As filed with the Securities and Exchange Commission on February 29, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-3489

THE WRIGHT MANAGED EQUITY TRUST

177 West Putnam Ave.

Greenwich, Connecticut 06830

Michael J. McKeen, Principal Financial Officer

Three Canal Plaza, Suite 600

Portland, ME 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2015 – December 31, 2015

ITEM 1. REPORT TO STOCKHOLDERS.

The Wright Managed Blue Chip Investment Funds

The Wright Managed Blue Chip Investment Funds consist of three equity funds from The Wright Managed Equity Trust and one fixed-income fund from The Wright Managed Income Trust. Each of the four funds have distinct investment objectives and policies. They can be used individually or in combination to achieve virtually any objective. Further, as they are all “no-load” funds (no commissions or sales charges), portfolio allocation strategies can be altered as desired to meet changing market conditions or changing requirements without incurring any sales charges.

Approved Wright Investment List

Securities selected for investment in these funds are chosen mainly from a list of “investment grade” companies maintained by Wright Investors’ Service (“Wright”, “WIS” or the “Adviser”). Over 39,000 global companies (covering 85 countries) in Wright’s database are screened as new data becomes available to determine any eligible additions or deletions to the list. The qualifications for inclusion as “investment grade” are companies that meet Wright’s Quality Rating criteria. This rating includes fundamental criteria for investment acceptance, financial strength, profitability & stability and growth. In addition, securities, which are not included in Wright’s “investment grade” list, may also be selected from companies in the fund’s specific benchmark (up to 20% of the market value of the portfolio) in order to achieve broad diversification.

Three Equity Funds

Wright Selected Blue Chip Equities Fund (WSBC) (the “Fund”) seeks to enhance total investment return through price appreciation plus income. The Fund’s portfolio is characterized as a blend of growth and value stocks. The market capitalization of the companies is typically between $1-$10 billion at the time of the Fund’s investment. The Adviser seeks to outperform the Standard & Poor’s MidCap 400 Index (“S&P MidCap 400”) by selecting stocks using fundamental company analysis and company specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries and sectors.

Wright Major Blue Chip Equities Fund (WMBC) (the “Fund”) seeks to enhance total investment return through price appreciation plus income by providing a broadly diversified portfolio of equities of larger well-established companies with market values of $5-$10 billion or more. The Adviser seeks to outperform the Standard & Poor’s 500 Index (“S&P 500”) by selecting stocks, using fundamental company analysis and company specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries and sectors.

Wright International Blue Chip Equities Fund (WIBC) (the “Fund”) seeks total return consisting of price appreciation plus income by investing in a broadly diversified portfolio of equities of well-established, non-U.S. companies. The Fund may buy common stocks traded on the securities exchange of the country in which the company is based or it may purchase American Depositary Receipts (“ADR’s”) traded in the United States. The portfolio is denominated in U.S. dollars and investors should understand that fluctuations in foreign exchange rates may impact the value of their investment. The Adviser seeks to outperform the MSCI World ex U.S. Index (“MSCI World ex U.S.”) by selecting stocks using fundamental company analysis and company-specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries, sectors and countries.

One Fixed-Income Fund

Wright Current Income Fund (WCIF) (the “Fund”) may be invested in a variety of securities and may use a number of strategies, including GNMAs, to produce a high level of income with reasonable stability of principal. The Fund reinvests all principal payments. Dividends are accrued daily and paid monthly. The Fund’s benchmark is the Barclays GNMA Backed Bond Index.

.

| Investment Objectives | inside front |

| Letter to Shareholders (Unaudited) | 2 |

| Management Discussion (Unaudited) | |

| Performance Summaries (Unaudited) | |

| Fund Expenses (Unaudited) | |

| Management and Organization (Unaudited) | |

| Important Notices Regarding Delivery of Shareholder Documents, Portfolio Holdings and Proxy Voting (Unaudited) | |

The Wright Managed Equity Trust | |

Wright Selected Blue Chip Equities Fund | |

| Statement of Assets and Liabilities | |

| Statement of Changes in Net Assets | |

Wright Major Blue Chip Equities Fund | |

| Statement of Assets and Liabilities | |

| Statements of Changes in Net Assets | |

Wright International Blue Chip Equities Fund | |

| Statement of Assets and Liabilities | |

| Statements of Changes in Net Assets | |

| Notes to Financial Statements | |

| Report of Independent Registered Public Accounting Firm | |

| Federal Tax Information (Unaudited) | |

The Wright Managed Income Trust | |

Wright Current Income Fund | |

| Notes to Financial Statements | |

| Report of Independent Registered Public Accounting Firm | |

| Federal Tax Information (Unaudited) | |

| Letter to Shareholders (Unaudited) |

Dear Shareholder:

SUMMARY: Following one of its weakest years since the bull market began in 2009, the U.S. stock market got off to one of its worst starts ever in January 2016. Concern about plunging stock prices in China, kicked off by a weakening economy, and a virtual freefall in oil have spread throughout the world, as has worry about global economic growth. Still, U.S. equities have outperformed their foreign counterparts, largely due to the strength of the dollar. Bonds have provided some protection from stock market volatility, even though the Federal Reserve began raising short-term interest rates at the end of 2015. But slowing economic growth here at home is adding to the concern. Investors are advised to be more cautious than ever this year, so a well-diversified portfolio of high-quality domestic and foreign equities and fixed-income securities is more important than ever.

U.S. stocks and bonds had a rough year in 2015, and if the first month of the year is any indication, 2016 is shaping up to be even more challenging. Both the Dow Jones Industrial Average and the S&P 500 achieved positive returns last year but only after dividends are included. The Dow ended the year down 2.2% in terms of price, its first losing year since 2008, but managed to eke out a 0.2% gain once dividends are included. The S&P 500 lost 0.7%, its first drop in price since 2011, but ended up with a 1.4% gain thanks to dividends. NASDAQ was the standout performer, rising 5.7% on a price basis and 7.0% after dividends. But January undid even those relatively modest gains. Both the Dow and the S&P 500 lost more than 5% while NASDAQ fell 7.8%.

Yet U.S. stocks have managed to outperform most of the rest of the world, largely due to the continued strength of the dollar overseas. In Europe, the MSCI Europe ex U.K. index lost 0.6% in dollar terms in 2015, nearly all of that loss attributable to the more than 11% gain in the dollar against the euro. The same was true in January, when the index lost an additional 6.8%. The one major market that the U.S. failed to beat last year was Japan, where stocks gained more than 9% in both dollar and yen terms. The yen was one of the few major currencies to hold its own against the greenback. But that luck didn’t carry over into 2016, as Japanese stocks dropped more than 8% in both yen and dollar terms in January.

One of the major negative factors driving global stocks downward has been China, both due to its weakening economic growth and its plunging stock market. The MSCI China index lost 7.8% last year in dollar terms and then another 13% in January. The main Chinese equity index, the Shanghai composite, dropped 22% in January. The index has lost nearly half of its value since last June’s peak and is now at its lowest level since November 2014, wiping out a good part of the 150+% gain it posted between June 2014 and June 2015. Slowing growth in China – the world’s second largest economy – is certainly one factor behind the market’s plunge. Economic growth slowed last year to 6.9%, the weakest annual performance in 25 years. But so is stock speculation, which the government has been unable to discourage. Indeed, not only has it been unsuccessful in deflating the stock bubble, it has taken measures to try to prop up stock prices, which is only prolonging the problem.

Another factor driving stock prices down has been the near freefall in oil prices, which shows no signs of bottoming out. Crude oil dropped another 30% last year after falling nearly 46% the previous year, and in January 2016 fell another 9% despite rising the last two weeks of the month. The price of WTI, the U.S. benchmark, has fallen below $30 a barrel, its lowest level since 2004. OPEC, led by Saudi Arabia, instead of trying to boost oil prices by limiting production, as it has usually done in the past, has been content to watch the price fall in order to gain competitive advantage over higher-cost producers such as U.S. shale oil providers and its political adversaries, Iran and Russia. Not surprisingly, energy stocks were by far the biggest

| Letter to Shareholders (Unaudited) |

losers among the S&P 500 last year, falling more than 21% after losing nearly 8% the prior year, when they were the only sector to finish in the red. They fell another 3% in the first month of 2016.

But there have been a few safe havens for investors, which points out the importance of having a well-balanced diversified portfolio. In January, as global stock markets were falling sharply, bonds were recording positive returns. The Barclays U.S. Bond Market Aggregate had a total return of 1.4%. The index is heavily weighted with U.S. Treasury securities, where yields dropped sharply despite the Federal Reserve’s first rate increase last December. The yield on the benchmark 10-year government note fell 35 basis points to end the month at 1.92%, its lowest level since last April. But not all bonds are alike: high-yield bonds lost 1.6% as investors worry about an expected wave of defaults in the oil industry.

But while investors fleeing stocks are certainly driving bond prices up and yields down, a weakening U.S. economy is also playing a role. The first estimate of GDP growth for the fourth quarter of 2015 came in weaker than expected at just 0.7%. That is down sharply from the 2% pace in the third quarter and 3.9% in Q2. For the full year, the economy grew by 2.4%, unchanged from 2014. The GDP numbers merely confirmed the recent downtrend. Leading indicators fell 0.2% in December while the Chicago Fed’s national activity index remained in negative territory. Durable goods orders fell 5.1% and were down 3.5% for the full year, the first annual decline since 2009. Industrial production fell 0.4%. Even the consumer wasn’t helping much. Personal spending was flat in December while retail sales fell 0.1% and were up only 2.1% for the year, the weakest annual increase since 2009.

Still, the housing and auto sectors – heavily dependent on low interest rates, to be sure – remain robust. Existing home sales rebounded in December and for the full year were up more than 7% to 5.3 million. New home sales rose 14.6% to 501,000, the most since 2007. Housing starts fell in December but for the year totaled 1.1 million, the most since 2007. Auto sales hit an annual record in 2015 as carmakers sold 17.5 million vehicles, breaking the previous record set in 2000, and in January the sales rate hit 17.6 million, the highest for the month since 2006.

Looking ahead, 2016 will likely be another challenging year for investors, if not more so than last year, as we’ve already seen so far. Oil and stock prices have given no indication of bottoming out, and the global economy is still not moving in the right direction. As a result, central banks will likely continue to play a major stimulus role. Already in January European Central Bank President Mario Draghi hinted strongly that the bank would announce additional stimulus measures at its meeting in March. That was quickly followed by the Bank of Japan’s surprise announcement that it was cutting interest rates to below zero. Both moves sparked big market rebounds, but are a stark indication of just how weak the major economies are.

The Federal Reserve’s main role this year may simply be to do nothing. While the Fed has indicated it plans to raise interest rates steadily over the next two to three years, by about 25 basis points per quarter, after beginning the process in December, it’s not clear if current market conditions will allow it to do so soon. The Fed took no action on rates at its January meeting, and unless something extremely positive happens in the meantime – an unlikely event – it’s hard to see it doing so at its next meeting in March, or even much beyond that. The fact that this is an election year would also weigh against any moves to tighten monetary policy.

| Letter to Shareholders (Unaudited) |

While that’s no guarantee against big negative market swings, it is one less thing for investors to worry about. Given the volatility we’ve seen the past two months, investors are wise to remain defensive, holding a well-diversified portfolio of high-quality stocks and bonds, including foreign securities. If you have any questions on Wright’s views on these matters or on other wealth management issues, please contact me.

Sincerely,

Amit S. Khandwala

Co-Chief Executive Officer

Chief Investment Officer

| Management Discussion (Unaudited) |

WRIGHT EQUITY FUNDS

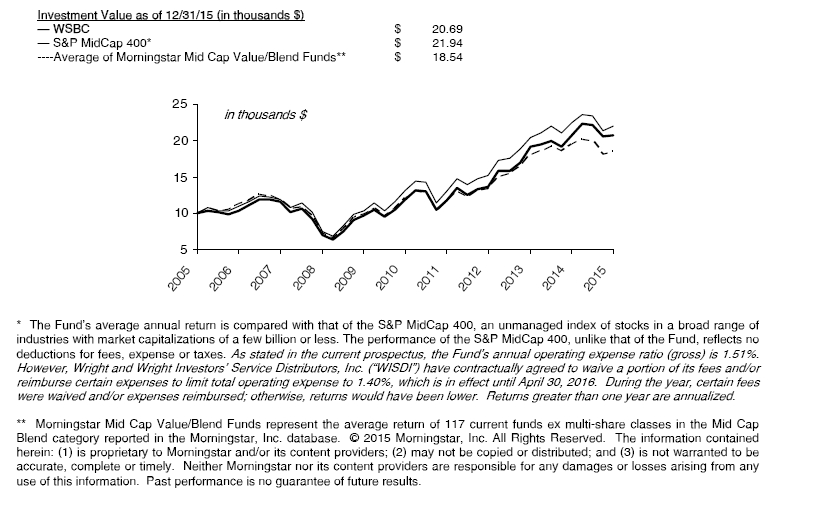

MAJOR BLUE CHIP FUND

The Wright Major Blue Chip Fund (WMBC) is managed as a blend of the large-cap growth and value stocks in the S&P 500 Composite, selected with a focus on the higher-quality issues in the index. The WMBC Fund had a total return of -2.9% in 2015, as compared with a 1.4% return for the S&P 500, the Fund’s benchmark.

The main positive contributors to the Fund’s relative performance in 2015 were energy stocks, both due to relative weighting and stock selection versus the benchmark index. Not only was the Fund underweight energy (4.6% of the portfolio versus 6.5% in the S&P 500) but the sector had a base return of -11.3% in 2015, versus -21.2% in the benchmark index. The Fund also got positive contributions from industrials and materials stocks, both due to stock selection; the Fund was underweight both of those sectors compared to the benchmark index, where they had negative returns. The biggest detractors to Fund performance in 2015 were information technology and consumer discretionary stocks, both due mainly to stock selection. Info tech stocks in the Fund had a return of negative 2.9%, versus a positive 5.9% in the benchmark index. Consumer discretionary stocks in the Fund also returned -2.9%, versus 10.1% in the benchmark. Both sectors were roughly equal weight in the Fund compared to the S&P 500. At December 31, 2015, the Fund’s biggest position was in financial stocks, accounting for 21.9% of the portfolio, which is overweight the sector compared to the index (16.5%).

The biggest individual contributor to Fund performance in 2015 was Microsoft, which had a base return of 22.7%. The Fund also got outsize contributions from Accenture PLC, General Dynamics, J.P. Morgan Chase and Humana Inc. The two biggest individual detractors were tech stocks: Oracle and Qualcomm. Other major detractors were Schlumberger in energy and Comcast, the big cable operator.

U.S. stocks had a rough year in 2015, with both the Dow Jones Industrial Average and the S&P 500 achieving positive returns only after dividends are included. Stocks were buffeted by weak global growth, in particular concerns about a hard economic landing in China, stagnant growth in Europe, tumbling world oil prices and the tightening of monetary policy by the Federal Reserve, which in December raised short-term interest rates for the first time since 2006 and promised more rate increases over the next two or three years.

With its focus on stocks that are, on average, of higher quality than those that populate the S&P 500, the WMBC Fund is believed to be well positioned for what we believe may be an even more challenging investment environment in 2016. Indeed, stock market volatility exacerbated as we entered the new year, with equity returns in January deeply negative around the globe, one of the worst starts to a year on record. The WMBC Fund has a higher average weighted market cap than the S&P 500 and a five-year earnings growth record nearly as good as that of the S&P 500.

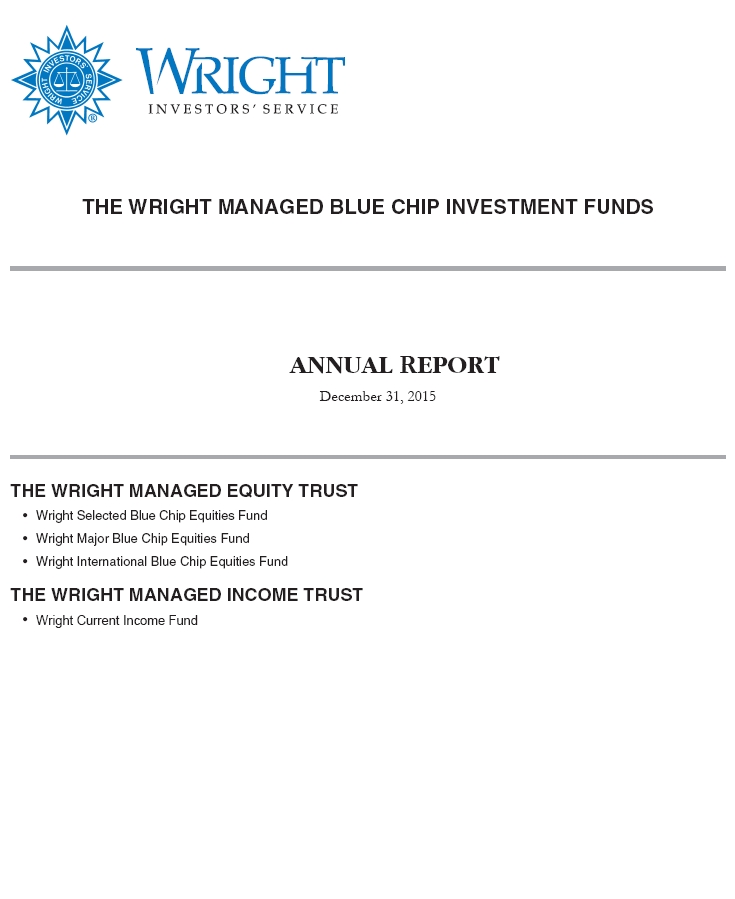

SELECTED BLUE CHIP FUND

The Wright Selected Blue Chip Fund (WSBC), a mid-cap blend fund, had a total return of -0.2% in 2015, outperforming its benchmark, the S&P MidCap Index, which returned -2.2%. In the prior three years, 2012-14, the WSBC Fund averaged a 0.9% premium over the S&P 400 MidCap Index’s 20.0% average annual total return.

| Management Discussion (Unaudited) |

The main positive contributors to the Fund’s performance in 2015 were industrial stocks, which outperformed similar stocks in the index by a wide margin. In addition, the Fund was overweight the sector (17.9%) compared to the index (15.1%). Industrial stocks in the Fund had a base return of 6.1% in 2015, compared to -3.1% in the index. The Fund also got positive contributions from info tech stocks, where the Fund was equal weight the sector. Info tech stocks in the Fund had a base return of 5.4% in 2015, versus 0.4% for similar stocks in the benchmark. Consumer discretionary and energy stocks also helped the Fund’s relative performance compared to the index. The biggest detractor to Fund performance was materials stocks, mainly due to stock selection; the sector had a return of -23% in 2015, compared to -12.7% for similar stocks in the index. However, materials accounted for less than 5% of the Fund’s portfolio at yearend. At 12/31/15, the Fund’s biggest position was in financial stocks, accounting for 23.4% of the portfolio, which is underweight the index (27.1%).

Among individual stocks, the biggest positive contributor to Fund performance in 2015 was HCC Insurance Holdings, a global specialty insurance company. It also got positive contributions from MSCI Inc., an investment information provider; Orbital ATK, an aerospace company; and Global Payments Inc., a payments solutions company. The biggest detractors from Fund performance were WestRock Co., a consumer packaging company, and Superior Energy Services, an oil and gas equipment provider.

With the U.S. economy still growing at a sub-par pace, we believe that the WSBC Fund’s focus on quality securities should continue to serve it well in 2016. WSBC continues to be slightly tilted toward the larger companies in the S&P MidCap 400 index. WSBC’s holdings have also shown better historical earnings growth than the MidCap index constituents.

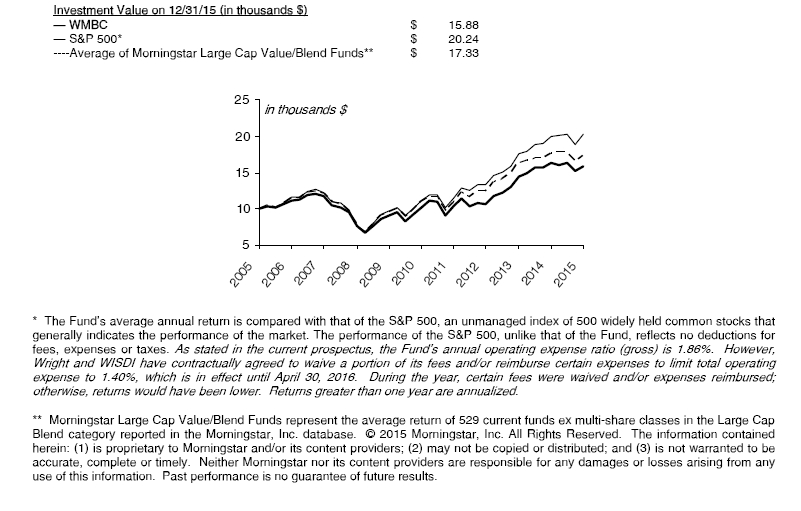

INTERNATIONAL BLUE CHIP FUND

Despite a 2% loss in 2015, the Wright International Blue Chip Fund (WIBC) outperformed its benchmark index, the MSCI World ex U.S. index, which lost 3%. Foreign stocks generally underperformed U.S. stocks during 2015, largely due to the strength of the dollar against most foreign currencies.

Financial stocks were the biggest positive contributor to Fund performance in 2015 relative to the index, with a base return of 2.2% versus a negative 4.4% return for those stocks in the index. The Fund is slightly underweight the sector compared to the index, 25.1% versus 26.8%. Telecom stocks also helped boost Fund performance, with a base return of 21.2% versus 3.5% for similar stocks in the index. The Fund is also overweight the sector, 6.7% versus 4.7% for the index. The biggest detractor from Fund performance came from consumer staples stocks, both due to stock selection and relative weighting. Stocks in the sector returned 5.0% in the Fund in 2015, versus 8.8% in the index. The Fund is also underweight the sector, 6.9% versus 11.4% for the index. At yearend, financials were the Fund’s largest position, at 25.1%, which is slightly underweight the index.

Among individual stocks, the biggest positive contributors to Fund performance were KDDI Corp., a leading Japanese telecom company, and Swiss Re. Of the top five positive contributors to Fund performance last year, three were Japanese companies and two were Swiss; the yen and the franc were among the few major currencies to largely hold their own against the dollar in 2015. The two biggest individual detractors were Volkswagen, which was embroiled in an emissions-fixing scandal, and Rio Tinto, the global mining company.

In the aggregate, WIBC Fund holdings are priced at a significant discount to the MSCI World ex U.S. index in

| Management Discussion (Unaudited) |

terms of current price/earnings ratios. Over the past five years, WIBC holdings have averaged superior earnings growth rates. In 2015, foreign stocks largely outperformed U.S. stocks, at least in their own currencies, although not in dollar terms. In 2016, foreign central banks are likely to continue to provide stimulus measures, even as the Federal Reserve appears to be moving in the opposite direction by raising interest rates. Already in January, European Central Bank President Mario Draghi held out the prospect of additional stimulus at the ECB’s meeting in March, adding that the bank would place “no limits” within its legal mandate to try to raise inflation in the euro zone. That was followed the next week by the Bank of Japan’s announcement that it was cutting interest rates to below zero in order to stimulate its moribund economy. At the same time, China has been seeking measures to boost economic growth as well as prop up its flagging stock market. We continue to see the inclusion of international stocks as likely to enhance risk-adjusted returns in diversified investment portfolios.

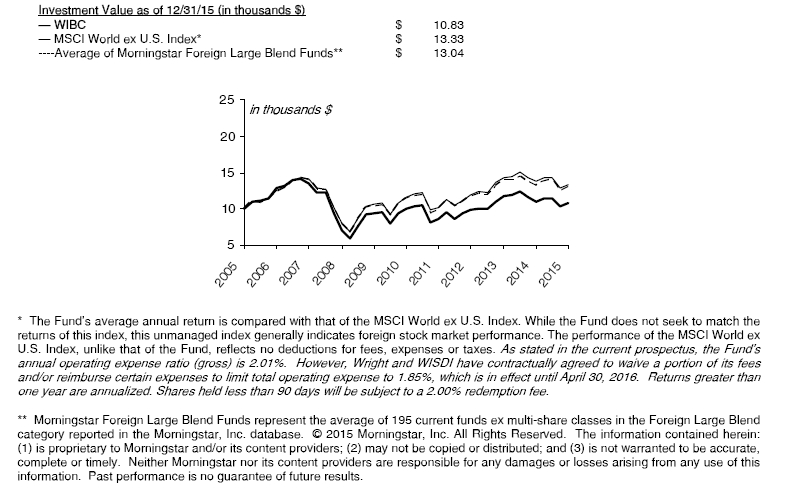

CURRENT INCOME FUND

The Wright Current Income Fund (WCIF) had a total return of 1.4% in 2015, matching the total return on the Barclays GNMA bond index, the Fund’s benchmark, while outperforming the Barclays U.S. Aggregate bond index, which had had a 0.5% total return. The WCIF Fund is managed to be invested in GNMA issues (mortgage-based securities, known as Ginnie Maes, guaranteed by the full faith and credit of the U.S. government) and other mortgage-based securities. The WCIF Fund is actively managed to maximize income and minimize principal fluctuation. WCIF had a yield of 3.3% at December 31, 2015, calculated according to SEC guidelines. Dividends paid by this Fund may be more or less than implied by this yield.

In addition to its holdings in GNMA-backed mortgage issues, WCIF also holds issues backed by Fannie Mae (FNMA) and Freddie Mac (FHLMC), both of which are under the conservatorship of the U.S. Treasury through the Federal Housing Finance Agency (FHFA). At the end of 2015, the WCIF Fund was 97% invested in agency-backed mortgages, versus 100% for the index, with 3% in cash, cash equivalents or agency securities.

The Fund continues to have a higher average coupon than the GNMA benchmark, reflecting the Fund’s mandate to maximize income. At December 31, 2015, WCIF’s average coupon was 5.1%, compared to 3.8% for the GNMA benchmark. The Fund remains substantially overweight in higher coupon mortgages relative to its benchmark. At the end of the year, the Fund held 68% of its assets in mortgages with 5% or greater coupons, compared to only 10% for the benchmark. Among the Fund’s biggest positions were mortgages with 5%-6% coupons (43%, versus 8% for the index) and 6%-7% coupons (22% of the portfolio, compared to 2% for the index). By comparison, 28% of the Fund’s assets were held in mortgages with 3%-5% coupons, compared to 89% for the GNMA benchmark. The emphasis on well-seasoned higher-coupon issues contributes to the Fund’s lesser negative convexity compared to the GNMA benchmark, which tends to result in a more stable performance when interest rates are volatile.

In 2015, the duration of mortgages in the Fund shortened relative to those in the benchmark. As interest rates held fairly steady in 2015, so did the average duration of the Fund, moving to 3.9 years at yearend from 3.8 one year earlier. By contrast, the average duration in the GNMA index lengthened by about half a year, to 4.1 years from 3.5 years at the end of 2014. At year-end, 63% of securities held in the Fund had a duration of three years or less, compared to 12% for the benchmark. By comparison, only 37% of the Fund’s assets had durations of three years or more, as compared to 88% for the GNMA index. The largest percentage of Fund

| Management Discussion (Unaudited) |

assets were in 2-3 year mortgages, accounting for 49% of the portfolio (versus 11% in the index) while the largest percentage of mortgages in the index, 68%, were in 3-5 year loans, versus 16% in the Fund.

While the Fed has indicated it plans to raise interest rates steadily over the next two to three years, by about 25 basis points per quarter, after beginning the process in December, it’s not clear if current market conditions – including extreme global financial market volatility and weakening economic growth – will allow it to do so. Moreover, even if the Fed should raise short-term rates, there is no reason to believe that long-term rates, which are largely set by the market, will necessarily follow – unless the Fed were to begin a new round of quantitative easing, which seems unlikely to happen. At the end of January 2016, the yield on the benchmark 10-year Treasury note – on which long-term mortgage rates are based – was well below 2.0% and at its lowest level since April 2015. Mortgage interest rates remain at historically low levels – about 4% for 30-year fixed-rate loans – which has enabled millions of homeowners and new homebuyers to lock in rates they are unlikely to disturb unless they sell their homes. As a result, we expect the mortgage market to remain stable over the foreseeable future, with loans staying on servicers’ books longer than historical norms.

| Performance Summaries (Unaudited) |

Important

The Total Investment Return is the percent return of an initial $10,000 investment made at the beginning of the period to the ending redeemable value assuming all dividends and distributions are reinvested. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Past performance is not predictive of future performance.

| |

| | WRIGHT SELECTED BLUE CHIP EQUITIES FUND |

| | Growth of $10,000 Invested 1/1/06 Through 12/31/15 |

| |

| | | Average Annual Total Return | |

| Last 1 Yr | | Last 5 Yrs | | Last 10 Yrs | |

| | | |

| | — WSBC | | | | | | | | | | | | | | | | |

| | | - Return before taxes | | | -0.22 | % | | | 11.56 | % | | | 7.54 | % | |

| | | - Return after taxes on distributions | | | -2.66 | % | | | 9.28 | % | | | 5.82 | % | |

| | | - Return after taxes on distributions and sales of fund shares | | | 1.96 | % | | | 9.12 | % | | | 6.05 | % | |

| | — S&P MidCap 400* | | | | | | -2.18 | % | | | 10.68 | % | | | 8.18 | % | |

| | ----Average of Morningstar Mid Cap Value/Blend Funds** | | | -4.51 | % | | | 8.97 | % | | | 6.37 | % | |

| | | | | | | | | | | | | | | |

| Performance Summaries (Unaudited) |

| WRIGHT SELECTED BLUE CHIP EQUITIES FUND | |

| | |

| Industry Weightings | | Ten Largest Stock Holdings |

| % of net assets @ 12/31/15 | | % of net assets @ 12/31/15 |

| | | | | | | | | | | | | | |

Software & Services Health Care Equipment & Services | | 8.7 8.6 | % % | | Consumer Durables & Apparel Technology Hardware & Equipment | | 5.1 5.1 | % % | | Jones Lang Lasalle, Inc. Foot Locker, Inc. | | 3.3 3.2 | % % |

| Commercial & Professional Services | | 7.6 | % | | Materials | | 4.7 | % | | Health Net, Inc. | | 3.0 | % |

| Capital Goods | | 6.9 | % | | Transportation | | 3.3 | % | | Centene Corp. | | 2.8 | % |

| Retailing | | 6.7 | % | | Food, Beverage & Tobacco | | 3.0 | % | | Cadence Design Systems, Inc. | | 2.8 | % |

| Banks | | 6.6 | % | | Energy | | 2.9 | % | | UGI Corp. | | 2.8 | % |

| Diversified Financials | | 6.3 | % | | Pharmaceuticals & Biotechnology | | 2.7 | % | | Hanesbrands, Inc. | | 2.7 | % |

Utilities Real Estate | | 5.8 5.3 | % % | | Semiconductor & Semiconductor Equipment | | 2.5 | % | | Packaging Corp. of America. RR Donnelley & Sons Co. | | 2.6 2.5 | % % |

| Insurance | | 5.2 | % | | Automobiles & Components | | 1.3 | % | | Signature Bank | | 2.4 | % |

| | | | | | Consumer Services | | 1.1 | % | | | | | |

| Performance Summaries (Unaudited) |

| |

| | WRIGHT MAJOR BLUE CHIP EQUITIES FUND |

| | Growth of $10,000 Invested 1/1/06 Through 12/31/15 |

| |

| | | Average Annual Total Return | |

| Last 1 Yr | | Last 5 Yrs | | Last 10 Yrs | |

| | | |

| | — WMBC | | | | | | | | | | | | | | | | |

| | | - Return before taxes | | | -2.91 | % | | | 9.10 | % | | | 4.73 | % | |

| | | - Return after taxes on distributions | | | -3.14 | % | | | 8.96 | % | | | 4.60 | % | |

| | | - Return after taxes on distributions and sales of fund shares | | | -1.46 | % | | | 7.20 | % | | | 3.77 | % | |

| | — S&P 500* | | | | | | 1.41 | % | | | 12.57 | % | | | 7.31 | % | |

| | ----Average of Morningstar Large Cap Value/Blend Funds** | | | -1.47 | % | | | 9.54 | % | | | 5.65 | % | |

| | | | | | | | | | | | | | | | | | |

| Performance Summaries (Unaudited) |

| WRIGHT MAJOR BLUE CHIP EQUITIES FUND | |

| | |

| Industry Weightings | | Ten Largest Stock Holdings |

| % of net assets @ 12/31/15 | | % of net assets @ 12/31/15 |

| | | | | | | | | | | | | | |

Software & Services Banks | | 12.4 11.4 | % % | | Food, Beverage & Tobacco Energy | | 4.7 4.6 | % % | | Comcast Corp. - Class A Wells Fargo & Co. | | 4.8 4.1 | % % |

| Pharmaceuticals & Biotechnology | | 9.9 | % | | Food & Staples Retailing | | 4.4 | % | | Apple, Inc. | | 4.1 | % |

| Retailing | | 6.5 | % | | Transportation | | 3.6 | % | | Microsoft Corp. | | 3.6 | % |

| Health Care Equipment & Services | | 5.9 | % | | Telecommunication Services | | 3.2 | % | | Anthem, Inc. | | 3.6 | % |

| Capital Goods | | 5.6 | % | | Materials | | 1.6 | % | | Southwest Airlines Co. | | 3.6 | % |

| Technology Hardware & Equipment | | 5.5 | % | | Utilities | | 1.5 | % | | Gilead Sciences, Inc. | | 3.5 | % |

Insurance Diversified Financials | | 5.4 5.0 | % % | | Semiconductor Equipment & Products | | 1.4 | % | | Oracle Corp. CVS Health Corp. | | 3.5 3.3 | % % |

| Media | | 4.8 | % | | Consumer Services | | 1.1 | % | | Pfizer, Inc. | | 3.2 | % |

| | | | | | Consumer Durables & Apparel | | 0.9 | % | | | | | |

| Performance Summaries (Unaudited) |

| |

| | WRIGHT INTERNATIONAL BLUE CHIP EQUITIES FUND |

| | Growth of $10,000 Invested 1/1/06 Through 12/31/15 |

| |

| | | Average Annual Total Return | |

| Last 1 Yr | | Last 5 Yrs | | Last 10 Yrs | |

| | | |

| | — WIBC | | | | | | | | | | | | | | | | |

| | | - Return before taxes | | | -2.11 | % | | | 1.56 | % | | | 0.80 | % | |

| | | - Return after taxes on distributions | | | -2.15 | % | | | 1.44 | % | | | 0.41 | % | |

| | | - Return after taxes on distributions and sales of fund shares | | | -0.70 | % | | | 1.44 | % | | | 0.41 | % | |

| | — MSCI World ex U.S. Index* | | | | | | -3.04 | % | | | 2.79 | % | | | 2.92 | % | |

| | ----Average of Morningstar Foreign Large Blend Funds** | | | -1.61 | % | | | 2.55 | % | | | 2.69 | % | |

| | | | | | | | | | | | | | | |

| Performance Summaries (Unaudited) |

| WRIGHT INTERNATIONAL BLUE CHIP EQUITIES FUND | |

| | |

| Country Weightings | | Ten Largest Stock Holdings |

| % of net assets @ 12/31/15 | | % of net assets @ 12/31/15 |

| | | | | | | | | | | | | | |

| Japan | | 25.3 | % | | Australia | | 2.4 | % | | KDDI Corp. | | 4.1 | % |

| Switzerland | | 12.5 | % | | Italy | | 2.4 | % | | Nestle SA | | 3.9 | % |

| United Kingdom | | 12.5 | % | | Denmark | | 2.0 | % | | Swiss Re AG | | 3.5 | % |

| Germany | | 12.3 | % | | Hong Kong | | 1.0 | % | | Actelion, Ltd. | | 3.2 | % |

Canada France Spain | | 8.6 7.9 4.7 | % % % | | Ireland Norway Luxembourg | | 1.0 0.8 0.4 | % % % | | Legal & General Group PLC Muenchener Rueckversicherungs- Gesellschaft AG – Class R | | 2.9 2.4 | % % |

| Israel | | 3.0 | % | | Marshall Islands | | 0.2 | % | | Intesa Sanpaolo SpA | | 2.4 | % |

| Netherlands | | 2.6 | % | | | | | | | Teva Pharmaceutical Industries, Ltd., ADR | | 2.3 | % |

| | | | | | | | | | | Alimentation Couche-Tard, Inc. – Class B | | 2.2 | % |

| | | | | | | | | | | ITOCHU Corp. | | 2.2 | % |

| Performance Summaries (Unaudited) |

| |

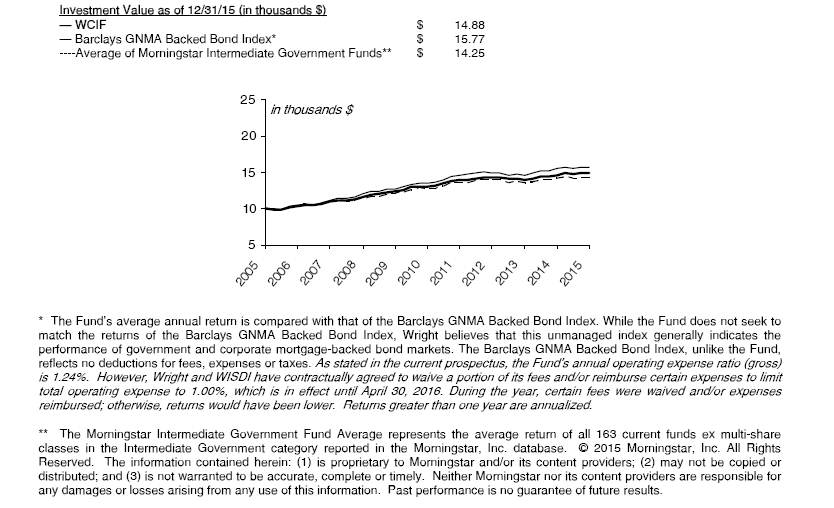

| | WRIGHT CURRENT INCOME FUND |

| | Growth of $10,000 Invested 1/1/06 Through 12/31/15 |

| |

| | | Average Annual Total Return | |

| Last 1 Yr | | Last 5 Yrs | | Last 10 Yrs | |

| | | |

| | — WCIF | | | | | | | | | | | | | | | | |

| | | - Return before taxes | | | 1.41 | % | | | 2.60 | % | | | 4.06 | % | |

| | | - Return after taxes on distributions | | | -0.13 | % | | | 1.04 | % | | | 2.41 | % | |

| | | - Return after taxes on distributions and sales of fund shares | | | 0.80 | % | | | 1.35 | % | | | 2.50 | % | |

| | — Barclays GNMA Backed Bond Index* | | | 1.39 | % | | | 3.05 | % | | | 4.66 | % | |

| | ----Average of Morningstar Intermediate Government Funds** | | | 0.47 | % | | | 2.35 | % | | | 3.60 | % | |

| | | | | | | | | | | | | | | |

| Performance Summaries (Unaudited) |

| WRIGHT CURRENT INCOME FUND | |

| | |

| Holdings by Security Type | Five Largest Bond Holdings |

| % of net assets @ 12/31/15 | % of net assets @ 12/31/15 |

| | | | | | | | | | | | | |

| Agency Mortgage-Backed Securities | | 94.7 | % | | | | | GNMA, Series 2010-116, Class PB | 5.00% | 06/16/40 | 3.5 | % |

| Other U.S. Government Guaranteed | | 2.6 | % | | | | | GNMA, Series 2008-65, Class PG | 6.00% | 08/20/38 | 3.3 | % |

| | | | | | | | | GNMA II Pool #MA2681 | 5.00% | 03/20/45 | 3.1 | % |

| | | | | | | | | FHLMC Gold Pool #U80611 | 4.50% | 11/01/33 | 2.9 | % |

| | | | | | | | | FNMA Pool #821082 | 6.00% | 03/01/35 | 2.7 | % |

| Weighted Average Maturity | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| @ 12/31/15 | | 11.1 | Years | | | | | | | | | |

| | | | | | | | | | | | | |

| Fund Expenses (Unaudited) |

Example:

As a shareholder of a fund, you incur two types of costs: (1) transaction costs, including redemption fees (if applicable); and (2) ongoing costs including management fees; distribution or service fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2015 – December 31, 2015).

Actual Expenses:

The first line of the tables shown on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes:

The second line of the tables provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees (if applicable). Therefore, the second line of the tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Fund Expenses (Unaudited) |

EQUITY FUNDS

Wright Selected Blue Chip Equities Fund

| | Beginning Account Value (7/1/15) | Ending Account Value (12/31/15) | Expenses Paid During Period* (7/1/15-12/31/15) |

| Actual Fund Shares | $1,000.00 | $935.72 | $6.88 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | $1,000.00 | $1,018.10 | $7.17 |

*Expenses are equal to the Fund’s annualized expense ratio of 1.41% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2015.

Wright Major Blue Chip Equities Fund

| | Beginning Account Value (7/1/15) | Ending Account Value (12/31/15) | Expenses Paid During Period* (7/1/15-12/31/15) |

| Actual Fund Shares | $1,000.00 | $970.25 | $6.95 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | $1,000.00 | $1,018.15 | $7.12 |

*Expenses are equal to the Fund’s annualized expense ratio of 1.40% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2015.

Wright International Blue Chip Equities Fund

| | Beginning Account Value (7/1/15) | Ending Account Value (12/31/15) | Expenses Paid During Period* (7/1/15-12/31/15) |

| Actual Fund Shares | $1,000.00 | $940.09 | $9.05 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | $1,000.00 | $1,015.88 | $9.40 |

*Expenses are equal to the Fund’s annualized expense ratio of 1.85% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2015.

FIXED-INCOME FUNDS

Wright Current Income Fund

| | Beginning Account Value (7/1/15) | Ending Account Value (12/31/15) | Expenses Paid During Period* (7/1/15-12/31/15) |

| Actual Fund Shares | $1,000.00 | $1,004.73 | $4.55 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | $1,000.00 | $1,020.67 | $4.58 |

*Expenses are equal to the Fund’s annualized expense ratio of 0.90% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2015.

Wright Selected Blue Chip Equities Fund (WSBC) Portfolio of Investments - As of December 31, 2015 |

EQUITY INTERESTS - 99.4% |

AUTOMOBILES & COMPONENTS - 1.3% |

| Gentex Corp. | 30,280 | | $ | 484,783 | |

BANKS - 6.6% |

| Commerce Bancshares, Inc. | 7,447 | | $ | 316,778 | |

| East West Bancorp, Inc. | 10,700 | | | 444,692 | |

| Fulton Financial Corp. | 33,785 | | | 439,543 | |

| New York Community Bancorp, Inc. | 24,120 | | | 393,639 | |

| Signature Bank* | 6,095 | | | 934,790 | |

| | | | $ | 2,529,442 | |

CAPITAL GOODS - 6.9% |

| AECOM* | 26,650 | | $ | 800,299 | |

| Carlisle Cos., Inc. | 6,940 | | | 615,509 | |

| Huntington Ingalls Industries, Inc. | 6,485 | | | 822,622 | |

| Orbital ATK, Inc. | 4,865 | | | 434,639 | |

| | | | $ | 2,673,069 | |

COMMERCIAL & PROFESSIONAL SERVICES - 7.6% |

| Deluxe Corp. | 15,045 | | $ | 820,554 | |

| ManpowerGroup, Inc. | 7,650 | | | 644,819 | |

| RR Donnelley & Sons Co. | 64,260 | | | 945,907 | |

| Towers Watson & Co. - Class A | 3,930 | | | 504,848 | |

| | | | $ | 2,916,128 | |

CONSUMER DURABLES & APPAREL - 5.1% |

| Hanesbrands, Inc. | 35,470 | | $ | 1,043,882 | |

| Toll Brothers, Inc.* | 27,850 | | | 927,405 | |

| | | | $ | 1,971,287 | |

CONSUMER SERVICES - 1.1% |

| Brinker International, Inc. | 8,625 | | $ | 413,569 | |

DIVERSIFIED FINANCIALS - 6.3% |

| FactSet Research Systems, Inc. | 1,360 | | $ | 221,095 | |

| Janus Capital Group, Inc. | 31,840 | | | 448,625 | |

| MSCI, Inc. | 10,765 | | | 776,479 | |

| Raymond James Financial, Inc. | 7,260 | | | 420,862 | |

| Waddell & Reed Financial, Inc. - Class A | 5,195 | | | 148,889 | |

| WisdomTree Investments, Inc. | 25,095 | | | 393,490 | |

| | | | $ | 2,409,440 | |

ENERGY - 2.9% |

| HollyFrontier Corp. | 6,719 | | $ | 268,021 | |

| Noble Corp. PLC | 14,900 | | | 157,195 | |

| Superior Energy Services, Inc. | 15,190 | | | 204,609 | |

| Western Refining, Inc. | 13,745 | | | 489,597 | |

| | | | $ | 1,119,422 | |

FOOD, BEVERAGE & TOBACCO - 3.0% |

| Dean Foods Co. | 21,250 | | $ | 364,437 | |

| Ingredion, Inc. | 8,090 | | | 775,346 | |

| | | | $ | 1,139,783 | |

HEALTH CARE EQUIPMENT & SERVICES - 8.6% |

| Amsurg Corp.* | 1,400 | | $ | 106,400 | |

| Centene Corp.* | 16,535 | | | 1,088,168 | |

| Health Net, Inc.* | 17,055 | | | 1,167,585 | |

| MEDNAX, Inc.* | 4,020 | | | 288,073 | |

| ResMed, Inc. | 2,940 | | $ | 157,849 | |

| Universal Health Services, Inc. - Class B | 1,945 | | | 232,408 | |

| VCA, Inc.* | 4,750 | | | 261,250 | |

| | | | $ | 3,301,733 | |

INSURANCE - 5.2% |

| American Financial Group, Inc. | 8,000 | | $ | 576,640 | |

| Everest Re Group, Ltd. | 2,595 | | | 475,119 | |

| Reinsurance Group of America, Inc. | 4,605 | | | 393,958 | |

| WR Berkley Corp. | 10,247 | | | 561,023 | |

| | | | $ | 2,006,740 | |

MATERIALS - 4.7% |

| Minerals Technologies, Inc. | 2,855 | | $ | 130,930 | |

| Packaging Corp. of America | 15,625 | | | 985,156 | |

| WestRock Co. | 15,370 | | | 701,180 | |

| | | | $ | 1,817,266 | |

PHARMACEUTICALS & BIOTECHNOLOGY - 2.7% |

| Charles River Laboratories International, Inc.* | 8,470 | | $ | 680,903 | |

| United Therapeutics Corp.* | 2,400 | | | 375,864 | |

| | | | $ | 1,056,767 | |

REAL ESTATE - 5.3% |

| Duke Realty Corp. REIT | 13,680 | | $ | 287,553 | |

| Jones Lang LaSalle, Inc. | 7,845 | | | 1,254,102 | |

| Omega Healthcare Investors, Inc. REIT | 13,860 | | | 484,823 | |

| | | | $ | 2,026,478 | |

RETAILING - 6.7% |

| Big Lots, Inc. | 8,495 | | $ | 327,397 | |

| CST Brands, Inc. | 10,820 | | | 423,495 | |

| Foot Locker, Inc. | 18,995 | | | 1,236,385 | |

| Murphy USA, Inc.* | 4,615 | | | 280,315 | |

| Signet Jewelers, Ltd. | 2,445 | | | 302,422 | |

| | | | $ | 2,570,014 | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 2.5% |

| Integrated Device Technology, Inc.* | 7,215 | | $ | 190,115 | |

| Skyworks Solutions, Inc. | 5,250 | | | 403,358 | |

| Synaptics, Inc.* | 4,865 | | | 390,854 | |

| | | | $ | 984,327 | |

SOFTWARE & SERVICES - 8.7% |

| Alliance Data Systems Corp.* | 1,450 | | $ | 401,026 | |

| Broadridge Financial Solutions, Inc. | 8,820 | | | 473,899 | |

| Cadence Design Systems, Inc.* | 51,030 | | | 1,061,934 | |

| Convergys Corp. | 9,595 | | | 238,820 | |

| Fortinet, Inc.* | 9,210 | | | 287,076 | |

| Global Payments, Inc. | 6,355 | | | 409,961 | |

| PTC, Inc.* | 14,330 | | | 496,248 | |

| | | | $ | 3,368,964 | |

TECHNOLOGY HARDWARE & EQUIPMENT - 5.1% |

| ARRIS Group, Inc.* | 20,360 | | $ | 622,405 | |

| Arrow Electronics, Inc.* | 9,725 | | | 526,900 | |

| Avnet, Inc. | 7,650 | | | 327,726 | |

| Jabil Circuit, Inc. | 12,450 | | | 289,961 | |

| See Notes to Financial Statements. | 19 | |

Wright Selected Blue Chip Equities Fund (WSBC) Portfolio of Investments - As of December 31, 2015 |

| Zebra Technologies Corp.* | 2,775 | | $ | 193,279 | |

| | | | $ | 1,960,271 | |

TRANSPORTATION - 3.3% |

| Alaska Air Group, Inc. | 10,115 | | $ | 814,359 | |

| JetBlue Airways Corp.* | 20,490 | | | 464,098 | |

| | | | $ | 1,278,457 | |

UTILITIES - 5.8% |

| Great Plains Energy, Inc. | 19,520 | | $ | 533,091 | |

| ONE Gas, Inc. | 12,801 | | | 642,226 | |

| UGI Corp. | 31,382 | | | 1,059,457 | |

| | | | $ | 2,234,774 | |

TOTAL EQUITY INTERESTS - 99.4% (identified cost, $32,197,111) | | $ | 38,262,714 | |

SHORT-TERM INVESTMENTS - 0.5% |

| Fidelity Government Money Market Fund, 0.12% (1) | 214,006 | | $ | 214,006 | |

TOTAL SHORT-TERM INVESTMENTS - 0.5% (identified cost, $214,006) | | $ | 214,006 | |

TOTAL INVESTMENTS — 99.9% (identified cost, $32,411,117) | | $ | 38,476,720 | |

| OTHER ASSETS, IN EXCESS OF LIABILITIES — 0.1% | | | 29,926 | |

| NET ASSETS — 100.0% | | $ | 38,506,646 | |

PLC — Public Limited Company

REIT — Real Estate Investment Trust

| * | Non-income producing security. |

| (1) | Variable rate security. Rate presented is as of December 31, 2015. |

| See Notes to Financial Statements. | 20 | |

Wright Selected Blue Chip Equities Fund (WSBC) |

| STATEMENT OF ASSETS AND LIABILITIES |

| As of December 31, 2015 |

| | | | | | | |

| ASSETS: | | | | |

| | Investments, at value | | | | |

| | (identified cost $32,411,117) (Note 1A) | | $ | 38,476,720 | ###### |

| | Receivable for fund shares sold | | | 22,055 | |

| | Dividends receivable | | | 27,960 | |

| | Prepaid expenses and other assets | | | 10,355 | |

| | Total assets | | $ | 38,537,090 | |

| | | | | | | |

| LIABILITIES: | | | | |

| | Payable for fund shares reacquired | | $ | 10,114 | |

| | Accrued expenses and other liabilities | | | 20,330 | |

| | Total liabilities | | $ | 30,444 | |

| NET ASSETS | | $ | 38,506,646 | |

| | | | | | | |

| NET ASSETS CONSIST OF: | | | | |

| | Paid-in capital | | $ | 31,665,780 | |

| | Accumulated net realized gain on investments | | | 775,263 | |

| | Unrealized appreciation on investments | | | 6,065,603 | |

| | Net assets applicable to outstanding shares | | $ | 38,506,646 | |

| | | | | | | |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING AT $0.000 PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | 3,369,383 | |

| | | | | | | |

| NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE OF BENEFICIAL INTEREST | | $ | 11.43 | |

| | | | | | | |

| STATEMENT OF OPERATIONS |

| For the Year Ended December 31, 2015 |

| | | | | | | |

| INVESTMENT INCOME (Note 1C) | | | | |

| 3E+07 | Dividend income | | $ | 645,039 | |

| | Total investment income | | $ | 645,039 | |

| | | | | | | |

| Expenses – | | | | |

| | Investment adviser fee (Note 3) | | $ | 233,694 | |

| | Administrator fee (Note 3) | | | 46,739 | |

| | Trustee expense (Note 3) | | | 16,870 | |

| | Custodian fee | | | 5,000 | |

| | Accountant fee | | | 39,255 | |

| | Distribution expenses (Note 4) | | | 97,372 | |

| | Transfer agent fee | | | 29,775 | |

| | Printing | | | 117 | |

| | Shareholder communications | | | 6,039 | |

| | Audit services | | | 17,000 | |

| | Legal services | | | 20,310 | |

| | Compliance services | | | 6,307 | |

| | Registration costs | | | 19,063 | |

| | Interest expense (Note 8) | | | 334 | |

| | Miscellaneous | | | 24,648 | |

| | Total expenses | | $ | 562,523 | |

| | | | | | | |

| Deduct – | | | | |

| | Waiver and/or reimbursement by the principal underwriter and/or investment adviser (Note 4) | | $ | (15,231 | ) |

| | Net expenses | | $ | 547,292 | |

| | Net investment income | | $ | 97,747 | |

| | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | |

| | Net realized gain on investment transactions | | $ | 2,938,459 | |

| | Net change in unrealized appreciation (depreciation) on investments | | | (3,165,113 | ) |

| | Net realized and unrealized loss on investments | | $ | (226,654 | ) |

| | Net decrease in net assets from operations | | $ | (128,907 | ) |

| | | | | | | |

| See Notes to Financial Statements. | 21 | |

| Wright Selected Blue Chip Equities Fund (WSBC) |

| | | | Years Ended | |

| STATEMENTS OF CHANGES IN NET ASSETS | | December 31, 2015 | | December 31, 2014 | |

| | | | | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | | |

From operations – | | | | | | | | | |

| | Net investment income | | $ | 97,747 | | | $ | 76,039 | | |

| 0 | Net realized gain on investment transactions | | | 2,938,459 | | | | 6,165,711 | | |

| | Net change in unrealized appreciation (depreciation) on investments | | | (3,165,113 | ) | | | (3,334,464 | ) | |

| | Net increase (decrease) in net assets from operations | | $ | (128,907 | ) | | $ | 2,907,286 | | |

| Distributions to shareholders (Note 2) | | | | | | | | | |

| | From net investment income | | $ | (58,600 | ) | | $ | (97,816 | ) | |

| | From net realized capital gains | | | (3,929,775 | ) | | | (6,795,055 | ) | |

| | Total distributions | | $ | (3,988,375 | ) | | $ | (6,892,871 | ) | |

| Net increase in net assets resulting from fund share transactions (Note 6) | | $ | 5,014,056 | | | $ | 1,391,495 | | |

| Net increase (decrease) in net assets | | $ | 896,774 | | | $ | (2,594,090 | ) | |

| | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | |

| | At beginning of year | | | 37,609,872 | | | | 40,203,962 | | |

| | At end of year | | $ | 38,506,646 | | | $ | 37,609,872 | | |

| | | | | | | | | | | |

| See Notes to Financial Statements. | 22 | |

| Wright Selected Blue Chip Equities Fund (WSBC) |

| These financial highlights reflect selected data for a share outstanding throughout each year. | | | | |

| | | Years Ended December 31, |

| FINANCIAL HIGHLIGHTS | | 2015 | 2014 | 2013 | 2012 | 2011 |

| | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 12.740 | | $ | 14.160 | | $ | 11.530 | | $ | 10.280 | | $ | 10.400 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) (1) | | | 0.032 | | | 0.027 | | | (0.007 | ) | | 0.028 | | | (0.018 | ) |

| Net realized and unrealized gain (loss) | | | (0.030 | ) | | 1.043 | | | 4.412 | | | 1.616 | | | (0.102 | ) |

| | Total income (loss) from investment operations | | 0.002 | | | 1.070 | | | 4.405 | | | 1.644 | | | (0.120 | ) |

| | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.019 | ) | | (0.036 | ) | | — | (2) | | (0.025 | ) | | — | |

| From net realized gains | | | (1.293 | ) | | (2.454 | ) | (1.775 | ) | | (0.369 | ) | | — | |

| | Total distributions | | | (1.312 | ) | | (2.490 | ) | | (1.775 | ) | | (0.394 | ) | | — | |

| Net asset value, end of year | | $ | 11.430 | | $ | 12.740 | | $ | 14.160 | | $ | 11.530 | | $ | 10.280 | |

Total Return(3) | | | (0.22 | )% | | 7.99 | % | | 39.82 | % | | 16.02 | % | | (1.15 | )% |

Ratios/Supplemental Data(4): | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $38,507 | | $37,610 | | $40,204 | | $29,922 | | $32,362 | |

| Ratios (As a percentage of average daily net assets): |

| Net expenses | | | 1.40 | % | 1.45 | % | 1.40 | % | 1.40 | % | 1.40 | % |

| Net investment income (loss) | | | 0.25 | % | 0.19 | % | (0.06 | )% | 0.25 | % | (0.17 | )% |

| Portfolio turnover rate | | | 55 | % | 66 | % | 76 | % | 54 | % | 82 | % |

| | | | | | | | | | | | | | | | | |

| | | | | For the years ended December 31, 2015, 2014, 2013, 2012 and 2011 | For the years ended December 31, 2015, 2014, 2013, 2012 and 2011 | | | | | | | |

| (1) | Computed using average shares outstanding. |

| (2) | Less than $0.001 per share. |

| (3) | Total return is calculated assuming a purchase at the net asset value on the first day and a sale at the net asset value on the last day of each year reported. Dividends and distributions, if any, are assumed to be reinvested at the net asset value on the reinvestment date. |

| (4) | For each of the years presented, the operating expenses of the Fund were reduced by a waiver of fees and/or allocation of expenses to the principal underwriter and/or investment adviser. Had such action not been undertaken, expenses and net investment income (loss) ratios would have been as follows: |

| | | | 2015 | 2014 | 2013 | 2012 | 2011 |

| | |

| Ratios (As a percentage of average daily net assets): |

| Expenses | | | 1.44 | % | | 1.51 | % | | 1.43 | % | | 1.48 | % | | 1.46 | % |

| Net investment income (loss) | | | 0.21 | % | | 0.13 | % | | (0.09 | )% | | 0.17 | % | | (0.23 | )% |

| | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 23 | |

Wright Major Blue Chip Equities Fund (WSBC) Portfolio of Investments - As of December 31, 2015 |

BANKS - 11.4% |

| Bank of America Corp. | 8,015 | | $ | 134,892 | |

| Citigroup, Inc. | 3,865 | | | 200,014 | |

| JPMorgan Chase & Co. | 4,545 | | | 300,106 | |

| U.S. Bancorp | 6,915 | | | 295,063 | |

| Wells Fargo & Co. | 9,660 | | | 525,118 | |

| | | | $ | 1,455,193 | |

CAPITAL GOODS - 5.6% |

| Boeing Co. (The) | 945 | | $ | 136,638 | |

| Lockheed Martin Corp. | 1,610 | | | 349,611 | |

| Northrop Grumman Corp. | 1,230 | | | 232,236 | |

| | | | $ | 718,485 | |

CONSUMER DURABLES & APPAREL - 0.9% |

| Coach, Inc. | 3,445 | | $ | 112,755 | |

CONSUMER SERVICES - 1.1% |

| Wyndham Worldwide Corp. | 1,990 | | $ | 144,573 | |

DIVERSIFIED FINANCIALS - 5.0% |

| Discover Financial Services | 4,075 | | $ | 218,501 | |

| Morgan Stanley | 5,965 | | | 189,747 | |

| Nasdaq, Inc. | 4,075 | | | 237,043 | |

| | | | $ | 645,291 | |

ENERGY - 4.6% |

| Marathon Petroleum Corp. | 3,600 | | $ | 186,624 | |

| Phillips 66 | 1,515 | | | 123,927 | |

| Schlumberger, Ltd. | 1,895 | | | 132,176 | |

| Valero Energy Corp. | 1,990 | | | 140,713 | |

| | | | $ | 583,440 | |

FOOD & STAPLES RETAILING - 4.4% |

| CVS Health Corp. | 4,260 | | $ | 416,500 | |

| Walgreens Boots Alliance, Inc. | 1,705 | | | 145,189 | |

| | | | $ | 561,689 | |

FOOD, BEVERAGE & TOBACCO - 4.7% |

| Altria Group, Inc. | 4,545 | | $ | 264,564 | |

| Philip Morris International, Inc. | 3,790 | | | 333,179 | |

| | | | $ | 597,743 | |

HEALTH CARE EQUIPMENT & SERVICES - 5.9% |

| Anthem, Inc. | 3,315 | | $ | 462,244 | |

| Humana, Inc. | 1,040 | | | 185,650 | |

| UnitedHealth Group, Inc. | 885 | | | 104,111 | |

| | | | $ | 752,005 | |

INSURANCE - 5.4% |

| MetLife, Inc. | 5,400 | | $ | 260,334 | |

| Progressive Corp. (The) | 9,850 | | | 313,230 | |

| WR Berkley Corp. | 2,065 | | | 113,059 | |

| | | | $ | 686,623 | |

MATERIALS - 1.6% |

| Dow Chemical Co. (The) | 4,075 | | $ | 209,781 | |

MEDIA - 4.8% |

| Comcast Corp. - Class A | 10,890 | | $ | 614,523 | |

PHARMACEUTICALS & BIOTECHNOLOGY - 9.9% |

| Amgen, Inc. | 1,515 | | $ | 245,930 | |

| Gilead Sciences, Inc. | 4,450 | | | 450,295 | |

| Johnson & Johnson | 1,610 | | | 165,379 | |

| Pfizer, Inc. | 12,595 | | | 406,567 | |

| | | | $ | 1,268,171 | |

RETAILING - 6.5% |

| Best Buy Co., Inc. | 6,725 | | $ | 204,776 | |

| Dollar General Corp. | 1,705 | | | 122,539 | |

| Foot Locker, Inc. | 1,990 | | | 129,529 | |

| Home Depot, Inc. (The) | 2,085 | | | 275,741 | |

| Macy's, Inc. | 2,855 | | | 99,868 | |

| | | | $ | 832,453 | |

SEMICONDUCTOR EQUIPMENT & PRODUCTS - 1.4% |

| Intel Corp. | 5,115 | | $ | 176,212 | |

SOFTWARE & SERVICES - 12.4% |

| Facebook, Inc.- Class A* | 1,610 | | $ | 168,503 | |

| International Business Machines Corp. | 1,325 | | | 182,346 | |

| MasterCard, Inc. - Class A | 3,410 | | | 331,998 | |

| Microsoft Corp. | 8,335 | | | 462,426 | |

| Oracle Corp. | 12,125 | | | 442,926 | |

| | | | $ | 1,588,199 | |

TECHNOLOGY HARDWARE & EQUIPMENT - 5.5% |

| Apple, Inc. | 4,925 | | $ | 518,406 | |

| Western Digital Corp. | 3,125 | | | 187,656 | |

| | | | $ | 706,062 | |

TELECOMMUNICATION SERVICES - 3.2% |

| AT&T, Inc. | 6,630 | | $ | 228,138 | |

| Verizon Communications, Inc. | 3,885 | | | 179,565 | |

| | | | $ | 407,703 | |

TRANSPORTATION - 3.6% |

| Southwest Airlines Co. | 10,700 | | $ | 460,742 | |

UTILITIES - 1.5% |

| NextEra Energy, Inc. | 1,895 | | $ | 196,872 | |

TOTAL EQUITY INTERESTS - 99.4% (identified cost, $12,806,003) | | $ | 12,718,515 | |

SHORT-TERM INVESTMENTS - 0.5% |

| Fidelity Government Money Market Fund, 0.12% (1) | 65,611 | | $ | 65,611 | |

TOTAL SHORT-TERM INVESTMENTS - 0.5% (identified cost, $65,611) | | $ | 65,611 | |

TOTAL INVESTMENTS — 99.9% (identified cost, $12,871,614) | | $ | 12,784,126 | |

| OTHER ASSETS, IN EXCESS OF LIABILITIES — 0.1% | | | 12,859 | |

| NET ASSETS — 100.0% | | $ | 12,796,985 | |

* — Non-income producing security.

| (1) | Variable rate security. Rate presented is as of December 31, 2015. |

| See Notes to Financial Statements. | 24 | |

Wright Major Blue Chip Equities Fund (WSBC) |

| STATEMENT OF ASSETS AND LIABILITIES |

| As of December 31, 2015 |

| | | | | | | |

| ASSETS: | | | | |

| | Investments, at value | | | | |

| | (identified cost $12,871,614) (Note 1A) | | $ | 12,784,126 | |

| | Receivable for fund shares sold | | | 2,404 | |

| | Dividends receivable | | | 15,157 | |

| | Prepaid expenses and other assets | | | 8,160 | |

| | Total assets | | $ | 12,809,847 | |

| | | | | | | |

| LIABILITIES: | | | | |

| | Accrued expenses and other liabilities | | | 12,862 | |

| | Total liabilities | | $ | 12,862 | |

| NET ASSETS | | $ | 12,796,985 | |

| | | | | | | |

| NET ASSETS CONSIST OF: | | | | |

| | Paid-in capital | | $ | 11,943,688 | |

| | Accumulated net realized gain on investments | | | 938,432 | |

| | Undistributed net investment income | | | 2,353 | |

| | Unrealized depreciation on investments | | | (87,488 | ) |

| | Net assets applicable to outstanding shares | | $ | 12,796,985 | |

| | | | | | | |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING AT $0.000 PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | 697,092 | |

| | | | | | | |

| NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE OF BENEFICIAL INTEREST | | $ | 18.36 | |

| | | | | | | |

| STATEMENT OF OPERATIONS |

| For the Year Ended December 31, 2015 |

| | | | | | | |

| INVESTMENT INCOME (Note 1C) | | | | |

| 1E+07 | Dividend income | | $ | 326,374 | |

| | Total investment income | | $ | 326,374 | |

| | | | | | | |

| Expenses – | | | | |

| | Investment adviser fee (Note 3) | | $ | 85,386 | |

| | Administrator fee (Note 3) | | | 17,077 | |

| | Trustee expense (Note 3) | | | 16,870 | |

| | Custodian fee | | | 5,000 | |

| | Accountant fee | | | 37,189 | |

| | Distribution expenses (Note 4) | | | 35,577 | |

| | Transfer agent fee | | | 25,349 | |

| | Printing | | | 41 | |

| | Shareholder communications | | | 4,744 | |

| | Audit services | | | 17,000 | |

| | Legal services | | | 7,491 | |

| | Compliance services | | | 5,478 | |

| | Registration costs | | | 18,677 | |

| | Interest expense (Note 8) | | | 569 | |

| | Miscellaneous | | | 15,856 | |

| | Total expenses | | $ | 292,304 | |

| | | | | | | |

| Deduct – | | | | |

| | Waiver and/or reimbursement by the principal underwriter and/or investment adviser (Note 4) | | $ | (92,502 | ) |

| | Net expenses | | $ | 199,802 | |

| | Net investment income | | $ | 126,572 | |

| | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | |

| | Net realized gain on investment transactions | | $ | 1,973,543 | |

| | Net change in unrealized appreciation (depreciation) on investments | | | (2,502,483 | ) |

| | Net realized and unrealized loss on investments | | $ | (528,940 | ) |

| | Net decrease in net assets from operations | | $ | (402,368 | ) |

| | | | | | | |

| See Notes to Financial Statements. | 25 | |

| Wright Major Blue Chip Equities Fund (WSBC) |

| | | | Years Ended | |

| STATEMENTS OF CHANGES IN NET ASSETS | | December 31, 2015 | | December 31, 2014 | |

| | | | | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | | |

From operations – | | | | | | | | | |

| | Net investment income | | $ | 126,572 | | | $ | 123,812 | | |

| 0 | Net realized gain on investment transactions | | | 1,973,543 | | | | 2,701,317 | | |

| | Net change in unrealized appreciation (depreciation) on investments | | | (2,502,483 | ) | | | (677,283 | ) | |

| | Net increase (decrease) in net assets from operations | | $ | (402,368 | ) | | $ | 2,147,846 | | |

| Distributions to shareholders (Note 2) | | | | | | | | | |

| | From net investment income | | $ | (126,527 | ) | | $ | (126,109 | ) | |

| | Total distributions | | $ | (126,527 | ) | | $ | (126,109 | ) | |

| Net decrease in net assets resulting from fund share transactions (Note 6) | | $ | (2,599,030 | ) | | $ | (3,788,496 | ) | |

| Net decrease in net assets | | $ | (3,127,925 | ) | | $ | (1,766,759 | ) | |

| | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | |

| | At beginning of year | | | 15,924,910 | | | | 17,691,669 | | |

| | At end of year | | $ | 12,796,985 | | | $ | 15,924,910 | | |

| | | | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME INCLUDED IN NET ASSETS AT END OF YEAR | | $ | 2,353 | | | $ | 2,308 | | |

| | | | | | | | | | | |

| See Notes to Financial Statements. | 26 | |

| Wright Major Blue Chip Equities Fund (WSBC) |

| These financial highlights reflect selected data for a share outstanding throughout each year. | | | | |

| | | Years Ended December 31, |

| FINANCIAL HIGHLIGHTS | | 2015 | 2014 | 2013 | 2012 | 2011 |

| | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 19.100 | | $ | 17.030 | | $ | 12.690 | | $ | 12.260 | | $ | 12.250 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) (1) | | | 0.168 | | | 0.127 | | | 0.096 | | | 0.082 | | | (0.012 | ) |

| Net realized and unrealized gain (loss) | | | (0.727 | ) | | 2.095 | | | 4.344 | | | 0.437 | | | 0.022 | |

| | Total income (loss) from investment operations | | (0.559 | ) | | 2.222 | | | 4.440 | | | 0.519 | | | 0.010 | |

| | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.181 | ) | | (0.152 | ) | | (0.100 | ) | | (0.089 | ) | | — | |

| Net asset value, end of year | | $ | 18.360 | | $ | 19.100 | | $ | 17.030 | | $ | 12.690 | | $ | 12.260 | |

Total Return(2) | | | (2.91 | )% | | 13.04 | % | | 35.03 | % | | 4.23 | % | | 0.08 | % |

Ratios/Supplemental Data(3): | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $12,797 | | $15,925 | | $17,692 | | $15,559 | | $18,921 | |

| Ratios (As a percentage of average daily net assets): |

| Net expenses | | | 1.40 | % | 1.40 | % | 1.40 | % | 1.40 | % | 1.40 | % |

| Net investment income (loss) | | | 0.89 | % | 0.71 | % | 0.65 | % | 0.64 | % | (0.09 | )% |

| Portfolio turnover rate | | | 118 | % | 62 | % | 64 | % | 76 | % | 154 | % |

| | | | | | | | | | | | | | | | | |

| | | | | For the years ended December 31, 2015, 2014, 2013, 2012 and 2011 | For the years ended December 31, 2015, 2014, 2013, 2012 and 2011 | | | | | | | |

| (1) | Computed using average shares outstanding. |

| (2) | Total return is calculated assuming a purchase at the net asset value on the first day and a sale at the net asset value on the last day of each year reported. Dividends and distributions, if any, are assumed to be reinvested at the net asset value on the reinvestment date. |

| (3) | For each of the years presented, the operating expenses of the Fund were reduced by a waiver of fees and/or allocation of expenses to the principal underwriter and/or investment adviser. Had such action not been undertaken, expenses and net investment income (loss) ratios would have been as follows: |

| | | | 2015 | 2014 | 2013 | 2012 | 2011 |

| | |

| Ratios (As a percentage of average daily net assets): |

| Expenses | | | 2.05 | % | | 1.86 | % | | 1.87 | % | | 1.84 | % | | 1.70 | % |

| Net investment income (loss) | | | 0.24 | % | | 0.25 | % | | 0.17 | % | | 0.20 | % | | (0.39 | )% |

| See Notes to Financial Statements. | 27 | |

Wright International Blue Chip Equities Fund (WIBC) Portfolio of Investments - As of December 31, 2015 |

AFA

AUSTRALIA - 2.4% |

| Australia & New Zealand Banking Group, Ltd. | 7,905 | | $ | 160,633 | |

| CIMIC Group, Ltd. | 8,738 | | | 154,483 | |

| CSL, Ltd. | 2,255 | | | 172,774 | |

| Woodside Petroleum, Ltd. | 5,731 | | | 119,751 | |

| | | | $ | 607,641 | |

CANADA - 8.6% |

| Alimentation Couche-Tard, Inc. - Class B | 12,970 | | $ | 568,716 | |

| Canadian Tire Corp., Ltd. - Class A | 3,021 | | | 256,973 | |

| CGI Group, Inc. - Class A* | 7,588 | | | 302,624 | |

| Magna International, Inc. | 6,113 | | | 246,967 | |

| Manulife Financial Corp. | 28,241 | | | 421,653 | |

| Toronto-Dominion Bank (The) | 9,860 | | | 385,002 | |

| | | | $ | 2,181,935 | |

DENMARK - 2.0% |

| AP Moeller - Maersk A/S - Class B | 131 | | $ | 171,144 | |

| Novo Nordisk A/S - Class B | 3,997 | | | 232,670 | |

| Pandora A/S | 864 | | | 109,670 | |

| | | | $ | 513,484 | |

FRANCE - 7.9% |

| AXA SA | 13,645 | | $ | 373,973 | |

| BNP Paribas SA | 4,275 | | | 242,553 | |

| Societe Generale SA | 4,674 | | | 216,143 | |

| TOTAL SA | 10,973 | | | 491,878 | |

| Veolia Environnement SA | 7,579 | | | 180,016 | |

| Vivendi SA | 20,487 | | | 441,985 | |

| Zodiac Aerospace | 2,299 | | | 54,893 | |

| | | | $ | 2,001,441 | |

GERMANY - 12.3% |

| Allianz SE | 1,547 | | $ | 274,847 | |

| BASF SE | 5,306 | | | 407,623 | |

| Bayer AG | 2,415 | | | 303,791 | |

| Bayerische Motoren Werke AG | 2,392 | | | 253,685 | |

| Continental AG | 970 | | | 236,611 | |

| Daimler AG | 4,245 | | | 357,748 | |

| Merck KGaA | 1,443 | | | 140,404 | |

| Muenchener Rueckversicherungs-Gesellschaft AG - Class R | 3,021 | | | 605,640 | |

| Siemens AG | 1,335 | | | 130,345 | |

| Volkswagen AG | 2,609 | | | 403,300 | |

| | | | $ | 3,113,994 | |

HONG KONG - 1.0% |

| CK Hutchison Holdings, Ltd. | 18,000 | | $ | 242,937 | |

IRELAND - 1.0% |

| Ryanair Holdings PLC* | 15,471 | | $ | 252,260 | |

ISRAEL - 3.0% |

| Check Point Software Technologies, Ltd.* | 2,272 | | $ | 184,896 | |

| Teva Pharmaceutical Industries, Ltd., ADR | 8,769 | | | 575,597 | |

| | | | $ | 760,493 | |

ITALY - 2.4% |

| Intesa Sanpaolo SpA | 178,905 | | $ | 600,136 | |

JAPAN - 25.3% |

| Asics Corp. | 1,445 | | $ | 30,319 | |

| Central Japan Railway Co. | 941 | | | 168,965 | |

| Daiwa House Industry Co., Ltd. | 6,500 | | | 189,280 | |

| Daiwa Securities Group, Inc. | 27,000 | | | 167,169 | |

| Fuji Heavy Industries, Ltd. | 5,700 | | | 238,197 | |

| Hitachi, Ltd. | 11,735 | | | 67,457 | |

| Hoya Corp. | 4,019 | | | 166,413 | |

| ITOCHU Corp. | 47,200 | | | 565,796 | |

| KDDI Corp. | 39,800 | | | 1,043,511 | |

| Konica Minolta, Inc. | 6,200 | | | 62,982 | |

| Mitsubishi Corp. | 8,500 | | | 143,298 | |

| Mitsubishi Electric Corp. | 9,000 | | | 95,952 | |

| Mitsubishi UFJ Financial Group, Inc. | 24,600 | | | 154,825 | |

| Mitsui & Co., Ltd. | 8,000 | | | 96,130 | |

| Murata Manufacturing Co., Ltd. | 1,800 | | | 262,904 | |

| NHK Spring Co., Ltd. | 11,400 | | | 115,805 | |

| Nippon Telegraph & Telephone Corp. | 12,100 | | | 486,434 | |

| Nissan Motor Co., Ltd. | 30,700 | | | 326,536 | |

| Nitto Denko Corp. | 1,200 | | | 88,901 | |

| NSK, Ltd. | 7,900 | | | 87,081 | |

| Omron Corp. | 3,800 | | | 128,409 | |

| ORIX Corp. | 17,800 | | | 253,842 | |

| Sekisui Chemical Co., Ltd. | 12,000 | | | 158,710 | |

| Sekisui House, Ltd. | 5,700 | | | 96,970 | |

| Shimadzu Corp. | 10,000 | | | 169,999 | |

| SMC Corp. | 300 | | | 79,230 | |

| Sumitomo Corp. | 25,300 | | | 260,897 | |

| Sumitomo Heavy Industries, Ltd. | 25,000 | | | 113,887 | |

| Tokyo Gas Co., Ltd. | 9,000 | | | 42,705 | |

| Toyota Motor Corp. | 8,600 | | | 535,324 | |

| | | | $ | 6,397,928 | |

LUXEMBOURG - 0.4% |

| Subsea 7 SA* | 15,000 | | $ | 106,848 | |

MARSHALL ISLANDS - 0.2% |

| Dynagas LNG Partners LP | 4,243 | | $ | 41,157 | |

NETHERLANDS - 2.6% |

| Boskalis Westminster | 9,196 | | $ | 375,909 | |

| ING Groep NV | 14,416 | | | 194,969 | |

| Koninklijke Philips NV | 3,449 | | | 88,271 | |

| | | | $ | 659,149 | |

NORWAY - 0.8% |

| Statoil ASA | 4,493 | | $ | 62,791 | |

| Yara International ASA | 3,338 | | | 144,398 | |

| | | | $ | 207,189 | |

SPAIN - 4.7% |

| Enagas SA | 5,773 | | $ | 163,052 | |

| Gas Natural SDG SA | 20,029 | | | 409,367 | |

| Iberdrola SA | 68,401 | | | 486,691 | |

| Red Electrica Corp. SA | 1,692 | | | 141,730 | |

| | | | $ | 1,200,840 | |

| See Notes to Financial Statements. | 28 | |

Wright International Blue Chip Equities Fund (WIBC) Portfolio of Investments - As of December 31, 2015 |

SWITZERLAND - 12.5% |

| Actelion, Ltd.* | 5,804 | | $ | 809,429 | |

| Credit Suisse Group AG | 5,529 | | | 119,804 | |

| Nestle SA | 13,083 | | | 974,364 | |

| Novartis AG | 4,478 | | | 388,302 | |

| Swiss Re AG | 9,027 | | | 885,115 | |

| | | | $ | 3,177,014 | |

UNITED KINGDOM - 12.5% |

| ARM Holdings PLC | 5,761 | | $ | 88,223 | |

| Aviva PLC | 46,669 | | | 354,933 | |

| BP PLC | 42,980 | | | 224,253 | |

| British American Tobacco PLC | 3,664 | | | 203,648 | |

| easyJet PLC | 5,250 | | | 134,641 | |

| Legal & General Group PLC | 183,367 | | | 723,769 | |

| Rio Tinto PLC | 10,471 | | | 305,500 | |

| Royal Dutch Shell PLC - Class B | 5,977 | | | 135,930 | |

| Shire PLC | 6,291 | | | 435,613 | |

| Vodafone Group PLC | 52,061 | | | 169,579 | |

| WPP PLC | 17,153 | | | 395,155 | |

| | | | $ | 3,171,244 | |

TOTAL EQUITY INTERESTS - 99.6% (identified cost, $21,374,957) | | $ | 25,235,690 | |

TOTAL INVESTMENTS — 99.6% (identified cost, $21,374,957) | | $ | 25,235,690 | |

| OTHER ASSETS, IN EXCESS OF LIABILITIES — 0.4% | | | 101,119 | |

| NET ASSETS — 100.0% | | $ | 25,336,809 | |

ADR — American Depositary Receipt

LP — Limited Partnership

PLC — Public Limited Company

| * | Non-income producing security. |

| See Notes to Financial Statements. | 29 | |

Wright International Blue Chip Equities Fund (WIBC) |

| STATEMENT OF ASSETS AND LIABILITIES |

| As of December 31, 2015 |

| | | | | | | |

| ASSETS: | | | | |

| | Investments, at value | | | | |

| | (identified cost $21,374,957) (Note 1A) | | $ | 25,235,690 | |

| | Foreign currency, at value | | | | |

| | (identified cost $14,935) (Note 1A) | | | 13,846 | |

| | Receivable for fund shares sold | | | 386 | |

| | Receivable for investment securities sold | | | 658,656 | |

| | Dividends receivable | | | 10,740 | |

| | Tax reclaims receivable | | | 114,705 | |

| | Prepaid expenses and other assets | | | 9,715 | |

| | Total assets | | $ | 26,043,738 | |

| | | | | | | |

| LIABILITIES: | | | | |

| | Outstanding line of credit (Note 8) | | $ | 685,636 | |

| | Accrued expenses and other liabilities | | | 21,293 | |

| | Total liabilities | | $ | 706,929 | |

| NET ASSETS | | $ | 25,336,809 | |

| | | | | | | |

| NET ASSETS CONSIST OF: | | | | |

| | Paid-in capital | | $ | 72,420,075 | |

| | Accumulated net realized loss on investments and foreign currency | | | (50,908,152 | ) |

| | Accumulated net investment loss | | | (17,159 | ) |

| | Unrealized appreciation on investments and foreign currency | | | 3,842,045 | |

| | Net assets applicable to outstanding shares | | $ | 25,336,809 | |

| | | | | | | |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING AT $0.000 PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | 1,759,585 | |

| | | | | | | |

| NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE OF BENEFICIAL INTEREST | | $ | 14.40 | |

| | | | | | | |

| STATEMENT OF OPERATIONS |

| For the Year Ended December 31, 2015 |

| | | | | | | |

| INVESTMENT INCOME (Note 1C) | | | | |

| 2E+07 | Dividend income (net of foreign taxes $106,062) | | $ | 841,256 | |

| | Total investment income | | $ | 841,256 | |

| | | | | | | |

| Expenses – | | | | |

| | Investment adviser fee (Note 3) | | $ | 227,233 | |

| | Administrator fee (Note 3) | | | 48,287 | |

| | Trustee expense (Note 3) | | | 16,870 | |

| | Custodian fee | | | 23,153 | |

| | Accountant fee | | | 62,373 | |

| | Distribution expenses (Note 4) | | | 71,010 | |

| | Transfer agent fee | | | 44,683 | |

| | Printing | | | 81 | |

| | Shareholder communications | | | 5,662 | |

| | Audit services | | | 17,000 | |

| | Legal services | | | 11,879 | |

| | Compliance services | | | 5,953 | |

| | Registration costs | | | 19,088 | |

| | Interest expense (Note 8) | | | 558 | |

| | Miscellaneous | | | 24,235 | |

| | Total expenses | | $ | 578,065 | |

| | | | | | | |

| Deduct – | | | | |

| | Waiver and/or reimbursement by the principal underwriter and/or investment adviser (Note 4) | | $ | (52,032 | ) |

| | Net expenses | | $ | 526,033 | |

| | Net investment income | | $ | 315,223 | |

| | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | |

| Net realized gain – | | | | |

| | Investment transactions | | $ | 479,931 | |

| | Foreign currency transactions | | | (11,115 | ) |

| | Net realized gain | | $ | 468,816 | |

| | | | | | | |

| Change in unrealized appreciation (depreciation) – | | | | |

| | Investments | | $ | (1,317,391 | ) |

| | Foreign currency translations | | | (6,575 | ) |

| | Net change in unrealized appreciation (depreciation) on investments | | $ | (1,323,966 | ) |

| | Net realized and unrealized loss on investments and foreign currency translations | | $ | (855,150 | ) |

| | Net decrease in net assets from operations | | $ | (539,927 | ) |

| | | | | | | |

| See Notes to Financial Statements. | 30 | |

| Wright International Blue Chip Equities Fund (WIBC) |

| | | | Years Ended | |

| STATEMENTS OF CHANGES IN NET ASSETS | | December 31, 2015 | | December 31, 2014 | |

| | | | | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | | |

From operations – | | | | | | | | | |

| | Net investment income | | $ | 315,223 | | | $ | 745,142 | | |

| -59379 | Net realized gain on investment and foreign currency transactions | | | 468,816 | | | | 1,041,806 | | |

| | Net change in unrealized appreciation (depreciation) on investments and foreign currency translations | (1,323,966 | ) | | | (3,715,302 | ) | |

| | Net decrease in net assets from operations | | $ | (539,927 | ) | | $ | (1,928,354 | ) | |

| Distributions to shareholders (Note 2) | | | | | | | | | |