UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES |

Investment Company Act file number: 811-1018

Dreyfus Funds, Inc.

---------------------------------------------------------------

(Exact name of registrant as specified in charter) |

210 University Boulevard, Suite 800, Denver, Colorado 80206

---------------------------------------------------------------

(Address of principal executive offices) (Zip code) |

Kenneth R. Christoffersen, Esq.

210 University Boulevard, Suite 800, Denver, Colorado 80206

---------------------------------------------------------------

(Name and address of agent for service) |

Registrant's telephone number, including area code: 303-394-4404

Date of fiscal year end: December 31

Date of reporting period: December 31, 2008

ITEM 1. REPORTS TO STOCKHOLDERS |

| | Discovery Fund is closed to new investors.

Please see the prospectus for additional information. |

| | ANNUAL REPORT December 31, 2008 |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus, Founders or any other person in our organization. Any such views are subject to change at any time based upon market or other conditions and we disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| |

| | THE FUND |

| |

| 2 | A Letter from the Chairman |

| |

| 3 | Discussion of Fund Performance |

| |

| 6 | Fund Performance |

| |

| 8 | Understanding Your Fund’s Expenses |

| |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| |

| 9 | Statement of Investments |

| |

| 15 | Statement of Assets and Liabilities |

| |

| 16 | Statement of Operations |

| |

| 17 | Statement of Changes in Net Assets |

| |

| 19 | Financial Highlights |

| |

| 25 | Notes to Financial Statements |

| |

| 37 | Report of Independent Registered Public Accounting Firm |

| |

| 38 | Factors Considered in Renewing the Advisory Agreement |

| |

| 46 | Your Board Representatives |

| |

| | FOR MORE INFORMATION |

| |

| | Back Cover |

| |

The Fund

A LETTER FROM THE CHAIRMAN

Dear Shareholder: |

We present to you this annual report for Dreyfus Discovery Fund, covering the 12-month period from January 1, 2008, through December 31, 2008.

2008 was the most difficult year in decades for the economy and stock market.A credit crunch that originated in 2007 in the U.S. sub-prime mortgage market exploded in mid-2008 into a global financial crisis, resulting in the failures of major financial institutions, a deep and prolonged recession and lower investment values across a broad range of asset classes. Governments and regulators throughout the world moved aggressively to curtail the damage, implementing unprecedented reductions of short-term interest rates, massive injections of liquidity into the banking system, government bailouts of struggling companies and plans for massive economic stimulus programs. After several years of strong relative returns, international stocks generally declined more sharply than their U.S. counterparts.

Although we expect the U.S. and global economies to remain weak until longstanding imbalances have worked their way out of the system, the financial markets currently appear to have priced in investors’ generally low expectations. In previous recessions, however, the markets have tended to anticipate economic improvement before it occurs, potentially leading to major rallies when few expected them. That’s why it makes sense to remain disciplined, maintain a long-term perspective and adopt a consistent asset allocation strategy that reflects one’s future goals and attitudes toward risk. As always, we urge you to consult with your financial advisor, who can recommend the course of action that is right for you. For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund’s Portfolio Manager.

Thank you for your continued confidence and support.

J. David Officer

Chairman, President and Chief Executive Officer

Founders Asset Management LLC

January 15, 2009 |

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2008, through December 31, 2008, as provided by B. Randall Watts, Jr., CFA, Portfolio Manager

Fund and Market Performance Overview

For the 12-month period ended December 31, 2008, Dreyfus Discovery Fund’s Class A shares produced a total return of –38.41%, Class B shares returned –38.95%, Class C shares returned –38.93%, Class F shares returned –38.22%, Class I shares returned –38.32% and Class T shares returned –38.68% .1 In comparison, the Russell 2000 Growth Index, the fund’s benchmark, produced a total return of –38.54% for the reporting period.2

Like other capitalizations ranges, small-cap stocks fell sharply in 2008, particularly over the second half of the year, amid an intensifying economic downturn and a global financial crisis.The fund produced returns that were roughly in line with its benchmark, as strong stock selections in the consumer discretionary, industrials and financials sectors offset disappointments in the health care and energy sectors.

The Fund’s Investment Approach

The fund invests primarily in small U.S.-based companies that we believe possess high-growth potential. The fund may also invest in larger companies if, in our opinion, they represent better prospects for capital appreciation.We use a “growth style” of investing, searching for companies whose fundamental strengths suggest the potential to provide superior earnings growth over time. Our “bottom-up” approach emphasizes individual stock selection.We go beyond Wall Street analysis and perform intensive qualitative and quantitative in-house research to determine whether companies meet our investment criteria.

Extreme Volatility Roiled the Financial Markets

After producing relatively modest declines over the first half of 2008, small-cap stocks tumbled during the second half.The bear market was triggered by the intensification of a credit crisis that began in 2007 and mushroomed in September 2008 with the failures of several major financial institutions. These developments exacerbated an ongoing economic slowdown, as lenders grew reluctant to extend credit even to

The Fund 3

| DISCUSSION OF FUND PERFORMANCE (continued) |

some of their most trusted customers, causing consumer spending and business investment to decline sharply, unemployment to rise and commodity prices to retreat from previous record levels. In late November, the National Bureau of Economic Research confirmed that the U.S. economy was mired its first recession since 2001.

Mixed Results Across Economic Sectors

Not surprisingly, the credit crisis was particularly hard on financial stocks. Because the fund held underweighted exposure to the financials sector, it was sheltered from the full brunt of volatility. In addition, our security selection strategy focused on companies that were relatively insulated from the banking crisis, including insurers such as Arch Capital Group, RLI Corp. and ProAssurance.

Traditionally economically sensitive consumer discretionary stocks also comprised one of the poorer performing sectors for the benchmark, but comprised one of the better areas for the fund.The fund achieved strongly positive absolute returns from specialty retailer Panera Bread, which was able to pass along higher food costs to its customers through frequent menu changes. Gaming companies WMS Industries and Bally Technologies bucked sagging industry trends as state governments expanded the availability of video lottery terminals to raise revenues. The fund’s holdings of luxury goods purveyors also held up relatively well, as consumer demand remained strong for specialty retailers including footwear and apparel chains Steve Madden,Volcom and True Religion Apparel, among others. We subsequently sold Volcom and True Religion Apparel to lock in gains. In the industrials sector, the fund received positive contributions to relative performance from business and legal services provider Huron Consulting Group, which we sold before it encountered greater weakness.

Although the health care sector historically has been considered a defensive haven during downturns, it produced returns in 2008 that, on average, lagged the overall small-cap market.The fund’s health care holdings fared somewhat worse than the sector overall, due mainly to our focus on several biotechnology companies that, in our judgment, have strong long-term prospects but suffered over the near term when large pharmaceutical companies cut their research-and-development budgets. Lifescience tools maker Covance, which was sold during the reporting period, also was hurt due to budget pressures.

4

The fund generated mixed results in the energy sector, where exploration-and-production companies fared relatively well but equipment-and-services firms disappointed. We focused on the latter industry group, which historically has been less sensitive to changing commodity prices. However, reduced spending by major integrated oil producers and reduced access to credit produced weakness in holdings such as Hornbeck Offshore Services, ION Geophysical, ENGlobal and Union Drilling, all of which were eliminated from the fund. NATCO Group and Dril-Quip also declined but were retained through year-end.

Managing Risks Through Diversification

As 2009 begins, the economic climate remains bleak.Therefore, we have maintained a generally defensive investment posture, reducing the fund’s exposure to consumer-oriented companies and maintaining an underweighted position in the industrials sector and, to a lesser extent, the information technology sector. Instead, we have found more opportunities among financial companies, where we have focused on insurers and avoided commercial banks, and the health care sector, where certain positive, long-term trends remain intact. In our view, these strategies and a well diversified portfolio will help the fund weather the current storm.

January 15, 2009

Small companies carry additional risks because their earnings and revenues tend to be less

predictable, and their share prices more volatile than those of larger, more established

companies. The shares of smaller companies tend to trade less frequently than those of

larger, more established companies.

Part of the fund’s recent performance is attributable to positive returns from its initial public

offering (IPO) investments. There can be no guarantee that IPOs will have or continue to

have a positive effect on fund performance.

Part of the fund’s historical performance is due to amounts received from class action

settlements regarding prior fund holdings. There is no guarantee that these settlement

distributions will occur in the future or have a similar impact on performance. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charges in the case of Class A and Class T shares, or the applicable contingent deferred sales charges imposed on redemptions in the case of Class B and Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. |

| |

| 2 | SOURCE: LIPPER INC. – Reflects reinvestment of dividends and, where applicable, capital gains distributions.The Russell 2000 Growth Index is an unmanaged index, which measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.The total return figure cited for this index assumes change in security prices and reinvestment of dividends, but does not reflect the costs of managing a mutual fund. |

| |

The Fund 5

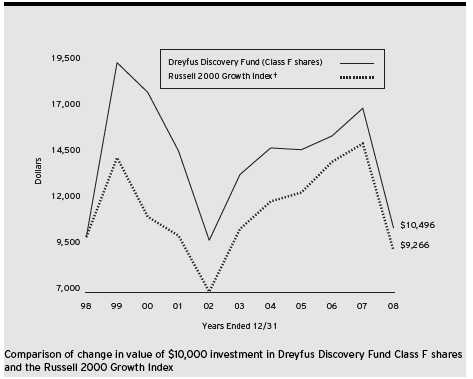

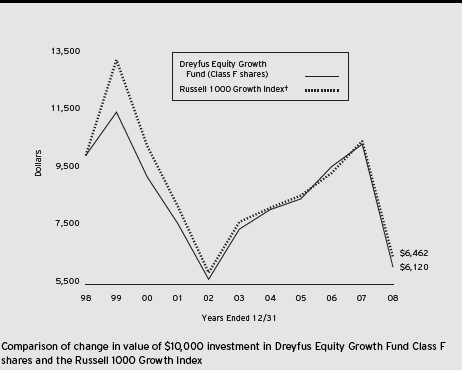

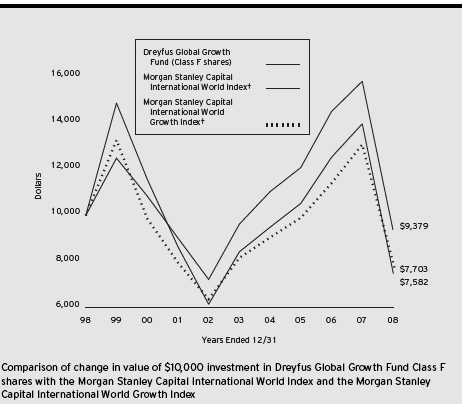

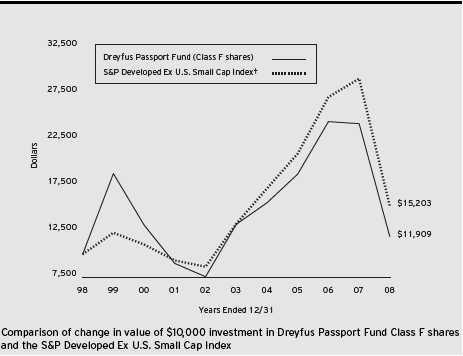

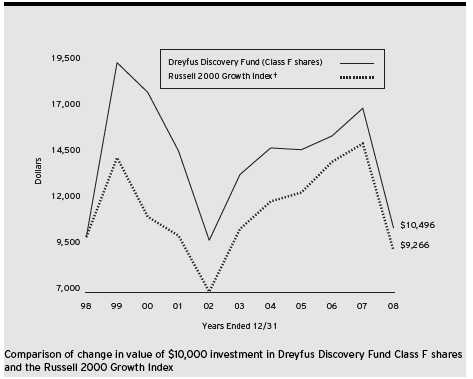

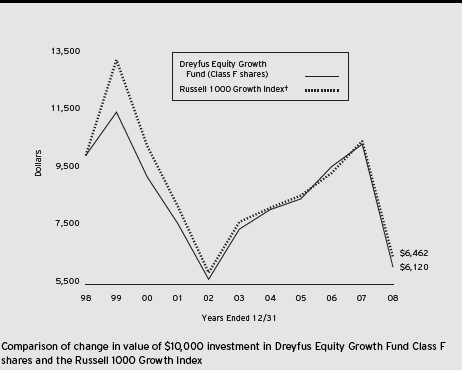

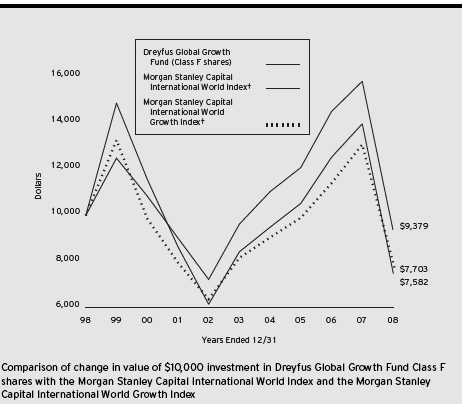

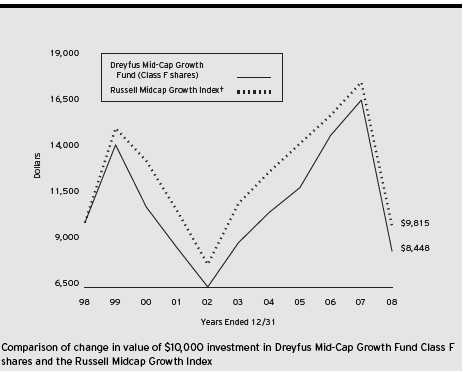

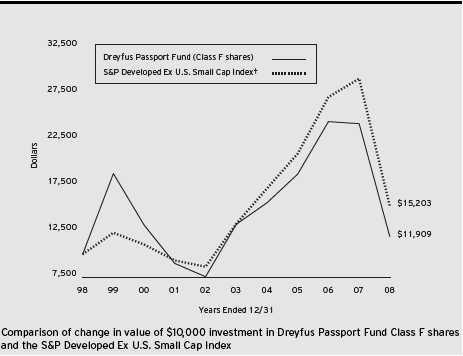

† Source: Lipper Inc.

Past performance is not predictive of future performance.

Part of the fund’s recent performance is attributable to positive returns from its initial public offering (IPO) investments. There can be no guarantee that IPOs will have or continue to have a positive effect on fund performance.

The above graph compares a $10,000 investment made in Class F shares of Dreyfus Discovery Fund on 12/31/98 to a $10,000 investment made in the Russell 2000 Growth Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested. Performance for Class A, Class B, Class C, Class I and Class T shares will vary from the performance of Class F shares shown above due to differences in charges and expenses.

The fund’s performance shown in the line graph takes into account all applicable Class F fees and expenses (after any expense reimbursements).The Index is an unmanaged index, which measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| Average Annual Total Returns as of 12/31/08 | | | | | | |

| |

| | | Inception | | | | | | | | From |

| | | Date | | 1 Year | | 5 Years | | 10 Years | | Inception |

| |

| |

| |

| |

| |

|

| Class A shares | | | | | | | | | | |

| with maximum sales charge (5.75%) | | 12/31/99 | | (41.95)% | | (6.07)% | | — | | (7.32)% |

| without sales charge | | 12/31/99 | | (38.41)% | | (4.95)% | | — | | (6.71)% |

| Class B shares | | | | | | | | | | |

| with applicable redemption charge † | | 12/31/99 | | (41.39)% | | (6.25)% | | — | | (7.27)%†† |

| without redemption | | 12/31/99 | | (38.95)% | | (5.87)% | | — | | (7.27)%†† |

| Class C shares | | | | | | | | | | |

| with applicable redemption charge ††† | | 12/31/99 | | (39.54)% | | (5.72)% | | — | | (7.49)% |

| without redemption | | 12/31/99 | | (38.93)% | | (5.72)% | | — | | (7.49)% |

| Class F shares | | 12/29/89 | | (38.22)% | | (4.77)% | | 0.49% | | N/A |

| Class I shares | | 12/31/99 | | (38.32)% | | (4.64)% | | — | | (6.44)% |

| Class T shares | | | | | | | | | | |

| with applicable sales charge (4.5%) | | 12/31/99 | | (41.44)% | | (6.16)% | | — | | (7.57)% |

| without sales charge | | 12/31/99 | | (38.68)% | | (5.29)% | | — | | (7.09)% |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Part of the fund’s historical performance is due to amounts received from class action settlements regarding prior fund holdings. There is no guarantee that these settlement distributions will occur in the future or have a similar impact on performance.

| † The maximum contingent deferred sales charge for Class B shares is 4%. After six years Class B shares convert to |

| Class A shares. |

| †† | | Assumes the conversion of Class B shares to Class A shares at the end of the sixth year following the date |

| | | of purchase. |

| ††† | | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | | date of purchase. |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund's prospectus or talk to your financial advisor.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Discovery Fund from July 1, 2008 to December 31, 2008. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.To estimate the expenses you paid on your account over this period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the results by the number in the Expenses paid per $1,000 line for the class of shares you own.

| | Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended December 31, 2008 |

| | | Class A | | Class B | | Class C | | Class F | | Class I | | Class T |

| |

| |

| |

| |

| |

| |

|

| Expenses paid | | | | | | | | | | | | |

| per $1,000† | | $ 8.06 | | $ 11.16 | | $ 11.29 | | $ 6.37 | | $ 7.17 | | $ 9.48 |

| Ending value | | | | | | | | | | | | |

| (after expenses) | | $678.10 | | $675.90 | | $675.20 | | $679.50 | | $678.50 | | $676.70 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended December 31, 2008 |

| | | Class A | | Class B | | Class C | | Class F | | Class I | | Class T |

| |

| |

| |

| |

| |

| |

|

| Expenses paid | | | | | | | | | | | | |

| per $1,000† | | $ 9.68 | | $ 13.40 | | $ 13.55 | | $ 7.66 | | $ 8.62 | | $ 11.39 |

| Ending value | | | | | | | | | | | | |

| (after expenses) | | $1,015.53 | | $1,011.81 | | $1,011.66 | | $1,017.55 | | $1,016.59 | | $1,013.83 |

| † Expenses are equal to the fund’s annualized expense ratio of 1.91% for Class A shares, 2.65% for Class B shares, |

| 2.68% for Class C shares, 1.51% for Class F shares, 1.70% for Class I shares and 2.25% for Class T shares; |

| multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

December 31, 2008 |

| Common Stocks—97.6% | | Shares | | Value ($) |

| |

| |

|

| Aerospace & Defense—2.6% | | | | |

| ManTech International, Cl. A | | 52,990 a | | 2,871,528 |

| Orbital Sciences | | 10,780 a | | 210,533 |

| | | | | 3,082,061 |

| Air Freight & Logistics—3.0% | | | | |

| Forward Air | | 43,140 | | 1,047,008 |

| UTi Worldwide | | 176,980 | | 2,537,893 |

| | | | | 3,584,901 |

| Apparel Retail—1.1% | | | | |

| Bebe Stores | | 84,570 | | 631,738 |

| Chico's FAS | | 172,160 a | | 719,629 |

| | | | | 1,351,367 |

| Apparel, Accessories & Luxury Goods—1.2% | | | | |

| Carter's | | 72,540 a | | 1,397,120 |

| Application Software—1.3% | | | | |

| Concur Technologies | | 46,970 a | | 1,541,555 |

| Biotechnology—7.2% | | | | |

| Acorda Therapeutics | | 32,500 a | | 666,575 |

| Alexion Pharmaceuticals | | 41,540 a | | 1,503,333 |

| Alnylam Pharmaceuticals | | 57,020 a | | 1,410,105 |

| BioMarin Pharmaceutical | | 59,780 a | | 1,064,084 |

| Celera | | 53,170 a | | 591,782 |

| Enzon Pharmaceuticals | | 102,720 a | | 598,858 |

| Kendle International | | 13,310 a | | 342,333 |

| OSI Pharmaceuticals | | 29,630 a | | 1,157,051 |

| Regeneron Pharmaceuticals | | 32,310 a | | 593,212 |

| United Therapeutics | | 11,750 a | | 734,963 |

| | | | | 8,662,296 |

| Casinos & Gaming—2.5% | | | | |

| Bally Technologies | | 52,608 a | | 1,264,170 |

| WMS Industries | | 64,910 a | | 1,746,079 |

| | | | | 3,010,249 |

| Communications Equipment—3.3% | | | | |

| Arris Group | | 165,160 a | | 1,313,022 |

| BigBand Networks | | 102,740 a | | 567,125 |

| Neutral Tandem | | 126,656 a | | 2,054,360 |

| | | | | 3,934,507 |

The Fund 9

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Construction & Engineering—1.4% | | | | |

| Quanta Services | | 84,950 a | | 1,682,010 |

| Consumer Finance—.7% | | | | |

| EZCORP, Cl. A | | 54,100 a | | 822,861 |

| Data Processing & Outsourced Services—2.2% | | | | |

| Metavante Technologies | | 82,529 a | | 1,329,542 |

| NeuStar, Cl. A | | 69,760 a | | 1,334,509 |

| | | | | 2,664,051 |

| Electric Utilities—.5% | | | | |

| UniSource Energy | | 22,110 | | 649,150 |

| Electronic Equipment & Instruments—1.6% | | | | |

| Cogent | | 98,400 a | | 1,335,288 |

| II-VI | | 33,960 a | | 648,296 |

| | | | | 1,983,584 |

| Electronic Manufacturing Services—.7% | | | | |

| IPG Photonics | | 67,110 a | | 884,510 |

| Environmental & Facilities Services—1.8% | | | | |

| Clean Harbors | | 33,300 a | | 2,112,552 |

| Food Distributors—1.6% | | | | |

| Spartan Stores | | 83,820 | | 1,948,815 |

| Food Retail—1.3% | | | | |

| Ruddick | | 54,940 | | 1,519,091 |

| Footwear—1.0% | | | | |

| Skechers USA, Cl. A | | 44,500 a | | 570,490 |

| Steven Madden | | 26,760 a | | 570,523 |

| | | | | 1,141,013 |

| Gas Utilities—.5% | | | | |

| Energen | | 21,920 | | 642,914 |

| Health Care Distributors—1.9% | | | | |

| Owens & Minor | | 18,140 | | 682,971 |

| PSS World Medical | | 83,380 a | | 1,569,212 |

| | | | | 2,252,183 |

| Health Care Equipment—10.3% | | | | |

| CONMED | | 73,580 a | | 1,761,505 |

| Exactech | | 30,310 a | | 510,420 |

| Integra LifeSciences Holdings | | 50,220 a | | 1,786,325 |

| Natus Medical | | 50,550 a | | 654,622 |

| NuVasive | | 27,200 a | | 942,480 |

10

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Health Care Equipment (continued) | | | | |

| Resmed | | 75,270 a | | 2,821,120 |

| Thoratec | | 23,000 a | | 747,270 |

| Volcano | | 90,773 a | | 1,361,595 |

| Wright Medical Group | | 92,650 a | | 1,892,840 |

| | | | | 12,478,177 |

| Health Care Facilities—1.1% | | | | |

| Psychiatric Solutions | | 45,410 a | | 1,264,668 |

| Health Care Services—1.5% | | | | |

| Catalyst Health Solutions | | 39,000 a | | 949,650 |

| Emergency Medical Services, Cl. A | | 22,628 a | | 828,411 |

| | | | | 1,778,061 |

| Health Care Supplies—.9% | | | | |

| West Pharmaceutical Services | | 28,240 | | 1,066,625 |

| Health Care Technology—.4% | | | | |

| Phase Forward | | 34,600 a | | 433,192 |

| Industrial Machinery—1.2% | | | | |

| Actuant, Cl. A | | 78,580 | | 1,494,592 |

| Internet Software & Services—3.9% | | | | |

| j2 Global Communications | | 90,320 a | | 1,810,013 |

| Marchex, Cl. B | | 62,430 | | 363,967 |

| SkillSoft, ADR | | 344,110 a | | 2,456,945 |

| | | | | 4,630,925 |

| IT Consulting & Other Services—2.7% | | | | |

| CACI International, Cl. A | | 62,080 a | | 2,799,187 |

| Ness Technologies | | 108,760 a | | 465,493 |

| | | | | 3,264,680 |

| Life Sciences Tools & Services—2.6% | | | | |

| Bio-Rad Laboratories, Cl. A | | 14,950 a | | 1,125,885 |

| Bruker | | 107,887 a | | 435,863 |

| Thermo Fisher Scientific | | 29,380 a | | 1,000,977 |

| Varian | | 16,430 a | | 550,569 |

| | | | | 3,113,294 |

| Movies & Entertainment—1.4% | | | | |

| Lions Gate Entertainment | | 230,430 a | | 1,267,365 |

| RHI Entertainment | | 49,330 a | | 400,560 |

| | | | | 1,667,925 |

The Fund 11

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Multi-Line Insurance—2.7% | | | | |

| Arch Capital Group | | 45,580 a | | 3,195,158 |

| Oil & Gas Equipment & | | | | |

| Services—2.7% | | | | |

| Cal Dive International | | 130,141 a | | 847,218 |

| Dril-Quip | | 75,580 a | | 1,550,146 |

| NATCO Group, Cl. A | | 52,850 a | | 802,263 |

| | | | | 3,199,627 |

| Oil & Gas Exploration & | | | | |

| Production—4.3% | | | | |

| Arena Resources | | 59,050 a | | 1,658,714 |

| Concho Resources | | 53,613 a | | 1,223,449 |

| Penn Virginia | | 52,960 | | 1,375,901 |

| Whiting Petroleum | | 27,240 a | | 911,450 |

| | | | | 5,169,514 |

| Packaged Foods & Meats—1.1% | | | | |

| Hain Celestial Group | | 70,180 a | | 1,339,736 |

| Personal Products—2.4% | | | | |

| Alberto-Culver | | 85,660 | | 2,099,527 |

| Nu Skin Enterprises, Cl. A | | 79,300 | | 827,099 |

| | | | | 2,926,626 |

| Pharmaceuticals—1.2% | | | | |

| Medarex | | 86,380 a | | 482,000 |

| Onyx Pharmaceuticals | | 29,650 a | | 1,012,844 |

| | | | | 1,494,844 |

| Property & Casualty Insurance—3.2% | | | | |

| ProAssurance | | 36,850 a | | 1,944,943 |

| RLI | | 31,870 | | 1,949,169 |

| | | | | 3,894,112 |

| Publishing—1.1% | | | | |

| Interactive Data | | 53,120 | | 1,309,939 |

| Regional Banks—.8% | | | | |

| IBERIABANK | | 20,040 | | 961,920 |

| Research & Consulting Services—3.5% | | | | |

| Exponent | | 56,950 a | | 1,713,056 |

12

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Research & Consulting Services (continued) | | | | |

| Huron Consulting Group | | 42,680 a | | 2,444,284 |

| | | | | 4,157,340 |

| Restaurants—2.2% | | | | |

| P.F. Chang's China Bistro | | 27,590 a | | 577,735 |

| Panera Bread, Cl. A | | 13,320 a | | 695,837 |

| Papa John's International | | 72,390 a | | 1,334,148 |

| | | | | 2,607,720 |

| Security & Alarm Services—1.2% | | | | |

| Cornell | | 75,460 a | | 1,402,801 |

| Semiconductor Equipment—.9% | | | | |

| ATMI | | 27,460 a | | 423,708 |

| Lam Research | | 31,180 a | | 663,510 |

| | | | | 1,087,218 |

| Semiconductors—.6% | | | | |

| PMC-Sierra | | 151,840 a | | 737,942 |

| Specialty Stores—.6% | | | | |

| Hibbett Sports | | 46,492 a | | 730,389 |

| Technology Distributors—.8% | | | | |

| Mellanox Technologies | | 115,280 a | | 906,101 |

| Trading Companies & Distributors—1.5% | | | | |

| MSC Industrial Direct, Cl. A | | 47,380 | | 1,745,005 |

| Trucking—3.4% | | | | |

| Knight Transportation | | 59,550 | | 959,946 |

| Landstar System | | 56,530 | | 2,172,448 |

| Werner Enterprises | | 55,230 | | 957,688 |

| | | | | 4,090,082 |

| Total Common Stocks | | | | |

| (cost $137,818,922) | | | | 117,015,003 |

| |

| |

|

| |

| Exchange Traded Funds—1.4% | | | | |

| |

| |

|

| iShares Russell 2000 Growth Index Fund | | 31,070 | | 1,580,220 |

| iShares Russell 2000 Index Fund | | 2,940 | | 144,766 |

| (cost $1,745,803) | | | | 1,724,986 |

The Fund 13

STATEMENT OF INVESTMENTS (continued)

| Other Investment—1.0% | | Shares | | Value ($) |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred | | | | |

| Plus Money Market Fund | | | | |

| (cost $1,210,000) | | 1,210,000 b | | 1,210,000 |

| |

| |

|

| |

| Total Investments (cost $140,774,725) | | 100.0% | | 119,949,989 |

| Cash and Receivables (Net) | | .0% | | 14,290 |

| Net Assets | | 100.0% | | 119,964,279 |

| |

| ADR—American Depository Receipts | | | | |

| a Non-income producing security. | | | | |

| b Investment in affiliated money market mutual fund. | | | | |

| Portfolio Summary (Unaudited)† | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Health Care | | 27.1 | | Consumer Staples | | 6.5 |

| Information Technology | | 19.9 | | Exchange Traded Funds | | 1.4 |

| Industrials | | 17.6 | | Utilities | | 1.1 |

| Consumer Discretionary | | 11.0 | | Money Market Investment | | 1.0 |

| Financials | | 7.4 | | | | |

| Energy | | 7.0 | | | | 100.0 |

| |

| † Based on net assets. | | | | | | |

| See notes to financial statements. | | | | | | |

14

| | STATEMENT OF ASSETS AND LIABILITIES

December 31, 2008 |

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement of Investments: | | | | |

| Unaffiliated issuers | | 139,564,725 | | 118,739,989 |

| Affiliated issuers | | 1,210,000 | | 1,210,000 |

| Cash | | | | 211,659 |

| Receivable for investment securities sold | | | | 2,854,415 |

| Dividends and interest receivable | | | | 24,427 |

| Receivable for shares of Common Stock subscribed | | | | 9,878 |

| Prepaid expenses | | | | 72,349 |

| Other assets | | | | 68,857 |

| | | | | 123,191,574 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to Founders Asset Management LLC and affiliates—Note 3(c) | | | | 168,862 |

| Payable for investment securities purchased | | | | 2,642,994 |

| Payable for shares of Common Stock redeemed | | | | 201,278 |

| Directors’ deferred compensation | | | | 68,857 |

| Accrued expenses | | | | 145,304 |

| | | | | 3,227,295 |

| |

| |

|

| Net Assets ($) | | | | 119,964,279 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 417,459,118 |

| Accumulated distributions in excess of investment income—net | | | | (127,770) |

| Accumulated net realized gain (loss) on investments | | | | (276,500,666) |

| Accumulated net unrealized appreciation | | | | |

| (depreciation) on investments | | | | (20,866,403) |

| |

| |

|

| Net Assets ($) | | | | 119,964,279 |

| Net Asset Value Per Share | | | | | | | | | | |

| | | Class A | | Class B | | Class C | | Class F | | Class I | | Class T |

| |

| |

| |

| |

| |

| |

|

| Net Assets ($) | | 5,424,559 | | 346,095 | | 1,235,334 | | 103,638,910 | | 9,240,228 | | 79,153 |

| Shares Outstanding | | 268,593 | | 18,651 | | 65,944 | | 5,092,735 | | 445,296 | | 4,065 |

| |

| |

| |

| |

| |

| |

|

| Net Asset Value | | | | | | | | | | | | |

| Per Share ($) | | 20.20 | | 18.56 | | 18.73 | | 20.35 | | 20.75 | | 19.47 |

| |

| See notes to financial statements. | | | | | | | | | | |

The Fund 15

| STATEMENT OF OPERATIONS | | |

| Year Ended December 31, 2008 | | |

| |

|

| |

| |

| |

| |

| Investment Income ($): | | |

| Income: | | |

| Cash dividends: | | |

| Unaffiliated issuers | | 706,213 |

| Affiliated issuers | | 109,019 |

| Total Income | | 815,232 |

| Expenses: | | |

| Investment advisory fee—Note 3(a) | | 1,756,041 |

| Shareholder servicing costs—Note 3(c) | | 353,133 |

| Distribution fees—Note 3(b) | | 189,255 |

| Accounting fees—Note 3(c) | | 112,617 |

| Professional fees | | 67,858 |

| Registration fees | | 66,108 |

| Prospectus and shareholders’ reports | | 55,775 |

| Custodian fees—Note 3(c) | | 24,355 |

| Directors’ fees and expenses—Note 3(d) | | 22,101 |

| Loan commitment fees—Note 2 | | 7,189 |

| Interest expense—Note 2 | | 598 |

| Miscellaneous | | 31,741 |

| Total Expenses | | 2,686,771 |

| Less—reduction in accounting fees—Note 3(c) | | (7,129) |

| Less—reduction in fees due to earnings credits—Note 1(c) | | (30,630) |

| Net Expenses | | 2,649,012 |

| Investment (Loss)—Net | | (1,833,780) |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

| Net realized gain (loss) on investments | | (43,009,047) |

| Net unrealized appreciation (depreciation) on investments | | (34,809,802) |

| Net Realized and Unrealized Gain (Loss) on Investments | | (77,818,849) |

| Net (Decrease) in Net Assets Resulting from Operations | | (79,652,629) |

| |

| See notes to financial statements. | | |

16

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended December 31, |

| | |

|

| | | 2008 | | 2007a |

| |

| |

|

| Operations ($): | | | | |

| Investment (loss)—net | | (1,833,780) | | (2,730,266) |

| Net realized gain (loss) on investments | | (43,009,047) | | 39,744,942 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | (34,809,802) | | (12,738,584) |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | (79,652,629) | | 24,276,092 |

| |

| |

|

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A Shares | | 678,427 | | 940,650 |

| Class B Shares | | 30,853 | | 32,730 |

| Class C Shares | | 248,924 | | 138,400 |

| Class F Shares | | 4,845,191 | | 7,011,491 |

| Class I Shares | | 3,037,366 | | 24,982,780 |

| Class T Shares | | 67,912 | | 47,348 |

| Cost of shares redeemed: | | | | |

| Class A Shares | | (2,473,778) | | (27,506,640) |

| Class B Shares | | (210,161) | | (688,450) |

| Class C Shares | | (493,414) | | (1,048,474) |

| Class F Shares | | (28,433,576) | | (70,053,374) |

| Class I Shares | | (6,440,640) | | (16,095,549) |

| Class T Shares | | (41,378) | | (124,423) |

| Increase (Decrease) in Net Assets | | | | |

| from Capital Stock Transactions | | (29,184,274) | | (82,363,511) |

| Total Increase (Decrease) in Net Assets | | (108,836,903) | | (58,087,419) |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 228,801,182 | | 286,888,601 |

| End of Period | | 119,964,279 | | 228,801,182 |

| Accumulated distributions in excess of | | | | |

| investment income—net | | (127,770) | | (179,066) |

The Fund 17

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Year Ended December 31, |

| | |

|

| | | 2008 | | 2007a |

| |

| |

|

| Capital Share Transactions: | | | | |

| Class Ab | | | | |

| Shares sold | | 24,094 | | 29,689 |

| Shares redeemed | | (91,626) | | (880,815) |

| Net Increase (Decrease) in Shares Outstanding | | (67,532) | | (851,126) |

| |

| |

|

| Class Bb | | | | |

| Shares sold | | 1,064 | | 1,036 |

| Shares redeemed | | (7,968) | | (23,427) |

| Net Increase (Decrease) in Shares Outstanding | | (6,904) | | (22,391) |

| |

| |

|

| Class C | | | | |

| Shares sold | | 9,469 | | 4,882 |

| Shares redeemed | | (18,574) | | (35,209) |

| Net Increase (Decrease) in Shares Outstanding | | (9,105) | | (30,327) |

| |

| |

|

| Class F | | | | |

| Shares sold | | 175,364 | | 222,651 |

| Shares redeemed | | (1,018,054) | | (2,212,860) |

| Net Increase (Decrease) in Shares Outstanding | | (842,690) | | (1,990,209) |

| |

| |

|

| Class I | | | | |

| Shares sold | | 100,083 | | 779,085 |

| Shares redeemed | | (222,125) | | (494,171) |

| Net Increase (Decrease) in Shares Outstanding | | (122,042) | | 284,914 |

| |

| |

|

| Class T | | | | |

| Shares sold | | 2,287 | | 1,509 |

| Shares redeemed | | (1,433) | | (4,062) |

| Net Increase (Decrease) in Shares Outstanding | | 854 | | (2,553) |

| a | | Effective June 1, 2007, Class R shares were redesignated as Class I shares. |

| b | | During the period ended December 31, 2008, 5,625 Class B shares representing $149,695, were automatically |

| | | converted to 5,194 Class A shares and during the period ended December 31, 2007, 14,074 Class B shares |

| | | representing $413,834 were automatically converted to 13,130 Class A shares. |

| See notes to financial statements. |

18

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | Year Ended December 31, | | |

| | |

| |

| |

|

| Class A Shares | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 32.80 | | 30.09 | | 28.63 | | 28.82 | | 26.04 |

| Investment Operations: | | | | | | | | | | |

| Investment (loss)—net | | (.37)a | | (.50)a | | (.35)a | | (.28)a | | (.64) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | (12.23) | | 3.21 | | 1.81 | | .09 | | 3.42 |

| Total from Investment Operations | | (12.60) | | 2.71 | | 1.46 | | (.19) | | 2.78 |

| Net asset value, end of period | | 20.20 | | 32.80 | | 30.09 | | 28.63 | | 28.82 |

| |

| |

| |

| |

| |

|

| Total Return (%)b | | (38.41) | | 9.01 | | 5.10 | | (.66) | | 10.68 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.77 | | 2.02 | | 1.51 | | 1.47 | | 1.38 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.77 | | 2.01 | | 1.51 | | 1.45 | | 1.37 |

| Ratio of net investment | | | | | | | | | | |

| (loss) to average net assets | | (1.30) | | (1.58) | | (1.15) | | (1.09) | | (1.11) |

| Portfolio Turnover Rate | | 234 | | 215 | | 202 | | 160 | | 98 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 5,425 | | 11,024 | | 35,719 | | 45,092 | | 65,763 |

| a | | Based on average shares outstanding at each month end. |

| b | | Exclusive of sales charge. |

| See notes to financial statements. |

The Fund 19

| | FINANCIAL HIGHLIGHTS (continued) |

| | | | | Year Ended December 31, | | |

| | |

| |

| |

|

| Class B Shares | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 30.40 | | 28.04 | | 27.10 | | 27.55 | | 25.12 |

| Investment Operations: | | | | | | | | | | |

| Investment (loss)—net | | (.58)a | | (.60)a | | (.61)a | | (.54)a | | (1.07) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | (11.26) | | 2.96 | | 1.55 | | .09 | | 3.50 |

| Total from Investment Operations | | (11.84) | | 2.36 | | .94 | | (.45) | | 2.43 |

| Net asset value, end of period | | 18.56 | | 30.40 | | 28.04 | | 27.10 | | 27.55 |

| |

| |

| |

| |

| |

|

| Total Return (%)b | | (38.95) | | 8.38 | | 3.51 | | (1.63) | | 9.67 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 2.76 | | 2.55 | | 2.64 | | 2.44 | | 2.30 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 2.75 | | 2.54 | | 2.64 | | 2.43 | | 2.29 |

| Ratio of net investment | | | | | | | | | | |

| (loss) to average net assets | | (2.29) | | (2.08) | | (2.28) | | (2.06) | | (2.03) |

| Portfolio Turnover Rate | | 234 | | 215 | | 202 | | 160 | | 98 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 346 | | 777 | | 1,344 | | 13,964 | | 18,795 |

| a | | Based on average shares outstanding at each month end. |

| b | | Exclusive of sales charge. |

| See notes to financial statements. |

20

| | | | | Year Ended December 31, | | |

| | |

| |

| |

|

| Class C Shares | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 30.67 | | 28.29 | | 27.14 | | 27.57 | | 25.14 |

| Investment Operations: | | | | | | | | | | |

| Investment (loss)—net | | (.55)a | | (.64)a | | (.56)a | | (.50)a | | (1.53) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | (11.39) | | 3.02 | | 1.71 | | .07 | | 3.96 |

| Total from Investment Operations | | (11.94) | | 2.38 | | 1.15 | | (.43) | | 2.43 |

| Net asset value, end of period | | 18.73 | | 30.67 | | 28.29 | | 27.14 | | 27.57 |

| |

| |

| |

| |

| |

|

| Total Return (%)b | | (38.93) | | 8.41 | | 4.24 | | (1.56) | | 9.67 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | �� | | | | | |

| to average net assets | | 2.60 | | 2.64 | | 2.36 | | 2.36 | | 2.28 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 2.60 | | 2.63 | | 2.36 | | 2.35 | | 2.27 |

| Ratio of net investment | | | | | | | | | | |

| (loss) to average net assets | | (2.13) | | (2.16) | | (2.01) | | (1.98) | | (2.01) |

| Portfolio Turnover Rate | | 234 | | 215 | | 202 | | 160 | | 98 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 1,235 | | 2,302 | | 2,981 | | 4,391 | | 6,668 |

| a | | Based on average shares outstanding at each month end. |

| b | | Exclusive of sales charge. |

| See notes to financial statements. |

The Fund 21

| FINANCIAL HIGHLIGHTS (continued) |

| | | | | Year Ended December 31, | | |

| | |

| |

| |

|

| Class F Shares | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 32.94 | | 30.03 | | 28.58 | | 28.77 | | 25.98 |

| Investment Operations: | | | | | | | | | | |

| Investment (loss)—net | | (.28)a | | (.32)a | | (.34)a | | (.30)a | | (.69) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | (12.31) | | 3.23 | | 1.79 | | .11 | | 3.48 |

| Total from Investment Operations | | (12.59) | | 2.91 | | 1.45 | | (.19) | | 2.79 |

| Net asset value, end of period | | 20.35 | | 32.94 | | 30.03 | | 28.58 | | 28.77 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | (38.22) | | 9.69 | | 5.08 | | (.66) | | 10.74 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.48 | | 1.49 | | 1.53 | | 1.46 | | 1.35 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.47 | | 1.48 | | 1.52 | | 1.45 | | 1.34 |

| Ratio of net investment | | | | | | | | | | |

| (loss) to average net assets | | (1.00) | | (1.01) | | (1.16) | | (1.09) | | (1.08) |

| Portfolio Turnover Rate | | 234 | | 215 | | 202 | | 160 | | 98 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 103,639 | | 195,510 | | 238,015 | | 351,087 | | 550,622 |

| |

| a Based on average shares outstanding at each month end. | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

22

| | | | | Year Ended December 31, | | |

| | |

| |

| |

|

| Class I Shares | | 2008 | | 2007a | | 2006 | | 2005 | | 2004 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 33.64 | | 30.67 | | 29.11 | | 29.22 | | 26.32 |

| Investment Operations: | | | | | | | | | | |

| Investment (loss)—net | | (.33)b | | (.32)b | | (.27)b | | (.24)b | | (.24) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | (12.56) | | 3.29 | | 1.83 | | .13 | | 3.14 |

| Total from Investment Operations | | (12.89) | | 2.97 | | 1.56 | | (.11) | | 2.90 |

| Net asset value, end of period | | 20.75 | | 33.64 | | 30.67 | | 29.11 | | 29.22 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | (38.32) | | 9.68 | | 5.36 | | (.38) | | 11.02 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.62 | | 1.49 | | 1.26 | | 1.18 | | 1.11 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.61 | | 1.48 | | 1.26 | | 1.17 | | 1.10 |

| Ratio of net investment | | | | | | | | | | |

| (loss) to average net assets | | (1.14) | | (.98) | | (.91) | | (.80) | | (.83) |

| Portfolio Turnover Rate | | 234 | | 215 | | 202 | | 160 | | 98 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 9,240 | | 19,086 | | 8,662 | | 8,315 | | 72,317 |

| a | | Effective June 1, 2007, Class R shares were redesignated as Class I shares. |

| b | | Based on average shares outstanding at each month end. |

| See notes to financial statements. |

The Fund 23

| | FINANCIAL HIGHLIGHTS (continued) |

| | | | | Year Ended December 31, | | |

| | |

| |

| |

|

| Class T Shares | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 31.75 | | 29.21 | | 27.91 | | 28.18 | | 25.55 |

| Investment Operations: | | | | | | | | | | |

| Investment (loss)—net | | (.46)a | | (.57)a | | (.45)a | | (.38)a | | (.65) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | (11.82) | | 3.11 | | 1.75 | | .11 | | 3.28 |

| Total from Investment Operations | | (12.28) | | 2.54 | | 1.30 | | (.27) | | 2.63 |

| Net asset value, end of period | | 19.47 | | 31.75 | | 29.21 | | 27.91 | | 28.18 |

| |

| |

| |

| |

| |

|

| Total Return (%)b | | (38.68) | | 8.70 | | 4.66 | | (.96) | | 10.29 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 2.19 | | 2.33 | | 1.84 | | 1.77 | | 1.71 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 2.18 | | 2.32 | | 1.84 | | 1.76 | | 1.70 |

| Ratio of net investment | | | | | | | | | | |

| (loss) to average net assets | | (1.71) | | (1.85) | | (1.51) | | (1.40) | | (1.44) |

| Portfolio Turnover Rate | | 234 | | 215 | | 202 | | 160 | | 98 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 79 | | 102 | | 168 | | 1,187 | | 1,648 |

| a | | Based on average shares outstanding at each month end. |

| b | | Exclusive of sales charge. |

| See notes to financial statements. |

24

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Discovery Fund (the “fund”) is a separate diversified series of Dreyfus Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering five series, including the fund.The fund’s investment objective is to seek capital appreciation. Founders Asset Management LLC (“Founders”) serves as the fund’s investment adviser. Founders is an indirect, wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”).

At a meeting of the Company’s Board of Directors held on September 22, 2008, the Board approved, effective December 1, 2008, a proposal to change the names of the Company and the fund from “Dreyfus Founders Funds, Inc.” and “Dreyfus Founders Discovery Fund” to “Dreyfus Funds, Inc.” and “Dreyfus Discovery Fund,” respectively.

Effective July 1, 2008, BNY Mellon reorganized and consolidated a number of its banking and trust company subsidiaries.As a result of the reorganization, any services previously provided to the fund by Mellon Bank, N.A. or Mellon Trust of New England, N.A. are now provided by The Bank of NewYork Mellon (formerly,The Bank of NewYork).

MBSC Securities Corporation (the “Distributor”), the direct owner of Founders and a wholly-owned subsidiary of The Dreyfus Corporation (“Dreyfus”), an affiliate of Founders, is the Distributor of the fund’s shares. The fund is authorized to issue up to 550 million shares of Common Stock, par value $.01 per share, in the following classes of shares: Class A, Class B, Class C, Class F, Class I and Class T shares. Class A and Class T shares are subject to a sales charge imposed at the time of purchase, although the shares may be purchased at net asset value (“NAV”) without a sales charge by certain categories of investors. Class B shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class B share redemptions made within six years of purchase and automatically convert to Class A shares after six years. The fund does not offer Class B shares, except in connection

The Fund 25

| NOTES TO FINANCIAL STATEMENTS (continued) |

with dividend reinvestment and permitted exchanges of Class B shares. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class F and Class I shares are sold at NAV per share. Class F shares are sold only to Class F grandfathered investors, and Class I shares are sold only to eligible institutional investors. Effective December 3, 2008, investments for new accounts were no longer permitted in Class T of the fund, except that participants in certain group retirement plans were able to open a new account in Class T of the fund, provided that the fund was established as an investment option under the plans before December 3, 2008. Other differences between the classes include the services offered to and the expenses borne by each class. Income and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

Each class of the fund bears expenses incurred specifically on its behalf and, in addition, each class bears a portion of general expenses based on the relative net assets or the number of shareholder accounts of the class.The type of expense determines the allocation method.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: A domestic equity security listed or traded on a securities exchange or in the over-the-counter market is valued at its last sale price on the exchange or market where it is principally traded or, in the case of a security traded on NASDAQ, at its official closing price. Lacking any sales on that day, the security is valued at the current closing bid price, or by quotes from dealers making a market in the security if the closing bid price is not available.

26

A foreign equity security traded on a foreign exchange is valued at the last quoted official closing price available before the time when the fund’s assets are valued, or at the last quoted sales price if the exchange does not provide an official closing price or if the foreign market has not yet closed. Lacking any sales that day, the security is valued at the current closing bid price. NewYork closing exchange rates are used to convert foreign currencies to U.S. dollars.

A debt security with a remaining maturity greater than 60 days at the time of purchase is valued in accordance with the evaluated bid price supplied by a pricing service approved by the Company’s Board of Directors or, if such price is not available, at the mean between the highest bid and lowest asked quotations obtained from at least two securities dealers.A debt security with a remaining maturity of 60 days or less at the time of purchase is valued at amortized cost, which approximates market value, unless it is determined that amortized cost would not represent market value, in which case the securities would be marked to market.

Registered investment companies that are not traded on an exchange are valued at their NAV.

If market quotations or official closing prices are not readily available or are determined not to reflect accurately fair value, securities will be valued at their fair value as determined in good faith by the Board of Directors or pursuant to procedures approved by the Board of Directors. These situations may include instances where an event occurs after the close of the market on which a security is traded but before the fund calculates its NAV, and it is determined that the event has materially affected the value of the security. Fair value of foreign equity securities may be determined with the assistance of a pricing service using calculations based on indexes of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts.

The Fund 27

| NOTES TO FINANCIAL STATEMENTS (continued) |

The fund adopted Statement of Financial Accounting Standards No. 157 “FairValue Measurements” (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the fund’s investments relating to FAS 157.These inputs are summarized in the three broad levels listed below.

| | Level 1—quoted prices in active markets for identical securities.

Level 2—other significant observable inputs (including quoted

prices for similar securities, interest rates, prepayment speeds,

credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own

assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of December 31, 2008 in valuing the fund’s investments carried at fair value:

| | | Investments in | | Other Financial |

| Valuation Inputs | | Securities ($) | | Instruments ($)† |

| |

| |

|

| Level 1—Quoted Prices | | 119,949,989 | | 0 |

| Level 2—Other Significant | | | | |

| Observable Inputs | | 0 | | 0 |

| Level 3—Significant | | | | |

| Unobservable Inputs | | 0 | | 0 |

| Total | | 119,949,989 | | 0 |

| † | | Other financial instruments include derivative instruments such as futures, forward currency |

| | | exchange contracts and swap contracts, which are valued at the unrealized appreciation |

| | | (depreciation) on the instrument and written options contracts which are shown at value. |

(b) Foreign Securities and Currency Transactions: The fund may invest at least a portion of its assets in foreign securities. Foreign securities carry more risk than U.S. securities, such as political and currency risks. In the event the fund executes a foreign security transaction, the fund may enter into a foreign currency contract to settle the foreign security transaction.The fund could be exposed to risk if counterpar-

28

ties are unable to meet the terms of the contracts or if the value of the currency changes unfavorably to the U.S. dollar.The resultant foreign currency gain or loss from the contract is recorded as foreign currency gain or loss and is presented as such in the Statement of Operations.

The accounting records of the fund are maintained in U.S. dollars.The market values of foreign securities, currency holdings and other assets and liabilities are translated into U.S. dollars based on the current exchange rates each business day. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions.

The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net unrealized appreciation (depreciation) on investments and foreign currency translations in the Statement of Operations.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized appreciation or depreciation on investments and foreign currency translation arises from changes in the values of assets and liabilities, including investments in securities held at the date of the financial statements, resulting from changes in the exchange rates and changes in market prices of securities held.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest

The Fund 29

| NOTES TO FINANCIAL STATEMENTS (continued) |

income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

(d) Affiliated issuers: Investments in other investment companies advised by Founders or its affiliates are defined as “affiliated” in the Act.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(f) Federal income taxes: No provision has been made for federal income taxes since it is the policy of the fund to comply with the requirements of Subchapter M of the Code that are applicable to regulated investment companies and to make distributions of income and capital gains sufficient to relieve it from all income taxes.The fund is treated as a separate tax entity for federal income tax purposes.

As of and during the period ended December 31, 2008, the fund did not have any liabilities for any unrecognized tax positions. The fund recognizes interest and penalties, if any, related to unrecognized tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the four-year period ended December 31, 2008 remains subject to examination by the Internal Revenue Service and state taxing authorities.

30

At December 31, 2008, the components of accumulated earnings on a tax basis were as follows: accumulated capital losses $252,605,739 and unrealized depreciation $26,604,111. In addition, the fund had $18,115,552 of capital losses realized after October 31, 2008, which were deferred for tax purposes to the first day of the following fiscal year.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to December 31, 2008. If not applied, $218,607,732 of the carryover expires in fiscal 2010, $14,100,467 expires in fiscal 2011 and $19,897,540 expires in fiscal 2016.

During the period ended December 31, 2008, as a result of permanent book to tax differences, primarily due to the tax treatment for net operating losses, the fund increased accumulated undistributed investment income-net by $1,885,076, and decreased paid-in-capital by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Line of Credit:

The Company has a line of credit arrangement (“LOC”) with State Street Bank and Trust Company, to be used for temporary or emergency purposes, primarily for financing redemption payments. The borrowings by each series of the Company are limited to the lesser of (a) $25 million, or (b) the lesser of 25% of the series’ total net assets or the maximum amount which the series is permitted to borrow pursuant to the prospectus, any law or any other agreement. Combined borrowings are subject to the $25 million cap on the total LOC. Each series agrees to pay annual fees and interest on the unpaid balance based on prevailing market rates as defined in the LOC.

The average daily amount of borrowings outstanding under the LOC during the period ended December 31,2008,was approximately $14,700 with a related weighted average annualized interest rate of 4.07% .

The Fund 31

| NOTES TO FINANCIAL STATEMENTS (continued) |

NOTE 3—Investment Advisory Fee and Other Transactions With Affiliates:

(a) In accordance with an investment advisory agreement between the Company and Founders, the fund compensates Founders for its services as investment adviser by the payment of fees computed daily and paid monthly at an annual rate equal to a percentage of the average daily value of the fund’s net assets.The fee is 1% of the first $250 million of net assets, .80% of the next $250 million of net assets and .70% of net assets in excess of $500 million.

During the period ended December 31, 2008, the Distributor retained $628 and $374 from sales commissions earned on sales of the fund’s Class A and ClassT shares, respectively, and $324 and $459 from CDSCs on redemptions of the fund’s Class B and Class C shares, respectively.

(b) Under a Distribution Plan (the “Class B, C and T Plan”) adopted pursuant to Rule 12b-1 under the Act, Class B, Class C and Class T shares pay the Distributor for distributing the shares at an annual rate of .75% of the value of the average daily net assets of Class B and Class C shares and .25% of the value of the average daily net assets of Class T shares. During the period ended December 31, 2008, Class B, Class C and Class T shares were charged $4,037, $13,460 and $250, respectively, pursuant to the Class B, C and T Plan.

The fund also has adopted a Distribution Plan pursuant to Rule 12b-1 under the Act applicable to its Class F shares (the “Class F Plan”).Under the Class F Plan, the fund is authorized to reimburse the Distributor for expenses paid for distributing or servicing its Class F shares at an annual rate of up to .25% of the value of the average daily net assets of the Fund’s Class F shares. During the period ended December 31, 2008, Class F shares were charged $171,508 pursuant to the Class F Plan.

(c) Under the Shareholder Services Plan, Class A, Class B, Class C and ClassT shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the

32

fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended December 31, 2008, Class A, Class B, Class C and Class T shares were charged $20,678, $1,346, $4,487 and $250, respectively, pursuant to the Shareholder Services Plan.

The Company has a shareholder services agreement with the Distributor, whereby the fund has agreed to compensate the Distributor for providing certain shareholder servicing functions to holders of Class F shares. The fund paid the Distributor a monthly fee equal, on an annual basis, to $24.00 per Class F shareholder account considered to be an open account at any time during a given month. During the period ended December 31, 2008, Class F shares were charged $120,805 pursuant to this shareholder services agreement.

Dreyfus Transfer, Inc. (“DTI”), a wholly-owned subsidiary of Dreyfus, is the transfer and dividend disbursing agent for all of the fund’s share classes.The Distributor pays the transfer and dividend agent fees, other than out-of-pocket charges, for Class F only.

The fees charged by DTI with respect to the fund’s Class A,B,C, I and T shares are paid by the fund. These transfer agency fees, including both the per account fees paid to DTI and out-of-pocket charges, during the period ended December 31, 2008 were $28,465.

The fund compensates The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Founders, under two cash management agreements for performing cash management services related to fund subscriptions and redemptions. During the period ended December 31, 2008, the fund was charged $23,768 for these services, which were partially offset by earnings credits pursuant to the cash management agreements.

The Fund 33

| NOTES TO FINANCIAL STATEMENTS (continued) |

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended December 31, 2008, the fund was charged $24,355 for these services. These fees were partially offset by earnings credits pursuant to the custody agreement.

The fund has agreed to compensate Dreyfus for providing accounting services, administration, compliance monitoring, regulatory and shareholder reporting, as well as related facilities, equipment and clerical help. The fee is computed at the annual rate of .06% of the average daily net assets of the fund on the first $500 million, .04% of the average daily net assets of the fund on the next $500 million and .02% of the average daily net assets of the fund in excess of $1 billion, plus reasonable out-of pocket expenses. Dreyfus has contractually agreed in writing to waive any fees received for these services to the extent they exceed its costs in providing the services and a reasonable allocation of the costs incurred by Founders and its affiliates related to the support and oversight of these services. During the period ended December 31, 2008, Dreyfus waived $7,129.

The components of “Due to Founders Asset Management LLC and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $95,375, Rule 12b-1 distribution plan fees $13,853, shareholder services plan fees $42,835, custodian fees $4,451, compliance support fees $1,833, transfer agency per account fees $4,638 and accounting fees $5,877.

(d) Annual retainer fees and attendance fees for the Company’s Board of Directors are allocated to each series of the Company based on net assets. During the period ended December 31, 2008, the fund paid $63,768 in directors’ fees. The Company’s Board of Directors has adopted a deferred compensation plan for Company directors that enables directors to elect to defer receipt of all or a portion of the annual compensation that they are entitled to receive from the Company. Under the plan, the compensation deferred is invested in shares of one or more of the Company’s series.The amount paid to

34

the director under the plan will be determined based upon the performance of the selected series.The current value of these amounts is included in Other Assets and Directors’ Deferred Compensation in the Statement of Assets and Liabilities. Increases in the market value of the deferred compensation accounts are added to the directors’ fees and expenses paid by the fund in the directors fees and expenses in the Statement of Operations, and decreases in the market value of the accounts are subtracted from such fees. During the period ended December 31, 2008, depreciation in the value of the accounts totaled $41,667. This depreciation also is included in the net unrealized appreciation (depreciation) on investments in the Statement of Operations. Deferral of directors’ fees under the plan does not affect the net assets of the fund.

Certain officers of the Company are also officers and/or directors of Founders or its affiliates, which pay their compensation. However, the fund pays a portion of the cost of the services performed by the Company’s Chief Compliance Officer and her staff. During the period ended December 31, 2008, the fund was charged $1,833 for these services, which is included in miscellaneous expenses. The affairs of the fund, including services provided by Founders, are subject to the supervision and general oversight of the Company’s Board of Directors.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2008, amounted to $407,546,641 and $437,243,656, respectively.

At December 31, 2008, the cost of investments for federal income tax purposes was $146,554,100; accordingly, accumulated net unrealized depreciation on investments was $26,604,111, consisting of $3,266,956 gross unrealized appreciation and $29,871,067 gross unrealized depreciation.

The Fund 35

| NOTES TO FINANCIAL STATEMENTS (continued) |

In March 2008, the Financial Accounting Standards Board released Statement of Financial Accounting Standards No. 161 “Disclosures about Derivative Instruments and Hedging Activities” (“FAS 161”). FAS 161 requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements. The application of FAS 161 is required for fiscal years and interim periods beginning after November 15, 2008.At this time, management is evaluating the implications of FAS 161 and its impact on the financial statements and the accompanying notes has not yet been determined.

NOTE 5—Subsequent Event:

On February 4, 2009, the fund issued to each holder of its Class T shares, in exchange for said shares, Class A shares of the fund having an aggregate net asset value equal to the aggregate net asset value of the shareholder’s Class T shares. Subsequent investments in the fund’s Class A shares made by prior holders of the fund’s ClassT shares who received Class A shares of the fund in exchange for their Class T shares are subject to the front-end sales load schedule that was in effect for Class T shares at the time of the exchange. Otherwise, all other Class A share attributes will be in effect.

36

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM |

| | Shareholders and Board of Directors

Dreyfus Discovery Fund |

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Discovery Fund (formerly, Dreyfus Founders Discovery Fund) (one of the series comprising Dreyfus Funds, Inc.) as of December 31, 2008, and the related statement of operations for the year then ended, and the statement of changes in net assets and financial highlights for each of the two years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the years ended December 31, 2006, 2005 and 2004 were audited by other auditors whose report dated February 23, 2007, expressed an unqualified opinion on such financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2008 by correspondence with the custodian and others. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the 2008 and 2007 financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Discovery Fund at December 31, 2008, the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for each of the two years in the period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

February 23, 2009 |

The Fund 37

FACTORS CONSIDERED IN RENEWING

THE ADVISORY AGREEMENT (Unaudited) |

At a meeting of the board of directors of Dreyfus Funds, Inc. (the “Funds” and, in reference to any one of the Funds’ portfolios, a “Fund”) held on August 20 and 21, 2008, the Funds’ directors unanimously approved the continuation of the Investment Advisory Agreement (“management agreement”) between each of the Funds and Founders Asset Management LLC, the Funds’ investment adviser (“Founders”), for a one-year term ending August 31, 2009.The board of directors of the Funds (“board”) is comprised entirely of individuals who have no affiliation with Founders or any affiliates of Founders (the “directors”).

Prior to the directors’ August 2008 meeting, Founders had provided the directors with extensive materials related to the renewal of the management agreement, including performance and expense information for other investment companies with similar investment objectives to each Fund derived from data compiled by Lipper Inc., an independent third party (“Lipper”).