UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03235

FMI Common Stock Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Wisconsin Avenue, Suite 2200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Ted D. Kellner

Fiduciary Management, Inc.

100 East Wisconsin Avenue, Suite 2200

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 226-4555

Registrant's telephone number, including area code:

Date of fiscal year end: September 30

Date of reporting period: September 30, 2013

Item 1. Reports to Stockholders.

ANNUAL REPORT

September 30, 2013

FMI Large Cap Fund

(FMIHX)

FMI Common Stock Fund

(FMIMX)

FMI International Fund

(FMIJX)

| | |

| FMI Funds

Advised by Fiduciary Management, Inc. www.fmifunds.com |

| | |

FMI Funds

TABLE OF CONTENTS

| FMI Large Cap Fund | | |

| Shareholder Letter | | 3 |

| Management’s Discussion of Fund Performance | | 7 |

| Schedule of Investments | | 8 |

| Industry Sectors | | 10 |

| | | |

| FMI Common Stock Fund | | |

| Shareholder Letter | | 11 |

| Management’s Discussion of Fund Performance | | 16 |

| Schedule of Investments | | 17 |

| Industry Sectors | | 19 |

| | | |

| FMI International Fund | | |

| Shareholder Letter | | 20 |

| Management’s Discussion of Fund Performance | | 25 |

| Schedule of Investments | | 26 |

| Industry Sectors | | 28 |

| | | |

| Financial Statements | | |

| Statements of Assets and Liabilities | | 29 |

| Statements of Operations | | 30 |

| Statements of Changes in Net Assets | | 31 |

| Financial Highlights | | 32 |

| Notes to Financial Statements | | 33 |

| | | |

| Report of Independent Registered Public Accounting Firm | | 38 |

| Cost Discussion | | 39 |

| Directors and Officers | | 40 |

| Additional Information | | 41 |

| Disclosure Information | | 41 |

| Notice of Privacy Policy | | 43 |

| Householding Notice | | 43 |

FMI

Large Cap

Fund

September 30, 2013

Dear Fellow Shareholders:

The FMI Large Cap Fund gained 4.48% in the September quarter compared to 5.24% for the benchmark Standard & Poor’s 500 Index. Stock market sectors aiding relative performance included Industrial Services, Energy Minerals and Consumer Non-Durables. Areas hurting relative performance included Process Industries, Health Technology and Technology Services. Schlumberger gained significantly in the quarter, however, Potash Corporation declined meaningfully. The year-to-date gain of the Fund and the S&P 500 has been spectacular, continuing an unusual and almost unbroken run from the March 9, 2009 lows. Since that time, the Fund is up approximately168% and the S&P 500 is up approximately 174%. As an aside, we are satisfied to have only modestly lagged during this remarkable period, as our conservative style doesn’t lend itself to keeping up in a runaway market. If the market continues to soar, however, we are likely to lag. According to statistics compiled by the Leuthold Group, the gain in the stock market over the past four and half years is roughly double the median gain of the 15 bull markets since 1929. The composite of the approximately four dozen different valuation measures that we monitor quarterly dipped to the 5th decile in early 2009 and is now in the 8th decile (the 10th decile being the most expensive). Moreover, as mentioned in last quarter’s letter, the broad expansion of multiples across the vast majority of sectors leaves most median valuation measures equal to or higher than what existed in the 1999-2000 tech/telecom/internet bubble top. Additionally, the underlying fundamentals of the U.S. and European economies are sluggish, while the BRIC countries (Brazil, Russia, India and China) have seen slowing. While some individual companies are thriving, on average they are either in slow growth mode or are stagnant. The overriding determinant of recent and expected near-term performance appears to be monetary policy, specifically easy money. This policy, in our opinion, is largely experimental and has already artificially inflated assets across a broad spectrum; it grossly misallocates resources, makes “the rich” richer (they own the inflating assets, not the middle class), has little “wealth-effect” on spending and long-term, could potentially spur difficult–to-control inflation.

By Permission of Chip Bok and Creators Syndicate, Inc.

Economic Growth and Labor

The U.S. economy remains stuck in a pattern of very low growth. The current Bloomberg estimate for 2013 real GDP growth is 1.6%. This recovery has averaged about 2% growth, which is less than half that of a normal recovery. Real wages have been falling. Labor Department data shows that adjusted for inflation, average hourly pay has declined 0.9% since the end of the recession in 2009. The headline unemployment rate of 7.3% has fallen, but the broader official Bureau of Labor measure of unemployment and underemployment, U6, shows a 14% rate. Remarkably, including people who are “long-term” discouraged, the figure is unofficially approximately 23% and has actually been rising during this so-called recovery, as can be seen in the nearby chart. A startlingly high number of people appear to be simply giving up

their job search. This is unprecedented in the post-WWII period and reflects just how broken the job creation machine has become.

The labor participation rate continues to fall and is at a multi-generational low of 63.2%. Weak labor figures, combined with tepid capital formation, virtually doom the economy to slow growth. The last decade has been one of the slowest periods of fixed business investment as a percentage of GDP in the past six decades. After the initial spike off the 2009 bottom, sales and earnings growth for corporations has dropped significantly. According to the Leuthold Group, twelve month trailing Standard & Poor’s 500 Index earnings per share (EPS) are $89.18, essentially flat from the fourth quarter of 2011.

Profit Margins

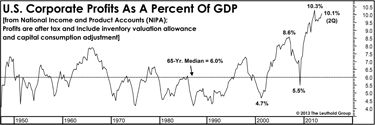

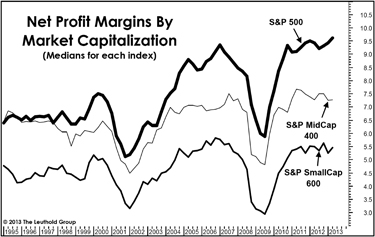

The fourth quarter of 2011 turned out to be the peak quarter of profitability in this cycle. Corporate profits reached 10.3% compared to the prior high of 8.6% (see chart). Today margins stand at 10.1%.

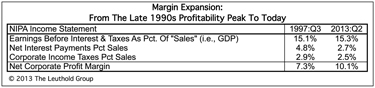

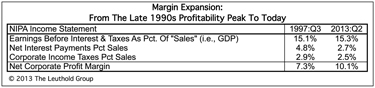

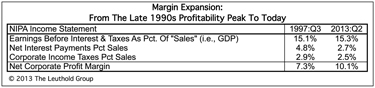

The Leuthold Group points out that contrary to what the experts believe, most of the margin expansion over the past fifteen years is not due to dramatic increases in corporate efficiency or outsourcing manufacturing to lower labor cost countries, but rather, decreases in interest rates and corporate taxes. Below is a table breaking out the difference between 1997 margins and 2013 margins. Net interest payments as a percent of sales dropped from 4.8% to 2.7%. Corporate taxes dropped from 2.9% to 2.5%. Indeed, a look at EBIT margins (earnings before interest and taxes), shows an increase of only 20 basis points since the tech era profitability peak.

Long-term interest rates have already moved sharply off the bottom. The 10-Year Treasury yield was 1.62% a year ago and now sits at 2.63%. This compares to the median rate of 5.95% since 1957. Corporate tax rates do not appear to be going higher, but the absence of a decline will make for more difficult comparative earnings growth rates. Unless there is a magical gain in revenue growth or productivity, it certainly looks like profit margins are headed lower. EPS growth is obviously going to be difficult given this backdrop.

The Stock Market

In spite of weak underlying fundamentals, the stock market continues to move higher. Words of caution are increasingly viewed with snobbish derision, as bullish investors become more emboldened by the day. Enormous faith has been put in the hands of our monetary and fiscal authorities and the minute any unpleasantness surfaces, they are expected to provide easy money or delay budgetary discipline. They have obliged (including the highly politicized sinking of the nomination of Lawrence Summers to lead the Fed, virtually handing the nomination to one of the most dovish Fed members). This self-fulfilling prophesy creates unreal expectations, which is currently manifested by high valuations. It is hard to imagine that the policy mistakes that led to the bubble of 2004-2007 could be repeated so soon. As mentioned earlier, our quarterly composite of 48 different valuation measures has moved into the 8th decile, reducing the downside protection for the market. One of the most difficult aspects of this market is the widespread lack of value. Normally, even in a bull market, there are a number of sectors that get beaten up, giving long-term investors opportunities to make contrary bets. These sectors are few and far between presently. Our stocks trade at a significant discount to the benchmark, but remain above average from an absolute historical perspective. We have an extensive list of terrific and durable business franchises we would like to own in the event their stock prices decline significantly. History shows markets to be much more volatile and varying than they have been over the past four years. We are ready for a return to volatility!

Below we highlight two investments.

Potash Corporation (POT)

(Analyst: Karl Poehls)

Description

Potash Corporation is the world’s largest fertilizer company by capacity and produces the following three primary crop nutrients: potash (K), phosphate (P) and nitrogen (N). The company has operations and business interests in seven countries and sells globally.

Good Business

| | • | Fertilizer roughly doubles the productivity of crop land, yet only accounts for approximately 20% of farmers’ costs. Thus, it is an absolute necessity in the ongoing quest to feed an increasing world population, and is an excellent value. |

| | • | Potash Corporation is the world’s largest potash producer with 17 million tons of total capacity planned for 2015, and has access to more than 65 years worth of scarce potash reserves in Canada. |

| | • | The company benefits from high barriers to entry in potash and phosphate rock production. It takes at least seven years to construct a conventional potash mine and costs more than $4 billion. |

| | • | Over the trailing 5-year and 10-year periods, Potash Corporation’s return on invested capital (ROIC) has averaged 22% and 17%, respectively. Therefore, its ROIC handsomely exceeds its cost of capital. |

| | • | The company maintains a strong balance sheet with net debt of $2.8 billion, which is less than one times estimated 2013 EBITDA (earnings before interest, taxes, depreciation and amortization). Potash Corporation’s interest coverage ratio exceeds 25 times. |

Valuation

| | • | Over the trailing 1-year, 2-year and 5-year periods, the stock has lagged the price return of the S&P 500 Index by 43%, 82% and 81%, respectively. This is significant underperformance. |

| | • | Potash Corporation’s forward price-to-earnings multiple (P/E) is 13.6 times. Since December 2004, the stock has traded for an average earnings multiple of 22.4 times. |

| | • | A conservative estimate of the replacement cost of the company’s assets is more than 50% higher than the current stock price. |

| | • | We expect free cash flow to approach $2.5-3.0 billion by 2015 as the company’s massive potash expansion project is completed. The current dividend yield is 4.3%. |

Management

| | • | The company is led by CEO Bill Doyle and CFO Wayne Brownlee. Both executives have been in senior leadership positions at Potash Corporation since the initial public offering of stock in 1989. |

| | • | Mr. Doyle has 39 years of experience in the fertilizer industry and is well respected among his peers. |

| | • | As of 2012 year-end, Mr. Doyle beneficially owned close to $100 million of the company’s stock. |

| | • | A significant component of executive compensation is directly linked to ROIC. |

Investment Thesis

Over the past 5 years, POT’s common stock has lagged the price performance of the S&P 500 by 80%+. Investors have been concerned about potential over-capacity in the potash industry as well as a recent announcement by a key competitor to pursue a volume-over-price strategy. We believe these fears are overblown and potash prices will remain strong enough to generate attractive profits. At today’s valuation, Potash Corporation’s stock trades for more than 50% below a conservative estimate of the replacement value of its assets. We believe this presents an adequate margin of safety and think the stock is attractive for long-term investors.

Bank of New York Mellon (BK)

(Analyst: Matthew Goetzinger)

Description

The Bank of New York Mellon is the world’s largest custodian bank, with over $26 trillion in assets under custody, and is one of the largest asset management companies, with $1.4 trillion under management. The company has the most diverse service offering within the trust bank industry. BK’s primary businesses are Investment Services — core custody, back and middle office outsourcing, securities clearing, execution, foreign exchange, debt issuance and trust services (72% of revenues); and Investment Management (28% of revenues).

Good Business

| | • | In the custodial bank arena, BK operates within a rational oligopoly industry structure. The company commands leading market shares in each of its diversified businesses. |

| | • | Scale, long-tenured client relationships, deeply intertwined technology platforms and a global resource base all represent significant durable competitive advantages. |

| | • | Recurring fee-based businesses comprise over 80% of the company’s revenues. |

| | • | The company’s long-term average return on tangible common equity is over 30% and recently has been 25%, depressed by the unusual rate environment. |

| | • | BK is securely financed with a Basel III capital ratio of 9.3%. The company generates significant excess capital, which eventually should come back to shareholders. |

| | • | Historically trust banks have traded in line with the S&P 500 on a P/E basis. On depressed earnings BK trades at a 4 multiple point discount to the market. |

| | • | Giving effect to a normalization in interest rates, BK’s earnings power is in excess of $4.00 per share. At a more normal P/E multiple, BK’s fair value is 50-100% higher than the current price. |

| | • | Over the past ten years BK has held a median book multiple of 1.9 times, ranging from the current low of 1.1 times to a high of over 3 times. |

Management

| | • | Gerald Hassell has been the company’s CEO since September 2011. Since joining BK thirty years ago, Mr. Hassell has had direct management responsibility for the company’s broad range of investment service businesses and owns roughly one million shares outright. |

| | • | Todd Gibbons is the company’s current CFO and previously served as the company’s Chief Risk Officer. |

| | • | Management is focused on driving organic growth, improving margins, and returns on capital, while at the same time returning excess capital to shareholders. Management incentive compensation is tied to return on equity capital. |

Investment Thesis

BK’s numerous capital-light financial processing franchises are significantly underappreciated by the market. Despite operating with significant scale as the market leader in many recurring fee-based businesses, BK’s valuation is comparable to that of a conventional bank. Over the next three to five years, BK’s growth rate and multiple should expand as international economies and capital market sophistication improve, interest rates return to normal, and operating leverage allows for higher dividends and share repurchases.

The Fund’s Board of Directors has declared a distribution effective December 20, 2013, payable on December 20, 2013 to shareholders of record on December 19, 2013. The distribution amounts will be determined at that time and will be posted to the Fund’s website www.fmifunds.com when available.

Thank you for your confidence in the FMI Large Cap Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

This shareholder letter is unaudited.

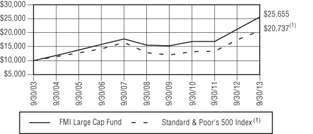

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

During the fiscal year ended September 30, 2013, the FMI Large Cap Fund (the “Fund”) had a total return of 20.94%. The benchmark S&P 500 returned 19.34% in the same period. Process Industries, Retail Trade and an elevated cash position all hurt relative performance. Potash Corporation declined in the period but we remain optimistic about the long-term prospects for this investment. Wal-Mart was up during the fiscal year, but lagged its industry group and the market. Devon Energy also trailed the overall Energy Minerals sector during the fiscal year. Electronic Technology, Producer Manufacturing and Distribution Services all aided relative performance. TE Connectivity, 3M and AmerisourceBergen were all up significantly in the period. Monsanto, Kimberly-Clark, Automatic Data Processing Inc., Ingersoll Rand and Omnicom were among those sold over the past year. Most of these sales were due to the stocks reaching or exceeding our determination of full value. Danone, PACCAR and Potash Corporation were among stocks added during the fiscal year. At September 30, 2013 the overweighted sectors included Producer Manufacturing and Distribution Services and the underweighted sectors included Electronic Technology, Communications and Utilities. The stock market continued its extraordinary rise in fiscal 2013, which we believe had more to do with monetary actions, i.e. quantitative easing, than meaningful improvement in either the underlying fundamentals of the economy or U.S. corporations. Real GDP growth remained anemic and broad measures of employment remained exceptionally weak. The debt crises showed little improvement in Europe, the United States or Japan over the fiscal year. Additionally, China appears to have much more debt than the official statistics would suggest. A credit-fueled boom in real estate and other infrastructure projects in China have increased the risk of significant negative consequences, not unlike those seen in the U.S. and Europe in 2009. In the U.S., valuations have moved higher from a year ago and fundamentals have not kept pace. Sales and earnings growth rates have fallen and profit margins for U.S. companies have weakened while at the same time valuations have expanded. From a macroeconomic and policy perspective, we do not see the fiscal or monetary initiatives of the past several years as being conducive to good long-term economic growth and employment. The high level of government liabilities and the rapid growth of regulations are particularly worrisome. While we continue to believe stocks have the best chance to adjust to a dynamic environment, and are thus attractive from a long-term perspective, we are less optimistic about the near-term. The Fund continues to sell at significant discount to the S&P 500 on most valuation measures and currently carries an above average level of cash.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI LARGE CAP FUND AND STANDARD & POOR’S 500 INDEX(1)

| AVERAGE ANNUALIZED TOTAL RETURN |

| | | | | Since |

| | | | | Inception |

| | 1-Year | 5-Year | 10-Year | 12/31/01 |

| FMI Large Cap Fund | 20.94% | 10.55% | 9.88% | 8.38% |

| S&P 500 Index | 19.34% | 10.02% | 7.57% | 5.39% |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

| (1) | The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e., its market price per share times the number of shares outstanding). Stocks may be added or deleted from the Index from time to time. |

| An investment cannot be made directly into an index. | |

This page is unaudited.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

September 30, 2013

| | Shares | | | | Cost | | | Value | |

| | |

| COMMON STOCKS — 87.0% (a) | |

| | |

| COMMERCIAL SERVICES SECTOR — 2.9% | |

| | | | Miscellaneous Commercial Services — 2.9% | |

| | | 4,520,000 | | Cintas Corp. | | $ | 130,932,811 | | | $ | 231,424,000 | |

| | |

| CONSUMER NON-DURABLES SECTOR — 6.1% | |

| | | | | Food: Major Diversified — 6.1% | |

| | | 18,850,000 | | Danone S.A. - SP-ADR | | | 264,458,375 | | | | 283,504,000 | |

| | | 3,056,000 | | Nestlé S.A. - SP-ADR | | | 143,118,869 | | | | 212,697,600 | |

| | | | | | | | 407,577,244 | | | | 496,201,600 | |

| CONSUMER SERVICES SECTOR — 2.6% | | | | | |

| | | | | Media Conglomerates — 2.6% | |

| | | 3,175,000 | | Time Warner Inc. | | | 83,095,288 | | | | 208,946,750 | |

| | |

| DISTRIBUTION SERVICES SECTOR — 5.7% | |

| | | | | Food Distributors — 2.4% | | | | | | | | |

| | | 6,210,000 | | Sysco Corp. | | | 168,159,594 | | | | 197,664,300 | |

| | | | | Medical Distributors — 3.3% | |

| | | 4,350,000 | | AmerisourceBergen Corp. | | | 131,156,744 | | | | 265,785,000 | |

| | |

| ELECTRONIC TECHNOLOGY SECTOR — 4.4% | |

| | | | | Electronic Components — 4.4% | |

| | | 6,946,000 | | TE Connectivity Ltd. | | | 183,234,855 | | | | 359,663,880 | |

| | |

| ENERGY MINERALS SECTOR — 4.2% | |

| | | | | Oil & Gas Production — 4.2% | |

| | | 5,915,000 | | Devon Energy Corp. | | | 362,217,764 | | | | 341,650,400 | |

| | |

| FINANCE SECTOR — 13.4% | |

| | | | | Financial Conglomerates — 3.3% | |

| | | 3,493,000 | | American Express Co. | | | 133,581,258 | | | | 263,791,360 | |

| | | | | Insurance Brokers/Services — 2.2% | |

| | | 4,176,000 | | Willis Group Holdings PLC | | | 159,709,388 | | | | 180,946,080 | |

| | | | | Major Banks — 7.9% | | | | | | | | |

| | | 12,135,000 | | Bank of New York Mellon Corp. | | | 295,617,813 | | | | 366,355,650 | |

| | | 7,010,000 | | Comerica Inc. | | | 216,460,410 | | | | 275,563,100 | |

| | | | | | | | 512,078,223 | | | | 641,918,750 | |

| HEALTH SERVICES SECTOR — 0.6% | |

| | | | | Managed Health Care — 0.6% | |

| | | 705,825 | | UnitedHealth Group Inc. | | | 50,656,535 | | | | 50,544,128 | |

| | |

| HEALTH TECHNOLOGY SECTOR — 6.2% | |

| | | | | Medical Specialties — 4.2% | |

| | | 5,569,000 | | Covidien PLC | | | 267,686,148 | | | | 339,374,860 | |

| | | | | Pharmaceuticals: Major — 2.0% | |

| | | 3,169,000 | | GlaxoSmithKline PLC - SP-ADR | | | 135,415,103 | | | | 158,988,730 | |

| | |

| INDUSTRIAL SERVICES SECTOR — 4.4% | |

| | | | | Oilfield Services/Equipment — 4.4% | |

| | | 4,000,000 | | Schlumberger Ltd. | | | 264,608,708 | | | | 353,440,000 | |

| | |

| PROCESS INDUSTRIES SECTOR — 5.2% | |

| | | | | Chemicals: Agricultural — 5.2% | |

| | | 13,560,000 | | Potash Corp. of Saskatchewan Inc. | | | 520,655,448 | | | | 424,156,800 | |

| | |

| PRODUCER MANUFACTURING SECTOR — 17.5% | |

| | | | | Industrial Conglomerates — 9.9% | |

| | | 3,457,000 | | 3M Co. | | | 263,778,954 | | | | 412,800,370 | |

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2013

| Shares or Principal Amount | | Cost | | | Value | |

| | | | | | | |

| COMMON STOCKS — 87.0% (a) (Continued) | | | | | | |

| | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 17.5% (Continued) | | | | | | |

| | | | Industrial Conglomerates — 9.9% (Continued) | |

| | | 3,477,000 | | Berkshire Hathaway Inc. - Cl B* | | $ | 250,004,548 | | | $ | 394,674,270 | |

| | | | | | | | 513,783,502 | | | | 807,474,640 | |

| | | | | Industrial Machinery — 4.9% | | | | | | | | |

| | | 5,160,000 | | Illinois Tool Works Inc. | | | 270,600,843 | | | | 393,553,200 | |

| | | | | Trucks/Construction/Farm Machinery — 2.7% | |

| | | 4,000,000 | | PACCAR Inc. | | | 170,974,477 | | | | 222,640,000 | |

| | |

| RETAIL TRADE SECTOR — 3.6% | |

| | | | | Discount Stores — 3.6% | | | | | | | | |

| | | 3,960,000 | | Wal-Mart Stores Inc. | | | 217,791,075 | | | | 292,881,600 | |

| | |

| TECHNOLOGY SERVICES SECTOR — 6.9% | |

| | | | | Information Technology Services — 4.4% | | | | | | | | |

| | | 4,860,000 | | Accenture PLC | | | 229,681,105 | | | | 357,890,400 | |

| | | | | Packaged Software — 2.5% | | | | | | | | |

| | | 6,158,000 | | Microsoft Corp. | | | 174,803,525 | | | | 205,122,980 | |

| | |

| TRANSPORTATION SECTOR — 3.3% | |

| | | | | Air Freight/Couriers — 3.3% | | | | | | | | |

| | | 6,150,000 | | Expeditors International of Washington Inc. | | | 231,833,459 | | | | 270,969,000 | |

| | | | | Total common stocks | | | 5,320,233,097 | | | | 7,065,028,458 | |

| | |

| SHORT-TERM INVESTMENTS — 13.0% (a) | |

| | | | | Commercial Paper — 2.5% | | | | | | | | |

| | $ | 129,000,000 | | U.S. Bank N.A., 0.01%, due 10/01/13 | | | 129,000,000 | | | | 129,000,000 | |

| | | 75,000,000 | | General Electric Co., 0.02%, due 10/09/13 | | | 74,999,667 | | | | 74,999,667 | |

| | | | | Total commercial paper | | | 203,999,667 | | | | 203,999,667 | |

| | | | | U.S. Treasury Securities — 10.5% | | | | | | | | |

| | | 375,000,000 | | U.S. Treasury Bills, 0.0050%, due 10/10/13 | | | 374,999,531 | | | | 374,999,531 | |

| | | 475,000,000 | | U.S. Treasury Bills, 0.0030%, due 10/24/13 | | | 474,999,090 | | | | 474,999,090 | |

| | | | | Total U.S. treasury securities | | | 849,998,621 | | | | 849,998,621 | |

| | | | | Total short-term investments | | | 1,053,998,288 | | | | 1,053,998,288 | |

| | | | | Total investments — 100.0% | | $ | 6,374,231,385 | | | | 8,119,026,746 | |

| | | | | Other assets, less liabilities — 0.0% (a)(b) | | | | | | | 2,989,010 | |

| | | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 8,122,015,756 | |

| * | | Non-income producing security. |

| (a) | | Percentages for the various classifications relate to net assets. |

| (b) | | Less than 0.05% of net assets. |

PLC – Public Limited Company

SP-ADR – Sponsored American Depositary Receipt

The accompanying notes to financial statements are an integral part of this schedule.

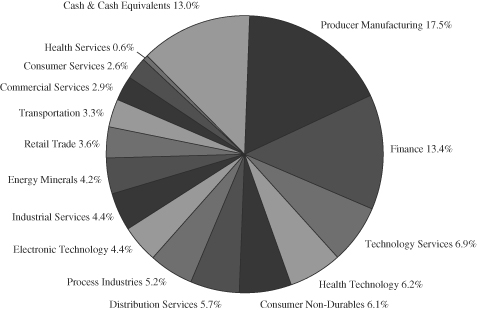

FMI Large Cap Fund

INDUSTRY SECTORS

as of September 30, 2013 (Unaudited)

FMI

Common Stock

Fund

September 30, 2013

Dear Fellow Shareholders:

The FMI Common Stock Fund gained 9.75% in the September quarter compared to 10.21% for the benchmark Russell 2000 Index. Stock market sectors aiding relative performance included Producer Manufacturing, Energy Minerals and Finance. In addition to abnormally high cash levels, sectors hurting relative performance included Health Technology, Process Industries and Distribution Services. Both Kaydon and Molex were acquired at significant premiums in the quarter and proceeds have not yet been redeployed. Compass Minerals declined in the period but we remain constructive on its prospects. McDermott also hurt performance in the September quarter and our reevaluation of its long-term outlook led to its removal. The year-to-date gain of the Fund and the Russell 2000 have been spectacular, continuing an unusual and almost unbroken run from the March 9, 2009 lows. Since that time, the Fund is up approximately 209% and the Russell 2000, up approximately 233%. As an aside, we are satisfied to have only modestly lagged during this remarkable period, as our conservative style doesn’t lend itself to keeping up in a runaway market. Today, we feel the benchmark Russell 2000 is loaded with overpriced and speculative merchandise. If, however, that index continues to soar, we will undoubtedly lag.

According to statistics compiled by the Leuthold Group, the gain in the stock market over the past four and half years is roughly double the median gain of the 15 bull markets since 1929. The composite of the approximately four dozen different valuation measures that we monitor quarterly dipped to the 5th decile in early 2009 and is now in the 8th decile (the 10th decile being the most expensive). Moreover, as mentioned in last quarter’s letter, the broad expansion of multiples across the vast majority of sectors leaves most median valuation measures equal to or higher than what existed in the 1999-2000 tech/telecom/internet bubble top. Additionally, the underlying fundamentals of the U.S. and European economies are sluggish, while the BRIC countries (Brazil, Russia, India and China) have seen slowing. While some individual companies are thriving, on average they are either in slow growth mode or are stagnant. The overriding determinant of recent and expected near-term performance appears to be monetary policy, specifically easy money. This policy, in our opinion, is largely experimental and has already artificially inflated assets across a broad spectrum; it grossly misallocates resources, makes “the rich” richer (they own the inflating assets, not the middle class), has little “wealth-effect” on spending and long-term, could potentially spur difficult–to-control inflation.

By Permission of Chip Bok and Creators Syndicate, Inc.

Economic Growth and Labor

The U.S. economy remains stuck in a pattern of very low growth. The current Bloomberg estimate for 2013 real GDP growth is 1.6%. This recovery has averaged about 2% growth, which is less than half that of a normal recovery. Real wages have been falling. Labor Department data shows that adjusted for inflation, average hourly pay has declined 0.9% since the end of the recession in 2009. The headline unemployment rate of 7.3% has fallen, but the broader official Bureau of Labor measure of unemployment and underemployment, U6, shows a 14% rate. Remarkably, including people who are “long-term” discouraged, the figure is unofficially approximately 23% and has actually been rising during this so-called

recovery, as can be seen in the chart on the previous page. A startlingly high number of people appear to be simply giving up their job search. This is unprecedented in the post-WWII period and reflects just how broken the job creation machine has become.

The labor participation rate continues to fall and is at a multi-generational low of 63.2%. Weak labor figures, combined with tepid capital formation, virtually doom the economy to slow growth. The last decade has been one of the slowest periods of fixed business investment as a percentage of GDP in the past six decades. After the initial spike off the 2009 bottom, sales and earnings growth for corporations has dropped significantly. According to the Leuthold Group, twelve month trailing Standard & Poor’s 500 Index earnings per share (EPS) are $89.18, essentially flat from the fourth quarter of 2011.

Profit Margins

The fourth quarter of 2011 turned out to be the peak quarter of profitability in this cycle. Corporate profits reached 10.3% compared to the prior high of 8.6% (see chart). Today margins stand at 10.1%.

The Leuthold Group points out that contrary to what the experts believe, most of the margin expansion over the past fifteen years is not due to dramatic increases in corporate efficiency or outsourcing manufacturing to lower labor cost countries, but rather, decreases in interest rates and corporate taxes. Below is a table breaking out the difference between 1997 margins and 2013 margins. Net interest payments as a percent of sales dropped from 4.8% to 2.7%. Corporate taxes dropped from 2.9% to 2.5%. Indeed, a look at EBIT margins (earnings before interest and taxes), shows an increase of only 20 basis points since the tech era profitability peak.

Long-term interest rates have already moved sharply off the bottom. The 10-Year Treasury yield was 1.62% a year ago and now sits at 2.63%. This compares to the median rate of 5.95% since 1957. Corporate tax rates do not appear to be going higher, but the absence of a decline will make for more difficult comparative earnings growth rates. Unless there is a magical gain in revenue growth or productivity, it certainly looks like profit margins are headed lower. EPS growth is obviously going to be difficult given this backdrop.

The margin data cited above are aggregate figures compiled by the National Income and Product Accounts (NIPA). It is also interesting to note how the margin picture looks based on company size. The graph on the left of the three S&P 500 indices (S&P 500, S&P MidCap 400 and S&P SmallCap

600). In recent periods the smaller cap companies’ margins have significantly lagged their bigger cap brethren. Additionally, smaller cap companies’ historically superior earnings growth rate has virtually disappeared over the past decade. Yet despite much lower relative growth and thinner margins, as well as being less liquid, small cap stocks continue to trade at a significant premium to large cap stocks. These realities, combined with great difficulty finding small caps that fit our fundamental and valuation criteria, leave the portfolio with higher-than-normal cash and a greater-than-normal aggregate market cap.

The Stock Market

In spite of weak underlying fundamentals, the stock market continues to move higher. Words of caution are increasingly viewed with snobbish derision, as bullish investors become more emboldened by the day. Enormous faith has been put in the hands of our monetary and fiscal authorities and the minute any unpleasantness surfaces, they are expected to provide easy money or delay budgetary discipline. They have obliged (including the highly politicized sinking of the nomination of Lawrence Summers to lead the Fed, virtually handing the nomination to one of the most dovish Fed members). This self-fulfilling prophesy creates unreal expectations, which is currently manifested by high valuations. It is hard to imagine that the policy mistakes that led to the bubble of 2004-2007 could be repeated so soon. As mentioned earlier, our quarterly composite of 48 different valuation measures has moved into the 8th decile, reducing the downside protection for the market. One of the most difficult aspects of this market is the widespread lack of value. Normally, even in a bull market, there are a number of sectors that get beaten up, giving long-term investors opportunities to make contrary bets. These sectors are few and far between presently. Our stocks trade at a significant discount to the benchmark, but remain above average from an absolute historical perspective. We have an extensive list of terrific and durable business franchises we would like to own in the event their stock prices decline significantly. History shows markets to be much more volatile and varying than they have been over the past four years. We are ready for a return to volatility!

Below we highlight two investments.

Broadridge Financial Solutions (BR)

(Analyst: Rob Helf)

Description

Broadridge Financial Solutions is a leading provider of investor communications and technology-driven processing solutions to banks, broker dealers, mutual funds and corporate issuers. Broadridge has significant market share in proxy distribution, proxy vote tabulation and other important communication as it sits between issuers and investors. The company serves over 800 bank customers, representing over 13,000 issuers. Additionally, the company provides securities transaction processing (order capture and execution, trade confirmation, settlement and accounting) and outsourcing for broker dealers and banks.

| | • | Broadridge provides a necessary service to public companies and the investment community. |

| | • | The company is a market leader by a wide margin in its core business of providing distribution and processing services in a highly regulated part of the financial service sector. The company’s technology is facilitating the move to electronic proxy and potentially greater participation in the proxy process. |

| | • | Broadridge has a high degree of recurring revenue, high customer retention rates and a scalable business model. |

| | • | The company expects to increase margins from already respectable levels. |

| | • | The business generates an ROIC (return on invested capital) of 15-16%, which is well in excess of its cost of capital. |

| | • | Broadridge produces very strong and highly predictable levels of cash flow. Free cash flow has exceeded net income by $30-50 million per annum over the past decade. |

| | • | Broadridge returns capital to its shareholders. In the most recent quarter, the company repurchased 3.3 million shares and increased its dividend by 17%. The current $0.84 annual dividend yields 2.7% and the payout ratio approximates 40%. |

| | • | The company is currently valued at approximately 15 times EPS (earnings per share), 8.2 times EBITDA (earnings before interest, taxes, depreciation and amortization) and 1.6 times sales. These metrics compare favorably to the general small and mid cap universe that currently trades at least 30% higher. |

| | • | Based on where similar businesses have been acquired, Broadridge appears to be trading at a significant discount to the current stock price. |

Management

| | • | Leslie Brun, age 61, is Broadridge’s Chairman and has served on the Board of Directors since 2007. Mr. Brun has served as a director of ADP (former parent of Broadridge) and as ADP’s Chairman since 2007. |

| | • | Richard Daly, age 60, is Broadridge’s CEO and has been a member of the Board of Directors since 2007. Prior to the March 2007 spin-off of Broadridge from ADP, Mr. Daly served as Group President of the Brokerage Services Group of ADP. |

| | • | John Hogan, age 64, is Broadridge’s President and COO. Prior to the spin-off, Mr. Hogan served along with Richard Daly as Group President of Brokerage Services. |

| | • | Dan Sheldon, age 56, is Broadridge’s Corporate VP and Chief Financial Officer. |

Investment Thesis

Broadridge has a very attractive recurring revenue business model with high ROICs and significant barriers to entry. The company should be able to grow revenues 4-5% organically and earnings at 10%, which compares favorably to the overall market. Some recent revenue drivers include: 1) the Broadridge/Accenture post-trade processing alliance, which targets European and Asian banks; and 2) an overall healthy securities trading environment. The shares have an attractive reward/risk profile based on the current valuation, business model and dividend yield/share repurchase program.

Arrow Electronics, Inc. (ARW)

(Analyst: Matt Sullivan)

Description

Arrow Electronics is a leading global distributor of semiconductors, passive and other electronic components, and midrange computing products. The company also offers a variety of value-added services including programming, system training and certification, solutions testing, and inventory and supply chain management. Arrow distributes these products and services to over 100,000 industrial and commercial customers spanning across 85 different countries.

Good Business

| | • | As a distributor of electronics and technology systems, Arrow Electronics benefits from the global growth in high technology without being exposed to the same obsolescence risk as technology manufacturers. |

| | • | Arrow is the second largest global IT distributor and controls a large market share position in the industry. It has stood the test of time, having incorporated in 1946. |

| | • | The company has a diversified set of vendors, customers and end markets. Arrow serves over 100,000 customers in 85 countries, including 12,000 value-added resellers. No single supplier accounts for more than 9% of overall revenues, and no single customer accounts for more than 3% of overall revenues. |

| | • | Arrow’s size and product offerings create a competitive advantage that translates into better margins than most of its smaller competitors. |

| | • | Over time, the company has proven its ability to consistently earn a return-on-capital that exceeds its cost-of-capital. |

| | • | The balance sheet is modestly levered with a debt-to-total capital ratio of approximately 35%. |

Valuation

| | • | Arrow is valued at 10.3 times forward EPS estimates and 0.33 times enterprise value-to-sales. |

| | • | The mean valuation for the company over the past 10 years has been 11.8 times forward EPS estimates and 0.33 times enterprise value-to-sales. |

| | • | The company trades at 7.5 times EBITDA compared to a 10-year average of 8 times. |

| | • | Michael Long is Chairman, President, and Chief Executive Officer. He has been CEO since 2009, and has been with the company since 1991. Prior to working at Arrow Electronics, Mr. Long worked at Schweber Electronics from 1983 until it merged with Arrow in 1991. |

| | • | Paul Reilly is Executive Vice President of Finance and Operations, and Chief Financial officer. He has held the position of CFO since 2001 and has been with the company since 1991. |

Investment Thesis

Arrow Electronics is one of the world’s largest distributors of electronic components and enterprise computing solutions. As a distributor of electronics, the company is in the advantageous position of benefitting from global technology growth, without being directly exposed to the short product cycles and cut-throat competition that exist for the innovators of technology. The cyclical downturn in the global components industry presented us with an opportunity to buy Arrow at an attractive price, which we believe will appreciate as some of the current trends begin to reverse.

The Fund’s Board of Directors has declared a distribution effective December 20, 2013, payable on December 20, 2013 to shareholders of record on December 19, 2013. The distribution amounts will be determined at that time and will be posted to the Fund’s website www.fmifunds.com when available.

Thank you for your confidence in the FMI Common Stock Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

This shareholder letter is unaudited.

FMI Common Stock Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

During the fiscal year ended September 30, 2013, the FMI Common Stock Fund (the “Fund”) had a total return of 26.63%. The benchmark Russell 2000 returned 30.06% in the same period. Higher than normal cash holdings were the primary reason for underperformance versus the benchmark. Additionally, Industrial Services, Process Industries and Consumer Services all hurt relative performance. McDermott, Compass Minerals and AptarGroup lagged in the period. McDermott was sold due to a significant change in the long-term fundamental outlook. Sectors that helped performance included Finance, Energy Minerals and Producer Manufacturing. Protective Life, Cimarex Energy and Molex were the prime contributors in these sectors. Stocks sold in the period included Covance, VCA Antech, West Pharmaceutical Services, Bio-Rad Laboratories, SPX Corp., Molex, Sigma-Aldrich and Bristow. A large number of companies reached or exceeded what we felt were full values. New purchases included Zions Bancorp, Greenlight Capital and Varian Medical. At September 30, the overweighted sectors included Commercial Services, Process Industries and Distribution Services. Underweighted sectors included Finance, Consumer Services and Electronic Technology. The stock market continued its extraordinary rise, which we believe had more to do with monetary actions, i.e. quantitative easing, than meaningful improvement in either the underlying fundamentals of the economy or U.S. corporations. Real GDP growth has been anemic and broad measures of employment remained exceptionally weak. The debt crises showed little improvement in Europe, the United States or Japan over the fiscal year. Additionally, China appears to have much more debt than the official statistics would suggest. A credit-fueled boom in real estate and other infrastructure projects in China has increased the risk of significant negative consequences, not unlike those seen in the U.S. and Europe in 2009. In the U.S., valuations have moved higher from a year ago and fundamentals have not kept pace. Small cap stocks appear especially vulnerable given profit margins that are weakening, growth rates that are slowing and valuations that are high from a historical basis. From a macroeconomic and policy perspective, we do not see the fiscal or monetary initiatives of the past several years as being conducive to good long-term economic growth and employment. The high level of government liabilities and the rapid growth of regulations are particularly worrisome. While we continue to believe stocks have the best chance to adjust to a dynamic environment, and are thus attractive from a long-term perspective, we are less optimistic about the near-term. The Fund continues to sell at significant discount to the Russell 2000 on most valuation measures and currently carries an above average level of cash.

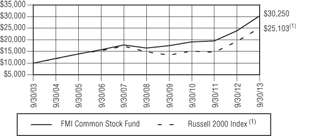

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI COMMON STOCK FUND AND THE RUSSELL 2000 INDEX(1)

| AVERAGE ANNUALIZED TOTAL RETURN |

| | | | | Since |

| | | | | Inception |

| | 1-Year | 5-Year | 10-Year | 12/18/81 |

| FMI Common | | | | |

| Stock Fund | 26.63% | 12.88% | 11.70% | 12.40% |

| Russell 2000 Index | 30.06% | 11.15% | 9.64% | 10.60% |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

| (1) | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which comprises the 3,000 largest U.S. companies based on total market capitalization. |

An investment cannot be made directly into an index.

This page is unaudited.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

September 30, 2013

| | Shares | | | | Cost | | | Value | |

| | |

| COMMON STOCKS — 80.4% (a) | |

| | |

| COMMERCIAL SERVICES SECTOR — 7.3% | |

| | | | Financial Publishing/Services — 2.3% | | | | | | |

| | | 272,000 | | The Dun & Bradstreet Corp. | | $ | 18,520,002 | | | $ | 28,247,200 | |

| | | | | Miscellaneous Commercial Services — 3.7% | | | | | | | | |

| | | 741,000 | | Cintas Corp. | | | 20,332,081 | | | | 37,939,200 | |

| | | 492,000 | | RPX Corp.* | | | 8,350,644 | | | | 8,624,760 | |

| | | | | | | | 28,682,725 | | | | 46,563,960 | |

| | | | | Personnel Services — 1.3% | | | | | | | | |

| | | 425,000 | | Robert Half International Inc. | | | 11,128,001 | | | | 16,587,750 | |

| | |

| CONSUMER DURABLES SECTOR — 0.4% | |

| | | | | Other Consumer Specialties — 0.4% | | | | | | | | |

| | | 95,350 | | Mine Safety Appliances Co. | | | 2,530,688 | | | | 4,921,014 | |

| | |

| DISTRIBUTION SERVICES SECTOR — 18.4% | |

| | | | | Electronics Distributors — 10.9% | | | | | | | | |

| | | 515,000 | | Anixter International Inc.* | | | 34,020,675 | | | | 45,144,900 | |

| | | 1,293,000 | | Arrow Electronics Inc.* | | | 26,779,111 | | | | 62,749,290 | |

| | | 857,000 | | ScanSource Inc.* | | | 22,062,384 | | | | 29,652,200 | |

| | | | | | | | 82,862,170 | | | | 137,546,390 | |

| | | | | Medical Distributors — 5.5% | | | | | | | | |

| | | 690,000 | | Owens & Minor Inc. | | | 19,866,306 | | | | 23,867,100 | |

| | | 1,113,000 | | Patterson Cos. Inc. | | | 24,876,228 | | | | 44,742,600 | |

| | | | | | | | 44,742,534 | | | | 68,609,700 | |

| | | | | Wholesale Distributors — 2.0% | | | | | | | | |

| | | 676,000 | | World Fuel Services Corp. | | | 27,739,331 | | | | 25,221,560 | |

| | |

| ELECTRONIC TECHNOLOGY SECTOR — 1.3% | |

| | | | | Electronic Production Equipment — 1.3% | | | | | | | | |

| | | 620,000 | | MKS Instruments Inc. | | | 16,677,639 | | | | 16,485,800 | |

| | |

| ENERGY MINERALS SECTOR — 4.2% | |

| | | | | Oil & Gas Production — 4.2% | | | | | | | | |

| | | 552,000 | | Cimarex Energy Co. | | | 31,659,276 | | | | 53,212,800 | |

| | |

| FINANCE SECTOR — 16.8% | |

| | | | | Finance/Rental/Leasing — 2.6% | | | | | | | | |

| | | 550,000 | | Ryder System Inc. | | | 24,635,921 | | | | 32,835,000 | |

| | | | | Insurance Brokers/Services — 1.5% | | | | | | | | |

| | | 423,000 | | Arthur J. Gallagher & Co. | | | 8,259,786 | | | | 18,463,950 | |

| | | | | Life/Health Insurance — 3.1% | | | | | | | | |

| | | 927,000 | | Protective Life Corp. | | | 14,744,788 | | | | 39,443,850 | |

| | | | | Property/Casualty Insurance — 4.7% | | | | | | | | |

| | | 804,000 | | Greenlight Capital Re Ltd.* | | | 19,808,449 | | | | 22,865,760 | |

| | | 840,000 | | W.R. Berkley Corp. | | | 20,975,570 | | | | 36,002,400 | |

| | | | | | | | 40,784,019 | | | | 58,868,160 | |

| | | | | Regional Banks — 4.9% | | | | | | | | |

| | | 605,000 | | Cullen/Frost Bankers Inc. | | | 35,152,346 | | | | 42,682,750 | |

| | | 680,000 | | Zions Bancorporation | | | 16,146,199 | | | | 18,645,600 | |

| | | | | | | | 51,298,545 | | | | 61,328,350 | |

| HEALTH TECHNOLOGY SECTOR — 2.6% | |

| | | | | Medical Specialties — 2.6% | | | | | | | | |

| | | 440,000 | | Varian Medical Systems Inc.* | | | 32,168,403 | | | | 32,881,200 | |

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

| Shares or Principal Amount | | Cost | | | Value | |

| | |

| COMMON STOCKS — 80.4% (a) (Continued) | |

| | |

| PROCESS INDUSTRIES SECTOR — 12.6% | |

| | | | Chemicals: Agriculture — 1.3% | | | | | | |

| | | 550,150 | | Sociedad Quimica y Minera de Chile SA | | $ | 17,377,335 | | | $ | 16,807,083 | |

| | | | | Chemicals: Specialty — 4.2% | | | | | | | | |

| | | 380,000 | | Compass Minerals International Inc. | | | 27,626,318 | | | | 28,982,600 | |

| | | 446,000 | | Innophos Holdings Inc. | | | 22,106,901 | | | | 23,539,880 | |

| | | | | | | | 49,733,219 | | | | 52,522,480 | |

| | | | | Containers/Packaging — 4.2% | | | | | | | | |

| | | 320,000 | | AptarGroup Inc. | | | 6,630,305 | | | | 19,241,600 | |

| | | 776,000 | | Avery Dennison Corp. | | | 22,252,409 | | | | 33,771,520 | |

| | | | | | | | 28,882,714 | | | | 53,013,120 | |

| | | | | Industrial Specialties — 2.9% | | | | | | | | |

| | | 814,000 | | H.B. Fuller Co. | | | 23,274,847 | | | | 36,784,660 | |

| | |

| PRODUCER MANUFACTURING SECTOR — 6.4% | |

| | | | | Industrial Machinery — 3.0% | | | | | | | | |

| | | 840,000 | | Kennametal Inc. | | | 33,600,357 | | | | 38,304,000 | |

| | | | | Miscellaneous Manufacturing — 3.4% | | | | | | | | |

| | | 616,000 | | Carlisle Cos. Inc. | | | 18,825,955 | | | | 43,298,640 | |

| | |

| RETAIL TRADE SECTOR — 3.0% | |

| | | | | Discount Stores — 3.0% | | | | | | | | |

| | | 527,000 | | Family Dollar Stores Inc. | | | 21,060,256 | | | | 37,954,540 | |

| | |

| TECHNOLOGY SERVICES SECTOR — 3.8% | |

| | | | | Data Processing Services — 3.8% | | | | | | | | |

| | | 1,491,850 | | Broadridge Financial Solutions Inc. | | | 32,858,473 | | | | 47,366,237 | |

| | |

| TRANSPORTATION SECTOR — 3.6% | |

| | | | | Air Freight/Couriers — 1.1% | | | | | | | | |

| | | 352,000 | | Forward Air Corp. | | | 11,267,415 | | | | 14,203,200 | |

| | | | | Marine Shipping — 2.5% | | | | | | | | |

| | | 358,000 | | Kirby Corp.* | | | 15,889,528 | | | | 30,984,900 | |

| | | | | Total common stocks | | | 689,203,927 | | | | 1,012,455,544 | |

| | |

| SHORT-TERM INVESTMENTS — 21.3% (a) | |

| | | | | Commercial Paper — 5.4% | | | | | | | | |

| | $ | 48,300,000 | | U.S. Bank N.A., 0.01%, due 10/01/13 | | | 48,300,000 | | | | 48,300,000 | |

| | | 20,000,000 | | General Electric Co., 0.02%, due 10/09/13 | | | 19,999,911 | | | | 19,999,911 | |

| | | | | Total commercial paper | | | 68,299,911 | | | | 68,299,911 | |

| | | | | U.S. Treasury Securities — 15.9% | | | | | | | | |

| | | 25,000,000 | | U.S. Treasury Bills, 0.0050%, due 10/10/13 | | | 24,999,969 | | | | 24,999,969 | |

| | | 100,000,000 | | U.S. Treasury Bills, 0.0025%, due 10/17/13 | | | 99,999,889 | | | | 99,999,889 | |

| | | 75,000,000 | | U.S. Treasury Bills, 0.0030%, due 10/24/13 | | | 74,999,856 | | | | 74,999,856 | |

| | | | | Total U.S. treasury securities | | | 199,999,714 | | | | 199,999,714 | |

| | | | | Total short-term investments | | | 268,299,625 | | | | 268,299,625 | |

| | | | | Total investments — 101.7% | | $ | 957,503,552 | | | | 1,280,755,169 | |

| | | | | Liabilities, less other assets — (1.7%) (a) | | | | | | | (21,596,678 | ) |

| | | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 1,259,158,491 | |

| * | | Non-income producing security. |

| (a) | | Percentages for the various classifications relate to net assets. |

The accompanying notes to financial statements are an integral part of this schedule.

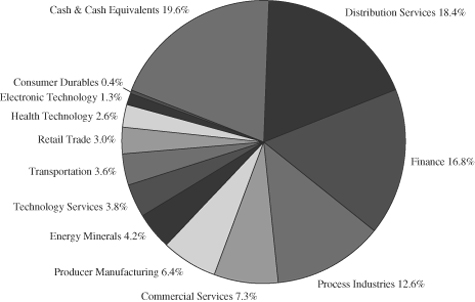

FMI Common Stock Fund

INDUSTRY SECTORS

as of September 30, 2013 (Unaudited)

FMI

International

Fund

September 30, 2013

Dear Fellow Shareholders:

The FMI International Fund (FMIJX) returned 4.32% in the three months ending September 30, 2013, which compares with the MSCI EAFE Index gain of 7.50% in local currency and 11.56% in U.S. Dollars (USD). Stock markets continued to soar in the quarter, with indices in Germany, France, the UK and Japan advancing by 7.98%, 11.07%, 5.70%, and 5.98%, respectively.(1) FMIJX was led by strong individual gains from Adecco, WPP and Electrocomponents, which were partially offset by losses from Potash, Shin-Etsu and Unilever. The Commercial Services, Industrial Services and Health Technology sectors performed well on a relative basis, while Process Industries, Finance and Consumer Non-Durables all lagged. A higher-than-normal cash position also weighed on the Fund’s relative performance. Calendar year-to-date, FMIJX has advanced by 16.14% while the MSCI EAFE is up 19.34% in local currency and 16.14% in USD.

Stock valuations remain elevated, and market exuberance continues to manifest itself at the will of central banks. The disconnect between stock prices and fundamentals is increasing as the proliferation of easy money and low interest rates has led to widespread asset inflation (as intended), which may soon prove to be a very dangerous game. Contrary to historical norms, stock prices have continued to rally even while economic forecasts repeatedly fall short of expectations, with the common belief that governments and central banks will come to the rescue. We are over four years removed from the biggest financial crisis of our generation, four years into an economic recovery, yet somehow GDP growth, employment and capital investment remain anemic, despite unprecedented accommodative policies. Is it time to admit that these policies are not working, and perhaps try something different (e.g., lower taxes, less regulation, incentives for capital investment)? We certainly believe the answer is a resounding YES, but we are not holding our breath.

Eurozone: Third Time A Charm?

The eurozone is showing some signs of life, with quarter-over-quarter GDP growth(2) (1.1% annualized) for the first time in seven quarters, ending the longest recession in the bloc’s history. Consumer confidence is on the rise, and the Markit manufacturing PMI(3) has tallied two consecutive months above 50 (51.4 in August, 50.3 in July), which implies expansion, after 23 straight months of contraction. However, we question whether Europe is out of the woods just yet. The European Central Bank (ECB) still predicts that eurozone GDP will contract by 0.4% over the full year, and unemployment remains at a record high of 12.1%(4), with nearly 20 million people still out of work. Youth unemployment in many countries tops 25%. Eurozone property prices hit a 7-year low in July, putting bank balance sheets further at risk. Paradoxically, European bank stock prices have surged 11% in the quarter and 28% over the past year,(5) outperforming the broader market. Spain, Italy and the Netherlands, which are the third, fourth and fifth largest economies in the eurozone, remain in a recession, and France is not far removed. France faces an uphill battle in terms of competitiveness, with high labor costs, low labor flexibility, early retirement (60 years), a 35-hour work week, 6+ weeks of paid vacation, high taxes, heavy public spending, et al. France’s new 10-year industrial plan provides little to instill confidence. Meanwhile in Germany, which is the bloc’s pillar of strength, the Bundesbank is predicting a slowdown in growth in the third quarter, and GDP growth of just 0.3% for the full year, a threshold which is underwhelming at best.

____________

(1)The following market indexes are being referred to above: Germany DAX, France CAC, FTSE All-Share (UK), and Japan TOPIX.

(2)As of June 2013 quarter.

(3)Purchasing Managers Index.

(4)As of July 2013.

(5)According to FTSE Eurofirst 300 banks index.

Let’s also not forget about Greece, which has been known to send ripples through the market from time to time. In August, Mr. Wolfgang Schäuble, Germany’s finance minister, publicly admitted that Greece will need a third bailout. This notion was quickly brushed under the rug, receiving minimal press coverage at the time. At this point it appears inevitable that Greece’s first two bailouts of ?73 billion and ?173 billion will come up short. While Mr. Schäuble commented that the International Monetary Fund (IMF) estimate of another ?11 billion through 2016 “appears reasonable,” Carsten Schneider, the spokesman on budget issues for Germany’s Social Democrat Party, has publicly argued that Greece’s financing needs are actually closer to ?77 billion. The Financial Times reports that “The IMF has insisted that any new programme must also ultimately deal with Greece’s massive debt pile, which despite unprecedented austerity and history’s largest sovereign default has only continued to rise.”(6) Government debt is now 175% of GDP which compares with 157% at the end of 2012. It certainly appears that the IMF, ECB and respective eurozone countries will continue to throw good money after bad, and another round of painful restructuring will eventually be in the cards.

While Greece Prime Minister Antonis Samaras and other European leaders are now calling for an end to austerity, a recent Forbes article(7) debunks a common perception that austerity in Europe has not worked: “Austerity hasn’t failed, it hasn’t even been tried,” writes Jeffrey Dorfman, a professor of economics at the University of Georgia. “In reality, few countries in Europe have actually reduced government spending. For those that have, economic growth is generally better than it is in countries that have continued to expand government spending. Data on 30 European countries from Eurostat, the official statistics agency of the European Union, show that only 8 countries reduced government spending between 2008 and 2012 […] Many countries that have purportedly tried austerity and failed are not on the above list. Greece, Spain, Italy and Portugal all increased government spending […] Austerity can indeed work if a country is willing to try it. Trying austerity means actually cutting government spending, not just slowing the growth in government spending. Austerity cannot have failed in countries where it was never tried.”

Japan: Booming Exports?

Thus far in 2013, Japan’s reported GDP growth(8) has been surprisingly strong, at 4.1% in the first quarter and 3.8% in the second quarter. Investors have been rewarded handsomely, with the TOPIX index gaining approximately 41% year-to-date and 63% from November 5, 2012. As mentioned in our June letter, however, we do not buy into the long-term efficacy of the “Abenomics” money printing experiment. Papering over deep structural problems is not a sustainable solution.

Recent export data calls into question the initial level of success of Prime Minister Abe’s program. As illustrated in the Japan Export Growth table, despite a sharp depreciation of the yen from November of 2012, export volumes have been weak, with only two months of positive volume growth (modest at that) over this time period. While headline export numbers (total export value) have looked strong, the reality is that foreigners have not been buying more products made in Japan over the past year. Instead, sales are simply being translated into more yen due to stronger foreign currencies. Thus far, it does not appear Japanese companies are using yen depreciation to become more competitive and go after market share, but instead are padding reported profits through currency translation. With weak volume growth, there is little incentive to invest in new domestic manufacturing capacity, which would create new jobs and spur domestic consumption. As a result, the long-term impact on the domestic economy may be less favorable than anticipated. It is worth noting that as of August, Japan has reported a trade deficit for 14 consecutive months, matching a 1979-1980 record set during the global oil shock.(9) For an economy that has long been heavily dependent upon exports, this is a concern, as rising input costs (e.g. energy imports) are offsetting gains made overseas (exports). Trade is becoming a drag on GDP instead of a growth driver, putting more pressure on Japan’s domestic consumer, which has historically been challenged, to carry the load.

____________

(6)“Third time lucky? The latest plan to rescue Greece” by Peter Spiegel. Financial Times, September 17, 2013.

(7)“Austerity Hasn’t Failed, It Hasn’t Even Been Tried” By Jeffrey Dorfman. Forbes, September 2, 2013.

(8)Quarter-over-quarter, annualized, expenditure approach.

(9)Japan’s August trade deficit (¥960 billion) rose by 25% year-over-year.

| Japan Export Growth: Year-over-year percentage change (%) |

| | Total Export | Export | Implied Price & |

| Date | Value (¥) | Volume | FX Impact |

| 8/13 | 14.70% | 1.90% | 12.80% |

| 7/13 | 12.20% | 1.80% | 10.40% |

| 6/13 | 7.40% | -5.00% | 12.40% |

| 5/13 | 10.10% | -1.20% | 11.30% |

| 4/13 | 3.80% | -3.00% | 6.80% |

| 3/13 | 1.10% | -7.10% | 8.20% |

| 2/13 | -2.90% | -12.80% | 9.90% |

| 1/13 | 6.40% | -1.50% | 7.90% |

| 12/12 | -5.80% | -11.80% | 6.00% |

| 11/12 | -4.10% | -7.70% | 3.60% |

| 10/12 | -6.50% | -8.50% | 2.00% |

| 9/12 | -10.30% | -11.60% | 1.30% |

| | | | |

Source: Bloomberg

We are also troubled by Japan’s level of corporate capital investment, which was flat in the second quarter after declining by 3.9% and 8.7% in the prior two quarters.(10) This calls into question the long-term confidence of Japanese corporations, as their lack of investment suggests that they, too, may be skeptical of the ability of “Abenomics” to generate sustainable growth. Mr. Abe, on the other hand, appears to have enough confidence in the outlook to implement an increase in the sales tax from 5% today to 8% by April 2014, and 10% by October 2015. If indeed the long-term health of the Japanese economy is weaker than perceived, an increase in the sales taxes would likely stunt domestic consumption, further compounding Japan’s long list of problems. Stay tuned.

China: More of the same

Optically it appears that China may be turning the corner, with HSBC (Hong Kong and Shanghai Banking Corporation) PMI(11) readings above 50 for two consecutive months, and reported gains in August in industrial output, retail sales and exports. While it’s possible that their supposed “recovery” is organic, we believe that China is resorting to its age-old playbook of excessive capital investment and persistent government stimulus. From our perspective, the risk of a housing and/or credit bubble in China remains very real. Real estate prices continue to rise, with residential properties in China’s three biggest cities (Beijing, Shanghai and Shenzen) up by 18% in August, and 6% in smaller cities. Ghost cities are still empty, and a lack of affordability remains. At the same time, The Wall Street Journal reports that credit is growing over two times faster than the economy, at 20% in the first half of 2013 compared with 7.6% GDP growth. This trend is unsustainable, especially considering that China’s total debt(12) to GDP is now believed to be over 200%.(13) Fitch Ratings argues that China is getting less bang for each buck, as much of the new credit is being used to refinance existing loans, which will not drive growth. They fear that problems could arise if financial conditions tighten, as borrowers would struggle to service their debt, which could lead to default, or even worse, a credit crisis. All bets are off if the housing bubble bursts, as it could potentially make the U.S. housing collapse look like a walk in the park.

The health of China’s banks is also a concern, as it is widely perceived that they are understating the true extent of their underperforming loans, hiding significant off-balance-sheet risk. The Financial Times reports that China’s commercial bank non-performing loans ratio was 1.1% in 2012, down from 17.9% in 2003. This figure appears suspect, especially considering widespread overcapacity and the vast number of low-quality investments that have been made in recent years. Many analysts believe that Chinese banks are far more exposed to shadow banking loans than is commonly perceived, and the practice of disguising “sizeable credit exposure as investments in wealth management products”(14) is running rampant. As China now accounts for over 13% of world GDP, the ripple effects of a banking crisis would be felt across the globe.

____________

(10)Year-over-year.

(11)Purchasing Managers Index.

(12)Total debt includes government, corporate and consumer credit.

(13)Goldman Sachs “Top of Mind” report, August 5, 2013.

(14)Standard & Poor’s Ratings Services report, cited in The Wall Street Journal article, “Fear Rises in China Over Bad Loans.” August 29, 2013.

As market bulls embrace an overly optimistic view through their quintessential rose-colored glasses (a.k.a. “Fed Goggles”), we remain skeptical and see growing risks to the downside. As a result, we will continue to remain cautious and prudent, building out our bench for a more favorable risk-to-reward environment. In the meantime, we expect FMIJX’s relative performance to be consistent with the firm’s long-term track record in domestic equities, lagging in periods of market euphoria (i.e. today) and outperforming in periods of market turmoil. While finding both quality and value in today’s stock markets is as challenging as we can remember, here are two FMIJX holdings that we believe fit the bill:

Potash Corporation (POT)

(Analyst: Karl Poehls)

Description

Potash Corporation is the world’s largest fertilizer company by capacity and produces the following three primary crop nutrients: potash (K), phosphate (P) and nitrogen (N). The company has operations and business interests in seven countries and sells globally.

Good Business

| | • | Fertilizer roughly doubles the productivity of crop land, yet only accounts for approximately 20% of farmers’ costs. Thus, it is an absolute necessity in the ongoing quest to feed an increasing world population, and is an excellent value. |

| | • | Potash Corporation is the world’s largest potash producer with 17 million tons of total capacity planned for 2015, and has access to more than 65 years worth of scarce potash reserves in Canada. |

| | • | The company benefits from high barriers to entry in potash and phosphate rock production. It takes at least seven years to construct a conventional potash mine and costs more than $4 billion. |

| | • | Over the trailing 5-year and 10-year periods, Potash Corporation’s return on invested capital (ROIC) has averaged 22% and 17%, respectively. Therefore, its ROIC handsomely exceeds its cost of capital. |

| | • | The company maintains a strong balance sheet with net debt of $2.8 billion, which is less than one times estimated 2013 EBITDA (earnings before interest, taxes, depreciation and amortization). Potash Corporation’s interest coverage ratio exceeds 25 times. |

Valuation

| | • | Over the trailing 1-year, 2-year and 5-year periods, the stock has lagged the price return of the S&P 500 Index by 43%, 82% and 81%, respectively. This is significant underperformance. |

| | • | Potash Corporation’s forward price-to-earnings multiple (P/E) is 13.6 times. Since December 2004, the stock has traded for an average earnings multiple of 22.4 times. |

| | • | A conservative estimate of the replacement cost of the company’s assets is more than 50% higher than the current stock price. |

| | • | We expect free cash flow to approach $2.5-3.0 billion by 2015 as the company’s massive potash expansion project is completed. The current dividend yield is 4.3%. |

Management

| | • | The company is led by CEO Bill Doyle and CFO Wayne Brownlee. Both executives have been in senior leadership positions at Potash Corporation since the initial public offering of stock in 1989. |

| | • | Mr. Doyle has 39 years of experience in the fertilizer industry and is well respected among his peers. |

| | • | As of 2012 year-end, Mr. Doyle beneficially owned close to $100 million of the company’s stock. |

| | • | A significant component of executive compensation is directly linked to ROIC. |

Investment Thesis

Over the past 5 years, POT’s common stock has lagged the price performance of the S&P 500 by 80%+. Investors have been concerned about potential over-capacity in the potash industry as well as a recent announcement by a key competitor to pursue a volume-over-price strategy. We believe these fears are overblown and potash prices will remain strong enough to generate attractive profits. At today’s valuation, Potash Corporation’s stock trades for more than 50% below a conservative estimate of the replacement value of its assets. We believe this presents an adequate margin of safety and think the stock is attractive for long-term investors.

Fairfax Financial Holdings (FFH)

(Analyst: Matthew Goetzinger)

Description

Fairfax is a multinational property/casualty insurance holding company run under the venerable investment sage Prem Watsa. The company’s primary operating units are: Northbridge Financial, operating in Canada; OdysseyRe, a specialty reinsurer; and Crum & Forster, a U.S. primary insurer. Approximately 50% of insurance premiums come from the U.S., with the remainder split between the Canadian and international markets. The business is balanced between short and longer-tailed risks.

Good Business

| | • | Fairfax’s operating businesses occupy leading market positions in durable niches within the global insurance market. |

| | • | The company’s business is predictable when viewed over the course of a cycle. |

| | • | Fairfax’s business provides necessary insurance coverages to enterprises globally. |

| | • | Over the past 27 years, Fairfax has delivered a 23% compound annual growth rate (CAGR) in book value per share. Management targets a long-term return on shareholder’s equity of at least 15%. |

| | • | Fairfax maintains a strong cash-rich balance sheet. Claims reserves have proven conservative through time. Current net premiums written are a small fraction of statutory capital. |

| | • | The company’s business model is transparent and fairly easy to understand. |

Valuation

| | • | Over the past five years, Fairfax has traded for an average discounted valuation of 1.1 times book value. |

| | • | Given the longer-term outlook of a 13-15% return on equity, the company’s fair value is 1.4-1.5 times accounting book value. |

| | • | Fairfax has considerable value not accurately captured by traditional GAAP (generally accepted accounting principals), including investment float, subsidiary company holdings and macroeconomic hedges. |

Management

| | • | Since 1985, Fairfax has been managed by Prem Watsa under the same guiding principles, that honesty and integrity are essential in all relationships, and will never be compromised. Prem owns 1.5% of the company outright. |

| | • | The company is managed under a conservative underwriting culture, with operating business units determining risk exposures. |

| | • | Fairfax has never lost a president or officer. |

| | • | Executives are long-term owners. Incentive stock options are inconsequential. |

Investment Thesis

Fairfax represents a conservative means to gain exposure to a resurgent global business environment through necessity insurance coverages. The company’s conservative underwriting culture positions Fairfax to benefit from a hardening of the insurance market. Despite a challenged near-term environment, we believe the company’s proven investment team will enable the company to navigate through a choppy market with decent returns.

The Fund’s Board of Directors has declared a distribution effective December 20, 2013, payable on December 20, 2013 to shareholders of record on December 19, 2013. The distribution amounts will be determined at that time and will be posted to the Fund’s website www.fmifunds.com when available.

Thank you for your continued support of the FMI International Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

This shareholder letter is unaudited.

FMI International Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

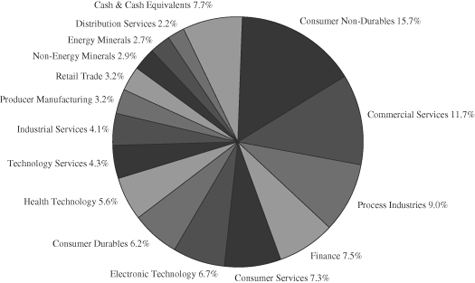

The FMI International Fund (the “Fund”) gained 20.87% in the fiscal year ended September 30, 2013. This compares to the 28.31% return of the MSCI EAFE Index (local currency) and the 23.77% of the MSCI EAFE Index (U.S. Dollar). Commercial Services, Non-Energy Minerals and Producer Manufacturing were among the outperforming sectors in the period. WPP PLC, SMC Corp., and TE Connectivity were up significantly in the period. Sectors that underperformed included Finance, Process Industries and Retail Trade. Higher-than-normal cash levels also hurt performance. Potash Corp. and Tesco declined during the fiscal year. Tesco was sold as our assessment of its long-term prospects diminished significantly. We remain optimistic about the long-term investment merits of Potash Corp. Brookfield Asset Management, Shimano, Ingersoll-Rand and SGS were sold in the fiscal year, all due to reaching our assessment of full value. New purchases this fiscal year included Amorepacific Preferred, Genting Malaysia Berhad, Taiwan Secom and Hyundai Greenfood. As of September 30, 2013, overweighted sectors included Commercial Services, Process Industries and Consumer Non-Durables. Underweighted groups included Finance, Health Technology and Producer Manufacturing. Stock markets around the globe were generally strong over the fiscal year, with exceptional performance from Japan. We believe markets were responding more to easy monetary policies than to true underlying improvement in the fundamentals. European economic growth remains weak, although the June quarter was the first positive GDP report in nearly two years. The United States GDP growth continues to be weak. Japan’s GDP growth has improved but the numbers are highly influenced by currency translation. China appears to be reigniting government stimulus programs to counter weaker economic growth. Broad measures of unemployment, in both Europe and the United States remains highly elevated. The debt crisis shows little sign of improvement in the Eurozone, or elsewhere across the globe. The United States was in the midst of a second major budget crisis as the fiscal year ended. Valuations have moved higher from a year ago and this presents the Fund with a less attractive investment landscape. While we continue to believe stocks have the best chance to adjust to a dynamic environment, and are thus attractive from a long-term perspective, we are less optimistic about the near-term. The Fund continues to sell at a discount to the MSCI EAFE on most valuation measures.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI INTERNATIONAL FUND AND MSCI EAFE(1)