UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-825_______________________________________________

American Growth Fund, Inc.______________________________________________________________

(Exact name of registrant as specified in charter)

1636 Logan Street, Denver, CO 80203______________________________________________________

(Address of principal executive offices)

(Zip code)

(Name and address of agent for service)

Registrant’s telephone number, including area code: _303-626-0600_____________________________

Date of fiscal year end: _July 31, 2018______________________________________________________

Date of reporting period: _ January 31, 2018_________________________________________________

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

This Form N-CSRS/A is being filed with a cover page, Items 2-13 and the related signature, our code of ethics, as well as updated certifications.

Dear Shareholders:

I am pleased to deliver to you the American Growth Fund Series One Semi-Annual Report for the six months ending January 31, 2018.

Since our last letter to you, Wall Street finished one of its best years since 2013. In general terms, the Dow Jones Industrial Average grew 25% edging closer to 25,000. In contrast, it took 14 years for the Dow to climb from 10,000 to 15,000 but just three and a half years to reach 20,000 in 2017. Also in 2017, the S&P 500 grew 19% and the Nasdaq grew 28%.1

Investment Strategy

Your Investment Committee uses a fundamental top down approach to manage your portfolio. First, we look at the general economic outlook, then we look at the industries that we feel have the biggest growth potential in the current and upcoming economies. From that, our objective is to choose what we believe could be the best companies in those industries. Many of these companies are established, large cap (defined as companies with a market capitalization of $5 billion or more) securities many of which are household names that you will easily recognize. Information about how we invest your monies is available in the Prospectus and Statement of Additional Information by visiting www.americangrowthfund.com or by calling 800-525-2406.

Performance Overview

Series One is invested primarily in large cap, growth-oriented domestic common stocks. When you examine the portfolio holdings on the following pages you will note while the largest investment sector is Diversified Company Industry at 8.88% of your portfolio, the largest security in your portfolio is Teradyne, Inc. at $1,498,372 who is a leading provider for auto test equipment for semiconductors.

Your American Growth Fund Series One Class A Shares delivered you a 10.46% return (including the sales load of 5.75%) since January 31, 2017 through close of business on January 31, 2018. The Dow Jones Industrial Average posted a gain of 34.80% while the S&P 500 posted a gain of 26.41% for the same time period as listed above. Of the stocks in your Series One portfolio, most of them contributed to the growth of the Fund. The top three active performing investments were Teradyne, Inc. whose market value rose 9.79% (a total portfolio gain of 0.73%), Chemed Corp whose market value rose 7.88% (a total portfolio gain of 0.59%) and Fair Isaac Corp whose market value rose 6.70% (a total portfolio gain of .50%).

Unfortunately, not all investments fared as well. Walgreens Boots Alliance, Inc. market value was a negative 2.36% (or a negative 0.18% of the total portfolio), Time Warner, Inc. market value was a negative 2.14% (or a negative 0.16% of the total portfolio) and General Electric market value was a negative 1.33% (or a negative 0.10% of the total portfolio).

The investment sectors that had the most positive influence on your Series One portfolio were Banks, Semiconductor Capital Equipment, and Insurance (Property and Causality). The investment sectors that had the most adverse effect on your portfolio were Pharmacy Services, Cable TV, and Entertainment.

Additional data, including long-term performance data, can be located on page 24 of this report. Remember, past performance is no guarantee of future results.

Manager’s Discussion

In our past letter, we spoke about tax reform and as it turned out one of the biggest catalysts was the sweeping tax cuts President Trump signed into law. “This tax law reform provides incentives that encourage companies to return foreign profits held overseas. Moody's estimates that mountains of offshore cash totals a record $1.4 trillion. Wall Street is anticipating a big chunk of the money will go towards share buybacks and paying down debt -- moves that should further increase stock prices. Most market strategists are predicting more gains in 2018, especially as the impact of the tax overhaul are felt.”1 The American economy continues to improve, evidenced by the real gross domestic product (GDP) that increased at an annual rate of 2.5 percent in the fourth quarter of 2017, according to the "second" estimate released by the Bureau of Economic Analysis. “In the third quarter, real GDP increased 3.2 percent. The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures, exports, nonresidential fixed investment, residential fixed investment, state and local government spending, and federal government spending that were partly offset by a negative contribution from private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.”2 Additionally, unemployment has remained stable 4.1% in February of 2018. In the past year, unemployment rates have varied between 4.5% and 4.1%, generally declining to 4.1% where we have been for the past four months.3 Despite some uncertainty revolving around Brexit, the prospect of faster economic growth abroad and cheaper valuations for many foreign equities grows. “GDP growth will likely continue strong in both China and Europe, where European Central Bank (ECB) President Mario Draghi says monetary stimulus will continue until at least September.

American Growth Fund, Inc. - Series One – Page 2

The rotation of big portfolios into more foreign stocks is expected to take place despite escalating tensions with Russia's Vladimir Putin and China's Xi Jinping, not to mention North Korea's nuclear threats.”4 It is our hope and general belief that we will see continued upward growth in the next six months.

My staff and I are always available to discuss your account or answer any question you might have. Please call our toll free number, 800 525-2406 or, within Colorado, 303-626-0600.

American Growth Fund wishes you A Good Future!

Sincerely,

Timothy Taggart

President and Investment Committee Member

American Growth Fund, Inc.

| 1. | http://money.cnn.com/2017/12/29/investing/stocks-2017-wall-street/index.html |

| 2. | http://bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm |

| 3. | http://data.bls.gov/timeseries/LNS14000000 |

| 4. | https://www.investors.com/news/2018-stock-market-forecast-best-countries-value-growth/ |

Large Cap Company Risk -Larger more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and consumer tastes. Many larger companies also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion.

American Growth Fund, Inc. - Series One – Page 3

This page intentionally left blank

American Growth Fund, Inc. - Series One – Page 4

How American Growth Fund, Inc. Series One

Has Its Shareholders' Money Invested

STATEMENT OF INVESTMENTS (unaudited)

January 31, 2018

| | | |

| | | | Market |

| Description of Security | Shares | | Value |

| |

| COMMON STOCK (continued) |

| |

| Diversified Company Industry 8.88% |

| Chemed Corp | 4,693 | $ | 1,222,855 |

| (Operates two wholly owned subsidiaries: VITAS Healthcare Corp., end of life hospice care, and | | | |

| Roto-Rooter, plumbing and drain cleaning services.) | | | |

| Honeywell International, Inc. | 2,414 | | 385,443 |

| (A Diversified technology and manufacturing company, serving customers worldwide with | | | |

| aerospace products and services, control, sensing and security technologies for buildings, | | | |

| homes, and industry; turbocharges and automotive products; and specialty chemicals, electronic | | | |

| and advanced materials, and process technology for refining and petrochemicals.) | | | |

| | | | 1,608,298 |

| |

| Semiconductor Capital Equipment 8.27% |

| Teradyne, Inc | 32,687 | | 1,498,372 |

| (The world's largest producer of automated test equipment for semiconductors.) | | | |

| |

| Machinery Industry 8.20% |

| Middleby Corp* | 7,817 | | 1,065,144 |

| (Develops, manufactures, markets and services equipment used for commercial food cooking, | | | |

| preparation, and processing.) | | | |

| Flowserve Corp | 9,281 | | 420,615 |

| (Makes, designs and markets fluid-handling equipment (pumps, valves and mechanical seals) | | | |

| for industries that use difficult-to-handle or corrosive fluids.) | | | |

| | | | 1,485,759 |

| |

| Computer Software and Services Industry 7.96% |

| Fair Isaac Corp | 8,359 | | 1,443,265 |

| (Provides decision-making solutions to clients in the financial services, telecommunications and | | | |

| retail industries.) | | | |

| |

| Biotechnology Industry 7.82% |

| Amgen Inc. | 5,287 | | 983,646 |

| (Utilizes biotechnology to develop human pharmaceutical products.) | | | |

| Biogen Inc.* | 691 | | 240,337 |

| (Is a biopharmaceutical company. It is engaged in discovering, developing, manufacturing and | | | |

| delivering therapies to patients for the treatment of neurodegenerative diseases, hematologic | | | |

| conditions and autoimmune disorders.) | | | |

| Novo Nordisk A/S | 3,490 | | 193,695 |

| (A Diversified technology and manufacturing company, serving customers worldwide with | | | |

| aerospace products and services, control, sensing and security technologies for buildings, | | | |

| homes, and industry; turbocharges and automotive products; and specialty chemicals, electronic | | | |

| and advanced materials, and process technology for refining and petrochemicals.) | | | |

| | | | 1,417,678 |

*Non-income producing security

See accompanying notes to financial statements

American Growth Fund, Inc. - Series One – Page 5

| | | |

| How American Growth Fund, Inc. Series One | | | |

| Has Its Shareholders' Money Invested | | | |

| STATEMENT OF INVESTMENTS (unaudited) | | | |

| January 31, 2018 | | | |

| |

| | | | Market |

| Description of Security | Shares | | Value |

| |

| COMMON STOCK (continued) |

| |

| Entertainment Industry 6.10% |

| Time Warner, Inc. | 10,057 | $ | 958,935 |

| (A leading internet/media provider.) | | | |

| Netflix Inc.* | 540 | | 145,962 |

| (Provides multimedia content through the internet and subscription based platform for television | | | |

| shows, movies, and original series.) | | | |

| | | | 1,104,897 |

| |

| Cable TV Industry 5.94% |

| Charter Communications, Inc * | 2,854 | | 1,076,671 |

| (Is a providers of cable services in the United States. The Company offers entertainment, | | | |

| information and communications solutions to residential and commercial customers.) | | | |

| |

| Insurance (Life) 5.53% |

| Lincoln National Corp | 12,107 | | 1,002,460 |

| (Through its subsidiaries, engages in multiple insurance and retirement businesses in the United | | | |

| States.) | | | |

| |

| Computer & Peripherals Industry 4.94% |

| Cisco Systems | 21,530 | | 894,356 |

| (The leading supplier of high-performance inter-networking products.) | | | |

| |

| Railroad 3.53% |

| Kansas City Southern | 5,655 | | 639,750 |

| (A holding company that has railroad investments in the U.S., Mexico and Panama.) | | | |

| |

| Semiconductor Industry 3.52% |

| Intel Corp | 13,240 | | 637,374 |

| (A leading manufacturer of integrated circuits.) | | | |

| |

| Environmental Industry 3.34% |

| Waste Management | 6,846 | | 605,392 |

| (The largest solid-waste disposal company in North America.) | | | |

| |

| Online Media 3.14% |

| Alphabet Inc. Class A* | 241 | | 284,915 |

| (Engaged in improving the ways people connect with information & products including Search, | | | |

| Android, YouTube, Apps, Maps & Ads. It also produces internet-connected home devices & | | | |

| provides internet services.) | | | |

| Facebook Inc.* | 1,521 | | 284,260 |

| (Operates a social networking website. The Company’s products are Facebook, Instagram, | | | |

| Messenger, WhatsApp, and Oculus. Its products enable people to connect and share through | | | |

| mobile devices and personal computers.) | | | |

| | | | 569,175 |

*Non-income producing security

See accompanying notes to financial statements.

American Growth Fund, Inc. - Series One – Page 6

| | | |

| How American Growth Fund, Inc. Series One | | | |

| Has Its Shareholders' Money Invested | | | |

| STATEMENT OF INVESTMENTS (unaudited) | | | |

| January 31, 2018 | | | |

| |

| | | | Market |

| Description of Security | Shares | | Value |

| |

| COMMON STOCK (continued) |

| |

| Drug 3.02% |

| Bristol-Myers Squibb Company | 5,131 | $ | 321,201 |

| (Engages in discovering, developing and delivering medicines that help patients prevail over | | | |

| serious diseases.) | | | |

| Johnson & Johnson | 1,638 | | 226,355 |

| (Engaged in the research and development, manufacture and sale of products in the health care | | | |

| field within its Consumer, Pharmaceutical and Medical Devices, and Diagnostic business | | | |

| segments.) | | | |

| | | | 547,556 |

| |

| Retail Store 2.29% |

| Dollar Tree, Inc.* | 3,609 | | 415,035 |

| (Operates discount variety stores in the United States and Canada. Its stores offer merchandise | | | |

| primarily at the fixed price of $1.00.) | | | |

| |

| Pharmacy Services 2.15% |

| Walgreens Boots Alliance Inc. | 5,175 | | 389,470 |

| (Operates a network of drugstores in the United States. It provides consumer goods and | | | |

| services, pharmacy, and health and wellness services through drugstores, as well as through | | | |

| mail, and by telephone and online.) | | | |

| |

| Application Software 1.72% |

| Microsoft Corporation | 3,275 | | 311,158 |

| (Engaged in designing, manufacturing, selling devices, and online advertising. Its products | | | |

| include operating systems for computing devices, servers, phones and other devices.) | | | |

| |

| Computer Hardware 1.66% |

| Apple Inc. | 1,795 | | 300,537 |

| (Designs, manufactures, & markets mobile communication & media devices, personal | | | |

| computers, & portable digital music plays, & sells a variety of related software, services, | | | |

| accessories, networking solutions, & third-party digital content.) | | | |

| |

| Insurance Industry 1.58% |

| AXA AS | 8,714 | | 286,691 |

| (The holding company of an international group of insurance and related financial services.) | | | |

| |

| Chemicals 1.52% |

| NewMarket Corp. | 362 | | 143,927 |

| (Manufactures and sells petroleum additives used in lubricating oils and fuels to enhance their | | | |

| performance in machinery, vehicles, and other equipment. The petroleum additives market has | | | |

| two products: lubricant additives and fuel additives.) | | | |

| Balchem Corporation | 1,659 | | 131,061 |

| (Is engaged in the development, manufacture and marketing of specialty performance | | | |

| ingredients and products for the food, nutritional, feed, pharmaceutical, medical sterilization and | | | |

| industrial markets.) | | | |

| | | | 274,988 |

*Non-income producing security

See accompanying notes to financial statements

American Growth Fund, Inc. - Series One – Page 7

| | | |

| How American Growth Fund, Inc. Series One | | | |

| Has Its Shareholders' Money Invested | | | |

| STATEMENT OF INVESTMENTS (unaudited) | | | |

| January 31, 2018 | | | |

| |

| | | | Market |

| Description of Security | Shares | | Value |

| |

| COMMON STOCK (continued) |

| |

| Farm & Construction Machinery 1.39% |

| Caterpillar Inc. | 1,549 | $ | 252,146 |

| (Manufacturer of construction and mining equipment, diesel and natural gas engines, industrial | | | |

| gas turbines and diesel-electric locomotives. The Company is also a U.S. exporter.) | | | |

| |

| Banks 1.37% |

| Bank of America Corp. | 4,000 | | 128,000 |

| (Bank of America Corporation is a bank holding and a financial holding company. The company | | | |

| provides financial products and services to people, companies and institutional investors.) | | | |

| JPMorgan Chase & Co. | 1,040 | | 120,297 |

| (JPMorgan Chase & Co is a financial services firm and a banking institution. It is engaged in | | | |

| investment banking, commercial banking, treasury and securities services, asset management, | | | |

| retail financial services, and credit card businesses.) | | | |

| | | | 248,297 |

| |

| Insurance (Property and Causality) 1.32% |

| Selective Insurance Group Inc. | 2,145 | | 124,946 |

| (Is a holding company that offers property and casualty insurance products and services in | | | |

| United States.) | | | |

| Markel Corp* | 100 | | 114,769 |

| (Markel Corp is engaged in the business of property and casualty insurance. It focuses primarily | | | |

| on specialty lines, such as executive liability to commercial equine insurance. It also invests in | | | |

| bakery equipment manufacturing and residential homebuilding.) | | | |

| | | | 239,715 |

| |

| Home Improvement Stores 1.30% |

| Home Depot Inc. (The) | 1,171 | | 235,254 |

| (Is a home improvement retailer. Its stores sell an assortment of building materials, home | | | |

| improvement and lawn and garden products and provide a number of services.) | | | |

| |

| Restaurants 0.88% |

| Starbucks Corporation | 2,823 | | 160,375 |

| (A roaster, marketer, & retailer of specialty coffee in the world, operating globally. It sells a | | | |

| variety of coffee & tea products. It sells goods and services under brands including Teavana, | | | |

| Tazo, and Seattle's Best Coffee.) | | | |

| |

| Steel 0.62% |

| Nucor Corp | 1,680 | | 112,493 |

| (Is engaged in the manufacturing of steel and steel products.) | | | |

| |

| Residential Construction 0.54% |

| NVR Inc.* | 31 | | 98,523 |

| (NVR Inc is a United States based company engaged in the construction and sale of single- | | | |

| family detached homes, town homes and condominium buildings. It also operates in mortgage | | | |

| banking and title services business.) | | | |

| |

| Oilfield Services & Equipment 0.49% |

| RPC, Inc | 4,388 | | 88,638 |

| (Provides a range of oilfield services and equipment to the oil and gas companies primarily in | | | |

| the United States.) | | | |

| |

| |

| *Non-income producing security | | | |

| See accompanying notes to financial statements. | | | |

American Growth Fund, Inc. - Series One – Page 8

| | | | | |

| How American Growth Fund, Inc. Series One | | | | | |

| Has Its Shareholders' Money Invested | | | | | |

| STATEMENT OF INVESTMENTS (unaudited) | | | | | |

| January 31, 2018 | | | | | |

| |

| | | | | Market | |

| Description of Security | Shares | | | Value | |

| |

| COMMON STOCK (continued) |

| |

| Business Services 0.37% |

| Paychex, Inc. | 971 | | $ | 66,271 | |

| (Is a provider of integrated payroll, human resources, insurance, and benefits outsourcing | | | | | |

| solutions for small- to medium-sized business in the United States.) | | | | | |

| |

| Building Materials 0.28% |

| US Concrete, Inc.* | 650 | | | 50,602 | |

| (US Concrete Inc. is engaged in producing and providing ready-mixed concrete, aggregates and | | | | | |

| concrete-related products and services to the construction industry in the markets in the United | | | | | |

| States.) | | | | | |

| |

| Total Common Stocks (cost $7,873,512) – 99.67% | | | | 18,061,196 | |

| |

| Total Investments, at Market Value (cost $7,873,512) | 99.67 | )% | | 18,061,196 | ) |

| Other Assets, Less Liabilities | 0.33 | )% | | 60,314 | ) |

| Net Assets | 100.00 | )% | | 18,121,510 | ) |

*Non-income producing security

See accompanying notes to financial statements

American Growth Fund, Inc. - Series One – Page 9

| | | |

| Financial Statements | | | |

| AMERICAN GROWTH FUND, INC. SERIES ONE | | | |

| STATEMENT OF ASSETS AND LIABILITIES (unaudited), SIX MONTHS ENDED JANUARY 31, 2018 | | | |

| |

| ASSETS: | | | |

| Investments, at market value (cost $7,873,512) | $ | 18,061,196 | |

| Cash | | 62,075 | |

| Receivables: | | | |

| Shares of beneficial interest sold | | 1,339 | |

| Securities sold | | - | |

| Dividends and interest | | 12,818 | |

| Recoverable Tax | | 36 | |

| Legal | | 13,160 | |

| Total assets | $ | 18,150,624 | |

| LIABILITIES: | | | |

| Payables: | | | |

| Shares of beneficial interest redeemed | | 395 | |

| Securities purchased | | - | |

| 12b-1 fees | | 13,439 | |

| Management fee | | 15,280 | |

| Total liabilities | | 29,114 | |

| NET ASSETS | $ | 18,121,510 | |

| |

| COMPOSITION OF NET ASSETS: | | | |

| Paid-in capital | $ | 17,951,149 | |

| Accumulated Net Investment Loss | | (336,756 | ) |

| Accumulated net realized loss from investment transactions | | (9,680,566 | ) |

| Net unrealized appreciation of investments | | 10,187,683 | |

| Net assets | $ | 18,121,510 | |

| |

| NET ASSET VALUE PER SHARE: | | | |

| |

| Class A Shares: | | | |

| Net asset value, redemption price and offering price per shares (based on net assets of $8,520,912 and | $ | 5.49 | |

| 1,552,585 shares of beneficial interest outstanding) | | | |

| Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) | $ | 5.82 | |

| |

| Class B Shares: | | | |

| Net asset value, redemption price and offering price per shares (based on net assets of $193,882 and 41,305 | $ | 4.69 | |

| shares of beneficial interest outstanding) | | | |

| |

| Class C Shares: | | | |

| Net asset value, redemption price and offering price per shares (based on net assets of $2,824,899 and | $ | 4.67 | |

| 604,934 shares of beneficial interest outstanding) | | | |

| |

| Class D Shares: | | | |

| Net asset value, redemption price and offering price per shares (based on net assets of $6,581,817 and | $ | 5.83 | |

| 1,129,903 shares of beneficial interest outstanding) | | | |

| Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) | $ | 6.19 | |

See accompanying notes to financial statements.

American Growth Fund, Inc. - Series One – Page 10

| | | |

| Financial Statements | | | |

| AMERICAN GROWTH FUND, INC. SERIES ONE | | | |

| STATEMENT OF OPERATIONS (unaudited), SIX MONTHS ENDED JANUARY 31, 2018 | | | |

| |

| INVESTMENT INCOME: | | | |

| Dividends (Net of $446 foreign withholding tax) | $ | 111,863 | |

| Interest | | 9 | |

| Total investment income | $ | 111,872 | |

| |

| EXPENSES: | | | |

| Investment advisory fees (Note 4) | | 86,045 | |

| Administration expenses (Note 4) | | 95,872 | |

| Transfer agent, shareholder servicing and data processing fees (Note 4) | | 49,968 | |

| Accounting Fees (Note 4) | | 30,000 | |

| Rent expense (Note 4) | | 50,466 | |

| Custodian fees | | 10,174 | |

| Professional fees | | 65,361 | |

| Registration and filing fees (Note 1) | | 12,797 | |

| Shareholder reports | | 2,151 | |

| Distribution and service fees (Note 4): | | | |

| Class A | | 12,022 | |

| Class B | | 809 | |

| Class C | | 13,641 | |

| Directors fees (Note 4) | | 11,206 | |

| Other expenses | | 8,116 | |

| Total expenses | $ | (448,628 | ) |

| Net Investment Loss | $ | (336,756 | ) |

| |

| REALIZED AND UNREALIZED GAIN OR LOSS ON INVESTMENTS: | | | |

| Net realized gain on investments | | 515,212 | |

| Net change in unrealized appreciation on investments | | 1,719,418 | |

| Net gain on investments | | 2,234,630 | |

| Net increase in net assets resulting from operations | | 1,897,874 | |

See accompanying notes to financial statements.

Series One – Page 11

Semi Annual Report For the six months ended January 31, 2017

| | | | |

| Financial Statements | | | | |

| AMERICAN GROWTH FUND, INC. SERIES ONE | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS (unaudited) | | | | |

| |

| |

| | Six | | | |

| | Months Ended | | Year Ended | |

| | January 31, 2018 | | July 31, 2017 | |

| | (unaudited) | | | |

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | |

| Net investment loss | (336,756 | ) | (800,947 | ) |

| Net realized gain on investments | 515,212 | | 1,295,829 | |

| Net change in unrealized appreciation on investments | 1,719,418 | | 1,332,420 | |

| Net increase in net assets resulting from operations | 1,897,874 | | 1,827,302 | |

| |

| BENEFICIAL INTEREST TRANSACTIONS: | | | | |

| Net increase (decrease) in net assets resulting form beneficial interest | | | | |

| transactions (Note 2): | | | | |

| Class A | (144,712 | ) | 937,384 | |

| Class B | 25,420 | | (10,048 | ) |

| Class C | (184,876 | ) | (261,215 | ) |

| Class D | (320,373 | ) | (575,422 | ) |

| Net change in net assets derived from beneficial interest transactions | (624,541 | ) | 90,699 | |

| Total increase | 1,273,333 | | 1,918,001 | |

| Net Assets – Beginning of year | 16,848,177 | | 14,930,176 | |

| Net Assets – End of year1 | 18,121,510 | | 16,848,177 | |

| 1 Includes net investment loss | (336,756 | ) | - | |

See accompanying notes to financial statements.

American Growth Fund, Inc. - Series One – Page 12

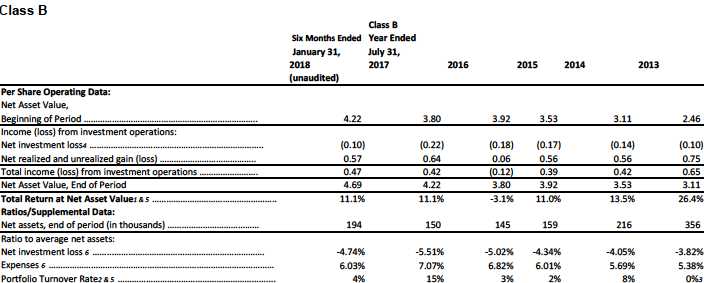

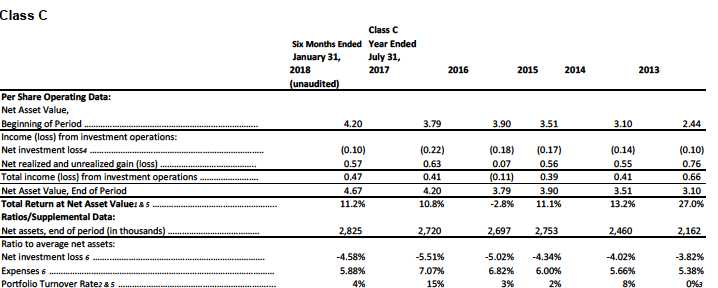

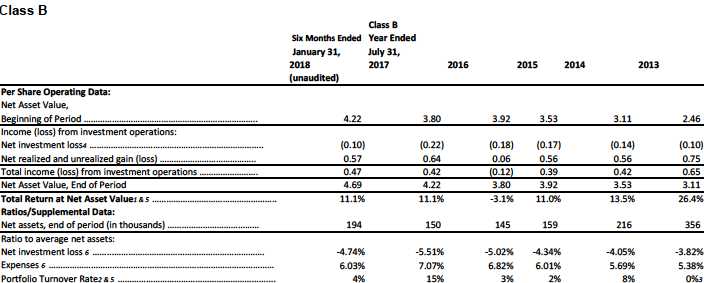

Financial Highlights

AMERICAN GROWTH FUND, INC. SERIES ONE

1. Assumes a hypothetical initial investment on the business day before the first day of the fiscal period with all dividends and distributions reinvested in additional shares on the reinvestment date and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in total returns.

2. The lesser of purchases and sales of portfolio securities for a period, divided by the monthly average of the market value of securities owned during the period. Securities with a maturity or expiration date at the time of acquisition of one year or less are excluded from the calculation. Purchases and sales of investment securities (other than short-term securities) for the six months ended January 31, 2018, aggregated $760,725 and $1,712,205, respectively.

3. Amount less than 0.5%.

4. Per share amounts have been calculated using the Average Shares Method 5. Six Months Ended Calculation has not been annualized.

6. Six Months Ended Calculation has been annualized.

See accompanying notes to financial statements.

American Growth Fund, Inc. - Series One – Page 13

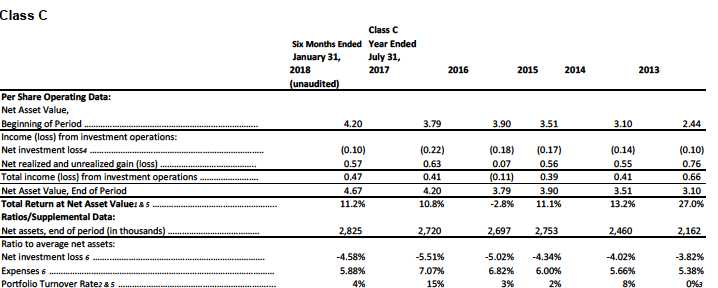

Financial Highlights

AMERICAN GROWTH FUND, INC. SERIES ONE

1. Assumes a hypothetical initial investment on the business day before the first day of the fiscal period with all dividends and distributions reinvested in additional shares on the reinvestment date and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in total returns.

2. The lesser of purchases and sales of portfolio securities for a period, divided by the monthly average of the market value of securities owned during the period. Securities with a maturity or expiration date at the time of acquisition of one year or less are excluded from the calculation. Purchases and sales of investment securities (other than short-term securities) for the six months ended January 31, 2018, aggregated $760,725 and $1,712,205, respectively.

3. Amount less than 0.5%.

4. Per share amounts have been calculated using the Average Shares Method 5. Six Months Ended Calculation has not been annualized.

6. Six Months Ended Calculation has been annualized.

See accompanying notes to financial statements.

American Growth Fund, Inc. - Series One – Page 14

Notes to Financial Statements

American Growth Fund, Inc. Series One (unaudited)

1. Summary of Significant Accounting Policies

American Growth Fund, Inc. Series One (the "Fund") is registered under the Investment Company Act of 1940, as amended, as a diversified, open-

end management investment company. The Fund is an investment company and accordingly follows the investment company accounting and

reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 “Financial Services – Investment

Companies.” The Fund's primary investment objective is growth of capital. The Fund's investment advisor is Investment Research Corporation (IRC).

The Fund offers Class A, Class B, Class C and Class D shares. Class D shares are available to shareholders of accounts established prior to March

1, 1996. Class A and Class D have a maximum sales charge (load) imposed on purchases (as a percentage of offering price) of 5.75%. Purchases of

Class A and Class D shares in amounts of $1,000,000 or more which are not subject to an initial sales charge generally will be subject to a contingent

deferred sales charge of 1.0% of amounts redeemed within the first year of purchase. Class B has a maximum deferred sales charge (Contingent

Deferred Sales Charge) as a percentage of original purchase price or redemption proceeds, whichever is lower, for the first 2 years of 5%, 3rd & 4th

years - 4%, 5th yr. - 3%, 6th yr. - 2%, 7th yr. - 1%. Class C has a maximum deferred sales charge as a percentage of original purchase price or

redemption proceeds, whichever is lower, of 1% for the first year. All classes of shares have identical rights to earnings, assets and voting privileges,

except that each class has its own distribution and/or service plan and expenses directly attributable to that class and exclusive voting rights with

respect to matters affecting that class. Class B shares will automatically convert to Class A shares seven years after date of purchase. The following

is a summary of significant accounting policies consistently followed by the Fund.

Reclassifications - Accounting principles generally accepted in the United States of America require that certain components of net assets be

reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

For the year ended July 31, 2017, the following reclassifications were made:

| | | | | | |

| | Accumulated | | Accumulated | | | |

| | Net Investment | | Net Realized | Paid | -In | |

| | Loss | | Loss | | Capital . | |

| $ | 800,947 | $ | 0 | $ | (800,947 | ) |

Investment Valuation – Investment securities traded on the New York Stock Exchange or other stock exchange approved for this purpose by the

board of directors will be valued on the basis of the closing sale thereof on such stock exchange, or, if such sale is lacking, at the mean between

closing bid and asked prices on such day. If no bid and asked prices are quoted for such day or information as to New York or other approved

exchange transactions is not readily available, the security will be valued by reference to recognized composite quotations or such other method as

the board of directors in good faith deems will reflect its fair market value. Securities not traded on any stock exchange but for which market

quotations are readily available are valued on the basis of the mean of the last bid and asked prices. Short-term securities are valued at the mean

between the closing bid and asked prices or by such other method as the board of directors determines to reflect their fair market value. The board of

directors in good faith determines the manner of ascertaining the fair market value of other securities and assets.

Allocation of Income, Expenses, Gains and Losses - Income, expenses (other than those attributable to a specific class), gains and losses are

allocated daily to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly

attributable to a specific class are charged against the operations of that class.

Federal Income Taxes - No provision for federal income or excise taxes has been made because the Fund intends to comply with the provisions of

subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to shareholders.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is "more likely than not" to be sustained assuming examination by

tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded

related to uncertain tax positions taken on returns filed for open tax years (2014-2016), or expected to be taken in the Fund's 2017 tax returns. The Fund

identifies its major tax jurisdictions as U.S. Federal, Colorado State and foreign jurisdictions where the Fund makes significant investments; however the Fund

is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next

twelve months.

Classification of Distributions to Shareholders - The character of distributions made during the year from net investment income or net realized

gains may differ from its ultimate characterization for federal income tax purposes. Also, due to timing of dividend distributions, the fiscal year in which

amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

Security Transactions and Related Investment Income - Investment transactions are accounted for on the date the investments are purchased or

sold (trade date). Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income is recorded on the accrual

basis. Realized gains and losses from investment

transactions are reported on an identified cost basis which is the same basis used for federal income tax purposes.

Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the

reporting period. Actual results could differ from those estimates.

Securities Valuations – As described in note 1, the Fund utilizes various methods to measure the fair value of most of its investments on a recurring

basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These

inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds,

credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own

assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information

available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of

security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the

security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair

value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level

3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the

fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the

fair value measurement in its entirety.

Semi-Annual Report for the six months ended January 31, 2018

American Growth Fund, Inc. - Series One – Page 15

Notes to Financial Statements

American Growth Fund, Inc. Series One (unaudited)

The following is a summary of the inputs used, as of January 31, 2018, in valuing the Fund’s assets carried at fair value:

| | | | | | |

| Equity | | Level 1 | Level 2 | Level 3 | | Total |

| Common Stock | $ | 18,061,196 | 0 | 0 | $ | 18,061,196 |

The industry classifications of Level 1 investments are included in the Statement of Investments.

There were no transfers in to or out of Level 1 or Level 2 for the six months ended January 31, 2018.

Transfers between levels are recognized at the end of the reporting period.

2. Shares of Beneficial Interest

The Fund has authorized an unlimited number of no par value shares of beneficial interest of each class. Transactions in shares of beneficial interest

were as follows:

| | | | | | | | | | |

| | Six Months Ended | | Year Ended | |

| | January 31,2018 | | July 31,2017 | |

| | Shares | | | Amount | | Shares | | | Amount | |

| Class A: | | | | | | | | | | |

| Sold | 58,931 | | $ | 296,705 | | 480,127 | | $ | 1,012,459 | |

| Dividends and distributions | | | | | | | | | | |

| reinvested | - | | | - | | - | | | - | |

| Redeemed | (87,512 | ) | $ | (441,417 | ) | (261,961 | ) | $ | (1,226,684 | ) |

| Net increase (decrease) | (28,581 | ) | $ | (144,712 | ) | 218,166 | | $ | 937,384 | |

| Class B: | | | | | | | | | | |

| Sold | 6,189 | | $ | 27,748 | | 502 | | $ | 1,959 | |

| Dividends and distributions | | | | | | | | | | |

| reinvested | - | | | - | | - | | | - | |

| Redeemed | (530 | ) | $ | (2,328 | ) | (3,035 | ) | $ | (12,007 | ) |

| Net decrease | 5,659 | | | 25,420 | | (2,533 | ) | $ | (10,048 | ) |

| Class C: | | | | | | | | | | |

| Sold | 3,994 | | | 17,442 | | 73,052 | | $ | 292,970 | |

| Dividends and distributions | | | | | | | | | | |

| reinvested | - | | | - | | - | | | - | |

| Redeemed | (46,672 | ) | | (202,318 | ) | (137,842 | ) | $ | (554,185 | ) |

| Net decrease | (42,678 | ) | | (184,876 | ) | (64,790 | ) | $ | (261,215 | ) |

| Class D: | | | | | | | | | | |

| Sold | 18,575 | | | 98,847 | | 6,780 | | $ | 34,650 | |

| Dividends and distributions | | | | | | | | | | |

| reinvested | - | | | - | | - | | | - | |

| Redeemed | (78,094 | ) | | (419,220 | ) | (125,689 | ) | $ | (610,072 | ) |

| Net decrease | (59,519 | ) | | (320,373 | ) | (118,909 | ) | $ | (575,422 | ) |

3. Realized and Unrealized Gains and Losses on Investments

The identified tax cost basis of investments at January 31, 2018 was $8,141,033. Net unrealized appreciation on investments of $9,920,163, based on

identified tax cost as of January 31, 2018, was comprised of gross appreciation of $9,934,497 and gross depreciation of $(14,334).

4. Underwriting, Investment Advisory Contracts, Service Fees and Other Related Parties

Under the investment advisory contract with IRC, the advisor receives annual compensation for investment advice, computed and paid monthly, equal

to 1% of the first $30 million of the Fund's average annual net assets and 0.75% such assets in excess of $30 million. The Fund pays its own

operating expenses.

Class B and Class C shares each are subject to annual service and distribution fees of 1.00% of average daily net assets. Class A shares are subject

to annual service and distribution fees no greater than 0.30% of average daily net assets.

For the six months ended January 31, 2018 commissions and sales charges paid by investors on the purchase of Fund shares totaled $13,648 of

which $1,988 was retained by World Capital Brokerage, Inc. ("WCB"), an affiliated broker/dealer which serves as the underwriter and distributor of the

Fund. Sales charges advanced to broker/dealers by WCB on sales of the Fund's Class B and C shares totaled $1,285 of which $0 was retained by

WCB. For the six months ended January 31, 2018, WCB received contingent deferred sales charges of $54 upon redemption of Class B and C

shares, as reimbursement for sales commissions advanced by WCB upon the sale of such shares. No payments were made by the Fund to WCB for

brokerage commission on securities transactions.

Certain officers of the Fund are also officers of WCB and IRC. For the six months ended January 31, 2018, the Fund paid directors' fees of $5,841,

expenses of $3,097, and the audit chair $2,268 for review.

For the six months ended January 31, 2018, under an agreement with IRC, the Fund was charged $95,872 for the costs and expenses related to

employees of IRC who provided administrative, clerical and accounting services to the Fund. In addition, the Fund was charged $50,466 by an

affiliated company of IRC for the rental of office space.

American Growth Fund, Inc. - Series One – Page 16

Semi-Annual Report for the six months ended January 31, 2018

Notes to Financial Statements

American Growth Fund, Inc. Series One (unaudited)

5. Federal Income Tax Matters

Dividends paid by the Fund from net investment income and distributions of net realized short-term capital gains are, for federal income tax purposes,

taxable as ordinary income to shareholders.

At July 31, 2017, the Fund had available for federal income tax purposes an unused capital loss carryover of $9,812,999, $6,545,554 expires in

and $3,267,445 expires 2019. The Fund utilized $664,828 of non-expiring long term capital loss carryover. $147,917 of non-expiring short-term

loss carryover, and $295,732 of capital loss carryover as of July 31, 2017.

The Fund distributes net realized capital gains, if any, to its shareholders at least annually, if not offset by capital loss carryovers. Income distributions

and capital gain distributions are determined in accordance with income tax regulations, which may differ from accounting principles generally

accepted in the United States of America. These differences are primarily due to the differing treatment of net operating losses, foreign currency and

tax allocations. Accordingly, these permanent differences in the character of income and distributions between financial statements and tax basis

have been reclassified to paid-in capital.

Net capital losses incurred after October 31, within the taxable year are deemed to arise on the first business day of the Fund’s next taxable year.

As of July 31, 2017 the components of accumulated losses on a tax-basis were as follows:

| | |

| Capital loss carry forward | (9,812,999 | ) |

| Unrealized appreciation | 8,085,486 | ) |

| | (1,727,513 | ) |

| 6. Subsequent Events | | |

In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date these financial

statements were issued.

7. Review of Affiliated Company’s Expenses – The Trust’s Audit Committee reviews, on a monthly and quarterly basis, the details of each

expense incurred by the Trust in order to determine the appropriateness. These expense are then presented to the Trust’s Board of Directors for

review and approval at the next quarterly Board Meeting.

For the six months ended January 31, 2018 the Trust paid to its affiliated companies, World Capital Brokerage, Inc. $3,728, Investment Research Corporation

$90,276, and AGF Properties, Inc. $52,198 for services they provided to the Trust and its shareholders. These payments resulted in these affiliated companies

earning profits totaling World Capital Brokerage, Inc. $(91), Investment Research Corporation $(51,457), and AGF Properties, Inc. $(52,240).

Analysis of Expenses (unaudited)

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end sales charges with respect

to Class A and D shares or contingent deferred sales charges ("CDSC") with respect to Class B and C shares; and (2) ongoing costs,

including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. The tables below are intended to

help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of

investing in other mutual funds.

The tables below are based on an investment of $1,000 invested on August 1, 2016 and held for the six months ended January 31,

2017.

Actual expenses (unaudited)

This table provides information about actual account values and actual expenses. You may use the information provided in this

table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you

paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 =

8.6), then multiply the result by the number under the heading entitled "Expenses Paid During the Period".

| | | | | | | | |

| For the six months ended January 31, 2018 | | | | |

| |

| | Actual | | | | | | | |

| | Total Return | | | | | | | |

| | Without | | | Beginning | | Ending | | Expenses |

| | Sales | | | Account | | Account | | Paid During |

| | Charges(1) | | | Value | | Value | | The Period(2) |

| Class A | 11.59 | % | $ | 1,000.00 | $ | 1,057.73 | $ | 58.17 |

| Class B | 11.14 | % | $ | 1,000.00 | $ | 1,044.39 | $ | 67.01 |

| Class C | 11.19 | % | $ | 1,000.00 | $ | 1,046.50 | $ | 65.40 |

| Class D | 11.90 | % | $ | 1,000.00 | $ | 1,064.18 | $ | 54.82 |

(1) Assumes reinvestment of all dividends and capital gain distributions, if any, at net asset value and does not reflect the deduction of the applicable

sales charges with respect to Class A or D shares or the applicable Contingent Deferred Sales Charges ("CDSC") with respect to Class B or C

Shares.

(2) Expenses are equal to the annualized expense ratio of 5.21%, 6.03%, 5.88% and 4.90% for the Fund’s Class A, B, C, and D shares,

respectively, multiplied by the average account value over the period multiplied by 184/365 (to reflect the one-half year period).

Hypothetical example for comparison purposes (unaudited)

The table below provides information about hypothetical account values and hypothetical expenses based on the actual expense

ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund's actual return. The hypothetical

account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other mutual funds. To

do so, compare this 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the

shareholder reports of other mutual funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any

transactional costs. The example does not reflect the deduction of contingent deferred sales charges ("CDSC") with respect to Class

Semi-Annual Report for the six months ended January 31, 2018

American Growth Fund, Inc. - Series One – Page 17

B and C shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total

costs of owning different mutual funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | |

| For the six months ended January 31, 2018 | | | | |

| |

| | Hypothetical | | | | | | | |

| | Annualized | | | Beginning | | Ending | | Expenses |

| | Total | | | Account | | Account | | Paid Expenses |

| | Return | | | Value | | Value | | The Period(1) |

| Class A | 5.00 | % | $ | 1,000.00 | $ | 971.77 | $ | 53.44 |

| Class B | 5.00 | % | $ | 1,000.00 | $ | 963.40 | $ | 61.81 |

| Class C | 5.00 | % | $ | 1,000.00 | $ | 964.91 | $ | 60.30 |

| Class D | 5.00 | % | $ | 1,000.00 | $ | 974.98 | $ | 50.23 |

(1) Expenses are equal to the annualized expense ratio 5.21%, 6.03%, 5.88% and 4.90% for the Fund’s Class A, B, C, and D shares, respectively,

multiplied by the average account value over the period multiplied by 184/365 (to reflect the one-half year period).

Allocation of Portfolio Assets (unaudited)

(Calculated as a percentage of Net Assets)

| | |

| January 31, 2018 | | |

| Sector Breakdown | | |

| Diversified Company Industry | 8.88 | )% |

| Semiconductor Capital Equipment | 8.27 | )% |

| Machinery Industry | 8.20 | )% |

| Computer Software and Services | 7.96 | )% |

| Biotechnology Industry | 7.82 | )% |

| Entertainment | 6.10 | )% |

| Cable TV | 5.94 | )% |

| Insurance (Life) | 5.53 | )% |

| Computer & Peripherals | 4.94 | )% |

| Railroad | 3.53 | )% |

| Semiconductor | 3.52 | )% |

| Environmental | 3.34 | )% |

| Online Media | 3.14 | )% |

| Drug | 3.02 | )% |

| Retail Store | 2.29 | )% |

| Pharmacy Services | 2.15 | )% |

| Application Software | 1.72 | )% |

| Computer Hardware | 1.66 | )% |

| Insurance | 1.58 | )% |

| Chemicals | 1.52 | )% |

| Farm & Construction Machinery | 1.39 | )% |

| Banks | 1.37 | )% |

| Insurance (Property and Causality) | 1.32 | )% |

| Home Improvement Stores | 1.30 | )% |

| Restaurants | 0.88 | )% |

| Steel | 0.62 | )% |

| Residential Construction | 0.54 | )% |

| Oilfield Services & Equipment | 0.49 | )% |

| Business Services | 0.37 | )% |

| Building Materials | 0.28 | )% |

| |

| Investments – Common Stocks | 99.67 | )% |

| Cash and Receivables, less Liabilities | 0.33 | )% |

| Total Net Assets | 100.00 | )% |

NOTICE TO SHAREHOLDERS at July 31, 2017 (Unaudited)

How to Obtain a Copy of the Fund’s Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is

available without charge upon request by calling 1-800-525-2406 or on the SEC’s website at http://www.sec.gov.

How to Obtain a Copy of the Fund’s Proxy Voting Records for the 12-Month Period

Ended June 30, 2017

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June

30 is available without charge, upon request, by calling 1-800-525-2406. Furthermore, you can obtain the Fund’s proxy voting

records on the SEC’s website at http://www.sec.gov.

American Growth Fund, Inc. - Series One – Page 18

Semi-Annual Report for the six months ended January 31, 2018

Quarterly Filings on Form N-Q

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-

Q. The Fund’s Form N-Q is available on the SEC’s website at http://www.sec.gov. The Fund’s Form N-Q may be reviewed and

copied at the SEC’s Public Reference Room in Washington, DC and information on the operation of the Public Reference Room may

be obtained by calling 1-800-SEC-0330. Information included in the Fund’s Form N-Q is also available by calling 1-800-525-2406.

INFORMATION ABOUT TRUSTEES AND OFFICERS (Unaudited)

The day-to-day operations of the Fund are managed by its officers subject to the overall supervision and control of the board of

directors. The Fund´s Audit Committee meets quarterly and is responsible for reviewing the financial statements of the Fund.

The following information about the interested directors2 of the Fund includes their principal occupations for the past five years:

| | | | | |

| | | | | Number of | |

| | | Term of Office1 and | Principal | | Other Directorships |

| | Position(s) Held | | | Portfolios in Fund | |

| Name, Address, and Age | | Length of Time | Occupation(s) | | Held by Director for |

| | with Fund | | | Complex Overseen | |

| | | Served | During Past 5 Years | | the Past Five Years |

| | | | | by Director | |

| |

| | | | Principal financial | | |

| |

| | | | and accounting | | Director of World |

| |

| Timothy E. Taggart, 1636 | | | officer, employee of | | Capital Brokerage, |

| Logan Street, Denver, | President, Director | | | | |

| |

| CO | and Treasurer | Since April 2004 | Adviser since 1983. | 2 | Inc. and Investment |

| |

| DOB: October 18, 1953 | | | See below for | | Research |

| | | | affiliation with | | Corporation |

| |

| | | | Distributor. | | |

The following information about the non-interested directors, officers and advisors of the Fund includes their principal occupations for

the past five years:

| | | | | |

| | | Term of | Principal | Number of | Other |

| Name, Address, and | Position(s) Held | Office1 and | Occupation(s) | Portfolios in Fund Directorships |

| | | | | Complex | Held by Director |

| Age | with Fund | Length of Time | During Past 5 | Overseen by | for the Past Five |

| | | Served | Years | Director | Years |

| | Director, Audit | | | | |

| Eddie R. Bush, 1400 | Committee | | | | |

| W. 122nd Ave., Suite | Chairman | Since September | Certified Public | | |

| 100, Westminster, CO | | | | 2 | None |

| | (financial expert), | 1987 | Accountant | | |

| DOB: December 31, | Lead Independent | | | | |

| 1939 | Director | | | | |

| Darrell E. Bush, 2714 | | | | | |

| |

| West 118th Ave, | | Since September | | | |

| Westminster, CO | Director | | Accountant | 2 | None |

| DOB: February 19, | | 2013 | | | |

| 1971 | | | | | |

| | | | | | World Capital |

| Michael L. Gaughan, | Chief Compliance | | | | Brokerage, Inc. |

| 115 Carlisle Pl., | | Since September | Employee of the | | |

| | Officer and | | | N/A | and Investment |

| Dorchester, NJ DOB: | | 2004 | Fund since 1995. | | |

| | Secretary | | | | Research |

| November 29, 1967 | | | | | Corporation |

| Patricia A. Blum, 1636 | | | | | |

| Logan Street, Denver, | | | Employee of the | | World Capital |

| | Vice President | Since June 2013 | | N/A | |

| CO DOB: June 27, | | | Fund since 2001. | | Brokerage, Inc. |

| 1959 | | | | | |

1. Trustees and officers of the fund serve until their resignation, removal or retirement.

2. Timothy Taggart is an "interested persons” of the Fund as defined by the Investment Company Act of 1940 because of the

following position which he holds.

Timothy Taggart is the sole shareholder, president and a director of Investment Research Corporation. He is also president and a

director of World Capital Brokerage, Inc., the Distributor.

Semi-Annual Report for the six months ended January 31, 2018

American Growth Fund, Inc. - Series One – Page 19

None of the above named persons received any retirement benefits or other form of deferred compensation from the Fund. There are

no other funds that together with the Fund constitute a Fund Complex.

The Fund's Statement of Additional Information includes additional information about the Fund's trustees, and is available without

charge upon request by calling 1-800-525-2406.

BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

Meeting of the Board of Directors Held on October 31, 2017

At a regular meeting of the Board of Directors (the “Board”) held on October 31, 2017 (the “meeting”), the Board, assisted by legal

counsel representing the Fund and the Independent Directors, including a majority of the Directors who are not interested persons

of the Board (the “Independent Directors”), considered the approval for another year of the investment advisory agreement (the

“Agreement”) between Investment Research Corporation (the “Adviser”) and American Growth Fund, Inc. (the “Fund”).

In connection with its review and approval of the Agreement for another year at the Meeting, the Independent Directors present

considered materials furnished by the Adviser, including information about, but not limited to, the Adviser’s personnel, operations and

financial condition. The Independent Directors also submitted questions to the Adviser prior to the Meeting. At the Meeting,

representatives from the Adviser, presented information to the Board regarding the Adviser and the Series One Fund, discussed with

the Independent Directors the factors set forth in the Gartenberg Case as they apply to the Director’s consideration of this matter,

and responded to questions from the Board.

Matters considered by the Board, including the Independent Directors, at the Meeting in connection with its re-approval of the

Agreement included the following:

Performance. The Board reviewed American Growth Fund’s investment performance reports, which compared the performance of

Series One with several other mutual funds with generally similar investment strategies, at least in part, over various time periods, as

well as with the Series One Fund’s benchmark index, the S&P 500 (the “S&P 500”), and discussed these reports with representatives

of the Adviser. The Board and the Independent Directors considered Series One’s comparative performance for various periods, both

long and short terms. A discussion was also held concerning the historical comparisons and how new funds are picked for

comparison purposes. Based upon the foregoing and other information provided by the Adviser, the Board, including a majority of the

Independent Directors, concluded that the performance of Series One to be satisfactory in light of the information presented at the

meeting by the Adviser.

Costs of Services and Profitability. The Board reviewed and considered the contractual annual advisory fee paid by each Series to

the Adviser, in light of the extent and quality of the advisory services provided by the Adviser to the Fund. The Board received and

considered information including a comparison of the Fund’s contractual advisory fee rate with those of peer funds. The Board also

reviewed and considered the total expense ratio for Series One, alongside comparative total expense ratio information for peer funds.

In doing so, the Board also considered the relative size of Series One compared to the peer funds.

In addition, the Board, including the Independent Directors, specifically considered the profits realized by the Adviser and its affiliates,

based in part on the Adviser financial information presented at the meeting and information regarding amounts paid to the Adviser

and its affiliates.

Nature, Extent, and Quality of the Services under the Investment Advisory Agreement: The Board received and

considered information regarding the nature, extent, and quality of services provided to Series One under the Agreement. The

Trustees reviewed certain background materials supplied by the Adviser in its presentation, including its Form ADV.

The Board reviewed and considered the Adviser’s investment advisory personnel, its history as an asset manager, and its

performance and the amount of assets currently under management by the Adviser and its affiliated entities. The Board also

reviewed the research and decision making processes utilized by the Adviser, including the methods adopted to seek to achieve

compliance with the investment objectives, and policies of each Series.

The Board considered the background and experience of the Adviser’s management in connection with the Fund, including reviewing

the qualifications, backgrounds, and responsibilities of the parties primarily responsible for the day to day portfolio management of

Series One and the extent of the resources devoted to research and analysis of actual and potential investments.

Economies of Scale. After discussion, it was the consensus of the Board that the Fund had not reached an asset level where any

material economies of scale were being realized by the Adviser that could be shared with the Fund. The Board specifically noted the

existence of the “break point” on advisory fees in the Agreement.

Other Benefits to the Adviser: The Board reviewed and considered any other incidental benefits derived or to be derived by the

Adviser from its relationship with Series One. The Board noted that the Adviser does not have any soft dollar arrangements.

Conclusion. In reviewing the factors above, the Board concluded that no single factor was identified by the Directors to be

determinative as the principal factor in whether to renew the Agreement. The Board concluded that:

(1) The nature and quality of services provided to Series One and its shareholders by IRC were reasonable and adequate;

(2) The profitability of IRC and its affiliates from their relationships with Series One was not unreasonable with respect to each Series;

(3) There were no material economies of scale or other incidental benefits accruing to the Adviser in connection with its relationship

with Series One;

(4) While performance of Series One lagged behind performance of respective peer funds and benchmarks over recent time periods,

the Adviser had presented substantive information at the meeting regarding measures aimed at improving performance; and

(5) Series One’s contractual advisory fee rate was within an acceptable range of the median for peer funds, and while Series One’s

American Growth Fund, Inc. - Series One – Page 20

Semi-Annual Report for the six months ended January 31, 2018

total expense ratio was generally greater than the median for peer funds, this could be attributed in part to the disparities in relative

fund size.

Based on the Board’s’ deliberations and their evaluation of the information described above, the Directors, including all of the

Independent Directors, concluded that the Adviser’s compensation for investment advisory services is consistent with the best

interests of Series One and its shareholders and accordingly approved continuation of the Investment Advisory Agreement for an

additional period.

Semi-Annual Report for the six months ended January 31, 2018

American Growth Fund, Inc. - Series One – Page 21

This page intentionally left blank

American Growth Fund, Inc. - Series One – Page 22

Semi-Annual Report for the six months ended January 31, 2018

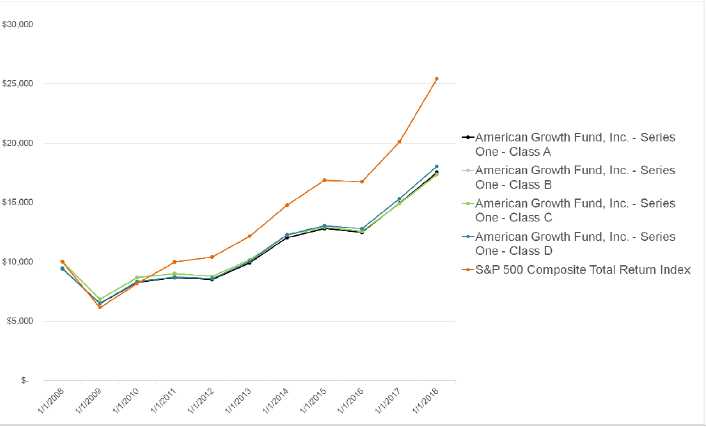

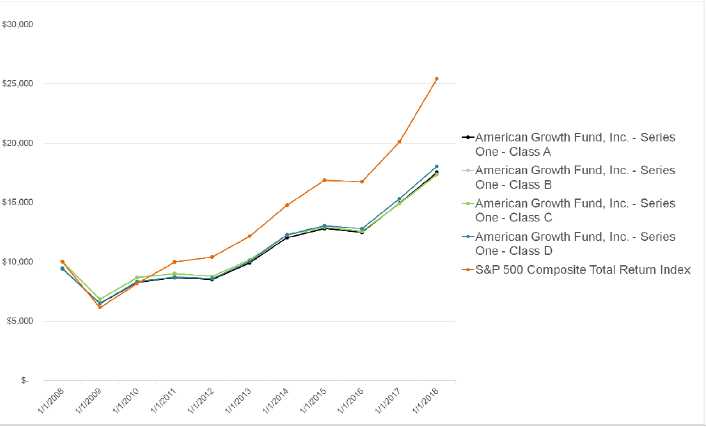

PERFORMANCE CHARTS (unaudited)

The following charts compare the change in value of a $10,000 investment in the American Growth Fund versus the Standard and Poors 500. Returns reflect a sales load for Class A and D while Class B and C are without a sales load.

Performance data quoted represents past performance and is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Indices are unmanaged and generally do not reflect deductions for management fees. You cannot invest directly in an index. Current performance data to the most recent month end can be obtained by calling 1-800-525-2406.

Semi-Annual Report for the six months ended January 31, 2018

American Growth Fund, Inc. - Series One – Page 23

On 3/1/96, the Fund adopted a multi-class distribution arrangement to issue additional classes of shares, designated as Class A, Class B and Class C

shares. Shares existing prior to 3/1/96 became Class D shares. Class A and Class D shares are subject to a maximum front-end sales charge of

5.75%, Class B shares are subject to a maximum contingent deferred sales charge of 5% and Class C shares are subject to a 1% contingent deferred

sales charge within the first year of purchase. The Fund may incur 12b-1 expenses up to an annual maximum of .30 of 1% on its average daily net

assets of its Class A shares, 1% of its average daily net assets of its Class B shares, and 1% of its average daily net assets of its Class C shares.

Class D shares have no 12b-1 fees. Performance figures for Class D shares include the 5.75% initial sales charge and assume the reinvestment of

income dividends and capital gain distributions. Performance quoted represents past performance and cannot be used to predict future results. The

investment return and principal value of an investment will fluctuate so that the investors shares, when redeemed, may be worth more or less than

their original cost. This material must be preceded or accompanied by a current prospectus. If you have not received, or need a current prospectus,

please feel free to call for one at 1-800-525-2406. Please read the prospectus carefully before investing. Period ending 01/31/2018. For current

performance figures please call 1-800-525-2406.

| | | | | | |

| | | | 5 years | | 10 years | |

| Series One (unaudited) | 1 | year | annualized | | annualized | |

| Class D without load | 17.78 | % | 12.47 | % | 6.73 | % |

| Class D with load* | 11.05 | % | 11.13 | % | 6.08 | % |

| Class A without load | 17.31 | % | 12.11 | % | 6.41 | % |

| Class A with load* | 10.46 | % | 10.78 | % | 5.78 | % |

| Class B without load | 16.38 | % | 11.35 | % | 5.68 | % |

| Class C without load | 16.46 | % | 11.33 | % | 5.67 | % |

| *Includes a 5.75% sales charge based on a $10,000 initial purchase. | | | |

TRANSFER AGENT: Fund Services, Inc., 8730 Stony Point Parkway, Stony Point Bldg. III - Suite # 205, Richmond, Va. 23235

CUSTODIAN: UMB Bank NA Investment Services Group, 928 Grand Blvd, Fifth Floor, Kansas City, MO 64106

RETIREMENT PLAN CUSTODIAN: UMB Bank NA Investment Services Group, 928 Grand Blvd, Fifth Floor, Kansas City, MO 64106

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM: Tait, Weller & Baker LLP, 1818 Market St., Suite 2400, Philadelphia, PA 19103

LEGAL COUNSEL: K&L Gates LLP, 1601 K St NW, Washington, DC 20006

UNDERWRITER/DISTRIBUTOR: World Capital Brokerage, Inc., 1636 Logan Street, Denver, CO 80203

| | | |

| OFFICERS AND DIRECTORS | INVESTMENT ADVISORS | |

| Timothy E. Taggart | President and Director | Investment Research Corporation | |

| Eddie R. Bush | Director | 1636 Logan Street | |

| Darrell E. Bush | Director | Denver, CO 80203 | |

| Patricia A. Blum | Vice President | OFFICERS AND DIRECTORS | |

| Michael L. Gaughan | Chief Compliance Officer | Timothy E. Taggart | President, Treasurer, and |

| | and Corporate Secretary | | Director |

| | | Michael L. Gaughan | Vice President, |

| | | | Secretary |

| | | | and Director |

| | | Patricia A. Blum | Vice President |

3/2018

2018-01-31(a) – Series 1

ITEM 2 – Code of Ethics

The Fund has adopted a Code of Ethics that applies to its Principal Executive Officer and Principal Financial Officer.

The Fund undertakes to provide to any person without charge, upon request, a copy of the Code of Ethics. Such

request can be made to American Growth Fund, Inc. at 800-525-2406 or to 1636 Logan Street, Denver, CO 80203.

ITEM 3 – Audit Committee Financial Expert

The Fund’s board has determined that Eddie R. Bush, CPA, a member of the Fund’s audit committee, is an “audit

committee financial expert” and "independent," as such terms are defined in this Item. This designation will not

increase the designee’s duties, obligations or liability as compared to his or her duties, obligations and liability as a

member of the audit committee and of the board, nor will it reduce the responsibility of the other audit

committee members. There may be other individuals who, through education or experience, would qualify as

"audit committee financial experts" if the board had designated them as such. Most importantly, the board

believes each member of the audit committee contributes significantly to the effective oversight of the Fund’s

financial statements and condition.

ITEM 4 – Principal Accountant Fees and Services

n/a

ITEM 5 – Audit Committee of Listed Funds

n/a

ITEM 6 – Schedule of Investments

Not applicable, insofar as the schedule is included as part of the report to shareholders filed under Item 1 of this

Form.

ITEM 7 – Disclosure of Proxy Voting Policies and Procedures for Closed End Management Investment Companies

Not applicable to this Fund, insofar as the Fund is not a closed end management investment company.

ITEM 8 – Portfolio Managers of Closed End Management Investment Companies

Not applicable to this Fund, insofar as the Fund is not a closed end management investment company.

ITEM 9 – Purchases of Equity Securities by Closed End Management Investment Company and Affiliated

Purchasers

Not applicable to this Fund, insofar as the Fund is not a closed end management investment company.

ITEM 10 – Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the

registrant’s board of Directors.

ITEM 11 – Controls and Procedures

(a) The Fund’s Principal Executive Officer and Principal Financial Officer have concluded, based on their

evaluation of the Fund’s disclosure controls and procedures (as such term is defined in Rule 30a-3 under the

Investment Company Act of 1940), that such controls and procedures are adequate and reasonably designed

to achieve the purposes described in paragraph (c) of such rule.

(b) There were no changes in the Fund’s internal controls over financial reporting (as defined in Rule 30a 3(d)

under the Investment Company Act of 1940) that occurred during the Fund’s second fiscal quarter of the

period covered by this report that has materially affected, or is reasonably likely to materially affect, the

Fund’s internal control over financial reporting.

ITEM 12 – Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable to this Fund, insofar as the Fund is not a closed end management investment company.

ITEM 13 – Exhibits

(a)(1) The Code of Ethics that is the subject of the disclosure required by Item 2 is attached as an exhibit hereto.

(a)(2) The certifications required by Rule 30a 2 of the Investment Company Act of 1940 and Sections 302 and

906 of the Sarbanes Oxley Act of 2002 are attached as exhibits hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the

Fund has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

AMERICAN GROWTH FUND, INC.

By/s/Timothy E. Taggart

Timothy E Taggart, President

Principal Executive and Principal Financial Officer

Date: November 12, 2020

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940,

this report has been signed below by the following persons on behalf of the Fund and in the capacities and on the

dates indicated.

By /s/Timothy E. Taggart

Timothy E. Taggart, President

Principal Executive and Principal Financial Officer

Date: November 12, 2020