UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-02224 |

|

MML Series Investment Fund |

(Exact name of registrant as specified in charter) |

|

1295 State Street, Springfield, MA | | 01111 |

(Address of principal executive offices) | | (Zip code) |

|

Richard J. Byrne 1295 State Street, Springfield, MA 01111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 413-788-8411 | |

|

Date of fiscal year end: | 12/31/2008 | |

|

Date of reporting period: | 12/31/2008 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

MML Series Investment Fund

Annual Report

MML Large Cap Value Fund

MML Equity Index Fund

MML Growth Equity Fund

MML NASDAQ-100® Fund

MML Small Cap Growth Equity Fund

MML Emerging Growth Fund

This annual report pertains to certain funds offered through the Series. Your variable product prospectus will list which of these funds are available through your variable product.

December 31, 2008

Table of Contents

| President's Letter to Shareholders | | | 1 | | |

|

| Economic and Market Review | | | 3 | | |

|

| Portfolio Manager Reports | | | 7 | | |

|

| Portfolio of Investments | |

|

| MML Large Cap Value Fund | | | 27 | | |

|

| MML Equity Index Fund | | | 29 | | |

|

| MML Growth Equity Fund | | | 35 | | |

|

| MML NASDAQ-100® Fund | | | 37 | | |

|

| MML Small Cap Growth Equity Fund | | | 39 | | |

|

| MML Emerging Growth Fund | | | 42 | | |

|

| Statements of Assets and Liabilities | | | 44 | | |

|

| Statements of Operations | | | 48 | | |

|

| Statements of Changes in Net Assets | | | 50 | | |

|

| Financial Highlights | | | 54 | | |

|

| Notes to Financial Statements | | | 61 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 77 | | |

|

| Trustees and Officers (Unaudited) | | | 78 | | |

|

| Federal Tax Information (Unaudited) | | | 82 | | |

|

| Other Information (Unaudited) | | | 83 | | |

|

This material must be preceded or accompanied by a current prospectus for the MML Series Investment Fund. Investors should consider a Fund's investment objective, risks and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus. Read it carefully before investing.

MML Series Investment Fund – President's Letter to Shareholders

To Our Shareholders

December 31, 2008

Richard J. Byrne

"While today's headlines may, at times, be alarming, it's important for you to keep in mind that your overall focus with respect to your retirement planning should not be on today's issues, but on whether or not your portfolio is positioned appropriately, based on your risk tolerance level and the number of years you expect to remain invested."

The economic challenges of 2008 remain, but maintaining a long-term approach is still critical

Welcome to the MML Series Investment Fund Annual Report, covering the one-year period ended December 31, 2008. During 2008, one of the most difficult years in recent history, Americans struggled through a broad range of economic challenges – many of which had not been seen in decades. These difficulties forced many to adopt lifestyle changes that necessitated a closer look at all expenditures, including those associated with preparing for a more secure financial future.

Throughout it all, however, it's important to remember that investing for retirement is a long-term proposition. So while today's headlines may, at times, be alarming, it's important for you to keep in mind that your overall focus with respect to your retirement planning should not be on today's issues, but on whether or not your portfolio is positioned appropriately, based on your risk tolerance level and the number of years you expect to remain invested.

What retirement investors can do in today's challenging environment

• Stay calm. While it is important to stay abreast of what is going on in the financial markets today, it's more important to keep it all in the proper perspective. If you're like most retirement investors, you won't be looking to withdraw your retirement funds in 2009. And even if you do begin to withdraw money this year, the majority of your retirement account will likely remain invested for many years to come.

• Get professional help. If you work with a financial professional, today's economic environment provides you with an excellent reason to consult him or her to assess your overall retirement plan. Together, you can determine any adjustments that should be made to your portfolio or your contribution levels to help you reach your long-term financial goals.

• Dollar-cost-averaging may help investors in volatile markets.1 Making investments at regular intervals, regardless of market conditions, can help you to take advantage of market swings by buying more shares/units when prices are down, and fewer shares/units when prices are up.

• Try to avoid sudden or drastic changes. While you may intend to remain invested for a number of years, it's important that you implement any changes to your portfolio based on a thorough review of your long-term needs and objectives. Your financial professional can help you assess your situation – and help you avoid sudden moves that investors often come to regret over time.

Keep your eye on the future

As a reminder, the financial markets, like our economy, have always been cyclical, but historically have provided opportunities for growth over the long term. We believe investors should consider a portfolio that is designed to function properly under all market conditions, based on your risk tolerance and the number of years you have until retirement. This can help to eliminate the need for sudden changes in positioning during times of market volatility. Most financial professionals believe that investors who maintain their financial strategy over time have the potential to reach their long-term financial objectives.

1 Dollar-cost-averaging does not assure a profit or protect against loss in a declining market, and involves continuous investment in securities regardless of fluctuating prices. An investor should consider his/her ability to continue investing through periods of low price levels. See the MML Series Investment Fund prospectus for complete details.

(Continued)

1

MML Series Investment Fund – President's Letter to Shareholders (Continued)

I thank you for your continued confidence in MassMutual.

Sincerely,

Richard J. Byrne

President

The information provided is the opinion of MassMutual Retirement Services Investment Services as of 1/1/09 and is subject to change without notice. It is not to be construed as tax, legal or investment advice. Of course, past performance does not guarantee future results.

2

MML Series Investment Fund – Economic and Market Review

December 31, 2008

Financial markets roiled by critical problems; U.S. Government intervention attempts to avoid economic meltdown

During the year ended December 31, 2008, severe problems that had begun to challenge many Americans before the year even began continued to rock the financial world – the subprime mortgage crisis, the weak U.S. housing market and high commodity (particularly oil) prices – and served as a drag on the economy in 2008. Oil prices dropped in the second half of the year on lowered demand, reflecting a global economic slowdown. Key market events triggered aggressive interventions from the U.S. Government and governments worldwide, including revised monetary policies and corporate bailouts, which were intended to pull economies the world over out of their decline and stabilize financial markets. The credit crunch created by the subprime mortgage crisis took its toll on businesses of all sizes, and U.S. unemployment rose substantially over the course of the year. Investors will also remember 2008 as the year that changed the face of Wall S treet. Indeed, the year marked the failures (or takeovers) of multiple major American financial institutions, including Bear Stearns, IndyMac Bancorp, Fannie Mae, Freddie Mac, American International Group (AIG), Merrill Lynch, Lehman Brothers, Washington Mutual and Wachovia.

Market performance

For the 12 months ended December 31, 2008, bonds outpaced equities in an environment of continual market volatility. The Dow Jones Industrial AverageSM ("Dow"), a recognized measure of blue-chip stock performance, shed 33.84% of its value during what turned out to be its worst year since 1931. Similarly, the S&P 500® Index ("S&P 500"), a measure of U.S. large-cap stock performance, gave back 37.00% of its value. Small-cap and technology stocks, as measured by the Russell 2000® Index and the NASDAQ Composite® Index ("NASDAQ"), respectively, posted losses of 33.80% and 40.53%. A significant loser in the U.S. equity market, however, was the Russell Midcap Growth Index, a benchmark of the performance of mid-cap U.S. common stocks, which lost 44.32% for the year. In international equity markets, the Morgan Stanley Capital International Europe, Australasia, Far East Index ("MSCI& reg; EAFE®"), a benchmark for foreign stocks in developed markets, fell 43.39%. Of particular note in the international equity marketplace in 2008 was the Morgan Stanley Capital International Emerging Markets Index, which measures the performance of emerging stock markets throughout the world, but excludes certain market segments unavailable to U.S.-based investors. It lost 53.33% of its value.*

Investments in the fixed-income markets for the most part fared significantly better than their equity peers during 2008. A standout performer was the Barclays Capital 1-3 Year U.S. Government Bond Index (formerly known as the Lehman Brothers® 1-3 Year U.S. Government Bond Index), which measures the results of U.S. Government bonds with one to three years remaining to the scheduled payment of principal. It advanced 6.66%. Other closely watched benchmarks in the fixed-income market also gained ground in 2008. The Barclays Capital U.S. Aggregate Bond Index (formerly known as the Lehman Brothers U.S. Aggregate Bond Index), a broad measure of the U.S. investment-grade bond markets, returned 5.24%. Treasury bills also advanced, as measured by the Salomon Smith Barney 3-Month Treasury Bill Index, which returned 1.80%. Reflecting investor preference for higher-quality securities and aversion to risk in this environment, the Barclays Capital U.S. Corporate High-Yield Bond Index (formerly known as the Lehman Brothers U.S. Corporate High-Yield Bond Index) – which measures the performance of fixed rate, non-investment-grade debt – lost 26.16%, but still managed to outperform the S&P 500 and the Dow.*

* Indexes are unmanaged, do not incur fees or expenses and cannot be purchased directly for investment.

(Continued)

3

MML Series Investment Fund – Economic and Market Review (Continued)

2008 stumbles out of the gate in the first quarter

2008 began against a backdrop of a subprime mortgage crisis and blue-chip financial company writedowns (i.e., the reduction of the book value of an asset because it is overvalued compared to the current market value) – along with countless earnings disappointments. Headlines announced departures of well-known senior and top executives from some of Wall Street's giants in the wake of the ever-growing impact of the subprime crisis – in an indication of what was yet to come. In this environment, U.S. and international stocks struggled and higher-quality bonds advanced, benefiting from concerned investors' preference for lower-risk investments. While the MSCI EAFE was weaker than the S&P 500 in local currency terms, a weak U.S. dollar boosted the former's dollar-based value.

As conditions in the financial markets deteriorated, the Federal Reserve ("Fed") responded to the burgeoning economic crisis by dramatically stepping up the pace at which Fed officials lowered short-term interest rates. After federal funds rate reductions of only 0.25% in October and December 2007, the Fed responded to January's falling stock market with an unscheduled 0.75% reduction on January 22, 2008 – with another 0.50% cut at the end of the month. The federal funds rate is the interest rate at which banks and other financial institutions lend to one another overnight. A weakening labor market and softening consumer spending, together with ongoing crisis conditions in the financials sector, prompted the Fed to make another 0.75% cut in March. In addition, in a major departure from previous Fed policy, the central bank announced that it was permitting investment banks to borrow directly from it, a privilege formerly reserved for com mercial banks. This change of policy provides a source of short-term funds that can be accessed at the current discount rate (the interest rate that regional Fed banks charge banks and other financial institutions when they borrow funds on a short-term basis).

The Fed's most controversial move during the first quarter was its involvement in the takeover of Bear Stearns, then the nation's fifth-largest investment bank, by JPMorgan Chase. As its customers withdrew funds at an accelerating pace and lenders pulled back on financing, Bear Stearns found itself in critical condition by mid-March. The Federal Reserve Bank of New York subsequently agreed to cover up to $29 billion in losses if Bear Stearns' assets should go bad, with JPMorgan Chase covering the first $1 billion, a move that proved to foretell of a new era in U.S. Government economic intervention. On March 31, 2008, Treasury Secretary Henry Paulson unveiled a plan to revamp the federal government's oversight of the U.S. financial markets.

The second quarter brings further challenges

In the second quarter of 2008, many sectors of both the stock and bond markets declined, as surging energy prices, which created a stiff headwind for the auto and airline industries, continued to challenge the American consumer. The surprising strength of the U.S. dollar during the quarter muted the returns of the MSCI EAFE, which nevertheless outperformed both the Dow and the S&P 500 for the three-month period. Crude oil touched $140 a barrel by the end of June, pushing the average price of a gallon of regular gasoline to more than $4.00. The May employment report unnerved investors, as the nation's unemployment rate rose from 5.0% to 5.5% and fueled concerns that the U.S. economy might enter a recession. Also weighing on investor sentiment in June was a worsening inflation picture. Elsewhere, home prices continued their decline. All of these factors led to slumping consumer confidence. On a brighter note, the U.S. dollar, which had bee n struggling against major currencies for quite some time, showed renewed strength.

4

MML Series Investment Fund – Economic and Market Review (Continued)

Government intervention accelerates in the third quarter

Investors had hoped that the March 2008 takeover of Bear Stearns by JPMorgan Chase marked the turning point of the crisis in the financials sector. However, an extraordinary – and seemingly relentless – series of events in the third quarter of 2008 sent investors reeling and consequently, put downward pressure on stock prices:

• July 11: Federal regulators seized IndyMac Bank;

• Sept. 7: The U.S. Government rescued government-sponsored entities Fannie Mae and Freddie Mac;

• Sept. 14: Brokerage and investment bank Merrill Lynch arranged to be bought by Bank of America;

• Sept. 15: Lehman Brothers, the fourth-largest U.S. investment bank, filed for Chapter 11 bankruptcy protection in the largest corporate bankruptcy filing ever in the United States;

• Sept. 16: Insurer AIG received an emergency, U.S. Government-underwritten $85 billion loan after its stock plunged and its debt was downgraded by all three major credit-rating agencies;

• Sept. 19: U.S. Treasury Secretary Paulson unveiled a sweeping $700 billion proposal to purchase hard-to-sell mortgage assets from banks;

• Sept. 21: Federal regulators agreed to allow the last two surviving U.S. investment banks, Goldman Sachs and Morgan Stanley, to become bank holding companies, in a move intended to help these banks survive the financial crisis and give them easier access to credit;

• Sept. 25: Savings and loan Washington Mutual was seized by federal regulators, and its loan portfolio and retail branches were sold to JPMorgan Chase;

• Sept. 29: Citigroup agreed to acquire the banking assets of Wachovia, the nation's fourth-largest bank, in a deal that excluded Wachovia's brokerage and asset management businesses. (The agreement never came to fruition. In the first week of October, Wells Fargo upended the Citigroup deal with one that included the purchase of all of Wachovia, including the firm's banking, retail brokerage, asset management, insurance and retirement services businesses.); and

• Also on Sept. 29, the U.S. House of Representatives defeated the Bush administration's economic rescue plan, sending stocks sharply lower.

During the third quarter of 2008, the Dow declined 4.40%, while the S&P 500 lost 8.36%. Foreign equities struggled against slumping economic activity abroad and a sharp rally in the U.S. dollar, resulting in a decline of 20.56% for the MSCI EAFE.

Fourth quarter: U.S. Government passes bailout act; recession confirmed

In early October, President Bush signed the Emergency Economic Stabilization Act of 2008 (EESA) into law. EESA authorized the Troubled Asset Relief Program (TARP), which was originally expected to support financial institutions by buying their troubled assets. U.S. Treasury Secretary Henry Paulson later indicated that TARP's focus was shifting to companies providing consumer debt in an effort to improve the flow of funds for consumer loans. In late December, President Bush made $17.4 billion in loans (taken from TARP assets) available to General Motors Corp. and Chrysler after the U.S. Senate had rejected a proposal earlier in the month.

The Fed responded to the weak economy and low consumer confidence by cutting interest rates three times in the fourth quarter of 2008, bringing the target federal funds rate to a historic low of between zero and 0.25%, from its prior target of 1%. The Fed also cut the discount rate to 0.5%.

The widely anticipated official declaration of a U.S. recession finally occurred at the beginning of December, when the National Bureau of Economic Research (NBER) announced that the economy

5

MML Series Investment Fund – Economic and Market Review (Continued)

had been in recession since the previous December (2007). Other headlines in the fourth quarter of 2008 also underscored the dire state of our economy:

• November's unemployment report revealed a loss of 533,000 jobs, the biggest one-month decline since 1974.

• Home prices continued to fall. In October, the 20-city Case-Shiller Home Price Index dropped by 18% versus a year earlier, marking 27 consecutive monthly declines for that benchmark.

• The Institute for Supply Management's manufacturing index – in part, reflecting depressed auto sales – receded to 36.2 in November, its lowest reading since May 1982.

• The retail industry suffered one of the worst holiday shopping seasons in years.

• The broader economy, as measured by GDP (gross domestic product), fell by a revised 0.5% in the third quarter, its largest decline in seven years.

The Dow declined 19.12% for the quarter – similarly, the S&P 500 fell 21.96% and the NASDAQ lost 24.61%. Stocks of foreign developed markets also struggled, as the MSCI EAFE Index declined 19.96%. Oil prices continued their slide during December, closing out the year near $45 per barrel, as violence in the Middle East escalated. (Prices had dropped to the low $30 range earlier in the quarter.) Most other commodities also suffered from declining demand in the face of the global economic downturn. The U.S. dollar remained strong for most of the quarter. Fixed-income performance was mixed, as the continuing flight to quality that started at the end of 2007 benefited this market segment during the fourth quarter of 2008. The yield on the benchmark 10-year Treasury Note declined 1.60% to finish the year at 2.25% – spurring an increase in mortgage refinancings in the second half of the fourth quarter.

As 2008 drew to a close, investors were hopeful that the U.S. economy would emerge from recession and market performance would return to positive territory; however, many market watchers are cautious about the immediate future with so few encouraging signs on the horizon.

The information provided is the opinion of MassMutual Retirement Services Investment Services as of 1/1/09 and is subject to change without notice. It is not to be construed as tax, legal or investment advice. Of course, past performance does not guarantee future results.

6

MML Large Cap Value Fund – Portfolio Manager Report

What is the investment objective of MML Large Cap Value Fund – and who is the Fund's sub-adviser?

The Fund seeks both capital growth and income by selecting businesses that possess characteristics that the Fund's sub-adviser believes foster the creation of long-term value, such as proven management, a durable franchise and business model, and sustainable competitive advantages. The Fund's sub-adviser is Davis Selected Advisers, L.P. (Davis).

How did the Fund perform during the 12 months ended December 31, 2008?

The Fund's Initial Class shares returned -39.30%, trailing the -37.00% return of the S&P 500® Index (the "benchmark"), a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies. In addition, the Fund underperformed the -36.85% return of the Russell 1000® Value Index, an unmanaged index consisting of those Russell 1000 securities (representing the 1,000 largest U.S. companies based on market capitalization) with greater-than-average value orientation that tend to exhibit lower price-to-book ratios and forecasted growth values than securities in the growth universe.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2008, please see the Economic and Market Review, beginning on page 3.

What factors contributed to the Fund's performance?

The sectors within the S&P 500 Index that turned in the weakest performance in 2008 were financials, materials and information technology. The sectors that turned in the strongest (but still negative) performance over the year were consumer staples and health care.

The Fund's holdings in the financials sector outperformed the corresponding sector within the benchmark, but were still the greatest detractors from performance. A higher relative average weighting in this sector detracted from both absolute and relative performance. American International Group (AIG), American Express, Merrill Lynch, Berkshire Hathaway, Loews and JPMorgan Chase substantially hampered performance. Conversely, Wells Fargo and Hartford Financial Services were among the top contributors to the Fund's performance.

Energy holdings also worked against the Fund's progress in 2008. The combination of an overweight position and the underperformance of the Fund's energy companies versus the benchmark was detrimental. ConocoPhillips and China Coal Energy were among the top detractors for the year.

The Fund's relative performance benefited from holding an overweight position in consumer staples companies. Unfortunately, the Fund's consumer staples holdings underperformed the corresponding sector within the benchmark. Walmart was among the most important contributors to performance, while Costco was among the most significant detractors. (The Fund no longer owned Walmart as of the end of 2008.)

The Fund's relative performance was harmed by having an underweight position in health care companies. The Fund's health care holdings underperformed the benchmark – despite the fact that Schering Plough was among the top contributors to overall performance for the year. H&R Block, a consumer discretionary company, was the most important contributor to the Fund's performance in 2008.

The Fund held approximately 9% of assets in foreign companies (including American Depositary Receipts) as of December 31, 2008. Overall, these companies underperformed the domestic companies held by the Fund during the year.

What is your outlook?

We do not overreact to past short-term performance from individual holdings on either the upside or the downside. We focus deliberately on the future, considering each company's long-term business fundamentals. As of December 31, 2008, four companies had dropped out of the Fund's top 10 holdings from December 31, 2007. Two of these holdings, Microsoft and American Express, were still among the Fund's top 20 holdings as 2009 began. Three new additions to the Fund's top 10 holdings at the end of 2008 included Wells Fargo, Comcast and EOG Resources – all of which were among the Fund's top 20 holdings at the end of 2007.

7

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

MML Large Cap Value Fund

Largest Holdings

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Costco Wholesale Corp. | | | 4.9 | % | |

Berkshire Hathaway, Inc.

Class A | | | 4.9 | % | |

| Wells Fargo & Co. | | | 4.3 | % | |

| JP Morgan Chase & Co. | | | 4.2 | % | |

| ConocoPhillips | | | 4.2 | % | |

| Occidental Petroleum Corp. | | | 4.1 | % | |

| Devon Energy Corp. | | | 3.4 | % | |

| Philip Morris International, Inc. | | | 3.3 | % | |

| EOG Resources, Inc. | | | 2.9 | % | |

| American Express Co. | | | 2.4 | % | |

| | | | 38.6 | % | |

MML Large Cap Value Fund

Sector Table

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Financial | | | 26.6 | % | |

| Energy | | | 16.9 | % | |

| Consumer, Non-cyclical | | | 16.4 | % | |

| Consumer, Cyclical | | | 10.0 | % | |

| Industrial | | | 6.2 | % | |

| Communications | | | 6.0 | % | |

| Technology | | | 5.1 | % | |

| Basic Materials | | | 2.4 | % | |

| Diversified | | | 0.6 | % | |

| Utilities | | | 0.2 | % | |

| Total Long-Term Investments | | | 90.4 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 9.6 | % | |

| Net Assets | | | 100.0 | % | |

8

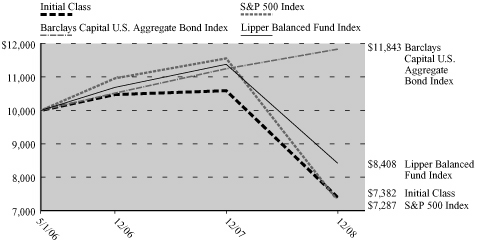

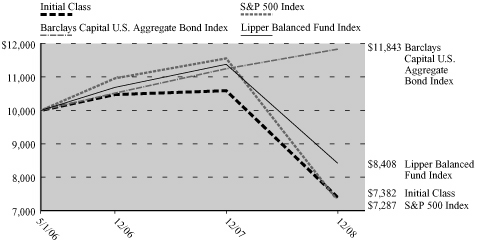

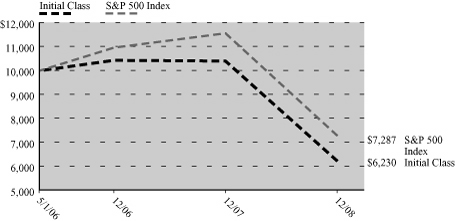

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

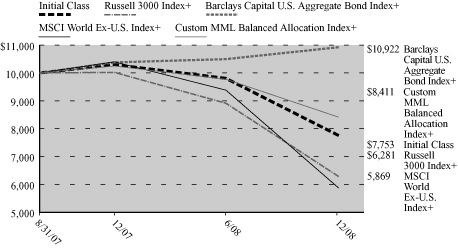

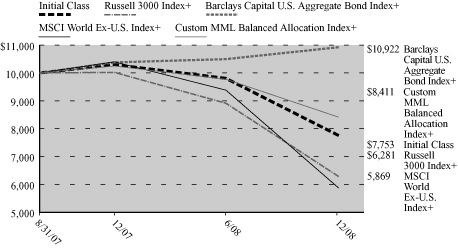

Growth of a $10,000 Investment

Hypothetical Investments in MML Large Cap Value Fund Initial Class, the S&P 500 Index and the Russell 1000 Value Index.

TOTAL RETURN

| | | One Year

1/1/08 -

12/31/08 | | Five Year

Average

Annual

1/1/04 -

12/31/08 | | Since

Inception

Average

Annual

5/1/00 -

12/31/08 | |

| Initial Class | | | (39.30 | )% | | | (2.45 | )% | | | (1.95 | )% | |

| S&P 500 Index* | | | (37.00 | )% | | | (2.19 | )% | | | (3.65 | )% | |

| Russell 1000 Value Index | | | (36.85 | )% | | | (0.79 | )% | | | 0.83 | % | |

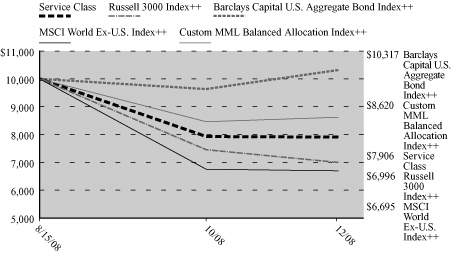

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

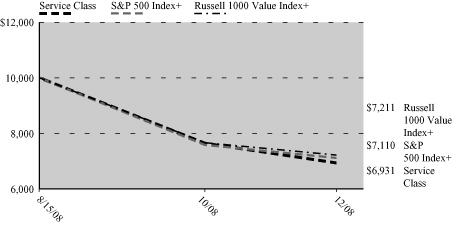

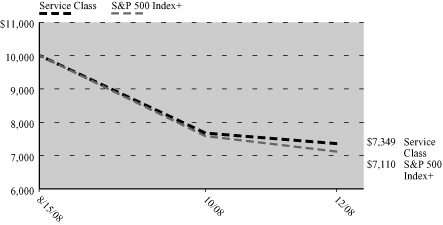

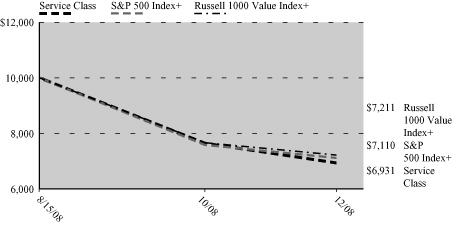

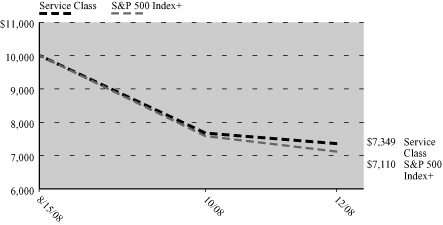

Hypothetical Investments in MML Large Cap Value Fund Service Class, the S&P 500 Index and the Russell 1000 Value Index.

TOTAL RETURN

| | | Since Inception

8/15/08 - 12/31/08 | |

| Service Class | | | (30.69 | )% | |

| S&P 500 Index* | | | (28.90 | )%+ | |

| Russell 1000 Value Index | | | (27.89 | )%+ | |

* Benchmark

+ From 9/1/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index and the Russell 1000 Value Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

9

MML Equity Index Fund – Portfolio Manager Report

What is the investment objective of MML Equity Index Fund – and who is the Fund's sub-adviser?

The Fund's investment objective is to provide investment results that correspond to the price and yield performance of publicly traded common stocks in the aggregate as represented by the S&P 500® Index. The Fund pursues this objective by investing at least 80% of its net assets in the securities of companies that make up the S&P 500 Index. The Fund's sub-adviser is Northern Trust Investments, N.A. (NTI).

How did the Fund perform during the 12 months ended December 31, 2008?

The Fund's Class I shares returned -37.26%, modestly lagging the -37.00% return of the S&P 500 Index (the "benchmark"), a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2008, please see the Economic and Market Review, beginning on page 3.

What factors contributed to the Fund's performance?

All benchmark sectors posted negative returns for the time period. Information technology, which is the largest sector in the benchmark, returned -43.14%. Energy, health care and financials, the three next-largest sectors in the benchmark, which cumulatively accounted for 41.4% of the benchmark, returned -34.87%, -22.81% and -55.32%, respectively, for the year.

The year 2008 was marked by extreme volatility in equity markets around the world, as the effects of the subprime mortgage crisis ricocheted throughout the financial system, resulting in a global credit crunch and economic slowdown. The near collapse of Bear Stearns in March of 2008, and the subsequent U.S. Government-orchestrated purchase of the bank by J.P. Morgan marked the beginning of a series of bank failures and government interventions. Following the bailout of Fannie Mae and Freddie Mac, the bankruptcy filing of Lehman Brothers, the acquisition of Merrill Lynch by Bank of America, the provision of an $85 billion emergency rescue loan to insurance giant American International Group (AIG) and the failure of Washington Mutual, a comprehensive fiscal rescue plan was developed by U.S. Government officials and congressional lawmakers.

The election of Barack Obama as the 44th president of the United States sparked a brief rally in early November, but market volatility subsequently continued nearly unchecked, as grim economic news persisted – including the announcement that the U.S. officially slid into a recession in December of 2007.

Oil prices peaked in the third quarter of 2008 and fell throughout the fourth quarter, closing at $41.02 a barrel on December 31.

What is your outlook?

As we entered 2009, investors faced a wide array of challenges. These included the ongoing housing and subprime mortgage crises, rapidly escalating unemployment, and the new threat of deflation, to name just a few. Despite these uncertainties, we believe that the Fund continues to be positioned to pursue returns that are relatively in line with those of the benchmark during 2009.

"Standard & Poor's®", "S&P®", "S&P 500®", "Standard & Poor's 500" and "500" are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use by the Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

10

MML Equity Index Fund – Portfolio Manager Report (Continued)

MML Equity Index Fund

Largest Holdings

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Exxon Mobil Corp. | | | 5.1 | % | |

| The Procter & Gamble Co. | | | 2.3 | % | |

| General Electric Co. | | | 2.1 | % | |

| AT&T, Inc. | | | 2.1 | % | |

| Johnson & Johnson | | | 2.1 | % | |

| Chevron Corp. | | | 1.9 | % | |

| Microsoft Corp. | | | 1.8 | % | |

| Wal-Mart Stores, Inc. | | | 1.6 | % | |

| Pfizer, Inc. | | | 1.5 | % | |

| JP Morgan Chase & Co. | | | 1.5 | % | |

| | | | 22.0 | % | |

MML Equity Index Fund

Sector Table

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Consumer, Non-cyclical | | | 25.3 | % | |

| Energy | | | 13.2 | % | |

| Financial | | | 12.8 | % | |

| Industrial | | | 11.1 | % | |

| Communications | | | 10.5 | % | |

| Technology | | | 10.1 | % | |

| Consumer, Cyclical | | | 8.0 | % | |

| Utilities | | | 4.0 | % | |

| Basic Materials | | | 2.9 | % | |

| Total Long-Term Investments | | | 97.9 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 2.1 | % | |

| Net Assets | | | 100.0 | % | |

11

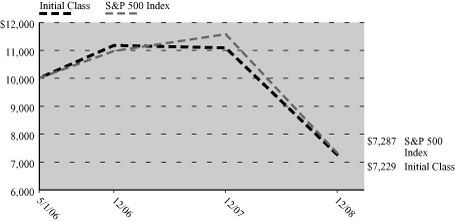

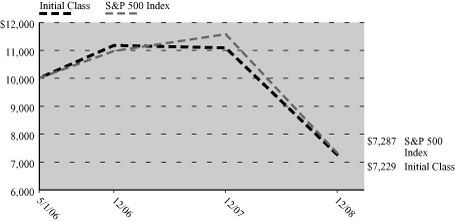

MML Equity Index Fund – Portfolio Manager Report (Continued)

Growth of a $10,000 Investment

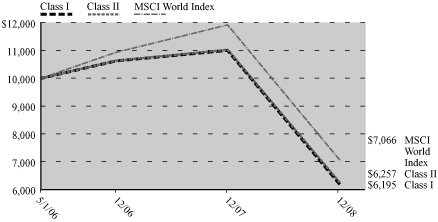

Hypothetical Investments in MML Equity Index Fund Class I and the S&P 500 Index.

TOTAL RETURN

| | | One Year

1/1/08 - 12/31/08 | | Five Year

Average Annual

1/1/04 - 12/31/08 | | Ten Year

Average Annual

1/1/99 - 12/31/08 | |

| Class I | | | (37.26 | )% | | | (2.57 | )% | | | (1.82 | )% | |

| S&P 500 Index | | | (37.00 | )% | | | (2.19 | )% | | | (1.38 | )% | |

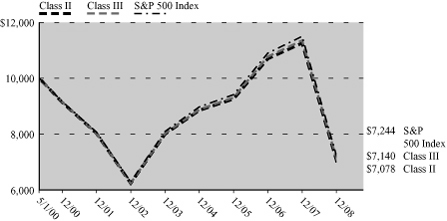

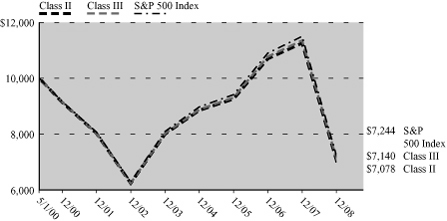

GROWTH OF $10,000 INVESTMENT FOR THE PAST TEN YEARS

Hypothetical Investments in MML Equity Index Fund Class II, Class III and the S&P 500 Index.

TOTAL RETURN

| | | One Year

1/1/08 - 12/31/08 | | Five Year

Average Annual

1/1/04 - 12/31/08 | | Since Inception

Average Annual

5/1/00 - 12/31/08 | |

| Class II | | | (37.14 | )% | | | (2.42 | )% | | | (3.91 | )% | |

| Class III | | | (37.09 | )% | | | (2.29 | )% | | | (3.81 | )% | |

| S&P 500 Index | | | (37.00 | )% | | | (2.19 | )% | | | (3.65 | )% | |

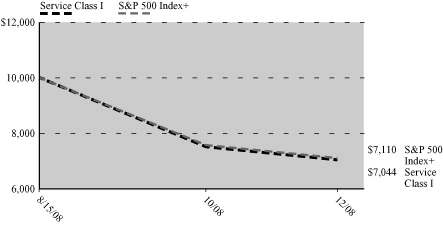

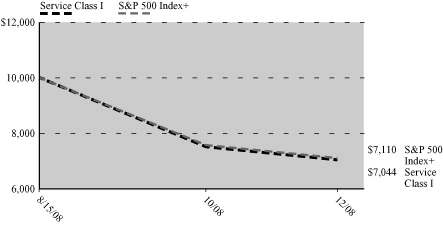

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Hypothetical Investments in MML Equity Index Fund Service Class I and the S&P 500 Index.

TOTAL RETURN

| | | Since Inception

8/15/08 - 12/31/08 | |

| Service Class I | | | (29.56 | )% | |

| S&P 500 Index | | | (28.90 | )%+ | |

+ From 9/1/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

12

MML Growth Equity Fund – Portfolio Manager Report

What is the investment objective of MML Growth Equity Fund – and who is the Fund's sub-adviser?

The Fund seeks long-term growth of capital and future income by normally investing at least 80% of its net assets in the common stocks and securities convertible into common stocks of companies which the Fund's sub-adviser believes offer prospects for long-term growth. The Fund's sub-adviser is T. Rowe Price Associates, Inc. (T. Rowe Price).

How did the Fund perform during the 12 months ended December 31, 2008?

The Fund's Initial Class shares returned -42.69%, trailing the -38.44% return of the Russell 1000® Growth Index (the "benchmark"), an unmanaged index consisting of those Russell 1000 securities (representing the 1,000 largest U.S. companies based on market capitalization) with greater-than-average growth orientation that tend to exhibit higher price-to-book ratios and forecasted growth values than securities in the value universe.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2008, please see the Economic and Market Review, beginning on page 3.

What factors contributed to the Fund's performance?

Health care contributed significantly to the Fund's performance, due to both its place as the second-best performer in the benchmark, and the portfolio's substantially overweight position relative to the benchmark in that sector. Within health care, biotechnology stocks performed strongly. Gilead Sciences continued to gain market share with an impressive HIV therapy franchise. Shares of Genentech were boosted by an acquisition bid from Swiss pharmaceutical maker Roche. Genentech also received Food and Drug Administration approval for Avastin, a drug used in the treatment of breast cancer. The portfolio also benefited from avoiding companies expected to be negatively affected by anticipated health care refo rm. The portfolio maintained a notably overweight position in this sector, on the belief that it offers some of the most attractive near-term growth opportunities. The Fund's underweight position in the energy sector also produced positive relative results. With falling energy prices in the second half of the year, the sector tumbled and was the second-worst performer in the benchmark for the year.

Consumer staples stocks were the primary detractor from the Fund's results relative to the benchmark, as the portfolio held an underweight position in this top-performing sector. A substantially overweight position in financials, the worst benchmark performer, was also a major detractor from the Fund's full-year performance. Stock selection in the capital markets industry had a negative impact. The high-margin business model of capital markets is expected to come under intensified scrutiny in the wake of U.S. Treasury bailouts for many companies in the financials sector. In order to receive government assistance, some traditional investment banks, such as portfolio holdings Morgan Stanley and Goldman Sachs, transformed into traditional deposit-accepting banks. With lower expectations, both of these companies drastically cut expenses, including staffing and compensation. Ameriprise Financial's stock fell on investor concerns about insurance c ompanies. As 2008 came to a close, the portfolio held an overweight position in the financials sector, almost exclusively in capital markets. While cautious, we believe selected capital markets companies are attractively priced.

Consumer discretionary underperformed on stock selection, notably in the hotels, restaurants and leisure industries. Gaming holdings, including Las Vegas Sands and MGM Mirage, notably disappointed. In past downturns, gaming stocks have generally been more defensive than others in the sector, but the current global credit crisis has severely limited access to financing and hampered development efforts. The portfolio has maintained its slightly overweight position in consumer discretionary, concentrated in Internet and catalog retail industry and hotels stocks.

What is your outlook?

While many hope that the worst of the market volatility has run its course, we believe it is very likely that markets will continue to be challenging. Our objective is to identify high-quality large-cap growth companies with strong fundamentals and attractive valuations. Amid tempered growth prospects, we see opportunities to invest in companies that we have been monitoring whose valuations and fundamentals are compelling. We believe that market fears and indiscriminate selling due to forced liquidations can lead to prices becoming disconnected from fundamentals, presenting significant buying opportunities.

13

MML Growth Equity Fund – Portfolio Manager Report (Continued)

MML Growth Equity Fund

Largest Holdings

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Google, Inc. Class A | | | 3.4 | % | |

| Gilead Sciences, Inc. | | | 3.4 | % | |

| Genentech, Inc. | | | 3.1 | % | |

| Apple, Inc. | | | 3.1 | % | |

| Amazon.com, Inc. | | | 3.0 | % | |

| Danaher Corp. | | | 2.8 | % | |

| Microsoft Corp. | | | 2.5 | % | |

| Wal-Mart Stores, Inc. | | | 2.1 | % | |

| Exxon Mobil Corp. | | | 2.0 | % | |

| Celgene Corp. | | | 2.0 | % | |

| | | | 27.4 | % | |

MML Growth Equity Fund

Sector Table

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Consumer, Non-cyclical | | | 29.1 | % | |

| Communications | | | 17.8 | % | |

| Technology | | | 14.7 | % | |

| Consumer, Cyclical | | | 11.0 | % | |

| Financial | | | 10.7 | % | |

| Energy | | | 7.0 | % | |

| Industrial | | | 4.5 | % | |

| Basic Materials | | | 3.5 | % | |

| Utilities | | | 0.6 | % | |

| Total Long-Term Investments | | | 98.9 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 1.1 | % | |

| Net Assets | | | 100.0 | % | |

14

MML Growth Equity Fund – Portfolio Manager Report (Continued)

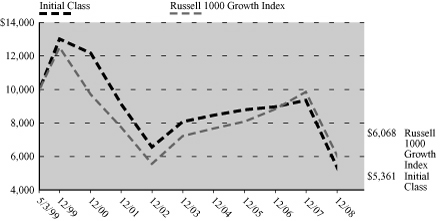

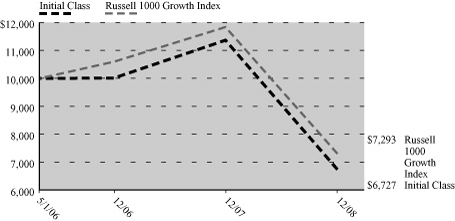

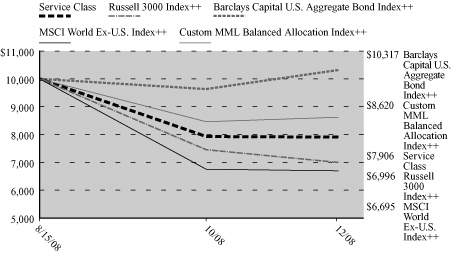

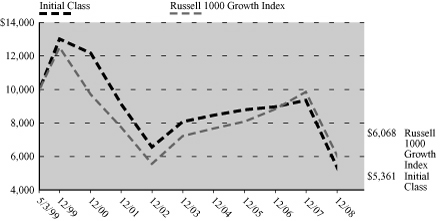

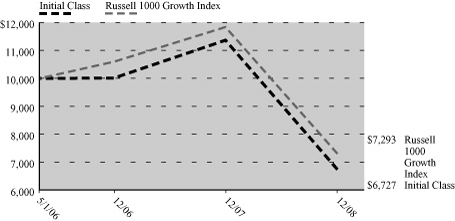

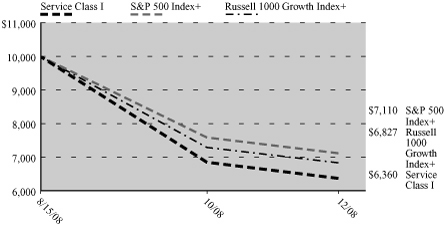

Growth of a $10,000 Investment

Hypothetical Investments in MML Growth Equity Fund Initial Class and the Russell 1000 Growth Index.

TOTAL RETURN

| | | One Year

1/1/08 - 12/31/08 | | Five Year

Average Annual

1/1/04 - 12/31/08 | | Since Inception

Average Annual

5/3/99 - 12/31/08 | |

| Initial Class | | | (42.69 | )% | | | (7.87 | )% | | | (6.25 | )% | |

Russell 1000

Growth Index | | | (38.44 | )% | | | (3.42 | )% | | | (5.04 | )% | |

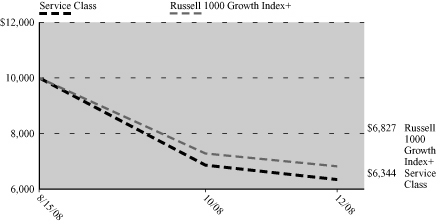

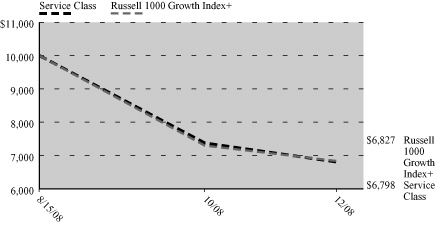

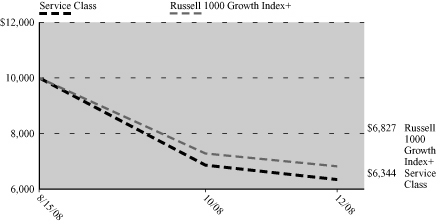

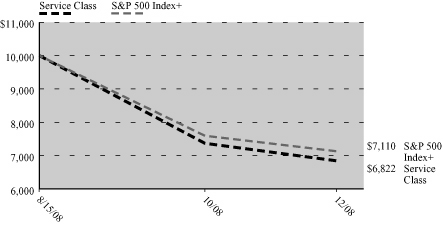

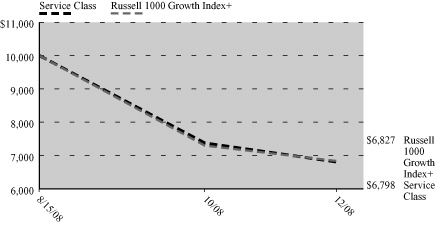

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Hypothetical Investments in MML Growth Equity Fund Service Class and the Russell 1000 Growth Index.

TOTAL RETURN

| | | Since Inception

8/15/08 - 12/31/08 | |

| Service Class | | | (36.56 | )% | |

| Russell 1000 Growth Index | | | (31.73 | )%+ | |

+ From 9/1/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 1000 Growth Index is unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

15

MML NASDAQ-100® Fund – Portfolio Manager Report

What is the investment objective of MML NASDAQ-100® Fund – and who is the Fund's sub-adviser?

The Fund seeks to approximate as closely as practicable (before fees and expenses) the total return of the NASDAQ-100 Index®. The Fund's sub-adviser is Northern Trust Investments, N.A. (NTI).

How did the Fund perform during the 12 months ended December 31, 2008?

The Fund's Initial Class shares returned -41.89%, matching the -41.89% return of the NASDAQ-100 Index (the "benchmark"). The NASDAQ-100 Index is a modified capitalization-weighted index composed of the 100 largest non-financial companies listed on the National Association of Securities Dealers Automated Quotations System (NASDAQ).

For a discussion on the economic and market environment during the 12-month period ended December 31, 2008, please see the Economic and Market Review, beginning on page 3.

What factors contributed to the Fund's performance?

All benchmark sectors posted negative returns for the time period. Information technology, the largest sector in the benchmark, returned -46.90% for the full year. The two next-largest sectors, consumer discretionary and health care, returned -46.09% and -8.66%, respectively, for the year.

The year 2008 was marked by extreme volatility in equity markets around the world, as the effects of the subprime mortgage crisis ricocheted throughout the financial system, resulting in a global credit crunch and economic slowdown. The near collapse of Bear Stearns in March of 2008, and the subsequent U.S. Government-orchestrated purchase of the bank by J.P. Morgan marked the beginning of a series of bank failures and government interventions. Following the bailout of Fannie Mae and Freddie Mac, the bankruptcy filing of Lehman Brothers, the acquisition of Merrill Lynch by Bank of America, the provision of an $85 billion emergency rescue loan to insurance giant American International Group (AIG) and the failure of Washington Mutual, a comprehensive fiscal rescue plan was developed by U.S. Government officials and congressional lawmakers.

The election of Barack Obama as the 44th president of the United States sparked a brief rally in early November, but market volatility subsequently continued nearly unchecked, as grim economic news persisted – including the announcement that the U.S. officially slid into a recession in December of 2007.

Oil prices peaked in the third quarter of 2008 and fell throughout the fourth quarter, closing at $41.02 a barrel on December 31.

What is your outlook?

As we entered 2009, investors faced a wide array of challenges. These included the ongoing housing and subprime mortgage crises, rapidly escalating unemployment, and the new threat of deflation, to name just a few. Despite these uncertainties, we believe that the Fund continues to be positioned to pursue returns that are relatively in line with those of the benchmark during 2009.

NASDAQ®, NASDAQ-100® and NASDAQ-100 Index® are trademarks of The NASDAQ Stock Market, Inc. (together with its affiliates, "NASDAQ") and are licensed for use by the Fund. The Fund has not been passed on by NASDAQ as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by NASDAQ. NASDAQ MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE FUND.

16

MML NASDAQ-100® Fund – Portfolio Manager Report (Continued)

MML NASDAQ-100 Fund

Largest Holdings

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Apple, Inc. | | | 9.7 | % | |

| Qualcomm, Inc. | | | 6.5 | % | |

| Microsoft Corp. | | | 5.4 | % | |

| Gilead Sciences, Inc. | | | 4.2 | % | |

| Google, Inc. Class A | | | 4.1 | % | |

| Oracle Corp. | | | 3.5 | % | |

| Cisco Systems, Inc. | | | 3.1 | % | |

| Intel Corp. | | | 2.6 | % | |

| Amgen, Inc. | | | 2.6 | % | |

Teva Pharmaceutical Industries

Ltd. Sponsored ADR (Israel) | | | 2.5 | % | |

| | | | 44.2 | % | |

MML NASDAQ-100 Fund

Sector Table

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Technology | | | 36.8 | % | |

| Communications | | | 25.1 | % | |

| Consumer, Non-cyclical | | | 23.4 | % | |

| Consumer, Cyclical | | | 7.7 | % | |

| Industrial | | | 3.7 | % | |

| Energy | | | 0.9 | % | |

| Basic Materials | | | 0.7 | % | |

| Total Long-Term Investments | | | 98.3 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 1.7 | % | |

| Net Assets | | | 100.0 | % | |

17

MML NASDAQ-100® Fund – Portfolio Manager Report (Continued)

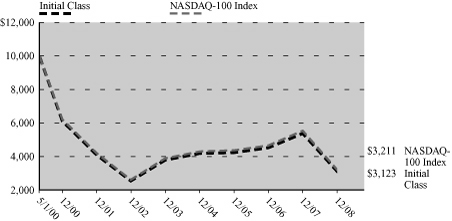

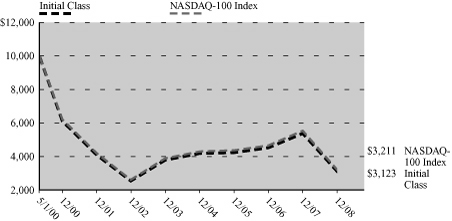

Growth of a $10,000 Investment

Hypothetical Investments in MML NASDAQ-100 Fund Initial Class and the NASDAQ-100 Index®.

TOTAL RETURN

| | | One Year

1/1/08 - 12/31/08 | | Five Year

Average Annual

1/1/04 - 12/31/08 | | Since Inception

Average Annual

5/1/00 - 12/31/08 | |

| Initial Class | | | (41.89 | )% | | | (3.78 | )% | | | (12.56 | )% | |

| NASDAQ-100 Index | | | (41.89 | )% | | | (3.76 | )% | | | (12.28 | )% | |

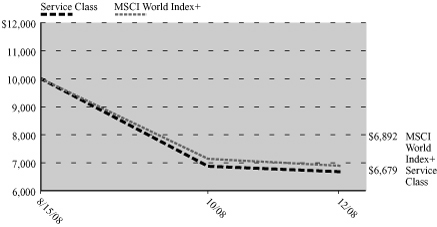

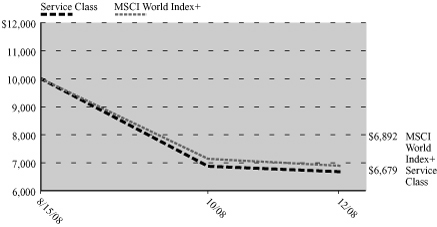

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Hypothetical Investments in MML NASDAQ-100 Fund Service Class and the NASDAQ-100 Index.

TOTAL RETURN

| | | Since Inception

8/15/08 - 12/31/08 | |

| Service Class | | | (38.28 | )% | |

| NASDAQ-100 Index | | | (35.29 | )%+ | |

+ From 9/1/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the NASDAQ-100 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

18

MML Small Cap Growth Equity Fund – Portfolio Manager Report

What is the investment objective of MML Small Cap Growth Equity Fund – and who are the Fund's sub-advisers?

The Fund seeks long-term capital appreciation by investing primarily in common stocks and equity securities of smaller companies that the Fund's sub-advisers believe offer potential for long-term growth. The Fund's two sub-advisers are Waddell & Reed Investment Management Company (Waddell & Reed), which was responsible for approximately 52% of the Fund's portfolio; and Wellington Management Company, LLP (Wellington Management), which managed approximately 48% of the Fund's portfolio, as of December 31, 2008.

How did the Fund perform during the 12 months ended December 31, 2008?

The Fund's Initial Class shares returned -38.54%, matching the -38.54% return of the Russell 2000® Growth Index (the "benchmark"), a widely recognized, unmanaged index that measures the performance of those Russell 2000 Index companies (representing small-capitalization U.S. common stocks) with higher price-to-book ratios and forecasted growth rates. The Fund's -38.54% return, however, underperformed the -33.79% return of the Russell 2000 Index, a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2008, please see the Economic and Market Review, beginning on page 3.

What factors contributed to the Fund's performance?

With respect to the Waddell & Reed component, during 2008, every sector that the portfolio had exposure to declined substantially. However, the portfolio's focus on quality helped throughout the year, as leveraged and unprofitable companies were especially hard hit by the credit freeze. The nature of the portfolio's investment process typically means that it tends to have lower weightings in commodity-related sectors, such as energy, materials and industrials. During the first half of 2008, commodities rose dramatically, causing the portfolio to underperform relative to the benchmark. As commodities plummeted in the second half of the year, however, the portfolio regained its ground – and then som e. October saw the credit freeze intensify and the Fund's higher-quality holdings (i.e., those with less debt, stronger cash flow) also helped the portfolio outperform the benchmark as the year drew to a close. Another contributor to the portfolio's relative performance was its favorable stock selection in the information technology sector.

On the other hand, detracting from performance were the portfolio's stock selections within the industrials sector. The portfolio's underweight position in the health care sector was a drag on performance for much of the year, but actually contributed to returns in the fourth quarter.

The Wellington Management portion of the Fund is managed by two fund managers, with each being responsible for their own portfolio.

One Wellington Management portfolio struggled due to stock selection within the financials, information technology and energy sectors. An underweight position in the health care sector also detracted from performance relative to the benchmark. Conversely, telecommunication services and industrials were positive contributors for the year. Low-cost wireless provider MetroPCS Communications performed well, as its attractive prepaid, unlimited calling plans allowed it to gain market share. Aecom Technology, a global planning, consulting, design and management services company for infrastructure projects, reported strong earnings, which boosted the portfolio's returns for the year.

The other Wellington Management portfolio was dragged down by less-than-favorable stock selection, led by investments within the health care, information technology and industrials sectors. An underweight position in financials, particularly small-cap banks, which performed well, was also a point of weakness. On the brighter side, the portfolio's stock selection in the consumer discretionary sector contributed to performance, led by DreamWorks Animation, Churchill Downs and Big Lots.

19

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

What is your outlook?

As we entered 2009, last year's problems remained front and center. We are somewhat optimistic about the Fund's prospects going forward, given what we view as the sold-out position of the market and the enormous amount of stimulus in the economic system. However, economic data, such as the unemployment rate and corporate profits, are likely to get worse, in our opinion. Our hope, however, is that as upcoming data becomes more anticipated and understood, it will have the potential to create less volatility in the financial markets.

When and by how much stocks may turn upward will depend in large part on how successful policy makers are in stabilizing the economy and credit markets, while getting banks to lend again. But, with credit likely remaining relatively impaired for the foreseeable future, stable companies with strong cash positions are desirable.

20

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

MML Small Cap Growth Equity Fund

Largest Holdings

(% of Net Assets) on 12/31/08

(Unaudited) | |

J.B. Hunt Transport

Services, Inc. | | | 2.1 | % | |

| Athenahealth, Inc. | | | 2.0 | % | |

| FactSet Research Systems, Inc. | | | 1.9 | % | |

| Alberto-Culver Co. | | | 1.8 | % | |

| Blackboard, Inc. | | | 1.8 | % | |

| Bankrate, Inc. | | | 1.6 | % | |

| Kansas City Southern | | | 1.4 | % | |

| O'Reilly Automotive, Inc. | | | 1.4 | % | |

| Blackbaud, Inc. | | | 1.4 | % | |

| LKQ Corp. | | | 1.4 | % | |

| | | | 16.8 | % | |

MML Small Cap Growth Equity Fund

Sector Table

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Consumer, Non-cyclical | | | 20.4 | % | |

| Technology | | | 18.5 | % | |

| Consumer, Cyclical | | | 14.8 | % | |

| Industrial | | | 13.0 | % | |

| Financial | | | 8.4 | % | |

| Communications | | | 7.7 | % | |

| Energy | | | 3.7 | % | |

| Funds | | | 3.1 | % | |

| Utilities | | | 1.3 | % | |

| Basic Materials | | | 0.4 | % | |

| Diversified | | | 0.2 | % | |

| Total Long-Term Investments | | | 91.5 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 8.5 | % | |

| Net Assets | | | 100.0 | % | |

21

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

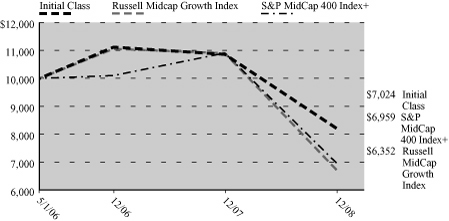

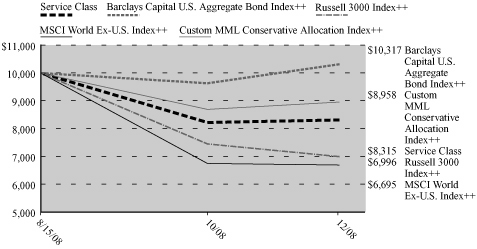

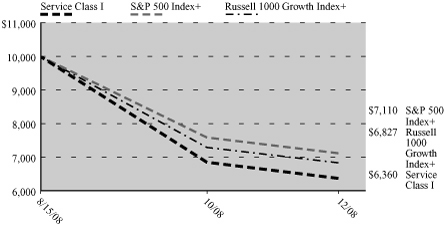

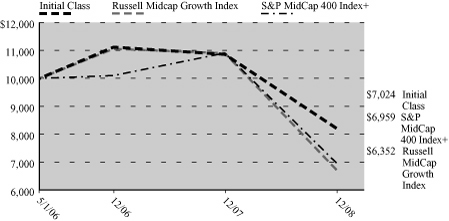

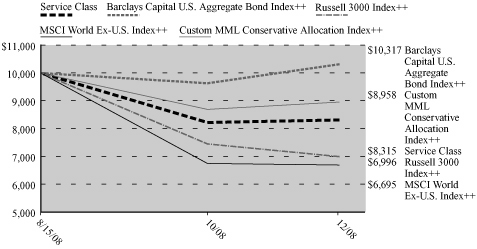

Growth of a $10,000 Investment

Hypothetical Investments in MML Small Cap Growth Equity Fund Initial Class, the Russell 2000 Growth Index and Russell 2000 Index.

TOTAL RETURN

| | | One Year

1/1/08 - 12/31/08 | | Five Year

Average Annual

1/1/04 - 12/31/08 | | Since Inception

Average Annual

5/3/99 - 12/31/08 | |

| Initial Class | | | (38.54 | )% | | | (1.47 | )% | | | 2.53 | % | |

Russell 2000

Growth Index* | | | (38.54 | )% | | | (2.35 | )% | | | (1.48 | )% | |

| Russell 2000 Index | | | (33.79 | )% | | | (0.93 | )% | | | 2.81 | % | |

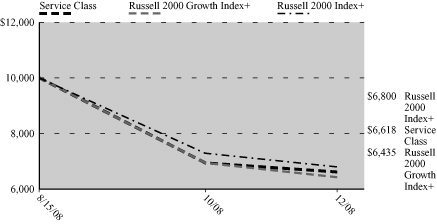

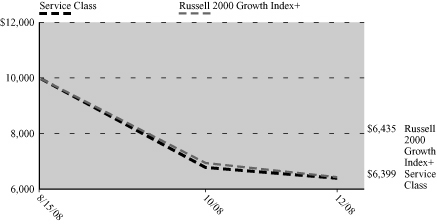

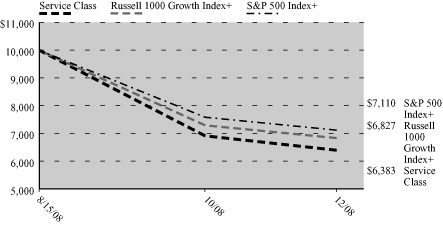

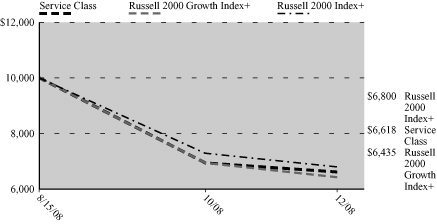

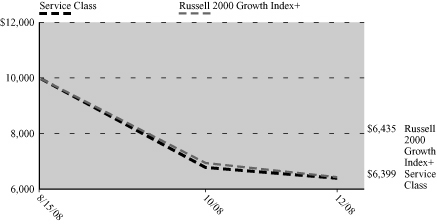

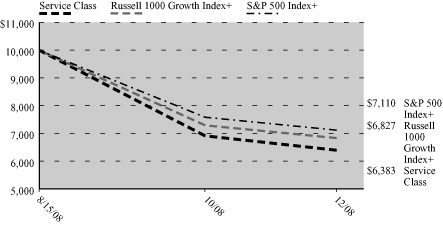

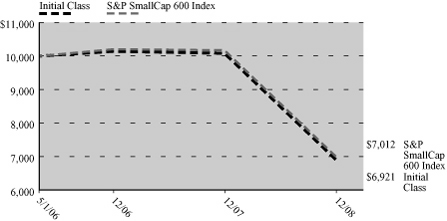

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Hypothetical Investments in MML Small Cap Growth Equity Fund Service Class, the Russell 2000 Growth Index and Russell 2000 Index.

TOTAL RETURN

| | | Since Inception

8/15/08 - 12/31/08 | |

| Service Class | | | (33.82 | )% | |

| Russell 2000 Growth Index* | | | (35.65 | )%+ | |

| Russell 2000 Index | | | (32.00 | )%+ | |

* Benchmark

+ From 9/1/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 2000 Growth Index and the Russell 2000 Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

22

MML Emerging Growth Fund – Portfolio Manager Report

What is the investment objective of MML Emerging Growth Fund – and who are the Fund's sub-advisers?

The Fund seeks capital appreciation by investing primarily in smaller, rapidly growing emerging growth companies, which may include companies growing earnings per share and/or revenues at above-average rates. The Fund's sub-advisers are Insight Capital Research & Management, Inc. (Insight Capital), which oversaw approximately 57% of the Fund's portfolio; and Essex Investment Management Company, LLC (Essex), which was responsible for approximately 43% of the Fund's portfolio, as of December 31, 2008. Effective September 10, 2008, Essex replaced Delaware Management Company (DMC) as the Fund's co-sub-adviser.

How did the Fund perform during the 12 months ended December 31, 2008?

The Fund's Initial Class shares returned -41.97%, underperforming the -38.54% return of the Russell 2000® Growth Index (the "benchmark"), a widely recognized, unmanaged index that measures the performance of those Russell 2000 Index companies (representing small-capitalization U.S. common stocks) with higher price-to-book ratios and forecasted growth rates.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2008, please see the Economic and Market Review, beginning on page 3.

What factors contributed to the Fund's performance?

With respect to the Insight Capital component of the Fund, stocks that had performed well in the portfolio for a long time began to lose strength in 2008, including consumer discretionary company Deckers Outdoors. In the second quarter, coal companies led the portfolio, with particularly strong performance from Alpha Natural Resources, Walters Industries and James River Coal. Unfortunately, the third quarter brought a break in energy prices, which fell hard and fast. By the end of July, Insight Capital had completely sold the coal companies in the portfolio. Elsewhere, after holding an underweight position relative to the benchmark for over two years, Insight Capital found compelling investment cases for h ealth care companies. An example of this was home health company Almost Family, which turned out to be a stable, growing addition to the portfolio. Finally, as the year wound down, one sector that worked well for the portfolio was the for profit education sector, where the biggest positive contributor to the portfolio was ITT Educational Services.

For the DMC component, less-than-favorable stock selection was the primary reason for the portfolio's underperformance for the reporting period from January 1 through September 9, 2008. Among the biggest detractors were online photo service Shutterfly Inc., which declined more than 40% as a result of increased pricing competition; Advanced Analogic Technologies Inc., a semiconductor company that was down 46% due to indications of weakness in one of their key markets; Under Armour Inc.; Taleo Corp. and Penwest Pharmaceuticals Co. – which lost over 35%, 30% and 55%, respectively. Other holdings with disappointing returns included Acadia Pharmaceuticals, Synchronoss Technologies and Chipotle Mexican Grill.

Conversely, top contributors to performance included Old Dominion Freight Line Inc.; Clean Harbors, Inc.; Gymboree Corp. and United Fire & Causalty Co. Finally, positive stock selection in the health care sector was unable to overcome weakness in the consumer services, basic industry and financial sectors.

With respect to the Essex component of the Fund, for the reporting period from September 10 through December 31, 2008, the portfolio's cautious stance on energy was validated, and its underweight position in traditional energy holdings benefited returns. Similar to commodities, capital goods-related groups, agricultural chemicals and basic materials holdings reversed course during the last half of the year, hurt by the slowing global economy. Additionally, the producer durables sector suffered from the economic slowdown, and portfolio holdings in that area were weighted toward emerging markets, which further depressed returns. Several detractors were sold, including L-1 Identity Solutions Inc. and EMCORE Corp. Consumer spending-related holdings also had a negative impact on returns, with sobering headlines of weak holiday sales, falling home prices and rising unemployment. On the other hand, education companies contributed positively, led by Corinthian Colleges Inc. However, these returns were more than offset by weakness in Central European Media Enterprises, which traded down due to its emerging markets exposure. In health care, investors embraced the sector's defensive characteristics, although the portfolio's returns were hurt by stock

23

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

selection. In technology, many stocks remained under pressure due to concerns about the sector's exposure to macroeconomic weakness. However, favorable stock selection held performance significantly above the benchmark: Asiainfo Holdings Inc., Shanda Interactive Entertainment Ltd. and EPIQ Systems Inc. were top contributors.

What is your outlook?

The global financial crisis continues, with key U.S. indicators expected to remain weak for several more quarters. While there are some preliminary signs of easing credit conditions, further evidence is needed to confirm these policies are gaining traction – namely, narrowing corporate bond spreads, stabilizing employment and falling home inventories.

We are hopeful that the lowering of short-term interest rates to near zero by the Federal Reserve, coupled with the expected enactment of the new administration's stimulus package, may help to set the stage for an economic recovery in the second half of 2009. While it is our view that financial markets will likely remain in a volatile bottoming phase as the unwinding of the credit boom continues, stock prices approaching their true values and high levels of cash could help to establish a market bottom.

24

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

MML Emerging Growth Fund

Largest Holdings

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Thoratec Corp. | | | 3.1 | % | |

| Alexion Pharmaceuticals, Inc. | | | 2.6 | % | |

ManTech International Corp.

Class A | | | 2.6 | % | |

| ITT Educational Services, Inc. | | | 2.6 | % | |

| Corinthian Colleges, Inc. | | | 2.5 | % | |

| Myriad Genetics, Inc. | | | 2.4 | % | |

| Axsys Technologies, Inc. | | | 2.2 | % | |

| Nuvasive, Inc. | | | 2.1 | % | |

| Almost Family, Inc. | | | 1.9 | % | |

| Life Partners Holdings, Inc. | | | 1.9 | % | |

| | | | 23.9 | % | |

MML Emerging Growth Fund

Sector Table

(% of Net Assets) on 12/31/08

(Unaudited) | |

| Consumer, Non-cyclical | | | 46.1 | % | |

| Industrial | | | 15.4 | % | |

| Technology | | | 11.8 | % | |

| Consumer, Cyclical | | | 8.4 | % | |

| Communications | | | 8.4 | % | |

| Financial | | | 5.5 | % | |

| Energy | | | 1.1 | % | |

| Total Long-Term Investments | | | 96.7 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 3.3 | % | |

| Net Assets | | | 100.0 | % | |

25

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

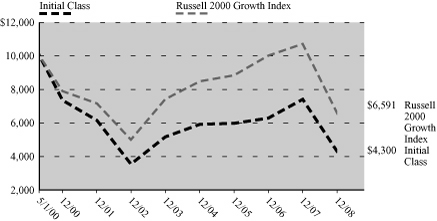

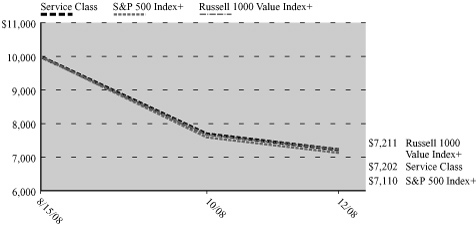

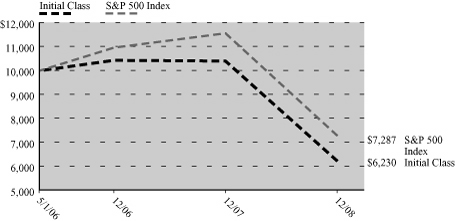

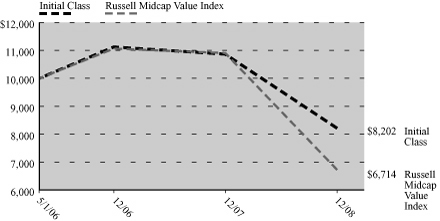

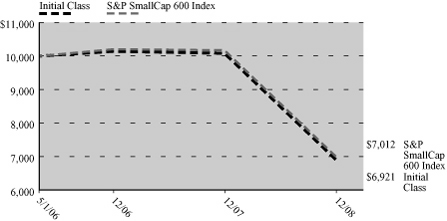

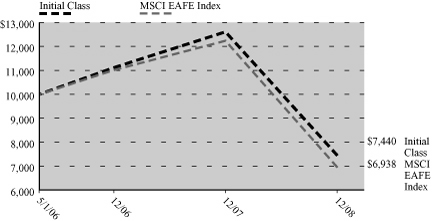

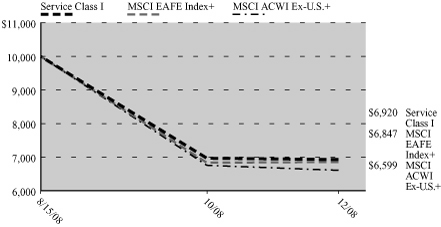

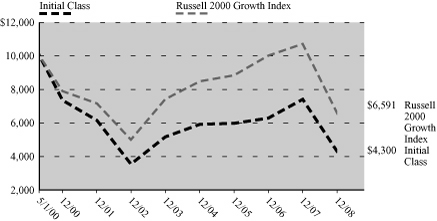

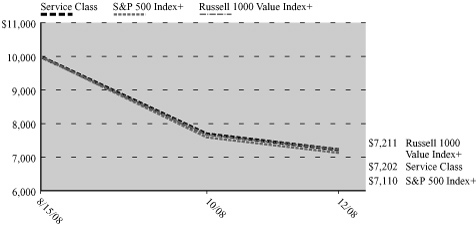

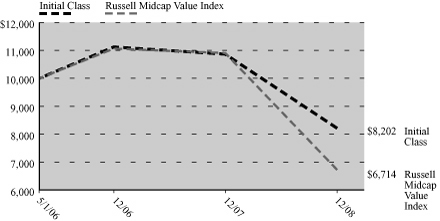

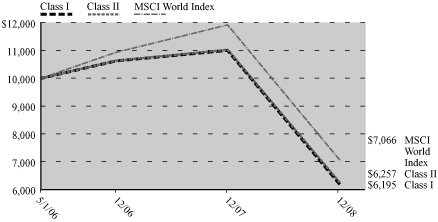

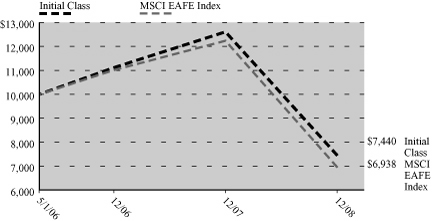

Growth of a $10,000 Investment

Hypothetical Investments in MML Emerging Growth Fund Initial Class and the Russell 2000 Growth Index.

TOTAL RETURN

| | | One Year

1/1/08 - 12/31/08 | | Five Year

Average Annual

1/1/04 - 12/31/08 | | Since Inception

Average Annual

5/1/00 - 12/31/08 | |

| Initial Class | | | (41.97 | )% | | | (3.58 | )% | | | (9.28 | )% | |

Russell 2000

Growth Index | | | (38.54 | )% | | | (2.35 | )% | | | (4.70 | )% | |

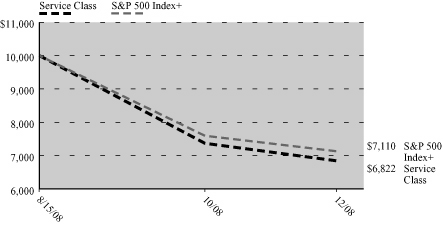

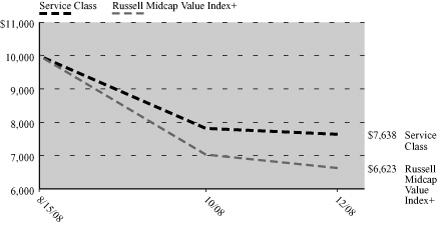

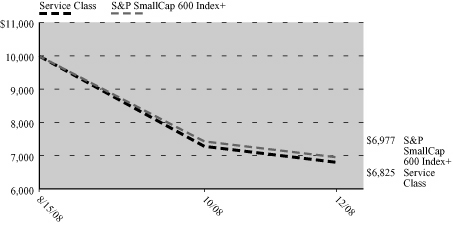

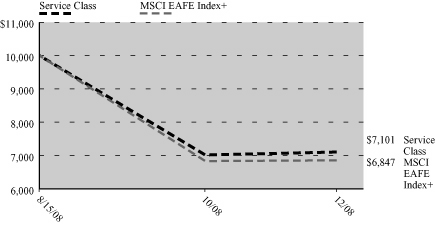

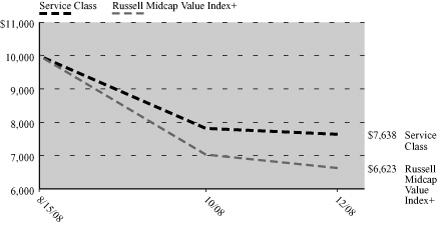

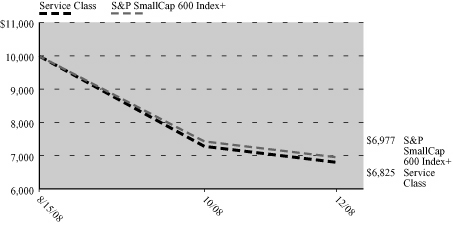

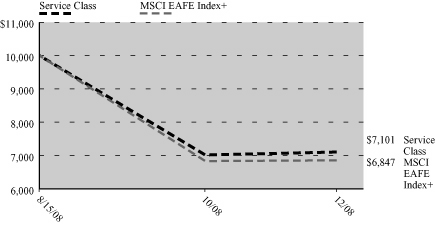

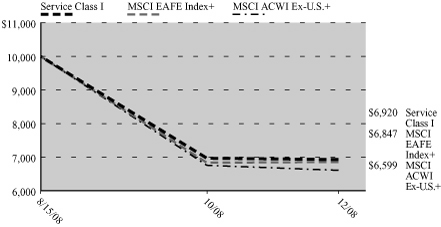

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Hypothetical Investments in MML Emerging Growth Fund Service Class and the Russell 2000 Growth Index.

TOTAL RETURN

| | | Since Inception

8/15/08 - 12/31/08 | |

| Service Class | | | (36.01 | )% | |

| Russell 2000 Growth Index | | | (35.65 | )%+ | |

+ From 9/1/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 2000 Growth Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

26

MML Large Cap Value Fund – Portfolio of Investments

December 31, 2008

| | | Number of

Shares | | Value | |

| EQUITIES — 90.3% | |

| COMMON STOCK — 90.3% | |

| Agriculture — 3.4% | |

| Altria Group, Inc. | | | 10,600 | | | $ | 159,636 | | |

Philip Morris

International, Inc. | | | 136,500 | | | | 5,939,115 | | |

| | | | 6,098,751 | | |

| Auto Manufacturers — 0.3% | |

| Paccar, Inc. | | | 19,720 | | | | 563,992 | | |

| Banks — 6.5% | |

The Bank of New York

Mellon Corp. | | | 119,900 | | | | 3,396,767 | | |

| State Street Corp. | | | 6,500 | | | | 255,645 | | |

| Wachovia Corp. | | | 58,479 | | | | 323,974 | | |

| Wells Fargo & Co. | | | 260,500 | | | | 7,679,540 | | |

| | | | 11,655,926 | | |

| Beverages — 2.1% | |

Diageo PLC Sponsored

ADR (United Kingdom) | | | 39,500 | | | | 2,241,230 | | |

Heineken Holding NV

Class A | | | 54,150 | | | | 1,550,246 | | |

| | | | 3,791,476 | | |

| Building Materials — 1.0% | |

| Martin Marietta Materials, Inc. | | | 17,700 | | | | 1,718,316 | | |

| Chemicals — 0.5% | |

| Monsanto Co. | | | 12,200 | | | | 858,270 | | |

| Coal — 0.4% | |

| China Coal Energy Co. | | | 806,700 | | | | 651,900 | | |

| Commercial Services — 4.3% | |

| Cosco Pacific Ltd. | | | 270,600 | | | | 278,593 | | |

| H&R Block, Inc. | | | 125,400 | | | | 2,849,088 | | |

| Iron Mountain, Inc.(a) | | | 129,699 | | | | 3,207,456 | | |

| Moody's Corp. | | | 56,200 | | | | 1,129,058 | | |

| Visa, Inc. Class A | | | 6,970 | | | | 365,577 | | |

| | | | 7,829,772 | | |

| Computers — 1.4% | |

| Dell, Inc.(a) | | | 55,200 | | | | 565,248 | | |

| Hewlett-Packard Co. | | | 55,600 | | | | 2,017,724 | | |

| | | | 2,582,972 | | |

| Cosmetics & Personal Care — 1.9% | |

| Avon Products, Inc. | | | 22,500 | | | | 540,675 | | |

| The Procter & Gamble Co. | | | 47,500 | | | | 2,936,450 | | |

| | | | 3,477,125 | | |

| | | Number of

Shares | | Value | |

| Diversified Financial — 8.2% | |

| American Express Co. | | | 233,300 | | | $ | 4,327,715 | | |

| Ameriprise Financial, Inc. | | | 40,780 | | | | 952,621 | | |

| Citigroup, Inc. | | | 57,100 | | | | 383,141 | | |

| Discover Financial Services | | | 12,400 | | | | 118,172 | | |

| E*Trade Financial Corp.(a) | | | 16,400 | | | | 18,860 | | |

The Goldman Sachs

Group, Inc. | | | 6,860 | | | | 578,915 | | |

| JP Morgan Chase & Co. | | | 238,216 | | | | 7,510,951 | | |

| Merrill Lynch & Co., Inc. | | | 64,428 | | | | 749,942 | | |

| Morgan Stanley | | | 8,300 | | | | 133,132 | | |

| | | | 14,773,449 | | |

| Electric — 0.2% | |

| The AES Corp.(a) | | | 44,600 | | | | 367,504 | | |

| Electronics — 1.3% | |

| Agilent Technologies, Inc.(a) | | | 85,400 | | | | 1,334,802 | | |

| Garmin Ltd. | | | 11,100 | | | | 212,787 | | |

| Tyco Electronics Ltd. | | | 49,680 | | | | 805,313 | | |

| | | | 2,352,902 | | |

| Engineering & Construction — 0.1% | |

ABB Ltd. Sponsored

ADR (Switzerland) | | | 16,340 | | | | 245,263 | | |

| Foods — 0.3% | |

| The Hershey Co. | | | 12,400 | | | | 430,776 | | |

| Whole Foods Market, Inc. | | | 16,500 | | | | 155,760 | | |

| | | | 586,536 | | |

| Forest Products & Paper — 0.4% | |

| Sino-Forest Corp.(a) | | | 97,000 | | | | 775,529 | | |

| Health Care – Products — 0.6% | |

| Johnson & Johnson | | | 18,700 | | | | 1,118,821 | | |

| Health Care – Services — 0.9% | |

| UnitedHealth Group, Inc. | | | 63,900 | | | | 1,699,740 | | |

| Holding Company – Diversified — 0.6% | |

China Merchants Holdings

International Co. Ltd. | | | 527,020 | | | | 1,038,525 | | |

| Housewares — 0.1% | |

| Hunter Douglas NV | | | 6,765 | | | | 222,536 | | |

| Insurance — 11.1% | |

American International

Group, Inc. | | | 203,150 | | | | 318,945 | | |

Berkshire Hathaway, Inc.

Class A(a) | | | 91 | | | | 8,790,600 | | |

The Hartford Financial

Services Group, Inc. | | | 36,200 | | | | 594,404 | | |

| Loews Corp. | | | 141,300 | | | | 3,991,725 | | |

| | | Number of

Shares | | Value | |

| Markel Corp.(a) | | | 495 | | | $ | 148,005 | | |

| MBIA, Inc.(a) | | | 13,600 | | | | 55,352 | | |

Nipponkoa

Insurance Co. Ltd. | | | 23,600 | | | | 183,464 | | |

Principal Financial

Group, Inc. | | | 16,200 | | | | 365,634 | | |

| The Progressive Corp. | | | 251,250 | | | | 3,721,012 | | |

| Sun Life Financial, Inc. | | | 9,840 | | | | 227,698 | | |

| Transatlantic Holdings, Inc. | | | 41,913 | | | | 1,679,035 | | |

| | | | 20,075,874 | | |

| Internet — 1.5% | |

| Amazon.com, Inc.(a) | | | 16,700 | | | | 856,376 | | |

| eBay, Inc.(a) | | | 24,800 | | | | 346,208 | | |

| Google, Inc. Class A(a) | | | 4,160 | | | | 1,279,824 | | |

Liberty Media Holding Corp.

Interactive Class A(a) | | | 40,700 | | | | 126,984 | | |

| | | | 2,609,392 | | |

| Leisure Time — 0.8% | |

| Harley-Davidson, Inc. | | | 81,100 | | | | 1,376,267 | | |

| Manufacturing — 1.1% | |

| Siemens AG | | | 10,600 | | | | 793,945 | | |

| Tyco International Ltd. | | | 52,200 | | | | 1,127,520 | | |

| | | | 1,921,465 | | |

| Media — 3.8% | |

Comcast Corp. Special

Class A | | | 259,850 | | | | 4,196,577 | | |

Liberty Media Corp.

Entertainment Class A(a) | | | 34,060 | | | | 595,369 | | |

| News Corp. Class A | | | 230,350 | | | | 2,093,882 | | |

WPP PLC Sponsored ADR

(United Kingdom) | | | 1,300 | | | | 38,467 | | |

| | | | 6,924,295 | | |

| Mining — 1.4% | |

| BHP Billiton PLC | | | 32,500 | | | | 612,199 | | |

| Rio Tinto PLC | | | 11,600 | | | | 251,335 | | |

| Vulcan Materials Co. | | | 22,700 | | | | 1,579,466 | | |

| | | | 2,443,000 | | |

| Oil & Gas — 16.5% | |

Canadian Natural

Resources Ltd. | | | 63,500 | | | | 2,538,730 | | |

| ConocoPhillips | | | 144,960 | | | | 7,508,928 | | |

| Devon Energy Corp. | | | 92,000 | | | | 6,045,320 | | |

| EOG Resources, Inc. | | | 78,400 | | | | 5,219,872 | | |

| Occidental Petroleum Corp. | | | 124,530 | | | | 7,470,554 | | |

| Transocean Ltd.(a) | | | 20,479 | | | | 967,633 | | |

| | | | 29,751,037 | | |

(Continued)

The accompanying notes are an integral part of the financial statements.

27

MML Large Cap Value Fund – Portfolio of Investments (Continued)

| | | Number of

Shares | | Value | |

| Packaging & Containers — 1.6% | |

| Sealed Air Corp. | | | 193,900 | | | $ | 2,896,866 | | |

| Pharmaceuticals — 2.8% | |

| Cardinal Health, Inc. | | | 37,800 | | | | 1,302,966 | | |

| Express Scripts, Inc.(a) | | | 29,600 | | | | 1,627,408 | | |

| Schering-Plough Corp. | | | 122,400 | | | | 2,084,472 | | |

| | | | 5,014,846 | | |

| Real Estate — 0.8% | |

Brookfield Asset

Management, Inc.

Class A | | | 57,700 | | | | 881,079 | | |

| Hang Lung Properties Ltd. | | | 163,000 | | | | 497,520 | | |

| | | | 1,378,599 | | |

| Retail — 8.8% | |

| Bed Bath & Beyond, Inc.(a) | | | 64,600 | | | | 1,642,132 | | |

| Carmax, Inc.(a) | | | 87,470 | | | | 689,264 | | |

| Costco Wholesale Corp. | | | 167,500 | | | | 8,793,750 | | |

| CVS Caremark Corp. | | | 127,698 | | | | 3,670,040 | | |

| Lowe's Cos., Inc. | | | 43,700 | | | | 940,424 | | |

| Sears Holdings Corp.(a) | | | 2,700 | | | | 104,949 | | |

| | | | 15,840,559 | | |

| Semiconductors — 1.3% | |

| Texas Instruments, Inc. | | | 153,600 | | | | 2,383,872 | | |

| Software — 2.4% | |

| Dun & Bradstreet Corp. | | | 11,450 | | | | 883,940 | | |

| Microsoft Corp. | | | 176,300 | | | | 3,427,272 | | |

| | | | 4,311,212 | | |

| Telecommunications — 0.7% | |

| Cisco Systems, Inc.(a) | | | 60,900 | | | | 992,670 | | |

| Sprint Nextel Corp.(a) | | | 161,700 | | | | 295,911 | | |

| | | | 1,288,581 | | |

| Transportation — 1.2% | |

China Shipping

Development Co. Ltd. | | | 262,000 | | | | 263,705 | | |

Kuehne & Nagel

International AG | | | 12,400 | | | | 803,968 | | |

United Parcel Service, Inc.

Class B | | | 18,200 | | | | 1,003,912 | | |

| | | | 2,071,585 | | |

TOTAL COMMON STOCK

(Cost $220,645,202) | | | 162,696,755 | | |

TOTAL EQUITIES

(Cost $220,645,202) | | | 162,696,755 | | |

| | | Principal

Amount | | Value | |

| BONDS & NOTES — 0.1% | |

| CORPORATE DEBT — 0.1% | |

| Forest Products & Paper — 0.1% | |

Sino-Forest Corp.

(Acquired 7/23/08,

Cost $350,424)(b) (c)

5.000% 8/01/13 | | $ | 359,000 | | | $ | 254,890 | | |

TOTAL CORPORATE DEBT

(Cost $351,087) | | | 254,890 | | |

TOTAL BONDS & NOTES

(Cost $351,087) | | | 254,890 | | |