UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03599

Name of Registrant: The Royce Fund

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

Name of agent for service: John E. Denneen, Esquire

Address of agent for service: 745 Fifth Avenue

New York, NY 10151

Registrant's telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31

Date of reporting period: January 1, 2021 – December 31, 2021

| Item 1. | Reports to Shareholders. |

The Royce Funds 2021 Annual

Review and Report to Shareholders

December 31, 2021

Royce Dividend Value Fund

Royce Global Financial Services Fund

Royce International Premier Fund

Royce Micro-Cap Fund

Royce Opportunity Fund

Royce Pennsylvania Mutual Fund

Royce Premier Fund

Royce Small-Cap Value Fund

Royce Smaller-Companies Growth Fund

Royce Special Equity Fund

Royce Total Return Fund

Table of Contents

| | This page is not part of the The Royce Funds 2021 Annual Report to Shareholders | 1 |

Letter to Our Shareholders

THE BEAR IS BACK—NOW WHAT?

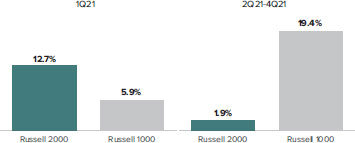

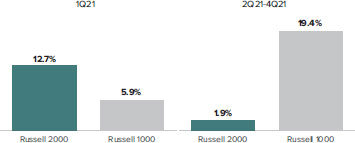

2021 was a year of decelerating optimism for many small-cap investors as performance momentum slowed as the weeks passed by between April and December. With the benefit of a late January vantage point, we can now see that decreasing market momentum, increasing concerns about inflation throughout the last nine months of 2021, and a significant Fed pivot all foreshadowed a sharp small-cap decline to start 2022. So while the Russell 2000 Index enjoyed a strong year on an absolute basis, rising 14.8%, nearly all of the year’s gain came in the first quarter, when the Russell 2000 climbed 12.7%. Following this strong and promising start, the small-cap index gained only 1.9% from the second through the fourth quarter of 2021. Having so little to show for the last nine months was even more frustrating in light of the generally strong earnings growth from small-cap companies, many of which also raised guidance or offered optimistic outlooks in the second half of 2021.

Bigger Was Better After 2021’s First Quarter

1Q21 Returns and 2Q21-4Q21 for the Russell 2000 and Russell 1000 Indexes

In addition to the disappointment felt by making little progress after a strong start, small-cap investors also saw the asset class progressively cede its wide first-quarter lead over large-caps, with the Russell 2000 finishing the year substantially behind the large-cap Russell 1000 Index’s 26.5% advance in 2021. We suspect that many investors turned to mega-cap stocks during the year in a ‘flight to safety’ as concerns about the Omicron variant and the pace of economic growth emerged, especially when interest rates were still so low. As the early results in 2022 have indicated, we expect these same mega-cap stocks to struggle going forward because their valuations are particularly vulnerable to higher inflation, rising interest rates, and constrained liquidity.

Regardless of the more recent struggles for equities of all capitalization sizes, we recognize that it may seem odd to characterize small-cap investors as feeling let down after a year that provided a healthy 14.8% return—while also marking a third consecutive year of double-digit positive performance for the Russell 2000. Yet we are cognizant that 2021 might feel like a year of unfulfilled promise for many of these investors. After all, 2021 did begin with an ample dose of confidence in both the absolute and relative returns for the Russell 2000—which was rewarded in the first quarter. However, a closer look at small-cap returns in 2021 suggests that one’s perspective on the year probably differs considerably depending on how heavily an investor leaned towards small-cap value or small-cap growth.

| 2 | This page is not part of the The Royce Funds 2021 Annual Report to Shareholders | Past performance is no guarantee of future results. |

LETTER TO OUR SHAREHOLDERS

VALUE: SMALL-CAP’S HAPPY EXCEPTION

The best news for small-cap investors in 2021 arguably came from value stocks. The Russell 2000 Value Index had a wonderful year—advancing 28.3% (thus beating the Russell 1000). The small-cap value index also walloped the Russell 2000 Growth Index, which was up a paltry 2.8% for the year. 2021 marked the first calendar-year outperformance for the Russell 2000 Value over its small-cap growth sibling since 2016. We think small-cap value is just starting to flex its relative performance muscles, as it were, and we see three reasons to be optimistic about small-cap value’s prospects. First, in spite of the strength it’s shown since the fourth quarter of 2020, the Russell 2000 Value’s annualized three- and five-year returns still trailed those for its growth sibling at the end of 2021—by a significant amount on the five-year number. Equally important, this result stands in stark contrast to the average return spread for all five-year periods, which is about 300 basis points in favor of small-cap value. Based on history, then, it appears that the Russell 2000 Value has further to go before fully reverting to its historical outperformance of the Russell 2000 Growth over multiyear periods. This also suggests that the difficult times for small-cap growth investors may persist longer than its adherents would like.

Small-Cap Growth’s Recent 5-Year Outperformance Contrasts with Historical Pattern

As of 12/31/21

ADVANTAGE VALUE?

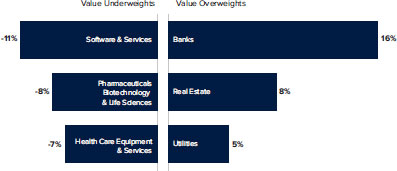

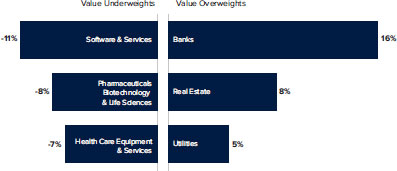

A second reason underscoring our confidence in the ongoing leadership for small-cap value is that significant differences exist in economic exposures among value and growth portfolios, which are mirrored by the meaningful divergences in composition between the two small-cap styles indexes. Looking into each index’s composition reveals certain factors that help explain why returns often have varied so much between the two style indexes over the last 40-plus years. The two industry groups where

the Russell 2000 Value is most overweight compared with the Russell 2000 Growth are banks and real estate, both traditional beneficiaries of inflation and cyclical activity. These industry groups, banks in particular, often have high exposures in active small-cap value portfolios. Conversely, the three industry groups where the Russell 2000 Value is most underweight—software & services; pharmaceuticals, biotechnology & life sciences; and health care equipment & services—are areas that have historically struggled in inflationary environments and tend not to participate in cyclical expansions. Notably, these three areas also have a large percentage of non-earning companies, and we expect that the forthcoming market environment of reduced liquidity will be much less supportive of non-earners than most of the past 10 years have been. We’ve also observed that these three areas are often lower weighted in active small-cap value portfolios. This compositional analysis corroborates our expectation that an economic environment of above-average growth and higher-than-average inflation is likely to favor the overweighted areas within small-cap value and create headwinds for those groups with greater exposure within small-cap growth.

Russell 2000 Value vs Russell 2000 Growth Top Three Underweights and Overweights by Industry Group

As of 12/31/21

Finally, as we have noted elsewhere, despite its significant outperformance, small-cap value is still priced near the bottom of its 20-year valuation range compared with small-cap growth, as measured by one of our preferred valuation metrics, the median last 12 months’ enterprise value over earnings before interest & taxes (LTM EV/EBIT), excluding companies with negative EBIT. For all these reasons, we think small-cap value may have many years left in its current outperformance trend.

| Past performance is no guarantee of future results. | This page is not part of the The Royce Funds 2021 Annual Report to Shareholders | 3 |

LETTER TO OUR SHAREHOLDERS

IN THE SHADOW OF THE BEAR

As of this writing, of course, most investors are wondering—and worrying—about the correction that pushed small-caps into bear territory (a decline of 20% or more). The Russell 2000 fell 20.7% from its most recent peak on 11/8/21 through 1/27/22, as share price weakness broadened and deepened considerably in January. The speed of this descent—just 49 days between the 52-week high in early November and its initial 52-week low in January—was the fourth fastest such move in the Russell 2000’s history. A genuinely startling fall, though steep, sharp declines have been more common than not since the Financial Crisis.

As we seek to understand the market’s latest movements, we think it’s important to note that bond market signals have yet to move in the direction they often took in prior equity declines—bond yields commonly fall, and high-yield spreads widen when there are heightened concerns about future economic growth. We have seen neither so far in 2022. The contrast between the dramatic volatility of stocks and the nonplussed reaction of the bond market leads us to view this decline as a resetting of equity valuations rather than an increased concern about, or signal of, recession. Even more important, this latter view is corroborated by our recent conversations with company managements, where their largest challenges remain supply channel issues and the shortage of skilled workers to keep pace with the demand these companies are seeing.

Still, in our view, it’s significant that the Federal Reserve is making such a consequential pivot—from extraordinary monetary accommodation to mitigate the effects of COVID to more aggressive, and opposite, actions in an attempt to tame inflation. Liquidity and inflation are therefore now center stage. They have pushed Omicron and the pace of GDP growth toward the wings, though it is fair to say that all these developments (along with lingering supply chain issues) are interrelated. Indeed, periods like the present offer a reminder, however sobering, that, while equity markets are connected to the economy, the Fed functions in large part as the connective

tissue between the two because it’s the gatekeeper of liquidity. The consequence of this interrelationship is that any major move from the Fed will spur volatility. The central bank’s newest policies constitute two significant reversals—the shift from keeping a lid on rates to raising them and the move away from keeping the capital markets awash in liquidity to limiting it. After being in place for most of the last decade, these related Fed policy reversals happened in comparably short order, and thus it’s not surprising that the market has been reacting in an extreme fashion. From our perspective as experienced small-cap investors, this downturn is not about company fundamentals—it’s about valuations and liquidity. The days of generous monetary policy driving multiple expansion are over. It made sense to us, then, that more speculative assets— cryptocurrencies and growth stocks, for instance—experienced some of the most negative reactions to the Fed’s policy shift.

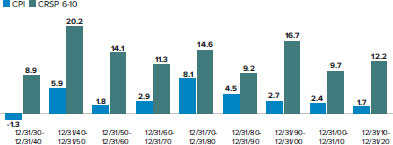

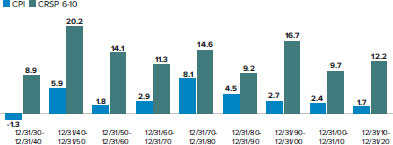

Importantly, if we are correct in suggesting that we are experiencing a valuation reset due to concerns about higher inflation, it’s worth recalling that, based on the CRSP (The Center for Research in Security Prices) data, small-caps are the only major asset class to have outpaced inflation in every decade since the 1970’s.

Small-Caps Have Beaten Inflation in Every Decade

Average Annual Consumer Price Index (CPI) versus Average Annual CRSP 6-10 Index

12/31/1930- 12/31/2020 (%)

Sources: Bureau of Labor Statistics (CPI) and CRSP

Additionally, since 2003, small-caps have on average delivered attractive returns when inflation expectations were

The best news for small-cap investors in 2021 arguably came from value stocks The Russell 2000 Value Index had a wonderful year—advancing 28.3% (thus beating the Russell 1000). The small-cap value index also walloped the Russell 2000 Growth Index, which was up a paltry 2.8% for the year.

| 4 | This page is not part of the The Royce Funds 2021 Annual Report to Shareholders | Past performance is no guarantee of future results. |

LETTER TO OUR SHAREHOLDERS

From our perspective as experienced small-cap investors, this downturn is not about company fundamentals—it’s about valuations and liquidity. The days of generous monetary policy driving multiple expansion are over.

rising. Finally, if all equity assets are undergoing a valuation reset, then it may be comforting to know that small-caps are at the low end of their relative valuation range over the past 20 years versus large-caps, which may limit their downside exposure relative to their larger siblings.

We hasten to add that we live in a complex world where it’s critical for us to practice humility about attributing causes and effects. As of this writing, there is also heightened geopolitical tension, and the possibility of an armed conflict on a scale not seen in decades. It’s difficult to imagine that these events are not exerting downward pressure of their own on equity valuations.

THE VALUE IN SMALL-CAP

What, then, are small-cap investors to do? We have already outlined why we think small-cap value stocks look poised to endure the current spate of higher volatility and lower returns in better shape than their growth counterparts. Even amid a challenging and uncertain climate for equities, much about the small-cap earnings picture remains constructive—particularly in the more cyclical precincts where we are most active currently. As we noted above, the probability of a U.S. recession looks low for at least this year and perhaps longer. U.S. and global GDP growth continue to trend in a positive, if bumpy, fashion. While our portfolio teams pursue distinct investment strategies and tend to focus on different types of small-cap stocks, they have found some common ground in identifying opportunities in the Industrial and Financial sectors, as well as in the lower valuation areas of Information Technology. Four areas that appear attractive are the semiconductor and housing ecosystems, select capital goods companies, and regional banks.

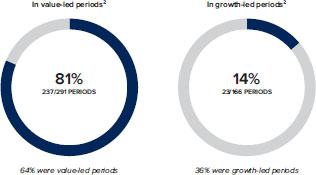

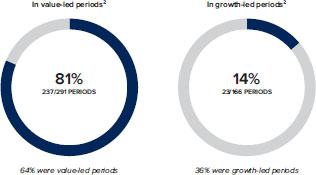

Given our confidence in the prospects for ongoing small-cap value leadership, we think it’s also useful for investors to know that a robust historical trend exists connecting value-led markets to success for active small-cap management. In 81% of value-led markets, active small-cap management outperformed the Russell 2000, a far more frequent record of success than in growth-led

markets, when active management outperformed the small-cap index in only 14% of the five-year periods ended 12/31/21.

Active Small Blend Management: Better in Value-Led Markets

% of Outperformance Periods for Morningstar Small Blend Category Average¹ vs the Russell 2000

12/31/78- 12/31/21

Small Blend outperformed in 68% of 10-year periods (270/397) with an average of 10.8% vs Russell 2000 average 10.0%. ¹There were 523 US Fund Small Blend Funds tracked by Morningstar with at least five years of performance history as of 12/31/21. ²5-Year Monthly Rolling Returns From 12/31/78 to 12/31/21 (457 Periods). Source: Morningstar

FACING THE GREAT UNKNOWN

How these various macroeconomic uncertainties play out is beyond our circle of competence. Our own expertise and focus lie in identifying attractive valued stocks. If pressed to offer a market outlook beyond our long-term confidence in small-cap value, we would be hard pressed to offer an expectation, starting from late January’s low levels, of other than an intermediate term-return similar to the Russell 2000’s historical average of about 10%. The favorable and unfavorable factors seem roughly in balance. For the latter, economic growth, though likely above average this year, will also likely slow next year; high-yield spreads, whose decline is often an accelerant for small-cap returns, remain at low levels; valuations, while not concerning, are also not so low that they offer much potential for expanding multiples, and a Federal Reserve that is removing monetary accommodation is rarely coincident with above-average equity returns. Still, on the positive side, we begin (as we often do) with the long term: Since 1945, based on data from CRSP, small-cap stocks have posted positive annualized three-year returns 88% of the time on a rolling monthly basis, with an average return in the low

| Past performance is no guarantee of future results. | This page is not part of the The Royce Funds 2021 Annual Report to Shareholders | 5 |

LETTER TO OUR SHAREHOLDERS

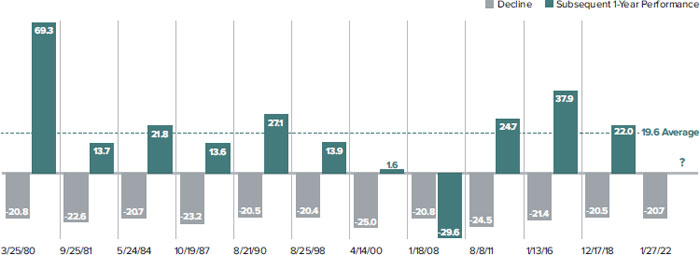

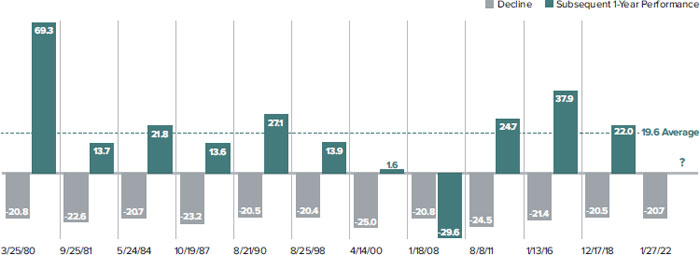

Subsequent 1-Year Performance of Russell 2000 after a 20% Decline

As of 1/31/22

First Day of 20% Decline

double digits. Moreover, there is the impressive record of small-cap rebounds from declines of 20% or more from a previous peak. The recent January 2022 low marked the twelfth such decline since the 1979 launch of the Russell 2000. The average subsequent one-year return from the first day of the eleven previous declines was 19.6%. In addition, the small-cap index produced positive returns over the subsequent year in all eleven periods, save one—which occurred in the Great Financial Crisis.

Even with the myriad challenges currently facing the world, we think it’s fair to say that current conditions do not resemble those of the Great Financial Crisis. However, another historical instance may be worth noting. The last time the Fed aggressively removed monetary accommodation with the move not triggering a recession occurred in 1994, when the Russell 2000 was down 1.8% for the year. But that reset year was followed by

a glorious period for small-caps, with the annualized return for 1995-97 totaling 22.3% for the Russell 2000.

We also remain convinced that earnings ultimately drive individual company stock returns, and (as we mentioned above) the earnings prospects for many small-cap companies remain promising, specifically those with sound fundamentals, including low-debt balance sheets, positive cash flows, and the ability to pass on higher costs in this inflationary period. We have always believed that focusing on what we know and not worrying about what we cannot control are paramount to effective and successful active management. Our commitment to a disciplined process across each of our small-cap strategies is the best way to give our shareholders the greatest opportunities to build wealth over the long run. This remains true even in the most challenging times.

| Sincerely, | | |

| | | |

|  |  |

| | | |

Charles M. Royce Chairman, Royce Investment Partners | Christopher D. Clark Chief Executive Officer, and Co-Chief Investment Officer, Royce Investment Partners | Francis D. Gannon Co-Chief Investment Officer, Royce Investment Partners |

| January 31, 2022 | | |

| 6 | This page is not part of the The Royce Funds 2021 Annual Report to Shareholders | Past performance is no guarantee of future results. |

Performance and Expenses

Performance and Expenses

As of December 31, 2021

| | | AVERAGE ANNUAL TOTAL RETURNS (%) | | ANNUAL OPERATING EXPENSES (%) |

| | | | | | | | SINCE | INCEPTION | | |

| | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | INCEPTION | DATE | GROSS | NET |

| Royce Dividend Value Fund | 20.11 | 17.65 | 10.66 | 10.54 | 8.05 | N/A | 9.08 | 5/3/04 | 1.602 | 1.342 |

| Royce Global Financial Services Fund | 20.27 | 19.84 | 12.79 | 13.29 | 7.55 | N/A | 9.10 | 12/31/03 | 2.072 | 1.682 |

| Royce International Premier Fund | 5.78 | 18.01 | 14.92 | 11.94 | N/A | N/A | 8.96 | 12/31/10 | 1.57 2 | 1.442 |

| Royce Micro-Cap Fund | 31.02 | 25.49 | 13.67 | 9.48 | 7.06 | 9.19 | 11.48 | 12/31/91 | 1.29 | 1.24 |

| Royce Opportunity Fund | 30.85 | 28.51 | 15.67 | 15.06 | 9.84 | 11.34 | 12.94 | 11/19/96 | 1.23 | 1.23 |

| Royce Pennsylvania Mutual Fund | 22.05 | 20.78 | 13.10 | 12.30 | 8.62 | 10.09 | 13.181 | N/A | 0.95 | 0.95 |

| Royce Premier Fund | 16.36 | 20.28 | 14.05 | 11.68 | 9.82 | 11.07 | 11.91 | 12/31/91 | 1.21 | 1.21 |

| Royce Small-Cap Value Fund | 28.24 | 12.34 | 6.74 | 7.58 | 5.93 | 8.41 | 9.10 | 6/14/01 | 1.622 | 1.492 |

| Royce Smaller-Companies Growth Fund | 7.78 | 25.77 | 16.04 | 13.62 | 8.33 | 11.50 | 12.24 | 6/14/01 | 1.542 | 1.492 |

| Royce Special Equity Fund | 22.50 | 14.02 | 7.58 | 9.68 | 8.20 | 9.52 | 9.12 | 5/1/98 | 1.23 | 1.23 |

| Royce Total Return Fund | 25.78 | 17.26 | 9.91 | 11.17 | 7.87 | 9.19 | 10.75 | 12/15/93 | 1.25 | 1.25 |

| INDEX | | | | | | | | | | |

| Russell 2000 | 14.82 | 20.02 | 12.02 | 13.23 | 8.69 | 9.36 | N/A | N/A | N/A | N/A |

| Russell Microcap | 19.34 | 20.90 | 11.69 | 13.62 | 7.51 | 9.04 | N/A | N/A | N/A | N/A |

| Russell 2000 Value | 28.27 | 17.99 | 9.07 | 12.03 | 7.19 | 9.18 | N/A | N/A | N/A | N/A |

| Russell 2500 | 18.18 | 21.91 | 13.75 | 14.15 | 9.67 | 10.30 | N/A | N/A | N/A | N/A |

| MSCI ACWI ex USA Small Cap | 12.93 | 16.46 | 11.21 | 9.46 | 5.59 | 10.03 | N/A | N/A | N/A | N/A |

| MSCI ACWI Small Cap | 16.10 | 18.96 | 12.28 | 11.78 | 7.82 | 10.31 | N/A | N/A | N/A | N/A |

1For Royce Pennsylvania Mutual Fund, the average annual total return shown is for the 45-year period ended 12/31/21.

2Reflects Service Class expenses which include a 25bps distribution fee.

Important Performance, Expense, and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Investment and Service Class shares redeemed within 30 days of purchase may be subject to a 1% redemption fee payable to the Fund (2% for Royce International Premier Fund). Redemption fees are not reflected in the performance shown above; if they were, performance would be lower. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.royceinvest.com. All performance and expense information reflects results of the Funds’ oldest share Class (Investment Class or Service Class, as the case may be). Price and total return information is based on net asset values calculated for shareholder transactions. Annual gross operating expenses reflect the Fund’s gross total annual operating expenses and include management fees, any 12b-1 distribution and service fees, other expenses, and any applicable acquired fund fees and expenses. Annual net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed to waive fees and/or reimburse operating expenses, excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business, to the extent necessary to maintain net operating expenses at or below: 1.24% for Royce Micro-Cap Fund; 1.34% for Royce Dividend Value Fund; 1.44% for Royce International Premier Fund; 1.49% for Royce Global Financial Services, Small-Cap Value, and Smaller-Companies Growth Funds through April 30, 2022. Acquired fund fees and expenses reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds, hedge funds, private equity funds, and other investment companies.

Service Class shares bear an annual distribution expense that is not borne by the Funds’ Investment Class. If such distribution expenses had been reflected for Funds showing Investment Class performance, returns would have been lower. Each series of The Royce Fund is subject to market risk–the possibility that common stock prices will decline, sometimes sharply and unpredictably, over short or extended periods of time. Such declines may be caused by various factors, including market, financial, and economic conditions, governmental or central bank actions, and other factors, such as the recent COVID-19 pandemic, that may not be directly related to the issuer of a security held by a Fund. This pandemic could adversely affect global market, financial, and economic conditions in ways that cannot necessarily be foreseen. Investments in securities of micro-cap, small-cap, and/or mid-cap companies may involve considerably more risk than investments in securities of larger-cap companies. (Please see “Primary Risks for Fund Investors” in the prospectus.) Certain Funds invest a significant portion of their respective assets in foreign companies that may be subject to different risks than investments in securities of U.S. companies, including adverse political, social, economic, or other developments that are unique to a particular country or region. (Please see “Investing in Foreign Securities” in the prospectus.) Therefore, the prices of securities of foreign companies in particular countries or regions may, at times, move in a different direction than those of securities of U.S. companies. (Please see “Primary Risk of Fund Investors” in the prospectus.) Certain Funds generally invest a significant portion of their assets in a limited number of stocks, which may involve considerably more risk than a more broadly diversified portfolio because a decline in the value of any of these stocks would cause their overall value to decline to a greater degree. A broadly diversified portfolio, however, does not ensure a profit or guarantee against loss. This Review and Report must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index along with the next smallest eligible securities as determined by Russell. The Russell 2000 Value Index consists of the respective value stocks within the Russell 2000 as determined by Russell Investments. The Russell 2500 is an unmanaged, capitalization-weighted index of the 2,500 smallest publicly traded U.S. companies in the Russell 3000 index. The MSCI ACWI ex USA Small Cap Index is an unmanaged, capitalization-weighted index of global small-cap stocks, excluding the United States. The MSCI ACWI Small Cap Index is an unmanaged, capitalization-weighted index of global small-cap stocks. Index returns include net reinvested dividends and/or interest income. The performance of an index does not represent exactly any particular investment as you cannot invest directly in an index. Distributor: Royce Fund Services, LLC.

| This page is not part of the The Royce Funds 2021 Annual Report to Shareholders | 7 |

MANAGERS’ DISCUSSION (UNAUDITED)

Royce Dividend Value Fund (RDV)

Chuck Royce

Miles Lewis, CFA®

FUND PERFORMANCE

Royce Dividend Value Fund advanced 20.1% in 2021, outperforming both its benchmark, the Russell 2500 Index, which rose 18.2%, and the Russell 2000 Index, which gained 14.8%, for the same period.

WHAT WORKED… AND WHAT DIDN’T

Seven of the portfolio’s nine equity sectors made a positive impact on calendar-year performance. The sectors making the largest positive contributions were Industrials, Financials, and Consumer Discretionary while the only negative impacts came from Energy and Real Estate. Consumer Staples made the smallest positive impact. At the industry level, capital markets (Financials), professional services (Industrials), and banks (Financials) contributed most in 2021 period while containers & packaging (Materials), chemicals (Materials), and software (Information Technology) were the largest detractors.

The Fund’s top contributor at the position level was Carlyle Group, which manages investment vehicles across four segments: corporate private equity, real assets, global credit, and investment solutions. The firm reported record levels of fee-related earnings with strong margins and a confident outlook in February, which was followed by healthy fee-based and other earnings announced in April. The firm then reported third-quarter results in October, highlighting additional progress in fee-related earnings, record highs in quarterly distributable earnings, and strong fund-raising momentum. KBR, the portfolio’s next-best contributor, is a global engineering & construction company. The company made an acquisition in 2020 in order to move further into the aerospace & defense markets and in January 2021 signed an agreement with Mura Technology to offer an advanced plastics recycling process. In October, KBR reported robust earnings and revenue growth while raising fiscal 2021 revenue and earnings guidance. Its success was driven mostly by government contracts and wins for its sustainable technology solutions. Carlyle and KBR were the Fund’s two biggest holdings at year-end.

The biggest detractor at the position level was B3-Brasil, Bolsa, Balcao, a stock exchange located in São Paulo, Brazil. Its decline in 2021 may have been a case of investors expecting more. Brazil’s economy and equity markets have been recovering in 2021, and the company reported slightly better-than-expected profits and earnings in May. The company’s third quarter results showed lower revenues compared to 3Q20 and 2Q21 (though those two quarters were positively impacted by the reversal of non-recurring provisions). However, third-quarter recurring net income rose, even as investors continued to avoid the stock. Headquartered in the U.K., Ashmore Group specializes in actively managed emerging markets strategies in equities, fixed income, and alternative investments. The company reported declines in adjusted net revenue and EBITDA (Earnings before Interest, Taxes, Depreciation, & Amortization) for the fiscal year ended 6/30/21 and then in October announced declines in assets under management and negative investment performance for the third quarter as market sentiment for certain of its key strategies deteriorated.

| | | | | |

| | Top Contributors to Performance | | Top Detractors from Performance | |

| | For 2021 (%)1 | | | For 2021 (%)2 | |

| | | | | | |

| | Carlyle Group | 2.55 | | B3-Brasil, Bolsa, Balcao | -0.84 | |

| | KBR | 2.18 | | Ashmore Group | -0.57 | |

| | Triumph Bancorp | 1.52 | | AptarGroup | -0.33 | |

| | Sprott | 1.42 | | USS | -0.32 | |

| | Applied Industrial Technologies | 1.18 | | Quaker Chemical | -0.26 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

The portfolio’s advantage over the Russell 2500 resulted from sector allocation decisions in 2021—stock selection was a negative factor versus the benchmark. The Fund’s substantially lower exposure to Health Care—which was the only sector in the Russell 2500 to finish the year in the red—helped most. Our stock selection was also positive in the sector. Both our significantly greater exposure and savvy stock picking provided a relative edge in Industrials, while our overweight in Financials also made a notable positive impact. Conversely, stock picking hampered relative results in Materials, overcoming the positive effect of our large sector overweight. Our stock selection and lower exposure hurt in Energy—which had the highest return of any sector in the Russell 2500. The same combination also led Real Estate to detract from relative performance in 2021

CURRENT POSITIONING AND OUTLOOK

We reduced the number of positions in the Fund in 2021, finishing the year with 49 holdings versus 67 at the end of 2020, while increasing our exposure to U.S. stocks. Our outlook is very positive for small-cap value, though it’s more nuanced for small-cap as a whole. The Russell 2500 enjoyed a third consecutive year of double-digit positive returns in 2021, which is rare for any equity index. It’s happened only twice before since the inception of the Russell 2500 in 1979: from 1991-1993 and 1995-1997. In each instance, a fourth year of double-digit positive performance failed to materialize. We always place a lot of weight on history, and this pattern, along with a less accommodative Fed, makes us think that performance for both the Russell 2500 and Russell 2000 will be more muted in 2022. History also tells us, however, that small-cap value and cyclicals do well, particularly on a relative basis, during periods of improving economic growth. This is consistent with the encouraging signs we’ve been seeing on a company-by-company basis. We also are optimistic of the relative performance outlook for high quality stocks—which we primarily define as companies with high returns on invested capital and stable returns on assets. We think the Fund’s combined focus on dividend payers, high-quality, and value should be supportive for attractive returns, particularly relative to its benchmark.

8 | The Royce Funds 2021 Annual Report to Shareholders

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | | TICKER SYMBOLS RYDVX RDVIX RDIIX RDVCX |

Performance and Expenses

Average Annual Total Return (%) Through 12/31/21

| | JUL-DEC 20211 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | SINCE INCEPTION (5/3/04) |

| RDV | 2.76 | 20.11 | 17.65 | 10.66 | 10.54 | 8.05 | 9.08 |

| Annual Gross Operating Expenses: 1.60% | Annual Net Operating Expenses: 1.34% |

1 Not annualized

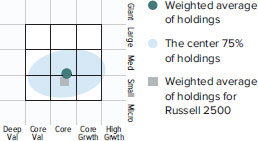

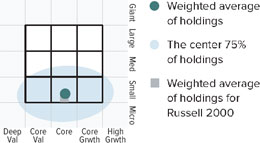

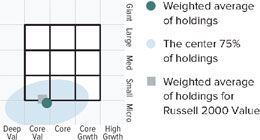

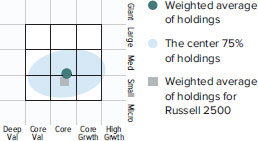

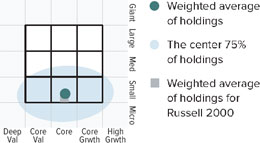

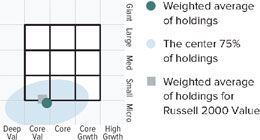

Morningstar Style Map™ As of 12/31/21

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 86 for additional information.

Value of $10,000

Invested on 5/3/04 as of 12/31/21 ($)

Top 10 Positions

% of Net Assets

| Carlyle Group | | 5.1 |

| KBR | | 5.0 |

| Applied Industrial Technologies | | 4.2 |

| HEICO Corporation Cl. A | | 3.9 |

| Spirax-Sarco Engineering | | 3.8 |

| Sprott | | 3.5 |

| Lindsay Corporation | | 3.5 |

| Franco-Nevada | | 3.3 |

| AptarGroup | | 3.3 |

| Worthington Industries | | 3.2 |

Portfolio Sector Breakdown

% of Net Assets

| Industrials | | 37.8 |

| Financials | | 29.9 |

| Materials | | 16.3 |

| Consumer Discretionary | | 5.9 |

| Health Care | | 3.4 |

| Information Technology | | 1.8 |

| Energy | | 1.4 |

| Cash and Cash Equivalents | | 3.5 |

Calendar Year Total Returns (%)

| YEAR | | RDV |

| 2021 | | 20.1 |

| 2020 | | 4.5 |

| 2019 | | 29.8 |

| 2018 | | -16.2 |

| 2017 | | 21.7 |

| 2016 | | 16.4 |

| 2015 | | -5.7 |

| 2014 | | -2.1 |

| 2013 | | 30.7 |

| 2012 | | 16.9 |

| 2011 | | -4.5 |

| 2010 | | 30.1 |

| 2009 | | 37.7 |

| 2008 | | -31.5 |

| 2007 | | -0.0 |

Upside/Downside Capture Ratios

Periods Ended 12/31/21 (%)

| | | UPSIDE | | DOWNSIDE |

| 10-Year | | 87 | | 107 |

| From 6/30/04 (Start of Fund’s First Full Quarter) | | 89 | | 91 |

Portfolio Diagnostics

| Fund Net Assets | | $76 million |

| Number of Holdings | | 49 |

| Turnover Rate | | 0% |

| Average Market Capitalization1 | | $6,258 million |

| Weighted Average P/E Ratio 2,3 | | 16.4x |

| Weighted Average P/B Ratio 2 | | 3.4x |

| Active Share 4 | | 98% |

| U.S. Investments (% of Net Assets) | | 69.8% |

| Non-U.S. Investments (% of Net Assets) | | 26.7% |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (8% of portfolio holdings as of 12/31/21). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Shares redeemed within 30 days of purchase may be subject to a 1% redemption fee payable to the Fund, which is not reflected in the performance shown above; if it were, performance would be lower. Current month-end performance may be higher or lower than performance quoted and may be obtained at www.royceinvest.com. All performance and risk information reflects results of the Service Class (its oldest class). Gross operating expenses reflect the Fund’s total gross annual operating expenses for the Service Class and include management fees, 12b-1 distribution and service fees, and other expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Service Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.34% through April 30, 2022. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2021. The Sharpe Ratio is calculated for a specified period by dividing a fund’s annualized excess returns by its annualized standard deviation. The higher the Sharpe ratio, the better the fund’s historical risk-adjusted performance. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark (Russell 2500). It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters.

The Royce Funds 2021 Annual Report to Shareholders | 9

MANAGER’S DISCUSSION (UNAUDITED)

Royce Global Financial Services Fund (RFS)

Chuck Royce

FUND PERFORMANCE

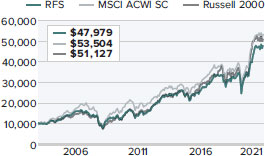

Royce Global Financial Services Fund rose 20.3% in 2021, outperforming its benchmark, the MSCI ACWI Small Cap Index, which was up 16.1% for the same period. In addition to its calendar-year advantage, the Fund also outperformed its benchmark for the 3-, 5-, and 10-year periods ended 12/31/21.

WHAT WORKED… AND WHAT DIDN’T

The Fund’s top contributor at the position level in 2021 was Sprott, a Canadian asset manager that focuses on precious metals. Its shares first rose during 1Q21, no doubt boosted by the announcement in February of an 88% increase in assets under management that helped earnings considerably. Strong third-quarter earnings then helped its shares recover from a brief mid-year slump. Popular, the portfolio’s second top contributor, is the largest bank by both assets and deposits in Puerto Rico and ranks as one of the top thrifts by total assets in the U.S. Its business benefited from the continued rebound in economic activity, the unprecedented level of federal stimulus, and the bank’s diversified sources of revenue. Adoption of the bank’s digital channels among its retail customers continues to grow, while its auto loan and lease originations, along with mortgage originations, remained solid. The next top contributor was KKR & Co., a leading alternative asset manager that offers investment strategies such as private equity, energy, credit, infrastructure, real estate, and hedge funds. The company enjoyed strong results throughout 2021, capped by third-quarter earnings in which the company reported fee-related earnings per share and after-tax distributable earnings that were as high as any KKR had ever reported, along with management fees that were up more than 50% since the third quarter of 2020. These improvements drove a 60% increase in fee-related earnings per share on a year-over-year basis.

The biggest detractor at the position level was B3-Brasil, Bolsa, Balcao, a stock exchange located in São Paulo, Brazil. Its decline in 2021 may have been a case of investors expecting more. Brazil’s economy and equity markets have been recovering in 2021, and the company reported slightly better-than-expected profits and earnings in May. The company’s third quarter results showed lower revenues compared to 3Q20 and 2Q21 (though those two quarters were positively impacted by the reversal of non-recurring provisions).

| | | | | |

| | Top Contributors to Performance | | Top Detractors from Performance | |

| | For 2021 (%)1 | | | For 2021 (%)2 | |

| | | | | | |

| | Sprott | 2.29 | | B3-Brasil, Bolsa, Balcao | -0.90 | |

| | Popular | 1.81 | | MarketAxess Holdings | -0.63 | |

| | KKR & Co. | 1.75 | | Ashmore Group | -0.58 | |

| | First Citizens BancShares Cl. A | 1.57 | | Trean Insurance Group | -0.46 | |

| | Carlyle Group | 1.43 | | Great Elm Group | -0.29 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

However, third-quarter recurring net income rose, even as investors continued to avoid the stock. The Fund’s second-biggest detractor at the position level was MarketAxess Holdings, which operates an electronic trading platform for corporate bonds and other fixed-income securities. Its shares typically do best during periods of high trading volume and volatility. For example, fixed income instruments saw higher-than-usual volatility and trading activity throughout 2020 and into early 2021, boosting the company’s revenues and earnings. However, its stock began to slip in 2Q21 as volatility fell in the fixed-income space, trading activity slowed, and analysts re-rated its shares. Credit-market trading continued to face headwinds in the second half due to a combination of historically low credit spreads and credit spread volatility. Through the first three quarters of fiscal 2021, commission revenue for MarketAxess was down about 1% versus the same point in 2020. We agree with management’s view, however, that credit conditions will mean revert, helping its shares to rebound. Headquartered in the U.K., Ashmore Group specializes in actively managed emerging markets strategies in equities, fixed income, and alternative investments. The company reported declines in adjusted net revenue and EBITDA (Earnings before Interest, Taxes, Depreciation, & Amortization) for the fiscal year ended 6/30/21 and then in October announced declines in assets under management and negative investment performance for the third quarter as market sentiment for certain of its key strategies deteriorated.

CURRENT POSITIONING AND OUTLOOK

We were very pleased with both the Fund’s shorter- and longer-term performance and think that these results validate the Fund’s central investment thesis—that our distinctive approach to investing in companies in the broadly defined financial services ecosystem can produce attractive results compared with the global small-cap asset class. We continue to focus on what we view as the most attractive business models and investment opportunities, while also maintaining diversification across sub-industries and geographies. At year end, the Fund had 50 holdings, down from 61 a year ago, while still holding investments in businesses that can be expected to fare differently at different stages of the economic and market cycles. These investments include select traditional banks and insurance companies that we see as cyclically favored, alternative asset managers where we see continued strong growth prospects, stock exchanges in non-U.S. countries where there are often considerable barriers to competitive entry, and specialized technology platforms serving niches of the financial services ecosystem where we often see high quality attributes such as enduring competitive advantages and low capital requirements. Looking towards 2022, many of the Fund’s investments tend to do well when their respective countries’ economies are expanding, so as the global economy continues its uneven path of recovery, we look forward to another year of strong performance for the Fund.

10 | The Royce Funds 2021 Annual Report to Shareholders

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | | TICKER SYMBOLS RYFSX RGFIX |

Performance and Expenses

Average Annual Total Return (%) Through 12/31/21

| | JUL-DEC 20211 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | SINCE INCEPTION (12/31/03) |

| RFS | 2.16 | 20.27 | 19.84 | 12.79 | 13.29 | 7.55 | 9.10 |

| Annual Gross Operating Expenses: 2.07% | Annual Net Operating Expenses: 1.68% |

1 Not annualized

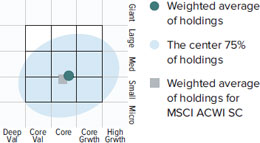

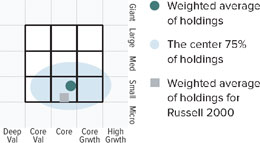

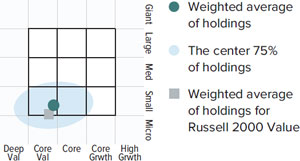

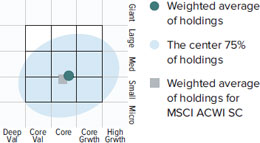

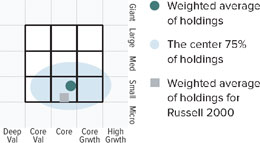

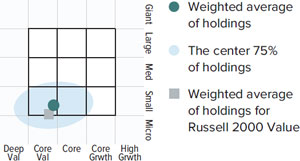

Morningstar Style Map™ As of 12/31/21

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 86 for additional information.

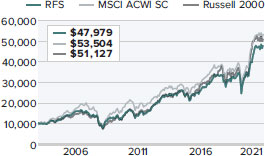

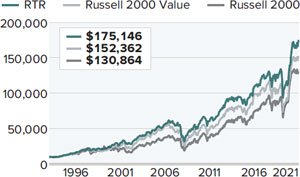

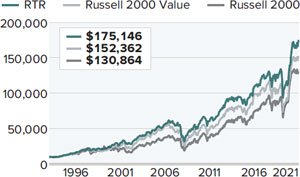

Value of $10,000

Invested on 12/31/03 as of 12/31/21 ($)

Top 10 Positions

% of Net Assets

| Sprott | | 4.8 |

| FirstService Corporation | | 4.3 |

| Popular | | 4.3 |

| First Citizens BancShares Cl. A | | 4.0 |

| Tel Aviv Stock Exchange | | 3.9 |

| KKR & Co. | | 3.7 |

| Canaccord Genuity Group | | 3.5 |

| Altus Group | | 3.5 |

| Franco-Nevada | | 3.4 |

| Charles Schwab | | 3.2 |

Portfolio Sector Breakdown

% of Net Assets

| Capital Markets | | 48.9 |

| Banks | | 16.4 |

| Real Estate Management & Development | | 9.0 |

| Insurance | | 4.7 |

| Metals & Mining | | 3.4 |

| Software | | 3.0 |

| Diversified Financial Services | | 1.9 |

| IT Services | | 1.7 |

| Thrifts & Mortgage Finance | | 1.2 |

| Closed-End Funds | | 0.9 |

| Professional Services | | 0.5 |

| Cash and Cash Equivalents | | 8.4 |

Upside/Downside Capture Ratios

Periods Ended 12/31/21 (%)

| | UPSIDE | DOWNSIDE |

| 10-Year | 99 | 83 |

| Fund’s First Full Quarter (12/31/03) | 88 | 85 |

Calendar Year Total Returns (%)

| YEAR | | RFS |

| 2021 | | 20.3 |

| 2020 | | 15.3 |

| 2019 | | 24.2 |

| 2018 | | -13.4 |

| 2017 | | 22.5 |

| 2016 | | 12.9 |

| 2015 | | -4.7 |

| 2014 | | 3.5 |

| 2013 | | 42.0 |

| 2012 | | 20.7 |

| 2011 | | -11.3 |

| 2010 | | 18.5 |

| 2009 | | 32.1 |

| 2008 | | -35.4 |

| 2007 | | -4.7 |

Portfolio Country Breakdown 1,2

% of Net Assets

| United States | | 47.1 |

| Canada | | 24.4 |

| United Kingdom | | 4.0 |

| Israel | | 3.8 |

| India | | 1.9 |

| New Zealand | | 1.9 |

| France | | 1.7 |

| Bermuda | | 1.6 |

| ¹ | Represents countries that are 1.5% or more of net assets. |

| ² | Securities are categorized by the country of their headquarters. |

Portfolio Diagnostics

| Fund Net Assets | | $38 million |

| Number of Holdings | | 50 |

| Turnover Rate | | 5% |

| Average Market Capitalization1 | | $3,931 million |

| Weighted Average P/E Ratio 2,3 | | 11.3x |

| Weighted Average P/B Ratio 2 | | 2.0x |

| Active Share 4 | | 99% |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (5% of portfolio holdings as of 12/31/21). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Shares redeemed within 30 days of purchase may be subject to a 1% redemption fee payable to the Fund, which is not reflected in the performance shown above; if it were, performance would be lower. Current month-end performance may be higher or lower than performance quoted and may be obtained at www.royceinvest.com. Gross operating expenses reflect the Fund’s gross total annual operating expenses for the Service Class and include management fees, 12b-1 distribution and service fees, other expenses and acquired fund fees and expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed to waive fees and/or reimburse expenses to the extent necessary to maintain the Fund’s net annual operating expenses, (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business), at or below 1.49% through April 30, 2022. Acquired fund fees and expenses reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds, hedge funds, private equity funds, and other investment companies. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2021. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark (MSCI ACWI SC). It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters.

The Royce Funds 2021 Annual Report to Shareholders | 11

MANAGERS’ DISCUSSION (UNAUDITED)

Royce International Premier Fund (RIP)

Mark Rayner, CA

Mark Fischer

FUND PERFORMANCE

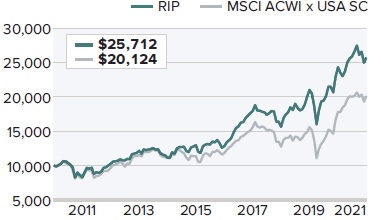

2021 saw Royce International Premier Fund underperform its benchmark after four consecutive years of outperformance. The Fund advanced 5.8% in 2021, trailing its benchmark, the MSCI ACWI ex-USA Small Cap Index, which was up 12.9% for the same period. The Fund beat the benchmark for the 3-, 5-, 10-year, and since inception (12/31/10) periods ended 12/31/21.

WHAT WORKED… AND WHAT DIDN’T

Four of the portfolio’s nine equity sectors made a positive impact on 2021’s performance, led by Industrials, Materials, and Real Estate, while Health Care, Information Technology, and Consumer Discretionary made the largest detractions. The Fund’s top-contributing position in 2021 was IMCD—a leading distributor of specialty chemicals. Based in the Netherlands, IMCD offers more than 40,000 products to a diverse range of industrial and life sciences customers in areas that range from personal care to food and pharmaceuticals. Its shares rose steadily in 2021 and gained nearly 75% for the year. Results for the first nine months of 2021, announced in November, saw strong organic growth stemming from the company’s pricing power (a key attribute in inflationary periods) and ability to gain market share. IMCD also announced 10 acquisitions in 2021, consistent with its proven ability to acquire businesses at attractive prices.

Next came Australia’s Hansen Technologies, which provides billing software and customer care technologies for utilities and the telecom industry. Its shares gained sharply in March on the announcement that it had executed a Master Agreement with Telefonica’s Germany operations before rallying again in June after the company announced it had received an unsolicited proposal to be acquired by private equity firm BGH. The stock then gave back much of those gains when BGH unexpectedly withdrew its proposal in September. As investors then re-focused on the company’s fundamentals, the stock was mostly flat through the rest of the year as sentiment fluctuated between optimism around long-term performance and concerns about cost inflation and the achievement of the company’s short-term organic growth targets.

| | | | | |

| | Top Contributors to Performance | | Top Detractors from Performance | |

| | For 2021 (%)1 | | | For 2021 (%)2 | |

| | | | | | |

| | IMCD | 1.40 | | Bravura Solutions | -0.69 | |

| | Hansen Technologies | 1.17 | | OBIC Business Consultants | -0.66 | |

| | Croda International | 0.97 | | TKC Corporation | -0.61 | |

| | IPH | 0.95 | | GVS | -0.51 | |

| | Marlowe | 0.90 | | NICE Information Service | -0.47 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

The top detracting position was Australia’s Bravura Solutions, which offers software solutions for the wealth management and fund administration industries. Its stock fell by almost 40% from mid-August through the end of the year, triggered by the release of full fiscal year 2021 results that, while in line with management’s guidance, reflected weaker results of “just” mid-teens growth. The company also announced the unexpected retirement of a popular long-time CEO, who was succeeded by the company’s COO. The market’s adverse reaction to his departure was exacerbated by the company’s limited communication about the departure, which followed an earlier management departure and the pending retirement of the company’s CFO. Our call with the company’s outgoing CFO, however, underlined Bravura’s strong ongoing customer retention, M&A pipeline, and positive long-term outlook supported by recovering client demand.

The second biggest detractor was Japan��s OBIC Business Consultants, an accounting software company with a leading market share among small- to medium-sized businesses. OBIC allows these companies to digitize and more efficiently conduct mission critical accounting processes. We suspect that 2021’s underperformance came from profit taking, as the year saw a broad reversal in the Japanese equity market. This reversal was particularly pronounced in the IT sector, where several companies that were in top performers in 2020 wound up correcting in 2021.

In 2021, non-U.S. small-cap companies in the top quintile of leverage underperformed those in the bottom quintile—and our holdings carry little to no debt. As such, our disadvantage came from stock selection in 2021, with the Information Technology, Health Care, and Financials sectors making the most significant negative impact on that basis while Industrials, Consumer Staples, and Real Estate contributed most to relative performance—mostly the result of sector allocation decisions.

CURRENT POSITIONING AND OUTLOOK

During 2021, ultra-low interest rates, substantial asset purchases by central banks, and unprecedented levels of COVID support packages from governments combined to soak financial markets with liquidity. At the same time, we believe the volatile nature of the pandemic continued to affect commerce and social behaviors, providing investors with both the means and the opportunity to bet on shorter-term stock market outcomes. The result, in our view, was a more speculative three-way tug of war between ‘growth at any price,’ ‘cheap re-opening plays,’ and ‘inflation hedges.’ Given that our investment philosophy is rooted in the focus on long-term value creation rather than the pursuit of short-term price appreciation, the market backdrop was difficult, to say the least. While the stock market hasn’t so far, in our view, correctly priced in the value that our portfolio companies created in 2021, we continue to believe that our approach will be rewarded with correlated price appreciation in the long run. Of course, we cannot predict when the market will refocus on ‘mathematics’ rather than ‘thematics.’ However, we do believe that such a moment is long overdue, and that, in the meantime, our companies continue to create additional shareholder value.

12 | The Royce Funds 2021 Annual Report to Shareholders

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | | TICKER SYMBOLS RYIPX RIPNX RINPX RIPIX |

Performance and Expenses

Average Annual Total Return (%) Through 12/31/21

| | JUL-DEC 20211 | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION (12/31/10) |

| RIP | -0.58 | 5.78 | 18.01 | 14.92 | 11.94 | 8.96 |

| Annual Gross Operating Expenses: 1.57% | Annual Net Operating Expenses: 1.44% |

1 Not annualized

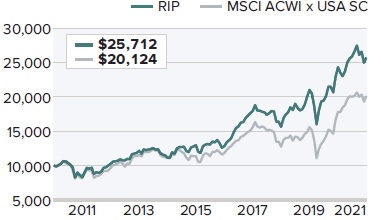

Relative Returns: Monthly Rolling Average Annual Return Periods

Since Inception Through 12/31/21

On a monthly rolling basis, The Fund outperformed the MSCI ACWI x USA SC in 100% of all 10-year periods; 100% of all 5-year periods; and 67% of all 1-year periods.

| | PERIODS BEATING THE INDEX | FUND AVG (%) 1 | INDEX AVG (%) 1 |

| 10-year | 13/13 | 100% | 10.1 | 7.4 |

| 5-year | 73/73 | 100% | 9.9 | 6.5 |

| 1-year | 81/121 | | 67% | 10.7 | 8.5 |

| | | | | | |

1Average of monthly rolling average annual total returns over the specified periods.

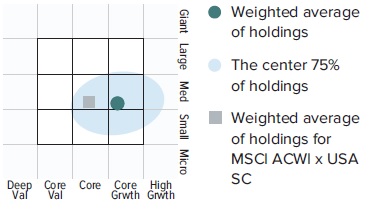

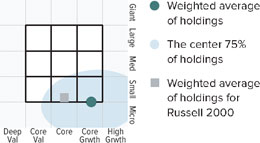

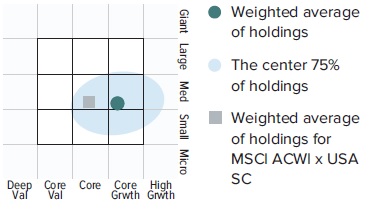

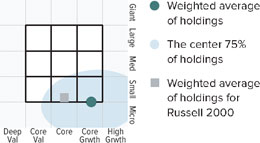

Morningstar Style Map™ As of 12/31/21

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 86 for additional information.

Value of $10,000

Invested on 12/31/10 as of 12/31/21 ($)

Top 10 Positions

% of Net Assets

| IPH | 3.3 |

| TKC Corporation | 2.9 |

| Meitec Corporation | 2.8 |

| Hansen Technologies | 2.5 |

| Victrex | 2.4 |

| Bravura Solutions | 2.3 |

| FUCHS PETROLUB | 2.2 |

| OBIC Business Consultants | 2.2 |

| Loomis | 2.1 |

| GVS | 2.1 |

Portfolio Sector Breakdown

% of Net Assets

| | |

| Industrials | 38.2 |

| Information Technology | 25.2 |

| Health Care | 11.7 |

| Materials | 7.1 |

| Financials | 4.1 |

| Communication Services | 3.9 |

| Consumer Discretionary | 1.5 |

| Real Estate | 1.4 |

| Preferred Stock | 2.2 |

| Cash and Cash Equivalents | 4.7 |

Upside/Downside Capture Ratios

Periods Ended 12/31/21 (%)

| | | UPSIDE | | DOWNSIDE |

| 10-Year | | 99 | | 76 |

| Fund’s First Full Quarter (12/31/10) | | 100 | | 79 |

Calendar Year Total Returns (%)

| YEAR | | RIP |

| 2021 | | 5.8 |

| 2020 | | 15.7 |

| 2019 | | 34.2 |

| 2018 | | -12.8 |

| 2017 | | 39.8 |

| 2016 | | -1.1 |

| 2015 | | 16.2 |

| 2014 | | -8.2 |

| 2013 | | 18.3 |

| 2012 | | 23.4 |

| 2011 | | -16.8 |

Portfolio Country Breakdown 1,2

% of Net Assets

| Japan | 18.2 |

| United Kingdom | 16.8 |

| Australia | 10.1 |

| Sweden | 8.9 |

| Switzerland | 7.1 |

| Germany | 6.9 |

| Italy | 4.9 |

| Canada | 4.8 |

| South Korea | 3.2 |

| 1 | Represents countries that are 3% or more of net assets. |

| 2 | Securities are categorized by the country of their headquarters. |

Portfolio Diagnostics

| Fund Net Assets | | $1,253 million |

| Number of Holdings | | 60 |

| Turnover Rate | | 32% |

| Average Market Capitalization 1 | | $2,325 million |

| Weighted Average P/E Ratio 2,3 | | 27.2x |

| Weighted Average P/B Ratio 2 | | 3.8x |

| Active Share 4 | | 99% |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (4% of portfolio holdings as of 12/31/21). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Shares redeemed within 30 days of purchase may be subject to a 2% redemption fee payable to the Fund, which is not reflected in the performance shown above; if it were, performance would be lower. Current month-end performance may be higher or lower than performance quoted and may be obtained at www.royceinvest.com. All performance and risk information reflects results of the Service Class (its oldest class). Price and total return information is based on net asset values for shareholder transactions. Certain immaterial adjustments were made to the net assets of Royce International Premier Fund at 12/31/19 and 12/31/20 for financial reporting purposes, and as a result the calendar year total returns based on those net asset values differ from the adjusted net asset values and calendar year total returns reported in the Financial Highlights. Gross operating expenses reflect total gross annual operating expenses for the Service Class and include management fees, 12b-1 distribution and service fees, and other expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed to waive its fees and/or reimburse operating expenses to the extent necessary to maintain the Fund’s net annual operating expenses, (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business), at or below 1.44% through April 30, 2022. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2021. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark (MSCI ACWI x USA SC). It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters.

The Royce Funds 2021 Annual Report to Shareholders | 13

MANAGERS’ DISCUSSION (UNAUDITED)

Royce Micro-Cap Fund (RMC)

Jim Stoeffel

Brendan Hartman

FUND PERFORMANCE

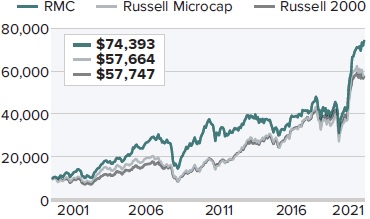

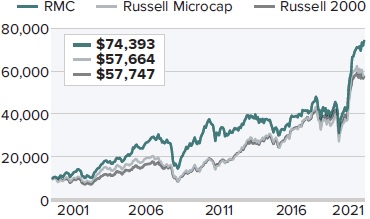

Royce Micro-Cap Fund gained 31.0% in 2021, beating both the Russell Microcap Index (+19.3%), its primary benchmark, and the Russell 2000 (+14.8%) for the same period. The Fund also outperformed both indexes for the 3- and 5-year periods ended 12/31/21. In addition, the Fund outpaced the Russell 2000 for the 25- year and identical 30-year and since inception periods ended 12/31/21. We are very pleased to have celebrated the Fund’s 30th anniversary at the end of 2021.

WHAT WORKED… AND WHAT DIDN’T

All 10 equity sectors in which the Fund held investments made positive contributions to performance for the calendar year. Information Technology, Industrials, and Financials made the most sizable positive impacts while Consumer Staples, Real Estate, and Communication Services made the smallest positive contributions. At the industry level, semiconductors & semiconductor equipment (Information Technology), specialty retail (Consumer Discretionary), and professional services (Industrials) contributed most in 2021 while auto components (Consumer Discretionary), electronic equipment, instruments & components (Information Technology), and electrical equipment (Industrials) were the largest detractors.

At the position level, the Fund gained most from Aehr Test Systems, a worldwide supplier of systems for testing and burning-in logic, memory, photonic, power devices, and SiC (silicon carbide) wafers. The company is beginning to see significant traction in applications such as electric vehicles, where the cost of semiconductor failure is extremely high. While we have trimmed shares given its significant price appreciation, we maintained a meaningful position at year-end as we believe we are at the early stages of adoption in many of the company’s key end markets. Aspen Aerogels was the Fund’s next top contributor. Aspen sells proprietary insulation materials to the energy market—which rebounded in 2021—and to developing markets, including electric vehicles. The company secured the necessary financing to double its production capacity over the next several years in 2021, allowing it to meet its growing demand. In addition, it has several exciting new product applications in the research and development phase that hold potential growth opportunities. We continue to hold a large position as we believe electric vehicles are a significant long-term growth opportunity. B. Riley Financial, a capital markets firm that boasts operations spanning from investment banking to retailer bankruptcy liquidations, was the third top contributing position in 2021 as it continued to benefit from market share gains in its brokerage business.

| | | | | |

| | Top Contributors to Performance | | Top Detractors from Performance | |

| | For 2021 (%)1 | | | For 2021 (%)2 | |

| | | | | | |

| | Aehr Test Systems | 2.41 | | Motorsport Games Cl A | -0.66 | |

| | Aspen Aerogels | 1.33 | | American Superconductor | -0.48 | |

| | B Riley Financial | 1.27 | | Profound Medical | -0.40 | |

| | Transcat | 1.21 | | CIRCOR International | -0.36 | |

| | Citi Trends | 1.11 | | Stoneridge | -0.33 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

Conversely, Motorsport Games, which develops gaming software, detracted most for the calendar year. Unfortunately, a NASCAR-themed game that was its first software release following its IPO, had technical glitches that resulted in lower-than-expected sales. We have been selling our position as we wait for more clarity as to whether this game’s failed launch has permanently damaged the company’s game development reputation. American Superconductor is an energy technologies company specializing in the design and manufacture of power systems and superconducting wire. As a smaller company dealing with state and local governments, utilities, and the U.S Navy, order flows and revenue generation tend to be unpredictable. After a strong year in 2020, new flows were less robust in 2021, resulting in the shares declining. We have been adding to our position as we view the company’s technology as vibrant and critical to improving electric grids and believe that as business opportunities gain scale, the company’s results will become less volatile. Profound Medical develops and commercializes technology for the treatment of localized prostate cancer and was impacted by limitations to sell its product given COVID restrictions in many hospitals.

The portfolio’s advantage over the Russell Microcap came primarily from stock selection in 2021, though sector allocation also helped. Our substantially lower exposure and stock picks in Health Care gave the Fund its biggest advantage, followed by savvy stock selection in Information Technology and Industrials. Conversely, ineffective stock picks and our lower exposure to Consumer Discretionary caused a drag on relative results for the calendar year while Financials and Real Estate detracted because of our lower weightings, though stock selection also hurt in the latter sector.

CURRENT POSITIONING AND OUTLOOK

Micro-cap stocks began the year with very strong returns before struggling through the second half of 2021. This has created considerable long-term prospects in many sectors, such as in technology, where supply chain consolidation has allowed certain micro-cap names to secure greater market share in a growing, high-demand industry. We have added on the margin to companies involved in energy and banks, where we remain underweight. This former group is mostly on the services side, with some holdings categorized in Industrials. In addition, we believe the long-term prospects and current valuations for value micro-caps look especially attractive to us. We think there is pent-up demand for autos and other consumer areas. With the global economy looking sound—especially once supply chain issues are resolved and COVID becomes more manageable—we are optimistic about the current environment, in particular for disciplined stock pickers with a long-term investment horizon like ourselves.

14 | The Royce Funds 2021 Annual Report to Shareholders

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | | TICKER SYMBOLS RYOTX RMCFX RYMCX |

Performance and Expenses

Average Annual Total Return (%) Through 12/31/21

| | JUL-DEC 20211 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | SINCE INCEPTION (12/31/91) |

| RCS | 4.58 | 31.02 | 25.49 | 13.67 | 9.48 | 7.06 | 9.19 | 10.24 | 11.48 |

| Annual Gross Operating Expenses: 1.29% Annual Net Operating Expenses: 1.24% |

1 Not annualized

Morningstar Style Map™ As of 12/31/21

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 86 for additional information.

Value of $10,000

Invested on 6/30/00 (Russell Microcap Index Inception) as of 12/31/21 ($)

Top 10 Positions

% of Net Assets

| Photronics | 1.2 |

| Citi Trends | 1.2 |

| B Riley Financial | 1.2 |

| Axcelis Technologies | 1.2 |

| Ultra Clean Holdings | 1.1 |

| Digi International | 1.1 |

| MeiraGTx Holdings | 1.1 |

| Haynes International | 1.1 |

| PDF Solutions | 1.1 |

| Camtek | 1.1 |

Portfolio Sector Breakdown

% of Net Assets

| | |

| Information Technology | 25.4 |

| Industrials | 23.4 |

| Financials | 12.6 |

| Health Care | 12.2 |

| Consumer Discretionary | 12.0 |

| Communication Services | 4.5 |

| Materials | 3.5 |

| Energy | 2.6 |

| Real Estate | 0.4 |

| Cash and Cash Equivalents | 3.4 |

Calendar Year Total Returns (%)

| YEAR | | RMC |

| 2021 | | 31.0 |

| 2020 | | 24.5 |

| 2019 | | 21.2 |

| 2018 | | -8.9 |

| 2017 | | 5.4 |

| 2016 | | 19.7 |

| 2015 | | -13.3 |

| 2014 | | -4.1 |

| 2013 | | 21.3 |

| 2012 | | 8.0 |

| 2011 | | -12.1 |

| 2010 | | 30.1 |

| 2009 | | 55.7 |

| 2008 | | -40.9 |

| 2007 | | 7.1 |

Upside/Downside Capture Ratios

Periods Ended 12/31/21 (%)

| | | UPSIDE | | DOWNSIDE |

| 10-Year | | 77 | | 87 |

| From 6/30/00 (Russell Microcap Index Inception) | | 91 | | 80 |

Portfolio Diagnostics

| Fund Net Assets | | $422 million |

| Number of Holdings | | 133 |

| Turnover Rate | | 26% |

| Average Market Capitalization 1 | | $644 million |

| Weighted Average P/B Ratio 2 | | 2.2x |

| Active Share 3 | | 91% |

| U S Investments (% of Net Assets) | | 85.3% |

| Non-U.S Investments (% of Net Assets) | | 11.3% |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information