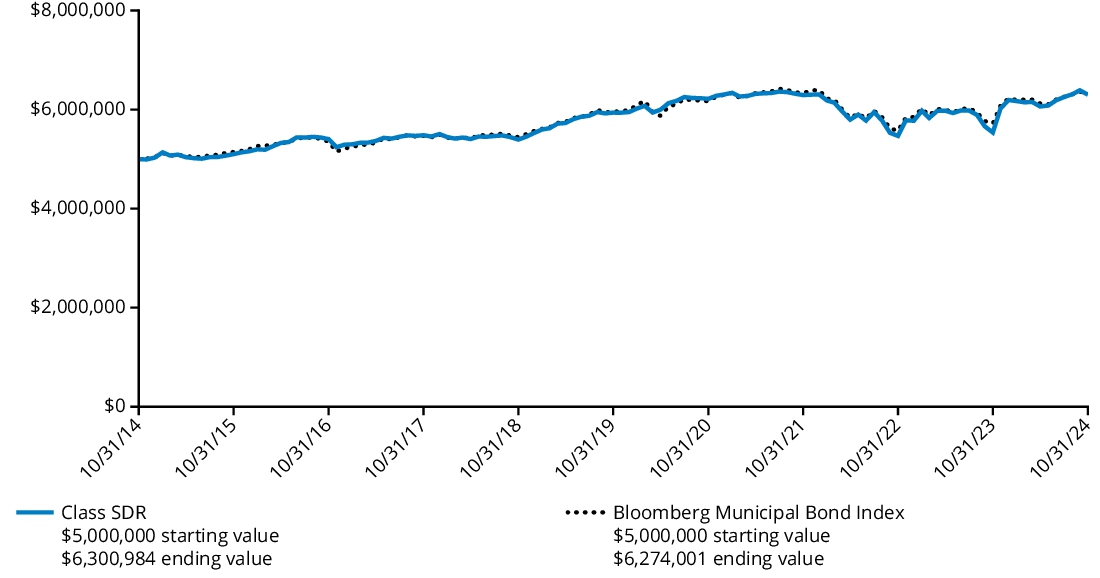

0000049905 hmfiii:C000172619Member oef:WithoutSalesLoadMember 2015-10-31 0000049905 hmfiii:C000148303Member us-gaap:ShortTermInvestmentsMember 2024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

The Hartford Mutual Funds II, Inc.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Copy to:

John V. O’Hanlon, Esquire

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110-2605

Registrant's telephone number, including area code:

Date of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a)

Annual Shareholder Report

October 31, 2024

The Hartford Growth Opportunities Fund

Class A/HGOAX

This annual shareholder report contains important information about The Hartford Growth Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class A | $140 | 1.10% |

Costs paid include the impact of expenses associated with the Fund’s shareholder meeting held on December 13, 2023, which was ultimately adjourned until January 23, 2024. If these expenses were excluded, the expense ratio would be as follows: 1.07%. Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 3000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection contributed positively to relative results. Strong security selection in the Information Technology, Financials, and Consumer Discretionary sectors contributed to relative returns.

Sector allocation, a result of the team’s bottom-up stock selection process, also contributed to relative returns. Allocation effect was driven by the Fund’s overweight to the Communication Services sector and underweights to the Consumer Staples and Industrials sectors.

Top individual contributors over the period were an overweight position in NVIDIA (Information Technology), an underweight position in Apple (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection within the Communication Services, Real Estate, and Consumer Staples sectors detracted from relative results.

The Fund’s underweight position to the Information Technology sector and overweight to the Healthcare and Real Estate sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Pinterest (Communication Services) and Dexcom (Healthcare), and an underweight position in QUALCOMM (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

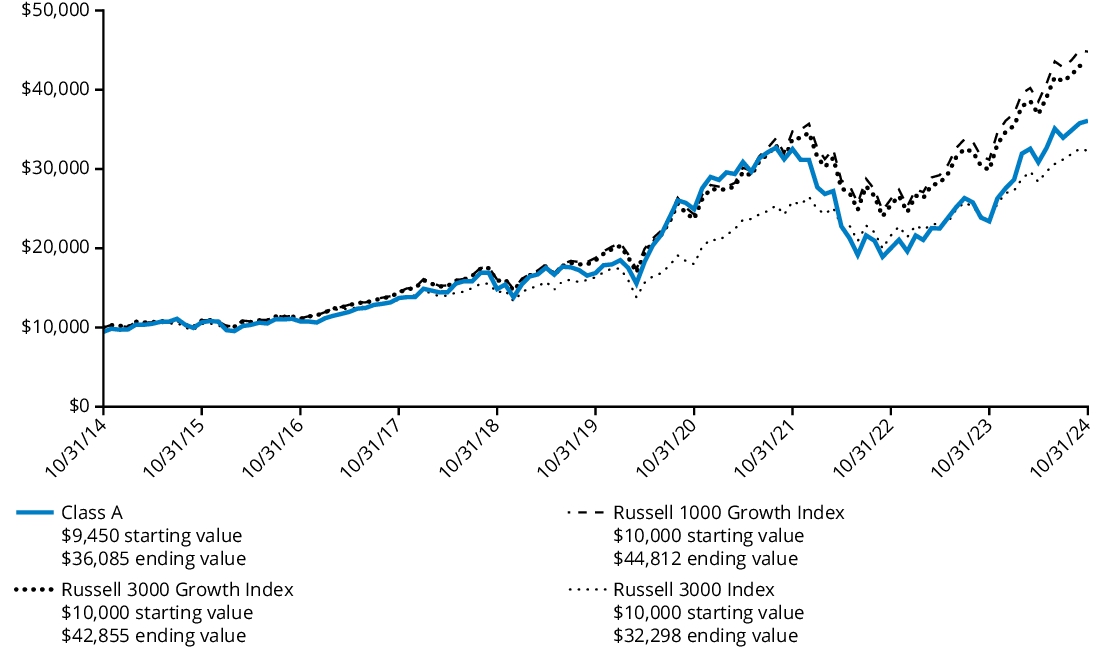

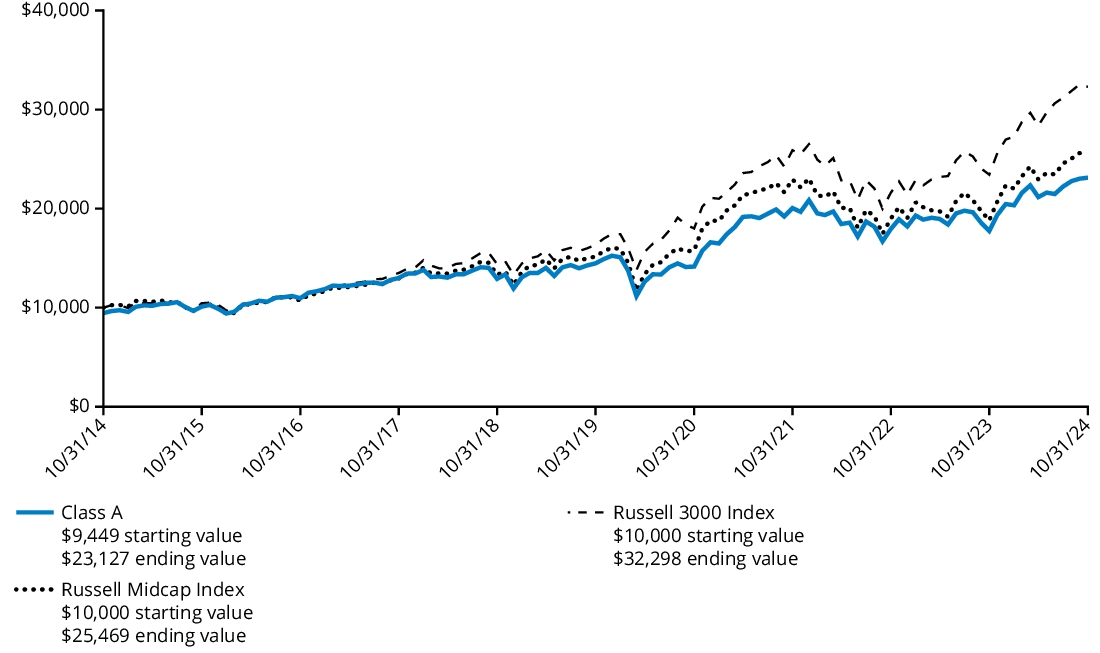

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class A shares and the comparative indices. The returns for Class A shares include the maximum front-end sales charge applicable to Class A shares.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class A (with 5.50% maximum front-end sales charge) | 45.77% | 15.12% | 13.69% |

| Class A (without 5.50% maximum front-end sales charge) | 54.25% | 16.43% | 14.34% |

| Russell 3000 Growth Index | 43.42% | 18.34% | 15.66% |

| Russell 1000 Growth Index | 43.77% | 19.00% | 16.18% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

The Russell 3000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 1000 Growth Index serves as the Fund’s secondary performance index. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $5,478,445,304% |

| Total number of portfolio holdings (excluding derivatives, if any) | $54% |

| Total investment management fees paid | $35,614,835% |

| Portfolio turnover rate | $104% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 44.6 | % |

| Communication Services | 18.8 | % |

| Consumer Discretionary | 10.7 | % |

| Health Care | 10.0 | % |

| Industrials | 7.3 | % |

| Financials | 5.5 | % |

| Real Estate | 1.3 | % |

| Energy | 0.9 | % |

| Short-Term Investments | 0.2 | % |

| Other Assets & Liabilities | 0.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

The Hartford Growth Opportunities Fund

Class C/HGOCX

This annual shareholder report contains important information about The Hartford Growth Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class C | $243 | 1.92% |

Costs paid include the impact of expenses associated with the Fund’s shareholder meeting held on December 13, 2023, which was ultimately adjourned until January 23, 2024. If these expenses were excluded, the expense ratio would be as follows: 1.89%. Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 3000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection contributed positively to relative results. Strong security selection in the Information Technology, Financials, and Consumer Discretionary sectors contributed to relative returns.

Sector allocation, a result of the team’s bottom-up stock selection process, also contributed to relative returns. Allocation effect was driven by the Fund’s overweight to the Communication Services sector and underweights to the Consumer Staples and Industrials sectors.

Top individual contributors over the period were an overweight position in NVIDIA (Information Technology), an underweight position in Apple (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection within the Communication Services, Real Estate, and Consumer Staples sectors detracted from relative results.

The Fund’s underweight position to the Information Technology sector and overweight to the Healthcare and Real Estate sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Pinterest (Communication Services) and Dexcom (Healthcare), and an underweight position in QUALCOMM (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

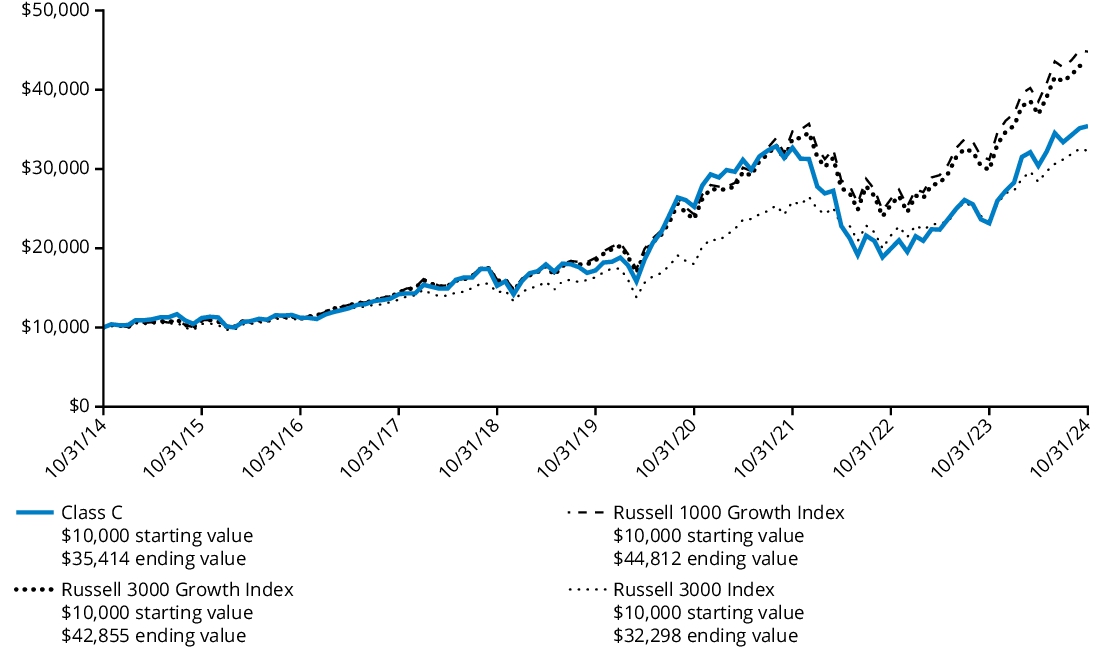

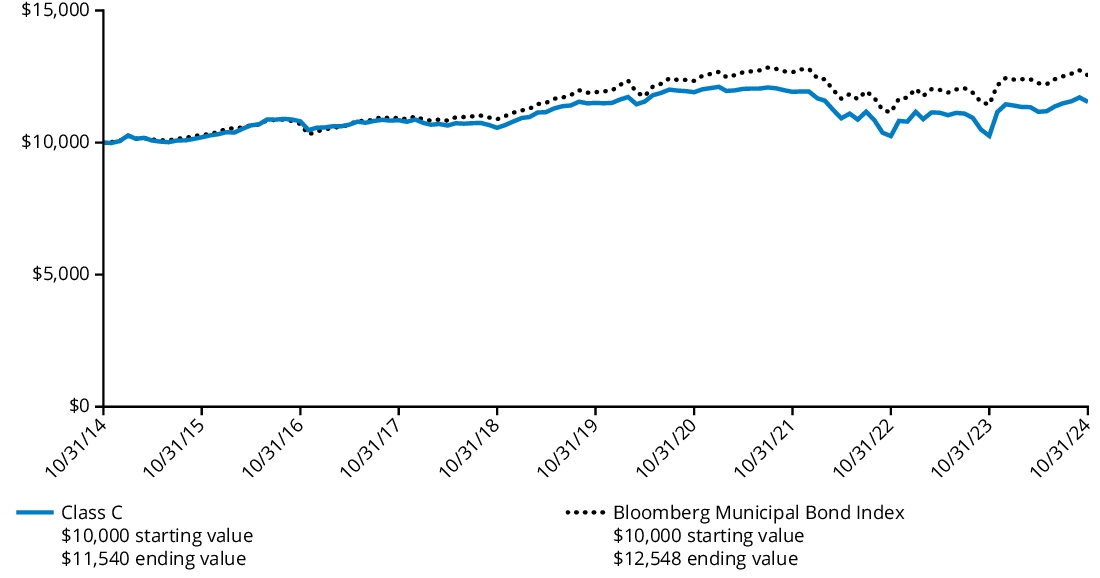

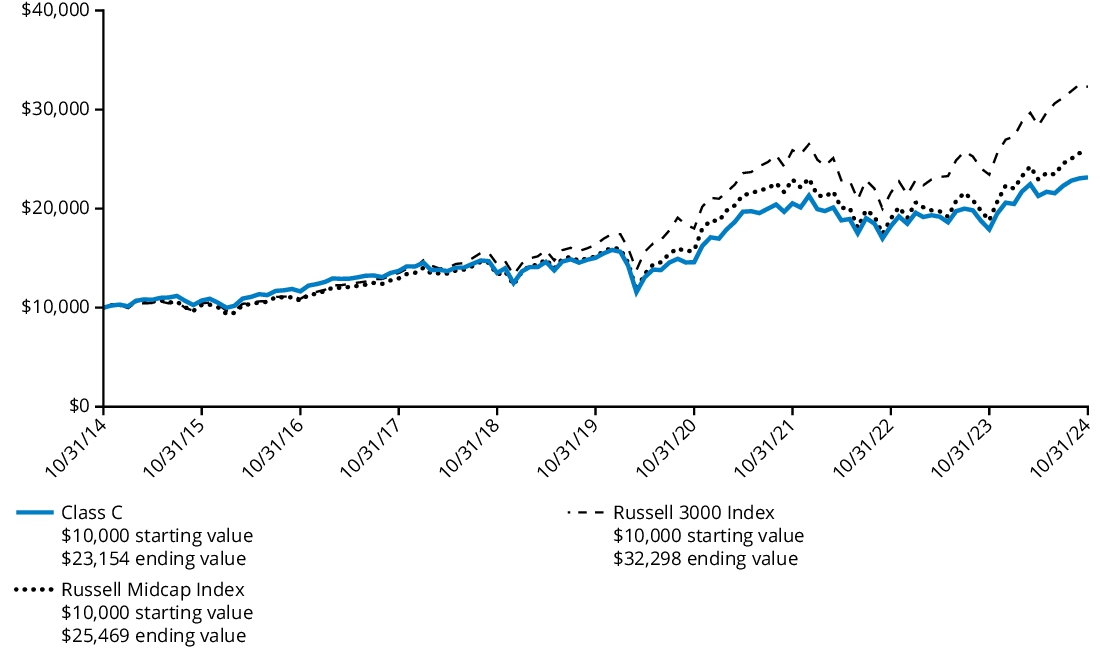

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class C shares (excluding sales charges) and the comparative indices. If sales charges had been included, the value would have been lower.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class C (with 1.00% contingent deferred sales charge) | 51.97% | 15.54% | 13.48% |

| Class C (without 1.00% contingent deferred sales charge) | 52.97% | 15.54% | 13.48% |

| Russell 3000 Growth Index | 43.42% | 18.34% | 15.66% |

| Russell 1000 Growth Index | 43.77% | 19.00% | 16.18% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

The Russell 3000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 1000 Growth Index serves as the Fund’s secondary performance index. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $5,478,445,304% |

| Total number of portfolio holdings (excluding derivatives, if any) | $54% |

| Total investment management fees paid | $35,614,835% |

| Portfolio turnover rate | $104% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 44.6 | % |

| Communication Services | 18.8 | % |

| Consumer Discretionary | 10.7 | % |

| Health Care | 10.0 | % |

| Industrials | 7.3 | % |

| Financials | 5.5 | % |

| Real Estate | 1.3 | % |

| Energy | 0.9 | % |

| Short-Term Investments | 0.2 | % |

| Other Assets & Liabilities | 0.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

The Hartford Growth Opportunities Fund

Class I/HGOIX

This annual shareholder report contains important information about The Hartford Growth Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class I | $109 | 0.86% |

Costs paid include the impact of expenses associated with the Fund’s shareholder meeting held on December 13, 2023, which was ultimately adjourned until January 23, 2024. If these expenses were excluded, the expense ratio would be as follows: 0.83%. Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 3000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection contributed positively to relative results. Strong security selection in the Information Technology, Financials, and Consumer Discretionary sectors contributed to relative returns.

Sector allocation, a result of the team’s bottom-up stock selection process, also contributed to relative returns. Allocation effect was driven by the Fund’s overweight to the Communication Services sector and underweights to the Consumer Staples and Industrials sectors.

Top individual contributors over the period were an overweight position in NVIDIA (Information Technology), an underweight position in Apple (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection within the Communication Services, Real Estate, and Consumer Staples sectors detracted from relative results.

The Fund’s underweight position to the Information Technology sector and overweight to the Healthcare and Real Estate sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Pinterest (Communication Services) and Dexcom (Healthcare), and an underweight position in QUALCOMM (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

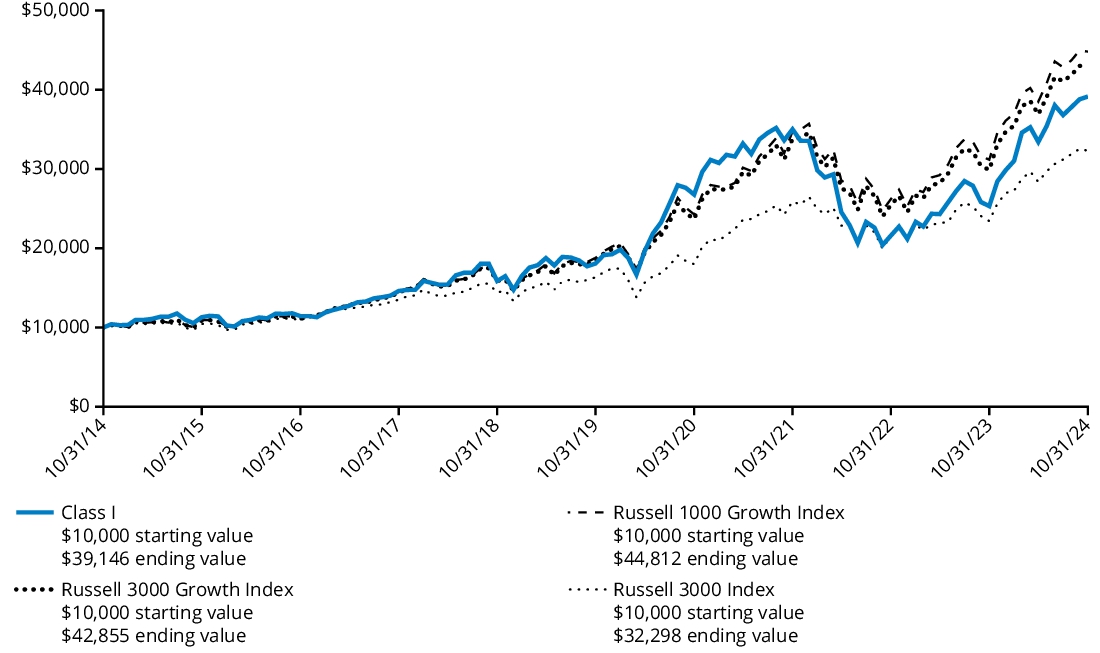

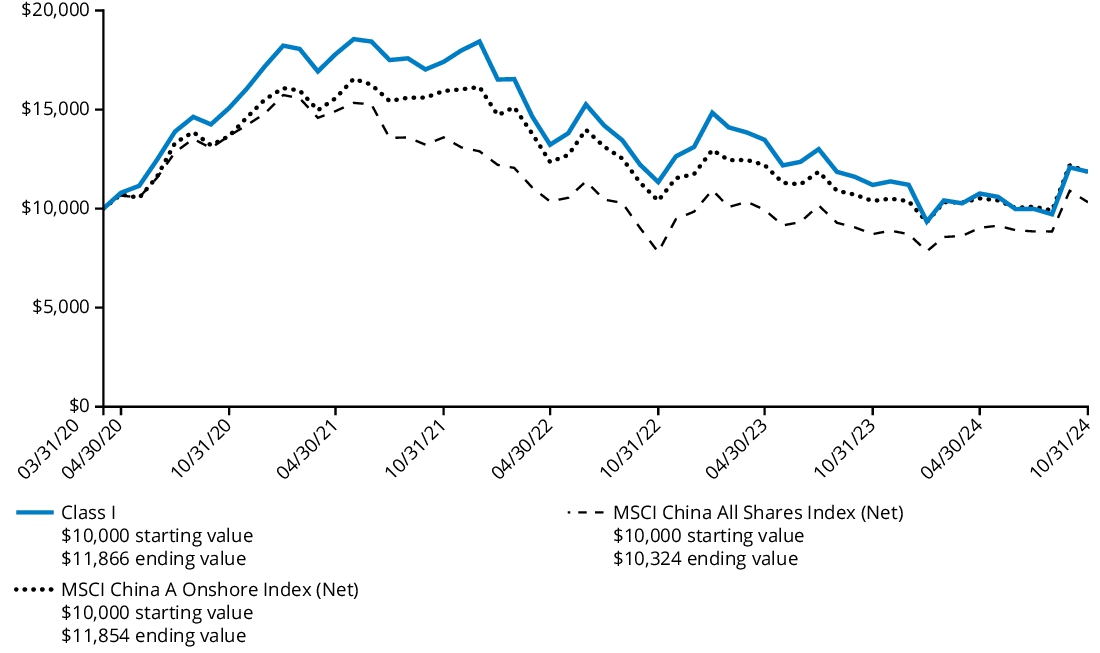

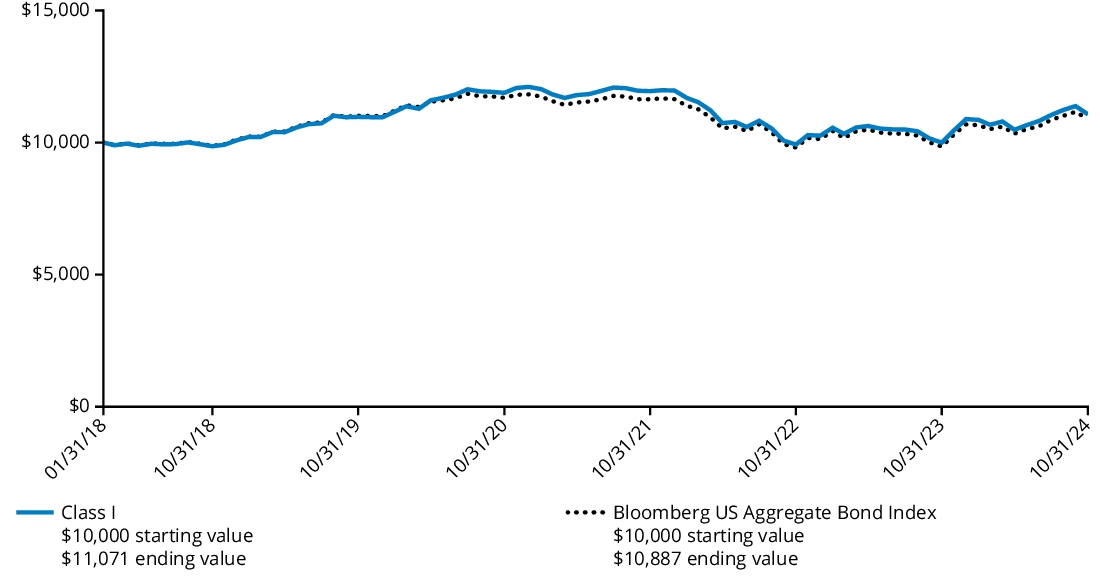

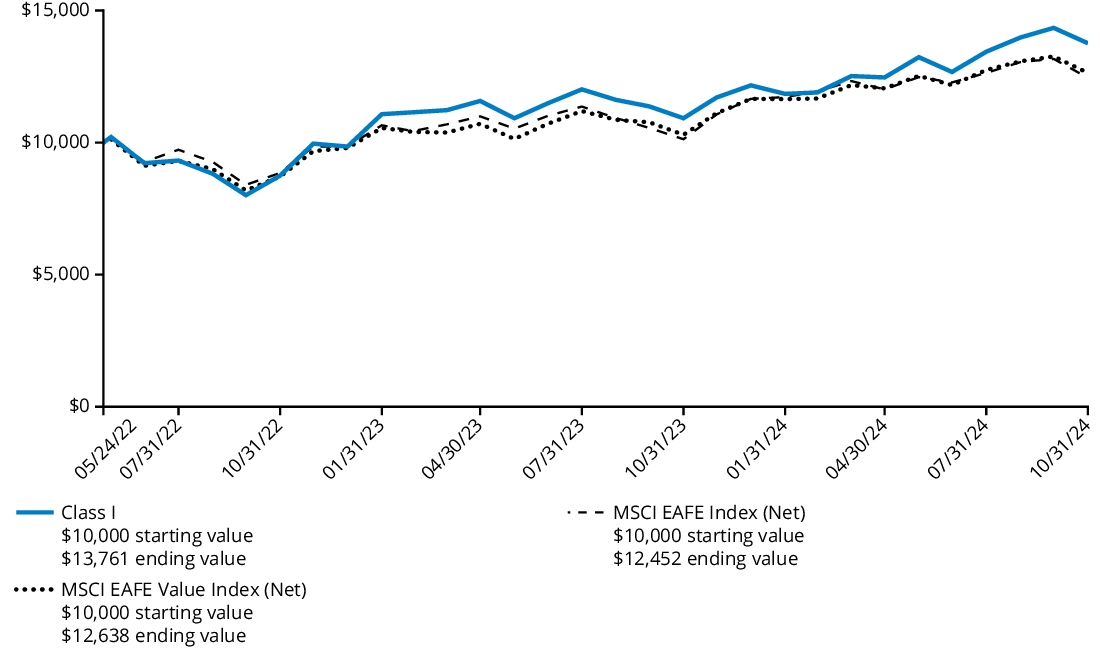

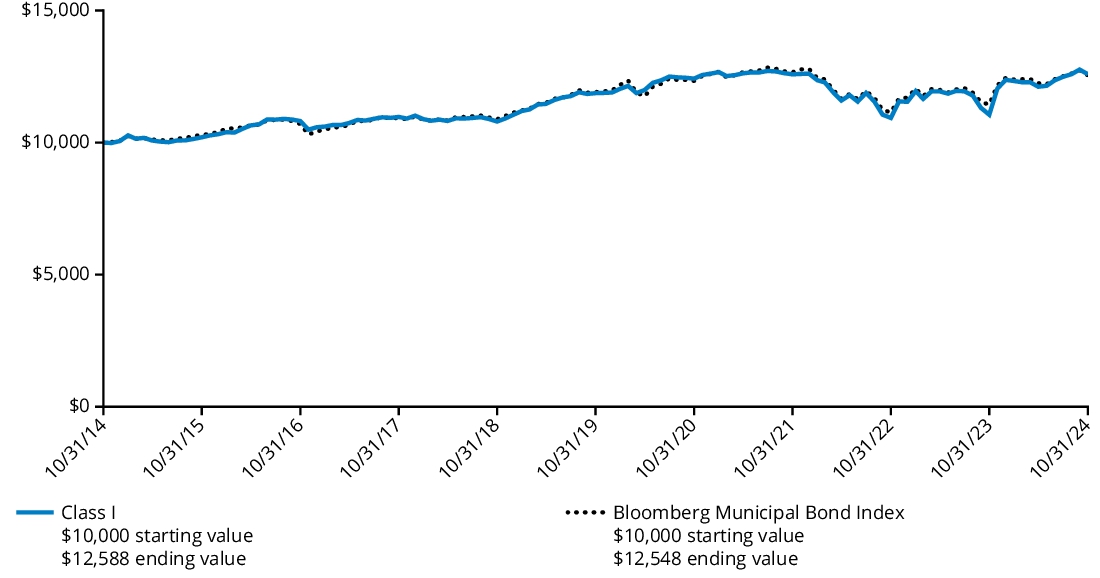

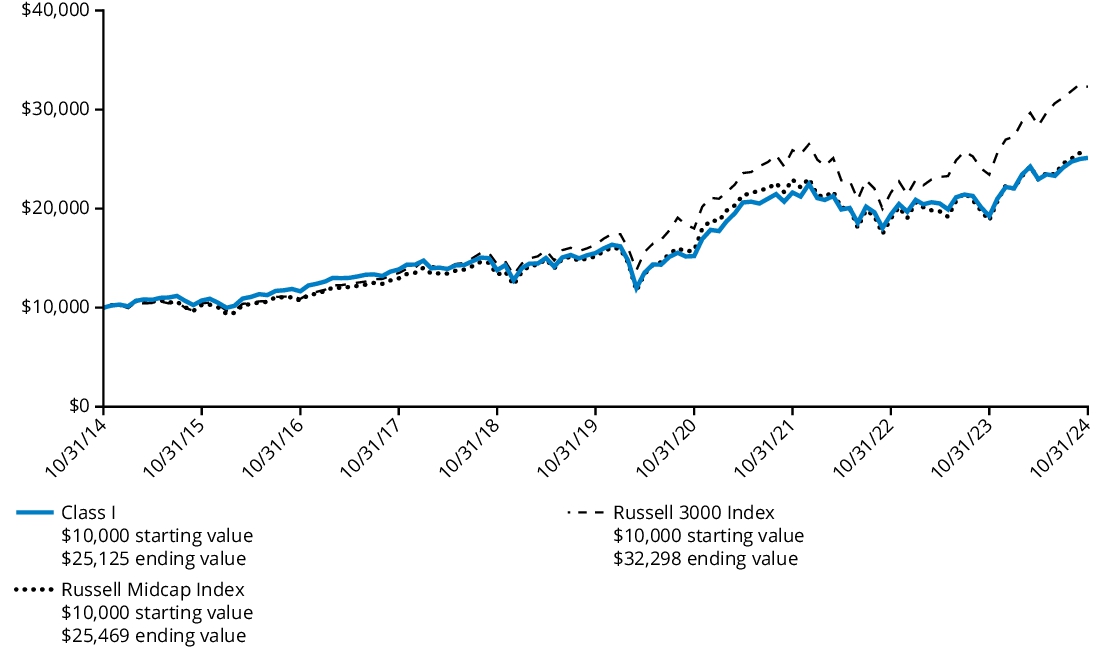

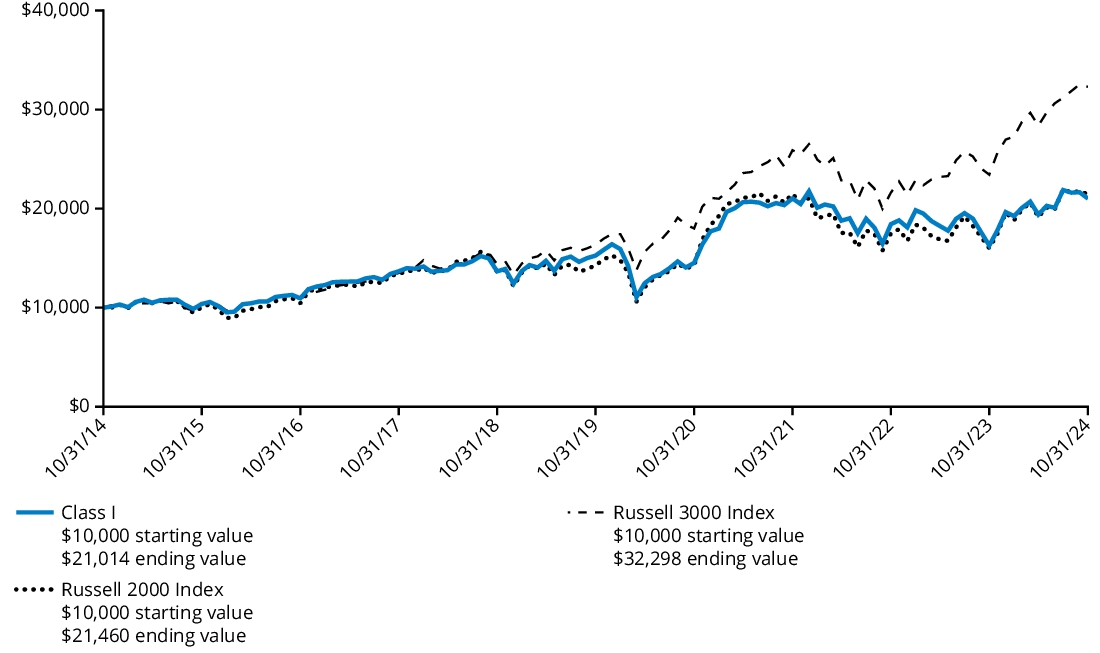

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class I shares and the comparative indices.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class I | 54.65% | 16.72% | 14.62% |

| Russell 3000 Growth Index | 43.42% | 18.34% | 15.66% |

| Russell 1000 Growth Index | 43.77% | 19.00% | 16.18% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

The Russell 3000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 1000 Growth Index serves as the Fund’s secondary performance index. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $5,478,445,304% |

| Total number of portfolio holdings (excluding derivatives, if any) | $54% |

| Total investment management fees paid | $35,614,835% |

| Portfolio turnover rate | $104% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 44.6 | % |

| Communication Services | 18.8 | % |

| Consumer Discretionary | 10.7 | % |

| Health Care | 10.0 | % |

| Industrials | 7.3 | % |

| Financials | 5.5 | % |

| Real Estate | 1.3 | % |

| Energy | 0.9 | % |

| Short-Term Investments | 0.2 | % |

| Other Assets & Liabilities | 0.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Material Fund Changes

This is a summary of certain changes to the Fund since the beginning of the reporting period.

Effective July 1, 2024, Hartford Administrative Services Company, the Fund’s transfer agent, contractually agreed to waive its transfer agency fee and/or reimburse transfer agency-related expenses to the extent necessary to limit the transfer agency fee for Class I of the Fund as follows: 0.107% of the average daily net assets attributable to the class. This contractual arrangement will remain in effect until February 28, 2025 unless the Board of Directors of the Fund approves its earlier termination.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

The Hartford Growth Opportunities Fund

Class R3/HGORX

This annual shareholder report contains important information about The Hartford Growth Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class R3 | $188 | 1.48% |

Costs paid include the impact of expenses associated with the Fund’s shareholder meeting held on December 13, 2023, which was ultimately adjourned until January 23, 2024. If these expenses were excluded, the expense ratio would be as follows: 1.44%. Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 3000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection contributed positively to relative results. Strong security selection in the Information Technology, Financials, and Consumer Discretionary sectors contributed to relative returns.

Sector allocation, a result of the team’s bottom-up stock selection process, also contributed to relative returns. Allocation effect was driven by the Fund’s overweight to the Communication Services sector and underweights to the Consumer Staples and Industrials sectors.

Top individual contributors over the period were an overweight position in NVIDIA (Information Technology), an underweight position in Apple (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection within the Communication Services, Real Estate, and Consumer Staples sectors detracted from relative results.

The Fund’s underweight position to the Information Technology sector and overweight to the Healthcare and Real Estate sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Pinterest (Communication Services) and Dexcom (Healthcare), and an underweight position in QUALCOMM (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

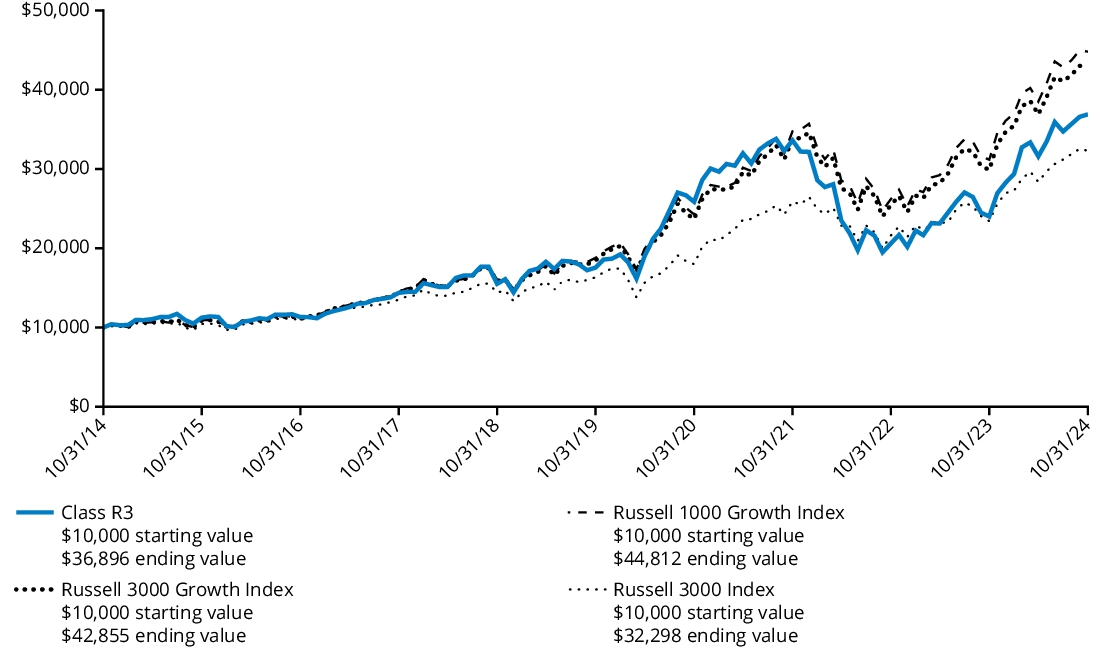

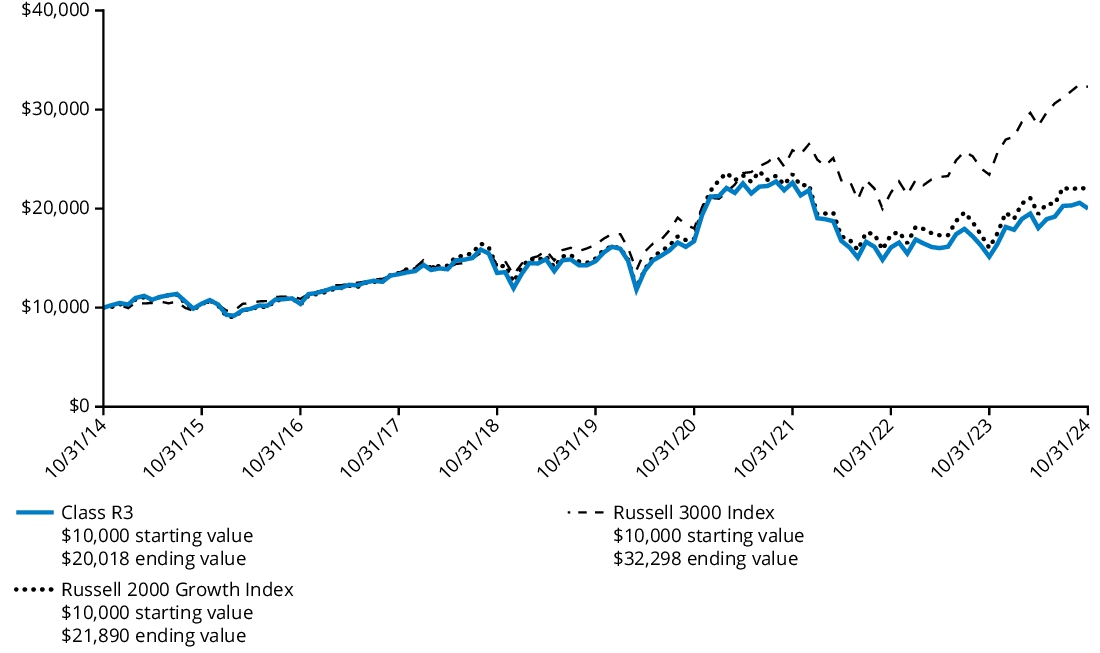

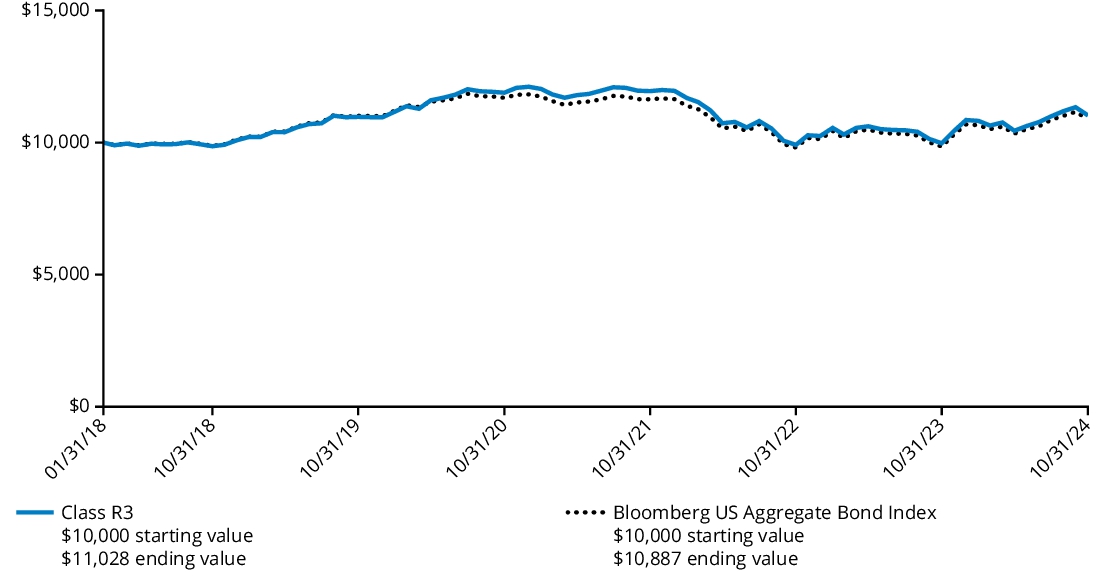

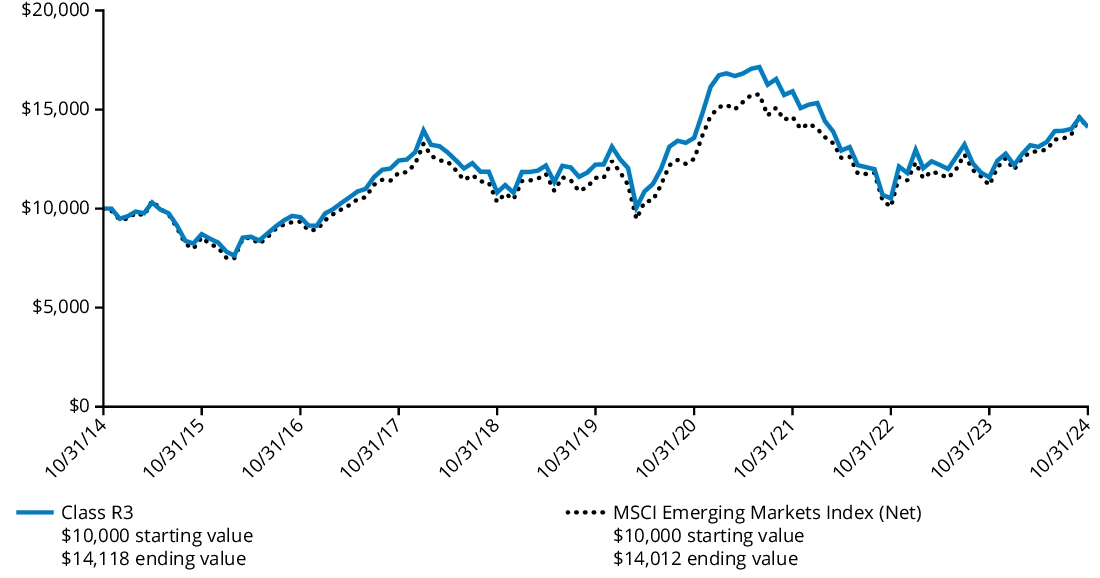

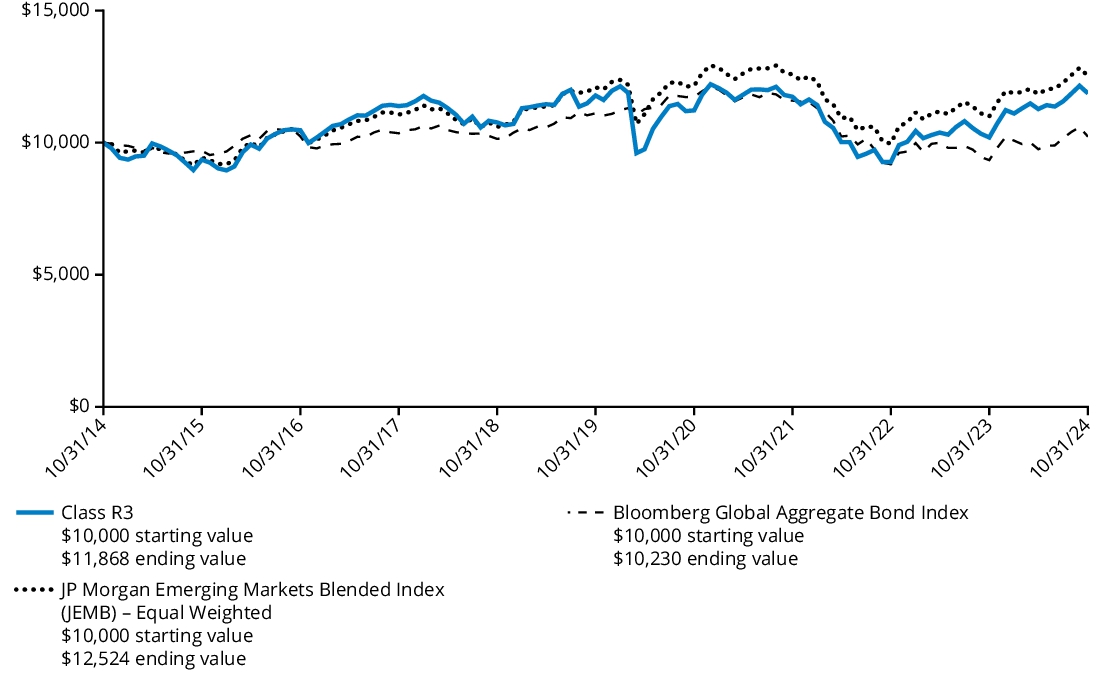

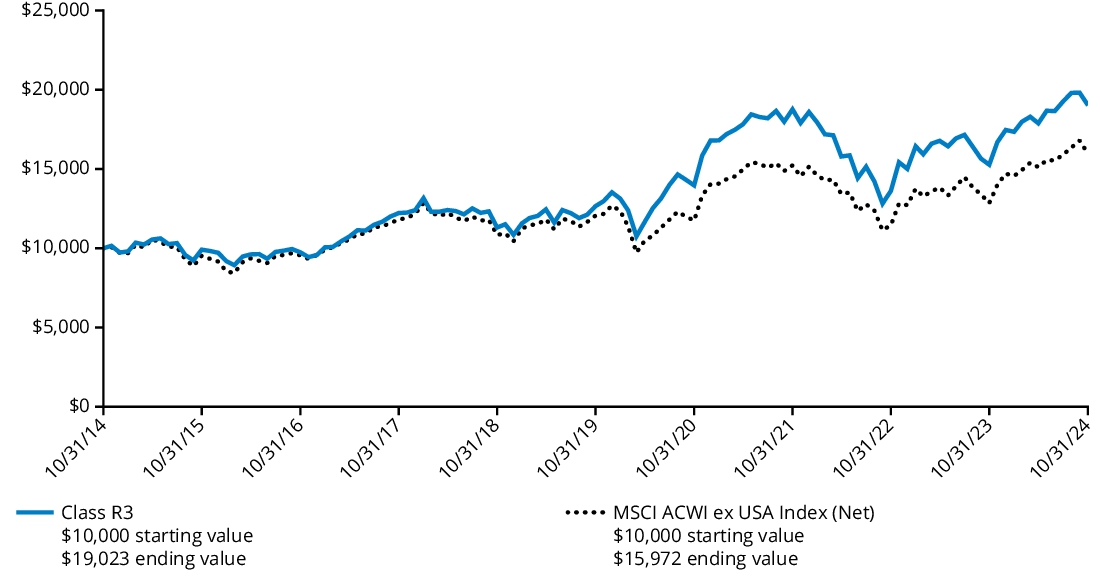

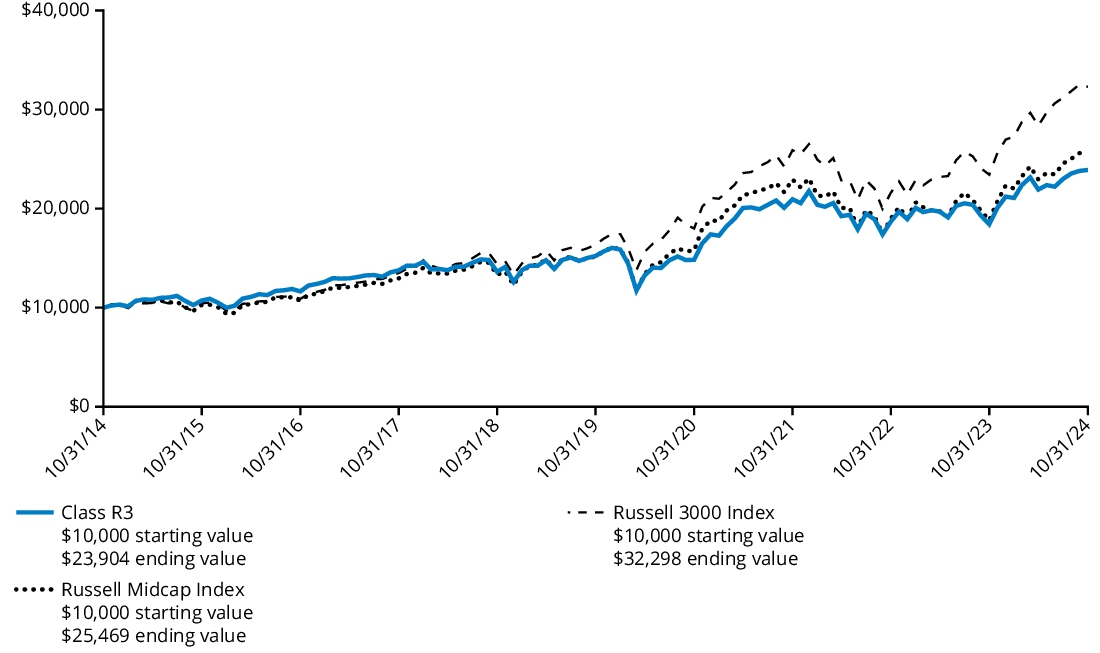

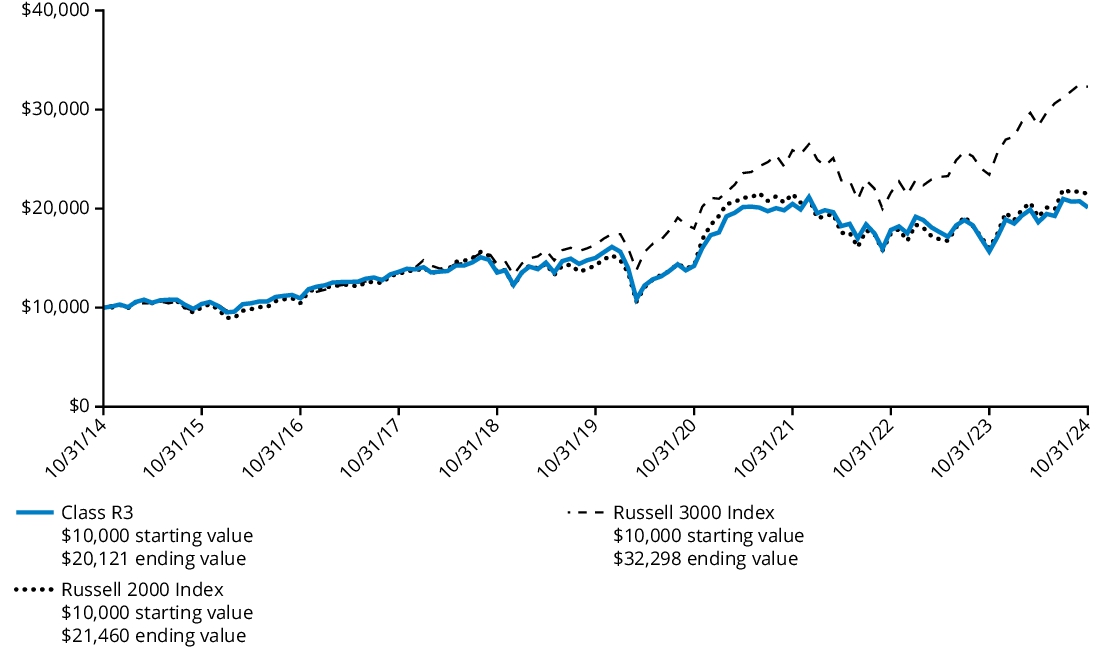

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class R3 shares and the comparative indices.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class R3 | 53.69% | 16.01% | 13.95% |

| Russell 3000 Growth Index | 43.42% | 18.34% | 15.66% |

| Russell 1000 Growth Index | 43.77% | 19.00% | 16.18% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

The Russell 3000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 1000 Growth Index serves as the Fund’s secondary performance index. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $5,478,445,304% |

| Total number of portfolio holdings (excluding derivatives, if any) | $54% |

| Total investment management fees paid | $35,614,835% |

| Portfolio turnover rate | $104% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 44.6 | % |

| Communication Services | 18.8 | % |

| Consumer Discretionary | 10.7 | % |

| Health Care | 10.0 | % |

| Industrials | 7.3 | % |

| Financials | 5.5 | % |

| Real Estate | 1.3 | % |

| Energy | 0.9 | % |

| Short-Term Investments | 0.2 | % |

| Other Assets & Liabilities | 0.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

The Hartford Growth Opportunities Fund

Class R4/HGOSX

This annual shareholder report contains important information about The Hartford Growth Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class R4 | $147 | 1.16% |

Costs paid include the impact of expenses associated with the Fund’s shareholder meeting held on December 13, 2023, which was ultimately adjourned until January 23, 2024. If these expenses were excluded, the expense ratio would be as follows: 1.13%. Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 3000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection contributed positively to relative results. Strong security selection in the Information Technology, Financials, and Consumer Discretionary sectors contributed to relative returns.

Sector allocation, a result of the team’s bottom-up stock selection process, also contributed to relative returns. Allocation effect was driven by the Fund’s overweight to the Communication Services sector and underweights to the Consumer Staples and Industrials sectors.

Top individual contributors over the period were an overweight position in NVIDIA (Information Technology), an underweight position in Apple (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection within the Communication Services, Real Estate, and Consumer Staples sectors detracted from relative results.

The Fund’s underweight position to the Information Technology sector and overweight to the Healthcare and Real Estate sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Pinterest (Communication Services) and Dexcom (Healthcare), and an underweight position in QUALCOMM (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

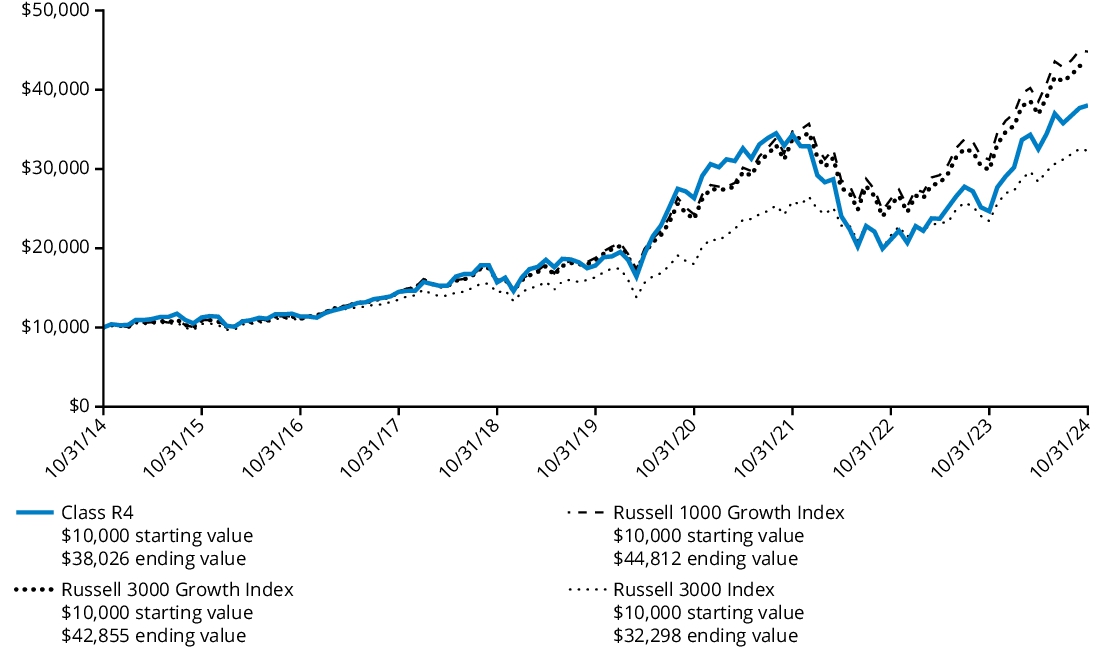

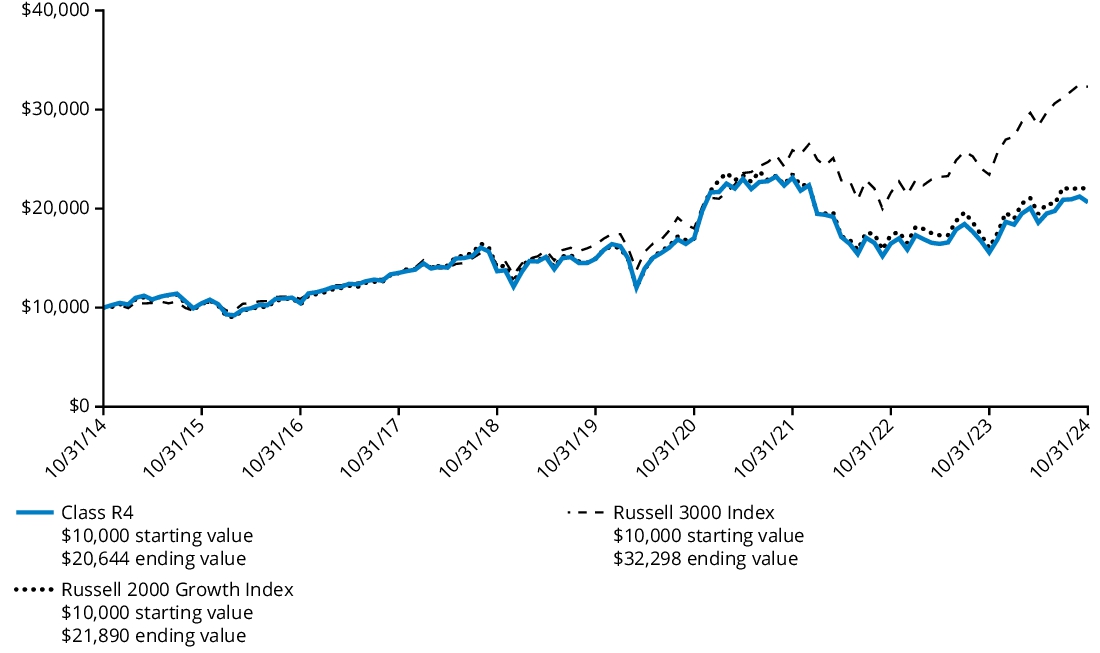

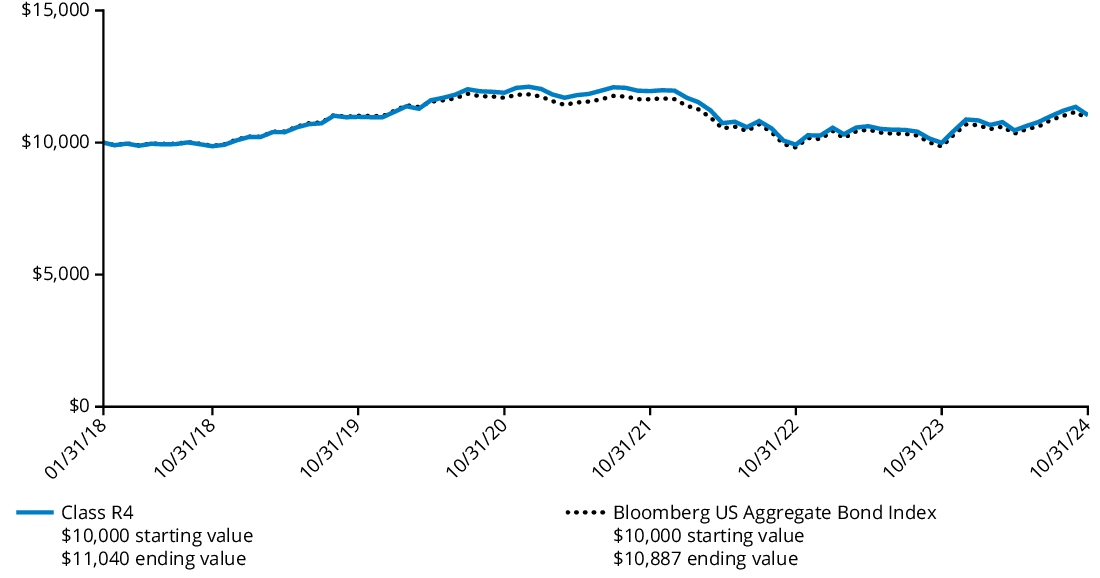

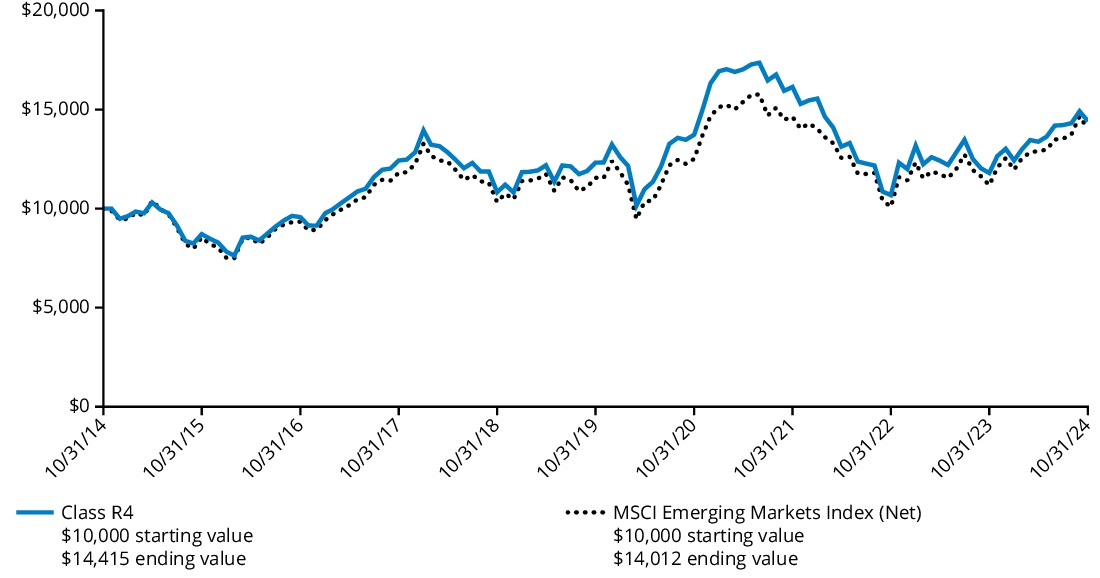

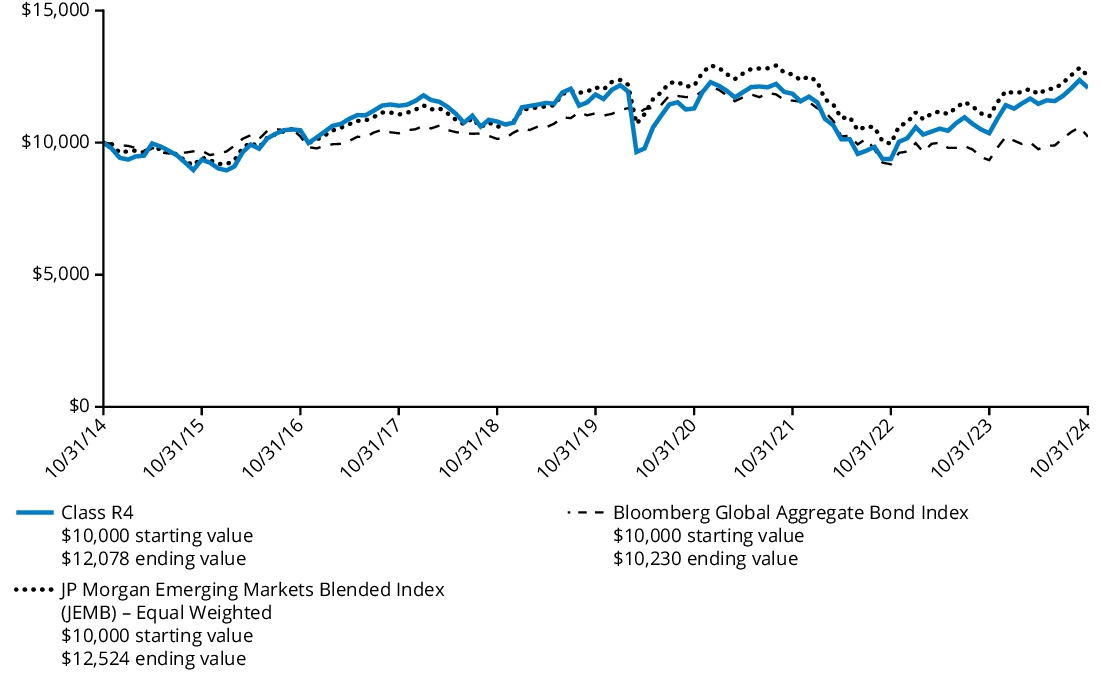

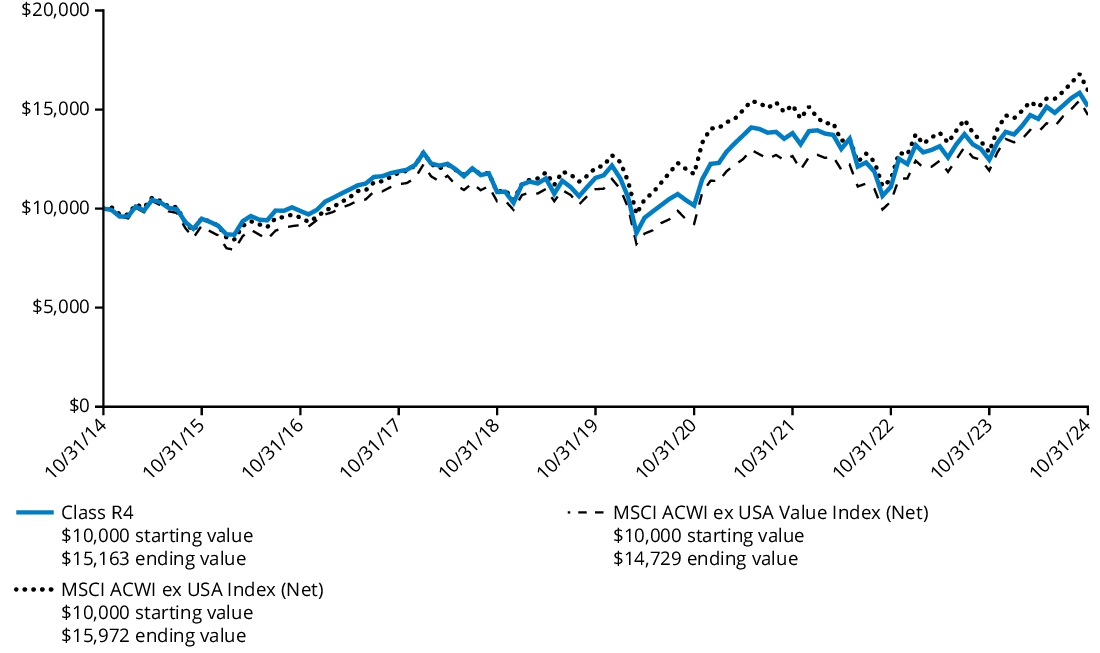

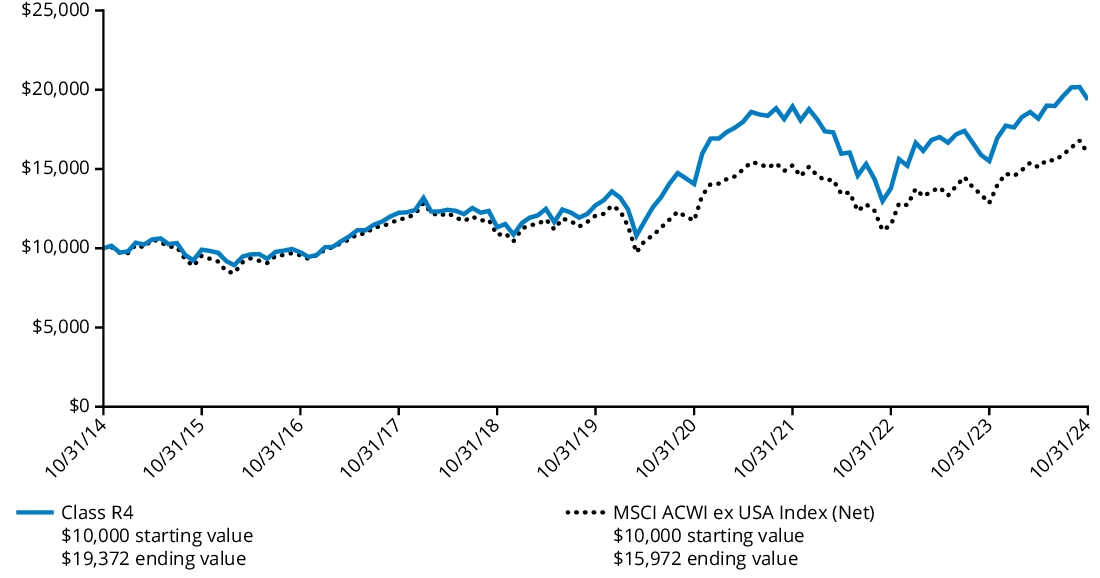

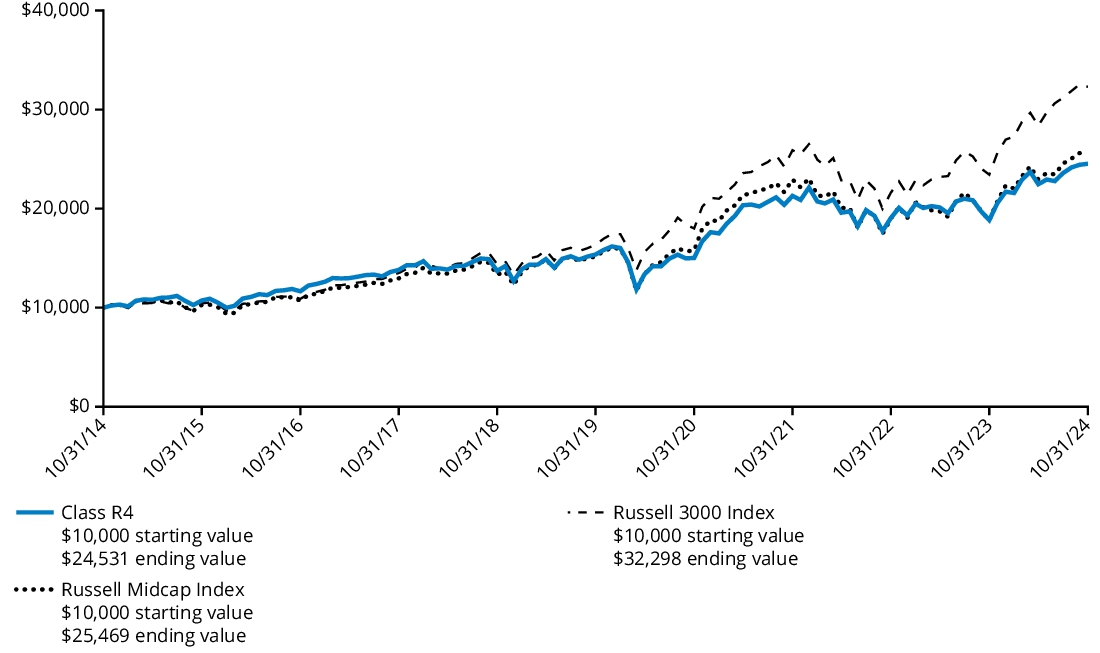

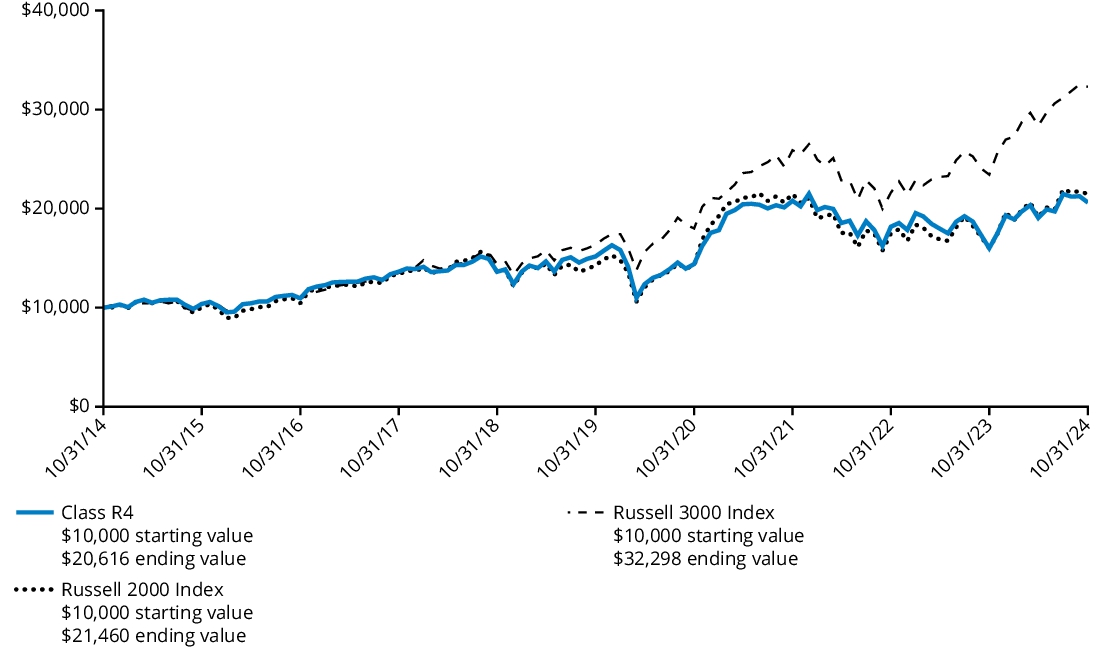

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class R4 shares and the comparative indices.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class R4 | 54.16% | 16.37% | 14.29% |

| Russell 3000 Growth Index | 43.42% | 18.34% | 15.66% |

| Russell 1000 Growth Index | 43.77% | 19.00% | 16.18% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

The Russell 3000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 1000 Growth Index serves as the Fund’s secondary performance index. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $5,478,445,304% |

| Total number of portfolio holdings (excluding derivatives, if any) | $54% |

| Total investment management fees paid | $35,614,835% |

| Portfolio turnover rate | $104% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 44.6 | % |

| Communication Services | 18.8 | % |

| Consumer Discretionary | 10.7 | % |

| Health Care | 10.0 | % |

| Industrials | 7.3 | % |

| Financials | 5.5 | % |

| Real Estate | 1.3 | % |

| Energy | 0.9 | % |

| Short-Term Investments | 0.2 | % |

| Other Assets & Liabilities | 0.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

The Hartford Growth Opportunities Fund

Class R5/HGOTX

This annual shareholder report contains important information about The Hartford Growth Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class R5 | $111 | 0.87% |

Costs paid include the impact of expenses associated with the Fund’s shareholder meeting held on December 13, 2023, which was ultimately adjourned until January 23, 2024. If these expenses were excluded, the expense ratio would be as follows: 0.83%. Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 3000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection contributed positively to relative results. Strong security selection in the Information Technology, Financials, and Consumer Discretionary sectors contributed to relative returns.

Sector allocation, a result of the team’s bottom-up stock selection process, also contributed to relative returns. Allocation effect was driven by the Fund’s overweight to the Communication Services sector and underweights to the Consumer Staples and Industrials sectors.

Top individual contributors over the period were an overweight position in NVIDIA (Information Technology), an underweight position in Apple (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection within the Communication Services, Real Estate, and Consumer Staples sectors detracted from relative results.

The Fund’s underweight position to the Information Technology sector and overweight to the Healthcare and Real Estate sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Pinterest (Communication Services) and Dexcom (Healthcare), and an underweight position in QUALCOMM (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

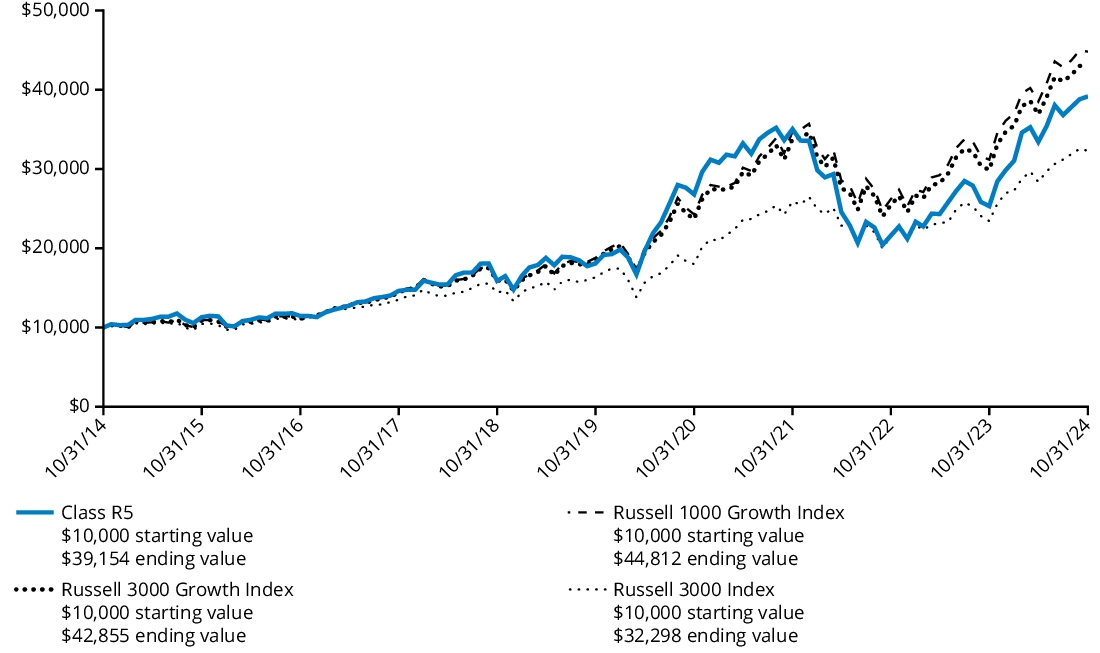

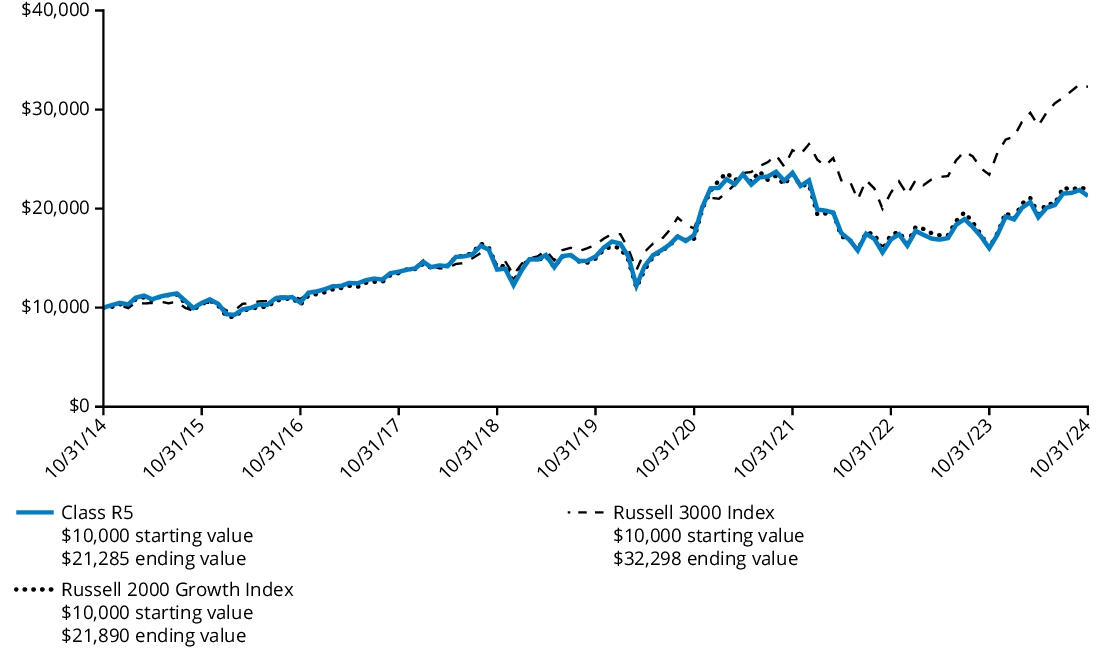

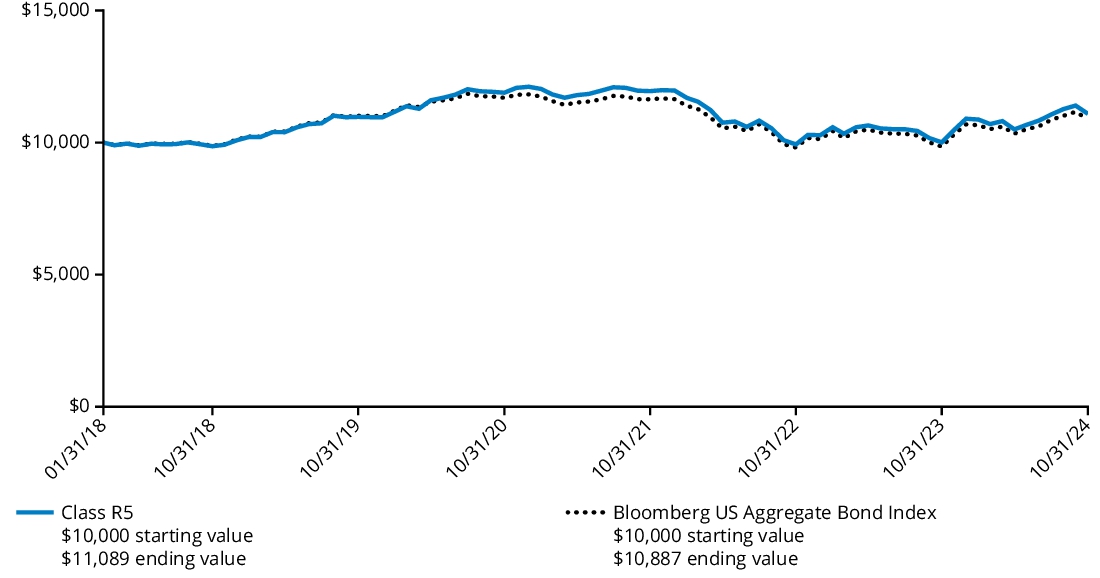

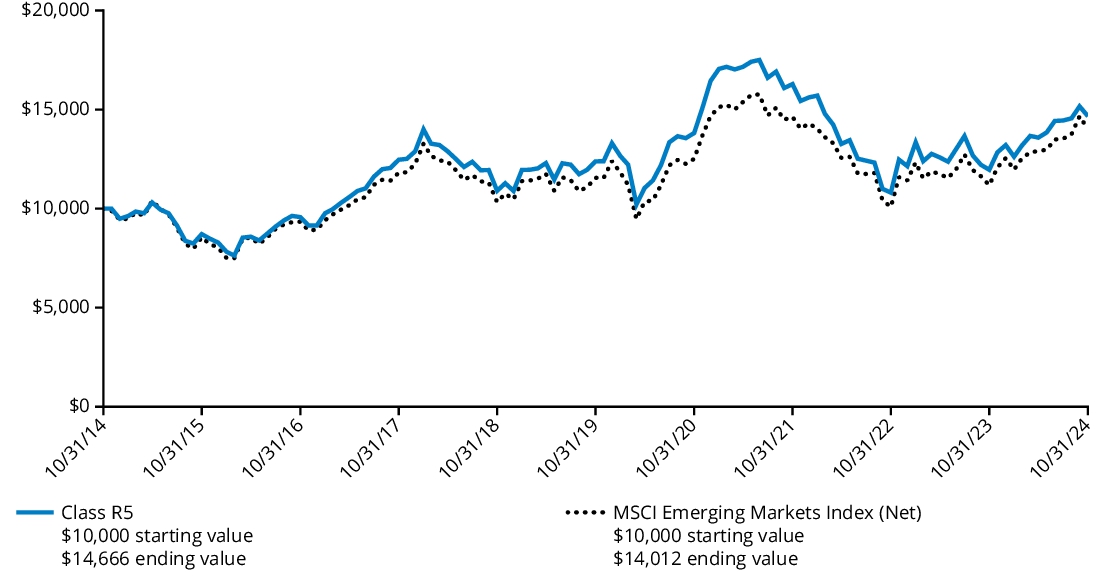

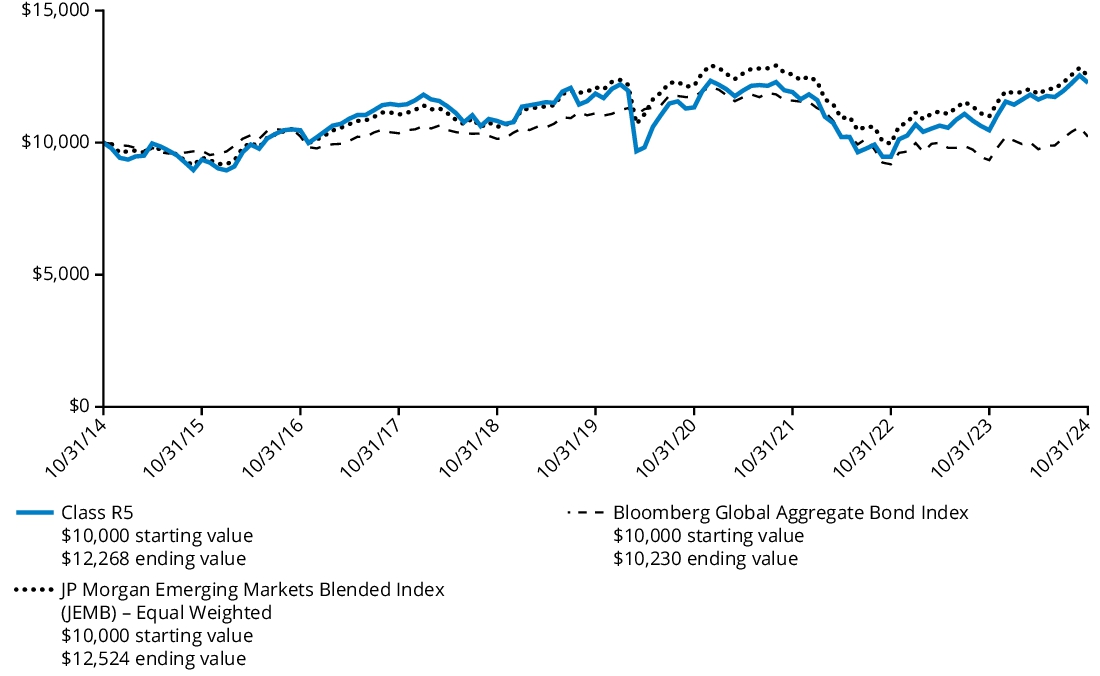

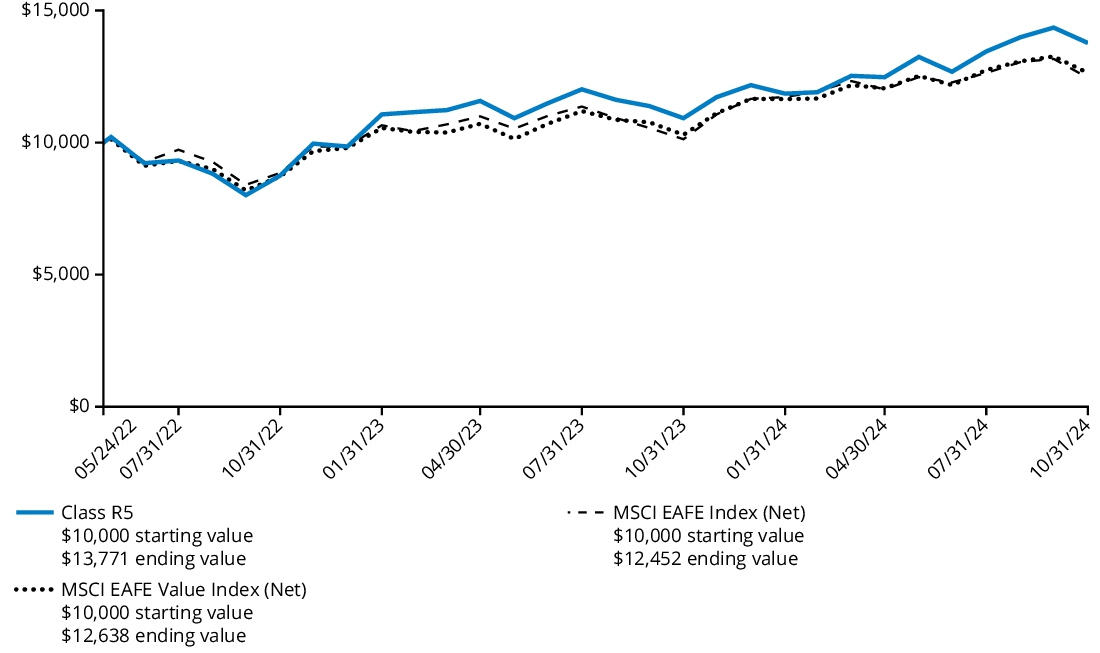

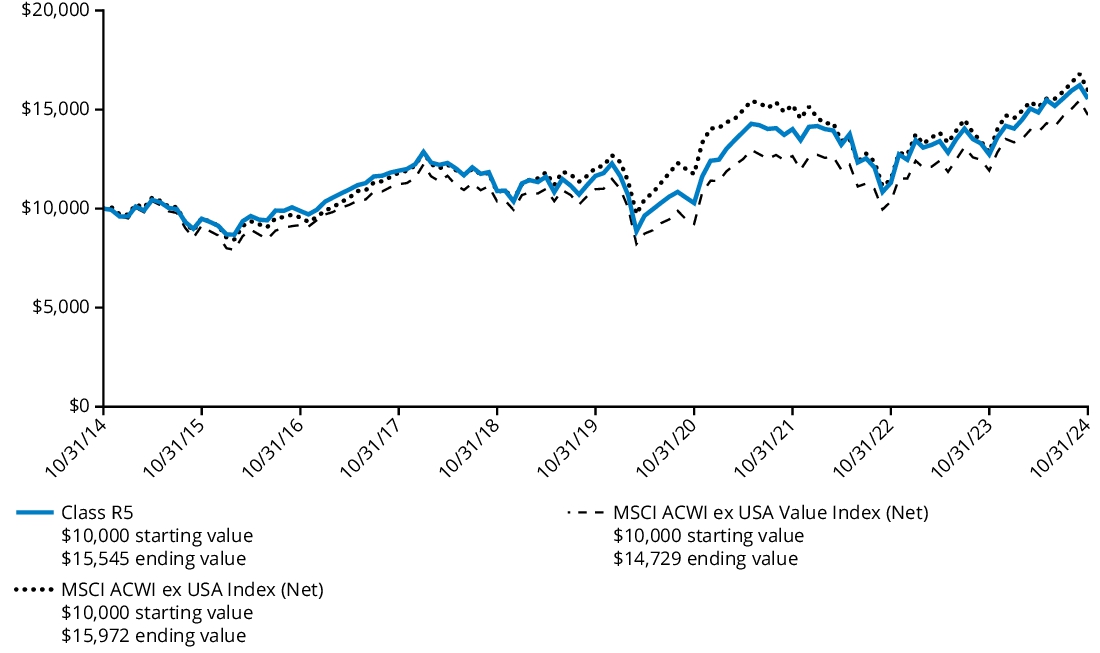

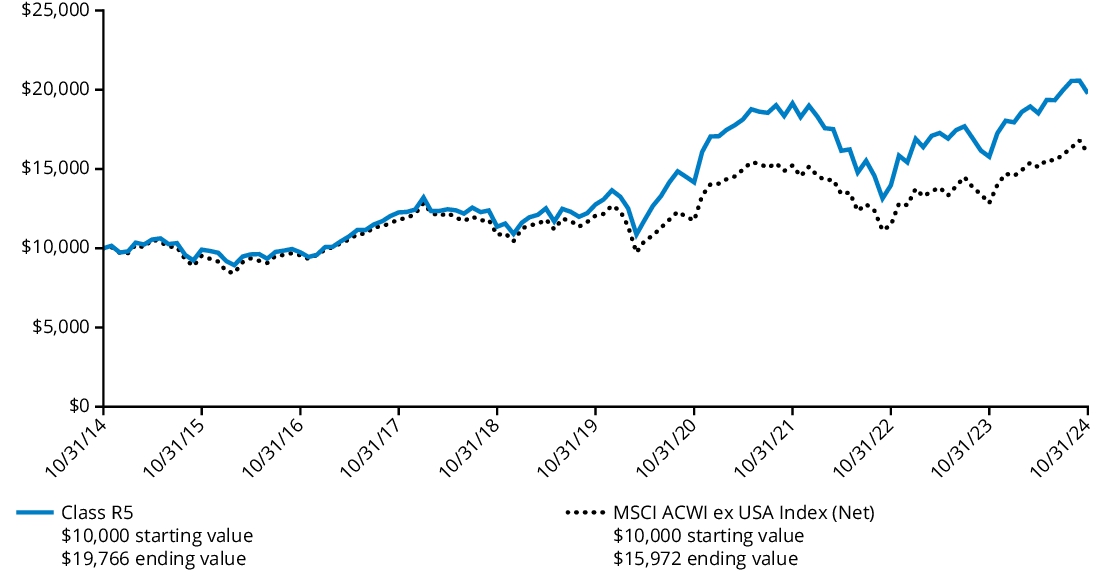

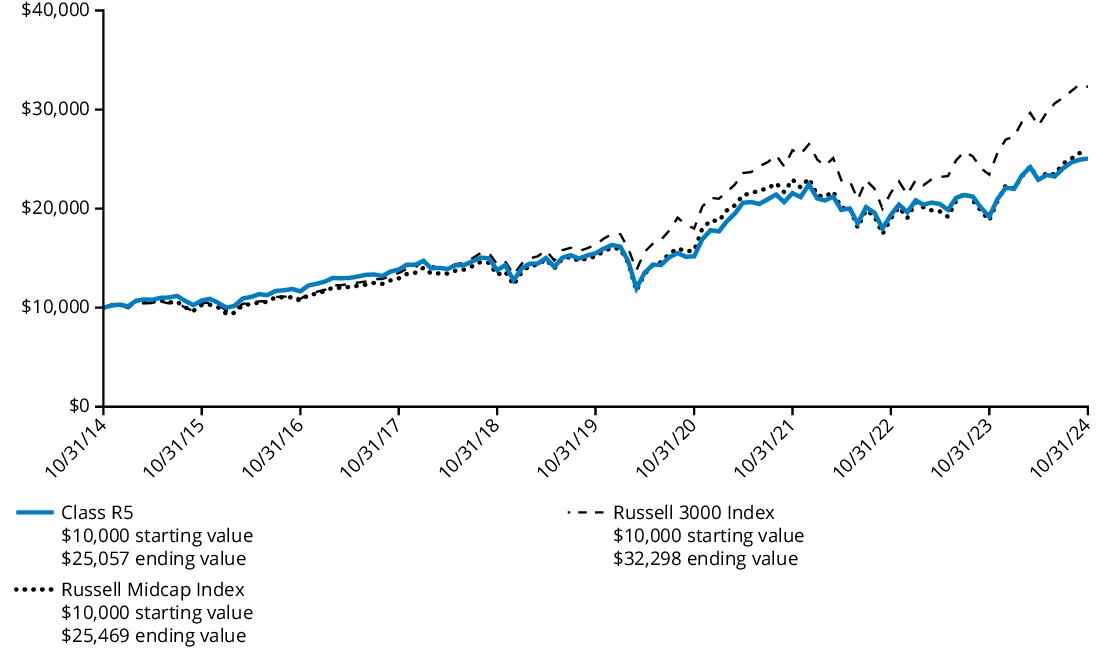

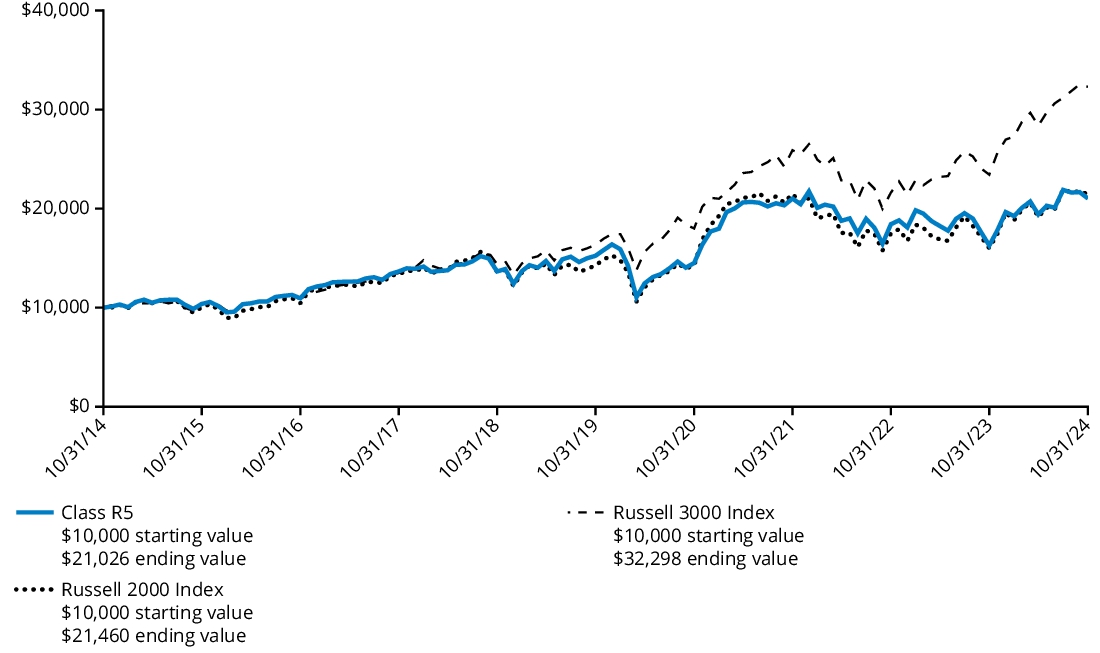

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class R5 shares and the comparative indices.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class R5 | 54.65% | 16.70% | 14.62% |

| Russell 3000 Growth Index | 43.42% | 18.34% | 15.66% |

| Russell 1000 Growth Index | 43.77% | 19.00% | 16.18% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

The Russell 3000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 1000 Growth Index serves as the Fund’s secondary performance index. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $5,478,445,304% |

| Total number of portfolio holdings (excluding derivatives, if any) | $54% |

| Total investment management fees paid | $35,614,835% |

| Portfolio turnover rate | $104% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 44.6 | % |

| Communication Services | 18.8 | % |

| Consumer Discretionary | 10.7 | % |

| Health Care | 10.0 | % |

| Industrials | 7.3 | % |

| Financials | 5.5 | % |

| Real Estate | 1.3 | % |

| Energy | 0.9 | % |

| Short-Term Investments | 0.2 | % |

| Other Assets & Liabilities | 0.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

The Hartford Growth Opportunities Fund

Class R6/HGOVX

This annual shareholder report contains important information about The Hartford Growth Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class R6 | $98 | 0.77% |

Costs paid include the impact of expenses associated with the Fund’s shareholder meeting held on December 13, 2023, which was ultimately adjourned until January 23, 2024. If these expenses were excluded, the expense ratio would be as follows: 0.73%. Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 3000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection contributed positively to relative results. Strong security selection in the Information Technology, Financials, and Consumer Discretionary sectors contributed to relative returns.

Sector allocation, a result of the team’s bottom-up stock selection process, also contributed to relative returns. Allocation effect was driven by the Fund’s overweight to the Communication Services sector and underweights to the Consumer Staples and Industrials sectors.

Top individual contributors over the period were an overweight position in NVIDIA (Information Technology), an underweight position in Apple (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection within the Communication Services, Real Estate, and Consumer Staples sectors detracted from relative results.

The Fund’s underweight position to the Information Technology sector and overweight to the Healthcare and Real Estate sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Pinterest (Communication Services) and Dexcom (Healthcare), and an underweight position in QUALCOMM (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

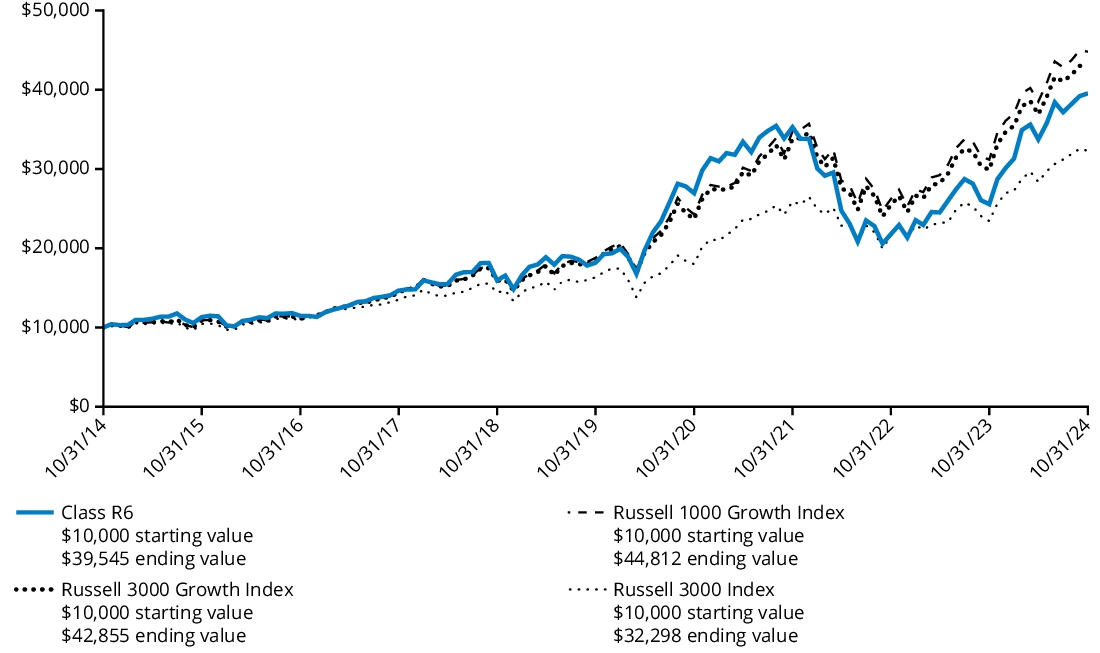

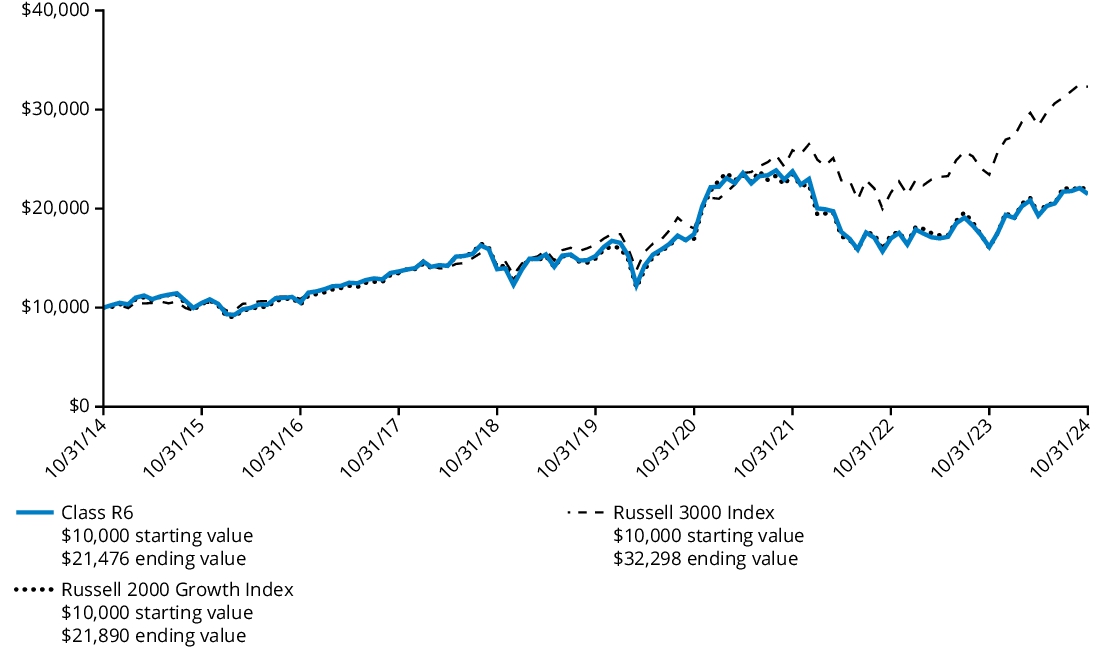

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class R6 shares and the comparative indices.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class R6 | 54.76% | 16.83% | 14.74% |

| Russell 3000 Growth Index | 43.42% | 18.34% | 15.66% |

| Russell 1000 Growth Index | 43.77% | 19.00% | 16.18% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

Class R6 shares commenced operations on November 7, 2014 and performance prior to that date is that of the Fund’s Class Y shares. Performance prior to the inception date of the class has not been adjusted to reflect the operating expenses of the class.

The Russell 3000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 1000 Growth Index serves as the Fund’s secondary performance index. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $5,478,445,304% |

| Total number of portfolio holdings (excluding derivatives, if any) | $54% |

| Total investment management fees paid | $35,614,835% |

| Portfolio turnover rate | $104% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 44.6 | % |

| Communication Services | 18.8 | % |

| Consumer Discretionary | 10.7 | % |

| Health Care | 10.0 | % |

| Industrials | 7.3 | % |

| Financials | 5.5 | % |

| Real Estate | 1.3 | % |

| Energy | 0.9 | % |

| Short-Term Investments | 0.2 | % |

| Other Assets & Liabilities | 0.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

The Hartford Growth Opportunities Fund

Class Y/HGOYX

This annual shareholder report contains important information about The Hartford Growth Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class Y | $107 | 0.84% |

Costs paid include the impact of expenses associated with the Fund’s shareholder meeting held on December 13, 2023, which was ultimately adjourned until January 23, 2024. If these expenses were excluded, the expense ratio would be as follows: 0.81%. Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 3000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection contributed positively to relative results. Strong security selection in the Information Technology, Financials, and Consumer Discretionary sectors contributed to relative returns.

Sector allocation, a result of the team’s bottom-up stock selection process, also contributed to relative returns. Allocation effect was driven by the Fund’s overweight to the Communication Services sector and underweights to the Consumer Staples and Industrials sectors.

Top individual contributors over the period were an overweight position in NVIDIA (Information Technology), an underweight position in Apple (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection within the Communication Services, Real Estate, and Consumer Staples sectors detracted from relative results.

The Fund’s underweight position to the Information Technology sector and overweight to the Healthcare and Real Estate sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Pinterest (Communication Services) and Dexcom (Healthcare), and an underweight position in QUALCOMM (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

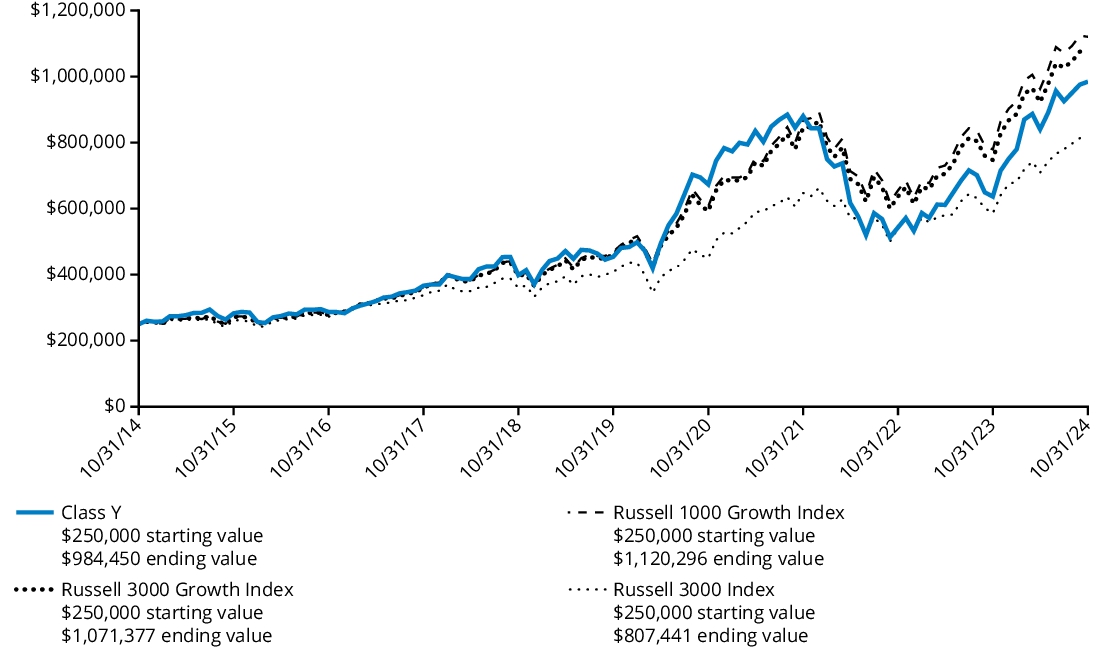

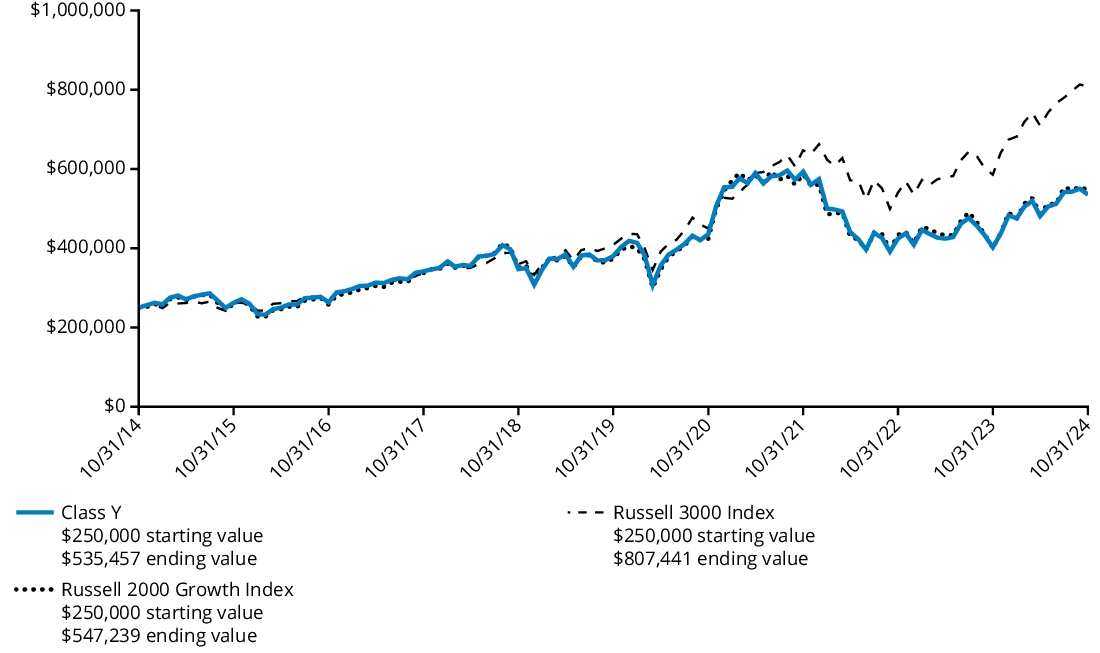

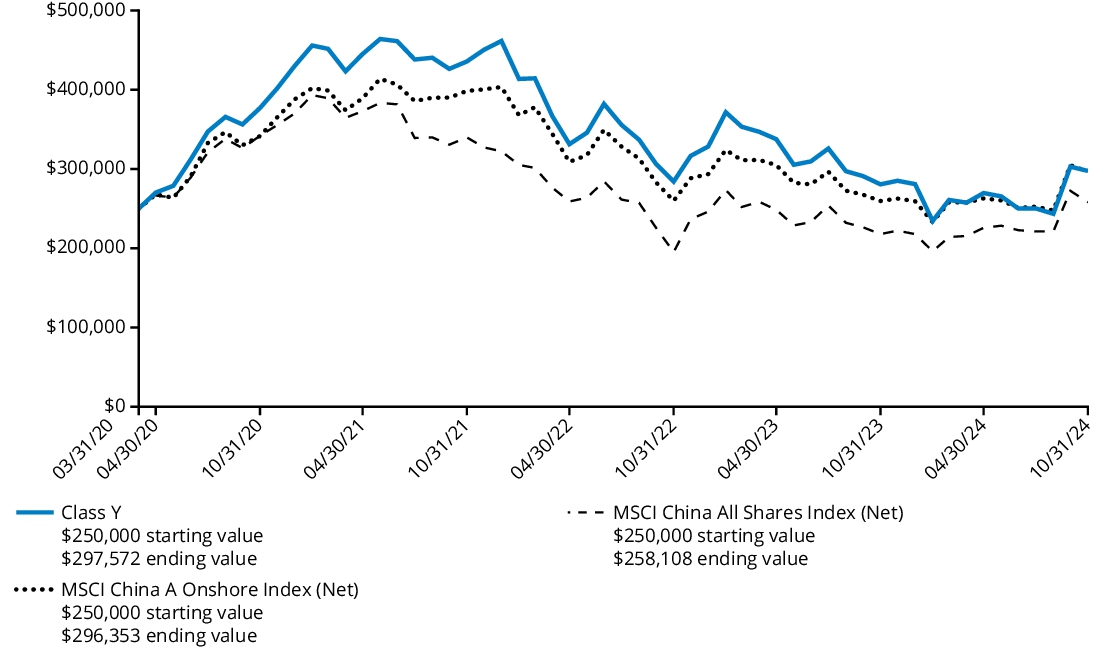

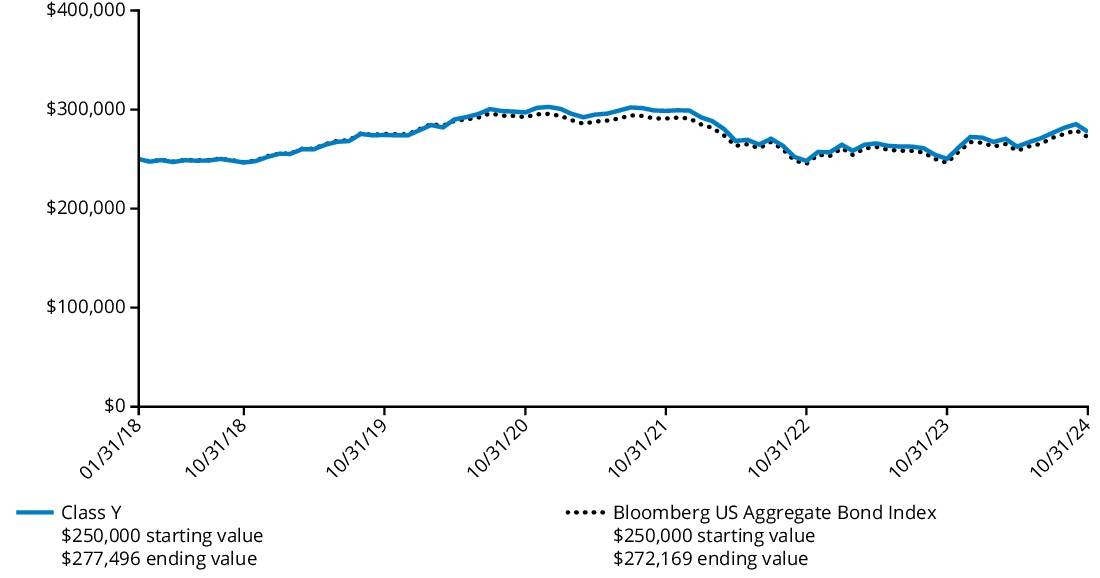

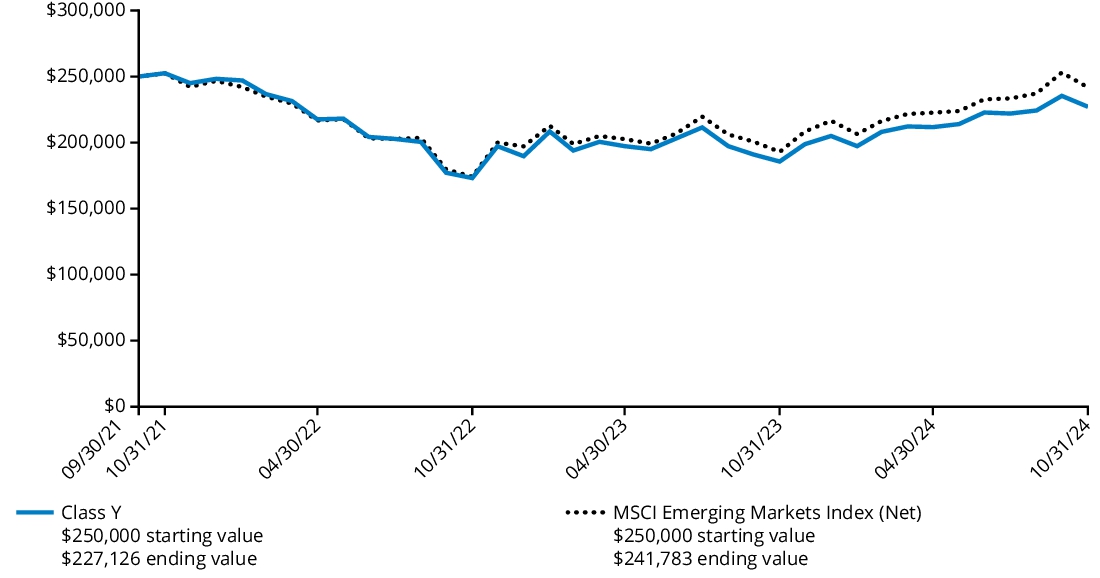

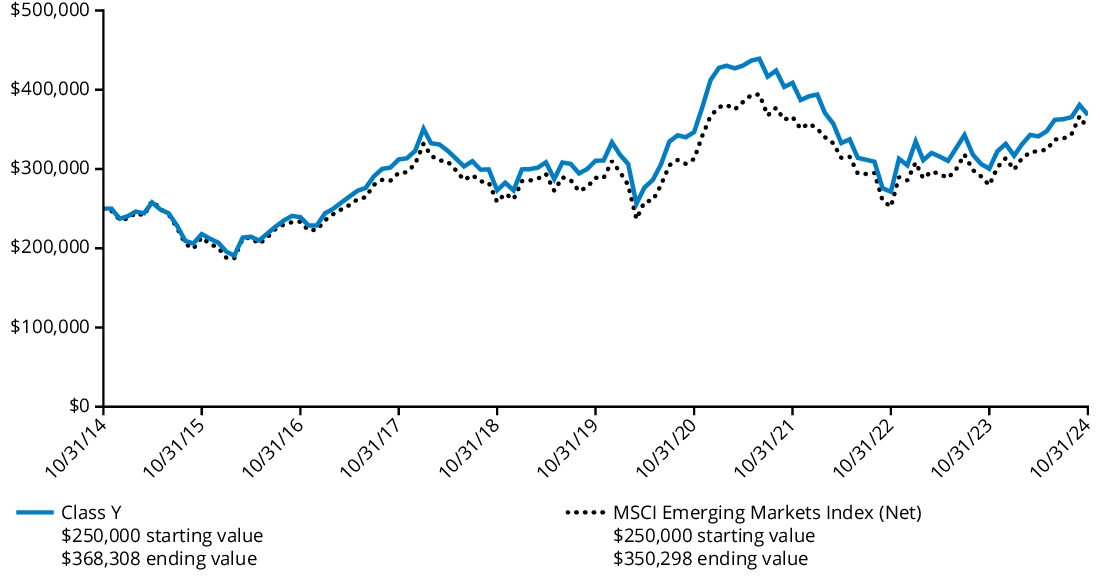

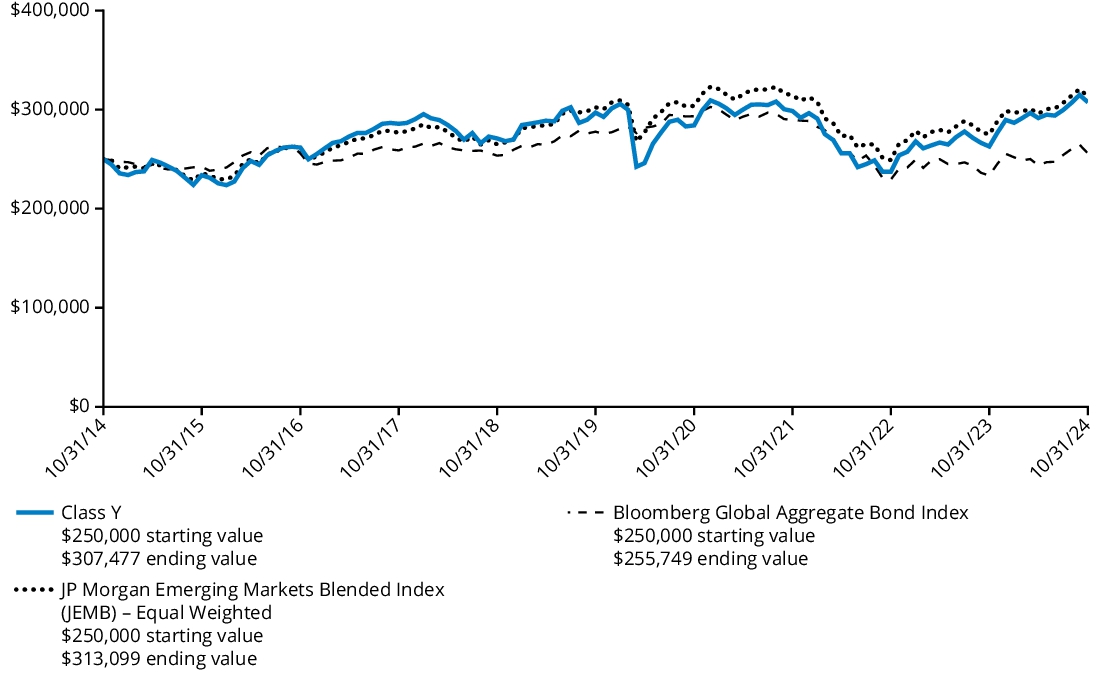

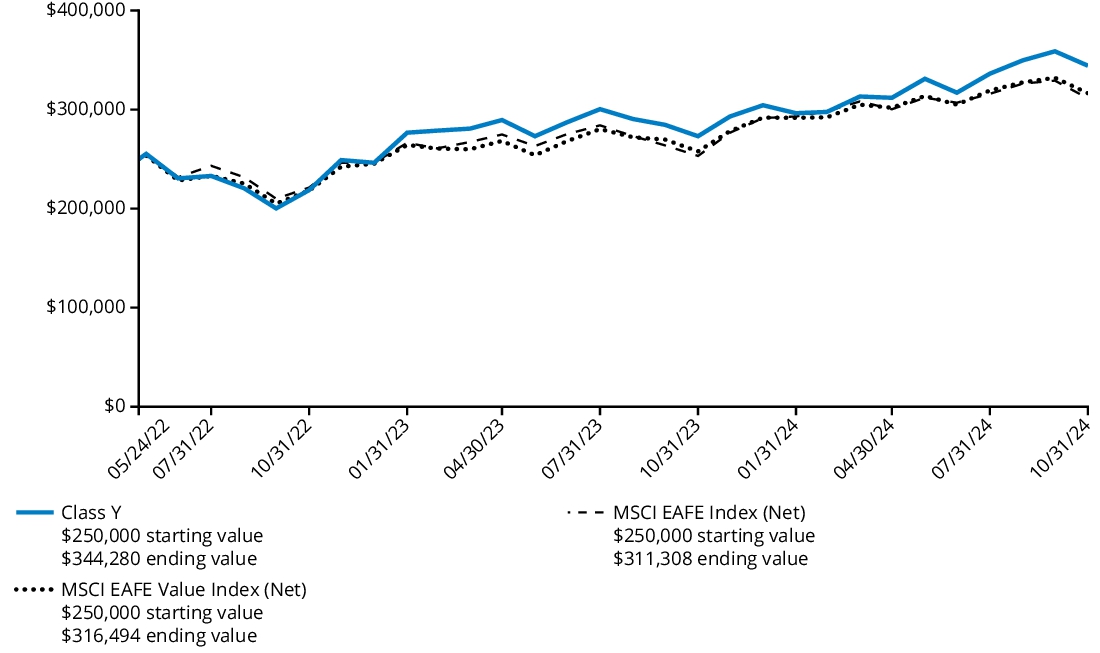

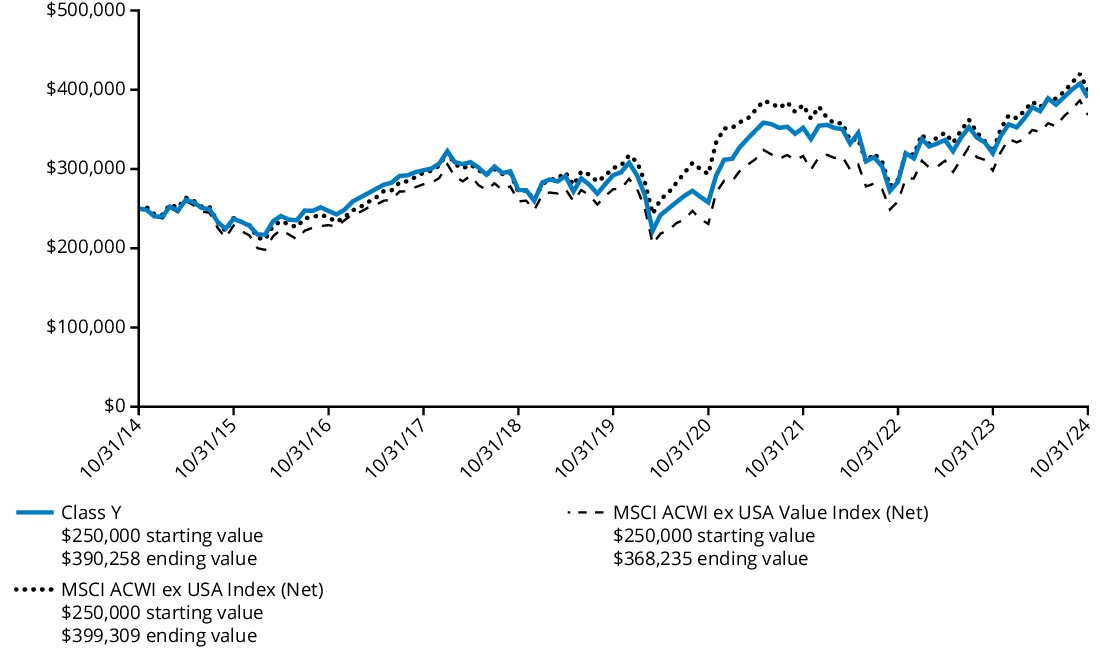

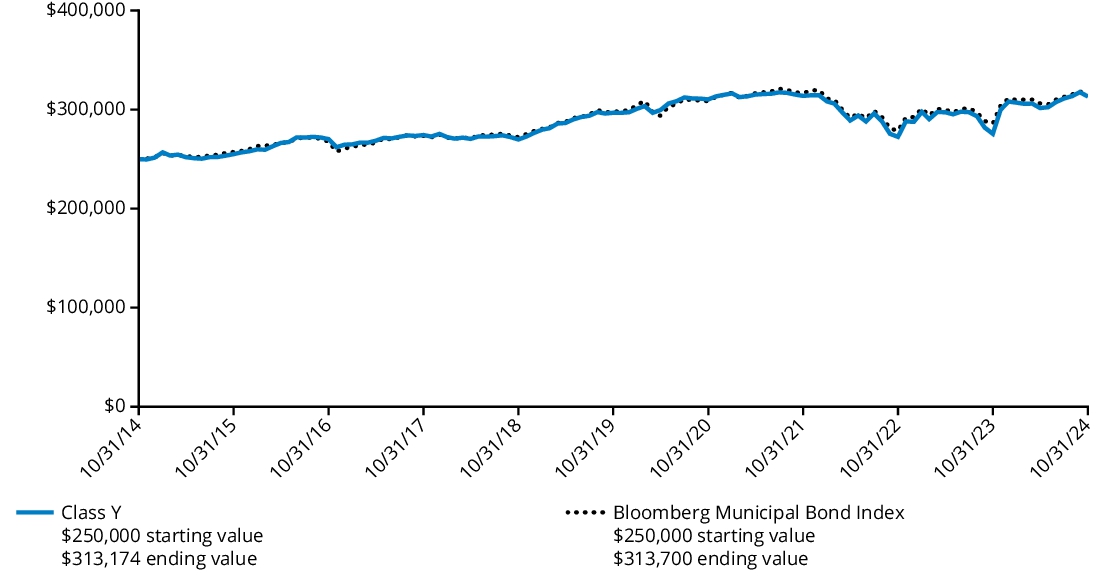

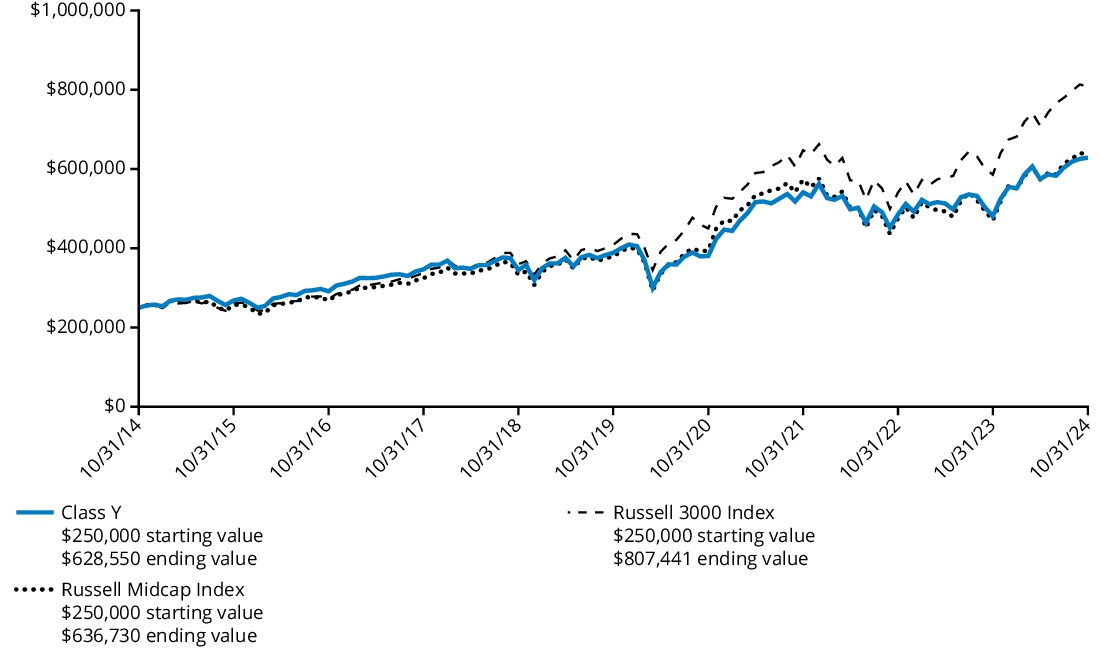

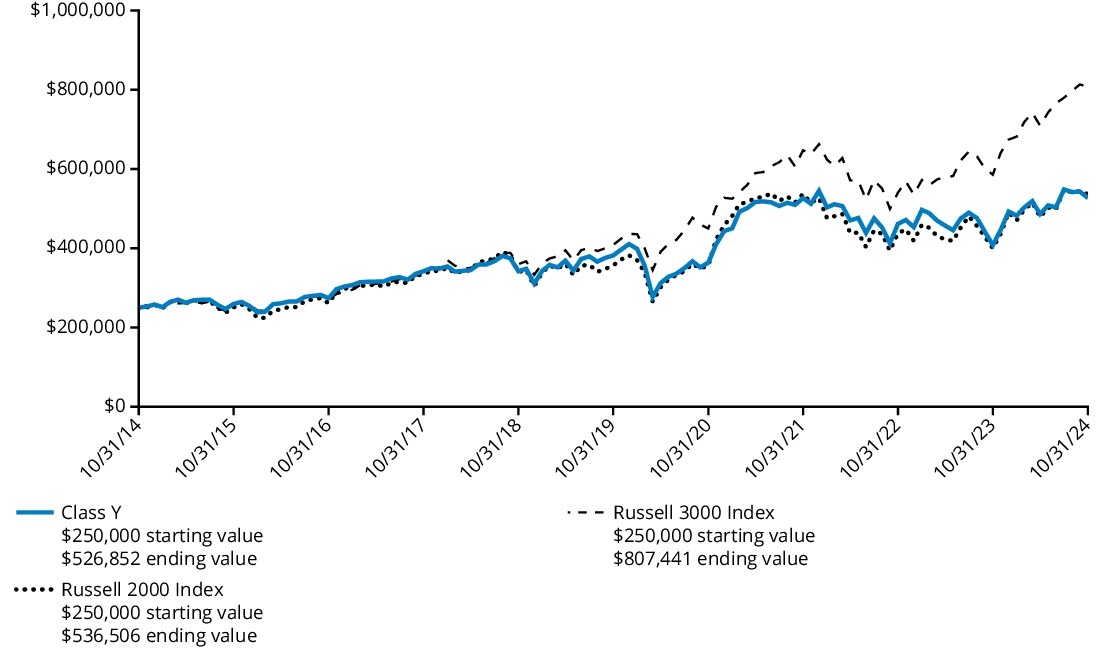

Comparison of Change in Value of $ 250,000 Investment

The graph below represents the hypothetical growth of a $250,000 investment in Class Y shares and the comparative indices.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class Y | 54.65% | 16.74% | 14.69% |

| Russell 3000 Growth Index | 43.42% | 18.34% | 15.66% |

| Russell 1000 Growth Index | 43.77% | 19.00% | 16.18% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

The Russell 3000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 1000 Growth Index serves as the Fund’s secondary performance index. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $5,478,445,304% |

| Total number of portfolio holdings (excluding derivatives, if any) | $54% |

| Total investment management fees paid | $35,614,835% |

| Portfolio turnover rate | $104% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 44.6 | % |

| Communication Services | 18.8 | % |

| Consumer Discretionary | 10.7 | % |

| Health Care | 10.0 | % |

| Industrials | 7.3 | % |

| Financials | 5.5 | % |

| Real Estate | 1.3 | % |

| Energy | 0.9 | % |

| Short-Term Investments | 0.2 | % |

| Other Assets & Liabilities | 0.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

The Hartford Growth Opportunities Fund

Class F/HGOFX

This annual shareholder report contains important information about The Hartford Growth Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class F | $98 | 0.77% |

Costs paid include the impact of expenses associated with the Fund’s shareholder meeting held on December 13, 2023, which was ultimately adjourned until January 23, 2024. If these expenses were excluded, the expense ratio would be as follows: 0.73%. Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 3000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Security selection contributed positively to relative results. Strong security selection in the Information Technology, Financials, and Consumer Discretionary sectors contributed to relative returns.

Sector allocation, a result of the team’s bottom-up stock selection process, also contributed to relative returns. Allocation effect was driven by the Fund’s overweight to the Communication Services sector and underweights to the Consumer Staples and Industrials sectors.

Top individual contributors over the period were an overweight position in NVIDIA (Information Technology), an underweight position in Apple (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection within the Communication Services, Real Estate, and Consumer Staples sectors detracted from relative results.

The Fund’s underweight position to the Information Technology sector and overweight to the Healthcare and Real Estate sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Pinterest (Communication Services) and Dexcom (Healthcare), and an underweight position in QUALCOMM (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

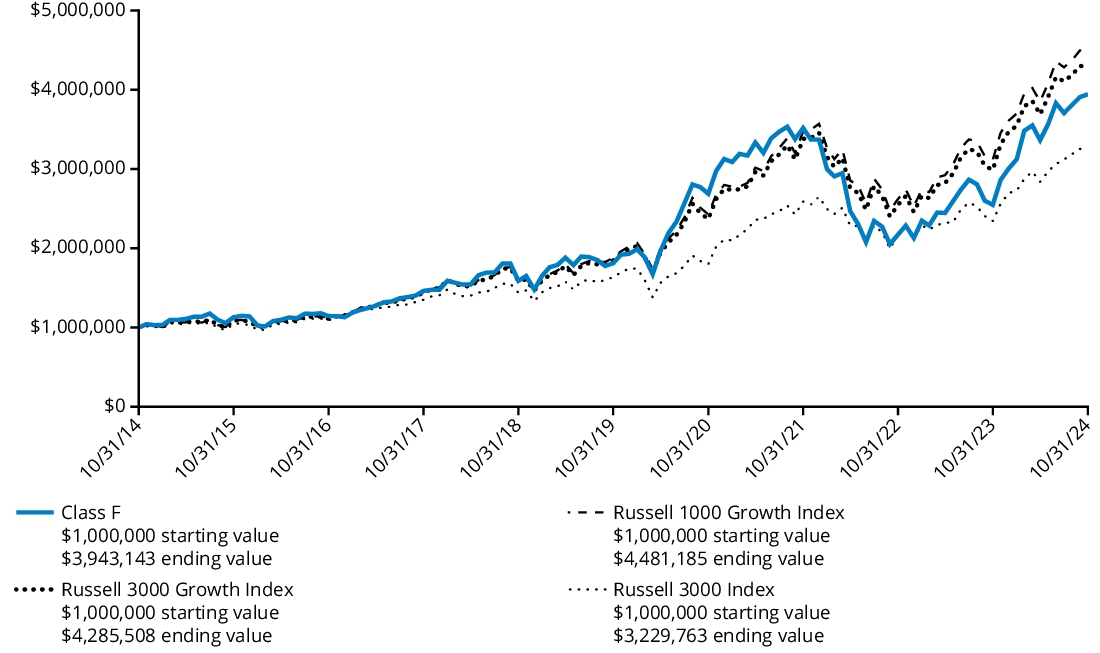

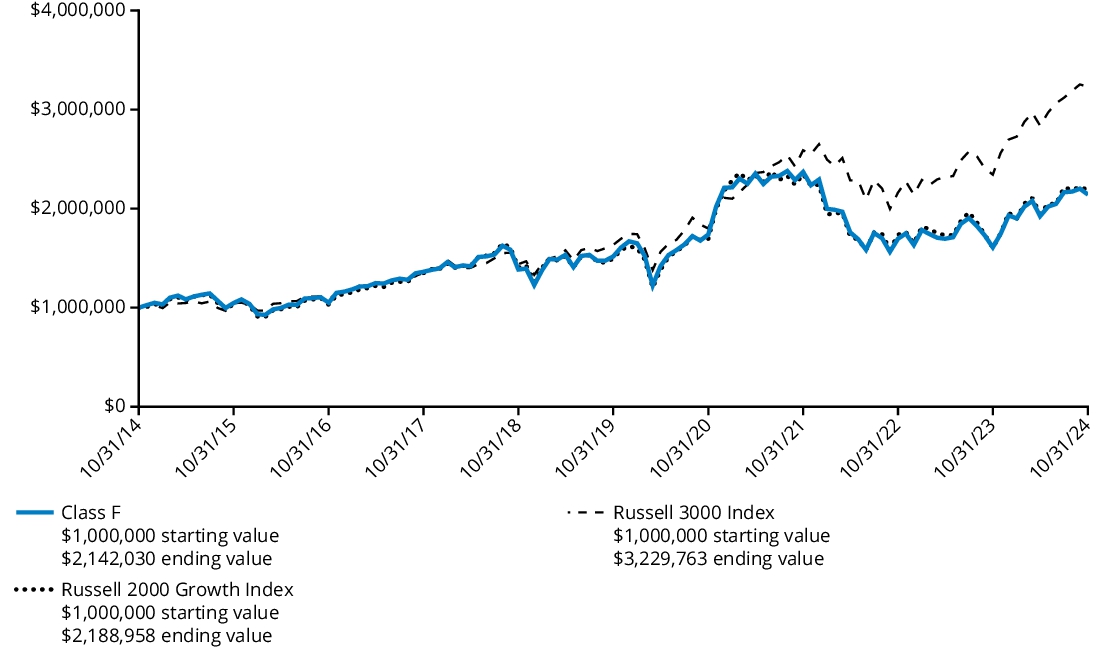

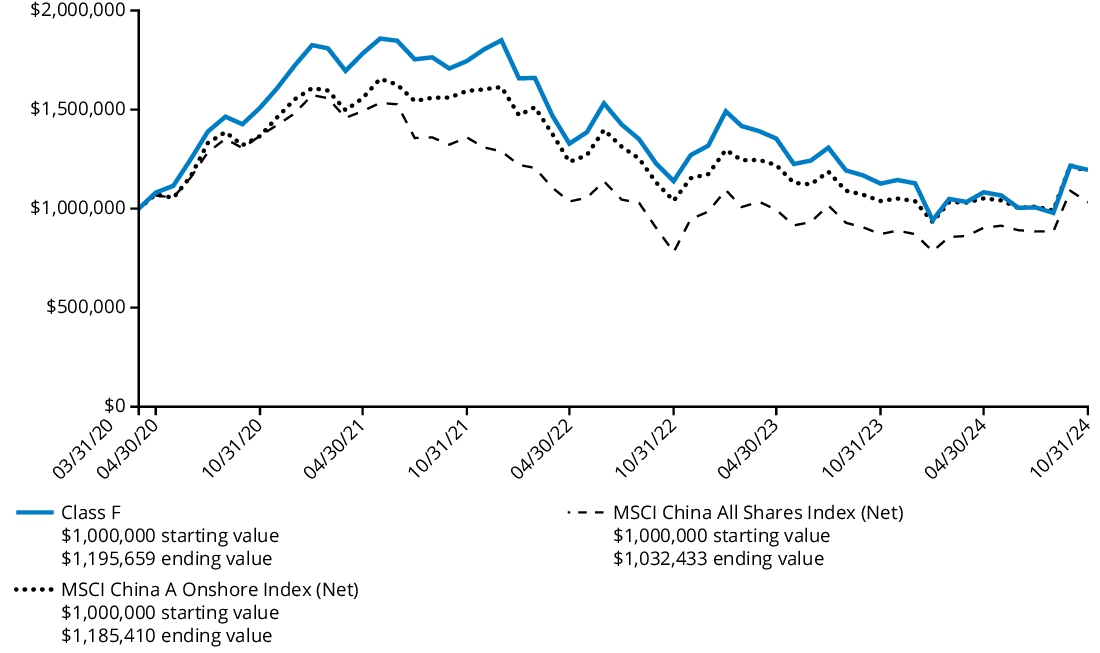

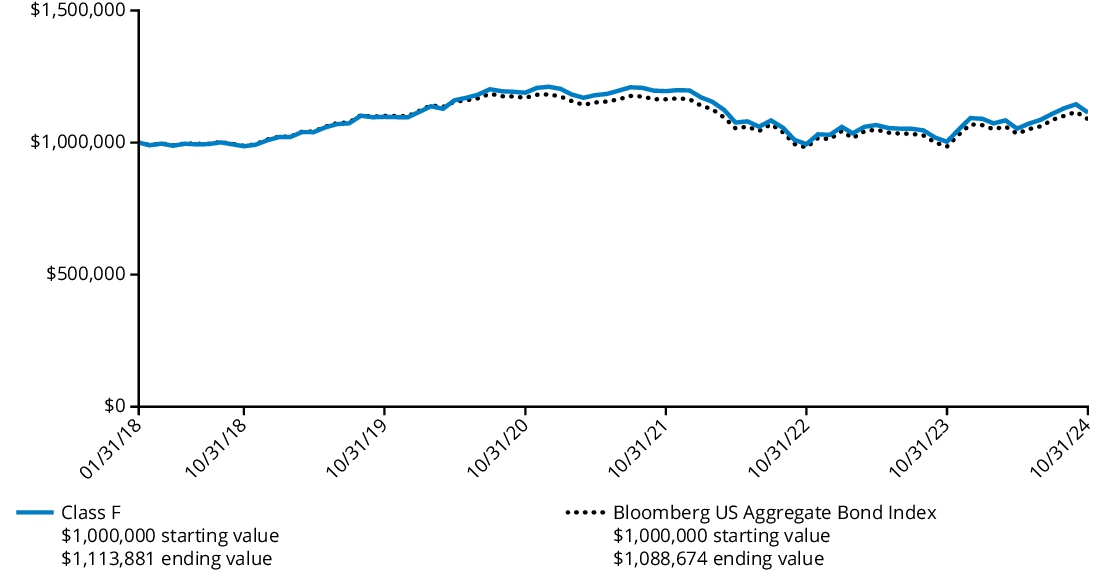

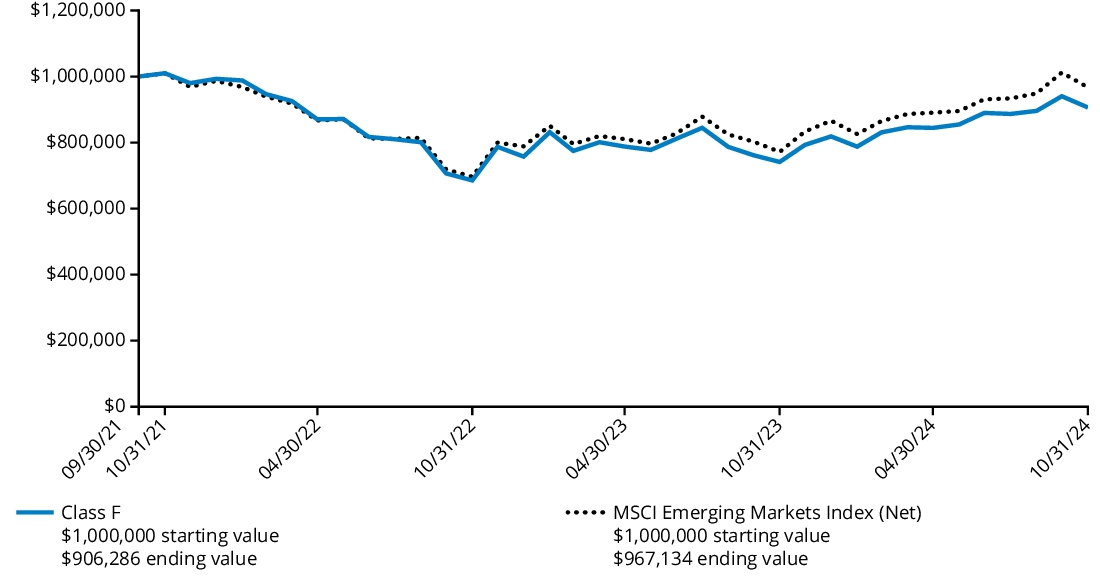

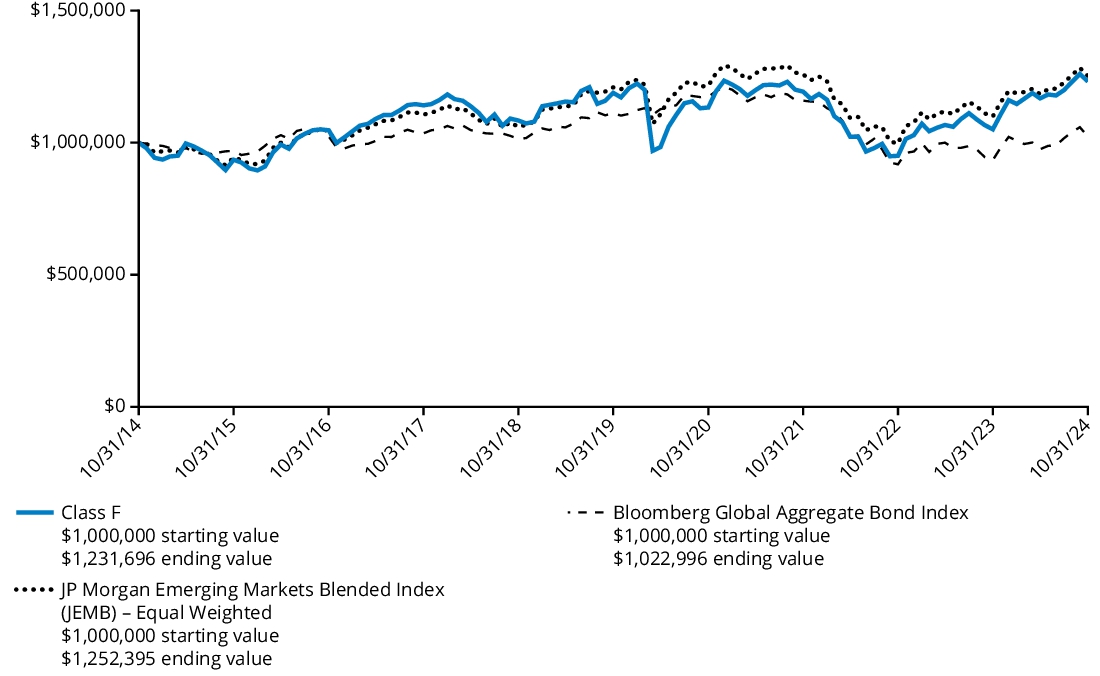

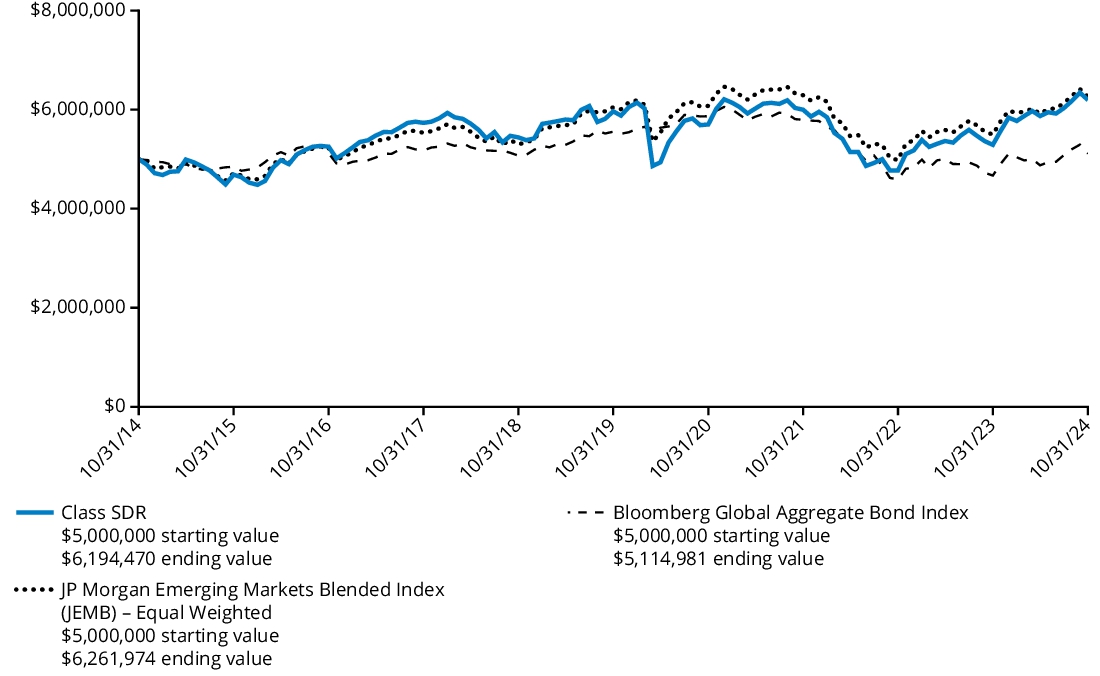

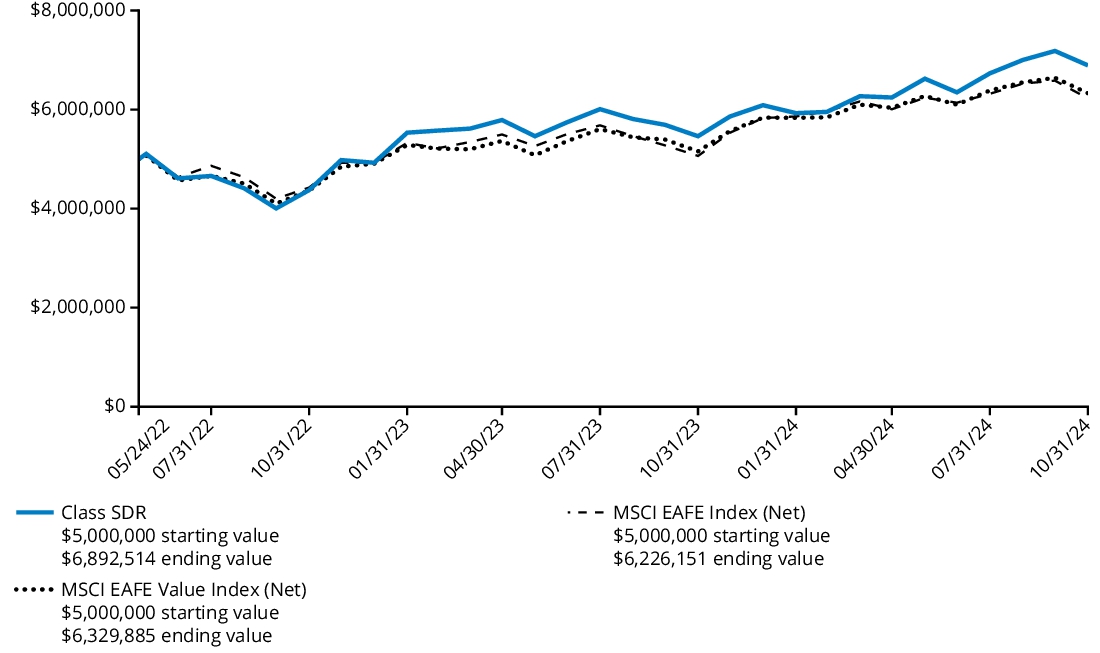

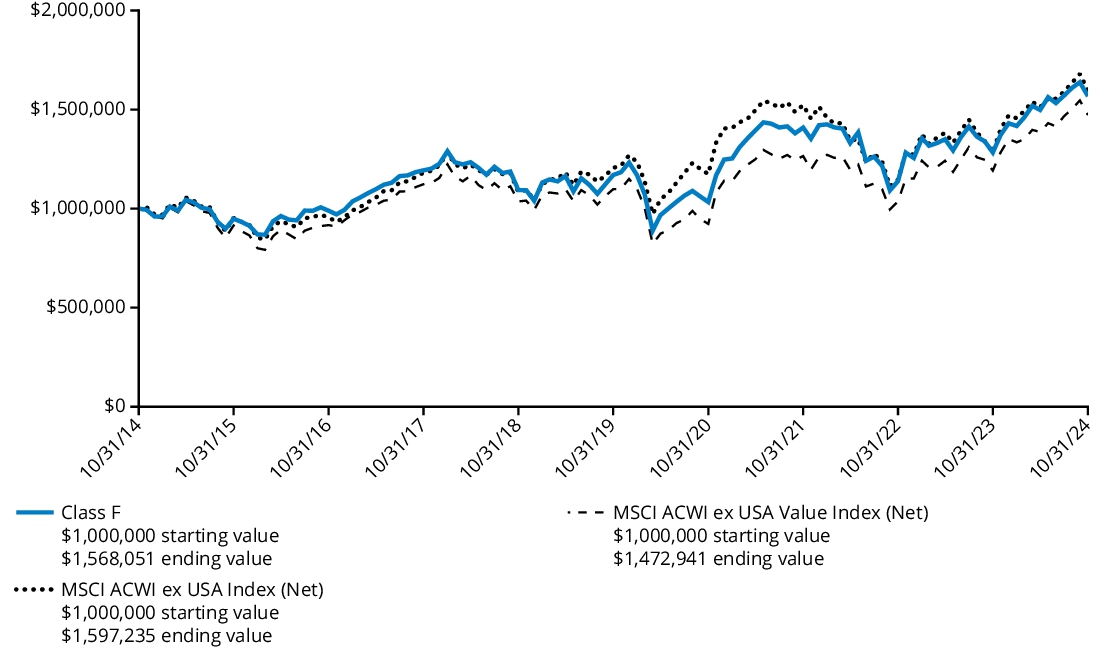

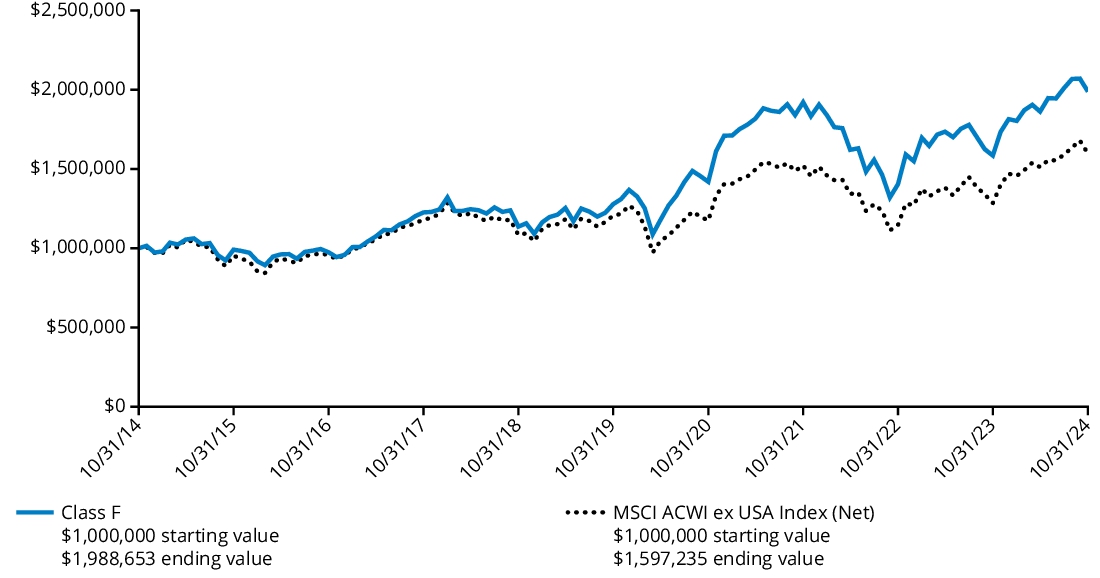

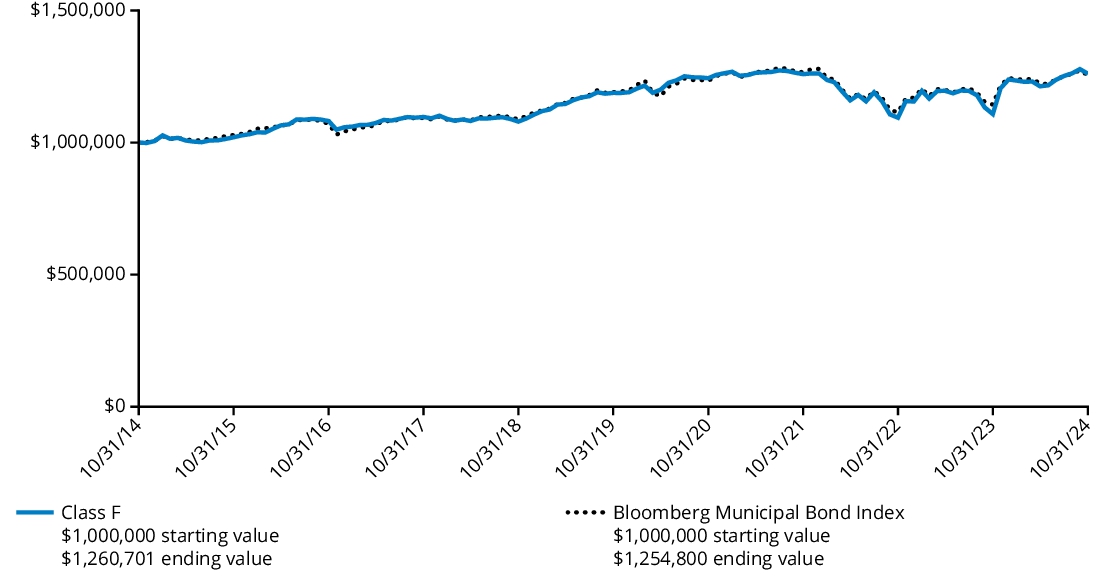

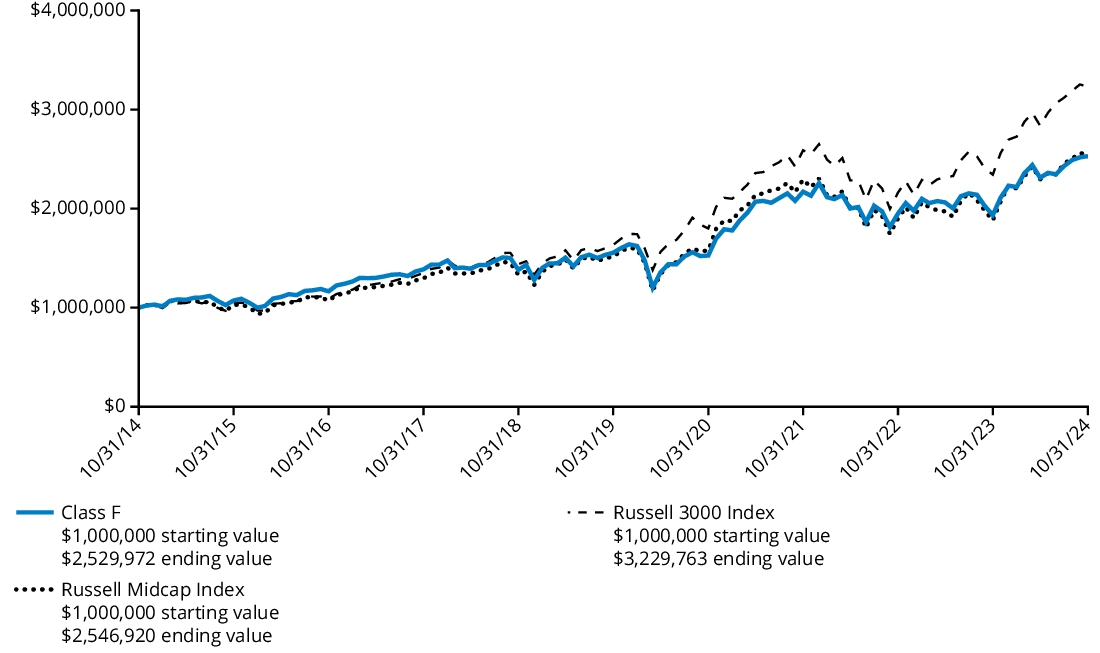

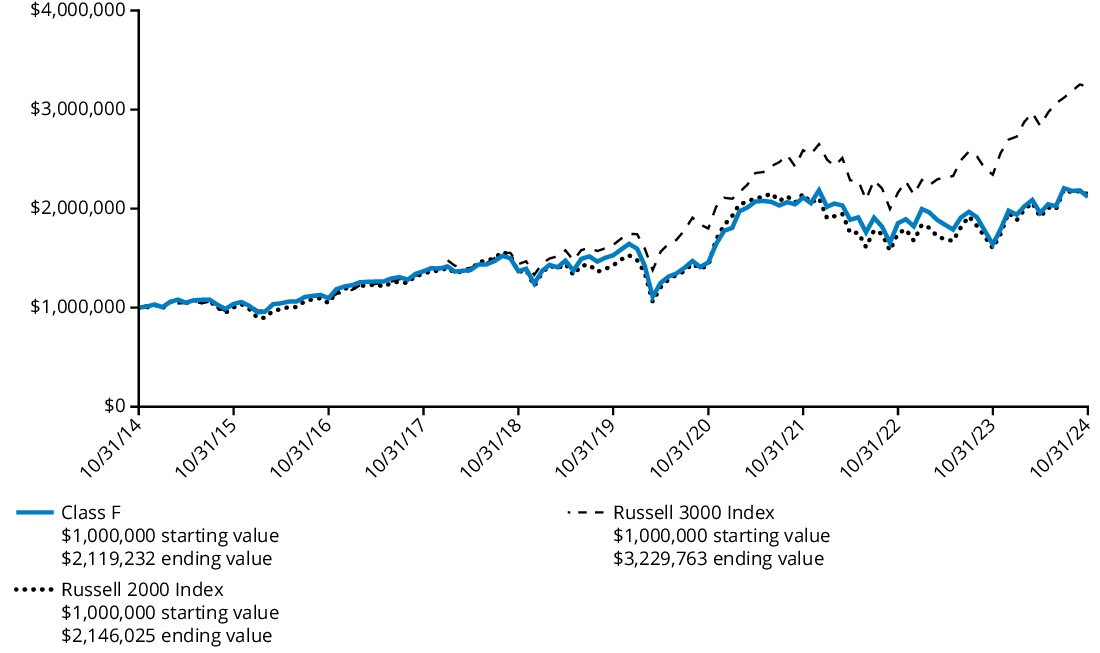

Comparison of Change in Value of $ 1,000,000 Investment

The graph below represents the hypothetical growth of a $1,000,000 investment in Class F shares and the comparative indices.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class F | 54.77% | 16.83% | 14.71% |

| Russell 3000 Growth Index | 43.42% | 18.34% | 15.66% |

| Russell 1000 Growth Index | 43.77% | 19.00% | 16.18% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

Class F shares commenced operations on February 28, 2017 and performance prior to that date is that of the Fund’s Class I shares. Performance prior to the inception date of the class has not been adjusted to reflect the operating expenses of the class.

The Russell 3000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 1000 Growth Index serves as the Fund’s secondary performance index. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $5,478,445,304% |

| Total number of portfolio holdings (excluding derivatives, if any) | $54% |

| Total investment management fees paid | $35,614,835% |

| Portfolio turnover rate | $104% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 44.6 | % |

| Communication Services | 18.8 | % |

| Consumer Discretionary | 10.7 | % |

| Health Care | 10.0 | % |

| Industrials | 7.3 | % |

| Financials | 5.5 | % |

| Real Estate | 1.3 | % |

| Energy | 0.9 | % |

| Short-Term Investments | 0.2 | % |

| Other Assets & Liabilities | 0.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

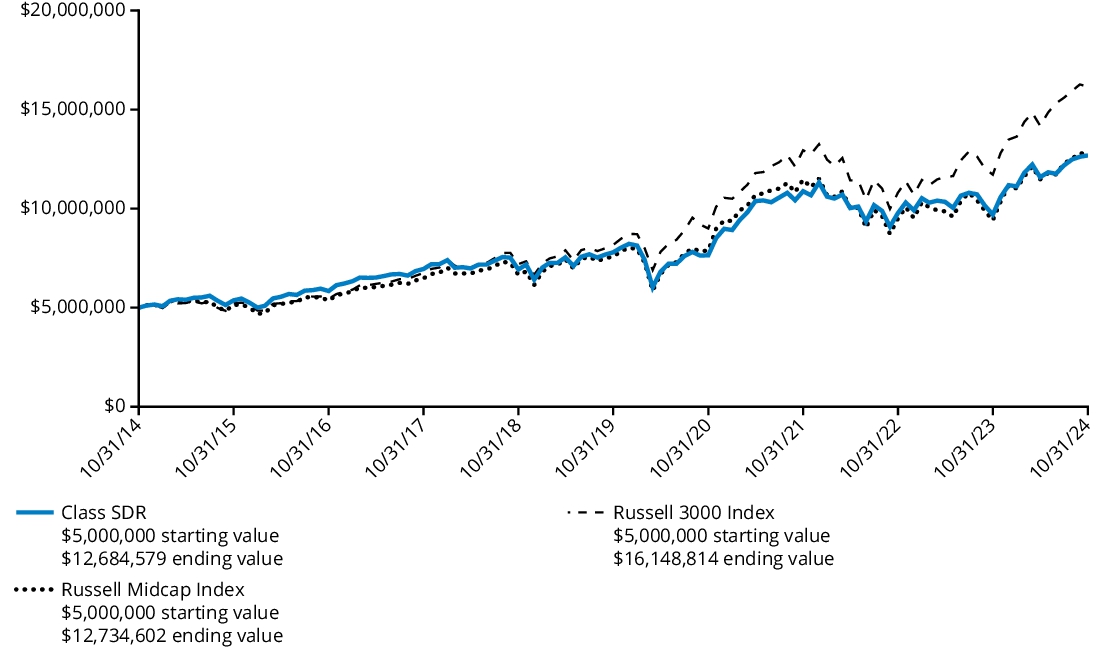

Annual Shareholder Report

October 31, 2024

The Hartford Small Cap Growth Fund

Class A/HSLAX

This annual shareholder report contains important information about The Hartford Small Cap Growth Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class A | $153 | 1.32% |

Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 2000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Sector allocation, a result of the team’s bottom-up stock selection process, contributed to relative performance over the period due to the Fund’s lack of exposure to the Utilities sector and overweight allocations to the Information Technology and Real Estate sectors.

Security selection within the Industrials, Consumer Staples, and Materials sectors contributed positively to performance.

Top individual contributors over the period were overweight positions in FTAI Aviation (Industrials) and StepStone Group (Financials) and an out-of-benchmark position in Freshpet (Consumer Staples).

Top Detractors to Performance

Security selection was the primary detractor from relative performance, driven by weak selection within the Information Technology, Health Care, and Communication Services sectors.

The largest individual detractors over the period were underweight positions in Super Micro Computer (Information Technology) and MicroStrategy (Information Technology) and not owning Sprouts Farmers Market (Consumer Staples).

An underweight allocation to the Consumer Staples sector and overweight allocations to the Consumer Discretionary and Materials sectors also detracted from relative performance.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

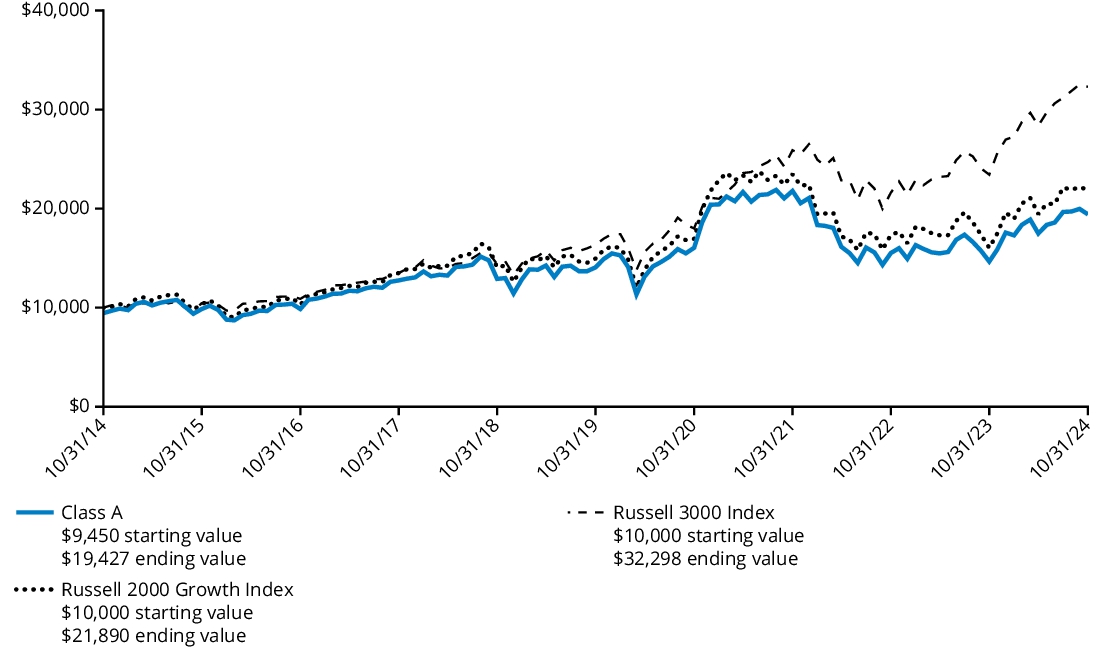

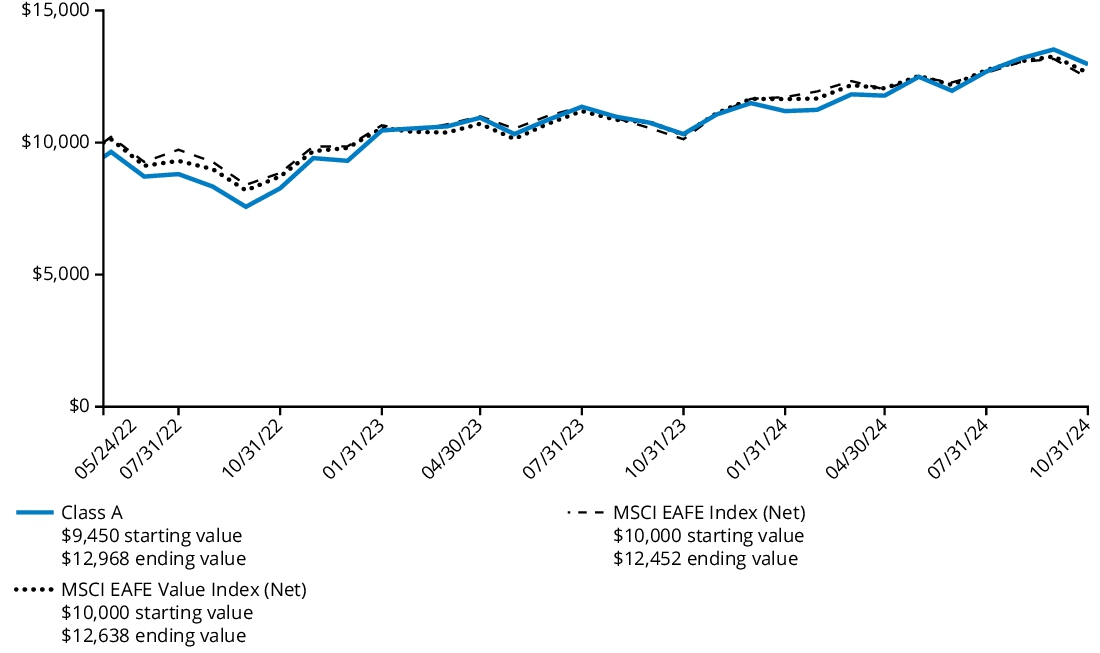

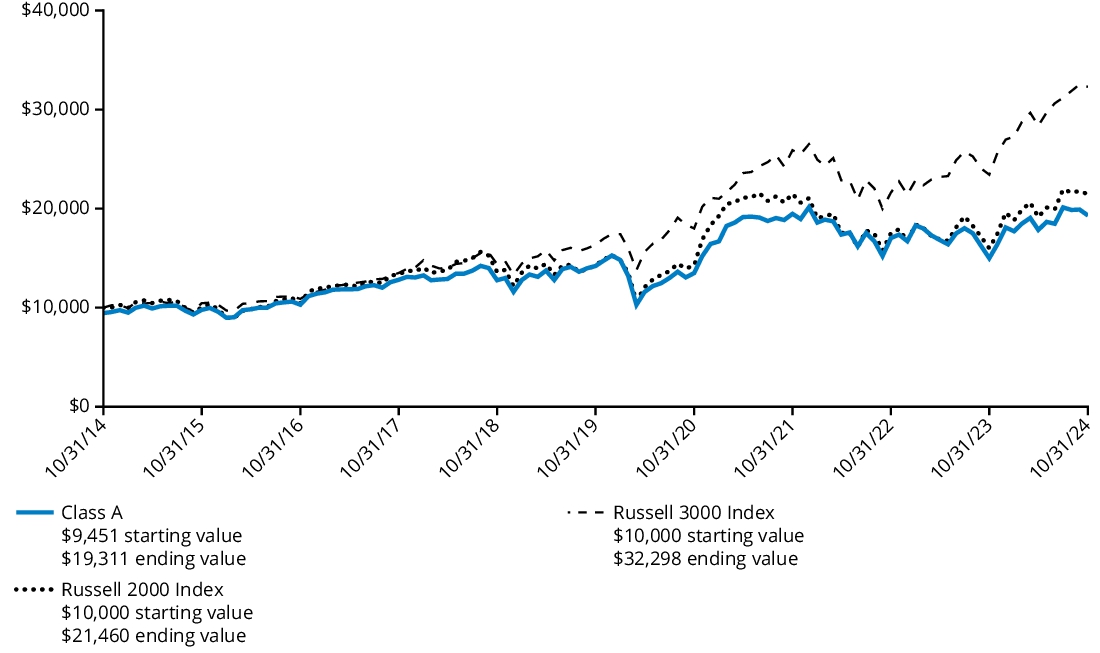

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class A shares and the comparative indices. The returns for Class A shares include the maximum front-end sales charge applicable to Class A shares.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class A (with 5.50% maximum front-end sales charge) | 25.25% | 5.47% | 6.87% |

| Class A (without 5.50% maximum front-end sales charge) | 32.54% | 6.67% | 7.47% |

| Russell 2000 Growth Index | 36.49% | 7.92% | 8.15% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

The Russell 2000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $349,549,466% |

| Total number of portfolio holdings (excluding derivatives, if any) | $158% |

| Total investment management fees paid | $3,117,074% |

| Portfolio turnover rate | $68% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Health Care | 26.4 | % |

| Industrials | 23.0 | % |

| Information Technology | 19.5 | % |

| Consumer Discretionary | 9.7 | % |

| Financials | 9.5 | % |

| Materials | 4.3 | % |

| Consumer Staples | 2.8 | % |

| Energy | 2.4 | % |

| Real Estate | 2.2 | % |

| Short-Term Investments | 0.7 | % |

| Other Assets & Liabilities | (0.5 | )% |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

The Hartford Small Cap Growth Fund

Class C/HSLCX

This annual shareholder report contains important information about The Hartford Small Cap Growth Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class C | $246 | 2.13% |

Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 2000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Sector allocation, a result of the team’s bottom-up stock selection process, contributed to relative performance over the period due to the Fund’s lack of exposure to the Utilities sector and overweight allocations to the Information Technology and Real Estate sectors.

Security selection within the Industrials, Consumer Staples, and Materials sectors contributed positively to performance.

Top individual contributors over the period were overweight positions in FTAI Aviation (Industrials) and StepStone Group (Financials) and an out-of-benchmark position in Freshpet (Consumer Staples).

Top Detractors to Performance

Security selection was the primary detractor from relative performance, driven by weak selection within the Information Technology, Health Care, and Communication Services sectors.

The largest individual detractors over the period were underweight positions in Super Micro Computer (Information Technology) and MicroStrategy (Information Technology) and not owning Sprouts Farmers Market (Consumer Staples).

An underweight allocation to the Consumer Staples sector and overweight allocations to the Consumer Discretionary and Materials sectors also detracted from relative performance.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

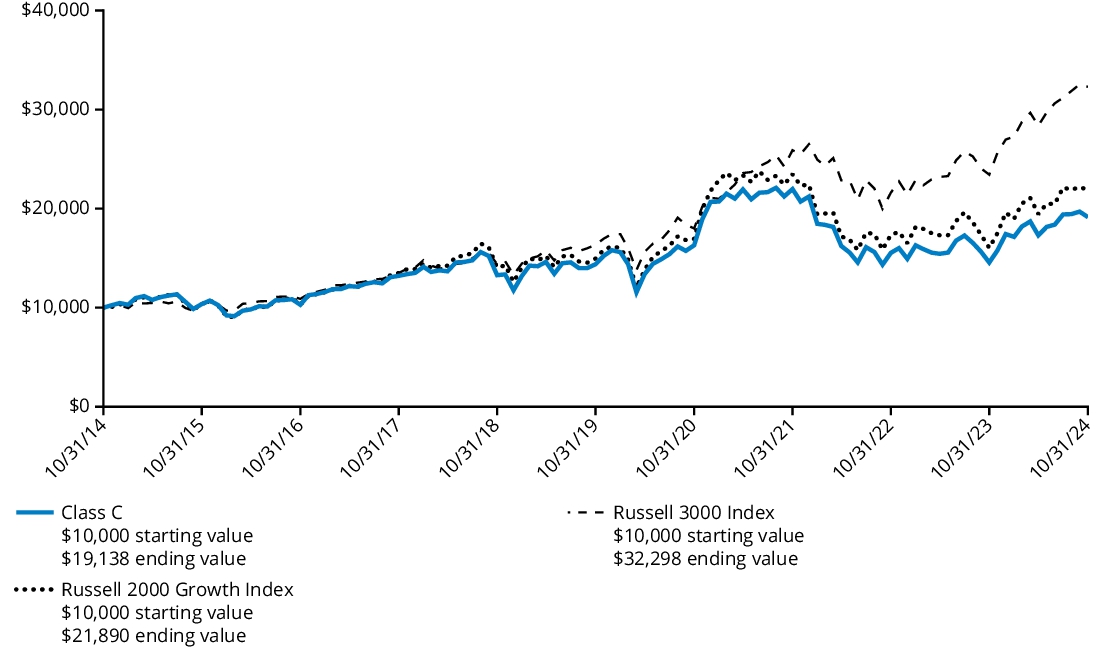

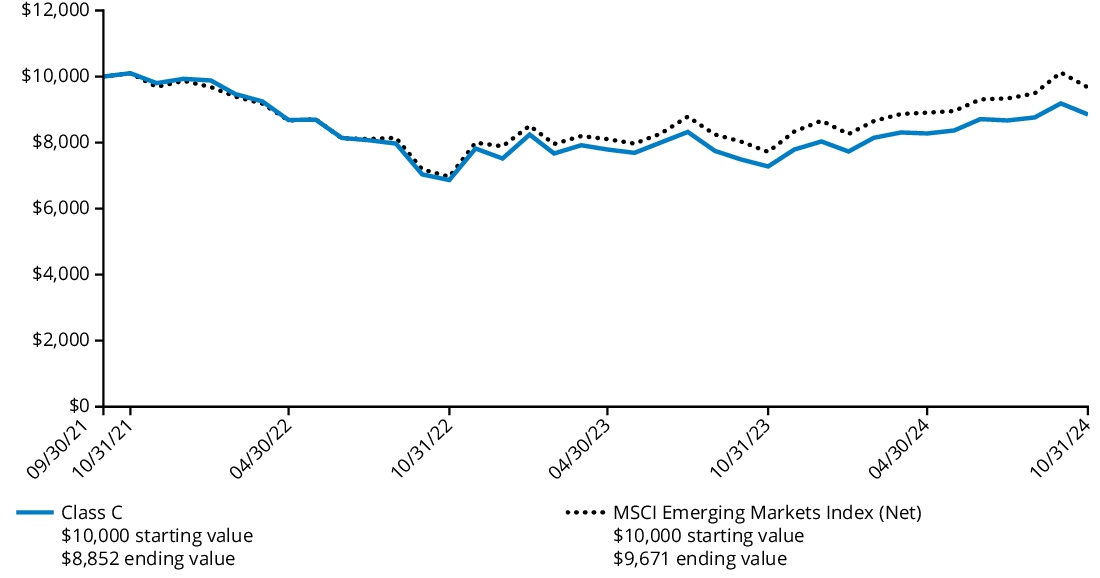

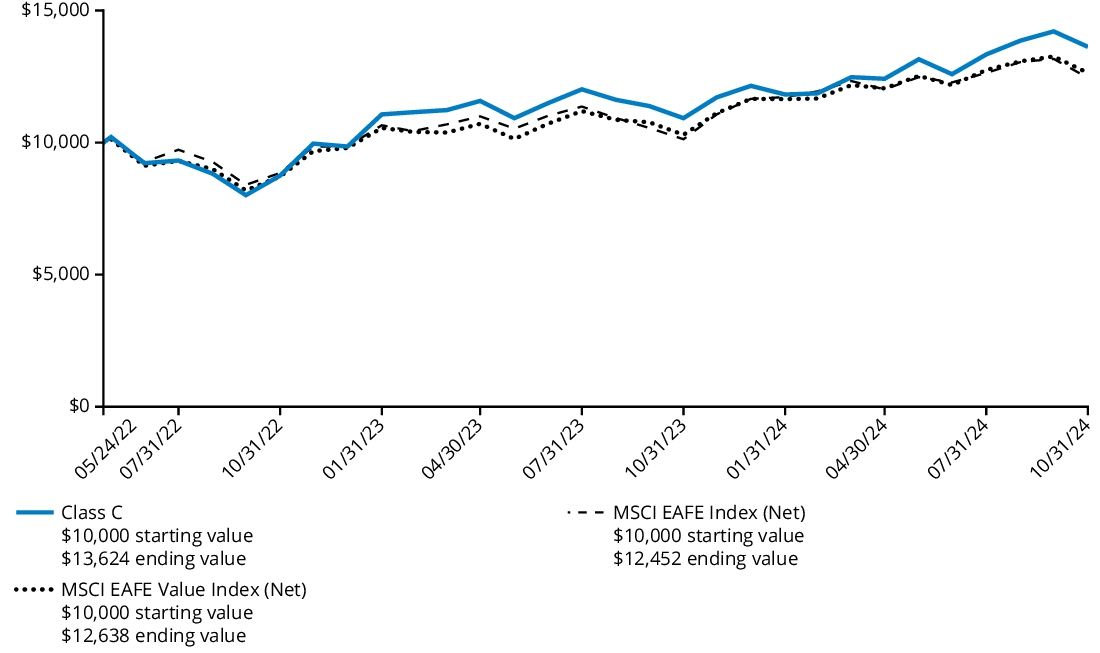

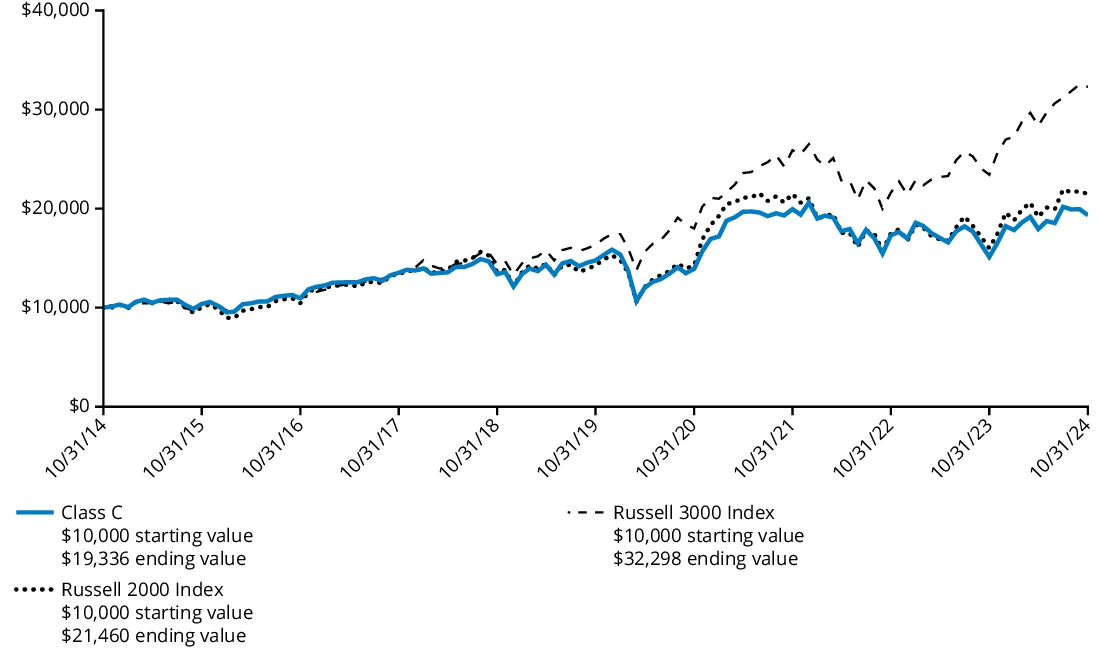

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class C shares (excluding sales charges) and the comparative indices. If sales charges had been included, the value would have been lower.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class C (with 1.00% contingent deferred sales charge) | 30.45% | 5.88% | 6.71% |

| Class C (without 1.00% contingent deferred sales charge) | 31.45% | 5.88% | 6.71% |

| Russell 2000 Growth Index | 36.49% | 7.92% | 8.15% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

The Russell 2000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $349,549,466% |

| Total number of portfolio holdings (excluding derivatives, if any) | $158% |

| Total investment management fees paid | $3,117,074% |

| Portfolio turnover rate | $68% |

Graphical Representation of Holdings as of October 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Health Care | 26.4 | % |

| Industrials | 23.0 | % |

| Information Technology | 19.5 | % |

| Consumer Discretionary | 9.7 | % |

| Financials | 9.5 | % |

| Materials | 4.3 | % |

| Consumer Staples | 2.8 | % |

| Energy | 2.4 | % |

| Real Estate | 2.2 | % |

| Short-Term Investments | 0.7 | % |

| Other Assets & Liabilities | (0.5 | )% |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Material Fund Changes

This is a summary of certain changes to the Fund since the beginning of the reporting period.

The expense ratio materially changed from the prior fiscal year due to changes in operating expenses.

For more complete information, you may review the Fund’s next prospectus, which we expect to be available by March 1, 2025, at hartfordfunds.com/reports‑hmf, upon request by calling 1-888-843-7824 or sending an e-mail to orders@mysummaryprospectus.com.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

October 31, 2024

The Hartford Small Cap Growth Fund

Class I/HSLIX

This annual shareholder report contains important information about The Hartford Small Cap Growth Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hmf. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Class I | $112 | 0.96% |

Costs paid excludes fees and expenses incurred indirectly as a result of investments in other investment companies.

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending October 31, 2024, with the S&P 500 Index surging to a record high that was driven by performance in a select group of mega-cap technology companies. The U.S. Federal Reserve (Fed) began easing monetary policy with an interest-rate cut of 50 basis points in September 2024 in an effort to generate a soft landing for the economy. Markets were also kept on edge in the third quarter of 2024 due to the anticipated extremely close presidential race between Vice President Kamala Harris and former President Donald Trump. Fund performance described below is relative to the Fund’s performance index, the Russell 2000 Growth Index, for the trailing twelve-month period ended October 31, 2024.

Top Contributors to Performance

Sector allocation, a result of the team’s bottom-up stock selection process, contributed to relative performance over the period due to the Fund’s lack of exposure to the Utilities sector and overweight allocations to the Information Technology and Real Estate sectors.

Security selection within the Industrials, Consumer Staples, and Materials sectors contributed positively to performance.

Top individual contributors over the period were overweight positions in FTAI Aviation (Industrials) and StepStone Group (Financials) and an out-of-benchmark position in Freshpet (Consumer Staples).

Top Detractors to Performance

Security selection was the primary detractor from relative performance, driven by weak selection within the Information Technology, Health Care, and Communication Services sectors.

The largest individual detractors over the period were underweight positions in Super Micro Computer (Information Technology) and MicroStrategy (Information Technology) and not owning Sprouts Farmers Market (Consumer Staples).

An underweight allocation to the Consumer Staples sector and overweight allocations to the Consumer Discretionary and Materials sectors also detracted from relative performance.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

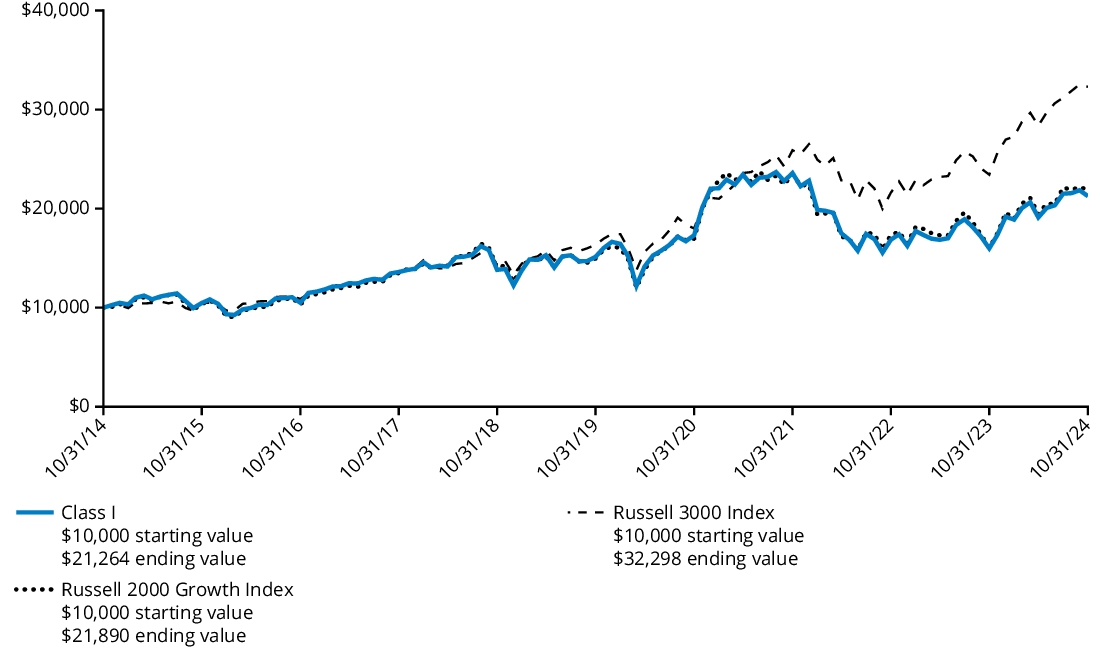

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class I shares and the comparative indices.

Average Annual Total Returns

For the Periods Ended October 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class I | 33.00% | 7.06% | 7.84% |

| Russell 2000 Growth Index | 36.49% | 7.92% | 8.15% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

The Russell 2000 Growth Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers and/or expense limitation arrangements, if any. Absent any applicable fee waivers and/or expense limitation arrangements, performance would have been lower. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of October 31, 2024

| Fund's net assets | $349,549,466% |