UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-03623 |

Exact name of registrant as specified in charter: | | The Prudential Series Fund |

Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

Registrant’s telephone number, including area code: | | 973-367-7521 |

Date of fiscal year end: | | 12/31/2009 |

Date of reporting period: | | 12/31/2009 |

Item 1 – Reports to Stockholders –

| | |

| | |

| ANNUAL REPORT | | DECEMBER 31, 2009 |

The Prudential Series Fund

| n | | Conservative Balanced Portfolio |

| n | | Diversified Bond Portfolio |

| n | | Flexible Managed Portfolio |

| n | | Government Income Portfolio |

| n | | High Yield Bond Portfolio |

| n | | Natural Resources Portfolio |

| n | | Small Capitalization Stock Portfolio |

Please note that inside is a Prospectus Supplement dated January 14, 2010.

This document is separate from and not part of the annual report.

0172024-00001-00

This report is one of several that provide financial information about certain investment choices available on variable life insurance and variable annuity contracts. Based on the variable contract you own or the portfolios you invested in, you may receive additional reports that provide financial information on those investment choices. Please refer to your variable life insurance or variable annuity contract prospectus to determine which portfolios are available to you.

This report must be preceded or accompanied by the current prospectuses for the Prudential Series Fund portfolios and the applicable variable life or annuity contract. The prospectuses contain information on the investment objectives, risks, and charges and expenses of the portfolios and the contract and should be read carefully.

The contract’s prospectus contains hypothetical performance illustrations that show the effect of various assumptions regarding the cost of insurance protection. You may also obtain a personalized illustration of historical performance that reflects the cost of your contract’s insurance protection.

A description of the Fund’s proxy voting policies and procedures is available, without charge, upon request. Owners of variable annuity contracts should call 888-778-2888 and owners of variable life insurance contracts should call 800-778-2255 to obtain descriptions of the Fund’s proxy voting policies and procedures. The description is also available on the website of the Securities and Exchange Commission (the “Commission”) at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available on the website of the Commission at www.sec.gov and on the Fund’s website.

The Fund files with the Commission a complete listing of portfolio holdings as of its first and third quarter-end on Form N-Q. Form N-Q is available on the Commission’s website at www.sec.gov or by visiting the Commission’s Public Reference Room. For more information on the Commission’s Public Reference Room, please visit the Commission’s website or call 1-800-SEC-0330. Form N-Q is also available on the Fund’s website at www.prudential.com or by calling the telephone numbers referenced above.

The Fund’s Statement of Additional Information contains additional information about the Fund’s Trustees and is available without charge upon request by calling 888-778-2888.

This report may include financial information pertaining to certain portfolios that are not available through the variable life insurance policy or variable annuity contract that you have chosen. Please refer to your variable life insurance or variable annuity prospectus to determine which portfolios are available to you.

| | | | |

The Prudential Series Fund Table of Contents | | Annual Report | | December 31, 2009 |

| n | | LETTER TO CONTRACT OWNERS |

| n | | PRESENTATION OF PORTFOLIO HOLDINGS |

| n | | FEES AND EXPENSES TABLE |

| | A1 | Schedule of Investments and Financial Statements |

| | B1 | Notes to Financial Statements |

| | D1 | Report of Independent Registered Public Accounting Firm |

| | E1 | Information about Trustees and Officers |

This report may include financial information pertaining to certain portfolios that are not available through the variable life insurance policy or variable annuity contract that you have chosen. Please refer to your variable life insurance or variable annuity prospectus to determine which portfolios are available to you.

| | | | |

The Prudential Series Fund Letter to Contract Owners | | Annual Report | | December 31, 2009 |

Our primary focus at Prudential is to help investors achieve and maintain long-term financial success. Our Prudential Series Fund annual report outlines our efforts to reach this goal. We hope you find it informative and useful.

Prudential has been building on a heritage of success for more than 130 years, and the quality of our businesses and risk diversification has enabled us to manage effectively through volatile markets. We believe the array of our products provides a highly attractive value proposition to clients like you who are focused on financial security.

Your financial professional is your best resource to make the most informed investment decisions to help meet your needs. Together, you can build a diversified investment portfolio that aligns with your long-term financial goals. Diversification does not assure a profit or protect against loss in declining markets.

Thank you for selecting Prudential as one of your financial partners. We value your trust and appreciate the opportunity to help you achieve financial security.

Sincerely,

Stephen Pelletier

President,

The Prudential Series Fund January 29, 2010 |

PRESIDENT

STEPHEN PELLETIER

| | |

The Prudential Series Fund, Conservative Balanced Portfolio Subadvised by: Prudential Investment Management, Inc., Quantitative Management Associates LLC | | December 31, 2009 |

Investment Manager’s Report - As of December 31, 2009

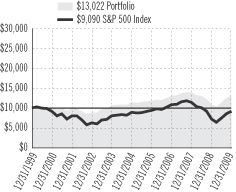

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

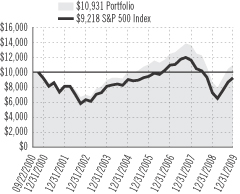

Portfolio | | 20.01 | % | | 2.72 | % | | 2.68 | % |

Blended Index | | 15.72 | | | 2.77 | | | 2.63 | |

S&P 500 Index | | 26.47 | | | 0.42 | | | -0.95 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

$10,000 INVESTED OVER 10 YEARS

Portfolio inception: 5/13/1983. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Conservative Balanced Portfolio rose 20.01%.

Quantitative Management Associates, LLC runs the Portfolio whose objective is total return consistent with a conservatively managed diversified portfolio. The Portfolio is diversified across a combination of equity and equity-related securities, debt obligations, and money market instruments.

A scorching broad-based rally in global equity markets began in March 2009 and continued during the year as global economic conditions improved. Developed market equities outperformed the U.S. stock market partially due to a weakening greenback. In the United States, mid-cap stocks and the growth style of investing led gains. Emerging market stocks were the stars, returning nearly 79% overall in U.S. dollar terms as investors increasingly sought riskier assets in pursuit of higher returns.

In the fixed-income markets, yield-hungry investors favored riskier debt securities encouraged by improving global economic conditions and the low interest-rate environment, among other factors. This preference for riskier assets, supply pressures that emerged as a flood of U.S. Treasury securities were issued to fund the federal deficit and stimulus programs, and renewed inflation fears pressured the U.S. Treasury market, which ended the year in the red.

The Portfolio outperformed the blended index because it maintained a slightly larger exposure to equities than the guideline weight of 50%. The Portfolio also benefited from a fixed-income strategy that emphasized investment-grade corporate bonds, commercial mortgage-backed securities, emerging market bonds, and certain other types of debt securities that carry greater credit risk than ultra safe U.S. Treasuries, which are backed by the federal government. These riskier bond markets posted strong gains in 2009 that easily outperformed the Barclays Capital U.S. Aggregate Bond Index.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Blended Index consists of S&P 500 Index (50%), Barclays Capital U.S. Aggregate Bond Index (40%), an unmanaged index comprised of more than 5,000 government and corporate bonds, and 3-Month T-Bill Index (10%), an unmanaged market value-weighted index of investment grade fixed rate public obligations of the U.S. Treasury with maturities of 3 months, excluding zero coupon strips. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings refer to the Schedule of Investments section of this report.

| | |

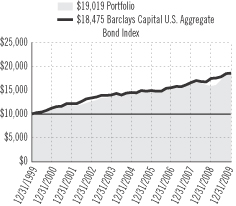

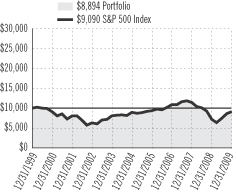

The Prudential Series Fund, Diversified Bond Portfolio Subadvised by: Prudential Investment Management, Inc. | | December 31, 2009 |

Investment Manager’s Report - As of December 31, 2009

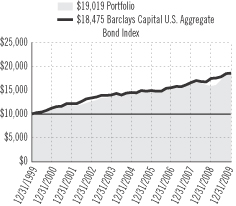

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | 20.51 | % | | 5.92 | % | | 6.64 | % |

Barclays Capital U.S. Aggregate Bond Index | | 5.93 | | | 4.97 | | | 6.33 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

$10,000 INVESTED OVER 10 YEARS

Portfolio inception: 5/13/1983. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Diversified Bond Portfolio rose 20.51%.

The U.S. government and the Federal Reserve took steps to steady the nation’s financial system and stimulate the economy. Both had been hurt by a protracted credit crisis. The financial system began to heal in 2009 and the economy began to tentatively emerge from the so-called “Great Recession,” even though job losses continued to climb. The favorable developments boosted investor confidence in bonds with greater credit risk than U.S. Treasury securities. Riskier bonds were also sought for their attractive yields in the low interest-rate environment. Most notably, prices soared on high yield corporate “junk” bonds, while the Treasury market ended 2009 in the red.

Prudential Fixed Income, which is part of Prudential Investment Management, Inc., runs the Portfolio, which outperformed the Barclays Capital U.S. Aggregate Bond Index (the Index) primarily because it had a larger exposure than the Index to investment-grade corporate bonds, commercial mortgage-backed securities, and asset-backed securities. Each of these markets beat the Index in 2009. In addition to support provided by generally improving economic conditions, corporate bonds gained as many firms strengthened their balance sheets. One initiative that aided the financial system was the Term Asset Backed Securities Loan Facility (TALF), which provides loans on favorable terms to investors who buy high-quality bonds backed by cash flows from credit cards, commercial mortgages, or certain other types of loans and leases. Sales of these bonds help keep credit flowing to businesses and consumers. TALF and a related initiative encouraged a rally in asset-backed securities, residential mortgage-backed securities not guaranteed by federal agencies, and commercial mortgage-backed securities.

The Portfolio had smaller exposures than the Index to Treasury securities, federal agency debt securities, and mortgage-backed securities guaranteed by Ginnie Mae, Fannie Mae, and Freddie Mac. This worked well because each of these markets trailed the Index in 2009. The Portfolio had a larger exposure than the Index to emerging market bonds, which also worked well as this market outperformed the Index.

The Portfolio benefited from its exposure to two riskier markets not included in the Index. It held high yield corporate bonds and leveraged bank loans, both of which beat the Index. Leveraged bank loans are generally considered a more conservative type of investment than high yield bonds because, in most cases, a bankrupt firm will pay off its leveraged loan before it pays off its high yield bonds.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index comprised of more than 5,000 government and corporate bonds. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings refer to the Schedule of Investments section of this report.

| | |

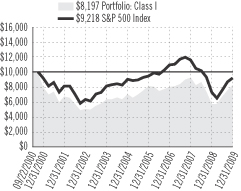

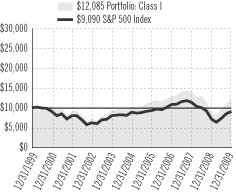

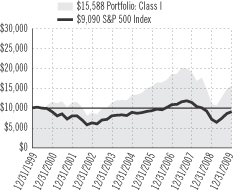

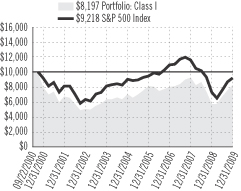

The Prudential Series Fund, Equity Portfolio Subadvised by: Jennison Associates LLC | | December 31, 2009 |

Investment Manager’s Report - As of December 31, 2009

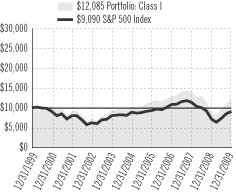

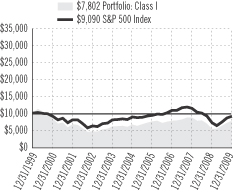

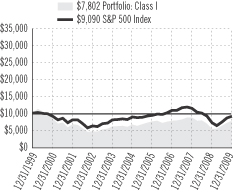

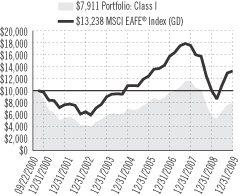

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

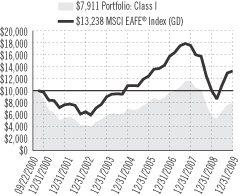

Portfolio: Class I | | 38.17 | % | | 3.23 | % | | 1.91 | % |

Portfolio: Class II | | 37.58 | | | 2.82 | | | 1.50 | |

Russell 1000® Index | | 28.43 | | | 0.79 | | | -0.49 | |

S&P 500 Index | | 26.47 | | | 0.42 | | | -0.95 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

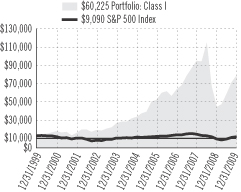

$10,000 INVESTED OVER 10 YEARS1

Portfolio (Class I) inception: 5/13/1983. Portfolio (Class II) inception: 5/4/1999. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted.

The Russell 1000® Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Equity Portfolio Class I shares rose 38.17%, while the Class II shares rose 37.58%, significantly outperforming the S&P 500 Index (the Index). The investment objective of this Portfolio is long-term growth of capital.

Every sector was a source of positive relative performance, and stock selection nearly across the board drove the Portfolio’s strong performance. The top 10 contributors came from seven different sectors.

Positions in information technology benefited absolute performance most. An overweight stance in the sector was the primary driver of outperformance. Energy positions also bolstered overall performance. Jennison remains bullish on the long-term supply/demand imbalances for oil and natural gas, and prefers exploration and production companies with organic production and reserve growth because they have the highest leverage to rising oil/gas prices. The investment team also seeks exploration and production companies with low per-barrel operating costs. The Portfolio substantially outperformed in financials and its underweight stance also added to performance relative to its benchmark, the S&P 500 Index.

Industrials was the one sector that detracted from absolute return. However, the Portfolio’s smaller exposure to the sector resulted in positive relative performance.

From the depths of their March lows, equity markets have posted impressive rebounds, with most indexes gaining 50% or more through year-end. Corporate profits, which have been much better than were thought possible at the beginning of 2009, largely due to workforce and inventory reductions, have provided much of the fuel for this recovery in equities. Favorable interest rate and liquidity conditions have been instrumental in spurring the rally, as well. With these tailwinds in place, there is reason to be optimistic that further gains lie ahead in 2010. Yet significant challenges remain, including high unemployment, still-weak housing markets, and probable increases in tax rates. Against this backdrop, Jennison remains cautiously optimistic.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

Russell 1000® Index is a market cap-weighted index that measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

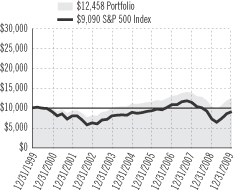

The Prudential Series Fund, Flexible Managed Portfolio Subadvised by: Prudential Investment Management, Inc., Quantitative Management Associates, LLC | | December 31, 2009 |

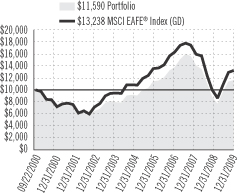

Investment Manager’s Report - As of December 31, 2009

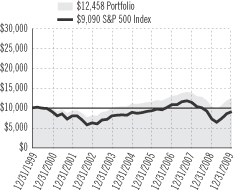

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

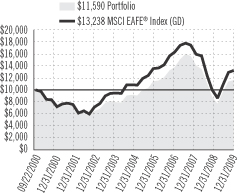

Portfolio | | 19.95 | % | | 2.30 | % | | 2.22 | % |

Blended Index | | 18.08 | | | 2.42 | | | 2.07 | |

S&P 500 Index | | 26.47 | | | 0.42 | | | -0.95 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

$10,000 INVESTED OVER 10 YEARS

Portfolio inception: 5/13/1983. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Flexible Managed Portfolio rose 19.95%.

Quantitative Management Associates, LLC runs the Portfolio whose objective is total return consistent with an aggressively managed diversified portfolio. The Portfolio is diversified across a combination of equity and equity-related securities, debt obligations, and money market instruments.

A scorching broad-based rally in global equity markets began in March 2009 and continued during the year as global economic conditions improved. Developed market equities outperformed the U.S. stock market partially due to a weakening greenback. In the United States, mid-cap stocks and the growth style of investing led gains. Emerging market stocks were the stars, returning nearly 79% overall in U.S. dollar terms as investors increasingly sought riskier assets in pursuit of higher returns.

In the fixed-income markets, yield-hungry investors snapped up riskier debt securities encouraged by improving global economic conditions and the low interest-rate environment, among other factors. This preference for riskier assets, supply pressures that emerged as a flood of U.S. Treasuries were issued, and renewed inflation fears pressured the U.S. Treasury market, which ended the year in the red.

The Portfolio outperformed the blended index because it maintained a slightly larger exposure to equities than the guideline weight of 60%. The Portfolio also benefited from a fixed-income strategy that emphasized investment-grade corporate bonds, commercial mortgage-backed securities, emerging market bonds, and certain other types of debt securities that carry greater credit risk than ultra-safe U.S. Treasury securities, which are backed by the federal government. These riskier bond markets posted strong gains in 2009 that easily outperformed the Barclays Capital U.S. Aggregate Bond Index.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Blended Index consists of S&P 500 Index (60%), Barclays Capital U.S. Aggregate Bond Index (35%), an unmanaged index comprised of more than 5,000 government and corporate bonds, and 3-Month T-Bill Index (5%), an unmanaged market value-weighted index of investment grade fixed rate public obligations of the U.S. Treasury with maturities of 3 months, excluding zero coupon strips. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings refer to the Schedule of Investments section of this report.

| | |

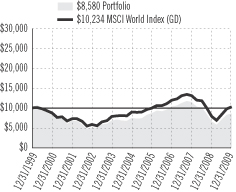

The Prudential Series Fund, Global Portfolio Subadvised by: LSV Asset Management, Marsico Capital Management, LLC, Quantitative Management Associates LLC, T. Rowe Price

Associates, Inc., William Blair & Company LLC | | December 31, 2009 |

Investment Manager’s Report - As of December 31, 2009

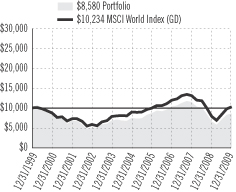

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | 31.39 | % | | 2.85 | % | | -1.52 | % |

MSCI World Index (GD) | | 30.79 | | | 2.57 | | | 0.23 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

$10,000 INVESTED OVER 10 YEARS

Portfolio inception: 9/19/1988. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Global Portfolio rose 31.39%.

The Portfolio is co-managed by four specialist firms: Marsico Capital Management (Marsico), T. Rowe Price Associates, Inc. (T. Rowe Price), William Blair & Company, LLC (William Blair), and LSV Asset Management (LSV). The Portfolio seeks growth of capital over the long term by investing in growth and value stocks of large companies in the United States and abroad.

A scorching broad-based rally in global equity markets began in March 2009 and continued during the year as global economic conditions improved. Developed market equities outperformed the U.S. stock market due partially to a weakening greenback. In the United States, mid-cap stocks and the growth style of investing led gains. Emerging market stocks were the stars, returning nearly 79% overall in U.S. dollar terms as investors increasingly sought riskier assets in pursuit of higher returns.

The Portfolio outperformed the MSCI World Index due to the strong relative performances of three of its portions versus their respective style-specific benchmark indexes. The U.S. large-cap value portion managed by T. Rowe Price outperformed its style-specific benchmark index driven by stock selection in the financials and industrials sectors. The T. Rowe Price portion also benefited from an overweight in the technology sector. An overweight in consumer discretionary and an underweight in utilities also aided relative results.

The LSV portion, which invests in international large-cap value stocks, outperformed its style-specific benchmark index largely because the attributes of its “deep value” investment style, including low price-to-earnings (P/E) and price-to-book (P/B) ratios and high dividend-yield stocks, were rewarded in 2009. The LSV portion also benefitted from strong stock selection in the industrials, consumer discretionary, and technology sectors.

The portion managed by William Blair, which invests in international mid- and large-cap growth stocks, outperformed its style-specific benchmark index largely due to country allocations. Exposure to emerging markets nations Brazil and South Africa boosted performance as they returned more than 100% and 50% respectively in U.S. dollar terms. An underweight in Japanese stocks also benefited performance as Japan was the worst performing developed market.

The Marsico portion, which invests in U.S. large-cap growth stocks, was the only one that underperformed its style-specific benchmark index. Most of its underperformance was driven by sector exposures, notably an overweight position in the financials sector, banks in particular, and an underweight to technology.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

MSCI World Index (GD) - The Morgan Stanley Capital International World Index is an unmanaged capitalization weighted index which includes the equity markets of Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Malaysia, Netherlands, New Zealand, Norway, Singapore, Spain, Sweden, Switzerland, United Kingdom and United States. The GD version does not reflect the impact of withholding taxes on reinvested dividends. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

The Prudential Series Fund, Government Income Portfolio Subadvised by: Prudential Investment Management, Inc. | | December 31, 2009 |

Investment Manager’s Report - As of December 31, 2009

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | 7.71 | % | | 4.78 | % | | 6.18 | % |

Barclays Capital Government Bond Index | | -2.20 | | | 4.87 | | | 6.17 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

$10,000 INVESTED OVER 10 YEARS

Portfolio inception: 5/1/1989. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Government Income Portfolio rose 7.71%.

The U.S. government and the Federal Reserve took steps to steady the nation’s financial system and stimulate the economy. Both had been hurt by a protracted credit crisis. The financial system began to heal in 2009 and the economy began to tentatively emerge from the so-called “Great Recession,” even though job losses continued to climb. The favorable developments boosted investor confidence in bonds with greater credit risk than U.S. Treasury securities. Riskier bonds were also sought for their attractive yields in the low interest-rate environment. Therefore, prices climbed on debt securities such as corporate bonds, while the U.S. Treasury market ended 2009 in the red.

Prudential Fixed Income which is part of Prudential Investment Management, Inc., runs the Portfolio, which outperformed the Barclays Capital U.S. Government Bond Index (the Index) because it had exposure to commercial mortgage-backed securities as well as good security selection within that market, which easily outperformed the Index in 2009. Commercial mortgage-backed securities gained sharply after the Fed launched the Term Asset Backed Securities Loan Facility (TALF), which provides loans at favorable terms to investors who buy high-quality bonds backed by cash flows from pools of credit cards, auto loans, commercial mortgages, or certain other types of loans. Sales of these debt securities help keep credit flowing to businesses and consumers.

The Portfolio also benefited from taking advantage of pricing inefficiencies within in the U.S. Treasury market between STRIPS (Separate Trading of Registered Interest and Principal of Securities) and TIPS (Treasury Inflation Protected Securities) and between newly issued Treasury securities and those issued earlier with higher coupons.

Another positive was the Portfolio’s favorable security selection among residential mortgage-backed securities guaranteed by Ginnie Mae, Fannie Mae, and Freddie Mac. The Portfolio emphasized mortgage-backed securities with higher coupons that benefited from a decrease in the rate of expected prepayments on the securities and from a program in which the Fed purchased the securities to help support the housing market and mortgage industry. Additionally, the Portfolio held shares of the Dryden Core Investment Fund—Short Term Bond Series, which gained in value amid the environment that favored riskier assets.

On a negative note, the Portfolio’s strategies for managing its duration (sensitivity to changes in the level of interest rates) and its positioning on the yield curve subtracted slightly from its performance in 2009.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Barclays Capital Government Bond Index is a weighted index comprised of securities issued or backed by the U.S. Government, its agencies and instrumentalities with a remaining maturity of one to thirty years. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings refer to the Schedule of Investments section of this report.

| | |

The Prudential Series Fund, High Yield Bond Portfolio Subadvised by: Prudential Investment Management, Inc. | | December 31, 2009 |

Investment Manager’s Report - As of December 31, 2009

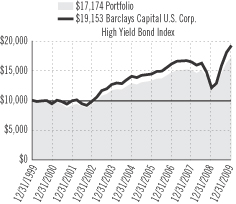

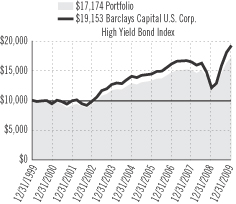

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | 47.16 | % | | 6.00 | % | | 5.56 | % |

Barclays Capital U.S. High Yield 2% Issuer Capped Index | | 58.76 | | | 6.49 | | | 6.87 | |

Barclays Capital U.S. High Yield 1% Issuer Capped Index | | 59.45 | | | 6.38 | | | 6.88 | |

Barclays Capital U.S. Corp. High Yield Bond Index | | 58.21 | | | 6.46 | | | 6.71 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

$10,000 INVESTED OVER 10 YEARS

Portfolio inception: 2/23/1987. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the High Yield Bond Portfolio rose 47.16%.

The U.S. government and the Federal Reserve took steps to steady the nation’s financial system and stimulate the economy. Both had been hurt by a protracted credit crisis. The financial system began to heal in 2009 and the economy began to tentatively emerge from the so-called “Great Recession,” even though job losses continued to climb. The favorable developments boosted investor confidence in bonds with greater credit risk than U.S. Treasury securities, which are backed by the federal government. Riskier bonds were also sought for their attractive yields in the low interest-rate environment. Most notably, prices soared on high yield corporate “junk” bonds, enabling the market for below investment-grade corporate bonds to post a record annual return in 2009 that outperformed other U.S. bond markets.

Within the high yield market, all ratings categories, sectors, and industries ended 2009 in positive territory. The lower rating categories, Caa and Ca-D, easily outperformed the higher rating categories, Ba and single-B. Some of the largest gains were posted by bonds of firms in cyclical industries that are more sensitive to the business cycle such as banking, retailers, automotive, and home construction. Some of the more modest gains were posted by bonds of firms in industries that tend to be less sensitive to the business cycle such as electric utilities and healthcare.

The Portfolio’s double-digit return reflected the bullish environment for investing in high yield bonds. However, it trailed the Barclays Capital U.S. High Yield 1% Issuer Capped Index (the Index) because Prudential Fixed Income which is part of Prudential Investment Management, Inc., maintained a generally cautious approach to sector allocation and security selection in the high yield market. Consequently, the Portfolio did not own certain types of lower-quality bonds that soared in value in 2009. For example, the Portfolio had a smaller exposure than the Index to the financial sector, which outperformed the Index in 2009. The Portfolio also had a larger exposure than the Index to defensive industries such as healthcare and electric utilities, which lagged the Index in 2009. As for security selection, holding bonds that performed particularly well in the paper sector helped the Portfolio’s performance versus the Index, but owning bank loans of a major utility holding company in Texas detracted from its relative performance.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

Barclays Capital U.S. High Yield 1% and 2% Issuer Capped Indexes cover the universe of U.S. dollar denominated, non-convertible, fixed-rate, non-investment-grade debt. Issuers are capped at 1% and 2% of the Index, respectively. Index holdings must have at least one year to final maturity, at least $150 million par amount outstanding, and be publicly issued with a rating of Ba1 or lower. Barclays Capital U.S. Corporate High Yield Bond Index is an unmanaged index of fixed-rate, non-investment-grade debt securities with at least one year remaining to maturity. It gives a broad look at how high yield (“junk”) bonds have performed. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

The Prudential Series Fund, Jennison Portfolio Subadvised by: Jennison Associates LLC | | December 31, 2009 |

Investment Manager’s Report - As of December 31, 2009

Average Annual Total Return Percentages

| | | | | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Portfolio: Class I | | 43.03 | % | | 3.22 | % | | -2.45 | % | | N/A | |

Portfolio: Class II | | 42.58 | | | 2.80 | | | N/A | | | -3.42 | % |

Russell 1000® Growth Index | | 37.21 | | | 1.63 | | | -3.99 | | | -3.55 | |

S&P 500 Index | | 26.47 | | | 0.42 | | | -0.95 | | | -0.44 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

$10,000 INVESTED OVER 10 YEARS1

Portfolio (Class I) inception: 4/25/1995. Portfolio (Class II) inception: 2/10/2000. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Unless noted otherwise, Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception (Class II).

The Russell 1000® Growth Index is a trademark/service of the Frank Russell Company. Russell® is the Frank Russell Company. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

In the year ended December 31, 2009, the Jennison Portfolio Class I shares rose 43.03%, while the Class II shares rose 42.58%.

Information technology holdings contributed most to the Portfolio’s return, as both an overweighting relative to its benchmark, the Russell 1000® Growth Index (the Index), and strong stock selection were beneficial. Notable performers in the sector included a well-known computer innovator that is benefiting from its cutting-edge software for managing, editing, and sharing digital data, photos, music, and video. The company is also gaining access to significant incremental growth opportunities in the mobile phone market. Another key contributor advanced on its technological lead and dominant position in Internet search.

Stock selection was also strong in consumer discretionary, where an online retailer continues to be a prime beneficiary of the secular shift to e-commerce. Jennison believes this company’s highly targeted merchandising and ability to control pricing, fulfillment, and delivery times distinguish it from its e-commerce competitors. Jennison expects it to continue to gain market share in both overall retail and e-commerce.

In healthcare, an optical care leader benefited from takeover speculation and a leading pharmacy benefits manager gained on the industry’s positive fundamental outlook and the company’s diverse and differentiated product offering. In financials, a major financial services company, gained on strong capital markets activity, declining systemic risks, and an improving investment banking deal pipeline.

Key detractors from return included overweight positions relative to the Index in healthcare and energy, and stock selection in industrials, where a defense contractor fell on concerns that future defense spending might be affected by the tight federal budget. In the consumer staples sector, a major retailer was challenged by currency exchange issues, tough same-store sales results, and higher general and administrative expenses.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

Russell 1000 Growth Index is a market cap-weighted index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

The Prudential Series Fund, Money Market Portfolio Subadvised by: Prudential Investment Management, Inc. | | December 31, 2009 |

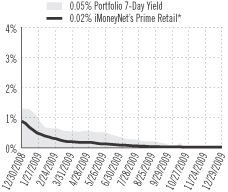

Investment Manager’s Report - As of December 31, 2009

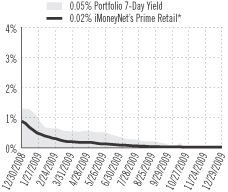

Average Annual Total Return Percentages

| | | | | | | | | | | | |

| | | 7-Day*

Current

Net Yield | | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | 0.05 | % | | 0.40 | % | | 3.14 | % | | 2.92 | % |

Lipper (VIP) Money Market Funds Avg. | | N/A | | | 0.19 | | | 2.87 | | | 2.70 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

7-DAY CURRENT NET YIELD*

Portfolio inception: 5/13/1983. The yield quotation more closely reflects the current earnings of the Portfolio than the total return quotation. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Money Market Portfolio had a total return of 0.40%.

The U.S. government and the Federal Reserve took steps to steady the nation’s financial system and stimulate the economy. Both had been hurt by a protracted credit crisis. Improvement in the financial system began slowly, then accelerated as liquidity returned to the markets, boosting investor confidence. Meanwhile, key initiatives aimed at stimulating consumer spending aided the economic recovery.

Money market yields declined to historically low levels in 2009 as the Federal Open Market Committee kept its target for the overnight bank lending rate at a record low range of zero to 0.25%, and reiterated its desire for short-term rates to remain low for an extended period of time to boost economic growth. The decline in money market yields was further exacerbated by an enormous amount of cash that needed to be invested at a time when issuers were decreasing their reliance on short-term financing and, therefore, issuing fewer eligible money market securities.

The Portfolio outperformed the Lipper (VIP) Money Market Funds Average in 2009. On December 29, 2009, the Portfolio’s 7-day current net yield was 0.05%, down from 1.32% on December 30, 2008. This yield more closely reflects the current earnings of the Portfolio than does the total return.

Due to the uncertainty in the credit markets, the Portfolio continued to employ a conservative strategy. It invested primarily in money market securities of highly rated corporate issuers, highly rated banks, and government agencies. Additionally, the Portfolio also invested in overnight repurchase agreements, contracts in which a seller of securities agrees to buy them back the next day at a specified price. This prudent approach resulted in a high level of liquidity in the Portfolio and positioned the Portfolio’s weighted average maturity (WAM) shorter than that of the average comparable fund for much of the year. (WAM measures a fund’s sensitivity to changes in the level of interest rates. It considers the maturity and quantity of each security held in a portfolio.)

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| * | Source: iMoneyNet, Inc. based on 324 funds in the iMoneyNet Prime Retail universe. Weekly 7-day current net yields of the Money Market Portfolio and the iMoneyNet Prime Retail universe as of 12/29/2009. |

The Lipper Variable Insurance Products (VIP) Funds Averages are calculated by Lipper Analytical Services, Inc., and reflect the investment return of certain portfolios underlying variable life and annuity products. These returns are net of investment fees and fund expenses, but not product charges. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index or average. For a complete list of holdings refer to the Schedule of Investments section of this report.

| | |

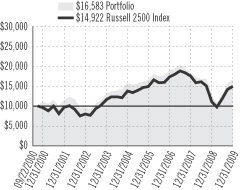

The Prudential Series Fund, Natural Resources Portfolio Subadvised by: Jennison Associates LLC | | December 31, 2009 |

Investment Manager’s Report - As of December 31, 2009

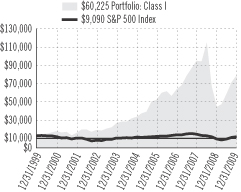

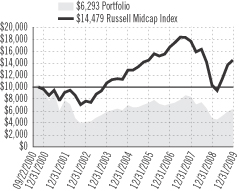

Average Annual Total Return Percentages

| | | | | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Portfolio: Class I | | 77.10 | % | | 18.65 | % | | 19.67 | % | | N/A | |

Portfolio: Class II | | 76.41 | | | N/A | | | N/A | | | 18.76 | % |

Lipper (VIP) Natural Resources Funds Avg. | | 50.06 | | | 12.16 | | | 13.67 | | | 12.58 | |

Lipper (VUF) Natural Resources Funds Index | | 53.38 | | | 11.84 | | | N/A | | | 12.88 | |

S&P 500 Index | | 26.47 | | | 0.42 | | | -0.95 | | | 1.33 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

$10,000 INVESTED OVER 10 YEARS1

Portfolio (Class I) inception: 5/1/1988. Portfolio (Class II) inception: 4/28/2005. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Unless noted otherwise, Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception (Class II). Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Natural Resources Portfolio Class I shares rose 77.10%, while the Class II shares rose 76.41%. Jennison’s Natural Resources strategy seeks capital appreciation by investing in the stocks of companies that own, explore, mine, process, or otherwise develop natural resource commodities.

All industries that the Portfolio invested in achieved double-digit absolute returns for the year. Among the most meaningful contributors to performance were metals and mining, which advanced 90%, and energy equipment and services, which appreciated 83% during the year.

The top contributor to performance was a U.S.-based copper and gold producer. Shares rose as the company reported strong financial results that surpassed consensus expectations mostly on higher-than-expected volumes across all metals. Jennison believes a large, long-term supply deficit should boost prices for both of these commodities. Furthermore, Jennison has confidence in the company’s strong management team, which operated well during the commodities downturn by quickly reducing capital expenditures and production to strengthen its financial position while preserving its long-lived reserves and future growth options.

Another copper and gold producer, this one based in Canada, was among the key contributors to performance. The company operates properties in the Central African copper belt, including Zambia, the Democratic Republic of Congo (DRC) and Mauritania. The stock performed well following the completion of a convertible debt offering, which will allow the company to consider strategic merger and acquisition activity.

A Brazil-based early stage exploration and production company also contributed to performance. Jennison remains positive on the longer-term prospects for large-scale exploitation of Brazil’s offshore and believes share prices remain attractively valued despite recent appreciation.

Among the holdings that detracted from performance was an aluminum producer that declined sharply earlier in the year as rising aluminum inventories led to a significant price decline for the commodity. The company closed facilities and exercised strict production discipline. Share prices have begun to recover with an improving demand outlook for aluminum that is being driven by manufacturing growth in China.

An independent power producer also detracted from return. Weaker than previously issued 2010 guidance and the impending departure of the company’s CFO pressured shares. Jennison believes that the company is likely being conservative with its guidance and continues to hold the position, as it has the potential to be one of the best investments of the independent power producers.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15% respectively of the average daily net assets of the Class II shares. |

The Lipper Variable Insurance Products (VIP) Natural Resources Funds Averages are calculated by Lipper Analytical Services, Inc., and reflect the investment return of certain portfolios underlying variable life and annuity products. The Lipper Variable Underlying Funds (VUF) Natural Resources Funds Index consists of an equal dollar-weighted composite of the 10 largest funds in the Lipper VUF Natural Resources Fund classification. The index is rebalanced quarterly. Natural Resources Funds are deemed as funds that invest primarily in the equity securities of domestic and foreign companies engaged in natural resources. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns are net of investment fees and fund expenses, but not product charges. Investors cannot invest directly in a market index or average. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

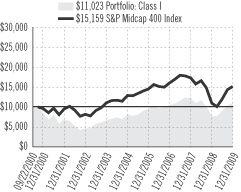

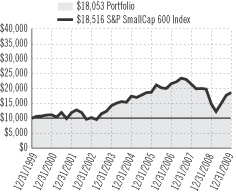

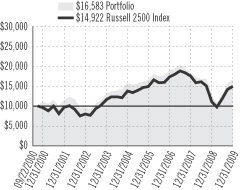

The Prudential Series Fund, Small Capitalization Stock Portfolio Subadvised by: Quantitative Management Associates LLC | | December 31, 2009 |

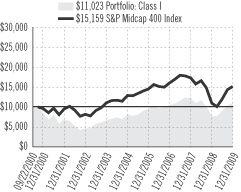

Investment Manager’s Report - As of December 31, 2009

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

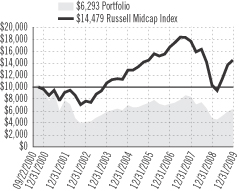

Portfolio | | 25.18 | % | | 1.10 | % | | 6.09 | % |

S&P SmallCap 600 Index | | 25.57 | | | 1.36 | | | 6.35 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

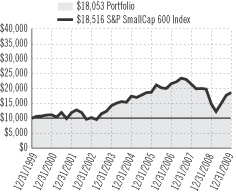

$10,000 INVESTED OVER 10 YEARS

Portfolio inception: 4/25/1995. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Small Capitalization Stock Portfolio rose 25.18%.

Quantitative Management Associates, LLC runs the Portfolio, which is an index fund that uses quantitative techniques to replicate the holdings and weights of the S&P SmallCap 600 Index.

The Portfolio performed in line with the S&P SmallCap 600 Index, helped by income the Portfolio earned from lending its securities to others, favorable trading processes and results, and stabilizing interest rates.

The U.S. government and the Federal Reserve (the Fed) took steps to steady the nation’s financial system and stimulate the economy, both of which had been hurt by a protracted credit crisis. The financial system began to heal in 2009 and the economy began to tentatively emerge from the so-called “Great Recession,” even though job losses continued to climb. The favorable developments boosted investor confidence in stocks and a powerful rally in the U.S. stock market that began in March 2009 continued during the year.

Shares of small, risky value companies often are the first to outperform as an economic recovery begins. Initially, small-cap stocks outperformed large-cap stocks, while value stocks of all market capitalizations outperformed growth stocks. However, as U.S. debt and unemployment numbers grew, investors recognized that the economic recovery may be less robust than initially hoped. Consequently, larger, more established growth companies with the financial stamina to expand earnings and revenue during a prolonged economic malaise assumed leadership. For the year, mid-cap stocks outperformed both small- and large-cap stocks.

Within the S&P SmallCap 600 Index, seven out of 10 sectors scored double-digit gains for the year. The best performers were the energy and consumer discretionary sectors. The less economically sensitive utilities sector posted a single-digit gain for the year. The worst performers in 2009 were the financials sector, which posted a single-digit decline, and the telecommunications services sector, which posted a hefty double-digit decline. Large portions of the financial industry had nearly collapsed in 2008 and required extraordinary support by the federal government. Telecommunications were hamstrung by a combination of growing debt levels, due to expansion into the wireless arena from the fixed-line business, and falling revenues, due to declining consumer spending on telecommunications products, including cellular phones.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

S&P SmallCap 600 Index is an unmanaged index representing the aggregate market value of the common equity of 600 small-company stocks. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings refer to the Schedule of Investments section of this report.

| | |

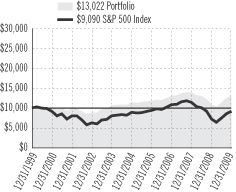

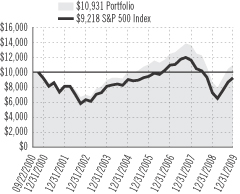

The Prudential Series Fund, Stock Index Portfolio Subadvised by: Quantitative Management Associates LLC | | December 31, 2009 |

Investment Manager’s Report - As of December 31, 2009

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Portfolio | | 26.07 | % | | 0.18 | % | | -1.16 | % |

S&P 500 Index | | 26.47 | | | 0.42 | | | -0.95 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

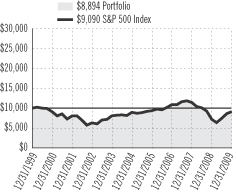

$10,000 INVESTED OVER 10 YEARS

Portfolio inception: 10/19/1987. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Stock Index Portfolio rose 26.07%.

Quantitative Management Associates, LLC runs the Portfolio, which is an index fund that uses a quantitative approach to approximate the holdings and weights of the S&P 500 Index, except for shares of Prudential Financial, Inc. The Portfolio cannot hold these shares because of compliance restrictions.

The Portfolio performed in line with the S&P 500 Index in 2009. Income the Portfolio earned from lending its securities to others offset the negative impact from the restriction on holding shares of Prudential Financial.

The U.S. government and the Federal Reserve took steps to steady the nation’s financial system and stimulate the economy. Both had been hurt by a protracted credit crisis. The financial system began to heal in 2009 and the economy began to tentatively emerge from the so-called “Great Recession,” even though job losses continued to climb. The favorable developments helped boost investor confidence in stocks and a powerful rally in the U.S. stock market that began in March 2009 continued during the year.

All sectors of the S&P 500 Index benefited from the rally. The largest contributions came from more economically sensitive stocks, the cyclicals, including top contributors information technology, materials and consumer discretionary, which stand to benefit from a global economic rebound. Information technology benefited from strong balance sheets and the anticipation that companies would upgrade their technology in order to increase efficiencies. The materials sector was attractive for its exposure to companies tied to commodities. Consumer discretionary scored attractive returns based on stronger-than-anticipated consumer spending in light of tighter credit conditions and higher unemployment. The less economically sensitive utilities and telecommunications services sectors posted the worst, although still positive, returns of any sectors.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses. Investors cannot invest directly in a market index. For a complete list of holdings refer to the Schedule of Investments section of this report.

| | |

The Prudential Series Fund, Value Portfolio Subadvised by: Jennison Associates LLC | | December 31, 2009 |

Investment Manager’s Report - As of December 31, 2009

Average Annual Total Return Percentages

| | | | | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Portfolio: Class I | | 41.93 | % | | 3.41 | % | | 4.52 | % | | N/A | |

Portfolio: Class II | | 41.39 | | | 3.00 | | | N/A | | | 2.83 | % |

Russell 1000® Value Index | | 19.69 | | | -0.25 | | | 2.47 | | | 2.20 | |

S&P 500 Index | | 26.47 | | | 0.42 | | | -0.95 | | | 0.59 | |

Past performance does not guarantee future returns. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

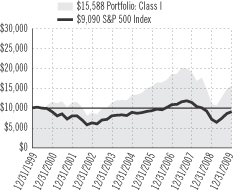

$10,000 INVESTED OVER 10 YEARS1

Portfolio (Class I) inception: 2/19/1988. Portfolio (Class II) inception: 5/14/2001. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. Unless noted otherwise, Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception (Class II). The Russell 1000® Value Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2009, the Value Portfolio Class I shares rose 41.93%, while the Class II shares rose 41.39%, significantly outperforming the Russell 1000® Value Index (the Index).

Stock selection nearly across the board drove the Portfolio’s strong returns.

Energy positions made the most meaningful positive impact on relative performance. Jennison remains bullish on the long-term supply/demand imbalances for oil and natural gas, and prefers exploration and production companies that are best positioned to benefit from rising oil/gas prices. The investment team also seeks exploration and production companies with low per-barrel operating costs.

The Portfolio’s overweight stance in information technology and stock selection in the financials, telecommunication services, healthcare, and consumer staples sectors also made a sizable contribution to relative performance.

The materials sector was the only sector that detracted from relative performance.

From the depths of their March lows, equity markets have posted impressive rebounds, with most indexes gaining 50% or more through year-end. Corporate profits, which have been much better than were thought possible at the beginning of 2009, largely due to workforce and inventory reductions, have provided much of the fuel for this recovery in equities. Favorable interest rate and liquidity conditions have been instrumental in spurring the rally, as well. Yet significant challenges remain, including high unemployment, still-weak housing markets, and probable increases in tax rates. Against this backdrop, Jennison remains cautiously optimistic.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

Russell 1000 Value Index is a market cap-weighted index that measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market. Investors cannot invest directly in a market index. For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | |

The Prudential Series Fund Presentation of Portfolio Holdings — unaudited | | December 31, 2009 |

| | |

| Conservative Balanced |

| Five Largest Holdings (% of Net Assets) |

| Exxon Mobil Corp. | | 1.6% |

| Federal National Mortgage Association, 6.000%, TBA 30 YR | | 1.5% |

U.S. Treasury Notes,

2.625%, 12/31/14 | | 1.5% |

| Microsoft Corp. | | 1.2% |

| | | |

| Apple, Inc. | | 0.9% |

| | |

| Diversified Bond |

| Allocation (% of Net Assets) |

| Corporate Bonds | | 47.2% |

| Commercial Mortgage-Backed Securities | | 15.6% |

| U.S. Government Mortgage-Backed Securities | | 12.7% |

| Asset-Backed Securities | | 5.2% |

| Residential Mortgage-Backed Securities | | 3.7% |

| | |

| Equity |

| Five Largest Holdings (% of Net Assets) |

| Occidental Petroleum Corp. | | 2.9% |

| | | |

| Google, Inc. (Class A Stock) | | 2.9% |

| | | |

| Goldman Sachs Group, Inc. (The) | | 2.7% |

| Apple, Inc. | | 2.7% |

| | | |

| Amazon.com, Inc. | | 2.4% |

| | |

| Flexible Managed | | |

| Five Largest Holdings (% of Net Assets) |

| Exxon Mobil Corp. | | 2.1% |

| Apple, Inc. | | 1.4% |

| | | |

| Microsoft Corp. | | 1.3% |

| | | |

| Procter & Gamble Co. (The) | | 1.3% |

| | | |

| JPMorgan Chase & Co. | | 1.3% |

| | |

| Global |

| Top Five Countries (% of Net Assets) |

| United States | | 41.5% |

| United Kingdom | | 9.5% |

| | | |

| Japan | | 8.1% |

| | | |

| France | | 5.1% |

| | | |

| Switzerland | | 4.5% |

| | |

| Government Income |

| Allocation (% of Net Assets) |

| Mortgage-Backed Securities | | 42.5% |

| U.S. Treasury Securities | | 28.7% |

| U.S. Government Agency Obligations | | 8.8% |

| Commercial Mortgage-Backed Securities | | 8.5% |

| Collateralized Mortgage Obligations | | 3.7% |

| | |

| High Yield Bond |

| Allocation (% of Net Assets) |

| Corporate Bonds | | 89.2% |

| | | |

| Bank Loans | | 6.1% |

| Collateralized Mortgage Obligations | | 0.2% |

| Asset-Backed Securities | | 0.2% |

| Common Stocks | | 0.1% |

| | |

| Jennison |

| Five Largest Holdings (% of Net Assets) |

| Google, Inc. (Class A Stock) | | 4.9% |

| | | |

| Apple, Inc. | | 4.8% |

| | | |

| Amazon.com, Inc. | | 4.2% |

| Microsoft Corp. | | 4.1% |

| QUALCOMM, Inc. | | 3.5% |

| | |

| Natural Resources |

| Five Largest Holdings (% of Net Assets) |

| Southwestern Energy Co. | | 2.7% |

| Freeport-McMoRan Copper & Gold, Inc. | | 2.2% |

| | | |

| Occidental Petroleum Corp. | | 2.1% |

| Halliburton Co. | | 2.0% |

| Apache Corp. | | 1.8% |

| | |

| Small Capitalization Stock | | |

| Five Largest Holdings (% of Net Assets) |

| Mednax, Inc. | | 0.7% |

| Varian Semiconductor Equipment Associates, Inc. | | 0.7% |

| Skyworks Solutions, Inc. | | 0.6% |

| Gardener Denver, Inc. | | 0.6% |

| St Mary Land & Exploration Co. | | 0.5% |

| | |

| Stock Index | | |

| Five Largest Holdings (% of Net Assets) |

| Exxon Mobil Corp. | | 3.2% |

| | | |

| Microsoft Corp. | | 2.3% |

| Apple, Inc. | | 1.9% |

| Johnson & Johnson | | 1.8% |

| Procter & Gamble Co. (The) | | 1.8% |

| | |

| Value | | |

| Five Largest Holdings (% of Net Assets) |

| Symantec Corp. | | 3.0% |

| | | |

| CA, Inc. | | 3.0% |

| H&R Block, Inc. | | 2.5% |

| IAC/InterActiveCorp | | 2.4% |

| NII Holdings, Inc. | | 2.2% |

For a complete list of holdings, please refer to the Schedule of Investments section of this report. Holdings reflect only long-term investments. Holdings/Issues/Industries/Sectors are subject to change.

| | |

The Prudential Series Fund Fees and Expenses — unaudited | | December 31, 2009 |

As a contract owner investing in Portfolios of the Fund through a variable annuity or variable life contract, you incur ongoing costs, including management fees, and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other investment options. This example does not reflect fees and charges under your variable annuity or variable life contract. If contract charges were included, the costs shown below would be higher. Please consult the prospectus for your contract for more information about contract fees and charges.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2009 through December 31, 2009.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the Portfolio expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Six-Month Period” to estimate the Portfolio expenses you paid on your account during this period. As noted above, the table does not reflect variable contract fees and charges.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other investment options. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other investment options.

Please note that the expenses shown in the table are meant to highlight your ongoing Portfolio costs only and do not reflect any contract fees and charges, such as sales charges (loads), insurance charges or administrative charges. Therefore the second line of the table is useful to compare ongoing investment option costs only, and will not help you determine the relative total costs of owning different contracts. In addition, if these contract fee and charges were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| The Prudential Series Fund Portfolios | | Beginning

Account Value

July 1, 2009 | | Ending

Account Value

December 31, 2009 | | Annualized Expense

Ratio based on the

Six-Month period | | | Expenses Paid

During the

Six-Month period |

| Conservative Balanced (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,150.80 | | 0.57 | % | | $ | 3.09 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.33 | | 0.57 | % | | $ | 2.91 |

| Diversified Bond (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,112.40 | | 0.42 | % | | $ | 2.24 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,023.09 | | 0.42 | % | | $ | 2.14 |

| Equity (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,241.00 | | 0.48 | % | | $ | 2.71 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.79 | | 0.48 | % | | $ | 2.45 |

| Equity (Class II) | | Actual | | $ | 1,000.00 | | $ | 1,238.10 | | 0.88 | % | | $ | 4.96 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,020.77 | | 0.88 | % | | $ | 4.48 |

| Flexible Managed (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,161.90 | | 0.62 | % | | $ | 3.38 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.08 | | 0.62 | % | | $ | 3.16 |

| Global (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,222.90 | | 0.83 | % | | $ | 4.65 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,021.02 | | 0.83 | % | | $ | 4.23 |

| Government Income (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,046.90 | | 0.46 | % | | $ | 2.37 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.89 | | 0.46 | % | | $ | 2.35 |

| High Yield Bond (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,190.20 | | 0.58 | % | | $ | 3.20 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.28 | | 0.58 | % | | $ | 2.96 |

| Jennison (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,246.70 | | 0.63 | % | | $ | 3.57 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.03 | | 0.63 | % | | $ | 3.21 |

| Jennison (Class II) | | Actual | | $ | 1,000.00 | | $ | 1,244.60 | | 1.03 | % | | $ | 5.83 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,020.01 | | 1.03 | % | | $ | 5.24 |

| Money Market (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,000.73 | | 0.36 | % | | $ | 1.82 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,023.39 | | 0.36 | % | | $ | 1.84 |

| | |

The Prudential Series Fund Fees and Expenses — unaudited (continued) | | December 31, 2009 |

| | | | | | | | | | | | | | |

| The Prudential Series Fund Portfolios | | Beginning

Account Value

July 1, 2009 | | Ending

Account Value

December 31, 2009 | | Annualized Expense

Ratio based on the

Six-Month period | | | Expenses Paid

During the

Six-Month period |

| Natural Resources (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,337.30 | | 0.53 | % | | $ | 3.12 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.53 | | 0.53 | % | | $ | 2.70 |

| Natural Resources (Class II) | | Actual | | $ | 1,000.00 | | $ | 1,334.80 | | 0.93 | % | | $ | 5.47 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,020.52 | | 0.93 | % | | $ | 4.74 |

| Small Capitalization Stock (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,244.80 | | 0.47 | % | | $ | 2.66 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,022.84 | | 0.47 | % | | $ | 2.40 |

| Stock Index (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,223.20 | | 0.36 | % | | $ | 2.02 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,023.39 | | 0.36 | % | | $ | 1.84 |

| Value (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,232.70 | | 0.42 | % | | $ | 2.36 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,023.09 | | 0.42 | % | | $ | 2.14 |

| Value (Class II) | | Actual | | $ | 1,000.00 | | $ | 1,229.50 | | 0.82 | % | | $ | 4.61 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,021.07 | | 0.82 | % | | $ | 4.18 |

Portfolio expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended December 31, 2009, and divided by the 365 days in the Portfolio’s fiscal year ended December 31, 2009 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Portfolio may invest.

| | | | | | |

| | | CONSERVATIVE BALANCED PORTFOLIO | | |

| |

| SCHEDULE OF INVESTMENTS | | December 31, 2009 |

| | | | | |

| LONG-TERM INVESTMENTS — 91.2% | | |

| COMMON STOCKS — 49.5% | | Shares

| | Value

(Note 2)

|

| | | | | | |

Aerospace & Defense — 1.4% | | | | | |

Boeing Co. (The) | | 77,000 | | $ | 4,168,010 |

General Dynamics Corp. | | 41,500 | | | 2,829,055 |

Goodrich Corp. | | 13,700 | | | 880,225 |

Honeywell International, Inc. | | 80,912 | | | 3,171,750 |

ITT Corp. | | 20,100 | | | 999,774 |

L-3 Communications Holdings, Inc. | | 11,900 | | | 1,034,705 |

Lockheed Martin Corp. | | 34,100 | | | 2,569,435 |

Northrop Grumman Corp. | | 33,662 | | | 1,880,023 |

Precision Castparts Corp. | | 13,900 | | | 1,533,865 |

Raytheon Co. | | 41,800 | | | 2,153,536 |

Rockwell Collins, Inc. | | 16,600 | | | 918,976 |

United Technologies Corp. | | 100,900 | | | 7,003,469 |

| | | | |

|

|

| | | | | | 29,142,823 |

| | | | |

|

|

Air Freight & Logistics — 0.5% | | | | | |

C.H. Robinson Worldwide, Inc. | | 18,800 | | | 1,104,124 |

Expeditors International of Washington, Inc. | | 22,700 | | | 788,371 |

FedEx Corp. | | 33,900 | | | 2,828,955 |

United Parcel Service, Inc. (Class B Stock) | | 107,000 | | | 6,138,590 |

| | | | |

|

|

| | | | | | 10,860,040 |

| | | | |

|

|

Airlines | | | | | |

Southwest Airlines Co. | | 79,300 | | | 906,399 |

| | | | |

|

|

Auto Components — 0.1% | | | | | |

Goodyear Tire & Rubber Co. (The)(a) | | 25,600 | | | 360,960 |

Johnson Controls, Inc. | | 70,600 | | | 1,923,144 |

| | | | |

|

|

| | | | | | 2,284,104 |

| | | | |

|

|

Automobiles — 0.2% | | | | | |

Ford Motor Co.(a)(b) | | 347,685 | | | 3,476,850 |

Harley-Davidson, Inc. | | 25,000 | | | 630,000 |

| | | | |

|

|

| | | | | | 4,106,850 |

| | | | |

|

|

Beverages — 1.3% | | | | | |

Brown-Forman Corp. (Class B Stock) | | 11,900 | | | 637,483 |

Coca-Cola Co. (The) | | 245,600 | | | 13,999,200 |

Coca-Cola Enterprises, Inc. | | 35,100 | | | 744,120 |

Constellation Brands, Inc. (Class A Stock)(a) | | 19,400 | | | 309,042 |