UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-02224 |

|

MML Series Investment Fund |

(Exact name of registrant as specified in charter) |

|

1295 State Street, Springfield, MA | | 01111 |

(Address of principal executive offices) | | (Zip code) |

|

David W. O’Leary |

1295 State Street, Springfield, MA 01111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 413-788-8411 | |

|

Date of fiscal year end: | 12/31/2005 | |

|

Date of reporting period: | 12/31/2005 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

(Annual Report for the period 1/1/05 through 12/31/05 is filed herewith)

MML Series Investment Fund

Annual Report

for the year ended

December 31, 2005

MML Large Cap Value Fund

MML Equity Index Fund

MML Growth Equity Fund

MML OTC 100 Fund

MML Small Cap Growth Equity Fund

MML Emerging Growth Fund

INVEST

INSURE

RETIRE

Table of Contents

| Letter to Shareholders | | | 1 | | |

|

| Portfolio Manager Reports | | | 3 | | |

|

| Portfolio of Investments | | | 21 | | |

|

MML Large Cap Value Fund

MML Equity Index Fund

MML Growth Equity Fund

MML OTC 100 Fund

MML Small Cap Growth Equity Fund

MML Emerging Growth Fund | | | 21

23

29

33

35

39 | | |

|

| Statement of Assets and Liabilities | | | 42 | | |

|

| Statement of Operations | | | 46 | | |

|

| Statement of Changes in Net Assets | | | 48 | | |

|

| Financial Highlights | | | 52 | | |

|

| Notes to Financial Statements | | | 59 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 69 | | |

|

| Trustees and Officers (Unaudited) | | | 70 | | |

|

| Federal Tax Information (Unaudited) | | | 72 | | |

|

| Other Information (Unaudited) | | | 73 | | |

|

This material must be preceded or accompanied by a current prospectus for the MML Series Investment Fund. Investors should consider a Fund's investment objective, risks and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus. Read it carefully before investing.

MML Series Investment Fund – Letter to Shareholders

To Our Shareholders

David O'Leary

The new year provides investors with an excellent opportunity to take their financial pulse by checking in with their financial representative. For 2006, there are mixed signals on the investment horizon. MassMutual, however, stands by its conviction that most investors are best served by attention to proper asset allocation and an investment strategy that concentrates on the long term.

2005: A stormy year in many respects

Weather-related stories dominated the headlines for the 12 months ended December 31, 2005 – beginning with the fallout from the late 2004 Indian Ocean tsunami. Elsewhere, October's devastating Pakistan earthquake and Hurricanes Katrina, Rita and Wilma heightened investors' awareness of the power of nature and the impact of current events on the markets.

On the economic front, the first three months of 2005 saw the broader U.S. stock averages struggle unsuccessfully against the headwinds of widespread expectations for slower economic growth, reduced corporate profits and rising inflation – especially in the form of rising crude oil prices. Foreign stocks substantially outperformed U.S. stocks in this environment, but bond prices struggled.

In the second quarter, U.S. stocks struggled to find direction, as moderately positive news on the economy and corporate earnings was tempered by high crude oil prices, rising short-term interest rates and concerns about slowing economic growth. A strong U.S. dollar hampered foreign stocks. In the bond market, Treasuries outperformed other fixed-income asset classes.

Broad-based U.S. stock indexes advanced in the third quarter, as favorable second quarter earnings boosted the market in July. In the bond market, longer-maturity yields rose in July on better-than-expected economic performance, then backed off as soaring crude oil prices once again raised fears of a slowing economy. The Lehman Brothers® Aggregate Bond Index, a broad measure of the U.S. investment-grade fixed-income markets, closed the quarter with a return of -0.67%.*

Stocks made upward progress in the fourth quarter, boosting many broad-based stock indexes into positive territory for full-year 2005. The U.S. economy grew at a pace of 4.1% in the third quarter, lower than initial estimates, but still pleasantly surprising many observers. For the full year, the Dow Jones Industrial AverageSM (The Dow), a barometer of blue-chip stock activity, returned -0.61%, after losing ground in the final week of December. The technology-focused Nasdaq Composite® Index gained 1.37% for the 12-month period, trailing the S&P 500® Index, a measure of U.S. large-cap stock performance, which returned 4.91% in the same period. The clear winner for the year, however, was the MSCI® EAFE® Index, a benchmark for foreign stocks that delivered an impressive 13.54% return.*

In the bond market during the fourth quarter, the yield curve continued to flatten – indicating a smaller difference in yields between shorter- and longer-term fixed income investments. This flattening of yields is due in large part to persistent upward pressure on short-term yields by the Federal Reserve's (Fed's) credit-tightening and the relatively flat movement of longer-term yields. For the full year, the Lehman Brothers Aggregate Bond Index advanced 2.43%.*

The Major Stories of 2005

Among the events affecting the financial markets during 2005, the sharp rise in energy prices qualifies as one of the most important. Crude oil prices, which began the year near the $40-per-barrel level, ended December around $60 a barrel, following a brief surge above $70 at the end of August. In pure percentage terms, the advance in natural gas was even greater. Many Americans felt the energy squeeze most acutely in the rising cost of unleaded gasoline – whose average per-gallon price

* Indexes are unmanaged, do not incur fees or expenses and cannot be purchased directly for investment.

(Continued)

1

MassMutual Funds – Letter to Shareholders (Continued)

increased during the year from around $1.75 to $2.20. Fears that higher energy costs might hamper consumer spending turned out to be unfounded, however. From the Friday after Thanksgiving through December 24, U.S. consumers spent 8.7% more in 2005 than in the previous year.

Rising short-term interest rates were another important trend in 2005. The Fed boosted the federal funds rate in 0.25% increments a total of eight times during the year – for a total of 2.0%. Rising interest rates mean higher costs for various types of consumer and business loans. One area of particular concern is home mortgages, along with home equity loans and lines of credit, which have helped finance a significant portion of consumer spending during the past few years. Many experts are concerned about what will happen to consumer spending if housing prices decelerate significantly. Two news items pointed to concerns about real estate's immediate prospects near the end of December. The Mortgage Bankers Association reported that U.S. mortgage applications fell to more than a three-and-a-half-year low, and the National Association of Realtors reported that inventories of existing homes for sale rose to their highest level in more than 19 years.

Outlook

The beginning of the new year is an ideal time to assess your long-term financial strategy. An annual check-up with your financial representative can help ensure that you have positioned yourself to reach your long-term financial goals.

As we proceed into 2006, key economic indicators are mixed. The positive factors include an economy that continues to grow faster than expected, rebounding consumer confidence, muted inflation and interest rates that are still low by historical standards. Currently, strong corporate balance sheets, forecasts for double-digit earnings growth in 2006 and moderate valuations are also positives. Cautionary factors include the possibility that consumer spending will weaken as home refinancing opportunities dry up, and a market that has slowed its advance somewhat in the third year of this bull market. That said, we believe that most investors are best served by attention to proper asset allocation and an investment strategy that focuses less on the market's short-term movements and more on the long term potential. (As always, past performance is no guarantee of future results.)

The information provided is the opinion of MassMutual as of 1/1/2006 and is subject to change without notice. It is not to be construed as tax, legal or investment advice.

David O'Leary

President

2

MML Large Cap Value Fund – Portfolio Manager Report

What is the investment objective of the MML Large Cap Value Fund? This Fund seeks both capital growth and income by selecting high-quality, large-capitalization companies primarily in the S&P 500® Index.

How did the Fund perform during the 12 months ended December 31, 2005? The Fund's shares returned 9.38%, outpacing the 4.91% return of the S&P 500 Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

What was the investment backdrop during the period? The first quarter saw the broader U.S. stock averages struggle unsuccessfully to remain above the break-even mark in the midst of widespread expectations for slower growth by the nation's economy and a reduction in corporate profits. On the fixed-income front, bond yields fell and prices rose in January, but fears of rising inflation later in the quarter reversed much of the advance. Additionally, there were two 0.25% hikes in short-term interest rates by the Federal Reserve (Fed) during the first three months of 2005. Turning to the second quarter, U.S. stocks traded indecisively, as moderately positive news on the economy and corporate earnings was tempered by high crude oil prices, rising short-term interest rates and concerns about slowing economic growth.

Broad-based U.S. stock indexes advanced in the third quarter, as favorable second quarter earnings boosted the market in July. In the bond space, longer-maturity yields rose in July on better-than-expected economic performance, then backed off as rising crude oil prices once again raised fears of a slowing economy. Stocks made upward progress in the fourth quarter, propelling many broad-based stock indexes into positive territory for full-year 2005. In the bond market, the yield curve – a measure of the disparity of yields of bonds of comparable credit quality across a range of maturities from three months to 30 years and used as an economic indicator – continued to flatten, due to the Fed's persistent upward pressure on short-term yields and the relatively flat movement of longer yields.

What factors contributed to the Fund's performance – and how did you respond? Energy companies were the most important contributors to the Fund's performance over the year. Energy was also the strongest-performing sector of the S&P 500 Index. The Fund benefited both by its overweight position in energy – and from positive stock selection within the sector. All of the Fund's energy companies performed well, with EOG Resources, Devon Energy, ConocoPhillips and Occidental Petroleum among the top performers.

The Fund's largest industry holdings were in diversified financial companies, insurance companies and consumer staples firms. All three sectors were important contributors to performance for the 12-month period. Moody's (a diversified financial company), Progressive, Loews, and American International Group (three insurance companies), and Altria (a consumer staples company) were among the Fund's top contributors to results. On the other hand, Avon Products – a consumer staples company initially purchased in June 2005 – ranked among the top detractors from performance.

The Fund's holdings in both consumer discretionary and industrial companies hampered its progress for the year. Consumer discretionary companies among the top detractors included Comcast, Gannett, and Autozone (sold in October 2005). Industrial companies hindering performance included Tyco and United Parcel Services. Lexmark, an information technology company, and Fifth Third Bancorp, a bank, were also among the top detractors.

The Fund had approximately 8% of its portfolio invested in foreign companies on December 31, 2005. Collectively, the foreign companies owned by the Fund underperformed the S&P 500 Index over the year.

3

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

What is your outlook? We enter 2006 with both positive and negative factors on the horizon. The positives include an economy that continues to grow more than expected, rebounding consumer confidence, muted inflation and interest rates that are still low by historical standards. Currently strong corporate balance sheets, forecasts for double-digit earnings growth in 2006 and moderate valuations also provide evidence of an optimistic outlook for the year. Conversely, cautionary factors include the possibility that consumer spending will weaken as home refinancing opportunities dry up, a historically challenging phase of the four-year presidential cycle and a market that has slowed its advance somewhat. In an environment with such conflicting signals, investors may be well served by focusing on proper asset allocation and an investment strategy tha t concentrates on long-term results.

MML Large Cap Value Fund

Industry Table

(% of Net Assets) on 12/31/05 | |

| Banking, Savings & Loans | | | 14.3 | % | |

| Financial Services | | | 13.6 | % | |

| Insurance | | | 13.3 | % | |

| Energy | | | 10.2 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 6.5 | % | |

| Retail | | | 5.9 | % | |

| Commercial Services | | | 4.9 | % | |

| Tobacco | | | 4.9 | % | |

| Industrial – Diversified | | | 4.4 | % | |

Broadcasting, Publishing &

Printing | | | 3.6 | % | |

| Healthcare | | | 3.1 | % | |

| Containers | | | 2.2 | % | |

| Computers & Information | | | 1.6 | % | |

| Beverages | | | 1.5 | % | |

| Automotive & Parts | | | 1.4 | % | |

Building Materials &

Construction | | | 1.4 | % | |

| Prepackaged Software | | | 1.3 | % | |

| Transportation | | | 1.2 | % | |

| Pharmaceuticals | | | 1.1 | % | |

| Communications | | | 0.8 | % | |

| Cosmetics & Personal Care | | | 0.8 | % | |

| Foods | | | 0.7 | % | |

Computers & Office

Equipment | | | 0.5 | % | |

| Advertising | | | 0.3 | % | |

| Computer Related Services | | | 0.2 | % | |

| Travel | | | 0.2 | % | |

| Household Products | | | 0.1 | % | |

| | | | 100.0 | % | |

MML Large Cap Value Fund

Largest Stock Holdings (12/31/05) | |

American International Group, Inc.

Altria Group, Inc.

American Express Co.

Tyco International Ltd.

JPMorgan Chase & Co.

Costco Wholesale Corp.

Golden West Financial Corp.

Progressive Corp.

Berkshire Hathaway, Inc. Cl. A

HSBC Holdings PLC

4

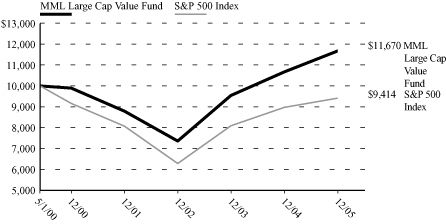

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

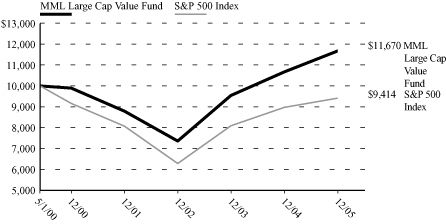

Growth of a $10,000 Investment

Hypothetical Investments in MML Large Cap Value Fund and the S&P 500 Index.

MML Series Investment Fund

| Total Return | | One Year

1/1/05 - 12/31/05 | | Five Year

Average Annual

1/1/01 - 12/31/05 | | Since Inception

Average Annual

5/1/00 - 12/31/05 | |

MML Large Cap

Value Fund | | | 9.38 | % | | | 3.36 | % | | | 2.76 | % | |

| S&P 500 Index | | | 4.91 | % | | | 0.54 | % | | | –1.06 | % | |

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website at www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged and does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. Total return figures would be lower for the periods presented if they reflected these charges.

5

MML Equity Index Fund – Portfolio Manager Report

What is the investment objective of the MML Equity Index Fund? The Fund seeks to provide investment results that correspond to the price and yield performance of publicly traded common stocks in the aggregate as represented by the S&P 500® Index. The Fund pursues this objective by investing at least 80% of its assets in the equity securities of companies that make up the S&P 500 Index.

How did the Fund perform during the 12 months ended December 31, 2005? The Fund's Class I shares returned 4.53%, moderately trailing the 4.91% return of the S&P 500 Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

What was the investment backdrop during the period? The first quarter saw the broader U.S. stock averages struggle unsuccessfully to remain above the break-even mark in the midst of widespread expectations for slower growth by the nation's economy and a reduction in corporate profits. On the fixed-income front, bond yields fell and prices rose in January, but fears of rising inflation later in the quarter reversed much of the advance. Additionally, there were two 0.25% hikes in short-term interest rates by the Federal Reserve (Fed) during the first three months of 2005. Turning to the second quarter, U.S. stocks traded indecisively, as moderately positive news on the economy and corporate earnings was tempered by high crude oil prices and rising short-term interest rates. In the bond market, Treasuries outperformed other fixed-income asset class es, while investment-grade bonds outpaced high-yield securities in the corporate sector.

The third quarter was dominated by a strong rally in oil prices, compounded by the impact of Hurricanes Katrina and Rita. The Fed raised the federal funds rate twice during the quarter, its main concern being the increasing risk of inflation due to escalating energy costs. The economic environment continued nearly unchanged in the fourth quarter, as oil prices and interest rates continued to dominate the headlines – and the Fed raised interest rates twice more, bringing the total to eight 0.25% increases in 2005. After reaching $70 per barrel at the end of August, light crude oil prices retreated during the fourth quarter and finished the year at $61 per barrel.

What factors contributed to the Fund's performance? In the first quarter, growth stocks outpaced value issues, and small- and mid-cap securities ended the period in negative territory. On a sector basis, the energy and utilities sectors posted the best performance – but not enough to bring the S&P 500 Index (the Index) into positive territory. The financial sector of the Index lost 6.38% and information technology dropped 7.33%. The worst-performing sector for the period, telecommunications services, returned –7.78%. Against the backdrop of high oil prices and two interest hikes by the Fed, the majority of U.S. equity indexes posted negative returns for the period.

In the second quarter, value stocks outpaced their growth counterparts, and small- and mid-cap securities posted positive returns. From a sector perspective, utilities and financials sectors posted the best performance, up 9.31% and 4.33%, respectively. The health care sector was also positive for the period, posting a return of 4.13%. The increase in the energy sector continued, as that sector advanced 1.99%. The worst-performing group for the second quarter was materials, which fell 9.47%.

Large-capitalization stocks in the third quarter underperformed both mid- and small-cap stocks. During the quarter, energy was the best-performing sector in the Index, returning 18.25%, and telecommunication services, with its loss of 1.05%, was the worst performer. In the final quarter of 2005, large-cap stocks once again underperformed mid-caps. This time, however, large issues outpaced their small-capitalization competition. Energy was the worst-performing sector in the Index, returning -7.36%; materials was the best-performing group, advancing 11.19%.

6

MML Equity Index Fund – Portfolio Manager Report (Continued)

What is your outlook? Conflicting signals abound as we enter 2006. Positive factors include an economy that continues to grow more than expected, rebounding consumer confidence, muted inflation interest rates that are still low by historical standards – along with currently strong corporate balance sheets, forecasts for double-digit earnings growth in 2006 and moderate valuations. Conversely, cautionary factors include the possibility that consumer spending will weaken as home refinancing opportunities dry up, a historically challenging phase of the four-year presidential cycle and a market that has slowed somewhat in its advance. In such an environment, proper asset allocation and an investment strategy that concentrates on the long term are important areas of focus for investors.

MML Equity Index Fund

Industry Table

(% of Net Assets) on 12/31/05 | |

| Energy | | | 9.3 | % | |

| Banking, Savings & Loans | | | 9.2 | % | |

| Pharmaceuticals | | | 8.5 | % | |

Electrical Equipment &

Electronics | | | 6.8 | % | |

| Financial Services | | | 6.2 | % | |

| Insurance | | | 5.9 | % | |

| Retail | | | 5.0 | % | |

| Computers & Information | | | 3.8 | % | |

| Prepackaged Software | | | 3.4 | % | |

| Electric Utilities | | | 3.0 | % | |

| Telephone Utilities | | | 3.0 | % | |

Broadcasting, Publishing &

Printing | | | 2.4 | % | |

| Cosmetics & Personal Care | | | 2.4 | % | |

| Medical Supplies | | | 2.4 | % | |

| Aerospace & Defense | | | 2.2 | % | |

| Beverages | | | 2.1 | % | |

| Transportation | | | 1.9 | % | |

| Commercial Services | | | 1.6 | % | |

| Industrial – Diversified | | | 1.6 | % | |

| Foods | | | 1.5 | % | |

| Healthcare | | | 1.5 | % | |

| Tobacco | | | 1.5 | % | |

| Chemicals | | | 1.4 | % | |

| Communications | | | 1.1 | % | |

Computers & Office

Equipment | | | 1.0 | % | |

| Machinery & Components | | | 1.0 | % | |

| Entertainment & Leisure | | | 0.9 | % | |

Data Processing &

Preparation | | | 0.8 | % | |

| Metals & Mining | | | 0.8 | % | |

| Apparel, Textiles & Shoes | | | 0.6 | % | |

| Automotive & Parts | | | 0.6 | % | |

| Household Products | | | 0.6 | % | |

| Restaurants | | | 0.6 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 0.6 | % | |

| Communications Equipment | | | 0.5 | % | |

Home Construction,

Furnishings & Appliances | | | 0.5 | % | |

| Real Estate | | | 0.5 | % | |

Computer Integrated Systems

Design | | | 0.4 | % | |

| Forest Products & Paper | | | 0.4 | % | |

| Information Retrieval Services | | | 0.4 | % | |

| Manufacturing | | | 0.4 | % | |

| Lodging | | | 0.3 | % | |

| Advertising | | | 0.2 | % | |

Building Materials &

Construction | | | 0.2 | % | |

| Containers | | | 0.2 | % | |

| Food Retailers | | | 0.2 | % | |

| Retail – Grocery | | | 0.2 | % | |

| Air Transportation | | | 0.1 | % | |

| Industrial – Distribution | | | 0.1 | % | |

Photography

Equipment/Supplies | | | 0.1 | % | |

| Toys, Games | | | 0.1 | % | |

Computer Programming

Services | | | 0.0 | % | |

| Travel | | | 0.0 | % | |

| | | | 100.0 | % | |

MML Equity Index Fund

Largest Stock Holdings (12/31/05) | |

General Electric Co.

Exxon Mobil Corp.

Citigroup, Inc.

Microsoft Corp.

The Procter & Gamble Co.

Bank of America Corp.

Johnson & Johnson

American International Group, Inc.

Pfizer, Inc.

Altria Group, Inc.

7

MML Equity Index Fund – Portfolio Manager Report (Continued)

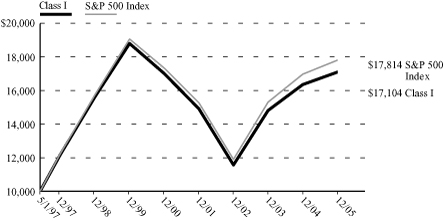

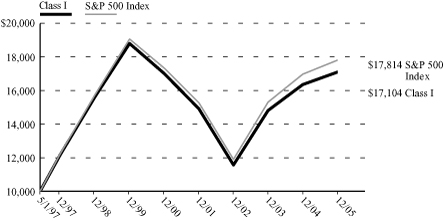

Growth of a $10,000 Investment

Hypothetical Investments in MML Equity Index Fund Class I and the S&P 500 Index.

MML Series Investment Fund

| Total Return | | One Year

1/1/05 - 12/31/05 | | Five Year

Average Annual

1/1/01 - 12/31/05 | | Since Inception

Average Annual

5/1/97 - 12/31/05 | |

MML Equity Index

Fund Class I | | | 4.53 | % | | | 0.10 | % | | | 6.39 | % | |

| S&P 500 Index | | | 4.91 | % | | | 0.54 | % | | | 6.89 | % | |

Hypothetical Investments in MML Equity Index Fund Class II, Class III and the S&P 500 Index.

MML Series Investment Fund

| Total Return | | One Year

1/1/05 - 12/31/05 | | Five Year

Average Annual

1/1/01 - 12/31/05 | | Since Inception

Average Annual

5/1/00 - 12/31/05 | |

MML Equity Index

Fund Class II | | | 4.65 | % | | | 0.27 | % | | | –1.35 | % | |

MML Equity Index

Fund Class III | | | 4.80 | % | | | 0.34 | % | | | –1.26 | % | |

| S&P 500 Index | | | 4.91 | % | | | 0.54 | % | | | –1.06 | % | |

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website at www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged and does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. Total return figures would be lower for the periods presented if they reflected these charges.

8

MML Growth Equity Fund – Portfolio Manager Report

What is the investment objective of the MML Growth Equity Fund? This Fund seeks long-term growth of capital and future income by normally investing at least 80% of its assets in the common stocks and securities convertible into common stocks of companies the Fund's sub-adviser believes offer prospects for long-term growth.

How did the Fund perform during the 12 months ended December 31, 2005? The Fund's shares returned 3.86%, lagging the 4.91% return of the S&P 500® Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

What was the investment background during the period? The first quarter of 2005 saw the majority of U.S. equity markets in the red, spurred in large part by mixed economic data, rising oil prices and concerns over inflation. Both large- and small-cap stocks produced negative returns for the period, although the large-cap universe slightly outpaced its small-cap counterpart. Most U.S. equity markets ended the second quarter in positive territory. Both large- and small-cap stocks rose, although the small-cap universe, in a reversal from the first quarter, slightly outpaced its large-cap competition. Also during the second quarter, the Federal Reserve (Fed) raised the federal funds rate twice – each time by 0.25%.

Despite the summer's hurricanes of devastating proportions, another federal interest rate increase, and an impending oil crisis, the third quarter of 2005 saw gains in domestic equity markets. Both large- and small-cap stocks produced positive returns for the period, although the small-cap universe slightly outpaced its large cap counterpart. The final quarter of 2005 witnessed a market that managed to stay afloat in spite of additional federal funds rate increases, rising health care and energy costs, and mixed reports pertaining to economic growth within the U.S. During the final three months of the year, both large- and small-cap stocks once again advanced, although large-cap issues slightly outpaced their small-cap brethren.

What factors contributed to the Fund's performance? During the first quarter, sector selection was positive, aided considerably by an overweight position in oil and gas. An underweight position in the financial sector also contributed to the portfolio's relative performance. Conversely, underweight positions in both health care and food/beverages detracted from relative returns. In the second quarter, sector selection was flat relative to the S&P 500 Index. The portfolio benefited from an underweight position in manufacturing and an overweight position in oil and gas. This positive performance, however, was offset by overweight positions in the primary process industry and automotive spaces, which underperformed as groups.

Turning to the third quarter, an overweight position in oil and gas and an underweight position in manufacturing provided tailwinds to the Fund. Other contributors included underweight positions in the services and transportation sectors. Detractors included an overweight position in retail stores and underweights to technology and metals and mining. Stock selection was negative overall for the quarter, particularly in the technology space. Stock picks among oil and gas, health care, and financial issues also detracted from performance for the period. Conversely, stock selection among consumer goods securities benefited the portfolio.

Finally, favorable stock selection in the fourth quarter within the health care, services, and consumer goods sectors fueled performance. Sector selection, however, detracted during the period, due in large part to the portfolio's overweight position in oil and gas and an underweight to transportation. An overweight position in retail stores contributed to relative returns, but not enough to offset the less-than-favorable sector results.

What is your outlook? Although the strong performance of the U.S. equity market for the past three years has been a positive for investors, it continues to be expensive, leaving little room for new opportunities. The market's inclination for risk over return appears unwarranted, but the eventual return to fundamental valuations should favor the portfolio's bias towards lower-risk investments.

9

MML Growth Equity Fund – Portfolio Manager Report (Continued)

MML Growth Equity Fund

Industry Table

(% of Net Assets) on 12/31/05 | |

| Retail | | | 14.7 | % | |

| Pharmaceuticals | | | 14.2 | % | |

Electrical Equipment &

Electronics | | | 9.4 | % | |

| Healthcare | | | 9.1 | % | |

| Computers & Information | | | 6.6 | % | |

| Energy | | | 5.6 | % | |

| Tobacco | | | 5.6 | % | |

| Insurance | | | 3.9 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 3.0 | % | |

| Financial Services | | | 2.4 | % | |

Data Processing &

Preparation | | | 2.2 | % | |

| Machinery & Components | | | 2.1 | % | |

| Communications Equipment | | | 1.9 | % | |

| Medical Supplies | | | 1.7 | % | |

| Apparel, Textiles & Shoes | | | 1.6 | % | |

| Banking, Savings & Loans | | | 1.4 | % | |

| Commercial Services | | | 1.3 | % | |

Home Construction,

Furnishings & Appliances | | | 1.3 | % | |

| Restaurants | | | 1.3 | % | |

| Beverages | | | 1.2 | % | |

| Aerospace & Defense | | | 1.1 | % | |

| Information Retrieval Services | | | 1.1 | % | |

| Telephone Utilities | | | 1.0 | % | |

| Lodging | �� | | 0.8 | % | |

| Prepackaged Software | | | 0.8 | % | |

| Automotive & Parts | | | 0.7 | % | |

| Cosmetics & Personal Care | | | 0.5 | % | |

Broadcasting, Publishing &

Printing | | | 0.4 | % | |

| Communications | | | 0.4 | % | |

| Foods | | | 0.4 | % | |

| Household Products | | | 0.4 | % | |

| Transportation | | | 0.4 | % | |

| Air Transportation | | | 0.3 | % | |

Computer Integrated

Systems Design | | | 0.3 | % | |

| Advertising | | | 0.2 | % | |

| Computer Related Services | | | 0.2 | % | |

| Electric Utilities | | | 0.2 | % | |

Computer Programming

Services | | | 0.1 | % | |

| Metals & Mining | | | 0.1 | % | |

| Real Estate | | | 0.1 | % | |

| Industrial – Distribution | | | 0.0 | % | |

| | | | 100.0 | % | |

MML Growth Equity Fund

Largest Stock Holdings (12/31/05) | |

UnitedHealth Group, Inc.

Altria Group, Inc.

Intel Corp.

The Home Depot, Inc.

Dell, Inc.

Wal-Mart Stores, Inc.

Merck & Co., Inc.

Lowe's Companies, Inc.

Texas Instruments, Inc.

Pfizer, Inc.

10

MML Growth Equity Fund – Portfolio Manager Report (Continued)

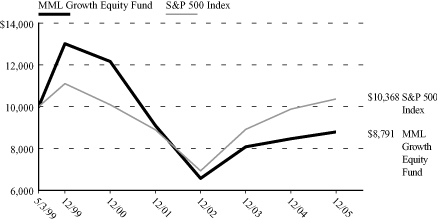

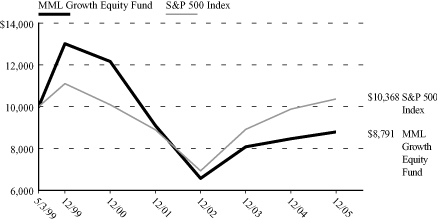

Growth of a $10,000 Investment

Hypothetical Investments in MML Growth Equity Fund and the S&P 500 Index.

MML Series Investment Fund

| Total Return | | One Year

1/1/05 - 12/31/05 | | Five Year

Average Annual

1/1/01 - 12/31/05 | | Since Inception

Average Annual

5/3/99 - 12/31/05 | |

MML Growth

Equity Fund | | | 3.86 | % | | | –6.28 | % | | | –1.91 | % | |

| S&P 500 Index | | | 4.91 | % | | | 0.54 | % | | | 0.54 | % | |

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website at www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged and does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. Total return figures would be lower for the periods presented if they reflected these charges.

11

MML OTC 100 Fund – Portfolio Manager Report

What is the investment objective of the MML OTC 100 Fund? This Fund seeks to approximate, as closely as practicable (before fees and expenses), the total return of the 100 largest publicly traded over-the-counter common stocks. The Fund pursues this objective by investing at least 80% of its assets in the equity securities of companies included in the NASDAQ 100 Index®, which is generally recognized as representative of the over-the-counter market.

How did the Fund perform during the 12 months ended December 31, 2005? The Fund's shares returned 1.26%, underperforming the 1.49% return of the NASDAQ 100 Index.

The NASDAQ 100 Index represents 100 of the largest non-financial U.S. and non-U.S. companies listed on the National Tier of the NASDAQ stock market. It is a modified capitalization-weighted index that is designed to limit domination by a few large stocks while generally retaining the ranking of companies by capitalization.

What was the investment backdrop during the period? The first quarter saw the broader U.S. stock averages struggle unsuccessfully to remain above the break-even mark in the midst of widespread expectations for slower growth by the nation's economy and a reduction in corporate profits. On the fixed-income front, bond yields fell and prices rose in January, but fears of rising inflation later in the quarter reversed much of the advance. Additionally, there were two 0.25% hikes in short-term interest rates by the Federal Reserve (Fed) during the first three months of 2005. Turning to the second quarter, U.S. stocks traded indecisively, as moderately positive news on the economy and corporate earnings was tempered by high crude oil prices, rising short-term interest rates and concerns about slowing economic growth.

Broad-based U.S. stock indexes advanced in the third quarter, as favorable second quarter earnings boosted the market in July. In the bond space, longer-maturity yields rose in July on better-than-expected economic performance, then backed off as rising crude oil prices once again raised fears of a slowing economy. Stocks made upward progress in the fourth quarter, propelling many broad-based stock indexes into positive territory for full-year 2005. In the bond market, the yield curve – a measure of the disparity of yields of bonds of comparable credit quality across a range of maturities from three months to 30 years and used as an economic indicator – continued to flatten, due to the Fed's persistent upward pressure on short-term yields and the relatively flat movement of longer yields.

What factors contributed to the Fund's performance? During the first quarter, all of the NASDAQ 100 Index's sectors posted negative returns. The information technology sector returned –6.60% for the period; consumer discretionary dropped 14.75%. Against the backdrop of high oil prices and two interest hikes by the Fed, the vast majority of U.S. equity indexes posted negative returns during the period. In the second quarter, the telecommunications services sector advanced with a gain of 11.42%. The information technology sector recovered somewhat from the first quarter, with its loss of only 0.09% at the mid-year point. Consumer discretionary also did better in the second quarter, with a return of –0.14%.

The NASDAQ 100 Index (the Index) finished the third quarter with a strong 7.33% advance. The greatest strength during the period came from the health care sector, which gained 16.62%. For the first time in 2005, the information technology sector, which accounts for over half of the Index, was in positive territory, with its 7.86% return. Similarly, consumer discretionary advanced for the first time during the year, with a 0.95% gain. During the final quarter of 2005, the Index advanced 2.84% – finishing the year with a 1.89% gain. A strong performance was seen in the consumer staples sector, which returned 15.19% for the fourth quarter. The large information technology sector advanced 2.21% for the period. Consumer discretionary, the second-largest sector in the Index, was also up for the quarter, with its 0.52% gain.

12

MML OTC 100 Fund – Portfolio Manager Report (Continued)

What is your outlook? As we proceed into 2006, positive factors on the horizon include an economy that continues to grow more than expected, rebounding consumer confidence, muted inflation and interest rates that are still low by historical standards. Currently strong corporate balance sheets, forecasts for double-digit earnings growth in 2006 and moderate valuations also provide evidence of a positive outlook for the year. Conversely, cautionary factors include the possibility that consumer spending will weaken as home refinancing opportunities dry up, a historically challenging phase of the four-year presidential cycle and a market that has slowed its advance somewhat. In such an environment, investors are well served by focusing on proper asset allocation and an investment strategy that concentrates on the long term.

MML OTC 100 Fund

Industry Table

(% of Net Assets) on 12/31/05 | |

| Prepackaged Software | | | 15.2 | % | |

Electrical Equipment &

Electronics | | | 12.7 | % | |

| Pharmaceuticals | | | 11.9 | % | |

| Computers & Information | | | 11.7 | % | |

| Communications | | | 9.7 | % | |

| Information Retrieval Services | | | 5.9 | % | |

| Commercial Services | | | 5.8 | % | |

| Retail | | | 5.1 | % | |

| Food Retailers | | | 2.2 | % | |

Broadcasting, Publishing &

Printing | | | 2.1 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 2.1 | % | |

Computer Integrated Systems

Design | | | 1.5 | % | |

| Medical Supplies | | | 1.5 | % | |

| Manufacturing | | | 1.4 | % | |

| Transportation | | | 1.2 | % | |

Computer Programming

Services | | | 1.0 | % | |

| Healthcare | | | 1.0 | % | |

| Automotive & Parts | | | 0.9 | % | |

| Computer Related Services | | | 0.9 | % | |

| Telephone Utilities | | | 0.9 | % | |

Data Processing &

Preparation | | | 0.7 | % | |

| Miscellaneous | | | 0.7 | % | |

| Retail – Grocery | | | 0.7 | % | |

| Advertising | | | 0.6 | % | |

| Apparel, Textiles & Shoes | | | 0.6 | % | |

| Travel | | | 0.6 | % | |

| Energy | | | 0.4 | % | |

| Lodging | | | 0.4 | % | |

| Communications Equipment | | | 0.3 | % | |

| Internet Content | | | 0.3 | % | |

| Futures | | | 0.0 | % | |

| | | | 100.0 | % | |

MML OTC 100 Fund

Largest Stock Holdings (12/31/05) | |

Microsoft Corp.

Qualcomm, Inc.

Apple Computer, Inc.

Intel Corp.

Google, Inc. Cl. A

Amgen

eBay, Inc.

Cisco Systems, Inc.

Starbucks Corp.

Yahoo!, Inc.

13

MML OTC 100 Fund – Portfolio Manager Report (Continued)

Growth of a $10,000 Investment

Hypothetical Investments in MML OTC 100 Fund and the NASDAQ 100 Index.

MML Series Investment Fund

| Total Return | | One Year

1/1/05 - 12/31/05 | | Five Year

Average Annual

1/1/01 - 12/31/05 | | Since Inception

Average Annual

5/1/00 - 12/31/05 | |

| MML OTC 100 Fund | | | 1.26 | % | | | –7.07 | % | | | –14.06 | % | |

| NASDAQ 100 Index | | | 1.49 | % | | | –6.82 | % | | | –13.63 | % | |

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website at www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the NASDAQ 100 Index is unmanaged and does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. Total return figures would be lower for the periods presented if they reflected these charges.

14

MML Small Cap Growth Equity Fund – Portfolio Manager Report

What is the investment objective of the MML Small Cap Growth Equity Fund? This Fund seeks long-term capital appreciation by investing primarily in common stocks and equity securities of smaller companies the managers believe offer potential for long-term growth.

How did the Fund perform during the 12 months ended December 31, 2005? The Fund's shares returned 11.58%, outperforming the 4.55% return of the Russell 2000® Index, a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

What was the investment background during the period? After registering positive returns in 2004, equity markets generally retreated in the first quarter of 2005 on concerns of rising interest rates, high oil prices and slowing earnings growth. In the second quarter, the market remained surprisingly resilient in the face of continued short-term interest rate increases, high energy prices and a slowing economy.

Entering the second half of the year, the U.S. small-cap equity market remained strong. Despite rising interest rates, two major hurricanes and high energy prices investors embraced solid corporate earnings and continued economic growth in the third quarter. In the final three months of the year, domestic equity markets showed signs of strength, as market participants were encouraged by retreating energy prices, waning inflationary pressures, and signs that the Federal Reserve (Fed) was nearing an end to its rate hikes.

What factors contributed to the Fund's performance – and how have you positioned the Fund as a result? In the first quarter, the technology sector of the Russell 2000 Index (the Index) closed down almost 12%. Conversely, the energy sector was the top performer with its 14.6% gain, as oil-related stocks maintained their advantage on the tailwind of rising oil prices. We were underweight in these two volatile and cyclical groups, due to our ongoing focus on those sectors that, in our belief, yield stable profitability. During the first quarter, the Fund's favorable stock selection in the health care sector fueled performance, while our picks in the consumer discretionary sector detracted from results. In the second quarter, positive contributions came from the financials sector. Conversely, unfavorable stock selection in the consumer discreti onary and information technology sectors hampered the Fund's returns.

In the third quarter, the portfolio was helped in part by strong stock selection in financials and energy – and favorable picks within the information technology sector. These results were offset by unfavorable stock selection in the materials and information technology sectors – along with less-than-favorable choices in both the consumer discretionary and industrials sectors. At the end of the period, the portfolio was overweight in the health care sector and underweight in financials.

As 2005 came to a close, the Fund's overweight position in the consumer discretionary sector, and stronger-than-Index stock selection within that sector, contributed to performance. Solid stock picks in the financials, information technology, and industrials sectors also provided some lift in the fourth quarter. These results contrasted with weakness in several holdings within the consumer staples and health care sectors – and by unfavorable stock selection in the utilities sector. The Fund closed out the year in a similar fashion as the third quarter, with an overweight position in the health care sector and an underweight position in the financials space.

What is your outlook? Although we expect the Fed to remain vigilant with respect to interest rates in the first half of 2006, we are optimistic about the economy's prospects for the year. We expect most sectors of the economy could progress without hesitation. In addition, although consumer spending remains fragile in the face of a slowing housing market, we still see strength in industrial demand and general business investment. We do, however, remain concerned that elevated interest rates and energy prices could still provide a tipping point for small cap's three-year-old recovery. For that reason, the attributes of quality continue to be our primary focus.

15

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

MML Small Cap Growth Equity Fund

Industry Table

(% of Net Assets) on 12/31/05 | |

Short-Term Investments and

Other Assets and Liabilities | | | 10.0 | % | |

| Commercial Services | | | 8.9 | % | |

| Prepackaged Software | | | 8.7 | % | |

| Healthcare | | | 5.9 | % | |

| Energy | | | 4.2 | % | |

| Pharmaceuticals | | | 3.9 | % | |

| Financial Services | | | 3.8 | % | |

Electrical Equipment &

Electronics | | | 3.3 | % | |

| Transportation | | | 3.2 | % | |

| Computers & Information | | | 3.1 | % | |

| Banking, Savings & Loans | | | 3.0 | % | |

| Computer Related Services | | | 2.9 | % | |

| Medical Supplies | | | 2.7 | % | |

| Insurance | | | 2.5 | % | |

Investment Management

Services | | | 2.5 | % | |

| Retail | | | 2.3 | % | |

| Advertising | | | 2.0 | % | |

Data Processing &

Preparation | | | 2.0 | % | |

| Foods | | | 1.9 | % | |

| Lodging | | | 1.9 | % | |

| Air Transportation | | | 1.7 | % | |

Computer Integrated

Systems Design | | | 1.7 | % | |

| Automotive & Parts | | | 1.3 | % | |

| Communications | | | 1.3 | % | |

| Machinery & Components | | | 1.3 | % | |

| Apparel, Textiles & Shoes | | | 1.2 | % | |

Computer Programming

Services | | | 1.2 | % | |

| Telephone Utilities | | | 1.1 | % | |

Building Materials &

Construction | | | 1.0 | % | |

| Entertainment & Leisure | | | 1.0 | % | |

Home Construction,

Furnishings & Appliances | | | 0.9 | % | |

Broadcasting, Publishing &

Printing | | | 0.8 | % | |

| Chemicals | | | 0.8 | % | |

| Heavy Machinery | | | 0.8 | % | |

| Information Retrieval Services | | | 0.8 | % | |

| Restaurants | | | 0.8 | % | |

| Metals & Mining | | | 0.7 | % | |

| Household Products | | | 0.6 | % | |

| Oil & Gas | | | 0.6 | % | |

| Electric Utilities | | | 0.4 | % | |

| Real Estate | | | 0.4 | % | |

Computer Maintenance &

Repair | | | 0.3 | % | |

| Aerospace & Defense | | | 0.2 | % | |

| Cosmetics & Personal Care | | | 0.2 | % | |

| Manufacturing | | | 0.2 | % | |

Computer & Other Data

Processing Service | | | 0.0 | % | |

| | | | 100 | % | |

MML Small Cap Growth Equity Fund

Largest Stock Holdings (12/31/05) | |

iShares Russell 2000 Growth Index Fund

Checkfree Corp.

The Corporate Executive Board Co.

ITT Educational Services, Inc.

Factset Research Systems, inc.

Getty Images, Inc.

American Healthways, Inc.

Newfield Exploration Co.

MicroStratergy, Inc. Cl. A

Cerner Corp.

16

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

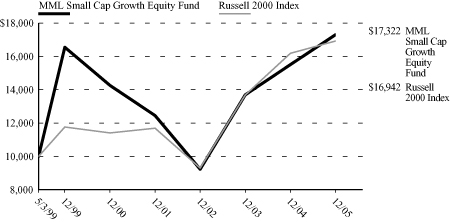

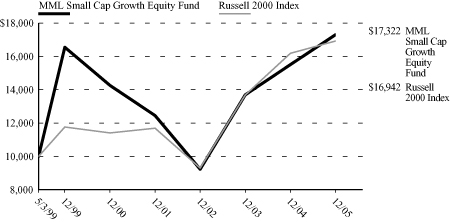

Growth of a $10,000 Investment

Hypothetical Investments in MML Small Cap Growth Equity Fund and the Russell 2000 Index.

MML Series Investment Fund

| Total Return | | One Year

1/1/05 - 12/31/05 | | Five Year

Average Annual

1/1/01 - 12/31/05 | | Since Inception

Average Annual

5/3/99 - 12/31/05 | |

MML Small Cap

Growth Equity Fund | | | 11.58 | % | | | 3.95 | % | | | 8.59 | % | |

| Russell 2000 Index | | | 4.55 | % | | | 8.22 | % | | | 8.23 | % | |

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website at www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 2000 Index is unmanaged and does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. Total return figures would be lower for the periods presented if they reflected these charges.

17

MML Emerging Growth Fund – Portfolio Manager Report

What is the investment objective of the MML Emerging Growth Fund? This Fund seeks capital appreciation by investing primarily in smaller, rapidly growing emerging companies – generally in industry segments experiencing rapid growth, and often including technology and technology-related concerns.

How did the Fund perform during the 12 months ended December 31, 2005? The Fund's shares returned 0.84%, trailing the 4.55% return of the Russell 2000® Index, a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

What was the investment backdrop during the period? The first quarter saw the broader U.S. stock averages struggle unsuccessfully to remain above the break-even mark in the midst of widespread expectations for slower growth by the nation's economy and a reduction in corporate profits. On the fixed-income front, bond yields fell and prices rose in January, but fears of rising inflation later in the quarter reversed much of the advance. Additionally, there were two 0.25% hikes in short-term interest rates by the Federal Reserve (Fed) during the first three months of 2005.

Turning to the second quarter, U.S. stocks traded indecisively, as moderately positive news on the economy and corporate earnings was tempered by high crude oil prices, rising short-term interest rates and concerns about slowing economic growth. In the bond market, Treasuries outperformed other fixed-income asset classes, while investment-grade bonds outpaced high-yield securities in the corporate sector.

Broad-based U.S. stock indexes advanced in the third quarter, as favorable second quarter earnings boosted the market in July. In the bond space, longer-maturity yields rose in July on better-than-expected economic performance, then backed off as rising crude oil prices once again raised fears of a slowing economy.

Stocks made upward progress in the fourth quarter, propelling many broad-based stock indexes into positive territory for full-year 2005. In the bond market, the yield curve – a measure of the disparity of yields of bonds of comparable credit quality across a range of maturities from three months to 30 years and used as an economic indicator – continued to flatten, due to persistent upward pressure on short-term yields by the Fed's credit-tightening and the relatively flat movement of longer-term yields.

What factors contributed to the Fund's performance – and how have you positioned the Fund as a result? In the first quarter, the Fund's underperformance primarily came from sector corrections in biotechnology, Internet and technology. Conversely, our better-performing stocks came from broader sectors of the economy – such as retail, energy, medical devices, consumer, software and health care services. In the second quarter, favorable stock selection drove the Fund's performance, especially in the software space. Health care proved to be another productive area for the portfolio as we approached the mid-year mark, with biotechnology holdings providing some of the best returns. Although our retail positions turned in decent performance, the portfolio encountered performance weakness in some Internet holdings.

In the third quarter, energy price spikes and rising shorter-term interest rates caused the market to depress consumer-related stocks. We maintained an overweight position in technology and Internet stocks, on the belief that corporations have significantly under-invested in information technology. Conversely, we maintained an underweight position in financials, producer durables and basic materials – three non-emerging sectors that fueled benchmark performance in the past three years – but whose sustainability we began to question. Finally, in the fourth quarter, our Internet-related positions produced strong returns, as did one of our primary e-commerce positions. Detracting from results, however, were certain segments of health care, which dragged down our relative results, as a number of biotechnology and drug development positions fell sharply.

18

MML Emerging Growth Equity Fund – Portfolio Manager Report (Continued)

What is your outlook? The consumer has driven the market for the past four years due to a rebounding economy and low interest rates. We believe that we are entering the later stages of an economic recovery, which tends to favor industries related to productivity spending and growth initiatives.

MML Emerging Growth Fund

Industry Table

(% of Net Assets) on 12/31/05 | |

| Commercial Services | | | 12.8 | % | |

| Medical Supplies | | | 8.8 | % | |

Electrical Equipment &

Electronics | | | 8.5 | % | |

| Prepackaged Software | | | 6.8 | % | |

| Healthcare | | | 5.9 | % | |

| Computers & Information | | | 5.5 | % | |

| Financial Services | | | 5.2 | % | |

| Retail | | | 4.2 | % | |

| Pharmaceuticals | | | 3.9 | % | |

| Telephone Utilities | | | 3.3 | % | |

| Communications | | | 3.0 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 3.0 | % | |

| Banking, Savings & Loans | | | 2.9 | % | |

| Restaurants | | | 2.7 | % | |

| Advertising | | | 2.5 | % | |

| Transportation | | | 2.1 | % | |

| Energy | | | 1.9 | % | |

| Machinery & Components | | | 1.9 | % | |

| Heavy Machinery | | | 1.8 | % | |

| Insurance | | | 1.8 | % | |

| Apparel, Textiles & Shoes | | | 1.6 | % | |

Computer Integrated Systems

Design | | | 1.5 | % | |

Building Materials &

Construction | | | 1.2 | % | |

| Computer Related Services | | | 1.2 | % | |

| Data Processing & Preparation | | | 1.1 | % | |

| Internet Software | | | 0.9 | % | |

| Air Transportation | | | 0.6 | % | |

| Beverages | | | 0.6 | % | |

| Foods | | | 0.6 | % | |

| Information Retrieval Services | | | 0.6 | % | |

Home Construction,

Furnishings & Appliances | | | 0.5 | % | |

| Lodging | | | 0.5 | % | |

Computer Programming

Services | | | 0.4 | % | |

Computer & Other Data

Processing Service | | | 0.2 | % | |

| Electric Utilites | | | 0.0 | % | |

| | | | 100.0 | % | |

MML Emerging Growth Fund

Largest Stock Holdings (12/31/05) | |

M-Systems Flash Disk Pioneers Ltd.

California Pizza Kitchen, Inc.

Zumiez, Inc.

Bright Horizons Family Solutions, Inc.

j2 Global Communications, Inc.

MicroStratergy, Inc. Cl. A

AMN Healthcare Services, Inc.

Affiliated Managers Group, Inc.

Grant Prideco, Inc.

Matria Healthcare, Inc.

19

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

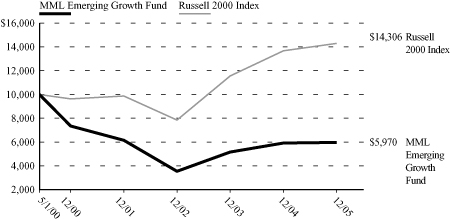

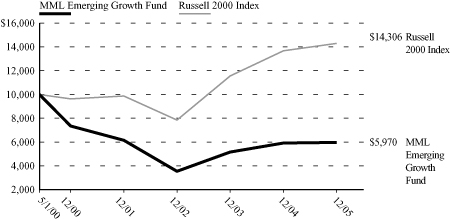

Growth of a $10,000 Investment

Hypothetical Investments in MML Emerging Growth Fund and the Russell 2000 Index.

MML Series Investment Fund

| Total Return | | One Year

1/1/05 - 12/31/05 | | Five Year

Average Annual

1/1/01 - 12/31/05 | | Since Inception

Average Annual

5/1/00 - 12/31/05 | |

MML Emerging

Growth Fund | | | 0.84 | % | | | –4.07 | % | | | –8.69 | % | |

| Russell 2000 Index | | | 4.55 | % | | | 8.22 | % | | | 6.52 | % | |

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website at www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 2000 Index is unmanaged and does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. Total return figures would be lower for the periods presented if they reflected these charges.

20

MML Large Cap Value Fund – Portfolio of Investments

December 31, 2005

| | | Number of

Shares | | Market

Value | |

| EQUITIES — 93.5% | |

| COMMON STOCK | |

| Advertising — 0.3% | |

WPP Group PLC, Sponsored

ADR (United Kingdom) | | | 6,000 | | | $ | 324,000 | | |

| Automotive & Parts — 1.4% | |

| Harley-Davidson, Inc. | | | 35,500 | | | | 1,827,895 | | |

| Banking, Savings & Loans — 14.3% | |

| Commerce Bancorp, Inc.(a) | | | 19,400 | | | | 667,554 | | |

| Fifth Third Bancorp(a) | | | 25,400 | | | | 958,088 | | |

Golden West

Financial Corp.(a) | | | 65,100 | | | | 4,296,600 | | |

| HSBC Holdings PLC | | | 214,427 | | | | 3,451,064 | | |

| JPMorgan Chase & Co. | | | 137,516 | | | | 5,458,010 | | |

Lloyds TSB Group PLC

Sponsored ADR

(United Kingdom)(a) | | | 24,800 | | | | 838,240 | | |

| State Street Corp. | | | 4,500 | | | | 249,480 | | |

| Wells Fargo & Co. | | | 50,800 | | | | 3,191,764 | | |

| | | | | | | | 19,110,800 | | |

| Beverages — 1.5% | |

Diageo PLC Sponsored

ADR (United Kingdom) | | | 23,500 | | | | 1,370,050 | | |

| Heineken Holding NV Cl. A | | | 23,250 | | | | 682,716 | | |

| | | | | | | | 2,052,766 | | |

| Broadcasting, Publishing & Printing — 3.6% | |

Comcast Corp.

Special, Cl. A(b) | | | 129,600 | | | | 3,329,424 | | |

| Gannett Co., Inc. | | | 6,800 | | | | 411,876 | | |

| Lagardere S.C.A. SA | | | 14,400 | | | | 1,107,709 | | |

| | | | | | | | 4,849,009 | | |

| Building Materials & Construction — 1.4% | |

Martin Marietta

Materials, Inc. | | | 12,700 | | | | 974,344 | | |

| Vulcan Materials Co. | | | 12,800 | | | | 867,200 | | |

| | | | | | | | 1,841,544 | | |

| Commercial Services — 4.9% | |

| Block (H&R), Inc.(a) | | | 70,500 | | | | 1,730,775 | | |

| Cosco Pacific, Limited | | | 164,000 | | | | 299,392 | | |

| Dun & Bradstreet Corp.(b) | | | 11,450 | | | | 766,692 | | |

| Iron Mountain, Inc.(a) (b) | | | 45,500 | | | | 1,921,010 | | |

| Moody's Corp. | | | 30,500 | | | | 1,873,310 | | |

| | | | | | | | 6,591,179 | | |

| | | Number of

Shares | | Market

Value | |

| Communications — 0.8% | |

Nokia Oyj Sponsored

ADR (Finland) | | | 17,700 | | | $ | 323,910 | | |

| NTL, Inc.(b) | | | 4,300 | | | | 292,744 | | |

SK Telecom Co., Ltd.

ADR (South Korea)(a) | | | 21,000 | | | | 426,090 | | |

| | | | | | | | 1,042,744 | | |

| Computer Related Services — 0.2% | |

| IAC/InterActiveCorp(b) | | | 9,850 | | | | 278,853 | | |

| Computers & Information — 1.6% | |

| Dell, Inc.(b) | | | 40,400 | | | | 1,211,596 | | |

Lexmark

International, Inc.(b) | | | 21,600 | | | | 968,328 | | |

| | | | | | | | 2,179,924 | | |

| Computers & Office Equipment — 0.5% | |

| Hewlett-Packard Co. | | | 25,200 | | | | 721,476 | | |

| Containers — 2.2% | |

| Sealed Air Corp.(a) (b) | | | 53,100 | | | | 2,982,627 | | |

| Cosmetics & Personal Care — 0.8% | |

| Avon Products, Inc. | | | 37,700 | | | | 1,076,335 | | |

| Energy — 10.2% | |

| ConocoPhillips | | | 56,360 | | | | 3,279,025 | | |

| Devon Energy Corp. | | | 51,600 | | | | 3,227,064 | | |

| EOG Resources, Inc.(a) | | | 44,000 | | | | 3,228,280 | | |

| Occidental Petroleum Corp. | | | 35,100 | | | | 2,803,788 | | |

| Transocean, Inc.(b) | | | 16,500 | | | | 1,149,885 | | |

| | | | | | | | 13,688,042 | | |

| Financial Services — 13.6% | |

| American Express Co. | | | 120,100 | | | | 6,180,346 | | |

| Ameriprise Financial, Inc. | | | 34,580 | | | | 1,417,780 | | |

Berkshire Hathaway,

Inc. Cl. A(b) | | | 46 | | | | 4,076,520 | | |

Centerpoint

Properties Corp.(a) | | | 40,400 | | | | 1,998,992 | | |

| Citigroup, Inc. | | | 64,800 | | | | 3,144,744 | | |

| Morgan Stanley | | | 14,100 | | | | 800,034 | | |

| Telewest Global, Inc.(b) | | | 21,900 | | | | 521,658 | | |

| | | | | | | | 18,140,074 | | |

| Foods — 0.7% | |

| The Hershey Co. | | | 17,700 | | | | 977,925 | | |

| Healthcare — 3.1% | |

| Caremark Rx, Inc.(b) | | | 30,800 | | | | 1,595,132 | | |

| HCA, Inc. | | | 50,900 | | | | 2,570,450 | | |

| | | | | | | | 4,165,582 | | |

| | | Number of

Shares | | Market

Value | |

| Household Products — 0.1% | |

| Hunter Douglas NV | | | 3,203 | | | $ | 174,215 | | |

| Industrial - Diversified — 4.4% | |

| Tyco International Ltd. | | | 204,543 | | | | 5,903,111 | | |

| Insurance — 13.3% | |

American International

Group, Inc. | | | 96,050 | | | | 6,553,491 | | |

| Aon Corp. | | | 29,300 | | | | 1,053,335 | | |

| Chubb Corp. | | | 3,800 | | | | 371,070 | | |

| Loews Corp. | | | 25,900 | | | | 2,456,615 | | |

| Markel Corp.(a) (b) | | | 300 | | | | 95,115 | | |

Marsh & McLennan

Companies, Inc. | | | 31,400 | | | | 997,264 | | |

Principal Financial

Group, Inc. | | | 9,000 | | | | 426,870 | | |

| Progressive Corp.(a) | | | 35,400 | | | | 4,134,012 | | |

| Sun Life Financial, Inc.(a) | | | 5,600 | | | | 224,728 | | |

| Transatlantic Holdings, Inc. | | | 20,800 | | | | 1,397,760 | | |

| | | | | | | | 17,710,260 | | |

| Pharmaceuticals — 1.1% | |

| Cardinal Health, Inc.(a) | | | 21,700 | | | | 1,491,875 | | |

| Prepackaged Software — 1.3% | |

| Microsoft Corp. | | | 64,400 | | | | 1,684,060 | | |

| Retail — 5.9% | |

| Costco Wholesale Corp.(a) | | | 108,700 | | | | 5,377,389 | | |

| Wal-Mart Stores, Inc. | | | 52,600 | | | | 2,461,680 | | |

| | | | | | | | 7,839,069 | | |

| Tobacco — 4.9% | |

| Altria Group, Inc. | | | 87,600 | | | | 6,545,472 | | |

| Transportation — 1.2% | |

China Merchants Holdings

International Co., Ltd. | | | 190,000 | | | | 411,797 | | |

Kuehne & Nagel

International AG | | | 1,400 | | | | 394,575 | | |

United Parcel

Service, Inc. Cl. B | | | 10,500 | | | | 789,075 | | |

| | | | | | | | 1,595,447 | | |

| Travel — 0.2% | |

| Expedia, Inc.(a) (b) | | | 9,950 | | | | 238,402 | | |

TOTAL EQUITIES

(Cost $100,450,161) | | | | | | | 125,032,686 | | |

(Continued)

The accompanying notes are an integral part of the financial statements.

21

MML Large Cap Value Fund – Portfolio of Investments (Continued)

| | | Principal

Amount | | Market

Value | |

| SHORT-TERM INVESTMENTS — 19.9% | |

| Cash Equivalents — 13.5%(d) | |

Abbey National PLC

Eurodollar Time Deposit

4.290% 01/11/2006 | | $ | 383,550 | | | $ | 383,550 | | |

American Beacon

Money Market Fund(c) | | | 164,927 | | | | 164,927 | | |

Bank of America

4.230% 01/20/2006 | | | 402,728 | | | | 402,728 | | |

Bank of America

4.270% 01/17/2006 | | | 295,124 | | | | 295,124 | | |

Bank of Montreal

Eurodollar Time Deposit

4.300% 01/19/2006 | | | 767,102 | | | | 767,102 | | |

Bank of Nova Scotia

Eurodollar Time Deposit

4.250% 01/27/2006 | | | 383,551 | | | | 383,551 | | |

Barclays

Eurodollar Time Deposit

4.300% 01/31/2006 | | | 383,551 | | | | 383,551 | | |

Barclays

Eurodollar Time Deposit

4.313% 01/17/2006 | | | 393,815 | | | | 393,815 | | |

Barclays

Eurodollar Time Deposit

4.410% 02/27/2006 | | | 191,775 | | | | 191,775 | | |

BGI Institutional

Money Market Fund(c) | | | 613,681 | | | | 613,681 | | |

Branch Banker & Trust

Eurodollar Time Deposit

4.260% 01/11/2006 | | | 191,775 | | | | 191,775 | | |

Calyon

Eurodollar Time Deposit

4.335% 02/06/2006 | | | 383,551 | | | | 383,551 | | |

Dexia Group

Eurodollar Time Deposit

4.230% 01/20/2006 | | | 383,551 | | | | 383,551 | | |

Dexia Group

Eurodollar Time Deposit

4.265% 01/27/2006 | | | 383,551 | | | | 383,551 | | |

Federal Home Loan

Bank Discount Note

4.186% 01/25/2006 | | | 229,109 | | | | 229,109 | | |

First Tennessee

National Corp.

Eurodollar Time Deposit

4.290% 01/13/2006 | | | 767,102 | | | | 767,102 | | |

Fortis Bank

Eurodollar Time Deposit

4.280% 01/12/2006 | | | 383,551 | | | | 383,551 | | |

Fortis Bank

Eurodollar Time Deposit

4.300% 01/04/2006 | | | 383,551 | | | | 383,551 | | |

| | | Principal

Amount | | Market

Value | |

Fortis Bank

Eurodollar Time Deposit

4.350% 01/03/2006 | | $ | 383,551 | | | $ | 383,551 | | |

Freddie Mac

Discount Note

4.234% 01/30/2006 | | | 308,009 | | | | 308,009 | | |

General Electric

Capital Corp.

4.274% 01/23/2006 | | | 762,755 | | | | 762,755 | | |

Goldman Sachs Financial

Square Prime Obligations

Money Market Fund(c) | | | 281,422 | | | | 281,422 | | |

Merrimac Cash Fund,

Premium Class(c) | | | 61,368 | | | | 61,368 | | |

Morgan Stanley

Dean Witter & Co.

4.330% 01/13/2006 | | | 767,102 | | | | 767,102 | | |

National Australia Bank

Eurodollar Time Deposit

4.156% 01/03/2006 | | | 1,250,223 | | | | 1,250,223 | | |

Rabobank Nederland

Eurodollar Time Deposit

4.150% 01/03/2006 | | | 498,616 | | | | 498,616 | | |

Rabobank Nederland

Eurodollar Time Deposit

4.210% 01/19/2006 | | | 613,681 | | | | 613,681 | | |

Royal Bank of Canada

Eurodollar Time Deposit

4.220% 01/20/2006 | | | 191,775 | | | | 191,775 | | |

Royal Bank of Canada

Eurodollar Time Deposit

4.250% 01/24/2006 | | | 383,551 | | | | 383,551 | | |

Royal Bank of Scotland

Eurodollar Time Deposit

4.250% 01/23/2006 | | | 383,551 | | | | 383,551 | | |

Royal Bank of Scotland

Eurodollar Time Deposit

4.300% 01/31/2006 | | | 575,326 | | | | 575,326 | | |

Skandinaviska Enskilda

Banken AB Eurodollar

Time Deposit (SEB)

4.230% 01/03/2006 | | | 191,775 | | | | 191,775 | | |

Skandinaviska Enskilda

Banken AB Eurodollar

Time Deposit (SEB)

4.300% 01/17/2006 | | | 536,971 | | | | 536,971 | | |

Societe Generale

Eurodollar Time Deposit

4.280% 01/30/2006 | | | 383,551 | | | | 383,551 | | |

Societe Generale

Eurodollar Time Deposit

4.280% 01/31/2006 | | | 383,551 | | | | 383,551 | | |

| | | Principal

Amount | | Market

Value | |

Svenska Handlesbanken

Eurodollar Time Deposit

4.100% 01/03/2006 | | $ | 437,716 | | | $ | 437,716 | | |

The Bank of the West

Eurodollar Time Deposit

4.290% 01/25/2006 | | | 613,681 | | | | 613,681 | | |

Toronto Dominion Bank

Eurodollar Time Deposit

4.300% 01/23/2006 | | | 383,551 | | | | 383,551 | | |

UBS AG

Eurodollar Time Deposit

4.255% 01/18/2006 | | | 191,775 | | | | 191,775 | | |

UBS AG

Eurodollar Time Deposit

4.260% 01/10/2006 | | | 383,551 | | | | 383,551 | | |

Wells Fargo

Eurodollar Time Deposit

4.270% 01/03/2006 | | | 322,183 | | | | 322,183 | | |

Wells Fargo

Eurodollar Time Deposit

4.300% 01/18/2006 | | | 767,102 | | | | 767,102 | | |

| | | | | | | | 18,141,882 | | |

| Repurchase Agreement — 6.4% | |

Investors Bank & Trust

Company Repurchase

Agreement, dated

12/30/2005, 3.02%,

due 01/03/2006(e) | | | 8,536,712 | | | | 8,536,712 | | |

TOTAL SHORT-TERM

INVESTMENTS

(At Amortized Cost) | | | | | | | 26,678,594 | | |

TOTAL INVESTMENTS — 113.4%

(Cost $127,128,755)(f) | | | | | | | 151,711,280 | | |

Other Assets/

(Liabilities) — (13.4%) | | | | | | | (17,954,815 | ) | |

| NET ASSETS — 100.0% | | | | | | $ | 133,756,465 | | |

Notes to Portfolio of Investments

ADR - American Depository Receipt

(a) Denotes all or a portion of security on loan (Note 2).

(b) Non-income producing security.

(c) Amount represents shares owned of the fund.

(d) Represents investments of security lending collateral. (Note 2).

(e) Maturity value of $8,539,577. Collateralized by U.S. Government Agency obligation with a rate of 3.737%, maturity date of 06/01/2033, and aggregate market value, including accrued interest, of $8,963,548.

(f) See Note 6 for aggregate cost for Federal tax purposes.

The accompanying notes are an integral part of the financial statements.

22

MML Equity Index Fund – Portfolio of Investments

December 31, 2005

| | | Number of

Shares | | Market

Value | |

| EQUITIES — 99.4% | |

| COMMON STOCK | |

| Advertising — 0.2% | |

Interpublic Group of

Companies, Inc.(a) (b) | | | 14,607 | | | $ | 140,958 | | |

Monster

Worldwide, Inc.(a) (b) | | | 4,076 | | | | 166,382 | | |

| Omnicom Group, Inc. | | | 6,506 | | | | 553,856 | | |

| | | | | | | | 861,196 | | |

| Aerospace & Defense — 2.2% | |

| Boeing Co. | | | 28,611 | | | | 2,009,637 | | |

| General Dynamics Corp. | | | 6,907 | | | | 787,743 | | |

| Goodrich Corp. | | | 4,139 | | | | 170,113 | | |

Honeywell

International, Inc. | | | 29,290 | | | | 1,091,052 | | |

| Lockheed Martin Corp. | | | 12,740 | | | | 810,646 | | |

| Northrop Grumman Corp. | | | 12,390 | | | | 744,763 | | |

| Raytheon Co. | | | 15,588 | | | | 625,858 | | |

| Rockwell Collins, Inc. | | | 6,068 | | | | 281,980 | | |

| United Technologies Corp. | | | 36,022 | | | | 2,013,990 | | |

| | | | | | | | 8,535,782 | | |

| Air Transportation — 0.1% | |

| Southwest Airlines Co. | | | 24,340 | | | | 399,906 | | |

| Apparel, Textiles & Shoes — 0.6% | |

| Coach, Inc.(a) | | | 13,000 | | | | 433,420 | | |

| Jones Apparel Group, Inc. | | | 4,196 | | | | 128,901 | | |

| Limited Brands | | | 12,130 | | | | 271,105 | | |

| Liz Claiborne, Inc.(b) | | | 3,774 | | | | 135,185 | | |

| Nike, Inc. Cl. B | | | 6,881 | | | | 597,202 | | |

| Nordstrom, Inc. | | | 7,770 | | | | 290,598 | | |

| Reebok International Ltd. | | | 2,056 | | | | 119,721 | | |

| The Gap, Inc. | | | 20,345 | | | | 358,886 | | |

| VF Corp. | | | 3,451 | | | | 190,978 | | |

| | | | | | | | 2,525,996 | | |

| Automotive & Parts — 0.6% | |

| AutoNation, Inc.(a) | | | 6,300 | | | | 136,899 | | |

Cooper Tire &

Rubber Co.(b) | | | 2,346 | | | | 35,941 | | |

| Dana Corp. | | | 5,303 | | | | 38,076 | | |

| Ford Motor Co. | | | 63,467 | | | | 489,965 | | |

| General Motors Corp.(b) | | | 19,830 | | | | 385,099 | | |

| Genuine Parts Co. | | | 6,129 | | | | 269,186 | | |

| Harley-Davidson, Inc. | | | 9,822 | | | | 505,735 | | |

Navistar

International Corp.(a) | | | 2,474 | | | | 70,806 | | |

| Paccar, Inc. | | | 6,083 | | | | 421,126 | | |

The Goodyear Tire &

Rubber Co.(a) (b) | | | 6,165 | | | | 107,148 | | |

| | | | | | | | 2,459,981 | | |

| | | Number of

Shares | | Market

Value | |

| Banking, Savings & Loans — 9.2% | |

| AmSouth Bancorporation | | | 12,559 | | | $ | 329,171 | | |

| Bank of America Corp.(b) | | | 139,956 | | | | 6,458,969 | | |

| Bank of New York Co., Inc. | | | 27,145 | | | | 864,568 | | |

| BB&T Corp. | | | 18,783 | | | | 787,196 | | |

| Capital One Financial Corp. | | | 10,000 | | | | 864,000 | | |

| Comerica, Inc. | | | 6,069 | | | | 344,476 | | |

| Compass Bancshares, Inc. | | | 3,800 | | | | 183,502 | | |

| Fannie Mae | | | 33,776 | | | | 1,648,607 | | |

| Fifth Third Bancorp(b) | | | 18,922 | | | | 713,738 | | |

First Horizon

National Corp.(b) | | | 4,400 | | | | 169,136 | | |

| Freddie Mac | | | 24,086 | | | | 1,574,020 | | |

Golden West

Financial Corp. | | | 9,010 | | | | 594,660 | | |

| JP Morgan Chase & Co. | | | 122,347 | | | | 4,855,952 | | |

| KeyCorp | | | 14,310 | | | | 471,228 | | |

| M&T Bank Corp. | | | 2,800 | | | | 305,340 | | |

Marshall and

Ilsley Corp.(b) | | | 7,300 | | | | 314,192 | | |

| Mellon Financial Corp. | | | 14,894 | | | | 510,119 | | |

| National City Corp. | | | 19,998 | | | | 671,333 | | |

North Fork

Bancorporation, Inc. | | | 16,550 | | | | 452,808 | | |

| Northern Trust Corp. | | | 8,488 | | | | 439,848 | | |

| Regions Financial Corp. | | | 16,270 | | | | 555,783 | | |

| SLM Corp. | | | 14,542 | | | | 801,119 | | |

| Sovereign Bancorp, Inc. | | | 12,877 | | | | 278,401 | | |

| State Street Corp. | | | 11,722 | | | | 649,868 | | |

| SunTrust Banks, Inc. | | | 12,390 | | | | 901,496 | | |

| Synovus Financial Corp. | | | 10,963 | | | | 296,111 | | |

| U.S. Bancorp | | | 63,532 | | | | 1,898,971 | | |