|

MINISTERO DELL’ECONOMIA E DELLE FINANZE |

PUBLIC DEBT REPORT 2022 |

INDEX

| INDEX | I |

| INDEX OF TABLES | II |

| INDEX OF CHARTS AND GRAPHIC FIGURES | III |

| FOREWORD | V |

| I. | DEBT MANAGEMENT OBJECTIVES FOR 2022 | 1 |

| I.1 | The objectives and risks of international debt management practices | 1 |

| I.2 | 2022 objectives: the institutional framework of reference | 2 |

| I.3 | Curbing the cost of debt while paying attention to the cost / risk profile | 6 |

| I.4 | Monitoring and managing the cash account to stabilise the balance | 13 |

| II. | THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT | 17 |

| II.1 | Monetary policies and effects on the Euro area money market | 17 |

| II.2 | The Euro area bond markets | 18 |

| II.3 | Trends in the Italian government bonds market | 23 |

| III. | PUBLIC DEBT MANAGEMENT IN 2022 | 41 |

| III.1 | Outstanding general public debt | 41 |

| III.2 | Debt management results in relation to objectives | 42 |

| III.3 | Government bonds activities | 49 |

| III.4 | Derivatives portfolio management | 71 |

| III.5 | The Treasury’s cash management | 75 |

| MINISTRY OF ECONOMY AND FINANCE | I |

INDEX OF TABLES

| Table I.1: | Domestic government securities | 3 |

| Table I.2: | Objectives for the end of 2022: percentage composition of the debt portfolio | 4 |

| Table III.1: | Average life of the stock of government securities (in years) | 47 |

| Table III.2: | Duration and ARP trend in the years 2021-2022 relating to the stock of government securities, ante derivatives, and European loans (in years)

| 49 |

| Table III.3: | Duration and ARP trend in the years 2021-2022 relating to the stock of government securities, post derivatives, and European loans (in years) | 49 |

| Table III.4: | Issuances, maturities and coverage of the State sector’s requirement (EUR million) | 50 |

| Table III.5: | Government bonds issued net of exchange operations (EUR million) | 51 |

| Table III.6: | Geographic distribution awards in 2022 syndicated placements of nominal BTP | 56 |

| Table III.7: | Distribution of awards by investor category in 2022 syndicated placements of nominal BTP | 56 |

| Table III.8: | Composition of 2020-2022 issuances in absolute value (EUR million) and % (including exchanges) | 70 |

| Table III.9: | Derivatives portfolio - years 2021 and 2022 (EUR million) | 73 |

Table III.10:

| Cash account and commitments of Treasury’s liquidity at the end of the month in 2022 (EUR million) | 79 |

| II | MINISTRY OF ECONOMY AND FINANCE |

INDEX OF CHARTS AND GRAPHIC FIGURES

| Chart I.1 | Annual maturity profile of medium/long-term bonds outstanding as at 31.12.2021 (EUR million) | 7 |

| Chart I.2: | Monthly maturity profile of medium/long-term bonds outstanding as at 31.12.2021 (EUR million) | 8 |

| Chart I.3: | Composition of the alternative issuance portfolios analysed for 2022 (EUR million) | 10 |

| Chart II.1: | Development of the main money market rates in 2021-2022 (%) | 18 |

| Chart II.2: | Trend of European government bond yields – 10-year maturity (%) | 20 |

| Figure 1: | Monthly net purchases under the PSPP and PEPP programmes (EUR billion) | 22 |

| Figure 2: | Annual volume (EUR billion) and average life (in years) of the stock of Italian government bonds purchased by the ECB under the PSPP programme | 22 |

| Chart II.3: | Market yields on government bonds by maturity from 2 to 50 years (%) | 23 |

| Chart II.4: | Government bonds yield spread, 10-year vs 2-year (basis points) | 24 |

| Chart II.5: | Government bonds yield spread, 30-year vs 10-year (basis points) | 25 |

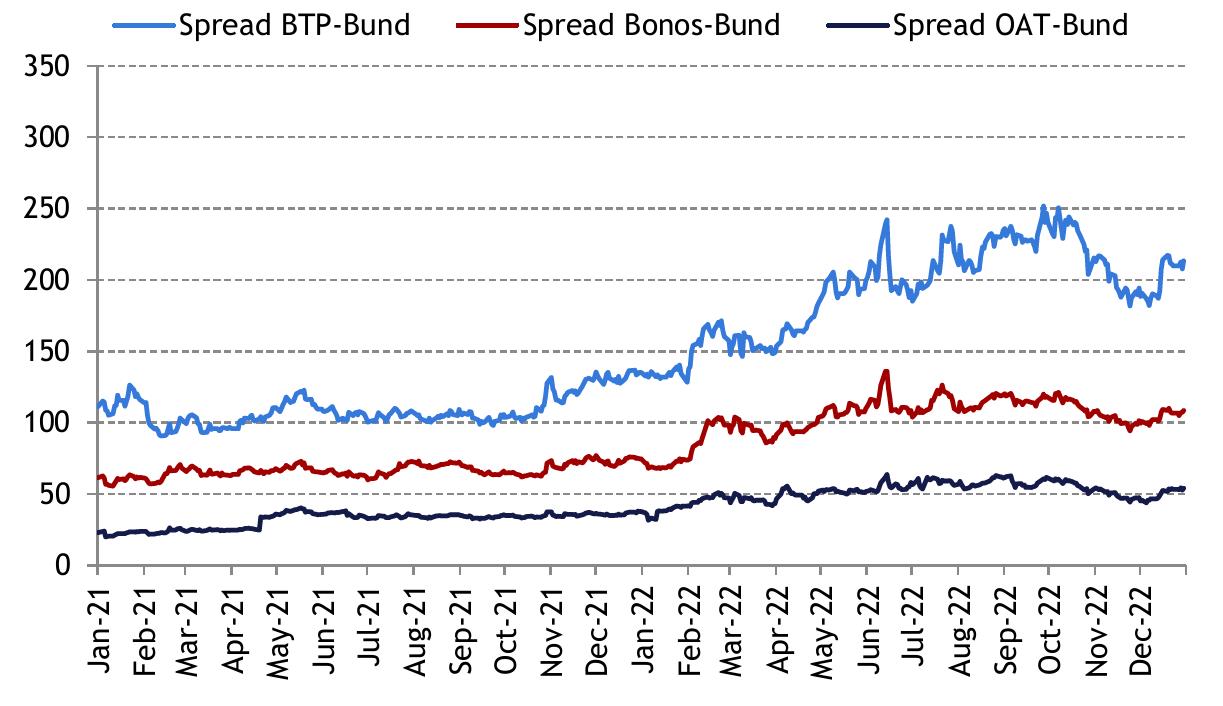

| Chart II.6: | Government bonds yield spread: BTP-Bund, OAT-Bund and Bonos-Bund, 10-year benchmark (basis points) | 26 |

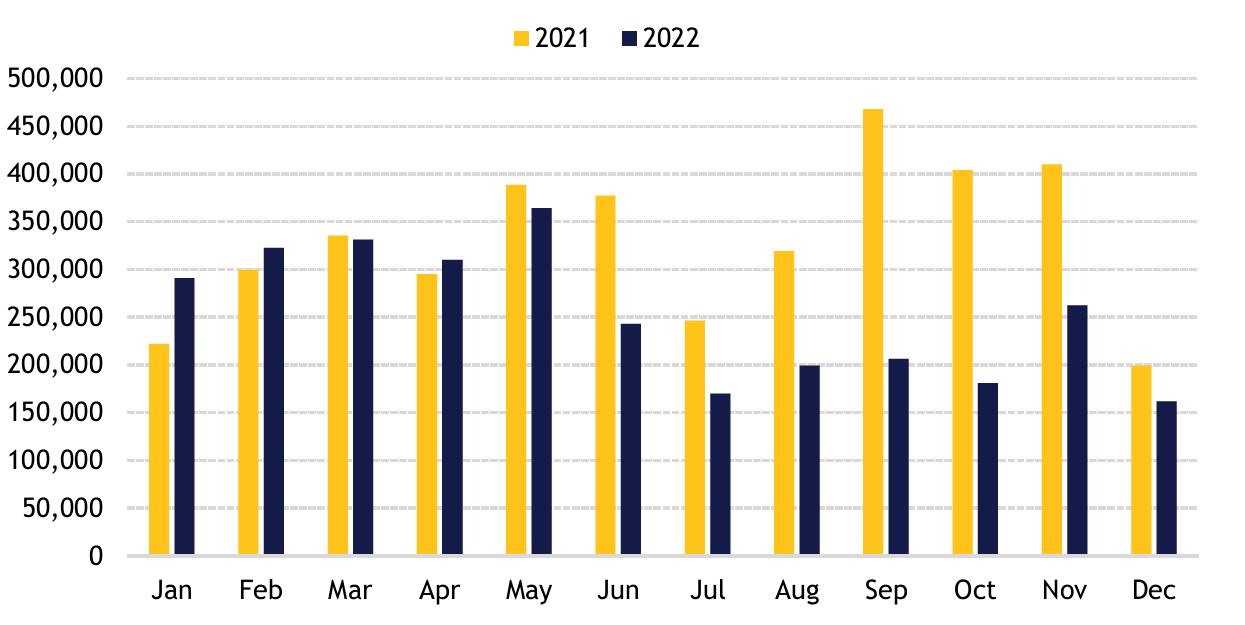

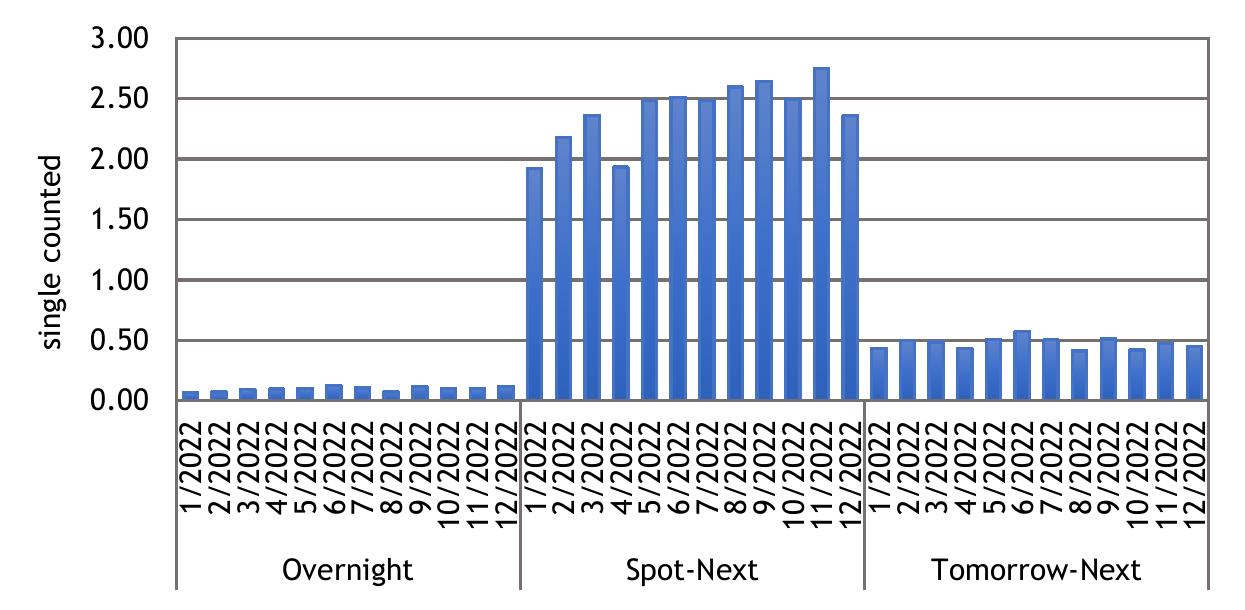

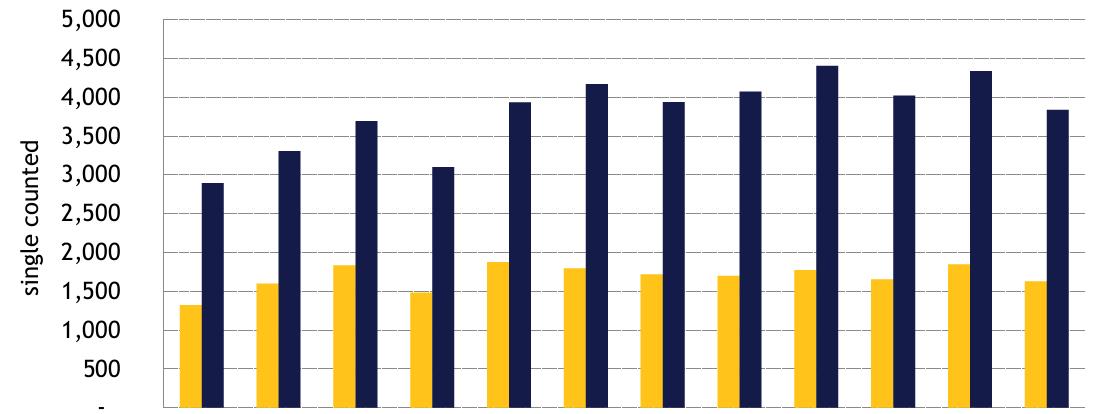

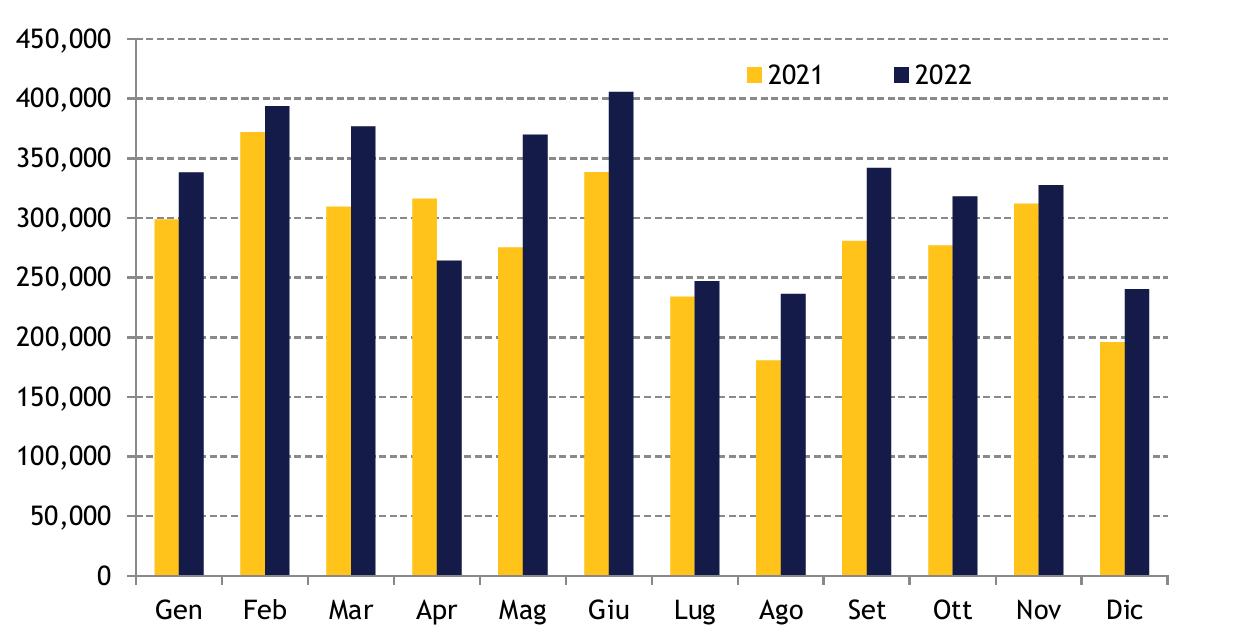

| Chart II.7: | Monthly volumes traded on the MTS platform (EUR million; single-counted) | 28 |

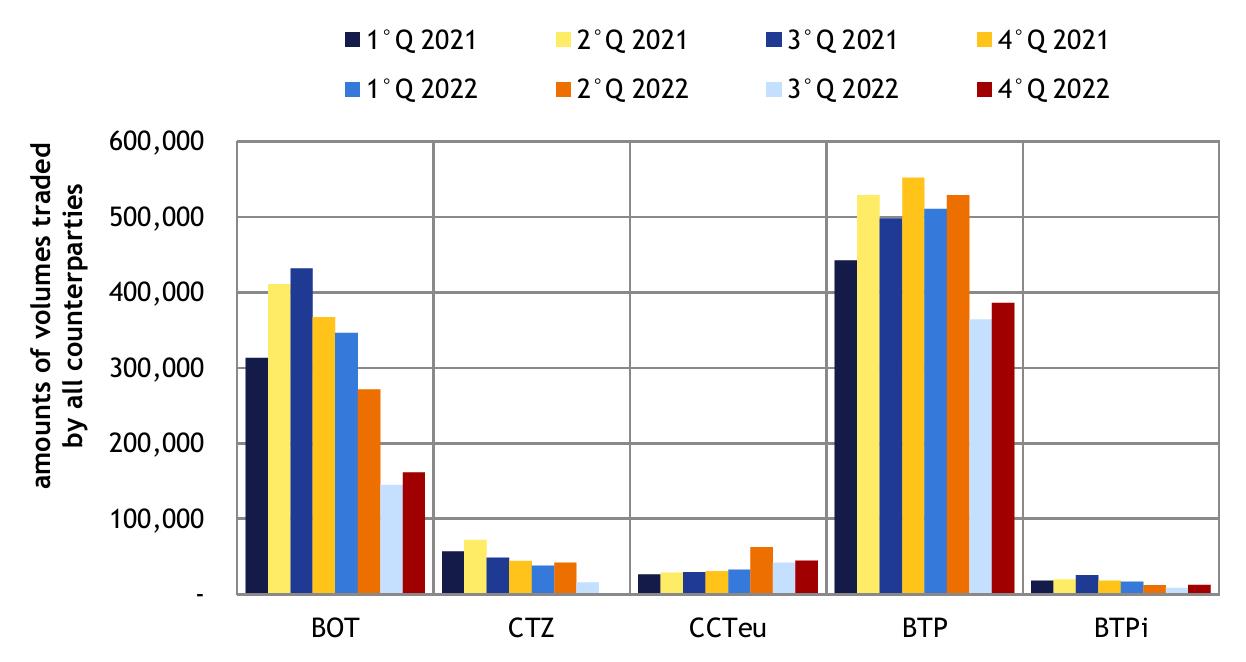

| Chart II.8: | Quarterly volumes traded on the MTS platform, by segment (EUR million; single-counted) | 28 |

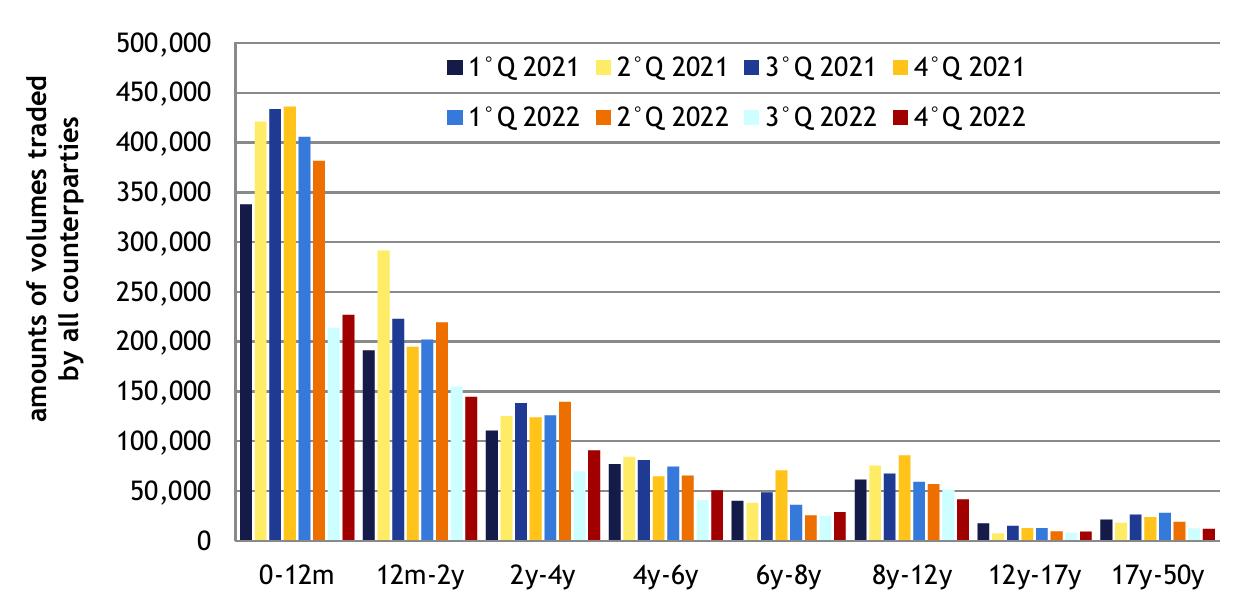

| Chart II.9: | Quarterly volumes traded on the MTS platform by maturity (EUR million; single-counted) | 29 |

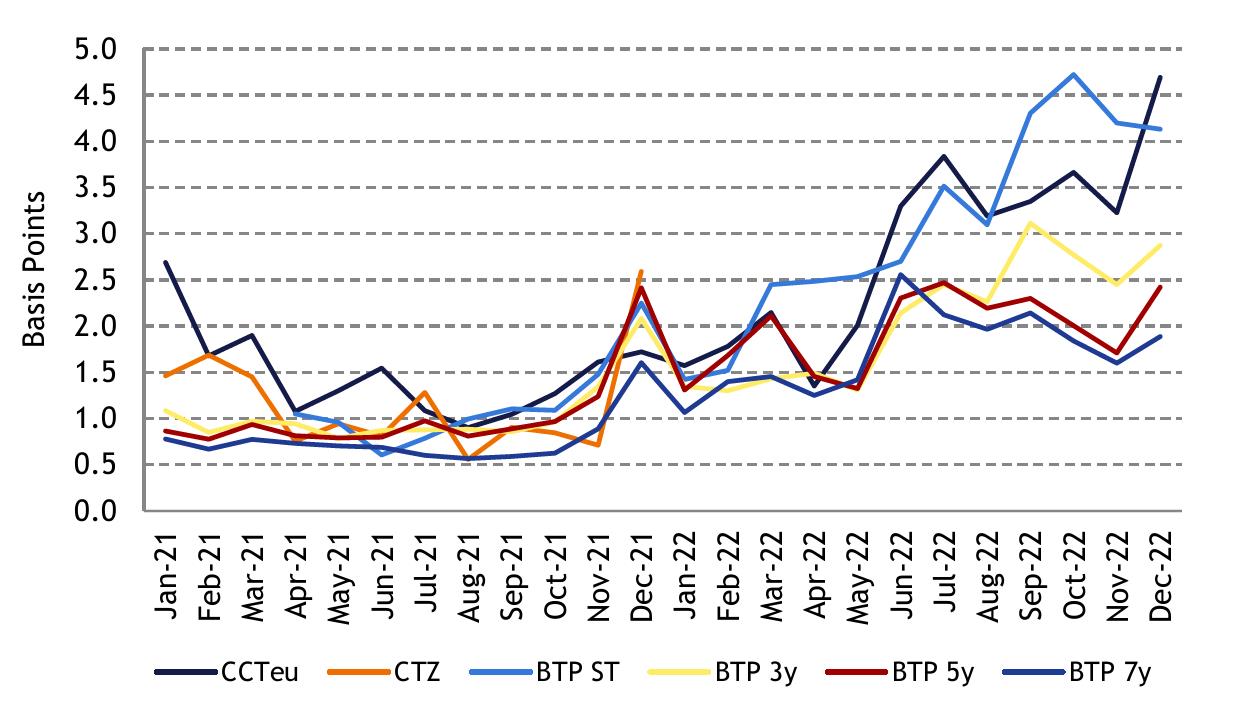

| Chart II.10a: | Bid-ask spread in basis points of CTZ, CCTeu, 3-, 5- and 7-year BTPs benchmark, recorded on the MTS platform - monthly averages | 30 |

| Chart II.10b: | Bid-ask spread in basis points of 10-, 15-, 20-, 30-, 50-year BTPs and BTP Green benchmark, recorded on the MTS platform - monthly averages | 30 |

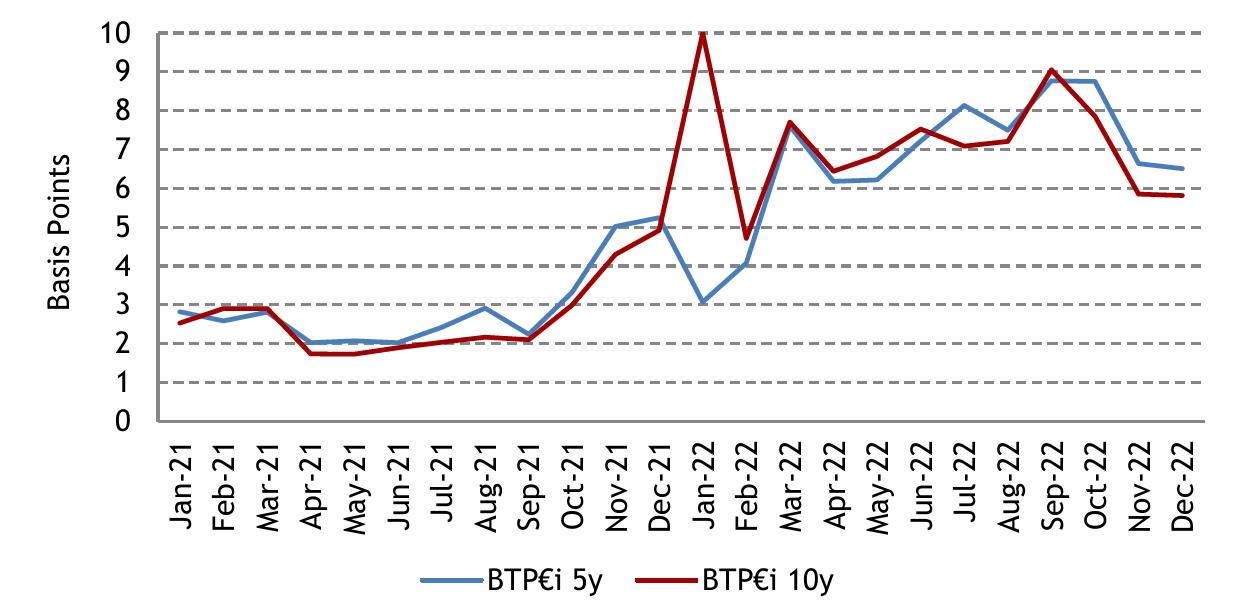

| Chart II.10c: | Bid-ask spread in basis points of 5- and 10-year BTP€is benchmark, recorded on the MTS platform - monthly averages | 31 |

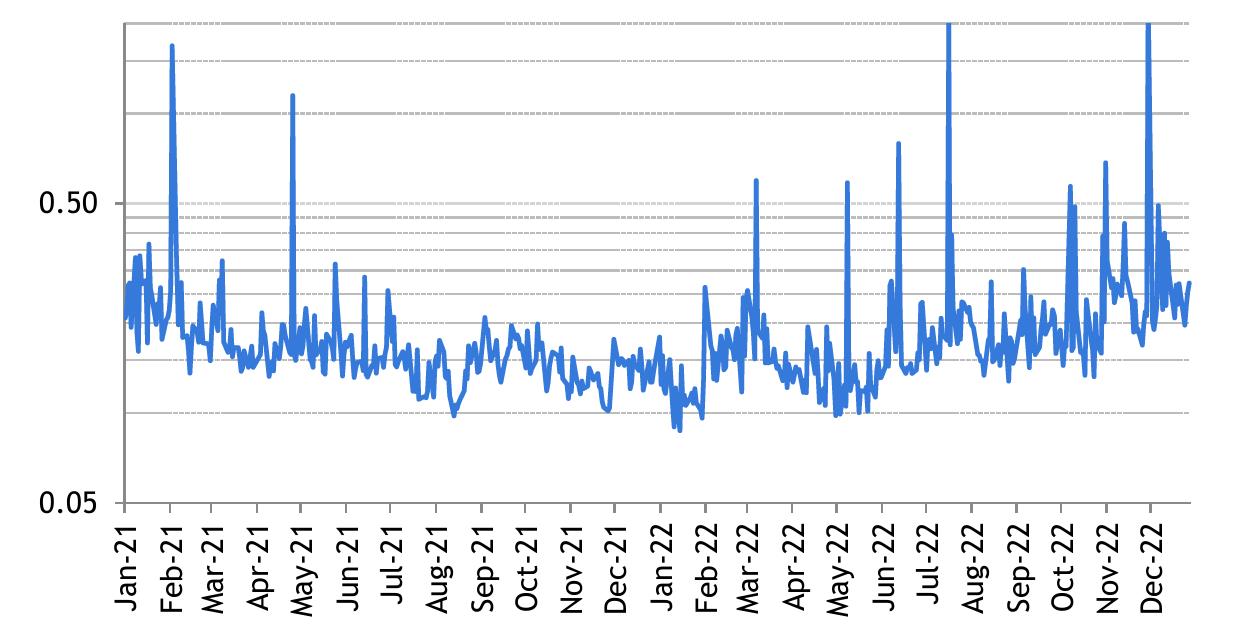

| Chart II.10d: | Daily slope on 10-year BTP benchmark (logarithmic scale) recorded on the MTS platform | 32 |

| Chart II.11: | Annual volumes traded in 2021 and 2022 on the MTS platform, by contract maturity (EUR million) | 33 |

| Chart II.12: | Monthly volumes traded in 2022 on the MTS platform, by contract maturity (EUR million) | 33 |

| Chart II.13: | Monthly Special Repo volumes traded on the MTS platform (EUR million) | 34 |

| MINISTRY OF ECONOMY AND FINANCE | III |

| Chart II.14: | Monthly volumes traded by specialists on platforms other than MTS (EUR million) | 35 |

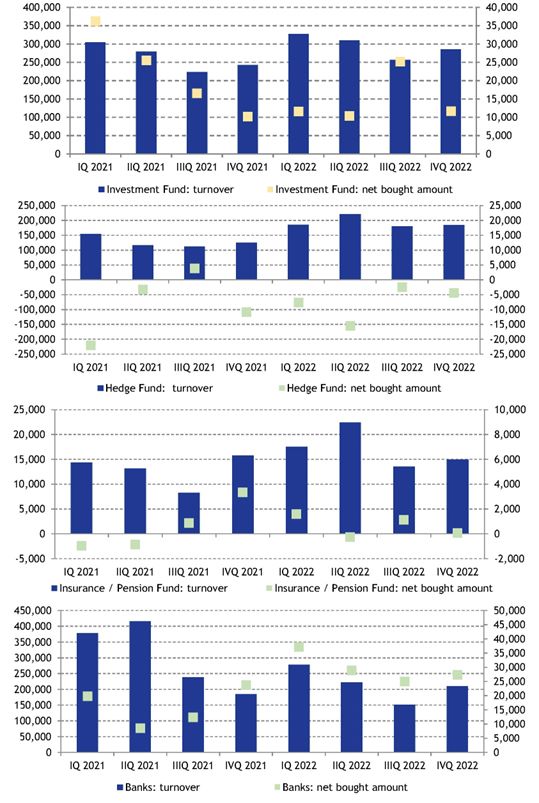

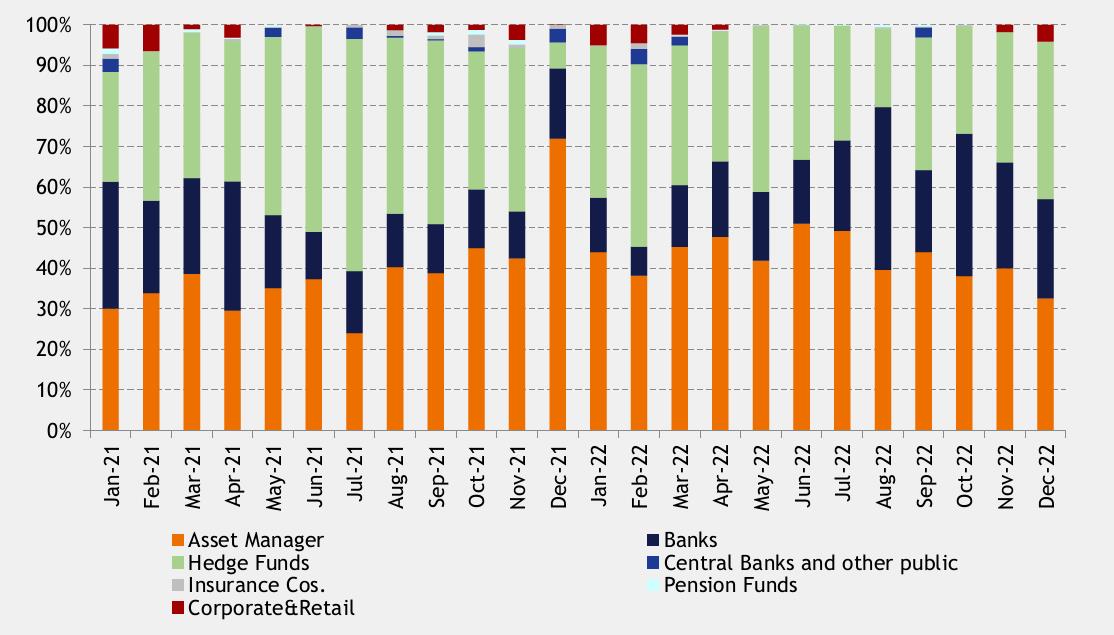

| Chart II.15: | Quarterly volumes traded by specialists by type of counterparty – fund managers, banks, pension and insurance funds, hedge funds (EUR million) | 37 |

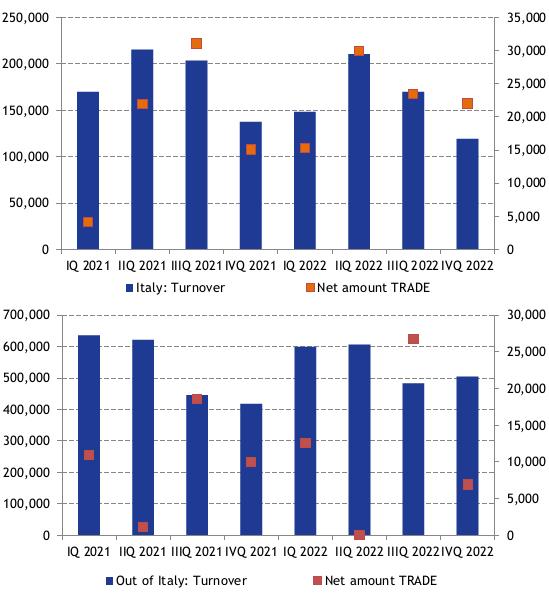

| Chart II.16: | Quarterly volumes traded by specialists by type of counterparty residence (EUR million) | 38 |

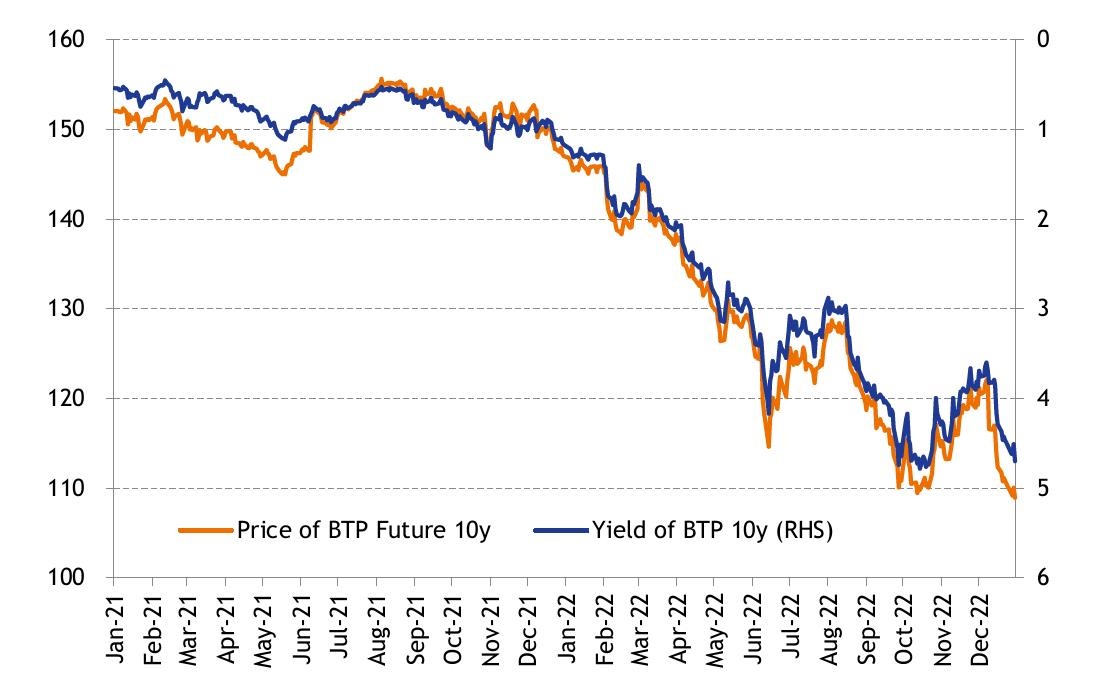

| Chart II.17: | Price of BTP Future and yield of 10-year benchmark BTP (reversed righthand scale, in %) | 39 |

| Chart II.18: | Volumes of traded lots and open interest of contracts for 10-year BTP-Future traded on the Eurex market | 40 |

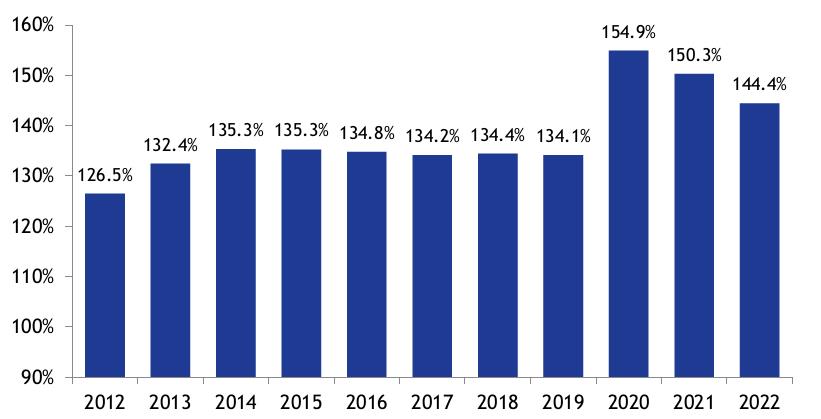

| Chart III.1: | Evolution of the debt-to-GDP ratio - 2012-2022 | 41 |

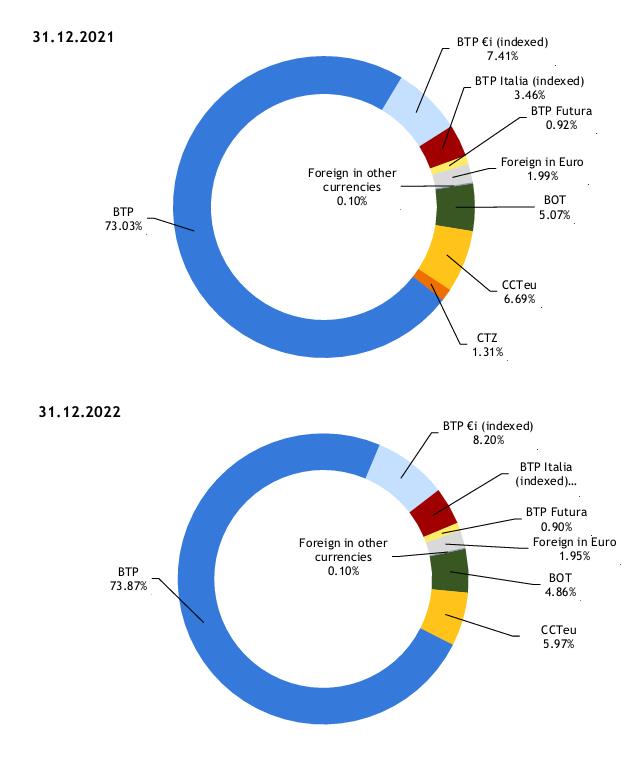

| Chart III.2: | Stock composition of government securities as of 31/12/2021 and 31/12/2022 | 43 |

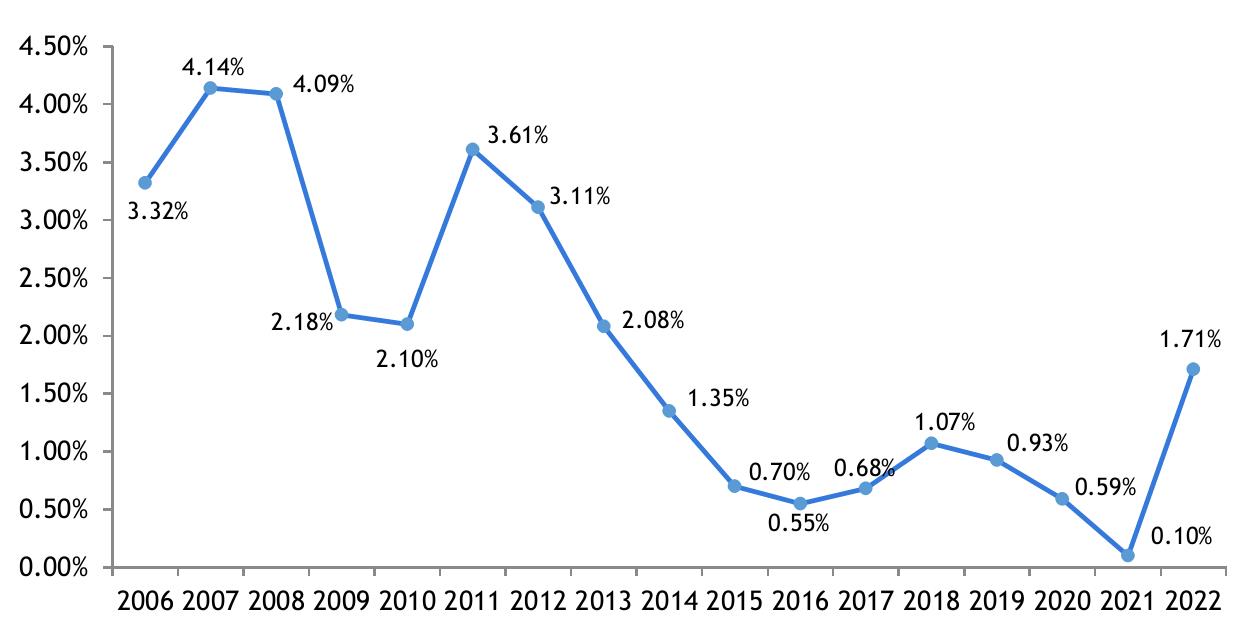

| Chart III.3: | Average cost at issuance of government securities - years 2006-2022 (%) | 44 |

| Chart III.4: | Average cash cost and ARP of government securities stock, pre and post derivatives - years 2016-2022 (%) | 45 |

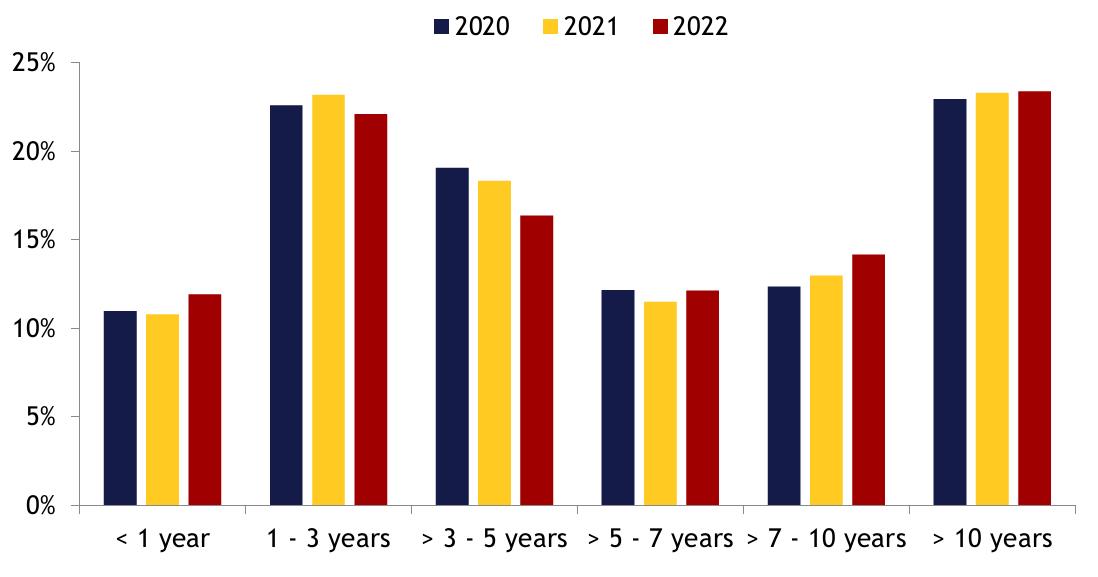

| Chart III.5: | Maturities by residual life, 2020-2022 | 46 |

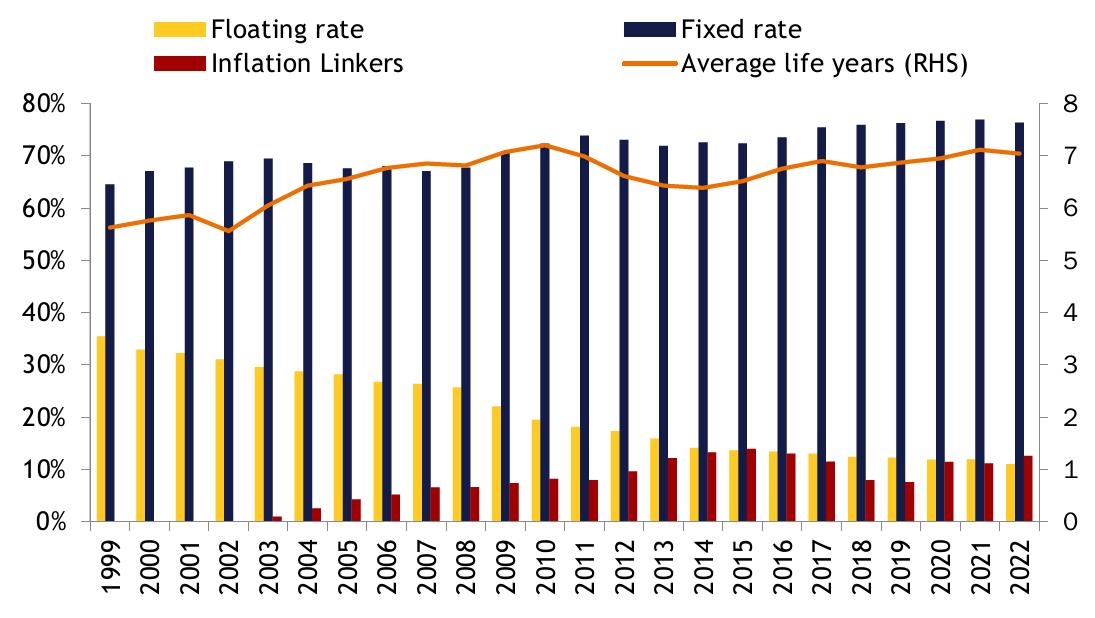

| Chart III.6: | Evolution of the debt structure and its average life (in years) | 47 |

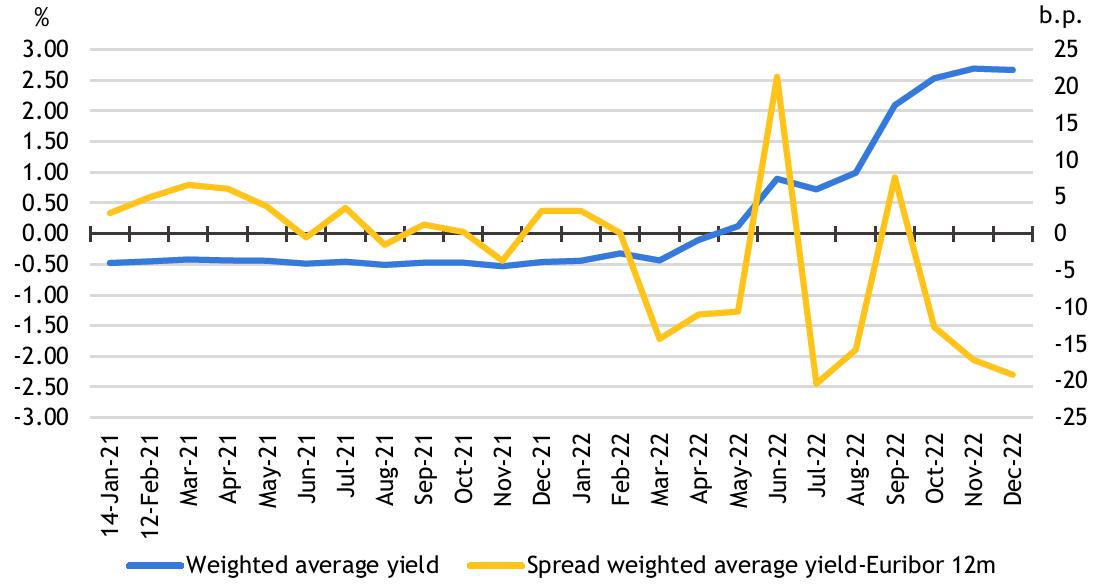

| Chart III.7: | Gross compound yield at issuance of 12-month BOT - years 2021-22 (%) and spread yield of 12-month BOT vs Euribor rate - years 2021-22 (basis points) | 53 |

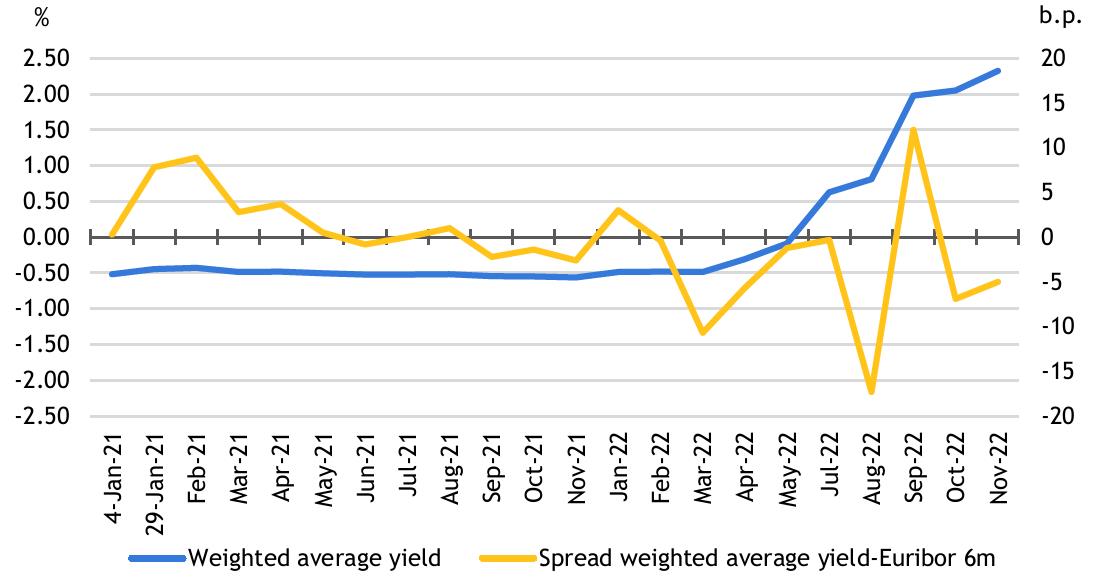

| Chart III.8: | Gross compound yield at issuance of 6-month BOT - years 2021-22 (%) and spread yield of 6-month BOT vs Euribor rate - years 2021-22 (basis points) | 53 |

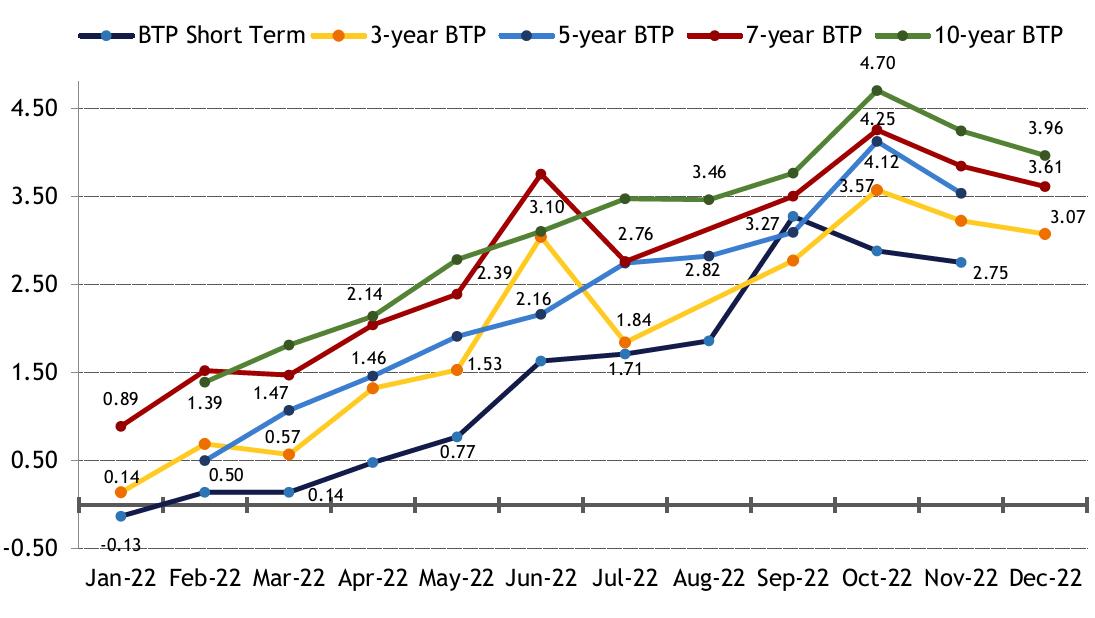

| Chart III.9: | Yield at issuance of BTPs with maturity between 3 and 10 years in 2022 (%) | 59 |

| Figure 3: | Breakdown by type of counterparty of orders placed in nominal BTPs auctions by specialists in government bonds - years 2021-2022 | 60 |

| Figure 4: | Breakdown by geographical area of orders placed in nominal BTPs auctions by specialists in government bonds - years 2021-2022 | 61 |

| Chart III.10: | 10-year break even inflation (bei) 2021-2022 (basis points) | 63 |

| Chart III.11: | Yield at issuance of CCTeus in 2022 (%) | 65 |

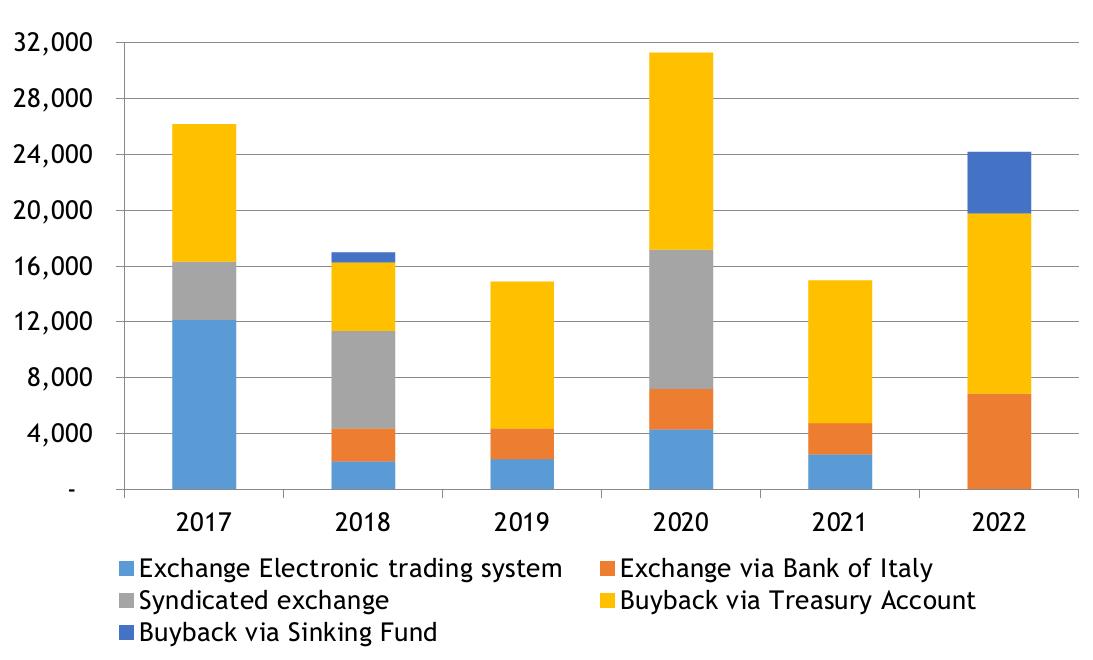

| Chart III.12: | Amount repurchased in extraordinary operations - years 2017-2022 (nominal amounts in EUR million) | 67 |

| Chart III.13: | Distribution of government bonds repurchased in extraordinary operations carried out in 2022 (nominal amounts in EUR million) | 68 |

| Chart III.14: | Comparison between the prospective trend of the notional amount for the existing derivatives portfolio, as at 31/12/2021 and 31/12/2022, respectively, assuming that all swaptions are exercised (EUR million) | 75 |

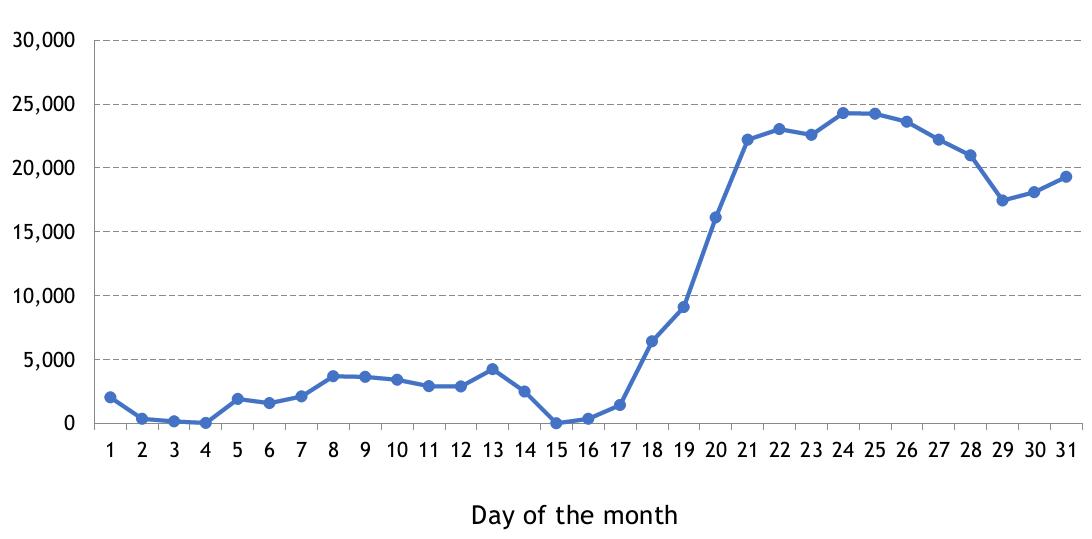

| Chart III.15: | Average infra-monthly variation in treasury cash and cash equivalents – gap with the monthly low - 2022 (EUR million) | 77 |

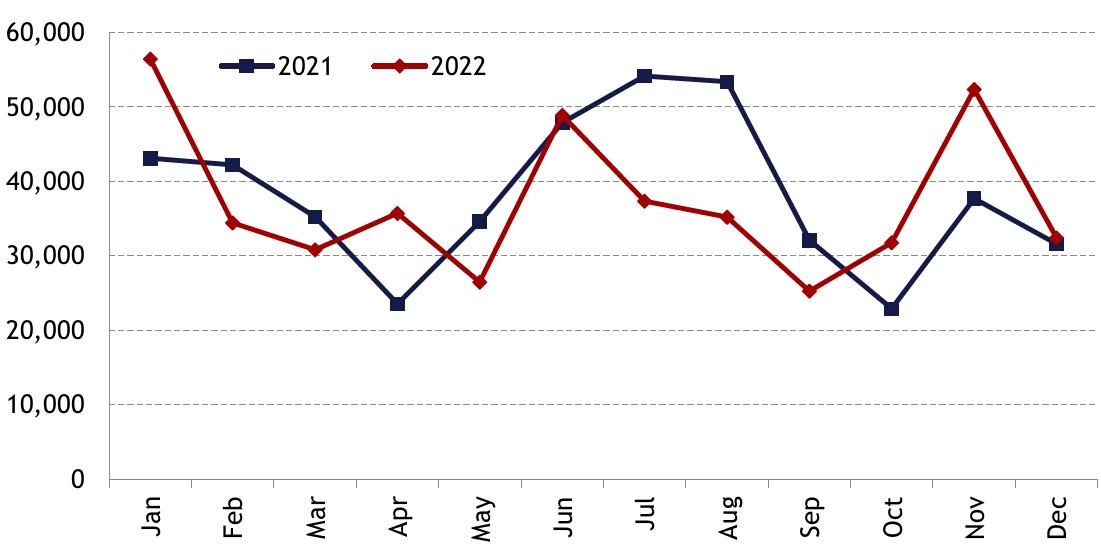

| Chart III.16: | Gap between low and high monthly balance of Treasury cash – 2021 and 2022 (EUR million) | 78 |

| Chart III.17: | Average breakdown of the Treasury’s liquidity – 2021 vs 2022 (EUR million) | 79 |

| IV | MINISTRY OF ECONOMY AND FINANCE |

FOREWORD

The Annual Report on Italian Public Debt Management for 2022 follows the format already introduced in the Report for the year 2021.

In terms of content, the Report covers a peculiar year for European and international financial markets, characterised by a very robust and rapid growth of interest rates decided by the monetary policy choices made by all central banks to counter the sharp rise in inflation.

These trends clearly reflected on the Italian Government Bonds Market which, as that of all the EU countries, is characterised by a sharp increase in yields at issuance and a sustained volatility of bond prices on the secondary market.

Notwithstanding the complex context and the challenges mentioned above, the public debt management has achieved to cover the State’s cash requirements and the exposure to the main market risks, by recurring to several management tools, as introduced over the last years, in terms of issuance modes, products offered on the market, management of existing tools and cash management.

As usual, the Report examines the objectives set out at the end of year 2021 and analyses the management activities realised during the year, by providing an accurate description of the reference market context.

| MINISTRY OF ECONOMY AND FINANCE | V |

| VI | MINISTRY OF ECONOMY AND FINANCE |

| I. | DEBT MANAGEMENT OBJECTIVES FOR 2022 |

| I.1 | THE OBJECTIVES AND RISKS OF INTERNATIONAL DEBT MANAGEMENT PRACTICES |

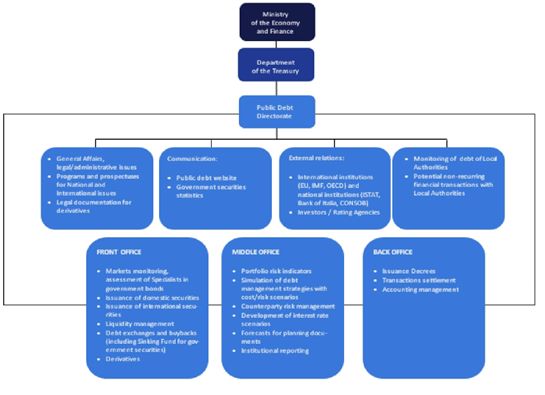

The Italian Treasury’s public debt management has always been in line with international best practices and fully complies with the recommendations of the main multilateral financial institutions as well as with the approaches adopted by other Debt Management Offices (DMOs) in advanced countries.

The main types of risk faced by DMOs refer to market risk, which includes interest rate risk and exchange rate risk, refinancing risk, liquidity risk and credit risk, in addition to the operational risk. Many of these risks involve, albeit in different ways, an unexpected increase in the cost of debt that could jeopardise debt sustainability.

International best practices recommend avoiding public debt portfolio structures that are too heavily weighted towards short-term and floating-rate instruments. Such structures may increase a country’s economic and financial vulnerability1.

In fact, despite reducing interest expenditure in the short term, these structures make it more volatile, while they also increase the market refinancing risk and interest rate risk inherent in the debt portfolio and, consequently, in the government budget2. On the other hand, under normal financial market conditions and regardless of the issuer’s creditworthiness, interest expenditure is higher for longer-term maturities, although longer maturities offer the benefit of effectively reducing the refinancing risk and interest rate risk.

However, DMOs are required to pursue both objectives: reducing the cost of debt at the same time as curbing market risks.

__

1 Considerations in this regard can be found in the Guide to the Debt Management Performance Assessment (DeMPA) Tool, World Bank 2009.

2 However, it should be noted that this risk assessment approach may only be considered optimal if focusing exclusively on government liabilities (and therefore on debt). Indeed, a different and broader point of view could also include government assets. Under this approach, debt management could thus aim to achieve a liability structure consistent with the risks inherent to assets (following a so-called “ALM” – Asset Liability Management approach). This may lead to choices that - in principle - could differ even quite significantly from those made by taking into account the debt composition alone. However, many countries, including Italy, have come across significant hurdles in implementing such an approach, due to both the practical difficulty of calculating the financial risk exposure of the government’s substantial assets - especially non-financial assets - and, in many cases, the fact that there is incomplete knowledge of the size and characteristics of said assets. Further information can be found in the World Bank Policy Research Working Paper How Do Countries Use an Asset and Liability Management Approach? A Survey on Sovereign Balance Sheet Management.

| MINISTRY OF ECONOMY AND FINANCE | 1 |

Therefore, in practice, public debt managers must forego maximising both of these objectives and must instead focus on managing their relative trade-off.

In other words, out of all the feasible options, they must select the cost-risk combination deemed satisfactory3 in relation to both portfolio characteristics and overall strategies. This trade-off is therefore not the same for all DMOs, and is therefore handled differently by public debt managers in each country, based on its specific characteristics, starting with its size in relation to the national economic system, its portfolio of instruments, its reference market and the fiscal policies pursued. Italy has taken a particularly prudent approach to this trade-off due to the size of its debt (among the highest in the world in absolute terms); this approach results in an idiosyncratic additional cost that does not allow for opportunistic tactics, but rather pushes for continuity, predictability and long-term strategies.

It goes without saying that the DMO’s task of minimising the cost of debt while maintaining an acceptable level of risk cannot be deemed to have been completed upon each issuance and in relation to the market conditions at the time of placement. Indeed, the structure of public debt, consisting of a wide and diversified portfolio of financial instruments with different characteristics and maturities, requires continuous, dynamic management even after issuance, conducted with suitable Instruments and in line with market developments.

| I.2 | 2022 OBJECTIVES: THE INSTITUTIONAL FRAMEWORK OF REFERENCE |

Public debt is made up of the total liabilities of the general government sector, divided into the sub-sectors of central government, territorial entities and public social security institutions. More than 80% of public debt is constituted by government bonds issued by the Treasury on both the domestic and foreign markets. As was also the case in previous years4, this Report refers to outstanding government bonds, which are subject to the special legislation represented by Italy’s “Consolidated Law on Public Debt” (TUDP)5 whose main characteristics are summarised in Table I.1.

__

3 In this regard, the International Monetary Fund and World Bank guidelines note that “Minimising cost, while ignoring risk, should not be an objective. Operations that appear to lower debt servicing costs often embody significant risks for the government and can limit its capacity to repay lenders Managing cost and risk therefore involves a trade-off”.

4 All editions of the Annual Public Debt Report can be found at:

https://www.dt.mef.gov.it/en/debito_pubblico/presentazioni_studi_relazioni/index.html

5 Consolidated Text of Legislative and Regulatory Provisions on Public Debt (Italian Presidential Decree No.

398 of 30 December 2003).

| 2 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2022 | |

| TABLE I.1: DOMESTIC GOVERNMENT SECURITIES |

| | BOT 1 | CCTeu 2 | BTP 3 | BTP€i 3 | BTP Italia 4 | BTP Futura 4 | BTP Green 5 |

| | Treasury Bills | Treasury Credit Certificates | Long-term Treasury Bonds | Long-term Treasury Bonds indexed to European inflation | Long-term Treasury Bonds indexed to Italian inflation | Long-term Treasury Bonds step-up | Long-term Treasury Bonds for financing expenditure with a positive environmental impact. |

| Maturity | 3, 6, 12 months and other possible maturities lower than standard | 5, 7 years | Short Term, 3, 5, 7, 10, 15, 20, 30, 50 years | 5, 10, 15, 30 years | 4, 6, 8 years | 8, 10, 12

years a) | Over 3 years |

| Remuneration | Issue discount | Half-yearly variable coupons indexed to the 6-month Euribor, possible issue discount | Half-yearly fixed coupons, possible issue discount | Half-yearly coupons indexed to European inflation (HICP index net of tobacco) possible issue discount and revaluation of principal at maturity | Half-yearly coupons indexed to Italian inflation (“FOI” index net of tobacco), half- yearly revaluation of principal and loyalty

premium b) at maturity | Half-yearly coupons with step-up mechanism with increasing yields and loyalty premium c) indexed to the average growth of Italian GDP during the life of the bond | Half-yearly fixed coupons, possible issue discount |

Issuance Frequency(d) | Monthly | Monthly | Monthly and based on market conditions for 15- and 30-year BTPs | Monthly | Once/twice a year, based on market conditions | Once/twice a year, based on market conditions | Flexible |

1) Issuance method: competitive yield auction. 2) Issuance method: marginal auction with discretionary determination of price and quantity issued. 3) Issuance method: marginal auction with discretionary determination of price and quantity issued. The first tranches of new long-term (above 10 years) BTPs or BTP€i can be offered on the market through syndicated placements. 4) Issuance method: through the MOT (Borsa Italiana), the electronic retail market. 5) Issuance method: syndicated placement (or marginal auction, with discretionary determination of price and quantity issued). -------------- a) Additionally, a BTP Futura bond with a maturity at issuance of 16 years was emitted in 2021. b) For individual savers and similar investors who purchase the bond at issuance during the first phase of the placement period. c) For individual savers and similar investors, to whom the BTP Futura bond is reserved, who purchased the bond during the placement period and held it until maturity. d) As of 2020, reopening operations of bonds destined only to Specialists have also been introduced. |

| MINISTRY OF ECONOMY AND FINANCE | 3 |

The part of public debt represented by government bonds was managed in accordance with: (i) the Italian Ministry of Economy and Finance’s general Directive for administrative procedures and management for 20226, and (ii) the “Framework Decree” for 20227, which defined the reference objectives for administrative action regarding financial operations for the management of public debt. The provisions contained in these decrees were then converted into the operational “Public debt management guidelines” for 20228 (hereinafter, “Guidelines”).

The general Directive identified as a strategic objective the effective and efficient management of public debt, focusing on containing its cost and extending or stabilising its average life.

As was the case in previous years, the Framework Decree for 2022, provided guidance for the work of the Public Debt Directorate as well as a number of specific objectives. In particular, Art. 2 states that debt should be “in accordance with the limit established annually by the law approving the State budget”, equal to the amount to cover the bonds maturing during the year and the Central Government’s borrowing requirements, being sure to “...reconcile the need to meet market demand with that of containing the overall borrowing cost in a medium-long term horizon, having considered the need to protect against the refinancing risk and exposure to interest rate fluctuations”.

The same article also identified the limits to be respected in terms of the percentage composition of debt at the end of 2022, broken down as follows:

| TABLE I.2: OBJECTIVES FOR THE END OF 2022: PERCENTAGE COMPOSITION OF THE DEBT PORTFOLIO |

| Type of Bond | Min. | Max. | Differences compared to 2021 |

| BOT (short-term) | 3% | 8% | -- |

| BTP (fixed-rate nominal) | 65% | 80% | extended from the previous 65%-78% range |

| CCTeu | 4% | 10% | -- |

| BTP€i and BTP Italia (“real” bonds) | -- | 15% | -- |

| Bonds issued on foreign markets | -- | 5% | -- |

| Source: Framework Decrees, different years |

In order to pursue the objectives of “curbing the overall debt cost, protecting against market risks and refinancing risks and ensuring the proper functioning of the secondary market for government bonds”, Art. 3 authorises the use of public debt management operations9 also through derivative financial instruments, exchanges or repurchase of government bonds.

In order to mitigate the credit risk stemming from derivatives, Art. 4 requires counterparties to have a high level of creditworthiness, according to the rating

__

6 For the Italian version of the General Directive for Administrative Action and Management of the Italian Ministry of Economy and Finance - Year 2022 see https://www.mef.gov.it/ministero/oiv/documenti/Direttiva-generale-per-lazione-amministrativa-e-la-gestione-per-lanno-....pdf.

7 Guidelines for the implementation of financial operations (Framework Decree) for 2022: (https://www.dt.mef.gov.it/export/sites/sitodt/modules/documenti_en/debito_pubblico/normativa_spalla_dest ra/2022_Framework_Decree_-_Directives_for_conducting_financial_transactions_xMin_Decree_30.12.2021x.pdf)

8 Public debt management guidelines for 2022:

(https://www.dt.mef.gov.it/export/sites/sitodt/modules/documenti_en/debito_pubblico/presentazioni_studi_r elazioni/Guidelines_for_public_debt_management_2022.pdf).

9 Art. 3 of the “TUDP” (Italian Consolidated Law on Public Debt) authorises the use of operations on a consensual basis that restructure certain features of the existing debt portfolio.

| 4 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2022 | |

given by the main rating agencies, also providing for possible agreements with the counter parties for mutual guarantees (collateralisation)10.

Lastly, Art. 6 states that the aim of cash account management11 must be “the efficient movement of cash balances, in relation to the government bonds issuance, prevailing market conditions and the constraints imposed by monetary policy provision”. To this end, year 2022 could have benefited from the new cash management tools introduced in 2021 (i.e., REPOs).

The 2022 aim remained that of consolidating the results achieved over the last years, in terms of exposure to interest rate and refinancing risk, taking advantage of a market environment which, albeit still fragile, has improved since the acute phase of the pandemic12.

Based on the outstanding bonds portfolio at the end of 2021, EUR 230 billion worth of bonds were scheduled to mature in 2021 (excluding BOTs), a slightly higher amount than the EUR 222 billion worth of medium-long term bonds outstanding at the end of 2020, maturing in 2021.

In the 2022 Guidelines, the Central Government cash needs were expected to be around EUR 100 billion, a level slightly below that of 2021, which might be revised downwards given the relevant improvement in cash needs recorded over the last months of the year. The cash needs could be covered not only by the national issuance programme, but also by the European resources made available by means of loans from both the SURE programme and the Recovery and Resiliency Facility package under the Next Generation EU programme.

In a macro-economic context in which there were uncertain expectations regarding the consolidation of the economic recovery, due to the evolution in European rates and the following reaction on behalf of institutional investors, the Treasury set out the following objectives in the Guidelines:

| 1) | The coverage of needs at a cost aligned, as much as possible, with the market trend; |

| 2) | the consolidation of the results already achieved in terms of exposure to the main risks, in particular the interest rate risk and refinancing risk; |

| 3) | the gradual improvement in liquidity conditions on the secondary market; |

| 4) | the efficient management of the Treasury’s cash. |

The Treasury’s strategy was therefore set to develop along the following lines:

| 1) | ensure predictable and regular issues for all the main segments of domestic bonds; |

| 2) | adjust the volumes offered to the market in order to give greater weighting to sectors with better liquidity on the secondary market and greater depth of demand; |

| 3) | use liability management tools (such as exchanges and repurchases), in line with the approach followed in recent years, with a frequency and intensity in |

__

10 For more information about these mutual guarantee agreements, please see Chap. III.4 (Derivatives portfolio management).

11 Regulations regarding the Treasury’s cash movements and the selection of the counter parties participating in the relative operations are based on the Italian Ministerial Decree dated 10/01/2022.

12 The evolution of the average life of the stock of government bonds is detailed in the following paragraphs.

| MINISTRY OF ECONOMY AND FINANCE | 5 |

line with market trends, with the aim of reducing dislocations on specific bonds, improving liquidity on the secondary market, managing the redemption profile for future years and managing the redemption profile of future years, and helping to reduce the average cost of outstanding debt;

| 4) | diversify the investor base also through foreign currency issues in Global format as well as EMTNs, with particular regard to issues in US dollars; |

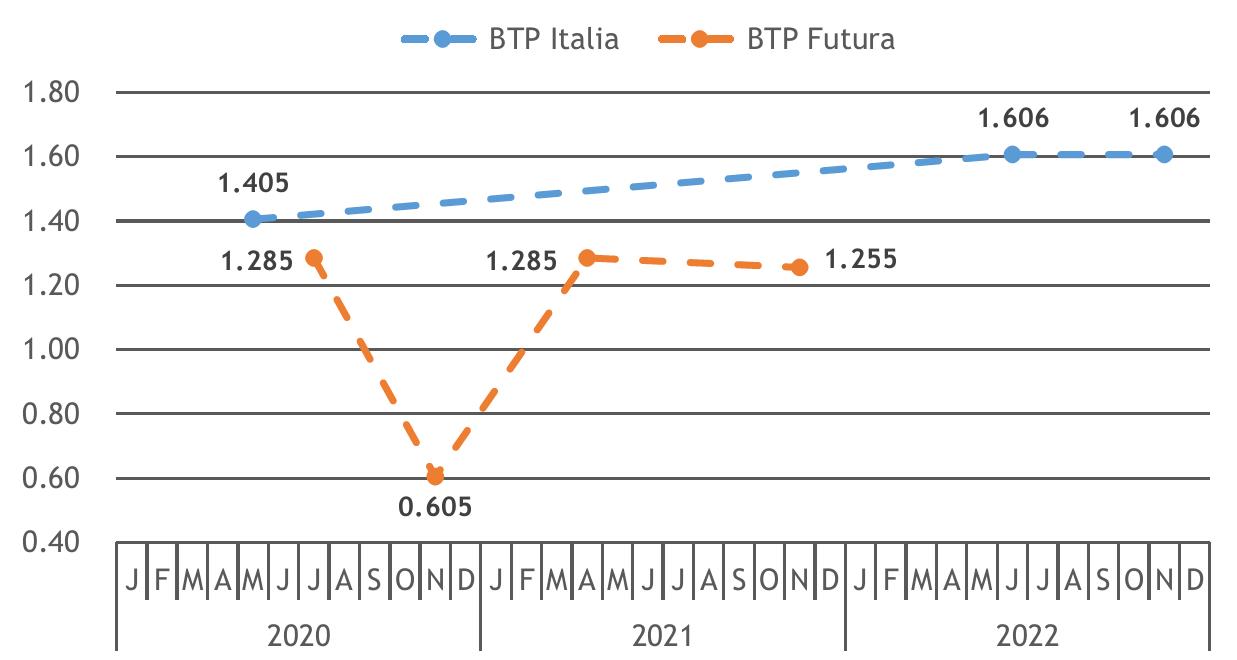

| 5) | continue the dedicated offering to retail investors, aimed at expanding their direct participation in public debt financing; |

| 6) | develop the BTP Green issuance programme in line with the eligible expenses listed in the State budget. |

| I.3 | CURBING THE COST OF DEBT WHILE PAYING ATTENTION TO THE COST/RISK PROFILE |

The cost-risk trade-off: Italy’s specific features

As in previous years, public debt management in Italy focuses on containing two main risks: the interest rate risk, by minimising the impact on interest expenditure13 caused by fluctuations of the interest rates at which the debt is placed; and the refinancing risk, by distributing the maturities of bonds more evenly over time in order to facilitate new issues.

When it comes to these risks, the Treasury’s objectives are in line with the practices followed by other DMOs. However, in Italy’s case, the management of a particularly high debt makes it necessary to pay greater attention to the credit risk premium requested by investors, based on the perceived sustainability of the debt, which becomes a significant component of the interest rate level at the issuance for Italian government bonds.

Another aspect to be considered in the management of the Italian state budget concerns the stability and predictability of interest expenditure, which allows to avoid the need to increase taxation should government-bond yields be affected by possible shocks and makes it easier to manage public finance commitments stemming from European requirements, mainly based on deficit control and debt dynamics.

The two aforementioned aspects therefore significantly contribute to guiding Italy’s debt management strategy with regard to keeping refinancing and interest rate risks under control.

__

13 In order to manage public finances correctly, it is necessary, where possible, to reduce costs and to plan outgoings with as much certainty as possible. This avoids unwanted and unexpected increases in the deficit and/or fiscal pressure, perhaps also significantly and in a short amount of time, as a result of costs or expenses not being duly planned for. Correct management of public finances therefore guarantees a framework of financial stability, which in turn allows for effective debt management.

| 6 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2022 | |

Refinancing and interest rate risks: metrics and management tools

The average life of the stock of government bonds is the best-known benchmark metric used to measure refinancing risk. This is calculated as the average of the maturities of all outstanding bonds, weighted according to the nominal value14 of each bond. At the end of 2021, the average life of government bonds stood at 7.11 years, up from end-2020 level.

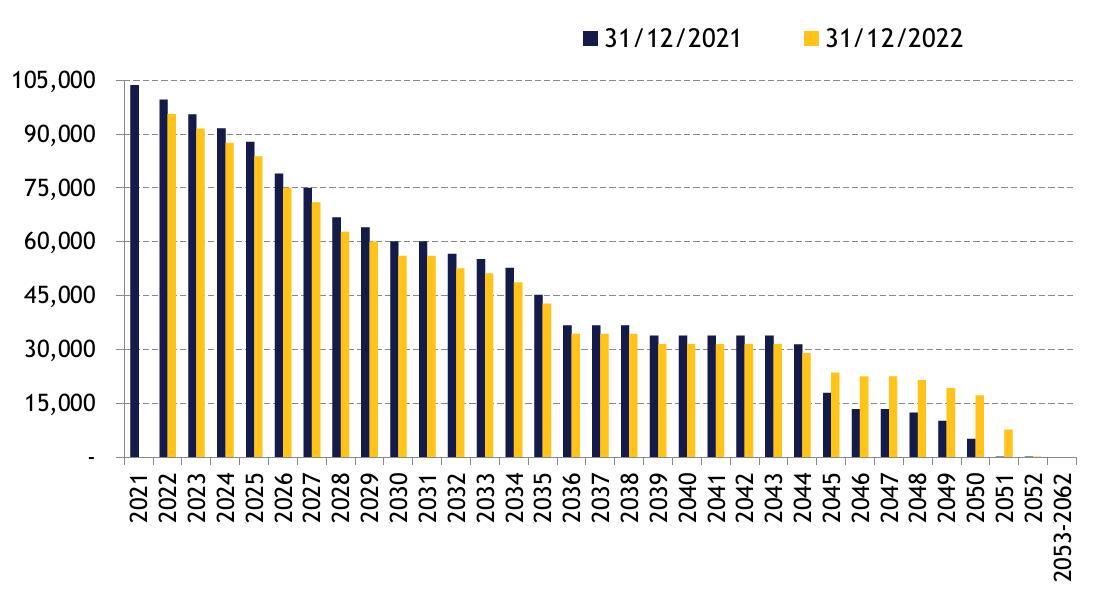

Below is the annual distribution of maturities from the end of 2021 (Chart I.1) and, in detail, the monthly distribution up to and including 2024 (Chart I.2).

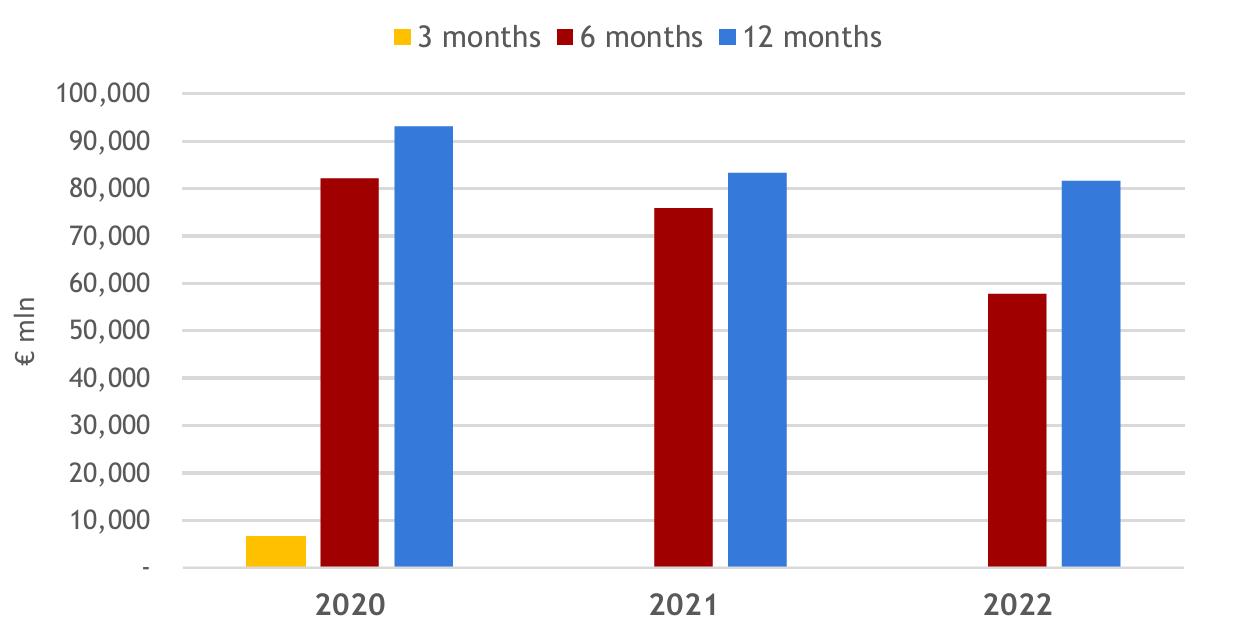

| CHART I.1: ANNUAL MATURITY PROFILE OF MEDIUM/LONG-TERM BONDS OUTSTANDING AS AT 31.12.2021 (EUR MILLION) |

|

| Source: MEF |

__

14 For “nominal value”, the definition adopted in EC Regulation no. 479/2009 of 25/05/2009 is used: “...The nominal value of a liability outstanding at the end of the year is the face value. The nominal value of an index-linked liability corresponds to its face value adjusted by the index-related change in the value of the principal accrued to the end of the year. [...] Liabilities denominated in a foreign currency shall be converted into the national currency on the basis of the representative market exchange rate prevailing on the last working day of each year. Liabilities denominated in a foreign currency and exchanged through contractual agreements to the national currency shall be converted into the national currency at the rate agreed on in those contracts”.

| MINISTRY OF ECONOMY AND FINANCE | 7 |

| CHART I.2: MONTHLY MATURITY PROFILE OF MEDIUM/LONG-TERM BONDS OUTSTANDING AS AT 31.12.2021 (EUR MILLION) |

|

| Source: MEF |

In detail, by the end of 2021, the medium-term refinancing risk improved significantly compared to the previous year with a decrease in the share of bonds15 to be refinanced in the five-year period (52.80% of the total), dropping from 54.74% as of 31/12/2021.The one-year refinancing risk, instead, remained almost unchanged (16.21% at the end of 2022, compared to 15.31% at the end of 2021).

The indicators used to quantify the interest rate risk on bond issuance portfolios, instead, are as follows:

| (i) | Financial duration, equal to the weighted average payment time for both principal and interest; |

| (ii) | the average refixing period, i.e., the average time taken by the debt portfolio to “integrate” market interest rate changes; |

| (iii) | the Cost-at-Risk, which quantifies the maximum additional cost in terms of interest expenditure in the event of adverse interest rate scenarios, along with the probability of actually having to bear this additional cost, deriving in turn from the probability that these adverse scenarios shall occur16. Cost-at-Risk (CaR) analysis is therefore used to identify, with a given probability, an expected cost level that may not be exceeded, as well as all the compositions of the bonds issuances whose cost-risk combinations are classed as being efficient, i.e., are such as to become dominant - for a given level of cost or risk - over any other hypothetical composition of the issuance portfolio. |

By simulating possible development scenarios of interest rates and inflation, it is possible to assess a series of issuance portfolios in the medium-term both in terms of cost of interest expenditure, calculated according to the ESA 2010 (European

__

15 The refinancing risk is measured on the stock of domestic and international government bonds post swap.

16 Please see the focus point on “The main quantitative indicators of interest rate risk” on page 22 of the 2014 Annual Public Debt Report, available at the address already provided on page 2 of this Chapter.

| 8 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2022 | |

System of Accounts), and of interest rate risk, also measured through the Cost-at-Risk. This identifies all potential issuance portfolios on the cost-risk efficient frontier, also called dominant portfolios, from which to elect the target portfolio for the year’s issuances.

From a technical point of view, the tool used for this analysis is an in-house developed model which the Public Debt Directorate has been using for a number of years, called “SAPE” (Issuance Portfolio Analysis Software)17.

The outstanding debt database used by SAPE at the end of 2021 was made up of domestic bonds, derivatives and bonds in USD. With regard to the latter, the Treasury’s policy is to issue any bonds in a foreign currency at generally better (or at least equal) cost conditions18 than those available for equivalent domestic instruments. Therefore, in order to estimate the refinancing costs of future maturities of USD-denominated bonds, the relevant derivative hedges were also taken into account, so that a currency exposure can be synthetically managed as if it were a Euro liability

The role of the issuance strategy in managing the rate/cost risk trade-off in 2022

In selecting the portfolio for future issuances, the trade-off between the incremental cost of the remuneration of the debt service required by the market (namely, the cost growth rate in the simulation period) and the risk, as measured by the indicators mentioned above, is fundamental. The purpose is to optimise the latter and minimise the previous one. Consequently, based on the market conditions, the investors’ needs and guaranteeing liquidity across the government bonds curve, the strategy attempts to increase the issuance of government bonds with longer maturities if economically efficient. In doing so, the Treasury’s issuance plan also considers the tools targeting retail investors (i.e., BTP Italia or Futura) and those with peculiar purposes (i.e., BTP Green).

The set of analysed portfolios can be effectively achieved, also in the presence of a different composition of the market segments, by allowing for financing:

| 1) | medium-long-term maturities expected in 2022 (equal to approx. EUR 230 billion); |

| 2) | outstanding BOTs (equal to about EUR 113 billion), with the so-called BOT roll-over during the year, i.e., the BOT issues necessary to cover the redemptions of the BOTs issued in the same year; |

| 3) | Central Government cash requirements, which, at the time, were estimated to be around EUR 100 billion19; |

| 4) | as well as ensuring that the Treasury has sufficient liquidity available to cater for all cash needs. |

__

17 Models and software are constantly being updated. A detailed description of the implications and functioning of the model can be found in the recently published study available in English at the following link: https://www.dt.mef.gov.it/en/debito_pubblico/Public_Debt_Management_Network/ebook/index.html.

A summary of the development of the model is included in Appendix 3 of the Report.

18 Including costs to hedge against exchange rate risks.

19 This figure formed the basis for public finance forecasts included in the 2021 Draft Budgetary Plan.

| MINISTRY OF ECONOMY AND FINANCE | 9 |

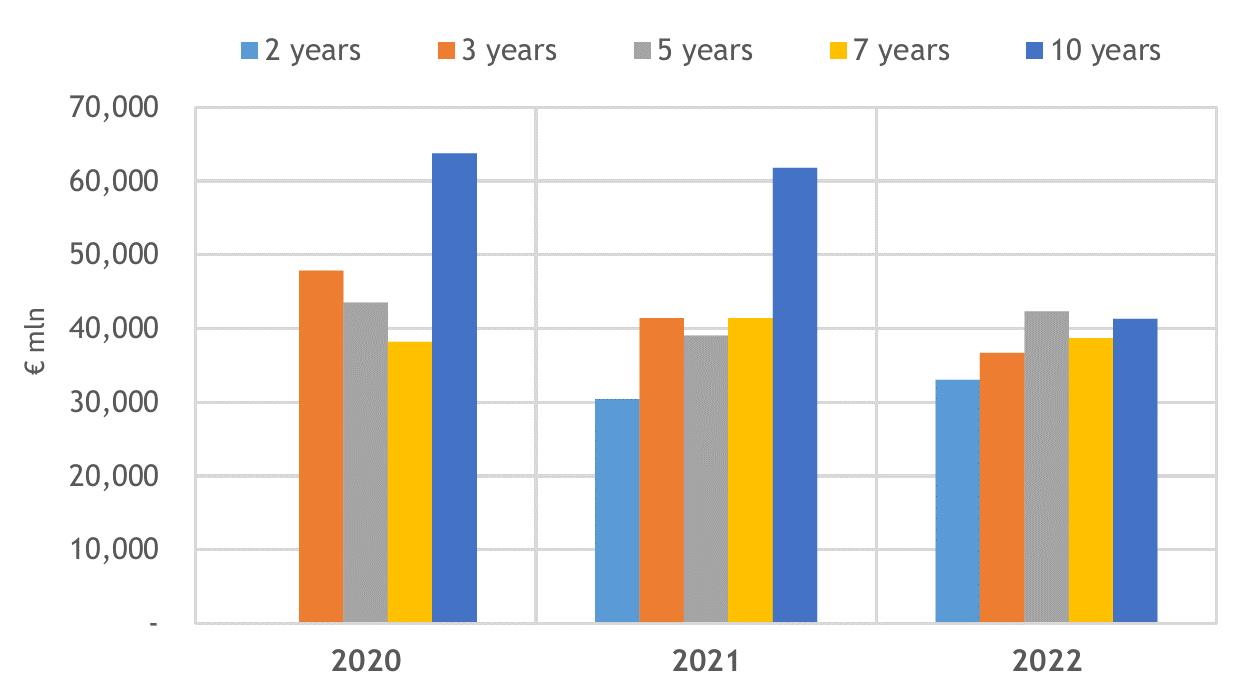

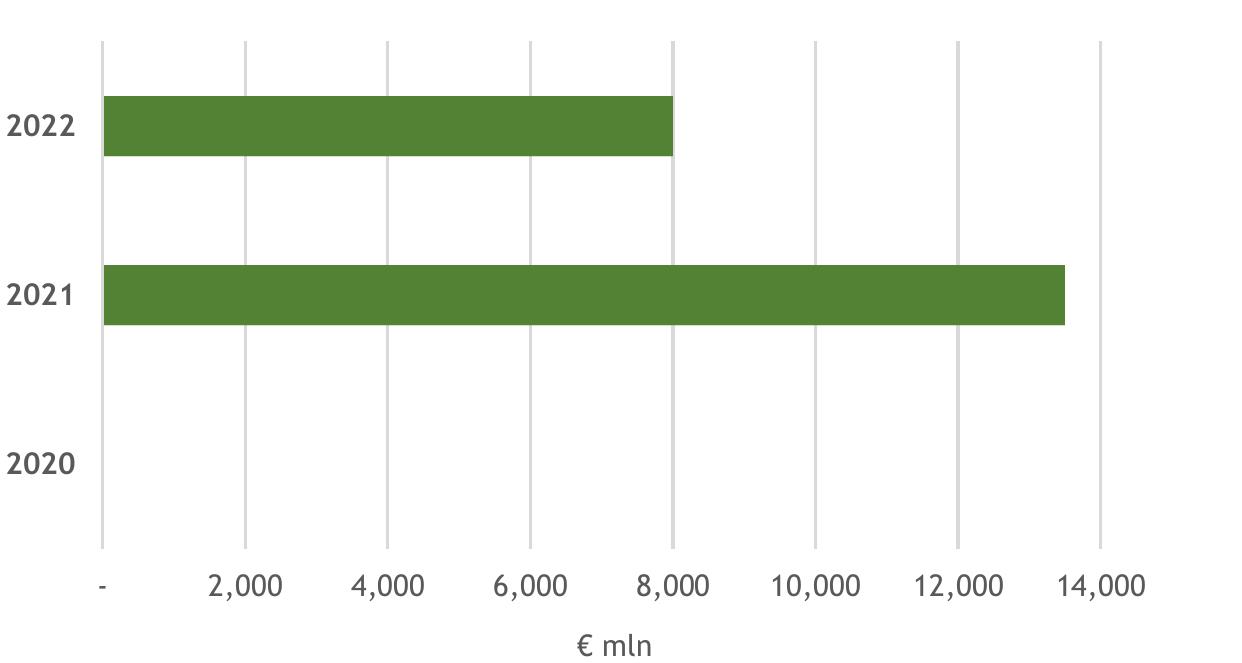

The set of portfolios analysed here reflects that of the previous year, as no considerable change was foreseen. The following chart shows the analysed portfolios:

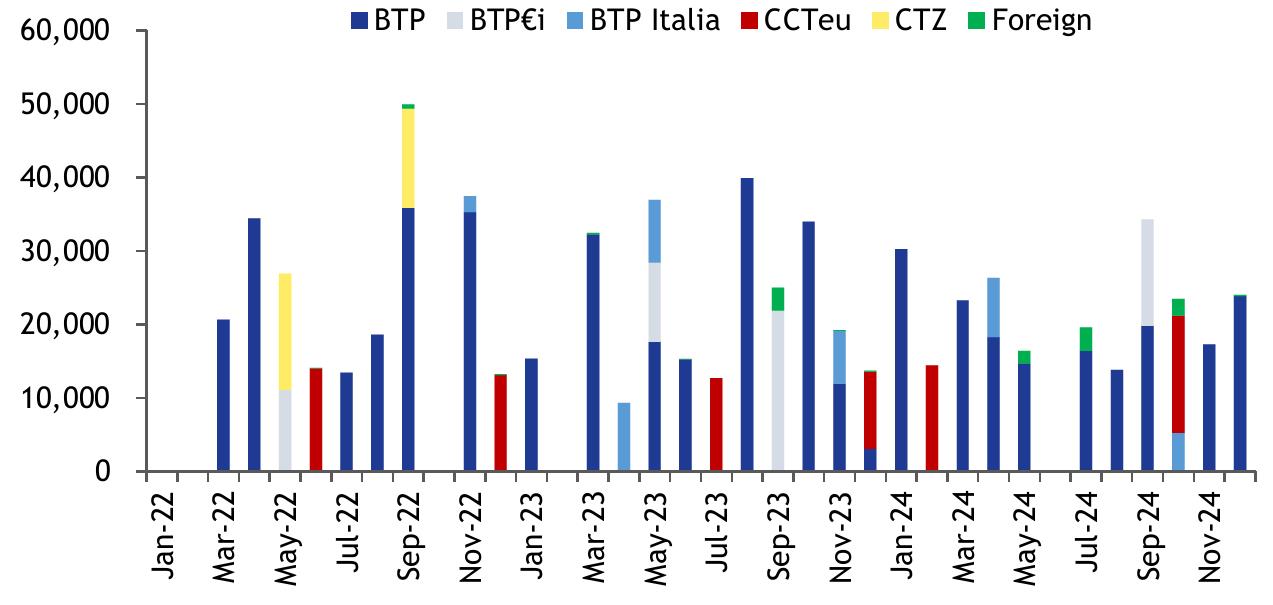

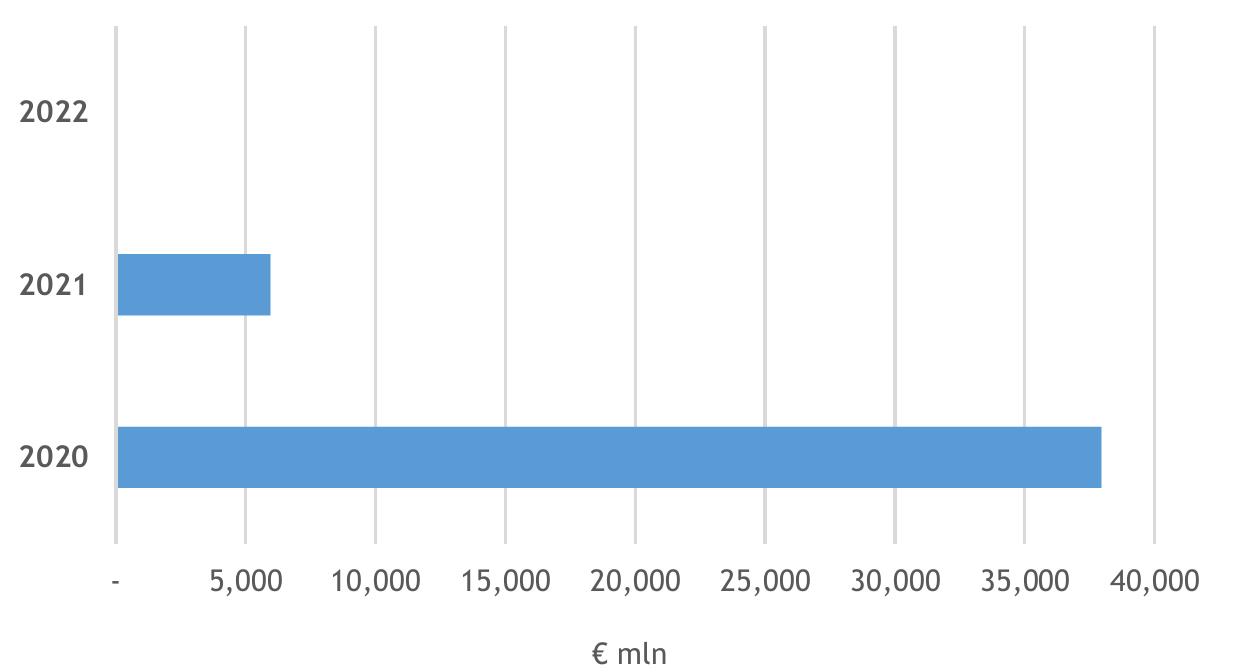

| CHART I.3: COMPOSITION OF THE ALTERNATIVE ISSUANCE PORTFOLIOS ANALYSED FOR 2022 (EUR MILLION) |

|

| Source: MEF |

The simulation assessment led to a portfolio selection for 2022 issuances in line with what was achieved in 2021. However, in relation to the previous year, the possible reduction of BOTs - more specifically those with 6-months maturity - was taken into account, given that part of the cash needs could have been hedged with Repo operations, also used in 2022, and a slight increase in CCTeus.

The role of derivative operations in managing the rate/cost risk trade-off for 2022

The Treasury has always carefully and constantly monitored the risks underlying its debt portfolio, identifying the main factors to which it is exposed from both a qualitative and a quantitative point of view. Any change occurring to the debt due to new placements and the natural maturity of the bonds is incorporated actively into the portfolio to contain and improve the portfolio’s risk profile. The Treasury, therefore, uses financial derivatives, in line with the prescriptions laid down in the Framework Decree, to contain the total cost of debt and protect the debt portfolio from the risk of interest and exchange rate increase, both during new issuances and after.

The 2022 Guidelines are in continuity with those of the previous years: derivative operations, therefore, have a variety of objectives, such as increasing the duration of debt, including the hedging through derivatives, by reducing

| 10 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2022 | |

exposure to unexpected and sudden interest rate fluctuations, guaranteeing good secondary market functioning of Government Bonds and improving the cost-risk profile in the medium to long term. Any change in the liability management policies might exclusively occur upon changes in the debt composition, portfolio underlying risks or risks or the strategic objectives pursued.

The pandemic crisis caused a significant burden on the state budget, reflected in an increase in the debt stock; despite this, the composition and riskiness of the debt did not change significantly. In line with the 2022 Guidelines, the management of the derivatives portfolio would have taken into account two main aspects:

(i) the evaluation and possible execution of both new Cross Currency Swaps to hedge the exchange rate risk associated with new currency operations and Interest Rate Swaps to mitigate exposure to interest rate rises and lengthen the duration if the swap curve continues to show shallow levels;

(ii) the possibility of restructuring positions in the portfolio to improve their effectiveness in terms of the objectives pursued, taking into account the changed market conditions compared to the time of their conclusion.

In 2022, the management of the derivative portfolio focused on: (i) hedging market risks, such as exchange rate risk, for possible issuances in foreign currency and interest rate risk; (ii) restructuring and/or concluding operations already in the derivatives portfolio; and (iii) managing collateral, through the collateralisation of additional existing derivative positions (subject to the availability of funds to be allocated to this project).

Measures to achieve debt issuance and management objectives for 2022

In relation to the set objectives, the Italian Treasury’s strategy for 2022 was structured as follows, covering the two phases of debt management:

Policies of domestic and foreign bonds at issuance

The Guidelines defined the issuance policy for 2022, taking into consideration the above-mentioned objectives in terms of average life, duration and the average refixing period, as well as the results of the cost-risk trade-off analysis.

In line with market conditions and given the need to ensure hedging of maturing bonds and of the Government Sector Needs, issuance choices in 2022 should therefore aim to:

| 1) | adjust BOT issuances to ensure an end-of-period stock, which would include the renewal of maturing bonds, although a reduction in net issuances is to be achieved compared to the previous year; |

| 2) | provide continuity with BTP Short Term issuances, specifically considering maturities occurring over the year and by integrating CTZ ones. The offered amount could have been as such as to produce net negative issuances; |

| 3) | as for 3- and 5-year BTPs, balance the overall amounts offered by reducing issuances compared to 2021. However, net issuances should be positive for both segments, although to a lesser extent for 5-yr BTPs vs. 3-yr BTPs, given the higher redemptions of the first compared to the second; |

| MINISTRY OF ECONOMY AND FINANCE | 11 |

| 4) | keep the gross issuances of 7-year BTPs in line with those of 2021, with a positive offer net of redemptions, to consolidate the 7-yr BTPs share on the stock of Government Bonds by the end of the year and contribute to extending the average life of debt. As for the 10-year BTP, in 2022, this instrument would have continued to be the benchmark for the yield curve of government bonds. Nevertheless, the issuance volume would have been lower than in 2021, and given the high maturities in the year, negative net issuance was expected. |

| 5) | allow that on the longer-term nominal maturities (15, 20, 30 and 50 years), in addition to ensuring liquidity on all instruments through regular and continuous issues, the Treasury would consider placing a new benchmark on the 15, 20 and 30-year maturities because of the float achieved by the current benchmarks. In the long-term sector, given the maturities, positive net issuance was expected; |

| 6) | increasing the supply of CCTeus compared to 2021 but not resulting in positive net issuance due to the high volume of maturing bonds. The Treasury also planned to place at least one new benchmark on maturities between 3 and 10 years; |

| 7) | ensure issuances in line with 2021 on the various maturities of BTP€is, with positive net issuances on the whole segment due to the reduced maturities during the year; |

| 8) | meet the demand for instruments dedicated to retail investors, envisaging at least one issue of BTP Italia, and reserving maximum flexibility on the most appropriate maturity, given the problematic predictability of the evolution of market conditions. Positive net issues were assumed for this instrument due to its short maturities. Similarly, for the other bond intended for the retail market, the BTP Futura, at least one issue with a maturity to be defined close to the placement was also planned; |

| 9) | continue issuing in US dollars regularly, solidifying the Treasury’s presence in this segment, in continuity with what has been implemented over the last three years. The objective is further building an ever more complete and liquid yield curve in USD, significantly broadening the base of institutional investors holding Italian public debt, with particular regard to strategic investors less present in the domestic bonds segment, such as insurance companies and Asian pension funds, and at the same time ensuring issuance costs aligned with those achievable on outstanding bonds. In continuity with previous years, provision was also made for the possibility of using the MTN programme in Euro and/or in foreign currency to meet the demand for public or private placements of primary institutional investors, subject to the minimum requirements20 of the issue format; |

| 10) | examine the possibility to reopen the existing BTP Green Bond with subsequent issuance tranches and a new benchmark. |

__

20 Maturity of at least three years, minimum amount of EUR 200 million and a minimum negotiable amount of EUR 500,000.

| 12 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2022 | |

Post-issuance debt management operations

As mentioned, the Italian Treasury may also use extraordinary exchange and repurchase operations regarding government bonds to achieve the objectives mentioned above for the existing debt portfolio.

The 2022 Guidelines called for a policy in line with that adopted in recent years. Extraordinary operations are, by their very nature, highly flexible in terms of methods and timing of execution and pursue a variety of purposes, such as managing refinancing risk, reshaping the maturity profile, supporting liquidity and ensuring the efficiency of the sovereign bond market, as well as reducing the average cost paid by the Treasury on outstanding bonds.

| I.4 | MONITORING AND MANAGING THE CASH ACCOUNT TO STABILISE THE BALANCE |

The cash account for Treasury services

The Cash Account is held by the Treasury with the Bank of Italy, where its incoming cash flows and payments are recorded. To ensure efficient handling of funds, the Account is used by all entities required to operate and consists of the sum of the balances of all accounts opened with the Treasury21. This setting is characterised by strong volatility due to the large number of entities that move funds with the Treasury and to the cyclical presence, usually on a monthly basis, of certain flows that significantly affect daily balances. In particular, a strong impact on the payment side - mainly in the first few days of the month - is determined by the disbursement of pensions, while on the collection side, the central days of the month are marked by the collection of tax revenues. Issuances and, to an even greater extent, redemptions of government bonds at maturity can also cause significant fluctuations in the Cash Account.

The Treasury and the Bank of Italy manage its liquidity according to forecasts of Treasury flows and related stocks. This approach also meets the European Central Bank’s (ECB) needs, which calls for monetary policy to be facilitated through an efficient forecast of the liquidity held by public institutions at national central banks in the Eurozone.

The regulatory context for cash management in 2022

Cash management principles were established in the MEF’s general Directive for administrative procedures and management in the recent Decree of the Ministry no. 1416 of 10/01/2022 concerning handling cash held on the Treasury Cash Account (General Decree) and in the 2022 Public Debt Management Guidelines.

In particular, the general Directive stated that the focus should be on improving the model to process daily cash forecasts for the Cash Account and that the

__

21 For further details, please refer to Italian Ministerial Decree No. 51961 of 26/06/2015 concerning the identification of government deposits held with the Bank of Italy, implementing Art. 5, paragraph 5, of Italian Presidential Decree No. 398/2003.

| MINISTRY OF ECONOMY AND FINANCE | 13 |

monitoring and management of that Account must be geared towards stabilising the balance. The Guidelines, with regard to the management of the MEF’s liquidity, emphasise how the introduction of the repurchase agreement (Repo) activity, already initiated in 2021, would have allowed the adoption of an issuance policy oriented to the continuation of the containment of short-term issues, on the one hand, and made possible further positive effects, both in terms of efficiency in the collection of very short-term liquidity, and in the management of distortions present in the market, on the other.

In 2022, the Treasury completed a process of general reform of the regulations on cash management activities, which came to fruition with the entry into force of the so-called General Decree, innovating the previous regulatory framework consisting of Decree No. 25391 of 25/10/2011.

The revision became necessary in order to update the framework for the performance of cash management operations and make it more in keeping with the trading-focused management methods most commonly used in the financial markets.

The Decree introduces essential new features. Non-collateralised liquidity-raising and liquidity-use operations may be conducted through bilateral negotiations and executed directly by the MEF both over the counter and on trading venues. At the same time, the operational activity carried out on overnight maturities through the auction mechanism is discontinued.

With regard to the counter parties eligible to participate in the operations mentioned above, the MEF simplified, for all the actors involved, the execution of liquidity collection or lending operations with the Treasury to guarantee a broader range of counter parties, including not only Specialists in Government Bonds, institutions or public entities that manage the liquidity of EU Member States but also counter parties selected by the Ministry based on structure and reliability criteria, to make the management of the MEF’s liquidity more efficient and effective.

With reference to the evolution of the monetary policy framework in the course of 2022, the European Central Bank (ECB) put in place essential measures that significantly altered the context in which the Treasury found itself managing the liquidity held in the Account, especially in the second half of the year.

In addition to having initiated a policy of normalising its reference rates22, bringing the deposit facility into positive territory after many years of negative rates, the ECB intervened in September, issuing a Decision on the remuneration of Government Deposits held with National Central Banks. Specifically, the ECB temporarily suspended the zero-remuneration regime for over-threshold government deposits where the deposit facility has a positive rate23, establishing instead the application of the lowest rate between the deposit facility and the €STR until the end of April 2023, with the removal of the 0%24.

__

22 For more details and insights, please refer to Chapter II - Monetary policies and effects on the Euro area Money Market.

23 In particular, see the address made by ECB/2019/7 (https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32019O0007) and the ECB/2019/8 Decision (https://eur-lex.europa.eu/legal-content/IT/TXT/?uri=CELEX:32019D0008).

24 For more details and insights, please refer to Chapter III - Treasury Cash Management.

| 14 | MINISTRY OF ECONOMY AND FINANCE |

I. DEBT MANAGEMENT OBJECTIVES FOR 2022 | |

Cash management

Liquidity management - or cash management - was established in 2007 and consists of the activity of daily movements on the money market of the liquid assets held in the account “Treasury liquidity for the treasury service”, held at the Bank of Italy, through both the execution of repurchase agreements (Repo) and by resorting to bilateral non-collateralised lending and funding negotiations on the money market, to ensure an adequate level of liquidity, in relation to the multiple movements of the State Treasury and seeking, at the same time, to adequately remunerate cash balances, taking into account market conditions and risk levels.

This activity is closely linked to public debt management and constitutes the link between bonds issues and the daily fluctuations of the Cash Account.

To carry out efficient cash management a preliminary monitoring and accurate estimation activity on both very short-term cash provisions and annual ones is fundamental.

The monitoring consists of a continuous exchange of information between the Bank of Italy and the MEF (State General Accounting Department and Department of the Treasury - Public Debt Directorate), with forecast and actual data on all collections and payments involving accounts held with the Treasury and the resulting estimate of the Cash Account balance. The information exchanges are updated repeatedly during each working day, to estimate the end-of-day balance of the Account. The liquidity forecasts of the MEF and the Bank of Italy also include longer-term scenarios, shared weekly, with a time horizon consistent with monetary policy and issuance planning requirements.

On the other hand, money market operations consist of lending or borrowing surplus liquidity to manage temporary cash shortages.

In recent years and until the first part of 2022, the cash management business had to operate in an environment characterised by permanently negative money market rates, low volatility, and a massive ECB presence through many unconventional monetary policy measures. This context had made it very difficult to engage in market lending at better rates than those applied by the central bank on the liquidity left with it. On the other hand, Repo activity, especially in funding, was particularly effective in that a single instrument was used to meet market makers’ need for collateral, particularly on some of the most sought-after government bonds, while at the same time allowing funding operations to be carried out at particularly advantageous rates.

The ECB decision on remuneration, reported in the previous paragraph, allowed the Treasury to continue to operate on the money market with the same continuity but, at the same time, prompted the decision to keep substantial portions of liquidity with the Bank of Italy since, in the absence of the decision to suspend the application of the cap, the Treasury - as well as all other European debt managers - would have been forced to invest surplus liquidity in the market to improve its remuneration, with inevitable impacts on the money market, the repo market and the effective functioning of the spot market for government bonds.

| MINISTRY OF ECONOMY AND FINANCE | 15 |

| LEARN MORE | The Repo Market and Treasury’s Operations The Repo market is the market where two counterparties agree to enter into an agreement whereby one party lends a repurchase bond (specific, in the case of “Special Repo”, or generic, in the case of “General Collateral”) for a fixed period (the term of the agreement) in exchange for liquidity. At the end of the operation, there is a reverse exchange (liquidity against bonds) at a predetermined price (rate). Operators can, therefore, trade Repos to meet a need for liquidity (typically in the General Collateral agreement) or for specific bonds (in the Special Repo agreement) that they temporarily lack. The Treasury could thus resort to Repo operations as a cash management instrument to use the surplus cash at more advantageous conditions than those imposed by the ECB on the balances deposited on the Cash Account. Alternatively, the Treasury could use Repo operations to collect cash to provide liquidity in case of temporarily limited availability and, simultaneously, satisfy the needs of Primary Dealers by facilitating their market-making commitments on the secondary market. The Treasury could also intervene in the secondary market in the event of tension caused by scarcity of specific bonds, temporally selling Repos to mitigate the effect of such scarcity on the performance of Government bonds. Therefore, when the Treasury borrows liquidity from the Repo market, it must, in return, cede to the counterparty one or more bonds as a guarantee of the successful outcome of the operation. For this reason, the Treasury had to preliminarily acquire a portfolio of Government bonds used in Repo operations. To this end, at the launch of the operation in May 2021, an ad hoc issuance of 15 BTPs, each worth EUR 1,000 million (for a total of EUR 15,000 million), issued exclusively for this specific purpose, was performed. In the months that followed, the total amount of the portfolio was progressively increased from EUR 15,000 million in 2021 to EUR 45,000 million in 2022, divided among 45 BTPs, in order to further streamline cash management and provide broader liquidity support on the secondary market - both spot and forward - for government bonds. |

| 16 | MINISTRY OF ECONOMY AND FINANCE |

| II. | THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

| II.1 | MONETARY POLICIES AND EFFECTS ON THE EURO AREA MONEY MARKET |

Monetary policies in the Euro area

The economic outlook for the Euro area throughout 2022 was strongly affected by post-Covid normalisation dynamics and tensions related to the invasion of Ukraine. After rebounding in 2021, growth in 2022 remained strong, albeit lower than in 2021, affected in particular by sharp increases in energy commodity prices and increased uncertainty related to the continuation of the war. Along with the repercussions on economic activity, the conflict contributed to the significant rise in the inflation rate throughout 2022, to record highs for the last two decades.

In the face of intensifying inflationary pressures and on the basis of its assessment of the outlook for the economy and prices, the ECB Governing Council adopted several measures necessary to ensure price stability and safeguard financial soundness in 2022.

In the first part of the year, it opted to maintain key interest rate levels at the previous year’s levels but signalled that the time was approaching when it would decide to raise them, and at the same time, revised the Asset Purchase Programme (APP), first by reducing the monthly net purchases and then by setting its end date as 1/07/2022. It was decided that the principal repaid on maturing bonds would continue to be reinvested beyond that date.

In the year’s second half, the ECB embarked on a phase of decisive and repeated increases in the main interest rates. In July, September, October and December, it raised the official rates by 0.50% and 0.75% on two consecutive occasions and finally by a further 0.50%, respectively, resulting in an overall increase of 2.5% of all key interest rates from July until the end of the year. At its last meeting of the year, the Governing Council also announced that these rates would still have to be raised significantly and steadily to support a timely return of inflation to the medium-term target. In addition, it decided to relax the terms applied to the targeted longer-term refinancing operations (TLTRO3) and announced the criteria according to which it will normalise the Euro system’s holdings of bonds for monetary policy purposes in December. The APP programme portfolio will be reduced at a measured and predictable pace, averaging EUR 15 billion per month from the beginning of March until the end of the second quarter of 2023. In contrast, the reinvestment of maturing bonds under the Pandemic Emergency Purchase Programme (PEPP) will continue at least until the end of 2024 and will be conducted in a flexible manner over time and across jurisdictions.

| MINISTRY OF ECONOMY AND FINANCE | 17 |

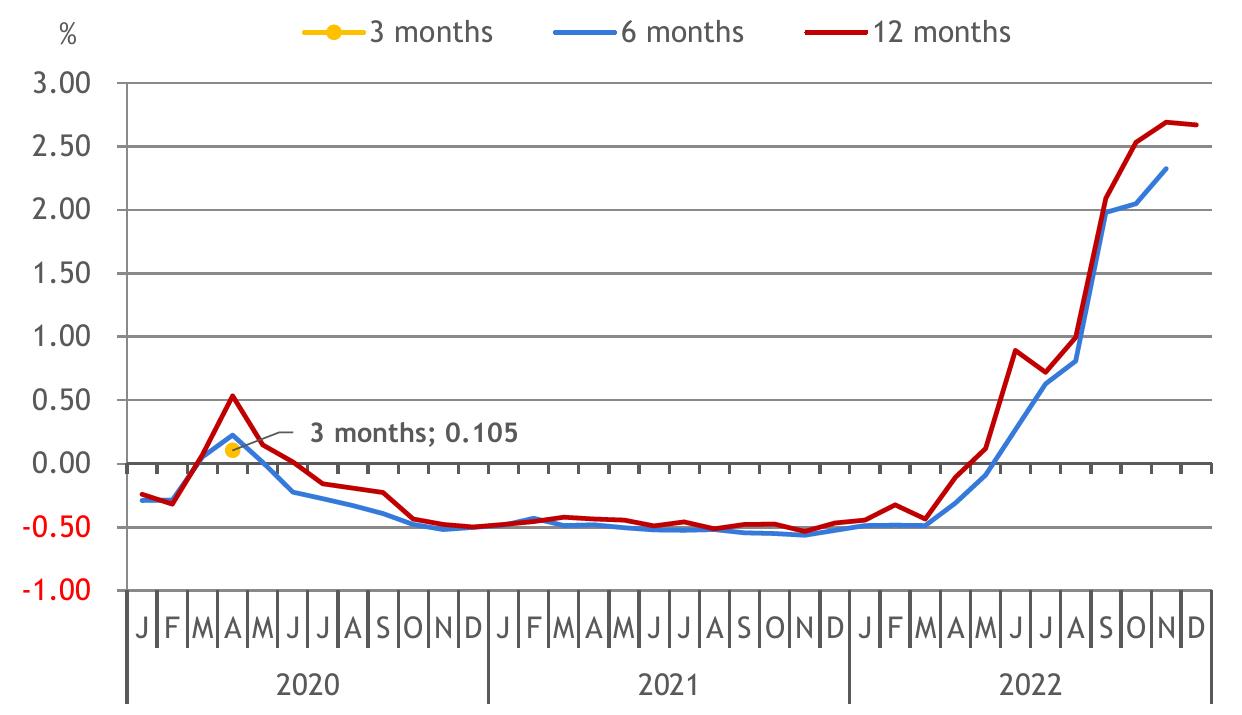

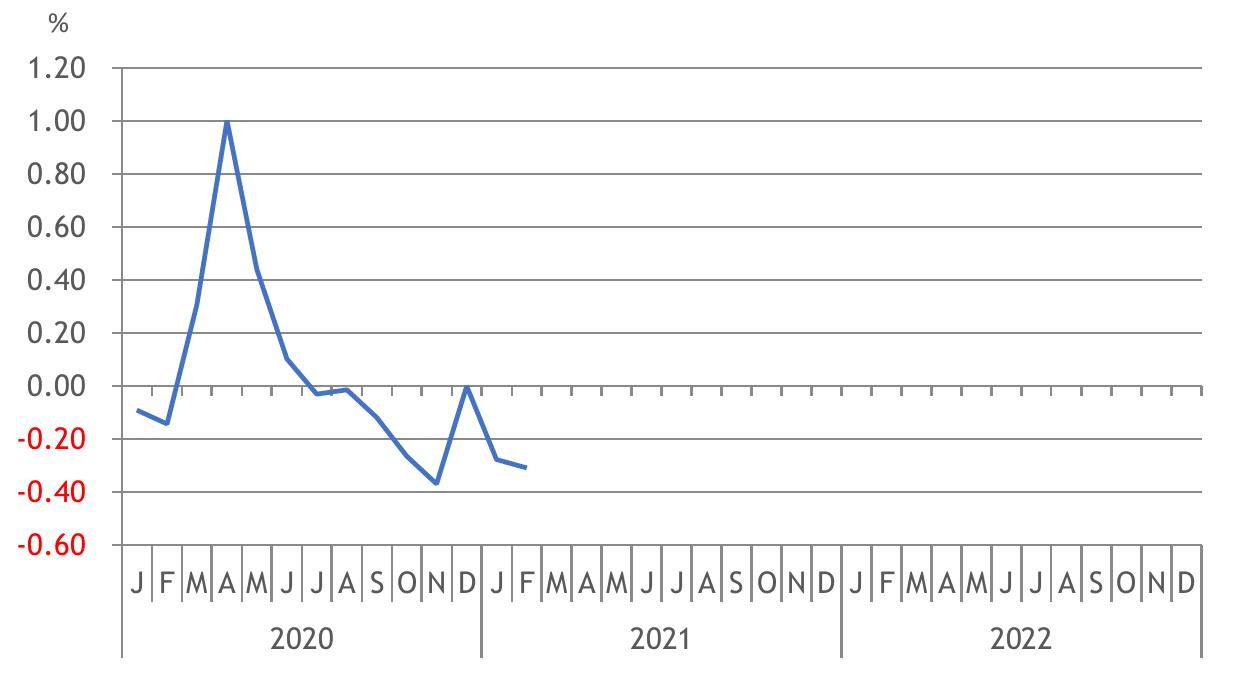

The Euro area money market

In Europe, the levels of the main ECB rates remained constant throughout the first half of 2022, confirming the ECB Deposit Facility (DF) rate at a negative 0.50%, the Main Refinancing Operation (MRO) rate at 0%, and the Marginal Lending Facility (MLF) rate at 0.25%.

However, as analysed in the previous section, the consequences brought about by the outbreak of war in Ukraine and the continuing problems in the ability of the logistics chain to supply raw materials and semi-finished products on time and in quantities to meet demand led the world’s main central banks to interrupt a long period of monetary easing to stem the sudden onset of inflationary pressures and to contain market expectations and initiate a phase of tightening monetary conditions. Therefore, in the second half of the year, the ECB raised its main reference rates, ending the year with the DF rate at 2%, the MRO at 2.5% and the MLF rate at 2.75%.

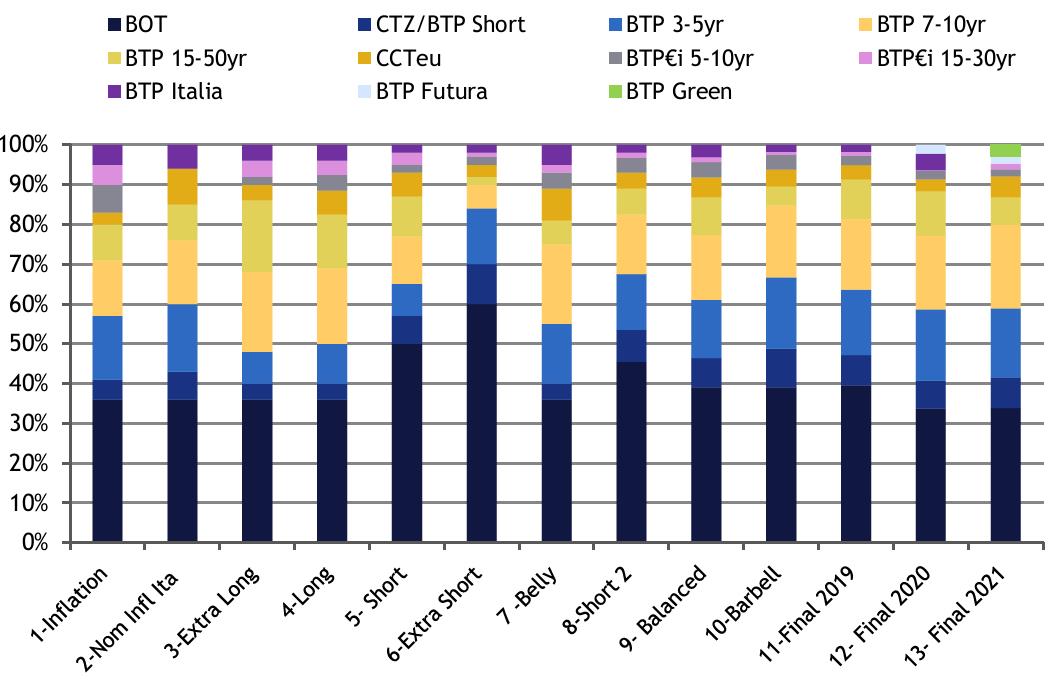

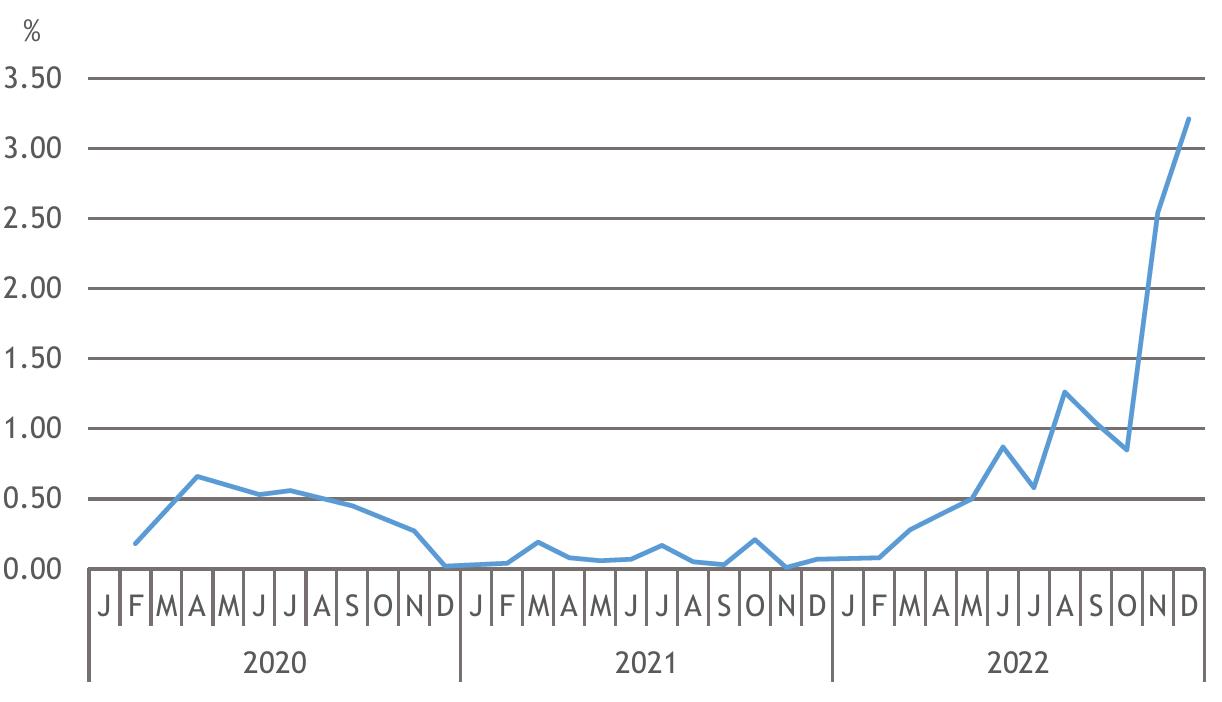

Below is a chart comparing the main money market rates with those of the ECB over the last two years.

CHART II.1: DEVELOPMENT OF THE MAIN MONEY MARKET RATES IN 2021-2022 (%) |

|

| Source: Elaboration on Reuters data |

As the chart shows, the level of the 1G money market rates (Eonia until its termination on 2/01/2022, and then €STR for the whole of 2022) remained broadly close to the level of the ECB deposit rate until the end of July, when the ECB announced the first increase in its rates and, as a result, the rest of the money market rates also adjusted to the new levels.

| II.2 | THE EURO AREA BOND MARKETS |

In 2022, multiple factors changed the reference framework of the financial markets: from the slowdown in economic activity produced by the COVID-19 pandemic to the dramatic war events in Ukraine, which caused an energy crisis with

| 18 | MINISTRY OF ECONOMY AND FINANCE |

II. THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

negative effects on consumer price trends and economic activity. To this already complex picture added - as repeatedly mentioned - the launch of restrictive measures by Central Banks in response to the changed macroeconomic context, characterised by a marked increase in inflation.

Therefore, unlike in 2021, when, thanks to the continuation of the European Central Bank’s bond purchase programmes, conditions in the financial markets and in particular in the government bond market had remained relatively relaxed, from 2022, volatility affected all asset classes, including the government bond market.

After a January characterised by substantial stability, the Ukraine conflict outbreak fuelled global uncertainty about the economic recovery and fears about rising inflation. Higher energy prices, on the one hand, and continuing supply bottlenecks, on the other, led to a marked increase in inflation in the world’s major economies. Central banks worldwide reacted to the changed environment by accelerating the normalisation of monetary policies. After the decisions of the Federal Reserve and the Bank of England in March to make the first (by 25 basis points) and third consecutive increases in reference rates, respectively, on 14 April, it was the turn of the ECB, which confirmed the reduction in net purchases of bonds, fuelling expectations of a rise in the deposit rate by the end of the year. At its meeting in early June, in the face of a marked inflationary scenario further exacerbated by the impact on energy prices of the war in Ukraine, the ECB continued to pave the road towards normalisation by announcing the end of the APP programme on 1 July on the one hand, and the intention to make the first 25 basis points rate hike at the July meeting on the other.

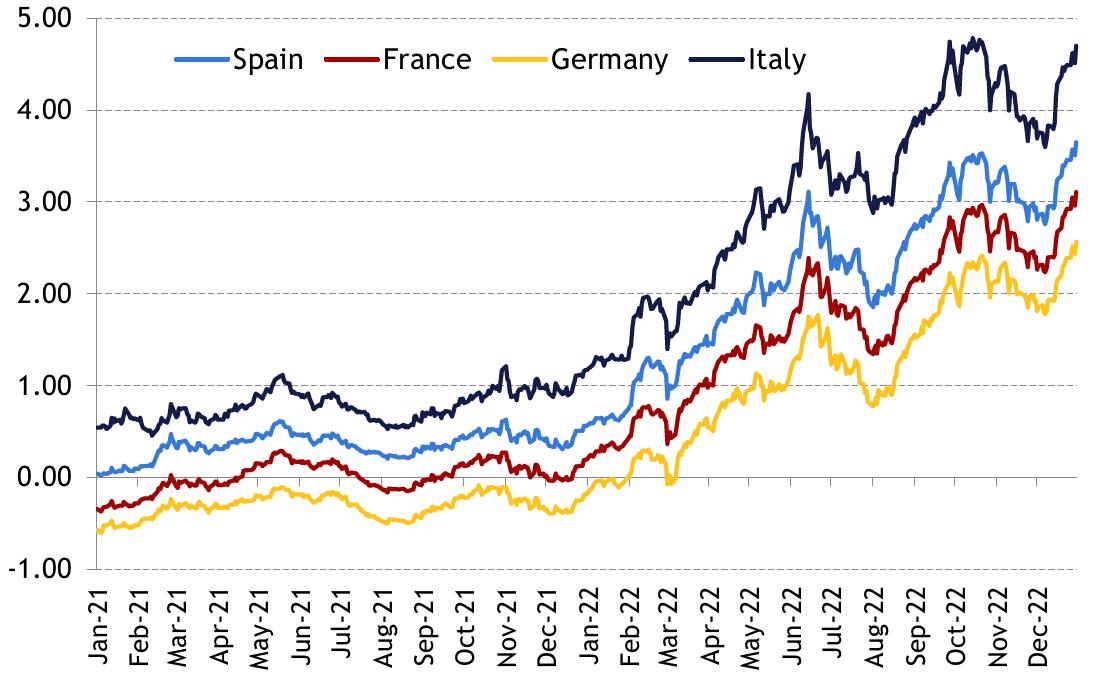

In this context, starting from the end of February and steadily until mid-June, the yield curve of Italian government bonds, as well as the government yield curves of other European issuers, showed a marked upward movement accompanied by a widening, albeit to a lesser extent, of the spread towards Germany. The general rise in rates was accompanied by a marked increase in intra-day volatility, especially in conjunction with the publication of inflation data, the speeches of ECB representatives, and the actual monetary policy announcements.

Tensions eased momentarily in the aftermath of the ECB’s ad-hoc meeting in mid-June, during which the European Central Bank showed greater readiness to adopt flexibility in reinvestments within the PEPP portfolio and announced to had taken concrete steps to complete the design of a new instrument (TPI - Transmission Protection Instrument), aimed at countering situations of deteriorating financing conditions in individual Euro area countries not justified by the fundamentals of their economies.

Following this announcement, the Euro area government bond market experienced a temporary drop in yields, accompanied by a reduction in the spread of peripheral countries compared to Germany. However, market conditions deteriorated again starting in July when to cope with well above-expected inflation, the ECB opted for three consecutive hikes in its reference rates, bringing them back into positive territory after eight years: the first in July by 50 basis points (higher than the 25 announced at the previous meeting), followed by one in September by 75 basis points and one in December by another 50 basis points. These hikes and the prospects of reduced bond purchases induced a significant rise in interest rates in all markets of advanced economies, including the Eurozone sovereign bond market.

| MINISTRY OF ECONOMY AND FINANCE | 19 |

Moreover, since the end of September, the announcement of a strongly expansionary fiscal programme by the United Kingdom led to a sharp rise in UK government bond yields, with consequences on the Euro area bond markets. The situation subsequently improved thanks to the Bank of England’s interventions in the market and the government’s decision to withdraw the announced fiscal policy measures, which was accompanied by a fall in yields and volatility.

Also, in the latter part of the year, hopes of lower increases in official rates by central banks generated a favourable climate on world markets, accompanied by the closure of previously risk-averse positions, in which government bonds of high debt countries such as Italy were underweight, generating a general reduction in yields and a compression of European countries’ spreads with respect to Germany.

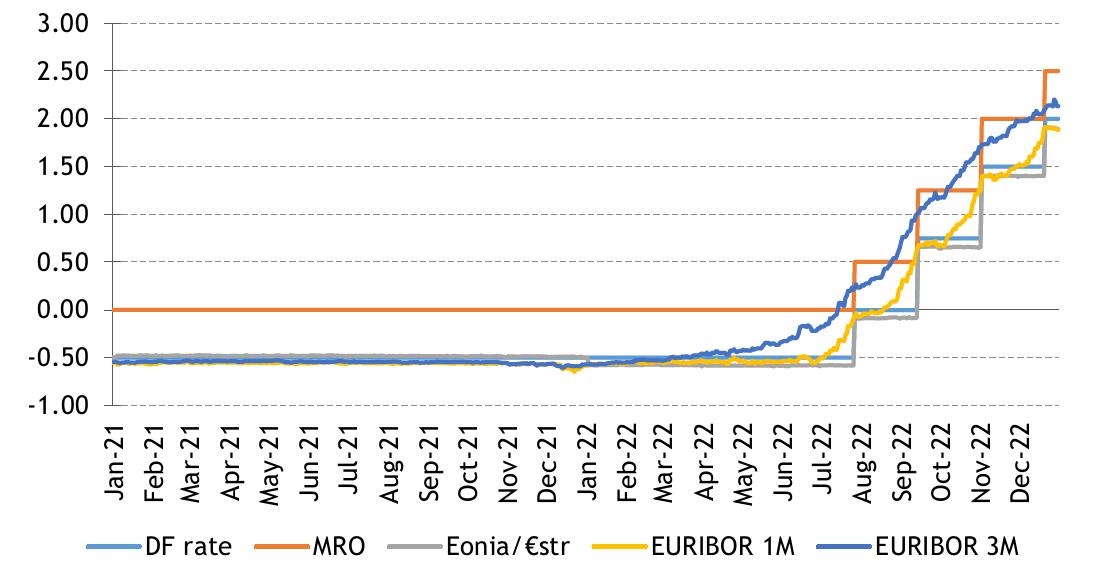

CHART II.2: TREND OF EUROPEAN GOVERNMENT BOND YIELDS - 10-YEAR MATURITY (%) |

|

| Source: Elaboration on Bloomberg data |

As shown in Chart II.2, looking at the dynamics of European government bond yields over the year as a whole, Italy recorded the most significant increase, amounting to around 349 basis points on the ten-year maturity, followed by Spain (around 305 basis points), France (around 286 basis points) and Germany (around 269 basis points). The bulk of this increase was recorded in the first half of the year, signalling that a significant part of the reduction in monetary stimulus and the progressive normalisation of monetary policy had already been incorporated into market participants’ expectations even before the actual rate hikes by the ECB.

| 20 | MINISTRY OF ECONOMY AND FINANCE |

II. THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

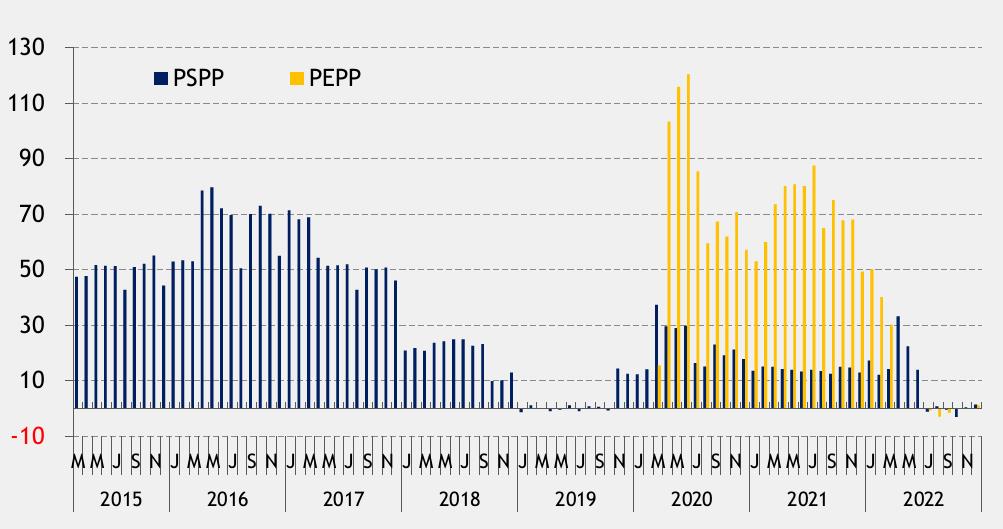

| FOCUS | Details on the evolution of the Public Sector Purchase Programme (PSPP) and the implementation of the Pandemic Emergency Purchase Programme (PEPP) during 2022

Within the Asset Purchase Programme (APP) the Public Sector Purchase Programme (PSPP) is the programme, which started on 9/03/2015, of net bonds purchases issued by central governments and public agencies of Euro area countries and supranational institutions. In 2020, following the spread of the Covid-19 pandemic, the FPA was further strengthened with an additional temporary endowment of EUR 120 billion25, as well as complemented by an extraordinary asset purchase programme (Pandemic Emergency Purchase Programme, PEPP) with a total endowment of EUR 750 billion26, later expanded to EUR 1,850 billion, and a time horizon of net purchases extended until at least the end of March 2022, with reinvestment of maturing capital until the end of 202327. In February 202228, in line with what was announced in December 2021, in the light of a significant increase in the inflation outlook, the Governing Council confirmed the discontinuation of net purchases under the PEPP at the end of March 2022 and the extension of the reinvestment horizon until the end of 2024, with flexibility in the choice of asset classes and countries to take account of possible pandemic-related market fragmentation. At the same time, to pursue the stabilisation of inflation in the medium term, the reduction in the pace of monthly net purchases under the APP was also confirmed, amounting to EUR 40 billion in Q2, EUR 30 billion in Q3 and EUR 20 billion from October 2022 onwards. However, following the Russian invasion of Ukraine and the ensuing climate of uncertainty, with its monetary policy decision of 10/03,29 the ECB revised the pace of monthly net purchases under the APP to EUR 40 billion in April, EUR 30 billion in May and EUR 20 billion in June, and then announced at the following meeting the complete discontinuation of purchases from the second half of the year, while continuing to reinvest in full the principal repaid on maturing bonds30. In addition, to cope with changing market dynamics and to safeguard the transmission mechanism of monetary policy, the Governing Council introduced a new instrument, the Transmission Protection Instrument (TPI), at its meeting on 21 July. The TPI provides for secondary market purchases of public sector bonds, with a residual maturity of between one and ten years, to counter deteriorating financing conditions in individual Euro Area countries that are not justified by fundamentals. However, unlike the other purchase programmes, the activation of this new instrument is subject to the Euro system jurisdictions’ compliance with eligibility criteria aimed at assessing the sustainability of their fiscal and macroeconomic policies31. Finally, in December 202232, taking into account the changed inflation outlook and with a view to pursuing a normalisation of the Euro system’s bonds holdings, the Governing Council announced a reduction in the APP portfolio starting in March 2023 at a pace averaging EUR 15 billion per month until the end of the second quarter, and subsequently redetermined over time. Figure 1 shows the evolution of monthly net purchases under the PSPP from the programme’s start (March 2015) until December 2022 and under the PEPP from the programme’s start (March 2020) until the end of the year. |

__

25 Monetary Policy Decisions 12/03/2020

26 Monetary Policy Decisions 18/03/2020

27 For more details on the features and changes to the PSPP and PEPP in each year, see the relevant focus in the Public Debt Report of previous years.

28 Monetary Policy Decisions 3/02/2022

29 Monetary Policy Decision 10/03/2022

30 Monetary Policy Decision 09/06/2022

31 For further details on the features of the TPI, please refer to the press release issued by the European Central Bank: The Transmission Protection Instrument 21/07/2022

32 Monetary Policy Decisions 15/12/2022

| MINISTRY OF ECONOMY AND FINANCE | 21 |

| | FIGURE 1: MONTHLY NET PURCHASES UNDER THE PSPP AND PEPP PROGRAMMES (IN EUR BILLION) |

|

| Source: Elaboration on ECB data |

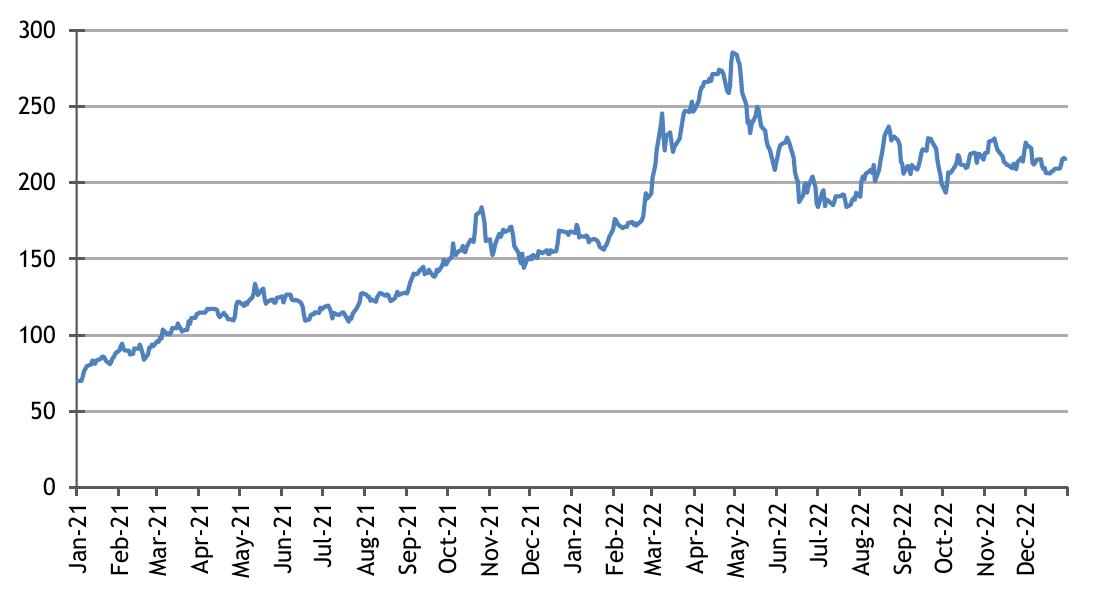

Regarding the ECB’s activity under the Pandemic Emergency Purchase Programme, net purchases amounted to EUR 116.305 billion in 2022, which was down sharply from EUR 840.40 billion in 2021 due to the programme’s discontinuation at the end of March. Thus, since the start of the programme, net purchases totalled EUR 1,713.87 billion. Monthly volumes of net purchases averaged EUR 40 billion in the first quarter of the year, when the programme was still in force, and then fell to zero in the remainder of the year when only the reinvestment of the principal repaid on maturing bonds was planned. With reference to Italian government bonds, net purchases under PEPPs during the year amounted to just over EUR 29 billion, compared to EUR 132 billion in 2021. Overall, at the end of the year, the stock of Italian bonds purchased stood at just over EUR 287 billion, with an average life of around 7.20 years, up from 7.12 years the previous year. |

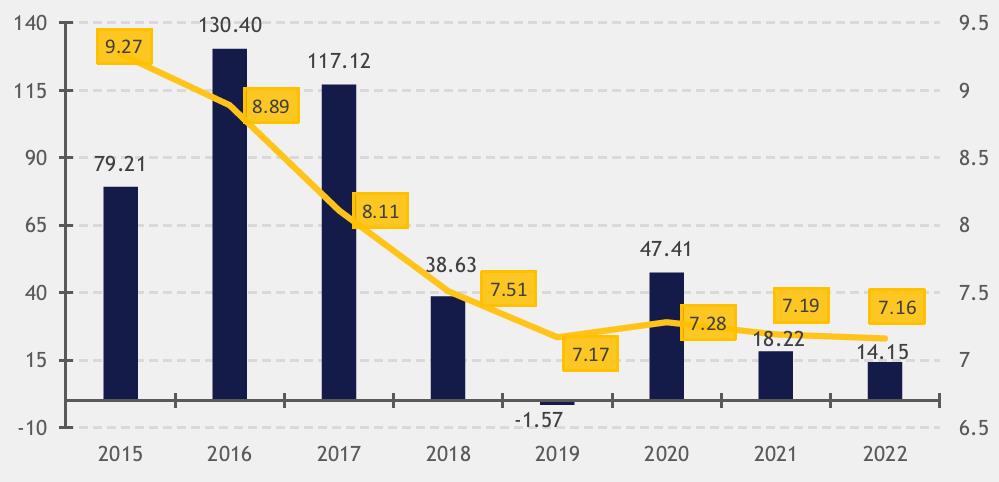

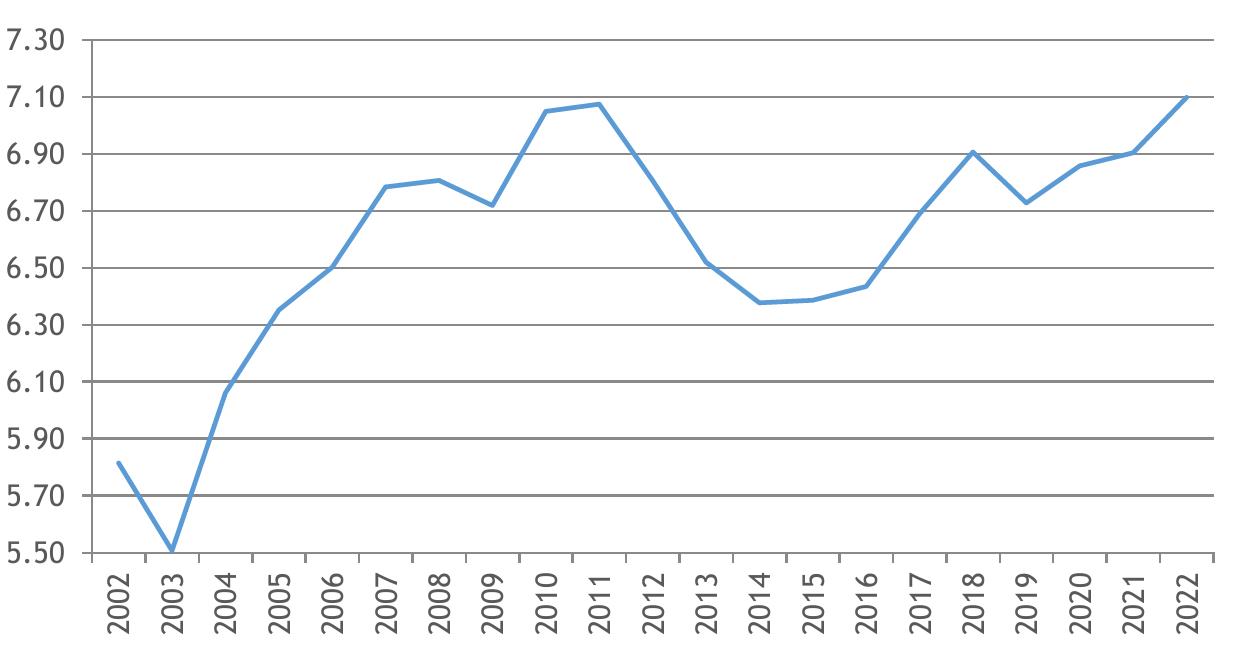

| FIGURE 2: ANNUAL VOLUME (EUR BILLION) AND AVERAGE LIFE (IN YEARS) OF THE STOCK OF ITALIAN GOVERNMENT BONDS PURCHASED BY THE ECB UNDER THE PSPP PROGRAMME |

|

| |

| 22 | MINISTRY OF ECONOMY AND FINANCE |

II. THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

| | In the context of the Public Sector Purchase Programme (Figure 2), on the other hand, Italian government bonds amounting to approximately EUR 14.15 billion were purchased last year, down from EUR 18.20 billion in 2021. The total volume of Italian bonds repurchased by the ECB from the start of the programme to 31/12/2022 is equal to EUR 443.56 billion33, while the average life of the stock stands at 7.16 years, slightly lower than the 7.19 years recorded at the end of 2021. |

| II.3 | TRENDS IN THE ITALIAN GOVERNMENT BONDS MARKET |

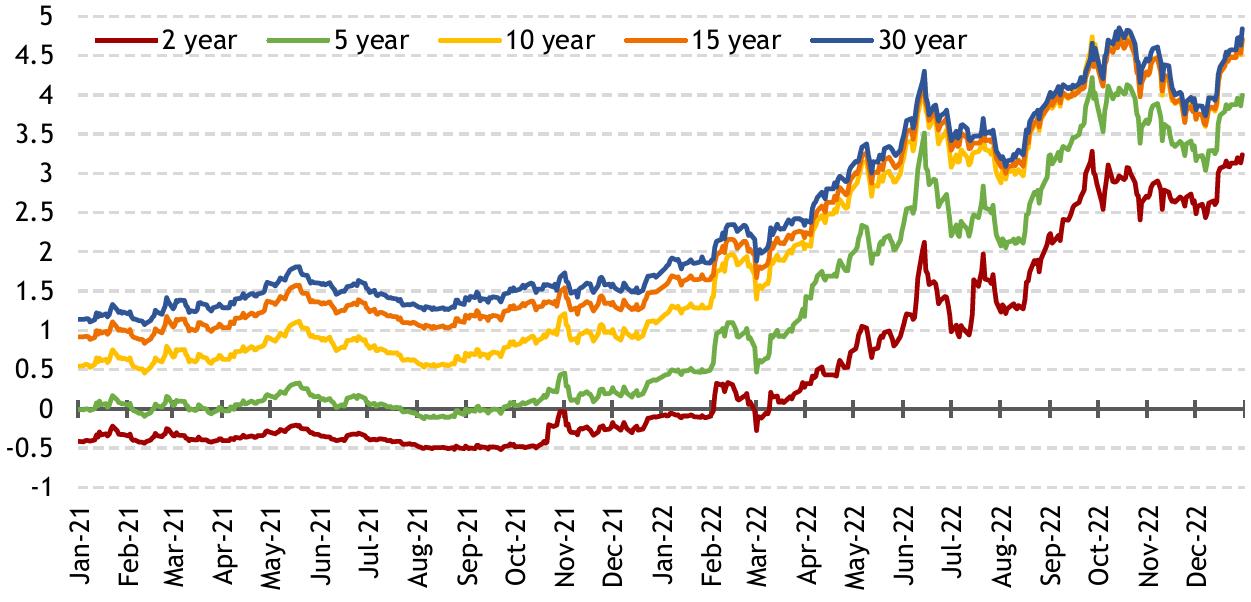

Evolution of the yield curve

As illustrated above, the dynamics of Italian government bond yields during 2022 were mainly influenced by growth and inflation trends, the resulting expectations on monetary policy orientations, and the geopolitical tensions triggered by the war in Ukraine.

In line with what happened in European bond markets, except for some temporary periods of market recovery in summer and in October and November, the Italian government bond market reacted to the context outlined above with a marked upward movement of the yield curve, accompanied by an increase in episodes of volatility, which were mainly concentrated on the occasion of the publication of macroeconomic data and central bank meetings.

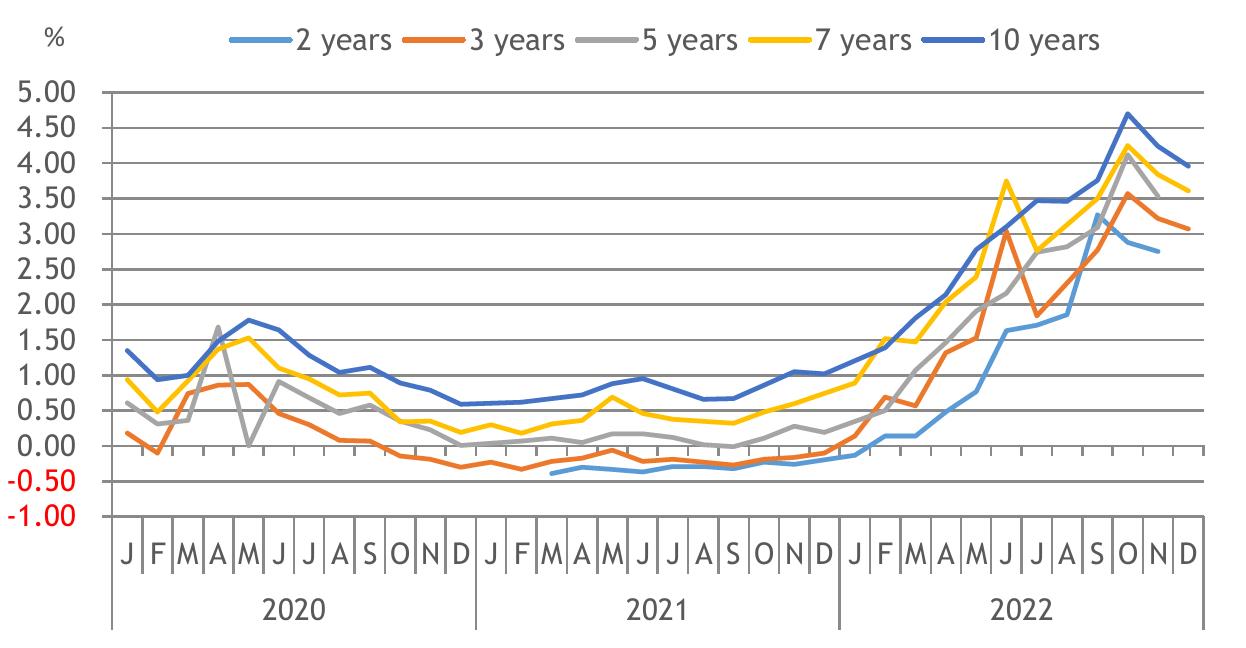

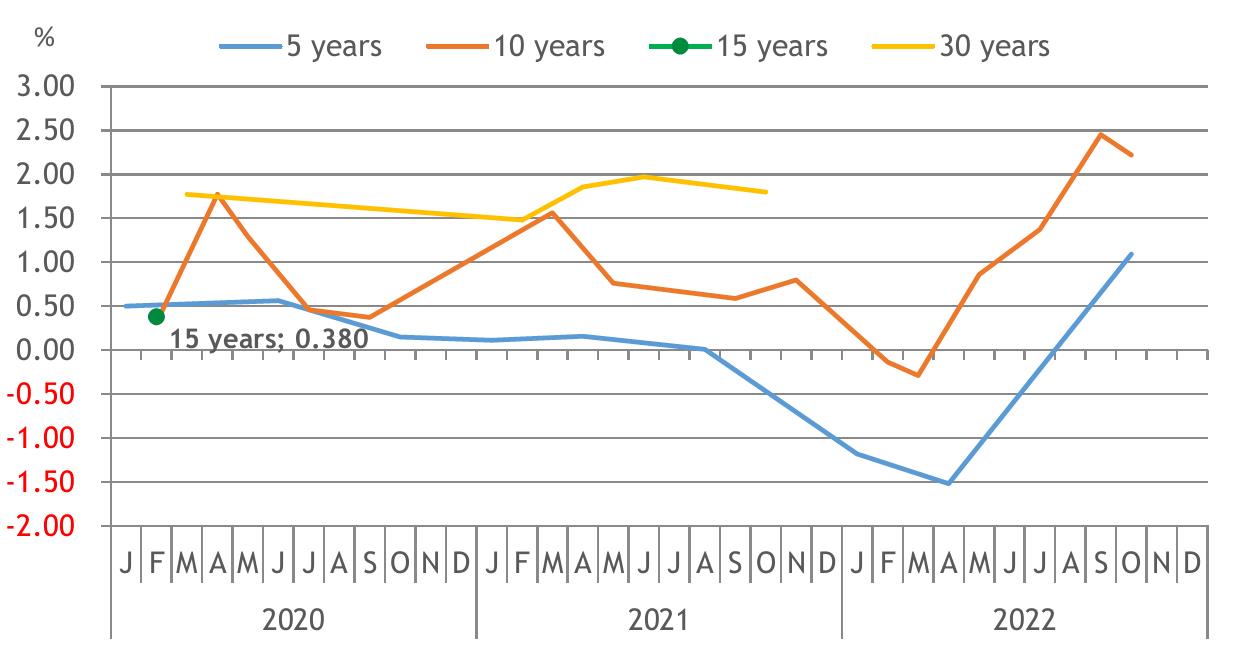

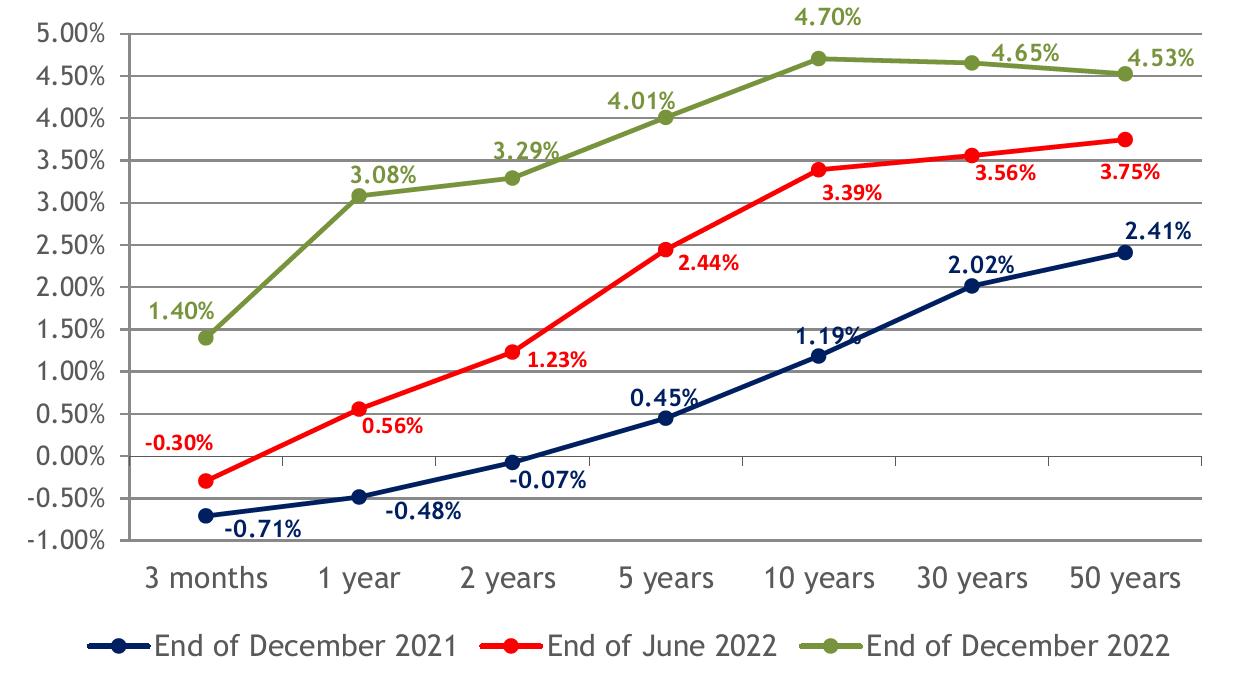

As shown in Chart II.3, all maturities of the yield curve closed sharply higher than at the beginning of the year: the increase was most pronounced on the range of the curve up to 10 years, which recorded an average increase of around 350 basis points, in contrast to the longer maturities for which the increase was more moderate and averaged 300 basis points.

| CHART II.3: MARKET YIELDS ON GOVERNMENT BONDS BY MATURITY FROM 2 TO 50 YEARS (%) |

|

| Source: Elaboration on Bloomberg data |

__

33 These amounts are expressed in countervalue terms.

| MINISTRY OF ECONOMY AND FINANCE | 23 |

The slope of the term structure of Italian rates on the 2–10-year stretch (Chart II.4) experienced a pretty different movement in the year’s first half compared to the second half. In particular, from the beginning of the year until the first week of July, there was a significant increase in the slope, up by about 95 basis points. In the context of rising rates, the 10-year maturity of the BTP curve recorded greater increases than the short-term part. This dynamic is attributable mainly to two aspects: on the one hand, to the pressure experienced by the ten-year point of the curve (on which a large portion of the Treasury’s funding programme falls), and, on the other, to the conservative attitude of investors who, in a context of uncertainty over inflation trends and the extent of the central banks’ reduction of monetary stimulus, tend to demand a higher premium for holding bonds with a longer maturity.

However, from mid-July onwards, the slope on the 2–10-year maturity experienced an opposite dynamic, with a flattening of about 80 basis points due to the better performance of the 10-year maturity compared to the 2-year maturity. This phenomenon, coinciding with the approach of the first-rate hike by the ECB, can be traced back to the structural anchoring of short-term rates to levels close to the monetary policy reference rates, which, as mentioned above, began to rise in July.

However, during 2022, the slope increased overall, which was rather small and amounted to about 17 basis points.

| CHART II.4: GOVERNMENT BONDS YIELD SPREAD, 10-YEAR VS 2 -YEAR (BASIS POINTS) |

|

| Source: Elaboration on Bloomberg data |

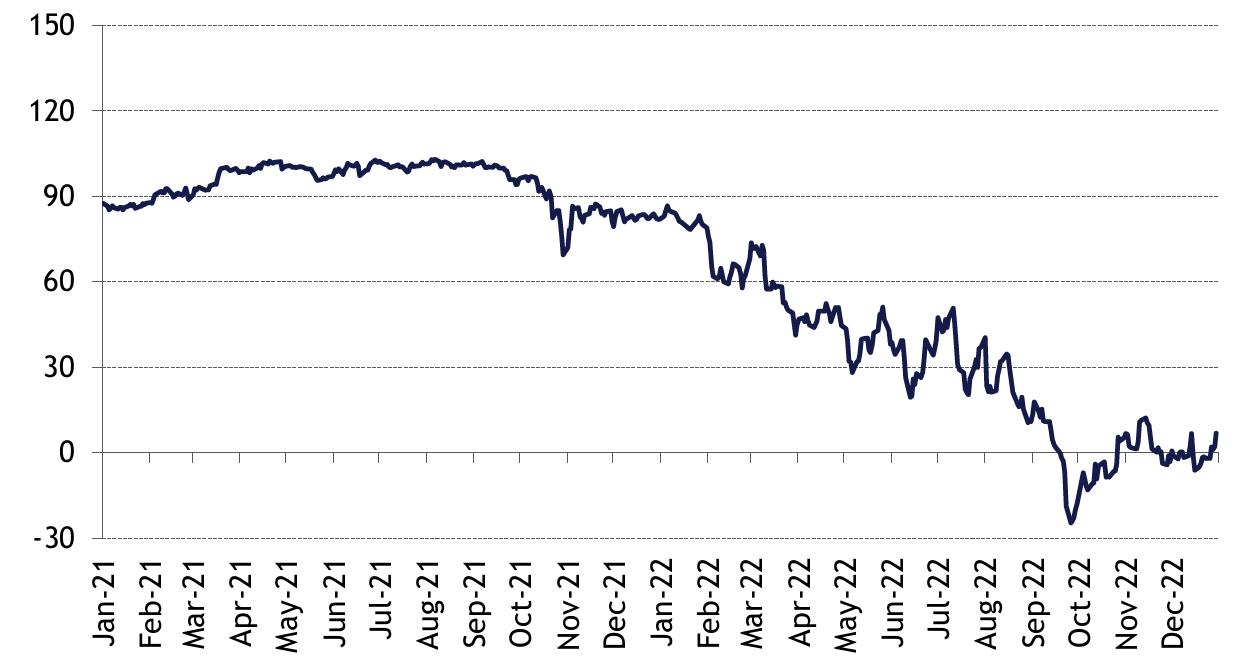

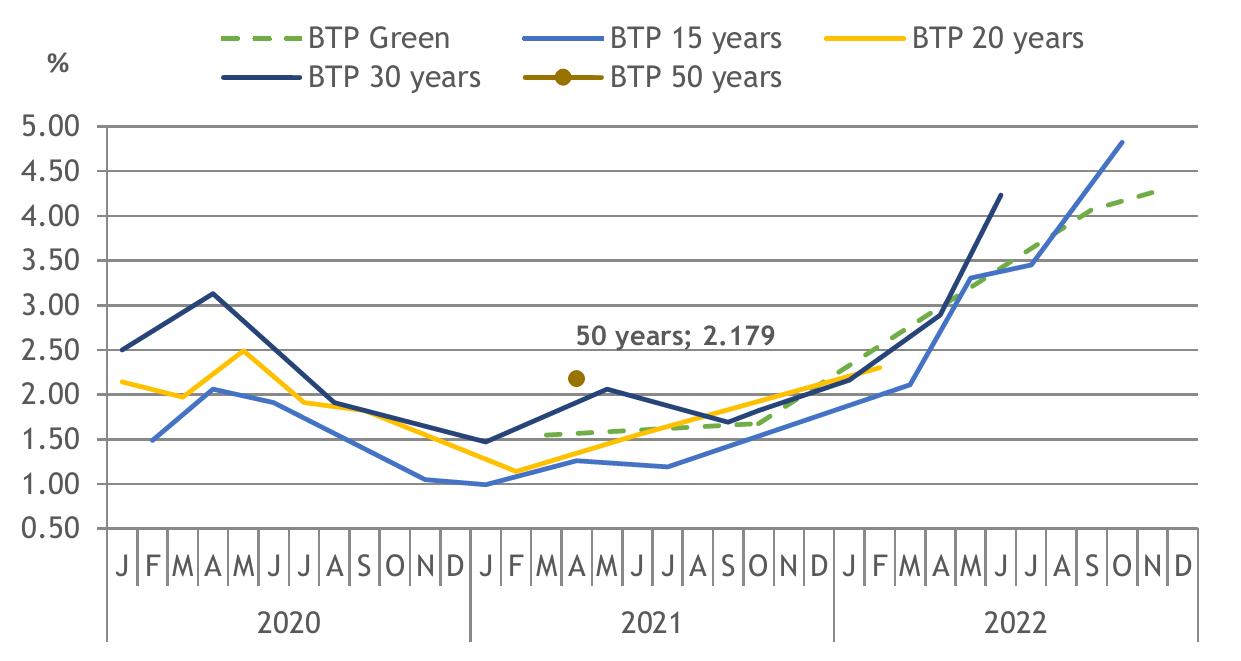

As shown in Chart II.5, the slope of the 10–30-year section of the Italian yield curve, in line with the trend of the other European curves, declined significantly, from around 83 basis points at the beginning of 2022, to fall into negative territory in September and October, and then rise again to a level that, although once again in positive territory, is still historically very low, at around 7 basis points. The

| 24 | MINISTRY OF ECONOMY AND FINANCE |

II. THE ITALIAN GOVERNMENT SECURITIES MARKET: PERFORMANCE IN THE INTERNATIONAL CONTEXT |

gradual flattening of the 10–30-year section of the curve and its momentary inversion in September and October is mainly attributable to the monetary policy cycle that began in 2022, based on a strategy of continuous rate hikes over an indefinite time horizon. Under these circumstances, on the short-term part of the yield curve, the market can only register the central bank’s decisions while, on long¬term rates, it incorporates expectations of the end of the rises and the start of a bearish phase. It is no coincidence that this phenomenon has been recorded in a much more marked way on all markets, from the USA to the main European countries, with curves widely inverted already starting from the maturities immediately following the short ones. In the Italian case, the inversion was recorded only after the 10-year maturity and is also due to the tension experienced during the year precisely by the 10-year maturity, which, in addition to absorbing, as mentioned above, a significant portion of issues, also thanks to its high liquidity tends to be used by the market to manage phases of volatility in contexts of uncertainty and general risk aversion.

The sector’s relative resilience over the long term is associated with this aspect, which can be attributed to its attractiveness in market environments characterised by uncertainty and volatility, such as those experienced during 2022. Indeed, this is a sector characterised, among other things, by a high degree of convexity34, which may be of particular interest to certain types of investors.

| CHART II.5: GOVERNMENT BONDS YIELD SPREAD, 30-YEAR VS 10-YEAR (BASIS POINTS) |

|

| Source: Elaboration on Bloomberg data |

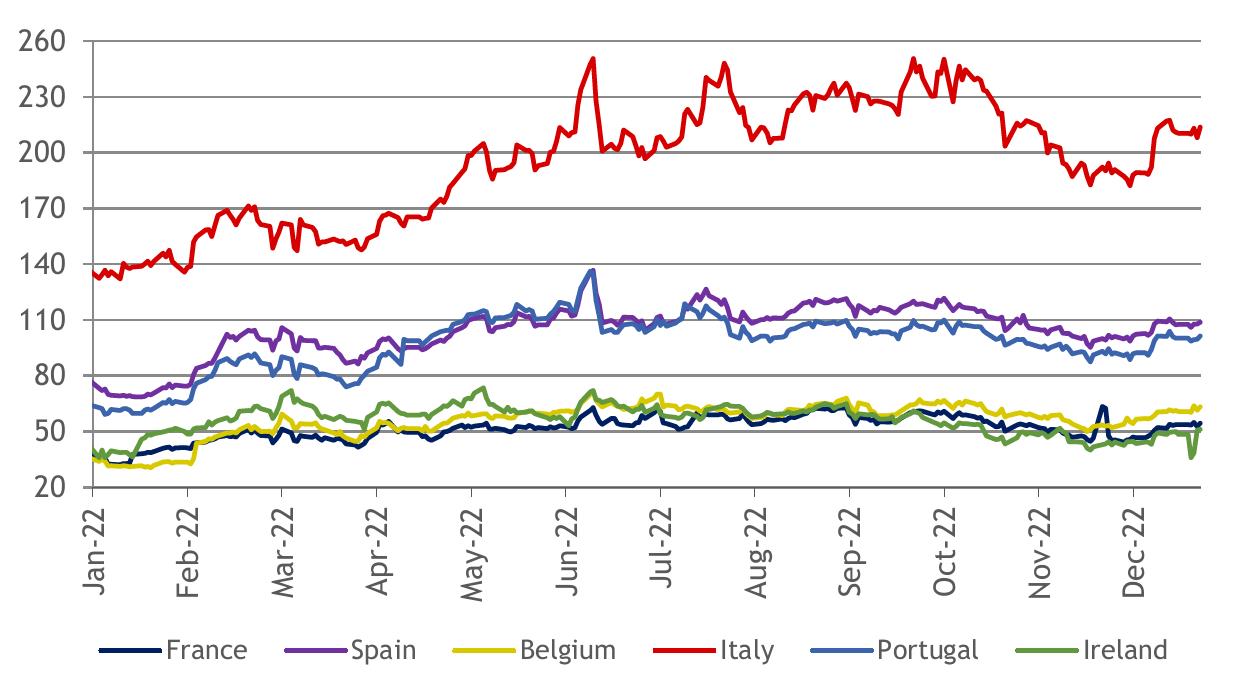

As mentioned above, the differential (spread) between Italian and German government bonds (Chart II.6) showed a profile that is partly attributable to the movement of absolute rates of return and partly has specific profiles due to the different perceptions of relative risk between the two countries.

__

34 Convexity is a measure of the curvature of the price/yield relationship function of a bond: the more positive the convexity of the bond, the greater the price increase in relation to falling yields compared to the price reduction that would occur in relation to an equivalent increase in yields.

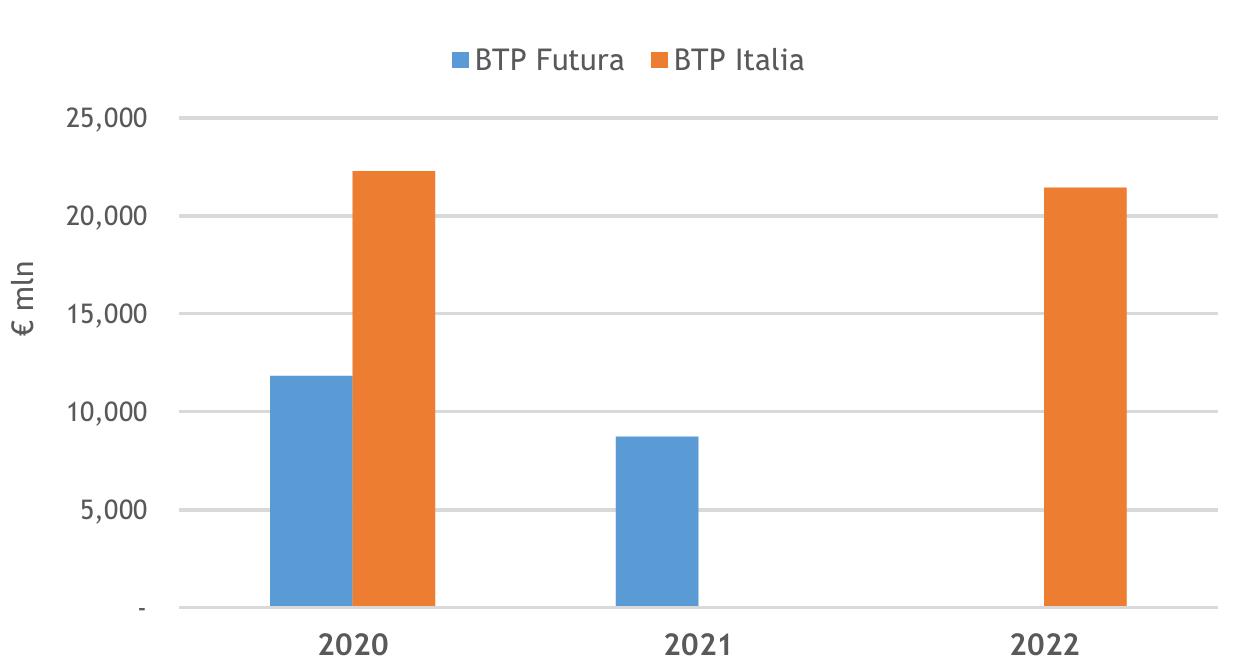

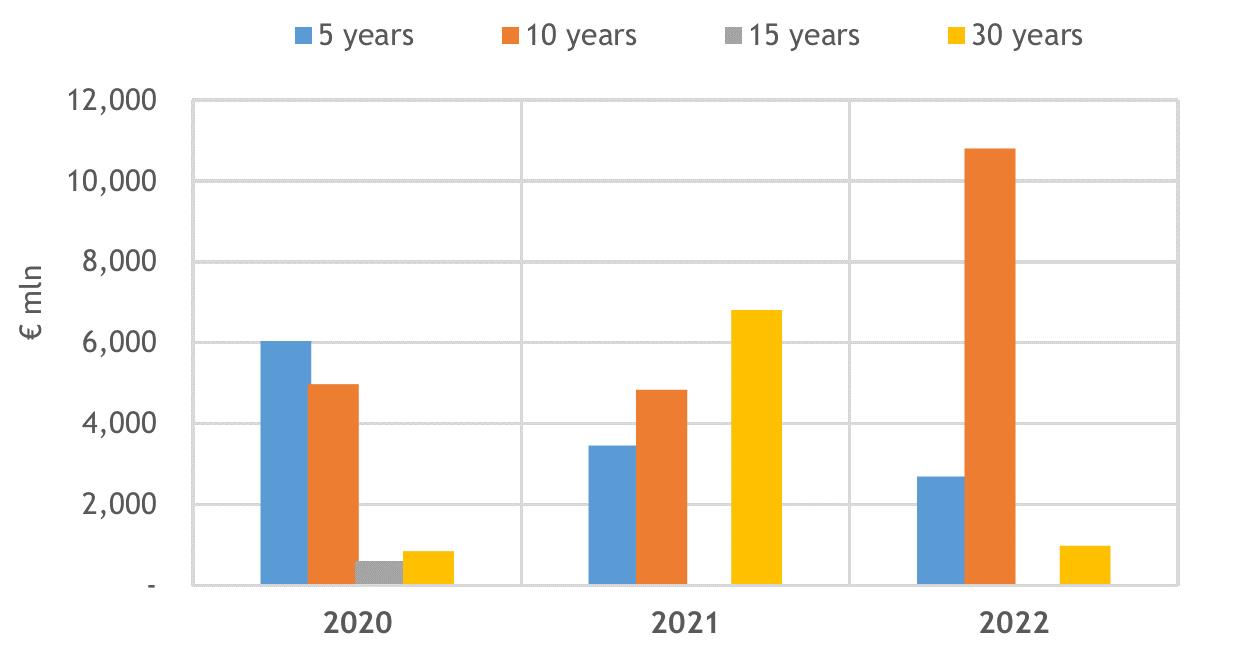

| MINISTRY OF ECONOMY AND FINANCE | 25 |