UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-00215

Fidelity Hastings Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | December 31, 2022 |

Item 1.

Reports to Stockholders

Fidelity® Series Emerging Markets Debt Fund

Fidelity® Series Emerging Markets Debt Local Currency Fund

Annual Report

December 31, 2022

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended December 31, 2022 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Series Emerging Markets Debt Fund | -14.45% | -1.27% | 1.75% |

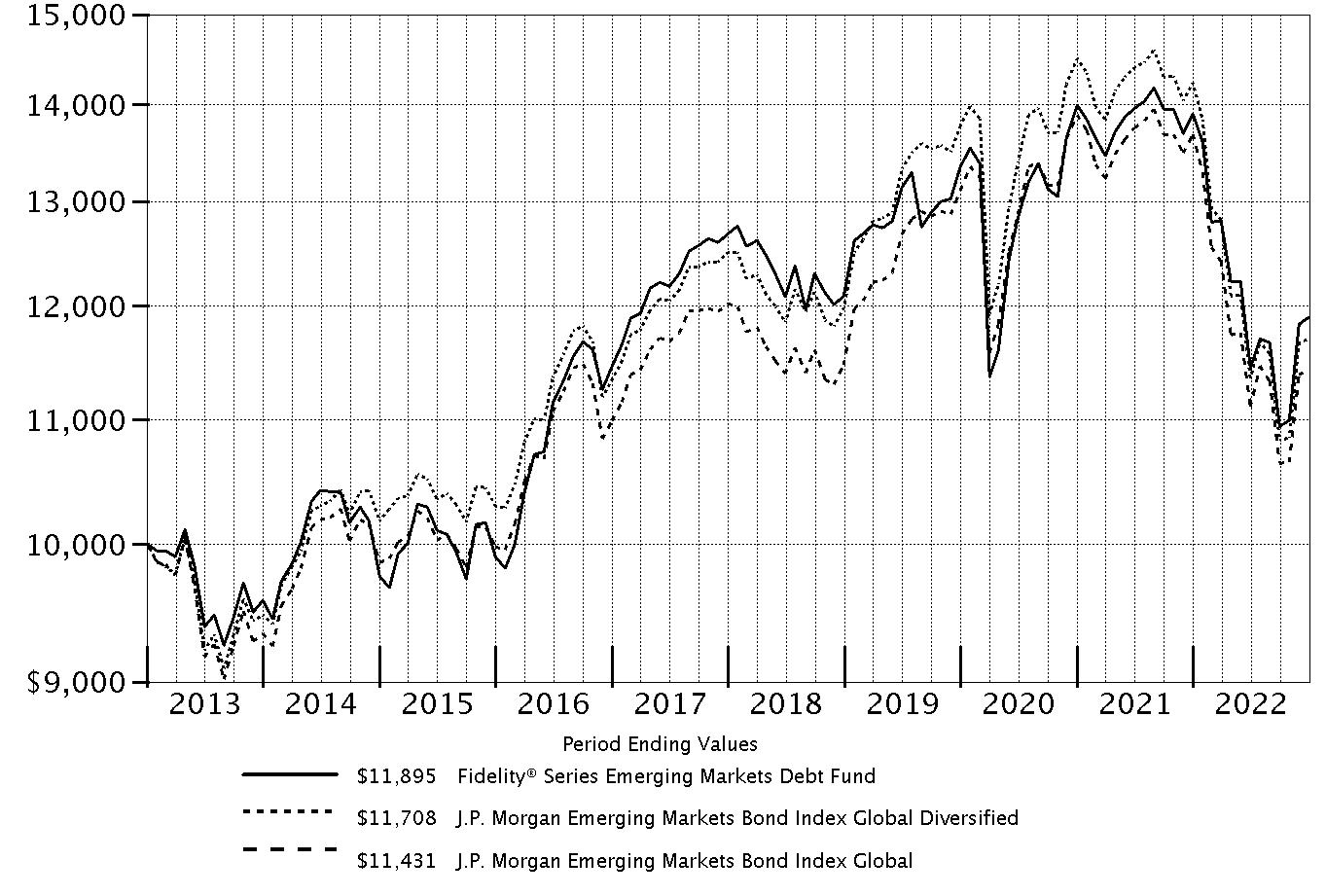

| $10,000 Over 10 Years |

| |

Let's say hypothetically that $10,000 was invested in Fidelity® Series Emerging Markets Debt Fund on December 31, 2012. The chart shows how the value of your investment would have changed, and also shows how the J.P. Morgan Emerging Markets Bond Index Global Diversified and J.P. Morgan Emerging Markets Bond Index Global performed over the same period. |

|

|

Effective October 3, 2022, the fund's benchmark changed from the J.P. Morgan Emerging Markets Bond Index Global to the J.P. Morgan Emerging Markets Bond Index Global Diversified.

Fidelity® Series Emerging Markets Debt Fund

Market Recap:

Emerging-markets debt returned -17.78% in 2022, according to the J.P. Morgan Emerging Markets Bond Index Global Diversified, as a multitude of crosscurrents challenged the global economy and financial markets. Persistently high inflation, exacerbated by energy price shocks from the Russia-Ukraine conflict, spurred the U.S. Federal Reserve to hike interest rates more aggressively than anticipated, as did central banks in other developed and emerging markets. Among other significant developments, the Chinese property market showed signs of weakness and China's zero-COVID policy created challenges for global supply chains and global economic growth. Commodity-importing countries and frontier markets were hit particularly hard by concern about recession. However, the index rallied in the final quarter of the year, as yield spreads tightened and U.S. Treasury yields stabilized amid signs of lower inflationary pressure, and China's lifting of COVID restrictions and policy stimulus raised hopes at the end of a tumultuous 2022. For the full year, investment-grade credit markets, including China (-8%), outpaced non-investment-grade countries in the index. Despite high inflation in Turkey (+3%), central bankers there cut interest rates, as currency reserves increased due to a pickup in foreign investment. Meanwhile, Russia and Belarus, which were removed from the index in March, each returned -100%. Ukraine returned roughly -77%, as the country received the permission of sovereign bondholders to delay debt payments for two years.

Comments from Co-Managers Timothy Gill and Nader Nazmi:

For the year, the fund returned -14.45%, outperforming the -17.78% result of the benchmark, the J.P. Morgan Emerging Markets Bond Index Global Diversified. Versus the benchmark, security selection more than offset negative market selection this year. The main contributor was Russia, where security selection among certain corporate bonds, which we held in lieu of sovereign and quasi-sovereign bonds, boosted relative performance. Elsewhere, our security selection in Argentina and Malaysia notably contributed to the fund's relative performance. The fund's cash position of about 3%, on average, the past 12 months significantly boosted our relative result amid the negative market backdrop. Conversely, an overweighting in Ukrainian bonds detracted, but security choices in Ukraine in shorter-maturity bonds offset some of this negative. An underweighting in China hurt because these generally higher-credit-quality bonds outpaced the benchmark. Security selection among Chinese bonds held back relative performance to a much lesser degree. Our non-benchmark stake in U.S. Treasuries, which we use from time to time as a risk-management tool and a means to increase the fund's duration, a measure of sensitivity to interest rates, also dragged on our relative result this year.

Note to shareholders:

On September 1, 2022, the fund's benchmark changed to a country-capped version of the J.P. Morgan Emerging Markets Bond Index Global, the J.P. Morgan Emerging Markets Bond Index Global Diversified.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® Series Emerging Markets Debt Fund

| Top Bond Issuers (% of Fund's net assets) |

(with maturities greater than one year) |

| Petroleos Mexicanos | 5.2 | |

| U.S. Treasury Obligations | 3.7 | |

| State of Qatar | 3.2 | |

| Dominican Republic | 3.2 | |

| Indonesian Republic | 3.1 | |

| Turkish Republic | 3.1 | |

| Arab Republic of Egypt | 2.8 | |

| Sultanate of Oman | 2.8 | |

| Colombian Republic | 2.6 | |

| United Mexican States | 2.0 | |

| | 31.7 | |

| |

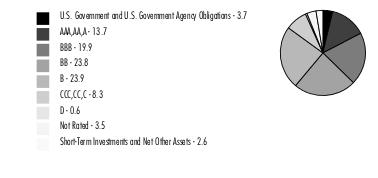

Quality Diversification (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

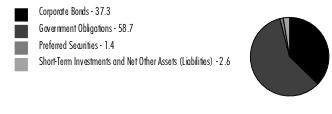

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 91.3% |

|

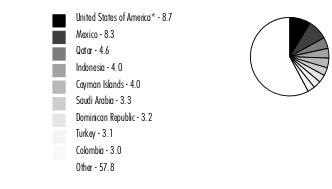

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable. |

| |

Foreign currency contracts and other assets and liabilities are included within United States of America, as applicable.

Fidelity® Series Emerging Markets Debt Fund

Showing Percentage of Net Assets

| Nonconvertible Bonds - 37.3% |

| | | Principal Amount (a) | Value ($) |

| Argentina - 0.7% | | | |

| YPF SA: | | | |

| 8.5% 3/23/25 (b) | | 2,216,875 | 2,012,923 |

| 8.75% 4/4/24 (b) | | 5,787,600 | 5,468,559 |

TOTAL ARGENTINA | | | 7,481,482 |

| Azerbaijan - 1.1% | | | |

| Southern Gas Corridor CJSC 6.875% 3/24/26 (b) | | 9,951,000 | 10,167,434 |

| State Oil Co. of Azerbaijan Republic 6.95% 3/18/30 (Reg. S) | | 3,015,000 | 3,100,362 |

TOTAL AZERBAIJAN | | | 13,267,796 |

| Bahrain - 1.5% | | | |

| The Oil and Gas Holding Co.: | | | |

| 7.5% 10/25/27 (b) | | 6,889,000 | 7,028,072 |

| 7.625% 11/7/24 (b) | | 8,680,000 | 8,822,678 |

| 8.375% 11/7/28 (b) | | 1,065,000 | 1,116,120 |

TOTAL BAHRAIN | | | 16,966,870 |

| Bailiwick of Jersey - 0.3% | | | |

| Galaxy Pipeline Assets BidCo Ltd. 2.625% 3/31/36 (b) | | 4,480,000 | 3,590,440 |

| Bermuda - 0.8% | | | |

| GeoPark Ltd. 5.5% 1/17/27 (b) | | 1,975,000 | 1,701,339 |

| Investment Energy Resources Ltd. 6.25% 4/26/29 (b) | | 2,970,000 | 2,779,363 |

| Qtel International Finance Ltd. 2.625% 4/8/31 (b) | | 2,755,000 | 2,362,413 |

| Tengizchevroil Finance Co. International Ltd. 3.25% 8/15/30 (b) | | 3,800,000 | 2,695,150 |

TOTAL BERMUDA | | | 9,538,265 |

| Brazil - 0.4% | | | |

| BRF SA 4.875% 1/24/30 (b) | | 1,320,000 | 1,113,217 |

| Natura Cosmeticos SA 4.125% 5/3/28 (b) | | 3,575,000 | 2,913,178 |

TOTAL BRAZIL | | | 4,026,395 |

| British Virgin Islands - 0.5% | | | |

| 1MDB Global Investments Ltd. 4.4% 3/9/23 | | 3,100,000 | 3,028,894 |

| ENN Clean Energy International Investment Ltd. 3.375% 5/12/26 (b) | | 3,775,000 | 3,213,469 |

TOTAL BRITISH VIRGIN ISLANDS | | | 6,242,363 |

| Canada - 0.4% | | | |

| Gcm Mining Corp. 6.875% 8/9/26 (b) | | 3,895,000 | 3,026,701 |

| MEGlobal Canada, Inc. 5% 5/18/25 (b) | | 1,635,000 | 1,601,585 |

TOTAL CANADA | | | 4,628,286 |

| Cayman Islands - 3.4% | | | |

| Baidu, Inc.: | | | |

| 1.72% 4/9/26 | | 2,540,000 | 2,242,998 |

| 2.375% 10/9/30 | | 1,395,000 | 1,105,161 |

| DP World Crescent Ltd.: | | | |

| 3.7495% 1/30/30 (b) | | 1,075,000 | 988,530 |

| 3.875% 7/18/29 (Reg. S) | | 7,405,000 | 6,908,865 |

| ENN Energy Holdings Ltd. 4.625% 5/17/27 (b) | | 3,430,000 | 3,311,665 |

| IHS Holding Ltd. 5.625% 11/29/26 (b) | | 2,420,000 | 2,008,298 |

| Lamar Funding Ltd. 3.958% 5/7/25 (b) | | 1,015,000 | 957,779 |

| Meituan: | | | |

| 2.125% 10/28/25 (b) | | 4,740,000 | 4,176,533 |

| 3.05% 10/28/30 (b) | | 1,995,000 | 1,521,562 |

| NagaCorp Ltd. 7.95% 7/6/24 (Reg. S) | | 4,420,000 | 3,974,685 |

| QNB Finance Ltd. 2.625% 5/12/25 (Reg. S) | | 3,305,000 | 3,115,582 |

| SA Global Sukuk Ltd. 1.602% 6/17/26 (b) | | 4,445,000 | 3,959,662 |

| Sable International Finance Ltd. 5.75% 9/7/27 (b) | | 2,287,000 | 2,112,616 |

| Termocandelaria Power Ltd. 7.875% 1/30/29 (b) | | 3,336,250 | 3,050,167 |

TOTAL CAYMAN ISLANDS | | | 39,434,103 |

| Chile - 0.9% | | | |

| Corporacion Nacional del Cobre de Chile (Codelco): | | | |

| 3% 9/30/29 (b) | | 2,000,000 | 1,743,500 |

| 3.15% 1/14/30 (b) | | 1,645,000 | 1,445,852 |

| 3.15% 1/15/51 (b) | | 1,865,000 | 1,296,525 |

| 3.7% 1/30/50 (b) | | 3,765,000 | 2,829,398 |

| VTR Comunicaciones SpA: | | | |

| 4.375% 4/15/29 (b) | | 933,000 | 541,023 |

| 5.125% 1/15/28 (b) | | 3,749,000 | 2,308,681 |

TOTAL CHILE | | | 10,164,979 |

| Colombia - 0.4% | | | |

| Oleoducto Central SA 4% 7/14/27 (b) | | 4,925,000 | 4,324,150 |

| Georgia - 0.3% | | | |

| JSC Georgian Railway 4% 6/17/28 (b) | | 3,580,000 | 3,111,915 |

| Guatemala - 0.3% | | | |

| CT Trust 5.125% 2/3/32 (b) | | 3,455,000 | 3,033,490 |

| Hong Kong - 0.2% | | | |

| Lenovo Group Ltd. 3.421% 11/2/30 (b) | | 2,915,000 | 2,293,376 |

| India - 0.4% | | | |

| JSW Steel Ltd. 3.95% 4/5/27 (b) | | 2,710,000 | 2,317,050 |

| Shriram Transport Finance Co. Ltd. 5.1% 7/16/23 (b) | | 1,900,000 | 1,876,250 |

TOTAL INDIA | | | 4,193,300 |

| Indonesia - 0.9% | | | |

| PT Adaro Indonesia 4.25% 10/31/24 (b) | | 3,515,000 | 3,366,272 |

| PT Freeport Indonesia: | | | |

| 4.763% 4/14/27 (b) | | 1,225,000 | 1,174,604 |

| 5.315% 4/14/32 (b) | | 2,085,000 | 1,913,217 |

| 6.2% 4/14/52 (b) | | 1,420,000 | 1,232,006 |

| PT Indonesia Asahan Aluminium Tbk 5.45% 5/15/30 (b) | | 2,955,000 | 2,818,885 |

TOTAL INDONESIA | | | 10,504,984 |

| Ireland - 0.4% | | | |

| C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (b) | | 2,060,000 | 1,907,818 |

| LCPR Senior Secured Financing DAC 5.125% 7/15/29 (b) | | 3,810,000 | 3,156,235 |

TOTAL IRELAND | | | 5,064,053 |

| Israel - 1.0% | | | |

| Energean Israel Finance Ltd. 4.875% 3/30/26 (Reg. S) (b) | | 3,470,000 | 3,202,463 |

| Israel Electric Corp. Ltd. 3.75% 2/22/32 (Reg. S) (b) | | 3,270,000 | 2,860,073 |

| Leviathan Bond Ltd.: | | | |

| 5.75% 6/30/23 (Reg. S) (b) | | 1,655,000 | 1,648,075 |

| 6.125% 6/30/25 (Reg. S) (b) | | 3,640,000 | 3,558,100 |

| 6.5% 6/30/27 (Reg. S) (b) | | 645,000 | 624,102 |

TOTAL ISRAEL | | | 11,892,813 |

| Kazakhstan - 0.2% | | | |

| KazMunaiGaz National Co.: | | | |

| 3.5% 4/14/33 (b) | | 2,010,000 | 1,479,611 |

| 5.75% 4/19/47 (b) | | 1,010,000 | 770,946 |

TOTAL KAZAKHSTAN | | | 2,250,557 |

| Luxembourg - 1.6% | | | |

| Adecoagro SA 6% 9/21/27 (b) | | 4,185,000 | 3,932,069 |

| B2W Digital Lux SARL 4.375% 12/20/30 (b) | | 4,260,000 | 2,691,255 |

| CSN Resources SA 5.875% 4/8/32 (b) | | 2,115,000 | 1,766,025 |

| EIG Pearl Holdings SARL 3.545% 8/31/36 (b) | | 4,680,000 | 3,924,765 |

| MC Brazil Downstream Trading SARL 7.25% 6/30/31 (b) | | 3,550,000 | 2,913,219 |

| Millicom International Cellular SA 4.5% 4/27/31 (b) | | 2,770,000 | 2,325,588 |

| VM Holding SA 6.5% 1/18/28 (b) | | 1,580,000 | 1,528,946 |

TOTAL LUXEMBOURG | | | 19,081,867 |

| Malaysia - 0.8% | | | |

| GENM Capital Labuan Ltd. 3.882% 4/19/31 (b) | | 3,610,000 | 2,725,550 |

| MISC Capital Two (Labuan) Ltd.: | | | |

| 3.625% 4/6/25 (b) | | 945,000 | 898,518 |

| 3.75% 4/6/27 (b) | | 3,090,000 | 2,815,376 |

| Petronas Capital Ltd.: | | | |

| 3.404% 4/28/61 (b) | | 1,570,000 | 1,072,546 |

| 3.5% 4/21/30 (b) | | 1,730,000 | 1,577,656 |

TOTAL MALAYSIA | | | 9,089,646 |

| Mauritius - 0.9% | | | |

| AXIAN Telecom 7.375% 2/16/27 (b) | | 2,870,000 | 2,487,573 |

| CA Magnum Holdings 5.375% (b)(c) | | 3,545,000 | 3,208,686 |

| HTA Group Ltd. 7% 12/18/25 (b) | | 3,305,000 | 3,033,990 |

| MTN (Mauritius) Investments Ltd. 4.755% 11/11/24 (b) | | 1,860,000 | 1,801,643 |

TOTAL MAURITIUS | | | 10,531,892 |

| Mexico - 6.0% | | | |

| Axtel S.A.B. de CV 6.375% 11/14/24 (b) | | 130,000 | 106,015 |

| CEMEX S.A.B. de CV 5.45% 11/19/29 (b) | | 1,420,000 | 1,358,141 |

| Comision Federal de Electricid: | | | |

| 3.348% 2/9/31 (b) | | 735,000 | 572,519 |

| 4.688% 5/15/29 (b) | | 3,085,000 | 2,714,414 |

| Petroleos Mexicanos: | | | |

| 4.625% 9/21/23 | | 800,000 | 784,120 |

| 4.875% 1/18/24 | | 8,087,000 | 7,917,173 |

| 6.5% 3/13/27 | | 1,725,000 | 1,567,594 |

| 6.5% 6/2/41 | | 2,587,000 | 1,673,789 |

| 6.625% 6/15/35 | | 15,841,000 | 11,432,450 |

| 6.7% 2/16/32 | | 6,367,000 | 4,990,136 |

| 6.75% 9/21/47 | | 10,407,000 | 6,628,010 |

| 6.875% 10/16/25 | | 2,295,000 | 2,232,318 |

| 6.875% 8/4/26 | | 2,485,000 | 2,361,993 |

| 6.95% 1/28/60 | | 9,575,000 | 6,058,581 |

| 7.69% 1/23/50 | | 20,563,000 | 14,214,174 |

| 8.625% 12/1/23 (d) | | 320,000 | 324,600 |

| TV Azteca SA de CV 8.25% 8/9/24 (Reg. S) (e) | | 10,535,000 | 4,832,931 |

TOTAL MEXICO | | | 69,768,958 |

| Mongolia - 0.0% | | | |

| Development Bank of Mongolia 7.25% 10/23/23 (b) | | 435,000 | 386,688 |

| Morocco - 0.3% | | | |

| OCP SA: | | | |

| 3.75% 6/23/31 (b) | | 3,150,000 | 2,624,934 |

| 4.5% 10/22/25 (b) | | 1,360,000 | 1,322,005 |

TOTAL MOROCCO | | | 3,946,939 |

| Multi-National - 0.3% | | | |

| GEMS MENASA Cayman Ltd. 7.125% 7/31/26 (b) | | 2,095,000 | 2,002,427 |

| JBS U.S.A. Lux SA / JBS Food Co. 2.5% 1/15/27 (b) | | 1,565,000 | 1,368,937 |

TOTAL MULTI-NATIONAL | | | 3,371,364 |

| Netherlands - 1.8% | | | |

| Embraer Netherlands Finance BV 5.05% 6/15/25 | | 3,625,000 | 3,516,930 |

| Equate Petrochemical BV 4.25% 11/3/26 (b) | | 1,930,000 | 1,841,703 |

| IHS Netherlands Holdco BV 8% 9/18/27 (b) | | 2,975,000 | 2,613,909 |

| Mong Duong Finance Holdings BV 5.125% 5/7/29 (b) | | 2,770,000 | 2,298,754 |

| Nostrum Oil & Gas Finance BV 8% 12/31/49 (b)(e) | | 15,783,000 | 4,103,422 |

| Prosus NV: | | | |

| 3.061% 7/13/31 (b) | | 760,000 | 588,970 |

| 3.832% 2/8/51 (b) | | 1,590,000 | 972,186 |

| 4.027% 8/3/50 (b) | | 650,000 | 412,263 |

| 4.193% 1/19/32 (b) | | 3,505,000 | 2,904,331 |

| VimpelCom Holdings BV 7.25% 4/26/23 (b) | | 1,375,000 | 1,203,125 |

TOTAL NETHERLANDS | | | 20,455,593 |

| Nigeria - 0.2% | | | |

| Access Bank PLC 6.125% 9/21/26 (b) | | 3,475,000 | 2,672,058 |

| Panama - 0.6% | | | |

| Aeropuerto Internacional de Tocumen SA: | | | |

| 4% 8/11/41 (b) | | 2,915,000 | 2,399,956 |

| 5.125% 8/11/61 (b) | | 1,230,000 | 1,006,524 |

| Cable Onda SA 4.5% 1/30/30 (b) | | 4,055,000 | 3,611,484 |

TOTAL PANAMA | | | 7,017,964 |

| Paraguay - 0.3% | | | |

| Telefonica Celular del Paraguay SA 5.875% 4/15/27 (b) | | 3,800,000 | 3,665,338 |

| Peru - 0.2% | | | |

| Camposol SA 6% 2/3/27 (b) | | 855,000 | 510,756 |

| Compania de Minas Buenaventura SAA 5.5% 7/23/26 (b) | | 2,100,000 | 1,796,550 |

TOTAL PERU | | | 2,307,306 |

| Qatar - 1.4% | | | |

| Qatar Petroleum: | | | |

| 1.375% 9/12/26 (b) | | 3,255,000 | 2,884,867 |

| 2.25% 7/12/31 (b) | | 6,745,000 | 5,565,890 |

| 3.3% 7/12/51 (b) | | 9,800,000 | 7,174,213 |

TOTAL QATAR | | | 15,624,970 |

| Saudi Arabia - 2.0% | | | |

| Saudi Arabian Oil Co.: | | | |

| 1.625% 11/24/25 (b) | | 3,815,000 | 3,465,212 |

| 3.5% 4/16/29 (b) | | 16,814,000 | 15,351,182 |

| 4.25% 4/16/39 (b) | | 2,385,000 | 2,117,135 |

| 4.375% 4/16/49 (b) | | 2,321,000 | 1,966,032 |

TOTAL SAUDI ARABIA | | | 22,899,561 |

| Singapore - 0.7% | | | |

| Indika Energy Capital IV Pte Ltd. 8.25% 10/22/25 (b) | | 2,060,000 | 2,029,100 |

| Medco Bell Pte Ltd. 6.375% 1/30/27 (b) | | 3,120,000 | 2,800,200 |

| Medco Laurel Tree PTE Ltd. 6.95% 11/12/28 (b) | | 3,730,000 | 3,299,418 |

TOTAL SINGAPORE | | | 8,128,718 |

| South Africa - 1.0% | | | |

| Eskom Holdings SOC Ltd.: | | | |

| 6.35% 8/10/28 (b) | | 3,515,000 | 3,242,588 |

| 6.75% 8/6/23 (b) | | 2,812,000 | 2,698,290 |

| 7.125% 2/11/25 (b) | | 5,515,000 | 5,004,173 |

| 8.45% 8/10/28 (b) | | 1,310,000 | 1,149,525 |

TOTAL SOUTH AFRICA | | | 12,094,576 |

| Spain - 0.3% | | | |

| EnfraGen Energia Sur SA 5.375% 12/30/30 (b) | | 5,545,000 | 3,867,166 |

| United Arab Emirates - 0.5% | | | |

| Abu Dhabi National Energy Co. PJSC: | | | |

| 4% 10/3/49 (b) | | 2,460,000 | 2,120,674 |

| 4.875% 4/23/30 (b) | | 545,000 | 560,090 |

| MDGH GMTN RSC Ltd.: | | | |

| 2.875% 11/7/29 (b) | | 1,515,000 | 1,362,364 |

| 3.375% 3/28/32 (Reg. S) | | 570,000 | 515,066 |

| 5.5% 4/28/33 (b) | | 1,620,000 | 1,709,404 |

TOTAL UNITED ARAB EMIRATES | | | 6,267,598 |

| United Kingdom - 1.5% | | | |

| Antofagasta PLC: | | | |

| 2.375% 10/14/30 (b) | | 3,865,000 | 3,084,270 |

| 5.625% 5/13/32 (b) | | 1,390,000 | 1,365,675 |

| Biz Finance PLC 9.75% 1/22/25 (b) | | 1,467,500 | 471,251 |

| Endeavour Mining PLC 5% 10/14/26 (b) | | 2,015,000 | 1,694,867 |

| Liquid Telecommunications Financing PLC 5.5% 9/4/26 (b) | | 3,665,000 | 2,624,598 |

| NAK Naftogaz Ukraine: | | | |

| 7.375% 7/19/24 (Reg. S) (e) | | 3,687,000 | 700,530 |

| 7.625% 11/8/26 (b) | | 1,235,000 | 197,600 |

| Oschadbank Via SSB #1 PLC 9.375% 3/10/23 (b) | | 201,800 | 141,739 |

| The Bidvest Group UK PLC 3.625% 9/23/26 (b) | | 1,985,000 | 1,777,568 |

| Tullow Oil PLC: | | | |

| 7% 3/1/25 (b) | | 1,060,000 | 641,300 |

| 10.25% 5/15/26 (b) | | 6,070,000 | 4,825,650 |

TOTAL UNITED KINGDOM | | | 17,525,048 |

| United States of America - 2.4% | | | |

| Azul Investments LLP: | | | |

| 5.875% 10/26/24 (b) | | 4,565,000 | 3,654,283 |

| 7.25% 6/15/26 (b) | | 1,600,000 | 980,300 |

| DAE Funding LLC 1.55% 8/1/24 (b) | | 3,570,000 | 3,326,348 |

| Kosmos Energy Ltd. 7.125% 4/4/26 (b) | | 9,060,000 | 7,691,374 |

| NBM U.S. Holdings, Inc. 6.625% 8/6/29 (b) | | 3,315,000 | 3,198,561 |

| Sasol Financing U.S.A. LLC: | | | |

| 4.375% 9/18/26 | | 3,760,000 | 3,322,430 |

| 5.875% 3/27/24 | | 1,705,000 | 1,662,375 |

| Stillwater Mining Co. 4% 11/16/26 (b) | | 4,430,000 | 3,893,693 |

TOTAL UNITED STATES OF AMERICA | | | 27,729,364 |

| Uzbekistan - 0.2% | | | |

| National Bank of Uzbekistan 4.85% 10/21/25 (Reg. S) | | 1,725,000 | 1,554,980 |

| Uzbekneftegaz JSC 4.75% 11/16/28 (b) | | 1,145,000 | 918,863 |

TOTAL UZBEKISTAN | | | 2,473,843 |

| Venezuela - 0.2% | | | |

| Petroleos de Venezuela SA: | | | |

| 5.375% 4/12/27 (e) | | 6,115,000 | 275,175 |

| 5.5% 4/12/37 (e) | | 3,475,000 | 156,499 |

| 6% 5/16/24 (b)(e) | | 8,980,000 | 426,550 |

| 6% 11/15/26 (b)(e) | | 15,840,000 | 712,800 |

| 9.75% 5/17/35 (b)(e) | | 12,585,000 | 597,788 |

| 12.75% 12/31/49 (b)(e) | | 3,065,000 | 137,950 |

TOTAL VENEZUELA | | | 2,306,762 |

| TOTAL NONCONVERTIBLE BONDS (Cost $535,765,354) | | | 433,222,836 |

| | | | |

| Government Obligations - 58.7% |

| | | Principal Amount (a) | Value ($) |

| Angola - 1.8% | | | |

| Angola Republic: | | | |

| 8% 11/26/29 (b) | | 2,290,000 | 2,015,200 |

| 8.25% 5/9/28 (b) | | 5,065,000 | 4,583,825 |

| 8.75% 4/14/32 (b) | | 2,575,000 | 2,227,375 |

| 9.125% 11/26/49 (b) | | 3,555,000 | 2,769,123 |

| 9.375% 5/8/48 (b) | | 3,125,000 | 2,461,523 |

| 9.5% 11/12/25 (b) | | 6,370,000 | 6,561,100 |

TOTAL ANGOLA | | | 20,618,146 |

| Argentina - 1.8% | | | |

| Argentine Republic: | | | |

| 0.5% 7/9/30 (f) | | 24,444,632 | 6,612,273 |

| 1% 7/9/29 | | 4,963,783 | 1,315,403 |

| 1.5% 7/9/35 (f) | | 17,033,027 | 4,292,323 |

| 3.875% 1/9/38 (f) | | 10,211,997 | 3,215,503 |

| Buenos Aires Province 5.25% 9/1/37 (b)(f) | | 3,235,000 | 1,116,075 |

| Provincia de Cordoba 6.875% 12/10/25 (b) | | 4,870,408 | 3,896,326 |

TOTAL ARGENTINA | | | 20,447,903 |

| Armenia - 0.1% | | | |

| Republic of Armenia 3.6% 2/2/31 (b) | | 1,795,000 | 1,425,679 |

| Azerbaijan - 0.2% | | | |

| Azerbaijan Republic 3.5% 9/1/32 (b) | | 2,535,000 | 2,103,733 |

| Bahrain - 0.2% | | | |

| Bahrain Kingdom 5.625% 5/18/34 (b) | | 3,055,000 | 2,629,782 |

| Barbados - 0.3% | | | |

| Barbados Government 6.5% 10/1/29 (b) | | 3,170,000 | 2,919,966 |

| Benin - 0.1% | | | |

| Republic of Benin 4.875% 1/19/32 (b) | EUR | 1,920,000 | 1,582,553 |

| Bermuda - 0.4% | | | |

| Bermuda Government: | | | |

| 2.375% 8/20/30 (b) | | 525,000 | 440,934 |

| 3.375% 8/20/50 (b) | | 965,000 | 677,490 |

| 3.717% 1/25/27 (b) | | 620,000 | 593,766 |

| 4.75% 2/15/29 (b) | | 2,270,000 | 2,253,401 |

| 5% 7/15/32 (b) | | 1,005,000 | 997,023 |

TOTAL BERMUDA | | | 4,962,614 |

| Brazil - 1.7% | | | |

| Brazilian Federative Republic: | | | |

| 3.875% 6/12/30 | | 7,525,000 | 6,512,888 |

| 5.625% 1/7/41 | | 4,146,000 | 3,496,374 |

| 5.625% 2/21/47 | | 2,183,000 | 1,726,344 |

| 7.125% 1/20/37 | | 2,080,000 | 2,159,040 |

| 8.25% 1/20/34 | | 5,204,000 | 5,824,577 |

TOTAL BRAZIL | | | 19,719,223 |

| Cameroon - 0.2% | | | |

| Cameroon Republic 5.95% 7/7/32 (b) | EUR | 3,570,000 | 2,815,495 |

| Chile - 1.0% | | | |

| Chilean Republic: | | | |

| 2.45% 1/31/31 | | 7,745,000 | 6,412,860 |

| 2.75% 1/31/27 | | 1,710,000 | 1,568,711 |

| 3.5% 1/31/34 | | 1,775,000 | 1,509,638 |

| 4% 1/31/52 | | 985,000 | 758,327 |

| 4.34% 3/7/42 | | 1,410,000 | 1,187,749 |

TOTAL CHILE | | | 11,437,285 |

| Colombia - 2.6% | | | |

| Colombian Republic: | | | |

| 3% 1/30/30 | | 8,280,000 | 6,325,920 |

| 3.125% 4/15/31 | | 4,300,000 | 3,186,838 |

| 3.875% 2/15/61 | | 1,490,000 | 830,489 |

| 4.125% 5/15/51 | | 3,120,000 | 1,870,635 |

| 4.5% 3/15/29 | | 2,065,000 | 1,780,159 |

| 5% 6/15/45 | | 9,250,000 | 6,346,656 |

| 5.2% 5/15/49 | | 5,390,000 | 3,681,370 |

| 6.125% 1/18/41 | | 1,475,000 | 1,173,363 |

| 7.375% 9/18/37 | | 845,000 | 792,346 |

| 8% 4/20/33 | | 4,615,000 | 4,605,770 |

TOTAL COLOMBIA | | | 30,593,546 |

| Costa Rica - 0.5% | | | |

| Costa Rican Republic: | | | |

| 5.625% 4/30/43 (b) | | 2,830,000 | 2,299,021 |

| 6.125% 2/19/31 (b) | | 2,535,000 | 2,453,088 |

| 7% 4/4/44 (b) | | 1,610,000 | 1,511,186 |

TOTAL COSTA RICA | | | 6,263,295 |

| Dominican Republic - 3.2% | | | |

| Dominican Republic: | | | |

| 4.5% 1/30/30 (b) | | 7,180,000 | 6,090,884 |

| 4.875% 9/23/32 (b) | | 6,360,000 | 5,258,130 |

| 5.3% 1/21/41 (b) | | 2,450,000 | 1,885,428 |

| 5.875% 1/30/60 (b) | | 5,220,000 | 3,814,841 |

| 5.95% 1/25/27 (b) | | 4,186,000 | 4,084,751 |

| 6% 7/19/28 (b) | | 2,999,000 | 2,874,916 |

| 6.4% 6/5/49 (b) | | 1,662,000 | 1,338,222 |

| 6.5% 2/15/48 (b) | | 3,345,000 | 2,747,708 |

| 6.85% 1/27/45 (b) | | 4,046,000 | 3,496,756 |

| 7.45% 4/30/44 (b) | | 6,031,000 | 5,598,653 |

TOTAL DOMINICAN REPUBLIC | | | 37,190,289 |

| Ecuador - 1.3% | | | |

| Ecuador Republic: | | | |

| 2.5% 7/31/35 (b)(f) | | 13,445,000 | 6,149,407 |

| 5.5% 7/31/30 (b)(f) | | 13,435,000 | 8,546,339 |

TOTAL ECUADOR | | | 14,695,746 |

| Egypt - 2.8% | | | |

| Arab Republic of Egypt: | | | |

| 5.8% 9/30/27 (b) | | 1,965,000 | 1,621,125 |

| 5.875% 2/16/31 (b) | | 2,625,000 | 1,815,023 |

| 7.0529% 1/15/32 (b) | | 830,000 | 603,721 |

| 7.5% 1/31/27 (b) | | 9,241,000 | 8,270,695 |

| 7.5% 2/16/61 (b) | | 3,735,000 | 2,278,350 |

| 7.6003% 3/1/29 (b) | | 9,841,000 | 8,020,415 |

| 7.903% 2/21/48 (b) | | 2,940,000 | 1,830,150 |

| 8.5% 1/31/47 (b) | | 7,939,000 | 5,239,740 |

| 8.7002% 3/1/49 (b) | | 2,865,000 | 1,883,738 |

| 8.875% 5/29/50 (b) | | 1,945,000 | 1,295,856 |

TOTAL EGYPT | | | 32,858,813 |

| El Salvador - 0.2% | | | |

| El Salvador Republic: | | | |

| 6.375% 1/18/27 (b) | | 435,000 | 188,355 |

| 7.1246% 1/20/50 (b) | | 3,292,000 | 1,250,549 |

| 7.625% 2/1/41 (b) | | 1,035,000 | 396,405 |

| 7.65% 6/15/35 (b) | | 1,185,000 | 465,335 |

TOTAL EL SALVADOR | | | 2,300,644 |

| Gabon - 0.4% | | | |

| Gabonese Republic: | | | |

| 6.95% 6/16/25 (b) | | 2,410,000 | 2,265,400 |

| 7% 11/24/31 (b) | | 3,620,000 | 2,962,291 |

TOTAL GABON | | | 5,227,691 |

| Georgia - 0.2% | | | |

| Georgia Republic 2.75% 4/22/26 (b) | | 2,915,000 | 2,624,958 |

| Ghana - 0.6% | | | |

| Ghana Republic: | | | |

| 7.75% 4/7/29 (b) | | 3,695,000 | 1,339,438 |

| 8.125% 1/18/26 (b) | | 1,603,076 | 629,207 |

| 8.125% 3/26/32 (b) | | 6,670,000 | 2,359,513 |

| 8.627% 6/16/49 (b) | | 2,845,000 | 974,413 |

| 10.75% 10/14/30 (b) | | 2,125,000 | 1,487,500 |

TOTAL GHANA | | | 6,790,071 |

| Guatemala - 0.4% | | | |

| Guatemalan Republic: | | | |

| 4.9% 6/1/30 (b) | | 485,000 | 457,507 |

| 5.25% 8/10/29 (b) | | 1,200,000 | 1,151,100 |

| 5.375% 4/24/32 (b) | | 2,015,000 | 1,963,743 |

| 6.125% 6/1/50 (b) | | 1,355,000 | 1,270,143 |

TOTAL GUATEMALA | | | 4,842,493 |

| Hungary - 0.6% | | | |

| Hungarian Republic: | | | |

| 2.125% 9/22/31 (b) | | 2,950,000 | 2,167,881 |

| 3.125% 9/21/51 (b) | | 2,045,000 | 1,219,076 |

| 5.25% 6/16/29 (b) | | 1,585,000 | 1,507,038 |

| 5.5% 6/16/34 (b) | | 1,650,000 | 1,536,872 |

TOTAL HUNGARY | | | 6,430,867 |

| Indonesia - 3.1% | | | |

| Indonesian Republic: | | | |

| 3.85% 10/15/30 | | 2,650,000 | 2,484,872 |

| 4.1% 4/24/28 | | 4,140,000 | 4,051,508 |

| 5.125% 1/15/45 (b) | | 3,353,000 | 3,231,823 |

| 5.25% 1/17/42 (b) | | 3,000,000 | 2,919,000 |

| 5.45% 9/20/52 | | 2,955,000 | 2,877,579 |

| 5.95% 1/8/46 (b) | | 2,100,000 | 2,190,300 |

| 6.625% 2/17/37 (b) | | 3,549,000 | 4,010,760 |

| 6.75% 1/15/44 (b) | | 3,035,000 | 3,403,328 |

| 7.75% 1/17/38 (b) | | 4,298,000 | 5,146,318 |

| 8.5% 10/12/35 (b) | | 4,169,000 | 5,260,236 |

TOTAL INDONESIA | | | 35,575,724 |

| Iraq - 0.1% | | | |

| Republic of Iraq 5.8% 1/15/28 (Reg. S) | | 1,872,063 | 1,719,723 |

| Ivory Coast - 0.9% | | | |

| Ivory Coast: | | | |

| 5.875% 10/17/31 (b) | EUR | 3,125,000 | 2,795,923 |

| 6.125% 6/15/33 (b) | | 2,050,000 | 1,824,500 |

| 6.375% 3/3/28 (b) | | 5,580,000 | 5,398,650 |

TOTAL IVORY COAST | | | 10,019,073 |

| Jamaica - 0.2% | | | |

| Jamaican Government: | | | |

| 6.75% 4/28/28 | | 920,000 | 971,060 |

| 7.875% 7/28/45 | | 1,685,000 | 1,888,569 |

TOTAL JAMAICA | | | 2,859,629 |

| Jordan - 0.7% | | | |

| Jordanian Kingdom: | | | |

| 4.95% 7/7/25 (b) | | 4,170,000 | 3,979,223 |

| 5.85% 7/7/30 (b) | | 980,000 | 871,159 |

| 6.125% 1/29/26 (b) | | 985,000 | 969,486 |

| 7.75% 1/15/28 (b) | | 1,725,000 | 1,738,261 |

TOTAL JORDAN | | | 7,558,129 |

| Kenya - 1.0% | | | |

| Republic of Kenya: | | | |

| 6.3% 1/23/34 (b) | | 3,575,000 | 2,761,688 |

| 6.875% 6/24/24 (b) | | 4,925,000 | 4,549,469 |

| 7% 5/22/27 (b) | | 4,840,000 | 4,337,850 |

TOTAL KENYA | | | 11,649,007 |

| Lebanon - 0.1% | | | |

| Lebanese Republic: | | | |

| 5.8% 12/31/49 (e) | | 5,875,000 | 336,520 |

| 6% 12/31/49 (e) | | 1,587,000 | 90,062 |

| 6.1% 12/31/49 (e) | | 685,000 | 39,237 |

| 6.375% 12/31/49 (e) | | 7,072,000 | 411,166 |

TOTAL LEBANON | | | 876,985 |

| Mexico - 2.0% | | | |

| United Mexican States: | | | |

| 3.25% 4/16/30 | | 4,960,000 | 4,311,480 |

| 3.75% 1/11/28 | | 3,415,000 | 3,216,930 |

| 4.5% 4/22/29 | | 2,040,000 | 1,948,200 |

| 4.75% 4/27/32 | | 970,000 | 907,132 |

| 5.75% 10/12/2110 | | 3,295,000 | 2,771,507 |

| 6.05% 1/11/40 | | 10,222,000 | 9,920,451 |

TOTAL MEXICO | | | 23,075,700 |

| Mongolia - 0.2% | | | |

| Mongolia Government 5.125% 4/7/26 (b) | | 2,480,000 | 2,133,073 |

| Morocco - 0.4% | | | |

| Moroccan Kingdom: | | | |

| 2.375% 12/15/27 (b) | | 3,675,000 | 3,183,009 |

| 4% 12/15/50 (b) | | 735,000 | 498,789 |

| 5.5% 12/11/42 (b) | | 920,000 | 783,610 |

TOTAL MOROCCO | | | 4,465,408 |

| Nigeria - 1.7% | | | |

| Republic of Nigeria: | | | |

| 6.125% 9/28/28 (b) | | 4,880,000 | 3,757,600 |

| 6.5% 11/28/27 (b) | | 4,902,000 | 3,939,983 |

| 7.143% 2/23/30 (b) | | 1,955,000 | 1,493,131 |

| 7.625% 11/21/25 (b) | | 6,193,000 | 5,674,336 |

| 7.625% 11/28/47 (b) | | 5,315,000 | 3,408,244 |

| 7.696% 2/23/38 (b) | | 980,000 | 662,603 |

| 7.875% 2/16/32 (b) | | 1,635,000 | 1,226,250 |

TOTAL NIGERIA | | | 20,162,147 |

| Oman - 2.8% | | | |

| Sultanate of Oman: | | | |

| 4.75% 6/15/26 (b) | | 1,002,000 | 964,300 |

| 5.375% 3/8/27 (b) | | 3,921,000 | 3,823,710 |

| 5.625% 1/17/28 (b) | | 6,505,000 | 6,400,513 |

| 6% 8/1/29 (b) | | 3,625,000 | 3,618,883 |

| 6.25% 1/25/31 (b) | | 1,610,000 | 1,613,824 |

| 6.5% 3/8/47 (b) | | 8,100,000 | 7,350,750 |

| 6.75% 10/28/27 (b) | | 1,585,000 | 1,637,305 |

| 6.75% 1/17/48 (b) | | 7,720,000 | 7,185,873 |

TOTAL OMAN | | | 32,595,158 |

| Pakistan - 0.5% | | | |

| Islamic Republic of Pakistan: | | | |

| 6% 4/8/26 (b) | | 6,130,000 | 2,452,674 |

| 6.875% 12/5/27 (b) | | 4,285,000 | 1,650,196 |

| 7.375% 4/8/31 (b) | | 2,355,000 | 830,397 |

| 8.25% 4/15/24 (b) | | 1,180,000 | 625,530 |

TOTAL PAKISTAN | | | 5,558,797 |

| Panama - 1.8% | | | |

| Panamanian Republic: | | | |

| 2.252% 9/29/32 | | 5,065,000 | 3,750,633 |

| 3.16% 1/23/30 | | 3,670,000 | 3,151,154 |

| 3.298% 1/19/33 | | 5,355,000 | 4,333,534 |

| 3.87% 7/23/60 | | 3,880,000 | 2,499,690 |

| 4.3% 4/29/53 | | 1,795,000 | 1,306,199 |

| 4.5% 5/15/47 | | 2,005,000 | 1,537,334 |

| 4.5% 4/16/50 | | 2,680,000 | 2,021,390 |

| 6.4% 2/14/35 | | 2,700,000 | 2,738,475 |

TOTAL PANAMA | | | 21,338,409 |

| Paraguay - 0.6% | | | |

| Republic of Paraguay: | | | |

| 2.739% 1/29/33 (b) | | 1,305,000 | 1,041,798 |

| 4.95% 4/28/31 (b) | | 3,865,000 | 3,730,450 |

| 5.4% 3/30/50 (b) | | 1,950,000 | 1,674,319 |

| 5.6% 3/13/48 (b) | | 445,000 | 386,955 |

TOTAL PARAGUAY | | | 6,833,522 |

| Peru - 1.6% | | | |

| Peruvian Republic: | | | |

| 2.783% 1/23/31 | | 8,580,000 | 7,093,515 |

| 3% 1/15/34 | | 5,225,000 | 4,114,034 |

| 3.3% 3/11/41 | | 9,510,000 | 6,929,224 |

TOTAL PERU | | | 18,136,773 |

| Philippines - 0.6% | | | |

| Philippine Republic: | | | |

| 2.65% 12/10/45 | | 2,130,000 | 1,427,334 |

| 2.95% 5/5/45 | | 865,000 | 620,733 |

| 5.609% 4/13/33 | | 1,670,000 | 1,762,034 |

| 5.95% 10/13/47 | | 2,670,000 | 2,870,544 |

TOTAL PHILIPPINES | | | 6,680,645 |

| Qatar - 3.2% | | | |

| State of Qatar: | | | |

| 3.75% 4/16/30 (b) | | 12,765,000 | 12,316,629 |

| 4% 3/14/29 (b) | | 5,455,000 | 5,348,628 |

| 4.4% 4/16/50 (b) | | 6,885,000 | 6,266,641 |

| 4.5% 4/23/28 (b) | | 2,565,000 | 2,581,108 |

| 4.817% 3/14/49 (b) | | 8,149,000 | 7,883,139 |

| 5.103% 4/23/48 (b) | | 2,960,000 | 2,959,630 |

TOTAL QATAR | | | 37,355,775 |

| Romania - 1.1% | | | |

| Romanian Republic: | | | |

| 3% 2/27/27 (b) | | 2,618,000 | 2,311,694 |

| 3% 2/14/31 (b) | | 9,651,000 | 7,562,765 |

| 3.375% 1/28/50 (Reg. S) | EUR | 1,255,000 | 770,196 |

| 3.625% 3/27/32 (b) | | 2,618,000 | 2,076,074 |

| 4% 2/14/51 (b) | | 955,000 | 627,196 |

TOTAL ROMANIA | | | 13,347,925 |

| Russia - 0.1% | | | |

| Ministry of Finance of the Russian Federation: | | | |

| 4.375% 3/21/29(Reg. S) (e)(g) | | 2,800,000 | 728,000 |

| 5.1% 3/28/35(Reg. S) (e)(g) | | 3,400,000 | 986,000 |

TOTAL RUSSIA | | | 1,714,000 |

| Rwanda - 0.2% | | | |

| Rwanda Republic 5.5% 8/9/31 (b) | | 3,410,000 | 2,579,452 |

| Saudi Arabia - 1.3% | | | |

| Kingdom of Saudi Arabia: | | | |

| 2.25% 2/2/33 (b) | | 4,030,000 | 3,254,981 |

| 3.625% 3/4/28 (b) | | 1,770,000 | 1,688,049 |

| 3.75% 1/21/55 (b) | | 3,755,000 | 2,941,338 |

| 4.5% 10/26/46 (b) | | 3,471,000 | 3,059,470 |

| 4.5% 4/22/60 (b) | | 2,055,000 | 1,815,207 |

| 4.625% 10/4/47 (b) | | 3,040,000 | 2,705,220 |

TOTAL SAUDI ARABIA | | | 15,464,265 |

| Senegal - 0.3% | | | |

| Republic of Senegal: | | | |

| 6.25% 5/23/33 (b) | | 2,700,000 | 2,217,038 |

| 6.75% 3/13/48 (b) | | 1,385,000 | 972,789 |

TOTAL SENEGAL | | | 3,189,827 |

| Serbia - 0.2% | | | |

| Republic of Serbia 2.125% 12/1/30 (b) | | 3,235,000 | 2,312,621 |

| South Africa - 1.0% | | | |

| South African Republic: | | | |

| 4.85% 9/30/29 | | 2,130,000 | 1,890,109 |

| 5% 10/12/46 | | 880,000 | 613,140 |

| 5.65% 9/27/47 | | 6,075,000 | 4,465,125 |

| 5.75% 9/30/49 | | 6,070,000 | 4,446,275 |

TOTAL SOUTH AFRICA | | | 11,414,649 |

| Sri Lanka - 0.5% | | | |

| Democratic Socialist Republic of Sri Lanka: | | | |

| 6.2% 5/11/27 (b)(e) | | 4,350,000 | 1,255,519 |

| 6.825% 7/18/26 (b)(e) | | 3,085,000 | 960,998 |

| 6.85% 11/3/25 (b)(e) | | 3,420,000 | 1,026,641 |

| 7.55% 3/28/30 (b)(e) | | 1,825,000 | 531,303 |

| 7.85% 3/14/29 (b)(e) | | 6,363,000 | 1,832,544 |

TOTAL SRI LANKA | | | 5,607,005 |

| Tunisia - 0.1% | | | |

| Tunisia Republic of 5.75% 1/30/25 (b) | | 1,260,000 | 854,674 |

| Turkey - 3.1% | | | |

| Turkish Republic: | | | |

| 4.25% 3/13/25 | | 3,275,000 | 3,062,125 |

| 4.75% 1/26/26 | | 3,660,000 | 3,330,600 |

| 4.875% 4/16/43 | | 4,735,000 | 3,069,760 |

| 5.125% 2/17/28 | | 3,070,000 | 2,647,875 |

| 5.6% 11/14/24 | | 3,295,000 | 3,204,388 |

| 5.75% 3/22/24 | | 1,020,000 | 1,007,441 |

| 5.75% 5/11/47 | | 4,880,000 | 3,310,165 |

| 5.95% 1/15/31 | | 2,685,000 | 2,228,550 |

| 6% 1/14/41 | | 4,622,000 | 3,339,395 |

| 6.125% 10/24/28 | | 2,140,000 | 1,905,001 |

| 6.35% 8/10/24 | | 1,550,000 | 1,528,009 |

| 6.375% 10/14/25 | | 4,480,000 | 4,300,800 |

| 6.75% 5/30/40 | | 2,112,000 | 1,660,560 |

| 7.375% 2/5/25 | | 841,000 | 843,103 |

TOTAL TURKEY | | | 35,437,772 |

| Ukraine - 0.8% | | | |

| Ukraine Government: | | | |

| 0% 8/1/41 (b)(d) | | 2,230,000 | 635,271 |

| 6.876% 5/21/31 (b) | | 3,585,000 | 678,461 |

| 7.253% 3/15/35 (b) | | 3,445,000 | 642,277 |

| 7.375% 9/25/34 (b) | | 2,130,000 | 394,449 |

| 7.75% 9/1/24 (b) | | 9,099,000 | 2,211,057 |

| 7.75% 9/1/25 (b) | | 9,100,000 | 2,040,675 |

| 7.75% 9/1/26 (b) | | 5,364,000 | 1,127,446 |

| 7.75% 9/1/27 (b) | | 1,750,000 | 362,906 |

| 7.75% 9/1/28 (b) | | 1,895,000 | 404,583 |

| 7.75% 9/1/29 (b) | | 2,594,000 | 550,901 |

| 9.75% 11/1/30 (b) | | 425,000 | 91,322 |

TOTAL UKRAINE | | | 9,139,348 |

| United Arab Emirates - 1.7% | | | |

| Emirate of Abu Dhabi: | | | |

| 1.7% 3/2/31 (b) | | 3,465,000 | 2,851,695 |

| 3.125% 9/30/49 (b) | | 13,102,000 | 9,644,710 |

| 3.875% 4/16/50 (b) | | 2,990,000 | 2,519,636 |

| Emirate of Dubai 3.9% 9/9/50 (Reg. S) | | 4,165,000 | 2,959,233 |

| United Arab Emirates 4.05% 7/7/32 (b) | | 1,415,000 | 1,391,829 |

TOTAL UNITED ARAB EMIRATES | | | 19,367,103 |

| United States of America - 3.7% | | | |

| U.S. Treasury Bonds: | | | |

| 2.875% 5/15/52 | | 43,848,000 | 35,290,748 |

| 3.25% 5/15/42 | | 9,177,000 | 8,045,648 |

TOTAL UNITED STATES OF AMERICA | | | 43,336,396 |

| Uruguay - 0.5% | | | |

| Uruguay Republic 5.1% 6/18/50 | | 6,360,000 | 6,270,960 |

| Uzbekistan - 0.6% | | | |

| Republic of Uzbekistan: | | | |

| 3.7% 11/25/30 (b) | | 1,595,000 | 1,324,648 |

| 3.9% 10/19/31 (b) | | 3,905,000 | 3,186,968 |

| 4.75% 2/20/24 (b) | | 1,110,000 | 1,081,764 |

| 5.375% 2/20/29 (b) | | 1,145,000 | 1,058,624 |

TOTAL UZBEKISTAN | | | 6,652,004 |

| Venezuela - 0.4% | | | |

| Venezuelan Republic: | | | |

| 9.25% 9/15/27 (e) | | 27,915,000 | 2,442,563 |

| 11.95% 8/5/31 (Reg. S) (e) | | 17,015,000 | 1,488,813 |

| 12.75% 12/31/49 (e) | | 3,625,000 | 280,938 |

TOTAL VENEZUELA | | | 4,212,314 |

| Vietnam - 0.9% | | | |

| Vietnamese Socialist Republic 5.5% 3/12/28 | | 10,646,667 | 10,365,861 |

| Zambia - 0.1% | | | |

| Republic of Zambia: | | | |

| 8.5% 4/14/24 (b) | | 585,000 | 263,250 |

| 8.97% 7/30/27 (b) | | 2,560,000 | 1,126,400 |

TOTAL ZAMBIA | | | 1,389,650 |

| TOTAL GOVERNMENT OBLIGATIONS (Cost $840,482,107) | | | 681,730,295 |

| | | | |

| Preferred Securities - 1.4% |

| | | Principal Amount (a) | Value ($) |

| Cayman Islands - 0.6% | | | |

| Banco Mercantil del Norte SA: | | | |

| 6.75% (b)(c)(d) | | 2,130,000 | 2,076,484 |

| 7.625% (b)(c)(d) | | 1,285,000 | 1,217,250 |

| DP World Salaam 6% (Reg. S) (c)(d) | | 3,215,000 | 3,271,263 |

TOTAL CAYMAN ISLANDS | | | 6,564,997 |

| Ireland - 0.1% | | | |

| Tinkoff Credit Systems 6% (b)(c)(d) | | 1,625,000 | 627,859 |

| Mexico - 0.3% | | | |

| CEMEX S.A.B. de CV 5.125% (b)(c)(d) | | 3,625,000 | 3,412,144 |

| United Arab Emirates - 0.4% | | | |

| Emirates NBD Bank PJSC 6.125% (Reg. S) (c)(d) | | 3,255,000 | 3,258,426 |

| NBK Tier 1 Financing 2 Ltd. 4.5% (b)(c)(d) | | 1,890,000 | 1,742,062 |

TOTAL UNITED ARAB EMIRATES | | | 5,000,488 |

| TOTAL PREFERRED SECURITIES (Cost $17,966,658) | | | 15,605,488 |

| | | | |

| Money Market Funds - 1.2% |

| | | Shares | Value ($) |

Fidelity Cash Central Fund 4.37% (h) (Cost $14,215,744) | | 14,212,901 | 14,215,744 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 98.6% (Cost $1,408,429,863) | 1,144,774,363 |

NET OTHER ASSETS (LIABILITIES) - 1.4% | 16,092,928 |

| NET ASSETS - 100.0% | 1,160,867,291 |

| | |

Currency Abbreviations

| EUR | - | European Monetary Unit |

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $746,061,769 or 64.3% of net assets. |

| (c) | Security is perpetual in nature with no stated maturity date. |

| (d) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (e) | Non-income producing - Security is in default. |

| (f) | Security initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

| (h) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.37% | 67,457,687 | 884,766,205 | 938,008,148 | 504,492 | 4,565 | (4,565) | 14,215,744 | 0.0% |

| Total | 67,457,687 | 884,766,205 | 938,008,148 | 504,492 | 4,565 | (4,565) | 14,215,744 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Corporate Bonds | 433,222,836 | - | 433,222,836 | - |

|

| Government Obligations | 681,730,295 | - | 680,016,295 | 1,714,000 |

|

| Preferred Securities | 15,605,488 | - | 15,605,488 | - |

|

| Money Market Funds | 14,215,744 | 14,215,744 | - | - |

| Total Investments in Securities: | 1,144,774,363 | 14,215,744 | 1,128,844,619 | 1,714,000 |

Fidelity® Series Emerging Markets Debt Fund

| Statement of Assets and Liabilities |

| | | | December 31, 2022 |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | $ | | | |

Unaffiliated issuers (cost $1,394,214,119) | | 1,130,558,619 | | |

Fidelity Central Funds (cost $14,215,744) | | 14,215,744 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $1,408,429,863) | | | $ | 1,144,774,363 |

| Cash | | | | 203,198 |

| Foreign currency held at value (cost $42) | | | | 26 |

| Receivable for fund shares sold | | | | 140,613 |

| Interest receivable | | | | 22,246,650 |

| Distributions receivable from Fidelity Central Funds | | | | 42,002 |

Total assets | | | | 1,167,406,852 |

| Liabilities | | | | |

| Payable for investments purchased | | $2,606,643 | | |

| Payable for fund shares redeemed | | 3,919,483 | | |

| Distributions payable | | 11,579 | | |

| Other payables and accrued expenses | | 1,856 | | |

| Total Liabilities | | | | 6,539,561 |

| Net Assets | | | $ | 1,160,867,291 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 1,585,203,501 |

| Total accumulated earnings (loss) | | | | (424,336,210) |

| Net Assets | | | $ | 1,160,867,291 |

Net Asset Value , offering price and redemption price per share ($1,160,867,291 ÷ 158,226,222 shares) | | | $ | 7.34 |

| | | | | |

| Statement of Operations |

| | | | Year ended December 31, 2022 |

| Investment Income | | | | |

| Dividends | | | $ | 1,419,102 |

| Interest | | | | 72,690,367 |

| Income from Fidelity Central Funds | | | | 504,492 |

| Income before foreign taxes withheld | | | | 74,613,961 |

| Less foreign taxes withheld | | | | (97,180) |

| Total Income | | | | 74,516,781 |

| Expenses | | | | |

| Custodian fees and expenses | | 6,182 | | |

| Independent trustees' fees and expenses | | 4,261 | | |

| Legal | | 4,147 | | |

| Total expenses before reductions | | 14,590 | | |

| Expense reductions | | (1,870) | | |

| Total expenses after reductions | | | | 12,720 |

| Net Investment income (loss) | | | | 74,504,061 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (93,497,802) | | |

| Fidelity Central Funds | | 4,565 | | |

| Foreign currency transactions | | (63,712) | | |

| Total net realized gain (loss) | | | | (93,556,949) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (187,659,786) | | |

| Fidelity Central Funds | | (4,565) | | |

| Assets and liabilities in foreign currencies | | 22,299 | | |

| Total change in net unrealized appreciation (depreciation) | | | | (187,642,052) |

| Net gain (loss) | | | | (281,199,001) |

| Net increase (decrease) in net assets resulting from operations | | | $ | (206,694,940) |

| Statement of Changes in Net Assets |

| |

| | Year ended December 31, 2022 | | Year ended December 31, 2021 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 74,504,061 | $ | 72,598,690 |

| Net realized gain (loss) | | (93,556,949) | | (16,006,513) |

| Change in net unrealized appreciation (depreciation) | | (187,642,052) | | (64,398,178) |

| Net increase (decrease) in net assets resulting from operations | | (206,694,940) | | (7,806,001) |

| Distributions to shareholders | | (66,732,572) | | (65,337,661) |

| Share transactions | | | | |

| Proceeds from sales of shares | | 118,610,757 | | 278,270,150 |

| Reinvestment of distributions | | 66,626,169 | | 65,320,232 |

| Cost of shares redeemed | | (193,506,975) | | (284,123,371) |

Net increase (decrease) in net assets resulting from share transactions | | (8,270,049) | | 59,467,011 |

| Total increase (decrease) in net assets | | (281,697,561) | | (13,676,651) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 1,442,564,852 | | 1,456,241,503 |

| End of period | $ | 1,160,867,291 | $ | 1,442,564,852 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | 15,614,535 | | 30,067,459 |

| Issued in reinvestment of distributions | | 8,801,859 | | 7,082,687 |

| Redeemed | | (25,220,427) | | (30,784,076) |

| Net increase (decrease) | | (804,033) | | 6,366,070 |

| | | | | |

Financial Highlights

| Fidelity® Series Emerging Markets Debt Fund |

| |

| Years ended December 31, | | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 9.07 | $ | 9.54 | $ | 9.60 | $ | 9.22 | $ | 10.25 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .470 | | .456 | | .519 | | .604 | | .576 |

| Net realized and unrealized gain (loss) | | (1.779) | | (.515) | | (.103) | | .341 | | (1.045) |

| Total from investment operations | | (1.309) | | (.059) | | .416 | | .945 | | (.469) |

| Distributions from net investment income | | (.421) | | (.411) | | (.476) | | (.565) | | (.561) |

| Total distributions | | (.421) | | (.411) | | (.476) | | (.565) | | (.561) |

| Net asset value, end of period | $ | 7.34 | $ | 9.07 | $ | 9.54 | $ | 9.60 | $ | 9.22 |

Total Return C | | (14.45)% | | (.60)% | | 4.75% | | 10.46% | | (4.66)% |

Ratios to Average Net Assets B,D,E | | | | | | | | | | |

Expenses before reductions F | | -% | | -% | | -% | | -% | | -% |

Expenses net of fee waivers, if any F | | -% | | -% | | -% | | -% | | -% |

Expenses net of all reductions F | | -% | | -% | | -% | | -% | | -% |

| Net investment income (loss) | | 6.12% | | 4.93% | | 5.73% | | 6.35% | | 5.95% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 1,160,867 | $ | 1,442,565 | $ | 1,456,242 | $ | 1,463,941 | $ | 1,254,003 |

Portfolio turnover rate G | | 27% | | 29% | | 84% | | 61% H | | 43% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Amount represents less than .005%.

G Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

H Portfolio turnover rate excludes securities received or delivered in-kind.

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

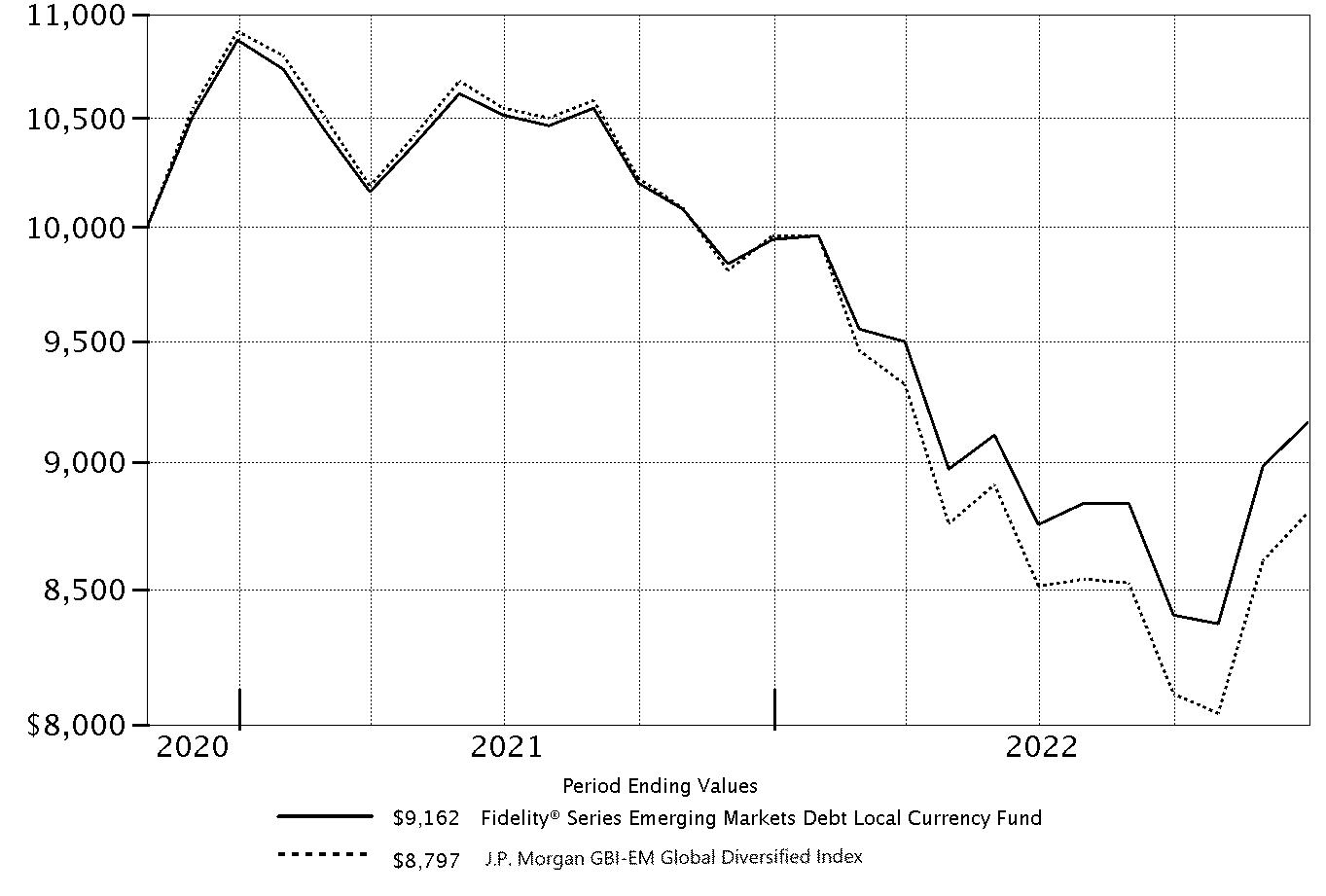

Periods ended December 31, 2022 | Past 1 year | Life of Fund A |

| Fidelity® Series Emerging Markets Debt Local Currency Fund | -7.85% | -3.96% |

A From October 30, 2020

| $10,000 Over Life of Fund |

| |

Let's say hypothetically that $10,000 was invested in Fidelity® Series Emerging Markets Debt Local Currency Fund, on October 30, 2020, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the J.P. Morgan GBI-EM Global Diversified Index performed over the same period. |

|

|

Fidelity® Series Emerging Markets Debt Local Currency Fund

Market Recap:

Emerging-markets debt returned -17.78% in 2022, according to the J.P. Morgan Emerging Markets Bond Index Global Diversified, as a multitude of crosscurrents challenged the global economy and financial markets. Persistently high inflation, exacerbated by energy price shocks from the Russia-Ukraine conflict, spurred the U.S. Federal Reserve to hike interest rates more aggressively than anticipated, as did central banks in other developed and emerging markets. Among other significant developments, the Chinese property market showed signs of weakness and China's zero-COVID policy created challenges for global supply chains and global economic growth. Commodity-importing countries and frontier markets were hit particularly hard by concern about recession. However, the index rallied in the final quarter of the year, as yield spreads tightened and U.S. Treasury yields stabilized amid signs of lower inflationary pressure, and China's lifting of COVID restrictions and policy stimulus raised hopes at the end of a tumultuous 2022. For the full year, investment-grade credit markets, including China (-8%), outpaced non-investment-grade countries in the index. Despite high inflation in Turkey (+3%), central bankers there cut interest rates, as currency reserves increased due to a pickup in foreign investment. Meanwhile, Russia and Belarus, which were removed from the index in March, each returned -100%. Ukraine returned roughly -77%, as the country received the permission of sovereign bondholders to delay debt payments for two years.

Comments from Lead Manager Constantin Petrov and Co-Managers Timothy Gill and Nader Nazmi:

For the year, the fund returned -7.85%, outperforming the -11.69% result of the benchmark, the J.P. Morgan GBI-EM Global Diversified Index. The EM debt local currency market declined this period amid a weaker macroeconomic outlook and continued U.S. dollar strength. Versus the benchmark, security selection and market selection drove the fund's outperformance the past 12 months. The main country contributor was Russia, where security selection boosted relative performance. Elsewhere, overweighted stakes in Brazil, China, Mexico, South Africa and Dominican Republic contributed because these local currency markets outperformed in 2022. Meanwhile, we were underweighted Egypt, which was a positive because this currency market underperformed. Conversely, security selection in Czech Republic and Poland weighed on our relative result the past 12 months. It also hurt to be underweight in Thailand and Malaysia, two markets that outperformed the benchmark.

Note to shareholders:

On January 3, 2022, Tim Gill and Nader Nazmi assumed co-management responsibilities for the fund, joining Lead Manager Constantin Petrov.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® Series Emerging Markets Debt Local Currency Fund

| Top Bond Issuers (% of Fund's net assets) |

(with maturities greater than one year) |

| Indonesian Republic | 10.1 | |

| United Mexican States | 9.9 | |

| Peoples Republic of China | 9.9 | |

| South African Republic | 9.7 | |

| Brazil Letras Do Tesouro Nacio | 5.4 | |

| Malaysian Government | 4.9 | |

| Brazilian Federative Republic | 4.7 | |

| Polish Government | 4.6 | |

| Kingdom of Thailand | 4.6 | |

| Romanian Republic | 3.7 | |

| | 67.5 | |

| |

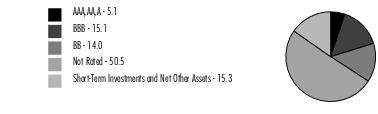

Quality Diversification (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

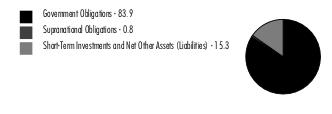

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 84.7% |

Currency Contracts - 14.4% |

|

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable. |

| |

Foreign currency contracts and other assets and liabilities are included within United States of America, as applicable.

Fidelity® Series Emerging Markets Debt Local Currency Fund

Showing Percentage of Net Assets

| Foreign Government and Government Agency Obligations - 83.9% |

| | | Principal Amount (a) | Value ($) |

| Brazil - 10.1% | | | |

| Brazil Letras Do Tesouro Nacio, yield at date of purchase 5.8628% to 13.7798% 7/1/23 to 1/1/26 | BRL | 120,770,000 | 20,763,707 |

| Brazilian Federative Republic: | | | |

| 10% 1/1/25 | BRL | 28,750,000 | 5,207,781 |

| 10% 1/1/27 | BRL | 38,000,000 | 6,644,915 |

| 10% 1/1/29 | BRL | 12,250,000 | 2,074,282 |

| 10% 1/1/31 | BRL | 18,000,000 | 2,974,253 |

| 10% 1/1/33 | BRL | 7,050,000 | 1,145,846 |

TOTAL BRAZIL | | | 38,810,784 |

| Chile - 2.2% | | | |

| Chilean Republic: | | | |

| 4.5% 3/1/26 | CLP | 3,050,000,000 | 3,435,694 |

| 4.7% 9/1/30 (Reg. S) (b) | CLP | 1,000,000,000 | 1,135,224 |

| 5% 3/1/35 | CLP | 1,825,000,000 | 2,126,989 |

| 6% 1/1/43 | CLP | 1,275,000,000 | 1,658,133 |

TOTAL CHILE | | | 8,356,040 |

| China - 9.9% | | | |

| Peoples Republic of China: | | | |

| 2.68% 5/21/30 | CNY | 92,250,000 | 13,223,508 |

| 2.88% 11/5/23 | CNY | 57,000,000 | 8,309,089 |

| 3.28% 12/3/27 | CNY | 88,750,000 | 13,239,260 |

| 3.81% 9/14/50 | CNY | 19,000,000 | 3,011,778 |

TOTAL CHINA | | | 37,783,635 |

| Colombia - 3.4% | | | |

| Colombian Republic: | | | |

| 5.75% 11/3/27 | COP | 31,100,000,000 | 4,835,303 |

| 6% 4/28/28 | COP | 1,850,000,000 | 283,815 |

| 7% 6/30/32 | COP | 22,800,000,000 | 3,182,594 |

| 7.25% 10/26/50 | COP | 8,500,000,000 | 991,163 |

| 7.5% 8/26/26 | COP | 13,650,000,000 | 2,398,534 |

| 9.25% 5/28/42 | COP | 9,500,000,000 | 1,411,401 |

TOTAL COLOMBIA | | | 13,102,810 |

| Czech Republic - 3.6% | | | |

| Czech Republic: | | | |

| 0.95% 5/15/30 (Reg. S) | CZK | 213,750,000 | 7,101,007 |

| 1.2% 3/13/31 | CZK | 45,000,000 | 1,484,903 |

| 1.5% 4/24/40 | CZK | 13,750,000 | 361,919 |

| 2% 10/13/33 | CZK | 142,000,000 | 4,712,587 |

TOTAL CZECH REPUBLIC | | | 13,660,416 |

| Dominican Republic - 0.7% | | | |

| Dominican Republic: | | | |

| 8.9% 2/15/23(Reg. S) | DOP | 116,250,000 | 2,047,616 |

| 9.75% 6/5/26 (Reg. S) | DOP | 26,500,000 | 447,561 |

TOTAL DOMINICAN REPUBLIC | | | 2,495,177 |

| Egypt - 0.4% | | | |

| Arab Republic of Egypt: | | | |

| 14.556% 10/13/27 | EGP | 36,000,000 | 1,234,914 |

| 16.1% 5/7/29 | EGP | 12,000,000 | 423,671 |

TOTAL EGYPT | | | 1,658,585 |

| Hungary - 2.5% | | | |

| Hungarian Republic: | | | |

| 2.25% 6/22/34 | HUF | 470,000,000 | 696,089 |

| 2.75% 12/22/26 | HUF | 1,144,000,000 | 2,289,257 |

| 3% 6/26/24 | HUF | 365,000,000 | 862,876 |

| 3% 10/27/38 | HUF | 500,000,000 | 708,383 |

| 3.25% 10/22/31 | HUF | 447,000,000 | 784,520 |

| 5.5% 6/24/25 | HUF | 675,000,000 | 1,580,839 |

| 6.75% 10/22/28 | HUF | 1,118,000,000 | 2,592,354 |

TOTAL HUNGARY | | | 9,514,318 |

| Indonesia - 10.1% | | | |

| Indonesian Republic: | | | |

| 6.375% 4/15/32 | IDR | 51,000,000,000 | 3,145,014 |

| 6.5% 6/15/25 | IDR | 34,750,000,000 | 2,241,143 |

| 7.125% 6/15/42 | IDR | 14,000,000,000 | 898,185 |

| 7.5% 4/15/40 | IDR | 61,750,000,000 | 4,059,812 |

| 8.125% 5/15/24 | IDR | 85,000,000,000 | 5,618,436 |

| 8.25% 5/15/29 | IDR | 102,000,000,000 | 7,023,864 |

| 8.25% 5/15/36 | IDR | 44,750,000,000 | 3,120,355 |

| 8.375% 9/15/26 | IDR | 120,750,000,000 | 8,241,328 |

| 8.375% 3/15/34 | IDR | 19,788,000,000 | 1,389,323 |

| 8.375% 4/15/39 | IDR | 42,750,000,000 | 3,024,835 |

TOTAL INDONESIA | | | 38,762,295 |

| Kazakhstan - 0.2% | | | |

| Kazakhstan Republic 10.5% 8/4/26 | KZT | 440,000,000 | 853,549 |

| Malaysia - 4.9% | | | |

| Malaysian Government: | | | |

| 3.582% 7/15/32 | MYR | 15,000,000 | 3,279,909 |

| 3.757% 5/22/40 | MYR | 10,000,000 | 2,089,921 |

| 3.828% 7/5/34 | MYR | 14,300,000 | 3,133,794 |

| 3.885% 8/15/29 | MYR | 10,350,000 | 2,326,647 |

| 4.065% 6/15/50 | MYR | 14,500,000 | 2,996,283 |

| 4.696% 10/15/42 | MYR | 9,000,000 | 2,119,730 |

| 4.762% 4/7/37 | MYR | 11,250,000 | 2,690,755 |

TOTAL MALAYSIA | | | 18,637,039 |

| Mexico - 9.9% | | | |

| United Mexican States: | | | |

| 5.75% 3/5/26 | MXN | 275,000,000 | 12,754,022 |

| 7.75% 11/23/34 | MXN | 44,500,000 | 2,062,759 |

| 7.75% 11/13/42 | MXN | 168,750,000 | 7,565,194 |

| 8% 12/7/23 | MXN | 123,750,000 | 6,192,787 |

| 8% 7/31/53 | MXN | 22,000,000 | 1,002,151 |

| 8.5% 5/31/29 | MXN | 171,500,000 | 8,546,551 |

TOTAL MEXICO | | | 38,123,464 |

| Peru - 2.0% | | | |

| Peruvian Republic: | | | |

| 5.35% 8/12/40 | PEN | 2,250,000 | 441,358 |

| 5.4% 8/12/34(Reg. S) | PEN | 8,850,000 | 1,864,734 |

| 6.35% 8/12/28 | PEN | 9,900,000 | 2,476,944 |

| 6.95% 8/12/31 | PEN | 11,500,000 | 2,853,723 |

TOTAL PERU | | | 7,636,759 |

| Philippines - 0.1% | | | |

| Philippine Republic 6.25% 1/14/36 | PHP | 30,000,000 | 488,578 |

| Poland - 4.6% | | | |

| Polish Government: | | | |

| 1.25% 10/25/30 | PLN | 11,300,000 | 1,732,700 |

| 1.75% 4/25/32 | PLN | 22,250,000 | 3,334,796 |

| 2.5% 7/25/26 | PLN | 43,600,000 | 8,597,102 |

| 2.5% 7/25/27 | PLN | 15,000,000 | 2,852,443 |

| 2.75% 10/25/29 | PLN | 7,000,000 | 1,255,793 |

TOTAL POLAND | | | 17,772,834 |

| Romania - 3.7% | | | |

| Romanian Republic: | | | |

| 3.65% 9/24/31 | RON | 15,550,000 | 2,518,576 |

| 4% 10/25/23 | RON | 9,750,000 | 2,066,196 |

| 4.25% 6/28/23 | RON | 20,250,000 | 4,332,148 |

| 4.75% 2/24/25 | RON | 5,550,000 | 1,149,717 |

| 4.75% 10/11/34 | RON | 2,500,000 | 394,929 |

| 5% 2/12/29 | RON | 16,450,000 | 3,083,052 |

| 5.8% 7/26/27 | RON | 2,750,000 | 552,395 |

TOTAL ROMANIA | | | 14,097,013 |

| South Africa - 9.7% | | | |

| South African Republic: | | | |

| 6.5% 2/28/41 | ZAR | 86,000,000 | 3,165,426 |

| 7% 2/28/31 | ZAR | 77,250,000 | 3,670,653 |

| 8% 1/31/30 | ZAR | 208,500,000 | 10,939,355 |

| 8.75% 2/28/48 | ZAR | 106,000,000 | 4,876,646 |

| 8.875% 2/28/35 | ZAR | 218,750,000 | 10,851,473 |

| 10.5% 12/21/26 | ZAR | 57,500,000 | 3,577,074 |

TOTAL SOUTH AFRICA | | | 37,080,627 |

| Thailand - 4.6% | | | |

| Kingdom of Thailand: | | | |

| 1.585% 12/17/35 | THB | 5,750,000 | 141,871 |

| 1.6% 12/17/29 | THB | 58,000,000 | 1,607,638 |

| 1.6% 6/17/35 | THB | 180,750,000 | 4,477,675 |

| 2% 12/17/31 | THB | 142,000,000 | 3,970,709 |

| 2% 6/17/42 | THB | 45,000,000 | 1,040,251 |

| 2.875% 6/17/46 | THB | 44,400,000 | 1,129,677 |

| 3.3% 6/17/38 | THB | 179,750,000 | 5,211,678 |

TOTAL THAILAND | | | 17,579,499 |

| Turkey - 1.1% | | | |

| Turkish Republic: | | | |

| 8% 3/12/25 | TRY | 38,250,000 | 1,992,033 |

| 11% 2/24/27 | TRY | 16,250,000 | 972,276 |

| 11.7% 11/13/30 | TRY | 12,500,000 | 841,476 |

| 12.4% 3/8/28 | TRY | 7,750,000 | 489,600 |

TOTAL TURKEY | | | 4,295,385 |

| Uruguay - 0.2% | | | |

| Uruguay Republic: | | | |

| 8.25% 5/21/31 | UYU | 31,500,000 | 681,738 |

| 8.5% 3/15/28 (Reg. S) | UYU | 5,500,000 | 125,692 |

TOTAL URUGUAY | | | 807,430 |

| TOTAL FOREIGN GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $356,374,535) | | | 321,516,237 |

| | | | |

| Supranational Obligations - 0.8% |

| | | Principal Amount (a) | Value ($) |

| Asian Infrastructure Investment Bank 2.375% 2/10/25 (Reg. S) | PHP | 57,900,000 | 955,735 |

| Inter-American Development Bank: | | | |

| 5.1% 11/17/26 | IDR | 15,000,000,000 | 926,170 |

| 5.7% 11/12/24 | INR | 105,000,000 | 1,229,599 |

| TOTAL SUPRANATIONAL OBLIGATIONS (Cost $3,655,671) | | | 3,111,504 |

| | | | |

| Money Market Funds - 13.7% |

| | | Shares | Value ($) |

Fidelity Cash Central Fund 4.37% (c) (Cost $52,392,505) | | 52,382,029 | 52,392,505 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 98.4% (Cost $412,422,711) | 377,020,246 |

NET OTHER ASSETS (LIABILITIES) - 1.6% | 6,272,578 |

| NET ASSETS - 100.0% | 383,292,824 |

| | |

| Forward Foreign Currency Contracts |

Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation/ (Depreciation) ($) |

| | | | | | | |

| BRL | 34,331,000 | USD | 6,415,570 | Bank of America, N.A. | 1/13/23 | 74,814 |

| BRL | 4,918,000 | USD | 914,466 | Citibank, N. A. | 1/13/23 | 15,297 |

| BRL | 11,686,000 | USD | 2,205,738 | Citibank, N. A. | 1/13/23 | 3,537 |

| BRL | 1,032,000 | USD | 198,043 | State Street Bank and Trust Co | 1/13/23 | (2,940) |

| CLP | 843,697,000 | USD | 970,603 | Bank of America, N.A. | 1/13/23 | 23,187 |

| CLP | 825,351,000 | USD | 941,644 | Citibank, N. A. | 1/13/23 | 30,537 |

| CLP | 812,017,000 | USD | 868,003 | Citibank, N. A. | 1/13/23 | 88,472 |

| CLP | 869,659,000 | USD | 928,726 | Goldman Sachs Bank USA | 1/13/23 | 95,645 |

| CLP | 874,938,000 | USD | 892,339 | HSBC Bank | 1/13/23 | 138,251 |

| CNY | 6,805,000 | USD | 980,670 | BNP Paribas S.A. | 1/13/23 | 6,506 |

| CNY | 9,195,000 | USD | 1,285,115 | Goldman Sachs Bank USA | 1/13/23 | 48,769 |

| CNY | 16,372,000 | USD | 2,322,270 | Goldman Sachs Bank USA | 1/13/23 | 52,756 |

| CNY | 3,424,000 | USD | 473,419 | State Street Bank and Trust Co | 1/13/23 | 23,288 |

| CNY | 3,663,000 | USD | 526,218 | State Street Bank and Trust Co | 1/13/23 | 5,160 |

| COP | 5,066,600,000 | USD | 1,039,303 | Bank of America, N.A. | 1/13/23 | 3,926 |

| COP | 9,243,500,000 | USD | 1,934,799 | Citibank, N. A. | 1/13/23 | (31,534) |

| COP | 4,246,200,000 | USD | 855,657 | Citibank, N. A. | 1/13/23 | 18,648 |

| COP | 4,360,200,000 | USD | 886,400 | Citibank, N. A. | 1/13/23 | 11,379 |

| COP | 1,712,600,000 | USD | 331,353 | Goldman Sachs Bank USA | 1/13/23 | 21,276 |

| COP | 4,570,600,000 | USD | 925,785 | State Street Bank and Trust Co | 1/13/23 | 15,315 |

| CZK | 22,108,000 | USD | 958,643 | BNP Paribas S.A. | 1/13/23 | 19,061 |

| CZK | 23,200,000 | USD | 923,407 | BNP Paribas S.A. | 1/13/23 | 102,591 |

| CZK | 20,025,000 | USD | 804,868 | Brown Brothers Harriman & Co | 1/13/23 | 80,718 |

| CZK | 7,833,000 | USD | 332,527 | Brown Brothers Harriman & Co | 1/13/23 | 13,880 |

| CZK | 22,765,000 | USD | 936,800 | Goldman Sachs Bank USA | 1/13/23 | 69,960 |

| CZK | 148,567,000 | USD | 5,899,946 | HSBC Bank | 1/13/23 | 670,286 |

| CZK | 22,439,000 | USD | 900,581 | State Street Bank and Trust Co | 1/13/23 | 91,762 |

| CZK | 22,588,000 | USD | 914,838 | State Street Bank and Trust Co | 1/13/23 | 84,094 |

| CZK | 43,918,000 | USD | 1,835,865 | State Street Bank and Trust Co | 1/13/23 | 106,366 |

| CZK | 23,372,000 | USD | 992,646 | State Street Bank and Trust Co | 1/13/23 | 40,958 |

| HUF | 195,534,000 | USD | 488,189 | BNP Paribas S.A. | 1/13/23 | 34,552 |

| HUF | 251,002,000 | USD | 634,872 | BNP Paribas S.A. | 1/13/23 | 36,156 |

| HUF | 367,113,000 | USD | 888,589 | Bank of America, N.A. | 1/13/23 | 92,851 |

| HUF | 384,365,000 | USD | 1,004,207 | Goldman Sachs Bank USA | 1/13/23 | 23,355 |

| HUF | 390,478,000 | USD | 915,919 | Goldman Sachs Bank USA | 1/13/23 | 127,984 |

| HUF | 1,269,211,000 | USD | 2,934,778 | HSBC Bank | 1/13/23 | 458,331 |

| IDR | 14,874,700,000 | USD | 956,695 | Bank of America, N.A. | 1/13/23 | (1,308) |

| IDR | 3,509,700,000 | USD | 225,947 | Citibank, N. A. | 1/13/23 | (522) |

| IDR | 41,439,700,000 | USD | 2,641,996 | Goldman Sachs Bank USA | 1/13/23 | 19,635 |

| IDR | 13,005,800,000 | USD | 837,409 | State Street Bank and Trust Co | 1/13/23 | (2,060) |

| IDR | 15,177,400,000 | USD | 967,946 | State Street Bank and Trust Co | 1/13/23 | 6,883 |

| IDR | 28,380,000,000 | USD | 1,815,739 | State Street Bank and Trust Co | 1/13/23 | 7,080 |

| INR | 152,447,000 | USD | 1,837,154 | BNP Paribas S.A. | 1/13/23 | 4,245 |

| INR | 35,084,000 | USD | 429,740 | Bank of America, N.A. | 1/13/23 | (5,963) |

| INR | 263,166,000 | USD | 3,175,265 | Citibank, N. A. | 1/13/23 | 3,502 |

| INR | 22,774,000 | USD | 274,524 | Citibank, N. A. | 1/13/23 | 561 |

| MXN | 19,201,000 | USD | 986,736 | BNP Paribas S.A. | 1/13/23 | (3,178) |

| MXN | 45,805,000 | USD | 2,298,573 | Brown Brothers Harriman & Co | 1/13/23 | 47,755 |

| MXN | 70,000,000 | USD | 3,588,216 | Brown Brothers Harriman & Co | 1/13/23 | (2,516) |

| MXN | 36,958,000 | USD | 1,881,051 | Goldman Sachs Bank USA | 1/13/23 | 12,097 |

| MXN | 11,121,000 | USD | 559,430 | State Street Bank and Trust Co | 1/13/23 | 10,236 |

| MYR | 24,690,000 | USD | 5,598,639 | Goldman Sachs Bank USA | 1/13/23 | 8,667 |

| MYR | 28,812,000 | USD | 6,078,481 | Goldman Sachs Bank USA | 1/13/23 | 464,967 |

| MYR | 9,044,000 | USD | 2,071,936 | Goldman Sachs Bank USA | 1/13/23 | (17,967) |

| MYR | 8,506,000 | USD | 1,882,691 | State Street Bank and Trust Co | 1/13/23 | 49,093 |

| MYR | 8,761,000 | USD | 1,957,765 | State Street Bank and Trust Co | 1/13/23 | 31,932 |

| PEN | 942,000 | USD | 234,358 | Citibank, N. A. | 1/13/23 | 13,494 |

| PEN | 3,585,000 | USD | 896,811 | HSBC Bank | 1/13/23 | 46,448 |

| PEN | 2,825,000 | USD | 737,598 | State Street Bank and Trust Co | 1/13/23 | 5,695 |

| PHP | 54,112,000 | USD | 956,211 | Bank of America, N.A. | 1/13/23 | 15,353 |

| PHP | 54,338,000 | USD | 980,476 | Citibank, N. A. | 1/13/23 | (4,854) |

| PHP | 54,717,000 | USD | 978,487 | Citibank, N. A. | 1/13/23 | 3,940 |

| PHP | 53,086,000 | USD | 949,320 | Citibank, N. A. | 1/13/23 | 3,822 |

| PHP | 61,138,000 | USD | 1,080,559 | Royal Bank of Canada | 1/13/23 | 17,156 |

| PLN | 26,081,000 | USD | 5,887,556 | Bank of America, N.A. | 1/13/23 | 60,432 |

| PLN | 4,186,000 | USD | 948,878 | Canadian Imperial Bk. of Comm. | 1/13/23 | 5,774 |

| PLN | 2,167,000 | USD | 449,307 | Goldman Sachs Bank USA | 1/13/23 | 44,895 |

| PLN | 3,725,000 | USD | 817,618 | Goldman Sachs Bank USA | 1/13/23 | 31,899 |

| PLN | 8,833,000 | USD | 1,942,286 | Goldman Sachs Bank USA | 1/13/23 | 72,152 |

| PLN | 1,899,000 | USD | 420,486 | Goldman Sachs Bank USA | 1/13/23 | 12,596 |

| PLN | 6,053,000 | USD | 1,363,684 | HSBC Bank | 1/13/23 | 16,752 |

| PLN | 13,918,000 | USD | 2,801,633 | HSBC Bank | 1/13/23 | 372,482 |

| RON | 4,998,000 | USD | 1,080,493 | BNP Paribas S.A. | 1/13/23 | 1,609 |

| RON | 10,813,000 | USD | 2,128,206 | BNP Paribas S.A. | 1/13/23 | 212,885 |

| RON | 5,042,000 | USD | 1,055,312 | BNP Paribas S.A. | 1/13/23 | 36,316 |

| RON | 2,346,000 | USD | 507,419 | Brown Brothers Harriman & Co | 1/13/23 | 506 |

| RON | 4,905,000 | USD | 1,047,254 | Brown Brothers Harriman & Co | 1/13/23 | 14,713 |

| RON | 1,340,000 | USD | 287,147 | HSBC Bank | 1/13/23 | 2,973 |

| SGD | 5,124,000 | USD | 3,604,468 | Royal Bank of Canada | 1/13/23 | 221,779 |

| THB | 27,705,000 | USD | 804,910 | JPMorgan Chase Bank, N.A. | 1/13/23 | (1,836) |

| THB | 34,410,000 | USD | 1,002,823 | JPMorgan Chase Bank, N.A. | 1/13/23 | (5,393) |

| THB | 31,764,000 | USD | 926,064 | JPMorgan Chase Bank, N.A. | 1/13/23 | (5,333) |

| THB | 161,160,000 | USD | 4,636,097 | JPMorgan Chase Bank, N.A. | 1/13/23 | 35,387 |

| THB | 43,084,000 | USD | 1,247,004 | JPMorgan Chase Bank, N.A. | 1/13/23 | 1,855 |

| THB | 737,890,000 | USD | 19,416,513 | JPMorgan Chase Bank, N.A. | 1/13/23 | 1,972,426 |

| THB | 30,313,000 | USD | 801,719 | JPMorgan Chase Bank, N.A. | 1/13/23 | 76,952 |

| THB | 36,805,000 | USD | 973,851 | JPMorgan Chase Bank, N.A. | 1/13/23 | 93,001 |

| THB | 33,272,000 | USD | 937,402 | JPMorgan Chase Bank, N.A. | 1/13/23 | 27,041 |

| USD | 993,620 | BRL | 5,217,000 | Bank of America, N.A. | 1/13/23 | 7,329 |

| USD | 1,139,224 | BRL | 6,047,000 | Citibank, N. A. | 1/13/23 | (3,981) |

| USD | 5,854,985 | BRL | 31,210,000 | Citibank, N. A. | 1/13/23 | (45,364) |

| USD | 906,942 | BRL | 4,912,000 | Citibank, N. A. | 1/13/23 | (21,687) |

| USD | 1,149,458 | BRL | 6,145,000 | Citibank, N. A. | 1/13/23 | (12,274) |

| USD | 258,435 | BRL | 1,371,000 | Citibank, N. A. | 1/13/23 | (756) |

| USD | 919,565 | BRL | 4,773,000 | Citibank, N. A. | 1/13/23 | 17,214 |

| USD | 964,041 | CLP | 839,824,000 | Bank of America, N.A. | 1/13/23 | (25,188) |

| USD | 673,890 | CLP | 664,523,000 | Bank of America, N.A. | 1/13/23 | (108,852) |

| USD | 950,289 | CLP | 859,061,000 | Citibank, N. A. | 1/13/23 | (61,599) |

| USD | 723,766 | CLP | 643,971,000 | Citibank, N. A. | 1/13/23 | (34,767) |

| USD | 945,179 | CLP | 864,650,000 | State Street Bank and Trust Co | 1/13/23 | (73,292) |

| USD | 3,952,911 | CNY | 27,534,000 | Citibank, N. A. | 1/13/23 | (41,344) |

| USD | 986,101 | CNY | 6,811,000 | Goldman Sachs Bank USA | 1/13/23 | (1,945) |

| USD | 813,086 | COP | 4,038,600,000 | Bank of America, N.A. | 1/13/23 | (18,473) |

| USD | 972,544 | COP | 4,721,700,000 | Citibank, N. A. | 1/13/23 | 332 |

| USD | 1,800,647 | COP | 8,605,400,000 | Citibank, N. A. | 1/13/23 | 28,769 |

| USD | 290,719 | COP | 1,415,800,000 | Citibank, N. A. | 1/13/23 | (799) |

| USD | 973,712 | COP | 4,933,800,000 | Citibank, N. A. | 1/13/23 | (42,172) |