QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 18-K/A

For Foreign Governments and Political Subdivisions Thereof

AMENDMENT NO. 1

TO

ANNUAL REPORT

of

HYDRO-QUÉBEC

QUÉBEC, CANADA

(Name of Registrant)

Date of end of last fiscal year: December 31, 2006

SECURITIES REGISTERED*

(As of the close of the fiscal year)

|

Title of Issue

| | Amounts as to Which

Registration is Effective

| | Names of Exchanges

on Which Registered

|

|---|

|

| N/A | | N/A | | N/A |

|

Name and address of persons authorized to receive notices

and communications from the Securities and Exchange Commission:

| |

|

|---|

MR. MICHEL ROBITAILLE

Delegate General

Québec Government House

One Rockefeller Plaza

26th Floor

New York, NY 10020-2102 |

Copies to: |

| | | |

MR. ROBERT E. BUCKHOLZ, JR.

Sullivan & Cromwell LLP

125 Broad Street

New York, NY 10004-2498 | | MR. DANIEL GARANT

Chief Financial Officer

Hydro-Québec

75 René-Lévesque Boulevard West

Montréal, Québec, Canada H2Z 1A4 |

* The Registrant is filing this annual report on a voluntary basis

The undersigned registrant hereby amends its Annual Report on Form 18-K for the fiscal year ended December 31, 2006 ("Annual Report") as follows:

The Annual Report on Form 18-K and amendments on Form 18-K/A are filed on a voluntary basis.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Amendment No. 1 to be signed on its behalf by its authorized agent.

| | | HYDRO-QUÉBEC |

|

|

By: |

|

/s/ LOUISE GUILLEMETTE

Authorized Officer |

| | | | | Name: Louise Guillemette

Title: Coordinator, Documentation |

Date: May 18, 2007

HYDRO-QUÉBEC

Quarterly Report

First Quarter 2007

Message from the Chairman of the Board

and the President and Chief Executive Officer

Summary of results

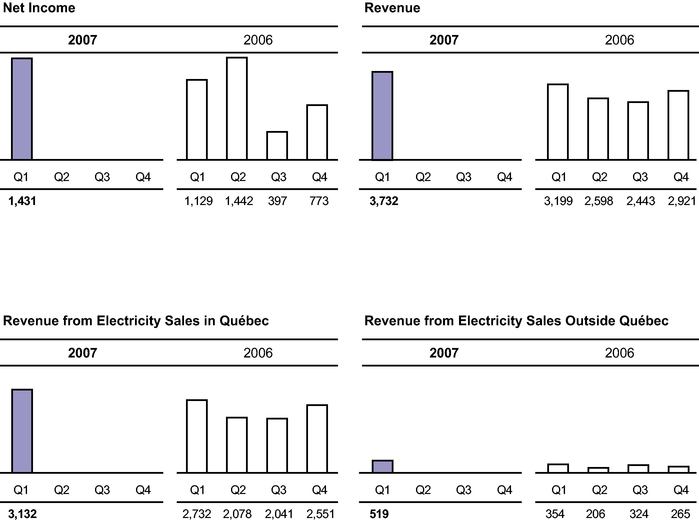

For the quarter ended March 31, 2007, income from continuing operations totaled $1,410 million, or $305 million more than first quarter 2006, mainly because of colder temperatures in 2007, which accounted for $121 million of the increase, and growth in net electricity exports by Hydro-Québec Production, which accounted for $134 million.

Income from discontinued operations was $21 million, compared to $24 million in 2006.

For the quarter ended March 31, 2007, net income totaled $1,431 million, or $302 million more than in 2006.

Consolidated results

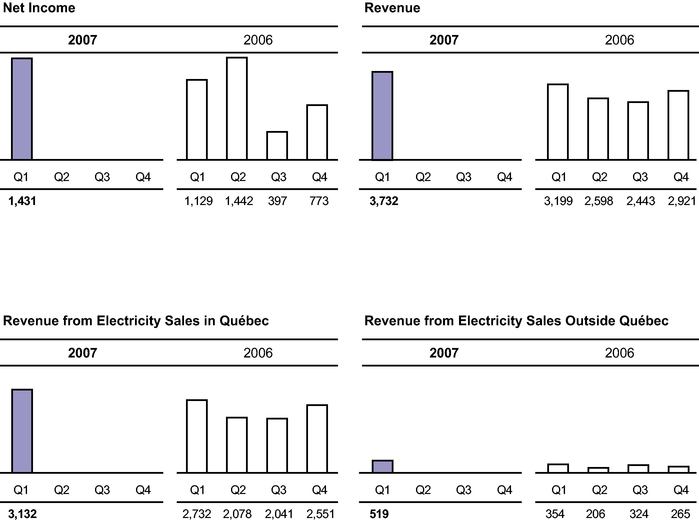

Revenue amounted to $3,732 million, or $533 million more than in 2006, on account of a $400-million increase in revenue from electricity sales in Québec due to colder temperatures in 2007 and the rate adjustment that went into effect on April 1, 2006. In addition, there was a $149-million increase in revenue from electricity sales by Hydro-Québec Production, chiefly due to a higher export volume.

Total expenditure was $1,704 million, up $140 million from 2006, primarily because of the increase in electricity purchases in excess of the heritage pool and the monthly payment of water-power royalties by Hydro-Québec Production to the Québec government since January 2007.

Financial expenses were $618 million, or $88 million more than in 2006. This increase is partly due to the depreciation of the Canadian dollar. In addition, the application of new accounting standards on financial instruments, which abolish the transitional rules granted in 2004, gave rise to an upward adjustment of retained earnings as at January 1, 2007, and consequently terminated the amortization of a deferred gain.

Discontinued operations contributed $21 million to net income in 2007, mainly because of an $18-million gain on the sale of our interest in DirectLink in Australia. This transaction, which was closed on February 28 2007, completes the sale of our foreign holdings.

Segmented results

Generation

In the first quarter, Hydro-Québec Production earned net income of $907 million, versus $807 million in 2006. This year-over-year increase of $100 million is chiefly due to growth in net electricity exports, mitigated by the monthly payment of water-power royalties, which began in January 2007.

Transmission

Hydro-Québec TransÉnergie's net income amounted to $127 million, an increase of $33 million over last year.

Revenue rose to $702 million from $632 million in 2006, for an increase of $70 million primarily due to the increase in native load transmission revenue resulting from the decisions handed down by the Régie de l'énergie in 2006 and 2007. For the first quarter of 2007, the impact of these decisions amounts to $57 million.

Distribution

Hydro-Québec Distribution posted net income of $393 million, versus $213 million in 2006. This $180-million improvement stems chiefly from the increase in revenue from electricity sales and the amortization of the liability resulting from the variance in supply costs for electricity in excess of the heritage pool in 2006; these factors were partially offset by the higher volume of electricity purchases in excess of the heritage pool and increased transmission costs.

Revenue from electricity sales totaled $3,129 million, up $397 million over last year, basically because of the effect of colder temperatures in first quarter 2007, the April 2006 rate adjustment and the increase in revenues related to special contracts with a number of large-power industrial customers. It should be noted that all revenue and expenditure related to these special contracts are transferred to Hydro-Québec Production. Sales volume was 51.5 TWh, an increase of 1.9 TWh attributable to the colder temperatures.

Construction

The Construction segment comprises the operations of Hydro-Québec Équipement and Société d'énergie de la Baie James.

In the first quarter, the volume of activity totaled $286 million, compared with $366 million in 2006. As in 2006, several major projects requiring sizable capital outlay are being carried out for Hydro-Québec Production and Hydro-Québec TransÉnergie. It should be noted that construction work on the Eastmain-1-A/Sarcelle/Rupert project began during the quarter.

2

Investment

As at March 31, 2007, investments in fixed and intangible assets and in the deployment of the Energy Efficiency Plan totaled $584 million, compared to $635 million in 2006. As anticipated, a large portion of this amount was devoted to the development projects of Hydro-Québec Production.

Hydro-Québec TransÉnergie continued developing its transmission system to accommodate new generating capacity. Hydro-Québec Distribution continued to invest in order to meet growth in demand and improve service quality, notably through the Customer Information System project, and also continued implementation of the Energy Efficiency Plan.

Financing

The 2007 borrowing program amounts to $1.1 billion, a relatively modest amount compared to previous years, mainly because of funds available from the disposal of our foreign holdings, which was completed at the end of February 2007. The proceeds from our borrowings will be used to refinance debt maturing this year and to finance the investment program.

In January 2007, a financing totaling $526 million was effected on the Canadian market by reopening the bond offering launched in October 2006 and maturing in February 2045. This transaction brought the amount outstanding for this offering to $1.5 billion. The cost of this borrowing is 4.73%.

|

|

| /s/ Michael L. Turcotte | /s/ Thierry Vandal |

Michael L. Turcotte

Chairman of the Board |

Thierry Vandal

President and Chief Executive Officer |

May 18, 2007

3

CONSOLIDATED STATEMENTS OF OPERATIONS

In millions of Canadian dollars

(unaudited)

| | | | | Three months ended

March 31 |

| | | Notes | | 2007 | | 2006 |

| | | | |

|

| Revenue | | | | 3,732 | | 3,199 |

Expenditure |

|

|

|

|

|

|

| | Operations | | | | 606 | | 559 |

| | Electricity and fuel purchases | | | | 422 | | 363 |

| | Depreciation and amortization | | 4 | | 482 | | 489 |

| | Taxes | | | | 208 | | 153 |

| | Regulatory deferrals | | 3 | | (14 | ) | — |

| | | | |

| |

|

| | | | | 1,704 | | 1,564 |

| Operating income | | | | 2,028 | | 1,635 |

| Financial expenses | | 5 | | 618 | | 530 |

| | | | |

| |

|

| Income from continuing operations | | | | 1,410 | | 1,105 |

| Income from discontinued operations | | 6 | | 21 | | 24 |

| | | | |

| |

|

| Net income | | | | 1,431 | | 1,129 |

| | | | |

| |

|

CONSOLIDATED STATEMENTS OF RETAINED EARNINGS

In millions of Canadian dollars

(unaudited)

| | | | | Three months ended March 31 |

| | | Note | | 2007 | | 2006 |

| | | | |

|

| Balance at beginning of period | | | | 14,474 | | 13,075 |

| Adjustments related to the adoption of new accounting policies | | 2 | | 298 | | — |

| Net income | | | | 1,431 | | 1,129 |

| | | | |

| |

|

| Balance at end of period | | | | 16,203 | | 14,204 |

| | | | |

| |

|

The accompanying notes are an integral part of the consolidated financial statements.

4

CONSOLIDATED BALANCE SHEETS

In millions of Canadian dollars

| | |

Notes | | As at March 31,

2007

(unaudited

|

)

| As at December 31,

2006

(audited

|

)

|

| ASSETS | | | | | | | |

Current assets |

|

|

|

|

|

|

|

| | Cash and cash equivalents | | | | 285 | | 52 | |

| | Short-term investments | | | | 711 | | 3,178 | |

| | Accounts receivable | | | | 2,371 | | 1,597 | |

| | Derivative instruments | | | | 1,435 | | 1,491 | |

| | Materials, fuel and supplies | | | | 371 | | 365 | |

| | Assets held for sale | | 6 | | — | | 11 | |

| | | | |

| |

| |

| | | | | 5,173 | | 6,694 | |

Property, plant and equipment |

|

|

|

51,850 |

|

51,813 |

|

| Investments | | | | 233 | | 232 | |

| Derivative instruments | | | | 1,095 | | 1,093 | |

| Intangible assets | | | | 897 | | 923 | |

| Other assets | | | | 2,376 | | 2,462 | |

| Assets held for sale | | 6 | | — | | 31 | |

| | | | |

| |

| |

| | | | | 61,624 | | 63,248 | |

| | | | |

| |

| |

LIABILITIES |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

| | Borrowings | | | | 65 | | 25 | |

| | Accounts payable and accrued liabilities | | | | 1,596 | | 1,818 | |

| | Dividends payable | | | | — | | 2,342 | |

| | Accrued interest | | | | 520 | | 936 | |

| | Regulatory liability | | | | 206 | | 251 | |

| | Current portion of long-term debt | | | | 1,335 | | 1,063 | |

| | Derivative instruments | | | | 614 | | 340 | |

| | Liabilities related to assets held for sale | | 6 | | — | | 1 | |

| | | | |

| |

| |

| | | | | 4,336 | | 6,776 | |

Long-term debt |

|

|

|

33,098 |

|

33,027 |

|

| Derivative instruments | | | | 1,749 | | 1,111 | |

| Asset retirement obligations | | | | 442 | | 431 | |

| Other long-term liabilities | | | | 663 | | 2,719 | |

| Long-term liabilities related to assets held for sale | | 6 | | — | | 7 | |

| Perpetual debt | | | | 334 | | 337 | |

| | | | |

| |

| |

| | | | | 40,622 | | 44,408 | |

| | | | |

| |

| |

SHAREHOLDER'S EQUITY |

|

|

|

|

|

|

|

| | Share capital | | | | 4,374 | | 4,374 | |

| | Retained earnings | | | | 16,203 | | 14,474 | |

| | Accumulated other comprehensive income | | 8 | | 425 | | (8 | ) |

| | | | |

| |

| |

| | | | | 16,628 | | 14,466 | |

| | | | |

| |

| |

| | | | | 21,002 | | 18,840 | |

| | | | |

| |

| |

| | | | | 61,624 | | 63,248 | |

| | | | |

| |

| |

| Commitments and contingencies | | 11 | | | | | |

The accompanying notes are an integral part of the consolidated financial statements.

5

CONSOLIDATED STATEMENTS OF CASH FLOWS

In millions of Canadian dollars

(unaudited)

| | | | | Three months ended

March 31 | |

| | | Notes | | 2007 | | 2006 | |

| | | | |

| |

| Operating activities | | | | | | | |

| | Net income | | | | 1,431 | | 1,129 | |

| | Income from discontinued operations | | 6 | | (21 | ) | (24 | ) |

| | | | |

| |

| |

| | Income from continuing operations | | | | 1,410 | | 1,105 | |

| | Adjustments | | | | | | | |

| | | Depreciation and amortization | | 4 | | 482 | | 489 | |

| | | Amortization of debt premiums, discounts and issue expenses | | | | 27 | | 2 | |

| | | Exchange gain | | | | (96 | ) | (11 | ) |

| | | Loss on instruments designated as hedging items | | | | 107 | | — | |

| | | Difference between contributions paid and pension cost | | | | 72 | | (7 | ) |

| | | Regulatory deferrals | | | | (14 | ) | — | |

| | | Other | | | | 17 | | (4 | ) |

| | Change in non-cash working capital items | | | | (1,427 | ) | (1,245 | ) |

| | | | |

| |

| |

| | | | | 578 | | 329 | |

Investing activities |

|

|

|

|

|

|

|

| | Property, plant and equipment and intangible assets | | | | (567 | ) | (626 | ) |

| | Long-term investments | | | | 3 | | — | |

| | Disposal of investments, net of divested cash and cash equivalents | | 6 | | 51 | | 162 | |

| | Energy Efficiency Plan | | | | (17 | ) | (9 | ) |

| | Net change in short-term investments | | | | 2,485 | | 223 | |

| | Other | | | | (3 | ) | 13 | |

| | | | |

| |

| |

| | | | | 1,952 | | (237 | ) |

Financing activities |

|

|

|

|

|

|

|

| | Issuance of long-term debt | | | | 523 | | 1,394 | |

| | Repayment of long-term debt at maturity and sinking fund redemption | | | | (583 | ) | (663 | ) |

| | Inflows resulting from credit risk management | | | | 154 | | 85 | |

| | Outflows resulting from credit risk management | | | | (95 | ) | (50 | ) |

| | Net change in short-term borrowings | | | | 40 | | 348 | |

| | Dividends paid | | | | (2,342 | ) | (1,126 | ) |

| | Other | | | | (1 | ) | 1 | |

| | | | |

| |

| |

| | | | | (2,304 | ) | (11 | ) |

| Change in foreign exchange on cash and cash equivalents | | | | — | | (1 | ) |

| | | | |

| |

| |

| Cash flows from continuing operations | | | | 226 | | 80 | |

| Cash flows from discontinued operations | | 6 | | 2 | | 8 | |

| | | | |

| |

| |

| Net change in cash and cash equivalents | | | | 228 | | 88 | |

| Cash and cash equivalents at beginning of period | | | | 57 | | 92 | |

| | | | |

| |

| |

| Cash and cash equivalents at end of period | | | | 285 | | 180 | |

| | | | |

| |

| |

Cash and cash equivalents |

|

|

|

|

|

|

|

| | Continuing operations | | | | 285 | | 85 | |

| | Discontinued operations | | | | — | | 95 | |

| | | | |

| |

| |

| | | | | 285 | | 180 | |

| | | | |

| |

| |

| Supplementary cash flow information | | 9 | | | | | |

The accompanying notes are an integral part of the consolidated financial statements.

6

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

In millions of Canadian dollars

(unaudited)

| | | | | Three months ended

March 31 |

| | | | | 2007 | | 2006 |

| | | | |

|

| Net income | | | | 1,431 | | 1,129 |

| | | | |

| |

|

Other comprehensive income |

|

|

|

|

|

|

| | Change in deferred losses on items designated as cash flow hedges | | | | (6 | ) | — |

| | Reclassification to operations of deferred losses on items designated as cash flow hedges | | | | (45 | ) | — |

| | | | |

| |

|

| | | | | (51 | ) | — |

| | | | |

| |

|

| | Other | | | | 5 | | — |

| | | | |

| |

|

| Comprehensive income | | | | 1,385 | | 1,129 |

| | | | |

| |

|

7

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Three-month periods ended March 31, 2007 and 2006

Amounts in tables are in millions of Canadian dollars.

Note 1 — Basis of Presentation

The consolidated financial statements have been prepared in accordance with Canadian generally accepted accounting principles (GAAP) and reflect the decisions of the Régie de l'énergie (the "Régie"). These decisions affect the timing of the recognition of certain transactions in consolidated operations, resulting in the recognition of regulatory assets and regulatory liabilities, which the Corporation considers it is likely to recover or settle subsequently through the rate-setting process. The quarterly consolidated financial statements and the present Notes should be read in conjunction with the Consolidated Financial Statements and accompanying Notes in Hydro-Québec's Annual Report 2006.

The accounting policies used to prepare the quarterly consolidated financial statements conform to those presented in Hydro-Québec's Annual Report 2006, except as regards the changes in accounting policies described in Note 2.

Certain figures from the corresponding period of the previous year have been reclassified in order to conform to the presentation adopted in the current year.

The Corporation's quarterly results are not necessarily indicative of results for the year on account of seasonal temperature fluctuations. Because of higher electricity demand during winter months, revenue from electricity sales in Québec is higher during the first and fourth quarters.

Note 2 — Changes in Accounting Policies

On January 1, 2007, Hydro-Québec adopted the recommendations of the Canadian Institute of Chartered Accountants (CICA) Handbook Section 3855, "Financial Instruments — Recognition and Measurement", which states requirements for the recognition and measurement of financial instruments, and Section 3865, "Hedges", which specifies how hedge accounting is applied and the required disclosures to be made in this context. It also adopted the recommendations of Section 3861, "Financial Instruments — Disclosure and Presentation", and Section 1530, "Comprehensive Income". This last section establishes standards for the reporting and presentation of comprehensive income, which includes net income and other comprehensive income.

Section 3855 requires that financial instruments be measured at fair value when they are initially recognized. In subsequent periods, the measurement and recognition of changes in the fair value of financial instruments will depend on the category in which such instruments are classified, namely, held-to-maturity investments, loans and receivables, financial assets and financial liabilities held for trading, available-for-sale financial assets, and other financial liabilities. Accounts receivable have been classified under loans and receivables, Derivative instruments under financial assets and financial liabilities held for trading, and Short-term investments under available-for-sale financial assets. Accounts payable and accrued liabilities, Current portion of long-term debt, Long-term debt, and Perpetual debt have been classified under other financial liabilities.

All financial instruments, including derivatives, are recorded at fair value at the balance sheet date, with the exception of held-to-maturity investments, loans and receivables, and other financial liabilities, which are measured at amortized cost, that is, including premiums, discounts and issue expenses. Commodity futures that can be settled net in cash are recorded at the date of settlement if there is a probability of delivery or receipt in accordance with expected requirements.

8

Financial assets held for trading, including derivative instruments, are recorded at fair value at the balance sheet date. Gains and losses arising from changes in fair value are recognized in operations for the period during which they occur, except in the case of derivative instruments designated as hedges in a cash flow hedging relationship accounted for in accordance with Section 3865. Available-for-sale financial assets are recorded at fair value at the balance sheet date. Deferred gains and losses arising from changes in fair value are recorded in Other comprehensive income until they are realized, at which time they are reclassified to operations.

As part of its integrated risk management, Hydro-Québec applies cash flow or fair value hedge accounting to the hedging relationships that meet the conditions established in Section 3865. In the case of a cash flow hedge, the effective portion of changes in the fair value of an instrument designated as a hedge is recognized in Other comprehensive income, and the gains and losses related to the ineffective portion are immediately recognized in operations, under the same line item as the hedged item. Amounts included in Accumulated other comprehensive income are reclassified to operations, also under the same line item as the hedged item, during the periods in which the change in cash flows attributable to the hedged item impacts operations. In the case of a fair value hedge, the derivative instrument is recorded at fair value, and gains and losses stemming from changes in the fair value, including those related to the ineffective portion of the hedge, are recognized in operations under the same line item as the hedged item. Changes in the fair value of the hedged items attributable to the hedged risk are recognized in operations as adjustments to the hedged item's carrying amount.

In addition, an embedded derivative must be separated from its host contract and recorded at fair value on the balance sheet under certain conditions. Hydro-Québec has chosen to apply this accounting treatment to all host contracts issued, acquired or substantially modified after January 1, 2003.

Hydro-Québec also adopted the recommendations of Section 1506, "Accounting Changes", which prescribes the accounting treatment and disclosure of changes in accounting policies, changes in accounting estimates and corrections of errors.

Prior period figures have not been restated in accordance with the new accounting policies, but certain balances on the consolidated balance sheet as at December 31, 2006, have been reclassified. Derivative instruments formerly presented under Accounts receivable, Swaps, Long-term debt, Current portion of long-term debt, Accounts payable and accrued liabilities, and Accrued interest are now reclassified under Derivative instruments on the balance sheet. Translation adjustments, which formerly were presented separately in Shareholder's equity, have been reclassified to Accumulated other comprehensive income.

The impacts of adopting the new accounting policies were as follows, as at January 1, 2007:

- •

- Retained earnings increased by $298 million, owing mainly to the abolition of transitional rules related to the application of accounting guideline AcG-13 of the CICA Handbook, "Hedging Relationships", to the cumulative ineffectiveness of hedges, and to the transition from the straight line method to the effective interest rate method for the amortization of financial assets and liabilities;

- •

- Accumulated other comprehensive income increased by $479 million, owing mainly to the recording of the effective portion of cash flow hedging relationships;

- •

- Long-term debt increased by $514 million mainly because of the presentation at unamortized cost using the effective interest rate method;

- •

- Other long-term liabilities decreased by $2,051 million, owing to the recording of cash flow hedging relationships, the write-off of unamortized transitional deferred gains related to the application of AcG-13, and the recording of financial assets and liabilities at unamortized cost using the effective interest rate method;

- •

- A decrease of $736 million in the net value of derivative instruments which represents the variance between the fair value of derivative instruments and the portion already recorded on the balance sheet.

9

Note 3 — Regulatory

TRANSMISSION

In decision D-2007-34 of March 30, 2007, the Régie set the Corporation's power transmission rates effective January 1, 2007. The new rates take into account a 7.78% return on the rate base, assuming a capital structure with 30% shareholder's equity. The impact of this decision is essentially a $57-million increase in the annual cost of native load transmission service, an increase which is not integrated into the Corporation's current electricity rates.

DISTRIBUTION

In its decision D-2007-22 of March 15, 2007, the Régie granted an across-the-board increase of 1.92% in the Corporation's electricity rates, effective April 1, 2007. This increase takes into account a 7.79% return on the rate base in 2007, assuming a capital structure with 35% shareholder's equity.

In accordance with the accounting practices authorized previously by the Régie, variances resulting from a modification of the annual cost of native load transmission service, a modification which is not integrated into current electricity rates, as well as cost variances related to electricity purchases in excess of the heritage pool give rise to the recognition of regulatory assets or liabilities, with a counterparty entry in Regulatory deferrals in the Consolidated Statements of Operations. The amortization of variances relative to 2005 and 2006 began in 2007 and amounted to a $36-million credit in the first quarter. This amount was included in Depreciation and amortization in the Consolidated Statements of Operations. The regulatory asset resulting from the increase in the annual cost of native load transmission service in 2007 was $14 million at the end of the first quarter.

Note 4 — Depreciation and Amortization

| | | Three months ended

March 31 |

| | | 2007 | | 2006 |

| | |

|

| Property, plant and equipment | | 454 | | 433 |

| Intangible assets | | 29 | | 29 |

| Regulatory assets and liabilities | | (4 | ) | 23 |

| Deferred charges | | 3 | | 4 |

| | |

| |

|

| | | 482 | | 489 |

| | |

| |

|

10

Note 5 — Financial Expenses

| | | Three months ended

March 31 | |

| | | 2007 | | 2006 | |

| | |

| |

| |

| Interest | | | | | |

| | Interest on debt securities | | 633 | | 571 | |

| | Amortization of debt premiums, discounts and issue expenses | | 27 | | 2 | |

| | |

| |

| |

| | | 660 | | 573 | |

| | |

| |

| |

| Net exchange loss (gain) | | 3 | | (8 | ) |

| Loan guarantee fees paid to the shareholder | | 42 | | 40 | |

| | |

| |

| |

| | | 45 | | 32 | |

| | |

| |

| |

| Less | | | | | |

| | Capitalized financial expenses | | 59 | | 68 | |

| | Net investment income | | 28 | | 7 | |

| | |

| |

| |

| | | 87 | | 75 | |

| | |

| |

| |

| | | 618 | | 530 | |

| | |

| |

| |

11

Note 6 — Discontinued Operations and Assets Held for Sale

On February 28, 2007, Hydro-Québec concluded the sale of its interest in HQI Australia Pty Ltd (DirectLink), through its wholly owned subsidiary Hydro-Québec International, for a cash consideration of $52 million, which gave rise to a gain of $18 million.

In the first quarter of 2006, Hydro-Québec concluded the sale of several of its foreign holdings for a total cash consideration of $247 million, resulting in a total gain of $25 million. For purposes of segmented information, the results of foreign holdings are classified under Corporate and Other Activities.

The following table presents operating results and cash flows from the interests presented as discontinued operations:

| | | Three months ended

March 31 | |

| | | 2007 | | 2006 | |

| | |

| |

| |

| Operations | | | | | |

| | Revenue | | 3 | | 107 | |

| | |

| |

| |

| | Income (loss) before net gain on disposal | | 2 | | (1 | ) |

| | |

| |

| |

| | Gain on disposal | | 19 | | 52 | |

| | Income taxes | | — | | (27 | ) |

| | |

| |

| |

| | Net gain on disposal | | 19 | | 25 | |

| | |

| |

| |

| Income from discontinued operations | | 21 | | 24 | |

| | |

| |

| |

| Cash flows | | | | | |

| | Operating activities | | 1 | | 32 | |

| | Investing activities | | — | | (15 | ) |

| | Financing activities | | — | | (10 | ) |

| | Change in foreign exchange on cash and cash equivalents | | 1 | | 1 | |

| | |

| |

| |

| Cash flows from discontinued operations | | 2 | | 8 | |

| | |

| |

| |

| The assets and liabilities sold, as at the disposal date, were as follows: | | | | | |

| | Cash and cash equivalents | | 2 | | 5 | |

| | Other current assets | | 9 | | 9 | |

| | Long-term assets | | 34 | | 217 | |

| | Current liabilities | | 3 | | 112 | |

| | Long-term liabilities | | 10 | | 21 | |

| | |

| |

| |

| | | 32 | | 98 | |

| | |

| |

| |

12

Note 7 — Financial Instruments

The fair value of derivative instruments, designated or not designated as hedges, was as follows:

| | | As at March 31, | |

| | | 2007 | |

| | |

| |

| Instruments designated as cash flow hedges(a) | | (744 | ) |

| Instruments designated as fair value hedges | | (145 | ) |

| Instruments not designated as hedges(b) | | 1,056 | |

- (a)

- A portion of the long-term debt, with a nominal value of $1,054 million as at March 31, 2007, was also designated as a cash flow hedge.

- (b)

- Transactions carried out as part of the Corporation's risk management, including $785 million in consideration of amounts received or disbursed with respect to credit risk mitigation arrangements.

Effect of cash flow hedges on operations

In the first quarter of 2007, the net gain recognized in operations as the ineffective portion of cash flow hedges was $1 million.

Moreover, as at March 31, 2007, Hydro-Québec estimated at $117 million the amount of existing net gains presented in Accumulated other comprehensive income which it expected to reclassify to operations in the next 12 months. At the same date, the maximum period over which Hydro-Québec would hedge its exposure to the variability of future cash flows for anticipated transactions was 23 years.

Effect of fair value hedges on operations

In the first quarter of 2007, the net loss recognized in operations as the ineffective portion of fair value hedges totaled $3 million.

Effect of revaluation of instruments not designated as hedges on operations

In the first quarter of 2007, the net gain recognized in operations following the revaluation at fair value of derivative instruments which were not accounted for using hedge accounting was $4 million.

13

Note 8 — Accumulated Other Comprehensive Income

| | | As at March 31,

2007 | |

| | |

| |

| | | Cash flow

hedges | | Other | | | | Total | |

| | |

| |

| | | |

| |

| Balance at beginning of period | | — | | (8 | ) | (a) | | (8 | ) |

| Adjustments related to the adoption of new accounting policies | | 479 | | — | | | | 479 | |

| Changes during the period | | (51 | ) | 5 | | | | (46 | ) |

| | |

| |

| | | |

| |

| Balance at end of period | | 428 | | (3 | ) | | | 425 | |

| | |

| |

| | | |

| |

- (a)

- With the adoption of new accounting policies, $8 million was reclassified to the opening balance of Accumulated other comprehensive income as Translation adjustments, which were previously presented separately under Shareholder's Equity.

Note 9 — Supplementary Cash Flow Information

| | | Three months ended

March 31 | |

| | | 2007 | | 2006 | |

| | |

| |

| |

| Change in non-cash working capital items | | | | | |

| | Accounts receivable | | (748 | ) | (611 | ) |

| | Materials, fuel and supplies | | (6 | ) | (26 | ) |

| | Accounts payable and accrued liabilities | | (255 | ) | (239 | ) |

| | Accrued interest | | (418 | ) | (369 | ) |

| | |

| |

| |

| | | (1,427 | ) | (1,245 | ) |

| | |

| |

| |

Investing activities not affecting cash |

|

|

|

|

|

| | Increase in property, plant and equipment and intangible assets | | 13 | | 9 | |

| | |

| |

| |

| Interest paid | | 940 | | 923 | |

| Income taxes paid | | 1 | | 5 | |

| | |

| |

| |

14

Note 10 — Employee Future Benefits

| | | Three months ended

March 31

|

| | |

2007 | | Pension Plan

2006 | |

2007 | | Other Plans

2006 |

| | |

| |

|

| Accrued benefit cost | | 76 | | 74 | | 24 | | 24 |

| | |

| |

| |

| |

|

Note 11 — Commitments and Contingencies

Guarantees

As at March 31, 2007, the potential maximum amount Hydro-Québec could have to pay under letters of credit and guarantees totaled $391 million. Of this amount, $310 million relates to the purchase of energy, for which a liability in the amount of $14 million has been recorded. Some guarantees expire between 2007 and 2019, while others do not have maturity dates.

Moreover, Hydro-Québec provided guarantees to the purchasers of its interests concerning all its representations and warranties in the sale agreements, for which no liability was recorded. The maximum quantifiable contingent risk under these guarantees is approximately $322 million. The representations and warranties of Hydro-Québec apply for a period ending no later than February 24, 2008, except with respect to the contingent tax liabilities and certain other customary representations which remain in effect until the applicable limitation periods expire.

15

Note 12 — Segmented Information

The following tables contain information related to operations and assets by segment:

Three months ended

March 31, 2007

|

| | |

Generation

| |

Transmission

| |

Distribution

| |

Construction

| | Corporate and

Other Activities

| | Intersegment

eliminations

| |

Total

|

| Revenue | | | | | | | | | | | | | | |

| | External customers | | 539 | | 10 | | 3,157 | | — | | 10 | | 16 | | 3,732 |

| | Intersegment | | 1,489 | | 692 | | 14 | | 286 | | 280 | | (2,761 | ) | —

|

Income (loss) from continuing operations |

|

907 |

|

127 |

|

393 |

|

1 |

|

(21 |

) |

3 |

|

1,410 |

| Net income | | 907 | | 127 | | 393 | | 1 | | — | | 3 | | 1,431 |

| Total assets as at March 31, 2007 | | 28,839 | | 15,942 | | 11,950 | | 208 | | 4,909 | | (224 | ) | 61,624 |

Three months ended

March 31, 2006

|

| | |

Generation

| |

Transmission

| |

Distribution

| |

Construction

| | Corporate and

Other Activities

| | Intersegment

eliminations

| |

Total

|

| Revenue | | | | | | | | | | | | | | |

| | External customers | | 434 | | 9 | | 2,750 | | — | | 7 | | (1 | ) | 3,199 |

| | Intersegment | | 1,387 | | 623 | | 14 | | 366 | | 260 | | (2,650 | ) | — |

Income (loss) from continuing operations |

|

807 |

|

94 |

|

213 |

|

— |

|

(8 |

) |

(1 |

) |

1,105 |

| Net income (net loss) | | 807 | | 94 | | 213 | | — | | 16 | | (1 | ) | 1,129 |

| Total assets as at March 31, 2006 | | 27,794 | | 15,633 | | 10,949 | | 246 | | 6,607 | | (244 | ) | 60,985 |

16

CONSOLIDATED FINANCIAL HIGHLIGHTS

In millions of Canadian dollars

(unaudited)

Summary of Operations | | Three months ended

March 31 |

|

| | | 2007 | | 2006 | | Change (%) |

|

| Revenue | | 3,732 | | 3,199 | | 16.7 | | UP |

| Expenditure | | 1,704 | | 1,564 | | 9.0 | | UP |

| Financial expenses | | 618 | | 530 | | 16.6 | | UP |

| Discontinued operations | | 21 | | 24 | | 12.5 | | DOWN |

| Net income | | 1,431 | | 1,129 | | 26.7 | | UP |

17

Quarter Highlights

Eastmain-1-A/Sarcelle/Rupert

On January 11, the Québec government and Hydro-Québec officially announced ground-breaking for the Eastmain-1-A and Sarcelle hydroelectric powerhouses as well as the partial diversion of the Rupert River.

Estimated at over $5 billion, the Eastmain-1-A/Sarcelle/Rupert project will raise Hydro-Québec's installed capacity by 893 MW and annual output by 8.5 TWh, which is the amount of energy necessary to supply about 425,000 residential customers. Commissioning will begin in late 2009 and finish in 2012. During the next six years, the equivalent of 33,000 people will work on this ambitious project. At the peak of construction, more than 4,000 workers will be at the jobsite.

Canadian Nuclear Safety Commission

After holding a public hearing March 7, the Canadian Nuclear Safety Commission announced on April 25 its decision to approve the construction and operation of new solid radioactive waste management facilities at Gentilly-2 generating station.

Conclusion of the sale of foreign holdings

On February 28, 2007, Hydro-Québec, through its subsidiary Hydro-Québec International, sold its 33% interest in DirectLink, in Australia, to Australian Pipeline Trust for the sum of $52 million. This transaction, which gave rise to a gain of approximately $18 million, completes the sale of our foreign holdings.

Régie de l'énergie

On March 15, the Régie authorized Hydro-Québec Distribution to raise its rates by 1.9% effective April 1, 2007, representing a monthly increase of about $1.96 in the average bill for a residential customer. In February, the Régie authorized up to a total amount of $655 million for investments of less than $10 million each and approved a budget of $245 million for energy efficiency programs in 2007. Between now and 2010, Hydro-Québec Distribution will invest $1.3 billion in these programs, for energy savings of 4.7 TWh.

On March 30, 2007, the Régie set the electricity transmission rates of Hydro-Québec TransÉnergie, taking effect on January 1, 2007. This decision basically translates into a $57-million increase in native load transmission revenue, from $2,483 million to $2,540 million, reflecting the cost of the transmission infrastructure required to meet demand growth in Québec.

Hydro-Québec, 75 René-Lévesque Blvd. West, Montréal, Québec H2Z 1A4

Ce document est également publié en français.

www.hydroquebec.com

ISSN 0848-5836

2007G001-1A

18

QuickLinks

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited) Three-month periods ended March 31, 2007 and 2006 Amounts in tables are in millions of Canadian dollars.