UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3587

Fidelity Financial Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | November 30 |

| |

Date of reporting period: | November 30, 2006 |

Item 1. Reports to Stockholders

Fidelity®

Equity-Income II

Fund

Annual Report

November 30, 2006

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | <Click Here> | Ned Johnson's message to shareholders. |

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion | <Click Here> | The manager's review of fund performance, strategy and outlook. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

Proxy Voting Results | <Click Here> | |

Board Approval of Investment Advisory Contracts and Management Fees | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Stock and bond markets around the world have seen largely positive results year to date, although weakness in the technology sector and growth stocks in general have tempered performance. While financial markets are always unpredictable, there are a number of time-tested principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third investment principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces unconstructive "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended November 30, 2006 | Past 1

year | Past 5

years | Past 10

years |

Fidelity® Equity-Income II | 12.28% | 8.13% | 8.81% |

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Equity-Income II Fund on November 30, 1996. The chart shows how the value of your investment would have changed, and also shows how the Russell 3000® Value Index performed over the same period.

Annual Report

Management's Discussion of Fund Performance

Comments from Stephen DuFour, who managed Fidelity® Equity-Income II Fund for most of the period covered by this report

There were a number of reasons why the overall U.S. stock market could have had subpar results during the 12-month period that ended on November 30, 2006, including rising interest rates, inflation concerns, historically high energy prices, unrest in the Middle East, North Korea's nuclear test and a worse-than-expected housing slump. Despite these negative conditions, though, U.S. stocks fared well. In fact, several bellwether market benchmarks reached record highs, including the larger-cap Dow Jones Industrial AverageSM - a gauge of 30 mega-cap, blue-chip stocks - and the small-cap-oriented Russell 2000® Index. The strength in equities was sparked in large part by two major factors: the double-digit earnings growth achieved by U.S. corporations, and steady economic growth that was neither overheated nor recessionary, thanks primarily to the Federal Reserve Board's monetary policy. For the 12 months overall, the Dow rose 15.76%, the Russell 2000 checked in with a 17.43% advance, the Standard & Poor's 500SM Index gained 14.23% and the NASDAQ Composite® Index returned 9.78%.

Equity-Income II Fund returned 12.28% during the past 12 months, compared with a gain of 20.40% for the benchmark Russell 3000® Value Index. Most of the fund's relative underperformance was the result of owning stocks whose returns, while generally strong, were not as good as those of some of the index's largest names, which helped the index produce a return that ran at the high end of its historical performance range. Among the stocks that detracted from performance relative to the index were mega-retailer Wal-Mart Stores, semiconductor giant Intel, student loan underwriter SLM Corp. and global insurance writer American International Group. A moderate underweighting in the energy sector also hampered relative performance, although good stock picking there - particularly in coal producer Peabody Energy - helped narrow the gap. A few good picks within the technology hardware/equipment and transportation groups - among them Hewlett-Packard and US Airways - as well as in the materials sector, helped boost the fund's return. Some of the stocks mentioned here were no longer in the fund at period end.

Note to shareholders: C. Robert Chow became Portfolio Manager of the fund on November 9, 2006.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (June 1, 2006 to November 30, 2006).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning

Account Value

June 1, 2006 | Ending

Account Value

November 30, 2006 | Expenses Paid

During Period*

June 1, 2006

to November 30, 2006 |

Actual | $ 1,000.00 | $ 1,089.10 | $ 3.51 |

Hypothetical (5% return per year before expenses) | $ 1,000.00 | $ 1,021.71 | $ 3.40 |

* Expenses are equal to the Fund's annualized expense ratio of .67%; multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

Annual Report

Investment Changes

Top Ten Stocks as of November 30, 2006 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Exxon Mobil Corp. | 5.7 | 5.5 |

American International Group, Inc. | 4.4 | 2.0 |

Citigroup, Inc. | 2.9 | 3.3 |

Wal-Mart Stores, Inc. | 2.9 | 5.0 |

General Growth Properties, Inc. | 2.7 | 3.2 |

Bank of America Corp. | 2.7 | 3.0 |

Merck & Co., Inc. | 2.5 | 0.9 |

Burlington Northern Santa Fe Corp. | 2.5 | 1.7 |

AT&T, Inc. | 2.3 | 1.8 |

Pfizer, Inc. | 2.1 | 1.7 |

| 30.7 | |

Top Five Market Sectors as of November 30, 2006 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Financials | 29.0 | 31.0 |

Energy | 13.3 | 9.0 |

Industrials | 12.6 | 12.3 |

Health Care | 12.1 | 7.1 |

Information Technology | 10.2 | 5.7 |

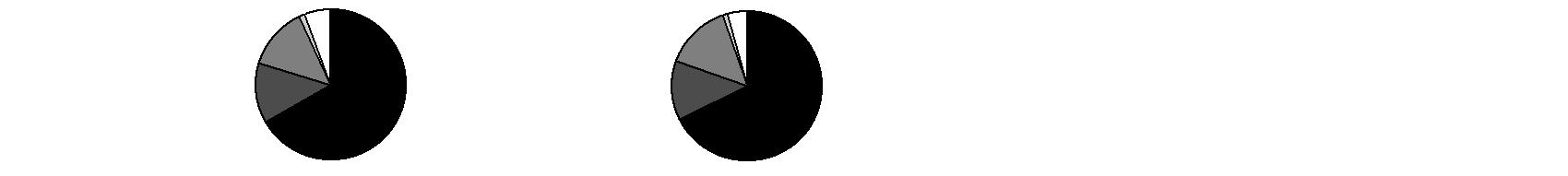

Asset Allocation (% of fund's net assets) |

As of November 30, 2006* | As of May 31, 2006** |

| Stocks 99.0% | |  | Stocks 93.2% | |

| Short-Term

Investments and

Net Other Assets 1.0% | |  | Short-Term

Investments and

Net Other Assets 6.8% | |

* Foreign investments | 2.4% | | ** Foreign investments | 4.4% | |

Annual Report

Investments November 30, 2006

Showing Percentage of Net Assets

Common Stocks - 99.0% |

| Shares | | Value (Note 1) (000s) |

CONSUMER DISCRETIONARY - 7.5% |

Hotels, Restaurants & Leisure - 0.3% |

Red Robin Gourmet Burgers, Inc. (a)(c) | 860,000 | | $ 29,558 |

Household Durables - 0.8% |

KB Home | 660,000 | | 34,115 |

Whirlpool Corp. | 660,000 | | 56,298 |

| | 90,413 |

Media - 3.8% |

Comcast Corp. Class A | 1,800,000 | | 72,828 |

Dow Jones & Co., Inc. | 1,600,000 | | 57,744 |

The Walt Disney Co. | 3,400,000 | | 112,370 |

Time Warner, Inc. | 5,900,000 | | 118,826 |

Viacom, Inc. Class B (non-vtg.) (a) | 2,200,000 | | 82,522 |

| | 444,290 |

Multiline Retail - 0.5% |

Target Corp. | 1,000,000 | | 58,090 |

Specialty Retail - 1.9% |

Big 5 Sporting Goods Corp. | 873,547 | | 21,376 |

Home Depot, Inc. | 3,800,000 | | 144,286 |

Williams-Sonoma, Inc. | 1,800,000 | | 57,096 |

| | 222,758 |

Textiles, Apparel & Luxury Goods - 0.2% |

Adidas-Salomon AG | 600,000 | | 29,548 |

TOTAL CONSUMER DISCRETIONARY | | 874,657 |

CONSUMER STAPLES - 6.7% |

Beverages - 1.0% |

Anheuser-Busch Companies, Inc. | 1,400,000 | | 66,514 |

The Coca-Cola Co. | 1,000,100 | | 46,835 |

| | 113,349 |

Food & Staples Retailing - 3.2% |

CVS Corp. | 1,100,000 | | 31,647 |

Wal-Mart Stores, Inc. | 7,300,000 | | 336,530 |

| | 368,177 |

Food Products - 1.4% |

General Mills, Inc. | 1,000,000 | | 55,950 |

Hershey Co. | 1,100,000 | | 58,267 |

McCormick & Co., Inc. (non-vtg.) | 1,197,599 | | 46,371 |

| | 160,588 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

CONSUMER STAPLES - continued |

Household Products - 0.7% |

Kimberly-Clark Corp. | 1,300,000 | | $ 86,411 |

Tobacco - 0.4% |

Altria Group, Inc. | 521,700 | | 43,932 |

TOTAL CONSUMER STAPLES | | 772,457 |

ENERGY - 13.3% |

Energy Equipment & Services - 3.3% |

Baker Hughes, Inc. | 820,000 | | 60,213 |

BJ Services Co. | 1,900,000 | | 64,163 |

Halliburton Co. | 3,700,000 | | 124,838 |

Schlumberger Ltd. (NY Shares) | 1,100,000 | | 75,328 |

Smith International, Inc. | 1,400,000 | | 59,304 |

| | 383,846 |

Oil, Gas & Consumable Fuels - 10.0% |

BP PLC sponsored ADR | 1,800,000 | | 122,544 |

Chevron Corp. | 2,500,000 | | 180,800 |

ConocoPhillips | 1,400,000 | | 94,220 |

Exxon Mobil Corp. | 8,600,000 | | 660,568 |

Massey Energy Co. | 1,713,496 | | 47,155 |

Valero Energy Corp. | 1,100,000 | | 60,577 |

| | 1,165,864 |

TOTAL ENERGY | | 1,549,710 |

FINANCIALS - 29.0% |

Capital Markets - 2.8% |

Merrill Lynch & Co., Inc. | 1,000,000 | | 87,430 |

Morgan Stanley | 1,540,000 | | 117,286 |

Northern Trust Corp. | 1,000,000 | | 56,960 |

State Street Corp. | 920,000 | | 57,160 |

| | 318,836 |

Commercial Banks - 2.6% |

U.S. Bancorp, Delaware | 3,800,000 | | 127,832 |

Wachovia Corp. | 580,657 | | 31,466 |

Wells Fargo & Co. | 4,000,000 | | 140,960 |

| | 300,258 |

Diversified Financial Services - 7.6% |

Bank of America Corp. | 5,900,000 | | 317,715 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

FINANCIALS - continued |

Diversified Financial Services - continued |

Citigroup, Inc. | 6,900,000 | | $ 342,171 |

JPMorgan Chase & Co. | 4,900,000 | | 226,772 |

| | 886,658 |

Insurance - 11.5% |

AFLAC, Inc. | 3,300,000 | | 145,662 |

American International Group, Inc. | 7,300,000 | | 513,336 |

Genworth Financial, Inc. Class A (non-vtg.) | 3,500,000 | | 114,800 |

Hartford Financial Services Group, Inc. | 1,300,000 | | 111,488 |

Lincoln National Corp. | 900,000 | | 57,231 |

Marsh & McLennan Companies, Inc. | 5,220,870 | | 164,040 |

MetLife, Inc. | 2,000,000 | | 117,460 |

The Chubb Corp. | 1,100,000 | | 56,936 |

XL Capital Ltd. Class A | 820,000 | | 58,318 |

| | 1,339,271 |

Real Estate Investment Trusts - 2.7% |

General Growth Properties, Inc. | 5,800,000 | | 318,652 |

Thrifts & Mortgage Finance - 1.8% |

Fannie Mae | 3,000,000 | | 171,090 |

MGIC Investment Corp. | 700,000 | | 40,572 |

| | 211,662 |

TOTAL FINANCIALS | | 3,375,337 |

HEALTH CARE - 12.1% |

Biotechnology - 0.5% |

Biogen Idec, Inc. (a) | 1,200,000 | | 62,712 |

Health Care Equipment & Supplies - 2.3% |

Bausch & Lomb, Inc. | 600,000 | | 29,052 |

Baxter International, Inc. | 1,600,000 | | 71,584 |

Becton, Dickinson & Co. | 1,200,000 | | 86,064 |

DENTSPLY International, Inc. | 847,054 | | 27,046 |

Hospira, Inc. (a) | 900,000 | | 29,520 |

Respironics, Inc. (a) | 800,000 | | 28,848 |

| | 272,114 |

Health Care Providers & Services - 4.2% |

Caremark Rx, Inc. | 600,000 | | 28,380 |

Health Net, Inc. (a) | 3,300,000 | | 152,262 |

Medco Health Solutions, Inc. (a) | 600,000 | | 30,126 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

HEALTH CARE - continued |

Health Care Providers & Services - continued |

Quest Diagnostics, Inc. | 1,200,000 | | $ 63,804 |

UnitedHealth Group, Inc. | 4,300,000 | | 211,044 |

| | 485,616 |

Pharmaceuticals - 5.1% |

Merck & Co., Inc. | 6,600,000 | | 293,766 |

Pfizer, Inc. | 8,700,000 | | 239,163 |

Wyeth | 1,200,000 | | 57,936 |

| | 590,865 |

TOTAL HEALTH CARE | | 1,411,307 |

INDUSTRIALS - 12.6% |

Aerospace & Defense - 1.5% |

Lockheed Martin Corp. | 680,000 | | 61,506 |

The Boeing Co. | 680,000 | | 60,200 |

United Technologies Corp. | 880,000 | | 56,786 |

| | 178,492 |

Air Freight & Logistics - 1.5% |

EGL, Inc. (a) | 860,000 | | 27,468 |

United Parcel Service, Inc. Class B | 1,900,000 | | 148,048 |

| | 175,516 |

Building Products - 0.3% |

Masco Corp. | 1,000,000 | | 28,690 |

Industrial Conglomerates - 3.2% |

3M Co. | 460,000 | | 37,472 |

General Electric Co. | 6,400,000 | | 225,792 |

Teleflex, Inc. | 460,000 | | 29,730 |

Tyco International Ltd. | 2,700,000 | | 81,783 |

| | 374,777 |

Machinery - 2.2% |

Caterpillar, Inc. | 960,000 | | 59,549 |

Graco, Inc. | 700,000 | | 29,239 |

Illinois Tool Works, Inc. | 1,200,000 | | 56,640 |

Oshkosh Truck Co. | 640,000 | | 30,726 |

SPX Corp. | 1,200,000 | | 73,332 |

| | 249,486 |

Road & Rail - 3.9% |

Burlington Northern Santa Fe Corp. | 3,800,000 | | 285,608 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

INDUSTRIALS - continued |

Road & Rail - continued |

CSX Corp. | 2,400,000 | | $ 86,064 |

Laidlaw International, Inc. | 1,389,373 | | 40,361 |

YRC Worldwide, Inc. (a) | 1,200,000 | | 46,500 |

| | 458,533 |

TOTAL INDUSTRIALS | | 1,465,494 |

INFORMATION TECHNOLOGY - 10.2% |

Communications Equipment - 1.0% |

Cisco Systems, Inc. (a) | 2,200,000 | | 59,136 |

Motorola, Inc. | 2,700,000 | | 59,859 |

| | 118,995 |

Computers & Peripherals - 2.6% |

Hewlett-Packard Co. | 4,400,000 | | 173,624 |

International Business Machines Corp. | 1,350,000 | | 124,092 |

| | 297,716 |

Electronic Equipment & Instruments - 1.5% |

Arrow Electronics, Inc. (a) | 866,300 | | 27,514 |

Avnet, Inc. (a) | 4,605,800 | | 114,178 |

Flextronics International Ltd. (a) | 2,500,000 | | 28,125 |

| | 169,817 |

Internet Software & Services - 0.3% |

Yahoo!, Inc. (a) | 1,400,000 | | 37,786 |

IT Services - 0.2% |

Computer Sciences Corp. (a) | 560,000 | | 29,232 |

Semiconductors & Semiconductor Equipment - 4.3% |

Analog Devices, Inc. | 1,800,000 | | 58,536 |

Applied Materials, Inc. | 5,200,000 | | 93,496 |

Intel Corp. | 5,300,000 | | 113,155 |

Linear Technology Corp. | 900,000 | | 28,926 |

Maxim Integrated Products, Inc. | 1,900,000 | | 59,812 |

MKS Instruments, Inc. (a) | 2,700,000 | | 56,187 |

National Semiconductor Corp. | 2,300,000 | | 55,637 |

Verigy Ltd. | 1,800,000 | | 32,112 |

| | 497,861 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

INFORMATION TECHNOLOGY - continued |

Software - 0.3% |

Microsoft Corp. | 1,000,000 | | $ 29,330 |

TOTAL INFORMATION TECHNOLOGY | | 1,180,737 |

MATERIALS - 1.1% |

Chemicals - 0.6% |

Airgas, Inc. | 1,100,000 | | 46,805 |

FMC Corp. | 306,772 | | 21,744 |

| | 68,549 |

Metals & Mining - 0.5% |

Alcoa, Inc. | 1,000,000 | | 31,170 |

Newmont Mining Corp. | 640,000 | | 30,022 |

| | 61,192 |

TOTAL MATERIALS | | 129,741 |

TELECOMMUNICATION SERVICES - 4.8% |

Diversified Telecommunication Services - 4.3% |

AT&T, Inc. | 8,000,000 | | 271,280 |

BellSouth Corp. | 2,713,700 | | 121,004 |

Verizon Communications, Inc. | 3,300,000 | | 115,302 |

| | 507,586 |

Wireless Telecommunication Services - 0.5% |

Sprint Nextel Corp. | 2,800,000 | | 54,628 |

TOTAL TELECOMMUNICATION SERVICES | | 562,214 |

UTILITIES - 1.7% |

Electric Utilities - 1.1% |

Entergy Corp. | 650,000 | | 59,358 |

Exelon Corp. | 1,208,400 | | 73,386 |

| | 132,744 |

Independent Power Producers & Energy Traders - 0.3% |

TXU Corp. | 500,000 | | 28,695 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

UTILITIES - continued |

Multi-Utilities - 0.3% |

Duke Energy Corp. | 1,207,200 | | $ 38,292 |

TOTAL UTILITIES | | 199,731 |

TOTAL COMMON STOCKS (Cost $10,076,910) | 11,521,385 |

Money Market Funds - 1.1% |

| | | |

Fidelity Cash Central Fund, 5.35% (b)

(Cost $123,642) | 123,642,001 | | 123,642 |

TOTAL INVESTMENT PORTFOLIO - 100.1% (Cost $10,200,552) | | 11,645,027 |

NET OTHER ASSETS - (0.1)% | | (10,408) |

NET ASSETS - 100% | $ 11,634,619 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. |

(c) Affiliated company |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Cash Central Fund | $ 11,746 |

Fidelity Securities Lending Cash Central Fund | 1,057 |

Total | $ 12,803 |

Other Affiliated Issuers |

An affiliated company is a company in which the fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

Affiliates (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value, end of period |

FMC Corp. | $ 99,205 | $ 48,907 | $ 163,132 | $ 1,289 | $ - |

MKS Instruments, Inc. | 67,721 | 36,748 | 56,694 | - | - |

Monaco Coach Corp. | 25,770 | - | 20,009 | 208 | - |

Red Robin Gourmet Burgers, Inc. | - | 30,164 | - | - | 29,558 |

Winnebago Industries, Inc. | - | 49,850 | 57,072 | 289 | - |

Total | $ 192,696 | $ 165,669 | $ 296,907 | $ 1,786 | $ 29,558 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amount) | November 30, 2006 |

| | |

Assets | | |

Investment in securities, at value -

See accompanying schedule: Unaffiliated issuers (cost $10,046,746) | $ 11,491,827 | |

Fidelity Central Funds (cost $123,642) | 123,642 | |

Other affiliated issuers (cost $30,164) | 29,558 | |

Total Investments (cost $10,200,552) | | $ 11,645,027 |

Foreign currency held at value (cost $20) | | 20 |

Receivable for investments sold | | 255,899 |

Receivable for fund shares sold | | 3,118 |

Dividends receivable | | 21,798 |

Interest receivable | | 891 |

Other receivables | | 434 |

Total assets | | 11,927,187 |

| | |

Liabilities | | |

Payable for investments purchased | $ 266,033 | |

Payable for fund shares redeemed | 19,376 | |

Accrued management fee | 4,485 | |

Other affiliated payables | 2,227 | |

Other payables and accrued expenses | 447 | |

Total liabilities | | 292,568 |

| | |

Net Assets | | $ 11,634,619 |

Net Assets consist of: | | |

Paid in capital | | $ 9,106,113 |

Undistributed net investment income | | 53,029 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 1,031,002 |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 1,444,475 |

Net Assets, for 463,136 shares outstanding | | $ 11,634,619 |

Net Asset Value, offering price and redemption price per share ($11,634,619 ÷ 463,136 shares) | | $ 25.12 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands | Year ended November 30, 2006 |

| | |

Investment Income | | |

Dividends (including $1,786 earned from other affiliated issuers) | | $ 238,136 |

Interest | | 1,630 |

Income from Fidelity Central Funds | | 12,803 |

Total income | | 252,569 |

| | |

Expenses | | |

Management fee | $ 54,695 | |

Transfer agent fees | 21,442 | |

Accounting and security lending fees | 1,349 | |

Custodian fees and expenses | 189 | |

Independent trustees' compensation | 45 | |

Appreciation in deferred trustee compensation account | 10 | |

Registration fees | 53 | |

Audit | 126 | |

Legal | 193 | |

Interest | 63 | |

Miscellaneous | 478 | |

Total expenses before reductions | 78,643 | |

Expense reductions | (1,502) | 77,141 |

Net investment income (loss) | | 175,428 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 1,016,709 | |

Other affiliated issuers | 52,175 | |

Foreign currency transactions | (126) | |

Total net realized gain (loss) | | 1,068,758 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 106,693 | |

Assets and liabilities in foreign currencies | (5) | |

Total change in net unrealized appreciation (depreciation) | | 106,688 |

Net gain (loss) | | 1,175,446 |

Net increase (decrease) in net assets resulting from operations | | $ 1,350,874 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

Amounts in thousands | Year ended

November 30,

2006 | Year ended

November 30,

2005 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 175,428 | $ 183,198 |

Net realized gain (loss) | 1,068,758 | 1,019,642 |

Change in net unrealized appreciation (depreciation) | 106,688 | (325,042) |

Net increase (decrease) in net assets resulting

from operations | 1,350,874 | 877,798 |

Distributions to shareholders from net investment income | (161,449) | (213,550) |

Distributions to shareholders from net realized gain | (950,596) | (333,350) |

Total distributions | (1,112,045) | (546,900) |

Share transactions

Proceeds from sales of shares | 684,251 | 910,438 |

Reinvestment of distributions | 1,066,583 | 522,706 |

Cost of shares redeemed | (2,602,829) | (2,147,906) |

Net increase (decrease) in net assets resulting from share transactions | (851,995) | (714,762) |

Total increase (decrease) in net assets | (613,166) | (383,864) |

| | |

Net Assets | | |

Beginning of period | 12,247,785 | 12,631,649 |

End of period (including undistributed net investment income of $53,029 and undistributed net investment income of $40,878, respectively) | $ 11,634,619 | $ 12,247,785 |

Other Information Shares | | |

Sold | 28,934 | 38,615 |

Issued in reinvestment of distributions | 46,025 | 22,238 |

Redeemed | (110,366) | (90,786) |

Net increase (decrease) | (35,407) | (29,933) |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

Years ended November 30, | 2006 | 2005 | 2004 | 2003 | 2002 |

Selected Per-Share Data | | | | | |

Net asset value,

beginning of period | $ 24.57 | $ 23.90 | $ 21.52 | $ 18.72 | $ 21.21 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .35 | .35 | .35 E | .25 | .24 |

Net realized and unrealized gain (loss) | 2.44 | 1.36 | 2.49 | 2.78 | (1.65) |

Total from investment

operations | 2.79 | 1.71 | 2.84 | 3.03 | (1.41) |

Distributions from net investment income | (.33) | (.41) | (.29) | (.23) | (.23) |

Distributions from net realized gain | (1.91) | (.63) | (.17) | - | (.85) |

Total distributions | (2.24) | (1.04) | (.46) | (.23) | (1.08) |

Net asset value, end of period | $ 25.12 | $ 24.57 | $ 23.90 | $ 21.52 | $ 18.72 |

Total Return A | 12.28% | 7.41% | 13.32% | 16.40% | (7.08)% |

Ratios to Average Net Assets C, F | | | | | |

Expenses before reductions | .67% | .68% | .68% | .70% | .70% |

Expenses net of fee waivers,

if any | .67% | .68% | .68% | .70% | .70% |

Expenses net of all reductions | .66% | .62% | .64% | .64% | .63% |

Net investment income (loss) | 1.50% | 1.49% | 1.56% | 1.31% | 1.26% |

Supplemental Data | | | | | |

Net assets, end of period

(in millions) | $ 11,635 | $ 12,248 | $ 12,632 | $ 11,525 | $ 10,156 |

Portfolio turnover rate D | 160% | 143% | 123% | 131% | 135% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Investment income per share reflects a special dividend which amounted to $.06 per share.

F Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended November 30, 2006

(Amounts in thousands except ratios)

1. Significant Accounting Policies.

Fidelity Equity-Income II Fund (the Fund) is a fund of Fidelity Financial Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund may invest in Fidelity Central Funds which are open-end investment companies available to investment companies and other accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the Fund, which are also consistently followed by the Fidelity Central Funds:

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the Fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. For example, when developments occur between the close of a market and the close of the NYSE that may materially affect the value of some or all of the securities, or when trading in a security is halted, those securities may be fair valued. Factors used in the determination of fair value may include monitoring news to identify significant market or security specific events such as changes in the value of U.S. securities markets, reviewing developments in foreign markets and evaluating the performance of ADRs, futures contracts and exchange-traded funds. Because the Fund's utilization of fair value pricing depends on market activity, the frequency with which fair value pricing is used can not be predicted and may be utilized to a significant extent. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

1. Significant Accounting Policies - continued

Foreign Currency. The Fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. Security transactions, including the Fund's investment activity in the Fidelity Central Funds, are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income and income distributions from the Fidelity Central Funds are accrued as earned, with any income distributions receivable as of period end included in Interest Receivable on the Statement of Assets and Liabilities. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each Fund in the trust. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Annual Report

1. Significant Accounting Policies - continued

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), Independent Trustees must defer receipt of a portion of, and may elect to defer receipt of an additional portion of, their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, the Fund will claim a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to short-term capital gains, foreign currency transactions, passive foreign investment companies (PFIC), market discount, deferred trustees compensation, and losses deferred due to wash sales.

The tax-basis components of distributable earnings and the federal tax cost as of period end were as follows:

Unrealized appreciation | $ 1,480,477 | |

Unrealized depreciation | (51,730) | |

Net unrealized appreciation (depreciation) | 1,428,747 | |

Undistributed ordinary income | 411,152 | |

Undistributed long-term capital gain | 611,814 | |

| | |

Cost for federal income tax purposes | $ 10,216,280 | |

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

1. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax character of distributions paid was as follows:

| November 30, 2006 | November 30, 2005 |

Ordinary Income | $ 208,243 | $ 234,787 |

Long-term Capital Gains | 903,802 | 312,113 |

Total | $ 1,112,045 | $ 546,900 |

New Accounting Pronouncements. In July 2006, Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement 109 (FIN 48), was issued and is effective for fiscal years beginning after December 15, 2006. FIN 48 sets forth a threshold for financial statement recognition, measurement and disclosure of a tax position taken or expected to be taken on a tax return. Management is currently evaluating the impact, if any, the adoption of FIN 48 will have on the Fund's net assets, results of operations and financial statement disclosures.

In addition, in September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

2. Operating Policies.

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the Fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Annual Report

3. Purchases and Sales of Investments.

Purchases and sales of securities other than short-term securities, aggregated $18,394,748 and $20,169,591, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .20% of the Fund's average net assets and a group fee rate that averaged ..27% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annual management fee rate was .47% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, is the Fund's transfer, dividend disbursing and shareholder servicing agent. FSC receives account fees and asset-based fees that vary according to account size and type of account. FSC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annual rate of .18% of average net assets.

Accounting and Security Lending Fees. FSC maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Investments in Fidelity Central Funds. The Fund may invest in Fidelity Central Funds. The Fund's Schedule of Investments lists each of the Fidelity Central Funds as an investment of the Fund but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds. A complete unaudited list of holdings for each Fidelity Central Fund is available upon request. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the EDGAR Database on the SEC's web site, www.sec.gov, or upon request.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $121 for the period.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

4. Fees and Other Transactions with Affiliates - continued

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the Fund, along with other registered investment companies having management contracts with FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the funds to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. The Fund's activity in this program during the period for which loans were outstanding was as follows:

Borrower or Lender | Average Daily Loan Balance | Weighted Average Interest Rate | Interest

Expense |

Borrower | $ 25,139 | 4.98% | $ 63 |

5. Committed Line of Credit.

The Fund participates with other funds managed by FMR in a $4.2 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro rata portion of the line of credit, which amounts to $33 and is reflected in Miscellaneous Expense on the Statement of Operations. During the period, there were no borrowings on this line of credit.

6. Security Lending.

The Fund lends portfolio securities from time to time in order to earn additional income. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. At period end, there were no security loans outstanding. Security lending income represents the income earned on investing cash collateral, less fees and expenses associated with the loan, plus any premium payments that may be received on the loan of certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Net income from lending portfolio securities during the period amounted to $1,057.

Annual Report

7. Expense Reductions.

Many of the brokers with whom FMR places trades on behalf of the Fund provided services to the Fund in addition to trade execution. These services included payments of certain expenses on behalf of the Fund totaling $1,106 for the period. In addition, through arrangements with the Fund's custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody and transfer agent expenses by $1 and $395, respectively.

8. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

The United States Securities and Exchange Commission ("SEC") is conducting an investigation of FMR (covering the years 2002 to 2004) arising from gifts, gratuities and business entertainment provided by certain brokers to certain individuals who were employed on FMR's domestic equity trading desk during that period. FMR is in discussions with the SEC staff regarding the possible resolution of the matter, but as of period-end no final resolution has been reached.

In December 2006, the Independent Trustees completed their own investigation of the matter with the assistance of independent counsel. The Independent Trustees and FMR agree that, despite the absence of proof that the Fidelity mutual funds experienced diminished execution quality as a result of the improper receipt of gifts and business entertainment, the conduct at issue was serious and is worthy of redress. Accordingly, the Independent Trustees have requested and FMR has agreed to pay $42 million to Fidelity mutual funds, plus interest to be determined at the time that payment is made. A method of allocating this payment among the funds has not yet been determined. In addition, subsequent to period-end, FMR has reimbursed related legal expenses. The total payment to the Fund is not anticipated to have a material impact on the Fund's net assets.

Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Financial Trust and the Shareholders of Fidelity Equity-Income II Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Equity-Income II Fund (a fund of Fidelity Financial Trust) at November 30, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fidelity Equity-Income II Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at November 30, 2006 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

January 18, 2007

Annual Report

Trustees and Officers

The Trustees, Member of the Advisory Board, and executive officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, and review the fund's performance. Except for William O. McCoy, each of the Trustees oversees 348 funds advised by FMR or an affiliate. Mr. McCoy oversees 350 funds advised by FMR or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) (Independent Trustee), shall retire not later than the last day of the calendar year in which his or her 72nd birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. The executive officers and Advisory Board Member hold office without limit in time, except that any officer and Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund's Statement of Additional information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-544-8544.

Interested Trustees*:

Correspondence intended for each Trustee who is an interested person may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Edward C. Johnson 3d (76) |

| Year of Election or Appointment: 1982 Mr. Johnson is Chairman of the Board of Trustees. Mr. Johnson serves as President (2006-present), Chief Executive Officer, Chairman, and a Director of FMR Corp.; Chairman and a Director of FMR; Chairman and a Director of Fidelity Research & Analysis Company (FRAC); Chairman and a Director of Fidelity Investments Money Management, Inc.; and Chairman (2001-present) and a Director of FMR Co., Inc. In addition, Mr. Johnson serves as Chairman and Director of Fidelity International Limited (FIL). |

Robert L. Reynolds (54) |

| Year of Election or Appointment: 2003 Mr. Reynolds is President and a Director of FMR (2005-present), Fidelity Investments Money Management, Inc. (2005-present), and FMR Co., Inc. (2005-present). Mr. Reynolds also serves as Vice Chairman (2006-present), a Director (2003-present), and Chief Operating Officer of FMR Corp. and a Director of Strategic Advisers, Inc. (2005-present). He also serves on the Board at Fidelity Investments Canada, Ltd. |

* Trustees have been determined to be "Interested Trustees" by virtue of, among other things, their affiliation with the trust or various entities under common control with FMR.

Annual Report

Independent Trustees:

Correspondence intended for each Independent Trustee (that is, the Trustees other than the Interested Trustees) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Age; Principal Occupation |

Dennis J. Dirks (58) |

| Year of Election or Appointment: 2005 Prior to his retirement in May 2003, Mr. Dirks was Chief Operating Officer and a member of the Board of The Depository Trust & Clearing Corporation (DTCC) (1999-2003). He also served as President, Chief Operating Officer, and Board member of The Depository Trust Company (DTC) (1999-2003) and President and Board member of the National Securities Clearing Corporation (NSCC) (1999-2003). In addition, Mr. Dirks served as Chief Executive Officer and Board member of the Government Securities Clearing Corporation (2001-2003) and Chief Executive Officer and Board member of the Mortgage-Backed Securities Clearing Corporation (2001-2003). Mr. Dirks also serves as a Trustee and a member of the Finance Committee of Manhattan College (2005-present) and a Trustee and a member of the Finance Committee of AHRC of Nassau County (2006-present). |

Albert R. Gamper, Jr. (64) |

| Year of Election or Appointment: 2006 Prior to his retirement in December 2004, Mr. Gamper served as Chairman of the Board of CIT Group Inc. (commercial finance). During his tenure with CIT Group Inc. Mr. Gamper served in numerous senior management positions, including Chairman (1987-1989; 1999-2001; 2002-2004), Chief Executive Officer (1987-2004), and President (1989-2002). He currently serves as a member of the Board of Directors of Public Service Enterprise Group (utilities, 2001-present), Chairman of the Board of Governors, Rutgers University (2004-present), and Chairman of the Board of Saint Barnabas Health Care System. |

George H. Heilmeier (70) |

| Year of Election or Appointment: 2004 Dr. Heilmeier is Chairman Emeritus of Telcordia Technologies (communication software and systems), where prior to his retirement, he served as company Chairman and Chief Executive Officer. He currently serves on the Boards of Directors of The Mitre Corporation (systems engineering and information technology support for the government), and HRL Laboratories (private research and development, 2004-present). He is Chairman of the General Motors Science & Technology Advisory Board and a Life Fellow of the Institute of Electrical and Electronics Engineers (IEEE). Dr. Heilmeier is a member of the Defense Science Board and the National Security Agency Advisory Board. He is also a member of the National Academy of Engineering, the American Academy of Arts and Sciences, and the Board of Overseers of the School of Engineering and Applied Science of the University of Pennsylvania. Previously, Dr. Heilmeier served as a Director of TRW Inc. (automotive, space, defense, and information technology, 1992-2002), Compaq (1994-2002), Automatic Data Processing, Inc. (ADP) (technology-based business outsourcing, 1995-2002), INET Technologies Inc. (telecommunications network surveillance, 2001-2004), and Teletech Holdings (customer management services). He is the recipient of the 2005 Kyoto Prize in Advanced Technology for his invention of the liquid crystal display, and a member of the Consumer Electronics Hall of Fame. |

James H. Keyes (66) |

| Year of Election or Appointment: 2007 Prior to his retirement in 2003, Mr. Keyes was Chairman, President, and Chief Executive Officer of Johnson Controls, Inc. (automotive supplier, 1993-2003). He currently serves as a member of the boards of LSI Logic Corporation (semiconductor technologies), Navistar International Corporation (manufacture and sale of trucks, buses, and diesel engines, 2002-present), and Pitney Bowes, Inc. (integrated mail, messaging, and document management solutions). |

Marie L. Knowles (60) |

| Year of Election or Appointment: 2001 Prior to Ms. Knowles' retirement in June 2000, she served as Executive Vice President and Chief Financial Officer of Atlantic Richfield Company (ARCO) (diversified energy, 1996-2000). From 1993 to 1996, she was a Senior Vice President of ARCO and President of ARCO Transportation Company. She served as a Director of ARCO from 1996 to 1998. She currently serves as a Director of Phelps Dodge Corporation (copper mining and manufacturing) and McKesson Corporation (healthcare service, 2002-present). Ms. Knowles is a Trustee of the Brookings Institution and the Catalina Island Conservancy and also serves as a member of the Advisory Board for the School of Engineering of the University of Southern California. |

Ned C. Lautenbach (62) |

| Year of Election or Appointment: 2000 Mr. Lautenbach is Chairman of the Independent Trustees (2006-present). Mr. Lautenbach has been a partner of Clayton, Dubilier & Rice, Inc. (private equity investment firm) since September 1998. Previously, Mr. Lautenbach was with the International Business Machines Corporation (IBM) from 1968 until his retirement in 1998. Mr. Lautenbach serves as a Director of Sony Corporation (2006-present) and Eaton Corporation (diversified industrial) as well as the Philharmonic Center for the Arts in Naples, Florida. He also is a member of the Board of Trustees of Fairfield University (2005-present), as well as a member of the Council on Foreign Relations. |

William O. McCoy (73) |

| Year of Election or Appointment: 1997 Prior to his retirement in December 1994, Mr. McCoy was Vice Chairman of the Board of BellSouth Corporation (telecommunications) and President of BellSouth Enterprises. He is currently a Director of Duke Realty Corporation (real estate). He is also a partner of Franklin Street Partners (private investment management firm). In addition, Mr. McCoy served as the Interim Chancellor (1999-2000) and a member of the Board of Visitors for the University of North Carolina at Chapel Hill and currently serves as Chairman of the Board of Directors of the University of North Carolina Health Care System. He also served as Vice President of Finance for the University of North Carolina (16-school system). |

Cornelia M. Small (62) |

| Year of Election or Appointment: 2005 Ms. Small is a member (2000-present) and Chairperson (2002-present) of the Investment Committee, and a member (2002-present) of the Board of Trustees of Smith College. Previously, she served as Chief Investment Officer (1999-2000), Director of Global Equity Investments (1996-1999), and a member of the Board of Directors of Scudder, Stevens & Clark (1990-1997) and Scudder Kemper Investments (1997-1999). In addition, Ms. Small served as Co-Chair (2000-2003) of the Annual Fund for the Fletcher School of Law and Diplomacy. |

William S. Stavropoulos (67) |

| Year of Election or Appointment: 2002 Mr. Stavropoulos is Chairman Emeritus of the Board of Directors of The Dow Chemical Company. Since joining The Dow Chemical Company in 1967, Mr. Stavropoulos served in numerous senior management positions, including President (1993-2000; 2002-2003), CEO (1995-2000; 2002-2004), and Chairman of the Executive Committee (2000-2004). Currently, he is a Director of NCR Corporation (data warehousing and technology solutions), BellSouth Corporation (telecommunications), Chemical Financial Corporation, Maersk Inc. (industrial conglomerate, 2002-present), and Metalmark Capital (private equity investment firm, 2005-present). He also serves as a member of the Board of Trustees of the American Enterprise Institute for Public Policy Research. In addition, Mr. Stavropoulos is a member of The Business Council, J.P. Morgan International Council and the University of Notre Dame Advisory Council for the College of Science. |

Kenneth L. Wolfe (67) |

| Year of Election or Appointment: 2005 Prior to his retirement in 2001, Mr. Wolfe was Chairman and Chief Executive Officer of Hershey Foods Corporation (1993-2001). He currently serves as a member of the boards of Adelphia Communications Corporation (2003-present), Bausch & Lomb, Inc., and Revlon Inc. (2004-present). |

Annual Report

Advisory Board Member and Executive Officers:

Correspondence intended for each executive officer and Mr. Lynch may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Peter S. Lynch (62) |

| Year of Election or Appointment: 2003 Member of the Advisory Board of Fidelity Financial Trust. Mr. Lynch is Vice Chairman and a Director of FMR, and Vice Chairman (2001-present) and a Director of FMR Co., Inc. Previously, Mr. Lynch served as a Trustee of the Fidelity funds (1990-2003). In addition, he serves as a Trustee of Boston College and as the Chairman of the Inner-City Scholarship Fund. |

Dwight D. Churchill (52) |

| Year of Election or Appointment: 2005 Vice President of Equity-Income II. Mr. Churchill also serves as Vice President of certain Equity Funds (2005-present). Mr. Churchill is Executive Vice President of FMR (2005-present) and FMR Co., Inc. (2005-present). Previously, Mr. Churchill served as Senior Vice President of Fidelity Investments Money Management, Inc. (2005-2006), Head of Fidelity's Fixed-Income Division (2000-2005), Vice President of Fidelity's Money Market Funds (2000-2005), Vice President of Fidelity's Bond Funds, and Senior Vice President of FMR. |

Bruce T. Herring (41) |

| Year of Election or Appointment: 2006 Vice President of Equity-Income II. Mr. Herring also serves as Vice President of certain Equity Funds (2006-present). Mr. Herring is Senior Vice President of FMR (2006-present) and Vice President of FMR Co., Inc. (2001-present). Previously, Mr. Herring served as a portfolio manager for Fidelity U.S. Equity Funds (2001-2005). |

C. Robert Chow (45) |

| Year of Election or Appointment: 2006 Vice President of Equity Income II. Mr. Chow also serves as Vice President of another fund advised by FMR. Prior to assuming his current responsibilities, Mr. Chow worked as a research analyst and manager. Mr. Chow also serves as Vice President of FMR (1999) and FMR Co., Inc. (2001). |

Eric D. Roiter (58) |

| Year of Election or Appointment: 1998 Secretary of Equity-Income II. He also serves as Secretary of other Fidelity funds; Vice President, General Counsel, and Secretary of FMR Co., Inc. (2001-present) and FMR; Assistant Secretary of Fidelity Management & Research (U.K.) Inc. (2001-present), Fidelity Research & Analysis Company (2001-present), and Fidelity Investments Money Management, Inc. (2001-present). Mr. Roiter is an Adjunct Member, Faculty of Law, at Boston College Law School (2003-present). Previously, Mr. Roiter served as Vice President and Secretary of Fidelity Distributors Corporation (FDC) (1998-2005). |

Stuart Fross (47) |

| Year of Election or Appointment: 2003 Assistant Secretary of Equity-Income II. Mr. Fross also serves as Assistant Secretary of other Fidelity funds (2003-present), Vice President and Secretary of FDC (2005-present), and is an employee of FMR. |

R. Stephen Ganis (40) |

| Year of Election or Appointment: 2006 Anti-Money Laundering (AML) officer of Equity-Income II. Mr. Ganis also serves as AML officer of other Fidelity funds (2006-present) and FMR Corp. (2003-present). Before joining Fidelity Investments, Mr. Ganis practiced law at Goodwin Procter, LLP (2000-2002). |

Joseph B. Hollis (58) |

| Year of Election or Appointment: 2006 Chief Financial Officer of Equity-Income II. Mr. Hollis also serves as Chief Financial Officer of other Fidelity funds. Mr. Hollis is President of Fidelity Pricing and Cash Management Services (FPCMS) (2005-present). Mr. Hollis also serves as President and Director of Fidelity Service Company, Inc. (2006-present). Previously, Mr. Hollis served as Senior Vice President of Cash Management Services (1999-2002) and Investment Management Operations (2002-2005). |

Kenneth A. Rathgeber (59) |

| Year of Election or Appointment: 2004 Chief Compliance Officer of Equity-Income II. Mr. Rathgeber also serves as Chief Compliance Officer of other Fidelity funds (2004-present) and Executive Vice President of Risk Oversight for Fidelity Investments (2002-present). He is Chief Compliance Officer of FMR (2005-present), FMR Co., Inc. (2005-present), Fidelity Management & Research (U.K.) Inc. (2005-present), Fidelity Research & Analysis Company (2005-present), Fidelity Investments Money Management, Inc. (2005-present), and Strategic Advisers, Inc. (2005-present). Previously, Mr. Rathgeber served as Executive Vice President and Chief Operating Officer for Fidelity Investments Institutional Services Company, Inc. (1998-2002). |

Bryan A. Mehrmann (45) |

| Year of Election or Appointment: 2005 Deputy Treasurer of Equity-Income II. Mr. Mehrmann also serves as Deputy Treasurer of other Fidelity funds (2005-present) and is an employee of FMR. Previously, Mr. Mehrmann served as Vice President of Fidelity Investments Institutional Services Group (FIIS)/Fidelity Investments Institutional Operations Corporation, Inc. (FIIOC) Client Services (1998-2004). |

Kimberley H. Monasterio (42) |

| Year of Election or Appointment: 2007 President and Treasurer of Equity-Income II. Ms. Monasterio also serves as President and Treasurer of other Fidelity funds (2007-present) and is an employee of FMR (2004-present). Previously, Ms. Monasterio served as Deputy Treasurer of the Fidelity funds (2004-2006). Before joining Fidelity Investments, Ms. Monasterio served as Treasurer (2000-2004) and Chief Financial Officer (2002-2004) of the Franklin Templeton Funds and Senior Vice President of Franklin Templeton Services, LLC (2000-2004). |

Kenneth B. Robins (37) |

| Year of Election or Appointment: 2005 Deputy Treasurer of Equity-Income II. Mr. Robins also serves as Deputy Treasurer of other Fidelity funds (2005-present) and is an employee of FMR (2004-present). Before joining Fidelity Investments, Mr. Robins worked at KPMG LLP, where he was a partner in KPMG's department of professional practice (2002-2004) and a Senior Manager (1999-2000). In addition, Mr. Robins served as Assistant Chief Accountant, United States Securities and Exchange Commission (2000-2002). |

Robert G. Byrnes (39) |

| Year of Election or Appointment: 2005 Assistant Treasurer of Equity-Income II. Mr. Byrnes also serves as Assistant Treasurer of other Fidelity funds (2005-present) and is an employee of FMR (2005-present). Previously, Mr. Byrnes served as Vice President of FPCMS (2003-2005). Before joining Fidelity Investments, Mr. Byrnes worked at Deutsche Asset Management where he served as Vice President of the Investment Operations Group (2000-2003). |

John H. Costello (60) |

| Year of Election or Appointment: 1990 Assistant Treasurer of Equity-Income II. Mr. Costello also serves as Assistant Treasurer of other Fidelity funds and is an employee of FMR. |

Peter L. Lydecker (52) |

| Year of Election or Appointment: 2004 Assistant Treasurer of Equity-Income II. Mr. Lydecker also serves as Assistant Treasurer of other Fidelity funds (2004) and is an employee of FMR. |

Mark Osterheld (51) |

| Year of Election or Appointment: 2002 Assistant Treasurer of Equity-Income II. Mr. Osterheld also serves as Assistant Treasurer of other Fidelity funds (2002) and is an employee of FMR. |

Gary W. Ryan (48) |

| Year of Election or Appointment: 2005 Assistant Treasurer of Equity-Income II. Mr. Ryan also serves as Assistant Treasurer of other Fidelity funds (2005-present) and is an employee of FMR (2005-present). Previously, Mr. Ryan served as Vice President of Fund Reporting in FPCMS (1999-2005). |

Salvatore Schiavone (41) |

| Year of Election or Appointment: 2005 Assistant Treasurer of Equity-Income II. Mr. Schiavone also serves as Assistant Treasurer of other Fidelity funds (2005-present) and is an employee of FMR (2005-present). Before joining Fidelity Investments, Mr. Schiavone worked at Deutsche Asset Management, where he most recently served as Assistant Treasurer (2003-2005) of the Scudder Funds and Vice President and Head of Fund Reporting (1996-2003). |

Annual Report

Distributions

The Board of Trustees of Fidelity Equity Income II Fund voted to pay to shareholders of record at the opening of business on record date, the following distributions per share derived from capital gains realized from sales of portfolio securities and dividends derived from net investment income:

Pay Date | Record Date | Dividends | Capital Gains |

12/18/06 | 12/15/06 | $ .12 | $ 1.17 |

01/08/07 | 01/05/07 | $ .00 | $ .90 |

The fund hereby designates as a capital gain dividend with respect to the taxable year ended November 30, 2006 $611,814,164, or, if subsequently determined to be different, the net capital gain of such year.

The fund designates 100%, 80%, 100%, 100%, and 100% of the dividends distributed in December 2005, January 2006, April 2006, July 2006, and October 2006, respectively during the fiscal year as qualifying for the dividends-received deduction for corporate shareholders.

The fund designates 100%, 76%, 100%, 100%, and 100% of the dividends distributed in December 2005, January 2006, April 2006, July 2006, and October 2006, respectively during the fiscal year as amounts which may be taken into account as a dividend for the purposes of the maximum rate under section 1(h)(11) of the Internal Revenue Code.

The fund will notify shareholders in January 2007 of amounts for use in preparing 2006 income tax returns.

Annual Report

Proxy Voting Results

A special meeting of the fund's shareholders was held on September 20, 2006. The results of votes taken among shareholders on the proposal before them are reported below. Each vote reported represents one dollar of net asset value held on the record date for the meeting.

PROPOSAL 1 |

To elect a Board of Trustees. A |

| # of

Votes | % of

Votes |

Dennis J. Dirks |

Affirmative | 10,327,434,641.22 | 95.770 |

Withheld | 456,199,004.95 | 4.230 |

TOTAL | 10,783,633,646.17 | 100.000 |

Albert R. Gamper, Jr. |

Affirmative | 10,322,116,523.07 | 95.720 |

Withheld | 461,517,123.10 | 4.280 |

TOTAL | 10,783,633,646.17 | 100.000 |

Robert M. Gates |

Affirmative | 10,288,766,799.53 | 95.411 |

Withheld | 494,866,846.64 | 4.589 |

TOTAL | 10,783,633,646.17 | 100.000 |

George H. Heilmeier |

Affirmative | 10,298,619,061.42 | 95.502 |

Withheld | 485,014,584.75 | 4.498 |

TOTAL | 10,783,633,646.17 | 100.000 |

Edward C. Johnson 3d |

Affirmative | 10,257,561,582.55 | 95.122 |

Withheld | 526,072,063.62 | 4.878 |

TOTAL | 10,783,633,646.17 | 100.000 |

Stephen P. Jonas |

Affirmative | 10,317,222,628.79 | 95.675 |

Withheld | 466,411,017.38 | 4.325 |

TOTAL | 10,783,633,646.17 | 100.000 |

James H. KeyesB |

Affirmative | 10,318,195,711.25 | 95.684 |

Withheld | 465,437,934.92 | 4.316 |

TOTAL | 10,783,633,646.17 | 100.000 |

| # of

Votes | % of

Votes |

Marie L. Knowles |

Affirmative | 10,317,835,129.19 | 95.681 |

Withheld | 465,798,516.98 | 4.319 |

TOTAL | 10,783,633,646.17 | 100.000 |

Ned C. Lautenbach |

Affirmative | 10,317,039,890.90 | 95.673 |