UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03235

FMI Common Stock Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Wisconsin Avenue, Suite 2200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Ted D. Kellner

Fiduciary Management, Inc.

100 East Wisconsin Avenue, Suite 2200

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 226-4555

(Registrant's telephone number, including area code)

Date of fiscal year end: September 30

Date of reporting period: March 31, 2013

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

March 31, 2013

FMI Large Cap Fund

(FMIHX)

FMI Common Stock Fund

(FMIMX)

FMI International Fund

(FMIJX)

| |

| |

| |

| |

| |

| |

| |

| FMI Funds |

| |

| Advised by Fiduciary Management, Inc. |

| |

| www.fmifunds.com |

| |

| |

| |

FMI Funds

TABLE OF CONTENTS

| FMI Large Cap Fund | | | |

| Shareholder Letter | | | 3 | |

| Schedule of Investments | | | 8 | |

| Industry Sectors | | | 9 | |

| | | | | |

| FMI Common Stock Fund | | | | |

| Shareholder Letter | | | 10 | |

| Schedule of Investments | | | 15 | |

| Industry Sectors | | | 16 | |

| | | | | |

| FMI International Fund | | | | |

| Shareholder Letter | | | 17 | |

| Schedule of Investments | | | 23 | |

| Industry Sectors | | | 25 | |

| | | | | |

| Financial Statements | | | | |

| Statements of Assets and Liabilities | | | 26 | |

| Statements of Operations | | | 27 | |

| Statements of Changes in Net Assets | | | 28 | |

| Financial Highlights | | | 29 | |

| Notes to Financial Statements | | | 32 | |

| | | | | |

| Additional Information | | | 36 | |

| Cost Discussion | | | 37 | |

| Advisory Agreements | | | 38 | |

| Disclosure Information | | | 38 | |

FMI

Large Cap

Fund

March 31, 2013

Dear Fellow Shareholders:

The FMI Large Cap Fund (FMIHX) gained 11.40%(1) in the quarter ending March 31, 2013. This compared to the benchmark Standard & Poor’s 500 Index return of 10.61%(2). Both the S&P 500 and the Fund benefitted from expanding multiples as fundamental sales and earnings growth remained in the low to mid-single-digit range. Sectors that contributed meaningfully to FMIHX returns included Electronic Technology, Finance, and Commercial Services. Finance was a significant relative detractor for the Fund last year as many lower quality financial stocks that had collapsed in 2008 and early 2009 continued to rebound (with a big assist from the Fed). We are hopeful that the better recent performance from this sector is a harbinger of what is to come. Comerica and Willis performed nicely in the March quarter, as did Berkshire Hathaway, 3M and Omnicom. On the flip side, Transportation, Health Technology and Energy Minerals had negative relative performance. Expeditors International, GlaxoSmithKline and Devon all lagged their respective sectors and the market. Near-term concerns about China and world economic growth are affecting Expeditors; Glaxo is suffering from ongoing negative European pricing trends; and Devon faces the near-term taint of being levered to natural gas, which is currently priced very low. We remain optimistic about the long-term prospects for Expeditors and Devon. Glaxo is a more complicated case where the stock is cheap but the growing uncertainties around paying for health care worldwide and the continuing lack of productivity in drug research is causing us to tread cautiously. Overall, we contend the FMI Large Cap Fund contains many good businesses. Relative to the benchmark, valuations are attractive but are somewhat above average from an absolute standpoint. As mentioned in the December letter (and the same situation applies today), overall market valuations are elevated from a historical perspective.

Some have questioned why we are not jumping on the stock market bandwagon. After all, housing is rebounding, employment is steady if not growing ever so slightly, corporate cash and cash flows are high, earnings yields are much greater than bond yields, and the public appears to be coming back to the market. Taking the first two together, housing is indeed continuing to bounce off of a very depressed bottom. Unusually low mortgage rates and FHA insurance (future bailout to follow) are assisting the housing market. Housing-related stocks have been huge winners over the past few years and seem to be discounting an environment that is much stronger than we envision. Over ten million households continue to owe more than their homes are worth. Shadow inventory remains high. A sustained improvement in housing will likely require stronger economic growth and better employment. Three things can drive economic growth: more people working, people working more hours, and more capital deployed. On the first item there has been a little progress, but as the nearby chart shows, declining labor participation is offsetting this improvement; on the second item, hours worked have been flat to down; and on the third item, fixed business investment orders have been falling, as articulated in our December letter. Gross domestic product (GDP) growth remains anemic in the 0-2% range.

Corporate cash and cash flow has been solid. A large portion of the cash is overseas and will incur a 35% tax upon repatriation. Unless tax laws change, these monies are unlikely to see our shores. Part of the cash flow dynamic reflects caution about spending on capital and people, as well as the desire for managements to continue to squeeze their cost structures as tightly as possible. This has enabled margins and earnings to remain near peak levels but this strategy cannot stay effective over the long run. Without increased capital, research and development (R&D) and people investment, sales and earnings growth degrades. In fact, sales growth and margins for the market (companies within the benchmark) peaked over a year ago. Health care mandates and higher tax rates have induced further caution in the executive and entrepreneurial ranks.

| (1) | The Fund’s 1-year and annualized 5-year and 10-year returns through March 31, 2013 were: 15.20%, 7.73% and 11.15%, respectively. |

| (2) | The S&P 500 Index, benchmark for FMIHX 1-year and annualized 5-year and 10-year returns through March 31, 2013 were: 13.96%, 5.81% and 8.53%, respectively. |

The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e., its market price per share times the number of shares outstanding). Stocks may be added or deleted from the Index from time to time. An investment cannot be made directly into an Index.

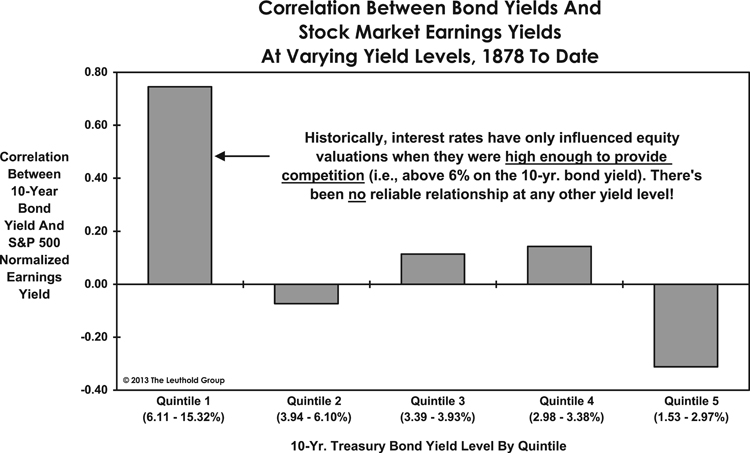

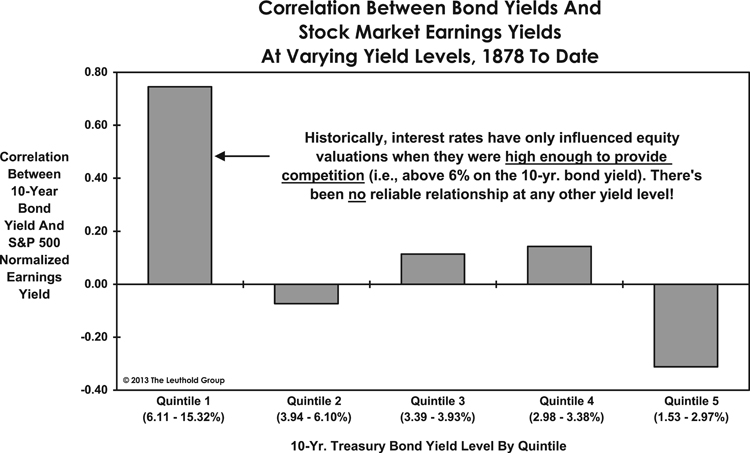

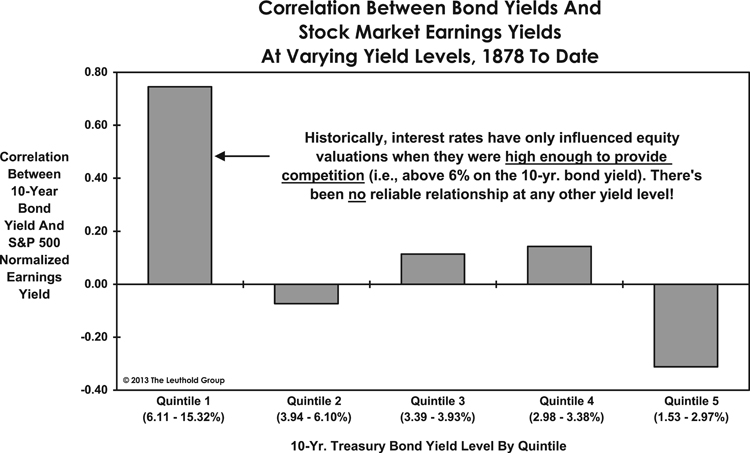

Many stock market prognosticators wax endlessly about the fact that the earnings yield (earnings per share divided by the stock price) is higher than the bond yield (10 Year Treasuries), with the implication that this means stocks are cheap. Comparing a fully priced asset (stocks) to a wildly overvalued asset (bonds) does not make stocks any cheaper. The Leuthold Group recently analyzed this phenomenon and determined that only when 10 Year Treasury yields are higher than 6%, when they pose true competition to stocks, is there even a relationship between these two yields. Eighty percent of the time there is no correlation between these ratios and they don’t seem to influence one another at all. Their conclusion: bond yields today are simply too low to matter.

Finally, we are left with the notion that positive equity fund flows will drive stock market performance. The excitement around this phenomenon seems to be related to the fact that equity mutual fund flows recently turned positive after a multi-year period of being negative. What is missing in this analysis is the role of Exchange Traded Funds (ETFs). The following chart measures fund flows broadly (equity mutual funds and equity ETFs together) along with equity returns. There are no clear discernible trends in this data; if anything, fund flows seem more apt to follow rather than lead equity returns. This

notion is supported by various studies showing the public’s actual long-term equity returns are only 30-40% of mutual fund returns, proving that they are terrible market timers. It is hard for us to get excited about the continuation of a bull market that has already outlasted the duration (48 months versus 43 months) and magnitude (153% vs. 83%) of the median of fifteen bull markets since 1929.

Investors always have to weigh the competing forces of fundamentals and valuation. Are there positives in the current environment? Of course; we articulated several of these in the December letter. Do we believe in stocks for the long run? Absolutely! Yet stocks are up over ten percent this quarter without much progress on the fundamentals, and valuations are extended. Economic growth and employment are relatively stagnant. The big problems – deficit spending, entitlements, debt, Eurozone, monetary debasement — are not going away. Investors appear to be putting an undue amount of faith in central bankers. Even if one believed money printing was a legitimate approach to “jump starting” the economy, how many times do you pull the crank before deciding that a new battery is needed? We’ve been at this for over four years. Perhaps more importantly, how do the Federal Reserve, the European Central Bank and the Bank of Japan undo what they’ve done? How do the leaders have so much confidence in ivory tower theories — the same ones that did not anticipate the housing or banking debacles — such that they can risk currency wars, misaligned investments, and inflation?

We continue to believe that despite the headwinds, stocks remain the best place to put long-term money. We are gratified that the Fund is mostly keeping up in this bull market that unfortunately seems to have a lot of air underneath it. We think the stocks we own will hold up better than most when trouble returns, but there are no guarantees. Bonds look vulnerable: ground-hugging yields and no inflation protection. Timber and agricultural land have had spectacular moves and now have low yields. Gold has no yield. Industrial and other precious metals look expensive. Much of the real estate world suffers with low cap rates. Art, particularly the contemporary variety, is very high. So, as always, we put our collective heads down and try to find good businesses at reasonable prices. Here are two stocks from the portfolio that we feel fit that bill.

3M Company (MMM)

(Analyst: Karl Poehls)

Description

3M Company, formerly known as Minnesota Mining and Manufacturing Company, operates a diversified set of industrial companies worldwide. 3M’s operations are divided into five business units: Industrial (33% of 2012 sales), Health Care (17%), Consumer (14%), Safety & Graphics (18%), and Electronics & Energy (18%). 3M is truly a global leader with approximately two-thirds of revenues generated outside the U.S.

Good Business

| | • | In 2012, 3M generated $30 billion in revenues, and greater than 60% of the total was through the sale of consumable products. |

| | • | The company is widely regarded as an innovation leader with its world-class R&D platform. In 2012, 3M ranked #3 on Booz & Company’s list of most innovative companies, behind Apple and Google. |

| | • | Over the past 10 years, 3M has consistently earned returns above its cost of capital. For the trailing 5-year and 10-year periods, the company’s return on invested capital has averaged 19% and 22%, respectively. |

| | • | 3M generates a significant amount of excess free cash flow. Over the past three years, the company has returned ~$10 billion of cash to shareholders via dividends and share buybacks. |

| | • | The company has a strong balance sheet with virtually zero net debt. 3M’s long-term debt is rated AA- at S&P and Aa2 at Moody’s. |

Valuation

| | • | The company’s current enterprise value-to-sales multiple is 2.3 times. This compares to 3M’s trailing 5-year average operating margin of 21.3%. |

| | • | 3M’s enterprise value-to-sales multiple is 15% below its trailing 10-year average of 2.7 times. |

| | • | Since 1989, 3M’s price-to-earnings (P/E) multiple has averaged 18.9 times. This compares to the company’s current P/E multiple of 15.3 times. |

Management

| | • | In early 2012, Inge Thulin was named CEO of 3M and succeeded George Buckley. Mr. Thulin joined the company in 1979 and had previously served as head of the International operations. |

| | • | Over the past three years, management has allocated capital efficiently and returned approximately 90% of free cash flow to shareholders in the form of dividends and share buybacks. |

| | • | Executive compensation is closely linked to economic profit growth and organic sales growth. |

Investment Thesis

3M is a leading global industrial franchise with a strong mix of consumable products. Slowing growth in Europe and Asia, as well as concerns over the U.S. budget sequester, are weighing on the top-line growth of major industrial companies. Further, the sluggish growth in the technology industry is pressuring 3M’s electronics revenue. This presents us with the opportunity to invest in a very strong global franchise at a historically low valuation level.

PACCAR Inc. (PCAR)

(Analyst: Dan Sievers)

Description

PACCAR (PCAR) is a highly efficient manufacturer and distributor of premium quality medium and heavy duty commercial trucks and related aftermarket parts. Its financial services company financed or leased 31% of the 140,400 trucks delivered in 2012. In 2012, the United States accounted for 44% of truck deliveries, and the U.S. and Canada together represented 57% of revenues. Europe contributed 24.5% of revenues; and Mexico, South America, Australia, and other geographies contributed 18.5% of revenues. The company controls three coveted brands in Kenworth (North America, South America, Australia), DAF (Europe, Mexico, South America, Australia), and Peterbilt (U.S. & Canada only), each supported by strong dealer networks. In 2012, PCAR’s share of the heavy duty U.S. & Canada market and the Western & Central European market was 28.9% and 16.0% respectively (both record levels).

Good Business

| | • | Trucking is a necessary business and market level replacement demand is estimable. |

| | • | PCAR has been a long-term organic share gainer in every one of its markets, aided by a strong R&D culture, rapid new product development, and the most profitable and well-capitalized dealer network. Through recent investments, the company is expanding into Russia, Brazil, and greater South America. |

| | • | Increasing truck sophistication raises revenue per truck, naturally lifts the aftermarket, and provides PCAR with opportunities to add proprietary content (producing further aftermarket lift). |

| | • | Aftermarket parts sales have compounded at 10% over the past 10 years with low sales and gross margin volatility. Parts contributed 40-108% of truck segment gross profit from 2007-2011 (5-year period). |

| | • | In North America, the truck manufacturing business is highly consolidated (4 main players). It requires few plants, little inventory (3- to 5-month lead times), and often generates negative working capital (cash in before delivery). As such, PCAR’s truck manufacturing return on invested capital (ROIC) is north of 20%. |

| | • | PCAR’s self-funding financial services arm has a stellar track record of low-losses and solid returns. |

Valuation

| | • | PCAR shares sell for 24% less than their 2007 high, though the S&P 500 has surpassed its high from the same period. The company trades at a reasonable 16 times trailing P/E multiple, though its 2012 truck gross margin remains 36% below the 2004-2007 (4-year period) average, as truck volumes remain at or below replacement demand in its main markets. |

| | • | PCAR trades at a discount to its 10-year average price to tangible book and enterprise value (EV) to sales multiples. |

Management

| | • | Mark Pigott (age 58), great grandson of founder William Pigott, has been Chairman and CEO since 1997, a PCAR employee for 32 years, and personally owns over $250 million in PCAR stock. The Pigott family holds two board seats and about 30% of the shares (between 36 family members). |

| | • | Growth has been organic since the 1996 DAF acquisition in Europe. |

| | • | PCAR pays regular and special dividends (50% average payout ratio) and has reduced the share count through opportunistic buybacks. |

| | • | Executive compensation is tied to returns on capital. |

Investment Thesis

PCAR is a high-quality, high-return manufacturing business that utilizes and develops industry-leading technology. PCAR’s management team has an excellent track record and continues to win market share and expand globally in a prudent way. The truck industry is cyclical and is currently producing units somewhat below the replacement level of demand across PCAR’s main markets. Given truck volumes and truck gross margins that are far from peak levels, we believe that PCAR is attractively priced below its average 10-year price to tangible book and EV to sales multiples.

Thank you for your confidence in the FMI Large Cap Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | | | | | | |

| COMMON STOCKS — 93.4% (a) | | | | | | |

| | | | | | | |

| COMMERCIAL SERVICES SECTOR — 6.5% | | | | | | |

| | | Advertising/Marketing | | | | | | |

| | | Services — 3.9% | | | | | | |

| | 4,788,000 | | Omnicom | | �� | | | | |

| | | | Group Inc. | | $ | 218,697,298 | | | $ | 282,013,200 | |

| | | | Miscellaneous Commercial | | | | | | | | |

| | | | Services — 2.6% | | | | | | | | |

| | 4,208,000 | | Cintas Corp. | | | 116,881,902 | | | | 185,699,040 | |

| | | | | | | | | | | | |

| CONSUMER NON-DURABLES SECTOR — 8.2% | | | | | | | | |

| | | | Food: Major | | | | | | | | |

| | | | Diversified — 5.7% | | | | | | | | |

| | 14,225,000 | | Danone | | | | | | | | |

| | | | S.A. - SP-ADR | | | 192,894,496 | | | | 199,576,750 | |

| | 2,921,000 | | Nestlé | | | | | | | | |

| | | | S.A. - SP-ADR | | | 133,781,245 | | | | 211,684,870 | |

| | | | | | | 326,675,741 | | | | 411,261,620 | |

| | | | Household/Personal | | | | | | | | |

| | | | Care — 2.5% | | | | | | | | |

| | 1,855,000 | | Kimberly-Clark | | | | | | | | |

| | | | Corp. | | | 111,334,017 | | | | 181,752,900 | |

| | | | | | | | | | | | |

| CONSUMER SERVICES SECTOR — 3.3% | | | | | | | | |

| | | | Media Conglomerates — 3.3% | | | | | | | | |

| | 4,090,700 | | Time Warner Inc. | | | 115,891,986 | | | | 235,706,134 | |

| | | | | | | | | | | | |

| DISTRIBUTION SERVICES SECTOR — 7.0% | | | | | | | | |

| | | | Food Distributors — 4.0% | | | | | | | | |

| | 8,262,100 | | Sysco Corp. | | | 229,863,313 | | | | 290,578,057 | |

| | | | Medical Distributors — 3.0% | | | | | | | | |

| | 4,196,000 | | AmerisourceBergen | | | | | | | | |

| | | | Corp. | | | 122,884,492 | | | | 215,884,200 | |

| | | | | | | | | | | | |

| ELECTRONIC TECHNOLOGY SECTOR — 4.3% | | | | | | | | |

| | | | Electronic Components — 4.3% | | | | | | | | |

| | 7,326,000 | | TE Connectivity Ltd. | | | 197,410,912 | | | | 307,179,180 | |

| | | | | | | | | | | | |

| ENERGY MINERALS SECTOR — 3.4% | | | | | | | | |

| | | | Oil & Gas Production — 3.4% | | | | | | | | |

| | 4,320,000 | | Devon Energy Corp. | | | 275,601,136 | | | | 243,734,400 | |

| | | | | | | | | | | | |

| FINANCE SECTOR — 13.6% | | | | | | | | |

| | | | Financial Conglomerates — 3.1% | | | | | | | | |

| | 3,303,000 | | American | | | | | | | | |

| | | | Express Co. | | | 120,045,248 | | | | 222,820,380 | |

| | | | Insurance Brokers/Services — 2.0% | | | | | | | | |

| | 3,609,400 | | Willis Group | | | | | | | | |

| | | | Holdings PLC | | | 137,409,444 | | | | 142,535,206 | |

| | | | Major Banks — 8.5% | | | | | | | | |

| | 13,500,000 | | Bank of New York | | | | | | | | |

| | | | Mellon Corp. | | | 348,544,628 | | | | 377,865,000 | |

| | 6,610,000 | | Comerica Inc. | | | 201,481,212 | | | | 237,629,500 | |

| | | | | | | 550,025,840 | | | | 615,494,500 | |

| HEALTH TECHNOLOGY SECTOR — 6.7% | | | | | | | | |

| | | | Medical Specialties — 3.8% | | | | | | | | |

| | 4,079,000 | | Covidien PLC | | | 191,739,030 | | | | 276,719,360 | |

| | | | Pharmaceuticals: Major — 2.9% | | | | | | | | |

| | 4,458,000 | | GlaxoSmithKline | | | | | | | | |

| | | | PLC - SP-ADR | | | 193,185,051 | | | | 209,124,780 | |

| | | | | | | | | | | | |

| INDUSTRIAL SERVICES SECTOR — 3.0% | | | | | | | | |

| | | | Oilfield Services/Equipment — 3.0% | | | | | | | | |

| | 2,890,000 | | Schlumberger Ltd. | | | 184,323,009 | | | | 216,432,100 | |

| | | | | | | | | | | | |

| PROCESS INDUSTRIES SECTOR — 2.3% | | | | | | | | |

| | | | Chemicals: Agricultural — 2.3% | | | | | | | | |

| | 1,577,550 | | Monsanto Co. | | | 94,402,548 | | | | 166,636,607 | |

| | | | | | | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 19.2% | | | | | | | | |

| | | | Industrial Conglomerates — 13.4% | | | | | | | | |

| | 3,660,000 | | 3M Co. | | | 283,403,903 | | | | 389,094,600 | |

| | 3,640,000 | | Berkshire Hathaway | | | | | | | | |

| | | | Inc. — Cl B* | | | 264,916,749 | | | | 379,288,000 | |

| | 3,615,000 | | Ingersoll-Rand PLC | | | 155,985,518 | | | | 198,861,150 | |

| | | | | | | 704,306,170 | | | | 967,243,750 | |

| | | | Industrial Machinery — 3.6% | | | | | | | | |

| | 4,275,000 | | Illinois Tool | | | | | | | | |

| | | | Works Inc. | | | 213,555,494 | | | | 260,518,500 | |

| | | | Trucks/Construction/Farm | | | | | | | | |

| | | | Machinery — 2.2% | | | | | | | | |

| | 3,060,000 | | PACCAR Inc. | | | 124,301,868 | | | | 154,713,600 | |

| | | | | | | | | | | | |

| RETAIL TRADE SECTOR — 3.5% | | | | | | | | |

| | | | Discount Stores — 3.5% | | | | | | | | |

| | 3,327,000 | | Wal-Mart | | | | | | | | |

| | | | Stores Inc. | | | 169,116,849 | | | | 248,959,410 | |

| | | | | | | | | | | | |

| TECHNOLOGY SERVICES SECTOR — 10.0% | | | | | | | | |

| | | | Data Processing Services — 2.8% | | | | | | | | |

| | 3,106,000 | | Automatic Data | | | | | | | | |

| | | | Processing Inc. | | | 130,171,113 | | | | 201,952,120 | |

| | | | Information Technology | | | | | | | | |

| | | | Services — 4.9% | | | | | | | | |

| | 4,643,000 | | Accenture PLC | | | 212,895,022 | | | | 352,728,710 | |

| | | | Packaged Software — 2.3% | | | | | | | | |

| | 5,818,000 | | Microsoft Corp. | | | 163,583,765 | | | | 166,452,980 | |

| | | | | | | | | | | | |

| TRANSPORTATION SECTOR — 2.4% | | | | | | | | |

| | | | Air Freight/Couriers — 2.4% | | | | | | | | |

| | 4,935,000 | | Expeditors | | | | | | | | |

| | | | International of | | | | | | | | |

| | | | Washington Inc. | | | 186,888,816 | | | | 176,228,850 | |

| | | | Total common stocks | | | 5,091,190,064 | | | | 6,732,369,584 | |

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2013 (Unaudited)

| Principal Amount | | | Cost | | | Value | |

| | | | | | | | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS — 6.0% (a) | | | | |

| | | | | |

| | | U.S. Treasury Securities — 5.5% | | | | | |

| $ | 100,000,000 | | U.S. Treasury Bills, | | | | | |

| | | | | 0.0075%, | | | | | |

| | | | due 04/04/13 | $ | 99,999,937 | | | $ | 99,999,937 | |

| | 100,000,000 | | U.S. Treasury Bills, | | | | | | | |

| | | | | 0.0250%, | | | | | | | |

| | | | due 04/11/13 | | 99,999,305 | | | | 99,999,305 | |

| | 100,000,000 | | U.S. Treasury Bills, | | | | | | | |

| | | | | 0.0550%, | | | | | | | |

| | | | due 04/18/13 | | 99,997,403 | | | | 99,997,403 | |

| | 100,000,000 | | U.S. Treasury Bills, | | | | | | | |

| | | | | 0.0600%, | | | | | | | |

| | | | due 04/25/13 | | 99,996,000 | | | | 99,996,000 | |

| | | | Total U.S. | | | | | | | |

| | | | Treasury Securities | | 399,992,645 | | | | 399,992,645 | |

| | | | | | | | | | | | |

| | | | Commercial Paper — 0.5% | | | | | | | |

| | 35,500,000 | | U.S. Bank, N.A., 0.02%, | | | | | | | |

| | | | due 04/01/13 | | 35,500,000 | | | | 35,500,000 | |

| | | | Total short-term | | | | | | | |

| | | | investments | | 435,492,645 | | | | 435,492,645 | |

| | | | Total investments | | | | | | | |

| | | | | — 99.4% | $ | 5,526,682,709 | | | | 7,167,862,229 | |

| | | | Other assets, | | | | | | | |

| | | | less liabilities | | | | | | | |

| | | | | — 0.6% (a) | | | | | | 42,649,450 | |

| | | | TOTAL NET | | | | | | | |

| | | | ASSETS — 100.0% | | | | | $ | 7,210,511,679 | |

| | | | | | | | | | | | |

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

PLC – Public Limited Company

SP-ADR – Sponsored American Depositary Receipt

The accompanying notes to financial statements are an integral part of this schedule.

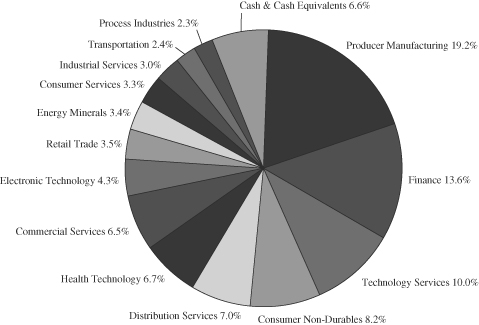

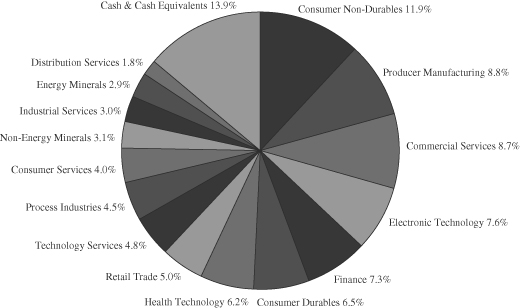

INDUSTRY SECTORS

as of March 31, 2013 (Unaudited)

FMI

Common Stock

Fund

March 31, 2013

Dear Fellow Shareholders:

The FMI Common Stock Fund (FMIMX) gained 10.20%(1) in the quarter ending March 31, 2013. This compared to the benchmark Russell 2000 Index return of 12.39%(2). Both the Russell 2000 and the FMI Common Stock Fund benefitted from expanding multiples as fundamental sales and earnings growth remained in the low to mid-single-digit range. Sectors that contributed meaningfully to FMIMX returns included Energy Minerals, Finance, and Electronic Technology. Finance was a significant relative detractor for the Fund last year as many lower quality financial stocks that had collapsed in 2008 and early 2009 continued to rebound (with a big assist from the Fed). We are hopeful that the better recent performance from this sector is a harbinger of what is to come. Protective Life and Ryder System performed nicely in the March quarter, as did Arthur Gallagher, Mine Safety, AptarGroup and Innophos Holdings. On the flip side, some of the distribution companies, including ScanSource and World Fuel Services, lagged in the quarter. Retail Trade and Commercial Services also detracted from performance. Family Dollar and Dun & Bradstreet were the culprits here. Some of the industrial and technology stocks are feeling the effects of a sluggish economy; Kennametal, Arrow and Molex were subpar performers in the March quarter. We remain optimistic about the long-term prospects for these companies. We took advantage of the bull market to sell several stocks this quarter that have reached our valuation limits. Overall, we contend the FMI Common Stock Fund contains many good businesses. Relative to the benchmark, valuations are very attractive but are somewhat above average from an absolute standpoint. As mentioned in the December letter (and the same situation applies today), overall market valuations are elevated from a historical perspective.

Some have questioned why we are not jumping on the stock market bandwagon. After all, housing is rebounding, employment is steady if not growing ever so slightly, corporate cash and cash flows are high, earnings yields are much greater than bond yields, and the public appears to be coming back to the market. Taking the first two together, housing is indeed continuing to bounce off of a very depressed bottom. Unusually low mortgage rates and FHA insurance (future bailout to follow) are assisting the housing market. Housing-related stocks have been huge winners over the past few years and seem to be discounting an environment that is much stronger than we envision. Over ten million households continue to owe more than their homes are worth. Shadow inventory remains high. A sustained improvement in housing will likely require stronger economic growth and better employment. Three things can drive economic growth: more people working, people working more hours, and more capital deployed. On the first item there has been a little progress, but as the nearby chart shows, declining labor participation is offsetting this improvement; on the second item, hours worked have been flat to down; and on the third item, fixed business investment orders have been falling, as articulated in our December letter. Gross domestic product (GDP) growth remains anemic in the 0-2% range.

Corporate cash and cash flow has been solid. A large portion of the cash is overseas and will incur a 35% tax upon repatriation. Unless tax laws change, these monies are unlikely to see our shores. Part of the cash flow dynamic reflects caution about spending on capital and people, as well as the desire for managements to continue to squeeze their cost structures as tightly as possible. This has enabled margins and earnings to remain near peak levels but this strategy cannot stay effective over the long run. Without increased capital, research and development (R&D) and people investment, sales and earnings growth degrades. In fact, sales growth and margins for the market (companies within the benchmark) peaked over a year ago. Health care mandates and higher tax rates have induced further caution in the executive and entrepreneurial ranks.

| (1) | The Fund’s 1-year and annualized 5-year and 10-year returns through March 31, 2013 were: 10.31%, 11.15%, and 12.46%, respectively. |

| (2) | The Russell 2000 Index, benchmark for FMIMX 1-year and annualized 5-year and 10-year returns through March 31, 2013 were: 16.30%, 8.24% and 11.52%, respectively. |

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index which comprises the 3,000 largest U.S. companies based on total market capitalization. An investment cannot be made directly into an index.

Many stock market prognosticators wax endlessly about the fact that the earnings yield (earnings per share divided by the stock price) is higher than the bond yield (10 Year Treasuries), with the implication that this means stocks are cheap. Comparing a fully priced asset (stocks) to a wildly overvalued asset (bonds) does not make stocks any cheaper. The Leuthold Group recently analyzed this phenomenon and determined that only when 10 Year Treasury yields are higher than 6%, when they pose true competition to stocks, is there even a relationship between these two yields. Eighty percent of the time there is no correlation between these ratios and they don’t seem to influence one another at all. Their conclusion: bond yields today are simply too low to matter.

Finally, we are left with the notion that positive equity fund flows will drive stock market performance. The excitement around this phenomenon seems to be related to the fact that equity mutual fund flows recently turned positive after a multi-year period of being negative. What is missing in this analysis is the role of Exchange Traded Funds (ETFs). The following chart measures fund flows broadly (equity mutual funds and equity ETFs together) along with equity returns. There are no clear discernible trends in this data; if anything, fund flows seem more apt to follow rather than lead equity returns. This

notion is supported by various studies showing the public’s actual long-term equity returns are only 30-40% of mutual fund returns, proving that they are terrible market timers. It is hard for us to get excited about the continuation of a bull market that has already outlasted the duration (48 months versus 43 months) and magnitude (153% vs. 83%) of the median of fifteen bull markets since 1929.

Investors always have to weigh the competing forces of fundamentals and valuation. Are there positives in the current environment? Of course; we articulated several of these in the December letter. Do we believe in stocks for the long run? Absolutely! Yet stocks are up over ten percent this quarter without much progress on the fundamentals, and valuations are extended. Economic growth and employment are relatively stagnant. The big problems – deficit spending, entitlements, debt, Eurozone, monetary debasement — are not going away. Investors appear to be putting an undue amount of faith in central bankers. Even if one believed money printing was a legitimate approach to “jump starting” the economy, how many times do you pull the crank before deciding that a new battery is needed? We’ve been at this for over four years. Perhaps more importantly, how do the Federal Reserve, the European Central Bank and the Bank of Japan undo what they’ve done? How do the leaders have so much confidence in ivory tower theories — the same ones that did not anticipate the housing or banking debacles — such that they can risk currency wars, misaligned investments, and inflation?

We continue to believe that despite the headwinds, stocks remain the best place to put long-term money. We are gratified that the Fund is mostly keeping up in this bull market that unfortunately seems to have a lot of air underneath it. We think the stocks we own will hold up better than most when trouble returns, but there are no guarantees. Bonds look vulnerable: ground-hugging yields and no inflation protection. Timber and agricultural land have had spectacular moves and now have low yields. Gold has no yield. Industrial and other precious metals look expensive. Much of the real estate world suffers with low cap rates. Art, particularly the contemporary variety, is very high. So, as always, we put our collective heads down and try to find good businesses at reasonable prices. Here are two stocks from the portfolio that we feel fit that bill.

MKS Instruments, Inc. (MKSI)

(Analyst: Dan Sievers)

Description

MKS Instruments, Inc. is a 50-year-old Andover, Massachusetts company, and the global leader in developing and providing instruments, components, and subsystems that measure, control, power, sterilize, and monitor the critical parameters of semiconductor manufacturing (64% of revenue) and other precision-controlled manufacturing industries (36%

of revenues), such as LED, data storage, medical, biopharma, solar, environmental, and purification. MKSI’s products are generally critical in the effort to enhance yield, throughput, and uptime of manufacturing tools and equipment in the industries served.

Good Business

| | • | MKSI claims a leading 34% global market share (equal to the next 5 competitors combined) in its core semiconductor markets, and is #1 or #2 in ten of its twelve main product lines. |

| | • | Manufacturing innovation demands increasing process chamber control, which has tended to benefit MKSI in terms of new products, new applications, and increased content. |

| | • | Relative to the greater semiconductor industry, MKSI’s products are easy to understand and there is a low risk of technological obsolescence. |

| | • | MKSI leverages consistent research and development (R&D) spending (7%-14% of cyclical revenues) outside of semiconductor markets, which will continue to be a driver of organic growth (and services growth), customer diversification, and high incremental returns on R&D spending. |

| | • | Returns on invested capital, though volatile, have averaged 16% and 13% over the past 5 and 10-year periods after adjusting for excess cash (operating cash assumed equal to 5% of sales). |

| | • | Net balance sheet cash equals 45% of MKSI’s market value. The company has a regular dividend (2.4% yield) and a history of share repurchases. |

Valuation

| | • | Adjusting for $11.80/share in net cash, MKSI trades for 9.2 times the FY2014 EPS estimate. |

| | • | Over the past nine years (following three weak years for semis), MKSI operating margins have averaged 13.4%. Margins fluctuate with the cycle, but structural margins have improved. MKSI’s profitability compares favorably to an enterprise value-to-sales multiple of 1.2. |

| | • | MKSI trades for 1.7 times its tangible book value ($16.10/share) vs. a 10-year average of 2.2 times. |

| | • | Over the past five years, free cash flow totaled $487 million (62% of the enterprise value). |

Management

| | • | Management’s reputation is excellent and executive turnover is remarkably low. |

| | • | CEO Leo Berlinghieri (58) has 32 years of MKSI experience, and former CEO and Chairman John Bertucci (71) has 42 years. |

| | • | Management invests with a long-term focus, facilitated by a conservative balance sheet. Financial presentations utilize few adjustments and MKSI compensation programs are well-designed – MKSI grants restricted stock units (RSUs), but not options. |

Investment Thesis

MKS is a durable and well-managed franchise with a leading global market position that should experience solid, though highly cyclical, growth in and out of semiconductor end-markets. Cyclically weak earnings and analyst and investor focus on timing the semiconductor cycle have resulted in shares that are cheap on an absolute basis, particularly when compared to MKSI’s historical price to tangible book multiples (or most other metrics that capture MKSI’s large cash hoard), and this provides an attractive entry point for longer-term investors.

McDermott International Inc.

(Analyst: Dan Sievers)

Description

McDermott International (MDR), based in Houston, Texas, has provided global engineering, procurement, construction & fabrication, marine installation (EPCI), and other marine services to the upstream offshore oil & gas industry since the industry’s advent in 1947. In this space, MDR continues to be one of five global leaders, generating $3.6 billion in 2012 revenues. When compared to the broader engineering & construction (E&C) industry, the barriers to entering MDR’s markets and bidding effectively are substantially higher given the criticality of the marine vessel fleet in providing end-to-end project solutions to offshore oil & gas customers. In any given year, MDR is likely to work on 30 to 40 projects, with 6 to 10 projects accounting for up to 75% of revenue.

Good Business

| | • | MDR is a leader in a necessary industry, which offers good visibility relative to other E&C markets, and a strong multi-year spending cycle appears to be accelerating. |

| | • | MDR is well-positioned in geographies where new projects are expected to be plentiful. |

| | • | Net balance sheet cash and equivalents account for 23% of market capitalization. |

| | • | Over the past eight years, MDR has had success earning low-to-mid-teen returns on its invested capital while managing the challenges inherent in fixed-price contracting (60-70% of revenues). This has been achieved, despite ownership of more physical assets (marine vessels), and higher net cash than a typical E&C company. |

Valuation

| | • | Premature exuberance for a strong spending cycle bid MDR shares to $25.00 following solid 2010 execution and backlog growth. Since April 2011, MDR shares have fallen 58% because of lower vessel utilization, three smaller problem contracts, and lumpy award bookings. |

| | • | MDR earned an 8.8% operating margin in 2012, but its targeted 10%-12% operating margin range looks achievable going forward (and in line with the 8-year average), leaving the business attractively priced at just 0.6 times enterprise value-to-sales; 4.5 times enterprise value-to-earnings before interest, taxes, depreciation and amortization (EV/EBITDA); and 1.3 times price-to-book. |

| | • | MDR’s Atlantic segment and its two young joint ventures showed losses in each of the past three years, although a reasonable spending cycle should correct this. |

Management

| | • | CEO Steve Johnson (61) had over 25 years of related industry experience at Fluor and URS before joining MDR in 2009. |

| | • | MDR management stresses return on capital, which became a compensation metric in 2011. |

| | • | Management has exhibited a solid price discipline early in the spending cycle, focusing on profitable favorably-priced contracts (occasionally working against bookings). |

Investment Thesis

Over the past eight years, MDR has achieved nearly the center of its 10%-12% long-term operating margin target on a GAAP basis (including impairment charges), although recent operational hiccups and low vessel utilization yielded 7.3% and 8.8% operating margins in 2011 and 2012, respectively. Over the same period, management has right-sized the vessel fleet and reduced fixed costs while adding to MDR’s solid deepwater competencies, but progress has been somewhat masked by trough activity in the Gulf of Mexico (made worse by the 2010 Macondo disaster) and losses at MDR’s young joint ventures. Positively, one of MDR’s major competitors recently announced that it will begin bidding more conservatively (for margin rather than market share), which may lend greater discipline to the industry. Earnings for 2013 continue to look depressed, but could easily double by 2015. With the backdrop of favorable industry spending, the shares provide an attractive risk/reward.

Thank you for your support of the FMI Common Stock Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | | | | | | | | |

| COMMON STOCKS — 87.9% (a) | | | | | | |

| | | | | | | |

| COMMERCIAL SERVICES SECTOR — 5.7% | | | | | | |

| | | Financial Publishing/ | | | | | | |

| | | Services — 1.9% | | | | | | |

| | 272,000 | | The Dun & | | | | | | |

| | | | Bradstreet Corp. | | $ | 18,520,002 | | | $ | 22,752,800 | |

| | | | Miscellaneous Commercial | | | | | | | | |

| | | | Services — 2.4% | | | | | | | | |

| | 646,000 | | Cintas Corp. | | | 15,472,786 | | | | 28,507,980 | |

| | | | Personnel Services — 1.4% | | | | | | | | |

| | 425,000 | | Robert Half | | | | | | | | |

| | | | International Inc. | | | 11,128,001 | | | | 15,950,250 | |

| | | | | | | | | | | | |

| CONSUMER DURABLES SECTOR — 1.6% | | | | | | | | |

| | | | Other Consumer | | | | | | | | |

| | | | Specialties — 1.6% | | | | | | | | |

| | 384,000 | | Mine Safety | | | | | | | | |

| | | | Appliances Co. | | | 10,977,247 | | | | 19,054,080 | |

| | | | | | | | | | | | |

| DISTRIBUTION SERVICES SECTOR — 17.1% | | | | | | | | |

| | | | Electronics Distributors — 9.4% | | | | | | | | |

| | 515,000 | | Anixter | | | | | | | | |

| | | | International Inc. | | | 34,020,675 | | | | 36,008,800 | |

| | 1,273,000 | | Arrow | | | | | | | | |

| | | | Electronics Inc.* | | | 26,008,249 | | | | 51,709,260 | |

| | 857,000 | | ScanSource Inc.* | | | 22,062,384 | | | | 24,184,540 | |

| | | | | | | 82,091,308 | | | | 111,902,600 | |

| | | | Medical Distributors — 5.4% | | | | | | | | |

| | 690,000 | | Owens & Minor Inc. | | | 19,866,306 | | | | 22,466,400 | |

| | 1,093,000 | | Patterson Cos. Inc. | | | 24,131,228 | | | | 41,577,720 | |

| | | | | | | 43,997,534 | | | | 64,044,120 | |

| | | | Wholesale Distributors — 2.3% | | | | | | | | |

| | 676,000 | | World Fuel | | | | | | | | |

| | | | Services Corp. | | | 27,739,331 | | | | 26,850,720 | |

| | | | | | | | | | | | |

| ELECTRONIC TECHNOLOGY SECTOR — 1.4% | | | | | | | | |

| | | | Electronic Production | | | | | | | | |

| | | | Equipment — 1.4% | | | | | | | | |

| | 620,000 | | MKS | | | | | | | | |

| | | | Instruments Inc. | | | 16,677,639 | | | | 16,864,000 | |

| | | | | | | | | | | | |

| ENERGY MINERALS SECTOR — 4.1% | | | | | | | | |

| | | | Oil & Gas Production — 4.1% | | | | | | | | |

| | 651,000 | | Cimarex Energy Co. | | | 37,691,540 | | | | 49,111,440 | |

| | | | | | | | | | | | |

| FINANCE SECTOR — 14.8% | | | | | | | | |

| | | | Finance/Rental/Leasing — 2.3% | | | | | | | | |

| | 464,000 | | Ryder System Inc. | | | 19,491,481 | | | | 27,724,000 | |

| | | | Insurance Brokers/ | | | | | | | | |

| | | | Services — 2.4% | | | | | | | | |

| | 698,000 | | Arthur J. | | | | | | | | |

| | | | Gallagher & Co. | | | 14,790,790 | | | | 28,834,380 | |

| | | | Life/Health Insurance — 2.8% | | | | | | | | |

| | 912,000 | | Protective Life Corp. | | | 14,176,471 | | | | 32,649,600 | |

| | | | | | | | | | | | |

| | | | Property/Casualty | | | | | | | | |

| | | | Insurance — 3.4% | | | | | | | | |

| | 125,050 | | Greenlight | | | | | | | | |

| | | | Capital Re Ltd.* | | | 3,062,989 | | | | 3,057,473 | |

| | 840,000 | | W.R. Berkley Corp. | | | 20,975,570 | | | | 37,270,800 | |

| | | | | | | 24,038,559 | | | | 40,328,273 | |

| | | | Regional Banks — 3.9% | | | | | | | | |

| | 605,000 | | Cullen/Frost | | | | | | | | |

| | | | Bankers Inc. | | | 35,152,346 | | | | 37,830,650 | |

| | 356,600 | | Zions Bancorporation | | | 7,544,247 | | | | 8,911,434 | |

| | | | | | | 42,696,593 | | | | 46,742,084 | |

| HEALTH TECHNOLOGY SECTOR — 2.5% | | | | | | | | |

| | | | Medical Specialties — 2.5% | | | | | | | | |

| | 239,000 | | Bio-Rad | | | | | | | | |

| | | | Laboratories Inc.* | | | 19,891,707 | | | | 30,114,000 | |

| | | | | | | | | | | | |

| INDUSTRIAL SERVICES SECTOR — 3.4% | | | | | | | | |

| | | | Oilfield Services/ | | | | | | | | |

| | | | Equipment — 3.4% | | | | | | | | |

| | 303,000 | | Bristow Group Inc. | | | 7,828,242 | | | | 19,979,820 | |

| | 1,824,000 | | McDermott | | | | | | | | |

| | | | International Inc.* | | | 22,912,791 | | | | 20,045,760 | |

| | | | | | | 30,741,033 | | | | 40,025,580 | |

| PROCESS INDUSTRIES SECTOR — 11.5% | | | | | | | | |

| | | | Chemicals: Specialty — 6.0% | | | | | | | | |

| | 313,000 | | Compass Minerals | | | | | | | | |

| | | | International Inc. | | | 22,650,054 | | | | 24,695,700 | |

| | 446,000 | | Innophos | | | | | | | | |

| | | | Holdings Inc. | | | 22,106,900 | | | | 24,333,760 | |

| | 285,000 | | Sigma-Aldrich Corp. | | | 13,854,975 | | | | 22,138,800 | |

| | | | | | | 58,611,929 | | | | 71,168,260 | |

| | | | Containers/Packaging — 2.9% | | | | | | | | |

| | 596,000 | | AptarGroup Inc. | | | 16,512,515 | | | | 34,180,600 | |

| | | | Industrial Specialties — 2.6% | | | | | | | | |

| | 789,000 | | H.B. Fuller Co. | | | 22,295,817 | | | | 30,834,120 | |

| | | | | | | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 14.7% | | | | | | | | |

| | | | Auto Parts: OEM — 2.5% | | | | | | | | |

| | 1,507,000 | | Gentex Corp. | | | 28,762,937 | | | | 30,155,070 | |

| | | | Electrical Products — 3.4% | | | | | | | | |

| | 1,645,000 | | Molex Inc. — Cl A | | | 29,088,904 | | | | 39,677,400 | |

| | | | Industrial Machinery — 2.8% | | | | | | | | |

| | 840,000 | | Kennametal Inc. | | | 33,600,357 | | | | 32,793,600 | |

| | | | Metal Fabrication — 0.1% | | | | | | | | |

| | 47,975 | | Kaydon Corp. | | | 1,231,903 | | | | 1,227,200 | |

| | | | Miscellaneous | | | | | | | | |

| | | | Manufacturing — 3.1% | | | | | | | | |

| | 546,000 | | Carlisle Cos. Inc. | | | 14,007,132 | | | | 37,013,340 | |

| | | | Office Equipment/Supplies — 2.8% | | | | | | | | |

| | 776,000 | | Avery | | | | | | | | |

| | | | Dennison Corp. | | | 22,252,409 | | | | 33,422,320 | |

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2013 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | | | | | | | | |

| | | | | | | | | |

| COMMON STOCKS — 87.9% (a) (Continued) | | | | | | |

| | | | | | | |

| RETAIL TRADE SECTOR — 3.6% | | | | | | |

| | | Apparel/Footwear | | | | | | |

| | | Retail — 1.0% | | | | | | |

| | 281,000 | | Jos. A. Bank | | | | | | |

| | | | Clothiers Inc.* | | $ | 11,283,515 | | | $ | 11,211,900 | |

| | | | Discount Stores — 2.6% | | | | | | | | |

| | 527,000 | | Family Dollar | | | | | | | | |

| | | | Stores Inc. | | | 21,060,256 | | | | 31,119,350 | |

| | | | | | | | | | | | |

| TECHNOLOGY SERVICES SECTOR — 4.1% | | | | | | | | |

| | | | Data Processing Services — 3.0% | | | | | | | | |

| | 1,421,000 | | Broadridge Financial | | | | | | | | |

| | | | Solutions Inc. | | | 30,627,063 | | | | 35,297,640 | |

| | | | Information Technology | | | | | | | | |

| | | | Services — 1.1% | | | | | | | | |

| | 276,000 | | Jack Henry & | | | | | | | | |

| | | | Associates Inc. | | | 4,854,788 | | | | 12,753,960 | |

| | | | | | | | | | | | |

| TRANSPORTATION SECTOR — 3.4% | | | | | | | | |

| | | | Air Freight/Couriers — 1.1% | | | | | | | | |

| | 352,000 | | Forward Air Corp. | | | 11,267,415 | | | | 13,126,080 | |

| | | | Marine Shipping — 2.3% | | | | | | | | |

| | 358,000 | | Kirby Corp.* | | | 15,889,528 | | | | 27,494,400 | |

| | | | Total common stocks | | | 751,468,490 | | | | 1,042,931,147 | |

| | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS — 12.3% (a) | | | | | | | | |

| | | | | | | | | |

| | | | U.S. Treasury Securities — 10.5% | | | | | | | | |

| $ | 25,000,000 | | U.S. Treasury Bills, | | | | | | | | |

| | | | 0.0075%, | | | | | | | | |

| | | | due 04/04/13 | | | 24,999,984 | | | | 24,999,984 | |

| | 25,000,000 | | U.S. Treasury Bills, | | | | | | | | |

| | | | 0.0250%, | | | | | | | | |

| | | | due 04/11/13 | | | 24,999,826 | | | | 24,999,826 | |

| | 25,000,000 | | U.S. Treasury Bills, | | | | | | | | |

| | | | 0.0550%, | | | | | | | | |

| | | | due 04/18/13 | | | 24,999,351 | | | | 24,999,351 | |

| | 50,000,000 | | U.S. Treasury Bills, | | | | | | | | |

| | | | 0.0600%, | | | | | | | | |

| | | | due 04/25/13 | | | 49,998,000 | | | | 49,998,000 | |

| | | | Total U.S. | | | | | | | | |

| | | | Treasury Securities | | | 124,997,161 | | | | 124,997,161 | |

| | | | Commercial Paper — 1.8% | | | | | | | | |

| | 21,700,000 | | U.S. Bank, N.A., 0.02%, | | | | | | | | |

| | | | due 04/01/13 | | | 21,700,000 | | | | 21,700,000 | |

| | | | Total short-term | | | | | | | | |

| | | | investments | | | 146,697,161 | | | | 146,697,161 | |

| | | | Total investments | | | | | | | | |

| | | | — 100.2% | | $ | 898,165,651 | | | | 1,189,628,308 | |

| | | | Liabilities, less other | | | | | | | | |

| | | | assets — (0.2%) (a) | | | | | | | (2,908,445 | ) |

| | | | TOTAL NET | | | | | | | | |

| | | | ASSETS — 100.0% | | | | | | $ | 1,186,719,863 | |

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

The accompanying notes to financial statements are an integral part of this schedule.

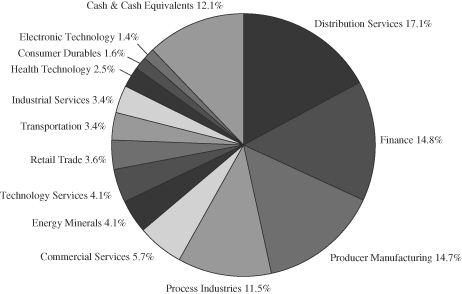

INDUSTRY SECTORS

as of March 31, 2013 (Unaudited)

FMI

International

Fund

March 31, 2013

Dear Fellow Shareholders:

After a strong showing in 2012, international markets continued to soar in the first quarter of 2013. The FMI International Fund (FMIJX) gained 10.23%(1) in the quarter, which compares with the MSCI EAFE Index return of 9.67%(2) in local currency and 5.13%(3) in U.S. Dollars (USD). The Japanese market led the charge (in the quarter), with the TOPIX Index advancing 21.37% on the back of “Abenomics” and a rapidly depreciating yen (more on this later). The UK also posted strong returns, with the FTSE 100 Index up 9.97%, while several European markets rose in the low- to mid-single-digits. The Fund’s performance was led by the Non-Energy Minerals, Electronic Technology, and Technology Services sectors, with strong contributions from CRH, Rolls-Royce, and Accenture. Health Technology, Distribution Services and an elevated cash position all detracted from relative performance, with Pirelli and Royal Dutch Shell generating the weakest absolute returns.

We sold our position in Brookfield Asset Management in March and rolled the proceeds into a greater ownership stake in Fairfax Financial. We initially trimmed Brookfield back in the third quarter of 2012 after it became public that the company was attempting to acquire the portion of General Growth Properties that it did not already own. We were concerned that the size and complexity was seemingly escalating with each incremental transaction at Brookfield. Then, in conjunction with the reporting of its fourth quarter and full year 2012 earnings in February, Brookfield changed the way in which it presents results, further reducing transparency into the underlying operations. In addition to these developments, the company has been a beneficiary of a historically low cap rate environment, and this was reflected in the significant appreciation of the stock price. We believe that Fairfax has a more realistic view of the world, as management is hedging their exposure to both equities and inflation. If we enter a period of rising interest rates, peer insurance underwriters may become capital constrained, while Fairfax should largely remain unscathed. With a stronger relative capital position, the company would have the ability to write significantly more quality business, as others are forced out of the market. The continued firming in commercial property and casualty pricing should also accrue to the company’s benefit, which we view as an additional positive over the long term.

Our general view is that the global stock market rally has outpaced the underlying fundamentals, which is now reflected in more expensive stock valuations. Investors can thank the Fed, European Central Bank (ECB), Bank of England (BOE) and Bank of Japan (BOJ) for the rapid price appreciation of a wide range of asset classes. Stock markets have been fueled by easy money and the notion that governments will continue to prop up struggling economies and businesses. However, this patchwork solution is not sustainable in our view. Ultimately, Europe remains a dysfunctional mess, Japan still faces massive secular issues, and China may be in the midst of a housing bubble which could dwarf that of the U.S. On balance, we believe

| (1) | The Fund’s 1-year and annualized since inception (12-31-10) returns through March 31, 2013 were: 18.63% and 11.60%, respectively. |

| (2) | The MSCI EAFE Index (LOC), benchmark for FMIJX 1-year return and annualized since inception (12-31-10) returns through March 31, 2013 were: 16.73% and 5.60%, respectively. |

| (3) | The MSCI EAFE Index (USD), benchmark for FMIJX 1-year return and annualized since inception (12-31-10) returns through March 31, 2013 were: 11.25% and 3.64%, respectively. |

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of May 27, 2010 the MSCI EAFE Index consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The MSCI EAFE Index is unmanaged and investors cannot invest directly in the Index. Index results are inclusive of dividends and net of foreign withholding taxes. The reported figures include reinvestment of dividends and capital gains distributions and do not reflect any fees or expenses.

The MSCI EAFE Index is calculated in local currency as well as in U.S. dollars (USD). The concept of a local currency calculation excludes the impact of currency fluctuations. All currencies of listing are considered in the Index calculation in local currency where current prices (t) and previous day prices (t-1) are converted into USD using the same exchange rate (exchange rate t-1) in the numerator and denominator. As a consequence, the FX factor drops out of the equation. The USD calculation includes exchange rates at t and t-1. Therefore, the local currency calculation only represents the price appreciation or depreciation of the securities, whereas the USD calculation also accounts for the performance of the currency (or currencies) relative to the USD.

MSCI EAFE is a service mark of MSCI Barra.

that there is more risk than opportunity, so we remain cautious. We have rarely seen an investment environment where there has been so little that meets our eye. As a result, we are holding a larger cash position than we would like, but we will be ready to pounce when the opportunity arises.

Europe: Risks Remain

A common perception is that the worst in Europe is behind us, with disaster averted last summer when Mario Draghi pledged to do “whatever it takes” to protect the eurozone from collapse. Despite complacency in Europe with lower sovereign yields and rising stock markets, we have not seen anything to suggest that the European economic situation can be managed without a political and fiscal union. It remains fragile, and the recent Cyprus debacle is a stark reminder of how little it takes to rattle the market.

The fundamentals in the eurozone are deteriorating, with the recession deepening in the fourth quarter as gross domestic product (GDP) shrunk by 0.6% sequentially. The Markit Flash Eurozone Purchasing Managers Index (PMI) in March was 46.5 (below 50 implies contraction), a 4-month low. Unemployment rates in Greece and Spain continue to climb, both now above 26%, and France’s economy has come to a screeching halt, declining sequentially in three of the last four quarters (-0.3% in the fourth quarter), forcing President Francois Hollande to warn that the country will miss its budget target of 3% by 2013. While Germany is still pushing for austerity, France has been pounding the table for government stimulus, and Italy’s national election essentially rebuffed austerity as well. There are growing divisions among the eurozone’s three largest economies (Germany, France and Italy), and great uncertainty remains.

Unfortunately, markets have come to expect a culture of bailouts and low interest rates, both of which we believe will be detrimental over the long run. The bailouts create a moral hazard, a frequent topic during the initial stages of the U.S. bailout, but one that has faded from public view in recent years. The Wikipedia definition says it all: “A situation where a party will have a tendency to take risks because the costs that could incur will not be felt by the party taking the risk.” The eurozone epitomizes the notion of moral hazard, with the excess spending, massive budget deficits and ballooning debt levels in the Southern European countries now falling on the shoulders of its Northern neighbors. Without deep, structural changes to the eurozone, we fear that leaders will simply continue to make politically expedient decisions and history will likely repeat itself.

Low interest rates and company bailouts can also lead to a proliferation of “zombie” companies, those which are barely profitable (or losing money) and would have gone out of business in a more normalized environment. These companies often struggle to service their debt, and are only able to do so because interest rates are unsustainably low. In a normal interest rate environment, they would be insolvent. They are neither investing in capital equipment nor hiring new employees, and compete away the returns of healthier, more viable businesses as they simply linger along, destroying economic value. Capitalism works in part because the lousy businesses are meant to fail, not be propped up by artificial means. Both Europe and Japan already have their fare share of zombies, and current policies will surely lead to more.

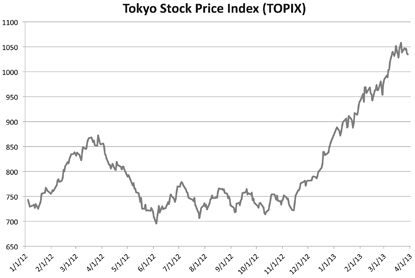

Japan: Easy Money

On November 15, 2012, Mr. Shinzo Abe, Japan’s leading candidate for Prime Minister (he was elected on December 26) called for “unlimited” monetary easing, which helped spark a 4-month rally (+42%) in the Tokyo Stock Price Index (TOPIX) and a 14% depreciation of the yen. He has since called for a 2% inflation target, and appointed Mr. Haruhiko Kuroda as governor of the Bank of Japan to push his agenda. The hope is to improve the competitiveness of Japan’s exporters, spur domestic demand, and put an end to the deflationary spiral.

Source: Bloomberg

It appears Mr. Abe is not going to address entitlements, government spending, and Japan’s mountain of debt, but instead, debase the currency and try to print his way out. Does this sound familiar? Perhaps he has learned a few tricks from the U.S. and Europe. The problem is that we are now seeing country after country doing virtually nothing to address the actual underlying problems, which by definition, suggests that the problems will become worse. It appears that everyone has the same playbook, which in the end will lead (or has already led) to a currency war, and race to the bottom.

This is a particularly dangerous game for Japan considering the massive size of its balance sheet. The risk was well articulated by Scott Minerd in a March 21, 2013 Financial Times article: “The current size of Japan’s public debt is approximately 230 percent of GDP, with total interest expense on JGBs [Japanese Government Bonds] representing about 40 percent of government receipts. Were interest rates to increase by 300 basis points over the next five years, which is in line with Mr. Abe’s stated objective of bringing inflation from -1% to 2%, interest expense would expand to approximately 80 percent of present total government revenues, with the prospect that this ratio could continue to rise.” Clearly this would not be sustainable. Should this scenario play out, a sovereign default or hyperinflation may be the end game.

China: Bubble Still Looms

We first highlighted the risk of a potential China property bubble in our March 2010 domestic shareholder letters (and several times since), and we remain concerned today. A recent “60 Minutes” segment which aired on CBS on March 3, 2013 provided additional data points, describing the building of yet another “ghost city of new towers with no residents, desolate condos and vacant subdivisions uninhabited for miles, and miles, and miles, and miles of empty apartments.” CBS interviewed Mr. Gillem Tulloch, a Hong Kong based financial analyst, who contends that, “Property values have doubled and tripled and more – so people in the middle class have sunk every last penny into buying five, even 10 apartments, fueling a building bonanza unprecedented in human history… They’re building somewhere between 12 and 24 new cities every single year.” He fears, when the bubble bursts, that “There are multiple classes of people that are going to get wiped out by this. People who have invested three generations worth of savings – so grandparents, parents and children – into properties, will see their savings evaporate. And then, of course, 50 million construction workers who are working on all these projects around China.” CBS also interviewed Mr. Wang Shi, the CEO of Vanke, China’s largest home builder, who acknowledged that there was a property bubble, and confirmed that prices in Shanghai were more than 45 times the average resident’s annual salary. To put this in perspective, this imbalance would be the equivalent to a U.S. worker with a $45,000 salary buying one or more investment properties for over $2 million, with the expectation for continued house price appreciation in the future. We have seen this story before (i.e. “U.S. housing prices have never gone down”) and it doesn’t end well. Real prices will inevitably come back down to earth, and it will be painful for the last ones standing.

While China’s central government has been taking action to help reduce property speculation (with limited success), they remain obsessed with growing their economy, especially after 2012 GDP expanded at the slowest rate in over a decade, at 7.8%. Unfortunately, fixed investments such as infrastructure and real estate, and not domestic consumption, continue to be the key engines of growth. It may be a telling sign that China’s ¥1 trillion ($157 billion) of infrastructure stimulus announced in the third quarter of 2012 pales in comparison to the $586 billion spent in 2008-09. Perhaps they realize that the empty cities, trains and roads to nowhere, and millions of vacant apartment buildings have gotten out of hand, and fear taking the same path once again. Additionally, despite what the government would like to have the general public believe, inflation in China is not under control (just ask any U.S. company that does business there), and this remains an area of concern. While we remain more positive on China over the long term, the short-term risks are continuing to mount and warrant added caution.

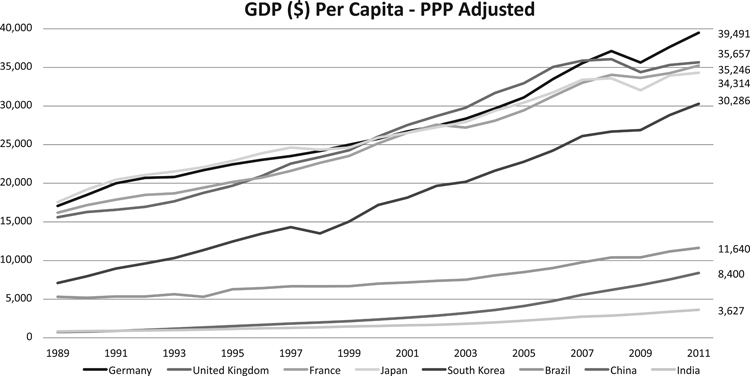

South Korea: Finding Value

While value is getting harder to find around the world, we have come across a number of intriguing opportunities in South Korea, which we recently visited during a research trip to Asia. We should note that we do not manage our portfolios to the benchmark, and try to find great multinational businesses regardless of geographies. We do not consider South Korea an emerging market, as the country is already the fifteenth largest economy measured by GDP, twelfth largest in terms of purchasing power parity, seventh largest importer, tenth largest exporter, and home to the thirteenth largest stock market (third largest in Asia Pacific). It is a member of the Organisation for Economic Co-operation and Development (OECD) and is ranked among the G-20 major economies based on the strength and size of its economy.(4) Additionally, when compared with emerging markets such as China, Brazil and India, GDP per capita is far more advanced in South Korea, and more in line with the developed world (see graph on next page).

| (4) | “Classifying South Korea as a Developed Market.” White paper report by FTSE publications. January 2013. |

Source: Bloomberg

In the March quarter we made our first investment in South Korea through Hyundai Greenfood. The company functions as a holding company for the Hyundai Department Store (HDS) Group, the third largest retail conglomerate in South Korea. The HDS Group split off from the larger Hyundai chaebol in the late 1990s. In essence, Greenfood offers access to three main businesses: catering and food distribution (Greenfood, 45% of fair value); department stores (Hyundai Department Store, 20% of fair value); and home shopping (Hyundai Home Shopping, 16% of fair value). These easy-to-understand businesses earn high returns on capital and enjoy strong competitive advantages. At our purchase price, Greenfood traded at 4.4 times enterprise value-to-earnings before interest and tax (EV/EBIT) after subtracting out the value of the company’s publicly traded entities and adjusting for taxes. Moreover, the main publicly traded entities, Hyundai Department Store and Hyundai Home Shopping, traded at a 70% and 43% discount to global peers, despite significantly better profitability. Lastly, in South Korea, corporate governance matters. Greenfood’s prominent place in the HDS Group, and the controlling family’s high direct ownership, provides excellent alignment with the controlling shareholders. Given the quality of the businesses, the attractive valuation, and the family’s strong track record, we initiated a 2.5% position.

Outlined below are detailed descriptions of two additional recent additions to the portfolio.

Danone S.A.

(Analyst: Karl Poehls)

Description

Danone S.A. engages in the food processing industry, operating through the following segments: Fresh Dairy Products (56% of 2012 sales), Waters (18%), Baby Nutrition (20%), and Medical Nutrition (6%). The Fresh Dairy Products segment produces and markets yogurts, fermented fresh dairy products, and other specialized fresh dairy products. The Waters segment comprises plain bottled water as well as flavored and vitamin-enriched water products. The Baby Nutrition segment focuses on specialized food for infants and toddlers, manufacturing infant formula, cereal snacks, biscuits, and other food products. The Medical Nutrition segment sells products that are designed to treat disease-related malnutrition by satisfying special food needs.

Good Business

| | • | Danone enjoys the following leadership positions worldwide: #1 in fresh dairy products, #3 in packaged water, and #2 in baby nutrition. |

| | • | In 2012, Forbes ranked Danone as the 25th most innovative company (up from 35th in 2011) and the 58th most powerful brand in the world. |

| | • | The company’s entire product portfolio is focused on health and wellness categories. Additionally, Danone’s products provide consumers with access to affordable, basic necessities. |

| | • | The business is easy to understand. |

| | • | Danone generates returns on invested capital that exceed its cost of capital. |

| | • | The company’s balance sheet is solid. As of 2012 year-end, net financial debt was €3.0 billion, which was equivalent to operating income. Further, Danone’s interest coverage ratio exceeded 10 times. |

Valuation

| | • | Over the past 5 years, Danone’s stock price has fallen 10% from its previous peak of €60 per share achieved in 2008. During this time, earnings per share have increased by more than 25%. |

| | • | The company’s forward price-to-earnings (P/E) multiple is 17.4 times. Over the trailing 10-year period, Danone’s price-to-earnings multiple has averaged 18.7 times. |

| | • | Since 2005, Danone’s enterprise value-to-earnings before interest, taxes, depreciation and amortization (EV/EBITDA) multiple has averaged 12.3 times. This compares to the current EV/EBITDA multiple of 9.8 times. |

| | • | At the current share price, Danone’s free cash flow yield is 6% and the dividend yield is 3%. |

| | • | Over the past 10 years, global food and consumer packaged goods companies have been acquired at an average EV/EBITDA multiple of 15 times. |

Management

| | • | Danone has been led by its Chairman and CEO, Franck Riboud, since 1996. Under his leadership, the company’s common stock has provided shareholders with a total return of 10.9% compounded annually. This compares to a total return of 6.0% per annum for the Standard & Poor’s 500 Index over a comparable timeframe. |

| | • | Trian Partners, led by activist Nelson Peltz, recently disclosed a 1% stake in Danone. We are hopeful that Trian’s involvement will lead to better discipline in regard to capital allocation. |

Investment Thesis

Today, investors are concerned with negative sales growth in Southern Europe for Danone’s Fresh Dairy business. Pricing pressure from private label products has forced Danone to cut prices in Spain and Italy, and drove a sizable reduction in management’s margin guidance in 2012. We believe that investors are overly focused on these headwinds and undervaluing the progress being made in Russia, the U.S., Brazil, and China. Danone’s stock offers an attractive 6% free cash flow yield and the potential for future cash flow growth of 5-10% per annum. Lastly, Danone sells basic necessities (yogurt, water, and milk formula) that consumers will continue to buy irrespective of how the global economy is performing. This is a defensive business trading at a discount to its intrinsic value.

Pirelli & C. S.p.A.

(Analyst: Jonathan Bloom)

Description

Pirelli is the world’s fifth largest tire manufacturer, with 2012 sales of € 6.1 billion and earnings before interest and tax (EBIT) of €781 million (12.9% margin). The company generated 73% of sales (78% of EBIT) in its consumer division (car and motorcycle), with the balance (27% and 22%) in its industrial division (truck and agriculture). Sales by channel were 24% original equipment and 76% replacement, with sales by geography as follows: Europe (34%), South America (34%), North America (12%), Middle East/Africa (9%), and Asia Pacific (7%). In 2012, approximately 38% of EBIT was generated in mature markets, with the remaining 62% coming from rapidly developing economies (RDEs). The company has focused on the high-end “premium” segment of the market (high performance, winter, SUV, run-flat tires, et al.), which accounts for approximately 50% of car sales and 80% of car EBIT. Pirelli estimates its market share to be 50% in the “prestige” tire market (i.e. Ferrari, Bentley, et al.) and 12-13% in “premium” (i.e. BMW, Mercedes, Audi, et al.).

Good Business

| | • | Improving returns: 2012 return on invested capital (ROIC) of 12% should continue to improve, exceeding the company’s cost of capital. |

| | • | Recurring revenue: 76% of sales are replacement. Premium tires wear faster than standard grade. |

| | • | Brand strength: Particularly strong brand positions in Europe and South America. High brand loyalty and awareness among high-income earners. Exclusive supplier for Formula 1 and World SBK. |

| | • | Customer captivity: Penetrating the original equipment manufacturer (OEM) relationships is difficult. Performance and safety are important. Emerging Asian competitors have penetrated standard tires, but premium has proven to be more difficult. |

| | • | Technology barriers: Advanced engineering, performance requirements, formulation and tread, industry know-how, etc. |

| | • | Understandable business: Pure play tire manufacturer. Relatively easy to understand. High return on invested time (ROIT). |

| | • | Reasonable balance sheet: Debt-to-capital of 51%. Interest coverage of approximately 5 times. |

Valuation

| | • | An enterprise value-to-sales ratio of 1.0 times compares favorably with 2012 EBIT margins of 12.9%. |

| | • | The company’s forward price-to-earnings multiple is 8.9 times, a deep discount to 5- and 10-year historical median of 10.7 times and 13.9 times. We believe a price-to-earnings multiple of 8.9 times is too low for a business growing the top-line at mid-to-high single digits while expanding margins. The quality of the business justifies a double-digit multiple, in our opinion. |

| | • | An enterprise value-to-EBIT of 7.6 times is attractive for a business of this quality. |

| | • | At the current share price, Pirelli’s dividend yield is 3.9%. |

| | • | Management’s mid-term margin targets imply ROIC improvement of more than 300 basis points. |

Management

| | • | Chairman and CEO Mr. Marco Tronchetti Provera has significant skin in the game, as he is believed to own between 6% and 7% of the shares outstanding. As the company’s largest shareholder, he controls ~26% of the shares outstanding through the holding company Camfin. |

| | • | Pirelli has sold off non-core assets in recent years (real estate, broadband, etc.) to become a pure play tire manufacturer. We have a favorable view of management’s strategic direction. |

| | • | Compensation is performance-driven, with economic value added (EVA) among the evaluation metrics. There is no stock option plan. |

| | • | Of the 20 board directors, 11 are independent. A shareholder’s agreement controls 45.5% of the shares. |

Investment Thesis

Pirelli’s premium mix (faster growth, higher margin, more difficult to penetrate) enhances the quality of the business beyond that of most peers. While the valuation implies that the business is equivalent to a subpar auto supplier, in our view, the discount is not justified. Pirelli’s brand has significant value, and its high exposure to the replacement market (76% of sales) reduces cyclicality and diminishes the OEMs’ ability to extract value. Pirelli’s valuation is attractive on both an enterprise value and price-to-earnings basis, providing an attractive risk/reward opportunity over a 3-5 year investment horizon.

Thank you for your continued support of the FMI International Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

FMI International Fund

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | | | | | | |

| COMMON STOCKS — 86.1% (a) | | | | | | |

| | | | | | | |

| COMMERCIAL SERVICES SECTOR — 8.7% | | | | | | |

| | | Advertising/Marketing | | | | | | |

| | | Services — 2.9% | | | | | | |

| | 183,100 | | WPP PLC (Jersey) (b) | | $ | 2,314,690 | | | $ | 2,926,142 | |

| | | | Miscellaneous Commercial | | | | | | | | |

| | | | Services — 2.2% | | | | | | | | |

| | 43,600 | | Secom Co. Ltd. | | | | | | | | |

| | | | (Japan) (b) | | | 2,049,066 | | | | 2,250,219 | |

| | | | Personnel Services — 3.6% | | | | | | | | |

| | 66,500 | | Adecco S.A. | | | | | | | | |

| | | | (Switzerland) (b) | | | 3,056,927 | | | | 3,647,407 | |

| | | | | | | | | | | | |

| CONSUMER DURABLES SECTOR — 6.5% | | | | | | | | |

| | | | Automotive Aftermarket — 2.4% | | | | | | | | |

| | 235,300 | | Pirelli & C. SpA | | | | | | | | |

| | | | (Italy) (b) | | | 2,656,415 | | | | 2,475,494 | |

| | | | Other Consumer Specialties — 2.5% | | | | | | | | |

| | 996,000 | | Samsonite | | | | | | | | |

| | | | International S.A. | | | | | | | | |

| | | | (Luxembourg) (b) | | | 2,010,073 | | | | 2,499,468 | |

| | | | Recreational Products — 1.6% | | | | | | | | |

| | 19,800 | | Shimano Inc. | | | | | | | | |