UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-02224 |

|

MML Series Investment Fund |

(Exact name of registrant as specified in charter) |

|

1295 State Street, Springfield, MA | | 01111 |

(Address of principal executive offices) | | (Zip code) |

|

Richard J. Byrne

1295 State Street, Springfield, MA 01111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 413-788-8411 | |

|

Date of fiscal year end: | 12/31/2007 | |

|

Date of reporting period: | 12/31/2007 | |

| | | | | | | |

Item 1. Reports to Stockholders.

MML Series

Investment Fund

Annual Report

MML Large Cap Value Fund

MML Equity Index Fund

MML Growth Equity Fund

MML NASDAQ-100® Fund

MML Small Cap Growth Equity Fund

MML Emerging Growth Fund

This annual report describes certain funds offered through the Series. Your variable product prospectus will list which of these funds are available through your variable product.

December 31, 2007

| insure | invest | retire |

Table of Contents

| Letter to Shareholders | | | 1 | | |

|

| Portfolio Manager Reports | | | 3 | | |

|

| Portfolio of Investments | | | 25 | | |

|

| MML Large Cap Value Fund | | | 25 | | |

|

| MML Equity Index Fund | | | 28 | | |

|

| MML Growth Equity Fund | | | 34 | | |

|

| MML NASDAQ-100® Fund | | | 37 | | |

|

| MML Small Cap Growth Equity Fund | | | 39 | | |

|

| MML Emerging Growth Fund | | | 43 | | |

|

| Statement of Assets and Liabilities | | | 46 | | |

|

| Statement of Operations | | | 48 | | |

|

| Statement of Changes in Net Assets | | | 50 | | |

|

| Financial Highlights | | | 54 | | |

|

| Notes to Financial Statements | | | 59 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 70 | | |

|

| Trustees and Officers (Unaudited) | | | 71 | | |

|

| Federal Tax Information (Unaudited) | | | 75 | | |

|

| Other Information (Unaudited) | | | 76 | | |

|

This material must be preceded or accompanied by a current prospectus for the MML Series Investment Fund. Investors should consider a Fund's investment objective, risks and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus. Read it carefully before investing.

MML Series Investment Fund Report – President's Letter to Shareholders

To Our Shareholders

Richard J. Byrne

Given the numerous challenges the market presented to investors in 2007, we believe current market conditions emphasize the critical nature of maintaining a disciplined focus on a long-term investment strategy. Financial professionals recommend that investment strategies align with an individual's risk tolerance, financial goals and time horizon—employing diversification based on these factors. It is extremely difficult to predict future market conditions, so developing and maintaining an appropriate investment strategy is key during periods of market volatility.

December 31, 2007

2007's challenging environment

Equities and fixed-income investments both advanced in 2007, although stocks in the U.S. stumbled in the last few months of the year. For the 12-month period ended December 31, 2007, the Dow Jones Industrial AverageSM ("the Dow"), a benchmark of blue-chip stocks, returned 6.43% and the S&P 500® Index, a measure of U.S. large-cap stock performance, gained 5.49%. The leader in the U.S. equity markets was the NASDAQ Composite® Index ("NASDAQ"), a barometer of technology stock performance, which advanced 9.81%. In foreign developed equity markets, the Morgan Stanley Capital International Europe, Australasia, Far East ("MSCI® EAFE®") Index outperformed most of its U.S. counterparts with its 11.17% return. In the fixed-income arena, the Lehman Brothers® Aggregate Bond Index, a broad measure of the U.S. investment-grade bond market, advanced 6.97%.*

Stocks in the U.S. showed little change during the first quarter of 2007, despite a significant increase in volatility. The Dow declined slightly; conversely, the S&P 500 Index and the NASDAQ each finished with a small advance. The depreciating U.S. dollar continued to support the returns of foreign stocks – helping drive the strong performance of the MSCI EAFE Index. Investor concerns about the weak housing market and subprime lender problems caused higher-quality bond prices to rally and yields to ease. Bond prices move in the opposite direction of interest rates (or yields); when yields rise, the prices of existing bonds fall – and vice versa. In this environment, the Lehman Brothers Aggregate Bond Index posted a positive return for the first quarter of 2007.

Most U.S. stock indexes advanced in the second quarter of 2007, as stocks rode a wave of optimism over corporate earnings and overcame short periods of increased volatility associated with investor concerns about soft retail sales, rising interest rates, inflation, the housing market and subprime mortgages. Performance was mixed among fixed-income categories, but investors favored shorter-term bonds.

Most categories of domestic stocks finished the third quarter of 2007 higher, despite significant market volatility caused by the escalating subprime mortgage crisis. In August, the Federal Reserve ("Fed") cut the discount rate – the interest rate that regional Fed banks charge banks and other financial institutions when they borrow funds on a short-term basis – by 0.50%. After some negative movement in key economic indicators, the Fed lowered the closely watched target federal funds rate by 0.50% to 4.75%, simultaneously cutting the discount rate an additional 0.50% at its September 18 meeting. The federal funds rate is the interest rate that banks and other financial institutions charge each other for borrowing funds overnight. As a result, most broad-based U.S. stock indexes were trading near their all-time highs at the end of the quarter, and the MSCI EAFE Index advanced slightly. In the bond marketplace, growing concerns about a weakening economy triggered a decline in bond yields and boosted prices, helping the Lehman Brothers Aggregate Bond Index advance for the quarter.

The fourth quarter began on a positive note, with investors still savoring the third-quarter Fed-engineered interest rate cuts. The Fed's fourth-quarter interest rate reductions (which totaled an additional 0.50% each from both the federal funds and discount rates) failed to help investor confidence in the face of inflationary pressures, lackluster holiday retail sales and news detailing the ramifications of subprime exposure on large financial companies. U.S. equities traded lower, as ongoing weakness in the housing market, escalating subprime concerns and crude oil prices that approached $100 per barrel undermined investor confidence. Foreign stocks were not immune during this difficult period: The MSCI EAFE Index fell 1.75% for the fourth quarter. In this environment,

* Indexes are unmanaged, do not incur fees or expenses and cannot be purchased directly for investment.

(Continued)

1

MML Series Investment Fund Report – President's Letter to Shareholders (Continued)

higher-quality bonds performed well amid growing concerns about a slowing economy and even a possible recession in the United States. In the end, the Lehman Brothers Aggregate Bond Index advanced 3.00% for the quarter.

A look back at 2007 as we head into 2008

Above all, 2007 was a year in which the subprime mortgage situation developed from a concern into a full-blown crisis. There had been speculation for some time that many subprime mortgages, with their low teaser interest rates scheduled to reset at much higher levels, were a potential threat to borrowers and, by extension, those who invested in securities backed by those loans. The dangers of subprime borrowing didn't seem to grab investors' attention, however, until the situation got bad enough to damage the earnings of some of Wall Street's largest and strongest blue-chip financial companies – such as Bear Stearns, Citigroup, Merrill Lynch, Morgan Stanley and Wachovia. Fourth-quarter profit projections for S&P 500 companies as a group swung from an 11.5% gain at the beginning of October 2007 to a 6.1% drop as of December 31, 2007, mainly due to the deteriorating environment in the financial sector. This movement represented the la rgest quarterly shift since 1999, according to Reuters Estimates.

Outlook

While the fourth-quarter earnings outlook was scaled back considerably, consensus estimates for 2008 remained upbeat, particularly for the second half of the year. Those forecasts assume that the economy will avoid a recession, in part because of an accommodative Fed. While the Fed has demonstrated its willingness to lower interest rates in order to head off a recession, inflationary pressures could limit the central bank's choices going forward. We are cautious, but the truth is that we cannot predict when recessions will occur. It is also true that stocks can perform well during a slowdown as long as economic activity doesn't decelerate too much. Given the difficulty of predicting future market conditions, you may want to consider consulting your financial representative. He or she can work with you to develop a course of action that will help you stay invested for the long term, according to a plan that fits your risk tolerance, time hori zon and financial objectives.

Richard J. Byrne

President

The information provided is the opinion of MassMutual Retirement Services Investments Marketing as of 1/1/08 and is subject to change without notice. It is not to be construed as tax, legal or investment advice. Of course, past performance does not guarantee future results.

2

MML Large Cap Value Fund – Portfolio Manager Report

What is the investment objective of the MML Large Cap Value Fund – and who is the Fund's sub-adviser? The Fund seeks both capital growth and income by selecting businesses that possess characteristics that the Fund's sub-adviser, Davis Selected Advisers, L.P. (Davis) believes foster the creation of long-term value, such as proven management, a durable franchise and business model, and sustainable competitive advantages.

How did the Fund perform during the 12 months ended December 31, 2007? The Fund returned 4.22%, trailing the 5.49% return of the S&P 500® Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies. The Fund did, however, outpace the -0.17% return of the Russell 1000® Value Index, an unmanaged index representative of stocks with a greater-than-average value orientation among the stocks of the largest 1000 U.S. companies based on capitalization.

What was the investment background during the period? Domestic stocks showed little change during the first quarter of 2007, despite a significant increase in volatility across the board. Although the Dow Jones Industrial AverageSM ("the Dow") notched a new closing high in February, the blue-chip benchmark declined slightly for the three months ended March 31, 2007. The S&P 500 Index finished with a small advance, as did the NASDAQ Composite® Index ("NASDAQ"), a barometer of technology stock performance, which barely managed to post a gain for the period. A depreciating U.S. dollar supported the returns of foreign stocks, helping the Morgan Stanley Capital International Europe, Australasia, Far East ("MSCI® EAFE®") Index outperform its U.S. counterparts for the quarter. Most U.S. stock i ndexes advanced in the second quarter, with some setting records along the way. Stocks rode a wave of optimism over corporate earnings early in the quarter and later overcame short periods of increased volatility associated with investor concerns about soft retail sales, rising interest rates, inflation, the housing market and subprime mortgages. During the period, the housing market remained depressed, and long-term interest rates moved decisively higher. Crude oil surged to close the quarter near $70 per barrel.

Most categories of domestic stocks finished the third quarter of 2007 higher, despite significant market volatility caused by the escalating subprime mortgage crisis. In August, the Federal Reserve ("Fed") cut the discount rate – the interest rate that regional Fed banks charge banks and other financial institutions when they borrow funds on a short-term basis – by 0.50%. After some negative movement in key economic indicators, the Fed lowered the closely watched target federal funds rate by 0.50% to 4.75%, simultaneously cutting the discount rate an additional 0.50% at its September 18 meeting. The federal funds rate is the interest rate that banks and other financial institutions charge each other for borrowing funds overnight. As a result, most broad-based U.S. stock indexes were trading near their all-time highs at the end of the third quarter, and the MSCI EAFE Index advanced slightly. The fourth quarter began on a positive no te, with investors still savoring the third-quarter Fed-engineered interest rate cuts. The Fed's fourth-quarter interest rate reductions (which totaled an additional 0.50% each from both the federal funds and discount rates) failed to help investor confidence in the face of inflationary pressures, lackluster holiday retail sales and news detailing the ramifications of subprime exposure on large financial companies. U.S. equities traded lower, as ongoing weakness in the housing market, escalating subprime concerns and crude oil prices that approached $100 per barrel undermined investor confidence. Foreign stocks were not immune during this difficult period: The MSCI EAFE Index fell 1.75% for the fourth quarter.

What factors contributed to the Fund's performance? In the first three months of 2007, the Fund's allocations to the health care and materials sectors fueled its performance – and helped balance the results from other sectors, which were flat to modestly negative. Individual contributors during the period included Martin Marietta, EOG Resources, Vulcan Materials, Loews Corp. and CVS/Caremark (formed out of the merger between CVS and Caremark Rx in March). Conversely, the stocks that detracted most from the Fund's return in the first quarter included Harley-Davidson, American Express, Comcast, American International Group and Progressive Corp. In the second quarter of 2007, the Fund's allocations to the financials, energy, consumer discretionary and consumer staples sectors contributed to its performance, while detractors were largely stock s pecific.

3

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

In the third quarter of 2007, the Fund's holdings in the energy and consumer staples sectors were the largest contributors to the Fund's performance, while select holdings in the consumer discretionary sector detracted. Finally, in the fourth quarter of 2007, the Fund's investments in the energy, consumer staples and information technology sectors were the greatest drivers of the portfolio's returns. Conversely, individual stocks in the consumer discretionary and financial sectors hampered the Fund's progress.

What is your outlook? Whatever happens in 2008 and whatever styles, industries or market capitalizations move into or out of favor, we remain committed to our investment discipline of buying durable businesses at value prices and holding them for the long term. We believe that keen attention to stock selection, in tandem with a sensible framework for building portfolios, can help the Fund withstand a variety of market conditions.

4

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

MML Large Cap Value Fund

Industry Table

(% of Net Assets) on 12/31/07

| Oil & Gas | | | 15.2 | % | |

| Insurance | | | 15.2 | % | |

| Diversified Financial | | | 11.6 | % | |

| Retail | | | 9.4 | % | |

| Banks | | | 6.3 | % | |

| Media | | | 4.8 | % | |

| Agriculture | | | 3.9 | % | |

| Commercial Services | | | 3.4 | % | |

| Software | | | 3.0 | % | |

| Beverages | | | 1.9 | % | |

| Computers | | | 1.8 | % | |

| Electronics | | | 1.8 | % | |

| Cosmetics & Personal Care | | | 1.6 | % | |

| Packaging & Containers | | | 1.5 | % | |

| Telecommunications | | | 1.5 | % | |

| Pharmaceuticals | | | 1.5 | % | |

| Health Care — Products | | | 1.5 | % | |

| Manufacturing | | | 1.3 | % | |

| Internet | | | 1.2 | % | |

| Mining | | | 1.2 | % | |

| Health Care — Services | | | 1.1 | % | |

| Leisure Time | | | 1.1 | % | |

| Transportation | | | 1.0 | % | |

| Coal | | | 0.8 | % | |

Holding Company —

Diversified | | | 0.8 | % | |

| Building Materials | | | 0.8 | % | |

| Semiconductors | | | 0.7 | % | |

| Foods | | | 0.2 | % | |

| Housewares | | | 0.1 | % | |

| Real Estate | | | 0.1 | % | |

Total Long-Term

Investments | | | 96.3 | % | |

Short-Term Investments

and Other Assets and

Liabilities | | | 3.7 | % | |

| | | | 100.0 | % | |

MML Large Cap Value Fund

Ten Largest Stock Holdings

(% of Net Assets) on 12/31/07

| Costco Wholesale Corp. | | | 4.8 | % | |

| ConocoPhillips | | | 4.7 | % | |

| American Express Co. | | | 4.2 | % | |

| Berkshire Hathaway, Inc. Cl. A | | | 3.9 | % | |

| Altria Group, Inc. | | | 3.9 | % | |

American International

Group, Inc. | | | 3.8 | % | |

| JP Morgan Chase & Co. | | | 3.6 | % | |

| Occidental Petroleum Corp. | | | 3.2 | % | |

| Devon Energy Corp. | | | 2.7 | % | |

| Microsoft Corp. | | | 2.6 | % | |

5

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

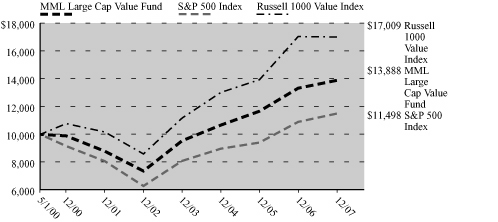

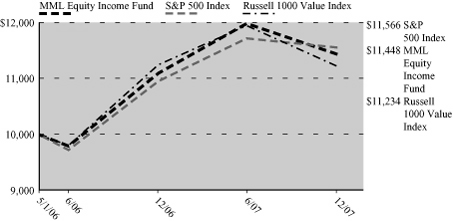

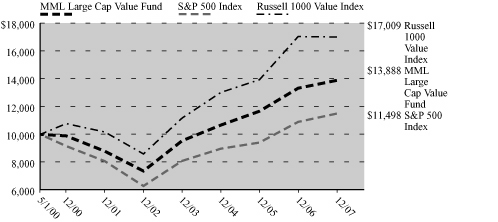

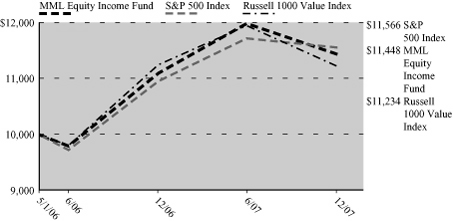

Growth of a $10,000 Investment

Hypothetical Investments in MML Large Cap Value Fund, the S&P 500 Index and the Russell 1000 Value Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/07 -

12/31/07 | | Five Year

Average

Annual

1/1/03 -

12/31/07 | | Since

Inception

Average

Annual

5/1/00 -

12/31/07 | |

MML Large Cap

Value Fund | | | 4.22 | % | | | 13.53 | % | | | 4.37 | % | |

| S&P 500 Index | | | 5.49 | % | | | 12.82 | % | | | 1.84 | % | |

| Russell 1000 Value Index | | | (0.17 | )% | | | 14.63 | % | | | 7.17 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index and the Russell 1000 Value Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

6

MML Equity Index Fund – Portfolio Manager Report

What is the investment objective of the MML Equity Index Fund – and who is the Fund's sub-adviser? The Fund seeks to provide investment results that correspond to the price and yield performance of publicly traded common stocks in the aggregate as represented by the S&P 500® Index. The Fund pursues this objective by investing at least 80% of its net assets in the securities of companies that make up the S&P 500 Index. The Fund's sub-adviser is Northern Trust Investments, N.A. (Northern).

How did the Fund perform during the 12 months ended December 31, 2007? The Fund's Class I shares returned 5.13%, lagging the 5.49% return of the S&P 500 Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

What was the investment background during the period? Overcoming a dip in the market in February, U.S. equity markets posted positive numbers for the first half of 2007, despite negative pressures surrounding subprime loan defaults, rising interest rates and geopolitical conflicts in the Middle East and Asia. The S&P 500 Index closed at an all-time high in May. Ongoing merger and acquisition activity, takeover announcements and strong earnings reports also contributed to the markets' performance in the first quarter of 2007. On January 18, 2007, crude oil prices dropped to $51 a barrel on higher-than-expected supply news. This retreat was short-lived, as oil closed higher at the end of the second quarter, at around $70 per barrel. The Federal Reserve ("Fed") kept interest rates unchanged during the second quarter of 2007.

Most categories of domestic stocks finished the third quarter of 2007 higher, despite significant market volatility caused by the escalating subprime mortgage crisis. In August, the Fed cut the discount rate – the interest rate that regional Fed banks charge banks and other financial institutions when they borrow funds on a short-term basis – by 0.50%. After some negative movement in key economic indicators, the Fed lowered the closely watched target federal funds rate by 0.50% to 4.75%, simultaneously cutting the discount rate an additional 0.50% at its September 18 meeting. The federal funds rate is the interest rate that banks and other financial institutions charge each other for borrowing funds overnight. As a result, most broad-based U.S. stock indexes were trading near their all-time highs at the end of the quarter. The fourth quarter began on a positive note, with investors still savoring the third-quarter Fed-engineered in terest rate cuts. The Fed's fourth-quarter interest rate reductions (which totaled an additional 0.50% each from both the federal funds and discount rates) failed to bolster investor confidence in the face of inflationary pressures, lackluster holiday retail sales and news detailing the ramifications of subprime exposure on large financial companies. U.S. equities traded lower, as ongoing weakness in the housing market, escalating subprime concerns and crude oil prices that approached $100 per barrel undermined investor confidence.

What factors contributed to the Fund's performance? Large capitalization stocks, as represented by the S&P 500 Index, returned 5.49% for the one-year period ended December 31, 2007. Large-cap stocks outpaced their small-cap counterparts for the 12-month period, as measured by the Russell 2000® Index, which returned -1.56%. From a style perspective, value stocks outpaced their growth competitors in the first half of 2007, while the trend reversed itself in the second half.

For full-year 2007, positive performance within sectors was broad based, with eight of 10 sectors posting positive returns. The energy, information technology and consumer staples sectors added the most value. The energy sector had the largest return for the 12-month period, with its advance of 34.40%. The information technology sector saw strong performance from computer and Internet software securities. Within the consumer staples sector, beverage and household product industry groups added the most value. Conversely, the financial and consumer discretionary sectors were the only detractors for the 12-month period. Financials were down 18.63% for the year, as the subprime fallout and housing slowdown had disastrous consequences for that market sector.

What is your outlook? As we enter 2008, investors face a wide array of challenges. These include the price of oil, the subprime crisis, Fed policy and inflation, to name just a few. Despite these uncertainties, we believe that the Fund continues to be positioned to pursue returns that are consistent with those of the S&P 500 Index.

"Standard & Poor's®", "S&P®", "S&P 500®", "Standard & Poor's 500" and "500" are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use by the Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

7

MML Equity Index Fund – Portfolio Manager Report (Continued)

MML Equity Index Fund

Industry Table

(% of Net Assets) on 12/31/07

| Oil & Gas | | | 10.2 | % | |

| Diversified Financial | | | 6.5 | % | |

| Telecommunications | | | 6.1 | % | |

| Pharmaceuticals | | | 5.7 | % | |

| Banks | | | 5.3 | % | |

| Retail | | | 5.0 | % | |

| Manufacturing | | | 5.0 | % | |

| Computers | | | 4.8 | % | |

| Insurance | | | 4.4 | % | |

| Software | | | 4.1 | % | |

| Electric | | | 3.3 | % | |

| Health Care — Products | | | 3.2 | % | |

| Semiconductors | | | 2.7 | % | |

| Media | | | 2.7 | % | |

| Beverages | | | 2.4 | % | |

| Aerospace & Defense | | | 2.3 | % | |

| Internet | | | 2.3 | % | |

| Cosmetics & Personal Care | | | 2.2 | % | |

| Oil & Gas Services | | | 1.9 | % | |

| Chemicals | | | 1.9 | % | |

| Foods | | | 1.8 | % | |

| Transportation | | | 1.7 | % | |

| Agriculture | | | 1.6 | % | |

| Health Care — Services | | | 1.5 | % | |

| Real Estate Investment Trusts (REITS) | | | 0.9 | % | |

| Biotechnology | | | 0.8 | % | |

| Mining | | | 0.8 | % | |

| Commercial Services | | | 0.7 | % | |

| Electronics | | | 0.6 | % | |

| Machinery — Diversified | | | 0.5 | % | |

| Pipelines | | | 0.5 | % | |

| Household Products | | | 0.4 | % | |

Machinery — Construction &

Mining | | | 0.4 | % | |

| Auto Manufacturers | | | 0.4 | % | |

| Electrical Components & Equipment | | | 0.4 | % | |

| Forest Products & Paper | | | 0.3 | % | |

| Lodging | | | 0.3 | % | |

| Iron & Steel | | | 0.3 | % | |

| Leisure Time | | | 0.2 | % | |

| Apparel | | | 0.2 | % | |

| Coal | | | 0.2 | % | |

| Automotive & Parts | | | 0.2 | % | |

| Engineering & Construction | | | 0.2 | % | |

| Savings & Loans | | | 0.2 | % | |

| Office Equipment/Supplies | | | 0.2 | % | |

| Gas | | | 0.2 | % | |

| Environmental Controls | | | 0.2 | % | |

| Metal Fabricate & Hardware | | | 0.1 | % | |

| Advertising | | | 0.1 | % | |

| Building Materials | | | 0.1 | % | |

| Packaging & Containers | | | 0.1 | % | |

| Entertainment | | | 0.1 | % | |

| Distribution & Wholesale | | | 0.1 | % | |

| Home Builders | | | 0.1 | % | |

| Home Furnishing | | | 0.1 | % | |

| Toys, Games & Hobbies | | | 0.1 | % | |

| Hand & Machine Tools | | | 0.1 | % | |

| Airlines | | | 0.1 | % | |

Holding Company —

Diversified | | | 0.1 | % | |

| Housewares | | | 0.1 | % | |

Total Long-Term

Investments | | | 99.0 | % | |

Short-Term Investments

and Other Assets and

Liabilities | | | 1.0 | % | |

| | | | 100.0 | % | |

MML Equity Index Fund

Ten Largest Stock Holdings

(% of Net Assets) on 12/31/07

| Exxon Mobil Corp. | | | 3.9 | % | |

| General Electric Co. | | | 2.9 | % | |

| Microsoft Corp. | | | 2.2 | % | |

| AT&T, Inc. | | | 1.9 | % | |

| The Procter & Gamble Co. | | | 1.8 | % | |

| Chevron Corp. | | | 1.5 | % | |

| Johnson & Johnson | | | 1.5 | % | |

| Bank of America Corp. | | | 1.4 | % | |

| Apple, Inc. | | | 1.3 | % | |

| Cisco Systems, Inc. | | | 1.3 | % | |

8

MML Equity Index Fund – Portfolio Manager Report (Continued)

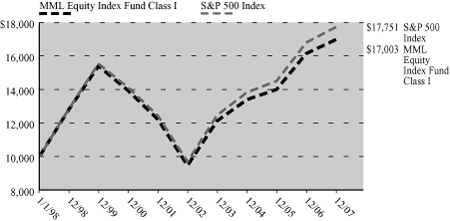

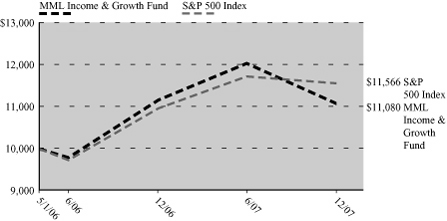

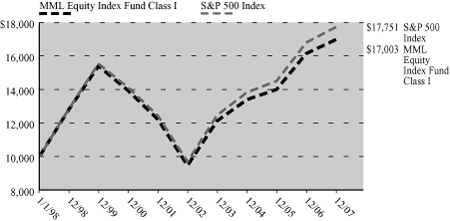

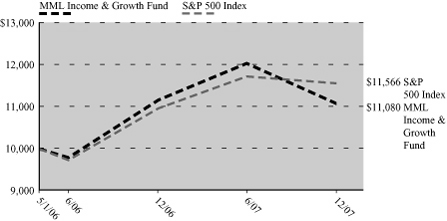

Growth of a $10,000 Investment

Hypothetical Investments in MML Equity Index Fund Class I and the S&P 500 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/07 -

12/31/07 | | Five Year

Average

Annual

1/1/03 -

12/31/07 | | Ten Year

Average

Annual

1/1/98 -

12/31/07 | |

MML Equity Index

Fund Class I | | | 5.13 | % | | | 12.37 | % | | | 5.45 | % | |

| S&P 500 Index | | | 5.49 | % | | | 12.82 | % | | | 5.91 | % | |

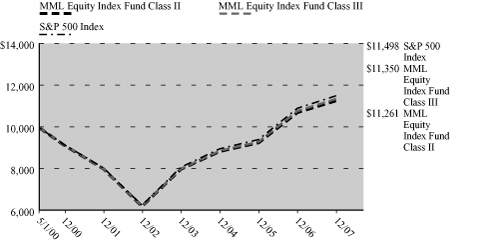

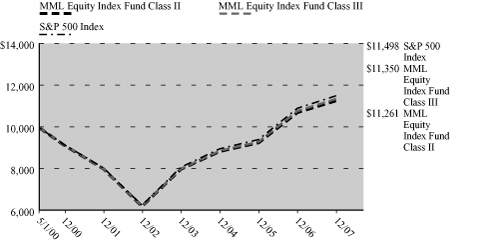

Hypothetical Investments in MML Equity Index Fund Class II, Class III and the S&P 500 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/07 -

12/31/07 | | Five Year

Average

Annual

1/1/03 -

12/31/07 | | Since

Inception

Average

Annual

5/1/00 -

12/31/07 | |

MML Equity Index

Fund Class II | | | 5.24 | % | | | 12.55 | % | | | 1.56 | % | |

MML Equity Index

Fund Class III | | | 5.40 | % | | | 12.70 | % | | | 1.66 | % | |

| S&P 500 Index | | | 5.49 | % | | | 12.82 | % | | | 1.84 | % | |

GROWTH OF $10,000 INVESTMENT FOR THE PAST TEN YEARS

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

9

MML Growth Equity Fund – Portfolio Manager Report

What is the investment objective of the MML Growth Equity Fund – and who is the Fund's sub-adviser? The Fund seeks long-term growth of capital and future income by normally investing at least 80% of its net assets in the common stocks and securities convertible into common stocks of companies that the Fund's sub-adviser believes offer prospects for long-term growth. Effective November 28, 2007, T. Rowe Price Associates, Inc. (T. Rowe Price) replaced Grantham, Mayo, Van Otterloo & Co. LLC (GMO) as the Fund's sub-adviser.

How did the Fund perform during the 12 months ended December 31, 2007? The Fund returned 4.34%, underperforming the 11.81% return of the Russell 1000® Growth Index, an unmanaged index consisting of those Russell 1000 securities (representing the 1000 largest U.S. companies based on market capitalization) with greater-than-average growth orientation that tend to exhibit higher price-to-book ratios and forecasted growth values than securities in the value universe. The Fund also trailed the 5.49% return of the S&P 500® Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

As we originally noted in the Fund's June 30, 2007 semi-annual report, going forward, the Fund's performance will be compared to the Russell 1000 Growth Index rather than the S&P 500 Index because the Russell 1000 Growth Index more closely represents the Fund's investment strategy.

What was the investment background during the period? Domestic stocks showed little change during the first quarter of 2007, despite a significant increase in volatility across the board. Although the Dow Jones Industrial AverageSM ("the Dow") notched a new closing high in February, the blue-chip benchmark declined slightly for the three months ended March 31, 2007. The S&P 500 Index finished with a small advance, as did the NASDAQ Composite® Index ("NASDAQ"), a barometer of technology stock performance, which barely managed to post a gain for the period. Most U.S. stock indexes advanced in the second quarter, with some setting records along the way. Stocks rode a wave of optimism over corporate earnings early in the quarter and later overcame short periods of increased volatility associated with investor concerns ab out soft retail sales, rising interest rates, inflation, the housing market and subprime mortgages. During the period, the housing market remained depressed, and long-term interest rates moved decisively higher. Crude oil surged to close the quarter near $70 per barrel.

Most categories of domestic stocks finished the third quarter of 2007 higher, despite significant market volatility caused by the escalating subprime mortgage crisis. In August, the Federal Reserve ("Fed") cut the discount rate – the interest rate that regional Fed banks charge banks and other financial institutions when they borrow funds on a short-term basis – by 0.50%. After some negative movement in key economic indicators, the Fed lowered the closely watched target federal funds rate by 0.50% to 4.75%, simultaneously cutting the discount rate an additional 0.50% at its September 18 meeting. The federal funds rate is the interest rate that banks and other financial institutions charge each other for borrowing funds overnight. As a result, most broad-based U.S. stock indexes were trading near their all-time highs at the end of the quarter. The Fed's fourth-quarter interest rate reductions (which totaled an additional 0.50% each from both the federal funds and discount rates) failed to help investor confidence in the face of inflationary pressures, lackluster holiday retail sales and news detailing the ongoing impact of subprime exposure on large financial companies. U.S. equities traded lower, as ongoing weakness in the housing market, escalating subprime concerns and crude oil prices that approached $100 per barrel undermined investor confidence.

What factors contributed to the Fund's performance? The portfolio's concentration in high-quality stocks – at the expense of their low-quality counterparts – detracted from returns in the first quarter of 2007. Of the portfolio's investment disciplines (valuation and momentum), momentum benefited performance during the period, whereas valuation detracted. After hindering the Fund's progress in the late-February stock market decline, momentum resumed its favorable performance in March, with a positive finish for the first quarter. Sector selection was a positive influence on results, aided by the Fund's positions in the oil/gas and retail stores sectors and de-emphasis of technology. The Fund's relative positions in the machinery, services and utility sectors all detracted from performance. Turning to the second quarter of 2007, the Fund 's valuation discipline fared poorly in April before stabilizing somewhat in May and June. On the other hand, the momentum portfolio declined steadily throughout the period. Sector selection detracted from the portfolio's returns, although holdings in the oil/gas, construction and automotive sectors

10

MML Growth Equity Fund – Portfolio Manager Report (Continued)

contributed to returns. On the downside, the strategy's overall positioning in retail stores, technology and machinery detracted.

Sector selection hampered the Fund's returns in the third quarter of 2007. Underweight positions in the transportation, financial, and utilities sectors contributed positively to results, whereas the portfolio's overweight position in retail stores and underweight in technology and machinery detracted. In the fourth quarter of 2007, the Fund's valuation investment discipline was detrimental, while momentum proved beneficial. From a sector perspective, the materials and information technology sectors were the leading contributors for the quarter. Consumer discretionary and financials were the laggards, posting negative returns.

What is your outlook? Numerous forces will continue to influence the direction that the market takes throughout 2008. These include the price of oil; the subprime crisis and its impact on housing in particular, and the U.S. economy in general; Fed policy and inflation – to name just a few. Despite these uncertainties, we believe that maintaining our disciplined investment approach will help the Fund successfully withstand any challenges that may lie ahead.

11

MML Growth Equity Fund – Portfolio Manager Report (Continued)

MML Growth Equity Fund

Industry Table

(% of Net Assets) on 12/31/07

| Telecommunications | | | 9.3 | % | |

| Diversified Financial | | | 8.2 | % | |

| Software | | | 7.7 | % | |

| Pharmaceuticals | | | 7.0 | % | |

| Internet | | | 6.8 | % | |

| Manufacturing | | | 6.1 | % | |

| Retail | | | 5.9 | % | |

| Oil & Gas Services | | | 5.6 | % | |

| Computers | | | 4.6 | % | |

| Health Care — Services | | | 4.3 | % | |

| Banks | | | 3.9 | % | |

| Semiconductors | | | 3.9 | % | |

| Health Care — Products | | | 3.6 | % | |

| Oil & Gas | | | 2.9 | % | |

| Aerospace & Defense | | | 2.6 | % | |

| Media | | | 2.0 | % | |

| Lodging | | | 1.7 | % | |

| Engineering & Construction | | | 1.7 | % | |

| Biotechnology | | | 1.7 | % | |

| Commercial Services | | | 1.7 | % | |

| Insurance | | | 1.6 | % | |

| Chemicals | | | 1.6 | % | |

| Cosmetics & Personal Care | | | 1.3 | % | |

| Mining | | | 1.2 | % | |

| Advertising | | | 0.6 | % | |

| Beverages | | | 0.5 | % | |

| Entertainment | | | 0.4 | % | |

| Toys, Games & Hobbies | | | 0.3 | % | |

| Foods | | | 0.3 | % | |

| Transportation | | | 0.2 | % | |

| Electronics | | | 0.2 | % | |

| Auto Manufacturers | | | 0.1 | % | |

Total Long-Term

Investments | | | 99.5 | % | |

Short-Term Investments

and Other Assets and

Liabilities | | | 0.5 | % | |

| | | | 100.0 | % | |

MML Growth Equity Fund

Ten Largest Stock Holdings

(% of Net Assets) on 12/31/07

| Google, Inc. Cl. A | | | 3.3 | % | |

| General Electric Co. | | | 3.2 | % | |

| Microsoft Corp. | | | 2.9 | % | |

| Schlumberger Ltd. | | | 2.6 | % | |

| Danaher Corp. | | | 2.5 | % | |

| Apple, Inc. | | | 2.4 | % | |

| State Street Corp. | | | 2.2 | % | |

| Amazon.com, Inc. | | | 2.1 | % | |

| CVS Caremark Corp. | | | 2.0 | % | |

| Smith International, Inc. | | | 1.8 | % | |

12

MML Growth Equity Fund – Portfolio Manager Report (Continued)

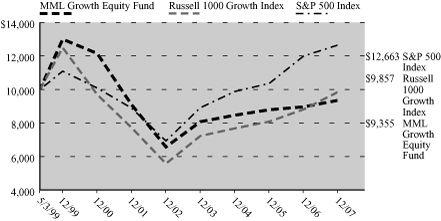

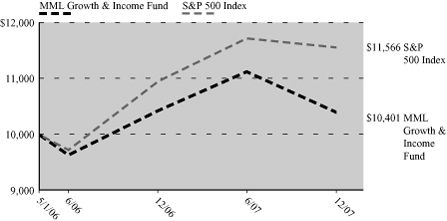

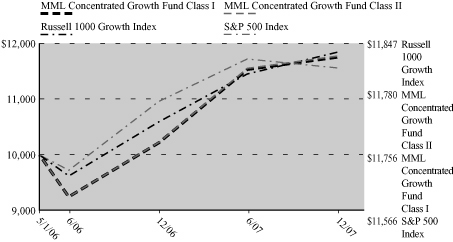

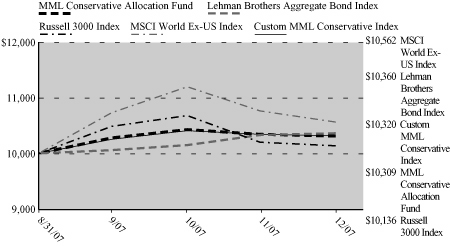

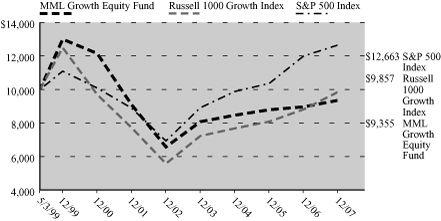

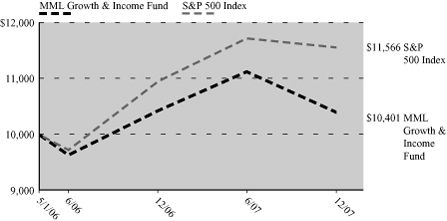

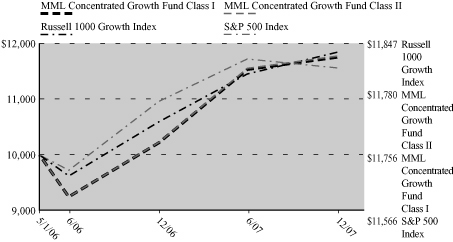

Growth of a $10,000 Investment

Hypothetical Investments in MML Growth Equity Fund, the Russell 1000 Growth Index and the S&P 500 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/07 -

12/31/07 | | Five Year

Average

Annual

1/1/03 -

12/31/07 | | Since

Inception

Average

Annual

5/3/99 -

12/31/07 | |

MML Growth

Equity Fund | | | 4.34 | % | | | 7.33 | % | | | (0.77 | )% | |

| Russell 1000 Growth Index | | | 11.81 | % | | | 12.11 | % | | | (0.17 | )% | |

| S&P 500 Index | | | 5.49 | % | | | 12.82 | % | | | 2.76 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 1000 Growth Index and the S&P 500 Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

13

MML NASDAQ-100® Fund – Portfolio Manager Report

What is the investment objective of the MML NASDAQ-100® Fund (formerly known as the MML OTC 100 Fund) – and who is the Fund's sub-adviser? On November 30, 2007, the MML OTC 100 Fund's name changed to the MML NASDAQ-100® Fund. The MML NASDAQ-100 Fund seeks to approximate, as closely as practicable (before fees and expenses), the total return of the NASDAQ-100 Index®. The Fund's sub-adviser is Northern Trust Investments, N.A. (Northern).

How did the Fund perform during the 12 months ended December 31, 2007? The Fund returned 18.86%, moderately exceeding the 18.67% return of the NASDAQ-100 Index. The NASDAQ-100 Index is a modified capitalization-weighted index composed of the 100 largest non-financial companies listed on the National Association of Securities Dealers Automated Quotations System ("NASDAQ").

What was the investment background during the period? Overcoming a dip in the market in February, U.S. equity markets posted positive numbers for the first half of 2007, despite negative pressures surrounding subprime loan defaults, rising interest rates and geopolitical conflicts in the Middle East and Asia. The S&P 500® Index closed at an all-time high in May. Ongoing merger and acquisition activity, takeover announcements and strong earnings reports also contributed to market performance in the first quarter of 2007. On January 18, 2007, crude oil prices dropped to $51 a barrel on higher-than-expected supply news. This retreat was short-lived, as oil closed higher at the end of the second quarter, at around $70 per barrel. The Federal Reserve ("Fed") kept interest rates unchanged during the second quarter of 2007.

Most categories of domestic stocks finished the third quarter of 2007 higher, despite significant market volatility caused by the escalating subprime mortgage crisis. In August, the Fed cut the discount rate – the interest rate that regional Fed banks charge banks and other financial institutions when they borrow funds on a short-term basis – by 0.50%. After some negative movement in key economic indicators, the Fed lowered the closely watched target federal funds rate by 0.50% to 4.75%, simultaneously cutting the discount rate an additional 0.50% at its September 18 meeting. The federal funds rate is the interest rate that banks and other financial institutions charge each other for borrowing funds overnight. As a result, most broad-based U.S. stock indexes were trading near their all-time highs at the end of the quarter. The fourth quarter began on a positive note, with investors still savoring the third-quarter Fed-engineered in terest rate cuts. The Fed's fourth-quarter interest rate reductions (which totaled an additional 0.50% each from both the federal funds and discount rates) failed to bolster investor confidence in the face of inflationary pressures, lackluster holiday retail sales and news detailing the ramifications of subprime exposure on large financial companies. U.S. equities traded lower, as ongoing weakness in the housing market, escalating subprime concerns and crude oil prices that approached $100 per barrel undermined investor confidence. Foreign stocks were not immune during this difficult period.

What factors contributed to the Fund's performance? Equity markets ended the 12-month period in positive territory, despite the equity markets' difficulties over concerns about credit risk, the health of the financials sector, and its potential effect on the broader economy. The Fed lowered the federal funds rate a total of 1.00% in the second half of the year to counter the tightening of financial conditions and protect against downside risks to the economy.

The federal funds rate ended 2007 at 4.25%, and the discount rate was 4.75% on December 31. The Federal Open Market Committee notes highlighted the "upward pressure on inflation" due to energy and commodity prices. Crude oil continued its climb towards $100 per barrel, surpassing $100 in intra-day trading in December and closing at $95.95 for 2007.

What is your outlook? As we enter 2008, investors face a wide array of challenges. These include the price of oil, the subprime crisis, Fed policy and inflation, to name just a few. Despite these uncertainties, we believe that the Fund continues to be positioned to pursue returns that are consistent with those of the NASDAQ-100 Index.

NASDAQ®, NASDAQ-100® and NASDAQ-100 Index® are trademarks of The NASDAQ Stock Market, Inc. (together with its affiliates, "NASDAQ") and are licensed for use by the Fund. The Fund has not been passed on by NASDAQ as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by NASDAQ. NASDAQ MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE FUND.

14

MML NASDAQ-100® Fund – Portfolio Manager Report (Continued)

MML NASDAQ-100 Fund

Industry Table

(% of Net Assets) on 12/31/07

| Computers | | | 20.4 | % | |

| Software | | | 15.7 | % | |

| Internet | | | 13.5 | % | |

| Telecommunications | | | 10.2 | % | |

| Semiconductors | | | 8.5 | % | |

| Pharmaceuticals | | | 5.4 | % | |

| Biotechnology | | | 4.9 | % | |

| Retail | | | 4.2 | % | |

| Media | | | 2.9 | % | |

| Health Care — Products | | | 2.1 | % | |

| Electronics | | | 1.7 | % | |

| Auto Manufacturers | | | 1.3 | % | |

| Commercial Services | | | 1.2 | % | |

| Transportation | | | 1.0 | % | |

| Lodging | | | 0.8 | % | |

| Engineering & Construction | | | 0.7 | % | |

| Advertising | | | 0.5 | % | |

| Airlines | | | 0.5 | % | |

Machinery — Construction &

Mining | | | 0.4 | % | |

| Chemicals | | | 0.4 | % | |

| Textiles | | | 0.3 | % | |

| Iron & Steel | | | 0.3 | % | |

| Foods | | | 0.3 | % | |

| Environmental Controls | | | 0.3 | % | |

| Beverages | | | 0.2 | % | |

Total Long-Term

Investments | | | 97.7 | % | |

Short-Term Investments

and Other Assets and

Liabilities | | | 2.3 | % | |

| | | | 100.0 | % | |

MML NASDAQ-100 Fund

Ten Largest Stock Holdings

(% of Net Assets) on 12/31/07

| Apple, Inc. | | | 13.4 | % | |

| Microsoft Corp. | | | 6.4 | % | |

| Google, Inc. Cl. A | | | 5.5 | % | |

| Qualcomm, Inc. | | | 4.3 | % | |

| Research In Motion Ltd. | | | 3.5 | % | |

| Cisco Systems, Inc. | | | 3.3 | % | |

| Intel Corp. | | | 3.0 | % | |

| Oracle Corp. | | | 2.7 | % | |

| Gilead Sciences, Inc. | | | 2.3 | % | |

| eBay, Inc. | | | 1.9 | % | |

15

MML NASDAQ-100® Fund – Portfolio Manager Report (Continued)

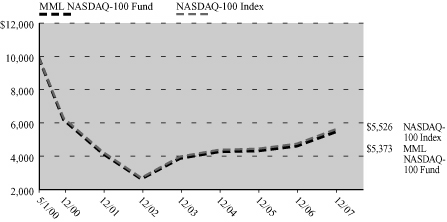

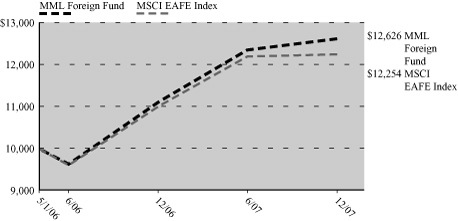

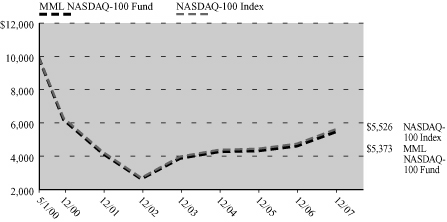

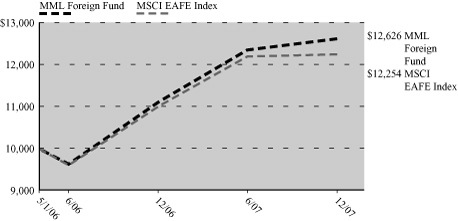

Growth of a $10,000 Investment

Hypothetical Investments in MML NASDAQ-100 Fund (formerly MML OTC 100 Fund) and the NASDAQ-100 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/07 -

12/31/07 | | Five Year

Average

Annual

1/1/03 -

12/31/07 | | Since

Inception

Average

Annual

5/1/00 -

12/31/07 | |

| MML NASDAQ-100 Fund | | | 18.86 | % | | | 16.10 | % | | | (7.78 | )% | |

| NASDAQ-100 Index | | | 18.67 | % | | | 16.20 | % | | | (7.45 | )% | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com

Investors should note that the Fund is a professionally managed mutual fund, while the NASDAQ-100 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

16

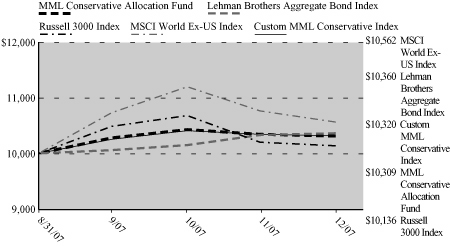

MML Small Cap Growth Equity Fund – Portfolio Manager Report

What is the investment objective of the MML Small Cap Growth Equity Fund – and who are the Fund's sub-advisers? The Fund seeks long-term capital appreciation by investing primarily in common stocks and equity securities of smaller companies that the Fund's sub-advisers believe offer potential for long-term growth. The Fund's sub-advisers are Wellington Management Company, LLP (Wellington Management) and Waddell & Reed Investment Management Company (Waddell & Reed). Each sub-adviser is responsible for a portion of the portfolio, but not necessarily equal weighted.

How did the Fund perform during the 12 months ended December 31, 2007? The Fund returned 9.66%, outperforming the 7.06% return of the Russell 2000® Growth Index, a widely recognized, unmanaged index that measures the performance of those Russell 2000 Index companies (representing small-capitalization U.S. common stocks) with higher price-to-book ratios and forecasted growth rates. The Fund's 9.66% return also exceeded the -1.56% return of the Russell 2000 Index, a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

As we originally noted in the Fund's June 30, 2007 semi-annual report, going forward, the Fund's performance will be compared to the Russell 2000 Growth Index rather than the Russell 2000 Index because the Russell 2000 Growth Index more closely represents the Fund's investment strategy. The Fund will retain the Russell 2000 Index as its supplemental benchmark for performance comparisons.

What was the investment background during the period? U.S. equity markets rose in the first quarter of 2007, as solid corporate earnings and continued merger and acquisition activity offset concerns of a weakening housing and credit environment. Despite the fact that most major indexes posted positive results, first-quarter returns were marked by extreme volatility. The markets were roiled by the subprime shakeout, a slowing U.S. economy and sentiment swings in emerging markets. In the second quarter of 2007, equity markets generally advanced, as better-than-expected corporate earnings and views of solidifying economic growth outweighed concerns of both rising interest rates and a continuing U.S. housing slump.

Most categories of domestic stocks finished the third quarter of 2007 higher, despite significant market volatility caused by the escalating subprime mortgage crisis. In August, the Federal Reserve ("Fed") cut the discount rate – the interest rate that regional Fed banks charge banks and other financial institutions when they borrow funds on a short-term basis – by 0.50%. After some negative movement in key economic indicators, the Fed lowered the closely watched target federal funds rate by 0.50% to 4.75%, simultaneously cutting the discount rate an additional 0.50% at its September 18 meeting. The federal funds rate is the interest rate that banks and other financial institutions charge each other for borrowing funds overnight. As a result, most broad-based U.S. stock indexes were trading near their all-time highs at the end of the third quarter. The Fed's fourth-quarter interest rate reductions (which totaled an additional 0.50% each from both the federal funds and discount rates) failed to help investor confidence in the face of inflationary pressures, lackluster holiday retail sales and news detailing the ramifications of subprime exposure on large financial companies. U.S. equities traded lower, as ongoing weakness in the housing market, escalating subprime concerns and crude oil prices that approached $100 per barrel undermined investor confidence.

What factors contributed to the Fund's performance? Broad-based, positive results in the consumer discretionary sector aided the Fund's performance in the first quarter of 2007, as did certain portfolio holdings in the financials sector, a sector that under-performed overall. Within energy, lower energy prices and rising costs proved to be a hindrance. Certain telecommunications positions also underperformed. Overall, sector allocation was favorable. On the downside, poor results from the portfolio's information technology stocks detracted. In the second quarter of 2007, the portfolio benefited from strong stock selection in the information technology, health care, financials and consumer discretionary sectors. Conversely, stock selection in consumer staples and telecommunication services hampered performance. Finally, the Fund's performance bene fited from its underweight position in the poor-performing financials sector.

17

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

During the third quarter of 2007, stock selection was the main performance driver. The Fund's security selection in financials aided results, as did Fund management's choices in the information technology, consumer discretionary, and industrials sectors. Conversely, certain stocks in the industrials sector, in tandem with some holdings in the energy sector, detracted from performance. Turning to the fourth quarter of 2007, from a sector standpoint, it was no surprise that the two poorest-performing sectors were financials and consumer discretionary – as the consumer continued to come under pressure due to the housing downturn, tighter credit availability and rising food and fuel prices. We believe these same components squeezed the financials sector as well. On the other hand, strong security selection, particularly in the energy, materials, information technology and financials sectors, contributed to the Fund's performance.

What is your outlook? In our view, the concerns that developed in 2007, such as the subprime mortgage fallout, inflation fears, possible recession, the housing market slowdown and high energy prices, will continue into 2008 and have the potential to worsen in the short term. As a result, we remain committed to focusing on what we feel are higher-quality growth stocks that have a more sustainable and visible earnings stream with the potential to grow through internal cash flows.

18

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

MML Small Cap Growth Equity Fund

Industry Table

(% of Net Assets) on 12/31/07

| Software | | | 11.2 | % | |

| Commercial Services | | | 7.5 | % | |

| Internet | | | 6.8 | % | |

| Computers | | | 4.8 | % | |

| Oil & Gas | | | 4.6 | % | |

| Retail | | | 4.5 | % | |

| Health Care — Services | | | 3.7 | % | |

| Pharmaceuticals | | | 3.6 | % | |

| Transportation | | | 3.3 | % | |

| Entertainment | | | 3.1 | % | |

Machinery — Construction &

Mining | | | 2.8 | % | |

| Chemicals | | | 2.7 | % | |

| Insurance | | | 2.5 | % | |

| Biotechnology | | | 2.3 | % | |

| Semiconductors | | | 2.3 | % | |

| Distribution & Wholesale | | | 2.3 | % | |

| Health Care — Products | | | 2.2 | % | |

| Engineering & Construction | | | 2.2 | % | |

| Investment Companies | | | 2.1 | % | |

| Diversified Financial | | | 1.9 | % | |

| Lodging | | | 1.4 | % | |

| Energy — Alternate Sources | | | 1.3 | % | |

| Aerospace & Defense | | | 1.3 | % | |

| Telecommunications | | | 1.2 | % | |

| Environmental Controls | | | 0.9 | % | |

| Home Furnishing | | | 0.9 | % | |

| Coal | | | 0.9 | % | |

| Cosmetics & Personal Care | | | 0.8 | % | |

| Packaging & Containers | | | 0.7 | % | |

| Machinery — Diversified | | | 0.7 | % | |

| Electronics | | | 0.6 | % | |

| Mining | | | 0.6 | % | |

| Banks | | | 0.5 | % | |

| Automotive & Parts | | | 0.5 | % | |

| Media | | | 0.5 | % | |

| Manufacturing | | | 0.5 | % | |

| Iron & Steel | | | 0.4 | % | |

| Advertising | | | 0.4 | % | |

| Household Products | | | 0.4 | % | |

| Oil & Gas Services | | | 0.3 | % | |

| Water | | | 0.3 | % | |

| Electric | | | 0.3 | % | |

| Real Estate Investment Trusts (REITS) | | | 0.3 | % | |

| Gas | | | 0.3 | % | |

| Trucking & Leasing | | | 0.2 | % | |

Holding Company —

Diversified | | | 0.2 | % | |

| Apparel | | | 0.2 | % | |

| Toys, Games & Hobbies | | | 0.2 | % | |

| Airlines | | | 0.2 | % | |

| Hand & Machine Tools | | | 0.2 | % | |

| Foods | | | 0.1 | % | |

| Beverages | | | 0.1 | % | |

Total Long-Term

Investments | | | 93.8 | % | |

Short-Term Investments

and Other Assets and

Liabilities | | | 6.2 | % | |

| | | | 100.0 | % | |

MML Small Cap Growth Equity Fund

Ten Largest Stock Holdings

(% of Net Assets) on 12/31/07

| Bucyrus International, Inc. Cl. A | | | 2.5 | % | |

| Chicago Bridge & Iron Co. | | | 2.2 | % | |

Adams Respiratory

Therapeutics, Inc. | | | 2.1 | % | |

iShares Russell 2000 Growth

Index Fund | | | 1.9 | % | |

| LKQ Corp. | | | 1.8 | % | |

| Blackbaud, Inc. | | | 1.7 | % | |

| Healthways, Inc. | | | 1.7 | % | |

| Blackboard, Inc. | | | 1.6 | % | |

| Bill Barrett Corp. | | | 1.6 | % | |

| FactSet Research Systems, Inc. | | | 1.5 | % | |

19

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

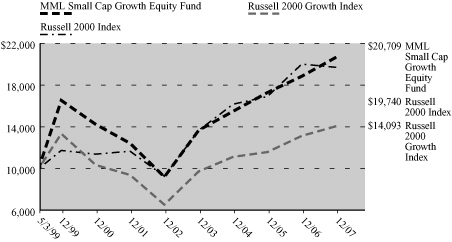

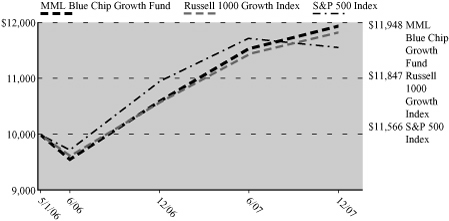

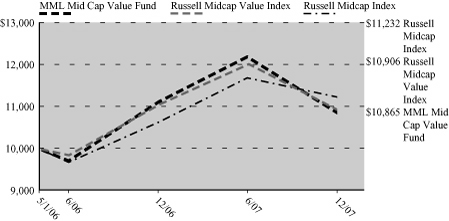

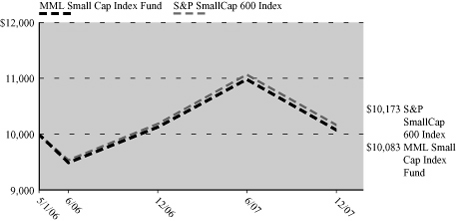

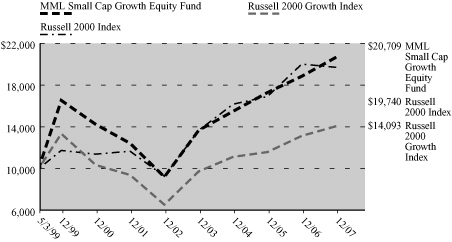

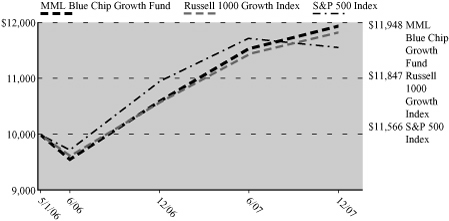

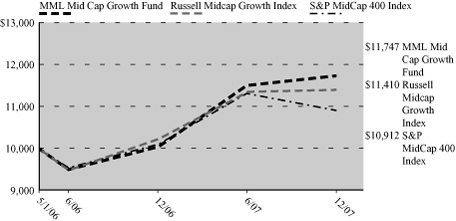

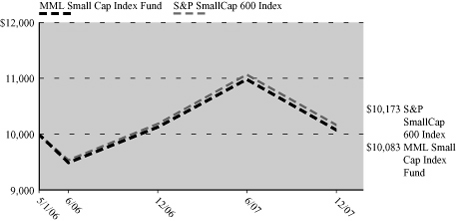

Growth of a $10,000 Investment

Hypothetical Investments in MML Small Cap Growth Equity Fund, the Russell 2000 Growth Index and the Russell 2000 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/07 -

12/31/07 | | Five Year

Average

Annual

1/1/03 -

12/31/07 | | Since

Inception

Average

Annual

5/3/99 -

12/31/07 | |

MML Small Cap

Growth Equity Fund | | | 9.66 | % | | | 17.56 | % | | | 8.76 | % | |

| Russell 2000 Growth Index | | | 7.06 | % | | | 16.50 | % | | | 4.04 | % | |

| Russell 2000 Index | | | (1.56 | )% | | | 16.25 | % | | | 8.16 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 2000 Growth Index and the Russell 2000 Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

20

MML Emerging Growth Fund – Portfolio Manager Report

What is the investment objective of the MML Emerging Growth Fund – and who are the Fund's sub-advisers? The Fund seeks capital appreciation by investing primarily in smaller, rapidly growing emerging growth companies, which may include companies growing earnings per share and/or revenues at above-average rates. The Fund's sub-advisers are Delaware Management Company (DMC) and Insight Capital Research & Management, Inc. (Insight Capital). Each sub-adviser is responsible for a portion of the portfolio, but not necessarily equal weighted.

How did the Fund perform during the 12 months ended December 31, 2007? The Fund returned 17.81%, significantly outperforming the 7.06% return of the Russell 2000® Growth Index, a widely recognized, unmanaged index that measures the performance of those Russell 2000 Index companies (representing small-capitalization U.S. common stocks) with higher price-to-book ratios and forecasted growth rates. The Fund's 17.81% return also significantly exceeded the -1.56% return of the Russell 2000 Index, a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

As we originally noted in the Fund's June 30, 2007 semi-annual report, going forward, the Fund's performance will be compared to the Russell 2000 Growth Index rather than the Russell 2000 Index because the Russell 2000 Growth Index more closely represents the Fund's investment strategy.

What was the investment backdrop during the period? The strength of corporate profit growth and heightened deal activity in the first quarter of 2007 extended the market rally that began in 2006, but not before the market took a major hit in February. Rising fears about contagion spreading from the subprime lending market, relatively weak economic growth data and announcements from Chinese authorities about their intent to curb market speculation all converged to cause a major sell-off late in the month. Over the ensuing weeks, many of these concerns abated, and the markets rebounded. Investors bought stocks with conviction during the second quarter of 2007, as the major indexes advanced throughout the period.

The third quarter of 2007 was marked by a period of volatility in the market. Concerns about a severe deterioration in credit markets, worries about a potential recession, and the ultimate lowering of interest rates by the Federal Reserve ("Fed") all had a significant effect on stock prices. Although stocks in the middle of the period experienced major declines, a positive response to the Fed's interest rate cuts left most indexes up slightly for the quarter. Concerns about the impact of housing-related credit problems on the overall economy drove stocks lower in the fourth quarter of 2007. The threat of inflation, largely as a response to oil prices approaching $100 a barrel, renewed fears about the future health of consumer spending. The convergence of these factors detracted from returns for the fourth quarter.

What factors contributed to the Fund's performance? In the first quarter of 2007, overall stock selection was positive, with the top contributors coming from the consumer nondurables, materials, health care and basic industry/capital goods sectors. Conversely, weakness in the information technology, industrials and consumer services sectors hindered the Fund's performance. In the second quarter of 2007, a slightly negative impact from sector allocation was more than overcome by superior stock selection. Leading the way with strong performance were the Fund's holdings in the business services, consumer services and health care sectors.

In the third quarter of 2007, enhanced stock selection in the business services, consumer services and consumer nondurables sectors was more than able to offset some weakness in the health care and financials sectors. Hampering sector allocation were an underweight position in the health care sector and an overweight position in the consumer nondurables sector. Conversely, the portfolio benefited from an underweight position in the transportation sector. In the fourth quarter of 2007, consumer discretionary and industrial holdings proved beneficial for the Fund, while information technology and health care holdings detracted from performance, as did stock picks in the consumer nondurables, consumer services and energy sectors. An overweight position in consumer nondurables also hindered the Fund's performance, as this was one of the worst-performing sectors during the quarter (due to fears that housing price declines and related credit probl ems would dampen consumer spending). In the energy sector, stock selection detracted, based on the Fund's underweight position in energy exploration and production stocks, which performed significantly better than the oil service-related companies in which the Fund has traditionally invested.

21

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

What is your outlook? As we enter 2008, worries remain as to whether the overall economy will be able to sustain the growth seen in 2007. Rising energy costs and falling housing prices are both detrimental to consumer spending. We have reduced our position in consumer-oriented names as a result of these concerns, while redeploying the proceeds largely to health care stocks, which are not as susceptible to these factors. There was a large disparity in performance between growth- and value-oriented stocks during 2007, which indicates that investors may still be willing to place their confidence in companies that have the ability to grow earnings and sales in the current environment. Consequently, we will continue to focus on companies with these characteristics.

22

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

MML Emerging Growth Fund

Industry Table

(% of Net Assets) on 12/31/07

| Pharmaceuticals | | | 9.5 | % | |

| Internet | | | 8.9 | % | |

| Commercial Services | | | 7.9 | % | |

| Computers | | | 6.4 | % | |

| Software | | | 4.8 | % | |

| Biotechnology | | | 4.4 | % | |

| Oil & Gas Services | | | 4.3 | % | |

| Health Care — Products | | | 4.1 | % | |

| Retail | | | 3.6 | % | |

| Apparel | | | 3.3 | % | |

| Semiconductors | | | 2.9 | % | |

| Metal Fabricate & Hardware | | | 2.4 | % | |

| Health Care — Services | | | 2.3 | % | |

| Chemicals | | | 2.3 | % | |

| Oil & Gas | | | 2.0 | % | |

| Machinery — Diversified | | | 1.9 | % | |

| Distribution & Wholesale | | | 1.9 | % | |

| Foods | | | 1.8 | % | |

| Insurance | | | 1.7 | % | |

| Energy — Alternate Sources | | | 1.6 | % | |

| Diversified Financial | | | 1.6 | % | |

| Aerospace & Defense | | | 1.3 | % | |

| Entertainment | | | 1.3 | % | |

| Telephone Utilities | | | 1.2 | % | |

| Leisure Time | | | 1.2 | % | |

| Coal | | | 1.1 | % | |

| Manufacturing | | | 1.0 | % | |

| Environmental Controls | | | 1.0 | % | |

| Engineering & Construction | | | 1.0 | % | |

| Household Products | | | 0.9 | % | |

| Electronics | | | 0.9 | % | |

| Telecommunications | | | 0.8 | % | |

| Hand & Machine Tools | | | 0.7 | % | |

| Banks | | | 0.6 | % | |

Total Long-Term

Investments | | | 92.6 | % | |

Short-Term Investments

and Other Assets and

Liabilities | | | 7.4 | % | |

| | | | 100.0 | % | |

MML Emerging Growth Fund

Ten Largest Stock Holdings

(% of Net Assets) on 12/31/07

| Priceline.com, Inc. | | | 3.1 | % | |

| Deckers Outdoor Corp. | | | 2.8 | % | |

| Synaptics, Inc. | | | 2.4 | % | |

| Terra Industries, Inc. | | | 2.3 | % | |

| Blue Coat Systems, Inc. | | | 2.3 | % | |

| Perrigo Co. | | | 2.2 | % | |

| United Therapeutics Corp. | | | 2.2 | % | |

| FTI Consulting, Inc. | | | 2.2 | % | |

| Arena Resources, Inc. | | | 2.0 | % | |

| LKQ Corp. | | | 1.9 | % | |

23

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

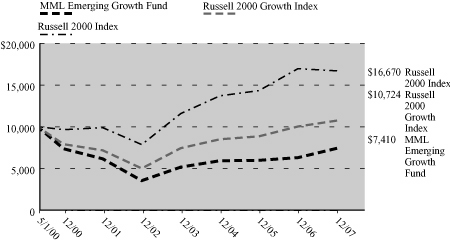

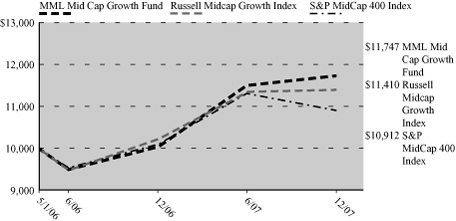

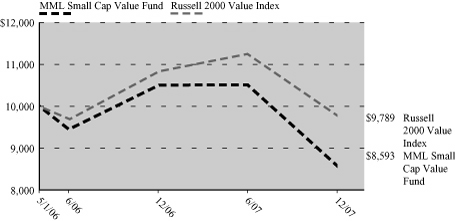

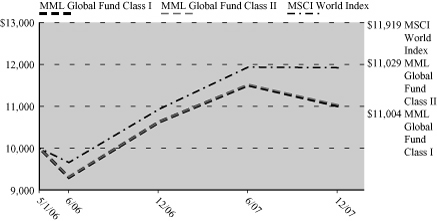

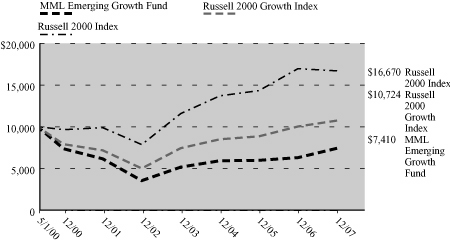

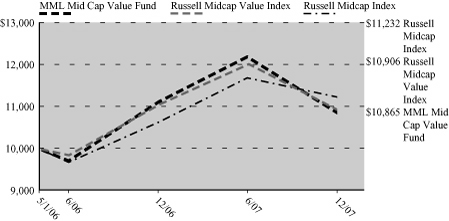

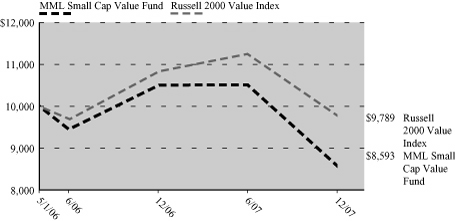

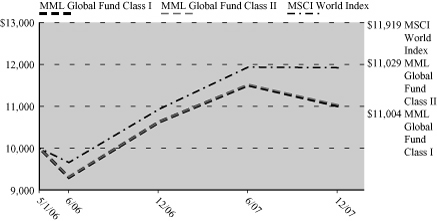

Growth of a $10,000 Investment

Hypothetical Investments in MML Emerging Growth Fund, the Russell 2000 Growth Index and the Russell 2000 Index.

MML Series Investment Fund

Total Returns

| | | One Year

1/1/07 -

12/31/07 | | Five Year

Average

Annual

1/1/03 -

12/31/07 | | Since

Inception

Average

Annual

5/1/00 -

12/31/07 | |

MML Emerging

Growth Fund | | | 17.81 | % | | | 15.92 | % | | | (3.83 | )% | |

| Russell 2000 Growth Index | | | 7.06 | % | | | 16.50 | % | | | 0.92 | % | |

| Russell 2000 Index | | | (1.56 | )% | | | 16.25 | % | | | 6.89 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 2000 Growth Index and the Russell 2000 Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges. The inclusion of these charges would have reduced the performance shown here.

24

MML Large Cap Value Fund – Portfolio of Investments

December 31, 2007

| | | Number of

Shares | | Market

Value | |

| EQUITIES — 96.3% | |

| COMMON STOCK — 96.3% | |

| Agriculture — 3.9% | |

| Altria Group, Inc. | | | 148,300 | | | $ | 11,208,514 | | |

| Banks — 6.3% | |

The Bank of New York

Mellon Corp. | | | 81,500 | | | | 3,973,940 | | |

Commerce

Bancorp, Inc.(a) | | | 39,600 | | | | 1,510,344 | | |

| HSBC Holdings PLC GBP | | | 88,728 | | | | 1,500,050 | | |

| State Street Corp. | | | 8,100 | | | | 657,720 | | |

| Wachovia Corp. | | | 121,079 | | | | 4,604,634 | | |

| Wells Fargo & Co. | | | 202,600 | | | | 6,116,494 | | |

| | | | 18,363,182 | | |

| Beverages — 1.9% | |

Diageo PLC Sponsored

ADR (United Kingdom) | | | 39,500 | | | | 3,390,285 | | |

Heineken Holding NV

Cl. A EUR | | | 38,550 | | | | 2,186,247 | | |

| | | | 5,576,532 | | |

| Building Materials — 0.8% | |

Martin Marietta

Materials, Inc.(a) | | | 17,700 | | | | 2,347,020 | | |

| Coal — 0.8% | |

| China Coal Energy Co. HKD | | | 806,700 | | | | 2,478,528 | | |

| Commercial Services — 3.4% | |

| Block (H&R), Inc. | | | 125,400 | | | | 2,328,678 | | |

| Cosco Pacific Ltd. HKD | | | 270,600 | | | | 714,880 | | |

| Iron Mountain, Inc.(b) | | | 129,699 | | | | 4,801,457 | | |

| Moody's Corp. | | | 55,700 | | | | 1,988,490 | | |

| | | | 9,833,505 | | |

| Computers — 1.8% | |

| Dell, Inc.(b) | | | 124,600 | | | | 3,053,946 | | |

| Hewlett-Packard Co. | | | 43,600 | | | | 2,200,928 | | |

| | | | 5,254,874 | | |

| Cosmetics & Personal Care — 1.6% | |

| Avon Products, Inc. | | | 32,900 | | | | 1,300,537 | | |

| The Procter & Gamble Co. | | | 47,500 | | | | 3,487,450 | | |

| | | | 4,787,987 | | |

| Diversified Financial — 11.6% | |

| American Express Co. | | | 233,300 | | | | 12,136,266 | | |

| Ameriprise Financial, Inc. | | | 53,680 | | | | 2,958,305 | | |

| Citigroup, Inc. | | | 86,500 | | | | 2,546,560 | | |

| Discover Financial Services | | | 12,400 | | | | 186,992 | | |

E*TRADE

Financial Corp.(a) (b) | | | 16,400 | | | | 58,220 | | |

| | | Number of

Shares | | Market

Value | |

| JP Morgan Chase & Co. | | | 242,916 | | | $ | 10,603,283 | | |

Merrill Lynch & Co., Inc.,

Restricted Private

Placement (Acquired

12/24/2007,

Cost $3,926,400)(b) (c) (h) | | | 81,800 | | | | 3,824,150 | | |

| Morgan Stanley | | | 25,600 | | | | 1,359,616 | | |

| | | | 33,673,392 | | |

| Electronics — 1.8% | |

Agilent

Technologies, Inc.(b) | | | 47,900 | | | | 1,759,846 | | |

| Tyco Electronics Ltd. | | | 93,860 | | | | 3,485,022 | | |

| | | | 5,244,868 | | |

| Foods — 0.2% | |

| The Hershey Co. | | | 12,400 | | | | 488,560 | | |

| Health Care – Products — 1.5% | |

| Covidien Ltd. | | | 98,060 | | | | 4,343,077 | | |

| Health Care – Services — 1.1% | |

| UnitedHealth Group, Inc. | | | 55,300 | | | | 3,218,460 | | |

| Holding Company – Diversified — 0.8% | |

China Merchants

Holdings International

Co. Ltd. HKD | | | 401,409 | | | | 2,449,574 | | |

| Housewares — 0.1% | |

| Hunter Douglas NV EUR | | | 5,303 | | | | 393,708 | | |

| Insurance — 15.2% | |

Ambac Financial

Group, Inc.(a) | | | 23,700 | | | | 610,749 | | |

American International

Group, Inc. | | | 189,150 | | | | 11,027,445 | �� | |

| Aon Corp. | | | 37,800 | | | | 1,802,682 | | |

Berkshire

Hathaway, Inc. Cl. A(b) | | | 81 | | | | 11,469,600 | | |

| Loews Corp. | | | 141,300 | | | | 7,113,042 | | |

| Markel Corp.(b) | | | 495 | | | | 243,095 | | |

| MBIA, Inc.(a) | | | 21,200 | | | | 394,956 | | |

| Millea Holdings, Inc. JPY | | | 53,200 | | | | 1,793,116 | | |

Nipponkoa

Insurance Co., Ltd. JPY | | | 23,600 | | | | 213,393 | | |

Principal Financial

Group, Inc. | | | 16,200 | | | | 1,115,208 | | |

| Progressive Corp. | | | 251,250 | | | | 4,813,950 | | |

| Sun Life Financial, Inc.(a) | | | 8,140 | | | | 455,352 | | |

| Transatlantic Holdings, Inc. | | | 42,013 | | | | 3,053,085 | | |

| | | | 44,105,673 | | |

| Internet — 1.2% | |

| Amazon.com, Inc.(b) | | | 10,600 | | | | 981,984 | | |

| Google, Inc. Cl. A(b) | | | 2,430 | | | | 1,680,296 | | |

| | | Number of

Shares | | Market

Value | |

Liberty Media Holding Corp.

Interactive Cl. A(a) (b) | | | 40,700 | | | $ | 776,556 | | |

| | | | 3,438,836 | | |

| Leisure Time — 1.1% | |

| Harley-Davidson, Inc. | | | 67,100 | | | | 3,134,241 | | |

| Manufacturing — 1.3% | |

| Tyco International Ltd. | | | 99,160 | | | | 3,931,694 | | |

| Media — 4.8% | |

Comcast Corp.

Special, Cl. A(b) | | | 341,950 | | | | 6,196,134 | | |

| Lagardere S.C.A. SA EUR | | | 18,800 | | | | 1,411,064 | | |

Liberty Media Holding

Corp. Capital Cl. A(b) | | | 8,315 | | | | 968,614 | | |

| News Corp., Inc. Cl. A | | | 230,350 | | | | 4,719,872 | | |

WPP Group PLC

Sponsored ADR

(United Kingdom)(a) | | | 8,500 | | | | 546,465 | | |

| | | | 13,842,149 | | |

| Mining — 1.2% | |

| BHP Billiton PLC GBP | | | 23,200 | | | | 720,212 | | |

| Rio Tinto PLC GBP | | | 8,300 | | | | 876,394 | | |

| Vulcan Materials Co.(a) | | | 22,700 | | | | 1,795,343 | | |

| | | | 3,391,949 | | |

| Oil & Gas — 15.2% | |

Canadian Natural

Resources Ltd.(a) | | | 50,100 | | | | 3,664,314 | | |

| ConocoPhillips | | | 153,760 | | | | 13,577,007 | | |

| Devon Energy Corp. | | | 89,500 | | | | 7,957,445 | | |

| EOG Resources, Inc. | | | 76,400 | | | | 6,818,700 | | |

| Occidental Petroleum Corp. | | | 121,530 | | | | 9,356,595 | | |

| Transocean, Inc. | | | 19,579 | | | | 2,802,734 | | |

| | | | 44,176,795 | | |

| Packaging & Containers — 1.5% | |

| Sealed Air Corp. | | | 193,900 | | | | 4,486,846 | | |

| Pharmaceuticals — 1.5% | |

| Cardinal Health, Inc. | | | 37,800 | | | | 2,182,950 | | |

| Express Scripts, Inc.(b) | | | 29,600 | | | | 2,160,800 | | |

| | | | 4,343,750 | | |

| Real Estate — 0.1% | |

Hang Lung

Development Co. HKD | | | 67,000 | | | | 360,969 | | |

| Retail — 9.4% | |

| Bed Bath & Beyond, Inc.(b) | | | 49,400 | | | | 1,451,866 | | |

| Carmax, Inc.(a) (b) | | | 87,470 | | | | 1,727,533 | | |

| Costco Wholesale Corp. | | | 198,800 | | | | 13,868,288 | | |

| CVS Caremark Corp. | | | 104,698 | | | | 4,161,746 | | |

(Continued)

The accompanying notes are an integral part of the financial statements.

25

MML Large Cap Value Fund – Portfolio of Investments (Continued)

| | | Number of

Shares | | Market

Value | |

| Lowe's Companies, Inc. | | | 43,700 | | | $ | 988,494 | | |

| Sears Holdings Corp.(a) (b) | | | 4,100 | | | | 418,405 | | |

| Wal-Mart Stores, Inc. | | | 100,400 | | | | 4,772,012 | | |

| | | | 27,388,344 | | |

| Semiconductors — 0.7% | |

| Texas Instruments, Inc. | | | 62,700 | | | | 2,094,180 | | |

| Software — 3.0% | |

| Dun & Bradstreet Corp. | | | 11,450 | | | | 1,014,814 | | |

| Microsoft Corp. | | | 214,500 | | | | 7,636,200 | | |

| | | | 8,651,014 | | |

| Telecommunications — 1.5% | |

SK Telecom Co. Ltd.

ADR (South Korea) | | | 47,300 | | | | 1,411,432 | | |

| Sprint Nextel Corp. | | | 161,700 | | | | 2,123,121 | | |

| Virgin Media, Inc. | | | 52,197 | | | | 894,657 | | |

| | | | 4,429,210 | | |

| Transportation — 1.0% | |

| Asciano Group AUD | | | 25,600 | | | | 156,727 | | |

Kuehne & Nagel

International AG CHF | | | 10,100 | | | | 969,342 | | |

| Toll Holdings, Ltd. AUD | | | 35,917 | | | | 359,783 | | |

United Parcel

Service, Inc. Cl. B | | | 18,200 | | | | 1,287,104 | | |

| | | | 2,772,956 | | |

TOTAL EQUITIES

(Cost $232,286,858) | | | 280,210,387 | | |

| | | Principal

Amount | | | |

| SHORT-TERM INVESTMENTS — 7.3% | |