UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-02224 |

|

MML Series Investment Fund |

(Exact name of registrant as specified in charter) |

|

1295 State Street, Springfield, MA | | 01111 |

(Address of principal executive offices) | | (Zip code) |

|

John F. Carlson

1295 State Street, Springfield, MA 01111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 413-788-8411 | |

|

Date of fiscal year end: | 12/31/2006 | |

|

Date of reporting period: | 12/31/2006 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

MML Series Investment Fund

Annual Report

for the period ended

December 31, 2006

| MML Large Cap Value Fund |

| MMLEquity Index Fund |

| MMLGrowth Equity Fund |

| MMLOTC 100 Fund |

| MMLSmall Cap Growth Equity Fund |

| MML Emerging Growth Fund |

You can’t predict. You can prepare®.

INVEST

INSURE

RETIRE

Table of Contents

| Letter to Shareholders | | | 1 | | |

|

| Portfolio Manager Reports | | | 3 | | |

|

| Portfolio of Investments | | | 21 | | |

|

| MML Large Cap Value Fund | | | 21 | | |

|

| MML Equity Index Fund | | | 24 | | |

|

| MML Growth Equity Fund | | | 30 | | |

|

| MML OTC 100 Fund | | | 34 | | |

|

| MML Small Cap Growth Equity Fund | | | 36 | | |

|

| MML Emerging Growth Fund | | | 41 | | |

|

| Statement of Assets and Liabilities | | | 44 | | |

|

| Statement of Operations | | | 48 | | |

|

| Statement of Changes in Net Assets | | | 50 | | |

|

| Financial Highlights | | | 54 | | |

|

| Notes to Financial Statements | | | 61 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 71 | | |

|

| Trustees and Officers (Unaudited) | | | 72 | | |

|

| Federal Tax Information (Unaudited) | | | 75 | | |

|

| Other Information (Unaudited) | | | 76 | | |

|

This material must be preceded or accompanied by a current prospectus for the MML Series Investment Fund. Investors should consider a Fund's investment objective, risks and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus. Read it carefully before investing.

[This page is intentionally left blank.]

MML Series Investment Fund – Letter to Shareholders

To Our Shareholders

December 31, 2006

John Carlson

Your financial representative can provide you with specific guidance, but MassMutual continues to believe that most investors should consider an investment program that features a diversification strategy that suits their risk tolerance, financial goals and time horizon, and that keeps them exposed to the powerful forces of long-term growth potential.

A Look Back at 2006: Stocks' Impressive Year

Despite a slow start in the first half, particularly in the U.S., stocks worldwide made some impressive gains in 2006. For the full year, the Dow Jones Industrial AverageSM ("the Dow"), which measures blue-chip stock activity, returned 16.29%. The technology-laden Nasdaq Composite® Index ("Nasdaq") advanced 9.52% and the S&P 500® Index, a broad measure of U.S. large-cap stock performance, gained 15.78%. The Russell 2000® Index, a measure of small-cap equity results, advanced 18.36%. But the standout performer in the equity markets by a large margin was the MSCI® EAFE® Index, a benchmark for foreign stocks, which returned 26.34%.*

In the bond market, the Lehman Brothers® Aggregate Bond Index, which measures the U.S. investment-grade fixed-income markets, returned 4.33% for the 12-month period ended December 31.* Bond investors continued to struggle due to a Federal Reserve ("Fed") that remained in a tightening mode until August.

Taking a closer look at the year on a quarter-by-quarter basis, most U.S. stock indexes posted strong gains in the first quarter of 2006 – although foreign stocks outperformed their U.S.-based counterparts in a pattern that would continue throughout the year. In the fixed-income markets, the Lehman Brothers Aggregate Bond Index fell slightly. The second quarter saw a turnaround in the fortunes of equity markets worldwide, as investor uncertainty led many of the world's markets lower. Meanwhile, with rising inflation and interest rates, bond prices remained on the defensive.

Both the stock and bond markets saw good returns in the third quarter of 2006. Markets were buoyed by the Fed's decision to hold interest rates steady in both August and September, falling crude oil prices and favorable readings in some key inflation measures. Foreign stocks also fared well. In most cases, stocks outperformed bonds – although moderating inflation readings and expectations of a slowing economy were particularly helpful to the bond market.

Domestic stocks forged higher once again during the fourth quarter, reaching some notable milestones along the way. The Dow posted a series of new highs and briefly crossed the 12,500 barrier, advancing 6.71% for the quarter. The S&P 500 Index broke the 1,400 level and closed up 6.69%. Small caps also ended the year strongly, as evidenced by the Russell 2000 Index, which rose 8.90%. For its part, Nasdaq returned 6.95% for the fourth quarter. The U.S. dollar weakened slightly during the period, supporting the returns of foreign stocks and helping the MSCI EAFE Index to rise 10.35%. The factors that initially triggered the summer stock market rally continued to support stock prices during the final quarter of 2006 – namely, the Fed's extended pause with regard to interest rate increases and lower crude oil prices.

In the fixed-income market, bond prices changed little in the fourth quarter, due in part to low default rates and generally favorable corporate earnings. Against this backdrop, the Lehman Brothers Aggregate Bond Index returned 1.24%. The yield curve remained inverted, with the yields of shorter-term securities generally staying higher than those of longer-term issues.

* Indexes are unmanaged, do not incur fees or expenses and cannot be purchased directly for investment.

(Continued)

1

MML Series Investment Fund – Letter to Shareholders (Continued)

It was a good year . . . after all

At the end of 2005, experts pointed out that the equity market had advanced for three consecutive years, the Fed was raising interest rates and crude oil was on the rise. Not only that, but 2006 was the second year in the presidential cycle, a time that often heralds weak performance for stocks. For the first half of the year, the markets appeared ready to fulfill that prophecy, since most of the popular averages were sluggish from January through early May.

After the Fed's Open Market Committee rate hike on May 10, investors reacted with a sell-off, triggering a two-month market correction. It seemed that their patience with the Fed's credit-tightening had reached an end. In retrospect, however, the correction set the stage for the sustained rally that began in July and continued through the end of the year.

Why did the equity markets reverse course and head higher? During the summer, data emerged that suggested a mildly slowing, but still-expanding economy (i.e., a "soft landing") – which was seen as the best-case outcome after the cycle of Fed tightening. Inflation eased a bit over the remainder of the year, and those developments made it feasible for the central bank to keep short-term interest rates unchanged in August. Stable interest rates, in turn, fueled share prices. Falling energy prices also drove stocks higher during the second half of the year and helped to improve inflation readings. After trending higher for the first six months of 2006, crude oil declined rapidly in August and September, stabilizing around the $60 per barrel level for the remainder of the year. Meanwhile, natural gas retreated by almost 50% during the year's second half.

Outlook

The U.S. economy's ability to remain relatively healthy in the face of rising interest rates and energy prices for much of 2006 serves as another reminder that our economy is a potent force. As we begin 2007, naturally some concerns remain. In particular, investors are waiting to see if the economy weakens further. Offsetting this worry somewhat is the likelihood that the Fed could reverse course and lower interest rates if the economy appeared to be seriously faltering. These uncertainties and the new year provide you with an excellent opportunity to touch base with your financial representative, who can help you assess your comfort level with your current investment strategy – and whether or not it is aligned with today's market conditions. That said, MassMutual continues to believe that most investors should consider an investment program that features a diversification strategy that suits their risk tolerance, financial goals and ti me horizon, and that keeps them exposed – through a judicious mix of stock- and bond-focused investments – to the powerful forces of long-term growth potential.

John Carlson

President

The information provided is the opinion of MassMutual Retirement Services Investments Marketing as of 1/1/07 and is subject to change without notice. It is not to be construed as tax, legal or investment advice. Of course, past performance does not guarantee future results.

2

MML Large Cap Value Fund – Portfolio Manager Report

What is the investment objective of the MML Large Cap Value Fund – and who is the Fund's sub-adviser? This Fund seeks both capital growth and income by investing in large-capitalization companies that the Fund's sub-adviser, Davis Selected Advisers, L.P. (Davis), believes foster the creation of long-term value, such as proven management, a durable franchise and business model, and sustainable competitive advantages.

How did the Fund perform during the 12 months ended December 31, 2006? The Fund returned 14.18%, trailing the 15.78% return of the S&P 500® Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

What was the investment backdrop during the period? Most U.S. stock indexes posted strong gains in the first three months of 2006 – although foreign stocks outperformed their U.S.-based counterparts in a pattern that would continue throughout the year. The second quarter saw a turnaround in the fortunes of equity markets worldwide, as investor uncertainty led many of the world's markets lower.

Both the stock and bond markets saw good returns in the third quarter of 2006. Markets were buoyed by the Federal Reserve's ("Fed's") decision to hold interest rates steady in both August and September, falling crude oil prices and favorable readings in some key inflation measures. Foreign stocks also fared well. Domestic stocks forged higher once again during the fourth quarter, reaching some notable milestones along the way. The U.S. dollar weakened slightly during the period, supporting the returns of foreign stocks and helping the MSCI® EAFE® Index rise 10.35%. The factors that initially triggered the summer stock market rally continued to support stock prices during the final quarter of 2006 – namely, the Fed's extended pause with regard to interest rate increases and lower crude oil prices.

What factors contributed to the Fund's performance? Consumer discretionary companies were the most important contributors to the Fund's performance over the 12-month period ended December 31, 2006. The Fund benefited from careful stock selection within this sector, as its consumer discretionary companies outperformed the Fund's benchmark, the S&P 500 Index. Diversified financial and consumer staple companies also made important contributions to performance. Two diversified financial companies, JPMorgan Chase and American Express, and one consumer staples company, Altria, were among the top contributors to performance. On the other hand, Hershey Foods (in the consumer staples sector) was among the top detractors from performance.

The Fund's largest investment in 2006 was in insurance companies. Although these companies made a positive contribution to performance, they underperformed the benchmark. Berkshire Hathaway and Loews were among the top performers. Progressive and Transatlantic Holdings were among the major detractors. The Fund's investments in telecommunication service and energy companies also contributed to the Fund's underperformance in 2006. Although telecommunication service companies were the strongest performers for the benchmark, the Fund's holdings within that sector did not perform as well. Similarly, while energy companies made positive contributions to the Fund's performance, they too underperformed the S&P 500 Index. One energy company in particular, however, ConocoPhillips, was among the top contributors to the Fund's absolute performance. Conversely, telecommunication services holding Sprint Nextel (purchased in March), and, EOG Resources, an energy company, were among the top detractors from the Fund's performance for 2006.

The Fund had approximately 10% of its assets invested in foreign companies as of December 31, 2006. As a group, the foreign companies owned by the Fund outperformed the benchmark over the 12-month period.

Consistent with our low-turnover strategy, only two companies dropped out of the Fund's top 10 holdings – Progressive and Golden West Financial. Progressive remained among the Fund's top 20 holdings at year-end and Wachovia acquired Golden West Financial. Taking Progressive and Golden West Financial's places in the top 10 were ConocoPhillips and Comcast, both of which were already top 20 holdings.

What is your outlook? Although it is impossible to predict with any certainty the direction that the equity markets will take throughout 2007, we do expect that numerous forces will continue to influence the direction that the market takes moving forward – such as oil prices, inflation, geopolitical unrest and Fed policy. We believe, however, that we have positioned the Fund to be ready to handle the wide array of market conditions that investors may face throughout the remainder of the year.

3

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

MML Large Cap Value Fund

Industry Table

(% of Net Assets) on 12/31/06

| Banking, Savings & Loans | | | 12.7 | % | |

| Energy | | | 11.8 | % | |

| Financial Services | | | 11.7 | % | |

| Insurance | | | 10.9 | % | |

| Retail | | | 7.6 | % | |

Broadcasting, Publishing &

Printing | | | 5.0 | % | |

| Commercial Services | | | 4.5 | % | |

| Tobacco | | | 4.5 | % | |

| Industrial — Diversified | | | 4.2 | % | |

| Healthcare | | | 2.7 | % | |

| Prepackaged Software | | | 2.2 | % | |

| Containers | | | 2.0 | % | |

| Beverages | | | 2.0 | % | |

| Automotive & Parts | | | 2.0 | % | |

| Entertainment & Leisure | | | 1.7 | % | |

Building Materials &

Construction | | | 1.5 | % | |

| Cosmetics & Personal Care | | | 1.5 | % | |

| Transportation | | | 1.4 | % | |

| Communications | | | 1.2 | % | |

| Telephone Utilities | | | 1.1 | % | |

| Pharmaceuticals | | | 0.9 | % | |

Computers & Office

Equipment | | | 0.6 | % | |

| Computers & Information | | | 0.6 | % | |

| Foods | | | 0.5 | % | |

| Metals & Mining | | | 0.4 | % | |

| Advertising | | | 0.2 | % | |

| Computer Related Services | | | 0.2 | % | |

| Household Products | | | 0.2 | % | |

| Travel | | | 0.1 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 4.1 | % | |

| | | | 100.0 | % | |

MML Large Cap Value Fund

Largest Stock Holdings (12/31/06)

Altria Group, Inc.

American Express Co.

American International Group, Inc.

Berkshire Hathaway, Inc. Cl. A

Comcast Corp. Special, Cl. A

ConocoPhillips

Costco Wholesale Corp.

HSBC Holdings PLC

JP Morgan Chase & Co.

Tyco International Ltd. | |

|

4

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

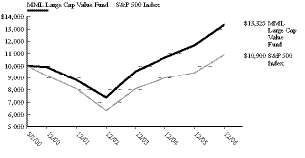

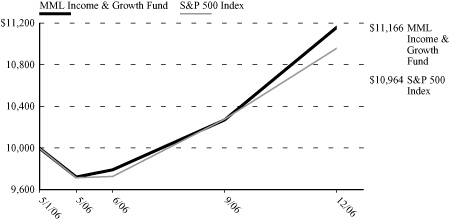

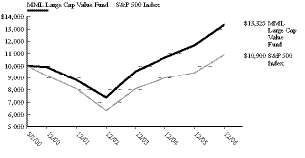

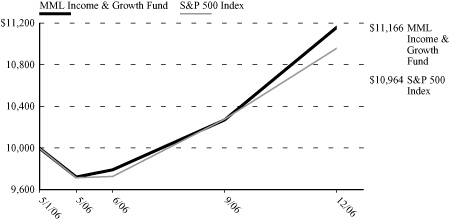

Growth of a $10,000 Investment

Hypothetical Investments in MML Large Cap Value Fund and the S&P 500 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/06 -

12/31/06 | | Five Year

Average

Annual

1/1/02 -

12/31/06 | | Since

Inception

Average

Annual

5/1/00 -

12/31/06 | |

| MML Large Cap Value Fund | | | 14.18 | % | | | 8.67 | % | | | 4.40 | % | |

| S&P 500 Index | | | 15.78 | % | | | 6.19 | % | | | 1.30 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

5

MML Equity Index Fund – Portfolio Manager Report

What is the investment objective of the MML Equity Index Fund – and who is the Fund's sub–adviser? The Fund seeks to provide investment results that correspond to the price and yield performance of publicly traded common stocks in the aggregate as represented by the S&P 500® Index. The Fund pursues this objective by investing at least 80% of its net assets in the equity securities of companies that make up the S&P 500 Index. The Fund's sub-adviser is Northern Trust Investments, N.A. (Northern).

How did the Fund perform during the 12 months ended December 31, 2006? The Fund's Class I shares returned 15.30%, moderately trailing the 15.78% return of the S&P 500 Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

What was the investment backdrop during the period? The Federal Reserve ("Fed") raised interest rates twice during the first quarter of 2006, bringing the federal funds rate to 4.75% as of March 31. Oil prices remained a concern for investors and cast a shadow over future growth in equity markets in both the U.S. and abroad. During this timeframe, crude oil prices in the U.S. ranged between $60 and $70 per barrel, within striking distance of the 2005 high of $71.

Turning to the second quarter, the Fed maintained its tightening policy and increased interest rates by 0.25% at each Federal Open Market Committee ("FOMC") meeting in May and June. The June increase was the 17th consecutive one since June 2004, and brought the federal funds rate to 5.25% as of June 29. The continued rise in energy and commodity prices fueled investor concerns about inflationary pressure on the U.S. economy. The lack of substantial progress in talks with Iran regarding their nuclear program contributed substantially to rising oil prices; additionally, the escalation of the conflict with North Korea that culminated with the actual testing of long-range missiles injected nervousness into the markets.

During the third quarter, equity markets benefited from the 3.9% fall in oil prices as well as the continued decline in interest rates, as the 10-year U.S. Treasury yield slipped to about 4.6% by the end of the quarter. Broadly speaking, equity investors saw lower energy costs and interest rates as beneficial to consumers and businesses. The Fed, however, showed less optimism about economic prospects, which helped to prompt its August decision to halt its tightening policy of the federal funds rate. This marked one of the most significant developments in the U.S. during the quarter.

Domestic stocks forged higher once again during the fourth quarter, and many of the major indexes even reached some notable milestones. The U.S. dollar weakened slightly during the period, which supported the returns of foreign stocks. The factors that initially triggered the summer stock market rally continued to support stock prices during the final quarter of 2006 – namely, the Fed's extended pause with regard to interest rate increases and lower crude oil prices. After reaching a high of $77.03 per barrel during the third quarter of 2006, oil prices retreated to the low $60s by the end of 2006.

What factors contributed to the Fund's performance? During the first quarter of 2006, large-capitalization stocks underperformed both mid- and small-cap stocks. Value stocks outpaced growth issues during the period. Telecommunication services was the best-performing sector in the Index, and utilities was the worst-performing sector. Turning to the second quarter, large-cap stocks outperformed both mid- and small-cap issues. Value stocks once again outpaced their growth counterparts. During the quarter, utilities was the best-performing sector in the Index, and technology was the worst-performing sector.

During the third quarter, telecommunication services was the best-performing sector in the Index. Health care, financials and information technology also showed solid results. With the decline in oil and gas prices, it was no surprise that energy was the worst-performing sector. In a reflection of the gradually slowing U.S. economy, materials was slightly negative.

All sectors of the Index posted positive results for the fourth quarter. Materials was the top performer, followed by the energy sector. Financials and information technology also posted healthy returns. Health care was the quarter's worst-performing sector.

What is your outlook? Although it is impossible to predict with any precision the direction that the equity markets will take in 2007, we do expect that many of the same forces that have influenced the markets over the past several years will continue. These factors include oil prices, inflation, geopolitical unrest and Fed policy. We are confident, however, that the Fund is positioned to pursue returns consistent with the S&P 500 Index.

6

MML Equity Index Fund – Portfolio Manager Report (Continued)

MML Equity Index Fund

Industry Table

(% of Net Assets) on 12/31/06

| Energy | | | 9.7 | % | |

| Banking, Savings & Loans | | | 9.2 | % | |

| Pharmaceuticals | | | 7.9 | % | |

| Financial Services | | | 6.6 | % | |

Electrical Equipment &

Electronics | | | 5.7 | % | |

| Insurance | | | 5.4 | % | |

| Retail | | | 4.5 | % | |

| Computers & Information | | | 4.0 | % | |

| Telephone Utilities | | | 3.4 | % | |

| Prepackaged Software | | | 3.2 | % | |

| Electric Utilities | | | 3.1 | % | |

Broadcasting, Publishing &

Printing | | | 2.5 | % | |

| Aerospace & Defense | | | 2.3 | % | |

| Cosmetics & Personal Care | | | 2.2 | % | |

| Medical Supplies | | | 2.1 | % | |

| Beverages | | | 2.0 | % | |

| Industrial — Diversified | | | 1.7 | % | |

| Transportation | | | 1.7 | % | |

| Tobacco | | | 1.5 | % | |

| Foods | | | 1.5 | % | |

| Commercial Services | | | 1.4 | % | |

| Chemicals | | | 1.3 | % | |

| Communications | | | 1.2 | % | |

Computers & Office

Equipment | | | 1.2 | % | |

| Healthcare | | | 1.1 | % | |

| Entertainment & Leisure | | | 1.1 | % | |

Information Retrieval

Services | | | 1.1 | % | |

| Machinery & Components | | | 1.1 | % | |

| Metals & Mining | | | 0.9 | % | |

| Real Estate | | | 0.9 | % | |

| Apparel, Textiles & Shoes | | | 0.6 | % | |

| Automotive & Parts | | | 0.6 | % | |

| Restaurants | | | 0.6 | % | |

Data Processing &

Preparation | | | 0.6 | % | |

| Household Products | | | 0.4 | % | |

| Manufacturing | | | 0.4 | % | |

Home Construction,

Furnishings & Appliances | | | 0.4 | % | |

| Lodging | | | 0.4 | % | |

| Forest Products & Paper | | | 0.4 | % | |

Computer Integrated Systems

Design | | | 0.3 | % | |

| Food Retailers | | | 0.3 | % | |

| Advertising | | | 0.2 | % | |

| Containers | | | 0.2 | % | |

Building Materials &

Construction | | | 0.2 | % | |

Computer Programming

Services | | | 0.1 | % | |

| Toys, Games | | | 0.1 | % | |

| Air Transportation | | | 0.1 | % | |

| Computer Related Services | | | 0.1 | % | |

Photography Equipment/

Supplies | | | 0.1 | % | |

| Retail — Grocery | | | 0.1 | % | |

| Industrial — Distribution | | | 0.0 | % | |

| Travel | | | 0.0 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 2.3 | % | |

| | | | 100.0 | % | |

MML Equity Index Fund

Largest Stock Holdings (12/31/06)

Altria Group, Inc.

American International Group, Inc.

Bank of America Corp.

Citigroup, Inc.

Exxon Mobil Corp.

General Electric Co.

Johnson & Johnson

Microsoft Corp.

Pfizer, Inc.

The Procter & Gamble Co. | |

|

7

MML Equity Index Fund – Portfolio Manager Report (Continued)

Growth of a $10,000 Investment

Hypothetical Investments in MML Equity Index Fund Class I and the S&P 500 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/06 -

12/31/06 | | Five Year

Average

Annual

1/1/02 -

12/31/06 | | Since

Inception

Average

Annual

5/1/97 -

12/31/06 | |

| MML Equity Index Fund Class I | | | 15.30 | % | | | 5.74 | % | | | 7.27 | % | |

| S&P 500 Index | | | 15.78 | % | | | 6.19 | % | | | 7.78 | % | |

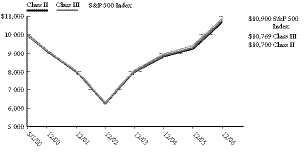

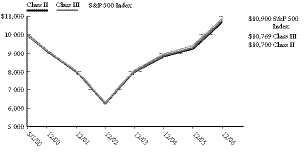

Hypothetical Investments in MML Equity Index Fund Class II, Class III and the S&P 500 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/06 -

12/31/06 | | Five Year

Average

Annual

1/1/02 -

12/31/06 | | Since

Inception

Average

Annual

5/1/00 -

12/31/06 | |

| MML Equity Index Fund Class II | | | 15.54 | % | | | 5.92 | % | | | 1.02 | % | |

| MML Equity Index Fund Class III | | | 15.72 | % | | | 6.06 | % | | | 1.12 | % | |

| S&P 500 Index | | | 15.78 | % | | | 6.19 | % | | | 1.30 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

8

MML Growth Equity Fund – Portfolio Manager Report

What is the investment objective of the MML Growth Equity Fund – and who is the Fund's sub-adviser? This Fund seeks long-term growth of capital and future income by normally investing at least 80% of its net assets in the common stocks and securities convertible into common stocks of companies that the Fund's sub-adviser, Grantham, Mayo, Van Otterloo & Co. LLC (GMO), believes offer prospects for long-term growth.

How did the Fund perform during the 12 months ended December 31, 2006? The Fund returned 1.98%, lagging the 15.78% return of the S&P 500® Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

What was the investment background during the period? Stocks picked up in the first quarter of 2006 exactly where they left off in late 2005, posting solid gains in the face of economic uncertainty and potentially setting the stage for a fourth consecutive year of equity gains since 2002. Solid growth in corporate profits and signs of an uptick in overall economic activity helped boost share prices during the first three months of the year. High-quality U.S. stocks again underperformed their low-quality counterparts, although the spread appeared to taper during the period. In a turnaround, the majority of the U.S. equity market indexes posted negative returns in the second quarter, with the exception of the Dow Jones Industrial AverageSM, which advanced 0.37%. Investor uncertainty caused in part by global unrest and rising oil prices l ed the markets lower. The spread between high- and low-quality stocks was considerable during the timeframe, although both ended the quarter in negative territory.

Both the stock and bond markets saw good returns in the third quarter of 2006. Markets held up well on news of the Federal Reserve's ("Fed's") decision to hold interest rates steady in both August and September, falling crude oil prices and favorable readings in some key inflation measures. Foreign stocks also fared well. Domestic stocks forged higher once again during the fourth quarter, reaching some notable milestones along the way. The factors that initially triggered the summer stock market rally continued to support stock prices during the final quarter of 2006 – namely, the Fed's extended pause with regard to interest rate increases and lower crude oil prices.

What factors contributed to the Fund's performance? The Fund's overweight position (relative to its benchmark, the S&P 500 Index) in health care and its underweight position in the services sector hindered portfolio performance in the first quarter. Lower-than-benchmark positions in the food and beverage, machinery and manufacturing sectors contributed to relative returns, but not enough to offset overall negative sector performance. Stock selection was negative for the quarter, due in large part to picks among technology issues. Turning to the second quarter, the Fund's underweight positions in manufacturing and consumer goods and its overweight position in health care hampered returns. The Fund's underweight position in technology and construction, and greater-than-benchmark allocations in the financial and oil and gas sectors contributed t o relative returns. Stock selection was negative for the quarter, due in large part to picks among health care, financial, retail stores and technology issues.

In the third quarter of 2006, an underweight position in technology and an overweight position in oil and gas impeded portfolio performance. Overweight positions in financials and health care and an underweight position in metals and mining contributed to relative returns, but not enough to offset overall negative sector performance for the period. Finally, in the fourth quarter, sector selection detracted from relative returns, although overweight positions in the food and beverage and automotive sectors, in tandem with an underweight position in machinery, added to relative returns. These advances were offset, however, by the Fund's overweight positions in retail and transportation and its underweight position in services. Stock selection was also negative for the quarter. The Fund's investments in the oil and gas, utility and retail sectors added to relative returns, while its picks in the technology, health care and transportation sector s detracted.

What is your outlook? Market conditions were quite favorable as we moved into 2007. Historically low volatility, record-high profit margins (especially at the lower-quality end of the spectrum) and easy access to capital seemed to be positive factors for the market's benign environment. Historically speaking, each of these factors, however, has tended to be short-lived, and thus we are confident that the advantageous environment will soon end. While timing is always an undeterminable factor in such forecasts, we continue to seek investments that help us to reduce risk wherever possible.

9

MML Growth Equity Fund – Portfolio Manager Report (Continued)

MML Growth Equity Fund

Industry Table

(% of Net Assets) on 12/31/06

| Retail | | | 14.5 | % | |

| Pharmaceuticals | | | 11.2 | % | |

| Computers & Information | | | 5.6 | % | |

| Transportation | | | 5.5 | % | |

| Financial Services | | | 4.9 | % | |

| Energy | | | 4.8 | % | |

| Commercial Services | | | 4.3 | % | |

| Insurance | | | 3.5 | % | |

Electrical Equipment &

Electronics | | | 3.3 | % | |

| Prepackaged Software | | | 3.2 | % | |

| Aerospace & Defense | | | 3.0 | % | |

| Healthcare | | | 2.9 | % | |

| Machinery & Components | | | 2.4 | % | |

| Medical Supplies | | | 2.3 | % | |

| Industrial — Diversified | | | 2.1 | % | |

Broadcasting, Publishing &

Printing | | | 1.9 | % | |

| Communications | | | 1.9 | % | |

| Food Retailers | | | 1.8 | % | |

| Foods | | | 1.8 | % | |

| Telephone Utilities | | | 1.7 | % | |

| Beverages | | | 1.7 | % | |

| Banking, Savings & Loans | | | 1.6 | % | |

| Entertainment & Leisure | | | 1.4 | % | |

| Apparel, Textiles & Shoes | | | 1.2 | % | |

| Tobacco | | | 1.2 | % | |

| Metals & Mining | | | 1.0 | % | |

| Cosmetics & Personal Care | | | 0.8 | % | |

| Automotive & Parts | | | 0.7 | % | |

Home Construction,

Furnishings & Appliances | | | 0.7 | % | |

| Manufacturing | | | 0.7 | % | |

| Data Processing & Preparation | | | 0.6 | % | |

Computers & Office

Equipment | | | 0.6 | % | |

| Chemicals | | | 0.5 | % | |

| Information Retrieval Services | | | 0.5 | % | |

Computer Programming

Services | | | 0.4 | % | |

| Internet Content | | | 0.3 | % | |

| Lodging | | | 0.3 | % | |

| Containers | | | 0.2 | % | |

| Restaurants | | | 0.2 | % | |

Building Materials &

Construction | | | 0.1 | % | |

Computer Integrated Systems

Design | | | 0.1 | % | |

| Advertising | | | 0.1 | % | |

| Industrial — Distribution | | | 0.1 | % | |

| Computer Related Services | | | 0.1 | % | |

| Toys, Games | | | 0.1 | % | |

| Electric Utilities | | | 0.1 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 2.1 | % | |

| | | | 100.0 | % | |

MML Growth Equity Fund

Largest Stock Holdings (12/31/06)

Cisco Systems, Inc.

Exxon Mobil Corp.

FedEx Corp.

Johnson & Johnson

Lowe's Companies, Inc.

Merck & Co., Inc.

Pfizer, Inc.

Starbucks Corp.

The Home Depot, Inc.

Wal-Mart Stores, Inc. | |

|

10

MML Growth Equity Fund – Portfolio Manager Report (Continued)

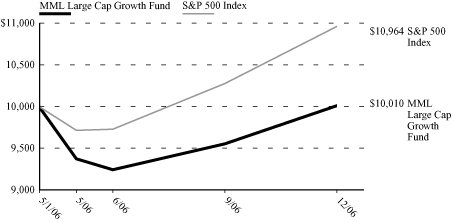

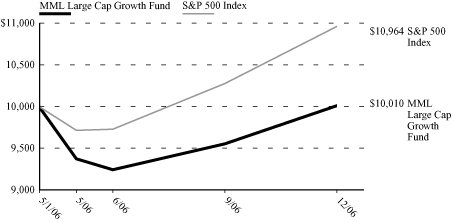

Growth of a $10,000 Investment

Hypothetical Investments in MML Growth Equity Fund and the S&P 500 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/06 -

12/31/06 | | Five Year

Average

Annual

1/1/02 -

12/31/06 | | Since

Inception

Average

Annual

5/3/99 -

12/31/06 | |

| MML Growth Equity Fund | | | 1.98 | % | | | –0.29 | % | | | –1.41 | % | |

| S&P 500 Index | | | 15.78 | % | | | 6.19 | % | | | 2.41 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

11

MML OTC 100 Fund – Portfolio Manager Report

What is the investment objective of the MML OTC 100 Fund – and who is the Fund's sub-adviser? This Fund seeks to approximate, as closely as practicable (before fees and expenses), the total return of the 100 largest publicly traded over-the-counter common stocks. The Fund pursues this objective by investing at least 80% of its net assets in the equity securities of companies included in the NASDAQ 100 Index®, which is generally recognized as representative of the over-the-counter market. The Fund's sub-adviser is Northern Trust Investments, N.A. (Northern).

How did the Fund perform during the 12 months ended December 31, 2006? The Fund returned 6.75%, nearly in line with the 6.79% return of the NASDAQ 100 Index. The NASDAQ 100 Index is a modified capitalization-weighted index composed of the 100 largest non-financial companies listed on the National Association of Securities Dealers Automated Quotations System ("NASDAQ").

What was the investment backdrop during the period? The Federal Reserve ("Fed") raised interest rates twice during the first quarter of 2006, bringing the federal funds rate to 4.75% as of March 31. Oil prices remained a concern for investors and cast a shadow over future growth in equity markets in both the U.S. and abroad. During this timeframe, crude oil prices in the U.S. ranged between $60 and $70 per barrel, within striking distance of the 2005 high of $71.

Turning to the second quarter, the Fed maintained its tightening policy and increased interest rates by 0.25% at each Federal Open Market Committee ("FOMC") meeting in May and June. The June increase was the 17th consecutive one since June 2004, and brought the federal funds rate to 5.25% as of June 29. The continued rise in energy and commodity prices fueled investor concerns about inflationary pressure on the U.S. economy. The lack of substantial progress in talks with Iran regarding their nuclear program contributed substantially to rising oil prices; additionally, the escalation of the conflict with North Korea that culminated with the actual testing of long-range missiles injected nervousness into the markets.

During the third quarter, equity markets were helped by the 3.9% fall in oil prices as well as the continued decline in interest rates, as the 10-year U.S. Treasury yield slipped to about 4.6% by the end of the quarter. Broadly speaking, lower energy costs and interest rates were seen by equity investors as benefiting consumers and businesses. The Fed, however, showed less optimism about economic prospects, which helped to prompt its August decision to finally halt its tightening policy of the federal funds rate. This marked one of the most significant developments in the U.S. during the quarter.

Domestic stocks forged higher once again during the fourth quarter, and many of the major indexes even reached some notable milestones. The U.S. dollar weakened slightly during the period, which supported the returns of foreign stocks. The factors that initially triggered the summer stock market rally continued to support stock prices during the final quarter of 2006 – namely, the Fed's extended pause with regard to interest rate increases and lower crude oil prices. After reaching a high of $77.03 per barrel during the third quarter of 2006, oil prices retreated to the low $60s by the end of 2006.

What factors contributed to the Fund's performance? The NASDAQ 100 Index finished the first quarter of 2006 up 3.69%. The industrial sector advanced 16.84% for the quarter, while the information technology sector returned 2.67%. Consumer discretionary also made progress, with its return of 5.35%. The second quarter produced very different results for the NASDAQ 100 Index. It finished the period with a loss of 7.47%, following poor performance from the information technology sector, which lost 10.44%. The energy and health care sectors also lagged, with returns of –11.14% and –7.97%, respectively. On the upside, the materials sector advanced 10.75%.

Turning to the third quarter, the NASDAQ 100 Index returned 5.13%. The strongest performance and the Fund's main contribution came from the information technology sector, its largest sector position, which returned 8.42%. Conversely, the worst-performing sector was energy, which posted a return of –15.79%. The NASDAQ 100 Index finished the fourth quarter up 6.44%. The strongest performance for the period came from the telecommunication services sector, with its return of 17.31%. However, due to the Fund's small allocation to this sector, it was not a significant contributor to performance. The Fund's largest position, information technology, posted a return of 6.45%. Another notable contributor was the consumer discretionary sector, which returned 10.49%. The Fund's two fourth-quarter detractors were energy and consumer staples, although the Fund's small allocation to these sectors did not detract much from the Fund's performance.

What is your outlook? Although it is impossible to predict with any precision the direction that the equity markets will take in 2007, we do expect that many of the same forces that have influenced the markets over the past several years will continue to do the same this year. These factors include oil prices, inflation, geopolitical unrest and Fed policy. We are confident, however, that the Fund is positioned to pursue returns consistent with those of the NASDAQ 100 Index.

12

MML OTC 100 Fund – Portfolio Manager Report (Continued)

MML OTC 100 Fund

Industry Table

(% of Net Assets) on 12/31/06

| Prepackaged Software | | | 14.6 | % | |

| Computers & Information | | | 12.9 | % | |

| Pharmaceuticals | | | 11.3 | % | |

Electrical Equipment &

Electronics | | | 10.8 | % | |

| Communications | | | 9.7 | % | |

Information Retrieval

Services | | | 5.6 | % | |

| Retail | | | 5.3 | % | |

| Commercial Services | | | 4.7 | % | |

Broadcasting, Publishing &

Printing | | | 3.9 | % | |

| Food Retailers | | | 2.4 | % | |

| Medical Supplies | | | 1.7 | % | |

Computer Integrated Systems

Design | | | 1.5 | % | |

Computer Programming

Services | | | 1.4 | % | |

| Manufacturing | | | 1.3 | % | |

| Transportation | | | 1.2 | % | |

| Automotive & Parts | | | 1.2 | % | |

| Telephone Utilities | | | 1.0 | % | |

| Computer Related Services | | | 1.0 | % | |

| Advertising | | | 0.7 | % | |

Data Processing &

Preparation | | | 0.7 | % | |

| Apparel, Textiles & Shoes | | | 0.7 | % | |

| Lodging | | | 0.7 | % | |

| Healthcare | | | 0.6 | % | |

| Travel | | | 0.5 | % | |

| Retail — Grocery | | | 0.4 | % | |

| Machinery & Components | | | 0.4 | % | |

| Internet Content | | | 0.3 | % | |

| Communications Equipment | | | 0.3 | % | |

| Energy | | | 0.2 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 3.0 | % | |

| | | | 100.0 | % | |

MML OTC 100 Fund

Largest Stock Holdings (12/31/06)

Amgen, Inc.

Apple, Inc.

Cisco Systems, Inc.

Comcast Corp. Cl. A

Google, Inc. Cl. A

Intel Corp.

Microsoft Corp.

Oracle Corp.

Qualc omm, Inc.

Starbucks Corp. | |

|

13

MML OTC 100 Fund – Portfolio Manager Report (Continued)

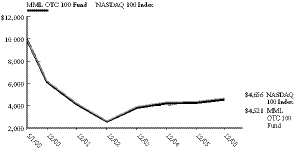

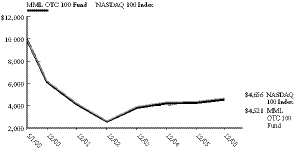

Growth of a $10,000 Investment

Hypothetical Investments in MML OTC 100 Fund and the NASDAQ 100 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/06 -

12/31/06 | | Five Year

Average

Annual

1/1/02 -

12/31/06 | | Since

Inception

Average

Annual

5/1/00 -

12/31/06 | |

| MML OTC 100 Fund | | | 6.75 | % | | | 2.04 | % | | | –11.22 | % | |

| NASDAQ 100 Index | | | 6.79 | % | | | 2.18 | % | | | –10.83 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the NASDAQ 100 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

14

MML Small Cap Growth Equity Fund – Portfolio Manager Report

What is the investment objective of the MML Small Cap Growth Equity Fund – and who are the Fund's sub-advisers? This Fund seeks long-term capital appreciation by investing primarily in common stocks and equity securities of smaller companies that the Fund's sub-advisers believe offer potential for long-term growth. The Fund's sub-advisers are Wellington Management Company, LLP (Wellington) and Waddell & Reed Investment Management Company (Waddell & Reed). Each sub-adviser is responsible for a portion of the portfolio, but not necessarily equal weighted.

How did the Fund perform during the 12 months ended December 31, 2006? The Fund returned 9.02%, trailing the 18.37% return of the Russell 2000® Index, a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

What was the investment background during the period? U.S. equity markets generally moved higher in the first quarter, supported by strength in corporate earnings, a solidifying global economy and benign inflation. Small caps outperformed their larger-cap peers for the quarter – all sectors within the Russell 2000 Index (also, the "benchmark") had positive returns. Turning to the second quarter, domestic equity markets moved lower, driven by inflationary fears, higher interest rates and concerns about a slowing economy. Small-cap stocks underperformed both mid and large caps. From a sector perspective, performance within the benchmark was tilted in favor of defensively oriented sectors. The energy, utilities and consumer staples sectors performed best, whereas information technology, health care and consumer discretionary lagged the benchmar k.

Equity markets generally increased during the third quarter, as declining energy prices and a halt in interest rate hikes by the Federal Reserve ("Fed") offset a slowing housing market. Small-cap stocks outperformed mid caps and underperformed large caps, when measured using the Russell 2000, S&P 400® Mid Cap and S&P 500® Indexes. Domestic stocks forged higher once again during the fourth quarter, and many major indexes reached some notable milestones along the way. The factors that initially triggered the summer stock market rally continued to support stock prices during the final quarter of 2006 – namely, the Fed's extended pause with regard to interest rate increases and lower crude oil prices.

What factors contributed to the Fund's performance? The vast majority of the Fund's underperformance in the first quarter came as a result of poor stock selection in the industrials sector. While heavy machinery and general industrial stocks in the benchmark were reaching new highs, our portfolio suffered from across-the-board underperformance in transportation-related stocks. On the upside, the financials sector excelled in the first quarter, due to underexposure (relative to the benchmark) to banks and thrifts and overexposure to investment managers and stock exchanges. Turning to the second quarter, stock selection in the information technology sector hurt relative performance during the period. Conversely, strong stock selection in the consumer discretionary, industrials and health care sectors contributed to the Fund's results.

During the third quarter, the portfolio experienced broad-based strength in the information technology sector. Strong stock selection across the transportation/airline, commercial services and capital goods industrial sub-sectors also provided the Fund with strength during the period. Conversely, stock selection in industrials hampered the Fund's performance, as several transportation holdings fell due to concerns regarding a weakening U.S. economy. Within energy, lower oil prices and concerns of slowing demand negatively impacted some of the portfolio's holdings and lower-than-benchmark exposure to the financials sector also detracted from performance. Finally, in the fourth quarter, the portfolio had solid results in telecommunication services and industrials, and there were a number of strong performers in the consumer discretionary sector. Positive stock selection in the materials and information technology sectors also benefited the por tfolio as 2006 came to a close. On the other hand, our health care holdings underperformed, and a few of our specialty pharmaceutical companies faced new potential competition for key drugs.

What is your outlook? We are neither decidedly bullish nor bearish about the economy. We are, however, cautious about the prospects for growth in the first half of 2007 – which may force us to pare back our exposure to more economically sensitive sectors.

Although the market seems to teeter on every new macroeconomic data point, we expect our relative performance will be largely driven by stock selection as opposed to sector allocation. Consequently, we are focused on those companies that have unique business models, special market opportunities, and can deliver growth regardless of the economic cycle.

15

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

MML Small Cap Growth Equity Fund

Industry Table

(% of Net Assets) on 12/31/06

| Prepackaged Software | | | 9.0 | % | |

| Commercial Services | | | 8.6 | % | |

| Healthcare | | | 5.4 | % | |

| Transportation | | | 4.4 | % | |

| Energy | | | 4.4 | % | |

| Medical Supplies | | | 4.1 | % | |

| Retail | | | 4.1 | % | |

| Entertainment & Leisure | | | 3.6 | % | |

| Pharmaceuticals | | | 3.6 | % | |

| Financial Services | | | 3.5 | % | |

Electrical Equipment &

Electronics | | | 3.4 | % | |

| Automotive & Parts | | | 3.1 | % | |

Data Processing &

Preparation | | | 2.8 | % | |

| Computers & Information | | | 2.8 | % | |

| Heavy Machinery | | | 2.5 | % | |

| Banking, Savings & Loans | | | 2.5 | % | |

| Insurance | | | 2.4 | % | |

| Apparel, Textiles & Shoes | | | 2.1 | % | |

| Computer Related Services | | | 1.6 | % | |

| Chemicals | | | 1.5 | % | |

Computer & Other Data

Processing Service | | | 1.5 | % | |

| Advertising | | | 1.4 | % | |

| Foods | | | 1.4 | % | |

| Telephone Utilities | | | 1.3 | % | |

| Information Retrieval Services | | | 1.3 | % | |

| Air Transportation | | | 1.1 | % | |

| Machinery & Components | | | 1.1 | % | |

Home Construction,

Furnishings & Appliances | | | 1.1 | % | |

Broadcasting, Publishing &

Printing | | | 1.0 | % | |

| Communications | | | 1.0 | % | |

| Lodging | | | 0.9 | % | |

| Restaurants | | | 0.9 | % | |

| Metals & Mining | | | 0.8 | % | |

| Household Products | | | 0.7 | % | |

| Aerospace & Defense | | | 0.6 | % | |

Computer Integrated Systems

Design | | | 0.5 | % | |

Computer Maintenance &

Repair | | | 0.4 | % | |

| Cosmetics & Personal Care | | | 0.2 | % | |

| Electric Utilities | | | 0.2 | % | |

| Internet Software | | | 0.2 | % | |

| Consumer Services | | | 0.1 | % | |

Building Materials &

Construction | | | 0.1 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 6.8 | % | |

| | | | 100.0 | % | |

MML Small Cap Growth Equity Fund

Largest Stock Holdings (12/31/06)

Allscripts Healthcare Solutions, Inc.

Blackbaud, Inc.

Bucyrus International, Inc. Cl. A

FactSet Research Systems, Inc.

Gaylord Entertainment

Healthways, Inc.

ITT Educational Services, Inc.

Kansas City Southern

LKQ Corp.

iShares Russell 2000 Growth Index Fund | |

|

16

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

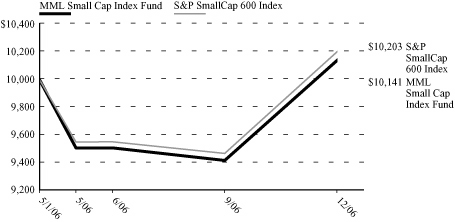

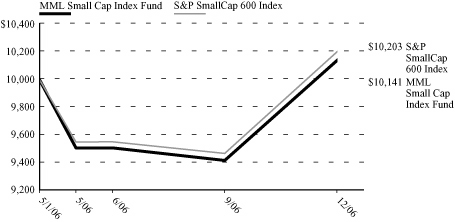

Growth of a $10,000 Investment

Hypothetical Investments in MML Small Cap Growth Equity Fund and the Russell 2000 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/06 -

12/31/06 | | Five Year

Average

Annual

1/1/02 -

12/31/06 | | Since

Inception

Average

Annual

5/3/99 -

12/31/06 | |

| MML Small Cap Equity Fund | | | 9.02 | % | | | 8.68 | % | | | 8.65 | % | |

| Russell 2000 Index | | | 18.37 | % | | | 11.39 | % | | | 9.50 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 2000 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

17

MML Emerging Growth Fund – Portfolio Manager Report

What is the investment objective of the MML Emerging Growth Fund – and who is the Fund's sub-adviser? This Fund seeks capital appreciation by investing primarily in smaller, rapidly growing emerging companies – generally in industry segments experiencing rapid growth, and often including technology and technology-related stocks. The Fund will normally invest at least 80% of its net assets in equity securities (primarily common stocks) of these emerging growth companies in both the U.S. and abroad. The Fund's sub-advisers are Delaware Management Company (Delaware) and Insight Capital Management, Inc. (Insight).

How did the Fund perform during the 12 months ended December 31, 2006? The Fund returned 5.36%, trailing the 18.37% return of the Russell 2000® Index, a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

What was the investment backdrop during the period? The second quarter saw a turnaround in the fortunes of the equity markets, as investor uncertainty (caused in part by global unrest and rising oil prices) led many of the markets lower. In fact, the Dow Jones Industrial AverageSM ("the Dow") was the only domestic equity benchmark to post a return in positive territory, advancing 0.37%. The investor pessimism that had defined markets from late March of 2006 began to give way toward the end of the third quarter of the year, as commodity prices experienced a significant drop and the Federal Reserve ("Fed") finally paused its regimen of successive rate hikes that continued for more than two years. Large-cap stocks were the primary beneficiaries, posting mid-single-digit returns, and the Dow came within a whisper of an all-time high. At th e lower end of the capitalization spectrum, however, investors were slower to forget the risk aversion that had contained them since March. As such, most small- and mid-cap indexes remained in check.

The rally in equities that began in August continued in the fourth quarter, as mounting evidence indicated that the threat of inflation had diminished and that interest rates and commodity prices would remain stable. Encouraged by the prospect of continued economic growth, investors drove stocks up across nearly the entire capitalization and style spectrums. Value outperformed growth universally. Large caps, which had been the early beneficiaries as investors shed their risk aversion in August, stepped aside in October for small caps, which rallied fiercely and led all market cap segments for the quarter. Among small-cap growth stocks, gains were widespread, with every sector of the Russell 2000® Growth Index posting returns in excess of 5%.

What factors contributed to the Fund's performance? During the first quarter, the Fund benefited from favorable stock selection in the energy sector. Our underweight position in metals and mining firms hampered the Fund during the period, as these cyclical businesses – which excelled throughout 2005 – were still selling at very high valuation levels (relative to long-term averages) as 2006 began. Turning to the second quarter, our best-performing stocks included Lifecell, a manufacturer of artificial skin, and J2 Global, which provides Internet fax services to individuals and small offices. Conversely, a number of our worst performers during this period were in the technology sector.

In the third quarter of 2006, the Fund's financials, consumer discretionary and consumer services holdings were generally beneficial – while its investments in the industrials and energy sector impeded performance. Meanwhile, our information technology holdings produced mixed results. Sector weightings during this time were generally positive for the Fund, with an overweight position in consumer nondurables being the primary contributor. In the fourth quarter, the Fund's industrial holdings were generally beneficial, while consumer discretionary, consumer staples and financials holdings detracted. Information technology investments once again produced mixed results. Overall, stock selection was neutral. Positive contributions from the financial, consumer nondurables and business services sectors were negated by relative weakness in the technology and basic industry/capital goods sectors. A slightly negative contribution from overall sec tor allocations further hindered relative performance.

What is your outlook? Looking into 2007, we believe the portfolio is well positioned to capitalize on continued economic growth. In the absence of a sudden, unexpected spike in inflation and energy prices, we expect consumer-related stocks to continue to do well. Additionally, major new product launches from some of the largest technology firms, coupled with the overdue need by much of corporate America to replace aging infrastructure, should bode well for the technology sector. In a slower growth environment, it is our expectation that companies possessing sustainable competitive advantages may be able to deliver growth in excess of the overall market – and we plan to maintain our focus on finding and retaining these market leaders across all market sectors.

18

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

MML Emerging Growth Fund

Industry Table

(% of Net Assets) on 12/31/06

| Apparel, Textiles & Shoes | | | 9.8 | % | |

| Pharmaceuticals | | | 8.2 | % | |

| Retail | | | 7.5 | % | |

| Commercial Services | | | 7.5 | % | |

Electrical Equipment &

Electronics | | | 6.7 | % | |

| Insurance | | | 5.5 | % | |

| Computers & Information | | | 4.8 | % | |

| Information Retrieval Services | | | 4.6 | % | |

| Prepackaged Software | | | 4.4 | % | |

| Communications | | | 4.4 | % | |

| Metals & Mining | | | 3.8 | % | |

| Forest Products & Paper | | | 3.6 | % | |

| Banking, Savings & Loans | | | 3.1 | % | |

| Automotive & Parts | | | 2.6 | % | |

| Medical Supplies | | | 2.4 | % | |

Home Construction,

Furnishings & Appliances | | | 2.1 | % | |

| Air Transportation | | | 1.8 | % | |

| Restaurants | | | 1.6 | % | |

| Financial Services | | | 1.6 | % | |

| Energy | | | 1.4 | % | |

| Telephone Utilities | | | 1.4 | % | |

| Machinery & Components | | | 1.4 | % | |

| Chemicals | | | 1.4 | % | |

| Entertainment & Leisure | | | 1.4 | % | |

| Healthcare | | | 1.0 | % | |

| Transportation | | | 0.7 | % | |

| Consumer Services | | | 0.7 | % | |

| Environmental Controls | | | 0.6 | % | |

Building Materials &

Construction | | | 0.5 | % | |

| Heavy Machinery | | | 0.3 | % | |

| Advertising | | | 0.3 | % | |

Data Processing &

Preparation | | | 0.3 | % | |

| Cosmetics & Personal Care | | | 0.2 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 2.4 | % | |

| | | | 100.0 | % | |

MML Emerging Growth Fund

Largest Stock Holdings (12/31/06)

CDC Corp. Cl. A

Crocs, Inc.

Force Protection, Inc.

Guess?, Inc.

PeopleSupport, Inc.

Polycom, Inc.

Priceline.com, Inc.

Rock-Tenn Co. Cl. A

Sigma Designs, Inc.

WellCare Health Plans, Inc. | |

|

19

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

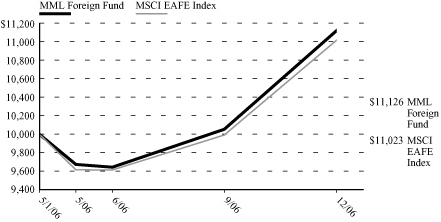

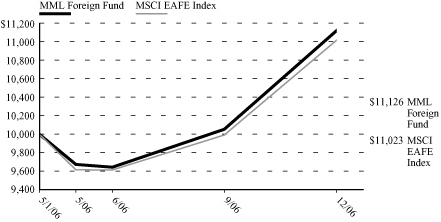

Growth of a $10,000 Investment

Hypothetical Investments in MML Emerging Growth Fund and the Russell 2000 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/06 -

12/31/06 | | Five Year

Average

Annual

1/1/02 -

12/31/06 | | Since

Inception

Average

Annual

5/1/00 -

12/31/06 | |

| MML Emerging Growth Fund | | | 5.36 | % | | | 0.45 | % | | | –6.71 | % | |

| Russell 2000 Index | | | 18.37 | % | | | 11.39 | % | | | 8.22 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 2000 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

20

MML Large Cap Value Fund – Portfolio of Investments

December 31, 2006

| | | Number of

Shares | | Market

Value | |

| EQUITIES — 95.9% | |

| COMMON STOCK — 95.9% | |

| Advertising — 0.2% | |

WPP Group PLC

Sponsored ADR

(United Kingdom) | | | 7,700 | | | $ | 521,598 | | |

| Automotive & Parts — 2.0% | |

| Harley-Davidson, Inc.(a) | | | 60,100 | | | | 4,235,247 | | |

| Banking, Savings & Loans — 12.7% | |

Commerce

Bancorp, Inc.(a) | | | 35,600 | | | | 1,255,612 | | |

| HSBC Holdings PLC | | | 300,993 | | | | 5,495,752 | | |

| JP Morgan Chase & Co. | | | 183,216 | | | | 8,849,333 | | |

| Mellon Financial Corp. | | | 23,400 | | | | 986,310 | | |

| State Street Corp. | | | 5,800 | | | | 391,152 | | |

| Wachovia Corp. | | | 90,879 | | | | 5,175,559 | | |

| Wells Fargo & Co. | | | 152,100 | | | | 5,408,676 | | |

| | | | 27,562,394 | | |

| Beverages — 2.0% | |

Diageo PLC Sponsored

ADR (United Kingdom) | | | 34,900 | | | | 2,767,919 | | |

| Heineken Holding NV Cl. A | | | 38,550 | | | | 1,560,125 | | |

| | | | 4,328,044 | | |

| Broadcasting, Publishing & Printing — 5.0% | |

Comcast Corp.

Special, Cl. A(b) | | | 174,100 | | | | 7,291,308 | | |

| Gannett Co., Inc. | | | 8,400 | | | | 507,864 | | |

| Lagardere S.C.A. SA | | | 22,200 | | | | 1,780,365 | | |

Liberty Media Holding

Corp. Capital Cl. A(b) | | | 6,240 | | | | 611,395 | | |

Liberty Media Holding

Corp. Interactive Cl. A(b) | | | 31,000 | | | | 668,670 | | |

| | | | 10,859,602 | | |

| Building Materials & Construction — 1.5% | |

Martin Marietta

Materials, Inc. | | | 17,000 | | | | 1,766,470 | | |

| Vulcan Materials Co.(a) | | | 16,300 | | | | 1,464,881 | | |

| | | | 3,231,351 | | |

| Commercial Services — 4.5% | |

| Apollo Group, Inc. Cl. A(b) | | | 13,800 | | | | 537,786 | | |

| Block (H&R), Inc. | | | 96,300 | | | | 2,218,752 | | |

| Cosco Pacific Ltd. | | | 220,600 | | | | 516,886 | | |

| Dun & Bradstreet Corp.(b) | | | 11,450 | | | | 947,946 | | |

| Iron Mountain, Inc.(a) (b) | | | 65,400 | | | | 2,703,636 | | |

| Moody's Corp. | | | 41,800 | | | | 2,886,708 | | |

| | | | 9,811,714 | | |

| | | Number of

Shares | | Market

Value | |

| Communications — 1.2% | |

Nokia Oyj Sponsored ADR

(Finland) | | | 24,400 | | | $ | 495,808 | | |

| NTL, Inc. | | | 39,997 | | | | 1,009,524 | | |

SK Telecom Co. Ltd. ADR

(South Korea)(a) | | | 42,800 | | | | 1,133,344 | | |

| | | | 2,638,676 | | |

| Computer Related Services — 0.2% | |

| IAC/InterActiveCorp(a) (b) | | | 12,750 | | | | 473,790 | | |

| Computers & Information — 0.6% | |

| Dell, Inc.(b) | | | 53,500 | | | | 1,342,315 | | |

| Computers & Office Equipment — 0.6% | |

| Hewlett-Packard Co. | | | 33,900 | | | | 1,396,341 | | |

| Containers — 2.0% | |

| Sealed Air Corp. | | | 67,300 | | | | 4,369,116 | | |

| Cosmetics & Personal Care — 1.5% | |

| Avon Products, Inc. | | | 25,400 | | | | 839,216 | | |

| The Procter & Gamble Co. | | | 36,300 | | | | 2,333,001 | | |

| | | | 3,172,217 | | |

| Energy — 11.8% | |

| BHP Billiton PLC | | | 23,200 | | | | 429,461 | | |

Canadian Natural

Resources Ltd. | | | 15,600 | | | | 830,388 | | |

| ConocoPhillips Co. | | | 135,460 | | | | 9,746,347 | | |

| Devon Energy Corp.(a) | | | 68,500 | | | | 4,594,980 | | |

| EOG Resources, Inc. | | | 58,500 | | | | 3,653,325 | | |

Occidental

Petroleum Corp. | | | 93,600 | | | | 4,570,488 | | |

| Transocean, Inc.(b) | | | 21,900 | | | | 1,771,491 | | |

| | | | 25,596,480 | | |

| Entertainment & Leisure — 1.7% | |

| News Corp., Inc. Cl. A | | | 170,250 | | | | 3,656,970 | | |

| Financial Services — 11.7% | |

| American Express Co. | | | 162,500 | | | | 9,858,875 | | |

| Ameriprise Financial, Inc. | | | 45,580 | | | | 2,484,110 | | |

Berkshire Hathaway,

Inc. Cl. A(b) | | | 61 | | | | 6,709,390 | | |

| Citigroup, Inc. | | | 86,900 | | | | 4,840,330 | | |

| Morgan Stanley | | | 18,300 | | | | 1,490,169 | | |

| | | | 25,382,874 | | |

| Foods — 0.5% | |

| The Hershey Co.(a) | | | 23,900 | | | | 1,190,220 | | |

| Healthcare — 2.7% | |

| Caremark Rx, Inc.(a) | | | 48,500 | | | | 2,769,835 | | |

| Express Scripts, Inc.(b) | | | 11,100 | | | | 794,760 | | |

| | | Number of

Shares | | Market

Value | |

| UnitedHealth Group, Inc. | | | 41,500 | | | $ | 2,229,795 | | |

| | | | 5,794,390 | | |

| Household Products — 0.2% | |

| Hunter Douglas NV | | | 5,303 | | | | 425,552 | | |

| Industrial – Diversified — 4.2% | |

| Tyco International Ltd. | | | 299,343 | | | | 9,100,027 | | |

| Insurance — 10.9% | |

Ambac Financial

Group, Inc. | | | 1,400 | | | | 124,698 | | |

American International

Group, Inc. | | | 134,050 | | | | 9,606,023 | | |

| Aon Corp. | | | 38,900 | | | | 1,374,726 | | |

| Chubb Corp. | | | 10,600 | | | | 560,846 | | |

| Loews Corp. | | | 108,400 | | | | 4,495,348 | | |

| Markel Corp.(b) | | | 400 | | | | 192,040 | | |

Principal Financial

Group, Inc. | | | 11,600 | | | | 680,920 | | |

| Progressive Corp. | | | 188,500 | | | | 4,565,470 | | |

| Sun Life Financial, Inc.(a) | | | 6,740 | | | | 285,439 | | |

Transatlantic

Holdings, Inc. | | | 26,613 | | | | 1,652,667 | | |

| | | | 23,538,177 | | |

| Metals & Mining — 0.4% | |

| China Coal Energy Co.(b) | | | 742,700 | | | | 482,400 | | |

| Rio Tinto PLC | | | 8,300 | | | | 441,850 | | |

| | | | 924,250 | | |

| Pharmaceuticals — 0.9% | |

| Cardinal Health, Inc. | | | 29,600 | | | | 1,907,128 | | |

| Prepackaged Software — 2.2% | |

| Microsoft Corp. | | | 160,900 | | | | 4,804,474 | | |

| Retail — 7.6% | |

| Amazon.com, Inc.(a) (b) | | | 36,100 | | | | 1,424,506 | | |

Bed Bath &

Beyond, Inc.(b) | | | 29,700 | | | | 1,131,570 | | |

| Carmax, Inc.(b) | | | 11,300 | | | | 606,019 | | |

| Costco Wholesale Corp. | | | 149,300 | | | | 7,893,491 | | |

| Lowe's Companies, Inc. | | | 31,500 | | | | 981,225 | | |

Sears

Holdings Corp.(a) (b) | | | 3,100 | | | | 520,583 | | |

| Wal-Mart Stores, Inc. | | | 84,400 | | | | 3,897,592 | | |

| | | | 16,454,986 | | |

| Telephone Utilities — 1.1% | |

| Sprint Nextel Corp. | | | 124,000 | | | | 2,342,360 | | |

| Tobacco — 4.5% | |

| Altria Group, Inc. | | | 112,800 | | | | 9,680,496 | | |

(Continued)

The accompanying notes are an integral part of the financial statements.

21

MML Large Cap Value Fund – Portfolio of Investments (Continued)

| | | Number of

Shares | | Market

Value | |

| Transportation — 1.4% | |

China Merchants Holdings

International Co. Ltd. | | | 316,268 | | | $ | 1,298,154 | | |

Kuehne & Nagel

International AG | | | 8,700 | | | | 631,775 | | |

United Parcel Service,

Inc. Cl. B | | | 13,300 | | | | 997,234 | | |

| | | | 2,927,163 | | |

| Travel — 0.1% | |

| Expedia, Inc.(b) | | | 13,350 | | | | 280,083 | | |

TOTAL EQUITIES

(Cost $161,890,596) | | | 207,948,035 | | |

| | | Principal

Amount | | | |

| SHORT-TERM INVESTMENTS — 12.4% | |

| Cash Equivalents — 7.6%(d) | |

Abbey National PLC

Eurodollar Time Deposit

5.280% 01/05/2007 | | $ | 409,491 | | | | 409,491 | | |

American Beacon

Money Market Fund(c) | | | 141,421 | | | | 141,421 | | |

BancoBilbao Vizcaya

Argentaria SA

Eurodollar Time Deposit

5.310% 01/03/2007 | | | 598,487 | | | | 598,487 | | |

Bank of America

5.270% 01/09/2007 | | | 314,993 | | | | 314,993 | | |

Bank of America

5.310% 03/08/2007 | | | 314,993 | | | | 314,993 | | |

Bank of America

5.320% 02/16/2007 | | | 94,498 | | | | 94,498 | | |

Bank of Nova Scotia

Eurodollar Time Deposit

5.290% 01/30/2007 | | | 188,996 | | | | 188,996 | | |

Bank of Nova Scotia

Eurodollar Time Deposit

5.290% 02/06/2007 | | | 629,987 | | | | 629,987 | | |

Bank of Nova Scotia

Eurodollar Time Deposit

5.300% 02/27/2007 | | | 409,491 | | | | 409,491 | | |

The Bank of the West

Eurodollar Time Deposit

5.285% 01/17/2007 | | | 157,497 | | | | 157,497 | | |

Barclays

Eurodollar Time Deposit

5.300% 01/03/2007 | | | 314,993 | | | | 314,993 | | |

Barclays

Eurodollar Time Deposit

5.310% 02/20/2007 | | | 314,993 | | | | 314,993 | | |

| | | Principal

Amount | | Market

Value | |

Barclays

Eurodollar Time Deposit

5.320% 02/13/2007 | | $ | 94,498 | | | $ | 94,498 | | |

BGI Institutional

Money Market Fund(c) | | | 297,572 | | | | 297,572 | | |

Calyon

Eurodollar Time Deposit

5.290% 03/05/2007 | | | 472,490 | | | | 472,490 | | |

Calyon

Eurodollar Time Deposit

5.310% 02/16/2007 | | | 157,497 | | | | 157,497 | | |

Calyon

Eurodollar Time Deposit

5.310% 02/22/2007 | | | 157,497 | | | | 157,497 | | |

Canadian Imperial

Bank of Commerce

Eurodollar Time Deposit

5.310% 01/29/2007 | | | 579,588 | | | | 579,588 | | |

Citigroup

Eurodollar Time Deposit

5.305% 03/05/2007 | | | 472,490 | | | | 472,490 | | |

Citigroup

Eurodollar Time Deposit

5.310% 03/16/2007 | | | 157,497 | | | | 157,497 | | |

Commonwealth

Bank of Australia

Commercial Paper

5.291% 01/08/2007 | | | 314,993 | | | | 314,993 | | |

Dexia Group

Eurodollar Time Deposit

5.285% 01/16/2007 | | | 314,993 | | | | 314,993 | | |

Dreyfus Cash

Management Plus

Money Market Fund(c) | | | 112,515 | | | | 112,515 | | |

Federal Home Loan Bank

Discount Note

5.145% 01/03/2007 | | | 52,758 | | | | 52,758 | | |

Federal Home Loan Bank

Discount Note

5.207% 01/19/2007 | | | 82,198 | | | | 82,198 | | |

First Tennessee

National Corp.

Eurodollar Time Deposit

5.290% 01/18/2007 | | | 314,993 | | | | 314,993 | | |

Fortis Bank

Eurodollar Time Deposit

5.295% 01/02/2007 | | | 125,997 | | | | 125,997 | | |

Fortis Bank

Eurodollar Time Deposit

5.300% 01/24/2007 | | | 472,490 | | | | 472,490 | | |

Fortis Bank

Eurodollar Time Deposit

5.300% 01/26/2007 | | | 472,490 | | | | 472,490 | | |

| | | Principal

Amount | | Market

Value | |

Freddie Mac

Discount Note

5.231% 01/23/2007 | | $ | 125,359 | | | $ | 125,359 | | |

General Electric

Capital Corp.

Commercial Paper

5.296% 01/26/2007 | | | 157,497 | | | | 157,497 | | |

Goldman Sachs Financial

Square Prime Obligations

Money Market Fund(c) | | | 282,184 | | | | 282,184 | | |

HBOS Halifax

Bank of Scotland

Eurodollar Time Deposit

5.300% 01/08/2007 | | | 440,991 | | | | 440,991 | | |

HBOS Halifax

Bank of Scotland

Eurodollar Time Deposit

5.300% 01/25/2007 | | | 314,993 | | | | 314,993 | | |

HBOS Halifax

Bank of Scotland

Eurodollar Time Deposit

5.305% 03/14/2007 | | | 251,995 | | | | 251,995 | | |

Lloyds TSB Bank

Eurodollar Time Deposit

5.300% 02/26/2007 | | | 472,490 | | | | 472,490 | | |

Marshall & Ilsley Bank

Eurodollar Time Deposit

5.300% 03/19/2007 | | | 188,996 | | | | 188,996 | | |

Rabobank Nederland

Eurodollar Time Deposit

5.250% 01/02/2007 | | | 787,483 | | | | 787,483 | | |

Rabobank Nederland

Eurodollar Time Deposit

5.300% 03/05/2007 | | | 283,494 | | | | 283,494 | | |

Royal Bank of Canada

Eurodollar Time Deposit

5.310% 02/14/2007 | | | 314,993 | | | | 314,993 | | |

Royal Bank of Canada

Eurodollar Time Deposit

5.310% 02/15/2007 | | | 466,190 | | | | 466,190 | | |

Royal Bank of Scotland

Eurodollar Time Deposit

5.280% 01/11/2007 | | | 314,993 | | | | 314,993 | | |

Royal Bank of Scotland

Eurodollar Time Deposit

5.290% 01/16/2007 | | | 62,999 | | | | 62,999 | | |

Royal Bank of Scotland

Eurodollar Time Deposit

5.290% 02/09/2007 | | | 157,497 | | | | 157,497 | | |

Royal Bank of Scotland

Eurodollar Time Deposit

5.310% 01/11/2007 | | | 251,995 | | | | 251,995 | | |

(Continued)

The accompanying notes are an integral part of the financial statements.

22

MML Large Cap Value Fund – Portfolio of Investments (Continued)

| | | Principal

Amount | | Market

Value | |

Societe Generale

Eurodollar Time Deposit

5.270% 01/19/2007 | | $ | 629,987 | | | $ | 629,987 | | |

Societe Generale

Eurodollar Time Deposit

5.290% 02/01/2007 | | | 472,490 | | | | 472,490 | | |

Societe Generale

Eurodollar Time Deposit

5.313% 01/02/2007 | | | 125,997 | | | | 125,997 | | |

Svenska Handlesbanken

Eurodollar Time Deposit

5.250% 01/02/2007 | | | 1,086,610 | | | | 1,086,610 | | |

UBS AG

Eurodollar Time Deposit

5.290% 01/02/2007 | | | 163,797 | | | | 163,797 | | |

UBS AG

Eurodollar Time Deposit