection and an overweight in communication services, detracted from performance relative to the Fund’s style-specific benchmark for the fiscal year. Stock selection and an underweight in energy, as well as stock selection and an overweight in materials, contributed to performance. The biggest contributors to performance for the 12-month period were IBM, Southern Company, Verizon Communications, AbbVie, and Tokio Marine. The biggest detractors from performance during the period were Spark New Zealand, MSC Industrial Direct, Adecco Group, Pfizer, and BCE. The following table outlines key factors that materially affected the Fund’s performance during the reporting period.

| FACTOR | IMPACT | SUMMARY |

IBM

| Positive

| After several years of investment, IBM has seen its hybrid cloud offering resonate with clients. This has benefited both the company’s software and consulting businesses.

|

Southern Company

| Positive

| Southern Company recently placed its second and final nuclear plant into service. In addition, the stock benefited from market sentiment that artificial intelligence (AI)-related demand and a desire from AI customers for green energy may provide good momentum for the business going forward.

|

Spark New Zealand

| Negative

| During the reporting period, the New Zealand economy and the company’s revenue slowed faster than expected. Given the uncertainty that developed about the sustainability of the company’s dividend, the Fund sold its shares.

|

| MSC Industrial Direct | Negative | A sluggish macroeconomy negatively impacted customer sentiment. In addition, the company had some execution issues regarding a web pricing initiative designed to help stimulate business among its core customers. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

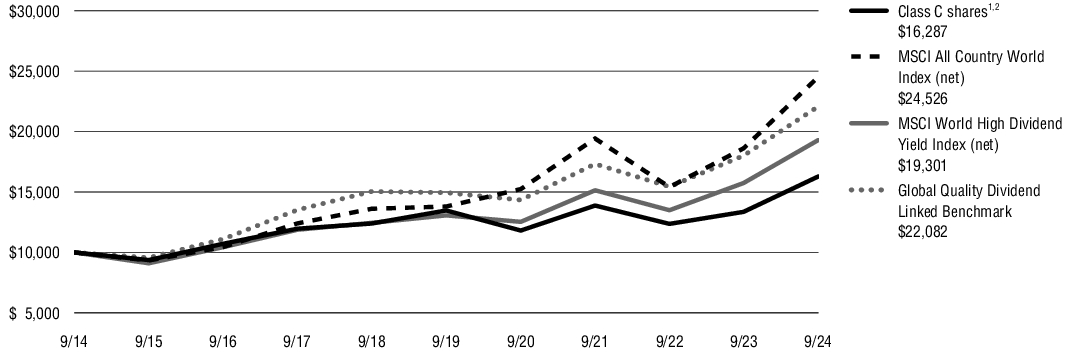

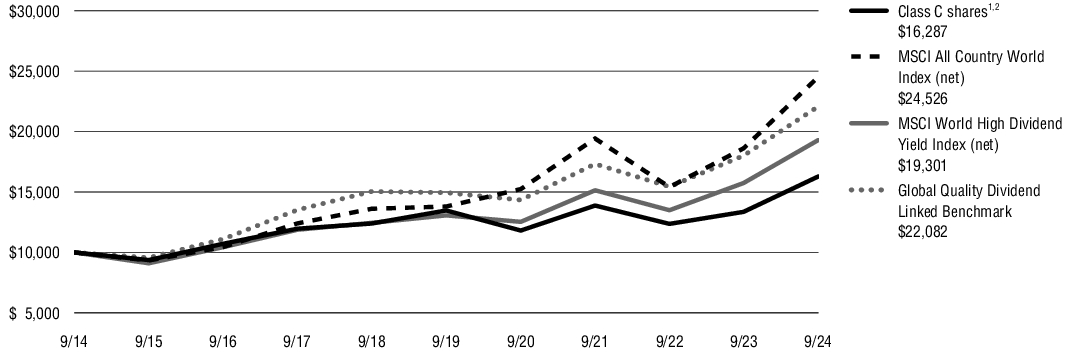

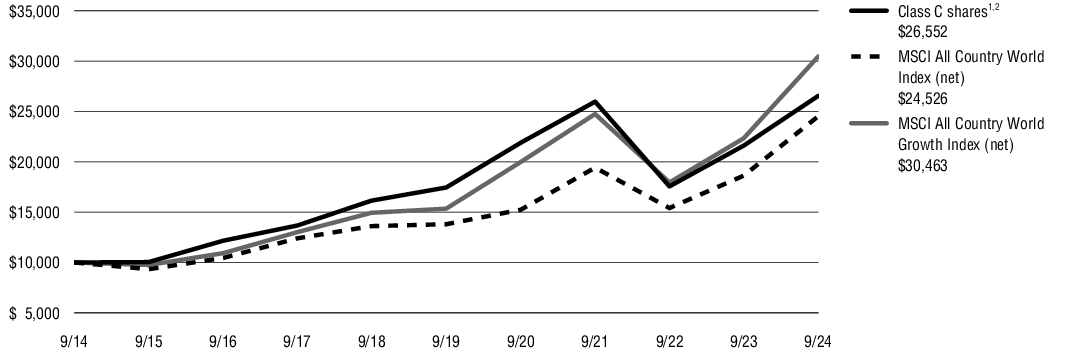

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class C shares. It assumes a $10,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific indexes for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 9/30/24 | 1 Year | 5 Years | 10 Years |

| Virtus KAR Global Quality Dividend Fund (Class C/PPTCX) at NAV(1) and with CDSC(2) | 21.93% | 3.87% | 5.00% |

| MSCI All Country World Index (net) | 31.76% | 12.19% | 9.39% |

| MSCI World High Dividend Yield Index (net) | 22.60% | 8.12% | 6.80% |