UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3462

The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2004

Date of reporting period: June 30, 2004

Item 1. Report to Stockholders.

The Flex-funds

The Muirfield Fund ®

The Dynamic Growth Fund

The Aggressive Growth Fund

The Total Return Utilities Fund

The Highlands Growth Fund ®

The U.S. Government Bond Fund

The Money Market Fund

2004 Semiannual Report

June 30, 2004

The Flex-funds

Managed by Meeder Asset Management, Inc.

6125 Memorial Drive, Dublin Ohio, 43017

Call Toll Free 800-325-3539 | 614-760-2159

Fax: 614-766-6669 | www.flexfunds.com

Email: flexfunds@meederfinancial.com

| | |

2004 Semiannual Report | June 30, 2004 | | The Flex-funds |

2004 Semiannual Report

Table of Contents

Page 1

| | |

The Flex-funds | | 2004 Semiannual Report | June 30, 2004 |

Robert Meeder, Jr.

President

Meeder Asset Management, Inc.

Letter to Shareholders

Stocks have trended sideways for most of the year so far, bound within a narrow trading range as investors grappled with many uncertainties, from the future direction of interest rates to political transition both at home and abroad. In the 2nd Quarter, activity in the equity market can be best described as a “whipsaw”: a short-term correction in April and May was followed by a quick rebound in June. Despite the volatility, a few leaders have emerged thus far in 2004: small- and mid-cap stock indices have outperformed the overall market, and large-cap value indices have demonstrated relative strength. Meanwhile, emerging markets and precious metals, which had performed well during last year’s rally, fell back in the first half of this year. Bond investors were hit hard in the 2nd Quarter, as the value of fixed income securities declined with the across-the-board rise in interest rates. Much of this activity in the bond market was expected, as investors anticipated the Federal Reserve’s quarter-point hike in the Fed funds target rate on June 30th.

Investment conditions have changed significantly from June 30th of last year to June 30th of this year. Last year, the liquidity-fueled equity rally was in its early stages, fired by the double-barrel effects of highly stimulative fiscal and monetary policies and growing improvement in the economy. Today, many of the conditions that energized last year’s favorable market performance remain in place. However, the market may have already discounted any future economic growth and improvement in corporate earnings. In addition, concerns over rising interest rates, rising inflation, and political uncertainty are clouding the investment horizon. These factors and others impacted the market in the first half of 2004, and will likely influence investor sentiment in the next six months of the year:

| | • | The Stock Market: Last year’s rally was supported by strong uptrends in several internal indicators of market performance. Market breadth expanded in the second half of 2003, as more stocks advanced on a daily basis than declined. Also, the trend in new 52-week highs gradually improved, while very few stocks were hitting new 52-week lows. So far this year, the uptrend in the equity market has stalled while the major indices entered a consolidation pattern. The number of stocks hitting new 52-week lows has expanded (mainly interest-rate sensitive issues such as preferred stocks, closed-end bond funds, etc.) as new 52-week highs have dropped off slightly. Advance/decline statistics have consolidated along with the major market indices, but have not corrected. Although the trends among various internal indicators have changed over the last twelve months, they continue to support a positive risk/reward relationship in the stock market. |

| | • | Interest Rates: On June 30th of last year, interest rates hovered at 45- year lows, thanks to an accommodative monetary policy by the Federal Reserve Board. The favorable interest rate environment had produced a surge of home construction and mortgage refinancing. Low interest rates also aided businesses and consumers, who benefited from reduced borrowing costs. |

On June 30th of this year, the Federal Reserve raised the Fed funds target rate by one-quarter of one percent to 1.25%. This rate hike was hardly a surprise, since investors had been anticipating the increase for some time. In January, the Fed had prompted the notion among investors that the days of an accommodative monetary policy were numbered, by omitting the words “for a considerable period” when discussing their intention to leave interest rates at their then-current level. Rates began rising across the board in March, most dramatically among bonds of longer maturities,

Page 2

| | |

2004 Semiannual Report | June 30, 2004 | | The Flex-funds |

when data began to show continued improvement in the economy, particularly in the employment markets. The market consensus at present says that the Federal Reserve is just beginning what will likely become a series of rate increases. But even if rates rise at a modest pace (as we expect,) they should remain low on an absolute basis and allow for continued economic growth and price stability.

Even if rates rise at a modest pace (as we expect,) they should remain low on an absolute basis and allow for continued economic growth and price stability.

| | • | Inflation: Inflation had been muted for most of last year, even with the effects of double-barreled fiscal and monetary stimulus pumping money into the economy. The Fed had been engaged in a 20-year war against inflation, beginning back in 1982 when Paul Volker was at the helm of the central bank. Last year, when Alan Greenspan and his band of Fed governors began worrying less about inflation and more about the threat of deflation, it essentially signaled the end of the war on inflation and the start of a new role for the Federal Reserve – that of keepers of the peace, charged with maintaining price stability consistent with solid economic growth. |

Energy prices were particularly volatile last quarter, as the price of oil climbed to more than $42 a barrel and U.S. gasoline prices rose to an average of $2.10 per gallon. Rising energy prices act like a tax on businesses and consumers, siphoning dollars that would otherwise be spent on goods and services or counted as earnings. Oil prices came down modestly from their highs as the 2nd Quarter ended. Drivers experienced some relief as well, as prices at the gas pumps declined even as the peak summer driving season approached. Increases in output from OPEC member countries, and in particular from the start-up of production in Iraq, helped ease some of the upward pressure on oil prices, although vulnerabilities in the supply chain, such as tanker shortages or sabotage on oil pipelines, may lead to continued volatility in the future.

| | • | Economic Recovery: The second half of last year saw the U.S. economic recovery accelerate at a robust pace. The GDP growth rate was clocked at 8.2% in the 3rd Quarter of 2003 – the fastest pace of economic growth in nearly 20 years – and continued to post strong numbers in subsequent quarters. Nearly all measurements of economic health indicated positive conditions for the U.S. economy over the last 12 months: gains were made in productivity, manufacturing, consumer confidence, and retail sales, among other indicators. Corporations were also doing well, registering record profits in 2003 and announcing improving quarterly earnings. The only holdout was employment, which in typical fashion lagged other economic indicators during the blossoming recovery. Improvement in the job market finally fell into place in the 2nd Quarter of 2004, with robust employment growth figures reported for March, April, and May. The economic recovery, which reportedly was on shaky ground earlier this year, now seems strong enough to roll on through the rest of this year. However, the market may have discounted most or all of the recovery already. |

| | • | U.S. Dollar: The value of the U.S. dollar relative to other currencies had declined considerably in 2003. The dollar’s depreciation rippled through many sectors of the economy, hurting foreign investors who saw the value of their U.S. investments lose value, but aiding domestic exporters who gained a degree of pricing power in overseas markets. The dollar took an upswing in the 2nd Quarter, breaking its long-term down trend. This reversal was felt in the precious metals markets, as gold prices dropped from a high of $433 per ounce on April 1st to a low of $375 per ounce on May 10th. |

Continued on Page 4

Page 3

| | |

| The Flex-funds | | 2004 Semiannual Report | June 30, 2004 |

Letter to Shareholders Continued from Page 3

The market now sees, with the emergence of Kerry, the likelihood of a more contentious campaign this November.

| | • | Taxes: On May 28th of last year, President Bush signed the Jobs & Growth Tax Relief Reconciliation Act, adding fiscal stimulus to the accommodative monetary policy of low interest rates as a means of jump-starting the economic recovery. The legislation lowered taxes for nearly all taxpayers, as well as offered benefits to investors including reduced tax rates on capital gains and qualified dividends. Some of the effects of the tax cut were felt immediately, such as the child tax credit rebate checks that were forwarded to parents with minor children last summer. The passage of tax relief sparked the strong stock market rally that ensued in the second half of 2003 and provided a boost to the economy at a critical time. Today, the markets continue to benefit from the positive results of the tax cut, although the market has largely discounted these effects already. |

| | • | Political Transition: As we have noted in previous commentaries, the third year has historically been the best year of the four-year presidential cycle for the stock market. Last year, stocks experienced strong gains consistent with this historical pattern. This year, the possibility of transition in the Oval Office creates an environment of uncertainty which could work against the markets. In fact, the stock market appeared to have entered its current trading range around the same time that John Kerry became the likely Democratic nominee for this fall’s presidential election. Where the market once saw a landslide re-election for George Bush over former Democratic front-runner Howard Dean, now it sees with the emergence of Kerry the likelihood of a more contentious campaign this November. |

Another transition that will be on the minds of many citizens over the next six months is the handover of authority in Iraq to a sovereign government of Iraqi citizens, which occurred officially on June 28th. Ongoing bloodshed and turmoil in parts of the country present substantial risks to the successful transfer of power, with the markets and the rest of the world watching the outcome closely. A worsening of the situation in Iraq, or any terrorist attacks within the U.S. or elsewhere in the world, would likely have an adverse impact on market conditions.

Looking ahead, the major events on the horizon that may sway the direction of the investment markets in the second half of the year are rising interest rates, progress in Iraq and the war on terror, and the upcoming presidential election. The market has already begun to discount future interest rate increases, but many will be watching just how far and how fast the Federal Reserve will go in raising short-term interest rates. Additionally, the developing political situations both at home and abroad, and the ever-present possibility of a terrorist attack are also likely to affect investors’ attitudes and expectations for the future. As always, we will continue to monitor market conditions on a daily basis and employ our disciplines to manage the Funds according to your expectations.

|

Sincerely, |

|

|

Robert Meeder, Jr. |

President |

Meeder Asset Management, Inc. |

August 24, 2004 |

Page 4

| | |

2004 Semiannual Report | June 30, 2004 | | The Flex-funds |

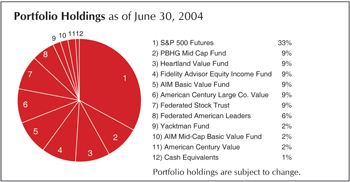

The Muirfield Fund

Performance Perspective

| | | | | | | | | | | | | | | | | | |

Period & Average Annual Total Returns as of June 30, 2004

| | 2004

YTD

| | | 1

year

| | | 3

years

| | | 5

years

| | | 10

years

| | | Since

Inception

| |

The Muirfield Fund | | 3.55 | % | | 21.87 | % | | 3.62 | % | | -2.10 | % | | 7.69 | % | | 8.98 | %1 |

S&P 500 Index3 | | 3.44 | % | | 19.10 | % | | -0.69 | % | | -2.20 | % | | 11.82 | % | | 10.96 | %2 |

Morningstar’s Average Asset Allocation Fund4 | | 1.72 | % | | 12.90 | % | | 2.18 | % | | 2.23 | % | | 8.26 | % | | 9.16 | %2 |

| 1 | Inception Date: 8/10/88. |

| 2 | Average annual total return from 8/1/88 to 6/30/04. |

Source for index and average fund data: Morningstar, Inc.

Semiannual Market Perspective

Robert S. Meeder, Sr.

Portfolio Manager

Kevin J. Kranz

Asst. Portfolio Manager

The U.S. equity markets were more volatile during the 2nd Quarter than the quarter-end performance indicates. During the three-month period, the stock market went through a corrective stage, as the S&P 500 Index, Dow Jones Industrial Average, and the Nasdaq Composite Index lost 5.5%, 5.9%, and 9.7% respectively from their quarterly highs to their low points in mid-May. Then, the major equity indices rebounded through the end of June, resulting in marginal gains for the quarter.

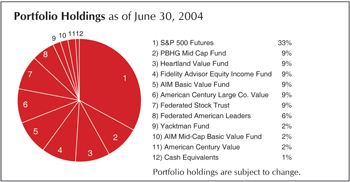

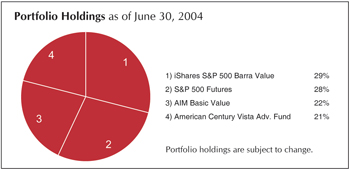

The Muirfield Fund reacted to the decline by holding a defensive position in cash of 35% of total assets until after the middle of May. At that point, the Fund returned to a fully-invested position in the stock market. In addition to adopting these defensive positions, the Fund was also structured to be less volatile than it was last year. This year, we hold more large-cap funds, and our holdings are tilted more toward value than growth. At quarter end, The Muirfield Fund returned 3.55% year-to-date. Over the same period, the S&P 500 Index returned 3.44%, and the average asset allocation fund returned 1.72%, according to Morningstar, Inc.

Investors had many geopolitical and economic factors to consider during the quarter. Some of the highlights include the government handover in Iraq, an expected rise in short-term interest rates thanks to the Federal Reserve, mixed economic data, the threat of inflation, expansion of terrorism into Saudi Arabia, and higher oil prices. These are challenging events for investors to navigate, but the market worked through the majority of these concerns to end the quarter on an up-note.

Nobody knows what tomorrow holds, but the market normally does a good job of discounting the future. Since the beginning of the year, the market has been trading in a narrow range and has not given clear indications of its future direction, even though on balance there has been a positive bias to the market. The uncertainty can be attributed to any combination of the aforementioned fears, but as evident in the market’s overall price action thus far this year, it is clear that the market is less optimistic now than it was last year. Plus, the market may have already discounted the recent improvement in the U.S. economy during the strong advance of the last 5 quarters. Either way, our defensive equity discipline is intended to protect investors’ assets on the down side while seeking to participate in market advances.

Past performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended June 30, 2004, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Expenses were reimbursed and/or management fees were waived in order to reduce the operating expenses of The Muirfield Fund during the periods shown above.

| 3 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 4 | An index of funds such as Morningstar’s Average Asset Allocation Fund index includes a number of mutual funds grouped by investment objective. Each of those funds interprets that objective differently, and each employs a different management style and investment strategy. |

Page 5

| | |

| The Flex-funds | | 2004 Semiannual Report | June 30, 2004 |

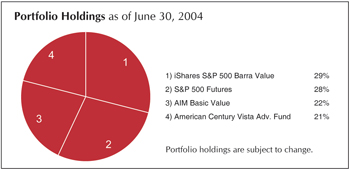

The Dynamic Growth Fund

Performance Perspective

| | | | | | | | | | | | |

Period & Average Annual Total Returns as of June 30, 2004

| | 2004

YTD

| | | 1

year

| | | 5

years

| | | Since

Inception

| |

The Dynamic Growth Fund | | -1.96 | % | | 18.99 | % | | — | | | -6.04 | %1 |

Meeder Asset Management, Inc. Growth Accounts Composite 4 | | -1.08 | % | | 20.99 | % | | 2.29 | % | | 12.47 | %2 |

S&P 500 Index 5 | | 3.44 | % | | 19.10 | % | | -2.20 | % | | -2.58 | %3 |

Morningstar’s Average Growth Fund 6 | | 3.48 | % | | 20.15 | % | | 0.15 | % | | -2.89 | %3 |

| 1 | Inception Date: 2/29/00. |

| 2 | Inception Date: 12/31/94. |

| 3 | Average annual total return from 3/1/00 to 6/30/04. |

Source for index and average fund data: Morninstar, Inc.

Semiannual Market Perspective

Robert M. Wagner, CFA

Portfolio Manager

During the stock market rally in the 12-month period from March 31, 2003 to March 31, 2004, The Dynamic Growth Fund outperformed the major equity market indices and its peer group, thanks in part to our allocation targeting the small- and mid-cap stock funds and funds closely correlated to the Nasdaq Composite Index. These areas of the market were the leaders during this rally, which was characterized by a strongly trending market that rewarded a patient approach in executing our discipline. During this period, every short-term correction resulted in a rally that surpassed the level reached prior to the correction. The best strategy in this kind of environment is to be patient and buy the market leading funds, holding them as long as the relative strength and trends exist.

However, as market conditions rapidly transitioned from one of a trending market to a sideways market this past quarter, the patient approach that worked so well over the 12-month period ending March 31, 2004 worked instead to the detriment of the Fund. Early in the 2nd Quarter, the previous leaders quickly became laggards, and rallies that used to carry the funds above previous highs failed to do so as the choppy markets became range-bound. Changes were made to the Fund to adjust to this new environment, eliminating or reducing the more volatile holdings and adding less volatile ones. In hindsight, the timing of the changes was not optimal for the market conditions that followed, and resulted in disappointing performance for the quarter. These conditions contributed to the Fund’s underperformance relative to its benchmark for the first half of 2004.

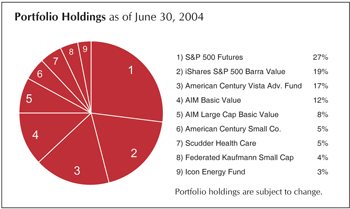

At the midpoint of the year, the Fund is targeting large-cap value funds, with some exposure to mid- and small-cap funds as well. Looking forward, we are waiting for the markets to emerge from their current trading ranges, and will adjust the portfolio accordingly. While these transitional periods can be difficult for our relative strength discipline, fortunately they are few and far between and can be overcome during periods when the market is demonstrating a clearer trend, which is typically the majority of the time. We are confident that our investment discipline will continue to allow the Fund to provide investors with returns that outpace its benchmarks over the long-term.

Past performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended June 30, 2004, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Expenses were reimbursed and/or management fees were waived in order to reduce the operating expenses of The Dynamic Growth Fund during the periods shown above.

| 4 | The returns for the Meeder Asset Management, Inc. Growth Accounts Composite represent a composite of the private accounts managed by Meeder Asset Management, Inc., manager of The Flex-funds, which employ a similar investment strategy to The Dynamic Growth Fund, and are net of investment advisory fees. We have included the returns of these privately-managed accounts to present the long-term performance of the investment strategies employed by The Dynamic Growth Fund. Please refer to the disclosure on page 12 for a description of what these returns represent and what they do not represent. |

| 5 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 6 | An index of funds such as Morningstar’s Average Growth Fund index includes a number of mutual funds grouped by investment objective. Each of those funds interprets that objective differently, and each employs a different management style and investment strategy. |

Page 6

| | |

2004 Semiannual Report | June 30, 2004 | | The Flex-funds |

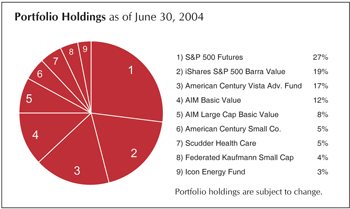

The Aggressive Growth Fund

Performance Perspective

| | | | | | | | | | | | |

Period & Average Annual Total Returns

as of June 30, 2004

| | 2004

YTD

| | | 1

year

| | | 5

years

| | | Since

Inception

| |

The Aggressive Growth Fund | | -2.41 | % | | 19.96 | % | | — | | | -9.45 | %1 |

Meeder Asset Management, Inc. | | | | | | | | | | | | |

Aggressive Growth Accounts Composite 4 | | -1.99 | % | | 20.53 | % | | 2.54 | % | | 12.80 | %2 |

Morningstar’s Average Aggressive Growth Fund5 | | 4.02 | % | | 22.02 | % | | 0.62 | % | | -10.33 | %3 |

Nasdaq Composite Index6 | | 2.22 | % | | 26.19 | % | | -5.28 | % | | -17.29 | %3 |

| 1 | Inception Date: 2/29/00. |

| 2 | Inception Date: 12/31/94. |

| 3 | Average annual total return from 3/1/00 to 6/30/04. |

Source for index and average fund data: Morningstar, Inc.

Semiannual Market Perspective

Robert M. Wagner, CFA

Portfolio Manager

During the 12-month period ending March 31, 2004, strong uptrends in the major stock market indices resulted in one of the best periods for equity investors in quite some time. Patience was rewarded throughout this rally as the market worked through minor corrections and climbed to higher ground. In particular, performance was exceptionally strong for the Nasdaq Composite Index as well as small- and mid-cap stocks, and we targeted these areas of the market for investment in The Aggressive Growth Fund. Our relative strength strategy helped the Fund significantly outperform both the major equity market indices and its peer group during this period.

The 2nd Quarter of 2004 was very much unlike the previous 12-month period, as the stock market exhibited corrective and choppy performance. The laggards of last year became the better performing groups over the last three months. The best example of this rotation is the recent strength of value stocks and the relative weakness of the high-tech stocks in the Nasdaq Composite Index.

Unfortunately, when we made our portfolio changes to adjust to the new conditions in the market, the volatility of the market accelerated and worked against our trades. The end result was a loss for the 2nd Quarter that eliminated our gains of the 1st Quarter. These conditions contributed to the Fund’s underperformance relative to its benchmark for the first six months of the year.

It is important to note that these sharp changes in market leadership occur infrequently, and we strive to overcome the underperformance that results from these periods by seeking stronger performance over the long-term. The Fund will strive to achieve competitive returns over the long-term, despite these short-term challenges to our investment discipline.

Past performance does not guarantee future results. All performance figures represent period and average annual total returns for the periods ended June 30, 2004, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Expenses were reimbursed and/or management fees were waived in order to reduce the operating expenses of The Aggressive Growth Fund during the periods shown above.

| 4 | The returns for the Meeder Asset Management, Inc. Aggressive Growth Accounts Composite represent a composite of the private accounts managed by Meeder Asset Management, Inc., manager of The Flex-funds, which employ a similar investment strategy to The Aggressive Growth Fund. We have included the returns of these privately-managed accounts to present the long-term performance of the investment strategies employed by The Aggressive Growth Fund. Please refer to the disclosure on page 12 for a description of what these returns represent and what they do not represent. |

| 5 | An index of funds such as Morningstar’s Average Aggressive Growth Fund index includes a number of mutual funds grouped by investment objective. Each of those funds interprets that objective differently, and each employs a different management style and investment strategy. |

| 6 | The Nasdaq Composite Index is a broad-based capitalization-weighted index of all Nasdaq national market and small-cap stocks. The Nasdaq Composite Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

Page 7

| | |

The Flex-funds | | 2004 Semiannual Report | June 30, 2004 |

The Highlands Growth Fund

Performance Perspective

| | | | | | | | | | | | | | | |

Period & Average Annual Total

Returns as of June 30, 2004

| | 2004

YTD

| | | 1

year

| | | 5

years

| | | 10

years

| | | Since

Inception

| |

The Highlands Growth Fund | | 1.35 | % | | 15.36 | % | | -4.31 | % | | 7.39 | % | | 7.21 | %1 |

S&P 500 Index 3 | | 3.44 | % | | 19.10 | % | | -2.20 | % | | 11.82 | % | | 12.81 | %2 |

| 1 | Inception Date: 3/20/85. 2 Average annual total return from 3/29/85 to 6/30/04. Source for index data: Morningstar, Inc., Bloomberg |

Semiannual Market Perspective

William L. Gurner

Portfolio Manager

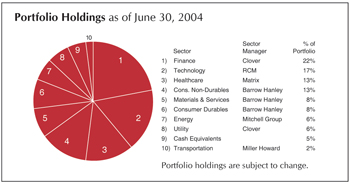

The Highlands Growth Fund gained 1.08% in the 2nd Quarter of 2004, bringing the Fund’s year-to-date return to 1.35%. In comparison, the S&P 500 Index rose 1.72% in the 2nd Quarter, for a yearto- date gain of 3.44%.

While it is good news that the stock market managed to show some progress in the first half of the year, what is amazing is that it was able to do so despite a raft of problems and uncertainties facing investors. Nearly every business and consumer had to deal with higher oil prices, higher interest rates, potentially higher inflation, and heavy debt burdens held by many Americans. On top of that, investors also had to tackle election year politics, fears of future terrorist attacks, and uncertainty regarding the length of our military’s continuing engagement in Iraq.

Thus far in 2004, we have sought to add value to investors and control their exposure to risk, by striving to reduce the number of stocks held in the Fund’s portfolio. At this midpoint of the year, we are holding approximately 115 stocks; one year ago, this number was nearly twice as much. Performance has lagged occasionally in the short term as we have cut back on the total number of our portfolio holdings. In the long run, we believe these efforts should aid shareholders, as we focus more of the Fund’s assets on the select stocks we feel are poised to grow in the future.

Our view on equities remains bullish. We believe that demand for U.S. stocks is as high as it has ever been, possibly higher. Price/earnings ratios have come down somewhat from where they were at the start of the year. And investors from around the world continue to invest their assets in U.S. equities. With higher inflation looming on the horizon, we believe equities continue to be one of the best long-term investments for producing real rates of return. We believe large-cap stocks will reap the benefits of the on-going positive economic conditions, and that our “sector neutral, style neutral” strategy will enable investors to take advantage of the opportunities that the market will present.

Past performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended June 30, 2004, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Expenses were reimbursed and/or management fees were waived in order to reduce the operating expenses of The Highlands Growth Fund during the periods shown above.

| 3 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

Page 8

| | |

2004 Semiannual Report | June 30, 2004 | | The Flex-funds |

The Total Return Utilities Fund

Performance Perspective

| | | | | | | | | | | | |

Period & Average Annual Total Returns

as of June 30, 2004

| | 2004

YTD

| | | 1

year

| | | 5

years

| | | Since

Inception

| |

The Total Return Utilities Fund | | 2.84 | % | | 10.51 | % | | -2.02 | % | | 7.09 | %1 |

S&P 500 Utilities Index 3 | | 3.79 | % | | 11.44 | % | | -2.01 | % | | 5.22 | %2 |

Average Utility Fund 4 | | 4.27 | % | | 14.98 | % | | -1.93 | % | | 7.58 | %2 |

| 1 | Inception Date: 6/21/95. 2 Average annual total return from 6/30/95 to 6/30/04. |

Source for index data: Bloomberg. Source for average fund data: Morningstar, Inc.

Semiannual Market Perspective

Lowell G. Miller

Portfolio Manager

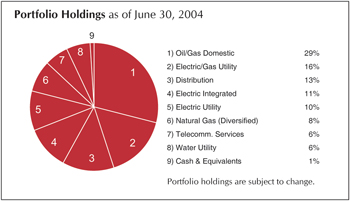

The Total Return Utilities Fund had a positive 2nd Quarter, even as the yield on 10-year U.S. Treasuries climbed over three-quarters of a percentage point. The Fund gained 0.66% for the 2nd Quarter, outperforming its new benchmark, the S&P 500 Utilities Index, which returned -1.31%. Year-to-date, the Fund has gained 2.84%, compared with the 3.77% year-to-date return of the S&P 500 Utilities Index.

Most of the Fund’s favorable performance for the 2nd Quarter came from our holdings among the exploration and pipeline (E&P) gas producers and from diversified utilities with natural gas production. We had been forecasting a new paradigm for natural gas prices in response to fundamental tightness in the supply and demand for gas in North America. Our early positioning of the Fund to overweight companies that stand to benefit from sustained higher natural gas prices has begun to pay off. Our more traditional electric and gas utilities lagged in the 2nd Quarter, more in line with the general utilities sector, but still were not especially problematic. Indeed, some of these companies have begun to look increasingly attractive on our valuation measures.

So far this year, it has been the lower quality or turnaround utility stocks that have led the benchmark index higher. In fact, the top ten performers in the S&P 500 Utilities Index are unavailable to the Fund to invest in, due to the fact that they either engage in nuclear power generation (which is against our socially responsible investment policy) or are of low financial quality. We did well to stay within one percentage-point of the index without holding the benchmark leaders.

We are pleased with the Fund’s balance of conservative, regulated utilities that steadily increase their dividends, as well as our diversified utility holdings that have exposure to rising gas prices. Further, our holdings in the E&P gas sector are working well, with significant upside potential if natural gas prices remain high. With earnings from our conservative utilities holdings likely to benefit from an improving economy and hotter weather in the summer forecast, we believe that steady dividend increases may insulate the Fund from any interest-rate induced malaise.

Past performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended June 30, 2004, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Expenses were reimbursed and/or management fees were waived in order to reduce the operating expenses of The Total Return Utilities Fund during the periods shown above. Because The Total Return Utilities Fund concentrates its investments in public utility companies, the value of the Fund’s shares may fluctuate more than if invested in a greater number of industries. Changes in interest rates may also affect the value of utility stocks, and rising interest rates can be expected to reduce the Fund’s net asset value.

| 3 | The S&P 500 Utilities Index is an unmanaged index of 33 utility sector stocks. This index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. The S&P 500 Utilities Index replaces the Fund’s previous benchmark, the New York Stock Exchange Utilities Index, which was discontinued at the start of this year. |

| 4 | An index of funds such as Morningstar’s Average Utility Fund index includes a number of mutual funds grouped by investment objective. Each of those funds interprets that objective differently, and each employs a different management style and investment strategy. |

Page 9

| | |

The Flex-funds | | 2004 Semiannual Report | June 30, 2004 |

The U.S. Government Bond Fund

Performance Perspective

| | | | | | | | | | | | | | | |

Period & Average Annual Total Returns

as of June 30, 2004

| | 2004

YTD

| | | 1

year

| | | 5

years

| | | 10

years

| | | Since

Inception

| |

The U.S. Government Bond Fund | | -0.47 | % | | -3.56 | % | | 3.12 | % | | 5.11 | % | | 6.01 | %1 |

Lehman Bros. Intermediate Government/Credit Index 2 | | -0.10 | % | | -0.06 | % | | 6.75 | % | | 6.89 | % | | n/a | |

Morningstar’s Average General U.S. Government Bond Fund3 | | -0.23 | % | | -0.77 | % | | 5.45 | % | | 5.82 | % | | n/a | |

| 1 | Inception Date: 5/9/85. Source for index and average fund data: Morningstar, Inc. |

Semiannual Market Perspective

Joseph A. Zarr

Co-Portfilio Manager

Christopher M. O’Daniel

Co-Portfilio Manager

For the 2nd Quarter of 2004, The Flex-funds U.S. Government Bond Fund returned –3.89%. Year-to-date, the Fund has returned –0.47%.

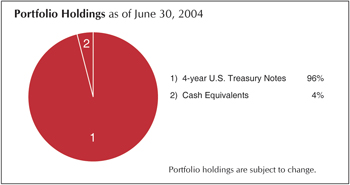

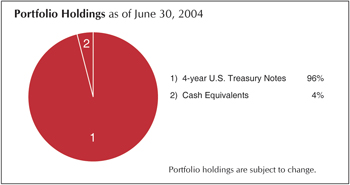

Our strategy for managing the Fund is to invest in longer- term securities when we believe rates are falling and bond prices are appreciating. When we believe rates are rising and prices are falling, we invest in short-term securities as a means of protecting investor capital during this high-risk market environment. We began the 2nd Quarter with an average maturity in the Fund of almost nine years, as the trend in bond prices was generally positive. Early on in the quarter, yields on 10-year notes rocketed more than one full percentage point over a 45-day period, from 3.8% on March 30th to over 4.8% in mid-May. In early April, the Fund began to transition away from the intermediate range of the market and focus on shorter-term maturities. In May, we shortened our average maturity even more, as the trend toward higher yields and lower prices persisted. Prior to and during the initial phases of the decline, the Fund’s average maturity was greater than that of its benchmark, resulting in the Fund’s underperformance relative to its benchmark for the first half of 2004. At the midpoint of the year, the average maturity of the Fund hovered around four years.

Our belief is that yields rose a bit too quickly as we entered mid-May and needed time to work off the momentum realized during the swift drop in prices for all fixed-income securities. A short-term reversal in prices to the upside would not be unexpected, as it appears as though the market moved too fast in too short a time. There may be times like these when it is advantageous to invest in longer-term securities for brief periods. But our underlying belief is that yields should continue higher for the remainder of the year. We would not be surprised to see the average maturity of the Fund reduced even more over the coming months.

Past performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended June 30, 2004, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Expenses were reimbursed and/or management fees were waived in order to reduce the operating expenses of The U.S. Government Bond Fund during the periods shown above.

| 2 | The Lehman Brothers Intermediate Government/Credit Index is an unmanaged index of fixed-rate bonds issued by the U.S. Government and its agencies that are rated investment grade or higher, have one to ten years remaining until maturity, and at least $100 million outstanding. The Lehman Brothers Intermediate Government/Credit Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 3 | An index of funds such as Morningstar’s Average General U.S. Government Bond Fund index includes a number of mutual funds grouped by investment objective. Each of those funds interprets that objective differently, and each employs a different management style and investment strategy. |

Page 10

| | |

2004 Semiannual Report | June 30, 2004 | | The Flex-funds |

The Money Market Fund

Performance Perspective

| | | | | | | | | | | | | | | |

Period & Average Annual Total Returns as of June 30, 2004

| | 2004 YTD

| | | 1 year

| | | 5 years

| | | 10 years

| | | Since Inception

| |

The Money Market Fund | | 0.41 | % | | 0.83 | % | | 3.14 | % | | 4.22 | % | | 5.26 | %1 |

Lipper’s Average General Purpose Money Market Fund3 | | 0.17 | % | | 0.35 | % | | 2.62 | % | | 3.81 | % | | 4.84 | %2 |

Current & Effective Yields | | 7-day simple yield: 0.88% | | | 7-day compound yield: 0.88% | |

| 1 | Inception Date: 3/27/85 2 Average Annual total return from 3/31/85 to 6/30/04. Source for average money market fund data: Lipper, Inc. |

As of June 30, 2004, yield quotations more closely reflect the earnings of The Money Market Fund than total return quotations.

Semiannual Market Perspective

Joseph A. Zarr

Co-Portfilio Manager

Christopher M. O’Daniel

Co-Portfilio Manager

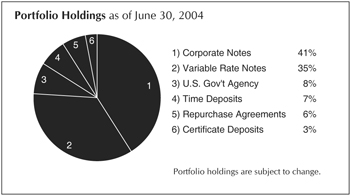

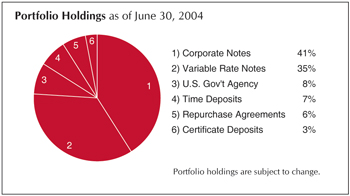

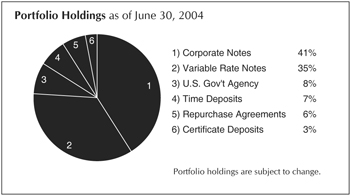

The Flex-funds Money Market Fund continued to provide investors with competitive yields throughout the 2nd Quarter of 2004. According to iMoneyNet, Inc., the Fund ranked among the top 10 general purpose money market funds for highest 12-month yield as of June 30, 2004.

For the year-to-date, the Fund has outperformed its peer group with a return of 0.41%, compared to the 0.17% year-to-date return of the average general purpose money market fund, according to Lipper, Inc.

Investors were finally able to see the light at the end of the interest rate tunnel during the 2nd Quarter, as short-term rates began to move upward. Economic statistics revealed rapid growth in the job market, while the new concern among investors turned to in-flation as opposed to the specter of deflation, which had held participants mesmerized for much of 2003.

In response to these and other market conditions, the Federal Reserve issued a quarter-point hike in the Fed funds target rate on the last day of the quarter, and suggested that future increases in rates would come at a “measured” pace. Federal Reserve watchers forwarded the argument that the Fed had fallen behind the curve by waiting so long to raise interest rates, highlighting the fact that short-term rates were already moving up at more than a measured pace, potentially leaving the projected incremental increases by Mr. Greenspan in the dust. Whether that happens to come about remains to be seen. For now, we expect gradual increases in the Fed funds target rate, continuing through the remainder of the year.

Our outlook calls for money market yields to increase through the end of the year, as they approach a more normal relationship with the rate of inflation. However, we are not among those money managers calling for an increase to the 3% level by year-end, since it may not be unlikely that the current pace of economic growth can be maintained over an extended period of time.

Past performance does not guarantee future results. Except for the current and effective yields, all performance figures represent average annual total returns for the periods ended June 30, 2004, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Expenses were reimbursed and/or management fees were waived in order to reduce the operating expenses of The Money Market Fund during the periods shown above. Investments in The Money Market Fund are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in The Money Market Fund.

| 3 | An index of funds such as Lipper’s Average General Purpose Money Market Fund index includes a number of mutual funds grouped by investment objective. Each of those funds interprets that objective differently, and each employs a different management style and investment strategy. |

Page 11

| | |

The Flex-funds | | 2004 Semiannual Report | June 30, 2004 |

PAST PERFORMANCE OF MEEDER ASSET MANAGEMENT, INC. GROWTH AND AGGRESSIVE GROWTH ACCOUNTS COMPOSITES

Purpose of Past Performance. The performance information on Pages 6 & 7 is provided to show the past performance of the advisor in managing substantially similar accounts to The Dynamic Growth Fund and The Aggressive Growth Fund.

What Past Performance Does Not Represent. The past performance shown on Pages 6 & 7 does not represent the performance of The Dynamic Growth Fund or The Aggressive Growth Fund. You should not consider the past performance for account composites shown on Pages 6 & 7 as an indication of the future performance of The Dynamic Growth Fund or The Aggressive Growth Fund.

Similar Accounts. Robert M. Wagner, CFA serves as the advisor’s portfolio manager for privately managed accounts having investment goals, policies, strategies and risks substantially similar to those of The Dynamic Growth Fund and The Aggressive Growth Fund. Substantially all of the assets of these privately managed accounts have invested in mutual funds.

Calculation of Past Performance. All returns presented were calculated on a total return basis and include all dividends and interest, accrued income and realized and unrealized gains and losses. All returns reflect the deduction of investment advisory fees, brokerage commissions and execution costs paid by the private accounts without providing for federal or state income taxes. Custodial fees, if any, were not used to reduce performance returns. The advisor’s composite includes all actual, fee paying, discretionary, private accounts managed by the advisor that have investment objectives, policies, strategies and risks substantially similar to those of The Dynamic Growth Fund and The Aggressive Growth Fund. Cash and equivalents are included in performance returns. The returns of the advisor’s composite combine the individual accounts’ returns by asset-weighting each individual account’s asset value as of the beginning of each quarter. The yearly returns are computed by linking the returns of each quarter within the calendar year.

Differences in Regulation. The private accounts that are included in the advisor’s composite are not subject to the same types of expenses to which The Dynamic Growth Fund or The Aggressive Growth Fund are subject nor to the diversification requirements, specific tax restrictions and investment limitations imposed on The Dynamic Growth Fund or The Aggressive Growth Fund by federal securities laws.

Page 12

| | |

2004 Semiannual Report | June 30, 2004 | | The Flex-funds |

2004 Semiannual Report

Portfolio Holdings &

Financial Statements

Page 13

Schedule of Investments

June 30, 2004 (unaudited)

The Muirfield Fund

| | | | | |

Security Description

| | Shares or

Principal

Amount ($)

| | Value ($)

| |

Registered Investment Companies — 63.0% | | | |

Aim Basic Value Fund — Class A # | | 179,977 | | 5,536,099 | |

Aim Mid Cap Basic Value

Fund — Class A # | | 90,924 | | 1,115,642 | |

American Century Large Company Value Fund — Class A | | 918,452 | | 5,492,342 | |

American Century Value Fund — Class A | | 140,805 | | 1,113,766 | |

Federated American Leaders

Fund — Class A | | 154,274 | | 3,637,766 | |

Federated Stock Trust Fund | | 155,606 | | 5,450,894 | |

Fidelity Advisor Equity Income

Fund — Class A | | 206,287 | | 5,534,681 | |

Heartland Value Fund | | 103,880 | | 5,534,752 | |

PBHG Mid-Cap Fund # | | 310,325 | | 5,545,499 | |

The Yacktman Fund | | 93,268 | | 1,442,859 | |

| | | | |

|

|

Total Registered Investment Companies (Cost $35,837,643) | | | | 40,404,300 | |

| | | | |

|

|

U.S. Government Obligations — 19.8% | | | |

U.S. Treasury Bills, 0.99%, due 07/01/04 * | | 11,500,000 | | 11,499,483 | |

U.S. Treasury Bills, 1.31%, due 09/30/04 * | | 1,200,000 | | 1,196,136 | |

| | | | |

|

|

Total U.S. Government Obligations

(Cost $12,695,570) | | | | 12,695,619 | |

| | | | |

|

|

Repurchase Agreements — 19.1% | | | |

Salomon Smith Barney, Inc., 1.55%, 07/01/04, (Collateralized by $12,497,524 various Commercial Paper, at 1.41%-1.44%, due 07/13/04-08/18/04,

value — $12,479,969) | | 12,235,000 | | 12,235,000 | |

| | | | |

|

|

Total Repurchase Agreements

(Cost $12,235,000) | | | | 12,235,000 | |

| | | | |

|

|

Total Investments — 101.9%

(Cost $60,768,213) (a) | | | | 65,334,919 | |

| | | | |

|

|

Liabilities less Other Assets — (1.9%) | | | | (1,157,759 | ) |

| | | | |

|

|

Total Net Assets — 100.0% | | | | 64,177,160 | |

| | | | |

|

|

Trustee Deferred Compensation ** | | | |

The Flex-funds Dynamic Growth Fund | | 2,716 | | 20,424 | |

The Flex-funds Highlands Growth Fund | | 2,786 | | 41,846 | |

The Flex-funds Muirfield Fund | | 9,292 | | 46,088 | |

The Flex-funds Total Return Utilities Fund | | 2,033 | | 29,621 | |

| | | | |

|

|

Total Trustee Deferred Compensation (Cost $148,099) | | | | 137,979 | |

| | | | |

|

|

| | | | |

Security Description

| | Long

Contracts

| | Unrealized

Appreciation

|

Futures Contracts | | | | |

Standard & Poors 500 expiring September 2004, notional value $21,097,400 | | 74 | | 36,596 |

| | | | |

|

Total Futures Contracts | | | | 36,596 |

| | | | |

|

| | (a) | | Represents cost for financial reporting purposes and may differ for federal income tax purposes by the amount of losses recognized in excess of federal income tax reporting. Cost for federal income tax purposes differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | |

Unrealized appreciation | | $ | 4,615,342 | |

Unrealized depreciation | | | (48,636 | ) |

| | |

|

|

|

Net unrealized appreciation (depreciation) | | $ | 4,566,706 | |

| | |

|

|

|

| # | | Represents non-income producing securities. |

| * | | Pledged as collateral on futures contracts. |

| ** | | Assets of affiliates to The Muirfield Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

See accompanying notes to financial statements.

The Flex-funds

14

Schedule of Investments

June 30, 2004 (unaudited)

The Total Return Utilities Fund

| | | | |

Security Description

| | Shares or

Principal

Amount ($)

| | Value ($)

|

Common Stocks — 99.2% | | | | |

| Electric/Gas Utility — 15.5% | | | | |

AGL Resources, Inc. | | 27,940 | | 811,657 |

ATMOS Energy Corp. | | 20,445 | | 523,392 |

MDU Resources Group, Inc. | | 35,565 | | 854,627 |

NiSource, Inc. | | 50,360 | | 1,038,423 |

| | | | |

|

| | | | | 3,228,099 |

| | | | |

|

| Electric Utility — 21.4% | | | | |

Cinergy Corp. | | 27,270 | | 1,036,260 |

Consolidated Edison, Inc. | | 5,085 | | 202,180 |

DPL, Inc. | | 20,375 | | 395,683 |

Energy East Corp. | | 26,140 | | 633,895 |

Keyspan Corp. | | 28,245 | | 1,036,592 |

IDACORP, Inc. | | 27,900 | | 753,300 |

Pepco Holdings, Inc. | | 21,950 | | 401,246 |

| | | | |

|

| | | | | 4,459,156 |

| | | | |

|

| Natural Gas (Distributor) — 21.3% | | | | |

Gulfterra Energy Partners, L.P. | | 16,350 | | 632,745 |

National Fuel Gas Co. | | 25,890 | | 647,250 |

Nicor, Inc. | | 29,580 | | 1,004,833 |

ONEOK, Inc. | | 29,520 | | 649,145 |

Southern Union Co. # | | 23,045 | | 485,789 |

Vectren Corp. | | 28,555 | | 716,445 |

WGL Holdings, Inc. | | 11,200 | | 321,664 |

| | | | |

|

| | | | | 4,457,871 |

| | | | |

|

| Oil & Natural Gas — 30.1% | | | | |

Anadarko Petroleum Corp. | | 8,685 | | 508,941 |

Burlington Resources, Inc. | | 14,980 | | 541,976 |

Devon Energy Corp. | | 7,445 | | 491,370 |

EOG Resources, Inc. | | 9,095 | | 543,062 |

Equitable Resources, Inc. | | 19,115 | | 988,437 |

Kinder Morgan Energy Partners, L.P. | | 27,983 | | 1,138,560 |

Peoples Energy Corp. | | 13,735 | | 578,930 |

Pioneer Natural Resources Co. | | 16,480 | | 578,118 |

Questar Corp. | | 23,680 | | 914,995 |

| | | | |

|

| | | | | 6,284,389 |

| | | | |

|

| Telecommunication Services — 5.4% | | | | |

Telefonos de Mexico SA de CV ADR | | 15,210 | | 506,037 |

CenturyTel, Inc. | | 17,515 | | 526,150 |

Time Warner Telecom, Inc. # | | 25,000 | | 104,750 |

| | | | |

|

| | | | | 1,136,937 |

| | | | |

|

| Water Utility — 5.5% | | | | |

Aqua America, Inc. | | 39,402 | | 790,010 |

United Utilities PLC | | 18,350 | | 350,852 |

| | | | |

|

| | | | | 1,140,862 |

| | | | |

|

Total Common Stocks

(Cost $18,630,632) | | | | 20,707,314 |

| | | | |

|

| | | | |

Security Description

| | Shares or

Principal

Amount ($)

| | Value ($)

|

Repurchase Agreements — 0.6% | | | | |

Salomon Smith Barney, Inc., 1.55%, 07/01/04, (Collateralized by $135,854 various Commercial Paper, at 1.41%-1.44%, due 07/13/04-08/18/04,

value — $135,663) | | 133,000 | | 133,000 |

| | | | |

|

Total Repurchase Agreements

(Cost $133,000) | | | | 133,000 |

| | | | |

|

Total Investments — 99.8%

(Cost $18,763,632) (a) | | | | 20,840,314 |

| | | | |

|

| Other Assets less Liabilities — 0.2% | | | | 38,587 |

| | | | |

|

| Total Net Assets — 100.0% | | | | 20,878,901 |

| | | | |

|

Trustee Deferred Compensation * | | | | |

The Flex-funds Dynamic Growth Fund | | 929 | | 6,986 |

The Flex-funds Highlands Growth Fund | | 788 | | 11,836 |

The Flex-funds Muirfield Fund | | 2,956 | | 14,662 |

The Flex-funds Total Return Utilities Fund | | 636 | | 9,267 |

| | | | |

|

Total Trustee Deferred Compensation (Cost $42,205) | | | | 42,751 |

| | | | |

|

| ADR: | | American Depository Receipt |

| (a) | | Represents cost for financial reporting purposes and may differ for federal income tax purposes by the amount of losses recognized in excess of federal income tax reporting. Cost for federal income tax purposes differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | |

Unrealized appreciation | | $ | 2,857,460 | |

Unrealized depreciation | | | (780,778 | ) |

| | |

|

|

|

Net unrealized appreciation (depreciation) | | $ | 2,076,682 | |

| | |

|

|

|

| # | | Represents non-income producing securities. |

| * | | Assets of affiliates to The Total Return Utilities Fund held for the benefit of the Fund’s Trustees in connection with the Trustees Deferred Compensation Plan. |

See accompanying notes to financial statements.

The Flex-funds

15

Schedule of Investments

June 30, 2004 (unaudited)

The Highlands Growth Fund

| | | | |

Security Description

| | Shares or

Principal

Amount ($)

| | Value ($)

|

Common Stocks — 94.6% | | | | |

| Capital Goods, Materials & Services — 8.4% | | |

| (Subadvised by Barrow, Hanley, Mewhinney & Strauss, Inc.) |

3M Co. | | 2,625 | | 236,276 |

American Power Conversion Corp. | | 6,290 | | 123,599 |

Caterpillar, Inc. | | 1,995 | | 158,483 |

Cendant Corp. | | 6,490 | | 158,875 |

Ingersoll-Rand Co. — Class A | | 1,970 | | 134,570 |

Masco Corp. | | 4,235 | | 132,047 |

Praxair, Inc. | | 3,605 | | 143,876 |

Sourcecorp # | | 4,330 | | 119,162 |

Tyco International Ltd. | | 7,015 | | 232,477 |

Weyerhaeuser Co. | | 2,270 | | 143,282 |

| | | | |

|

| | | | | 1,582,647 |

| | | | |

|

| Consumer Durable Goods — 7.6% | | | | |

| (Subadvised by Barrow, Hanley, Mewhinney & Strauss, Inc.) |

Aeropostale, Inc. # | | 3,200 | | 86,112 |

Best Buy Co., Inc. | | 1,365 | | 69,260 |

Costco Wholesale Corp. # | | 1,905 | | 78,448 |

General Motors Corp. | | 1,180 | | 54,976 |

Home Depot, Inc. | | 5,355 | | 188,496 |

Lowe’s Cos., Inc. | | 2,720 | | 142,936 |

Target Corp. | | 4,260 | | 180,922 |

Wal-Mart Stores, Inc. | | 9,120 | | 481,172 |

Walgreen Co. | | 3,990 | | 144,478 |

| | | | |

|

| | | | | 1,426,800 |

| | | | |

|

| Consumer Non-durable Goods — 12.4% | | |

| (Subadvised by Barrow, Hanley, Mewhinney & Strauss, Inc.) |

Action Performance Cos., Inc. | | 10,040 | | 151,303 |

Altria Group, Inc. | | 6,420 | | 321,321 |

Bunge Ltd. | | 5,080 | | 197,815 |

Coca-Cola Co., The | | 4,070 | | 205,454 |

Comcast Corp. — Special — Class A # | | 6,640 | | 183,330 |

Haggar Corp. | | 560 | | 11,194 |

Hain Celestial Group, Inc. # | | 5,070 | | 91,767 |

JAKKS Pacific, Inc. # | | 9,000 | | 187,110 |

PepsiCo, Inc. | | 5,010 | | 269,939 |

Procter & Gamble Co. | | 4,580 | | 249,335 |

Time Warner, Inc. # | | 7,350 | | 129,213 |

Viacom, Inc. — Class B | | 4,213 | | 150,488 |

Wendy’s International, Inc. | | 5,340 | | 186,046 |

| | | | |

|

| | | | | 2,334,315 |

| | | | |

|

| Energy — 6.6% | | | | |

| (Subadvised by The Mitchell Group, Inc.) | | |

BP PLC Sponsored ADR # | | 1,348 | | 72,212 |

Chevron Texaco Corp. | | 1,056 | | 99,380 |

ConocoPhillips | | 1,800 | | 137,322 |

Devon Energy Corp. | | 1,000 | | 66,000 |

Exxon Mobil Corp. | | 6,624 | | 294,172 |

FMC Technologies, Inc. # | | 2,600 | | 74,880 |

Halliburton Co. | | 2,400 | | 72,624 |

New York Community Bancorp Inc. | | 2,550 | | 50,057 |

Pioneer Natural Resources Co. # | | 2,600 | | 91,208 |

Pride International, Inc. # | | 5,000 | | 85,550 |

| | | | |

Security Description

| | Shares or

Principal

Amount ($)

| | Value ($)

|

Common Stocks — continued | | | | |

Range Resources Corp. | | 4,700 | | 68,620 |

Schlumberger, Ltd. | | 1,100 | | 69,861 |

XTO Energy, Inc. | | 2,100 | | 62,559 |

| | | | |

|

| | | | | 1,244,445 |

| | | | |

|

| Finance — 15.4% | | | | |

| (Subadvised by Clover Partners LP) | | | | |

Bank of America Corp. | | 2,887 | | 244,298 |

Capital One Financial Corp. | | 4,220 | | 288,564 |

Citigroup, Inc. | | 11,935 | | 554,978 |

Conseco, Inc. # | | 11,120 | | 221,288 |

Crescent Real Estate Equities Co. | | 12,850 | | 207,142 |

General Electric Co. | | 22,175 | | 718,468 |

Goldman Sachs Group, Inc. | | 3,560 | | 335,210 |

Janus Capital Group, Inc. | | 23,440 | | 386,526 |

Legg Mason, Inc. | | 1,340 | | 121,953 |

Merrill Lynch & Co., Inc. | | 3,580 | | 193,248 |

NewAlliance Bancshares, Inc. # | | 15,400 | | 214,984 |

State Street Corp. | | 2,030 | | 99,551 |

Wachovia Corp. — Preferred Dividend Equalization | | 1,700 | | — |

| | | | |

|

| | | | | 3,586,210 |

| | | | |

|

| Health — 12.7% | | | | |

| (Subadvised by Matrix Asset Advisors, Inc.) | | |

AMGEN, Inc. # | | 4,225 | | 230,558 |

Baxter International, Inc. | | 6,125 | | 211,374 |

Boston Scientific Corp. # | | 1,300 | | 55,640 |

Bristol-Myers Squibb Co. | | 8,500 | | 208,250 |

Guidant Corp. | | 4,800 | | 268,224 |

Medimmune, Inc. # | | 11,200 | | 261,968 |

Merck & Co., Inc. | | 5,675 | | 269,563 |

Pfizer, Inc. | | 18,600 | | 637,608 |

Wyeth | | 6,725 | | 243,176 |

| | | | |

|

| | | | | 2,386,361 |

| | | | |

|

| Technology — 24.2% | | | | |

| (Subadvised by Dresdner RCM Global Investors, L.L.C.) |

3M Co. | | 1,290 | | 116,113 |

Analog Devices, Inc. | | 1,060 | | 49,905 |

Circuit City Stores, Inc. | | 1,815 | | 23,504 |

Cisco Systems, Inc. # | | 13,080 | | 309,995 |

Citrix Systems, Inc. # | | 4,300 | | 87,548 |

Comverse Technology, Inc. # | | 5,660 | | 112,860 |

Corning, Inc. | | 2,500 | | 32,650 |

Dell, Inc. # | | 2,235 | | 80,058 |

Telefonaktiebolaget LM Ericsson Sponsored ADR # | | 2,750 | | 82,225 |

General Dynamics Corp. | | 610 | | 60,573 |

Hewlett-Packard Co. | | 2,350 | | 49,585 |

Honeywell International, Inc. | | 2,460 | | 90,110 |

Intel Corp. | | 5,190 | | 143,244 |

JAKKS Pacific, Inc. # | | 1,080 | | 22,453 |

Lockheed Martin Corp. | | 710 | | 36,977 |

Marvell Technology Group, Ltd. # | | 3,740 | | 99,858 |

Maxim Integrated Products, Inc. | | 480 | | 25,162 |

Mercury Interactive Corp. # | | 1,230 | | 61,291 |

The Flex-funds

16

Schedule of Investments

June 30, 2004 (unaudited)

The Highlands Growth Fund

| | | | |

Security Description

| | Shares or

Principal

Amount ($)

| | Value ($)

|

Common Stocks — continued | | | | |

Microsoft Corp. | | 22,360 | | 638,602 |

Motorola, Inc. | | 7,440 | | 135,780 |

NCR Corp., Inc. # | | 2,250 | | 111,578 |

National Semiconductor Corp. # | | 4,230 | | 93,018 |

Network Appliance, Inc. # | | 1,220 | | 26,267 |

Northrop Grumman Corp. | | 1,000 | | 53,700 |

Raytheon Co. Class B | | 490 | | 17,527 |

Research in Motion, Ltd. # | | 820 | | 56,129 |

Riggs National Corp. | | 16,440 | | 347,213 |

Rockwell Collins, Inc. | | 390 | | 12,995 |

SAP AG Sponsored ADR # | | 920 | | 38,465 |

SINA Corp. # | | 2,590 | | 85,444 |

Symantec Corp. # | | 980 | | 42,902 |

Union Planters Corp. | | 5,410 | | 161,272 |

United Technologies Corp. | | 1,215 | | 111,148 |

VF Corp. | | 1,130 | | 55,031 |

Veritas Software Corp. # | | 3,290 | | 91,429 |

Yahoo! Inc. # | | 7,340 | | 267,176 |

eBay, Inc. # | | 470 | | 43,217 |

| | | | |

|

| | | | | 3,873,004 |

| | | | |

|

| Transportation — 1.6% | | | | |

| (Subadvised by Miller/Howard Investments, Inc.) | | |

Burlington Northern Santa Fe Corp. | | 655 | | 22,971 |

CNF, Inc. | | 300 | | 12,468 |

CSX Corp. | | 382 | | 12,518 |

Delta Air Lines, Inc. | | 220 | | 1,566 |

FedEx Corp. | | 455 | | 37,169 |

Norfolk Southern Corp. | | 690 | | 18,299 |

Ryder System, Inc. | | 115 | | 4,608 |

Southwest Airlines Co. | | 1,408 | | 23,612 |

Union Pacific Corp. | | 450 | | 26,753 |

United Parcel Service, Inc. — Class B | | 1,775 | | 133,427 |

| | | | |

|

| | | | | 293,391 |

| | | | |

|

| Utilities — 5.7% | | | | |

| (Subadvised by Clover Partners LP) |

AT&T Wireless Services, Inc. # | | 6,705 | | 96,016 |

FirstEnergy Corp. | | 2,614 | | 97,790 |

Nextel Communications, Inc. | | 5,270 | | 140,498 |

PG & E Corp. # | | 5,447 | | 152,189 |

TXU Corp. | | 3,910 | | 158,394 |

Verizon Communications, Inc. | | 8,761 | | 317,061 |

Western Gas Resources, Inc. | | 3,680 | | 119,526 |

| | | | |

|

| | | | | 1,081,474 |

| | | | |

|

Total Common Stocks

(Cost $16,714,694) | | | | 17,808,647 |

| | | | |

|

| | | | | |

Security Description

| | Shares or

Principal

Amount ($)

| | Value ($)

| |

U.S. Government Obligations — 0.8% | | | |

U.S. Treasury Bills,

0.99%, due 07/01/2004 | | | | | |

Total U.S. Government Obligations

(Cost $150,000) | | | | 150,000 | |

| | | | |

|

|

Repurchase Agreements — 4.7% | | | | | |

Salomon Smith Barney, Inc., 1.55%, 07/01/04, (Collateralized by $903,989 various Commercial Paper, at 1.41%-1.44%, due 07/13/04-08/18/04,

value — $902,719) | | 885,000 | | 885,000 | |

| | | | |

|

|

Total Repurchase Agreements

(Cost $885,000) | | | | 885,000 | |

| | | | |

|

|

Total Investments — 100.1%

(Cost $17,749,694) (a) | | | | 18,843,647 | |

| | | | |

|

|

Liabilities less Other Assets — (0.1%) | | | | (11,245 | ) |

| | | | |

|

|

Total Net Assets — 100.0% | | | | 18,832,402 | |

| | | | |

|

|

Trustee Deferred Compensation * | | | | | |

The Flex-funds Dynamic Growth Fund | | 1,428 | | 10,739 | |

The Flex-funds Highlands Growth Fund | | 1,285 | | 19,301 | |

The Flex-funds Muirfield Fund | | 4,670 | | 23,163 | |

The Flex-funds Total Return Utilities Fund | | 1,026 | | 14,949 | |

| | | | |

|

|

Total Trustee Deferred Compensation

(Cost $70,341) | | | | 68,152 | |

| | | | |

|

|

ADR: American Depository Receipt

| (a) | | Represents cost for financial reporting purposes and differs for federal income tax purposes by the amount of losses recognized in excess of federal income tax reporting of approximately $288,686. Cost for federal income tax purposes differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | |

Unrealized appreciation | | $ | 1,717,077 | |

Unrealized depreciation | | | (911,810 | ) |

| | |

|

|

|

Net unrealized appreciation (depreciation) | | $ | 805,267 | |

| | |

|

|

|

| # | | Represents non-income producing securities. |

| * | | Assets of affiliates to The Highlands Growth Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

See accompanying notes to financial statements.

The Flex-funds

17

Schedule of Investments

June 30, 2004 (unaudited)

The Dynamic Growth Fund

| | | | | |

Security Description

| | Shares or

Principal

Amount ($)

| | Value ($)

| |

Registered Investment Companies — 71.6% | | | |

Aim Basic Value Fund — Class A # | | 150,000 | | 4,614,014 | |

American Century Vista Fund — Advisor Class # | | 320,665 | | 4,354,633 | |

iShares S&P 500/BARRA Value Index Fund | | 105,800 | | 6,060,223 | |

| | | | |

|

|

Total Registered Investment Companies

(Cost $14,526,303) | | | | 15,028,870 | |

| | | | |

|

|

U.S. Government Obligations — 16.2% | | | |

U.S. Treasury Bills, 0.99%, due 07/01/04 * | | 3,100,000 | | 3,099,871 | |

U.S. Treasury Bills, 1.31%, due 09/30/04 * | | 300,000 | | 299,034 | |

| | | | |

|

|

Total U.S. Government Obligations

(Cost $3,398,893) | | | | 3,398,905 | |

| | | | |

|

|

Repurchase Agreements — 13.4% | | | | | |

Salomon Smith Barney, Inc., 1.55%, 07/01/04, (Collateralized by $2,868,251 various Commercial Paper, at 1.41%-1.44%, due 07/13/04-08/18/04,

value — $2,864,222) | | 2,808,000 | | 2,808,000 | |

| | | | |

|

|

Total Repurchase Agreements

(Cost $2,808,000) | | | | 2,808,000 | |

| | | | |

|

|

Total Investments — 101.2%

(Cost $20,733,196) | | | | 21,235,775 | |

| | | | |

|

|

Liabilities less Other Assets — (1.2%) | | | | (248,236 | ) |

| | | | |

|

|

Total Net Assets — 100.0% | | | | 20,987,539 | |

| | | | |

|

|

Trustee Deferred Compensation ** | | | | | |

The Flex-funds Dynamic Growth Fund | | 599 | | 4,504 | |

The Flex-funds Highlands Growth Fund | | 406 | | 6,098 | |

The Flex-funds Muirfield Fund | | 1,816 | | 9,007 | |

The Flex-funds Total Return Utilities Fund | | 392 | | 5,711 | |

| | | | |

|

|

Total Trustee Deferred Compensation (Cost $22,975) | | | | 25,320 | |

| | | | |

|

|

| | | | |

Security Description

| | Long

Contracts

| | Unrealized

Appreciation

|

Futures Contracts | | | | |

Standard & Poors 500 expiring September 2004, notional

value $5,131,800 | | 18 | | 26,200 |

| | | | |

|

Total Futures Contracts | | | | 26,200 |

| | | | |

|

| (a) | | Represents cost for financial reporting purposes and may differ for federal income tax purposes by the amount of losses recognized in excess of federal income tax reporting. Cost for federal income tax purposes differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | |

Unrealized appreciation | | $ | 529,313 | |

Unrealized depreciation | | | (26,734 | ) |

| | |

|

|

|

Net unrealized appreciation (depreciation) | | $ | 502,579 | |

| | |

|

|

|

| # | | Represents non-income producing security. |

| * | | Pledged as collateral on futures contracts. |

| ** | | Assets of affiliates to The Dynamic Growth Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

See accompanying notes to financial statements.

The Flex-funds

18

Schedule of Investments

June 30, 2004 (unaudited)

The Aggressive Growth Fund

| | | | | |

Security Description

| | Shares or

Principal

Amount ($)

| | Value ($)

| |

Registered Investment Companies — 73.1% | | | |

Aim Basic Value Fund — Class A # | | 36,167 | | 1,112,488 | |

Aim Large Cap Basic Value

Fund — Class A # | | 53,286 | | 692,190 | |

American Century Small Company

Fund — Investor Class | | 51,494 | | 469,622 | |

American Century Vista Fund — Advisor Class # | | 111,522 | | 1,514,465 | |

Federated Kaufmann Small Cap

Fund — Class A | | 19,195 | | 374,500 | |

iShares S&P 500/BARRA Value Index Fund | | 30,000 | | 1,718,400 | |

Icon Energy Fund # | | 13,163 | | 257,210 | |

Scudder Health Care Fund — Class A | | 20,360 | | 442,412 | |

| | | | |

|

|

Total Registered Investment Companies (Cost $6,279,963) | | | | 6,581,287 | |

| | | | |

|

|

U.S. Government Obligations — 14.4% | | | |

U.S. Treasury Bills, 0.99%, due 07/01/04 * | | 1,200,000 | | 1,199,948 | |

U.S. Treasury Bills, 1.31%, due 09/30/04 * | | 100,000 | | 99,678 | |

| | | | |

|

|

Total U.S. Government Obligations

(Cost $1,299,622) | | | | 1,299,626 | |

| | | | |

|

|

Repurchase Agreements — 13.3% | | | |

Salomon Smith Barney, Inc., 1.55%, 07/01/04, (Collateralized by $1,219,619 various Commercial Paper, at 1.41%-1.44%, due 07/13/04-08/18/04,

value — $1,217,906) | | 1,194,000 | | 1,194,000 | |

| | | | |

|

|

Total Repurchase Agreements

(Cost $1,194,000) | | | | 1,194,000 | |

| | | | |

|

|

Total Investments — 100.8%

(Cost $8,773,585) (a) | | | | 9,074,913 | |

| | | | |

|

|

Liabilities less Other Assets — (0.8%) | | | | (76,306 | ) |

| | | | |

|

|

Total Net Assets — 100.0% | | | | 8,998,607 | |

| | | | |

|

|

Trustee Deferred Compensation ** | | | |

The Flex-funds Dynamic Growth Fund | | 518 | | 3,895 | |

The Flex-funds Highlands Growth Fund | | 348 | | 5,227 | |

The Flex-funds Muirfield Fund | | 1,568 | | 7,777 | |

The Flex-funds Total Return Utilities Fund | | 338 | | 4,925 | |

| | | | |

|

|

Total Trustee Deferred Compensation (Cost $19,763) | | | | 21,824 | |

| | | | |

|

|

| | | | |

Security Description

| | Long

Contracts

| | Unrealized

Appreciation

|

Futures Contracts | | |

Standard & Poors 500 expiring September 2004, notional

value $1,995,700 | | 7 | | 11,375 |

| | | | |

|

Total Futures Contracts | | | | 11,375 |

| | | | |

|

| (a) | | Represents cost for financial reporting purposes and may differ for federal income tax purposes by the amount of losses recognized in excess of federal income tax reporting. Cost for federal income tax purposes differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | |

Unrealized appreciation | | $ | 319,063 | |

Unrealized depreciation | | | (17,735 | ) |

| | |

|

|

|

Net unrealized appreciation (depreciation) | | $ | 301,328 | |

| | |

|

|

|

| # | | Represents non-income producing securities. |

| * | | Pledged as collateral on futures contracts. |

| ** | | Assets of affiliates to The Aggressive Growth Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

See accompanying notes to financial statements.

The Flex-funds

19

Schedule of Investments

June 30, 2004 (unaudited)

The U.S. Government Bond Fund

| | | | |

Security Description

| | Principal

Amount ($)

or Shares

| | Value ($)

|

U.S. Government Obligations — 97.5% | | | | |

U.S. Treasury Bills, 0.99%, due 07/01/04 | | 190,000 | | 190,000 |

U.S. Treasury Notes, 3.38%, due 11/15/08 | | 9,500,000 | | 9,406,484 |

| | | | |

|

Total U.S. Government Obligations

(Cost $9,584,260) | | | | 9,596,484 |

| | | | |

|

Repurchase Agreements — 2.1% | | | | |

Salomon Smith Barney, Inc., 1.55%, 07/01/04, (Collateralized by $215,527 various Commercial Paper, at 1.41%-1.44%, due 07/13/04-08/18/04,

value — $215,224) | | 211,000 | | 211,000 |

| | | | |

|

Total Repurchase Agreements

(Cost $211,000) | | | | 211,000 |

| | | | |

|

Total Investments — 99.6%

(Cost $9,795,260) (a) | | | | 9,807,484 |

| | | | |

|

Other Assets less Liabilities — 0.4% | | | | 37,559 |

| | | | |

|

Total Net Assets — 100.0% | | | | 9,845,043 |

| | | | |

|

Trustee Deferred Compensation * | | | | |

The Flex-funds Dynamic Growth Fund | | 695 | | 5,226 |

The Flex-funds Highlands Growth Fund | | 626 | | 9,403 |

The Flex-funds Muirfield Fund | | 2,246 | | 11,140 |

The Flex-funds Total Return Utilities Fund | | 485 | | 7,066 |

| | | | |

|

Total Trustee Deferred Compensation

(Cost $32,815) | | | | 32,835 |

| | | | |

|

| (a) | | Represents cost for financial reporting purposes and differs for federal income tax purposes by the amount of losses recognized in excess of federal income tax reporting of approximately $7,765. Cost for federal income tax purposes differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | |

Unrealized appreciation | | $ | 50,319 | |

Unrealized depreciation | | | (45,860 | ) |

| | |

|

|

|

Net unrealized appreciation (depreciation) | | $ | 4,459 | |

| | |

|

|

|

| * | | Assets of affiliates to The U.S. Government Bond Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

See accompanying notes to financial statements.

The Flex-funds

20

Schedule of Investments

June 30, 2004 (unaudited)

Money Market Portfolio

| | | | | | | | | |

Security Description

| | Coupon/

Yield

| | | Maturity

| | Principal

Amount ($)

or Shares

| | Value ($)

|

Certificate of Deposit — 2.5% | | | | |

Huntington National

Bank CD | | 1.32 | % | | 08/24/04 | | 5,000,000 | | 5,000,000 |

| | | | | | | | | |

|

Total Certificate of Deposit

(Cost $5,000,000) | | | | | | | 5,000,000 |

| | | | | | | | | |

|

Corporate Obligations — 72.9% | | | | |

Abbott Laboratories | | 5.13 | % | | 07/01/04 | | 2,500,000 | | 2,500,000 |

Aquarium Holdings, KY** | | 1.31 | %* | | 07/01/04 | | 108,000 | | 108,000 |

Associates Corp. | | 6.63 | % | | 06/15/05 | | 618,000 | | 643,558 |

Austin Printing Co., Inc.** | | 1.40 | %* | | 07/01/04 | | 1,675,000 | | 1,675,000 |

Bath Technologies, Inc.** | | 1.35 | %* | | 07/01/04 | | 1,280,000 | | 1,280,000 |

Bank Of America Corp. | | 7.63 | % | | 04/15/05 | | 1,365,000 | | 1,431,778 |

Bank Of America Corp. | | 7.75 | % | | 08/15/04 | | 651,000 | | 656,092 |

Bear Stearns Co., Inc. | | 6.63 | % | | 10/01/04 | | 2,850,000 | | 2,888,011 |

Bear Stearns Co., Inc. | | 6.65 | % | | 12/01/04 | | 1,089,000 | | 1,113,552 |

Bear Stearns Co., Inc. | | 7.63 | % | | 02/01/05 | | 1,000,000 | | 1,036,997 |

Bear Stearns Co., Inc.** | | 1.95 | %* | | 07/01/04 | | 1,000,000 | | 1,000,874 |

Beaver Creek

Enterprise** | | 1.35 | %* | | 07/01/04 | | 1,990,000 | | 1,990,000 |

Cascade Plaza Project** | | 1.35 | %* | | 07/01/04 | | 8,266,000 | | 8,266,000 |

ChevronTexaco Corp. | | 6.63 | % | | 10/01/04 | | 2,500,000 | | 2,532,387 |

Citigroup, Inc. | | 7.13 | % | | 10/15/04 | | 6,000,000 | | 6,100,283 |

Citigroup, Inc. | | 7.63 | % | | 05/01/05 | | 1,440,000 | | 1,513,855 |

Clark Grave Vault Co.** | | 1.31 | %* | | 07/01/04 | | 1,050,000 | | 1,050,000 |

Commercial Credit Co. | | 7.88 | % | | 07/15/04 | | 1,430,000 | | 1,433,599 |

Countrywide Home Loans, Inc. | | 6.84 | % | | 10/22/04 | | 4,000,000 | | 4,064,072 |

Don’s Launderers-Cleaners, Inc.** | | 1.31 | %* | | 07/01/04 | | 1,000,000 | | 1,000,000 |

DuPont, E.I.,De Nemours & Co. | | 6.75 | % | | 10/15/04 | | 1,567,000 | | 1,591,474 |

Espanola/Nambe** | | 1.40 | %* | | 07/01/04 | | 915,000 | | 915,000 |

FleetBoston Financial Corp. | | 8.00 | % | | 09/15/04 | | 4,590,000 | | 4,652,482 |

FleetBoston Financial Corp. | | 8.13 | % | | 07/01/04 | | 3,000,000 | | 3,000,000 |

Gordon Flesch Co. Project** | | 1.35 | %* | | 07/01/04 | | 900,000 | | 900,000 |

International Lease Finance Corp | | 8.15 | % | | 10/01/04 | | 1,000,000 | | 1,016,994 |

Isaac Tire, Inc.** | | 1.31 | %* | | 07/01/04 | | 840,000 | | 840,000 |