UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-1018

Dreyfus Founders Funds, Inc.

---------------------------------------------------------------

(Exact name of registrant as specified in charter)

210 University Boulevard, Suite 800, Denver, Colorado 80206

---------------------------------------------------------------

(Address of principal executive offices) (Zip code)

Kenneth R. Christoffersen, Esq.

210 University Boulevard, Suite 800, Denver, Colorado 80206

---------------------------------------------------------------

(Name and address of agent for service)

Registrant's telephone number, including area code: 303-394-4404

Date of fiscal year end: December 31

Date of reporting period: December 31, 2007

ITEM 1. REPORTS TO STOCKHOLDERS

| Dreyfus Founders |

| Balanced Fund |

| | Balanced Fund is closed to new investors.

Please see the prospectus for additional information.

|

ANNUAL REPORT December 31, 2007

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio managers only through the end of the period covered and do not necessarily represent the views of Founders or any other person in the Founders organization.Any such views are subject to change at any time based upon market or other conditions and Founders disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus Founders Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus Founders Fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| Contents |

| |

| | | THE FUND |

| |

|

| 2 | | A Letter from the Chairman |

| 3 | | Discussion of Fund Performance |

| 6 | | Fund Performance |

| 8 | | Understanding Your Fund’s Expenses |

| 8 | | Comparing Your Fund’s Expenses |

| | | With Those of Other Funds |

| 9 | | Statement of Investments |

| 24 | | Statement of Assets and Liabilities |

| 25 | | Statement of Operations |

| 26 | | Statement of Changes in Net Assets |

| 29 | | Financial Highlights |

| 35 | | Notes to Financial Statements |

| 47 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 48 | | Important Tax Information |

| 49 | | Factors Considered in Renewing |

| | | the Advisory Agreement |

| 57 | | Your Board Representatives |

| |

| FOR MORE INFORMATION |

|

| | | Back Cover |

| Dreyfus Founders |

| Balanced Fund |

A LETTER FROM THE CHAIRMAN

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Founders Balanced Fund, covering the 12-month period from January 1, 2007, through December 31, 2007.

Looking back, 2007 was a year of significant change for the stock market.Turmoil in the sub-prime mortgage market, declining housing values and soaring energy prices sparked a “flight to quality” in which investors reassessed their attitudes toward risk.As a result, smaller, more speculative companies that had led the stock market over the past several years lost value over the second half of the year, while shares of larger, multinational growth companies returned to favor. Many financial services and consumer discretionary companies were hurt by repercussions from the sub-prime lending crisis and economic downturn, but energy and basic materials producers generally moved higher along with underlying commodity prices.

The turbulence of 2007 reinforced a central principle of successful investing: diversification. Investors with broad exposure to the world’s stock and bond markets were better protected from the full impact of market volatility in areas that, earlier in the year, were among the bright spots at the time. As we look ahead, we believe that now is the perfect time to meet with your financial advisor, who can help you plan and diversify your investment portfolio in a way that manages the potential opportunities and risks that may continue to arise in 2008.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund’s Portfolio Managers.

Thank you for your continued confidence and support.

2

DISCUSSION OF FUND PERFORMANCE

For the period between January 1, 2007, and December 31, 2007, as provided by John B. Jares, CFA, and Catherine Powers, CFA, Portfolio Managers

Fund and Market Performance Overview

Softer consumer spending, a slowing U.S. economy and escalating sub-prime mortgage delinquencies and defaults weighed on U.S. stock and bond markets during 2007. However, large-capitalization growth stocks posted stronger returns than most other equity market segments as investors grew increasingly risk-averse, and U.S. Treasury bonds gained value in a “flight to quality” among investors.The fund’s returns generally were slightly higher than its benchmark, mainly due to strength among the growth-oriented stocks favored by the fund’s equity portfolio.

For the 12-month period ended December 31, 2007, Dreyfus Founders Balanced Fund produced total returns of 6.24% for Class A shares, 6.54% for Class B shares, 5.21% for Class C shares, 6.27% for Class F shares, 6.37% for Class I shares and 5.52% for Class T shares,1 in comparison to its benchmark, the Standard & Poor’s 500 Composite Stock Price Index, which gained 5.49% for the same time period.2

The Fund’s Investment Approach

The fund seeks current income and capital appreciation by investing in a balanced portfolio of common stocks, U.S. and foreign government debt securities and corporate fixed-income obligations. The fund’s equity portion uses a “growth style” of investing, in which we search for companies whose fundamental strengths suggest the potential for superior earnings growth over time. Our “bottom-up” approach emphasizes individual stock selection through intensive qualitative and quantitative research.When choosing bonds, we consider their income characteristics as well as the potential for capital appreciation.We may invest in U.S. government securities, investment-grade and high yield corporate bonds, mortgage-related securities and asset-backed securities.

Stocks and Bonds Posted Mixed Results amid Heightened Volatility

Stocks advanced broadly and bonds remained in a narrow trading range over the first half of 2007, due to strong corporate earnings, moderate economic growth and stable short-term interest rates. However, market conditions changed dramatically over the second half

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

of the year, when a credit crisis emanating from the sub-prime mortgage market spread to other areas of the financial markets.As investors reassessed their attitudes toward risk, they turned away from the smaller, more speculative stocks and higher-yielding bonds that previously led the markets’ advances. Instead, newly risk-averse investors began to favor U.S. Treasury securities and large growth companies with a presence in overseas markets.

Our Sector Allocation and Security Selection Strategies Boosted Equity Results

The fund’s underweighted allocation to lagging financial and consumer discretionary stocks supported its relative performance. In addition, our security selection strategy scored a number of successes. In the consumer discretionary area, specialty retailer Gap, Inc. benefited from solid execution by a new management team in restructuring the company. In the telecommunication services sector,handset maker Nokia saw an increase in Chinese and Indian contracts. In other industry groups, brokerage firm Charles Schwab & Co. benefited from strong asset inflows, while oil producer Exxon Mobil’s stock price advanced along with crude oil prices. Among information technology companies, computer and electronics producer Apple scored a resounding success with the introduction of its iPhone, and software giant Microsoft achieved gains in its gaming platforms and operating systems divisions. Online media leader Google and hardware manufacturer Hewlett-Packard both captured larger shares of their respective markets.

However, strong performance in these areas was partly offset by underweighted allocations to the industrials and materials areas and a lack of exposure to some of these sectors’ top individual performers. In addition, semiconductor manufacturers Marvell Technology Group and Broadcom were hindered by company-specific issues, while banking giant Citigroup fell victim to subprime mortgage turmoil and retailer Home Depot suffered from depressed activity in the housing industry.

Non-Treasury Holdings Constrained Fixed-Income Performance

The fund’s relatively light holdings of U.S.Treasuries and overweighted position in shorter-duration corporate bonds and asset-backed securities proved to be a drag on performance.We had adopted a defensive investment posture with regard to investment-grade corporate bonds, including an emphasis on issuers that tend to be less vulnerable to risks associated with leveraged buyouts. However, this focus detracted from

4

relative performance during the credit crisis. While the portfolio’s holdings of asset-backed securities were composed primarily of AAA-rated bonds and fixed-rate mortgages, their underperformance had a negative impact on the portfolio’s returns.

On a more positive note, underweighted exposure to mortgage-backed securities helped shield the fund from some of the sector’s weakness during the downturn, and our “bulleted” yield curve strategy benefited from widening yield differences along the market’s maturity range.

Finding Growth and Income Opportunities in a Challenging Market

Despite the Federal Reserve Board’s attempts to calm the stock and bond markets, uncertainty has persisted with regard to elevated energy prices, the housing recession, ongoing sub-prime turmoil and mounting bank losses. We believe recent price dislocations have created opportunities to purchase stocks and high-quality corporate bonds at more attractive valuations. However, we are proceeding cautiously until the economic outlook becomes clearer.

On November 8, 2007, the fund’s Board of Directors approved, subject to shareholder approval, an Agreement and Plan of Reorganization, which provides for the transfer of the fund’s assets to the Growth and Income Portfolio of Dreyfus LifeTime Portfolios, Inc. (“Growth and Income Portfolio”) in a tax-free exchange for shares of the Growth and Income Portfolio. If approved, the Reorganization is expected to be completed in the second quarter of 2008.

January 15, 2008

| | | Part of the fund’s performance is due to assets received from class action settlements |

| | | regarding prior fund holdings. There is no guarantee that these settlement distributions will |

| | | occur in the future or have a similar impact on performance. |

| 1 | | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | | consideration the maximum initial sales charges in the case of Class A and Class T shares, or the |

| | | applicable contingent deferred sales charges imposed on redemptions in the case of Class B and |

| | | Class C shares. Had these charges been reflected, returns would have been lower. Past performance |

| | | is no guarantee of future results. Share price and investment return fluctuate such that upon |

| | | redemption, fund shares may be worth more or less than their original cost. Return figures provided |

| | | for the fund’s Class I and Class T shares reflect the absorption of certain portfolio expenses by an |

| | | affiliate of Founders pursuant to an agreement that will extend through at least August 31, 2008, |

| | | and will not be terminated without prior notice to the fund’s Board of Directors. Had these |

| | | expenses not been absorbed, the fund’s Class I and Class T shares’ returns would have been lower. |

| 2 | | SOURCE: LIPPER, INC. – The Standard & Poor’s 500 Composite Stock Price Index is a |

| | | widely accepted, unmanaged index of U.S. stock market performance.The total return figure cited |

| | | for this index assumes change in security prices and reinvestment of dividends, but does not reflect |

| | | the costs of managing a mutual fund. |

The Fund 5

FUND PERFORMANCE

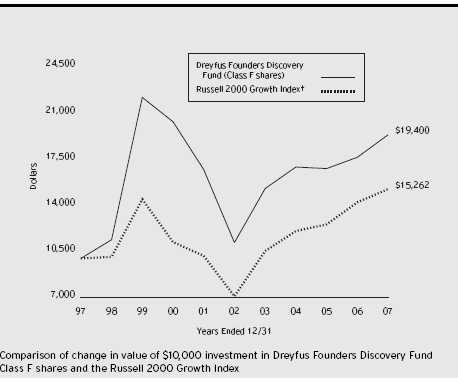

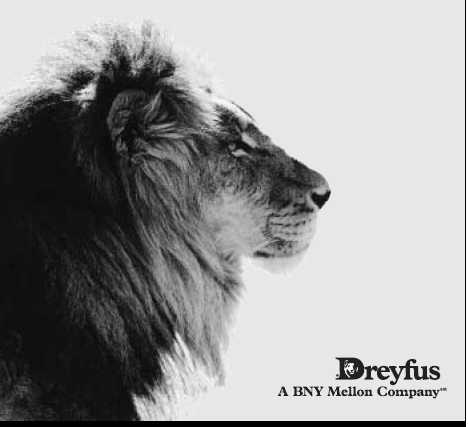

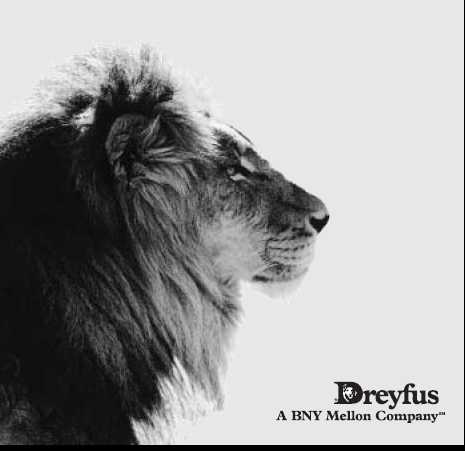

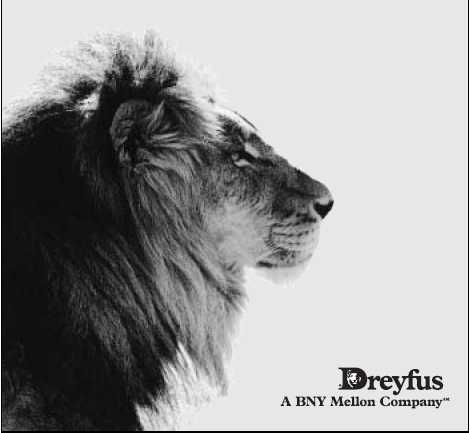

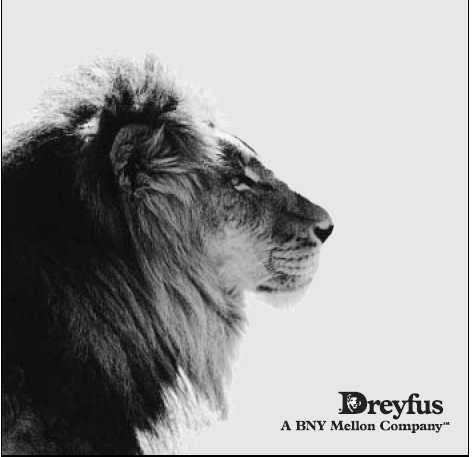

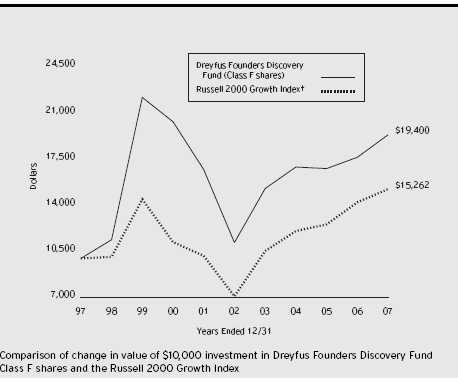

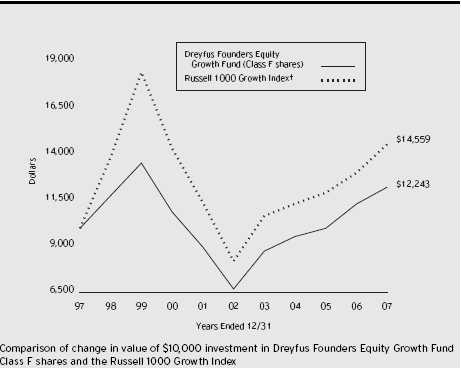

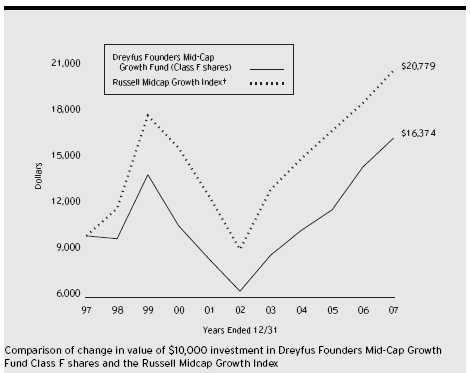

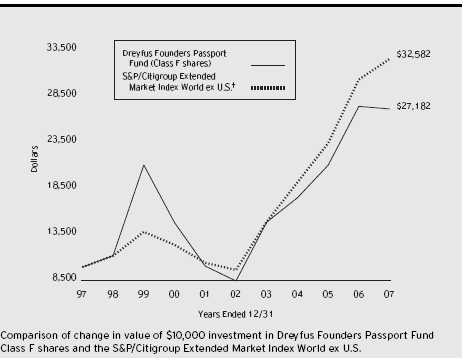

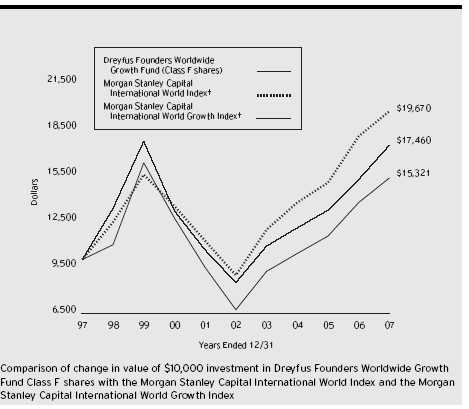

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in Class F shares of Dreyfus Founders Balanced Fund on 12/31/97 to a $10,000 investment made in each of the Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500 Index”) and the Lipper Balanced Fund Index (the “Lipper Index”) on that date.All dividends and capital gain distributions are reinvested. Performance for Class A, Class B, Class C, Class I and Class T shares will vary from the performance of Class F shares shown above due to differences in charges and expenses.

The fund’s performance shown in the line graph takes into account all applicable Class F fees and expenses (after any expense reimbursements).The S&P 500 Index is designed to be representative of the U.S. equities market and consists of 500 leading companies in leading industries of the U.S. economy. Unlike the fund, it does not contain a fixed-income component.The Lipper Balanced Fund Index is an equal dollar weighted index of the largest mutual funds within the Balanced Fund classification, as defined by Lipper. Unlike a mutual fund, the indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

| Average Annual Total Returns as of 12/31/07 | | | | | | |

| |

| | | Inception | | | | | | | | From |

| | | Date | | 1 Year | | 5 Years | | 10 Years | | Inception |

| |

| |

| |

| |

| |

|

| Class A shares | | | | | | | | | | |

| with maximum sales charge (5.75%) | | 12/31/99 | | 0.14% | | 7.68% | | — | | (0.55)% |

| without sales charge | | 12/31/99 | | 6.24% | | 8.98% | | — | | 0.19% |

| Class B shares | | | | | | | | | | |

| with applicable redemption charge † | | 12/31/99 | | 2.54% | | 8.08% | | — | | (0.37)%†† |

| without redemption | | 12/31/99 | | 6.54% | | 8.38% | | — | | (0.37)%†† |

| Class C shares | | | | | | | | | | |

| with applicable redemption charge ††† | | 12/31/99 | | 4.21% | | 8.00% | | — | | (0.85)% |

| without redemption | | 12/31/99 | | 5.21% | | 8.00% | | — | | (0.85)% |

| Class F shares | | 2/19/63 | | 6.27% | | 9.16% | | 1.41% | | N/A |

| Class I shares | | 12/31/99 | | 6.37% | | 9.13% | | — | | 0.26% |

| Class T shares | | | | | | | | | | |

| with applicable sales charge (4.5%) | | 12/31/99 | | 0.73% | | 7.49% | | — | �� | (0.43)% |

| without sales charge | | 12/31/99 | | 5.52% | | 8.47% | | — | | 0.14% |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, but does reflect expense reimbursements for certain share classes. Part of the fund’s performance is due to amounts received from class action settlements regarding prior fund holdings.There is no guarantee that these settlement distributions will occur in the future or have a similar impact on performance.

| † | | The maximum contingent deferred sales charge for Class B shares is 4%. After six years Class B shares convert to |

| | | Class A shares. |

| †† | | Assumes the conversion of Class B shares to Class A shares at the end of the sixth year following the date of |

| | | purchase. |

| ††† | | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | | date of purchase. |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial advisor.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Founders Balanced Fund from July 1, 2007 to December 31, 2007. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.To estimate the expenses you paid on your account over this period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the results by the number in the Expenses paid per $1,000 line for the class of shares you own.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended December 31, 2007

|

| | | Class A | | Class B | | Class C | | Class F | | Class I | | Class T |

| |

| |

| |

| |

| |

| |

|

| Expenses paid | | | | | | | | | | | | |

| per $1,000 † | | $ 8.28 | | $ 10.18 | | $ 14.07 | | $ 8.02 | | $ 9.20 | | $ 13.00 |

| Ending value | | | | | | | | | | | | |

| (after expenses) | | $1,026.60 | | $1,029.50 | | $1,022.30 | | $1,026.70 | | $1,026.90 | | $1,022.60 |

| | COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

|

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended December 31, 2007

|

| | | Class A | | Class B | | Class C | | Class F | | Class I | | Class T |

| |

| |

| |

| |

| |

| |

|

| Expenses paid per | | | | | | | | | | | | |

| $1,000 † | | $ 8.24 | | $ 10.11 | | $ 13.99 | | $ 7.98 | | $ 9.15 | | $ 12.93 |

| Ending value | | | | | | | | | | | | |

| (after expenses) | | $1,017.04 | | $1,015.17 | | $1,011.29 | | $1,017.29 | | $1,016.13 | | $1,012.35 |

| † Expenses are equal to the fund’s annualized expense ratio of 1.62% for Class A shares, 1.99% for Class B shares, |

| 2.76% for Class C shares, 1.57% for Class F shares, 1.80% for Class I shares and 2.55% for Class T shares; |

| multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

December 31, 2007

|

| Common Stocks—62.0% | | Shares | | Value ($) |

| |

| |

|

| Advertising—.6% | | | | |

| Omnicom Group | | 6,846 | | 325,390 |

| Air Freight & Logistics—.4% | | | | |

| FedEx | | 2,322 | | 207,053 |

| Apparel Retail—2.3% | | | | |

| Gap | | 38,554 | | 820,429 |

| Urban Outfitters | | 15,499 a | | 422,503 |

| | | | | 1,242,932 |

| Application Software—.4% | | | | |

| Autodesk | | 4,121 a | | 205,061 |

| Asset Management & Custody Banks—1.0% | | |

| Janus Capital Group | | 8,232 | | 270,421 |

| State Street | | 3,722 | | 302,226 |

| | | | | 572,647 |

| Automotive Retail—1.1% | | | | |

| Advance Auto Parts | | 15,762 | | 598,799 |

| Biotechnology—2.6% | | | | |

| Amylin Pharmaceuticals | | 11,296 a | | 417,952 |

| Genentech | | 5,811 a | | 389,744 |

| Gilead Sciences | | 13,381 a | | 615,660 |

| | | | | 1,423,356 |

| Broadcasting & Cable TV—.3% | | | | |

| Discovery Holding, Cl. A | | 7,100 a | | 178,494 |

| Casinos & Gaming—.5% | | | | |

| International Game Technology | | 5,919 | | 260,022 |

| Communications Equipment—3.2% | | |

| Cisco Systems | | 34,246 a | | 927,039 |

| Corning | | 16,174 | | 388,014 |

| Juniper Networks | | 13,708 a | | 455,106 |

| | | | | 1,770,159 |

| Computer & Electronics Retail—1.0% | | |

| Best Buy | | 9,923 | | 522,446 |

| Computer Hardware—3.2% | | | | |

| Apple | | 4,637 a | | 918,497 |

| Hewlett-Packard | | 12,869 | | 649,627 |

| Teradata | | 7,141 a | | 195,735 |

| | | | | 1,763,859 |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Computer Storage & Peripherals—.7% | | | | |

| EMC | | 19,595 a | | 363,095 |

| Department Stores—.5% | | | | |

| Nordstrom | | 7,421 | | 272,573 |

| Diversified Chemicals—.5% | | | | |

| E.I. du Pont de Nemours & Co. | | 6,006 | | 264,805 |

| Education Services—.4% | | | | |

| DeVry | | 4,369 | | 227,013 |

| Environmental & Facilities Services—.9% | | |

| Waste Management | | 15,026 | | 490,899 |

| Food Retail—1.1% | | | | |

| Whole Foods Market | | 15,403 | | 628,442 |

| Health Care Equipment—.3% | | | | |

| Medtronic | | 3,443 | | 173,080 |

| Home Entertainment Software—1.4% | | | | |

| Electronic Arts | | 13,052 a | | 762,367 |

| Home Improvement Retail—.5% | | | | |

| Home Depot | | 10,047 | | 270,666 |

| Household Products—1.1% | | | | |

| Colgate-Palmolive | | 3,986 | | 310,749 |

| Procter & Gamble | | 4,208 | | 308,951 |

| | | | | 619,700 |

| Hypermarkets & Super Centers—2.3% | | | | |

| Costco Wholesale | | 4,350 | | 303,456 |

| Wal-Mart Stores | | 19,880 | | 944,896 |

| | | | | 1,248,352 |

| Industrial Conglomerates—1.9% | | | | |

| General Electric | | 28,231 | | 1,046,523 |

| Integrated Oil & Gas—2.8% | | | | |

| Chevron | | 3,985 | | 371,920 |

| Exxon Mobil | | 12,204 | | 1,143,393 |

| | | | | 1,515,313 |

| Integrated Telecommunication—.5% | | | | |

| Verizon Communications | | 6,017 | | 262,883 |

| Internet Retail—1.1% | | | | |

| Amazon.com | | 1,778 a | | 164,714 |

| eBay | | 13,124 a | | 435,586 |

| | | | | 600,300 |

10

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Internet Software & Services—2.3% | | | | |

| Google, Cl. A | | 1,310 a | | 905,839 |

| Yahoo! | | 15,815 a | | 367,857 |

| | | | | 1,273,696 |

| Investment Banking & Brokerage—1.9% | | | | |

| Charles Schwab | | 28,174 | | 719,846 |

| Goldman Sachs Group | | 1,517 | | 326,231 |

| | | | | 1,046,077 |

| IT Consulting & Other Services—.4% | | | | |

| Accenture, Cl. A | | 6,831 | | 246,121 |

| Leisure Facilities—.5% | | | | |

| Royal Caribbean Cruises | | 6,526 | | 276,964 |

| Life & Health Insurance—1.0% | | | | |

| Unum Group | | 23,285 | | 553,950 |

| Life Sciences Tools & Services—2.0% | | | | |

| Pharmaceutical Product Development | | 10,128 | | 408,867 |

| Thermo Fisher Scientific | | 12,142 a | | 700,351 |

| | | | | 1,109,218 |

| Movies & Entertainment—.4% | | | | |

| Walt Disney | | 7,480 | | 241,454 |

| Oil & Gas Equipment & Services—1.3% | | | | |

| Halliburton | | 7,417 | | 281,178 |

| Schlumberger | | 4,341 | | 427,024 |

| | | | | 708,202 |

| Oil & Gas Exploration & Production—.6% | | | | |

| Ultra Petroleum | | 4,493 a | | 321,250 |

| Oil & Gas Refining & Marketing—.7% | | | | |

| Sunoco | | 2,592 | | 187,764 |

| Tesoro | | 3,835 | | 182,930 |

| | | | | 370,694 |

| Other Diversified Financial Services—.6% | | | | |

| Citigroup | | 11,613 | | 341,887 |

| Packaged Foods & Meats—1.9% | | | | |

| Cadbury Schweppes, ADR | | 7,304 | | 360,599 |

| Dean Foods | | 13,137 | | 339,723 |

| Kraft Foods, Cl. A | | 10,751 | | 350,805 |

| | | | | 1,051,127 |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Personal Products—1.4% | | | | |

| Avon Products | | 12,633 | | 499,382 |

| Estee Lauder Cos., Cl. A | | 5,877 | | 256,296 |

| | | | | 755,678 |

| Pharmaceuticals—3.8% | | | | |

| Allergan | | 9,225 | | 592,614 |

| Covance | | 1,734 a | | 150,199 |

| Johnson & Johnson | | 2,830 | | 188,761 |

| Merck & Co. | | 8,613 | | 500,501 |

| Pfizer | | 10,561 | | 240,052 |

| Schering-Plough | | 14,937 | | 397,922 |

| | | | | 2,070,049 |

| Property & Casualty Insurance—.2% | | |

| MBIA | | 4,762 | | 88,716 |

| Railroads—.5% | | | | |

| Canadian National Railway | | 5,323 | | 249,808 |

| Restaurants—.4% | | | | |

| Starbucks | | 11,484 a | | 235,077 |

| Semiconductor Equipment—1.3% | | | | |

| KLA-Tencor | | 6,107 | | 294,113 |

| MEMC Electronic Materials | | 4,477 a | | 396,170 |

| | | | | 690,283 |

| Semiconductors—2.0% | | | | |

| Broadcom, Cl. A | | 14,819 a | | 387,369 |

| Intersil, Cl. A | | 6,505 | | 159,242 |

| Marvell Technology Group | | 19,418 a | | 271,464 |

| Maxim Integrated Products | | 11,376 | | 301,236 |

| | | | | 1,119,311 |

| Specialized Finance—.5% | | | | |

| CME Group | | 423 | | 290,178 |

| Specialty Chemicals—.4% | | | | |

| Ecolab | | 3,853 | | 197,312 |

| Systems Software—4.4% | | | | |

| Adobe Systems | | 13,439 a | | 574,249 |

| Microsoft | | 51,544 | | 1,834,966 |

| | | | | 2,409,215 |

| Tobacco—.9% | | | | |

| Altria Group | | 6,607 | | 499,357 |

| Total Common Stocks | | | | |

| (cost $29,318,231) | | | | 33,961,853 |

12

| | �� | Coupon | | Maturity | | Principal | | |

| Bonds and Notes—36.8% | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Aerospace & Defense—.2% | | | | | | | | |

| Boeing Capital, | | | | | | | | |

| Sr. Unscd. Notes | | 7.38 | | 9/27/10 | | 100,000 | | 107,354 |

| Asset-Backed Ctfs./ | | | | | | | | |

| Auto Receivables—.7% | | | | | | | | |

| Americredit Prime Automobile | | | | | | | | |

| Receivables, Ser. 2007-1, Cl. B | | 5.35 | | 9/9/13 | | 20,000 | | 20,118 |

| Americredit Prime Automobile | | | | | | | | |

| Receivables, Ser. 2007-1, Cl. C | | 5.43 | | 2/10/14 | | 20,000 | | 19,726 |

| Ford Credit Auto Owner Trust, | | | | | | | | |

| Ser. 2005-B, Cl. B | | 4.64 | | 4/15/10 | | 74,000 | | 74,016 |

| Ford Credit Auto Owner Trust, | | | | | | | | |

| Ser. 2007-A, Cl. C | | 5.80 | | 2/15/13 | | 100,000 | | 97,489 |

| Hyundai Auto Receivables Trust, | | | | | | | | |

| Ser. 2006-B, Cl. C | | 5.25 | | 5/15/13 | | 100,000 | | 99,191 |

| Wachovia Auto Loan Owner Trust, | | | | | | |

| Ser. 2007-1, Cl. D | | 5.65 | | 2/20/13 | | 75,000 | | 70,506 |

| | | | | | | | | 381,046 |

| Asset-Backed Ctfs./Credit Cards—.7% | | | | | | |

| BA Credit Card Trust, | | | | | | | | |

| Ser. 2007-C1, Cl. C1 | | 5.32 | | 6/15/14 | | 200,000 b | | 186,032 |

| Citibank Credit Card Issuance | | | | | | | | |

| Trust, Ser. 2006-C4, Cl. C4 | | 5.47 | | 1/9/12 | | 190,000 b | | 183,648 |

| | | | | | | | | 369,680 |

| Asset-Backed Ctfs./ | | | | | | | | |

| Home Equity Loans—.1% | | | | | | | | |

| Credit Suisse Mortgage Capital | | | | | | | | |

| Certificates, Ser. 2007-1, | | | | | | | | |

| Cl. 1A6A | | 5.86 | | 2/25/37 | | 65,000 b | | 61,903 |

| Automotive—.2% | | | | | | | | |

| Ford Motor Credit, | | | | | | | | |

| Unscd. Notes | | 7.38 | | 10/28/09 | | 100,000 | | 94,124 |

| Banking—2.9% | | | | | | | | |

| BTM Curacao Holdings, | | | | | | | | |

| Bank Gtd. Notes | | 4.76 | | 7/21/15 | | 175,000 b,c | | 174,213 |

| Chevy Chase Bank, | | | | | | | | |

| Sub. Notes | | 6.88 | | 12/1/13 | | 55,000 | | 52,388 |

| Chuo Mitsui Trust & Banking, | | | | | | | | |

| Jr. Sub. Notes | | 5.51 | | 12/29/49 | | 100,000 b,c | | 91,949 |

| Citigroup, | | | | | | | | |

| Sr. Unscd. Notes | | 5.30 | | 10/17/12 | | 50,000 | | 50,651 |

The Fund 13

STATEMENT OF INVESTMENTS (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Banking (continued) | | | | | | | | |

| Compass Bank, | | | | | | | | |

| Bonds | | 5.50 | | 4/1/20 | | 110,000 | | 103,494 |

| Credit Suisse First Boston USA, | | | | | | | | |

| Gtd. Notes | | 4.13 | | 1/15/10 | | 165,000 | | 164,212 |

| Credit Suisse Guernsey, | | | | | | | | |

| Jr. Sub. Notes | | 5.86 | | 5/29/49 | | 52,000 b | | 46,550 |

| Credit Suisse USA, | | | | | | | | |

| Gtd. Notes | | 5.50 | | 8/16/11 | | 125,000 | | 128,441 |

| Glitnir Banki, | | | | | | | | |

| Sub. Notes | | 6.69 | | 6/15/16 | | 100,000 b,c | | 100,739 |

| JPMorgan Chase & Co., | | | | | | | | |

| Sub. Notes | | 5.13 | | 9/15/14 | | 115,000 | | 112,721 |

| M&T Bank, | | | | | | | | |

| Sr. Unscd. Bonds | | 5.38 | | 5/24/12 | | 55,000 | | 54,855 |

| Marshall & Ilsley, | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 8/17/09 | | 105,000 | | 106,044 |

| Royal Bank of Scotland Group, | | | | | | | | |

| Jr. Sub. Bonds | | 6.99 | | 10/29/49 | | 100,000 b,c | | 99,699 |

| Wachovia Bank, | | | | | | | | |

| Sub. Notes | | 5.00 | | 8/15/15 | | 115,000 | | 108,749 |

| Washington Mutual, | | | | | | | | |

| Sr. Sub. Notes | | 8.25 | | 4/1/10 | | 110,000 | | 105,045 |

| Zions Bancorporation, | | | | | | | | |

| Sub. Notes | | 6.00 | | 9/15/15 | | 85,000 | | 82,528 |

| | | | | | | | | 1,582,278 |

| Brokerage—2.5% | | | | | | | | |

| Amvescap, | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 12/15/14 | | 25,000 | | 23,434 |

| Bear Stearns, | | | | | | | | |

| Notes | | 3.25 | | 3/25/09 | | 170,000 | | 164,613 |

| Bear Stearns, | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 8/15/11 | | 90,000 | | 88,865 |

| Goldman Sachs Capital II, | | | | | | | | |

| Gtd. Bonds | | 5.79 | | 12/29/49 | | 35,000 b | | 31,161 |

| Goldman Sachs Group, | | | | | | | | |

| Sr. Notes | | 5.35 | | 1/15/16 | | 110,000 | | 108,997 |

| Janus Capital Group, | | | | | | | | |

| Notes | | 6.25 | | 6/15/12 | | 40,000 | | 40,955 |

| Jefferies Group, | | | | | | | | |

| Sr. Unscd. Debs | | 6.25 | | 1/15/36 | | 120,000 | | 107,264 |

14

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Brokerage (continued) | | | | | | | | |

| Lehman Brothers Holdings, | | | | | | | | |

| Notes | | 4.25 | | 1/27/10 | | 165,000 | | 162,130 |

| Lehman Brothers Holdings, | | | | | | | | |

| Sr. Notes | | 6.00 | | 7/19/12 | | 85,000 | | 86,550 |

| Merrill Lynch & Co., | | | | | | | | |

| Notes | | 4.79 | | 8/4/10 | | 165,000 | | 163,495 |

| Merrill Lynch & Co., | | | | | | | | |

| Sub. Notes | | 6.05 | | 5/16/16 | | 140,000 | | 137,560 |

| Morgan Stanley, | | | | | | | | |

| Notes | | 4.00 | | 1/15/10 | | 170,000 | | 167,164 |

| Morgan Stanley, | | | | | | | | |

| Notes | | 5.55 | | 4/27/17 | | 100,000 | | 97,517 |

| | | | | | | | | 1,379,705 |

| Chemicals—.0% | | | | | | | | |

| Rohm & Haas, | | | | | | | | |

| Unsub. Notes | | 5.60 | | 3/15/13 | | 15,000 | | 15,587 |

| Commercial Mortgage | | | | | | | | |

| Pass-Through Ctfs.—4.1% | | | | | | | | |

| Banc of America Commercial | | | | | | | | |

| Mortgage, Ser. 2002-2, Cl. A3 | | 5.12 | | 7/11/43 | | 95,000 | | 96,203 |

| Bear Stearns Commercial Mortgage | | | | | | | | |

| Securities, Ser. 2006-PW14, | | | | | | | | |

| Cl. AAB | | 5.17 | | 12/11/38 | | 190,000 | | 188,946 |

| Bear Stearns Commercial Mortgage | | | | | | | | |

| Securities, Ser. 2007-T26, | | | | | | | | |

| Cl. AAB | | 5.43 | | 1/12/45 | | 225,000 | | 225,918 |

| Bear Stearns Commercial Mortgage | | | | | | | | |

| Securities, Ser. 2006-PW13, | | | | | | | | |

| Cl. A3 | | 5.52 | | 9/11/41 | | 30,000 | | 30,224 |

| Bear Stearns Commercial Mortgage | | | | | | | | |

| Securities, Ser. 2006-T24, Cl. AAB | | 5.53 | | 10/12/41 | | 110,000 | | 111,340 |

| Citigroup/Deutsche Bank Commercial | | | | | | |

| Mortgage Trust, Ser. 2007-CD4, | | | | | | | | |

| Cl. A2B | | 5.21 | | 12/11/49 | | 110,000 | | 109,982 |

| Crown Castle Towers, | | | | | | | | |

| Ser. 2006-1A, Cl. B | | 5.36 | | 11/15/36 | | 25,000 c | | 24,548 |

| Crown Castle Towers, | | | | | | | | |

| Ser. 2006-1A, Cl. C | | 5.47 | | 11/15/36 | | 70,000 c | | 68,151 |

| Crown Castle Towers, | | | | | | | | |

| Ser. 2006-1A, Cl. D | | 5.77 | | 11/15/36 | | 55,000 c | | 52,708 |

The Fund 15

STATEMENT OF INVESTMENTS (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | |

| Global Signal Trust, | | | | | | | | |

| Ser. 2006-1, Cl. D | | 6.05 | | 2/15/36 | | 45,000 c | | 43,829 |

| GMAC Commercial Mortgage | | | | | | | | |

| Securities, Ser. 2003-C3, | | | | | | | | |

| Cl. A3 | | 4.65 | | 4/10/40 | | 175,000 | | 174,874 |

| Goldman Sachs Mortgage Securities | | | | | | |

| Corporation II, Ser. 2007-EOP, | | | | | | | | |

| Cl. E | | 5.69 | | 3/6/20 | | 45,000 b,c | | 43,205 |

| Goldman Sachs Mortgage Securities | | | | | | |

| Corporation II, Ser. 2007-EOP, | | | | | | | | |

| Cl. K | | 6.30 | | 3/6/20 | | 25,000 b,c | | 22,728 |

| J.P. Morgan Chase Commercial | | | | | | | | |

| Mortgage Securities, | | | | | | | | |

| Ser. 2004-C1, Cl. A2 | | 4.30 | | 1/15/38 | | 85,000 | | 83,911 |

| JP Morgan Chase Commercial | | | | | | | | |

| Mortgage Securities, | | | | | | | | |

| Ser. 2006-LDP7, Cl. ASB | | 5.88 | | 4/15/45 | | 125,000 b | | 129,168 |

| LB-UBS Commercial Mortgage Trust, | | | | | | |

| Ser. 2001-C3, Cl. A2 | | 6.37 | | 12/15/28 | | 95,000 | | 99,948 |

| Merrill Lynch Mortgage Trust, | | | | | | | | |

| Ser. 2002-MW1, Cl. A4 | | 5.62 | | 7/12/34 | | 215,000 | | 221,635 |

| Morgan Stanley Capital I, | | | | | | | | |

| Ser. 2005-HQ5, Cl. A2 | | 4.81 | | 1/14/42 | | 70,000 | | 69,794 |

| Morgan Stanley Capital I, | | | | | | | | |

| Ser. 2006-IQ12, Cl. AAB | | 5.33 | | 12/15/43 | | 110,000 | | 110,178 |

| Morgan Stanley Capital I, | | | | | | | | |

| Ser. 2006-HQ9, Cl. A3 | | 5.71 | | 7/12/44 | | 215,000 | | 218,704 |

| Sovereign Commercial Mortgage | | | | | | | | |

| Securities Trust, | | | | | | | | |

| Ser. 2007-C1, Cl. D | | 5.78 | | 7/22/30 | | 30,000 b,c | | 24,027 |

| TIAA Seasoned Commercial Mortgage | | | | | | |

| Trust, Ser. 2007-C4, Cl. A3 | | 6.10 | | 8/15/39 | | 70,000 b | | 72,190 |

| | | | | | | | | 2,222,211 |

| Construction—.3% | | | | | | | | |

| Atlas Copco, | | | | | | | | |

| Bonds | | 5.60 | | 5/22/17 | | 20,000 c | | 20,007 |

| Case New Holland, | | | | | | | | |

| Gtd. Notes | | 7.13 | | 3/1/14 | | 35,000 | | 34,912 |

16

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Construction (continued) | | | | | | | | |

| John Deere Capital, | | | | | | | | |

| Notes | | 5.16 | | 9/1/09 | | 110,000 b | | 110,213 |

| | | | | | | | | 165,132 |

| Diversified Financial Services—1.0% | | | | | | |

| American Express Credit, | | | | | | | | |

| Sr. Unscd. Notes | | 5.30 | | 11/9/09 | | 40,000 b | | 39,324 |

| Capital One Financial, | | | | | | | | |

| Sr. Unsub. Notes | | 5.43 | | 9/10/09 | | 105,000 b | | 99,243 |

| Capmark Financial Group, | | | | | | | | |

| Gtd. Notes | | 5.88 | | 5/10/12 | | 110,000 c | | 87,072 |

| Countrywide Financial, | | | | | | | | |

| Gtd. Notes | | 5.80 | | 6/7/12 | | 30,000 | | 21,915 |

| General Electric Capital, | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 10/19/12 | | 200,000 | | 204,548 |

| HSBC Finance, | | | | | | | | |

| Notes | | 5.50 | | 1/19/16 | | 110,000 | | 107,353 |

| | | | | | | | | 559,455 |

| Electric—1.5% | | | | | | | | |

| Appalachian Power, | | | | | | | | |

| Sr. Unscd. Notes, Ser. O | | 5.65 | | 8/15/12 | | 25,000 | | 25,405 |

| Cleveland Electric Illumination, | | | | | | | | |

| Sr. Unscd. Notes | | 5.70 | | 4/1/17 | | 50,000 | | 48,825 |

| Connecticut Light and Power, | | | | | | | | |

| First Mortgage Bonds, Ser. A | | 5.38 | | 3/1/17 | | 100,000 | | 97,046 |

| Consolidated Edison of NY, | | | | | | | | |

| Sr. Unscd. Debs., Ser. D | | 5.30 | | 12/1/16 | | 90,000 | | 88,529 |

| Consumers Energy, | | | | | | | | |

| First Mortgage Bonds | | 5.65 | | 4/15/20 | | 55,000 | | 54,353 |

| FPL Group Capital, | | | | | | | | |

| Gtd. Debs | | 5.63 | | 9/1/11 | | 110,000 | | 112,637 |

| Gulf Power, | | | | | | | | |

| Sr. Unsub. Notes, Ser. M | | 5.30 | | 12/1/16 | | 110,000 | | 109,347 |

| Nevada Power, | | | | | | | | |

| Mortgage Notes, Ser. R | | 6.75 | | 7/1/37 | | 30,000 | | 31,011 |

| NiSource Finance, | | | | | | | | |

| Gtd. Notes | | 5.25 | | 9/15/17 | | 35,000 | | 32,176 |

| PacifiCorp, | | | | | | | | |

| First Mortgage Bonds | | 6.90 | | 11/15/11 | | 150,000 | | 161,531 |

The Fund 17

STATEMENT OF INVESTMENTS (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Electric (continued) | | | | | | | | |

| Sierra Pacific Power, | | | | | | | | |

| Mortgage Notes, Ser. P | | 6.75 | | 7/1/37 | | 15,000 | | 15,505 |

| Southern, | | | | | | | | |

| Sr. Unsub. Notes, Ser. A | | 5.30 | | 1/15/12 | | 25,000 | | 25,454 |

| | | | | | | | | 801,819 |

| Energy—.0% | | | | | | | | |

| Chesapeake Energy, | | | | | | | | |

| Gtd. Notes | | 7.50 | | 6/15/14 | | 10,000 | | 10,175 |

| Entertainment—.1% | | | | | | | | |

| AOL Time Warner, | | | | | | | | |

| Gtd. Notes | | 6.75 | | 4/15/11 | | 50,000 | | 52,077 |

| Environmental—.3% | | | | | | | | |

| Allied Waste North America, | | | | | | | | |

| Scd. Notes, Ser. B | | 5.75 | | 2/15/11 | | 20,000 | | 19,600 |

| Allied Waste North America, | | | | | | | | |

| Scd. Notes | | 6.38 | | 4/15/11 | | 20,000 | | 19,800 |

| Republic Services, | | | | | | | | |

| Sr. Unsub. Notes | | 6.75 | | 8/15/11 | | 80,000 | | 83,861 |

| Waste Management, | | | | | | | | |

| Gtd. Notes | | 7.38 | | 5/15/29 | | 25,000 | | 27,321 |

| | | | | | | | | 150,582 |

| Food & Beverages—.0% | | | | | | | | |

| Kraft Foods, | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 2/11/13 | | 10,000 | | 10,281 |

| Gaming—.0% | | | | | | | | |

| MGM Mirage, | | | | | | | | |

| Gtd. Notes | | 8.38 | | 2/1/11 | | 25,000 | | 25,563 |

| Health Care—.0% | | | | | | | | |

| Community Health Systems, | | | | | | | | |

| Gtd. Notes | | 8.88 | | 7/15/15 | | 20,000 | | 20,375 |

| Health Insurance—.1% | | | | | | | | |

| Coventry Health Care, | | | | | | | | |

| Sr. Unscd. Notes | | 5.95 | | 3/15/17 | | 30,000 | | 29,415 |

| Wellpoint, | | | | | | | | |

| Sr. Unsub. Notes | | 5.88 | | 6/15/17 | | 30,000 | | 30,204 |

| | | | | | | | | 59,619 |

| Integrated Oil & Gas—.3% | | | | | | | | |

| PC Financial Partnership, | | | | | | | | |

| Gtd. Notes | | 5.00 | | 11/15/14 | | 115,000 | | 111,844 |

18

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Integrated Oil & Gas (continued) | | | | | | | | |

| Pemex Project Funding Master | | | | | | | | |

| Trust, Gtd. Notes | | 5.75 | | 3/1/18 | | 45,000 c | | 44,888 |

| | | | | | | | | 156,732 |

| Life Insurance—.6% | | | | | | | | |

| American International Group, | | | | | | | | |

| Sr. Unscd. Notes | | 5.05 | | 10/1/15 | | 115,000 | | 111,058 |

| American International Group, | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 10/18/11 | | 50,000 | | 50,797 |

| MetLife, | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 6/15/15 | | 115,000 | | 111,291 |

| Prudential Financial, | | | | | | | | |

| Notes | | 5.10 | | 12/14/11 | | 40,000 | | 40,462 |

| | | | | | | | | 313,608 |

| Media—.4% | | | | | | | | |

| Comcast Cable Communications, | | | | | | | | |

| Gtd. Notes | | 6.88 | | 6/15/09 | | 40,000 | | 41,143 |

| Comcast, | | | | | | | | |

| Gtd. Notes | | 5.50 | | 3/15/11 | | 65,000 | | 65,621 |

| News America Holdings, | | | | | | | | |

| Gtd. Debs | | 7.70 | | 10/30/25 | | 50,000 | | 56,167 |

| Time Warner Cable, | | | | | | | | |

| Gtd. Notes | | 5.85 | | 5/1/17 | | 35,000 | | 35,086 |

| | | | | | | | | 198,017 |

| Metals and Mining—.1% | | | | | | | | |

| Steel Dynamics, | | | | | | | | |

| Sr. Notes | | 7.38 | | 11/1/12 | | 30,000 c | | 30,150 |

| Packaging & Containers—.1% | | | | | | | | |

| Ace INA Holdings, | | | | | | | | |

| Gtd. Notes | | 5.70 | | 2/15/17 | | 50,000 | | 49,550 |

| Ball, | | | | | | | | |

| Gtd. Notes | | 6.88 | | 12/15/12 | | 15,000 | | 15,225 |

| | | | | | | | | 64,775 |

| Pipelines—.1% | | | | | | | | |

| National Grid, | | | | | | | | |

| Sr. Unscd. Notes | | 6.30 | | 8/1/16 | | 50,000 | | 51,045 |

| Railroads—.3% | | | | | | | | |

| Norfolk Southern, | | | | | | | | |

| Sr. Unscd. Notes | | 6.75 | | 2/15/11 | | 50,000 | | 53,578 |

The Fund 19

STATEMENT OF INVESTMENTS (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Railroads (continued) | | | | | | | | |

| Union Pacific, | | | | | | | | |

| Sr. Unscd. Notes | | 3.88 | | 2/15/09 | | 85,000 | | 84,275 |

| | | | | | | | | 137,853 |

| Real Estate Investment Trusts—1.1% | | | | | | |

| Avalonbay Communities, | | | | | | | | |

| Sr. Unscd. Notes | | 6.63 | | 9/15/11 | | 25,000 | | 26,111 |

| Boston Properties, | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 4/15/15 | | 85,000 | | 82,202 |

| Duke Realty, | | | | | | | | |

| Sr. Notes | | 5.88 | | 8/15/12 | | 85,000 | | 85,869 |

| ERP Operating, | | | | | | | | |

| Notes | | 5.13 | | 3/15/16 | | 60,000 | | 55,824 |

| ERP Operating, | | | | | | | | |

| Unscd. Notes | | 5.20 | | 4/1/13 | | 50,000 | | 48,376 |

| Federal Realty Investment Trust, | | | | | | | | |

| Notes | | 6.00 | | 7/15/12 | | 20,000 | | 20,527 |

| Federal Realty Investment Trust, | | | | | | | | |

| Notes | | 6.20 | | 1/15/17 | | 55,000 | | 54,842 |

| Healthcare Realty Trust, | | | | | | | | |

| Sr. Unscd. Notes | | 8.13 | | 5/1/11 | | 50,000 | | 54,589 |

| Liberty Property, | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 12/15/16 | | 20,000 | | 18,712 |

| Mack-Cali Realty, | | | | | | | | |

| Sr. Unscd. Notes | | 7.75 | | 2/15/11 | | 50,000 | | 54,737 |

| Regency Centers, | | | | | | | | |

| Gtd. Notes | | 5.88 | | 6/15/17 | | 25,000 | | 24,159 |

| Simon Property, | | | | | | | | |

| Notes | | 5.63 | | 8/15/14 | | 85,000 | | 83,157 |

| | | | | | | | | 609,105 |

| Retailers—.1% | | | | | | | | |

| CVS Caremark, | | | | | | | | |

| Sr. Unscd. Notes | | 5.75 | | 8/15/11 | | 25,000 | | 25,608 |

| Federated Retail Holdings, | | | | | | | | |

| Gtd. Bonds | | 5.35 | | 3/15/12 | | 20,000 | | 19,486 |

| Federated Retail Holdings, | | | | | | | | |

| Gtd. Notes | | 5.90 | | 12/1/16 | | 20,000 | | 18,836 |

| Lowe’s Companies, | | | | | | | | |

| Sr. Unscd. Notes | | 5.60 | | 9/15/12 | | 15,000 | | 15,406 |

| | | | | | | | | 79,336 |

20

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| State/Territory Gen Oblg—2.1% | | | | | | | | |

| Delaware Housing Authority, | | | | | | | | |

| SFMR | | 5.80 | | 7/1/16 | | 35,000 | | 35,645 |

| Michigan Tobacco Settlement | | | | | | | | |

| Finance Authority, Tobacco | | | | | | | | |

| Settlement Asset-Backed Bonds | | 7.05 | | 6/1/34 | | 200,000 b | | 189,620 |

| Tennessee Valley Authority, | | | | | | | | |

| Bonds, Ser. A | | 5.63 | | 1/18/11 | | 800,000 | | 840,858 |

| Tobacco Settlement Finance | | | | | | | | |

| Authority of West Virginia, | | | | | | | | |

| Tobacco Settlement | | | | | | | | |

| Asset-Backed Bonds | | 7.47 | | 6/1/47 | | 105,000 | | 100,842 |

| | | | | | | | | 1,166,965 |

| Supermarkets—.0% | | | | | | | | |

| Delhaize Group, | | | | | | | | |

| Sr. Unsub Notes | | 6.50 | | 6/15/17 | | 15,000 | | 15,345 |

| Transportation Services—.1% | | | | | | | | |

| Erac USA Finance, | | | | | | | | |

| Gtd. Notes | | 7.00 | | 10/15/37 | | 50,000 c | | 45,411 |

| U.S. Government Agencies—.6% | | | | | | | | |

| Federal National Mortgage | | | | | | | | |

| Association, Notes | | 4.63 | | 10/15/13 | | 315,000 | | 324,667 |

| U.S. Government Agencies/ | | | | | | | | |

| Mortgage-Backed—11.5% | | | | | | | | |

| Federal Home Loan Mortgage Corp.: | | | | | | |

| 5.00%, 10/1/35 | | | | | | 571,052 | | 557,621 |

| 6.00%, 9/1/37 | | | | | | 981,678 | | 996,492 |

| Federal National Mortgage Association: | | | | | | |

| 4.50%, 6/1/20 | | | | | | 414,678 | | 407,865 |

| 5.00%, 1/1/36—2/1/37 | | | | | | 707,037 | | 690,126 |

| 5.50%, 4/1/22—5/1/36 | | | | | | 2,465,681 | | 2,469,103 |

| 6.00%, 4/1/22—10/1/37 | | | | | | 776,836 | | 792,318 |

| Government National Mortgage Association I: | | | | | | |

| Ser. 2007-52, Cl. A, 4.05%, 1/16/48 | | | | 64,330 | | 63,641 |

| Ser. 2005-87, Cl. A, 4.45%, 3/16/25 | | | | 344,798 | | 343,246 |

| | | | | | | | | 6,320,412 |

| U.S. Government Securities—4.2% | | | | | | |

| U.S. Treasury Bonds | | 4.50 | | 2/15/36 | | 1,226,000 | | 1,232,226 |

| U.S. Treasury Notes | | 3.88 | | 10/31/12 | | 300,000 | | 305,883 |

| U.S. Treasury Notes | | 4.63 | | 12/31/11 | | 575,000 | | 603,121 |

The Fund 21

STATEMENT OF INVESTMENTS (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| U.S. Government | | | | | | | | |

| Securities (continued) | | | | | | | | |

| U.S. Treasury Notes | | 4.63 | | 11/15/16 | | 17,000 | | 17,804 |

| U.S. Treasury Notes | | 4.75 | | 8/15/17 | | 60,000 | | 63,370 |

| U.S. Treasury Notes | | 4.88 | | 6/30/12 | | 65,000 | | 68,941 |

| | | | | | | | | 2,291,345 |

| Wireless Telecommunication | | | | | | | | |

| Services—.5% | | | | | | | | |

| AT & T Wireless, | | | | | | | | |

| Sr. Unscd. Notes | | 8.75 | | 3/1/31 | | 20,000 | | 25,919 |

| AT & T, | | | | | | | | |

| Sr. Unscd. Notes | | 7.30 | | 11/15/11 | | 100,000 b | | 108,351 |

| KPN, | | | | | | | | |

| Sr. Unsub. Notes | | 8.00 | | 10/1/10 | | 15,000 | | 16,087 |

| KPN, | | | | | | | | |

| Sr. Unsub. Bonds | | 8.38 | | 10/1/30 | | 7,000 | | 8,393 |

| Qwest, | | | | | | | | |

| Sr. Unscd. Notes | | 7.50 | | 10/1/14 | | 36,000 | | 36,540 |

| Telefonica Emisiones, | | | | | | | | |

| Gtd. Notes | | 5.98 | | 6/20/11 | | 100,000 | | 102,869 |

| | | | | | | | | 298,159 |

| Total Bonds and Notes | | | | | | | | |

| (cost $20,075,452) | | | | | | | | 20,171,891 |

| |

| |

| |

| |

|

| |

| Exchange Traded Funds—.8% | | | | | | | | |

| |

| |

| |

| |

|

| iShares Russell 1000 Growth Index Fund | | | | 4,307 | | 261,779 |

| Standard & Poor’s Depository | | | | | | | | |

| Receipts (Tr. Ser. 1) | | | | | | 1,373 | | 200,746 |

| Total Exchange Traded Funds | | | | | | | | |

| (cost $473,943) | | | | | | | | 462,525 |

22

| Other Investment—.2% | | Shares | | Value ($) |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred | | | | |

| Plus Money Market Fund | | | | |

| (cost $115,000) | | 115,000 d | | 115,000 |

| |

| |

|

| Total Investments (cost $49,982,626) | | 99.8% | | 54,711,269 |

| Cash and Receivables (Net) | | .2% | | 130,360 |

| Net Assets | | 100.0% | | 54,841,629 |

| ADR—American Depository Receipts |

| a Non-income producing security. |

| b Variable rate security—interest rate subject to periodic change. |

| c Securities exempt from registration under Rule 144A of the Securities Act of 1933.These securities may be resold in |

| transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2007, these |

| securities amounted to $973,324 or 1.8% of net assets. |

| d Investment in affiliated money market mutual fund. |

| Portfolio Summary | | (Unaudited) † | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Information Technology | | 19.4 | | Materials | | .8 |

| Consumer Discretionary | | 9.6 | | Telecom Services | | .5 |

| Consumer Staples | | 8.8 | | Other | | .8 |

| Health Care | | 8.7 | | Fixed Income Investments | | 36.8 |

| Energy | | 5.3 | | Money Market Investments | | .2 |

| Financials | | 5.3 | | | | |

| Industrials | | 3.6 | | | | 99.8 |

| † Based on net assets. |

| See notes to financial statements. |

The Fund 23

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2007

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement of Investments: | | |

| Unaffiliated issuers | | 49,867,626 | | 54,596,269 |

| Affiliated issuers | | 115,000 | | 115,000 |

| Cash | | | | 186,693 |

| Dividends and interest receivable | | | | 233,448 |

| Receivable for shares of Common Stock subscribed | | 6,131 |

| Prepaid expenses | | | | 35,170 |

| Other assets | | | | 356,258 |

| | | | | 55,528,969 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to Founders Asset Management LLC and affiliates—Note 3(c) | | 77,167 |

| Payable for shares of Common Stock redeemed | | 114,781 |

| Interest payable—Note 2 | | | | 449 |

| Accrued expenses | | | | 138,685 |

| Directors’ deferred compensation | | | | 356,258 |

| | | | | 687,340 |

| |

| |

|

| Net Assets ($) | | | | 54,841,629 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 228,450,893 |

| Accumulated distributions in excess of investment income—net | | (46,938) |

| Accumulated net realized gain (loss) on investments | | (178,310,312) |

| Accumulated net unrealized appreciation | | |

| (depreciation) on investments | | | | 4,747,986 |

| |

| |

|

| Net Assets ($) | | | | 54,841,629 |

| Net Asset Value Per Share | | | | | | | | | | |

| | | Class A | | Class B | | Class C | | Class F | | Class I | | Class T |

| |

| |

| |

| |

| |

| |

|

| Net Assets ($) | | 2,192,473 | | 282,267 | | 164,087 | | 52,056,707 | | 100,675 | | 45,420 |

| Shares Outstanding | | 227,585 | | 29,032 | | 17,332 | | 5,397,496 | | 10,519 | | 4,578 |

| |

| |

| |

| |

| |

| |

|

| Net Asset Value | | | | | | | | | | | | |

| Per Share ($) | | 9.63 | | 9.72 | | 9.47 | | 9.64 | | 9.57 | | 9.92 |

| |

| See notes to financial statements. | | | | | | | | | | |

24

STATEMENT OF OPERATIONS

Year Ended December 31, 2007

|

| Investment Income ($): | | |

| Income: | | |

| Dividends (net of $1,831 foreign taxes withheld at source): | | |

| Unaffiliated issuers | | 556,685 |

| Affiliated issuers | | 147,568 |

| Interest | | 1,005,769 |

| Total Income | | 1,710,022 |

| Expenses: | | |

| Investment advisory fee—Note 3(a) | | 378,543 |

| Shareholder servicing costs—Note 3(c) | | 149,340 |

| Distribution fees—Note 3(b) | | 139,139 |

| Registration fees | | 50,424 |

| Professional fees | | 37,161 |

| Accounting fees—Note 3(c) | | 34,416 |

| Prospectus and shareholders’ reports | | 21,793 |

| Directors’ fees and expenses—Note 3(d) | | 32,443 |

| Custodian fees—Note 3(c) | | 8,931 |

| Loan commitment fees—Note 2 | | 2,251 |

| Interest expense—Note 2 | | 992 |

| Miscellaneous | | 59,306 |

| Total Expenses | | 914,739 |

| Less—reduction in custody fees due to | | |

| earnings credits—Note 1(c) | | (6,041) |

| Less—reduction in accounting fees—Note 3(c) | | (10,628) |

| Less—expense offset to broker commission—Note 1 | | (633) |

| Less—reimbursed/waived expenses—Note 3(c) | | (176) |

| Net Expenses | | 897,261 |

| Investment Income—Net | | 812,761 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments | | 3,214,482 |

| Net unrealized appreciation (depreciation) on investments | | (453,533) |

| Net Realized and Unrealized Gain (Loss) on Investments | | 2,760,949 |

| Net Increase in Net Assets Resulting from Operations | | 3,573,710 |

| |

| See notes to financial statements. | | |

The Fund 25

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended December 31, |

| |

|

| | | 2007 a | | 2006 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 812,761 | | 909,261 |

| Net realized gain (loss) on investments | | 3,214,482 | | 2,944,480 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | (453,533) | | 2,332,121 |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | | 3,573,710 | | 6,185,862 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A shares | | (30,480) | | (45,385) |

| Class B shares | | (4,640) | | (334) |

| Class C shares | | (900) | | (1,027) |

| Class F shares | | (774,189) | | (1,580,307) |

| Class I shares | | (1,050) | | (1,485) |

| Class T shares | | (419) | | (1,052) |

| Total Dividends | | (811,678) | | (1,629,590) |

| |

| |

|

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A shares | | 508,978 | | 671,584 |

| Class B shares | | 17,862 | | 121,336 |

| Class C shares | | 74,490 | | 23,263 |

| Class F shares | | 3,056,982 | | 3,863,377 |

| Class I shares | | 52,728 | | 203 |

| Class T shares | | 15,572 | | 18,236 |

26

| | | Year Ended December 31, |

| |

|

| | | 2007 a | | 2006 |

| |

| |

|

| Capital Stock Transactions ($) (continued): | | |

| Dividends reinvested: | | | | |

| Class A shares | | 24,987 | | 40,018 |

| Class B shares | | 3,387 | | 254 |

| Class C shares | | 522 | | 505 |

| Class F shares | | 746,391 | | 1,528,006 |

| Class I shares | | 1,050 | | 1,484 |

| Class T shares | | 291 | | 729 |

| Cost of shares redeemed: | | | | |

| Class A shares | | (418,676) | | (630,365) |

| Class B shares | | (200,859) | | (781,673) |

| Class C shares | | (99,964) | | (46,335) |

| Class F shares | | (13,342,192) | | (19,699,238) |

| Class I shares | | (2,015) | | (13,000) |

| Class T shares | | (29,783) | | (103) |

| Increase (Decrease) in Net Assets | | | | |

| from Capital Stock Transactions | | (9,590,249) | | (14,901,719) |

| Total Increase (Decrease) in Net Assets | | (6,828,217) | | (10,345,447) |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 61,669,846 | | 72,015,293 |

| End of Period | | 54,841,629 | | 61,669,846 |

| Accumulated distibution in | | | | |

| excess of investment income—net | | (46,938) | | (49,576) |

The Fund 27

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Year Ended December 31, |

| |

|

| | | 2007 a | | 2006 |

| |

| |

|

| Capital Share Transactions: | | | | |

| Class A b | | | | |

| Shares sold | | 53,856 | | 76,063 |

| Shares issued for dividends reinvested | | 2,636 | | 4,419 |

| Shares redeemed | | (43,760) | | (70,773) |

| Net Increase (Decrease) in Shares Outstanding | | 12,732 | | 9,709 |

| |

| |

|

| Class B b | | | | |

| Shares sold | | 1,891 | | 13,825 |

| Shares issued for dividends reinvested | | 359 | | 29 |

| Shares redeemed | | (21,013) | | (89,931) |

| Net Increase (Decrease) in Shares Outstanding | | (18,763) | | (76,077) |

| |

| |

|

| Class C | | | | |

| Shares sold | | 8,132 | | 2,778 |

| Shares issued for dividends reinvested | | 57 | | 57 |

| Shares redeemed | | (10,877) | | (5,354) |

| Net Increase (Decrease) in Shares Outstanding | | (2,688) | | (2,519) |

| |

| |

|

| Class F | | | | |

| Shares sold | | 322,384 | | 432,639 |

| Shares issued for dividends reinvested | | 78,650 | | 168,738 |

| Shares redeemed | | (1,410,653) | | (2,220,047) |

| Net Increase (Decrease) in Shares Outstanding | | (1,009,619) | | (1,618,670) |

| |

| |

|

| Class I | | | | |

| Shares sold | | 5,600 | | 22 |

| Shares issued for dividends reinvested | | 111 | | 165 |

| Shares redeemed | | (217) | | (1,453) |

| Net Increase (Decrease) in Shares Outstanding | | 5,494 | | (1,266) |

| |

| |

|

| Class T | | | | |

| Shares sold | | 1,610 | | 1,999 |

| Shares issued for dividends reinvested | | 30 | | 78 |

| Shares redeemed | | (3,054) | | (12) |

| Net Increase (Decrease) in Shares Outstanding | | (1,414) | | 2,065 |

| a | | Effective June 1, 2007, Class R shares were redesignated as Class I shares. |

| b | | During the period ended December 31, 2007, 7,754 Class B shares representing $73,999 were automatically |

| | | converted to 7,794 Class A shares and during the period ended December 31, 2006, 31,019 Class B shares |

| | | representing $271,694 were automatically converted to 30,728 Class A shares. |

| See notes to financial statements. |

28

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class A Shares | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 9.20 | | 8.58 | | 8.45 | | 7.88 | | 6.68 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net | | .13a | | .12a | | .08 | | .08 | | .05 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | .43 | | .71 | | .13 | | .57 | | 1.20 |

| Total from Investment Operations | | .56 | | .83 | | .21 | | .65 | | 1.25 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.13) | | (.21) | | (.08) | | (.08) | | (.05) |

| Net asset value, end of period | | 9.63 | | 9.20 | | 8.58 | | 8.45 | | 7.88 |

| |

| |

| |

| |

| |

|

| Total Return (%) b | | 6.24 | | 9.66 | | 2.51 | | 8.31 | | 18.81 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.60 | | 1.56 | | 1.69 | | 1.49 | | 1.83 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.57 | | 1.56 | | 1.66 | | 1.48 | | 1.83 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.35 | | 1.28 | | .90 | | .96 | | .63 |

| Portfolio Turnover Rate | | 151 | | 197 | | 181 | | 134 | | 108 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 2,192 | | 1,976 | | 1,760 | | 1,682 | | 1,572 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

The Fund 29

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class B Shares | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 9.24 | | 8.50 | | 8.37 | | 7.80 | | 6.63 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net | | .13a | | .02a | | .01a | | .01 | | .01 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | .47 | | .72 | | .13 | | .58 | | 1.17 |

| Total from Investment Operations | | .60 | | .74 | | .14 | | .59 | | 1.18 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.12) | | — | | (.01) | | (.02) | | (.01) |

| Net asset value, end of period | | 9.72 | | 9.24 | | 8.50 | | 8.37 | | 7.80 |

| |

| |

| |

| |

| |

|

| Total Return (%) b | | 6.54 | | 8.75 | | 1.66 | | 7.63 | | 17.76 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.57 | | 2.56 | | 2.47 | | 2.21 | | 2.53 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.55 | | 2.56 | | 2.45 | | 2.21 | | 2.53 |

| Ratio of net investment income | | | | | | | | | | |

| (loss) to average net assets | | 1.40 | | .25 | | .08 | | .23 | | (.08) |

| Portfolio Turnover Rate | | 151 | | 197 | | 181 | | 134 | | 108 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 282 | | 442 | | 1,053 | | 1,625 | | 1,647 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

30

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class C Shares | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 9.05 | | 8.36 | | 8.24 | | 7.69 | | 6.54 |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—net | | .03a | | .03a | | .00a,b | | .01a | | (.01) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | .50 | | .71 | | .13 | | .56 | | 1.16 |

| Total from Investment Operations | | .53 | | .74 | | .13 | | .57 | | 1.15 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.11) | | (.05) | | (.01) | | (.02) | | (.00)b |

| Net asset value, end of period | | 9.47 | | 9.05 | | 8.36 | | 8.24 | | 7.69 |

| |

| |

| |

| |

| |

|

| Total Return (%) c | | 5.21 | | 8.87 | | 1.54 | | 7.42 | | 17.59 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 2.59 | | 2.53 | | 2.54 | | 2.35 | | 2.69 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 2.57 | | 2.53 | | 2.51 | | 2.34 | | 2.69 |

| Ratio of net investment income | | | | | | | | | | |

| (loss) to average net assets | | .38 | | .31 | | .02 | | .08 | | (.17) |

| Portfolio Turnover Rate | | 151 | | 197 | | 181 | | 134 | | 108 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 164 | | 181 | | 189 | | 264 | | 295 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Amount represents less than $.01 per share. | | | | | | | | |

| c | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

The Fund 31

FINANCIAL HIGHLIGHTS (continued)

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Class F Shares | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 9.20 | | 8.59 | | 8.46 | | 7.88 | | 6.69 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net | | .14a | | .13a | | .09 | | .08 | | .06 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | .43 | | .72 | | .14 | | .59 | | 1.20 |

| Total from Investment Operations | | .57 | | .85 | | .23 | | .67 | | 1.26 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.13) | | (.24) | | (.10) | | (.09) | | (.07) |

| Net asset value, end of period | | 9.64 | | 9.20 | | 8.59 | | 8.46 | | 7.88 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 6.27 | | 9.91 | | 2.75 | | 8.58 | | 18.96 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.53 | | 1.42 | | 1.43 | | 1.34 | | 1.54 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.51 | | 1.42 | | 1.40 | | 1.33 | | 1.54 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.43 | | 1.41 | | 1.14 | | 1.08 | | .93 |

| Portfolio Turnover Rate | | 151 | | 197 | | 181 | | 134 | | 108 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 52,057 | | 58,969 | | 68,926 | | 89,701 | | 119,835 |

| |

| a Based on average shares outstanding at each month end. | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

32

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class I Shares | | 2007 a | | 2006 | | 2005 | | 2004 | | 2003 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 9.14 | | 8.56 | | 8.43 | | 7.86 | | 6.68 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net | | .13b | | .15b | | .11 | | .09 | | .16 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | .45 | | .71 | | .14 | | .58 | | 1.05 |

| Total from Investment Operations | | .58 | | .86 | | .25 | | .67 | | 1.21 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.15) | | (.28) | | (.12) | | (.10) | | (.03) |

| Net asset value, end of period | | 9.57 | | 9.14 | | 8.56 | | 8.43 | | 7.86 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 6.37 | | 10.10 | | 3.01 | | 8.63 | | 18.12 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.72 | | 1.38 | | 1.36 | | 1.35 | | 2.62 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.56 | | 1.21 | | 1.17 | | 1.21 | | 2.37 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.34 | | 1.62 | | 1.38 | | 1.21 | | .01 |

| Portfolio Turnover Rate | | 151 | | 197 | | 181 | | 134 | | 108 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 101 | | 46 | | 54 | | 59 | | 72 |

| |

| a | | Effective June 1, 2007, Class R shares were redesignated as Class I shares. | | | | | | |

| b | | Based on average shares outstanding at each month end. | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

The Fund 33

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class T Shares | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 9.47 | | 8.81 | | 8.68 | | 8.09 | | 6.88 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net | | .07a | | .10a | | .05 | | .03 | | .21 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | .45 | | .74 | | .14 | | .62 | | 1.00 |

| Total from Investment Operations | | .52 | | .84 | | .19 | | .65 | | 1.21 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.07) | | (.18) | | (.06) | | (.06) | | (.00)b |

| Net asset value, end of period | | 9.92 | | 9.47 | | 8.81 | | 8.68 | | 8.09 |

| |

| |

| |

| |

| |

|

| Total Return (%) c | | 5.52 | | 9.56 | | 2.21 | | 8.01 | | 17.65 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 2.35 | | 1.96 | | 2.15 | | 2.02 | | 3.18 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 2.17 | | 1.79 | | 1.87 | | 1.77 | | 2.73 |

| Ratio of net investment income | | | | | | | | | | |

| (loss) to average net assets | | .75 | | 1.06 | | .69 | | .66 | | (.29) |

| Portfolio Turnover Rate | | 151 | | 197 | | 181 | | 134 | | 108 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 45 | | 57 | | 35 | | 35 | | 36 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Amount represents less than $.01 per share. | | | | | | | | |

| c | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

34

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Founders Balanced Fund (the “fund”) is a separate diversified series of Dreyfus Founders Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering six series, including the fund.The fund’s investment objective is to seek current income and capital appreciation. Founders Asset Management LLC (“Founders”) serves as the fund’s investment adviser. During the first half of the reporting period, Founders was an indirect wholly-owned subsidiary of Mellon Financial Corporation (“Mellon Financial”).

On July 1, 2007, Mellon Financial and The Bank of New York Company, Inc. merged, forming The Bank of New York Mellon Corporation (“BNY Mellon”). As part of this transaction, Founders became an indirect, wholly-owned subsidiary of BNY Mellon.

The Company’s Board of Directors approved the redesignation of the fund’s Class R shares as Class I shares, effective June 1, 2007.The eligibility requirements for Class I shares remained the same as for Class R shares.

MBSC Securities Corporation (the “Distributor”), the direct owner of Founders and a wholly-owned subsidiary of The Dreyfus Corporation (“Dreyfus”), an affiliate of Founders, is the distributor of the fund’s shares. The fund is authorized to issue up to 850 million shares of Common Stock, par value $ .01 per share, in the following classes of shares: Class A, Class B, Class C, Class F, Class I and Class T shares. Class A and Class T shares are subject to a sales charge imposed at the time of purchase, although the shares may be purchased at net asset value (“NAV”) without a slaes charge by certain categories of investors. Class B shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class B share redemptions made within six years of purchase and automatically convert to Class A shares after six

The Fund 35

NOTES TO FINANCIAL STATEMENTS (continued)

years.The fund does not offer Class B shares, except in connection with dividend reinvestment and permitted exchanges of Class B shares.Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class F and Class I shares are sold at (“NAV”) per share. Class F shares are sold only to Class F grandfathered investors, and Class I shares are sold only to eligible institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class.Income and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

Each class of the fund bears expenses incurred specifically on its behalf and, in addition, each class bears a portion of general expenses based on the relative net assets or the number of shareholder accounts of the class.The type of expense determines the allocation method.

The Company’s Board of Directors has authorized the payment of certain fund expenses with commissions on fund portfolio transactions. These commissions reduce miscellaneous expenses and are included in the expense offset to broker commissions in the Statement of Operations.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which require the use of management estimates and assumptions. Actual results could differ from those estimates.