ANNUAL REPORT

September 30, 2012

FMI Large Cap Fund

(FMIHX)

FMI Common Stock Fund

(FMIMX)

FMI International Fund

(FMIJX)

| | |

| | |

| FMI Funds Advised by Fiduciary Management, Inc. |

| | |

| | |

FMI Funds

| FMI Large Cap Fund | |

| Shareholder Letter | 3 |

| Management’s Discussion of Fund Performance | 8 |

| Schedule of Investments | 9 |

| Industry Sectors | 10 |

| | |

| FMI Common Stock Fund | |

| Shareholder Letter | 11 |

| Management’s Discussion of Fund Performance | 16 |

| Schedule of Investments | 17 |

| Industry Sectors | 18 |

| | |

| FMI International Fund | |

| Shareholder Letter | 19 |

| Management’s Discussion of Fund Performance | 23 |

| Schedule of Investments | 24 |

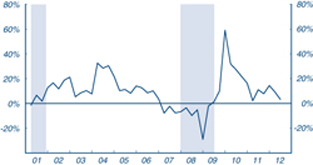

| Industry Sectors | 25 |

| | |

| Financial Statements | |

| Statements of Assets and Liabilities | 26 |

| Statements of Operations | 27 |

| Statements of Changes in Net Assets | 28 |

| Financial Highlights | 29 |

| Notes to Financial Statements | 30 |

| | |

| Report of Independent Registered Public Accounting Firm | 35 |

| Cost Discussion | 36 |

| Directors and Officers | 37 |

| Additional Information | 38 |

| Disclosure Information | 38 |

| Notice of Privacy Policy | 39 |

| Householding Notice | 39 |

FMI

Large Cap

Fund

September 30, 2012

Dear Fellow Shareholders,

The FMI Large Cap Fund gained 4.76% in the quarter ending September 30, 2012 compared to the benchmark Standard & Poor’s 500 Index return of 6.35%. For the calendar nine months, the Fund advanced 13.97% which lagged the 16.44% gain in the S&P 500. From a group standpoint, Finance, Distribution Services, Energy Minerals and Technology Services hurt relative performance, while Consumer Services and Process Industries helped. Staples Corp. continued to perform poorly in the period and the challenges at this company now appear to be more structural and longer term in nature; we decided to sell that position. Our initial foray into Expeditors International proved premature as the slowdown in trade between Asia and the U.S., which we thought was adequately discounted in the price, was not. With economic weakness seeming to accelerate toward the end of the quarter, the takeoff for this stock may be bumpy and elongated. It’s an excellent company, however, and has strong management and a gold-plated balance sheet, so we will ride out the cyclical weakness. We’ve highlighted the stock below. The last stock on the “perp walk” is Willis Group Holdings. They have struggled to integrate a domestic acquisition and effectively manage a couple of restructurings. While the numbers haven’t turned yet, a late September presentation by the company was more encouraging with respect to a U.S. turnaround. The performance of the strategy year-to-date is about what we would expect. Historically we have generally lagged in strong up markets (while more than making up for it in difficult markets). It’s not to say we haven’t made mistakes, as the scorecard would attest. Our style, however, does seem to be somewhat out-of-favor, with growth stocks significantly outperforming value stocks in recent periods. Finally, the recent rally seems to be more about financial engineering by the Fed than anything fundamental. We’re not confident that this “Bernanke trade” will outlast the deteriorating economic and corporate earnings picture.

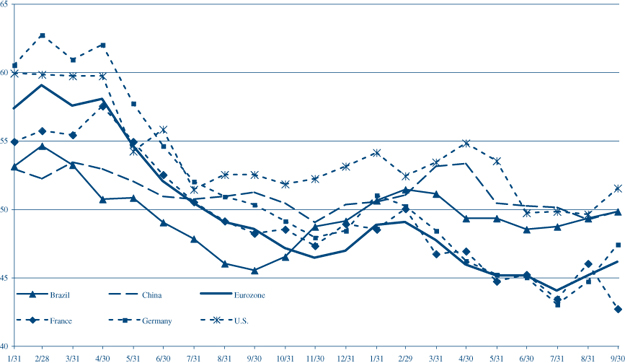

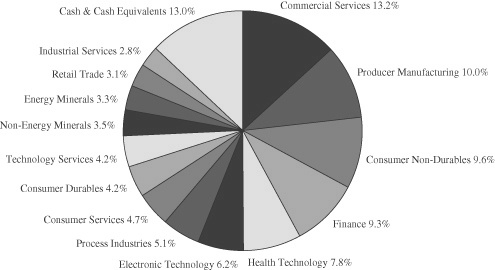

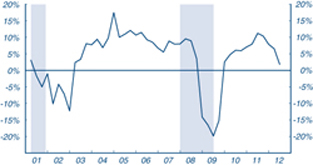

Most of the major regions of the world seem to be slowing or already experiencing recessionary conditions. The eurozone appears to be in a full-blown recession. China and Brazil have slowed significantly. The United States is sputtering. Economists pay attention to the Purchasing Managers Index (PMI) as an indicator of whether economic conditions are improving or deteriorating (numbers less than 50 indicate deterioration). The United States, China, Germany, Japan, the United Kingdom, Italy, Brazil, Australia, Canada and most of the large countries have PMIs less than 50.

The recent stabilization of the unemployment rate in the U.S. is undermined by a plunge in the labor force (the denominator in the calculation). The labor participation rate of 63.5% is the lowest in over 30 years. 11.2% of the labor force is out of work, if we include the 7 million no longer seeking employment. The key leading indicator of business capital spending slid 3.4% in July and has been down four of the past five months. Housing has certainly bounced off the bottom, but with true unemployment so high and the economy weakening, we have doubts about a continuing recovery in this sector. Business capital expenditures,

| |

| Manufacturing PMI |

| 1/31/2011 - 9/30/2012 |

| |

|

| |

Source: Bloomberg

incidentally, are 7% of GDP whereas housing is only 2% of GDP. Household net worth is down significantly over the past five years and real incomes have fallen. In short, the economic picture, both here and abroad, is not very good.

The Fed, European Central Bank (ECB) and other central bankers have taken it upon themselves to fix this problem. That is the way they think. Both the fiscal and monetary authorities look to governments to solve fundamental problems, reflecting a general lack of trust in classic economic policies and free markets. To Mr. Bernanke, the fact that four years of unprecedented stimulus yielded little in the way of results (and has perhaps dangerous long term consequences) is not a reason to stop and reassess. It’s an opportunity to say that not enough has been done; it’s a call to action. The latest iteration of money printing, QE3, is now underway, with the Fed expanding its balance sheet once again to the tune of an additional $40 billion per month ($85 billion per month in total) indefinitely. Mario Draghi, the head of the ECB, is using the same playbook. He’s doing “whatever it takes” to solve the eurozone problem, including an “unlimited” bond buying program. Japan recently followed with a $126 billion “asset purchasing program.” Brazil is talking up the same game. Even Switzerland has begun their own version of quantitative easing. In the long run, easy money policies rarely achieve their objectives and often have very serious repercussions. Yet stock markets seem to be cheering it on in the short run.

With the constant calling for governments and central banks to do more, perhaps it would be useful to talk briefly about the potential downside of these policies. Fiscal challenges have been addressed repeatedly in recent letters and will be put aside here, save this one statement: historically, U.S. federal government spending has been about 19-20% of GDP; today it is 24%. From a monetary perspective, we quote the highly respected economist David Malpass: “Whatever the Fed’s theory, the reality is that its attempts to prime the pump haven’t worked. They distort and weaken the economy and chase capital into such job losers as gold, government bonds, and factories abroad.” Today’s ground-hugging interest rate policies have decimated the saver and the risk averse. Horizon Kinetics, in their July report, estimates that the U.S. bond market is approximately $36.9 trillion with about 37% ($13.65 trillion) maturing over the next 60 months. The average coupon on maturing bonds is about 4.27% and these are being replaced by bonds with an average coupon of 1.55%. The difference in these two coupons means that if interest rates remain roughly where they are today, $371 billion of income will be lost each and every year for the next five years. That is 2.45% of GDP lost each year (of course, there is an offsetting impact to borrowers). Imagine the fallout if one introduced a tax of this magnitude! Most likely related to quantitative easing, commodity prices have also skyrocketed over the past few years. This has had a very negative impact with respect to food and gasoline prices. It’s tantamount to a significant regressive tax. At the same time, the leveraged hedge fund speculators and Wall Street “carry traders” win big from the Bernanke rally. The very people the administration demonizes are the same ones for whom the Fed is throwing a party. It’s fascinating, not to mention ironic, to see leaders who denigrated trickle down economic growth theories emanating from lower tax rates now embrace trickle down wealth theories coming from the Fed. Long term it seems logical to expect what has nearly always happened when governments print money at a far greater rate than the underlying economies are growing: inflation and currency debasement. Interestingly, despite extensive economic weakness, the September eurozone inflation rate is expected to rise to 2.8%, up from 2.6% in August and well above the ECB’s target of 2.0%.

Howard Marks, who has managed money for forty years and is one of the great investors of our time, recently made this statement: “The world seems more uncertain today than at any other time in my life.” We confess to similar sentiments, but there is always the chance that we are misreading the tea leaves and that the stock market gains anticipate a better economic environment in 2013. Perhaps following the elections Congress will address the so-called fiscal cliff with sensible compromises. Perhaps the leaders will come to acceptable pathways that will reduce deficits and corral the many unfunded liabilities. Perhaps Europe will somehow stem their fiscal and monetary crises and not drag the Federal Reserve into the fray. Every investor has to ask whether these events are likely and whether the 2012 stock market rally already discounts it.

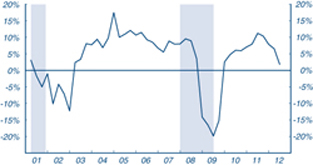

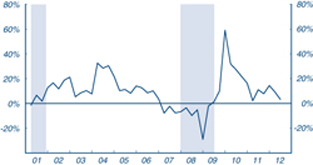

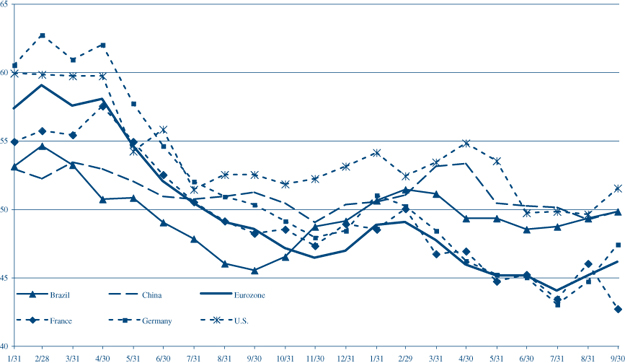

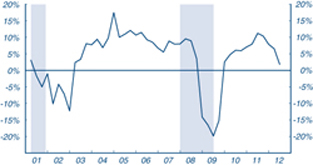

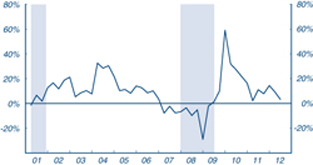

This stock market move, which began in March of 2009, recently hit 43 months, which is the median duration of 15 bull markets since 1929. The 129.6% gain in the current stretch compares to a median of 83.1%. There is nothing magical or predictive from these facts other than to point out that it might take some fundamental improvement in earnings, sales growth or productivity to keep it going. The economic outlook today, both here and abroad, does not look like it will provide much lift in the near term and unfortunately, both sales growth and profit margins appear to be headed the other way, as the charts on the following page depict.

| S&P 500 Sales Per Share | Corporate Profits |

| Year to Year Percentage Change | Year to Year Percentage Change |

| | |

|  |

| | |

| Source: Standard & Poor’s Corporation | Source: Bureau of Economic Analysis |

| Shaded areas represent recessionary periods. | Corporate Profits: After Tax with Inventory Valuation |

| | and Capital Consumption Adjustments |

| | Shaded areas represent recessionary periods. |

A large number of transportation and industrial stocks are announcing poor earnings outlooks and orders. FedEx, Norfolk Southern, Expeditors, Forward Air, Caterpillar, Navistar, Joy Global, Steel Dynamics, Rockwell and many others have had recent confessions. Stocks that depend on better employment or capital spending have been especially hurt. Business confidence is slipping. It is getting to be an old story but it’s impossible to say when it will end. The best we can do in the interim is to let valuation and long term “strength of franchise” be our guide. Higher multiple stocks, lower quality balance sheet stocks, and money losing enterprises have been among the big winners so far in 2012. Valuations remain elevated. We think investors should be wary and stay focused on quality, even if that results in near term underperformance. Somewhat paradoxically, considering the near term economic outlook, the portfolio might begin to tilt more heavily in coming periods toward some of the cyclical companies as their stocks come under increasing pressure. There is always a tug-of-war between valuation and fundamentals and having a long term investment time horizon gives us opportunities to buy superior cyclical franchises when their near term operating environment is weak. We’ve highlighted one such idea below, Expeditors International.

While today is very cloudy, we do expect sunnier economic times to eventually return, along with better underlying business fundamentals. Why? Business people want to grow. They want to invest. They want to build and they are willing to add labor… when they feel the systems and environment will reward such activity. This will be a far sturdier foundation for equity performance than government stimulus or Federal Reserve financial engineering.

Expeditors International of Washington

(Analyst: Rob Helf)

Description

Seattle-based Expeditors is a $6 billion, international, non-asset-based global logistics provider focused primarily on air and ocean freight forwarding and customs brokerage. The company utilizes its strong relationships with airline and ocean freight carriers, as well as its sophisticated IT systems and professional workforce, to earn strong margins and returns.

Good Business

| | • | Expeditors is a leading provider of international freight forwarding and logistics services. |

| | • | The company benefits from the growth of global trade and complex supply chains. Shippers should continue to increase their reliance on leading logistics partners to ease international trade issues. |

| | • | The business model is asset-light as the company owns no planes or ships and relies on capacity owners to move the freight. This results in high returns and cash flow. |

| | • | Expeditors has built a superior global business platform through organic growth, an integrated IT platform and a committed professional staff. |

| | • | The company has ample opportunity to grow as it generates $6 billion in gross revenues, which represents less than 5% of the $150 billion air and ocean freight market. |

| | • | The company has an outstanding track record of growth of both sales and profits. |

| | • | The business model generates strong returns and cash flow. Historically, Expeditors’ return-on-capital has been in the 15-20% range. |

| | • | The balance sheet has a large cash balance ($1.4 billion) and no debt. |

Valuation

| | • | Expeditors currently trades at 1.1 times enterprise value-to-sales (EV/S) and 22 times depressed 2012 earnings per share (EPS). On a cash-adjusted basis, the stock trades at 18 times EPS. |

| | • | Historically, the stock has traded at 1.6 times EV/S and 33 times EPS. The shares are at a discount to one standard deviation below their historical mean. |

Management

| | • | Expeditors’ management team has delivered steady growth and profitability for years. Importantly, management takes a long-term view of the company, eschews a short-term, Wall Street mentality and uses compensation as a powerful tool to incentivize its professional staff. The company has maintained a consistent compensation philosophy which includes a modest base salary and the opportunity to share in a fixed percentage of profits generated. This has resulted in superior value creation for shareholders and has motivated employees. |

| | • | Mr. Peter Rose is Chairman and CEO of Expeditors. He has served as a director and officer of the company since 1981. |

| | • | Mr. James Wang is President-Asia Pacific and has served as a director since 1988. Mr. R. Jordan Gates is President and COO. He is also a director and joined the company in 1991. |

Investment Thesis

Expeditors has built an enviable international forwarding platform with both strong customer and asset-owner relationships. It has grown at above-average rates over the past decade while generating high returns-on-capital. The shares, which historically have carried a large growth premium, are down substantially. Recent concerns over international trade volumes, particularly coming east from Asia, and paradoxically (given economic weakness) tight commercial airlines lift capacity, have provided an entry point for this strong franchise. Over the long run, we expect Asian growth to resume, and for Expeditors to regain some of its former premium.

Sysco Corp.

(Analyst: Karl Poehls)

Description

Sysco is the largest provider of foodservice products in the U.S. and Canada, distributing more than 300,000 products to 400,000 restaurants, schools, hotels, health-care institutions, and other foodservice customers. Restaurants account for two-thirds of Sysco’s annual sales, with independents contributing 60% of restaurant sales and chains making up the rest. The company’s SYGMA network focuses on serving large chain restaurants in the quick-service or quick-family markets (13% of revenues).

Good Business:

| | • | Sysco is a dominant franchise and industry leader; it is the largest foodservice distributor in the U.S. with 18% market share, and benefits from significant economies of scale. Evidence can be found in the company’s operating margin, which is roughly 3 times its closest competitor. |

| | • | The company provides products that are necessities for daily life, and is an easy business to understand. |

| | • | Sysco has a long history of generating extremely consistent revenues and earnings. |

| | • | Sysco generated a strong return on invested capital (ROIC) of 14.8% in fiscal 2012 versus a 5-year and 10-year average ROIC of 17.6% and 20.0%, respectively. |

| | • | Generation of excess free cash flow in conjunction with modest capital requirements has allowed the company to return 67% of net income to shareholders over the past 5 years, through a combination of dividends and share repurchases. |

| | • | The balance sheet is conservatively financed and Sysco maintains an A+ senior bond rating from Standard & Poor’s. |

Valuation

| | • | Sysco’s stock is trading 24% below its all-time high and has been a laggard for a number of years. |

| | • | The company’s current EV/S multiple is 0.46 times which is one standard deviation below its 10-year average multiple of 0.63 times. |

| | • | Sysco’s current EV/EBITDA (earnings before interest, taxes, depreciation and amortization) multiple is 8.4 times, nearly one standard deviation below its 10-year average multiple of 10.4 times. |

| | • | The company’s fiscal year 2013 price-to-earnings (P/E) multiple is 15.6 times very depressed earnings, which compare to the trailing 5-year and 10-year average P/E multiples of 15.2 times and 19.9 times, respectively. Further, the company’s substantial business transformation investment is expected to depress fiscal 2013 earnings by $0.30 per share. |

| | • | Precedent mergers and acquisitions transactions announced for 12 comparable companies between 2000 and 2007 were executed at a median EV/EBITDA multiple of 11.0 times. |

| | • | Sysco’s common shares have an attractive 3.5% dividend yield. |

| | • | A conservative discounted cash flow (DCF) valuation yields a per share value 30% higher than the current stock price. |

Management

| | • | Sysco’s top 10 executive managers have been with the company for an average of 20 years. |

| | • | Executive management is compensated based on three key operating metrics: earnings per share growth, return on equity, and operating company performance. |

Investment Thesis

Over the past 5 years, the U.S. casual dining industry has experienced an unprecedented downturn with 20 consecutive quarters of negative traffic growth before seeing slight improvement in 2011. This headwind has brought the historically strong growth in Sysco’s revenues and earnings to a near standstill. In addition, the company is investing north of $1 billion to improve its internal operations, including the implementation of a company-wide enterprise resource planning (ERP) system, which has led to elevated operating expenses. These factors have limited investor excitement about Sysco’s near-term outlook. However, the company continues to strengthen its competitive position and its shares are available at an attractive valuation.

******

Distributions: Our Board of Directors has declared a distribution effective October 31, 2012, of $0.13009458 per share from net investment income; $0.08634 per share from short-term capital gains which will be treated as ordinary income; and $0.11869 per share from net long-term capital gains, payable October 31, 2012 to shareholders of record on October 26, 2012.

Thank you for your continued support of the FMI Large Cap Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

This shareholder letter is unaudited.

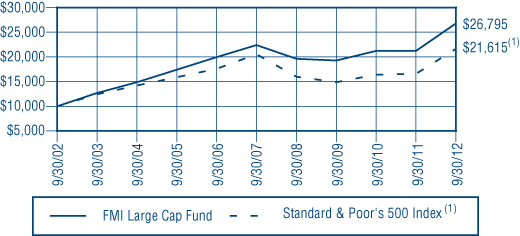

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

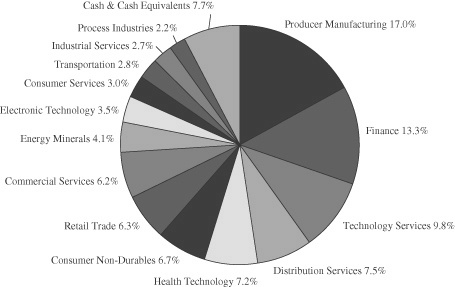

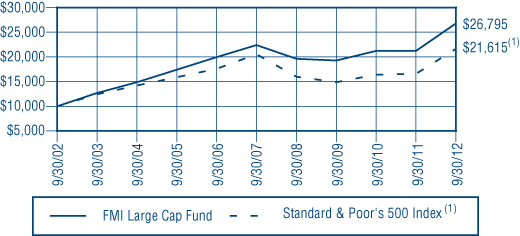

During the fiscal year ended September 30, 2012, the FMI Large Cap Fund (the “Fund”) had a total return of 26.17%. The benchmark Standard & Poor’s 500 Index(1) returned 30.20% in the same period. Finance, Retail, Electronic Technology and excess cash all hurt relative performance. Underweighted positions in Finance and Electronic Technology, two strong areas for the market, exacerbated the relative underperformance coming from stock selection. Producer Manufacturing, Consumer Non-Durables, Utilities, and Technology Services all aided relative performance. Stock selection was an important factor in the positive relative performance of all of these sectors except for Utilities, where our underweighted position was the helping factor. Willis Group, Staples, Expeditors International, GlaxoSmithKline, and Devon Energy were all negative contributors. Ingersoll-Rand, Illinois Tool Works and Covidien were positive contributors. Diageo and Rockwell were sold during the fiscal year because of valuation. Staples was sold because we underestimated the secular challenges to this business. UPS was sold partly due to valuation but also due to an escalating problem with their exposure to multi-employer pension plan liabilities. Kohl’s, Illinois Tool Works and Expeditors International were among stocks added during the fiscal year. At September 30, 2012, the overweighted sectors included Producer Manufacturing and Commercial Services and the underweighted sectors included Electronic Technology, Communications and Utilities. The stock market rebounded significantly in fiscal 2012, which we believe had more to do with monetary actions, i.e. quantitative easing, than any meaningful improvement in underlying fundamentals. As the fiscal year ended, economic activity had weakened across a broad spectrum of geographies. The debt crisis showed little sign of improvement in Europe, the United States or Japan. Valuations have moved higher from a year ago and do not look particularly attractive from a long term historical basis. From a macroeconomic and policy perspective, we do not see the fiscal or monetary initiatives of the past several years as being conducive to good long-term growth and employment. The explosive growth in government liabilities is particularly worrisome. Despite these negatives, we believe equities are the most attractive asset class over a long term investment time horizon. The Fund continues to sell at a discount to the S&P 500 on most valuation measures. Over long periods of time, lower valuation securities tend to outperform higher valuation ones. Future results, however, may differ from the past.

| | | |

| | COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN | |

| | FMI LARGE CAP FUND AND STANDARD & POOR’S 500 INDEX(1) | |

| | | |

| |  | |

| | | |

AVERAGE ANNUALIZED TOTAL RETURN |

| | | | | Since |

| | | | | Inception |

| | 1-Year | 5-Year | 10-Year | 12/31/01 |

| FMI Large Cap Fund | 26.17% | 3.61% | 10.36% | 7.28% |

| S&P 500 Index | 30.20% | 1.05% | 8.01% | 4.18% |

| | | | | |

| | The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

(1) The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e., its market price per share times the number of shares outstanding). Stocks may be added or deleted from the Index from time to time. An investment cannot be made directly into an index. | |

| | | |

This page is unaudited.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

| Shares | | | | Cost | | | Value | |

| | | | | | | | | |

| COMMON STOCKS — 92.3% (a) | | | | | | |

| | | | | | | |

| COMMERCIAL SERVICES SECTOR — 6.2% | | | | | | |

| | | Advertising/Marketing | | | | | | |

| | | Services — 3.5% | | | | | | |

| 4,149,000 | | Omnicom Group Inc. | | $ | 182,382,769 | | | $ | 213,922,440 | |

| | | Miscellaneous | | | | | | | | |

| | | Commercial Services — 2.7% | | | | | | | | |

| 4,068,000 | | Cintas Corp. | | | 110,867,898 | | | | 168,618,600 | |

| | | | | | | | | | | |

| CONSUMER NON-DURABLES SECTOR — 6.7% | | | | | | | | |

| | | Food: Major Diversified — 2.9% | | | | | | | | |

| 2,841,000 | | Nestlé S.A. - SP-ADR | | | 128,338,653 | | | | 179,579,610 | |

| | | Household/Personal Care — 3.8% | | | | | | | | |

| 2,748,000 | | Kimberly-Clark Corp. | | | 176,119,404 | | | | 235,723,440 | |

| | | | | | | | | | | |

| CONSUMER SERVICES SECTOR — 3.0% | | | | | | | | |

| | | Media Conglomerates — 3.0% | | | | | | | | |

| 4,015,700 | | Time Warner Inc. | | | 111,845,669 | | | | 182,031,681 | |

| | | | | | | | | | | |

| DISTRIBUTION SERVICES SECTOR — 7.5% | | | | | | | | |

| | | Food Distributors — 4.4% | | | | | | | | |

| 8,735,000 | | Sysco Corp. | | | 245,074,325 | | | | 273,143,450 | |

| | | Medical Distributors — 3.1% | | | | | | | | |

| 4,923,000 | | AmerisourceBergen | | | | | | | | |

| | | Corp. | | | 151,151,247 | | | | 190,569,330 | |

| | | | | | | | | | | |

| ELECTRONIC TECHNOLOGY SECTOR — 3.5% | | | | | | | | |

| | | Electronic Components — 3.5% | | | | | | | | |

| 6,408,150 | | TE Connectivity Ltd. | | | 165,976,687 | | | | 217,941,182 | |

| | | | | | | | | | | |

| ENERGY MINERALS SECTOR — 4.1% | | | | | | | | |

| | | Oil & Gas Production — 4.1% | | | | | | | | |

| 4,205,000 | | Devon Energy Corp. | | | 269,151,300 | | | | 254,402,500 | |

| | | | | | | | | | | |

| FINANCE SECTOR — 13.3% | | | | | | | | |

| | | Financial Conglomerates — 3.0% | | | | | | | | |

| 3,218,000 | | American | | | | | | | | |

| | | Express Co. | | | 114,851,027 | | | | 182,975,480 | |

| | | Insurance Brokers/Services — 2.1% | | | | | | | | |

| 3,504,400 | | Willis Group | | | | | | | | |

| | | Holdings PLC | | | 133,437,529 | | | | 129,382,448 | |

| | | Major Banks — 8.2% | | | | | | | | |

| 13,500,000 | | Bank of New York | | | | | | | | |

| | | Mellon Corp. | | | 348,544,627 | | | | 305,369,999 | |

| 6,485,000 | | Comerica Inc. | | | 197,278,667 | | | | 201,359,250 | |

| | | | | | 545,823,294 | | | | 506,729,249 | |

| HEALTH TECHNOLOGY SECTOR — 7.2% | | | | | | | | |

| | | Medical Specialties — 3.9% | | | | | | | | |

| 3,994,000 | | Covidien PLC | | | 186,511,636 | | | | 237,323,480 | |

| | | Pharmaceuticals: Major — 3.3% | | | | | | | | |

| 4,348,000 | | GlaxoSmithKline | | | | | | | | |

| | | PLC - SP-ADR | | | 188,235,705 | | | | 201,051,520 | |

| | | | | | | | | | | |

| INDUSTRIAL SERVICES SECTOR — 2.7% | | | | | | | | |

| | | Oilfield Services/Equipment — 2.7% | | | | | | | | |

| 2,270,000 | | Schlumberger Ltd. | | | 138,319,400 | | | | 164,189,100 | |

| | | | | | | | | | | |

| PROCESS INDUSTRIES SECTOR — 2.2% | | | | | | | | |

| | | Chemicals: Agricultural — 2.2% | | | | | | | | |

| 1,522,550 | | Monsanto Co. | | | 89,141,027 | | | | 138,582,501 | |

| | | | | | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 17.0% | | | | | | | | |

| | | Industrial Conglomerates — 13.0% | | | | | | | | |

| 3,580,000 | | 3M Co. | | | 275,417,164 | | | | 330,863,600 | |

| 3,550,000 | | Berkshire Hathaway | | | | | | | | |

| | | Inc. - Cl B* | | | 256,260,087 | | | | 313,110,000 | |

| 3,510,000 | | Ingersoll-Rand PLC | | | 152,875,444 | | | | 157,318,200 | |

| | | | | | 684,552,695 | | | | 801,291,800 | |

| | | Industrial Machinery — 4.0% | | | | | | | | |

| 4,170,000 | | Illinois Tool | | | | | | | | |

| | | Works Inc. | | | 207,181,092 | | | | 247,989,900 | |

| | | | | | | | | | | |

| RETAIL TRADE SECTOR — 6.3% | | | | | | | | |

| | | Department Stores — 2.4% | | | | | | | | |

| 2,855,000 | | Kohl’s Corp. | | | 144,031,851 | | | | 146,233,100 | |

| | | Discount Stores — 3.9% | | | | | | | | |

| 3,252,000 | | Wal-Mart Stores Inc. | | | 163,607,247 | | | | 239,997,600 | |

| | | | | | | | | |

| | | Data Processing Services — 2.9% | | | | | | | | |

| 3,031,000 | | Automatic Data | | | | | | | | |

| | | Processing Inc. | | | 125,616,368 | | | | 177,798,460 | |

| | | Information Technology Services — 4.2% | | | | | | | | |

| 3,681,000 | | Accenture PLC | | | 146,245,819 | | | | 257,780,430 | |

| | | Packaged Software — 2.7% | | | | | | | | |

| 5,673,000 | | Microsoft Corp. | | | 159,469,971 | | | | 168,941,940 | |

| | | | | | | | | |

| | | Air Freight/Couriers — 2.8% | | | | | | | | |

| 4,820,000 | | Expeditors International | | | | | | | | |

| | | of Washington Inc. | | | 182,581,968 | | | | 175,255,200 | |

| | | Total common stocks | | | 4,750,514,581 | | | | 5,691,454,441 | |

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

| Principal Amount | | | | Cost | | | Value | |

| SHORT-TERM INVESTMENTS — 7.5% (a) | | | | | | |

| | | Commercial Paper — 7.5% | | | | | | |

| $265,200,000 | | U.S. Bank, N.A., 0.05%, | | | | | | |

| | | due 10/01/12 | | $ | 265,200,000 | | | $ | 265,200,000 | |

| 200,000,000 | | GE Capital Corp., 0.04%, | | | | | | | | |

| | | due 10/12/12 | | | 199,997,556 | | | | 199,997,556 | |

| | | Total short-term | | | | | | | | |

| | | investments | | | 465,197,556 | | | | 465,197,556 | |

| | | Total investments | | | | | | | | |

| | | — 99.8% | | $ | 5,215,712,137 | | | | 6,156,651,997 | |

| | | Other assets, | | | | | | | | |

| | | less liabilities | | | | | | | | |

| | | — 0.2% (a) | | | | | | | 11,161,366 | |

| | | TOTAL NET | | | | | | | | |

| | | ASSETS — 100.0% | | | | | | $ | 6,167,813,363 | |

| * | | Non-income producing security. |

| (a) | | Percentages for the various classifications relate to net assets. |

| PLC – Public Limited Company |

| SP-ADR – Sponsored American Depositary Receipt |

| | | |

The accompanying notes to financial statements are an integral part of this schedule.

as of September 30, 2012 (Unaudited)

FMI

Common Stock

Fund

September 30, 2012

Dear Fellow Shareholders,

The FMI Common Stock Fund gained 1.15% in the quarter ended September 30, 2012 compared to the benchmark Russell 2000 Index return of 5.25%. For the calendar nine months, the Fund advanced 5.65% which lagged the 14.23% gain in the benchmark. From a group standpoint, Process Industries, Finance, and Distribution Services hurt relative performance, while Transportation and Industrial Services helped. There was an inordinate amount of activity late in the second quarter and through most of the third quarter as the rally allowed us to harvest winners such as Lancaster, Valspar, PetSmart, and Eagle Materials. Additionally, after reunderwriting a number of stocks, we also sold Bemis, United Stationers, TeleTech and two other equities that were not yet completed by the end of the quarter. These five stocks face more challenging fundamentals than we originally anticipated. This activity resulted in a relatively high level of cash, which hurt investment performance. Additionally, our technology related distribution stocks, including a new purchase, Anixter, significantly underperformed year-to-date as worries about the economy and technology spending escalated. We like our investments in this space even though Wall Street currently does not. Below we highlight Anixter. Similarly, cyclical concerns clipped Kennametal and Kirby, but both of these companies are strong and can weather bumpy times. In short, we didn’t get much right in the quarter or in the year-to-date period and 2012 looks like a mirror image of 2011’s strong relative performance. Adding salt to the wounds, our style seems to be somewhat out of favor, with so-called growth stocks significantly outperforming value stocks in recent periods. Valuations, however, are stretched for the stocks that make up the benchmark Russell 2000. Additionally, the strong move in the Russell so far this year seems to be a low quality affair; 510 out of the stocks in the benchmark are losing money and those stocks were up nearly 30% on a year-to-date basis. Historically we have generally lagged in strong up markets (while more than making up for it in difficult markets), but of course, there are no guarantees. Finally, the recent rally seems to be more about financial engineering by the Fed than anything fundamental. We’re not confident that this “Bernanke trade” will outlast the deteriorating economic picture.

Most of the major regions of the world seem to be slowing or already experiencing recessionary conditions. The eurozone appears to be in a full-blown recession. China and Brazil have slowed significantly. The United States is sputtering. Economists pay attention to the Purchasing Managers Index (PMI) as an indicator of whether economic conditions are improving or deteriorating (numbers less than 50 indicate deterioration). The United States, China, Germany, Japan, the United Kingdom, Italy, Brazil, Australia, Canada and most of the large countries have PMIs less than 50.

Manufacturing PMI

1/31/2011 - 9/30/2012

Source: Bloomberg

The recent stabilization of the unemployment rate in the U.S. is undermined by a plunge in the labor force (the denominator in the calculation). The labor participation rate of 63.5% is the lowest in over 30 years. 11.2% of the labor force is out of work, if we include the 7 million no longer seeking employment. The key leading indicator of business capital spending slid 3.4% in July and has been down four of the past five months. Housing has certainly bounced off the bottom, but with true unemployment so high and the economy weakening, we have doubts about a continuing recovery in this sector. Business capital expenditures, incidentally, are 7% of GDP whereas housing is only 2% of GDP. Household net worth is down significantly over the past five years and real incomes have fallen. In short, the economic picture, both here and abroad, is not very good.

The Fed, European Central Bank (ECB) and other central bankers have taken it upon themselves to fix this problem. That is the way they think. Both the fiscal and monetary authorities look to governments to solve fundamental problems, reflecting a general lack of trust in classic economic policies and free markets. To Mr. Bernanke, the fact that four years of unprecedented stimulus yielded little in the way of results (and has perhaps dangerous long term consequences) is not a reason to stop and reassess. It’s an opportunity to say that not enough has been done; it’s a call to action. The latest iteration of money printing, QE3, is now underway, with the Fed expanding its balance sheet once again to the tune of an additional $40 billion per month ($85 billion per month in total) indefinitely. Mario Draghi, the head of the ECB, is using the same playbook. He’s doing “whatever it takes” to solve the eurozone problem, including an “unlimited” bond buying program. Japan recently followed with a $126 billion “asset purchasing program.” Brazil is talking up the same game. Even Switzerland has begun their own version of quantitative easing. In the long run, easy money policies rarely achieve their objectives and often have very serious repercussions. Yet stock markets seem to be cheering it on in the short run.

With the constant calling for governments and central banks to do more, perhaps it would be useful to talk briefly about the potential downside of these policies. Fiscal challenges have been addressed repeatedly in recent letters and will be put aside here, save this one statement: historically, U.S. federal government spending has been about 19-20% of GDP; today it is 24%. From a monetary perspective, we quote the highly respected economist David Malpass: “Whatever the Fed’s theory, the reality is that its attempts to prime the pump haven’t worked. They distort and weaken the economy and chase capital into such job losers as gold, government bonds, and factories abroad.” Today’s ground-hugging interest rate policies have decimated the saver and the risk averse. Horizon Kinetics, in their July report, estimates that the U.S. bond market is approximately $36.9 trillion with about 37% ($13.65 trillion) maturing over the next 60 months. The average coupon on maturing bonds is about 4.27% and these are being replaced by bonds with an average coupon of 1.55%. The difference in these two coupons means that if interest rates remain roughly where they are today, $371 billion of income will be lost each and every year for the next five years. That is 2.45% of GDP lost each year (of course, there is an offsetting impact to borrowers). Imagine the fallout if one introduced a tax of this magnitude! Most likely related to quantitative easing, commodity prices have also skyrocketed over the past few years. This has had a very negative impact with respect to food and gasoline prices. It’s tantamount to a significant regressive tax. At the same time, the leveraged hedge fund speculators and Wall Street “carry traders” win big from the Bernanke rally. The very people the administration demonizes are the same ones for whom the Fed is throwing a party. It’s fascinating, not to mention ironic, to see leaders who denigrated trickle down economic growth theories emanating from lower tax rates now embrace trickle down wealth theories coming from the Fed. Long term it seems logical to expect what has nearly always happened when governments print money at a far greater rate than the underlying economies are growing: inflation and currency debasement. Interestingly, despite extensive economic weakness, the September eurozone inflation rate is expected to rise to 2.8%, up from 2.6% in August and well above the ECB’s target of 2.0%.

Howard Marks, who has managed money for forty years and is one of the great investors of our time, recently made this statement: “The world seems more uncertain today than at any other time in my life.” We confess to similar sentiments, but there is always the chance that we are misreading the tea leaves and that the stock market gains anticipate a better economic environment in 2013. Perhaps following the elections Congress will address the so-called fiscal cliff with sensible compromises. Perhaps the leaders will come to acceptable pathways that will reduce deficits and corral the many unfunded liabilities. Perhaps Europe will somehow stem their fiscal and monetary crises and not drag the Federal Reserve into the fray. Every investor has to ask whether these events are likely and whether the 2012 stock market rally already discounts it.

This stock market move, which began in March of 2009, recently hit 43 months, which is the median duration of 15 bull markets since 1929. The 129.6% gain in the current stretch compares to a median of 83.1%. There is nothing magical or predictive from these facts other than to point out that it might take some fundamental improvement in earnings, sales growth or productivity to keep it going. The economic outlook today, both here and abroad, does not look like it will provide much lift in the near term and unfortunately, both sales growth and profit margins appear to be headed the other way, as the charts on the following page depict.

| | |

| S&P 500 Sales Per Share | Corporate Profits |

| Year to Year Percentage Change | Year to Year Percentage Change |

| | |

|  |

| | |

| Source: Standard & Poor’s Corporation | Source: Bureau of Economic Analysis |

| Shaded areas represent recessionary periods. | Corporate Profits: After Tax with Inventory Valuation |

| | and Capital Consumption Adjustments |

| | Shaded areas represent recessionary periods. |

A large number of transportation and industrial stocks are announcing poor earnings outlooks and orders. FedEx, Norfolk Southern, Expeditors, Forward Air, Caterpillar, Navistar, Joy Global, Steel Dynamics, Rockwell and many others have had recent confessions. Stocks that depend on better employment or capital spending have been especially hurt. Business confidence is slipping. It is getting to be an old story but it’s impossible to say when it will end. The best we can do in the interim is to let valuation and long term “strength of franchise” be our guide. Higher multiple stocks, lower quality balance sheet stocks, and money losing enterprises have been among the big winners so far in 2012. Valuations remain elevated. We think investors should be wary and stay focused on quality, even if that results in near term underperformance. Somewhat paradoxically, considering the near term economic outlook, the portfolio might begin to tilt more heavily in coming periods toward some of the cyclical companies as their stocks come under increasing pressure. There is always a tug-of-war between valuation and fundamentals and having a long term investment time horizon gives us opportunities to buy superior cyclical franchises when their near term operating environment is weak. We’ve highlighted one such idea below, Anixter International.

While today is very cloudy, we do expect sunnier economic times to eventually return, along with better underlying business fundamentals. Why? Business people want to grow. They want to invest. They want to build and they are willing to add labor… when they feel the systems and environment will reward such activity. This will be a far sturdier foundation for equity performance than government stimulus or Federal Reserve financial engineering.

Anixter International

(Analyst: Rob Helf)

Description

Anixter is a leading global distributor of communications infrastructure products (55% of sales), which includes cabling and security systems, as well as industrial wire and cable (26%) and fasteners/other components to original equipment manufacturers (OEMs) for use in assembled products. Anixter distributes more than 450,000 products to an estimated $50-$60 billion combined addressable market from over 7,000 suppliers through locations in 263 cities in 50 countries. Anixter sells across a wide variety of geographies including North America (71% of sales), Europe (19%) and Asia/Latin America (10%).

Good Business

| | • | Anixter is a leader in the distribution of cabling and wiring around the globe. |

| | • | The company has a global infrastructure of 225 strategically located facilities worldwide. Additionally, the company has a common, proprietary IT system connecting its infrastructure. |

| | • | The company distributes 450,000 products to 100,000 customers from 7,000 suppliers, and the top five largest suppliers represent 30% of sales. Project exposure averages 15% of revenue. |

| | • | The products that Anixter distributes represent a small percentage of customers’ total expenditures. |

| | • | Organic growth should be better than average as the company benefits from the secular expansion of data/communication and security as well as the company’s emerging market initiatives. Over the last 10 years, Anixter has grown sales and earnings per share (EPS) at 8% and 17%, respectively. |

| | • | Anixter has generated an average return on invested capital (ROIC) of approximately 10% over the past 12 years. This is above the company’s weighted average cost of capital. |

| | • | The balance sheet is appropriately levered. |

Valuation

| | • | Anixter currently trades at approximately 0.47 times enterprise value (EV)-to-revenues, 7.4 times earnings before interest, taxes, depreciation and amortization (EBITDA) and 10 times forward earnings per share (EPS) estimates. |

| | • | Historically, the company has traded at 0.5 times revenues, 10 times EBITDA and 15 times EPS. |

Management

| | • | Mr. Robert Eck, 52 years old, is President, Chief Executive Officer and a Director of the company. He has been with Anixter since 1989. Prior to his current position, Eck was Executive VP and COO of Enterprise Cabling and Security Solutions. Eck joined the company in 1989 and during his tenure he has held several executive positions including Senior VP-Supply Chain Solutions and Regional VP. |

| | • | Mr. Ted Dosch, 51, is Executive VP and CFO. He joined the company in January 2009 from Whirlpool. His experience includes Corporate VP-Global Productivity at Whirlpool; CFO-North America and VP-Maytag Integration at Whirlpool and other executive positions. Since his hiring, Mr. Dosch has been involved in working capital management and financial performance measurement. |

| | • | Mr. Sam Zell has been Chairman since 1985. He owns 5 million shares, or 14% of the company. |

| | • | Management incentives are based on targeted goals for each executive and generally include a return on capital component. The company has exhibited capital discipline in the past, including special dividends, share repurchases and acquisitions/divestitures. |

Investment Thesis

Anixter should be able grow sales, earnings and cash flow at above-average rates through organic expansion and acquisitions, while generating a return on capital in excess of its cost of capital. Anixter provides a low tech avenue to higher technology spending growth. The company has built a global distribution network which benefits from secular trends and emerging market expansion. Importantly, the experienced management team has demonstrated fiscal discipline, including debt management in periods of expansion and contraction as well as returning capital to shareholders through buybacks and special dividends.

Advance Auto Parts Inc.

(Analyst: Dan Sievers)

Description

Advance Auto Parts is a leading specialty retailer of automotive aftermarket parts, accessories, batteries and maintenance items with over 3,600 stores and a #1 market position in the Northeast, Mid-Atlantic, and Southeast United States. Advance was constructed as a do-it-yourself (DIY) retail concept, but entered the larger and somewhat faster growing commercial do-it-for-me (DIFM) market in 1996, leveraging an enhanced retail infrastructure to sell to a large and highly fragmented market of small automotive garages. DIFM sales represented 34% of the total in 2011 (up from 25% in 2007), and 38% of the total sales in the first half of 2012. DIFM delivery programs exist at about 90% of its stores.

Good Business

| | • | In geographies representing 78% of sales, Advance commands the leading #1 market position. |

| | • | The company’s traffic and transactions are often based on need (batteries, starters, alternators, belts & hoses, mufflers, etc.), producing a low correlation between sales and consumer discretionary spending. |

| | • | Auto parts retailing is inventory intensive (parts availability is paramount), which limits the economic case for traditional e-commerce models. Additional limiting characteristics include strong customer service intensity, the frequent need for immediate installation, and the “high-weight-to-value” of most parts (which limits a vendor’s ability to offer low-cost shipping options). |

| | • | We expect continued share gains by each of the top three hybrid-DIY/DIFM players, as each has built an advantaged supply chain and distribution system when compared to many small competitors. |

| | • | This is an easy business to understand and favorable industry trends include: (1) record average vehicle age, (2) growing miles driven, (3) and OEM dealership consolidation. |

| | • | Including the heavy burden of capitalized operating leases, we estimate that Advance generates an average ROIC of greater than 10%. |

Valuation

| | • | At 6.0 times EV/EBITDA, Advance trades at one standard deviation below the 5 and 10 year averages of 7.1 times and 8.4 times, respectively (competitors AutoZone and O’Reilly trade above 9 times). |

| | • | The 0.82 times EV/Sales multiple appears out of step with the company’s improving profitability (10.8% EBIT margin in 2011), which we believe can reach 12% over the next few years. |

| | • | Based on 2011 results, the stock offers an attractive 11% free cash flow yield. |

Management

| | • | Darren Jackson, 47, has served as CEO since January 2008. Mr. Jackson, previously EVP at Best Buy, has brought increased focus on merchandising and supply chain initiatives, while driving the company towards a 50/50 balance between retail DIY and commercial DIFM sales. He has done an admirable job shifting corporate focus away from heavy new store growth and towards improving operating margins, working capital efficiency, and returns on invested capital (ROIC). |

| | • | Management’s current initiatives aiming at daily store replenishment are significant and should increase the company’s competitive position in coming years. |

| | • | Advance has opportunistically repurchased and retired 41% of the 2004 share base at an average price of $43, a shrewd use of capital benefitting long-term shareholders. |

| | • | Economic value added (EVA) became the governor of long-term incentive compensation in 2008. |

Investment Thesis

Advance Auto Parts is a good-quality provider of automotive aftermarket parts with good balance between the DIY and DIFM channels, which together represent a relatively stable though mature end market. Large players like Advance, AutoZone and O’Reilly enjoy a significant competitive advantage versus smaller local players and hold a combined market share of 33% in the DIY space and just under 11% in the DIFM space, according to the Automotive Aftermarket Industry Association (AAIA). 2012 industry trends have been soft, exacerbated by weather-related inventory issues. Additionally, Advance faces a potential competitive incursion in Florida from O’Reilly. Though we do not expect an immediate rebound in same store sales, we believe that investor focus on the weak near term results has offered the opportunity to invest in a solid and increasingly well-managed franchise at an attractive 11% free cash flow yield.

******

Distributions: Our Board of Directors has declared a distribution effective October 31, 2012, of $0.08649616 per share from net investment income; $0.28379 per share from short-term capital gains which will be treated as ordinary income; and $2.12186 per share from net long-term capital gains, payable October 31, 2012 to shareholders of record on October 26, 2012.

Thank you for your support of the FMI Common Stock Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

This shareholder letter is unaudited.

FMI Common Stock Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

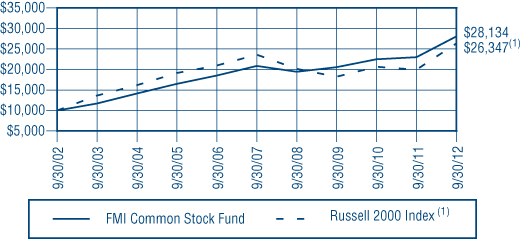

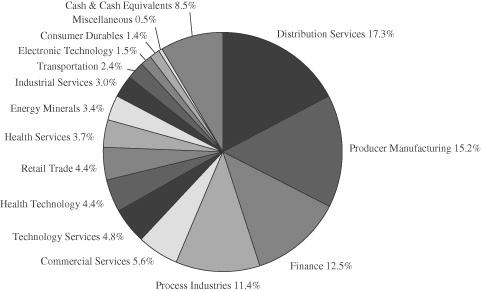

During the fiscal year ended September 30, 2012, the FMI Common Stock Fund (the “Fund”) had a total return of 22.38%. The benchmark Russell 2000 Index(1) returned 31.91% in the same period. Distribution Services, Health Services, Finance, Health Technology, Process Industries and cash were among the several sectors that underperformed the benchmark. Stock selection and relative weightings both contributed significantly to the underperformance. Harte-Hanks, Kennametal, Bemis, AptarGroup, Patterson, ScanSource, Covance and others hurt relative performance. Sectors that helped performance included Non-Energy Minerals, Electronic Technology, and Producer Manufacturing. Eagle Materials, Carlisle, and Woodward aided relative performance. Woodward, Lancaster, JB Hunt, Federated Investors, United Stationers, Bemis and Alliant Techsystems were among stocks that were sold during the fiscal year. The first three, Woodward, Lancaster and JB Hunt, were sold due to valuation. The others listed were sold due to a reassessment of the long term fundamentals. New purchases included H.B. Fuller, Innophos, Cimarex, and Gentex. At September 30, the overweighted sectors included Producer Manufacturing, Process Industries and Distribution Services. Underweighted sectors included Finance, Consumer Non-Durables and Consumer Services. The stock market rebounded significantly in fiscal 2012, which we believe had more to do with monetary actions, i.e. quantitative easing, than any meaningful improvement in underlying fundamentals. As the fiscal year ended, economic activity had weakened across a broad spectrum of geographies. The debt crisis showed little sign of improvement in Europe, the United States or Japan. Valuations have moved higher from a year ago and do not look particularly attractive from a long term historical basis. From a macroeconomic and policy perspective, we do not see the fiscal or monetary initiatives of the past several years as being conducive to good long-term growth and employment. The explosive growth in government liabilities is particularly worrisome. Despite these negatives, we believe equities are the most attractive asset class over a long term investment time horizon. The Fund continues to sell at a discount to the Russell 2000 on most valuation measures. Over long periods of time, lower valuation securities tend to outperform higher valuation ones. Future results, however, may differ from the past.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI COMMON STOCK FUND AND THE RUSSELL 2000 INDEX(1)

AVERAGE ANNUALIZED TOTAL RETURN |

| | | | | Since |

| | | | | Inception |

| | 1-Year | 5-Year | 10-Year | 12/18/81 |

| FMI Common | | | | |

| Stock Fund | 22.38% | 6.12% | 10.90% | 11.96% |

| Russell 2000 Index | 31.91% | 2.21% | 10.17% | 10.02% |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

(1) The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which comprises the 3,000 largest U.S. companies based on total market capitalization.

An investment cannot be made directly into an index.

This page is unaudited.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 91.5% (a) | | | | | | |

| | | | | | | |

| COMMERCIAL SERVICES SECTOR — 5.6% | | | | | | |

| | | Advertising/Marketing | | | | | | |

| | | Services — 0.8% | | | | | | |

| 1,233,075 | | Harte-Hanks Inc. | | $ | 14,015,785 | | | $ | 8,545,210 | |

| | | Financial Publishing/ | | | | | | | | |

| | | Services — 2.1% | | | | | | | | |

| 290,000 | | The Dun & Bradstreet | | | | | | | | |

| | | Corp. | | | 19,868,506 | | | | 23,089,800 | |

| | | Miscellaneous Commercial | | | | | | | | |

| | | Services — 2.7% | | | | | | | | |

| 736,000 | | Cintas Corp. | | | 17,929,877 | | | | 30,507,200 | |

| | | | | | | | | | | |

| CONSUMER DURABLES SECTOR — 1.4% | | | | | | | | |

| | | Other Consumer | | | | | | | | |

| | | Specialties — 1.4% | | | | | | | | |

| 414,000 | | Mine Safety | | | | | | | | |

| | | Appliances Co. | | | 12,032,362 | | | | 15,429,780 | |

| | | | | | | | | | | |

| DISTRIBUTION SERVICES SECTOR — 17.3% | | | | | | | | |

| | | Electronics | | | | | | | | |

| | | Distributors — 8.9% | | | | | | | | |

| 425,000 | | Anixter | | | | | | | | |

| | | International Inc. | | | 28,156,288 | | | | 24,420,500 | |

| 1,403,000 | | Arrow | | | | | | | | |

| | | Electronics Inc.* | | | 31,275,434 | | | | 47,295,130 | |

| 882,000 | | ScanSource Inc.* | | | 22,931,882 | | | | 28,241,640 | |

| | | | | | 82,363,604 | | | | 99,957,270 | |

| | | Medical Distributors — 6.6% | | | | | | | | |

| 585,000 | | Owens & Minor Inc. | | | 16,778,650 | | | | 17,479,800 | |

| 1,631,000 | | Patterson Cos. Inc. | | | 40,534,664 | | | | 55,845,440 | |

| | | | | | 57,313,314 | | | | 73,325,240 | |

| | | Wholesale | | | | | | | | |

| | | Distributors — 1.8% | | | | | | | | |

| 566,000 | | World Fuel Services | | | | | | | | |

| | | Corp. | | | 23,216,290 | | | | 20,155,260 | |

| | | | | | | | | | | |

| ELECTRONIC TECHNOLOGY SECTOR — 1.5% | | | | | | | | |

| | | Electronic Production | | | | | | | | |

| | | Equipment — 1.5% | | | | | | | | |

| 635,000 | | MKS Instruments Inc. | | | 17,090,625 | | | | 16,186,150 | |

| | | | | | | | | | | |

| ENERGY MINERALS SECTOR — 3.4% | | | | | | | | |

| | | Oil & Gas Production — 3.4% | | | | | | | | |

| 652,000 | | Cimarex Energy Co. | | | 37,798,978 | | | | 38,174,600 | |

| FINANCE SECTOR — 12.5% | | | | | | | | |

| | | Finance/Rental/ | | | | | | | | |

| | | Leasing — 1.7% | | | | | | | | |

| 494,000 | | Ryder System Inc. | | | 20,780,371 | | | | 19,295,640 | |

| | | Insurance Brokers/ | | | | | | | | |

| | | Services — 2.4% | | | | | | | | |

| 763,000 | | Arthur J. | | | | | | | | |

| | | Gallagher & Co. | | | 16,392,496 | | | | 27,330,660 | |

| | | Life/Health | | | | | | | | |

| | | Insurance — 2.3% | | | | | | | | |

| 997,000 | | Protective Life Corp. | | | 15,983,284 | | | | 26,131,370 | |

| | | Property/Casualty | | | | | | | | |

| | | Insurance — 3.0% | | | | | | | | |

| 905,000 | | W.R. Berkley Corp. | | | 22,734,967 | | | | 33,928,450 | |

| | | Regional Banks — 3.1% | | | | | | | | |

| 604,000 | | Cullen/Frost | | | | | | | | |

| | | Bankers Inc. | | | 35,205,404 | | | | 34,687,720 | |

| | | | | | | | | | | |

| HEALTH SERVICES SECTOR — 3.7% | | | | | | | | |

| | | Health Industry | | | | | | | | |

| | | Services — 2.3% | | | | | | | | |

| 552,000 | | Covance Inc.* | | | 23,637,911 | | | | 25,772,880 | |

| | | Medical/Nursing | | | | | | | | |

| | | Services — 1.4% | | | | | | | | |

| 809,000 | | VCA Antech Inc.* | | | 16,997,846 | | | | 15,961,570 | |

| | | | | | | | | | | |

| HEALTH TECHNOLOGY SECTOR — 4.4% | | | | | | | | |

| | | Medical Specialties — 4.4% | | | | | | | | |

| 258,875 | | Bio-Rad | | | | | | | | |

| | | Laboratories Inc.* | | | 22,127,426 | | | | 27,627,140 | |

| 408,000 | | West Pharmaceutical | | | | | | | | |

| | | Services Inc. | | | 16,327,619 | | | | 21,652,560 | |

| | | | | | 38,455,045 | | | | 49,279,700 | |

| INDUSTRIAL SERVICES SECTOR — 3.0% | | | | | | | | |

| | | Oilfield Services/ | | | | | | | | |

| | | Equipment — 3.0% | | | | | | | | |

| 313,000 | | Bristow Group Inc. | | | 8,134,903 | | | | 15,822,150 | |

| 1,458,000 | | McDermott | | | | | | | | |

| | | International Inc.* | | | 18,965,858 | | | | 17,816,760 | |

| | | | | | 27,100,761 | | | | 33,638,910 | |

| MISCELLANEOUS SECTOR — 0.5% | | | | | | | | |

| | | Investment Trusts/ | | | | | | | | |

| | | Mutual Funds — 0.5% | | | | | | | | |

| 267,950 | | PICO Holdings Inc.* | | | 8,444,922 | | | | 6,114,619 | |

| | | | | | | | | | | |

| PROCESS INDUSTRIES SECTOR — 11.4% | | | | | | | | |

| | | Chemicals: Specialty — 6.3% | | | | | | | | |

| 333,000 | | Compass Minerals | | | | | | | | |

| | | International Inc. | | | 24,168,637 | | | | 24,838,470 | |

| 476,000 | | Innophos | | | | | | | | |

| | | Holdings Inc. | | | 23,636,301 | | | | 23,081,240 | |

| 315,000 | | Sigma-Aldrich Corp. | | | 15,670,380 | | | | 22,670,550 | |

| | | | | | 63,475,318 | | | | 70,590,260 | |

| | | Containers/Packaging — 3.0% | | | | | | | | |

| 651,000 | | AptarGroup Inc. | | | 19,162,286 | | | | 33,663,210 | |

| | | Industrial Specialties — 2.1% | | | | | | | | |

| 752,000 | | H.B. Fuller Co. | | | 20,886,926 | | | | 23,071,360 | |

| | | | | | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 15.2% | | | | | | | | |

| | | Auto Parts: OEM — 1.6% | | | | | | | | |

| 1,068,000 | | Gentex Corp. | | | 20,602,809 | | | | 18,166,680 | |

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

| | Shares or | | | | | | | | | |

| | Principal Amount | | | | Cost | | | | Value | |

| COMMON STOCKS — 91.5% (a) (Continued) | | | | | | |

| | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 15.2% (Continued) | | | | | | |

| | | Electrical Products — 3.4% | | | | | | |

| | 1,735,000 | | Molex Inc. - Cl A | | $ | 31,532,890 | | | $ | 37,684,200 | |

| | | | Industrial | | | | | | | | |

| | | | Conglomerates — 2.4% | | | | | | | | |

| | 407,000 | | SPX Corp. | | | 22,883,026 | | | | 26,621,870 | |

| | | | Industrial Machinery — 3.1% | | | | | | | | |

| | 923,000 | | Kennametal Inc. | | | 37,218,259 | | | | 34,224,840 | |

| | | | Miscellaneous | | | | | | | | |

| | | | Manufacturing — 2.9% | | | | | | | | |

| | 626,000 | | Carlisle Cos. Inc. | | | 16,800,707 | | | | 32,501,920 | |

| | | | Office Equipment/ | | | | | | | | |

| | | | Supplies — 1.8% | | | | | | | | |

| | 619,000 | | Avery Dennison Corp. | | | 16,602,918 | | | | 19,696,580 | |

| | | | | | | | | | | | |

| RETAIL TRADE SECTOR — 4.4% | | | | | | | | |

| | | | Discount Stores — 1.5% | | | | | | | | |

| | 252,000 | | Family Dollar | | | | | | | | |

| | | | Stores Inc. | | | 4,945,740 | | | | 16,707,600 | |

| | | | Specialty Stores — 2.9% | | | | | | | | |

| | 475,000 | | Advance Auto | | | | | | | | |

| | | | Parts Inc. | | | 32,193,067 | | | | 32,509,000 | |

| | | | | | | | | | | | |

| TECHNOLOGY SERVICES SECTOR — 4.8% | | | | | | | | |

| | | | Data Processing | | | | | | | | |

| | | | Services — 3.0% | | | | | | | | |

| | 1,434,000 | | Broadridge Financial | | | | | | | | |

| | | | Solutions Inc. | | | 30,925,092 | | | | 33,455,220 | |

| | | | Information Technology | | | | | | | | |

| | | | Services — 1.8% | | | | | | | | |

| | 531,000 | | Jack Henry & | | | | | | | | |

| | | | Associates Inc. | | | 9,767,741 | | | | 20,124,900 | |

| | | | | | | | | | | | |

| TRANSPORTATION SECTOR — 2.4% | | | | | | | | |

| | | | Air Freight/Couriers — 1.0% | | | | | | | | |

| | 352,000 | | Forward Air Corp. | | | 11,267,415 | | | | 10,704,320 | |

| | | | Marine Shipping — 1.4% | | | | | | | | |

| | 285,000 | | Kirby Corp.* | | | 11,152,557 | | | | 15,754,800 | |

| | | | Total common stocks | | | 856,779,099 | | | | 1,022,988,789 | |

| | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS — 8.4% (a) | | | | | | | | |

| | | | Commercial Paper — 8.4% | | | | | | | | |

| $ | 68,700,000 | | U.S. Bank, N.A., 0.05%, | | | | | | | | |

| | | | due 10/01/12 | | | 68,700,000 | | | | 68,700,000 | |

| | 25,000,000 | | GE Capital Corp., 0.04%, | | | | | | | | |

| | | | due 10/12/12 | | | 24,999,694 | | | | 24,999,694 | |

| | | | Total short-term | | | | | | | | |

| | | | investments | | | 93,699,694 | | | | 93,699,694 | |

| | | | Total investments | | | | | | | | |

| | | | — 99.9% | | $ | 950,478,793 | | | | 1,116,688,483 | |

| | | | Other assets, | | | | | | | | |

| | | | less liabilities | | | | | | | | |

| | | | — 0.1% (a) | | | | | | | 1,812,130 | |

| | | | TOTAL NET | | | | | | | | |

| | | | ASSETS — 100.0% | | | | | | $ | 1,118,500,613 | |

| | | | | | | | | | | | |

* | Non-income producing security. |

(a) Percentages for the various classifications relate to net assets.

The accompanying notes to financial statements are an integral part of this schedule.

as of September 30, 2012 (Unaudited)

FMI

International

Fund

September 30, 2012

Dear Fellow Shareholders,

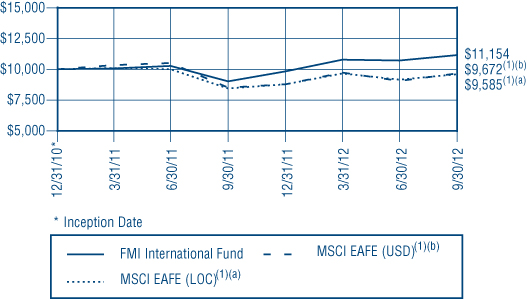

The FMI International Fund gained 4.09% in the three months ending September 30, 2012, compared with the MSCI EAFE Index’s return of 4.67% in local currency and 6.92% in U.S. Dollars (USD). Through nine months, the Fund has advanced 13.55% while the benchmarks, MSCI EAFE local and USD, are up 9.10% and 10.08%, respectively. While unprecedented monetary action by the European Central Bank (ECB), U.S. Federal Reserve (Fed), and Bank of Japan have helped fuel the recent stock rally, the core economic environment and employment landscape remain weak. With a number of significant macro concerns still outstanding, we will continue to proceed with heightened caution and prudence.

In the third quarter, strong individual stock performance was generated by Henkel, Adecco and Tesco, while SMC Corp, CRH, and Rolls Royce all lagged. Positive sector contributions from Consumer Non-Durables, Commercial Services and Process Industries were partially offset by weaker relative performance in Finance, Producer Manufacturing, and Health Technology.

We welcome new shareholders and remind them that the last year of our shareholder letters for the Fund – as well as the FMI Common Stock Fund and the FMI Large Cap Fund – are accessible on our website at www.fmifunds.com.

Ladies & Gentlemen: Start Your Printing Presses!

In a continuing Pavlovian response to fundamental economic weakness and unemployment, governments are “stimulating” on the fiscal front and “accommodating” on the monetary front. The third quarter was a busy one, with four new initiatives announced in September alone. The ECB unveiled a potentially unlimited bond-buying program, China announced ¥1 trillion ($157 billion) of infrastructure stimulus, the Fed launched QE3 with $40 billion of mortgage purchases per month, and the Bank of Japan (BOJ) added ¥10 trillion ($126 billion) to its asset-purchasing program, which now totals ¥80 trillion ($1 trillion). While these measures may have bought some time and helped boost stock prices in the near-term, they are, unfortunately, unlikely to solve the underlying problems. China is a special case, but with respect to other major developed areas mentioned above, the structural debt issues and lack of competitiveness won’t be ameliorated by the wave of a government magic wand.

In Europe, ECB President Mario Draghi overcame a clash with Germany’s Bundesbank and has pushed through a bond-buying program aimed at lowering the borrowing cost of troubled eurozone countries. Before Draghi’s pledge on July 26 to do “whatever it takes to preserve the euro,” Spain and Italy’s 10-year bond yields had peaked at 7.6% and 6.6%, respectively, levels which are deemed unsustainable.(1) The ECB’s assertion that buying short-term sovereign debt (less than 3 years) is an act of providing liquidity, and does not violate its restriction on financing governments, would be laughable under normal circumstances, but instead reveals the degree to which expediency rules the day. Draghi is now “All In,” with no real “Plan B” in sight. The ECB will be taking on meaningful credit risk, making a promise that puts every eurozone country, particularly Germany, in jeopardy, and there is little doubt, at least in our minds, that should the monetary union collapse, it will come back on the United States. Draghi knows that in a widespread European financial panic, the U.S. will be the backstop. The Fed has done it before and given Mr. Bernanke’s philosophical bent, is likely to do it again – only the problem is significantly bigger this time. While we will have to wait and see what the market will say over time, we expect that investors will continue to differentiate between eurozone sovereigns, and that the latest ECB “solution” will not put an end to the debt crisis. Financial engineering does little to make the European fundamentals brighter.

The economy in Europe continues to reflect tough times. The eurozone appears to be in its second recession in three years (flat real GDP growth in the first quarter, -0.5% growth in the second quarter, and a Bloomberg survey of -0.8% growth in the third quarter)(2). Even Germany looks to be turning down. In September, Germany’s Manufacturing Purchasing

_________________

| (1) | | On September 30, 2012, Spain and Italy’s 10-year bond yields had dropped to 5.9% and 5.1%, respectively. |

| (2) | | Growth is reported year-over-year. |

Manufacturing PMI

1/31/2011 - 9/30/2012

Source: Bloomberg

Managers Index (PMI) reading(3) of 47.4 showed that the manufacturing sector has contracted for 7 straight months (10 out of the last 12), hitting a three-year low in July (43.0). The eurozone’s PMI figures tell a similar story (see chart), with manufacturing contracting for 14 straight months, also reaching a 3-year low in July (44.0). Good news is hard to find in Europe and we would expect this reality to eventually outweigh the money printing rally.

Our observations in Asia also give us some cause for concern. For the same reasons that we have highlighted in prior shareholder letters, China’s economy continues to slow sharply. We can now add FedEx, Dow Chemical, and Applied Materials to the growing list of multinational companies citing a slowdown in China. The country’s playbook of stimulative fixed investment may not be sustainable. There appears to be a tug-of-war going on in China between the Keynesians and the free marketers. The $157 billion infrastructure stimulus program is far less than the $586 billion spent in 2008-09. Perhaps some of the central planners recognize the danger in empty high rise apartment buildings, bridges to nowhere and bullet trains with few riders. With political turmoil intensifying in the midst of the once-a-decade change in communist leadership, China’s outlook remains unsettled. We quickly add, however, that longer term we are more positive on China. We never want to underestimate a country that values education, sacrifice and hard work.

In Japan, real GDP growth(4) is expected to slow from 3% in the first half of 2012 to 1.6%(5) in the second half of the year, driven by weak exports and soft consumer spending. A strengthening yen continues to disadvantage exporters, while challenging demographics (a shrinking population) hinders domestic growth opportunities. Japan’s debt level as a percentage of GDP is by far the highest of any major developed economy, projected to be upwards of 230% by 2013, and no real efforts are being made to address what has likely become an insurmountable burden. The International Monetary Fund (IMF) is projecting 1.5% real GDP growth in Japan in 2013, an uninspiring figure, but one which may prove to be overly optimistic if a global recovery does not start to take form.

While we may come across as overly bearish at the macro level, we do see attractive investment prospects when evaluating specific stock ideas. Some of the market’s best opportunities come during times of fear and uncertainty, and FMI has shown in the past that we have the ability to make money for our shareholders through difficult times. We strive to identify high-quality businesses that can withstand almost any economic environment, and buy them at discount valuations. We evaluate companies from the bottom-up with a focus on in-depth security analysis, striving to generate above-average returns while taking below-average risk. As always, we will continue to “eat our own cooking” and invest alongside our shareholders. Below we highlight two of the Fund’s investments:

CRH PLC

(Analyst: Karl Poehls)

Description

CRH PLC is a company based in Dublin, Ireland, which manufactures and distributes building material products. The company’s products include cement, aggregates, asphalt, ready-mixed concrete, agricultural and chemical lime, and concrete

| (3) | | A reading of less than 50 implies contraction and greater than 50 implies expansion. |

| (4) | | Growth is reported year-over-year. |

| (5) | | According to a Bloomberg survey on September 20, 2012. |

products. The company also offers concrete paving and landscaping; precast concrete products; clay bricks, pavers, roofing tiles, and blocks; prepackaged concrete mixes; glass fabrication; and construction accessories. In addition, CRH markets and sells builders’ supplies to the construction industry as well as the do-it-yourself (DIY) market. The company’s earnings before interest, taxes, depreciation and amortization (EBITDA) can be segmented geographically as follows: 50% North America; 35% Western Europe; and 15% Emerging Regions, including Poland, China, and India.

Good Business:

| | • | CRH’s aggregates, asphalt, and cement products are absolutely necessary elements of global infrastructure. Therefore, as buildings, roads, highways, and bridges wear out over time, replacement demand will ultimately translate into increased revenue for the company. |

| | • | CRH owns or leases 14 billion tons of aggregates reserves globally and is a top 10 cement producer in Western Europe. In the U.S., CRH operates as Oldcastle Inc. and is the third largest aggregates producer as well as the market leader in asphalt. |

| | • | We estimate that CRH’s weighted average cost of capital is approximately 7-8%. Over the past 10 years, the company’s return on invested capital (ROIC) has averaged 9%. |

| | • | The company generates considerable excess free cash flow (FCF). Over the past 5 years, CRH’s FCF has averaged €1.1 billion. This funds the annual dividend, which currently yields 4%. |

| | • | CRH has a solid balance sheet with net debt of €3.9 billion. As of June 2012, CRH’s interest coverage and financial leverage ratios were 6.7 times and 2.4 times, respectively. |

Valuation

| | • | At the current price, the company’s stock is 58% below its all-time high of €36 achieved in 2007. |

| | • | CRH currently trades for 1.1 times price-to-book value (P/B). This is below its trailing 7-year and 10-year average P/B multiples of 1.4 times and 1.5 times, respectively. |

| | • | We estimate the company’s aggregates reserves are worth €6.5-7.0 billion or €9 per share, which provides downside support. |

| | • | Over the past 20 years, CRH’s shares have traded for an average price-to-cash flow (P/CF) multiple of 7-8 times. Based on normalized operating cash flow of €1.8-€2.0 billion, we calculate the company’s intrinsic value is over 50% greater than the current stock price. |

Management

| | • | Mr. Myles Lee was appointed Group Chief Executive (CEO) in January 2009. He joined CRH in 1982 and has held various management roles within the company over the past 30 years. |

| | • | Mr. Mark Towe was appointed a CRH Board Director in July 2008; he joined the company in 1997. In July 2008, he was named CEO of the company’s U.S. subsidiary, Oldcastle Inc. Mr. Towe brings valuable insight to the company, with his 40 years of experience in the building materials industry. |

| | • | A meaningful portion of executive compensation is directly tied to return on net assets. |

Investment Thesis

In CRH’s core geographic regions, construction and housing markets are in disarray and threatened by government austerity measures. Moreover, U.S. aggregates consumption, a proxy for infrastructure spending, has seen its worst volume decline since the Great Depression. This has negatively impacted CRH’s financial results and driven its valuation to multi-decade lows. As a result, we are presented with the opportunity to invest in a top-notch building materials company at an attractive valuation. In addition, the current dividend payment provides a 4% annual return while we wait for end markets to normalize.

SMC Corp.

(Analyst: Jonathan Bloom)

Description

With a 32% global market share, SMC Corp. is the world leader in pneumatic control technology, producing crucial components used in factory automation worldwide. Pneumatic technology is essentially the use of compressed air to transmit power, through the utilization of air compressors, air preparation equipment, air line equipment, direction control components

and actuators. In the fiscal year ending March of 2012, the company generated sales of ¥341.9 billion ($4.4 billion) with operating profits of ¥88.1 billion ($1.1 billion, 25.8% margin). Over 60% of sales came from overseas, with geographic distribution reported as follows: Japan (39%), Asia (28%), Europe (16%), North America (13%), and Other (4%).

Good Business: