UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03235

FMI Common Stock Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Wisconsin Avenue, Suite 2200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Ted D. Kellner

Fiduciary Management, Inc.

100 East Wisconsin Avenue, Suite 2200

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 226-4555

Registrant's telephone number, including area code:

Date of fiscal year end: September 30

Date of reporting period: September 30, 2011 Item 1. Reports to Stockholders.

ANNUAL REPORT

September 30, 2011

FMI Large Cap Fund

(FMIHX)

FMI Common Stock Fund

(FMIMX)

FMI International Fund

(FMIJX)

| |  | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | FMI Funds | |

| | | |

| | Advised by Fiduciary Management, Inc. | |

| | www.fmifunds.com | |

| | | |

| | | | |

FMI Funds

TABLE OF CONTENTS

| FMI Large Cap Fund | |

| | Shareholder Letter | 3 |

| | Management’s Discussion of Fund Performance | 8 |

| | Schedule of Investments | 9 |

| | Industry Sectors | 10 |

| | | |

| FMI Common Stock Fund | |

| | Shareholder Letter | 11 |

| | Management’s Discussion of Fund Performance | 16 |

| | Schedule of Investments | 17 |

| | Industry Sectors | 19 |

| | | |

| FMI International Fund | |

| | Shareholder Letter | 20 |

| | Management’s Discussion of Fund Performance | 25 |

| | Schedule of Investments | 26 |

| | Industry Sectors | 27 |

| | | |

| Financial Statements | |

| | Statements of Assets and Liabilities | 28 |

| | Statements of Operations | 29 |

| | Statements of Changes in Net Assets | 30 |

| | Financial Highlights | 32 |

| | Notes to Financial Statements | 34 |

| | | |

| Report of Independent Registered Public Accounting Firm | 38 |

| Cost Discussion | 39 |

| Directors and Officers | 40 |

| Notice of Privacy Policy | 42 |

| Householding Notice | 42 |

FMI

Large Cap

Fund

September 30, 2011

Dear Fellow Shareholders:

The FMI Large Cap Fund (FMIHX) declined 14.05% in the three months ending September 30th. This compares to the benchmark Standard & Poor’s 500 Index fall of 13.87% in the corresponding period. Through nine months FMIHX lost 8.33% and the benchmark retreated 8.68%. Economically sensitive groups such as Producer Manufacturing, Energy and Finance dropped significantly as worries about a global recession intensified. From an individual stock perspective, 3M, Devon, and Bank of New York suffered steep declines, reflecting worries about industrial growth and financial turmoil. We continue to feel strongly about the strength and long-term prospects of these businesses. Consumer Non-Durables, Retail and Commercial Services, while all down in the period, were relatively strong. Kimberly-Clark, Wal-Mart, and McGraw Hill led the way in these three sectors.

While there are a multitude of issues causing investor angst, and we will touch briefly on a few of these, valuations have become more attractive. The FMI Large Cap Fund has recently been adding attractive businesses at very reasonable, if not bargain prices and has added to a number of existing positions as prices have fallen. The companies in this Fund currently sell for a median of 12 times earnings and 1.6 times annual revenue. The profitability and financial position of the constituents are excellent. Of course there is no way to predict when the current bear market will end, but we are confident in the quality and durability of the Fund’s investments.

As a reminder, the March 31st and September 30th letters touch briefly on big picture issues before discussing a couple of investments, while the June 30th and December 31st letters delve deeper into various issues that impact the investment landscape. An archive of letters for this Fund, as well as the FMI Common Stock Fund and the FMI International Fund, can be found on our website, www.fmifunds.com.

Weakening global economic growth has been added to the worries about excessive sovereign debt in Europe, America and elsewhere. Growth has slowed across Europe, and even in Germany--which heretofore has been the pillar of strength--business activity has downshifted. As we foreshadowed in last quarter’s letter, and despite very real inflation, China is showing signs of slowing. Chinese industrial production appears to be contracting, as evidenced by HSBC’s flash Purchasing Managers Index (PMI) figure of 49.4. We have felt for some time that China has been on an unsustainable growth path, driven by massive state funded infrastructure expansion. Part of the funding apparatus resides in the regional bank system controlled by party officials. These officials earn compensation and preferred status from the party for sales of state-owned land to developers. Local government income from land sales accounted for 7% of China’s gross domestic product (GDP) last year. Credit has been expanding rapidly in recent years at a much higher rate than economic growth and may today be at dangerous levels. A recent International Monetary Fund (IMF) report shows bank credit in China growing over 30% compared to the official GDP growth of approximately 10%.

There is a growing body of evidence that suggests massive overbuilding of not only Chinese public infrastructure, but housing and commercial property, too. Construction spending, as a percentage of GDP, is up over fourfold in the past 12 years. Recently Chinese residential real estate prices and transaction volumes appear to be falling significantly, with reports of 20-30% price declines in Beijing and Shanghai and two-thirds of the country experiencing a negative growth rate. We take all Chinese figures with a grain of salt, but the slowdown seems also to be reflected in a steep decline in copper prices (down nearly 30% over the past two months), oil and other industrial commodities. Chinese leaders may be able to pull a rabbit out of the hat again by pumping up infrastructure spending but our feeling is that this is an unsustainable policy. Their economy is significantly imbalanced, driven by a surfeit of infrastructure spending and a shortage of domestic consumption spending.

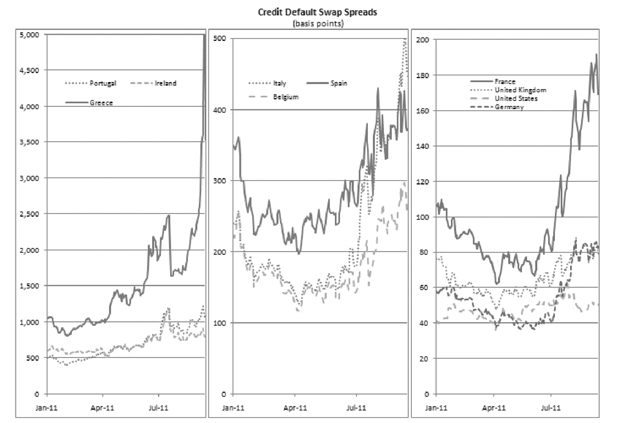

The debt woes of Europe remain intractable. In the September 21st global financial stability report, the IMF had this to say about European sovereign debt: “Nearly half of the €6.5 trillion stock of government debt issued by euro area

governments is showing signs of heightened credit risk.” Credit default swap spreads (essentially what investors pay to insure against default) have risen dramatically, not just for so-called PIIGS, but also for the rest of Europe.

Source: Bloomberg, Fiduciary Management, Inc.

The cognoscenti appear to be pinning their hopes on containment, i.e. a restructuring of Greek debt, an exchange of sovereign debt held by banks for new debt backed by another euro authority, and a bet that this bailout facility is large enough to forestall a domino effect from other countries on the brink. Details are sketchy at this point. It is likely to take further restructuring, additional austerity measures and a resetting of relative wage rates to set a course for sustainable recovery. Realistically, the vast majority of the UK and European banks would be insolvent if the sovereign debt of Greece, Portugal, Ireland and Spain were marked to market (not to mention Italy). While we don’t anticipate outright bankruptcies of these financial institutions, we think many will have to raise capital, diluting existing shareholders and stunting earnings per share for years to come. We are unsure about how European instability will impact the financial stocks in the FMI Large Cap Fund, but we continue to monitor and evaluate the situation closely.

Unfortunately, the fiscal and monetary situation in the United States isn’t very good either. Policy makers continue to spend more on the same kind of ideas that didn’t work in the 1930s and certainly haven’t worked in the 2000s, with the latest iterations adding unprecedented amounts of debt to the country’s balance sheet. Apparently, none of the policy makers feel comfortable doing nothing, much less reducing government’s involvement in the economy. The Federal Reserve’s actions are especially noteworthy since there is essentially no congressional oversight and Bernanke can run his experiments with virtual impunity. Imagine a policy that eliminates nearly all of the income of the risk-averse saver (think elderly widow with CDs and T-Bills) yet provides nearly free money to the billionaire hedge fund borrower! Business managers remain fearful of health care mandates and higher taxes and are not adding employees or significant capital to their businesses. Productivity is reasonably high but the economy needs more job creation and capital formation. An improvement in tax policy might go a long way toward improving these metrics. Right now smaller businesses (the engines of employment growth) pay a significantly higher effective tax rate than the large corporations, who employ complicated tax avoidance strategies. Personal tax rates are a crazy mishmash where a factory worker could, as Buffett said, find himself paying a higher rate than a billionaire. Perhaps the budget turmoil will have a collateral benefit of a better tax policy.

The U.S. economy remains mired in a pattern of slow growth followed by retractions. Some of the traditional drivers of renewed growth, such as housing, continue to be highly depressed. Housing inventory remains very high, prices are still trending down on an annual basis, and transaction volume is well below normal.

Twenty-seven months after the recession, consumer confidence remains extremely low (see accompanying chart). It is difficult to envision a good recovery until these conditions change:

The short summary of the macro picture is generally not very positive. Greater recognition of this has impacted stock prices quite significantly in the quarter. We think the valuations of the companies in the FMI Large Cap Fund are attractive, and the business franchises, first rate. Long-term investors should consider buying into prevailing concerns and uncertainty when valuations and strong companies are on their side. History shows good equity returns have accrued to those who have the fortitude to invest in difficult times.

In last quarter’s letter we mentioned that we had undertaken another review of the pharmaceutical industry. Recall that this sector was discussed in the context of industries that had become so-called value traps. It has been our contention for a long time that the research efforts of the large pharmaceutical firms were not generating positive economic value. Cost, length of the approval process, and probability of success had changed so significantly over the years that the expected drug pipeline value had declined dramatically. This has gradually been changing more recently and through the detailed work of one of our senior analysts, Matthew Goetzinger, we feel the industry is now on much better footing. Below we highlight our investment in GlaxoSmithKline. The other stock featured this quarter is Omnicom. This is a business that is somewhat misunderstood by the investment community. Rob Helf, another of our senior analysts, believes Wall Street is overly focused on expensive, pure-play digital advertising stocks, and is undervaluing the broad-based, diversified advertising services companies like Omnicom.

GlaxoSmithKline (GSK)

(Analyst: Matthew Goetzinger)

Description

GlaxoSmithKline is one of the largest global pharmaceuticals firms with a leading presence in respiratory, vaccines and other small and large molecule therapeutic areas. Pharmaceutical business unit sales are split between the U.S. market (35%), Europe (31%), emerging markets (16%), Asia Pacific/Japan (14%), and other (4%). The company’s Consumer Healthcare business (OTC, Oral Care, and Nutritionals) accounts for 18% of revenues.

Good Business

• GSK’s pharmaceutical business is widely diversified across therapeutic classes, geography and molecular formulation. Importantly, the company’s business does not rely on a large outsized contribution from a handful of blockbuster drugs.

• GSK serves markets with fairly inelastic demand, producing a consumable product for the treatment of various diseases.

• The company’s incremental returns on capital are improving. Historically, the company has generated above peer returns.

• The balance sheet is A+ rated, and retains low financial leverage (0.8 times net debt-to-earnings before interest, taxes, depreciation and amortization [EBITDA]).

• The business generates stable, predictable and growing free cash flow.

• The pharmaceutical industry is highly regulated, creating a significant barrier to entry.

Valuation

• Current pharmaceutical equity valuations imply that the market is placing no value on pipeline assets, and is valuing the existing drug franchise as a run-off asset with virtually zero percent growth in perpetuity.

• Beyond the expiration of significant patents for GSK and the industry, GSK trades at an attractive 8.6 times earnings, and 6.5 times EBITDA.

• Despite superior business metrics, GSK trades at a 25% discount to the broad stock market.

• On a sum-of-the-parts basis, GSK’s fair value is at least 75% higher than the current share price.

• The yield is approximately 5%.

Management

• Andrew Witty took over as CEO in May 2008. Witty has championed a number of positive endeavors including the company’s novel approach to research and development (R&D), tiered emerging market pricing, and R&D accountability. Witty is an economist by training, and has not been part of the “old guard.”

• Simon Dingemans is the company’s newly appointed CFO, bringing outside banking and strategic experience to GSK.

• GSK has a stable and diverse cadre of R&D personnel, all held to objective oversight.

Investment Thesis

Current market valuations unduly penalize GSK, placing an ultra-low multiple on trough (post patent expiry) earnings, and thus ignoring the mix of stable, diverse, and competitively positioned growing drug franchises. Moreover, little value is being accorded to the company’s drug development pipeline despite early signs of improvements in productivity, with an increasing number of meaningful, novel drugs in phase III development. Serving markets with relatively inelastic demand curves, an investment in GSK should prove defensive, while at the same time adding exposure to an upturn in R&D productivity and emerging market growth. The balance sheet is solid and the stock yields approximately 5%.

Omnicom Group Inc. (OMC)

(Analyst: Rob Helf)

Description

Omnicom Group (OMC) is a strategic holding company of advertising and marketing firms that operate in more than 100 countries with more than 5,000 clients. Its businesses focus on traditional media advertising and more than 30 marketing services, including customer relationship management, public relations, and specialty communications.

Good Business

• Omnicom is one of the world’s largest advertising and marketing services companies. Approximately 50% of its revenue comes from the U.S., and the other half from Europe and the rest of the world. The top ten agencies generate 85%+ of the industry’s revenues.

• The company offers a diversified mix of fee-based services. OMC should benefit from the current and anticipated growth in digital advertising expenditures.

• Agencies have taken on a more consultative role in the age of newer media as changes are rapid. The move to digital marketing should help increase profit growth.

• Omnicom’s largest client represents less than 4% of overall revenues.

• Agencies generally develop integrated relationships with clients, resulting in high switching costs.

• Omnicom should benefit from increased spending on advertising/marketing in a healthier economy, along with industry consolidation and beneficial fee structures.

• Over the past decade, OMC has generated a return on invested capital (ROIC) greater than its weighted average cost of capital (WACC) every year.

• The balance sheet is in good shape with debt approximately 1.9 times EBITDA.

• Omnicom’s annual dividend is $0.85/year, to yield 2.3%.

• OMC has generally repurchased approximately $500 million of equity each year.

Valuation

• OMC currently trades at approximately 1.0 times enterprise value (EV)-to-revenues, 6.8 times EBITDA and 12 times forward earnings per share (EPS) estimates. Profit margins are approximately 150 bps below the 10-year average.

• Historically, the company has been valued at 1-2 times sales, 11.5 times EBITDA and 15-27 times EPS.

• A zero-growth discounted cash flow (DCF) analysis equates to a stock price considerably higher than today’s. We expect earnings growth of 8-9%.

Management

• Bruce Crawford, 81, is Chairman of Omnicom. He began his career in advertising in 1956 and joined BBDO in 1963. He previously held the President and CEO positions.

• John Wren has been President and CEO since 1997. He has been in advertising since 1984 and joined OMC in 1986.

• Andrew Robertson (CEO of BBDO), Tom Carroll (CEO of TBWA) and Randy Weisenburger (EVP, CFO) are the other key executives.

• Both Messrs. Wren and Robertson appear to be focusing more effort on ROIC and returning excess cash to shareholders. Historically they seemed more focused on their own compensation, so we are watching this situation carefully.

Investment Thesis

Omnicom is currently valued at or below the low-end of historical parameters. When the world economy recovers, OMC should experience revenue acceleration and margin improvement based on higher corporate marketing expenditures. EPS power should be greater than $4.00 in the next few years as the company returns to 13.0% margins and repurchases shares. The stock has significant upside potential if these events transpire. Conversely, the current valuation seems to adequately discount a tough environment.

******

Distribution: Our Board of Directors has declared distributions effective October 31, 2011, of $0.12090441 per share from net investment income and $0.33849 per share from net long-term capital gains, payable October 31, 2011 to shareholders of record on October 28, 2011.

Thank you for your support of the FMI Large Cap Fund.

Sincerely,

| |  |  |

| | Ted D. Kellner, CFA | Patrick J. English, CFA |

| | Executive Chairman | CEO & Chief Investment Officer |

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

This shareholder letter is unaudited.

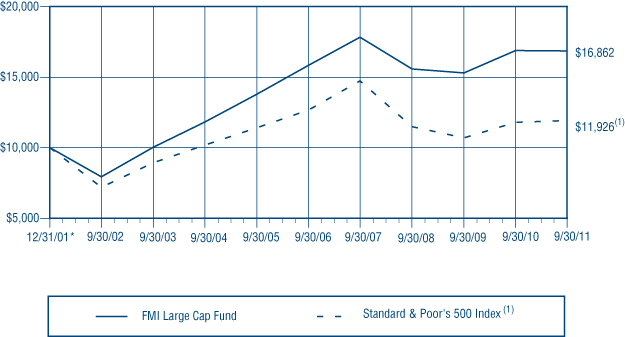

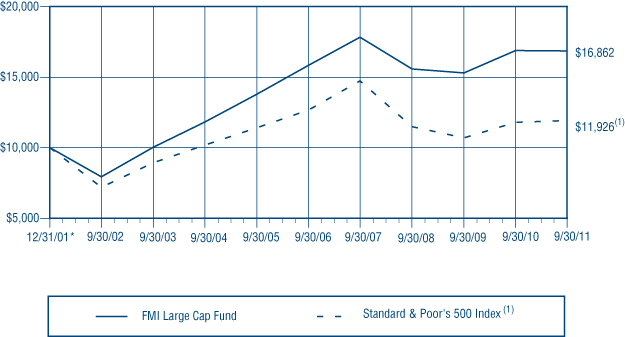

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

During the fiscal year ended September 30, 2011, the FMI Large Cap Fund (the “Fund”) had a total return of -0.13%. The benchmark S&P 500 returned 1.14% in the same period. Technology Services, Process Industries, Commercial Services, and Distribution Services all aided relative performance. Stock selection was an important factor in the positive relative performance of all of these sectors except for Distribution Services. A higher relative weighting in Technology Services and Commercial Services aided relative performance. Accenture, Monsanto, McGraw-Hill and AmerisourceBergen were strong contributors. Retail Trade, Energy Minerals, and Consumer Services all detracted from relative performance. Staples, Devon Energy and Time Warner contributed to the negative relative performance. Additionally, Ingersoll-Rand and 3M declined significantly in the period. Even though Finance was a positive relative performer from a group perspective, due to our underweighting, Comerica, Berkshire Hathaway and Bank of New York all performed negatively in the period. The stock market sold off significantly in the fourth fiscal quarter, which we believe reflects global economic slowing, policy mistakes and excessive sovereign debt issues that will not be resolved easily or in short order. Valuations have declined significantly and consumer and stock market sentiment is poor. Historically, these conditions have been favorable to value-oriented investors, although the timing of when a strong relative move unfolds is impossible to determine. We have taken advantage of lower stock prices to make several new investments in the Fund, including Microsoft, Comerica, GlaxoSmithKline and Rockwell, and we have added to a large number of existing holdings. The overweighted sectors include Technology Services, Consumer Non-Durables and Producer Manufacturing and the underweighted sectors include Finance, Energy and Utilities. From a macroeconomic and policy perspective, we do not see the fiscal or monetary initiatives of the past decade or more as being conducive to good long-term growth and employment. We think this is largely reflected in current valuations. The Fund continues to sell at a discount to the S&P 500 on most valuation measures. Over long periods of time, lower valuation securities tend to outperform higher valuation stocks. Future results, however, may differ from the past.

| | | | | | |

| | COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN | |

| | FMI Large Cap Fund and Standard & Poor’s 500 Index(1) | |

| | | | | | |

| | | |  | | |

| | | | | | |

| | | | *Inception date | | |

| | | | Past performance does not predict future performance. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | |

| | | | | | |

| | (1) | The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e., its market price per share times the number of shares outstanding). Stocks may be added or deleted from the Index from time to time. | |

| | | | |

| AVERAGE ANNUALIZED TOTAL RETURN |

| | | | | | Since Inception |

| | 3 Months | 1-Year | 3-Year | 5-Year | 12/31/01 |

| FMI Large Cap Fund | (14.05%) | (0.13%) | 2.67% | 1.26% | 5.51% |

| Standard & Poor’s 500 Index | (13.87%) | 1.14% | 1.23% | (1.18%) | 1.82% |

This page is unaudited.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

September 30, 2011

| Shares | | | | Cost | | | Value | |

| | | | | | | | | |

| COMMON STOCKS — 93.9% (a) | | | | | | |

| | | | | | | | | |

| COMMERCIAL SERVICES SECTOR — 9.3% | | | | | | |

| | | Advertising/Marketing | | | | | | |

| | | Services — 3.2% | | | | | | |

| | 3,439,000 | | Omnicom Group Inc. | | $ | 148,669,336 | | | $ | 126,692,760 | |

| | | | | | | | | | | | |

| | | | Financial Publishing/ | | | | | | | | |

| | | | Services — 3.7% | | | | | | | | |

| | 3,580,000 | | McGraw-Hill | | | | | | | | |

| | | | Companies, Inc. | | | 101,650,598 | | | | 146,780,000 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Commercial | | | | | | | | |

| | | | Services — 2.4% | | | | | | | | |

| | 3,463,000 | | Cintas Corp. | | | 88,834,481 | | | | 97,448,820 | |

| | | | | | | | | | | | |

| CONSUMER NON-DURABLES SECTOR — 12.1% | | | | | | | | |

| | | | Beverages: Alcoholic — 3.1% | | | | | | | | |

| | 1,645,000 | | Diageo | | | | | | | | |

| | | | PLC - SP-ADR | | | 104,894,110 | | | | 124,904,850 | |

| | | | | | | | | | | | |

| | | | Food: Major Diversified — 5.0% | | | | | | | | |

| | 3,634,000 | | Nestlé | | | | | | | | |

| | | | S.A. - SP-ADR | | | 171,319,385 | | | | 200,233,400 | |

| | | | | | | | | | | | |

| | | | Household/Personal Care — 4.0% | | | | | | | | |

| | 2,268,000 | | Kimberly-Clark Corp. | | | 138,791,307 | | | | 161,050,680 | |

| | | | | | | | | | | | |

| CONSUMER SERVICES SECTOR — 3.3% | | | | | | | | |

| | | | Media Conglomerates — 3.3% | | | | | | | | |

| | 4,381,000 | | Time Warner Inc. | | | 123,751,548 | | | | 131,298,570 | |

| | | | | | | | | | | |

| DISTRIBUTION SERVICES SECTOR — 8.4% | | | | | | | | |

| | | | Food Distributors — 4.6% | | | | | | | | |

| | 7,180,000 | | Sysco Corp. | | | 199,767,842 | | | | 185,962,000 | |

| | | | | | | | | | | | |

| | | | Medical Distributors — 3.8% | | | | | | | | |

| | 4,068,000 | | AmerisourceBergen | | | | | | | | |

| | | | Corp. | | | 118,266,456 | | | | 151,614,360 | |

| | | | | | | | | | | |

| ELECTRONIC TECHNOLOGY SECTOR — 3.4% | | | | | | | | |

| | | | Electronic Components — 3.4% | | | | | | | | |

| | 4,788,000 | | TE Connectivity | | | | | | | | |

| | | | Limited | | | 113,047,341 | | | | 134,734,320 | |

| | | | | | | | | | | |

| ENERGY MINERALS SECTOR — 3.8% | | | | | | | | |

| | | | Oil & Gas Production — 3.8% | | | | | | | | |

| | 2,720,000 | | Devon Energy | | | | | | | | |

| | | | Corporation | | | 181,909,101 | | | | 150,796,800 | |

| | | | | | | | | | | |

| FINANCE SECTOR — 15.4% | | | | | | | | |

| | | | Financial Conglomerates — 3.0% | | | | | | | | |

| | 2,658,000 | | American | | | | | | | | |

| | | | Express Co. | | | 84,437,794 | | | | 119,344,200 | |

| | | | | | | | | | | | |

| | | | Insurance Brokers/ | | | | | | | | |

| | | | Services — 2.5% | | | | | | | | |

| | 2,911,000 | | Willis Group | | | | | | | | |

| | | | Holdings PLC | | | 111,842,723 | | | | 100,051,070 | |

| | | | | | | | | | | | |

| | | | Major Banks — 5.9% | | | | | | | | |

| | 8,321,000 | | Bank of New York | | | | | | | | |

| | | | Mellon Corp. | | | 233,802,354 | | | | 154,687,390 | |

| | 3,485,000 | | Comerica, | | | | | | | | |

| | | | Incorporated | | | 117,559,858 | | | | 80,050,450 | |

| | | | | | | 351,362,212 | | | | 234,737,840 | |

| | | | Property/Casualty | | | | | | | | |

| | | | Insurance — 4.0% | | | | | | | | |

| | 2,258,000 | | Berkshire Hathaway | | | | | | | | |

| | | | Inc. - Cl B* | | | 151,684,694 | | | | 160,408,320 | |

| | | | | | | | | | | |

| HEALTH TECHNOLOGY SECTOR — 6.4% | | | | | | | | |

| | | | Medical Specialties — 3.2% | | | | | | | | |

| | 2,888,000 | | Coviden PLC | | | 126,593,072 | | | | 127,360,800 | |

| | | | | | | | | | | | |

| | | | Pharmaceuticals: Major — 3.2% | | | | | | | | |

| | 3,141,000 | | GlaxoSmithKline | | | | | | | | |

| | | | PLC - SP-ADR | | | 134,260,541 | | | | 129,691,890 | |

| | | | | | | | | | | |

| INDUSTRIAL SERVICES SECTOR — 0.1% | | | | | | | | |

| | | | Oilfield Services/Equipment — 0.1% | | | | | | | | |

| | 49,200 | | Schlumberger | | | | | | | | |

| | | | Limited | | | 2,949,176 | | | | 2,938,716 | |

| | | | | | | | | | | |

| PROCESS INDUSTRIES SECTOR — 1.8% | | | | | | | | |

| | | | Chemicals: Agricultural — 1.8% | | | | | | | | |

| | 1,234,000 | | Monsanto Co. | | | 65,958,502 | | | | 74,089,360 | |

| | | | | | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 7.4% | | | | | | | | |

| | | | Industrial Conglomerates — 6.5% | | | | | | | | |

| | 2,491,000 | | 3M Co. | | | 182,210,430 | | | | 178,828,890 | |

| | 2,890,000 | | Ingersoll-Rand PLC | | | 129,835,777 | | | | 81,180,100 | |

| | | | | | | 312,046,207 | | | | 260,008,990 | |

| | | Industrial Machinery — 0.9% | | | | | | | | |

| | 614,850 | | Rockwell | | | | | | | | |

| | | | Automation, Inc. | | | 32,016,855 | | | | 34,431,600 | |

| | | | | | | | | | | |

| RETAIL TRADE SECTOR — 8.5% | | | | | | | | |

| | | | Discount Stores — 4.5% | | | | | | | | |

| | 3,519,000 | | Wal-Mart | | | | | | | | |

| | | | Stores, Inc. | | | 178,424,920 | | | | 182,636,100 | |

| | | | | | | | | | | | |

| | | | Specialty Stores — 4.0% | | | | | | | | |

| | 12,148,000 | | Staples, Inc. | | | 239,079,278 | | | | 161,568,400 | |

| | | | | | | | | | | |

| TECHNOLOGY SERVICES SECTOR — 9.9% | | | | | | | | |

| | | | Data Processing Services — 2.9% | | | | | | | | |

| | 2,511,000 | | Automatic Data | | | | | | | | |

| | | | Processing, Inc. | | | 97,378,488 | | | | 118,393,650 | |

| | | | | | | | | | | | |

| | | | Information Technology | | | | | | | | |

| | | | Services — 4.1% | | | | | | | | |

| | 3,132,000 | | Accenture PLC | | | 109,272,072 | | | | 164,993,760 | |

| | | | | | | | | | | | |

| | | | Packaged Software — 2.9% | | | | | | | | |

| | 4,733,000 | | Microsoft | | | | | | | | |

| | | | Corporation | | | 131,542,109 | | | | 117,804,370 | |

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2011

| Shares or | | | | | | | |

| Principal Amount | | | Cost | | | Value | |

| | | | | | | | | |

| COMMON STOCKS — 93.9% (a) (Continued) | | | | | | |

| | | | | | | | | |

| TRANSPORTATION SECTOR — 4.1% | | | | | | |

| | | Air Freight/Couriers — 4.1% | | | | | | |

| | 2,600,000 | | United Parcel | | | | | | |

| | | | Service, Inc. - Cl B | | $ | 160,607,601 | | | $ | 164,190,000 | |

| | | | Total common stocks | | | 3,780,357,749 | | | | 3,764,165,626 | |

| | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS — 5.5% (a) | | | | | | | | |

| | | Commercial Paper — 5.5% | | | | | | | | |

| $ | 220,200,000 | | U.S. Bank, N.A., 0.02%, | | | | | | | | |

| | | | due 10/03/11 | | $ | 220,199,755 | | | $ | 220,199,755 | |

| | | | Total short-term | | | | | | | | |

| | | | investments | | | 220,199,755 | | | | 220,199,755 | |

| | | | Total investments | | | | | | | | |

| | | | — 99.4% | | $ | 4,000,557,504 | | | | 3,984,365,381 | |

| | | | Cash and receivables, | | | | | | | | |

| | | | less liabilities | | | | | | | | |

| | | | — 0.6% (a) | | | | | | | 24,393,008 | |

| | | | TOTAL NET | | | | | | | | |

| | | | ASSETS — 100.0% | | | | | | $ | 4,008,758,389 | |

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

PLC – Public Limited Company

SP-ADR – Sponsored American Depositary Receipts

The accompanying notes to financial statements are an integral part of this schedule.

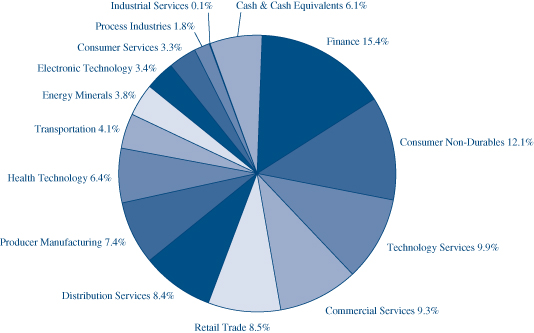

INDUSTRY SECTORS

as of September 30, 2011 (Unaudited)

FMI

Common Stock

Fund

September 30, 2011

Dear Fellow Shareholders:

The FMI Common Stock Fund (FMIMX) declined 16.31% in the three months ending September 30th. This compares to the benchmark Russell 2000 Index fall of 21.87% in the corresponding period. Through nine months FMIMX lost 9.77% and the benchmark retreated 17.02%. Economically sensitive groups such as Producer Manufacturing, Non-Energy Minerals and Finance dropped significantly as worries about a global recession intensified. From an individual stock perspective, SPX Corporation, Eagle Materials, and Cullen/Frost Bankers suffered steep declines, reflecting worries about industrial growth and financial turmoil. We continue to feel strongly about the strength and long-term prospects of these businesses. Consumer Non-Durables, Retail and Technology Services, while all down in the period, were relatively strong. Lancaster Colony, Family Dollar, and Jack Henry & Associates led the way in these three sectors.

While there are a multitude of issues causing investor angst, and we will touch briefly on a few of these, valuations have become more attractive. The FMI Common Stock Fund has added to a number of existing positions as prices have fallen. The companies in this Fund currently sell for a median of 13.5 times earnings and 1.0 times annual revenue. The profitability and financial position of the constituents are solid. Of course there is no way to predict when the current bear market will end, but we are confident in the quality and durability of the Fund’s investments.

As a reminder, the March 31st and September 30th letters touch briefly on big picture issues before discussing a couple of investments, while the June 30th and December 31st letters delve deeper into various issues that impact the investment landscape. An archive of letters for this Fund, as well as the FMI Large Cap Fund and the FMI International Fund, can be found on our website, www.fmifunds.com.

Weakening global economic growth has been added to the worries about excessive sovereign debt in Europe, America and elsewhere. Growth has slowed across Europe, and even in Germany--which heretofore has been the pillar of strength--business activity has downshifted. As we foreshadowed in last quarter’s letter, and despite very real inflation, China is showing signs of slowing. Chinese industrial production appears to be contracting, as evidenced by HSBC’s flash Purchasing Managers Index (PMI) figure of 49.4. We have felt for some time that China has been on an unsustainable growth path, driven by massive state funded infrastructure expansion. Part of the funding apparatus resides in the regional bank system controlled by party officials. These officials earn compensation and preferred status from the party for sales of state-owned land to developers. Local government income from land sales accounted for 7% of China’s gross domestic product (GDP) last year. Credit has been expanding rapidly in recent years at a much higher rate than economic growth and may today be at dangerous levels. A recent International Monetary Fund (IMF) report shows bank credit in China growing over 30% compared to the official GDP growth of approximately 10%.

There is a growing body of evidence that suggests massive overbuilding of not only Chinese public infrastructure, but housing and commercial property, too. Construction spending, as a percentage of GDP, is up over fourfold in the past 12 years. Recently Chinese residential real estate prices and transaction volumes appear to be falling significantly, with reports of 20-30% price declines in Beijing and Shanghai and two-thirds of the country experiencing a negative growth rate. We take all Chinese figures with a grain of salt, but the slowdown seems also to be reflected in a steep decline in copper prices (down nearly 30% over the past two months), oil and other industrial commodities. Chinese leaders may be able to pull a rabbit out of the hat again by pumping up infrastructure spending but our feeling is that this is an unsustainable policy. Their economy is significantly imbalanced, driven by a surfeit of infrastructure spending and a shortage of domestic consumption spending.

The debt woes of Europe remain intractable. In the September 21st global financial stability report, the IMF had this to say about European sovereign debt: “Nearly half of the €6.5 trillion stock of government debt issued by euro area

governments is showing signs of heightened credit risk.” Credit default swap spreads (essentially what investors pay to insure against default) have risen dramatically, not just for so-called PIIGS, but also for the rest of Europe.

Source: Bloomberg, Fiduciary Management, Inc.

The cognoscenti appear to be pinning their hopes on containment, i.e. a restructuring of Greek debt, an exchange of sovereign debt held by banks for new debt backed by another euro authority, and a bet that this bailout facility is large enough to forestall a domino effect from other countries on the brink. Details are sketchy at this point. It is likely to take further restructuring, additional austerity measures and a resetting of relative wage rates to set a course for sustainable recovery. Realistically, the vast majority of the UK and European banks would be insolvent if the sovereign debt of Greece, Portugal, Ireland and Spain were marked to market (not to mention Italy). While we don’t anticipate outright bankruptcies of these financial institutions, we think many will have to raise capital, diluting existing shareholders and stunting earnings per share for years to come. We are unsure about how European instability will impact the financial stocks in the FMI Common Stock Fund, but we continue to monitor and evaluate the situation closely.

Unfortunately, the fiscal and monetary situation in the United States isn’t very good either. Policy makers continue to spend more on the same kind of ideas that didn’t work in the 1930s and certainly haven’t worked in the 2000s, with the latest iterations adding unprecedented amounts of debt to the country’s balance sheet. Apparently, none of the policy makers feel comfortable doing nothing, much less reducing government’s involvement in the economy. The Federal Reserve’s actions are especially noteworthy since there is essentially no congressional oversight and Bernanke can run his experiments with virtual impunity. Imagine a policy that eliminates nearly all of the income of the risk-averse saver (think elderly widow with CDs and T-Bills) yet provides nearly free money to the billionaire hedge fund borrower! Business managers remain fearful of health care mandates and higher taxes and are not adding employees or significant capital to their businesses. Productivity is reasonably high but the economy needs more job creation and capital formation. An improvement in tax policy might go a long way toward improving these metrics. Right now smaller businesses (the engines of employment growth) pay a significantly higher effective tax rate than the large corporations, who employ complicated tax avoidance strategies. Personal tax rates are a crazy mishmash where a factory worker could, as Buffett said, find himself paying a higher rate than a billionaire. Perhaps the budget turmoil will have a collateral benefit of a better tax policy.

The U.S. economy remains mired in a pattern of slow growth followed by retractions. Some of the traditional drivers of renewed growth, such as housing, continue to be highly depressed. Housing inventory remains very high, prices are still trending down on an annual basis, and transaction volume is well below normal.

Twenty-seven months after the recession, consumer confidence remains extremely low (see accompanying chart). It is difficult to envision a good recovery until these conditions change:

The short summary of the macro picture is generally not very positive. Greater recognition of this has impacted stock prices quite significantly in the quarter. We think the valuations of the companies in the FMI Common Stock Fund are attractive, and the business franchises, first rate. Long-term investors should consider buying into prevailing concerns and uncertainty when valuations and strong companies are on their side. History shows good equity returns have accrued to those who have the fortitude to invest in difficult times.

Below we highlight two relatively recent additions to the portfolio:

Dun & Bradstreet Corp. (DNB)

(Analyst: Dan Sievers)

Description

Dun & Bradstreet (DNB), founded in 1867, is the global leader in providing commercial credit information and insight on businesses and industries, allowing customers to make more informed decisions when dealing with creditors, debtors, suppliers, distributors, sales leads, and end-users. The scope and coverage of DNB’s commercial database is unparalleled with over 200 million global business records, and the value of these records is enhanced by applying the DUNSRight Quality Process, which typically matches, links, and refines record entries, provides indicators of behavior, and organizes records in a searchable format.

Good Business

• DNB controls more than 200 million business records (its largest competitor controls about 45 million), and is the global leader in providing vital commercial credit information to businesses. DNB data and products are well entrenched with important customers (financial institutions and large corporations).

• Data and reports have long been purchased by customers in a recurring manner, but the rapid conversion of customers to the DNBi subscription service has resulted in more predictable recurring revenue.

• DNB has a strong track record of reducing structural fixed cost and headcount (often through minor restructuring) and now generates operating margins between 25%-30%, and an even higher return on invested capital (ROIC).

• The business requires little capital spending and generates impressive excess free cash flow, much of which is used to pay dividends and repurchase shares.

• Recent investments in its database and technology infrastructure have yielded strong new product development initiatives that are likely to elevate DNB’s recent tepid growth.

Valuation

• DNB shares are down 43% from the July 2008 peak. The shares trade for 10.8 times 2011 earnings per share (EPS), 7.6 times enterprise value-to-earnings before interest, taxes, depreciation and amortization (EV/EBITDA), 2.2 times EV/Sales, and 11 times price-to-free cash flow (P/FCF), vs. 5-year average comparable multiples of 17, 9.9, 2.6, and 17, respectively.

• DNB is a predictable advantaged business that generates high returns, and has a reasonable balance sheet. A premium multiple is warranted.

• Despite its defensive qualities, DNB will benefit from an increase in general business activity and U.S. loan volume, as a significant portion of revenue (especially among large customers) is transactional and therefore sensitive to somewhat cyclical aspects of corporate spending and borrowing.

Management

• Sara Matthew (54) became the CEO in January 2010, but came to DNB in 2001 as CFO and has also served as COO. Previously, Ms. Matthew held various executive positions at P&G. She holds a number of degrees from India and a U.S. MBA.

• Rich Veldran was promoted to CFO in May 2011 from Chief Strategy Officer. Previously, Mr. Veldran was CFO of North America, Treasurer, and Leader of Global Reengineering. He joined DNB in 2003 from ADP.

Investment Thesis

DNB is a high quality franchise in possession of an immense database of difficult-to-replicate value-added business credit records. The firm’s predictable revenue, high margins, high returns, and solid balance sheet argue for premium multiples, though high market penetration among large customers limits the growth rate. Poor economic conditions and commercial loan activity have weighed on the smaller transactional portion of DNB’s business. Separately, the 2010 reacquisition of DNB Australia and the $110-$130 million strategic technology investment have weighed on recent cash returns to shareholders. That said, as loan volumes improve and new products like DNB360 and DNB Pro bear fruit with smaller customers, DNB is likely to trade at higher multiples.

Kennametal (KMT)

(Analyst: Matthew Goetzinger)

Description

Kennametal is a leading global supplier of tooling, engineered components, and advanced materials consumed in production processes. The company operates through two segments, Industrial and Infrastructure. Both segments provide consumable metal-cutting tools and tooling systems to manufacturing companies for use in the mining, construction, and engineered applications. The company markets its products under the Kennametal and WIDIA brand names. In aggregate, KMT controls approximately an 18% share of an estimated $13 billion global market.

Good Business

• Kennametal’s respected industry position, history of quality and innovation, and global scale all substantiate the durability of the company’s market position.

• Tooling represents 3 to 5% of customers’ total manufacturing costs, and yields productivity enhancements of approximately 20%.

• Approximately 80% of KMT’s revenues are derived from recurring sales of cutting tools. A cutting tool’s average useful life ranges from as short as one shift to as long as several days.

• Future capital requirements of the business are low.

• Incremental returns on invested capital should reach the mid-teens over the next two years.

• The company’s balance sheet leverage is low (0.2 times net debt/EBITDA).

• The business is easy to understand.

• Over 2001-2007, KMT averaged a forward price-to-earnings (P/E) ratio of 16, ranging from 11 to 22. Today the P/E is under 10.

• Using a conservative mid-cycle P/E multiple of 13 results in a fair value estimate that is over 75% higher than today.

• A company characterized by recurring consumables revenue growth in the mid-to-high single digits, generating operating margins in the mid-to-high teens, with a sound balance sheet merits a 1.8 to 2 times revenue multiple. This suggests 75-100% upside.

Management

• Carlos Cardoso joined Kennametal in 2003 as COO, taking over as CEO in 2007. Mr. Cardoso is well respected within the industry, and brings a deep level of manufacturing experience to the company.

• Frank Simpkins is the company’s CFO. Mr. Simpkins joined Kennametal in October 1995. He is also a member of the Board of Directors of Kennametal India.

• The company’s Board of Directors has a diverse industry perspective.

• Long-term compensation is tied to earnings before interest and tax (EBIT) and return on invested capital (ROIC).

Investment Thesis

Over the past several years, Kennametal has done an admirable job of restructuring its product portfolio, simplifying its business (reducing lower margin stock keeping units (SKUs), selling non-core businesses, combining and closing redundant facilities), investing in new products, and diversifying its business mix across end markets and geographies. The 2008-2009 downturn accelerated the company’s cost reduction actions, resulting in a significantly lower fixed cost structure. There is ample capacity to absorb a resumption in order growth beyond the near term economic concerns.

******

Distribution: Our Board of Directors has declared distributions effective October 31, 2011, of $0.03383905 per share from net investment income, $0.22267 per share from short-term capital gains which will be treated as ordinary income and $1.62081 per share from net long-term capital gains, payable October 31, 2011 to shareholders of record on October 28, 2011.

Thank you for your support of the FMI Common Stock Fund.

Sincerely,

| |  |  |

| | Ted D. Kellner, CFA | Patrick J. English, CFA |

| | Executive Chairman | CEO & Chief Investment Officer |

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

This shareholder letter is unaudited.

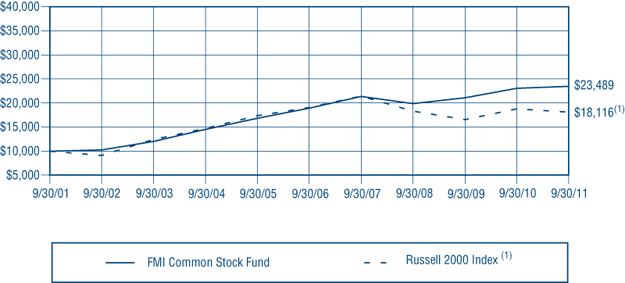

FMI Common Stock Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

During the fiscal year ended September 30, 2011, the FMI Common Stock Fund (the “Fund”) had a total return of 2.03%. The benchmark Russell 2000 returned -3.53% in the same period. Retail Trade, Transportation, Distribution Services and Consumer Non-Durables all aided relative performance. Overweighting in most of these sectors was an important factor in the better relative performance, although stock selection was also a factor. PetSmart, Kirby Corp., Arrow Electronics and Flowers Foods were strong contributors. Electronic Technology, Health Services, and Consumer Services all detracted from relative performance. Alliant Techsystems, VCA Antech, and Meredith contributed to the negative relative performance. Additionally, Harte-Hanks, PICO Holdings and SPX Corporation declined significantly in the period. Even though Finance was a positive relative performer from a group perspective, due to our underweighting, Federated Investors, Cullen/Frost Bankers and Protective Life all performed negatively in the period. The stock market sold off significantly in the fourth fiscal quarter, which we believe reflects global economic slowing, policy mistakes and excessive sovereign debt issues that will not be resolved easily or in short order. Valuations have declined significantly and consumer and stock market sentiment is poor. Historically, these conditions have been favorable to value-oriented investors, although the timing of when a strong relative move unfolds is impossible to determine. We have taken advantage of lower stock prices to make several new investments in the Fund, including Avery Dennison, Kennametal and Cullen/Frost Bankers, and we have added to a large number of existing holdings. The overweighted sectors include Distribution Services, Retail Trade and Transportation and the underweighted sectors include Finance, Health Technology and Electronic Technology. From a macroeconomic and policy perspective, we do not see the fiscal or monetary initiatives of the past decade or more as being conducive to good long-term growth and employment. We think this is largely reflected in current valuations. The Fund continues to sell at a discount to the Russell 2000 on most valuation measures. Over long periods of time, lower valuation securities tend to outperform higher valuation stocks. Future results, however, may differ from the past.

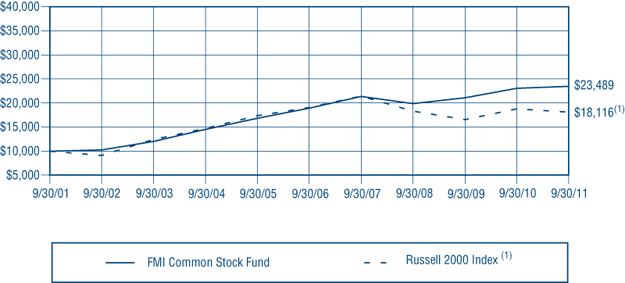

| | COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN | |

| | FMI COMMON STOCK FUND AND THE RUSSELL 2000 INDEX(1) | |

| | | | | | |

| | | |  | | |

| | | | | | |

| | | | Past performance does not predict future performance. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | |

| | | | | | |

| | (1) | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which comprises the 3,000 largest U.S. companies based on total market capitalization. | |

| AVERAGE ANNUALIZED TOTAL RETURN |

| | | | | | | Since Inception |

| | 3 Months | 1-Year | 3-Year | 5-Year | 10-Year | 12/18/81 |

| FMI Common Stock Fund | (16.31%) | 2.03% | 5.74% | 4.40% | 8.91% | 11.63% |

| Russell 2000 Index | (21.87%) | (3.53%) | (0.37%) | (1.02%) | 6.12% | 9.35% |

This page is unaudited.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

September 30, 2011

| Shares | | | | Cost | | | Value | |

| | | | | | | | | |

| COMMON STOCKS — 90.3% (a) | | | | | | |

| | | | | | | | | |

| COMMERCIAL SERVICES SECTOR — 7.0% | | | | | | |

| | | Advertising/Marketing | | | | | | |

| | | Services — 1.4% | | | | | | |

| | 1,556,000 | | Harte-Hanks, Inc. | | $ | 21,392,465 | | | $ | 13,194,880 | |

| | | | | | | | | | | | |

| | | | Financial Publishing/ | | | | | | | | |

| | | | Services — 2.4% | | | | | | | | |

| | 374,000 | | The Dun & Bradstreet | | | | | | | | |

| | | | Corporation | | | 29,017,640 | | | | 22,911,240 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Commercial | | | | | | | | |

| | | | Services — 3.2% | | | | | | | | |

| | 736,000 | | Cintas Corp. | | | 17,929,877 | | | | 20,711,040 | |

| | 620,000 | | TeleTech | | | | | | | | |

| | | | Holdings, Inc.* | | | 10,768,978 | | | | 9,448,800 | |

| | | | | | | 28,698,855 | | | | 30,159,840 | |

| CONSUMER DURABLES SECTOR — 0.8% | | | | | | | | |

| | | | Other Consumer | | | | | | | | |

| | | | Specialties — 0.8% | | | | | | | | |

| | 289,950 | | Mine Safety | | | | | | | | |

| | | | Appliances Co. | | | 8,040,367 | | | | 7,817,052 | |

| | | | | | | | | | | |

| CONSUMER NON-DURABLES SECTOR — 5.7% | | | | | | | | |

| | | | Food: Meat/Fish/Dairy — 2.1% | | | | | | | | |

| | 411,000 | | Sanderson | | | | | | | | |

| | | | Farms, Inc. | | | 16,561,195 | | | | 19,522,500 | |

| | | | | | | | | | | | |

| | | | Food: Specialty/Candy — 3.6% | | | | | | | | |

| | 842,125 | | Flowers Foods, Inc. | | | 14,485,516 | | | | 16,387,752 | |

| | 286,000 | | Lancaster Colony | | | | | | | | |

| | | | Corporation | | | 15,533,682 | | | | 17,448,860 | |

| | | | | | | 30,019,198 | | | | 33,836,612 | |

| CONSUMER SERVICES SECTOR — 0.3% | | | | | | | | |

| | | | Publishing: Books/ | | | | | | | | |

| | | | Magazines — 0.3% | | | | | | | | |

| | 110,100 | | Meredith Corp. | | | 1,847,527 | | | | 2,492,664 | |

| | | | | | | | | | | |

| DISTRIBUTION SERVICES SECTOR — 11.6% | | | | | | | | |

| | | | Electronics | | | | | | | | |

| | | | Distributors — 5.7% | | | | | | | | |

| | 1,248,000 | | Arrow | | | | | | | | |

| | | | Electronics, Inc.* | | | 25,084,996 | | | | 34,669,440 | |

| | 658,000 | | ScanSource, Inc.* | | | 16,255,090 | | | | 19,450,480 | |

| | | | | | | 41,340,086 | | | | 54,119,920 | |

| | | | Medical Distributors — 4.3% | | | | | | | | |

| | 1,433,000 | | Patterson | | | | | | | | |

| | | | Companies Inc. | | | 34,064,024 | | | | 41,026,790 | |

| | | | | | | | | | | | |

| | | | Wholesale | | | | | | | | |

| | | | Distributors — 1.6% | | | | | | | | |

| | 538,000 | | United | | | | | | | | |

| | | | Stationers Inc. | | | 10,887,604 | | | | 14,660,500 | |

| | | | | | | | | | | | |

| ELECTRONIC TECHNOLOGY SECTOR — 1.9% | | | | | | | | |

| | | | Aerospace & Defense — 1.9% | | | | | | | | |

| | 326,000 | | Alliant | | | | | | | | |

| | | | Techsystems Inc. | | | 26,521,823 | | | | 17,770,260 | |

| | | | | | | | | | | |

| FINANCE SECTOR — 10.7% | | | | | | | | |

| | | | Insurance Brokers/ | | | | | | | | |

| | | | Services — 3.6% | | | | | | | | |

| | 1,293,000 | | Arthur J. | | | | | | | | |

| | | | Gallagher & Co. | | | 30,422,381 | | | | 34,005,900 | |

| | | | | | | | | | | | |

| | | | Investment Managers — 0.8% | | | | | | | | |

| | 445,000 | | Federated | | | | | | | | |

| | | | Investors, Inc. Cl B | | | 11,678,313 | | | | 7,800,850 | |

| | | | | | | | | | | | |

| | | | Life/Health Insurance — 1.3% | | | | | | | | |

| | 808,000 | | Protective Life Corp. | | | 12,052,821 | | | | 12,629,040 | |

| | | | | | | | | | | | |

| | | | Property/Casualty | | | | | | | | |

| | | | Insurance — 3.6% | | | | | | | | |

| | 1,145,000 | | W.R. Berkley Corp. | | | 29,330,749 | | | | 33,995,050 | |

| | | | | | | | | | | | |

| | | | Regional Banks — 1.4% | | | | | | | | |

| | 293,000 | | Cullen/Frost | | | | | | | | |

| | | | Bankers, Inc. | | | 17,233,550 | | | | 13,436,980 | |

| | | | | | | | | | | |

| HEALTH SERVICES SECTOR — 3.1% | | | | | | | | |

| | | | Health Industry | | | | | | | | |

| | | | Services — 2.1% | | | | | | | | |

| | 447,000 | | Covance Inc.* | | | 18,606,960 | | | | 20,316,150 | |

| | | | | | | | | | | | |

| | | | Medical/Nursing | | | | | | | | |

| | | | Services — 1.0% | | | | | | | | |

| | 573,000 | | VCA Antech, Inc.* | | | 12,538,615 | | | | 9,156,540 | |

| | | | | | | | | | | |

| HEALTH TECHNOLOGY SECTOR — 3.5% | | | | | | | | |

| | | | Medical Specialties — 3.5% | | | | | | | | |

| | 199,000 | | Bio-Rad | | | | | | | | |

| | | | Laboratories, Inc.* | | | 16,582,829 | | | | 18,063,230 | |

| | 408,000 | | West Pharmaceutical | | | | | | | | |

| | | | Services, Inc. | | | 16,327,619 | | | | 15,136,800 | |

| | | | | | | 32,910,448 | | | | 33,200,030 | |

| INDUSTRIAL SERVICES SECTOR — 4.2% | | | | | | | | |

| | | | Oilfield Services/ | | | | | | | | |

| | | | Equipment — 4.2% | | | | | | | | |

| | 563,000 | | Bristow Group, Inc. | | | 16,893,272 | | | | 23,888,090 | |

| | 399,000 | | Dresser-Rand | | | | | | | | |

| | | | Group, Inc.* | | | 7,004,689 | | | | 16,171,470 | |

| | | | | | | 23,897,961 | | | | 40,059,560 | |

| MISCELLANEOUS SECTOR — 1.0% | | | | | | | | |

| | | | Investment Trusts/ | | | | | | | | |

| | | | Mutual Funds — 1.0% | | | | | | | | |

| | 457,000 | | PICO Holdings, Inc.* | | | 14,826,764 | | | | 9,373,070 | |

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2011

| Shares or | | | | | | | |

| Principal Amount | | | Cost | | | Value | |

| | | | | | | | | |

| COMMON STOCKS — 90.3% (a) (Continued) | | | | | | |

| | | | | | | | | |

| NON-ENERGY MINERALS SECTOR — 1.8% | | | | | | |

| | | Construction Materials — 1.8% | | | | | | |

| | 999,950 | | Eagle Materials Inc. | | $ | 25,147,349 | | | $ | 16,649,168 | |

| | | | | | | | | | | |

| PROCESS INDUSTRIES SECTOR — 9.0% | | | | | | | | |

| | | | Chemicals: Specialty — 2.1% | | | | | | | | |

| | 315,000 | | Sigma-Aldrich Corp. | | | 15,670,380 | | | | 19,463,850 | |

| | | | | | | | | | | | |

| | | | Containers/Packaging — 4.6% | | | | | | | | |

| | 561,000 | | AptarGroup, Inc. | | | 14,873,741 | | | | 25,059,870 | |

| | 638,000 | | Bemis | | | | | | | | |

| | | | Company, Inc. | | | 15,865,413 | | | | 18,699,780 | |

| | | | | | | 30,739,154 | | | | 43,759,650 | |

| | | | Industrial Specialties — 2.3% | | | | | | | | |

| | 702,000 | | Valspar Corp. | | | 18,970,075 | | | | 21,909,420 | |

| | | | | | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 11.4% | | | | | | | | |

| | | | Electrical Products — 2.7% | | | | | | | | |

| | 1,494,000 | | Molex Inc. Cl A | | | 26,828,960 | | | | 25,218,720 | |

| | | | | | | | | | | | |

| | | | Industrial | | | | | | | | |

| | | | Conglomerates — 1.9% | | | | | | | | |

| | 407,000 | | SPX Corporation | | | 22,883,026 | | | | 18,441,170 | |

| | | | | | | | | | | | |

| | | | Industrial Machinery — 3.1% | | | | | | | | |

| | 604,000 | | Kennametal Inc. | | | 23,446,246 | | | | 19,774,960 | |

| | 333,000 | | Woodward Inc. | | | 9,119,789 | | | | 9,124,200 | |

| | | | | | | 32,566,035 | | | | 28,899,160 | |

| | | | Miscellaneous | | | | | | | | |

| | | | Manufacturing — 2.1% | | | | | | | | |

| | 626,000 | | Carlisle | | | | | | | | |

| | | | Companies Inc. | | | 16,800,707 | | | | 19,956,880 | |

| | | | | | | | | | | | |

| | | | Office Equipment/ | | | | | | | | |

| | | | Supplies — 1.6% | | | | | | | | |

| | 620,000 | | Avery Dennison | | | | | | | | |

| | | | Corporation | | | 19,882,561 | | | | 15,549,600 | |

| | | | | | | | | | | |

| RETAIL TRADE SECTOR — 9.2% | | | | | | | | |

| | | | Catalog/Specialty | | | | | | | | |

| | | | Distribution — 1.8% | | | | | | | | |

| | 522,600 | | HSN, Inc.* | | | 14,348,523 | | | | 17,313,738 | |

| | | | | | | | | | | | |

| | | | Discount Stores — 2.3% | | | | | | | | |

| | 425,000 | | Family Dollar | | | | | | | | |

| | | | Stores, Inc. | | | 9,798,097 | | | | 21,615,500 | |

| | | | | | | | | | | | |

| | | | Food Retail — 1.9% | | | | | | | | |

| | 471,650 | | Ruddick Corp. | | | 12,112,374 | | | | 18,389,634 | |

| | | | | | | | | | | | |

| | | | Specialty Stores — 3.2% | | | | | | | | |

| | 714,000 | | PetSmart, Inc. | | | 15,264,504 | | | | 30,452,100 | |

| | | | | | | | | | | | |

| TECHNOLOGY SERVICES SECTOR — 5.3% | | | | | | | | |

| | | | Data Processing | | | | | | | | |

| | | | Services — 2.6% | | | | | | | | |

| | 1,211,000 | | Broadridge Financial | | | | | | | | |

| | | | Solutions Inc. | | | 26,059,426 | | | | 24,389,540 | |

| | | | | | | | | | | | |

| | | | Information Technology | | | | | | | | |

| | | | Services — 2.7% | | | | | | | | |

| | 885,000 | | Jack Henry & | | | | | | | | |

| | | | Associates, Inc. | | | 18,204,870 | | | | 25,647,300 | |

| | | | | | | | | | | |

| TRANSPORTATION SECTOR — 3.8% | | | | | | | | |

| | | | Marine Shipping — 1.7% | | | | | | | | |

| | 303,000 | | Kirby Corp.* | | | 9,571,255 | | | | 15,949,920 | |

| | | | | | | | | | | | |

| | | | Trucking — 2.1% | | | | | | | | |

| | 542,000 | | J.B. Hunt Transport | | | | | | | | |

| | | | Services, Inc. | | | 12,686,787 | | | | 19,577,040 | |

| | | | Total common stocks | | | 779,423,429 | | | | 854,667,818 | |

| | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS — 9.5% (a) | | | | | | | | |

| | | | Commercial Paper — 9.5% | | | | | | | | |

| $ | 25,000,000 | | Barclays US | | | | | | | | |

| | | | Funding LLC, 0.04%, | | | | | | | | |

| | | | due 10/03/11 | | | 24,999,944 | | | | 24,999,944 | |

| | 64,800,000 | | U.S. Bank, N.A., 0.02%, | | | | | | | | |

| | | | due 10/03/11 | | | 64,799,928 | | | | 64,799,928 | |

| | | | Total short-term | | | | | | | | |

| | | | investments | | | 89,799,872 | | | | 89,799,872 | |

| | | | Total investments | | | | | | | | |

| | | | — 99.8% | | $ | 869,223,301 | | | | 944,467,690 | |

| | | | Cash and receivables, | | | | | | | | |

| | | | less liabilities | | | | | | | | |

| | | | — 0.2% (a) | | | | | | | 1,522,812 | |

| | | | TOTAL NET | | | | | | | | |

| | | | ASSETS — 100.0% | | | | | | $ | 945,990,502 | |

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

The accompanying notes to financial statements are an integral part of this schedule.

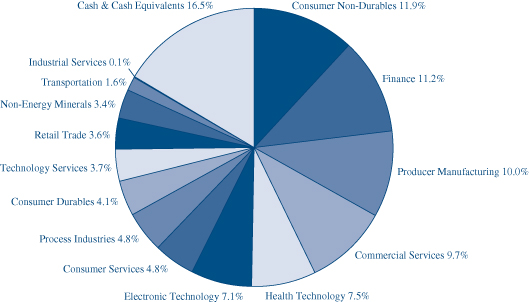

FMI Common Stock Fund

INDUSTRY SECTORS

as of September 30, 2011 (Unaudited)

FMI

International

Fund

September 30, 2011

Dear Fellow Shareholders:

The FMI International Fund (FMIJX) declined 12.16% in the three months ending September 30th. This compares to the benchmark MSCI EAFE (local currency) fall of 15.74% and the MSCI EAFE (U.S. dollar) decline of 19.01% in the corresponding period. Stock markets around the world suffered a tough quarter, with declines over 20% in Germany and Hong Kong. Through nine months FMIJX lost 9.70% and the local and U.S. dollar benchmark retreated 15.59% and 14.98%, respectively. Economically sensitive groups such as Producer Manufacturing, Electronic Technology and Transportation dropped significantly as worries about a global recession intensified. Ingersoll-Rand, TE Connectivity and TNT Express suffered steep declines. Consumer Non-Durables, Health Technology and other “defensive” sectors performed reasonably well in the quarter. Diageo, GlaxoSmithKline and SECOM all held up in an environment where the vast majority of stocks were down double digit percentages.

While there are a multitude of issues causing investor angst, and we will touch briefly on a few of these, valuations have become much more attractive. The FMI International Fund has recently been adding attractive businesses at very reasonable, if not bargain prices and has added to a number of existing positions as prices have fallen. The strong global franchises in this Fund currently sell for a median of 13 times earnings and 1.3 times annual revenue. Balance sheets are superb. Of course there is no way to predict when the current bear market will end, but we are confident in the quality and durability of the Fund’s investments.

As a reminder, the March 31st and September 30th letters touch briefly on big picture issues before discussing a couple of investments, while the June 30th and December 31st letters delve deeper into various issues that impact the investment landscape. An archive of letters for this Fund, as well as the FMI Large Cap Fund and the FMI Common Stock Fund, can be found on our website, www.fmifunds.com.

Weakening global economic growth has been added to the worries about excessive sovereign debt in Europe, America and elsewhere. Growth has slowed across Europe, and even in Germany – which heretofore has been the pillar of strength--business activity has downshifted. As we foreshadowed in last quarter’s letter, and despite very real inflation, China is showing signs of slowing. Chinese industrial production appears to be contracting, as evidenced by HSBC’s flash Purchasing Managers Index (PMI) figure of 49.4. We have felt for some time that China has been on an unsustainable growth path, driven by massive state funded infrastructure expansion. Part of the funding apparatus resides in the regional bank system controlled by party officials. These officials earn compensation and preferred status from the party for sales of state-owned land to developers. Local government income from land sales accounted for 7% of China’s gross domestic product (GDP) last year. Credit has been expanding rapidly in recent years at a much higher rate than economic growth and may today be at dangerous levels. A recent International Monetary Fund (IMF) report shows bank credit in China growing over 30% compared to the official GDP growth of approximately 10%.

There is a growing body of evidence that suggests massive overbuilding of not only Chinese public infrastructure, but housing and commercial property, too. Construction spending, as a percentage of GDP, is up over fourfold in the past 12 years. Recently Chinese residential real estate prices and transaction volumes appear to be falling rapidly, with reports of 20-30% price declines in Beijing and Shanghai and two-thirds of the country experiencing a negative growth rate. We take all Chinese figures with a grain of salt, but the slowdown seems also to be reflected in a steep decline in copper prices (down nearly 30% over the past two months), oil and other industrial commodities. Chinese leaders may be able to pull a rabbit out of the hat again by pumping up infrastructure spending but our feeling is that this is an unsustainable policy. Their economy is significantly imbalanced, driven by a surfeit of infrastructure spending and a shortage of domestic consumption spending.

The debt woes of Europe remain intractable. In the September 21st global financial stability report, the IMF had this to say about European sovereign debt: “Nearly half of the €6.5 trillion stock of government debt issued by euro area governments is showing signs of heightened credit risk.” Credit default swap spreads (essentially what investors pay to insure against default) have risen dramatically, not just for so-called PIIGS, but also for the rest of Europe.

Source: Bloomberg, Fiduciary Management, Inc.

The cognoscenti appear to be pinning their hopes on containment, i.e. a restructuring of Greek debt, an exchange of sovereign debt held by banks for new debt backed by another euro authority, and a bet that this bailout facility is large enough to forestall a domino effect from other countries on the brink. Details are sketchy at this point. We hope it works but we aren’t building a portfolio around this expectation. It is likely to take further restructuring, additional austerity measures and a resetting of relative wage rates to set a course for sustainable recovery. Realistically, the vast majority of the UK and European banks would be insolvent if the sovereign debt of Greece, Portugal, Ireland and Spain were marked to market (not to mention Italy). It is one of the reasons we don’t own European bank stocks in the portfolio. While we don’t anticipate outright bankruptcies of these financial institutions, we think many will have to raise capital, diluting existing shareholders and stunting earnings per share for years to come. Some contrarian investors who are buying these stocks may end up hitting home runs if this pessimism is misplaced. We are willing to forego some opportunities in order to avoid situations with a nontrivial probability of a disastrous outcome. Besides, we don’t like an investment that depends on a bunch of bureaucrats making great decisions.

Unfortunately, the fiscal and monetary situation in the United States isn’t very good either. Policy makers continue to spend more on the same kind of ideas that didn’t work in the 1930s and certainly haven’t worked in the 2000s, with the latest iterations adding unprecedented amounts of debt to the country’s balance sheet. The Federal Reserve’s actions are especially noteworthy since there is essentially no congressional oversight and Bernanke can run his experiments with virtual impunity. Imagine a policy that eliminates nearly all of the income of the risk-averse saver (think elderly widow with CDs and T-Bills) yet provides nearly free money to the billionaire hedge fund borrower! Business managers remain fearful of health care mandates and higher taxes and are not adding employees or significant capital to their businesses. Productivity is reasonably high but the economy needs more job creation and capital formation. An improvement in tax policy might go a long way toward improving these metrics. Right now smaller businesses (the engines of employment growth) pay a significantly higher effective tax rate than the large corporations, who employ complicated tax avoidance strategies. Personal tax rates are a crazy mishmash where a factory worker could, as Buffett said, find himself paying a higher rate than a billionaire. Perhaps the budget turmoil will have a collateral benefit of a better tax policy.

The short summary of the macro picture is generally not very positive. Greater recognition of this has impacted stock prices quite significantly in the quarter. We think the valuations of the companies in the FMI International Fund are attractive, and the business franchises, first rate. Long-term investors should buy into prevailing concerns and uncertainty when valuations and strong companies are on their side. We’ve backed up this belief by increasing our personal investment in the Fund. History shows good equity returns accrue to those who have the fortitude to invest in difficult times.

Below we highlight two of the FMI International Fund investments:

Adecco S.A. (ADEN VX)

(Analyst: Jonathan Bloom)

Description

Adecco is the world’s largest provider of general and professional staffing, with over €18.5bn in sales in 2010. Approximately 92% of revenue falls under the temporary staffing segment, with 2% in permanent placement, 1% in outplacement, and 5% in outsourcing, consulting and other. The company’s general staffing business (Industrial: 48%, Office: 20%, & Emerging Markets: 7%) accounted for approximately 75% of group revenues in 2010, with its professional staffing business generating the remaining 25%. The largest geographic segments were: France (30% of sales), North America (19%), UK & Ireland (9%), Japan (7%), Germany & Austria (7%), Emerging Markets (7%), Benelux (5%), and Italy (4%), among others.

Good Business

• Attractive ROIC: The 5- and 10-year average return on invested capital (ROIC) is 12.2% and 11.6%, respectively.

• Economies of scale: As the global No. 1, Adecco is able to benefit from economies of scale compared to smaller competitors as it relates to its associate talent pool, client network, cost leadership, etc.

• Modestly priced products: With general staffing (low-skill, “blue collar”) at 75% of sales, Adecco strives to be the low-cost provider in the industry, providing clients with an affordable solution.

• Recurring revenue: There is a high level of repeat business. Temporary staffing is not going to disappear, as it is a key element of the global employment landscape, providing employers with increased flexibility.

• Understandable business.

• Sound balance sheet: Debt/capital is 31.9%. Debt: €1.5bn, Cash: €386mn.

Valuation

• Current enterprise value (EV)-to-sales of 0.36 times and EV-to-earnings before interest, tax, depreciation and amortization (EBITDA) of 7.7, respectively, and both are over one standard deviation below historical averages. This compares favorably with management’s EBITA margin target of 5.5%+.

• Next twelve months (NTM) price-to-earnings (P/E) is an attractive 9.6, which compares with a 10-year average of 16.7.

• Adecco is currently trading at a 9.2% free cash flow (FCF) yield (on an EV basis), based on a 5-year average of FCF.

• The dividend yield is 3%. The price-to-book (P/B) multiple is 1.7, compared with a 10-year average of 3.9 times.

Management

• Patrick De Maeseneire became the group’s CEO in June of 2009, and has continued to focus on economic value added (EVA), which was implemented company-wide in 2006 for evaluating operations and acquisitions.

• Compensation for top management as well as local branch managers is tied directly to EVA. The company uses a 10% weighted average cost of capital (WACC), despite an actual figure which is lower. Adecco does not use stock options.

• Strong corporate governance, with separate CEO & Chairman, and no management on the board.

• Large insider ownership, with the Jacobs Family owning over 18% of the total shares outstanding.

Investment Thesis

Adecco is the global leader in a necessary, growing industry. The company benefits from economies of scale vs. smaller competitors, as illustrated by its ability to earn a ROIC above its cost of capital. Adecco is led by a solid management team focused on EVA and margin expansion, has family ownership with skin in the game, and a track record of returning cash to shareholders via dividends and buybacks. The current valuation is undemanding, providing investors with a favorable risk-reward ratio.

Henkel AG & Co. KGaA (HEN DE)

(Analyst: Jonathan Bloom)

Description

Henkel is a global leader in adhesive technologies, laundry and home care products, and cosmetics/toiletries. The company has a strong position in both the consumer and industrial end markets, with top brands including Persil, Purex, Schwarzkopf, Dial, Loctite, et al. In 2010, business segment distribution (as a % of sales) was reported as follows: adhesive technologies (48%), laundry and home care (29%), and cosmetics/toiletries (22%). While based in Germany, the company had 41% of sales generated in emerging markets, with the following geographic distribution: Western Europe (36%), North America (18%), Eastern Europe (18%), Asia-Pacific (14%), Latin America (7%), and Africa/Middle East (6%).

Good Business

• Attractive returns: The 5-year average ROIC is 10.2%, with further room to improve.

• Economies of scale: As the global #1 in adhesives, #3 in laundry, #4 in home care, and #4 in hair care, Henkel should be able to benefit from economies of scale compared with smaller competitors.

• Modestly priced products: Adhesives have a low share of total product/project cost, but a very high cost of failure. Purex and Dial brands are among the low-price alternatives in the home and personal care space.

• Recurring revenue: Consumer staples (laundry detergent, soap, cleaning products, hair care, etc.) and adhesives are recurring in nature. Trust and brand loyalty tend to foster repeat consumption.

• Easy to understand: the business is relatively simple and the path to success is straightforward.

• Sound balance sheet: Debt/capital 33%, Debt: €3.9bn, Cash: €1.4bn, Pension shortfall: €566mn.

Valuation

• Current adjusted EV/Sales of 1.1 times and EV/EBITDA of 8.7 times, a meaningful discount to industry peers. This compares with a FY10 adjusted operating margin of 12.3% (14% target by FY12).

• P/E (NTM) is an attractive 9.7, which compares with a 10-year average of 13.1.

• Henkel is currently trading at a 9.3% FCF yield (on an adjusted EV basis), based on a 2-year average of FCF.

• The ordinary shares (HEN DE) trade at a 17.6% discount (nearly 2 standard deviations below the mean) to the preferred shares (HEN3 DE), which is economically unjustified. The 10-year average discount is 10.3%.

• The dividend yield is 2.1%. The P/B multiple is 1.8, which is below its 10-year average of 2.2.

• Merger and acquisition transactions from 2000-10 have averaged 2.5 times EV/Sales and 13 times EV/EBITDA.

Management

• Chairman & CEO Kasper Rorsted took the reins in 2008 and has orchestrated a successful turnaround. Mr. Rorsted has grown operating margins from 10% in 2007 to 12.3% by 2010, with a target of 14% by 2012. He has closed over 55 factories since the second quarter of 2008 and cut the workforce by nearly 10,000 employees.

• The Henkel family owns over 53% of the ordinary shares and the voting rights, so it has significant skin in the game. The family’s ownership interests are valued at over $6bn.

Investment Thesis

Henkel is the dominant player in an attractive adhesives technology market, with customer captivity and the potential for economies of scale. The company also has a strong position in several global HPC markets, with particular strength in Europe. Over a full cycle, Henkel should be able to grow the top line in the low-to-mid single digits, with significant opportunities for margin expansion. At an attractive valuation of just 9.7 times earnings and 1.1 times EV/Sales for what has the potential to be a mid-teen margin business, Henkel is an attractive core holding over a 3-5 year investment horizon.

******

Distribution: Our Board of Directors has declared a distribution effective October 31, 2011, of $0.16477493 per share from net investment income, payable October 31, 2011 to shareholders of record on October 28, 2011.

Thank you for your support of the FMI International Fund.

Sincerely,

| |  |  |

| | Ted D. Kellner, CFA | Patrick J. English, CFA |

| | Executive Chairman | CEO & Chief Investment Officer |

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

This shareholder letter is unaudited.

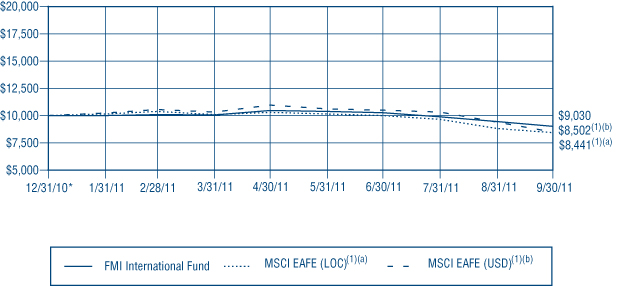

FMI International Fund

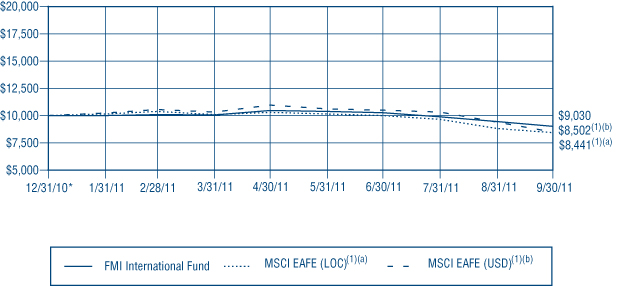

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE