As filed with the Securities and Exchange Commission on February 28, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-3489

THE WRIGHT MANAGED EQUITY TRUST

440 Wheelers Farms Road

Milford, Connecticut 06461

Megan Hadley Koehler

Three Canal Plaza, Suite 600

Portland, ME 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2013 – December 31, 2013

ITEM 1. REPORT TO STOCKHOLDERS.

The Wright Managed Blue Chip Investment Funds

The Wright Managed Blue Chip Investment Funds consist of three equity funds from The Wright Managed Equity Trust and two fixed-income funds from The Wright Managed Income Trust. Each of the five funds have distinct investment objectives and policies. They can be used individually or in combination to achieve virtually any objective. Further, as they are all “no-load” funds (no commissions or sales charges), portfolio allocation strategies can be altered as desired to meet changing market conditions or changing requirements without incurring any sales charges.

Approved Wright Investment List

Securities selected for investment in these funds are chosen mainly from a list of “investment grade” companies maintained by Wright Investors’ Service (“Wright”, “WIS” or the “Adviser”). Over 37,000 global companies (covering 69 countries) in Wright’s database are screened as new data becomes available to determine any eligible additions or deletions to the list. The qualifications for inclusion as “investment grade” are companies that meet Wright’s Quality Rating criteria. This rating includes fundamental criteria for investment acceptance, financial strength, profitability & stability and growth. In addition, securities, which are not included in Wright’s “investment grade” list, may also be selected from companies in the fund’s specific benchmark (up to 20% of the market value of the portfolio) in order to achieve broad diversification.

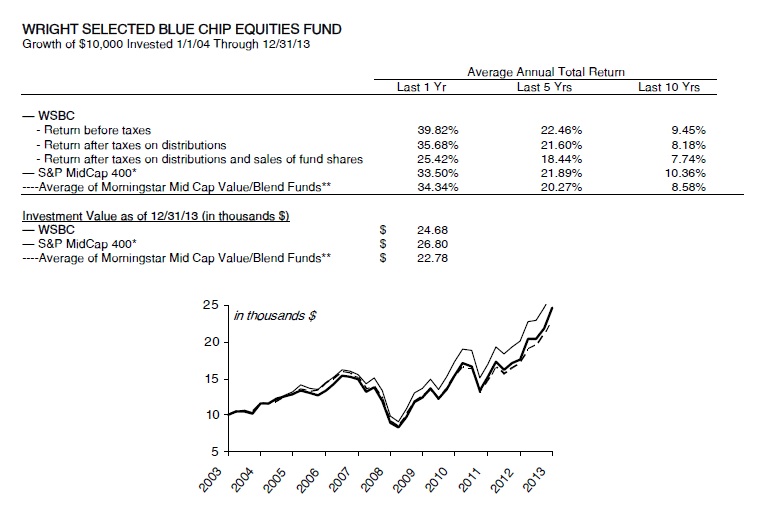

Three Equity Funds

Wright Selected Blue Chip Equities Fund (WSBC) (the “Fund”) seeks to enhance total investment return through price appreciation plus income. The Fund’s portfolio is characterized as a blend of growth and value stocks. The market capitalization of the companies is typically between $1-$10 billion at the time of the Fund’s investment. The Adviser seeks to outperform the Standard & Poor’s MidCap 400 Index (“S&P MidCap 400”) by selecting stocks using fundamental company analysis and company specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries and sectors.

Wright Major Blue Chip Equities Fund (WMBC) (the “Fund”) seeks to enhance total investment return through price appreciation plus income by providing a broadly diversified portfolio of equities of larger well-established companies with market values of $5-$10 billion or more. The Adviser seeks to outperform the Standard & Poor’s 500 Index (“S&P 500”) by selecting stocks, using fundamental company analysis and company specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries and sectors.

Wright International Blue Chip Equities Fund (WIBC) (the “Fund”) seeks total return consisting of price appreciation plus income by investing in a broadly diversified portfolio of equities of wellestablished, non-U.S. companies. The Fund may buy common stocks traded on the securities exchange of the country in which the company is based or it may purchase American Depositary Receipts (“ADR’s”) traded in the United States. The portfolio is denominated in U.S. dollars and investors should understand that fluctuations in foreign exchange rates may impact the value of their investment. The Adviser seeks to outperform the MSCI World ex U.S. Index (“MSCI World ex U.S.”) by selecting stocks using fundamental company analysis and company-specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries, sectors and countries.

(continued on inside back cover)

Table of Contents

| Investment Objectives | inside front |

| Letter to Shareholders (unaudited) | 2 |

| Management Discussion (Unaudited) | 4 |

| Performance Summaries (Unaudited) | 8 |

| Fund Expenses (Unaudited) | 18 |

| Management and Organization (Unaudited) | 68 |

| Important Notices Regarding Delivery of Shareholder Documents, Portfolio Holdings and Proxy Voting (Unaudited) | 69 |

| | |

| | The Wright Managed Equity Trust |

| Wright Selected Blue Chip Equities Fund | |

| Portfolio of Investments | 20 |

| Statement of Assets and Liabilities | 22 |

| Statement of Operations | 22 |

| Statements of Changes in Net Assets | 23 |

| Financial Highlights | 24 |

| Wright Major Blue Chip Equities Fund | |

| Portfolio of Investments | 25 |

| Statement of Assets and Liabilities | 26 |

| Statement of Operations | 26 |

| Statements of Changes in Net Assets | 27 |

| Financial Highlights | 28 |

| Wright International Blue Chip Equities Fund | |

| Portfolio of Investments | 29 |

| Statement of Assets and Liabilities | 31 |

| Statement of Operations | 31 |

| Statements of Changes in Net Assets | 32 |

| Financial Highlights | 33 |

| | |

| Notes to Financial Statements | 34 |

| Report of Independent Registered Public Accounting Firm | 42 |

| Federal Tax Information (Unaudited) | 43 |

| | The Wright Managed Income Trust |

| Wright Total Return Bond Fund | |

| Portfolio of Investments | 44 |

| Statement of Assets and Liabilities | 48 |

| Statement of Operations | 48 |

| Statements of Changes in Net Assets | 49 |

| Financial Highlights | 50 |

| Wright Current Income Fund | |

| Portfolio of Investments | 51 |

| Statement of Assets and Liabilities | 56 |

| Statement of Operations | 56 |

| Statements of Changes in Net Assets | 57 |

| Financial Highlights | 58 |

| | |

| Notes to Financial Statements | 59 |

| Report of Independent Registered Public Accounting Firm | 66 |

| Federal Tax Information (Unaudited) | 67 |

Letter to Shareholders (Unaudited)

Dear Shareholder:

As it had in the first three quarters of 2013, the U.S. stock market rang up healthy returns again during the fourth quarter. The S&P 500 squeezed what is almost a normal annual return (10.5%) into the final three months of the year, swelling its total return for all of 2013 to a bit more than 32%. Signs that economic strength was building combined with a continuation of easy monetary policies from the Federal Reserve to power stock prices higher. Not even the Fed’s decision in December to begin cutting back on its bond buying as 2014 began slowed the market’s momentum. Perhaps the year-end rally was in appreciation of the fact that the economy and Fed monetary policy appear to be starting to normalize; in any event, considering that U.S. stocks were closing in on the fifth anniversary of the 2009 market bottom, the strong Q4 market action was most impressive.

Foreign stock markets had a strong fourth-quarter showing as well, although for the most part returns were not in the same class as those in U.S. equities. Returns to stocks in the developed markets of the world outside the U.S. were roughly half those in the U.S. during Q4. Here too, a sense that the pace of economic activity was improving was instrumental in the year-end rally. In local currency terms, Japan and Germany had outsized returns for the quarter and the year, but U.S. dollar returns were trimmed in the case of Japan by the depreciating yen (which lost 18% against the dollar for all of 2013) and enhanced in the case of Germany by the appreciating euro (which gained 4% vis-à-vis the dollar). Emerging market returns were positive on average during the fourth quarter, but not enough to put this laggard asset category in the black for the year. Perhaps characteristic of 2013 trends, Greece was the best performing market in the emerging market class, with returns averaging more than 50%.

Yields went higher in the best credits during 2013 and were flat to lower in some of the worst. U.S. and German 10-year bond yields rose 100 and 60 basis points, respectively. By contrast, U.S. high yield bond rates declined about 40 bps during 2013, and yields on peripheral sovereign debt in Europe declined by 40 bps (Italy), by 110 bps (Spain) and, in the extreme case, by more than 300 bps (Greece). This improving confidence that the economic abyss envisioned for Europe in 2011 grew less and less likely as 2013 progressed was reflected in a sharp narrowing of yield spreads in Europe but more broadly as well.

The U.S. bond market had a small loss in the fourth quarter, as Treasury yields rose, with shorter maturity and lower quality securities generally performing better. Virtually all of the bond market’s losses last year occurred in the second quarter – when Federal Reserve Chairman Ben Bernanke introduced the idea of tapering bond purchases. But that was enough to produce the first full-year loss for the Barclays U.S. bond market aggregate (-2.0%) since 1999. In the end, when the Fed finally announced in mid-December that it would begin to trim QE bond buying, bond prices retreated nominally, while stocks raced to new highs as the year ended.

Government shutdown and the approaching debt ceiling affected markets early in the fourth quarter, but a deal was struck to end the shutdown and suspend the debt ceiling. The special Paul Ryan/Patty Murray Congressional committee that was created to craft a budget that both sides could agree on delivered a budget outline that President Obama signed into law in the final week of December. The debt ceiling suspension set to expire in early February may be more problematic, although the October 17 budget deal provides a template of sorts for extending the suspension of the debt ceiling, which was done twice in 2013. Given the failed strategy of government shutdown, Wright suspects further debt ceiling suspensions may be the easiest course for Congress until and unless the 2014 Congressional elections produce a material shift in the balance of power in Washington. While investors, consumers and businesses cannot ignore Washington politics, the

2

Letter to Shareholders (Unaudited)

country may be best served by their going about their business in the hope that government policy will be more benign in 2014 than it was in 2013.

There is no question that the appreciation in the S&P 500 in the 58 months since the March 2009 low has been extraordinary, indeed, among the biggest five-year moves in stock market history. The S&P 500 has increased at an annual rate of nearly 16% since the March 9, 2009 low. With dividends, the S&P 500’s total return for the period has been roughly 18.5%, much better than the lower “new normal” returns so many of us expected in the days following the Lehman bankruptcy in the financial crisis of 2008. To be sure, the unprecedented monetary accommodation engineered by the Federal Reserve went way beyond expectations and has lent considerable support to stock prices. But at the same time, there has also been genuine growth in corporate fundamentals: corporate profits from current production have increased at a 17% compound annual rate in the 19 quarters since the Q4 2008 low. On a trailing 12-month basis, the S&P 500’s P/E was 17x as 2014 began, perhaps a bit on the high side, but certainly not at the level of most past market peaks. The telling factor in equity performance in 2014 is more likely to be how well corporations are able to boost their profits. Given our forecast of increasing economic growth, there is a good chance earnings for the S&P 500 will grow more rapidly in 2014 than the 5%-6% averaged over the past two years.

Notwithstanding the weak jobs numbers reported for December, we continue to believe that the world economy and financial system are getting stronger. The Federal Reserve’s plan to withdraw a modicum of monetary ease during 2014 is an indication of this improvement. If you have any questions on Wright’s views on these matters or on other investment or wealth management issues, please contact me.

Sincerely,

Peter M. Donovan

Chairman & CEO

3

Management Discussion (Unaudited)

WRIGHT EQUITY FUNDS

SELECTED BLUE CHIP FUND

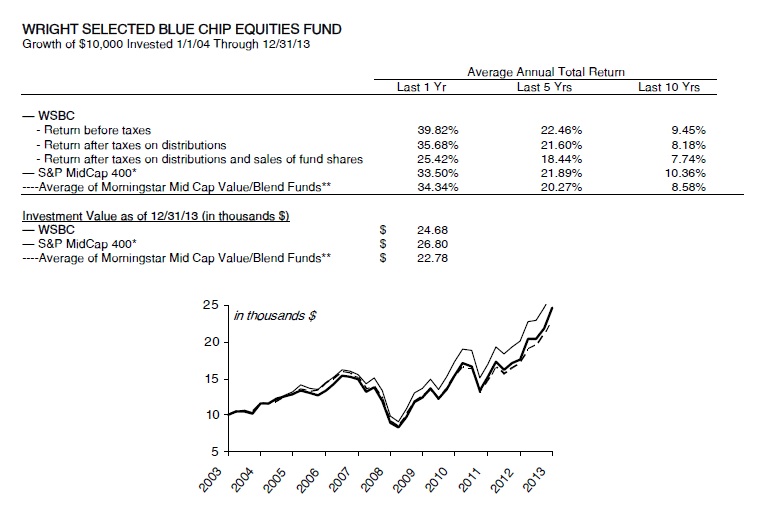

The Wright Selected Blue Chip Fund (WSBC), our mid-cap blend fund, had a total return of 12.6% in the fourth quarter, beating its benchmark, the S&P Midcap Index, which returned 8.3%. For the year, the Fund also beat its benchmark with a total return of 39.8% versus 33.5% for the index.

The main positive contributors to the Fund’s performance in both the fourth quarter and the full year were financials and health care stocks, due mainly to stock selection, although the Fund is slightly overweight both sectors relative to the index. Materials stocks were the main detractors to Fund performance in Q4, while consumer staples and energy stocks were the main negative contributors for the full year.

Among individual stocks, the biggest positive contributors to Fund performance for both Q4 and the full year were the same three stocks – Endo Pharmaceuticals, Alliance Data Systems and Waddell & Reed Financial – in that identical order for both periods. The biggest negative contributor to fourth quarter performance was Resmed Inc., which develops medical products for sleep-disordered breathing problems. The biggest detractor for the full year was Rackspace Hosting, which the Fund sold in Q3.

In the face of an economy trying to break out of sub-par growth, the WSBC Fund is positioned in the mid-cap universe to take advantage of a preference for quality. WSBC continues to be tilted toward the larger companies in the S&P MidCap 400 index, those with larger median and weighted-average market caps compared to the S&P 400. WSBC’s holdings have shown better historic earnings growth than the MidCap index constituents. WIS continues to advise diversity in investment portfolios as the best way to navigate challenging economic times.

MAJOR BLUE CHIP FUND

The Wright Major Blue Chip Fund (WMBC) is managed as a blend of the large-cap growth and value stocks in the S&P 500 Composite, selected with a focus on the higher-quality issues in the index. The WMBC Fund had a total return of 11.5% in the fourth quarter of 2013, beating the 10.5% return for the S&P 500, the Fund’s benchmark. For full year 2013, the Fund had a total return of 35.0%, also outperforming the S&P 500, which returned 32.4% for the year.

The main positive contributors to the Fund’s performance in the fourth quarter were financial stocks, which contributed 0.8% to the Fund’s relative performance advantage over the benchmark, mainly due to stock selection, and information technology stocks, which contributed 0.6% to the Fund’s performance, also due to stock selection. The Fund is slightly overweight both of those sectors compared to its benchmark index. The main negative contributor to Fund performance was energy, mainly due to stock selection, detracting 0.4% from WMBC’s relative performance. The Fund is slightly underweight this sector compared to its benchmark. For the full year, health care stocks were by far the main positive contributors to Fund performance, contributing 2.4% to its relative performance, mainly due to stock selection, although the Fund is also overweight the sector compared to its benchmark. The Fund also got a strong positive contribution from consumer staples, mainly due to stock selection, as the Fund is sharply underweight this sector. The biggest negative contributors to Fund performance for the full year were materials and telecommunications stocks.

The biggest individual positive contributors to the Fund’s performance in the fourth quarter were three big info tech companies – Microsoft, Oracle and Google – each of which contributed 0.6% to the Fund’s relative

4

Management Discussion (Unaudited)

performance. For the full year, the biggest positive contributor was biopharmaceutical maker Gilead Sciences, which contributed 2.6%. The Fund also got significant positive contributions from Microsoft and Bristol Myers Squibb. The biggest detractor to Fund performance in Q4 was Cisco Systems while the biggest detractor for the year was Rackspace Hosting Inc., which the Fund sold during the third quarter.

U.S. stocks recorded their best returns in more than 15 years in 2013, capped off by double-digit gains in the fourth quarter, with the Dow Jones Industrial Average and the S&P 500 closing the year at near-record levels and NASDAQ at its highest level since 2000. NASDAQ recorded its best year since 2009 while the S&P 500 had its best year since 1997 and the Dow its best year since 1995. Wright expects a better business climate in the coming year, with increasing corporate earnings growth, but more modest stock returns in the range of the historical average of 10%-11%. Since stocks rose in 2013 without any major pullbacks, the market may be due for some correction. Indeed, 2014 got off to a rocky start. Investors appear to have become increasingly demanding about corporate earnings, punishing those companies that fail to deliver while rewarding those that exceed forecasts.

In our view, WMBC is well positioned for the current environment, with its focus on stocks that are, on average, of higher quality than those that populate the S&P 500. The WMBC Fund has a higher median market cap and a substantially better earnings growth record over the past five years than the S&P 500, while offering attractive valuations. Based on current and forward earnings, the WMBC’s P/E multiples are lower than the S&P 500’s comparable P/E multiples.

INTERNATIONAL BLUE CHIP FUND

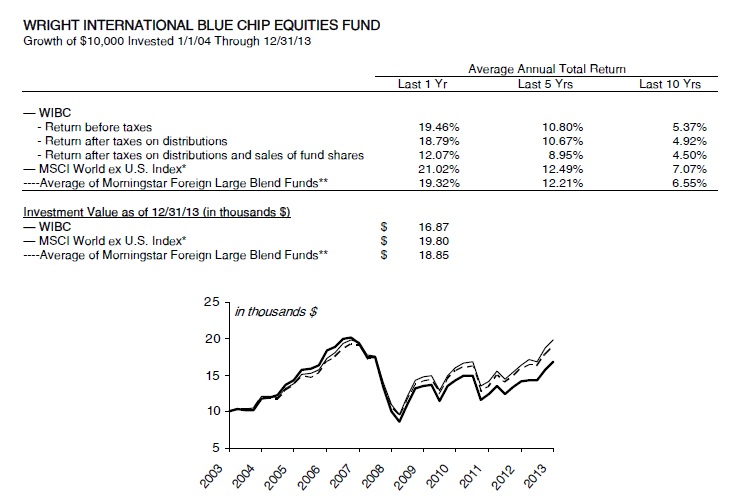

The Wright International Blue Chip Fund (WIBC) had a total return of 7.1% in the fourth quarter, beating its benchmark, the MSCI World ex U.S index, which returned 5.6%. For the full year, the Fund returned 19.5%, compared to 21.0% for the index. Foreign stocks generally underperformed U.S. stocks both in the fourth quarter and the full year, although they did relatively well in Q4, helped by the rebound in the euro zone and Japanese markets.

Financial stocks were the main positive contributors to the WIBC Fund’s performance in both Q4 and for the full year, mainly due to stock selection. Financials are the Fund’s biggest position by far, although the Fund is equal weight the sector compared to its benchmark. Consumer discretionary stocks were the biggest detractors for both the quarter and the full year.

The biggest individual positive contributor to the Fund’s performance in the fourth quarter was Legal & General Group, the London-based financial services firm, which was also the second-biggest contributor for the full year. Conversely, the second-biggest contributor in Q4 and the biggest for the full year was KDDI Corp, the Japanese telecom provider, which had been a major detractor in Q3. The biggest detractor from Fund performance in Q4 was Japanese clothing retailer Adastria Holdings Co., while the biggest detractor for the full year was BHP Billiton, a London-based mining company.

WIBC is overweight in health care, telecom, industrials and consumer discretionary stocks and underweight in consumer staples, energy and info tech. In the aggregate, WIBC holdings are priced at significant discounts to the MSCI World ex U.S. index in terms of current price/earnings ratios.

The World Bank and the International Monetary Fund recently raised their global economic growth forecasts for 2014. Both organizations expect future growth to be driven by the developed, high-income countries (the U.S., euro zone and Japan), in strong contrast to recent years, when developing countries, led by China, were

5

Management Discussion (Unaudited)

largely responsible for driving growth. Indeed, economic growth is finally starting to take hold after years of recession in Europe and stagnation in Japan, while recent reports from China indicate a slowing in economic growth in late 2013 and into early 2014. We continue to see the inclusion of international stocks as likely to enhance risk-adjusted returns in diversified investment portfolios.

WRIGHT FIXED INCOME FUNDS

TOTAL RETURN BOND FUND

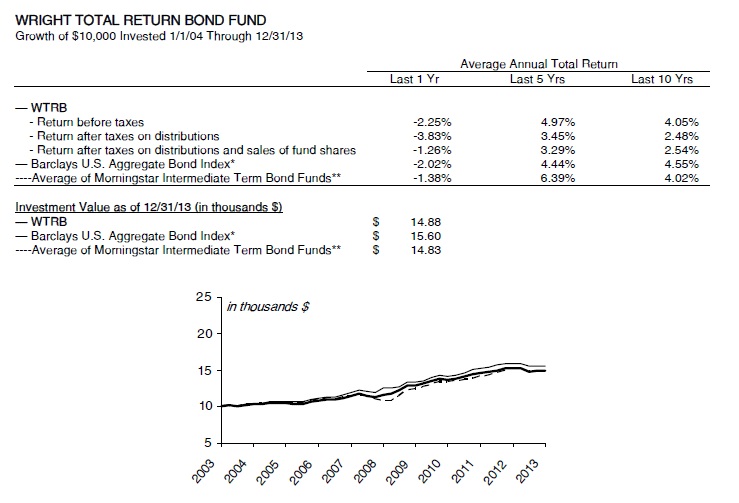

The Wright Total Return Bond Fund (WTRB), a diversified bond fund, had a total return of negative 0.01% in the fourth quarter of 2013, slightly ahead of its benchmark, the Barclays U.S. Aggregate Bond index, which had a return of negative 0.1%. For the full year, the Fund lost 2.3%, versus the 2.0% loss for the benchmark index. WTRB had a yield of 2.5% as of December 31, 2013, calculated according to SEC guidelines. Dividends paid by this Fund may be more or less than implied by this yield.

Bonds had negative returns in 2013 for the first time since 1999, as long-term interest rates ended the year at their highest levels in nearly three years. Interest rates began rising in late October as investors grew more certain that the Federal Reserve was about to begin tapering its $85 billion a month quantitative easing bond purchase program, which it finally did on December 18, when it said it would reduce its purchases in January 2014 by $10 billion, to $75 billion. The Fed has indicated that it will continue to reduce those purchases in measured increments, possibly by $10 billion after each of its eight monetary policy meetings in 2014, with the program ending before the end of the year, provided economic growth continues apace. Wright believes that economic growth and job creation will be strong enough to convince the Fed to follow that course, even as the program has lost some of its effectiveness. Looking ahead, Wright believes bonds will do well to earn a low single-digit return in 2014, but their lower volatility warrant a place in balanced portfolios.

The WTRB Fund continues to have a shorter average duration compared to the Barclays U.S. Aggregate by about a half year. The average duration of the Fund was 4.8 years at the end of 2013, compared to 5.4 years for the Barclays U.S. Aggregate. On a duration basis, 45% of the Fund’s assets were held in securities with an average duration of three years or less, compared to 29% in the benchmark index. By contrast, 21% of the Fund’s assets were held in securities with average durations of between three and five years, compared to 30% for the index, and 35% of the Fund’s assets had an average duration of five years or more, versus 42% for the index. The biggest discrepancy between Fund holdings and the benchmark in terms of duration is in the 2-3 year area, where the Fund holds 32% of its assets versus 13% for the index. This duration positioning reflects our view that, given the uncertainty in the current economic environment, limiting potential losses from rising interest rates is an appropriate strategy even if it would hamper returns should interest rates fall.

The Fund continues to be significantly overweight in corporate bonds and underweight in government bonds relative to the Barclays Aggregate benchmark. At the end of the year, the Fund held 45% of its assets in corporate bonds, compared to 28% for the index, and 15% of its portfolio in Treasury securities, versus 36% for the benchmark. The rest of the Fund’s holdings included 32% mortgage-backed securities versus 30% in the benchmark; 6% commercial mortgages versus 2%; agency bonds 0% versus 4%; and asset-backed securities 1% versus 0%. On a credit basis, 55% of the Fund’s assets were in AAA-rated securities, versus 73% for the benchmark; 20% in A-rated paper versus 11% for the benchmark, and 19% in BBB-rated securities versus 12% for the Aggregate.

The Fund also remains substantially overweight in higher-coupon bond issues compared to the index. At

6

Management Discussion (Unaudited)

December 31, 2013, 63% of the Fund’s holdings were in bonds with coupons of 5% or greater, compared to only 21% for the index. The Fund’s largest positions were in bonds with 5%-6% coupons (22%, versus 12% for the index) and 6%-7% coupons (20%, versus 6% for the index).

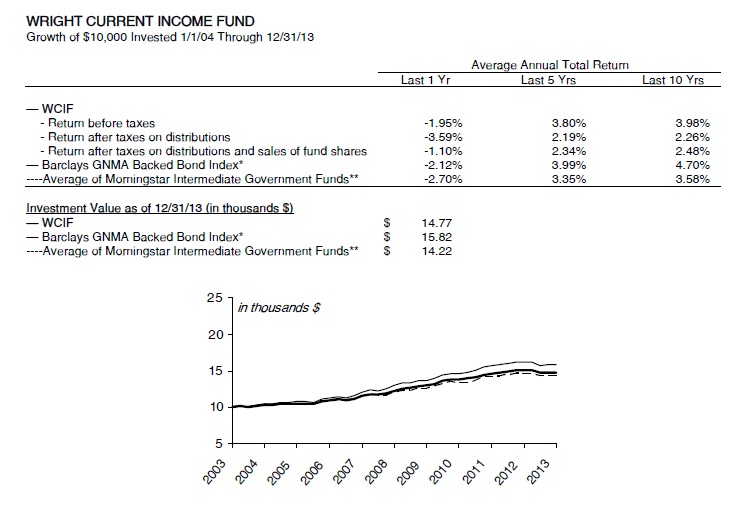

CURRENT INCOME FUND

The Wright Current Income Fund (WCIF) had a total return of negative 0.3% in the fourth quarter of 2013, outperforming the Barclays GNMA bond index, the Fund’s benchmark, which lost 0.5%, although behind the Barclays U.S. Aggregate bond index, which lost 0.1%. For full year 2013, the Fund lost 2.0%, compared to the 2.1% loss for the GNMA index and 2.0% loss for the Barclays U.S. Aggregate index. WCIF is managed to be invested in GNMA issues (mortgage-based securities, known as Ginnie Maes, guaranteed by the full faith and credit of the U.S. government) and other mortgage-based securities. The WCIF Fund is actively managed to maximize income and minimize principal fluctuation. WCIF had a yield of 2.5% at December 31, 2013, calculated according to SEC guidelines. Dividends paid by this Fund may be more or less than implied by this yield.

In addition to its holdings in GNMA-backed mortgage issues, WCIF also holds issues backed by Fannie Mae (FNMA) and Freddie Mac (FHLMC), both of which are under the conservatorship of the U.S. Treasury through the Federal Housing Finance Agency (FHFA). At the end of 2013, the WCIF Fund was 96% invested in agency-backed mortgages, versus 100% for the index, with 4% in cash or cash equivalents.

The Fund continues to have a higher average coupon than the GNMA benchmark, reflecting the Fund’s mandate to maximize income. At December 31, 2013, WCIF’s average coupon was 5.4%, compared to 4.0% for the GNMA benchmark. The Fund remains substantially overweight in higher coupon mortgages relative to its benchmark. At the end of the year, the Fund held 77% of its assets in mortgages with 5% or greater coupons, compared to only 19% for the benchmark. The Fund’s biggest positions were in mortgages with 6%-7% coupons (35%, versus 4% for the index) and 5%-6% coupons (33% of the portfolio, compared to 15% for the index). By comparison, 16% of the Fund’s assets were held in mortgages with 3%-5% coupons, compared to 80% for the GNMA benchmark. The emphasis on well-seasoned higher-coupon issues contributes to the Fund’s lesser negative convexity compared to the GNMA benchmark, which tends to result in a more stable performance when interest rates are volatile.

At year-end, the average duration of the mortgages held by the Fund remained more than a year shorter than the index’s duration. As interest rates rose during the fourth quarter, the average duration of the Fund increased to 4.4 years from 4.2 years at the end of Q3, while the average duration in the index lengthened to 5.6 years from 5.3 years. At year-end, 31% of securities held in the Fund had a duration of three years or less, compared to 2% for the benchmark. By contrast, 68% of the Fund’s assets had durations of three years or more, compared to 98% for the index. The biggest duration difference between WCIF and its GNMA benchmark was in the 5-7 year range, where 7% of the Fund’s assets resided (versus 40% for the index). Similarly, 7% of the Fund’s assets had a duration of 7-10 years, compared to 19% for the index.

7

Performance Summaries (Unaudited)

Important

The Total Investment Return is the percent return of an initial $10,000 investment made at the beginning of the period to the ending redeemable value assuming all dividends and distributions are reinvested. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Past performance is not predictive of future performance.

* The Fund’s average annual return is compared with that of the S&P MidCap 400, an unmanaged index of stocks in a broad range of industries with market capitalizations of a few billion or less. The performance of the S&P MidCap 400, unlike that of the Fund, reflects no deductions for fees, expense or taxes. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.48%. However, Wright and Wright Investors’ Service Distributors, Inc. (“WISDI”) have contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expense to 1.40%, which is in effect until April 30, 2014. During the year, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. Returns greater than one year are annualized.

** Morningstar Mid Cap Funds represent the average return of 138 current funds ex multi-share classes in the Mid Cap Blend category reported in the Morningstar, Inc. database. © 2013 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

8

Performance Summaries (Unaudited)

| WRIGHT SELECTED BLUE CHIP EQUITIES FUND | |

| | |

| Industry Weightings | | Ten Largest Stock Holdings |

| % of net assets @ 12/31/13 | | % of net assets @ 12/31/13 |

| | | | | | | | | | | | | | |

| Capital Goods | | 10.9 | % | | Technology Hardware & Equipment | | 2.8 | % | | Alliance Data Systems Corp. | | 3.9 | % |

| Software & Services | | 10.4 | % | | Consumer Durables & Apparel | | 2.7 | % | | B/E Aerospace, Inc. | | 3.3 | % |

| Banks | | 9.3 | % | | Media | | 2.6 | % | | Waddell & Reed Financial, Inc. –Class A | | 2.7 | % |

| Retailing | | 8.2 | % | | Utilities | | 2.3 | % | | Hanesbrands, Inc. | | 2.7 | % |

| Diversified Financials | | 7.1 | % | | Commercial & Professional Services | | 2.1 | % | | Brinker International, Inc. | | 2.4 | % |

| Health Care Equipment & Services | | 6.9 | % | | Household & Personal Products | | 2.0 | % | | Universal Health Services, Inc. – Class B | | 2.4 | % |

| Insurance | | 5.5 | % | | Transportation | | 1.7 | % | | Advance Auto Parts, Inc. | | 2.3 | % |

| Materials | | 5.2 | % | | Commercial Services & Supplies | | 1.3 | % | | HollyFrontier Corp. | | 2.3 | % |

| Consumer Services | | 4.6 | % | | Food, Beverage & Tobacco | | 0.8 | % | | Foot Locker, Inc. | | 2.1 | % |

| Pharmaceuticals & Biotechnology | | 3.9 | % | | Communications Equipment | | 0.8 | % | | BancorpSouth, Inc. | | 2.1 | % |

| Energy | | 3.7 | % | | Industrial | | 0.6 | % | | | | | |

| | | | | | | | | | | | | | |

9

Performance Summaries (Unaudited)

* The Fund’s average annual return is compared with that of the S&P 500, an unmanaged index of 500 widely held common stocks that generally indicates the performance of the market. The performance of the S&P 500, unlike that of the Fund, reflects no deductions for fees, expenses or taxes. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.84%. However, Wright and WISDI have contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expense to 1.40%, which is in effect until April 30, 2014. During the year, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. Returns greater than one year are annualized.

** Morningstar Large Cap Funds represent the average return of 486 current funds ex multi-share classes in the Large Cap Blend category reported in the Morningstar, Inc. database. © 2013 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

10

Performance Summaries (Unaudited)

| WRIGHT MAJOR BLUE CHIP EQUITIES FUND | |

| | |

| Industry Weightings | | Ten Largest Stock Holdings |

| % of net assets @ 12/31/13 | | % of net assets @ 12/31/13 |

| | | | | | | | | | | | | | |

| Software & Services | | 14.7 | % | | Health Care Equipment & Services | | 3.7 | % | | Microsoft Corp. | | 4.8 | % |

| Capital Goods | | 12.1 | % | | Telecommunication Services | | 3.6 | % | | JPMorgan Chase & Co. | | 4.5 | % |

| Pharmaceuticals & Biotechnology | | 11.8 | % | | Food & Staples Retailing | | 3.3 | % | | Oracle Corp. | | 4.3 | % |

| Diversified Financials | | 10.2 | % | | Utilities | | 3.1 | % | | Johnson & Johnson | | 4.3 | % |

| Energy | | 9.1 | % | | Consumer Durables & Apparel | | 2.8 | % | | Intel Corp. | | 3.7 | % |

| Insurance | | 7.0 | % | | Materials | | 2.3 | % | | Chevron Corp. | | 3.7 | % |

| Technology Hardware & Equipment | | 5.4 | % | | Food, Beverage & Tobacco | | 1.8 | % | | MetLife, Inc. | | 3.7 | % |

| Retailing | | 5.2 | % | | Consumer Services | | 1.2 | % | | Amgen, Inc. | | 3.6 | % |

| Semiconductors & Semiconductor Equipment | | 3.7 | % | | | | | | | AT&T, Inc. | | 3.6 | % |

| | | | | | | | | | | TJX Cos., Inc. | | 3.4 | % |

11

Performance Summaries (Unaudited)

* The Fund’s average annual return is compared with that of the MSCI World ex U.S. Index. While the Fund does not seek to match the returns of this index, this unmanaged index generally indicates foreign stock market performance. The performance of the MSCI World ex U.S. Index, unlike that of the Fund, reflects no deductions for fees, expenses or taxes. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 2.01%. However, Wright and WISDI have contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expense to 1.85%, which is in effect until April 30, 2014. Returns greater than one year are annualized. Shares held less than 90 days will be subject to a 2.00% redemption fee.

** Morningstar International Equity Funds represent the average of 209 current funds ex multi-share classes in the Foreign Large Blend category reported in the Morningstar, Inc. database. © 2013 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

12

Performance Summaries (Unaudited)

| WRIGHT INTERNATIONAL BLUE CHIP EQUITIES FUND | |

| | |

| Country Weightings | | Ten Largest Stock Holdings |

| % of net assets @ 12/31/13 | | % of net assets @ 12/31/13 |

| | | | | | | | | | | | | | |

| Japan | | 21.5 | % | | Norway | | 1.5 | % | | Legal & General Group PLC | | 3.4 | % |

| United Kingdom | | 20.3 | % | | Hong Kong | | 1.5 | % | | BASF SE | | 3.1 | % |

| Germany | | 13.1 | % | | Netherlands | | 1.4 | % | | AstraZeneca PLC | | 3.0 | % |

| France | | 12.0 | % | | Denmark | | 1.1 | % | | Nestle SA | | 2.9 | % |

| Switzerland | | 11.7 | % | | Austria | | 0.9 | % | | Swiss Re AG | | 2.8 | % |

| Canada | | 3.5 | % | | Ireland | | 0.7 | % | | KDDI Corp. | | 2.7 | % |

| Australia | | 3.4 | % | | Luxembourg | | 0.4 | % | | Rolls-Royce Holdings PLC | | 2.4 | % |

| Spain | | 2.8 | % | | Sweden | | 0.3 | % | | BNP Paribas SA | | 2.2 | % |

| Italy | | 1.6 | % | | | | | | | Vodafone Group PLC | | 2.1 | % |

| | | | | | | | | | | Toronto-Dominion Bank (The) | | 2.0 | % |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

13

Performance Summaries (Unaudited)

* The Fund’s average annual return is compared with that of the Barclays U.S. Aggregate Bond Index, an unmanaged index that is a broad representation of the investment-grade fixed income market in the U.S. The Barclays U.S. Aggregate Bond Index, unlike the Fund, reflects no deductions for fees, expenses or taxes. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.41%. However, Wright and WISDI have contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expense to 0.95%, which is in effect until April 30, 2014. During the year, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. Returns greater than one year are annualized.

** Morningstar average represents the return of 282 current funds ex multi-share classes in the Intermediate Term Bond category in the Morningstar, Inc. database. © 2013 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

14

Performance Summaries (Unaudited)

| WRIGHT TOTAL RETURN BOND FUND | | |

| | | |

| Holdings by Security Type | | Five Largest Bond Holdings |

| % of net assets @ 12/31/13 | | % of net assets @ 12/31/13 |

| | | | | | | | | | | | | |

| Asset-Backed Securities | | 0.6 | % | | | | | U.S. Treasury Note | 2.63% | 11/15/20 | 5.6 | % |

| Corporate Bonds | | 44.3 | % | | | | | U.S. Treasury Strip Coupon | 2.52-2.89% | 05/15/22 | 4.9 | % |

| Mortgage-Backed Securities | | 38.0 | % | | | | | GNMA , Series 2010-44, Class NK | 4.00% | 10/20/37 | 4.3 | % |

| U.S. Treasuries | | 15.2 | % | | | | | FHLMC, Series 2627, Class MW | 5.00% | 06/15/23 | 3.3 | % |

| | | | | | | | | U.S. Treasury Bond | 3.13% | 02/15/42 | 3.1 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Holdings by Credit Quality | | | | | | |

| % of net assets @ 12/31/13 | | | | | | |

| | | | | | | | | | | | | | |

| A | | 20 | % | | | | | | | | | | |

| Aa | | 4 | % | | | | | | | | | | |

| Aaa | | 55 | % | | | | | | | | | | |

| BBB | | 19 | % | | | | | | | | | | |

| <BBB | | 2 | % | | | | | | | | | | |

| U.S. Government Agencies | | 0 | % | | | | | | | | | | |

| U.S. Treasuries | | 0 | % | | | | | | | | | | |

15

Performance Summaries (Unaudited)

* The Fund��s average annual return is compared with that of the Barclays GNMA Backed Bond Index. While the Fund does not seek to match the returns of the Barclays GNMA Backed Bond Index, Wright believes that this unmanaged index generally indicates the performance of government and corporate mortgage-backed bond markets. The Barclays GNMA Backed Bond Index, unlike the Fund, reflects no deductions for fees, expenses or taxes. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.16%. However, Wright and WISDI have contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expense to 1.00%, which is in effect until April 30, 2014. During the year, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. Returns greater than one year are annualized.

** The Morningstar Intermediate Government Fund Average represents the average return of all 76 current funds ex multi-share classes in the Intermediate Government category reported in the Morningstar, Inc. database. © 2013 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

16

Performance Summaries (Unaudited)

| WRIGHT CURRENT INCOME FUND | |

| | |

| Holdings by Security Type | Five Largest Bond Holdings |

| % of net assets @ 12/31/13 | % of net assets @ 12/31/13 |

| | | | | | | | | | | | | |

| | | | | | | | | GNMA, Series 2010-116, Class PB | 5.00% | 06/16/40 | 3.7 | % |

| Agency Mortgage-Backed Securities | | 95.9 | % | | | | | FHLMC, Series 4142, Class PN | 2.50% | 12/15/32 | 3.0 | % |

| | | | | | | | | FNMA Pool #891367 | 4.75% | 04/01/36 | 2.4 | % |

| | | | | | | | | GNMA II Pool #004838 | 6.50% | 10/20/40 | 2.2 | % |

| | | | | | | | | FNMA Pool #846323 | 4.25% | 11/01/35 | 1.8 | % |

| Weighted Average Maturity | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| @ 12/31/13 | | 5.5 | Years | | | | | | | | | |

| | | | | | | | | | | | | |

17

Fund Expenses (Unaudited)

Example:

As a shareholder of a fund, you incur two types of costs: (1) transaction costs, including redemption fees (if applicable); and (2) ongoing costs including management fees; distribution or service fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2013 – December 31, 2013).

Actual Expenses:

The first line of the tables shown on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes:

The second line of the tables provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees (if applicable). Therefore, the second line of the tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

18

Fund Expenses (Unaudited)

EQUITY FUNDS

Wright Selected Blue Chip Equities Fund

| | Beginning Account Value (7/1/13) | Ending Account Value (12/31/13) | Expenses Paid During Period* (7/1/13-12/31/13) |

| Actual Fund Shares | $1,000.00 | $ 1,206.08 | $7.78 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | $1,000.00 | $1,018.15 | $7.12 |

*Expenses are equal to the Fund’s annualized expense ratio of 1.40% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2013.

Wright Major Blue Chip Equities Fund

| | Beginning Account Value (7/1/13) | Ending Account Value (12/31/13) | Expenses Paid During Period* (7/1/13-12/31/13) |

| Actual Fund Shares | $1,000.00 | $1,181.51 | $7.70 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | $1,000.00 | $1,018.15 | $7.12 |

*Expenses are equal to the Fund’s annualized expense ratio of 1.40% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2013.

Wright International Blue Chip Equities Fund

| | Beginning Account Value (7/1/13) | Ending Account Value (12/31/13) | Expenses Paid During Period* (7/1/13-12/31/13) |

| Actual Fund Shares | $1,000.00 | $1,182.68 | $10.18 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | $1,000.00 | $1,015.88 | $ 9.40 |

*Expenses are equal to the Fund’s annualized expense ratio of 1.85% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2013.

FIXED-INCOME FUNDS

Wright Total Return Bond Fund

| | Beginning Account Value (7/1/13) | Ending Account Value (12/31/13) | Expenses Paid During Period* (7/1/13-12/31/13) |

| Actual Fund Shares | $1,000.00 | $1,003.28 | $4.80 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | $1,000.00 | $1,020.42 | $4.84 |

*Expenses are equal to the Fund’s annualized expense ratio of 0.95% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2013.

Wright Current Income Fund

| | Beginning Account Value (7/1/13) | Ending Account Value (12/31/13) | Expenses Paid During Period* (7/1/13-12/31/13) |

| Actual Fund Shares | $1,000.00 | $ 997.76 | $4.53 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | $1,000.00 | $1,020.67 | $4.58 |

*Expenses are equal to the Fund’s annualized expense ratio of 0.90% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2013.

19

Wright Selected Blue Chip Equities Fund (WSBC)

Portfolio of Investments - As of December 31, 2013

AFA

| | | Shares | | | Value | |

| | | | | | |

| BANKS - 9.3% | | | | | | |

| BancorpSouth, Inc. | | | 33,275 | | | $ | 845,851 | |

| City National Corp. | | | 5,645 | | | | 447,197 | |

| Commerce Bancshares, Inc. | | | 6,046 | | | | 271,481 | |

| East West Bancorp, Inc. | | | 16,045 | | | | 561,094 | |

| First Niagara Financial Group, Inc. | | | 35,430 | | | | 376,267 | |

| FirstMerit Corp. | | | 21,170 | | | | 470,609 | |

| Fulton Financial Corp. | | | 48,205 | | | | 630,521 | |

| Valley National Bancorp | | | 13,520 | | | | 136,822 | |

| | | | | | | $ | 3,739,842 | |

| CAPITAL GOODS - 10.9% | | | | | | | | |

| AGCO Corp. | | | 3,415 | | | $ | 202,134 | |

| Alliant Techsystems, Inc. | | | 5,260 | | | | 640,037 | |

| AMETEK, Inc. | | | 7,725 | | | | 406,876 | |

| B/E Aerospace, Inc.* | | | 15,300 | | | | 1,331,559 | |

| Carlisle Cos., Inc. | | | 5,350 | | | | 424,790 | |

| Huntington Ingalls Industries, Inc. | | | 2,970 | | | | 267,330 | |

| Terex Corp. | | | 10,550 | | | | 442,994 | |

| Triumph Group, Inc. | | | 5,125 | | | | 389,859 | |

| URS Corp. | | | 5,050 | | | | 267,599 | |

| | | | | | | $ | 4,373,178 | |

| COMMERCIAL & PROFESSIONAL SERVICES - 2.1% | | | | | | | | |

| Deluxe Corp. | | | 9,435 | | | $ | 492,413 | |

| Towers Watson & Co. - Class A | | | 2,750 | | | | 350,927 | |

| | | | | | | $ | 843,340 | |

| COMMERCIAL SERVICES & SUPPLIES - 1.3% | | | | | | | | |

| AECOM Technology Corp.* | | | 17,920 | | | $ | 527,386 | |

| COMMUNICATIONS EQUIPMENT - 0.8% | | | | | | | | |

| Exelis, Inc. | | | 16,640 | | | $ | 317,158 | |

| CONSUMER DURABLES & APPAREL - 2.7% | | | | | | | | |

| Hanesbrands, Inc. | | | 15,375 | | | $ | 1,080,401 | |

| CONSUMER SERVICES - 4.6% | | | | | | | | |

| Apollo Education Group, Inc.* | | | 8,690 | | | $ | 237,411 | |

| Brinker International, Inc. | | | 21,020 | | | | 974,067 | |

| Cheesecake Factory, Inc. (The) | | | 13,295 | | | | 641,749 | |

| | | | | | | $ | 1,853,227 | |

| DIVERSIFIED FINANCIALS - 7.1% | | | | | | | | |

| Affiliated Managers Group, Inc.* | | | 2,600 | | | $ | 563,888 | |

| CBOE Holdings, Inc. | | | 3,640 | | | | 189,134 | |

| MSCI, Inc.* | | | 13,445 | | | | 587,816 | |

| Raymond James Financial, Inc. | | | 7,960 | | | | 415,432 | |

| Waddell & Reed Financial, Inc. - Class A | | | 16,860 | | | | 1,097,923 | |

| | | | | | | $ | 2,854,193 | |

| ENERGY - 3.7% | | | | | | | | |

| Atwood Oceanics, Inc.* | | | 3,490 | | | $ | 186,331 | |

| HollyFrontier Corp. | | | 18,244 | | | | 906,544 | |

| Murphy USA, Inc.* | | | 2,500 | | | | 103,900 | |

| Oil States International, Inc.* | | | 1,480 | | | | 150,546 | |

| Patterson-UTI Energy, Inc. | | | 6,120 | | | | 154,958 | |

| | | | | | | $ | 1,502,279 | |

| | | Shares | | | Value | |

| | | | | | | | | |

| FOOD, BEVERAGE & TOBACCO - 0.8% | | | | | | | | |

| Green Mountain Coffee Roasters, Inc.* | | | 2,450 | | | $ | 185,171 | |

| Ingredion, Inc. | | | 1,930 | | | | 132,128 | |

| | | | | | | $ | 317,299 | |

| HEALTH CARE EQUIPMENT & SERVICES - 6.9% | | | | | | | | |

| Cooper Cos., Inc. (The) | | | 1,410 | | | $ | 174,614 | |

| MEDNAX, Inc.* | | | 4,160 | | | | 222,061 | |

| Omnicare, Inc. | | | 13,145 | | | | 793,432 | |

| ResMed, Inc. | | | 13,220 | | | | 622,398 | |

| Universal Health Services, Inc. - Class B | | | 11,810 | | | | 959,681 | |

| | | | | | | $ | 2,772,186 | |

| HOUSEHOLD & PERSONAL PRODUCTS - 2.0% | | | | | | | | |

| Energizer Holdings, Inc. | | | 7,280 | | | $ | 787,987 | |

| INDUSTRIAL - 0.6% | | | | | | | | |

| Gentex Corp. | | | 7,855 | | | $ | 259,136 | |

| INSURANCE - 5.5% | | | | | | | | |

| American Financial Group, Inc. | | | 7,010 | | | $ | 404,617 | |

| Everest Re Group, Ltd. | | | 1,190 | | | | 185,485 | |

| HCC Insurance Holdings, Inc. | | | 18,050 | | | | 832,827 | |

| Old Republic International Corp. | | | 6,745 | | | | 116,486 | |

| Reinsurance Group of America, Inc. | | | 3,270 | | | | 253,131 | |

| WR Berkley Corp. | | | 9,732 | | | | 422,272 | |

| | | | | | | $ | 2,214,818 | |

| MATERIALS - 5.2% | | | | | | | | |

| Albemarle Corp. | | | 2,700 | | | $ | 171,153 | |

| Louisiana-Pacific Corp.* | | | 18,795 | | | | 347,896 | |

| Olin Corp. | | | 13,295 | | | | 383,561 | |

| Packaging Corp. of America | | | 8,840 | | | | 559,395 | |

| Rock-Tenn Co. - Class A | | | 4,085 | | | | 428,966 | |

| Worthington Industries, Inc. | | | 4,530 | | | | 190,622 | |

| | | | | | | $ | 2,081,593 | |

| MEDIA - 2.6% | | | | | | | | |

| John Wiley & Sons, Inc. - Class A | | | 10,325 | | | $ | 569,940 | |

| Meredith Corp. | | | 9,360 | | | | 484,848 | |

| | | | | | | $ | 1,054,788 | |

| PHARMACEUTICALS & BIOTECHNOLOGY - 3.9% | | | | | | | | |

| Covance, Inc.* | | | 3,130 | | | $ | 275,628 | |

| Endo Health Solutions, Inc.* | | | 9,955 | | | | 671,564 | |

| United Therapeutics Corp.* | | | 5,495 | | | | 621,375 | |

| | | | | | | $ | 1,568,567 | |

| RETAILING - 8.2% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 8,495 | | | $ | 940,227 | |

| Ascena Retail Group, Inc.* | | | 11,440 | | | | 242,070 | |

| CST Brands, Inc. | | | 3,175 | | | | 116,586 | |

| Dick's Sporting Goods, Inc. | | | 3,465 | | | | 201,317 | |

| Foot Locker, Inc. | | | 20,575 | | | | 852,628 | |

| Ross Stores, Inc. | | | 10,250 | | | | 768,032 | |

| Williams-Sonoma, Inc. | | | 3,270 | | | | 190,576 | |

| | | | | | | $ | 3,311,436 | |

See Notes to Financial Statements. 20

Wright Selected Blue Chip Equities Fund (WSBC)

Portfolio of Investments - As of December 31, 2013

| | | Shares | | | Value | |

| SOFTWARE & SERVICES - 10.4% | | | | | | | | |

| Acxiom Corp.* | | | 16,420 | | | $ | 607,212 | |

| Alliance Data Systems Corp.* | | | 6,015 | | | | 1,581,524 | |

| Cadence Design Systems, Inc.* | | | 39,815 | | | | 558,206 | |

| Jack Henry & Associates, Inc. | | | 4,515 | | | | 267,333 | |

| Leidos Holdings, Inc. | | | 7,935 | | | | 368,898 | |

| NeuStar, Inc. - Class A* | | | 8,765 | | | | 437,023 | |

| ValueClick, Inc.* | | | 14,960 | | | | 349,615 | |

| | | | | | | $ | 4,169,811 | |

| TECHNOLOGY HARDWARE & EQUIPMENT - 2.8% | | | | | | | | |

| 3D Systems Corp.* | | | 2,965 | | | $ | 275,537 | |

| Arrow Electronics, Inc.* | | | 4,235 | | | | 229,749 | |

| Avnet, Inc. | | | 13,965 | | | | 615,996 | |

| | | | | | | $ | 1,121,282 | |

| TRANSPORTATION - 1.7% | | | | | | | | |

| Alaska Air Group, Inc. | | | 9,135 | | | $ | 670,235 | |

| UTILITIES - 2.3% | | | | | | | | |

| ONEOK, Inc. | | | 11,290 | | | $ | 702,012 | |

| UGI Corp. | | | 5,645 | | | | 234,042 | |

| | | | | | | $ | 936,054 | |

| TOTAL EQUITY INTERESTS - 95.4% (identified cost, $25,791,016) | | | | | | $ | 38,356,196 | |

| SHORT-TERM INVESTMENTS - 4.5% | | | | | | | | |

| Fidelity Government Money Market Fund, 0.01% (1) | | | 1,819,498 | | | $ | 1,819,498 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS - 4.5% (identified cost, $1,819,498) | | | | | | $ | 1,819,498 | |

| TOTAL INVESTMENTS — 99.9% (identified cost, $27,610,514) | | | | | | $ | 40,175,694 | |

| OTHER ASSETS, IN EXCESS OF LIABILITIES — 0.1% | | | | | | | 28,268 | |

| NET ASSETS — 100.0% | | | | | | $ | 40,203,962 | |

* — Non-income producing security.

| (1) | Variable rate security. Rate presented is as of December 31, 2013. |

See Notes to Financial Statements. 21

Wright Selected Blue Chip Equities Fund (WSBC)

| STATEMENT OF ASSETS AND LIABILITIES |

| As of December 31, 2013 |

| | | | | |

| ASSETS: | | | TRUE | |

| Investments, at value | | | | |

| (identified cost $27,610,514) (Note 1A) | | $ | 40,175,694 | ###### |

| Receivable for fund shares sold | | | 12,669 | |

| Dividends receivable | | | 27,378 | |

| Prepaid expenses and other assets | | | 16,335 | |

| Total assets | | $ | 40,232,076 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for fund shares reacquired | | $ | 10,685 | |

| Accrued expenses and other liabilities | | | 17,429 | |

| Total liabilities | | $ | 28,114 | |

| NET ASSETS | | $ | 40,203,962 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 25,260,229 | |

| Accumulated net realized gain on investments | | | 2,378,553 | |

| Unrealized appreciation on investments | | | 12,565,180 | |

| Net assets applicable to outstanding shares | | $ | 40,203,962 | |

| | | | | |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING AT $0.000 PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | 2,839,850 | |

| | | | | |

| NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE OF BENEFICIAL INTEREST | | $ | 14.16 | |

| | | | | |

| STATEMENT OF OPERATIONS |

| For the Year Ended December 31, 2013 |

| | | | | | | |

| INVESTMENT INCOME (Note 1C) | | | TRUE | |

| | 3E | +07 | Dividend income | | $ | 496,695 | |

| | | | Total investment income | | $ | 496,695 | |

| | | | | | | | |

| Expenses – | | | | |

| | | | Investment adviser fee (Note 3) | | $ | 221,153 | |

| | | | Administrator fee (Note 3) | | | 44,231 | |

| | | | Trustee expense (Note 3) | | | 14,040 | |

| | | | Custodian fee | | | 3,711 | |

| | | | Accountant fee | | | 38,911 | |

| | | | Distribution expenses (Note 4) | | | 92,147 | |

| | | | Transfer agent fee | | | 28,794 | |

| | | | Printing | | | 131 | |

| | | | Shareholder communications | | | 5,604 | |

| | | | Audit services | | | 17,000 | |

| | | | Legal services | | | 12,979 | |

| | | | Compliance services | | | 6,098 | |

| | | | Registration costs | | | 18,469 | |

| | | | Interest expense (Note 8) | | | 1,162 | |

| | | | Miscellaneous | | | 21,078 | |

| | | | Total expenses | | $ | 525,508 | |

| | | | | | | | |

| Deduct – | | | | |

| | | | Waiver and/or reimbursement by the principal underwriter and/or investment adviser (Note 4) | | $ | (8,322 | ) |

| | | | Net expenses | | $ | 517,186 | |

| | | | Net investment loss | | $ | (20,491 | ) |

| | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | |

| | | | Net realized gain on investment transactions | | $ | 5,721,464 | |

| | | | Net change in unrealized appreciation (depreciation) on investments | | | 6,436,418 | |

| | | | Net realized and unrealized gain on investments | | $ | 12,157,882 | |

| | | | Net increase in net assets from operations | | $ | 12,137,391 | |

| | | | | | | | |

See Notes to Financial Statements. 22

Wright Selected Blue Chip Equities Fund (WSBC)

| | | | | Years Ended |

| STATEMENTS OF CHANGES IN NET ASSETS | | December 31, 2013 | | December 31, 2012 |

| | | | | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| From operations – | | | | | | | | |

| | | Net investment income (loss) | | $ | (20,491 | ) | | $ | 87,380 | |

| | 0 | | Net realized gain on investment transactions | | | 5,721,464 | | | | 1,739,677 | |

| | | | Net change in unrealized appreciation (depreciation) on investments | | | 6,436,418 | | | | 3,290,176 | |

| | | | Net increase in net assets from operations | | $ | 12,137,391 | | | $ | 5,117,233 | |

| Distributions to shareholders (Note 2) | | | | | | | | |

| | | | From net investment income | | $ | (7,466 | ) | | $ | (68,336 | ) |

| | | | From net realized capital gains | | | (4,709,210 | ) | | | (1,149,678 | ) |

| | | | Total distributions | | $ | (4,716,676 | ) | | $ | (1,218,014 | ) |

| Net increase (decrease) in net assets resulting from fund share transactions (Note 6) | $ | 2,860,851 | | | $ | (6,338,582 | ) |

| Net increase (decrease) in net assets | | $ | 10,281,566 | | | $ | (2,439,363 | ) |

| | ## | | | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| | | | At beginning of year | | | 29,922,396 | | | | 32,361,759 | |

| | | | At end of year | | $ | 40,203,962 | | | $ | 29,922,396 | |

| | | | | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME INCLUDED IN NET ASSETS AT END OF YEAR | | $ | - | | | $ | 7,446 | |

| | | | | | | | | | | | |

See Notes to Financial Statements. 23

Wright Selected Blue Chip Equities Fund (WSBC)

| These financial highlights reflect selected data for a share outstanding throughout each year. | | | | |

| | | Years Ended December 31, |

| FINANCIAL HIGHLIGHTS | | 2013 | 2012 | 2011 | 2010 | 2009 |

| | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 11.530 | | $ | 10.280 | | $ | 10.400 | | $ | 8.400 | | $ | 6.060 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) (1) | | | (0.007 | ) | | 0.028 | | | (0.018 | ) | | (0.022 | ) | | 0.011 | |

| Net realized and unrealized gain (loss) | | | 4.412 | | | 1.616 | | | (0.102 | ) | | 2.030 | | | 2.329 | |

| | Total income (loss) from investment operations | | 4.405 | | | 1.644 | | | (0.120 | ) | | 2.008 | | | 2.340 | |

| | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | |

| From net investment income | | | — | (2) | | (0.025 | ) | | — | | | (0.008 | ) | | — | |

| From net realized gains | | | (1.775 | ) | | (0.369 | ) | — | | | — | | | — | |

| | Total distributions | | | (1.775 | ) | | (0.394 | ) | | — | | | (0.008 | ) | | — | |

| Net asset value, end of year | | $ | 14.160 | | $ | 11.530 | | $ | 10.280 | | $ | 10.400 | | $ | 8.400 | |

Total Return(3) | | | 39.82 | % | | 16.02 | % | | (1.15 | )% | | 23.93 | % | | 38.61 | % |

Ratios/Supplemental Data(4): | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $40,204 | | $29,922 | | $32,362 | | $28,370 | | $16,763 | |

| Ratios (As a percentage of average daily net assets): |

| Net expenses | | | 1.40 | % | 1.40 | % | 1.40 | % | 1.40 | % | 1.36 | % |

| Net expenses after custodian fee reduction | | | N/A | | | N/A | | | N/A | | | N/A | | | 1.36 | % |

| Net investment income (loss) | | | (0.06 | )% | 0.25 | % | (0.17 | )% | (0.24 | )% | 0.15 | % |

| Portfolio turnover rate | | | 76 | % | 54 | % | 82 | % | 60 | % | 41 | % |

| | | | | | | | | | | | | | | | | |

| | | | | For the years ended December 31, 2013, 2012, 2011, 2010 and 2009 | For the years ended December 31, 2013, 2012, 2011, 2010 and 2009 | | | | | | | |

| (1) | Computed using average shares outstanding. |

| (2) | Less than $0.001 per share. |

| (3) | Total return is calculated assuming a purchase at the net asset value on the first day and a sale at the net asset value on the last day of each year reported. Dividends and distributions, if any, are assumed to be reinvested at the net asset value on the reinvestment date. |

| (4) | For each of the years presented, the operating expenses of the Fund were reduced by a waiver of fees and/or allocation of expenses to the principal underwriter and/or investment adviser. Had such action not been undertaken, expenses and net investment income (loss) ratios would have been as follows: |

| | | | 2013 | 2012 | 2011 | 2010 | 2009 |

| | |

| Ratios (As a percentage of average daily net assets): |

| Expenses | | | 1.43 | % | | 1.48 | % | | 1.46 | % | | 1.79 | % | | 2.15 | % |

| Expenses after custodian fee reduction | | | N/A | | | N/A | | | N/A | | | N/A | | | 2.15 | % |

| Net investment income (loss) | | | (0.09 | )% | | 0.17 | % | | (0.23 | )% | | (0.63 | )% | | (0.64 | )% |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements. 24

Wright Major Blue Chip Equities Fund (WMBC)

Portfolio of Investments - As of December 31, 2013

AFA

| | | Shares | | | Value | |

| | | | | | | |

EQUITY INTERESTS - 101.0% | | | | | | |

| CAPITAL GOODS - 12.1% | | | | | | |

| 3M Co. | | | 4,280 | | | $ | 600,270 | |

| Cummins, Inc. | | | 1,455 | | | | 205,111 | |

| General Dynamics Corp. | | | 4,000 | | | | 382,200 | |

| Illinois Tool Works, Inc. | | | 4,455 | | | | 374,576 | |

| Rockwell Automation, Inc. | | | 4,940 | | | | 583,711 | |

| | | | | | | $ | 2,145,868 | |

| CONSUMER DURABLES & APPAREL - 2.8% | | | | | | | | |

| Mattel, Inc. | | | 10,450 | | | $ | 497,211 | |

| CONSUMER SERVICES - 1.2% | | | | | | | | |

| Starbucks Corp. | | | 2,780 | | | $ | 217,924 | |

| DIVERSIFIED FINANCIALS - 10.2% | | | | | | | | |

| IntercontinentalExchange Group, Inc. | | | 1,860 | | | $ | 418,351 | |

| JPMorgan Chase & Co. | | | 13,495 | | | | 789,188 | |

| T. Rowe Price Group, Inc. | | | 7,195 | | | | 602,725 | |

| | | | | | | $ | 1,810,264 | |

| ENERGY - 9.1% | | | | | | | | |

| Chevron Corp. | | | 5,225 | | | $ | 652,655 | |

| Halliburton Co. | | | 10,685 | | | | 542,264 | |

| HollyFrontier Corp. | | | 3,920 | | | | 194,785 | |

| Murphy Oil Corp. | | | 3,390 | | | | 219,943 | |

| | | | | | | $ | 1,609,647 | |

| FOOD & STAPLES RETAILING - 3.3% | | | | | | | | |

| Walgreen Co. | | | 10,000 | | | $ | 574,400 | |

| FOOD, BEVERAGE & TOBACCO - 1.8% | | | | | | | | |

| Coca-Cola Co. (The) | | | 3,930 | | | $ | 162,348 | |

| Monster Beverage Corp.* | | | 2,340 | | | | 158,582 | |

| | | | | | | $ | 320,930 | |

| HEALTH CARE EQUIPMENT & SERVICES - 3.7% | | | | | | | | |

| Humana, Inc. | | | 880 | | | $ | 90,834 | |

| Stryker Corp. | | | 7,440 | | | | 559,041 | |

| | | | | | | $ | 649,875 | |

| INSURANCE - 7.0% | | | | | | | | |

| Aflac, Inc. | | | 8,955 | | | $ | 598,194 | |

| MetLife, Inc. | | | 11,965 | | | | 645,153 | |

| | | | | | | $ | 1,243,347 | |

| MATERIALS - 2.3% | | | | | | | | |

| CF Industries Holdings, Inc. | | | 1,645 | | | $ | 383,351 | |

| Monsanto Co. | | | 185 | | | | 21,562 | |

| | | | | | | $ | 404,913 | |

| PHARMACEUTICALS & BIOTECHNOLOGY - 11.8% | | | | | | | | |

| Amgen, Inc. | | | 5,595 | | | $ | 638,725 | |

| Bristol-Myers Squibb Co. | | | 7,075 | | | | 376,036 | |

| Gilead Sciences, Inc.* | | | 4,290 | | | | 322,394 | |

| Johnson & Johnson | | | 8,260 | | | | 756,533 | |

| | | | | | | $ | 2,093,688 | |

| | | Shares | | | Value | |

| RETAILING - 5.2% | | | | | | | | |

| Bed Bath & Beyond, Inc.* | | | 3,780 | | | $ | 303,534 | |

| TJX Cos., Inc. | | | 9,530 | | | | 607,347 | |

| | | | | | | $ | 910,881 | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 3.7% | | | | | | | | |

| Intel Corp. | | | 25,275 | | | $ | 656,139 | |

| SOFTWARE & SERVICES - 14.7% | | | | | | | | |

| Google, Inc. - Class A* | | | 425 | | | $ | 476,302 | |

| Intuit, Inc. | | | 775 | | | | 59,148 | |

| MasterCard, Inc. - Class A | | | 535 | | | | 446,971 | |

| Microsoft Corp. | | | 22,565 | | | | 844,608 | |

| Oracle Corp. | | | 19,975 | | | | 764,243 | |

| | | | | | | $ | 2,591,272 | |

| TECHNOLOGY HARDWARE & EQUIPMENT - 5.4% | | | | | | | | |

| Apple, Inc. | | | 940 | | | $ | 527,443 | |

| Cisco Systems, Inc. | | | 12,820 | | | | 287,809 | |

| QUALCOMM, Inc. | | | 1,900 | | | | 141,075 | |

| | | | | | | $ | 956,327 | |

| TELECOMMUNICATION SERVICES - 3.6% | | | | | | | | |

| AT&T, Inc. | | | 17,995 | | | $ | 632,704 | |

| UTILITIES - 3.1% | | | | | | | | |

| NextEra Energy, Inc. | | | 6,480 | | | $ | 554,818 | |

| TOTAL EQUITY INTERESTS - 101.0% (identified cost, $14,777,930) | | | | | | $ | 17,870,208 | |

| TOTAL INVESTMENTS — 101.0% (identified cost, $14,777,930) | | | | | | $ | 17,870,208 | |

| LIABILITIES, IN EXCESS OF OTHER ASSETS — (1.0)% | | | | | | | (178,539 | ) |

| NET ASSETS — 100.0% | | | | | | $ | 17,691,669 | |

* — Non-income producing security.

See Notes to Financial Statements. 25

Wright Major Blue Chip Equities Fund (WMBC)

| STATEMENT OF ASSETS AND LIABILITIES |

| As of December 31, 2013 |

| | | | | |

| ASSETS: | | | TRUE | |

| Investments, at value | | | | |

| (identified cost $14,777,930) (Note 1A) | | $ | 17,870,208 | ###### |

| Receivable for fund shares sold | | | 276 | |

| Dividends receivable | | | 6,925 | |

| Prepaid expenses and other assets | | | 14,257 | |

| Total assets | | $ | 17,891,666 | |

| | | | | |

| LIABILITIES: | | | | |

| Outstanding line of credit (Note 8) | | $ | 186,670 | |

| Accrued expenses and other liabilities | | | 13,327 | |

| Total liabilities | | $ | 199,997 | |

| NET ASSETS | | $ | 17,691,669 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 18,331,214 | |

| Accumulated net realized loss on investments | | | (3,736,428 | ) |

| Undistributed net investment income | | | 4,605 | |

| Unrealized appreciation on investments | | | 3,092,278 | |

| Net assets applicable to outstanding shares | | $ | 17,691,669 | |

| | | | | |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING AT $0.000 PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | 1,038,913 | |

| | | | | |

| NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE OF BENEFICIAL INTEREST | | $ | 17.03 | |

| | | | | |

| STATEMENT OF OPERATIONS |

| For the Year Ended December 31, 2013 |

| | | | | | | |

| INVESTMENT INCOME (Note 1C) | | | TRUE | |

| | 1E | +07 | Dividend income | | $ | 335,186 | |

| | | | Total investment income | | $ | 335,186 | |

| | | | | | | | |

| Expenses – | | | | |

| | | | Investment adviser fee (Note 3) | | $ | 98,020 | |

| | | | Administrator fee (Note 3) | | | 19,604 | |

| | | | Trustee expense (Note 3) | | | 14,040 | |

| | | | Custodian fee | | | 5,000 | |

| | | | Accountant fee | | | 37,290 | |

| | | | Distribution expenses (Note 4) | | | 40,842 | |

| | | | Transfer agent fee | | | 25,575 | |

| | | | Printing | | | 59 | |

| | | | Shareholder communications | | | 4,732 | |

| | | | Audit services | | | 17,000 | |

| | | | Legal services | | | 4,328 | |

| | | | Compliance services | | | 5,489 | |

| | | | Registration costs | | | 18,383 | |

| | | | Interest expense (Note 8) | | | 607 | |

| | | | Miscellaneous | | | 14,590 | |

| | | | Total expenses | | $ | 305,559 | |

| | | | | | | | |

| Deduct – | | | | |

| | | | Waiver and/or reimbursement by the principal underwriter and/or investment adviser (Note 4) | | $ | (76,238 | ) |

| | | | Net expenses | | $ | 229,321 | |

| | | | Net investment income | | $ | 105,865 | |

| | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | |

| | | | Net realized gain on investment transactions | | $ | 1,526,891 | |

| | | | Net change in unrealized appreciation (depreciation) on investments | | | 3,279,155 | |

| | | | Net realized and unrealized gain on investments | | $ | 4,806,046 | |

| | | | Net increase in net assets from operations | | $ | 4,911,911 | |

| | | | | | | | |

See Notes to Financial Statements. 26

Wright Major Blue Chip Equities Fund (WMBC)

| | | | | Years Ended |

| STATEMENTS OF CHANGES IN NET ASSETS | | December 31, 2013 | | December 31, 2012 |

| | | | | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| From operations – | | | | | | | | |

| | | Net investment income | | $ | 105,865 | | | $ | 114,040 | |

| | 0 | | Net realized gain (loss) on investment transactions | | | 1,526,891 | | | | (39,296 | ) |

| | | | Net change in unrealized appreciation (depreciation) on investments | | �� | 3,279,155 | | | | 746,759 | |

| | | | Net increase in net assets from operations | | $ | 4,911,911 | | | $ | 821,503 | |

| Distributions to shareholders (Note 2) | | | | | | | | |

| | | | From net investment income | | $ | (103,923 | ) | | $ | (111,377 | ) |

| | | | Total distributions | | $ | (103,923 | ) | | $ | (111,377 | ) |

| Net decrease in net assets resulting from fund share transactions (Note 6) | | $ | (2,675,499 | ) | | $ | (4,071,909 | ) |

| Net increase (decrease) in net assets | | $ | 2,132,489 | | | $ | (3,361,783 | ) |

| | ## | | | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| | | | At beginning of year | | | 15,559,180 | | | | 18,920,963 | |

| | | | At end of year | | $ | 17,691,669 | | | $ | 15,559,180 | |

| | | | | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME INCLUDED IN NET ASSETS AT END OF YEAR | | $ | 4,605 | | | $ | 2,663 | |

| | | | | | | | | | | | |

See Notes to Financial Statements. 27

Wright Major Blue Chip Equities Fund (WMBC)

| These financial highlights reflect selected data for a share outstanding throughout each year. | | | | |

| | | Years Ended December 31, |

| FINANCIAL HIGHLIGHTS | | 2013 | 2012 | 2011 | 2010 | 2009 |

| | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 12.690 | | $ | 12.260 | | $ | 12.250 | | $ | 10.870 | | $ | 9.340 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) (1) | | | 0.096 | | | 0.082 | | | (0.012 | ) | | 0.044 | | | 0.099 | |

| Net realized and unrealized gain (loss) | | | 4.344 | | | 0.437 | | | 0.022 | | | 1.389 | | | 1.564 | |

| | Total income from investment operations | | 4.440 | | | 0.519 | | | 0.010 | | | 1.433 | | | 1.663 | |

| | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.100 | ) | | (0.089 | ) | | — | | | (0.053 | ) | | (0.133 | ) |

| Net asset value, end of year | | $ | 17.030 | | $ | 12.690 | | $ | 12.260 | | $ | 12.250 | | $ | 10.870 | |

Total Return(2) | | | 35.03 | % | | 4.23 | % | | 0.08 | % | | 13.19 | % | | 17.83 | % |

Ratios/Supplemental Data(3): | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $17,692 | | $15,559 | | $18,921 | | $21,676 | | $27,337 | |

| Ratios (As a percentage of average daily net assets): |

| Net expenses | | | 1.40 | % | 1.40 | % | 1.40 | % | 1.41 | % | 1.36 | % |

| Net expenses after custodian fee reduction | | | N/A | | | N/A | | | N/A | | | N/A | | | 1.36 | % |

| Net investment income (loss) | | | 0.65 | % | 0.64 | % | (0.09 | )% | 0.39 | % | 1.06 | % |

| Portfolio turnover rate | | | 64 | % | 76 | % | 154 | % | 68 | % | 69 | % |

| | | | | | | | | | | | | | | | | |

| | | | | For the years ended December 31, 2013, 2012, 2011, 2010 and 2009 | For the years ended December 31, 2013, 2012, 2011, 2010 and 2009 | | | | | | | |

| (1) | Computed using average shares outstanding. |

| (2) | Total return is calculated assuming a purchase at the net asset value on the first day and a sale at the net asset value on the last day of each year reported. Dividends and distributions, if any, are assumed to be reinvested at the net asset value on the reinvestment date. |

| (3) | For each of the years presented, the operating expenses of the Fund were reduced by a waiver of fees and/or allocation of expenses to the principal underwriter and/or investment adviser. Had such action not been undertaken, expenses and net investment income (loss) ratios would have been as follows: |

| | | | 2013 | 2012 | 2011 | 2010 | 2009 |

| | |

| Ratios (As a percentage of average daily net assets): |

| Expenses | | | 1.87 | % | | 1.84 | % | | 1.70 | % | | 1.68 | % | | 1.55 | % |

| Expenses after custodian fee reduction | | | N/A | | | N/A | | | N/A | | | N/A | | | 1.55 | % |

| Net investment income (loss) | | | 0.17 | % | | 0.20 | % | | (0.39 | )% | | 0.13 | % | | 0.86 | % |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements. 28

Wright International Blue Chip Equities Fund (WIBC)

Portfolio of Investments - As of December 31, 2013

AFA

| | | Shares | | | Value | |

| EQUITY INTERESTS - 97.7% | | | | | | |

| AUSTRALIA - 3.4% | | | | | | |

| Australia & New Zealand Banking Group, Ltd. | | | 11,003 | | | $ | 317,267 | |

| Commonwealth Bank of Australia | | | 5,400 | | | | 375,860 | |

| CSL, Ltd. | | | 2,434 | | | | 150,166 | |

| Flight Centre Travel Group, Ltd. | | | 3,615 | | | | 153,784 | |

| Rio Tinto, Ltd. | | | 1,333 | | | | 81,309 | |

| | | | | | | $ | 1,078,386 | |

| AUSTRIA - 0.9% | | | | | | | | |

| OMV AG | | | 6,002 | | | $ | 287,729 | |

| CANADA - 3.5% | | | | | | | | |

| Agrium, Inc. | | | 3,482 | | | $ | 318,443 | |

| Manulife Financial Corp. | | | 8,194 | | | | 161,644 | |

| Toronto-Dominion Bank (The) | | | 6,918 | | | | 651,822 | |

| | | | | | | $ | 1,131,909 | |

| DENMARK - 1.1% | | | | | | | | |

| AP Moeller - Maersk A/S - Class B | | | 20 | | | $ | 217,395 | |

| Novo Nordisk A/S - Class B | | | 812 | | | | 149,079 | |

| | | | | | | $ | 366,474 | |

| FRANCE - 12.0% | | | | | | | | |

| Alcatel-Lucent* | | | 47,735 | | | $ | 214,299 | |

| AtoS | | | 1,852 | | | | 167,894 | |

| AXA SA | | | 7,981 | | | | 222,258 | |

| BNP Paribas SA | | | 8,943 | | | | 698,098 | |

| Cie Generale des Etablissements Michelin | | | 2,600 | | | | 276,761 | |

| Danone | | | 1,883 | | | | 135,753 | |

| Kering | | | 537 | | | | 113,695 | |

| Orange SA | | | 17,542 | | | | 217,548 | |

| Publicis Groupe SA | | | 1,290 | | | | 118,225 | |

| Rubis SCA | | | 1,864 | | | | 118,241 | |

| Safran SA | | | 2,324 | | | | 161,751 | |

| Sanofi | | | 4,220 | | | | 448,449 | |

| Technip SA | | | 997 | | | | 95,975 | |

| Total SA | | | 10,498 | | | | 644,158 | |

| Veolia Environnement SA | | | 8,727 | | | | 142,561 | |

| Vivendi SA | | | 2,677 | | | | 70,658 | |

| | | | | | | $ | 3,846,324 | |

| GERMANY - 13.1% | | | | | | | | |

| Allianz SE | | | 1,457 | | | $ | 261,700 | |

| BASF SE | | | 9,181 | | | | 980,322 | |

| Bayer AG | | | 2,302 | | | | 323,389 | |

| Bayerische Motoren Werke AG | | | 2,802 | | | | 329,036 | |

| Continental AG | | | 1,209 | | | | 265,551 | |

| Daimler AG | | | 4,057 | | | | 351,632 | |