Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03732

MFS VARIABLE INSURANCE TRUST II

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

MFS® International Growth Portfolio

MFS® Variable Insurance Trust II

ANNUAL REPORT

December 31, 2011

FCI-ANN

Table of Contents

MFS® INTERNATIONAL GROWTH PORTFOLIO

The report is prepared for the general information of contract owners.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK OR CREDIT UNION GUARANTEE Ÿ NOT A DEPOSIT Ÿ NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR NCUA/NCUSIF

Table of Contents

MFS International Growth Portfolio

LETTER FROM THE CHAIRMAN AND CEO

Dear Contract Owners:

We are indeed living through some volatile times. Economic uncertainty is everywhere, as it seems no place in the world has been unmoved by crisis. We have seen a devastating earthquake and tsunami that have led to disruptions in the Japanese markets

and supply chains. Protests have changed the face of the Middle East and left in their wake lingering tensions and resultant higher oil prices. We have seen debt limits tested in Europe and the United States and policymakers grappling to craft often unpopular monetary and fiscal responses at a time when consumers and businesses struggle with what appears to be a slowing global economy. On top of all of that, we have seen long-term U.S. debt lose its Standard & Poor’s AAA rating and the long-term debt ratings of 15 eurozone nations put on negative watch.

When markets become volatile, managing risk becomes a top priority for investors and their advisors. At MFS® risk management is foremost in our minds in all market climates. Our analysts and portfolio managers keep risks firmly in mind when evaluating securities. Additionally, we have a team of quantitative analysts that measures and assesses the risk profiles of our portfolios and securities on an ongoing basis. The chief investment risk officer, who oversees the team, reports directly to the firm’s president and chief investment officer so the risk associated with each portfolio can be assessed objectively and independently of the portfolio management team.

As always, we continue to be mindful of the many economic challenges faced at the local, national, and international levels. It is in times such as these that we want to remind investors of the merits of maintaining a long-term view, adhering to basic investing principles such as asset allocation and diversification, and working closely with their advisors to research and identify appropriate investment opportunities.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management®

February 15, 2012

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

Table of Contents

MFS International Growth Portfolio

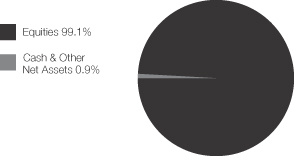

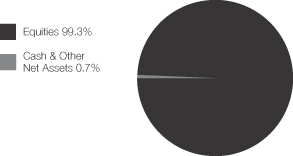

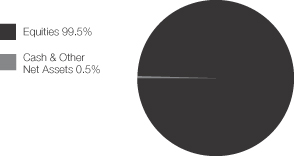

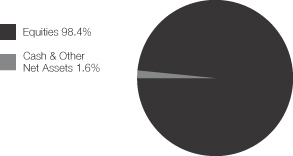

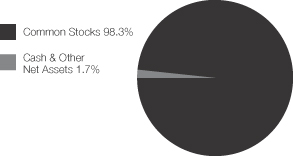

Portfolio structure

| Top ten holdings | ||||

| Groupe Danone | 2.7% | |||

| LVMH Moet Hennessy Louis Vuitton S.A. | 2.6% | |||

| Linde AG | 2.3% | |||

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 2.1% | |||

| Compass Group PLC | 2.0% | |||

| Diageo PLC | 1.8% | |||

| BHP Billiton Ltd. | 1.8% | |||

| ASML Holding N.V. | 1.8% | |||

| Uni-Charm Corp. | 1.8% | |||

| Reckitt Benckiser Group PLC | 1.7% | |||

| Equity sectors | ||||

| Consumer Staples | 14.1% | |||

| Basic Materials | 11.6% | |||

| Retailing | 11.3% | |||

| Technology | 11.2% | |||

| Financial Services | 10.9% | |||

| Health Care | 10.7% | |||

| Special Products & Services | 7.6% | |||

| Industrial Goods & Services | 6.4% | |||

| Energy | 5.3% | |||

| Transportation | 3.6% | |||

| Utilities & Communications | 2.9% | |||

| Autos & Housing | 2.1% | |||

| Leisure | 1.4% | |||

| Issuer country weightings (x) | ||||

| France | 15.3% | |||

| United Kingdom | 14.8% | |||

| Switzerland | 10.7% | |||

| Japan | 9.4% | |||

| Germany | 8.7% | |||

| Netherlands | 4.5% | |||

| Brazil | 4.5% | |||

| Australia | 4.1% | |||

| Israel | 2.9% | |||

| Other Countries | 25.1% | |||

| Currency exposure weightings (y) | ||||

| Euro | 30.7% | |||

| British Pound Sterling | 14.8% | |||

| United States Dollar | 11.5% | |||

| Swiss Franc | 10.7% | |||

| Japanese Yen | 9.4% | |||

| Hong Kong Dollar | 4.2% | |||

| Australian Dollar | 4.1% | |||

| Brazilian Real | 3.5% | |||

| Taiwan Dollar | 2.1% | |||

| Other Currencies | 9.0% | |||

| (x) | Represents the portfolio’s exposure to issuer countries as a percentage of a portfolio’s total net assets. |

| (y) | Represents the portfolio’s exposure to a particular currency as a percentage of a portfolio’s total net assets. |

Percentages are based on net assets as of 12/31/11.

The portfolio is actively managed and current holdings may be different.

2

Table of Contents

MFS International Growth Portfolio

Summary of Results

For the twelve months ended December 31, 2011, Initial Class shares of the MFS International Growth Portfolio (the “fund”) provided a total return of –10.89%, while Service Class shares of the fund provided a total return of –11.11%. These compare with a return of –13.93% for the fund’s benchmark, the Morgan Stanley Capital International (MSCI) All Country World (ex-U.S.) Growth Index.

Market Environment

Early in the period, the U.S. Federal Reserve (the “Fed”) responded to weak economic growth by loosening monetary policy further. More easing by the Fed improved market sentiment and drove risk-asset prices markedly higher. The December 2010 agreement on a surprisingly large (relative to expectations) expansionary U.S. fiscal package also boosted sentiment. During the subsequent several months, the renewed positive market sentiment, coupled with better indications of global macroeconomic activity, pushed many asset valuations to post-crisis highs. At the same time, the yields of the perceived “safest” global sovereign credits rose, indicating a renewed risk-seeking environment.

However, towards the middle of the period, a weakening macroeconomic backdrop and renewed concerns over peripheral euro zone sovereign debt caused a flight-to-quality move that pushed high-quality sovereign bond yields lower. In the U.S., concerns about sovereign debt default and the long-term sustainability of the trend in U.S. fiscal policy resulted in one agency downgrading U.S. credit quality. Amidst this turmoil, global equity markets declined sharply. As a result of these developments, global consumer and producer sentiment indicators fell precipitously and highly-rated sovereign bond yields hit multi-decade lows. Towards the end of the reporting period, uncertainty in financial markets spiked higher as markets more seriously contemplated the possible failure of the euro zone.

Contributors to Performance

A combination of stock selection and an underweight position in the basic materials sector was a primary driver of performance relative to the MSCI All Country World (ex-U.S.) Growth Index. Holdings of strong-performing mining company Iluka Resources (Australia) benefited relative results over the reporting period.

Stock selection in the technology and industrial goods & services sectors was another factor that aided relative performance. Within the technology sector, the fund’s holdings of semiconductor manufacturer Taiwan Semiconductor (Taiwan) and software solutions and consulting services provider Dassault Systems (France) boosted relative returns. Shares of Taiwan Semiconductor rallied as the company forecast higher-than-anticipated sales projections for the fourth quarter. There were no individual stocks within the industrial goods & services sector that were among the fund’s top relative contributors.

Stocks in other sectors that benefited relative performance included Hong Kong-based telecommunications service provider China Unicom (Hong Kong) Ltd., global consulting and outsourcing company Accenture (b), personal care products maker Uni-Charm (Japan), catering company Compass Group (United Kingdom), fashion distributor Industria de Diseno Textil S.A. (Spain), financial services company Credicorp (b) (Peru), and alcoholic beverage producer Diageo (United Kingdom). Shares of Diageo appreciated significantly in the second half of 2011 after management reported a 5% increase in full-year operating profit and forecasted a medium-term goal of 6% organic revenue growth.

Detractors from Performance

Stock selection and, to a lesser extent, an underweight position in the consumer staples sector hindered relative performance. Not holding shares of strong-performing tobacco company British American Tobacco (United Kingdom) and global consumer products provider Unilever (United Kingdom) detracted from relative results.

Security selection in the autos & housing sector also weakened relative performance. There were no securities within this sector that were among the fund’s top relative detractors for the reporting period.

Elsewhere, holdings of Brazilian financial services firm Banco Santander (Brasil), Austrian financial services company Erste Group Bank (h), diversified mining company Teck Resources (h) (Canada), information technology products and electronics maker Acer (h) (Taiwan), financial services firm Credit Suisse (b) (Switzerland), recruiting firm Michael Page (b) (United Kingdom), recruitment and human resources provider Hays (b)(h) (United Kingdom), and banking services firm Akbank T.A.S (h) (Turkey) held back relative results. Shares of Erste Group Bank declined in the second part of the reporting period due, in part, to investors’ concerns about the bank’s exposure to European sovereign debt as well as the bank’s potential losses on non-performing loans issued to Hungarian borrowers.

3

Table of Contents

MFS International Growth Portfolio

Management Review – continued

During the reporting period, the fund’s currency exposure, resulting primarily from holdings of foreign currency denominated securities, was a detractor from relative performance. All of MFS’ investment decisions are driven by the fundamentals of each individual opportunity and as such, it is common for our portfolios to have different currency exposure than the benchmark.

Respecfully,

David Antonelli

Portfolio Manager

| (b) | Security is not a benchmark constituent. |

| (h) | Security was not held in the fund at period end. |

The views expressed in this report are those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

4

Table of Contents

MFS International Growth Portfolio

PERFORMANCE SUMMARY THROUGH 12/31/11

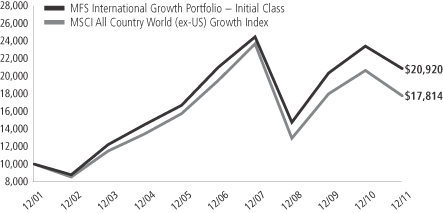

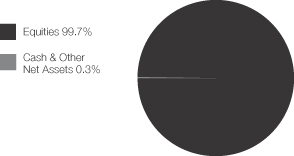

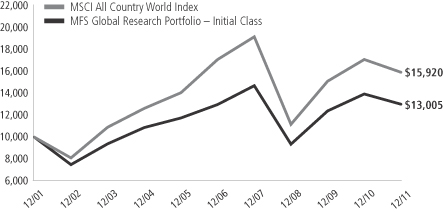

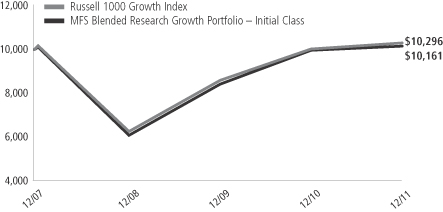

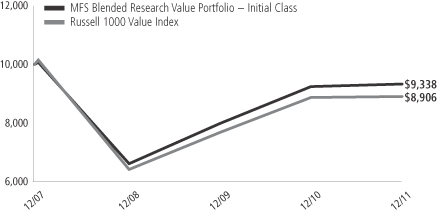

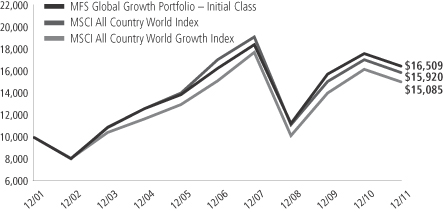

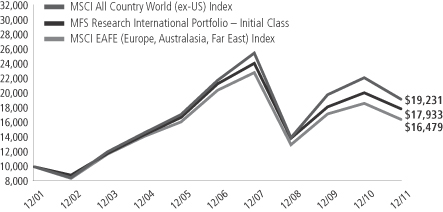

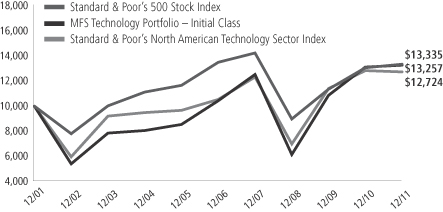

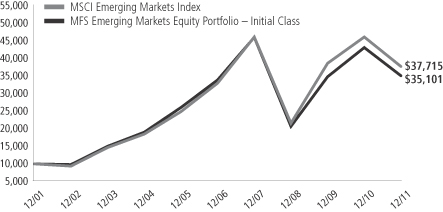

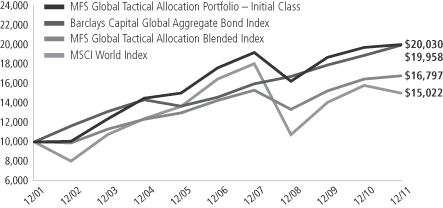

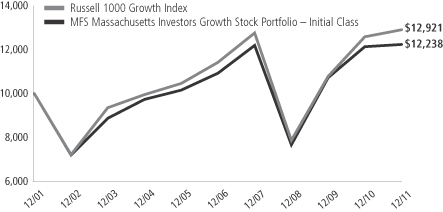

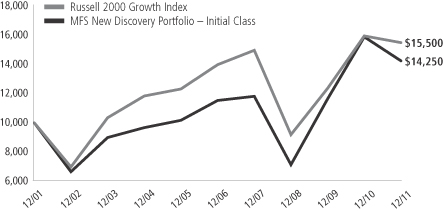

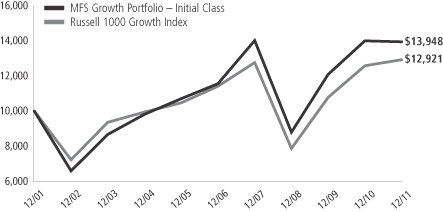

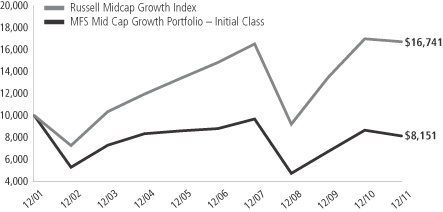

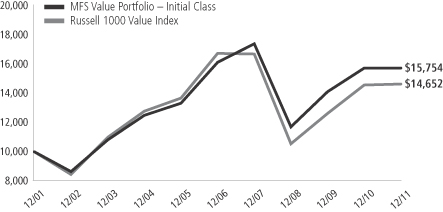

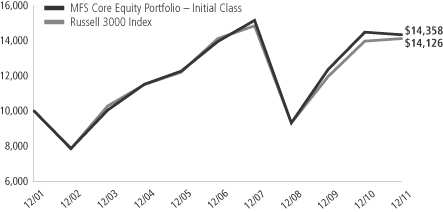

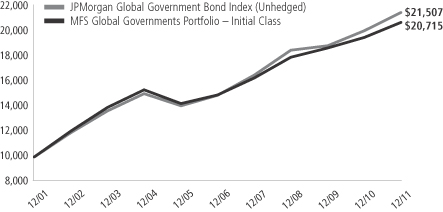

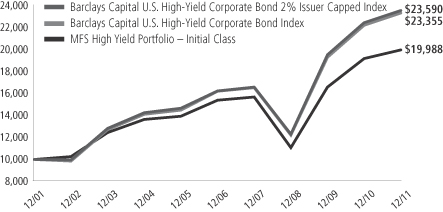

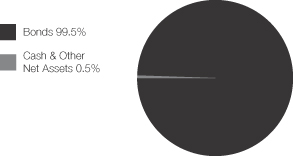

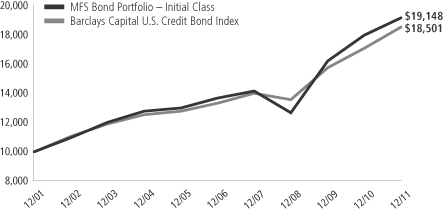

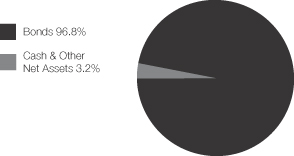

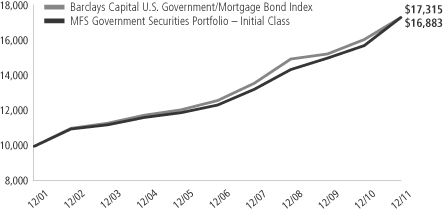

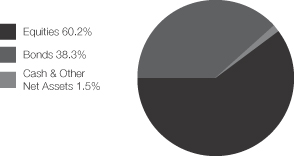

The following chart illustrates the historical performance of the fund in comparison to its benchmark(s). Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect any fees or expenses. The performance of other share classes will be greater than or less than that of the class depicted below. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your units, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a contract holder would pay on fund distributions or the redemption of contract units. The returns for the fund shown also do not reflect the deduction of expenses associated with variable products, such as mortality and expense risk charges, separate account charges, and sales charges imposed by the insurance company separate accounts. Such expenses would reduce the overall returns shown.

Growth of a Hypothetical $10,000 Investment

Total Returns through 12/31/11

Average annual total returns

| Share class | Class inception date | 1-yr | 5-yr | 10-yr | ||||||||

| Initial Class | 6/03/96 | (10.89)% | (0.12)% | 7.66% | ||||||||

| Service Class | 8/24/01 | (11.11)% | (0.38)% | 7.40% | ||||||||

| Comparative benchmark | ||||||||||||

| MSCI All Country World (ex-US) Growth Index (f) | (13.93)% | (1.84)% | 5.94% | |||||||||

| (f) | Source: FactSet Research Systems Inc. |

Benchmark Definition

MSCI All Country World (ex-US) Growth Index – a market capitalization-weighted index that is designed to measure equity market performance for growth securities in the global developed and emerging markets, excluding the U.S.

It is not possible to invest directly in an index.

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details. All results are historical and assume the reinvestment of any dividends and capital gains distributions.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

5

Table of Contents

MFS International Growth Portfolio

Fund Expenses Borne by the Contract Holders During the Period,

July 1, 2011 through December 31, 2011

As a contract holder of the fund, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2011 through December 31, 2011.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight the fund’s ongoing costs only and do not take into account the fees and expenses imposed under the variable contracts through which your investment in the fund is made. Therefore, the second line for each share class in the table is useful in comparing ongoing costs associated with an investment in vehicles (such as the fund) which fund benefits under variable annuity and variable life insurance contracts and to qualified pension and retirement plans only, and will not help you determine the relative total costs of investing in the fund through variable annuity and variable life insurance contracts. If the fees and expenses imposed under the variable contracts were included, your costs would have been higher.

| Share Class | Annualized Expense Ratio | Beginning Account Value 7/01/11 | Ending Account Value | Expenses Paid During Period (p) 7/01/11-12/31/11 | ||||||||||||||

| Initial Class | Actual | 1.06% | $1,000.00 | $852.29 | $4.95 | |||||||||||||

| Hypothetical (h) | 1.06% | $1,000.00 | $1,019.86 | $5.40 | ||||||||||||||

| Service Class | Actual | 1.31% | $1,000.00 | $851.14 | $6.11 | |||||||||||||

| Hypothetical (h) | 1.31% | $1,000.00 | $1,018.60 | $6.67 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. |

6

Table of Contents

MFS International Growth Portfolio

PORTFOLIO OF INVESTMENTS – 12/31/11

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer | Shares/Par | Value ($) | ||||||

| COMMON STOCKS – 99.1% | ||||||||

| Airlines – 1.0% | ||||||||

| Copa Holdings S.A., “A” | 36,060 | $ | 2,115,640 | |||||

|

| |||||||

| Alcoholic Beverages – 5.7% | ||||||||

| Carlsberg A.S., “B” | 26,923 | $ | 1,898,528 | |||||

| Diageo PLC | 181,120 | 3,956,194 | ||||||

| Heineken N.V. | 68,694 | 3,171,288 | ||||||

| Pernod Ricard S.A. | 36,645 | 3,391,716 | ||||||

|

| |||||||

| $ | 12,417,726 | |||||||

|

| |||||||

| Apparel Manufacturers – 5.3% | ||||||||

| Compagnie Financiere Richemont S.A. | 38,612 | $ | 1,944,217 | |||||

| Li & Fung Ltd. | 1,553,200 | 2,875,778 | ||||||

| LVMH Moet Hennessy Louis Vuitton S.A. | 40,398 | 5,691,616 | ||||||

| Swatch Group Ltd. | 2,770 | 1,032,052 | ||||||

|

| |||||||

| $ | 11,543,663 | |||||||

|

| |||||||

| Automotive – 1.7% | ||||||||

| Bayerische Motoren Werke AG | 32,464 | $ | 2,170,388 | |||||

| Honda Motor Co. Ltd. | 47,800 | 1,458,158 | ||||||

|

| |||||||

| $ | 3,628,546 | |||||||

|

| |||||||

| Broadcasting – 1.4% | ||||||||

| Publicis Groupe S.A. | 67,215 | $ | 3,084,811 | |||||

|

| |||||||

| Brokerage & Asset Managers – 0.8% | ||||||||

| Aberdeen Asset Management PLC | 371,098 | $ | 1,217,440 | |||||

| BM&F Bovespa S.A. | 117,100 | 615,242 | ||||||

|

| |||||||

| $ | 1,832,682 | |||||||

|

| |||||||

| Business Services – 7.6% | ||||||||

| Accenture PLC, “A” | 58,290 | $ | 3,102,777 | |||||

| Amadeus IT Holding S.A. | 89,876 | 1,451,900 | ||||||

| Capita Group PLC | 185,657 | 1,812,125 | ||||||

| Compass Group PLC | 463,980 | 4,393,157 | ||||||

| Experian Group Ltd. | 110,183 | 1,498,105 | ||||||

| Intertek Group PLC | 68,684 | 2,162,399 | ||||||

| LPS Brasil – Consultoria de Imoveis S.A. | 40,300 | 561,748 | ||||||

| Michael Page International PLC | 268,967 | 1,451,968 | ||||||

|

| |||||||

| $ | 16,434,179 | |||||||

|

| |||||||

| Computer Software – 3.6% | ||||||||

| Check Point Software Technologies Ltd. (a) | 39,030 | $ | 2,050,636 | |||||

| Dassault Systems S.A. | 41,602 | 3,334,522 | ||||||

| SAP AG | 46,466 | 2,456,663 | ||||||

|

| |||||||

| $ | 7,841,821 | |||||||

|

| |||||||

| Computer Software – Systems – 1.0% | ||||||||

| NICE Systems Ltd., ADR (a) | 62,850 | $ | 2,165,183 | |||||

|

| |||||||

| Construction – 0.4% | ||||||||

| Bellway PLC | 79,483 | $ | 879,489 | |||||

|

| |||||||

| Consumer Products – 3.5% | ||||||||

| Reckitt Benckiser Group PLC | 76,770 | $ | 3,783,098 | |||||

| Uni-Charm Corp. | 77,200 | 3,806,340 | ||||||

|

| |||||||

| $ | 7,589,438 | |||||||

|

| |||||||

| Issuer | Shares/Par | Value ($) | ||||||

| COMMON STOCKS – continued | ||||||||

| Electrical Equipment – 3.1% | ||||||||

| Legrand S.A. | 108,048 | $ | 3,461,368 | |||||

| Schneider Electric S.A. | 60,924 | 3,183,938 | ||||||

|

| |||||||

| $ | 6,645,306 | |||||||

|

| |||||||

| Electronics – 5.9% | ||||||||

| ASML Holding N.V. | 92,250 | $ | 3,855,128 | |||||

| Infineon Technologies AG | 230,869 | 1,737,834 | ||||||

| Samsung Electronics Co. Ltd. | 2,683 | 2,464,075 | ||||||

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 359,180 | 4,637,014 | ||||||

|

| |||||||

| $ | 12,694,051 | |||||||

|

| |||||||

| Energy – Independent – 1.5% | ||||||||

| CNOOC Ltd. | 989,000 | $ | 1,729,279 | |||||

| INPEX Corp. | 241 | 1,518,579 | ||||||

|

| |||||||

| $ | 3,247,858 | |||||||

|

| |||||||

| Energy – Integrated – 2.8% | ||||||||

| BG Group PLC | 125,034 | $ | 2,666,640 | |||||

| OAO Gazprom, ADR | 161,540 | 1,722,016 | ||||||

| Suncor Energy, Inc. | 60,163 | 1,735,057 | ||||||

|

| |||||||

| $ | 6,123,713 | |||||||

|

| |||||||

| Engineering – Construction – 1.1% | ||||||||

| JGC Corp. | 101,000 | $ | 2,424,945 | |||||

|

| |||||||

| Food & Beverages – 4.4% | ||||||||

| Groupe Danone | 93,341 | $ | 5,867,578 | |||||

| Nestle S.A. | 65,883 | 3,782,528 | ||||||

|

| |||||||

| $ | 9,650,106 | |||||||

|

| |||||||

| Food & Drug Stores – 3.3% | ||||||||

| Dairy Farm International Holdings Ltd. | 194,400 | $ | 1,813,752 | |||||

| Lawson, Inc. | 39,400 | 2,459,621 | ||||||

| Tesco PLC | 449,042 | 2,813,508 | ||||||

|

| |||||||

| $ | 7,086,881 | |||||||

|

| |||||||

| General Merchandise – 0.5% | ||||||||

| Lojas Renner S.A. | 39,100 | $ | 1,014,787 | |||||

|

| |||||||

| Insurance – 0.5% | ||||||||

| AIA Group Ltd. | 359,800 | $ | 1,123,419 | |||||

|

| |||||||

| Internet – 0.7% | ||||||||

| Yahoo Japan Corp. | 4,886 | $ | 1,573,651 | |||||

|

| |||||||

| Machinery & Tools – 2.2% | ||||||||

| KONE Oyj “B” | 39,032 | $ | 2,019,013 | |||||

| Schindler Holding AG | 22,734 | 2,647,822 | ||||||

|

| |||||||

| $ | 4,666,835 | |||||||

|

| |||||||

| Major Banks – 4.7% | ||||||||

| Credit Suisse Group AG | 89,601 | $ | 2,105,285 | |||||

| HSBC Holdings PLC | 333,744 | 2,533,523 | ||||||

| Julius Baer Group Ltd. | 67,655 | 2,631,237 | ||||||

| Standard Chartered PLC | 134,630 | 2,931,234 | ||||||

|

| |||||||

| $ | 10,201,279 | |||||||

|

| |||||||

7

Table of Contents

MFS International Growth Portfolio

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| COMMON STOCKS – continued | ||||||||

| Medical & Health Technology & Services – 2.1% | ||||||||

| Diagnosticos da America S.A. | 150,200 | $ | 1,248,144 | |||||

| Fleury S.A. | 83,600 | 959,142 | ||||||

| Fresenius Medical Care AG & Co. KGaA | 34,759 | 2,361,810 | ||||||

|

| |||||||

| $ | 4,569,096 | |||||||

|

| |||||||

| Medical Equipment – 2.9% | ||||||||

| Essilor International S.A. | 30,205 | $ | 2,129,573 | |||||

| Sonova Holding AG | 34,188 | 3,576,036 | ||||||

| Synthes, Inc. (n) | 3,565 | 596,747 | ||||||

|

| |||||||

| $ | 6,302,356 | |||||||

|

| |||||||

| Metals & Mining – 3.3% | ||||||||

| BHP Billiton Ltd. | 111,521 | $ | 3,926,073 | |||||

| Iluka Resources Ltd. | 75,456 | 1,196,234 | ||||||

| Rio Tinto Ltd. | 34,712 | 2,140,858 | ||||||

|

| |||||||

| $ | 7,263,165 | |||||||

|

| |||||||

| Oil Services – 1.0% | ||||||||

| Saipem S.p.A. | 37,142 | $ | 1,569,863 | |||||

| Technip | 7,350 | 686,953 | ||||||

|

| |||||||

| $ | 2,256,816 | |||||||

|

| |||||||

| Other Banks & Diversified Financials – 4.6% | ||||||||

| Banco Santander Brasil S.A., ADR | 129,640 | $ | 1,055,270 | |||||

| Banco Santander Chile, ADR | 8,910 | 674,487 | ||||||

| Bank Rakyat Indonesia | 1,493,500 | 1,111,787 | ||||||

| China Construction Bank | 1,364,410 | 952,167 | ||||||

| Credicorp Ltd. | 22,360 | 2,447,749 | ||||||

| HDFC Bank Ltd. | 156,683 | 1,259,394 | ||||||

| Itau Unibanco Multiplo S.A., ADR | 59,520 | 1,104,691 | ||||||

| Siam Commercial Bank Co. Ltd. | 357,200 | 1,301,997 | ||||||

|

| |||||||

| $ | 9,907,542 | |||||||

|

| |||||||

| Pharmaceuticals – 5.7% | ||||||||

| Bayer AG | 45,853 | $ | 2,931,656 | |||||

| Novo Nordisk A/S, “B” | 19,785 | 2,273,623 | ||||||

| Roche Holding AG | 18,026 | 3,048,514 | ||||||

| Santen Pharmaceutical Co. Ltd. | 48,300 | 1,989,230 | ||||||

| Teva Pharmaceutical Industries Ltd., ADR | 50,140 | 2,023,650 | ||||||

|

| |||||||

| $ | 12,266,673 | |||||||

|

| |||||||

| Precious Metals & Minerals – 0.7% | ||||||||

| Newcrest Mining Ltd. | 51,854 | $ | 1,569,874 | |||||

|

| |||||||

| Railroad & Shipping – 2.6% | ||||||||

| Canadian National Railway Co. | 47,160 | $ | 3,704,890 | |||||

| Kuehne & Nagel, Inc. AG | 16,550 | 1,852,333 | ||||||

|

| |||||||

| $ | 5,557,223 | |||||||

|

| |||||||

| Real Estate – 0.3% | ||||||||

| Brasil Brokers Participacoes | 226,700 | $ | 678,186 | |||||

|

| |||||||

| Issuer | Shares/Par | Value ($) | ||||||

| COMMON STOCKS – continued | ||||||||

| Specialty Chemicals – 7.6% | ||||||||

| Akzo Nobel N.V. | 60,035 | $ | 2,888,582 | |||||

| L’Air Liquide S.A. | 18,630 | 2,304,855 | ||||||

| Linde AG | 33,229 | 4,943,614 | ||||||

| Nitto Denko Corp. | 39,000 | 1,395,427 | ||||||

| Shin-Etsu Chemical Co. Ltd. | 54,300 | 2,673,730 | ||||||

| Symrise AG | 86,402 | 2,305,848 | ||||||

|

| |||||||

| $ | 16,512,056 | |||||||

|

| |||||||

| Specialty Stores – 2.2% | ||||||||

| Hennes & Mauritz AB, “B” | 43,760 | $ | 1,404,112 | |||||

| Industria de Diseno Textil S.A. | 41,378 | 3,380,708 | ||||||

|

| |||||||

| $ | 4,784,820 | |||||||

|

| |||||||

| Telecommunications – Wireless – 1.7% | ||||||||

| MTN Group Ltd. | 65,351 | $ | 1,160,679 | |||||

| Tim Participacoes S.A., ADR | 98,590 | 2,543,622 | ||||||

|

| |||||||

| $ | 3,704,301 | |||||||

|

| |||||||

| Telephone Services – 1.2% | ||||||||

| China Unicom Ltd. | 1,196,000 | $ | 2,516,241 | |||||

|

| |||||||

| Tobacco – 0.5% | ||||||||

| Japan Tobacco, Inc. | 230 | $ | 1,081,720 | |||||

|

| |||||||

| Total Common Stocks (Identified Cost, $207,284,984) | $ | 214,956,078 | ||||||

|

| |||||||

| MONEY MARKET FUNDS – 0.8% | ||||||||

| MFS Institutional Money Market Portfolio, 0.05%, at Cost and Net Asset Value (v) | 1,785,076 | $ | 1,785,076 | |||||

|

| |||||||

| Total Investments (Identified Cost, $209,070,060) | $ | 216,741,154 | ||||||

|

| |||||||

| OTHER ASSETS, LESS LIABILITIES – 0.1% | 234,418 | |||||||

|

| |||||||

| Net Assets – 100.0% | $ | 216,975,572 | ||||||

|

| |||||||

| (a) | Non-income producing security. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $596,747 representing 0.3% of net assets. |

| (v) | Underlying affiliated fund that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

The following abbreviations are used in this report and are defined:

| ADR | American Depository Receipt |

| PLC | Public Limited Company |

See Notes to Financial Statements

8

Table of Contents

MFS International Growth Portfolio

FINANCIAL STATEMENTS | STATEMENT OF ASSETS AND LIABILITIES

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

At 12/31/11 | ||||||||

Assets | ||||||||

Investments – | ||||||||

Non-affiliated issuers, at value (identified cost, $207,284,984) | $214,956,078 | |||||||

Underlying affiliated funds, at cost and value | 1,785,076 | |||||||

Total investments, at value (identified cost, $209,070,060) | $216,741,154 | |||||||

Cash | 13,021 | |||||||

Foreign currency, at value (identified cost, $2,424) | 2,424 | |||||||

Receivables for | ||||||||

Fund shares sold | 236,673 | |||||||

Interest and dividends | 258,220 | |||||||

Other assets | 6,595 | |||||||

Total assets | $217,258,087 | |||||||

Liabilities | ||||||||

Payables for | ||||||||

Investments purchased | $83,190 | |||||||

Fund shares reacquired | 79,550 | |||||||

Payable to affiliates | ||||||||

Investment adviser | 16,533 | |||||||

Shareholder servicing costs | 159 | |||||||

Distribution and/or service fees | 591 | |||||||

Payable for Trustees’ compensation | 460 | |||||||

Deferred country tax expense payable | 13,064 | |||||||

Accrued expenses and other liabilities | 88,968 | |||||||

Total liabilities | $282,515 | |||||||

Net assets | $216,975,572 | |||||||

Net assets consist of | ||||||||

Paid-in capital | $209,937,764 | |||||||

Unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies (net of $13,064 deferred country tax) | 7,652,535 | |||||||

Accumulated distributions in excess of net realized gain on investments and foreign currency transactions | (3,115,725 | ) | ||||||

Undistributed net investment income | 2,500,998 | |||||||

Net assets | $216,975,572 | |||||||

Shares of beneficial interest outstanding | 19,595,602 |

| Net assets | Shares outstanding | Net asset value per share | ||||||||||

Initial Class | $188,065,689 | 16,968,457 | $11.08 | |||||||||

Service Class | 28,909,883 | 2,627,145 | 11.00 | |||||||||

See Notes to Financial Statements

9

Table of Contents

MFS International Growth Portfolio

FINANCIAL STATEMENTS | STATEMENT OF OPERATIONS

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

Year ended 12/31/11 | ||||||||

Net investment income | ||||||||

Income | ||||||||

Dividends | $5,703,311 | |||||||

Interest | 93,315 | |||||||

Dividends from underlying affiliated funds | 4,719 | |||||||

Foreign taxes withheld | (505,469 | ) | ||||||

Total investment income | $5,295,876 | |||||||

Expenses | ||||||||

Management fee | $2,150,516 | |||||||

Distribution and/or service fees | 77,233 | |||||||

Shareholder servicing costs | 25,953 | |||||||

Administrative services fee | 79,850 | |||||||

Trustees’ compensation | 29,047 | |||||||

Custodian fee | 139,364 | |||||||

Shareholder communications | 6,831 | |||||||

Auditing fees | 55,827 | |||||||

Legal fees | 5,457 | |||||||

Miscellaneous | 37,909 | |||||||

Total expenses | $2,607,987 | |||||||

Fees paid indirectly | (27 | ) | ||||||

Net expenses | $2,607,960 | |||||||

Net investment income | $2,687,916 | |||||||

Realized and unrealized gain (loss) on investments and foreign currency transactions | ||||||||

Realized gain (loss) (identified cost basis) | ||||||||

Investment transactions (net of $6,085 country tax) | $(2,444,103 | ) | ||||||

Foreign currency transactions | (163,505 | ) | ||||||

Net realized gain (loss) on investments and foreign currency transactions | $(2,607,608 | ) | ||||||

Change in unrealized appreciation (depreciation) | ||||||||

Investments (net of $30,742 decrease in deferred country tax) | $(25,331,030 | ) | ||||||

Translation of assets and liabilities in foreign currencies | (23,831 | ) | ||||||

Net unrealized gain (loss) on investments and foreign currency translation | $(25,354,861 | ) | ||||||

Net realized and unrealized gain (loss) on investments and foreign currency | $(27,962,469 | ) | ||||||

Change in net assets from operations | $(25,274,553 | ) |

See Notes to Financial Statements

10

Table of Contents

MFS International Growth Portfolio

FINANCIAL STATEMENTS | STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

For years ended 12/31 | 2011 | 2010 | ||||||

Change in net assets | ||||||||

From operations | ||||||||

Net investment income | $2,687,916 | $2,797,449 | ||||||

Net realized gain (loss) on investments and foreign currency transactions | (2,607,608 | ) | 27,881,035 | |||||

Net unrealized gain (loss) on investments and foreign currency translation | (25,354,861 | ) | 7,205,823 | |||||

Change in net assets from operations | $(25,274,553 | ) | $37,884,307 | |||||

| Distributions declared to shareholders | ||||||||

From net investment income | $(2,595,452 | ) | $(1,936,143 | ) | ||||

From net realized gain on investments | (20,352,060 | ) | — | |||||

Total distributions declared to shareholders | $(22,947,512 | ) | $(1,936,143 | ) | ||||

Change in net assets from fund share transactions | $12,393,444 | $9,593,366 | ||||||

Total change in net assets | $(35,828,621 | ) | $45,541,530 | |||||

Net assets | ||||||||

At beginning of period | 252,804,193 | 207,262,663 | ||||||

At end of period (including undistributed net investment income of $2,500,998 and | $216,975,572 | $252,804,193 |

See Notes to Financial Statements

11

Table of Contents

MFS International Growth Portfolio

FINANCIAL STATEMENTS | FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Initial Class | Years ended 12/31 | |||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

Net asset value, beginning of period | $13.85 | $12.13 | $8.90 | $17.63 | $17.93 | |||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||

Net investment income (d) | $0.15 | $0.15 | $0.14 | $0.16 | $0.21 | |||||||||||||||

Net realized and unrealized gain (loss) on investments | (1.60 | ) | 1.68 | 3.20 | (6.04 | ) | 2.57 | |||||||||||||

Total from investment operations | $(1.45 | ) | $1.83 | $3.34 | $(5.88 | ) | $2.78 | |||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||

From net investment income | $(0.15 | ) | $(0.11 | ) | $(0.11 | ) | $(0.19 | ) | $(0.27 | ) | ||||||||||

From net realized gain on investments | (1.17 | ) | — | — | (2.66 | ) | (2.81 | ) | ||||||||||||

Total distributions declared to shareholders | $(1.32 | ) | $(0.11 | ) | $(0.11 | ) | �� | $(2.85 | ) | $(3.08 | ) | |||||||||

Net asset value, end of period (x) | $11.08 | $13.85 | $12.13 | $8.90 | $17.63 | |||||||||||||||

Total return (%) (k)(s)(x) | (10.89 | ) | 15.16 | 38.06 | (39.82 | ) | 16.58 | |||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: | ||||||||||||||||||||

Expenses (f) | 1.06 | 1.09 | 1.25 | 1.22 | 1.11 | |||||||||||||||

Net investment income | 1.16 | 1.21 | 1.39 | 1.25 | 1.16 | |||||||||||||||

Portfolio turnover | 52 | 66 | 56 | 73 | 56 | |||||||||||||||

Net assets at end of period (000 omitted) | $188,066 | $221,456 | $179,925 | $87,034 | $139,633 | |||||||||||||||

| Service Class | Years ended 12/31 | |||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

Net asset value, beginning of period | $13.76 | $12.06 | $8.84 | $17.53 | $17.85 | |||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||

Net investment income (d) | $0.11 | $0.11 | $0.12 | $0.13 | $0.15 | |||||||||||||||

Net realized and unrealized gain (loss) on investments | (1.58 | ) | 1.67 | 3.18 | (6.00 | ) | 2.56 | |||||||||||||

Total from investment operations | $(1.47 | ) | $1.78 | $3.30 | $(5.87 | ) | $2.71 | |||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||

From net investment income | $(0.12 | ) | $(0.08 | ) | $(0.08 | ) | $(0.16 | ) | $(0.22 | ) | ||||||||||

From net realized gain on investments | (1.17 | ) | — | — | (2.66 | ) | (2.81 | ) | ||||||||||||

Total distributions declared to shareholders | $(1.29 | ) | $(0.08 | ) | $(0.08 | ) | $(2.82 | ) | $(3.03 | ) | ||||||||||

Net asset value, end of period (x) | $11.00 | $13.76 | $12.06 | $8.84 | $17.53 | |||||||||||||||

Total return (%) (k)(s)(x) | (11.11 | ) | 14.86 | 37.69 | (39.96 | ) | 16.26 | |||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: | ||||||||||||||||||||

Expenses (f) | 1.31 | 1.34 | 1.50 | 1.46 | 1.37 | |||||||||||||||

Net investment income | 0.89 | 0.94 | 1.17 | 1.04 | 0.85 | |||||||||||||||

Portfolio turnover | 52 | 66 | 56 | 73 | 56 | |||||||||||||||

Net assets at end of period (000 omitted) | $28,910 | $31,348 | $27,338 | $18,056 | $28,689 | |||||||||||||||

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (k) | The total return does not reflect expenses that apply to separate accounts. Inclusion of these charges would reduce the total return figures for all periods shown. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (x) | The net asset values per share and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

12

Table of Contents

MFS International Growth Portfolio

| (1) | Business and Organization |

MFS International Growth Portfolio (the fund) is a series of MFS Variable Insurance Trust II (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The shareholders of each series of the trust are separate accounts of insurance companies, which offer variable annuity and/or life insurance products, and qualified retirement and pension plans.

| (2) | Significant Accounting Policies |

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund invests in foreign securities, including securities of emerging market issuers. Investments in foreign securities are vulnerable to the effects of changes in the relative values of the local currency and the U.S. dollar and to the effects of changes in each country’s legal, political, and economic environment. The markets of emerging markets countries are generally more volatile than the markets of developed countries with more mature economies. All of the risks of investing in foreign securities previously described are heightened when investing in emerging markets countries.

In December 2011, the Financial Accounting Standards Board issued Accounting Standards Update 2011-11, Balance Sheet (Topic 210) – Disclosures about Offsetting Assets and Liabilities (“ASU 2011-11”). Effective for annual reporting periods beginning on or after January 1, 2013 and interim periods within those annual periods, ASU 2011-11 is intended to enhance disclosure requirements on the offsetting of financial assets and liabilities. Although still evaluating the potential impacts of ASU 2011-11 to the fund, management expects that the impact of the fund’s adoption will be limited to additional financial statement disclosures.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price as provided by a third-party pricing service on the market or exchange on which they are primarily traded. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Equity securities held short, for which there were no sales reported for that day, are generally valued at the last quoted daily ask quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Short-term instruments with a maturity at issuance of 60 days or less generally are valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. Values obtained from third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the

13

Table of Contents

MFS International Growth Portfolio

Notes to Financial Statements – continued

issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. The following is a summary of the levels used as of December 31, 2011 in valuing the fund’s assets or liabilities:

| Investments at Value | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Equity Securities: | ||||||||||||||||

France | $11,506,955 | $21,629,976 | $— | $33,136,931 | ||||||||||||

United Kingdom | 10,959,421 | 21,139,458 | — | 32,098,879 | ||||||||||||

Switzerland | 8,329,144 | 14,887,628 | — | 23,216,772 | ||||||||||||

Japan | 20,381,400 | — | — | 20,381,400 | ||||||||||||

Germany | 16,737,426 | 2,170,388 | — | 18,907,814 | ||||||||||||

Netherlands | 3,855,128 | 6,059,870 | — | 9,914,998 | ||||||||||||

Brazil | 9,780,831 | — | — | 9,780,831 | ||||||||||||

Australia | 8,833,039 | — | — | 8,833,039 | ||||||||||||

Israel | 6,239,469 | — | — | 6,239,469 | ||||||||||||

Other Countries | 41,459,669 | 10,986,276 | — | 52,445,945 | ||||||||||||

| Mutual Funds | 1,785,076 | — | — | 1,785,076 | ||||||||||||

| Total Investments | $139,867,558 | $76,873,596 | $— | $216,741,154 | ||||||||||||

For further information regarding security characteristics, see the Portfolio of Investments.

Of the level 2 investments presented above, equity investments amounting to $60,238,645 would have been considered level 1 investments at the beginning of the period. Of the level 1 investments presented above, equity investments amounting to $6,231,285 would have been considered level 2 investments at the beginning of the period. The primary reason for changes in the classifications between levels 1 and 2 occurs when foreign equity securities are fair valued using other observable market-based inputs in place of the closing exchange price due to events occurring after the close of the exchange or market on which the investment is principally traded. The fund’s foreign equity securities may often be valued at fair value. The fund’s policy is to recognize transfers between the levels as of the end of the period.

Foreign Currency Translation – Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

Security Loans – State Street Bank and Trust Company (“State Street”), as lending agent, loans the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. The loans are collateralized by cash and/or U.S. Treasury and federal agency obligations in an amount typically at least equal to the market value of the securities loaned. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. State Street provides the fund with indemnification against Borrower default. The fund bears the risk of loss with respect to the investment of cash collateral. On loans collateralized by cash, the cash collateral is invested in a money market fund or short-term securities. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between

14

Table of Contents

MFS International Growth Portfolio

Notes to Financial Statements – continued

the fund and the lending agent. Income from securities lending is included in interest income on the Statement of Operations. The dividend and interest income earned on the securities loaned is accounted for in the same manner as other dividend and interest income.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend and interest payments received in additional securities are recorded on the ex-dividend or ex-interest date in an amount equal to the value of the security on such date.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the year ended December 31, 2011, is shown as a reduction of total expenses on the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service. Foreign taxes have been accrued by the fund in the accompanying financial statements.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate to wash sale loss deferrals.

The tax character of distributions declared to shareholders for the last two fiscal years is as follows:

| 12/31/11 | 12/31/10 | |||||||

| Ordinary income (including any short-term capital gains) | $4,599,059 | $1,936,143 | ||||||

| Long-term capital gains | 18,348,453 | — | ||||||

| Total distributions | $22,947,512 | $1,936,143 | ||||||

The federal tax cost and the tax basis components of distributable earnings were as follows:

| As of 12/31/11 | ||||

| Cost of investments | $212,056,240 | |||

| Gross appreciation | 18,070,877 | |||

| Gross depreciation | (13,385,963 | ) | ||

| Net unrealized appreciation (depreciation) | $4,684,914 | |||

| Undistributed ordinary income | 2,504,745 | |||

| Capital loss carryforwards | (129,545 | ) | ||

| Other temporary differences | (22,306 | ) |

As of December 31, 2011, the fund had capital loss carryforwards available to offset future realized gains. Such losses are characterized as follows:

| Short-term losses | $(129,545 | ) |

15

Table of Contents

MFS International Growth Portfolio

Notes to Financial Statements – continued

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), the above net capital losses may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losses were carried forward for eight years and treated as short-term losses.

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution and/or service fees. The fund’s income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. The fund’s distributions declared to shareholders as reported on the Statements of Changes in Net Assets are presented by class as follows:

| From net investment income | From net realized gain on investments | |||||||||||||||

| Year ended 12/31/11 | Year ended 12/31/10 | Year ended 12/31/11 | Year ended 12/31/10 | |||||||||||||

| Initial Class | $2,313,897 | $1,752,956 | $17,674,412 | $— | ||||||||||||

| Service Class | 281,555 | 183,187 | 2,677,648 | — | ||||||||||||

| Total | $2,595,452 | $1,936,143 | $20,352,060 | $— | ||||||||||||

| (3) | Transactions with Affiliates |

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at the following annual rates:

| First $1 billion of average daily net assets | 0.90% | |||

| Next $1 billion of average daily net assets | 0.80% | |||

| Average daily net assets in excess of $2 billion | 0.70% |

The management fee incurred for the year ended December 31, 2011 was equivalent to an annual effective rate of 0.90% of the fund’s average daily net assets.

The investment adviser has agreed in writing to pay a portion of the fund’s total annual operating expenses, exclusive of interest, taxes, extraordinary expenses, brokerage and transaction costs and investment-related expenses, such that total annual operating expenses do not exceed 1.35% of average daily net assets for the Initial Class shares and 1.60% of average daily net assets for the Service Class shares. This written agreement will continue until April 30, 2013. For the year ended December 31, 2011, the fund’s actual operating expenses did not exceed the limit and therefore, the investment adviser did not pay any portion of the fund’s expenses related to this agreement.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, is the distributor of shares of the fund. The Trustees have adopted a distribution plan for the Service Class shares pursuant to Rule 12b-1 under the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD distribution and/or service fees equal to 0.25% per annum of its average daily net assets attributable to Service Class shares as partial consideration for services performed and expenses incurred by MFD and financial intermediaries (including participating insurance companies that invest in the fund to fund variable annuity and variable life insurance contracts, sponsors of qualified retirement and pension plans that invest in the fund, and affiliates of these participating insurance companies and plan sponsors) in connection with the sale and distribution of the Service Class shares. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent. For the year ended December 31, 2011, the fee was $25,927, which equated to 0.0109% annually of the fund’s average daily net assets. MFSC also receives payment from the fund for out-of-pocket expenses paid by MFSC on behalf of the fund. For the year ended December 31, 2011, these costs amounted to $26.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund partially reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the year ended December 31, 2011 was equivalent to an annual effective rate of 0.0334% of the fund’s average daily net assets.

Trustees’ and Officers’ Compensation – The fund pays compensation to Trustees in the form of a retainer, attendance fees, and additional compensation to the Board chairperson. The fund does not pay compensation directly to officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers of the fund are officers or directors of MFS, MFD, and MFSC.

16

Table of Contents

MFS International Growth Portfolio

Notes to Financial Statements – continued

Other – This fund and certain other funds managed by MFS (the funds) have entered into services agreements (the Agreements) which provide for payment of fees by the funds to Tarantino LLC and Griffin Compliance LLC in return for the provision of services of an Independent Chief Compliance Officer (ICCO) and Assistant ICCO, respectively, for the funds. The ICCO and Assistant ICCO are officers of the funds and the sole members of Tarantino LLC and Griffin Compliance LLC, respectively. The funds can terminate the Agreements with Tarantino LLC and Griffin Compliance LLC at any time under the terms of the Agreements. MFS has agreed to bear all expenses associated with office space, other administrative support, and supplies provided to the ICCO and Assistant ICCO. For the year ended December 31, 2011, the aggregate fees paid by the fund to Tarantino LLC and Griffin Compliance LLC were $3,925 and are included in miscellaneous expense on the Statement of Operations.

The fund invests in the MFS Institutional Money Market Portfolio which is managed by MFS and seeks a high level of current income consistent with preservation of capital and liquidity. Income earned on this investment is included in dividends from underlying affiliated funds on the Statement of Operations. This money market fund does not pay a management fee to MFS.

| (4) | Portfolio Securities |

Purchases and sales of investments, other than U.S. Government securities, purchased option transactions, and short-term obligations, aggregated $124,061,638 and $130,515,161, respectively.

| (5) | Shares of Beneficial Interest |

The fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest. Transactions in fund shares were as follows:

| Year ended 12/31/11 | Year ended 12/31/10 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Shares sold | ||||||||||||||||

Initial Class | 2,376,645 | $29,705,818 | 5,318,787 | $62,995,452 | ||||||||||||

Service Class | 529,083 | 6,566,825 | 529,150 | 6,406,687 | ||||||||||||

| 2,905,728 | $36,272,643 | 5,847,937 | $69,402,139 | |||||||||||||

| Shares issued to shareholders in reinvestment of distributions | ||||||||||||||||

Initial Class | 1,714,263 | $19,988,309 | 142,981 | $1,752,956 | ||||||||||||

Service Class | 255,323 | 2,959,203 | 15,004 | 183,187 | ||||||||||||

| 1,969,586 | $22,947,512 | 157,985 | $1,936,143 | |||||||||||||

| Shares reacquired | ||||||||||||||||

Initial Class | (3,115,040 | ) | $(41,294,745 | ) | (4,301,835 | ) | $(55,307,266 | ) | ||||||||

Service Class | (435,552 | ) | (5,531,966 | ) | (532,563 | ) | (6,437,650 | ) | ||||||||

| (3,550,592 | ) | $(46,826,711 | ) | (4,834,398 | ) | $(61,744,916 | ) | |||||||||

| Net change | ||||||||||||||||

Initial Class | 975,868 | $8,399,382 | 1,159,933 | $9,441,142 | ||||||||||||

Service Class | 348,854 | 3,994,062 | 11,591 | 152,224 | ||||||||||||

| 1,324,722 | $12,393,444 | 1,171,524 | $9,593,366 | |||||||||||||

| (6) | Line of Credit |

The fund and certain other funds managed by MFS participate in a $1.1 billion unsecured committed line of credit, subject to a $1 billion sublimit, provided by a syndication of banks under a credit agreement. Borrowings may be made for temporary financing needs. Interest is charged to each fund, based on its borrowings, generally at a rate equal to the higher of the Federal Reserve funds rate or one month LIBOR plus an agreed upon spread. A commitment fee, based on the average daily, unused portion of the committed line of credit, is allocated among the participating funds at the end of each calendar quarter. In addition, the fund and other funds managed by MFS have established unsecured uncommitted borrowing arrangements with certain banks for temporary financing needs. Interest is charged to each fund, based on its borrowings, at a rate equal to the Federal Reserve funds rate plus an agreed upon spread. For the year ended December 31, 2011, the fund’s commitment fee and interest expense were $1,825 and $0, respectively, and are included in miscellaneous expense on the Statement of Operations.

17

Table of Contents

MFS International Growth Portfolio

Notes to Financial Statements – continued

| (7) | Transactions in Underlying Affiliated Funds – Affiliated Issuers |

An affiliated issuer may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. For the purposes of this report, the fund assumes the following to be affiliated issuers:

| Underlying Affiliated Funds | Beginning Shares/Par Amount | Acquisitions Shares/Par Amount | Dispositions Shares/Par Amount | Ending Shares/Par Amount | ||||||||||||

| MFS Institutional Money Market Portfolio | 2,123,761 | 61,669,351 | (62,008,036 | ) | 1,785,076 | |||||||||||

| Underlying Affiliated Funds | Realized Gain (Loss) | Capital Gain Distributions | Dividend Income | Ending Value | ||||||||||||

| MFS Institutional Money Market Portfolio | $— | $— | $4,719 | $1,785,076 | ||||||||||||

18

Table of Contents

MFS International Growth Portfolio

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of MFS Variable Insurance Trust II and the Shareholders of MFS International Growth Portfolio:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of MFS International Growth Portfolio (the “Fund”) (one of the portfolios comprising MFS Variable Insurance Trust II) as of December 31, 2011, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2011, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of MFS International Growth Portfolio as of December 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

February 15, 2012

19

Table of Contents

MFS International Growth Portfolio

RESULTS OF SHAREHOLDER MEETING (unaudited)

At a special meeting of shareholders of MFS International Growth Portfolio, which was held on December 1, 2011, the following actions were taken for which shareholders of all series of MFS Variable Insurance Trust II voted together as a single class with respect to Item 1 and shareholders of MFS International Growth Portfolio voted as a separate class with respect to Items 2 and 3:

Item 1: Election of ten Trustees as members of the Board of Trustees of the Trust effective January 1, 2012:

| Number of Shares | ||||||||

| For | Withheld Authority | |||||||

| Robert E. Butler | 681,916,712.8686 | 46,472,894.9218 | ||||||

| Maureen R. Goldfarb | 682,835,794.8512 | 45,553,812.9392 | ||||||

| David H. Gunning | 681,500,267.3085 | 46,889,340.4819 | ||||||

| William R. Gutow | 681,050,223.5547 | 47,339,384.2357 | ||||||

| Michael Hegarty | 682,477,088.8584 | 45,912,518.9320 | ||||||

| John P. Kavanaugh | 683,794,425.4269 | 44,595,182.3635 | ||||||

| Robert J. Manning | 682,699,559.7374 | 45,690,048.0530 | ||||||

| J. Dale Sherratt | 681,362,743.0513 | 47,026,864.7391 | ||||||

| Laurie J. Thomsen | 683,408,094.0000 | 44,981,513.7904 | ||||||

| Robert W. Uek | 681,424,852.0247 | 46,964,755.7657 | ||||||

Item 2: To approve a new investment advisory agreement dated January 1, 2012, between the Trust, on behalf of MFS International Growth Portfolio, and MFS:

| Number of Shares | ||||||||||||

| For | Against | Withheld Authority | ||||||||||

| 16,469,268.2422 | 484,757.3434 | 1,635,124.3846 | ||||||||||

Item 3: To approve revisions to and restatements of certain fundamental investment restrictions of MFS International Growth Portfolio effective January 1, 2012 as detailed below:

| Number of Shares | ||||||||||||||

| For | Against | Withheld Authority | ||||||||||||

| A. | Borrowing | 15,887,816.5161 | 890,538.7119 | 1,810,794.7422 | ||||||||||

| B. | Underwriting Securities | 16,149,501.4067 | 691,334.6627 | 1,748,313.9008 | ||||||||||

| C. | Issuance of Senior Securities | 16,154,543.5090 | 725,566.4789 | 1,709,039.9823 | ||||||||||

| D. | Lending of Money or Securities | 15,943,898.5164 | 827,295.5461 | 1,817,955.9077 | ||||||||||

| E. | Purchases or Sales of Real Estate; Interests in Oil, Gas or Mineral Leases; and Commodities | 16,338,888.8471 | 667,596.5620 | 1,582,664.5611 | ||||||||||

| F. | Industry Concentration | 16,327,873.0509 | 680,711.1367 | 1,580,565.7826 | ||||||||||

20

Table of Contents

MFS International Growth Portfolio

TRUSTEES AND OFFICERS – IDENTIFICATION AND BACKGROUND

The Trustees and officers of the Trust, as of February 1, 2012, are listed below, together with their principal occupations during the past five years. (Their titles may have varied during that period.) The address of each Trustee and officer is 500 Boylston Street, Boston, Massachusetts 02116.

Name, Age | Position(s) with Fund | Trustee/Officer Since (h) | Principal Occupations | Other Directorships (j) | ||||

| INTERESTED TRUSTEES | ||||||||

Robert J. Manning (k) (age 48) | Trustee | February 2004 | Massachusetts Financial Services Company, Chairman, Chief Executive Officer and Director; President (until December 2009); Chief Investment Officer (until July 2010) | N/A | ||||

| INDEPENDENT TRUSTEES | ||||||||

David H. Gunning (age 69) | Trustee and Chair of Trustees | January 2004 | Retired; Cleveland-Cliffs Inc. (mining products and service provider), Vice Chairman/Director (until May 2007) | Lincoln Electric Holdings, Inc. (welding equipment manufacturer), Director; Development Alternatives, Inc. (consulting), Director/Non-Executive Chairman; Portman Limited (mining), Director (until 2008) | ||||

Robert E. Butler (age 70) | Trustee | January 2006 | Consultant – investment company industry regulatory and compliance matters | N/A | ||||

Maureen R. Goldfarb (age 56) | Trustee | January 2009 | Private investor | N/A | ||||

William R. Gutow (age 70) | Trustee | December 1993 | Private investor and real estate consultant; Capitol Entertainment Management Company (video franchise), Vice Chairman | Atlantic Coast Tan (tanning salons), Vice Chairman (until 2007); Texas Donuts (donut franchise), Vice Chairman (until 2010) | ||||

Michael Hegarty (age 67) | Trustee | December 2004 | Private investor | N/A | ||||

John P. Kavanaugh (age 57) | Trustee | January 2009 | Private investor; The Hanover Insurance Group, Inc., Vice President and Chief Investment Officer (until 2006); Allmerica Investment Trust, Allmerica Securities Trust and Opus Investment Trust (investment companies), Chairman, President and Trustee (until 2006) | N/A | ||||

J. Dale Sherratt (age 73) | Trustee | June 1989 | Insight Resources, Inc. (acquisition planning specialists), President; Wellfleet Investments (investor in health care companies), Managing General Partner | N/A | ||||

Laurie J. Thomsen (age 54) | Trustee | March 2005 | Private investor; New Profit, Inc. (venture philanthropy), Executive Partner (until 2010) | The Travelers Companies (property and casualty insurance), Director | ||||

Robert W. Uek (age 70) | Trustee | January 2006 | Consultant to investment company industry | N/A | ||||

| OFFICERS | ||||||||

John M. Corcoran (k) (age 46) | President | October 2008 | Massachusetts Financial Services Company, Senior Vice President (since October 2008); State Street Bank and Trust (financial services provider), Senior Vice President, (until September 2008) | N/A | ||||

| Christopher R. Bohane (k) (age 38) | Assistant Secretary and Assistant Clerk | July 2005 | Massachusetts Financial Services Company, Vice President and Senior Counsel | N/A | ||||

Kino Clark (k) (age 43) | Assistant Treasurer | January 2012 | Massachusetts Financial Services Company, Assistant Vice President | N/A | ||||

21

Table of Contents

MFS International Growth Portfolio

Trustees and Officers – continued

Name, Age | Position(s) with Fund | Trustee/Officer Since (h) | Principal Occupations | Other Directorships (j) | ||||

Ethan D. Corey (k) (age 48) | Assistant Secretary and Assistant Clerk | July 2005 | Massachusetts Financial Services Company, Senior Vice President and Associate General Counsel | N/A | ||||

David L. DiLorenzo (k) (age 43) | Treasurer | July 2005 | Massachusetts Financial Services Company, Vice President | N/A | ||||

Robyn L. Griffin (age 36) | Assistant Independent Chief Compliance Officer | August 2008 | Griffin Compliance LLC (provider of compliance services), Principal (since August 2008); State Street Corporation (financial services provider), Mutual Fund Administration Assistant Vice President (October 2006 – July 2008); Liberty Mutual Group (insurance), Personal Market Assistant Controller (April 2006 – October 2006); Deloitte & Touche LLP (professional services firm). | N/A | ||||

Brian E. Langenfeld (k) (age 38) | Assistant Secretary and Assistant Clerk | June 2006 | Massachusetts Financial Services Company, Vice President and Senior Counsel | N/A | ||||

Ellen Moynihan (k) (age 54) | Assistant Treasurer | April 1997 | Massachusetts Financial Services Company, Senior Vice President | N/A | ||||

Susan S. Newton (k) (age 61) | Assistant Secretary and Assistant Clerk | May 2005 | Massachusetts Financial Services Company, Senior Vice President and Associate General Counsel | N/A | ||||