UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-00945

Virtus Equity Trust

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9668

(Address of principal executive offices) (Zip code)

Kevin J. Carr, Esq.

Senior Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-2608

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 243-1574

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

| (b) | Not applicable. |

| Virtus KAR Capital Growth Fund |

| Virtus KAR Equity Income Fund |

| Virtus KAR Global Quality Dividend Fund |

| Virtus KAR Mid-Cap Core Fund |

| Virtus KAR Mid-Cap Growth Fund |

| Virtus KAR Small-Cap Core Fund |

| Virtus KAR Small-Cap Growth Fund |

| Virtus KAR Small-Cap Value Fund |

| Virtus KAR Small-Mid Cap Core Fund |

| Virtus KAR Small-Mid Cap Growth Fund |

| Virtus KAR Small-Mid Cap Value Fund |

| Virtus SGA Emerging Markets Growth Fund |

| Virtus SGA Global Growth Fund |

| Virtus SGA New Leaders Growth Fund |

| Virtus Tactical Allocation Fund |

| 1 | ||

| 2 | ||

| 6 | ||

| Fund | Fund Summary | Schedule of Investments |

| 9 | 43 | |

| 11 | 44 | |

| 13 | 46 | |

| 15 | 47 | |

| 17 | 48 | |

| 19 | 50 | |

| 21 | 51 | |

| 23 | 52 | |

| 25 | 53 | |

| 27 | 54 | |

| 29 | 55 | |

| 31 | 56 | |

| 34 | 57 | |

| 37 | 58 | |

| 39 | 59 | |

| 72 | ||

| 80 | ||

| 83 | ||

| 91 | ||

| 102 | ||

| 122 | ||

| 124 | ||

| 125 | ||

| 126 | ||

| 129 | ||

President, Virtus Funds

| Beginning Account Value April 1, 2021 | Ending Account Value September 30, 2021 | Annualized Expense Ratio | Expenses Paid During Period* | |||||

KAR Capital Growth Fund | ||||||||

| Class A | $ 1,000.00 | $ 1,102.80 | 1.20 % | $ 6.33 | ||||

| Class C | 1,000.00 | 1,098.10 | 2.06 | 10.83 | ||||

| Class I | 1,000.00 | 1,103.90 | 1.00 | 5.27 | ||||

| Class R6 | 1,000.00 | 1,105.30 | 0.73 | 3.85 | ||||

KAR Equity Income Fund | ||||||||

| Class A | 1,000.00 | 1,016.90 | 1.26 | 6.37 | ||||

| Class C | 1,000.00 | 1,012.80 | 2.00 | 10.09 | ||||

| Class I | 1,000.00 | 1,018.00 | 1.01 | 5.11 | ||||

| Class R6 | 1,000.00 | 1,018.50 | 0.96 | 4.86 | ||||

KAR Global Quality Dividend Fund | ||||||||

| Class A | 1,000.00 | 1,020.80 | 1.35 | 6.84 | ||||

| Class C | 1,000.00 | 1,016.50 | 2.10 | 10.62 | ||||

| Class I | 1,000.00 | 1,022.20 | 1.10 | 5.58 | ||||

| Class R6 | 1,000.00 | 1,023.40 | 0.78 | 3.96 | ||||

KAR Mid-Cap Core Fund | ||||||||

| Class A | 1,000.00 | 1,095.90 | 1.20 | 6.30 | ||||

| Class C | 1,000.00 | 1,091.90 | 1.95 | 10.23 | ||||

| Class I | 1,000.00 | 1,097.10 | 0.95 | 4.99 | ||||

| Class R6 | 1,000.00 | 1,097.70 | 0.87 | 4.57 | ||||

KAR Mid-Cap Growth Fund | ||||||||

| Class A | 1,000.00 | 1,099.50 | 1.27 | 6.68 | ||||

| Class C | 1,000.00 | 1,095.20 | 2.00 | 10.50 | ||||

| Class I | 1,000.00 | 1,100.80 | 1.01 | 5.32 | ||||

| Class R6 | 1,000.00 | 1,101.80 | 0.83 | 4.37 | ||||

KAR Small-Cap Core Fund | ||||||||

| Class A | 1,000.00 | 1,035.60 | 1.26 | 6.43 | ||||

| Class C | 1,000.00 | 1,032.00 | 1.98 | 10.09 | ||||

| Class I | 1,000.00 | 1,037.10 | 0.99 | 5.06 | ||||

| Class R6 | 1,000.00 | 1,037.50 | 0.91 | 4.65 | ||||

KAR Small-Cap Growth Fund | ||||||||

| Class A | 1,000.00 | 1,055.70 | 1.34 | 6.91 | ||||

| Class C | 1,000.00 | 1,052.00 | 2.05 | 10.55 | ||||

| Class I | 1,000.00 | 1,057.00 | 1.07 | 5.52 | ||||

| Class R6 | 1,000.00 | 1,057.50 | 0.97 | 5.00 |

| Beginning Account Value April 1, 2021 | Ending Account Value September 30, 2021 | Annualized Expense Ratio | Expenses Paid During Period* | |||||

KAR Small-Cap Value Fund | ||||||||

| Class A | $1,000.00 | $ 985.20 | 1.21% | $ 6.02 | ||||

| Class C | 1,000.00 | 981.50 | 1.97 | 9.79 | ||||

| Class I | 1,000.00 | 986.30 | 0.96 | 4.78 | ||||

| Class R6 | 1,000.00 | 986.60 | 0.91 | 4.53 | ||||

KAR Small-Mid Cap Core Fund | ||||||||

| Class A | 1,000.00 | 1,043.00 | 1.30 | 6.66 | ||||

| Class C | 1,000.00 | 1,039.50 | 2.05 | 10.48 | ||||

| Class I | 1,000.00 | 1,045.00 | 1.00 | 5.13 | ||||

| Class R6 | 1,000.00 | 1,045.40 | 0.97 | 4.97 | ||||

KAR Small-Mid Cap Growth Fund | ||||||||

| Class A | 1,000.00 | 1,093.00 | 1.30 | 6.82 | ||||

| Class C | 1,000.00 | 1,088.00 | 2.05 | 10.73 | ||||

| Class I | 1,000.00 | 1,093.90 | 1.05 | 5.51 | ||||

| Class R6 | 1,000.00 | 1,094.90 | 0.99 | 5.20 | ||||

KAR Small-Mid Cap Value Fund** | ||||||||

| Class A | 1,000.00 | 964.00 | 1.17 | 1.83 | ||||

| Class C | 1,000.00 | 963.00 | 1.92 | 2.99 | ||||

| Class I | 1,000.00 | 964.00 | 0.92 | 1.44 | ||||

| Class R6 | 1,000.00 | 965.00 | 0.82 | 1.28 | ||||

SGA Emerging Markets Growth Fund | ||||||||

| Class A | 1,000.00 | 928.30 | 1.48 | 7.15 | ||||

| Class C | 1,000.00 | 925.10 | 2.23 | 10.76 | ||||

| Class I | 1,000.00 | 930.10 | 1.23 | 5.95 | ||||

| Class R6 | 1,000.00 | 930.30 | 1.05 | 5.08 | ||||

SGA Global Growth Fund | ||||||||

| Class A | 1,000.00 | 1,057.20 | 1.38 | 7.12 | ||||

| Class C | 1,000.00 | 1,053.20 | 2.15 | 11.07 | ||||

| Class I | 1,000.00 | 1,058.60 | 1.13 | 5.83 | ||||

| Class R6 | 1,000.00 | 1,059.90 | 0.90 | 4.65 | ||||

SGA New Leaders Growth Fund | ||||||||

| Class A | 1,000.00 | 1,025.00 | 1.39 | 7.06 | ||||

| Class C | 1,000.00 | 1,021.20 | 2.14 | 10.84 | ||||

| Class I | 1,000.00 | 1,026.00 | 1.14 | 5.79 | ||||

| Class R6 | 1,000.00 | 1,026.90 | 0.91 | 4.62 | ||||

Tactical Allocation Fund | ||||||||

| Class A | 1,000.00 | 1,072.50 | 1.02 | 5.30 | ||||

| Class C | 1,000.00 | 1,068.50 | 1.78 | 9.23 | ||||

| Class I | 1,000.00 | 1,072.90 | 0.79 | 4.11 | ||||

| Class R6 | 1,000.00 | 1,074.20 | 0.63 | 3.28 |

| * | Expenses are equal to the relevant Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (183) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

| ** | August 4, 2021, is the date the Fund started accruing expenses. Expenses are equal to the Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (58) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

| Beginning Account Value April 1, 2021 | Ending Account Value September 30, 2021 | Annualized Expense Ratio | Expenses Paid During Period* | |||||

KAR Capital Growth Fund | ||||||||

| Class A | $ 1,000.00 | $ 1,019.05 | 1.20 % | $ 6.07 | ||||

| Class C | 1,000.00 | 1,014.74 | 2.06 | 10.40 | ||||

| Class I | 1,000.00 | 1,020.05 | 1.00 | 5.06 | ||||

| Class R6 | 1,000.00 | 1,021.41 | 0.73 | 3.70 | ||||

KAR Equity Income Fund | ||||||||

| Class A | 1,000.00 | 1,018.75 | 1.26 | 6.38 | ||||

| Class C | 1,000.00 | 1,015.04 | 2.00 | 10.10 | ||||

| Class I | 1,000.00 | 1,020.00 | 1.01 | 5.11 | ||||

| Class R6 | 1,000.00 | 1,020.26 | 0.96 | 4.86 | ||||

KAR Global Quality Dividend Fund | ||||||||

| Class A | 1,000.00 | 1,018.30 | 1.35 | 6.83 | ||||

| Class C | 1,000.00 | 1,014.54 | 2.10 | 10.61 | ||||

| Class I | 1,000.00 | 1,019.55 | 1.10 | 5.57 | ||||

| Class R6 | 1,000.00 | 1,021.16 | 0.78 | 3.95 | ||||

KAR Mid-Cap Core Fund | ||||||||

| Class A | 1,000.00 | 1,019.05 | 1.20 | 6.07 | ||||

| Class C | 1,000.00 | 1,015.29 | 1.95 | 9.85 | ||||

| Class I | 1,000.00 | 1,020.31 | 0.95 | 4.81 | ||||

| Class R6 | 1,000.00 | 1,020.71 | 0.87 | 4.41 | ||||

KAR Mid-Cap Growth Fund | ||||||||

| Class A | 1,000.00 | 1,018.70 | 1.27 | 6.43 | ||||

| Class C | 1,000.00 | 1,015.04 | 2.00 | 10.10 | ||||

| Class I | 1,000.00 | 1,020.00 | 1.01 | 5.11 | ||||

| Class R6 | 1,000.00 | 1,020.91 | 0.83 | 4.20 | ||||

KAR Small-Cap Core Fund | ||||||||

| Class A | 1,000.00 | 1,018.75 | 1.26 | 6.38 | ||||

| Class C | 1,000.00 | 1,015.14 | 1.98 | 10.00 | ||||

| Class I | 1,000.00 | 1,020.10 | 0.99 | 5.01 | ||||

| Class R6 | 1,000.00 | 1,020.51 | 0.91 | 4.61 | ||||

KAR Small-Cap Growth Fund | ||||||||

| Class A | 1,000.00 | 1,018.35 | 1.34 | 6.78 | ||||

| Class C | 1,000.00 | 1,014.79 | 2.05 | 10.35 | ||||

| Class I | 1,000.00 | 1,019.70 | 1.07 | 5.42 | ||||

| Class R6 | 1,000.00 | 1,020.21 | 0.97 | 4.91 | ||||

KAR Small-Cap Value Fund | ||||||||

| Class A | 1,000.00 | 1,019.00 | 1.21 | 6.12 | ||||

| Class C | 1,000.00 | 1,015.19 | 1.97 | 9.95 | ||||

| Class I | 1,000.00 | 1,020.26 | 0.96 | 4.86 | ||||

| Class R6 | 1,000.00 | 1,020.51 | 0.91 | 4.61 | ||||

KAR Small-Mid Cap Core Fund | ||||||||

| Class A | 1,000.00 | 1,018.55 | 1.30 | 6.58 | ||||

| Class C | 1,000.00 | 1,014.79 | 2.05 | 10.35 | ||||

| Class I | 1,000.00 | 1,020.05 | 1.00 | 5.06 | ||||

| Class R6 | 1,000.00 | 1,020.21 | 0.97 | 4.91 | ||||

KAR Small-Mid Cap Growth Fund | ||||||||

| Class A | 1,000.00 | 1,018.55 | 1.30 | 6.58 | ||||

| Class C | 1,000.00 | 1,014.79 | 2.05 | 10.35 | ||||

| Class I | 1,000.00 | 1,019.80 | 1.05 | 5.32 | ||||

| Class R6 | 1,000.00 | 1,020.10 | 0.99 | 5.01 |

| Beginning Account Value April 1, 2021 | Ending Account Value September 30, 2021 | Annualized Expense Ratio | Expenses Paid During Period* | |||||

KAR Small-Mid Cap Value Fund** | ||||||||

| Class A | $1,000.00 | $1,006.09 | 1.17% | $ 1.86 | ||||

| Class C | 1,000.00 | 1,004.89 | 1.92 | 3.06 | ||||

| Class I | 1,000.00 | 1,006.48 | 0.92 | 1.47 | ||||

| Class R6 | 1,000.00 | 1,006.64 | 0.82 | 1.31 | ||||

SGA Emerging Markets Growth Fund | ||||||||

| Class A | 1,000.00 | 1,017.65 | 1.48 | 7.49 | ||||

| Class C | 1,000.00 | 1,013.89 | 2.23 | 11.26 | ||||

| Class I | 1,000.00 | 1,018.90 | 1.23 | 6.23 | ||||

| Class R6 | 1,000.00 | 1,019.80 | 1.05 | 5.32 | ||||

SGA Global Growth Fund | ||||||||

| Class A | 1,000.00 | 1,018.15 | 1.38 | 6.98 | ||||

| Class C | 1,000.00 | 1,014.29 | 2.15 | 10.86 | ||||

| Class I | 1,000.00 | 1,019.40 | 1.13 | 5.72 | ||||

| Class R6 | 1,000.00 | 1,020.56 | 0.90 | 4.56 | ||||

SGA New Leaders Growth Fund | ||||||||

| Class A | 1,000.00 | 1,018.10 | 1.39 | 7.03 | ||||

| Class C | 1,000.00 | 1,014.34 | 2.14 | 10.81 | ||||

| Class I | 1,000.00 | 1,019.35 | 1.14 | 5.77 | ||||

| Class R6 | 1,000.00 | 1,020.51 | 0.91 | 4.61 | ||||

Tactical Allocation Fund | ||||||||

| Class A | 1,000.00 | 1,019.95 | 1.02 | 5.16 | ||||

| Class C | 1,000.00 | 1,016.14 | 1.78 | 9.00 | ||||

| Class I | 1,000.00 | 1,021.11 | 0.79 | 4.00 | ||||

| Class R6 | 1,000.00 | 1,021.91 | 0.63 | 3.19 |

| * | Expenses are equal to the relevant Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (183) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

| ** | August 4, 2021, is the date the Fund started accruing expenses. Expenses are equal to the Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (58) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

| Ticker Symbols: | |

| Class A: PSTAX | |

| Class C: SSTFX | |

| Class I: PLXGX | |

| Class R6: VCGRX |

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is diversified and has an investment objective of long-term capital growth. There is no guarantee that the Fund will meet its objective. |

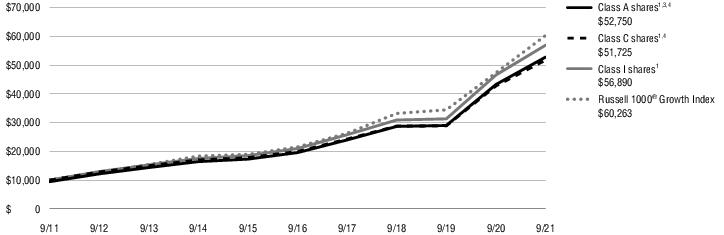

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 21.98%, Class C shares at NAV returned 21.00%, Class I shares at NAV returned 22.23%, and Class R6 shares at NAV returned 22.55%. For the same period, the Russell 1000® Growth Index, which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 27.32%. |

| Information Technology | 42% |

| Consumer Discretionary | 21 |

| Communication Services | 13 |

| Industrials | 7 |

| Health Care | 6 |

| Financials | 5 |

| Consumer Staples | 4 |

| Other (includes short-term investment) | 2 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||||||||

| Class A shares at NAV2 | 21.98 % | 21.93 % | 18.76 % | — % | — | |||||||

| Class A shares at POP3,4 | 15.28 | 20.56 | 18.09 | — | — | |||||||

| Class C shares at NAV2 and with CDSC4 | 21.00 | 20.98 | 17.86 | — | — | |||||||

| Class I shares at NAV2 | 22.23 | 22.07 | 18.99 | — | — | |||||||

| Class R6 shares at NAV2 | 22.55 | — | — | 19.45 | 1/30/18 | |||||||

| Russell 1000® Growth Index | 27.32 | 22.84 | 19.68 | 20.63 5 | — | |||||||

| Fund Expense Ratios6: Class A shares: 1.23%; Class C shares: 2.00%; Class I shares: 1.01%; Class R6 shares: Gross 0.94%, Net 0.73%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: PDIAX | |

| Class C: PGICX | |

| Class I: PXIIX | |

| Class R6: VECRX |

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is diversified and has investment objectives of capital appreciation and current income. There is no guarantee that the Fund will meet its objectives. |

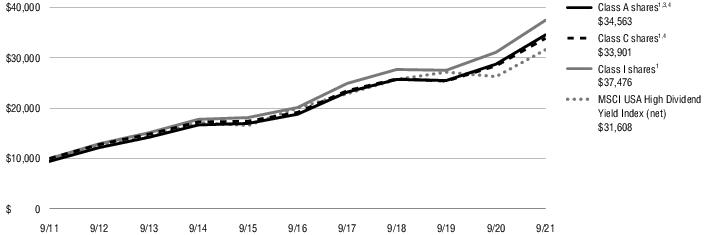

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 20.23%, Class C shares at NAV returned 19.31%, Class I shares at NAV returned 20.49%, and Class R6 shares at NAV returned 20.55%. For the same period, the MSCI USA High Dividend Yield Index (net), which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 20.32%. |

| Financials | 16% |

| Consumer Staples | 13 |

| Industrials | 13 |

| Information Technology | 11 |

| Health Care | 11 |

| Utilities | 9 |

| Materials | 8 |

| Other (includes short-term investment and securities lending collateral) | 19 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||||||||

| Class A shares at NAV2 | 20.23 % | 12.95 % | 13.85 % | — % | — | |||||||

| Class A shares at POP3,4 | 13.62 | 11.68 | 13.20 | — | — | |||||||

| Class C shares at NAV2 and with CDSC4 | 19.31 | 12.09 | 12.98 | — | — | |||||||

| Class I shares at NAV2 | 20.49 | 13.22 | 14.12 | — | — | |||||||

| Class R6 shares at NAV2 | 20.55 | — | — | 9.11 | 1/30/18 | |||||||

| MSCI USA High Dividend Yield Index (net) | 20.32 | 9.54 | 12.20 | 6.21 5 | — | |||||||

| Fund Expense Ratios6: Class A shares: Gross 1.35%, Net 1.20%; Class C shares: Gross 2.11%, Net 1.95%; Class I shares: Gross 1.10%, Net 0.95%; Class R6 shares: Gross 1.03%; Net 0.91%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: PPTAX | |

| Class C: PPTCX | |

| Class I: PIPTX | |

| Class R6: VGQRX |

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is diversified and has an investment objective of total return, consisting of both capital appreciation and current income. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 18.42%, Class C shares at NAV returned 17.52%, Class I shares at NAV returned 18.78%, and Class R6 shares at NAV returned 19.15%. The MSCI World High Dividend Yield Index (net), which serves as the Fund’s broad-based index, returned 20.84% and the Global Quality Dividend Linked Benchmark, the Fund’s style-specific Index, returned 20.84%. |

| Financials | 21% |

| Communication Services | 19 |

| Industrials | 12 |

| Utilities | 10 |

| Consumer Staples | 10 |

| Health Care | 9 |

| Information Technology | 7 |

| Other (includes short-term investment) | 12 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||||||||

| Class A shares at NAV2 | 18.42 % | 6.11 % | 9.57 % | — % | — | |||||||

| Class A shares at POP3,4 | 11.91 | 4.91 | 8.95 | — | — | |||||||

| Class C shares at NAV2 and with CDSC4 | 17.52 | 5.31 | 8.75 | — | — | |||||||

| Class I shares at NAV2 | 18.78 | 6.37 | 9.85 | — | — | |||||||

| Class R6 shares at NAV2 | 19.15 | — | — | 4.53 | 8/1/19 | |||||||

| MSCI World High Dividend Yield Index (net) | 20.84 | 7.73 | 8.83 | 8.17 5 | — | |||||||

| Global Quality Dividend Linked Benchmark | 20.84 | 9.30 | 12.67 | 8.17 5 | — | |||||||

| Fund Expense Ratios6: Class A shares: Gross 1.61%, Net 1.35%; Class C shares: Gross 2.35%, Net 2.10%; Class I shares: Gross 1.40%, Net 1.10%; Class R6 shares: Gross 1.27%, Net 0.78%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: VMACX | |

| Class C: VMCCX | |

| Class I: VIMCX | |

| Class R6: VRMCX |

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is diversified and has an investment objective of long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

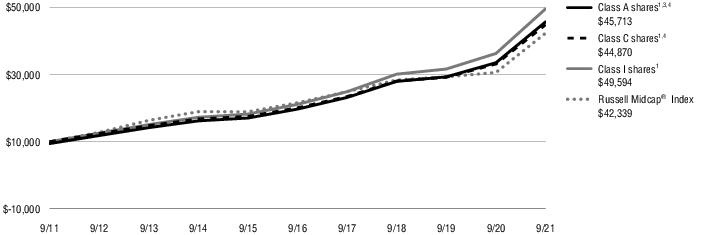

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 36.25%, Class C shares at NAV returned 35.23%, Class I shares at NAV returned 36.59%, and Class R6 shares at NAV returned 36.67%. For the same period, the Russell Midcap® Index, which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 38.11%. |

| Industrials | 33% |

| Health Care | 18 |

| Information Technology | 18 |

| Financials | 13 |

| Consumer Discretionary | 10 |

| Consumer Staples | 3 |

| Real Estate | 2 |

| Short-Term Investment | 3 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||||||||

| Class A shares at NAV2 | 36.25 % | 18.29 % | 17.07 % | — % | — | |||||||

| Class A shares at POP3,4 | 28.76 | 16.96 | 16.41 | — | — | |||||||

| Class C shares at NAV2 and with CDSC4 | 35.23 | 17.40 | 16.20 | — | — | |||||||

| Class I shares at NAV2 | 36.59 | 18.58 | 17.37 | — | — | |||||||

| Class R6 shares at NAV2 | 36.67 | — | — | 16.02 | 1/30/18 | |||||||

| Russell Midcap® Index | 38.11 | 14.39 | 15.52 | 12.55 5 | — | |||||||

| Fund Expense Ratios6: Class A shares: Gross 1.35%, Net 1.21%; Class C shares: Gross 2.10%, Net 1.96%; Class I shares: Gross 1.10%, Net 0.96%; Class R6 shares: Gross 1.01%, Net 0.88%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: PHSKX | |

| Class C: PSKCX | |

| Class I: PICMX | |

| Class R6: VRMGX |

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is diversified and has an investment objective of capital appreciation. There is no guarantee that the Fund will meet its objective. |

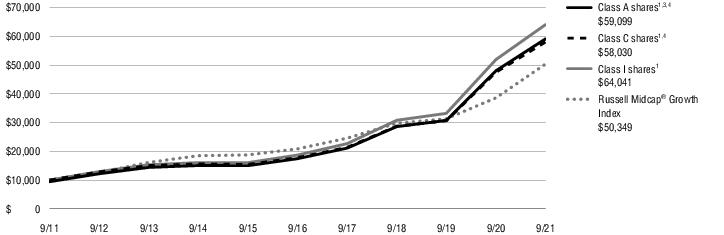

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 23.07%, Class C shares at NAV returned 22.13%, Class I shares at NAV returned 23.35%, and Class R6 shares at NAV returned 23.57%. For the same period, the Russell Midcap® Growth Index, which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 30.45%. |

| Information Technology | 39% |

| Consumer Discretionary | 19 |

| Health Care | 11 |

| Industrials | 9 |

| Consumer Staples | 9 |

| Financials | 8 |

| Communication Services | 2 |

| Short-Term Investment | 3 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||||||||

| Class A shares at NAV2 | 23.07 % | 27.61 % | 20.12 % | — % | — | |||||||

| Class A shares at POP3,4 | 16.30 | 26.17 | 19.44 | — | — | |||||||

| Class C shares at NAV2 and with CDSC4 | 22.13 | 26.65 | 19.22 | — | — | |||||||

| Class I shares at NAV2 | 23.35 | 27.90 | 20.41 | — | — | |||||||

| Class R6 shares at NAV2 | 23.57 | — | — | 27.23 | 1/30/18 | |||||||

| Russell Midcap® Growth Index | 30.45 | 19.27 | 17.54 | 17.60 5 | — | |||||||

| Fund Expense Ratios6: Class A shares: 1.28%; Class C shares: 2.04%; Class I shares: 1.05%; Class R6 shares: Gross 0.95%, Net 0.85%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: PKSAX | |

| Class C: PKSCX | |

| Class I: PKSFX | |

| Class R6: VSCRX |

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is diversified and has an investment objective of long-term capital appreciation, with dividend income a secondary consideration. There is no guarantee that the Fund will meet its objectives. |

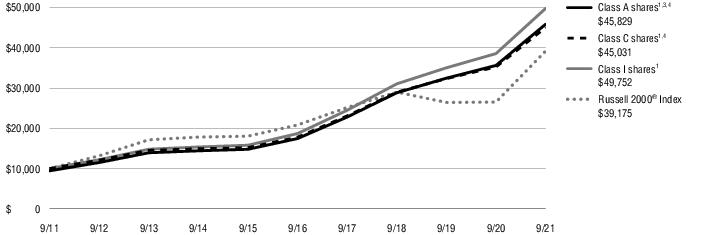

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 28.68%, Class C shares at NAV returned 27.74%, Class I shares at NAV returned 29.03%, and Class R6 shares at NAV returned 29.14%. For the same period, the Russell 2000® Index, which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 47.68%. |

| Industrials | 37% |

| Financials | 20 |

| Information Technology | 16 |

| Communication Services | 8 |

| Health Care | 6 |

| Consumer Discretionary | 5 |

| Consumer Staples | 2 |

| Other (includes short-term investment) | 6 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||||||||

| Class A shares at NAV2 | 28.68 % | 21.27 % | 17.10 % | — % | — | |||||||

| Class A shares at POP3,4 | 21.60 | 19.91 | 16.44 | — | — | |||||||

| Class C shares at NAV2 and with CDSC4 | 27.74 | 20.38 | 16.24 | — | — | |||||||

| Class I shares at NAV2 | 29.03 | 21.60 | 17.40 | — | — | |||||||

| Class R6 shares at NAV2 | 29.14 | 21.70 | — | 17.49 | 11/12/14 | |||||||

| Russell 2000® Index | 47.68 | 13.45 | 14.63 | 10.89 5 | — | |||||||

| Fund Expense Ratios6: Class A shares: 1.28%; Class C shares: 2.01%; Class I shares: 1.00%; Class R6 shares: 0.93%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: PSGAX | |

| Class C: PSGCX | |

| Class I: PXSGX | |

| Class R6: VRSGX |

Kayne Anderson Rudnick Investment Management, LLC

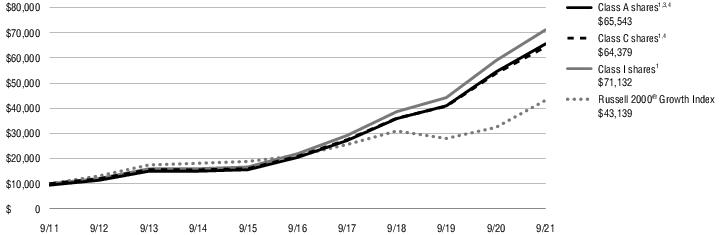

| ■ | The Fund is diversified and has an investment objective of long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 20.46%, Class C shares at NAV returned 19.60%, Class I shares at NAV returned 20.77%, and Class R6 shares at NAV returned 20.88%. For the same period, the Russell 2000® Growth Index, which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 33.27%. |

| Information Technology | 32% |

| Financials | 22 |

| Communication Services | 15 |

| Consumer Discretionary | 13 |

| Industrials | 7 |

| Health Care | 4 |

| Consumer Staples | 3 |

| Short-Term Investment | 4 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||||||||

| Class A shares at NAV2 | 20.46 % | 26.21 % | 21.37 % | — % | — | |||||||

| Class A shares at POP3,4 | 13.83 | 24.79 | 20.68 | — | — | |||||||

| Class C shares at NAV2 and with CDSC4 | 19.60 | 25.28 | 20.47 | — | — | |||||||

| Class I shares at NAV2 | 20.77 | 26.54 | 21.68 | — | — | |||||||

| Class R6 shares at NAV2 | 20.88 | — | — | 22.75 | 1/30/18 | |||||||

| Russell 2000® Growth Index | 33.27 | 15.34 | 15.74 | 12.58 5 | — | |||||||

| Fund Expense Ratios6: Class A shares: 1.36%; Class C shares: 2.08%; Class I shares:1.10%; Class R6 shares: 1.00%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: PQSAX | |

| Class C: PQSCX | |

| Class I: PXQSX | |

| Class R6: VQSRX |

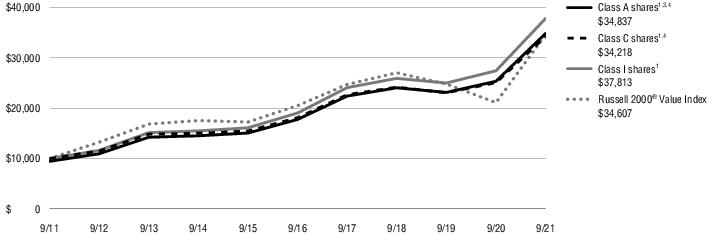

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is diversified and has an investment objective of long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 37.45%, Class C shares at NAV returned 36.44%, Class I shares at NAV returned 37.83%, and Class R6 shares at NAV returned 37.85%. For the same period, the Russell 2000® Value Index, which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 63.92%. |

| Industrials | 27% |

| Consumer Discretionary | 22 |

| Financials | 17 |

| Information Technology | 14 |

| Consumer Staples | 6 |

| Materials | 5 |

| Real Estate | 4 |

| Other (includes short-term investment) | 5 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||||||||

| Class A shares at NAV2 | 37.45 % | 14.41 % | 13.94 % | — % | — | |||||||

| Class A shares at POP3,4 | 29.89 | 13.12 | 13.29 | — | — | |||||||

| Class C shares at NAV2 and with CDSC4 | 36.44 | 13.58 | 13.09 | — | — | |||||||

| Class I shares at NAV2 | 37.83 | 14.70 | 14.23 | — | — | |||||||

| Class R6 shares at NAV2 | 37.85 | — | — | 16.12 | 11/3/16 | |||||||

| Russell 2000® Value Index | 63.92 | 11.03 | 13.22 | 12.59 5 | — | |||||||

| Fund Expense Ratios6: Class A shares: 1.23%; Class C shares: 1.98%; Class I shares: 0.99%; Class R6 shares: 0.89%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: VKSAX | |

| Class C: VKSCX | |

| Class I: VKSIX | |

| Class R6: VKSRX |

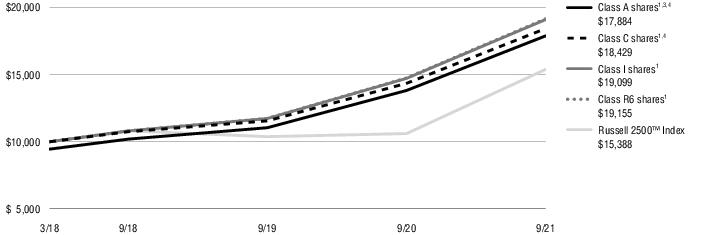

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is diversified and has an investment objective of long-term capital appreciation, with dividend income a secondary consideration. There is no guarantee that the Fund will meet its objectives. |

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 29.38%, Class C shares at NAV returned 28.39%, Class I shares at NAV returned 29.72%, and Class R6 shares at NAV returned 29.82%. For the same period, the Russell 2500™ Index, which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 45.03%. |

| Information Technology | 26% |

| Industrials | 20 |

| Consumer Discretionary | 17 |

| Health Care | 14 |

| Financials | 14 |

| Materials | 4 |

| Short-Term Investment | 5 |

| Total | 100% |

| 1 Year | Since inception | Inception date | ||||||

| Class A shares at NAV2 | 29.38 % | 19.56 % | 3/7/18 | |||||

| Class A shares at POP3,4 | 22.27 | 17.68 | 3/7/18 | |||||

| Class C shares at NAV2 and with CDSC4 | 28.39 | 18.68 | 3/7/18 | |||||

| Class I shares at NAV2 | 29.72 | 19.87 | 3/7/18 | |||||

| Class R6 shares at NAV2 | 29.82 | 19.97 | 3/7/18 | |||||

| Russell 2500™ Index | 45.03 | 12.83 5 | — | |||||

| Fund Expense Ratios6: Class A shares: Gross 1.40%, Net 1.31%; Class C shares: Gross 2.08%, Net 2.06%; Class I shares: Gross 1.10%, Net 1.06%; Class R6 shares: Gross 1.00%, Net 0.98%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: VAKSX | |

| Class C: VCKSX | |

| Class I: VIKSX | |

| Class R6: VRKSX |

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is diversified and has an investment objective of long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal period December 8, 2020 (inception date) through September 30, 2021, the Fund’s Class A shares at NAV returned 7.00%*, Class C shares at NAV returned 6.30%*, Class I shares at NAV returned 7.20%*, and Class R6 shares at NAV returned 7.30%*. For the same period, the Russell 2500™ Growth Index, which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 9.46%*. |

| Information Technology | 31% |

| Industrials | 22 |

| Health Care | 22 |

| Financials | 10 |

| Consumer Discretionary | 9 |

| Communication Services | 4 |

| Consumer Staples | 2 |

| Total | 100% |

| Since inception | Inception date | |||||

| Class A shares at NAV2 | 7.00 % | 12/8/20 | ||||

| Class A shares at POP3,4 | 1.12 | 12/8/20 | ||||

| Class C shares at NAV2 | 6.30 | 12/8/20 | ||||

| Class C shares with CDSC4 | 5.30 | 12/8/20 | ||||

| Class I shares at NAV2 | 7.20 | 12/8/20 | ||||

| Class R6 shares at NAV2 | 7.30 | 12/8/20 | ||||

| Russell 2500™ Growth Index | 9.46 5 | — | ||||

| Fund Expense Ratios6: Class A shares: Gross 1.40%, Net 1.30%; Class C shares: Gross 2.09%, Net 2.05%; Class I shares: Gross 1.14%, Net 1.05%; Class R6 shares: Gross 1.05%, Net 0.99%. | ||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: VKSDX | |

| Class C: VKSEX | |

| Class I: VKSFX | |

| Class R6: VKSGX |

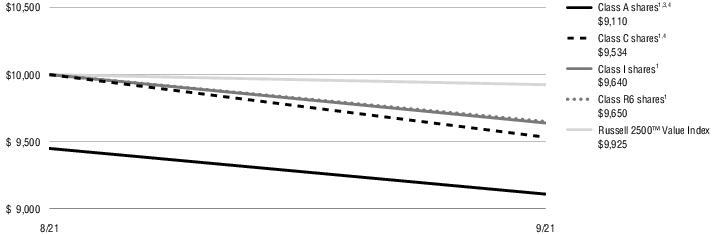

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is diversified and has an investment objective of long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal period August 3, 2021 (inception date) through September 30, 2021, the Fund’s Class A shares at NAV returned -3.60%*, Class C shares at NAV returned -3.70%*, Class I shares at NAV returned -3.60%*, and Class R6 shares at NAV returned -3.50%*. For the same period, the Russell 2500™ Value Index, which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned -0.75%*. |

| Industrials | 25% |

| Information Technology | 23 |

| Consumer Discretionary | 15 |

| Financials | 14 |

| Real Estate | 7 |

| Materials | 6 |

| Consumer Staples | 5 |

| Other (includes short-term investment) | 5 |

| Total | 100% |

| Since inception | Inception date | |||||

| Class A shares at NAV2 | -3.60 % | 8/3/21 | ||||

| Class A shares at POP3,4 | -8.90 | 8/3/21 | ||||

| Class C shares at NAV2 | -3.70 | 8/3/21 | ||||

| Class C shares with CDSC4 | -4.66 | 8/3/21 | ||||

| Class I shares at NAV2 | -3.60 | 8/3/21 | ||||

| Class R6 shares at NAV2 | -3.50 | 8/3/21 | ||||

| Russell 2500™ Value Index | -0.75 5 | — | ||||

| Fund Expense Ratios6: Class A shares: Gross 1.28%, Net 1.17%; Class C shares: Gross 2.03%, Net 1.92%; Class I shares: Gross 1.05%, Net 0.92%; Class R6 shares: Gross 0.95%; Net 0.82%. | ||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of the Fund. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective August 2, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through January 31, 2023. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: VAEGX | |

| Class C: VCEGX | |

| Class I: VIEGX | |

| Class R6: VESRX |

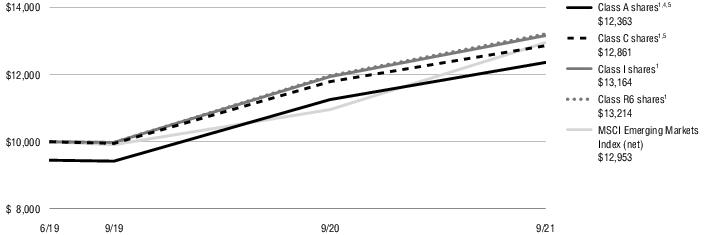

Sustainable Growth Advisers, LP

| ■ | The Fund is non-diversified and has an investment objective of long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 9.84%†, Class C shares at NAV returned 9.08%, Class I shares at NAV returned 10.24%, and Class R6 shares at NAV returned 10.38%. For the same period, the MSCI Emerging Markets Index (net), which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 18.20%. |

| Consumer Staples | 29% |

| Financials | 24 |

| Consumer Discretionary | 23 |

| Health Care | 6 |

| Information Technology | 6 |

| Communication Services | 5 |

| Real Estate | 3 |

| Other (includes short-term investment) | 4 |

| Total | 100% |

| 1 Year | Since inception | Inception date | ||||||

| Class A shares at NAV2 | 9.84 % 3 | 12.39 % | 6/13/19 | |||||

| Class A shares at POP4,5 | 3.80 | 9.66 | 6/13/19 | |||||

| Class C shares at NAV2 and with CDSC5 | 9.08 | 11.56 | 6/13/19 | |||||

| Class I shares at NAV2 | 10.24 | 12.69 | 6/13/19 | |||||

| Class R6 shares at NAV2 | 10.38 | 12.87 | 6/13/19 | |||||

| MSCI Emerging Markets Index (net) | 18.20 | 11.90 6 | — | |||||

| Fund Expense Ratios7: Class A shares: Gross 3.99%, Net 1.49%; Class C shares: Gross 4.71%, Net 2.24%; Class I shares: Gross 3.58%, Net 1.24%; Class R6 shares: Gross 3.73%, Net 1.06%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | Total Return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the NAV at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual report and semiannual report. |

| 4 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 5 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 6 | The since inception index return is from the Fund’s inception date. |

| 7 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: SGAAX | |

| Class C: SGACX | |

| Class I: SGAPX | |

| Class R6: SGARX |

Sustainable Growth Advisers, LP

| ■ | The Fund is diversified and has an investment objective of long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 19.49%, Class C shares at NAV returned 18.62%, Class I shares at NAV returned 19.78%, and Class R6 shares at NAV returned 20.07%. For the same period, the MSCI AC World Index (net), returned 27.44%, and the MSCI AC World Growth Index (net), returned 23.83%. |

| Information Technology | 32% |

| Health Care | 18 |

| Consumer Discretionary | 13 |

| Communication Services | 9 |

| Financials | 8 |

| Consumer Staples | 8 |

| Industrials | 5 |

| Other (includes short-term investment) | 7 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||||||||

| Class A shares at NAV2 | 19.49 % | 17.27 % | — % | 14.08 % | 10/4/13 | |||||||

| Class A shares at POP3,4 | 12.92 | 15.95 | — | 13.27 | 10/4/13 | |||||||

| Class C shares at NAV2 and with CDSC4 | 18.62 | 16.39 | — | 13.22 | 10/4/13 | |||||||

| Class I shares at NAV2 | 19.78 | 17.41 | — | 14.18 | 10/4/13 | |||||||

| Class R6 shares at NAV2 | 20.07 | 17.77 | 15.49 | — | — | |||||||

| MSCI AC World Index (net) | 27.44 | 13.20 | 11.90 | 10.06 5 | — | |||||||

| MSCI AC World Growth Index (net) | 23.83 | 17.76 | 14.73 | 13.46 5 | — | |||||||

| Fund Expense Ratios6: Class A shares: 1.37%; Class C shares: Gross 2.15%, Net 2.14%; Class I shares: Gross 1.21%, Net 1.14%; Class R6 shares: Gross 1.09%, Net 0.91%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class A shares, Class C shares and Class I shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: VNLAX | |

| Class C: VNLCX | |

| Class I: VNLIX | |

| Class R6: VNLRX |

Sustainable Growth Advisers, LP

| ■ | The Fund is non-diversified and has an investment objective of long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal period November 17, 2020 (inception date) through September 30, 2021, the Fund’s Class A shares at NAV returned 6.50%*, Class C shares at NAV returned 5.80%*, Class I shares at NAV returned 6.70%*, and Class R6 shares at NAV returned 6.90%*. For the same period, the MSCI AC World Mid Cap Index (net), which serves as both the Fund’s broad-based and style-specific index appropriate the comparison, returned 19.21%*. |

| Information Technology | 26% |

| Health Care | 25 |

| Consumer Staples | 13 |

| Consumer Discretionary | 11 |

| Communication Services | 10 |

| Financials | 9 |

| Real Estate | 3 |

| Other (includes short-term investment) | 3 |

| Total | 100% |

| Since inception | Inception date | |||||

| Class A shares at NAV2 | 6.50 % | 11/17/20 | ||||

| Class A shares at POP3,4 | 0.64 | 11/17/20 | ||||

| Class C shares at NAV2 | 5.80 | 11/17/20 | ||||

| Class C shares with CDSC4 | 4.80 | 11/17/20 | ||||

| Class I shares at NAV2 | 6.70 | 11/17/20 | ||||

| Class R6 shares at NAV2 | 6.90 | 11/17/20 | ||||

| MSCI AC World Mid Cap Index (net) | 19.21 5 | — | ||||

| Fund Expense Ratios6: Class A shares: Gross 1.45%, Net 1.39%; Class C shares: Gross 2.16%, Net 2.14%; Class I shares: Gross 1.24%, Net 1.14%; Class R6 shares: Gross 1.13%, Net 0.91%. | ||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A: NAINX | |

| Class C: POICX | |

| Class I: VTAIX | |

| Class R6: VTARX |

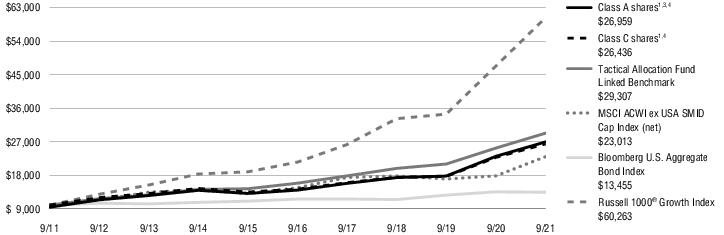

Kayne Anderson Rudnick

Investment Management, LLC

(Domestic and International Equity

Portfolio) and Newfleet Asset

Management, LLC

(Fixed Income Portfolio)

| ■ | The Fund is diversified and has investment objectives of capital appreciation and income. There is no guarantee that the Fund will meet its objectives. |

| ■ | For the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 16.69%, Class C shares at NAV returned 15.82%, and Class I shares at NAV returned 16.88%, and Class R6 shares at NAV from October 20, 2020 (inception date) through September 30, 2021, returned 13.23%*. For the fiscal year ended September 30, 2021, the Bloomberg U.S. Aggregate Bond Index; a broad-based fixed income index, returned -0.90%, the MSCI ACWI ex USA SMID Cap Index (net); a broad-based International Index, returned 28.94%; and the Russell 1000® Growth Index; a broad-based US equity index, returned 27.32%. The Tactical Allocation Fund Linked Benchmark, the Fund’s style-specific benchmark, returned 15.76%. |

| Common Stocks | 68% | |

| Information Technology | 23% | |

| Consumer Discretionary | 13 | |

| Communication Services | 10 | |

| All Other Common Stocks | 22 | |

| Corporate Bonds and Notes | 11 | |

| Financials | 4 | |

| Energy | 1 | |

| Information Technology | 1 | |

| All Other Corporate Bonds and Notes | 5 | |

| Mortgage-Backed Securities | 8 | |

| U.S. Government Securities | 4 | |

| Asset-Backed Securities | 3 | |

| Leveraged Loans | 3 | |

| Foreign Government Securities | 1 | |

| Other (includes short-term investment and securities lending collateral) | 2 | |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||||||||

| Class A shares at NAV2 | 16.69 % | 13.95 % | 11.05 % | — % | — | |||||||

| Class A shares at POP3,4 | 10.27 | 12.67 | 10.43 | — | — | |||||||

| Class C shares at NAV2 and with CDSC4 | 15.82 | 13.09 | 10.21 | — | — | |||||||

| Class I shares at NAV2 | 16.88 | — | — | 21.50 | 1/29/19 | |||||||

| Class R6 shares at NAV2 | — | — | — | 13.23 | 10/20/20 | |||||||

| Bloomberg U.S. Aggregate Bond Index | -0.90 | 2.94 | 3.01 | — 5 | — | |||||||

| MSCI ACWI ex USA SMID Cap Index (net) | 28.94 | 9.40 | 8.69 | — 6 | — | |||||||

| Russell 1000® Growth Index | 27.32 | 22.84 | 19.68 | — 7 | ||||||||

| Tactical Allocation Fund Linked Benchmark | 15.76 | 13.02 | 11.35 | — 8 | — | |||||||

| Fund Expense Ratios9: Class A shares: Gross 1.06%, Net 0.99%; Class C shares: Gross 1.84%, Net 1.75%; Class I shares: Gross 0.85%, Net 0.76%; Class R6 shares: Gross 0.76%, Net 0.60%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index returned 5.18% for the inception date of Class I shares and -0.63% for the inception date of Class R6 shares. |

| 6 | The since inception index returned 13.58% for the inception date of Class I shares and 25.50% for the inception date of Class R6 shares. |

| 7 | The since inception index returned 30.78% for the inception date of Class I shares and 24.26% for the inception date of Class R6 shares. |

| 8 | The since inception index returned 18.10% for the inception date of Class I shares and 14.14% for the inception date of Class R6 shares. |

| 9 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2022. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Shares | Value | ||

| Common Stocks—98.7% | |||

| Communication Services—12.8% | |||

| Facebook, Inc. Class A(1) | 142,100 | $ 48,227 | |

| Netflix, Inc.(1) | 46,780 | 28,552 | |

| Tencent Holdings Ltd. Unsponsored ADR | 303,650 | 18,149 | |

| ZoomInfo Technologies, Inc. Class A(1) | 139,520 | 8,537 | |

| 103,465 | |||

| Consumer Discretionary—21.0% | |||

| Airbnb, Inc. Class A(1) | 66,165 | 11,099 | |

| Alibaba Group Holding Ltd. Sponsored ADR(1) | 137,180 | 20,310 | |

| Amazon.com, Inc.(1) | 19,662 | 64,590 | |

| Home Depot, Inc. (The) | 33,685 | 11,057 | |

| Marriott International, Inc. Class A(1) | 63,920 | 9,466 | |

| MercadoLibre, Inc.(1) | 12,780 | 21,463 | |

| NIKE, Inc. Class B | 145,370 | 21,112 | |

| Ross Stores, Inc. | 94,226 | 10,257 | |

| 169,354 | |||

| Consumer Staples—4.5% | |||

| Estee Lauder Cos., Inc. (The) Class A | 29,944 | 8,981 | |

| McCormick & Co., Inc. | 75,570 | 6,123 | |

| Monster Beverage Corp.(1) | 115,013 | 10,217 | |

| Procter & Gamble Co. (The) | 77,580 | 10,846 | |

| 36,167 | |||

| Financials—4.7% | |||

| Bank of America Corp. | 382,715 | 16,246 | |

| CME Group, Inc. Class A | 33,410 | 6,461 | |

| MarketAxess Holdings, Inc. | 25,580 | 10,761 | |

| Progressive Corp. (The) | 49,850 | 4,506 | |

| 37,974 | |||

| Shares | Value | ||

| Health Care—5.7% | |||

| Danaher Corp. | 63,322 | $ 19,278 | |

| HealthEquity, Inc.(1) | 72,380 | 4,687 | |

| Zoetis, Inc. Class A | 114,257 | 22,182 | |

| 46,147 | |||

| Industrials—7.3% | |||

| CoStar Group, Inc.(1) | 180,590 | 15,541 | |

| Equifax, Inc. | 33,600 | 8,515 | |

| Fair Isaac Corp.(1) | 18,980 | 7,553 | |

| Roper Technologies, Inc. | 29,489 | 13,156 | |

| Uber Technologies, Inc.(1) | 308,021 | 13,799 | |

| 58,564 | |||

| Information Technology—41.6% | |||

| Accenture plc Class A | 42,388 | 13,561 | |

| Amphenol Corp. Class A | 265,626 | 19,452 | |

| Avalara, Inc.(1) | 152,410 | 26,637 | |

| Bill.com Holdings, Inc.(1) | 274,976 | 73,405 | |

| DocuSign, Inc.(1) | 30,160 | 7,764 | |

| Duck Creek Technologies, Inc.(1) | 367,685 | 16,266 | |

| MongoDB, Inc. Class A(1) | 16,880 | 7,959 | |

| NVIDIA Corp. | 250,852 | 51,966 | |

| Paycom Software, Inc.(1) | 73,522 | 36,449 | |

| Snowflake, Inc. Class A(1) | 38,166 | 11,543 | |

| Trade Desk, Inc. (The) Class A(1) | 243,720 | 17,133 | |

| Visa, Inc. Class A | 152,834 | 34,044 | |

| Workday, Inc. Class A(1) | 75,691 | 18,914 | |

| 335,093 | |||

| Materials—1.1% | |||

| Ecolab, Inc. | 43,336 | 9,041 | |

| Total Common Stocks (Identified Cost $233,344) | 795,805 | ||

| Total Long-Term Investments—98.7% (Identified Cost $233,344) | 795,805 | ||

| Shares | Value | ||

| Short-Term Investment—1.4% | |||

| Money Market Mutual Fund—1.4% | |||

| Dreyfus Government Cash Management Fund - Institutional Shares (seven-day effective yield 0.030%)(2) | 11,388,998 | $ 11,389 | |

| Total Short-Term Investment (Identified Cost $11,389) | 11,389 | ||

| TOTAL INVESTMENTS—100.1% (Identified Cost $244,733) | $807,194 | ||

| Other assets and liabilities, net—(0.1)% | (854) | ||

| NET ASSETS—100.0% | $806,340 | ||

| Abbreviation: | |

| ADR | American Depositary Receipt |

| Footnote Legend: | |

| (1) | Non-income producing. |

| (2) | Shares of this fund are publicly offered, and its prospectus and annual report are publicly available. |

| Country Weightings (Unaudited)† | |

| United States | 92% |

| China | 5 |

| Brazil | 3 |

| Total | 100% |

| ��� % of total investments as of September 30, 2021. | |

| Total Value at September 30, 2021 | Level 1 Quoted Prices | ||

| Assets: | |||

| Equity Securities: | |||

| Common Stocks | $795,805 | $795,805 | |

| Money Market Mutual Fund | 11,389 | 11,389 | |

| Total Investments | $807,194 | $807,194 |

| Shares | Value | ||

| Common Stocks—98.4% | |||

| Communication Services—8.3% | |||

| Omnicom Group, Inc. | 74,250 | $ 5,380 | |

| Verizon Communications, Inc. | 114,753 | 6,198 | |

| 11,578 | |||

| Consumer Discretionary—5.7% | |||

| Home Depot, Inc. (The) | 4,618 | 1,516 | |

| Leggett & Platt, Inc. | 108,350 | 4,858 | |

| McDonald’s Corp. | 6,420 | 1,548 | |

| 7,922 | |||

| Consumer Staples—13.2% | |||

| Clorox Co. (The) | 5,560 | 921 | |

| Coca-Cola Co. (The) | 69,740 | 3,659 | |

| Kellogg Co. | 66,950 | 4,279 | |

| Kimberly-Clark Corp. | 33,313 | 4,412 | |

| PepsiCo, Inc. | 24,680 | 3,712 | |

| Procter & Gamble Co. (The) | 10,690 | 1,495 | |

| 18,478 | |||

| Financials—16.6% | |||

| Bank of Hawaii Corp. | 69,419 | 5,704 | |

| PNC Financial Services Group, Inc. (The) | 41,142 | 8,049 | |

| U.S. Bancorp | 63,625 | 3,782 | |

| Zurich Insurance Group AG ADR(1) | 140,065 | 5,751 | |

| 23,286 | |||

| Health Care—11.2% | |||

| Johnson & Johnson | 8,503 | 1,373 | |

| Merck & Co., Inc. | 41,630 | 3,127 | |

| Patterson Cos., Inc. | 185,350 | 5,586 | |

| Pfizer, Inc. | 130,780 | 5,625 | |

| 15,711 | |||

| Industrials—12.9% | |||

| BAE Systems plc Sponsored ADR(1) | 168,578 | 5,154 | |

| MSC Industrial Direct Co., Inc. Class A | 71,008 | 5,694 | |

| Snap-on, Inc. | 6,453 | 1,348 | |

| Watsco, Inc. | 22,133 | 5,857 | |

| 18,053 | |||

| Shares | Value | ||

| Information Technology—11.6% | |||

| Analog Devices, Inc. | 9,196 | $ 1,540 | |

| Cisco Systems, Inc. | 101,770 | 5,540 | |

| International Business Machines Corp. | 45,100 | 6,266 | |

| Paychex, Inc. | 25,506 | 2,868 | |

| 16,214 | |||

| Materials—8.3% | |||

| Amcor plc | 438,674 | 5,084 | |

| Eastman Chemical Co. | 39,719 | 4,001 | |

| Sonoco Products Co. | 42,606 | 2,539 | |

| 11,624 | |||

| Real Estate—1.6% | |||

| Crown Castle International Corp. | 12,820 | 2,222 | |

| Utilities—9.0% | |||

| Fortis, Inc. | 81,700 | 3,622 | |

| NextEra Energy, Inc. | 34,310 | 2,694 | |

| Southern Co. (The) | 69,040 | 4,278 | |

| WEC Energy Group, Inc. | 22,030 | 1,943 | |

| 12,537 | |||

| Total Common Stocks (Identified Cost $120,110) | 137,625 | ||

| Total Long-Term Investments—98.4% (Identified Cost $120,110) | 137,625 | ||

| Short-Term Investment—1.4% | |||

| Money Market Mutual Fund—1.4% | |||

| Dreyfus Government Cash Management Fund - Institutional Shares (seven-day effective yield 0.030%)(2) | 2,005,646 | 2,006 | |

| Total Short-Term Investment (Identified Cost $2,006) | 2,006 | ||

| Shares | Value | ||

| Securities Lending Collateral—1.4% | |||

| Dreyfus Government Cash Management Fund - Institutional Shares (seven-day effective yield 0.030%)(2)(3) | 1,905,030 | $ 1,905 | |

| Total Securities Lending Collateral (Identified Cost $1,905) | 1,905 | ||

| TOTAL INVESTMENTS—101.2% (Identified Cost $124,021) | $141,536 | ||

| Other assets and liabilities, net—(1.2)% | (1,734) | ||

| NET ASSETS—100.0% | $139,802 | ||

| Abbreviation: | |

| ADR | American Depositary Receipt |

| Footnote Legend: | |

| (1) | All or a portion of security is on loan. |

| (2) | Shares of this fund are publicly offered, and its prospectus and annual report are publicly available. |

| (3) | Represents security purchased with cash collateral received for securities on loan. |

| Country Weightings (Unaudited)† | |

| United States | 86% |

| Switzerland | 4 |

| United Kingdom | 4 |

| Jersey | 4 |

| Canada | 2 |

| Total | 100% |

| † % of total investments as of September 30, 2021. | |

| Total Value at September 30, 2021 | Level 1 Quoted Prices | ||

| Assets: | |||

| Equity Securities: | |||

| Common Stocks | $137,625 | $137,625 | |

| Securities Lending Collateral | 1,905 | 1,905 | |

| Money Market Mutual Fund | 2,006 | 2,006 | |

| Total Investments | $141,536 | $141,536 |

| Shares | Value | ||

| Common Stocks—98.1% | |||

| Communication Services—18.6% | |||

| BCE, Inc. | 38,938 | $ 1,949 | |

| Omnicom Group, Inc. | 16,214 | 1,175 | |