UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03752

THE MANAGERS FUNDS

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2012 – December 31, 2012

(Annual Shareholder Report)

The Report relates solely to Managers Bond Fund, Managers Global Income Opportunity Fund and Managers Special Equity Fund, each a series of The Managers Trust (the “Trust”). The Report does not relate to any other series of the Trust.

| Item 1. | Reports to Shareholders |

Managers Special Equity Fund

Annual Report — December 31, 2012

| | | | |

TABLE OF CONTENTS | | Page | |

| |

LETTER TO SHAREHOLDERS | | | 1 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 2 | |

| |

PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULE OF PORTFOLIO INVESTMENTS | | | 3 | |

| |

NOTES TO SCHEDULE OF PORTFOLIO INVESTMENTS | | | 11 | |

| |

FINANCIAL STATEMENTS | | | | |

| |

Statement of Assets and Liabilities | | | 12 | |

Balance sheet, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statement of Operations | | | 13 | |

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the year | | | | |

| |

Statements of Changes in Net Assets | | | 14 | |

Detail of changes in assets for the past two years | | | | |

| |

FINANCIAL HIGHLIGHTS | | | 15 | |

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| |

NOTES TO FINANCIAL HIGHLIGHTS | | | 16 | |

| |

NOTES TO FINANCIAL STATEMENTS | | | 17 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 22 | |

| |

TRUSTEES AND OFFICERS | | | 23 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the Managers Family of Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholder:

Thank you for your investment in The Managers Funds. Our foremost goal at Managers Investment Group (MIG) is to provide investment products and solutions that help our shareholders and clients successfully reach their investment goals and objectives. We do this by offering a broad selection of funds managed by a collection of Affiliated Managers Group’s (AMG) Affiliate investment boutiques, along with a complementary series of open-architecture mutual funds.

The past year has been an exciting one for us at MIG. In connection with AMG’s investment in Yacktman Asset Management (“Yacktman”), MIG partnered with Yacktman in reorganizing the Yacktman Focused Fund and the Yacktman Fund into The Managers Funds. The addition of the Yacktman Funds to our platform brought our total assets under management to over $25 billion at the end of 2012.

Additionally, in an effort to better meet our shareholders’ needs as well as bring consistency across our funds, we restructured our share class offerings across many of our Funds, which included discontinuing certain share classes with sales charges (commonly called sales loads). As a result, many of our Funds now offer three No Load share classes – Investor, Service, and Institutional Share Classes. We believe this simplified structure makes it easier for our clients as well as Financial Advisors to select the appropriate share class to match their needs.

During 2012, we also executed on other changes to certain Funds, which included reducing expense ratios on several Funds to ensure that our offerings remain competitive and affordable for our clients.

As we enter into 2013, both known and unknown risks remain to the global economy and its growth prospects. Nevertheless, we remain optimistic that the collective fiscal and monetary efforts undertaken over the past several years will continue to have a positive impact on the global economy. In the meantime, we remain confident that our Funds are well positioned to weather an uncertain economic environment.

We thank you for your continued confidence and investment in The Managers Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

The Managers Funds

About Your Fund’s Expenses

| | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. Actual Expenses The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Hypothetical Example for Comparison Purposes The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. | | |

| | | | | | | | | | | | | | | | |

Six Months Ended

December 31, 2012 | | Expense Ratio

for the Period | | | Beginning

Account Value

07/01/12 | | | Ending

Account Value

12/31/2012 | | | Expenses

Paid During

the Period* | |

Managers Special Equity Fund | |

Managers Class | |

Based on Actual Fund Return | | | 1.36 | % | | $ | 1,000 | | | $ | 1,022 | | | $ | 6.91 | |

Hypothetical (5% return before expenses) | | | 1.36 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 6.90 | |

Institutional Class | |

Based on Actual Fund Return | | | 1.11 | % | | $ | 1,000 | | | $ | 1,023 | | | $ | 5.64 | |

Hypothetical (5% return before expenses) | | | 1.11 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.63 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the period (184), then divided by 366. |

2

Managers Special Equity Fund

Portfolio Manager’s Comments

The Managers Special Equity Fund’s (the “Fund”) investment objective is to achieve long-term capital appreciation through a diversified portfolio of equity securities of small- and medium-sized companies.

THE PORTFOLIO MANAGERS

The Fund employs multiple subadvisors who specialize in distinct investment approaches. This ���intelligence diversification” not only serves to manage risk, but also helps us tap the markets’ full potential by focusing different analytical insights on each prospective investment. Fund management strives to achieve its performance and diversification objectives while ensuring that the Fund operates within the framework of its investment objective and principal investment strategies.

Federated MDTA, LLC

Federated MDTA, LLC (“MDT”) utilizes a quantitative process to score stocks based on earnings estimate momentum, long-term growth rates, share buyback and issuance, cash earnings-to-price ratios, tangible book-to-price ratios and earnings risk. A decision-tree approach provides an intuitive, non-linear way to score companies. Stocks are grouped into clusters determined by analyzing different combinations of factor scores and returns, with each cluster containing companies with a different pattern of fundamental characteristics. Optimization is then used to build a portfolio that maximizes the stock selection score, while adhering to diversification constraints and trading costs. A position is sold or trimmed if the quantitative model identifies a more attractive opportunity (net of trading costs) or if a holding exceeds the maximum company weight of 1.3%. The Portfolio typically holds between 100 and 110 stocks, with no position exceeding 1.3% of the Portfolio. Industry weights are limited to +/- 13.5% of the benchmark weight, while sector weights are limited to +/- 22.5% of the benchmark weight.

Lord, Abbett & Co., LLC

The team at Lord, Abbett & Co., LLC (“Lord Abbett”), led by Tom O’Halloran, focuses its stock selection effort on companies that have revenue growth of at least 15% and are experiencing year-to-year operating margin improvement and earnings growth driven by top-line growth, rather than being driven by one-time events or simple cost cutting measures. The focus is also on identifying companies with higher-quality balance sheets (often captured by finding companies with manageable debt-to-total-capital ratios) and that are already profitable. Once this process is completed, the focus for the team is on forecasting both revenue and earnings growth over the next several years. To achieve this goal and to find companies that will be growing considerably faster than their industry average, members of the team spend an extensive amount of time understanding the competitive advantages of a firm, the industry dynamics within which they operate and the strength of management. A position is sold or trimmed if there is a fundamental change in the business, a more attractive alternative is found, or if a holding reaches a 5% weight in the overall portfolio. The portion of the Fund managed by Lord Abbett typically holds between 100 and 150 stocks with no individual holding exceeding 5%. Lord Abbett has established a risk constraint that prevents any individual industry from being greater than 25% of the total weight of its portion of the Fund.

Ranger Investment Management, LLC

The team at Ranger Investment Management, L.P. (“Ranger”), led by Conrad Doenges, starts with a universe of stocks with market capitalization between $100M and $2B, from which they establish a list of approximately 250 to 300 companies on which they conduct detailed research. Each Ranger sector manager builds detailed earnings and cash-flow models for the companies they follow, and also qualitatively gauge, through a stock scoring model, their conviction level in each stock. Companies in the Fund’s portfolio managed by Ranger will typically have a high degree of recurring revenue, steady and/or accelerating sales and earnings growth, solid balance sheets, strong free-cash flows, conservative accounting practices and a seasoned management team. The Portfolio typically contains 35 and 60 stocks, with individual position sizes capped at 5%. Sector exposures are also limited to a maximum of 30%. A stock may be reduced or sold if material changes occur in the company’s earnings estimates, the company’s valuations exceed historical levels, a pre-determined price target is achieved, the stock reaches the maximum position size of 5%, capitalization limit of $5 billion or it can be replaced with a better risk/reward opportunity.

Smith Asset Management Group, L.P.

Smith Asset Management Group, L.P.’s (“Smith Group”) investment process is based on a combination of a well-conceived quantitative screening process coupled with experienced, intelligent fundamental and qualitative analysis. The team is focused on predicting which attractively valued companies will report a succession of positive earnings surprises. The process begins by seeking companies with attractive risk profiles and valuations, as well as dramatically improving business fundamentals. To manage risk, Smith screens for companies with good corporate governance, strong financial quality, attractive valuation and moderate portfolio beta. To identify high-earnings-growth companies, Smith screens for rising earnings expectations, improving earnings quality, a high percentage of positive earnings surprise and high earnings growth rate. The Fund’s portfolio managed by Smith will typically hold 100 to 120 stocks, with no individual position greater than 3.0%. Sector weightings are limited to no more than two times the weighting in the Russell 2000® Index. Stocks are sold from the portfolio if a negative earnings surprise is predicted by the process or management guidance, a negative earnings surprise is actually reported, the stock’s valuation level is too high or a buyout announcement is made.

THE YEAR IN REVIEW

For the year ended December 31, 2012, the Managers Special Equity Fund Managers Class returned 10.35% and the Institutional Class returned 10.62%, both underperforming the 14.59% return of the Russell 2000® Growth Index.

Managers Special Equity Fund

Portfolio Manager’s Comments (continued)

U.S. equity markets posted solid double-digit returns for the year shaking off concerns about the fiscal cliff crisis here in the U.S. and the potential impact to the domestic economy from a recession in Europe and a slowing China. The year started with a continuation of the increased optimism surrounding a potential resolution to the European debt crisis that we witnessed at the end of 2011. This was visible not just via strong double-digit equity returns globally, but also through the sharp reduction in global equity market volatility. However, during the second quarter debt and growth issues dominated the headlines again causing a muted version of the “risk off” trade to return to prominence. The summer months were dominated by the anticipation of a Federal Reserve action in the form of another round of quantitative easing in response to weak economic growth and a sluggish domestic job market. Investors’ expectations were met when the Fed announced their third round of quantitative easing (QE3) in September with a promise of increased purchases of agency mortgage-backed securities and an extension of the promise to keep short-term interest rates at “exceptionally low levels” until mid-2015. As expected the fourth quarter economic landscape was dominated by the U.S. Presidential and Congressional elections and their collective impact on the fiscal cliff. After the elections were completed, markets nervously awaited the outcome of the fiscal cliff negotiations as economists generally predicted dire consequences for the U.S. economy in 2013 if a timely resolution was not reached by the end of the year. Despite a resolution on the tax aspects of the fiscal cliff not being reached until just beyond the final hours, equities and other risk based assets generally held their returns from earlier in the year. For the full calendar year, there was a sharp dichotomy in performance at the sector level within small-cap growth equities with the cyclically geared consumer discretionary, financials and materials sectors posting returns greater than 20%. Meanwhile, energy and utility equities posted negative returns for the year.

The Fund delivered strong absolute performance but underperformed the benchmark Russell 2000® Growth Index. The underperformance was primarily driven by relative weakness within the Fund’s health care and information technology sectors.

LOOKING FORWARD

The team at Managers continues to spend considerable time evaluating the Fund and reaffirming our confidence in the subadvisors within the Fund. This past year was our third calendar year with our existing group of subadvisors, all of whom maintain a growth bias. Although the Fund did not outperform this year as it had in the two years prior, we continue to believe that the changes we made to the Fund subadviser lineup in 2009 will to be beneficial to shareholders long term.

Heading into 2013, the Fund has its largest exposures to more cyclically geared sectors as a healing economy provides this area of the market sufficient opportunities. Entering the year, the consumer discretionary sector is the Fund’s largest absolute and relative sector exposure. While the Fund’s exposure to information technology sector is a slight underweight relative to the benchmark, it still represents 20% of the Fund’s holdings. As macroeconomic headwinds continue to be addressed domestically, the combination of pent-up demand and compelling valuations, particularly relative to historically low-yielding bonds, make small-cap growth equities look compelling even after strong results were generated by the asset class in 2012.

This commentary reflects the viewpoints of Federated MDTA, LLC. Lord, Abbett & Co., LLC, Ranger Investment Management, L.P. and Smith Asset Management Group, L.P. as of December 31, 2012 and is not intended as a forecast or guarantee of future results.

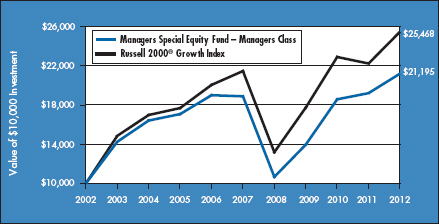

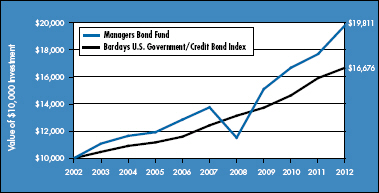

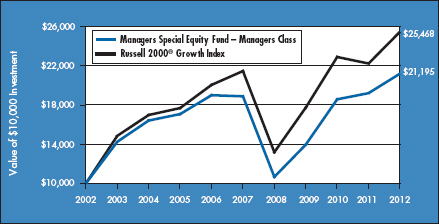

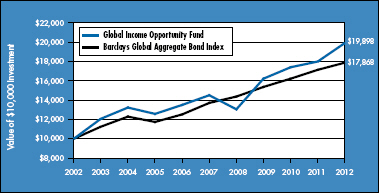

Cumulative Total Return Performance

Managers Special Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The first chart compares a hypothetical $10,000 investment made in Managers Special Equity Fund – Managers Class on December 31, 2002, to a $10,000 investment made in the Russell 2000® Growth Index for the same time period. Performance for periods longer than one year is annualized. The graphs and tables do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

Managers Special Equity Fund

Portfolio Manager’s Comments (continued)

Cumulative Total Return Performance (continued)

The table below shows the average annual total returns for Managers Special Equity Fund–Managers Class and the Russell 2000® Growth Index for the same time periods ended December 31, 2012.

| | | | | | | | | | | | |

Average Annualized Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | |

Managers Special Equity Fund - Managers Class 2,3 | | | 10.35 | % | | | 2.34 | % | | | 7.80 | % |

Russell 2000® Growth Index 4 | | | 14.59 | % | | | 3.49 | % | | | 9.80 | % |

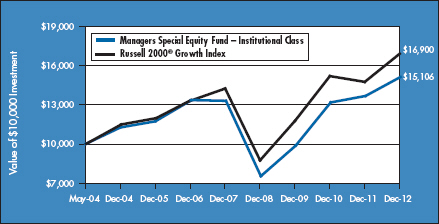

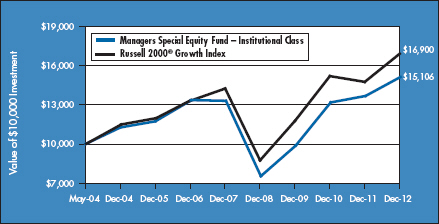

The table below shows the average annual total returns for Managers Special Equity Fund–Institutional Class and the Russell 2000® Growth Index for the same time periods ended December 31, 2012.

| | | | | | | | | | | | | | | | |

Average Annualized Total Returns1 | | One

Year | | | Five

Years | | | Since

Inception | | | Inception

Date | |

Managers Special Equity Fund - Institutional Class 2,3 | | | 10.62 | % | | | 2.60 | % | | | 4.88 | % | | | 05/03/04 | |

Russell 2000® Growth Index 4 | | | 14.59 | % | | | 3.49 | % | | | 6.38 | % | | | 05/03/04 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

| | |

| | | Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit at www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., a member of FINRA. † Date reflects inception date of the Fund, not the index. 1 Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2012. All returns are in U.S. dollars($). 2 From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 3 The Fund is subject to risks associated with investments in small capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history, and a reliance on one or a limited number of products. 4 The Russell 2000® Growth Index measures the performance of the Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. Unlike the fund, the index is unmanaged, is not available for investment and does not incur expenses. The Russell 2000® Growth Index and the Russell 2000® Index are trademarks of Russell Investments. Russell® is a trademark of Russell Investments. Not FDIC insured, nor bank guaranteed. May lose value. |

5

Managers Special Equity Fund

Fund Snapshots

December 31, 2012

Portfolio Breakdown (unaudited)

| | | | | | | | |

Industry | | Managers

Special Equity Fund** | | | Russell

2000®

Growth Index | |

Consumer Discretionary | | | 21.7 | % | | | 16.2 | % |

Information Technology | | | 19.6 | % | | | 21.5 | % |

Health Care | | | 17.7 | % | | | 20.3 | % |

Industrials | | | 16.0 | % | | | 18.0 | % |

Financials | | | 8.0 | % | | | 7.8 | % |

Energy | | | 6.2 | % | | | 5.7 | % |

Consumer Staples | | | 5.3 | % | | | 4.6 | % |

Materials | | | 2.3 | % | | | 4.8 | % |

Telecommunication Services | | | 0.0 | %# | | | 0.8 | % |

Utilities | | | 0.0 | % | | | 0.3 | % |

Other Assets and Liabilities | | | 3.2 | % | | | 0.0 | % |

| ** | As a percentage of net assets. |

| # | Rounds to less than 0.1% |

Top Ten Holdings (unaudited)

| | | | |

Security Name | | % of

Net Assets | |

Air Methods Corp.* | | | 1.8 | % |

Pier 1 Imports, Inc.* | | | 1.5 | |

Wabtec Corp.* | | | 1.4 | |

Coinstar, Inc. | | | 1.3 | |

Centene Corp. | | | 1.2 | |

Steven Madden, Ltd. | | | 1.1 | |

Akorn, Inc. | | | 1.0 | |

Bank of the Ozarks, Inc. | | | 1.0 | |

Healthcare Services Group, Inc. | | | 1.0 | |

HMS Holdings Corp. | | | 0.9 | |

Top Ten as a Group | | | 12.2 | % |

| | | | |

| * | Top Ten Holding at June 30, 2012 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

6

Managers Special Equity Fund

Schedule of Portfolio Investments

December 31, 2012

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Common Stocks - 96.8% | | | | | | | | |

Consumer

Discretionary - 21.7% | | | | | |

Aeropostale, Inc.* | | | 23,206 | | | $ | 301,910 | |

ANN, Inc.* | | | 31,883 | | | | 1,078,921 | |

Asbury Automotive Group, Inc.* | | | 43,660 | | | | 1,398,430 | |

Ascena Retail Group, Inc.* | | | 52,365 | | | | 968,229 | |

Belo Corp., Class A | | | 50,600 | | | | 388,102 | |

Bridgepoint Education, Inc.* | | | 18,943 | | | | 195,113 | |

Brunswick Corp. | | | 26,743 | | | | 777,954 | |

Buckle, Inc., The | | | 9,380 | | | | 418,723 | |

Buffalo Wild Wings, Inc.* | | | 21,317 | | | | 1,552,304 | |

Cabela’s, Inc.* | | | 16,088 | | | | 671,674 | |

Capella Education Co.* | | | 9,255 | | | | 261,269 | |

Cheesecake Factory, Inc., The | | | 10,275 | | | | 336,198 | |

Children’s Place Retail Stores, Inc., The* | | | 5,817 | | | | 257,635 | |

Coinstar, Inc.*,1 | | | 51,460 | | | | 2,676,435 | |

Columbia Sportswear Co.1 | | | 11,574 | | | | 617,589 | |

Cooper Tire & Rubber Co. | | | 3,400 | | | | 86,224 | |

Cracker Barrel Old Country Store, Inc. | | | 17,964 | | | | 1,154,367 | |

Crocs, Inc.* | | | 31,402 | | | | 451,875 | |

Ctrip.com International, Ltd., ADR*,1 | | | 12,035 | | | | 274,278 | |

Dana Holding Corp. | | | 64,642 | | | | 1,009,062 | |

Deckers Outdoor Corp.*,1 | | | 14,733 | | | | 593,298 | |

Dick’s Sporting Goods, Inc. | | | 5,579 | | | | 253,789 | |

Domino’s Pizza, Inc. | | | 1,700 | | | | 74,035 | |

DSW, Inc., Class A | | | 11,452 | | | | 752,282 | |

Ethan Allen Interiors, Inc. | | | 9,588 | | | | 246,507 | |

Express, Inc.* | | | 20,618 | | | | 311,126 | |

Francesca’s Holdings Corp.*,1 | | | 42,161 | | | | 1,094,500 | |

Genesco, Inc.* | | | 6,085 | | | | 334,675 | |

GNC Holdings, Inc., Class A | | | 14,481 | | | | 481,928 | |

Group 1 Automotive, Inc. | | | 24,200 | | | | 1,500,158 | |

Groupon, Inc.*,1 | | | 52,652 | | | | 256,942 | |

Hibbett Sports, Inc.* | | | 18,347 | | | | 966,887 | |

HSN, Inc. | | | 20,608 | | | | 1,135,089 | |

Interval Leisure Group, Inc. | | | 22,840 | | | | 442,868 | |

Jos. A. Bank Clothiers, Inc.* | | | 19,477 | | | | 829,331 | |

LifeLock, Inc.* | | | 46,857 | | | | 380,947 | |

Lumber Liquidators Holdings, Inc.* | | | 7,649 | | | | 404,097 | |

Meritage Homes Corp.* | | | 19,860 | | | | 741,771 | |

Movado Group, Inc. | | | 12,500 | | | | 383,500 | |

Overstock.com, Inc.* | | | 24,420 | | | | 349,450 | |

PetMed Express, Inc. | | | 14,100 | | | | 156,510 | |

Pier 1 Imports, Inc. | | | 151,170 | | | | 3,023,400 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Pool Corp. | | | 18,800 | | | $ | 795,616 | |

Red Robin Gourmet Burgers, Inc.* | | | 23,260 | | | | 820,845 | |

Restoration Hardware Holdings, Inc.*,1 | | | 10,001 | | | | 337,334 | |

Saks, Inc.* | | | 24,869 | | | | 261,373 | |

Sally Beauty Holdings, Inc.* | | | 52,449 | | | | 1,236,223 | |

Select Comfort Corp.* | | | 14,531 | | | | 380,276 | |

Six Flags Entertainment Corp. | | | 6,740 | | | | 412,488 | |

SodaStream International, Ltd.* | | | 2,500 | | | | 112,225 | |

Sonic Corp.* | | | 152,635 | | | | 1,588,930 | |

Steven Madden, Ltd.* | | | 53,334 | | | | 2,254,428 | |

Sturm Ruger & Co., Inc. | | | 5,540 | | | | 251,516 | |

Tenneco, Inc.* | | | 38,428 | | | | 1,349,207 | |

Tesla Motors, Inc.*,1 | | | 16,684 | | | | 565,087 | |

Tumi Holdings, Inc.*,1 | | | 25,751 | | | | 536,908 | |

Tupperware Brands Corp. | | | 16,830 | | | | 1,078,803 | |

Ulta Salon Cosmetics & Fragrance, Inc. | | | 2,864 | | | | 281,417 | |

Under Armour, Inc., Class A* | | | 2,499 | | | | 121,276 | |

Valassis Communications, Inc. | | | 28,480 | | | | 734,214 | |

Vera Bradley, Inc.*,1 | | | 1,094 | | | | 27,459 | |

Vitamin Shoppe, Inc.* | | | 9,700 | | | | 556,392 | |

World Wrestling Entertainment, Inc., Class A | | | 34,700 | | | | 273,783 | |

Total Consumer Discretionary | | | | | | | 43,565,182 | |

Consumer Staples - 5.3% | | | | | |

Annie’s, Inc.* | | | 31,869 | | | | 1,065,381 | |

Boston Beer Co., Inc., The, Class A* | | | 1,857 | | | | 249,674 | |

Cal-Maine Foods, Inc. | | | 9,445 | | | | 379,878 | |

Casey’s General Stores, Inc. | | | 13,725 | | | | 728,798 | |

Coca-Cola Bottling Co. Consolidated | | | 2,045 | | | | 135,992 | |

Fresh Market, Inc., The* | | | 5,125 | | | | 246,461 | |

Hain Celestial Group, Inc., The* | | | 9,750 | | | | 528,645 | |

Harris Teeter Supermarkets, Inc. | | | 19,646 | | | | 757,550 | |

Inter Parfums, Inc. | | | 37,950 | | | | 738,507 | |

Nu Skin Enterprises, Inc., Class A | | | 20,601 | | | | 763,267 | |

Pilgrim’s Pride Corp.* | | | 40,800 | | | | 295,800 | |

Prestige Brands Holdings, Inc.* | | | 35,510 | | | | 711,265 | |

Pricesmart, Inc. | | | 8,155 | | | | 628,343 | |

Revlon, Inc., Class A* | | | 16,095 | | | | 233,378 | |

Rite Aid Corp.* | | | 221,025 | | | | 300,594 | |

TreeHouse Foods, Inc.* | | | 14,250 | | | | 742,853 | |

United Natural Foods, Inc.* | | | 35,023 | | | | 1,876,883 | |

USANA Health Sciences, Inc.* | | | 8,445 | | | | 278,094 | |

Total Consumer Staples | | | | | | | 10,661,363 | |

Energy - 6.2% | | | | | | | | |

Approach Resources, Inc.* | | | 62,000 | | | | 1,550,620 | |

|

The accompanying notes are an integral part of these financial statements. 7 |

Managers Special Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Energy - 6.2% (continued) | | | | | | | | |

Atwood Oceanics, Inc.* | | | 11,204 | | | $ | 513,031 | |

Berry Petroleum Co., Class A | | | 11,185 | | | | 375,257 | |

Bonanza Creek Energy, Inc.* | | | 1,778 | | | | 49,411 | |

Callon Petroleum Co.* | | | 166,200 | | | | 781,140 | |

CARBO Ceramics, Inc.1 | | | 3,152 | | | | 246,928 | |

Cheniere Energy, Inc.* | | | 27,659 | | | | 519,436 | |

Delek US Holdings, Inc. | | | 4,600 | | | | 116,472 | |

Dril-Quip, Inc.* | | | 9,465 | | | | 691,418 | |

Energy XXI Bermuda, Ltd. | | | 46,411 | | | | 1,493,970 | |

GasLog, Ltd. | | | 34,899 | | | | 433,795 | |

Geospace Technologies Corp.* | | | 3,938 | | | | 349,970 | |

Gulfport Energy Corp.* | | | 20,260 | | | | 774,337 | |

Hornbeck Offshore Services, Inc.* | | | 7,239 | | | | 248,587 | |

Pacific Drilling SA* | | | 140,010 | | | | 1,321,694 | |

Stone Energy Corp.* | | | 18,764 | | | | 385,037 | |

Vaalco Energy, Inc.* | | | 48,650 | | | | 420,822 | |

W&T Offshore, Inc.1 | | | 36,901 | | | | 591,523 | |

Western Refining, Inc. | | | 52,651 | | | | 1,484,232 | |

Total Energy | | | | | | | 12,347,680 | |

Financials - 8.0% | | | | | | | | |

Altisource Asset Management Corp.*,1 | | | 224 | | | | 18,368 | |

Altisource Portfolio Solutions SA* | | | 2,241 | | | | 194,194 | |

Altisource Residential Corp., Class B*,1 | | | 747 | | | | 11,832 | |

Amtrust Financial Services, Inc. | | | 7,300 | | | | 209,437 | |

Bank of the Ozarks, Inc. | | | 57,080 | | | | 1,910,467 | |

Cash America International, Inc.1 | | | 8,077 | | | | 320,415 | |

eHealth, Inc.* | | | 22,906 | | | | 629,457 | |

Evercore Partners, Inc., Class A | | | 12,600 | | | | 380,394 | |

Financial Engines, Inc.* | | | 24,883 | | | | 690,503 | |

Hilltop Holdings, Inc.* | | | 75,286 | | | | 1,019,372 | |

Home BancShares, Inc. | | | 34,206 | | | | 1,129,482 | |

MarketAxess Holdings, Inc. | | | 27,925 | | | | 985,753 | |

Navigators Group, Inc., The* | | | 8,000 | | | | 408,560 | |

Netspend Holdings, Inc.* | | | 22,085 | | | | 261,045 | |

Ocwen Financial Corp.* | | | 11,216 | | | | 387,961 | |

PrivateBancorp, Inc. | | | 116,780 | | | | 1,789,070 | |

Signature Bank* | | | 25,571 | | | | 1,824,235 | |

SVB Financial Group* | | | 22,790 | | | | 1,275,556 | |

Texas Capital Bancshares, Inc.* | | | 33,243 | | | | 1,489,951 | |

Western Alliance Bancorp* | | | 29,739 | | | | 313,152 | |

WisdomTree Investments, Inc.* | | | 7,111 | | | | 43,519 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

World Acceptance Corp.* | | | 6,470 | | | $ | 482,403 | |

Zillow, Inc., Class A* | | | 8,568 | | | | 237,762 | |

Total Financials | | | | | | | 16,012,888 | |

Health Care - 17.7% | | | | | | | | |

Affymax, Inc.* | | | 3,400 | | | | 64,600 | |

Agenus, Inc.* | | | 24,100 | | | | 98,810 | |

Air Methods Corp. | | | 96,942 | | | | 3,576,190 | |

Akorn, Inc.* | | | 145,630 | | | | 1,945,617 | |

Align Technology, Inc.* | | | 13,412 | | | | 372,183 | |

Alnylam Pharmaceuticals, Inc.* | | | 9,905 | | | | 180,766 | |

AMAG Pharmaceuticals, Inc.* | | | 8,510 | | | | 125,182 | |

Amedisys, Inc.* | | | 629 | | | | 7,089 | |

AMN Healthcare Services, Inc.* | | | 37,690 | | | | 435,319 | |

Analogic Corp. | | | 5,425 | | | | 403,077 | |

Arena Pharmaceuticals, Inc.* | | | 10,960 | | | | 98,859 | |

Ariad Pharmaceuticals, Inc.* | | | 19,554 | | | | 375,046 | |

Array BioPharma, Inc.* | | | 43,655 | | | | 162,397 | |

athenahealth, Inc.*,1 | | | 19,352 | | | | 1,421,404 | |

BioMarin Pharmaceutical, Inc.* | | | 17,844 | | | | 878,817 | |

Celldex Therapeutics, Inc.* | | | 24,755 | | | | 166,106 | |

Centene Corp.* | | | 59,179 | | | | 2,426,339 | |

Cepheid, Inc.* | | | 7,803 | | | | 263,819 | |

Chemed Corp. | | | 5,275 | | | | 361,812 | |

ChemoCentryx, Inc.* | | | 6,300 | | | | 68,922 | |

Computer Programs & Systems, Inc. | | | 22,040 | | | | 1,109,494 | |

CryoLife, Inc. | | | 16,095 | | | | 100,272 | |

Cubist Pharmaceuticals, Inc.* | | | 8,997 | | | | 378,414 | |

Cyberonics, Inc.* | | | 4,904 | | | | 257,607 | |

Cynosure, Inc.,

Class A* | | | 16,300 | | | | 392,993 | |

DexCom, Inc.* | | | 40,645 | | | | 553,178 | |

Genomic Health, Inc.* | | | 6,056 | | | | 165,087 | |

HeartWare International, Inc.*,1 | | | 7,047 | | | | 591,596 | |

HMS Holdings Corp.* | | | 72,824 | | | | 1,887,598 | |

ICU Medical, Inc.* | | | 2,000 | | | | 121,860 | |

Impax Laboratories, Inc.* | | | 86,155 | | | | 1,765,316 | |

Incyte Corp., Ltd.*,1 | | | 18,825 | | | | 312,683 | |

Insulet Corp.* | | | 19,283 | | | | 409,185 | |

Integra LifeSciences Holdings Corp.* | | | 12,002 | | | | 467,718 | |

InterMune, Inc.*,1 | | | 12,100 | | | | 117,249 | |

Invacare Corp. | | | 4,665 | | | | 76,039 | |

Jazz Pharmaceuticals PLC* | | | 9,010 | | | | 479,332 | |

Medidata Solutions, Inc.* | | | 26,029 | | | | 1,020,077 | |

Medivation, Inc.* | | | 9,505 | | | | 486,276 | |

|

The accompanying notes are an integral part of these financial statements. 8 |

Managers Special Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Health Care - 17.7% (continued) | | | | | | | | |

Merrimack Pharmaceuticals, Inc.* | | | 20,700 | | | $ | 126,063 | |

Molina Healthcare, Inc.* | | | 15,505 | | | | 419,565 | |

MWI Veterinary Supply, Inc.* | | | 7,033 | | | | 773,630 | |

National Research Corp. | | | 3,280 | | | | 177,776 | |

Natus Medical, Inc.* | | | 17,832 | | | | 199,362 | |

OncoGenex Pharmaceutical, Inc.* | | | 5,500 | | | | 72,160 | |

Onyx Pharmaceuticals, Inc.* | | | 6,557 | | | | 495,250 | |

Orexigen Therapeutics, Inc.* | | | 29,700 | | | | 156,519 | |

Owens & Minor, Inc.1 | | | 35,032 | | | | 998,762 | |

PAREXEL International Corp.* | | | 22,590 | | | | 668,438 | |

Pharmacyclics, Inc.*,1 | | | 13,122 | | | | 759,764 | |

Questcor Pharmaceuticals, Inc.1 | | | 10,193 | | | | 272,357 | |

RTI Biologics, Inc.* | | | 65,715 | | | | 280,603 | |

Sarepta Therapeutics, Inc.* | | | 18,841 | | | | 486,098 | |

Spectrum Pharmaceuticals, Inc. | | | 7,675 | | | | 85,883 | |

STERIS Corp. | | | 40,588 | | | | 1,409,621 | |

Team Health Holdings, Inc.* | | | 36,529 | | | | 1,050,939 | |

Theravance, Inc.*,1 | | | 4,225 | | | | 94,091 | |

Trius Therapeutics, Inc.* | | | 29,255 | | | | 139,839 | |

Vanda Pharmaceuticals, Inc.* | | | 29,210 | | | | 108,077 | |

Vical, Inc.* | | | 26,990 | | | | 78,541 | |

Vocera Communications, Inc.* | | | 67,282 | | | | 1,688,778 | |

WellCare Health Plans, Inc.* | | | 15,913 | | | | 774,804 | |

Total Health Care | | | | | | | 35,441,248 | |

Industrials - 16.0% | | | | | | | | |

Advisory Board Co., The* | | | 38,910 | | | | 1,820,599 | |

Alaska Air Group, Inc.* | | | 23,586 | | | | 1,016,321 | |

Allegiant Travel Co. | | | 9,131 | | | | 670,307 | |

American Science & Engineering, Inc. | | | 7,465 | | | | 486,793 | |

American Woodmark Corp.* | | | 4,500 | | | | 125,190 | |

Applied Industrial Technologies, Inc. | | | 21,925 | | | | 921,069 | |

AZZ, Inc. | | | 14,700 | | | | 564,921 | |

Beacon Roofing Supply, Inc.* | | | 36,041 | | | | 1,199,444 | |

Belden, Inc. | | | 4,347 | | | | 195,572 | |

Brink’s Co., The | | | 41,326 | | | | 1,179,031 | |

Chart Industries, Inc.* | | | 24,710 | | | | 1,647,416 | |

Corporate Executive Board Co., The | | | 16,612 | | | | 788,406 | |

Deluxe Corp. | | | 32,169 | | | | 1,037,128 | |

DigitalGlobe, Inc.* | | | 10,127 | | | | 247,504 | |

EMCOR Group, Inc. | | | 5,105 | | | | 176,684 | |

EnerSys, Inc.* | | | 41,348 | | | | 1,555,925 | |

Exponent, Inc.* | | | 9,075 | | | | 506,657 | |

Generac Holdings, Inc. | | | 27,111 | | | | 930,178 | |

Genesee & Wyoming, Inc., Class A* | | | 10,409 | | | | 791,917 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Healthcare Services Group, Inc. | | | 82,030 | | | $ | 1,905,557 | |

HEICO Corp. | | | 6,896 | | | | 308,665 | |

Hexcel Corp.* | | | 28,452 | | | | 767,066 | |

HNI Corp. | | | 14,910 | | | | 448,195 | |

Hub Group, Inc.,

Class A* | | | 26,750 | | | | 898,800 | |

Interface, Inc. | | | 25,241 | | | | 405,875 | |

Knoll, Inc. | | | 31,836 | | | | 489,001 | |

Meritor, Inc.* | | | 31,300 | | | | 148,049 | |

Middleby Corp.* | | | 6,890 | | | | 883,367 | |

Mine Safety Appliances Co. | | | 8,240 | | | | 351,930 | |

Mueller Industries, Inc. | | | 1,645 | | | | 82,299 | |

Polypore International, Inc.*,1 | | | 6,877 | | | | 319,780 | |

Portfolio Recovery Associates, Inc.* | | | 5,176 | | | | 553,107 | |

Proto Labs, Inc.* | | | 14,175 | | | | 558,779 | |

RBC Bearings, Inc.* | | | 9,012 | | | | 451,231 | |

RPX Corp.* | | | 41,000 | | | | 370,640 | |

Standex International Corp. | | | 2,295 | | | | 117,711 | |

Taser International, Inc.* | | | 36,800 | | | | 328,992 | |

Thermon Group Holdings, Inc.* | | | 12,668 | | | | 285,410 | |

Triumph Group, Inc. | | | 27,250 | | | | 1,779,425 | |

United Rentals, Inc.* | | | 21,199 | | | | 964,978 | |

United Stationers, Inc. | | | 12,071 | | | | 374,080 | |

US Ecology, Inc. | | | 8,100 | | | | 190,674 | |

USG Corp.*,1 | | | 13,423 | | | | 376,784 | |

Wabtec Corp. | | | 32,940 | | | | 2,883,568 | |

Total Industrials | | | | | | | 32,105,025 | |

Information Technology - 19.6% | | | | | | | | |

3D Systems Corp.*,1 | | | 13,711 | | | | 731,482 | |

ADTRAN, Inc.1 | | | 18,050 | | | | 352,697 | |

Amkor Technology, Inc.* | | | 8,354 | | | | 35,505 | |

Angie’s List, Inc.* | | | 44,030 | | | | 527,920 | |

Anixter International, Inc. | | | 20,881 | | | | 1,335,966 | |

Applied Micro Circuits Corp.* | | | 116,755 | | | | 980,742 | |

Arris Group, Inc.* | | | 29,320 | | | | 438,041 | |

Aruba Networks, Inc.* | | | 29,431 | | | | 610,693 | |

Aspen Technology, Inc.* | | | 20,366 | | | | 562,916 | |

AVG Technologies N.V.* | | | 69,980 | | | | 1,107,783 | |

Bankrate, Inc.*,1 | | | 27,070 | | | | 337,022 | |

CACI International, Inc., Class A* | | | 9,104 | | | | 500,993 | |

Calix, Inc.* | | | 9,500 | | | | 73,055 | |

Cavium, Inc.* | | | 22,449 | | | | 700,633 | |

Ciena Corp.* | | | 29,315 | | | | 460,245 | |

Cirrus Logic, Inc.* | | | 11,216 | | | | 324,928 | |

CommVault Systems, Inc.* | | | 9,380 | | | | 653,880 | |

Concur Technologies, Inc.* | | | 7,987 | | | | 539,282 | |

|

The accompanying notes are an integral part of these financial statements. 9 |

Managers Special Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Information

Technology - 19.6% (continued) | | | | | |

Cornerstone OnDemand, Inc.* | | | 21,985 | | | $ | 649,217 | |

CoStar Group, Inc.* | | | 9,637 | | | | 861,259 | |

Cree, Inc.*,1 | | | 18,689 | | | | 635,052 | |

CSG Systems International, Inc.* | | | 18,700 | | | | 339,966 | |

Daktronics, Inc. | | | 36,100 | | | | 399,627 | |

Demand Media, Inc.* | | | 12,850 | | | | 119,377 | |

EPAM Systems, Inc.* | | | 21,481 | | | | 388,806 | |

Fair Isaac Corp. | | | 28,997 | | | | 1,218,744 | |

FARO Technologies, Inc.* | | | 7,319 | | | | 261,142 | |

First Solar, Inc.*,1 | | | 16,054 | | | | 495,748 | |

Fusion-io, Inc.*,1 | | | 16,913 | | | | 387,815 | |

Heartland Payment Systems, Inc. | | | 14,270 | | | | 420,965 | |

Imperva, Inc.* | | | 13,215 | | | | 416,669 | |

Infoblox, Inc.* | | | 21,454 | | | | 385,528 | |

Inphi Corp.* | | | 63,078 | | | | 604,287 | |

InvenSense, Inc.* | | | 66,546 | | | | 739,326 | |

IPG Photonics Corp. | | | 11,677 | | | | 778,272 | |

Jive Software, Inc.* | | | 25,195 | | | | 366,083 | |

LivePerson, Inc.* | | | 103,991 | | | | 1,366,442 | |

Manhattan Associates, Inc.* | | | 8,645 | | | | 521,639 | |

MAXIMUS, Inc. | | | 29,150 | | | | 1,842,863 | |

MercadoLibre, Inc. | | | 7,666 | | | | 602,317 | |

MicroStrategy, Inc., Class A* | | | 3,246 | | | | 303,111 | |

Millennial Media, Inc.*,1 | | | 36,063 | | | | 451,869 | |

MTS Systems Corp. | | | 8,630 | | | | 439,526 | |

Netscout Systems, Inc.* | | | 13,530 | | | | 351,645 | |

NetSuite, Inc.* | | | 10,221 | | | | 687,873 | |

OpenTable, Inc.* | | | 5,694 | | | | 277,867 | |

Palo Alto Networks, Inc.* | | | 4,999 | | | | 267,546 | |

Parametric Technology Corp.* | | | 38,869 | | | | 874,941 | |

Peregrine Semiconductor Corp.*,1 | | | 24,600 | | | | 376,626 | |

Plantronics, Inc. | | | 9,970 | | | | 367,594 | |

Progress Software Corp.* | | | 29,339 | | | | 615,826 | |

Qihoo 360 Technology Co., Ltd., ADR*,1 | | | 13,143 | | | | 390,216 | |

QLIK Technologies, Inc.* | | | 50,207 | | | | 1,090,496 | |

Ruckus Wireless, Inc.* | | | 2,900 | | | | 65,337 | |

ServiceNow, Inc.*,1 | | | 7,885 | | | | 236,787 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Sohu.com, Inc.* | | | 6,872 | | | $ | 325,320 | |

Sourcefire, Inc.* | | | 19,140 | | | | 903,791 | |

Splunk, Inc.* | | | 13,353 | | | | 387,504 | |

SPS Commerce, Inc.* | | | 30,673 | | | | 1,143,183 | |

Stratasys, Ltd.* | | | 9,591 | | | | 768,719 | |

Synchronoss Technologies, Inc.* | | | 78,233 | | | | 1,649,934 | |

Tangoe, Inc.* | | | 73,252 | | | | 869,501 | |

Ultimate Software Group, Inc.* | | | 5,498 | | | | 519,066 | |

Unisys Corp.* | | | 35,976 | | | | 622,385 | |

ValueClick, Inc.* | | | 14,500 | | | | 281,445 | |

Velti PLC* | | | 28,034 | | | | 126,153 | |

Websense, Inc.* | | | 23,801 | | | | 357,967 | |

Yelp, Inc.* | | | 26,901 | | | | 507,084 | |

Total Information Technology | | | | | | | 39,334,239 | |

Materials - 2.3% | | | | | | | | |

Coeur d’Alene Mines Corp.* | | | 5,940 | | | | 146,124 | |

Eagle Materials, Inc. | | | 21,099 | | | | 1,234,291 | |

Georgia Gulf Corp. | | | 10,700 | | | | 441,696 | |

Kraton Performance Polymers, Inc.* | | | 63,820 | | | | 1,533,595 | |

Minerals Technologies, Inc. | | | 11,510 | | | | 459,479 | |

Molycorp, Inc.*,1 | | | 25,631 | | | | 241,957 | |

Myers Industries, Inc. | | | 9,510 | | | | 144,076 | |

Schweitzer-Mauduit International, Inc. | | | 8,020 | | | | 313,021 | |

Total Materials | | | | | | | 4,514,239 | |

Telecommunication Services - 0.0%# | | | | | | | | |

Premiere Global Services, Inc.* | | | 8,340 | | | | 81,565 | |

Total Common Stocks

(cost $174,541,903) | | | | | | | 194,063,429 | |

Other Investment Companies - 9.6%2 | | | | | | | | |

BNY Mellon Overnight Government Fund, 0.19%3 | | | 12,675,364 | | | | 12,675,364 | |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.06% | | | 6,613,816 | | | | 6,613,816 | |

Total Other Investment Companies

(cost $19,289,180) | | | | | | | 19,289,180 | |

Total Investments - 106.4%

(cost $193,831,083) | | | | 213,352,609 | |

Other Assets, less Liabilities - (6.4)% | | | | | | | (12,803,124 | ) |

Net Assets - 100.0% | | | | | | $ | 200,549,485 | |

|

The accompanying notes are an integral part of these financial statements. 10 |

Notes to Schedule of Portfolio Investments

The following footnotes and abbreviations should be read in conjunction with the Schedule of Portfolio Investments previously presented in this report.

Based on the approximate cost of investments of $196,872,505 for Federal income tax purposes at December 31, 2012, the aggregate gross unrealized appreciation and depreciation were $23,485,733 and $7,005,629, respectively, resulting in net unrealized appreciation of investments of $16,480,104.

| | * | Non-income producing security. |

| | # | Rounds to less than 0.1%. |

| | 1 | Some or all of these shares, amounting to a market value of $12,734,430, or approximately 6.3% of net assets, were out on loan to various brokers. |

| | 2 | Yield shown for each investment company represents the December 31, 2012, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| | 3 | Collateral received from brokers for securities lending was invested in this short-term investment. |

As of December 31, 2012, the securities in the Fund were all valued using Level 1 inputs. For a detailed break-out of the common stocks by major industry classification, please refer to the Schedule of Portfolio Investments previously presented in this report. (See Note 1(a) in the Notes to Financial Statements.)

As of December 31, 2012, the Fund had no transfers between levels from the beginning of the reporting period.

Investment Definitions and Abbreviations:

ADR: ADR after the name of a holding stands for American Depositary Receipt, representing ownership of foreign securities on deposit with a domestic custodian bank. The value of the ADR security is determined or significantly influenced by trading on exchanges not located in the United States or Canada. Sponsored ADRs are initiated by the underlying foreign company.

|

The accompanying notes are an integral part of these financial statements. 11 |

Statement of Assets and Liabilities

December 31, 2012

| | | | |

Assets: | | | | |

Investments at value* (including securities on loan valued at $12,734,430) | | $ | 213,352,609 | |

Cash | | | 6,121 | |

Receivable for investments sold | | | 1,889,950 | |

Dividends, interest and other receivables | | | 413,691 | |

Receivable for Fund shares sold | | | 108,948 | |

Receivable from affiliate | | | 26,713 | |

Prepaid expenses | | | 11,878 | |

Total assets | | | 215,809,910 | |

Liabilities: | | | | |

Payable upon return of securities loaned | | | 12,675,364 | |

Payable for investments purchased | | | 1,707,296 | |

Payable for fund shares repurchased | | | 559,785 | |

Accrued expenses: | | | | |

Investment management and advisory fees | | | 152,622 | |

Administrative fees | | | 42,395 | |

Shareholder Servicing fees - Managers Class | | | 38,984 | |

Trustee fees & expenses | | | 1,115 | |

Other | | | 82,864 | |

Total liabilities | | | 15,260,425 | |

Net Assets | | $ | 200,549,485 | |

Net Assets Represent: | | | | |

Paid-in capital | | $ | 391,663,579 | |

Undistributed net investment loss | | | (37,506 | ) |

Accumulated net realized loss from investments | | | (210,598,114 | ) |

Net unrealized appreciation of investments | | | 19,521,526 | |

Net Assets | | $ | 200,549,485 | |

Managers Shares: | | | | |

Net Assets | | $ | 184,142,372 | |

Shares outstanding | | | 3,061,803 | |

Net asset value, offering and redemption price per share | | $ | 60.14 | |

Institutional Class: | | | | |

Net Assets | | $ | 16,407,113 | |

Shares outstanding | | | 267,489 | |

Net asset value, offering and redemption price per share | | $ | 61.34 | |

* Investments at cost | | $ | 193,831,083 | |

|

The accompanying notes are an integral part of these financial statements. 12 |

Statement of Operations

For the year ended December 31, 2012

| | | | |

Investment Income: | | | | |

Dividend income | | $ | 1,917,966 | 1 |

Securities lending income | | | 336,526 | |

Interest income | | | 690 | |

Total investment income | | | 2,255,182 | |

Expenses: | | | | |

Investment management and advisory fees | | | 2,116,747 | |

Administrative fees | | | 587,987 | |

Shareholder Servicing fees - Managers Class | | | 547,646 | |

Transfer agent | | | 70,488 | |

Custodian | | | 98,236 | |

Registration fees | | | 61,200 | |

Professional fees | | | 50,935 | |

Reports to shareholders | | | 41,515 | |

Trustees fees and expenses | | | 16,010 | |

Extraordinary expense | | | 8,048 | |

Miscellaneous | | | 11,625 | |

Total expenses before offsets | | | 3,610,437 | |

Expense reimbursements | | | (444,026 | ) |

Expense reductions | | | (28,269 | ) |

Net expenses | | | 3,138,142 | |

Net investment loss | | | (882,960 | ) |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain on investments | | | 30,311,197 | |

Net change in unrealized appreciation (depreciation) of investments | | | (4,258,379 | ) |

Net realized and unrealized gain | | | 26,052,818 | |

Net increase in net assets resulting from operations | | $ | 25,169,858 | |

| 1 | Includes non-recurring dividends of $852,431. |

|

The accompanying notes are an integral part of these financial statements. 13 |

Statements of Changes in Net Assets

For the year ended December 31,

| | | | | | | | |

| | | 2012 | | | 2011 | |

Increase (Decrease) in Net Assets From Operations: | | | | | | | | |

Net investment loss | | $ | (882,960 | ) | | $ | (2,850,490 | ) |

Net realized gain on investments | | | 30,311,197 | | | | 42,550,826 | |

Net change in unrealized appreciation (depreciation) of investments | | | (4,258,379 | ) | | | (37,008,078 | ) |

Net increase in net assets resulting from operations | | | 25,169,858 | | | | 2,692,258 | |

Capital Share Transactions: | | | | | | | | |

Managers Class: | | | | | | | | |

Proceeds from sale of shares | | | 13,657,712 | | | | 152,829,719 | |

Cost of shares repurchased | | | (96,985,080 | ) | | | (189,754,386 | ) |

Net decrease from Managers Class share transactions | | | (83,327,368 | ) | | | (36,924,667 | ) |

Institutional Class: | | | | | | | | |

Proceeds from sale of shares | | | 4,033,024 | | | | 11,950,135 | |

Cost of shares repurchased | | | (3,145,437 | ) | | | (3,388,450 | ) |

Net increase from Institutional Class share transactions | | | 887,587 | | | | 8,561,685 | |

Net decrease from capital share transactions | | | (82,439,781 | ) | | | (28,362,982 | ) |

Total decrease in net assets | | | (57,269,923 | ) | | | (25,670,724 | ) |

Net Assets: | | | | | | | | |

Beginning of year | | | 257,819,408 | | | | 283,490,132 | |

End of year | | $ | 200,549,485 | | | $ | 257,819,408 | |

End of year undistributed net investment loss | | $ | (37,506 | ) | | $ | (53,875 | ) |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Managers Class: | | | | | | | | |

Sale of shares | | | 228,746 | | | | 2,679,236 | |

Shares repurchased | | | (1,640,865 | ) | | | (3,492,876 | ) |

Net decrease in shares | | | (1,412,119 | ) | | | (813,640 | ) |

Institutional Class: | | | | | | | | |

Sale of shares | | | 67,753 | | | | 224,397 | |

Shares repurchased | | | (52,036 | ) | | | (62,207 | ) |

Net increase in shares | | | 15,717 | | | | 162,190 | |

|

The accompanying notes are an integral part of these financial statements. 14 |

Managers Special Equity Fund

Financial Highlights

For a share outstanding throughout each year

| | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

Managers Class | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

Net Asset Value, Beginning of Year | | $ | 54.51 | | | $ | 52.71 | | | $ | 39.60 | | | $ | 30.28 | | | $ | 64.27 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss1 | | | (0.24 | )4 | | | (0.50 | ) | | | (0.41 | ) | | | (0.34 | ) | | | (0.28 | ) |

Net realized and unrealized gain (loss) on investments1 | | | 5.87 | | | | 2.30 | | | | 13.52 | | | | 9.66 | | | | (27.93 | ) |

Total from investment operations | | | 5.63 | | | | 1.80 | | | | 13.11 | | | | 9.32 | | | | (28.21 | ) |

Less Distribution to Shareholder from: | | | | | | | | | | | | | | | | | | | | |

Net realized gain from investments | | | — | | | | — | | | | — | | | | — | | | | (5.78 | ) |

Net Asset Value, End of Year | | $ | 60.14 | | | $ | 54.51 | | | $ | 52.71 | | | $ | 39.60 | | | $ | 30.28 | |

Total Return2 | | | 10.35 | % | | | 3.41 | %5 | | | 33.11 | % | | | 30.78 | % | | | (43.49 | )% |

Ratio of net expenses to average net assets | | | 1.35 | %6 | | | 1.37 | %7 | | | 1.48 | % | | | 1.58 | % | | | 1.48 | % |

Ratio of net investment loss to average net assets2 | | | (0.40 | )%6 | | | (0.89 | )% | | | (0.95 | )% | | | (1.08 | )% | | | (0.52 | )% |

Portfolio turnover | | | 107 | % | | | 126 | % | | | 138 | % | | | 186 | % | | | 138 | % |

Net assets at end of year (000’s omitted) | | $ | 184,142 | | | $ | 243,858 | | | $ | 278,701 | | | $ | 221,159 | | | $ | 352,106 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios absent expense offsets:3 | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 1.55 | % | | | 1.54 | % | | | 1.55 | % | | | 1.61 | % | | | 1.51 | % |

Ratio of net investment loss to average net assets | | | (0.60 | )% | | | (1.06 | )% | | | (1.02 | )% | | | (1.11 | )% | | | (0.55 | )% |

| | | | | | | | | | | | | | | | | | | | |

| |

| | | For the year ended December 31, | |

Institutional Class | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

Net Asset Value, Beginning of Year | | $ | 55.45 | | | $ | 53.43 | | | $ | 40.04 | | | $ | 30.56 | | | $ | 64.71 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss1 | | | (0.05 | )4 | | | (0.29 | ) | | | (0.30 | ) | | | (0.26 | ) | | | (0.15 | ) |

Net realized and unrealized gain (loss) on investments1 | | | 5.94 | | | | 2.31 | | | | 13.69 | | | | 9.74 | | | | (28.16 | ) |

Total from investment operations | | | 5.89 | | | | 2.02 | | | | 13.39 | | | | 9.48 | | | | (28.31 | ) |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net realized gain from investments | | | — | | | | — | | | | — | | | | — | | | | (5.84 | ) |

Net Asset Value, End of Year | | $ | 61.34 | | | $ | 55.45 | | | $ | 53.43 | | | $ | 40.04 | | | $ | 30.56 | |

Total Return2 | | | 10.62 | % | | | 3.78 | % | | | 33.44 | %5 | | | 31.02 | %5 | | | (43.35 | )% |

Ratio of net expenses to average net assets | | | 1.10 | %6 | | | 1.12 | %7 | | | 1.23 | % | | | 1.33 | % | | | 1.23 | % |

Ratio of net investment loss to average net assets2 | | | (0.08 | )%6 | | | (0.53 | )% | | | (0.70 | )% | | | (0.83 | )% | | | (0.29 | )% |

Portfolio turnover | | | 107 | % | | | 126 | % | | | 138 | % | | | 186 | % | | | 138 | % |

Net assets at end of year (000’s omitted) | | $ | 16,407 | | | $ | 13,961 | | | $ | 4,786 | | | $ | 8,028 | | | $ | 92,439 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios absent expense offsets:3 | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 1.30 | % | | | 1.29 | % | | | 1.30 | % | | | 1.36 | % | | | 1.26 | % |

Ratio of net investment loss to average net assets | | | (0.28 | )% | | | (0.70 | )% | | | (0.77 | )% | | | (0.86 | )% | | | (0.32 | )% |

| | | | | | | | | | | | | | | | | | | | |

Notes to Financial Highlights

The following footnotes should be read in conjunction with the Financial Highlights of the Fund previously presented in this report.

| 1 | Per share numbers have been calculated using average shares. |

| 2 | Total returns and net investment income would have been lower had certain expenses not been reduced. (See Note 1(c) of Notes to Financial Statements.) |

| 3 | Excludes the impact of expense reimbursements or fee waivers and expense reductions such as brokerage credits, but includes expense repayments and non-reimbursable expenses, if any, such as interest, taxes and extraordinary expenses. (See Note 1(c) of Notes to Financial Statements.) |

| 4 | Includes non-recurring dividends. Without these dividends, net investment income per share would have been $(0.45) and $(0.27) for the Managers Class and Institutional Class, respectively. |

| 5 | The Total Return is based on the Financial Statement Net Asset Values as shown above. |

| 6 | Includes non-routine extraordinary expenses amounting to $7,399 or 0.003% and $649 or 0.004% of average net assets for the Managers Class and Institutional Class, respectively. |

| 7 | Effective July 1, 2011, as described in the current prospectus, the Fund’s expense cap was reduced to 1.11% from 1.14%. For the period April 1, 2011 through June 30, 2011, the Fund’s expense cap was 1.14%. From January 1, 2011 through March 31, 2011, the Fund’s expense cap was 1.19%. The expense ratio shown reflects the weighted average expense ratio for the full year ended December 31, 2011. |

Notes to Financial Statements

December 31, 2012

| 1. | Summary of Significant Accounting Policies |

The Managers Funds (the “Trust”) is an open-end management investment company, organized as a Massachusetts business trust, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust consists of a number of different Funds, each having distinct investment management objectives, strategies, risks and policies. Included in this report is the Managers Special Equity Fund (“Special Equity” or the “Fund”).

The Fund offers both Managers Class shares and Institutional Class shares. The Institutional Class shares, which are designed primarily for institutional investors that meet certain administrative and servicing criteria, have a minimum investment of $2,500,000. Managers Class shares are offered to all other investors. Each class represents an interest in the same assets of the Fund and the classes are identical except for class specific expenses related to shareholder activity. Each class has equal voting privileges except that each class has exclusive voting rights with respect to its services and/or distribution plan. Please refer to a current prospectus for additional information on each share class.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

| a. | Valuation of Investments |

Equity securities traded on a domestic or international securities exchange are valued at the last quoted sale price, or, lacking any sales, at the last quoted bid price. Over-the-counter securities are valued at the Nasdaq Official Closing Price, if one is available. Lacking any sales, over-the-counter securities are valued at the last quoted bid price. The Fund’s investments are generally valued based on market quotations provided by third-party pricing services approved by the Board of Trustees of the Fund (the “Board”).

Short-term investments having a remaining maturity of 60 days or less are generally valued at amortized cost, which approximates market value. Investments in other open-end regulated investment companies are valued at their end of day net asset value per share.

Under certain circumstances, the value of certain Fund investments (including derivatives) may be based on an evaluation of fair value, pursuant to procedures established by and under the general supervision of the Board. The Pricing Committee is the committee formed by the Board to make fair value determinations for such investments. When determining the fair value of an investment, the Pricing Committee seeks to determine the price that the Fund might reasonably expect to receive from a current sale of that investment in an arm’s-length transaction. Fair value determinations shall be based upon consideration of all available facts and information, including, but not limited to (i) attributes specific to the investment;

(ii) fundamental analytical data and press releases relating to the investment and its issuer; (iii) the value of comparable securities or relevant financial instruments, including derivative securities, traded on other markets or among dealers; and (iv) other factors, such as future cash flows, interest rates, yield curves, volatilities, credit risks and/or default rates. The Board will be presented with a quarterly report comparing fair values determined by the Pricing Committee against subsequent market valuations for those securities. The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long-term investments. Further, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material. The Fund may use the fair value of a portfolio investment to calculate its net asset value (“NAV”) when, for example, (1) market quotations are not readily available because a portfolio investment is not traded in a public market or the principal market in which the investment trades is closed, (2) trading in a portfolio investment is suspended and has not resumed before the Fund calculates its NAV, (3) a significant event affecting the value of a portfolio investment is determined to have occurred between the time of the market quotation provided for a portfolio investment and the time as of which the Fund calculates its NAV, (4) an investment’s price has remained unchanged over a period of time (often referred to as a “stale price”), or (5) Managers Investment Group LLC (the “Investment Manager”) determines that a market quotation is inaccurate. Portfolio investments that trade primarily on foreign markets are priced based upon the market quotation of such securities as of the close of their respective principal markets. Under certain circumstances, the Investment Manager may adjust such prices based on its determination of the impact of events occurring subsequent to the close of such markets but prior to the time as of which the Fund calculates its NAV. The Fund may invest in securities that may be thinly traded. The Board has adopted procedures to adjust prices of thinly traded securities that are judged to be stale so that they reflect fair value. An investment valued on the basis of its fair value may be valued at a price higher or lower than available market quotations. An investment’s valuation may differ depending on the method used and the factors considered in determining value according to the Fund’s fair value procedures.

U.S. GAAP defines fair value as the price that a Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP also establishes a framework for measuring fair value, and a three level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the

Notes to Financial Statements (continued)

circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation.

The three-tier hierarchy of inputs is summarized below:

Level 1 – inputs are quoted prices in active markets for identical investments (e.g., equity securities, open-end investment companies)

Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market corroborated inputs) (e.g., debt securities, government securities, foreign securities utilizing international fair value pricing, broker-quoted securities, fair valued securities with observable inputs)

Level 3 – inputs are significant unobservable inputs (including the Fund’s own assumptions used to determine the fair value of investments) (e.g., fair valued securities with unobservable inputs)

Changes in inputs or methodologies used for valuing investments may result in a transfer in or out of levels within the fair value hierarchy. The inputs or methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

Security transactions are accounted for as of trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

| c. | Investment Income and Expenses |

Dividend income is recorded on the ex-dividend date. Dividend and interest income on foreign securities is recorded net of any withholding tax. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Non-cash dividends included in dividend income, if any, are reported at the fair market value of the securities received. Other income and expenses are recorded on an accrual basis. Expenses that cannot be directly attributed to a Fund are apportioned among the Funds in the Trust and in some cases other affiliated funds based upon their relative average net assets or number of shareholders. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund and certain Fund level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund.

The Fund had certain portfolio trades directed to various brokers, under a brokerage recapture program, which paid a portion of the Fund’s expenses. For the year ended December 31, 2012, the amount by which the Fund’s expenses were reduced and the impact on the expense ratio if any, was: $28,207 or 0.01%.

The Fund has a “balance credit” agreement with The Bank of New York Mellon (“BNYM”), the Fund’s custodian, whereby the Fund is credited with an interest factor equal to 0.75% below the effective

90-day T-Bill rate for account balances left uninvested overnight. If the T-Bill rate falls below 0.75%, no credits will be earned. These credits serve to reduce custody expenses that otherwise would be charged to the Fund. For the year ended December 31, 2012, the custodian expense was not reduced.

Overdrafts will cause a reduction of any balance credits, computed at 2% above the Federal funds rate on the day of the overdraft. For the year ended December 31, 2012, overdraft fees equaled $2.

The Fund also has a balance credit arrangement with its Transfer Agent, BNY Mellon Investment Servicing (US) Inc., whereby balance credits are used to offset banking charges and other out-of-pocket expenses. For the year ended December 31, 2012, the transfer agent expense was reduced by $62.

Total returns and net investment income for the Fund would have been lower had certain expenses not been offset. Total expenses before offsets exclude the impact of expense reimbursements or fee waivers and expense reductions such as brokerage recapture credits, but include non-reimbursable expenses, if any, such as interest, taxes and extraordinary expenses.

| d. | Dividends and Distributions |

Dividends resulting from net investment income and distributions of capital gains, if any, normally will be declared and paid annually in December and when required for Federal excise tax purposes. Dividends and distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differing treatments for losses deferred due to wash sales, equalization accounting for tax purposes and market discount transactions. Permanent book and tax basis differences, if any, relating to shareholder distributions will result in reclassifications to paid-in capital.

As of December 31, 2012, the components of distributable earnings (excluding unrealized appreciation/depreciation) on a tax basis consisted of:

| | | | |

Capital loss carryforward | | $ | 205,491,204 | |

Undistributed ordinary income | | | — | |

Undistributed short-term capital gains | | | — | |

Undistributed long-term capital gains | | | — | |

Post-October loss deferral | | | 2,079,601 | |

The Fund intends to comply with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, to distribute substantially all of its taxable income and gains to its shareholders and to meet certain diversification and income requirements with respect to investment companies. Therefore, no provision for Federal income or excise tax is included in the accompanying financial statements.

Additionally, based on the Fund’s understanding of the tax rules and rates related to income, gains and transactions for the foreign jurisdictions in which it invests, the Fund will provide for foreign taxes, and where appropriate, deferred foreign taxes.

Notes to Financial Statements (continued)

Management has analyzed the Fund’s tax positions taken on Federal income tax returns as of December 31, 2012 and for all open tax years, and has concluded that no provision for federal income tax is required in the Fund’s financial statements. Additionally, the Fund is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Under the Regulated Investment Company Modernization Act of 2010, post-enactment capital losses may be carried forward for an unlimited time period. However, any new losses incurred will be required to be utilized prior to any loss carryovers incurred in pre-enactment taxable years, which generally expire eight years following the close of the taxable year in which they were incurred. As a result of this ordering rule, pre-enactment capital loss carryovers may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward retain their tax character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

| f. | Capital Loss Carryovers and Deferrals |

As of December 31, 2012, the Fund had accumulated net realized capital loss carryovers from security transactions for Federal income tax purposes as shown in the following chart. These amounts may be used to offset realized capital gains, if any, through the expiration date listed or in the case of post-enactment losses, for an unlimited time period.

| | | | | | | | | | |

| | | Capital Loss Carryover Amounts | | | Expires |

| | | Short-Term | | | Long-Term | | | December 31, |

(Pre-Enactment) | | $ | 21,869,427 | | | | | | | 2016 |

(Pre-Enactment) | | | 183,621,777 | | | | | | | 2017 |

| | | | | | | | | | |

Total | | $ | 205,491,204 | | | | — | | | |

| | | | | | | | | | |

For the year ended December 31, 2012, the Fund utilized capital loss carryovers in the amount of $29,638,144.

The Trust’s Declaration of Trust authorizes for each series the issuance of an unlimited number of shares of beneficial interest, without par value. The Fund records sales and repurchases of its capital stock on the trade date. The cost of securities contributed to the Fund in connection with the issuance of shares is based on the valuation of those securities in accordance with the Fund’s policy on investment valuation.

At December 31, 2012, certain unaffiliated shareholders of record, specifically omnibus accounts, individually or collectively held greater than 10% of the outstanding shares of the Fund as follows: two collectively own 51%. Transactions by these shareholders may have a material impact on the Fund.

| 2. | Agreements and Transactions with Affiliates |

The Trust has entered into an Investment Management Agreement under which the Investment Manager, a subsidiary of Affiliated Managers Group, Inc. (“AMG”), serves as investment manager to the Fund and is responsible for the Fund’s overall administration and operations. The Investment Manager selects subadvisors for the

Fund (subject to Board approval) and monitors the subadvisor’s investment performance, security holdings and investment strategies. The Fund’s investment portfolio is managed by one or more portfolio managers who serves pursuant to a subadvisory agreement with the Investment Manager.

Investment management fees are paid directly by the Fund to the Investment Manager based on average daily net assets. For the year ended December 31, 2012 the investment management fee rate, as a percentage of average daily net assets, was 0.90%.

The Investment Manager has contractually agreed, until at least May 1, 2013, to waive management fees and/or reimburse Fund expenses, in order to limit total annual Fund operating expenses after fee waiver and expense reimbursements (exclusive of taxes, interest (including interest incurred in connection with bank and custody overdrafts), shareholder servicing fees, brokerage commissions and other transaction costs, acquired fund fees and expenses, and extraordinary expenses) to 1.11% of the Fund’s average daily net assets.

The Fund is obligated to repay the Investment Manager such amounts waived, paid or reimbursed in future years provided that the repayment occurs within thirty-six (36) months after the waiver or reimbursement and that such repayment would not cause the Fund’s total operating expenses in any such future year to exceed the Fund’s expense cap. For the year ended December 31, 2012, the Fund’s components of reimbursement are detailed in the following chart:

| | | | |

Reimbursement Available - 12/31/11 | | $ | 550,121 | |

Additional Reimbursements | | | 444,026 | |

Repayments | | | — | |

Expired Reimbursements | | | — | |

| | | | |

Reimbursement Available - 12/31/12 | | $ | 994,147 | |

| | | | |