Exhibit (8)

|

MINISTERO DELL’ECONOMIA E DELLE FINANZE |

PUBLIC DEBT REPORT 2021 |

INDEX

| INDEX | I |

| INDEX OF TABLES | II |

| INDEX OF CHARTS AND GRAPHIC FIGURES | III |

| FOREWORD | VII |

| I. | DEBT MANAGEMENT OBJECTIVES FOR 2021 | 1 |

| I.1 | The objectives and risks of international debt management practices | 1 |

| I.2 | 2021 objectives: the institutional framework of reference | 2 |

| I.3 | Curbing the cost of debt while paying attention to the cost / risk profile | 6 |

| I.4 | Monitoring and managing the cash account to stabilise the balance | 14 |

| II. | THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE INTHE INTERNATIONAL CONTEXT | 17 |

| II.1 | Monetary policies and effects on the euro area money market | 17 |

| II.2 | Euro area bond markets | 19 |

| II.3 | Trends in the italian government securities market | 23 |

| III. | PUBLIC DEBT MANAGEMENT IN 2021 | 41 |

| III.1 | Outstanding general public debt | 41 |

| III.2 | Government bonds activities | 42 |

| III.3 | Derivatives portfolio management | 65 |

| III.4 | Debt management results in relation to objectives | 67 |

| III.5 | The Treasury’s cash management | 80 |

| MINISTRY OF ECONOMY AND FINANCE | I |

INDEX OF TABLES

| Table I.1: | Domestic government securities | 3 |

| Table I.2: | Objectives for the end of 2021: percentage composition of the debt portfolio | 4 |

| Table III.1: | Maturities and coverage of the state sector’s requirement (eur million) | 43 |

| Table III.2: | Government bonds issued net of exchange operations (eur million) | 43 |

| Table III.3: | Geographical distribution of awards in syndicated placements of nominal btp in 2021 | 49 |

| Table III.4: | Distribution by investor category of awards in syndicated placements of nominal btp in 2021 | 50 |

| Table III.5: | Summary of exchange operations (nominal amounts in eur million) | 64 |

| Table III.6: | Summary of repurchased from the cash account (nominal amounts in eur million) | 65 |

| Table III.7: | Composition of 2019-2021 issues, in absolute (EUR million) and percentage terms (including exchanges)* | 69 |

| Table III.8: | Average life of the stock of government securities | 71 |

| Table III.9: | Duration and arp trend during the 2019-2021 period, relating to the stock of government securities before derivatives (in years) | 72 |

| Table III.10: | Duration and arp trend during the 2019-2021 period, relating to the stock of government securities after derivatives (in years) | 73 |

| Table III.11: | Derivatives portfolio – years 2020-2021 (eur million) | 74 |

| Table III.12: | Duration and arp trend during the 2020-2021 period, relating to the stock of government securities before derivatives (in years) | 80 |

| Table III.13: | Duration and arp trend during the 2020-2021 period, relating to the stock of government securities after derivatives and european loans (in years) | 80 |

| Table III.14: | Cash account and investments of the Treasury’s liquidity at the end of each month - 2021 (eur million) | 84 |

| II | MINISTRY OF ECONOMY AND FINANCE |

INDEX OF CHARTS AND GRAPHIC FIGURES

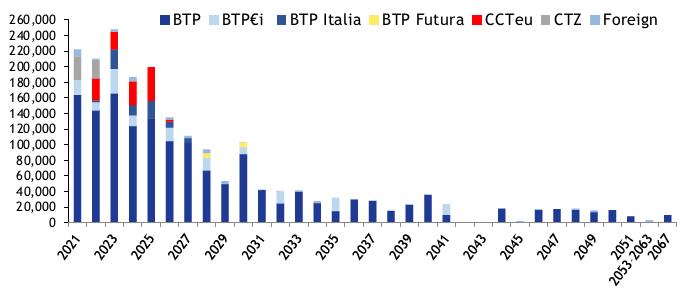

| Chart I.1 | Annual maturity profile of medium/long-term securities outstanding as at 31.12.2020 (eur million) | 7 |

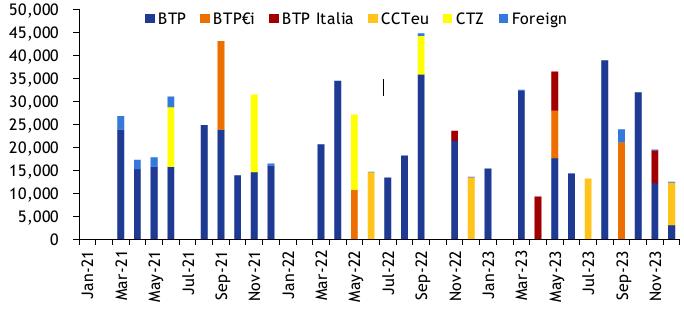

| Chart I.2: | Monthly maturity profile of medium/long-term securities outstanding as at 31.12.2020 (eur million) | 8 |

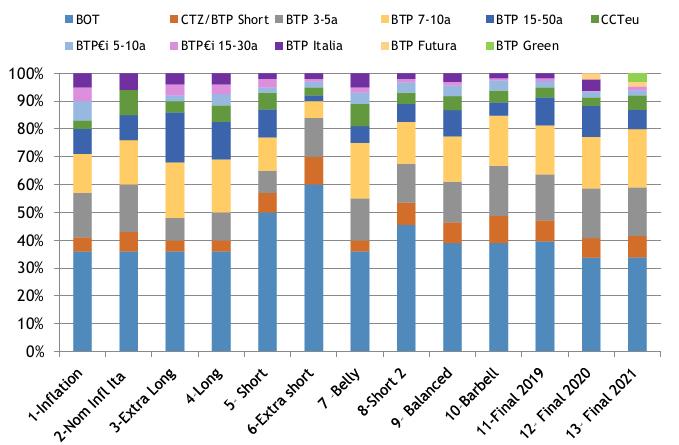

| Chart I.3: | Composition of the alternative issuance portfolios analysed for 2021 (eur million) | 10 |

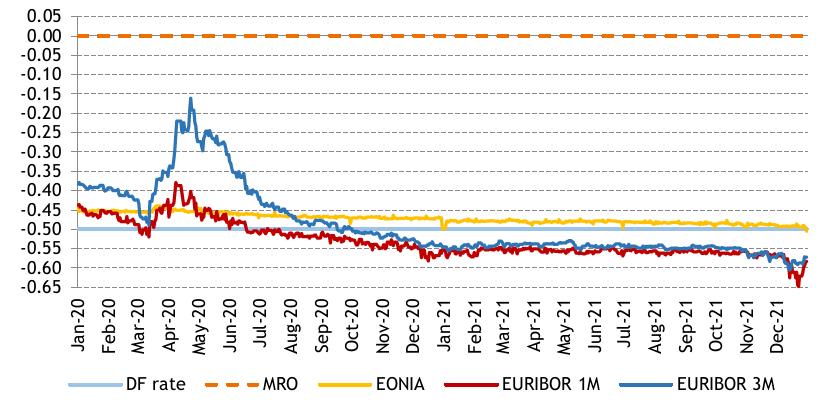

| Chart II.1: | Performance of the main money market rates, 2020 - 2021 (percentage values) | 18 |

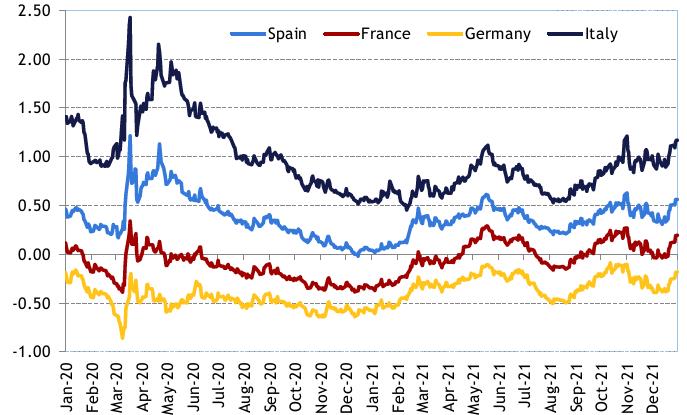

| Chart II.2: | Trend of european government bond yields - 10-year maturity (percentage values) | 20 |

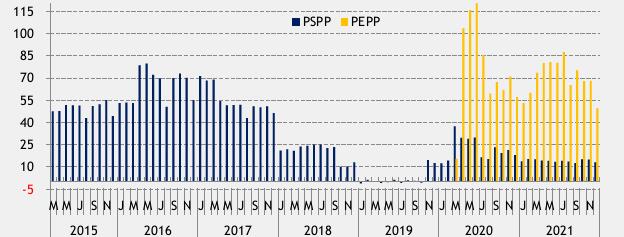

| Figure 1: | Monthly net purchases under the pspp and pepp programmes (eur billion) | 21 |

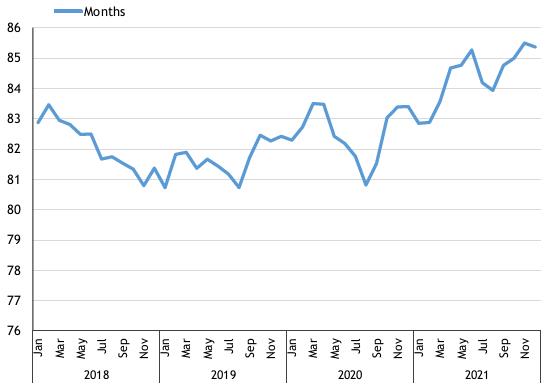

| Figure 2: | Volume (eur billion) and average life (years) of the stock of italian government securities purchased by the ecb under the pspp programme | 22 |

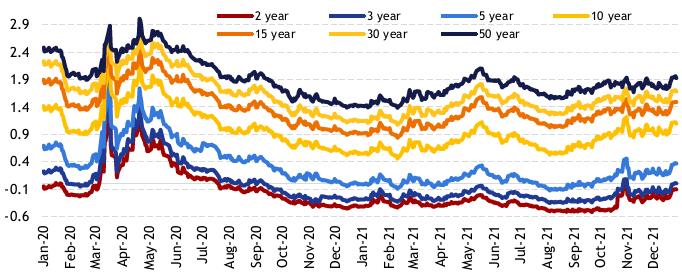

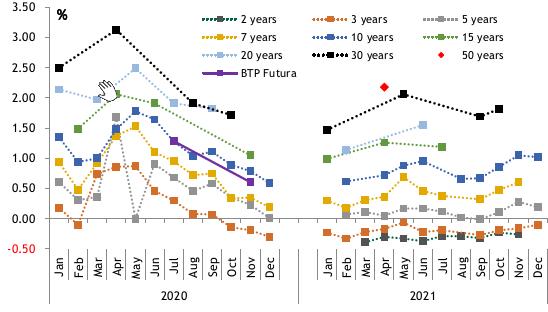

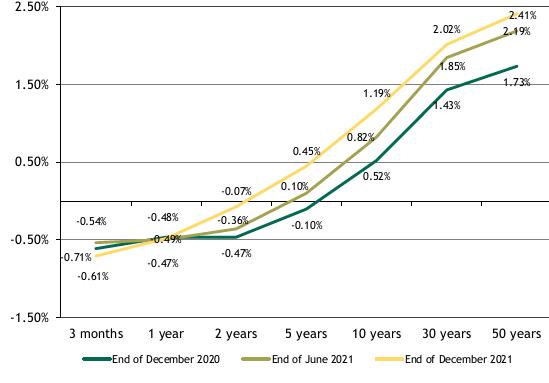

| Chart II.3: | Market yields on government securities with 2 to 50-year maturities (percentage values) | 23 |

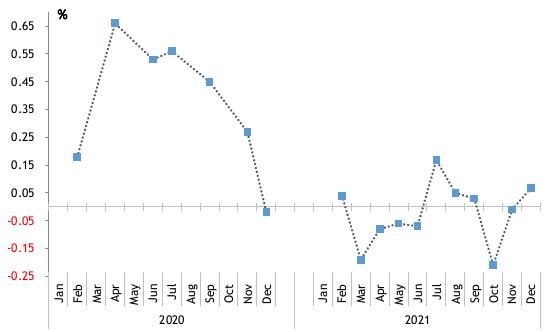

| Chart II.4: | Government securities yield spread, 10-year vs. 2-year (basis points) | 24 |

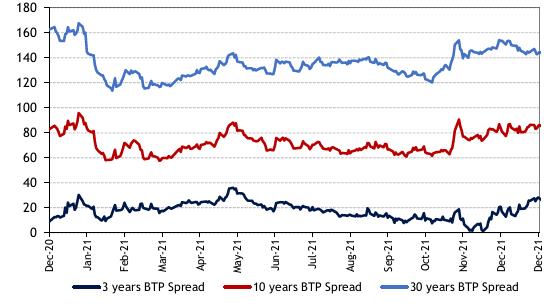

| Chart II.5: | Government securities yield spread, 30-year vs. 10-year (basis points) | 25 |

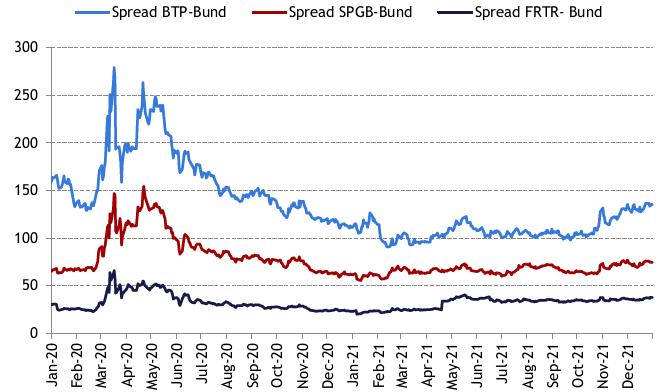

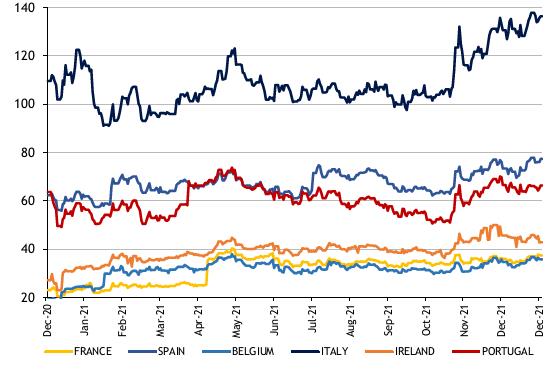

| Chart II.6: | Yield spread: btp-bund, oat-bund bonos-bund and oat-bund, 10-year benchmark (basis points) | 25 |

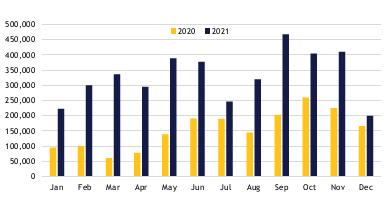

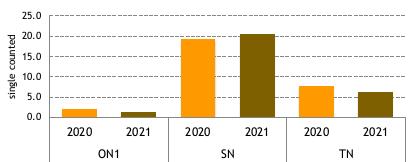

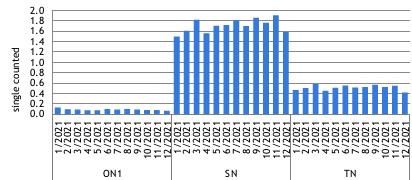

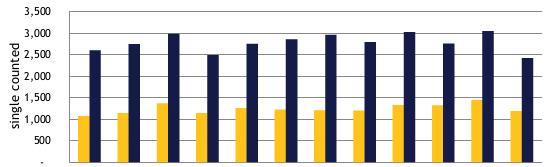

| Chart II.7: | Monthly volumes traded on the mts platform (eur million; single-counted) | 27 |

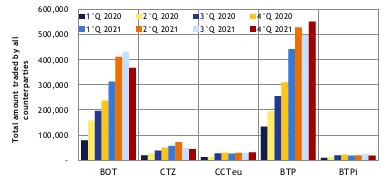

| Chart II.8: | Quarterly volumes traded on the mts platform, by segment (eur million; single- counted) | 28 |

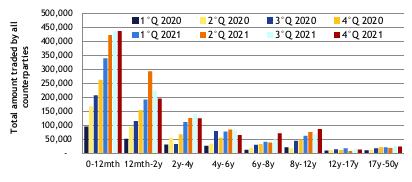

| Chart II.9: | Quarterly volumes traded on the mts platform, by maturity (eur million; single- counted) | 28 |

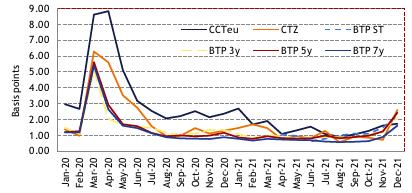

| Chart II.10a: | Bid-ask spread (in basis points) for ctzs, ccteus, 3-, 5- and 7-year benchmark btps, as recorded on the mts platform - monthly averages | 29 |

| Chart II.10b: | Bid-ask spread (in basis points) for 10-, 15-, 20-, 30- and 50-year benchmark btps, as recorded on the mts platform - monthly averages | 29 |

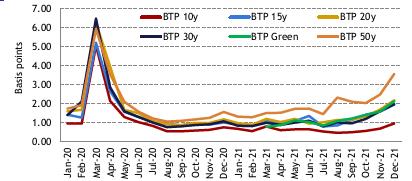

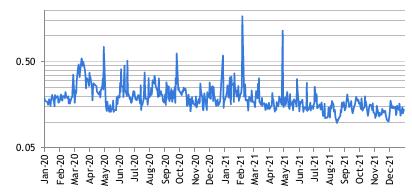

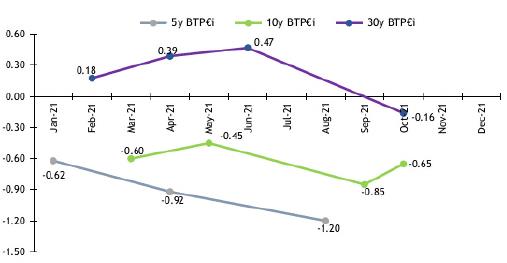

| Chart II.10c: | Bid-ask spread (in basis points) for 5- and 10-year benchmark btp€is, as recorded on the mts platform - monthly averages | 30 |

| Chart II.10d: | Daily slope on 10-year benchmark btp (logarithmic scale), as recorded on the mts platform | 31 |

| Chart II.11: | Annual volumes traded on the mts platform in 2020 and 2021, by contract maturity (eur million) | 32 |

| Chart II.12: | Monthly volumes traded on the mts platform in 2021, by contract maturity (eur million) | 32 |

| Chart II.13: | Monthly special repo volumes traded on the mts platform (eur million) | 33 |

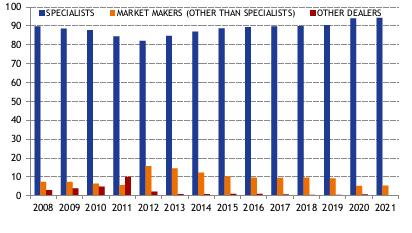

| Chart II.14: | Annual volumes traded by specialists on the mts platform (%) | 34 |

| MINISTRY OF ECONOMY AND FINANCE | III |

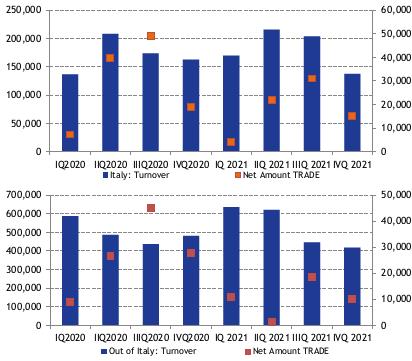

| Chart II.15: | Monthly volumes traded by specialists on platforms other than mts (eur million) | 35 |

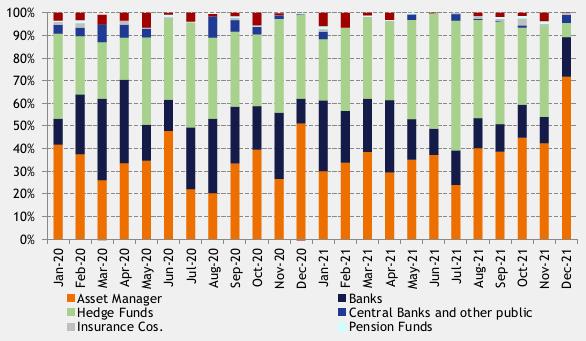

| Chart II.16: | Quarterly volumes traded by specialists by type of counterparty - fund managers, banks, pension and insurance funds, hedge funds (eur million) | 36 |

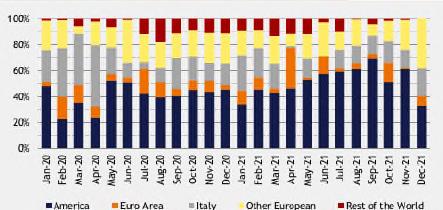

| Chart II.17: | Quarterly volumes traded by specialists according to counterparty residence (eur million) | 37 |

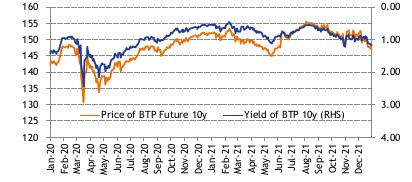

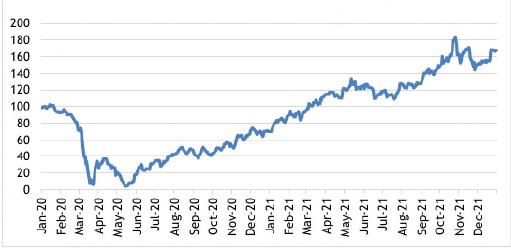

| Chart II.18: | Prices of the btp futura and yield of the 10-year benchmark btp (right-hand scale inverted, in %) | 38 |

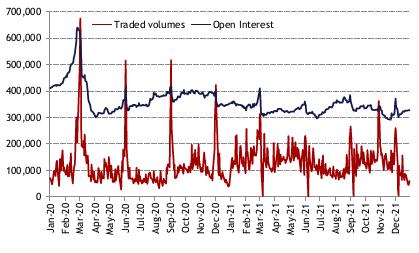

| Chart II.19: | Volumes of lots traded and open interest for the 10-year btp futura contract traded on the eurex market | 39 |

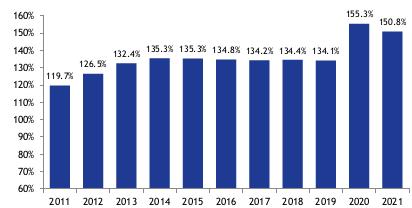

| Chart III.1: | 2011-2022 Evolution of the debt-to-gdp ratio | 41 |

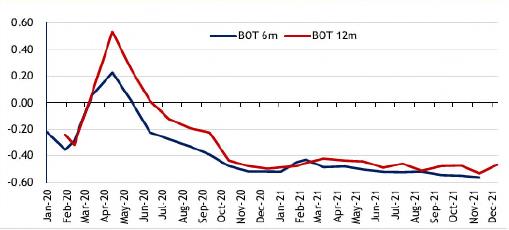

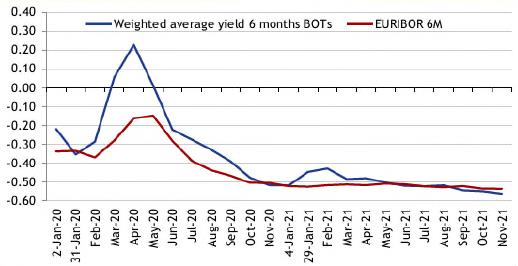

| Chart III.2: | Gross compound yields on issuance of 6- and 12-month bots, 2020-2021 (expressed in percentage points) | 46 |

| Chart III.3: | Yield at issuance of 6-month bots and comparison with euribor rate - years 2020-21 (expressed in percentage points) | 46 |

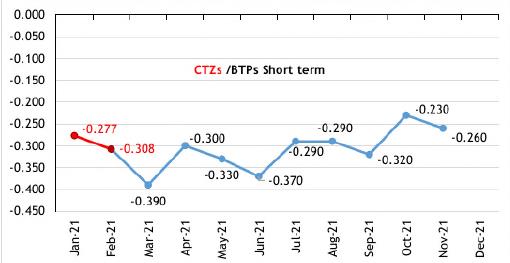

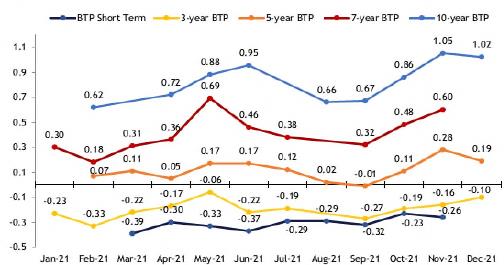

| Chart III.4: | CTZ and BTP short term yields at issuance (expressed in percentage rates) in 2021 | 48 |

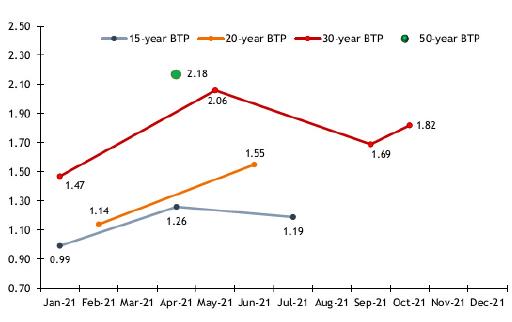

| Chart III.5: | Yields at issuance of long-term btps in 2021 (expressed in percentage points) | 51 |

| Chart III.6: | Yields at issuance of btps with 3-10 year maturities in 2021 (in percentage points) | 54 |

| Figure 3: | Breakdown by type of counterparty of orders placed in nominal btp auctions by specialists in government bonds - year 2021 | 55 |

| Figure 4: | Breakdown by geographical area of orders placed in nominal btp auctions by specialists in government bonds - year 2021 | 55 |

| Chart III.7: | Break even inflation (bei) a 10 anni 2020-2021 (espressa in punti base) | 57 |

| Chart III.8: | 10-Year break-even inflation (bei) 2020-2021 (expressed in basis points) | 58 |

| Chart III.9: | Yields on the issue of ccteus in 2020 (expressed in percentage points) | 61 |

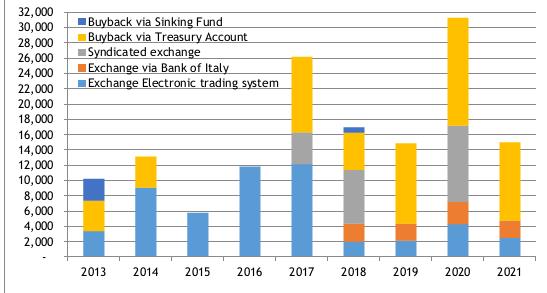

| Chart III.10: | Amount repurchased in extraordinary operations - years 2013-2021 (nominal amounts in eur million) | 63 |

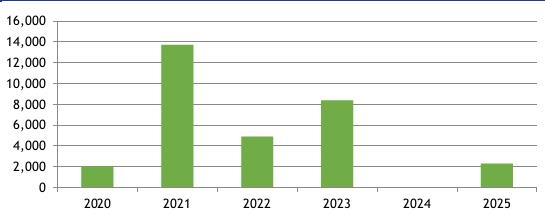

| Chart III.11: | Distribution of government bonds repurchased in extraordinary operations carried out in 2021 (nominal amounts in eur million) | 65 |

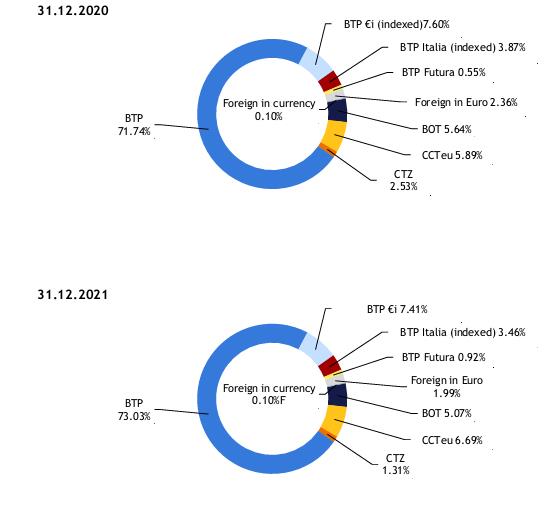

| Chart III.12: | Composition of the stock of government securities as of 31 december 2020 and 31 december 2021 | 70 |

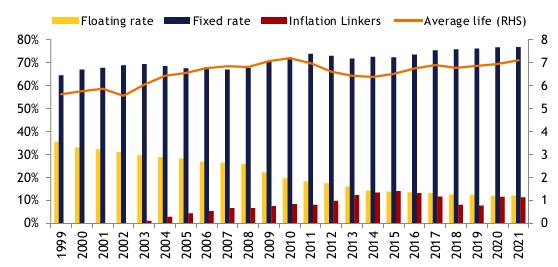

| Chart III.13: | Evolution of the structure and average life of debt (in years) | 71 |

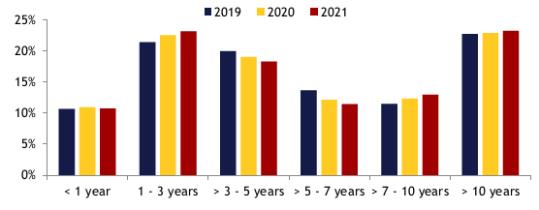

| Chart III.14: | Maturities by residual life, 2019-2021 | 72 |

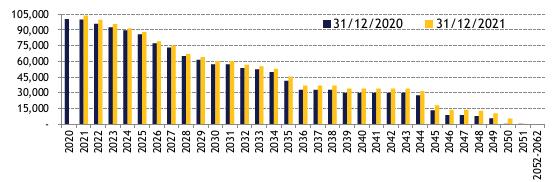

| Chart III.15: | Comparison between the prospective trend of the notional amount for the existing derivatives portfolio, as at 31/12/2020 and 31/12/2021, respectively, assuming that all swaptions are exercised (eur million) | 75 |

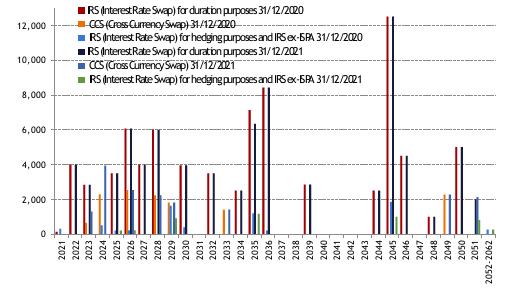

| Chart III.16: | Comparison between the maturity structure of the existing derivatives portfolio, as at 31/12/2020 and 31/12/2021, respectively, assuming that all swaptions are exercised (eur million) | 76 |

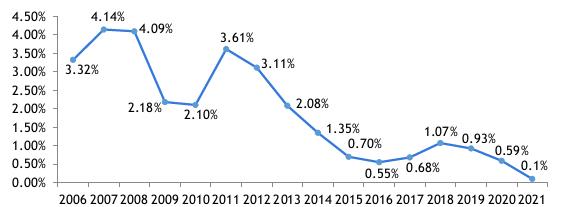

| Chart III.17: | Average cost at issuance of government securities - 2006-2021 (Percentage points) | 76 |

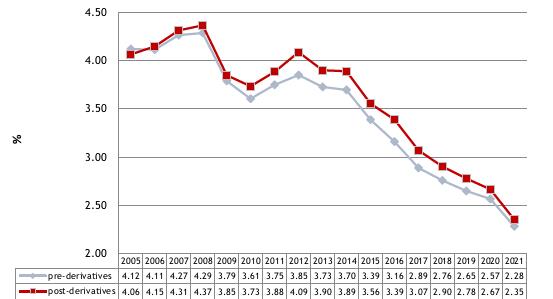

| Chart III.18: | Average cost of the stock of government securities, before and after derivatives - 2005-2021 (Percentage points) | 77 |

| IV | MINISTRY OF ECONOMY AND FINANCE |

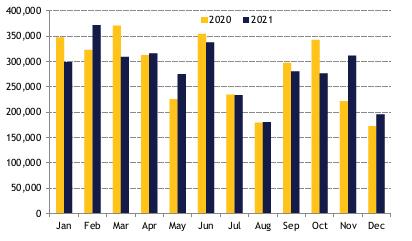

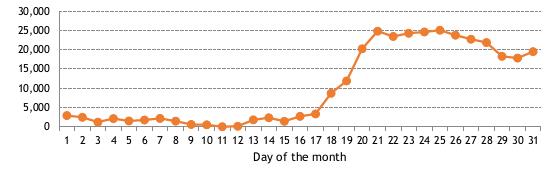

| Chart III.19: | Average intra-monthly changes in the Treasury’s available cash - differences compared with the monthly minimum - 2021 (eur million) | 82 |

| Chart III.20: | Difference between monthly maximum and minimum Treasury’s cash account – 2020 and 2021 (eur million) | 83 |

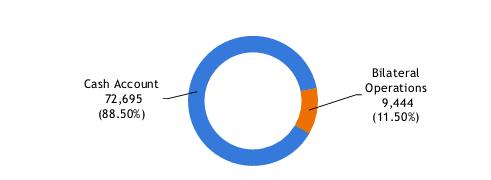

| Chart III.21: | Breakdown of the Treasury liquidity - average values for 2021 (eur million) | 84 |

| MINISTRY OF ECONOMY AND FINANCE | V |

| MINISTRY OF ECONOMY AND FINANCE | VI |

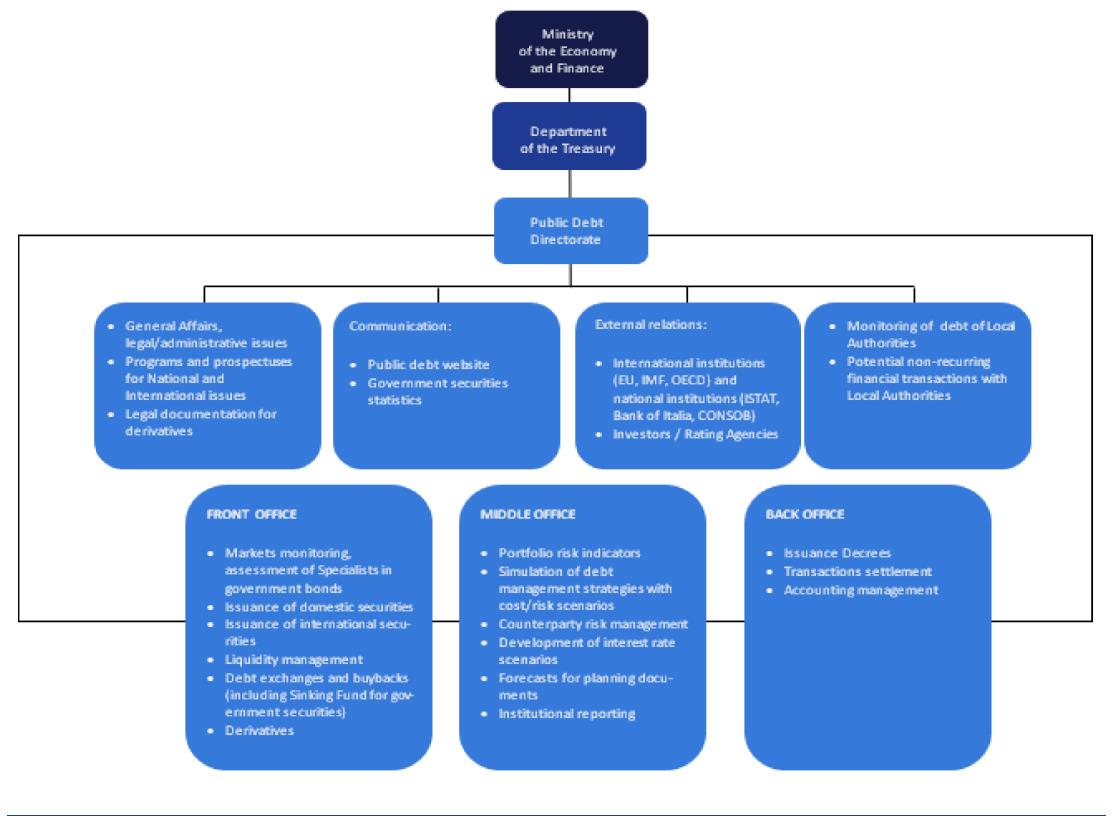

FOREWORD

The eight edition of the 2021 Annual Report on Italian Public Debt Management was slightly modified in its form and content. These changes do not alter the core structure of the Report, but merely make it easier to read. The document is also supplemented by the information available on the Public Debt section of the MEF Department of the Treasury website (www.dt.mef.gov.it/en/debito_pubblico/), which is regularly updated.

First of all, the Report was divided into two parts, leaving in-depth studies and statistical data in a separate section. The latter were primarily displayed in chart form, so that the main trends could be more immediately perceived. Please refer to the relevant pages available on the website for the underlying data.

With regard to contents, the objective was to focus on the newest and most peculiar aspects of debt management - largely determined by the absolutely exceptional market conditions experienced over the last two years - which also entailed a redefinition of the organisational structure to better meet the institutional objectives of a large issuer such as the Italian one.

Hopefully, this Report has become increasingly accessible also to less experienced readers who are rightfully interested in the evolution of Italy’s public debt management, a phenomenon that, if only due to its size, directly or indirectly has a significant influence on national economic performance.

| MINISTRY OF ECONOMY AND FINANCE | VII |

| VIII | MINISTRY OF ECONOMY AND FINANCE |

| I. | DEBT MANAGEMENT OBJECTIVES FOR 2021 |

| I.1 | THE OBJECTIVES AND RISKS OF INTERNATIONAL DEBT MANAGEMENT PRACTICES |

The Italian Treasury’s public debt management has always been in line with international best practices and fully complies with the recommendations of the main multilateral financial institutions as well as with the approaches adopted by other Debt Management Offices (DMOs) in advanced countries.

The main types of risk faced by DMOs refer to market risk, which includes interest rate risk and exchange rate risk, refinancing risk, liquidity risk and credit risk, in addition to the operational risk. Many of these risks involve, albeit in different ways, an unexpected increase in the cost of debt that could jeopardise debt sustainability.

International best practices recommend avoiding public debt portfolio structures that are too heavily weighted towards short-term and floating-rate instruments. Such structures may increase a country’s economic and financial vulnerability1.

In fact, despite reducing interest expenditure in the short term, these structures make it more volatile, while they also increase the market refinancing risk and interest rate risk inherent in the debt portfolio and, consequently, in the government budget2. On the other hand, under normal financial market conditions and regardless of the issuer’s creditworthiness, interest expenditure is higher for longer-term maturities, although longer maturities offer the benefit of effectively reducing the refinancing risk and interest rate risk.

However, DMOs are required to pursue both objectives: reducing the cost of debt at the same time as curbing market risks. Therefore, in practice, public debt managers must forego maximising both of these objectives and must instead focus on managing their relative trade-off.

__

1 Considerations in this regard can be found in the Guide to the Debt Management Performance Assessment (DeMPA) Tool, World Bank 2009

2 However, it should be noted that this risk assessment approach may only be considered optimal if focusing exclusively on government liabilities (and therefore on debt). Indeed, a different and broader point of view could also include government assets. Under this approach, debt management could thus aim to achieve a liability structure consistent with the risks inherent to assets (following a so-called “ALM”–“Asset Liability Management” approach). This may lead to choices that - in principle - could differ even quite significantly from those made by taking into account the debt composition alone. However, many countries, including Italy, have come across significant hurdles in implementing such an approach, due to both the practical difficulty of calculating the financial risk exposure of the government’s substantial assets - especially non-financial assets - and, in many cases, the fact that there is incomplete knowledge of the size and characteristics of said assets. Further information can be found in the World Bank Policy Research Working Paper How Do Countries Use an Asset and Liability Management Approach? A Survey on Sovereign Balance Sheet Management.

| MINISTRY OF ECONOMY AND FINANCE | 1 |

In other words, out of all the feasible options, they must select the cost-risk combination deemed satisfactory3 in relation to both portfolio characteristics and overall strategies. This trade-off is therefore not the same for all DMOs, and is therefore handled differently by public debt managers in each country, based on its specific characteristics, starting with its size in relation to the national economic system, its portfolio of instruments, its reference market and the fiscal policies pursued. Italy has taken a particularly prudent approach to this trade-off due to the size of its debt (among the highest in the world in absolute terms); this approach results in an idiosyncratic additional cost that does not allow for opportunistic tactics, but rather pushes for continuity, predictability and long-term strategies.

It goes without saying that the DMO’s task of minimising the cost of debt while maintaining an acceptable level of risk cannot be deemed to have been completed upon each issuance and in relation to the market conditions at the time of placement. Indeed, the structure of public debt, consisting of a wide and diversified portfolio of financial instruments with different characteristics and maturities, requires continuous, dynamic management even after issuance, conducted with suitable instruments and in line with market developments.

| I.2 | 2021 OBJECTIVES: THE INSTITUTIONAL FRAMEWORK OF REFERENCE |

Public debt is made up of the total liabilities of the general government sector, divided into the subsectors of central government, territorial entities and public social security institutions. More than 80% of public debt is constituted by government securities issued by the Treasury on both the domestic and foreign markets.

As was also the case in previous years4, this Report refers to outstanding government securities, which are subject to the special legislation represented by Italy’s “Consolidated Law on Public Debt” (TUDP)5, whose main characteristics are summarised in Table I.1.

__

3 In this regard, the International Monetary Fund and World Bank guidelines note that “Minimizing cost, while ignoring risk, should not be an objective. Operations that appear to lower debt servicing costs often embody significant risks for the government and can limit its capacity to repay lenders. Managing cost and risk therefore involves a trade-off”.

4 All editions of the Annual Public Debt Report can be found at:

www.dt.mef.gov.it/en/debito_pubblico/presentazioni_studi_relazioni/

5 Consolidated Text of Legislative and Regulatory Provisions on Public Debt (Italian Presidential Decree No.

398 of 30 December 2003).

| 2 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2021 | |

| TABLE I.1: DOMESTIC GOVERNMENT SECURITIES |

| | BOT | CTZ | CCTeu | BTP | BTP€i | BTP Italia | BTP Futura | BTP Green |

| | Treasury Bills | Zero- Coupon Treasury Bonds | Treasury Credit Certificates | Long-term Treasury Bonds | Long-term Treasury Bonds indexed to European inflation | Long-term Treasury Bonds indexed to Italian inflation | Long-term Treasury

Bonds step-up | Long-term Treasury Bonds for financing expenditure with a positive environment al impact. |

| Maturity | 3, 6, 12 months and less than 12 months (flexible BOTs) | 24 months | 5, 7 years | Short Term, 3, 5,

7, 10, 15, 20, 30 and 50 years | 5, 10, 15 and 30 years | 4, 6, 8 years | 8, 10 and 12 years a) | Over 10

years |

| Remuneration | Issue discount | Issue discount | Half-yearly variable coupons indexed to the 6- month Euribor, possible issue discount | Half-yearly fixed coupons, possible issue discount | Half-yearly coupons indexed to European inflation (HICP index net of tobacco), possible issue discount and revaluation of principal at maturity | Half-yearly coupons indexed to Italian inflation

(“FOI” index net of tobacco), half- yearly revaluation of principal and loyalty premium b) at maturity | Half-yearly coupons with step-up mechanism with increasing yields and loyalty premium c) indexed to the average growth of Italian GDP during the life of the bond | Half-yearly fixed coupons, possible issue discount |

Issuance procedure d) | Competitive, yield- based auction | Marginal auction with discretio nary determin ation of the price and quantity issued | Marginal auction with discretiona ry determinati on of the price and quantity issued | Marginal auction

e) with discretionary determination of the price and quantity issued | Marginal auction e) with discretionary determinati on of the price and quantity issued | Through the MOT (Borsa Italiana), the electronic market dedicated to retail trading | Through the MOT (Borsa Italiana), the electronic market dedicated to retail trading | Placement syndicate (or marginal auction, with discretionary determinatio n of price and quantity issued) |

| Issuance frequency | Monthly | Monthly | Monthly | Monthly and based on market conditions for 15- and 30-year BTPs | Monthly | Once/twice a year, based on market conditions | Once/twice a year, based on market conditions | Flexible |

a) Additionally, a BTP Futura bond with a maturity at issuance of 16 years was emitted in 2021. b) For individual savers and similar investors who purchase the security at issuance during the first phase of the placement period. c) For individual savers and similar investors, to whom the BTP Futura bond is reserved, who purchased the bond during the placement period and held it until maturity. d) As of 2020, reopenings of securities destined only to Primary dealers have also been introduced. e) The first tranches of new long-term BTPs (over 10 years) or BTP€is may be offered on the market through placement syndicate. | |

The part of public debt represented by government securities was managed in accordance with: (i) the Italian Ministry of Economy and Finance’s general Directive

| MINISTRY OF ECONOMY AND FINANCE | 3 |

for administrative procedures and management for 20216, and (ii) the “Framework Decree” for 20217, which defined the reference objectives for administrative action regarding financial operations for the management of public debt. The provisions contained in these decrees were then converted into the operational “Public debt management guidelines” for 20218 (hereinafter, “Guidelines”).

The general Directive identified as a strategic objective the effective and efficient management of public debt, focusing on containing its cost and extending or stabilising its average life.

As was the case in previous years, the Framework Decree for 2021, provided guidance for the work of the Public Debt Directorate as well as a number of specific objectives. In particular, Art. 2 states that debt should be “in accordance with the limit established annually by the law approving the State budget”, equal to the amount to cover the securities maturing during the year and the Central Government’s borrowing requirements, being sure to “...reconcile the need to meet market demand with that of containing the overall borrowing cost in a medium-long term horizon, having considered the need to protect against the refinancing risk and exposure to interest rate fluctuations”.

The same article also identified the limits to be respected in terms of the percentage composition of debt at the end of 2021, broken down as follows:

| TABLE I.2: OBJECTIVES FOR THE END OF 2021: PERCENTAGE COMPOSITION OF THE DEBT PORTFOLIO |

| Type of security | Min. | Max. | Differences compared to 2020 |

| BOT (short-term) | 3% | 8% | -- |

| BTP (fixed-rate, nominal) | 65% | 78% | -- |

| CCTeu | 4% | 10% | -- |

| CTZ | -- | 4% | -- |

| BTP€i and BTP Italia (“real” securities) | -- | 15% | -- |

| Securities issued on foreign markets | -- | 5% | -- |

| Source: Framework Decree for 2021 |

In order to pursue the objectives of “curbing the overall debt cost, protecting against market risks and refinancing risks and ensuring the proper functioning of the secondary market for government securities”, Art. 3 authorises the use of public debt management operations9 also through derivative financial instruments, exchanges or repurchase of government securities.

In order to mitigate the credit risk stemming from derivatives, Art. 4 requires counterparties to have a high level of creditworthiness, according to the rating

__

6 For the Italian version of the General Directive for administrative action and management of the Italian Ministry of Economy and Finance –Year 2021, see www.mef.gov.it/ministero/oiv/direttiva_generale.html.

7 Guidelines for the implementation of financial operations (Framework Decree) for 2021: (www.dt.mef.gov.it/export/sites/sitodt/modules/documenti_en/debito_pubblico/normativa_spalla_destra/2021_Framework_Decree_-_Directives_for_conducting_financial_transactions_xD_M_30.12.2020x.pdf).

8 Guidelines for public debt management for 2021: (www.dt.mef.gov.it/export/sites/sitodt/modules/documenti_en/debito_pubblico/presentazioni_studi_relazioni/Guidelines_for_public_debt_management_2021.pdf).

9 Art. 3 of the “TUDP”(Italian Consolidated Law on Public Debt) authorises the use of operations on a consensual basis that restructure certain features of the existing debt portfolio.

| 4 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2021 | |

given by the main rating agencies, also providing for possible agreements with the counterparties for mutual guarantees (collateralisation)10.

Lastly, Art. 6 states that the aim of cash account management11 must be “the efficient movement of cash balances, in relation to the government securities issuance, prevailing market conditions and the constraints imposed by monetary policy provisions”. To this end, this year saw the introduction of repurchase agreements (REPOs) on specifically issued tranches of government securities.

Debt management was given the objective of stabilising the structure of the government securities portfolio at the end of 2021, with no deviation from what was planned for 2020. The aim remained, therefore, to consolidate the results achieved in recent years in terms of exposure to interest rate and refinancing risk, taking advantage of a market environment which, albeit still fragile, has improved since the acute phase of the pandemic12.

Based on the outstanding securities portfolio at the end of 2020, EUR 222 billion worth of securities were scheduled to mature in 2021 (excluding BOTs), of which EUR 9.3 billion referring to the foreign programme, a slightly higher amount than the approximately EUR 202 billion worth of medium/long-term securities outstanding at the end of 2019, maturing in 2020.

In the 2021 Guidelines, the Central Government cash needs were expected to be around EUR 145 billion, a level slightly below that of 2020, to be covered not only by the national issuance programme, but also by the European resources made available by means of loans from both the SURE programme and the Recovery and Resiliency Facility package under the Next Generation EU programme. It was therefore expected that the total volume of government securities offered to the market in 2021 could be maintained at a lower level than in the previous year.

In particular, in the abovementioned document the Treasury pursued the following objectives:

| 1) | the meeting of borrowing requirements at costs as aligned as possible with market trends; |

| 2) | the consolidation of the results already achieved in terms of exposure to the main risks, in particular the interest rate risk and refinancing risk; |

| 3) | the gradual improvement in liquidity conditions on the secondary market; |

| 4) | the efficient management of the Treasury’s cash, also through a greater diversification of the instruments available. |

The Treasury’s strategy was therefore set to develop along the following lines:

| 1) | ensure predictable and regular issues for all the main segments of domestic securities; |

| 2) | adjust the volumes offered to the market in order to give greater weighting to sectors with better liquidity on the secondary market and greater depth of demand; |

__

10 For more information about these mutual guarantee agreements, please see Chap. III.3 “Derivatives portfolio management”.

11 Regulations regarding the Treasury’s cash movements and the selection of the counterparties participating in the relative operations are based on the Italian Ministerial Decree dated 10 January 2022.

12 The evolution of the average life of the stock of government securities is detailed in the following paragraphs.

| MINISTRY OF ECONOMY AND FINANCE | 5 |

| 3) | use liability management tools (such as exchanges and repurchases), in line with the approach followed in recent years, with a frequency and intensity in line with market trends, with the aim of reducing dislocations on specific securities, improving liquidity on the secondary market, managing the redemption profile for future years and managing the redemption profile of future years, and helping to reduce the average cost of outstanding debt; |

| 4) | diversify the investor base also through foreign currency issues in Global format as well as EMTNs, with particular regard to issues in US dollars; continue the dedicated offering to retail investors, aimed at expanding their direct participation in public debt financing; |

| 5) | put in place all organisational and market interventions necessary to start the issuance of “green” government securities, introduced into domestic law by the Budget Law for 2020 (Italian Law No. 160 of 27 December 2019); |

| 6) | introduce the BTP Short Term, a new nominal bond with a coupon and maturity between 18 and 30 months, replacing CTZs. |

| I.3 | CURBING THE COST OF DEBT WHILE PAYING ATTENTION TO THE COST/RISK PROFILE |

The cost-risk trade-off: Italy’s specific features

As in previous years, public debt management in Italy focuses on containing two main risks: the interest rate risk, by minimising the impact on interest expenditure13 caused by fluctuations of the interest rates at which the debt is placed; and the refinancing risk, by distributing the maturities of securities more evenly over time in order to facilitate new issues.

When it comes to these risks, the Treasury’s objectives are in line with the practices followed by other DMOs. However, in Italy’s case, the management of a particularly high debt makes it necessary to pay greater attention to the credit risk premium requested by investors, based on the perceived sustainability of the debt, which becomes a significant component of the interest rate level at the issuance for Italian government securities.

Another aspect to be considered in the management of the Italian state budget concerns the stability and predictability of interest expenditure, which allows to avoid the need to increase taxation should government-security yields be affected by possible shocks and makes it easier to manage public finance commitments stemming from European requirements, mainly based on deficit control and debt dynamics.

The two aforementioned aspects therefore significantly contribute to guiding Italy’s debt management strategy with regard to keeping refinancing and interest rate risks under control.

__

13 In order to manage public finances correctly, it is necessary, where possible, to reduce costs and to plan outgoings with as much certainty as possible. This avoids unwanted and unexpected increases in the deficit and/or fiscal pressure, perhaps also significantly and in a short amount of time, as a result of costs or expenses not being duly planned for. Correct management of public finances therefore guarantees a framework of financial stability, which in turn allows for effective debt management.

| 6 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2021 | |

Refinancing risk metrics and management tools

The average life of the stock of government securities is the best-known benchmark metric used to measure refinancing risk: this is calculated as the average of the maturities of all outstanding securities, weighted according to the nominal value14 of each security. At the end of 2020, the average life of government securities stood at 6.95 years, up from end-2019 level.

Below is the annual distribution of maturities from the end of 2020 (Chart I.1) and, in detail, the monthly distribution up to and including 2023 (Chart I.2).

In 2021, the reshaping of the maturity profile was aimed not only at guaranteeing the effective management of refinancing risk by reducing expected redemptions, especially during the course of the year and in 2022, but also at cutting the average cost paid by the Treasury on the stock of debt, by decreasing the outstanding amount of high-coupon securities. The Treasury also aimed to withdraw from the market shares of the last outstanding CTZs and variable-coupon securities, a market segment that, in recent years, had been particularly exposed to tensions in the financial markets.

| CHART I.1: ANNUAL MATURITY PROFILE OF MEDIUM/LONG-TERM SECURITIES OUTSTANDING AS AT 31.12.2020 (EUR MILLION) |

|

| Source: MEF |

__

14 For “nominal value”, the definition adopted in EC Regulation no. 479/2009 of 25 May 2009 is used: “...The nominal value of a liability outstanding at the end of the year is the face value. The nominal value of an index- linked liability corresponds to its face value adjusted by the index-related change in the value of the principal accrued to the end of the year. [...] Liabilities denominated in a foreign currency shall be converted into the national currency on the basis of the representative market exchange rate prevailing on the last working day of each year. Liabilities denominated in a foreign currency and exchanged through contractual agreements to the national currency shall be converted into the national currency at the rate agreed on in those contacts”.

| MINISTRY OF ECONOMY AND FINANCE | 7 |

| CHART I.2: MONTHLY MATURITY PROFILE OF MEDIUM/LONG-TERM SECURITIES OUTSTANDING AS AT 31.12.2020 (EUR MILLION) |

|

| Source: MEF |

Interest rate risk metrics and the SAPE model and software used by the Italian Treasury

The three main indicators used to quantify the interest rate risk are (i) financial duration, equal to the weighted average payment time for both principal and interest; (ii) the average refixing period, i.e. the average time taken by the debt portfolio to “integrate” market interest rate changes, and, lastly, (iii) Cost-at-Risk, which quantifies the maximum additional cost in terms of interest expenditure in the event of adverse interest rate scenarios, along with the probability of actually having to bear this additional cost, deriving in turn from the probability that these adverse scenarios shall occur15. Cost-at-Risk (CaR) analysis is therefore used to identify, with a given probability, an expected cost level that may not be exceeded, as well as all the compositions of the securities issuances whose cost-risk combinations are classed as being efficient, i.e. are such as to become dominant - for a given level of cost or risk - over any other hypothetical composition of the issuance portfolio.

In this way, it is possible to test the characteristics of a series of hypothetical issuance portfolios, estimating both the cost in terms of interest expenditure and the interest rate risk (measured in terms of Cost-at-Risk) for each over a given amount of time in the future, calculated with different possible scenarios as to how the interest and inflation rates will evolve.

From a technical point of view, the tool used for this analysis is an in-house developed model which the Public Debt Directorate has been using for a number of

__

15 Please see the focus point on “The main quantitative indicators of interest rate risk” on page 22 of the 2014 Annual Public Debt Report, available at the address already provided in note 8 of this Chapter.

| 8 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2021 | |

years, called “SAPE” (Software di Analisi dei Portafogli di Emissione - Issuance Portfolio Analysis Software)16.

The outstanding debt database used by SAPE at the end of 2020 was made up of domestic securities, derivatives and securities in USD. With regard to the latter, the Treasury’s policy is to issue any securities in a foreign currency at generally better (or at least equal) cost conditions17 than those available for equivalent domestic instruments. Therefore, when estimating the refinancing costs of future redemptions for securities in USD, data on domestic securities were used, with no new derivative operations expected to manage the rate risk.

The role of the issuance strategy in managing the interest rate risk-cost trade-off in 2021

For debt management, especially of a large amount, it is essential to identify a cost-risk combination that minimises costs without increasing risk. This may also be interpreted as promoting a medium- and long-term perspective, which not only reduces present costs as much as possible, but also aims at creating the conditions for a lasting and gradual reduction in borrowing costs (which also depend on investors’ perception of credit risk).

For this reason, improvements in refinancing and interest rate risk metrics should always be evaluated by also taking into account the higher costs involved with this strategy. In fact, as already mentioned, the market demands higher remuneration for securities with longer maturities. This trade-off must therefore be taken into consideration when planning the issuance portfolio, i.e. estimating the marginal cost required by the market to improve the aforementioned risk metrics.

To do this, the Public Debt Directorate conducted an analysis of the set of hypothetical issuance portfolios for domestic securities already identified when defining the Guidelines in previous years, assessing their actual feasibility and sensitivity to certain market elements.

As a precondition, said portfolios must make it possible to fund:

| 1) | the redemptions of medium- and long-term securities scheduled for 2021 (amounting to approximately EUR 222 billion); |

| 2) | outstanding BOTs (amounting to approximately EUR 121 billion), together with the so-called “BOT rollover” during the year, i.e. the BOT issues necessary to cover the redemptions of the BOTs issued in the same year; |

| 3) | Central Government cash requirements, which, at the time, were estimated to be around EUR 145 billion18; |

| 4) | as well as ensuring that the Treasury has sufficient liquidity available to cater for all cash needs. |

__

16 Models and software are constantly being updated. A detailed description of the implications and functioning of the model can be found in the recently published study available in English at the following link: www.dt.mef.gov.it/en/debito_pubblico/Public_Debt_Management_Network/ebook/.

Furthermore, a summary of the development of the model is included in Appendix 3 of the Report.

17 Including costs to hedge against exchange rate risks.

18 This figure formed the basis for public finance forecasts included in the 2021 Draft Budgetary Plan.

| MINISTRY OF ECONOMY AND FINANCE | 9 |

The portfolio initially used for the analysis reflected the composition of domestic issues in 2020, characterised in gross terms by around 34% of BOT issuances (almost equally divided between annual and 6-months maturities), 7% of CTZs, around 3% of CCTeus and over 6% of inflation-indexed securities (including BTP€i and BTP Italia). Nominal BTPs therefore represented just under 48% of the total, of which approximately 18% were represented by securities with the shortest durations (3 and 5 years), 18.5% by 7- and 10-year maturities and, lastly, just over 11% relating to the segment with the longest duration.

The following chart shows all the portfolios analysed:

| CHART I.3: COMPOSITION OF THE ALTERNATIVE ISSUANCE PORTFOLIOS ANALYSED FOR 2021 (EUR MILLION) |

|

| Source: MEF |

The results of the analysis confirmed the validity of a strategy in line with that of 2020 and with the portfolio implemented during the same year. Indeed, an analysis of the final 2021 portfolio shows how the Treasury opted for a composition of the issuance generally in line with that of the previous year, albeit with some differences. In particular, the issuance ratio of securities with maturities in the middle of the curve, between 7 and 10 years (equal to 21%), increased, while that of the segment with the longest duration fell to 7%. The share of indexed securities decreased, mainly due to a lack of BTP Italia issuances, while CCTeus grew to over 5%. Lastly, about 3% of the portfolio is represented by issues of the new BTP Green, the first government security connected to the sustainable finance market, launched by the Treasury in 2021.

| 10 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2021 | |

The role of derivative operations in managing the interest rate risk-cost trade-off for 2021

The Treasury has always carefully and constantly monitored the risks underlying its debt portfolio, identifying the main factors to which it is exposed from both a qualitative and a quantitative point of view. Any change occurring to the debt as a result of both new placements and the natural maturity of the securities is not incorporated passively into the portfolio; instead, active risk management is conducted in order to improve the portfolio’s risk profile. The Treasury therefore uses liability management tools to actively manage risks, such as interest rate, refinancing and exchange rate risk, alongside new issues and possibly also following them. To this end, like many other sovereign issuers, the Treasury uses derivative financial instruments, as well as exchange and repurchase operations.

In authorising the use of derivatives, the Framework Decree states that they should contribute to achieving the general management objectives of curbing overall borrowing costs, protecting against market risks and refinancing risks, as well as ensuring the proper functioning of the secondary market for government securities.

Derivative operations therefore have a variety of objectives, such as increasing the financial duration of debt, reducing exposure to unexpected and sudden interest rate fluctuations, and improving the cost-risk profile in the medium to long term. Hence, these instruments do not have a funding objective, but rather a risk containment objective. The guidelines in derivative activities remain consistent and in line with those of previous years: changes in the policies for managing liability management instruments may only be necessary due to changes in the composition of debt, the risks underlying the portfolio or the strategic objectives pursued. Despite the pandemic crisis and the resulting increase in the notional amount of securities issued, the composition or riskiness of debt has not been substantially affected.

In line with the 2021 Guidelines, the management of the derivatives portfolio would have taken into account two main aspects: (i) the availability of collateralisation agreements for the execution of new derivative positions and the conclusion of new collateralisation agreements for past operations, consistent with the State’ s cash resources (ii) the possibility of restructuring existing positions in the portfolio.

With regard to the first point, the process of entering into19 bilateral guarantee agreements (the so-called Credit Support Annex - CSA) for the new derivative operations was completed during 2019, with all government bond specialists. Moreover, over time the legal framework had already been supplemented with a system of bilateral guarantees on selected existing contracts, thus also supporting the management of existing positions with a limited number of counterparties, characterised by significant credit exposure to the Treasury.

Although the level of swap rates was rising, albeit still contained on a historical basis, the Treasury would consider both restructuring existing positions and

__

19 On this, see the 2018 and 2019 Public Debt Reports.

| MINISTRY OF ECONOMY AND FINANCE | 11 |

executing new derivative operations to both mitigate the exposure to interest rate risk and extend the overall duration of the debt, in line with the past.

In 2021, the management of the derivatives portfolio was thus set to focus on: (i) hedging market risks, such as exchange rate risk, for possible issuances in foreign currency, and interest rate risk; (ii) restructuring and/or concluding operations already in the derivatives portfolio; and (iii) managing collateral, through the collateralisation of additional existing derivative positions (subject to the availability of funds to be allocated to this project).

Measures to achieve debt issuance and management objectives for 2021

In relation to the set objectives, the Italian Treasury’s strategy for 2021 was structured as follows, covering the two phases of debt management:

Policies at issuance of domestic and foreign securities

The Guidelines defined the issuance policy for 2021 taking into consideration the above-mentioned objectives in terms of average life, duration and the average refixing period, as well as the results of the cost-risk trade-off analysis.

In line with market conditions and given the lower volumes offered compared to the previous year, issuance choices in 2021 should therefore aim:

| 1) | to adjust BOT issuances in order to ensure an end-of-period stock which would include the renewal of maturing securities; |

| 2) | to replace CTZ issuances with the BTP Short Term, a new instrument with a fixed coupon and maturity between 18 and 30 months, aligning new securities offered with maturing CTZs; |

| 3) | for 3- and 5-year BTPs, to balance the overall amounts offered on the two segments, and to reduce the volumes offered compared to the previous year. Slightly positive net issues were expected on both segments; |

| 4) | to keep the gross issuances of 7-year BTPs in line with those of 2020, given the about EUR 32 billion worth of amounts maturing, so as to consolidate the share of 7-year BTPs within the stock of government securities at the end of the year, thereby contributing to extending the average life of the debt. In 2021, the Treasury planned to continue to offer 10-year BTPs through regular monthly auctions, albeit for a slightly lower total amount than in the previous year. Despite the amount expiring (over EUR 47 billion) largely positive net issuances were expected on this segment; |

| 5) | for longer-term nominal maturities, to provide liquidity on all available instruments (15, 20, 30 and 50 years) by resorting to both the reopening of outstanding securities and the issuance of new ones, deciding on a case-by-case basis which of the available maturities to offer depending on the conditions on the secondary market. With regard to long-term securities, the plan was to keep overall issuance levels lower to those of the previous year, while still achieving positive net issuance in the various segments, with the exception of 15-year securities, given the considerable amount maturing, at around EUR 25 billion. In the presence of favourable market conditions, it was |

| 12 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2021 | |

also planned to use a placement syndicate for new securities on the various benchmark maturities in this segment;

| 6) | to keep the offer of CCTeus, in line with that of 2020, with positive net issuances, given the absence of expiring securities. The Treasury also planned the placement of at least one new benchmark over maturities between 3 and 7 years; |

| 7) | to continue to ensure a constant presence for the various maturities of BTP€is, with higher volumes on offer than in the previous year. However, given the significant amount of securities expiring, negative net issuance on the segment was expected. The conditions for launching a new security on the longer-term segment of the real yield curve was also to be examined; |

| 8) | to ensure at least one issuance for retail investors, keeping maximum flexibility regarding the most appropriate maturity, given that market conditions are difficult to predict. The Treasury would also have considered the possibility of carrying out exchange or repurchase operations on BTP Italia securities with a particularly high outstanding amount, in order to contribute to the management of the redemption profile for the coming years; |

| 9) | to continue issuing in USD on a regular basis, solidifying the Treasury’s presence in this sector, as announced following the 2019 multi- tranche global bond issue and in line with what was implemented in the following year. The aim was to continue to build a USD yield curve ever more complete and liquid, significantly increasing the number of institutional investors managing Italy’s Public Debt, with particular regard to strategic investors less present in the domestic securities sector, such as Asian insurance companies and pension funds, while ensuring issuance costs in line with those of outstanding securities. In line with previous years, the guidelines provided for the possibility to recourse to the MTN program, in euro/foreign currency, to meet the demand for public or private placements among primary institutional investors, subject to minimum requirements being met20 regarding the issue format; |

| 10) | to prepare all organisational and market actions for the issuance of a “green” government bond for financing projects with a positive environmental impact. |

Post-issuance debt management operations

As already mentioned, the Italian Treasury may also use extraordinary exchange and repurchase operations regarding government securities in order to achieve the aforementioned objectives for the existing debt portfolio.

The 2021 Guidelines called for a policy in line with that adopted in recent years. Extraordinary operations are in fact, by their very nature, highly flexible in terms of methods and timing of execution, and pursue a variety of purposes, such as managing refinancing risk, reshaping the maturity profile, supporting liquidity and ensuring the efficiency of the sovereign bond market, as well as reducing the average cost paid by the Treasury on outstanding securities. As was the case in

__

20 Maturity of at least three years, minimum amount of EUR 200 million and a minimum negotiable amount of EUR 500,000.

| MINISTRY OF ECONOMY AND FINANCE | 13 |

recent years, exchange and repurchase operations were also allowed to be carried out through syndication and would have been aimed, inter alia, at facilitating the process of reducing the overall maturity stock in individual years.

| I.4 | MONITORING AND MANAGING THE CASH ACCOUNT TO STABILISE THE BALANCE |

The cash account for Treasury services

The Cash Account is the account held by the Treasury with the Bank of Italy, where its incoming cash flows and payments are recorded. The balance of this account is the sum of the balances of all the accounts held by the Treasury21 and is characterised by strong volatility, due to both the large number of entities that move funds with the Treasury and to the cyclical presence, usually on a monthly basis, of certain flows that have a significant effect on daily balances. In particular, a strong impact on the payment side - mainly in the first few days of the month - is determined by the disbursement of pensions, while on the collection side, the central days of the month are marked by the collection of tax revenues. Issuances and, to an even greater extent, redemptions of government securities at maturity can also cause significant fluctuations in the Cash Account.

The Treasury, together with the Bank of Italy, manages its liquidity according to forecasts of Treasury flows and related stocks. This approach also meets the needs of the European Central Bank (ECB), which call for monetary policy to be facilitated through an efficient forecast of the liquidity held by public institutions at national central banks in the euro area.

The regulatory context for cash management in 2021

Cash management principles were established in the MEF’s general Directive for administrative procedures and management and in the Framework Decree, as well as in the 2021 Public Debt Management Guidelines. In particular, the general guidelines stated that the focus should be on improving the model to process daily cash forecasts for the Cash Account and that the monitoring and management of that Account must be geared towards stabilising the balance. The Framework Decree stated that management of the cash account must aim at efficient cash movements, in line with the government security issuance strategy and the prevailing market conditions, at the same time as complying with the constraints imposed by monetary policy provisions. Lastly, the Public Debt Management Guidelines set the objective of maintaining a constant presence in the money market through bilateral liquidity investment operations with a maturity of more than one day, for the purpose of improving its management and profitability, with a view to reducing counterparty risks.

__

21 For further details, please refer to Italian Ministerial Decree No. 51961 of 26 June 2015 concerning the identification of government deposits held with the Bank of Italy, implementing Article 5, paragraph 5, of Italian Presidential Decree No. 398/2003.

| 14 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2021 | |

With regard to legislation governing the movement and management of the cash deposited in the Cash Account, reference continues to be made to the Framework Decree, which substantially refers to the Italian Ministerial Decree dated 25 October 201122.

At the same time, the monetary policy interventions of the European Central Bank (ECB) changed the framework under which the Treasury managed the cash deposited in the Cash Account, increasingly penalising the deposits held in the Bank of Italy. As is known, as of 1 October 2019, the procedure to pay interest on government deposits held with national central banks was reformed as a result of new provisions issued by the ECB in April 201923. More precisely, also in the year 2021, liquidity not exceeding the threshold of 0.04% of GDP (equal to EUR 671 million), was subject to the EONIA rate, while liquidity in excess of this threshold was subject to the ECB deposit rate (Deposit Facility) equal to -0.50%, which remained unchanged throughout the year.

Cash management

The cash management service was set up in 2007 and consists of monitoring Treasury balances and flows, in order to carry out daily operations on the money market to ensure an adequate level of liquidity in light of the multiple movements of the Treasury. This activity is closely linked to public debt management and constitutes the link between securities issues and the daily fluctuations of the Cash Account.

The monitoring consists of a continuous exchange of information between the Bank of Italy and the MEF (State General Accounting Department and Department of the Treasury - Public Debt Directorate), with forecast and actual data on all collections and payments involving accounts held with the Treasury and the resulting estimate of the Cash Account balance. The information exchanges are updated repeatedly during each working day, with the aim of estimating the end-of-day balance of the Account. The liquidity forecasts of the MEF and the Bank of Italy also include longer-term scenarios, shared on a weekly basis, with a time horizon consistent with monetary policy requirements.

Money market operations, on the other hand, consist of lending or borrowing surplus liquidity in order to manage possible, temporary cash shortages.

__

22 For further details on that Italian Ministerial Decree, please refer to the following link:

www.dt.mef.gov.it/export/sites/sitodt/modules/documenti_en/debito_pubblico/normativa_spalla_destra/Management-of-the-liquidity-available-on-the-Treasury-Account-25-October-2011.pdf

23 Remuneration changes include:

1) for government deposits up to a maximum balance equal to either EUR 200 million or 0.04% of GDP, whichever is higher, the EONIA (Euro Overnight Index Average) rate shall continue to be applied until 3 January 2022, which is when the new €STR (€uro short-term rate) shall come into force;

2) the previous ECB guidelines, which came into force in 2014, stated that zero interest was to be paid on any liquidity in excess of the threshold, in the case of a positive or zero deposit facility rate applied by the ECB, or at negative rates in the event of a negative DF rate. The new ECB guidelines state that, should the DF rate be higher than the rate applied to the sums within the threshold, then interest shall be paid on all government deposits at the same rate applied to said sums (i.e. EONIA or €STR).

For more information, please refer to:

ECB Guideline ECB/2019/7 (https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32019O0007)

and ECB Decision ECB/2019/8 (https://eur-lex.europa.eu/legal-content/IT/TXT/?uri=CELEX:32019D0008).

| MINISTRY OF ECONOMY AND FINANCE | 15 |

Given the market scenario of the last few years, which has been characterised by a surplus of liquidity and an increased purchase of government bonds on the market by the ECB, together with the progressive shortage of collateral, the Treasury urged to accelerate the reform process of cash management and to adopt a new operational instrument, the Repo or repurchase agreement24.

LEARN MORE

| The Repo Market and Treasury’s Operations The Repo market is the market where two counterparties agree to enter into an agreement whereby one party lends a repurchase security (specific, in the case of “Special Repo”, or generic, in the case of “General Collateral”), for a fixed period of time (the duration of the agreement) in exchange for liquidity. At the end of the operation there is a reverse exchange (liquidity against securities) at a predetermined price (rate). Operators can therefore trade Repos either to meet a need for liquidity (typically in the General Collateral agreement) or for specific securities (in the Special Repo agreement) that they temporarily lack. The Treasury could thus resort to Repo operations as a cash management instrument, to use the surplus cash at more advantageous conditions than those imposed by the ECB on the balances deposited on the Cash Account. Alternatively, the Treasury could use Repo operations to collect cash in order to provide liquidity in case of temporarily limited availability and, at the same time, satisfy the needs of Primary Dealers by facilitating their market making commitments on the secondary market. The Treasury could also intervene on the secondary market in the event of tension caused by scarcity of specific securities, temporally selling Repos in order to mitigate the effect of such scarcity on the performance of Government securities. Therefore, when the Treasury borrows liquidity from the Repo market, it must in return cede to the counterparty one or more securities as a guarantee of the successful outcome of the operation. For this reason, the Treasury had to preliminarily acquire a portfolio of Government securities used in Repo operations. To this end, at the launch of the operation in May 2021, an ad hoc issuance of 15 BTPs, each worth 1,000 million (for a total of 15,000 million), issued exclusively for this specific purpose, was performed. |

__

24 For a more detailed analysis of the instruments used, see Chapter III below.

| 16 | MINISTRY OF ECONOMY AND FINANCE |

| II. | THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

| II.1 | MONETARY POLICIES AND EFFECTS ON THE EURO AREA MONEY MARKET |

Monetary policies in the euro area

The year 2021 started under essentially the same conditions as the previous year: the second wave of Covid-19 infections in the autumn of 2020 resulted in a new and further slowdown in global economic activity - which began immediately after the outbreak of the pandemic due to prolonged lockdowns and disruptions in production chains - yet, at the same time, contributed to the implementation of large-scale vaccination campaigns. This positive outcome, together with policies supporting households and economic activity introduced by the governments of the world’s main economies, positively affected global growth prospects. The economy, despite the continuing spread of the pandemic and the restrictive measures adopted in Europe and the United States, has in fact begun to show signs of a slow recovery in consumption and investment, mainly due to the first, albeit very partial, re-openings.

With regard to inflation dynamics, some elements of tension, although still very moderate, already emerged, especially in the second half of 2021, due to both the continued presence of supply-chain disruptions - especially in Asian manufacturing areas - and the increase in energy commodity prices as a result of the rebound in production activity.

Given this underlying macroeconomic scenario, the Governing Council of the ECB repeatedly confirmed in 2021 the accommodative stance of its monetary policy as well as the extraordinary measures adopted in spring 2020: the Expanded Asset Purchase Programme (APP) and the Pandemic Emergency Purchase Programme (PEPP). During the course of 2021, however, the ECB repeatedly emphasised its intention to gradually reduce its expansive and accommodative stance, so much so that, in the last quarter of 2021, it announced a cut in the purchases of the APP programme (from EUR 40 billion to EUR 20 billion), planning to end the programme until “shortly before” the rise in key interest rates. The cut in the programme was in any case neither fast nor sharp and such as to prevent the rise in yields observed in international markets from translating into a premature tightening of financial conditions in the euro area, which would not have been justified by the economic outlook at the time. The Council reiterated on several occasions, however, that these extraordinary instruments would be adjusted if necessary, in order to ensure that inflation would continue to approach the 2% target level. In particular, at its July meeting, also as a result of its strategy review, the Council announced a

| MINISTRY OF ECONOMY AND FINANCE | 17 |

symmetrical inflation target of 2% in the medium term25. Also, while until July 2021 the intent was to confirm the PEPP in net terms at sustained and constant purchase levels until the end of March 2022, from September 2021 onwards - as the economy continued to improve - the Governing Council began to gradually change the tone and to refer to PEPP purchases being conducted in “moderately lower” volumes than in previous quarters. This trend continued to such an extent that, in December 2021, not only was it confirmed that the PEPP programme would be closed in net terms in March 2022, but it was also announced that the end of the reinvestment period for PEPP-purchased securities would be postponed from the end of 2023 to the end of 2024, so as to ensure a more gradual but certain phase-out of this emergency instrument.

Lastly, the Council left the level of the key interest rates unchanged, keeping the ECB’s Deposit Facility (DF) rate at -0.50%, the Main Refinancing Operation (MRO) rate at 0% and the Marginal Lending Facility (MLF) rate at 0.25%.

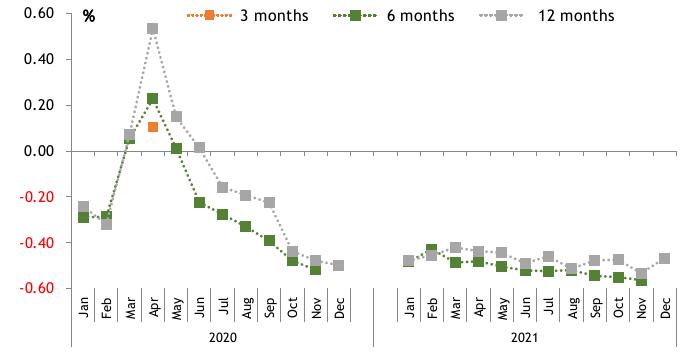

The euro area money market

The continuation of the pandemic crisis and the confirmation of the decisions taken in the previous year, which led to further injections of liquidity into the financial market, affected the level of the main money market rates such as EURIBOR (Euro Inter Bank Offered Rate) and EONIA (Euro OverNight Index Average). Chart II.1 below compares the main money market rates with the ECB’s Deposit Facility and MRO rates over the last two years.

CHART II.1: PERFORMANCE OF THE MAIN MONEY MARKET RATES, 2020-2021 (PERCENTAGE VALUES) |

|

| Source: Based on Reuters data |

The chart shows that in the period prior to the outbreak of the pandemic, levels were substantially higher than ECB rates. However, towards the beginning of the second quarter, these levels suddenly and abruptly rose again, due to the

__

25 Replacing the inflation rate target sufficiently close but still below 2%.

| 18 | MINISTRY OF ECONOMY AND FINANCE |

II. THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

generalised fear in the banking system of a possible and imminent liquidity crisis for the reasons described in the 2020 Public Debt Report.

The trend then changed in response to market participants’ injection of confidence in monetary policy decisions and in the instruments adopted to mitigate tensions in the financial and banking markets. Indeed, Euribor rate levels gradually and steadily began to fall, so much so that, already by the end of the previous year and for the whole of 2021, they were firmly below the Deposit Facility rate due to the abundant liquidity on the market.

With regard to the Eonia rate, the effects of the spread of Covid-19 were less sudden. The rate levels remained substantially above the Deposit Facility rate, maintaining the average spread fairly constant during the first two quarters of the year 202026 and thus in the midst of the pandemic crisis. As the second half of the year began, there was a gradual narrowing of the average spread, mainly due to the effects of the extraordinary instruments adopted by the Council. As in the case of EURIBOR rates, therefore, the EONIA rate also started to get increasingly closer to the ECB deposit rate. The downward trend then continued throughout 2021, so much so that at the end of the year it recorded its all-time low of -0.505%, reaching, for the first time, a level lower than the Deposit Facility rate.

| II.2 | EURO AREA BOND MARKETS |

During 2021, euro area financial markets continued to be affected by the uncertainty surrounding the course of the pandemic, mainly due to the spread of Covid-19 variants, which led to an increase in infections and the reintroduction of restrictive measures at various times during the year.

Financial market conditions, and in particular government bond market conditions, nevertheless remained rather relaxed throughout 2021. The economic recovery as well as the ongoing bond purchase programmes (APP and PEPP) by the Eurosystem played a decisive role in maintaining low levels of volatility, favourable funding conditions and liquidity in the government bond market. Additionally, the uptrend in economic activity, with its positive impact on the government budget, contributed to reducing the volumes being issued on the European bond markets compared to the previous year, although the average levels continued to be higher than those of the pre-Covid years, thus alleviating any tensions.

After the summer, favourable growth prospects and rising inflation - driven mainly by higher energy prices - began to raise fears about a possible withdrawal of monetary stimulus measures, pushing up government bond yields in all European countries. As shown in Chart II.2, by the end of 2021, yields on 10-year maturity bonds of the major European countries generally rose by about 50 basis points compared with the beginning of the year, although they continued to remain at low levels on average.

__

26 In the first quarter of 2020, the average spread between the Eonia and Deposit Facility rates amounted to 4.8 basis points. In the second quarter it amounted to 4.4 basis points.

| MINISTRY OF ECONOMY AND FINANCE | 19 |

CHART II.2: TREND OF EUROPEAN GOVERNMENT BOND YIELDS - 10-YEAR MATURITY (PERCENTAGE VALUES) |

|

| Source: Based on Bloomberg data |

In this framework, the yield curve of Italian government bonds contained the upward trend, also due to the substantial stability of spreads towards other issuers, both core and peripheral. The conclusion of the SURE programme and the launch of the Next Generation EU programme, on the other hand, contributed to consolidate a constructive climate in the financial markets. These factors, together with the stability of the national political framework and the strong growth of the Gross Domestic Product, made it possible to anticipate the decline in the debt-to-GDP ratio, thus positively influencing the ratings expressed by numerous Rating Agencies in recent months.

In the framework outlined above, debt management allowed the average cost at issuance to be reduced, which in 2021 was equal to 0.10% (the lowest level ever), while the average cost of debt - calculated as the ratio between the interest and the general government debt stock - remained stable at a level of about 2.4%.

Market conditions and management decisions have also allowed to maintain the increase in the average life of the debt, which at the end of 2021, in relation to the stock of government securities, was equal to 7.11 years (7.29 years, loans under the SURE and NGEU Programmes included), which is higher than the figure at the end of 2020, equal to 6.95 years. This was thanks to the various issuances on the longer end of the yield curve, completed both through auctions and through the syndicated placements of several new nominal benchmark securities (10, 15, 20 and 50 years, plus the BTP Green maturing in 2045).

| 20 | MINISTRY OF ECONOMY AND FINANCE |

II. THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

FOCUS

| Details on how the Public Sector Purchase Programme (PSPP) evolved and how the Pandemic Emergency Purchase Programme (PEPP) was implemented during 2021 As part of the Asset Purchase Programme (APP), the Public Sector Purchase Programme (PSPP), which began on 9 March 2015, involves net acquisitions of securities issued by central governments and public agencies of euro area countries, as well as those issued by supranational institutions. Suspended in January 2019, the APP Programme was later reactivated on 1 November of the same year in response to the deteriorating macroeconomic environment and the growing distance from the inflation target, with its duration conditional on the ECB achieving its monetary policy objectives. Following the propagation of the COVID-19 pandemic, the Governing Council decided to further strengthen the existing Asset Purchase Programme with an additional temporary endowment of EUR 120 billion27, as well as to launch a EUR 750 billion28 Pandemic Emergency Purchase Programme (PEPP) until the end of the critical phase of the pandemic29. During 2020, with the aim of providing a more durable monetary stimulus and counteracting the prolonged impact of the pandemic on the outlook for growth and inflation in the euro area, the PEPP was also further expanded both in terms of its overall envelope, which reached a total of EUR 1,850 billion, and the time horizon of purchases, extended until at least the end of March 2022, with reinvestment of maturing capital until at least the end of 2023. Lastly, in December 202130, given recovering economic growth and an improving inflation outlook, the Council announced its decision to discontinue net purchases under the PEPP at the end of March 2022, extending the reinvestment horizon until the end of 2024. Concurrently, the pace of monthly net purchases under the PPA was also revised to EUR 40 billion in Q2, EUR 30 billion in Q3 and EUR 20 billion from October 2022 onwards, in order to gradually reduce overall purchases. Figure 1 below shows the net monthly purchase trend under the PSPP from the beginning of the programme (March 2015) until December 2021, and under the PEPP from the beginning of the programme (March 2020) until the end of the year. |

FIGURE 1: MONTHLY NET PURCHASES UNDER THE PSPP AND PEPP PROGRAMMES (EUR BILLION) |

|

| Source: Based on ECB data |

__

27 www.ecb.europa.eu/press/pr/date/2020/html/ecb.mp200312~8d3aec3ff2.en.html

28 www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200318_1~3949d6f266.en.html

29 For further details on the features and changes made to the PSPP and PEPP each year, please refer to

the relative focus section in previous years’ Public Debt Reports.

30 www.ecb.europa.eu/press/pr/date/2021/html/ecb.mp211216~1b6d3a1fd8.en.html

| MINISTRY OF ECONOMY AND FINANCE | 21 |

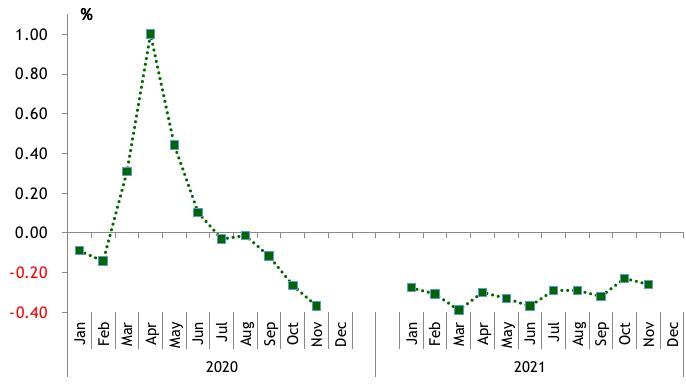

| | As regards the ECB’s activity under the PSPP, net purchases in 2021 reached a total of EUR 840.40 billion, compared with EUR 757.166 billion at the end of 2020. Thus, since the start of the programme, net purchases totalled EUR 1,597.565 billion. Total volumes of securities purchased under the PSPP averaged EUR 70 billion per month in 2021, with a peak between April and July and a subsequent decline in the final months of the year. |

| FIGURE 2: VOLUME (EUR BILLION) AND AVERAGE LIFE (YEARS) OF THE STOCK OF ITALIAN GOVERNMENT SECURITIES PURCHASED BY THE ECB UNDER THE PSPP PROGRAMME |

|

Under the PSPP, as shown in Figure 2, the total volume of Italian Government securities purchased in 2021 was approximately EUR 18.20 billion, down from the EUR 47.40 billion purchased in the previous year. Also, the total volumes of Italian securities purchased by the ECB from the start of the programme to the end of 2021 amounted to EUR 429.415 billion31. The average life of the stock of Italian securities held by the ECB as at 31 December 2021 was 7.19 years compared to 7.28 years a year earlier. As regards the PEPP, the total volume of Italian Government securities purchased during the year was approximately EUR 132 billion, slightly higher than the EUR 126 billion purchased in 2020. Overall, at the end of 2021, the stock of Italian securities purchased through the PEPP programme came to just under EUR 260 billion, with an average life of 7.12 years, up from around 6.8 years the previous year. |

__

31 These amounts are expressed in terms of their net equivalent value.

| 22 | MINISTRY OF ECONOMY AND FINANCE |

II. THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

| II.3 | TRENDS IN THE ITALIAN GOVERNMENT SECURITIES MARKET |

Evolution of the yield curve

As already mentioned, yield dynamics for Italian Government securities were largely influenced by the Covid-19 variants, growth and inflation trends, and the resulting expectations on monetary policy orientations.

Yields on Italian Government securities remained fairly stable in the first part of the year, in line with the ECB’s accommodative monetary policy stance, the good performance of vaccination campaigns and the improving outlook for economic growth.

The consolidation of growth prospects and the rise in inflation - which prompted the ECB to gradually reduce its monetary stimulus - led to a general steepening of the yield curve from October onwards.

As shown in Chart II.3, the yield on Italian Government securities at the end of 2021 was higher than at the beginning of the year: while the short- and medium-term sections of the yield curve limited the upward movement (recording an increase of 34, 32 and 42 basis points, respectively, for 2-, 3- and 5-year maturities), the segment with 10-year maturities and above saw an increase above 60 basis points (63, 62 and 60 for 10-, 15- and 30-year maturities, respectively). This trend seemed to reflect a conservative stance on the part of investors who, in uncertain situations resulting - as already noted - from the evolution of the pandemic and economic policy actions, generally increase the risk premium for holding securities with longer maturities.

| CHART II.3: MARKET YIELDS ON GOVERNMENT SECURITIES WITH 2 TO 50-YEAR MATURITIES (PERCENTAGE VALUES) |

|

| Source: Based on Bloomberg data |

Therefore, given the trend described above, the slope of the Italy’s forward yield structure recorded an overall significant increase of about 28 basis points along the 2-10-year section (Chart II.4), passing from approximately 96 basis points at the beginning of 2021 and then closing the year at about 124 basis points. It should be noted that this trend was driven for most of the year by the movement of the 10-year BTP, against a substantial stability of the 2-year BTP.

| MINISTRY OF ECONOMY AND FINANCE | 23 |

| CHART II.4: GOVERNMENT SECURITIES YIELD SPREAD, 10-YEAR VS. 2-YEAR (BASIS POINTS) |

|

| Source: Based on Bloomberg data |

Chart II.5 shows that the slope of the 10- to 30-year section of the yield curve initially increased in the first quarter of 2021, then remained fairly stable for most of the year, and declined moderately from the end of September, only to recover in the last two months of the year. The overall impact of this movement was minimal, as the yield spread between the 30-year and 10-year maturity contracted by less than 6 basis points compared to the beginning of the year. The overall stability of the trend is related to an almost similar movement (both in direction and magnitude) of the 10-year and 30-year maturity section, except for the first part of the year in which the 10-year maturity showed greater resilience than the 30-year one, while in the last four months of the year the 10-year section seemed to be more affected than the longer-term one by the widespread rise in yields.

| CHART II.5: GOVERNMENT SECURITIES YIELD SPREAD, 30-YEAR VS. 10-YEAR (BASIS POINTS) |

|

| Source: Based on Bloomberg data |

| 24 | MINISTRY OF ECONOMY AND FINANCE |

II. THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

The spread between Italian and German government securities (Chart II.6) showed a rather stable trend for most of 2021, thanks to the fairly similar behaviour of Italian and German ten-year securities. Starting in September 2021, the above-mentioned prospects of a slowdown in the monetary policy stimulus and a renewed attitude towards risk aversion among investors, on the one hand favoured a reduction in the yield rates for German ten-year government securities and, on the other hand, caused an increase in the yield rates for Italian securities, thus widening the spread. All in all, the spread between Italian and German government securities increased by around 24 basis points compared to the beginning of 2021.

| CHART II.6: YIELD SPREAD: BTP-BUND, OAT-BUND BONOS-BUND AND OAT-BUND, 10-YEAR BENCHMARK (BASIS POINTS) |

|

| Source: Based on Bloomberg data |

| MINISTRY OF ECONOMY AND FINANCE | 25 |

Secondary market performance

General introduction

The secondary market for Italian government securities was affected by national and international events of a political, economic and financial nature, as Reported above. Also, the evolution of the market during 2021 was of course influenced by the features of the Italian market. The latter include (i) the role of market making; (ii) the Primary Dealership system which, in 2021, besides confirming the presence of 16 Specialists in Italian government securities, saw the arrival of three new Aspiring Specialists and the candidature of a fourth one; (iii) the functioning of the futures market which, over time, has taken on a leading role for effective market making among primary dealers; (iv) the growing contribution of the Repo and strips markets; and (v) the interrelationships with the primary market (regularity and continuity of issues compared with benchmark securities along several points of the curve).