UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2008

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER: 1-8519

CINCINNATI BELL INC.

| | |

| Ohio | | 31-1056105 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

221 East Fourth Street, Cincinnati, Ohio 45202

Telephone 513-397-9900

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | | | Name of each exchange on which registered |

Common Shares (par value $0.01 per share) | | | | New York Stock Exchange |

6 3/4% Convertible Preferred Shares | | | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common shares owned by non-affiliates of the registrant was $0.9 billion, computed by reference to the closing sale price of the common stock on the New York Stock Exchange on June 30, 2008, the last trading day of the registrant’s most recently completed second fiscal quarter. The Company has no non-voting common shares.

At February 1, 2009, there were 227,881,466 common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement relating to the Company’s 2009 Annual Meeting of Shareholders are incorporated by reference into Part III of this report to the extent described herein.

TABLE OF CONTENTS

This report contains trademarks, service marks and registered marks of Cincinnati Bell Inc., as indicated.

Part I

Item 1. Business

General

Cincinnati Bell Inc. and its consolidated subsidiaries (the “Company”) is a full-service regional provider of data and voice communications services and equipment over wireline and wireless networks. The Company provides telecommunications service primarily on its owned local and wireless networks with a well-regarded brand name and reputation for service. In addition, the Company provides business customers with efficient, scalable office communications systems and complex information technology solutions, including data center and managed services, telecommunications equipment, and information technology hardware. The Company operates in three segments: Wireline, Wireless, and Technology Solutions.

The Company is an Ohio corporation, incorporated under the laws of Ohio in 1983. Its principal executive offices are at 221 East Fourth Street, Cincinnati, Ohio 45202 (telephone number (513) 397-9900 and website addresshttp://www.cincinnatibell.com). As soon as practicable after they have been electronically filed, the Company makes available its reports on Form 10-K, 10-Q, and 8-K (as well as all amendments to these reports), proxy statement and other information, free of charge, on its website at the Investor Relations section.

The Company files annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”) under the Exchange Act. These reports and other information filed by the Company may be read and copied at the Public Reference Room of the SEC, 100 F Street N.E., Washington, D.C. 20549. Information about the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports, proxy statements, and other information about issuers, like the Company, which file electronically with the SEC. The address of that site ishttp://www.sec.gov.

Wireline

The Wireline segment provides local voice, data, long-distance, voice over internet protocol (“VoIP”), and other services. Local voice services include local telephone service, switched access, information services such as directory assistance, and value-added services such as caller identification, voicemail, call waiting, call return and text messaging. Data services include Digital Subscriber Line (“DSL”), which provides high-speed data transmission via the internet, dial-up internet access, dedicated network access, and Gigabit Ethernet (“Gig-E”) and Asynchronous Transfer Mode (“ATM”) based data transport, which businesses principally utilize to transport large amounts of data typically over a private network. Long distance services include long distance voice, audio conferencing, VoIP services and new broadband services including private line and multi protocol labeling switching (“MPLS”) which is a technology that enables a business customer to privately interconnect voice and data services at its locations. Other services offered by the Wireline segment consist of security monitoring services, public payphones, television over coaxial cable and fiber optical cable in limited areas, DirecTV commissioning over its entire operating area, inside wire installation for business enterprises, billing, clearinghouse and other ancillary services primarily for inter-exchange (long distance) carriers.

Cincinnati Bell Telephone Company LLC and Cincinnati Bell Extended Territories LLC

The Company provides wireline voice and data services to its historical operating territory in southwestern Ohio, northern Kentucky and southeastern Indiana through the operations of Cincinnati Bell Telephone Company LLC (“CBT”), an Incumbent Local Exchange Carrier (“ILEC”). The Company’s core ILEC franchise covers approximately 2,400 square miles in a 25-mile radius around Cincinnati, Ohio. The Company has operated its core ILEC franchise for 135 years.

The Company has expanded its voice and data services beyond its ILEC territory, particularly in Dayton and Mason, Ohio, through a product suite offered to business and residential customers. Cincinnati Bell Extended Territories LLC (“CBET”), a subsidiary of CBT, operates as a Competitive Local Exchange Carrier (“CLEC”) and provides voice and data services on either its own network or through purchasing unbundled network elements (“UNE-L” or “loops”) from various incumbent local carriers. The ILEC and CLEC territories are linked

3

through a Synchronous Optical Fiber Network (“SONET”), which provides route diversity between the two territories via two separate paths.

The Wireline segment provides voice services over a 100% digital, circuit switch-based network to end users via access lines. In recent years, the Company’s voice access lines have decreased as its customer base has increasingly employed wireless technologies in lieu of wireline voice services (“wireless substitution”), or have migrated to competitors, including cable companies, which offer VoIP solutions. The Wireline segment had approximately 779,700 voice access lines in service on December 31, 2008, which is a 7% and 12% reduction in comparison to 834,300 and 887,000 access lines in service at December 31, 2007 and 2006, respectively.

Despite the decline in access lines, the Wireline segment has been able to nearly offset the effect of these losses on revenue by:

| (1) | increasing DSL penetration to existing consumer and business customers; |

| (2) | increasing the sale of high capacity data circuits to business customers; and |

| (3) | increasing the sale of long distance and VoIP services including voice and data offerings. |

The Company has deployed DSL capable electronics throughout its territory, allowing it to offer high-speed DSL internet access services to over 95% of its in-territory primary consumer access lines. The Company’s DSL subscribers were 233,200, 221,500, and 198,300 at December 31, 2008, 2007, and 2006, respectively. CBT’s in-territory primary consumer penetration of DSL service was 48% of addressable lines at the end of 2008, an increase of 6 percentage points compared to the end of 2007.

Also, CBT’s network includes the use of fiber-optic cable, with SONET rings linking Cincinnati’s downtown with other area business centers. These SONET rings offer increased reliability and redundancy to CBT’s major business customers. CBT has an extensive business-oriented data network, offering native speed Ethernet services over an interlaced ATM – Gig-E backbone network, delivered to end users via high-capacity circuits. CBT business revenues were $427.4 million, $435.1 million, and $416.3 million in 2008, 2007, and 2006, respectively.

In 2008, Wireline voice revenue totaled $389.1 million and data revenue totaled $273.5 million, of which $93.8 million was associated with DSL service. Approximately 95% of the voice and data revenue was generated within the Company’s ILEC operating territory.

CBT’s subsidiary Cincinnati Bell Telecommunications Services LLC operates the National Payphone Clearinghouse (“NPC”) in an agency function, facilitating payments from inter-exchange carriers to payphone service providers (“PSPs”) relating to the compensation due to PSPs for originating access code calls, subscriber 800 calls, and other toll free and qualifying calls pursuant to the rules of the Federal Communications Commission (“FCC”) and state regulatory agencies. As the NPC agent, the Company does not take title to any funds to be paid to the PSPs, nor does the Company accept liability for the payments owed to the PSPs.

Cincinnati Bell Any Distance Inc.

Cincinnati Bell Any Distance Inc. (“CBAD”) provides long distance, audio conferencing and VoIP services to businesses and residential customers in the Greater Cincinnati and Dayton, Ohio areas. In 2007, CBAD began to provide new broadband services, including private line and MPLS, beyond its traditional territory to business customers. Residential customers can choose from a variety of long distance plans, which include unlimited long distance for a flat fee, purchase of minutes at a per-minute-of-use rate, or a fixed number of minutes for a flat fee. In addition to long distance, business customers can choose from a variety of other services, which include audio conferencing, dedicated long distance, and VoIP. At December 31, 2008, CBAD had approximately 531,600 long distance subscribers, consisting of 352,700 residential and 178,900 business subscribers, compared to 548,300 and 552,300 long distance subscribers at December 31, 2007 and 2006, respectively. The decrease in subscribers from 2007 was related to a 6% decline in residential subscribers, consistent with the CBT access line loss, partially offset by a 3% increase in business subscribers. In 2008, CBAD produced $98.3 million in revenue for the Wireline segment compared to $79.3 million in 2007, and $71.8 million in 2006. Approximately $13.0 million of the revenue increase in 2008 resulted from the February 2008 acquisition of eGIX Inc. (“eGix”), a CLEC provider of voice and long distance services primarily to business customers in Indiana and Illinois, for

4

$18.1 million. See Note 5 to the Consolidated Financial Statements for further information regarding this acquisition.

Cincinnati Bell Complete Protection Inc.

Cincinnati Bell Complete Protection Inc. (“CBCP”) provides surveillance hardware and monitoring services to residential and business customers in the Greater Cincinnati area. At December 31, 2008, CBCP had approximately 11,800 monitoring subscribers in comparison to 9,900 and 8,600 monitoring subscribers at December 31, 2007 and 2006, respectively. CBCP produced $4.5 million, $4.0 million, and $3.6 million in revenue in 2008, 2007, and 2006, respectively, for the Wireline segment.

Public Payphone Business

The Company’s public payphone business (“Public”) provides public payphone services primarily within the geographic area of the Wireline segment. Public had approximately 1,900, 2,200, and 2,900 stations in service as of December 31, 2008, 2007, and 2006, respectively, and generated approximately $1.3 million, $1.9 million, and $2.9 million in revenue in 2008, 2007, and 2006, respectively, or less than 1% of consolidated revenue in each year. The revenue decrease results primarily from wireless substitution, as usage of payphones continues to decrease in favor of wireless products, and a targeted reduction in unprofitable lines.

Video

In March 2007, CBET purchased a local telecommunications business which offers voice, data and cable TV services in Lebanon, Ohio for a purchase price of $7.0 million. As a result of this acquisition, Wireline now offers cable TV to 3,900 customers in Lebanon, Ohio. Additionally, in 2008, the Company’s capital expenditures for its network included fiber optical cable in limited areas. The large bandwidth of fiber optical cable allows the Company to provide customers with voice, data, and entertainment services. The Company spent $14.7 million in 2008 for fiber network capital expenditures to provide all these services.

In addition to providing entertainment over coaxial cable and fiber optical cable in limited areas, the Company also is an authorized sales agent and offers DirecTV© satellite programming through its retail distribution outlets to Cincinnati Bell customers. The Company does not deliver satellite television services. Instead, DirecTV© pays the Company a commission for each subscriber and in some circumstances may offer a bundle price discount directly to the Cincinnati Bell customer subscribing to its satellite television service. At December 31, 2008, the Company had 22,000 customers that were subscribers to DirecTV©.

The Wireline segment produced $803.6 million, $821.7 million, and $810.4 million, or 57%, 61%, and 64%, of consolidated revenue in 2008, 2007, and 2006, respectively. The Wireline segment produced operating income of $261.7 million, $252.5 million, and $291.8 million in 2008, 2007, and 2006, respectively.

Wireless

Through Cincinnati Bell Wireless LLC (“CBW”), the Wireless segment provides advanced digital wireless voice and data communications services through the operation of a Global System for Mobile Communications/General Packet Radio Service (“GSM”) network with a 3G Universal Mobile Telecommunications System (“3G”) network overlay in the Company’s licensed service territory, which includes Greater Cincinnati and Dayton, Ohio, and areas of northern Kentucky and southeastern Indiana. Its digital wireless network is connected to approximately 440 towers currently utilizing 50 MHz of its licensed wireless spectrum in the Cincinnati Basic Trading Area and 40 MHz of its licensed spectrum in the Dayton Basic Trading Area.

To satisfy increasing demand for existing voice minutes of use by customers as well as to provide enhanced data services such as streaming video, the Company purchased an additional 20 MHz of advanced wireless spectrum for the Cincinnati and Dayton, Ohio regions in the Advanced Wireless Services spectrum auction conducted by the FCC in 2006 to construct a 3G wireless overlay of its GSM network. The 3G overlay is compatible with the Company’s existing GSM network, and future capital expenditures to increase the network’s capacity for minutes of use are lower with the 3G network overlay. The Company spent approximately $16 million in 2008 and $11 million in 2007 to complete its 3G network overlay. In the fourth quarter of 2008, the Company launched 3G for commercial services.

5

In early 2008, the Company purchased additional advanced wireless spectrum for the Cincinnati and Dayton, Ohio regions. In addition to the Cincinnati and Dayton regions spectrum purchased in 2006 and 2008, the Company also purchased advanced wireless spectrum in Indianapolis, Indiana in 2006. The Company does not have specific plans to utilize the Indianapolis spectrum license at this time. The Company’s 2006 purchases of the Cincinnati, Dayton and Indianapolis area spectrum totaled $37.1 million, and the 2008 spectrum purchase totaled $2.8 million.

As of December 31, 2008, the Wireless segment served approximately 550,600 subscribers of which 403,700 were postpaid subscribers who are billed monthly in arrears, and 146,900 were prepaid i-wirelessSM subscribers who purchase service in advance. In support of its service business, the segment sells wireless handset devices at or below cost, as well as related accessories. Additionally, the segment sells services to other wireless carriers for their customers to access voice and data services on the Company’s Wireline and Wireless networks through roaming agreements as well as through the lease of space on Company-owned towers.

The Wireless segment competes against all of the U.S. national wireless carriers by offering superior network quality, unique rate plans, which may be bundled with the Company’s wireline services, and extensive and conveniently located retail outlets. The segment offers unique rate plans and products, such as the “Unlimited Everyday Calling Plan” to any Cincinnati Bell local voice, wireless or business customers and Fusion WiFi, which utilizes Unlicensed Mobile Access (“UMA”) technology on a dual-mode wireless handset to provide converged wireline and wireless network services. The UMA technology allows the handset to send and receive voice and data transmissions over the internet via the Company’s broadband access network while within the range of a wireless fidelity access point. This allows for enhanced in-building wireless voice reception and faster rates of data transmission compared to alternative wireless data services.In addition, the Company also offers several family plans, including the “Unlimited Family Plan” as well as a “Smart Device Family Plan.” These plans allow the first subscriber to get a wireless voice rate plan and, if selected, a data plan, at regular price and then each additional family member can be added at a lower price.

Postpaid subscriber service revenue generated approximately 74% of 2008 segment revenue. A variety of rate plans are available to postpaid subscribers, and these plans can include a fixed number of national minutes, an unlimited number of Cincinnati Bell mobile-to-mobile (calls to and from other Wireless subscribers), an unlimited number of calls to and from a CBT access line, and/or local minutes for a flat monthly rate. For plans with a fixed number of minutes, postpaid subscribers can purchase additional minutes at a per-minute-of-use rate. A variety of data plans are also available including mobile messaging, mobile internet, and smart device data plans as a bolt-on to voice rate plans. Prepaid i-wirelessSM subscribers, which accounted for 16% of 2008 segment revenue, can purchase airtime cards for use with pay per minute, pay by day, pay by week, or pay by month rate plans. Revenue from other wireless service providers for the purchase of roaming minutes for the carrier’s own subscribers using minutes on CBW’s network, collocation revenue (rent received for the placement of other carriers’ radios on CBW towers), and reciprocal compensation for other carriers’ subscribers who terminate calls on CBW’s network, accounted for approximately 2% of total 2008 segment revenue.

Sales of handsets and accessories generated the remaining 8% of 2008 segment revenue. CBW sells handsets and accessories, often below its purchase cost, to promote acquisition and retention of subscribers. Sales take place at the Company’s owned retail stores, on the Company’s website, and in independent distributors’ retail stores pursuant to agency agreements. CBW purchases handsets and accessories from a variety of manufacturers and maintains an inventory to support sales.

The Wireless segment contributed $316.1 million, $294.5 million, and $262.0 million, or 23%, 22%, and 21%, of consolidated revenue in 2008, 2007, and 2006, respectively. The Wireless segment produced operating income of $46.8 million in 2008, $34.3 million in 2007, and $20.2 million in 2006.

Technology Solutions

The Technology Solutions segment provides outsourced telecommunications and IT solutions in multiple states through the Company’s subsidiaries, Cincinnati Bell Technology Solutions Inc. (“CBTS”) and GramTel Inc. (“GramTel”). GramTel was purchased in December 2007 for $20.3 million and provides data center services to small and medium-size companies in Chicago, northwestern Indiana, and southwestern Michigan. Refer to Note 5 to the Consolidated Financial Statements for further information about the GramTel acquisition.

6

Technology Solutions sells products, software, and labor services to customers in three separate product lines: telecom and IT equipment distribution, data center and managed services, and professional services. By offering a full range of equipment and outsourced managed services in conjunction with the Company’s wireline network services, Technology Solutions provides end-to-end IT telecommunications infrastructure management designed to reduce cost and mitigate risk while optimizing performance for its customers.

The telecom and IT equipment distribution product line is the value-added reseller operation of Technology Solutions. The Company maintains relationships with over ten branded technology vendors, which allows it to sell, install, and maintain a wide array of telecommunications and computer equipment and operating systems to meet the needs of small to large businesses. This unit also manages the implementation and maintenance of traditional voice systems as well as converged VoIP systems.

The data center and managed services product line includes the operations of ten data centers totaling 209,000 square feet of billable data center capacity, a network operations center that provides off-site infrastructure monitoring, and a wide array of IT infrastructure management products, which includes network management, electronic data storage, disaster recovery, and data security management. Data center services include 24-hour monitoring of the customer’s computer equipment in the data center, redundant power, and environmental controls. CBTS’ data centers are connected with one another and to its customers’ data networks through the fully redundant facilities of CBT’s telecommunications network and/or CBTS’ dedicated dense wave division multiplexing optical network. This connectivity and the geographical dispersion of the data centers provide enhanced data reliability and disaster recovery.

The Technology Solutions model combines data center collocation services with value-added IT managed services into a fully managed and outsourced infrastructure service. Data center customer contracts typically range from three to fifteen years in length and produce attractive returns on invested capital. The Company intends to continue to pursue additional customers and growth specific to its data center business and is prepared to commit additional resources, including capital expenditures and working capital, to support this growth.

The professional services product line provides IT outsourcing through staff augmentation and professional IT consulting by highly technical, certified employees. These engagements can be short-term IT implementation and project-based work as well as longer term staffing and permanent placement assignments. Technology Solutions utilizes a team of experienced recruiting and hiring personnel to provide its customers a wide range of skilled IT professionals at competitive hourly rates.

The Technology Solutions segment produced total revenue of $315.2 million, $258.3 million, and $216.6 million and constituted approximately 22%, 19%, and 17% of consolidated revenue in 2008, 2007, and 2006, respectively. The Technology Solutions segment produced operating income of $18.1 million in both 2008 and 2007 and $15.8 million in 2006.

Customers

As the Company’s growth products, such as data center services, wireless services and wireline data services, continue to increase in revenue, and the Company’s legacy products, such as voice service in its ILEC territory, continue to decrease in revenue, the Company’s revenue portfolio is becoming more diversified than in the past, as the comparison between 2008 revenue and 2005 revenue demonstrates below.

| | | | | | | | | |

| Percentage of revenue (before intercompany eliminations) | | 2008 | | | 2005 | | | Change | |

Wireline local voice | | 27 | % | | 41 | % | | (14 | )pts |

Technology Solutions | | 22 | % | | 14 | % | | 8 | |

Wireless | | 22 | % | | 20 | % | | 2 | |

Wireline data | | 19 | % | | 18 | % | | 1 | |

Other Wireline, including long distance | | 10 | % | | 7 | % | | 3 | |

| | | | | | | | | |

Total | | 100 | % | | 100 | % | | | |

7

Additionally, the Company’s mix of business and consumer customers is changing, as many of the Company’s growth products, such as data center services and data transport services, are geared primarily toward business customers. In 2008, the Company’s revenues were comprised of 59% to business customers and 41% to consumers. By comparison, the Company’s 2005 revenues were comprised of 53% to business customers and 47% to consumers.

Employees

At February 1, 2009, the Company had approximately 3,300 employees. CBT has approximately 1,200 employees covered under a collective bargaining agreement with the Communications Workers of America (“CWA”), which is affiliated with the AFL-CIO.

Business Segment Information

The amount of revenue, intersegment revenue, operating income, expenditures for long-lived assets, and depreciation and amortization attributable to each of the Company’s business segments for the years ended December 31, 2008, 2007, and 2006, and assets as of December 31, 2008 and 2007, is set forth in Note 14 to the Consolidated Financial Statements.

Item 1A. Risk Factors

The Company’s substantial debt could limit its ability to fund operations, expose it to interest rate volatility, limit its ability to raise additional capital and have a material adverse effect on its ability to fulfill its obligations and on its business and prospects generally.

The Company has a substantial amount of debt and has significant debt service obligations. As of December 31, 2008, the Company and its subsidiaries had outstanding indebtedness of $2.0 billion on which it incurred $139.7 million of interest expense in 2008, and had total shareowners’ deficit of $709.3 million. In addition, at December 31, 2008, the Company had the ability to borrow additional amounts under its revolving credit facility totaling approximately $151.4 million, subject to compliance with certain conditions. The Company may incur additional debt from time to time, subject to the restrictions contained in its credit facilities and other debt instruments.

The Company’s substantial debt could have important consequences, including the following:

| | • | | the Company will be required to use a substantial portion of its cash flow from operations to pay principal and interest on its debt, thereby reducing the availability of cash flow to fund working capital, capital expenditures, strategic acquisitions, investments and alliances, and other general corporate requirements; |

| | • | | the Company’s interest expense could increase if interest rates, in general, increase because approximately 30% of the Company’s indebtedness is based on variable interest rates; |

| | • | | the Company’s interest rate on its revolving credit facility depends on the level of the Company’s specified financial ratios, and therefore could increase if the Company’s specified financial ratios require a higher rate; |

| | • | | the Company’s substantial debt will increase its vulnerability to general economic downturns and adverse competitive and industry conditions and could place the Company at a competitive disadvantage compared to those of its competitors that are less leveraged; |

| | • | | the Company’s debt service obligations could limit its flexibility to plan for, or react to, changes in its business and the industry in which it operates; |

| | • | | the Company’s level of debt and shareowners’ deficit may restrict it from raising additional financing on satisfactory terms to fund working capital, capital expenditures, strategic acquisitions, investments and joint ventures and other general corporate requirements; and |

| | • | | a potential failure to comply with the financial and other restrictive covenants in the Company’s debt instruments, which, among other things, require it to maintain specified financial ratios could, if not cured or waived, have a material adverse effect on the Company’s ability to fulfill its obligations and on its business and prospects generally. |

8

The current credit and financial market conditions may exacerbate certain risks affecting the Company and its business.

As widely reported, financial markets in the United States, Europe and Asia have been experiencing extreme disruption in recent months, including, among other things, extreme volatility in security prices, severely diminished liquidity and credit availability, and rating downgrades of certain investments and declining valuations of others. Governments have taken unprecedented actions intended to address extreme market conditions that include severely restricted credit and declines in real estate values. The Company believes the current credit and financial market conditions could adversely affect its operations in several ways:

| | • | | The Company’s Corporate revolving credit facility expires in February 2010. Although the Company believes it will be able to refinance its revolving credit facility, further severe disruption in the financial markets as noted above could cause the Company not to be able to refinance its revolving credit facility on acceptable terms; |

| | • | | The Company has significant bonds maturing in 2013. These adverse economic conditions could impair the Company’s ability to access credit markets to refinance these bonds; |

| | • | | The current tightening of credit in financial markets adversely affects the ability of customers, both business and consumer, to obtain appropriate financing and could result in a cancellation of, a decrease in, or inability to pay for orders for the Company’s products and services; |

| | • | | The Company’s suppliers are also adversely affected, and the lack of appropriate financing to fund key supplier operations could lead to a shortage or cancellation of key supplier products and services, which could have an adverse effect on the Company’s operations; |

| | • | | The Company’s Corporate credit facility is funded by a consortium of banks, and the Company’s interest rate swaps are entered into with counterparties that have been adversely affected by the current credit and financial market conditions. If one or more of these banks or counterparties were not able to fulfill its funding obligations, the Company’s financial condition could be adversely affected. The Corporate credit facility is funded by 15 different financial institutions, with no financial institution having more than 10% of the total facility. The Company’s counterparty exposure related to the interest rate swaps is limited to the unrealized gains on the interest rate swaps, which totaled $18.8 million at December 31, 2008, and realized gains not yet received; and |

| | • | | The Company’s pension plan investment assets have suffered investment losses of 23% for the year ended December 31, 2008. These losses and any future losses could negatively impact the level of pension funding required by the Company in future years, the amount of pension expense to be recorded in the future, and the level of shareowners’ deficit. |

The Company is unable to predict the likely duration and severity of the current disruption in financial markets and adverse economic conditions in the U.S. and other countries.

Uncertainty in the U.S. and world securities markets and adverse medical cost trends could cause the Company’s pension and postretirement costs to increase.

Investment returns of the Company’s pension funds depend largely on trends in the U.S. and world securities markets and the U.S. and world economies in general. As noted above, pension investment losses in 2008 equaled 23%. The Company expects that the decreased plan assets, caused primarily by 2008 investment losses, will, in and of itself, cause an $11 million increase to 2009 pension expense compared to 2008. See “Future Operating Trends” for further discussion of 2009 pension expense. Continued uncertainty in the securities markets and economy could result in further investment returns that are less than those previously assumed and could cause a further decline in the value of plan assets, which the Company would be required to recognize over the next several years under generally accepted accounting principles. Additionally, the Company’s postretirement costs are adversely affected by increases in medical and prescription drug costs. Should the securities markets decline further and medical and prescription drug costs increase significantly, the Company would expect to face even higher annual net pension and postretirement costs. Refer to Note 9 to the Consolidated Financial Statements for further information.

9

Adverse changes in the value of assets or obligations associated with the Company’s employee benefit plans could negatively impact shareowner’s deficit and liquidity.

The Company sponsors three noncontributory defined benefit pension plans: one for eligible management employees, one for non-management employees, and one supplemental, nonqualified, unfunded plan for certain senior executives. The Company’s consolidated balance sheets indirectly reflect the value of all plan assets and benefit obligations under these plans. The accounting for employee benefit plans is complex, as is the process of calculating the benefit obligations under the plans. The adverse market conditions of 2008 have resulted in an increase to the Company’s unfunded pension liability of $123 million and an increase to shareholder’s deficit of $78 million, tax effected, at December 31, 2008 as compared to December 31, 2007. Further adverse changes in interest rates or market conditions, among other assumptions and factors, could cause a further significant increase in the Company’s benefit obligations or a significant decrease of the asset values, without necessarily impacting the Company’s net income. In addition, the Company’s benefit obligations could increase significantly if it needs to unfavorably revise the assumptions used to calculate the obligations. These further adverse changes could have a further significant negative impact on the Company’s shareowners’ deficit. In addition, with respect to the Company’s pension plans, the Company expects to make $288 million of estimated cash contributions to its qualified pension plans for the years 2009 to 2018. Further, adverse changes to plan assets could require the Company to contribute additional material amounts of cash to the plan or could accelerate the timing of required payments.

The servicing of the Company’s indebtedness requires a significant amount of cash, and its ability to generate cash depends on many factors beyond its control.

The Company’s ability to generate cash is subject to general economic, financial, competitive, legislative, regulatory, and other factors, many of which are beyond its control. The Company cannot provide assurance that its business will generate sufficient cash flow from operations, that additional sources of debt financing will be available or that future borrowings will be available under its credit facilities, in each case, in amounts sufficient to enable the Company to service its indebtedness or to fund other liquidity needs. If the Company cannot service its indebtedness, it will have to take actions such as reducing or delaying capital expenditures, strategic acquisitions, investments and joint ventures, or selling assets, restructuring or refinancing indebtedness, or seeking additional equity capital, which may adversely affect its shareholders, debtholders, and customers. The Company may not be able to negotiate remedies on commercially reasonable terms, or at all. In addition, the terms of existing or future debt instruments may restrict the Company from adopting any of these alternatives.

The Company depends on the receipt of dividends or other intercompany transfers from its subsidiaries.

Certain of the Company’s material subsidiaries are subject to regulatory authority that may potentially limit the ability of a subsidiary to distribute funds or assets. If the Company’s subsidiaries were to be prohibited from paying dividends or making distributions to Cincinnati Bell Inc. (“CBI”), the parent company, CBI may not be able to make the scheduled interest and principal repayments on its $1.6 billion of debt. This would have a material adverse effect on the Company’s liquidity and the trading price of Cincinnati Bell’s common stock, preferred stock, and debt instruments.

The Company’s creditors and preferred stockholders have claims that are superior to claims of the holders of Cincinnati Bell common stock. Accordingly, in the event of the Company’s dissolution, bankruptcy, liquidation, or reorganization, payment is first made on the claims of creditors of the Company and its subsidiaries, then preferred stockholders and finally, if amounts are available, to holders of Cincinnati Bell common stock.

The Company depends on its credit facilities to provide for its financing requirements in excess of amounts generated by operations.

The Company depends on its credit facilities to provide for temporary financing requirements in excess of amounts generated by operations. As of December 31, 2008, the Company had $73.0 million of outstanding borrowings under its revolving credit facility and outstanding letters of credit totaling $25.6 million, leaving $151.4 million in additional borrowing availability under its $250 million revolving credit facility. The Company’s revolving credit facility expires in February of 2010 and will need to be renewed at that time.

10

Although the Company believes it will be able to refinance its revolving credit facility, further severe disruption in the financial markets as noted above could cause the Company not to be able to refinance its revolving credit facility on acceptable terms. Additionally, the ability to borrow from the credit facilities is predicated on the Company’s compliance with covenants. Failure to satisfy these covenants would constrain or prohibit its ability to borrow under the credit facilities.

The credit facilities and other indebtedness impose significant restrictions on the Company.

The Company’s debt instruments impose, and the terms of any future debt may impose, operating and other restrictions on the Company. These restrictions affect, and in many respects limit or prohibit, among other things, the Company’s ability to:

| | • | | incur additional indebtedness; |

| | • | | enter into transactions with affiliates; |

| | • | | guarantee indebtedness; |

| | • | | declare or pay dividends or other distributions to shareholders; |

| | • | | repurchase equity interests; |

| | • | | redeem debt that is junior in right of payment to such indebtedness; |

| | • | | enter into agreements that restrict dividends or other payments from subsidiaries; |

| | • | | issue or sell capital stock of certain of its subsidiaries; and |

| | • | | consolidate, merge, or transfer all or substantially all of its assets and the assets of its subsidiaries on a consolidated basis. |

In addition, the Company’s credit facilities and debt instruments include restrictive covenants that may materially limit the Company’s ability to prepay debt and preferred stock. The agreements governing the credit facilities also require the Company to achieve and maintain compliance with specified financial ratios.

The restrictions contained in the terms of the credit facilities and its other debt instruments could:

| | • | | limit the Company’s ability to plan for or react to market conditions or meet capital needs or otherwise restrict the Company’s activities or business plans; and |

| | • | | adversely affect the Company’s ability to finance its operations, strategic acquisitions, investments or alliances, or other capital needs, or to engage in other business activities that would be in its interest. |

A breach of any of these restrictive covenants or the Company’s inability to comply with the required financial ratios would result in a default under some or all of the debt agreements. During the occurrence and continuance of a default, lenders may elect to declare all outstanding borrowings, together with accrued interest and other fees, to be immediately due and payable. Additionally, under the credit facilities, the lenders may elect not to provide loans until such default is cured or waived. The Company’s debt instruments also contain cross-acceleration provisions, which generally cause each instrument to be subject to early repayment of outstanding principal and related interest upon a qualifying acceleration of any other debt instrument.

In 2008, the Company repurchased and retired $76.8 million of its common stock and $108.1 million face amount of its corporate bonds at an average discount of 14%. Payments to repurchase common stock under the Company’s repurchase program and prepay debt are considered restricted payments under certain of the Company’s debt agreements, and such payments are limited under these debt agreements. The Company believes it has sufficient ability under these debt agreements to make these restricted payments to buy back intended amounts of outstanding common stock and debt in 2009. However, a downturn in the Company’s profitability could cause the Company not to have sufficient ability under its debt agreements to make its intended common stock buybacks and prepayments of debt in 2009, and/or could cause the Company not to be able to make additional common stock buybacks and prepayments of debt in the future.

11

The Company’s future cash flows could be adversely affected if it is unable to realize fully its deferred tax assets.

As of December 31, 2008, the Company had net deferred income taxes of $563.0 million, which includes U.S. federal net operating loss carryforwards of approximately $439.1 million, alternative minimum tax credit carryforwards of $12.2 million, state and local net operating loss carryforwards of approximately $66.0 million, deferred tax temporary differences and other tax attributes of $118.6 million, offset by valuation allowances of $72.9 million. The valuation allowances have been provided against deferred tax assets related to certain state and local net operating losses and other deferred tax assets due to the uncertainty of the Company’s ability to utilize the assets within the statutory expiration period. For more information concerning the Company’s net operating loss carryforwards, deferred tax assets, and valuation allowance, see Note 12 to the Consolidated Financial Statements. The use of the Company’s deferred tax assets enables it to satisfy current and future tax liabilities without the use of the Company’s cash resources. If the Company is unable for any reason to generate sufficient taxable income to fully realize its deferred tax assets, or if the use of its net operating loss carryforwards are limited by Internal Revenue Code Section 382 or similar state statute, its net income, shareowners’ equity, and future cash flows could be adversely affected.

The Company operates in highly competitive industries, and its customers may not continue to purchase services, which could result in reduced revenue and loss of market share.

The telecommunications industry is very competitive. Competitors may reduce pricing, create new bundled offerings, or develop new technologies, products, or services. If the Company cannot continue to offer reliable, competitively priced, value-added services, or if the Company does not keep pace with technological advances, competitive forces could adversely affect it through a loss of market share or a decrease in revenue and profit margins. The Company has lost, and will likely continue to lose, access lines as a part of its customer base utilizes the services of competitive wireline or wireless providers in lieu of the Company’s local wireline service.

The Wireline segment faces competition from other local exchange carriers, wireless service providers, inter-exchange carriers, and cable, broadband, and internet service providers. The Company believes CBT could face greater competition as new facilities-based service providers with existing service relationships with CBT’s customers compete more aggressively and focus greater resources on the Greater Cincinnati operating area. Insight Cable, which provides cable service in the northern Kentucky portion of the Company’s ILEC territory, began to offer VoIP and long distance services in 2007. Time Warner Cable, AT&T, Verizon, and others offer VoIP and long distance services in Cincinnati and Dayton. Wireless providers offer plans with no additional fees for long distance. Partially as a result of this increased competition, the Company’s access lines decreased by 7% and long distance subscribers decreased by 3% in 2008. If the Company is unable to effectively implement strategies to retain access lines and long distance subscribers, or replace such access line loss with other sources of revenue, the Company’s Wireline business will be adversely affected.

Wireless competes against national, well-funded wireless service providers in the Cincinnati and Dayton, Ohio metropolitan market areas, including AT&T, Sprint Nextel, T-Mobile, Verizon and Leap. In addition, in 2008, several major cable companies including Time Warner Cable made a significant investment in Clearwire, a company created by combining certain wireless assets of Sprint Nextel and Clearwire. Clearwire is in the process of constructing a nationwide wireless 4G network. The Company anticipates that continued competition could compress its margins for wireless products and services as carriers continue to offer more minutes for equivalent or lower service fees while CBW cannot offer more minutes without incremental capital expenditures and operating costs. Also, new wireless products are not always available to the Company as other competitors may have exclusive agreements for these new products, such as the iPhone™. CBW’s ability to compete will depend, in part, on its ability to anticipate and respond to various competitive factors affecting the telecommunications industry.

Furthermore, there has been a trend in the wireless communications industry towards consolidation through joint ventures, reorganizations, and acquisitions. The Company expects this consolidation trend to lead to larger competitors with greater resources and more service offerings than CBW. In addition, wireless subscribers are

12

permitted to retain their wireless phone numbers when changing to another wireless carrier within the same geographic area. The Company generally does not enter into long-term contracts with its wireless subscribers, and therefore, this portability could have a significant adverse affect on the Company. The Company also believes that these wireless competitors, and in particular, companies that offer unlimited wireless service plans for a flat monthly fee, are a cause of CBT’s access line loss.

The Technology Solutions segment competes against numerous other information technology consulting, web-hosting, data center and computer system integration companies, many of which are larger, national in scope, and better financed. This market is rapidly evolving, highly competitive and likely to be characterized by over-capacity and industry consolidation. Other competitors may consolidate with one another or acquire software application vendors or technology providers, enabling them to more effectively compete with Technology Solutions. The Company believes that many of the participants in this market must grow rapidly and achieve a significant presence to compete effectively. This consolidation could affect prices and other competitive factors in ways that could impede the Technology Solutions segment’s ability to compete successfully in the market.

The effect of the foregoing competition on any of the Company’s segments could have a material adverse impact on its businesses, financial condition, results of operations, and cash flows.

Maintaining the Company’s networks and data centers requires significant capital expenditures, and its inability or failure to maintain its networks and data centers would have a material impact on its market share and ability to generate revenue.

During the year ended December 31, 2008, capital expenditures totaled $230.9 million, which included $103.6 million of capital expenditures related to new data center facilities, the 3G wireless network overlay, and fiber network construction. The Company expects to spend similar amounts of total capital in 2009.

The Company currently operates ten data centers, including those acquired through the purchase of GramTel in December 2007, and any further data center expansion will involve significant capital expenditures for data center construction. In order to provide guaranteed levels of service to our data center customers, the network infrastructure must be protected against damage from human error, natural disasters, unexpected equipment failure, power loss or telecommunications failures, terrorism, sabotage, or other intentional acts of vandalism. The Company’s disaster recovery plan may not address all of the problems that may be encountered in the event of a disaster or other unanticipated problem, which may result in disruption of service to data center customers.

The Company may also incur significant additional capital expenditures as a result of unanticipated developments, regulatory changes, and other events that impact the business. If the Company is unable or fails to adequately maintain or expand its networks to meet customer needs, there could be a material adverse impact on the Company’s market share and its ability to generate revenue.

Maintenance of CBW’s wireless network, growth in the wireless business, or the addition of new wireless products and services may require CBW to obtain additional spectrum and transmitting sites which may not be available or be available only on less than favorable terms.

CBW uses spectrum licensed to the Company for its GSM network. In 2006 and in early 2008, the Company acquired additional spectrum licenses, primarily for its current operating territory and Indianapolis. Introduction of new wireless products and services, as well as maintenance of the existing wireless business, may require CBW to obtain additional spectrum either to supplement or to replace the existing spectrum. Furthermore, the Company’s network depends on the deployment of radio frequency equipment on towers and on buildings. The Company both owns and leases space on these towers and buildings and typically leases underlying land. There can be no assurance that spectrum or the appropriate transmitting locations will be available to CBW or will be available on commercially favorable terms. Failure to obtain or retain any needed spectrum or transmitting locations could have a materially adverse impact on the wireless business as a whole, the quality of the wireless networks, and the ability to offer new competitive products and services.

13

The Company depends on a number of third-party providers, and the loss of, or problems with, one or more of these providers may impede our growth or cause us to lose customers.

The Company depends on third-party providers to supply products and services. For example, many of the Company’s information technology functions and call center functions are performed by third party providers, network equipment is purchased from and maintained by vendors, and data center space is leased from landlords. Any failure on the part of third party suppliers to provide the contracted services, additional required services, additional products, or additional leased space could impede the growth of the Company’s business and cause financial results to suffer.

The Company could be subject to increased operating costs, as well as claims, litigation or other potential liability, in connection with risks associated with internet security and system security.

A significant barrier to the growth of e-commerce and communications over the internet has been the need for secure transmission of confidential information. Several of the Company’s infrastructure systems and application services use encryption and authentication technology licensed from third parties to provide the protections necessary for secure transmission of confidential information, including credit card information from customers. We also rely on personnel in our network operations centers, data centers, and retail stores to follow Company policies when handling sensitive information. Any unauthorized access, computer viruses, accidental or intentional actions and other disruptions could result in increased operating costs.

Data center business could be harmed by prolonged electrical power outages or shortages, increased costs of energy or general lack of availability of electrical resources.

Data centers are susceptible to regional costs of power, planned or unplanned power outages and shortages, and limitations on the availability of adequate power resources. Power outages, such as those that occurred in California in 2001, the Northeast in 2003, and from the tornados on the east coast of the U.S. in 2004, could harm the Company’s customers and business. The Company attempts to limit exposure to system downtime by using backup generators and power supplies. As a result of these data center redundancies, the Company’s data center customers incurred only minimal downtime during the aftermath of the Hurricane Ike windstorm that caused severe disruption to power sources in the Cincinnati area for approximately two weeks in September 2008. However, the Company may not be able to limit the exposure entirely in future occurrences even with those protections in place. In addition, global fluctuations in the price of power can increase the cost of energy, and although contractual price increase clauses may exist and, in some cases, the data center customer pays directly for the cost of power, the Company may not be able to pass all of these increased costs on to customers, or the increase in power costs may impact additional sales of data center space.

The long sales cycle for data center services may materially affect the data center business and results of its operations.

A customer’s decision to lease cabinet space in one of the Company’s data centers and to purchase additional services typically involves a significant commitment of resources, significant contract negotiations regarding the service level commitments, and significant due diligence on the part of the customer regarding the adequacy of the Company’s facilities, including the adequacy of carrier connections. As a result, the sale of data center space has a long sales cycle. Furthermore, the Company may expend significant time and resources in pursuing a particular sale or customer that may not result in revenue. Delays in the length of the data center sales cycle may have a material adverse effect on the Technology Solutions segment and results of its operations.

The Company’s failure to meet performance standards under its agreements could result in customers terminating their relationships with the Company or customers being entitled to receive financial compensation, which could lead to reduced revenues and/or increased costs.

The Company’s agreements with its customers contain various requirements regarding performance and levels of service. If the Company fails to provide the levels of service or performance required by its agreements, customers may be able to receive service credits for their accounts and other financial compensation, and also may be able to terminate their relationship with the Company. In addition, any inability to meet service level

14

commitments or other performance standards could reduce the confidence of customers and could consequently impair the Company’s ability to obtain and retain customers, which would adversely affect both the Company’s ability to generate revenues and operating results.

The regulation of the Company’s businesses by federal and state authorities may, among other things, place the Company at a competitive disadvantage, restrict its ability to price its products and services, and threaten its operating licenses.

Several of the Company’s subsidiaries are subject to regulatory oversight of varying degrees at both the state and federal levels, which may differ from the regulatory scrutiny faced by the Company’s competitors. A significant portion of CBT revenue is derived from pricing plans that require regulatory overview and approval. Different interpretations by regulatory bodies may result in adjustments to revenue in future periods. In recent years, these regulated pricing plans have required CBT to decrease or fix the rates it charges for some services while its competition has typically been able to set rates for its services with limited restriction. In the future, regulatory initiatives that would put CBT at a competitive disadvantage or mandate lower rates for its services could result in lower profitability and cash flow for the Company. In addition, different regulatory interpretations of existing regulations or guidelines may affect the Company’s revenues and expenses in future periods.

At the federal level, CBT is subject to the Telecommunications Act of 1996, including the rules subsequently adopted by the FCC to implement the 1996 Act, which has impacted CBT’s in-territory local exchange operations in the form of greater competition. At the state level, CBT conducts local exchange operations in portions of Ohio, Kentucky, and Indiana, and, consequently, is subject to regulation by the Public Utilities Commissions in those states. Various regulatory decisions or initiatives at the federal or state level may from time to time have a negative impact on CBT’s ability to compete in its markets.

CBW’s FCC licenses to provide wireless services are subject to renewal and revocation. Although the FCC has routinely renewed wireless licenses in the past, the Company cannot be assured that challenges will not be brought against those licenses in the future. Revocation or non-renewal of CBW’s licenses could result in a cessation of CBW’s operations and consequently lower operating results and cash flow for the Company.

From time to time, different regulatory agencies conduct audits to ensure that the Company is in compliance with the respective regulations. If found not to be in compliance, the Company could be subject to fines and penalties which could be material to the Company’s financial statements.

There are currently many regulatory actions under way and being contemplated by federal and state authorities regarding issues that could result in significant changes to the business conditions in the telecommunications industry. Assurances cannot be given that changes in current or future regulations adopted by the FCC or state regulators, or other legislative, administrative, or judicial initiatives relating to the telecommunications industry, will not have a material adverse effect on the Company’s business, financial condition, results of operations, and cash flows.

Future declines in the fair value of the Company’s wireless licenses could result in future impairment charges.

The market values of wireless licenses have varied dramatically over the last several years and may vary significantly in the future. In particular, valuation swings could occur if:

| | • | | Consolidation in the wireless industry allows or requires carriers to sell significant portions of their wireless spectrum holdings; |

| | • | | A sudden large sale of spectrum by one or more wireless providers occurs; or |

| | • | | Market prices decline as a result of the sale prices in recent and upcoming FCC auctions. |

In addition, the price of wireless licenses could decline as a result of the FCC’s pursuit of policies designed to increase the number of wireless licenses available in each of the Company’s markets. For example, the FCC auctioned an additional 90 MHz of spectrum in the 1700 MHz to 2100 MHz band in the Advanced Wireless Services spectrum auction in 2006 and, in early 2008, auctioned 62 MHz of 700 MHz wireless spectrum. If the market value of wireless licenses were to decline significantly, the value of the Company’s wireless licenses could be subject to non-cash impairment charges.

15

The Company reviews potential impairments to indefinite-lived intangible assets, including wireless licenses and trademarks, annually and when there is evidence that events or changes in circumstances indicate that an impairment condition may exist. A significant impairment loss, most likely resulting from reduced cash flow, could have a material adverse effect on the Company’s operating income and on the carrying value of the wireless licenses on the balance sheet.

Failure to anticipate the needs for and introduce new products and services or to compete with new technologies may compromise the Company’s success in the telecommunications industry.

The Company’s success depends, in part, on being able to anticipate the needs of current and future business, carrier, and consumer customers. The Company seeks to meet these needs through new product introductions, service quality, and technological superiority. New products are not always available to the Company, as other competitors may have exclusive agreements for those new products, such as the iPhone™. New products and services are important to the Company’s success as its industry is technologically driven, such that new technologies can offer alternatives to the Company’s existing services. The development of new technologies and products could accelerate the Company’s loss of access lines and increase wireless customer churn, which could have a material adverse effect on the Company’s revenue, results of operations, and cash flows.

Terrorist attacks and other acts of violence or war may affect the financial markets and the Company’s business, financial condition, results of operations, and cash flows.

Terrorist attacks may negatively affect the Company’s operations and financial condition. There can be no assurance that there will not be further terrorist attacks against the U.S. and U.S. businesses, or armed conflict involving the U.S. Further terrorist attacks or other acts of violence or war may directly impact the Company’s physical facilities or those of its customers and vendors. These events could cause consumer confidence and spending to decrease or result in increased volatility in the U.S. and world financial markets and economy. They could result in an economic recession in the U.S. or abroad. Any of these occurrences could have a material adverse impact on the Company’s business, financial condition, results of operations, and cash flows.

The Company could incur significant costs resulting from complying with, or potential violations of, environmental, health, and human safety laws.

The Company’s operations are subject to laws and regulations relating to the protection of the environment, health, and human safety, including those governing the management and disposal of, and exposure to, hazardous materials and the cleanup of contamination, and the emission of radio frequency. While the Company believes its operations are in substantial compliance with environmental, health, and human safety laws and regulations, as an owner or operator of property, and in connection with the current and historical use of hazardous materials and other operations at our sites, the Company could incur significant costs resulting from complying with or violations of such laws, the imposition of cleanup obligations, and third-party suits. For instance, a number of the Company’s sites formerly contained underground storage tanks for the storage of used oil and fuel for back-up generators and vehicles. In addition, a few sites currently contain underground fuel tanks for back-up generator use, and many of the Company’s sites have aboveground fuel tanks for similar purposes.

The Company generates a substantial portion of its revenue by serving a limited geographic area.

The Company generates a substantial portion of its revenue by serving customers in the Greater Cincinnati and Dayton, Ohio areas. An economic downturn or natural disaster occurring in this limited operating territory could have a disproportionate effect on the Company’s business, financial condition, results of operations, and cash flows compared to similar companies of a national scope and similar companies operating in different geographic areas.

Third parties may claim that the Company is infringing upon their intellectual property, and the Company could suffer significant litigation or licensing expenses or be prevented from selling products.

Although the Company does not believe that any of its products or services infringe upon the valid intellectual property rights of third parties, the Company may be unaware of intellectual property rights of others that may cover some of its technology, products, or services. Any litigation growing out of third-party patents or

16

other intellectual property claims could be costly and time-consuming and could divert the Company’s management and key personnel from its business operations. The complexity of the technology involved and the uncertainty of intellectual property litigation increase these risks. Resolution of claims of intellectual property infringement might also require the Company to enter into costly license agreements. Likewise, the Company may not be able to obtain license agreements on acceptable terms. The Company also may be subject to significant damages or injunctions against development and sale of certain of its products. Further, the Company often relies on licenses of third-party intellectual property useful for its businesses. The Company cannot ensure these licenses will be available in the future on favorable terms or at all.

Third parties may infringe the Company’s intellectual property, and the Company may expend significant resources enforcing its rights or suffer competitive injury.

The Company’s success depends in significant part on the competitive advantage it gains from its proprietary technology and other valuable intellectual property assets. The Company relies on a combination of patents, copyrights, trademarks and trade secrets protections, confidentiality provisions, and licensing arrangements to establish and protect its intellectual property rights. If the Company fails to successfully enforce its intellectual property rights, its competitive position could suffer, which could harm its operating results.

The Company may also be required to spend significant resources to monitor and police its intellectual property rights. The Company may not be able to detect third-party infringements and its competitive position may be harmed before the Company does so. In addition, competitors may design around the Company’s technology or develop competing technologies. Furthermore, some intellectual property rights are licensed to other companies, allowing them to compete with the Company using that intellectual property.

The loss of any of the senior management team or attrition among key sales associates could adversely affect the Company’s business, financial condition or results of operations.

The Company’s success will continue to depend to a significant extent on our senior management team and key sales associates. Senior management has specific knowledge relating to the Company and the industry that would be difficult to replace. The loss of key sales associates would hinder the Company’s ability to continue to benefit from long-standing relationships with customers. The Company cannot provide any assurance that we will be able to retain our current senior management team or key sales associates. The loss of any of these individuals could adversely affect the Company’s business, financial condition or results of operations.

If the Company fails to extend or renegotiate its collective bargaining agreements with its labor union when they expire, or if its unionized employees were to engage in a strike or other work stoppage, the Company’s business and operating results could be materially harmed.

The Company is a party to collective bargaining agreements with its labor union, which represents a significant number of its employees. Although the Company believes that its relations with its employees are satisfactory, no assurance can be given that the Company will be able to successfully extend or renegotiate its collective bargaining agreements when they expire. If the Company fails to extend or renegotiate its collective bargaining agreements, if disputes with its union arise, or if its unionized workers engage in a strike or a work stoppage, the Company could experience a significant disruption of operations or incur higher ongoing labor costs, either of which could have a material adverse effect on the business. The Company’s collective bargaining agreement was renewed in February 2008 for three years and will expire in 2011.

The Company could be required to take additional measures for its shares to remain listed on the New York Stock Exchange (“NYSE”).

The Company’s common stock and preferred stock are currently listed on the NYSE. The NYSE has several quantitative and qualitative requirements with which listed companies must comply to maintain this listing, including an average $1.00 minimum closing price for common shares over a consecutive thirty day trading period. To remain in compliance with NYSE listing standards, the Company may be required to take additional measures, including those necessary to keep the closing stock price for its common shares above the specified minimum. If such measures are insufficient for the Company to remain in compliance with NYSE listing

17

standards in the future, the Company’s common stock and preferred stock could be subject to notice, suspension and delisting procedures initiated by the NYSE. Suspension and delisting could reduce the liquidity and market price for those shares and negatively impact the Company’s ability to raise equity capital in the future by reducing the number of investors willing to hold or acquire the Company’s stock.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Cincinnati Bell Inc. and its subsidiaries own or maintain facilities in Ohio, Kentucky, Indiana, Michigan, and Illinois. Principal office locations are in Cincinnati, Ohio.

The property of the Company principally comprises telephone plant and equipment in its local telephone franchise area (i.e., Greater Cincinnati), and the infrastructure associated with its wireless business in the Greater Cincinnati and Dayton, Ohio operating areas. Each of the Company’s subsidiaries maintains some investment in furniture and office equipment, computer equipment and associated operating system software, application system software, leasehold improvements, and other assets.

With regard to its local telephone operations, the Company owns substantially all of the central office switching stations and the land upon which they are situated. Some business and administrative offices are located in rented facilities, some of which are recorded as capital leases. With regard to its wireless operations, CBW both owns and leases the locations that house its switching and messaging equipment. CBW owns approximately half of the tower structures and leases almost all of the land upon which its towers reside. CBW leases space primarily from other wireless carriers or tower companies for the remaining tower sites and its ground leases are typically renewable at CBW’s option with predetermined rate escalations. In addition, CBW leases 24 Company-run retail locations. Technology Solutions operates ten data centers – four owned and six leased – in Ohio, Kentucky, Indiana, Michigan, and Illinois. The data centers provide 24-hour monitoring of the customer’s computer equipment in the data center, power, environmental controls, and high-speed, high bandwidth point-to-point optical network connections. CBTS also has a leased office located in Kentucky.

The Company’s gross investment in property, plant, and equipment was $3,007.4 million and $2,808.5 million at December 31, 2008 and 2007, respectively, and was divided among the operating segments as follows:

| | | | | | |

| | | December 31, | |

| | | 2008 | | | 2007 | |

Wireline | | 78.8 | % | | 82.1 | % |

Wireless | | 12.3 | % | | 12.1 | % |

Technology Solutions | | 8.8 | % | | 5.7 | % |

Corporate | | 0.1 | % | | 0.1 | % |

| | | | | | |

Total | | 100.0 | % | | 100.0 | % |

| | | | | | |

For additional information about the Company’s properties, see Note 4 to the Consolidated Financial Statements.

Item 3. Legal Proceedings

The information required by this Item is included in Note 11 to the Consolidated Financial Statements contained in Item 8 of this Report.

Item 4. Submission of Matters to a Vote of the Security Holders

None.

18

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

(a) Market Information

The Company’s common shares (symbol: CBB) are listed on the New York Stock Exchange. The high and low daily closing prices during each quarter for the last two fiscal years are listed below:

| | | | | | | | | | |

| | | | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter |

2008 | | High | | $4.52 | | $4.71 | | $4.38 | | $3.04 |

| | Low | | $3.75 | | $3.89 | | $2.98 | | $1.39 |

2007 | | High | | $5.04 | | $6.14 | | $5.95 | | $5.58 |

| | Low | | $4.26 | | $4.70 | | $4.41 | | $4.34 |

(b) Holders

As of February 1, 2009, there were 26,992 holders of record of the 227,881,466 outstanding common shares of the Company.

(c) Dividends

The Company does not currently intend to pay dividends on its common shares. Certain covenants in its various debt agreements limit its ability to pay dividends to its common shareowners. For additional information about the restrictions on the Company’s ability to pay dividends, see Note 7 to the Consolidated Financial Statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

(d) Securities Authorized For Issuance Under Equity Compensation Plans

The following table provides information as of December 31, 2008 regarding securities of the Company to be issued and remaining available for issuance under the equity compensation plans of the Company.

| | | | | | | | |

Plan Category | | Number of

securities to be

issued upon

exercise of

outstanding stock

options, awards,

warrants and

rights | | | Weighted-

average exercise

price of

outstanding stock

options, awards,

warrants and

rights | | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a)) |

| | | (a) | | | (b) | | (c) |

Equity compensation plans approved by security holders | | 25,378,970 | (1) | | $ | 9.34 | | 2,499,167 |

Equity compensation plans not approved by security holders | | 187,938 | (2) | | | — | | — |

| | | | | | | | |

Total | | 25,566,908 | | | $ | 9.34 | | 2,499,167 |

| | | | | | | | |

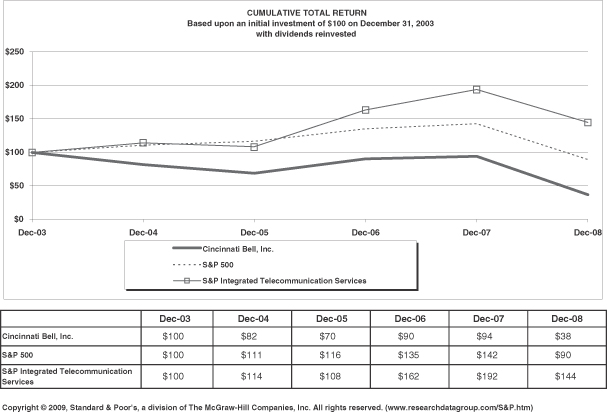

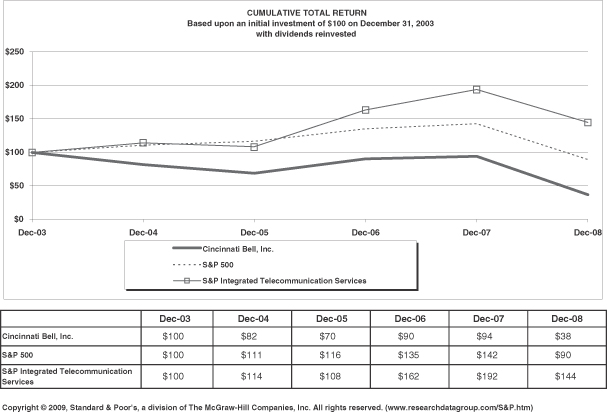

| (1) | Includes 22,769,572 outstanding stock options not yet exercised, 302,581 shares of time-based restricted stock, and 2,306,817 shares of performance-based awards, restrictions on which have not expired as of December 31, 2008. Awards were granted under various incentive plans approved by Cincinnati Bell Inc. shareholders. The number of performance-based awards assumes the maximum awards that can be earned if the performance conditions are achieved. |