BMC FUND, INC.

FINANCIAL STATEMENTS AND

SUPPLEMENTARY INFORMATION

Year Ended October 31, 2009

TABLE OF CONTENTS

Page No.

| Letter to Shareholders – Management’s Discussion of Fund Performance | | 1 |

| | | |

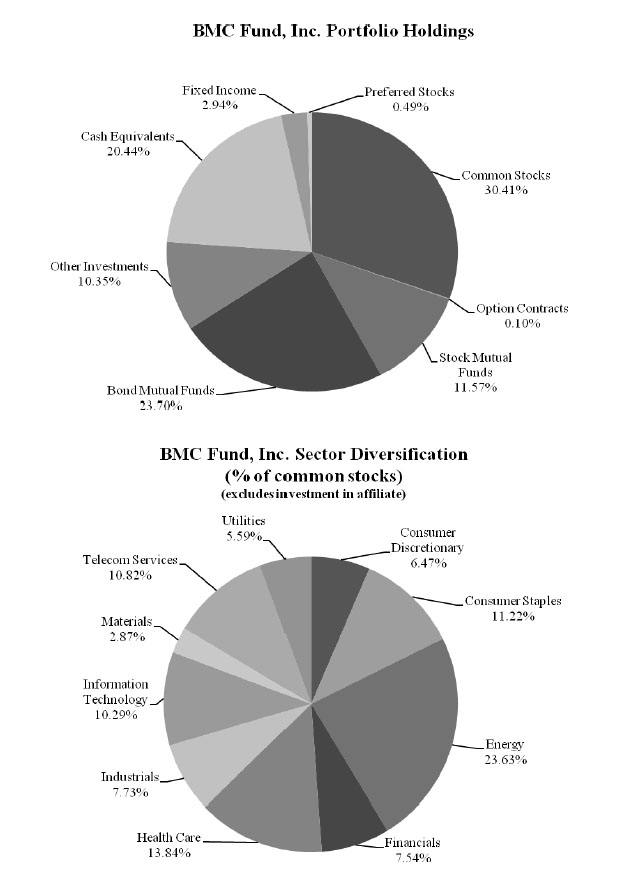

| Graphic Presentation of Portfolio Holdings and Sector Diversification | | 3 |

| | | |

| Federal Income Tax Information | | 4 |

| | | |

| Supplemental Information | | 4 |

| | | |

| Report of Independent Registered Public Accounting Firm | | 5 |

| | | |

| Statement of Assets and Liabilities | | 6 |

| | | |

| Statement of Operations | | 7 |

| | | |

| Statements of Changes In Net Assets | | 8 |

| | | |

| Notes to Financial Statements | | 9 |

| | | |

| Directors and Officers | | 17 |

| | | |

| Additional Information | | 21 |

| | | |

| Financial Highlights | | 22 |

| | | |

| Schedule of Investments | | 23 |

| | | |

| Schedule of Open Written Option Contracts | | 35 |

TO OUR SHAREHOLDERS: MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

What a difference a year makes! After one of the worst declines in market history, equities bounced back with a vengeance across the globe, driven by unprecedented monetary and fiscal stimulus from policymakers worldwide. For the twelve months ending October 31, 2009, BMC Fund, Inc. (the “Fund”) appreciated 14.8%, a full 5% better than the S&P 500 with a significantly lower risk profile and lower realized volatility.

As we believed that markets began a “bottoming process” in October of last year, we began our own fiscal year conservatively positioned across four major asset classes: global equities, fixed income, alternative investments, and cash equivalents. Extreme levels of volatility at the time provided us with a tremendous opportunity to enhance income for our shareholders by selling options. Specifically, by selling put options on various indices and high quality equities, we were paid a handsome premium for holding ourselves out as willing buyers at levels that we considered very attractive prices. This strategy generated significant income for the Fund over the course of the year, but did not result in an increased allocation to stocks, as global central bank efforts to reflate asset prices arrested the free fall in risk assets and prevented what may have been The Great Depression 2.0.

Despite enjoying remarkable rebound since the March low valuations, we remain cautious on the future. Government regulation, borrowing and money printing cannot bode well for the economy long term.

Importantly, our cautious stance is not dependent upon a particularly dire “macro forecast” as risk clearly outweighs reward at today’s valuations, even assuming a “normal” post-war recovery and benign economic environment. While stocks are “cheap” compared to record overvaluations of 2000 and 2007 (and well off the highs reached in those periods), markets are still overvalued to a level from which uninspiring long-term returns have always followed.

Our long term objectives remain the same, despite dramatic changes in the investment landscape over the years. We believe our focus on capital preservation and consistent growth and income will serve our shareholders well despite the increased risk levels associated with the journey towards a “new normal.” Against this backdrop, we are particularly excited about the prospect for high quality equities in the years ahead. Many of the strongest franchises around the globe today trade at valuations not seen in decades, despite their pristine balance sheets, consistent return on capital and ongoing earnings growth. As this year’s liquidity-driven junk rally left quality stocks at the starting gate, high-quality equities simply look cheap, and are priced to deliver near double digit excess returns over their lower-quality brethren.

As Seth Klarman reminds us, The best investors do not target return; they focus first on risk, and only then decide whether the projected return justifies taking each particular risk. We like the idea of owning quality in the “new normal” given the risks associated with extended periods of deleveraging. In the long run, high quality stocks have proven to be the one “free lunch” offered by Mr. Market – superior risk-adjusted returns.

During the year ended October 31, 2009, the Fund paid the following dividends per share:

| December 10, 2008 to shareholders of record November 25, 2008 | | $ | 1.12 | |

| March 10, 2009 to shareholders of record February 25, 2009 | | | .25 | |

| June 10, 2009 to shareholders of record May 25, 2009 | | | .15 | |

| September 10, 2009 to shareholders of record August 31, 2009 | | | .20 | |

| | | | | |

| Total | | $ | 1.72 | |

The Fund paid a dividend of $0.20 per share on December 10, 2009 to shareholders of record November 25, 2009.

The attached Schedule of Investments is a listing of the entire Fund’s diversified securities at October 31, 2009 with a total market value of $105,257,784.

Paul H. Broyhill, Chairman and

Chief Executive Officer

M. Hunt Broyhill, President

FEDERAL INCOME TAX INFORMATION

We are required by the Internal Revenue Code to advise you within 60 days of the Fund’s fiscal year end (October 31, 2009) as to the federal tax status of dividends paid by the Fund during such fiscal year. Accordingly, we are advising you that during the year ended October 31, 2009, the Fund paid distributions to its shareholders totaling $1.72 per share, comprised of $.77 per share ordinary income and $.95 retained earnings prior to becoming an investment company which are taxable as ordinary income. The shareholders are furnished a Form 1099 in January of each year, which details the federal tax status of dividends paid by the Fund during the calendar year. There were no undistributed capital gains during the fiscal year.

SUPPLEMENTAL INFORMATION

Paul H. Broyhill, Chairman and Chief Executive Officer, Michael G. Landry, Vice President and Chief Investment Officer, M. Hunt Broyhill, President, Christopher R. Pavese, CFA, Managing Director, and Dan J. Wakin, Managing Director – Alternative Investments, are primarily responsible for the day-to-day management of the Fund’s portfolio. Mr. Paul Broyhill has had such responsibility since the inception of the Fund. Messrs. Landry and Hunt Broyhill have had such responsibility since 2001. Messrs. Landry and Hunt Broyhill have been engaged in asset management for various institutions and high net worth individuals for more than five years. Prior to joining the Fund on March 1, 2005, Mr. Pavese was a Vice President and Portfolio Manager at JPMorgan Private Bank from January 1999 until February 2005. At JPMorgan, Mr. Pavese was engaged in asset management, portfolio strategy, and asset allocation for high net worth individuals, personal trusts, endowments and foundations. Mr. Wakin has had such responsibility since February 2006, and has served the Fund in other capacities since 1995.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Shareholders of BMC Fund, Inc.

We have audited the accompanying statement of assets and liabilities of the BMC Fund, Inc. (the “Company”), including the schedules of investments, as of October 31, 2009 and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the years ended October 31, 2009, 2008, 2007, 2006, 2005, 2004, and 2003, and the seven months ended October 31, 2002, and the years ended March 31, 2002, and 2001. These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the year ended March 31, 2000, were audited by other auditors whose report dated May 19, 2000, expressed an unqualified opinion on the financial highlights for that year.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2009 by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

As explained in note 2, the financial statements include investments valued at $11,406,675 (10.9 percent of net assets), whose fair values have been estimated by management in the absence of readily determinable fair values. Management’s estimates are based upon information provided by the Fund’s managers or the general partners.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of BMC Fund, Inc. as of October 31, 2009, the results of its operations for the year then ended, the changes in its net assets for the each of the two years in the period then ended, and the financial highlights for each of the years ended October 31, 2009, 2008, 2007, 2006, 2005, 2004, and 2003, and the seven months ended October 31, 2002, and the years ended March 31, 2002, and 2001, in conformity with accounting principles generally accepted in the United States of America.

Charlotte, North Carolina

December 23, 2009

BMC FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2009

| ASSETS AT MARKET VALUE: | | | |

| Investment securities (cost - $109,969,667) | | $ | 104,731,153 | |

| Investments in affiliate - wholly owned subsidiary (equity value $484,798) | | | 526,631 | |

| Cash and short-term investments | | | 108,363 | |

| Receivables, accrued interest and dividends | | | 153,439 | |

| Other assets | | | 36,388 | |

| | | | | |

| Total assets | | | 105,555,974 | |

| | | | | |

| LIABILITIES: | | | | |

| Call options written, at fair value (premiums received $130,848) | | | 89,935 | |

| Payable to broker | | | 765,910 | |

| Accounts payable and accrued expenses | | | 6,807 | |

| Accounts payable to affiliates | | | 90,633 | |

| | | | | |

| Total liabilities | | | 953,285 | |

| | | | | |

| NET ASSETS AT OCTOBER 31, 2009 - EQUIVALENT TO $21.20 PER | | | | |

| SHARE ON 4,933,281 SHARES OF COMMON STOCK OUTSTANDING | | $ | 104,602,689 | |

| | | | | |

| SUMMARY OF SHAREHOLDERS' EQUITY: | | | | |

| Common stock, par value $5.00 per share - authorized 70,000,000 shares; | | | | |

| outstanding, 4,933,281 shares | | $ | 24,666,405 | |

| Retained earnings prior to becoming investment company | | | 80,136,113 | |

| Undistributed net investment income | | | 377,544 | |

| Realized loss on investments | | | (616,319 | ) |

| Undistributed nontaxable gain | | | 5,194,714 | |

| Unrealized depreciation of investments | | | (5,155,768 | ) |

| | | | | |

| NET ASSETS APPLICABLE TO COMMON STOCK OUTSTANDING | | $ | 104,602,689 | |

See accompanying notes to financial statements.

BMC FUND, INC.

STATEMENT OF OPERATIONS

Year Ended October 31, 2009

| INVESTMENT INCOME: | | | |

| Income: | | | |

| Interest - fixed income | | $ | 182,934 | |

| Other interest and dividends | | | 3,479,908 | |

| Equity in losses of wholly-owned subsidiary | | | (91,170 | ) |

| | | | | |

| Total income | | | 3,571,672 | |

| | | | | |

| Expenses: | | | | |

| Legal and professional fees | | | 67,358 | |

| Directors' fees (Note 8) | | | 61,000 | |

| Investment expense | | | 108,372 | |

| Salaries | | | 612,394 | |

| Property and liability insurance | | | 59,611 | |

| Depreciation expense | | | 4,466 | |

| Taxes and licenses | | | 109,666 | |

| Rent | | | 42,772 | |

| Office supplies and expense | | | 38,433 | |

| Dues and subscriptions | | | 62,949 | |

| Travel and entertainment | | | 12,184 | |

| | | | | |

| Total expenses | | | 1,179,205 | |

| | | | | |

| Investment income, net | | | 2,392,467 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | | |

| Realized gain from investments sold - net | | | 319,550 | |

| Unrealized appreciation of investments for the period - net | | | 7,801,751 | |

| | | | | |

| Net gain on investments | | | 8,121,301 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 10,513,768 | |

See accompanying notes to financial statements.

BMC FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

Years Ended October 31, 2009 and 2008

| | | 2009 | | | 2008 | |

| | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | |

| Investment income, net | | $ | 2,392,467 | | | $ | 3,578,112 | |

| Realized gains (losses) from investment securities sold - net | | | 319,550 | | | | (935,869 | ) |

| Unrealized appreciation (depreciation) of investments for the year - net | | | 7,801,751 | | | | (53,225,219 | ) |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | | 10,513,768 | | | | (50,582,976 | ) |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net realized gain on investment securities | | | - | | | | (7,018,329 | ) |

| Net investment income | | | (4,552,385 | ) | | | (5,117,542 | ) |

| Retained earnings prior to becoming an investment company | | | (3,932,858 | ) | | | - | |

| P. B. Realty, Inc. spin off | | | - | | | | (13,681,803 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 2,028,525 | | | | (76,400,650 | ) |

| | | | | | | | | |

| NET ASSETS AT BEGINNING OF YEAR | | | 102,574,164 | | | | 178,974,814 | |

| | | | | | | | | |

| NET ASSETS AT END OF YEAR (Including undistributed net investment income: 2009 - $377,544; 2008 - $2,537,462) | | $ | 104,602,689 | | | $ | 102,574,164 | |

See accompanying notes to financial statements.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2009

BMC Fund, Inc. (the “Company”) is a closed-end, diversified investment company registered under the Investment Company Act of 1940, as amended. Prior to becoming a regulated investment company on April 1, 1981, BMC Fund, Inc. operated as a regular corporation. The following is a summary of significant accounting policies followed by the Company in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles for investment companies.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

A. Investment Valuations – The investment securities are stated at market value as determined by closing prices on national securities exchanges. Investment securities include corporate bonds, mutual funds, and common and preferred stocks.

The investments in limited partnerships, other investments and venture capital are stated at estimated fair value as determined by the management of these investments and are approved by the Company’s Valuation Committee after giving consideration to historical and projected financial results, economic conditions, financial condition of investee and other factors and events subject to change, and ratified by the Company’s Board of Directors. Because of the inherent uncertainty of those valuations, the estimated values may differ significantly from the values that would have been used had a ready market value for the investments existed, and these differences could be material.

The carrying value of the investment in the wholly owned subsidiary is based on independent appraisals and internal assessments of the fair market values of the subsidiary’s underlying investments. Equity in earnings of the wholly owned subsidiary in the statement of operations represents the current year earnings of the subsidiary accounted for using the equity method.

B. Investment Transactions – Investment transactions are accounted for on the date the order to buy or sell is executed. Realized gains and losses on investments are determined on the basis of specific identification of issues sold or matured. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Discounts and premiums on securities purchased are amortized over the lives of the respective securities.

For the year ended October 31, 2009, the Company purchased and sold securities in the amount of $80,605,191 and $58,528,889 (excluding short-term investments and options), respectively.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2009

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

C. Option Writing – When the Company writes an option, an amount equal to the premium received by the Company is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Company on the expiration date as realized gains from investments. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether the Company has realized a gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Company. The Company as writer of an option bears the market risk of an unfavorable change in the price of the security underlying the written option.

D. Income Taxes – No federal tax provision is required as it is the Company’s policy to comply with the provisions of Subchapter M of the Internal Revenue Code of 1954, as amended, including the distribution to its shareholders of substantially all of its income and any capital gains not offset by capital losses. Also, no state income tax provision has been provided because the states in which the Company has income recognize the tax exempt status of a regulated investment company.

E. Dividend Policy – It is the Company’s policy to pay dividends during the year in sufficient amounts to meet the requirements to maintain its status as a regulated investment company.

F. Cash and Short-Term Investments – For purposes of financial reporting, the Company considers all investments at financial institutions with original maturities of three months or less to be equivalent to cash. Short-term money market investments managed by third party investors are included in investment securities.

G. Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

H. Fair Value Measurements – The Company applies a three-tier hierarchy to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2009

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Company’s investments as of the reporting period end. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy:

Level 1 – Quoted prices in active markets for identical investments

Level 2 – Other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – Significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments)

The following is a summary of the inputs used to value the Company’s investments as of October 31, 2009.

Asset Description | | Quoted Prices in Active Markets for Identical Assets (Level 1) | | | Significant Other Observable Inputs (Level 2) | | | Significant Unobservable Inputs (Level 3) | | | Total | |

| Fixed Income | | $ | 3,097,204 | | | $ | - | | | $ | - | | | $ | 3,097,204 | |

| Mutual Funds | | | | | | | | | | | | | | | | |

| Bond Mutual Funds | | | 24,925,360 | | | | - | | | | - | | | | 24,925,360 | |

| Stock Mutual Funds | | | 12,174,218 | | | | - | | | | - | | | | 12,174,218 | |

| Other Investments | | | | | | | | | | | | | | | | |

| Limited Partnerships | | | - | | | | - | | | | 10,880,044 | | | | 10,880,044 | |

| Warrants | | | 438 | | | | - | | | | - | | | | 438 | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Common Stocks – Publicly Traded | | | 31,456,688 | | | | - | | | | - | | | | 31,456,688 | |

| Common Stocks – Affiliate | | | - | | | | - | | | | 526,631 | | | | 526,631 | |

| Call Options | | | (11,935 | ) | | | - | | | | - | | | | (11,935 | ) |

| Put Options | | | 116,500 | | | | - | | | | - | | | | 116,500 | |

| Preferred Stocks | | | 510,300 | | | | - | | | | - | | | | 510,300 | |

| Short-term Investments | | | 21,492,401 | | | | - | | | | - | | | | 21,492,401 | |

| Total Investments | | $ | 93,761,174 | | | $ | - | | | $ | 11,406,675 | | | $ | 105,167,849 | |

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2009

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

The table below presents a reconciliation for the year ended October 31, 2009, for all Level 3 assets that are measured at fair value on a recurring basis.

| | | Fair Value Measurement Using Significant Unobservable Inputs | |

Balance at October 31, 2008 | | $ | 12,126,307 | |

| Purchases | | | 3,500,000 | |

| Sales | | | (4,344,060 | ) |

| Total realized and unrealized gains or losses | | | 124,428 | |

Balance at October 31, 2009 | | $ | 11,406,675 | |

| 3. | UNREALIZED APPRECIATION AND DEPRECIATION ON INVESTMENTS |

(tax basis)

The amount of net unrealized appreciation (depreciation) and the cost of investment securities for tax purposes, including short-term securities as October 31, 2009, were as follows:

| Gross appreciation (excess of value over tax cost) | | $ | 7,832,169 | |

| Gross depreciation (excess of tax cost over value) | | | (12,987,937 | ) |

| Net unrealized depreciation | | $ | (5,155,768 | ) |

| Cost of investments for income tax purposes | | $ | 110,323,617 | |

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2009

| 4. | INVESTMENT IN AFFILIATE |

| | Under Section 2(a)(3) of the Investment Company Act of 1940, a portfolio company is defined as “affiliated” if a fund owns five percent or more of its voting stock. The Company held at least five percent of the outstanding voting stock of the following company during the period ended October 31, 2009. |

| Issuer | | Number of Shares Held 10/31/09 | | | | | | | | | | |

| | | | | | | | | | | | | |

| Broyhill Industries, Inc. – Wholly-owned subsidiary | | | 1,000 | | | $ | (91,170 | ) | | $ | - | | | $ | 526,631 | |

| (1) | All of the dividends received by BMC Fund, Inc. from its wholly owned subsidiary have been credited to the investment account since BMC Fund, Inc. is accounting for its investment in the subsidiary company on the equity method. |

As of October 31, 2009, portfolio securities valued at $2,294,525 were held in escrow by the custodian as cover for call options written by the Company.

Transactions in options written during the year ended October 31, 2009 were as follows:

| | | Number of Contracts | | | Premiums Received | |

| Options outstanding at October 31, 2008 | | | - | | | $ | - | |

| Options written | | | 31,275 | | | | 4,172,296 | |

| Options terminated in closing purchase transactions | | | (4,704 | ) | | | (1,113,791 | ) |

| Options expired | | | (23,625 | ) | | | (2,609,257 | ) |

| Options exercised | | | (2,476 | ) | | | (318,400 | ) |

| Options outstanding at October 31, 2009 | | | 470 | | | $ | 130,848 | |

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2009

| 6. | DISTRIBUTIONS TO SHAREHOLDERS |

Classifications of distributions, net investment income/(loss) and net realized gain/(loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Company.

On December 10, 2008, a distribution of $1.12 per share was paid to shareholders of record on November 25, 2008.

On March 10, 2009, a distribution of $0.25 was paid to shareholders of record on February 25, 2009.

On June 10, 2009, a distribution of $0.15 was paid to shareholders of record on May 25, 2009.

On September 10, 2009, a distribution of $.20 per share was paid to shareholders of record on August 31, 2009.

The Company conducted a spin-off of P. B. Realty, Inc. effective October 31, 2008, the amount below reflects the tax value of the units distributed.

The tax character of distributions paid during 2009 and 2008 was as follows:

| | | 2009 | | | 2008 | |

| Distributions paid from: | | | | | | |

| Ordinary income | | $ | 3,794,348 | | | $ | 4,306,882 | |

| Long-term capital gains | | | - | | | | 7,471,580 | |

| P. B. Realty spin off | | | - | | | | 18,771,472 | |

| Retained earnings prior to becoming an investment company | | | 4,690,895 | | | | 357,409 | |

| | | $ | 8,485,243 | | | $ | 30,907,343 | |

As of October 31, 2009, there were no components of distributable earnings on a tax basis.

The tax components of distributable earnings are determined in accordance with income tax regulations, which may differ from composition of net assets reported under generally accepted accounting principles. The difference for the period ended October 31, 2009 reflects $377,544 of undistributed net investment income under generally accepted accounting principles.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2009

| 7. | NEW ACCOUNTING STANDARDS |

In June 2009, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (“ASU”) 2009-01, an update to the accounting standards for Generally Accepted Accounting Principles, - amendments based on The FASB Accounting Standards CodificationTM and the Hierarchy of Generally Accepted Accounting Principles. The Codification became the source of authoritative United States Generally Accepted Accounting Principles recognized by the FASB to be applied by nongovernmental entities and supersedes all non-SEC accounting and reporting standards. This update is effective for financial statements issued for interim and annual financial statements ending after September 15, 2009. The Company adopted this update during the fourth quarter of 2009, and the adoption did not have a material effect on the financial statements.

In September 2009, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (“ASU”) 2009-12, Fair Value Measurements and Disclosures which addresses investments in certain entities that calculate net asset value per share and is effective for interim and annual periods ending after December 15, 2009. The Company plans to adopt the ASU 2009-12 during the first quarter of 2010 and believes that is will not have a material effect on the financial statements.

On February 27, 2009, the Company entered into an agreement with a bank for an unsecured line of credit in the amount of $5,000,000 to provide the Company more flexibility in its payment of dividends and management of its investments. The interest rate on any borrowings is at the one month LIBOR market index rate plus 150 basis points. The Company will pay a commitment fee of 25 basis points on any unused balance. As of October 31, 2009, the Company had no borrowings from this line of credit, which expires on March 31, 2010.

| 9. | ADVISORY BOARD AND REMUNERATION OF DIRECTORS |

The Company does not have an advisory board. The independent directors are paid an annual fee of $3,000 plus $1,000 for each meeting attended in person or $500 cash for each meeting attended by telephone. Each such independent director is paid an additional $1,000 for each day attending a committee meeting in person or $500 by telephone other than on the date of a board meeting. In addition, all directors are reimbursed for their reasonable expenses incurred in attending meetings.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2009

The Company owns one wholly-owned subsidiary, Broyhill Industries, Inc. During the year, the Fund contributed an additional $10,000 of capital to Broyhill Industries, Inc.

The Company leases office space from Broyhill Investments, Inc., which is controlled by Paul H. Broyhill and M. Hunt Broyhill, both officers of BMC Fund, Inc. The expense associated with this related party lease for the year ended October 31, 2009 amounted to $42,773. Broyhill Investments, Inc. also acts as a common paymaster for payroll and other shared services. This service is provided at no cost to the Company. All amounts paid by Broyhill Investments, Inc. on behalf of the Company are reimbursed by the Company. The outstanding payable related to these transactions at October 31, 2009 was $90,633.

Selected securities at the end of the year have significant investment impairment issues. These selected securities have an aggregate cost basis of $8,001,109 and have been assigned no value at October 31, 2009.

| 12. | REVIEW FOR SUBSEQUENT EVENTS |

In connection with the preparation of the financial statements of the Company as of and for the year ended October 31, 2009, events and transactions subsequent to October 31, 2009 through December 23, 2009 the date the financial statements were issued, have been evaluated by the Company’s management for possible adjustment and/or disclosure. Management has not identified any subsequent events requiring financial statement disclosure as of the date these financial statements were issued.

BMC FUND, INC.

DIRECTORS AND OFFICERS

Year Ended October 31, 2009 (Unaudited)

The following table provides information about the directors and the officers of the Fund:

| Directors Who Are Interested Persons |

Name, Address and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past 5 Years | | Other Directorships Held

by Director |

James T. Broyhill (82) 1930 Virginia Road Winston-Salem, NC 27104 | | Director Vice Chairman | | Since 1976 Since 2005 | | Retired; Director of Shepherd Street Equity Fund (1998-2008); Vice President of Old Clemmons School Properties, Inc. (2006-present); President of Old Clemmons School Properties, Inc. (1998-2006); former Secretary of the North Carolina Department of Commerce (1989-1991); former Chairman of the North Carolina Economic Development Board (1987-1989); former member, U. S. Senate (1986); former member, U.S. House of Representatives (1963-1986) | | None |

| | | | | | | | | |

M. Hunt Broyhill (45) 1870 9th Street Court, NW Hickory, NC 28601 | | Director President Vice President | | Since 2008 Since 2007 2001-2007 | | President of the Fund since February 2007; former Vice President of the Fund (2001-2007); Chief Executive of Broyhill Affinity Fund, LLC (2008-present), Broyhill Asset Management, LLC and Broyhill Wakin General Partners, LLC (1997-present); Director and President of Broyhill Investments, Inc. (1988-present); Director (1983-present) and President of Broyhill Family Foundation, Inc. (1988-present); General Partner of CapitalSouth Partners Fund I, LP and Capital South Partners Fund II, LP (2000-present); General Partner of CapitalSouth Partners Fund III, LP (2007-present); Senior Managing Partner and Director of Flagship Capital Partners, LLC (2007-present); Manager and Vice President of P. B. Realty, LLC (formerly P. B. Realty, Inc.) (1995-present) | | None |

BMC FUND, INC.

DIRECTORS AND OFFICERS

Year Ended October 31, 2009 (Unaudited)

| Directors Who Are Interested Persons |

Name, Address and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past 5 Years | | Other Directorships Held

by Director |

Paul H. Broyhill (85) 135 Claron Place, S.E. Lenoir, NC 28645 | | Director Chief Executive Officer Chairman | | Since 1976 Since 2001 Since 1976 | | Director, Chairman and Chief Executive Officer of the Fund; former President of the Fund (2001-2007); Director (1972-present) and Chairman of Broyhill Investments, Inc. (1988-present); Director (1946-present) and Chairman of Broyhill Family Foundation, Inc. (1989-present); former President of Broyhill Family Foundation, Inc. (1980-1988); Manager and President of P. B. Realty, LLC (formerly P. B. Realty, Inc.) (1983-present) | | None |

| | | | | | | | | |

Jan E. Gordon (58) 3075 Rolling Woods Drive Palm Harbor, FL 34683 | | Director | | Since 2001 | | Retired; former election assistant, Pinellas County, FL Supervisor of Elections (1992-2005) | | None |

| | | | | | | | | |

Michael G. Landry (63) 2501 Barcelona Drive Ft. Lauderdale, FL 33301 | | Director Vice President and Chief Investment Officer | | Since 1993 Since 2001 | | Director; Vice President and Chief Investment Officer of the Fund (2001-present); Investment Committee Chairman, Hudson Fairfax India Fund (2006-2008); CEO of Mackenzie Investment Management, Inc., Chairman of Ivy Funds and Executive Vice President of Mackenzie Financial Fund (1987-1999) | | None |

| | | | | | | | | |

Allene B. Stevens (87) 153 Hillhaven Place SE Lenoir, NC 28645 | | Director | | Since 1983 | | Private Investor | | |

BMC FUND, INC.

DIRECTORS AND OFFICERS

Year Ended October 31, 2009 (Unaudited)

| Directors Who Are Not Interested Persons |

Name, Address and Age | | Positions Held with Fund | | Term of Office and Length of Time Served | | Principal Occupation During Past 5 Years | | Other Directorships Held

by Director |

R. Donald Farmer (62) 273 Leeward Point Loop Taylorsville, NC 28681 | | Director | | Since 2008 | | President of Don Farmer, CPA, PA, an independent public accounting firm and producer of federal income tax seminars and seminar materials (1984-present) | | None |

| | | | | | | | | |

Robert G. Fox, Jr. (60) 6525 Robin Hollow Drive Charlotte, NC 28227 | | Director | | Since 2008 | | President and Chief Banking Officer of NewDominion Bank (2005-present); Executive Vice President of First Charter Bank/First Charter Corporation (1993-2005) | | None |

| | | | | | | | | |

Gene A. Hoots (70) 3524 Kylemore Court Charlotte, NC 28210 | | Director | | Since 1987 | | Chairman Emeritus, CornerCap Investment Counsel, a registered investment adviser serving private and pension fund clients (since 2001) | | None |

| | | | | | | | | |

Brent B. Kincaid (78) 2703 Lakeview Drive Lenoir, NC 28645 | | Director | | Since 2005 | | Retired since 1998; former President and CEO of Broyhill Furniture Industries, Inc. | | None |

| | | | | | | | | |

John S. Little (78) 4601 Gulf Shore Blvd. N. #18 Naples, FL 34103 | | Director | | Since 2001 | | Retired; former Managing Director and Chief Executive, Associated Octel, London (1989-1995); former Senior Vice President of Corporate Technology, Great Lakes Chemical Corporation (1981-1989) | | None |

| | | | | | | | | |

L. Glenn Orr, Jr. (70) 2735 Forest Drive Winston-Salem, NC 27104 | | Director | | Since 1999 | | Managing Director, The Orr Group, an investment banking firm (since 1995) | | Highwoods Properties, Inc.; Medical Properties Trust |

BMC FUND, INC.

DIRECTORS AND OFFICERS

Year Ended October 31, 2009 (Unaudited)

Name, Address and Age | | Positions Held with Fund | | Term of Office and Length of Time Served | | Principal Occupation During Past 5 Years | | Other Directorships Held

by Officer |

Boyd C. Wilson, Jr. (57) 646 Pleasant Hill Road Lenoir, NC 28645 | | Vice President and Chief Financial Officer | | Since 2006 | | Vice President and Chief Financial Officer of the Fund since February 2006; Director (2007-present) and Executive Vice President of Broyhill Investments, Inc. (2005-present); Vice President of Broyhill Family Foundation, Inc. (2007-present); Treasurer of Broyhill Wakin General Partners, LLC (2008-present); Manager and Vice President of P. B. Realty, LLC (formerly P. B. Realty, Inc.) (2006-present); Vice President – Finance & Administration of Kincaid Furniture Company, Incorporated (1990-2005) | | Bank of Granite Corporation |

| | | | | | | | | |

Carol Frye (52) 210 Beall Street Lenoir, NC 28645 | | Secretary and Treasurer | | Since 2001 | | Secretary and Treasurer of the Fund since 2001; Secretary and Treasurer of Broyhill Investments, Inc. (2000-present); Director (2001-present), Secretary and Treasurer of Broyhill Family Foundation, Inc. (2003-present); Secretary of Broyhill Wakin General Partners, LLC (1997-present); Secretary and Treasurer of P. B. Realty, LLC (formerly P. B. Realty, Inc.) (2001-present) | | None |

BMC FUND, INC.

ADDITIONAL INFORMATION

Year Ended October 31, 2009 (Unaudited)

Proxy Voting - The policies and procedures that the Fund uses to determine how to vote proxies relating to its portfolio securities are available without charge, upon request, by calling 828-758-6100; on the Fund’s website at http://www.bmcfund.com; and on the Securities and Exchange Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 828-758-6100, and on the SEC’s website at http://www.sec.gov (see Form N-PX).

Portfolio Holdings - The Fund files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Fund’s Form N-Q filings are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-202-551-8090.

BMC FUND, INC.

FINANCIAL HIGHLIGHTS

Years Ended October 31, 2009, 2008, 2007, 2006, 2005, 2004, and 2003, Seven Month Period Ended October 31, 2002, and Each of the Three Years in the Period Ended March 31, 2002

The following table presents financial information divided into three parts: per share operating performance, total investment return and ratios and supplemental data for the years ended October 31, 2009, 2008, 2007, 2006, 2005, 2004, and 2003, the seven month period ended October 31, 2002, and each of the three years in the period ended March 31, 2002. The first part, per share operating performance, details the changes on a per share basis of the Company's beginning net asset value to its ending net asset value. The second part, total investment return, is based on the market price of the Company's shares of stock. Part three, ratios and supplemental data, provides additional financial information related to the Company's performance.

Item. 2. Code of Ethics.

On July 26, 2003, the Board of Directors of the Registrant adopted a Code of Ethics for the principal executive officer and principal financial and accounting officer. The Code was amended by the Board of Directors on February 24, 2007.

(c)-(e) N/A

(f) A copy of the Code of Ethics is attached as an exhibit.

Item 3. Audit Committee Financial Expert.

The Board of Directors of the Registrant has determined that R. Donald Farmer, a member of its Audit Committee, is an audit committee financial expert. Mr. Farmer is an independent director of the Registrant.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees: $41,484.00 for the fiscal year ended October 31, 2008; $53,900.00 for the fiscal year ended October 31, 2009.

(b) Audit-Related Fees: $1,884.00 for the fiscal year ended October 31, 2008; $2,054.00 for the fiscal year ended October 31, 2009. These fees were incurred for travel-related expenses.

(c) Tax Fees: $0.00 for the fiscal year ended October 31, 2008; $0.00 for the fiscal year ended October 31, 2009. These fees were incurred for review of the tax returns.

(d) All Other Fees: $0.00 for the fiscal year ended October 31, 2008; $1,899.00 for the fiscal year ended October 31, 2009. These fees were incurred for report production and printing.

(e)(1) A copy of the Audit Committee's pre-approval policies and procedures is attached as an exhibit.

(e)(2) One hundred percent of the services described in Items 4(b) through 4(d) were approved in accordance with the Audit Committee Pre-Approval Policy. As a result, none of such services was approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) None of the hours expended on the principal accountant's engagement to audit the Registrant's financial statements for the fiscal year ended October 31, 2009 was attributed to work performed by persons other than the principal accountant's full-time, permanent employees.

(g) N/A

(h) N/A

Item 5. Audit Committee of Listed Registrants.

N/A

Item 6. Schedule of Investments.

Included as a part of the report to shareholders filed under Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The Board of Directors of the Registrant adopted Proxy Voting Policies and Procedures on July 26, 2003 and amended them October 30, 2003, April 5, 2004 and May 26, 2005. A copy as amended is attached as an exhibit.

Item 8. Portfolio Managers of Closed-End Investment Companies.

(a)(1) As of the date of filing of this report, Paul H. Broyhill, Chairman and Chief Executive Officer, Michael G. Landry, Vice President and Chief Investment Officer, M. Hunt Broyhill, President, Christopher R. Pavese, CFA, Managing Director, and Dan J. Wakin, Managing Director – Alternative Investments, are primarily responsible for the day-to-day management of the Registrant’s portfolio. Mr. Paul Broyhill has served in such capacity since the inception of the Registrant in 1982. Messrs. Landry and Hunt Broyhill have served in such capacity since 2001. Messrs. Landry and Hunt Broyhill have been engaged in asset management for various institutions and high net worth individuals for more than five years. Prior to joining the Registrant on March 1, 2005, Mr. Pavese was a Vice President and Portfolio Manager at JP Morgan Private Bank from January 1999 until February 2005. At JP Morgan, Mr. Pavese was engaged in asset management, portfolio strategy, and asset allocation for high net worth individuals, personal trusts, endowments and foundations. Mr. Wakin has served as a portfolio manager since February 2006. He has been employed by the Registrant since 1995, researching and advising management about hedge funds and other alternative investments.

(a)(2) The following tables provide information regarding registered investment companies other than the Registrant, other pooled investment vehicles, and other accounts over which the Registrant’s portfolio managers also have day-to-day management responsibilities. The tables provide the numbers of such accounts, the total assets in such accounts and the number of accounts and the total assets in the accounts with respect to which the fees are based on performance. The information is provided as of the Registrant’s fiscal year ended October 31, 2009.

Paul H. Broyhill

| | Other Registered Investment Companies | Other Pooled Investment Vehicles | Other Accounts |

Number of Accounts Managed | None | None | 5 |

Number of Accounts Managed with Performance-Based Advisory Fees | None | None | None |

| Assets Managed | $0 | $0 | $38,600,000 |

Assets Managed with Performance-Based Advisory Fees | $0 | $0 | $0 |

Michael G. Landry

| | Other Registered Investment Companies | Other Pooled Investment Vehicles | Other Accounts |

Number of Accounts Managed | None | None | 0 |

Number of Accounts Managed with Performance-Based Advisory Fees | None | None | 0 |

| Assets Managed | $0 | $0 | $0 |

Assets Managed with Performance-Based Advisory Fees | $0 | $0 | $0 |

M. Hunt Broyhill

| | Other Registered Investment Companies | Other Pooled Investment Vehicles | Other Accounts |

Number of Accounts Managed | None | 1 | 3 |

Number of Accounts Managed with Performance-Based Advisory Fees | None | None | None |

| Assets Managed | $0 | $11,000,000 | $22,300,000 |

Assets Managed with Performance-Based Advisory Fees | $0 | $11,900,000 | $0 |

Christopher R. Pavese

| | Other Registered Investment Companies | Other Pooled Investment Vehicles | Other Accounts |

Number of Accounts Managed | None | 1 | 23 |

Number of Accounts Managed with Performance-Based Advisory Fees | None | 1 | None |

| Assets Managed | $0 | $18,500,000 | $7,800,000 |

Assets Managed with Performance-Based Advisory Fees | $0 | $6,900,000 | $0 |

Dan J. Wakin

| | Other Registered Investment Companies | Other Pooled Investment Vehicles | Other Accounts |

Number of Accounts Managed | None | 1 | 40 |

Number of Accounts Managed with Performance-Based Advisory Fees | None | 1 | None |

| Assets Managed | $0 | $11,000,000 | $7,200,000 |

Assets Managed with Performance-Based Advisory Fees | $0 | $11,900,000 | $0 |

Material Conflicts of Interest

The Fund recognizes that actual or potential conflicts of interest are inherent in our business. These actual or potential conflicts may arise when a portfolio manager has day-to-day portfolio management responsibilities with respect to more than one fund or account. Certain investments may be appropriate for the Fund and also for other clients advised by the portfolio manager. Investment decisions for the Fund and other clients are made with a view to achieving their respective investment objectives and after consideration of such factors as their current holdings, availability of cash for investment and the size of their investments generally. Therein lies the possibility that a particular security could be bought or sold for the Fund and also for other clients, along with the possibility that a particular security could be bought or sold for the Fund while the opposite transaction could be occurring for other clients due to their investment strategy.

To the extent that a portfolio manager has responsibilities for managing accounts in addition to the Fund, the portfolio manager will need to divide his time and attention among relevant accounts.

The Fund also recognizes that in some cases, an actual or potential conflict may arise where a portfolio manager may have an incentive, such as a performance-based fee.

The Fund is in the process of developing written policies and procedures designed to address conflicts of interest its portfolio managers may face.

(a)(3)

Compensation Structure of Portfolio Managers

The compensation structure for each portfolio manager is based upon a fixed salary as well as a discretionary bonus determined by the senior management of the Fund. Salaries are determined by the senior management and are based upon an individual’s position and overall value to the Fund. Bonuses are also determined by management and are based upon an individual’s overall contribution to the success of the Fund and the profitability of the Fund. Salaries and bonuses for portfolio managers are not based upon criteria such as performance of the Fund or the value of assets of the Fund. Portfolio managers also have the opportunity to participate in other employee benefits available to all of the employees of the Fund.

(a)(4) The dollar range of the Registrant’s equity securities owned beneficially by the Registrant’s portfolio managers as of the Registrant’s fiscal year ended October 31, 2009 is set forth below:

| Name of Portfolio Manager | Dollar ($) Range of

Registrant’s Shares

Beneficially Owned |

| Paul H. Broyhill | Over $1,000,000 |

| Michael G. Landry | $1-$10,000 |

| M. Hunt Broyhill | Over $1,000,000 |

| Christopher R. Pavese | None |

| Dan J. Wakin | None |

(b) N/A

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

None

Item 10. Submission of Matters to a Vote of Security Holders.

N/A

Item 11. Controls and Procedures.

Within the 90 days prior to the date of this report, the Registrant's management carried out an evaluation, under the supervision and with the participation of Registrant's Chief Executive Officer and Chief Financial Officer, of the effectiveness of the Registrant's disclosure controls and procedures pursuant to Rule 30a-3(b) of the Investment Company Act of 1940. Based upon the evaluation, the Chief Executive Officer and Chief Financial Officer concluded as of a date within 90 days of the filing of this report that the Registrant's disclosure controls and procedures are effective in timely alerting them to material information relating to the Registrant required to be included in the Registrant's periodic SEC filings.

There were no significant changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the second fiscal quarter of the period covered by the report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The Registrant's Code of Ethics is attached as Exhibit 12(a)(1).

(a)(2) Certifications.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

BMC Fund, Inc.

By

/s/ Boyd C. Wilson, Jr.

Boyd C. Wilson, Jr.

Vice President and

Chief Financial Officer

Date: December 23, 2009

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By

/s/ Paul H. Broyhill

Paul H. Broyhill

President and Chief Executive Officer

Date: December 23, 2009

By

/s/ Boyd C. Wilson, Jr.

Boyd C. Wilson, Jr.

Vice President and

Chief Financial Officer

Date: December 23, 2009