UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-03623

The Prudential Series Fund

Exact name of registrant as specified in charter:

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

Address of principal executive offices:

Deborah A. Docs

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

Name and address of agent for service:

Registrant’s telephone number, including area code: 973-367-7521

Date of fiscal year end: 12/31/2006

Date of reporting period: 12/31/2006

Item 1 – Reports to Stockholders

ANNUAL REPORT

DECEMBER 31, 2006

The Prudential Series Fund

| n | | Conservative Balanced Portfolio |

| n | | Diversified Bond Portfolio |

| n | | Flexible Managed Portfolio |

| n | | Government Income Portfolio |

| n | | High Yield Bond Portfolio |

| n | | Natural Resources Portfolio |

| n | | Small Capitalization Stock Portfolio |

Please note inside are Prospectus Supplements dated November 16, & December 29, 2006 and February 9, 2007.

These documents are separate from and not a part of the annual report.

The Prudential Insurance Company of America

751 Broad Street, Newark, NJ 07102-3777

Pruco Life Insurance Company

Pruco Life Insurance Company of New Jersey

213 Washington Street, Newark, NJ 07102-3777

Pruco Life Insurance Company is not licensed to do business in New York.

IFS-A114446

T | his report is one of several that provide financial information about certain investment choices available on variable life insurance and variable annuity contracts. Based on the variable contract you own or the portfolios you invested in, you may receive additional reports that provide financial information on those investment choices. Please refer to your variable life insurance or variable annuity contract prospectus to determine which portfolios are available to you. A list of the variable contracts that this report supports is located on the inside back cover. |

This report must be preceded or accompanied by the current prospectuses for the Prudential Series Fund portfolios and the applicable variable life or annuity contract. The prospectuses contain information on the investment objectives, risks, and charges and expenses and should be read carefully.

The contract’s prospectus contains hypothetical performance illustrations that show the effect of various assumptions regarding the cost of insurance protection. You may also obtain a personalized illustration of historical performance that reflects the cost of your policy’s insurance protection.

DISCOVER THE BENEFITS OF eDelivery

| n | | Eliminate receiving printed reports. |

| n | | View documents on-line as they become available. |

| n | | Download and store e-reports on your PC. |

| n | | Help the environment by using less paper. |

To receive your semiannual/annual reports on-line, go to www.prudential.com/edelivery and enroll. Instead of receiving printed reports, you will receive notification via e-mail when new materials are available for your review. You can cancel your enrollment or change your e-mail address at any time by visiting the internet address listed above.

A description of the Fund’s proxy voting policies and procedures is available, without charge, upon request. Owners of variable annuity contracts should call 888-778-2888 and owners of variable life insurance contracts should call 800-778-2255 to obtain descriptions of the Fund’s proxy voting policies and procedures. The description is also available on the website of the Securities and Exchange Commission (the “Commission”) at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available on the website of the Commission at www.sec.gov and on the Fund’s website.

The Fund files with the Commission a complete listing of portfolio holdings as of its first and third quarter-end on Form N-Q. Form N-Q is available on the Commission’s website at www.sec.gov or by visiting the Commission’s Public Reference Room. For more information on the Commission’s Public Reference Room, please visit the Commission’s website or call 1-800-SEC-0330. Form N-Q is also available on the Fund’s website at www.prudential.com or by calling the telephone numbers referenced above.

The Fund’s Statement of Additional Information contains additional information about the Fund’s Trustees and is available without charge upon request by calling 888-778-2888.

GLOSSARY OF BENCHMARK DEFINITIONS

Conservative Balanced Custom Blended Index consists of a blend of the S&P 500 Index (50%), the Lehman Brothers Aggregate Bond Index (40%), and the 3-Month T-Bill (10%).

Flexible Managed Custom Blended Index consists of a blend of the S&P 500 Index (60%), the Lehman Brothers Aggregate Bond Index (35%), and the 3-Month T-Bill (5%).

Lehman Brothers U.S. Aggregate Bond Index is an unmanaged index comprised of more than 5,000 government and corporate bonds.

Lehman Brothers U.S. Corporate High Yield Index is an unmanaged index of fixed-rate, non-investment-grade debt securities with at least one year remaining to maturity. It gives a broad look at how high yield (“junk”) bonds have performed.

Lehman Brothers U.S. Corporate High Yield 2% Issuer Capped index covers the universe of U.S. dollar denominated, non-convertible, fixed-rate, non-investment-grade debt. Issuers are capped at 2% of the Index. Index holdings must have at least one year to final maturity, at least $150 million par amount outstanding, and be publicly issued with a rating of Ba1 or lower.

Lehman Brothers Government Bond Index is an unmanaged index comprised of securities issued or backed by the U.S. government, its agencies, and instrumentalities with a remaining maturity of 1 to 30 years.

The Lipper Variable Insurance Products (VIP) Funds Averages are calculated by Lipper Analytical Services, Inc., and reflect the investment return of certain portfolios underlying variable life and annuity products. These returns are net of investment fees and fund expenses, but not product charges.

| | | | |

| General U.S. Government Funds Average | | Large-Cap Growth Funds Average | | Small-Cap Core Funds Average |

| Global Growth Funds Average | | Large-Cap Value Funds Average | | |

| High Current Yield Funds Average | | Money Market Funds Average | | |

| International Growth Funds Average | | Multi-Cap Value Funds Average | | |

| Mixed Asset Allocation. Growth Fds Average | | Natural Resources Funds Average | | |

| Mixed Asset Allocation. Moderate Fds Average | | S&P 500 Index Funds Average | | |

Morgan Stanley Capital International Europe, Australasia, and the Far East (MSCI EAFE) Index (GD & ND) – The Morgan Stanley Capital International Europe, Australasia, Far East Index is an unmanaged capitalization-weighted index generally accepted as a benchmark for major overseas markets. The ND and GD versions of the MSCI EAFE differ in that ND returns reflect the impact of the maximum withholding taxes on reinvested dividends while the GD version does not reflect the impact of withholding taxes on reinvested dividends. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses.

Morgan Stanley Capital International (MSCI) World Index (GD & ND) – The Morgan Stanley Capital International World Index is an unmanaged capitalization weighted index which includes the equity markets of Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Malaysia, Netherlands, New Zealand, Norway, Singapore, Spain, Sweden, Switzerland, United Kingdom and United States. The ND and GD versions of the MSCI World Index differ in that ND returns reflect the impact of the maximum withholding taxes on reinvested dividends while the GD version does not reflect the impact of withholding taxes on reinvested dividends. These returns do not include the effect of any investment management expenses. These returns would have been lower if they included the effect of these expenses.

Russell 1000 Growth Index is a market cap-weighted index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000 Index is a market cap-weighted index that measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market.

Russell 1000 Value Index is a market cap-weighted index that measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 3000 Index is a market cap-weighted index that measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

S&P SmallCap 600 Index is an unmanaged index representing the aggregate market value of the common equity of 600 small-company stocks.

This page may include certain benchmarks not applicable to the portfolios available in this particular report. Investors cannot invest directly in a market index or average.

The Prudential Series Fund

Annual Report

December 31, 2006

Table of Contents

| n | | LETTER TO CONTRACT OWNERS |

| n | | FEES AND EXPENSES TABLE |

A1 Financial Statements

B1 Schedule of Investments

C1 Notes to Financial Statements

D1 Financial Highlights

E1 Report of Independent Registered Accounting Firm

F1 Management of the Prudential Series Fund

This report may include financial information pertaining to certain portfolios that are not available through the variable life insurance policy or variable annuity contract that you have chosen. Please refer to your variable life insurance or variable annuity prospectus to determine which portfolios are available to you.

The Prudential Series Fund

Letter to Contract Owners

December 31, 2006

At Prudential, we are committed to helping you achieve and sustain financial success. We hope that you find the annual report for the Prudential Series Fund to be an informative and valuable resource.

Each year, we remind our clients about the benefits of diversification within their portfolios. A diversified portfolio helps you manage downside risk by not being overly invested in any particular asset class, and it helps better position your investments as asset classes rotate in and out of favor. Not only is diversification the best way to balance risk and return, but it can also help align your long-term goals with your risk tolerance. The result is a portfolio that may help you weather market fluctuations and more closely meet your long-term needs.

Contact your financial professional to take the first step in creating a diversified investment plan. Together you should review your reasons for investing, personal investment horizon and risk tolerance to develop a strategy that works best for you. A carefully chosen and broad mix of assets—reviewed periodically over time—can help you stay focused on meeting your long-term objectives.

Thank you for selecting our financial products. At Prudential, your financial security is our priority and we value the opportunity to help you grow and protect your wealth.

Sincerely,

David R. Odenath, Jr.

President,

The Prudential Series Fund | January 31, 2007 |

PRESIDENT

DAVID R. ODENATH, JR.

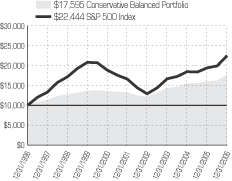

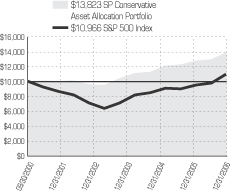

The Prudential Series Fund, Conservative Balanced Portfolio

Subadvised by: Prudential Investment Management, Inc., Quantitative Management Associates LLC

December 31, 2006

Investment Manager’s Report

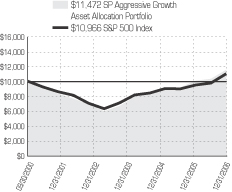

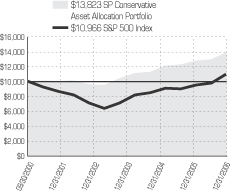

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Conservative Balanced Portfolio | | 10.44 | % | | 5.93 | % | | 5.81 | % |

S&P 500 Index | | 15.78 | | | 6.18 | | | 8.42 | |

Conservative Balanced Custom Blend Index | | 10.00 | | | 5.59 | | | 7.40 | |

Lipper Mixed Asset Target Allocation Growth Funds Avg. | | 11.67 | | | 6.37 | | | 7.18 | |

Portfolio inception: 5/13/1983.

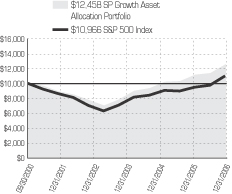

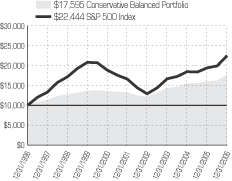

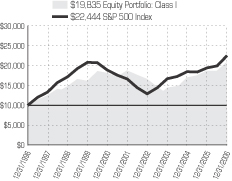

$10,000 INVESTED OVER 10 YEARS

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the Conservative Balanced Portfolio had a total return that was above its Blend Index (50% stock, 40% bond, 10% cash), but trailed the average return of its peer group.

The Portfolio’s stock holdings are managed as an index fund, with performance characteristics similar to those of the S&P 500 Index, while its bond holdings are more actively managed, focusing on high-grade bonds. Allocations to these asset classes are actively managed within a fairly wide range to take advantage of different market conditions.

The Portfolio benefited from emphasizing stocks in a year when they had exceptionally high returns. In addition, the managers added a small allocation to international stocks, which substantially outperformed the domestic market. Not only did foreign markets generally have higher returns than the United States, their returns to U.S. investors were augmented by the decline of the U.S. dollar against all major currencies except the Japanese yen. The Portfolio was underweighted in cash equivalents (very short-term securities), which added to its return in the strong markets. Its bond holdings outperformed the Lehman Aggregate Bond Index, thanks to allocations to high yield (junk) and emerging market bonds, good selection among investment grade corporate bonds, and positions in securities backed by mortgages and other assets.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings refer to the Schedule of Investments section of this report.

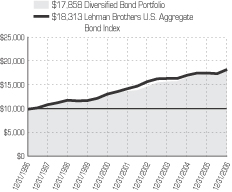

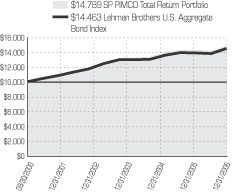

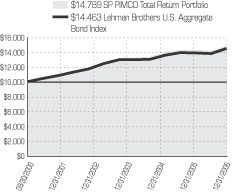

The Prudential Series Fund, Diversified Bond Portfolio

Subadvised by: Prudential Investment Management, Inc.

December 31, 2006

Investment Manager’s Report

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Diversified Bond Portfolio | | 4.98 | % | | 5.67 | % | | 5.97 | % |

Lehman Brothers U.S Aggregate Bond Index | | 4.33 | % | | 5.06 | % | | 6.24 | % |

Lipper VP Intermediate Investment Grade Debt Funds Avg. | | 4.14 | % | | 4.90 | % | | 5.81 | % |

Portfolio inception: 5/13/1983.

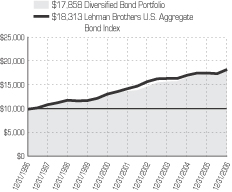

$10,000 INVESTED OVER 10 YEARS

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the Diversified Bond Portfolio had a total return that was above its benchmark index and the average of its peer group.

In the fixed income markets, 2006 proved to be a banner year for emerging market bonds and U.S. high yield corporate bonds, commonly called “junk” bonds because they are rated below investment grade. Money from around the world flowed into these debt securities as investors sought assets that provided attractive yields. They were also drawn to the high yield market by its historically low default rate and the healthy credit fundamentals of companies, many of which generated free cash flow and carried positive cash balances on their financial statements. Investors favored emerging market bonds as the global economic expansion continued, the ratings of many emerging market bonds improved, and prudent fiscal policies resulted in lower levels of public debt in some developing nations.

Both high yield bonds and emerging market bonds significantly outperformed U.S. Treasury and federal agency securities. Exposure to high yield bonds and emerging market bonds, and favorable security selection in both areas, were key reasons that the Portfolio performed better than the benchmark index, a gauge of U.S. investment grade bonds that excludes high yield and emerging market bonds. For example, the Portfolio held General Motors Corp. bonds that rallied as the troubled auto maker cut costs by reducing its work force and raised money by selling a controlling interest in General Motors Acceptance Corp. The Portfolio’s emerging-market exposure consisted of mostly sovereign bonds and a few positions in corporate bonds.

In other areas of the U.S. fixed income market, the Portfolio had overweight exposures to investment-grade corporate bonds, commercial mortgage-backed securities, and asset-backed securities (compared to the benchmark index). This strategy worked well because these markets also outperformed U.S. Treasury and federal agency securities in 2006. Even though economic growth slowed in the United States as repeated increases in short-term interest rates by the Federal Reserve took a toll on the housing sector, corporate earnings remained strong, supporting investment-grade corporate bonds. Among the Portfolio’s holding were bonds of airlines, which benefited from falling fuel prices and higher ticket prices as conditions improved in the travel industry.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings refer to the Schedule of Investments section of this report.

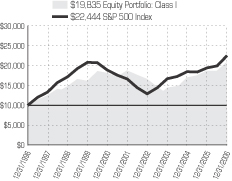

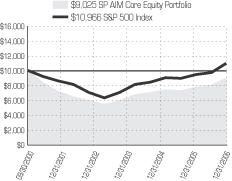

The Prudential Series Fund, Equity Portfolio

Subadvised by: Jennison Associates LLC, ClearBridge Advisors, LLC

December 31, 2006

Investment Manager’s Report

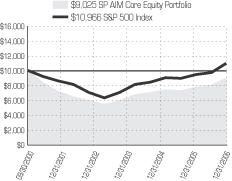

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | | | Since

Inception |

Equity Portfolio: Class I | | 12.57 | % | | 7.12 | % | | 7.09 | % | | N/A |

Equity Portfolio: Class II | | 12.13 | | | 6.70 | | | N/A | | | 2.95 |

S&P 500 Index | | 15.78 | | | 6.18 | | | 8.42 | | | 2.41 |

Russell 1000® Index | | 15.46 | | | 6.82 | | | 8.64 | | | 2.97 |

Lipper Large-Cap Core Funds Avg. | | 13.31 | | | 5.22 | | | 6.71 | | | 1.98 |

Portfolio (Class I) inception: 5/13/1983. Portfolio (Class II) inception: 5/4/1999.

$10,000 INVESTED OVER 10 YEARS1

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception (Class II).

The Russell 1000® Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the Equity Portfolio had a total return that was below its benchmarks and the average return of its peer group.

Approximately half of the Portfolio was managed by Jennison Associates, a unit of Prudential Investment Management, and approximately half by ClearBridge Advisors (formerly known as Salomon Brothers Asset Management).

Stock selection, particularly in the Jennison segment and particularly in the healthcare, technology, telecommunications, consumer non-cyclical, and consumer cyclical sectors, accounted for most of the Portfolio’s underperformance. Moreover, in an investment environment that strongly favored value stocks, it suffered from a tilt to the growth style, primarily in the Jennison segment. This was manifested in above-average acceleration of its holdings’ business fundamentals and their below-average exposure to value characteristics such as low price-to-earnings and price-to-book value ratios and debt levels.

The Portfolio’s sector distribution had a positive impact on its return. It was overweight compared with its benchmark in the strong basic materials sector and underweight in the relatively weak financials and transportation sectors. However, an underweight in the high-returning telecommunications sector detracted from its relative performance. Both managers’ segments contributed to the positive sector exposures.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15% respectively of the average daily net assets of the Class II shares. |

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings, refer to the Schedule of Investments section of this report.

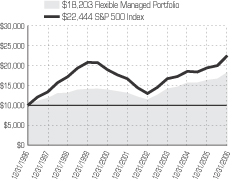

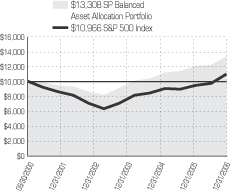

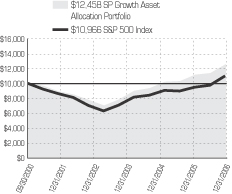

The Prudential Series Fund, Flexible Managed Portfolio

Subadvised by: Prudential Investment Management, Inc., Quantitative Management Associates, LLC

December 31, 2006

Investment Manager’s Report

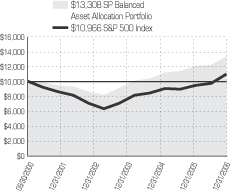

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Flexible Managed Portfolio | | 12.17 | % | | 6.92 | % | | 6.17 | % |

S&P 500 Index | | 15.78 | | | 6.18 | | | 8.42 | |

Flexible Managed Custom Blended Index | | 11.13 | | | 5.84 | | | 7.74 | |

Lipper Mixed Target Allocation Growth Funds Avg. | | 11.67 | | | 6.37 | | | 7.18 | |

Portfolio inception: 5/13/1983.

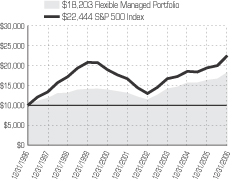

$10,000 INVESTED OVER 10 YEARS

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the Flexible Managed Portfolio had a total return that was above both its Blend Index (60% stocks, 35% bonds, 5% cash) and the average of its peer group.

The Portfolio’s stock holdings are actively managed with risk characteristics similar to those of the S&P 500 Index, while its bond holdings are more actively managed, focusing on high-grade bonds. Allocations to these asset classes are actively managed within a fairly wide range to take advantage of different market conditions.

The Portfolio benefited from emphasizing stocks in a year when they had exceptionally high returns. In addition, the managers added a small allocation to international stocks, which substantially outperformed the domestic market. Not only did foreign markets generally have higher returns than the United States, their returns to U.S. investors were augmented by the decline of the U.S. dollar against all major currencies except the Japanese yen. The Portfolio was underweighted in cash equivalents (very short-term securities), which added to its return in the strong markets. Its bond holdings outperformed the Lehman Aggregate Bond index, thanks to allocations to high yield (junk) and emerging market bonds, good selection among investment grade corporate bonds, and positions in securities backed by mortgages and other assets.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings refer to the Schedule of Investments section of this report.

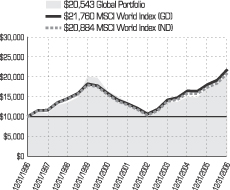

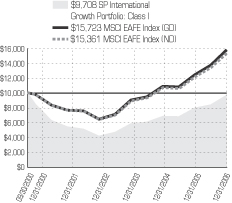

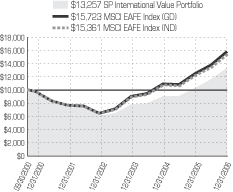

The Prudential Series Fund, Global Portfolio

Subadvised by: William Blair & Company LLC, LSV Asset Management, Marsico Capital Management, LLC, T. Rowe Price Associates, Inc.

December 31, 2006

Investment Manager’s Report

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Global Portfolio | | 19.65 | % | | 8.84 | % | | 7.46 | % |

MSCI World Index (GD) | | 20.65 | | | 10.49 | | | 8.08 | |

MSCI World Index (ND) | | 20.07 | | | 9.97 | | | 7.64 | |

Lipper (VIP) Global Growth Funds Avg. | | 18.78 | | | 10.54 | | | 8.95 | |

Portfolio inception: 9/19/1988.

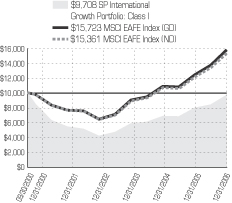

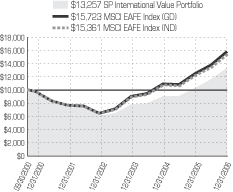

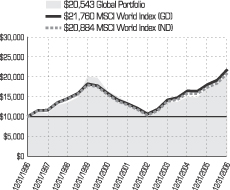

$10,000 INVESTED OVER 10 YEARS

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the Global Portfolio had a total return that was in line with the very strong return of its benchmark and above the average of its peer group.

The Portfolio is co-managed by four specialist asset managers: Marsico Capital Management manages its large-cap domestic growth stocks; T. Rowe Price manages its large-cap domestic value stocks; William Blair & Company manages its international growth stocks; and LSV Asset Management manages its international value stocks. Each firm manages approximately a quarter of the Portfolio’s assets. We expect this diversified structure to reduce style and risk exposures so that most of the Portfolio’s variance from its benchmark will be due to its co-managers’ stock selection. The major exception is that William Blair has the flexibility to invest in emerging markets stocks, which are not part of the Portfolio’s benchmark.

During 2006, the Portfolio benefited from the geographic distribution of its holdings, particularly its underexposure to the United States. Although U.S. stocks performed well over the year, international stocks performed even better, aided by the decline of the U.S. dollar against most other major currencies. In addition, William Blair’s exposure to Mexico, China, India, and Brazil improved the Portfolio’s performance. Its distribution among economic sectors had relatively little impact because the benefit of an overweight in technology compared with the benchmark was largely offset by an underweight in the strong utilities sector and an overweight in the relatively soft industrials sector. Investment style and risk factors made a modestly positive contribution to relative performance, primarily due to an emphasis compared with the benchmark on stocks of smaller companies. These outperformed those of larger firms during 2006. The Portfolio also benefited slightly from a modest emphasis on stocks with rising price momentum.

The Portfolio’s performance was enhanced by its stock selection, particularly within the financials and consumer discretionary sectors. However, its healthcare holdings did not keep up with the corresponding sector of the benchmark.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings refer to the Schedule of Investments section of this report.

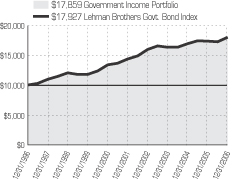

The Prudential Series Fund, Government Income Portfolio

Subadvised by: Prudential Investment Management, Inc.

December 31, 2006

Investment Manager’s Report

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Government Income Portfolio | | 3.74 | % | | 4.71 | % | | 5.97 | % |

Lehman Brothers Govt. Bond Index | | 3.48 | | | 4.64 | | | 6.01 | |

Lipper (VIP) General U.S. Govt. Funds Avg. | | 2.81 | | | 4.46 | | | 5.51 | |

Portfolio inception: 5/1/1989.

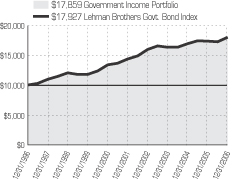

$10,000 INVESTED OVER 10 YEARS

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the Government Income Portfolio had a total return that was above its benchmark index and the average of its peer group.

The investment environment for U.S. fixed income securities improved in 2006. In the first half of the year, the Federal Reserve (“the Fed”) increased the target for the federal funds rate on overnight loans between banks four times. This was part of its latest effort to slow economic growth and pull down inflation. The total rate increase from 4.25% to 5.25%, along with concern that persistent inflation might lead the Fed to continue tightening monetary policy, at times put upward pressure on bond yields, causing bond prices to fall as bond prices move inversely to yields. But in the second half of the year, the Fed left short-term rates unchanged as economic growth, which had begun to slow in the spring of 2006, continued to moderate in the second half of the year. There was even speculation that the Fed would have to cut short-term rates in 2007 to reinvigorate the economy. From time to time, this expectation of lower rates put downward pressure on bond yields, which boosts bond prices.

The Portfolio performed better than its benchmark index because some of the bonds it held were not included in its benchmark index, which is composed of U.S. Treasury and federal agency securities. In the global low interest-rate environment, investors sought assets with attractive yields, enabling bonds such as mortgage-backed securities and commercial mortgage-backed securities to outperform comparable Treasury securities in 2006. While the Portfolio held Treasury and federal agency securities, the bulk of its holdings consisted of mortgage-backed securities, commercial mortgage-backed securities and sovereign bonds issued by governments of nations, such as Germany and Norway. During the year, the Portfolio began to invest in foreign government bonds because they provide diversification away from the U.S. market, incremental yield, and potential gains from currency appreciation.

The Portfolio also performed better than its benchmark Index because it had a shorter duration. Duration measures a portfolio’s sensitivity to changes in interest rates. Having a shorter duration provided the Portfolio with some degree of protection as, on net, yields rose across the Treasury yield curve for the year.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings refer to the Schedule of Investments section of this report.

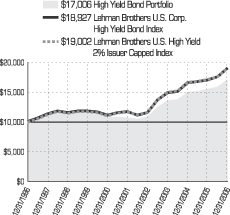

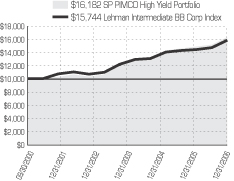

The Prudential Series Fund, High Yield Bond Portfolio

Subadvised by: Prudential Investment Management, Inc.

December 31, 2006

Investment Manager’s Report

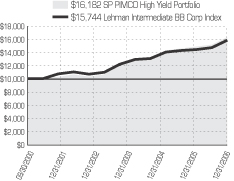

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

High Yield Bond Portfolio | | 10.25 | % | | 9.80 | % | | 5.45 | % |

Lehman Brothers U.S. Corp. High Yield Bond Index | | 11.85 | | | 10.18 | | | 6.59 | |

Lehman Brothers U.S. High Yield 2% Issuer Capped Index | | 10.76 | | | 10.20 | | | 6.63 | |

Lipper (VIP) High Current Yield Funds Average | | 9.96 | | | 8.94 | | | 5.35 | |

Portfolio inception: 2/23/1987.

$10,000 INVESTED OVER 10 YEARS

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the High Yield Portfolio had a total return that was below that of its benchmark index but above the average of its peer group.

Money flowed into high yield bonds, commonly called “junk” bonds, as investors from around the world sought assets that provided attractive yields. This helped the high yield market absorb a record amount of newly issued bonds in 2006. Investors were also drawn to the market’s historically low default rate and the solid credit fundamentals of companies, many of which continued to generate free cash flow and carried positive cash balances on their financial statements. The Portfolio has to maintain a modest cash position to meet the liquidity needs of its shareholders; but in a year in which high yield bonds rallied, the cash position was a drag on its performance.

The Portfolio benefited from favorable security selection in 2006, particularly in the healthcare and pharmaceuticals sector where it held bonds of Warner Chilcot Corp. and Skilled Healthcare Group. The managers favored healthcare and pharmaceuticals, two of the more defensive industries that tend to do well even when the economy loses steam. Economic growth slowed in 2006 because the Federal Reserve repeatedly increased short-term interest rates to slow economic growth and pull back inflationary pressures. The target for the federal funds rate on overnight loans between banks was raised a total of 17 times between June 2004 and June 2006, increasing the rate from 1.00% to 5.25%. The last four increases occurred in the first half of 2006.

The troubled U.S. automotive industry posted a solid return in 2006 even though General Motors Corp. and Ford Motor Co. continued to lose market share in the United States. The Portfolio benefited from favorable security selection among bonds of auto parts suppliers. It held debt securities of Visteon Corp. and Lear Corp. but avoided bonds of Dura Automotive Systems, which filed for bankruptcy in 2006.

By contrast, exposure to bonds of packaging companies Tekni-Plex Inc. and Crown Holdings detracted from the Portfolio’s relative performance as rising commodity prices and higher input costs hurt the industry. Exposure to the paper and forest products industry also weakened the Portfolio’s relative performance. It held bonds of Ainsworth Lumber that performed poorly in part because prices of oriented strand board, which is used in residential and commercial construction, declined due to the housing slump.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings refer to the Schedule of Investments section of this report.

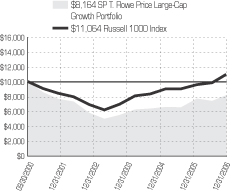

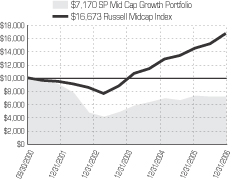

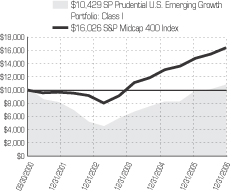

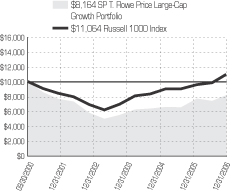

The Prudential Series Fund, Jennison Portfolio

Subadvised by: Jennison Associates LLC

December 31, 2006

Investment Manager’s Report

Performance Summary - As of December 31, 2006

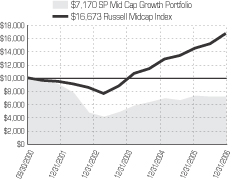

Average Annual Total Return Percentages

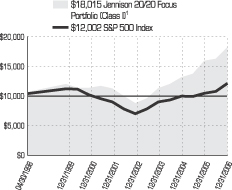

| | | | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | | | Since

Inception |

Jennison Portfolio: Class I | | 1.79 | % | | 2.83 | % | | 7.17 | % | | N/A |

Jennison Portfolio: Class II | | 1.37 | | | 2.41 | | | N/A | | | -4.78 |

S&P 500 Index | | 15.78 | | | 6.18 | | | 8.42 | | | 1.89 |

Russell 1000® Growth Index | | 9.07 | | | 2.69 | | | 5.44 | | | -4.27 |

Lipper (VIP) Large-Cap Growth Funds Avg. | | 6.30 | | | 2.70 | | | 6.09 | | | -2.63 |

Portfolio (Class I) inception: 4/25/1995. Portfolio (Class II) inception: 2/10/2000.

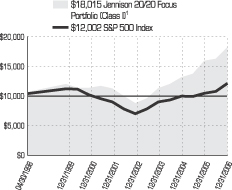

$10,000 INVESTED OVER 10 YEARS1

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception (Class II).

The Russell® 1000 Growth Index is a trademark/service of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the Jennison Portfolio had a total return that was substantially below its benchmarks and the average of its peer group.

Jennison looks for companies whose earnings and/or free cash flow they project to grow faster than average, compared with both the broad market and industry peers, and that have a moderate valuation for such growth prospects. This strategy worked very poorly in 2006, particularly during the strong value-oriented market in the first seven months of the year.

The largest detractor from the Portfolio’s performance relative to the Russell 1000 Growth Index was an overweight in grocery chain Whole Foods. The stock fell after the company warned that it expected slower growth in 2007 because it would be a transitional year for the firm. Several holdings in the technology sector also detracted from the Portfolio’s return. However, stocks in the asset management and energy industries enhanced its performance compared with the comparable sectors of the benchmark.

The Portfolio’s sector positioning is a result of its selection of individual stocks, not a separate strategic decision. Overall, the positioning hurt its performance in 2006, as greater-than-benchmark exposure to technology and an underweight in consumer noncyclical sectors weakened it more than its overweight in financials helped. The Portfolio also was hurt by having stronger growth characteristics than its benchmark and greater exposure to volatile stocks, inherent characteristics of its style that fared poorly in this market.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15%, respectively, of the average daily net assets of the Class II shares. |

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings, refer to the Schedule of Investments section of this report.

The Prudential Series Fund, Money Market Portfolio

Subadvised by: Prudential Investment Management, Inc.

December 31, 2006

Investment Manager’s Report

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | | | | |

| | | 7-Day*

Current

Net Yield | | | 1-Year | | | 5-Year | | | 10-Year | |

Money Market Portfolio | | 4.98 | % | | 4.74 | % | | 2.20 | % | | 3.69 | % |

Lipper (VIP) Money Market Funds Avg. | | N/A | | | 4.54 | % | | 1.99 | % | | 3.50 | % |

Portfolio inception: 5/13/1983.

SEVEN-DAY CURRENT NET YIELD *

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

The yield quotation more closely reflects the current earnings of the Portfolio than the total return quotation. Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the Money Market Portfolio had a total return of 4.74% that was above the average of its peer group. On December 26, 2006, the Portfolio’s 7-day current yield was 4.98%, up from 3.92% on December 27, 2005. The yield more closely reflects the current earnings of the Portfolio than the total return.

Among the most influential developments in the money markets during 2006 was the decision by the Federal Reserve (“the Fed”) to leave short-term interest rates unchanged in the second half of the year after repeatedly increasing them in the first half. In this changing investment environment, the Portfolio provided a competitive yield and ample liquidity to help shareholders meet their financial needs.

Fed policymakers, hoping to slow economic growth and bring down inflation, increased the target for the federal funds rate on overnight loans between banks 17 times from June 2004 to June 2006, raising the rate from 1.00% to 5.25%. The last four rate hikes occurred in the first half of 2006. During these months, the timing of their regularly scheduled meetings, which occur roughly every six weeks, remained a focal point of our investment strategy. We purchased short-term debt securities that matured around the time of the next meeting and reinvested their proceeds in higher yielding money market securities that became available after the Fed tightened monetary policy.

Economic growth began to slow in the spring of 2006, particularly as higher interest rates began to take a toll on the housing sector. The economy continued to lose steam in the second half of the year, allowing the Fed to leave short-term rates unchanged from July through December. Even though the Fed continued to express concern about inflation in the second half of the year (core inflation remained above the Fed’s unofficial target of 2%), many market participants expected it to cut short-term rates in 2007 to reinvigorate the economy. Under these conditions, longer-term money market yields declined to unattractive levels, and we found value in the one- to- three-month sector of the yield curve.

Throughout 2006, we maintained a large exposure to adjustable-rate money market securities that reset periodically based on formulas tied to either the one- or three-month London Interbank Offered Rates (LIBOR). Such securities were in great demand because their interest rates reset to higher levels as short-term rates rose. After the Fed stopped tightening monetary policy, and because many market participants expected the Fed to cut rates in 2007, three-month LIBOR was often the highest-yielding sector of the money market yield curve. Therefore, adjustable-rate securities based on three-month LIBOR remained a very attractive investment opportunity.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| * | Source: iMoneyNet, Inc. based on 357 funds in the iMoneyNet Prime Retail universe. Weekly 7-day current net yields of the Money Market Portfolio and the iMoneyNet Prime Retail universe as of 12/26/06. Prudential Investment Management, Inc. is the source for Money Market Portfolio information. |

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings refer to the Schedule of Investments section of this report.

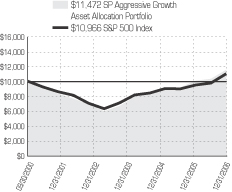

The Prudential Series Fund, Natural Resources Portfolio

Subadvised by: Jennison Associates LLC

December 31, 2006

Investment Manager’s Report

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Natural Resources Portfolio: Class I | | 22.20 | % | | 31.56 | % | | 17.97 | % | | N/A | |

Natural Resources Portfolio: Class II | | 21.72% | | | N/A | | | N/A | | | 43.47 | % |

S&P 500 Index | | 15.78 | % | | 6.18 | % | | 8.42 | % | | 15.16 | % |

Lipper (VIP) Natural Resources Funds Avg. | | 19.46 | % | | 21.80 | % | | 12.70 | % | | 33.41 | % |

Portfolio (Class I) inception: 5/1/1988. Portfolio (Class II) inception: 4/28/2005.

$10,000 INVESTED OVER 10 YEARS1

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception (Class II). Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the Natural Resources Portfolio had a total return that was higher than both its benchmark index and the average of its peer group.

The Portfolio seeks to invest in low-cost producers of natural resources using a value-driven investment style. We expect its returns to be less volatile than the majority of its peers because it is diversified across natural resource subsectors and because its value approach tends to leave less room for share price declines.

In 2006, the Portfolio particularly benefited from its holdings of metals and mining companies. The manager believes that emerging economies, especially China, will drive increased demand for metals. Global supplies, particularly of copper and iron ore, remain strained because the easiest exploited sources of these metals have long been tapped. The Portfolio focuses on the producers with the largest and most productive reserves.

The return of the Portfolio was affected by a severe sell-off in commodities in September 2006. Despite the sell-off, commodity prices remain historically high. The volatility largely reflects the impact of short-term speculation. The manager believes that over the long term, fundamentals in many commodities are strong because the costs of new production will be higher than most expectations, while demand continues to be robust.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15% respectively of the average daily net assets of the Class II shares. |

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings, refer to the Schedule of Investments section of this report.

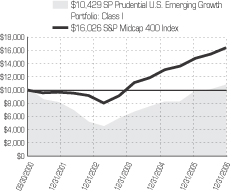

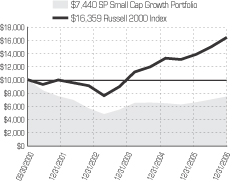

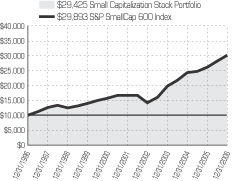

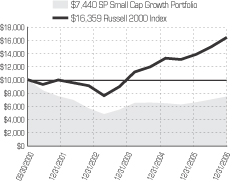

The Prudential Series Fund, Small Capitalization Stock Portfolio

Subadvised by: Quantitative Management Associates LLC

December 31, 2006

Investment Manager’s Report

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Small Capitalization Stock Portfolio | | 14.67 | % | | 12.04 | % | | 11.40 | % |

S&P SmallCap 600 Index | | 15.12 | | | 12.49 | | | 11.57 | |

Lipper (VIP) Small-Cap Core Funds Avg. | | 15.23 | | | 10.28 | | | 10.42 | |

Portfolio inception: 4/25/1995.

$10,000 INVESTED OVER 10 YEARS

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

Prudential’s research group monitors and reports upon the performance of all Series fund Portfolios. In 2006, the Small Capitalization Stock Portfolio was managed by Quantitative Management Associates LLC (QMA), a unit of Prudential Investment Management. It is managed with the goal of having a return before fees and expenses that is close to that of the S&P SmallCap 600 Index (“the Index”). The Portfolio, the Index, and the Lipper (VIP) Small-Cap Core Funds Average all fell within a 0.60 percentage point range in 2006. The Lipper Average includes portfolios that have more aggressive strategies.

The Index return in 2006 was above its 10-year average and about in line with that of large-cap stocks. The foundation of its above-average return was very strong performance by the industrials sector, one of its largest. This sector includes the agricultural products group, whose return was above 50%, in part because of the rising price for corn for conversion to ethanol. The Index’s highest sector returns, however, were in the tiny telecommunication services sector, up almost 40%, and the somewhat larger materials and consumer staples sectors. The materials sector, which rose more than 30%, was driven by the metals & mining group. These industries are benefiting from the long-term rise in demand from developing economies that are building up their infrastructure. The consumer staples sector rose almost 30% on the strength of its tobacco, personal products, and beverages industries.

The financials sector, among the largest in the Index, contributed a good return although it didn’t keep up with the exceptional performance of the leading sectors. Its consumer finance group was among the strongest in the market. The energy sector was led by oil & gas refining and marketing, but its coal & consumable fuels group dropped sharply. The utilities sector had a good return, albeit not quite up with the leading sectors.

In this strong market, even the weakest sectors had returns close to 9% over the year. The technology sector, one of the two largest in this Index, was pulled down by the substantial drop of its computers & peripherals group and by information technology (IT) services. The consumer discretionary sector had several groups with negative returns, including multiline retail, distributors, catalog retail, and homebuilders. The healthcare sector was helped by its strong biotechnology group, but held back by poor performance by healthcare providers & services.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings refer to the Schedule of Investments section of this report.

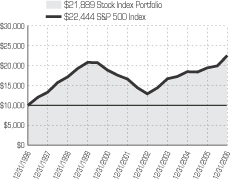

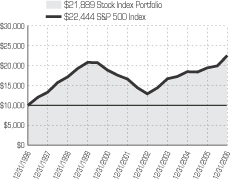

The Prudential Series Fund, Stock Index Portfolio

Subadvised by: Quantitative Management Associates LLC

December 31, 2006

Investment Manager’s Report

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Stock Index Portfolio | | 15.54 | % | | 5.88 | % | | 8.15 | % |

S&P 500 Index | | 15.78 | | | 6.18 | | | 8.42 | |

Lipper (VIP) S&P 500 Index Objective Funds Avg. | | 15.38 | | | 5.78 | | | 8.11 | |

Portfolio inception: 10/19/1987.

$10,000 INVESTED OVER 10 YEARS

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

In 2006, the Stock Index Portfolio was managed by QMA, a unit of Prudential Investment Management. The average index fund generally trails the S&P 500 Index (“the Index”) primarily because funds have fees and expenses that an index does not. The Portfolio’s return, although slightly below the Index, was above the average of similar funds.

The Index return for 2006 was above its historical average. All sectors, except health care and technology, made double-digit advances, most above 18%. The market benefited from exceptionally high corporate profits. In addition, substantial merger and acquisition activity helped prices in the real estate, utilities, telecommunications services, metals, and media industries. Investment bank stocks reflected high advising and trading income. Shares of ExxonMobil and Chevron, together composing almost 5% of the Index, had substantial gains. The aerospace and defense industry had high returns, in part because of demand for Boeing’s civilian aircraft. The impact of the slowing housing sector was mitigated by a pickup in nonresidential construction and by construction in the developing world. Demand for shares of companies producing construction materials continued to be strong. Metals stocks, particularly those of steel companies, and firms making construction machinery were in high demand. Negative returns for the managed health care and biotechnology industries contributed to making the healthcare sector the weakest in the Index.

Homebuilding stocks, which had fallen 45% from their January peak, recovered somewhat by year-end. Nonetheless, homebuilding and home improvement stocks had negative annual returns. After the U.S. Federal Reserve let its August 8 meeting pass without an interest-rate hike, the first break in two years, other industries rebounded significantly from steep losses earlier in the year. These included Internet & catalog retailers, human resource & employment services, Internet software & services, and wireless telecommunication services. Semiconductor and semiconductor equipment stocks recovered more modestly. Conversely, the rising price of corn drove agricultural products giant Archer-Daniels-Midland to give up some of a huge first-half gain.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings refer to the Schedule of Investments section of this report.

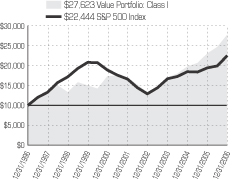

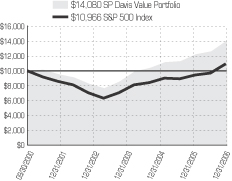

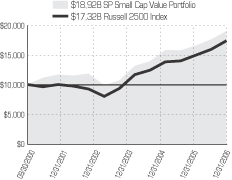

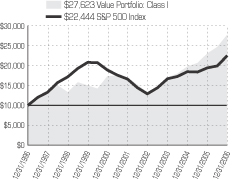

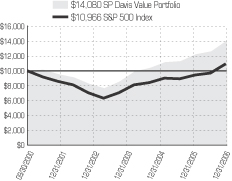

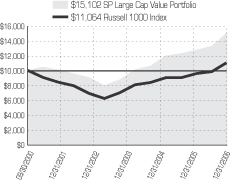

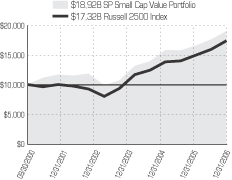

The Prudential Series Fund, Value Portfolio

Subadvised by: Jennison Associates LLC

December 31, 2006

Investment Manager’s Report

Performance Summary - As of December 31, 2006

Average Annual Total Return Percentages

| | | | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | | | Since

Inception |

Value Portfolio: Class I | | 19.94 | % | | 10.22 | % | | 10.69 | % | | N/A |

Value Portfolio: Class II | | 19.43 | | | 9.76 | | | N/A | | | 7.77 |

S&P 500 Index | | 15.78 | | | 6.18 | | | 8.42 | | | 4.05 |

Russell 1000® Value Index | | 22.25 | | | 10.86 | | | 11.00 | | | 8.66 |

Lipper (VIP) Large Cap Value Funds Avg. | | 19.01 | | | 7.73 | | | 8.75 | | | 6.34 |

Lipper (VIP) Multi Cap Value Funds Avg. | | 17.30 | | | 8.99 | | | 9.25 | | | 7.27 |

Portfolio (Class I) inception: 2/19/1988. Portfolio (Class II) inception: 5/14/2001.

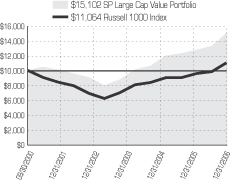

$10,000 INVESTED OVER 10 YEARS1

Past performance does not guarantee future returns. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

Unless noted otherwise, Lipper Average and Index returns reflect performance beginning the closest month-end date to the Portfolio’s inception (Class II). Although Lipper classifies the Portfolio within the Multi-Cap Value Funds Average, the returns for the Large-Cap Value Funds Average are also shown, because the management of the portfolios included in the Large-Cap Value Funds Average is more consistent with the management of the Portfolio. The Russell 1000® Value Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

For the year ended December 31, 2006, the Value Portfolio had a total return below the exceptionally high return of its style-specific benchmark index, but above the average of its peer group.

The Portfolio is managed in a relative value substyle. During this reporting period that substyle led to holding positions that varied more than the Russell 1000 Value Index. During 2006, this greater exposure to volatile stocks and the Portfolio’s less pronounced value characteristics than its benchmark both hurt its performance. Value stocks strongly outperformed growth over the first half of the year, and this environment was unfriendly to the Portfolio’s style. In fact, the Lipper Average of comparably managed funds trailed the benchmark by an even larger margin, showing that the very strong market provided few toeholds for active managers. Nonetheless, the Portfolio’s overall return was quite high by historical standards.

The Portfolio’s stock selection among large-cap value stocks eroded its return compared with its benchmark, particularly its selections within the technology and telecommunication sectors. A position in a computer software company, CA, had particularly large impact when the stock fell upon news about management turnover and a delay in filing its annual financial report with the SEC. Stock selection in the basic materials and financials sectors improved the Portfolio’s performance. It also benefited from a favorable distribution of its holdings among economic sectors. It was overweight compared with the benchmark in the very strong energy sector as well as in the above-average consumer noncyclicals and basic materials sectors, and correspondingly underweight in the financials sector, which was not among the market leaders.

Prudential Investments LLC (PI), an indirect, wholly owned subsidiary of Prudential Financial, Inc., serves as the investment manager for the Fund.

| 1 | The graph is based on the performance of Class I shares. Performance of Class II shares will be lower due to differences in the fee structure. Class II shares have associated 12b-1 and administrative fees at an annual rate of 0.25% and 0.15% respectively of the average daily net assets of the Class II shares. |

For average and index definitions, refer to the Glossary of Benchmark Definitions page. Investors cannot invest directly in a market index or average. For a complete list of holdings, refer to the Schedule of Investments section of this report.

Presentation of Portfolio Holdings for the Prudential Series Fund as of December 31, 2006 (Unaudited)

| | | | | | | | | | | | | | |

| Conservative Balanced | | | | | | Diversified Bond | | | | | | Equity | | |

| Five Largest Holdings (% Assets) of Net | | | | Five Largest Issues (% Net Assets) of | | | | Five Largest Holdings (% of Net Assets) |

Exxon Mobil Corp. | | 1.8% | | | | Federal National Mortgage Association, 5.50%, 1/01/33 | | 4.9% | | | | Microsoft Corp. | | 2.6% |

General Electric Co. | | 1.5% | | | | Federal National Mortgage Association, 5.00%, 3/01/34 | | 2.5% | | | | General Electric Co. | | 2.3% |

Citigroup, Inc. | | 1.1% | | | | Trains HY-1 2006, 7.548%, 5/01/16 | | 1.6% | | | | QUALCOMM, Inc. | | 2.1% |

Microsoft Corp. | | 1.0% | | | | Government of Hungary, 8.00%, 2/12/15 | | 1.4% | | | | Motorola, Inc. | | 2.0% |

Bank of America Corp. | | 1.0% | | | | Federal National Mortgage Association, 5.00%, 1/01/20 | | 1.3% | | | | Cisco Systems, Inc. | | 1.9% |

| | | | | | | | | | | | | | |

| Flexible Managed | | | | | | Global | | | | | | Government Income | | |

| Five Largest Holdings (% Net Assets) of | | | | Five Largest Holdings (% Net Assets) of | | | | Five Largest Issues (% Net Assets) of |

Exxon Mobil Corp. | | 1.8% | | | | UnitedHealth Group, Inc. | | 1.4% | | | | Federal National Mortgage Association, 4.875%, 4/10/08 | | 8.0% |

General Electric Co. | | 1.5% | | | | Goldman Sachs Group, Inc. | | 1.3% | | | | Federal National Mortgage Association, 5.30%, 2/22/11 | | 4.6% |

Citigroup, Inc. | | 1.2% | | | | Comcast Corp. (Class A Stock) | | 1.3% | | | | Federal National Mortgage Association, 5.00%, TBA | | 2.9% |

Federal National Mortgage Association, 5.50%, TBA | | 1.2% | | | | HBOS PLC | | 1.1% | | | | Tennessee Valley Authority, Series B, 4.375%, 6/15/15 | | 2.7% |

International Business Machines Corp. | | 1.1% | | | | Genentech, Inc. | | 1.0% | | | | United States Treasury Inflation Indexed Notes, 3.875%, 1/15/09 | | 2.4% |

| | | | | | | | | | | | | | |

| High Yield Bond | | | | | | Jennison | | | | | | Natural Resources | | |

| Five Largest Issues (% of Net Assets) | | | | Five Largest Holdings (% of Net Assets) | | | | Five Largest Holdings (% of Net Assets) |

General Motors Acceptance Corp.,

6.875%, 9/15/11 | | 1.6% | | | | Google, Inc. (Class “A” Stock) | | 4.1% | | | | Suncor Energy, Inc. | | 3.3% |

Ford Motor Credit Co., 7.875%, 6/15/10 | | 1.5% | | | | Microsoft Corp. | | 3.6% | | | | National-Oilwell Varco, Inc. | | 2.5% |

Accellent, Inc., 10.50%, 12/01/13 | | 1.0% | | | | Cisco Systems, Inc. | | 3.3% | | | | Transocean, Inc. | | 2.5% |

HCA, Inc., 8.114%, 11/14/13 | | 0.9% | | | | Adobe Systems, Inc. | | 3.2% | | | | OPTI Canada, Inc. (Canada) | | 2.4% |

Ford Motor Co., 8.36%, 12/12/13 | | 0.9% | | | | American International Group, Inc. | | 3.2% | | | | Southwestern Energy Co. | | 2.2% |

| | | | | | | | | | | | | | |

| Small Capitalization Stock | | | | | | Stock Index | | | | | | Value | | |

| Five Largest Holdings (% of Net Assets) | | | | Five Largest Holdings (% of Net Assets) | | | | Five Largest Holdings (% Net Assets) of |

Manitowac Co., Inc. | | 0.6% | | | | Exxon Mobil Corp. | | 3.5% | | | | Citigroup, Inc. | | 3.0% |

Energen Corp | | 0.6% | | | | General Electric Co. | | 3.0% | | | | American International Group, Inc. | | 2.8% |

Frontier Oil Corp. | | 0.5% | | | | Citigroup, Inc. | | 2.1% | | | | Merrill Lynch & Co., Inc. | | 2.4% |

Global Payments, Inc. | | 0.5% | | | | Microsoft Corp. | | 2.0% | | | | Altria Group, Inc. | | 2.3% |

Veritas DGC, Inc. | | 0.5% | | | | Bank of America Corp. | | 1.9% | | | | Bank of New York Co., Inc. (The) | | 2.2% |

For a complete listing of holdings, refer to the Schedule of Investments section of this report.

Holdings reflect only long-term investments. Holdings/Issues/Industries/Sectors are subject to change.

Fees and Expenses (Unaudited)

As a contract owner investing in Portfolios of the Fund through a variable annuity or variable life contract, you incur ongoing costs, including management fees, distribution and service (12b-1*) fees, and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other investment options. This example does not reflect fees and charges under your variable annuity or variable life contract. If contract charges were included, the costs shown below would be higher. Please consult the prospectus for your contract for more information about contract fees and charges.

* 12b-1 fees are paid by the fund out of fund assets to cover distribution expenses and sometimes shareholder service expenses.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2006 through December 31, 2006.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the Portfolio expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the Portfolio expenses you paid on your account during this period. As noted above, the table does not reflect variable contract fees and charges.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other investment options. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other investment options.

Please note that the expenses shown in the table are meant to highlight your ongoing Portfolio costs only and do not reflect any contract fees and charges, such as sales charges (loads), insurance charges or administrative charges. Therefore the second line of the table is useful to compare ongoing investment option costs only, and will not help you determine the relative total costs of owning different contracts. In addition, if these contract fee and charges were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| The Prudential Series Fund Portfolios | | Beginning Account

Value

July 1, 2006 | | Ending Account

Value

December 31, 2006 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | | |

Conservative Balanced

(Class I) | | Actual | | $ | 1,000.00 | | $ | 1,090.80 | | 0.56 | % | | $ | 2.95 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,022.38 | | 0.56 | % | | $ | 2.85 |

| | | | | | | | | | | | | | | |

| Diversified Bond (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,058.30 | | 0.45 | % | | $ | 2.33 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,022.94 | | 0.45 | % | | $ | 2.29 |

| | | | | | | | | | | | | | | |

| Equity (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,118.80 | | 0.47 | % | | $ | 2.51 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,022.84 | | 0.47 | % | | $ | 2.40 |

| | | | | | | | | | | | | | | |

| Equity (Class II) | | Actual | | $ | 1,000.00 | | $ | 1,116.70 | | 0.87 | % | | $ | 4.64 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,020.82 | | 0.87 | % | | $ | 4.43 |

| | | | | | | | | | | | | | | |

| Flexible Managed (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,100.10 | | 0.61 | % | | $ | 3.23 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,022.13 | | 0.61 | % | | $ | 3.11 |

| | | | | | | | | | | | | | | |

| Global (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,129.90 | | 0.74 | % | | $ | 3.97 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,021.48 | | 0.74 | % | | $ | 3.77 |

| | | | | | | | | | | | | | | |

| Government Income (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,044.00 | | 0.51 | % | | $ | 2.63 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,022.63 | | 0.51 | % | | $ | 2.60 |

| | | | | | | | | | | | | | | |

| High Yield Bond (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,073.10 | | 0.57 | % | | $ | 2.98 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,022.33 | | 0.57 | % | | $ | 2.91 |

| | | | | | | | | | | | | | | |

| Jennison (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,090.40 | | 0.63 | % | | $ | 3.32 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,022.03 | | 0.63 | % | | $ | 3.21 |

| | | | | | | | | | | | | | |

| The Prudential Series Fund Portfolios | | Beginning Account

Value

July 1, 2006 | | Ending Account

Value

December 31, 2006 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | | |

| Jennison (Class II) | | Actual | | $ | 1,000.00 | | $ | 1,088.00 | | 1.03 | % | | $ | 5.42 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,020.01 | | 1.03 | % | | $ | 5.24 |

| | | | | | | | | | | | | | | |

| Money Market (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,025.10 | | 0.42 | % | | $ | 2.14 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,023.09 | | 0.42 | % | | $ | 2.14 |

| | | | | | | | | | | | | | | |

| Natural Resources (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,039.40 | | 0.50 | % | | $ | 2.57 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,022.68 | | 0.50 | % | | $ | 2.55 |

| | | | | | | | | | | | | | | |

| Natural Resources (Class II) | | Actual | | $ | 1,000.00 | | $ | 1,037.30 | | 0.90 | % | | $ | 4.62 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,020.67 | | 0.90 | % | | $ | 4.58 |

| | | | | | | | | | | | | | | |

Small Capitalization Stock

(Class I) | | Actual | | $ | 1,000.00 | | $ | 1,067.20 | | 0.44 | % | | $ | 2.29 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,022.99 | | 0.44 | % | | $ | 2.24 |

| | | | | | | | | | | | | | | |

| Stock Index (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,125.80 | | 0.36 | % | | $ | 1.93 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,023.39 | | 0.36 | % | | $ | 1.84 |

| | | | | | | | | | | | | | | |

| Value (Class I) | | Actual | | $ | 1,000.00 | | $ | 1,123.80 | | 0.42 | % | | $ | 2.25 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,023.09 | | 0.42 | % | | $ | 2.14 |

| | | | | | | | | | | | | | | |

| Value (Class II) | | Actual | | $ | 1,000.00 | | $ | 1,121.30 | | 0.82 | % | | $ | 4.38 |

| | Hypothetical | | $ | 1,000.00 | | $ | 1,021.07 | | 0.82 | % | | $ | 4.18 |

| * | Portfolio expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended December 31, 2006, and divided by the 365 days in the Portfolio’s fiscal year ended December 31, 2006 (to reflect the six-month period). |

| | | | |

| | | CONSERVATIVE BALANCED PORTFOLIO | | |

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2006

| | | |

| ASSETS | | | |

Investments, at value including securities on loan of $196,798,835: | | | |

Unaffiliated investments (cost $2,022,194,120) | | $ | 2,469,261,024 |

Affiliated investments (cost $546,923,952) | | | 546,988,257 |

Cash | | | 116,699 |

Foreign currency, at value (cost $26,841) | | | 27,060 |

Receivable for investments sold | | | 52,574,428 |

Dividends and interest receivable | | | 10,479,778 |

Receivable for Series shares sold | | | 46,474 |

Prepaid expenses | | | 42,886 |

Foreign tax reclaim receivable | | | 36,623 |

| | |

|

|

Total Assets | | | 3,079,573,229 |

| | |

|

|

| LIABILITIES | | | |

Collateral for securities on loan | | | 204,591,018 |

Payable for investments purchased | | | 101,997,507 |

Management fee payable | | | 1,297,142 |

Payable for Series shares repurchased | | | 608,357 |

Due to broker—variation margin | | | 246,824 |

Accrued expenses and other liabilities | | | 230,407 |

Unrealized depreciation on swaps | | | 21,669 |

Transfer agent fee payable | | | 316 |

| | |

|

|

Total Liabilities | | | 308,993,240 |

| | |

|

|

| NET ASSETS | | $ | 2,770,579,989 |

| | |

|

|

| |

Net assets were comprised of: | | | |