UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| |

| Investment Company Act file number: | | 811-03623 |

| |

| Exact name of registrant as specified in charter: | | The Prudential Series Fund |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

| Date of fiscal year end: | | 12/31/2012 |

| |

| Date of reporting period: | | 12/31/2012 |

| Item 1 | – Reports to Stockholders |

THE PRUDENTIAL SERIES FUND

ANNUAL REPORT Ÿ DECEMBER 31, 2012

This report is one of several that provides financial information about certain investment choices available under variable life insurance contracts. Based on the variable contract you own or the portfolios you invested in, you may receive additional reports that provide financial information on those investment choices. Please refer to your variable life insurance contract prospectus to determine which portfolios are available to you.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Please note that this document may include prospectus supplements that are separate from and not a part of the annual report. Please refer to your variable life insurance contract prospectus to determine which supplements are applicable to you.

Make Life Easier with e-Delivery

You can stop receiving printed annual reports and start reviewing them online by using e-Delivery.

To receive your annual reports online, go to www.prudential.com/edelivery, or scan the code below.

|

Conservative Balanced Portfolio |

Diversified Bond Portfolio |

Equity Portfolio |

Flexible Managed Portfolio |

Global Portfolio |

Government Income Portfolio |

High Yield Bond Portfolio |

Jennison Portfolio |

Money Market Portfolio |

Natural Resources Portfolio |

Small Capitalization Stock Portfolio |

Stock Index Portfolio |

Value Portfolio |

| | | | |

The Prudential Series Fund Table of Contents | | Annual Report | | December 31, 2012 |

| n | | LETTER TO CONTRACT OWNERS |

| n | | PRESENTATION OF PORTFOLIO HOLDINGS |

| n | | FEES AND EXPENSES TABLE |

| | | | |

| Section A | | Schedule of Investments and Financial Statements |

| | |

| | | Conservative Balanced Portfolio | | A1 |

| | | Diversified Bond Portfolio | | A30 |

| | | Equity Portfolio | | A57 |

| | | Flexible Managed Portfolio | | A61 |

| | | Global Portfolio | | A89 |

| | | Government Income Portfolio | | A96 |

| | | High Yield Bond Portfolio | | A103 |

| | | Jennison Portfolio | | A121 |

| | | Money Market Portfolio | | A125 |

| | | Natural Resources Portfolio | | A130 |

| | | Small Capitalization Stock Portfolio | | A135 |

| | | Stock Index Portfolio | | A146 |

| | | Value Portfolio | | A155 |

| | |

| Section B | | Notes to Financial Statements | | |

| Section C | | Financial Highlights | | |

| Section D | | Report of Independent Registered Public Accounting Firm | | |

| Section E | | Information about Trustees and Officers | | |

This report may include financial information pertaining to certain portfolios that are not available through the variable life insurance policy or variable annuity contract that you have chosen. Please refer to your variable life insurance or variable annuity prospectus to determine which portfolios are available to you.

| | | | |

The Prudential Series Fund Letter to Contract Owners | | Annual Report | | December 31, 2012 |

At Prudential, our primary objective is to help investors achieve and maintain long-term financial success. This Prudential Series Fund annual report outlines our efforts to achieve this goal. We hope you find it informative and useful.

Prudential has been building on a heritage of success for more than 135 years. The quality of our businesses and risk diversification has enabled us to manage effectively through volatile markets over time. We believe the array of our products provides a highly attractive value proposition to clients like you who are focused on financial security.

Your financial professional is the best resource to help you make the most informed investment decisions. Together, you can build a diversified investment portfolio that aligns with your long-term financial goals. Please keep in mind that diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

Thank you for selecting Prudential as one of your financial partners. We value your trust and appreciate the opportunity to help you achieve financial security.

Sincerely,

Robert F. O’Donnell

President,

The Prudential Series Fund | January 31, 2013 |

| | |

The Prudential Series Fund, Conservative Balanced Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 11.23 | % | | | 4.16 | % | | | 6.67 | % |

Blended Index | | | 9.68 | | | | 3.70 | | | | 6.08 | |

S&P 500 Index | | | 15.99 | | | | 1.66 | | | | 7.10 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

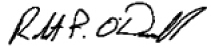

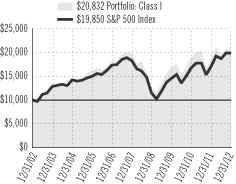

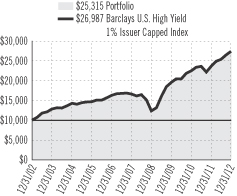

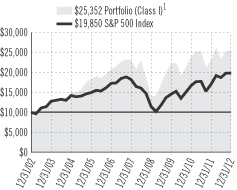

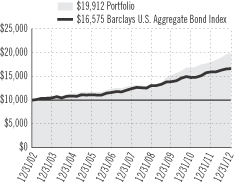

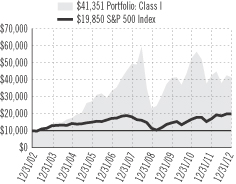

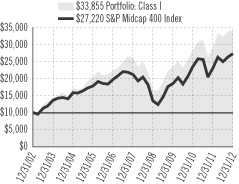

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2012, the Conservative Balanced Portfolio returned 11.23%.

The Portfolio is subadvised by Prudential Investment Management Inc. and Quantitative Management Associates LLC. The Portfolio’s investment objective is total investment return consistent with a conservatively managed diversified portfolio.

The Portfolio’s gain for the year reflected strong equity market performance, combined with solid fixed income returns. The Portfolio out-performed its blended benchmark due to solid active returns from the fixed income portion of the Portfolio, timely tactical asset allocation calls, and strong active returns from the equity portion of the Portfolio. The Portfolio was overweight stocks and underweight cash for much of the year though we did retreat closer to benchmarks during the spring slump for stocks. A more aggressive stance toward year end also paid off, as stocks recovered from the post-election correction and rallied strongly on the last day of 2012.

Throughout the year, the news media was full of reports about investors’ and business owners’ anxiety and uncertainty. But at the end of the year, stocks were up more than 15% in the U.S., as the economic recovery continued (albeit at a slow pace), housing showed signs of life, Europe seemed to stabilize a bit, and the worst-case global scenario did not materialize. Aggressive monetary policy in the U.S. and Europe, although politically controversial, seemed to succeed in encouraging somewhat more risk-taking and improving market confidence. These policies will not continue indefinitely, but central banks seemed committed to keeping them in place until clear signs of a more sustainable recovery are apparent.

U.S. Treasury bonds and other high-quality sovereign debt hit record-low yields in 2012 before rising modestly by year-end. Investors continued to pour money into bond funds in 2012, though there were some reports that this flow may have moderated toward year end, and that investors might re-discover stocks in 2013.

The Portfolio uses fully collateralized futures to manage daily cash flows, which had no material impact on portfolio performance.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Blended Index consists of S&P 500 Index (50%), Barclays U.S. Aggregate Bond Index (40%), an unmanaged index comprised of more than 5,000 government and corporate bonds, and 3-Month T-Bill Index (10%), an unmanaged market value-weighted index of investment grade fixed rate public obligations of the U.S. Treasury with maturities of three months, excluding zero coupon strips. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

Prudential Investment Management, Inc., and Quantitative Management Associates LLC are registered investment advisors and Prudential Financial companies.

| | |

| The Prudential Series Fund, Diversified Bond Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 10.68 | % | | | 8.89 | % | | | 7.13 | % |

Barclays U.S. Aggregate Bond Index | | | 4.22 | | | | 5.95 | | | | 5.18 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

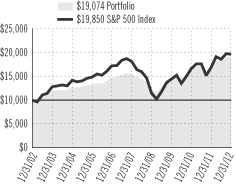

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2012, the Diversified Bond Portfolio returned 10.68%.

The Portfolio is subadvised by Prudential Fixed Income, a unit of Prudential Investment Management, Inc. The Portfolio’s investment objective is a high level of income over a longer term while providing reasonable safety of capital.

2012 was an outstanding year for fixed-income securities, especially ones that carried credit risk. This favorable environment enabled the Portfolio to finish the year well ahead of the Barclays U.S. Aggregate Bond Index (the Index), which returned 4.22%. Treasury bonds, mortgage-backed securities and agency debentures, which comprise the vast majority of the Index, were significantly outpaced by riskier assets, as a general improvement in the European sovereign debt crisis quelled investor fears of a catastrophic Euro-zone event triggering excess market volatility. Moreover, repeated intervention by the Federal Reserve (the Fed) led to U.S. government bond yields declining from already low levels at the end of 2011. Bond prices and yields move in opposite directions, so prices rose in this environment.

Helping to push yields lower was the announcement in June of a continuation of Operation Twist, in which the Fed sold shorter-term debt and used the proceeds to buy longer-term Treasuries. In September the Fed unveiled plans to purchase $40 billion per month of agency mortgage-backed securities, and in December the central bank committed to buying an additional $45 per month of longer-term Treasury securities. These new rounds of quantitative easing were dubbed “QE3” and “QE4,” respectively. Likewise, in September the European Central Bank (ECB) announced a program of Outright Monetary Transactions, effectively establishing the ECB as a “lender of last resort” for debt-strapped sovereigns in the Euro-zone.

An overweight to spread sectors which outperformed government bonds was the primary driver of performance relative to the Index. The Portfolio’s overweight in commercial mortgage-backed securities (CMBS) also contributed to returns as the sector has benefited from stabilizing commercial real estate values and improving supply/demand levels. The Portfolio’s positions in high yield corporate bonds, bank loans and emerging market debt also boosted returns.

Security selection was another prominent contributor. In asset-backed securities, positions in AAA-rated collateralized loan obligations were beneficial, as were positions in mortgage-backed securities. In investment grade corporate bonds, an emphasis on financials helped as the sector continued to recover from the global credit crisis that began in 2008.

Foreign exchange positions added value in certain G10 currencies (a group of ten currencies considered to be world’s most liquid) including New Zealand, Australia and the Canadian dollar, and in a variety of emerging market currencies as many outperformed the U.S. dollar for the year. Tactical duration strategies and yield curve positioning also contributed to the Portfolio’s performance. (Duration measures the approximate price change of a bond portfolio for a given change in interest rates.)

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of more than 5,000 government and corporate bonds. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

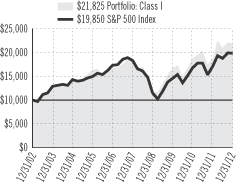

| The Prudential Series Fund, Equity Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio: Class I | | | 13.69 | % | | | 0.97 | % | | | 7.62 | % |

Portfolio: Class II | | | 13.23 | | | | 0.56 | | | | 7.19 | |

Russell 1000® Index | | | 16.42 | | | | 1.92 | | | | 7.52 | |

S&P 500 Index | | | 15.99 | | | | 1.66 | | | | 7.10 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

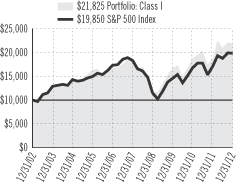

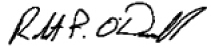

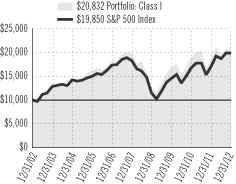

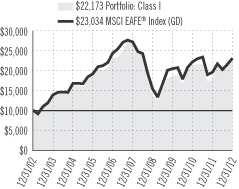

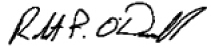

$10,000 INVESTED OVER 10 YEARS1

The Russell 1000® Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company.

For the year ended December 31, 2012, the Equity Portfolio Class I shares returned 13.69% and Class II shares returned 13.23%.

The Portfolio is subadvised by Jennison Associates LLC (Jennison). The Portfolio’s investment objective is long-term growth of capital.

Despite a largely flat fourth quarter, U.S. equity markets, as measured by the broad market indexes, realized substantial gains for the year. The S&P 500 (the Index) rose nearly 16.0%, with all sectors posting double digit returns except energy and utilities, which had single-digit returns. The financials and consumer discretionary sectors had the strongest performances. The Portfolio underperformed the Index.

Stock selection was detrimental in most sectors, and especially in healthcare and telecommunication services.

Telecommunication services included the largest individual detractor, NII Holdings, a wireless provider that has been converting to 3G services in Latin America and has been hurt by price competition and adverse exchange rates. Other notable detractors came from a variety of sectors, including Marvell Technology Group in information technology, Anadarko Petroleum in energy, and Chipotle Mexican Grill, the fast casual restaurant company, in consumer discretionary. Marvell’s profits declined because of continued weakness in both its mobile and wireless and storage segments. Jennison’s investment expectations did not play out as anticipated and the manager closed its position.

An underweight position in financials further detracted from relative returns. The absence of Bank of America from the Portfolio was the most significant source of relative weakness in the sector.

Stock selection was beneficial in information technology and industrials. Several of the top individual contributors in the Portfolio were information technology companies, including Apple, MasterCard, and salesforce.com. Despite some weak picks in consumer discretionary, several companies in the sector were among the largest individual contributors, including Comcast and Amazon.

Shares of Comcast rose steadily through the period, and the stock remains attractive in Jennison’s view because of the company’s stable growth in its cable business, recent initiatives to fill in gaps in its wireless product lineups, and the likelihood of a large share buyback in the near future.

Salesforce.com, whose hosted applications provide access to software functions remotely as a web-based service, derives strength from its original application, salesforce.com, and new offerings, which are helping the company both expand to new markets and deepen relationships with existing customers.

An overweight position in consumer discretionary and an underweight position in utilities also provided a boost to relative returns. Liberty Global and Lululemon Athletica were two significant consumer discretionary contributors absent from the index.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

Russell 1000® Index is an unmanaged market cap-weighted index that measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

Jennison Associates LLC is a registered investment advisor and a Prudential Financial company.

| | |

| The Prudential Series Fund, Flexible Managed Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 13.37 | % | | | 3.63 | % | | | 7.37 | % |

Blended Index | | | 11.07 | | | | 3.53 | | | | 6.44 | |

S&P 500 Index | | | 15.99 | | | | 1.66 | | | | 7.10 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

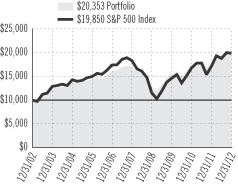

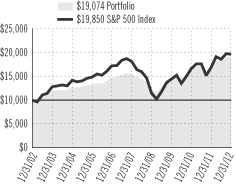

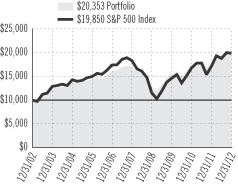

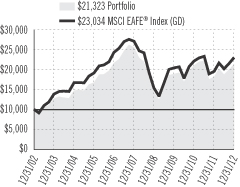

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2012, the Flexible Managed Portfolio returned 13.37%.

The Portfolio is subadvised by Prudential Investment Management, Inc. and Quantitative Management Associates LLC. The Portfolio’s investment objective is total return consistent with an aggressively managed, diversified portfolio.

The Portfolio’s gain for the year reflected strong equity market performance, combined with solid fixed income returns. The Portfolio out-performed its blended benchmark due to solid active returns from the fixed income portion of the Portfolio, timely tactical asset allocation calls, and strong active returns from the equity portion of the Portfolio. The Portfolio was overweight stocks and underweight cash for much of the year, though we did retreat closer to benchmarks during the spring slump for stocks. A more aggressive stance toward year end also paid off, as stocks recovered from the post-election correction and rallied strongly on the last day of 2012.

Throughout the year, the news media was full of reports about investors’ and business owners’ anxiety and uncertainty. But at the end of the year, stocks were up more than 15% in the U.S., as the economic recovery continued (albeit at a slow pace), housing showed signs of life, Europe seemed to stabilize a bit, and the worst-case global scenario did not materialize. Aggressive monetary policy in the U.S. and Europe, although politically controversial, seemed to succeed in encouraging somewhat more risk-taking and improving market confidence. These policies will not continue indefinitely, but central banks seemed committed to keeping them in place until clear signs of a more sustainable recovery are apparent.

U.S. Treasury bonds and other high-quality sovereign debt hit record-low yields in 2012 before rising modestly by year-end. Investors continued to pour money into bond funds in 2012, though there were some reports that this flow may have moderated toward year-end, and that investors might re-discover stocks in 2013.

The Portfolio uses fully collateralized futures to manage daily cash flows, which had no material impact on portfolio performance.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Blended Index consists of S&P 500 Index (60%), Barclays U.S. Aggregate Bond Index (35%), an unmanaged index comprised of more than 5,000 government and corporate bonds, and 3-Month T-Bill Index (5%), an unmanaged market value-weighted index of investment grade fixed rate public obligations of the U.S. Treasury with maturities of three months, excluding zero coupon strips. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

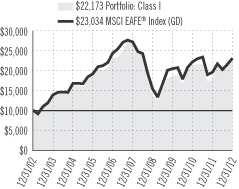

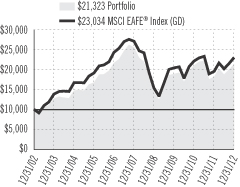

| The Prudential Series Fund, Global Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 17.52 | % | | | -1.56 | % | | | 7.62 | % |

MSCI World Index (GD) | | | 16.54 | | | | -0.60 | | | | 8.08 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

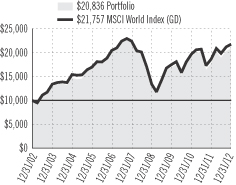

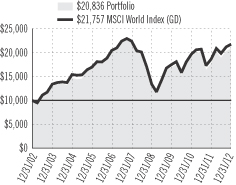

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2012, the Global Portfolio returned 17.52%.

The Portfolio is subadvised by Marsico Capital Management, LLC (U.S. growth stocks), T. Rowe Price Associates, Inc. (U.S. value stocks), William Blair & Company LLC (international growth stocks), and LSV Asset Management (international value stocks). The Portfolio’s investment objective is to achieve long-term growth of capital.

The MSCI World Index (GD) (the Index) returned 16.54%, with the domestic market performing near the average, Japan considerably behind, and Europe, despite the economic uncertainty there, turning in a strong performance. The United Kingdom was about average. In terms of economic sectors, financials and consumer discretionary led both the domestic and international markets. The international telecommunications, energy, and utilities sectors had negative returns over the year. Although no domestic sector declined, the utilities and energy sectors also were notably weak, the only ones with single-digit returns.

The William Blair International Growth segment was the top contributor to the Portfolio’s good performance relative to the Index, outperforming the broad international equity market during the period because of strong stock selection in the healthcare, industrials, materials, and telecommunication sectors. It also was helped by an underweight in Japan. The T. Rowe Price Large Cap Value segment outperformed the Russell 1000 Value index, driven primarily by good stock selection, particularly within the financial services sector.

On the negative side, both the large cap growth segment managed by Marsico Capital Management and the international value segment managed by LSV Asset Management trailed their targets. Underperformance of the large cap growth segment was due primarily to stock selection in the healthcare, consumer discretionary, and energy sectors. The top detractors in international value were stock selection in the consumer staples sector and overweights in the poor-performing telecommunications services and energy sectors. This was partially offset by good stock selection within the materials sector.

The use of derivative instruments in this Portfolio is not a principal strategy of the four subadvisers. The types of derivatives employed most often are equity futures contracts (to help manage cash flows in the Portfolio) and currency forwards and futures contracts (to hedge a portion of currency exposure in the Portfolio). Currency hedging in the portion of the Portfolio managed by William Blair had a positive impact on portfolio performance during 2012.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

MSCI World Index (GD) - The Morgan Stanley Capital International World Index is an unmanaged capitalization weighted index which includes the equity markets of Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Malaysia, Netherlands, New Zealand, Norway, Singapore, Spain, Sweden, Switzerland, United Kingdom, and United States. The GD version does not reflect the impact of withholding taxes on reinvested dividends. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

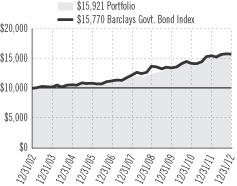

| The Prudential Series Fund, Government Income Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 3.63 | % | | | 6.04 | % | | | 4.76 | % |

Barclays Government Bond Index | | | 2.02 | | | | 5.23 | | | | 4.66 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

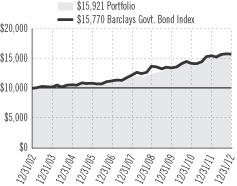

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2012, the Government Income Portfolio returned 3.63%.

The Portfolio is subadvised by Prudential Investment Management, Inc. and its investment objective is a high level of income over the long term consistent with the preservation of capital.

With the U.S. economy on track to grow at a more moderate pace, bond investors generally became less risk averse, especially through the second half of the year. However, broad fixed income indexes painted a bland picture of overall bond performance in 2012, as the Barclays U.S. Aggregate Bond Index posted a modest return. Tensions in Europe declined through the second half of the year. As a result, yields on the debt of peripheral countries in the Euro-zone declined and created a tailwind for most bonds globally as fears of a financial “contagion-effect” in Europe abated. In the final weeks of the year, the media focused primarily on the so-called “U.S. fiscal cliff.” However, the markets largely shrugged off the cliff, as it morphed into more of a manageable slope.

The Portfolio outperformed its benchmark, the Barclays Government Bond Index (the Index), which returned 2.02%. Sector selection was the primary driver of the Portfolio’s performance. The Portfolio held an overweight exposure relative in the Index to high quality commercial mortgage-backed securities (CMBS) which performed strongly during the year. While it was a decent year for U.S. Treasuries, most other high-quality fixed-income asset classes, including mortgage-backed securities, and CMBS in which the Portfolio invests, outperformed U.S. government debt by a considerable margin. The Portfolio’s underweight in Treasuries and overweight in these other high quality sectors contributed to outperformance.

These positive factors were modestly offset by security selection within the CMBS sector, as the Portfolio had a higher quality bias at a time when lower credit quality securities within the sector were rallying the most.

Tactical duration strategies and yield curve positioning that were partially implemented via interest rate swaps (derivatives) modestly benefited performance. (Duration measures the approximate price change of a bond portfolio for a given change in interest rates.) The Portfolio’s exposure to the Prudential Short Term Bond Fund also benefited performance as the Fund’s net asset value (NAV), which moves inversely from the yield, rose throughout much of the year as yields declined.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Barclays Government Bond Index is a weighted unmanaged index comprised of securities issued or backed by the U.S. Government, its agencies, and instrumentalities with a remaining maturity of one to 30 years. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

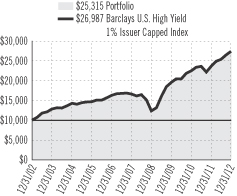

| The Prudential Series Fund, High Yield Bond Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 14.43 | % | | | 9.42 | % | | | 9.73 | % |

Barclays U.S. High Yield 1% Issuer Capped Index | | | 15.50 | | | | 10.26 | | | | 10.44 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2012, the High Yield Bond Portfolio returned 14.43%, net of fees and expenses.

The Portfolio is subadvised by Prudential Investment Management, Inc. and its investment objective is high total return.

With the U.S. economy on track to grow at a more moderate pace, bond investors generally became less risk averse, especially through the second half of the year. Tensions in Europe declined through the second half of the year. As a result, yields on the debt of peripheral countries in the Euro-zone declined and created a tailwind for most bonds globally as fears of a financial “contagion-effect” in Europe abated. In the final weeks of the year, the media focused primarily on the so-called “U.S. fiscal cliff.” However, the markets largely shrugged off the cliff, as it morphed into more of a manageable slope.

High yield bonds in the U.S. and in Europe delivered double-digit returns as investors searched for yield in a record-low interest rate environment. In the U.S., high yield bond prices were also supported by relatively stable credit fundamentals. Although the average yield on the broad U.S. high yield market closed the year at a new all-time low, the asset class still offered attractive yields relative to similar-maturity U.S. Treasuries and to periods with similar, low default rates. The European high yield market benefited from strong investor demand, despite ongoing recessionary concerns. Both the U.S and European high yield markets posted record levels of new issuance. In the U.S., a majority of the new supply was used to refinance existing debt, leaving net supply manageable. In Europe, the size of the high yield market expanded nearly 50%, boosted by the entrance of new participants including a number of downgraded issues and issuers from the senior secured loan market.

The Portfolio underperformed its benchmark, the Barclays U.S. High Yield 1% Issuer Capped Index (the Index), which returned 15.50%. An emphasis on higher quality and shorter duration relative to the Index hurt the Portfolio’s performance in a year when lower quality and longer duration bonds outperformed. Sector selection also detracted from performance, in particular, underweights to banking and building materials, and to a lesser extent, insurance and telecom, as these were among the better performing sectors.

Security selection partially offset these negative factors. Selections within health care, pharmaceuticals, media, entertainment and telecom were large contributors to overall performance.

The Portfolio makes use of derivatives including credit default swaps to increase or hedge exposure to individual issuers and the broader market. Use of the CDX, a credit default swap index, provided market exposure during periods of lower liquidity, partially offsetting the drag from cash. Cash held for liquidity purposes in short-term, low-rate securities, created a drag on performance during the strong rally.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Barclays U.S. High Yield 1% Issuer Capped Index is an unmanaged index that covers the universe of U.S. dollar denominated, non-convertible, fixed-rate, non-investment-grade debt. Issuers are capped at 1% of the Index. Index holdings must have at least one year to final maturity, at least $150 million par amount outstanding, and be publicly issued with a rating of Ba1 or lower. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

| The Prudential Series Fund, Jennison Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio: Class I | | | 16.18 | % | | | 3.20 | % | | | 8.12 | % |

Portfolio: Class II | | | 15.73 | | | | 2.79 | | | | 7.67 | |

Russell 1000® Growth Index | | | 15.26 | | | | 3.12 | | | | 7.52 | |

S&P 500 Index | | | 15.99 | | | | 1.66 | | | | 7.10 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

$10,000 INVESTED OVER 10 YEARS1

The Russell 1000® Growth Index is a trademark/service of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company.

For the year ended December 31, 2012, the Jennison Portfolio Class I shares returned 16.18% and Class II shares returned 15.73%.

The Portfolio is subadvised by Jennison Associates LLC (Jennison). The Portfolio’s investment objective is long-term growth of capital.

Information technology holdings contributed most to the Portfolio’s return, as stock selection and an overweight position relative to the Russell 1000® Growth Index were beneficial. Apple reported impressive sales of iPhones, iPads, and Mac personal computers. Jennison believes the company’s innovative product design, software, and operating systems, which allow seamless integration of services and apps across mobile and desktop product lines, will continue to foster consumer loyalty and drive share gains. Salesforce.com’s revenue, earnings, and billings growth exceeded consensus forecasts. Jennison believes its hosted applications market opportunity remains substantial.

MasterCard and Visa rose on strong growth in the value of cardholder transactions and reduced legal risk. Jennison expects both companies to continue to benefit from the consumer shift from paper money to electronic credit/debit transactions. LinkedIn’s global online professional network has altered the talent-recruiting market and provides what Jennison considers unique access to a scale database of active and passive job candidates.

Stock selection and an underweight stance were beneficial in consumer staples, where Whole Foods reported strong sales and earnings, with solid operating margins and continued capital discipline.

In financials, broadcast, communications, and wireless tower operator American Tower benefited from the expansion of mobile data, household migration to wireless-only service, high competitive barriers to entry, pricing power, low maintenance expenses, and international expansion.

Monsanto, the world’s largest agricultural seed maker, was a notable contributor in the materials sector. Jennison views it as a high-quality, technology-driven growth company and consider agriculture sector fundamentals strong.

Overweight positions in consumer discretionary and health care worked well, but stock selection in both sectors detracted from relative return. Watchmaker Fossil fell after reporting lighter-than-projected revenue, partly due to weakness in Europe. Jennison eliminated the Portfolio’s position in Fossil. Reflecting the tenuous nature of consumer confidence, fast casual restaurant company Chipotle Mexican Grill declined on signs of a deceleration in sales activity. Jennison believes Chipotle’s brand positioning and unit-growth opportunities remain positive.

In healthcare, Shire and Bristol-Myers Squibb, which earlier had been rewarded for attractive business opportunities, lagged a surge in biotechnology stocks. Jennison expects Shire’s strong product pipeline to continue to generate strong revenue growth and believes Bristol-Myers will benefit from product momentum, new product launches, pipeline data, and strong business development deals.

An underweight position largely offset detrimental stock selection in energy, where independent oil and natural gas exploration and production company Anadarko Petroleum was hurt by uncertainty related to ongoing litigation. Jennison eliminated the Portfolio’s position in Anadarko.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

Russell 1000 Growth Index is an unmanaged market cap-weighted index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

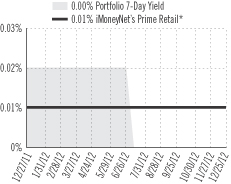

| The Prudential Series Fund, Money Market Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns | | 7-Day*

Current

Net Yield | | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 0.00 | % | | | 0.01 | % | | | 0.62 | % | | | 1.75 | % |

Lipper (VIP) Money Market Funds Avg. | | | N/A | | | | -0.03 | | | | 0.47 | | | | 1.58 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

The yield quotation more closely reflects the current earnings of the Portfolio than the total return quotation. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

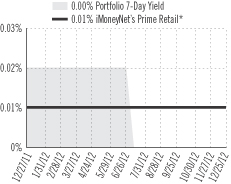

7-DAY CURRENT NET YIELD*

For the year ended December 31, 2012, the Money Market Portfolio returned 0.01%.

The Portfolio is subadvised by Prudential Fixed Income, a unit of Prudential Investment Management, Inc. The investment objective is to seek maximum current income consistent with the stability of capital and maintenance of liquidity.

The seven-day current yield and total return of the Portfolio remained near zero throughout the period, as yields on all money market funds in the United States are at historically low levels. Recessionary data kept central bankers around the globe on the path of monetary easing, forcing interest rates lower across the board. The general trend towards a resolution of the European debt problems helped to push three-month LIBOR rates down to 0.30% during the year. At home, the Federal Reserve extended the outlook of easier monetary policy and introduced Mortgage Backed Securities to its Quantitative Easing programs. The Federal Funds effective rate ended the year at 0.09%.

For much of the year, the Portfolio’s weighted average maturity was shorter than the peer group, as tight corporate spreads and a flat yield curve provided few investment opportunities. Furthermore, given the on-going sovereign and banking crisis in Europe, the Portfolio maintained a defensive posture relative to the peer group, which adversely impacted performance. The Fund, instead, maintained a high level of liquidity by purchasing government and agency securities as well as repurchase agreements.

As year-end approached, the Portfolio reduced its exposure to very short-term transactions known as repurchase agreements, which are collateralized by U.S. Treasury securities or federal agency securities, as the collateral necessary for such transactions became less abundant. The Portfolio subsequently increased its holdings of government agency securities primarily by adding LIBOR based agency floating rate securities as spreads on this sector widened.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| * | Source: iMoneyNet, Inc. based on 281 funds in the iMoneyNet Prime Retail universe. Weekly 7-day current net yields of the Money Market Portfolio and the iMoneyNet Prime Retail universe as of 12/25/2012. |

The Lipper Variable Insurance Products (VIP) Funds Average is calculated by Lipper Analytical Services, Inc., and reflects the investment return of certain portfolios underlying variable life and annuity products. These returns are net of investment fees and fund expenses, but not product charges. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index or average. For a complete list of holdings, refer to the Schedule of Investments section of this report.

An investment in the Money Market Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Portfolio seeks to preserve the value of your investment at $10.00 per share, it is possible to lose money by investing in the Portfolio.

| | |

| The Prudential Series Fund, Natural Resources Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Portfolio: Class I | | | -2.47 | % | | | -3.40 | % | | | 15.25 | % | | | N/A | |

Portfolio: Class II | | | -2.92 | | | | -3.79 | | | | N/A | | | | 11.02 | % |

Lipper (VUF) Natural Resources Funds Index | | | 2.01 | | | | -4.00 | | | | 11.70 | | | | 8.56 | |

S&P 500 Index | | | 15.99 | | | | 1.66 | | | | 7.10 | | | | 4.96 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio (Class II) inception: 4/28/2005. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Unless noted otherwise, Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception (Class II). Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

$10,000 INVESTED OVER 10 YEARS1

For the year ended December 31, 2012, the Natural Resources Portfolio Class I shares declined by -2.47% and Class II shares declined by -2.92%.

The Portfolio’s subadviser is Jennison Associates LLC (Jennison). The Portfolio’s investment objective is long-term growth of capital.

Much of the Portfolio’s underperformance relative to the broader market reflected the year’s extraordinary commodity price volatility. Persistent concerns over the prospects for global economic growth, especially those centered on Europe and China against a backdrop of continuing political tensions in the Middle East and Africa, have heightened the level of uncertainty in the natural resources sector.

Energy names led Portfolio detractors for the period. Shares of OGX Petroleo e Gas Participacoes, Brazil’s largest independent exploration and production company, rallied at the beginning of 2012, then suffered a notable setback toward the end of June and remained on a downtrend after a disappointing report on one of its key offshore exploratory fields. Despite a series of letdowns regarding its projections, the Portfolio manager continues to believe the company is on the verge of a multi-year growth trajectory that remains underappreciated. Key Energy Services share prices peaked at the end of February and then trended down over the balance of the period as management repeatedly lowered production guidance. Jennison ultimately chose to exit the position in favor of other investment candidates with more promising risk-reward profiles.

Losses by metals and mining holdings Cliffs Natural Resources and Alacer Gold also hurt the year’s performance. Cliffs came under severe pressure in the second half of the period as a steep decline in iron ore prices raised questions about the company’s ability to sustain its dividend. The stock recovered some toward year-end as iron ore prices rose by more than 50% in the fourth quarter on signs of a pickup in China’s economic activity. Despite near-term uncertainty, Jennison believes iron ore is likely to command a higher price than most anticipate over the longer run. Mid-continent petroleum refiners HollyFrontier and Marathon Petroleum led the year’s contributors, benefiting for much of the period from favorable refining margins and wider-than-anticipated discounts for West Texas Intermediate crude oil versus other global light/sweet oils such as Brent and Light Louisiana Sweet. The inland refiners may come up against some near-term macro headwinds, as markets readjust to changing conditions for Gulf Coast refiners. Nevertheless, the manager continues to like both HollyFrontier and Marathon Petroleum for their strong balance sheets, solid management, and demonstrated commitment to growth and returning cash to shareholders.

Independent oil exploration and production company Cobalt International Energy also ended the year among the Portfolio’s leading contributors. The company specializes in drilling for oil in technically challenging, ultra-deepwater and pre-salt fields. The company has a robust near-term drilling slate, and Jennison continues to believe in the potential of its portfolio of assets.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

The Lipper Variable Underlying Funds (VUF) Natural Resources Funds Index is calculated by Lipper Analytical Services, Inc. and consists of an equal dollar-weighted composite of the 10 largest funds in the Lipper VUF Natural Resources Fund classification. The index is rebalanced quarterly. Natural Resources Funds are deemed as funds that invest primarily in the equity securities of domestic and foreign companies engaged in natural resources. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns are net of investment fees and fund expenses, but not product charges. Investors cannot invest directly in a market index or average. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

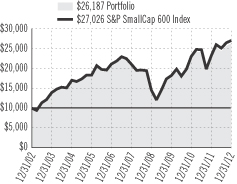

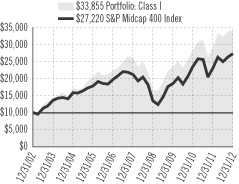

| The Prudential Series Fund, Small Capitalization Stock Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 16.03 | % | | | 4.87 | % | | | 10.11 | % |

S&P SmallCap 600 Index | | | 16.33 | | | | 5.14 | | | | 10.45 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

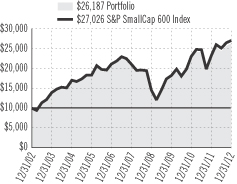

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2012, the Small Capitalization Stock Portfolio returned 16.03%.

The Portfolio is subadvised by Quantitative Management Associates LLC (QMA). The Portfolio’s investment objective is long-term growth of capital.

Throughout 2012, headlines screamed about the very real threats to the U.S. and global economies. Europe was mired in recession. Asian economies, most notably China, slowed. Growth in the U.S. was lackluster and, toward the end of the year, all eyes were focused on the fiscal cliff. Despite these concerns, the market rose strongly during the year. The Portfolio met its objective of closely tracking the performance of the small-cap market as measured by the Index.

During the year, the Portfolio had a small exposure to derivative instruments to enhance its liquidity, but the position did not have a material impact on its performance.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

S&P SmallCap 600 Index is an unmanaged index representing the aggregate market value of the common equity of 600 small-company stocks. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

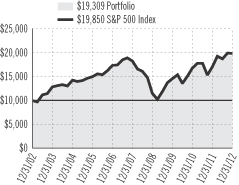

| The Prudential Series Fund, Stock Index Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | | 15.68 | % | | | 1.44 | % | | | 6.80 | % |

S&P 500 Index | | | 15.99 | | | | 1.66 | | | | 7.10 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

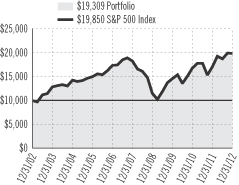

$10,000 INVESTED OVER 10 YEARS

For the year ended December 31, 2012, the Stock Index Portfolio returned 15.68%.

The Portfolio is subadvised by Quantitative Management Associates LLC (QMA). The Portfolio’s investment objective is to achieve investment results that generally correspond to the performance of publicly traded common stocks.

Potential tracking error differences, brokerage costs, as well as other costs and expenses of the Portfolio, may cause its return to be lower than that of the S&P 500 Index. It underperformed the S&P 500 Index by a modest amount in 2012.

At the end of the year, Congress was well on its way to partially resolving its differences over the much-dreaded “fiscal cliff,” which should help forestall recessionary fears in the U.S. during 2013. Little noticed was that the S&P 500 turned in a near 16% performance for 2012, its third straight positive annual return. In fact, with a little more luck in the U.S. and abroad, it is possible that 2013 will follow suit, thereby continuing the “quiet bull market” we have enjoyed since 2010.

Housing looked to be on the outer edges of a rebound, which, considering its role in bringing the U.S. economy to its veritable knees in recent years, is a particularly positive sign for the near-term economic future. Other sectors, notably autos, chimed in with positive news for the year. Financials were among the best performing sectors during the year. Economically sensitive sectors, such as industrials and materials, performed well, while defensive sectors such as consumer staples, telecom, and utilities performed poorly.

The Portfolio uses derivative instruments, though not as a principal investment strategy. It had a small position in futures contracts on the S&P 500 Index to help enhance the liquidity of the Portfolio. This exposure did not have a material impact on its performance.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

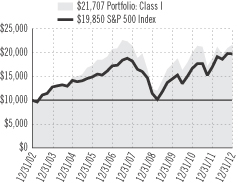

| The Prudential Series Fund, Value Portfolio | | December 31, 2012 |

Investment Manager’s Report - As of December 31, 2012

| | | | | | | | | | | | |

| Average Annual Total Returns | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio: Class I | | | 14.62 | % | | | 0.19 | % | | | 8.06 | % |

Portfolio: Class II | | | 14.14 | | | | -0.22 | | | | 7.63 | |

Russell 1000® Value Index | | | 17.51 | | | | 0.59 | | | | 7.38 | |

S&P 500 Index | | | 15.99 | | | | 1.66 | | | | 7.10 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The Russell 1000® Value Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

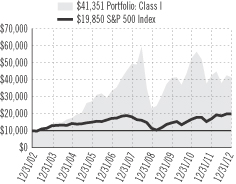

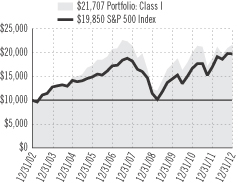

$10,000 INVESTED OVER 10 YEARS1

For the year ended December 31, 2012, the Value Portfolio Class I shares returned 14.62% and Class II shares returned 14.14%.

The Portfolio is subadvised by Jennison Associates LLC (Jennison). The Portfolio’s investment objective is capital appreciation.

Stock selection in the materials sector was the main driver of the Portfolio’s performance shortfall against its benchmark index. Newmont Mining reported a loss attributed to a $1.6 billion write-down on its Hope Bay mine operations in Canada and also fell in tandem with declining gold prices throughout much of the period. Jennison continues to see Newmont as an attractively valued opportunity, offering dividend growth prospects and other potential returns of capital.

The telecom service sector also detracted from relative results due mostly to one position, NII Holdings. Shares of the Latin American telecommunications provider plummeted during the period as earnings were disappointing due to price competition, as well as a strengthening U.S. dollar. NII’s focus has been on introducing its 3G services on a new network in Chile, Mexico, and Brazil and enhancing its Push-to-Talk (PTT) services. Jennison believes that it will still be several quarters until the turnaround begins to be reflected in improved financial results. Nevertheless, Jennison likes the company’s very capable management and cash-heavy balance sheet, allowing it to fund planned growth projects.

Overweight positions in information technology and energy were also sources of relative weakness.

The healthcare sector was the largest contributor to relative gain due to stock selection, led by Mylan. Shares rose amid several favorable announcements. Credit rating agencies upgraded its rating to investment grade, which frees the company from certain debt covenants and allows it to institute a large stock buyback if it chooses. In addition, Mylan received regulatory approval to produce and sell several different generic versions of brand name drugs. In Jennison’s opinion, Mylan has grown into one of the most attractive global generic drug companies.

An underweight in utilities and an overweight in consumer discretionary boosted relative results. However, stock selection in both sectors was comparatively weak.

Other notable contributors were media companies Comcast and Liberty Global. Shares of Comcast climbed steadily during the period, as net income increased amid rising high-speed Internet subscriptions and fewer customer cancellations. It also reported the best cable revenue growth since the first quarter of 2009. Jennison likes Comcast for its stable growth cable business, recent initiatives in their wireless product lineups, and the likelihood of a large stock buyback in the near future.

Another media company, Liberty Global, also saw its shares rise steadily. Despite Europe’s economic troubles, the company enjoyed strong growth due to an effective pricing strategy and presence in select European markets like Germany, Holland, Belgium, and Switzerland. Jennison believes that Liberty Global is well-positioned, given consumers’ desire for faster broadband and digital television. In addition, Jennison believes that growth will accelerate with the repositioning of its portfolio by selling less successful holdings in Australia and expanding in Europe.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

Russell 1000 Value Index is an unmanaged market cap-weighted index that measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

The Prudential Series Fund Presentation of Portfolio Holdings — unaudited | | December 31, 2012 |

| | | | |

| Conservative Balanced | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Apple, Inc. | | | 2.0% | |

Exxon Mobil Corp. | | | 1.6% | |

| U.S. Treasury Notes, 0.750%, 12/31/17 | | | 1.3% | |

| Federal National Mortgage Association, 3.500%, TBA 30 YR | | | 1.3% | |

| Government National Mortgage Association, 4.000%, TBA 30 YR | | | 0.9% | |

| | | | |

| Diversified Bond | |

| Allocation | | | (% of Net Assets | ) |

| Corporate Bonds | | | 44.2% | |

| Commercial Mortgage-Backed Securities | | | 12.3% | |

| Non-Residential Mortgage-Backed Securities | | | 5.5% | |

| Residential Mortgage-Backed Securities | | | 5.3% | |

Sovereigns | | | 4.8% | |

| | | | |

| Equity | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Apple, Inc. | | | 3.4% | |

MasterCard, Inc. (Class A Stock) | | | 2.5% | |

Morgan Stanley | | | 2.3% | |

Google, Inc. (Class A Stock) | | | 2.1% | |

Amazon.com, Inc. | | | 1.7% | |

| | | | |

| Flexible Managed | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Apple, Inc. | | | 2.3% | |

| Exxon Mobil Corp. | | | 2.0% | |

Chevron Corp. | | | 1.3% | |

| Pfizer, Inc. | | | 1.2% | |

JPMorgan Chase & Co. | | | 1.1% | |

| | | | |

| Global | |

| Top Five Countries | | | (% of Net Assets | ) |

| United States | | | 48.6% | |

| United Kingdom | | | 11.3% | |

Japan | | | 6.7% | |

| France | | | 5.0% | |

Germany | | | 4.3% | |

| | | | |

| Government Income | |

| Allocation | | | (% of Net Assets | ) |

| Mortgage-Backed Securities | | | 39.5% | |

| U.S. Treasury Securities | | | 32.7% | |

| Commercial Mortgage-Backed Securities | | | 17.2% | |

| Corporate Bonds | | | 2.4% | |

| U.S. Government Agency Obligations | | | 2.2% | |

| | | | |

| High Yield Bond | |

| Allocation | | | (% of Net Assets | ) |

| Corporate Bonds | | | 91.1% | |

| Bank Loans | | | 3.4% | |

| Asset-Backed Securities | | | 0.5% | |

| Collateralized Mortgage Obligations | | | 0.1% | |

| Common Stocks | | | 0.1% | |

| | | | |

| Jennison | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Apple, Inc. | | | 6.1% | |

| Mastercard, Inc. | | | 3.6% | |

| Google, Inc. | | | 3.6% | |

Amazon.com, Inc. | | | 3.0% | |

| Precision Castparts Corp. | | | 2.6% | |

| | | | |

| Natural Resources | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Cameron International Corp. | | | 3.4% | |

| Noble Energy, Inc. | | | 3.3% | |

| Schlumberger Ltd. | | | 2.7% | |

EOG Resources, Inc. | | | 2.6% | |

| Anadarko Petroleum Corp. | | | 2.5% | |

| | | | |

| Small Capitalization Stock | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Extra Space Storage, Inc. | | | 0.7% | |

| Kilroy Realty Corp. | | | 0.7% | |

| Tanger Factory Outlet Centers | | | 0.6% | |

| CommVault Systems, Inc. | | | 0.6% | |

Cymer, Inc. | | | 0.5% | |

| | | | |

| Stock Index | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Apple, Inc. | | | 3.8% | |

| Exxon Mobil Corp. | | | 3.0% | |

| General Electric Co. | | | 1.7% | |

| Chevron Corp. | | | 1.6% | |

| International Business Machines Corp. | | | 1.6% | |

| | | | |

| Value | |

| Five Largest Holdings | | | (% of Net Assets | ) |

| Liberty Global, Inc., Ser. C | | | 4.0% | |

| Comcast Corp. (Class A Stock) | | | 3.0% | |

| Mylan, Inc. | | | 2.9% | |

| Wells Fargo & Co. | | | 2.8% | |

Flextronics International Ltd. | | | 2.5% | |

For a complete list of holdings, please refer to the Schedule of Investments section of this report. Holdings reflect only long-term investments. Holdings/Issues/Industries/Sectors are subject to change.

| | |

The Prudential Series Fund Fees and Expenses — unaudited | | December 31, 2012 |

As a contract owner investing in Portfolios of the Fund through a variable annuity or variable life contract, you incur ongoing costs, including management fees, and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other investment options. This example does not reflect fees and charges under your variable annuity or variable life contract. If contract charges were included, the costs shown below would be higher. Please consult the prospectus for your contract for more information about contract fees and charges.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2012 through December 31, 2012.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the Portfolio expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Six-Month Period” to estimate the Portfolio expenses you paid on your account during this period. As noted above, the table does not reflect variable contract fees and charges.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other investment options. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other investment options.

Please note that the expenses shown in the table are meant to highlight your ongoing Portfolio costs only and do not reflect any contract fees and charges, such as sales charges (loads), insurance charges or administrative charges. Therefore the second line of the table is useful to compare ongoing investment option costs only, and will not help you determine the relative total costs of owning different contracts. In addition, if these contract fees and charges were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| The Prudential Series Fund Portfolios | | Beginning

Account Value

July 1, 2012 | | | Ending

Account Value

December 31, 2012 | | | Annualized Expense

Ratio based on the

Six-Month period | | | Expenses Paid

During the

Six-Month period* | |

| Conservative Balanced (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,042.80 | | | | 0.58 | % | | $ | 2.98 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.22 | | | | 0.58 | % | | $ | 2.95 | |

| Diversified Bond (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,054.60 | | | | 0.44 | % | | $ | 2.27 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.92 | | | | 0.44 | % | | $ | 2.24 | |

| Equity (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,074.10 | | | | 0.47 | % | | $ | 2.45 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.77 | | | | 0.47 | % | | $ | 2.39 | |

| Equity (Class II) | | Actual | | $ | 1,000.00 | | | $ | 1,072.00 | | | | 0.87 | % | | $ | 4.53 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.76 | | | | 0.87 | % | | $ | 4.42 | |

| Flexible Managed (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,052.70 | | | | 0.63 | % | | $ | 3.25 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.97 | | | | 0.63 | % | | $ | 3.20 | |

| Global (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,101.30 | | | | 0.83 | % | | $ | 4.38 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.96 | | | | 0.83 | % | | $ | 4.22 | |

| Government Income (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,015.30 | | | | 0.49 | % | | $ | 2.48 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.67 | | | | 0.49 | % | | $ | 2.49 | |

| High Yield Bond (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,073.60 | | | | 0.57 | % | | $ | 2.97 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.27 | | | | 0.57 | % | | $ | 2.90 | |

| Jennison (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,044.10 | | | | 0.63 | % | | $ | 3.24 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.97 | | | | 0.63 | % | | $ | 3.20 | |

| Jennison (Class II) | | Actual | | $ | 1,000.00 | | | $ | 1,042.10 | | | | 1.03 | % | | $ | 5.29 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,019.96 | | | | 1.03 | % | | $ | 5.23 | |

Money Market

(Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,000.00 | | | | 0.23 | % | | $ | 1.16 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,023.98 | | | | 0.23 | % | | $ | 1.17 | |

| | |

The Prudential Series Fund Fees and Expenses — unaudited (continued) | | December 31, 2012 |

| | | | | | | | | | | | | | | | | | |

| The Prudential Series Fund Portfolios | | Beginning

Account Value

July 1, 2012 | | | Ending

Account Value

December 31, 2012 | | | Annualized Expense

Ratio based on the

Six-Month period | | | Expenses Paid

During the

Six-Month period* | |

| Natural Resources (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,091.30 | | | | 0.49 | % | | $ | 2.58 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.67 | | | | 0.49 | % | | $ | 2.49 | |

| Natural Resources (Class II) | | Actual | | $ | 1,000.00 | | | $ | 1,088.70 | | | | 0.89 | % | | $ | 4.67 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.66 | | | | 0.89 | % | | $ | 4.52 | |

| Small Capitalization Stock (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,076.60 | | | | 0.46 | % | | $ | 2.40 | |

| | Hypothetical | | $ | 1,000.00 | �� | | $ | 1,022.82 | | | | 0.46 | % | | $ | 2.34 | |

| Stock Index (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,057.90 | | | | 0.32 | % | | $ | 1.66 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,023.53 | | | | 0.32 | % | | $ | 1.63 | |

| Value (Class I) | | Actual | | $ | 1,000.00 | | | $ | 1,104.50 | | | | 0.43 | % | | $ | 2.27 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.97 | | | | 0.43 | % | | $ | 2.19 | |

| Value (Class II) | | Actual | | $ | 1,000.00 | | | $ | 1,102.40 | | | | 0.83 | % | | $ | 4.39 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.96 | | | | 0.83 | % | | $ | 4.22 | |

* Portfolio expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended December 31, 2012, and divided by the 366 days in the Portfolio’s fiscal year ended December 31, 2012 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Portfolio may invest.

| | | | | | |

| | | CONSERVATIVE BALANCED PORTFOLIO | | |

| |

| SCHEDULE OF INVESTMENTS | | December 31, 2012 |

| | | | | | | | |

| LONG-TERM INVESTMENTS — 92.7% | | | | |

| COMMON STOCKS — 52.5% | | Shares

| | | Value

(Note 2)

| |

Aerospace & Defense — 1.2% | | | | | | | | |

BAE Systems PLC (United Kingdom) | | | 16,977 | | | $ | 94,362 | |

Boeing Co. (The) | | | 60,600 | | | | 4,566,816 | |

European Aeronautic Defense and Space Co. NV (Netherlands) | | | 9,218 | | | | 363,387 | |

General Dynamics Corp. | | | 31,700 | | | | 2,195,859 | |

Honeywell International, Inc. | | | 68,412 | | | | 4,342,110 | |

L-3 Communications Holdings, Inc. | | | 9,000 | | | | 689,580 | |

Lockheed Martin Corp. | | | 24,000 | | | | 2,214,960 | |

Northrop Grumman Corp. | | | 22,962 | | | | 1,551,772 | |

Precision Castparts Corp. | | | 12,900 | | | | 2,443,518 | |

Raytheon Co. | | | 28,700 | | | | 1,651,972 | |

Rockwell Collins, Inc.(a) | | | 14,000 | | | | 814,380 | |

Singapore Technologies Engineering Ltd. (Singapore) | | | 33,000 | | | | 104,155 | |