UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: | | 811-03623 |

| |

Exact name of registrant as specified in charter: | | The Prudential Series Fund |

| |

Address of principal executive offices: | | Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

Name and address of agent for service: | | Deborah A. Docs Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

Date of fiscal year end: | | 12/31/2013 |

| |

Date of reporting period: | | 12/31/2013 |

Item 1 – Reports to Stockholders

THE PRUDENTIAL SERIES FUND

ANNUAL REPORT Ÿ DECEMBER 31, 2013

This report is one of several that provides financial information about certain investment choices available under the variable annuity or variable life insurance contract you own. Based on the variable contract you own or the portfolios you invested in, you may receive additional reports that provide financial information on those investment choices. Please refer to your variable annuity or variable life insurance contract prospectus to determine which portfolios are available to you.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Please note that this document may include prospectus supplements that are separate from and not a part of this report. Please refer to your variable annuity or variable life insurance contract prospectus to determine which supplements are applicable to you.

For information regarding enrollment in the e-Delivery program, please see the inside front cover of this report.

|

Conservative Balanced Portfolio |

Diversified Bond Portfolio |

Equity Portfolio |

Flexible Managed Portfolio |

Global Portfolio |

Government Income Portfolio |

High Yield Bond Portfolio |

Jennison Portfolio |

Money Market Portfolio |

Natural Resources Portfolio |

Small Capitalization Stock Portfolio |

Stock Index Portfolio |

Value Portfolio |

For information about enrolling in e-Delivery, please refer to the instructions below. Thank you.

Individual Annuity Contract Owners - To receive your reports online, go to www.annuities.prudential.com/investor/edelivery, or scan the code below.

Individual Life Insurance Contract Owners - To receive your reports online, go to www.prudential.com/edelivery, or scan the code below.

Group Variable Universal Life Contract Owners - To receive your reports online, go to www.prudential.com/gulgvul, or scan the code below.

| | | | |

The Prudential Series Fund Table of Contents | | Annual Report | | December 31, 2013 |

| n | | LETTER TO CONTRACT OWNERS |

| n | | PRESENTATION OF PORTFOLIO HOLDINGS |

| n | | FEES AND EXPENSES TABLE |

| | | | |

| Section A | | Schedule of Investments and Financial Statements |

| | |

| | | Conservative Balanced Portfolio | | A1 |

| | | Diversified Bond Portfolio | | A31 |

| | | Equity Portfolio | | A61 |

| | | Flexible Managed Portfolio | | A65 |

| | | Global Portfolio | | A93 |

| | | Government Income Portfolio | | A100 |

| | | High Yield Bond Portfolio | | A108 |

| | | Jennison Portfolio | | A128 |

| | | Money Market Portfolio | | A132 |

| | | Natural Resources Portfolio | | A137 |

| | | Small Capitalization Stock Portfolio | | A142 |

| | | Stock Index Portfolio | | A153 |

| | | Value Portfolio | | A163 |

| | |

| Section B | | Notes to Financial Statements | | |

| Section C | | Financial Highlights | | |

| Section D | | Report of Independent Registered Public Accounting Firm | | |

| Section E | | Information about Trustees and Officers | | |

This report may include financial information pertaining to certain portfolios that are not available through the variable life insurance policy or variable annuity contract that you have chosen. Please refer to your variable life insurance or variable annuity prospectus to determine which portfolios are available to you.

| | | | |

The Prudential Series Fund Letter to Contract Owners | | Annual Report | | December 31, 2013 |

At Prudential, our primary objective is to help investors achieve and maintain long-term financial success. This Prudential Series Fund annual report outlines our efforts to achieve this goal. We hope you find it informative and useful.

Prudential has been building on a heritage of success for more than 135 years. The quality of our businesses and risk diversification has enabled us to manage effectively through volatile markets over time. We believe the array of our products provides a highly attractive value proposition to clients like you who are focused on financial security.

Your financial professional is the best resource to help you make the most informed investment decisions. Together, you can build a diversified investment portfolio that aligns with your long-term financial goals. Please keep in mind that diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

Thank you for selecting Prudential as one of your financial partners. We value your trust and appreciate the opportunity to help you achieve financial security.

Sincerely,

Robert F. O’Donnell

President,

The Prudential Series Fund | January 31, 2014 |

| | |

The Prudential Series Fund, Conservative Balanced Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 16.15 | % | | | 12.63 | % | | | 6.43 | % |

Blended Index | | | 14.31 | | | | 10.88 | | | | 5.95 | |

S&P 500 Index | �� | | 32.37 | | | | 17.93 | | | | 7.40 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

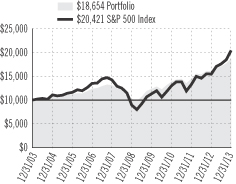

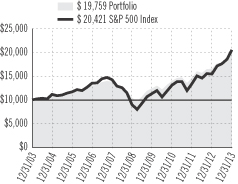

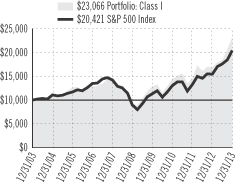

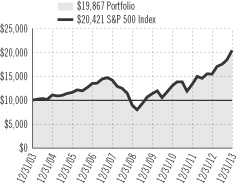

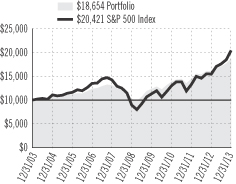

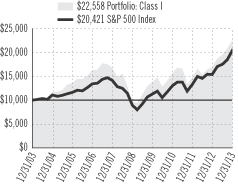

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2013, the Conservative Balanced Portfolio returned 16.15%.

The Portfolio is subadvised by Prudential Investment Management Inc. and Quantitative Management Associates LLC. The Portfolio’s investment objective is total investment return consistent with a conservatively managed diversified portfolio.

Historically strong equity market gains drove the Portfolio’s gain, despite a weak year for fixed income markets. The Portfolio topped its benchmark due to the tactical asset allocation decision to overweight stocks all year combined with solid active returns in equities and fixed income. In addition, cutting bond allocations and adding to cash helped returns in the second half of 2013 as bond yields rose, prices fell, and bonds slipped to negative returns.

Despite repeated calls by some for a correction in equity prices throughout 2013, as well as periodic chaos in Washington, the S&P 500 went nearly straight up in 2013, providing a total return over 30% without a single 5% pullback. Evidence mounted through the year that the U.S. economy was finally gaining some traction and breaking out of its weak 2% average annual Gross Domestic Product (GDP) growth pattern that had prevailed since 2009. By the third quarter, a reduced fiscal drag, recovery in housing, autos and other consumer goods, a highly stimulative Federal Reserve policy, contributions from a revived U.S. energy sector, and inventory accumulation resulted in a strong 4.1% GDP growth. Although there is no guarantee that growth will continue at this robust pace, consensus expectations have been rising closer to the 3%-plus average of the post-war period after wallowing for years at 2% or worse.

Equity returns were driven by rising Price-Earnings (P/E) multiples in 2013, since market returns were far above the more modest 6% earnings growth rate. Investors cannot count on multiples increasing indefinitely, but today’s levels are roughly in line with historical averages, and well below levels that led to bear markets. Returns in 2014 and over the next few years are more likely to come from sales and earnings growth rather than the rocket fuel of higher P/E ratios. But if the economy continues to recover and drive growth, returns in the vicinity of the historical average of around 10% may not be unreasonable.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Blended Index consists of S&P 500 Index (50%), Barclays U.S. Aggregate Bond Index (40%), an unmanaged index comprised of more than 5,000 government and corporate bonds, and 3-Month T-Bill Index (10%), an unmanaged market value-weighted index of investment grade fixed rate public obligations of the U.S. Treasury with maturities of three months, excluding zero coupon strips. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

Prudential Investment Management, Inc., and Quantitative Management Associates LLC are registered investment advisers and Prudential Financial companies.

| | |

| The Prudential Series Fund, Diversified Bond Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | -0.71 | % | | | 9.50 | % | | | 6.28 | % |

Barclays U.S. Aggregate Bond Index | | | -2.02 | | | | 4.44 | | | | 4.55 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2013, the Diversified Bond Portfolio declined by 0.71%.

The Portfolio is subadvised by Prudential Investment Management, Inc. The Portfolio’s investment objective is a high level of income over a longer term while providing reasonable safety of capital.

For the most part, the fixed-income markets were a challenging place to be in 2013, particularly the most rate-sensitive sectors. U.S. Treasury yields began a steep ascent in mid-May, after the Federal Reserve (Fed) indicated that it could begin to scale back its massive quantitative easing (QE) program later in the year, if warranted by the economic data. The rise in yields was briefly interrupted in September, after the Fed surprised the markets by postponing action on QE. However, improving economic data brought consideration of tapering QE back to the front burner late in the year, and the Fed finally pulled the trigger in December, announcing a $10 billion-per-month reduction of its bond-buying campaign. Consequently, Treasury yields finished the year near their highs, and government bond prices struggled, especially those with longer maturities. The yield of the bellwether 10-year Treasury note ended the year at 3.14%, versus just 1.78% on the final day of 2012. However, other fixed-income sectors, such as high-yield corporate bonds, short-term investment-grade corporates, and bank loans, finished the year with positive returns.

The Portfolio outperformed its benchmark, the Barclays Capital U.S. Aggregate Bond Index (the Index), which declined by 2.02%. Security selection was the largest contributor to performance, adding value in all but the second quarter. The most notable successes here were in subprime non-agency mortgage backed securities (MBS), high-yield and investment-grade corporates, and emerging markets (EM) bonds.

Sector allocation was also a contributor to performance. The fund benefited from positions in a number of non-benchmark sectors — most notably, high-yield bonds and bank loans, both of which delivered positive returns — and from an underweighting in U.S. Treasury securities. An allocation to EM debt detracted from performance for the year overall, although a stronger second half of the year partially offset losses in the first half for this group.

Non-dollar exposure detracted from performance results for the full year, most notably from January through early July, when there was a strong rally in the U.S. dollar. Subsequently, the dollar reversed its strengthening trend due to the postponement of the anticipated QE taper and expectations of successful budget and debt ceiling negotiations around the end of the third quarter.

Duration and curve positioning detracted from performance. The Portfolio’s longer-duration bias had a negative impact for much of the May through August period, when rates climbed steadily, but contributed in September and October, after the Fed made its no-taper call, and was a positive contributor for the third quarter as a whole.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of more than 5,000 government and corporate bonds. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

| The Prudential Series Fund, Equity Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio: Class I | | | 33.53 | % | | | 17.77 | % | | | 7.77 | % |

Portfolio: Class II | | | 32.99 | | | | 17.30 | | | | 7.34 | |

Russell 1000® Index | | | 33.11 | | | | 18.59 | | | | 7.78 | |

S&P 500 Index | | | 32.37 | | | | 17.93 | | | | 7.40 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

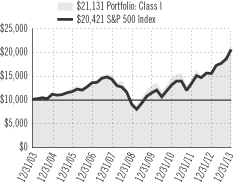

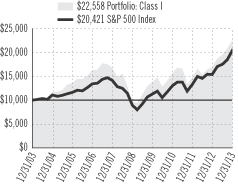

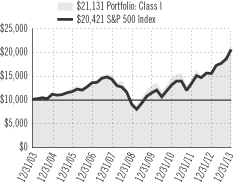

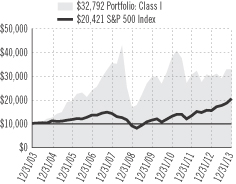

$10,000 INVESTED OVER 10 YEARS1

The Russell 1000® Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company.

For the year ended December 31, 2013, the Equity Portfolio Class I shares returned 33.53% and Class II shares returned 32.99%.

The Portfolio’s investment objective is long-term growth of capital. It is subadvised by Jennison Associates LLC (Jennison).

The U.S. equity markets, as measured by the broad market indexes, realized substantial gains for the year. The S&P 500 Index (the “Index”) rose 32.37%, with double-digit gains in all sectors. Consumer discretionary, healthcare, and industrials had the strongest returns; those in telecommunication services and utilities were more modest. The Portfolio performed in line with the Index.

Stock selection in information technology, financials, and industrials and an overweight position in consumer discretionary contributed most to relative returns. LinkedIn, Mastercard, Google, and Microsoft were key contributors in information technology. Morgan Stanley and MetLife led contributors in financials while Boeing led in industrials. LinkedIn is a leading global online professional network that provides what Jennison considers unique access to a large database of active and passive job candidates. Adjacent growth opportunities in marketing services and professional publishing are added potential drivers in early phases of development. MasterCard, the No. 2 payment system in the U.S., is likely to continue to benefit from the long-term shift from cash to electronic credit/debit transactions.

During the period, Morgan Stanley continued to make progress on several fronts; it announced an unexpected share buyback, anticipates being compliant with the Basel III supplementary leverage ratios by 2015, enjoyed steady growth in its wealth management division, and reported that it is on track to achieve expense reduction targets. Boeing reported several strong successive quarters, putting behind it a rocky start to the year as a result of 787 battery problems. Margins have been particularly strong as a result of higher production rates in high margin legacy programs and lower than expected research and development costs. Costs of 787 production also have continued to decline and free cash flow has consistently exceeded expectations.

Individual stock selection in materials and consumer discretionary was most detrimental to relative performance. An underweight in industrials and an overweight in energy also detracted. In materials, the gold-mining companies Kinross Gold and Goldcorp were the source of weakness, due largely to declining gold prices. Those mining companies that can get their costs under control now — and Jennison believes Goldcorp has demonstrated that it is able to — will most likely benefit from significant operating leverage when gold prices finally rise again.

JCPenney was the key detractor in consumer discretionary. JCPenney has been in the midst of a turnaround and began to show signs that it had reached a turning point late in the period, in Jennison’s view. Shares probably declined on profit taking as positive indicators accumulated.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

Russell 1000® Index is an unmanaged market cap-weighted index that measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

Jennison Associates LLC is a registered investment adviser and a Prudential Financial company.

| | |

| The Prudential Series Fund, Flexible Managed Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 20.15 | % | | | 13.82 | % | | | 7.05 | % |

Blended Index | | | 17.67 | | | | 12.46 | | | | 6.38 | |

S&P 500 Index | | | 32.37 | | | | 17.93 | | | | 7.40 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

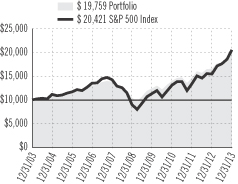

$10,000 INVESTED OVER 10 YEARS

For the year ending December 31, 2013, the Flexible Managed Portfolio returned a 20.15%.

The Portfolio is subadvised by Prudential Investment Management Inc. and Quantitative Management Associates LLC. The Portfolio’s investment objective is total investment return consistent with an aggressively managed diversified portfolio.

Historically strong equity market gains drove the Portfolio’s gain, despite a weak year for fixed income markets. The Portfolio topped its benchmark with the tactical asset allocation decision to overweight stocks all year combining with solid active returns in equities and fixed income to deliver value-added to the portfolio. In addition, cutting bond allocations and adding to cash helped returns in the second half of 2013 as bond yields rose, prices fell, and bonds slipped to negative returns.

Despite repeated calls by some in the media for a correction in equity prices throughout 2013 and despite periodic chaos in Washington, the S&P 500 went nearly straight up in 2013, providing a total return over 30% without even one 5% pullback. The evidence mounted throughout the year that the U.S. economy was finally gaining some traction and breaking out of its weak, 2% average annual GDP growth pattern that prevailed since 2009. By Q3, a reduced fiscal drag, recovery in housing, autos and other consumer goods, a highly stimulative Federal Reserve policy, contributions from a revived U.S. energy sector and inventory accumulation resulted in a strong 4.1% GDP growth. Although there is no guarantee that growth will continue at this robust pace, consensus expectations have been rising closer to the 3%+ average of the post-war period after wallowing for years at 2% or worse.

Equity returns were driven by rising Price-Earnings (P/E) multiples in 2013, since market returns were far above the more modest 6% earnings growth rate. Investors cannot count on multiples increasing indefinitely, but today’s levels are roughly in line with historical averages, and well below levels that led to bear markets. Returns in 2014 and over the next few years are more likely to come from sales and earnings growth rather than the rocket fuel of higher P/E ratios. But if the economy continues to recover and drive growth, returns in the vicinity of the historical average of around 10% are not unreasonable.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Blended Index consists of S&P 500 Index (60%), Barclays U.S. Aggregate Bond Index (35%), an unmanaged index comprised of more than 5,000 government and corporate bonds, and 3-Month T-Bill Index (5%), an unmanaged market value-weighted index of investment grade fixed rate public obligations of the U.S. Treasury with maturities of three months, excluding zero coupon strips. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

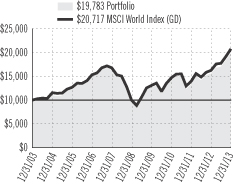

| The Prudential Series Fund, Global Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 27.29 | % | | | 15.57 | % | | | 7.06 | % |

MSCI World Index (GD) | | | 27.37 | | | | 15.68 | | | | 7.56 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

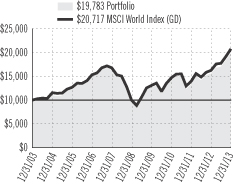

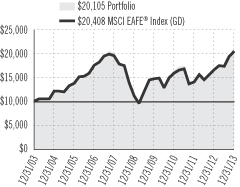

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2013, the Global Portfolio rose 27.29%.

The Portfolio seeks long-term growth of capital by investing in stocks, with about half of its assets invested in companies in the United States and half in companies located abroad. The Portfolio is co-managed by five subadvisers: Brown Advisory (Brown), LLC, (U.S. growth stocks), T. Rowe Price Associates, Inc. (U.S. value stocks), William Blair & Company LLC (international growth stocks), LSV Asset Management (international value stocks), and Quantitative Management Associates LLC. Brown replaced Marsico Capital Management, LLC early in 2013.

The MSCI World Index (GD) (the Index) rose 27.37%. Over the course of the year, investors came to realize that the economies of developed countries were in a sustained, albeit slow, recovery and that of these the United States was growing most rapidly. Nonetheless, the U.S. Federal Reserve was not going to allow interest rates to rise sharply and choke off the recovery. This set the stage for very strong domestic stock markets and sound international markets. The broad U.S. stock market, represented by the Russell 3000 Index, returned 33.55%, while the MSCI EAFE Index of other developed countries was about 10 percentage points lower, still a very good return.

The LSV International Value segment was the top contributor to the Portfolio’s performance relative to the Index due to strong stock selection in the financials, materials, and energy sectors. The Portfolio was also helped by an overweight in France compared with the Index, but hurt by an underweight in Japan, both of which had above-average returns for the international developed country markets.

The international growth segment of the Portfolio, managed by William Blair & Company, underperformed its target, primarily because of poor stock selection in the healthcare, consumer staples, and energy sectors. This was partially offset by good stock selection within the technology and consumer discretionary sectors.

None of the four subadvisers use derivative instruments as a principal investment strategy. The types of derivatives employed most often are stock futures contracts (to help manage cash flows in the Portfolio) and currency forwards and futures contracts (to hedge a portion of the Portfolio’s currency exposure).

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

MSCI World Index (GD) - The Morgan Stanley Capital International World Index is an unmanaged capitalization weighted index which includes the equity markets of Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Malaysia, Netherlands, New Zealand, Norway, Singapore, Spain, Sweden, Switzerland, United Kingdom, and United States. The GD version does not reflect the impact of withholding taxes on reinvested dividends. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

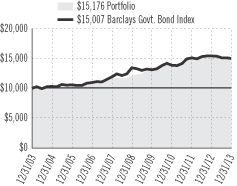

| The Prudential Series Fund, Government Income Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | -2.34 | % | | | 4.65 | % | | | 4.26 | % |

Barclays Government Bond Index | | | -2.60 | | | | 2.26 | | | | 4.14 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

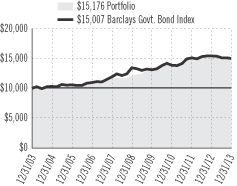

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2013, the Government Income Portfolio returned -2.34%.

The Portfolio is subadvised by Prudential Investment Management, Inc., and its investment objective is a high level of income over the long term consistent with the preservation of capital.

U.S. Treasury yields began a steep ascent in mid-May, after the Federal Reserve (Fed) indicated that it could begin to scale back its massive quantitative easing (QE) program later in the year, if warranted by the economic data. The rise in yields was briefly interrupted in September, after the Fed surprised the markets by postponing action on QE. However, improving economic data brought consideration of tapering QE back to the front burner late in the year, and the Fed finally pulled the trigger in December, announcing a $10 billion-per-month reduction of its bond-buying campaign. Consequently, Treasury yields finished the year near their highs, and government bond prices struggled, especially those with longer maturities. The yield of the bellwether 10-year Treasury note ended the year at 3.14%, versus just 1.78% on the final day of 2012.

The Portfolio outperformed its benchmark, the Barclays Capital Government Bond Index (the Index). Sector allocation was the primary driver of performance. U.S. Treasuries were outperformed by most other high-quality fixed-income sectors, including commercial mortgage-backed securities (CMBS) and agency mortgages. Consequently, the Portfolio’s overweights in these high-quality sectors and its underweighting in Treasuries contributed to performance versus the index.

Security selection also contributed to performance, most notably within mortgage-backed securities. The Portfolio was overweight in CMBS and agency mortgages. Investment grade corporate bonds were an out-of-benchmark position.

The Portfolio’s exposure to the Prudential Core Short-Term Bond Fund was a key contributor to performance, as this Fund’s net asset value rose throughout much of the year.

These positive factors were modestly offset by security selection within the CMBS and MBS sectors, as the Portfolio had a higher-quality bias at a time when securities of lower credit quality performed best.

Tactical duration strategies and yield curve positioning that were partially implemented via interest rate swaps (derivatives) modestly benefited performance. (Duration measures the approximate price change of a bond portfolio for a given change in interest rates.)

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Barclays Government Bond Index is a weighted unmanaged index comprised of securities issued or backed by the U.S. Government, its agencies, and instrumentalities with a remaining maturity of one to 30 years. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

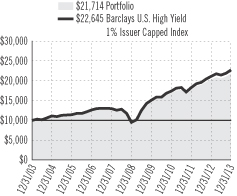

| The Prudential Series Fund, High Yield Bond Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 7.26 | % | | | 16.70 | % | | | 8.06 | % |

Barclays U.S. High Yield 1% Issuer Capped Index | | | 7.48 | | | | 18.99 | | | | 8.52 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

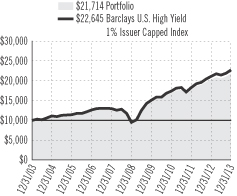

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2013, the High Yield Bond Portfolio returned 7.26%.

The Portfolio is subadvised by Prudential Investment Management, Inc., and its investment objective is high total return.

High-yield bonds were a bright spot on the U.S. and European fixed-income landscape in 2013. In the U.S., Treasury yields began a steep ascent in mid-May, after the Federal Reserve (Fed) indicated that it could begin to scale back its massive quantitative easing program later in the year — a forecast the Fed followed through on in December. European sovereign yields increased around the same time. As a result of rising rates, government bond prices struggled during the year both in the U.S. and Europe. However, high-yield bonds are less affected by movements in interest rates and are more sensitive to corporate profits and credit default conditions. Both of these factors remained generally supportive during the year. Additionally, high-yield bond prices frequently move in tandem with stocks, which enjoyed sizable gains in Europe and especially the U.S. Consequently, many high-yield bond benchmarks closed the year near their highs.

The U.S. economic recovery continued to make progress, albeit at a pace that fell considerably short of most previous recoveries. Meanwhile, the euro zone officially emerged from its lengthy recession in the second quarter of 2013, although data showed the economies of core nations Germany and France faltering again in the third quarter. Perhaps in response to this disappointing news, the European Central Bank implemented a surprise cut in short-term interest rates in November, which helped keep equity and high-yield bond prices on an upward trajectory.

During 2013, issuance of high-yield bonds continued at a record pace in Europe, where many companies found the market an attractive source of financing amid continued retrenching by the region’s banks. In the U.S., issuance of junk bonds was robust but fell short of the record set in 2012.

The Portfolio underperformed its benchmark, the Barclays U.S. High Yield 1% Issuer Capped Index (the Index), which returned 7.48%. An emphasis on higher quality and shorter duration relative to the Index helped the Portfolio, as longer-duration bonds underperformed in an environment of sharply higher interest rates.

The Portfolio was aided by both sector allocation and security selection. In the former category, overweighted exposure to information technology and food retailers helped, as did an underweighting in pipelines. Conversely, underweightings in insurance and consumer retailing detracted somewhat, along with an overweighting in electric utilities.

Looking at security selection, our picks in technology and gaming were strong contributors, somewhat offset by positioning in the energy and media/entertainment groups.

The Portfolio makes use of derivatives, including credit default swaps, to increase or hedge exposure to individual issuers and the broader market. Use of the CDX, a credit default swap index, provided market exposure during periods of lower liquidity, partially offsetting the drag from cash. Cash held for liquidity purposes in short-term, low-rate securities created a drag on performance during the strong rally.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Barclays U.S. High Yield 1% Issuer Capped Index is an unmanaged index that covers the universe of U.S. dollar denominated, non-convertible, fixed-rate, non-investment-grade debt. Issuers are capped at 1% of the Index. Index holdings must have at least one year to final maturity, at least $150 million par amount outstanding, and be publicly issued with a rating of Ba1 or lower. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

| The Prudential Series Fund, Jennison Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

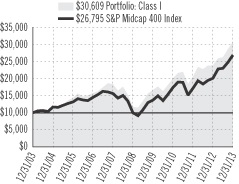

Portfolio: Class I | | | 37.66 | % | | | 20.76 | % | | | 8.72 | % |

Portfolio: Class II | | | 37.11 | | | | 20.30 | | | | 8.28 | |

Russell 1000® Growth Index | | | 33.48 | | | | 20.39 | | | | 7.83 | |

S&P 500 Index | | | 32.37 | | | | 17.93 | | | | 7.40 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

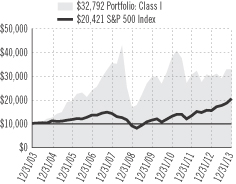

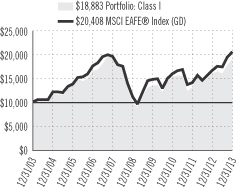

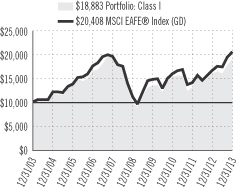

$10,000 INVESTED OVER 10 YEARS1

The Russell 1000® Growth Index is a trademark/service of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company.

For the year ended December 31, 2013, the Jennison Portfolio Class I shares returned 37.66% and Class II shares returned 37.11%.

The investment objective of the Portfolio is long-term growth of capital. The Portfolio is built from the bottom up, with stocks selected one at a time, based on fundamental analysis of individual companies. The Portfolio is subadvised by Jennison Associates LLC (Jennison).

Consumer discretionary positions, which hold a major weight in the Portfolio, were strong contributors to return as both an overweight and stock selection were beneficial. Amazon.com accelerated its business investment to drive robust longer-term growth not only in its core retail business but through the proliferation of digital commerce via the mobile market. Substantial revenue growth reflected its efforts. Gross bookings growth increased at online travel company Priceline.com, which Jennison believes is poised to benefit from the long-term shift to online travel spending.

Healthcare holdings, in particular biopharmaceutical companies, which held a meaningful weight in the Portfolio, were strong contributors to return. The Food and Drug Administration (FDA) approved Biogen Idec’s Tecfidera for multiple sclerosis. Jennison believes the drug’s ease of use could support broad adoption and potential market leadership. Tecfidera may also eventually treat other neurodegenerative diseases such as ALS and Parkinson’s. The FDA also approved Gilead Sciences’ Sovaldi for the treatment of hepatitis C. Sovaldi could shorten treatment duration, and trial data indicate that it is significantly more effective than current regimens. Gilead’s oncology pipeline also looks promising.

Stock selection was beneficial in information technology. MasterCard’s strong revenue and earnings were driven by strong growth in global dollar volume and processed transactions. Jennison expects MasterCard to continue to benefit from the long-term shift from cash to electronic credit/debit transactions. Google performed well, reflecting its competitive position, strong advertising revenue, and YouTube income-generating opportunities. LinkedIn’s revenue and earnings exceeded consensus expectations significantly. The company is a leading global online professional network that provides what Jennison considers unique access to a scale database of active and passive job candidates. Adjacent growth opportunities in marketing services and professional publishing are added potential drivers in early phases of development. Facebook, whose ad revenue advanced strongly, was driven by gains in mobile. Jennison views Facebook as the world’s preeminent Internet-based social network with a dominance Jennison believes no rival can easily match and a network effect that creates formidable barriers to entry.

Other technology holdings detracted from performance. Rackspace Hosting’s difficulties were largely related to changes in its sales force structure and concerns that its business is being commoditized. Rackspace provides Web and cloud-hosting services to more than 180,000 enterprise customers. VMware was hurt by uncertainty about the timing and pace of new product revenue acceleration. Jennison eliminated the Portfolio’s position in Rackspace.

In industrials, Boeing reported strong earnings-per-share (EPS), revenue, cash flow, and margins. Of particular note, the profitability of the company’s 787 Dreamliner improved, due to an accelerated production rate.

Portfolio holdings in energy and materials posted solid double-digit returns but lagged the returns of the benchmark sectors.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

Russell 1000 Growth Index is an unmanaged market cap-weighted index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

Jennison Associates LLC is a registered investment adviser and a Prudential Financial company.

| | |

| The Prudential Series Fund, Money Market Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns | | 7-Day*

Current

Net Yield | | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 0.00 | % | | | 0.00 | % | | | 0.09 | % | | | 1.67 | % |

Lipper (VIP) Money Market Funds Avg. | | | N/A | | | | -0.03 | | | | 0.02 | | | | 1.51 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

The yield quotation more closely reflects the current earnings of the Portfolio than the total return quotation. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

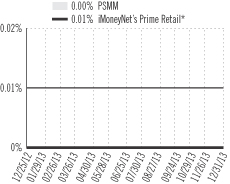

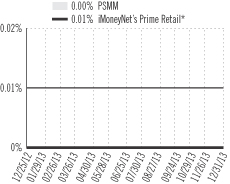

7-DAY CURRENT NET YIELD*

For the year ended December 31, 2013, the Money Market Portfolio returned 0.00%.

The Portfolio is subadvised by Prudential Investment Management, Inc. The investment objective is to seek maximum current income consistent with the stability of capital and maintenance of liquidity.

The seven-day current yield and total return of the Portfolio remained near zero during the period. Throughout the year, the yields on all money market funds in the United States stayed at historically low levels, as the Federal Reserve (Fed) maintained its efforts to keep rates low in hopes of fueling economic growth. In mid-spring, comments by Fed Chairman Ben Bernanke suggesting the Fed might begin winding down its bond-buying program sooner rather than later, drove longer term rates higher. Overall, the markets remained volatile in anticipation of Fed tapering and in response to fiscal gridlock in Washington, D.C., which emerged early in the fourth quarter.

During the reporting period, the three-month LIBOR (the interest rate at which banks borrow funds from other banks) declined from 0.30% to 0.25% as it was evident that global efforts to support the banking system would continue. The Federal Funds effective rate ended the year at 0.07%.

On average, the Portfolio’s weighted average maturity was well within its permitted limits as a flat yield curve and scarce supply provided few investment opportunities. Corporations took advantage of low interest rates to issue debt with maturities of longer than one year. At the same time, demand was strong for a limited number of shorter-term issues. As corporate spreads (the difference in yield between corporate bonds and government bonds of similar maturities) narrowed, the Portfolio focused on increasing its exposure to government securities. In the latter part of the year, fiscal policy antics in Washington, D.C. disrupted the short end of the U.S. treasury market. U.S. treasuries maturing in October and November rose in yield, as investors avoided holding any security likely to defer payment, temporarily creating a buying opportunity for the Portfolio.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| * | Source: iMoneyNet, Inc. based on 270 funds in the iMoneyNet Prime Retail universe. Weekly 7-day current net yields of the Money Market Portfolio and the iMoneyNet Prime Retail universe as of 12/31/2013. |

The Lipper Variable Insurance Products (VIP) Funds Average is calculated by Lipper Analytical Services, Inc., and reflects the investment return of certain portfolios underlying variable life and annuity products. These returns are net of investment fees and fund expenses, but not product charges. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index or average. For a complete list of holdings, refer to the Schedule of Investments section of this report.

An investment in the Money Market Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Portfolio seeks to preserve the value of your investment at $10.00 per share, it is possible to lose money by investing in the Portfolio.

| | |

| The Prudential Series Fund, Natural Resources Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Portfolio: Class I | | | 10.23 | % | | | 14.56 | % | | | 12.61 | % | | | N/A | |

Portfolio: Class II | | | 9.76 | | | | 14.09 | | | | N/A | | | | 10.87 | % |

Lipper (VUF) Natural Resources Funds Index | | | 14.33 | | | | 13.33 | | | | 9.64 | | | | 9.21 | |

S&P 500 Index | | | 32.37 | | | | 17.93 | | | | 7.40 | | | | 7.81 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio (Class II) inception: 4/28/2005. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Unless noted otherwise, Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception (Class II). Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

$10,000 INVESTED OVER 10 YEARS1

For the year ended December 31, 2013, the Natural Resources Portfolio Class I shares gained 10.23% and Class II shares gained 9.76%.

The Portfolio’s subadviser is Jennison Associates LLC (Jennison). The Portfolio’s investment objective is long-term growth of capital.

U.S. equity markets posted strong gains in 2013: the broad market Russell 3000® Index rose 33.55%, while the S&P 500 Index advanced 32.37% for the year. All 10 sectors of the S&P index showed positive returns, with the most significant gains coming from financials and healthcare. The Natural Resources Portfolio posted a solid gain for the period, but underperformed the broad market indexes.

Ambiguity over the prospects for global economic growth, against a backdrop of continuing political tensions in the Middle East and Africa, heightened the level of uncertainty in the natural resources sector. Toward the end of the year, signs of strengthening economic activity, particularly in the U.S., helped to buoy the energy markets. However, precious metals prices continued to slide, with gold marking its first annual decline in 13 years.

Metals and mining names led Portfolio detractors for the year. Eldorado Gold declined with the price of gold bullion. Additionally, the company operates in challenging environments in Greece, Turkey, and China and has experienced slippage in some of the projects in its pipeline. Nevertheless, Jennison continues to like Eldorado’s geographic diversity and the quality of its assets.

Shares of London-based gold exploration and mining company Randgold Resources also fell along with the price of gold. Heightened sensitivity to rising political tensions in Africa weighed on performance. While Jennison continues to monitor these developments, it expects Randgold will continue to be successful in managing its operations through challenging environments as it has in the past. Silver Wheaton was another holding that lost ground amid declining precious metal prices. However, Jennison continues to like the company’s business model of purchasing silver by-product from non-silver mines at a fixed unit cost.

Energy companies dominated the year’s largest positive contributors, led by some of the Portfolio’s highest conviction holdings. Dril-Quip’s solid performance was driven by strong eastern hemisphere, revenue growth, specifically Asia Pacific, and continued improvements in operating margins. With persistent order backlog, robust cash flow, and good growth prospects, Jennison continues to like the company. Halliburton benefited from improving margins in North America and healthy performance in the eastern hemisphere. Jennison sees Halliburton as attractively valued and believes the company’s current programs focused on cost cutting and efficiency gains could amplify expected North American and international growth in the months ahead.

Shares of independent oil and gas E&P EOG Resources saw a particularly strong third quarter before pulling back a bit after mid-October. Given the depth of its portfolio, the health of its balance sheet, and its stepped-up cash flow, Jennison believes EOG has the potential to command a premium and outperform irrespective of oil and gas prices.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

The Lipper Variable Underlying Funds (VUF) Natural Resources Funds Index is calculated by Lipper Analytical Services, Inc. and consists of an equal dollar-weighted composite of the 10 largest funds in the Lipper VUF Natural Resources Fund classification. The index is rebalanced quarterly. Natural Resources Funds are deemed as funds that invest primarily in the equity securities of domestic and foreign companies engaged in natural resources. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns are net of investment fees and fund expenses, but not product charges. Investors cannot invest directly in a market index or average. For a complete list of holdings, refer to the Schedule of Investments section of this report.

Jennison Associates LLC is a registered investment adviser and a Prudential Financial company.

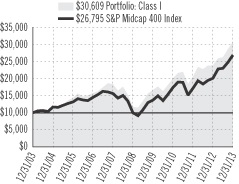

| | |

| The Prudential Series Fund, Small Capitalization Stock Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

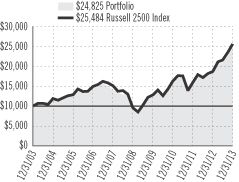

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 40.95 | % | | | 20.99 | % | | | 10.32 | % |

S&P SmallCap 600 Index | | | 41.31 | | | | 21.37 | | | | 10.65 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

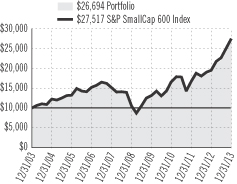

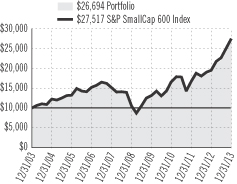

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2013, the Small Capitalization Stock Portfolio returned 40.95%.

The Portfolio is subadvised by Quantitative Management Associates LLC (QMA). The Portfolio’s investment objective is long-term growth of capital.

U.S. market performance was strong during 2013. Steady, albeit moderate, growth in the U.S. economy, positive news on the employment front, a more conciliatory environment in Washington regarding the budget, and a Federal Reserve that continues to be accommodative with only moderate tapering buoyed the market. In this type of environment, investors were willing to hold riskier assets in their portfolio in lieu of more defensive, stable, high quality assets. Cyclical sectors outperformed, as did lower quality stocks.

Potential tracking error differences, brokerage costs, as well as other costs and expenses of the Portfolio, may cause its return to be lower than that of the S&P SmallCap 600 Index. It underperformed the S&P 600 Index by a modest amount in 2013.

During the year, the Portfolio had a small exposure to derivative instruments to enhance its liquidity, but the position did not have a material impact on its performance.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

S&P SmallCap 600 Index is an unmanaged index representing the aggregate market value of the common equity of 600 small-company stocks. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

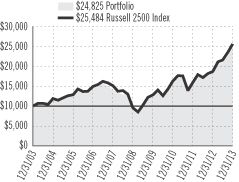

| The Prudential Series Fund, Stock Index Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

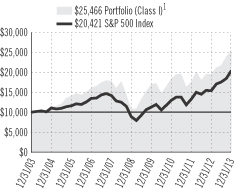

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 31.89 | % | | | 17.58 | % | | | 7.11 | % |

S&P 500 Index | | | 32.37 | | | | 17.93 | | | | 7.40 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

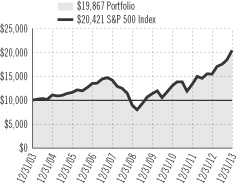

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2013, the Prudential Stock Index Portfolio returned 31.89%.

Quantitative Management Associates LLC subadvises the Portfolio which is an index fund that uses a risk-controlled quantitative approach that seeks to effectively track the performance of its benchmark, the S&P 500 Index (the “Index”). While Prudential is one of the components of the S&P 500, the Portfolio cannot hold shares of Prudential Financial, Inc. because of compliance restrictions. The Portfolio’s investment objective is to achieve investment results that generally correspond to the performance of publicly traded common stocks.

Potential tracking error differences, brokerage costs, as well as other costs and expenses of the Portfolio, may cause its return to be lower than that of the Index. In 2013, the Portfolio modestly underperformed the Index which returned 32.37%.

U.S. market performance was strong in 2013. The market was buoyed by steady, albeit moderate, growth in the U.S. economy, positive news on the employment front, a more conciliatory environment in Washington regarding the budget, and a Federal Reserve that continues to be accommodative although a measured tapering of its bond-buying program was announced shortly before the period ended. In this environment, investors were willing to hold riskier assets in their portfolio in lieu of more defensive, stable, high quality assets.

All sectors in the Index finished the year firmly in positive territory. Cyclical sectors outperformed led by consumer discretionary, healthcare and industrials. Interest rate sensitive sectors including utilities and telecommunication services trailed although both posted double-digit returns. Lower quality stocks outperformed higher quality as investors became more comfortable with holding riskier assets. Small-capitalization stocks outperformed mid- and large-capitalization stocks. Often during a recovery, stocks of smaller firms, and particularly rapidly growing smaller firms, lead the markets.

The Portfolio uses derivative instruments, though not as a principal investment strategy. It had a small position in futures contracts on the S&P 500 Index to help enhance the Portfolio’s liquidity. This exposure did not have a material impact on performance.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

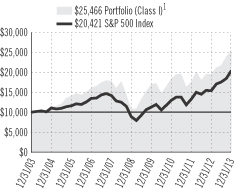

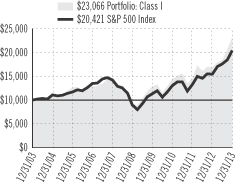

| The Prudential Series Fund, Value Portfolio | | December 31, 2013 |

Investment Manager’s Report - As of December 31, 2013

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio: Class I | | | 33.09 | % | | | 18.41 | % | | | 8.48 | % |

Portfolio: Class II | | | 32.53 | | | | 17.94 | | | | 8.04 | |

Russell 1000® Value Index | | | 32.53 | | | | 16.67 | | | | 7.58 | |

S&P 500 Index | | | 32.37 | | | | 17.93 | | | | 7.40 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The Russell 1000® Value Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

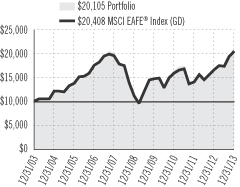

$10,000 INVESTED OVER 10 YEARS1

For the year ended December 31, 2013, the Value Portfolio Class I shares returned 33.09% and Class II shares returned 32.53%.

The Portfolio’s investment objective is capital appreciation. The Portfolio is subadvised by Jennison Associates LLC (Jennison).

The Portfolio performed in line with its benchmark index, the Russell 1000 Value Index. Stock selection in financials and industrials were the most important contributors to relative performance. Several strong performers from diverse sub-sectors contributed and were led by Morgan Stanley and MetLife. During the period, Morgan Stanley continued to make progress on several fronts; it announced an unexpected share buyback, anticipates being compliant with the Basel III supplementary leverage ratios by 2015, enjoyed steady growth in its wealth management division, and reported that it is on track to achieve expense reduction targets. Jennison considers MetLife to be an excellent, attractively valued company that has significantly reduced risk, improved its business mix, and is seeing growth in its emerging markets businesses.

In industrials, Boeing, Delta Air Lines, and United Continental Holdings were especially strong contributors. Boeing reported several strong successive quarters, putting behind it a rocky start to the year as a result of 787 battery problems. Margins have been particularly strong as a result of higher production rates in high margin legacy programs and lower than expected research and development costs. Costs of 787 production also have continued to decline and free cash flow has consistently exceeded expectations. The Portfolio no longer holds a position in Delta Air Lines.

Stock selection was most detrimental to relative returns in materials, information technology, and consumer discretionary, but overweight positions in the latter two sectors offset a significant portion of the negative impact. In materials, two gold mining companies, Newmont Mining and Goldcorp, hurt by declining gold prices, accounted for most of the losses. Those mining companies that can get their costs under control now — and Jennison believes Goldcorp has demonstrated that it is able to — will most likely benefit from significant operating leverage when gold prices finally rise again. The Portfolio no longer holds a position in Newmont Mining.

In information technology, only JDS Uniphase and Maxim Integrated lost ground, and their losses were offset by several strong performers, including Google, Flextronics International, and Microsoft. However, the absence from the Portfolio of a couple of strong holdings in the benchmark weakened relative performance.

In consumer discretionary, JC Penney detracted. JCPenney has been in the midst of a turnaround and began to show signs that it had reached a turning point late in the period, in Jennison’s view. Shares probably declined on profit taking as positive indicators accumulated. Lear, Liberty Global, and Comcast, meanwhile, were major contributors in the sector.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

Russell 1000 Value Index is an unmanaged market cap-weighted index that measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

Jennison Associates LLC is a registered investment adviser and a Prudential Financial company.

| | |

The Prudential Series Fund Presentation of Portfolio Holdings — unaudited | | December 31, 2013 |

| | | | |

| Conservative Balanced | |

| Five Largest Holdings | | | (% of Net Assets | ) |

Apple, Inc. | | | 1.6% | |

Exxon Mobil Corp. | | | 1.4% | |

Google, Inc. (Class A Stock) | | | 1.0% | |

| General Electric Co. | | | 0.9% | |

| Microsoft Corp. | | | 0.9% | |

| | | | |

| Diversified Bond | |

Issuer | | | (% of Net Assets | ) |

Credit Suisse Commercial Mortgage Trust | | | 0.9% | |

MBNA Credit Card Master Note Trust | | | 0.8% | |

JPMorgan Chase Commercial Mortgage Securities Trust | | | 0.8% | |

Verizon Communications, Inc. | | | 0.7% | |

General Electric Capital Corp. | | | 0.6% | |

| | | | |

| Equity | |

| Five Largest Holdings | | | (% of Net Assets | ) |

MasterCard, Inc. (Class A Stock) | | | 3.2% | |

Google, Inc. (Class A Stock) | | | 2.9% | |

Goldman Sachs Group, Inc. (The) | | | 2.5% | |

| Amazon.com, Inc. | | | 2.3% | |

| Apple, Inc. | | | 2.0% | |

| | | | |

| Flexible Managed | |

| Five Largest Holdings | | | (% of Net Assets | ) |

Apple, Inc. | | | 2.0% | |

Exxon Mobil Corp. | | | 1.7% | |

Google, Inc. | | | 1.5% | |

Johnson & Johnson | | | 1.4% | |

Chevron Corp. | | | 1.2% | |

| | | | |

| Global | |

| Top Five Countries | | | (% of Net Assets | ) |

United States | | | 49.5% | |

United Kingdom | | | 9.2% | |

Japan | | | 9.2% | |

France | | | 4.7% | |

Germany | | | 3.6% | |

| | | | |

| Government Income | |

| Allocation | | | (% of Net Assets | ) |

| U.S. Government Agency Obligations | | | 48.8% | |

| U.S. Treasury Obligations | | | 27.9% | |

| Commercial Mortgage-Backed Securities | | | 17.3% | |

| Corporate Bonds | | | 1.9% | |

| Municipal Bonds | | | 1.8% | |

| | | | |

| High Yield Bond | |

Issuer | | | (% of Net Assets | ) |

CIT Group, Inc. | | | 0.8% | |

CommScope Holding Co., Inc. | | | 0.7% | |

Energy Future Intermediate Holding Co. LLC | | | 0.7% | |

HCA, Inc. | | | 0.7% | |

First Data Corp. | | | 0.7% | |

| | | | |

| Jennison | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| MasterCard, Inc., (Class A Stock) | | | 4.4% | |

| Google, Inc., (Class A Stock) | | | 4.4% | |

Apple, Inc. | | | 3.8% | |

| Amazon.com, Inc. | | | 3.7% | |

| priceline.com, Inc. | | | 2.7% | |

| | | | |

| Natural Resources | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Noble Energy, Inc. | | | 3.9% | |

| Schlumberger Ltd. | | | 3.7% | |

Dril-Quip, Inc. | | | 3.5% | |

Halliburton Co. | | | 3.3% | |

EOG Resources, Inc. | | | 3.1% | |

| | | | |

| Small Capitalization Stock | |

| Five Largest Holdings | | | (% of Net Assets | ) |

Align Technology, Inc. | | | 0.6% | |

Fifth & Pacific Cos., Inc. | | | 0.5% | |

FEI Co. | | | 0.5% | |

Toro Co. | | | 0.5% | |

Financial Engines, Inc. | | | 0.5% | |

| | | | |

| Stock Index | |

| Five Largest Holdings | | | (% of Net Assets | ) |

Apple, Inc. | | | 3.0% | |

Exxon Mobil Corp. | | | 2.6% | |

Google, Inc., (Class A Stock) | | | 1.9% | |

Microsoft Corp. | | | 1.7% | |

General Electric Co. | | | 1.7% | |

| | | | |

| Value | |

| Five Largest Holdings | | | (% of Net Assets | ) |

JPMorgan Chase & Co. | | | 3.1% | |

Wells Fargo & Co. | | | 3.0% | |

Liberty Global PLC (United Kingdom) (Class C Stock) | | | 2.6% | |

Goldman Sachs Group, Inc. | | | 2.5% | |

Citigroup, Inc. | | | 2.3% | |

��

For a complete list of holdings, please refer to the Schedule of Investments section of this report. Holdings reflect only long-term investments. Holdings/Issues/Industries/Sectors are subject to change.

| | |

The Prudential Series Fund Fees and Expenses — unaudited | | December 31, 2013 |

As a contract owner investing in Portfolios of the Fund through a variable annuity or variable life contract, you incur ongoing costs, including management fees, and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other investment options. This example does not reflect fees and charges under your variable annuity or variable life contract. If contract charges were included, the costs shown below would be higher. Please consult the prospectus for your contract for more information about contract fees and charges.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2013 through December 31, 2013.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the Portfolio expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Six-Month Period” to estimate the Portfolio expenses you paid on your account during this period. As noted above, the table does not reflect variable contract fees and charges.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other investment options. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other investment options.

Please note that the expenses shown in the table are meant to highlight your ongoing Portfolio costs only and do not reflect any contract fees and charges, such as sales charges (loads), insurance charges or administrative charges. Therefore the second line of the table is useful to compare ongoing investment option costs only, and will not help you determine the relative total costs of owning different contracts. In addition, if these contract fees and charges were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| The Prudential Series Fund Portfolios | | Beginning

Account Value

July 1, 2013 | | | Ending

Account Value

December 31, 2013 | | | Annualized Expense

Ratio based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Conservative Balanced (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,093.80 | | | | 0.59 | % | | $ | 3.11 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.23 | | | | 0.59 | % | | $ | 3.01 | |

| Diversified Bond (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,019.10 | | | | 0.45 | % | | $ | 2.29 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.94 | | | | 0.45 | % | | $ | 2.29 | |

| Equity (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,197.70 | | | | 0.48 | % | | $ | 2.66 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.79 | | | | 0.48 | % | | $ | 2.45 | |

| Equity (Class II) | | Actual | | $ | 1,000.00 | | | $ | 1,195.40 | | | | 0.88 | % | | $ | 4.87 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.77 | | | | 0.88 | % | | $ | 4.48 | |

| Flexible Managed (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,113.70 | | | | 0.63 | % | | $ | 3.36 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.03 | | | | 0.63 | % | | $ | 3.21 | |

| Global (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,168.40 | | | | 0.83 | % | | $ | 4.54 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.02 | | | | 0.83 | % | | $ | 4.23 | |

| Government Income (Class I) | | Actual | | $ | 1,000.00 | | | $ | 998.80 | | | | 0.49 | % | | $ | 2.47 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.74 | | | | 0.49 | % | | $ | 2.50 | |

| High Yield Bond (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,058.30 | | | | 0.57 | % | | $ | 2.96 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.33 | | | | 0.57 | % | | $ | 2.91 | |

| Jennison (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,256.40 | | | | 0.63 | % | | $ | 3.58 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.03 | | | | 0.63 | % | | $ | 3.21 | |

| Jennison (Class II) | | Actual | | $ | 1,000.00 | | | $ | 1,253.70 | | | | 1.03 | % | | $ | 5.85 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.01 | | | | 1.03 | % | | $ | 5.24 | |

Money Market

(Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,000.00 | | | | 0.15 | % | | $ | 0.76 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,024.45 | | | | 0.15 | % | | $ | 0.77 | |

| | |

The Prudential Series Fund Fees and Expenses — unaudited (continued) | | December 31, 2013 |

| | | | | | | | | | | | | | | | | | |

| The Prudential Series Fund Portfolios | | Beginning

Account Value

July 1, 2013 | | | Ending

Account Value

December 31, 2013 | | | Annualized Expense

Ratio based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Natural Resources (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,138.30 | | | | 0.45 | % | | $ | 2.43 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.94 | | | | 0.45 | % | | $ | 2.29 | |

| Natural Resources (Class II) | | Actual | | $ | 1,000.00 | | | $ | 1,135.90 | | | | 0.85 | % | | $ | 4.58 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.92 | | | | 0.85 | % | | $ | 4.33 | |

| Small Capitalization Stock (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,214.50 | | | | 0.39 | % | | $ | 2.18 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,023.24 | | | | 0.39 | % | | $ | 1.99 | |

| Stock Index (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,160.70 | | | | 0.32 | % | | $ | 1.74 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,023.59 | | | | 0.32 | % | | $ | 1.63 | |

| Value (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,151.30 | | | | 0.38 | % | | $ | 2.06 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,023.29 | | | | 0.38 | % | | $ | 1.94 | |

| Value (Class II) | | Actual | | $ | 1,000.00 | | | $ | 1,148.60 | | | | 0.78 | % | | $ | 4.22 | |