UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 18-K

For Foreign Governments and Political Subdivisions Thereof

ANNUAL REPORT

of

HYDRO-QUÉBEC

QUÉBEC, CANADA

(Name of Registrant)

Date of end of last fiscal year: December 31, 2006

SECURITIES REGISTERED*

(As of the close of the fiscal year)

Title of Issue | | Amounts as to Which

Registration is Effective | | Names of Exchanges

on Which Registered |

N/A | | N/A | | N/A |

Name and address of persons authorized to receive notices

and communications from the Securities and Exchange Commission:

MR. MICHEL ROBITAILLE

Delegate General

Québec Government House

One Rockefeller Plaza

26th Floor

New York, NY 10020-2102

Copies to:

Mr. Robert E. Buckholz, JR. | | Mr. Daniel Garant |

Sullivan & Cromwell LLP | | Chief Financial Officer |

125 Broad Street | | Hydro-Québec |

New York, NY 10004-2498 | | 75 René-Lévesque Boulevard West |

| | Montréal, Québec, Canada H2Z 1A4 |

*The Registrant is filing this annual report on a voluntary basis.

The information set forth below is to be furnished:

1. In respect of each issue of securities of the registrant registered, a brief statement as to:

(a) The general effect of any material modifications, not previously reported, of the rights of the holders of such securities.

Not applicable.

(b) The title and the material provisions of any law, decree or administrative action, not previously reported, by reason of which the security is not being serviced in accordance with the terms thereof.

Not applicable.

(c) The circumstances of any other failure, not previously reported, to pay principal, interest, or any sinking fund or amortization installment.

Not applicable.

2. A statement as of the close of the last fiscal year of the registrant giving the total outstanding of:

(a) Internal funded debt of the registrant. (Total to be stated in the currency of the registrant. If any internal funded debt is payable in foreign currency, it should not be included under this paragraph (a), but under paragraph (b) of this item.)

Reference is made to pages 48 and 62 of Exhibit (d) hereto.

(b) External funded debt of the registrant. (Totals to be stated in the respective currencies in which payable. No statement need be furnished as to intergovernmental debt.)

Reference is made to pages 48, 63 and 64 of Exhibit (d) hereto.

3. A statement giving the title, date of issue, date of maturity, interest rate and amount outstanding, together with the currency or currencies in which payable, of each issue of funded debt of the registrant outstanding as of the close of the last fiscal year of the registrant.

Reference is made to pages 62 to 64 of Exhibit (d) hereto.

4. (a) As to each issue of securities of the registrant which is registered, there should be furnished a break-down of the total amount outstanding, as shown in Item 3, into the following:

(1) Total amount held by or for the account of the registrant.

None.

(2) Total estimated amount held by nationals of the registrant (or if registrant is other than a national government by the nationals of its national government); this estimate need be furnished only if it is practicable to do so.

Not practicable to do so.

(3) Total amount otherwise outstanding.

Not applicable.*

*No securities of the registrant are registered under the U.S. Exchange Act of 1934, as amended.

i

(b) If a substantial amount is set forth in answer to paragraph (a) (1) above, describe briefly the method employed by the registrant to reacquire such securities.

Not applicable.

5. A statement as of the close of the last fiscal year of the registrant giving the estimated total of:

(a) Internal floating indebtedness of the registrant. (Total to be stated in the currency of the registrant.)

$370.1 million (including $345.0 million to one of our subsidiaries). The item “floating indebtedness” refers to indebtedness with an original maturity of less than one year.

(b) External floating indebtedness of the registrant. (Total to be stated in the respective currencies in which payable.)

None.

6. Statements of the receipts, classified by source, and of the expenditures, classified by purpose, of the registrant for each fiscal year of the registrant ended since the close of the latest fiscal year for which such information was previously reported. These statements should be so itemized as to be reasonably informative and should cover both ordinary and extraordinary receipts and expenditures; there should be indicated separately, if practicable, the amount of receipts pledged or otherwise specifically allocated to any issue registered, indicating the issue.

Reference is made to pages 28 to 61 of Exhibit (d) hereto.

7. (a) If any foreign exchange control, not previously reported, has been established by the registrant (or if the registrant is other than a national government, by its national government), briefly describe the effect of any such action, not previously reported.

None.

(b) If any foreign exchange control previously reported has been discontinued or materially modified, briefly describe the effect of any such action, not previously reported.

Not applicable.

This annual report comprises:

(a) The cover page and pages numbered i to iv consecutively.

(b) The following exhibits:

(a) None.

(b) None.

(c) None.

(d) Description of Hydro-Québec, dated as of May 10, 2007, including audited consolidated financial statements of Hydro-Québec for the year ended December 31, 2006.

(e) Consent of KPMG LLP and Ernst & Young LLP and

Consent of Samson Bélair/Deloitte & Touche s.e.n.c.r.l. and PricewaterhouseCoopers LLP.

This annual report is filed subject to the Instructions for Form 18-K for Foreign Governments and Political Subdivisions Thereof.

ii

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized, in Montréal, Canada, on the 10th day of May 2007.

| | | HYDRO-QUÉBEC |

| | | |

| | | | |

| | By: | /s/ | Daniel Garant |

| | | Daniel Garant |

| | | Chief Financial Officer |

iii

EXHIBIT INDEX

Exhibits | | Description |

| | |

(d) | | Description of Hydro-Québec, dated as of May 10, 2007, including audited consolidated financial statements of

Hydro-Québec for the year ended December 31, 2006. |

| | |

(e) | | Consent of KPMG LLP and Ernst & Young LLP and Consent of Samson Bélair/Deloitte & Touche s.e.n.c.r.l. and PricewaterhouseCoopers LLP. |

iv

EXHIBIT (d)

This description of Hydro-Québec is dated as of May 10, 2007 and appears as Exhibit (d) to Hydro-Québec’s annual report on

Form 18-K to the U.S. Securities and Exchange Commission for the fiscal year ended December 31, 2006.

This document may be delivered to you at any time but you should assume that the information is accurate only as of May 10, 2007. Hydro-Québec’s business, financial condition, results of operations and prospects may have changed since that date.

This document does not constitute an offer to sell or the solicitation of an offer to buy any securities of Hydro-Québec, unless it is included in a registration statement filed under the Securities Act of 1933, as amended.

TABLE OF CONTENTS

| | Page |

FOREIGN EXCHANGE | | 2 |

SUMMARY | | 3 |

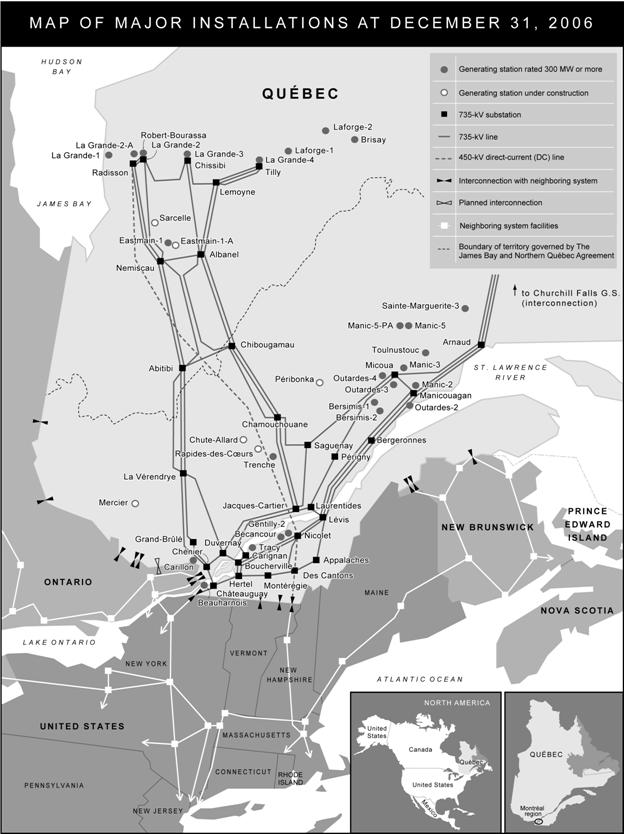

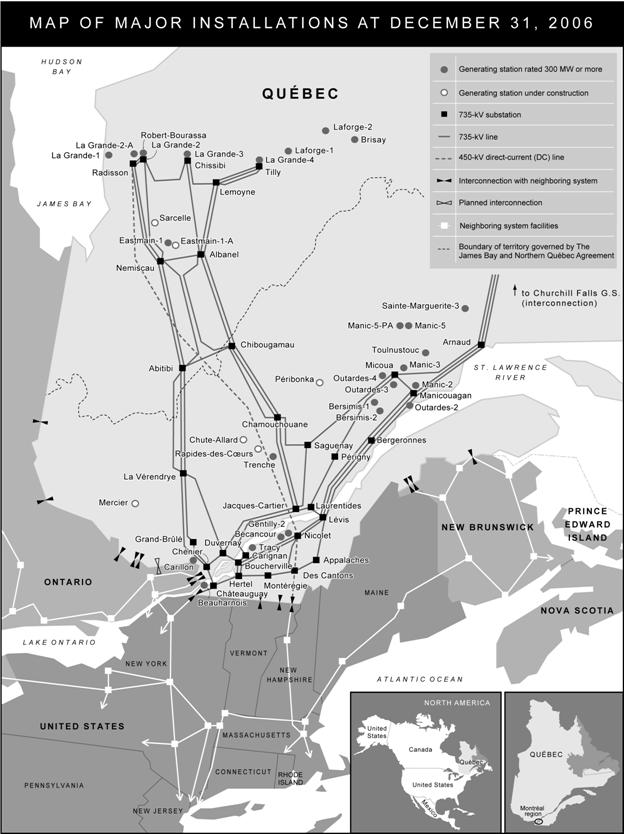

MAP OF MAJOR INSTALLATIONS AT DECEMBER 31, 2006 | | 4 |

HYDRO-QUÉBEC | | 5 |

General | | 5 |

distribution | | 5 |

Facilities | | 5 |

Québec Market | | 5 |

Rates | | 6 |

Electricity Sales and Revenue | | 6 |

transmission | | 7 |

Transmission System | | 7 |

generation | | 8 |

Generation Operations | | 8 |

Wholesale and Trading Operations | | 10 |

construction | | 11 |

corporate and other activities | | 12 |

corporate outlook | | 12 |

Development Strategy | | 12 |

Generations Fund | | 13 |

Capital Investment Program | | 14 |

Regulatory Framework | | 16 |

Litigation | | 18 |

Employees | | 18 |

Management’s Financial Discussion | | 19 |

WHERE YOU CAN FIND MORE INFORMATION | | 24 |

FORWARD-LOOKING STATEMENTS | | 24 |

SUMMARY OF CERTAIN MATERIAL DIFFERENCES BETWEEN CANADIAN GAAP AND US GAAP | | 25 |

AUDITORS’ REPORT | | 27 |

CONSOLIDATED FINANCIAL STATEMENTS | | 28 |

LONG-TERM DEBT BY ISSUE | | 62 |

FOREIGN EXCHANGE

Canada maintains a floating exchange rate for the Canadian dollar in order to permit the rate to be determined by fundamental forces without intervention except as required to maintain orderly conditions. Annual average noon spot exchange rates for major foreign currencies in which the debt of Hydro-Québec is denominated, expressed in Canadian dollars, are shown below.

Foreign Currency | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 (1) | |

| | | | | | | | | | | | | |

United States Dollar | | $ | 1.5704 | | $ | 1.4015 | | $ | 1.3015 | | $ | 1.2116 | | $ | 1.1341 | | $ | 1.1623 | |

Euro | | 1.4832 | | 1.5826 | | 1.6169 | | 1.5090 | | 1.4237 | | 1.5349 | |

Swiss Franc | | 1.0112 | | 1.0418 | | 1.0473 | | 0.9746 | | 0.9050 | | 0.9464 | |

Pound Sterling | | 2.3582 | | 2.2883 | | 2.3842 | | 2.2067 | | 2.0886 | | 2.2817 | |

100 Japanese Yen | | 1.2554 | | 1.2088 | | 1.2035 | | 1.1035 | | 0.9753 | | 0.9746 | |

| | | | | | | | | | | | | | | | | | | |

(1) Monthly average through the end of April 2007.

Source: Bank of Canada.

In this document, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in Canadian dollars.

2

SUMMARY

The information below is qualified in its entirety by the detailed information contained elsewhere in this document.

| | Years ended December 31 | |

| | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| | (dollar amounts in millions) | |

Statistical Information - Electricity | | | | | | | | | | | |

| | | | | | | | | | | |

Electricity sales (in TWh) | | | | | | | | | | | |

Québec | | 158.6 | | 167.1 | | 165.9 | | 169.2 | | 167.3 | |

Outside Québec. | | 54.2 | | 15.8 | | 14.4 | | 15.3 | | 14.5 | |

| | 212.8 | | 182.9 | | 180.3 | | 184.5 | | 181.8 | |

| | | | | | | | | | | |

Revenue from electricity sales | | | | | | | | | | | |

Québec | | $ | 8,112 | | $ | 8,578 | | $ | 8,922 | | $ | 9,121 | | $ | 9,402 | |

Outside Québec | | 3,466 | | 1,345 | | 1,084 | | 1,464 | | 1,149 | |

| | $ | 11,578 | | $ | 9,923 | | $ | 10,006 | | $ | 10,585 | | $ | 10,551 | |

| | | | | | | | | | | |

Rate increase (Québec) (1) | | nil | | nil | | 4.45 | % | 1.2 | % | 5.33 | % |

| | | | | | | | | | | |

Customer accounts at end of year (in thousands) | | 3,597 | | 3,644 | | 3,701 | | 3,753 | | 3,815 | |

Installed capacity at end of period (in MW) (2) | | 32,661 | | 33,616 | | 33,892 | | 34,571 | | 35,315 | |

Peak power demand in Québec for winter beginning in the preceding December (in MW) | | 34,989 | | 36,268 | | 34,956 | | 33,636 | | 36,251 | |

| | | | | | | | | | | |

Consolidated financial information | | | | | | | | | | | |

| | | | | | | | | | | |

Total revenue | | $ | 11,852 | | $ | 10,197 | | $ | 10,341 | | $ | 10,888 | | $ | 11,161 | |

Interest expenses (including capitalized interest) | | $ | 2,711 | | $ | 2,563 | | $ | 2,382 | | $ | 2,305 | | $ | 2,466 | |

Net income (3)(4) | | $ | 1,585 | | $ | 1,938 | | $ | 2,435 | | $ | 2,252 | | $ | 3,741 | |

Earnings before interest, depreciation, amortization, decommissioning (3) | | $ | 5,852 | | $ | 5,897 | | $ | 6,438 | | $ | 6,308 | | $ | 7,823 | |

Capital expenditures | | $ | 2,256 | | $ | 2,694 | | $ | 2,217 | | $ | 3,399 | | $ | 1,469 | |

Interest coverage (5) | | 1.63 | | 1.73 | | 1.79 | | 2.00 | | 2.06 | |

Total assets (3) | | $ | 59,247 | | $ | 57,823 | | $ | 58,118 | | $ | 60,432 | | $ | 63,248 | |

Long-term and perpetual debt | | $ | 37,386 | | $ | 34,842 | | $ | 32,958 | | $ | 31,658 | | $ | 34,476 | |

Shareholder’s equity (3)(6) | | $ | 14,208 | | $ | 15,128 | | $ | 16,220 | | $ | 17,376 | | $ | 18,840 | |

Capitalization ratio (3)(7)(8) | | 26.2 | % | 29.8 | % | 32.8 | % | 34.2 | % | 36.1 | % |

Permanent employees at end of year (in thousands) (8) | | 18.0 | | 18.3 | | 18.8 | | 19.0 | | 19.1 | |

(1) Effective April 1 except in 2004. For 2004: 3% effective January 1 and 1.41% effective April 1.

(2) Of total installed and minimum firm capacity available at December 31, 2006, 93% was hydroelectric, 5% was thermal and 2% was nuclear. In addition, we have access to 4,765 MW of the generation of the Churchill Falls power plant and we also purchase all the output from six privately-owned wind farms with a total installed capacity of 320 MW. Furthermore, 1,206 MW are available under various agreements with other independent suppliers.

(3) In 2004, financial statements for the years 2002 and 2003 were restated as a result of the retroactive application of a new Canadian accounting standard on asset retirement obligations, which required the recognition and measurement of liabilities for legal obligations associated with the retirement of an asset.

(4) Net income originally reported for the years 2002 and 2003 was $1,526 million and $1,931 million, respectively.

(5) Sum of operating income and net investment income divided by gross interest expense.

(6) Shareholder’s equity originally reported for the years 2002 and 2003 was $14,215 million and $15,127 million, respectively.

(7) Shareholder’s equity divided by the sum of shareholder’s equity, long-term debt, perpetual debt, short-term borrowings and current portion of long-term debt, less swaps and sinking funds.

(8) The capitalization ratio originally reported for the years 2002 and 2003 was 26.2% and 29.9%, respectively.

(9) Excludes employees of subsidiaries and joint ventures.

Units of measurement:

GW: | | gigawatt, or 1 million kilowatts | | | | |

MW: | | megawatt, or 1 million watts | | | | |

kWh: | | kilowatthour, or 1 thousand watthours | | | | |

| | | | | | |

GWh: | | gigawatthour, or 1 million kilowatthours | | | | |

TWh: | | terawatthour, or 1 billion kilowatthours | | | | |

kV: | | kilovolt, or 1 thousand volts | | | | |

3

4

HYDRO-QUÉBEC

General

We operate one of the two largest systems in Canada for the generation and distribution of electric power. We supply virtually all electric power distributed in Québec, the largest province in Canada in land area and the second largest in population.

Hydro-Québec was created in 1944 by the Hydro-Québec Act of the Parliament of Québec and is an agent of Québec. All capital stock of Hydro-Québec is held by the Minister of Finance on behalf of the government of Québec (the “Government”).

Our head office is located at 75 René-Lévesque Boulevard West, Montréal, Québec, Canada H2Z 1A4.

Our operations are allocated among five business segments:

· Distribution: Hydro-Québec Distribution develops and operates our distribution system and is responsible for sales and service to Québec customers. It also has responsibility for ensuring the security of the supply of electricity to the Québec market.

· Transmission: Hydro-Québec TransÉnergie develops and operates our transmission system in Québec.

· Generation: Hydro-Québec Production operates and develops our generation facilities in Québec. It guarantees the supply of heritage pool electricity to the Québec market (see “Regulatory Framework - Energy Board Act”) and it participates in the Québec wholesale market by responding to calls for tenders from Hydro-Québec Distribution. It sells electricity on wholesale markets outside Québec and engages in energy trading activities.

· Construction: Hydro-Québec Équipement and our wholly-owned subsidiary, Société d’énergie de la Baie James (“SEBJ”), provide engineering services and carry out construction projects, mainly for our Transmission and Generation segments.

· Corporate and Other Activities: includes corporate activities related to financial services, human resources, strategic planning and corporate affairs, procurement and telecommunications. It also includes activities related to computer services, research and development of our technologies. In 2005, the operations of TransÉnergie HQ inc. (“TransÉnergie HQ”), which held our interest in the Cross-Sound Cable Company, LLC and those of Hydro-Québec International inc. (“Hydro-Québec International”), which held our interests in Latin America and Australia, were reclassified under Corporate and Other Activities as Assets held for sale (see “Management’s Financial Discussion – Financial Results of the Corporate and Other Activities Business Segment”). As of February 2007, all such assets have been sold.

DISTRIBUTION

The primary responsibility of Hydro-Québec Distribution is to supply Québec customers with the electricity they need. To fulfill this responsibility, the division purchases up to 165 TWh/year of heritage pool electricity from Hydro-Québec Production, at a regulated average fixed price of 2.79 cents per kWh. Beyond this volume, Hydro-Québec Distribution must supply Québec customers by issuing calls for tenders from suppliers in the market (see “Regulatory Framework – Energy Board Act”).

Facilities

Our distribution system is made up of 67,600 miles of medium voltage lines (almost exclusively 25 kV), as well as 37,900 miles of low voltage lines. Approximately 9% of all such lines are underground.

Québec Market

We sell to a wide range of customers, from industrial users, which accounted for 43.8% of sales volume in 2006, to residential customers and farms, which represented 33.9% of sales volume in the same period. Revenues are also derived from sales to commercial and institutional customers as well as municipalities.

Through marketing efforts, we have developed some flexibility in the management of our system. We currently have 1,600 MW of interruptible power and 780 MW of concurrent peak-saving capacity in our residential dual-energy market.

5

We have entered into seven risk and profit-sharing agreements with various industrial customers for whom electricity costs represent a substantial proportion of total production costs. Most of these agreements provide for the sale, on a long-term basis, of firm energy at prices that vary in accordance with a formula based on the market price of aluminum produced by those customers. We manage the exposure to fluctuations in aluminum prices resulting from these contracts by entering into financial transactions, such as futures or swaps (see Note 16 to the 2006 Consolidated Financial Statements). In 2006, deliveries under these agreements accounted for approximately 29% of the total energy deliveries to industrial users.

Further to calls for tenders issued since 2002, Hydro-Québec Distribution signed contracts with Hydro-Québec Production for the supply of 600 MW beginning in March 2007 and with five independent producers for the supply of more than 1,500 MW (including 990 MW of wind-generated electricity) from July 2006 through December 2012. In 2005, Hydro-Québec Distribution issued a call for tenders for an additional 2,000 MW, with deliveries starting no later than September 2010. In 2006, Hydro-Québec Distribution issued two calls for tenders to meet short-term domestic demand for 2006 and part of 2007 and 38 contracts were signed for the supply of up to 500 MW. Also, in March 2007, Hydro-Québec Distribution issued a call for tenders for the sale of excess short-term energy supply. Further to this call for tenders, 35 contracts were signed for a total of 350 MW/month for the period from April through September 2007. We expect that more calls for tenders will be made in the coming years in order to balance energy supply and demand in Québec (see “Regulatory Framework – Energy Board Act”).

Rates

Under the applicable provisions of the Energy Board Act, rates are fixed or modified by the Energy Board (see “Regulatory Framework – Energy Board Act”). Rates are fixed to allow recovery of authorized service costs, including estimated supply costs, and a reasonable rate of return on shareholder’s equity. In February 2007, the Energy Board approved an average rate increase of 1.92% effective April 1, 2007.

The following table shows rate increases applicable for each year from 2002 to 2007 as well as annual inflation rates:

| | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | |

Rate increase (1) | | nil | | nil | | 4.45 | % (2) | 1.2 | % | 5.33 | % | 1.92 | % |

Inflation Rate (3) | | 2.2 | % | 2.8 | % | 1.9 | % | 2.2 | % | 2.0 | % | 2.0 | % (4) |

(1) Effective April 1, except in 2004.

(2) For 2004: 3% effective January 1 and 1.41% effective April 1.

(3) Canadian Consumer Price Index.

(4) Estimate.

Electricity Sales and Revenue

The following table summarizes electricity sales and revenue in Québec by class of customers for the years 2002 through 2006.

ELECTRICITY SALES AND REVENUE IN QUÉBEC

| | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| | (TWh) | |

ELECTRICITY SALES | | | | | | | | | | | |

Residential and farm | | 53.2 | | 57.2 | | 58.0 | | 57.3 | | 56.7 | |

General and institutional | | 31.7 | | 32.3 | | 33.2 | | 33.5 | | 32.4 | |

Industrial | | 68.6 | | 72.6 | | 69.7 | | 73.4 | | 73.3 | |

Other | | 5.1 | | 5.0 | | 5.0 | | 5.0 | | 4.9 | |

TOTAL ELECTRICITY SALES | | 158.6 | | 167.1 | | 165.9 | | 169.2 | | 167.3 | |

| | (millions of dollars) | |

| | | | | | | | | | | |

REVENUE FROM ELECTRICITY SALES | | | | | | | | | | | |

Residential and farm | | $ | 3,246 | | $ | 3,504 | | $ | 3,690 | | $ | 3,690 | | $ | 3,775 | |

General and institutional | | 2,058 | | 2,096 | | 2,234 | | 2,284 | | 2,356 | |

Industrial | | 2,577 | | 2,742 | | 2,751 | | 2,892 | | 3,022 | |

Other | | 231 | | 236 | | 247 | | 255 | | 249 | |

TOTAL REVENUE FROM ELECTRICITY SALES | | $ | 8,112 | | $ | 8,578 | | $ | 8,922 | | $ | 9,121 | | $ | 9,402 | |

| | | | | | | | | | | |

NUMBER OF CUSTOMER ACCOUNTS | | | | | | | | | | | |

Residential and farm | | 3,295,544 | | 3,343,271 | | 3,399,776 | | 3,450,455 | | 3,501,709 | |

General and institutional | | 281,696 | | 281,997 | | 282,748 | | 283,616 | | 295,618 | |

Industrial | | 13,509 | | 13,383 | | 13,117 | | 12,796 | | 12,032 | |

Other | | 5,793 | | 5,812 | | 5,634 | | 5,643 | | 5,767 | |

Total number of customer accounts | | 3,596,542 | | 3,644,463 | | 3,701,275 | | 3,752,510 | | 3,815,126 | |

6

TRANSMISSION

In Québec, Hydro-Québec TransÉnergie provides the following services:

· transmission of electricity to supply local distribution; Hydro-Québec Distribution is the division’s largest customer;

· point-to-point transmission service; as at the end of 2006, Hydro-Québec TransÉnergie had signed transmission service agreements with 30 customers, including Hydro-Québec Production which is the main user of this service; and

· connections of privately-owned generation facilities to our transmission system; we currently serve 27 private producers.

This segment also includes our holding in Cedars Rapids Transmission Company, Limited which operates the interconnection between our Les Cèdres plant and the Cornwall Electric load in Ontario as well as the National Grid network in the U.S.

Transmission System

In Québec, our generation stations are located at substantial distances from consumer centers. As a result, our power transmission system is one of the most extensive and comprehensive in North America, comprising more than 20,000 miles of lines.

This system includes the following facilities as at December 31, 2006.

Voltage | | Substations | | Lines (miles) (1) | |

| | | | | |

765 kV and 735 kV | | 38 | | 7,097 | |

450 kV DC | | 2 | | 757 | |

315 kV | | 63 | | 3,186 | |

230 kV | | 50 | | 1,850 | |

161 kV | | 40 | | 1,165 | |

120 kV | | 213 | | 4,101 | |

69 kV or less | | 102 | | 2,241 | |

TOTAL | | 508 | | 20,397 | |

(1) Miles covered by the transmission system. Many facilities carry two lines on the same infrastructure.

In May 1997, we opened access to our transmission grid in accordance with the Hydro-Québec Open Access Transmission Tariff. Consequently, electricity distributors, producers and marketers in and outside Québec have the option to enter into transactions with distributors and producers located outside Québec to buy or sell electricity and to wheel in, wheel out or wheel through Hydro-Québec TransÉnergie’s transmission lines at specified rates. The capacity available on the system is posted on the OASIS (Open Access Same-Time Information System) website.

Hydro-Québec TransÉnergie’s System Control Center in Montréal and regional telecontrol centers are designed to optimize energy resources, supervise power flow and monitor system security. The transmission system is linked with other major power systems in Canada and the Northeastern United States.

7

The following table shows existing interconnections with neighboring systems outside Québec, excluding the lines to Churchill Falls, as at December 31, 2006.

INTERCONNECTIONS WITH NEIGHBORING SYSTEMS OUTSIDE QUÉBEC

| | Maximum Carrying

Capacity | | Hydro-Québec’s Current

Reception Capacity | | Voltage | |

| | (MW) | | (MW) | | (kV) | |

| | | | | | | |

CANADA | | | | | | | |

Ontario | | 1,295 | (1) | 720 | | 120 and 230 | |

New Brunswick | | 1,200 | | 785 | | 230, 315 and 345 | |

| | | | | | | |

UNITED STATES | | | | | | | |

New York | | 2,125 | (1) | 1,000 | | 120 and 765 | |

New England | | 2,305 | | 1,870 | | 120 and 450 | |

(1) Ontario and New York State are partially served by the same installations, limiting the simultaneous export capacity to these two systems to 3,100 MW.

GENERATION

Hydro-Québec Production supplies electricity to the Québec market and is an active player in energy markets in the northeastern part of North America. We sell surplus electricity generated in Québec, purchase electricity for resale and perform energy trading operations.

The following subsidiaries, affiliates and interests are also part of this segment:

· Bucksport Energy LLC (69.44% interest; cogeneration plant in Maine)

· Churchill Falls (Labrador) Corporation Limited (“CF(L)Co”) (34.2% interest; generation activities)

· Société en commandite Betsiamites (86.31% interest; development and operation of the partial diversion of the Portneuf, Sault aux Cochons and Manouane rivers)

· Gestion Production HQ inc. (wholly-owned; investment in local generation businesses and consulting)

· H.Q. Energy Marketing Inc. (“HQEM”) (wholly-owned; energy trading activities and investment in energy trading companies in other Canadian provinces and the U.S.)

· H.Q. Energy Services (U.S.) Inc. (“HQUS”) (wholly-owned; power marketer in the U.S.)

Generation Operations

Facilities

In Québec, our electric generation system comprises 85 power stations currently in service, of which 55 are hydroelectric, 28 are thermal, one is nuclear and one is a wind farm, with a total installed capacity of 35,315 MW as of December 31, 2006.

8

The following table lists the generation facilities in service as of such date.

GENERATION FACILITIES IN SERVICE IN QUÉBEC (1)

Name of Facility | | Years Commissioned (2) | | Capacity | |

| | | | (MW) | |

| | | | | |

Hydroelectric | | | | | |

Robert-Bourassa | | 1979-1981 | | 5,616 | |

La Grande-4 | | 1984-1986 | | 2,779 | |

La Grande-3 | | 1982-1984 | | 2,417 | |

La Grande-2A | | 1991-1992 | | 2,106 | |

Beauharnois | | 1932 and 1961 | | 1,673 | |

Manic-5 | | 1970-1971 | | 1,528 | |

La Grande-1 | | 1994-1995 | | 1,436 | |

Manic-3 | | 1975-1976 | | 1,244 | |

Bersimis-1 | | 1956-1959 | | 1,125 | |

Manic-5-PA | | 1989-1990 | | 1,064 | |

Manic-2 | | 1965-1967 | | 1,041 | |

Outardes-3 | | 1969 | | 1,026 | |

Others (43 facilities - less than 1,000 MW) (3) | | 1910-2006 | | 9,918 | |

Total | | | | 32,973 | |

| | | | | |

Thermal | | | | | |

Tracy (oil) | | 1964-1968 | | 660 | |

Bécancour, La Citière and Cadillac (gas-turbine) | | 1976-1993 | | 881 | |

Others (24 diesel plants) (3) | | 1946-2001 | | 124 | |

Total | | | | 1,665 | |

| | | | | |

Nuclear | | | | | |

Gentilly-2 (4) | | 1983 | | 675 | |

| | | | | |

Wind Farm | | | | | |

Saint-Ulric (3 wind turbines) | | 2001 | | 2 | |

(1) Installed capacity shown for the generation stations reflects the capacity of alternators operating in winter conditions at a water temperature of 41°F.

(2) Indicates years when facilities began commercial operation.

(3) Some facilities are owned by Hydro-Québec Distribution.

(4) The Gentilly-2 plant has a Canada-Deuterium-Uranium heavy water moderated reactor, using heavy water as a moderator and coolant, and uranium dioxide as fuel.

Power Purchases

We purchase power and energy from the Churchill Falls generation station in Labrador through agreements with CF(L)Co and Newfoundland and Labrador Hydro (“N&LH”). Under an initial power contract with CF(L)Co, we have agreed to purchase annually, through the year 2041, 4,083 MW of power. In June 1999, we signed another agreement with CF(L)Co to guarantee us the availability of 682 MW of additional power until 2041 for each November 1 to March 31 period. In February 2001, we agreed to purchase approximately 1.5 TWh annually from N&LH until March 2004. In 2004, this contract was renewed for the purchase of approximately 1.4 TWh annually for a five-year period. In 2006, purchases under the CF(L)Co and N&LH agreements amounted to 31.2 TWh at a cost of $159 million as compared to 30.1 TWh at a cost of $154 million in 2005.

We have a capacity agreement with New Brunswick Power Generation Corporation (formerly known as New Brunswick Power Corporation) for the purchase of 200 MW annually until October 31, 2011. We also have an agreement with Alcan, which was amended in 2006, for the purchase of 365 MW of peak power and 375 MW of additional peak power until December 31, 2045. Under this 2006 amendment, we agreed to purchase from Alcan 150 MW of additional peak power until January 1st, 2013 which, if certain conditions are met, will be extended until December 31, 2045.

In addition, we purchase power under 84 long-term contracts with independent producers located in Québec. During 2006, 4.0 TWh were purchased under these contracts, at a total cost of $254 million. We expect to purchase approximately 5.3 TWh annually over the initial term of these contracts which extend through 2033; the majority of these contracts include renewal clauses.

We also purchase power in connection with our trading operations (see “Wholesale and Trading Operations”).

9

Peak

We use energy purchased from our neighboring systems, which experience different demand patterns, to meet a portion of our peak power needs in Québec (see “Wholesale and Trading Operations”). The following table summarizes our peak power demand in Québec and installed capacity as at December 31 for the years 2002 through 2006.

| | Peak Power | | Installed | | Total | |

| | Demand (1) | | Capacity (2)(3) | | Average Load (4) | |

| | (MW) | |

2002 | | 34,989 | | 32,661 | | 22,022 | |

2003 | | 36,268 | | 33,616 | | 22,237 | |

2004 | | 34,956 | | 33,892 | | 21,975 | |

2005 | | 33,636 | | 34,571 | | 22,851 | |

2006 | | 36,251 | | 35,315 | | 22,768 | |

(1) Total power demand at the annual domestic peak for the winter beginning in the preceding December, including interruptible power. The 2006-2007 winter peak occurred at 5:30 p.m. on February 5, 2007.

(2) In addition to the installed capacity of our own generation stations, we have access to 4,765 MW of the generation of the Churchill Falls power plant and we also purchase all the output from six privately-owned wind farms with a total installed capacity of 320 MW. Furthermore, 1,206 MW are available under various agreements with other independent suppliers.

(3) Installed capacity shown for the generation stations reflects the capacity of alternators operating in winter conditions at a water temperature of 41°F.

(4) Annual energy demand, including sales outside Québec, divided by the number of hours in the year.

Investment outside Québec

We hold an indirect interest in Bucksport Energy LLC, a thermal energy plant located in Maine, U.S. The plant, which started its commercial operations in January 2001, produces approximately 1.3 TWh of electricity per year. HQUS supplies the plant with natural gas and receives most of the electricity under fifteen-year contracts through January 2016.

Wholesale and Trading Operations

Québec Wholesale Market

The Québec wholesale electricity market has been open since May 1, 1997. This market is comprised of 11 distributors:

Hydro-Québec Distribution, nine distributors operating municipal systems and one regional electricity cooperative. As a result of the opening of the wholesale market, the municipal systems can, subject to the Government’s authorization, purchase electricity from suppliers other than Hydro-Québec Distribution, and independent generators in Québec can sell their electricity on the wholesale market using Hydro-Québec TransÉnergie’s transmission facilities.

Under a call for tenders issued by Hydro-Québec Distribution in 2002, Hydro-Québec Production signed an agreement with

Hydro-Québec Distribution for the supply of 600 MW over a 20-year period starting in March 2007, which is in addition to the heritage pool elecricity.

Markets Outside Québec

Currently, our main markets outside Québec consist of neighboring networks located in Canada and the Northeastern United States.

In 2006, electricity sales outside Québec accounted for 8.0% of our total electricity sales, down from 8.3% in 2005 (see “Management’s Financial Discussion - Financial Results of the Generation Business Segment”). Additional sales commitments were met using electricity purchases and our surplus Québec generation capacity.

Our energy-trading subsidiary, HQUS, is a member of New York ISO, ISO New England, Midwest ISO (which includes all or parts of Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Montana, Nebraska, North Dakota, Ohio, Pennsylvania, South Dakota, Wisconsin and Manitoba) and PJM Interconnection (which includes all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia). ISOs, or Independent Systems Operators, and RTOs, or Regional Transmission Organizations, enable participants to buy and sell energy, schedule bilateral transactions and reserve transmission service. HQUS holds a permit from the U.S. Federal Energy Regulatory Commission to sell at market-based rates.

10

HQEM, our wholly-owned energy-trading subsidiary operating in Canada, trades in the Ontario and New Brunswick wholesale markets. HQEM is a member of IESO (the Ontario ISO).

We have two long-term export contracts for the sale of energy or power. The following table summarizes our principal energy export agreements.

PRINCIPAL ENERGY EXPORT AGREEMENTS

| | Expiry

Date | | Power | | Maximum

Annual

Deliveries | |

| | | | (MW) | | (TWh) | |

| | | | | | | |

Long-term sales - power and energy (not interruptible) | | | | | | | |

| | | | | | | |

Cornwall Electric - Canada | | 2019 | | 45 | | 0.2 | |

Vermont Joint Owners (“VJO”) | | 2020 | | 335 | (1) | 2.2 | |

(1) By separate agreement with a VJO Member, 25 MW (0.2 TWh) are being repurchased annually until April 30, 2012.

Electricity Sales and Revenue

The following table summarizes electricity sales and revenue outside Québec by category for the years 2002 through 2006.

ELECTRICITY SALES AND REVENUE OUTSIDE QUÉBEC

| | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| | (TWh) | |

ELECTRICITY SALES | | | | | | | | | | | |

Canada-United States (long-term sales) | | 2.2 | | 2.1 | | 1.9 | | 2.0 | | 2.4 | |

Canada-United States (short-term sales) | | 52.0 | | 13.7 | | 12.5 | | 13.3 | | 12.1 | |

TOTAL ELECTRICITY SALES | | 54.2 | | 15.8 | | 14.4 | | 15.3 | | 14.5 | |

| | (millions of dollars) | |

REVENUE FROM ELECTRICITY SALES | | | | | | | | | | | |

Canada-United States (long-term sales) | | $ | 233 | | $ | 207 | | $ | 179 | | $ | 174 | | $ | 198 | |

Canada-United States (short-term sales) | | 3,233 | | 1,138 | | 905 | | 1,290 | | 951 | |

TOTAL REVENUE FROM ELECTRICITY SALES | | $ | 3,466 | | $ | 1,345 | | $ | 1,084 | | $ | 1,464 | | $ | 1,149 | |

CONSTRUCTION

Hydro-Québec Équipement offers consulting services in engineering, environment and project management and acts as general contractor for our other divisions, mainly Hydro-Québec Production and Hydro-Québec TransÉnergie. SEBJ is primarily engaged in developing projects for us in the territory governed by the James Bay and Northern Québec Agreement.

11

CORPORATE AND OTHER ACTIVITIES

This segment encompasses our Technology Group, which was created in February 2006, and corporate services such as the procurement of goods and services, finance and human resources. The following are under the supervision of the Technology Group:

· Hydro-Québec CapiTech inc. (“HQ CapiTech”) (wholly-owned; a venture capital company investing in businesses that provide energy-related high-technology products and services)

· Hydro-Québec IndusTech inc. (wholly-owned; it holds a 64.2% interest in TM4, a joint venture with Groupe Industriel Marcel Dassault, which is pursuing the development of an electrical motor for automobiles)

· IREQ (our energy-technology research and development division)

In 2006, we sold our interests in foreign holdings previously held through Hydro-Québec International and TransÉnergie HQ for a gain of approximately $917 million (see “Management’s Financial Discussion – Financial Results of the Corporate and Other Activities Business Segment”).

CORPORATE OUTLOOK

Development Strategy

In September 2006, we presented a revised version of our five-year Strategic Plan (the “Strategic Plan”) for the 2006-2010 period. This Strategic Plan was discussed in a parliamentary commission in September 2006 and approved in February 2007 by the Government. Its central theme is sustainable development and it comes in the wake of the Government’s energy strategy, published in May 2006, which emphasizes energy efficiency and the development of renewable energy sources.

The Strategic Plan sets forth three priorities: energy efficiency; complementary development of hydroelectric and wind power, the two main renewable energy sources in Québec, and technological innovation. More specifically, we plan on improving our overall performance in the following areas:

· conservation of energy by investing in energy saving programs;

· increase of our hydroelectric generating capacity by accelerating project development and by creating a portfolio of projects with a total generating capacity of 4,500 MW;

· complementary development of our hydroelectric capacity and of 4,000 MW of wind power by 2015;

· technological innovation to increase the productivity of our generating facilities, reduce losses on our transmission and distribution systems and make buildings more energy-efficient; and

· development of innovative energy efficiency technologies.

As stated in the Strategic Plan, our objective is to maintain net income from continuing operations at approximately $2.5 billion per year from 2006 to 2010, which is a goal set in accordance with our shareholder’s expectations, taking into account the payment of hydraulic charges (see “Generations Fund”). Over the same period, dividends in the aggregate of $6.3 billion, or 50% of total net income (excluding extraordinary gains), are expected to be paid to the shareholder. However, if we include the income of $0.9 billion from the sale of foreign holdings in 2006, total dividends to be paid over the 2006-2010 period are estimated at $7.2 billion. Shareholder’s equity is expected to increase by $6.3 billion over the same period.

Total capital investments are expected to amount to $19.4 billion as a result of the addition of new capacity to the hydroelectric generating facilities, an increase in power transmission capacity and investments in the distribution system to meet growing demand in Québec.

The Strategic Plan assumes that Québec sales will grow by 13.2 TWh between 2005 and 2014, which takes into account the annual energy saving target of 8 TWh by 2015 as proposed in the Québec Energy Strategy 2006-2015. Sales to industrial customers are expected to increase by 6.1 TWh, the smelting and refining industry accounting for 3.8 TWh of this increase. The remaining expected increase in industrial sales would arise from growing industrial output. Sales to residential customers are expected to rise by 4.9 TWh, supported primarily by the home-building sector.

12

The Strategic Plan requires Hydro-Québec Distribution to ensure adequate supply to meet the energy requirements of our Québec market. Our distributor’s main supply is at an average fixed price of 2.79 cents per kWh for 165 TWh (see “Regulatory Framework – Energy Board Act”). Additional power will continue to be obtained through calls for tenders. Furthermore, Hydro-Québec Distribution will continue to offer its customers rates which are among the lowest in North America.

The Strategic Plan restates the three conditions for undertaking new projects: they must be profitable under market conditions, environmentally acceptable and well received by local communities.

Between 2006 and 2014, Hydro-Québec Production intends to increase its annual generating capacity by 15.8 TWh as follows:

· new facilities that are currently under construction for a total capacity of 6.1 TWh;

· the refurbishing of some existing facilities that will add about 1 TWh to the existing generating capacity; and

· the Eastmain-1-A/Sarcelle/Rupert project that will add 8.5 TWh and has been approved by the regulators.

Hydro-Québec TransÉnergie will continue to develop our transmission system to maintain service reliability and quality while meeting growing power transmission needs. Furthermore, investments will be made to keep up with consumption growth in Québec, integrate new hydroelectric and wind power generation capacity, replace equipment and incorporate more efficient technologies. Among these investments, the division plans to build a new 1,250 MW interconnection with the province of Ontario.

Generations Fund

In June 2006, the National Assembly of Québec adopted the Act to reduce the debt and establish the Generations Fund (the “Generations Fund Act”). Hydro-Québec will contribute to the Generations Fund by paying:

· hydraulic charges that Hydro-Québec Production began to pay in January 2007; and

· a portion of the profits that Hydro-Québec will earn on foreign sales of electricity produced from new generating capacity.

Hydro-Québec Production will pay the same charges as those currently paid by private producers of hydro-electricity, i.e. the statutory and contractual charges stipulated by the Watercourses Act (Québec). For 2007, these charges, indexed annually to the Consumer Price Index, consist of:

· a statutory charge of $2.72 per thousand kilowatt-hours of electricity produced; and

· a contractual charge of $0.639 per thousand kilowatt-hours of electricity produced.

Under the Generations Fund Act, payment of these charges is being phased in over two years beginning January 1, 2007 and charges are expected to amount to $265 million for 2007 (which corresponds to half the legal rate) and $545 million for 2008 (which corresponds to the full legal rate).

13

Capital Investment Program

Our capital investment program includes capital expenditures for fixed and intangible assets and other investments, including energy efficiency programs and investments in, and advances to, affiliates. The following table is a summary of our projected capital investments affecting cash for the years 2002 through 2006. The table also includes estimates for 2007 and the three-year period from 2008 to 2010; these estimates are based on, among other things, a projected growth in demand for electricity in Québec of 1.1% yearly for the next four years.

CAPITAL INVESTMENTS AFFECTING CASH

| | | | | | | | | | | | Estimated | |

| | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 through

2010 | |

| | (millions of dollars) | |

Fixed and intangible assets | | | | | | | | | | | | | | | |

Distribution | | $ | 540 | | $ | 540 | | $ | 601 | | $ | 645 | | $ | 690 | | $ | 805 | | $ | 2,089 | |

Transmission (1) | | 452 | | 609 | | 541 | | 723 | | 882 | | 931 | | 3,075 | |

Generation | | 1,018 | | 1,428 | | 1,820 | | 1,780 | | 1,615 | | 2,251 | | 6,141 | |

Construction | | 9 | | 4 | | 11 | | 6 | | 4 | | 9 | | 21 | |

Corporate and Other Activities | | 213 | | 158 | | 98 | | 128 | | 157 | | 208 | | 554 | |

| | 2,232 | | 2,739 | | 3,071 | | 3,282 | | 3,348 | | 4,204 | | 11,880 | |

Other (2) | | 24 | | (45 | )(3) | (854 | ) (4) | 117 | | (1,879 | ) (5) | 213 | (6) | 810 | |

Total investments | | $ | 2,256 | | $ | 2,694 | | $ | 2,217 | | $ | 3,399 | | $ | 1,469 | | $ | 4,417 | | $ | 12,690 | |

(1) Includes sub-transmission.

(2) Includes advances to, and participations in, affiliates and energy efficiency programs. The energy efficiency programs are estimated at $245 million for 2007 and a total of $772 million for the 2008 to 2010 period.

(3) Includes intersegment eliminations of $4 million.

(4) Includes proceeds from the sale of our interests in Noverco and our investments in Asia.

(5) Includes proceeds from the sale of our foreign holdings.

(6) Excludes cash flows from discontinued operations, but includes proceeds from the sale of foreign holdings in the first quarter of 2007.

In 2006, capital investments in fixed and intangible assets, excluding Other investments, amounted to $3.3 billion. As at December 31, 2006, we had various projects under construction for an additional total installed capacity of 575 MW and to increase annual output by 3.4 TWh.

The commissioning of the Eastmain-1 powerhouse several months ahead of schedule, added 480 MW to our installed capacity and 2.7 TWh to our annual output. This $2.3 billion development further optimizes the La Grande complex.

Construction, at an estimated cost of $176 million, of the Mercier generation facility in the Outaouais region is in progress. The

51-MW facility, which is expected to be commissioned in 2007, will add 0.3 TWh in annual output.

On the Péribonka River, in the Saguenay-Lac-St-Jean region, we are investing approximately $1.4 billion to build a 385 MW generation facility that will produce 2.2 TWh a year. Reservoir impoundment is scheduled for fall 2007, followed by the commissioning of three generation units in 2007 and early 2008.

Construction of the Chute-Allard and Rapides-des-Coeurs projects on the Saint-Maurice River is ongoing. When these generation facilities come on stream in late 2008, they will supply a combined installed capacity of 139 MW and annual output of 0.9 TWh, for an estimated total capital outlay of approximately $0.7 billion.

The environmental impact assessment of the Romaine hydroelectric complex in the Mingan region is expected to be submitted in the second half of 2007. As currently planned, this complex will consist of four generation facilities with a total installed capacity of 1,550 MW and annual output of 7.7 TWh.

The Government approved the Eastmain-1-A/Sarcelle/Rupert project in November 2006 and the federal authorities issued their approval in December 2006. At a planned cost of $5.0 billion, this project is Québec’s largest hydroelectric facility complex of the decade. Two powerhouses will be constructed, the Rupert River will be partially diverted to the Eastmain-1 reservoir and the output of the three existing generation facilities in the lower Grande Rivière will be increased by the new inflows. When completed, the project will add 893 MW to our installed capacity and 8.5 TWh in annual output. Operation of the diversion and powerhouses will start in stages from the end of 2009 through winter of 2012.

14

We are considering the construction of a 1,500 MW complex on the Petit Mécatina River, about 300 km east of the Romaine River. In 2006, we began studies and conducted surveys to determine the configuration and cost of this complex.

The total estimated cash requirements for 2007 are approximately $6.8 billion, and include approximately $4.4 billion in capital investments, approximately $0.1 billion for long-term debt repayment and sinking fund redemption and approximately $2.3 billion for the payment of dividends for 2006. Our self-financing ratio (defined as cash from operations less dividends paid, divided by the sum of investments (excluding net changes in short-term investments), long-term debt maturities and sinking fund redemption) is expected to be 43.9% in 2007, compared to 86.5% in 2006. The higher ratio in 2006 resulted from proceeds derived from the sale of our foreign holdings.

We estimate that cash requirements for capital investments, long-term debt repayment and sinking fund redemption will amount to approximately $16 billion in aggregate for the period from 2008 through 2010.

Allocation of capital expenditures for our Distribution, Transmission and Generation business segments

The following tables summarize the allocation of estimated capital expenditures for 2007 and for the period of 2008 through 2010 among our three major business segments.

DISTRIBUTION BUSINESS SEGMENT

| | Estimated Capital Expenditures | |

| | 2007 | | 2008 through 2010 | |

| | (millions of dollars) | |

Distribution system (1) | | | | | |

System maintenance | | $ | 203 | | $ | 707 | |

System improvements and demand growth | | 353 | | 1,051 | |

Other | | 249 | (2) | 331 | (3) |

| | $ | 805 | | $ | 2,089 | |

(1) Includes investments in distribution facilities and investments in generation and transmission facilities of our off-grid systems.

(2) Includes 74.5% in equipment, 17.1% in buildings and 8.4% in telecommunications and technology.

(3) Includes 70.7% in equipment, 18.2% in buildings and 11.1% in telecommunications and technology.

TRANSMISSION BUSINESS SEGMENT

| | Planned Date | | Estimated Capital Expenditures | |

| | of Operation | | 2007 | | 2008 through 2010 | |

| | | | (millions of dollars) | |

Transmission facilities (1) | | | | | | | |

| | | | | | | |

Equipment improvement (2) | | Continuous program | | $ | 558 | | $ | 2,025 | |

System improvement program | | | | | | | |

De-icing equipment at Levis substation | | 2007 | | 34 | | — | |

Rapides-des-Coeurs and Chute-Allard integration | | 2007 | | 64 | | 1 | |

Péribonka integration | | 2007-2008 | | 79 | | 11 | |

Ontario interconnection | | 2009-2010 | | 46 | | 524 | |

La Sarcelle integration | | 2010-2011 | | 3 | | 93 | |

Wind Power interconnection | | 2007-2012 | | 87 | | 231 | |

Poste Hauterive (Alcoa) | | 2009-2012 | | 1 | | 54 | |

Other | | | | 59 | (3) | 136 | (4) |

| | | | $ | 931 | | $ | 3,075 | |

(1) Includes sub-transmission facilities.

(2) Includes system maintenance and demand growth.

(3) Includes 53.4% in equipment, 11.7% in buildings and 34.9% in technology.

(4) Includes 57.5% in equipment, 14.1% in buildings and 28.4% in technology.

15

GENERATION BUSINESS SEGMENT

| | Available | | Planned Date | | Estimated Capital Expenditures | |

| | Power | | of Operation | | 2007 | | 2008 through 2010 | |

| | (MW) | | | | (millions of dollars) | |

Main Rehabilitation Projects | | | | | | | | | |

Improvement and rebuilding of facilities | | — | | Continuous

program | | $ | 483 | | $ | 2,056 | |

Ongoing Generation Station and Partial Diversion Projects | | | | | | | | | |

Mercier | | 51 | | 2007 | | 16 | | — | |

Péribonka | | 385 | | 2007-2008 | | 299 | | 131 | |

Chute-Allard and Rapides-des-cœurs | | 139 | | 2008 | | 240 | | 78 | |

Eastmain-1-A/Sarcelle/Rupert powerhouse | | 893 | | 2009-2012 | | 909 | | 3,296 | |

Other projects | | — | | — | | 189 | | 47 | |

Generation Station and Partial Diversion Projects under Study | | | | | | | | | |

Complexe La Romaine | | 1,550 | | — | | 26 | | 400 | |

Other | | — | | — | | 89 | (1) | 133 | (2) |

| | | | | | $ | 2,251 | | $ | 6,141 | |

(1) Includes 90.5% in equipment and 9.5% in buildings.

(2) Includes 81.6% in equipment and 18.4% in buildings.

Regulatory Framework

Hydro-Québec Act

Under the Hydro-Québec Act, our objectives are to supply power and to pursue endeavors in energy-related research and promotion, energy conversion and conservation, and any field connected with or related to power or energy. The Hydro-Québec Act provides that we shall estimate the energy needs of Québec and the means of meeting them within the scope of the Government’s energy policies.

Under the Hydro-Québec Act, the Government is entitled to declare a dividend from Hydro-Québec when certain financial criteria are met (see Note 18 to the 2006 Consolidated Financial Statements).

Energy Board Act

Certain aspects of our activities and those of natural gas distributors in Québec are subject to the jurisdiction of the Energy Board which was established by the Act respecting the Régie de l’énergie (the “Energy Board Act”) enacted in December 1996. The Energy Board consists of seven members appointed by the Government and is charged with reconciling the public interest, consumer protection and the fair treatment of the electric power carrier and of distributors. The Energy Board Act was amended in December 2006 to grant the Energy Board new powers regarding energy efficiency programs and actions as well as mandatory reliability standards.

Under the Energy Board Act, we have been granted exclusive rights for the distribution of electric power throughout Québec, excluding the territories served by distributors operating a municipal or private electric system as of May 13, 1997.

The Energy Board has the authority to:

· fix, or modify, after holding public hearings, our rates and conditions for the transmission and distribution of electric power;

· approve our electric power supply plan;

· designate a reliability coordinator for Québec and adopt the standards of reliability proposed by the designated reliability coordinator;

· authorize our transmission and distribution investment projects;

· approve our distribution commercial programs; and

· rule upon complaints from customers concerning rates or service.

16

Generation. The Energy Board’s jurisdiction does not extend to generation but we are required to supply heritage pool electricity. Heritage pool electricity corresponds to the net annual consumption of Québec markets, up to 165 TWh per year, for which the average cost is set at 2.79 cents per kWh.

Energy generated in excess of the heritage pool electricity may be sold on the market at market-based rates. Purchase and sales transactions outside Québec are unregulated under the Energy Board Act.

Transmission. Transmission rates and service terms and conditions are subject to approval by the Energy Board. In July 2006,

Hydro-Québec TransÉnergie filed with the Energy Board an application to modify its rates and service terms and conditions. On March 18, 2007, the Energy Board approved an annual rate of $70.82/kw/year for firm point-to-point service and an hourly rate of $7.92/MWh, applicable retroactively as of January 1, 2007, and set the amount payable for transmission of the local load supply at $2,539,746,840 per year. The Energy Board also approved the cost allocation methodology of Hydro-Québec TransÉnergie and the proposed terms and conditions for its Open Access Transmission Tariff.

On February 28, 2007, Hydro-Québec TransÉnergie filed with the Energy Board an application to be designated the reliability coordinator for Québec. This application is pending.

Distribution. Electricity required to meet Québec’s needs in excess of the heritage pool electricity must be purchased through a competitive bidding process. The Energy Board approved our Electricity Supply Plan 2005-2014, as well as our Call for Tenders and Contract Awarding Procedure and Code of Ethics on Conducting Calls for Tenders. Purchase contracts for electricity in excess of the heritage pool are subject to the approval of the Energy Board.

In August 2006, Hydro-Québec Distribution filed with the Energy Board an application to modify its rates and certain conditions regarding the distribution of electricity in Québec for the rate year beginning April 1, 2007. The Energy Board rendered its decision on February 27, 2007 and granted to Hydro-Québec Distribution an average rate increase of 1.92%.

National Energy Board Act

Our exports of electric power are subject to the National Energy Board Act which provides that a permit or license must be obtained from the National Energy Board of Canada (the “National Board”) for such exports. We hold the following four permits for short-term exports (contracts of five years or less):

· two permits expiring on December 31, 2010 authorizing us to export annually, for a continuous period of no more than five years for any single contract, up to 30 TWh of interruptible energy and up to 20 TWh of firm energy to the United States;

· two permits granted to our subsidiary, HQEM, expiring on April 7, 2009. These permits allow HQEM, as a power marketer outside Québec, to export annually to the United States up to 30 TWh of firm and interruptible energy from interconnections located in other provinces, under contracts with a term of five years or less.

Each of these permits allows us to take advantage of the spot market in the United States; however‚ long-term export contracts (more than five years) require prior issuance of specific permits or licenses by the National Board.

On March 5, 2007, HQEM’s permit to export natural gas to the United States was renewed for a two-year period.

The National Board also regulates international power lines and we operate our interconnections with the United States in accordance with the terms and conditions of Certificates of Public Convenience and Necessity issued by the National Board.

Environmental Regulation

Our activities are subject to federal and provincial environmental laws and regulations, and, to some extent, municipal by-laws.

Before beginning new construction, our projects are subject to environmental impact assessment studies as well as information and consultation processes. The studies are submitted for review and approval by government departments and agencies responsible for issuing governmental authorizations. In some instances, the approval process includes public hearings by an independent body.

17

We have formal policies, procedures and guidelines regarding environmental matters. Since the early 1970’s, we have responded to environmental concerns in the planning, design and construction of new facilities. For example, we conduct studies and research on mercury levels in reservoirs, the biological effects of electric and magnetic fields of our transmission lines, biodiversity under our transmission lines and greenhouse gas emissions of our hydroelectric generation stations with reservoirs. We publish an annual sustainability report which describes our progress in relation to the environment, society and the Québec economy.

Moreover, all the divisions and units that may have a significant impact on the environment (e.g. distribution, transmission, generation, procurement and construction) have implemented environmental management systems and obtained ISO 14001 certifications. ISO 14001 is the environmental management standard of the International Organization for Standardization.

Litigation

Innu of Takuikan Uashat Mak Mani-Utenam

On December 30, 2003, representatives of the Innus of Takuikan Uashat Mak Mani-Utenam instituted an action against the Attorney-General of Canada, the Attorney-General of Québec and us seeking judicial recognition of their aboriginal rights and of their unextinguished Indian title over certain areas of land in Québec. Plaintiffs who claim not to be parties to the 1975 James Bay and Northern Québec Agreement (the “Agreement”) allege that the Agreement and certain federal and provincial laws are illegal, inoperative, unconstitutional and not binding upon the plaintiffs. The plaintiffs seek various orders, including rendering of accounts and revenue sharing for the unlawful use and management of the lands, notably in respect of hydroelectric facilities on these lands, and awarding damages from Canada, Québec and us, jointly and severally, in an amount of up to $1.5 billion (subject to further increase by the plaintiffs). In June 2005, as requested by the parties, the Québec Superior Court suspended the legal action for five years. Negotiations are ongoing between the governments and the Innus.

Innus of Pessamit

In November 2006, the Innus of Pessamit re-activated an action which was filed in 1998 against the Attorney-General of Canada, the Attorney-General of Québec and us seeking judicial recognition of their aboriginal rights and title over certain areas of land in Québec where our Manicouagan-Outardes hydroelectric facilities are located. The Innus intend to seek various orders including an award of damages against Canada, Québec and us, jointly and severally, in an amount of $11 billion. With Québec, we intend to contest this claim.

Employees

We had 19,116 permanent employees as at December 31, 2006, and an average of 3,799 temporary employees during 2006. These numbers do not include employees of our subsidiaries and joint ventures. Unionized employees represent 85.0% of our work force.

Eight collective agreements govern the working conditions of our unionized employees. These collective agreements provide for a profit-sharing plan tied to the attainment of our business objectives and annual salary increases of 2% annually through 2008, except for our 3,300 specialists who have already agreed to a further 2% increase in 2009.

18

MANAGEMENT’S FINANCIAL DISCUSSION

Financial Objectives

Our business objectives are to promote continuously improved customer service, sustainable growth and profitability. Our ability to meet these objectives and our financial position are dependent upon certain key economic variables, including:

· the rate of economic growth in Québec and, consequently, the growth rate of electricity sales in Québec;

· the average interest rate on our borrowings;

· exchange rates between the Canadian dollar and other currencies; and

· the world price of crude oil and other commodities, upon which electricity prices, under certain sales or purchase contracts, are pegged.

We have been seeking to alleviate the impact of some of these variables by pursuing the following objectives and strategies in managing our debt and financial risk:

· Debt management | | |

| | |

· to maintain our presence and impact in capital markets | | · planning of bond issuance to establish liquid benchmarks; · staggered debt maturities in order to maintain our annual financing program at a stable level; and · focus on strategic capital markets, in particular the Canadian bond market. |

| | |

· to diversify our sources of funding while minimizing foreign exchange risk | | · continued access to foreign capital markets, particularly the U.S. dollar markets; · swaps to hedge foreign financing in currencies other than U.S. dollar; and · financing in the lowest cost market. |

| | |

· to manage our debt effectively | | · debt redemption prior to maturity whenever possible, if such operations allow us to reduce the cost of our debt. |

| | |

· Financial risk management | | |

| | |

· to limit the impact of adverse changes in interest rates, foreign exchange rates and aluminum prices on our financial results | | · short-term: active integrated management to limit impact on our results; and · medium and long-term: risk mitigation such as raising debt in U.S. dollars as a hedge against U.S. dollar sales. |

Consolidated Financial Results for the year ended December 31, 2006

In 2006, our revenue from continuing operations increased to $11.2 billion, from $10.9 billion in 2005, which represents an increase of $273 million, or 2.5%, over 2005, mainly as a result of the recognition of a $234 million foreign exchange gain on debts and swaps denominated in U.S. dollars. Net income for the year was $3.7 billion, including a gain of approximately $917 million from the sale of our foreign holdings, compared to $2.3 billion in 2005. Net income from continuing operations increased by $446 million, or 19.0%, to $2.8 billion, mainly as the result of the recognition of the abovementioned foreign exchange gain. Self-financing (defined as cash from operations less dividends paid, divided by the sum of investments (excluding net change in short-term investments), long-term debt maturities and sinking fund redemption) was 86.5% in 2006, as compared to 58.6% in 2005. The higher ratio in 2006 resulted from proceeds derived from the sale of our foreign holdings.

19

Expenditure

In 2006, expenditure decreased by $198 million, or 3.1%, from 2005 to $6,152 million, largely due to a reduction in short-term electricity purchases by Hydro-Québec Production.

Operating Expenses. In 2006, operating expenses were $2,394 million, higher by $146 million, or 6.5%, as compared to the previous year. Excluding the $80 million increase in pension expense and additional expenses of $27 million incurred to restore service following extreme weather events in 2006, operating expenses would have risen only by 1.9%, which is comparable to the inflation rate during the year.

Electricity and Fuel Purchased. Purchases of electricity and fuel decreased by $181 million, or 12.1%, to $1,315 million, as compared to 2005, in large part as a result of a $238 million reduction in short-term electricity purchases.

Depreciation and Amortization. These expenses decreased from $2,023 million in 2005 to $2,007 million in 2006. In 2005, we reported a final write-off of $115 million for the Grande-Baleine draft-design study and, as a result of the commissioning of the Toulnustouc production facility in 2005 and of Eastmain-1 in the second half of 2006, the depreciation and amortization expenses increased by $99 million. As a result, the net decrease for 2006 was $16 million.

Taxes. Tax expenses decreased by $65 million from 2005 to $529 million in 2006 mainly because of a reduction in the capital tax rate from 0.6% to 0.525%.

Financial Expenses

Financial expenses increased by $25 million, from $2,187 million in 2005 to $2,212 million in 2006; during the year, higher financial expenses were partially offset by income derived from the investment of proceeds from the sale of our foreign holdings.

Segment Information

Our power distribution and transmission activities in Québec are regulated. Consequently, our financial results reflect the following regulated revenues and charges:

· transmission rates approved by the Energy Board;

· electricity rates for Québec customers, frozen from 1998 through December 31, 2003 and since then subject to approval by the Energy Board; and

· an average fixed price of 2.79 cents per kWh to be charged by Hydro-Québec Production to Hydro-Québec Distribution for heritage pool electricity (up to 165 TWh per year), regardless of whether the electricity is generated or purchased.

All intersegment revenue and expenses not related to electricity are valued at full cost. Revenue, operating expenses and purchases of electricity and fuel are earned or incurred directly by the respective segments.

Depreciation and amortization expenses related to fixed or other assets are allocated to the respective segments. Taxes and financial expenses are managed by corporate units but allocated to the operating segments. Taxes are generally allocated according to the net assets managed by the segments. Financial expenses are allocated based on the financing rates applied to the net assets of each segment. Finally, expenses related to corporate activities, or corporate expenses, are generally allocated to the segments based on their operating expenses.

Discontinued Operations

In 2005, we decided to sell most of our investments outside Québec and, consequently, we presented the operating results of those businesses under discontinued operations in 2005 and 2006. Results for 2006 reflect the impact of the sale of those foreign holdings. Consolidated income from discontinued operations for 2006 was $944 million.

20

The following table shows segmented results for the year 2006 and changes from the previous year.

SEGMENT RESULTS FOR 2006

| | Distribution | | Transmission | | Generation | | Construction | | Corporate

and Other

Activities (1) | | Intersegment

eliminations | | Total | |

| | (millions of dollars) | |

Revenue | | | | | | | | | | | | | | | |

External Customers | | 9,488 | | 32 | | 1,594 | | — | | 48 | | (1 | ) | 11,161 | |

Change 2005 -2006 | | 307 | | 5 | | (114 | ) | (6 | ) | 33 | | 48 | | 273 | |

| | | | | | | | | | | | | | | |

Intersegment Revenue | | 55 | | 2,809 | | 4,570 | | 1,999 | (2) | 1,146 | | (10,579 | ) | — | |

| | | | | | | | | | | | | | | |

Change 2005 -2006 | | — | | 342 | | 38 | | (54 | ) | 72 | | (398 | ) | — | |

Total revenue | | 9,543 | | 2,841 | | 6,164 | | 1,999 | (2) | 1,194 | | (10,580 | ) | 11,161 | |

Change 2005-2006 | | 307 | | 347 | | (76 | ) | (60 | ) | 105 | | (350 | ) | 273 | |

| | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | 42 | | 632 | | 2,114 | | 2 | | — | | 7 | | 2,797 | |

Change 2005- 2006 | | (130 | ) | 252 | | 241 | | (3 | ) | 71 | | 15 | | 446 | |

| | | | | | | | | | | | | | | |

Discontinued operations | | — | | — | | — | | — | | 944 | | — | | 944 | |

Net income (loss) | | 42 | | 632 | | 2,114 | | 2 | | 944 | | 7 | | 3,741 | |

Change 2005 -2006 | | (188 | ) | 252 | | 241 | | (3 | ) | 1,172 | | 15 | | 1,489 | |

(1) Includes the results of the Technology Group and the activities of Hydro-Québec International and TransÉnergie HQ.

(2) Intersegment revenue generated by the Construction segment corresponds to capital expenditures for its client segments.

Financial Results of the Distribution Business Segment

In 2006, the segment’s total revenue increased by $307 million to $9,543 million. This segment recorded net income of $42 million as compared to net income of $230 million in 2005. The increase in revenue from electricity sales, mainly as a result of rate increases, were insufficient to fully offset the increase in cost of supply, depreciation and amortization expense and operating expenses. In addition, regulatory deferral related to cost variances for electricity purchases in excess of the heritage pool reduced revenues from electricity sales recognized in 2006. Results for 2005 also included a non-recurring gain of $48 million related to the sale of assets held by HydroSolution.

Electricity Sales in Québec

In 2006, electricity sales in Québec decreased by approximately 1.8 TWh, or 1.1%, to 167.3 TWh and revenue increased by $291 million, or 3.2%, to $9,402 million. The net reduction in sales was mainly the result of mild temperatures in 2006, and consequently lower heating requirements in the residential and farm category, which was partially offset by a 1.5 TWh increase in baseload demand, primarily as a result of housing starts.

The following table shows the variation in sales and revenue by category of customers between 2005 and 2006.

ELECTRICITY SALES IN QUÉBEC, BY CATEGORY

| | Sales | | Revenue | |

| | 2006 | | Change 2005-2006 | | 2006 | | Change 2005-2006 | |

| | (TWh) | | (TWh) | | (%) | | ($M) | | ($M) | | (%) | |

Residential and farm | | 56.7 | | (0.5 | ) | (0.9 | ) | 3,775 | | 85 | | 2.3 | |

General and institutional | | 32.4 | | (1.0 | ) | (3.0 | ) | 2,356 | | 72 | | 3.2 | |

Industrial | | 73.3 | | (0.2 | ) | (0.3 | ) | 3,022 | | 130 | | 4.5 | |

Other | | 4.9 | | (0.1 | ) | (2.0 | ) | 249 | | 4 | | 1.6 | |

Total | | 167.3 | | (1.8 | ) | (1.1 | ) | 9,402 | | 291 | | 3.2 | |

21

Residential and farm Category. Electricity sales to this group of customers decreased by 0.5 TWh, or 0.9%, to 56.7 TWh. Residential construction contributed to an increase in sales of 1.7 TWh and $111 million in revenue. This category’s heating requirements make it the most sensitive to temperature fluctuations and milder temperatures in 2006 are accountable for an estimated reduction in demand of 2.2 TWh and $158 million in revenue. In terms of sales revenue, the rate adjustments account for an increase of $144 million.

General and institutional Category. In this category, we noted a decrease in demand of 0.1 TWh. However, rate increases contributed an additional $95 million in revenue.

Industrial Category. Baseload demand decreased by 0.2 TWh, or 0.3%; however revenue increased by $130 million as a result of rate increases and growth in revenue based on the price of aluminium.

Other Category. This category consists of independent distributors, namely nine municipal networks and one regional cooperative. Revenue increased by $4 million. None of the distributors have taken advantage of the deregulation of the wholesale market which began in May 1997.

Financial Results of the Transmission Business Segment

In 2006, revenue amounted to $2,841 million, an increase of $347 million, or 13.9%, from 2005. The Energy Board authorized an increase in transmission rates for 2005 and 2006, and increase in revenue of $340 million was recorded in 2006 and included $170 million for 2005 and $170 million for 2006. Most of our revenue from transmission was generated by tolling charges collected from Hydro-Québec Distribution and was related to the electricity transmission requirements of our Québec customers. Operating expenses increased by $38 million to $739 million mainly due to an increase of $13 million in pension costs. Depreciation and amortization expense was $535 million, up $40 million as new transmission equipment was commissioned during 2006. Net income increased by $252 million over 2005 to $632 million in 2006.

Financial Results of the Generation Business Segment

In 2006, revenue from electricity sales of $5,669 million was down $275 million from 2005. This decrease in revenue was mostly attributable to a reduction in short-term trading transactions outside Québec. However, net income increased by $241 million, or 12.9%, over 2005, mainly due to the recognition of a $234 million foreign exchange gain on debts and swaps denominated in U.S. dollars.

Electricity and fuel purchases by this segment amounted to $1,190 million in 2006, representing a $194 million decrease from 2005. Electricity purchased for resale on outside markets totaled $371 million for 6.8 TWh in 2006, compared to $609 million for 8.0 TWh in 2005.

Electricity Sales to Hydro-Québec Distribution

Electricity sales to our distribution division amounted to 165.1 TWh, down from 165.9 TWh in 2005, and revenue generated by these sales amounted to $4,520 million, up $40 million from 2005. This increase is attributable to the higher price of aluminium which was partially offset by the stronger Canadian dollar.

Electricity Sales Outside Québec

In 2006, electricity sales outside Québec totaled 14.5 TWh and generated revenue of $1,149 million as compared to sales of 15.3 TWh and revenue of $1,464 million in 2005. These amounts include revenue earned from energy-related derivative instruments.

Net sales outside Québec generated $814 million for a net reservoir drawdown of 7.0 TWh, compared with $830 million for 6.7 TWh in 2005.

Because runoff was below the historical mean in the first three quarters of 2006, we limited net electricity exports. With the commissioning of the Eastmain-1 development in the second half of 2006 and higher-than-average runoff in the fourth quarter, we were able to build up our reserves and increase the volume of exports by year end.

22

Financial Results of the Construction Business Segment

In 2006, the Construction segment completed orders of $1,999 million compared to $2,059 million in 2005. This revenue represents almost entirely charges to other divisions for costs of capital projects undertaken on their behalf. This growth was derived from several large scale Generation and Transmission projects. SEBJ operations generated revenue of $245 million in 2006, compared with $532 million in 2005. This reduction in revenue results from the completion of the Eastmain-1 project.

Financial Results of the Corporate and Other Activities Business Segment